UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-04615

HARTFORD HLS SERIES FUND II, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Hartford HLS Funds Annual Report December 31, 2020 Hartford Balanced HLS Fund Hartford Capital Appreciation HLS Fund Hartford Disciplined Equity HLS Fund Hartford Dividend and Growth HLS Fund Hartford Healthcare HLS Fund Hartford International Opportunities HLS Fund Hartford MidCap HLS Fund Hartford Small Cap Growth HLS Fund Hartford Small Company HLS Fund Hartford Stock HLS Fund

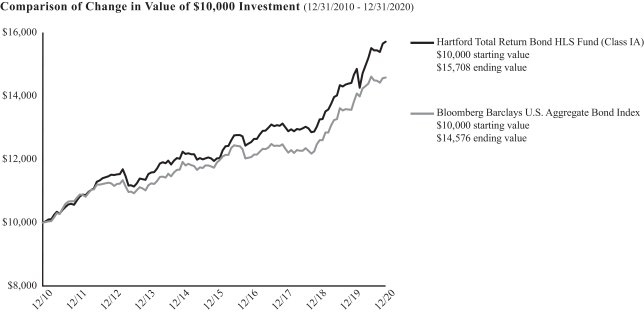

Hartford Total Return Bond HLS Fund

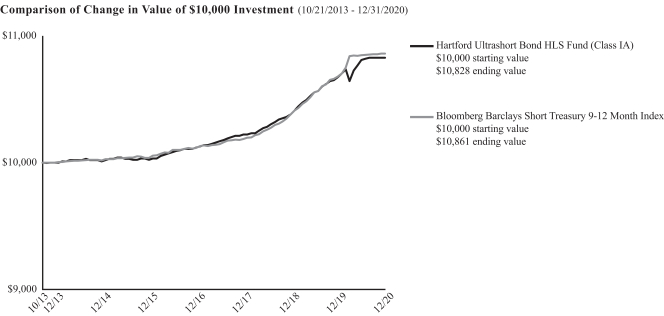

Hartford Ultrashort Bond HLS Fund

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford HLS Funds. The following is the Funds’ Annual Report covering the period from January 1, 2020 to December 31, 2020.

Market Review

During the 12 months ended December 31, 2020, U.S. stocks, as measured by the S&P 500 Index,1 gained 18.40% – a stunning market-recovery story that few would have thought possible after the index dropped significantly in March 2020 in response to

the coronavirus (COVID-19) pandemic.

After all the ups and downs of a volatile year, it may be difficult to recall the initial flood of optimism that characterized the mood of early 2020 – a time of record-low unemployment, positive stock performances, and an improving global economy. That optimism faded in late January with the arrival of the novel coronavirus (COVID-19) pandemic, which quickly triggered a global recession and ended the longest bull market in U.S. economic history.

Almost overnight, economies shut down. Hospitals and healthcare providers struggled to care for the sick and the dying. Unemployment soared to 14.7%. Social distancing measures, business lockdowns, facemask requirements, and Zoom meetings upended lives.

To avert catastrophe, policymakers quickly swung into action. The U.S. Congress enacted the $2 trillion CARES Act in late March 2020 while the U.S. Federal Reserve (Fed) acted to reduce interest rates to near zero while pledging trillions in U.S. securities purchases. The combined fiscal and monetary support provided a lifeline to countless individuals and businesses. By late April 2020, the markets had largely recovered from their March losses. By November 2020, the U.S. unemployment rate had fallen to 6.7%.

The month of November was also notable for the election of Joseph R. Biden Jr. as the 46th President of the United States – ending a highly contentious political campaign that sharply divided the nation. In the days following the election, Pfizer and Moderna received federal approval for distribution of two COVID-19 vaccines that clinical trials showed were both safe and effective. The announcements set off yet another market rally and marked a major turning point that offered new hope for an eventual end to the pandemic, which by late December 2020 had taken the lives of more than 350,000 Americans.

As the period ended, the nation struggled to find efficient ways to distribute the vaccines to a nation racked by resurgent infections, localized lockdown measures, and continued dislocations in the travel, leisure, and service industries. A new $900 billion economic stimulus package fitfully made its way through Congress as the year drew to a close. Through it all, the stock market broke new records.

With two COVID-19 vaccines being distributed globally and the potential defeat of virus within sight, we look to a new year with a renewed sense of hopefulness. That said, a unified Democratic party in control of both the White House and Congress could prompt continued market volatility in the near term. In these unprecedented times, it is more important than ever to maintain a strong relationship with your financial professional.

Thank you again for investing in Hartford HLS Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford HLS Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

| | The index is unmanaged and not available for direct investment. Past performance does not guarantee future results. |

Hartford HLS Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s portfolio manager(s) through the end of the period and are subject to change based on market and other conditions, and we disclaim any responsibility to update the views contained herein. These views may contain statements that are “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in each Fund’s Manager Discussion reflects the returns of such Fund’s Class IA shares. Returns for such Fund’s other classes differ only to the extent that the classes do not have the same expenses.

|

| Hartford Balanced HLS Fund |

Fund Overview

December 31, 2020 (Unaudited)

| | |

Inception 03/31/1983 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks long-term total return. |

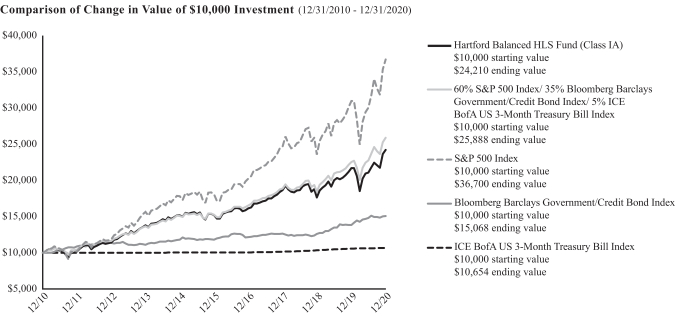

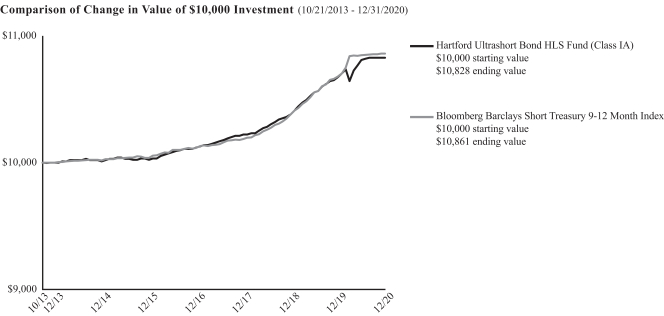

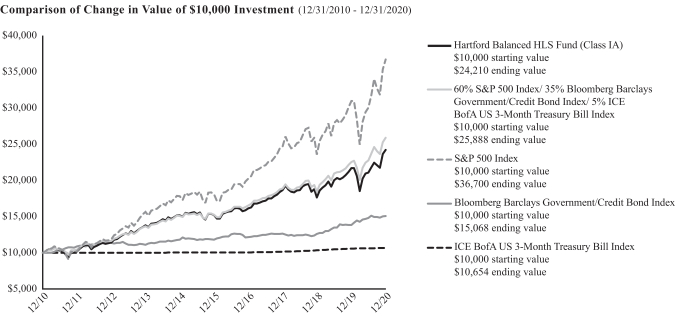

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for Class IB shares differ only to the extent that Class IA shares and Class IB shares do not have the same expenses.

