UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04719

The TETON Westwood Funds

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Teton Advisors, Inc.

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: September 30

Date of reporting period: September 30, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained inForm N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

TETON WESTWOOD FUNDS

|

|

| Mighty MitesSMFund |

| |

|

| SmallCap Equity Fund |

| |

|

| Convertible Securities Fund |

| |

|

| Equity Fund |

| |

|

| Balanced Fund |

| |

|

| Intermediate Bond Fund |

Annual Report

September 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.tetonadv.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Funds, you may call800-937-8966 or send an email request to info@tetonadv.com.

TETON WESTWOOD FUNDS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class AAA Shares | | | | | | Class A Shares | |

| | | Average Annual Returns – September 30, 2019 (a) | | | | | | Average Annual Returns – September 30, 2019 (a)(b)(c) | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Since Inception | | | Gross Expense

Ratio | | | Expense Ratio after Adviser Reimbursements | | | | | | 1 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Since

Inception | | | Gross

Expense

Ratio | | | Expense Ratio after Adviser

Reimbursements | |

Mighty Mites | | | (8.00 | )% | | | 6.00 | % | | | 10.07 | % | | | 9.33 | % | | | 10.44 | % | | | 1.40 | % | | | 1.40 | % | | | | | | | (11.93 | )% | | | 4.88 | % | | | 9.34 | % | | | 8.77 | % | | | 10.00 | % | | | 1.65 | % | | | 1.65 | % |

SmallCap Equity | | | (5.56 | ) | | | 8.55 | | | | 10.60 | | | | 8.79 | | | | 7.48 | | | | 1.72 | | | | 1.25 | | | | | | | | (9.52 | ) | | | 7.40 | | | | 9.88 | | | | 8.24 | | | | 7.11 | | | | 1.97 | | | | 1.50 | |

Convertible Securities | | | 5.08 | | | | 6.28 | | | | 9.37 | | | | 6.62 | | | | 7.56 | | | | 2.03 | | | | 1.15 | | | | | | | | 0.63 | | | | 5.16 | | | | 8.65 | | | | 6.07 | | | | 7.14 | | | | 2.28 | | | | 1.40 | |

Equity | | | 5.84 | | | | 9.24 | | | | 11.06 | | | | 8.31 | | | | 10.03 | | | | 1.60 | | | | 1.60 | | | | | | | | 1.37 | | | | 8.10 | | | | 10.34 | | | | 7.75 | | | | 9.66 | | | | 1.85 | | | | 1.85 | |

Balanced | | | 6.44 | | | | 6.87 | | | | 7.94 | | | | 6.62 | | | | 8.33 | | | | 1.34 | | | | 1.34 | | | | | | | | 1.88 | | | | 5.74 | | | | 7.24 | | | | 6.06 | | | | 7.91 | | | | 1.59 | | | | 1.59 | |

Intermediate Bond | | | 4.97 | | | | 1.63 | | | | 1.93 | | | | 2.66 | | | | 4.34 | | | | 2.22 | | | | 1.00 | | | | | | | | 0.68 | | | | 0.71 | | | | 1.41 | | | | 2.26 | | | | 4.12 | | | | 2.32 | | | | 1.10 | |

| | | |

| | | Class C Shares | | | | | | Class I Shares | |

| | | Average Annual Returns – September 30, 2019 (a)(c)(d) | | | | | | Average Annual Returns – September 30, 2019 (a)(c) | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Since

Inception | | | Gross

Expense

Ratio | | | Expense Ratio after Adviser

Reimbursements | | | | | | 1 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Since

Inception | | | Gross Expense Ratio | | | Expense Ratio after Adviser

Reimbursements | |

Mighty Mites | | | (9.61 | )% | | | 5.22 | % | | | 9.25 | % | | | 8.52 | % | | | 9.74 | % | | | 2.15 | % | | | 2.15 | % | | | | | | | (7.80 | )% | | | 6.27 | % | | | 10.34 | % | | | 9.54 | % | | | 10.59 | % | | | 1.15 | % | | | 1.15 | % |

SmallCap Equity | | | (7.14 | ) | | | 7.74 | | | | 9.78 | | | | 7.85 | | | | 6.81 | | | | 2.47 | | | | 2.00 | | | | | | | | (5.27 | ) | | | 8.82 | | | | 10.88 | | | | 9.01 | | | | 7.62 | | | | 1.47 | | | | 1.00 | |

Convertible Securities | | | 3.30 | | | | 5.49 | | | | 8.55 | | | | 5.82 | | | | 6.97 | | | | 2.78 | | | | 1.90 | | | | | | | | 5.33 | | | | 6.57 | | | | 9.64 | | | | 6.84 | | | | 7.71 | | | | 1.78 | | | | 0.90 | |

Equity | | | 3.99 | | | | 8.42 | | | | 10.23 | | | | 7.50 | | | | 9.50 | | | | 2.35 | | | | 2.35 | | | | | | | | 6.08 | | | | 9.50 | | | | 11.32 | | | | 8.51 | | | | 10.12 | | | | 1.35 | | | | 1.35 | |

Balanced | | | 4.58 | | | | 6.08 | | | | 7.15 | | | | 5.82 | | | | 7.75 | | | | 2.09 | | | | 2.09 | | | | | | | | 6.63 | | | | 7.13 | | | | 8.22 | | | | 6.82 | | | | 8.45 | | | | 1.09 | | | | 1.09 | |

Intermediate Bond | | | 3.15 | | | | 0.88 | | | | 1.16 | | | | 1.89 | | | | 3.84 | | | | 2.97 | | | | 1.75 | | | | | | | | 5.14 | | | | 1.86 | | | | 2.18 | | | | 2.84 | | | | 4.44 | | | | 1.97 | | | | 0.75 | |

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. For the SmallCap Equity, Convertible Securities, and Intermediate Bond Funds (and for the Mighty Mites Fund through September 30, 2005), Teton Advisors, Inc. (the Adviser) reimbursed expenses to limit the expense ratio. Had such limitations not been in place, returns would have been lower. The contractual expense limitations are in effect through January 31, 2021 and are renewable annually by the Adviser. The Funds, except for the Equity, Balanced, and Intermediate Bond Funds, impose a 2.00% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of a Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. |

| (b) | Includes the effect of the maximum 4.00% sales charge at the beginning of the period. |

| (c) | The performance of the Class AAA Shares is used to calculate performance for the periods prior to the issuance of Class A Shares, Class C Shares, and Class I Shares. The performance for the Class A Shares and Class C Shares would have been lower due to the additional fees and expenses associated with these classes of shares. The performance for the Class I Shares would have been higher due to the lower expenses associated with this class of shares. The inception dates for the Class AAA Shares and the initial issuance dates for the Class A Shares, Class C Shares, and Class I Shares after which shares remained continuously outstanding are listed below. |

| (d) | Assuming payment of the 1.00% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. |

| | | | | | | | |

| | | Inception Dates |

| | | Class AAA Shares | | Class A Shares | | Class C Shares | | Class I Shares |

Mighty Mites | | 05/11/98 | | 11/26/01 | | 08/03/01 | | 01/11/08 |

SmallCap Equity | | 04/15/97 | | 11/26/01 | | 11/26/01 | | 01/11/08 |

Convertible Securities | | 09/30/97 | | 05/09/01 | | 11/26/01 | | 01/11/08 |

Equity | | 01/02/87 | | 01/28/94 | | 02/13/01 | | 01/11/08 |

Balanced | | 10/01/91 | | 04/06/93 | | 09/25/01 | | 01/11/08 |

Intermediate Bond | | 10/01/91 | | 07/26/01 | | 10/22/01 | | 01/11/08 |

The TETON Westwood Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on FormN-PORT. Shareholders may obtain this information at www.tetonadv.com or by calling the Funds at800-WESTWOOD(800-937-8966). The Funds’ FormN-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling800-SEC-0330.

Proxy Voting

Each Fund files FormN-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Funds’ proxy voting policies, procedures, and how the Funds voted proxies relating to portfolio securities are available without charge, upon request, by (i) calling800-WESTWOOD(800-937-8966); (ii) writing to The TETON Westwood Funds at One Corporate Center, Rye, NY 10580-1422; and (iii) visiting the SEC’s website at www.sec.gov.

