UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-04750 | |

| Fenimore Asset Management Trust |

| (Exact name of registrant as specified in charter) |

| 384 North Grand Street, P.O. Box 399 Cobleskill, New York | 12043 |

| (Address of principal executive offices) | (Zip code) |

Michael F. Balboa

| Fenimore Asset Management Trust 384 North Grand Street, P.O. Box 399 Cobleskill, New York, 12043 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | 1-800-453-4392 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

FAM VALUE FUND | |

| Letter to Shareholders | 1 |

| Portfolio Data | 8 |

| Schedule of Investments | 9 |

| FAM DIVIDEND FOCUS FUND | |

| Letter to Shareholders | 11 |

| Portfolio Data | 18 |

| Schedule of Investments | 19 |

| FAM SMALL CAP FUND | |

| Letter to Shareholders | 21 |

| Portfolio Data | 28 |

| Schedule of Investments | 29 |

| Statements of Assets and Liabilities | 31 |

| Statements of Operations | 32 |

| Statements of Changes in Net Assets | 33 |

| Notes to Financial Statements | 36 |

| Expense Data | 50 |

| Information About Trustees and Officers | 52 |

| Supplemental Information | 54 |

| Board Consideration of the Continuation of the Investment Advisory Agreements for the Funds | 55 |

| Privacy Policy | 59 |

FAM Funds has adopted a Code of Ethics that applies to its principal executive and principal financial officers. You may obtain a copy of this Code without charge, by calling FAM Funds at (800) 932-3271.

| FAM VALUE FUND (Unaudited) |

December 31, 2023

Dear Fellow FAM Value Fund Shareholder,

If you survey all the 2023 U.S. economic retrospectives, chances are you will encounter a number of quotes about the futility of trying to predict the stock market — and for good reason. Few predicted the economic strength and bull market we experienced last year. Entering the year, debate centered on whether the Federal Reserve engineered economic slowdown to cool inflation would lead to a “hard” or “soft” landing, yet we exited the year at cruising altitude with near record low unemployment and impressive GDP (gross domestic product) growth. Furthermore, the median prediction by 20 Wall Street firms was that the S&P 500 Index would return 4.5% in 2023, and yet it finished over 26% and near all-time highs.1 All this despite an unexpectedly moribund Chinese economic recovery, the sudden failure of three U.S. banks, and the outbreak of war in the Mideast.

Within this context, the Value Fund registered strong absolute performance of 16.09%, in our opinion, but lagged our benchmark, the Russell Midcap Index,† which returned 17.23%.2 As we have said in the past, we typically outperform broad indices — including our benchmark — in down years and underperform in strong markets such as the past year.

It is often as difficult to explain market behavior as it is to predict it. Among the many factors that surprised pundits in 2023 were avoidance of a recession, slower inflation, and (relatedly) expectations of lower interest rates. The sudden emergence of generative artificial intelligence (AI) also contributed, especially as hope and hype drove the stocks of the largest technology companies, warranted or not.

Throughout the year, we engaged in hundreds of calls and meetings with the management teams of our holdings to discuss these issues, and more. We talked about changes in customer demand, what they are seeing — and expect to see — on the inflation front, how interest rate changes will affect their earnings power, and how they intend to improve that earnings power using AI. These discussions are a bedrock to our business-like approach to investing because we seek to own a few great, well-run businesses rather than owning the stock market. These discussions with management are just a part of a process designed to help us reduce the uncertainty and surprises that plague those who focus on markets.

Portfolio Activity

Similar to last year, we were more active than usual in 2023 as the relatively volatile market gave us several opportunities to make what we deemed to be value-enhancing alterations to the fund. We initiated three new positions, sold six holdings, and added to or trimmed a myriad of positions.

Purchases

The three new companies we invested in were Waters (WAT), McCormick & Co. (MKC), and ExlService Holdings (EXLS).

| ● | Waters: Waters is a leading manufacturer of life science instruments and related equipment. Their liquid chromatography, mass spectrometry, and thermal analyzer instruments can be found in leading laboratories throughout the world and are used in everything from the discovery of new drugs to ensuring the safety of the food you eat. Some investors might recognize this name as we first bought it in 2011. We exited our original position in 2020 for several reasons, including lost confidence in the management team. Soon after, they hired a new CEO who, we feel, understands how to grow this high-quality business. We were able to reestablish a position because Waters, and its life sciences peers, are facing slowing sales in China and restrained demand by their biotech and pharmaceutical customers in the U.S. We believe both dynamics are transitory and will continue to build the position as opportunities arise. |

| 1 | FactSet as of 12/31/2023 |

| 2 | FactSet as of 12/31/2023 |

| FAM VALUE FUND (Unaudited) |

| ● | McCormick: McCormick is a leading supplier of spices and condiments to consumers and institutional food services. Their red caps are familiar sights in grocery spice aisles. Other brands include French’s mustard, Frank’s Red Hot, Cholula, and Old Bay, all of which are number one in their respective categories. McCormick’s leadership has translated into impressive profitability and steady growth. We were able to initiate a position at what we feel should prove to be attractive prices as the company faced challenges with sales in China. |

| ● | ExlService Holdings: ExlService is a business process outsourcing company (BPO). Historically, BPOs focused on taking over non-core activities from a company and managing them overseas. While this is still part of ExlService’s offering, they now perform much higher-value services like data collection, standardization, and analysis as well as business process improvement. EXLS specializes in the insurance, finance, and healthcare industries where demand for their outsource expertise is large and growing. EXLS sold off during the year, partially due to fear of competition from generative AI. We take the contrary view — we expect that EXLS will actually benefit from AI. |

We refer you to the 2023 Semi-Annual Report in which we discuss the positions added in the first half of 2023: Amphenol (APH), Fortune Brands Holding (FBIN), Microchip (MCHP), Pinnacle Financial Partners (PNFP), and T. Rowe Price (TROW). In the second half of the year, we added to Progressive (PGR).

Sales

Our full sales during the first half of year were Black Knight (BKI), M&T Bank (MTB), and MasterBrand (MBC). Please refer to the Semi-Annual Report for our discussion on those sales.

During the second half of 2023, we sold all our shares of Air Products and Chemicals (APD), Avery Denison (AVY), and Fidelity Information Services (FIS). We sold Air Products and Chemicals because they are pivoting from their core business of supplying bottled and onsite industrial gases to becoming a large-scale producer of environmentally friendly hydrogen. Though we like the transition in concept, it comes with significant financial and operational risk in our opinion. We may own APD again if their new business model is proven durable and profitable. We sold Fidelity Information Services after a series of earnings disappointments and questionable management decisions which resulted in the firm (partially) undoing their value-destroying 2019 acquisition of Worldpay. We sold Avery Dennison to make room for the purchase of EXLS. Avery is a fine company in our view that we may own again.

