UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04615

HARTFORD HLS SERIES FUND II, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Hartford HLS Funds

Annual Report

December 31, 2023

| ■ Hartford Balanced HLS Fund |

| ■ Hartford Capital Appreciation HLS Fund |

| ■ Hartford Disciplined Equity HLS Fund |

| ■ Hartford Dividend and Growth HLS Fund |

| ■ Hartford Healthcare HLS Fund |

| ■ Hartford International Opportunities HLS Fund |

| ■ Hartford MidCap HLS Fund |

| ■ Hartford Small Cap Growth HLS Fund |

| ■ Hartford Small Company HLS Fund |

| ■ Hartford Stock HLS Fund |

| ■ Hartford Total Return Bond HLS Fund |

| ■ Hartford Ultrashort Bond HLS Fund |

A MESSAGE FROM THE PRESIDENT

Dear Shareholders

Thank you for investing in Hartford HLS Funds. The following is the Funds’ Annual Report covering the period from January 1, 2023 to December 31, 2023.

Market Review

During the 12 months ended December 31, 2023, U.S. stocks, as measured by the S&P 500 Index,1 gained 26.29%. While performance was strong during the period, it was a turbulent, up-and-down ride for investors almost from start to finish. For example, a January 2023 equity rally followed a surprise drop in the Consumer Price Index (CPI),2 briefly raising hopes for an early pivot by the Federal Reserve (Fed) on its interest-rate hiking strategy. Nonetheless, Fed Chair Jerome Powell quickly reaffirmed the central bank's higher-for-longer policy stance, triggering a February 2023 sell-off.

Similarly, a promising late-spring equity rally lost steam in the face of rising U.S. Treasury yields, sending stocks lower in mid-July 2023. But in mid-December 2023, when the Fed began signaling the possibility of rate cuts in 2024, stocks rose once again, right up until the end of the month. The push and pull between investor optimism versus the Fed's periodic declarations of policy resolve became something of a regular feature of market performance during the period.

The March 2023 banking crisis prompted by the collapse of Silicon Valley Bank and Signature Bank provided a major jolt to investor confidence as the impact of higher interest rates briefly raised the specter of U.S. financial instability. The Fed’s quick action to provide extra liquidity to the banking system, in combination with the balm of continued price moderation, went a long way in quelling fears of financial contagion.

Indeed, the June 2023 CPI report showed an annual inflation rate of only 3%, leaving the Fed with plenty of room to pause rate hikes in the same month. By November 2023, annual inflation was rising by 3.1%.

Yet another jolt to markets occurred in May 2023 as an unexpectedly positive forward-guidance report from chipmaker NVIDIA helped kick off a fresh equity rally, lifting the value of several growth-oriented companies linked to artificial-intelligence technology. The rally continued through July 2023 before finally cooling off amidst a sudden surge in U.S. Treasury yields. In mid-October 2023, the bellwether 10-Year Treasury note closed at 4.98% amid a growing sense that hoped-for interest-rate cuts would be delayed once more in the face of unexpected economic resilience.

By December 2023, continued progress on the inflation front prompted the Fed, once again, to pause rate hikes and, for the first time, to publicly declare the likelihood of interest-rate cuts sometime in 2024. Markets interpreted the Fed pivot as a signal to launch yet another equity rally, one that saw the S&P 500 Index close at 4,781.58 on December 27, 2023, only 15 points below its all-time high.

As of the end of the period, market participants found themselves closely reexamining the Federal Open Market Committee December 2023 meeting minutes for clues of future direction—mindful that any near-term resumption in inflation or even a hint of recession could change the timetable for rate cuts. With market volatility likely to persist, it’s more important than ever to maintain a strong relationship with your financial professional.

Thank you again for investing in Hartford HLS Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford HLS Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. Indices are unmanaged and not available

for direct investment. Past performance does not guarantee future results. |

| 2 | The Consumer Price Index (CPI) in the United States is defined by the Bureau of Labor Statistics as a measure of the average change over time in the prices

paid by urban consumers for a market basket of consumer goods and services. |

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s portfolio Manager(s) through the end of the period and are subject to change based on market and other conditions, and we disclaim any responsibility to update the views contained herein. These views may contain statements that are “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in each Fund’s Manager Discussion reflects the returns of such Fund’s Class IA shares. Returns for such Fund’s other classes differ only to the extent that the classes do not have the same expenses.

Hartford Balanced HLS Fund

Fund Overview

December 31, 2023 (Unaudited)

Inception 03/31/1983

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks long-term total return. |

Comparison of Change in Value of $10,000 Investment (12/31/2013 - 12/31/2023)

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for Class IB shares differ only to the extent that Class IA shares and Class IB shares do not have the same expenses.

| Average Annual Total Returns |

| for the Periods Ended 12/31/2023 |

| | 1 Year | 5 Years | 10 Years |

| Class IA | 14.78% | 10.26% | 7.61% |

| Class IB | 14.50% | 9.99% | 7.34% |

| 60% S&P 500 Index/ 35% Bloomberg US Government/Credit Bond Index/ 5% ICE BofA US 3-Month Treasury Bill Index1 | 17.75% | 10.16% | 8.13% |

| S&P 500 Index | 26.29% | 15.69% | 12.03% |

| Bloomberg US Government/Credit Bond Index | 5.72% | 1.41% | 1.97% |

| ICE BofA US 3-Month Treasury Bill Index | 5.01% | 1.88% | 1.25% |

| 1 | Calculated by Hartford Funds Management Company, LLC |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2023, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

You cannot invest directly in an index.

See "Benchmark Glossary" for benchmark descriptions.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA shares and Class IB shares were 0.66% and 0.91%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2023.

