| OMB APPROVAL |

OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-04750 | |

| Fenimore Asset Management Trust |

| (Exact name of registrant as specified in charter) |

| 384 North Grand Street, P.O. Box 399 Cobleskill, New York | 12043 |

| (Address of principal executive offices) | (Zip code) |

Thomas O. Putnam

Fenimore Asset Management Trust 384 North Grand Street, P.O. Box 399 Cobleskill, New York, 12043 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | 1-800-453-4392 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| Chairman’s Commentary | 1 |

| Expense Data | 4 |

| FAM VALUE FUND | |

| Letter to Shareholders | 6 |

| Portfolio Data | 13 |

| Schedule of Investments | 15 |

| FAM DIVIDEND FOCUS FUND | |

| Letter to Shareholders | 17 |

| Portfolio Data | 24 |

| Schedule of Investments | 26 |

| FAM SMALL CAP FUND | |

| Letter to Shareholders | 28 |

| Portfolio Data | 36 |

| Schedule of Investments | 38 |

| Statements of Assets and Liabilities | 40 |

| Statements of Operations | 41 |

| Statements of Changes in Net Assets | 42 |

| Notes to Financial Statements | 45 |

| Report of Independent Registered Public Accounting Firm | 58 |

| Board Consideration of the Continuation of the Investment Advisory Agreements for the Funds | 60 |

| Information About Trustees and Officers | 65 |

| Supplemental Information | 67 |

| Privacy Policy | 68 |

FAM Funds has adopted a Code of Ethics that applies to its principal executive and principal financial officers. You may obtain a copy of this Code without charge, by calling FAM Funds at (800) 932-3271.

December 31, 2020

Dear Fellow Shareholder,

The past year has been among the most memorable in my nearly five-decade investment career. When reflecting upon 2020, there are both good and bad memories. To be sure, the virus exacted a nearly incalculable human and economic toll that we have all felt in one way or another. As we exited the year, however, there was much room for optimism.

The pandemic led to great human perseverance and ingenuity resulting in, among other things, the discovery and development of multiple vaccines in less than one-tenth of the time it typically takes. And, while the initial rollout of vaccinations has been slower than expected, we believe we are on track to return to a world that more resembles 2019 than 2020. While there is near-term uncertainty about the pace of economic recovery, we are confident about the long-term prospects of our holdings.

Market Performance

The S&P 500, an index of large U.S. companies, returned +18.4% in one of the most volatile years on record. The index began the year in positive territory hitting a (then) high on February 19 before plummeting -34% in only 23 trading days due to the uncertainty of the impact of a little-understood virus.1

Sentiment very quickly reversed on March 23 upon news of a $2 trillion stimulus package, which, along with improving economic data, sent the market soaring to new highs by early September. A resurgence in cases put pause to the rally until the November 9 announcement by Pfizer/BioNTech that their vaccine candidate showed 90+% effectiveness in clinical trials and could be approved and available for distribution by year’s end.

With this news, companies and industries that had disproportionally suffered from the economic effects of the pandemic (e.g., airlines, hotels, and restaurants) led a resumption of the bull market to new highs by year-end. Smaller companies did even better than larger companies. The Russell 2000, an index of small-cap businesses, returned 19.9% including its best quarter in two decades.2

FAM Fund Performance

Our mutual funds did well on an absolute basis, but underperformed their benchmarks for reasons explained later in this letter. More importantly, we were more active than we have been in years. As a result of the volatility, we were able to invest more in current holdings as well as new ideas — quality businesses from our perspective. Our investment research team has followed some of these new ideas for years, but they were perennially too expensive for our taste.

In the three funds combined, we initiated 23 positions in companies ranging from uniform rental to semiconductor manufacturing and logistics software to pool supplies. We feel we were able to improve both the quality and expected return of the funds. Please read each of the fund letters for more detail on our 2020 activities.

Resilience: An Update

In our last letter, we talked about the resilience of our portfolio holdings in the face of the pandemic, which, at that point, was only a couple of months old. As the year progressed, our researchers were even more pleased with the performance of our holdings’ management teams. Nearly all took extraordinary and effective measures to protect the physical and financial well-being of their employees. They found new ways to provide value to their customers, lowered their cost structures (even with additional COVID costs), and improved their competitive positioning. In some cases, sales have not returned to pre-pandemic levels, but all are poised to grow from our vantage point. Owning what we believe are quality businesses with strong balance sheets and skilled, ethical leaders feels good every year; it felt particularly good in 2020.

| 1 | FactSet as of December 31, 2020 |

| 2 | FactSet as of December 31, 2020 |

Market Timing

Some investors react to alarming headlines and/or market declines by “going to cash” with the anticipation of “getting back in” when things look or feel better. This is despite how much has been researched and written about how hard it is to successfully time the market and how costly it can be to even try. The problem is that the market often sees the light at the end of the tunnel well before the investor — pricing in a recovery before it happens and leaving the market timer waiting for a better time to “get back in.” You would be hard pressed to get a better example of this than 2020. Various surveys have shown that up to 25% of investors sold all their equities during the intense March downturn while up to 40% more sold some of their stocks during that time.3

A recent study was published on the S&P 500 from December 31, 1980 to August 31, 2020. During that time, if you missed just the 5 best days, your annual growth fell from 12.2% to 10.8% and your final account balance was 38% lower than if you were invested all 14,280 days. If you missed the 30 best days, your final account balance would have been 84% lower.4

Staying the course can be difficult, especially in an era where the more shocking the headline the more views a story gets. Our associates also understand that countless people faced very difficult situations in 2020 and had no choice but to liquidate their assets. Everyone’s circumstances are different. That is why we focus on the long-term investment horizon (measured in years, not months) while seeking to own a collection of quality, well-capitalized, well-run businesses that have a history of growing value through all kinds of circumstances.

Outlook

Following a year of the unprecedented use of the word “unprecedented,” outlooks should be greeted with more skepticism than usual. We entered 2020 with a strong economy and record low unemployment while the prevalent concern was trade relations with China — but nobody foresaw what transpired. It was yet another reminder that the seas can get stormy unexpectedly and quickly. That is why we always want to sail with a fleet of sturdy ships.

Our holdings are weathering this storm remarkably, in our opinion, with water-tight business models, able crews, and steady-handed (and headed) captains. Based on our experience, Fenimore’s team believes that this is the best way to preserve and grow your wealth. While we do not know what 2021 will bring, we believe that vaccines, stimulus, and time will continue to mend the economy. Meanwhile, if volatility continues into next year, we will view it as an opportunity — as we always have — seeking to invest in what we deem to be wonderful, durable businesses.

| 4 | Fidelity Investments, 2020, “Keep perspective: downturns are normal.” |

Thank you for the trust you place in us. If you need assistance, please call us at 800-932-3271 or email info@fenimoreasset.com. Our associates welcome the opportunity to help you.

Thomas O. Putnam

Founder & Executive Chairman

Research Team:

Andrew F. Boord

John D. Fox, CFA

Kevin D. Gioia,CFA

Antonio Hebert

Paul C. Hogan, CFA

William W. Preston, CFA

Marc D. Roberts, CFA

Drew P. Wilson, CFA

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| FAM FUNDS — Expense Data (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Funds, you incur ongoing costs, including management fees, shareholder servicing fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (July 1, 2020) and held until the end of the period (December 31, 2020).

