UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04777

MFS SERIES TRUST I

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2011

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS® Cash Reserve Fund

SEMIANNUAL REPORT

February 28, 2011

LMM-SEM

MFS® CASH RESERVE FUND

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

LETTER FROM THE CEO

Dear Shareholders:

After an extended rebound in the financial markets, uncertainty returned in 2010 as investors began to question the durability of the recovery for global economies and markets. That uncertainty led to increased risk aversion, especially as investors saw the eurozone struggle with the debt woes of many of its members. Last September, the U.S. Federal Reserve Board’s promises to further loosen monetary policy helped assuage market fears and drive asset prices off their recent lows. A combination of solid earnings and improving economic data gave an additional boost to investor sentiment. For 2011, we are cautiously optimistic that economic growth will continue to improve and that the global economies will recover from the shocks of the past few years. We expect the pace of recovery worldwide will be uneven and volatile and acknowledge the elevated uncertainty created by events in Japan, Europe, and the Middle East.

As always, we continue to be mindful of the many economic challenges faced at the local, national, and international levels. It is in times such as these that we want to remind investors of the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with their advisors to research and identify appropriate investment opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

April 15, 2011

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

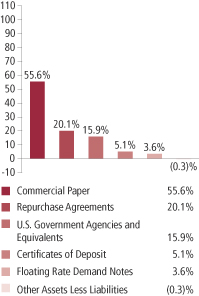

PORTFOLIO COMPOSITION

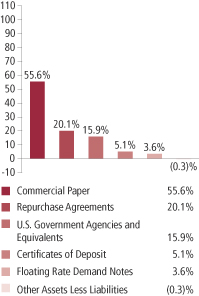

Portfolio structure (u)

| | | | |

| Composition including fixed income credit quality (a)(u) | | | | |

| A-1+ | | | 3.1% | |

| A-1 | | | 97.2% | |

| Not Rated | | | 0.0% | |

| Cash & Other | | | (0.3)% | |

| |

| Maturity breakdown (u) | | | | |

| 0 - 7 days | | | 32.3% | |

| 8 - 29 days | | | 24.1% | |

| 30 - 59 days | | | 18.2% | |

| 60 - 89 days | | | 12.3% | |

| 90 - 366 days | | | 13.4% | |

| Other Assets Less Liabilities | | | (0.3)% | |

| (a) | The composition table shows the percentage of portfolio assets falling within each rating category. Included in each rating category are short-term debt securities, the ratings of which are based on the short-term credit quality ratings of the securities’ issuers. For repurchase agreements, the credit quality is based on the short-term rating of the counterparty with which MFS trades the repurchase agreement. Each short-term debt security is assigned a rating in accordance with the following ratings hierarchy; If the issuer is rated by Moody’s, then that rating is used; if not rated by Moody’s, then a Standard & Poor’s rating is used; if not rated by S&P, then a Fitch rating is used. Cash and other portfolio assets that are not securities are not included in the categories mentioned above. Ratings are converted to the S&P scale and are subject to change. |

| (u) | For purposes of this presentation, accrued interest, where applicable, is included. |

From time to time “Other Assets Less Liabilities” may be negative due to timing of cash receipts.

Percentages are based on net assets as of 2/28/11, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

2

EXPENSE TABLE

Fund expenses borne by the shareholders during the period,

September 1, 2010 through February 28, 2011

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2010 through February 28, 2011.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

9/01/10 | | | Ending

Account Value

2/28/11 | | | Expenses

Paid During

Period (p)

9/01/10-2/28/11 | |

| A | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| B | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| C | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| R1 | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| R2 | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| R3 | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| R4 | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| 529A | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| 529B | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| 529C | | Actual | | | 0.23% | | | | $1,000.00 | | | | $1,000.00 | | | | $1.14 | |

| | Hypothetical (h) | | | 0.23% | | | | $1,000.00 | | | | $1,023.65 | | | | $1.15 | |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Expense Changes Impacting the Table

As more fully disclosed in footnote 3 to the financial statements, the expense ratios reported above include additional expense reductions to avoid a negative yield.

4

PORTFOLIO OF INVESTMENTS

2/28/11 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Certificates of Deposit - 5.1% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Major Banks - 5.1% | | | | | | | | |

| BNP Paribas/New York Branch, 0.52%, due 8/22/11 | | $ | 13,580,000 | | | $ | 13,580,000 | |

| Royal Bank of Canada/Chicago Branch, 0.33%, due 6/07/11 | | | 9,690,000 | | | | 9,690,000 | |

| Total Certificates of Deposit, at Cost and Value | | | | | | $ | 23,270,000 | |

| | |

| Commercial Paper (y) - 55.6% | | | | | | | | |

| Electrical Equipment - 1.4% | | | | | | | | |

| General Electric Co., 0.2%, due 3/10/11 | | $ | 6,200,000 | | | $ | 6,199,691 | |

| | |

| Food & Beverages - 6.2% | | | | | | | | |

| Coca-Cola Co., 0.22%, due 5/18/11 (t) | | $ | 5,765,000 | | | $ | 5,762,252 | |

