UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4946

THOMPSON IM FUNDS, INC.

(Exact name of registrant as specified in charter)

918 Deming Way

Madison, Wisconsin 53717

(Address of principal executive offices)--(Zip code)

John W. Thompson

Chief Executive Officer and President

Thompson IM Funds, Inc.

918 Deming Way

Madison, Wisconsin 53717

(Name and address of agent for service)

With a copy to:

Fredrick G. Lautz, Esq.

Quarles & Brady LLP

411 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Registrant's telephone number, including area code: (608) 827-5700

Date of fiscal year end: November 30, 2013

Date of reporting period: May 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W., Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

THOMPSON IM FUNDS, INC.

SEMI-ANNUAL REPORT TO SHAREHOLDERS

NOTE ON FORWARD-LOOKING STATEMENTS

The matters discussed in this report may constitute forward-looking statements. These include any Advisor or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, investment styles, market sectors, interest rates, economic trends and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current Prospectus, other factors bearing on these reports include the accuracy of the Advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the Advisor or portfolio manager and the ability of the Advisor or portfolio manager to implement its strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks.

1

THOMPSON IM FUNDS, INC.

SEMI-ANNUAL REPORT TO SHAREHOLDERS

May 31, 2013

CONTENTS

| Page(s) |

| LARGECAP FUND | |

| Investment review | 3-5 |

| Schedule of investments | 6-7 |

| |

| MIDCAP FUND | |

| Investment review | 8-10 |

| Schedule of investments | 11-12 |

| |

| BOND FUND | |

| Investment review | 13-16 |

| Schedule of investments | 17-29 |

| |

| FUND EXPENSE EXAMPLES | 30 |

| |

| FINANCIAL STATEMENTS | |

| Statements of assets and liabilities | 31 |

| Statements of operations | 32 |

| Statements of changes in net assets | 33 |

| Notes to financial statements | 34-39 |

| Financial highlights | 40-42 |

| |

| ADDITIONAL INFORMATION | 43 |

This report contains information for existing shareholders of Thompson IM Funds, Inc. It

does not constitute an offer to sell. This Semi-Annual Report is authorized for distribution to prospective investors

only when preceded or accompanied by a Fund Prospectus, which contains information about

the Funds’ objectives and policies, risks, management, expenses and other information.

A Prospectus can be obtained by calling 1-800-999-0887.

Please read your Prospectus carefully.

2

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) |

| May 31, 2013 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

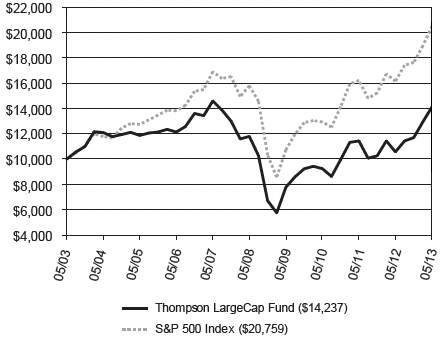

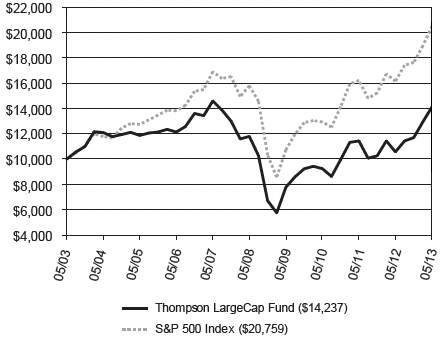

The LargeCap Fund produced a total return of 21.28% for the six-month period ended May 31, 2013, as compared to its benchmark, the S&P 500 Index, which returned 16.43%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 05/31/13 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

| Thompson LargeCap Fund | | 34.47% | | 15.57% | | 3.76% | | 3.60% | |

| S&P 500 Index | | 27.28% | | 16.87% | | 5.43% | | 7.58% | |

Gross Expense Ratio as of 03/31/13 was 1.31%.

Net Expense Ratio after reimbursement was 1.20%.*

* The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the LargeCap Fund through March 31, 2014 so that the annual operating expenses of the Fund do not exceed 1.20% of its average daily net assets.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

See Notes to Financial Statements.

3

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

Management Commentary

The semi-annual time period proved to be profitable for shareholders, with strong relative and absolute performance. Our pro-cyclical positioning of the portfolio was rewarded with both sector and individual issue attribution contributing to relative returns. Technology and Consumer Discretionary stocks were the best performing areas in the portfolio, but winners were also scattered throughout most of the other areas of the market. Only Energy was materially disappointing, as weakness in natural gas prices hurt several of our holdings in the sector.

More broadly, the semi-annual period contained the start of the fifth year of the current bull market. The S&P 500 is up roughly 164% through May 31, 2013 from the 3/9/2009 bottom, or approaching 26% a year, on average. Mid-sized firms have appreciated at an even faster rate from that point. Despite these returns, many individuals have been selling their equities and reducing their portfolio risk levels over the last few years. With the S&P 500 setting new all time closing highs, it’s natural to ask if the bull market can really continue. After all, a number of traditional metrics the public relies on to gauge the strength of the U.S. economy remain weak as compared to historical levels. These include the unemployment rate, family income growth, and the effectiveness of our political system to solve pressing problems.

It is important to emphasize that we believe stocks ultimately respond to one factor above all others: the profits and cash flow generated by the companies they represent. And on that basis the market appears very healthy. At the last market peak in 2007, the cumulative earnings of all the firms in the S&P 500 totaled roughly $87 per share. In 2012 that number was close to $102, and if consensus estimates for 2013 are correct we will see $110. So earnings are meaningfully higher than they were the last time the market was at these levels. At the same time, we believe that the quality of those earnings is better. In 2007, the Financial sector contributed 27% of S&P 500 earnings, some of which were later “de-booked” as the real estate bubble popped and the financial crisis ensued. It does not appear that today’s earnings are being artificially inflated by a similar effect, suggesting the overall improvement may be even better than the headline numbers imply.

The contradiction between high corporate profits and poor employment statistics can be explained by productivity. Technology has allowed both services companies and manufacturers to increase output while employing fewer people. In this environment, corporate profits and shareholders were able to enjoy financial gains at a much faster pace than individuals. At the end of 2011, corporate after-tax profits stood at 11.7 percent of national income, the highest on record, going back to 1947. We expect the final 2012 statistic should ultimately come in even higher. The oversupply of labor means wages have been low, and in fact inflation-adjusted net wages are less than they were ten years ago. How to improve the status of the individual is a topic beyond the scope of this commentary, but one that our political system will ultimately need to address.

Regardless, we believe we are still finding under-valued securities to purchase and that market valuations are reasonable. The government deficit and potential inflation are longer-term concerns, but we remain optimistic about the near-term future. The market can always experience a temporary pull- back based on short-term concerns, and may do so again despite the strong earnings growth discussed above. But, in our opinion, the increase in the S&P 500 since 2009 is justified, as are potential new market highs that may be set in the future.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, tax, and other laws. A REIT’s share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 6 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the fund’s future returns.

See Notes to Financial Statements.

4

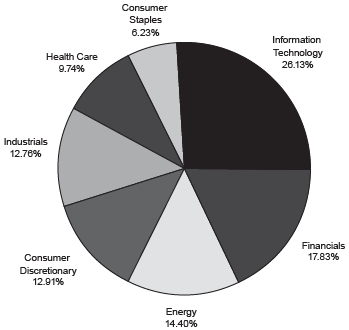

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

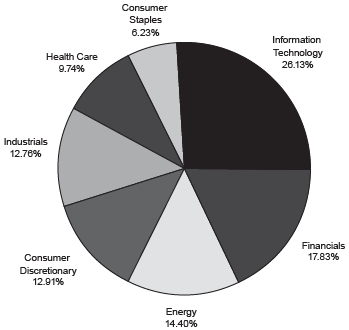

Sector Weightings at 05/31/13

% of Total Investments

| Top 10 Equity Holdings at 05/31/13 |

| | | % of Fund’s |

| Company | Industry | | Net Assets |

| Microsoft Corp. | Software & Computer Services | | 3.34% |

| Exxon Mobil Corp. | Oil & Gas Producers | | 2.70% |

| Bank of America Corp. | Banks | | 2.48% |

| Cisco Systems, Inc. | Technology Hardware & Equipment | | 2.23% |

| JPMorgan Chase & Co. | Banks | | 2.22% |

| Walgreen Co. | Food & Drug Retailers | | 2.12% |

| Express Scripts Holding Co. | Health Care Equipment & Services | | 2.09% |

| JDS Uniphase Corp. | Technology Hardware & Equipment | | 2.05% |

| Citigroup Inc. | Banks | | 1.99% |

| General Electric Co. | General Industrials | | 1.98% |

As of May 31, 2013, 99.9% of the Fund’s net assets were in equity, cash and short-term instruments.

See Notes to Financial Statements.

