UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-04615

HARTFORD HLS SERIES FUND II, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610)386-4068

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders underRule 30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

1

Item 1. Reports to Stockholders.

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford HLS Funds. The following is the Funds’ Annual Report covering the period from January 1, 2019 to December 31, 2019.

Market Review

During the 12 months ended December 31, 2019, U.S. stocks, as measured by the S&P 500 Index1, gained a healthy 31.49%, as U.S. consumers continued their strong

support for a domestic economic expansion lasting longer than any on record, according to the National Bureau of Economic Research.

The past year witnessed spasms of market volatility that seemed to come and go. In early August, 2019, for example, concerns about U.S.-China trade policy caused the Chicago Board Options Exchange’s VIX Volatility Index2 to more than double. For the remainder of the year, volatility receded, despite persistent U.S.-China trade tensions, ongoing uncertainty surrounding the 2020 U.S. elections, and the still unknown impact of President Trump’s impeachment by the U.S. House of Representatives.

Significantly, an agreement in December 2019 between the U.S. and China to delay implementation of U.S. tariffs calmed markets for the remaining portion of the period. In addition, the Brexit crisis (the United Kingdom’s exit from the European Union) appears headed for resolution, which appears to have reduced global market uncertainty to some degree. That said, economic data continues to reflect signs of a slowing global economy, freeing most central banks to continue pursuing a more accommodative monetary policy.

By contrast, after three rate cuts during 2019, the U.S. Federal Reserve is expected to pause further reductions, signaling reduced fears of an imminent U.S. recession. As of November, the U.S. unemployment rate stood at 3.5%, reflecting job gains in healthcare, professional and technical services, and in manufacturing.

Unforeseen political surprises at home, combined with other potential economic and geopolitical risks abroad, spell caution as we move through the late cycle of the current economic expansion. For this reason, we encourage you to maintain a strong relationship with your financial advisor, who can help guide you through shifting markets confidently. He or she can help you proactively find a fit within our family of funds as you work toward your unique investment goals.

Thank you again for investing in Hartford HLS Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford HLS Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

| | The index is unmanaged and not available for direct investment. Past performance is not indicative of future results. |

| 2 | “VIX,” commonly referred to as the “Fear Index,” is the ticker symbol for the Chicago Board Options Exchange (Cboe) Volatility Index and measures the market’s expectation of 30-day volatility. |

Hartford HLS Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’ssub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in each Fund’s Manager Discussion reflects the returns of such Fund’s Class IA shares. Returns for such Fund’s other classes differ only to the extent that the classes do not have the same expenses.

|

| Hartford Balanced HLS Fund |

Fund Overview

December 31, 2019 (Unaudited)

| | |

Inception 3/31/1983 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks long-term total return. |

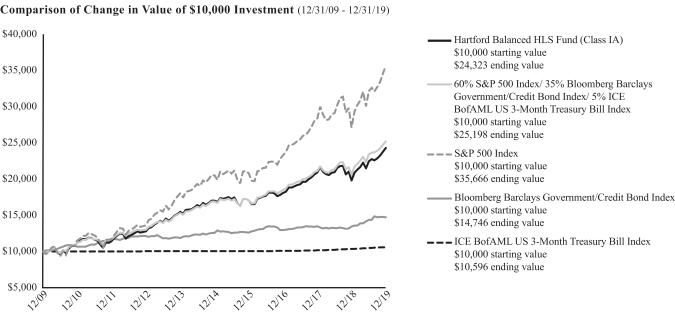

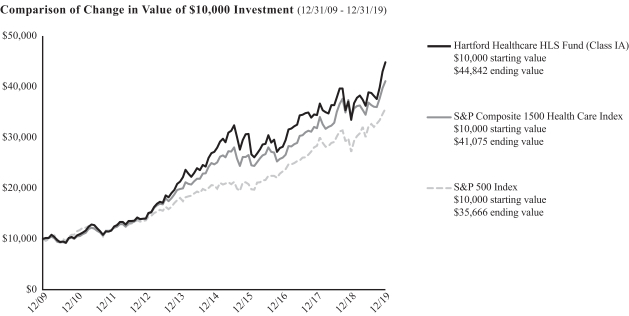

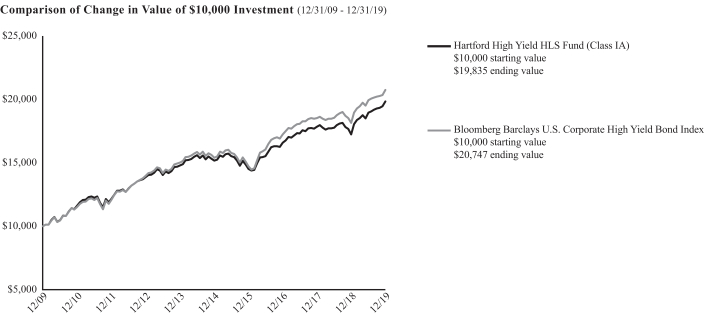

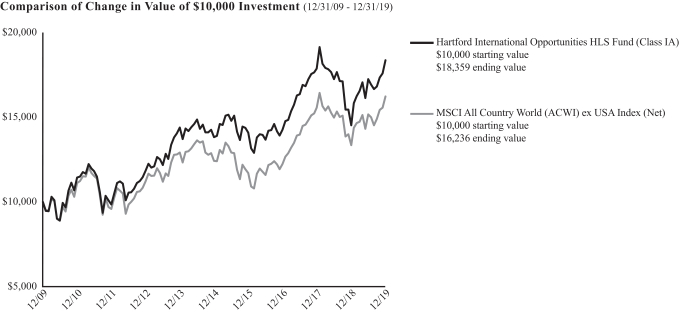

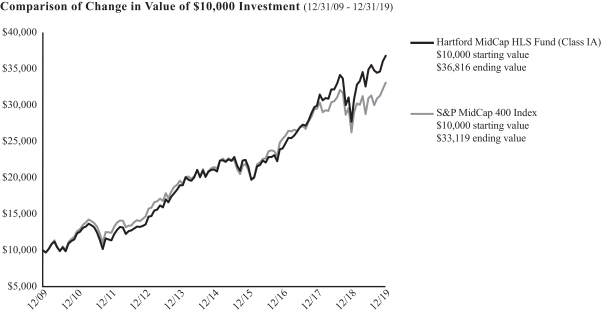

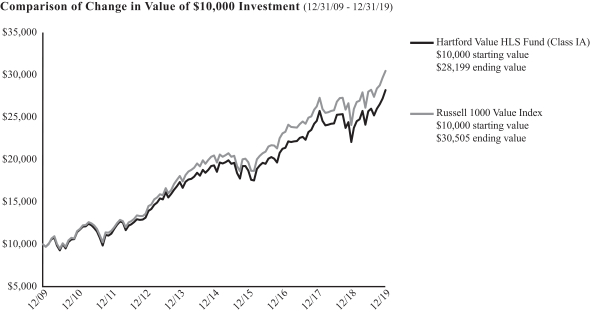

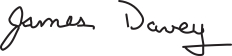

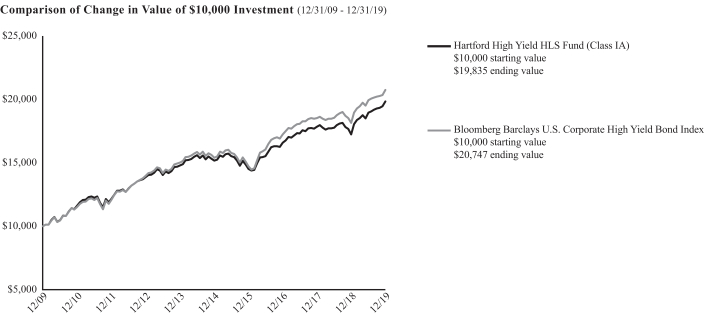

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/19

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 22.80% | | | | 7.40% | | | | 9.30% | |

Class IB | | | 22.47% | | | | 7.13% | | | | 9.02% | |

60% S&P 500 Index/ 35% Bloomberg Barclays

Government/Credit Bond Index/ 5% ICE

BofAML US3-Month Treasury Bill Index1 | | | 22.20% | | | | 8.34% | | | | 9.68% | |