Class IA shares and Class IB shares of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

Hartford Balanced HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

Portfolio Managers

Adam H. Illfelder, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Loren L. Moran, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Matthew C. Hand, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of Hartford Balanced HLS Fund returned 14.78% for the twelve-month period ended December 31, 2023, underperforming the Fund’s custom benchmark, which is comprised of 60% S&P 500 Index/ 35% Bloomberg US Government/Credit Bond Index/ 5% ICE BofA US 3-Month Treasury Bill Index, which returned 17.75% for the same period. Individually, the S&P 500 Index, Bloomberg US Government/Credit Bond Index, and ICE BofA US 3-Month Treasury Bill Index returned 26.29%, 5.72%, and 5.01%, respectively, during the period. For the same period, the Class IA shares of the Fund also underperformed the 15.59% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between 60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, rose during the twelve-month period ended on December 31, 2023 amid easing inflation, optimism for lower interest rates, strong performances in select mega-cap technology companies, and steady Gross Domestic Product (GDP) growth. U.S. equities advanced during the first quarter. The collapse of two U.S. regional banks prompted swift policy actions by federal regulators, which helped stabilize liquidity and stem the potential for broader contagion. Shares of large technology companies surged, helping growth stocks to significantly outperform their value counterparts. The U.S. Federal Reserve (Fed) slowed its pace of policy tightening, raising interest rates by 0.25% in February and March, to a range between 4.75% – 5%. U.S. equities rose again in the second quarter, largely driven by a potent rally in a narrow group of mega-cap technology companies that benefited from investor optimism about their earnings potential and growth prospects and exuberance surrounding generative artificial intelligence (AI). U.S. equities fell in the third quarter, pressured by rising Treasury yields amid views that the Fed would keep interest rates elevated for a prolonged period. Even as household budgets were strained by tightening credit conditions and lofty prices, markets dialed back the probability of recession as cooling inflation, a solid job market, and resilient consumer spending increased the potential that the U.S. economy could achieve a “soft landing.” Economic data released during the third quarter indicated healthy momentum in the

U.S. economy after GDP in the second quarter grew at a 2.1% annualized rate. U.S. equities registered their largest quarterly return in three years for the fourth quarter as gains broadened beyond those of the “Magnificent Seven” stocks that dominated the stock market’s performance for most of the year. A rapid descent in inflation prompted the Fed to pivot from its “higher-for-longer” policy stance in December, sending Treasury yields lower and driving stocks higher. The Fed’s Summary of Economic Projections implied that policymakers anticipate 75 basis points of interest-rate cuts in 2024.

During the twelve-month period, nine of the eleven sectors within the S&P 500 Index posted positive results, with the Information Technology (57.65%), Communication Services (55.80%), and Consumer Discretionary (42.23%) sectors performing the best. Conversely, the Utilities (-7.08%) and Energy (-1.33%) sectors performed the worst with negative returns.

Global fixed income sectors generated positive total returns during the trailing twelve months ended December 31, 2023 despite elevated interest rate volatility over most of the period. The Bloomberg US Aggregate Bond Index returned 5.53% during the period. Higher-yielding sectors generally performed best, benefiting from their coupon advantage, and spread tightening. Global sovereign debt yields ended mixed. Yields rose earlier in the period amid multiple rate increases from the Fed and other major central banks across Europe, while Asian central banks pursued more dovish approaches. Yields plunged by the end of the period in response to accommodative central bank policy expectations amid weaker economic data, including moderating inflation.

The underperformance of the equity portion of the Fund versus the S&P 500 Index was mainly driven by security selection during the period. Weak selection within the Information Technology, Consumer Discretionary, and Industrials sectors was partially offset by stronger selection in the Financials, Healthcare, and Real Estate sectors. Sector allocation, a result of our bottom-up stock selection process, also detracted from relative performance due to the Fund’s overweight position in the Healthcare sector, underweight position to the Information Technology sector, and overweight position to the Financials sector. This was partially offset by the Fund’s underweights to the Consumer Staples, Energy, and Utilities sectors.

Hartford Balanced HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

From a security selection perspective, within the equity portion of the Fund, not holding NVIDIA (Information Technology) and Meta Platforms (Communication Services), as well as an overweight position in Pfizer (Healthcare), were the top detractors from relative performance during the period. Not owning benchmark constituents NVIDIA or Meta Platforms weighed on relative performance as shares of both companies rose during the period. NVIDIA reported strong quarterly revenue over the period driven by data center demand on the growing need of chips for generative artificial intelligence and language learning models. Meta Platforms also reported strong quarterly results consecutively throughout the period. The company boosted its stock buyback authorization by $40 billion earlier in the period and went through layoffs as part of their cost cutting initiative which significantly benefited the company’s operating margin. Shares of Pfizer fell during the period. The company reported mixed results for their obesity and diabetes drugs study. Soft demand for Covid related products added further pressure to the company's shares.

Top contributors to relative performance within the equity portion of the Fund during the period included an overweight position in Salesforce (Information Technology), an out-of-benchmark position in Ares Management (Financials), as well as an overweight position in Alphabet (Communication Services). Shares of Salesforce rose as the company reported quarterly earnings which beat expectations consecutively. Strong demand, cost cutting measures including layoffs, and their price increase announcement all benefited the profitability outlook for the company. Shares of Ares Management rose during the period on the back of fundraising momentum, new commitments, and easing inflation in 2023. Shares of Alphabet rose during the period as quarterly earnings beat expectations consecutively. Revenue growth in the cloud computing unit, stabilizing ad demand, potential upside driven by AI, and cost management all contributed positively to the positive market sentiment.

The fixed-income portion of the Fund outperformed the Bloomberg US Government/Credit Bond Index during the period. Security selection within investment-grade corporate credit was the primary driver of relative outperformance, particularly within the Industrials, Financial Institutions, and Utilities sectors. An overweight to the Financial Institutions sector also contributed positively to relative returns. An underweight to the Industrials sector and an overweight to the Utilities sector detracted from performance over the period. Within non-corporate credit, an underweight to supranational bonds and security selection within taxable municipal bonds contributed positively to relative performance over the period. Additionally, out-of-benchmark allocations to commercial mortgage-backed securities (CMBS) had a positive impact on relative performance. Conversely, out-of-benchmark exposure to agency mortgage-backed securities (agency MBS) detracted from relative performance during the period. Asset backed securities (ABS) had a negligible impact on performance. Duration and yield curve positioning had a positive impact on relative performance over the period where credit spread duration positioning detracted from performance.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

In the equity allocation of the Fund, as of the end of the period, we continue to focus on seeking high-quality businesses that we believe have attractive valuation and capital returns. We take a balanced approach to portfolio construction—not leaning too heavily on any one scenario—and we always strive to upgrade the quality of the positions within the Fund. Within equities, the Fund ended the period with its largest overweight in the Financials sector and the largest underweight in the Consumer Staples sector.