| Coca-Cola Co., 0.23%, due 3/16/11 (t) | | | 8,012,000 | | | | 8,011,232 | |

| Nestle Capital Corp., 0.2%, due 3/16/11 (t) | | | 14,442,000 | | | | 14,440,797 | |

| | | | | | | | |

| | | | | | | $ | 28,214,281 | |

| Machinery & Tools - 1.1% | | | | | | | | |

| Deere and Co., 0.19%, due 3/24/11 (t) | | $ | 5,057,000 | | | $ | 5,056,386 | |

| | |

| Major Banks - 20.2% | | | | | | | | |

| Abbey National North America LLC, 0.32%, due 3/22/11 | | $ | 7,889,000 | | | $ | 7,887,527 | |

| Abbey National North America LLC, 0.33%, due 3/15/11 | | | 6,102,000 | | | | 6,101,217 | |

| Bank of America Corp., 0.24%, due 4/26/11 | | | 13,661,000 | | | | 13,655,900 | |

| Barclays U.S. Funding Corp., 0.15%, due 3/01/11 | | | 3,135,000 | | | | 3,135,000 | |

| Credit Suisse First Boston, Inc., 0.22%, due 4/08/11 | | | 12,167,000 | | | | 12,164,175 | |

| Credit Suisse First Boston, Inc., 0.26%, due 5/18/11 | | | 1,450,000 | | | | 1,449,183 | |

| HSBC USA, Inc., 0.24%, due 4/15/11 | | | 12,879,000 | | | | 12,875,136 | |

| JPMorgan Chase & Co., 0.23%, due 4/25/11 | | | 4,777,000 | | | | 4,775,321 | |

| JPMorgan Chase & Co., 0.23%, due 5/16/11 | | | 9,861,000 | | | | 9,856,212 | |

| Toronto Dominion Holdings (USA), Inc., 0.22%, due 3/18/11 (t) | | | 7,061,000 | | | | 7,060,266 | |

| Toronto Dominion Holdings (USA), Inc., 0.24%, due 4/20/11 (t) | | | 6,885,000 | | | | 6,882,705 | |

| Westpac Banking Corp., 0.22%, due 5/24/11 (t) | | | 5,843,000 | | | | 5,840,001 | |

| | | | | | | | |

| | | | | | | $ | 91,682,643 | |

| Medical Equipment - 2.3% | | | | | | | | |

| Merck & Co., Inc., 0.19%, due 3/28/11 (t) | | $ | 10,269,000 | | | $ | 10,267,537 | |

5

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Commercial Paper (y) - continued | | | | | | | | |

| Network & Telecom - 3.0% | | | | | | | | |

| AT&T, Inc., 0.26%, due 3/01/11 (t) | | $ | 2,455,000 | | | $ | 2,455,000 | |

| AT&T, Inc., 0.26%, due 3/11/11 (t) | | | 11,324,000 | | | | 11,323,182 | |

| | | | | | | | |

| | | | | | | $ | 13,778,182 | |

| Other Banks & Diversified Financials - 14.3% | | | | | | | | |

| Bank of Montreal, 0.24%, due 3/01/11 | | $ | 9,018,000 | | | $ | 9,018,000 | |

| Bank of Nova Scotia, 0.235%, due 4/08/11 | | | 7,292,000 | | | | 7,290,191 | |

| Bank of Nova Scotia, 0.255%, due 5/18/11 | | | 6,330,000 | | | | 6,326,503 | |

| Citigroup Funding, Inc., 0.3%, due 3/28/11 | | | 6,948,000 | | | | 6,946,437 | |

| Citigroup Funding, Inc., 0.3%, due 4/20/11 | | | 6,966,000 | | | | 6,963,098 | |

| Rabobank USA Financial Corp., 0.29%, due 5/10/11 | | | 4,332,000 | | | | 4,329,557 | |

| Rabobank USA Financial Corp., 0.3%, due 5/10/11 | | | 10,320,000 | | | | 10,313,980 | |

| UBS Finance (Delaware) LLC, 0.255%, due 4/20/11 | | | 2,397,000 | | | | 2,396,151 | |

| UBS Finance (Delaware) LLC, 0.285%, due 3/14/11 | | | 11,550,000 | | | | 11,548,811 | |

| | | | | | | | |

| | | | | | | $ | 65,132,728 | |

| Pharmaceuticals - 3.5% | | | | | | | | |

| Abbott Laboratories, 0.2%, due 3/08/11 (t) | | $ | 14,443,000 | | | $ | 14,442,438 | |

| Johnson & Johnson, 0.2%, due 3/09/11 (t) | | | 1,573,000 | | | | 1,572,930 | |

| | | | | | | | |

| | | | | | | $ | 16,015,368 | |

| Retailers - 1.6% | | | | | | | | |

| Wal-Mart Stores, Inc., 0.16%, due 3/21/11 (t) | | $ | 7,343,000 | | | $ | 7,342,347 | |