S&P 500 Index | | | 31.49% | | | | 11.70% | | | | 13.56% | |

Bloomberg Barclays Government/Credit

Bond Index | | | 9.71% | | | | 3.23% | | | | 3.96% | |

ICE BofAML US3-Month Treasury Bill Index | | | 2.28% | | | | 1.07% | | | | 0.58% | |

| 1 | Calculated by Hartford Funds Management Company, LLC |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2019, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

As shown in the Fund’s current prospectus, the gross expense ratios are as follows: 0.66% (Class IA) and 0.91% (Class IB). The net expense ratios as shown in the Fund’s current prospectus are as follows: 0.63% (Class IA) and 0.88% (Class IB). Gross expenses do not reflect fee waiver arrangements. Net expenses reflect such arrangements, which remain in effect until April 30, 2020 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended December 31, 2019.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

Portfolio Managers

Adam H. Illfelder, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Michael E. Stack, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Loren L. Moran, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Balanced HLS Fund returned 22.80% for the twelve-month period ended December 31, 2019, outperforming the Fund’s custom benchmark, which is comprised of 60% S&P 500 Index, 35% Bloomberg Barclays Government/Credit Bond Index, and 5% ICE BofAML US3-Month Treasury Bill Index, which returned 22.20% for the same period. Individually, the S&P 500 Index, Bloomberg Barclays Government/Credit Bond Index, and ICE BofAML US3-Month Treasury Bill Index returned 31.49%, 9.71%, and 2.28%, respectively, during the period. For the same period, the Class IA shares of the Fund outperformed the 20.51% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending December 31, 2019. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, buoyed by an accommodative shift in U.S. Federal Reserve (Fed) policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. U.S. equity markets surged in the fourth quarter, as equities benefited from waning recession fears, improved trade sentiment, and accommodative Fed policies.

During the twelve-month period, all of the eleven sectors within the S&P 500 Index posted positive returns, led by the Information Technology (+50%), Communication Services (+33%), and Financials (+32%) sectors, while the Energy (+12%) and Healthcare (+21%) sectors lagged on a relative basis.

Over the period, global fixed-income markets generated largely positive total returns, driven by a decline in sovereign debt yields across most markets, particularly in the first three quarters of 2019. At the end of the period, yields increased across most markets amid stabilizing global activity indicators and progress on trade talks, despite continued accommodative global central bank policies. Geopolitical uncertainty remained elevated amid ongoing trade talks between the U.S. and China, negotiations surrounding the U.K.’s exit from the EU (also known as “Brexit”), and U.S. presidential impeachment proceedings. Despite these concerns, corporate bond spreads tightened over optimism that

monetary accommodation could offset the drag on global growth from restrictive trade policies. The U.S. dollar cemented its safe-haven status, strengthening versus most currencies amid trade frictions and slowing global growth prospects. Inflation showed no meaningful acceleration even as wage growth edged higher.

For much of the year, sovereign debt yields fell due to global economic uncertainty, accommodative shifts by central banks, and escalating trade tensions. Most major credit risk sectors posted positive returns over the period. Higher-yielding sectors outperformed investment-grade credit, benefiting from continued investor demand for yield-producing assets.

During the period, asset allocation decisions drove benchmark-relative outperformance. The Fund was generally overweight equities and underweight fixed income and cash relative to its custom benchmark. The equity portion of the Fund underperformed the S&P 500 Index, while the fixed income portion of the Fund outperformed the Bloomberg Barclays Government/Credit Bond Index.

Equity underperformance versus the S&P 500 Index was driven primarily by sector allocation, which is a residual of ourbottom-up security selection process. The Fund’s underweight allocation to the Information Technology sector and overweight to the Healthcare sector detracted most from performance. This was partially offset by the Fund’s underweight allocation in the Consumer Staples and Utilities sectors. Security selection also detracted from relative results, primarily within the Information Technology, Communication Services, and Consumer Staples sectors. Strong selection within the Financials, Industrials, and Healthcare sectors partially offset these results.

Stocks that detracted the most from returns relative to the S&P 500 Index in the equity portion of the Fund during the period were Apple (Information Technology), Facebook (Communication Services), and Tapestry (Consumer Discretionary). We sold out of Apple, a provider of consumer electronics, at the beginning of the year. Over the course of the year, the stock returned more than 80% on the back of strong earnings and a surge in sales in its wearable segment. In particular, sales of Apple Watch, AirPods, and Beats headphones nearly tripled in the fourth quarter of 2019 on a year-over-year basis. We initiated a position in Facebook halfway through the year after the stock had already risen significantly from its starting point at the beginning of the year. Shares climbed in the latter half of the year after the company reported steady user growth and strong revenue in the third quarter. Although the Fund’s position ended the period with a gain, it detracted

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

from results relative to the S&P 500 Index, as the Fund did not hold the name earlier in the year. Shares of Tapestry, a luxury goods company formerly known as Coach, fell after the company missed on earnings and cut guidance early in the year, citing a volatile macroeconomic and geopolitical backdrop. In the second half of the year the stock was weighed down when the Kate Spade line did not return to sales growth as predicted, prompting the company to pull back on store openings for the brand. TD Ameritrade (Financials), Nektar Therapeutics (Healthcare), and Tapestry (Consumer Discretionary) were the top detractors from absolute returns during the period.

Top contributors to performance relative to the S&P 500 Index in the equity portion of the Fund during the period included KLA (Information Technology), Qualcomm (Information Technology), and Fortune Brands Home (Industrials). Shares of KLA, a semiconductor equipment company, traded higher on strong earnings and an upward revision in guidance. Some analysts see profit increasing due to advanced chips for 5G smartphones and artificial intelligence devices boosting demand for KLA’s chip-inspection equipment in the next few years. The stock also benefited from secular tailwinds from expectations around improved memory-chip prices and a return to growth for the industry. Shares of Qualcomm jumped early in the year after announcing it had reached a settlement with Apple ending a long-running legal dispute over royalty payments. In the fourth quarter of 2019, the company raised guidance on expectations of increased demand for its 5G technology as the market continues to accelerate. Shares of Fortune Brands Home, a U.S.-based provider of home and security products, rose after the stock was upgraded by some analysts on the outlook that exposure to repair and remodeling may offset concerns about a cyclical peak in homebuilding. Microsoft (Information Technology), Alphabet (Communication Services), and JPMorgan Chase (Financials) were the top contributors to absolute returns during the period.

The fixed income portion of the Fund outperformed the Bloomberg Barclays Government/Credit Bond Index during the period. Security selection within investment-grade credit was the largest contributor to outperformance relative to the Bloomberg Barclays Government/Credit Bond Index, particularly selection within the Industrials, Financials and Taxable Municipals sectors. An overweight to investment-grade credit was a modestly positive contributor overall, as positive impacts from an overweight to the Financials and Taxable Municipals sectors were largely offset by a negative impact from an underweight to the Industrials and Sovereign Bonds.Out-of-benchmark allocations to securitized sectors such as agency mortgage-backed securities (MBS) pass-throughs, collateralized loan obligations (CLOs),non-agency mortgage backed securities (NA MBS), and commercial mortgage-backed securities (CMBS) all contributed positively to performance. Duration/yield curve positioning contributed modestly over the period, particularly long positioning in the intermediate region of the yield curve. A modestout-of-benchmark allocation to Treasury Inflation-Protected Securities (TIPS) also contributed positively to performance.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

The U.S. economy grew 2.1% in the third quarter of 2019, with healthy consumer spending serving as the key driver of economic growth. The labor market remained strong, with job growth consistently exceeding

expectations, wage growth hovering around 3%, and unemployment falling to a historic low of 3.5%. U.S. small business sentiment rose in November 2019, adding to signs that a key part of the economy is on positive footing. The Conference Board reported that consumer confidence remained elevated but eased throughout the quarter as expectations and optimism moderated amid a volatile global environment.

On the fixed income side, we believe credit valuations are modestly high given risks around geopolitics, trade tensions, and elections; however, supportive global central banks may continue to support asset valuations. We expect global inflation to remain benign, making it unlikely that we see a sustained move higher in global interest rates in 2020. We have positioned the fixed income portion of the Fund to be slightly overweight to duration relative to the Bloomberg Barclays Government/Credit Bond Index.

While we are increasingly cautious around the cycle and believe that credit fundamentals have deteriorated in part due to slowing earning growth, credit remains the main investment focus of the portfolio and we continue to look for opportunities within the sector. The Fund is overweight corporate credit relative to the Bloomberg Barclays Government/Credit Bond Index and has a bias towards more defensive sectors like Utilities and Telecommunications. We believe that the Taxable Municipals sector remains fairly valued and a high-quality diversifier relative to our corporate bond risk. We remain overweight to the sector, but have slightly reduced it recently, particularly within thenot-for-profit hospitals space given secular challenges and tight valuations.