In the fixed income portion of the Fund, we maintain a very modestly procyclical stance as of the end of the period. Markets enjoyed a substantial boost in the latter part of 2023 on the back of receding inflation data and dovish pivots from global central banks that drove a full embrace of expectations for a soft landing with modestly below trend growth, a gradual rise in unemployment and easing monetary policy to minimize the impact to the real economy. That said, we believe valuations for risk assets and lower yields have priced in much of this good news and we remain cognizant of the balance of risks around the real economy, monetary policy and geopolitics. In our view, the lagged impacts of a rapid tightening campaign are finally starting to show signs of slowing economic growth but have had a less pronounced impact on inflation than expected. Central banks remain in an uneasy position with resilient employment leads and inflation still above target and an unclear path toward achieving/sustaining 2% inflation. On balance, we are beginning to see early signs of weakening growth as consumer demand ebbs alongside the depletion of excess savings that support a softer landing.

Investment grade credit fundamentals remain strong but appear to have peaked and have shown some deterioration both in leverage and interest coverage, in our view. While financial conditions tightened meaningfully in 2022 and 2023, we believe the lagged impacts are still emerging. Corporate fundamentals have been more resilient than expected post the Silicon Valley Bank failure given the success of the Fed’s Bank Term Funding Program and substantial excess savings for the consumer. The Investment Grade cohort has maintained high-quality balance sheets and has been relatively insulated from rising rates given long term debt maturity profiles. We have seen a substantial change in issuance activity from corporates given higher rates as many issuers shy away from issuing longer duration debt. We believe this supply response, at a time where all in yields are attractive to many long duration buyers, has driven a substantial flattening in credit curves.

Our concerns around the economic cycle, coupled with relatively tight credit valuations, has pushed us to reduce the Fund’s exposure to cyclical issuers with less resilient cash flow generation profiles and highly levered balance sheets as of the end of the period. While headline index spreads have tightened to around the 25th percentile, we believe there is substantial variability underlying this cohort with the greatest value in the intermediate duration part of the market and within the financial sector. Despite higher all-in yields, we are most cautious on the long duration segment given weakening fundamentals and tight spreads that offer little cushion against widening. From a sector perspective, as of the end of the period, we maintained an overweight in the Utilities sector and some parts of insurance where valuations are attractive in our view. In non-corporate credit, as of the

Hartford Balanced HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

end of the period, we are positive on taxable municipals as we think the sector still provides diversification and comprises high-quality issuers that have benefited from fiscal support.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • Fixed income security risks include credit, liquidity, call, duration, event, and interest-rate risk. As interest rates rise, bond prices generally fall. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. • Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government. • Mortgage-related and asset-backed securities' risks include credit, interest-rate, prepayment, and extension risk. • To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur.

| Composition by Security Type(1) |

| as of 12/31/2023 |

| Category | Percentage of

Net Assets |

| Equity Securities | |

| Common Stocks | 66.0% |

| Fixed Income Securities | |

| Asset & Commercial Mortgage-Backed Securities | 1.4% |

| Corporate Bonds | 12.4 |

| Municipal Bonds | 0.8 |

| U.S. Government Agencies(2) | 0.8 |

| U.S. Government Securities | 17.8 |

| Total | 33.2% |

| Short-Term Investments | 0.3 |

| Other Assets & Liabilities | 0.5 |

| Total | 100.0% |

| (1) | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| (2) | All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities as of December 31, 2023. |

Hartford Capital Appreciation HLS Fund

Fund Overview

December 31, 2023 (Unaudited)

Inception 04/02/1984

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks growth of capital. |

Comparison of Change in Value of $10,000 Investment (12/31/2013 - 12/31/2023)

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

| Average Annual Total Returns |

| for the Periods Ended 12/31/2023 |

| | 1 Year | 5 Years | 10 Years |

| Class IA | 20.00% | 13.30% | 9.27% |

| Class IB | 19.70% | 13.02% | 9.00% |

| Class IC | 19.38% | 12.73% | 8.73% |

| Russell 3000 Index | 25.96% | 15.16% | 11.48% |

| S&P 500 Index | 26.29% | 15.69% | 12.03% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2023, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class IC shares commenced operations on 04/30/2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

You cannot invest directly in an index.

See "Benchmark Glossary" for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA shares, Class IB shares and Class IC shares were 0.67%, 0.92% and 1.17%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2023.

Class IA shares and IB shares of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

Hartford Capital Appreciation HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

Portfolio Managers

Gregg R. Thomas, CFA

Senior Managing Director and Director, Investment Strategy

Wellington Management Company LLP

Thomas S. Simon, CFA, FRM

Senior Managing Director and Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of the Hartford Capital Appreciation HLS Fund returned 20.00% for the twelve-month period ended December 31, 2023, underperforming the Fund’s primary benchmark, the Russell 3000 Index, which returned 25.96% for the same period, and the Fund’s secondary benchmark, the S&P 500 Index, which returned 26.29% for the same period. For the same period, the Class IA shares of the Fund underperformed the 21.37% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the Russell 3000 Index, posted positive results over the trailing twelve-month period ended December 31, 2023. U.S. equities advanced during the first quarter. The collapse of two U.S. regional banks prompted swift policy actions by federal regulators, which helped stabilize liquidity and stem the potential for broader contagion. Shares of large technology companies surged, helping growth stocks to significantly outperform their value counterparts. The U.S. Federal Reserve (Fed) slowed its pace of policy tightening, raising interest rates by 25 basis points (bps) in February and March, to a range between 4.75% – 5%.

U.S. equities rose again in the second quarter, largely driven by a potent rally in a narrow group of mega-cap technology companies that benefited from investor optimism about their earnings potential and growth prospects and exuberance surrounding generative artificial intelligence (AI). U.S. equities fell in the third quarter, pressured by rising Treasury yields amid views that the Fed would keep interest rates elevated for a prolonged period. Even as household budgets were strained by tightening credit conditions and lofty prices, markets dialed back the probability of recession as cooling inflation, a solid job market, and resilient consumer spending increased the potential that the U.S. economy could achieve a “soft landing.” Economic data released during the third quarter indicated healthy momentum in the U.S. economy after Gross Domestic Product in the second quarter grew at a surprisingly strong 2.1% annualized rate.

U.S. equities registered their largest quarterly return in three years for the fourth quarter as gains broadened beyond those of the “Magnificent Seven” stocks that dominated the stock market’s performance for most of the year. A rapid descent in inflation prompted the Fed to pivot from its “higher-for-longer” policy stance in

December, sending Treasury yields lower and driving stocks higher. The Fed’s Summary of Economic Projections implied that policymakers anticipate 75 bps of interest-rate cuts in 2024.

Returns varied by market cap during the period; mid-cap and small-cap equities, as measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively, underperformed large-cap equities, as measured by the S&P 500 Index. Nine of eleven sectors in the Russell 3000 Index had positive returns during the period. The Information Technology (56.3%), Communication Services (53.1%), and Consumer Discretionary (40.0%) sectors were the top performers.

