Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04603

Thrivent Series Fund, Inc.

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Rebecca A. Paulzine, Assistant Secretary

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-5168

Date of fiscal year end: December 31

Date of reporting period: June 30, 2013

Table of Contents

| Item 1. | Report to Stockholders |

Table of Contents

Table of Contents

NEW! Make variable annuity changes online, quickly and easily

Now you have more options to manage your variable annuity—in fewer steps

You’ve invested in an annuity—now Thrivent Financial for Lutherans gives you another way to manage it with our new online annuity service center. With 24/7 access, it’s there when you want it. Plus, you can make changes any time in seconds.

The online annuity service center offers you more options, including:

|  | |

• Complete reallocation (available now).

• Partial reallocation (available now).

• New money allocation (available now).

• Partial withdrawals (available now).

• Transaction status and history (coming late summer 2013). |

Just log in* to Thrivent.com and select your variable annuity contract by clicking on Manage Contract to make changes. It’s the easiest and most convenient way to update your annuity. Save time by making changes with just a few easy clicks!

As always, your Thrivent Financial representative is available to answer any questions you may have.

| * | In order to access your variable annuity contract on Thrivent.com, you must be a registered user. If you are not already registered, you can register immediately by clicking on Register Now next to the login area. |

This page is not part of the semiannual report.

Table of Contents

| 2 | ||||

Portfolio Summaries | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

Schedules of Investments | ||||

| 25 | ||||

| 34 | ||||

| 53 | ||||

| 73 | ||||

| 92 | ||||

| 94 | ||||

| 97 | ||||

| 99 | ||||

| 103 | ||||

| 106 | ||||

| 109 | ||||

| 112 | ||||

| 115 | ||||

| 123 | ||||

| 125 | ||||

| 128 | ||||

| 130 | ||||

| 137 | ||||

| 155 | ||||

| 157 | ||||

| 160 | ||||

| 163 | ||||

| 166 | ||||

| 168 | ||||

| 173 | ||||

| 175 | ||||

| 179 | ||||

| 186 | ||||

| 192 | ||||

| 205 | ||||

| 213 | ||||

| 226 | ||||

| 240 | ||||

| 247 | ||||

| 258 | ||||

| 262 | ||||

| 266 | ||||

| 274 | ||||

| 282 | ||||

| 294 | ||||

| 312 | ||||

| 324 | ||||

| 325 | ||||

Table of Contents

Dear Member:

Financial markets were a study in contrasts during the six-month period ended June 30, 2013. In the U.S., stock prices soared as the economy continued its slow but stubborn recovery, while bond prices fell on worries that an improving economy could lead to higher interest rates. Stocks outside the U.S. were mostly flat to lower, with the exception of Japan, which registered sharp gains.

Economic review

The U.S. economy can be faulted for the pace of its recovery since the 2007-2009 recession, but not for its persistence. During the first three months of 2013, the nation’s gross domestic product (GDP) expanded for the 15th consecutive quarter, growing at a revised annual rate of 1.8%. That was up from a revised 0.4% in the fourth quarter of 2012, with economists widely anticipating further gains in the second quarter.

Although it has not matched the 3%-plus growth rates typical of past recoveries, the U.S. economy has been a relative anchor of stability in a global context. Europe, squeezed by high levels of debt and austere fiscal policies, has already slipped into another recession. China, which had been growing at a 10% pace for much of the past decade, more recently has been expanding at about a 7% rate, and many economists are suspicious that China’s government may be artificially inflating even that figure. Japan’s economy grew at a 4.1% annual rate in the first quarter, exciting investors, but is coming off a relatively low base following more than a decade of economic stagnation.

The U.S. economy recorded gains on a broad front, with lower government spending and exports as the notable exceptions. Personal consumption, which accounts for about 70% of GDP, advanced at a revised annual rate of 2.6% during the first quarter. Durable goods grew at a 7.6% rate, nondurable goods grew by 2.8%, and services were up 1.7%. Private inventory investment and residential fixed investment also grew.

Perhaps most encouraging to many investors was the rebound in the housing sector, whose collapse was at the core of the last recession. In May, existing-home sales jumped to a seasonally adjusted annual rate of 5.18 million, up 12.9% from the year-earlier pace. Meanwhile, the median sales price for existing homes rose to $208,000 that month, up 15.4% from a year earlier. That marked the sixth straight month of double-digit increases and the biggest year-over-year monthly gain since October 2005.

Slow-growing economies usually do not create jobs at a rapid pace, and that has held true during this latest recovery. Still, the pace of job creation did pick up slightly during the reporting period. U.S. nonfarm payrolls grew by an average of 202,000 per month, up from an average 183,000 per month for all of 2012. The unemployment rate fell slightly to 7.6%, down from 7.8% at the end of 2012, but still well above the 5% to 6% typical of an economy firing on all cylinders.

In any event, the economic news in the first half of the year was sufficient to hearten consumers. The Conference Board’s Consumer Confidence Index rose to 81.4 in June, up from 66.7 at the end of last year and its highest level since January 2008. Given the importance of consumer spending to GDP, this bodes well for the economy.

Market review

The U.S. stock market blasted out of the starting gate in January after Congress permanently extended most of the Bush-era tax cuts in a “fiscal cliff” compromise that also averted some impending spending cuts. The Dow Jones Industrial Average jumped more than 300 points on the first day of trading. By March, with investor confidence growing, major U.S. stock market indexes hit their first record highs in nearly 5 1/2 years. Stock prices continued to surge in April and May before giving back a small portion of their gains in June, when investors began to worry that the improving economy might prompt the Federal Reserve to start tightening monetary policy and raise interest rates. Still, the S&P 500 Index of large-company stocks finished the first half with a total return of 13.8%, nearly matching the 16% it earned in all of 2012. Small-company stocks did even better, with the Russell 2000 Index generating a total return of 15.9%.

While the prospect of tighter monetary policy gave equity investors pause, they could take solace in the knowledge that a stronger economy should ultimately be good for corporate profits and, hence, the stock market. For fixed-income investors, hints of a less-accommodating Federal Reserve may have been more unnerving.

The Fed announced in December 2012 that as long as inflation remains low, it does not plan to raise its target for short-term interest rates until the unemployment rate falls to 6.5%. Most economists don’t expect that to happen until late 2014 at the earliest, and the Fed has repeatedly reaffirmed its plans. However, the Fed said in June that if the economy continues to show improvement, it might start scaling back its $85 billion-per-month bond-buying program—which it has used to help suppress longer-term interest rates—later this year.

When longer-term interest rates rise, prices for existing longer-term bonds fall. Hoping to get ahead of the move, some fixed-income investors began selling bonds feverishly following the Fed’s announcement, sending bond yields soaring. By the end of the reporting period, the yield on the 10-year Treasury note stood at 2.5%, up from just under 1.7% at the beginning of May. The Barclays U.S. 20+ Year Treasury Bond Index posted a total return of -8.5% for the first half of 2013.

2

Table of Contents

Due largely to the sell off in the Treasury market, the Barclays U.S. Aggregate Bond Index—a broad barometer for the fixed-income markets—posted a loss for the first half, with a total return of -2.4%. Among the few pockets of strength in the fixed-income sector were corporate high-yield bonds prized for their yield, and convertible bonds that can be exchanged for stock. The Merrill Lynch High Yield U.S. Corporates Index earned 1.5%, while the Merrill Lynch All Convertibles Index earned 9.9%.

Outside the U.S., equity markets were mixed. Shares in Europe ended the reporting period about where they started, despite a number of dips and surges along the way. Headwinds included better-than-expected performance by anti-austerity candidates in Italy’s elections, which created uncertainty about Europe’s ongoing efforts to work through its debt problems; a brief panic, centered on troubled banks in Cyprus; and—as the period drew to a close—worries about the fallout from potentially tighter monetary policy in the U.S.

Meanwhile, Japan’s stock markets soared on hopes that stimulative economic policies backed by newly elected Prime Minister Shinzo Abe would end more than a decade of deflation in that country. The Nikkei 225 Index of Japanese stocks rose more than 31% during the first half of 2013, even after investors took profits in the final six weeks of the period. Thanks in large part to Japan’s rally, the MSCI EAFE Index—which tracks developed markets in Europe, Asia and Australia—posted a total return of 4.1% for the first half of the year.

Stocks in emerging markets fell sharply, victim to slowing economic growth in many developing countries and concerns about how they would be impacted by changing conditions in the U.S. and China. The MSCI Emerging Markets Index posted a total return of -9.4%.

Outlook

It is difficult to imagine that during the second half of this year U.S. stocks will be able to duplicate their exceptional performance of the first half. Nonetheless, the outlook for both the U.S. economy and U.S. stocks remains constructive.

We expect the economy to continue growing at a modest pace for the rest of 2013, notching full-year growth of 2% or slightly higher. The nonpartisan Congressional Budget Office (CBO) predicts the economy will begin to accelerate in 2014, and recent economic reports reinforce that view. In particular, rising consumer confidence suggests that consumer spending will support further GDP growth, and any continued improvement in the housing and labor markets could drive additional gains.

Risks to further economic expansion include cuts in federal spending, which will remain a possibility as long as Washington is searching for a solution to the nation’s burgeoning long-term debt. Near term, though, the federal government’s finances are showing some improvement. The CBO has estimated that the federal budget deficit will shrink to $642 billion this year, or to just 4% of GDP, before dwindling to 2.1% of GDP by 2015. By contrast, the deficit equaled 10.1% of the nation’s economic output as recently as 2009.

All this creates a favorable backdrop for stocks, which— despite their recent gains—remain reasonably valued relative to what corporations are expected to earn this year. By at least one measure, stock prices have actually lagged corporate profits. When the S&P 500 passed its prerecession high in March, the per-share earnings of the companies in that index were already 14% above their prerecession peak.

The outlook for Europe’s economy and financial markets is more unsettled, although gains by European stocks in late June and early July suggest investors expect brighter days ahead. Certainly, their worries about the financial stresses that have challenged the future of the euro have moderated. Also, some European policymakers have begun to ask whether the region’s austerity agenda—which many economists blame for contributing to Europe’s economic malaise—is still appropriate. Whether they will adopt more growth-oriented policies remains to be seen. In the meantime, given that stocks are frequently cheap during a recession, investors with a long-term view may find European stocks worth considering.

The outlook for emerging markets also is cloudy. Recently, the International Monetary Fund reduced its growth forecasts for China and Russia, in part over concern about the U.S. adopting a less-stimulative monetary policy.

Prospects for the U.S. fixed-income markets are modest but not, in our view, as disastrous as the May-June sell off suggested. While further upticks in interest rates will produce capital losses on existing bond holdings, rising bond yields will, over time, help to offset those losses.