Average Annual Total Returns

for the Periods Ending 12/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 11.62% | | | | 9.74% | | | | 9.24% | |

Class IB | | | 11.35% | | | | 9.47% | | | | 8.97% | |

60% S&P 500 Index/ 35% Bloomberg Barclays Government/Credit Bond Index/ 5% ICE BofA US 3-Month Treasury Bill Index1 | | | 14.87% | | | | 11.13% | | | | 9.98% | |

S&P 500 Index | | | 18.40% | | | | 15.22% | | | | 13.88% | |

Bloomberg Barclays US Government/Credit Bond Index | | | 8.92% | | | | 4.98% | | | | 4.19% | |

ICE BofA US 3-Month Treasury Bill Index2 | | | 0.67% | | | | 1.20% | | | | 0.64% | |

| 1 | Calculated by Hartford Funds Management Company, LLC |

| 2 | Effective 01/01/2020, the ICE BofAML US 3-Month Treasury Bill Index was rebranded as ICE BofA US 3-Month Treasury Bill Index. |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The table and chart do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Total returns for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

As shown in the Fund’s current prospectus, the gross expense ratios were as follows: 0.66% (Class IA) and 0.91% (Class IB). As shown in the Fund’s current prospectus, the net expense ratios were as follows: 0.63% (Class IA) and 0.88% (Class IB). Gross expenses do not reflect fee waiver arrangements. Net expenses reflect such arrangements, which remain in effect until 04/30/2021 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2020.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Adam H. Illfelder, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Michael E. Stack, CFA*

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Loren L. Moran, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Matthew C. Hand, CFA

Managing Director and Equity Research Analyst

* Michael E. Stack, CFA announced his plan to retire and withdraw from the partnership of Wellington Management Company LLP’s parent company, and effective June 30, 2021, he will no longer serve as a portfolio manager for the Fund. Mr. Stack’s portfolio management responsibilities for the fixed income portion of the Fund will transition to Ms. Moran in the months leading up to his departure.

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Balanced HLS Fund returned 11.62% for the twelve-month period ended December 31, 2020, underperforming the Fund’s blended benchmark, which is comprised of 60% S&P 500 Index, 35% Bloomberg Barclays Government/Credit Bond Index, and 5% ICE BofA US 3-Month Treasury Bill Index, which returned 14.87% for the same period. Individually, the S&P 500 Index, Bloomberg Barclays Government/Credit Bond Index, and ICE BofA US 3-Month Treasury Bill Index returned 18.40%, 8.92%, and 0.67%, respectively, during the period. For the same period, the Class IA shares of the Fund underperformed the 20.51% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between 60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending December 31, 2020. During the first quarter of 2020, U.S. equities ended lower after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. During the fourth quarter of 2020, U.S. equities rallied, bolstered by better-than-expected third quarter earnings, economic resilience, substantial monetary support from the U.S. Federal Reserve (Fed), and optimism that vaccines will support a broad reopening of the U.S. economy in 2021.

During the twelve-month period, eight of the eleven sectors within the S&P 500 Index posted positive returns, led by the Information Technology (+44%), Consumer Discretionary (+33%), and Communication Services (+24%) sectors, while the Energy (-34%) and Real Estate (-2%) sectors lagged on a relative basis.

Over the period, most global fixed income sectors generated positive returns, driven by a decline in sovereign debt yields across most markets during the period, particularly in the earlier part of 2020 at the onset of

the pandemic. In March 2020, credit spreads widened over expectations that the decline in economic activity and supply chain disruptions would cause credit fundamentals to deteriorate. Credit spreads later recouped most of their widening, helped by central bank policies, support from fiscal policy and ultimately by encouraging vaccine developments. Through the rest of 2020, market volatility remained elevated as markets oscillated between the negative effects of virus containment measures and support provided by monetary and fiscal policy.

Global gross domestic product (GDP) releases indicated deep recessions in the second quarter of 2020 following various restrictions to business activity in order to combat the spread of the virus. By the end of period, global GDP sharply rebounded as economies emerged from lockdowns and labor data showed signs of improvement but remained strained by some metrics. By the end of the period, front-end yields remained anchored with the prospect of continued accommodative central bank policy while long-end yields rose with the prospect of additional fiscal stimulus. Global central banks maintained highly accommodative policy stances during the period. The Fed provided additional assurance that asset buying would continue for the foreseeable future. The European Central Bank (ECB) extended its pandemic emergency purchase program through at least March 2022.

During the period, asset allocation decisions contributed positively to the Fund’s performance relative to the blended benchmark. The Fund was generally overweight equities and underweight fixed income and cash relative to the blended benchmark. The equity portion of the Fund underperformed the S&P 500 Index, while the fixed income portion of the Fund outperformed the Bloomberg Barclays Government/Credit Bond Index.

Equity underperformance versus the S&P 500 Index was driven primarily by security selection. Weak selection within the Information Technology, Healthcare, and Consumer Discretionary sectors was partially offset by stronger selection in the Real Estate, Communication Services, and Financials sectors. Sector allocation, a residual of our bottom-up stock selection process, also detracted from results due to the Fund’s underweight allocation to the Information Technology sector and

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

overweight allocation to the Financials sector. This was partially offset by the Fund’s underweight allocations to the Energy and Utilities sectors.

From an individual stock perspective within the equity portion of the Fund, not holding large benchmark constituents such as Apple (Information Technology) and Amazon (Consumer Discretionary), along with the Fund’s overweight position in Noble Energy (Energy), detracted the most from performance relative to the S&P 500 Index. Shares of Apple benefited from a strong iPhone cycle as 5G capabilities go mainstream, and the company also continued to see strength in its growing, high margin services segment (App Store, Apple Pay, and Apple TV+, among others). Shares of e-commerce giant Amazon also rose during 2020 on the back of strong e-commerce demand amid the global pandemic, as well as from the continued growth in its cloud business, Amazon Web Services. Noble Energy was down more than 70% over the course of 2020; the company’s share price rose in the fourth quarter of 2020 on the news that Chevron planned to acquire it.

Top contributors to performance relative to the S&P 500 Index in the equity portion of the Fund included not holding benchmark constituents Wells Fargo (Financials) and AT&T (Communication Services), as well as the Fund’s overweight position in Adobe. Shares of Adobe rose on strong earnings throughout 2020 and management released 2021 guidance that was above consensus estimates. In the fourth quarter of 2020, Adobe’s Digital Media annual recurring revenue grew 22% and Adobe’s Experience Cloud subscriptions grew 14%. Over the past year, Wells Fargo faced significant challenges after being charged with engaging in fraudulent sales practices for more than a decade. In February 2020, the bank announced that it had entered into a $3 billion dollar settlement agreement with the United States Department of Justice and the U.S. Securities and Exchange Commission (SEC). The coronavirus outbreak added further pressure, causing net interest income to fall and provisions for credit losses to rise. The company reported a loss in the second quarter of 2020 driven by large provisions which more than doubled first quarter levels. Finally, in the case of AT&T, the company came under pressure amid challenges in its media and video businesses related to the pandemic.