2

Performance Discussion (Unaudited)

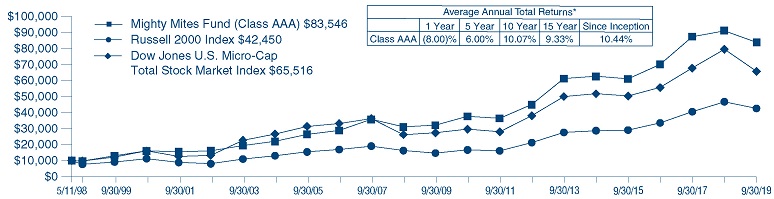

Mighty Mites Fund

For the fiscal year ended September 30, 2019, the TETON Westwood Mighty Mites Fund net asset value (NAV) per Class AAA Share depreciated (8.0)% versus a loss of (8.9)% for the Russell 2000 Index. See the next page for additional performance information.

The Fund primarily invests in small andmicro-cap equity securities that have a market capitalization of $500 million or less at time of initial investment. The portfolio management team focuses on bottom up stock selection, seeking bite sized companies with excellent management teams, strong balance sheets, and superior long term fundamentals. As bottom up, fundamental, research driven investors, the team seeks to purchase the inefficiently priced stocks of excellent companies selling at a discount to their Private Market Value (PMV), and possess a catalyst that can unlock hidden value within the enterprise. As such, (y)our portfolio is diversified across a broad cross section of companies sharing these valuation characteristics.

U.S. equity markets declined sharply in the fourth quarter of 2018 as investor sentiment turned negative in the face of an increasingly conflicted set of economic indicators. On one hand, the broad U.S. economy and consumer remained healthy with low unemployment, persistent job and wage growth, manageable inflation, and robust corporate profits. On the other, pockets of the economy such as housing and autos showed signs of slowing, global commodity prices, led by oil, declined steeply, and growth in many international markets stalled. Added to these factors was a fiercely divided U.S. government, intensifying trade disputes with China and other nations, and mounting (but now dissipating) concerns that the Federal Reserve might move too aggressively to raise interest rates, and the results were extensive pessimism and widespread selling as the year came to an end.

U.S. stock market indices rebounded during the first quarter of 2019 following sharp declines atyear-end as economic indicators slowed, but data suggested the U.S. economy was still on a solid foundation. Additionally, fourth quarter earnings reports were exceptional, as double-digit earnings growth including the benefit of the Tax Cut and Jobs Act and multiple expansion supported the recovery in share prices.

The U.S. economic data were mixed in the first quarter; consequently, the Federal Open Market Committee maintained the federal funds rate at2.25%-2.50% following four rate hikes in 2018. The pause eased concerns that the committee would raise rates too quickly; however, the yield curve temporarily inverted, which raised recession fears.

The U.S. consumer remained resilient as employment and household wealth were at healthy levels and near historical highs. According to the Bureau of Labor Statistics (BLS) report, the March unemployment rate was 3.8% and wages increased over 3%. Household wealth was $104 trillion including the impact of equity losses in the fourth quarter.

Markets strengthened in the second quarter of 2019 despite continued deceleration in global growth and weakening indicators in key segments of the U.S. economy. The U.S. unemployment rate through June stood near record lows (3.7%) and domestic GDP growth remained solid through the first quarter (increased 3.1%).

Over the course of the third quarter of 2019, U.S. equity markets fluctuated widely as investors worked to discount an increasingly divergent set of macroeconomic indicators. As expected, The Federal Reserve acted to reduce interest rates for the first time in a decade with two 25 basis point cuts in July and September, but stopped short of communicating an ongoing policy towards lower rates. Lower unemployment and persistent wage growth suggested a strengthening U.S. consumer, but consumer confidence declined more than anticipated in both August and September. Second quarter earnings were broadly ahead of expectations and U.S. corporate profits continued to rise.

Among our stronger performing stocks for the year were Aerojet Rocketdyne Holdings (5.8% of net assets as of September 30, 2019), a technology-based company providing solutions to customers in the aerospace, defense, and real estate markets; Casella Waste Systems, Inc. (1.8%), which serves customers with integrated services beyond the traditional waste disposal model; and Federal Signal Corp. (1.9%), a designer and manufacturer of products and integrated solutions for municipal, governmental, industrial, and commercial customers.

Some of the weaker holdings in the portfolio included Ferro Corp. (1.3%), a leading provider of functional coatings and color solutions; Marine Products Corp. (1.2%), a manufacturer of fiberglass motorized boats distributed through its independent dealer network; and Twin Disc, Inc. (0.6%), which provides transmission technology for drivelines and powertrains for tractors, trucks, turbines, work boats, and pleasure craft.

We appreciate your continued confidence and trust.

3

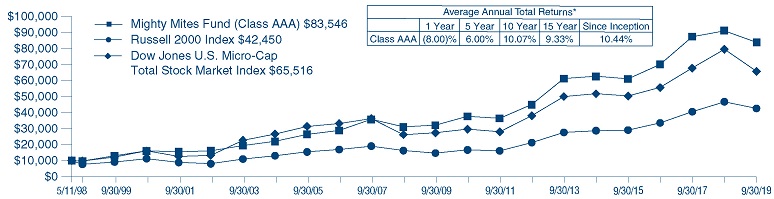

| | | | | | | | | | | | | | | | | | | | |

Average Annual Returns through September 30, 2019 (a) (Unaudited) | |

| | | 1 Year | | | 5 Year | | 10 Year | | 15 Year | | Since

Inception

(5/11/98) |

Mighty Mites Fund Class AAA | | | (8.00 | )% | | | 6.00 | % | | | 10.07 | % | | | 9.33 | % | | | 10.44 | % |

Dow Jones U.S.Micro-Cap Total Stock Market Index | | | (17.33 | ) | | | 4.90 | | | | 9.16 | | | | 6.20 | | | | 7.67 | (b) |

Russell 2000 Index | | | (8.89 | ) | | | 8.19 | | | | 11.19 | | | | 8.19 | | | | 6.99 | |

Lipper Small Cap Value Fund Average | | | (8.99 | ) | | | 5.41 | | | | 9.45 | | | | 7.26 | | | | 7.51 | (b) |

In the current prospectuses dated January 28, 2019, as amended March 18, 2019, the expense ratio for Class AAA Shares is 1.40%. See page 38 for the expense ratios for the year ended September 30, 2019. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Teton Advisors, Inc., (the Adviser) reimbursed expenses through September 30, 2005 to limit the expense ratios. Had such limitations not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com.Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Dow Jones U.S.Micro-Cap Total Stock Market Index is designed to provide a comprehensive measure of themicro-cap segment of the U.S. stock market. The Russell 2000 Index is an unmanaged indicator which measures the performance of the small cap segment of the U.S. equity market. The Lipper Small Cap Value Fund Average reflects the average performance of mutual funds classified in this particular category. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. | |

| (b) | Dow Jones U.S.Micro-Cap Total Stock Market Index and Lipper Small Cap Value Fund Average since inception performance is as of April 30, 1998. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE MIGHTY MITES FUND CLASS AAA, THE RUSSELL 2000 INDEX,

AND THE DOW JONES U.S. MICRO-CAP TOTAL STOCK MARKET INDEX (Unaudited)

*Past performance is not predictive of future results.The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

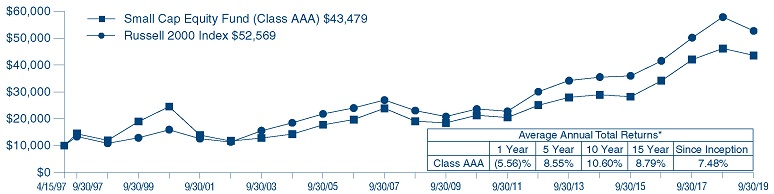

SmallCap Equity Fund (Unaudited)

For the fiscal year ended September 30, 2019, the TETON Westwood SmallCap Equity Fund NAV per Class AAA Share decreased (5.6)% compared with a loss of (8.9)% for the Russell 2000 Index. See the next page for additional performance information.

The Fund invests primarily in small cap companies that, throughbottom-up fundamental research, the portfolio manager believes are attractively priced relative to their earnings growth potential or Private Market Value. The Fund characterizes small capitalization companies as those companies with a market capitalization between $100 million and $2.5 billion at the time of the Fund’s initial investment.

