| | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-04528) | |

| |

| Exact name of registrant as specified in charter: | Putnam Ohio Tax Exempt Income Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | | |

| Name and address of agent for service: | | Beth S. Mazor, Vice President |

| | | One Post Office Square |

| | | Boston, Massachusetts 02109 |

| | | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | | Ropes & Gray LLP |

| | | One International Place |

| | | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: May 31, 2009 | |

| |

| Date of reporting period: June 1, 2008 — May 31, 2009 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Since 1937, when George Putnam created a prudent mix of stocks and bonds in a single, professionally managed portfolio, we have championed the wisdom of the balanced approach. Today, we offer a world of equity, fixed-income, multi-asset, and absolute-return portfolios so investors can pursue a range of financial goals. Our seasoned portfolio managers seek superior results over time, backed by original, fundamental research on a global scale. We believe in service excellence, in the value of experienced financial advice, and in putting clients first in everything we do.

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

Putnam Ohio

Tax Exempt

Income Fund

Annual Report

5|31|09

| |

| Message from the Trustees | 1 |

| About the fund | 2 |

| Performance and portfolio snapshots | 4 |

| Interview with your fund’s Portfolio Manager | 5 |

| Performance in depth | 8 |

| Expenses | 10 |

| Portfolio turnover | 11 |

| Your fund’s management | 12 |

| Terms and definitions | 13 |

| Trustee approval of management contract | 14 |

| Other information for shareholders | 17 |

| Financial statements | 18 |

| Federal tax information | 31 |

| About the Trustees | 32 |

| Officers | 36 |

Message from the Trustees

Dear Fellow Shareholder:

Following many months of painful losses, the stock market finally reversed course this spring and posted solid gains. Returns in the fixed-income area have been more mixed, with Treasuries losing ground but corporate and high-yield debt rebounding. We are pleased to report that, in many instances, Putnam mutual fund performance has also been strong in recent months, demonstrating the power of active portfolio management and the substantial efforts of an investment team infused with new talent and a singular focus.

Putnam Investments and the Board of Trustees continue to evolve during this exciting time of renewal. After several years of steady leadership, Charles E. “Ed” Haldeman, Jr. has stepped down as President of the Putnam Funds and as a member of the Board of Trustees of the Funds. Effective July 1, 2009, Robert L. Reynolds, President and Chief Executive Officer of Putnam Investments and a Trustee of the Putnam Funds, replaced Mr. Haldeman as President of the Putnam Funds.

In other developments at Putnam, Walter C. Donovan, a 25-year investment industry veteran, has joined the firm as Chief Investment Officer. Mr. Donovan will oversee a reinvigorated investment organization strengthened by the recent arrival of several industry-leading senior portfolio managers, research analysts, and traders.

Ravi Akhoury has been elected to the Board of Trustees of the Putnam Funds and W. Thomas Stephens has rejoined the Board. From 1992 to 2007, Mr. Akhoury was Chairman and CEO of MacKay Shields, a multi-product investment management firm with more than $40 billion in assets under management. Mr. Stephens retired in December 2008 as Chairman and Chief Executive Officer of Boise Cascade, L.L.C., a paper, forest products, and timberland assets company.

We would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

Respectfully yours,

About the fund

Seeking a high level of tax-free income for Ohio investors

Municipal bonds can help investors keep more of their investment income while also financing important public projects such as schools, roads, and hospitals. Municipal bonds are typically issued by states and local municipalities to raise funds for building and maintaining public facilities, and they offer income that is generally exempt from federal income tax.

For residents of the state where the bond is issued, income is typically exempt from state and local income taxes. While the stated yields on municipal bonds are usually lower than those on taxable bonds, tax exemption is an especially powerful advantage in Ohio because the state’s top income tax rate is among the highest in the United States. And the sheer size of the Ohio municipal bond market provides a wide array of investment opportunities.

Putnam Ohio Tax Exempt Income Fund seeks to capitalize on investment opportunities in Ohio by investing in bonds across a range of market sectors. The fund also combines bonds of differing credit quality to increase income potential. In addition to investing in high-quality bonds, the fund’s managers allocate a smaller portion of the portfolio to lower-rated bonds, which may offer higher income in return for more risk.

When deciding whether to invest in a bond, the fund’s managers consider the risks involved — including credit risk, interest-rate risk, and the risk that the bond will be prepaid. The managers are backed by the resources of Putnam’s fixed-income organization, in which municipal bond analysts are grouped into sector teams and conduct ongoing, rigorous research. Once a bond has been purchased, the managers monitor for developments that may affect the bond market, the sector, and the issuer of the bond.

The goal of the fund’s in-depth research and active management is to stay a step ahead of the industry and pinpoint opportunities for investors.

The fund invests in fewer issuers or concentrates its investments by region or sector, and involves more risk than a fund that invests more broadly. Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

Understanding tax-equivalent yield

To understand the value of tax-free income, it is helpful to compare a municipal bond’s yield with the “tax- equivalent yield” — the before-tax yield that must be offered by a taxable bond in order to equal the municipal bond’s yield after taxes.

How to calculate tax-equivalent yield:

The tax-equivalent yield equals the municipal bond’s yield divided by “one minus the tax rate.” For example, if a municipal bond’s yield is 5%, then its tax-equivalent yield is 7.7%, assuming the maximum 35% federal tax rate for 2009.

Results for investors subject to lower tax rates would not be as advantageous.

Municipal bonds may finance a range of projects in your

community and thus play a key role in its development.

Performance and

portfolio snapshots

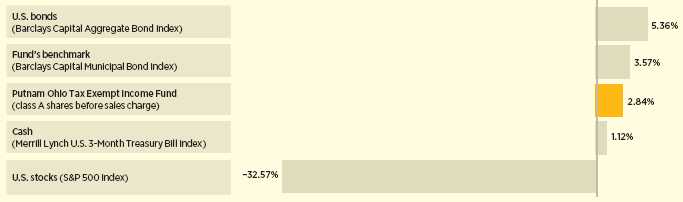

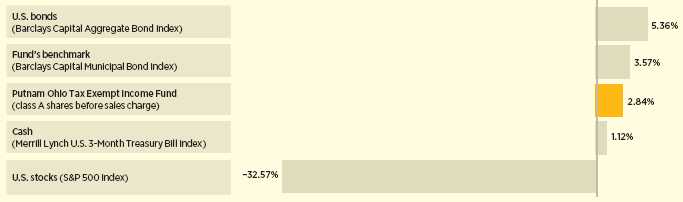

Average annual total return (%) comparison as of 5/31/09

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 5 and 8–10 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. Due to market volatility, current performance may be higher or lower than performance shown. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit putnam.com.

