Exhibit 99-2

Legal Notice - Forward-Looking Information

This Financial Report contains forward-looking information. You can usually identify this information by such words as "plan," "anticipate," "forecast," "believe," "target," "intend," "expect," "estimate," "budget" or other similar wording suggesting future outcomes or statements about an outlook. We list below examples of references to forward-looking information:

o business strategies and goals o outlook (including operational updates and strategic milestones) o future capital, exploration and other expenditures o future resource purchases and sales o construction and repair activities o refinery turnarounds o anticipated refining margins o future oil and gas production levels and the sources of their growth o project development and expansion schedules and results o future results of exploration activities and dates by which certain areas may be developed or may come on-stream | o retail throughputs o pre-production and operating costs o reserves and resources estimates o royalties and taxes payable o production life-of-field estimates o natural gas export capacity o future financing and capital activities (including purchases of Petro- Canada common shares under the Company's normal course issuer bid (NCIB) program) o contingent liabilities (including potential exposure to losses related to retail licensee agreements) o environmental matters o future regulatory approvals |

Such forward-looking information is subject to known and unknown risks and uncertainties. Other factors may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Such factors include, but are not limited to:

o industry capacity o imprecise reserves estimates of recoverable quantities of oil, natural gas and liquids from resource plays and other sources not currently classified as reserves o the effects of weather and climate conditions o the results of exploration and development drilling and related activities o the ability of suppliers to meet commitments o decisions or approvals from administrative tribunals o risks attendant with domestic and international oil and gas operations o expected rates of return | o general economic, market and business conditions o competitive action by other companies o fluctuations in oil and gas prices o refining and marketing margins o the ability to produce and transport crude oil and natural gas to markets o fluctuations in interest rates and foreign currency exchange rates o actions by governmental authorities, including changes in taxes, royalty rates and resource-use strategies o changes in environmental and other regulations o international political events |

Many of these and other similar factors are beyond the control of Petro-Canada. Petro-Canada discusses these factors in greater detail in filings with the Canadian provincial securities commissions and the United States (U.S.) Securities and Exchange Commission (SEC).

We caution readers that this list of important factors affecting forward-looking information is not exhaustive. Furthermore, the forward-looking information in this Financial Report is made as of March 1, 2007 and, except as required by applicable law, Petro-Canada does not update it publicly or revise it. This cautionary statement expressly qualifies the forward-looking information in this Financial Report.

Petro-Canada disclosure of reserves

Petro-Canada's qualified reserves evaluators prepare the reserves estimates the Company uses. The Canadian provincial securities commissions do not consider our reserves staff and management as independent of the Company. Petro-Canada has obtained an exemption from certain Canadian reserves disclosure requirements that allows us to make disclosure in accordance with SEC standards. This exemption allows comparisons with U.S. and other international issuers.

As a result, Petro-Canada formally discloses its reserves data and other oil and gas data using U.S. requirements and practices, and these may differ from Canadian domestic standards and practices. Note that when we use the term barrel of oil equivalent (boe) in this Financial Report, it may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet (Mcf) to one barrel (bbl) is based on an energy equivalency conversion method. This method primarily applies at the burner tip and does not represent a value equivalency at the wellhead.

To disclose reserves in SEC filings, oil and gas companies must prove they are economically and legally producible under existing economic and operating conditions. Proof comes from actual production or conclusive formation tests. The use of terms such as "probable," "possible," "recoverable," or "potential reserves and resources" in this Financial Report does not meet the SEC guidelines for SEC filings.

The table below describes the industry definitions that we currently use:

Definitions Petro-Canada uses | Reference |

Proved oil and gas reserves (includes both proved developed and proved undeveloped) | U.S. SEC reserves definition (Accounting Rules Regulation S-X 210.4-10, FASB-69) |

Unproved reserves, probable and possible reserves | CIM (Petroleum Society) definitions (Canadian Oil and Gas Evaluation Handbook, Vol. 1 Section 5) |

Contingent and prospective resources | Society of Petroleum Engineers, World Petroleum Congress and American Association of Petroleum Geologist definitions (approved February 2000) |

There is no certainty that it will be economically viable or technically feasible to produce any portion of the resources. For use in this Financial Report, "total resources" means reserves plus resources.

SEC regulations do not define proved reserves from our oil sands mining operations as an oil and gas activity. These reserves are classified as a mining activity and are estimated in accordance with SEC Industry Guide 7. For internal management purposes, we view these reserves and their development as part of our total exploration and production operations.

Throughout this Financial Report, total Company reserves, total Company production, total Company reserves replacement and total Company reserves life index (RLI) are calculated using the sum of oil and gas activities, and oil sands mining activities. Before royalties, oil sands mining 2006 year-end proved reserves were 345 million barrels (MMbbls) and oil sands mining annual 2006 production was 11 MMbbls.

The Strategic Overview Report, published under separate cover, but available at the same time as the Financial Report provides additional detail on the Company’s business strategy and progress toward delivering on long-term goals. This Financial Report provides more detail on Petro-Canada’s operational and financial capability. The Report to the Community, which the Company publishes in mid-2007, will elaborate on Petro-Canada’s commitment to corporate responsibility objectives and performance.

Petro-Canada is one of Canada’s largest oil and gas companies, operating in both the upstream and the downstream sectors of the industry in Canada and internationally. The Company creates value by responsibly developing energy resources and providing world class petroleum products and services. Petro-Canada is proud to be a National Partner to the Vancouver 2010 Olympic and Paralympic Winter Games. Petro-Canada’s common shares trade on the Toronto Stock Exchange (TSX) under the symbol PCA and on the New York Stock Exchange (NYSE) under the symbol PCZ.

Management's Discussion and Analysis

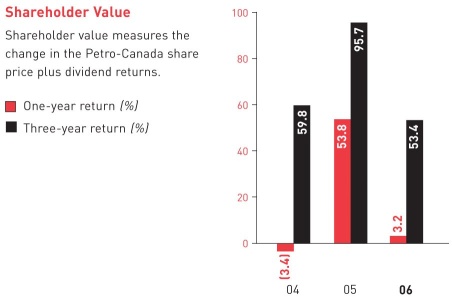

This Management's Discussion and Analysis (MD&A), dated effective as of February 12, 2007, should be read in conjunction with the audited Consolidated Financial Statements and Notes for the year ended December 31, 2006, included in the 2006 Financial Report and the 2006 Annual Information Form (AIF). Financial data has been prepared in accordance with Canadian generally accepted accounting principles (GAAP), unless otherwise specified. All dollar values are Canadian dollars, unless otherwise indicated. All oil and natural gas production and reserves volumes are stated before deduction of royalties, unless otherwise indicated. Graphs accompanying the text identify the Company's "value drivers," the key measures of performance in each segment of Petro-Canada's business. A glossary of financial terms and ratios can be found on page 92 of this report.

NON-GAAP MEASURES

Cash flow, which is expressed as cash flow from operating activities before changes in non-cash working capital, is used by the Company to analyse operating performance, leverage and liquidity. Operating earnings represent net earnings, excluding gains or losses on foreign currency translation, disposal of assets and unrealized gains or losses on the mark-to-market valuation of the derivative contracts associated with the Buzzard acquisition. Operating earnings are used by the Company to evaluate operating performance. Cash flow and operating earnings do not have a standardized meaning prescribed by Canadian GAAP and, therefore, may not be comparable with the calculation of similar measures for other companies. For reconciliation of the operating earnings and cash flow amounts to the associated GAAP measures, refer to the tables on pages 12 and 14, respectively, of this MD&A.

Business Environment

The major economic factors influencing Petro-Canada's upstream financial performance include crude oil and natural gas prices, and foreign exchange, particularly the Canadian dollar/U.S. dollar rates. Crude oil and natural gas prices are affected by a number of factors, including supply and demand balance, weather and political events. Factors influencing Downstream financial performance include the level and volatility of crude oil prices, industry refining margins, movements in crude oil price differentials, demand for refined petroleum products and the degree of market competition.

BUSINESS ENVIRONMENT IN 2006

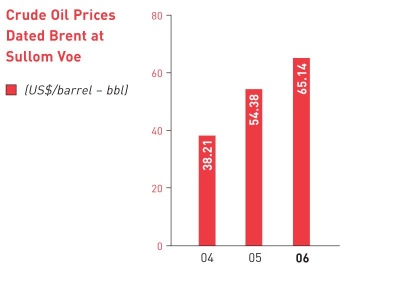

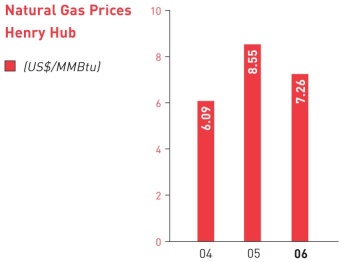

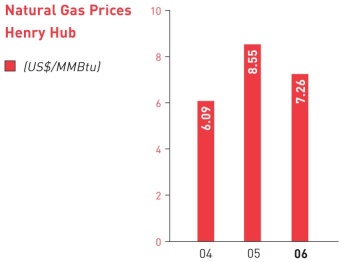

The year 2006 was characterized by volatile crude oil and natural gas prices. The price of North Sea Brent (Dated Brent) moved between highs, in excess of $77 US/bbl, to lows of almost $55 US/bbl. Similarly, benchmark North American natural gas prices at the Henry Hub fluctuated between highs in excess of $10 US/million British thermal units (MMBtu) to lows close to $4 US/MMBtu.