Within equities, the Fund ended the period with the Healthcare sector as its largest overweight and the Consumer Staples sector as its largest underweight. Within fixed income, we had a moderatelypro-cyclical risk posture as of the end of the period, continuing to favor investment-grade credit. As of the end of the period, we increased the Fund’sout-of-benchmark mortgage allocation and favored low to mid coupon agency pass-throughs and collateralized mortgage obligations (CMOs) for their favorable prepayment profile. As of the end of the period, the Fund held a modestout-of-benchmark allocation to prime, NA MBS. As of the end of the period, the Fund also held anout-of-benchmark allocations to the securitized sectors such as asset backed securities, CLOs, and CMBS, which we believe offer attractive value and diversification relative to corporates. However, we are focused on acquiring high-quality issuance and senior portions of the capital structure in the securitized space.

At the end of the period, the Fund’s equity exposure was at 68.5% compared to 60% in its custom benchmark.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different asset classes. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.•Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.•Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.•Mortgage related- and asset-backed securities’ risks include credit, interest-rate, prepayment,

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

and extension risk.•Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government.

Composition by Security Type(1)

as of December 31, 2019

| | | | |

| Category | | Percentage of

Net Assets | |

Equity Securities | |

Common Stocks | | | 67.7 | % |

| | | | |

Total | | | 67.7 | % |

| | | | |

Fixed Income Securities | |

Asset & Commercial Mortgage Backed Securities | | | 2.7 | % |

Corporate Bonds | | | 17.6 | |

Foreign Government Obligations | | | 0.5 | |

Municipal Bonds | | | 0.9 | |

U.S. Government Agencies(2) | | | 2.3 | |

U.S. Government Securities | | | 7.1 | |

| | | | |

Total | | | 31.1 | % |

| | | | |

Short-Term Investments | | | 1.0 | |

Other Assets & Liabilities | | | 0.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| (2) | All or a portion of the securities categorized as U.S. Government Agencies were agency mortgage backed securities as of December 31, 2019. |

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview

December 31, 2019 (Unaudited)

| | |

Inception 4/02/1984 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

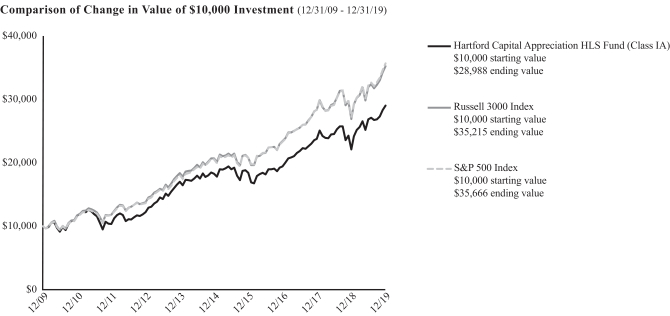

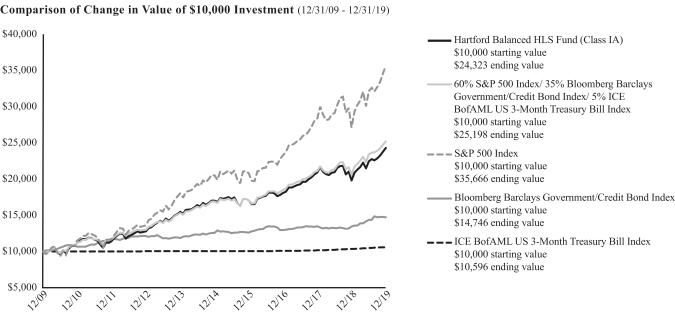

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/19

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 31.28% | | | | 9.72% | | | | 11.23% | |

Class IB | | | 30.96% | | | | 9.45% | | | | 10.95% | |

Class IC | | | 30.63% | | | | 9.17% | | | | 10.68% | |

Russell 3000 Index | | | 31.02% | | | | 11.24% | | | | 13.42% | |

S&P 500 Index | | | 31.49% | | | | 11.70% | | | | 13.56% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2019, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.67%, 0.92% and 1.17%, respectively. Gross and net

expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended December 31, 2019.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

Portfolio Managers

Gregg R. Thomas, CFA

Senior Managing Director and Director of Investment Strategy

Wellington Management Company LLP

Tom S. Simon, CFA, FRM

Senior Managing Director and Portfolio Manager

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Capital Appreciation HLS Fund returned 31.28% for the twelve-month period ended December 31, 2019, outperforming one of its benchmarks, the Russell 3000 Index, which returned 31.02% for the same period. For the same period, Class IA shares of the Fund underperformed its other benchmark, the S&P 500 Index, which returned 31.49% for the same period. For the same period, the Class IA shares of the Fund outperformed the 28.15% average return of the LipperMulti-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the Russell 3000 Index, posted positive results over the trailing twelve-month period ending December 31, 2019. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, buoyed by an accommodative shift in U.S. Federal Reserve (Fed) policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. By the summer of 2019, unresolved trade tensions between the U.S. and its trading partners unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose for the third consecutive quarter, as the U.S. economy remained resilient despite elevated geopolitical uncertainties and slowing global growth. The Fed lowered its benchmark interest rate in July and September by a combined 0.50% in an effort to sustain the U.S. economic expansion and mitigate the risks of moderating growth and trade frictions. U.S. equity markets surged in the fourth quarter of 2019, as equities benefited from waning recession fears, improved trade sentiment, and accommodative Fed policies. In October, the Fed lowered interest rates for the final time in 2019, cutting rates by 0.25%. Trade tensions continued to be volatile during the fourth quarter of 2019, but eased in December after the U.S. and China reached a phase one trade agreement.

Returns varied by market cap during the period, aslarge-cap equities, as measured by the S&P 500 Index, outperformed both small- andmid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. All eleven sectors in the Russell 3000 Index had positive returns during the period. The Information Technology (+49%), Communication Services (+32%), and Financials (+31%) sectors were the top performers, while the Energy (+10), Healthcare (+22%), and Materials (+24%) sectors lagged on a relative basis.

Sector allocation, a result of ourbottom-up security selection process, detracted from performance relative to the Russell 3000 Index during the period. Underweight exposure to the Information Technology sector detracted the most and was only partially offset by an underweight exposure to the Energy sector, which contributed positively. Security selection contributed positively to performance relative to the Russell 3000 Index during the period. Strong stock selection in the Healthcare, Consumer Discretionary, and Materials sectors was only partially offset by weaker selection in the Communication Services, Information Technology, and Consumer Staples sectors, which detracted from relative performance.

Strategies included in the Fund are chosen based on extensive analysis of qualitative and quantitative factors. Risk factors managed within the overall portfolio include but are not limited to: growth, value, momentum, contrarian, high volatility, low volatility, quality and leverage. The Fund’s style factor exposures detracted from performance led by exposure to higher volatility factors; this was partially offset by the Fund’s smaller capitalization footprint and exposure to momentum and value factors. International exposure (country and currency) contributed positively to performance, with the Fund’s exposure within North America (United States) and Europe (Belgium and Germany) contributing the most to relative performance, and exposure to Japan detracting from relative performance.

The largest detractors from performance relative to the Russell 3000 Index over the period were underweight exposures to Apple (Information Technology) and Microsoft (Information Technology) as well as anout-of-benchmark exposure to Uber Technologies (Industrials). Apple engages in designing, manufacturing, and marketing mobile communication, media devices, personal computers, and portable digital music players. Apple’s stock was up during the period as the company repeatedly announced above-consensus earnings. Towards the end of the year, the services segment reaccelerated and iPhone volume forecasts improved leading to a stronger outlook for the company moving forward. We initiated a position in the stock during the period but the Fund remains underweight. The Fund’s underweight exposure to Microsoft, relative to the Russell 3000 Index, was another top detractor from relative performance. Strong earnings throughout the year propelled the stock higher during the year. In particular, growth in Azure, the company’s commercial cloud offering, helped overcome some of the weakness within the company’s gaming unit. We remain underweight relative to the benchmark and trimmed the Fund’s position during the period. Uber Technologies, a technology platform for people and things mobility, also detracted from relative performance. During the period, the valuation of the Fund’s private placement in the company declined amid well publicized negative events and the ultimate departure of its CEO. Following the initial public offering (IPO), the company delivered mixed

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

results which drove the stock price down. As of the end of the period, the Fund continued to own the stock. 2U (Information Technology) and Pinterest (Communication Services) were among the top absolute detractors from performance during the period.