5

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2013 |

| | Shares | | Value |

| COMMON STOCKS - 99.9% | | | | | |

| | | | | | |

| Consumer Discretionary - 12.8% | | | | | |

| Automobiles & Parts - 2.9% | | | | | |

| Harley-Davidson, Inc. | | 15,450 | | $ | 842,643 |

| Johnson Controls, Inc. | | 48,075 | | | 1,796,082 |

| LKQ Corp. (a) | | 24,750 | | | 605,880 |

| | | | | 3,244,605 |

| General Retailers - 4.9% | | | | | |

| Bed Bath & Beyond Inc. (a) | | 16,400 | | | 1,119,300 |

| Best Buy Co., Inc. | | 61,190 | | | 1,685,784 |

| Kohl’s Corp. | | 29,260 | | | 1,504,257 |

| Target Corp. | | 15,960 | | | 1,109,220 |

| | | | | 5,418,561 |

| Household Products - 1.3% | | | | | |

| D.R. Horton, Inc. | | 24,550 | | | 598,038 |

| Jarden Corp. (a) | | 19,185 | | | 893,637 |

| | | | | 1,491,675 |

| Leisure Goods - 0.5% | | | | | |

| Brunswick Corp. | | 16,550 | | | 555,584 |

| |

| Media - 2.4% | | | | | |

| The Walt Disney Co. | | 17,450 | | | 1,100,746 |

| Time Warner Inc. | | 13,200 | | | 770,484 |

| Viacom Inc. Class B | | 11,925 | | | 785,738 |

| | | | | 2,656,968 |

| Personal Goods - 0.8% | | | | | |

| Hanesbrands, Inc. | | 17,850 | | | 890,001 |

| |

| Consumer Staples - 6.2% | | | | | |

| Beverages - 1.1% | | | | | |

| PepsiCo, Inc. | | 15,650 | | | 1,264,050 |

| |

| Food & Drug Retailers - 4.2% | | | | | |

| Sysco Corp. | | 22,445 | | | 758,641 |

| Walgreen Co. | | 49,000 | | | 2,340,240 |

| Wal-Mart Stores, Inc. | | 20,500 | | | 1,534,220 |

| | | | | 4,633,101 |

| Household Goods & | | | | | |

| Home Construction - 0.9% | | | | | |

| The Procter & Gamble Co. | | 12,825 | | | 984,447 |

| |

| Energy - 14.4% | | | | | |

| Oil & Gas Producers - 11.9% | | | | | |

| Anadarko Petroleum Corp. | | 12,992 | | | 1,136,410 |

| Apache Corp. | | 14,750 | | | 1,211,418 |

| Chevron Corp. | | 15,845 | | | 1,944,974 |

| Devon Energy Corp. | | 20,175 | | | 1,146,949 |

| Encana Corp. | | 28,225 | | | 537,122 |

| Exxon Mobil Corp. | | 32,970 | | | 2,982,796 |

| Forest Oil Corp. (a) | | 180,825 | | | 822,754 |

| Goodrich Petroleum Corp. (a) | | 55,025 | | | 691,114 |

| Hess Corp. | | 11,520 | | | 776,563 |

| Noble Energy, Inc. | | 19,350 | | | 1,115,527 |

| Southwestern Energy Co. (a) | | 22,300 | | | 840,487 |

| | | | | | 13,206,114 |

| Oil Equipment, Services & | | | | | |

| Distribution - 2.5% | | | | | |

| Helmerich & Payne, Inc. | | 8,800 | | | 543,312 |

| Schlumberger Ltd. | | 21,944 | | | 1,602,570 |

| Seadrill Ltd. | | 13,715 | | | 555,869 |

| | | | | 2,701,751 |

| Financials - 17.8% | | | | | |

| Banks - 10.5% | | | | | |

| Associated Banc-Corp | | 94,265 | | | 1,452,624 |

| Bank of America Corp. | | 200,350 | | | 2,736,781 |

| Citigroup Inc. | | 42,275 | | | 2,197,877 |

| First Horizon National Corp. | | 106,910 | | | 1,227,327 |

| JPMorgan Chase & Co. | | 44,875 | | | 2,449,726 |

| PNC Financial Services Group, Inc. | | 12,530 | | | 897,649 |

| Zions Bancorporation | | 22,150 | | | 621,308 |

| | | | | 11,583,292 |

| Financial Services - 5.3% | | | | | |

| CIT Group Inc. (a) | | 19,000 | | | 875,520 |

| Discover Financial Services | | 11,620 | | | 550,904 |

| MSCI Inc. (a) | | 43,175 | | | 1,521,487 |

| Northern Trust Corp. | | 19,495 | | | 1,133,634 |

| State Street Corp. | | 27,100 | | | 1,793,478 |

| | | | | | 5,875,023 |

| Insurance - 1.0% | | | | | |

| Aflac, Inc. | | 20,260 | | | 1,128,279 |

| |

| Real Estate Investment | | | | | |

| Trusts - 1.0% | | | | | |

| DiamondRock Hospitality Co. | | 58,100 | | | 552,531 |

| Host Hotels & Resorts Inc. | | 30,825 | | | 548,377 |

| | | | | | 1,100,908 |

| Health Care - 9.7% | | | | | |

| Health Care Equipment & | | | | | |

| Services - 5.8% | | | | | |

| Baxter International Inc. | | 11,460 | | | 805,982 |

| Express Scripts Holding Co. (a) | | 37,125 | | | 2,306,205 |

| Henry Schein, Inc. (a) | | 6,040 | | | 581,592 |

| Hologic, Inc. (a) | | 49,700 | | | 1,031,275 |

| Medtronic, Inc. | | 11,565 | | | 589,931 |

| ResMed Inc. | | 11,275 | | | 541,200 |

| Zimmer Holdings, Inc. | | 7,370 | | | 578,619 |

| | | | | 6,434,804 |

See Notes to Financial Statements.

6

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| | | | | | |

| Health Care (continued) | | | | | |

| Health Care Services - 1.3% | | | |

| McKesson Corp. | | 12,375 | | $ | 1,409,017 |

| |

| Pharmaceuticals & | | | | | |

| Biotechnology - 2.6% | | | | | |

| Amgen Inc. | | 7,715 | | | 775,589 |

| Celgene Corp. (a) | | 8,700 | | | 1,075,755 |

| Johnson & Johnson | | 12,635 | | | 1,063,614 |

| | | | | | 2,914,958 |

| Industrials - 12.8% | | | | | |

| Construction & Materials - 1.3% | | | |

| Masco Corp. | | 68,800 | | | 1,446,176 |

| |

| Electrical Equipment - 1.3% | | | |

| Emerson Electric Co. | | 24,250 | | | 1,393,405 |

| |

| General Industrials - 3.5% | | | | | |

| General Electric Co. | | 93,600 | | | 2,182,752 |

| 3M Co. | | 15,345 | | | 1,692,093 |

| | | | | 3,874,845 |

| Industrial Engineering - 4.6% | | | |

| ABB Ltd. ADR | | 86,200 | | | 1,878,298 |

| Illinois Tool Works Inc. | | 17,425 | | | 1,222,015 |

| Ingersoll-Rand PLC (a) | | 10,300 | | | 592,559 |

| Rockwell Automation, Inc. | | 15,675 | | | 1,379,713 |

| | | | | | 5,072,585 |

| Industrial Transportation - 1.2% | | | |

| FedEx Corp. | | 13,975 | | | 1,346,351 |

| |

| Support Services - 0.9% | | | | | |

| Mobile Mini, Inc. (a) | | 28,450 | | | 957,343 |

| |

| Information Technology - 26.2% | | | |

| Computer Programs - 2.8% | | | | | |

| Electronic Arts Inc. (a) | | 87,510 | | | 2,011,855 |

| Take-Two Interactive | | | | | |

| Software, Inc. (a) | | 67,000 | | | 1,114,880 |

| | | | | 3,126,735 |

| Electronic & Electrical | | | | | |

| Equipment - 1.0% | | | | | |

| Maxwell Technologies, Inc. (a) | | 152,450 | | | 1,102,214 |

| |

| Internet Programs & | | | | | |

| Services - 0.7% | | | | | |

| eBay Inc. (a) | | 13,995 | | | 757,130 |

| | | | | |

| IT Services - 1.8% | | | | | |

| Alliance Data Systems Corp. (a) | | 4,700 | | | 832,323 |

| Visa Inc. Class A | | 6,245 | | | 1,112,484 |

| | | | | 1,944,807 |

| Software & Computer | | | | | |

| Services - 5.9% | | | | | |

| Google Inc. Class A (a) | | 1,970 | | | 1,714,708 |

| Microsoft Corp. | | 105,751 | | | 3,688,595 |

| Oracle Corp. | | 32,250 | | | 1,088,760 |

| | | | | | 6,492,063 |

| Technology Hardware & | | | | | |

| Equipment - 14.0% | | | | | |

| Altera Corp. | | 33,575 | | | 1,114,354 |

| Broadcom Corp. Class A | | 40,765 | | | 1,463,871 |

| Cisco Systems, Inc. | | 102,260 | | | 2,462,421 |

| EMC Corp. (a) | | 47,400 | | | 1,173,624 |

| Hewlett-Packard Co. | | 49,900 | | | 1,218,558 |

| Intel Corp. | | 87,225 | | | 2,117,823 |

| JDS Uniphase Corp. (a) | | 166,135 | | | 2,262,759 |

| Linear Technology Corp. | | 22,220 | | | 833,250 |

| Maxim Integrated Products, Inc. | | 24,680 | | | 727,813 |

| Qualcomm, Inc. | | 32,405 | | | 2,057,069 |

| | | | | | 15,431,542 |

| |

| TOTAL COMMON STOCKS | | | | | |

| (COST $91,676,573) | | | | | 110,438,334 |

| |

| SHORT-TERM INVESTMENTS - 0.0% | | | | | |

| | | | | | |

| Money Market Funds - 0.0% | | | | | |

| Fidelity Money Market Portfolio | | | | | |

| Class I, 0.077% (b) | | 145 | | | 145 |

| |

| Total Money Market Funds | | | | | 145 |

| |

| TOTAL SHORT-TERM | | | | | |

| INVESTMENTS (COST $145) | | | | | 145 |

| |

| TOTAL INVESTMENTS - 99.9% | | | | | |

| (COST $91,676,718) | | | | | 110,438,479 |

| |

| NET OTHER ASSETS AND | | | | | |

| LIABILITIES - 0.1% | | | | | 74,459 |

| |

| NET ASSETS - 100.0% | | | | $ | 110,512,938 |

| | (a) | Non-income producing security. |

| (b) | Interest rate shown represents the current coupon rate at May 31, 2013. |

ADR: American Depositary Receipt

PLC: Public Limited Company

See Notes to Financial Statements.

7

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) |

| May 31, 2013 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

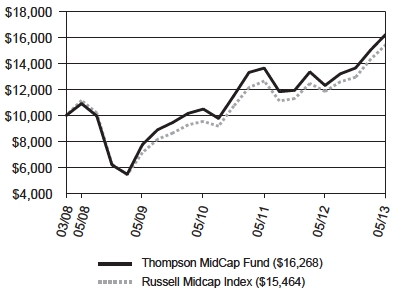

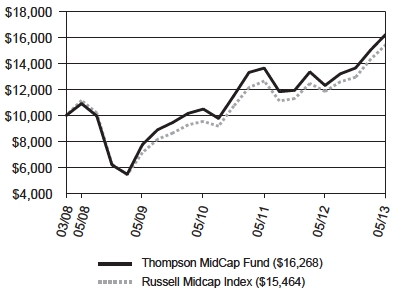

The MidCap Fund produced a total return of 19.13% for the six-month period ended May 31, 2013, as compared to its benchmark, the Russell Midcap Index, which returned 19.49%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 05/31/13 |

| | | | | | | | Since | |

| | | | | | | | Inception | |

| | | 1 Year | | 3 Year | | 5 Year | | (03/31/08) | |

| Thompson MidCap Fund | | 32.13% | | 15.76% | | 8.32% | | 9.88% | |

| Russell Midcap Index | | 30.51% | | 17.46% | | 6.75% | | 8.81% | |

Gross Expense Ratio as of 03/31/13 was 1.83%.