On an annual average basis, the price of Dated Brent reached $65.14 US/bbl, its highest annual average value ever and almost 20% higher than the average in 2005. High oil prices in 2006 were driven by continuing demand growth from China and increased geopolitical tensions globally. Relative to last year, international light/heavy crude (Dated Brent/Mexican Maya) price differentials stabilized in 2006 around the $14 US/bbl level, while Canadian light/heavy crude (Edmonton Light/Western Canada Select (WCS)) spreads narrowed noticeably.

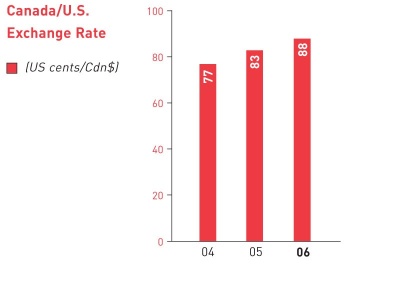

The continuing appreciation of the Canadian dollar during 2006 reduced the positive impact of higher international prices on Canadian crude prices. The Canadian dollar averaged 88 cents US in 2006, compared with 83 cents US in 2005.

North American natural gas prices suffered a setback during 2006. Record high levels of gas in storage and lower weather-related demand led to significantly lower prices, compared with 2005. Henry Hub prices averaged $7.26 US/MMbtu in 2006, 15% lower than in 2005. Natural gas prices in 2005 reflected the severe impact of hurricanes on U.S. Gulf of Mexico production. In 2006, the Canadian natural gas price at the AECO-C hub fell in line with U.S. prices and averaged almost 18% below its 2005 level.

In the downstream sector, it is estimated that, in 2006, refined petroleum product sales in Canada declined by 1% on top of the 1% reduction in 2005. In spite of lower overall industry product sales and relatively unchanged international light/heavy crude price spreads, overall refining margins increased in 2006, compared with 2005. The impact of the introduction of ultra-low sulphur diesel in the U.S. and Canada effective June 2006 was to maintain heating crack spreads at strong levels. The phasing out of Methyl Tertiary Butyl Ether (MTBE) from gasoline in the U.S. and a heavy refinery turnaround season helped to improve gasoline margins relative to 2005.

Commodity Price Indicators and Exchange Rates

(averages for the years indicated) | | 2006 | 2005 | 2004 |

| | | | | |

Crude oil price indicators (per bbl) | | | | |

Dated Brent at Sullom Voe | US$ | 65.14 | 54.38 | 38.21 |

West Texas Intermediate (WTI) at Cushing | US$ | 66.22 | 56.56 | 41.40 |

WTI/Dated Brent price differential | US$ | 1.08 | 2.18 | 3.19 |

Dated Brent/Mexican Maya price differential | US$ | 13.94 | 13.52 | 8.20 |

Edmonton Light | Cdn$ | 73.23 | 69.22 | 52.78 |

Edmonton Light/WCS (heavy) price differential | Cdn$ | 22.40 | 25.27 | N/A |

| Natural gas price indicators | | | | |

Henry Hub (per MMBtu) | US$ | 7.26 | 8.55 | 6.09 |

AECO-C spot (per Mcf) | Cdn$ | 7.28 | 8.84 | 7.08 |

Henry Hub/AECO basis differential (per MMBtu) | US$ | 1.09 | 1.53 | 0.87 |

New York Harbor 3-2-1 refinery crack spread (per bbl) | US$ | 9.80 | 9.47 | 7.02 |

| US$ per Cdn$ exchange rate | US$ | 0.88 | 0.83 | 0.77 |

COMPETITIVE CONDITIONS

It is becoming increasingly challenging for the energy sector to find new sources of oil and gas. Petro-Canada is well positioned to successfully compete for new opportunities that could complement existing upstream resources and increase production of oil and gas. The Company has an estimated 15.9 billion boe of total resources from which to develop new production. Approximately two-thirds of the total resources are located in Alberta's oil sands. As well, with different upstream businesses operating in Canada and internationally, the Company has the flexibility to pursue a wide range of opportunities. While the Company has wide operational scope, it remains a mid-sized global company as measured by production levels. This means Petro-Canada has the operational capability and balance sheet strength to invest in large projects, but smaller acquisitions can also impact the Company's production levels and financial returns.

Petro-Canada is well positioned to compete in the petroleum product refining and marketing business in Canada. The Company accounts for 13% of the total refining capacity in Canada and has a 16% share of the petroleum products market in Canada. Its more than 1,312 retail service station network has the highest gasoline sales per site in Canada among the national integrated oil companies. It also has Canada's largest commercial road transport network, with 219 locations, as well as a robust bulk fuel sales channel.

The Company believes that its strong financial position, combined with a track record of executing large capital projects, and depth of management experience will enable it to continue to compete successfully in the current business environment.

OUTLOOK FOR BUSINESS ENVIRONMENT IN 2007

Prices for energy commodities are expected to remain volatile in 2007, reflecting the unpredictable nature of weather, the level of industry inventories, and political and natural events. High levels of crude oil and refined product inventories, coupled with increased supplies from countries outside of the Organization of the Petroleum Exporting Countries (OPEC), are expected to be more than enough to meet anticipated growth in global oil demand during 2007, thus lessening the upward pressure experienced by oil prices during 2006. The extent of the anticipated price correction will depend on OPEC production adjustments as it tries to mitigate downward price pressures arising from slackened global supply/demand conditions.

Demand growth in North American natural gas markets is expected to be minimal due primarily to lower weather-related demand experienced for most of this heating season. This, combined with high levels of gas in storage, will continue to exert downward pressure on natural gas prices across the continent. The resultant downward pressure on natural gas prices could be partially offset by the challenge to grow production.

In the industry's downstream sector, 2007 refining margins are expected to remain highly volatile and are unlikely to match the high levels experienced in 2006 due to the expectation of slower growth in U.S. and Canadian refined product sales and narrower light/heavy price differentials. The uncertainty arising from continuing changes in the specification for key products, such as motor gasoline and middle distillates, will be a contributing factor to the expected volatility in margins. Also, potential shifts in weather patterns, such as warmer-than-normal temperatures driving down demand for heating fuels or a severe hurricane season that results in damage to key refining centres, could influence refining margins in 2007.

ECONOMIC SENSITIVITIES

The following table shows the estimated after-tax effects that changes in certain factors would have had on Petro-Canada's 2006 net earnings from continuing operations had these changes occurred.

Sensitivities affecting net earnings

Factor1, 2 | | Change (+) | | Annual Net Earnings Impact | | Annual Net Earnings Impact | |

| | | | | (millions of Canadian dollars) | | ($/share)3 | |

Upstream | | | | | | | |

Price received for crude oil and liquids4 | | $ | 1.00/bbl | | $ | 39 | | $ | 0.08 | |

| Price received for natural gas | | $ | 0.25/Mcf | | | 32 | | | 0.06 | |

Exchange rate: Cdn$/US$ refers to impact on upstream operating earnings from continuing operations5 | | $ | 0.01 | | | (33 | ) | | (0.07 | ) |

Crude oil and liquids production (barrels per day - b/d) | | | 1,000 b/d | | | 9 | | | 0.02 | |

Natural gas production (million cubic feet per day - MMcf/d) | | | 10 MMcf/d | | | 9 | | | 0.02 | |

Downstream | | | | | | | | | | |

| New York Harbor 3-2-1 crack spread | | $ | 0.10 US/bbl | | | 5 | | | 0.01 | |

| Light/heavy crude price differential | | $ | 1.00 US/bbl | | | 6 | | | 0.01 | |

Corporate | | | | | | | | | | |

Exchange rate: Cdn$/US$ refers to impact of the revaluation of U.S. dollar-denominated, long-term debt6 | | $ | 0.01 | | $ | 14 | | $ | 0.03 | |

1 The impact of a change in one factor may be compounded or offset by changes in other factors. This table does not consider the impact of any inter-relationship among the factors.

2 The impact of these factors is illustrative.

3 Per share amounts are based on the number of shares outstanding at December 31, 2006.

4 This sensitivity is based upon an equivalent change in the price of WTI and Dated Brent.

5 A strengthening Canadian dollar versus the U.S. dollar has a negative effect on upstream earnings from continuing operations.

6 A strengthening Canadian dollar versus the U.S. dollar has a positive effect on corporate earnings because the Company holds U.S. denominated debt. The impact refers to gains or losses on $1.4 billion US of the Company's U.S. denominated long-term debt and interest costs on U.S. denominated debt. Gains or losses on $1.1 billion US of the Company's U.S. denominated long-term debt, associated with the self-sustaining International business segment and the U.S. Rockies operations included in the North American Natural Gas business segment, are deferred and included as part of shareholders' equity.

Business Strategy

VALUE PROPOSITION AND STRATEGY

The value proposition Petro-Canada offers to its investors can best be summarized as "Integrated Value from a Diversified Resource Base." The Company's business strategy continues to be:

| § | improving the profitability of the base business |

| - | selecting the right assets to develop and then driving for first quartile performance1 |

| § | taking a disciplined approach to profitable growth |

| - | leveraging existing assets |

| - | accessing new opportunities with a focus on long-life assets |

| - | building a balanced exploration program |

Execution of the corporate strategy across all the business units is based on our key beliefs. These influence decisions Petro-Canada makes to deliver value from the integrated portfolio. The Company believes its structure and scope strategically position Petro-Canada to deliver long-term shareholder value. For example, with a base in Canada, Petro-Canada is situated in a stable, resource-rich and demand-driven market. An international presence and integration across businesses provide the Company access to more growth opportunities and an ability to better manage risk. As a mid-sized global company, even smaller sized investments can have a material impact. Last, the Company is committed to developing energy resources responsibly and encouraging opportunities and growth for employees.