| | |

| Tobacco - 2.0% | | | | | | | | |

| Philip Morris International, Inc., 0.21%, due 3/14/11 (t) | | $ | 5,504,000 | | | $ | 5,503,583 | |

| Philip Morris International, Inc., 0.23%, due 3/02/11 (t) | | | 3,681,000 | | | | 3,680,976 | |

| | | | | | | | |

| | | | | | | $ | 9,184,559 | |

| Total Commercial Paper, at Amortized Cost and Value | | | | | | $ | 252,873,722 | |

| |

| U.S. Government Agencies and Equivalents (y) - 15.9% | | | | | |

| Fannie Mae, 0.22%, due 3/01/11 | | $ | 6,500,000 | | | $ | 6,500,000 | |

| Fannie Mae, 0.24%, due 8/01/11 | | | 4,100,000 | | | | 4,095,818 | |

| Federal Home Loan Bank, 0.2%, due 6/03/11 | | | 2,500,000 | | | | 2,498,694 | |

| Federal Home Loan Bank, 0.23%, due 6/01/11 | | | 6,000,000 | | | | 5,996,473 | |

| Freddie Mac, 0.17%, due 5/02/11 | | | 6,970,000 | | | | 6,967,959 | |

| Freddie Mac, 0.3%, due 4/26/11 | | | 15,600,000 | | | | 15,592,720 | |

| Freddie Mac, 0.17%, due 3/14/11 | | | 575,000 | | | | 574,965 | |

| Freddie Mac, 0.22%, due 9/14/11 | | | 13,934,000 | | | | 13,917,225 | |

| Freddie Mac, 0.24%, due 8/16/11 | | | 4,000,000 | | | | 3,995,520 | |

6

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| U.S. Government Agencies and Equivalents (y) - continued | | | | | |

| Freddie Mac, 0.17%, due 5/18/11 | | $ | 5,000,000 | | | $ | 4,998,158 | |

| Freddie Mac, 0.2%, due 7/06/11 | | | 7,083,000 | | | | 7,078,003 | |

Total U.S. Government Agencies and Equivalents,

at Amortized Cost and Value | | | | | | $ | 72,215,535 | |

| |

| Floating Rate Demand Notes - 3.6% | | | | | |

| Industrial Revenue - Other - 3.6% | | | | | | | | |

| East Baton Rouge, LA, Pollution Control Rev. (Exxon Mobil Corp.), 0.15%, due 3/01/11 | | $ | 9,700,000 | | | $ | 9,700,000 | |

| Lincoln County, WY, Pollution Control Rev. (Exxon Mobil Corp.), 0.15%, due 3/01/11 | | | 5,300,000 | | | | 5,300,000 | |

| Lincoln County, WY, Pollution Control Rev. (Exxon Mobil Corp.), “A”, 0.16%, due 3/01/11 | | | 1,300,000 | | | | 1,300,000 | |

| Total Floating Rate Demand Notes, at Cost and Value | | | | | | $ | 16,300,000 | |

| |

| Repurchase Agreements - 20.1% | | | | | |

Bank of America Corp., 0.17%, dated 2/28/11, due 3/01/11,

total to be received $45,584,215 (secured by U.S. Treasury and Federal Agency obligations valued at $46,495,832 in a jointly

traded account) | | $ | 45,584,000 | | | $ | 45,584,000 | |

| Goldman Sachs, 0.19%, dated 2/28/11, due 3/01/11, total to be received $45,584,241 (secured by U.S. Treasury and Federal Agency obligations valued at $46,495,693 in a jointly traded account) | | | 45,584,000 | | | | 45,584,000 | |

| Total Repurchase Agreements, at Cost and Value | | | | | | $ | 91,168,000 | |

| Total Investments, at Amortized Cost and Value | | | | | | $ | 455,827,257 | |

| | |

| Other Assets, Less Liabilities - (0.3)% | | | | | | | (1,324,987 | ) |

| Net Assets - 100.0% | | | | | | $ | 454,502,270 | |

| (t) | Security exempt from registration with the U.S. Securities and Exchange Commission under Section 4(2) of the Securities Act of 1933. |

| (y) | The rate shown represents an annualized yield at time of purchase. |

See Notes to Financial Statements

7

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 2/28/11 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments, at amortized cost and value | | | $364,659,257 | |