The table below illustrates each Fund’s ongoing costs in two ways:

Actual Expenses

The first line for each Fund in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each Fund in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical example of the table is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| FAM FUNDS — Expense Data (Unaudited) Continued |

| | Beginning | Ending | | |

| | Account | Account | Net | Expenses |

| | Value | Value | Expense | Paid During |

| | 7/1/2020 | 12/31/2020 | Ratio | Period |

| | | | | |

| FAM Value Fund - | | | | |

| Investor Shares: | | | | |

| Actual Return | $1,000.00 | $1,210.00 | 1.18% | $6.56 |

| Hypothetical 5% Return | $1,000.00 | $1,019.20 | 1.18% | $5.99 |

| | | | | |

| FAM Value Fund - | | | | |

| Institutional Shares: | | | | |

| Actual Return | $1,000.00 | $1,211.10 | 0.99% | $5.50 |

| Hypothetical 5% Return | $1,000.00 | $1,020.16 | 0.99% | $5.03 |

| | | | | |

| FAM Dividend Focus Fund - | | | | |

| Investor Shares: | | | | |

| Actual Return | $1,000.00 | $1,239.90 | 1.23% | $6.93 |

| Hypothetical 5% Return | $1,000.00 | $1,018.95 | 1.23% | $6.24 |

| | | | | |

| FAM Small Cap Fund - | | | | |

| Investor Shares: | | | | |

| Actual Return | $1,000.00 | $1,306.00 | 1.29% | $7.48 |

| Hypothetical 5% Return | $1,000.00 | $1,018.65 | 1.29% | $6.55 |

| | | | | |

| FAM Small Cap Fund - | | | | |

| Institutional Shares: | | | | |

| Actual Return | $1,000.00 | $1,306.50 | 1.17% | $6.78 |

| Hypothetical 5% Return | $1,000.00 | $1,019.25 | 1.17% | $5.94 |

| * | Expense are calculated using each Fund’s annualized net expense ratios, which represent net expenses as a percentage of average daily net assets for the one-half year period ended December 31, 2020. Expenses are calculated by multiplying the annualized expense ratio by the average account value of the period; then multiplying the result by the number of days in the most recent one-half year period (184); and then dividing that result by the number of days in the current fiscal year (366). |

December 31, 2020

Dear Fellow Value Fund Shareholder,

2020 is a year that no one expected and we would all like to forget. As we write this letter, the country is in a race between increasing infections and the rollout of two vaccines from Pfizer/BioNTech and Moderna. So far, the rollout has been slow with just over two million people in the United States receiving the vaccine as of December 29. While we are certainly not medical experts, we believe the pace of vaccinations should increase and eventually we will return to activities that we all miss — travel, dining out, live entertainment, and getting together with family and friends.

If we told you on New Year’s Eve 2019 that the upcoming year will bring a pandemic, the worst recession since the 1930s, and a contentious presidential election, the natural reaction would be to sell everything on the first business day of the new year! Of course, this would have been a mistake with the stock market producing above-average returns in 2020. While the market indices showed annual returns of 9% to 20%, there was a big difference in the performance of various groups of stocks. Technology stocks were the best performing group and were up more than 43% on the year. Some of the worst performing groups included energy firms (down 32%) and airline stocks (down 28%).1

An easy way to think about the groups is stay-at-home versus mobility. Technology stocks benefited from people working from home and online shopping. Workers needed new equipment to be productive at home and people increased their online purchases as stores were temporarily closed. Stay-at-home really hurt entertainment, restaurants, cruise ships, airlines, and demand for gasoline which is a key factor for oil companies.

Another aspect of the stock market this year, in our opinion, was a high degree of speculation with renewed interest in initial public offerings (IPOs) and day trading. The Wall Street Journal reports that 2020 was a record year for IPOs with 454 new companies raising $167 billion. The amount raised is about 50% above the previous record set in 1999.

Another parallel to 1999 is the return of online day trading. Some of you might remember early E*TRADE brokerage commercials in the late 1990s. At the time, E*TRADE was a new kind of broker offering online accounts and day trading. The E*TRADE of our current day is Robinhood. Robinhood allows you to trade stocks, options, and crypto currencies from your mobile phone. They opened three million new accounts in 2020.2 Even a personal finance writer at The Wall Street Journal gave it a try, opening an account with $200 provided by his editor. His stated goal was to make as much money as fast as possible!

Looking back on the year, it reinforces our belief that no one can predict what’s going to happen in the economy or the stock market. With perfect foresight into the events of 2020, a prognosticator would have probably advised selling everything and putting it under the mattress. Of course, the correct advice was to buy the most speculative stocks possible.

Portfolio Activity

During January and February, we were cautious buying only one stock, Monro (MNRO), and selling the majority of our shares in two industrial stocks — Donaldson (DCI) and Snap-on (SNA).

In early March, we switched from sellers to buyers as the stock market quickly declined more than 30%. Since we did not know the magnitude or duration of the market decline, we decided to buy, slowly.

| 1 | FactSet as of December 31, 2020 |

| 2 | BusinessofApps.com, November 11, 2020 |

Our team focused on buying stock in the highest quality businesses from our viewpoint — both new investments and existing holdings. From the day the market went down 10% from the peak, February 27,3 to the first week of April, we purchased 17 stocks for a total of $73 million. These purchases were primarily funded by reducing our cash position from more than $80 million to less than $40 million and assorted sales including Monro and FLIR Systems (FLIR).

Sales

In the first half of the year, we sold most of our shares in Donaldson, and all our shares in Snap-On, FLIR Systems, Marriott International (MAR), and Monro. A discussion of these sales can be found in our Semi-Annual Letter as of June 30, 2020. In the second half of the year, we made three significant sales: Mohawk Industries (MHK), Waters Corporation (WAT), and Xilinx (XLNX).

Mohawk is one of the two largest flooring manufacturers in the United States. Historically a manufacturer of carpet, Mohawk added other popular flooring choices like hardwood and ceramic. The company also expanded overseas acquiring several large flooring businesses in Europe. This expansion of product line and geography proved very successful and, over the five years ending in December 2017, the stock more than tripled. Unfortunately, that was the stock’s high-water mark.

While management had done an admirable job diversifying away from domestic carpet, they missed a major competitive threat that has emerged in the last few years. Low price imports from China, called LVT (luxury vinyl tile), began to take market share from traditional flooring. LVT is much lower in cost and has acceptable quality for the consumer. As LVT grew at a very high rate, management tried to get in the game by building LVT manufacturing capacity.

Unfortunately, Mohawk has not been able to produce the product at the planned volumes and continues to lose market share to lower-priced products. While the new plant investment may ultimately be successful, we decided to reinvest the money from Mohawk into two other companies, Analog Devices (ADI) and Vulcan Materials Company (VMC), that we believe have better long-term prospects.