EXECUTION OF THE STRATEGY IN 2006

IMPROVING BASE BUSINESS PROFITABILITY

The cornerstone of improving the profitability of the base business is delivering operational excellence. Petro-Canada expects its operated and non-operated facilities to run with high reliability and prudently managed costs. These measures are constantly tracked, reported and improved upon.

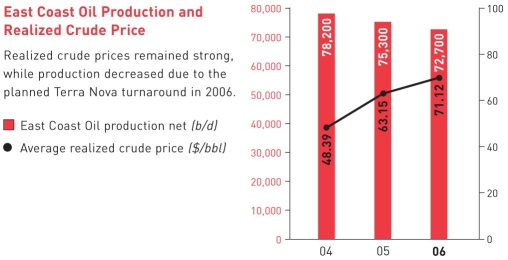

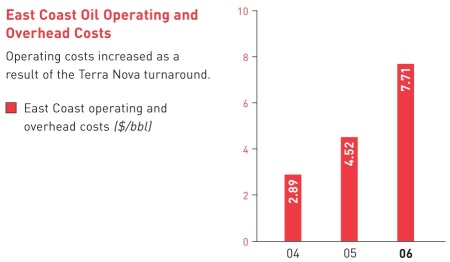

| § | In East Coast Oil, the partner-operated platforms at Hibernia and White Rose had solid operational performance in 2006. Petro-Canada operated Terra Nova had a challenging year when a planned maintenance turnaround was advanced and the turnaround to complete regulatory inspections and reliability improvements was extended. In November, oil production from the Terra Nova field resumed and the Company is targeting to achieve reliability2 above 90% over time. |

| § | In North American Natural Gas, Western Canada natural gas processing facilities operated at reliability rates greater than 98%. In 2006, the business continued to be faced with industry-wide cost pressures. |

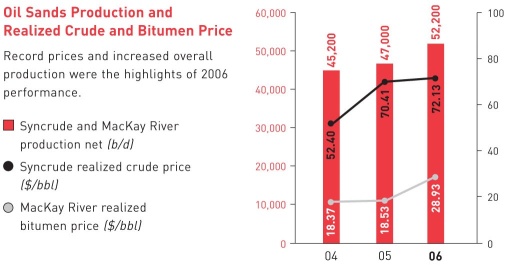

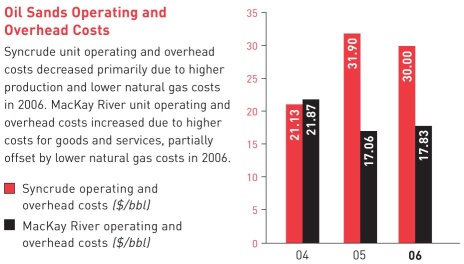

| § | In Oil Sands, the MacKay River in situ plant operated at more than 92% reliability. The independently operated Syncrude facility had varying reliability performance through the year, experiencing some delays bringing on the Stage III expansion mid-year, but providing increased production for the last four months of the year. |

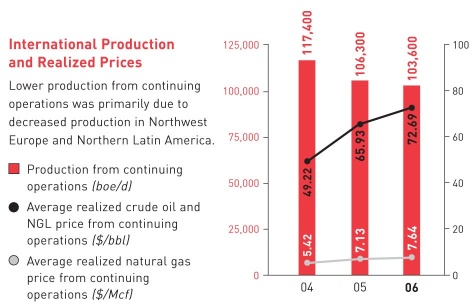

| § | The International business unit's production from Northwest Europe exceeded expectations, led by high reliability and the early ramp up to full production of the De Ruyter field. This strong performance was partially offset by lower reservoir performance in Libya and Train 4 startup problems in Trinidad and Tobago. |

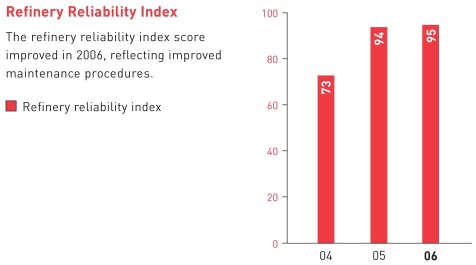

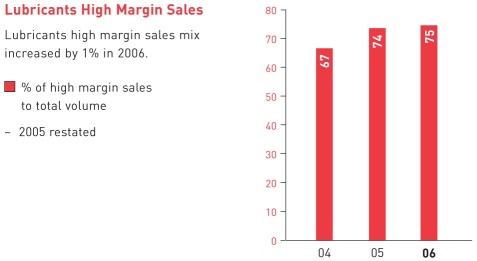

| § | In the Downstream, solid operations at the Edmonton and Montreal refineries resulted in a combined reliability index of 95. The Company completed its ultra-low sulphur diesel projects at its Edmonton and Montreal refineries, thereby providing cleaner burning fuels to consumers. A fire at the lubricants plant early in the year was a setback; however, the facility operated with solid reliability for the remainder of the year. |

| § | Corporate wide, the Company views safety and environmental performance as an indicator of operational excellence. In 2006, total recordable injury frequency (TRIF) was reduced by 25% and environmental exceedances were lowered by more than 20%, compared with 2005. |

1 References to first quartile operations in this report do not refer to industry-wide benchmarks or externally known measures. The Company has a variety of internal metrics that define and track first quartile operational performance.

2 Throughout this MD&A, the Company refers to reliability within the five business units. These reliability rates are calculated using internal methods that vary among the business units and take various factors into account. There are no existing external or industry-wide standards used in calculating reliability rates and, therefore, resulting calculations are not necessarily comparable to other companies in the oil and gas industry.

LONG-TERM PROFITABLE GROWTH

The Company recognizes that adding new material opportunities is fundamental to long-term growth. Petro-Canada is seeking to increase the relative proportion of long-life resources in the portfolio as a means to deliver sustainable cash flow and earnings. In addition to bringing major projects on-stream, the Company is creating value through its balanced exploration program and business development opportunities.

| § | In East Coast Oil, discoveries were made in the west and southwest sections of the White Rose field in 2006. Petro-Canada and its partners suspended negotiations with the Government of Newfoundland and Labrador on the Hebron development; however, Petro-Canada continues to consider Hebron a quality asset. At Hibernia, government approval of the development plans for the Southern Extension were not received in 2006, limiting additional production in 2007. |

| § | In North American Natural Gas, the business continued to focus on optimizing the Company's conventional assets and on the transition to unconventional production in Western Canada and the U.S. Rockies. Water treatment permits for wells in the U.S. Rockies were approved, permitting the ramp up of coal de-watering. While the Company is optimistic about its coal bed methane (CBM) opportunities in the U.S. Rockies, it also plans to bring on additional tight gas in areas like the Denver-Julesberg Basin. Progress was also made on the longer term strategy of accessing new supplies, with the addition of acreage in Alaska and advancement of the proposed Gros-Cacouna re-gasification project. |

| § | In Oil Sands, Petro-Canada advanced the Fort Hills project with the filing of a regulatory application to construct and operate the Sturgeon Upgrader near Edmonton. MacKay River production capacity was increased with the addition of a third well pad. The Company also increased in situ oil sands landholdings with the purchase of additional leases adjacent to MacKay River. |

| § | In International, Petro-Canada completed the sale of the Company's mature, high-decline producing assets in Syria. Later in the year, the Company completed an agreement to purchase a 90% interest in the Ash Shaer and Cherrife natural gas fields in central Syria, with future plans to build and operate a long-life natural gas development. In the Netherlands sector of the North Sea, the Company-operated De Ruyter project achieved first oil in September, while L5b-C achieved first natural gas in November. In September 2006, the Company furthered its balanced exploration program by securing drilling rigs for its 2007 and 2008 well programs. As well, exploration acreage was added in Libya and the North Sea in 2006. In the United Kingdom (U.K.) sector of the North Sea, the Buzzard project achieved first oil in early 2007. The field is expected to ramp up to full production in mid-2007. |

| § | In the Downstream, capacity at the lubricants plant was expanded by 25% in 2006. Construction to convert the Edmonton refinery to process 100% bitumen-based feedstock commenced and, by year end, 18% of the project was completed. The Downstream also furthered work to evaluate the feasibility of adding a coker to the Montreal refinery. |

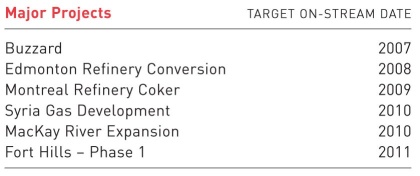

BUSINESS STRATEGY LOOKING FORWARD

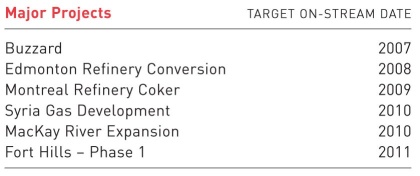

Ensuring existing facilities run safely, reliably and efficiently through excellent execution will continue to be a key focus for Petro-Canada. This same focus on execution will apply to the advancement of major projects. Business plans see the Company adding five major projects over the next several years. Most of these are long-life projects with stable production for 10 years or more. The Buzzard project will ramp up in 2007 and the Edmonton refinery conversion project has been sanctioned and is under construction, with expected completion in 2008. The subsequent projects, shown in the table, are expected to be sanctioned once sufficient front-end engineering work has been completed. Capital expenditures are expected to increase to between $4 billion and $5 billion per year for the next several years, reflecting spending on these major projects.