Predicting what bonds will earn in the short run is always difficult, but over time they tend to reflect current yields, less any default losses. At the end of the reporting period, yields on longer-term Treasuries were in the 2.5% to 3.5% range, while high-yield corporate bonds were yielding about 6%. Actual long-term returns could fall short of those numbers if interest rates and/or credit losses tick higher, although we do not anticipate any dramatic, sustained moves on those fronts anytime soon.

If you have questions about how to best position your portfolio for what we expect will be a gradually improving economic recovery, we encourage you to meet with your Thrivent Financial representative. He or she can help you craft an investment policy and financial plan suited to your objectives and tolerance for risk.

As always, thank you for the trust you have placed with our entire team of Thrivent Financial investment professionals.

Sincerely,

Russell W. Swansen

President

Thrivent Series Fund, Inc.

3

Table of Contents

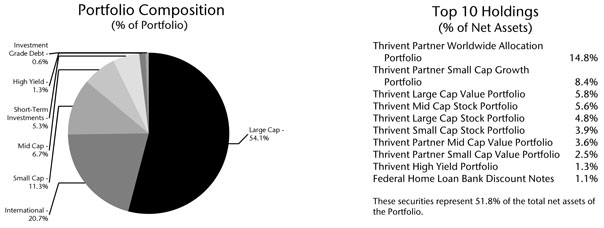

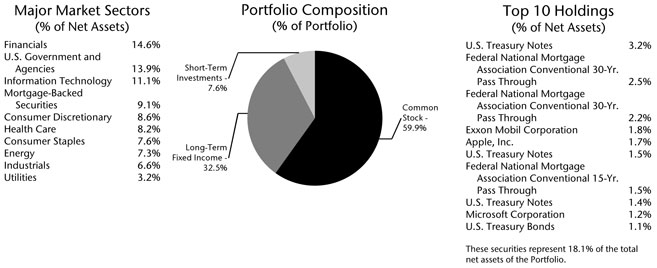

Thrivent Aggressive Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA Portfolio Co-Managers

The Thrivent Aggressive Allocation Portfolio seeks long-term capital growth.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus.

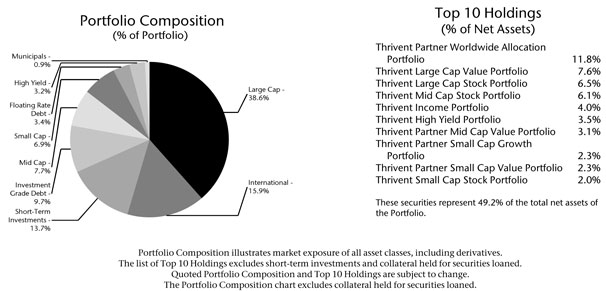

Thrivent Moderately Aggressive Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA Portfolio Co-Managers

The Thrivent Moderately Aggressive Allocation Portfolio seeks long-term capital growth.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus.

4

Table of Contents

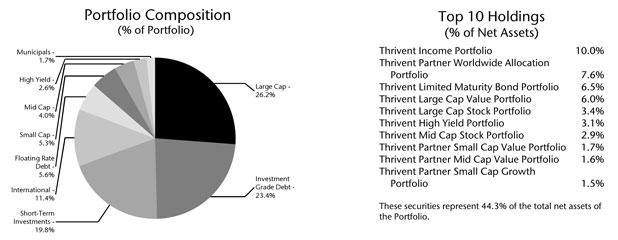

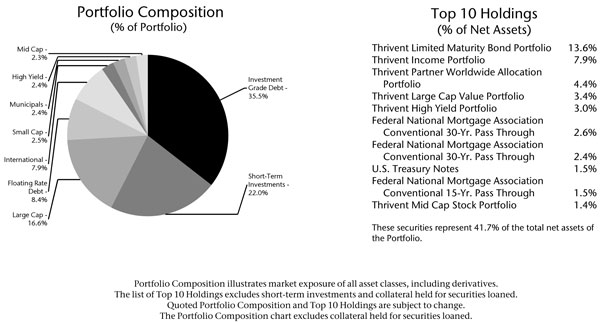

Thrivent Moderate Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA Portfolio Co-Managers

The Thrivent Moderate Allocation Portfolio seeks long-term capital growth while providing reasonable stability of principal.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus.

Thrivent Moderately Conservative Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA Portfolio Co-Managers

The Thrivent Moderately Conservative Allocation Portfolio seeks long-term capital growth while providing reasonable stability of principal.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus.

5

Table of Contents

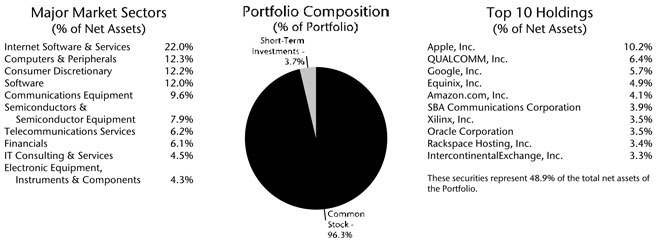

Thrivent Partner Technology Portfolio

Subadvised by Goldman Sachs Asset Management, L.P.

Thrivent Partner Technology Portfolio seeks long-term growth of capital.

The Portfolio primarily invests in securities of technology-related companies. As a consequence, the Portfolio may be subject to greater price volatility than a portfolio investing in a broad range of industries. These and other risks are described in the Portfolio’s prospectus.

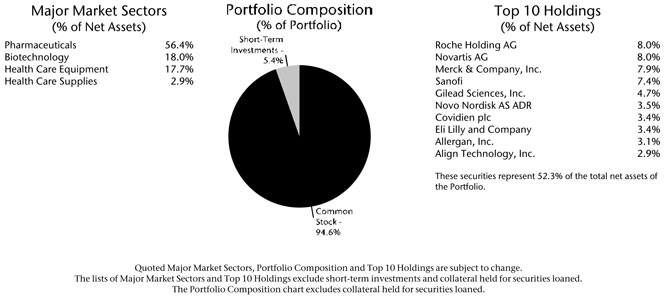

Thrivent Partner Healthcare Portfolio

Subadvised by Sectoral Asset Management, Inc.

Thrivent Partner Healthcare Portfolio seeks long-term capital growth.

The Portfolio’s investments are concentrated in issuers in the health care industry; therefore, the Portfolio is more vulnerable to price changes in the securities of issuers in this industry and factors specific to this industry than a more broadly diversified portfolio. In addition, as a non-diversified portfolio, the Portfolio is susceptible to the risk that events affecting a particular issuer will significantly affect the Portfolio’s performance. These and other risks are described in the Portfolio’s prospectus.

6

Table of Contents

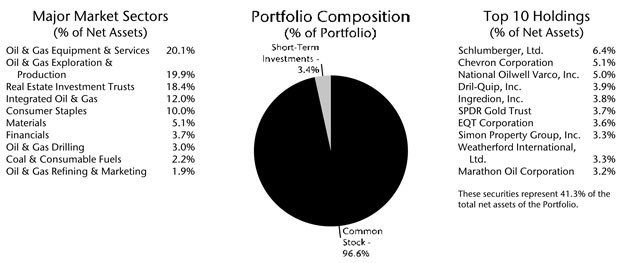

Thrivent Natural Resources Portfolio

David C. Francis, CFA and Darren M. Bagwell, CFA, Portfolio Co-Managers

Thrivent Natural Resources Portfolio seeks long-term capital growth.

The Portfolio’s investments are concentrated in issuers in the natural resources industry; therefore, the Portfolio is more vulnerable to price changes in the securities of issuers in this industry and factors specific to this industry than a more broadly diversified portfolio. In addition, as a non-diversified portfolio, the Portfolio is susceptible to the risk that events affecting a particular issuer will significantly affect the Portfolio’s performance. These and other risks are described in the Portfolio’s prospectus.

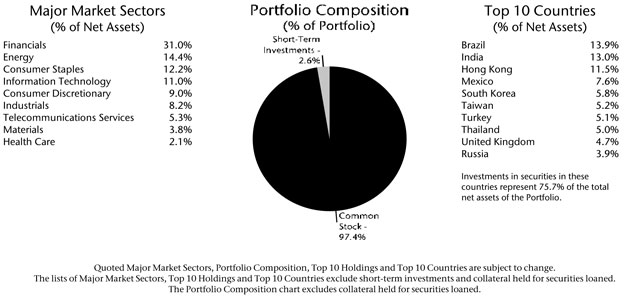

Thrivent Partner Emerging Markets Equity Portfolio

Subadvised by Aberdeen Asset Managers Limited

Thrivent Partner Emerging Markets Equity Portfolio seeks long-term capital growth.

Foreign investments, as compared to domestic ones, involve additional risks, including currency fluctuations, different accounting standards, and greater political, economic and market instability. These risks are magnified when the Portfolio invests in emerging markets, which may be of relatively small size and less liquid than domestic markets. These and other risks are described in the Portfolio’s prospectus.

7

Table of Contents

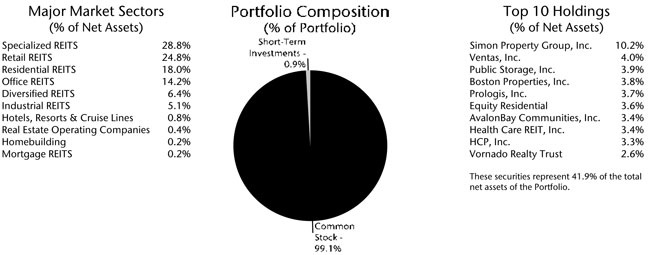

Thrivent Real Estate Securities Portfolio

Reginald L. Pfeifer, CFA, Portfolio Manager

Thrivent Real Estate Securities Portfolio seeks to provide long-term capital appreciation and high current income.

The Portfolio is subject to risks arising from the fact that it invests, under normal circumstances, at least 80% of its total assets in securities of companies that are primarily engaged in the real estate industry. Portfolio security prices are influenced by the underlying value of properties owned by the issuer, which may be influenced by the supply and demand for space and other factors. The real estate industry is cyclical, and securities issued by companies doing business in the real estate industry may fluctuate in value. These and other risks are described in the Portfolio’s prospectus.

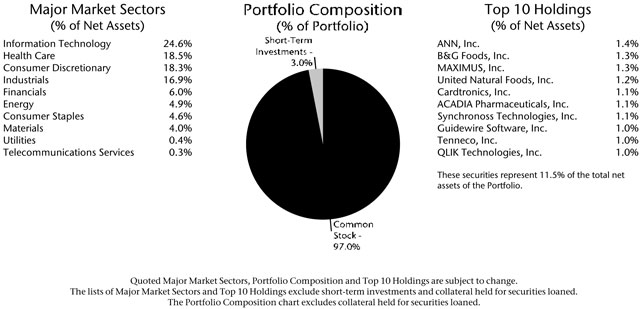

Thrivent Partner Small Cap Growth Portfolio

Subadvised by Turner Investments, L.P.