The fixed income portion of the Fund outperformed the Bloomberg Barclays Government/Credit Bond Index during the period. Security selection within investment-grade credit contributed positively to outperformance relative to the Bloomberg Barclays Government/Credit Bond Index, particularly selection within the Industrials and Financials sectors during the period. Within non-corporate credit, security selection and an underweight to local agency securities were the primary contributors. Out-of-benchmark allocations to agency mortgage-backed securities (MBS) pass-throughs and collateralized loan obligations (CLOs) contributed positively to relative performance. An out-of-benchmark allocation to commercial mortgage-backed securities (CMBS) moderately detracted from relative performance over the period. Duration/yield curve positioning also detracted from relative performance as the Fund was positioned with underweight positions to the short and long end of the yield curve during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

We seek to consistently mitigate the downside risk of the Fund over a market cycle. We continue to favor companies that we believe have the potential to perform well in strong market environments.

On the fixed income side, we believe credit valuations are modestly high given near term uncertainty. We expect the Fed to hold short-term interest rates low while we believe long interest rates could rise over time as economic activity rebounds post vaccine rollout. We have positioned the fixed income portion of the Fund with a slight duration underweight relative to Bloomberg Barclays Government/Credit Bond Index.

While fundamentals are likely to remain strained for the medium term, credit markets continue as the main investment focus of the fixed income portion of the Fund and are well supported by global central bank policy, in our opinion. As of the end of the period, the Fund was overweight to corporate credit relative to the Bloomberg Barclays Government/Credit Bond Index in market value terms but underweight from a spread duration perspective, reflecting our more cautious view as valuations are less compelling given near-term uncertainty.

Within the equity portion of the Fund, the Fund ended the period with the Healthcare sector as its largest overweight and the Information Technology sector as its largest underweight. Within the fixed income portion of the Fund, the Fund is positioned overweight to the less cyclical sectors like the Communications and Utilities sectors as of the end of the period. We remain cautious on more cyclical sectors, such as the Energy sector, as of the end of the period. The fixed income portion of the Fund remains overweight to Taxable Municipals as of the end of the period given the diversification benefit and resilient underlying credit quality coupled with relatively attractive valuations in our view.

At the end of the period, the Fund’s equity exposure was at 67.8% compared to 60% in the blended benchmark.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different asset classes. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • Fixed income security risks include credit, liquidity, call, duration, event, and interest-rate risk. As interest rates rise, bond prices generally fall. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. • Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government. • Mortgage-related and asset-backed securities’ risks include credit, interest-rate, prepayment, and extension risk.

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Composition by Security Type(1)

as of 12/31/2020

| | | | |

| Category | | Percentage of

Net Assets | |

Equity Securities | | | | |

Common Stocks | | | 67.9 | % |

| | | | |

Total | | | 67.9 | % |

| | | | |

Fixed Income Securities | | | | |

Asset & Commercial Mortgage-Backed Securities | | | 2.2 | % |

Corporate Bonds | | | 14.7 | |

Foreign Government Obligations | | | 0.4 | |

Municipal Bonds | | | 0.9 | |

U.S. Government Agencies(2) | | | 0.7 | |

U.S. Government Securities | | | 11.2 | |

| | | | |

Total | | | 30.1 | % |

| | | | |

Short-Term Investments | | | 2.3 | |

Other Assets & Liabilities | | | (0.3 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| (2) | All or a portion of the securities categorized as U.S. Government Agencies were agency mortgage-backed securities as of December 31, 2020. |

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview

December 31, 2020 (Unaudited)

| | |

Inception 04/02/1984 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

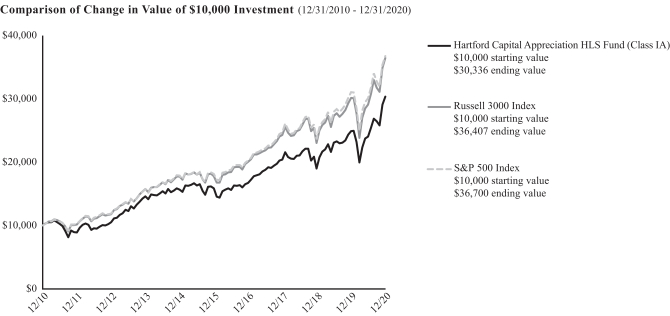

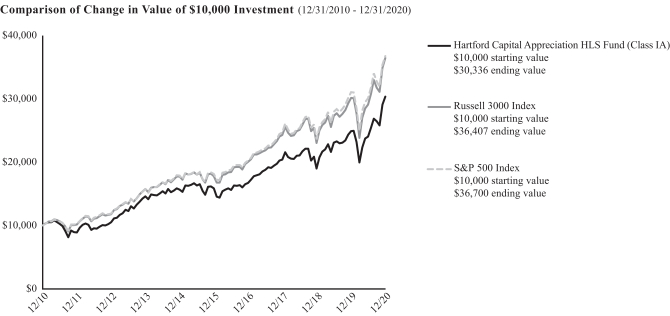

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

Average Annual Total Returns

for the Periods Ending 12/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 21.91% | | | | 13.93% | | | | 11.74% | |

Class IB | | | 21.62% | | | | 13.64% | | | | 11.46% | |

Class IC | | | 21.32% | | | | 13.36% | | | | 11.18% | |

Russell 3000 Index | | | 20.89% | | | | 15.43% | | | | 13.79% | |

S&P 500 Index | | | 18.40% | | | | 15.22% | | | | 13.88% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The table and chart do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Total returns for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

Class IC shares commenced operations on 04/30/2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.67%, 0.92% and 1.17%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2020.

Class IA and IB shares of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Gregg R. Thomas, CFA

Senior Managing Director and Director of Investment Strategy

Wellington Management Company LLP

Thomas S. Simon, CFA, FRM

Senior Managing Director and Portfolio Manager

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Capital Appreciation HLS Fund returned 21.91% for the twelve-month period ended December 31, 2020, outperforming the Fund’s benchmarks, the Russell 3000 Index, which returned 20.89% for the same period, and the S&P 500 Index, which returned 18.40% for the same period. For the same period, the Class IA shares of the Fund also outperformed the 15.73% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the Russell 3000 Index, posted positive results over the trailing twelve-month period ending December 31, 2020. During the first quarter of 2020, U.S. equities ended lower after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. Many states adopted extraordinary measures to fight the contagion, while companies shuttered stores and production, withdrew earnings guidance, and drew down credit lines at a record pace as borrowing costs soared. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market.

During the second quarter of 2020, U.S. equities finished higher after an extraordinary rally drove U.S. equities to their largest quarterly gain since the fourth quarter of 1998. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the U.S. Federal Reserve (Fed) in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Risk sentiment eased towards the end of the quarter on concerns about a sharp rise in infections in some southern and western states, the rapid speed of the market’s rebound, and cautious comments from the Fed regarding the economic outlook.

In the third quarter of 2020, U.S. equities extended their strong rally, as markets were bolstered by ongoing monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. The U.S. economy gradually recovered during the third quarter; however, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many areas of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus.

U.S. equities rose again in the fourth quarter of 2020, bolstered by better-than-expected third-quarter 2020 earnings, economic resilience, substantial monetary support from the Fed and optimism that vaccines would support a broad reopening of the U.S. economy in 2021. A sharp escalation in coronavirus infections across the country and renewed restrictions to curb the spread of the virus were overshadowed by highly

encouraging vaccine developments. In December 2020, the government unveiled a long-awaited fifth stimulus package, worth approximately $900 billion, and the Fed committed to purchasing at least $120 billion of U.S. government debt per month. Joe Biden was elected president after a closely contested election.

Returns were positive across market capitalizations during the period. Seven of the eleven sectors in the Russell 3000 Index had positive returns during the period. The Consumer Discretionary (+47.0), Information Technology (+46.1), and Communication Services (+25.8) sectors were the top performers, while the Energy (-33.2), Real Estate (-4.7%), and Financials (-2.1%) sectors lagged during the period.

Security selection was the primary contributor to Fund performance relative to the Russell 3000 Index during the period. Strong stock selection in the Communication Services, Healthcare, and Industrials sectors was only partially offset by weaker selection in the Consumer Discretionary, Consumer Staples, and Information Technology sectors, which detracted from performance during the period. Sector allocation, a residual of our bottom-up security selection process, detracted from performance relative to the Russell 3000 Index during the period. Underweight exposure to the Information Technology sector detracted most from performance and was only partially offset by underweight exposure to the Energy and Financials sectors and overweight exposure to the Consumer Discretionary sector, which contributed positively to performance.

The Fund employs a multiple portfolio manager structure. Allocations to the underlying portfolio managers who manage a portion of the Fund’s assets are chosen based on extensive analysis of qualitative and quantitative factors. Risk factors managed within the overall portfolio include but are not limited to: growth, value, momentum, contrarian, volatility, quality and leverage. The Fund’s style factor exposures contributed positively to performance during the period, driven by the Fund’s exposure to stocks with greater volatility and a modest underweight exposure to dividend-paying stocks. This was partially offset by the Fund’s underweight exposure to higher momentum stocks and its smaller-cap footprint relative to the Russell 3000 Index.

The largest contributors to performance relative to the Russell 3000 Index during the period were Pinterest (Communication Services), Square (Information Technology), and Roku (Communication Services). Pinterest operates a pinboard-style photo-sharing website allowing users to create and manage theme-based image collections. Shares moved higher during the period following strong second-quarter revenue that exceeded analyst expectations and strong growth in monthly active users. The company continued its momentum into the third quarter of 2020, where it again reported revenue and user growth in excess of expectations. As of the end of the period, the Fund remained overweight in the stock relative to the Russell 3000 Index. During the period, the

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

share price of Square, a credit card processing solutions company, surged higher as lockdown measures related to the spread of coronavirus continued the need for merchants to process transactions electronically. Strong momentum in the company’s Cash App also helped contribute to positive performance. As of the end of the period, the Fund remained overweight the stock relative to the Russell 3000 Index. Roku, a streaming platform for television, reported solid user growth in the first quarter of 2020 but it was only a slight acceleration from the prior quarter. Despite a surge in over-the-top (OTT) viewing during the period, advertiser spending weakened as a result of the global pandemic. The second quarter of 2020 resulted in revenue in excess of analyst estimates; however, the outlook for the resumption of advertiser spending remained uncertain, with expectations that it could take until 2021 to recover to pre-pandemic levels. Towards the end of the period, Roku reported strong third-quarter 2020 results as advertising revenue bounced back and drove growth. The company recognized over 40% growth in active accounts. During the period, we trimmed the Fund’s exposure to the company on share-price strength but as of the end of the period, the Fund remained overweight in the stock relative to the Russell 3000 Index.

The largest detractors from relative performance during the period were underweight exposures to Apple (Information Technology), Tesla (Consumer Discretionary), and Microsoft (Information Technology). Apple designs, manufactures, and sells personal computers, tablets, wearables, and a variety of related services. The share price of Apple moved higher during the period on quarterly earnings and revenue ahead of consensus estimates. The company participated in a four-for-one stock split during the period. As of the end of the period, we continued to hold an underweight position in the stock relative to the Russell 3000 Index. Tesla engages in the design, development, manufacture, and sale of fully electric vehicles, energy generation and storage systems. Shares of the company moved higher during the period as the company reported its fourth consecutive quarter of profitability which many viewed as the last hurdle towards Tesla’s inclusion in the S&P 500 Index. The stock entered the S&P 500 Index at the end of 2020 and shares moved higher amid positive investor sentiment. We initiated a small position in the stock during the period, which we subsequently sold later in the period as we sought to capitalize on strength while pursuing other opportunities that we believed would provide better risk and return profiles. Microsoft, a company that engages in the development and support of software, services, devices, and solutions, performed well during the beginning of the period with stay-at-home and remote-work related businesses (Teams, Gaming, virtual desktop) gaining traction. The stock continued to move higher during the period before giving back some gains after it was announced that the company’s bid for video-sharing site TikTok was not accepted. In the fourth quarter of 2020, the company reported strong quarterly results with growth in its cloud business and acceleration in commercial bookings. The market reacted negatively, however, to management’s issued guidance for the upcoming quarter which noted expected weakness in personal computing and Xbox supply constraints. As of the end of the period, the Fund remained underweight to the stock relative to the Russell 3000 Index.

During the period, the Fund, at times, used derivative instruments such as currency forwards to hedge currency risk and/or equity index futures to hedge the market risk. During the period, the use of currency forwards

did not have a significant impact on performance, while the use of equity index futures contributed positively to results.

What is the outlook as of the end of the period?

At the end of the period, considerable macroeconomic challenges persist as markets balance long-term optimism with near-term challenges. Positive news surrounding the efficacy and distribution of coronavirus vaccines has fueled investor exuberance amid expectations for a post-pandemic economic recovery. Meanwhile, a new wave of coronavirus infections is impacting regions across the country, increasing the potential for broad shutdowns and their associated negative economic ramifications, including the risk of companies becoming insolvent. To that end, we expect continued market volatility and remain vigilant in seeking to manage risks in the Fund, seeking to ensure that security selection drives results.

At the end of the period, the Fund’s largest overweights were to the Consumer Staples and Consumer Discretionary sectors, while the Fund’s largest underweights were to the Information Technology and Communication Services sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund’s strategy for allocating assets among portfolio management teams may not work as intended. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. •Small- and mid-cap securities can have greater risks and volatility than large-cap securities. •Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks are generally greater for investments in emerging markets. •The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of 12/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 6.5 | % |

Consumer Discretionary | | | 16.7 | |

Consumer Staples | | | 10.4 | |

Energy | | | 1.0 | |

Financials | | | 10.0 | |

Health Care | | | 16.3 | |

Industrials | | | 8.6 | |

Information Technology | | | 20.3 | |

Materials | | | 2.8 | |

Real Estate | | | 3.6 | |

Utilities | | | 1.4 | |

| | | | |

Total | | | 97.6 | % |

| | | | |

Short-Term Investments | | | 2.2 | |

Other Assets & Liabilities | | | 0.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview

December 31, 2020 (Unaudited)

| | |

Inception 05/29/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

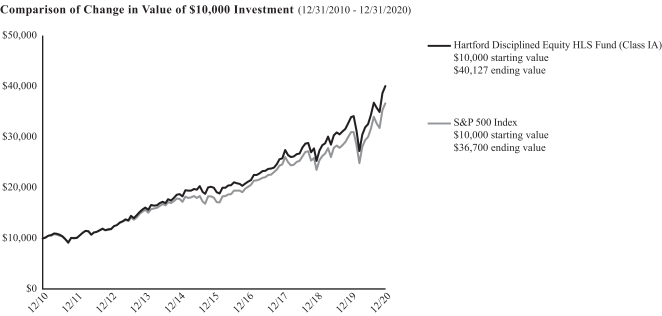

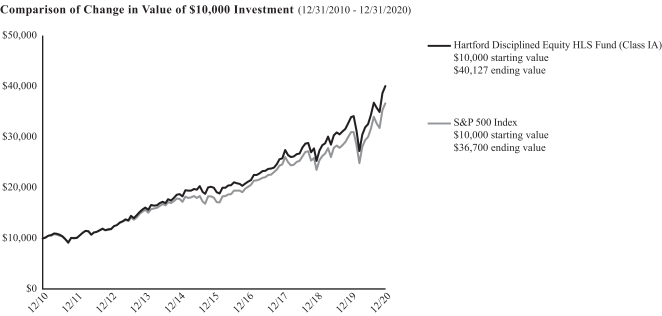

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

Average Annual Total Returns

for the Periods Ending 12/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 18.04 | % | | | 14.88 | % | | | 14.91 | % |