As a result of the Company having such a strong suite of projects, Petro-Canada will further focus its portfolio in 2007 to those projects and areas that can make a material difference, that balance the Company's risk profile and that can be executed effectively. As a result, the Company may divest smaller assets and interests in 2007.

Risk Management

PETRO-CANADA'S RISK PROFILE

Petro-Canada's results are impacted by risk and management's strategy for handling risks. Petro-Canada characterizes and manages risks in four broad categories: business risks, market risks, operational risks and foreign risks. Within these categories, risks are listed in alphabetical order below. Management believes each major risk requires a unique response based on Petro-Canada's business strategy and financial tolerance. While some risks can be effectively managed through internal controls and business processes, others are managed through insurance and hedging. The Audit, Finance and Risk Committee of the Board of Directors has responsibility to oversee risk management.1 The following describes Petro-Canada's approach to managing major risks.

BUSINESS RISKS

Counterparties

Petro-Canada is exposed to credit risk due to the uncertainty of business partners' or counterparties' ability to fulfil their obligations. The Company has internal credit policies and procedures that include financial assessments, exposure limits and processes to monitor and minimize the exposures against these limits. Where appropriate, Petro-Canada also uses netting and collateral arrangements to minimize risk.

Environmental Regulations

Petro-Canada has always been subject to the impact of changing environmental regulations on its operations; however, the risk is considered to be increasing as related laws and regulations become more stringent in Canada and in other countries where Petro-Canada operates. Petro-Canada invests capital to satisfy new product specifications and/or address environmental issues. In 2007, the Company anticipates that it will invest $100 million of its capital expenditure program toward regulatory compliance. As well, the Company conducts Life-Cycle Value Assessments (LCVA), a system to integrate and balance environmental, social and economic decisions for major projects. This process encourages the exploration of alternatives when considering the life-cycle of an asset or product from construction through to abandonment. The LCVA is a useful technique, but it cannot predict changes in environmental regulations. As a result, changes in environmental regulations may impact Petro-Canada's business results.

The Kyoto Protocol, effective in Canada since 2005, requires signatory nations to reduce their emissions of carbon dioxide and other greenhouse gases. The details of implementation of the Protocol in Canada have not been finalized. Depending on the specifics of the regulations, Petro-Canada may be required to reduce emissions of greenhouse gases from operations, to purchase emission-trading credits or pay for other types of offsets. The impact on Petro-Canada could result in substantially higher capital expenditures and/or operating expenses. The Government of Canada may also impose higher vehicle fuel efficiency standards. The impact of this action could be to decrease the demand for gasoline and diesel fuels sold by Petro-Canada and depress industry-wide margins for refined products. Through industry organizations, Petro-Canada works with a number of regulatory groups and government associations to find an approach that will minimize the negative financial impact of the greenhouse gas emission regulations on the Company, while still reducing emissions. The level of influence these efforts have on the Government of Canada's implementation plan may be quite limited.

Government Regulations

Petro-Canada's operations are regulated by, and could be intervened upon by, a variety of governments around the world. Governments could impact the contracting of exploration and production interests, impose specific drilling obligations, and expropriate or cancel contract rights. Governments may also regulate prices of commodities or refined products, or intervene indirectly on prices through taxes, royalties and exploration rights.

Petro-Canada tries to mitigate the potentially disruptive impact of government regulations by selecting operating environments with stable governments and by maintaining respectful relationships with governments and regulators. Contact with regulators and governments usually occurs through the Company's management and/or regulatory affairs and government relations personnel. Petro-Canada aims to have regular, constructive communication with regulators and governments so issues can be resolved in a mutually acceptable fashion. The Company also has a strong record of regulatory compliance within the jurisdictions where it operates. By virtue of Petro-Canada's integrated portfolio of businesses, the Company operates in many different jurisdictions and derives revenue from several categories of products. This diversification makes financial performance less sensitive to the action of any single government. Nevertheless, Petro-Canada has limited ability to influence regulations that may have a material adverse effect on the Company.

1 Further detail regarding the Audit, Finance and Risk Committee can be found in the AIF along with a copy of its Charter, attached as Schedule C.

Licence to Operate

Petro-Canada's oil and gas production and refining operations impact communities and surrounding environments. Those impacted can become concerned over the use of scarce resources, such as land and water, the perceived or real threat to human health, the potential impact on biodiversity, and/or possible societal changes to surrounding communities. Petro-Canada must secure and maintain formal regulatory approvals and licences to conduct its operations. In addition, broader societal acceptance of the Company's activities is necessary for resource development. An inability for Petro-Canada to secure local community support, necessary regulatory approvals and licences, and broader societal acceptance can result in projects being delayed or stopped, increasing project costs and damage to the Company's reputation. Lack of local community and stakeholder support can also lead to pressure to limit or shut down operations.

Petro-Canada manages this risk by applying a set of Principles for Responsible Investment and Operations to its businesses. These Principles provide a framework whereby Petro-Canada's operations around the world are conducted in a manner that is economically rewarding to all parties and recognized as being ethically, environmentally and socially responsible. These Principles and the Company's activities in support of them can be found on Petro-Canada's website at www.petro-canada.ca. Even though Petro-Canada is committed to following its Principles and respecting two-way dialogue with applicable stakeholders, there is no guarantee the Company will be granted the licences needed to operate projects within expected timelines or that its reputation with affected stakeholders will not be damaged.

Non-Operated Interests

Petro-Canada has a significant interest in assets where the management of construction or operation is done by other companies. Business assets in which Petro-Canada has a major interest, but does not operate, include Hibernia (20% interest), Syncrude (12% interest), White Rose (27.5% interest) and Buzzard (29.9% interest). Joint venture executive committees manage major projects, so Petro-Canada does have some ability to influence these projects. As well, Petro-Canada has joint venture or other operating agreements, which specify the Company's expectations from third-party operators. Nevertheless, third-party operation and management of the Company's assets could adversely affect Petro-Canada's financial performance.

Project Execution

Petro-Canada manages a variety of projects to support continuing operations and future growth. Petro-Canada's goal is to consistently deliver projects in alignment with expectations. Project execution risks include, but are not limited to, changes in project scope, labour availability and productivity, material and services availability and costs, design and construction errors, regulatory approvals, project management and operational capability. To mitigate these risks, Petro-Canada applies a project delivery management system, establishes strong project management teams, breaks large projects down into manageable components, builds on experience and existing technologies, works with all stakeholders on safety and environmental expectations, and conducts post-project reviews to improve project management and operational capabilities. Petro-Canada primarily delivers projects through engineering, procurement and construction (EPC) companies. Through the establishment of strong, internal project management teams, the Company establishes effective working relationships with EPC companies.

In 2006, Petro-Canada completed a number of projects, including converting refineries to produce cleaner burning fuels, expansion of the lubricants plant and bringing the Company-operated De Ruyter project in the North Sea on-stream. These projects represented $1.7 billion of investment, which was completed on time and on budget. Nevertheless, the inability of Petro-Canada to execute projects as expected is a risk to the Company. Globally, there is a focus on execution and projects are tending to be larger and more complex at the same time as the pool of experienced personnel is declining. The Company has recognized the need to provide the organizational capability to successfully execute these projects and, as such has been building its capabilities through recruiting and internal training; however, the inability to adequately source the staffing requirements could jeopardize successful project execution.

Reserves Estimates

Estimates of economically recoverable oil and gas reserves are based upon a number of variables and assumptions. These include geoscientific interpretation, commodity prices, operating and capital costs, and historical production from properties. Petro-Canada has well-established, corporate-wide reserves booking practices that have been continuously improved for more than a decade. PricewaterhouseCoopers LLP, as contract internal auditor, has tested aspects of the non-engineering control processes Petro-Canada used in establishing reserves. As well, independent engineering firms assess a significant portion of reserves estimates every year. Over time, this means all of Petro-Canada's reserves estimates are assessed by external evaluators. The Board of Directors also reviews and approves the Company's annual reserves filings. More information on reserves booking practices can be found in the Company's AIF.

Reserves Replacement 1,2

Petro-Canada's future cash flows from continuing operations are highly dependent on its ability to offset natural declines as reserves are produced. As basins mature, replacement of reserves becomes more challenging and expensive. In some geographic areas, the Company may choose to allow its reserves to decline if replacement is uneconomical, pursuing other reserves additions instead from successful exploration or acquisitions.

Petro-Canada's reserves objective is to fully replace proved reserves over a five-year period. In 2006, the Company replaced 134% of its production on a proved reserves basis, compared with 111% in 2005. The Company's five-year proved replacement ratio was 160% at year-end 2006. There is no assurance Petro-Canada will successfully replace reserves that are produced in any given year.

MARKET RISKS

More detailed quantification of the impact of some of the following risks can be found in the earnings sensitivities table on page 5 of the Business Environment section in the MD&A.

Commodity Prices

The prices of crude oil and natural gas fluctuate in response to market factors that are external to Petro-Canada. Commodity prices are volatile and influenced by factors such as supply and demand fundamentals, geopolitical events, OPEC decisions and weather. For historical commodity prices, please refer to page 4 of the Business Environment section in the MD&A. Changes in crude oil and natural gas prices affect the price that Petro-Canada receives for its upstream production. Commodity prices also impact the refined product margins realized in the Downstream business. Petro-Canada's ability to maintain product margins in an environment of higher feedstock costs is contingent upon the Company's ability to pass on higher costs to customers.

Petro-Canada generally does not hedge large volumes of production. Management believes commodity prices are volatile and difficult to predict. The business is managed so that the Company can substantially withstand the impact of a lower price environment while maintaining the opportunity to capture significant upside when the price environment is higher. However, commodity prices and margins may be hedged occasionally to capture opportunities that represent extraordinary value and/or to reduce commodity price risk on specific exposures. Certain Downstream physical transactions are routinely hedged for operational needs and to facilitate sales to customers.

