UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4946

THOMPSON IM FUNDS, INC.

(Exact name of registrant as specified in charter)

918 Deming Way

Madison, Wisconsin 53717

(Address of principal executive offices)--(Zip code)

Jason L. Stephens

Chief Executive Officer

Thompson IM Funds, Inc.

918 Deming Way

Madison, Wisconsin 53717

(Name and address of agent for service)

With a copy to:

Fredrick G. Lautz, Esq.

Quarles & Brady LLP

411 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Registrant's telephone number, including area code: (608) 827-5700

Date of fiscal year end: November 30, 2016

Date of reporting period: May 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W., Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

THOMPSON IM FUNDS, INC.

SEMI-ANNUAL REPORT TO SHAREHOLDERS

NOTE ON FORWARD-LOOKING STATEMENTS

The matters discussed in this report may constitute forward-looking statements. These include any Advisor or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, investment styles, market sectors, interest rates, economic trends and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current Prospectus, other factors bearing on these reports include the accuracy of the Advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the Advisor or portfolio manager and the ability of the Advisor or portfolio manager to implement its strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks.

1

THOMPSON IM FUNDS, INC.

SEMI-ANNUAL REPORT TO SHAREHOLDERS

May 31, 2016

CONTENTS

| Page(s) |

| LARGECAP FUND | |

| Investment review | 3-5 |

| Schedule of investments | 6-8 |

| |

| MIDCAP FUND | |

| Investment review | 9-11 |

| Schedule of investments | 12-14 |

| |

| BOND FUND | |

| Investment review | 15-18 |

| Schedule of investments | 19-26 |

| |

| FUND EXPENSE EXAMPLES | 27 |

| |

| FINANCIAL STATEMENTS | |

| Statements of assets and liabilities | 28 |

| Statements of operations | 29 |

| Statements of changes in net assets | 30 |

| Notes to financial statements | 31-37 |

| Financial highlights | 38-40 |

| |

| ADDITIONAL INFORMATION | 41 |

This report contains information for existing shareholders of Thompson IM Funds, Inc. It

does not constitute an offer to sell. This Semi-Annual Report is authorized for distribution to prospective investors

only when preceded or accompanied by a Fund Prospectus, which contains information about

the Funds’ objectives and policies, risks, management, expenses and other information.

A Prospectus can be obtained by calling 1-800-999-0887.

Please read your Prospectus carefully.

2

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) |

| May 31, 2016 |

| Portfolio Managers |

| | James T. Evans, CFA |

| Jason L. Stephens, CFA |

| John W. Thompson, CFA |

Performance

The LargeCap Fund produced a total return of 0.86% for the six-month period ended May 31, 2016, as compared to its benchmark, the S&P 500 Index, which returned 1.93%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 05/31/16 |

| 1 Year | | 3 Year | | 5 Year | | 10 Year | |

| Thompson LargeCap Fund | -5.83% | | 7.68% | | 9.16% | | 3.84% | |

| S&P 500 Index | 1.72% | | 11.06% | | 11.67% | | 7.41% | |

Gross Expense Ratio as of 03/31/16 was 1.22%.

Net Expense Ratio after reimbursement as of 03/31/16 was 1.13%.*

| * | The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the LargeCap Fund through March 31, 2017, so that the annual operating expenses of the Fund do not exceed 1.13% of its average daily net assets. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and has been licensed for use by Thompson Investment Management, Inc. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). The Thompson IM Funds are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates, and none of S&P Dow Jones Indices LLC, Dow Jones, S&P nor their respective affiliates makes any representation regarding the advisability of investing in such products.

See Notes to Financial Statements.

3

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

Management Commentary

The performance of the LargeCap Fund during the semi-annual period was largely driven by two competing effects, one negative and one positive. While we are hopeful the first one is temporary, we are encouraged by the second one as it validates a central element of our strategy.

First, on the negative side, the yield on the 10-year Treasury declined from 2.207% at the start of the period to 1.847% by the end. The Fund has an underweight positioning in stocks that tend to benefit from lower interest rates. This was most evident within our sector selection, as the Fund is underweight Telecom, Utilities and Consumer Staples, sectors that widely outperformed the benchmark return. This impact also was apparent through issue selection within Financials, as the Fund’s holdings in bank and lending-related firms lagged the returns of real estate investment trust (REITs) and other industries that typically benefit from lower rates. We remain convinced the long run direction of interest rates should not be permanently down, and thus are wary of owning stocks that in our opinion are very expensive and require further declines in rates to provide attractive returns. We believe less risky opportunities lie elsewhere.

On the positive side, offsetting this interest rate related weakness was solid issue selection, especially within the Materials, Technology, Energy and Industrials sectors. No single name contributed to the Fund’s return in an outsized manner, but a common theme was evident in that the best performing stocks for the Fund within the semi-annual period in many cases had been laggards in prior time periods. A level of patience, and in some cases a willingness to acquire additional shares of the stock even as the price declined, helped shareholders in these stocks.

The outperforming stocks of the semi-annual period for the Fund highlight an important part of our investment strategy. We believe it is important to view each holding on an individual fundamental basis, and not automatically selling a name once it has declined if we feel the source of the underperformance is more temporary in nature. Permanent impairment in contrast generally warrants a sale regardless of prior stock price weakness. While we will not always be right in distinguishing between temporary and permanent problems, we believe the risk/reward profile of continuing to hold such stocks skews in our favor. This is because the stocks already reflect a pessimistic outlook. Assuming we have adequately screened out holdings that have a materially higher bankruptcy/going concern issue, the downside to owning such stocks and being wrong is often more the opportunity cost of not owning a different name rather than a further price decline. The benefit to being right can often vastly outpace the returns available elsewhere.

While we obviously prefer owning companies that never experience these hiccups, ideally increasing in value alongside a steady gain in earnings, the reality is most firms have issues from time to time. As portfolio managers these issues are hard to predict, as often they are fairly minor in nature. Thus it is how we react to them that may create an opportunity for shareholders to benefit. Going back to the market bottom in 2009, many of the Fund’s biggest winners of the past 7 plus years on a relative basis were relative losers at some point after their purchase. If as portfolio managers we make good decisions regarding our holdings, this pattern will hopefully continue into the future as well.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, tax, and other laws. A REIT’s share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 6 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Yield is the income earned from a bond, which takes into account the sum of the interest payment, the redemption value at the bond’s maturity, and the initial purchase price of the bond.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the Fund’s future returns.

See Notes to Financial Statements.

4

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

| Top 10 Equity Holdings at 05/31/16 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| Exxon Mobil Corp. | Oil, Gas & Consumable Fuels | 3.13% |

| Alphabet, Inc. Class A | Internet Software & Services | 2.76% |

| Microsoft Corp. | Software | 2.51% |

| Bank of America Corp. | Banks | 2.33% |

| Viacom Inc. Class B | Media | 2.23% |

| Chevron Corp. | Oil, Gas & Consumable Fuels | 2.21% |

| JPMorgan Chase & Co. | Banks | 2.17% |

| Citigroup Inc. | Banks | 2.14% |

| Cisco Systems, Inc. | Communications Equipment | 2.10% |

| Express Scripts Holding Co. | Health Care Providers & Services | 2.09% |

As of May 31, 2016, 99.7% of the Fund’s net assets were in equity and short-term investments.

See Notes to Financial Statements.