Security selection was the driver of the Fund’s underperformance relative to the Russell 3000 Index during the period. Weak stock selection in the Information Technology, Consumer Discretionary, and Industrials sectors was partially offset by stronger selection in the Energy, Communication Services, and Materials sectors during the period. Sector allocation, a residual of the bottom-up security selection process, also detracted from relative performance during the period. An underweight exposure to the Information Technology sector detracted most, while an underweight exposure to the Energy sector contributed positively to relative performance.

Style had a negative impact on relative performance during the period, driven by the Fund’s overweight exposure to what we view to be lower risk companies relative to the Russell 3000 Index. This was partially offset by the positive impact from the Fund’s overweight exposure to the most liquid names and its smaller cap footprint relative to the Russell 3000 Index.

The largest detractors from performance relative to the Russell 3000 Index during the period were underweight positions in Apple (Information Technology) and NVIDIA (Information Technology) along with an overweight position in Pfizer (Healthcare). Shares of iPhone maker Apple ended the period higher on the back of growing revenue in its Services and iPhones segments, with the iPhone install base reaching an all-time high early in the year. We increased the Fund’s exposure to Apple over the period but the Fund remained underweight relative to the benchmark. NVIDIA is a supplier of graphics processing units for PCs, workstations, gaming consoles, and mobile devices. Shares benefited from strong earnings over the period driven by surging demand for chips used in AI and learning language models. We maintain the Fund’s underweight position relative to the benchmark as of the end of the period. Pfizer is a U.S.-based pharmaceutical company. Shares fell over the period as declining demand for the company’s COVID-19 products weighed on its revenue outlook for the year. We reduced the Fund’s overweight position

Hartford Capital Appreciation HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

relative to the Russell 3000 Index during the period. Pfizer (Healthcare) and FMC (Materials) were the top detractors from absolute performance during the period.

The largest contributors to performance relative to the Russell 3000 Index over the period were not holding Exxon Mobil (Energy) or Chevron (Energy) as well as an overweight position in Meta Platforms (Communication Services). Exxon Mobil and Chevron are both American multinational oil and gas corporations. Shares of both companies declined over the year as oil prices fell amid concerns about global fuel demand. Oil production outside OPEC reached record levels. We continue to not hold Exxon Mobil or Chevron in the Fund as of the end of the period. Shares of U.S.-based social networking company Meta Platforms gained over the period as user engagement, bolstered by an improved AI powered recommendation engine, continued to exceed market expectations and top line acceleration and capital discipline have helped drive earnings growth. We maintained the Fund’s overweight position relative to the Russell 3000 Index as of the end of the period. Meta Platforms (Communication Services) and Microsoft (Information Technology) were the top contributors to absolute performance for the period.

During the period, the Fund, at times, used derivative instruments such as equity index futures to equitize cash or hedge market risk. During the period, the use of equity index futures contributed positively to performance relative to the Russell 3000 Index during the period.

What is the outlook as of the end of the period?

While equities rallied to finish out 2023, we believe the potential for downside risk remains as investors balance the impact a variety of macroeconomic uncertainties may have on equity markets. We expect volatility to persist as investors react to the ramifications of different central bank decisions across the globe, a challenging growth backdrop in China, and ever evolving geopolitical tensions. As allocators, we have a keen focus on risk management, and we seek to balance risks in the portfolio such that security selection drives results.

The Fund maintains structural exposures to sleeve managers that use a “quality” approach, a “value” approach, and a “growth” approach. We look to the sleeve managers’ stock selection skills to help navigate evolving markets and to seek to differentiate companies poised to perform well in this current market from those that may be more challenged. Within the growth universe, we remain wary of heightened speculative risks associated with longer duration growth stocks and rely on our sleeve managers to seek to find stocks with strong long-term fundamentals. Within the value universe, we continue to be mindful of exposure to companies with elevated risk of becoming insolvent. We look to the value sleeve managers' security selection processes to seek to identify attractively valued companies that we believe are more likely to benefit in the current market environment while avoiding those that are not. We seek to balance these allocations with exposure to the quality sleeve manager who looks to own stable businesses. We continue to be mindful of the possible impacts that persistently higher interest rates could have on historically stable business models. We seek to create a portfolio diversified across style and philosophies to help navigate through changing market environments.

At the end of the period, the Fund’s largest overweights were to the Industrials and Healthcare sectors, while the largest underweights were to the Information Technology and Consumer Discretionary sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. The Fund's strategy for allocating assets among portfolio management teams may not work as intended. • Mid-cap securities can have greater risks and volatility than large-cap securities. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks are generally greater for investments in emerging markets. • To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur.

| Composition by Sector(1) |

| as of 12/31/2023 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 8.6% |

| Consumer Discretionary | 8.5 |

| Consumer Staples | 7.1 |

| Energy | 3.0 |

| Financials | 13.1 |

| Health Care | 14.9 |

| Industrials | 12.8 |

| Information Technology | 21.1 |

| Materials | 3.2 |

| Real Estate | 3.3 |

| Utilities | 2.3 |

| Total | 97.9% |

| Short-Term Investments | 0.9 |

| Other Assets & Liabilities | 1.2 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Disciplined Equity HLS Fund

Fund Overview

December 31, 2023 (Unaudited)

Inception 05/29/1998

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks growth of capital. |

Comparison of Change in Value of $10,000 Investment (12/31/2013 - 12/31/2023)

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

| Average Annual Total Returns |

| for the Periods Ended 12/31/2023 |

| | 1 Year | 5 Years | 10 Years |

| Class IA | 21.24% | 14.32% | 11.84% |

| Class IB | 20.95% | 14.03% | 11.56% |

| Class IC | 20.66% | 13.75% | 11.29% |

| S&P 500 Index | 26.29% | 15.69% | 12.03% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2023, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class IC shares commenced operations on 09/18/2020. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

You cannot invest directly in an index.

See "Benchmark Glossary" for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA shares, Class IB shares and Class IC shares were 0.59%, 0.84% and 1.09%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2023.