Foreign Exchange

Because energy commodity prices are primarily in U.S. dollars, Petro-Canada's revenue stream is affected by the Canada/U.S. exchange rate. As a result, the Company's earnings are negatively affected by a strengthening Canadian dollar. The Company is also exposed to fluctuations in other foreign currencies, such as the euro and the British pound. Generally, Petro-Canada does not hedge foreign exchange exposures, although the Company partially mitigates the U.S. dollar exposure by denominating the majority of its debt obligations in U.S. dollars. Foreign exchange exposure related to asset acquisitions or divestitures, or project capital expenditures, may be hedged on a case-by-case basis.

Interest Rates

Petro-Canada targets a blend of fixed and floating rate debt. Generally, this strategy lets the Company take advantage of lower interest rates on floating debt, while matching overall debt maturities with the life of cash-generating assets. While the Company is exposed to fluctuations in the rate of interest it pays on floating rate debt, this interest rate exposure is within the Company's risk tolerance. Periodically, the Company reviews the proportion of fixed to floating rate debt issued.

1 See legal notice on page 2 regarding oil and gas, and oil sands mining activities.

2 Proved reserves replacement ratio is calculated by dividing the year-over-year net change in proved reserves, before deducting production, by the annual production over the same period. The reserves replacement ratio is a general indicator of the Company's reserves growth. It is only one of a number of metrics that can be used to analyse a company's upstream business.

Derivative Instruments

Petro-Canada has a formal policy that prohibits the use of derivative instruments for speculative purposes. All derivative instruments entered into are for the purpose of mitigating identified price risks.

Petro-Canada continually monitors outstanding derivative instruments. This includes an assessment of fair values of all derivative instruments using independent third-party quotes to determine the value of each derivative instrument. The objectives of all price risk mitigation transactions are documented, and the effectiveness of each derivative instrument in offsetting the identified price risk is periodically assessed. Petro-Canada also limits the transaction term of its derivative instruments.

The Company applied mark-to-market accounting treatment to all derivative transactions that it entered into in 2006. Realized and unrealized gains and losses resulting from changes in the fair value of derivative instruments that do not qualify for hedge accounting are recognized in "Investment and Other Income." For derivative instruments that qualify for hedge accounting, Petro-Canada may elect to apply hedge accounting treatment.

During 2004, as part of the Company's acquisition of an interest in the Buzzard field in the U.K. sector of the North Sea, the Company entered into a series of derivative contracts related to the future sale of Dated Brent crude oil. The purpose of these transactions was to ensure value-added returns to Petro-Canada on this investment, even in the event of a material decrease in oil prices. These contracts effectively lock in an average forward price of approximately $26 US/bbl on a volume of 35,840,000 bbls. This volume represents approximately 50% of the Company's share of estimated plateau production from July 1, 2007 to December 31, 2010. As at December 31, 2006, the Buzzard derivative instruments had a recognized mark-to-market unrealized loss of $1,007 million after-tax, of which $240 million was recognized in the income statement in 2006.

In 2006, other derivative instruments in place for refining supply and product purchases resulted in an increase in net earnings from continuing operations of about $1 million after-tax, compared with an increase of about $4 million in 2005.

OPERATIONAL RISKS

Exploring for, developing, producing, refining, transporting and marketing oil, natural gas and refined products involve significant operational risks. These risks include situations such as well blowouts, fires, explosions, gaseous leaks, equipment failures, migration of harmful substances and oil spills. Any of these operational incidents, including events beyond the Company's control, could cause personal injury, environmental contamination, interruption of production, and/or damage and destruction of the Company's assets.

Petro-Canada manages operational risks primarily through a Total Loss Management (TLM) system that has standards to prevent losses. Regular TLM audits test compliance with these standards. The Company also has a Zero-Harm philosophy, a belief that injuries and illnesses, on and off the job, are foreseeable and preventable.

The Company also purchases insurance to transfer the financial impact of some operational risks to third-party insurers. On an annual basis, Petro-Canada management evaluates its operational risk exposures and adjusts its insurance coverage, including deductibles and limits. While Petro-Canada maintains insurance consistent with industry practices, the Company cannot and does not fully insure against all risks. Losses resulting from operational incidents could have an adverse impact on the Company.

Interruption to production at any one of Petro-Canada's facilities could result in an adverse financial impact; however, the risk of multiple facilities experiencing production interruptions at the same time is mitigated by having multiple large producing and upgrading assets in various geographic locations throughout the world.

FOREIGN RISKS

Petro-Canada has significant operations in a number of countries that have varying political, economic and social systems. As a result, the Company's operations and related assets are subject to potential risks of actions by governmental authorities, internal unrest, war, political disruption, economic and legal sanctions (such as restrictions against countries that the U.S. government may deem to sponsor terrorism), and changes in global trade policies. The Company's operations may be restricted, disrupted or prohibited in any country in which these risks occur. Petro-Canada also has production in countries that are members of OPEC, which has resulted in, and may result in, the future for production volumes to be constrained by quotas.

The Company continually evaluates exposure in any one country in the context of total operations. Investment may be limited to avoid excessive exposure in any one country or region. The Company also purchases political risk insurance to partially mitigate certain political risks.

Consolidated Financial Results

ANALYSIS OF CONSOLIDATED EARNINGS AND CASH FLOW

Consolidated Financial Results

On January 31, 2006, Petro-Canada closed the sale of the Company's producing assets in Syria. These assets and associated results are reported as discontinued operations and are excluded from continuing operations.

(millions of Canadian dollars, unless otherwise indicated) | | 2006 | | 2005 | | 2004 | |

Net earnings | | $ | 1,740 | | $ | 1,791 | | $ | 1,757 | |

| Net earnings from discontinued operations | | | 152 | | | 98 | | | 59 | |

Net earnings from continuing operations | | $ | 1,588 | | $ | 1,693 | | $ | 1,698 | |

Gain on foreign currency translation 1 | | | 1 | | | 73 | | | 63 | |

Unrealized loss on Buzzard derivative contracts 2 | | | (240 | ) | | (562 | ) | | (205 | ) |

| Gain on sale of assets | | | 25 | | | 34 | | | 11 | |

Operating earnings from continuing operations 3, 4 | | $ | 1,802 | | $ | 2,148 | | $ | 1,829 | |

| Stock-based compensation | | | (31 | ) | | (66 | ) | | (11 | ) |

Insurance proceeds (surcharges) 5 | | | 8 | | | (75 | ) | | 31 | |

| Income tax adjustments | | | (185 | ) | | 22 | | | 13 | |

| Oakville closure costs | | | - | | | 2 | | | (46 | ) |

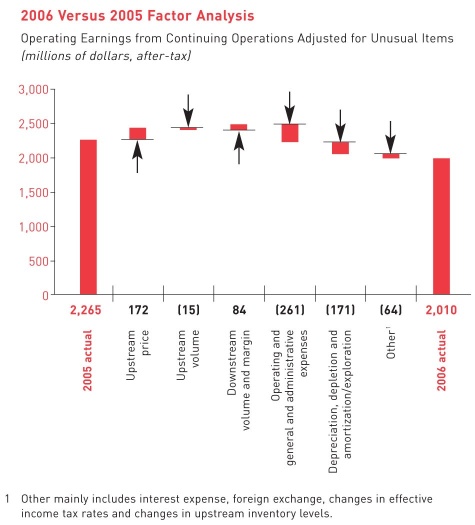

Operating earnings from continuing operations adjusted for unusual items | | $ | 2,010 | | $ | 2,265 | | $ | 1,842 | |

Earnings per share from continuing operations (dollars) - basic | | $ | 3.15 | | $ | 3.27 | | $ | 3.21 | |

- diluted | | | 3.11 | | | 3.22 | | | 3.17 | |

Earnings per share (dollars) - basic | | $ | 3.45 | | $ | 3.45 | | $ | 3.32 | |

| - diluted | | | 3.41 | | | 3.41 | | | 3.28 | |

Cash flow from continuing operating activities before changes in non-cash working capital 4, 6 | | | 3,687 | | | 3,787 | | | 3,425 | |

Cash flow from continuing operating activities before changes in non-cash working capital per share (dollars) | | | 7.32 | | | 7.31 | | | 6.47 | |

| Debt | | | 2,894 | | | 2,913 | | | 2,580 | |

Cash and cash equivalents 7 | | | 499 | | | 789 | | | 170 | |

Average capital employed 7 | | $ | 12,868 | | $ | 11,860 | | $ | 10,533 | |

Return on capital employed (%) 7 | | | 14.3 | | | 16.0 | | | 17.5 | |

Operating return on capital employed (%) 7 | | | 15.0 | | | 19.8 | | | 18.8 | |

Return on equity (%) 7 | | | 17.5 | | | 19.7 | | | 21.5 | |

1 Foreign currency translation reflects gains or losses on U.S. dollar-denominated long-term debt not associated with the self-sustaining International business unit and the U.S. Rockies operations included in the North American Natural Gas business unit.

2 As part of its acquisition of an interest in the Buzzard field in the U.K. sector of the North Sea in June 2004, the Company entered into derivative contracts for half of its share of estimated production for 3½ years, starting July 1, 2007.

3 Operating earnings, which represent net earnings excluding gains or losses on foreign currency translation and on disposal of assets and the unrealized gains or losses associated with the Buzzard derivative contracts, are used by the Company to evaluate operating performance.