“Municipal bonds in the first quarter of 2009

posted their best quarterly performance in years.”

Thalia Meehan, Portfolio Manager, Putnam Ohio Tax Exempt Income Fund

Credit qualities shown as a percentage of portfolio value as of 5/31/09. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody’s but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

4

Interview with your fund’s Portfolio Manager

Thalia Meehan

The past 12 months have been difficult for fixed-income markets and challenging for national, state, and municipal economies. How did the municipal bond market perform in this environment?

The second half of 2008 was dominated by continued extreme turmoil in the credit markets following the collapse of Lehman Brothers. Forced selling by hedge funds and investment banks also put pressure on municipal bonds as these firms needed to raise capital and cover losses. All of this added up to an environment in which all investment-grade asset classes, including municipal bonds, underperformed U.S. Treasuries.

The economy remained weak in the first quarter of 2009, extending the recession that took hold in 2008, as financial markets, although improved from the fourth quarter, remained volatile. Consumer confidence was weak, housing prices continued to retreat, and unemployment rose to levels not seen in decades. The U.S. government, notably the Fed [Federal Reserve Board] and the Treasury, instituted several wide-ranging measures to restore market stability and investor confidence, joining policymakers around the world in efforts to shore up bank balance sheets and reestablish the flow of credit.

Against this backdrop, municipal bonds in the first quarter of 2009, as measured by the Barclays Capital Municipal Bond Index, posted their best quarterly performance in years. Strong coupon reinvestment in January and February aided performance in high-grade municipal bonds. April marked a continuation of the municipal bond upswing, buoyed by the introduction of Build America Bonds [BABs], a new form of debt that was unveiled as part of the stimulus package.

Designed to help cash-strapped state and local governments achieve easier access to capital, BABs are taxable securities issued by municipalities, which traditionally issue tax-exempt bonds. The municipality receives a 35% subsidy of the interest direct from the Treasury. BABs tamped down the supply of municipal bonds and kept their prices up, continuing the municipal bond rally into May. [For more on BABs, see “In the News” on page 7.]

How did Putnam Ohio Tax Exempt Income Fund perform?

In a volatile market, the fund outperformed its peers. For the 12 months ended May 31, 2009, the fund returned 2.84%, outperforming its Lipper peer group, Ohio Municipal Debt Funds, which returned 0.98%. The fund lagged its

Broad market index and fund performance

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 5/31/09. See the previous page and pages 8–10 for additional fund performance information. Index descriptions can be found on page 13.

5

benchmark, the Barclays Capital Municipal Bond Index, which returned 3.57%. The national benchmark tracks the performance of a broader range of municipal bonds.

What is the state budget situation in Ohio?

Governor Ted Strickland and Buckeye State lawmakers are facing a $3.2 billion budget gap, which is likely to be addressed through program and personnel cuts and other adjustments to close this fiscal year’s shortfall. The state may also tap much of its rainy day fund, but this action would call into question how Ohio will meet its 2010–2011 budget. Ohio is earmarked to receive approximately $8 billion as part of the federal stimulus package, which should help ease budgetary pressures. Given these challenges, the credit rating agency Fitch downgraded the state’s general obligation bonds from AA+ to AA in June, following the close of the reporting period. The move makes it more costly for Ohio to borrow money. Still, many expect the federal stimulus package should help ease budgetary pressures.

What happened with municipal bonds during the period?

During the fourth quarter of 2008, dealer liquidity became more constrained with the bankruptcy of Lehman Brothers, the exit of UBS from the institutional market, and the purchase of Merrill Lynch by Bank of America. We saw a temporary lack of primary market supply as municipal bond issuers delayed new issuance due to market conditions. Because new issues typically help provide price discovery in the marketplace, secondary market liquidity was negatively affected, as dealers delayed pricing new issues. All of these issues put downward pressure on municipal bond prices, further hurting asset class performance. Spreads widened to unprecedented levels in mid-December before partially recovering as the primary market reopened and fund flows turned positive. Municipal bond prices continued to rally in April and May as concerns increased about future supply.

How did you position the portfolio in light of these ongoing issues?

During the period, the fund’s overall credit quality was high and we remained underweight the long end of the yield curve. This positioning aided relative performance as the lower-rated issues underperformed their higher-quality peers. In addition, the portfolio’s underweight to longer maturity issues aided relative performance.

By way of background, the yield curve is a graphical representation of the difference in yields between shorter- and longer-term maturity bonds. A bond with a longer maturity typically carries more risk and ties up an investor’s money for a longer time and therefore offers a higher yield.

From a sector perspective, an overweight to tobacco constrained performance.

Were there any notable contributors and detractors?

High-quality bonds benefited as investors sought out quality during the period. Within Putnam Ohio Tax Exempt Income

Comparison of maturity composition

This chart illustrates the fund’s composition by maturity, showing the percentage of holdings in different maturity ranges and how the composition has changed over the past six months. Holdings and maturity ranges will vary over time. The effective maturity dates of bonds with call features may change as a result of market conditions.

6

Fund, holding issues of Ohio State general obligation bonds aided relative performance. These high-quality, short-maturity issuers fared well during the period as the yield curve steepened and higher-quality issues outperformed their lower-quality counterparts.

Holdings that hurt performance included bonds with longer maturities or lower credit quality. These holdings suffered as the yield curve steepened and lower-rated instruments were punished as investors fled from perceived risk. Buckeye Tobacco bonds, which have longer maturities and lower credit ratings, is an example of this type of holding. Tobacco settlement bonds are secured by the income stream from tobacco companies’ lawsuit settlement obligations to individual states — and generally offer higher yields than bonds of comparable quality. The tobacco sector, however, underper-formed as investors began a flight to quality credit. Because the market for tobacco bonds is large and relatively liquid, investors who wanted to trim credit exposure sold these liquid bonds first, which put pressure on the sector as a whole.

What is your outlook for the municipal bond market?