Class IA shares and Class IB shares of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

Hartford Disciplined Equity HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

Portfolio Managers

Mammen Chally, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Douglas W. McLane, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

| * | Mammen Chally, CFA announced his plan to retire and withdraw from the partnership of Wellington Management Company LLP's parent company, and effective June 30, 2024, he will no longer serve as a portfolio manager for the Fund. Mr. Chally’s portfolio management responsibilities will transition to Douglas W. McLane, CFA in the months leading up to his departure. |

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of the Hartford Disciplined Equity HLS Fund returned 21.24% for the twelve-month period ended December 31, 2023, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 26.29% for the same period. For the same period, the Class IA shares of the Fund underperformed the 24.34% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, rose during the twelve-month period ended on December 31, 2023, amid easing inflation, optimism for lower interest rates, strong performances in select mega-cap technology companies, and steady Gross Domestic Product (GDP) growth. U.S. equities advanced during the first quarter. The collapse of two U.S. regional banks prompted swift policy actions by federal regulators, which helped stabilize liquidity and stem the potential for broader contagion. Shares of large technology companies surged, helping growth stocks to significantly outperform their value counterparts. The U.S. Federal Reserve (Fed) slowed its pace of policy tightening, raising interest rates by 25 basis points (bps) in February and March, to a range between 4.75% – 5%. U.S. equities rose again in the second quarter, largely driven by a potent rally in a narrow group of mega-cap technology companies that benefited from investor optimism about their earnings potential and growth prospects and exuberance surrounding generative artificial intelligence (AI). U.S. equities fell in the third quarter, pressured by rising Treasury yields amid views that the Fed would keep interest rates elevated for a prolonged period. Even as household budgets were strained by tightening credit conditions and lofty prices, markets dialed back the probability of recession as cooling inflation, a solid job market, and resilient consumer spending increased the potential that the U.S. economy could achieve a “soft landing.” Economic data released during the third quarter indicated healthy momentum in the U.S. economy after GDP in the second quarter grew at a 2.1% annualized rate. U.S. equities registered their largest quarterly return in three years for the fourth quarter as gains broadened beyond those

of the “Magnificent Seven” stocks that dominated the stock market’s performance for most of the year. A rapid descent in inflation prompted the Fed to pivot from its “higher-for-longer” policy stance in December, sending Treasury yields lower and driving stocks higher. The Fed’s Summary of Economic Projections implied that policymakers anticipate 75 bps of interest-rate cuts in 2024.

Returns varied by market-cap during the period, as large-cap stocks, as measured by the S&P 500 Index, outperformed mid-cap stocks, as measured by the S&P MidCap 400 Index, and small-cap stocks, as measured by the Russell 2000 Index. During the twelve-month period, nine out of eleven sectors within the S&P 500 Index rose, led by the Information Technology (58%), Communication Services (56%), and Consumer Discretionary (42%) sectors. Utilities was the bottom performing sector, down (-7%) during the period.

Security selection was the primary driver of relative underperformance during the period. Selection within the Information Technology, Industrials, and Consumer Discretionary sectors detracted most while selection within the Healthcare, Communication Services, and Real Estate sectors contributed positively. Sector allocation, which is a residual of the bottom-up security selection process, also detracted from relative performance during the period. The overweight allocations to the Healthcare and Consumer Staples sectors and an underweight allocation to the Communication Services sector detracted the most. This was partially offset by underweight allocations to the Energy, Materials, and Real Estate sectors.

Top detractors from benchmark-relative performance over the period were underweight positions in NVIDIA (Information Technology) and Tesla (Consumer Discretionary) and an overweight in Meta Platforms (Communication Services). Shares of NVIDIA rose over the period after the chipmaker provided second-quarter revenue and gross margin outlook sharply above estimates, driven by strong data center demand on the growing need of chips for generative AI and language learning models. At the end of May, the company became the first chipmaker to achieve a $1 trillion market valuation. Shares of Tesla ended the period higher. The company's Model Y was the number one selling vehicle globally in the first quarter, with unit volume climbing 69% year-over-year, becoming the first Electric Vehicle to claim that

Hartford Disciplined Equity HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

title. Additionally, during a meeting with Foreign Minister Qin Gang in Beijing, CEO Elon Musk said he was willing to expand his business in China. Shares of Meta Platforms rose over the period after the company reported consistently positive results that beat expectations. Most recently, Meta reported the third quarter revenue of $34.15 billion, up 23%, and net income more than doubling to $11.58 billion. The company had a 40% operating margin in the third quarter, a two-year high, which was largely due to cost cutting efforts through a reduction in workforce.

The largest contributors to benchmark-relative performance over the period were not owning Johnson & Johnson (Healthcare) and Exxon Mobil (Energy) and an overweight position in Palo Alto Networks (Information Technology). Shares of Johnson & Johnson fell during the period. The federal court voted against Johnson & Johnson’s attempt to use bankruptcy law via shell company LTL Management to transfer accountability for lawsuits related to their talc-based products. Johnson & Johnson now faces liabilities for over 38,000 lawsuits alleging that the company failed to warn consumers about cancer risks associated with these products. Shares of Exxon Mobil fell after a volatile year. The company fell as oil prices decreased on the back of have a negative view of sentiment that has taken over due to worries that the market is oversupplied from record oil production outside OPEC, notably the U.S. producing at a record pace. The company also reported third quarter 2023 earnings that saw earnings per share (EPS) and revenue miss consensus estimates while later announcing a target annual project spend of $22 – $27 billion through 2027. Shares of cybersecurity company Palo Alto Networks rose after revenue and earnings for the fiscal second quarter beat consensus estimates, driven by strength in the Product business. Management raised EPS guidance for fiscal year 2023 above the expected range.

Derivatives were not used in the Fund during the period.

What is the outlook as of the end of the period?

With increasingly dovish commentary and an updated Fed "dot plot" indicating several rate cuts in 2024, we believe the U.S. market has now fully embraced that the dramatic rate cycle which began in March 2022 has come to an end. There has been constructive evidence that inflationary trends are in fact moving downward towards the Fed's stated goal of 2%, yet what remains to be seen is the precise onset, cadence, and true depth of how interest rate cuts will be enacted. We believe any disappointment in the degree or timing of rate cuts could leave increasingly expectant markets susceptible to short-term weakness.

In our view, labor markets have remained resilient and continue to underpin the U.S. economy, and unemployment levels have not risen to the higher levels many expected would be required for the Federal Open Market Committee (FOMC) to reach its inflationary target. We believe that job security and employment prospects continue to provide confidence to the U.S. consumer, yet incremental challenges from rising student loan obligations, increased credit utilization at still-high rates and the complete drawdown of "excess savings" from all but the higher-end cohorts does remove some of the support that the U.S. consumer carried through last year.