Repurchase agreements, at cost and value | | | 91,168,000 | |

Total investments, at amortized cost and value | | | $455,827,257 | |

Cash | | | 147 | |

Receivables for | | | | |

Fund shares sold | | | 992,152 | |

Interest | | | 11,089 | |

Receivable from investment adviser and distributor | | | 56,888 | |

Other assets | | | 4,628 | |

Total assets | | | $456,892,161 | |

| Liabilities | | | | |

Payable for fund shares reacquired | | | $2,138,962 | |

Payable to affiliate for shareholder servicing costs | | | 189,798 | |

Payable for independent Trustees’ compensation | | | 21,434 | |

Accrued expenses and other liabilities | | | 39,697 | |

Total liabilities | | | $2,389,891 | |

Net assets | | | $454,502,270 | |

| Net assets consist of | | | | |

Paid-in capital | | | $454,729,975 | |

Accumulated net realized gain (loss) on investments | | | (207,598 | ) |

Accumulated distributions in excess of net investment income | | | (20,107 | ) |

Net assets | | | $454,502,270 | |

Shares of beneficial interest outstanding | | | 454,732,474 | |

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

Class A | | | $129,666,277 | | | | 129,737,475 | | | | $1.00 | |

Class B | | | 50,503,852 | | | | 50,550,938 | | | | 1.00 | |

Class C | | | 45,379,554 | | | | 45,409,369 | | | | 1.00 | |

Class R1 | | | 26,218,013 | | | | 26,227,665 | | | | 1.00 | |

Class R2 | | | 100,441,449 | | | | 100,478,591 | | | | 1.00 | |

Class R3 | | | 81,020,500 | | | | 81,051,470 | | | | 1.00 | |

Class R4 | | | 5,109,308 | | | | 5,111,020 | | | | 1.00 | |

Class 529A | | | 9,475,611 | | | | 9,477,179 | | | | 1.00 | |

Class 529B | | | 1,283,690 | | | | 1,284,005 | | | | 1.00 | |

Class 529C | | | 5,404,016 | | | | 5,404,762 | | | | 1.00 | |

A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, Class C, Class 529B, and Class 529C shares. Redemption price per share was equal to the net asset value per share for Classes R1, R2, R3, R4, and 529A.

See Notes to Financial Statements

8

Financial Statements

STATEMENT OF OPERATIONS

Six months ended 2/28/11 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income | | | | |

| Interest income | | | $558,583 | |

Expenses | | | | |

Management fee | | | $962,377 | |

Distribution and service fees | | | 1,252,606 | |

Program manager fees | | | 8,431 | |

Shareholder servicing costs | | | 539,097 | |

Administrative services fee | | | 36,556 | |

Independent Trustees’ compensation | | | 11,355 | |

Custodian fee | | | 33,245 | |

Shareholder communications | | | 17,223 | |

Auditing fees | | | 15,807 | |

Legal fees | | | 4,829 | |

Miscellaneous | | | 68,851 | |

Total expenses | | | $2,950,377 | |

Fees paid indirectly | | | (83 | ) |

Reduction of expenses by investment adviser and distributor | | | (2,391,791 | ) |

Net expenses | | | $558,503 | |

Net investment income | | | $80 | |

Change in net assets from operations | | | $80 | |

See Notes to Financial Statements

9

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| Change in net assets | | Six months ended

2/28/11

(unaudited) | | | Year ended

8/31/10 | |

| From operations | | | | | | | | |

Net investment income | | | $80 | | | | $169 | |

Net realized gain (loss) on investments | | | — | | | | 1,037 | |

Change in net assets from operations | | | $80 | | | | $1,206 | |

| Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(80 | ) | | | $(22,677 | ) |

From tax return of capital | | | — | | | | (490 | ) |

Total distributions declared to shareholders | | | $(80 | ) | | | $(23,167 | ) |

Change in net assets from fund share transactions | | | $(57,979,765 | ) | | | $(108,281,987 | ) |

Total change in net assets | | | $(57,979,765 | ) | | | $(108,303,948 | ) |

| Net assets | | | | | | | | |

At beginning of period | | | 512,482,035 | | | | 620,785,983 | |

At end of period (including accumulated distributions in excess of net investment income of $20,107 and $20,107, respectively) | | | $454,502,270 | | | | $512,482,035 | |

See Notes to Financial Statements

10

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class A | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Net realized and unrealized gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r)(t) | | | 0.00 | (n)(w) | | | 0.00 | (w) | | | 0.31 | | | | 3.43 | | | | 5.06 | | | | 4.19 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.95 | (a) | | | 0.85 | | | | 0.72 | | | | 0.87 | | | | 0.83 | | | | 0.89 | |

Expenses after expense reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.39 | | | | 0.47 | | | | 0.43 | | | | 0.49 | |

Net investment income | | | 0.00 | (a)(w) | | | 0.00 | (w) | | | 0.33 | | | | 3.29 | | | | 4.94 | | | | 4.14 | |

Net assets at end of period (000 omitted) | | | $129,666 | | | | $141,832 | | | | $173,135 | | | | $189,684 | | | | $136,204 | | | | $114,481 | |

See Notes to Financial Statements

11

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class B | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r)(t) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.10 | | | | 2.40 | | | | 4.02 | | | | 3.16 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.70 | (a) | | | 1.69 | | | | 1.72 | | | | 1.86 | | | | 1.83 | | | | 1.89 | |

Expenses after expense reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.60 | | | | 1.46 | | | | 1.43 | | | | 1.49 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.08 | | | | 2.44 | | | | 3.94 | | | | 3.09 | |

Net assets at end of period (000 omitted) | | | $50,504 | | | | $66,601 | | | | $104,696 | | | | $112,707 | | | | $154,176 | | | | $222,661 | |