Net Expense Ratio after reimbursement was 1.30%.*

* The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the MidCap Fund through March 31, 2014 so that the annual operating expenses of the Fund do not exceed 1.30% of its average daily net assets.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index based on total market capitalization. You cannot directly invest in an index.

See Notes to Financial Statements.

8

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

Management Commentary

The MidCap Fund modestly trailed its benchmark during the semi-annual time period, primarily due to poor stock selection within the Energy sector. Several natural gas companies in the Fund’s portfolio lagged the sector by a wide margin, despite a 12% increase in natural gas spot prices during the period. Natural gas contracts for longer maturities were generally flat-to-up during the time period as well. We were able to partially offset this weakness with strong sector selection, especially in our decisions to underweight Utilities and overweight Industrials. Strong individual stock performance within Technology and Financials also contributed to the Fund’s performance. But in the end the weakness in key Energy holdings was too much to completely overcome.

During the semi-annual time period, we celebrated the five-year anniversary of the MidCap Fund at the end of March. Starting an equity mutual fund the year of the worst financial crisis in almost 80 years was certainly not without its challenges. There is always uncertainty in the marketplace, but the volatility and outright investor fear on display that particular year was stunning. We very much appreciate the support of shareholders who were willing to join the Fund in its infancy amidst such turmoil.

As we’ve noted before, we look for companies that we believe have solid earnings growth potential, trading at reasonable valuation multiples. We maintain a diversified portfolio of securities with the goal of generating competitive returns over the long run. Now that the Fund has reached five years, we have some evidence as to whether or not this goal has been realized. Since inception through the five-year anniversary, the fund outpaced its benchmark. The five-year annual return for the Fund through May 31, 2013 was 8.32%, while the benchmark returned 6.75% for the same period.

We are proud of the Fund’s record during its first five years, and of the process we developed to manage it. We look forward to working together on it for many years to come.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Midcap companies tend to have limited liquidity and greater volatility than large-capitalization companies. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, tax, and other laws. A REIT’s share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 11 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the fund’s future returns.

Diversification does not assure a profit nor protect against loss in a declining market.

See Notes to Financial Statements.

9

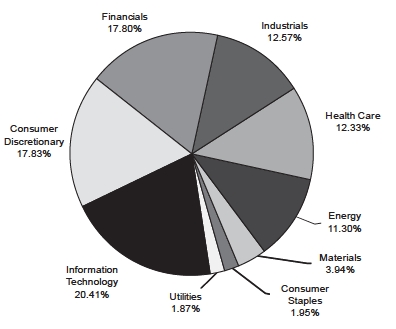

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

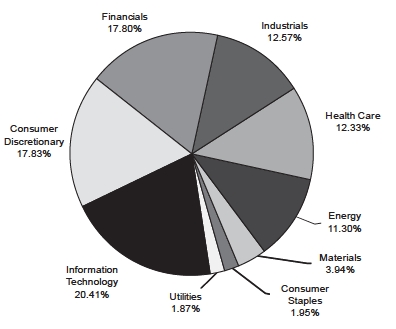

Sector Weightings at 05/31/13

% of Total Investments

| Top 10 Equity Holdings at 05/31/13 |

| | | | % of Fund’s |

| Company | | Industry | | Net Assets |

| First Horizon National Corp. | | Banks | | 2.12% |

| Associated Banc-Corp | | Banks | | 2.09% |

| MSCI Inc. | | Financial Services | | 2.07% |

| JDS Uniphase Corp. | | Technology Hardware & Equipment | | 2.06% |

| Broadcom Corp. Class A | | Technology Hardware & Equipment | | 2.05% |

| Maxwell Technologies, Inc. | | Electronic & Electrical Equipment | | 1.99% |

| Take-Two Interactive Software, Inc. | | Computer Programs | | 1.87% |

| Kohl’s Corp. | | General Retailers | | 1.83% |

| Bed Bath & Beyond Inc. | | General Retailers | | 1.81% |

| Electronic Arts Inc. | | Computer Programs | | 1.80% |

As of May 31, 2013, 99.9% of the Fund’s net assets were in equity, cash and short-term instruments.

See Notes to Financial Statements.

10

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2013 |

| | Shares | | Value |

| COMMON STOCKS - 99.9% | | | | | |

| | | | | | |

| Consumer Discretionary - 17.8% | | | | | |

| Automobiles & Parts - 2.8% | | | | | |

| Allison Transmission Holdings, Inc. | | 13,300 | | $ | 316,540 |

| Harley-Davidson, Inc. | | 5,600 | | | 305,424 |

| LKQ Corp. (a) | | 10,070 | | | 246,514 |

| | | | | 868,478 |

| General Retailers - 7.0% | | | | | |

| Bed Bath & Beyond Inc. (a) | | 8,230 | | | 561,697 |

| Best Buy Co., Inc. | | 8,900 | | | 245,195 |

| Jos. A. Bank Clothiers, Inc. (a) | | 9,085 | | | 408,189 |

| Kohl’s Corp. | | 11,045 | | | 567,823 |

| Nordstrom, Inc. | | 6,670 | | | 392,329 |

| | | | | 2,175,233 |

| Household Products - 2.2% | | | | | |

| D.R. Horton, Inc. | | 6,525 | | | 158,949 |

| Jarden Corp. (a) | | 11,537 | | | 537,393 |

| | | | | 696,342 |

| Leisure Goods - 1.0% | | | | | |

| Brunswick Corp. | | 9,400 | | | 315,558 |

| |

| Personal Goods - 3.0% | | | | | |

| Coach, Inc. | | 8,028 | | | 467,711 |

| Hanesbrands, Inc. | | 9,028 | | | 450,136 |

| | | | | 917,847 |

| Travel & Leisure - 1.8% | | | | | |

| Darden Restaurants, Inc. | | 10,531 | | | 545,506 |

| |

| Consumer Staples - 1.9% | | | | | |

| Food Producers - 1.9% | | | | | |

| Ingredion Inc. | | 2,200 | | | 149,864 |

| McCormick & Co., Inc. | | 2,043 | | | 141,130 |

| The J. M. Smucker Co. | | 3,087 | | | 311,664 |

| | | | | 602,658 |

| Energy - 11.3% | | | | | |

| Oil & Gas Producers - 9.0% | | | | | |

| Bill Barrett Corp. (a) | | 13,690 | | | 308,983 |

| Denbury Resources Inc. (a) | | 4,335 | | | 79,547 |

| Encana Corp. | | 8,350 | | | 158,901 |

| Forest Oil Corp. (a) | | 68,200 | | | 310,310 |

| Goodrich Petroleum Corp. (a) | | 26,050 | | | 327,188 |

| Murphy Oil Corp. | | 3,551 | | | 224,849 |

| Noble Energy, Inc. | | 9,136 | | | 526,690 |

| Oasis Petroleum Inc. (a) | | 4,300 | | | 159,788 |

| Range Resources Corp. | | 6,040 | | | 454,087 |

| Swift Energy Co. (a) | | 5,750 | | | 77,970 |

| Ultra Petroleum Corp. (a) | | 7,275 | | | 165,725 |

| | | | | 2,794,038 |

| Oil Equipment, Services & | | | | | |

| Distribution - 2.3% | | | | | |

| Dresser-Rand Group, Inc. (a) | | 3,995 | | | 242,097 |

| Helmerich & Payne, Inc. | | 3,645 | | | 225,042 |

| Seadrill Ltd. | | 5,860 | | | 237,506 |

| | | | | 704,645 |

| Financials - 17.8% | | | | | |

| Banks - 6.1% | | | | | |

| Associated Banc-Corp | | 41,959 | | | 646,588 |

| First Horizon National Corp. | | 57,220 | | | 656,886 |

| Regions Financial Corp. | | 18,485 | | | 168,768 |

| SunTrust Banks, Inc. | | 5,120 | | | 164,301 |

| Zions Bancorporation | | 9,260 | | | 259,743 |

| | | | | 1,896,286 |

| Financial Services - 6.9% | | | | | |

| CIT Group Inc. (a) | | 7,075 | | | 326,016 |

| Discover Financial Services | | 8,129 | | | 385,396 |

| Eaton Vance Corp. | | 5,720 | | | 237,437 |

| MSCI Inc. (a) | | 18,210 | | | 641,720 |

| Northern Trust Corp. | | 9,525 | | | 553,879 |

| | | | | 2,144,448 |

| Insurance - 1.8% | | | | | |

| Cincinnati Financial Corp. | | 4,820 | | | 228,179 |

| Unum Group | | 11,235 | | | 319,973 |

| | | | | 548,152 |

| Real Estate Investment | | | | | |

| Trusts - 3.0% | | | | | |

| DiamondRock Hospitality Co. | | 32,550 | | | 309,551 |

| Host Hotels & Resorts Inc. | | 17,085 | | | 303,942 |

| LaSalle Hotel Properties | | 11,670 | | | 308,088 |

| | | | | 921,581 |

| Health Care - 12.3% | | | | | |

| Health Care Equipment & | | | | | |

| Services - 9.7% | | | | | |

| Hanger, Inc. (a) | | 9,950 | | | 317,505 |

| Henry Schein, Inc. (a) | | 3,169 | | | 305,143 |

| Hologic, Inc. (a) | | 19,325 | | | 400,994 |

| Masimo Corp. (a) | | 7,500 | | | 162,375 |

| MedAssets Inc. (a) | | 25,040 | | | 410,656 |

| Natus Medical Inc. (a) | | 25,025 | | | 352,602 |

| Patterson Cos., Inc. | | 7,580 | | | 296,226 |

| ResMed Inc. | | 9,425 | | | 452,400 |

| Zimmer Holdings, Inc. | | 3,850 | | | 302,264 |

| | | | | 3,000,165 |

| Health Care Services - 1.0% | | | | | |

| McKesson Corp. | | 2,720 | | | 309,699 |

See Notes to Financial Statements.