U.S. equity markets declined sharply in the fourth quarter of 2018 as investor sentiment turned negative in the face of an increasingly conflicted set of economic indicators. A year that began on a strong note of optimism, confidence and synchronized global growth violently reversed to close out with doubt and concern over potential global growth. The sharp market decline in the fourth quarter was caused by a host of factors: U.S. Federal Reserve monetary tightening, fears over a trade war with China, slowing global growth, collapsing oil prices, and a federal government shutdown.

The first quarter of 2019 saw stocks post their strongest first quarter in over a decade. Major indexes have recouped almost all of the losses sustained in the final months of 2018, when fears over a potential economic slowdown sent global markets tumbling. Much of the rally was driven by relief that central banks were backing off rate hike campaigns amidst slowing growth from the Eurozone to China. Consequently, long term interest rates have declined, with three-month U.S. Treasury bills slightly higher than the yield onten-year U.S. treasury notes.

The two primary fears which gripped the market in December — escalating trade disputes and steadily rising interest rates — abruptly turned around in the first quarter. Firstly, U.S. and Chinese officials placed a stay on added tariffs while negotiating towards a solution. Concurrently, earnings reports continued to reflect the absorption of inflation (provoked by an initial round of tariffs last fall) via pass-through pricing. In still another dramatic reversal, the Federal Reserve acknowledged market concerns by signaling a hold to further interest rate hikes for the year, citing a diminished inflation outlook and slowing global growth (namely Europe). With both of those exogenous threats receding, the focus returned to economic growth, albeit at a moderating pace.

Stocks posted solid gains in the quarter amidst volatility wrought by headlines and emotion. Stocks sharply reversed course twice over fears that China trade sanctions would impede global economic growth. The S&P 500 gained 17%, so far this year, its best first half performance since 1997, while the Russell 2000small-cap benchmark has lagged. We view this environment as ripe with opportunity. Such markets overlay our active investment style of combining cumulative research that identifies quality companies with our disciplined pricing approach of using both upside and downside price targets to guide our entry and exit points. Having already identified which stocks we would like to own and at what price serves to quickly highlight opportunities during exaggerated market swings, we look to deploy capital following a record year of takeout activity within the portfolio.

The second quarter of 2019 began on a stable economic note as the Purchasing Manager Index (PMI) marked a rebound in March for both the U.S. (rising from 54.2 to 55.3) and China (from 49.3 to 50.5) after easing in prior months. Even the Eurozone and Germany, both already at contraction levels below a reading of 50, halted their declines. The month of May began with President Trump’s escalation of trade tensions, coming in the form of a Sunday morning “tweet” (May 5) threatening a spike in tariffs to 25% on Chinese goods by the end of the week. May closed out with another “tweet” (May 30) that threatened to upend the USMCA Agreement (NAFTA 2.0) by imposing an arbitrary 5% tariff that would accelerate to 25% unless illegal immigration was deemed solved. This injection of uncertainty caused a sustained decline in the market. Alongside investors, corporate leaders responded to uncertainty, reflected in durable goods orders (excluding aircraft) which declined sequentially for three out of the last four months.

In September of last year, President Trump decisively intensified the trade battle against China with the publication of “U.S. Section 301 Final List 3”, outlining additional tariffs on a broader swath of goods. Since late last summer, small capitalization stocks (as measured by the Russell 2000 Index and the Russell 2000 Value Index) have declined while the larger cap S&P 500 Index remains slightly higher. Domestic-orientation was expected to shield small cap companies from potential tariff-driven overseas weakness. But it became clear that increased trade actions have extended that pressure to the domestic economy. At the moment, recession forecasts have frequented news headlines along with debates around “stall speed”, the lowest level of growth which the economy can sustain.

At the end of the fund’s final fiscal quarter, macro data points were undeniably gloomier than at the start. Chief among these are the manufacturing indices — those which directly correlate with the impact of tariff actions upon the production of goods. Though the U.S. purchasing managers index (PMI) appeared to stabilize earlier in the year, it turned downwards following additional tariff actions and has now marked two months below a reading of 50 (seen as contractionary). Similar PMI measurements in the Eurozone have continued 18 months of freefall readings, with Germany marking a reading of 41.7 in September and linked quarter GDP of-0.1% in Q2.

In response, The Federal Reserve is attempting to extend the economic expansion, with two 25 basis point cuts during the quarter. While the Fed forecast no further rate cuts for the year, Chairman Powell stated “we’re prepared to be aggressive” if the economy weakens more. Market expectations rose for a third cut by the end of the year based upon interpretation of recent data.

Among our stronger performing stocks for the year were: Entegris Inc. (3.0% of net assets as of September 30, 2019), a global leader in advanced materials science, including filtration products, gas delivery systems, and specialty coatings; Cypress Semiconductor Corp. (1.9%), whose products include programmablesystems-on-chips, general-purpose microcontrollers, andUSB-based connectivity solutions; and Winnebago Industries Inc. (2.0%), a U.S. manufacturer of outdoor lifestyle products whose brands include Winnebago, Grand Design, and Chris-Craft.

Some of the weaker holdings in the portfolio included Centennial Resource Development (0.6%), an independent oil producer focused in the southern Delaware Basin;Patterson-UTI Energy Inc. (2.1%), which provides drilling and pressure pumping services, directional drilling, and rental equipment for oil fields; and Ferro Corp. (0.9%), a global supplier of technology-based functional coatings and color solutions for glass, metal, ceramic, and other substrates.

We thank you for your continued confidence and trust.

5

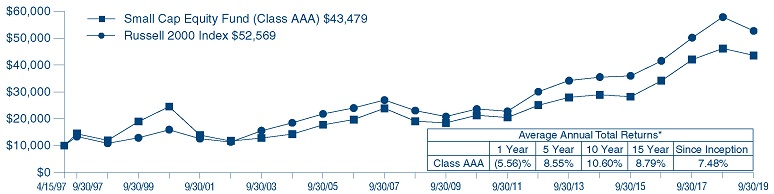

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Returns through September 30, 2019 (a) (Unaudited) | | | Since |

| | | | | | | | | | | | Inception |

| | | 1 Year | | | 5 Year | | 10 Year | | 15 Year | | (4/15/97) |

SmallCap Equity Fund Class AAA | | | (5.56) | % | | | 8.55 | % | | | 10.60 | % | | | 8.79 | % | | | 7.48 | % |

Russell 2000 Index | | | (8.89) | | | | 8.19 | | | | 11.19 | | | | 8.19 | | | | 8.32 | |

Russell 2000 Value Index | | | (8.24) | | | | 7.17 | | | | 10.06 | | | | 7.23 | | | | 8.90 | |

In the current prospectuses dated January 28, 2019, the gross expense ratio for Class AAA Shares is 1.72%, and the net expense ratio is 1.25% after contractual reimbursements by Teton Advisors, Inc. (the Adviser) in place through January 31, 2020. See page 39 for the expense ratios for the year ended September 30, 2019. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com.Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Russell 2000 Index is an unmanaged indicator which measures the performance of the small cap segment of the U.S. equity market. The Russell 2000 Value Index measures the performance of the small capitalization sector of the U.S. equity market and is a subset of the Russell 2000 Index. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE SMALLCAP EQUITY FUND

CLASS AAA AND THE RUSSELL 2000 INDEX (Unaudited)

| * | Past performance is not predictive of future results.The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

6

Convertible Securities Fund (Unaudited)

For the fiscal year ended September 30, 2019, the TETON Convertible Securities Fund NAV per Class AAA Share appreciated 5.1% compared with gains of 4.3% and 4.0% for the Standard & Poor’s (S&P) 500 Index and the ICE Bank of America Merrill Lynch U.S. Convertibles Index, respectively. See the next page for additional performance information.

The Fund invests in convertible securities. By investing in convertible securities, the portfolio managers seek the opportunity to participate in the capital appreciation of underlying stocks, while at the same time relying on the fixed income aspect of the convertible securities to provide current income and reduced price volatility, which can limit the risk of loss in a down equity market. The Fund may invest in securities of any market capitalization or credit quality, and may from time to time invest a significant amount of its assets in securities of smaller companies.

U.S. equity markets, including the convertible market, declined sharply in the fourth quarter of 2018 as investor sentiment turned negative in the face of an increasingly conflicted set of economic indicators. A year that began on a strong note of optimism, confidence and synchronized global growth violently reversed to close out with doubt and concern over potential global growth. The sharp market decline in the fourth quarter was caused by a host of factors: U.S. Federal Reserve monetary tightening, fears over a trade war with China, slowing global growth, collapsing oil prices, and a federal government shutdown.