Thrivent Partner Small Cap Growth Portfolio seeks long-term capital growth.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volume and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

8

Table of Contents

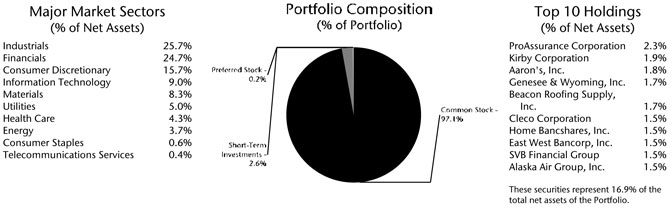

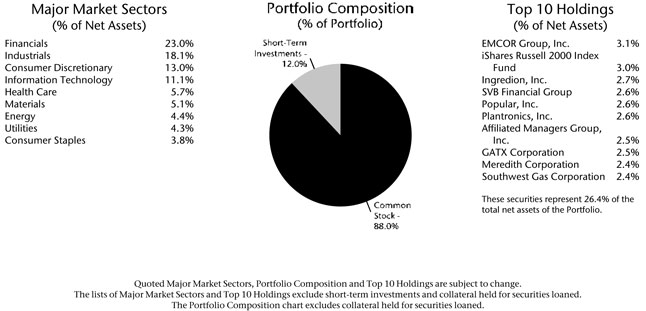

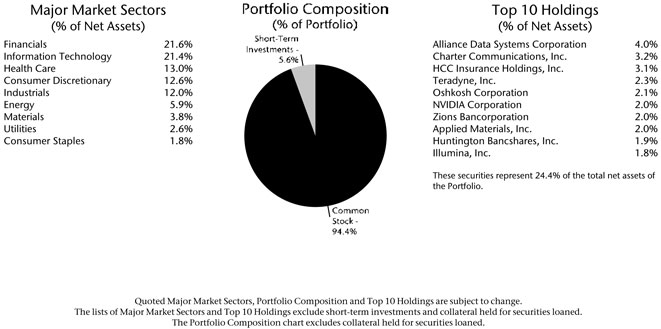

Thrivent Partner Small Cap Value Portfolio

Subadvised by T. Rowe Price Associates, Inc.

Thrivent Partner Small Cap Value Portfolio seeks long-term capital appreciation.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volume and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

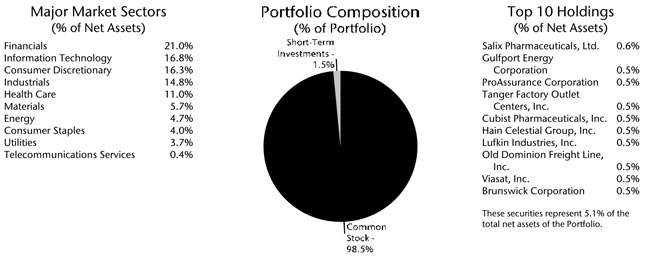

Thrivent Small Cap Stock Portfolio

Matthew D. Finn, CFA, Portfolio Manager*

Thrivent Small Cap Stock Portfolio seeks long-term capital growth.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volume and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

* Effective March 2013, Matthew D. Finn became the Portfolio Manager.

9

Table of Contents

Thrivent Small Cap Index Portfolio

Kevin R. Brimmer, FSA, Portfolio Manager

Thrivent Small Cap Index Portfolio strives for capital growth that tracks the performance of the S&P SmallCap 600 Index.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volume and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. While the Portfolio attempts to closely track the S&P SmallCap 600 Index, it does not duplicate the composition of the Index. Individuals may not invest directly in any index. Index portfolios are subject to the same market risks associated with the stocks in their respective indexes. These and other risks are described in the Portfolio’s prospectus.

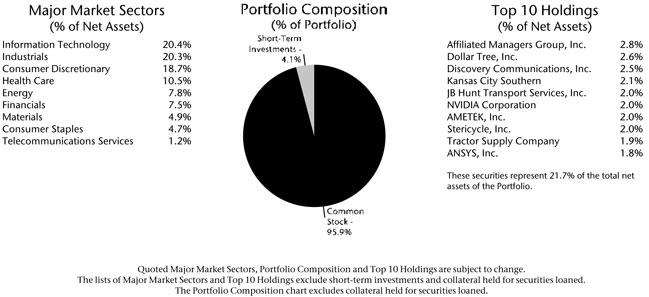

Thrivent Mid Cap Growth Portfolio

Andrea J. Thomas, CFA, Portfolio Manager

Thrivent Mid Cap Growth Portfolio seeks long-term growth of capital.

Mid-cap stocks offer the potential for long-term gains but can be subject to short-term price movements. Mid-sized company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

10

Table of Contents

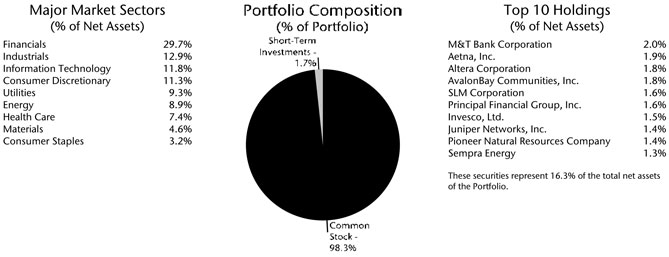

Thrivent Partner Mid Cap Value Portfolio

Subadvised by Goldman Sachs Asset Management, L.P.

Thrivent Partner Mid Cap Value Portfolio seeks to achieve long-term capital appreciation.

Mid-cap stocks offer the potential for long-term gains but can be subject to short-term price movements. Mid-sized company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

Thrivent Mid Cap Stock Portfolio

Brian J. Flanagan, CFA, Portfolio Manager

Thrivent Mid Cap Stock Portfolio seeks long-term capital growth.

Mid-cap stocks offer the potential for long-term gains but can be subject to short-term price movements. Mid-sized company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

11

Table of Contents

Thrivent Mid Cap Index Portfolio

Kevin R. Brimmer, FSA, Portfolio Manager

Thrivent Mid Cap Index Portfolio seeks total returns that track the performance of the S&P MidCap 400 Index.

Mid-cap stocks offer the potential for long term gains but can be subject to short term price movements. Mid-sized company stock prices are generally more volatile than large company stock prices. While the Portfolio attempts to closely track the S&P MidCap 400 Index, it does not duplicate the composition of the index. Individuals may not invest directly in any index. Index portfolios are subject to the same market risks associated with the stocks in their respective indexes. These and other risks are described in the Portfolio’s prospectus.

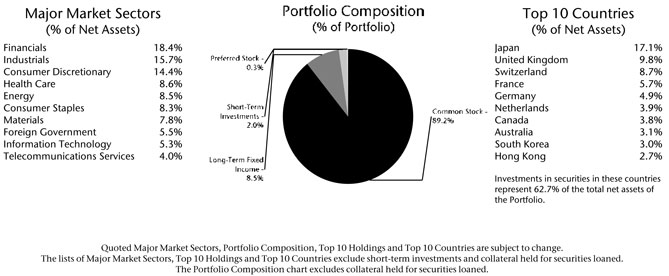

Thrivent Partner Worldwide Allocation Portfolio

Subadvised by Principal Global Investors, LLC, Mercator Asset Management, LP, Victory Capital Management Inc., Aberdeen Asset Managers Limited, Goldman Sachs Asset Management, L.P. and DuPont Capital Management Corporation

Thrivent Partner Worldwide Allocation Portfolio seeks long-term capital growth.

Foreign investments, as compared to domestic ones, involve additional risks, including currency fluctuations, different accounting standards, and greater political, economic and market instability. These risks are magnified when the Portfolio invests in emerging markets, which may be of relatively small size and less liquid than domestic markets. These and other risks are described in the Portfolio’s prospectus.

12

Table of Contents

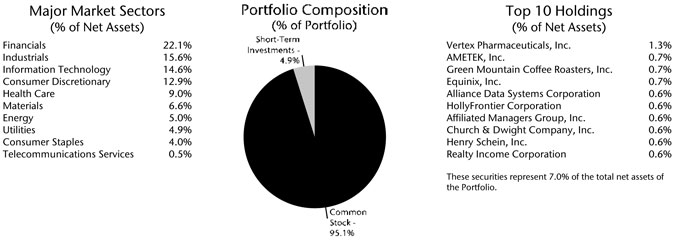

Thrivent Partner Socially Responsible Stock Portfolio

Subadvised by Calvert Investment Management, Inc. and Atlanta Capital Management, L.L.C.

Thrivent Partner Socially Responsible Stock Portfolio seeks long-term capital growth.

The Portfolio primarily invests in common stock. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment advisers. Medium-sized companies often have greater price volatility and less liquidity than larger companies. Large cap companies may be unable to respond quickly to new competitive challenges a may not be able to attain a high growth rate. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards.

As of August 16, 2013, the Portfolio has been merged into Thrivent Large Cap Stock Portfolio.

Thrivent Partner All Cap Growth Portfolio

Subadvised by Calamos Advisors LLC

Thrivent Partner All Cap Growth Portfolio seeks long-term capital growth.

The Portfolio primarily invests in equity securities issued by U.S. companies. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment advisers. Medium-sized companies often have greater price volatility and less liquidity than larger companies. Large cap companies may be unable to respond quickly to new competitive challenges a may not be able to attain a high growth rate.

As of August 16, 2013, the Portfolio has been merged into Thrivent Large Cap Stock Portfolio.

13

Table of Contents

Thrivent Partner All Cap Value Portfolio

Subadvised by OppenheimerFunds, Inc.

Thrivent Partner All Cap Value Portfolio seeks long-term capital growth.

The Portfolio primarily invests in equity securities. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment advisers. Small and medium-sized companies often have greater price volatility and less liquidity than larger companies. Large cap companies may be unable to respond quickly to new competitive challenges a may not be able to attain a high growth rate. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets.

As of August 16, 2013, the Portfolio has been merged into Thrivent Large Cap Stock Portfolio.

Thrivent Partner All Cap Portfolio

Subadvised by Pyramis Global Advisors, LLC, an affiliate of Fidelity Investments

Thrivent Partner All Cap Portfolio seeks long-term growth of capital.

Stocks are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

14

Table of Contents

Thrivent Large Cap Growth Portfolio

David C. Francis, CFA, Portfolio Manager

Thrivent Large Cap Growth Portfolio seeks long-term growth of capital.