The Fed and the Treasury have taken unprecedented steps to inject liquidity into the credit markets, boost the economy, and help ease the flow of credit. However, it is important to understand that the effects of many of the changes will take time, and markets are likely, in our view, to remain challenging in the near term — particularly with the lingering concerns over state budgets, the future of bond insurers, and the potential for regulatory changes.

Despite the current market environment, we see two key reasons why municipal bond funds remain attractive. The first is future tax rates. We believe that income tax rates are unlikely to fall from here and may even rise with the Obama administration in the White House, given that the Bush administration tax cuts are scheduled to sunset in 2010. This may cause municipal bonds to become an even more attractive asset class relative to taxable fixed income.

Second, the overall credit quality of the municipal asset class remains strong. The fund has benefited from having a bias for higher-quality holdings in the portfolio. We believe that many areas of the municipal bond market have been oversold by panicked investors, creating unique opportunities for the fund to add highly rated bonds paying unusually high yields.

IN THE NEWS

Build America Bonds (BABs) are designed to help cash-strapped municipalities fund job-creating public works projects, such as roads, bridges, schools, and water treatment plants. Part of the American Recovery and Reinvestment Act, BABs provide an attractive way for state and local governments to issue debt. They are issued as taxable municipal debt, with local and state governments receiving a 35% rebate on the interest payments directly from the U.S. Treasury. BABs are attracting buyers such as pensions and foreign governments that would otherwise invest in corporate, Treasury, or agency debt. The net effect is a lower supply of new tax-exempt debt, which is positive for municipal bond prices.

Thank you, Thalia, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

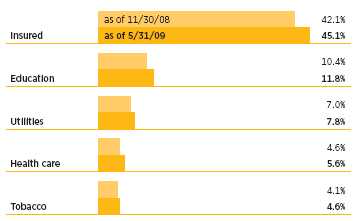

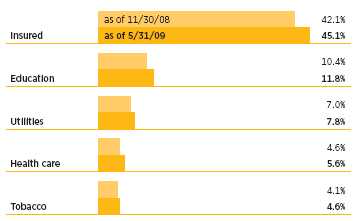

Comparison of top sector weightings

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Holdings will vary over time. Sector concentrations listed after the portfolio schedule in the Financial Statements section of this shareholder report are exclusive of insured status and may differ from the summary information below.

7

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended May 31, 2009, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section of putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 5/31/09

| | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

| (inception dates) | (10/23/89) | (7/15/93) | (10/3/06) | (4/3/95) | (1/2/08) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV |

|

| Annual average (life of fund) | 5.46% | 5.25% | 4.73% | 4.73% | 4.67% | 4.67% | 5.12% | 4.94% | 5.48% |

|

| 10 years | 50.16 | 44.15 | 40.75 | 40.75 | 39.21 | 39.21 | 45.88 | 41.22 | 50.62 |

| Annual average | 4.15 | 3.72 | 3.48 | 3.48 | 3.36 | 3.36 | 3.85 | 3.51 | 4.18 |

|

| 5 years | 20.21 | 15.41 | 16.42 | 14.46 | 15.73 | 15.73 | 18.61 | 14.73 | 20.58 |

| Annual average | 3.75 | 2.91 | 3.09 | 2.74 | 2.96 | 2.96 | 3.47 | 2.79 | 3.81 |

|

| 3 years | 10.97 | 6.55 | 8.83 | 5.89 | 8.50 | 8.50 | 10.02 | 6.46 | 11.31 |

| Annual average | 3.53 | 2.14 | 2.86 | 1.93 | 2.76 | 2.76 | 3.23 | 2.11 | 3.64 |

|

| 1 year | 2.84 | –1.28 | 2.06 | –2.86 | 2.01 | 1.03 | 2.56 | –0.79 | 3.04 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class Y shares have no initial sales charge or CDSC. Performance for class B, C, M, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund may have limited expenses, without which returns would have been lower.

Due to market volatility, current performance may be higher or lower than performance shown. A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

Change in the value of a $10,000 investment ($9,600 after sales charge) Cumulative total return from 5/31/99 to 5/31/09

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $14,075 and $13,921, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,675 after sales charge) would have been valued at $14,122 at public offering price. A $10,000 investment in the fund’s class Y shares would have been valued at $15,062.

8

Comparative index returns For periods ended 5/31/09

| | |

| | Barclays Capital Municipal | Lipper Ohio Municipal Debt Funds |

| | Bond Index | category average* |

|

| Annual average (life of fund) | 6.33% | 5.66% |

|

| 10 years | 62.09 | 46.35 |

| Annual average | 4.95 | 3.87 |

|

| 5 years | 24.08 | 18.63 |

| Annual average | 4.41 | 3.47 |

|

| 3 years | 12.79 | 9.25 |

| Annual average | 4.09 | 2.98 |

|

| 1 year | 3.57 | 0.98 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 5/31/09, there were 40, 35, 34, 30, and 7 funds, respectively, in this Lipper category.

Fund price and distribution information For the 12-month period ended 5/31/09

| | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class Y |

|

| Number | 12 | 12 | 12 | 12 | 12 |

|

| Income 1 | $0.372696 | $0.317768 | $0.305027 | $0.349479 | $0.391165 |

|

| Capital gains 2 | — | — | — | — | — |

|

| Total | $0.372696 | $0.317768 | $0.305027 | $0.349479 | $0.391165 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV |

|

| 5/31/08 | $8.93 | $9.30 | $8.93 | $8.93 | $8.94 | $9.24 | $8.93 |

|

| 5/31/09 | 8.79 | 9.16 | 8.78 | 8.79 | 8.80 | 9.10 | 8.79 |

|

| Current yield (end of period) | NAV | POP | NAV | NAV | NAV | POP | NAV |

|

| Current dividend rate 3 | 4.20% | 4.03% | 3.57% | 3.42% | 3.94% | 3.81% | 4.42% |

|

| Taxable equivalent 4 | 6.87 | 6.59 | 5.84 | 5.59 | 6.44 | 6.23 | 7.23 |

|

| Current 30-day SEC yield 5,6 | | | | | | | |

| (with expense limitation) | N/A | 3.55 | 3.07 | 2.92 | N/A | 3.30 | 3.93 |

|

| Taxable equivalent 4 | N/A | 5.81 | 5.02 | 4.78 | N/A | 5.40 | 6.43 |

|

| Current 30-day SEC yield 6 | | | | | | | |

| (without expense limitation) | N/A | 3.54 | 3.05 | 2.90 | N/A | 3.29 | 3.92 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 For some investors, investment income may be subject to the federal alternative minimum tax.