11

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| | | | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| | | | | | |

| Health Care (continued) | | | | |

| | Pharmaceuticals & | | | | |

| | Biotechnology - 1.6% | | | | |

| | Exact Sciences Corp. (a) | 29,300 | | $ | 329,332 |

| | Illumina, Inc. (a) | 2,525 | | | 177,558 |

| | | | | | 506,890 |

| Industrials - 12.6% | | | | |

| | Construction & | | | | |

| | Materials - 2.9% | | | | |

| | | Masco Corp. | 22,075 | | | 464,017 |

| | Mueller Water Products, Inc. Class A | 30,900 | | | 235,149 |

| | USG Corp. (a) | 6,650 | | | 181,745 |

| | | | | | 880,911 |

| | | Electrical Equipment - 1.3% | | | | |

| | | Regal-Beloit Corp. | 5,955 | | | 402,022 |

| | |

| | Industrial Engineering - 4.7% | | | | |

| | Ingersoll-Rand PLC (a) | 8,350 | | | 480,375 |

| | Rockwell Automation, Inc. | 5,310 | | | 467,386 |

| | SPX Corp. | 6,350 | | | 501,142 |

| | | | | | 1,448,903 |

| | Industrial Transportation - 1.0% | | | | |

| | Expeditors International of | | | | |

| | Washington, Inc. | 8,025 | | | 313,216 |

| | |

| | Support Services - 2.7% | | | | |

| | Cintas Corp. | 6,600 | | | 301,323 |

| | Mobile Mini, Inc. (a) | 9,420 | | | 316,983 |

| | W.W. Grainger, Inc. | 888 | | | 228,607 |

| | | | | | 846,913 |

| Information Technology - 20.5% | | | | |

| | Computer Programs - 3.7% | | | | |

| | Electronic Arts Inc. (a) | 24,240 | | | 557,278 |

| | Take-Two Interactive | | | | |

| | Software, Inc. (a) | 34,885 | | | 580,486 |

| | | | | | 1,137,764 |

| | Electronic & Electrical | | | | |

| | Equipment - 3.1% | | | | |

| | Celestica Inc. (a) | 18,281 | | | 169,099 |

| | Flextronics International Ltd. (a) | 21,492 | | | 160,330 |

| | Maxwell Technologies, Inc. (a) | 85,225 | | | 616,177 |

| | | | | | 945,606 |

| | Internet Programs & | | | | |

| | Services - 0.8% | | | | |

| | Liquidity Services Inc. (a) | 6,200 | | | 248,062 |

| | |

| | IT Services - 2.1% | | | | |

| | Alliance Data Systems Corp. (a) | 2,290 | | | 405,536 |

| | Fiserv, Inc. (a) | 2,672 | | | 232,892 |

| | | | | | 638,428 |

| | Technology Hardware & | | | | |

| | Equipment - 10.8% | | | | |

| | Altera Corp. | 9,425 | | | 312,816 |

| | Broadcom Corp. Class A | 17,705 | | | 635,787 |

| | Cavium Inc. (a) | 12,150 | | | 398,034 |

| | InvenSense Inc. (a) | 18,500 | | | 238,280 |

| | JDS Uniphase Corp. (a) | 46,856 | | | 638,179 |

| | Linear Technology Corp. | 8,210 | | | 307,875 |

| | Maxim Integrated Products, Inc. | 14,401 | | | 424,685 |

| | Stratasys Ltd. (a) | 2,025 | | | 170,201 |

| | 3D Systems Corp. (a) | 4,600 | | | 223,192 |

| | | | | | 3,349,049 |

| Materials - 3.9% | | | | |

| | Chemicals - 2.9% | | | | |

| | Ecolab Inc. | 5,281 | | | 446,086 |

| | International Flavors & | | | | |

| | Fragrances Inc. | 5,710 | | | 458,456 |

| | | | | | 904,542 |

| | Household Materials - 1.0% | | | | |

| | The Scotts Miracle-Gro Co. Class A | 6,646 | | | 314,156 |

| | | | | |

| Utilities - 1.8% | | | | |

| | Electricity - 0.4% | | | | |

| | Pepco Holdings, Inc. | 6,660 | | | 138,328 |

| | | | | | |

| | Gas, Water & Multiutilities - 1.4% | | | | |

| | MDU Resources Group, Inc. | 8,622 | | | 222,965 |

| | SCANA Corp. | 4,289 | | | 216,337 |

| | | | | | 439,302 |

| | | | | | | |

| | TOTAL COMMON STOCKS | | | | |

| | (COST $25,037,990) | | | | 30,954,728 |

| | |

| SHORT-TERM INVESTMENTS - 0.0% | | | | |

| | | | | |

| Money Market Funds - 0.0% | | | | |

| | Fidelity Money Market Portfolio | | | | |

| | Class I, 0.077% (b) | 637 | | | 637 |

| | | | | | |

| | Total Money Market Funds | | | | 637 |

| | | | | | |

| | TOTAL SHORT-TERM | | | | |

| | INVESTMENTS (COST $637) | | | | 637 |

| | | | | | |

| | TOTAL INVESTMENTS - 99.9% | | | | |

| | (COST $25,038,627) | | | | 30,955,365 |

| | | | | | |

| | NET OTHER ASSETS AND | | | | |

| | LIABILITIES - 0.1% | | | | 16,766 |

| | | | | | |

| | NET ASSETS - 100.0% | | | $ | 30,972,131 |

| | (a) | Non-income producing security. |

| | (b) | Interest rate shown represents the current coupon rate at May 31, 2013. |

PLC: Public Limited Company

See Notes to Financial Statements.

12

| BOND FUND INVESTMENT REVIEW (Unaudited) |

| May 31, 2013 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

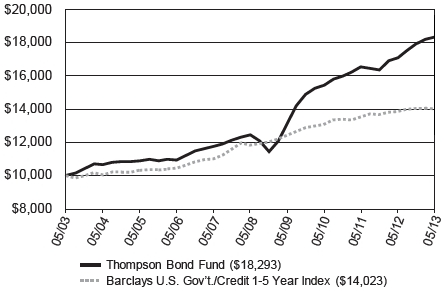

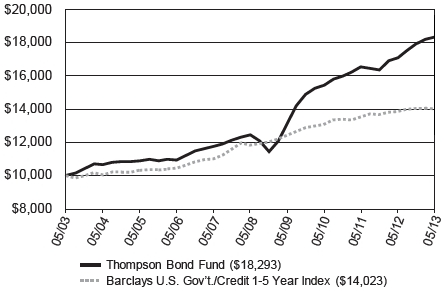

The Bond Fund produced a total return of 2.18% for the six-month period ended May 31, 2013, as compared to its benchmark, the Barclays U.S. Government/Credit 1-5 Year Index, which returned 0.07%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 05/31/13 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson Bond Fund | | 7.27% | | 5.82% | | 8.01% | | 6.23% |

| Barclays U.S. Gov’t./Credit 1-5 Year Index | | 1.23% | | 2.44% | | 3.51% | | 3.44% |

| Gross Expense Ratio as of 03/31/13 was 0.78%. | 30-Day SEC Yield as of 05/31/13 was 2.06%. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Barclays U.S. Government/Credit 1-5 Year Index is a market-value-weighted index of all investment-grade bonds with maturities of more than one year and less than 5 years. You cannot directly invest in an index.

See Notes to Financial Statements.

13

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

Management Commentary

The Fund’s positive relative return was largely attributable to its significant allocation to corporate bonds. Credit spreads continued to narrow during the first half of the fiscal year. This coupled with the relatively attractive current yields allowed performance to remain competitive in an environment of modestly rising interest rates. Interest-rate risk remains very high in the bond market overall. We cannot predict when or how quickly rates will rise, but believe it would be unrealistic to think that they would move much lower. Hence, we continue to favor taking credit risk for additional yield over extending the portfolio duration. When rates finally do rise, this strategy may change.

We believe the biggest risk to short-term performance of the Fund is that credit spreads widen. There are a few ways in which this risk can manifest itself. First, a general increase in fear regarding economic conditions can drive investors from corporate bonds to U.S. Treasury bonds, depressing corporate bond prices. In the fall of 2011 we experienced this phenomenon, as concerns over the financial solvency of some European countries worried some investors that the economy was at the precipice of another financial crisis. We did not believe this to be the case, and took advantage of some of the attractive values it created. Fear can also widen credit spreads when corporations take on too much debt in the aggregate, or the economy enters a recession. For now, we do not think either of those scenarios is imminent.

The second way credit risk can manifest itself is in the deterioration of an issuer’s fundamentals (or at least the perception of a decline), which is often reflected in a rating downgrade of an individual bond. The price of the bond will likely decline to reflect this weaker outlook. Once this happens, we then must determine whether the event that triggered the downgrade is material enough to warrant the bond’s disposal, or whether we believe the company will still meet its future obligations. If we think there’s real trouble, we generally will sell. If not, we generally will hold. For example, the Fund continues to hold bonds of R.R. Donnelly, an issue that was downgraded to junk in May of 2011. The company used some of its capital to buy back stock, which suggested to the ratings agencies that it was managing its balance sheet more for stockholders than bondholders. We determined at that time that we remained comfortable with the company’s ability to meet its obligations to us because of its large free cash flow, so we continue to hold the bonds.

It is critical to understand how this affects the pattern of shareholder returns. When the price of a bond declines, the net asset value of the fund takes a proportionally direct hit. This impacts performance going backwards, but as long as the bond successfully matures it actually increases the future return of the portfolio. This is because the bond has a higher yield-to-maturity at the new lower price. This is why we focus on the probability of our shareholders being repaid when we buy a bond, rather than on how the market will perceive changes in the bond’s fundamentals. As long as the bond does not default, shareholders should ultimately enjoy the full return of the bond, even if the timing of said returns is uncertain. It is also why we believe the Fund is more attractive to shareholders after spreads have widened than before.

We cannot predict the short-term fluctuations in investor sentiment with respect to credit risk. We simply seek to out-earn other short-term investments through the generation of interest income. When rates do finally rise materially from here, we will likely reduce our exposure to credit risk by reallocating some of the Fund’s portfolio from corporate debt to more intermediate-maturity U.S. Treasury and Agency debt, while still being mindful of the overall duration of the Fund’s portfolio. Until then, changes in investors’ perception of credit risk will likely be more impactful on the Fund’s relative performance than a rise in prevailing interest rates.