The largest contributors during the period to performance relative to the Russell 3000 Index were CoStar Group (Industrials), lack of exposure to Berkshire Hathaway (Financials), and Advanced Micro Devices (Information Technology). Costar Group is a provider of data and analytics for the commercial real estate industry. Shares of the company trended higher throughout the year as the company consistently met or exceeded market expectations for quarterly results during the year. We reduced the Fund’s exposure during the period; however, we still believe the stock is well positioned to benefit from continued positive company-specific and macro conditions. Berkshire Hathaway is a diversified company operating in property and casualty insurance and reinsurance, utilities and energy, freight rail transportation, finance, manufacturing, retailing, and services. Not holding the stock contributed positively to performance as the share price moved higher during the period but underperformed relative to the broader market. As of the end of the period, the Fund did not hold the stock. Advanced Micro Devices, a semiconductor manufacturer, reported strong results throughout the period that were in line with consensus estimates. Results were driven by strong sales of new client and server CPU business in addition to benefiting from a recovering gaming GPU market. As of the end of the period, the Fund continued to hold the stock. American Tower (Real Estate) and Microsoft (Information Technology) were among the top absolute contributors during the period.

During the period, the Fund, at times, uses derivative instruments such as currency forwards to hedge currency risk and/or equity index futures to hedge the market risk. During the period, the use of currency forwards did not have a significant impact on performance, while the use of equity index futures contributed modestly to results.

What is the outlook as of the end of the period?

At the end of the period, macro challenges created a volatile backdrop for the market in 2019, and we expect this to persist into the new year. We note an unusual lack of consensus across the industry around the macroeconomic outlook as of the end of the period, which leads to a wide range of potential outcomes from our perspective. As a result, we seek to balance the Fund’s risk allocations in an effort to guard against a possible downturn without giving up the potential for participating in the event of a market reacceleration. In our capital allocation framework, we seek to balance risk factor exposure in the Fund by allocating to underlying managers with varying investment styles, but all of whom focus on growth of capital as an objective.

In addition to persistent market volatility, we believe there could also be persistence in the factor volatility that we saw in 2019. We monitor the portfolio for meaningful changes in risk characteristics and seek to actively manage allocations with respect to a changing risk landscape. To that end, we seek to balance risk relative to various potential market outcomes.

At the end of the period, the Fund’s largest overweights were to the Healthcare and Industrials sectors, while the Fund’s largest underweights were to the Information Technology and Financials sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different portfolio management teams. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.•Small- andmid-cap securities can have greater risks and volatility thanlarge-cap securities.•Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks are generally greater for investments in emerging markets.•The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of December 31, 2019

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 8.0 | % |

Consumer Discretionary | | | 11.5 | |

Consumer Staples | | | 6.5 | |

Energy | | | 2.9 | |

Financials | | | 11.7 | |

Health Care | | | 17.8 | |

Industrials | | | 12.2 | |

Information Technology | | | 16.8 | |

Materials | | | 2.5 | |

Real Estate | | | 4.9 | |

Utilities | | | 3.3 | |

| | | | |

Total | | | 98.1 | % |

| | | | |

Short-Term Investments | | | 2.8 | |

Other Assets & Liabilities | | | (0.9 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview

December 31, 2019 (Unaudited)

| | |

Inception 5/29/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

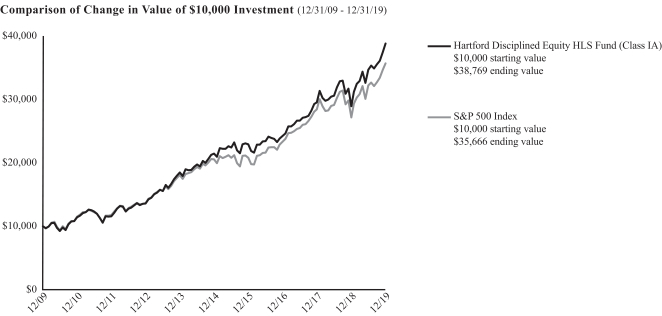

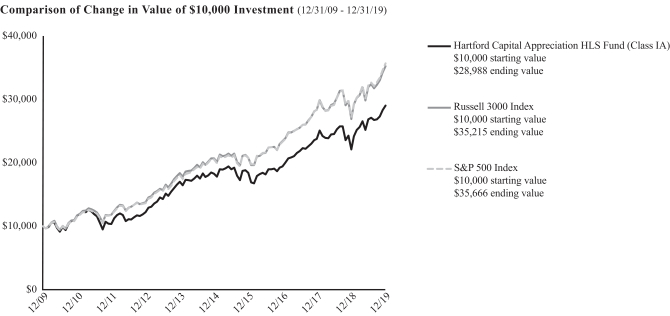

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/19

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 34.12% | | | | 12.61% | | | | 14.51% | |

Class IB | | | 33.76% | | | | 12.33% | | | | 14.22% | |

S&P 500 Index | | | 31.49% | | | | 11.70% | | | | 13.56% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2019, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s prospectus dated May 1, 2019, the total annual fund operating expense ratios for Class IA and Class IB were 0.78% and 1.03%, respectively. The Fund filed a supplement to its prospectus, dated November 27, 2019, with the U.S. Securities and Exchange Commission that updated the Fund’s total annual fund operating expense table effective January 1, 2020. However, the information in this annual report is as of December 31, 2019 and does not reflect any changes made to the total annual fund operating expense table in the prospectus, as supplemented. The total annual fund

operating expense ratios shown in the supplement are as follows: 0.73% (Class IA) and 0.98% (Class IB). Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended December 31, 2019.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

Portfolio Managers

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Douglas W. McLane, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Disciplined Equity HLS Fund returned 34.12% for the twelve-month period ended December 31, 2019, outperforming its benchmark, the S&P 500 Index, which returned 31.49% for the same period. For the same period, the Class IA shares of the Fund also outperformed the 29.61% average return of the LipperLarge-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending December 31, 2019. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, buoyed by an accommodative shift in U.S. Federal Reserve (Fed) policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. By the summer of 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose for the third consecutive quarter, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war and the potential for a longer-term decoupling of the world’s two largest economies eroded consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September by a combined 0.50% in an effort to sustain the U.S. economic expansion and mitigate the risks of moderating growth and trade frictions. U.S. equity markets surged in the fourth quarter of 2019, as equities benefited from waning recession fears, improved trade sentiment, and accommodative Fed policies. In October, the Fed lowered interest rates for the final time in 2019, cutting rates by 0.25%. Trade tensions were volatile during the fourth quarter of 2019 but eased in December after the U.S. and China reached a phase one trade agreement. The U.S. House of Representatives voted to impeach President Trump; however, markets were unaffected given that theRepublican-led Senate is unlikely to support his impeachment.

Returns varied by market cap during the period, aslarge-cap equities, as measured by the S&P 500 Index, outperformed both small- andmid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, all eleven sectors within the S&P 500 Index rose, led by the Information Technology (+50%), Communication Services (+33%), and Financials (+32%) sectors.

Security selection was the primary contributor to returns relative to the S&P 500 Index during the period, primarily within the Industrials, Healthcare, and Financials sectors, which more than offset weaker selection within the Energy and Communication Services sectors, which detracted from relative performance. Sector allocation, which is a residual of ourbottom-up security selection process, detracted from relative results driven by an overweight to the Healthcare sector and an underweight to the Information Technology sector. This was partially offset by an underweight allocation to the Energy sector, which contributed positively to relative performance.

Top contributors to performance relative to the S&P 500 Index over the period were Leidos Holdings (Information Technology), Teradyne (Information Technology), and not owning Pfizer (Healthcare). Shares of Leidos advanced during the period, fueled by strong earnings. More recently, the company announced a $1.65 billion deal to acquire cybersecurity firm Dynetics. The purchase is expected to add both sales growth and margins. Shares of the chip maker Teradyne also rose during the period. Due to strength in China for smartphone testing and base station testing, the company finished 2019 on a very strong note with an aggressive 5G base station camp. Pfizer is a U.S.-based biopharmaceutical company. The stock underperformed on the announcement of the company’s plans to merge itsoff-patent drugs business with generic drug manufacturer Mylan, which the market did not like. Apple (Information Technology) was the top absolute contributor to performance during the period.

