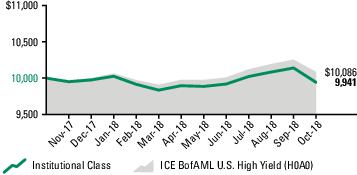

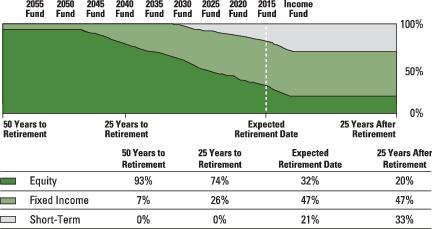

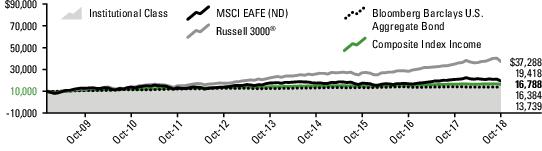

Composite Index Income—The Composite Index Income is derived by applying the Harbor Target Retirement Fund’s (the “Income Fund”) target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (with respect to Harbor International Growth Fund weightings, prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, ICE BofAML U.S. High Yield Index (H0A0), ICE BofAML U.S. Non-Distressed High Yield Index (with respect to the Harbor High-Yield Bond Fund; prior to March 31, 2015, the ICE BofAML U.S. High Yield Index (H0A0) was this fund’s benchmark and a component of the Composite Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index, ICE BofAML U.S. 3-Month Treasury Bill Index. The weights of the Composite Index Income match the Income Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the Income Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Composite Index 2015—The Composite Index 2015 is derived by applying the Harbor Target Retirement 2015 Fund’s (the “2015 Fund”) target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (with respect to Harbor International Growth Fund weightings, prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, ICE BofAML U.S. High Yield Index (H0A0), ICE BofAML U.S. Non-Distressed High Yield Index (with respect to the Harbor High-Yield Bond Fund; prior to March 31, 2015, the ICE BofAML U.S. High Yield Index (H0A0) was this fund’s benchmark and a component of the Composite Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index, ICE BofAML U.S. 3-Month Treasury Bill Index. The weights of the Composite Index 2015 match the 2015 Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the 2015 Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

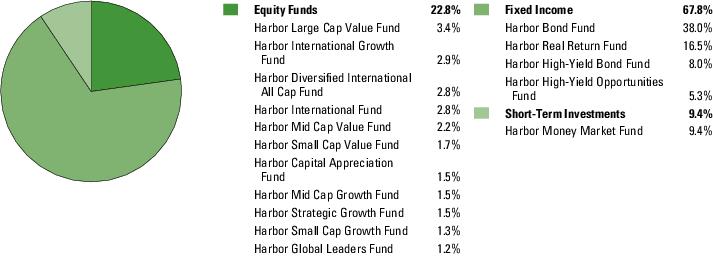

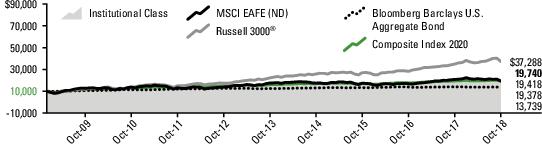

Composite Index 2020—The Composite Index 2020 is derived by applying the Harbor Target Retirement 2020 Fund’s (the “2020 Fund”) target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (with respect to Harbor International Growth Fund weightings, prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, ICE BofAML U.S. High Yield Index (H0A0), ICE BofAML U.S. Non-Distressed High Yield Index (with respect to the Harbor High-Yield Bond Fund; prior to March 31, 2015, the ICE BofAML U.S. High Yield Index (H0A0) was this fund’s benchmark and a component of the Composite Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index, ICE BofAML U.S. 3-Month Treasury Bill Index. The weights of the Composite Index 2020 match the 2020 Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the 2020 Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

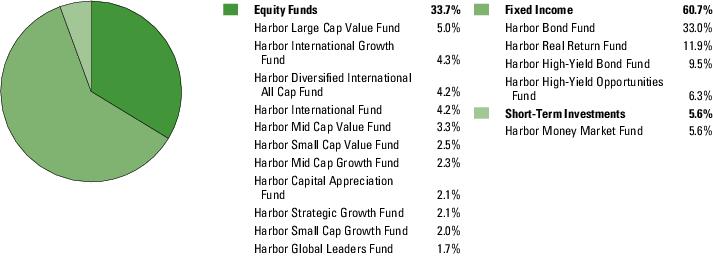

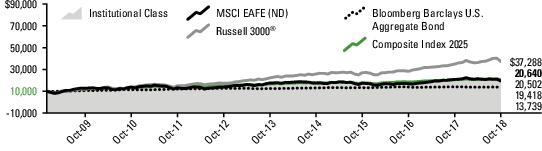

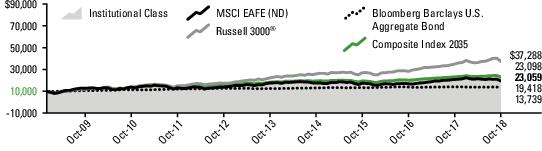

Composite Index 2025—The Composite Index 2025 is derived by applying the Harbor Target Retirement 2025 Fund’s (the “2025 Fund”) target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (with respect to Harbor International Growth Fund weightings, prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, ICE BofAML U.S. High Yield Index (H0A0), ICE BofAML U.S. Non-Distressed High Yield Index (with respect to the Harbor High-Yield Bond Fund; prior to March 31, 2015, the ICE BofAML U.S. High Yield Index (H0A0) was this fund’s benchmark and a component of the Composite Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index. The weights of the Composite Index 2025 match the 2025 Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the 2025 Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Composite Index 2030—The Composite Index 2030 is derived by applying the Harbor Target Retirement 2030 Fund’s (the “2030 Fund”) target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (with respect to Harbor International Growth Fund weightings, prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, ICE BofAML U.S. High Yield Index (H0A0), ICE BofAML U.S. Non-Distressed High Yield Index (with respect to the Harbor High-Yield Bond Fund; prior to March 31, 2015, the ICE BofAML U.S. High Yield Index (H0A0) was this fund’s benchmark and a component of the Composite Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS