The fund’s portfolio 5/31/15

| Key to holding’s abbreviations |

AGM Assured Guaranty Municipal Corporation

AGO Assured Guaranty, Ltd.

AMBAC AMBAC Indemnity Corporation

COP Certificates of Participation

FNMA Coll. Federal National Mortgage Association Collateralized

FRB Floating Rate Bonds: the rate shown is the current interest rate at the close of the reporting period

G.O. Bonds General Obligation Bonds

GNMA Coll. Government National Mortgage Association Collateralized

NATL National Public Finance Guarantee Corp.

SGI Syncora Guarantee, Inc.

U.S. Govt. Coll. U.S. Government Collateralized

VRDN Variable Rate Demand Notes, which are floating-rate securities with long-term maturities that carry coupons that reset and are payable upon demand either daily, weekly or monthly. The rate shown is the current interest rate at the close of the reporting period.

| MUNICIPAL BONDS AND NOTES (97.8%)* | Rating** | | Principal

amount | Value |

| Guam (0.9%) | | | | |

| Territory of GU, Govt. Ltd. Oblig. Rev. Bonds (Section 30), Ser. A, 5 3/4s, 12/1/34 | BBB+ | | $500,000 | $563,685 |

| Territory of GU, Govt. Wtr. Wks. Auth. Wtr. & Waste Wtr. Syst. Rev. Bonds, 5 5/8s, 7/1/40 | A– | | 350,000 | 388,007 |

| Territory of GU, Pwr. Auth. Rev. Bonds, Ser. A, 5 1/2s, 10/1/40 | BBB | | 250,000 | 276,953 |

| | | | | 1,228,645 |

| Ohio (95.2%) | | | | |

| Akron, G.O. Bonds, AGM, 5s, 12/1/25 (Prerefunded 12/1/17) | AA | | 1,005,000 | 1,105,621 |

| Allen Cnty., Hosp. Fac. Rev. Bonds

(Catholic Hlth. Care), Ser. A, 5 1/4s, 6/1/38 | AA– | | 1,000,000 | 1,119,390 |

| American Muni. Pwr., Inc. Rev. Bonds | | | | |

| (Prairie State Energy Campus), Ser. A, AGO, U.S. Govt. Coll., 5 3/4s, 2/15/39 (Prerefunded 2/15/19) | AA | | 1,500,000 | 1,740,330 |

| Ser. A, 5 1/4s, 2/15/33 | A1 | | 250,000 | 280,835 |

| 5s, 2/15/39 | A1 | | 1,000,000 | 1,110,830 |

| (Prairie State Energy Campus), 5s, 2/15/38 | A1 | | 90,000 | 96,080 |

| (Prairie State Energy Campus), U.S. Govt. Coll., 5s, 2/15/38 (Prerefunded 2/15/18) | AAA/P | | 1,410,000 | 1,557,458 |

| Barberton, City School Dist. G.O. Bonds

(School Impt.), U.S. Govt. Coll., 5 1/4s, 12/1/28 (Prerefunded 6/1/18) | AA | | 1,390,000 | 1,558,593 |

| Brookfield, Local School Dist. G.O. Bonds

(School Fac. Impt.), AGM, 5s, 1/15/26 | Aa2 | | 1,000,000 | 1,091,620 |

| Buckeye, Tobacco Settlement Fin. Auth. Rev. Bonds, Ser. A-2 | | | | |

| 5 3/4s, 6/1/34 | B3 | | 2,000,000 | 1,595,560 |

| 5 3/8s, 6/1/24 | B3 | | 690,000 | 588,853 |

| Cincinnati, G.O. Bonds, Ser. D, 4s, 12/1/32 | Aa2 | | 500,000 | 522,055 |

| Cincinnati, City School Dist. COP, AGM | | | | |

| 5s, 12/15/28 (Prerefunded 12/15/16) | AA | | 1,840,000 | 1,965,433 |

| 5s, 12/15/28 (Prerefunded 12/15/16) | AA | | 660,000 | 704,992 |

| Cleveland, G.O. Bonds, Ser. A, AGO, 5s, 12/1/29 | AA | | 2,000,000 | 2,135,820 |

Ohio Tax Exempt Income Fund 21

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | | Principal

amount | Value |

| Ohio cont. | | | | |

| Cleveland, Arpt. Syst. Rev. Bonds, Ser. C, AGM, 5s, 1/1/23 | AA | | $1,500,000 | $1,589,295 |

| Cleveland, Income Tax Rev. Bonds (Bridges & Roadways), Ser. B, AGO, 5s, 10/1/29 | AA | | 1,000,000 | 1,085,510 |

| Cleveland, Pkg. Fac. Rev. Bonds, AGM | | | | |

| 5 1/4s, 9/15/22 | AA | | 1,630,000 | 1,884,427 |

| 5 1/4s, 9/15/22 (Escrowed to maturity) | AA | | 770,000 | 940,555 |

| Cleveland, Pub. Pwr. Syst. Rev. Bonds, Ser. B-1, NATL, zero %, 11/15/25 | AA– | | 3,000,000 | 2,053,620 |

| Cleveland, State U. Rev. Bonds, 5s, 6/1/37 | A1 | | 1,500,000 | 1,652,580 |

| Cleveland, Urban Renewal Increment Rev. Bonds (Rock & Roll Hall of Fame), 6 3/4s, 3/15/18 | B/P | | 555,000 | 557,337 |

| Cleveland, Wtr. Rev. Bonds (2nd Lien) | | | | |

| Ser. X, 5s, 1/1/42 | Aa1 | | 1,000,000 | 1,109,110 |

| Ser. A, 5s, 1/1/26 | Aa2 | | 500,000 | 578,330 |

| Cleveland-Cuyahoga Cnty., Rev. Bonds

(Euclid Ave. Dev., Corp.), 5s, 8/1/39 | A2 | | 1,000,000 | 1,083,200 |

| Columbus, G.O. Bonds, Ser. A | | | | |

| 5s, 2/15/25 | Aaa | | 1,500,000 | 1,787,010 |

| 5s, 8/15/24 | Aaa | | 1,000,000 | 1,217,380 |

| Columbus, Swr. VRDN, Ser. B, 0.07s, 6/1/32 | VMIG1 | | 1,430,000 | 1,430,000 |

| Cuyahoga Cmnty., College Dist. Rev. Bonds | | | | |

| Ser. C, 5 1/4s, 2/1/29 | Aa2 | | 995,000 | 1,138,678 |

| Ser. D, 5s, 8/1/32 | Aa2 | | 750,000 | 841,875 |

| Ser. C, 5s, 8/1/25 | Aa2 | | 1,500,000 | 1,713,645 |

| Cuyahoga Cnty., COP (Convention Hotel), 5s, 12/1/27 | Aa3 | | 1,250,000 | 1,430,950 |

| Dayton, City School Dist. G.O. Bonds, 5s, 11/1/23 | Aa2 | | 750,000 | 890,798 |

| Elyria, OH City School Dist. G.O. Bonds (Classroom Fac. & School Impt.) | | | | |

| SGI, 5s, 12/1/35 (Prerefunded 6/1/17) | A1 | | 110,000 | 119,260 |

| U.S. Govt. Coll., SGI, 5s, 12/1/35 (Prerefunded 6/1/17) | A1 | | 390,000 | 422,830 |

| Erie Cnty., OH Hosp. Fac. Rev. Bonds

(Firelands Regl. Med. Ctr.), Ser. A, 5 1/4s, 8/15/46 | A3 | | 590,000 | 595,829 |

| Franklin Cnty., Hlth. Care Fac. Rev. Bonds | | | | |

| (Presbyterian Svcs.), Ser. A, 5 5/8s, 7/1/26 | BBB– | | 1,100,000 | 1,206,238 |

| 5s, 11/15/44 | A–/F | | 1,000,000 | 1,073,960 |

| Gallia Cnty., Local School Impt. Dist. G.O. Bonds, 5s, 11/1/27 | Aa2 | | 815,000 | 960,200 |

| Greene Cnty., Hosp. Facs. Rev. Bonds

(Kettering Hlth. Network), 5 1/2s, 4/1/39 | A | | 1,000,000 | 1,108,440 |

| Hamilton Cnty., Econ. Dev. Rev. Bonds

(King Highland Cmnty. Urban), Ser. A, NATL,

U.S. Govt. Coll., 5s, 6/1/22 | AA– | | 1,745,000 | 1,814,783 |

| Hamilton Cnty., Hlth. Care Rev. Bonds

(Life Enriching Cmntys.), 6 5/8s, 1/1/46 | BBB | | 590,000 | 674,960 |

22 Ohio Tax Exempt Income Fund

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | | Principal

amount | Value |

| Ohio cont. | | | | |

| Hamilton Cnty., Sales Tax Rev. Bonds, Ser. B, AMBAC | | | | |

| zero %, 12/1/24 | A2 | | $3,000,000 | $2,200,710 |

| zero %, 12/1/22 | A2 | | 500,000 | 401,470 |

| Hamilton Cnty., Swr. Syst. Rev. Rev. Bonds | | | | |

| (Metro. Swr. Dist.), Ser. A, NATL, U.S. Govt. Coll., 5s, 12/1/28 (Prerefunded 12/1/16) | AA+ | | 1,500,000 | 1,599,675 |

| Ser. A, 5s, 12/1/22 | AA+ | | 750,000 | 898,950 |

| Hamilton, City School Dist. G.O. Bonds

(School Impt.), AGM, U.S. Govt. Coll., 5s, 12/1/26 (Prerefunded 6/1/17) | AA | | 1,000,000 | 1,084,180 |

| Huran Cnty., Human Svcs. G.O. Bonds, NATL, 6.55s, 12/1/20 | Aa3 | | 1,540,000 | 1,751,042 |

| JobsOhio Beverage Syst. Rev. Bonds

(Statewide Sr. Lien Liquor Profits), Ser. A, 5s, 1/1/38 | AA | | 700,000 | 771,302 |

| Lake Cnty., Hosp. Fac. Rev. Bonds

(Lake Hosp. Syst.), Ser. C, 6s, 8/15/43 | A3 | | 1,115,000 | 1,245,187 |

| Lakewood, City School Dist. G.O. Bonds | | | | |

| NATL, zero %, 12/1/17 | Aa2 | | 1,190,000 | 1,148,445 |

| AGM, zero %, 12/1/16 | Aa2 | | 1,250,000 | 1,230,400 |

| Lancaster, City Fac. Construction & Impt. School Dist. G.O. Bonds, 5s, 10/1/37 | AA | | 1,000,000 | 1,099,560 |

| Lorain Cnty., Hosp. Rev. Bonds (Catholic), Ser. H, AGO, 5s, 2/1/29 | AA | | 2,000,000 | 2,170,720 |

| Lorain Cnty., Port Auth. Econ. Dev. Facs. Rev. Bonds (Kendal at Oberlin), 5s, 11/15/30 | A– | | 750,000 | 811,133 |

| Lorain Cnty., Port Auth. Recovery Zone Fac. Rev. Bonds (U.S. Steel Corp.), 6 3/4s, 12/1/40 | BB– | | 500,000 | 557,310 |

| Lucas Cnty., Hlth. Care Fac. Rev. Bonds | | | | |

| (Lutheran Homes), Ser. A, 7s, 11/1/45 | BB+ | | 700,000 | 768,397 |

| (Sunset Retirement Cmntys.), 5 1/2s, 8/15/30 | A–/F | | 650,000 | 719,947 |

| Miami Cnty., Hosp. Fac. Rev. Bonds

(Upper Valley Med. Ctr.), 5 1/4s, 5/15/17 | A2 | | 1,250,000 | 1,302,650 |

| Milford, Exempt Village School Dist. G.O. Bonds, 5s, 12/1/19 | Aa2 | | 200,000 | 229,002 |

| Montgomery Cnty., Rev. Bonds (Catholic Hlth. Initiatives), Ser. D, 6 1/4s, 10/1/33 | A2 | | 1,000,000 | 1,138,910 |

| Montgomery Cnty., VRDN (Miami Valley Hosp.), Ser. C, 0.07s, 11/15/39 | VMIG1 | | 1,100,000 | 1,100,000 |

| Mount Healthy, City School Dist. G.O. Bonds (School Impt.), AGM, 5 1/4s, 12/1/22 (Prerefunded 6/1/18) | A1 | | 1,105,000 | 1,239,025 |

| Mount Healthy, City School Dist. G.O. Bonds, 5s, 12/1/21 | Aa2 | | 500,000 | 584,955 |

| Napoleon, City Fac. Construction & Impt. School Dist. G.O. Bonds, 5s, 12/1/36 | Aa3 | | 500,000 | 541,015 |

| New Albany, Plain Local School Dist. G.O. Bonds (School Impt.), 4s, 12/1/29 | Aa1 | | 1,410,000 | 1,486,563 |

Ohio Tax Exempt Income Fund 23

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | | Principal

amount | Value |

| Ohio cont. | | | | |

| OH Hsg. Fin. Agcy. Rev. Bonds

(Single Fam. Mtge.), Ser. 1, GNMA Coll., FNMA Coll., 5s, 11/1/28 | Aaa | | $580,000 | $613,744 |

| OH State G.O. Bonds | | | | |

| (Hwy. Cap. Impts.), Ser. Q, 5s, 5/1/27 | AAA | | 1,500,000 | 1,740,750 |

| Ser. R, 5s, 5/1/24 | AAA | | 1,000,000 | 1,218,210 |

| (Infrastructure Impt.), Ser. B, 5s, 8/1/23 | Aa1 | | 1,250,000 | 1,516,363 |

| OH State Rev. Bonds | | | | |

| (Regl. Swr. Dist.), 5s, 11/15/49 | Aa1 | | 1,250,000 | 1,396,538 |

| (Northeast OH Regl. Swr. Dist.), 5s, 11/15/44 | Aa1 | | 250,000 | 281,448 |

| Ser. A, U.S. Govt. Coll., 5s, 10/1/22 (Prerefunded 4/1/18) | AA– | | 3,090,000 | 3,432,805 |

| (Revitalization), Ser. A, AMBAC, U.S. Govt. Coll., 5s, 4/1/19 (Prerefunded 4/1/16) | AA– | | 1,750,000 | 1,818,390 |

| OH State Air Quality Dev. Auth. FRB

(Columbus Southern Pwr. Co.), Ser. B, 5.8s, 12/1/38 | Baa1 | | 1,000,000 | 1,114,680 |

| OH State Air Quality Dev. Auth. Rev. Bonds (Buckeye Pwr. Recvy. Zone Fac.), 6s, 12/1/40 | A2 | | 1,000,000 | 1,157,500 |

| OH State Air Quality Dev. Auth., Poll. Control Mandatory Put Bonds (5/1/20) (FirstEnergy Nuclear), Ser. C, 3.95s, 11/1/32 | Baa3 | | 300,000 | 311,943 |

| OH State Higher Edl. Fac. Rev. Bonds | | | | |

| (Case Western Reserve U.), 6 1/4s, 10/1/18 | AA– | | 1,000,000 | 1,158,900 |

| (U. of Dayton), Ser. A, 5 5/8s, 12/1/41 | A2 | | 1,200,000 | 1,364,976 |

| (U. of Dayton), 5 1/2s, 12/1/36 | A2 | | 1,000,000 | 1,118,280 |

| OH State Higher Edl. Fac. Comm. Rev. Bonds | | | | |

| (Summa Hlth. Syst. — 2010), 5 3/4s, 11/15/40 | Baa1 | | 1,000,000 | 1,101,430 |

| (Kenyon College), 5s, 7/1/44 | A1 | | 2,000,000 | 2,148,040 |

| (Xavier U.), 5s, 5/1/40 | A3 | | 750,000 | 811,590 |

| (Oberlin Coll.), 5s, 10/1/31 | Aa2 | | 650,000 | 738,472 |

| (Cleveland Clinic Hlth.), 5s, 1/1/31 | Aa2 | | 1,500,000 | 1,682,595 |

| (Cleveland Clinic Hlth.), 5s, 1/1/25 | Aa2 | | 1,145,000 | 1,328,154 |

| (U. of Dayton), Ser. A, 5s, 12/1/24 | A2 | | 285,000 | 340,102 |

| OH State Higher Edl. Fac. Comm. VRDN (Cleveland Clinic Foundation), Ser. B-4, 0.08s, 1/1/43 | VMIG1 | | 1,400,000 | 1,400,000 |

| OH State Poll. Control Rev. Bonds

(Standard Oil Co.), 6 3/4s, 12/1/15 | A2 | | 1,700,000 | 1,730,634 |

| OH State Private Activity Rev. Bonds

(Portsmouth Bypass Gateway Group, LLC),

AGM, 5s, 12/31/39 | AA | | 750,000 | 807,795 |

| OH State Tpk. Comm. Rev. Bonds | | | | |

| (Infrastructure), Ser. A-1, 5 1/4s, 2/15/32 | A1 | | 350,000 | 399,889 |

| 5s, 2/15/48 | A1 | | 1,250,000 | 1,372,888 |

| OH State U. Rev. Bonds | | | | |

| Ser. A, 5s, 12/1/39 | Aa1 | | 1,000,000 | 1,135,850 |

| (Gen. Receipts Special Purpose), Ser. A, 5s, 6/1/38 | Aa2 | | 1,000,000 | 1,114,140 |

24 Ohio Tax Exempt Income Fund

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | | Principal

amount | Value |

| Ohio cont. | | | | |

| OH State Wtr. Dev. Auth. Poll. Control Mandatory Put Bonds (6/3/19) (FirstEnergy Nuclear Generation, LLC), 4s, 12/1/33 | Baa3 | | $750,000 | $791,985 |

| OH U. Gen. Recipients Athens Rev. Bonds | | | | |

| 5s, 12/1/43 | Aa3 | | 1,035,000 | 1,137,993 |

| 5s, 12/1/42 | Aa3 | | 500,000 | 547,150 |

| Penta Career Ctr. COP, 5s, 4/1/20 | Aa3 | | 1,500,000 | 1,695,000 |

| Princeton, City School Dist. G.O. Bonds, 5s, 12/1/36 | AA | | 500,000 | 564,885 |

| Rickenbacker, Port Auth. Rev. Bonds

(OASBO Expanded Asset Pooled), Ser. A, 5 3/8s, 1/1/32 | A2 | | 1,830,000 | 1,865,209 |

| River Valley, Local School Dist. G.O. Bonds

(School Fac. Construction & Impt.), AGM, 5 1/4s, 11/1/23 | Aa2 | | 300,000 | 361,974 |

| Scioto Cnty., Hosp. Rev. Bonds

(Southern Med. Ctr.), 5 1/2s, 2/15/28 | A2 | | 1,250,000 | 1,371,663 |

| South Western City, School Dist. G.O. Bonds (Franklin & Pickway Cnty.), AGM, 4 3/4s, 12/1/23 | Aa2 | | 2,000,000 | 2,123,920 |

| Steubenville Hosp. Rev. Bonds (Trinity Hlth. Syst.), 5s, 10/1/30 | A3 | | 500,000 | 544,085 |

| Sylvania, City School Dist. G.O. Bonds

(School Impt.), AGO, U.S. Govt. Coll., 5s, 12/1/27 (Prerefunded 6/1/17) | AA | | 1,500,000 | 1,627,845 |

| Toledo, City School Facs Impt. Dist. G.O. Bonds, 5s, 12/1/26 | Aa2 | | 1,000,000 | 1,162,830 |

| Toledo-Lucas Cnty., Port Auth. Rev. Bonds

(CSX Transn, Inc.), 6.45s, 12/15/21 | Baa1 | | 1,900,000 | 2,355,753 |

| U. of Akron Rev. Bonds, Ser. A | | | | |

| 5s, 1/1/31 | A1 | | 500,000 | 563,610 |

| 5s, 1/1/28 | A1 | | 1,000,000 | 1,137,280 |

| U. of Cincinnati Rev. Bonds | | | | |

| Ser. F, 5s, 6/1/34 | Aa3 | | 1,500,000 | 1,668,585 |

| Ser. A, 5s, 6/1/31 | Aa3 | | 500,000 | 563,005 |

| Ser. A, 5s, 6/1/30 | Aa3 | | 1,000,000 | 1,130,050 |

| Warren Cnty., Hlth. Care Fac. Rev. Bonds (Otterbein Homes Oblig. Group) | | | | |

| Ser. A, 5 3/4s, 7/1/33 | A | | 500,000 | 572,870 |

| 5s, 7/1/39 | A | | 1,000,000 | 1,081,000 |

| Westerville, G.O. Bonds | | | | |

| AMBAC, 5s, 12/1/26 | Aaa | | 105,000 | 115,076 |

| AMBAC, U.S. Govt Coll., 5s, 12/1/26 (Prerefunded 12/1/17) | Aaa | | 1,215,000 | 1,338,237 |

| Westlake, Rev. Bonds (American Greetings-Crocker Park Pub. Impt.), 5s, 12/1/33 | Aa1 | | 1,000,000 | 1,131,500 |

| Youngstown State U. Rev. Bonds | | | | |

| AGO, 5 1/4s, 12/15/29 | AA | | 500,000 | 562,870 |

| 5s, 12/15/25 | A+ | | 500,000 | 563,925 |

Ohio Tax Exempt Income Fund 25

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | | Principal

amount | Value |

| Ohio cont. | | | | |

| Zanesville, Hsg. Dev. Corp. Mtge. Rev. Bonds, U.S. Govt. Coll. | | | | |

| 7 3/8s, 10/1/21 (Escrowed to maturity) | AAA/P | | $220,000 | $232,819 |

| 7 3/8s, 10/1/20 (Escrowed to maturity) | AAA/P | | 205,000 | 216,945 |

| 7 3/8s, 10/1/19 (Escrowed to maturity) | AAA/P | | 185,000 | 195,780 |

| 7 3/8s, 10/1/18 (Escrowed to maturity) | AAA/P | | 180,000 | 190,489 |

| 7 3/8s, 10/1/17 (Escrowed to maturity) | AAA/P | | 160,000 | 169,323 |

| 7 3/8s, 10/1/16 (Escrowed to maturity) | AAA/P | | 155,000 | 164,032 |

| | | | | 136,318,612 |

| Puerto Rico (0.9%) | | | | |

| Children’s Trust Fund Tobacco Settlement (The) Rev. Bonds, 5 3/8s, 5/15/33 | BBB | | 360,000 | 363,298 |

| Cmnwlth. of PR, Sales Tax Fin. Corp. Rev. Bonds | | | | |

| Ser. A, 5 3/8s, 8/1/39 | CCC+ | | 435,000 | 268,626 |

| Ser. C, 5 1/4s, 8/1/41 | CCC+ | | 370,000 | 225,707 |

| Ser. A, NATL, zero %, 8/1/43 | AA– | | 3,000,000 | 483,210 |

| | | | | 1,340,841 |

| Virgin Islands (0.8%) | | | | |

| VI Pub. Fin. Auth. Rev. Bonds | | | | |

| Ser. A, 6s, 10/1/39 | Baa3 | | 300,000 | 334,508 |

| Ser. A-1, 5s, 10/1/39 | Baa2 | | 375,000 | 397,005 |

| Ser. A, 5s, 10/1/25 | Baa2 | | 350,000 | 389,134 |

| |

1,120,647

|

| TOTAL INVESTMENTS | |

| Total investments (cost $132,065,710) | $140,008,745 |

| Notes to the fund’s portfolio |

| Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from June 1, 2014 through May 31, 2015 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures and references to “OTC”, if any, represent over-the-counter. |

* | Percentages indicated are based on net assets of $143,101,808. |

** | The Moody’s, Standard & Poor’s or Fitch ratings indicated are believed to be the most recent ratings available at the close of the reporting period for the securities listed. Ratings are generally ascribed to securities at the time of issuance. While the agencies may from time to time revise such ratings, they undertake no obligation to do so, and the ratings do not necessarily represent what the agencies would ascribe to these securities at the close of the reporting period. Securities rated by Putnam are indicated by “/P.” Securities rated by Fitch are indicated by “/F.” If a security is insured, it will usually be rated by the ratings organizations based on the financial strength of the insurer. Ratings are not covered by the Report of Independent Registered Public Accounting Firm. For further details regarding security ratings, please see the Statement of Additional Information. |

| On Mandatory Put Bonds, the rates shown are the current interest rates at the close of the reporting period and the dates shown represent the next mandatory put dates. |

| The dates shown parenthetically on prerefunded bonds represent the next prerefunding dates. |

| The dates shown on debt obligations are the original maturity dates. |

26 Ohio Tax Exempt Income Fund

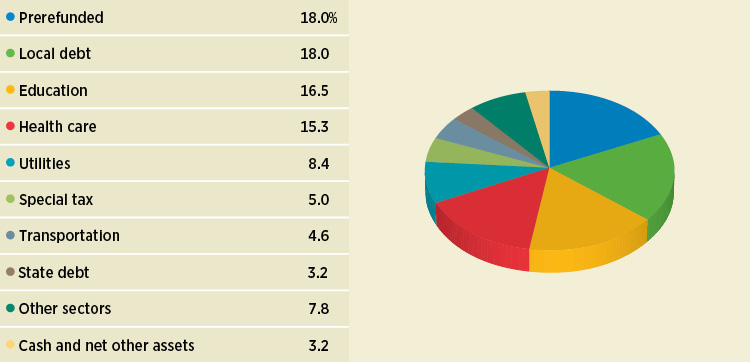

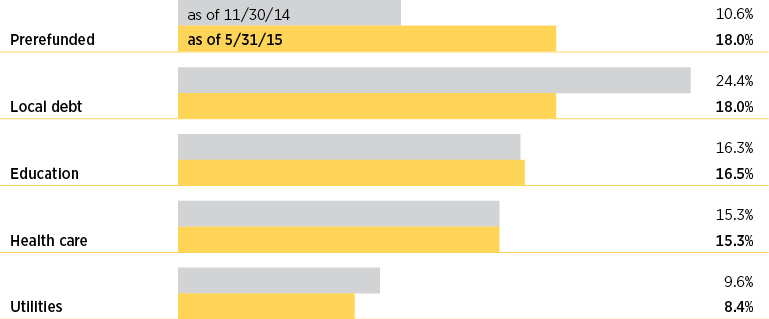

| The fund had the following sector concentrations greater than 10% at the close of the reporting period (as a percentage of net assets): |

| Local debt | 17.7% |

| Education | 17.4 |

| Health care | 16.9 |

| Prerefunded | 16.4 |

| The fund had the following insurance concentration greater than 10% at the close of the reporting period (as a percentage of net assets): |

| AGM | 11.3% |

| ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows: |

| Level 1: Valuations based on quoted prices for identical securities in active markets. |

| Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

| Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement. |

| The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period: |

| | Valuation inputs |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Municipal bonds and notes | $— | $140,008,745 | $— |

| Totals by level | $— | $140,008,745 | $— |

| During the reporting period, transfers within the fair value hierarchy, if any, did not represent, in the aggregate, more than 1% of the fund’s net assets measured as of the end of the period. |

The accompanying notes are an integral part of these financial statements.

Ohio Tax Exempt Income Fund 27

| Statement of assets and liabilities 5/31/15 | |

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $132,065,710) | $140,008,745 |

| Cash | 1,420,012 |

| Interest and other receivables | 2,185,789 |

| Receivable for shares of the fund sold | 9,219 |

| Receivable for investments sold | 35,157 |

| Prepaid assets | 1,813 |

| Total assets | 143,660,735 |

| LIABILITIES | |

| Payable for shares of the fund repurchased | 215,684 |

| Payable for compensation of Manager (Note 2) | 51,819 |

| Payable for custodian fees (Note 2) | 2,628 |

| Payable for investor servicing fees (Note 2) | 16,454 |

| Payable for Trustee compensation and expenses (Note 2) | 72,685 |

| Payable for administrative services (Note 2) | 535 |

| Payable for distribution fees (Note 2) | 55,474 |

| Payable for auditing and tax fees | 55,630 |

| Distributions payable to shareholders | 70,420 |

| Other accrued expenses | 17,598 |

| Total liabilities | 558,927 |

| Net assets | $143,101,808 |

| | |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $138,279,773 |

| Distributions in excess of net investment income (Note 1) | (42,256) |

| Accumulated net realized loss on investments (Note 1) | (3,078,744) |

| Net unrealized appreciation of investments | 7,943,035 |

| Total — Representing net assets applicable to capital shares outstanding | $143,101,808 |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

| Net asset value and redemption price per class A share ($117,935,270 divided by 12,998,995 shares) | $9.07 |

| Offering price per class A share (100/96.00 of $9.07)* | $9.45 |

| Net asset value and offering price per class B share ($1,791,247 divided by 197,673 shares)** | $9.06 |

| Net asset value and offering price per class C share ($10,797,701 divided by 1,190,080 shares)** | $9.07 |

| Net asset value and redemption price per class M share ($546,281 divided by 60,194 shares) | $9.08 |

| Offering price per class M share (100/96.75 of $9.08)† | $9.39 |

| Net asset value, offering price and redemption price per class Y share ($12,031,309 divided by 1,324,908 shares) | $9.08 |

* | On single retail sales of less than $100,000. On sales of $100,000 or more the offering price is reduced. |

** | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

† | On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

28 Ohio Tax Exempt Income Fund

| Statement of operations Year ended 5/31/15 | |

| INTEREST INCOME | $5,874,599 |

| | |

| EXPENSES | |

| Compensation of Manager (Note 2) | 616,707 |

| Investor servicing fees (Note 2) | 81,272 |

| Custodian fees (Note 2) | 7,735 |

| Trustee compensation and expenses (Note 2) | 5,263 |

| Distribution fees (Note 2) | 399,106 |

| Administrative services (Note 2) | 3,747 |

| Other | 104,340 |

| Total expenses | 1,218,170 |

| Expense reduction (Note 2) | (238) |

| Net expenses | 1,217,932 |

| Net investment income | 4,656,667 |

| | |

| Net realized loss on investments (Notes 1 and 3) | (600,664) |

| Net unrealized depreciation of investments during the year | (128,114) |

| Net loss on investments | (728,778) |

| Net increase in net assets resulting from operations | $3,927,889 |

The accompanying notes are an integral part of these financial statements.

Ohio Tax Exempt Income Fund 29

| Statement of changes in net assets | | |

| INCREASE (DECREASE) IN NET ASSETS | Year ended 5/31/15 | Year ended 5/31/14 |

| Operations: | | |

| Net investment income | $4,656,667 | $4,845,555 |

| Net realized loss on investments | (600,664) | (1,322,088) |

| Net unrealized depreciation of investments | (128,114) | (2,595,467) |

| Net increase in net assets resulting from operations | 3,927,889 | 928,000 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Taxable net investment income | | |

| Class A | (285) | (15,896) |

| Class B | (4) | (251) |

| Class C | (25) | (1,673) |

| Class M | (1) | (69) |

| Class Y | (13) | (914) |

| From tax-exempt net investment income | | |

| Class A | (3,946,316) | (4,190,412) |

| Class B | (47,332) | (53,591) |

| Class C | (270,839) | (313,308) |

| Class M | (15,339) | (15,670) |

| Class Y | (344,848) | (220,092) |

| Increase (decrease) from capital share transactions (Note 4) | 1,958,749 | (17,249,047) |

| Total increase (decrease) in net assets | 1,261,636 | (21,132,923) |

| NET ASSETS | | |

| Beginning of year | 141,840,172 | 162,973,095 |

| End of year (including distributions in excess of net investment income of $42,256 and $42,272, respectively) | $143,101,808 | $141,840,172 |

| |

The accompanying notes are an integral part of these financial statements.

30 Ohio Tax Exempt Income Fund

This page left blank intentionally.

Ohio Tax Exempt Income Fund 31

Financial highlights (For a common share outstanding throughout the period)

INVESTMENT OPERATIONS: | LESS DISTRIBUTIONS: | | RATIOS AND SUPPLEMENTAL DATA: |

Period ended | Net asset value, beginning of period | Net investment income (loss) | Net realized and unrealized gain (loss) on investments | Total from investment operations | From

net investment income | Total

distributions | Redemption

fees | Non-recurring reimbursements | Net asset value, end of period | Total return at net asset value (%)a | Net assets, end of period (in thousands) | Ratio of expenses to average net assets (%)b | Ratio of

net investment income (loss) to average net assets (%) | Portfolio turnover (%) |

Class A | | | | | | | | | | | | | | |

May 31, 2015 | $9.12 | .30 | (.05) | .25 | (.30) | (.30) | — | — | $9.07 | 2.74 | $117,935 | .80 | 3.28 | 16 |

May 31, 2014 | 9.31 | .31 | (.19) | .12 | (.31) | (.31) | — | — | 9.12 | 1.40 | 123,335 | .81 | 3.48 | 9 |

May 31, 2013 | 9.35 | .32 | (.05) | .27 | (.31) | (.31) | — | — | 9.31 | 2.96 | 138,049 | .80 | 3.36 | 10 |

May 31, 2012 | 8.84 | .34 | .51 | .85 | (.34) | (.34) | —c | —c,d | 9.35 | 9.81 | 135,448 | .80 | 3.79 | 12 |

May 31, 2011 | 9.05 | .36 | (.21) | .15 | (.36) | (.36) | — | —c,e | 8.84 | 1.74 | 132,617 | .79 | 4.14 | 11 |

Class B | | | | | | | | | | | | | | |

May 31, 2015 | $9.11 | .24 | (.05) | .19 | (.24) | (.24) | — | — | $9.06 | 2.11 | $1,791 | 1.42 | 2.66 | 16 |

May 31, 2014 | 9.30 | .25 | (.19) | .06 | (.25) | (.25) | — | — | 9.11 | .78 | 1,807 | 1.43 | 2.86 | 9 |

May 31, 2013 | 9.33 | .26 | (.03) | .23 | (.26) | (.26) | — | — | 9.30 | 2.43 | 2,179 | 1.42 | 2.73 | 10 |

May 31, 2012 | 8.83 | .29 | .50 | .79 | (.29) | (.29) | —c | —c,d | 9.33 | 9.01 | 1,676 | 1.43 | 3.16 | 12 |

May 31, 2011 | 9.04 | .31 | (.21) | .10 | (.31) | (.31) | — | —c,e | 8.83 | 1.10 | 1,852 | 1.42 | 3.49 | 11 |

Class C | | | | | | | | | | | | | | |

May 31, 2015 | $9.12 | .23 | (.05) | .18 | (.23) | (.23) | — | — | $9.07 | 1.95 | $10,798 | 1.57 | 2.51 | 16 |

May 31, 2014 | 9.31 | .24 | (.19) | .05 | (.24) | (.24) | — | — | 9.12 | .62 | 10,681 | 1.58 | 2.71 | 9 |

May 31, 2013 | 9.35 | .24 | (.04) | .20 | (.24) | (.24) | — | — | 9.31 | 2.17 | 14,421 | 1.57 | 2.59 | 10 |

May 31, 2012 | 8.84 | .27 | .51 | .78 | (.27) | (.27) | —c | —c,d | 9.35 | 9.00 | 11,574 | 1.58 | 3.00 | 12 |

May 31, 2011 | 9.05 | .30 | (.22) | .08 | (.29) | (.29) | — | —c,e | 8.84 | .97 | 8,487 | 1.57 | 3.36 | 11 |

Class M | | | | | | | | | | | | | | |

May 31, 2015 | $9.12 | .27 | (.04) | .23 | (.27) | (.27) | — | — | $9.08 | 2.57 | $546 | 1.07 | 3.01 | 16 |

May 31, 2014 | 9.31 | .29 | (.20) | .09 | (.28) | (.28) | — | — | 9.12 | 1.13 | 498 | 1.08 | 3.21 | 9 |

May 31, 2013 | 9.35 | .29 | (.04) | .25 | (.29) | (.29) | — | — | 9.31 | 2.68 | 586 | 1.07 | 3.08 | 10 |

May 31, 2012 | 8.84 | .32 | .51 | .83 | (.32) | (.32) | —c | —c,d | 9.35 | 9.50 | 490 | 1.08 | 3.47 | 12 |

May 31, 2011 | 9.06 | .34 | (.22) | .12 | (.34) | (.34) | — | —c,e | 8.84 | 1.35 | 852 | 1.07 | 3.85 | 11 |