5

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2016 |

| | | | | Shares | | Value |

| COMMON STOCKS - 99.7% | | | | | |

| | | | | | |

| Consumer Discretionary - 16.4% | | | | | |

| | Auto Components - 1.6% | | | | | |

| | Johnson Controls, Inc. | | 39,100 | | $ | 1,726,265 |

| | |

| | Automobiles - 1.0% | | | | | |

| | Harley-Davidson, Inc. | | 23,625 | | | 1,095,964 |

| | |

| | Distributors - 1.0% | | | | | |

| | LKQ Corp. (a) | | 33,075 | | | 1,093,790 |

| | |

| | Household Durables - 1.3% | | | | | |

| | D.R. Horton, Inc. | | 21,225 | | | 648,636 |

| | TopBuild Corp. (a) | | 19,602 | | | 708,416 |

| | | | | | | 1,357,052 |

| | Leisure Products - 1.1% | | | | | |

| | Brunswick Corp. | | 23,750 | | | 1,136,912 |

| | |

| | Media - 5.8% | | | | | |

| | CBS Corp. Class B | | 30,375 | | | 1,676,700 |

| | The Walt Disney Co. | | 10,500 | | | 1,041,810 |

| | Time Warner Inc. | | 15,425 | | | 1,167,055 |

| | Viacom Inc. Class B | | 54,125 | | | 2,401,526 |

| | | | | | | 6,287,091 |

| | Multiline Retail - 2.6% | | | | | |

| | Kohl’s Corp. | | 30,035 | | | 1,082,461 |

| | Target Corp. | | 24,910 | | | 1,713,310 |

| | | | | | | 2,795,771 |

| | Specialty Retail - 1.5% | | | | | |

| | Bed Bath & Beyond Inc. | | 26,175 | | | 1,171,331 |

| | Lumber Liquidators Holdings, Inc. (a) | | 36,650 | | | 480,115 |

| | | | | | | 1,651,446 |

| | Textiles, Apparel & Luxury | | | | | |

| | Goods - 0.5% | | | | | |

| | Hanesbrands, Inc. | | 19,200 | | | 519,744 |

| | |

| Consumer Staples - 5.3% | | | | | |

| | Food & Staples Retailing - 3.8% | | | | | |

| | CVS Health Corp. | | 10,475 | | | 1,010,314 |

| | Walgreens Boots Alliance, Inc. | | 26,725 | | | 2,068,515 |

| | Wal-Mart Stores, Inc. | | 14,600 | | | 1,033,388 |

| | | | | | | 4,112,217 |

| | Household Products - 1.5% | | | | | |

| | Kimberly-Clark Corp. | | 5,568 | | | 707,359 |

| | The Procter & Gamble Co. | | 11,850 | | | 960,324 |

| | | | | | | 1,667,683 |

| Energy - 11.9% | | | | | |

| | Energy Equipment & | | | | | |

| | Services - 1.4% | | | | | |

| | Schlumberger Ltd. | | 20,369 | | | 1,554,155 |

| | |

| | Oil, Gas & Consumable | | | | | |

| | Fuels - 10.5% | | | | | |

| | Apache Corp. | | 23,475 | | | 1,341,361 |

| | Chevron Corp. | | 23,595 | | | 2,383,095 |

| | Devon Energy Corp. | | 58,950 | | | 2,127,506 |

| | EOG Resources, Inc. | | 14,825 | | | 1,206,162 |

| | Exxon Mobil Corp. | | 37,895 | | | 3,373,413 |

| | Noble Energy, Inc. | | 24,950 | | | 891,962 |

| | | | | | | 11,323,499 |

| Financials - 17.3% | | | | | |

| | Banks - 12.4% | | | | | |

| | Associated Banc-Corp | | 65,415 | | | 1,222,606 |

| | Bank of America Corp. | | 169,625 | | | 2,508,754 |

| | CIT Group Inc. | | 42,550 | | | 1,457,763 |

| | Citigroup Inc. | | 49,575 | | | 2,308,708 |

| | First Horizon National Corp. | | 86,585 | | | 1,260,678 |

| | JPMorgan Chase & Co. | | 35,850 | | | 2,339,929 |

| | PNC Financial Services Group, Inc. | | 10,305 | | | 924,771 |

| | SunTrust Banks, Inc. | | 15,675 | | | 686,879 |

| | Zions Bancorporation | | 23,875 | | | 668,978 |

| | | | | | | 13,379,066 |

| | Capital Markets - 2.9% | | | | | |

| | Northern Trust Corp. | | 16,235 | | | 1,203,013 |

| | State Street Corp. | | 31,200 | | | 1,967,472 |

| | | | | | | 3,170,485 |

| | Consumer Finance - 0.6% | | | | | |

| | Discover Financial Services | | 10,620 | | | 603,322 |

| | |

| | Insurance - 1.0% | | | | | |

| | Aflac, Inc. | | 15,410 | | | 1,070,379 |

| | |

| | Real Estate Investment | | | | | |

| | Trusts - 0.4% | | | | | |

| | DiamondRock Hospitality Co. | | 45,475 | | | 406,547 |

See Notes to Financial Statements.

6

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| | | | | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| | | | | | |

| Health Care - 12.0% | | | | | |

| | Biotechnology - 5.9% | | | | | |

| | AbbVie Inc. | | 22,750 | | $ | 1,431,657 |

| | Amgen Inc. | | 6,990 | | | 1,104,071 |

| | Baxalta Inc. | | 12,160 | | | 549,997 |

| | Celgene Corp. (a) | | 18,075 | | | 1,907,274 |

| | Exact Sciences Corp. (a) | | 208,600 | | | 1,385,104 |

| | | | | | | 6,378,103 |

| | Health Care Equipment & | | | | | |

| | Supplies - 0.5% | | | | | |

| | Zimmer Biomet Holdings, Inc. | | 4,400 | | | 537,284 |

| | |

| | Health Care Providers & | | | | | |

| | Services - 4.6% | | | | | |

| | Express Scripts Holding Co. (a) | | 29,800 | | | 2,251,390 |

| | Hanger, Inc. (a) | | 82,300 | | | 529,189 |

| | McKesson Corp. | | 11,710 | | | 2,144,569 |

| | | | | | | 4,925,148 |

| | Pharmaceuticals - 1.0% | | | | | |

| | Johnson & Johnson | | 9,210 | | | 1,037,875 |

| | |

| Industrials - 11.5% | | | | | |

| | Air Freight & Logistics - 1.3% | | | | | |

| | FedEx Corp. | | 8,800 | | | 1,451,736 |

| | |

| | Airlines - 0.5% | | | | | |

| | Delta Air Lines, Inc. | | 12,975 | | | 563,894 |

| | |

| | Building Products - 1.5% | | | | | |

| | Masco Corp. | | 49,975 | | | 1,631,184 |

| | |

| | Electrical Equipment - 3.0% | | | | | |

| | ABB Ltd. ADR | | 89,475 | | | 1,859,290 |

| | Rockwell Automation, Inc. | | 11,475 | | | 1,331,674 |

| | | | | | | 3,190,964 |

| | Industrial Conglomerates - 2.8% | | | | | |

| | General Electric Co. | | 66,500 | | | 2,010,295 |

| | 3M Co. | | 6,195 | | | 1,042,742 |

| | | | | | | 3,053,037 |

| | Machinery - 1.5% | | | | | |

| | Illinois Tool Works Inc. | | 9,975 | | | 1,057,649 |

| | Ingersoll-Rand PLC | | 7,875 | | | 526,129 |

| | | | | | | 1,583,778 |

| | Trading Companies & | | | | | |

| | Distributors - 0.9% | | | | | |

| | HD Supply Holdings, Inc. (a) | | 26,550 | | | 937,215 |

| | | | | | | |

| Information Technology - 23.8% | | | | | |

| | Communications | | | | | |

| | Equipment - 3.7% | | | | | |

| | Cisco Systems, Inc. | | 77,885 | | | 2,262,559 |

| | Lumentum Holdings Inc. (a) | | 29,807 | | | 755,309 |

| | Viavi Solutions Inc. (a) | | 149,535 | | | 1,021,324 |

| | | | | | | 4,039,192 |

| | Electronic Equipment, | | | | | |

| | Instruments & | | | | | |

| | Components - 1.9% | | | | | |

| | Corning Inc. | | 73,475 | | | 1,534,893 |

| | Maxwell Technologies, Inc. (a) | | 93,997 | | | 501,004 |

| | | | | | | 2,035,897 |

| | Internet Software & | | | | | |

| | Services - 3.2% | | | | | |

| | Alphabet, Inc. Class A (a) | | 3,982 | | | 2,981,921 |

| | eBay Inc. (a) | | 21,070 | | | 515,372 |

| | | | | | | 3,497,293 |

| | IT Services - 3.2% | | | | | |

| | Alliance Data Systems Corp. (a) | | 8,075 | | | 1,794,184 |

| | PayPal Holdings, Inc. (a) | | 30,270 | | | 1,143,903 |

| | Visa Inc. Class A | | 6,625 | | | 522,978 |

| | | | | | | 3,461,065 |

| | Semiconductors & | | | | | |

| | Semiconductor | | | | | |

| | Equipment - 5.6% | | | | | |

| | Intel Corp. | | 31,275 | | | 987,977 |

| | Linear Technology Corp. | | 16,870 | | | 798,288 |

| | Maxim Integrated Products, Inc. | | 21,555 | | | 818,228 |

| | NXP Semiconductors N.V. (a) | | 13,675 | | | 1,292,151 |

| | Qualcomm, Inc. | | 39,980 | | | 2,195,702 |

| | | | | | | 6,092,346 |

| | Software - 4.2% | | | | | |

| | Microsoft Corp. | | 51,201 | | | 2,713,653 |

| | Oracle Corp. | | 44,150 | | | 1,774,830 |

| | | | | | | 4,488,483 |

| | Technology Hardware, Storage | | | | | |

| | & Peripherals - 2.0% | | | | | |

| | EMC Corp. | | 38,675 | | | 1,080,966 |

| | Hewlett Packard Enterprise Co. | | 31,125 | | | 574,879 |

| | HP Inc. | | 38,025 | | | 508,775 |

| | | | | | | 2,164,620 |

| Materials - 1.5% | | | | | |

| | Metals & Mining - 1.5% | | | | | |

| | Freeport-McMoRan Inc. (a) | | 143,625 | | | 1,591,365 |

| | |

| | TOTAL COMMON STOCKS | | | | | |

| | (COST $113,247,603) | | | | | 107,611,867 |

See Notes to Financial Statements.