As a reminder, most of our full sales fall into five categories:

| 1. | We made a mistake on the business, including misreading the competitive dynamics. |

| 2. | We changed our view on the company due to management’s actions or inactions (e.g., a large acquisition in a different industry). |

| 3. | We put the capital into an enterprise we feel has better return prospects. |

| 4. | The price gets so high relative to our estimate of value that we think future returns are likely to be disappointing. |

| 5. | The shares originated from, or are involved in, a special situation such as a spinoff or pending acquisition. |

Our sale of Fidelity Information Services falls into category 1; APD in category 2; and AVY in category 3.

Positions trimmed throughout the year include Berkshire Hathaway (BRK.A), Brown and Brown (BRO), CarMax (KMX), EOG Resources (EOG), Illinois Tool Works (ITW), and T. Rowe Price.

| 3 | FactSet as of 12/31/2022 |

| FAM VALUE FUND (Unaudited) |

Closing

We prepare for markets rather than predict them. Developing a deep understanding of businesses and a good sense of their worth allows us to welcome market volatility rather than fear it. Sometimes, that means moving on to what we think are better opportunities — as we did several times this year. Other times, it means buying more shares in the face of market panic. We believe that having a long-term perspective, knowing what you own, and investing in high-quality, well-run businesses is the best way to preserve and grow wealth.

Thank you for your trust in us.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2022 to 12/31/2023

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Brown & Brown | 7.38% | 2.06% |

| CDW Corp. | 7.57% | 1.98% |

| Ross Stores | 6.42% | 1.39% |

| Vulcan Materials Co. | 4.12% | 1.30% |

| Booking Holdings | 2.20% | 1.29% |

This reflects the FAM Value Fund’s best and worst performers, in descending order, based on individual stock perfor-mance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Dollar General Corp. | 1.77% | -1.29% |

| Air Products and Chemicals | 3.34% | -0.40% |

| IDEX Corp. | 6.42% | -0.39% |

| Fidelity National Information Services | 1.01% | -0.28% |

| Black Knight | 0.29% | -0.08% |

Past performance does not indicate future results.

|  |  |

| | | |

| John D. Fox, CFA | Drew P. Wilson, CFA | Marc D. Roberts, CFA |

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| FAM VALUE FUND (Unaudited) |

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter. |

| FAM VALUE FUND (Unaudited) |

TOP 10 HOLDINGS

AS OF 12/31/2023

| | % of |

| FAM Value Fund | Net Assets |

| CDW Corporation | 7.9% |

| Ross Stores, Inc. | 7.0% |

| Brown & Brown, Inc. | 6.4% |

| IDEX Corporation | 5.8% |

| Markel Group, Inc. | 4.8% |

| Vulcan Materials Company | 4.2% |

| Brookfield Corporation - Class A | 4.0% |

| Illinois Tool Works, Inc. | 4.0% |

| Stryker Corporation | 3.9% |

| Graco, Inc. | 3.6% |

| Total Net Assets | $1,601,821,268 |

The portfolios are actively managed and current holdings may be different.

AVERAGE ANNUAL TOTAL RETURNS

AS OF 12/31/2023

| | | | | | | Total Fund |

| | | | | | Since | Operating |

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception | Expenses |

| FAM Value Fund | | | | | | 1.17% (gross) |

| Investor Class | 16.09% | 7.79% | 11.76% | 9.45% | 10.31% | 1.18%* (net) |

| Russell Midcap Index | 17.23% | 5.92% | 12.68% | 9.42% | 11.26% | N/A |

| S&P 500 Index | 26.29% | 10.00% | 15.69% | 12.03% | 10.77% | N/A |

The performance data quoted represents past performance.

PERFORMANCE DISCLOSURES

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month-end for each fund as well as other information on the FAM Funds, please go to fenimoreasset. com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

IMPORTANT RISK INFORMATION

Risk Disclosures: The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

| FAM VALUE FUND (Unaudited) |

This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

*FAM Value Fund Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.18% for the Investor Class. The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 0.99% after fee waivers of (0.15)% for the Institutional Class. When excluding Acquired Funds Fees and Expenses, which are not direct costs paid by the Fund’s shareholders, and fee waivers, the total annual operating expense as reported in the FAM Value Fund’s audited financial statements for the Investor Class is 1.18% after a 0.01% recoupment and the Institutional Class is 0.99% after a few waiver of (0.15%) as of December 31, 2023. The Advisor has contractually agreed, May 1, 2024, to waive fees and/or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to cap Net Fund Operating Expenses for Investor Shares at 1.18% and Institutional Shares at 0.99%.

Institutional Class shares became available for sale on January 1, 2017. For performance prior to that date, this table includes the actual performance of the Fund’s Investor Class (and uses the Fund’s Investor Class’ actual expenses), without adjustment. The performance results shown on this and the next page for the periods prior to January 1, 2017, the date of commencement of operations for Institutional Shares, are for the Investor Shares, which are subject to higher fees due to differences in the shareholder administrative services fees and certain other fees paid by each class. Institutional Shares and Investor Shares would have substantially similar performance results because the shares of each class are invested in the same portfolio securities of the Fund. Because of the difference in the level of fees paid by Investor Shares, the returns for the Investor Shares may be lower than the returns of the Institutional Shares.

†The Russell Midcap is an unmanaged index that measures the performance of a mid-cap segment of the U.S. equity universe. This benchmark is used for comparative purposes only and very generally reflects the risk or investment style of the investments reported.

| FAM VALUE FUND (Unaudited) |

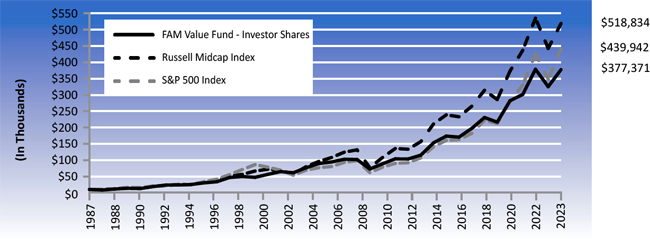

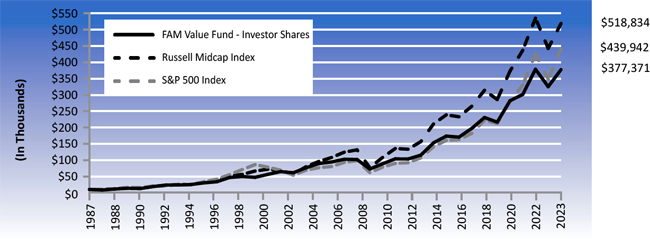

The chart below depicts the change in value of a $10,000 investment in the Investor Shares of the FAM Value Fund since inception on January 2, 1987, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard & Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard & Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM VALUE