Large-cap stocks are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

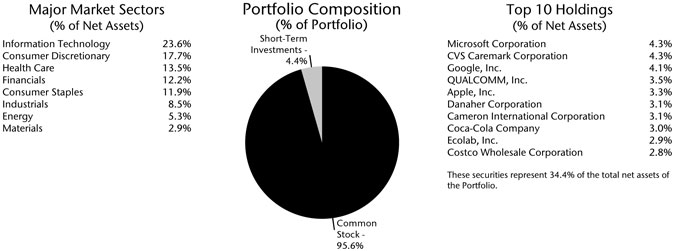

Thrivent Partner Growth Stock Portfolio

Subadvised by T. Rowe Price Associates, Inc.

Thrivent Partner Growth Stock Portfolio seeks long-term growth of capital and, secondarily, to increase dividend income.

Stocks, in general, are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

15

Table of Contents

Thrivent Large Cap Value Portfolio

Kurt J. Lauber, CFA, Portfolio Manager*

Thrivent Large Cap Value Portfolio seeks long-term growth of capital.

Large-cap stocks are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

* Effective March 2013, Kurt J. Lauber became the Portfolio Manager.

Thrivent Large Cap Stock Portfolio

David C. Francis, CFA and Kurt J. Lauber*, CFA, Portfolio Co-Managers

Thrivent Large Cap Stock Portfolio seeks long-term capital growth.

Large-cap stocks are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

* Effective March 2013, Kurt J. Lauber became a Portfolio Co-Manager.

16

Table of Contents

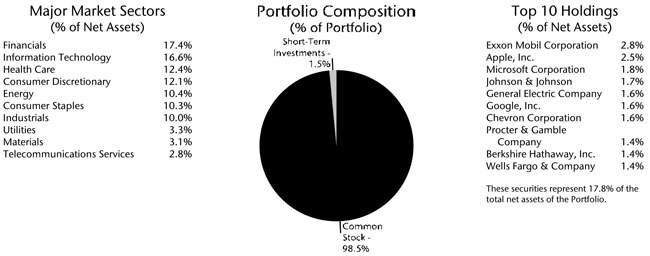

Thrivent Large Cap Index Portfolio

Kevin R. Brimmer, FSA, Portfolio Manager

Thrivent Large Cap Index Portfolio seeks total returns that track the performance of the S&P 500 Index.

Large-cap stocks are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. While the Portfolio attempts to closely track the S&P 500 Index, it does not exactly duplicate the composition of the index. Individuals may not invest directly in any index. Index portfolios are subject to the same market risks associated with the stocks in their respective indexes. These and other risks are described in the Portfolio’s prospectus.

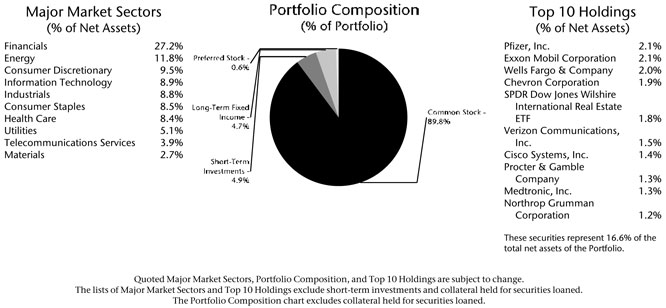

Thrivent Equity Income Plus Portfolio

David R. Spangler, CFA and Kevin R. Brimmer, FSA, Portfolio Co-Managers

Thrivent Equity Income Plus Portfolio seeks income plus long-term capital growth.

The Portfolio may invest in, among others, preferred stocks and foreign (including emerging market) stocks. These investments are subject to unique risks. The Portfolio may also sell covered options on any securities in which the Portfolio invests. Successful use of this strategy can augment portfolio return but can also magnify losses if executed incorrectly. These and other risks are described in the Portfolio’s prospectus. As of August 16, 2013, the Portfolio has become the Thrivent Growth and Income Plus Portfolio. The portfolio managers and some of the principal strategies and risks have also changed. Please see the Portfolio’s prospectus for more information.

17

Table of Contents

Kevin R. Brimmer, FSA and Michael G. Landreville, CFA and CPA (inactive), Portfolio Co-Managers

Thrivent Balanced Portfolio seeks long-term total return through a balance between income and the potential for long-term capital growth.

The Portfolio is subject to interest-rate risk, credit risk and volatility risk, which may result in overall price fluctuations over short or even extended time periods. Stocks are subject to the basic market risk that a particular security, or securities in general, may decrease in value over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus. As of August 16, 2013, the Portfolio has become Thrivent Balanced Income Plus Portfolio. The portfolio managers, some of the principal strategies and risks, and the investment advisory fee have also changed. Please see the Portfolio’s prospectus for more information.

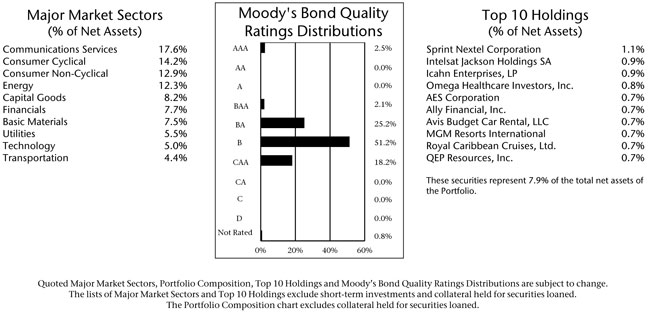

Paul J. Ocenasek, CFA, Portfolio Manager

Thrivent High Yield Portfolio seeks to achieve a higher level of income. The Portfolio will also consider growth of capital as a secondary objective.

The Portfolio typically invests a majority of its assets in high-yield bonds (commonly referred to as junk bonds). Although high-yield bonds typically have a higher current yield than investment-grade bonds, high-yield bonds are also subject to greater price fluctuations and increased risk of loss of principal than investment-grade bonds. The Portfolio is subject to interest-rate risk, credit risk and volatility risk, which may result in overall price fluctuations over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

18

Table of Contents

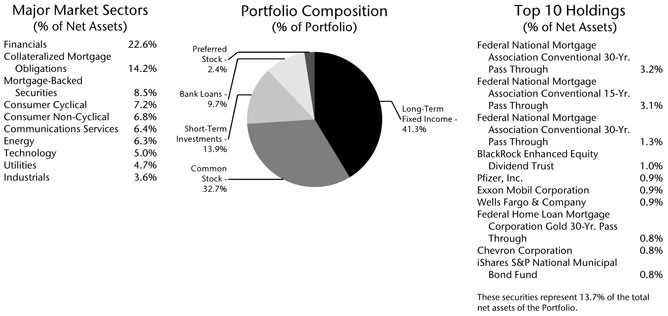

Thrivent Diversified Income Plus Portfolio

Mark L. Simenstad, CFA, David R. Spangler, CFA and Paul J. Ocenasek, CFA, Portfolio Co-Managers

Thrivent Diversified Income Plus Portfolio seeks to maximize income while maintaining prospects for capital appreciation.

The Portfolio may invest in debt or equity securities. Debt securities include high-yield, high-risk securities commonly known as “junk bonds.” High-yield securities are subject to greater price fluctuations and increased risk of loss of principal than investment grade bonds. Debt securities also include mortgage-related and other asset-backed securities, the value of which will be influenced by factors affecting the housing market and the assets underlying such securities. The Portfolio is subject to interest-rate risk, credit risk and volatility risk, which may result in overall price fluctuations over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

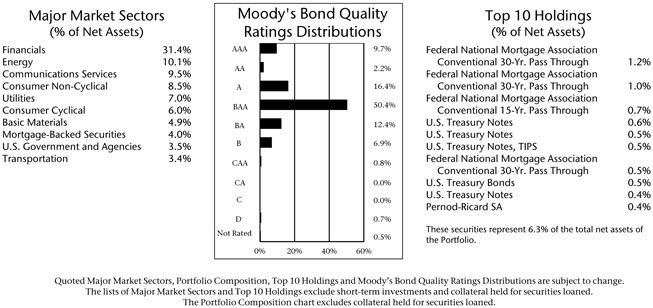

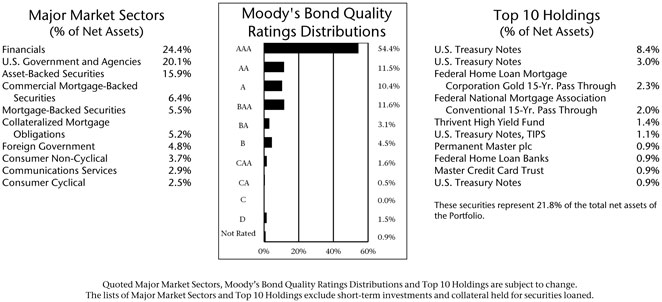

Stephen D. Lowe, CFA, Portfolio Manager

Thrivent Income Portfolio seeks a high level of income over the longer term while providing reasonable safety of capital.

The Portfolio is subject to interest rate risk, credit risk related to a company’s underlying financial position and volatility risk, which may result in overall price fluctuations over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

19

Table of Contents

Michael G. Landreville, CFA and CPA (inactive), Portfolio Manager

Thrivent Bond Index Portfolio strives for investment results similar to the total return of the Barclays Capital U.S. Aggregate Bond Index.

The Portfolio is subject to interest rate risk, credit risk related to a company’s underlying financial position, and prepayment and extension risk. While the Portfolio attempts to closely track the Barclays Capital U.S. Aggregate Bond Index, it does not duplicate the composition of the Index. Individuals may not invest directly in any index. Index portfolios are subject to the same market risks associated with the securities in their respective indexes. These and other risks are described in the Portfolio’s prospectus.

Thrivent Limited Maturity Bond Portfolio

Michael G. Landreville, CFA and CPA (inactive) and Gregory R. Anderson, CFA, Portfolio Co-Managers

Thrivent Limited Maturity Bond Portfolio seeks a high level of current income with stability of principal.

The Portfolio is subject to interest rate risk, credit risk related to a company’s underlying financial position and volatility risk, which may result in overall price fluctuations over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

20

Table of Contents

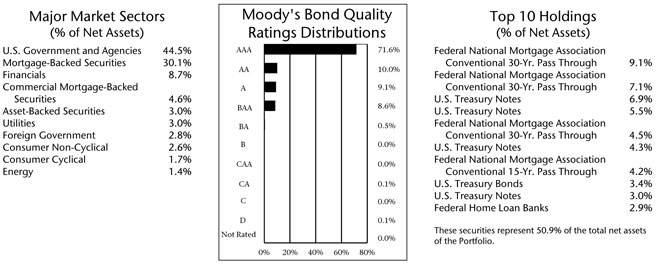

Thrivent Mortgage Securities Portfolio

Gregory R. Anderson, CFA and Scott A. Lalim, Portfolio Co-Managers

Thrivent Mortgage Securities Portfolio seeks a combination of current income and long-term capital appreciation.