Class Y | | | | | | | | | | | | | | |

May 31, 2015 | $9.12 | .32 | (.04) | .28 | (.32) | (.32) | — | — | $9.08 | 3.08 | $12,031 | .57 | 3.52 | 16 |

May 31, 2014 | 9.32 | .33 | (.20) | .13 | (.33) | (.33) | — | — | 9.12 | 1.52 | 5,519 | .58 | 3.71 | 9 |

May 31, 2013 | 9.35 | .34 | (.03) | .31 | (.34) | (.34) | — | — | 9.32 | 3.30 | 7,738 | .57 | 3.59 | 10 |

May 31, 2012 | 8.84 | .36 | .51 | .87 | (.36) | (.36) | —c | —c,d | 9.35 | 10.07 | 6,650 | .58 | 3.98 | 12 |

May 31, 2011 | 9.06 | .38 | (.22) | .16 | (.38) | (.38) | — | —c,e | 8.84 | 1.87 | 3,650 | .57 | 4.38 | 11 |

a Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

b Includes amounts paid through expense offset arrangements, if any (Note 2). Also excludes acquired fund fees and expenses, if any.

c Amount represents less than $0.01 per share.

d Reflects a non-recurring reimbursement related to restitution amounts in connection with a distribution plan approved by the Securities and Exchange Commission (the SEC) which amounted to less than $0.01 per share outstanding on July 21, 2011.

e Reflects a non-recurring reimbursement related to short-term trading related lawsuits, which amounted to less than $0.01 per share outstanding on May 11, 2011.

The accompanying notes are an integral part of these financial statements.

32 | Ohio Tax Exempt Income Fund | Ohio Tax Exempt Income Fund | 33 |

Notes to financial statements 5/31/15

Within the following Notes to financial statements, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “OTC”, if any, represent over-the-counter. Unless otherwise noted, the “reporting period” represents the period from June 1, 2014 through May 31, 2015.

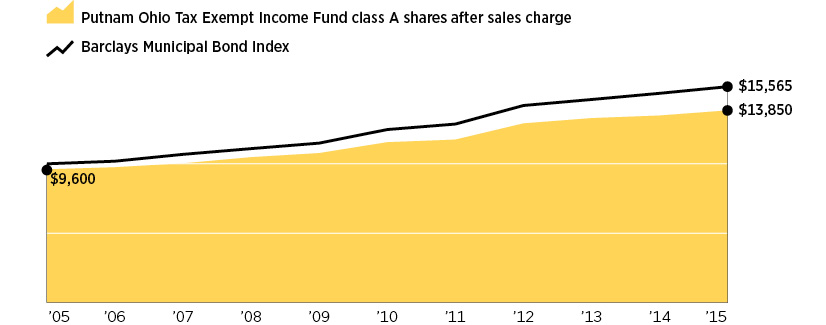

Putnam Ohio Tax Exempt Income Fund (the fund) is a Massachusetts business trust, which is registered under the Investment Company Act of 1940, as amended, as a diversified open-end management investment company. The goal of the fund is to seek as high a level of current income exempt from federal income tax and Ohio personal income tax as Putnam Management believes is consistent with preservation of capital. The fund invests mainly in bonds that pay interest that is exempt from federal income tax and Ohio personal income tax (but that may be subject to federal alternative minimum tax (AMT)), are investment-grade in quality, and have intermediate- to long-term maturities (three years or longer). Putnam Management may consider, among other factors, credit, interest rate and prepayment risks, as well as general market conditions, when deciding whether to buy or sell investments.

The fund offers class A, class B, class C, class M and class Y shares. Class A and class M shares are sold with a maximum front-end sales charge of 4.00% and 3.25%, respectively, and generally do not pay a contingent deferred sales charge. Class B shares, which convert to class A shares after approximately eight years, do not pay a front-end sales charge and are subject to a contingent deferred sales charge if those shares are redeemed within six years of purchase. Class C shares have a one-year 1.00% contingent deferred sales charge and do not convert to class A shares. The expenses for class A, class B, class C, and class M shares may differ based on the distribution fee of each class, which is identified in Note 2. Class Y shares, which are sold at net asset value, are generally subject to the same expenses as class A, class B, class C, and class M shares, but do not bear a distribution fee. Class Y shares are not available to all investors.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

Note 1: Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized and unrealized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. If the fund were liquidated, shares of each class would receive their pro-rata share of the net assets of the fund. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees. The Trustees have formed a Pricing Committee to oversee the implementation of these procedures and have delegated responsibility for valuing the fund’s assets in accordance with these procedures to Putnam Management. Putnam Management has established an internal Valuation Committee that is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Pricing Committee.

Tax-exempt bonds and notes are generally valued on the basis of valuations provided by an independent pricing service approved by the Trustees. Such services use information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities in determining value. These securities will generally be categorized as Level 2.

34 Ohio Tax Exempt Income Fund

Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. To assess the continuing appropriateness of fair valuations, the Valuation Committee reviews and affirms the reasonableness of such valuations on a regular basis after considering all relevant information that is reasonably available. Such valuations and procedures are reviewed periodically by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures, recovery rates, sales and other multiples and resale restrictions. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income is recorded on the accrual basis. All premiums/discounts are amortized/accreted on a yield-to-maturity basis. The premium in excess of the call price, if any, is amortized to the call date; thereafter, any remaining premium is amortized to maturity.

Interfund lending The fund, along with other Putnam funds, may participate in an interfund lending program pursuant to an exemptive order issued by the SEC. This program allows the fund to borrow from other Putnam funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be based on the average of certain current market rates. During the reporting period, the fund did not utilize the program.

Lines of credit The fund participates, along with other Putnam funds, in a $392.5 million unsecured committed line of credit and a $235.5 million unsecured uncommitted line of credit, both provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to the Federal Funds rate plus 1.25% for the committed line of credit and the Federal Funds rate plus 1.30% for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds. In addition, a commitment fee of 0.11% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

At May 31, 2015, the fund had a capital loss carryover of $2,957,608 available to the extent allowed by the Code to offset future net capital gain, if any. The amounts of the carryovers and the expiration dates are:

Loss carryover |

Short-term | Long-term | Total | Expiration |

$609,393 | $1,623,623 | $2,233,016 | * |

413,222 | N/A | 413,222 | May 31, 2017 |

97,718 | N/A | 97,718 | May 31, 2018 |

213,652 | N/A | 213,652 | May 31, 2019 |

*Under the Regulated Investment Company Modernization Act of 2010, the fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any

Ohio Tax Exempt Income Fund 35

losses incurred will be required to be utilized prior to the losses incurred in pre-enactment tax years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

Pursuant to federal income tax regulations applicable to regulated investment companies, the fund has elected to defer $55,393 of certain losses recognized during the period between November 1, 2014 and May 31, 2015 to its fiscal year ending May 31, 2016.

Distributions to shareholders Income dividends are recorded daily by the fund and are paid monthly. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences include temporary and/or permanent differences from straddle loss deferrals. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. At the close of the reporting period, the fund reclassified $31,649 to increase distributions in excess of net investment income and $31,649 to decrease accumulated net realized loss.

The tax basis components of distributable earnings and the federal tax cost as of the close of the reporting period were as follows:

Unrealized appreciation | $8,755,572 |

Unrealized depreciation | (780,888) |

Net unrealized appreciation | 7,974,684 |

Undistributed ordinary income | 172 |

Undistributed tax-exempt income | 27,992 |

Capital loss carryforward | (2,957,608) |

Post-October capital loss deferral | (55,393) |

Cost for federal income tax purposes | $132,034,061 |

Note 2: Management fee, administrative services and other transactions

The fund pays Putnam Management a management fee (based on the fund’s average net assets and computed and paid monthly) at annual rates that may vary based on the average of the aggregate net assets of most open-end funds, as defined in the fund’s management contract, sponsored by Putnam Management. Such annual rates may vary as follows:

0.590% | of the first $5 billion, |

0.540% | of the next $5 billion, |

0.490% | of the next $10 billion, |

0.440% | of the next $10 billion, |

0.390% | of the next $50 billion, |

0.370% | of the next $50 billion, |

0.360% | of the next $100 billion and |

0.355% | of any excess thereafter. |

Putnam Management has contractually agreed, through September 30, 2016, to waive fees or reimburse the fund’s expenses to the extent necessary to limit the cumulative expenses of the fund, exclusive of brokerage, interest, taxes, investment-related expenses, extraordinary expenses, acquired fund fees and expenses and payments under the fund’s investor servicing contract, investment management contract and distribution plans, on a fiscal year-to-date basis to an annual rate of 0.20% of the fund’s average net assets over such fiscal year-to-date period. During the reporting period, the fund’s expenses were not reduced as a result of this limit.

Putnam Investments Limited (PIL), an affiliate of Putnam Management, is authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Putnam Management from time to time. Putnam Management pays a quarterly sub-management fee to PIL for its services at an annual rate of 0.40% of the average net assets of the portion of the fund managed by PIL.

The fund reimburses Putnam Management an allocated amount for the compensation and related expenses of certain officers of the fund and their staff who provide administrative services to the fund. The aggregate amount of all such reimbursements is determined annually by the Trustees.

Custodial functions for the fund’s assets are provided by State Street. Custody fees are based on the fund’s asset level, the number of its security holdings and transaction volumes.