The largest detractors from performance relative to the S&P 500 Index over the period were Apple (Information Technology), NetApp (Information Technology), and GoDaddy (Information Technology). Shares of the tech giant Apple advanced during the period. The company recently reported positive fourth-quarter 2019 results, beating consensus estimates and benefiting from a surge in sales in its wearable market. The Fund’s underweight position in the company’s stock detracted from relative results. GoDaddy, one of the global leaders in domain name registry and web hosting and business applications, was

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

among the top detractors from relative performance. Shares of the company underperformed after a slowdown in growth in the company’s web hosting business and a CEO transition. Shares of NetApp declined during the period after the company announced disappointing first-quarter fiscal year results and revised its previously issued guidance for full year 2020. NetApp was the top absolute detractor during the period, and we eliminated the Fund’s position.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

As we look ahead to 2020, many of the constructive fundamental drivers of U.S. economic growth in 2019 persist. We believe labor markets remain healthy, and wage gains continue to bolster consumer confidence, but may not trigger outsized inflation due to continued productivity improvements. In our view, the U.S. housing market has turned the corner after six quarters of negative growth, responding to rate cuts by the Fed. Moving forward, Fed action is likely to be more gradual, having now achieved targeted levels of inflation. This may also result in less volatility for the U.S. dollar.

We believe trade negotiations between the U.S. and China will remain vitally important to markets. In our view, the year ended with encouraging progress; the “List 4” tariffs slated for December implementation were delayed, and indications that forward progress for a phase one agreement were in place. Additionally, the U.S. House of Representatives passed thetri-party United States-Mexico-Canada Agreement (USMCA), a replacement for the North American Free Trade Agreement (NAFTA), which is expected to be ratified by the U.S. Senate. The ratification of this trade agreement is expected to provide important certainty to North American supply chains. As the new year begins, we believe that U.S. politics will first be dominated by a historic presidential impeachment trial in the U.S. Senate, before yielding to a rapid succession of Democratic primaries which will provide more certainty into both the eventual Democratic candidate as well as the main platform issues to be put forward by that party in the presidential election. The outcome at the ballot box could warrant future action in the Fund, but given the wide range of possible outcomes at this point, we believe that this bears more monitoring than action at this time.

At the end of the period, the Fund’s largest overweights relative to the S&P 500 Index were to the Healthcare, Consumer Staples, and Industrials sectors, while the Fund’s largest underweights relative to the S&P 500 Index were to the Communication Services, Energy, and Information Technology sectors.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

Composition by Sector(1)

as of December 31, 2019

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 7.1 | % |

Consumer Discretionary | | | 9.1 | |

Consumer Staples | | | 10.4 | |

Energy | | | 1.6 | |

Financials | | | 13.7 | |

Health Care | | | 17.6 | |

Industrials | | | 10.5 | |

Information Technology | | | 20.8 | |

Materials | | | 1.9 | |

Real Estate | | | 2.4 | |

Utilities | | | 4.6 | |

| | | | |

Total | | | 99.7 | % |

| | | | |

Short-Term Investments | | | 0.4 | |

Other Assets & Liabilities | | | (0.1 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview

December 31, 2019 (Unaudited)

| | |

Inception 3/09/1994 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

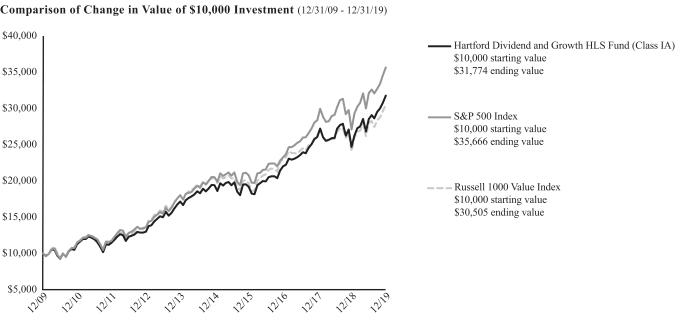

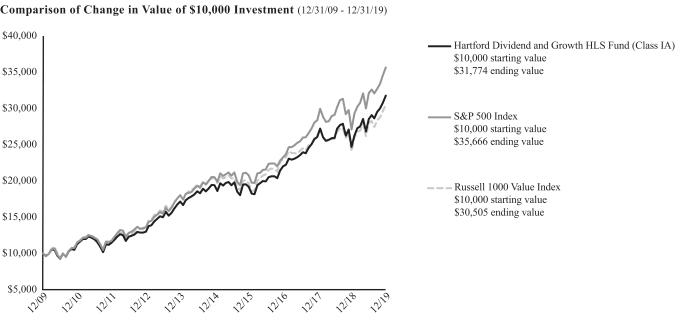

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/19

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 28.60% | | | | 10.35% | | | | 12.26% | |

Class IB | | | 28.30% | | | | 10.08% | | | | 11.98% | |

S&P 500 Index | | | 31.49% | | | | 11.70% | | | | 13.56% | |

Russell 1000 Value Index | | | 26.54% | | | | 8.29% | | | | 11.80% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2019, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.68% and 0.93%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended December 31, 2019.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

Portfolio Managers

Edward P. Bousa, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mark E. Vincent

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Nataliya Kofman

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

* Edward P. Bousa, CFA announced his plan to retire, and effective June 30, 2020, he will no longer serve as a portfolio manager for the Fund.

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Dividend and Growth HLS Fund returned 28.60% for the twelve-month period ended December 31, 2019, underperforming one of its benchmarks, the S&P 500 Index, which returned 31.49% for the same period. For the same period, Class IA shares of the Fund outperformed its other benchmark, the Russell 1000 Value Index, which returned 26.54% for the same period. For the same period, the Class IA shares of the Fund outperformed the 24.43% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending December 31, 2019. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, buoyed by an accommodative shift in U.S. Federal Reserve (Fed) policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. By the summer of 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose for the third consecutive quarter, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war between the U.S. and China and the potential for a longer-term decoupling of the world’s two largest economies eroded consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September by a combined 0.50% in an effort to sustain economic expansion and mitigate the risks of moderating growth and trade frictions. U.S. equity markets surged in the fourth quarter of 2019, as equities benefited from waning recession fears, improved trade sentiment, and accommodative Fed

policies. In October, the Fed lowered interest rates for the final time in 2019, cutting rates by 0.25%. Trade tensions were volatile during the fourth quarter of 2019 but eased in December after the U.S. and China reached a phase one trade agreement. The U.S. House of Representatives voted to impeach President Trump; however, markets were unaffected given that the Republican-led Senate is unlikely to support his impeachment.

Returns varied by market cap during the period, as large-cap equities, as measured by the S&P 500 Index, outperformed both small- and mid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, all eleven sectors within the S&P 500 Index posted positive returns, led by the Information Technology (+50%), Communication Services (+33%), and Financials (+32%) sectors. The Energy (+12%), Healthcare (+21%), and Materials (+25%) sectors lagged on a relative basis.

Sector allocation, a result of our bottom-up stock selection process, was the primary driver of underperformance relative to the S&P 500 Index during the period. An underweight to the Information Technology sector and an overweight to the Energy sector detracted from relative performance. This was partially offset by underweights to the Consumer Discretionary and Consumer Staples sectors, which contributed positively to relative performance. Additionally, security selection positively contributed to relative performance during the period. Strong selection within the Energy, Financials, and Industrials sectors were partially offset by weaker selection within the Information Technology and Communication Services sectors, which detracted from relative performance.

The Fund’s top detractor from performance relative to the S&P 500 Index was the Fund’s underweight to Apple (Information Technology). Returns were also held back by overweights to Verizon Communications (Communication Services) and Pfizer (Healthcare). Shares of Apple gained throughout the year, following the company’s strong services acceleration, in addition to strength in the company’s wearables division, which includes watches, AirPods, and Beats headphones. Despite reporting strong wireless service revenue, coupled with a positive

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

outlook, Verizon’s stock price faltered during the period as net customer additions were a bit weaker than anticipated. Pfizer’s share price declined after the company announced its Upjohn business merger with Mylan.