7

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| Shares | | Value |

| SHORT-TERM INVESTMENTS - 0.0% | | | | |

| | | | | |

| Money Market Funds - 0.0% | | | | |

| Fidelity Money Market Portfolio | | | | |

| Class I, 0.335% (b) | 421 | | $ | 421 |

| | | | | |

| Total Money Market Funds | | | | 421 |

| | | | | |

| TOTAL SHORT-TERM | | | | |

| INVESTMENTS (COST $421) | | | | 421 |

| | | | | |

| TOTAL INVESTMENTS - 99.7% | | | | |

| (COST $113,248,024) | | | | 107,612,288 |

| | | | | |

| NET OTHER ASSETS AND | | | | |

| LIABILITIES - 0.3% | | | | 290,406 |

| | | | | |

| NET ASSETS - 100.0% | | | $ | 107,902,694 |

| | (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at May 31, 2016. |

| |

| | |

| | ADR: | American Depositary Receipt |

| | N.V.: | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| | PLC: | Public Limited Company |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management, Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect thereto or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

8

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) |

| May 31, 2016 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

Performance

The MidCap Fund produced a total return of 0.64% for the six-month period ended May 31, 2016, as compared to its benchmark, the Russell Midcap Index, which returned 2.21%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 05/31/16 |

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(03/31/08) | |

| Thompson MidCap Fund | | -7.13% | | 6.74% | | 7.71% | | 8.71% | |

| Russell Midcap Index | | -1.97% | | 10.19% | | 10.33% | | 9.31% | |

Gross Expense Ratio as of 03/31/16 was 1.49%.

Net Expense Ratio after reimbursement as of 03/31/16 was 1.25%.*| * | The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the MidCap Fund through March 31, 2017, so that the annual operating expenses of the Fund do not exceed 1.25% of its average daily net assets. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index based on total market capitalization. You cannot directly invest in an index.

Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

See Notes to Financial Statements.

9

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

Management Commentary

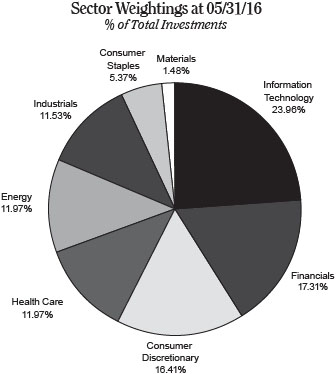

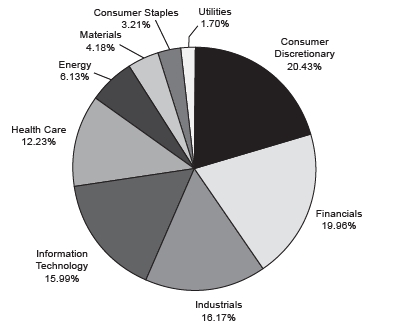

The MidCap Fund’s performance lag over this time period was primarily driven by a key characteristic of the portfolio’s current composition.

The Fund is positioned for a rising rate environment. In this scenario, securities that investors use as substitutes for long maturity bonds tend to underperform. However, interest rates generally declined over the last six months, and these bond substitutes therefore performed well. For example, the Fund’s low allocation to the Utility Sector relative to the benchmark hurt its performance, as this sector contains a disproportionate number of bond substitutes relative to the overall market. Also, the portfolio is allocated more heavily to banks within the Financial Sector and has a low weighting in real estate investment trusts (REITs) relative to its benchmark. Banks typically benefit from rising rates, while REITs do not. Again, as interest rates declined over the timeframe described in this report, the portfolio’s positioning within the Financial Sector subtracted from relative performance.

Security selection was strong across most sectors and added to relative performance. It was, however, not strong enough to overcome the impact of declining interest rates on the portfolio. This relationship isn’t just a direct one. To a large degree, short-term interest rate movements appear to have been closely correlated to changes in investor sentiment with respect to the health of the global economy and the ability of companies to grow earnings. An increase in interest rates as signaled by a less accommodative Federal Reserve Open Market Committee would likely reflect positive sentiment on this front and correlate with an increase in investor risk appetite. Because the Fund’s portfolio construction anticipates at least a moderately growing U.S. economy, an increase in interest rates could translate to an appreciation in even those sectors not directly impacted by changes in interest rates. It is an interesting time, to be sure, considering that in most scenarios historically a rise in interest rates has depressed stock prices to some extent.

Though the focus of this commentary has been on macroeconomic trends and their impact on the Fund, we must be clear that the portfolio’s makeup is still primarily driven by bottom-up fundamental analysis. We simply are finding value and growth opportunities in those areas of the market that are currently less loved, like banks, and are increasingly concerned about the downside risk of securities that act like bond substitutes.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Midcap companies tend to have more limited liquidity and greater volatility than large-capitalization companies. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, tax, and other laws. A REIT’s share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 12 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Correlation is a statistical measure of the degree to which the movements of two variables (stock/option/convertible prices or returns) are related.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the fund’s future returns.

See Notes to Financial Statements.

10

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

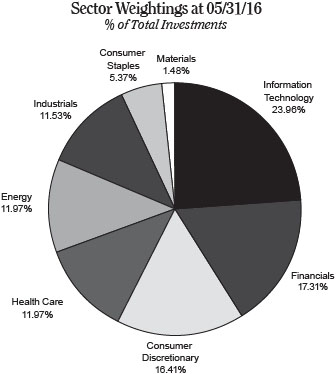

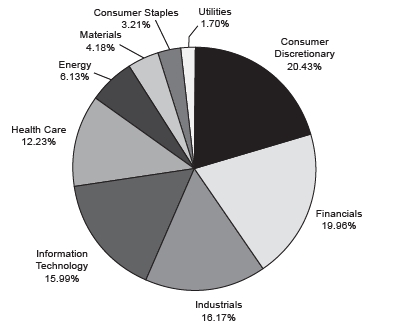

Sector Weightings at 05/31/16

% of Total Investments

| Top 10 Equity Holdings at 05/31/16 |

| Company | Industry | % of Fund’s

Net Assets |

| Alliance Data Systems Corp. | IT Services | 2.23% |

| First Horizon National Corp. | Banks | 2.19% |

| CIT Group Inc. | Banks | 2.07% |

| Northern Trust Corp. | Capital Markets | 1.93% |

| Bed Bath & Beyond Inc. | Specialty Retail | 1.89% |

| Associated Banc-Corp | Banks | 1.83% |

| NXP Semiconductors N.V. | Semiconductors & Semiconductor Equipment | 1.78% |

| Exact Sciences Corp. | Biotechnology | 1.76% |

| Ingersoll-Rand PLC | Machinery | 1.73% |

| Urban Outfitters, Inc. | Specialty Retail | 1.69% |

As of May 31, 2016, 100.0% of the Fund’s net assets were in equity and short-term investments.

See Notes to Financial Statements.