An easing in the cost of capital for companies and consumers alike may be constructive for the U.S. economy and could lead to an improved housing market, increased merger and acquisition activity, and increasing levels of investment which we believe may benefit more rate-sensitive sectors, including the Financials sector. Further, we believe robust and continued innovation within the Technology sector promises to provide opportunities for driving productivity within the U.S. workforce as companies continue to explore the burgeoning capabilities that AI promises to bring.

In our view, 2024 will also bring pivotal elections in both Congress and the Executive branch that have important ramifications for the direction of markets. Given 2023 will have seen the U.S. government generate a budget deficit at close to 8% of GDP, the largest of any developed nation and well above the 3.7% level in 2022, the expected debate over fiscal restraint will be an important outcome for this market.

At the end of the period, the Fund’s largest overweights were to the Healthcare, Utilities, and Financials sectors, while the largest underweights were to the Industrials, Materials, and Real Estate sectors, relative to the benchmark.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

| Composition by Sector(1) |

| as of 12/31/2023 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 9.0% |

| Consumer Discretionary | 10.6 |

| Consumer Staples | 5.5 |

| Energy | 3.5 |

| Financials | 13.6 |

| Health Care | 14.6 |

| Industrials | 7.5 |

| Information Technology | 28.4 |

| Materials | 1.5 |

| Real Estate | 1.7 |

| Utilities | 3.2 |

| Total | 99.1% |

| Short-Term Investments | 0.1 |

| Other Assets & Liabilities | 0.8 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Dividend and Growth HLS Fund

Fund Overview

December 31, 2023 (Unaudited)

Inception 03/09/1994

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

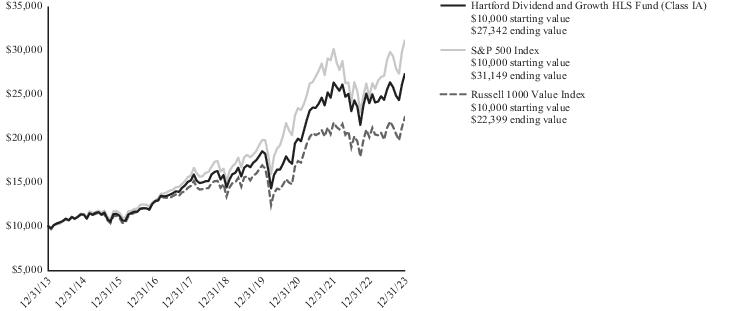

Comparison of Change in Value of $10,000 Investment (12/31/2013 - 12/31/2023)

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for Class IB shares differ only to the extent that Class IA shares and Class IB shares do not have the same expenses.

| Average Annual Total Returns |

| for the Periods Ended 12/31/2023 |

| | 1 Year | 5 Years | 10 Years |

| Class IA | 14.18% | 13.72% | 10.58% |

| Class IB | 13.89% | 13.44% | 10.31% |

| S&P 500 Index | 26.29% | 15.69% | 12.03% |

| Russell 1000 Value Index | 11.46% | 10.91% | 8.40% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2023, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

You cannot invest directly in an index.

See "Benchmark Glossary" for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA shares and Class IB shares were 0.65% and 0.90%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2023.

Class IA shares and Class IB shares of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

Hartford Dividend and Growth HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

Portfolio Managers

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Nataliya Kofman

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Brian J. Schmeer, CFA

Vice President and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of the Hartford Dividend and Growth HLS Fund returned 14.18% for the twelve-month period ended December 31, 2023, underperforming the Fund’s primary benchmark, the S&P 500 Index, which returned 26.29% for the same period, and outperforming the Fund’s secondary benchmark, the Russell 1000 Value Index, which returned 11.46% for the same period. For the same period, the Class IA shares of the Fund outperformed the 11.40% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, rose during the twelve-month period ended on December 31, 2023, amid easing inflation, optimism for lower interest rates, strong performances in select mega-cap technology companies, and steady Gross Domestic Product (GDP) growth. U.S. equities advanced during the first quarter. The collapse of two U.S. regional banks prompted swift policy actions by federal regulators, which helped stabilize liquidity and stem the potential for broader contagion. Shares of large technology companies surged, helping growth stocks to significantly outperform their value counterparts. The U.S. Federal Reserve (Fed) slowed its pace of policy tightening, raising interest rates by 25 basis points (bps) in February and March, to a range between 4.75% – 5%. In the second quarter, U.S. equities rose again largely driven by a potent rally in a narrow group of mega-cap technology companies that benefited from investor optimism about their earnings potential and growth prospects and exuberance surrounding generative artificial intelligence (AI). U.S. equities fell in the third quarter, pressured by rising Treasury yields amid views that the Fed would keep interest rates elevated for a prolonged period. Even as household budgets were strained by tightening credit conditions and lofty prices, markets dialed back the probability of recession as cooling inflation, a solid job market, and resilient consumer spending increased the potential that the U.S. economy could achieve a “soft landing.” Economic data released during the third quarter indicated healthy momentum in the U.S. economy after GDP in the second quarter grew at a surprisingly strong 2.1% annualized rate.

U.S. equities registered their largest quarterly return in three years for the fourth quarter as gains broadened beyond those of the “Magnificent Seven” stocks that dominated the stock market’s performance for most of the year. A rapid descent in inflation prompted the Fed to pivot from its “higher-for-longer” policy stance in December, sending Treasury yields lower and driving stocks higher. The Fed’s Summary of Economic Projections implied that policymakers anticipate 75 bps of interest-rate cuts in 2024.

Returns varied by market cap during the period, as large-cap stocks, as measured by the S&P 500 Index, outperformed small-cap and mid-cap stocks, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, nine out of eleven sectors within the S&P 500 Index rose, led by the Information Technology (58%), Communication Services (56%), and Consumer Discretionary (42%) sectors. Conversely, Energy (-1%) and Utilities (-7%) were the lone sectors with negative performance.

Sector allocation, a result of our bottom-up stock selection process, was the primary driver of the Fund’s underperformance relative to the S&P 500 Index over the period. Underweight allocations to the Information Technology, Consumer Discretionary, and an overweight allocation to the Utilities sectors detracted the most from relative performance but was marginally offset by an overweight allocation to the Communication Services sector. Security selection also detracted from relative returns during the period. Selection within the Information Technology, Healthcare, and Consumer Discretionary sectors contributed negatively while selection within the Energy and Utilities sectors contributed positively.