Top contributors to performance relative to the S&P 500 Index over the period included overweight allocations to Hess (Energy) and KLA (Information Technology), as well as not holding benchmark constituent Berkshire Hathaway (Financials). Hess traded well due to higher oil prices over the period, and we believe the company remains well positioned over the next several years due to its significant oil discovery in Guyana. KLA continued to outperform its semiconductor equipment peer group with strong fourth-quarter 2019 earnings and guidance for September that beat consensus expectations. The Fund’s overweight position in KLA also contributed positively to relative performance during the period. Not holding Berkshire Hathaway contributed positively to performance as the share price moved higher during the period but underperformed relative to the broader market. As of the end of the period, we do not hold Berkshire Hathaway in the Fund.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

Despite much volatility and changes in market leadership throughout 2019, the combination of stabilizing economic data, accommodative central banks, and continued optimism around an eventual trade deal between the U.S. and China provided a favorable backdrop for equities. We expect that 2020 will be somewhat more challenging for robust stock returns due to higher valuations at the start of the year, limited room for further easing by central banks, and the many uncertainties related to geopolitics.

Notably, the consumer was particularly strong in 2019 as low unemployment, tax rebates, and solid spending helped propel the economy forward. While we believe the economy will still benefit from strong consumer support, it will likely be less significant. We are enthusiastic about the prospects for many individual businesses.

At the end of the period, the Fund’s largest overweights relative to the S&P 500 Index were to the Financials, Energy, and Healthcare sectors, while the Fund’s largest underweights were to the Information Technology and Consumer Discretionary sectors.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.•For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.•Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.

Composition by Sector(1)

as of December 31, 2019

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 9.5 | % |

Consumer Discretionary | | | 5.4 | |

Consumer Staples | | | 5.6 | |

Energy | | | 7.7 | |

Financials | | | 20.7 | |

Health Care | | | 16.2 | |

Industrials | | | 8.7 | |

Information Technology | | | 14.5 | |

Materials | | | 3.1 | |

Real Estate | | | 3.1 | |

Utilities | | | 3.9 | |

| | | | |

Total | | | 98.4 | % |

| | | | |

Short-Term Investments | | | 1.6 | |

Other Assets & Liabilities | | | 0.0 | * |

| | | | |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to zero. |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Global Growth HLS Fund |

Fund Overview

December 31, 2019 (Unaudited)

| | |

Inception 9/30/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

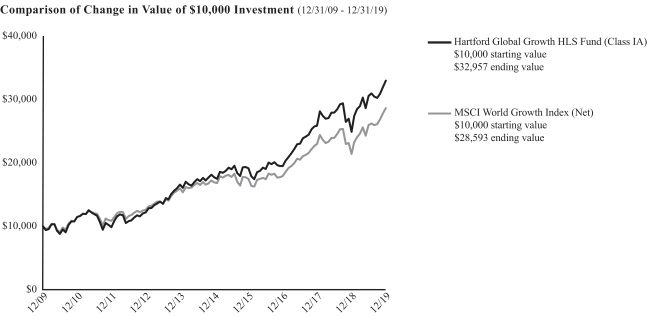

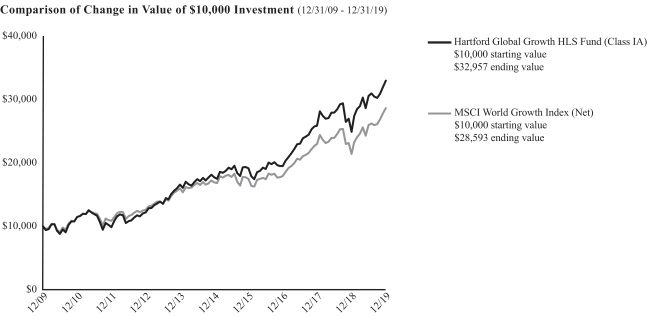

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/19

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 32.61% | | | | 13.28% | | | | 12.67% | |

Class IB | | | 32.29% | | | | 12.98% | | | | 12.38% | |

MSCI World Growth Index (Net) | | | 33.68% | | | | 11.09% | | | | 11.08% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2019, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.80% and 1.05%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended December 31, 2019.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Global Growth HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

Portfolio Managers

John A. Boselli, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew D. Hudson, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Global Growth HLS Fund returned 32.61% for the twelve-month period ended December 31, 2019, underperforming its benchmark, the MSCI World Growth Index (Net), which returned 33.68% for the same period. For the same period, the Class IA shares of the Fund outperformed the 29.19% average return of the Lipper GlobalMulti-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

For the twelve-month period ended December 31, 2019, global equities rose more than 26.6% as measured by the MSCI ACWI Index. In the first quarter of 2019, global markets recovered and surged due to productive trade negotiations between the U.S. and China, and due to accommodative rhetoric and policy actions from the major central banks. In the second quarter of 2019, global equities rose for the second straight quarter. Trade tensions between China and the U.S. escalated in May but eased at the end of the quarter after the two countries agreed to resume trade negotiations at the G20 summit. The United Kingdom’s (U.K.’s) exit from the European Union (EU), also known as Brexit, was a major concern, with the U.K. avoiding an abruptno-deal departure after the EU leaders granted the U.K. a flexible extension. U.K. Prime Minister Theresa May announced that she would resign after failing to secure a Brexit deal. In the third quarter of 2019, Boris Johnson was appointed as the new prime minister of the U.K. after his victory in the Conservative Party leadership contest. U.K. opposition parties vowed to block Prime Minister Johnson’s bid for a general election and Parliament passed legislation requiring him to request an additional extension to the Brexit process if he failed to secure an acceptable deal. On the monetary front, the U.S. Federal Reserve (Fed) cut interest rates in July, September, and October to extend the U.S. economic expansion amid a slowdown in growth and trade uncertainty. The European Central Bank (ECB) unveiled a sweeping, long-term economic stimulus package to bolster the Eurozone economy against slowing growth and trade frictions, including an open-ended asset purchase program and more favorable bank lending conditions. In the fourth quarter, waning recession fears and forecasts for improving global growth in 2020 helped to bolster risk sentiment, while geopolitics and trade disputes continued to be major drivers of market volatility. The U.S. canceled tariffs that were scheduled to take effect in an effort to secure a phase one trade deal with China. U.K. equities rose after the Conservative Party’s victory in the general election lifted the uncertainty about the country’s departure from the EU and eliminated concerns about the Labor Party’s plans to nationalize large swaths of the nation’s economy.

During the period, U.S. equities outperformednon-U.S. equities, as measured by the S&P 500 Index and MSCI EAFE Index, respectively, and emerging-market equities underperformed their developed-market counterparts, as measured by the MSCI Emerging Markets Index and MSCI World Index, respectively. Within the MSCI World Growth Index (Net), all sectors posted positive returns during the period. The Information Technology (54%), Materials (34%), and Communication Services (33%) sectors gained the most during the period.

The Fund slightly underperformed the MSCI World Growth Index (Net) during the period. In particular, selection in the Information Technology, Communication Services, and Consumer Staples sectors detracted most from relative performance, which was partially offset by stronger selection in the Financials, Real Estate, and Industrials sectors, all of which contributed positively to relative performance. The Fund’s overweight to the Healthcare, Financials, and Communication Services sectors detracted most from relative performance. However, this was partially offset by an overweight to the Information Technology sector, which contributed positively to relative performance.

The top detractors from the Fund’s performance relative to the MSCI World Growth Index (Net) were an underweight position in Apple (Information Technology), and overweight positions in TD Ameritrade (Financials) and Uber (Industrials). Shares of Apple, which specializes in mobile devices and digital content distribution, outperformed over the period. In Apple management’s second-quarter release, the company announced strong guidance ahead of expectations as iPhone results were not as bad as feared, services remained strong, and wearables surprised to the upside. TD Ameritrade, a U.S.-based online securities broker, announced the departure of CEO Tim Hockey. The news surprised investors and put pressure on the stock price. We sold this position in the Fund in order to invest in more attractive opportunities in our view. The shares of Uber, a technology platform offering transportation and food ordering services, experienced material regulatory and competitive pressures amid inconsistent operating results. Top absolute detractors from Fund performance included Eisai (Healthcare) and Micron Technology (Information Technology).