The risks presented by mortgage securities include, but are not limited to, reinvestment of prepaid principal at lower rates of return. The real estate industry — and therefore, the performance of the Portfolio — is highly sensitive to economic conditions. In addition, the value of mortgage securities may fluctuate in response to changes in interest rates. The Portfolio is subject to interest-rate risk, credit risk and volatility risk, which may result in overall price fluctuations over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus. As of August 16, 2013, the Portfolio has become Thrivent Opportunity Income Plus Portfolio. The portfolio managers and some of the principal strategies and risks have also changed. Please see the Portfolio’s prospectus for more information.

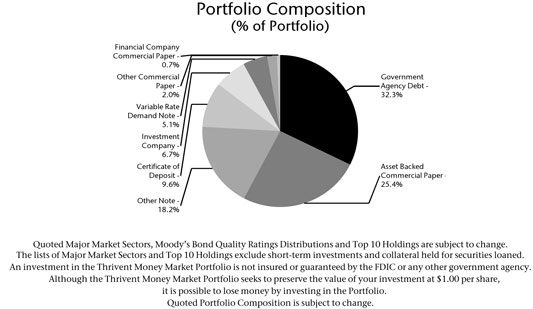

Thrivent Money Market Portfolio

William D. Stouten, Portfolio Manager

Thrivent Money Market Portfolio seeks to achieve the maximum current income that is consistent with stability of capital and maintenance of liquidity.

The principal risk of investing in the Portfolio is current income risk — that is, the income the Portfolio receives may fall as a result of a decline in interest rates. The Portfolio is subject to interest-rate risk and credit risk, which may result in overall price fluctuations over short or even extended time periods. These and other risks are described in the Portfolio’s prospectus.

21

Table of Contents

(unaudited)

As a shareholder of the Thrivent Series Fund, Inc., you incur ongoing costs, including management fees and other Portfolio expenses. This Shareholder Expense Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2013 through June 28, 2013. Shares in a Portfolio are currently sold, without sales charges, only to separate accounts of Thrivent Financial for Lutherans and Thrivent Life Insurance Company, which are used to fund benefits of variable life insurance and variable annuity contracts issued by Thrivent Financial for Lutherans and Thrivent Life Insurance Company, and retirement plans sponsored by Thrivent Financial for Lutherans. Expenses associated with these variable contracts and retirement plans are not included in these examples and had these costs been included, your costs would have been higher.

Actual Expenses

In the table below, the first section, labeled “Actual,” provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid.

Hypothetical Example for Comparison Purposes

In the table below, the second section, labeled “Hypothetical,” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| Beginning Account Value 1/1/2013 | Ending Account Value 6/28/2013 | Expenses Paid During Period 1/1/2013 - 6/28/2013* | Annualized Expense Ratio | |||||||||||||

Thrivent Aggressive Allocation Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 1,088 | $ | 2.26 | 0.44 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.19 | 0.44 | % | ||||||||

Thrivent Moderately Aggressive Allocation Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 1,071 | $ | 1.58 | 0.31 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,023 | $ | 1.54 | 0.31 | % | ||||||||

Thrivent Moderate Allocation Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 1,047 | $ | 1.39 | 0.28 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,023 | $ | 1.37 | 0.28 | % | ||||||||

Thrivent Moderately Conservative Allocation Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 1,023 | $ | 1.34 | 0.27 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,023 | $ | 1.34 | 0.27 | % | ||||||||

Thrivent Partner Technology Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 1,036 | $ | 5.55 | 1.11 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,019 | $ | 5.50 | 1.11 | % | ||||||||

Thrivent Partner Healthcare Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 1,136 | $ | 6.55 | 1.25 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,018 | $ | 6.19 | 1.25 | % | ||||||||

Thrivent Natural Resources Portfolio | ||||||||||||||||

Actual | $ | 1,000 | $ | 998 | $ | 5.00 | 1.02 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 5.05 | 1.02 | % | ||||||||

22

Table of Contents

| Beginning Account Value 1/1/2013 | Ending Account Value 6/28/2013 | Expenses Paid During Period 1/1/2013 - 6/28/2013* | Annualized Expense Ratio | |||||||||||||

Thrivent Partner Emerging Markets Equity Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 913 | $ | 6.57 | 1.40 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,018 | $ | 6.93 | 1.40 | % | ||||||||

Thrivent Real Estate Securities Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,058 | $ | 4.67 | 0.93 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.58 | 0.93 | % | ||||||||

Thrivent Partner Small Cap Growth Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,146 | $ | 5.17 | 0.98 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.87 | 0.98 | % | ||||||||

Thrivent Partner Small Cap Value Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,146 | $ | 4.57 | 0.87 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.30 | 0.87 | % | ||||||||

Thrivent Small Cap Stock Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,146 | $ | 3.98 | 0.76 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.75 | 0.76 | % | ||||||||

Thrivent Small Cap Index Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,160 | $ | 2.35 | 0.44 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.20 | 0.44 | % | ||||||||

Thrivent Mid Cap Growth Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,077 | $ | 2.36 | 0.46 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.30 | 0.46 | % | ||||||||

Thrivent Partner Mid Cap Value Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,154 | $ | 4.16 | 0.79 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.90 | 0.79 | % | ||||||||

Thrivent Mid Cap Stock Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,135 | $ | 3.77 | 0.72 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.57 | 0.72 | % | ||||||||

Thrivent Mid Cap Index Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,144 | $ | 2.70 | 0.51 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.55 | 0.51 | % | ||||||||

Thrivent Partner Worldwide Allocation Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,005 | $ | 4.46 | 0.91 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.49 | 0.91 | % | ||||||||

Thrivent Partner Socially Responsible Stock Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,099 | $ | 5.04 | 0.98 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.85 | 0.98 | % | ||||||||

Thrivent Partner All Cap Growth Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,058 | $ | 5.05 | 1.00 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.95 | 1.00 | % | ||||||||

Thrivent Partner All Cap Value Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,102 | $ | 5.05 | 0.98 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.85 | 0.98 | % | ||||||||

Thrivent Partner All Cap Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,120 | $ | 5.31 | 1.02 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 5.06 | 1.02 | % | ||||||||

Thrivent Large Cap Growth Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,094 | $ | 2.29 | 0.45 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.21 | 0.45 | % | ||||||||

23

Table of Contents

| Beginning Account Value 1/1/2013 | Ending Account Value 6/28/2013 | Expenses Paid During Period 1/1/2013 - 6/28/2013* | Annualized Expense Ratio | |||||||||||||

Thrivent Partner Growth Stock Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,109 | $ | 4.93 | 0.95 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,020 | $ | 4.73 | 0.95 | % | ||||||||

Thrivent Large Cap Value Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,158 | $ | 3.40 | 0.64 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.18 | 0.64 | % | ||||||||

Thrivent Large Cap Stock Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,109 | $ | 3.51 | 0.68 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.36 | 0.68 | % | ||||||||

Thrivent Large Cap Index Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,136 | $ | 2.14 | 0.41 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,023 | $ | 2.03 | 0.41 | % | ||||||||

Thrivent Equity Income Plus Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,106 | $ | 4.11 | 0.80 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.94 | 0.80 | % | ||||||||

Thrivent Balanced Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,080 | $ | 2.32 | 0.45 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.25 | 0.45 | % | ||||||||

Thrivent High Yield Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,010 | $ | 2.20 | 0.45 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.21 | 0.45 | % | ||||||||

Thrivent Diversified Income Plus Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,053 | $ | 2.48 | 0.49 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.44 | 0.49 | % | ||||||||

Thrivent Income Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 976 | $ | 2.13 | 0.44 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.18 | 0.44 | % | ||||||||

Thrivent Bond Index Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 974 | $ | 2.25 | 0.46 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.30 | 0.46 | % | ||||||||

Thrivent Limited Maturity Bond Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 996 | $ | 2.14 | 0.44 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,022 | $ | 2.16 | 0.44 | % | ||||||||

Thrivent Mortgage Securities Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 977 | $ | 3.83 | 0.79 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,021 | $ | 3.92 | 0.79 | % | ||||||||

Thrivent Money Market Portfolio |

| |||||||||||||||

Actual | $ | 1,000 | $ | 1,000 | $ | 1.13 | 0.23 | % | ||||||||

Hypothetical** | $ | 1,000 | $ | 1,023 | $ | 1.15 | 0.23 | % | ||||||||

| * | Expenses are equal to the Portfolio’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 179/365 to reflect the one-half year period. |

| ** | Assuming 5% annualized total return before expenses. |

24

Table of Contents

Aggressive Allocation Portfolio

Schedule of Investments as of June 28, 2013

(unaudited)

Shares | Mutual Funds (52.5%) | Value | ||||||

| Equity Mutual Funds (50.3%) | |||||||

| 3,574,409 | Thrivent Partner Small Cap Growth Portfolioa | $ | 55,607,432 | |||||

| 689,344 | Thrivent Partner Small Cap Value Portfolio | 16,334,770 | ||||||

| 1,714,586 | Thrivent Small Cap Stock Portfolio | 25,685,008 | ||||||

| 1,466,458 | Thrivent Partner Mid Cap Value Portfolio | 23,516,117 | ||||||

| 2,511,818 | Thrivent Mid Cap Stock Portfolio | 37,154,567 | ||||||

| 11,257,943 | Thrivent Partner Worldwide Allocation Portfolio | 97,472,397 | ||||||