The first quarter of 2019 was a quarter of reversals. There was a reversal of equity prices as the poor performance of the fourth quarter of 2018 was replaced by a strong upward move. There was a reversal of interest rate expectations as10-year treasury bonds, once expected to move above 3.5% traded below 2.5%. We saw a reversal of expectations for Federal Reserve Board tightening of monetary policy. Through all of this, convertible securities performed well and participated in most of the rise in the equity market. For the quarter, the S&P 500 Index was up 13.6%.

Among U.S. convertible issues, the Technology and Energy sectors had the strongest performance for the quarter, while Transports and Finance underperformed. Equity sensitive convertibles drove returns, outperforming balanced convertibles and the credit sensitive (yield alternative) segment of the Index. By keeping pace with equity markets during the strong start to the year, we saw the benefits of using convertibles as a reduced volatility equity alternative. The asymmetrical return structure allowed us to outperform falling equity markets in 2018 while remaining invested so as not to miss the rebound at the beginning of 2019.

The second quarter of 2019 was a quarter of continuation. There was a continuation of rising equity prices, as the strong bounce back from the poor performance of the fourth quarter of 2018 brought equity prices back to near record levels. The Federal Reserve Board continued to raise expectation of a loosening of monetary policy. Through all of this, convertible securities performed well, and participated in most of the rise in the equity market. Among U.S. convertible issues, the Technology and Communications sectors had the strongest performance during the quarter, while Consumer Staples and Transports underperformed. Equity sensitive convertibles drove returns, outperforming balanced convertibles and the credit sensitive (yield alternative) segment of the Index.

Mixed signals in the U.S. economy caused more volatility in the markets during the third quarter of 2019, the final quarter of the Fund’s fiscal year. There was strong performance in stocks in July followed by a pullback in August and September. The Federal Reserve cut interest rates for a second time, citing a global business slowdown caused by the ongoing trade negotiations. Disruption in the oil markets caused by disputes in the Middle East and the attack on the Saudi Aramco oil facility also raised concern, while manufacturing in the U.S. showed some weakness.

After a strong start to the year, the Convertible securities market was down marginally in the third quarter of 2019. The U.S. convertible market ended the quarter with 456 issues and $219 billion in market capitalization. Issuance was strong, driven by declining interest rates and strong equity markets providing an opportunity for issuers to raise capital at attractive rates. September alone saw issuance of $17 billion globally including $11.4 billion in the U.S.

Among our stronger performing positions for the year were: MercadoLibre 2.0%, 8/15/28 (1.5% of net assets as of September 30, 3019), which hosts the largest online commerce and payments ecosystem in Latin America; Pros Holdings Inc. 2.0%, 6/01/47 (1.1%), a provider ofAI-based solutions for conducting commerce in the digital economy; and Coupa Software Inc. 0.375%, 1/15/23 (1.3%), a cloud platform for business spending which helps customers achieve cost savings and drive profitability.

Some of the weaker holdings in the portfolio included Bristow Group Inc. 4.5%, 6/01/23 (0.1%), a provider of industrial aviation services offering helicopter transportation, search and rescue, and aircraft support services to government and civil organizations; Evolent Health Inc. 1.5%, 10/15/25 (0.9%), which partners with health systems and health care providers to gain operational scale and improve clinical performance; and Teladoc 3.0%, 12/15/22 (1.0%), a provider of virtual health care solutions serving businesses and individuals.

We appreciate your continued confidence and trust.

7

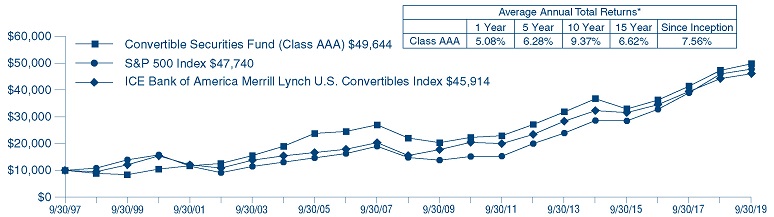

| | | | | | | | | | | | | | | | | | | | |

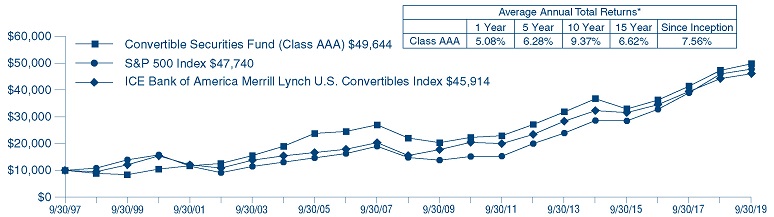

| Average Annual Returns through September 30, 2019 (a) (Unaudited) | |

| | | 1 Year | | 5 Year | | 10 Year | | 15 Year | | Since

Inception

(9/30/97) |

Convertible Securities Fund Class AAA | | | 5.08 | % | | | 6.28 | % | | | 9.37 | % | | | 6.62 | % | | | 7.56 | % |

S&P 500 Index | | | 4.25 | | | | 10.84 | | | | 13.24 | | | | 9.01 | | | | 7.35 | |

ICE Bank of America Merrill Lynch U.S. Convertibles Index | | | 4.01 | | | | 7.29 | | | | 9.94 | | | | 7.51 | | | | 7.17 | |

In the current prospectuses dated January 28, 2019, the gross expense ratio for Class AAA Shares is 2.03%, and the net expense ratio is 1.15%, after contractual reimbursements by Teton Advisors, Inc. (the Adviser) in place through January 31, 2020. See page 40 for the expense ratios for the year ended September 30, 2019. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com.Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. The ICE Bank of America Merrill Lynch U.S. Convertibles Index is a market value weighted index of all dollar denominated convertible securities that are exchangeable into U.S. equities that have a market value of more than $50 million. Dividends are considered reinvested. You cannot invest directly in an index. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE CONVERTIBLE SECURITIES FUND

CLASS AAA, THE S&P 500 INDEX AND

THE ICE BANK OF AMERICA MERRILL LYNCH U.S. CONVERTIBLES INDEX (Unaudited)

| * | Past performance is not predictive of future results.The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

8

Equity Fund (Unaudited)

The TETON Westwood Equity Fund outperformed the benchmark S&P 500 Index over the fiscal year. For the twelve months ended September 30, 2019, the Equity Fund Class AAA shares posted a gain of 5.8%, net of expenses, versus the S&P 500 Index gain of 4.3%. See the next page for additional performance information.

The Fund seeks to provide capital appreciation. The Fund’s secondary goal is to produce current income.

The fourth quarter of 2018 saw the S&P 500 Index suffered one of the worst quarters in the last 50 years, having fallen over 13% and ending the year with pessimism reigning supreme. Small caps fared worse, down over 20%, with growth declining moderately more than value for both small and large cap stocks. Global equity markets declined as well, adding to their losses for the year. The same fears generally throughout the year were cited as causes — trade wars, slowing growth, and higher interest rates. Making progress with China in resolving theon-going trade dispute seemed challenging; earnings reports weighed on sentiment as results were underwhelming. The Federal Reserve raised the federal funds rate, as expected, though its commentary shifted to be more balanced regarding future actions. Volatility reemerged and remained elevated for the quarter.

In the first quarter of 2019 the S&P 500 Index reversed course from the end of the year and rallied for one of the best first quarters to start the year in two decades. The major worries of the market that pressured shares turned into tailwinds. Fears over growth were placated for the majority of companies when they reported earnings. This optimism drove small cap stocks to outpace large caps and growth stocks to rally over value stocks. Optimism also rose for a potential trade deal with China, as some progress appeared to have been made which helped bolster both domestic and global markets during the quarter.

Markets remained volatile during the second quarter of 2019, after one of the strongest starts to the year, as investor sentiment oscillated with each passing headline. Growth concerns were temporarily placated with the initial U.S. GDP estimate exceeding forecasts at 3.2% for the first quarter of 2019, though that marked the high point for expectations. Corporations reported better than expected earnings, with management teams expressing caution regarding implications from moderating growth and disruptions from the trade dispute. Optimism around a potential trade deal was crushed as negotiations collapsed, with little progress made during the quarter. Hope rested on theG-20 meeting that happened over the last weekend in June which produced some progress towards a resolution. These headwinds culminated in pressures on interest rates, as investors moved into safe haven assets, which sent the yield on the10-year treasury to multi-year lows below 2%. Inflation remained relatively tame, further bolstering confidence in the Federal Reserve’s pivot towards easier monetary policy.