See Notes to Financial Statements

12

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class C | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r)(t) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.10 | | | | 2.40 | | | | 4.02 | | | | 3.15 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.70 | (a) | | | 1.69 | | | | 1.72 | | | | 1.87 | | | | 1.83 | | | | 1.89 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.60 | | | | 1.47 | | | | 1.43 | | | | 1.49 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.08 | | | | 2.18 | | | | 3.94 | | | | 3.14 | |

Net assets at end of period (000 omitted) | | | $45,380 | | | | $50,196 | | | | $70,005 | | | | $79,091 | | | | $60,390 | | | | $56,456 | |

See Notes to Financial Statements

13

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class R1 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.10 | | | | 2.35 | | | | 3.91 | | | | 3.04 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.70 | (a) | | | 1.69 | | | | 1.72 | | | | 1.91 | | | | 1.97 | | | | 2.09 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.58 | | | | 1.51 | | | | 1.53 | | | | 1.59 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.09 | | | | 2.10 | | | | 3.82 | | | | 3.15 | |

Net assets at end of period (000 omitted) | | | $26,218 | | | | $30,233 | | | | $29,457 | | | | $27,361 | | | | $8,538 | | | | $898 | |

See Notes to Financial Statements

14

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class R2 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.04 | | | | $0.04 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.01 | ) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.04 | | | | $0.03 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.17 | | | | 2.86 | | | | 4.38 | | | | 3.51 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.20 | (a) | | | 1.19 | | | | 1.22 | | | | 1.41 | | | | 1.52 | | | | 1.63 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.51 | | | | 1.01 | | | | 1.09 | | | | 1.13 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.15 | | | | 2.58 | | | | 4.28 | | | | 3.73 | |

Net assets at end of period (000 omitted) | | | $100,441 | | | | $109,362 | | | | $120,476 | | | | $98,825 | | | | $36,027 | | | | $4,909 | |

See Notes to Financial Statements

15

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class R3 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.23 | | | | 3.12 | | | | 4.63 | | | | 3.77 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.95 | (a) | | | 0.94 | | | | 0.97 | | | | 1.15 | | | | 1.23 | | | | 1.28 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.45 | | | | 0.75 | | | | 0.83 | | | | 0.88 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.20 | | | | 2.82 | | | | 4.53 | | | | 4.06 | |

Net assets at end of period (000 omitted) | | | $81,021 | | | | $90,331 | | | | $104,062 | | | | $82,454 | | | | $32,545 | | | | $1,019 | |

See Notes to Financial Statements

16

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class R4 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r) | | | 0.00 | (n)(w) | | | 0.00 | (w) | | | 0.31 | | | | 3.39 | | | | 4.96 | | | | 4.09 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.70 | (a) | | | 0.68 | | | | 0.72 | | | | 0.90 | | | | 0.93 | | | | 0.99 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.38 | | | | 0.50 | | | | 0.53 | | | | 0.59 | |

Net investment income | | | 0.00 | (a)(w) | | | 0.00 | (w) | | | 0.23 | | | | 3.24 | | | | 4.80 | | | | 4.03 | |

Net assets at end of period (000 omitted) | | | $5,109 | | | | $6,172 | | | | $5,697 | | | | $4,094 | | | | $3,717 | | | | $53 | |

See Notes to Financial Statements

17

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class 529A | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.03 | | | | $0.05 | | | | $0.04 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.28 | | | | 3.23 | | | | 4.80 | | | | 3.93 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.05 | (a) | | | 1.03 | | | | 1.12 | | | | 1.40 | | | | 1.44 | | | | 1.49 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.40 | | | | 0.65 | | | | 0.68 | | | | 0.74 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.19 | | | | 3.05 | | | | 4.69 | | | | 3.92 | |

Net assets at end of period

(000 omitted) | | | $9,476 | | | | $9,919 | | | | $6,926 | | | | $3,777 | | | | $2,548 | | | | $2,135 | |

See Notes to Financial Statements

18

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class 529B | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r)(t) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.08 | | | | 2.21 | | | | 3.77 | | | | 2.90 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.80 | (a) | | | 1.79 | | | | 1.83 | | | | 2.04 | | | | 2.09 | | | | 2.14 | |

Expenses after expense

reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.51 | | | | 1.64 | | | | 1.69 | | | | 1.74 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.04 | | | | 1.91 | | | | 3.69 | | | | 2.88 | |

Net assets at end of period (000 omitted) | | | $1,284 | | | | $1,613 | | | | $1,942 | | | | $700 | | | | $328 | | | | $297 | |

See Notes to Financial Statements

19

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/11 (unaudited) | | | Years ended 8/31 | |

| Class 529C | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Income (loss) from investment

operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Net realized and unrealized

gain (loss) on investments | | | — | | | | 0.00 | (w) | | | (0.00 | )(w) | | | — | | | | (0.00 | )(w) | | | (0.00 | )(w) |

Total from investment operations | | | $0.00 | | | | $0.00 | (w) | | | $0.00 | (w) | | | $0.02 | | | | $0.04 | | | | $0.03 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

