UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-04750 | |

| Fenimore Asset Management Trust |

| (Exact name of registrant as specified in charter) |

| 384 North Grand Street, P.O. Box 399 Cobleskill, New York | 12043 |

| (Address of principal executive offices) | (Zip code) |

Michael F. Balboa

| Fenimore Asset Management Trust 384 North Grand Street, P.O. Box 399 Cobleskill, New York, 12043 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | 1-800-453-4392 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2022 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

| FAM VALUE FUND | |

| Letter to Shareholders | 1 |

| Portfolio Data | 9 |

| Schedule of Investments | 10 |

| FAM DIVIDEND FOCUS FUND | |

| Letter to Shareholders | 12 |

| Portfolio Data | 19 |

| Schedule of Investments | 20 |

| FAM SMALL CAP FUND | |

| Letter to Shareholders | 22 |

| Portfolio Data | 30 |

| Schedule of Investments | 31 |

| Statements of Assets and Liabilities | 33 |

| Statements of Operations | 34 |

| Statements of Changes in Net Assets | 35 |

| Notes to Financial Statements | 38 |

| Expense Data | 52 |

| Information About Trustees and Officers | 54 |

| Supplemental Information | 56 |

| Board Consideration of the Continuation of the Investment Advisory Agreements for the Funds | 57 |

| Privacy Policy | 62 |

FAM Funds has adopted a Code of Ethics that applies to its principal executive and principal financial officers. You may obtain a copy of this Code without charge, by calling FAM Funds at (800) 932-3271.

FAM VALUE FUND (Unaudited)

Letter to Shareholders

December 31, 2022

Dear Fellow Value Fund Shareholder,

There were few places to hide from falling prices in U.S. financial markets in 2022. The S&P 500 Index, a measure of the largest U.S. publicly traded companies, returned -18.11%, its worst showing since 2008 and third worst in the past 40 years. The Nasdaq Composite, which is heavily weighted toward technology companies, fell -32.54%. Most other broad stock indices declined as well. Bonds also fared poorly as yields rose and prices dropped. The Bloomberg Aggregate Index, the broadest measure of U.S. investment grade fixed income securities (government, agency, and corporate), fell -13.01%, its worst performance since the index was created in 1976.1

There are several reasons for the 2022 decline in equity prices. A significant factor was the Federal Reserve’s rapid raising of interest rates (in response to high and persistent inflation). Because inflation is largely a problem of demand outstripping supply, one way to fight inflation is to reduce demand by making it more costly to consume goods or services. If the Fed accomplishes its goals, sales growth at American businesses will slow. In addition, higher interest rates will increase borrowing costs for indebted companies. These will likely be a one -two punch on earnings for many firms. Lastly, higher rates reduce the amount investors are willing to pay for a share of stock. If an investor can get more yield on a bond today than yesterday, they would require a higher return (in the form of a lower price) for stock today than yesterday since stocks and bonds are competing for their investing dollar.

Another factor was that stocks began the year at relatively high valuations. It may be hard to remember in a year like this, but stocks had a remarkable run in the preceding three years with the S&P 500 returning 31.2%, 18.0%, and 28.5% in 2019, 2020, and 2021, respectively. Including 2022, the S&P’s compounded average annual return was nearly 19% over four years. This is in the context of a return of 9.80% over the past 20 years.2 One of the several reasons for optimism is that valuations for many businesses have become much more reasonable and expected returns from here have improved.

Within this environment, the FAM Value Fund (FAMVX) outperformed its benchmark, returning -14.12% versus the Russell Midcap Index’s -17.32%.3 The Value Fund tends to outperform in down markets and this year was no exception. The reasons for this tendency are rooted in the foundations of our investment philosophy: paying reasonable prices for what we believe are high-quality businesses with strong balance sheets and skilled management teams. Down markets often precede or coincide with economic volatility or uncertainty (as was the case this year). High-quality enterprises often defend (or even improve) their earnings power better than low-quality businesses. Stronger balance sheets mean our companies face less earnings volatility — or even existential uncertainty — than highly levered operations. Strong, proven management teams are often able to adroitly allocate capital to strengthen competitive positions. And being mindful of valuations typically means less room for prices to fall. Looking back, we saw many instances of these factors in play. Of course, we couldn’t fully escape the headwinds, but we were very pleased with how our holdings’ management teams performed faced with these challenges.

Contributors & Detractors

Our top three contributors to performance in 2022 were EOG Resources (EOG), AutoZone (AZO), and Progressive Insurance (PGR).

| 1 | FactSet as of 12/31/2022 |

| 2 | FactSet as of 12/31/2022 |

| 3 | FactSet as of 12/31/2022 |

FAM VALUE FUND (Unaudited)

| ● | EOG is one of the largest and best-run oil producers in the country in our view. Out of the 11 economic sectors, energy was one of only two that was up in 2022 due largely to higher global energy prices as a result of Russia’s invasion of Ukraine. In addition, EOG continued to reduce its costs and improve productivity so that it could return more cash to shareholders, which management did with a special dividend. |

| ● | While best known for its stores, one-third of AutoZone’s sales “goes out the back door” in a delivery truck to local garages and service stations. This part of their business benefited from the inventory shortage of new cars and higher interest rates causing fewer used car sales. Both dynamics are causing people to keep their cars longer. Older and/or higher-mileage cars require more maintenance which means more parts sold by AutoZone. |

| ● | Progressive is one of the largest auto insurers in the United States. In addition to personal auto, Progressive has growing businesses in commercial transportation, homeowners, and small business insurance. Auto insurers’ claims costs have been rising due to more frequent and more costly accidents. Progressive reacted very quickly to these trends by raising prices, which slowed policy growth but helped grow profit margins in their insurance operations. Furthermore, higher interest rates mean that they should earn more interest income on the premiums collected and held for potential claims payments (also known as “float”). |

Our top three detractors from performance in 2022 were CarMax (KMX), Brookfield Asset Management (BN/BAM), and Zebra Technologies (ZBRA).

| ● | CarMax is the largest used car retailer in America. Several factors weighed on KMX’s performance this year. First, a lack of availability of new cars drove used car prices to historically high levels. Higher prices, combined with rapidly rising interest rates, made consumers either unwilling or unable to purchase a (used) car. This headwind should moderate as slower demand leads to lower prices, which is already happening. A longer-term issue is that competitive dynamics have raised the cost of doing business and potentially diminished the profitability of the used car industry. Though competitor Carvana (not held in the portfolio) is struggling right now, it introduced the idea of a fully online used car transaction — from appraisal and trade of an old car to shopping, financing, and delivery of a new car. CarMax responded by building the infrastructure to match this capability, which is showing signs of success but has eaten into earnings. We believe CarMax’s omnichannel approach of giving consumers a choice between transacting in-store and online should be successful in the end. |

| ● | Brookfield Asset Management is one of the largest and best-run alternative asset managers in our opinion, though less known than many of its publicly traded peers such as KKR and Blackstone (not held in the portfolio). Alternative asset managers, as a whole, performed relatively poorly this year. Most use a fair amount of debt when buying assets so higher interest rates mean higher deal costs. In addition, inflation, slower economic growth, and higher interest rates mean their portfolio companies are likely worth less. For sure, these factors are headwinds for Brookfield, but they are less affected than many of their peers for several reasons including less use of debt, assets that either are immune to or actually benefit from inflation, and a stronger balance sheet. |

| ● | Zebra Technologies is a leading provider of barcode scanner and RFID systems (e.g., the scanner at the grocery store). However, the company faced several challenges this year including a slowing of capital expenditures by retailers, supply chain disruptions, setbacks in expansion of their distribution network, and elevated transportation costs. We believe most of these challenges are temporary and Zebra should continue to lead significant growth in global scanning and asset tracking applications over the coming years. |

FAM VALUE FUND (Unaudited)

Portfolio Activity

By our standards, we were active in 2022. We initiated two new positions, sold out of five positions, and added to or trimmed a myriad of positions as volatility gave us opportunities to increase the quality and/or expected return of the fund in our estimation.