Waters Corporation makes specialty instruments for use in scientific and manufacturing processes. The instruments are very specialized and require regular servicing which creates a nice continuing revenue stream. We observed that Water’s sales growth was below that of its competitors and that a number of key employees had left. After the CEO was fired in June, we suspected the problems we were monitoring may be bigger than we originally thought and sold our shares.

The final significant sale in the latter half of the year was Xilinx when it was acquired by another company at a substantial gain.

Purchases

The majority of our stock purchases occurred in the first half of the year when we bought 18 stocks — 16 of those 18 purchases occurred between February 27 and April 3. The holdings are listed below.

| 3 | Bloomberg as of December 31, 2020 |

| Securities Purchased in the FAM Value Fund |

| Between Feb 27 and April 3, 2020 |

| Analog Devices | Genpact |

| Berkshire Hathaway | Landstar System |

| Black Knight | STERIS |

| Broadridge Financial Solutions | Stryker Corp. |

| CarMax | The Hanover Group |

| Fastenal Co. | Vulcan Materials |

| Fidelity National Information Services | Xilinx |

| Fortune Brands Home & Security | Zebra Technologies |

In the second half of the year, we had two periods when we added to existing positions.

The first was early October when we purchased additional shares in Fidelity National Information Services (FIS) after their third quarter earnings report. FIS is a provider of what’s called “CORE” banking systems. A core system is the software a bank uses to run its internal operations. It is a very stable business, in our opinion, with good pricing power as it is very difficult for a bank to switch its core system. The act of switching has been described to us as doing a “heart and lung transplant at the same time.” In addition to a stable software business, FIS has a global payments operation where they make money on debit and credit payments around the world. About 25% of this business is travel and dining related which has seen a large decline during the pandemic. Our team believes that once hospitality companies return to normal, the payments operation should provide a real boost to FIS’ earnings.

Our last group of purchases occurred in early November on the announcement of the favorable results of the Pfizer vaccine Phase 3 trial. We purchased small amounts of a number of stocks that performed poorly to that point in 2020, but we believed should benefit from a return to normal. This group included an aircraft parts supplier, an energy firm, a handful of banks, and the previously mentioned FIS.

Closing Thoughts

In the 2020 Semi-Annual Letter we wrote the following:

Given the highly uncertain outlook, we are focusing on buying shares of stock in what we deem to be the best companies at good prices, increasing the quality of our holdings, and reducing our exposure to balance sheets with debt. Two of our sales, Marriott International and Monro, were some of our highest debt businesses. We are conscience that this strategy will likely underperform the initial snapback in stock prices during a recovery, but believe it’s the best long-term (2+ years) strategy for protecting capital in a potential decline and achieving long-term returns.

Since May, the FAM Value Fund has underperformed its primary benchmark, the Russell Midcap Index, resulting in the annual return lagging the benchmark by about 10% for the year. When we study the year-to-date performance, it’s clear that the Fund’s Top 10 Holdings appreciated significantly less than the market overall. With the Top 10 Holdings comprising almost 50% of the portfolio’s assets, this was too large of a drag to overcome.

When we examine these holdings, they fall into three groups:

CarMax and Ross Stores: Store closures and stay-at-home orders reduced traffic for brick-and-mortar retailers resulting in lower profits for the year. However, these two companies are “category killers” in their respective industries, used cars and off-price retail, and are long-term winners in our view. Current Wall Street estimates project significant increases in sales and earnings for next year.

Berkshire Hathaway, Brookfield Asset Management, and Markel Corporation: These three businesses are involved in various parts of the financial markets including insurance, investment management, private equity, and real estate. While all three stocks underperformed the markets, we believe each company made good progress in growing their intrinsic value. We value Berkshire and Markel on book value per share. We expect both to be very profitable in 2020 and report all-time high book values as of December 31. We value Brookfield by adding the value of their investments to the value of their asset management business. They are one of the largest and most successful asset managers in the world and we expect the earnings in that business to grow well in excess of 15%. Our estimates of Brookfield’s value per share is also at an all-time high. We believe all three companies are quality enterprises and can compound shareholder value for many years.

The remainder of the Top 10 Holdings are a mix of financial, industrial, and technology companies that had varied results in 2020. Three of these firms grew pre-tax profits in the pandemic year while two experienced declines in profits of 10% to 17%.

As our team assesses these 10 positions, we still believe they are excellent businesses with good prospects for future growth trading near their intrinsic values. In a few cases, we see fairly good discounts from their value.

Our Investment Philosophy and Process

Finally, especially during these extraordinary days, we feel it is important to reiterate our investment approach as we did in our 2019 letters.

Our philosophy can be summed up in the idea of intrinsic value. We believe that every asset, be it a bond, piece of real estate, or company has a value that is “intrinsic” to that asset. The value of an asset comes from the amount of cash it produces and the rate of growth of that cash flow into the future. If you know the future outcomes of these two variables, it is fairly easy to figure out what an asset is worth.

This is how we think about valuing companies and therefore the value of their stock. A share of stock represents a fractional ownership in that business; therefore, the price of the stock should track the value of that enterprise over time. Of course, making accurate projections about the future is difficult. As a result, we build guardrails into our investment process to mitigate risk if our forecasts are wrong.

Our process focuses on four core criteria:

| 1. | A good business that is growing and protected by some competitive advantage |

| 2. | A strong financial position with low debt, high profit margins, cash profits, and high returns on capital |

| 3. | An excellent management team that exhibits both honesty and the ability to allocate capital for the benefit of the shareholders |

| 4. | A purchase price that is below what we think the stock is worth |

Once we purchase a stock, we follow it closely and try to meet with management face-to-face at least once a year. We also monitor the price-to-value relationship over time. As long as the stock does not become significantly overvalued, we tend to hold onto our stocks for many years.

This long-term view is reflected in the Fund’s low turnover ratio which is significantly lower than the mutual fund industry average. One benefit of a long holding period is that when we do sell a stock and realize a capital gain, it is usually a long-term gain which is taxed at a lower rate than a short-term gain.

FAM Funds will continue to follow our business-first approach as we conduct in-depth, firsthand research at the company level. Our steadfast focus is to invest in a collection of quality businesses that we think are becoming more valuable over time — regardless of the short-term political or economic environment.