From tax return of capital | | | — | | | | (0.00 | )(w) | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $— | | | | $(0.00 | )(w) | | | $(0.00 | )(w) | | | $(0.02 | ) | | | $(0.04 | ) | | | $(0.03 | ) |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return (%) (r)(t) | | | 0.00 | (n) | | | 0.00 | (w) | | | 0.08 | | | | 2.21 | | | | 3.76 | | | | 2.90 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.80 | (a) | | | 1.78 | | | | 1.83 | | | | 2.04 | | | | 2.09 | | | | 2.14 | |

Expenses after expense reductions (f) | | | 0.23 | (a) | | | 0.27 | | | | 0.52 | | | | 1.64 | | | | 1.68 | | | | 1.74 | |

Net investment income | | | 0.00 | (a) | | | 0.00 | (w) | | | 0.04 | | | | 1.85 | | | | 3.69 | | | | 2.89 | |

Net assets at end of period (000 omitted) | | | $5,404 | | | | $6,224 | | | | $4,391 | | | | $1,820 | | | | $814 | | | | $688 | |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01 and 0.01%, respectively. |

See Notes to Financial Statements

20

NOTES TO FINANCIAL STATEMENTS

(unaudited)

| (1) | | Business and Organization |

MFS Cash Reserve Fund (the fund) is a series of MFS Series Trust I (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

| (2) | | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

Investment Valuations – Pursuant to procedures approved by the Board of Trustees, investments held by the fund are generally valued at amortized cost, which approximates market value. Amortized cost involves valuing an instrument at its cost as adjusted for amortization of premium or accretion of discount rather than its current market value. The amortized cost value of an instrument can be different from the market value of an instrument.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of February 28, 2011 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Short Term Securities | | | $— | | | | $455,827,257 | | | | $— | | | | $455,827,257 | |

21

Notes to Financial Statements (unaudited) – continued

For further information regarding security characteristics, see the Portfolio of Investments.

Repurchase Agreements – The fund entered into repurchase agreements with approved counterparties. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to a custodian. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement. The fund and other funds managed by MFS may utilize a joint trading account for the purpose of entering into one or more repurchase agreements.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the six months ended February 28, 2011, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax

22

Notes to Financial Statements (unaudited) – continued

purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate the timing of recognition of certain expenses.

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| | | | |

| | | 8/31/10 | |

Ordinary income (including any

short-term capital gains) | | | $22,677 | |

| Tax return of capital (b) | | | 490 | |

| Total distributions | | | $23,167 | |

| | (b) | Distributions in excess of tax basis earnings and profits are reported in the financial statements as a tax return of capital. | |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | | |

| As of 2/28/11 | | | |

| Cost of investments | | | $455,827,257 | |

| |

| As of 8/31/10 | | | |

| Capital loss carryforwards | | | (207,598 | ) |

| Other temporary differences | | | (20,107 | ) |

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

As of August 31, 2010, the fund had capital loss carryforwards available to offset future realized gains. Such losses expire as follows:

| | | | |

| 8/31/15 | | | $(219 | ) |

| 8/31/16 | | | (22,989 | ) |

| 8/31/17 | | | (184,390 | ) |

| Total | | | $(207,598 | ) |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution, service, and program manager fees. The fund’s income and common expenses are allocated to shareholders based on the value of settled shares outstanding of each class. The fund’s realized and unrealized gain (loss) are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to

23

Notes to Financial Statements (unaudited) – continued

differences in separate class expenses. Class B and Class 529B shares will convert to Class A and Class 529A shares, respectively, approximately eight years after purchase. The fund’s distributions declared to shareholders as reported on the Statements of Changes in Net Assets are presented by class as follows:

| | | | | | | | | | | | | | | | |

| | | From net investment

income | | | From tax return of

capital | |

| | | Six months ended

2/28/11 | | | Year ended

8/31/10 | | | Six months ended

2/28/11 | | | Year ended

8/31/10 | |

| Class A | | | $77 | | | | $6,567 | | | | $— | | | | $139 | |

| Class B | | | — | | | | 3,645 | | | | — | | | | 73 | |

| Class C | | | — | | | | 2,323 | | | | — | | | | 49 | |

| Class R1 | | | — | | | | 1,155 | | | | — | | | | 26 | |

| Class R2 | | | — | | | | 4,372 | | | | — | | | | 99 | |

| Class R3 | | | — | | | | 3,865 | | | | — | | | | 85 | |

| Class R4 | | | 3 | | | | 226 | | | | — | | | | 5 | |

| Class 529A | | | — | | | | 281 | | | | — | | | | 7 | |

| Class 529B | | | — | | | | 81 | | | | — | | | | 2 | |

| Class 529C | | | — | | | | 162 | | | | — | | | | 5 | |

| Total | | | $80 | | | | $22,677 | | | | $— | | | | $490 | |

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund.

The management fee is computed daily and paid monthly at an annual rate of 0.40% of the fund’s average daily net assets.

During the six months ended February 28, 2011, MFS voluntarily waived receipt of $962,377 of the fund’s management fee to ensure the fund avoids a negative yield. This amount is reflected as a reduction of total expenses in the Statement of Operations. The management fee incurred for the six months ended February 28, 2011, was equivalent to an annual effective rate of 0.00% of the fund’s average daily net assets.