Purchases

The two new businesses we invested in were Booking Holdings (BKNG) and Burlington Stores (BURL). We refer you to our Semi-Annual Letter where both companies were profiled.

We added to several positions in the first half of 2022: Amphenol (APH), Analog Devices (ADI), Clarivate (CLVT), Fidelity Information Services (FIS), M&T Bank (MTB), Pinnacle Financial Partners (PNFP), SouthState Corporation (SSB), and Zebra Technologies (ZBRA). Our second half additions were small by comparison and limited to Analog Devices and Zebra Technologies.

Sales

Sales and trims were primarily executed to raise cash for what we thought were higher quality and/or better return opportunities.

Our full sales during the year were Broadridge Financial (BF), Genpact (G), Burlington Stores (BURL), NVR (NVR), and Clarivate (CLVT).

Position trims included Berkshire Hathaway (BRK.A), Brown & Brown (BRO), EOG Resources (EOG), IDEX Corporation (IEX), Illinois Tool Works (ITW), Markel Corporation (MKL), M&T Bank (MTB), AutoZone (AZO), and Black Knight (BKI).

In addition to these actions, in the fourth quarter two of our portfolio holdings spun off a portion of their operations into stand-alone, publicly traded companies. This added two more holdings, albeit small ones, to the Value Fund. The first was Fortune Brand Holdings (FBHS), which formed MasterBrand Cabinet (MBC) with its MasterCraft cabinet segment. MBC is now the largest stand-alone cabinet manufacturer in the United States. The remaining business was renamed Fortune Brands Innovation (FBIN) and is comprised of the plumbing, outdoor materials, and security divisions.

The second was Brookfield Asset Management’s (BAM) spinoff of 25% of its asset management division. The newly formed entity took the old name and ticker of BAM. And the former Brookfield Asset Management was renamed Brookfield Corporation (BN). At the close of the year, we continued to hold both newly formed businesses.

Closing Thoughts

We closed our Semi-Annual Letter with two causes for optimism:

| 1. | Prospective returns were likely to be better. |

| 2. | Market volatility creates opportunity for investors with the right temperament. |

Though the Value Fund is up more than 8% from that time and we have made many “tweaks” to the portfolio, we feel both are still applicable. To these, we would like to add a few more bright spots we have observed since we last wrote:

| ● | The rate of inflation is slowing in many areas. |

| ● | Supply chains are healing. |

| ● | Transportation costs are falling. |

| ● | Job postings are getting easier to fill. |

| ● | Individuals and institutions are acclimating to higher interest rates. |

| ● | Capital is being deployed more thoughtfully. |

FAM VALUE FUND (Unaudited)

Some of these are interrelated and some are evidence that the Fed’s medicine is starting to work. However, as Benjamin Franklin said, “There is such a thing as too much of a good thing.” If the Fed overcorrects, some of these pluses could become minuses.

One of our greatest sources of optimism, though, comes from having watched the people we have partnered with during the last three years. It is hard to overstate the challenges faced by American businesses during the pandemic and its aftermath. Almost without exception, our portfolio companies performed remarkably well under the circumstances in our opinion. This is largely because of creative, focused, and resilient people — from the CEO to the salesclerk — skillfully navigating the turbulent environment. The past three years have been an unrelenting test of our notion that we own strong, competitively advantaged businesses with fantastic leaders.

Thank you for investing with us in the FAM Value Fund.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2021 TO 12/31/2022

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| EOG Resources | 3.14% | 1.28% |

| AutoZone | 3.16% | 0.69% |

| Progressive Corp. | 1.91% | 0.41% |

| Ross Stores | 5.07% | 0.33% |

| Markel Corp. | 4.87% | 0.29% |

This reflects the FAM Value Fund’s best and worst performers, in descending order, based on individual stock perfor-mance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| CarMax | 3.37% | -2.46% |

| Brookfield Corp. | 5.30% | -2.16% |

| Zebra Technologies Corp. | 2.79% | -1.86% |

| Brown & Brown | 7.14% | -1.41% |

| Fidelity National Information Services | 2.41% | -1.07% |

Past performance does not indicate future results.

FAM VALUE FUND (Unaudited)

|  |  |

| | | |

| John D. Fox, CFA | Drew P. Wilson, CFA | Marc D. Roberts, CFA |

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter. |

| ** | All investing involves risk including the possible loss of principal. Before investing, carefully read the fund’s prospectus which includes investment objectives, risks, charges, expenses and other information about the fund. Please call us at 800-932-3271 or visit fenimoreasset.com for a prospectus or summary prospectus. Past performance and Morningstar ratings are not an indicator of a fund’s future returns. |

Securities offered through Fenimore Securities, Inc. Member FINRA/SIPC, and advisory services offered through Fenimore Asset Management, Inc.

FAM VALUE FUND (Unaudited)

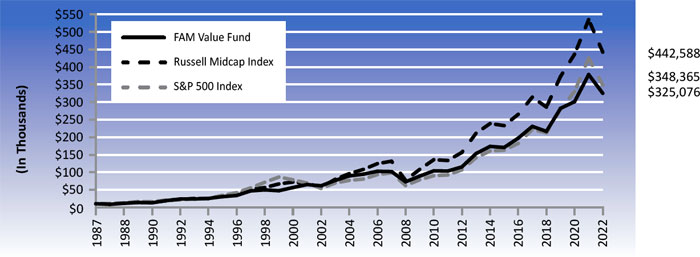

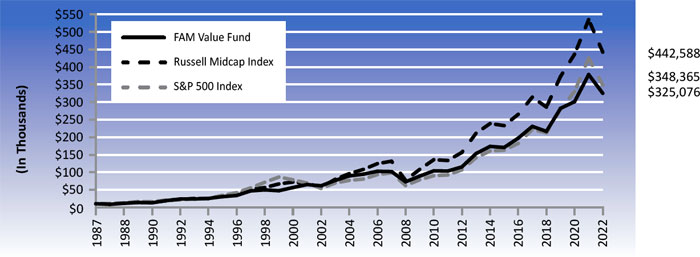

The chart below depicts the change in value of a $10,000 investment in the Investor Shares of the FAM Value Fund since inception on January 2, 1987, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard & Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard & Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM VALUE FUND,

THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Value Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

FAM VALUE FUND — Portfolio Data

December 31, 2022 (Unaudited)

TOP 10 HOLDINGS

AS OF 12/31/2022

| | % OF |

| FAM VALUE FUND | NET ASSETS |

| CDW Corporation | 6.9% |

| IDEX Corporation | 6.8% |

| Brown & Brown, Inc. | 6.6% |

| Ross Stores, Inc. | 6.5% |

| Markel Corporation | 4.9% |

| Illinois Tool Works, Inc. | 3.9% |

| Air Products & Chemicals, Inc. | 3.8% |

| Vulcan Materials Company | 3.6% |

| Stryker Corporation | 3.5% |

| Brookfield Corporation - Class A | 3.5% |

| TOTAL NET ASSETS | $1,442,334,419 |

The portfolios are actively managed and current holdings may be different.