FUND - INVESTOR SHARES, THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Value Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| FAM VALUE FUND — Portfolio Data |

|

| December 31, 2023 (Unaudited) |

| COMPOSITION OF NET ASSETS |

| Insurance | 14.6% |

| Electronic Equipment, Instruments & Components | 14.5% |

| Machinery | 13.4% |

| Specialty Retail | 11.7% |

| Capital Markets | 6.5% |

| Semiconductors & Semiconductor Equipment | 4.9% |

| Construction Materials | 4.2% |

| Banks | 4.0% |

| Health Care Equipment & Supplies | 3.9% |

| Money Market Funds | 3.7% |

| Trading Companies & Distributors | 3.2% |

| Diversified Financial Services | 2.9% |

| Life Sciences Tools & Services | 2.9% |

| Hotels, Restaurants & Leisure | 2.5% |

| Professional Services | 2.1% |

| Oil, Gas & Consumable Fuels | 1.8% |

| Multi-Line Retail | 1.2% |

| Building Products | 1.1% |

| Food Products | 0.9% |

| Other | 0.0%(a) |

| (a) | Percentage rounds to less than 0.01%. |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT; (ii) the complete listing is available on the Commission’s website at www.sec.gov; and (iii) the Fund makes the exhibit to Form N-PORT available to shareholders at fenimoreasset.com, or upon request, by calling FAM FUNDS at 1-800-932-3271.

| FAM VALUE FUND — Schedule of Investments |

|

| December 31, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS — 96.3% | | | | | | | | |

| Banks — 4.0% | | | | | | | | |

| Pinnacle Financial Partners, Inc. | | | 386,527 | | | $ | 33,712,885 | |

| SouthState Corporation | | | 364,610 | | | | 30,791,314 | |

| | | | | | | | 64,504,199 | |

| Building Products — 1.1% | | | | | | | | |

| Fortune Brands Innovations, Inc. | | | 226,732 | | | | 17,263,375 | |

| Capital Markets — 6.5% | | | | | | | | |

| Brookfield Asset Management Ltd. - Class A | | | 397,940 | | | | 15,985,250 | |

| Brookfield Corporation - Class A | | | 1,591,760 | | | | 63,861,411 | |

| T. Rowe Price Group, Inc. | | | 229,320 | | | | 24,695,471 | |

| | | | | | | | 104,542,132 | |

| Construction Materials — 4.2% | | | | | | | | |

| Vulcan Materials Company | | | 297,930 | | | | 67,633,089 | |

| Diversified Financial Services — 2.9% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class A (a) | | | 86 | | | | 46,665,753 | |

| Electronic Equipment, Instruments & Components — 14.5% | | | | | | | | |

| Amphenol Corporation - Class A | | | 573,240 | | | | 56,825,281 | |

| CDW Corporation | | | 558,200 | | | | 126,890,024 | |

| Zebra Technologies Corporation - Class A (a) | | | 179,460 | | | | 49,051,802 | |

| | | | | | | | 232,767,107 | |

| Food Products — 0.9% | | | | | | | | |

| McCormick & Company, Inc. | | | 215,300 | | | | 14,730,826 | |

| Health Care Equipment & Supplies — 3.9% | | | | | | | | |

| Stryker Corporation | | | 208,000 | | | | 62,287,680 | |

| Hotels, Restaurants & Leisure — 2.5% | | | | | | | | |

| Booking Holdings, Inc. (a) | | | 11,350 | | | | 40,260,947 | |

| Insurance — 14.6% | | | | | | | | |

| Brown & Brown, Inc. | | | 1,441,492 | | | | 102,504,496 | |

| Markel Group, Inc. (a) | | | 53,850 | | | | 76,461,615 | |

| Progressive Corporation (The) | | | 340,000 | | | | 54,155,200 | |

| | | | | | | | 233,121,311 | |

| Life Sciences Tools & Services — 2.9% | | | | | | | | |

| Waters Corporation (a) | | | 138,700 | | | | 45,664,201 | |

| Machinery — 13.4% | | | | | | | | |

| Graco, Inc. | | | 670,180 | | | | 58,144,817 | |

| IDEX Corporation | | | 431,530 | | | | 93,689,478 | |

| Illinois Tool Works, Inc. | | | 242,560 | | | | 63,536,167 | |

| | | | | | | | 215,370,462 | |

| Multi—Line Retail — 1.2% | | | | | | | | |

| Dollar General Corporation | | | 146,300 | | | | 19,889,485 | |

| Oil, Gas & Consumable Fuels — 1.8% | | | | | | | | |

| EOG Resources, Inc. | | | 233,500 | | | | 28,241,825 | |

See Notes to Financial Statements

| FAM VALUE FUND — Schedule of Investments Continued |

| December 31, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS — 96.3% (Continued) | | | | | | | | |

| Professional Services — 2.1% | | | | | | | | |

| ExlService Holdings, Inc. (a) | | | 1,072,900 | | | $ | 33,098,965 | |

| Semiconductors & Semiconductor Equipment — 4.9% | | | | | | | | |

| Analog Devices, Inc. | | | 279,510 | | | | 55,499,505 | |

| Microchip Technology, Inc. | | | 258,860 | | | | 23,343,995 | |

| | | | | | | | 78,843,500 | |

| Specialty Retail — 11.7% | | | | | | | | |

| AutoZone, Inc. (a) | | | 18,265 | | | | 47,226,167 | |

| CarMax, Inc. (a) | | | 373,296 | | | | 28,646,735 | |

| Ross Stores, Inc. | | | 810,688 | | | | 112,191,112 | |

| | | | | | | | 188,064,014 | |

| Trading Companies & Distributors — 3.2% | | | | | | | | |

| Fastenal Company | | | 780,900 | | | | 50,578,893 | |

| Total Common Stocks (Cost $516,344,348) | | | | | | $ | 1,543,527,764 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 3.7% | | | | | | | | |

| Invesco Treasury Portfolio - Institutional Class, 5.27% (b) (Cost $59,038,565) | | | 59,038,565 | | | $ | 59,038,565 | |

| | | | | | | | | |

| Total Investments at Value — 100.0% (Cost $575,382,913) | | | | | | $ | 1,602,566,329 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.0%) (c) | | | | | | | (745,061 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,601,821,268 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of December 31, 2023. |

| (c) | Percentage rounds to less than 0.1%. |

See Notes to Financial Statements

| FAM DIVIDEND FOCUS FUND (Unaudited) |

December 31, 2023

Dear Fellow FAM Dividend Focus Fund Shareholder,

2023 Highlights

| ● | FAM Dividend Focus Fund posted a return of 19.70% for 2023, besting the Russell Midcap Index† by 247 basis points.1 |

| ● | Portfolio companies increased their cash dividends paid to shareholders by 9.5% for the year.2 |

As we conclude 2023, we are pleased to provide an update on the performance and strategic direction of our portfolio. Looking ahead, 2024 marks a significant milestone for Fenimore Asset Management as we celebrate our 50th Anniversary. This anniversary is not just a testament to our longevity, but also to the consistent value we have tried to deliver to our investors over the decades.