Thank you for investing with us in the FAM Value Fund.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2019 TO 12/31/2020

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Zebra Technologies Corp. | 3.14% | 1.25% |

| Brown & Brown | 6.37% | 1.07% |

| Graco | 3.63% | 1.02% |

| IDEX Corp. | 6.65% | 0.91% |

| Black Knight | 3.14% | 0.88% |

This reflects the FAM Value Fund’s best and worst performers, in descending order, based on individual stock perfor-mance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| EOG Resources | 1.69% | -1.12% |

| FLIR Systems | Sold | -0.89% |

| Mohawk Industries | Sold | -0.73% |

| Marriott International | Sold | -0.54% |

| M&T Bank Corp. | 1.59% | -0.53% |

Past performance does not indicate future results.

|  |  |

| | | |

| John D. Fox, CFA | Thomas O. Putnam | Drew P. Wilson, CFA |

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter. |

| FAM VALUE FUND — Performance Summary Continued |

| December 31, 2020 (Unaudited) |

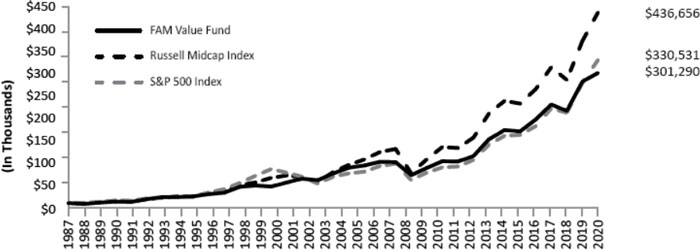

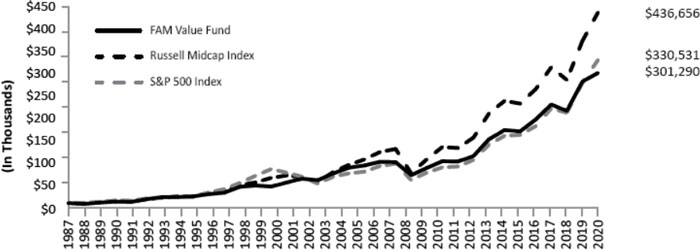

The chart below depicts the change in value of a $10,000 investment in the Investor Shares of the FAM Value Fund since inception on January 2, 1987, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard & Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard & Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM VALUE FUND,

THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Value Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| FAM VALUE FUND — Performance Summary Continued |

| December 31, 2020 (Unaudited) |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2020

The performance data quoted represents past performance.

| | | | | | Since |

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception |

| FAM Value Fund - Investor Shares* | 6.82% | 9.31% | 12.05% | 11.25% | 10.53% |

| Russell Midcap Index | 17.10% | 11.61% | 13.40% | 12.41% | 11.75% |

| S&P 500 Index | 18.40% | 14.18% | 15.22% | 13.88% | 10.84% |

| * | Disclosure: The total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.19% after fee waivers of (0.01%) for the Investor Class. The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.00% after fee waivers of (0.12%) for the Institutional Class. The total annual operating expense ratio as reported in the Fund’s audited financial statements is 1.18% as of December 31, 2020 after a fee waiver of (0.01%) for the Investor Class. The total annual operating expenses as reported in the Fund’s audited financial statements is 0.99% as of December 31, 2020 after a fee waiver of (0.12%)for the Institutional Class. The Advisor has contractually agreed, until May 1, 2022, to waive fees and/or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to maintain Net Fund Operating Expenses for Investor Shares at 1.18% and Institutional Shares at 0.99%. |

Past performance is not indicative of future results, current performance may be lower or higher than the performance date quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about the FAM Value Fund and should be read carefully before you invest or send money. The principal risks of investing in the Funds are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

To obtain a prospectus or summary prospectus and performance data that is current to the most recent month-end for each fund as well as other information on the FAM Value Fund, please go to famfunds.com or call (800) 932-3271.

This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

| FAM VALUE FUND — Portfolio Data |

| December 31, 2020 (Unaudited) |

| TOP TEN EQUITY HOLDINGS |

| (% of Net Assets) | |

| Ross Stores, Inc. | 7.0% |

| IDEX Corporation | 6.7% |

| Brown & Brown, Inc. | 6.4% |

| CDW Corporation | 5.2% |

| Brookfield Asset Management, Inc. - Class A | 4.8% |

| Markel Corporation | 4.4% |

| CarMax, Inc. | 4.2% |

| Illinois Tool Works, Inc. | 4.1% |

| Berkshire Hathaway, Inc. - Class A | 4.0% |

| Graco, Inc. | 3.6% |

| FAM VALUE FUND — Portfolio Data Continued |

| December 31, 2020 (Unaudited) |

| COMPOSITION OF NET ASSETS |

| Machinery | 14.4% |

| Specialty Retail | 13.4% |

| Insurance | 11.6% |

| Electronic Equipment, Instruments & Components | 8.3% |

| IT Services | 7.5% |

| Capital Markets | 7.1% |

| Banks | 4.2% |

| Diversified Financial Services | 4.0% |

| Health Care Equipment & Supplies | 3.8% |

| Money Market Funds | 3.6% |

| Chemicals | 3.4% |

| Construction Materials | 3.1% |

| Semiconductors & Semiconductor Equipment | 3.1% |

| Trading Companies & Distributors | 2.7% |

| Road & Rail | 2.2% |

| Multi-Line Retail | 2.2% |

| Containers & Packaging | 2.0% |

| Oil, Gas & Consumable Fuels | 1.7% |

| Building Products | 1.2% |

| Household Durables | 0.5% |

| Aerospace & Defense | 0.1% |

| Other | -0.1% |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT; (ii) the complete listing is available on the Commission’s website at www.sec.gov; and (iii) the Fund makes the exhibit to Form N-PORT available to shareholders, upon request, by calling FAM FUNDS at 1-800-932-3271.

| FAM VALUE FUND — Schedule of Investments |

| December 31, 2020 |

| | | Shares | | | Value | |

| COMMON STOCKS — 96.5% | | | | | | | | |

| Aerospace & Defense — 0.1% | | | | | | | | |

| HEICO Corporation - Class A | | | 19,200 | | | $ | 2,247,552 | |

| | | | | | | | | |

| Banks — 4.2% | | | | | | | | |

| First Hawaiian, Inc. | | | 170,000 | | | | 4,008,600 | |

| M&T Bank Corporation | | | 179,000 | | | | 22,786,700 | |

| Pinnacle Financial Partners, Inc. | | | 70,000 | | | | 4,508,000 | |

| South State Corporation | | | 388,110 | | | | 28,060,353 | |

| | | | | | | | 59,363,653 | |

| | | | | | | | | |

| Building Products — 1.2% | | | | | | | | |

| Fortune Brands Home & Security, Inc. | | | 200,000 | | | | 17,144,000 | |

| | | | | | | | | |

| Capital Markets — 7.1% | | | | | | | | |

| Brookfield Asset Management, Inc. - Class A | | | 1,653,750 | | | | 68,250,263 | |

| T. Rowe Price Group, Inc. | | | 214,390 | | | | 32,456,502 | |

| | | | | | | | 100,706,765 | |

| | | | | | | | | |

| Chemicals — 3.4% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 175,500 | | | | 47,950,110 | |

| | | | | | | | | |

| Construction Materials — 3.1% | | | | | | | | |

| Vulcan Materials Company | | | 297,930 | | | | 44,185,998 | |

| | | | | | | | | |

| Containers & Packaging — 2.0% | | | | | | | | |

| Avery Dennison Corporation | | | 187,000 | | | | 29,005,570 | |

| | | | | | | | | |

| Diversified Financial Services — 4.0% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class A (a) | | | 165 | | | | 57,389,475 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 8.3% | | | | | | | | |

| CDW Corporation | | | 558,200 | | | | 73,565,178 | |

| Zebra Technologies Corporation - Class A (a) | | | 116,720 | | | | 44,858,998 | |