| 2,773,409 | Thrivent Large Cap Value Portfolio | 37,965,201 | ||||||

| 3,128,201 | Thrivent Large Cap Stock Portfolio | 31,612,975 | ||||||

| 550,683 | Thrivent Equity Income Plus Portfolio | 5,857,557 | ||||||

|

| |||||||

| Total | 331,206,024 | |||||||

|

| |||||||

| Fixed Income Mutual Funds (2.2%) | |||||||

| 1,775,744 | Thrivent High Yield Portfolio | 8,780,878 | ||||||

| 573,155 | Thrivent Income Portfolio | 5,904,299 | ||||||

|

| |||||||

| Total | 14,685,177 | |||||||

|

| |||||||

| Total Mutual Funds (cost $346,587,081) | 345,891,201 | |||||||

|

| |||||||

Common Stock (40.8%) | ||||||||

| Consumer Discretionary (6.6%) | |||||||

| 20,842 | Abercrombie & Fitch Company | 943,101 | ||||||

| 7,956 | Amazon.com, Inc.a,b | 2,209,302 | ||||||

| 4,150 | AutoZone, Inc.a | 1,758,314 | ||||||

| 20,830 | CBS Corporation | 1,017,962 | ||||||

| 5,500 | Charter Communications, Inc.a | 681,175 | ||||||

| 25,920 | Cheesecake Factory, Inc. | 1,085,789 | ||||||

| 13,500 | Chico’s FAS, Inc. | 230,310 | ||||||

| 84,898 | Comcast Corporationb | 3,555,528 | ||||||

| 2,700 | Conn’s, Inc.a | 139,752 | ||||||

| 977 | CST Brands, Inc.a | 30,101 | ||||||

| 3,700 | Dana Holding Corporation | 71,262 | ||||||

| 4,350 | Darden Restaurants, Inc. | 219,588 | ||||||

| 10,329 | Delphi Automotive plc | 523,577 | ||||||

| 2,900 | DeVry, Inc. | 89,958 | ||||||

| 16,449 | Discovery Communications, Inc.a | 1,270,027 | ||||||

| 7,900 | DISH Network Corporation | 335,908 | ||||||

| 25,918 | Dollar Tree, Inc.a | 1,317,671 | ||||||

| 2,845 | Finish Line, Inc. | 62,192 | ||||||

| 34,565 | Foot Locker, Inc. | 1,214,268 | ||||||

| 13,100 | Gap, Inc. | 546,663 | ||||||

| 28,470 | GNC Holdings, Inc. | 1,258,659 | ||||||

| 2,100 | Grand Canyon Education, Inc.a | 67,683 | ||||||

| 2,470 | Harley-Davidson, Inc. | 135,405 | ||||||

| 7,414 | Hasbro, Inc. | 332,370 | ||||||

| 24,800 | Home Depot, Inc.b | 1,921,256 | ||||||

| 11,000 | Hovnanian Enterprises, Inc.a | 61,710 | ||||||

| 3,100 | iShares Dow Jones US Home Construction Index Fund | 69,378 | ||||||

| 16,319 | L Brands, Inc. | 803,711 | ||||||

| 34,660 | Las Vegas Sands Corporation | 1,834,554 | ||||||

| 5,996 | LifeLock, Inc.a | 70,213 | ||||||

| 24,520 | Lowe’s Companies, Inc. | 1,002,868 | ||||||

| 2,363 | M/I Homes, Inc.a | 54,254 | ||||||

| 8,700 | Macy’s, Inc. | 417,600 | ||||||

| 11,600 | Marriott International, Inc. | 468,292 | ||||||

| 2,800 | Marriott Vacations Worldwide Corporationa | 121,072 | ||||||

| 10,462 | MDC Partners, Inc. | 188,734 | ||||||

| 27,050 | Meredith Corporation | 1,290,285 | ||||||

| 3,700 | Michael Kors Holdings, Ltd.a | 229,474 | ||||||

| 300 | Netflix, Inc.a | 63,327 | ||||||

| 9,300 | New York Times Companya | 102,858 | ||||||

| 17,660 | News Corporation | 579,601 | ||||||

| 25,580 | Nexstar Broadcasting Group, Inc. | 907,067 | ||||||

| 42,200 | NIKE, Inc. | 2,687,296 | ||||||

| 5,400 | Omnicom Group, Inc. | 339,498 | ||||||

| 4,268 | O’Reilly Automotive, Inc.a | 480,662 | ||||||

| 14,670 | Papa John’s International, Inc.a | 958,978 | ||||||

| 5,000 | Penn National Gaming, Inc.a | 264,300 | ||||||

| 6,192 | PetSmart, Inc. | 414,802 | ||||||

| 57,768 | Pier 1 Imports, Inc. | 1,356,970 | ||||||

| 8,400 | Pulte Group, Inc.a | 159,348 | ||||||

| 5,100 | Ross Stores, Inc. | 330,531 | ||||||

| 40,700 | Sally Beauty Holdings, Inc.a | 1,265,770 | ||||||

| 25,100 | Sirius XM Radio, Inc. | 84,085 | ||||||

| 35,000 | Smith & Wesson Holding Corporationa | 349,300 | ||||||

| 2,881 | Stage Stores, Inc. | 67,704 | ||||||

| 19,800 | Standard Pacific Corporationa | 164,934 | ||||||

| 5,900 | Staples, Inc. | 93,574 | ||||||

| 1,800 | Sturm, Ruger & Company, Inc. | 86,472 | ||||||

| 1,900 | Target Corporation | 130,834 | ||||||

| 6,000 | Tempur-Pedic International, Inc.a | 263,400 | ||||||

| 5,080 | Time Warner Cable, Inc. | 571,398 | ||||||

| 6,100 | TJX Companies, Inc. | 305,366 | ||||||

| 30,200 | Toll Brothers, Inc.a | 985,426 | ||||||

| 8,273 | Tractor Supply Company | 972,988 | ||||||

| 6,300 | Under Armour, Inc.a | 376,173 | ||||||

| 2,000 | Urban Outfitters, Inc.a | 80,440 | ||||||

| 3,900 | Valassis Communications, Inc. | 95,901 | ||||||

| 5,600 | Vera Bradley, Inc.a | 121,296 | ||||||

| 1,026 | VF Corporation | 198,080 | ||||||

| 5,200 | Wynn Resorts, Ltd. | 665,600 | ||||||

|

| |||||||

| Total | 43,153,945 | |||||||

|

| |||||||

| Consumer Staples (2.6%) | |||||||

| 17,700 | Altria Group, Inc. | 619,323 | ||||||

| 1,230 | Andersons, Inc. | 65,424 | ||||||

| 18,783 | Annie’s, Inc.a | 802,785 | ||||||

| 15,100 | Archer-Daniels-Midland Company | 512,041 | ||||||

| 3,400 | Avon Products, Inc. | 71,502 | ||||||

| 13,217 | British American Tobacco plc ADR | 1,360,558 | ||||||

| 6,900 | Bunge, Ltd. | 488,313 | ||||||

| 7,900 | Campbell Soup Company | 353,841 | ||||||

| 6,239 | Clorox Company | 518,711 | ||||||

| 9,500 | Colgate-Palmolive Company | 544,255 | ||||||

| 23,000 | CVS Caremark Corporation | 1,315,140 | ||||||

| 2,441 | Energizer Holdings, Inc. | 245,345 | ||||||

| 8,700 | Hain Celestial Group, Inc.a | 565,239 | ||||||

| 28,183 | Ingredion, Inc. | 1,849,368 | ||||||

| 3,200 | Kimberly-Clark Corporation | 310,848 | ||||||

| 4,723 | Kraft Foods Group, Inc. | 263,874 | ||||||

The accompanying Notes to Financial Statements are an integral part of this schedule.

25

Table of Contents

Aggressive Allocation Portfolio

Schedule of Investments as of June 28, 2013

(unaudited)