Equity markets ended the third quarter of 2019 in positive territory despite continued concerns over the ongoing trade dispute and future economic growth given the deterioration of economic data. The U.S. market outperformed international equities and large caps fared far better than small caps. GDP growth for the second quarter remained steady at 2%, though several economic indicators such as the ISM’s PMI for the manufacturing segment fell into contraction. Investors continued to look for additional clues regarding the health of the economy given the longevity of the business cycle. The Federal Reserve cut rates twice during the quarter, marking the first time for such actions in over a decade. Interest rates fell sharply during the quarter, notably the yield on the10-year U.S. treasury declined to 1.66%, falling 34 basis points over increasing demand for safe-haven assets amidst the uncertainty. The impact from macroeconomic uncertainty clearly weighed on business confidence, though company fundamentals have so far remained relatively resilient.

Among our stronger performing positions for the year were: Motorola Solutions, Inc. (2.1% of net assets as of September 30, 2019), a leader in mission-critical communications, including command center software, video security, and managed and support services; WEC Energy Group Inc. (2.0%), a Midwest electric and natural gas holding company serving 4.5 million customers in Wisconsin, Illinois, Michigan, and Minnesota; and NextEra Energy, Inc. (2.0%), a clean energy company headquartered in Florida, and which owns Florida Power & Light Company and Gulf Power Company, which together serve more than five million customers in Florida.

Some of the weaker holdings in the portfolio included: EOG Resources, Inc. (2.0%), a crude oil and natural gas exploration and production company with reserves in the U.S., Trinidad, and China; FedEx Corporation (no longer held), which provides customers and businesses worldwide with a portfolio of transportation,e-commerce, and business services; and CVS Health Corporation (3.8%), a health care company that provides retail pharmacy, pharmacy benefits management, clinical services, and specialty pharmacy services.

We appreciate your continued confidence and trust.

9

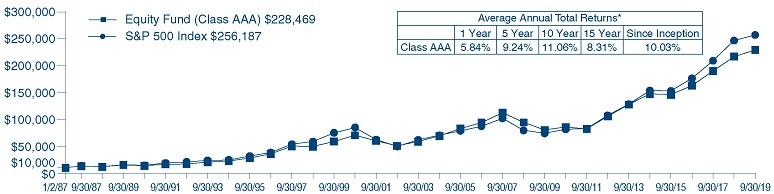

| | | | | | | | | | | | | | | | | | | | |

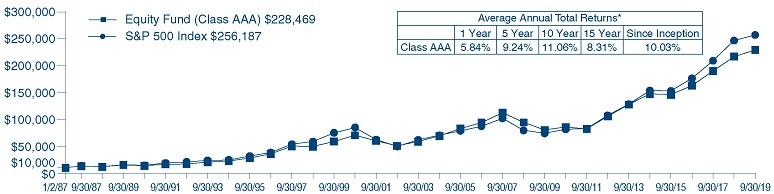

| Average Annual Returns through September 30, 2019 (a) (Unaudited) | |

| | | | | | | | | | | Since |

| | | 1 Year | | 5 Year | | 10 Year | | 15 Year | | Inception

(1/2/87) |

Equity Fund Class AAA | | | 5.84 | % | | | 9.24 | % | | | 11.06 | % | | | 8.31 | % | | | 10.03 | % |

S&P 500 Index | | | 4.25 | | | | 10.84 | | | | 13.24 | | | | 9.01 | | | | 10.41 | (b) |

In the current prospectuses dated January 28, 2019, the expense ratio for Class AAA Shares is 1.60%. See page 41 for the expense ratios for the year ended September 30, 2019. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com.Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. | |

| (b) | S&P 500 Index since inception performance is as of December 31, 1986. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE EQUITY FUND CLASS AAA AND THE S&P 500 INDEX (Unaudited)

| * | Past performance is not predictive of future results.The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

10

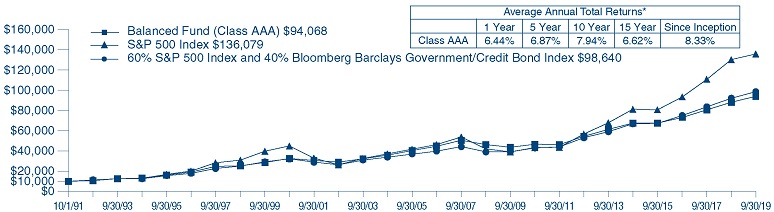

Balanced Fund (Unaudited)

For fiscal year ended September 30, 2019, the TETON Westwood Balanced Fund Class AAA Shares posted a return of 6.4%, net of expenses, versus the Bloomberg Barclays Government/Credit Bond Index return of 11.3%. The Fund’s return was less than a common balanced benchmark comprised of 60% S&P 500 Index and 40% of the Bloomberg Barclays Capital Government/Credit Bond Index which returned 7.1%. See the next page for additional performance information.

The Fund invests in a combination of equity and debt securities. The Fund is primarily equity-oriented, and uses atop-down approach in seeking to provide equity-like returns but with lower volatility than a fully invested equity portfolio. Westwood Management Corp., the Fund’ssub-adviser (the “WestwoodSub-Adviser”) will typically invest 30% to 70% of the Fund’s assets in equity securities and 70% to 30% in debt securities, and the balance of the Fund’s assets in cash or cash equivalents. The actual mix of assets will vary depending on the WestwoodSub-Adviser’s analysis of market and economic conditions.

The Fund invests in stocks of seasoned companies. Seasoned companies generally have market capitalizations of $1 billion or more and have been operating for at least three years. The WestwoodSub-Adviser chooses stocks of seasoned companies with proven records and above-average earnings growth potential. The WestwoodSub-Adviser has disciplines in place that serve as sell signals such as a security reaching a predetermined price target, a change to a company’s fundamentals that make the risk/reward profile unattractive, or a need to improve the overall risk/reward profile of the Fund.

The debt securities held by the Fund are investment grade securities of corporate and government issuers and commercial paper and mortgage and asset-backed securities. Investment grade debt securities are securities rated in one of the four highest ratings categories by a Nationally Recognized Statistical Rating Organization (“NRSRO”). The Fund may invest in fixed income securities of any maturity.

The Fund may also invest up to 25% of its total assets in foreign equity securities and in European Depositary Receipts (“EDRs”) or American Depositary Receipts (“ADRs”), including in those of companies located in emerging markets. The Fund may also invest in foreign debt securities.

The fourth quarter of 2018 saw the S&P 500 Index suffered one of the worst quarters in the last 50 years, having fallen over 13% and ending the year with pessimism reigning supreme. Small caps fared worse, down over 20%, with growth declining moderately more than value for both small and large cap stocks. Global equity markets declined as well, adding to their losses for the year. The same fears generally throughout the year were cited as causes — trade wars, slowing growth, and higher interest rates. Making progress with China in resolving theon-going trade dispute seemed challenging; earnings reports weighed on sentiment as results were underwhelming. Yields on intermediate Treasuries fell, and total returns on investment grade bonds were mixed for the period. Yields on the5-year Treasury note fell by 44 basis points from 2.95% to 2.51%, while the 10 year Treasury note fell by 38 basis points from 3.06% to 2.68% during the quarter. Notwithstanding some inter-period volatility, the trend was clearly down. The U.S. Treasury Yield Curve continued to flatten as the yield differential between10-year and2-year Treasuries slightly narrowed. Investment grade credit spreads widened by approximately 48 basis points during the quarter causing U.S. Treasury and Agencies to outperform duration matched corporates. The higher the quality and longer the duration the more these debt securities participated in the December rally.

In the first quarter of 2019 the S&P 500 Index reversed course from the end of the year and rallied for one of the best first quarters to start the year in two decades. The major worries of the market that pressured shares turned into tailwinds. Fears over growth were placated for the majority of companies when they reported earnings. This optimism drove small cap stocks to outpace large caps and growth stocks to rally over value stocks. Optimism also rose for a potential trade deal with China, as some progress appeared to have been made which helped bolster both domestic and global markets during the quarter. Credit in general benefitted from the Fed’s perceived “dovish” shift in policy guidance early in the first quarter of 2019. Hence yields on intermediate Treasuries fell, and total returns on investment grade bonds rebounded smartly for the period. Yields on the5-year Treasury note fell by 28 basis points from 2.51% to 2.23%, while the10-year Treasury note fell by 27 basis points from 2.68% to 2.41% during the quarter.