| | | | | | | | 118,424,176 | |

| | | | | | | | | |

| Health Care Equipment & Supplies — 3.8% | | | | | | | | |

| STERIS plc | | | 17,500 | | | | 3,316,950 | |

| Stryker Corporation | | | 208,000 | | | | 50,968,320 | |

| | | | | | | | 54,285,270 | |

| | | | | | | | | |

| Household Durables — 0.5% | | | | | | | | |

| NVR, Inc. (a) | | | 1,890 | | | | 7,710,936 | |

| | | | | | | | | |

| Insurance — 11.6% | | | | | | | | |

| Brown & Brown, Inc. | | | 1,919,392 | | | | 90,998,374 | |

| Hanover Insurance Group, Inc. (The) | | | 61,100 | | | | 7,143,812 | |

| Markel Corporation (a) | | | 60,850 | | | | 62,876,305 | |

| White Mountains Insurance Group Ltd. | | | 5,233 | | | | 5,236,454 | |

| | | | | | | | 166,254,945 | |

| | | | | | | | | |

See Notes to Financial Statements

| FAM VALUE FUND — Schedule of Investments Continued |

| December 31, 2020 |

| | | Shares | | | Value | |

| COMMON STOCKS — 96.5% (Continued) | | | | | | | | |

| IT Services — 7.5% | | | | | | | | |

| Black Knight, Inc. (a) | | | 508,611 | | | $ | 44,935,782 | |

| Broadridge Financial Solutions, Inc. | | | 72,900 | | | | 11,168,280 | |

| Fidelity National Information Services, Inc. | | | 145,400 | | | | 20,568,284 | |

| Genpact Ltd. | | | 741,600 | | | | 30,672,576 | |

| | | | | | | | 107,344,922 | |

| | | | | | | | | |

| Machinery — 14.4% | | | | | | | | |

| Graco, Inc. | | | 716,650 | | | | 51,849,627 | |

| IDEX Corporation | | | 476,750 | | | | 94,968,600 | |

| Illinois Tool Works, Inc. | | | 289,950 | | | | 59,115,006 | |

| | | | | | | | 205,933,233 | |

| | | | | | | | | |

| Multi-Line Retail — 2.2% | | | | | | | | |

| Dollar General Corporation | | | 146,300 | | | | 30,766,890 | |

| | | | | | | | | |

| Oil Gas & Consumable Fuels — 1.7% | | | | | | | | |

| EOG Resources, Inc. | | | 483,000 | | | | 24,087,210 | |

| | | | | | | | | |

| Road & Rail — 2.2% | | | | | | | | |

| Landstar System, Inc. | | | 230,721 | | | | 31,068,890 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 3.1% | | | | | | | | |

| Analog Devices, Inc. | | | 222,950 | | | | 32,936,403 | |

| Microchip Technology, Inc. | | | 80,000 | | | | 11,048,800 | |

| | | | | | | | 43,985,203 | |

| | | | | | | | | |

| Specialty Retail — 13.4% | | | | | | | | |

| AutoZone, Inc. (a) | | | 26,700 | | | | 31,651,248 | |

| CarMax, Inc. (a) | | | 634,900 | | | | 59,972,654 | |

| Ross Stores, Inc. | | | 810,688 | | | | 99,560,593 | |

| | | | | | | | 191,184,495 | |

| | | | | | | | | |

| Trading Companies & Distributors — 2.7% | | | | | | | | |

| Fastenal Company | | | 780,900 | | | | 38,131,347 | |

| | | | | | | | | |

| Total Common Stocks (Cost $481,706,279) | | | | | | $ | 1,377,170,640 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 3.6% | | | | | | | | |

| Invesco Short-Term Investments Trust – Institutional Class, 0.01% (b) | | | | | | | | |

| (Cost $51,504,389) | | | 51,504,389 | | | $ | 51,504,389 | |

| | | | | | | | | |

| Total Investments at Value — 100.1% (Cost $533,210,668) | | | | | | $ | 1,428,675,029 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (798,876 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,427,876,153 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of December 31, 2020. |

See Notes to Financial Statements

December 31, 2020

Dear Fellow Dividend Focus Fund Shareholder,

What if we told you at the beginning of 2020 that, amidst a global pandemic, the U.S. would see unemployment touch 14%, full-year GDP (gross domestic product) would be estimated to shrink 3.5%, and corporate profits (measured by S&P 500 earnings) would be down 15%, yet the U.S. equity market would be up double-digits and finish the year near all-time highs?1

You, like us, would probably be skeptical of such a prediction, yet 2020 provided the clearest reminder in recent memory that the stock market and economy are not the same thing and that the two can diverge — sometimes significantly.

While the economy took a massive blow due to widespread lockdowns, people and businesses propped up by significant government stimulus, lower interest rates, and lending programs. This massive liquidity and stimulus, along with an influx of retail traders, created an ideal backdrop for equities to have an exceptional year in our view. The FAM Dividend Focus Fund (the “Fund”) delivered a +13.2% return for the year, an outcome that would have been hard to grasp in late March when the Fund’s performance was down more than -35.0%.

The Fund’s performance lagged the Russell Midcap Index benchmark which was up 17.1%, but a deeper look at returns throughout the year shows two distinct periods.2 For roughly the first three quarters of the year, the Fund outperformed its benchmark. During that time, when uncertainty was high, investors favored companies that had minimal or no COVID-related disruptions, quality balance sheets, or benefited from the developing work-from-home trend.

However, as the year progressed and clarity grew on the timing of vaccine approval and distribution and the economy inched toward reopening, investors shifted toward more speculative and cyclical investments. This was very evident in the fourth quarter.

Signs of this speculative shift included a record year for IPO (initial public offering) activity, particularly early-stage biotechs and high-growth, yet unprofitable tech companies. 2020 also saw the mainstream emergence of SPACs (special purpose acquisition companies). These investment vehicles are essentially blank checks for management teams to make an acquisition and are an avenue for businesses to go public without traditional investor scrutiny. Additional areas that investors frenzied for included work-from-home beneficiaries, anything electric vehicle related, and bitcoin.

Some of these investments may live up to the early investor hype, in our opinion, but history tells us that most probably will not. Many of these businesses are nascent and unproven and their financial profile usually falls well short of our investment criteria. Importantly, it would be rare for any of these stocks to have a sound dividend growth policy given their growth and early stage. On the other hand, the majority of the Fund’s holdings demonstrated their financial excellence by growing or sustaining their dividend in 2020.

During the year, 21 of the Fund’s 28 holdings measured at year-end grew their dividend by an average growth rate of 9%.3 An additional five companies maintained their dividend.4 Ross Stores was the only company that suspended their dividend, ending a payout streak of 25 years. Despite being hit hard by COVID-related lockdowns as a brick-and-mortar retailer, we believe Ross Stores remains well positioned for growth as we move past the virus and is committed to paying a dividend in the long run.

| 1 | FactSet as of December 31, 2020 |

| 2 | Bloomberg as of December 31, 2020 |

| 3 | FactSet as of December 31, 2020 |

| 4 | Not included is Trane Technologies, which, as described later in the letter, was spun out of Ingersoll Rand in March |

Portfolio Activity

We had significantly higher-than-usual portfolio activity in 2020 with the market experiencing its strongest decline since the Great Financial Crisis when it fell by more than -30% in March.5 We took the opportunity to upgrade the Fund’s portfolio by purchasing stock in what we believe are several quality businesses that we have long followed but waited on for attractive entry prices. While most of this activity was in the first half of the year, we were able to add three new names and sell another four in the second half. That brought full-year activity to eight new names and 13 sales.