2 Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

4 Assumes maximum 38.85% federal and state combined tax rate for 2009. Results for investors subject to lower tax rates would not be as advantageous.

5 For a portion of the period, this fund may have limited expenses, without which yields would have been lower.

6 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter Total return for periods ended 6/30/09

| | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

| (inception dates) | (10/23/89) | (7/15/93) | (10/3/06) | (4/3/95) | (1/2/08) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV |

|

| Annual average (life of fund) | 5.37% | 5.16% | 4.64% | 4.64% | 4.58% | 4.58% | 5.03% | 4.85% | 5.40% |

|

| 10 years | 50.29 | 44.29 | 40.89 | 40.89 | 39.40 | 39.40 | 46.16 | 41.35 | 50.94 |

| Annual average | 4.16 | 3.73 | 3.49 | 3.49 | 3.38 | 3.38 | 3.87 | 3.52 | 4.20 |

|

| 5 years | 18.47 | 13.74 | 14.60 | 12.66 | 14.05 | 14.05 | 16.78 | 12.94 | 19.02 |

| Annual average | 3.45 | 2.61 | 2.76 | 2.41 | 2.66 | 2.66 | 3.15 | 2.46 | 3.54 |

|

| 3 years | 9.95 | 5.57 | 7.84 | 4.92 | 7.51 | 7.51 | 9.13 | 5.58 | 10.44 |

| Annual average | 3.21 | 1.82 | 2.55 | 1.61 | 2.44 | 2.44 | 2.96 | 1.83 | 3.37 |

|

| 1 year | 2.58 | –1.58 | 1.93 | –2.98 | 1.88 | 0.89 | 2.29 | –1.07 | 2.92 |

|

9

Fund’s annual operating expenses For the fiscal year ended 5/31/08

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y† |

|

| Net expenses* | 0.89% | 1.52% | 1.67% | 1.17% | 0.67% |

|

| Total annual fund operating expenses | 0.90 | 1.53 | 1.68 | 1.18 | 0.68 |

|

* Reflects Putnam Management’s decision to contractually limit expenses through 5/31/09.

† Expenses for class Y shares (added 1/2/08) are based on class A shares excluding distribution (12b-1) fees for the last fiscal year.

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The following table shows the expenses you would have paid on a $1,000 investment in Putnam Ohio Tax Exempt Income Fund from December 1, 2008, to May 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Expenses paid per $1,000* | $4.43 | $7.70 | $8.48 | $5.89 | $3.29 |

|

| Ending value (after expenses) | $1,090.30 | $1,086.90 | $1,087.60 | $1,090.30 | $1,091.50 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 5/31/09. The expense ratio may differ for each share class (see the last table in this section).

Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended May 31, 2009, use the following calculation method. To find the value of your investment on December 1, 2008, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Expenses paid per $1,000* | $4.28 | $7.44 | $8.20 | $5.69 | $3.18 |

|

| Ending value (after expenses) | $1,020.69 | $1,017.55 | $1,016.80 | $1,019.30 | $1,021.79 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 5/31/09. The expense ratio may differ for each share class (see the last table in this section).

Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

10

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Your fund’s annualized expense ratio* | 0.85% | 1.48% | 1.63% | 1.13% | 0.63% |

|

| Average annualized expense ratio for Lipper peer group† | 0.85% | 1.48% | 1.63% | 1.13% | 0.63% |

|

* For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

† Putnam keeps fund expenses below the Lipper peer group average expense ratio by limiting our fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage/service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times; the fund’s expense ratio shown here is annualized data for the most recent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer grou p funds as of 3/31/09.

Your fund’s portfolio turnover

Putnam funds are actively managed by experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s average portfolio value within a given period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the following table to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons Percentage of holdings that change every year

| | | | | |

| | 2009 | 2008 | 2007 | 2006 | 2005 |

|

| Putnam Ohio Tax Exempt Income Fund | 20% | 36% | 15% | 6% | 12% |

|

| Lipper Ohio Municipal Debt Funds category average | 29% | 30% | 19% | 17% | 17% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on May 31. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2009 is based on information available as of 5/31/09.

11

Your fund’s management

In addition to Thalia Meehan, your fund’s Portfolio Managers are Paul Drury, Brad Libby, and Susan McCormack.

Trustee and Putnam employee fund ownership

As of May 31, 2009, all of the Trustees of the Putnam funds owned fund shares. The following table shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | | |

| Assets in | Total assets in | |

| the fund | all Putnam funds | |

| |

| Trustees | $41,000 | $36,000,000 | |

| |

| Putnam employees | $13,000 | $357,000,000 | |

| |

Other Putnam funds managed by the Portfolio Managers

Thalia Meehan, Paul Drury, Brad Libby, and Susan McCormack are Portfolio Managers of Putnam’s open-end tax-exempt funds for the following states: Arizona, California, Massachusetts, Michigan, Minnesota, New Jersey, New York, Ohio, and Pennsylvania. The same group also manages Putnam AMT-Free Municipal Fund, Putnam Managed Municipal Income Trust, Putnam Municipal Opportunities Trust, Putnam Tax Exempt Income Fund, and Putnam Tax-Free High Yield Fund.

Thalia Meehan, Paul Drury, Brad Libby, and Susan McCormack may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Portfolio management fund ownership

The following table shows how much the fund’s current Portfolio Managers have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of May 31, 2009, and May 31, 2008.