Performance Overview

It was a very positive year for the stock market and investors in the FAM Dividend Focus Fund in our opinion. Despite the turbulent start to the year with lingering uncertainties from high inflation, rising interest rates, and three large bank failures — and then the market dominance of Artificial Intelligence (AI) — we navigated these waters with resilience.

The Dividend Focus Fund achieved strong performance, in our view, with a return of 19.70%. This surpassed our benchmark, the Russell Midcap Index, which posted a return of 17.23%.3 The outperformance demonstrates our strategic approach of investing in what we believe are high- quality businesses that pay growing dividends over time and letting these companies compound. This approach has stood the test of time and has allowed the portfolio to outperform the benchmark over the last three, five, and 10 years. This performance has earned the fund a 5-Star Overall Morningstar Rating™ and puts the portfolio in the top quartile of its Morningstar category over each of those time periods.*

Dividends

The Dividend Focus Fund’s primary strategy is investing in businesses that pay growing dividends over time. While the dividend modestly contributes to total return, a growing dividend serves as an effective investment filter for a number of reasons. First, a growing dividend typically signals that the enterprise generates more cash than it needs for reinvestment. Second, a commitment to a sound dividend growth policy is a powerful signal from management about the stability of the company’s cash generation and its future growth prospects. Lastly, this strategy enforces discipline in capital allocation decisions, requiring a balance between reinvestment and paying a growing dividend.

| 1,2,3 | FactSet as of 12/31/2023 |

| * | The Morningstar Rating™ is a quantitative assessment of a fund’s past performance — both return and risk — as measured from 1 to 5 stars. It uses focused comparison groups to better measure fund manager skill. The Morningstar Rating™ is intended for use as the first step in the fund evaluation process. A high rating alone is not a sufficient basis for investment decisions. |

The Morningstar Rating™ for funds, or “star rating,” is calculated for funds with at least a three-year history. (Exchange traded funds and open-end mutual funds are considered a single population for comparative purposes.) It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly excess performance (excluding the effect of sales charges, if any), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each fund category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star.

The FAM Dividend Focus Fund received a 5-Star Overall Morningstar Rating™ as well as a 5-Star Morningstar Rating™ for the 3-Year, a 5-Star Morningstar Rating™ for the 5-Year, and a 5-Star Morningstar Rating™ for the 10-Year periods ending 12/31/2023 among 385, 363, and 241 Mid-Cap Blend funds, respectively.

Past performance is no guarantee of future results. The Morningstar Analyst Rating should not be used as the sole basis in evaluating a mutual fund. Morningstar Ratings involve unknown risks and uncertainties which may cause Morningstar’s expectations not to occur or to differ significantly from what we expected. Rating, risk, and return values are relative to each fund’s Morningstar Category. Visit Morningstar.com to see their methodology.

| FAM DIVIDEND FOCUS FUND (Unaudited) |

Over the last five years, the average annual growth rate of dividends paid by our holdings is 10.5%. Over the last 12 months, the average growth in dividends was 9.5%, which is well ahead of inflation. The largest dividend increases were by Microchip Technology (MCHP), which increased their dividend 33.8%, Cintas Corporation (CTAS) with an increase of 17.4%, and Fastenal Company (FAST), which rose 12.9%.4 Every holding, except one, paid a higher dividend in 2023 than 2022. Entegris (ENTG) held its dividend constant as it focused on paying down debt from its recent acquisition of CMC Materials.

Hands-On Portfolio Management

A cornerstone of our investment philosophy is the deep, hands-on approach we take with every holding. We make it a priority to visit each company, engaging directly with their management teams. This practice has been instrumental in building strong conviction in our holdings, especially during turbulent times in the market. Due to our regular meetings with management over long holding periods, we have accumulated a wealth of knowledge about these businesses and their respective industries. This in-depth understanding underpins our ability to make informed and strategic decisions, contributing significantly to the portfolio’s long-term performance.

Portfolio Activity

Purchases

We added Agilent Technologies (A) in the fourth quarter. Agilent sells instruments, consumables, and services supporting research and production across a variety of end markets ranging from pharmaceuticals and diagnostics to applied materials and chemicals. Their specialized instruments allow customers to produce very accurate and reliable scientific results. The company was spun off from Hewlett-Packard in 1999. Since then, it has compounded at an impressive rate in our opinion. More recently, Agilent experienced an earnings downturn due mostly to reduced Chinese demand as a result of their weakening economy. We believe this is temporary and it provided us with an excellent opportunity to acquire shares at a favorable price. Longer term, we expect strong growth in revenue and earnings due to its leadership position in most of their technology vertical markets, new product introductions, and M&A opportunities in high-growth areas.

Martin Marietta Materials (MLM) was added to the portfolio late in the year. This supplier of aggregates (crushed stone), cement, ready mixed concrete, and asphalt holds a top position in the industry with 500 locations serving 28 states as well as Canada and the Bahamas. We like this industry because each rock quarry tends to be a local monopoly since rock is costly to transport given its weight and believe higher price and volume should drive future stock returns. Martin Marietta is also divesting non-core assets which should provide them with capital for acquisitions in high-margin areas. We expect that the U.S. infrastructure bill should be additive to historical results. Our team has owned MLM in the past, so we are very familiar with the industry and the management team.

We initiated a stake in Verisk Analytics (VRSK). Verisk provides data solutions for property and casualty insurers that power their underwriting and claims processes and decision making. Verisk’s products often have no substitute and its long-term contracts, which are tied to premium growth, support meaningful revenue growth even during the rockiest of economic periods. We have followed Verisk for some time, but our interest was heightened after they made significant changes. Management divested its non-insurance assets, implemented a more shareholder-friendly capital allocation policy, and enacted several governance reforms.

| 4 | FactSet as of 12/31/2023 |

| FAM DIVIDEND FOCUS FUND (Unaudited) |

Sales

Genpact (G) was sold because it has been affected by concerns around the negative impact generative AI will have on its outsourcing business model. The firm also experienced a cyclical downturn in advisory work which will likely depress earnings for some time. Genpact is also dealing with material management turnover, which may be a long-term positive, but it also increases near-term uncertainty. Taken together, these concerns significantly compressed its valuation. We moved the capital into other names that we believe have much higher return potential.

We exited The Hanover Insurance Group (THG). THG reported several quarters of above-average catastrophe losses. We ultimately exited the position during the year after determining it could not earn an adequate ROTE (return on tangible equity) with elevated catastrophe losses. This may eventually normalize, but we do not know when and think we have better opportunities over the next five years.

We sold First Hawaiian Bank (FHB), a decision we started to implement in 2022 and finished in January, well before the banking crisis began. Our team earmarked FHB for sale because: 1) it was not growing its dividend, 2) of the potential impact to its book value by declining values in its securities portfolio with rising short-term rates, and 3) of concerns about how robust loan growth would be in a recession.