Purchases

Here are the new holdings:

| ● | Cintas (CTAS) is the largest provider of uniform rentals, first aid, and safety products in the U.S. and Canada. Cintas utilizes its scale advantage to enable them to acquire and serve customers at a lower cost than their competitors. We also like Cintas’ high rates of recurring revenue and historical customer retention rates. The company has also paid a dividend every year since it went public in 1983. |

| ● | Jack Henry & Associates (JKHY) provides critical core processing software to financial institutions which creates high recurring revenue and profitability. The firm continues to grow through increased tech spending by banks and credit unions. Management has a track record of capital allocation and runs the business with a clean balance sheet, typically net cash. It has grown its dividend for 26 straight fiscal years. |

| ● | Paychex (PAYX) provides HR, payroll, and benefits and insurance services for small- and medium-sized businesses. They serve approximately 670,000 clients and more than 12 million employees. Paychex benefits from increased regulations, which drive more outsourcing of payroll and HR solutions. The stock often trades around employment numbers, which enabled us to build our position in the stock. |

| ● | Republic Services (RSG) is the second largest solid waste collection and recycling provider in North America. Trash collection is a highly durable business with predictable cash generation that supports M&A (mergers and acquisitions) and a shareholder friendly capital allocation policy. RSG has returned nearly $5 billion in cash to shareholders (approximately 18% of its current market cap) over the last five years in dividends and stock buybacks. |

| ● | STERIS (STE) provides sterilization equipment and services to healthcare providers like hospitals, surgical centers, and outpatient GI procedure centers as well as medical device and pharma manufacturers. STERIS benefits from growth in medical procedures and more than 75% of its revenue is recurring. Additionally, the medical industry is highly regulated, which makes their products and methods very sticky with customers. The business has paid a growing dividend every year since 2005. |

| ● | HEICO (HEI) is a market leader in aftermarket parts and repair services for commercial aircraft. They also provide a broad list of electronic components to a variety of end markets (e.g., defense, space, and medical). Their aircraft replacement products, which need FAA approval, are typically priced 30% to 50% below OEMs (original equipment manufacturers) and provide cost savings for airlines. While flight segment demand was decimated during the pandemic, we believe the value proposition HEICO offers should lead to market share gains during the recovery. |

| ● | First Hawaiian Bank (FHB) was repurchased in November after a sale earlier in the year. At the time of the initial sale, we had significant concerns about the impact of lower interest rates, rising credit costs, and Hawaii’s dependence on tourism. With a conservative credit culture, the bank’s |

| 5 | Bloomberg as of December 31, 2020 |

balance sheet held up nicely throughout the year. Once we received some clarity on the impact to FHB’s financials and the distribution of a vaccine, we repurchased shares and believe the stock should benefit from an economic reopening.

| ● | A position in Graco (GGG) was initiated. This diversified industrial company is best known for their paint sprayers and we expect them to benefit from economic expansion. Graco also has a track record of growing their dividend and buying back shares. |

Sales

| ● | Essential Utilities (WTRG) was formerly known as Aqua America until its purchase of a natural gas utility in late 2018 (transaction closed in March 2020). We thought this acquisition was outside their core competency and believed they paid a more than full price at 15 times EBITDA (earnings before interest, taxes, depreciation, and amortization). Our team was initially attracted to WTRG due to the economics of water utilities and this transaction complicated that thesis, so we decided to fully exit our position. |

| ● | Ingersoll Rand (IR) was sold after its separation from Trane Technologies (TT). In the first half of 2020, Ingersoll Rand split its HVAC business off into a separate company (Trane Technologies). The remaining industrial compressor, vacuum, and blower business merged with competitor Gardner Denver and kept the Ingersoll Rand name and stock ticker. We are happy to continue to own the durable HVAC business in a pure-play format, but sold IR which is more cyclical and doesn’t pay a dividend. |

| ● | Marriott International (MAR) was sold as their business suffered greatly from the virus outbreak. Liquidity concerns forced Marriott to complete several debt raises and suspend their dividend “until further notice.” We believe there is too much uncertainty in its immediate future and, with increased balance sheet risk, decided to move on. |

| ● | We sold our stakes in Monro (MNRO) and South State Bank (SSB) not because anything was wrong with the businesses or our investment theses, but rather to use the proceeds to fund other purchases in enterprises that we hope should be even better compounders. |

| ● | A small stake was purchased in Penske Auto Group (PAG) as we looked to put cash to work at attractive valuations in a fully valued market. This was subsequently sold after they suspended their dividend. |

| ● | National Instruments (NATI) was sold as we believe results have been subpar despite a decent operating environment over the last few years. The company also recently completed an entire corporate reorganization and last year surprisingly announced a CEO transition after only three years. |

| ● | Snap-on (SNA) was another business that we sold as growth issues have persisted for several years. The operation’s stagnation increased our concerns about inventory levels and operating margins along with their ability to continue to create value for shareholders. |

| ● | US Ecology’s (ECOL) $900 million acquisition of NRC Group Holdings Corp. (NRCG) in 2019 was an example, we believe, of a company completing M&A too far away from its core competency. The transaction created much execution risk, in our view, and we exited our remaining position. |

| ● | Watsco (WSO) was sold at the beginning of the year after running up 30% in 2019. Recent results have been below our expectations as their technology spending has weighed on margins and the sustainable level of growth has come into question. Additionally, its dividend payout ratio (dividends/ free cash flow) has run in excess of 86% over the last two years, which could put it at risk for a cut. |

| ● | ResMed (RMD) was sold after a brief stint in the Fund. ResMed is a leading provider of air flow medical devices for the treatment of sleep apnea. They also have a growing respiratory care (i.e., ventilators) and software business. We started buying the stock during the market selloff in March, but the price ran up before we could build a full position as its ventilator business saw astronomical demand due to the coronavirus. With uncertainty over reopening rates of sleep clinics and a looming CMS (Centers for Medicare & Medicaid Services) reimbursement ruling, we decided to sell. It represented less than 1% of the Fund’s assets at the time of sale. |

| ● | We sold our position in Xilinx (XLNX) in late October shortly after the firm announced it was being acquired by Advanced Micro Devices (AMD) in an all-stock transaction. Xilinx, a semiconductor company, had been a Fund holding since 2009. We decided to sell and lock in gains since we would not be keeping AMD shares, which has a greater than $100B market cap and is well outside our mid-cap focus. Additionally, we thought it was prudent to raise cash amid broader market volatility. |

| ● | We exited EOG Resources (EOG) in September. Their business was greatly impacted by the declines in oil prices and spent much of the year down more than 30%. EOG is a well-run, low-cost producer in our view, but this attribute is weakened by the inability to control the price at which they can sell their oil. While EOG would have cyclical tailwinds during an economic reopening, we believe secular headwinds will continue to grow. |

Closing Thoughts

With the multitude of hardships that 2020 brought, many people are looking forward to turning the calendar to 2021. As we look forward to next year, the FAM Dividend Focus Fund will be celebrating an important milestone — its 25th Anniversary.