11

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2016 |

| Shares | | Value |

| COMMON STOCKS - 99.9% | | | | |

| | | | | |

| Consumer Discretionary - 20.4% | | | | |

| Automobiles - 1.3% | | | | |

| Harley-Davidson, Inc. | 10,500 | | $ | 487,095 |

| |

| Distributors - 1.5% | | | | |

| LKQ Corp. (a) | 17,720 | | | 586,000 |

| |

| Household Durables - 5.0% | | | | |

| D.R. Horton, Inc. | 13,575 | | | 414,852 |

| Newell Brands, Inc. | 8,656 | | | 412,805 |

| PulteGroup Inc. | 21,125 | | | 396,305 |

| Toll Brothers, Inc. (a) | 7,125 | | | 207,694 |

| TopBuild Corp. (a) | 13,250 | | | 478,855 |

| | | | | 1,910,511 |

| Leisure Products - 1.3% | | | | |

| Brunswick Corp. | 10,075 | | | 482,290 |

| |

| Multiline Retail - 1.9% | | | | |

| Kohl’s Corp. | 15,785 | | | 568,891 |

| Nordstrom, Inc. | 4,800 | | | 182,304 |

| | | | | 751,195 |

| Specialty Retail - 4.9% | | | | |

| Bed Bath & Beyond Inc. | 16,330 | | | 730,767 |

| Chico’s FAS, Inc. | 15,325 | | | 166,276 |

| Lumber Liquidators Holdings, Inc. (a) | 27,300 | | | 357,630 |

| Urban Outfitters, Inc. (a) | 22,900 | | | 653,337 |

| | | | | 1,908,010 |

| Textiles, Apparel & | | | | |

| Luxury Goods - 4.5% | | | | |

| Coach, Inc. | 11,555 | | | 455,498 |

| Hanesbrands, Inc. | 21,385 | | | 578,892 |

| Michael Kors Holdings Ltd. (a) | 7,625 | | | 325,740 |

| Skechers U.S.A., Inc. Class A (a) | 12,625 | | | 393,521 |

| | | | | 1,753,651 |

| Consumer Staples - 3.2% | | | | |

| Food Products - 3.2% | | | | |

| Ingredion Inc. | 1,475 | | | 173,180 |

| Inventure Foods, Inc. (a) | 62,375 | | | 467,189 |

| The Hain Celestial Group, Inc. (a) | 6,650 | | | 328,776 |

| The J. M. Smucker Co. | 2,080 | | | 268,632 |

| | | | | 1,237,777 |

| Energy - 6.1% | | | | |

| Energy Equipment & | | | | |

| Services - 1.4% | | | | |

| FMC Technologies, Inc. (a) | 13,125 | | | 357,394 |

| Helmerich & Payne, Inc. | 3,235 | | | 197,820 |

| | | | | 555,214 |

| Oil, Gas & Consumable | | | | |

| Fuels - 4.7% | | | | |

| Cameco Corp. | 14,775 | | | 171,833 |

| Devon Energy Corp. | 11,850 | | | 427,666 |

| Noble Energy, Inc. | 17,375 | | | 621,156 |

| Pioneer Natural Resources Co. | 1,675 | | | 268,536 |

| Southwestern Energy Co. (a) | 23,350 | | | 319,195 |

| | | | | 1,808,386 |

| Financials - 20.0% | | | | |

| Banks - 9.2% | | | | |

| Associated Banc-Corp | 37,805 | | | 706,575 |

| CIT Group Inc. | 23,305 | | | 798,429 |

| First Horizon National Corp. | 57,970 | | | 844,043 |

| Regions Financial Corp. | 22,135 | | | 217,587 |

| SunTrust Banks, Inc. | 10,495 | | | 459,891 |

| Zions Bancorporation | 19,035 | | | 533,361 |

| | | | | 3,559,886 |

| Capital Markets - 3.0% | | | | |

| Eaton Vance Corp. | 11,295 | | | 410,686 |

| Northern Trust Corp. | 10,030 | | | 743,223 |

| | | | | 1,153,909 |

| Consumer Finance - 1.3% | | | | |

| Discover Financial Services | 8,829 | | | 501,575 |

| |

| Insurance - 2.0% | | | | |

| Cincinnati Financial Corp. | 4,215 | | | 291,257 |

| Unum Group | 12,655 | | | 467,223 |

| | | | | 758,480 |

| Real Estate Investment | | | | |

| Trusts - 3.4% | | | | |

| Annaly Capital Management Inc. | 36,375 | | | 384,848 |

| DiamondRock Hospitality Co. | 35,450 | | | 316,923 |

| Host Hotels & Resorts Inc. | 20,435 | | | 314,699 |

| LaSalle Hotel Properties | 11,920 | | | 275,471 |

| | | | | 1,291,941 |

| Thrifts & Mortgage | | | | |

| Finance - 1.1% | | | | |

| Flagstar Bancorp, Inc. (a) | 16,950 | | | 410,868 |

| |

| Health Care - 12.2% | | | | |

| Biotechnology - 2.9% | | | | |

| Exact Sciences Corp. (a) | 102,150 | | | 678,276 |

| MiMedx Group Inc. (a) | 55,475 | | | 436,588 |

| | | | 1,114,864 |

See Notes to Financial Statements.

12

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| | | | | |

| Health Care (continued) | | | | |

| Health Care Equipment & | | | | |

| Supplies - 2.9% | | | | |

| Hologic, Inc. (a) | 7,575 | | $ | 260,656 |

| Natus Medical Inc. (a) | 4,725 | | | 152,759 |

| ResMed Inc. | 5,446 | | | 321,641 |

| Zimmer Biomet Holdings, Inc. | 3,150 | | | 384,647 |

| | | | | 1,119,703 |

| Health Care Providers & | | | | |

| Services - 4.6% | | | | |

| Envision Healthcare Holdings, Inc. (a) | 19,000 | | | 471,390 |

| Hanger, Inc. (a) | 61,269 | | | 393,960 |

| McKesson Corp. | 1,740 | | | 318,664 |

| Patterson Cos., Inc. | 12,480 | | | 609,149 |

| | | | | 1,793,163 |

| Life Sciences Tools & | | | | |

| Services - 0.4% | | | | |

| Fluidigm Corp. (a) | 16,200 | | | 159,408 |

| |

| Pharmaceuticals - 1.4% | | | | |

| Jazz Pharmaceuticals PLC (a) | 3,500 | | | 530,460 |

| |

| Industrials - 16.1% | | | | |

| Air Freight & Logistics - 1.4% | | | | |

| Expeditors Int’l. of Washington, Inc. | 11,500 | | | 558,325 |

| |

| Building Products - 3.1% | | | | |

| A.O. Smith Corp. | 2,500 | | | 205,750 |

| Masco Corp. | 19,925 | | | 650,352 |

| USG Corp. (a) | 12,125 | | | 349,928 |

| | | | | 1,206,030 |

| Electrical Equipment - 3.5% | | | | |

| Plug Power, Inc. (a) | 102,500 | | | 196,800 |

| Regal Beloit Corp. | 9,080 | | | 518,740 |

| Rockwell Automation, Inc. | 5,600 | | | 649,880 |

| | | | | 1,365,420 |

| Machinery - 5.6% | | | | |

| Allison Transmission Holdings, Inc. | 13,375 | | | 375,704 |

| Ingersoll-Rand PLC | 10,000 | | | 668,100 |

| Mueller Water Products, Inc. Class A | 33,700 | | | 371,037 |

| SPX Corp. (a) | 15,750 | | | 260,978 |

| SPX Flow, Inc. (a) | 15,750 | | | 472,027 |

| | | | | 2,147,846 |

| Trading Companies & | | | | |

| Distributors - 2.5% | | | | |

| HD Supply Holdings, Inc. (a) | 16,575 | | | 585,097 |

| W.W. Grainger, Inc. | 1,638 | | | 374,037 |

| | | | | 959,134 |

| Information Technology - 16.0% | | | | |

| Communications Equipment - 1.8% | | | | |

| Lumentum Holdings Inc. (a) | 10,156 | | | 257,353 |

| Viavi Solutions Inc. (a) | 62,281 | | | 425,379 |

| | | | 682,732 |

| Electronic Equipment, | | | | |

| Instruments & | | | | |

| Components - 1.6% | | | | |

| FARO Technologies, Inc. (a) | 5,800 | | | 205,262 |

| InvenSense Inc. (a) | 23,475 | | | 145,076 |

| Maxwell Technologies, Inc. (a) | 50,397 | | | 268,616 |

| | | | | 618,954 |

| Internet Software & | | | | |

| Services - 1.2% | | | | |

| Liquidity Services, Inc. (a) | 70,100 | | | 469,670 |

| |

| IT Services - 3.1% | | | | |

| Alliance Data Systems Corp. (a) | 3,875 | | | 860,986 |

| Fiserv, Inc. (a) | 3,019 | | | 317,991 |

| | | | | 1,178,977 |

| Semiconductors & | | | | |

| Semiconductor | | | | |

| Equipment - 5.2% | | | | |

| Cavium Inc. (a) | 7,650 | | | 380,588 |

| Linear Technology Corp. | 7,590 | | | 359,159 |

| Maxim Integrated Products, Inc. | 15,366 | | | 583,293 |

| NXP Semiconductors N.V. (a) | 7,250 | | | 685,052 |

| | | | | 2,008,092 |

| Software - 0.5% | | | | |

| Take-Two Interactive Software, Inc. (a) | 4,935 | | | 192,021 |

| |

| Technology Hardware, Storage | | | | |

| & Peripherals - 2.6% | | | | |

| CPI Card Group Inc. | 52,000 | | | 216,320 |

| Nimble Storage, Inc. (a) | 25,100 | | | 224,143 |

| Pure Storage, Inc. Class A (a) | 13,650 | | | 160,797 |

| Silicon Graphics Int’l. Corp. (a) | 42,825 | | | 225,260 |

| Stratasys Ltd. (a) | 3,900 | | | 88,998 |

| 3D Systems Corp. (a) | 7,550 | | | 101,095 |

| | | | | 1,016,613 |

| Materials - 4.2% | | | | |

| Chemicals - 2.0% | | | | |

| Ecolab Inc. | 3,156 | | | 370,009 |

| Int’l. Flavors & Fragrances Inc. | 2,960 | | | 381,840 |

| | | | | 751,849 |

| Metals & Mining - 2.2% | | | | |

| Freeport-McMoRan Inc. (a) | 50,550 | | | 560,094 |

| Lundin Mining Corp. (a) | 43,600 | | | 144,752 |

| Stillwater Mining Co. (a) | 15,200 | | | 153,824 |

| | | | | 858,670 |

See Notes to Financial Statements.

13

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| | | | | |

| Utilities - 1.7% | | | | |

| Multi-Utilities - 1.7% | | | | |

| MDU Resources Group, Inc. | 17,300 | | $ | 395,651 |

| SCANA Corp. | 3,750 | | | 262,163 |

| | | | | 657,814 |

| |

| TOTAL COMMON STOCKS | | | | |

| (COST $37,591,837) | | | | 38,546,533 |

| |

| SHORT-TERM INVESTMENTS - 0.1% | | | | |

| Money Market Funds - 0.1% | | | | |

| Fidelity Money Market Portfolio | | | | |

| Class I, 0.335% (b) | 22,394 | | | 22,394 |

| |

| Total Money Market Funds | | | | 22,394 |

| |

| TOTAL SHORT-TERM | | | | |

| INVESTMENTS (COST $22,394) | | | | 22,394 |

| |

| TOTAL INVESTMENTS - 100.0% | | | | |

| (COST $37,614,231) | | | | 38,568,927 |

| |

| NET OTHER ASSETS AND | | | | |

| LIABILITIES - 0.0% | | | | 8,093 |

| |

| NET ASSETS - 100.0% | | | $ | 38,577,020 |

| | (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at May 31, 2016. |

| | |

| | N.V.: | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| | PLC: | Public Limited Company |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management, Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect thereto or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