See Notes to Financial Statements.

14

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in bonds of foreign issuers involve greater volatility, political and economic risks, and differences in accounting methods. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please refer to the Schedule of Investments on page 17 of this report for holdings information. The management commentary above as well as Fund holdings should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings are subject to change.

The federal government guarantees interest payments from government securities while dividend payments carry no such guarantee. Government securities, if held to maturity, guarantee the timely payment of principal and interest.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

SEC Yield is a standardized yield computed by dividing the net investment income per share earned during the 30-day period prior to quarter-end and was created to allow for fairer comparisons among bond funds.

Yield-to-Maturity is the rate of return anticipated on a bond if it is held until the maturity date, which takes into account the current market price, par value, coupon interest rate and time to maturity.

Yield is the income earned from a bond, which takes into account the sum of the interest payment, the redemption value at the bond’s maturity, and the initial purchase price of the bond.

Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

See Notes to Financial Statements.

15

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2013 |

| Portfolio Concentration at 05/31/13 |

| (Includes cash and cash equivalents) |

| % Total Investments |

| Quality |

| U.S. Government & Agency Issues | 0.07 | % | |

| AAA | 0.16 | % | |

| AA | 0.47 | % | |

| A | 8.51 | % | |

| BBB | 87.28 | % | |

| BB and Below | 2.06 | % | |

| Not Rated | 1.36 | % | |

| Money Market Funds | 0.09 | % | |

| 100.00 | % | |

| |

| Effective Maturity |

| Under 1 year | 12.44 | % | |

| 1 to 3 years | 29.95 | % | |

| 3 to 5 years | 31.37 | % | |

| 5 to 10 years | 26.24 | % | |

| 100.00 | % | |

| |

| Asset Allocation |

| Corporate Bonds | 88.66 | % | |

| Asset-Backed Securities | 7.27 | % | |

| Taxable Municipal Bonds | 3.13 | % | |

| Convertible Bonds | 0.48 | % | |

| Sovereign Government Bonds | 0.29 | % | |

| Money Market Funds | 0.09 | % | |

| Federal Agency Mortgage-Backed Securities | 0.07 | % | |

| Tax-Exempt Municipal Bonds | 0.01 | % | |

| 100.00 | % | |

| |

See Notes to Financial Statements.

16

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2013 |

| | | | Principal | | | |

| | | Amount | | Value |

| BONDS - 98.0% | | | | | |

| | | | | | | |

| Asset-Backed Securities - 7.1% | | | | | |

| | Ameritech Capital Funding Corp. | | | | | |

| | 9.100% due 6/1/2016 | $ | 4,694 | | $ | 5,361 |

| | |

| | AWAS Aviation Capital Ltd. | | | | | |

| | 7.000% due 10/17/2016 (d) | | 42,900,480 | | | 44,938,253 |

| | |

| | Beaver Valley II Funding | | | | | |

| | 9.000% due 6/1/2017 | | 10,000 | | | 10,213 |

| | |

| | Continental Airlines 2009-2 B | | | | | |

| | 9.250% due 5/10/2017 | | 691,193 | | | 777,592 |

| | |

| | Continental Airlines 2010-1 B | | | | | |

| | | 6.000% due 1/12/2019 | | 81,588 | | | 84,851 |

| | |

| | Delta Air Lines 2002-1 G-1 | | | | | |

| | 6.718% due 1/2/2023 | | 4,561 | | | 5,063 |

| | |

| | Delta Air Lines 2007-1 A | | | | | |

| | 6.821% due 8/10/2022 | | 10,573,605 | | | 12,331,996 |

| | |

| | Delta Air Lines 2009-1 B | | | | | |

| | 9.750% due 12/17/2016 | | 578,054 | | | 658,982 |

| | |

| | Doric Nimrod Air Finance | | | | | |

| | Alpha Ltd. 2012-1 B | | | | | |

| | 6.500% due 5/30/2021 (d) | | 17,685,389 | | | 18,384,421 |

| | |

| | Express Pipeline LP | | | | | |

| | 7.390% due 12/31/2017 (d) | | 2,638,000 | | | 2,883,210 |

| | |

| | FPL Energy Caithness | | | | | |

| | Funding Corp. | | | | | |

| | 7.645% due 12/31/2018 (d) | | 2,168,960 | | | 2,326,700 |

| | |

| | General American Railcar 1997-1 | | | | | |

| | 6.690% due 9/20/2016 (d) | | 313,656 | | | 322,548 |

| | |

| | General American Railcar II | | | | | |

| | 6.210% due 9/20/2017 | | 5,614,115 | | | 5,843,063 |

| | |

| | General American Railcar III | | | | | |

| | 7.760% due 8/20/2018 (d) | | 1,107,437 | | | 1,127,743 |

| | |

| | Maritimes & Northeast | | | | | |

| | Pipeline LLC | | | | | |

| | 7.500% due 5/31/2014 (d) | | 28,573,600 | | | 30,052,827 |

| | | | | |

| | Midwest Family Housing LLC | | | | | |

| | 5.168% due 7/1/2016 (d) | | 332,000 | | | 344,311 |

| | |

| | Northwest Airlines 1999-2 A | | | | | |

| | 7.575% due 3/1/2019 | | 185,767 | | | 215,489 |

| | |

| | Northwest Airlines 2001-1 A-1 | | | | | |

| | 7.041% due 4/1/2022 | | 460,353 | | | 512,142 |

| | |

| | Northwest Airlines 2002-1 G-2 | | | | | |

| | 6.264% due 11/20/2021 | | 1,103,940 | | | 1,177,463 |

| | |

| | Northwest Airlines 2007-1 A | | | | | |

| | 7.027% due 11/1/2019 | | 8,208,558 | | | 9,193,584 |

| | |

| | PP&L Montana LLC | | | | | |

| | 8.903% due 7/2/2020 | | 2,920,165 | | | 3,251,721 |

| | |

| | Prologis, Inc. | | | | | |

| | 7.810% due 2/1/2015 | | 2,010,600 | | | 2,089,914 |

| | |

| | World Financial Properties | | | | | |

| | Tower B Corp. | | | | | |

| | 6.910% due 9/1/2013 (d) | | 70,975 | | | 71,320 |

| | |

| | Total Asset-Backed Securities | | | | | 136,608,767 |

| | |

| Convertible Bonds - 0.5% | | | | | |

| | EMC Corp. | | | | | |

| | 1.750% due 12/1/2013 | | 1,000,000 | | | 1,546,250 |

| | |

| | Hospitality Properties Trust | | | | | |

| | 3.800% due 3/15/2027 | | 7,309,000 | | | 7,304,432 |

| | |

| | NASDAQ OMX Group, Inc. | | | | | |

| | 2.500% due 8/15/2013 | | 215,000 | | | 215,269 |

| | |

| | Total Convertible Bonds | | | | | 9,065,951 |

| | |

| Corporate Bonds - 87.0% | | | | | |

| | Abbey National Treasury | | | | | |

| | Services PLC | | | | | |

| | 2.875% due 4/25/2014 | | 8,604,000 | | | 8,762,400 |

| | |

| | Advance Auto Parts, Inc. | | | | | |

| | 5.750% due 5/1/2020 | | 21,826,000 | | | 23,958,138 |

See Notes to Financial Statements.