36 Ohio Tax Exempt Income Fund

Putnam Investor Services, Inc., an affiliate of Putnam Management, provides investor servicing agent functions to the fund. Putnam Investor Services, Inc. received fees for investor servicing that included (1) a per account fee for each direct and underlying non-defined contribution account (“retail account”) of the fund and each of the other funds in its specified category, which was totaled and then allocated to each fund in the category based on its average daily net assets; (2) a specified rate of the fund’s assets attributable to defined contribution plan accounts; and (3) for the portion of the fund’s fiscal year beginning after January 1, 2015, a specified rate based on the average net assets in retail accounts. Putnam Investor Services has agreed that the aggregate investor servicing fees for each fund’s retail and defined contribution accounts will not exceed an annual rate of 0.320% of the fund’s average assets attributable to such accounts. During the reporting period, the expenses for each class of shares related to investor servicing fees were as follows:

Class A | $68,060 |

Class B | 1,009 |

Class C | 6,149 |

Class M | 293 |

Class Y | 5,761 |

Total | $81,272 |

The fund has entered into expense offset arrangements with Putnam Investor Services, Inc. and State Street whereby Putnam Investor Services, Inc.’s and State Street’s fees are reduced by credits allowed on cash balances. For the reporting period, the fund’s expenses were reduced by $238 under the expense offset arrangements.

Each Independent Trustee of the fund receives an annual Trustee fee, of which $85, as a quarterly retainer, has been allocated to the fund, and an additional fee for each Trustees meeting attended. Trustees also are reimbursed for expenses they incur relating to their services as Trustees.

The fund has adopted a Trustee Fee Deferral Plan (the Deferral Plan) which allows the Trustees to defer the receipt of all or a portion of Trustees fees payable on or after July 1, 1995. The deferred fees remain invested in certain Putnam funds until distribution in accordance with the Deferral Plan.

The fund has adopted an unfunded noncontributory defined benefit pension plan (the Pension Plan) covering all Trustees of the fund who have served as a Trustee for at least five years and were first elected prior to 2004. Benefits under the Pension Plan are equal to 50% of the Trustee’s average annual attendance and retainer fees for the three years ended December 31, 2005. The retirement benefit is payable during a Trustee’s lifetime, beginning the year following retirement, for the number of years of service through December 31, 2006. Pension expense for the fund is included in Trustee compensation and expenses in the Statement of operations. Accrued pension liability is included in Payable for Trustee compensation and expenses in the Statement of assets and liabilities. The Trustees have terminated the Pension Plan with respect to any Trustee first elected after 2003.

The fund has adopted distribution plans (the Plans) with respect to its class A, class B, class C and class M shares pursuant to Rule 12b–1 under the Investment Company Act of 1940. The purpose of the Plans is to compensate Putnam Retail Management Limited Partnership, an indirect wholly-owned subsidiary of Putnam Investments, LLC, for services provided and expenses incurred in distributing shares of the fund. The Plans provide for payments by the fund to Putnam Retail Management Limited Partnership at an annual rate of up to 0.35%, 1.00%, 1.00% and 1.00% of the average net assets attributable to class A, class B, class C and class M shares, respectively. The Trustees have approved payment by the fund at the annual rate of 0.85%, 1.00% and 0.50% of the average net assets for class B, class C and class M shares, respectively. For class A shares, the annual payment rate will equal the weighted average of (i) 0.20% on the net assets of the fund attributable to class A shares purchased and paid for prior to April 1, 2005 and (ii) 0.25% on all other net assets of the fund attributable to class A shares. During the reporting period, the class specific expenses related to distribution fees were as follows:

Class A | $272,386 |

Class B | 15,226 |

Class C | 108,923 |

Class M | 2,571 |

Total | $399,106 |

For the reporting period, Putnam Retail Management Limited Partnership, acting as underwriter, received net commissions of $11,135 and $117 from the sale of class A and class M shares, respectively, and received $1,130 and $20 in contingent deferred sales charges from redemptions of class B and class C shares, respectively.

A deferred sales charge of up to 1.00% is assessed on certain redemptions of class A shares. For the reporting period, Putnam Retail Management Limited Partnership, acting as underwriter, received $14,120 on class A redemptions.

Ohio Tax Exempt Income Fund 37

Note 3: Purchases and sales of securities

During the reporting period, the cost of purchases and proceeds from sales, excluding short-term investments, were as follows:

| Cost of purchases | Proceeds from sales |

Investments in securities (Long-term) | $21,795,363 | $21,936,496 |

U.S. government securities (Long-term) | — | — |

Total | $21,795,363 | $21,936,496 |

Note 4: Capital shares

At the close of the reporting period, there were an unlimited number of shares of beneficial interest authorized. Transactions in capital shares were as follows:

| Year ended 5/31/15 | Year ended 5/31/14 |

Class A | Shares | Amount | Shares | Amount |

Shares sold | 1,101,449 | $10,053,272 | 1,210,131 | $10,873,443 |

Shares issued in connection with reinvestment of distributions | 381,818 | 3,491,038 | 408,162 | 3,634,573 |

| 1,483,267 | 13,544,310 | 1,618,293 | 14,508,016 |

Shares repurchased | (2,012,144) | (18,367,642) | (2,919,999) | (26,011,380) |

Net decrease | (528,877) | $(4,823,332) | (1,301,706) | $(11,503,364) |

| Year ended 5/31/15 | Year ended 5/31/14 |

Class B | Shares | Amount | Shares | Amount |

Shares sold | 19,141 | $174,468 | 16,479 | $146,972 |

Shares issued in connection with reinvestment of distributions | 4,864 | 44,424 | 5,461 | 48,579 |

| 24,005 | 218,892 | 21,940 | 195,551 |

Shares repurchased | (24,812) | (225,636) | (57,842) | (516,508) |

Net decrease | (807) | $(6,744) | (35,902) | $(320,957) |

| Year ended 5/31/15 | Year ended 5/31/14 |

Class C | Shares | Amount | Shares | Amount |

Shares sold | 231,536 | $2,111,596 | 158,472 | $1,419,638 |

Shares issued in connection with reinvestment of distributions | 26,880 | 245,793 | 31,592 | 281,250 |

| 258,416 | 2,357,389 | 190,064 | 1,700,888 |

Shares repurchased | (239,783) | (2,188,333) | (567,735) | (5,057,108) |

Net increase (decrease) | 18,633 | $169,056 | (377,671) | $(3,356,220) |

| Year ended 5/31/15 | Year ended 5/31/14 |

Class M | Shares | Amount | Shares | Amount |

Shares sold | 4,289 | $39,171 | 3,378 | $30,209 |

Shares issued in connection with reinvestment of distributions | 1,344 | 12,290 | 1,407 | 12,539 |

| 5,633 | 51,461 | 4,785 | 42,748 |

Shares repurchased | (33) | (300) | (13,138) | (116,047) |

Net increase (decrease) | 5,600 | $51,161 | (8,353) | $(73,299) |

38 Ohio Tax Exempt Income Fund

| Year ended 5/31/15 | Year ended 5/31/14 |

Class Y | Shares | Amount | Shares | Amount |

Shares sold | 836,244 | $7,634,241 | 163,092 | $1,451,503 |

Shares issued in connection with reinvestment of distributions | 24,133 | 221,081 | 10,969 | 97,742 |

| 860,377 | 7,855,322 | 174,061 | 1,549,245 |

Shares repurchased | (140,347) | (1,286,714) | (399,765) | (3,544,452) |

Net increase (decrease) | 720,030 | $6,568,608 | (225,704) | $(1,995,207) |

Note 5: Market, credit and other risks

In the normal course of business, the fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to changes in the market (market risk) or failure of the contracting party to the transaction to perform (credit risk). The fund may be exposed to additional credit risk that an institution or other entity with which the fund has unsettled or open transactions will default. The fund concentrates a majority of its investments in the state of Ohio and may be affected by economic and political developments in that state.

Ohio Tax Exempt Income Fund 39

Federal tax information (Unaudited)

The fund has designated 99.99% of dividends paid from net investment income during the reporting period as tax exempt for Federal income tax purposes.

The Form 1099 that will be mailed to you in January 2016 will show the tax status of all distributions paid to your account in calendar 2015.

40 Ohio Tax Exempt Income Fund

About the Trustees

Independent Trustees

Liaquat Ahamed

Born 1952, Trustee since 2012

Principal occupations during past five years: Pulitzer Prize-winning author of Lords of Finance: The Bankers Who Broke the World, whose articles on economics have appeared in such publications as the New York Times, Foreign Affairs, and the Financial Times. Director of Aspen Insurance Co., a New York Stock Exchange company, and Chair of the Aspen Board’s Investment Committee. Trustee of the Brookings Institution.

Other directorships: The Rohatyn Group, an emerging-market fund complex that manages money for institutions

Ravi Akhoury

Born 1947, Trustee since 2009

Principal occupations during past five years: Trustee of American India Foundation and of the Rubin Museum. From 1992 to 2007, was Chairman and CEO of MacKay Shields, a multi-product investment management firm.