| Shares | Common Stock (40.8%) | Value | ||||||

| Consumer Staples (2.6%) - continued | |||||||

| 15,300 | Kroger Company | $ | 528,462 | |||||

| 13,970 | Mondelez International, Inc. | 398,564 | ||||||

| 10,700 | Monster Beverage Corporationa | 650,239 | ||||||

| 22,300 | Nestle SA | 1,463,335 | ||||||

| 3,591 | Philip Morris International, Inc. | 311,052 | ||||||

| 28,500 | Procter & Gamble Company | 2,194,215 | ||||||

| 5,500 | Safeway, Inc. | 130,130 | ||||||

| 11,500 | Tyson Foods, Inc. | 295,320 | ||||||

| 5,700 | Wal-Mart Stores, Inc. | 424,593 | ||||||

| 17,114 | Whole Foods Market, Inc. | 881,029 | ||||||

|

| |||||||

| Total | 17,163,506 | |||||||

|

| |||||||

| Energy (4.7%) | |||||||

| 131,391 | Alpha Natural Resources, Inc.a | 688,489 | ||||||

| 30,639 | BP plc ADR | 1,278,872 | ||||||

| 10,200 | Cameron International Corporationa | 623,832 | ||||||

| 11,020 | Chevron Corporation | 1,304,107 | ||||||

| 10,300 | Cobalt International Energy, Inc.a | 273,671 | ||||||

| 14,398 | Concho Resources, Inc.a | 1,205,401 | ||||||

| 41,400 | Consol Energy, Inc. | 1,121,940 | ||||||

| 5,300 | Delek US Holdings, Inc. | 152,534 | ||||||

| 6,900 | Dril-Quip, Inc.a | 623,001 | ||||||

| 4,000 | Ensco plc | 232,480 | ||||||

| 12,483 | EOG Resources, Inc. | 1,643,761 | ||||||

| 14,400 | EQT Corporation | 1,142,928 | ||||||

| 17,600 | Exxon Mobil Corporation | 1,590,160 | ||||||

| 7,400 | Helmerich & Payne, Inc. | 462,130 | ||||||

| 8,500 | HollyFrontier Corporation | 363,630 | ||||||

| 95,018 | Marathon Oil Corporation | 3,285,722 | ||||||

| 6,000 | Marathon Petroleum Corporation | 426,360 | ||||||

| 11,100 | National Oilwell Varco, Inc. | 764,790 | ||||||

| 31,100 | Oasis Petroleum, Inc.a | 1,208,857 | ||||||

| 4,800 | Occidental Petroleum Corporation | 428,304 | ||||||

| 2,800 | Oil States International, Inc.a | 259,392 | ||||||

| 56,400 | Patterson-UTI Energy, Inc. | 1,091,622 | ||||||

| 32,379 | Peabody Energy Corporation | 474,028 | ||||||

| 16,800 | Petroleo Brasileiro SA ADR | 225,456 | ||||||

| 4,800 | Range Resources Corporation | 371,136 | ||||||

| 48,350 | Rex Energy Corporationa | 849,993 | ||||||

| 43,570 | Schlumberger, Ltd. | 3,122,226 | ||||||

| 15,400 | SM Energy Company | 923,692 | ||||||

| 21,200 | Southwestern Energy Companya | 774,436 | ||||||

| 2,400 | Tesoro Corporation | 125,568 | ||||||

| 13,800 | Ultra Petroleum Corporationa | 273,516 | ||||||

| 8,800 | Valero Energy Corporation | 305,976 | ||||||

| 242,118 | Weatherford International, Ltd.a | 3,317,017 | ||||||

| 5,900 | Western Refining, Inc. | 165,613 | ||||||

|

| |||||||

| Total | 31,100,640 | |||||||

|

| |||||||

| Financials (6.8%) | |||||||

| 9,330 | ACE, Ltd. | 834,848 | ||||||

| 17,402 | Affiliated Managers Group, Inc.a | 2,852,884 | ||||||

| 3,700 | Allied World Assurance Company Holdings AG | 338,587 | ||||||

| 6,390 | Allstate Corporation | 307,487 | ||||||

| 9,500 | American Assets Trust, Inc. | 293,170 | ||||||

| 5,100 | American Capital, Ltd.a | 64,617 | ||||||

| 8,800 | Ameriprise Financial, Inc. | 711,744 | ||||||

| 29,700 | Annaly Capital Management, Inc. | 373,329 | ||||||

| 7,000 | Aspen Insurance Holdings, Ltd. | 259,630 | ||||||

| 6,100 | Axis Capital Holdings, Ltd. | 279,258 | ||||||

| 81,620 | Bank of America Corporation | 1,049,633 | ||||||

| 3,700 | Banner Corporation | 125,023 | ||||||

| 11,077 | BGC Partners, Inc. | 65,243 | ||||||

| 4,405 | Boston Properties, Inc. | 464,595 | ||||||

| 16,700 | CapitalSource, Inc. | 156,646 | ||||||

| 15,800 | CBL & Associates Properties, Inc. | 338,436 | ||||||

| 46,171 | Citigroup, Inc. | 2,214,823 | ||||||

| 1,872 | CNA Financial Corporation | 61,065 | ||||||

| 10,890 | Colonial Properties Trust | 262,667 | ||||||

| 3,500 | Comerica, Inc. | 139,405 | ||||||

| 39,900 | DCT Industrial Trust, Inc. | 285,285 | ||||||

| 13,782 | Discover Financial Services | 656,574 | ||||||

| 7,689 | Equity Residential | 446,423 | ||||||

| 5,800 | Extra Space Storage, Inc. | 243,194 | ||||||

| 29,700 | Fifth Third Bancorp | 536,085 | ||||||

| 18,100 | First Republic Bank | 696,488 | ||||||

| 22,627 | HCC Insurance Holdings, Inc. | 975,450 | ||||||

| 3,254 | Health Care REIT, Inc. | 218,116 | ||||||

| 5,900 | Home Loan Servicing Solutions, Ltd. | 141,423 | ||||||

| 17,648 | Host Hotels & Resorts, Inc. | 297,722 | ||||||

| 51,200 | Huntington Bancshares, Inc. | 403,456 | ||||||

| 16,130 | Invesco, Ltd. | 512,934 | ||||||

| 28,080 | iShares Russell 2000 Index Fund | 2,728,253 | ||||||

| 600 | iShares Russell 3000 Index Fund | 57,840 | ||||||

| 27,523 | J.P. Morgan Chase & Company | 1,452,939 | ||||||

| 13,000 | Janus Capital Group, Inc. | 110,630 | ||||||

| 20,579 | Kimco Realty Corporation | 441,008 | ||||||

| 8,731 | Lazard, Ltd. | 280,702 | ||||||

| 7,000 | Leucadia National Corporation | 183,540 | ||||||

| 2,700 | M&T Bank Corporation | 301,725 | ||||||

| 2,500 | MasterCard, Inc. | 1,436,250 | ||||||

| 20,130 | MetLife, Inc. | 921,149 | ||||||

| 4,400 | Montpelier Re Holdings, Inc. | 110,044 | ||||||

| 21,990 | Morgan Stanley | 537,216 | ||||||

| 11,800 | NASDAQ OMX Group, Inc. | 386,922 | ||||||

| 6,300 | Northern Trust Corporation | 364,770 | ||||||

| 11,100 | Pebblebrook Hotel Trust | 286,935 | ||||||

| 13,600 | Piedmont Office Realty Trust, Inc. | 243,168 | ||||||

| 58,251 | Popular, Inc.a | 1,766,753 | ||||||

| 900 | Portfolio Recovery Associates, Inc.a | 138,267 | ||||||

| 4,800 | ProAssurance Corporation | 250,368 | ||||||

| 3,000 | Progressive Corporation | 76,260 | ||||||

| 6,800 | Protective Life Corporation | 261,188 | ||||||

| 2,753 | Public Storage, Inc. | 422,117 | ||||||

| 3,310 | Simon Property Group, Inc. | 522,715 | ||||||

| 10,900 | SLM Corporation | 249,174 | ||||||

| 4,900 | SPDR Gold Trusta | 583,835 | ||||||

| 21,200 | SPDR S&P 500 ETF Trust | 3,392,212 | ||||||

| 7,280 | State Street Corporation | 474,729 | ||||||

| 2,136 | Stewart Information Services Corporation | 55,942 | ||||||

| 22,390 | SVB Financial Groupa | 1,865,535 | ||||||

| 7,400 | T. Rowe Price Group, Inc. | 541,310 | ||||||

| 3,325 | Taubman Centers, Inc. | 249,874 | ||||||

| 7,300 | TCF Financial Corporation | 103,514 | ||||||

| 20,340 | Terreno Realty Corporation | 376,900 | ||||||

| 12,349 | Tower Group International, Ltd. | 253,278 | ||||||

The accompanying Notes to Financial Statements are an integral part of this schedule.

26

Table of Contents

Aggressive Allocation Portfolio

Schedule of Investments as of June 28, 2013

(unaudited)