12

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Barclays Capital Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

13

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”). In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2008, the Contract Committee met several times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2008.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees, were subject to the continued application of certain expense reductions and waivers and other considerations noted below, and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their conside ration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. In this regard, the Trustees also noted that shareholders of your fund voted in 2007 to approve new management contracts containing an identical fee structure. The Trustees f ocused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 50th percentile in management fees and in the 60th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2007 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distributio n (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations initially implemented in January 2004. The Trustees have received a commitment from Putnam Management and its parent company to continue this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2008, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will

14

be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2007. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

In addition, the Trustees devoted particular attention to analyzing the Putnam funds’ fees and expenses relative to those of competitors in fund complexes of comparable size and with a comparable mix of asset categories. The Trustees concluded that this analysis did not reveal any matters requiring further attention at the current time.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of the fund (as a percentage of fund assets) declines as the fund grows in size and crosses specified asset thresholds. Conversely, if the fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale at current asset levels.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not guarantee fa vorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

While the Trustees noted the satisfactory investment performance of certain Putnam funds, they considered the disappointing investment performance of many funds in recent periods, particularly over periods in 2007 and 2008. They discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has taken steps to strengthen its investment personnel and processes to address areas of underperformance, including recent efforts to further centralize Putnam Management’s equity research function. In this regard, the Trustees took into consideration efforts by Putnam Management to improve its ability to assess and mitigate investment risk in individual funds, across asset classes, and across the complex as a whole. The Trustees indicated their intention to continue to monitor performan ce trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted. In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Ohio Municipal Debt Funds) (compared using tax-adjusted performance to recognize the different federal income tax treatment for capital gains distributions and exempt-interest distributions) for the one-year, three-year, and five-year periods ended December 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | 17th | |

| |

| Three-year period | 19th | |

| |

| Five-year period | 28th | |

| |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report.) Over the one-year, three-year, and five-year periods ended December 31, 2007, there were 46, 41, and 41 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.

As a general matter, the Trustees believe that cooperative efforts between the

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Ohio Municipal Debt Funds category for the one-year, five-year, and ten-year periods ended June 30, 2009, were 47%, 40%, and 39%, respectively. Over the one-year, five-year, and ten-year periods ended June 30, 2009, your fund ranked 19th out of 40, 14th out of 34, and 12th out of 30 funds, respectively. Unlike the information above, these rankings reflect performance before taxes. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

15

Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered changes made in 2008, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policy, which expanded the permitted categories of brokerage and research services payable with soft dollars and increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage and trends in industry practice to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract arrangements also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the investor servicing agreement, the Trustees considered that certain shareholder servicing functions were shifted to a third-party service provider by PFTC in 2007.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparisons of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset classes are typicall y higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

16

Other information for shareholders

Putnam’s policy on confidentiality

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ addresses, telephone numbers, Social Security numbers, and the names of their financial representatives. We use this information to assign an account number and to help us maintain accurate records of transactions and account balances. It is our policy to protect the confidenti-ality of your information, whether or not you currently own shares of our funds, and, in particular, not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use. Under certain circumstances, we share this information with outside vendors who provide services to us, such as mailing and proxy solicitation. In those cases, the service providers enter into conf identiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. We may also share this information with our Putnam affiliates to service your account or provide you with information about other Putnam products or services. It is also our policy to share account information with your financial representative, if you’ve listed one on your Putnam account. If you would like clarification about our confidentiality policies or have any questions or concerns, please don’t hesitate to contact us at 1-800-225-1581, Monday through Friday, 8:30 a.m. to 8:00 p.m., or Saturdays from 9:00 a.m. to 5:00 p.m. Eastern Time.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2008, are available in the Individual Investors section of putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings —from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

18

Report of Independent Registered Public Accounting Firm

To the Trustees and Shareholders of

Putnam Ohio Tax Exempt Income Fund:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Putnam Ohio Tax Exempt Income Fund (the “fund”) at May 31, 2009, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those s tandards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments owned at May 31, 2009 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

July 10, 2009

19

The fund’s portfolio 5/31/09

| |

| Key to abbreviations | |

| | |

| AGO Assured Guaranty, Ltd. | FRB Floating Rate Bonds |

| AMBAC AMBAC Indemnity Corporation | FSA Financial Security Assurance |

| Cmnwlth. of PR Gtd. Commonwealth of Puerto Rico Guaranteed | GNMA Coll. Government National Mortgage Association Collateralized |

| COP Certificates of Participation | G.O. Bonds General Obligation Bonds |

| FGIC Financial Guaranty Insurance Company | NATL National Public Finance Guarantee Corp. |

| FHA Insd. Federal Housing Administration Insured | U.S. Govt. Coll. U.S. Government Collateralized |

| FHLMC Coll. Federal Home Loan Mortgage Corporation Collateralized | VRDN Variable Rate Demand Notes |

| FNMA Coll. Federal National Mortgage Association Collateralized | XLCA XL Capital Assurance |

| | | |

| MUNICIPAL BONDS AND NOTES (98.4%)* | Rating** | Principal amount | Value |

|

| Ohio (91.1%) | | | |

| Akron, G.O. Bonds, FSA, 5s, 12/1/25 | AAA | $1,005,000 | $1,065,632 |

|

| Akron, Wtr. Wks. Rev. Bonds, NATL | | | |

| 6s, 12/1/12 | AA– | 875,000 | 965,834 |

| 5 1/4s, 12/1/17 | Baa1 | 1,285,000 | 1,313,334 |

|

| Allen Cnty., Hosp. Fac. VRDN (Catholic Hlth. Care), Ser. B, 0.25s, 10/1/31 | VMIG1 | 400,000 | 400,000 |

|

| American Muni. Pwr. — Ohio, Inc. Rev. Bonds (Prairie State Energy Campus), Ser. A | | | |

| AGO, 5 3/4s, 2/15/39 | AAA | 1,500,000 | 1,531,155 |

| 5s, 2/15/38 | A1 | 1,500,000 | 1,451,070 |

|

| Anthony Wayne Local School Dist. G.O. Bonds (School Fac. Construction & Impt.), | | | |

| FSA, 5 1/2s, 12/1/19 | AAA | 1,565,000 | 1,659,526 |

|

| Barberton, City School Dist. G.O. Bonds (School Impt.), 5 1/4s, 12/1/28 | AA | 1,390,000 | 1,471,690 |

|

| Brookfield, Local School Dist. G.O. Bonds (School Fac. Impt.), FSA, 5s, 1/15/26 | AAA | 1,000,000 | 1,067,730 |

|

| Buckeye, Tobacco Settlement Fin. Auth. Rev. Bonds | | | |

| Ser. A-2, 6s, 6/1/42 | BBB | 250,000 | 173,190 |

| Ser. A-2, 5 3/4s, 6/1/34 | BBB | 6,000,000 | 4,344,720 |

| Ser. A-2, 5 3/8s, 6/1/24 | BBB | 695,000 | 603,191 |

| Ser. A-3, stepped coupon zero % (6.25%s, 12/1/12), 2037 †† | BBB | 1,200,000 | 622,104 |