Class IB | | | 17.78 | % | | | 14.60 | % | | | 14.62 | % |

Class IC | | | 17.46 | % | | | 14.31 | % | | | 14.34 | % |

S&P 500 Index | | | 18.40 | % | | | 15.22 | % | | | 13.88 | % |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The table and chart do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Total returns for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

Class IC shares commenced operations on 09/18/2020. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus for Class IA and IB, the total annual fund operating expense ratios for Class IA and Class IB were 0.61% and 0.86, respectively. As shown in the Fund’s current prospectus for Class IC, the total annual fund operating expense ratio for Class IC shares was 1.11%. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2020.

Class IA and Class IB of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus for Class IA and Class IB.

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Douglas W. McLane, CFA

Senior Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of the Hartford Disciplined Equity HLS Fund returned 18.04% for the twelve-month period ended December 31, 2020, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 18.40% for the same period. For the same period, the Class IA shares of the Fund slightly outperformed the 17.29% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended December 31, 2020. U.S. equities ended the first quarter of 2020 sharply lower after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. Many states adopted extraordinary measures to fight the contagion, while companies shuttered stores and production, withdrew earnings guidance, and drew down credit lines at a record pace as borrowing costs soared. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market.

U.S. equities ended the second quarter of 2020 higher after an extraordinary rally drove U.S. equities to their largest quarterly gain since the fourth quarter of 1998. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the U.S. Federal Reserve (Fed) in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Risk sentiment eased at the end of the second quarter on concerns about a sharp rise in infections in some southern and western states, the rapid speed of the market’s rebound, and cautious comments from the Fed regarding the economic outlook.

In the third quarter of 2020, U.S. equities extended their strong rally, with markets bolstered by substantial monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. The U.S. economy gradually recovered during the third quarter; however, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many areas of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus. In September, the S&P 500 Index declined for the first time in five months. The Fed signaled its expectation to hold interest rates near zero until inflation is on track to moderately exceed 2%.

During the fourth quarter of 2020, U.S. equities rallied, bolstered by better-than-expected third quarter earnings, economic resilience, substantial monetary support from the Fed, and optimism that vaccines would support a broad reopening of the U.S. economy in 2021. A sharp escalation in coronavirus infections across the country and renewed restrictions to curb the spread of the virus were overshadowed by highly encouraging vaccine developments. In December 2020, the government unveiled a long-awaited fifth stimulus package, worth approximately $900 billion, and the Fed committed to purchasing at least $120 billion of U.S. government debt per month. Joe Biden was elected president, removing a key element of uncertainty for the market. Third-quarter earnings results for companies in the S&P 500 Index were significantly better than expected.

Returns varied by market capitalization during the period as large-cap equities, as measured by the S&P 500 Index, underperformed small-cap equities, as measured by the Russell 2000 Index, but outperformed mid-cap equities, as measured by the S&P MidCap 400 Index. During the twelve-month period, eight of the eleven sectors within the S&P 500 Index rose, led by the Information Technology (+44%), Consumer Discretionary (33%), and Communication Services (+24%) sectors. The Energy sector performed worst, down (-34%) during the period.

Security selection was the primary detractor from the Fund’s returns relative to the S&P 500 Index during the period. Selection within the Information Technology, Consumer Discretionary, and Real Estate sectors detracted most from relative performance, while selection within the Consumer Staples, Industrials, and Utilities sectors contributed positively to relative returns. Sector allocation, which is a residual of our bottom-up security selection process, contributed positively to relative performance driven by underweights to the Energy and Real Estate sectors, and an overweight to the Healthcare sector. This was partially offset by an underweight allocation to both the Information Technology and Communication Services sectors, and an overweight allocation to the Consumer Staples sector, which detracted from performance.

Top detractors from relative performance over the period were PVH (Consumer Discretionary), Boston Properties (Real Estate), and not owning NVIDIA (Information Technology), a constituent of the S&P 500 Index. Shares of PVH, a U.S.-based global apparel company, fell during the period as retail demand slowed globally in response to the coronavirus pandemic. Share prices, however, partially recovered towards the end of the twelve-month period after the company reported better-than-expected third-quarter fiscal results, citing strength in its international business, a solid e-commerce performance, and rising demand for casual wear. We sold this position in the Fund during the period. Shares of Boston Properties declined over the year; due to the

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

stay-at-home policies during the year, physical occupancy within the company’s properties was low. We sold this position in the Fund during the period. Shares of chip maker NVIDIA rose during the period after reporting consecutively strong quarterly results. NVIDIA has benefited from much of the world working and learning from home as sales of laptops and game consoles using NVIDIA chips lifted earnings for the company. Not owning the stock during the period was a detractor from Fund performance due to the stock’s strong performance.

The largest contributors to the Fund’s performance relative to the S&P 500 Index over the period were not owning both Exxon Mobil (Energy) and Wells Fargo (Financials), which are each constituents of the S&P 500 Index, as well as an overweight holding in Teradyne (Information Technology). Shares of the oil- and gas-producing company Exxon Mobil came under pressure the past year due to a decrease in crude oil and natural gas prices amid escalating concerns of a slowing macroeconomic environment. Not owning the stock was a positive contributor over the period due to poor performance. Shares of Wells Fargo declined over the year after reporting consecutive disappointing quarterly results. In July, the company announced it set aside a record $9.5 billion for credit losses. Executives warned they would earmark more for soured loans as the pandemic continued to rage throughout the U.S. and weigh on companies and workers. Falling yields have also negatively affected the bank. Not owning the stock was a positive contributor to Fund performance over the period due to the stock’s poor performance. Shares of Teradyne, an automated test equipment and industrial automation company, rose during the period. Towards the end of the period, the company released third-quarter earnings that beat consensus and guided revenue expectations for the fourth quarter higher.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

We are keeping an eye on the Georgia runoff election for the Senate, and whether control of the Senate will flip to the Democrats. Depending on the outcome, we will consider various policy implications from that event, including if there is alignment of majorities for both legislative houses and the presidency.

It is encouraging that there is an effort underway to vaccinate the population even if the pace of the initial rollout has been disappointing relative to earlier expectations. Despite worries about different strains, at least so far, we remain optimistic about the potential for putting the pandemic behind us this year. Given the efficacy of the various vaccines, there still may be some lasting lifestyle changes and we are mindful of this development. Despite these changes, we expect unemployment rates to come down in 2021 as a recovery takes hold, especially in some of the hardest-hit industries.

We remain cautious, being mindful of pockets of extreme speculation and valuations that are hard to justify. On the positive side, we believe the combination of a high savings rate, stimulus payments, and rehiring more recently implies a very healthy consumer when the economic recovery takes shape.

As always, we continue to focus on the long term. While we did make some changes to portfolio holdings in the Fund during the period, we continue to be incremental and mindful of the impact of volatility.