Outlook

While there are many unknowns going into 2024, including if the Federal Reserve will cut interest rates and who will win the presidential election, our holdings should continue to execute on their plans to grow market share, drive earnings growth, and increase dividends. In the long run, this is what makes stock prices go higher. We like all the names in the portfolio and are excited about their prospects. Our team firmly believes that the Dividend Focus Fund is positioned to prosper in the years to come.

Closing Thoughts

As Fenimore celebrates our 50th Anniversary in 2024, our commitment to you remains steadfast. We are dedicated to seeking to maintain the highest standards of integrity, transparency, and performance. Our focus continues to be on delivering sustainable long-term value, navigating market challenges, and capitalizing on opportunities that align with our strategic objectives.

We thank you for your continued trust and support and look forward to a prosperous and exciting year ahead.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2022 to 12/31/2023

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Trane Technologies | 6.80% | 3.02% |

| Entegris | 4.12% | 2.82% |

| Broadridge Financial Solutions | 4.56% | 2.24% |

| CDW Corp. | 7.42% | 1.91% |

| Arthur J. Gallagher & Co. | 7.91% | 1.82% |

This reflects the FAM Dividend Focus Fund’s best and worst performers, in descending order, based on individual stock performance and portfolio weighting. Past performance does not indicate future results.

| FAM DIVIDEND FOCUS FUND (Unaudited) |

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Genpact | 2.85% | -0.92% |

| The Hanover Insurance Group | 1.88% | -0.77% |

| Air Products and Chemicals | 5.06% | -0.58% |

| IDEX Corp. | 3.45% | -0.26% |

| Jack Henry & Associates | 3.14% | -0.25% |

Past performance does not indicate future results.

|  |

| | |

| Paul Hogan, CFA | William Preston, CFA |

| Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter. |

| ** | All investing involves risk including the possible loss of principal. Before investing, carefully read the fund’s prospectus which includes investment objectives, risks, charges, expenses and other information about the fund. Please call us at 800-932-3271 or visit fenimoreasset. com for a prospectus or summary prospectus. Past performance and Morningstar ratings are not an indicator of a fund’s future returns. |

Securities offered through Fenimore Securities, Inc. Member FINRA/SIPC, and advisory services offered through Fenimore Asset Management, Inc.

| FAM DIVIDEND FOCUS FUND (Unaudited) |

TOP 10 HOLDINGS

AS OF 12/31/2023

| | % of |

| FAM Dividend Focus Fund | Net Assets |

| CDW Corporation | 7.3% |

| Trane Technologies plc | 7.2% |

| Arthur J. Gallagher & Company | 7.0% |

| Microchip Technology, Inc. | 5.5% |

| Ross Stores, Inc. | 4.9% |

| Broadridge Financial Solutions, Inc. | 4.9% |

| Stryker Corporation | 4.8% |

| Entegris, Inc. | 4.5% |

| Republic Services, Inc. | 3.7% |

| Paychex, Inc. | 3.7% |

| Total Net Assets | $674,341,659 |

The portfolios are actively managed and current holdings may be different.

AVERAGE ANNUAL TOTAL RETURNS

AS OF 12/31/2023

| | | | | | | Total Fund |

| | | | | | Since | Operating |

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception | Expenses |

| FAM Dividend Focus Fund | | | | | | 1.21% (gross) |

| 19.70% | 9.18% | 14.32% | 11.10% | 9.60% | 1.21%* (net) |

| Russell Midcap Index | 17.23% | 5.92% | 12.68% | 9.42% | 10.18% | N/A |

| S&P 500 Index | 26.29% | 10.00% | 15.69% | 12.03% | 9.49% | N/A |

The performance data quoted represents past performance.

PERFORMANCE DISCLOSURES:

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month- end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

IMPORTANT RISK INFORMATION:

Risk Disclosures: The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the

| FAM DIVIDEND FOCUS FUND (Unaudited) |

stock market in general). This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

*FAM Dividend Focus Fund Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.23%. The total operating expense as reported in the FAM Dividend Focus Fund’s audited financial statements as of December 31, 2023 is 1.21%. The Advisor has contractually agreed, until May 1, 2024, to waive fees and/or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to cap Net Fund Operating Expenses for Investor Shares at 1.26%.

†The Russell Midcap is an unmanaged index that measures the performance of a mid-cap segment of the U.S. equity universe. This benchmark is used for comparative purposes only and very generally reflects the risk or investment style of the investments reported.

| FAM DIVIDEND FOCUS FUND (Unaudited) |

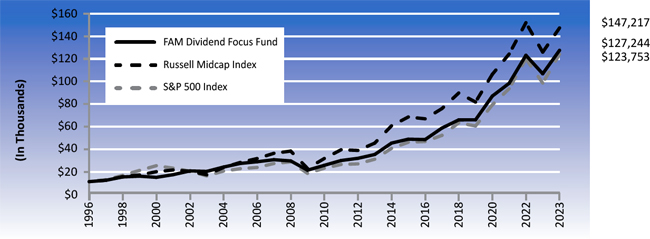

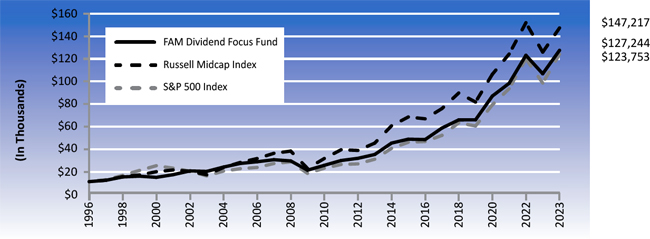

The chart below depicts the change in value of a $10,000 investment in the FAM Dividend Focus Fund since inception on April 1, 1996, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard and Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard and Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM DIVIDEND FOCUS FUND,

THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Dividend Focus Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| FAM DIVIDEND FOCUS FUND — Portfolio Data |

|

| December 31, 2023 (Unaudited) |

| COMPOSITION OF NET ASSETS |

| IT Services | 11.3% |

| Semiconductors & Semiconductor Equipment | 10.0% |

| Building Products | 9.3% |

| Electronic Equipment, Instruments & Components | 8.4% |

| Health Care Equipment & Supplies | 7.2% |

| Insurance | 7.0% |

| Specialty Retail | 4.9% |

| Trading Companies & Distributors | 4.7% |

| Commercial Support Services | 3.7% |

| Commercial Services & Supplies | 3.6% |

| Machinery | 3.6% |

| Construction Materials | 3.5% |

| Chemicals | 3.2% |

| Distributors | 3.2% |

| Containers & Packaging | 3.0% |

| Aerospace & Defense | 2.9% |

| Money Market Funds | 2.8% |

| Life Sciences Tools & Services | 2.1% |

| Industrial Conglomerates | 2.0% |

| Professional Services | 2.0% |

| Food Products | 1.1% |

| Capital Markets | 0.5% |

| Other | 0.0%(a) |

| (a) | Percentage rounds to less than 0.01%. |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT; (ii) the complete listing is available on the Commission’s website at www.sec.gov; and (iii) the Fund makes the exhibit to Form N-PORT available to shareholders at fenimoreasset.com, or upon request, by calling FAM FUNDS at 1-800-932-3271.