14

| BOND FUND INVESTMENT REVIEW (Unaudited) |

| May 31, 2016 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

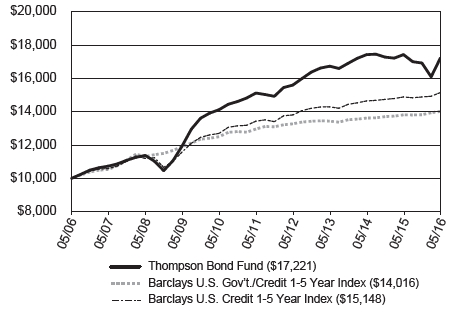

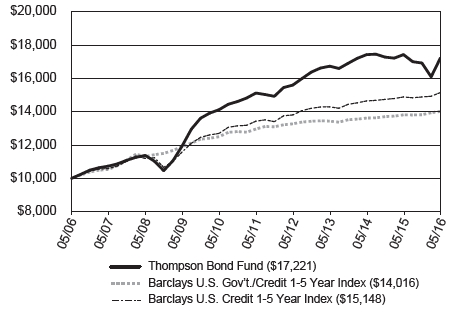

The Bond Fund produced a total return of 1.78% for the six-month period ended May 31, 2016, as compared to its benchmark, the Barclays U.S. Government/Credit 1-5 Year Index, which returned 1.42%, and as compared to the Barclays U.S. Credit 1-5 Year Index, which returned 1.77%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 05/31/16 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

| Thompson Bond Fund | | -1.16% | | 0.97% | | 2.64% | | 5.59% | |

| Barclays U.S. Gov’t./Credit 1-5 Year Index | | 1.49% | | 1.42% | | 1.58% | | 3.43% | |

| Barclays U.S. Credit 1-5 Year Index | | 1.78% | | 1.96% | | 2.44% | | 4.24% | |

Gross Expense Ratio as of 03/31/16 was 0.71%. 30-Day SEC Yield as of 05/31/16 was 4.96%.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the investor’s original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may have been in effect. In the absence of such waivers, total return would have been reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Barclays U.S. Government/Credit 1-5 Year Index is a market-value-weighted index of all investment-grade bonds with maturities of more than one year and less than 5 years. The Barclays U.S. Credit 1-5 Year Index is a market-value-weighted index which includes virtually every major investment-grade rated corporate bond with 1-5 years remaining until maturity that serves as a supplementary benchmark. You cannot directly invest in an index.

Barclays® is a trademark of Barclays Bank PLC.

See Notes to Financial Statements.

15

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

Management Commentary

The semi-annual period proved to be a volatile one for both bond market participants and shareholders of the Bond Fund. The concerns investors felt in the fourth quarter of 2015 regarding certain energy and commodity-oriented bonds cascaded into a full-blown panic during the first month and a half of the new year. As a result, a subset of the Fund’s holdings in these areas saw their prices fall precipitously on fairly low volume, sending the Fund’s mid-period return down several percentage points. Yet by the end of the semi-annual period, the Fund’s performance was not only positive on an absolute basis, but was ahead of its benchmark. Needless to say, this was a sharp reversal in a mere few months. While we do not desire this level of volatility, we feel that looking into the details should help shareholders better understand the driving factors behind this volatility and to feel more comfortable with our belief that the degree of recent price fluctuations should not be repeated in the rest of the fiscal year.

Coming into the fiscal year, both the market and we thought that oil prices were likely to largely bounce within a $40-60 range for the foreseeable future, with some temporary deviations from this range based on short term supply/demand imbalances. Over the past decade, prices below this range were not sustainable, as the ultimate production costs of global oil dictated that much of the incremental supply brought onto the market was breakeven at best at such levels. Sharp declines in capital expenditures, operating rig counts, and even employment supported the thesis that global production was in the process of gradually adjusting to the reality that $100 oil was not likely to reoccur soon. Investment-grade ratings by S&P and Moody’s for many bonds in the sectors appeared to be based on these assumptions, with some of the Fund’s bonds affirmed in the fourth quarter of calendar 2015 based on oil prices in this range. Our own credit analysis of the Fund’s holdings agreed with this assessment, as we calculated the issuers of our bonds should have the capability to successfully redeem them. The Fund has made a concerted effort to avoid many junk rated energy companies that we believe are unlikely to survive long term under these conditions.

Things changed in January and early February. A combination of a storage capacity problem in the U.S. exacerbated by an unusually warm winter, the lifting of sanctions against Iran, and fears over a hard economic landing for China sent oil prices lower, ultimately bottoming at a closing low of $26.21 per barrel on February 11th. S&P and Moody’s swiftly reversed course, putting the entire sector, including AAA-rated Exxon Mobil, on negative watch. Many names were downgraded as much as two notches. This reaction appears to have been mostly in response to changes in the spot rate of oil, notwithstanding the fact that many larger oil companies tend to hedge their production by using futures contracts, which are typically less volatile. The 12-month out futures contract never closed below $35, and it is unclear how many barrels of production were ultimately sold at the spot-price low. Nevertheless, ratings agencies appear essentially to have assumed those prices would persist for an extended period of time.

Of course, as is often the case, once the market grew concerned about downgrade risk, it ceased to differentiate between high and low-quality energy companies. During the first calendar quarter, the Fund’s total exposure to the Energy sector varied in the mid to upper teens, but it was really a smaller subset of the sector—for the Fund, consisting of just six issuers totaling less than 10% of assets—where the majority of the volatility occurred. Three of the six were downgraded during that calendar quarter, but all of them saw yields generally balloon out to the mid-to-high teens for maturities ranging from 2017 to 2022. On a dollar weighted basis, these yields generally translated into an average price decline of just over 40% from their par value. The volatility occurred despite in some cases the issuer already having enough cash on hand to successfully redeem its debt through at least the issue we own or not having any outstanding debt maturing before 2019 or later, which would allow the company the luxury of time for circumstances to potentially change. Most of these bonds traded lower on light volume. This suggests to us that the significantly lower prices were likely attributable to a handful of sellers that were desperate to sell the bonds and were willing to accept sharply lower prices to accomplish their goals.

The damage in the market was not completely confined to energy bonds, as spreads on 10-year corporate bonds in general at the BBB credit quality tier widened out over 30 basis points beyond the normal 1-2% range typical of non-recessionary time periods. Financial lenders with possible exposure to energy markets saw their spreads widen even more. Equities were not immune either, with the S&P 500 at one point declining over 10% on a year-to-date basis despite what we saw as evidence of an improving economy.

Yet as February turned to March it became apparent that the market had again overreacted to short-term noise. The aforementioned corporate spreads narrowed back down to within a 2% level, and equities rallied back to breakeven. Oil prices rallied to finish May at $49.10 per barrel, actually up nicely over the full semi-annual period from a $41.65 starting point.

See Notes to Financial Statements.

16

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

Many of the same bonds that had gotten hammered during the first two-and-a-half months of the semi-annual period traded up on similarly light volume, as almost no other holders were willing to sell their positions at depressed prices, meaning even a handful of buyers had to pay up if they wanted the bonds.

Ultimately, short-term volatility in market expectations is to be expected. What was unusual is the degree to which asset prices reacted to those expectations, and the extremes to which they varied over such a short period of time. Much as we did not anticipate the magnitude of the weakness in those six bonds, we also did not expect the market to rally back as quickly as it did. It is reasonable to conclude that there must have been forced sellers of these bonds that exacerbated the price reaction, which caused an equally sharp reaction once they had successfully exited their positions and few other sellers remained.

We believe that the volatility experienced in the semi-annual period is not likely to recur soon for several reasons. First, having already downgraded many names in the energy sector to junk there is less S&P and Moody’s could do that would scare investors to the same degree. After all, their presumable fear of repeating mistakes made during the real estate bubble suggests they will be slow to consider upgrading bond ratings despite the rebound in oil prices. This suggests their opinion already reflects fairly conservative assumptions that should prove easier to exceed. Second, the concentration of weakness into only a handful of names has caused us to re-evaluate how we weight issuer concentration within the Fund. We have refined our investment process with respect to how we think about the concentrations of new positions to further delineate among gradients within S&P’s investment-grade rating system. We believe this should translate to less Fund price volatility for shareholders relative to the benchmark.

Despite the rally in prices during the second half of the semi-annual period, we believe the 30-day SEC yield and potential future return opportunity of the Fund remain quite attractive to shareholders. While we have made tweaks to better moderate the Fund’s volatility, our overall strategy remains the same and we are hopeful that it benefits shareholders as it has in the past. We appreciate the trust shareholders have placed in our management team and are working hard to justify their faith.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in bonds of foreign issuers involve greater volatility, political and economic risks, and differences in accounting methods. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please refer to the Schedule of Investments on page 19 of this report for holdings information. The management commentary above as well as Fund holdings should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings are subject to change.

The federal government guarantees interest payments from government securities while dividend payments carry no such guarantee. Government securities, if held to maturity, guarantee the timely payment of principal and interest.

SEC Yield is a standardized yield computed by dividing the net investment income per share earned during the 30-day period prior to quarter-end and was created to allow for fairer comparisons among bond funds.

Basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument.

Junk bond is a security rated below investment grade having a rating of BBB- or below.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

Yield is the income earned from a bond, which takes into account the sum of the interest payment, the redemption value at the bond’s maturity, and the initial purchase price of the bond.

Credit Ratings are provided by Standard & Poor’s, who assign a rating based on their analysis of the issuer’s credit worthiness. The highest rating given is AAA and the lowest is C.

The purpose of Moody’s ratings is to provide investors with a simple system of gradation by which relative creditworthiness of securities may be noted. Gradations of creditworthiness are indicated by rating symbols, with each symbol representing a group in which the credit characteristics are broadly the same. The highest rating assigned by Moody’s is AAA and the lowest is C.