This is a long time in the industry, and much has changed — even the Fund’s name. But what hasn’t changed is the investment process that has enabled the longevity and success of the Fund.

Over the decades, we have learned from our mistakes and continually work to improve our research process while maintaining the core principles our Founder, Tom Putnam, established on day one. Our team is committed to investing in what we deem to be quality businesses with sustainable competitive advantages, financially sound balance sheets, and strong management teams at attractive prices relative to fundamentals. And once we invest in these companies, we continue to monitor them closely and visit (or Zoom) with the management teams annually.

Since our launch in 1996, our investment process has been tested by a variety of market environments like the tech boom in the late ’90s and the Great Financial Crisis, but our ability to take a long-term view has helped us stay focused and enabled the Fund to endure.

Over the next 25 years, our success should be predicated on doing more of the same — adhering to our investment process and maintaining a long-term view. If we do this, we are very optimistic about the Fund’s future.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2019 TO 12/31/2020

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Entegris | 5.36% | 2.56% |

| Pool Corp | 3.94% | 1.84% |

| Microchip Technology | 6.12% | 1.48% |

| Arthur J. Gallagher & Co. | 5.82% | 1.34% |

| Broadridge Financial Solutions | 4.79% | 1.03% |

This reflects the FAM Dividend Focus Fund’s best and worst performers, in descending order, based on individual stock performance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Marriott International | Sold | -1.85% |

| Monro | Sold | -1.15% |

| EOG Resources | Sold | -1.07% |

| US Ecology | Sold | -0.60% |

| South State Bank | Sold | -0.60% |

Past performance does not indicate future results.

|  |  |

| | | |

| Paul Hogan, CFA | Thomas O. Putnam | William W. Preston, CFA |

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter. |

| FAM DIVIDEND FOCUS FUND — Performance Summary Continued |

| December 31, 2020 (Unaudited) |

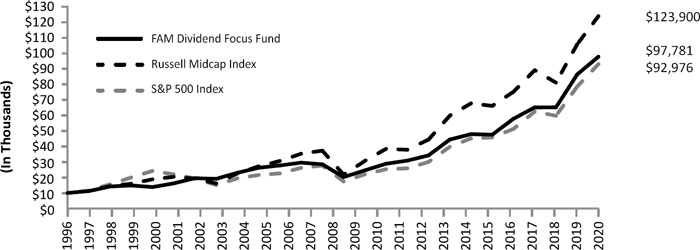

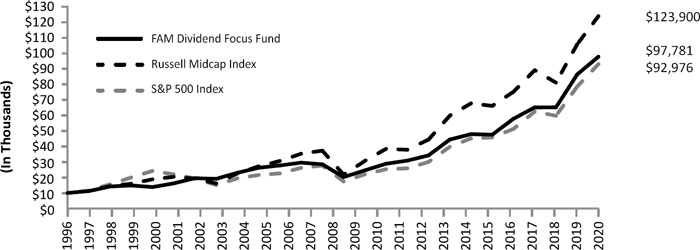

The chart below depicts the change in value of a $10,000 investment in the FAM Dividend Focus Fund since inception on April 1, 1996, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard and Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard and Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM DIVIDEND FOCUS FUND,

THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Dividend Focus Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| FAM DIVIDEND FOCUS FUND — Performance Summary Continued |

| December 31, 2020 (Unaudited) |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2020

The performance data quoted represents past performance.

| | 1 YEAR | 3 YEAR | 5 YEAR | 10 YEAR | SINCE

INCEPTION |

| FAM Dividend Focus Fund | 13.20% | 14.51% | 15.51% | 12.98% | 9.65% |

| Russell Midcap Index | 17.10% | 11.61% | 13.40% | 12.41% | 10.70% |

| S&P 500 Index | 18.40% | 14.18% | 15.22% | 13.88% | 9.43% |

| * | Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.26%. The total operating expense as reported in the FAM Dividend Focus Fund’s audited financial statements as of December 31, 2020 is 1.24%. |

Past performance is not indicative of future results, current performance may be lower or higher than the performance date quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about the FAM Dividend Focus Fund and should be read carefully before you invest or send money. The principal risks of investing in the Funds are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

To obtain a prospectus or summary prospectus and performance data that is current to the most recent month-end for each fund as well as other information on the FAM Dividend Focus Fund, please go to famfunds.com or call (800) 932-3271.

This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

| FAM DIVIDEND FOCUS FUND — Portfolio Data |

| December 31, 2020 (Unaudited) |

| TOP TEN EQUITY HOLDINGS |

| (% of Net Assets) | |

| Microchip Technology, Inc. | 6.1% |

| Arthur J. Gallagher & Company | 5.8% |

| Trane Technologies plc | 5.7% |

| CDW Corporation | 5.6% |

| Ross Stores, Inc. | 5.5% |

| Air Products & Chemcials, Inc. | 5.4% |

| Entegris, Inc. | 5.4% |

| Stryker Corporation | 5.3% |

| Broadridge Financial Solutions, Inc. | 4.8% |

| Genpact Ltd. | 4.1% |

| FAM DIVIDEND FOCUS FUND — Portfolio Data Continued |

| December 31, 2020 (Unaudited) |

| COMPOSITION OF NET ASSETS |

| IT Services | 14.1% |

| Semiconductors & Semiconductor Equipment | 11.5% |

| Insurance | 9.0% |

| Health Care Equipment & Supplies | 6.6% |

| Building Products | 5.7% |

| Electronic Equipment, Instruments & Components | 5.6% |

| Specialty Retail | 5.5% |

| Chemicals | 5.4% |

| Machinery | 4.2% |

| Money Market Funds | 4.2% |

| Containers & Packaging | 4.0% |

| Distributors | 3.9% |

| Trading Companies & Distributors | 3.3% |

| Construction Materials | 3.0% |

| Equity Real Estate Investment Trusts (REITs) | 2.9% |

| Industrial Conglomerates | 2.4% |

| Banks | 2.1% |

| Aerospace & Defense | 2.1% |

| Commercial Services & Supplies | 1.9% |

| Capital Markets | 1.1% |

| Commercial Support Services | 1.0% |

| Food Products | 0.5% |

| Other | 0.0%(a) |

| (a) | Percentage rounds to less than 0.1%. |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT; (ii) the complete listing is available on the Commission’s website at www.sec.gov; and (iii) the Fund makes the exhibit to Form N-PORT available to shareholders, upon request, by calling FAM FUNDS at 1-800-932-3271.