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2022

| | | | | | | Total Fund |

| | | | | | Since | Operating |

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception | Expenses |

| | | | | | | 1.18% |

| | | | | | | (gross) |

| | | | | | | 1.18%* |

| FAM Value Fund Investor Class* | (14.12)% | 4.85% | 7.10% | 10.94% | 10.15% | (net) |

| Russell Midcap Index | (17.32)% | 5.88% | 7.10% | 10.96% | 11.10% | N/A |

| S&P 500 Index | (18.11)% | 7.66% | 9.42% | 12.56% | 10.37% | N/A |

| * | Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.19% for the Investor Class. The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.00% after fee waivers of (0.12)% for the Institutional Class. When excluding Acquired Funds Fees and Expenses, which are not direct costs paid by the Fund’s shareholders, and fee waivers, the total annual operating expense as reported in the FAM Value Fund’s audited financial statements for the Investor Class is 1.18% and the Institutional Class is 0.99% after a fee waiver of (0.15%) as of December 31, 2022. The Advisor has contractually agreed, until May 1, 2023, to waive fees and/ or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to maintain Net Fund Operating Expenses for Investor Shares at 1.18% and Institutional Shares at 0.99%. |

FAM VALUE FUND (Unaudited)

Important Disclosures:

Past performance is not indicative of future results, current perfor-mance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month-end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Risk Disclosures: The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

FAM VALUE FUND — Portfolio Data

December 31, 2022 (Unaudited)

| COMPOSITION OF NET ASSETS |

| Machinery | 13.8% |

| Insurance | 13.7% |

| Electronic Equipment, Instruments & Components | 12.6% |

| Specialty Retail | 12.0% |

| Capital Markets | 5.9% |

| Banks | 4.2% |

| Semiconductors & Semiconductor Equipment | 4.0% |

| Money Market Funds | 3.9% |

| Chemicals | 3.8% |

| Construction Materials | 3.6% |

| IT Services | 3.6% |

| Health Care Equipment & Supplies | 3.5% |

| Diversified Financial Services | 3.2% |

| Trading Companies & Distributors | 2.6% |

| Multi-Line Retail | 2.5% |

| Containers & Packaging | 2.3% |

| Oil, Gas & Consumable Fuels | 2.3% |

| Hotels, Restaurants & Leisure | 1.6% |

| Building Products | 0.9% |

| Other | (0.0%)(a) |

| (a) | Percentage rounds to less than 0.1% |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT; (ii) the complete listing is available on the Commission’s website at www.sec.gov; and (iii) the Fund makes the exhibit to Form N-PORT available to shareholders at fenimoreasset.com, or upon request, by calling FAM FUNDS at 1-800-932-3271.

FAM VALUE FUND — Schedule of Investments

December 31, 2022

| | | Shares | | | Value | |

| COMMON STOCKS — 96.1% | | | | | | | | |

| Banks — 4.2% | | | | | | | | |

| M&T Bank Corporation | | | 168,870 | | | $ | 24,496,282 | |

| Pinnacle Financial Partners, Inc. | | | 120,500 | | | | 8,844,700 | |

| SouthState Corporation | | | 364,610 | | | | 27,841,620 | |

| | | | | | | | 61,182,602 | |

| Building Products — 0.9% | | | | | | | | |

| Fortune Brands Home & Security, Inc. | | | 200,000 | | | | 11,422,000 | |

| MasterBrand, Inc. (a) | | | 200,000 | | | | 1,510,000 | |

| | | | | | | | 12,932,000 | |

| Capital Markets — 5.9% | | | | | | | | |

| Brookfield Asset Management Ltd. - Class A (a) | | | 397,940 | | | | 11,408,940 | |

| Brookfield Corporation - Class A | | | 1,591,760 | | | | 50,076,770 | |

| T. Rowe Price Group, Inc. | | | 214,390 | | | | 23,381,373 | |

| | | | | | | | 84,867,083 | |

| Chemicals — 3.8% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 175,500 | | | | 54,099,630 | |

| Construction Materials — 3.6% | | | | | | | | |

| Vulcan Materials Company | | | 297,930 | | | | 52,170,522 | |

| Containers & Packaging — 2.3% | | | | | | | | |

| Avery Dennison Corporation | | | 187,000 | | | | 33,847,000 | |

| Diversified Financial Services — 3.2% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class A (a) | | | 98 | | | | 45,933,678 | |

| Electronic Equipment, Instruments & Components — 12.6% | | | | | | | | |

| Amphenol Corporation - Class A | | | 475,240 | | | | 36,184,773 | |

| CDW Corporation | | | 558,200 | | | | 99,683,356 | |

| Zebra Technologies Corporation - Class A (a) | | | 179,460 | | | | 46,015,339 | |

| | | | | | | | 181,883,468 | |

| Health Care Equipment & Supplies — 3.5% | | | | | | | | |

| Stryker Corporation | | | 208,000 | | | | 50,853,920 | |

| Hotels, Restaurants & Leisure — 1.6% | | | | | | | | |

| Booking Holdings, Inc. (a) | | | 11,350 | | | | 22,873,428 | |

| Insurance — 13.7% | | | | | | | | |

| Brown & Brown, Inc. | | | 1,679,392 | | | | 95,674,962 | |

| Markel Corporation (a) | | | 53,850 | | | | 70,946,837 | |

| Progressive Corporation (The) | | | 240,000 | | | | 31,130,400 | |

| | | | | | | | 197,752,199 | |

| IT Services — 3.6% | | | | | | | | |

| Black Knight, Inc. (a) | | | 399,041 | | | | 24,640,782 | |

| Fidelity National Information Services, Inc. | | | 402,400 | | | | 27,302,840 | |

| | | | | | | | 51,943,622 | |

See Notes to Financial Statements

FAM VALUE FUND — Schedule of Investments Continued

December 31, 2022

| | | Shares | | | Value | |

| COMMON STOCKS — 96.1% (Continued) | | | | | | | | |

| Machinery — 13.8% | | | | | | | | |

| Graco, Inc. | | | 670,180 | | | $ | 45,076,307 | |

| IDEX Corporation | | | 431,530 | | | | 98,531,245 | |

| Illinois Tool Works, Inc. | | | 254,560 | | | | 56,079,568 | |

| | | | | | | | 199,687,120 | |

| Multi-Line Retail — 2.5% | | | | | | | | |

| Dollar General Corporation | | | 146,300 | | | | 36,026,375 | |

| Oil, Gas & Consumable Fuels — 2.3% | | | | | | | | |

| EOG Resources, Inc. | | | 256,500 | | | | 33,221,880 | |

| Semiconductors & Semiconductor Equipment — 4.0% | | | | | | | | |

| Analog Devices, Inc. | | | 279,510 | | | | 45,848,025 | |

| Microchip Technology, Inc. | | | 160,000 | | | | 11,240,000 | |

| | | | | | | | 57,088,025 | |

| Specialty Retail — 12.0% | | | | | | | | |

| AutoZone, Inc. (a) | | | 18,265 | | | | 45,044,778 | |

| CarMax, Inc. (a) | | | 559,944 | | | | 34,094,990 | |

| Ross Stores, Inc. | | | 810,688 | | | | 94,096,556 | |

| | | | | | | | 173,236,324 | |

| Trading Companies & Distributors — 2.6% | | | | | | | | |

| Fastenal Company | | | 780,900 | | | | 36,952,188 | |

| | | | | | | | | |

| Total Common Stocks (Cost $508,873,379) | | | | | | $ | 1,386,551,064 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 3.9% | | | | | | | | |