|

| Canal Winchester, Local School Dist. G.O. Bonds, NATL, zero %, 12/1/33 | A3 | 1,180,000 | 290,846 |

|

| Cincinnati, City School Dist. COP (School Impt.), FSA, 5s, 12/15/28 | AAA | 2,500,000 | 2,548,675 |

|

| Cleveland, G.O. Bonds, Ser. A | | | |

| AGO, 5s, 12/1/29 | AAA | 2,000,000 | 2,023,640 |

| FGIC, NATL, 4 3/4s, 11/15/26 | AA | 1,790,000 | 1,799,380 |

|

| Cleveland, Arpt. Syst. FRB, Ser. C, FSA, 5s, 1/1/23 | AAA | 1,500,000 | 1,565,265 |

|

| Cleveland, Income Tax Rev. Bonds (Bridges & Roadways), Ser. B, AGO, 5s, 10/1/29 | AAA | 1,000,000 | 1,038,250 |

|

| Cleveland, Muni. School Dist. G.O. Bonds, FSA, 5s, 12/1/27 | AAA | 1,375,000 | 1,414,738 |

|

| Cleveland, Parking Fac. Rev. Bonds, FSA, 5 1/4s, 9/15/22 | AAA | 2,400,000 | 2,495,400 |

|

| Cleveland, Pub. Pwr. Syst. Rev. Bonds, Ser. B-1, NATL, zero %, 11/15/25 | AA– | 3,000,000 | 1,320,750 |

|

| Cleveland, Urban Renewal Increment Rev. Bonds (Rock & Roll Hall of Fame), 6 3/4s, 3/15/18 | B+/P | 1,150,000 | 1,150,173 |

|

| Columbus, City School Dist. G.O. Bonds, FSA, zero %, 12/1/27 | AAA | 1,895,000 | 785,345 |

|

| Cuyahoga Cmnty., College Dist. Rev. Bonds, Ser. C, 5s, 8/1/25 | Aa3 | 1,500,000 | 1,563,015 |

|

| Cuyahoga Cnty., Hosp. VRDN (U. Hosp.), 0.16s, 1/1/16 | VMIG1 | 1,545,000 | 1,545,000 |

|

| Dublin, G.O. Bonds, Ser. B, 6.4s, 12/1/14 | Aaa | 1,300,000 | 1,480,258 |

|

| Elyria, OH City School Dist. G.O. Bonds (Classroom Fac. & School Impt.), XLCA, 5s, 12/1/35 | A3 | 500,000 | 501,305 |

|

| Erie Cnty., OH Hosp. Fac. Rev. Bonds (Firelands Regl. Med. Ctr.), 5 5/8s, 8/15/32 | A | 1,000,000 | 840,440 |

|

| Field, Local School Dist. G.O. Bonds (School Fac. Construction & Impt.), AMBAC, 5s, 12/1/22 | A/P | 1,170,000 | 1,137,556 |

|

| Franklin Cnty., Rev. Bonds (OCLC Online Computer Library Ctr.), 5s, 4/15/13 | A | 2,610,000 | 2,844,952 |

|

| Franklin Cnty., Dev. Rev. Bonds (American Chemical Society), 5.8s, 10/1/14 | A+ | 2,000,000 | 2,039,860 |

|

| Franklin Cnty., Econ. Dev. Rev. Bonds (Capitol South Cmnty. Urban), 5 3/4s, 6/1/11 | BBB–/P | 1,000,000 | 987,640 |

|

| Franklin Cnty., Hlth. Care Fac. Rev. Bonds (OH Presbyterian Svcs.), U.S. Govt. Coll., | | | |

| 7 1/8s, 7/1/29 (Prerefunded) | BBB | 2,000,000 | 2,251,300 |

|

| Hamilton Cnty., Rev. Bonds, Ser. B, AMBAC, zero %, 12/1/22 | A2 | 500,000 | 240,115 |

|

| Hamilton Cnty., Econ. Dev. Rev. Bonds (King Highland Cmnty. Urban), Ser. A, NATL, 5s, 6/1/22 | AA– | 1,745,000 | 1,844,011 |

|

| Hamilton Cnty., Sales Tax Rev. Bonds, Ser. B, AMBAC, zero %, 12/1/24 | A2 | 3,000,000 | 1,253,910 |

|

| Hamilton Cnty., Swr. Syst. Rev. Rev. Bonds (Metro. Swr. Dist.), Ser. A, NATL, 5s, 12/1/28 | AA | 1,500,000 | 1,567,635 |

|

20

| | | |

| MUNICIPAL BONDS AND NOTES (98.4%)* cont. | Rating** | Principal amount | Value |

|

| Ohio cont. | | | |

| Hamilton, City School Dist. G.O. Bonds (School Impt.), FSA, 5s, 12/1/26 | AAA | $3,000,000 | $3,149,070 |

|

| Huran Cnty., Human Svcs. Rev. Bonds, NATL, 6.55s, 12/1/20 | AA– | 1,800,000 | 2,160,774 |

|

| Kings, Local School Dist. G.O. Bonds (School Impt.), NATL, 5s, 12/1/27 | AA | 750,000 | 776,228 |

|

| Lake Cnty., Hosp. Fac. Rev. Bonds (Lake Hosp. Syst.), Ser. C, 6s, 8/15/43 | Baa1 | 850,000 | 772,812 |

|

| Lakewood, City School Dist. G.O. Bonds | | | |

| FGIC, NATL, zero %, 12/1/17 | Aa3 | 1,190,000 | 876,661 |

| FSA, zero %, 12/1/16 | AAA | 1,250,000 | 985,325 |

|

| Lakota, School Dist. Rev. Bonds, AMBAC, 7s, 12/1/10 | Aa1 | 1,000,000 | 1,081,130 |

|

| Lorain Cnty., Elderly Hsg. Corp. Multi-Fam. Rev. Bonds (Harr Plaza & Intl.), Ser. A, | | | |

| 6 3/8s, 7/15/19 | BBB | 1,165,000 | 1,142,562 |

|

| Lorain Cnty., Hosp. Rev. Bonds (Catholic), Ser. H, AGO, 5s, 2/1/29 | AAA | 2,000,000 | 2,022,960 |