To ensure the fund avoids a negative yield for the six months ended February 28, 2011, MFS voluntarily agreed to reduce certain other expenses in the amount of $167,610, which is shown as a reduction of total expenses in the Statement of Operations.

Distributor – The Board of Trustees has adopted a distribution plan for certain class shares pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan

24

Notes to Financial Statements (unaudited) – continued

is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Distribution Plan Fee Table:

| | | | | | | | | | | | | | | | | | | | |

| | | Distribution

Fee Rate (d) | | | Service

Fee Rate (d) | | | Total

Distribution

Plan (d) | | | Annual

Effective

Rate (e) | | | Distribution

and Service

Fee | |

| Class A | | | — | | | | 0.25% | | | | 0.25% | | | | 0.00% | | | | $168,443 | |

| Class B | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 0.00% | | | | 291,869 | |

| Class C | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 0.00% | | | | 234,749 | |

| Class R1 | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 0.00% | | | | 139,159 | |

| Class R2 | | | 0.25% | | | | 0.25% | | | | 0.50% | | | | 0.00% | | | | 263,937 | |

| Class R3 | | | — | | | | 0.25% | | | | 0.25% | | | | 0.00% | | | | 106,459 | |

| Class 529A | | | — | | | | 0.25% | | | | 0.25% | | | | 0.00% | | | | 12,108 | |

| Class 529B | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 0.00% | | | | 7,155 | |

| Class 529C | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 0.00% | | | | 28,727 | |

| Total Distribution and Service Fees | | | | $1,252,606 | |

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’ average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the six months ended February 28, 2011 based on each class’ average daily net assets. MFD has agreed in writing to waive the Class A and Class 529A service fee. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue until at least December 31, 2011. These reductions for Class A and Class 529A amounted to $168,443 and $12,108, respectively, and are shown as a reduction of total expenses in the Statement of Operations. During the six months ended February 28, 2011, MFD voluntarily waived a receipt of $1,072,055 of the fund’s distribution and service fees to ensure the fund avoids a negative yield for Class B, Class C, Class R1, Class R2, Class R3, Class 529B, and Class 529C shares. This amount is reflected as a reduction of total expenses in the Statement of Operations. |

Certain Class A shares acquired through an exchange may be subject to a contingent deferred sales charge (CDSC) upon redemption depending on when the shares exchanged were originally purchased. Class C and Class 529C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B and Class 529B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the six months ended February 28, 2011, were as follows:

| | | | |

| | | Amount | |

| Class A | | | $24 | |

| Class B | | | 100,203 | |

| Class C | | | 7,249 | |

| Class 529B | | | 71 | |

| Class 529C | | | 25 | |

25

Notes to Financial Statements (unaudited) – continued

The fund has entered into and may from time to time enter into contracts with program managers and other parties which administer the tuition programs through which an investment in the fund’s 529 share classes is made. The fund has entered into an agreement with MFD pursuant to which MFD receives an annual fee of up to 0.10% of the average daily net assets attributable to each 529 share class. The services provided by MFD, or a third party with which MFD contracts, include recordkeeping and tax reporting and account services, as well as services designed to maintain the program’s compliance with the Internal Revenue Code and other regulatory requirements. Program manager fees for the six months ended February 28, 2011, were as follows:

| | | | |

| | | Amount | |

| Class 529A | | | $4,843 | |

| Class 529B | | | 715 | |

| Class 529C | | | 2,873 | |

| Total Program Manager Fees | | | $8,431 | |

During the six months ended February 28, 2011, MFD voluntarily waived a receipt of $8,431 of the fund’s program manager fees, in order to avoid a negative yield for Class 529A, Class 529B, and Class 529C shares. This amount is reflected as a reduction of total expenses in the Statement of Operations. The program manager fees incurred for the six months ended February 28, 2011 were equivalent to an annual effective rate of 0.00% of average daily net assets for each of the fund’s 529 share classes.

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the six months ended February 28, 2011, the fee was $196,538, which equated to 0.0817% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to affiliated and unaffiliated service providers. For the six months ended February 28, 2011, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $342,559.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended February 28, 2011 was equivalent to an annual effective rate of 0.0152% of the fund’s average daily net assets.

26

Notes to Financial Statements (unaudited) – continued

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Prior to December 31, 2001, the fund had an unfunded defined benefit plan (“DB plan”) for independent Trustees. As of December 31, 2001, the Board took action to terminate the DB plan with respect to then-current and any future independent Trustees, such that the DB Plan covers only certain of those former independent Trustees who retired on or before December 31, 2001. The DB Plan resulted in a pension expense of $1,149 and is included in independent Trustees’ compensation for the six months ended February 28, 2011. The liability for deferred retirement benefits payable to certain independent Trustees under the DB plan amounted to $18,798 at February 28, 2011, and is included in payable for independent Trustees’ compensation on the Statement of Assets and Liabilities.