Markets remained volatile during the second quarter of 2019, after one of the strongest starts to the year, as investor sentiment oscillated with each passing headline. Growth concerns were temporarily placated with the initial U.S. GDP estimate exceeding forecasts at 3.2% for the first quarter of 2019, though that marked the high point for expectations. Corporations reported better than expected earnings, with management teams expressing caution regarding implications from moderating growth and disruptions from the trade dispute. After a reported collapse of trade negotiations in May damaged market sentiment, optimism increased at the end of June with progress toward a resolution at theG-20 meeting in Japan. Interest rates moved significantly lower during the quarter reflecting the concerns regarding economic strength and the flight to quality in Treasuries the increased uncertainty and volatility brings. The10-year Treasury, which had begun the quarter in the2.40%-2.50% range and peaked at about 2.60% in April, traded below 2.00% in June and settled in.

Equity markets ended the third quarter of 2019 in positive territory despite continued concerns over the ongoing trade dispute and future economic growth given the deterioration of economic data. The U.S. market outperformed international equities and large caps fared far better than small caps. GDP growth for the second quarter remained steady at 2%, though several economic indicators such as the ISM’s PMI for the manufacturing segment fell into contraction. Investors continued to look for additional clues regarding the health of the economy given the longevity of the business cycle. The Federal Reserve cut rates twice during the quarter, marking the first time for such actions in over a decade. Interest rates fell sharply during the quarter, notably the yield on the10-year U.S. treasury declined to 1.66%, falling 34 basis points over increasing demand for safe-haven assets amidst the uncertainty. The impact from macroeconomic uncertainty clearly weighed on business confidence, though company fundamentals have so far remained relatively resilient.

We appreciate your confidence and trust.

11

| | | | | | | | | | | | | | | | | | | | |

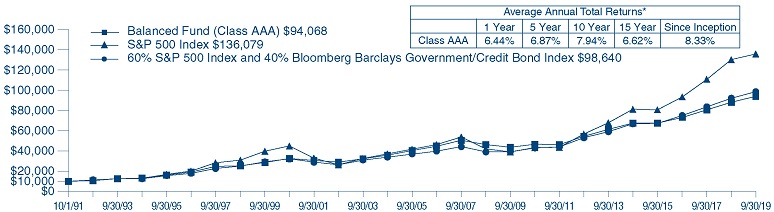

| Average Annual Returns through September 30, 2019 (a) (Unaudited) | |

| | | | | | | | | | | Since |

| | | | | | | | | | | Inception |

| | | 1 Year | | 5 Year | | 10 Year | | 15 Year | | (10/1/91) |

Balanced Fund Class AAA | | | 6.44 | % | | | 6.87 | % | | | 7.94 | % | | | 6.62 | % | | | 8.33 | % |

Bloomberg Barclays Government/Credit Bond Index | | | 11.32 | | | | 3.61 | | | | 3.94 | | | | 4.26 | | | | 5.74 | (b) |

S&P 500 Index | | | 4.25 | | | | 10.84 | | | | 13.24 | | | | 9.01 | | | | 9.76 | (b) |

60% S&P 500 Index and 40% Bloomberg Barclays Government/Credit Bond Index(c) | | | 7.08 | | | | 7.95 | | | | 9.52 | | | | 7.11 | | | | 8.15 | |

In the current prospectuses dated January 28, 2019, the expense ratio for Class AAA Shares is 1.34%. See page 42 for the expense ratios for the year ended September 30, 2019. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Teton Advisors, Inc. (the Adviser) reimbursed expenses in years prior to 1998 to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com.Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Bloomberg Barclays Government/Credit Bond Index is a market value weighted index that tracks the performance of fixed rate, publicly placed, dollar denominated obligations. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. | |

| (b) | S&P 500 Index and Bloomberg Barclays Government/Credit Bond Index since inception performances are as of September 30, 1991. |

| (c) | The Blended Index consists of a blend of 60% of the S&P 500 Index and 40% of the Bloomberg Barclays Government/Credit Bond Index. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE BALANCED FUND CLASS AAA,

THE S&P 500 INDEX, AND A COMPOSITE OF 60% OF THE S&P 500 INDEX AND 40% OF

THE BLOOMBERG BARCLAYS GOVERNMENT/CREDIT BOND INDEX (Unaudited)

| * | Past performance is not predictive of future results.The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

12

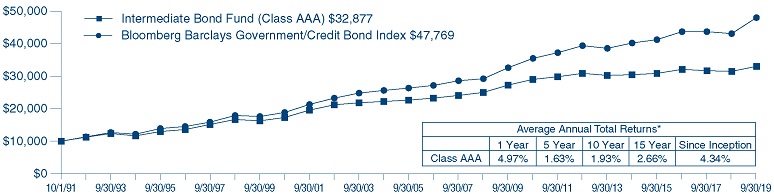

Intermediate Bond Fund (Unaudited)

For the fiscal year ended September 30, 2019, the TETON Westwood Intermediate Bond Fund NAV per Class AAA Share increased 5.0% compared with the Bloomberg Barclays Government/Credit Bond Index which was up 11.3%. See page 14 for additional performance information.

Under normal market conditions the Fund invests at least 80% of its net assets (which includes, for purposes of this test, the amount of any borrowings for investment purposes) in bonds of various types and with various maturities. The Intermediate Bond Fund focuses on investment grade bonds of domestic corporations and governments. Investment grade debt securities are securities rated in the four highest ratings categories by a Nationally Recognized Statistical Rating Organization.

The fourth quarter of 2018 saw global uncertainty and volatility in the equity markets, and the reversal of performance for higher quality fixed income assets. Yields on intermediate Treasuries fell, and total returns on investment grade bonds were mixed for the period. Yields on the5-year Treasury note fell by 44 basis points from 2.95% to 2.51%, while the 10 year Treasury note fell by 38 basis points from 3.06% to 2.68% during the quarter. Notwithstanding some inter-period volatility, the trend was clearly down. The U.S. Treasury Yield Curve continued to flatten as the yield differential between10-year and2-year Treasuries slightly narrowed. Investment grade credit spreads widened by approximately 48 basis points during the quarter causing U.S. Treasury and Agencies to outperform duration matched corporates. The higher the quality and longer the duration the more these debt securities participated in the December rally.

Credit in general benefitted from the Fed’s perceived “dovish” shift in policy guidance early in the first quarter of 2019. Hence yields on intermediate Treasuries fell, and total returns on investment grade bonds rebounded smartly for the period. Yields on the5-year Treasury note fell by 28 basis points from 2.51% to 2.23%, while the10-year Treasury note fell by 28 basis points from 2.68% to 2.41% during the quarter. Notwithstanding some mild inter-period volatility, the trend was clearly down. The U.S. Treasury Yield Curve continued to flatten as the yield differential between10-year and2-year Treasuries slightly narrowed. Investment grade credit spreads tightened by approximately 32 basis points during the quarter causing corporate bonds to outperform duration matched U.S. Agency and U.S. Treasury securities. Longer duration fixed income securities participated more fully in the quarter’s rally, significantly outperforming shorter dated bonds.

The markets were volatile during the second quarter of 2019, after one of the strongest first quarters in decades for equities. Daily headlines, tweets and the game of “Deal or No Deal” in trade negotiations, put investors on a bit of a rollercoaster. While corporate earnings were generally better than expected, indications of moderating domestic growth and the aforementioned trade “wars” kept traders and investors cautious and reactive. Growth concerns were temporarily placated with the initial U.S. GDP estimate exceeding forecasts at 3.2% for the first quarter of 2019, though that marked the high point for expectations. After a reported collapse of trade negotiations in May damaged market sentiment, optimism increased at the end of June with progress toward a resolution at theG-20 meeting in Japan. Interest rates moved significantly lower during the quarter reflecting the concerns regarding economic strength and the flight to quality in Treasuries the increased uncertainty and volatility brings. The10-year Treasury, which had begun the quarter in the2.40%-2.50% range and peaked at about 2.60% in April, traded below 2.00% in June and settled in.