|

| Miami Cnty., Hosp. Fac. Rev. Bonds (Upper Valley Med. Ctr.), 5 1/4s, 5/15/17 | A3 | 1,250,000 | 1,146,800 |

|

| Midview, School Dist. COP (School Bldg. Fac.), 5 1/4s, 11/1/17 | A | 2,535,000 | 2,642,991 |

|

| Montgomery Cnty., Rev. Bonds (Catholic Hlth. Initiatives), Ser. D, 6 1/4s, 10/1/33 | Aa2 | 1,000,000 | 1,112,570 |

|

| Montgomery Cnty., VRDN (Catholic Hlth. Initiatives), Ser. B-2, 0.1s, 4/1/37 | VMIG1 | 600,000 | 600,000 |

|

| Mount Healthy, City School Dist. G.O. Bonds (School Impt.), FSA, 5 1/4s, 12/1/22 | Aa3 | 1,105,000 | 1,224,329 |

|

| OH Hsg. Fin. Agcy. Rev. Bonds | | | |

| Ser. B, GNMA Coll., 5s, 3/1/34 | Aaa | 810,000 | 804,079 |

| (Res. Dev.), Ser. A, GNMA Coll., 4.6s, 9/1/28 | Aaa | 25,000 | 24,951 |

| (Res. Mtge.), Ser. E, GNMA Coll., FNMA Coll., FHLMC Coll., 4 1/4s, 3/1/15 | Aaa | 430,000 | 427,162 |

| (Res. Mtge.), Ser. C, GNMA Coll., FNMA Coll., 4.1s, 3/1/15 | Aaa | 420,000 | 411,835 |

|

| OH Hsg. Fin. Agcy. Single Fam. Mtge. Rev. Bonds | | | |

| Ser. G, GNMA Coll., 7.14s, 3/2/23 | Aaa | 100,000 | 100,000 |

| Ser. 85-A, FGIC, FHA Insd., zero %, 1/15/15 | AAA/P | 15,000 | 8,556 |

|

| OH State Rev. Bonds | | | |

| Ser. A, 5s, 10/1/22 | AA– | 3,090,000 | 3,287,018 |

| (Revitalization), Ser. A, AMBAC, 5s, 4/1/19 | AA– | 1,750,000 | 1,892,660 |

|

| OH State Air Quality Dev. Auth. Mandatory Put Bonds (OH Pwr.), 7 1/8s, 6/1/10 | A3 | 500,000 | 511,305 |

|

| OH State Air Quality Dev. Auth. VRDN (First Energy), Ser. B, 0.2s, 8/1/29 | VMIG1 | 2,800,000 | 2,800,000 |

|

| OH State Env. Impt. Rev. Bonds (USX Corp.), 5 5/8s, 5/1/29 | Baa1 | 750,000 | 674,925 |

|

| OH State Higher Edl. Fac. Mandatory Put Bonds (Kenyon College), 5.05s, 7/1/16 | A1 | 2,000,000 | 2,053,780 |

|

| OH State Higher Edl. Fac. Rev. Bonds | | | |

| (Case Western Reserve U.), 6 1/4s, 10/1/18 | AA– | 1,000,000 | 1,185,660 |

| (Case Western Reserve U.), 6s, 10/1/14 | AA– | 1,000,000 | 1,146,650 |

| (U. of Dayton), 5 1/2s, 12/1/36 | A2 | 1,000,000 | 1,007,350 |

| (Oberlin College), 5 1/8s, 10/1/24 | Aa2 | 1,500,000 | 1,568,790 |

|

| OH State Higher Edl. Fac. Commn. Rev. Bonds | | | |

| (U. Hosp. Hlth. Syst.), Ser. 09-A, 6 3/4s, 1/15/39 | A2 | 2,000,000 | 2,108,060 |

| (John Carroll U.), 5 1/2s, 11/15/18 | A2 | 335,000 | 358,108 |

| (John Carroll U.), 5 1/2s, 11/15/17 | A2 | 420,000 | 448,791 |

| (Oberlin College), 5s, 10/1/33 | Aa2 | 1,000,000 | 1,012,730 |

| (Northern U.), 4 3/4s, 5/1/19 | A3 | 2,500,000 | 2,512,075 |

|

| OH State Hsg. Fin. Agcy. Rev. Bonds (Res. Mtge.) | | | |

| Ser. F, GNMA Coll., FNMA Coll., FHLMC Coll., 5.45s, 9/1/33 | Aaa | 1,990,000 | 2,038,476 |

| Ser. L, GNMA Coll., FNMA Coll., 4 3/4s, 3/1/37 | Aaa | 2,000,000 | 1,720,940 |

|

| OH State Poll. Control Rev. Bonds (Standard Oil Co.), 6 3/4s, 12/1/15 | Aa1 | 3,350,000 | 3,880,640 |

|

| OH State U. Rev. Bonds, Ser. A | | | |

| 5 1/8s, 12/1/31 | Aa2 | 1,000,000 | 1,015,800 |

| 5s, 12/1/27 | Aa2 | 1,000,000 | 1,050,910 |

|

| OH State Wtr. Dev. Auth. Poll. Control Rev. Bonds (Wtr. Quality), Ser. B, zero %, 12/1/14 | Aaa | 3,500,000 | 3,012,275 |

|

| OH State Wtr. Dev. Auth. Poll. Control Fac. Mandatory Put Bonds (First Energy Generation), | | | |

| Ser. C, 7 1/4s, 11/1/12 | Baa2 | 500,000 | 516,965 |

|

| OH State Wtr. Dev. Auth. Solid Waste Disp. Rev. Bonds (Bay Shore Power Co.), Ser. A, | | | |

| 5 7/8s, 9/1/20 | BB+/P | 1,000,000 | 847,480 |

|

| OH U. Gen. Recipients Athens Rev. Bonds, NATL, 5s, 12/1/25 | AA– | 2,265,000 | 2,296,937 |

|

| Powell, G.O. Bonds, FGIC, NATL, 5 1/2s, 12/1/25 | AA+ | 1,500,000 | 1,548,000 |

|

| Rickenbacker, Port Auth. Rev. Bonds (OASBO Expanded Asset Pooled), Ser. A, 5 3/8s, 1/1/32 | A2 | 2,165,000 | 2,092,148 |