Other directorships: RAGE Frameworks, Inc., a private software company; English Helper, Inc., a private software company

Barbara M. Baumann

Born 1955, Trustee since 2010

Principal occupations during past five years: President and Owner of Cross Creek Energy Corporation, a strategic consultant to domestic energy firms and direct investor in energy projects. Current Board member of The Denver Foundation. Former Chair and current Board member of Girls Incorporated of Metro Denver. Member of the Finance Committee, the Children’s Hospital of Colorado.

Other directorships: Buckeye Partners, L.P., a publicly traded master limited partnership focused on pipeline transport, storage, and distribution of petroleum products; Devon Energy Corporation, a leading independent natural gas and oil exploration and production company

Jameson A. Baxter

Born 1943, Trustee since 1994, Vice Chair from 2005 to 2011, and Chair since 2011

Principal occupations during past five years: President of Baxter Associates, Inc., a private investment firm. Chair of Mutual Fund Directors Forum. Chair Emeritus of the Board of Trustees of Mount Holyoke College. Director of the Adirondack Land Trust and Trustee of the Nature Conservancy’s Adirondack Chapter.

Robert J. Darretta

Born 1946, Trustee since 2007

Principal occupations during past five years: From 2009 until 2012, served as Health Care Industry Advisor to Permira, a global private equity firm. Until April 2007, was Vice Chairman of the Board of Directors of Johnson & Johnson. Served as Johnson & Johnson’s Chief Financial Officer for a decade.

Other directorships: UnitedHealth Group, a diversified health-care company

Katinka Domotorffy

Born 1975, Trustee since 2012

Principal occupations during past five years: Voting member of the Investment Committees of the Anne Ray Charitable Trust and Margaret A. Cargill Foundation, part of the Margaret A. Cargill Philanthropies. Until 2011, Partner, Chief Investment Officer, and Global Head of Quantitative Investment Strategies at Goldman Sachs Asset Management.

Other directorships: Reach Out and Read of Greater New York, an organization dedicated to promoting childhood literacy; Great Lakes Science Center

John A. Hill

Born 1942, Trustee since 1985 and Chairman from 2000 to 2011

Principal occupations during past five years: Founder and Vice-Chairman of First Reserve Corporation, the leading private equity buyout firm focused on the worldwide energy industry. Trustee and Chairman of the Board of Trustees of Sarah Lawrence College. Member of the Advisory Board of the Millstein Center for Global Markets and Corporate Ownership at The Columbia University Law School.

Other directorships: Devon Energy Corporation, a leading independent natural gas and oil exploration and production company

Ohio Tax Exempt Income Fund 41

Paul L. Joskow

Born 1947, Trustee since 1997

Principal occupations during past five years: Economist and President of the Alfred P. Sloan Foundation, a philanthropic institution focused primarily on research and education on issues related to science, technology, and economic performance. Elizabeth and James Killian Professor of Economics, Emeritus at the Massachusetts Institute of Technology (MIT). Prior to 2007, served as the Director of the Center for Energy and Environmental Policy Research at MIT.

Other directorships: Yale University; Exelon Corporation, an energy company focused on power services; Boston Symphony Orchestra; Prior to April 2013, served as Director of TransCanada Corporation and TransCanada Pipelines Ltd., energy companies focused on natural gas transmission, oil pipelines and power services

Kenneth R. Leibler

Born 1949, Trustee since 2006

Principal occupations during past five years: Founder and former Chairman of Boston Options Exchange, an electronic marketplace for the trading of derivative securities. Serves on the Board of Trustees of Beth Israel Deaconess Hospital in Boston, Massachusetts. Director of Beth Israel Deaconess Care Organization. Until November 2010, director of Ruder Finn Group, a global communications and advertising firm.

Other directorships: Eversource Corporation, which operates New England’s largest energy delivery system

Robert E. Patterson

Born 1945, Trustee since 1984

Principal occupations during past five years: Co-Chairman of Cabot Properties, Inc., a private equity firm investing in commercial real estate, and Chairman of its Investment Committee. Past Chairman and Trustee of the Joslin Diabetes Center.

George Putnam, III

Born 1951, Trustee since 1984

Principal occupations during past five years: Chairman of New Generation Research, Inc., a publisher of financial advisory and other research services. Founder and President of New Generation Advisors, LLC, a registered investment advisor to private funds. Director of The Boston Family Office, LLC, a registered investment advisor.

W. Thomas Stephens

Born 1942, Trustee from 1997 to 2008 and since 2009

Principal occupations during past five years: Retired as Chairman and Chief Executive Officer of Boise Cascade, LLC, a paper, forest products, and timberland assets company, in December 2008. Prior to 2010, Director of Boise Inc., a manufacturer of paper and packaging products.

Other directorships: Prior to April 2014, served as Director of TransCanada Pipelines Ltd., an energy infrastructure company

Interested Trustee

Robert L. Reynolds*

Born 1952, Trustee since 2008 and President of the Putnam Funds since 2009

Principal occupations during past five years: President and Chief Executive Officer of Putnam Investments since 2008 and, since 2014, President and Chief Executive Officer of Great-West Financial, a financial services company that provides retirement savings plans, life insurance, and annuity and executive benefits products, and of Great-West Lifeco U.S. Inc., a holding company that owns Putnam Investments and Great-West Financial. Prior to joining Putnam Investments, served as Vice Chairman and Chief Operating Officer of Fidelity Investments from 2000 to 2007.

*Mr. Reynolds is an “interested person” (as defined in the Investment Company Act of 1940) of the fund and Putnam Investments. He is President and Chief Executive Officer of Putnam Investments, as well as the President of your fund and each of the other Putnam funds.

The address of each Trustee is One Post Office Square, Boston, MA 02109.

As of May 31, 2015, there were 117 Putnam funds. All Trustees serve as Trustees of all Putnam funds.

Each Trustee serves for an indefinite term, until his or her resignation, retirement at age 75, removal, or death.

42 Ohio Tax Exempt Income Fund

Officers

In addition to Robert L. Reynolds, the other officers of the fund are shown below:

Jonathan S. Horwitz (Born 1955)

Executive Vice President, Principal Executive Officer, and Compliance Liaison

Since 2004

Steven D. Krichmar (Born 1958)

Vice President and Principal Financial Officer

Since 2002

Chief of Operations, Putnam Investments and Putnam Management

Robert T. Burns (Born 1961)

Vice President and Chief Legal Officer

Since 2011

General Counsel, Putnam Investments, Putnam Management, and Putnam Retail Management

Robert R. Leveille (Born 1969)

Vice President and Chief Compliance Officer

Since 2007

Chief Compliance Officer, Putnam Investments, Putnam Management, and Putnam Retail Management

Michael J. Higgins (Born 1976)

Vice President, Treasurer, and Clerk

Since 2010

Manager of Finance, Dunkin’ Brands (2008–2010); Senior Financial Analyst, Old Mutual Asset Management (2007–2008); Senior Financial Analyst, Putnam Investments (1999–2007)

Janet C. Smith (Born 1965)

Vice President, Principal Accounting Officer, and Assistant Treasurer

Since 2007

Director of Fund Administration Services, Putnam Investments and Putnam Management

Susan G. Malloy (Born 1957)

Vice President and Assistant Treasurer

Since 2007

Director of Accounting & Control Services, Putnam Investments and Putnam Management

James P. Pappas (Born 1953)

Vice President

Since 2004

Director of Trustee Relations, Putnam Investments and Putnam Management

Mark C. Trenchard (Born 1962)

Vice President and BSA Compliance Officer

Since 2002

Director of Operational Compliance, Putnam Investments and Putnam Retail Management

Nancy E. Florek (Born 1957)

Vice President, Director of Proxy Voting and Corporate Governance, Assistant Clerk, and Associate Treasurer

Since 2000

The principal occupations of the officers for the past five years have been with the employers as shown above, although in some cases they have held different positions with such employers. The address of each officer is One Post Office Square, Boston, MA 02109.

Ohio Tax Exempt Income Fund 43

Services for shareholders

Investor services

Systematic investment plan Tell us how much you wish to invest regularly — weekly, semimonthly, or monthly — and the amount you choose will be transferred automatically from your checking or savings account. There’s no additional fee for this service, and you can suspend it at any time. This plan may be a great way to save for college expenses or to plan for your retirement.

Please note that regular investing does not guarantee a profit or protect against loss in a declining market. Before arranging a systematic investment plan, consider your financial ability to continue making purchases in periods when prices are low.

Systematic exchange You can make regular transfers from one Putnam fund to another Putnam fund. There are no additional fees for this service, and you can cancel or change your options at any time.

Dividends PLUS You can choose to have the dividend distributions from one of your Putnam funds automatically reinvested in another Putnam fund at no additional charge.

Free exchange privilege You can exchange money between Putnam funds free of charge, as long as they are the same class of shares. A signature guarantee is required if you are exchanging more than $500,000. The fund reserves the right to revise or terminate the exchange privilege.

Reinstatement privilege If you’ve sold Putnam shares or received a check for a dividend or capital gain, you may reinvest the proceeds with Putnam within 90 days of the transaction and they will be reinvested at the fund’s current net asset value — with no sales charge. However, reinstatement of class B shares may have special tax consequences. Ask your financial or tax representative for details.

Check-writing service You have ready access to many Putnam accounts. It’s as simple as writing a check, and there are no special fees or service charges. For more information about the check-writing service, call Putnam or visit our website.