17

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| Principal | | | |

| Amount | | Value |

| BONDS (continued) | | | | | |

| | | | | | |

| Corporate Bonds (continued) | | | | | |

| Aetna Inc. | | | | | |

| 6.750% due 9/15/2013 | $ | 188,000 | | $ | 191,128 |

| | | | | | |

| Agilent Technologies, Inc. | | | | | |

| 2.500% due 7/15/2013 | | 165,000 | | | 165,356 |

| | | | | | |

| Airgas, Inc. | | | | | |

| 7.125% due 10/1/2018 | | 415,000 | | | 437,551 |

| | | | | | |

| Alcoa Inc. | | | | | |

| 6.000% due 7/15/2013 | | 192,000 | | | 193,122 |

| | | | | | |

| Alltel Corp. | | | | | |

| 6.500% due 11/1/2013 | | 8,000 | | | 8,191 |

| | | | | | |

| Altria Group, Inc. | | | | | |

| 7.000% due 11/4/2013 | | 41,000 | | | 41,921 |

| 8.500% due 11/10/2013 | | 90,000 | | | 93,067 |

| | | | | | |

| AMB Property LP | | | | | |

| 5.900% due 8/15/2013 | | 8,000 | | | 8,078 |

| | | | | | |

| Ameren Corp. | | | | | |

| 8.875% due 5/15/2014 | | 1,210,000 | | | 1,298,232 |

| | | | | | |

| American Express | | | | | |

| 6.650% due 9/15/2015 | | 90,000 | | | 100,450 |

| 6.900% due 9/15/2015 | | 277,000 | | | 311,935 |

| | | | | | |

| American Financial Group, Inc. | | | | | |

| 9.875% due 6/15/2019 | | 1,751,000 | | | 2,349,924 |

| | | | | | |

| American General Finance | | | | | |

| 6.000% due 10/15/2014 | | 1,000,000 | | | 1,019,760 |

| 6.000% due 12/15/2014 | | 1,000,000 | | | 1,027,090 |

| | | | | | |

| American Standard Inc. | | | | | |

| 5.500% due 4/1/2015 | | 25,000 | | | 26,650 |

| | | | | | |

| Amphenol Corp. | | | | | |

| 4.750% due 11/15/2014 | | 1,698,000 | | | 1,796,401 |

| | | | | | |

| Anadarko Petroleum Corp. | | | | | |

| 7.625% due 3/15/2014 | | 988,000 | | | 1,041,523 |

| | | | | | |

| Arden Realty LP | | | | | |

| 5.250% due 3/1/2015 | | 3,040,000 | | | 3,244,048 |

| | | | | | |

| Aspen Insurance Holdings Ltd. | | | | | |

| 6.000% due 8/15/2014 | | 4,669,000 | | | 4,922,405 |

| | | | | | |

| Associated Banc-Corp | | | | | |

| 9.250% due 10/15/2018 | | 387,000 | | | 394,647 |

| | | | | | |

| Associates Corp. N.A. | | | | | |

| 6.950% due 11/1/2018 | | 691,000 | | | 838,694 |

| | | | | | |

| Assurant, Inc. | | | | | |

| 5.625% due 2/15/2014 | | 30,000 | | | 30,963 |

| | | | | | |

| Astoria Financial Corp. | | | | | |

| 5.000% due 6/19/2017 | | 26,873,000 | | | 28,534,047 |

| | | | | | |

| AutoZone, Inc. | | | | | |

| 4.375% due 6/1/2013 | | 155,000 | | | 155,000 |

| | | | | | |

| Avnet, Inc. | | | | | |

| 5.875% due 3/15/2014 | | 15,175,000 | | | 15,710,177 |

| 6.000% due 9/1/2015 | | 225,000 | | | 243,313 |

| 6.625% due 9/15/2016 | | 551,000 | | | 621,946 |

| | | | | | |

| Avon Products, Inc. | | | | | |

| 5.750% due 3/1/2018 | | 5,275,000 | | | 5,828,595 |

| 6.500% due 3/1/2019 | | 24,451,000 | | | 28,047,106 |

| 4.600% due 3/15/2020 | | 500,000 | | | 528,420 |

| | | | | | |

| Axis Capital Holdings | | | | | |

| 5.750% due 12/1/2014 | | 5,622,000 | | | 5,998,348 |

| | | | | | |

| Bank of America Corp. | | | | | |

| 4.750% due 8/15/2013 | | 590,000 | | | 594,742 |

| 4.750% due 8/15/2013 | | 20,000 | | | 20,116 |

| 7.375% due 5/15/2014 | | 926,000 | | | 982,701 |

| 5.375% due 6/15/2014 | | 50,000 | | | 52,242 |

| 5.350% due 9/15/2015 | | 549,000 | | | 591,692 |

| 5.250% due 12/1/2015 | | 333,000 | | | 359,570 |

| 5.625% due 10/14/2016 | | 935,000 | | | 1,053,072 |

| 6.000% due 8/15/2017 | | 115,000 | | | 132,234 |

| 6.050% due 8/15/2017 | | 948,000 | | | 1,072,456 |

| 5.750% due 12/1/2017 | | 555,000 | | | 635,555 |

| 5.350% due 3/15/2018 | | 81,000 | | | 88,933 |

| 5.800% due 2/15/2019 | | 10,000 | | | 11,358 |

| 7.625% due 6/1/2019 | | 730,000 | | | 919,474 |

| 6.400% due 8/15/2019 | | 141,000 | | | 163,210 |

See Notes to Financial Statements.

18

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| Principal | | | |

| Amount | | Value |

| BONDS (continued) | | | | | |

| | | | | | |

| Corporate Bonds (continued) | | | | | |

| Bank of America Corp. (continued) | | | | | |

| 6.750% due 8/15/2019 | $ | 671,000 | | $ | 791,948 |

| 4.625% due 3/30/2020 (b) | | 680,000 | | | 685,814 |

| 5.560% due 11/23/2020 (b) | | 85,000 | | | 85,683 |

| | | | | | |

| Bear Stearns Cos. LLC | | | | | |

| 5.300% due 9/15/2013 | | 20,000 | | | 20,273 |

| 2.920% due 3/10/2014 (a) | | 270,000 | | | 271,296 |

| 2.870% due 4/10/2014 (a) | | 100,000 | | | 100,051 |

| | | | | | |

| Best Buy Co., Inc. | | | | | |

| 7.250% due 7/15/2013 (a) | | 570,000 | | | 572,850 |

| 3.750% due 3/15/2016 | | 17,902,000 | | | 18,125,775 |

| | | | | | |

| Bio-Rad Laboratories, Inc. | | | | | |

| 8.000% due 9/15/2016 | | 21,770,000 | | | 23,016,703 |

| | | | | | |

| Black Hills Corp. | | | | | |

| 9.000% due 5/15/2014 | | 2,452,000 | | | 2,624,214 |

| | | | | | |

| BMC Software, Inc. | | | | | |

| 7.250% due 6/1/2018 | | 26,928,000 | | | 29,158,258 |

| | | | | | |

| Boston Properties LP | | | | | |

| 5.625% due 4/15/2015 | | 331,000 | | | 359,475 |

| | | | | | |

| Boston Scientific Corp. | | | | | |

| 5.450% due 6/15/2014 | | 1,471,000 | | | 1,540,742 |

| 6.250% due 11/15/2015 (a) | | 3,358,000 | | | 3,736,823 |

| | | | | | |

| Brinker International | | | | | |

| 5.750% due 6/1/2014 | | 9,512,000 | | | 9,980,466 |

| | | | | | |

| Brocade Communications | | | | | |

| Systems, Inc. | | | | | |

| 6.875% due 1/15/2020 | | 3,118,000 | | | 3,390,825 |

| | | | | | |

| CA, Inc. | | | | | |

| 6.125% due 12/1/2014 | | 1,614,000 | | | 1,729,704 |

| | | | | | |

| Capital One Financial | | | | | |

| 6.150% due 9/1/2016 | | 300,000 | | | 340,495 |

| | | | | | |

| Carpenter Technology Corp. | | | | | |

| 7.060% due 5/21/2018 | | 500,000 | | | 549,671 |

| 7.030% due 5/22/2018 | | 8,000 | | | 8,785 |

| | | | | | |

| Centel Capital Corp. | | | | | |

| 9.000% due 10/15/2019 | | 10,000 | | | 12,164 |

| | | | | | |

| CenterPoint Energy, Inc. | | | | | |

| 6.850% due 6/1/2015 | | 192,000 | | | 213,579 |

| | | | | | |

| Chesapeake & Potomac | | | | | |

| Telephone Co. | | | | | |

| 7.150% due 5/1/2023 | | 3,949,000 | | | 3,957,723 |

| 7.150% due 5/1/2023 | | 54,000 | | | 54,119 |

| | | | | | |

| Citigroup Funding, Inc. | | | | | |

| 4.250% due 12/15/2018 (b) | | 10,000 | | | 10,122 |

| 4.000% due 8/11/2020 (b) | | 180,000 | | | 184,310 |

| | | | | | |

| Citigroup, Inc. | | | | | |

| 6.500% due 8/19/2013 | | 1,463,000 | | | 1,480,875 |

| 6.000% due 12/13/2013 | | 3,620,000 | | | 3,722,707 |

| 5.125% due 5/5/2014 | | 3,000 | | | 3,118 |

| 5.000% due 9/15/2014 | | 7,085,000 | | | 7,411,363 |

| 6.010% due 1/15/2015 | | 244,000 | | | 262,674 |

| 4.875% due 5/7/2015 | | 115,000 | | | 122,055 |

| 5.500% due 2/15/2017 | | 180,000 | | | 200,040 |

| 6.125% due 11/21/2017 | | 1,269,000 | | | 1,484,474 |

| 6.125% due 5/15/2018 | | 176,000 | | | 207,507 |

| | | | | | |

| Cleveland Electric | | | | | |

| Illuminating Co. | | | | | |

| 5.650% due 12/15/2013 | | 332,000 | | | 340,631 |

| | | | | | |

| Cliffs Natural Resources Inc. | | | | | |

| 3.950% due 1/15/2018 | | 1,200,000 | | | 1,188,174 |

| 5.900% due 3/15/2020 | | 41,774,000 | | | 42,918,566 |

| 4.875% due 4/1/2021 | | 500,000 | | | 480,005 |

| | | | | | |

| CMS Energy Corp. | | | | | |

| 2.750% due 5/15/2014 | | 10,000 | | | 10,170 |

| | | | | | |

| CNA Financial Corp. | | | | | |

| 5.850% due 12/15/2014 | | 1,552,000 | | | 1,658,472 |

| 6.500% due 8/15/2016 | | 1,250,000 | | | 1,426,645 |

| 6.950% due 1/15/2018 | | 605,000 | | | 707,286 |

| | | | | | |

| Commercial Net Lease | | | | | |

| Realty, Inc. | | | | | |

| 6.250% due 6/15/2014 | | 1,060,000 | | | 1,097,004 |

| 6.150% due 12/15/2015 | | 443,000 | | | 498,619 |

See Notes to Financial Statements.