Top detractors from performance relative to the S&P 500 Index over the period included lack of exposure to benchmark constituents NVIDIA (Information Technology), Meta Platforms (Communication Services), and Amazon.com (Consumer Discretionary). Shares of NVIDIA surged over the period after the chipmaker provided third-quarter revenue forecast above expectations, indicating that demand for chips used in AI computing remains robust. The company also reported second-quarter revenue and gross margin outlook sharply above estimates, driven by strong data center demand on the growing need of chips for generative AI and language learning models. At the end of May, the company became the first chipmaker to achieve a $1 trillion market valuation. Shares of Meta Platforms rose over the period. The company reported better-than-forecast revenue

Hartford Dividend and Growth HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

for the fourth quarter and boosted its stock buyback authorization by $40 billion. Strong full year results were buoyed by a rebound in online advertising and cost cutting. Shares of Amazon.com ended the period higher. Ongoing demand for AI is expected to benefit Amazon Web Services and increase demand for its cloud computing platforms. The e-commerce giant reported third quarter results that beat consensus estimates as revenue rose 13% compared to the prior quarter. The company saw sales growth within its Amazon Web Services (AWS) business as well as its third-party seller services and advertising units.

The Fund’s top contributors to performance relative to S&P 500 Index during the period were an overweight position in Alphabet (Communication Services), and lack of exposure to benchmark constituents Johnson & Johnson (Healthcare) and Exxon Mobil (Energy). Shares of Alphabet rose over the period on the back of the company’s moves in the rapidly expanding AI arena, like integrating generative AI results directly on top of Alphabet’s search results, and the incorporation of generative AI capabilities across its product suite. Quarterly results also topped consensus estimates due to revenue growth in the Search and Alphabet Cloud segments. Shares of Johnson & Johnson fell over the period. Shares were pressured by the announcement of slow production of COVID-19 vaccines due to weakening demand as well as mixed quarterly-earnings results that showed declining sales driven by waning COVID-19 vaccines and foreign exchange (FX) challenges. Additionally, costs related to the company’s spin-off of its consumer-health business as well as ongoing talc litigations remained an overhang. Shares of Exxon Mobil fell as oil prices decreased on the back of have a negative view of sentiment that has taken over due to worries that the market is oversupplied from record oil production outside OPEC, notably the U.S. producing at a record pace. The company also reported third quarter 2023 earnings that saw earnings per share and revenue miss consensus estimates.

The Fund did not utilize derivatives during the period.

What is the outlook as of the end of the period?

U.S. equities rallied to end the year. Broad gains were driven by declining yields and expectations for interest rate cuts in 2024. While we see a path for the Fed to cease rate increases, we believe the magnitude of rate cuts forecast for 2024 is likely too high. Despite an improving inflation environment, persistent labor market tightness and wage growth seem inconsistent with the expectation for a continual moderation in inflation in our view. Currently, we are not ruling out the potential for an inflation reacceleration in the latter half of the year.

Given the current wide range of outcomes, we remain focused on seeking to find companies with consistent pricing power, strong balance sheets, and sustainable and growing cash flows trading at attractive valuations. As of the end of the period, we remain cautious on valuation. We continue to believe that opportunistically investing in out of favor growth and cyclical names with positive risk/reward skews may provide upside potential while maintaining an overweight to more defensive segments (e.g., insurance, Healthcare services, consumer defensive) may provide the opportunity for upside participation while potentially insulating the portfolio from valuation-driven corrections.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. • Different investment styles may go in and out of favor, which may cause the Fund to underperform the broader stock market. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. • To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur. • Integration of environmental, social, and/or governance (ESG) characteristics into the investment process may not work as intended.

| Composition by Sector(1) |

| as of 12/31/2023 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 9.2% |

| Consumer Discretionary | 3.2 |

| Consumer Staples | 6.6 |

| Energy | 7.5 |

| Financials | 16.7 |

| Health Care | 14.7 |

| Industrials | 7.5 |

| Information Technology | 19.6 |

| Materials | 4.7 |

| Real Estate | 3.3 |

| Utilities | 5.3 |

| Total | 98.3% |

| Short-Term Investments | 0.8 |

| Other Assets & Liabilities | 0.9 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Healthcare HLS Fund

Fund Overview

December 31, 2023 (Unaudited)

Inception 05/01/2000

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks long-term capital appreciation. |

Comparison of Change in Value of $10,000 Investment (12/31/2013 - 12/31/2023)

The chart above represents the hypothetical growth of a $10,000 investment in Class IA shares. Returns for Class IB shares differ only to the extent that Class IA shares and Class IB shares do not have the same expenses.

| Average Annual Total Returns |

| for the Periods Ended 12/31/2023 |

| | 1 Year | 5 Years | 10 Years |

| Class IA | 4.11% | 10.88% | 10.18% |

| Class IB | 3.81% | 10.61% | 9.89% |

| S&P Composite 1500 Health Care Index | 1.92% | 11.24% | 11.32% |

| S&P 500 Index | 26.29% | 15.69% | 12.03% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 12/31/2023, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

You cannot invest directly in an index.

See "Benchmark Glossary" for benchmark descriptions.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA shares and Class IB shares were 0.91% and 1.16%, respectively. Gross and net expenses are the same. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 12/31/2023.

Class IA shares and Class IB shares of the Fund are closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

Hartford Healthcare HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

Portfolio Managers

Rebecca D. Sykes, CFA

Senior Managing Director and Global Industry Analyst

Wellington Management Company LLP

Wen Shi, PhD, CFA

Managing Director and Global Industry Analyst

Wellington Management Company LLP

David M. Khtikian, CFA

Managing Director and Global Industry Analyst

Wellington Management Company LLP

Fayyaz Mujtaba

Managing Director and Global Industry Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of Hartford Healthcare HLS Fund returned 4.11% for the twelve-month period ended December 31, 2023, outperforming the S&P Composite 1500 Health Care Index, which returned 1.92% for the same period, while underperforming the S&P 500 Index, which returned 26.29% for the same period. For the same period, the Class IA shares of the Fund underperformed the 4.89% average return of the Lipper Global Health and Biotechnology peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) healthcare equities returned 1.92% for the period as measured by the S&P Composite 1500 Health Care Index, underperforming both the broader U.S. equity market, which returned 26.29% as measured by the S&P 500 Index, and the global equity market, which returned 24.42% during the period, as measured by the MSCI World Index. Within the S&P Composite 1500 Health Care Index, medical technology returned 4%, large-cap biopharma returned 2%, healthcare services returned 1%, mid-cap biopharma returned -8%, and small-cap biopharma returned -15% during the period.