| Shares | Common Stock (40.8%) | Value | ||||||

| Financials (6.8%) - continued |

| ||||||

| 11,100 | Visa, Inc. | $ | 2,028,525 | |||||

| 4,397 | Vornado Realty Trust | 364,291 | ||||||

| 7,486 | W.R. Berkley Corporation | 305,878 | ||||||

| 52,062 | Wells Fargo & Companyb | 2,148,599 | ||||||

| 67,815 | Zions Bancorporation | 1,958,497 | ||||||

|

| |||||||

| Total | 44,839,092 | |||||||

|

| |||||||

| Health Care (4.5%) | |||||||

| 2,300 | Abbott Laboratories | 80,224 | ||||||

| 3,679 | Actavis, Inc.a | 464,363 | ||||||

| 28,200 | Akorn, Inc.a | 381,264 | ||||||

| 24,400 | Align Technology, Inc.a | 903,776 | ||||||

| 23,600 | Allscripts Healthcare Solutions, Inc.a | 305,384 | ||||||

| 10,292 | AmerisourceBergen Corporation | 574,602 | ||||||

| 6,000 | Amgen, Inc. | 591,960 | ||||||

| 14,200 | Astex Pharmaceuticals, Inc.a | 58,362 | ||||||

| 6,910 | Baxter International, Inc. | 478,656 | ||||||

| 1,200 | Biogen Idec, Inc.a | 258,240 | ||||||

| 11,300 | BioMarin Pharmaceutical, Inc.a | 630,427 | ||||||

| 2,200 | Bio-Reference Laboratories, Inc.a | 63,250 | ||||||

| 2,358 | C.R. Bard, Inc. | 256,267 | ||||||

| 6,936 | Catamaran Corporationa | 337,922 | ||||||

| 4,900 | Celgene Corporationa | 572,859 | ||||||

| 6,030 | CIGNA Corporation | 437,115 | ||||||

| 8,000 | Community Health Systems, Inc. | 375,040 | ||||||

| 36,010 | Covidien plc | 2,262,868 | ||||||

| 5,200 | Eli Lilly and Company | 255,424 | ||||||

| 3,622 | ExamWorks Group, Inc.a | 76,895 | ||||||

| 43,200 | Express Scripts Holding Companya | 2,665,008 | ||||||

| 77,600 | Gilead Sciences, Inc.a | 3,973,896 | ||||||

| 9,626 | HeartWare International, Inc.a | 915,529 | ||||||

| 30,851 | Hologic, Inc.a | 595,424 | ||||||

| 5,000 | Illumina, Inc.a | 374,200 | ||||||

| 8,500 | Medicines Companya | 261,460 | ||||||

| 31,480 | Merck & Company, Inc. | 1,462,246 | ||||||

| 3,754 | Mettler-Toledo International, Inc.a | 755,305 | ||||||

| 15,600 | Neurocrine Biosciences, Inc.a | 208,728 | ||||||

| 8,435 | NuVasive, Inc.a | 209,104 | ||||||

| 5,383 | Onyx Pharmaceuticals, Inc.a | 467,352 | ||||||

| 3,000 | PAREXEL International Corporationa | 137,820 | ||||||

| 13,786 | PDL BioPharma, Inc. | 106,428 | ||||||

| 7,300 | Perrigo Company | 883,300 | ||||||

| 2,800 | Pfizer, Inc. | 78,428 | ||||||

| 2,500 | Questcor Pharmaceuticals, Inc. | 113,650 | ||||||

| 13,200 | ResMed, Inc. | 595,716 | ||||||

| 17,080 | Sanofi ADR | 879,791 | ||||||

| 3,100 | Santarus, Inc.a | 65,255 | ||||||

| 6,700 | Seattle Genetics, Inc.a | 210,782 | ||||||

| 21,100 | Shire Pharmaceuticals Group plc ADR | 2,006,821 | ||||||

| 13,276 | Spectrum Pharmaceuticals, Inc. | 99,039 | ||||||

| 27,800 | Thoratec Corporationa | 870,418 | ||||||

| 4,900 | United Therapeutics Corporationa | 322,518 | ||||||

| 14,963 | UnitedHealth Group, Inc. | 979,777 | ||||||

| 4,600 | Vertex Pharmaceuticals, Inc.a | 367,402 | ||||||

| 2,200 | Waters Corporationa | 220,110 | ||||||

| 9,858 | Zimmer Holdings, Inc. | 738,759 | ||||||

|

| |||||||

| Total | 29,929,164 | |||||||

|

| |||||||

| Industrials (5.6%) | |||||||

| 29,840 | Actuant Corporation | 983,825 | ||||||

| 15,600 | Acuity Brands, Inc. | 1,178,112 | ||||||

| 17,150 | ADT Corporationa | 683,427 | ||||||

| 1,200 | AGCO Corporation | 60,228 | ||||||

| 23,340 | AMETEK, Inc. | 987,282 | ||||||

| 9,796 | B/E Aerospace, Inc.a | 617,932 | ||||||

| 2,757 | Briggs & Stratton Corporation | 54,588 | ||||||

| 25,255 | CSX Corporation | 585,663 | ||||||

| 3,700 | Deluxe Corporation | 128,205 | ||||||

| 26,500 | DigitalGlobe, Inc.a | 821,765 | ||||||

| 33,424 | EMCOR Group, Inc. | 1,358,686 | ||||||

| 2,900 | EnerSys, Inc. | 142,216 | ||||||

| 15,400 | Expeditors International of Washington, Inc. | 585,354 | ||||||

| 14,481 | Flowserve Corporation | 782,119 | ||||||

| 14,300 | Fortune Brands Home and Security, Inc. | 553,982 | ||||||

| 11,600 | Foster Wheeler AGa | 251,836 | ||||||

| 29,000 | GATX Corporation | 1,375,470 | ||||||

| 18,620 | General Electric Company | 431,798 | ||||||

| 7,800 | Graco, Inc. | 493,038 | ||||||

| 33,800 | HNI Corporation | 1,219,166 | ||||||

| 35,265 | Honeywell International, Inc. | 2,797,925 | ||||||

| 1,200 | Huntington Ingalls Industries, Inc. | 67,776 | ||||||

| 14,500 | Ingersoll-Rand plc | 805,040 | ||||||

| 52,820 | Jacobs Engineering Group, Inc.a | 2,911,967 | ||||||

| 14,180 | JB Hunt Transport Services, Inc. | 1,024,363 | ||||||

| 26,900 | JetBlue Airways Corporationa | 169,470 | ||||||

| 9,818 | Kansas City Southern | 1,040,315 | ||||||

| 18,300 | Landstar System, Inc. | 942,450 | ||||||

| 2,500 | Lockheed Martin Corporation | 271,150 | ||||||

| 11,667 | Manitowoc Company, Inc. | 208,956 | ||||||

| 27,400 | Manpower, Inc. | 1,501,520 | ||||||

| 2,400 | MRC Global, Inc.a | 66,288 | ||||||

| 15,225 | Oshkosh Corporationa | 578,093 | ||||||

| 3,128 | Parker Hannifin Corporation | 298,411 | ||||||

| 14,362 | Pentair, Ltd. | 828,544 | ||||||

| 18,700 | Pitney Bowes, Inc. | 274,516 | ||||||

| 27,900 | Quanta Services, Inc.a | 738,234 | ||||||

| 7,300 | Republic Airways Holdings, Inc.a | 82,709 | ||||||

| 11,300 | Robert Half International, Inc. | 375,499 | ||||||

| 7,132 | Roper Industries, Inc. | 885,937 | ||||||

| 23,500 | Southwest Airlines Company | 302,915 | ||||||

| 8,881 | Stericycle, Inc.a | 980,729 | ||||||

| 9,740 | Tennant Company | 470,150 | ||||||

| 2,700 | Terex Corporationa | 71,010 | ||||||

| 14,500 | Union Pacific Corporation | 2,237,060 | ||||||

| 9,100 | United Rentals, Inc.a | 454,181 | ||||||

| 1,798 | United Stationers, Inc. | 60,323 | ||||||

| 18,198 | United Technologies Corporation | 1,691,322 | ||||||

| 3,100 | USG Corporationa | 71,455 | ||||||

| 8,800 | Wabash National Corporationa | 89,584 | ||||||

| 25,100 | Woodward, Inc. | 1,004,000 | ||||||

|

| |||||||

| Total | 36,596,584 | |||||||

|

| |||||||

| Information Technology (7.6%) | |||||||

| 32,900 | Activision Blizzard, Inc. | 469,154 | ||||||

The accompanying Notes to Financial Statements are an integral part of this schedule.

27

Table of Contents

Aggressive Allocation Portfolio

Schedule of Investments as of June 28, 2013

(unaudited)

| Shares | Common Stock (40.8%) | Value | ||||||

| Information Technology (7.6%) - continued |

| ||||||

| 18,757 | Agilent Technologies, Inc. | $ | 802,049 | |||||

| 4,700 | Alliance Data Systems Corporationa | 850,841 | ||||||

| 12,235 | ANSYS, Inc.a | 894,379 | ||||||

| 5,400 | AOL, Inc.a | 196,992 | ||||||

| 11,402 | Apple, Inc.b | 4,516,104 | ||||||

| 28,284 | Applied Materials, Inc. | 421,714 | ||||||

| 217,273 | Atmel Corporationa | 1,596,957 | ||||||

| 25,957 | Autodesk, Inc.a | 880,981 | ||||||

| 90,500 | Brocade Communications Systems, Inc.a | 521,280 | ||||||

| 19,800 | Ciena Corporationa | 384,516 | ||||||

| 51,750 | Cisco Systems, Inc. | 1,258,042 | ||||||

| 35,700 | Citrix Systems, Inc.a | 2,153,781 | ||||||

| 8,400 | Computer Sciences Corporation | 367,668 | ||||||

| 23,238 | CoreLogic, Inc.a | 538,424 | ||||||

| 3,700 | Cray, Inc.a | 72,668 | ||||||

| 1,575 | DST Systems, Inc. | 102,895 | ||||||

| 34,216 | eBay, Inc.a | 1,769,652 | ||||||

| 3,500 | Ellie Mae, Inc.a | 80,780 | ||||||

| 49,800 | ExactTarget, Inc.a | 1,679,256 | ||||||

| 9,892 | F5 Networks, Inc.a | 680,570 | ||||||

| 48,300 | Facebook, Inc.a | 1,200,738 | ||||||

| 7,000 | FLIR Systems, Inc. | 188,790 | ||||||

| 3,673 | Google, Inc.a,b | 3,233,599 | ||||||

| 11,900 | Guidewire Software, Inc.a | 500,395 | ||||||

| 28,300 | Informatica Corporationa | 989,934 | ||||||

| 38,500 | Intel Corporation | 932,470 | ||||||

| 6,400 | InterDigital, Inc. | 285,760 | ||||||

| 7,717 | Itron, Inc.a | 327,432 | ||||||

| 2,900 | j2 Global, Inc. | 123,279 | ||||||

| 32,410 | Juniper Networks, Inc.a | 625,837 | ||||||

| 14,841 | Lam Research Corporationa | 658,050 | ||||||

| 5,765 | Lexmark International, Inc. | 176,236 | ||||||

| 1,500 | LinkedIn Corporationa | 267,450 | ||||||

| 4,800 | Mentor Graphics Corporation | 93,840 | ||||||

| 4,953 | Mercadolibre, Inc. | 533,735 | ||||||

| 20,462 | Microchip Technology, Inc. | 762,209 | ||||||

| 14,570 | Microsoft Corporation | 503,102 | ||||||

| 48,882 | NetApp, Inc.a | 1,846,762 | ||||||

| 5,775 | Nice Systems, Ltd. ADR | 213,040 | ||||||

| 26,593 | Nuance Communications, Inc.a | 488,779 | ||||||

| 102,368 | NVIDIA Corporation | 1,436,223 | ||||||

| 24,800 | NXP Semiconductors NVa | 768,304 | ||||||

| 24,066 | Plantronics, Inc. | 1,056,979 | ||||||

| 40,820 | QUALCOMM, Inc.b | 2,493,286 | ||||||

| 5,530 | Red Hat, Inc.a | 264,445 | ||||||

| 16,776 | SAIC, Inc. | 233,690 | ||||||

| 6,700 | Skyworks Solutions, Inc.a | 146,663 | ||||||

| 8,200 | SunEdison, Inc.a | 66,994 | ||||||

| 3,100 | SunPower Corporationa | 64,170 | ||||||

| 36,380 | Symantec Corporation | 817,459 | ||||||

| 13,800 | Synopsys, Inc.a | 493,350 | ||||||

| 77,664 | Teradyne, Inc.a | 1,364,556 | ||||||

| 31,130 | Texas Instruments, Inc. | 1,085,503 | ||||||

| 38,706 | TriQuint Semiconductor, Inc.a | 268,233 | ||||||

| 3,313 | Unisys Corporationa | 73,118 | ||||||

| 13,973 | VeriFone Systems, Inc.a | 234,886 | ||||||

| 89,400 | Vishay Intertechnology, Inc.a | 1,241,766 | ||||||

| 32,300 | VMware, Inc.a | 2,163,777 | ||||||

| 4,000 | Western Digital Corporation | 248,360 | ||||||

| 26 | Workday, Inc.a | 1,666 | ||||||

| 18,513 | Xilinx, Inc. | 733,300 | ||||||

| 18,700 | Yahoo!, Inc.a | 469,557 | ||||||

|

| |||||||

| Total | 49,916,425 | |||||||

|

| |||||||

| Materials (1.3%) | |||||||

| 7,200 | Airgas, Inc. | 687,312 | ||||||

| 7,700 | Albemarle Corporation | 479,633 | ||||||

| 6,000 | Axiall Corporation | 255,480 | ||||||

| 16,100 | Buckeye Technologies, Inc. | 596,344 | ||||||

| 14,758 | Celanese Corporation | 661,158 | ||||||

| 1,700 | CF Industries Holdings, Inc. | 291,550 | ||||||

| 7,000 | Cliffs Natural Resources, Inc. | 113,750 | ||||||

| 8,190 | Dow Chemical Company | 263,472 | ||||||

| 10,800 | Eagle Materials, Inc. | 715,716 | ||||||

| 7,132 | FMC Corporation | 435,480 | ||||||

| 16,700 | H.B. Fuller Company | 631,427 | ||||||

| 1,238 | Innophos Holdings, Inc. | 58,396 | ||||||

| 6,300 | Mosaic Company | 339,003 | ||||||

| 8,324 | Newmont Mining Corporation | 249,304 | ||||||

| 6,030 | Nucor Corporation | 261,220 | ||||||

| 9,100 | Owens-Illinois, Inc.a | 252,889 | ||||||

| 4,754 | Silgan Holdings, Inc. | 223,248 | ||||||

| 9,053 | Silver Wheaton Corporation | 178,073 | ||||||

| 12,545 | Southern Copper Corporation | 346,493 | ||||||

| 21,870 | Steel Dynamics, Inc. | 326,082 | ||||||

| 31,100 | SunCoke Energy, Inc.a | 436,022 | ||||||

| 27,800 | Teck Resources, Ltd. | 594,086 | ||||||

| 6,400 | Walter Energy, Inc. | 66,560 | ||||||

|

| |||||||

| Total | 8,462,698 | |||||||

|

| |||||||

| Telecommunications Services (0.3%) | |||||||

| 21,900 | AT&T, Inc. | 775,260 | ||||||

| 3,276 | SBA Communications Corporationa | 242,817 | ||||||

| 12,175 | TW Telecom, Inc.a | 342,604 | ||||||

| 9,958 | Verizon Communications, Inc. | 501,286 | ||||||

|

| |||||||

| Total | 1,861,967 | |||||||

|

| |||||||

| Utilities (0.8%) | |||||||

| 20,300 | Calpine Corporationa | 430,969 | ||||||

| 12,000 | CMS Energy Corporation | 326,040 | ||||||

| 18,890 | NiSource, Inc. | 541,009 | ||||||

| 14,000 | NRG Energy, Inc. | 373,800 | ||||||

| 17,690 | PG&E Corporation | 808,964 | ||||||