Top contributors to the Fund’s performance relative to the MSCI World Growth Index (Net) during the period were Advanced Micro Devices (Information Technology), Seattle Genetics (Healthcare), and MediaTek (Information Technology). Shares of Advanced Micro Devices, a semiconductor manufacturer, performed well as the company continued to grow market share across desktop, mobile, and server CPUs. Seattle Genetics, a biotechnology firm focused on developing treatments for cancer, saw its stock price rise during the period after reporting positive Phase 3 results for a drug that treats metastatic breast cancer. Semiconductor chip designer, MediaTek, posted positive results amid

|

| Hartford Global Growth HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

rising demand for next generation technologies, such as connected consumer products and 5G internet. Microsoft (Information Technology) was a top absolute contributor to Fund performance during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

Looking ahead, we expect that our focus will remain on stock selection driven bybottom-up, fundamental research, regular meetings with the management of leading companies globally, and leveraging the deep research capabilities of our firm. However, we believe that risks remain on the horizon, including the upcoming U.S. elections, trade negotiations between the U.S. and China, and increased geopolitical tensions globally. We remain focused on seeking companies with improving fundamentals and catalysts that we think should lead to accelerating earnings growth above consensus expectations.

At the end of the period, the Fund’s largest sector overweights were to the Information Technology, Communication Services, and Financials sectors, while the Fund’s largest underweights were to the Industrials, Healthcare and Materials sectors, relative to the MSCI World Growth Index (Net).

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different portfolio management teams. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.•Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks may be greater for investments in emerging markets.•Mid-cap securities can have greater risk and volatility thanlarge-cap securities.•Different investment styles may go in and out of favor, which may cause the Fund to underperform the broader stock market.

Composition by Country(1)

as of December 31, 2019

| | | | |

| Country | | Percentage of

Net Assets | |

Bermuda | | | 0.7 | % |

Brazil | | | 0.4 | |

Canada | | | 1.1 | |

China | | | 4.3 | |

France | | | 2.0 | |

Germany | | | 0.6 | |

Hong Kong | | | 1.3 | |

India | | | 0.5 | |

Ireland | | | 0.5 | |

Italy | | | 1.2 | |

Japan | | | 2.0 | |

Netherlands | | | 1.4 | |

Portugal | | | 0.5 | |

Russia | | | 0.5 | |

South Korea | | | 0.5 | |

Spain | | | 0.5 | |

Sweden | | | 1.6 | |

Switzerland | | | 4.0 | |

Taiwan | | | 1.8 | |

United Kingdom | | | 5.8 | |

United States | | | 68.5 | |

Short-Term Investments | | | 1.1 | |

Other Assets & Liabilities | | | (0.8 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | The table above is based on Bloomberg’s country of risk classifications. For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

| Hartford Growth Opportunities HLS Fund |

Fund Overview

December 31, 2019 (Unaudited)

| | |

Inception 3/24/1987 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks capital appreciation. |

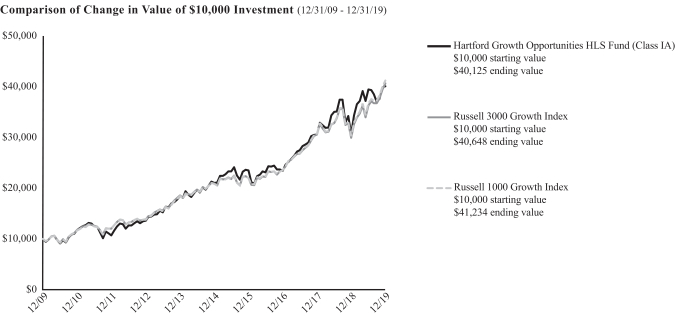

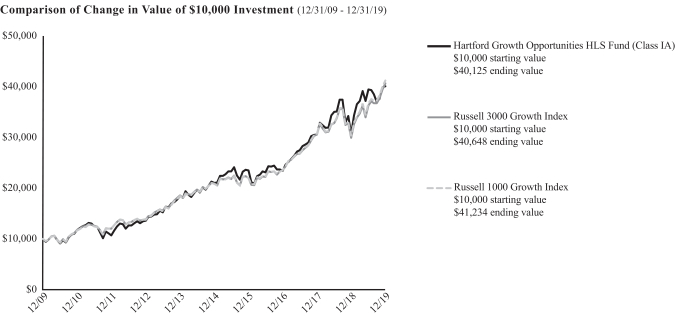

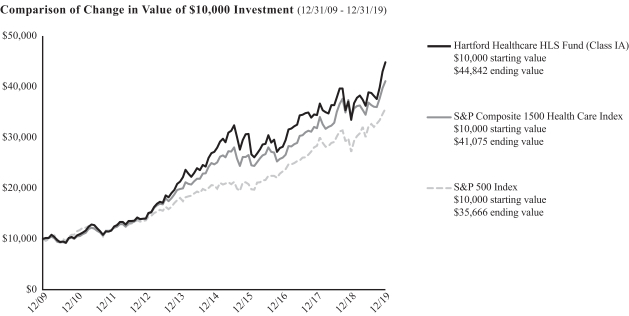

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/19

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 30.68% | | | | 13.76% | | | | 14.91% | |

Class IB | | | 30.35% | | | | 13.48% | | | | 14.62% | |

Class IC | | | 30.04% | | | | 13.20% | | | | 14.34% | |

Russell 3000 Growth Index | | | 35.85% | | | | 14.23% | | | | 15.05% | |

Russell 1000 Growth Index | | | 36.39% | | | | 14.63% | | | | 15.22% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2019, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.65%, 0.90% and 1.15%, respectively. Gross and net

expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended December 31, 2019.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Growth Opportunities HLS Fund |

Fund Overview – (continued)

December 31, 2019 (Unaudited)