| FAM DIVIDEND FOCUS FUND — Schedule of Investments |

| December 31, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS — 97.2% | | | | | | | | |

| Aerospace & Defense — 2.9% | | | | | | | | |

| HEICO Corporation - Class A | | | 139,305 | | | $ | 19,842,604 | |

| Building Products — 9.3% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 27,380 | | | | 13,660,156 | |

| Trane Technologies plc | | | 200,300 | | | | 48,853,170 | |

| | | | | | | | 62,513,326 | |

| Capital Markets — 0.5% | | | | | | | | |

| T. Rowe Price Group, Inc. | | | 32,400 | | | | 3,489,156 | |

| Chemicals — 3.2% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 78,702 | | | | 21,548,608 | |

| Commercial Services & Supplies — 3.6% | | | | | | | | |

| Cintas Corporation | | | 39,783 | | | | 23,975,623 | |

| Commercial Support Services — 3.7% | | | | | | | | |

| Republic Services, Inc. | | | 152,890 | | | | 25,213,090 | |

| Construction Materials — 3.5% | | | | | | | | |

| Vulcan Materials Company | | | 102,830 | | | | 23,343,438 | |

| Containers & Packaging — 3.0% | | | | | | | | |

| Avery Dennison Corporation | | | 100,367 | | | | 20,290,193 | |

| Distributors — 3.2% | | | | | | | | |

| Pool Corporation | | | 53,900 | | | | 21,490,469 | |

| Electronic Equipment, Instruments & Components — 8.4% | | | | | | | | |

| Amphenol Corporation - Class A | | | 75,251 | | | | 7,459,632 | |

| CDW Corporation | | | 217,000 | | | | 49,328,440 | |

| | | | | | | | 56,788,072 | |

| Food Products — 1.1% | | | | | | | | |

| McCormick & Company, Inc. | | | 103,200 | | | | 7,060,944 | |

| Health Care Equipment & Supplies — 7.2% | | | | | | | | |

| STERIS plc | | | 75,800 | | | | 16,664,630 | |

| Stryker Corporation | | | 107,000 | | | | 32,042,220 | |

| | | | | | | | 48,706,850 | |

| Industrial Conglomerates — 2.0% | | | | | | | | |

| Roper Technologies, Inc. | | | 25,200 | | | | 13,738,284 | |

| Insurance — 7.0% | | | | | | | | |

| Arthur J. Gallagher & Company | | | 208,500 | | | | 46,887,480 | |

| IT Services — 11.3% | | | | | | | | |

| Broadridge Financial Solutions, Inc. | | | 159,400 | | | | 32,796,550 | |

| Jack Henry & Associates, Inc. | | | 112,300 | | | | 18,350,943 | |

| Paychex, Inc. | | | 209,000 | | | | 24,893,990 | |

| | | | | | | | 76,041,483 | |

| Life Sciences Tools & Services — 2.1% | | | | | | | | |

| Agilent Technologies, Inc. | | | 99,730 | | | | 13,865,462 | |

See Notes to Financial Statements

| FAM DIVIDEND FOCUS FUND — Schedule of Investments Continued |

| December 31, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS — 97.2% (Continued) | | | | | | | | |

| Machinery — 3.6% | | | | | | | | |

| IDEX Corporation | | | 110,800 | | | $ | 24,055,788 | |

| Professional Services — 2.0% | | | | | | | | |

| Verisk Analytics, Inc. | | | 56,320 | | | | 13,452,595 | |

| Semiconductors & Semiconductor Equipment — 10.0% | | | | | | | | |

| Entegris, Inc. | | | 253,000 | | | | 30,314,460 | |

| Microchip Technology, Inc. | | | 414,920 | | | | 37,417,485 | |

| | | | | | | | 67,731,945 | |

| Specialty Retail — 4.9% | | | | | | | | |

| Ross Stores, Inc. | | | 240,026 | | | | 33,217,198 | |

| Trading Companies & Distributors — 4.7% | | | | | | | | |

| Fastenal Company | | | 349,000 | | | | 22,604,730 | |

| Watsco, Inc. | | | 21,720 | | | | 9,306,368 | |

| | | | | | | | 31,911,098 | |

| Total Common Stocks (Cost $313,297,363) | | | | | | $ | 655,163,706 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 2.8% | | | | | | | | |

| Invesco Treasury Portfolio — Institutional Class, 5.27% (a) (Cost $19,158,705) | | | 19,158,705 | | | $ | 19,158,705 | |

| | | | | | | | | |

| Total Investments at Value — 100.0% (Cost $332,456,068) | | | | | | $ | 674,322,411 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.0% (b) | | | | | | | 19,248 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 674,341,659 | |

| | | | | | | | | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2023. |

| (b) | Percentage rounds to less than 0.1%. |

See Notes to Financial Statements

| FAM SMALL CAP FUND (Unaudited) |

December 31, 2023

Dear Fellow Small Cap Fund Shareholder,

For 2023, the FAM Small Cap Fund (FAMFX) rose 20.11%. In comparison, the Russell 2000 Index† (the benchmark we use for performance comparisons) rose 16.93%; however, we find longer-term returns more meaningful. Over the prior 10 years, the fund returned 8.45% versus the Russell 2000’s 7.16%. Since its inception on March 1, 2012, the Small Cap Fund has returned 11.13% versus the Russell 2000’s 9.49%.1 We are quite pleased with this performance.

This performance is an output of our philosophy and process. Our team focuses exclusively on what we consider to be quality companies with strong leadership and a solid financial position. These businesses usually have some competitive advantage which allows them to be more profitable and/or grow faster than their peers. Furthermore, we want to invest in these potential jewels at reasonable, if not attractive, valuations. This typically means that the business is “under a cloud” (i.e., temporarily stumbling) or “under a rock” (i.e., unknown by many investors) at the time of purchase. If we get all this right, then our holdings should be larger and more profitable in the future and lead to healthy long-term returns. As always, owning quality enterprises for the long term, with the occasional adjustment, continues to be our game plan in 2024.

To provide some real-world examples of our philosophy in practice, here is a quick summary of our top three holdings (as a percentage of the portfolio).

CBIZ (CBZ) is a large American provider of financial, insurance, and advisory services with 120+ offices. They are essentially a large accounting firm with a significant employee benefits and insurance unit. Their key differentiators include a well-known brand, a larger collection of services than their small peers, and a strong culture. CBIZ has a diverse client base, but is particularly strong with middle-market companies and their owners that need more depth of services than small firms provide. About 75% of their revenues are recurring, like annual tax returns or regular payroll processing.