Equity markets ended the third quarter of 2019 in positive territory despite continued concerns over the ongoing trade dispute and future economic growth given the deterioration of economic data. The U.S. market outperformed international equities and large caps fared far better than small caps. GDP growth for the second quarter remained steady at 2%, though several economic indicators such as the ISM’s PMI for the manufacturing segment fell into contraction. Investors continue to look for additional clues regarding the health of the economy given the longevity of the business cycle. The Federal Reserve cut rates twice during the quarter, marking the first time for such actions in over a decade. Interest rates fell sharply during the quarter, notably the yield on the10-year U.S. treasury declined to 1.66%, falling 34 basis points over increasing demand for safe-haven assets amidst the uncertainty. The impact from macroeconomic uncertainty clearly weighed on business confidence.

We appreciate your continued confidence and trust.

13

| | | | | | | | | | | | | | | | | | | | |

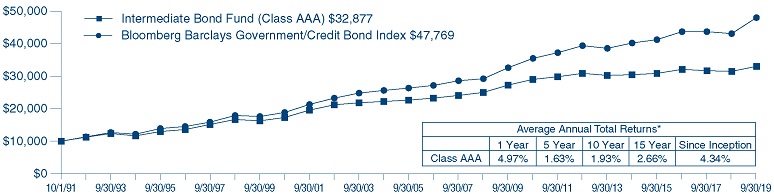

Average Annual Returns through September 30, 2019 (a) (Unaudited) | |

| | | | | | | | | | | Since |

| | | | | | | | | | | Inception |

| | | 1 Year | | 5 Year | | 10 Year | | 15 Year | | (10/1/91) |

Intermediate Bond Fund Class AAA | | | 4.97 | % | | | 1.63 | % | | | 1.93 | % | | | 2.66 | % | | | 4.34 | % |

Bloomberg Barclays Government/Credit Bond Index | | | 11.32 | | | | 3.61 | | | | 3.94 | | | | 4.26 | | | | 5.74 | (b) |

In the current prospectuses dated January 28, 2019, the gross expense ratio for AAA Shares is 2.22%, and the net expense ratio is 1.00% after contractual reimbursements by Teton Advisors, Inc., (the Adviser) in place through January 31, 2020. See page 43 for the expense ratios for the year ended September 30, 2019. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com.Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Bloomberg Barclays Government/Credit Bond Index is a market value weighted index that tracks the performance of fixed rate, publicly placed, dollar denominated obligations. Dividends are considered reinvested. You cannot invest directly in an index. | |

| (b) | The Bloomberg Barclays Government/Credit Bond Index since inception performance is as of September 30, 1991. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE

INTERMEDIATE BOND FUND CLASS AAA AND

THE BLOOMBERG BARCLAYS GOVERNMENT/CREDIT BOND INDEX (Unaudited)

| * | Past performance is not predictive of future results.The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

TETON Westwood Funds

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period from April 1, 2019 through September 30, 2019

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table on page 16 illustrates your Fund’s costs in two ways:

Actual Fund Return:This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’sactualreturn during the past six months, and the Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return:This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used isnotthe Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the fiscal year ended September 30, 2019.

15

TETON Westwood Funds

Disclosure of Fund Expenses (Unaudited) (Continued)

For the Six Month Period from April 1, 2019 through September 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense Table | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Actual Fund Return | | Hypothetical 5% Return |

| | | Beginning | | Ending | | Annualized | | Expenses | | Beginning | | Ending | | Annualized | | Expenses |

| | | Account Value | | Account Value | | Expense | | Paid During | | Account Value | | Account Value | | Expense | | Paid During |

| | | 04/01/19 | | 09/30/19 | | Ratio | | Period* | | 04/01/19 | | 09/30/19 | | Ratio | | Period* |

TETON Westwood Mighty Mites Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | $ | 1,000.00 | | | | $ | 1,001.20 | | | | | 1.39 | % | | | $ | 6.97 | | | | $ | 1,000.00 | | | | $ | 1,018.10 | | | | | 1.39 | % | | | $ | 7.03 | |

Class A | | | $ | 1,000.00 | | | | $ | 1,000.00 | | | | | 1.64 | % | | | $ | 8.22 | | | | $ | 1,000.00 | | | | $ | 1,016.85 | | | | | 1.64 | % | | | $ | 8.29 | |

Class C | | | $ | 1,000.00 | | | | $ | 997.70 | | | | | 2.14 | % | | | $ | 10.72 | | | | $ | 1,000.00 | | | | $ | 1,014.34 | | | | | 2.14 | % | | | $ | 10.81 | |

Class I | | | $ | 1,000.00 | | | | $ | 1,002.70 | | | | | 1.14 | % | | | $ | 5.72 | | | | $ | 1,000.00 | | | | $ | 1,019.35 | | | | | 1.14 | % | | | $ | 5.77 | |

TETON Westwood SmallCap Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | $ | 1,000.00 | | | | $ | 1,005.60 | | | | | 1.25 | % | | | $ | 6.28 | | | | $ | 1,000.00 | | | | $ | 1,018.80 | | | | | 1.25 | % | | | $ | 6.33 | |

Class A | | | $ | 1,000.00 | | | | $ | 1,004.70 | | | | | 1.50 | % | | | $ | 7.54 | | | | $ | 1,000.00 | | | | $ | 1,017.55 | | | | | 1.50 | % | | | $ | 7.59 | |

Class C | | | $ | 1,000.00 | | | | $ | 1,002.10 | | | | | 2.00 | % | | | $ | 10.04 | | | | $ | 1,000.00 | | | | $ | 1,015.04 | | | | | 2.00 | % | | | $ | 10.10 | |

Class I | | | $ | 1,000.00 | | | | $ | 1,007.50 | | | | | 1.00 | % | | | $ | 5.03 | | | | $ | 1,000.00 | | | | $ | 1,020.05 | | | | | 1.00 | % | | | $ | 5.06 | |

TETON Convertible Securities Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | $ | 1,000.00 | | | | $ | 1,057.40 | | | | | 1.15 | % | | | $ | 5.93 | | | | $ | 1,000.00 | | | | $ | 1,019.30 | | | | | 1.15 | % | | | $ | 5.82 | |

Class A | | | $ | 1,000.00 | | | | $ | 1,055.70 | | | | | 1.40 | % | | | $ | 7.21 | | | | $ | 1,000.00 | | | | $ | 1,018.05 | | | | | 1.40 | % | | | $ | 7.08 | |

Class C | | | $ | 1,000.00 | | | | $ | 1,053.00 | | | | | 1.90 | % | | | $ | 9.78 | | | | $ | 1,000.00 | | | | $ | 1,015.54 | | | | | 1.90 | % | | | $ | 9.60 | |

Class I | | | $ | 1,000.00 | | | | $ | 1,058.50 | | | | | 0.90 | % | | | $ | 4.64 | | | | $ | 1,000.00 | | | | $ | 1,020.56 | | | | | 0.90 | % | | | $ | 4.56 | |

TETON Westwood Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | $ | 1,000.00 | | | | $ | 1,088.60 | | | | | 1.65 | % | | | $ | 8.64 | | | | $ | 1,000.00 | | | | $ | 1,016.80 | | | | | 1.65 | % | | | $ | 8.34 | |

Class A | | | $ | 1,000.00 | | | | $ | 1,087.90 | | | | | 1.90 | % | | | $ | 9.94 | | | | $ | 1,000.00 | | | | $ | 1,015.54 | | | | | 1.90 | % | | | $ | 9.60 | |

Class C | | | $ | 1,000.00 | | | | $ | 1,084.90 | | | | | 2.41 | % | | | $ | 12.60 | | | | $ | 1,000.00 | | | | $ | 1,012.99 | | | | | 2.41 | % | | | $ | 12.16 | |

Class I | | | $ | 1,000.00 | | | | $ | 1,089.80 | | | | | 1.40 | % | | | $ | 7.33 | | | | $ | 1,000.00 | | | | $ | 1,018.05 | | | | | 1.40 | % | | | $ | 7.08 | |

TETON Westwood Balanced Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | $ | 1,000.00 | | | | $ | 1,072.30 | | | | | 1.39 | % | | | $ | 7.22 | | | | $ | 1,000.00 | | | | $ | 1,018.10 | | | | | 1.39 | % | | | $ | 7.03 | |

Class A | | | $ | 1,000.00 | | | | $ | 1,071.40 | | | | | 1.63 | % | | | $ | 8.46 | | | | $ | 1,000.00 | | | | $ | 1,016.90 | | | | | 1.63 | % | | | $ | 8.24 | |

Class C | | | $ | 1,000.00 | | | | $ | 1,068.50 | | | | | 2.15 | % | | | $ | 11.15 | | | | $ | 1,000.00 | | | | $ | 1,014.29 | | | | | 2.15 | % | | | $ | 10.86 | |