Portfolio Managers

Michael T. Carmen, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

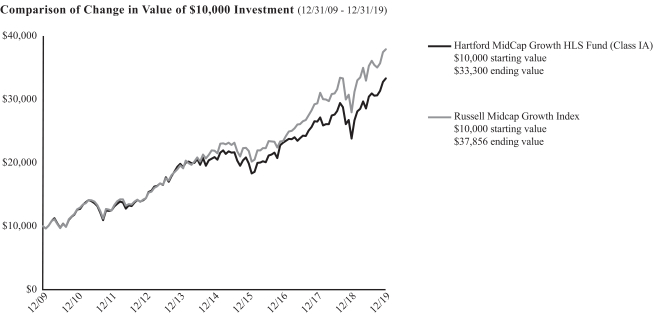

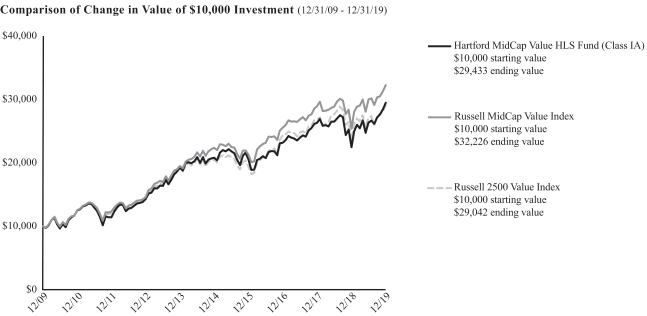

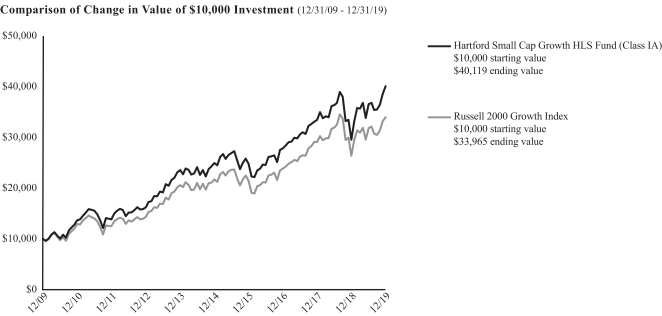

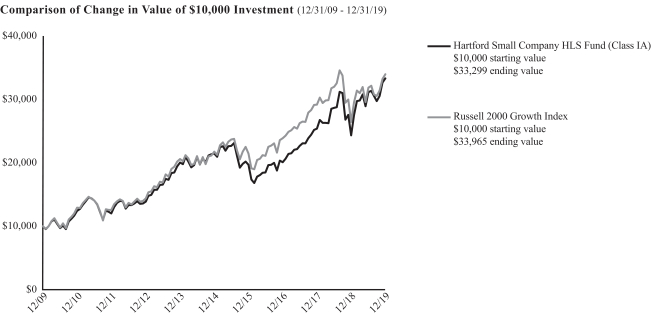

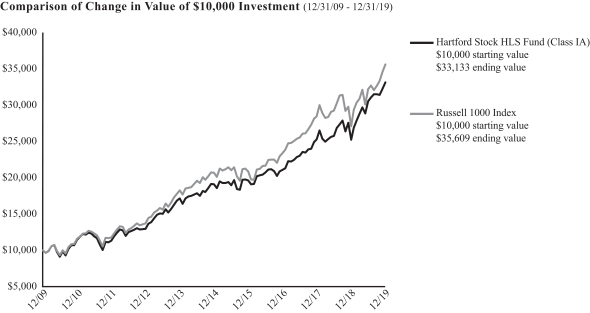

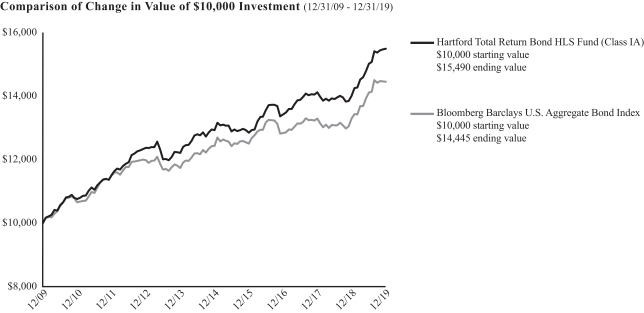

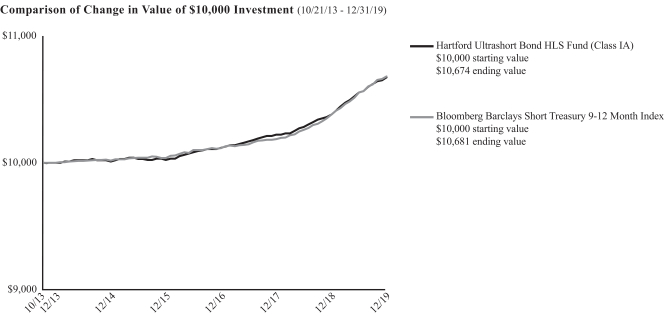

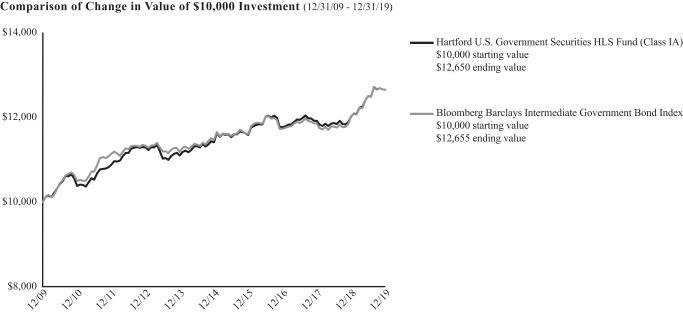

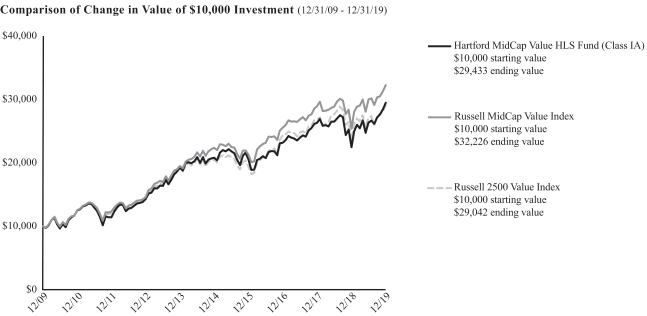

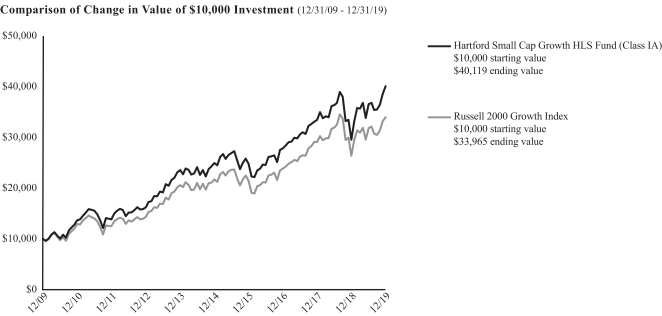

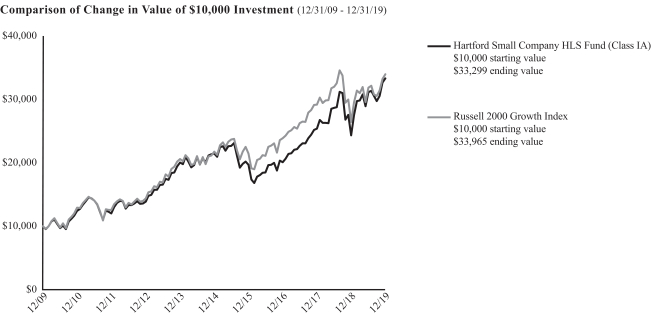

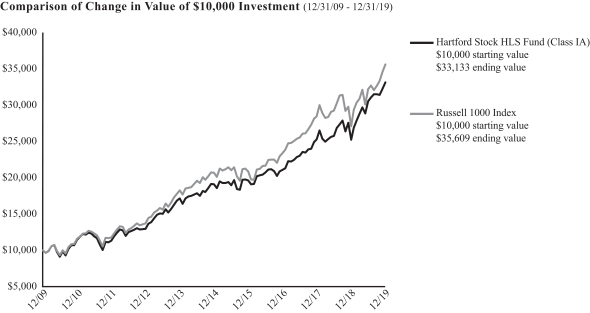

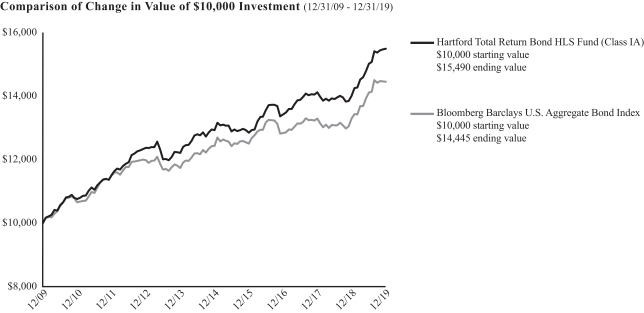

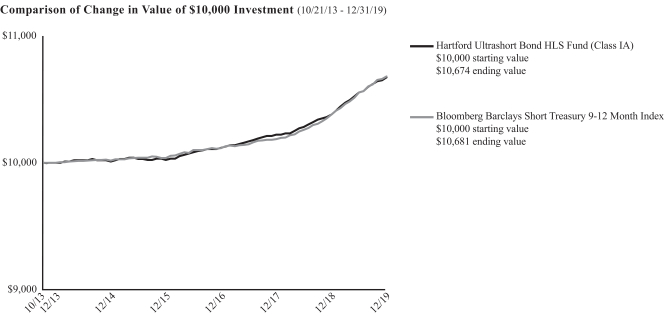

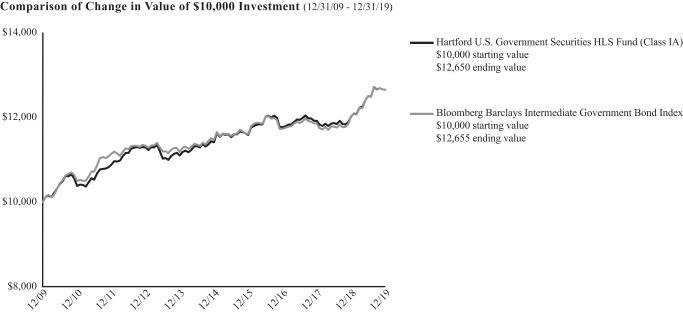

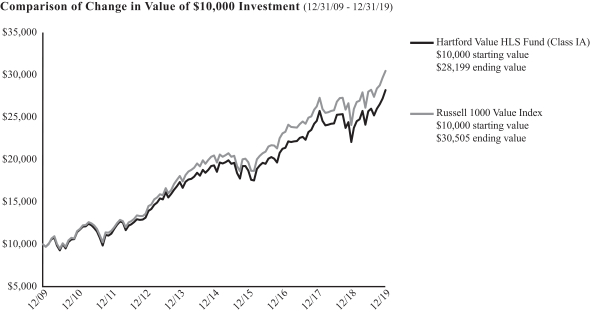

Stephen Mortimer