4 Operating earnings and cash flow from continuing operations do not have any standardized meaning prescribed by Canadian GAAP and, therefore, may not be comparable with the calculation of similar measures for other companies.

5 Insurance premium surcharges include accruals and surcharges for Oil Insurance Ltd. (OIL) and sEnergy Insurance Ltd. (sEnergy) policies. OIL is a mutual insurance company that insures against property damage in the energy sector. sEnergy was a mutual insurance company that provided business interruption and excess property insurance to the energy sector.

6 Cash flow, which is expressed before changes in non-cash working capital items relating to operating activities, is used by the Company to analyse operating performance, leverage and liquidity.

7 Includes discontinued operations.

2006 COMPARED WITH 2005

Operating earnings from continuing operations adjusted for unusual items decreased 11% to $2,010 million in 2006, compared with $2,265 million in 2005. Lower upstream production, declining realized natural gas prices and higher operating and exploration costs were partially offset by stronger realized crude oil prices.

In 2006, operating earnings from continuing operations included a number of unusual items: $185 million charge for income tax rate and other tax adjustments, $37 million in insurance proceeds, a $31 million charge related to the mark-to-market of stock-based compensation and a $29 million insurance premium surcharge.

In 2005, operating earnings from continuing operations included a number of unusual items: a $77 million insurance premium surcharge, a $66 million charge related to the mark-to-market of stock-based compensation and a $22 million positive adjustment related to income tax rate and other tax adjustments.

Net earnings from continuing operations in 2006 were $1,588 million, down 6% compared with $1,693 million in 2005, primarily due to lower production, declining realized natural gas prices and income tax adjustments, partially offset by lower realized losses on Buzzard derivative contracts. Net earnings from continuing operations included gains or losses on foreign currency translation, unrealized losses on Buzzard derivative contracts and gains on asset sales.

QUARTERLY INFORMATION

Consolidated Quarterly Financial Results

| | | 2006 | | 2005 |

| (millions of Canadian dollars, unless otherwise indicated) | | Quarter 1 | | Quarter 2 | | Quarter 3 | | Quarter 4 | | Quarter 1 | | Quarter 2 | | Quarter 3 | | Quarter 4 |

| Total revenue from continuing operations | | $ | 4,188 | | $ | 4,730 | | $ | 5,201 | | $ | 4,550 | | $ | 3,275 | | $ | 3,945 | | $ | 4,721 | | $ | 4,838 |

| Operating earnings from continuing operations | | | 202 | | | 532 | | | 597 | | | 471 | | | 427 | | | 476 | | | 597 | | | 648 |

| Net earnings from continuing operations | | | 54 | | | 472 | | | 678 | | | 384 | | | 110 | | | 322 | | | 593 | | | 668 |

| Cash flow from continuing operating activities before changes in non-cash working capital | | | 857 | | | 754 | | | 1,085 | | | 991 | | | 801 | | | 869 | | | 1,001 | | | 1,116 |

Earnings per share from continuing operations (dollars) | | | | | | | | | | | | | | | | | | | | | | | | |

- basic | | $ | 0.11 | | $ | 0.93 | | $ | 1.36 | | $ | 0.77 | | $ | 0.21 | | $ | 0.62 | | $ | 1.14 | | $ | 1.29 |

- diluted | | $ | 0.10 | | $ | 0.92 | | $ | 1.34 | | $ | 0.76 | | $ | 0.21 | | $ | 0.61 | | $ | 1.13 | | $ | 1.28 |

Earnings per share (dollars) | | | | | | | | | | | | | | | | | | | | | | | | |

- basic | | $ | 0.40 | | $ | 0.93 | | $ | 1.36 | | $ | 0.77 | | $ | 0.23 | | $ | 0.66 | | $ | 1.19 | | $ | 1.38 |

- diluted | | $ | 0.40 | | $ | 0.92 | | $ | 1.34 | | $ | 0.76 | | $ | 0.22 | | $ | 0.66 | | $ | 1.17 | | $ | 1.36 |

Revenue and net earnings variances from quarter to quarter resulted mainly from fluctuations in commodity prices and refinery cracking margins, the impact on production and processed volumes from maintenance and other shutdowns at major facilities, and the level of exploration drilling activity. For further analysis of quarterly results, refer to Petro-Canada's quarterly reports to shareholders available on the Company's website at www.petro-canada.ca.

Liquidity and Capital Resources

Summary of Cash Flows

(millions of Canadian dollars) | | 2006 | | 2005 | | 2004 | |

Cash flow from continuing operating activities | | $ | 3,608 | | $ | 3,783 | | $ | 3,928 | |

| Increase (decrease) in non-cash working capital related to continuing operating activities and other | | | 79 | | | 4 | | | (503 | ) |

Cash flow from continuing operations | | $ | 3,687 | | $ | 3,787 | | $ | 3,425 | |

| Cash flow from discontinued operating activities | | | 15 | | | 204 | | | 233 | |

| Increase (decrease) in non-cash working capital related to discontinued operating activities | | | 2 | | | 41 | | | (29 | ) |

Cash flow | | | 3,704 | | | 4,032 | | | 3,629 | |

| Net cash inflows (outflows) from: | | | | | | | | | | |

investing activities before changes in non-cash working capital | | | (2,797 | ) | | (3,595 | ) | | (4,591 | ) |

financing activities before changes in non-cash working capital | | | (1,175 | ) | | (10 | ) | | (19 | ) |

| (Increase) decrease in non-cash working capital | | | (22 | ) | | 192 | | | 516 | |

| Increase (decrease) in cash and cash equivalents | | $ | (290 | ) | $ | 619 | | $ | (465 | ) |

Cash and cash equivalents at end of year | | $ | 499 | | $ | 789 | | $ | 170 | |

Cash and cash equivalents - discontinued operations | | $ | - | | $ | 68 | | $ | 206 | |

In 2006, cash flow from continuing operations was $3,687 million ($7.32/share), compared with $3,787 million ($7.31/share) in 2005. The decrease in cash flow reflected lower operating earnings from continuing operations.

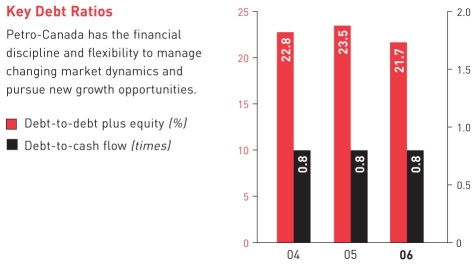

Financial Ratios

| | 2006 | 2005 | 2004 |

Interest coverage from continuing operations (times)1 | | | |

Net earnings basis | 19.2 | 17.9 | 20.0 |

EBITDAX basis | 27.0 | 25.4 | 29.2 |

Cash flow basis | 27.4 | 28.9 | 30.4 |

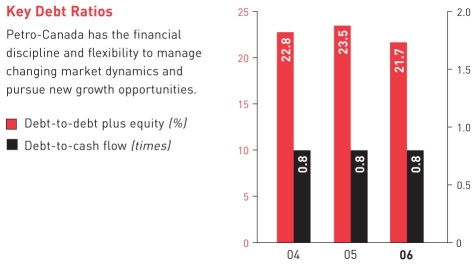

Debt-to-cash flow (times)2 | 0.8 | 0.8 | 0.8 |

Debt-to-debt plus equity (%) | 21.7 | 23.5 | 22.8 |

1 Refer to the Glossary of Terms and Ratios on page 92 for methods of calculation.

2 From continuing operations.

Petro-Canada's financing strategy is designed to maintain financial strength and flexibility to support profitable growth in all business environments. Two key measures that Petro-Canada uses to measure the Company's overall financial strength are debt-to-cash flow from continuing operations and debt-to-debt plus equity. Petro-Canada's debt-to-cash flow from continuing operations ratio, the key short-term measure, was 0.8 times at December 31, 2006 and 2005. This was well within the Company's target range of no more than 2.0 times. Debt-to-debt plus equity, the long-term measure for capital structure, was 21.7% at year-end 2006, down from 23.5% at year-end 2005. This was below the target range of 25% to 35% for both years, providing the financial flexibility to fund the Company's capital program and profitable growth opportunities. Financial covenants associated with the Company's various debt arrangements are reviewed regularly and controls are in place to ensure compliance with these covenants.

OPERATING ACTIVITIES

Excluding cash and cash equivalents, short-term notes payable and the current portion of long-term debt, the operating working capital deficiency, including discontinued operations, was $1,014 million at December 31, 2006, compared with an operating working capital deficiency, including discontinued operations, of $697 million at December 31, 2005. The working capital deficiency, including discontinued operations, was higher primarily due to a decrease in accounts receivable and an increase in accounts payable.