| FAM DIVIDEND FOCUS FUND — Schedule of Investments |

| December 31, 2020 |

| | | Shares | | | Value | |

| COMMON STOCKS — 95.8% | | | | | | | | |

| Aerospace & Defense — 2.1% | | | | | | | | |

| HEICO Corporation - Class A | | | 90,305 | | | $ | 10,571,103 | |

| | | | | | | | | |

| Banks — 2.1% | | | | | | | | |

| First Hawaiian, Inc. | | | 463,750 | | | | 10,935,225 | |

| | | | | | | | | |

| Building Products — 5.7% | | | | | | | | |

| Trane Technologies plc | | | 200,300 | | | | 29,075,548 | |

| | | | | | | | | |

| Capital Markets — 1.1% | | | | | | | | |

| T. Rowe Price Group, Inc. | | | 38,000 | | | | 5,752,820 | |

| | | | | | | | | |

| Chemicals — 5.4% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 100,500 | | | | 27,458,610 | |

| | | | | | | | | |

| Commercial Services & Supplies – 1.9% | | | | | | | | |

| Cintas Corporation | | | 26,950 | | | | 9,525,747 | |

| | | | | | | | | |

| Commercial Support Services — 1.0% | | | | | | | | |

| Republic Services, Inc. | | | 50,550 | | | | 4,867,965 | |

| | | | | | | | | |

| Construction Materials — 3.0% | | | | | | | | |

| Vulcan Materials Company | | | 102,830 | | | | 15,250,717 | |

| | | | | | | | | |

| Containers & Packaging — 4.0% | | | | | | | | |

| Avery Dennison Corporation | | | 130,000 | | | | 20,164,300 | |

| | | | | | | | | |

| Distributors — 3.9% | | | | | | | | |

| Pool Corporation | | | 53,900 | | | | 20,077,750 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 5.6% | | | | | | | | |

| CDW Corporation | | | 217,000 | | | | 28,598,430 | |

| | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) — 2.9% | | | | | | | | |

| Digital Realty Trust, Inc. | | | 104,000 | | | | 14,509,040 | |

| | | | | | | | | |

| Food Products — 0.5% | | | | | | | | |

| McCormick & Company, Inc. | | | 26,700 | | | | 2,552,520 | |

| | | | | | | | | |

| Health Care Equipment & Supplies — 6.6% | | | | | | | | |

| STERIS plc | | | 34,230 | | | | 6,487,954 | |

| Stryker Corporation | | | 111,000 | | | | 27,199,440 | |

| | | | | | | | 33,687,394 | |

| | | | | | | | | |

| Industrial Conglomerates – 2.4% | | | | | | | | |

| Roper Technologies, Inc. | | | 28,000 | | | | 12,070,520 | |

| | | | | | | | | |

| Insurance — 9.0% | | | | | | | | |

| Arthur J. Gallagher & Company | | | 239,920 | | | | 29,680,503 | |

| Hanover Insurance Group, Inc. (The) | | | 137,200 | | | | 16,041,424 | |

| | | | | | | | 45,721,927 | |

| | | | | | | | | |

| IT Services — 14.1% | | | | | | | | |

| Broadridge Financial Solutions, Inc. | | | 159,400 | | | | 24,420,080 | |

| Genpact Ltd. | | | 508,300 | | | | 21,023,288 | |

| Jack Henry & Associates, Inc. | | | 90,008 | | | | 14,580,396 | |

| Paychex, Inc. | | | 128,450 | | | | 11,968,971 | |

| | | | | | | | 71,992,735 | |

| | | | | | | | | |

See Notes to Financial Statements

| FAM DIVIDEND FOCUS FUND — Schedule of Investments Continued |

| December 31, 2020 |

| | | Shares | | | Value | |

| COMMON STOCKS — 95.8% (Continued) | | | | | | | | |

| Machinery — 4.2% | | | | | | | | |

| Graco, Inc. | | | 74,450 | | | $ | 5,386,458 | |

| IDEX Corporation | | | 81,174 | | | | 16,169,861 | |

| | | | | | | | 21,556,319 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 11.5% | | | | | | | | |

| Entegris, Inc. | | | 284,000 | | | | 27,292,400 | |

| Microchip Technology, Inc. | | | 226,000 | | | | 31,212,860 | |

| | | | | | | | 58,505,260 | |

| | | | | | | | | |

| Specialty Retail — 5.5% | | | | | | | | |

| Ross Stores, Inc. | | | 228,686 | | | | 28,084,928 | |

| | | | | | | | | |

| Trading Companies & Distributors — 3.3% | | | | | | | | |

| Fastenal Company | | | 349,000 | | | | 17,041,670 | |

| | | | | | | | | |

| Total Common Stocks (Cost $277,451,596) | | | | | | $ | 488,000,528 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 4.2% | | | | | | | | |

| Invesco Short-Term Investments Trust – Institutional Class, 0.01% (a) | | | | | | | | |

| (Cost $21,507,881) | | | 21,507,881 | | | $ | 21,507,881 | |

| | | | | | | | | |

| Total Investments at Value — 100.0% (Cost $298,959,477) | | | | | | $ | 509,508,409 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.0% (b) | | | | | | | 157,875 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 509,666,284 | |

| | | | | | | | | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2020. |

| (b) | Percentage rounds to less than 0.1%. |

See Notes to Financial Statements

December 31, 2020

Dear Fellow Small Cap Fund Shareholder,

One of the Fund’s managers played a couple years of high school baseball. Frankly, he was not that talented and remains short and slow to this day, but he learned many lessons that actually apply to investing. All young ballplayers aspire to be like their baseball heroes and hit towering home runs. Who wouldn’t like the glory? The standing ovations? The problem is that when a batter tries to hit home runs, they can end up with a few home runs and lots of strikeouts. Instead, a good hitter learns to “just hit the ball hard somewhere.” As a result, the number of strikeouts usually drops precipitously. The batter is also more likely to produce hard-hit ground balls and line drives that can turn into many singles, a few extra base hits, and occasional home runs.

This lesson has always applied to investing, from our standpoint, but it seemed particularly appropriate in 2020. As COVID-19 spread and many businesses were hit by a drop in demand or government-mandated closures (particularly in March and April), a few investments turned into permanent losses of capital — or strikeouts. Oddly, by the second half of 2020, many investors forgot about those painful strikeouts and instead obsessed on trying to hit home runs.

We believe you can see this phenomenon in the returns of domestic small-cap stocks. The Russell 2000, our primary index we compare performance against, fell -40.4% to a yearly low on March 18, 2020. Then, as conditions improved and the animal spirits returned, the index ended the year up an amazing +19.9%. The breakdown underlying this 19.9% return was fascinating from our viewpoint. Of the 2000 companies represented in the Russell 2000 Index, 131 have revenues less than $1 million, so they barely exist to some extent; yet those tiny, speculative businesses rose an average of 35.7%.1

Speculators are always around. History is filled with stories of “get-rich-quick schemes” and speculative bubbles. For whatever reason, speculation seems more common lately. We see excesses in many areas including the excitement over the revolutions in electric vehicles and genomics, the hope the Biden administration will trigger a boom in renewable power, work-from-home “plays,” and a surge in online trading (and usage of leverage and options) by individual investors. Many of these investors seem to be riding high on the excitement of recent gains, but we believe many might ultimately be disappointed.

We could write a letter on each of these speculative areas, but will focus on electric vehicles (EVs for short) because they are a good example. EVs are impressive and we think they could gradually displace the internal combustion engine and reduce pollution. There is much to be excited about. However, along with the traditional auto manufacturers, dozens of new global EV companies, and even a few tech giants, are competing for the same customers. Predicting which one(s) wins and how profitable they will ultimately be is a truly daunting task.