Although the makeup of the Bond Fund’s portfolio is constantly changing, as of May 31, 2016, 81.63% of the Fund’s portfolio was invested in corporate bonds. Due to prevailing market conditions, the composition of the Fund’s portfolio as of that date was consistent with the composition of the Fund’s portfolio over the past 5 years. In addition, as of that date 67.32% of the Fund’s portfolio was invested in bonds rated BBB by Standard & Poor’s, while an additional 16.75% of the Fund’s portfolio was rated below investment grade and 3.37% of the Fund’s portfolio was not rated by Standard & Poor’s. For portfolio information current as of the most recent quarter-end, please call 1-800-999-0887 or visit our website at www.thompsonim.com. Compared to a portfolio that is more evenly allocated between government and corporate bonds, a portfolio that is heavily allocated to corporate bonds may provide higher returns, but is also subject to greater levels of credit and liquidity risk and to greater price fluctuations. A portfolio that is significantly allocated to bonds having lower and below-investment-grade ratings may also be subject to greater levels of credit and liquidity risk and experience greater price fluctuations than a portfolio comprised of higher-rated investment-grade bonds.

See Notes to Financial Statements.

17

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| May 31, 2016 |

| Portfolio Concentration at 05/31/16 | |

| (Includes cash and cash equivalents) | |

| % Total Investments | |

| Asset Allocation | |

| | Corporate Bonds | 81.63% | |

| Asset-Backed Securities | 11.17% | |

| Taxable Municipal Bonds | 3.82% | |

| U.S. Government & Agency Issues | 2.61% | |

| Convertible Bonds | 0.44% | |

| | Tax-Exempt Municipal Bonds | 0.33% | |

| | 100.00% | |

| | | |

| Quality | |

| U.S. Government & Agency Issues | 2.61% | |

| AA | 1.39% | |

| A | 8.55% | |

| BBB | 67.32% | |

| BB and Below | 16.75% | |

| Not Rated | 3.37% | |

| Money Market Funds | 0.01% | |

| | 100.00% | |

| | | |

| | |

| Top 10 Bond Holdings at 05/31/16 | |

| % of Fund’s Net Assets | |

| MBIA Inc. | 3.96% | |

| GFI Group Inc. | 3.61% | |

| SESI LLC | 3.59% | |

| Freeport-McMoran Oil & Gas LLC | 3.51% | |

| XL Group PLC | 3.28% | |

| American Airlines Group Inc. | 3.10% | |

| Jabil Circuit, Inc. | 2.96% | |

| Noble Corporation PLC | 2.81% | |

| Kinder Morgan Inc. | 2.78% | |

| MPT Operating Partnership, L.P. | 2.59% | |

See Notes to Financial Statements.

18

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2016 |

| | | | Principal | | | |

| | | | | Amount | | Value |

| BONDS - 95.3% | | | | | | |

| | | | | | | |

| Asset-Backed Securities - 10.9% | | | | | | |

| | America West Airlines | | | | | | |

| | 7.930% due 1/2/2019, | | | | | | |

| | Series 1999-1 | | $ | 6,674,563 | | $ | 7,200,185 |

| | 8.057% due 7/2/2020, | | | | | | |

| | Series 2000-1 | | | 25,005 | | | 27,880 |

| | 7.100% due 4/2/2021, | | | | | | |

| | Series 2001-1 | | | 4,858,152 | | | 5,198,223 |

| | |

| | | American Airlines | | | | | | |

| | 7.000% due 1/31/2018, | | | | | | |

| | Series 2011-1 B (e) | | | 23,868,427 | | | 24,882,835 |

| | |

| | Ameritech Capital Funding Corp. | | | | | | |

| | 9.100% due 6/1/2016 | | | 9,680 | | | 9,680 |

| | |

| | Basketball Properties Ltd. | | | | | | |

| | 6.650% due 3/1/2025 (e) | | | 4,649,354 | | | 5,021,303 |

| | |

| | Beaver Valley II Funding | | | | | | |

| | 9.000% due 6/1/2017 | | | 1,000 | | | 1,005 |

| | |

| | British Airways PLC | | | | | | |

| | 5.625% due 6/20/2020, | | | | | | |

| | Series 2013-1 B (e) | | | 35,752,225 | | | 37,182,314 |

| | 5.625% due 6/20/2020, | | | | | | |

| | Series 2013-1 B (e) | | | 74,467 | | | 77,445 |

| | |

| | Bvps II Funding Corp. | | | | | | |

| | 8.890% due 6/1/2017 | | | 5,000 | | | 5,184 |

| | |

| | Continental Airlines | | | | | | |

| | 9.000% due 7/8/2016, | | | | | | |

| | Series 2009-1 | | | 585,847 | | | 593,463 |

| | 6.748% due 3/15/2017, | | | | | | |

| | Series 1998-1 B | | | 107,249 | | | 111,485 |

| | 6.648% due 9/15/2017, | | | | | | |

| | Series 1998-1 A | | | 886,937 | | | 909,643 |

| | 6.900% due 1/2/2018, | | | | | | |

| | Series 1997-4 A | | | 144,932 | | | 147,917 |

| | 6.820% due 5/1/2018, | | | | | | |

| | Series 1998-3 A-1 | | | 67,492 | | | 70,192 |

| | 6.000% due 1/12/2019, | | | | | | |

| | Series 2010-1 B | | | 2,003,654 | | | 2,103,837 |

| | 7.256% due 3/15/2020, | | | | | | |

| | Series 1999-2 A-1 | | | 28,856 | | | 30,948 |

| | 6.250% due 4/11/2020, | | | | | | |

| | Series 2012-1 B | | | 6,966,378 | | | 7,366,944 |

| | 5.500% due 10/29/2020, | | | | | | |

| | Series 2012-2 B | | | 10,380,594 | | | 10,717,964 |

| | | | | | | | | |

| | Delta Air Lines | | | | | | |

| | 9.750% due 12/17/2016, | | | | | | |

| | Series 2009-1 B | | | 913,058 | | | 949,580 |

| | 8.021% due 8/10/2022, | | | | | | |

| | Series 2007-1 B | | | 2,480,632 | | | 2,843,301 |

| | |

| | Doric Nimrod Air Alpha | | | | | | |

| | 6.125% due 11/30/2019, | | | | | | |

| | Series 2013-1B (e) | | | 30,518,135 | | | 30,899,612 |

| | 6.125% due 11/30/2019, | | | | | | |

| | Series 2013-1B (e) | | | 4,972,709 | | | 5,034,868 |

| | |

| | Doric Nimrod Air | | | | | | |

| | Finance Alpha Ltd. | | | | | | |

| | 6.500% due 5/30/2021, | | | | | | |

| | Series 2012-1 B (e) | | | 12,768,484 | | | 13,044,833 |

| | |

| | Express Pipeline LP | | | | | | |

| | 7.390% due 12/31/2017 (e) | | | 840,000 | | | 874,070 |

| | |

| | Federal Express Corp. | | | | | | |

| | 7.840% due 1/30/2018, | | | | | | |

| | Series 1996-B2 | | | 167,766 | | | 179,509 |

| | |

| | FPL Energy Caithness | | | | | | |

| | Funding Corp. | | | | | | |

| | 7.645% due 12/31/2018 (e) | | | 2,682,770 | | | 2,803,494 |

| | |

| | General American Railcar | | | | | | |

| | 6.690% due 9/20/2016, | | | | | | |

| | Series 1997-1 (e) | | | 31,272 | | | 31,538 |

| | |

| | Great River Energy | | | | | | |

| | 5.829% due 7/1/2017 (e) | | | 1,042,882 | | | 1,064,095 |

| | |

| | Hidden Ridge Facility | | | | | | |

| | 5.650% due 1/1/2022 (e) | | | 4,267,240 | | | 4,363,876 |

| | |

| | Landmark Leasing LLC | | | | | | |

| | 6.200% due 10/1/2022, | | | | | | |

| | Series 2004A (e) | | | 349,922 | | | 352,540 |

| | |

| | Latam Airlines Group | | | | | | |

| | 4.500% due 11/15/2023, | | | | | | |

| | Series 2015-1 B (e) | | | 5,836,246 | | | 5,135,897 |

| | 4.200% due 11/15/2027, | | | | | | |

| | Series 2015-1 A (e) | | | 3,832,664 | | | 3,411,071 |

See Notes to Financial Statements.