19

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| Principal | | | |

| Amount | | Value |

| BONDS (continued) | | | | | |

| | | | | | |

| Corporate Bonds (continued) | | | | | |

| Commonwealth Edison Co. | | | | | |

| 7.500% due 7/1/2013 | $ | 37,000 | | $ | 37,183 |

| | | | | | |

| Computer Sciences Corp. | | | | | |

| 6.500% due 3/15/2018 | | 19,477,000 | | | 22,502,343 |

| | | | | | |

| Con-way Inc. | | | | | |

| 7.250% due 1/15/2018 | | 13,089,000 | | | 15,212,559 |

| | | | | | |

| Cooperatieve Centrale Raiffeisen- | | | | | |

| Boerenleenbank B.A. | | | | | |

| 2.000% due 1/15/2014 | | 25,000 | | | 25,087 |

| | | | | | |

| Countrywide Financial Corp. | | | | | |

| 5.000% due 5/11/2015 | | 30,000 | | | 29,481 |

| 5.750% due 6/24/2015 (b) | | 560,000 | | | 560,302 |

| 6.500% due 7/28/2015 (b) | | 138,000 | | | 137,662 |

| 6.250% due 5/15/2016 | | 952,000 | | | 1,057,386 |

| 5.250% due 5/27/2020 | | 218,000 | | | 215,503 |

| 6.000% due 8/26/2020 (b) | | 117,000 | | | 116,227 |

| | | | | | |

| Countrywide Home Loans, Inc. | | | | | |

| 6.000% due 1/24/2018 | | 1,077,000 | | | 1,066,876 |

| 5.500% due 5/16/2018 | | 240,000 | | | 237,064 |

| | | | | | |

| Coventry Health Care, Inc. | | | | | |

| 6.300% due 8/15/2014 | | 8,184,000 | | | 8,703,668 |

| 6.125% due 1/15/2015 | | 1,136,000 | | | 1,224,991 |

| 5.950% due 3/15/2017 | | 854,000 | | | 978,605 |

| | | | | | |

| Crane Co. | | | | | |

| 5.500% due 9/15/2013 | | 75,000 | | | 75,869 |

| | | | | | |

| CRH America, Inc. | | | | | |

| 5.300% due 10/15/2013 | | 10,000 | | | 10,167 |

| | | | | | |

| Darden Restaurants | | | | | |

| 7.125% due 2/1/2016 | | 136,000 | | | 153,154 |

| | | | | | |

| Dean Witter Discover & Co. | | | | | |

| 6.750% due 10/15/2013 | | 287,000 | | | 293,458 |

| | | | | | |

| Dell Inc. | | | | | |

| 1.400% due 9/10/2013 | | 5,942,000 | | | 5,946,635 |

| | | | | | |

| Discover Financial Services | | | | | |

| 6.450% due 6/12/2017 | | 590,000 | | | 683,832 |

| 10.250% due 7/15/2019 | | 7,870,000 | | | 10,290,222 |

| | | | | | |

| Domtar Corp. | | | | | |

| 9.500% due 8/1/2016 | | 580,000 | | | 693,105 |

| 10.750% due 6/1/2017 | | 17,379,000 | | | 22,116,672 |

| | | | | | |

| Dow Chemical Co. | | | | | |

| 4.300% due 6/15/2013 | | 35,000 | | | 35,029 |

| 6.850% due 8/15/2013 | | 335,000 | | | 338,892 |

| 5.900% due 2/15/2015 | | 650,000 | | | 705,442 |

| 4.150% due 12/15/2017 | | 65,000 | | | 65,043 |

| 5.000% due 9/15/2020 | | 105,000 | | | 105,311 |

| 5.050% due 9/15/2020 | | 197,000 | | | 197,610 |

| 4.500% due 6/15/2021 | | 25,000 | | | 25,003 |

| | | | | | |

| Duke Energy Corp. | | | | | |

| 5.650% due 6/15/2013 | | 192,000 | | | 192,275 |

| | | | | | |

| Duquesne Light Holdings Inc. | | | | | |

| 5.500% due 8/15/2015 | | 6,799,000 | | | 7,391,478 |

| | | | | | |

| Enbridge Energy Partners, L.P. | | | | | |

| 4.750% due 6/1/2013 | | 25,000 | | | 25,000 |

| | | | | | |

| Endurance Specialty | | | | | |

| Holdings Ltd. | | | | | |

| 6.150% due 10/15/2015 | | 6,158,000 | | | 6,787,908 |

| | | | | | |

| Enel Finance Int’l. N.V. | | | | | |

| 6.250% due 9/15/2017 (d) | | 2,706,000 | | | 3,050,420 |

| 5.125% due 10/7/2019 (d) | | 5,000,000 | | | 5,412,250 |

| 5.125% due 10/7/2019 | | 500,000 | | | 541,225 |

| | | | | | |

| Energy Transfer Partners, L.P. | | | | | |

| 6.000% due 7/1/2013 | | 1,001,000 | | | 1,004,379 |

| 8.500% due 4/15/2014 | | 278,000 | | | 295,952 |

| | | | | | |

| Entergy New Orleans, Inc. | | | | | |

| 5.250% due 8/1/2013 | | 32,000 | | | 32,184 |

| | | | | | |

| Exelon Generation Co., LLC | | | | | |

| 5.350% due 1/15/2014 | | 122,000 | | | 125,463 |

| | | | | | |

| Expedia, Inc. | | | | | |

| 7.456% due 8/15/2018 | | 17,549,000 | | | 20,676,618 |

| | | | | | |

| Fairfax Financial Holdings Ltd. | | | | | |

| 8.250% due 10/1/2015 | | 1,904,000 | | | 2,172,626 |

| 7.375% due 4/15/2018 | | 17,937,000 | | | 20,796,463 |

| 5.800% due 5/15/2021 (d) | | 12,040,000 | | | 12,697,023 |

See Notes to Financial Statements.

20

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| Principal | | | |

| Amount | | Value |

| BONDS (continued) | | | | | |

| | | | | | |

| Corporate Bonds (continued) | | | | | |

| Fidelity National Financial, Inc. | | | | | |

| 6.600% due 5/15/2017 | $ | 15,861,000 | | $ | 17,790,364 |

| | | | | | |

| Fidelity National Information | | | | | |

| Services, Inc. | | | | | |

| 7.875% due 7/15/2020 | | 16,273,000 | | | 18,234,580 |

| | | | | | |

| First Horizon National Corp. | | | | | |

| 5.375% due 12/15/2015 | | 895,000 | | | 977,902 |

| | | | | | |

| First Tennessee Bank | | | | | |

| 5.050% due 1/15/2015 | | 2,757,000 | | | 2,899,959 |

| 5.650% due 4/1/2016 | | 5,247,000 | | | 5,727,930 |

| | | | | | |

| Fortune Brands, Inc. | | | | | |

| 4.875% due 12/1/2013 | | 239,000 | | | 243,575 |

| 5.375% due 1/15/2016 | | 10,000 | | | 10,992 |

| | | | | | |

| Frontier Oil Corp. | | | | | |

| 6.875% due 11/15/2018 | | 1,920,000 | | | 2,083,200 |

| | | | | | |

| GATX Corp. | | | | | |

| 8.750% due 5/15/2014 | | 135,000 | | | 144,902 |

| | | | | | |

| Gazprom OAO Via Gaz | | | | | |

| Capital S.A. | | | | | |

| 8.125% due 7/31/2014 (d) | | 24,896,000 | | | 26,735,814 |

| 4.950% due 5/23/2016 (d) | | 5,000,000 | | | 5,343,200 |

| 9.250% due 4/23/2019 (d) | | 1,500,000 | | | 1,908,750 |

| | | | | | |

| General Electric Capital Corp. | | | | | |

| 4.150% due 6/15/2013 | | 19,000 | | | 19,014 |

| 5.600% due 7/15/2014 | | 500,000 | | | 524,602 |

| 5.250% due 6/15/2015 | | 25,000 | | | 26,879 |

| 5.400% due 6/15/2015 | | 59,000 | | | 63,525 |

| 5.500% due 8/15/2015 | | 30,000 | | | 32,719 |

| 5.450% due 1/15/2016 | | 49,000 | | | 49,174 |

| 5.000% due 4/15/2016 | | 45,000 | | | 49,186 |

| 4.750% due 3/15/2017 | | 395,000 | | | 397,007 |

| 5.000% due 3/15/2018 | | 182,000 | | | 180,645 |

| 5.000% due 3/15/2018 | | 128,000 | | | 127,993 |

| 6.750% due 4/15/2018 | | 373,000 | | | 445,199 |

| 6.300% due 5/15/2018 | | 1,790,000 | | | 2,095,766 |

| 6.000% due 7/15/2018 | | 57,000 | | | 66,289 |

| 6.000% due 7/15/2018 | | 39,000 | | | 45,153 |

| 5.450% due 7/15/2019 | | 50,000 | | | 50,121 |

| 5.500% due 7/15/2019 | | 16,000 | | | 16,038 |

| 6.150% due 7/15/2019 | | 80,000 | | | 78,759 |

| 5.750% due 1/15/2020 | | 110,000 | | | 110,393 |

| | | | | | |

| Genworth Financial Inc. | | | | | |

| 5.750% due 6/15/2014 | | 3,580,000 | | | 3,735,981 |

| 8.625% due 12/15/2016 | | 8,264,000 | | | 9,991,878 |

| 6.515% due 5/22/2018 | | 17,629,000 | | | 20,216,391 |

| 7.700% due 6/15/2020 | | 7,667,000 | | | 9,151,439 |

| 7.200% due 2/15/2021 | | 423,000 | | | 501,568 |

| | | | | | |

| Genworth Global | | | | | |

| Funding Trusts | | | | | |

| 5.500% due 6/15/2013 | | 260,000 | | | 259,998 |

| 5.350% due 7/15/2013 | | 32,000 | | | 32,108 |

| 5.250% due 8/15/2013 | | 33,000 | | | 33,188 |

| 5.000% due 9/15/2013 | | 20,000 | | | 20,148 |

| | | | | | |

| GFI Group Inc. | | | | | |

| 9.625% due 7/19/2018 (a) | | 551,000 | | | 542,735 |

| | | | | | |

| GMAC LLC | | | | | |

| 6.000% due 7/15/2013 | | 60,000 | | | 60,176 |

| 0.000% due 6/15/2015 (c) | | 1,250,000 | | | 1,175,250 |

| 6.350% due 2/15/2016 (b) | | 75,000 | | | 75,408 |

| 6.500% due 2/15/2016 (b) | | 100,000 | | | 100,182 |

| 6.500% due 9/15/2016 (b) | | 87,000 | | | 87,417 |

| 7.250% due 9/15/2017 | | 259,000 | | | 259,078 |

| | | | | | |

| Goldman Sachs Group, Inc. | | | | | |

| 4.750% due 7/15/2013 | | 386,000 | | | 387,779 |

| 5.400% due 4/30/2014 | | 45,000 | | | 46,745 |

| 5.625% due 1/15/2017 | | 565,000 | | | 627,735 |

| 5.950% due 1/18/2018 | | 9,647,000 | | | 11,123,859 |

| | | | | | |

| Great Plains Energy Inc. | | | | | |

| 6.875% due 9/15/2017 | | 30,000 | | | 35,511 |

| | | | | | |

| Harley-Davidson | | | | | |

| 15.000% due 2/1/2014 | | 500,000 | | | 544,063 |

| | | | | | |

| Harsco Corp. | | | | | |

| 5.125% due 9/15/2013 | | 146,000 | | | 147,767 |

| | | | | | |

| Hartford Financial Services | | | | | |

| 4.750% due 3/1/2014 | | 932,000 | | | 956,250 |

See Notes to Financial Statements.