| Invesco Short-Term Investments Trust - Institutional Class, 4.20% (b) (Cost $55,914,560) | | | 55,914,560 | | | $ | 55,914,560 | |

| | | | | | | | | |

| Total Investments at Value — 100.0% (Cost $564,787,939) | | | | | | $ | 1,442,465,624 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — 0.0% (c) | | | | | | | (131,205 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,442,334,419 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of December 31, 2022. |

| (c) | Percentage rounds to less than 0.1%. |

See Notes to Financial Statements

FAM DIVIDEND FOCUS FUND (Unaudited)

Letter to Shareholders

December 31, 2022

Dear Fellow Dividend Focus Fund Shareholder,

2022 Highlights1

The FAM Dividend Focus Fund (FAMEX) posted a return of -13.42% for the year, 3.90% better than the Russell Midcap Index (FAMEX’s benchmark) which finished at -17.32%.

Earnings for portfolio companies are expected to increase by 10.0% for fiscal 2022.

Dividends from portfolio companies increased by 12.6% for the year.

The FAM Dividend Focus Fund (“the Fund”) focuses on investing in companies that pay a growing dividend over time. We invest in businesses that are primarily in the mid-cap spectrum as they tend to grow faster than larger capitalization corporations. Our research team strives to generate investment returns with lower volatility and less risk than the overall market by investing in what we deem to be competitively advantaged businesses that generate strong cash flow and have modest and manageable debt. In other words, we like to purchase shares in companies that allow our investors and us to sleep well at night.

Performance

After strong performance for stocks in 2021, we were cautious about future return prospects given the worsening inflationary environment and expectation for higher interest rates to help cool economic growth. This played out in 2022 as stocks lost ground for the entire year.

The Fund was not immune to the market weakness; however, our holdings, which skew to the higher quality side of the spectrum in our view, held up significantly better than the overall market and our benchmark. Our holdings typically earn high returns on capital and pay dividends that grow in line with earnings. They have superior management teams, in our estimation, and have a long history of growing their businesses through economic cycles and stiff competition. We believe these attributes are the foundation upon which long-term returns are built.

The Fund declined -13.42% in 2022, which compares favorably to our benchmark, the Russell Midcap Index, which declined -17.32% for the same period. This outperformance is attributable to a few of our larger holdings that put up positive returns for the year. More importantly, the Fund also bested the benchmark over 3, 5, 10, and 15 years.2

Despite the environment worsening throughout the year from higher inflation, higher interest rates, and a weakening economy, 2022 earnings estimates for the Fund’s holdings actually increased by 2.0 percentage points since the beginning of the year.3 Said differently, while the economic outlook worsened, the profit our holdings were expected to generate in 2022 increased. We attribute this to strong execution of portfolio companies.

For example, IDEX Corporation (IEX), best known for high performance pumps as well as the fire and rescue tool the Jaws of Life, introduced components that are used in laser-based communication between communications satellites. Until this year, this type of satellite-to-satellite communication was done by radio wave. This is a step forward for the industry and IDEX is playing a key role by pushing their technology into new markets. As impressive as this development is in our opinion, many of our shareholders with a sweet tooth will be more impressed that 80% of the world’s chocolate production uses an IDEX pump.

| 1 | FactSet as of 12/31/2022 |

| 2 | FactSet as of 12/31/2022 |

| 3 | FactSet as of 12/31/2022 |

FAM DIVIDEND FOCUS FUND (Unaudited)

Another example of strong execution is Jack Henry & Associates (JKHY), a fintech (financial technology) company that specializes in software for banks and credit unions as well as payments processing. The business has been taking share in the credit union market and they are the fastest growing company among the core processors. In August, they acquired Payrailz, which enhances their Payment-as-a-Service strategy by providing AI-enabled digital payments solutions that allow banks and credit unions to compete with industry disruptors.

Air Products & Chemicals (APD) is a yet another example of a business that is making things happen. This industrial gas company generates more cash than it needs to run its operation. Management embarked on a strategy of taking this excess cash and investing it in large projects around the world such as coal gasification, carbon capture and sequestration, and hydrogen production. Today, Air Products is the largest producer of hydrogen in the world and is directing tremendous amounts of capital toward green hydrogen which uses wind, solar, and hydro as the energy source for producing the hydrogen. APD is being rewarded with contracts in Saudi Arabia, Texas, New York, and Alberta Canada. Once the facilities are completed, they will operate under long-term contracts.

These three examples show how our holdings are moving forward, even while the market and economy stagnate. This is the type of mindset that allows these businesses to be long-term compounders of capital.

Dividends

The overarching strategy of the Fund is to invest in companies that pay a dividend and consistently increase that dividend over time. We believe dividend growth is important because only businesses that are growing their cash flow are able to consistently grow their dividends. We favor investing in businesses that are growing their dividends quickly because it means the underlying operation is expanding. It also means that they are generating more cash than needed to reinvest back into the business. These growing dividends contribute to the total return of the investment.

Over the last five years, the average annual growth rate of dividends paid by our holdings is 12.0% annualized. Over the last 12 months, the average growth in dividends was 12.6%. The largest dividend increases were by Microchip Technology (MCHP), which increased their dividend by 41.4%, and Entegris (ENTG) and Pool Corporation (POOL), which increased their dividends by 25.0%. Cintas Corporation (CTAS) increased their dividend by 21.1% and CDW Corporation (CDW) increased by 18.0%.4 Every holding, except one, paid a higher dividend in 2022 than the year prior.

Portfolio Activity

While our portfolio activity picked up a little bit in 2022, our overall turnover remained quite low. We continue to be very happy with the Fund’s holdings.

Purchases

We took advantage of the increase in market volatility to increase positions in some of our existing names while also investing in two new companies, Watsco (WSO) and Amphenol Corporation (APH).

We initiated a position in Watsco, a market-leading HVAC distributor primarily in the sunbelt states. Watsco experienced robust demand over the last two years, and we believe they remain well-positioned to benefit from secular tailwinds including higher energy efficiency standards, refrigerant changes, demand for improved indoor air quality, and growing electrification of heating and cooling equipment.

Our other new position was Amphenol, a designer and manufacturer of electrical connectors and sensors, or solutions that help transmit power and signals. Amphenol generates industry leading returns, and we believe it has a long runway for continued growth given tailwinds from the ongoing “electronification” of the world (e.g., electric vehicles and increasing bandwidth needs) and fantastic mergers and acquisitions capabilities.

| 4 | FactSet as of 12/31/2022 |

FAM DIVIDEND FOCUS FUND (Unaudited)

The other additions during the year were in label and tag maker Avery Dennison (AVY), business process outsourcer Genpact (G), replacement aircraft parts manufacturer HEICO (HEI.A), and payroll processor Paychex (PAYX).