At the end of the period, the Fund’s largest overweights were to the Consumer Staples, Healthcare, and Financials sectors, while the Fund’s largest underweights were to the Energy, Real Estate, and Consumer Discretionary sectors, relative to the S&P 500 Index.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

Composition by Sector(1)

as of 12/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 10.7 | % |

Consumer Discretionary | | | 11.9 | |

Consumer Staples | | | 8.6 | |

Energy | | | 0.9 | |

Financials | | | 11.1 | |

Health Care | | | 13.9 | |

Industrials | | | 8.5 | |

Information Technology | | | 27.6 | |

Materials | | | 2.1 | |

Real Estate | | | 1.6 | |

Utilities | | | 2.6 | |

| | | | |

Total | | | 99.5 | % |

| | | | |

Short-Term Investments | | | 0.5 | |

Other Assets & Liabilities | | | 0.0 | * |

| | | | |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to zero. |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview

December 31, 2020 (Unaudited)

| | |

Inception 03/09/1994 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

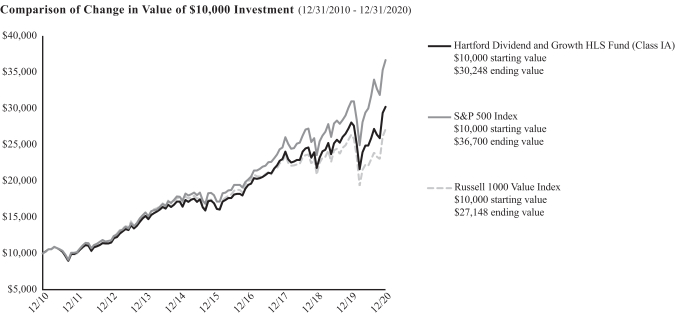

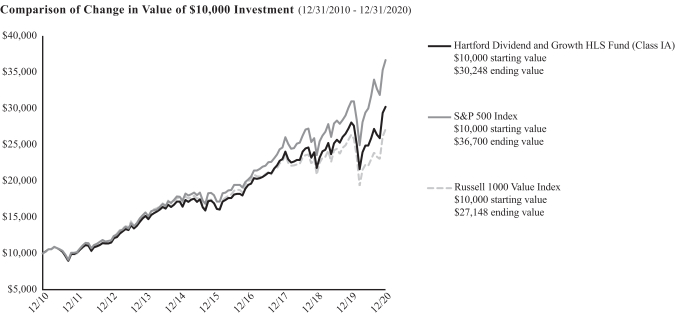

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for Class IB shares differ only to the extent that Class IA shares and Class IB shares do not have the same expenses.

Average Annual Total Returns

for the Periods Ending 12/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 7.77% | | | | 12.28% | | | | 11.70% | |

Class IB | | | 7.45% | | | | 11.99% | | | | 11.42% | |

S&P 500 Index | | | 18.40% | | | | 15.22% | | | | 13.88% | |

Russell 1000 Value Index | | | 2.80% | | | | 9.74% | | | | 10.50% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The table and chart do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Total returns for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.66% and 0.91%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2020.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Nataliya Kofman

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Dividend and Growth HLS Fund returned 7.77% for the twelve-month period ended December 31, 2020, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 18.40% for the same period, and outperforming the Fund’s other benchmark, the Russell 1000 Value Index, which returned 2.80% for the same period. For the same period, the Class IA shares of the Fund outperformed the 4.27% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended December 31, 2020. U.S. equities ended the first quarter of 2020 sharply lower after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. Many states adopted extraordinary measures to fight the contagion, while companies shuttered stores and production, withdrew earnings guidance, and drew down credit lines at a record pace as borrowing costs soared. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market.

U.S. equities ended the second quarter of 2020 higher after an extraordinary rally drove U.S. equities to their largest quarterly gain since the fourth quarter of 1998. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the U.S. Federal Reserve (Fed) in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Risk sentiment eased at the end of the second quarter on concerns about a sharp rise in infections in some southern and western states, the rapid speed of the market’s rebound, and cautious comments from the Fed regarding the economic outlook.

In the third quarter of 2020, U.S. equities extended their strong rally, with markets bolstered by substantial monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. The U.S. economy gradually recovered during the third quarter; however, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many areas of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus. In September, the S&P 500 Index declined for the first time in five months. The Fed signaled its expectation to hold interest rates near zero until inflation is on track to moderately exceed 2%.

During the fourth quarter of 2020, U.S. equities rallied, bolstered by better-than-expected third quarter earnings, economic resilience, substantial monetary support from the Fed, and optimism that vaccines would support a broad reopening of the U.S. economy in 2021. A sharp escalation in coronavirus infections across the country and renewed restrictions to curb the spread of the virus were overshadowed by highly encouraging vaccine developments. In December 2020, the government unveiled a long-awaited fifth stimulus package, worth approximately $900 billion, and the Fed committed to purchasing at least $120 billion of U.S. government debt per month. Joe Biden was elected president, removing a key element of uncertainty for the market. Third-quarter earnings results for companies in the S&P 500 Index were significantly better than expected.

Returns varied by market cap during the period, as small-cap equities, as measured by the Russell 2000 Index, outperformed both large- and mid-cap equities, as measured by the S&P 500 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, eight of the eleven sectors within the S&P 500 Index posted positive returns, led by Information Technology (+44%), Consumer Discretionary (+33%), and Communication Services (+24%). Energy (-34%), Real Estate (-2%) and Financials (-2%) lagged.

Sector allocation, a result of our bottom-up stock selection process, was the primary driver of the Fund’s underperformance relative to the S&P 500 Index during the period. An underweight to the Information Technology sector and overweights to the Energy and Financials sectors detracted from performance; however, this was partially offset by an overweight to the Industrials sector and an underweight to the Real Estate sector, both of which contributed positively. Security selection also detracted from relative performance over the period. Weak selection within the Information Technology, Consumer Discretionary, and Communication Services sectors was partially offset by stronger selection within the Energy and Financials sectors, which contributed positively to the Fund’s relative performance.

The Fund’s top detractors from performance relative to the S&P 500 Index included not owning Amazon (Consumer Discretionary), an underweight to Apple (Information Technology) and an overweight to Bank of America (Financials), as well as an allocation to Suncor Energy (Energy), which was outside of the benchmark. Not holding S&P 500 Index constituent Amazon (Consumer Discretionary) was a top relative detractor from performance during the period as shares of the company rose during the period. An underweight to Apple (Information Technology) was the other significant relative detractor from performance during the period as shares of Apple rose during the period. We maintained the Fund’s underweight in Apple stock due to what we viewed as a high valuation for relatively moderate growth. Shares of Bank of America fell as coronavirus worries sent U.S. Treasury yields lower. U.S. 30-year Treasury notes fell to a record low, and 10-year

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Treasury notes fell to levels not seen since 2016, narrowing the spread on the bank’s longer-term assets funded with shorter-term liabilities. Broadly speaking, the Energy sector was the worst performing sector as the correction in oil prices was set off by the failed Organization of the Petroleum Exporting Countries Plus supply agreement and was further exacerbated by severe demand reduction due to restrictions on global economic activity. At the end of the period, shares of Suncor were under pressure driven by lower commodity prices and elevated costs and expenses. We eliminated the Fund’s position in the first quarter of 2020 as we preferred large integrated Energy companies.