21

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| Principal | | | |

| Amount | | Value |

| BONDS (continued) | | | | | |

| | | | | | |

| Corporate Bonds (continued) | | | | | |

| Hartford Life Insurance Co. | | | | | |

| 5.050% due 7/15/2013 | $ | 35,000 | | $ | 35,116 |

| | | | | | |

| Hasbro, Inc. | | | | | |

| 6.125% due 5/15/2014 | | 1,000,000 | | | 1,050,485 |

| | | | | | |

| HCP, Inc. | | | | | |

| 5.650% due 12/15/2013 | | 1,593,000 | | | 1,635,344 |

| 6.000% due 3/1/2015 | | 5,879,000 | | | 6,379,027 |

| 7.072% due 6/8/2015 | | 703,000 | | | 784,670 |

| | | | | | |

| Hewlett-Packard Co. | | | | | |

| 1.250% due 9/13/2013 | | 2,157,000 | | | 2,159,446 |

| 6.125% due 3/1/2014 | | 656,000 | | | 680,477 |

| 1.550% due 5/30/2014 | | 2,449,000 | | | 2,464,593 |

| 2.600% due 9/15/2017 | | 4,673,000 | | | 4,751,516 |

| 5.500% due 3/1/2018 | | 13,866,000 | | | 15,630,227 |

| | | | | | |

| Horace Mann Educators Corp. | | | | | |

| 6.850% due 4/15/2016 | | 8,370,000 | | | 9,245,109 |

| | | | | | |

| Hospitality Properties Trust | | | | | |

| 7.875% due 8/15/2014 | | 10,953,000 | | | 11,460,737 |

| 5.125% due 2/15/2015 | | 4,594,000 | | | 4,783,048 |

| 6.300% due 6/15/2016 | | 271,000 | | | 298,334 |

| 5.625% due 3/15/2017 | | 2,651,000 | | | 2,917,977 |

| 6.700% due 1/15/2018 | | 1,047,000 | | | 1,189,835 |

| | | | | | |

| Host Hotels & Resorts LP | | | | | |

| 5.875% due 6/15/2019 | | 230,000 | | | 252,960 |

| | | | | | |

| Howard Hughes | | | | | |

| Medical Institute | | | | | |

| 3.450% due 9/1/2014 | | 85,000 | | | 88,146 |

| | | | | | |

| HRPT Properties Trust | | | | | |

| 5.750% due 2/15/2014 | | 1,280,000 | | | 1,290,609 |

| 5.750% due 11/1/2015 | | 3,332,000 | | | 3,538,614 |

| 6.250% due 8/15/2016 | | 3,815,000 | | | 4,122,420 |

| 6.250% due 6/15/2017 | | 1,865,000 | | | 2,028,243 |

| 6.650% due 1/15/2018 | | 21,869,000 | | | 24,231,727 |

| | | | | | |

| HSBC Finance Corp. | | | | | |

| 4.750% due 7/15/2013 | | 347,000 | | | 348,630 |

| 5.350% due 7/15/2013 | | 91,000 | | | 91,421 |

| 5.750% due 7/15/2013 | | 549,000 | | | 551,924 |

| 3.610% due 9/15/2013 (a) | | 366,000 | | | 363,434 |

| 3.810% due 10/10/2013 (a) | | 331,000 | | | 326,793 |

| 1.850% due 12/15/2013 | | 33,000 | | | 33,178 |

| 3.590% due 1/10/2014 (a) | | 335,000 | | | 338,538 |

| 2.500% due 1/15/2014 | | 5,000 | | | 5,033 |

| 2.400% due 2/15/2014 | | 5,000 | | | 5,025 |

| 2.500% due 2/15/2014 | | 690,000 | | | 696,569 |

| 4.950% due 3/15/2014 | | 10,000 | | | 10,279 |

| 2.050% due 4/15/2014 | | 20,000 | | | 20,149 |

| 2.150% due 4/15/2014 | | 25,000 | | | 25,213 |

| 5.600% due 4/15/2014 | | 665,000 | | | 687,153 |

| 1.900% due 6/15/2014 | | 20,000 | | | 20,127 |

| 5.500% due 7/15/2014 | | 30,000 | | | 31,195 |

| 6.000% due 8/15/2014 | | 553,000 | | | 584,666 |

| 6.000% due 8/15/2014 | | 67,000 | | | 70,785 |

| 5.800% due 9/15/2014 | | 153,000 | | | 161,192 |

| 5.850% due 9/15/2014 | | 325,000 | | | 343,771 |

| 5.650% due 10/15/2014 | | 30,000 | | | 31,681 |

| 5.750% due 10/15/2014 | | 274,000 | | | 290,930 |

| 5.350% due 11/15/2014 | | 30,000 | | | 31,623 |

| 5.600% due 2/15/2018 | | 250,000 | | | 280,750 |

| | | | | | |

| HSBC USA Inc. | | | | | |

| 9.500% due 4/15/2014 | | 157,000 | | | 168,239 |

| | | | | | |

| Iberdrola Finance Ireland Ltd. | | | | | |

| 3.800% due 9/11/2014 (d) | | 6,000,000 | | | 6,186,120 |

| 5.000% due 9/11/2019 (d) | | 12,453,000 | | | 13,492,452 |

| | | | | | |

| Ingersoll-Rand | | | | | |

| 9.500% due 4/15/2014 | | 1,281,000 | | | 1,374,911 |

| | | | | | |

| Ingram Micro Inc. | | | | | |

| 5.250% due 9/1/2017 | | 1,000,000 | | | 1,080,773 |

| | | | | | |

| International Game Technology | | | | | |

| 7.500% due 6/15/2019 | | 383,000 | | | 453,354 |

| | | | | | |

| International Paper Co. | | | | | |

| 5.500% due 1/15/2014 | | 50,000 | | | 51,289 |

| 7.400% due 6/15/2014 | | 50,000 | | | 53,120 |

| | | | | | |

| Jabil Circuit, Inc. | | | | | |

| 7.750% due 7/15/2016 | | 6,632,000 | | | 7,626,800 |

| 8.250% due 3/15/2018 | | 9,015,000 | | | 10,908,150 |

| | | | | | |

| Janus Capital Group Inc. | | | | | |

| 6.119% due 4/15/2014 | | 40,000 | | | 40,628 |

See Notes to Financial Statements.

22

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2013 |

| Principal | | | |

| Amount | | Value |

| BONDS (continued) | | | | | |

| | | | | | |

| Corporate Bonds (continued) | | | | | |

| Jefferson-Pilot Corp. | | | | | |

| 4.750% due 1/30/2014 | $ | 4,063,000 | | $ | 4,170,869 |

| | | | | | |

| John Hancock Life Ins. Co. | | | | | |

| 4.800% due 10/15/2013 | | 5,000 | | | 5,054 |

| 4.750% due 11/15/2013 | | 5,000 | | | 5,065 |

| 5.000% due 12/15/2013 | | 5,000 | | | 5,083 |

| 5.450% due 9/15/2015 | | 201,000 | | | 215,218 |

| 5.450% due 10/15/2015 | | 29,000 | | | 31,194 |

| 5.500% due 11/15/2015 | | 75,000 | | | 80,675 |

| 5.250% due 12/15/2015 | | 25,000 | | | 26,777 |

| 5.500% due 12/15/2015 | | 25,000 | | | 26,929 |

| 5.000% due 4/15/2016 | | 60,000 | | | 64,183 |

| | | | | | |

| JPMorgan Chase & Co. | | | | | |

| 5.250% due 5/15/2018 | | 65,000 | | | 63,753 |

| 5.250% due 3/15/2019 | | 20,000 | | | 19,905 |

| 7.900% due 12/29/2099 (a) | | 8,684,000 | | | 10,138,570 |

| | | | | | |

| Korea Development Bank | | | | | |

| 5.750% due 9/10/2013 | | 30,000 | | | 30,375 |

| 8.000% due 1/23/2014 | | 583,000 | | | 608,116 |

| | | | | | |

| Lexmark International, Inc. | | | | | |

| 6.650% due 6/1/2018 | | 3,370,000 | | | 3,780,618 |

| | | | | | |

| Liberty Property LP | | | | | |

| 5.650% due 8/15/2014 | | 36,000 | | | 37,960 |

| | | | | | |

| Lincoln National Corp. | | | | | |

| 4.750% due 2/15/2014 | | 1,638,000 | | | 1,682,513 |

| | | | | | |

| Macy’s Retail Holdings, Inc. | | | | | |

| 7.625% due 8/15/2013 | | 56,000 | | | 56,693 |

| | | | | | |

| Manufacturers & Traders | | | | | |

| Trust Co. | | | | | |

| 5.585% due 12/28/2020 (a) | | 347,000 | | | 355,597 |

| | | | | | |

| Marriott International, Inc. | | | | | |

| 5.810% due 11/10/2015 | | 373,000 | | | 407,942 |

| | | | | | |

| Masco Corp. | | | | | |

| 7.125% due 8/15/2013 | | 4,402,000 | | | 4,446,020 |

| 4.800% due 6/15/2015 | | 1,475,000 | | | 1,552,107 |

| 6.125% due 10/3/2016 | | 4,502,000 | | | 5,038,737 |

| 5.850% due 3/15/2017 | | 2,899,000 | | | 3,215,278 |

| 6.625% due 4/15/2018 | | 11,640,000 | | | 13,215,649 |

| | | | | | |

| Maxim Integrated | | | | | |

| Products, Inc. | | | | | |

| 3.450% due 6/14/2013 | | 115,000 | | | 115,083 |

| | | | | | |

| Maytag Corp. | | | | | |

| 5.000% due 5/15/2015 | | 50,000 | | | 53,251 |

| | | | | | |

| MBIA Inc. | | | | | |

| 6.400% due 8/15/2022 | | 9,798,000 | | | 9,798,000 |

| | | | | | |

| MBNA Corp. | | | | | |

| 5.000% due 6/15/2015 | | 800,000 | | | 855,382 |

| | | | | | |

| McDonald’s Corp. | | | | | |

| 4.125% due 6/1/2013 | | 49,000 | | | 49,000 |

| | | | | | |

| McKesson Corp. | | | | | |

| 6.500% due 2/15/2014 | | 6,000 | | | 6,246 |

| | | | | | |

| Merrill Lynch & Co. | | | | | |

| 0.000% due 8/30/2013 (c) | | 260,000 | | | 259,226 |

| 5.000% due 2/3/2014 | | 259,000 | | | 266,290 |

| 5.450% due 7/15/2014 | | 1,082,000 | | | 1,132,589 |

| 5.000% due 1/15/2015 | | 343,000 | | | 362,994 |

| 5.300% due 9/30/2015 | | 1,712,000 | | | 1,859,307 |

| 6.050% due 5/16/2016 | | 3,000,000 | | | 3,332,628 |

| 6.400% due 8/28/2017 | | 3,048,000 | | | 3,544,086 |

| 6.875% due 4/25/2018 | | 233,000 | | | 277,547 |

| 6.500% due 7/15/2018 | | 2,668,000 | | | 3,142,482 |