The Fund outperformed the S&P Composite 1500 Health Care Index over the period, which was due primarily to favorable security selection decisions. Security selection was strongest in large-cap biopharma, mid-cap biopharma, and small-cap biopharma, while selection in medical technology was weakest. Sector allocation detracted from the Fund’s performance relative to the S&P Composite 1500 Health Care Index. The Fund’s overweight to mid-cap biopharma and small-cap biopharma detracted from relative performance during the period. This was partially offset by positive results from an overweight to healthcare services.

Johnson & Johnson (large-cap biopharma), Bristol-Myers Squibb (large-cap biopharma), and Seagen (large-cap biopharma) were the top contributors to performance relative to the S&P Composite 1500 Health Care Index over the period. Not holding a position in Johnson & Johnson, a constituent of the S&P Composite 1500 Health Care

Index, contributed positively to relative performance, as shares were pressured by multiple challenges over the year, including slowing demand for COVID-19 vaccines, costs related to the company’s spin-off of its consumer-health business, ongoing overhang from talc litigations, IRA drug price negotiations, and patent cliff challenges. An underweight to Bristol-Myers Squibb contributed positively to relative performance, as shares declined during the period. The company continued to suffer from patent cliff challenges. Bristol-Myers Squibb reported third quarter revenue decreased 2% year-over-year driven by multiple myeloma drug Revlimid. Globally, Revlimid sales fell 41% largely due to generic erosion. Six out of eight launch products missed revenue expectations and management downgraded mid-term launch product sales guidance. Shares of Seagen rose during the period on news that Pfizer would acquire the company at a premium of $229 per share for a total value of $43 billion. The acquisition was completed in December. Eli Lilly, Vertex Pharmaceuticals, and Zoetis were the top absolute contributors to the Fund’s performance during the period.

Intuitive Surgical (medical technology), AdaptHealth (healthcare services), and Aclaris Therapeutics (small-cap biopharma) detracted from results relative to the S&P Composite 1500 Health Care Index over the period. Not owning Intuitive Surgical detracted from relative performance as shares rose on the back of strong first quarter 2023 revenues driven by higher-than-expected procedure growth. Management raised procedure growth guidance for the full year and provided an improved outlook given the expectation of a return to normal utilization trend as patients return to healthcare providers post the COVID-19 pandemic. Shares of AdaptHealth fell after the company reported fourth quarter 2022 results showing weaker than expected earnings and revenues. Management of AdaptHealth cited larger impacts from revenue mix and cost pressures than previously expected and ultimately lowered its revenue outlook for 2023. We subsequently eliminated the position in the Fund. Shares of Aclaris Therapeutics fell during the period, most recently as the company announced disappointing top-line results from its Phase 2b study of oral MK2 inhibitor zunsemetinib for the treatment of rheumatoid arthritis. The results did not meet the primary endpoint of an ACR20 response after 12 weeks nor did they meet the secondary endpoints of

Hartford Healthcare HLS Fund

Fund Overview – (continued)

December 31, 2023 (Unaudited)

ACR50 response, ACR70 response or DAS28-CRP. The trial will now be discontinued. Top detractors from absolute performance included Pfizer, Illumina, and AdaptHealth.

Derivatives were not used in the Fund during the period.

What is the outlook as of the end of the period?

As of the end of the period, we have a positive outlook across the Healthcare opportunity set. We believe groundbreaking innovation, supportive valuations and business models positioned to show resilience through the cycle may benefit long-term investors in the sector.

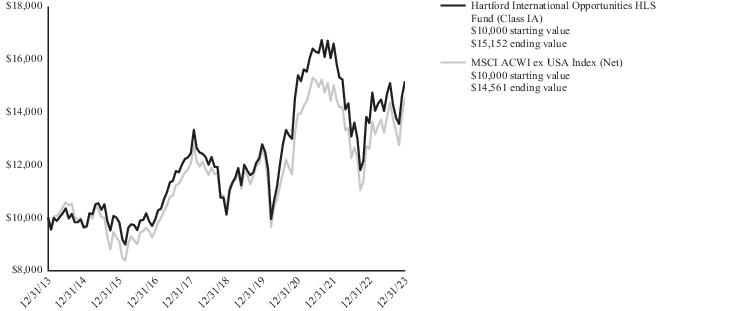

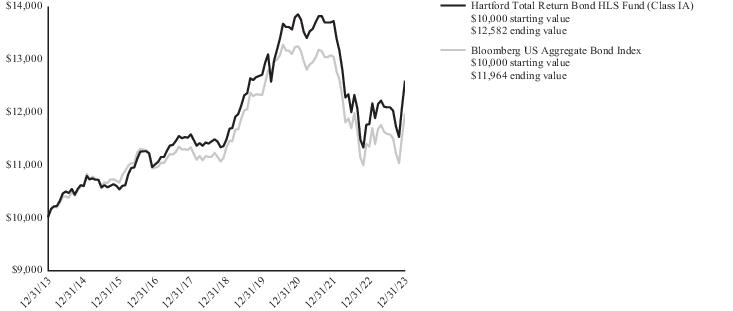

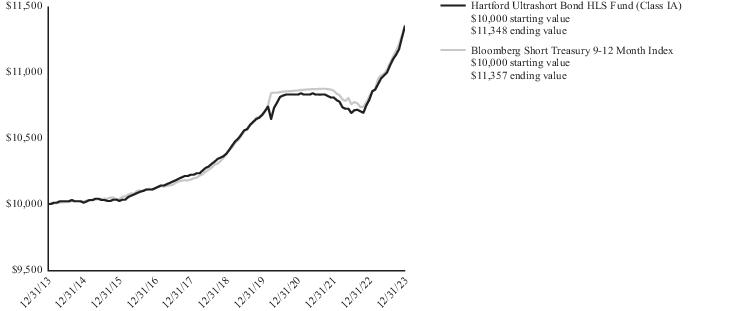

Biopharma remains a rich environment for innovation in our view. We are excited about developments in GLP-1 and next generation metabolic medicines, ADCs for cancer treatment, and various forms of genetic medicines. We remain selective in large-cap biopharma, where regulatory challenges (patent cliffs, IRA) affect companies inequitably. We believe small and mid-cap biopharma companies remain well positioned as sources of innovation and potential solutions to pipeline gaps for larger companies. Market sentiment may continue to improve with a more supportive interest rate backdrop and increasing merger and acquisition activity in our view. In the U.S., we continue to watch next steps in Inflation Reduction Act policy implementation, but we believe valuations remain attractive and recent clinical readouts continue to support robust growth assumptions for major indications.