Top contributors to Fund performance relative to the S&P 500 Index over the period included underweight allocations to Exxon Mobil (Energy) and Wells Fargo (Financials), as well as an overweight to Deere & Co (Industrials). ExxonMobil (Energy) was a top contributor to relative performance during the period, as we exited the position prior to the energy market collapse in March 2020. Not owning shares of Well Fargo contributed to relative performance as the company’s shares fell over the period after the chief financial officer predicted higher loan-loss provisions in addition to a sharp drop in interest income for the year. Deere & Co shares rose during the period as it reported strong earnings results and increased its sales outlook for the year as demand remained resilient despite the uncertainty related to the coronavirus pandemic.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

The market continued its positive trajectory in the fourth quarter of 2020, bolstered by enthusiasm around the positive vaccine announcements. Now that the U.S. Food and Drug Administration (FDA) has approved a number of vaccines, we believe a successful distribution and administration of the vaccine may allow the economy to regain some normalcy by the end of the year. Despite this clear positive, risks remain such as rising geopolitical uncertainty, new waves of the coronavirus, and massive debt. That being said, we believe that many areas of the market were overlooked in 2020. Our framework during these turbulent times has been to seek to avoid balance sheet risk while seeking to identify mispriced opportunities that have the potential to create enormous value on the other side of the pandemic.

At the end of the period, the Fund remained most overweight in the Financials and Energy sectors and most underweight in the Information Technology and Consumer Discretionary sectors, relative to the S&P 500 Index.

In the face of great uncertainty, we remain focused on seeking to invest the Fund’s assets in companies that we believe to have reasonable valuations, with attractive long-term free cash flow generation, solid balance sheets, and resilient fundamentals.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. •For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. •Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.

Composition by Sector(1)

as of 12/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 8.8 | % |

Consumer Discretionary | | | 6.5 | |

Consumer Staples | | | 5.7 | |

Energy | | | 4.5 | |

Financials | | | 19.2 | |

Health Care | | | 15.3 | |

Industrials | | | 9.5 | |

Information Technology | | | 19.0 | |

Materials | | | 4.0 | |

Real Estate | | | 2.3 | |

Utilities | | | 3.5 | |

| | | | |

Total | | | 98.3 | % |

| | | | |

Short-Term Investments | | | 1.2 | |

Other Assets & Liabilities | | | 0.5 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Healthcare HLS Fund |

Fund Overview

December 31, 2020 (Unaudited)

| | |

Inception 05/01/2000 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks long-term capital appreciation. |

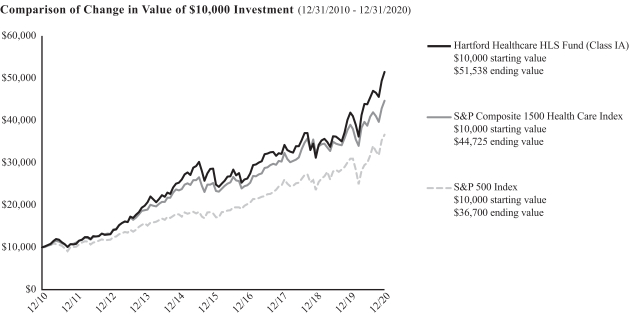

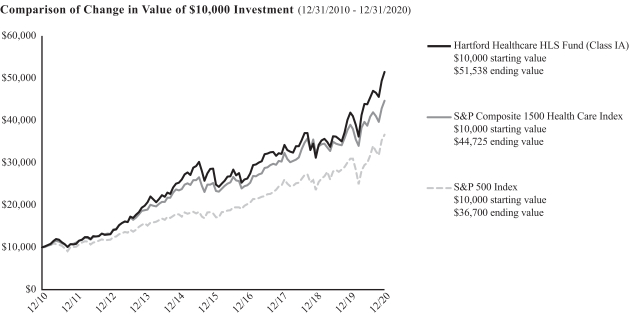

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for Class IB shares differ only to the extent that Class IA shares and Class IB shares do not have the same expenses.

Average Annual Total Returns

for the Periods Ending 12/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 23.10% | | | | 12.44% | | | | 17.82% | |

Class IB | | | 22.79% | | | | 12.16% | | | | 17.52% | |

S&P Composite 1500 Health Care Index | | | 14.55% | | | | 12.12% | | | | 16.16% | |

S&P 500 Index | | | 18.40% | | | | 15.22% | | | | 13.88% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The table and chart do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Total returns for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.92% and 1.17%, respectively. Gross and net expenses are the same. Expenses shown include acquired fund fees and expenses. Actual expenses

may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2020.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Healthcare HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

Jean M. Hynes, CFA*

Senior Managing Director and Global Industry Analyst

Wellington Management Company LLP

Ann C. Gallo

Senior Managing Director and Global Industry Analyst

Wellington Management Company LLP

Robert L. Deresiewicz

Senior Managing Director and Global Industry Analyst

Wellington Management Company LLP

Rebecca D. Sykes

Senior Managing Director and Global Industry Analyst

Wellington Management Company LLP

* Effective June 30, 2021, Ms. Hynes will no longer serve as a portfolio manager to the Fund. Through June 30, 2021, Ms. Hynes will transition her portfolio management responsibilities to Ms. Sykes.

Manager Discussion and Analysis

How did the Fund perform during the period?

The Class IA shares of Hartford Healthcare HLS Fund returned 23.10% for the twelve-month period ended December 31, 2020, outperforming the Fund’s benchmarks, the S&P Composite 1500 Health Care Index, which returned 14.55% for the same period, and the S&P 500 Index, which returned 18.40% for the same period. For the same period, the Class IA shares of the Fund outperformed the 12.77% average return of the Lipper Global Health and Biotechnology peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) healthcare equities underperformed the broader U.S. market and global equity market during the period, as measured by the S&P Composite 1500 Health Care Index, S&P 500 Index, and the MSCI World Index, respectively. Within the S&P Composite 1500 Health Care Index, mid-cap biopharma returned 23%, medical technology returned 22%, healthcare services returned 15%, large-cap biopharma returned 8%, and small-cap biopharma returned 2% for the period.

The Fund outperformed the S&P Composite 1500 Health Care Index over the period primarily because of favorable security selection decisions. Security selection was strongest in mid- and small-cap biopharma. Sector allocation detracted from performance relative to the S&P Composite 1500 Health Care Index. An overweight to small-cap biopharma and the Fund’s cash position detracted from results relative to the S&P Composite 1500 Health Care Index during the period, offsetting positive results from an overweight to mid-cap biopharma and an underweight to large-cap biopharma.

Forty Seven (small-cap biopharma), Momenta Pharmaceuticals (mid-cap biopharma), and Zai Lab (mid-cap biopharma) were the top contributors to performance relative to the S&P Composite 1500 Health Care Index. In March, Forty Seven, a U.S.-based development-stage targeted oncology company, announced an agreement in which Gilead Sciences would acquire Forty Seven for $4.9 billion, a 60% premium to the stock’s February 2020 end-of-month closing price. Shares of Momenta Pharmaceuticals, a U.S.-based biopharmaceutical company focused on

developing drugs and biosimilars for cancer and autoimmune diseases,

rose sharply in August after the company announced it had been acquired by Johnson & Johnson for approximately $6.5 billion in cash, which is approximately a 70% premium over the stock’s prior closing price. Subsequently, we eliminated both positions (Forty Seven and Momenta Pharmaceuticals) in the Fund during the period after the respective announcements. Zai Lab, a Chinese biopharma focused on treatments for cancer, autoimmune, and infectious diseases traded higher following the March 2020 drawdown due to strong demand for the company’s products. More recently, the stock was up after the company’s partner, Macrogenics, announced U.S. Food & Drug Administration (FDA) approval of its drug for patients with pretreated metastatic HER2-positive breast cancer. Top absolute contributors relative to the S&P Composite 1500 Health Care Index during the period included Forty Seven, UnitedHealth Group, and Thermo Fisher Scientific.