Growth comes from both organic means and acquisitions. Most years, the core business grows modestly by adding a few more customers, cross-selling additional services to existing customers, and moderate price increases that generally follow the rate of inflation. They produce considerable free cash flow which allows management to regularly purchase smaller companies, often adding additional service lines to existing offices and sometimes entering new cities. We purchased our first shares in 2017 at what we estimated to be a reasonable valuation and the company has grown earnings at a healthy clip.

Colliers International (CIGI) is a global provider of real estate services operating in 66 countries. They do not own real estate directly, but rather provide services to commercial real estate owners and lenders. Services include property management, engineering and construction management, and leasing. They also own an investment management arm focused on both real estate and infrastructure asset classes that produces about one-third of their adjusted EBITDA. 2 While there is variability such as the current decline in demand for brokering the sales of office buildings, the volatile business lines tend to normalize over time and approximately 70% of their adjusted EBITDA is considered recurring.

Growth comes from multiple engines. First, a decentralized entrepreneurial culture has generated healthy organic growth over time. Additionally, management has proven to be adept at acquisitions, spending more than $3.5 billion, and producing 15%+ returns on invested capital. We purchased our first shares in 2018 and have added to the position on stock price declines as recently as November of 2023.

ExlService Holdings (EXLS) is an analytics and digital operations provider. Customers include 9 of the top 10 U.S. insurers, 6 of the top 10 U.S. healthcare payers, and 8 of the top 10 U.S. banks. The analytics segment helps customers aggregate, manage, and analyze their data (which includes utilizing artificial intelligence). End uses are quite diverse but include point-of-sale lending, bank statement mining, and early

| 1 | FactSet as of 12/31/2023 |

| 2 | Earnings before interest, taxes, depreciation, and amortization. |

| FAM SMALL CAP FUND (Unaudited) |

identification of high-risk patients. The digital operations segment often takes on an entire client operation under a multi-year contract, such as running the claims management department for an insurer. They then digitally transform the operation to reduce costs and improve customer satisfaction. Approximately 80% of revenues are recurring.

Growth comes from the natural demand from customers to reduce costs, increase delivery speed, and improve customer satisfaction. EXLS regularly sees the opportunity to do more for existing customers and pick up additional customers. The company generates significant amounts of free cash flow which is allocated to both occasional acquisitions and repurchasing their own shares below management’s estimate of their worth. We initiated our position in 2016 after the firm reported a soft quarter.

Portfolio Activity

While we began the year with what we considered to be a fine collection of investments in impressive companies, we can never rest on our laurels. Conditions change and even the best businesses can fade over time. Additionally, we occasionally make a mistake. Therefore, much of what we did in 2023 was retesting our earlier conclusions by interacting with our holdings as well as other less-biased sources such as former employees and customers. While many call us “buy-and-hold” investors, we think of ourselves more as “buy-and-constantly-recheck” investors. Overall, we were pleased with the portfolio and only made modest adjustments in 2023.

Sales

During 2023, we completely exited four positions and made two small trims.

We sold our position in Paya Holdings (PAYA) in January after they announced their sale to a larger competitor. We purchased our shares in the second half of 2021 as the stock price was declining. At the time, we thought it was a nice opportunity to invest in what we considered to be a quality business that could grow at a fast pace for many years. But as sometimes happens, we did not get the opportunity to hold our shares for the long term.

In June, news broke that a competitor was interested in purchasing Carriage Services (CSV), an owner of funeral homes and cemeteries. The stock price surged on the news, at which time we sold half of our position. While we hoped to sell the rest at an even higher price, by November, it was clear that a transaction was unlikely. With no sale on the horizon, plus the recent or upcoming departure of key executives we admired, we opted to sell our remaining shares.

In August, we exited our position in Penske Automotive Group (PAG) at a substantial gain. Our first purchase came just after Brexit, in June of 2016, when shares in Penske, which owns quite a few UK auto dealerships, sold off. Even with some headwinds during COVID, earnings marched higher. By the summer of 2023, it was difficult to call Penske a “small cap” any longer, so we sold our shares and concluded this positive chapter.

We awoke to the news in early September that Smucker’s (not held in the fund) was purchasing Hostess Brands (TWNK) at a premium price. We sold our shares a few days later. While pleased to enjoy the profits, we were sad to see Hostess go. It is a well- run company in our view with strong brands and a leadership team that made intelligent acquisitions.

Finally, we sold a small piece of our holdings in SPS Commerce (SPSC) and CBIZ (CBIZ). We remain happy shareholders of both companies and believe they should grow much larger over time. SPS Commerce, a software firm that connects thousands of suppliers to many major retailers, hit a valuation high enough that a modest reduction in the position size made sense. Similarly, we trimmed our position in CBIZ, described earlier in the letter, due to a combination of a large position size, high valuation, and some evidence that demand for some of their more economically sensitive business lines might slow.

| FAM SMALL CAP FUND (Unaudited) |

Purchases

During 2023, we purchased three new positions in the fund and added shares to 11 existing holdings.

Our first purchase of the year was Element Solutions (ESI) in July. Element provides plating chemicals utilized in a variety of applications including the assembly of printed circuit boards for electronics and wear protection in many industrial applications. Often, Element’s chemists assist manufacturers in devising specific chemistry for new applications and are, to some extent, “designed in” for the length of the product’s existence. This creates high switching costs and makes it a fine business. Furthermore, management, led by CEO Ben Gliklich, is adept at allocating their ample free cash flow well, often purchasing small product line extensions that add nicely to profits. Earnings were a bit depressed in 2023 on lower demand for a few products, especially cell phones. Such cycles are inevitable, so we were delighted to take advantage of the opportunity and buy a position in Element at what we expect should prove to be a low entry point.

In August, after years of waiting for a reasonable valuation, we added a modest position in Exponent (EXPO). We increased the position in the fall after they reported soft third- quarter earnings. Exponent is essentially a company of scientific and engineering expert consultants, the largest in their field. The majority of their work comes from litigation, such as after a catastrophic failure when they are hired to determine the root causes. The rest is more proactive, like helping a business develop a leading-edge technology with complicated science. A modest slowdown in proactive demand from consumer electronics firms scared investors with more of a short-term focus. Given our longer-term view, we were pleased to become shareholders.

Our last purchase of the year was Dutch Bros (BROS). Dutch Bros operates approximately 800 beverage-focused, drive-through shops with plans to reach 4,000 units within 10 to 15 years. For a variety of qualitative reasons, including a strong service culture, Dutch Bros’ stores almost always achieve impressive unit-level economics in our view. We believe that they should attain their goal of 4,000 units and produce significantly higher profits over the coming years.

Dutch Bros went public in the fall of 2021 and for many months traded at a high valuation. As the old saying goes, “If a stock is priced for perfection, then results better be perfect.” They were not. Dutch Bros struggled with some issues around softer demand, wage inflation, and construction cost inflation that we believe should pass. None of these issues were shocking given the macro environment. Furthermore, we don’t think they impact their long- term potential. We took advantage of the pullback to what we believed was a more reasonable valuation and bought our shares.