Sales

We also exited two positions. The first was data center Digital Realty (DLR), which we believed would be negatively impacted by rising interest rates and struggle with growing customer concentration among large technology titans — namely Google, Amazon, Facebook, and Microsoft. The other sale was our small position in Graco (GGG), a maker of industrial spraying equipment. We did not have reservations about GGG as we did DLR, but rather looked to concentrate capital in other names.

We also trimmed our position in First Hawaiian Bank (FHB), a regional bank in Hawaii. Like GGG, we used the proceeds to help fund purchases.

Closing Thoughts

We are optimistic over the long term. We believe the companies in the Fund should be able to continue their growth which should lead to higher dividends to shareholders. In short, the “compounders” should continue to compound.

In the near term, however, the picture is murkier. We will likely experience more turbulence in the market. While this may be uncomfortable for investors, it has historically provided the Fund managers great purchasing opportunities. We have cash at the ready to invest in what we believe are additional quality companies or to add to existing quality holdings.

As always, we will continue to work diligently on your behalf.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2021 TO 12/31/2022

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Arthur J. Gallagher & Co. | 7.01% | 0.98% |

| Air Products and Chemicals | 4.71% | 0.32% |

| Jack Henry & Associates | 3.91% | 0.27% |

| Ross Stores | 3.93% | 0.19% |

| Cintas Corp. | 2.38% | 0.18% |

This reflects the FAM Dividend Focus Fund’s best and worst performers, in descending order, based on individual stock performance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Entegris | 4.55% | -3.27% |

| Pool Corp. | 3.65% | -2.31% |

| Broadridge Financial Solutions | 4.26% | -1.13% |

| Fastenal Company | 3.23% | -0.87% |

| Microchip Technology | 5.05% | -0.86% |

Past performance does not indicate future results.

FAM DIVIDEND FOCUS FUND (Unaudited)

|  |

| | |

| Paul Hogan, CFA | William Preston, CFA |

| Portfolio Manager | Portfolio Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter. |

| ** | All investing involves risk including the possible loss of principal. Before investing, carefully read the fund’s prospectus which includes investment objectives, risks, charges, expenses and other information about the fund. Please call us at 800-932-3271 or visit fenimoreasset.com for a prospectus or summary prospectus. Past performance and Morningstar ratings are not an indicator of a fund’s future returns. |

Securities offered through Fenimore Securities, Inc. Member FINRA/SIPC, and advisory services offered through Fenimore Asset Management, Inc.

FAM DIVIDEND FOCUS FUND (Unaudited)

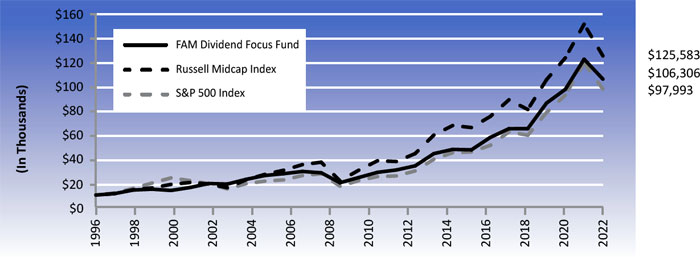

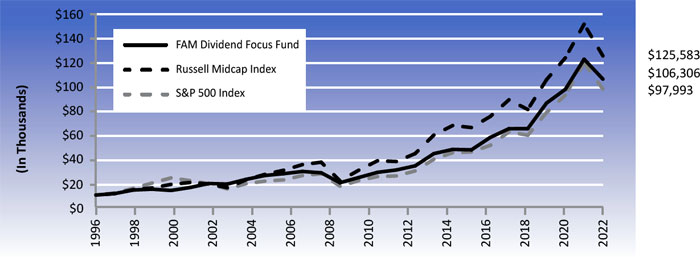

The chart below depicts the change in value of a $10,000 investment in the FAM Dividend Focus Fund since inception on April 1, 1996, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard and Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard and Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM DIVIDEND FOCUS FUND,

THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Dividend Focus Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

FAM DIVIDEND FOCUS FUND (Unaudited)

TOP 10 HOLDINGS

AS OF 12/31/2022

| | % OF |

| FAM DIVIDEND FOCUS FUND | NET ASSETS |

| Arthur J. Gallagher & Company | 7.4% |

| CDW Corporation | 6.9% |

| Trane Technologies plc | 6.0% |

| Air Products & Chemcials, Inc. | 5.7% |

| Microchip Technology, Inc. | 5.2% |

| Ross Stores, Inc. | 5.0% |

| Stryker Corporation | 4.7% |

| Avery Dennison Corporation | 4.1% |

| Genpact Ltd. | 3.9% |

| Broadridge Financial Solutions, Inc. | 3.8% |

| TOTAL NET ASSETS | $ 559,125,919 |

The portfolios are actively managed and current holdings may be different.

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2022

| | | | | | | Total Fund |

| | | | | | Since | Operating |

| | 1Year | 3 Year | 5 Year | 10 Year | Inception | Expenses |

| | | | | | | 1.22% |

| | | | | | | (gross) |

| | | | | | | 1.22%* |

| FAM Dividend Focus Fund* | (13.42)% | 7.16% | 10.30% | 12.00% | 9.24% | (net) |

| Russell Midcap Index | (17.32)% | 5.88% | 7.10% | 10.96% | 9.92% | N/A |

| S&P 500 Index | (18.11)% | 7.66% | 9.42% | 12.56% | 8.91% | N/A |

| * | Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.23%. The total operating expense as reported in the FAM Dividend Focus Fund’s audited financial statements as of December 31, 2022 is 1.22%. The Advisor has contractually agreed, until May 1, 2023, to waive fees and/or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to maintain Net Fund Operating Expenses for Investor Shares at 1.26%. |

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month-end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Important Disclosures:

Risk Disclosures: The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not

FAM DIVIDEND FOCUS FUND (Unaudited)

realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

This presentation was prepared by Fenimore Asset Management, Inc. (“Fenimore”). Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

FAM DIVIDEND FOCUS FUND — Portfolio Data

December 31, 2022 (Unaudited)

| COMPOSITION OF NET ASSETS |

| IT Services | 14.8% |

| Insurance | 10.7% |

| Semiconductors & Semiconductor Equipment | 8.2% |

| Electronic Equipment, Instruments & Components | 8.0% |

| Health Care Equipment & Supplies | 6.6% |

| Building Products | 6.0% |

| Chemicals | 5.7% |

| Specialty Retail | 5.0% |

| Money Market Funds | 4.6% |

| Containers & Packaging | 4.1% |

| Trading Companies & Distributors | 3.9% |

| Commercial Support Services | 3.5% |

| Machinery | 3.3% |

| Construction Materials | 3.2% |

| Aerospace & Defense | 3.0% |

| Distributors | 2.9% |

| Commercial Services & Supplies | 2.7% |

| Industrial Conglomerates | 1.6% |

| Banks | 1.1% |

| Capital Markets | 0.6% |

| Food Products | 0.5% |

| Other | 0.0%(a) |

| (a) | Percentage rounds to less than 0.1% |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT; (ii) the complete listing is available on the Commission’s website at www.sec.gov; and (iii) the Fund makes the exhibit to Form N-PORT available to shareholders at fenimoreasset.com, or upon request, by calling FAM FUNDS at 1-800-932-3271.