19

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| | | | Principal | | | |

| | | | | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | |

| Asset-Backed Securities (continued) | | | |

| | Midwest Family Housing LLC | | | | | | |

| | 5.168% due 7/1/2016 (e) | | $ | 50,847 | | $ | 51,004 |

| | |

| | Northwest Airlines | | | | | | |

| | 8.028% due 11/1/2017, | | | | | | |

| | Series 2007-1 B | | | 92,545 | | | 98,672 |

| | 7.575% due 3/1/2019, | | | | | | |

| | Series 1999-2 A | | | 793,737 | | | 825,487 |

| | 7.150% due 10/1/2019, | | | | | | |

| | Series 2000-1 G (b) | | | 20,372 | | | 21,570 |

| | 7.027% due 11/1/2019, | | | | | | |

| | Series 2007-1 A | | | 11,546,119 | | | 12,851,985 |

| | 6.264% due 11/20/2021, | | | | | | |

| | Series 2002-1 G-2 | | | 578,240 | | | 611,836 |

| | |

| | United Air Lines | | | | | | |

| | | 10.400% due 11/1/2016, | | | | | | |

| | Series 2009-1 | | | 1,328,388 | | | 1,381,524 |

| | 5.375% due 8/15/2021, | | | | | | |

| | Series 2013-1 B | | | 2,155,419 | | | 2,242,282 |

| | |

| | US Airways | | | | | | |

| | 8.360% due 1/20/2019, | | | | | | |

| | Series 1999-1A | | | 65,227 | | | 68,570 |

| | 8.000% due 10/1/2019, | | | | | | |

| | Series 2012-1 B | | | 20,215,102 | | | 22,300,209 |

| | 7.076% due 3/20/2021, | | | | | | |

| | Series 2001-1G | | | 1,017,657 | | | 1,105,430 |

| | |

| | Virgin Australia Trust | | | | | | |

| | 5.000% due 10/23/2023, | | | | | | |

| | Series 2013-1A (e) | | | 204,482 | | | 211,383 |

| | |

| | Total Asset-Backed Securities | | | | | | 214,416,683 |

| | |

| Convertible Bonds - 0.4% | | | | | | |

| | Hospitality Properties Trust | | | | | | |

| | 3.800% due 3/15/2027 | | | 7,309,000 | | | 7,345,545 |

| | |

| | Prospect Capital Corp. | | | | | | |

| | 5.500% due 8/15/2016 | | | 1,075,000 | | | 1,080,375 |

| | |

| | Total Convertible Bonds | | | | | | 8,425,920 |

| | |

| Corporate Bonds - 79.9% | | | | | | |

| | Activision Blizzard, Inc. | | | | | | |

| | 5.625% due 9/15/2021 (e) | | | 5,840,000 | | | 6,132,000 |

| | | | | | | | |

| | Alcoa Inc. | | | | | | |

| | 5.550% due 2/1/2017 | | | 143,000 | | | 146,396 |

| | |

| | Assured Guaranty US | | | | | | |

| | Holdings Inc. | | | | | | |

| | 6.400% due 12/15/2066 (b) | | | 15,242,000 | | | 9,526,250 |

| | |

| | Astoria Financial Corp. | | | | | | |

| | 5.000% due 6/19/2017 | | | 30,696,000 | | | 31,537,132 |

| | |

| | Athene Global Funding | | | | | | |

| | 2.875% due 10/23/2018 (e) | | | 32,217,000 | | | 31,850,274 |

| | |

| | Aviation Capital Group Corp. | | | | | | |

| | 3.875% due 9/27/2016 (e) | | | 1,639,000 | | | 1,647,195 |

| | 4.625% due 1/31/2018 (e) | | | 1,080,000 | | | 1,105,650 |

| | |

| | Avon Products, Inc. | | | | | | |

| | 6.500% due 3/1/2019 | | | 46,803,000 | | | 43,292,775 |

| | 6.350% due 3/15/2020 (b) | | | 500,000 | | | 423,880 |

| | |

| | Bank of America Corp. | | | | | | |

| | 6.000% due 6/15/2016 | | | 160,000 | | | 160,266 |

| | 2.325% due 10/9/2024 (b) | | | 35,000,000 | | | 33,731,250 |

| | |

| | Bank of Oklahoma | | | | | | |

| | 1.316% due 5/15/2017 (b) | | | 50,000 | | | 49,351 |

| | |

| | BGC Partners Inc. | | | | | | |

| | 5.375% due 12/9/2019 | | | 110,000 | | | 114,975 |

| | |

| | BMC Software, Inc. | | | | | | |

| | 7.250% due 6/1/2018 | | | 5,312,000 | | | 4,913,600 |

| | |

| | Cabot Corp. | | | | | | |

| | 2.550% due 1/15/2018 | | | 2,850,000 | | | 2,846,788 |

| | |

| | Carpenter Technology Corp. | | | | | | |

| | 6.990% due 4/20/2018 | | | 2,415,000 | | | 2,550,271 |

| | 7.060% due 5/21/2018 | | | 500,000 | | | 525,846 |

| | 7.030% due 5/22/2018 | | | 8,000 | | | 8,409 |

| | |

| | Centrais Eletricas | | | | | | |

| | Brasileiras S.A. | | | | | | |

| | 6.875% due 7/30/2019 (e) | | | 21,023,000 | | | 20,539,471 |

| | 5.750% due 10/27/2021 (e) | | | 16,365,000 | | | 14,053,444 |

See Notes to Financial Statements.

20

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| | | | | Principal | | | |

| | | | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| | Citigroup, Inc. | | | | | | |

| | 2.250% due 10/15/2024 (b) | | $ | 35,000,000 | | $ | 33,965,050 |

| | |

| | Cliffs Natural Resources Inc. | | | | | | |

| | 5.950% due 1/15/2018 (b) | | | 2,761,000 | | | 2,070,750 |

| | 5.900% due 3/15/2020 | | | 22,799,000 | | | 9,575,580 |

| | |

| | Columbia Property Trust | | | | | | |

| | 5.875% due 4/1/2018 | | | 130,000 | | | 137,519 |

| | |

| | Copano Energy, LLC | | | | | | |

| | 7.125% due 4/1/2021 | | | 3,685,000 | | | 3,787,915 |

| | |

| | Countrywide Financial Corp. | | | | | | |

| | 5.250% due 5/27/2020 | | | 379,000 | | | 380,366 |

| | 6.000% due 8/26/2020 (c) | | | 140,000 | | | 138,998 |

| | |

| | Countrywide Home Loans, Inc. | | | | | | |

| | 5.500% due 5/16/2018 | | | 249,000 | | | 247,671 |

| | |

| | Denali Borrower LLC / Denali | | | | | | |

| | Finance Corp. | | | | | | |

| | 5.625% due 10/15/2020 (e) | | | 22,645,000 | | | 23,811,217 |

| | |

| | Development Bank of | | | | | | |

| | Kazakhstan | | | | | | |

| | 6.500% due 6/3/2020 (e) | | | 5,055,000 | | | 5,189,766 |

| | 4.125% due 12/10/2022 (e) | | | 15,035,000 | | | 13,869,788 |

| | |

| | Devon Energy Corp. | | | | | | |

| | 6.300% due 1/15/2019 | | | 5,000,000 | | | 5,279,475 |

| | |

| | Diamond 1 Finance Corp. / | | | | | | |

| | Diamond 2 Finance Corp. | | | | | | |

| | 4.420% due 6/15/2021 (e) (g) | | | 500,000 | | | 509,984 |

| | |

| | Discover Financial Services | | | | | | |

| | 6.450% due 6/12/2017 | | | 1,320,000 | | | 1,377,709 |

| | 10.250% due 7/15/2019 | | | 11,302,000 | | | 13,327,737 |

| | |

| | Domtar Corp. | | | | | | |

| | 9.500% due 8/1/2016 | | | 362,000 | | | 366,309 |

| | 10.750% due 6/1/2017 | | | 9,390,000 | | | 10,056,831 |

| | |

| | El Paso Corp. | | | | | | |

| | 7.000% due 6/15/2017 | | | 3,177,000 | | | 3,316,232 |

| | | | | | | | |

| | Embraer Overseas Ltd. | | | | | | |

| | 6.375% due 1/24/2017 | | | 12,406,000 | | | 12,700,643 |

| | |

| | Enbridge Energy Partners, L.P. | | | | | | |

| | 5.875% due 12/15/2016 | | | 362,000 | | | 369,796 |

| | |

| | Enterprise Products | | | | | | |

| | �� Operating LLC | | | | | | |

| | 7.000% due 6/1/2067 (b) | | | 8,538,000 | | | 6,552,915 |

| | | |

| | Everest Reinsurance | | | | | | |

| | Holdings Inc. | | | | | | |

| | 6.600% due 5/15/2037 (b) | | | 8,692,000 | | | 7,127,440 |

| | |

| | Fairfax Financial Holdings Ltd. | | | | | | |

| | 7.375% due 4/15/2018 | | | 24,226,500 | | | 25,924,996 |

| | |

| | Fidelity National Financial, Inc. | | | | | | |

| | 6.600% due 5/15/2017 | | | 3,160,000 | | | 3,299,508 |

| | |

| | Fifth Third Bancorp | | | | | | |

| | 4.900% due 9/30/2019 (b) (d) | | | 42,312,000 | | | 37,075,890 |

| | |

| | First Midwest Bancorp, Inc. | | | | | | |

| | 5.875% due 11/22/2016 | | | 1,175,000 | | | 1,195,231 |

| | |

| | Freeport-McMoran Oil & | | | | | | |

| | Gas LLC | | | | | | |

| | 6.125% due 6/15/2019 | | | 11,733,000 | | | 11,557,005 |

| | 6.625% due 5/1/2021 | | | 28,585,000 | | | 27,084,287 |

| | |

| | General Electric Capital Corp. | | | | | | |

| | 1.013% due 5/5/2026 (b) | | | 613,000 | | | 570,339 |

| | |

| | Genworth Financial Inc. | | | | | | |

| | 7.700% due 6/15/2020 | | | 2,918,000 | | | 2,567,840 |

| | |

| | GFI Group Inc. | | | | | | |

| | 8.375% due 7/19/2018 (b) | | | 66,699,000 | | | 70,784,314 |

| | |

| | Globo Comunicacao e | | | | | | |

| | Participacoes S.A. | | | | | | |

| | 5.307% due 5/11/2022 (c) (e) | | | 16,990,000 | | | 17,159,900 |

| | |

| | Great Plains Energy Inc. | | | | | | |

| | 6.875% due 9/15/2017 | | | 30,000 | | | 31,457 |

See Notes to Financial Statements.