INVESTING ACTIVITIES

Capital and Exploration Expenditures

(millions of Canadian dollars) | | 2007 Outlook 1 | | 2006 | | 2005 | | 2004 | |

Upstream | | | | | | | | | |

| North American Natural Gas | | $ | 780 | | $ | 788 | | $ | 713 | | $ | 666 | |

| East Coast Oil | | | 210 | | | 256 | | | 314 | | | 275 | |

| Oil Sands | | | 770 | | | 377 | | | 772 | | | 397 | |

International 2 | | | 865 | | | 760 | | | 696 | | | 1,707 | 3 |

| | | $ | 2,625 | | $ | 2,181 | | $ | 2,495 | | $ | 3,045 | |

Downstream | | | | | | | | | | | | | |

| Refining and Supply | | $ | 1,215 | | $ | 1,038 | | $ | 883 | | $ | 656 | |

| Sales and Marketing | | | 150 | | | 142 | | | 108 | | | 171 | |

| Lubricants | | | 25 | | | 49 | | | 62 | | | 12 | |

| | | $ | 1,390 | | $ | 1,229 | | $ | 1,053 | | $ | 839 | |

Shared Services | | $ | 35 | | $ | 24 | | $ | 12 | | $ | 9 | |

Total property, plant and equipment and exploration | | $ | 4,050 | | $ | 3,434 | | $ | 3,560 | | $ | 3,893 | |

| Deferred charges and other assets | | | 10 | | | 50 | | | 70 | | | 36 | |

| Acquisition of Prima Energy Corporation | | | - | | | - | | | - | | | 644 | |

Total continuing operations | | $ | 4,060 | | $ | 3,484 | | $ | 3,630 | | $ | 4,573 | |

| Discontinued operations | | $ | - | | $ | 1 | | $ | 46 | | $ | 62 | |

Total | | $ | 4,060 | | $ | 3,485 | | $ | 3,676 | | $ | 4,635 | |

1 The 2007 outlook was previously released on December 14, 2006.

2 International excludes capital expenditures related to the Syrian producing assets, which are reflected as discontinued operations.

3 Includes $1,218 million for the Buzzard acquisition.

Capital and exploration expenditures were $3,485 million in 2006, down 5% compared with $3,676 million in 2005, mainly reflecting lower investment in Oil Sands assets.

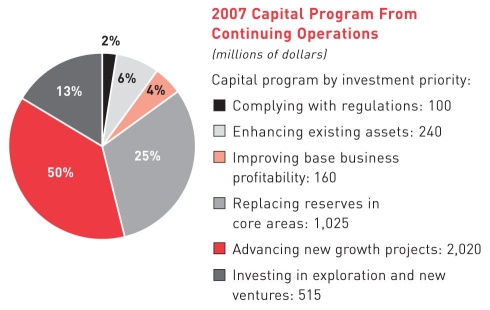

In 2007, spending on new growth projects is expected to increase. More than 60% of planned capital expenditures support delivering profitable new growth, and funding exploration and new ventures. This estimate is up from nearly 53% in these categories in 2006. The remaining 40% of the 2007 planned capital expenditures are directed toward replacing reserves in core areas, enhancing existing assets, improving base business profitability and complying with regulations. The regulatory compliance portion of the program was greater in 2006, primarily reflecting expenditures to produce cleaner burning fuels at Downstream refineries.

FINANCING ACTIVITIES AND DIVIDENDS

Sources of Capital Employed

(millions of Canadian dollars) | | 2006 | | 2005 | | 2004 |

| Short-term notes payable | | $ | - | | $ | - | | $ | 299 |

| Long-term debt, including current portion | | | 2,894 | | | 2,913 | | | 2,281 |

| Shareholders' equity | | | 10,441 | | | 9,488 | | | 8,739 |

Total | | $ | 13,335 | | $ | 12,401 | | $ | 11,319 |

Total debt decreased to $2,894 million at December 31, 2006, compared with $2,913 million at the previous year end. The decrease in debt was due to capital lease repayments made in 2006.

2006 Financing Activities

During the fourth quarter, Petro-Canada increased its syndicated committed credit facilities to $2,200 million from $2,000 million. At December 31, 2006, the Company also had bilateral demand credit facilities of $829 million. A total of $1,444 million of the credit facilities was used for letters of credit and overdraft coverage at December 31, 2006. The syndicated facilities also provide liquidity support to Petro-Canada's commercial paper program. No commercial paper was outstanding at year-end 2006. The Company will continue to use its cash position, draw on bank lines and issue commercial paper or long-term notes as necessary to meet working capital and other financing requirements. Petro-Canada plans to meet remaining debt repayment commitments from a combination of cash flow and debt refinancing.

The Company's unsecured long-term debt securities are rated Baa2 by Moody's Investors Service, BBB by Standard & Poor's and A (low) by Dominion Bond Rating Service. The Company's long-term debt ratings remained unchanged from year-end 2005.

Petro-Canada's short-term debt securities are rated R-1 (low) by Dominion Bond Rating Service. This rating remains unchanged from year-end 2005.

Returning Cash to Shareholders

Petro-Canada's first priority use of cash is to fund its capital program and profitable growth opportunities, and then to look to return cash to shareholders through dividends and a share buyback program.

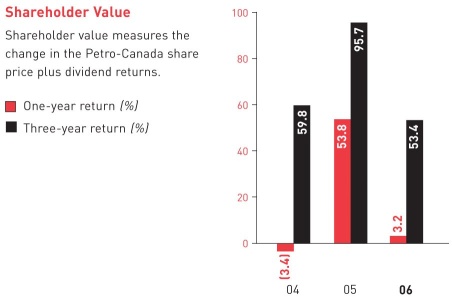

Petro-Canada regularly reviews its dividend strategy to ensure the alignment of the dividend policy with shareholder expectations, and financial and growth objectives. Consistent with these objectives, on December 14, 2006, the Company declared a 30% increase in its quarterly dividend to $0.13/share, commencing with the dividend payable April 1, 2007. Total dividends paid in 2006 were $201 million, compared with $181 million in 2005.

In 2004, Petro-Canada initiated a NCIB program, which was renewed in 2005 and 2006. The current program, which extends to June 21, 2007, entitles the Company to purchase up to 5% of the outstanding common shares, subject to certain conditions. The level of activity in the NCIB program during the first two quarters of 2006 reflected the use of proceeds from the sale of the mature Syrian assets to buy back shares.

Period | Shares Repurchased | Average Price | Total Cost |

| | 2006 | 2005 | 2006 | 2005 | 2006 | 2005 |

| Full year | 19,778,400 | 8,333,400 | $51.10 | $41.54 | $1,011 million | $346 million |

Off Balance Sheet

The Company has certain retail licensee and wholesale marketing agreements that would constitute variable interest entities as described in Note 26 to the Consolidated Financial Statements. These entities are not consolidated because Petro-Canada is not the primary beneficiary and, therefore, consolidation is not required. The Company's maximum exposure to losses from these arrangements would not be material. Other off balance sheet activities are limited to the accounts receivable securitization program, which does not meet the criteria for consolidation and guarantees.

Pension Plans

At year-end 2006, Petro-Canada's defined benefit pension plans were underfunded by $300 million, compared with an underfunded position of $378 million at year-end 2005. For both the defined benefit and defined contribution pension plans, the Company made cash contributions of $114 million and recorded a pension expense of $91 million before-tax in 2006. This compares with $112 million of cash contributions and $78 million before-tax of pension expense in 2005. The Company expects to make pension contributions of approximately $115 million in 2007.

Contractual Obligations - Summary

| | | |

| | | PAYMENTS DUE BY PERIOD |

(millions of Canadian dollars) | | | Total | | 2007 | | 2008-2009 | | 2010-2011 | | 2012 and thereafter |

Unsecured debentures and senior notes 1 | | $ | 6,260 | | $ | 175 | | $ | 351 | | $ | 351 | | $ | 5,383 |

Capital lease obligations 1 | | | 142 | | | 15 | | | 21 | | | 21 | | | 85 |

| Operating leases | | | 1,149 | | | 492 | | | 246 | | | 174 | | | 237 |

| Transportation agreements | | | 1,741 | | | 215 | | | 358 | | | 238 | | | 930 |

Product purchase/delivery obligations 2 | | | 2,539 | | | 280 | | | 375 | | | 275 | | | 1,609 |

Exploration work commitments 3 | | | 132 | | | 88 | | | 36 | | | 8 | | | - |

| Asset retirement obligations | | | 3,481 | | | 67 | | | 106 | | | 126 | | | 3,182 |

Other long-term obligations 4, 5 | | | 2,756 | | | 197 | | | 853 | | | 393 | | | 1,313 |

| Total contractual obligations | | $ | 18,200 | | $ | 1,529 | | $ | 2,346 | | $ | 1,586 | | $ | 12,739 |

1 Obligations include related interest. For further details, see Note 18 to the 2006 Consolidated Financial Statements.

2 Excludes supply purchase agreements contracted at market prices of $11,400 million, where the products could reasonably be re-sold into the market.

3 Excludes other amounts related to the Company's expected future capital spending. Capital spending plans are reviewed and revised annually to reflect Petro-Canada's strategy, operating performance and economic conditions. For further information regarding future capital spending plans, refer to the business segment and investing activities discussions of the 2006 MD&A.

4 Includes processing agreement with Suncor Energy Inc., receivables securitization program, pension funding obligations for the periods prior to the Company's next required pension plan valuation and other obligations. Pension obligations beyond the next required pension valuation date were excluded due to the uncertainty as to the amount or timing of these obligations.

5 Petro-Canada is involved in litigation and claims associated with normal operations. Management is of the opinion that any resulting settlements would not materially affect the financial position of the Company. The table excludes amounts for these contingencies due to the uncertainty as to the amount or timing of any settlements.

During 2006, Petro-Canada's total contractual obligations increased by approximately $1.5 billion, mainly due to an increase in the estimate of asset retirement obligations, additional product purchase obligations and operating lease commitments.

Upstream

Petro-Canada's upstream operations consisted of four business segments in 2006: North American Natural Gas, with current production in Western Canada and the U.S. Rockies; East Coast Oil, with three major developments offshore Newfoundland and Labrador; Oil Sands operations in Northeast Alberta; and International, where the Company is active in three core areas: Northwest Europe, North Africa/Near East and Northern Latin America.