FAM DIVIDEND FOCUS FUND — Schedule of Investments

December 31, 2022

| | | Shares | | | Value | |

| COMMON STOCKS — 95.4% | | | | | | | | |

| Aerospace & Defense — 3.0% | | | | | | | | |

| HEICO Corporation - Class A | | | 139,305 | | | $ | 16,695,704 | |

| Banks — 1.1% | | | | | | | | |

| First Hawaiian, Inc. | | | 226,000 | | | | 5,885,040 | |

| Building Products — 6.0% | | | | | | | | |

| Trane Technologies plc | | | 200,300 | | | | 33,668,427 | |

| Capital Markets — 0.6% | | | | | | | | |

| T. Rowe Price Group, Inc. | | | 32,400 | | | | 3,533,544 | |

| Chemicals — 5.7% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 103,350 | | | | 31,858,671 | |

| Commercial Services & Supplies — 2.7% | | | | | | | | |

| Cintas Corporation | | | 33,220 | | | | 15,002,816 | |

| Commercial Support Services — 3.5% | | | | | | | | |

| Republic Services, Inc. | | | 152,890 | | | | 19,721,281 | |

| Construction Materials — 3.2% | | | | | | | | |

| Vulcan Materials Company | | | 102,830 | | | | 18,006,562 | |

| Containers & Packaging — 4.1% | | | | | | | | |

| Avery Dennison Corporation | | | 125,500 | | | | 22,715,500 | |

| Distributors — 2.9% | | | | | | | | |

| Pool Corporation | | | 53,900 | | | | 16,295,587 | |

| Electronic Equipment, Instruments & Components — 8.0% | | | | | | | | |

| Amphenol Corporation - Class A | | | 75,251 | | | | 5,729,611 | |

| CDW Corporation | | | 217,000 | | | | 38,751,860 | |

| | | | | | | | 44,481,471 | |

| Food Products — 0.5% | | | | | | | | |

| McCormick & Company, Inc. | | | 36,700 | | | | 3,042,063 | |

| Health Care Equipment & Supplies — 6.6% | | | | | | | | |

| STERIS plc | | | 57,845 | | | | 10,683,393 | |

| Stryker Corporation | | | 107,000 | | | | 26,160,430 | |

| | | | | | | | 36,843,823 | |

| Industrial Conglomerates — 1.6% | | | | | | | | |

| Roper Technologies, Inc. | | | 20,000 | | | | 8,641,800 | |

| Insurance — 10.7% | | | | | | | | |

| Arthur J. Gallagher & Company | | | 219,000 | | | | 41,290,260 | |

| Hanover Insurance Group, Inc. (The) | | | 137,200 | | | | 18,539,836 | |

| | | | | | | | 59,830,096 | |

| IT Services — 14.8% | | | | | | | | |

| Broadridge Financial Solutions, Inc. | | | 159,400 | | | | 21,380,322 | |

| Genpact Ltd. | | | 473,000 | | | | 21,909,360 | |

| Jack Henry & Associates, Inc. | | | 112,300 | | | | 19,715,388 | |

| Paychex, Inc. | | | 173,080 | | | | 20,001,125 | |

| | | | | | | | 83,006,195 | |

See Notes to Financial Statements

FAM DIVIDEND FOCUS FUND — Schedule of Investments Continued

December 31, 2022

| | | Shares | | | Value | |

| COMMON STOCKS — 95.4% (Continued) | | | | | | | | |

| Machinery — 3.3% | | | | | | | | |

| IDEX Corporation | | | 81,174 | | | $ | 18,534,460 | |

| Semiconductors & Semiconductor Equipment — 8.2% | | | | | | | | |

| Entegris, Inc. | | | 253,000 | | | | 16,594,270 | |

| Microchip Technology, Inc. | | | 414,920 | | | | 29,148,130 | |

| | | | | | | | 45,742,400 | |

| Specialty Retail — 5.0% | | | | | | | | |

| Ross Stores, Inc. | | | 240,026 | | | | 27,859,818 | |

| Trading Companies & Distributors — 3.9% | | | | | | | | |

| Fastenal Company | | | 349,000 | | | | 16,514,680 | |

| Watsco, Inc. | | | 21,720 | | | | 5,416,968 | |

| | | | | | | | 21,931,648 | |

| | | | | | | | | |

| Total Common Stocks (Cost $296,243,773) | | | | | | $ | 533,296,906 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 4.6% | | | | | | | | |

| Invesco Short-Term Investments Trust - Institutional Class, 4.20% (a) (Cost $25,779,885) | | | 25,779,885 | | | $ | 25,779,885 | |

| | | | | | | | | |

| Total Investments at Value — 100.0% (Cost $322,023,658) | | | | | | $ | 559,076,791 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.0% (b) | | | | | | | 49,128 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 559,125,919 | |

| | | | | | | | | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2022. |

| (b) | Percentage rounds to less than 0.1%. |

See Notes to Financial Statements

FAM SMALL CAP FUND (Unaudited)

Letter to Shareholders

December 31, 2022

Dear Fellow Small Cap Fund Shareholder,

For 2022, the FAM Small Cap Fund (FAMFX) declined -12.42%. In comparison, the Russell 2000 Index (the benchmark we use for performance comparisons) fell -20.44%. Since its inception on March 1, 2012, the Small Cap Fund returned 10.34% versus the Russell 2000’s 8.83%.1

Our team focuses exclusively on what we consider to be quality companies with strong leadership and a solid financial position. These businesses usually have some competitive advantage which allows them to be more profitable and/or grow faster than their peers. Furthermore, we want to invest in these potential jewels at reasonable, if not attractive, valuations. This typically means that the business is “under a cloud” (i.e., temporarily stumbling) or “under a rock” (i.e., unknown by many investors) at the time of purchase. Our hope is that if we get all this right, then our holdings should be larger and more profitable in the future. This in turn should lead to healthy returns.

Owning quality businesses for the long term, with the occasional adjustment, continued to be our game plan in 2022.

We believe that our quality/value approach aided our relative performance in 2022. In periods when aggressive speculation abates, we tend to outperform as we did this year. This is, in our opinion, simply because we were not “rolling the dice” on companies that promised a bright future while losing vast amounts of money. A few high-risk enterprises may pull this off and eventually turn profitable and grow into wonderful operations; however, the majority will probably learn that it is much easier to make a promise than build a business. Many of these unprofitable companies are seeing lower revenues and thus greater losses. Their investors are increasingly unwilling to provide capital to finance those losses and, with lower stock prices, employees with worthless stock options are asking for higher cash compensation. While we seek growing businesses, our holdings tend to produce nice profits and generate plenty of cash while not being dependent on the capital markets to finance their growth.

Similarly, when there are signs of economic weakness and concerns that a recession is coming, stocks of weaker businesses tend to decline more than the indices. While the best company in an industry might struggle during a downturn, the weaker players often fail or are so damaged they emerge from the downturn even further behind. Our quality/value approach tends to keep us invested in what we deem to be the strongest companies that are best suited to handle a downturn.

The other aspect of our quality/value approach is that we love a good bargain. In periods of economic weakness and declining stock prices, we often find interesting opportunities to upgrade the portfolio.