Dollar cost averaging When you’re investing for long-term goals, it’s time, not timing, that counts. Investing on a systematic basis is a better strategy than trying to figure out when the markets will go up or down. This means investing the same amount of money regularly over a long period. This method of investing is called dollar cost averaging. When a fund’s share price declines, your investment dollars buy more shares at lower prices. When it increases, they buy fewer shares. Over time, you will pay a lower average price per share.

For more information

Visit the Individual Investors section at putnam.com A secure section of our website contains complete information on your account, including balances and transactions, updated daily. You may also conduct transactions, such as exchanges, additional investments, and address changes. Log on today to get your password.

Call us toll free at 1-800-225-1581 Ask a helpful Putnam representative or your financial advisor for details about any of these or other services, or see your prospectus.

44 Ohio Tax Exempt Income Fund

Founded over 75 years ago, Putnam Investments was built around the concept that a balance between risk and reward is the hallmark of a well-rounded financial program. We manage over 100 funds across income, value, blend, growth, asset allocation, absolute return, and global sector categories.

Investment Manager

Putnam Investment

Management, LLC

One Post Office Square

Boston, MA 02109

Investment Sub-Manager

Putnam Investments Limited

57–59 St James’s Street

London, England SW1A 1LD

Marketing Services

Putnam Retail Management

One Post Office Square

Boston, MA 02109

Custodian

State Street Bank

and Trust Company

Legal Counsel

Ropes & Gray LLP

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

Trustees

Jameson A. Baxter, Chair

Liaquat Ahamed

Ravi Akhoury

Barbara M. Baumann

Robert J. Darretta

Katinka Domotorffy

John A. Hill

Paul L. Joskow

Kenneth R. Leibler

Robert E. Patterson

George Putnam, III

Robert L. Reynolds

W. Thomas Stephens

Officers

Robert L. Reynolds

President

Jonathan S. Horwitz

Executive Vice President,

Principal Executive Officer, and

Compliance Liaison

Steven D. Krichmar

Vice President and

Principal Financial Officer

Robert T. Burns

Vice President and

Chief Legal Officer

Robert R. Leveille

Vice President and

Chief Compliance Officer

Michael J. Higgins

Vice President, Treasurer,

and Clerk

Janet C. Smith

Vice President,

Principal Accounting Officer,

and Assistant Treasurer

Susan G. Malloy

Vice President and

Assistant Treasurer

James P. Pappas

Vice President

Mark C. Trenchard

Vice President and

BSA Compliance Officer

Nancy E. Florek

Vice President, Director of

Proxy Voting and Corporate

Governance, Assistant Clerk,

and Associate Treasurer

This report is for the information of shareholders of Putnam Ohio Tax Exempt Income Fund. It may also be used as sales literature when preceded or accompanied by the current prospectus, the most recent copy of Putnam’s Quarterly Performance Summary, and Putnam’s Quarterly Ranking Summary. For more recent performance, please visit putnam.com. Investors should carefully consider the investment objectives, risks, charges, and expenses of a fund, which are described in its prospectus. For this and other information or to request a prospectus or summary prospectus, call 1-800-225-1581 toll free. Please read the prospectus carefully before investing. The fund’s Statement of Additional Information contains additional information about the fund’s Trustees and is available without charge upon request by calling 1-800-225-1581.

| |

| (a) The fund’s principal executive, financial and accounting officers are employees of Putnam Investment Management, LLC, the Fund’s investment manager. As such they are subject to a comprehensive Code of Ethics adopted and administered by Putnam Investments which is designed to protect the interests of the firm and its clients. The Fund has adopted a Code of Ethics which incorporates the Code of Ethics of Putnam Investments with respect to all of its officers and Trustees who are employees of Putnam Investment Management, LLC. For this reason, the Fund has not adopted a separate code of ethics governing its principal executive, financial and accounting officers. |

| |

| (c) In July 2013, the Code of Ethics of Putnam Investment Management, LLC was amended. The changes to the Code of Ethics were as follows: (i) eliminating the requirement for employees to hold their shares of Putnam mutual funds for specified periods of time, (ii) removing the requirement to preclear transactions in certain kinds of exchange-traded funds and exchange-traded notes, although reporting of all such instruments remains required; (iii) eliminating the excessive trading rule related to employee transactions in securities requiring preclearance under the Code; (iv) adding provisions related to monitoring of employee trading; (v) changing from a set number of shares to a set dollar value of stock of mid- and large-cap companies on the Restricted List that can be purchased or sold; (vi) adding a requirement starting in March 2014 for employees to generally use certain approved brokers that provide Putnam with an electronic feed of transactions and statements for their personal brokerage accounts; and (vii) certain other changes. |

| |

| Item 3. Audit Committee Financial Expert: |

| |

| The Funds’ Audit and Compliance Committee is comprised solely of Trustees who are “independent” (as such term has been defined by the Securities and Exchange Commission (“SEC”) in regulations implementing Section 407 of the Sarbanes-Oxley Act (the “Regulations”)). The Trustees believe that each of the members of the Audit and Compliance Committee also possess a combination of knowledge and experience with respect to financial accounting matters, as well as other attributes, that qualify them for service on the Committee. In addition, the Trustees have determined that each of Mr. Leibler, Mr. Hill, Mr. Darretta, and Ms. Baumann qualifies as an “audit committee financial expert” (as such term has been defined by the Regulations) based on their review of his or her pertinent experience and education. The SEC has stated, and the funds’ amended and restated agreement and Declaration of Trust provides, that the designation or identification of a person as an audit committee financial expert pursuant to this Item 3 of Form N-CSR does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the Audit and Compliance Committee and the Board of Trustees in the absence of such designation or identification. |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| The following table presents fees billed in each of the last two fiscal years for services rendered to the fund by the fund’s independent auditor: |

| | | | | |

| Fiscal year ended | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

|

|

| | | | | |

| May 31, 2015 | $44,515 | $ — | $11,576 | $ — |

| May 31, 2014 | $45,082 | $ — | $11,522 | $ — |

| |

| For the fiscal years ended May 31, 2015 and May 31, 2014, the fund’s independent auditor billed aggregate non-audit fees in the amounts of $629,775 and $511,522 respectively, to the fund, Putnam Management and any entity controlling, controlled by or under common control with Putnam Management that provides ongoing services to the fund. |

| |

| Audit Fees represent fees billed for the fund’s last two fiscal years relating to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| Audit-Related Fees represent fees billed in the fund’s last two fiscal years for services traditionally performed by the fund’s auditor, including accounting consultation for proposed transactions or concerning financial accounting and reporting standards and other audit or attest services not required by statute or regulation. |

| |

| Tax Fees represent fees billed in the fund’s last two fiscal years for tax compliance, tax planning and tax advice services. Tax planning and tax advice services include assistance with tax audits, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

| |

| Pre-Approval Policies of the Audit and Compliance Committee. The Audit and Compliance Committee of the Putnam funds has determined that, as a matter of policy, all work performed for the funds by the funds’ independent auditors will be pre-approved by the Committee itself and thus will generally not be subject to pre-approval procedures. |

| |

| The Audit and Compliance Committee also has adopted a policy to pre-approve the engagement by Putnam Management and certain of its affiliates of the funds’ independent auditors, even in circumstances where pre-approval is not required by applicable law. Any such requests by Putnam Management or certain of its affiliates are typically submitted in writing to the Committee and explain, among other things, the nature of the proposed engagement, the estimated fees, and why this work should be performed by that particular audit firm as opposed to another one. In reviewing such requests, the Committee considers, among other things, whether the provision of such services by the audit firm are compatible with the independence of the audit firm. |

| |

| The following table presents fees billed by the fund’s independent auditor for services required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X. |

| | | | | |

| Fiscal year ended | Audit-Related Fees | Tax Fees | All Other Fees | Total Non-Audit Fees |

|

|

| May 31, 2015 | $ — | $618,199 | $ — | $ — |

| May 31, 2014 | $ — | $500,000 | $ — | $ — |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| Item 6. Schedule of Investments: |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the report to shareholders in Item 1 above. |

| |

| Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies: |

| |

| Item 8. Portfolio Managers of Closed-End Investment Companies |

| |

| Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers: |

| |

| Item 10. Submission of Matters to a Vote of Security Holders: |

| |

| Item 11. Controls and Procedures: |

| |

| (a) The registrant’s principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant’s disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms. |

| |

| (b) Changes in internal control over financial reporting: Not applicable |

| |

| (a)(1) The Code of Ethics of The Putnam Funds, which incorporates the Code of Ethics of Putnam Investments, is filed herewith. |

| |

| (a)(2) Separate certifications for the principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended, are filed herewith. |

| |

| (b) The certifications required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended, are filed herewith. |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

| |

| Putnam Ohio Tax Exempt Income Fund |

| |

| By (Signature and Title): |

| |

| /s/ Janet C. Smith

Janet C. Smith

Principal Accounting Officer

|

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| |

| By (Signature and Title): |

| |

| /s/ Jonathan S. Horwitz

Jonathan S. Horwitz

Principal Executive Officer

|

| |

| By (Signature and Title): |

| |

| /s/ Steven D. Krichmar

Steven D. Krichmar

Principal Financial Officer

|