Boston Scientific (medical technology), Tricida (small-cap biopharma), and not owning AbbVie (large-cap biopharma) detracted most from results relative to the S&P Composite 1500 Health Care Index over the period. Boston Scientific, a U.S.-based medical device company, was one of the first large healthcare companies to forecast a negative sales impact to Chinese operations from the coronavirus pandemic. While coronavirus spread throughout Europe and the U.S., shares slid further as investors anticipated additional business disruption. Towards the end of the period, the company reported that its Scope II trial missed the primary endpoint and that it has initiated a global, voluntary recall of all unused inventory of the LOTUS Edge Aortic Valve System due to complexities associated with the product delivery system. Shares of Tricida, a clinical-stage biopharma company that is focused on treatment of metabolic acidosis, declined during the period after the FDA issued a Complete Response Letter (CRL) to the company regarding its New Drug Application for veverimer, a treatment for metabolic acidosis in patients with chronic kidney disease. Based on more recent discussions with the FDA, the additional clinical data required is more robust than previously anticipated, creating a more challenging path forward for the company. We eliminated the Fund’s position during the period. Not owning strong-performing AbbVie detracted from performance relative to the S&P Composite 1500 Health Care Index. The company reported

|

| Hartford Healthcare HLS Fund |

Fund Overview – (continued)

December 31, 2020 (Unaudited)

better-than-expected first- and third-quarter earnings results and maintained full year guidance, driven by sales of top arthritis drug Humira. Boston Scientific, Anthem, and Medtronic were top detractors from absolute performance during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

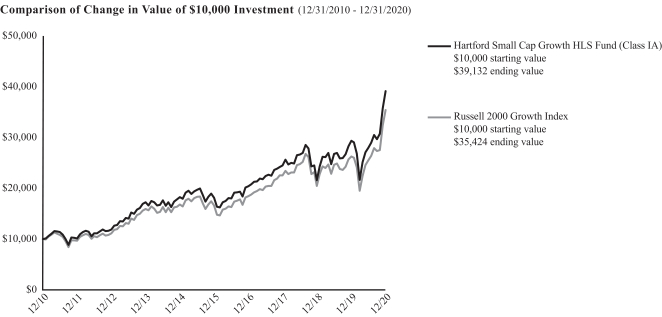

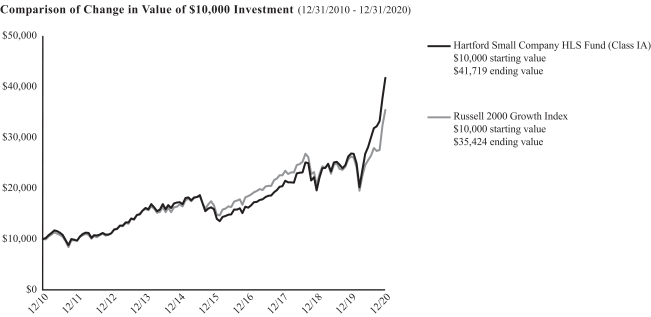

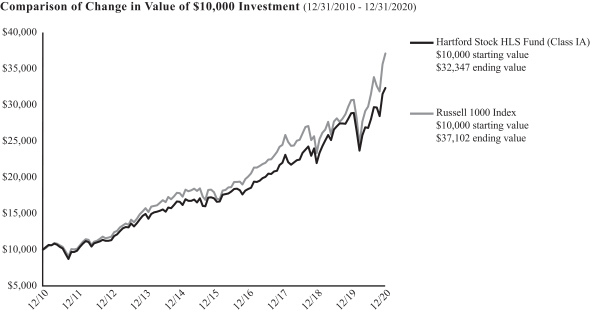

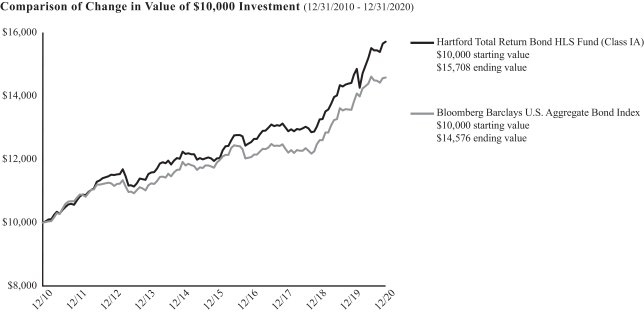

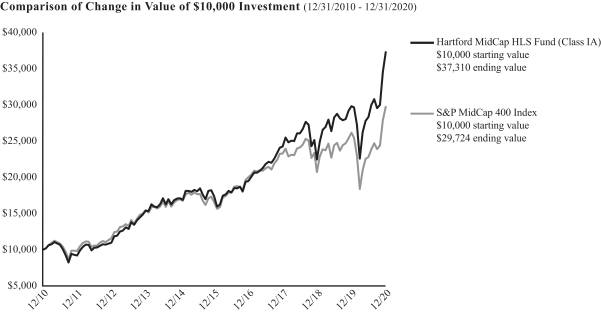

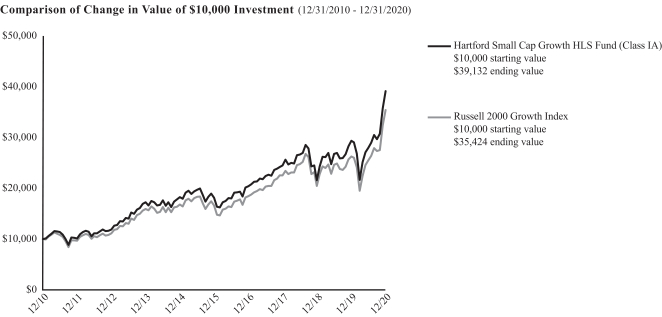

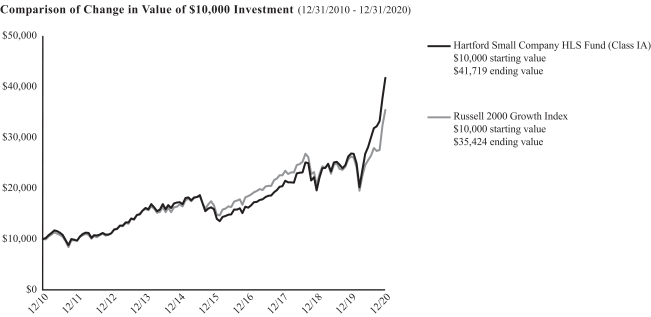

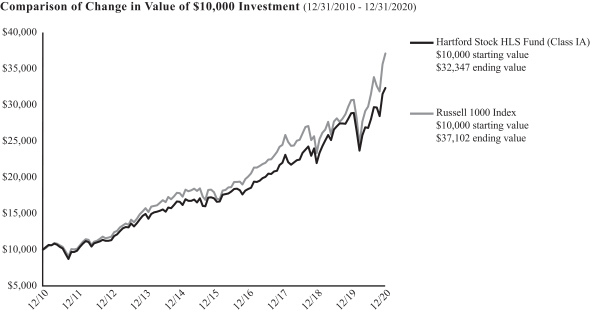

What is the outlook as of the end of the period?