Portfolio Activity

Like past years, we began the year with what we thought was a fine collection of quality businesses run by impressive leadership teams. But, as always, we kept digging — both retesting our conclusions and looking for opportunities to improve the portfolio.

Sales

We trimmed seven positions in 2022. With four of those trims, we thought the valuations were high enough that selling a few shares made sense while still retaining the bulk of our position. Additionally, we sold some shares of three positions late in the year to reduce our tax bill.

We also exited five positions completely.

| 1 | FactSet as of 12/31/2022 |

FAM SMALL CAP FUND (Unaudited)

We sold our position in Cambridge Bancorp (CATC) and used most of the proceeds to add to our position in Home Bancshares (HOMB). While we admire Cambridge greatly, we believe that Home has a bright future and elected to concentrate on them.

For many years Monro (MNRO) was an excellent operator of automotive repair shops in our view, but unfortunately their glory days seem to be behind them. After a few frustrating years of waiting for them to return execution back to previous levels, we decided to move on.

We also closed out our position in U.S. Physical Therapy (USPH) and reinvested the proceeds into FirstService Corporation (FSV). This was a difficult decision as we really admire USPH and their leadership who excelled even while regularly facing reimbursement cuts from the government. Ultimately, we think the future is brighter as an investor in FirstService (please see “Purchases”).

OneSpaWorld Holdings (OSW) proved to be an unfortunate investment for us. We purchased our first shares weeks before COVID-19 hit, which was bad news for this operator of cruise ship spas. The stock declined so dramatically that we elected to maintain our position and wait for better days. While OSW certainly made significant progress and is possibly on the cusp of a return to old levels of profitability, they increased their borrowings considerably during the pandemic. Consequently, when it became clear that a recession was quite possible and that it could be challenging for them to handle it given their debt levels, we elected to sell our shares.

Ryan Specialty Holdings (RYAN), a quite successful investment for us in our opinion, was also sold. The valuation was uncomfortably high and it was increasingly more of a mid-cap stock and a bit out of place for a small-cap fund. Additionally, we believed we could reinvest the proceeds well, including adding to our new position in SiteOne Landscape Supply (SITE) (please see “Purchases”).

Purchases

As usual, the most straightforward opportunities were to purchase additional shares in businesses we already own. In virtually every case, we have spent years studying these companies — which put us in what we believed was a good position to take advantage of opportunities. In 2022, we added to our positions in nine companies.

Additionally, we took advantage of falling prices to establish new positions in Hagerty (HGTY), FirstService Corporation (FSV), Floor & Decor (FND), and SiteOne Landscape Supply (SITE). With the exception of Hagerty, the other three investments had depressed stock prices explained at least in part due to fears that a housing slowdown would pressure earnings. While a cyclical slowdown in housing and remodeling is likely, we believed that the stock prices more than reflected this risk and should do well from here, especially over the mid to long term.

We built a position in Hagerty, which is the largest provider of auto insurance for collectible automobiles including antiques, exotic super cars, and muscle cars. From our viewpoint, Hagerty has several advantages over competitors including extensive valuation data, a highly specialized claims adjusting network, selling agreements with several major standard auto insurers, and a collection of related businesses (such as running major auto shows and auctions that improve the customer experience).

Hagerty makes most of their money from managing the insurance program for a commission and then shares in the insurance risk (and usually profits) with Markel Corporation (MKL), a longtime holding in the FAM Value Fund. Markel is also a significant owner of Hagerty shares. Currently, Hagerty is spending considerable time and money setting up an integrated technology referral system with State Farm (not a portfolio holding). While this should add materially to profitability as State Farm’s collector car policies move to Hagerty, for now it is obscuring their earnings power. Our thesis is that Hagerty should be able to keep pressing their advantages, grow market share, and produce higher profits over the long term.

FAM SMALL CAP FUND (Unaudited)

After years of studying and waiting for the right opportunity, we finally purchased shares in FirstService after the stock price declined significantly. FirstService has two divisions. FirstService Residential is the largest manager of condo and homeowners’ associations in North America. They collect the rent, staff the offices, manage the grounds, and take care of a litany of back-office functions for a fee. Size gives them advantages over their smaller competitors. The second division, FirstService Brands, houses a collection of service businesses including two major restoration brands (e.g., repairs after a fire or flood) and home service brands like California Closets and CertaPro Painters.

FirstService is a fairly asset-light operation that generates considerable free cash flow, which historically management reinvests through acquisitions of small players to build up their brands. Colliers International Group (CIGI), another holding in the portfolio, was incubated at FirstService before being spun off as a separate company in 2015. Inflation and labor shortages hurt FirstService’s profits in 2022, but less so as the year went on. Additionally, there is a concern that homeowners will spend less on remodeling in 2023, which would hurt units like California Closets. All of the above is likely why the stock price declined significantly giving us this opportunity.

Long-term shareholders may remember that we purchased shares in Floor & Decor Holdings in 2019 and 2020, later selling our position in 2021 for a nice gain in our opinion. At the time, the price advanced enough that we could no longer view it as a small business so it fell outside of our targeted universe. However, the stock price fell again in 2022, in part due to fear of a slowdown in housing. At the lower price, we believed it was once more at an attractive valuation and a “small-cap” company, so we re-established a position. We are big fans and pleased to be investors again.

The thesis for Floor & Decor has not changed and now they are further along in executing their plan. They simply have a better mousetrap in our opinion, with much more selection and/or better prices than the small “mom-and-pop” retailers and large home improvement store chains. While inflation, higher interest rates, and potentially slowing demand could all impact near-term results, we believe the long-term potential remains outstanding. Floor & Decor should be able to keep opening new stores and grow market share for many years.

Our final new investment of the year was SiteOne Landscape Supply, the nation’s largest distributor of landscaping materials. Primarily, they sell plants, stones, irrigation systems, lawn chemicals, and more to professional landscapers. Size and a keen focus on execution are their advantages in our view. SiteOne routinely purchases small, usually one-location competitors and improves them over time by implementing their systems and harnessing their larger buying power.

SiteOne’s stock price fell significantly from its peak in late 2021 over fears of a slowdown. This gave us the opportunity to purchase shares at what we believed was an attractive level. While landscaping spending could certainly slow, a significant portion of their sales are tied to more recurring activities such as traditional maintenance, so they should be able to power through any temporary downturn.

Closing Thoughts

Obviously, 2022 was a year with plenty of things to worry about, including inflation, rising interest rates, and the war in Ukraine. Investors don’t like fear.

Currently, we see definite signs that higher interest rates are dramatically impacting the most sensitive areas of the economy, such as homes and automobiles where a consumer typically needs to borrow money to make a purchase. This weakness will likely spread to other parts of the economy over time.

Also, on the falling inflation side of the ledger, businesses are responding to the inflationary pressures that came from supply-chain issues. Many moved some of their supply chain closer to home and added capacity in warehouses and freight moving equipment, all of which is helping to alleviate bottlenecks and lower inflation.

FAM SMALL CAP FUND (Unaudited)

However, we are still seeing considerable inflation in many areas such as wages and housing. As a result, the Federal Reserve and other central banks are likely to continue raising interest rates until overall inflation rates decelerate more meaningfully.