The diverse asset base provides a balanced portfolio and a platform for long-term growth. In 2007, Petro-Canada is consolidating its East Coast Oil and International businesses. The purpose of the consolidation is to leverage and grow the capabilities of similar operations.

NORTH AMERICAN NATURAL GAS

BUSINESS SUMMARY AND STRATEGY

North American Natural Gas explores for and produces natural gas and crude oil and natural gas liquids (NGL) in Western Canada and the U.S. Rockies. This business also markets natural gas in North America and has established resources in the Mackenzie Delta/Corridor and Alaska.

The North American Natural Gas strategy is to be a significant market participant by accessing new and diverse natural gas supply sources in North America. Key features of the strategy include:

| § | targeting 75% to 80% reserves replacement |

| § | transitioning further into unconventional gas plays |

| § | optimizing core properties in Western Canada and developing CBM and tight gas in the U.S. Rockies |

| § | increasing the focus on exploration |

| § | developing liquefied natural gas (LNG) import capacity at Gros-Cacouna, Quebec |

| § | building the northern resource base for long-term growth |

North American Natural Gas Financial Results

(millions of Canadian dollars) | | 2006 | | 2005 | | 2004 |

Net earnings | | $ | 405 | | $ | 674 | | $ | 500 |

| Gain on sale of assets | | | 3 | | | 14 | | | - |

Operating earnings | | $ | 402 | | $ | 660 | | $ | 500 |

| Insurance premium surcharges | | | (1 | ) | | (4 | ) | | - |

| Income tax adjustments | | | 6 | | | 28 | | | 7 |

Operating earnings adjusted for unusual items | | $ | 397 | | $ | 636 | | $ | 493 |

| Cash flow from operating activities before changes in non-cash working capital | | $ | 739 | | $ | 1,193 | | $ | 882 |

| Expenditures on property, plant and equipment and exploration | | $ | 788 | | $ | 713 | | $ | 666 |

| Total assets | | $ | 4,151 | | $ | 3,763 | | $ | 3,477 |

2006 COMPARED WITH 2005

North American Natural Gas contributed $397 million of operating earnings adjusted for unusual items, down considerably from $636 million in 2005. Weak natural gas prices, lower Western Canada production, increased operating costs, higher exploration expenses and higher depreciation, depletion and amortization were partially offset by higher U.S. Rockies production.

Net earnings for North American Natural Gas were $405 million in 2006, down from $674 million in 2005. Net earnings in 2006 included a $6 million income tax adjustment, a $3 million gain on sale of assets and a $1 million insurance premium surcharge. Net earnings in 2005 included a $14 million gain on sale of assets, a $4 million insurance premium surcharge and a $28 million positive adjustment to income tax rate and other tax adjustments.

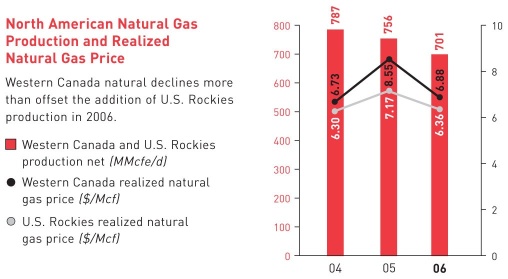

Oil and natural gas production averaged 701 million cubic feet/day of natural gas equivalent (MMcfe/d) in 2006, down from 756 MMcfe/d in 2005, as natural declines in Western Canada were partially offset by U.S. Rockies production growth. Natural gas commodity prices declined in 2006. The North American realized natural gas price averaged $6.85/Mcf in 2006, down 19% from $8.47/Mcf in 2005.

2006 OPERATING REVIEW AND STRATEGIC INITIATIVES

The North American Natural Gas business is positioning for the future with an increased focus on unconventional gas plays, acquisition of land in the Far North and progress on the proposed Quebec LNG project.

2006 Operating Review

| | | 2006 | | 2005 | | 2004 | |

Production net (MMcfe/d) | | | | | | | |

Western Canada | | | 646 | | | 704 | | | 764 | |

U.S. Rockies | | | 55 | | | 52 | | | 23 | 1 |

| Total North American Natural Gas production net | | | 701 | | | 756 | | | 787 | |

Western Canada realized natural gas price ($/Mcf) | | $ | 6.88 | | $ | 8.55 | | $ | 6.73 | |

U.S. Rockies realized natural gas price ($/Mcf) | | $ | 6.36 | | $ | 7.17 | | $ | 6.30 | |

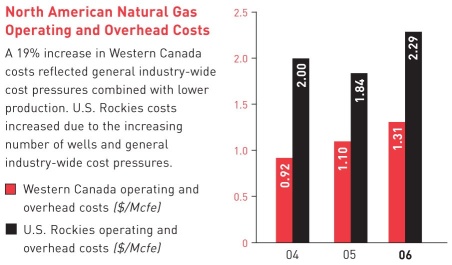

Western Canada operating and overhead costs ($/Mcfe) | | $ | 1.31 | | $ | 1.10 | | $ | 0.92 | |

U.S. Rockies operating and overhead costs ($/Mcfe) | | $ | 2.29 | | $ | 1.84 | | $ | 2.00 | |

1 U.S. Rockies production in 2004 is from the date of acquisition in July 2004.

Western Canada

Western Canada natural gas production averaged 646 MMcfe/d in 2006, down 8% from 704 MMcfe/d in 2005. Exploration and development drilling activity in Western Canada resulted in 393 successful wells (gross), for an overall success rate of 93% in 2006. Western Canada operating and overhead costs were $1.31/Mcfe in 2006, up from $1.10/Mcfe in the previous year. The operating and overhead cost increase in Western Canada reflected general industry-wide cost pressures for materials, fuel and labour, combined with lower production.

U.S. Rockies

U.S. Rockies natural gas production averaged 55 MMcfe/d in 2006, up 6% from 52 MMcfe/d in 2005. The increase reflected natural gas breakthrough at the Wild Turkey CBM field. Exploration and development drilling activity in the U.S. Rockies during 2006 resulted in more than 280 gross wells, down from the 300 wells in 2005. In addition, Petro-Canada obtained 396 permits for new CBM wells in 2006, with 363 applications submitted for consideration. Most of the new CBM wells are currently in the de-watering phase. U.S. Rockies operating and overhead costs were $2.29/Mcfe in 2006, compared with $1.84/Mcfe in 2005. This increase reflected costs associated with the increasing number of wells, along with general industry-wide cost pressures.

2006 Strategic Initiatives

In Western Canada, the Company commenced its planned shallow tight gas drilling program in the Medicine Hat area, and drilled more than 290 wells in 2006. The business expects to drill another 270 wells in 2007. In the southern Alberta Foothills, Petro-Canada successfully fulfilled the conditions required to earn a 60% working interest in the Sullivan natural gas field. The Company plans to seek regulatory approval in early 2007 to proceed with a multi-well development program in the Sullivan field. As part of the Company's ongoing optimization of its portfolio of assets, Petro-Canada completed the sale of its 31% working interest in the Brazeau plant and the majority of its 10% working interest in the West Pembina plant in early 2007.

In the U.S. Rockies, Petro-Canada is targeting increased CBM production with the Wild Turkey, North Shell Draw, Cedar Draw and Kingsbury projects. Increased CBM natural gas production follows a period of de-watering, which lowers the pressure in the coal seams, allowing natural gas breakthrough and production. Delays in obtaining CBM water treatment permits in 2005 pushed back the gas production increase in 2006. In February 2006, water treatment permits required for wells planned in 2005 and 2006 were approved. With water treatment permits in place, the U.S. Rockies continued to ramp up coal de-watering. Natural gas breakthrough at the Wild Turkey field occurred in the third quarter of 2006, with net production reaching 17 MMcf/d in late December. The Company continues to drill in the Denver-Julesburg Basin for natural gas from tight sands. Petro-Canada expects to double U.S. Rockies production to 100 MMcfe/d net by the end of 2007.

Furthering the strategic shift to increased unconventional production in the first half of 2006, the Company acquired approximately 50,000 net exploration acres of tight gas prone land for future development, including approximately 36,000 net acres in the Uinta Basin in eastern Utah.

During 2006, the Company continued to position itself for long-term North American supply by building its land position in Alaska and by participating in the drilling of an exploration well. At state and federal lease sales in 2006, Petro-Canada and its partners, Anadarko Petroleum Corporation and BG Group, were successful bidders on approximately 412,000 gross acres in the Alaska Foothills (a portion of this acreage remains subject to state title verification), giving each company a net land position in the Alaska Foothills of approximately one million acres, including option acreage.

Early in 2006, Petro-Canada and FEX L.P. (a subsidiary of Talisman Energy Inc.) reached a pooling agreement for the joint exploration of acreage in the National Petroleum Reserve-Alaska (NPR-A). As a result of this agreement, Petro-Canada obtained a 30% interest in the Aklaq-2 exploration well, which was drilled in the first quarter of 2006 and found to have hydrocarbons in quantities that were not commercially economical. In the latter part of 2006, FEX and Petro-Canada acquired 48 leases, or 562,000 gross acres, at the NPR-A lease sale for $10.4 million US and subsequently pooled the majority of their NPR-A leaseholdings, covering approximately 1.2 million gross acres. As a result, in jointly held NPR-A acreage with FEX, Petro-Canada's net acreage position is just over 500,000 acres.

Consistent with the Company's strategy to build long-term resources in Canada's North, Petro-Canada made an offer to acquire Canada Southern Petroleum with interests in lands in the Arctic islands. The offer was unsuccessful; however, the Company remains the largest landholder in Arctic island gas and will continue to look for opportunities to consolidate its interests in the North.