Class I | | | $ | 1,000.00 | | | | $ | 1,073.80 | | | | | 1.14 | % | | | $ | 5.93 | | | | $ | 1,000.00 | | | | $ | 1,019.35 | | | | | 1.14 | % | | | $ | 5.77 | |

TETON Westwood Intermediate Bond Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | $ | 1,000.00 | | | | $ | 1,027.20 | | | | | 1.02 | % | | | $ | 5.18 | | | | $ | 1,000.00 | | | | $ | 1,019.95 | | | | | 1.02 | % | | | $ | 5.16 | |

Class A | | | $ | 1,000.00 | | | | $ | 1,026.70 | | | | | 1.12 | % | | | $ | 5.69 | | | | $ | 1,000.00 | | | | $ | 1,019.45 | | | | | 1.12 | % | | | $ | 5.67 | |

Class C | | | $ | 1,000.00 | | | | $ | 1,023.20 | | | | | 1.78 | % | | | $ | 9.03 | | | | $ | 1,000.00 | | | | $ | 1,016.14 | | | | | 1.78 | % | | | $ | 9.00 | |

Class I | | | $ | 1,000.00 | | | | $ | 1,027.60 | | | | | 0.77 | % | | | $ | 3.91 | | | | $ | 1,000.00 | | | | $ | 1,021.21 | | | | | 0.77 | % | | | $ | 3.90 | |

| * | Expenses are equal to the Funds’ annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183 days), then divided by 365. |

16

Summary of Portfolio Holdings (Unaudited)

The following tables present portfolio holdings as a percent of net assets as of September 30, 2019:

| | | | | | | | | | | | |

TETON Westwood Mighty Mites Fund | | | | | | | | | | | | |

Diversified Industrial | | | 11.8 | % | | | | Automotive | | | 1.2 | % |

Financial Services | | | 9.6 | % | | | | Metals and Mining | | | 1.2 | % |

Health Care | | | 8.7 | % | | | | Consumer Services | | | 0.8 | % |

Equipment and Supplies | | | 6.9 | % | | | | Semiconductors | | | 0.8 | % |

Aerospace and Defense | | | 6.6 | % | | | | Energy and Utilities: Natural Gas | | | 0.8 | % |

Hotels and Gaming | | | 4.6 | % | | | | Entertainment | | | 0.7 | % |

Electronics | | | 3.7 | % | | | | Agriculture | | | 0.6 | % |

Real Estate | | | 3.5 | % | | | | Communications Equipment | | | 0.4 | % |

Food and Beverage | | | 3.2 | % | | | | U.S. Government Obligations | | | 0.4 | % |

Business Services | | | 3.1 | % | | | | Energy and Utilities: Integrated | | | 0.2 | % |

Consumer Products | | | 3.0 | % | | | | Energy and Utilities: Services | | | 0.2 | % |

Machinery | | | 2.8 | % | | | | Wireless Communications | | | 0.2 | % |

Specialty Chemicals | | | 2.2 | % | | | | Paper and Forest Products | | | 0.2 | % |

Telecommunications | | | 2.2 | % | | | | Closed-End Funds | | | 0.1 | % |

Aviation: Parts and Services | | | 2.2 | % | | | | Airlines | | | 0.1 | % |

Computer Software and Services | | | 2.1 | % | | | | Educational Services | | | 0.1 | % |

Restaurants | | | 2.1 | % | | | | Miscellaneous | | | 0.1 | % |

Manufactured Housing and Recreational Vehicles | | | 2.1 | % | | | | Energy and Utilities | | | 0.1 | % |

Building and Construction | | | 2.1 | % | | | | Transportation | | | 0.0 | %* |

Environmental Control | | | 1.9 | % | | | | Energy and Utilities: Oil | | | 0.0 | %* |

Retail | | | 1.8 | % | | | | Other Assets and Liabilities (Net) | | | (0.1 | )% |

| | | | | | | | | | | | |

Automotive: Parts and Accessories | | | 1.7 | % | | | | | | | 100.0 | % |

| | | | | | | | | | | | |

Energy and Utilities: Water | | | 1.5 | % | | | | | | | | |

Publishing | | | 1.3 | % | | | | * Amount represents less than 0.05%. | | | | |

Broadcasting | | | 1.2 | % | | | | | | | | |

TETON Westwood SmallCap Equity Fund | | | | | | | | | | | | |

Banking | | | 24.3 | % | | | | Consumer Products | | | 2.2 | % |

Semiconductors | | | 11.4 | % | | | | Diversified Industrial | | | 1.7 | % |

Energy and Utilities | | | 8.2 | % | | | | Communications | | | 1.5 | % |

U.S. Government Obligations | | | 7.2 | % | | | | Machinery | | | 1.2 | % |

Computer Software and Services | | | 6.5 | % | | | | Equipment and Supplies | | | 1.1 | % |

Health Care | | | 5.8 | % | | | | Real Estate | | | 1.1 | % |

Electronics | | | 4.9 | % | | | | Environmental Control | | | 1.0 | % |

Communications Equipment | | | 4.9 | % | | | | Aviation: Parts and Services | | | 0.8 | % |

Business Services | | | 4.5 | % | | | | Broadcasting | | | 0.8 | % |

Financial Services | | | 3.5 | % | | | | Aerospace | | | 0.8 | % |

Automotive | | | 3.4 | % | | | | Transportation | | | 0.6 | % |

Specialty Chemicals | | | 3.3 | % | | | | Other Assets and Liabilities (Net) | | | (5.8 | )% |

| | | | | | | | | | | | |

Retail | | | 2.8 | % | | | | | | | 100.0 | % |

| | | | | | | | | | | | |

Building and Construction | | | 2.3 | % | | | | | | | | |

TETON Convertible Securities Fund | | | | | | | | | | | | |

Computer Software and Services | | | 23.2 | % | | | | Energy and Utilities: Water | | | 1.2 | % |

Health Care | | | 16.4 | % | | | | Aviation: Parts and Services | | | 1.1 | % |

Semiconductors | | | 8.8 | % | | | | Equipment and Supplies | | | 1.1 | % |

Energy and Utilities: Integrated | | | 7.4 | % | | | | Publishing | | | 1.1 | % |

Energy and Utilities: Services | | | 5.9 | % | | | | Aerospace and Defense | | | 1.0 | % |

Financial Services | | | 4.5 | % | | | | Consumer Products | | | 1.0 | % |

Telecommunications | | | 4.3 | % | | | | Consumer Services | | | 0.8 | % |

U.S. Government Obligations | | | 4.2 | % | | | | Agriculture | | | 0.2 | % |

Communications Equipment | | | 3.6 | % | | | | Other Assets and Liabilities (Net) | | | (1.4 | )% |

| | | | | | | | | | | | |

Business Services | | | 3.5 | % | | | | | | | 100.0 | % |

| | | | | | | | | | | | |

Real Estate Investment Trusts | | | 3.1 | % | | | | | | | | |

Diversified Industrial | | | 2.9 | % | | | | | | | | |

Transportation | | | 2.1 | % | | | | | | | | |

Cable and Satellite | | | 1.5 | % | | | | | | | | |

Industrials | | | 1.3 | % | | | | | | | | |

Automotive | | | 1.2 | % | | | | | | | | |

17

Summary of Portfolio Holdings (Unaudited) (Continued)

| | | | | | | | | | | | |

TETON Westwood Equity Fund | | | | | | | | | | | | |

Health Care | | | 12.1 | % | | | | Entertainment | | | 2.7 | % |

Banking | | | 11.7 | % | | | | Business Services | | | 2.2 | % |

Financial Services | | | 8.5 | % | | | | Consumer Products | | | 2.1 | % |

Retail | | | 8.4 | % | | | | Energy and Energy Services | | | 2.0 | % |

Computer Software and Services | | | 8.2 | % | | | | Diversified Industrial | | | 1.9 | % |

Energy: Integrated | | | 8.0 | % | | | | Transportation | | | 1.7 | % |

Food and Beverage | | | 6.4 | % | | | | Other Investment Companies | | | 1.1 | % |

Aerospace | | | 6.1 | % | | | | Semiconductors | | | 1.0 | % |

Telecommunications | | | 5.5 | % | | | | Other Assets and Liabilities (Net) | | | 0.3 | % |

| | | | | | | | | | | | |