For now, we are watching this tug of war, waiting to see when inflation is clearly on the retreat. We have no doubt that the Federal Reserve will beat back inflation, as they always have in the past. However, economic conditions, and thus corporate earnings, could easily get worse before rebounding. With stock prices down considerably, this may already be “priced in.”

Rather than make guesses about difficult to predict near-term conditions, our plan is to keep following our quality/value investing process. We want to own shares in 25 to 30 companies that we believe can post better-than-average stock performance over the medium to long term. To do this, we must keep studying our holdings, regularly confirming our thesis on each firm.

Simultaneously, we continue to learn about potential new investments. Occasionally, we take advantage of what we think are quality, mispriced securities and make purchases. Hopefully, by carefully studying a limited number of excellent enterprises, we can make the right portfolio decisions that lead to impressive long-term results.

Thank you for investing with us and for your ongoing trust. We will continue to work diligently on your behalf.

TOP 5 CONTRIBUTORS AND DETRACTORS*

12/31/2021 TO 12/31/2022

Top 5 Contributors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| ExlService Holdings | 7.11% | 1.19% |

| CBIZ | 6.48% | 1.10% |

| Paya Holdings | 2.33% | 0.78% |

| Cass Information Systems | 2.68% | 0.56% |

| Hostess Brands | 4.21% | 0.45% |

This reflects the FAM Small Cap Fund’s best and worst performers, in descending order, based on individual stock per-formance and portfolio weighting. Past performance does not indicate future results.

Top 5 Detractors

| | Average | Contribution |

| Name | Weight (%) | (%) |

| Carriage Services | 3.30% | -2.80% |

| Colliers International Group | 4.74% | -2.17% |

| Dream Finders Homes | 2.07% | -1.60% |

| Frontdoor | 2.70% | -1.48% |

| Choice Hotels International | 4.18% | -1.37% |

Past performance does not indicate future results.

|  |

| | |

| Andrew F. Boord | Kevin D. Gioia, CFA |

| Portfolio Manager | Portfolio Manager |

FAM SMALL CAP FUND (Unaudited)

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| * | Reflects top contributors and top detractors to the fund’s performance based on each holding’s contribution to the overall fund’s return for the period shown. The information provided does not reflect all positions purchased, sold or recommended for advisory clients during the period shown. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. Past performance is no guarantee, nor is it indicative, of future results. For more detailed information on the calculation and methodology as well as a complete list of every holding’s contribution to the overall fund’s performance during the time period shown, please call (800) 932-3271 or visit the fund’s website at famfunds.com. Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as an offer or a recommendation, by the fund, the portfolio managers, or the fund’s distributor, to purchase or sell any security or other financial instrument. The summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of its affiliated funds. The portfolio holdings are as of the most recent quarter most recent quarter. |

| ** | All investing involves risk including the possible loss of principal. Before investing, carefully read the fund’s prospectus which includes investment objectives, risks, charges, expenses and other information about the fund. Please call us at 800-932-3271 or visit fenimoreasset.com for a prospectus or summary prospectus. Past performance and Morningstar ratings are not an indicator of a fund’s future returns. |

Securities offered through Fenimore Securities, Inc. Member FINRA/SIPC, and advisory services offered through Fenimore Asset Management, Inc.

FAM SMALL CAP FUND (Unaudited)

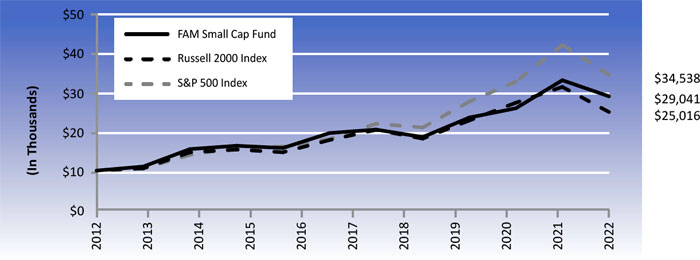

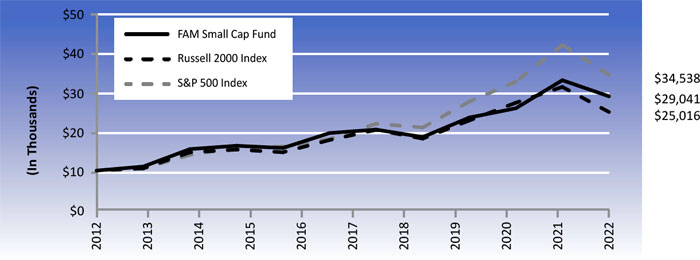

The chart below depicts the change in the value of a $10,000 investment in the Investor Shares of the FAM Small Cap Fund, since inception on March 1, 2012 as compared with the growth of the Russell 2000 Index, the Fund’s primary benchmark index, and the Standard & Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell 2000 Index is an unmanaged index generally representative of the market for the stocks of smaller size U.S. companies. The Standard & Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies. Investors cannot invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FAM SMALL CAP FUND, THE RUSSELL 2000 INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Small Cap Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

FAM SMALL CAP FUND (Unaudited)

TOP 10 HOLDINGS

AS OF 12/31/2022

| | % OF |

| FAM SMALL CAP FUND | NET ASSETS |

| ExlService Holdings, Inc. | 7.5% |

| CBIZ, Inc. | 7.1% |

| Trisura Group, Ltd. | 5.0% |

| Pinnacle Financial Partners, Inc. | 4.3% |

| Hostess Brands, Inc. | 4.1% |

| Colliers International Group, Inc. | 4.1% |

| Chemed Corporation | 4.0% |

| Choice Hotels International, Inc. | 3.8% |

| Landstar System, Inc. | 3.7% |

| Boston Omaha Corporation | 3.7% |

| TOTAL NET ASSETS | $ 287,042,013 |

The portfolios are actively managed and current holdings may be different.

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2022

| | | | | | | Total Fund |

| | | | | | Since | Operating |

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception | Expenses |

| | | | | | | 1.25% |

| | | | | | | (gross) |

| | | | | | | 1.25%* |

| FAM Small Cap Fund Investor Class* | (12.42)% | 7.19% | 7.21% | 10.16% | 10.34% | (net) |

| Russell 2000 Index | (20.44)% | 3.10% | 4.13% | 9.01% | 8.83% | N/A |

| S&P 500 Index | (18.11)% | 7.66% | 9.42% | 12.56% | 12.12% | N/A |

| * | Disclosure: The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.27% for the Investor Class. The Fund’s total annual operating expense ratio as stated in the fee table of the Fund’s most recent prospectus is 1.16% for the Institutional Class. When excluding Acquired Funds Fees and Expenses, which are not direct costs paid by the Fund’s shareholders and fee waivers, the total annual operating expense as reported in the FAM Small Cap Fund’s audited financial statements for the Investor Class is 1.25% and the Institutional Class is 1.15% as of December 31, 2022. The Advisor has contractually agreed, until May 1, 2023, to waive fees and/or reimburse the Fund certain expenses (excluding interest, taxes, brokerage costs, Acquired Fund Fees and Expenses, dividend expense and extraordinary expenses) to the extent necessary to maintain Net Fund Operating Expenses for Investor Shares at 1.42% and Institutional Shares at 1.20%. |

FAM SMALL CAP FUND (Unaudited)

Important Disclosures:

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month-end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Risk Disclosures: The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).