Outlook

Lately, of course, the major economic story has been the tensions between rising interest rates, inflation, employment levels, and more. This created some volatility in stock prices in 2023 which we believe helped us make some attractive purchases. At this point, investors are considerably calmer as it seems that inflation is abating while the economy is growing more slowly without stumbling into a recession.

As we consider what might happen in 2024, we will not make the mistake of espousing grand, macroeconomic predictions like so many others — this is a futile game. Instead, our focus remains on identifying what we deem to be the best companies, adding shares if they are available at reasonable prices, and holding them for many years as they grow earnings. Our plan is to keep retesting the reasoning behind why we own stock in each of the fund’s businesses and make sure that their leaders are maintaining, if not strengthening, their competitive advantages. Simultaneously, we will keep looking for even better opportunities.

While we will not make a prediction, we will point out that years lacking political surprises, economic anxieties, and volatile stock prices are historically very rare. Therefore, we expect that 2024 could be an interesting year.

Thank you for your trust and investing with us in the FAM Small Cap Fund.

| FAM SMALL CAP FUND (Unaudited) |

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2022 to 12/31/2023

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Dream Finders Homes | 2.90% | 4.27% |

| CBIZ | 7.55% | 2.50% |

| Hostess Brands | 3.22% | 2.17% |

| Colliers International Group | 5.06% | 1.80% |

| SPS Commerce | 3.77% | 1.72% |

This reflects the FAM Small Cap Fund’s best and worst performers, in descending order, based on individual stock performance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Boston Omaha Corp. | 3.12% | -1.87% |

| Trisura Group | 3.94% | -1.23% |

| ExlService Holdings | 6.61% | -0.88% |

| Brookfield Infrastructure Corp. | 3.79% | -0.41% |

| Hagerty | 2.19% | -0.08% |

Past performance does not indicate future results.

|  |

| | |

| Andrew F. Boord | Kevin D. Gioia, CFA |

| Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

*Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter.

| FAM SMALL CAP FUND (Unaudited) |

TOP 10 HOLDINGS

AS OF 12/31/2023

| | % of |

| FAM Small Cap Fund | Net Assets |

| CBIZ, Inc. | 7.2% |

| Colliers International Group, Inc. | 5.8% |

| ExlService Holdings, Inc. | 5.4% |

| Pinnacle Financial Partners, Inc. | 4.4% |

| Dream Finders Homes, Inc. - Class A | 4.2% |

| Chemed Corporation | 3.6% |

| SiteOne Landscape Supply, Inc. | 3.6% |

| Brookfield Infrastructure Corporation - Class A | 3.6% |

| Landstar System, Inc. | 3.5% |

| Trisura Group Ltd. | 3.5% |

| Total Net Assets | $362,861,659 |

The portfolios are actively managed and current holdings may be different.

AVERAGE ANNUAL TOTAL RETURNS

AS OF 12/31/2023

| | | | | | | Total Fund |

| | | | | | Since | Operating |

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception | Expenses |

| FAM Small Cap Fund | | | | | | 1.24% (gross) |

| Investor Class | 20.11% | 10.34% | 13.42% | 8.45% | 11.13% | 1.24%* (net) |

| Russell 2000 Index | 16.93% | 2.22% | 9.97% | 7.16% | 9.49% | N/A |

| S&P 500 Index | 26.29% | 10.00% | 15.69% | 12.03% | 13.25% | N/A |

The performance data quoted represents past performance.

PERFORMANCE DISCLOSURES

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month- end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

IMPORTANT RISK INFORMATION

Risk Disclosures: The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

| FAM SMALL CAP FUND (Unaudited) |

This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profit-able or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

| * | FAM Small Cap Fund Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.26% for the Investor Class. The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.16% for the Institutional Class. When excluding Acquired Funds Fees and Expenses, which are not direct costs paid by the Fund’s shareholders and fee waivers, the total annual operating expense as reported in the FAM Small Cap Fund’s audited financial statements for the Investor Class is 1.24% and the Institutional Class is 1.14% as of December 31, 2023. The Advisor has contractually agreed, until May 1, 2024, to waive fees and/or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to cap Net Fund Operating Expenses for Investor Shares at 1.42% and Institutional Shares at 1.20%. |

Institutional Class shares became available for sale on January 1, 2016. For performance prior to that date, this table includes the actual performance of the Fund’s Investor Class (and uses the Fund’s Investor Class’ actual expenses), without adjustment. The performance results shown on this and the next page for the periods prior to January 1, 2016, the date of commencement of operations for Institutional Shares, are for the Investor Shares, which are subject to higher fees due to differences in the shareholder administrative services fees and certain other fees paid by each class. Institutional Shares and Investor Shares would have substantially similar performance results because the shares of each class are invested in the same portfolio securities of the Fund. Because of the difference in the level of fees paid by Investor Shares, the returns for the Investor Shares will be lower than the returns of the Institutional Shares.

| † | The Russell 2000 is an unmanaged index that measures the performance of a small-cap segment of the U.S. equity universe. This benchmark is used for comparative purposes only and very generally reflects the risk or investment style of the investments reported. |

| FAM SMALL CAP FUND (Unaudited) |

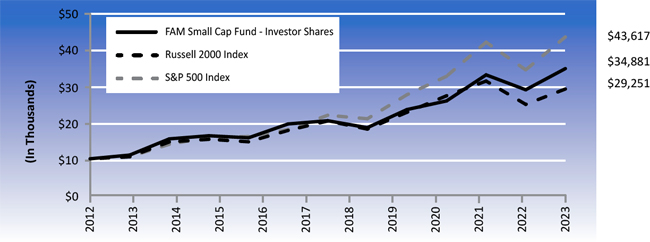

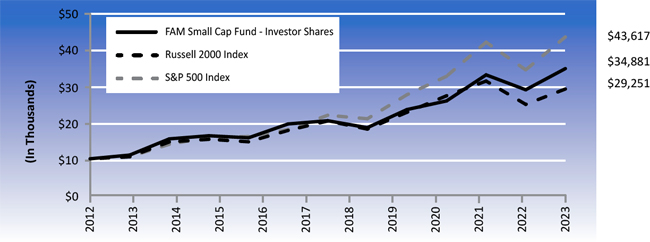

The chart below depicts the change in the value of a $10,000 investment in the Investor Shares of the FAM Small Cap Fund, since inception on March 1, 2012 as compared with the growth of the Russell 2000 Index, the Fund’s primary benchmark index, and the Standard & Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell 2000 Index is an unmanaged index generally representative of the market for the stocks of smaller size U.S. companies. The Standard & Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM SMALL CAP

FUND - INVESTOR SHARES, THE RUSSELL 2000 INDEX AND THE S&P 500 INDEX