|

21

| | | |

| MUNICIPAL BONDS AND NOTES (98.4%)* cont. | Rating** | Principal amount | Value |

|

| Ohio cont. | | | |

| River Valley, Local School Dist. G.O. Bonds (School Fac. Construction & Impt.), FSA, | | | |

| 5 1/4s, 11/1/23 | Aa2 | $300,000 | $349,737 |

|

| Sandusky Cnty., Hosp. Fac. Rev. Bonds (Memorial Hosp.), 5.15s, 1/1/10 | BBB– | 830,000 | 827,585 |

|

| Scioto Cnty., Hosp. Rev. Bonds (Southern Med. Ctr.), 5 1/2s, 2/15/28 | A2 | 1,750,000 | 1,624,455 |

|

| South Western City, School Dist. G.O. Bonds (Franklin & Pickway Cnty.), FSA, 4 3/4s, 12/1/23 | AAA | 2,000,000 | 2,089,720 |

|

| Summit Cnty., G.O. Bonds, Ser. R, FGIC, NATL, 5 1/2s, 12/1/18 | Aa2 | 500,000 | 597,590 |

|

| Sylvania, City School Dist. G.O. Bonds (School Impt.), AGO, 5s, 12/1/27 | AAA | 1,500,000 | 1,536,735 |

|

| Tallmadge, City School Dist. G.O. Bonds (School Fac.), FSA, 5s, 12/1/26 | AAA | 1,410,000 | 1,473,027 |

|

| Toledo, G.O. Bonds (Macys), Ser. A, NATL, 6.35s, 12/1/25 | AA– | 1,500,000 | 1,500,225 |

|

| Toledo, Swr. Syst. Mtge. Rev. Bonds, AMBAC, 6.2s, 11/15/12 | A | 2,405,000 | 2,770,488 |

|

| Toledo, Wtr. Wks. Mtge. Rev. Bonds, AMBAC, 6.2s, 11/15/12 | A | 965,000 | 1,106,749 |

|

| Toledo-Lucas Cnty., Port Auth. Rev. Bonds (CSX Transn, Inc.), 6.45s, 12/15/21 | Baa3 | 1,900,000 | 2,008,870 |

|

| Twin Valley, Cmnty. Local School Dist. Rev. Bonds, FGIC, NATL, 7.05s, 12/1/11 | AA– | 785,000 | 827,508 |

|

| U. of Cincinnati COP (Jefferson Ave. Residence Hall), NATL, 5 1/8s, 6/1/28 | AA– | 1,000,000 | 1,000,070 |

|

| Westerville, G.O. Bonds, AMBAC, 5s, 12/1/26 | Aa1 | 1,320,000 | 1,388,046 |

|

| Woodridge, School Dist. Rev. Bonds, AMBAC, 6.8s, 12/1/14 | A | 2,650,000 | 2,963,734 |

|

| Youngstown State U. Rev. Bonds, AGO, 5 1/4s, 12/15/29 | AAA | 500,000 | 516,130 |

|

| Zanesville, Hsg. Dev. Corp. Mtge. Rev. Bonds, U.S. Govt. Coll. | | | |

| 7 3/8s, 10/1/21 (Prerefunded) | AAA/P | 220,000 | 289,676 |

| 7 3/8s, 10/1/20 (Prerefunded) | AAA/P | 205,000 | 269,926 |

| 7 3/8s, 10/1/19 (Prerefunded) | AAA/P | 185,000 | 243,591 |

| 7 3/8s, 10/1/18 (Prerefunded) | AAA/P | 180,000 | 237,008 |

| 7 3/8s, 10/1/17 (Prerefunded) | AAA/P | 160,000 | 210,674 |

| 7 3/8s, 10/1/16 (Prerefunded) | AAA/P | 155,000 | 204,090 |

|

| | | | 141,293,537 |

| Puerto Rico (6.9%) | | | |

| Children’s Trust Fund Tobacco Settlement Rev. Bonds, 5 3/8s, 5/15/33 | BBB | 525,000 | 437,120 |

|

| Cmnwlth. of PR, Aqueduct & Swr. Auth. Rev. Bonds, Ser. A | | | |

| 6s, 7/1/44 | Baa3 | 1,000,000 | 978,460 |

| 6s, 7/1/38 | Baa3 | 3,350,000 | 3,331,542 |

|

| Cmnwlth. of PR, Hsg. Fin. Corp. Rev. Bonds, Ser. B, GNMA Coll., FNMA Coll., FHLMC Coll., | | | |

| 4.45s, 6/1/27 | Aaa | 155,000 | 154,298 |

|

| Cmnwlth. of PR, Hwy. & Trans. Auth. Rev. Bonds | | | |

| Ser. W, 5 1/2s, 7/1/15 | BBB+ | 1,000,000 | 1,019,070 |

| Ser. G, 5s, 7/1/33 | BBB | 100,000 | 84,377 |

| Ser. G, 5s, 7/1/33 (Prerefunded) | Aaa | 195,000 | 221,565 |

| Ser. K, 5s, 7/1/13 | BBB | 500,000 | 501,075 |

|

| Cmnwlth. of PR, Indl. Tourist Edl. Med. & Env. Control Fac. Rev. Bonds (Cogen. Fac.-AES), | | | |

| 6 5/8s, 6/1/26 | Baa3 | 1,000,000 | 1,002,590 |

|

| Cmnwlth. of PR, Infrastructure Fin. Auth. Special Tax Bonds, Ser. C, FGIC, 5 1/2s, 7/1/19 | BBB+ | 1,000,000 | 1,004,560 |

|

| Cmnwlth. of PR, Pub. Bldg. Auth. Rev. Bonds (Govt. Fac.) | | | |

| Ser. M-3, NATL, Cmnwlth. of PR Gtd., 6s, 7/1/28 | AA | 500,000 | 501,010 |

| Ser. N, Cmnwlth. of PR Gtd., 5 1/2s, 7/1/19 | Baa3 | 1,070,000 | 1,074,098 |

|

| Cmnwlth. of PR, Sales Tax Fin. Corp. Rev. Bonds, Ser. A, NATL, zero %, 8/1/43 | AA– | 3,000,000 | 373,860 |

|

| | | | 10,683,625 |

| Virgin Islands (0.4%) | | | |