21

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| | | | | Principal | | | |

| | | | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| | Harsco Corp. | | | | | | |

| | 5.750% due 5/15/2018 | | $ | 21,479,000 | | $ | 19,223,705 |

| | |

| | HCP, Inc. | | | | | | |

| | 6.300% due 9/15/2016 | | | 827,000 | | | 838,518 |

| | |

| | Hiland Partners, LP | | | | | | |

| | | 7.250% due 10/1/2020 (e) | | | 23,110,000 | | | 24,116,672 |

| | |

| | Hospitality Properties Trust | | | | | | |

| | 5.625% due 3/15/2017 | | | 11,260,000 | | | 11,553,458 |

| | 6.700% due 1/15/2018 | | | 5,007,000 | | | 5,243,365 |

| | |

| | HRPT Properties Trust | | | | | | |

| | 6.250% due 6/15/2017 | | | 5,773,000 | | | 5,889,372 |

| | 6.650% due 1/15/2018 | | | 33,478,000 | | | 35,015,511 |

| | |

| | International Lease | | | | | | |

| | Finance Corp. | | | | | | |

| | 6.750% due 9/1/2016 (e) | | | 14,286,000 | | | 14,428,860 |

| | |

| | INVISTA Finance LLC | | | | | | |

| | 4.250% due 10/15/2019 (e) | | | 32,365,000 | | | 31,474,962 |

| | |

| | Jabil Circuit, Inc. | | | | | | |

| | 7.750% due 7/15/2016 | | | 4,694,000 | | | 4,723,338 |

| | 8.250% due 3/15/2018 | | | 48,966,000 | | | 53,250,525 |

| | |

| | JPMorgan Chase & Co. | | | | | | |

| | 7.900% due 4/30/2018 (b) (d) | | | 37,491,000 | | | 38,334,547 |

| | |

| | Kinder Morgan Inc. | | | | | | |

| | 7.000% due 2/1/2018 | | | 22,258,000 | | | 23,342,543 |

| | |

| | Kraft Foods Group, Inc. | | | | | | |

| | 6.125% due 8/23/2018 (e) | | | 50,000 | | | 54,833 |

| | |

| | Lexmark International, Inc. | | | | | | |

| | 6.650% due 6/1/2018 | | | 4,134,000 | | | 4,319,827 |

| | |

| | Lincoln National Corp. | | | | | | |

| | 2.985% due 5/17/2066 (b) | | | 25,985,000 | | | 17,813,237 |

| | 6.050% due 4/20/2067 (b) | | | 19,155,000 | | | 12,958,932 |

| | | | | | | | |

| | Manufacturers & Traders | | | | | | |

| | Trust Co. | | | | | | |

| | 1.669% due 12/28/2020 (b) | | | 14,173,000 | | | 13,879,520 |

| | 5.629% due 12/1/2021 (b) | | | 1,002,000 | | | 974,445 |

| | |

| | Masco Corp. | | | | | | |

| | 6.625% due 4/15/2018 | | | 13,741,000 | | | 14,702,870 |

| | |

| | MBIA Inc. | | | | | | |

| | 6.400% due 8/15/2022 | | | 78,492,000 | | | 77,707,080 |

| | |

| | Merrill Lynch & Co. | | | | | | |

| | 6.400% due 8/28/2017 | | | 1,000,000 | | | 1,058,713 |

| | |

| | Midcontinent Express | | | | | | |

| | Pipeline LLC | | | | | | |

| | 6.700% due 9/15/2019 (e) | | | 23,665,000 | | | 22,349,226 |

| | |

| | Morgan Stanley | | | | | | |

| | 3.018% due 4/1/2021 (b) | | | 130,000 | | | 133,575 |

| | 3.018% due 6/9/2023 (b) | | | 100,000 | | | 98,750 |

| | |

| | MPT Operating | | | | | | |

| | Partnership, L.P. | | | | | | |

| | 6.875% due 5/1/2021 | | | 38,813,000 | | | 40,298,374 |

| | 6.375% due 2/15/2022 | | | 10,000,000 | | | 10,476,100 |

| | |

| | Nabors Industries, Inc. | | | | | | |

| | 2.350% due 9/15/2016 (e) | | | 250,000 | | | 250,125 |

| | |

| | National City Bank of | | | | | | |

| | Cleveland OH | | | | | | |

| | 5.800% due 6/7/2017 | | | 705,000 | | | 734,336 |

| | |

| | National Retail Properties Inc. | | | | | | |

| | 6.875% due 10/15/2017 | | | 1,023,000 | | | 1,089,942 |

| | |

| | NationsBank Corp. | | | | | | |

| | 7.800% due 9/15/2016 | | | 770,000 | | | 783,732 |

| | |

| | Navient Corp. | | | | | | |

| | 5.875% due 3/25/2021 | | | 500,000 | | | 470,000 |

| | |

| | Neuberger Berman Group LLC | | | | | | |

| | 5.875% due 3/15/2022 (e) | | | 7,049,000 | | | 7,339,771 |

See Notes to Financial Statements.

22

| BOND FUND SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2016 |

| | | | | Principal | | | |

| | | | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | | |

| | Corporate Bonds (continued) | | | | | | |

| | NIPSCO Capital Markets, Inc. | | | | | | |

| | 7.860% due 3/27/2017 | | $ | 96,000 | | $ | 98,015 |

| | |

| | | Noble Drilling Corp. | | | | | | |

| | | 7.500% due 3/15/2019 | | | 21,234,000 | | | 20,490,810 |

| | |

| | | Noble Holding Int’l. Ltd. | | | | | | |

| | | 4.900% due 8/1/2020 | | | 21,828,000 | | | 17,462,400 |

| | | 4.625% due 3/1/2021 | | | 22,764,000 | | | 17,186,820 |

| | |

| | | Northern Indiana Public | | | | | | |

| | | Service Co. | | | | | | |

| | | 7.590% due 6/12/2017 | | | 182,000 | | | 188,181 |

| | |

| | | Owens Corning | | | | | | |

| | | 6.500% due 12/1/2016 | | | 249,000 | | | 253,103 |

| | |

| | | Pemex Project Funding | | | | | | |

| | | Master Trust | | | | | | |

| | | 9.250% due 3/30/2018 | | | 20,000 | | | 21,730 |

| | |

| | | Pitney Bowes Inc. | | | | | | |

| | | 5.250% due 1/15/2037 | | | 4,359,000 | | | 4,421,656 |

| | |

| | | Plains Exploration & | | | | | | |

| | | Production Co. | | | | | | |

| | | 6.500% due 11/15/2020 | | | 17,327,000 | | | 16,633,920 |

| | | 6.750% due 2/1/2022 | | | 14,470,000 | | | 13,565,625 |

| | |

| | | Pride Int’l., Inc. | | | | | | |

| | | 8.500% due 6/15/2019 | | | 22,476,000 | | | 22,172,574 |

| | |

| | | Regency Energy Partners LP | | | | | | |

| | | 6.500% due 7/15/2021 | | | 45,484,000 | | | 46,802,081 |

| | |

| | | Reinsurance Group of | | | | | | |

| | | America, Inc. | | | | | | |

| | | 3.299% due 12/15/2065 (b) | | | 33,768,000 | | | 23,351,585 |

| | |

| | | Reliance Steel & Aluminum Co. | | | | | | |

| | | 6.200% due 11/15/2016 | | | 1,821,000 | | | 1,853,483 |

| | |

| | | Seagate HDD Cayman | | | | | | |

| | | 7.000% due 11/1/2021 | | | 2,569,000 | | | 2,605,621 |

| | |

| | | Select Income REIT | | | | | | |

| | | 2.850% due 2/1/2018 | | | 21,756,000 | | | 21,851,639 |

| | | | | | | | |

| | | Seminole Indian | | | | | | |

| | | Tribe of Florida | | | | | | |

| | | 8.030% due 10/1/2020 (e) | | | 28,800,000 | | | 30,276,000 |

| | |

| | | SESI LLC | | | | | | |

| | | 6.375% due 5/1/2019 | | | 30,231,000 | | | 28,190,407 |

| | | 7.125% due 12/15/2021 | | | 46,739,000 | | | 42,123,524 |

| | |

| | | SLM Corp. | | | | | | |

| | | 5.500% due 3/15/2019 | | | 800,000 | | | 731,655 |

| | | 6.000% due 3/15/2019 (c) | | | 140,000 | | | 129,554 |

| | | 6.600% due 3/15/2019 (c) | | | 395,000 | | | 371,480 |

| | | 5.190% due 4/24/2019 | | | 529,000 | | | 509,163 |

| | | 8.000% due 3/25/2020 | | | 671,000 | | | 689,453 |

| | | 6.250% due 9/15/2020 (c) | | | 172,000 | | | 151,569 |

| | | 6.500% due 12/15/2020 (c) | | | 71,000 | | | 64,741 |

| | | 6.750% due 12/15/2020 (c) | | | 306,000 | | | 267,640 |

| | | 6.750% due 12/15/2020 (c) | | | 95,000 | | | 83,071 |

| | | 6.000% due 6/15/2021 | | | 20,000 | | | 16,668 |