Other – This fund and certain other funds managed by MFS (the funds) have entered into services agreements (the Agreements) which provide for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) and Assistant ICCO, respectively, for the funds. The ICCO and Assistant ICCO are officers of the funds and the sole members of Tarantino LLC and Griffin Compliance LLC, respectively. The funds can terminate the Agreements with Tarantino LLC and Griffin Compliance LLC at any time under the terms of the Agreements. For the six months ended February 28, 2011, the aggregate fees paid by the fund to Tarantino LLC and Griffin Compliance LLC were $2,879 and are included in miscellaneous expense on the Statement of Operations. MFS has agreed to reimburse the fund for a portion of the payments made by the fund in the amount of $767, which is shown as a reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO and Assistant ICCO.

Purchases and sales of money market securities, exclusive of securities subject to repurchase agreements, aggregated $1,650,295,334 and $1,706,569,000, respectively.

27

Notes to Financial Statements (unaudited) – continued

| (5) | | Shares of Beneficial Interest |

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | | | | | | | | | | | | | | | |

| | | Six months ended

2/28/11 | | | Year ended

8/31/10 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | | | | | | | | | | | | | | |

Class A | | | 25,431,400 | | | | $25,431,398 | | | | 67,811,504 | | | | $67,811,516 | |

Class B | | | 9,398,128 | | | | 9,398,128 | | | | 34,447,545 | | | | 34,447,545 | |

Class C | | | 18,794,539 | | | | 18,794,539 | | | | 29,118,542 | | | | 29,118,542 | |

Class R1 | | | 5,416,983 | | | | 5,416,983 | | | | 18,665,394 | | | | 18,665,394 | |

Class R2 | | | 22,455,570 | | | | 22,455,570 | | | | 65,575,281 | | | | 65,575,281 | |

Class R3 | | | 21,879,566 | | | | 21,879,566 | | | | 48,952,936 | | | | 48,952,936 | |

Class R4 | | | 1,871,782 | | | | 1,871,782 | | | | 4,994,689 | | | | 4,994,689 | |

Class 529A | | | 1,933,688 | | | | 1,933,688 | | | | 6,903,031 | | | | 6,903,031 | |

Class 529B | | | 280,988 | | | | 280,988 | | | | 366,627 | | | | 366,627 | |

Class 529C | | | 981,911 | | | | 981,911 | | | | 4,332,541 | | | | 4,332,541 | |

| | | 108,444,555 | | | | $108,444,553 | | | | 281,168,090 | | | | $281,168,102 | |

Shares issued to shareholders in

reinvestment of distributions | |

Class A | | | 9 | | | | $9 | | | | 6,185 | | | | $6,185 | |

Class B | | | — | | | | — | | | | 3,379 | | | | 3,379 | |

Class C | | | — | | | | — | | | | 2,082 | | | | 2,082 | |

Class R1 | | | — | | | | — | | | | 1,173 | | | | 1,173 | |

Class R2 | | | — | | | | — | | | | 4,413 | | | | 4,413 | |

Class R3 | | | — | | | | — | | | | 3,908 | | | | 3,908 | |

Class R4 | | | 3 | | | | 3 | | | | 231 | | | | 231 | |

Class 529A | | | — | | | | — | | | | 283 | | | | 283 | |

Class 529B | | | — | | | | — | | | | 83 | | | | 83 | |

Class 529C | | | — | | | | — | | | | 167 | | | | 167 | |

| | | 12 | | | | $12 | | | | 21,904 | | | | $21,904 | |

| Shares reacquired | |

Class A | | | (37,597,096 | ) | | | $(37,597,096 | ) | | | (99,114,040 | ) | | | $(99,114,042 | ) |

Class B | | | (25,495,034 | ) | | | (25,495,034 | ) | | | (72,542,130 | ) | | | (72,542,144 | ) |

Class C | | | (23,610,607 | ) | | | (23,610,607 | ) | | | (48,927,616 | ) | | | (48,927,616 | ) |

Class R1 | | | (9,431,952 | ) | | | (9,431,952 | ) | | | (17,889,771 | ) | | | (17,889,771 | ) |

Class R2 | | | (31,375,988 | ) | | | (31,375,988 | ) | | | (76,689,598 | ) | | | (76,689,598 | ) |

Class R3 | | | (31,190,180 | ) | | | (31,190,180 | ) | | | (62,684,367 | ) | | | (62,684,367 | ) |

Class R4 | | | (2,934,120 | ) | | | (2,934,120 | ) | | | (4,519,609 | ) | | | (4,519,609 | ) |

Class 529A | | | (2,377,173 | ) | | | (2,377,173 | ) | | | (3,909,889 | ) | | | (3,909,889 | ) |

Class 529B | | | (610,621 | ) | | | (610,621 | ) | | | (695,191 | ) | | | (695,191 | ) |

Class 529C | | | (1,801,559 | ) | | | (1,801,559 | ) | | | (2,499,766 | ) | | | (2,499,766 | ) |

| | | (166,424,330 | ) | | | $(166,424,330 | ) | | | (389,471,977 | ) | | | $(389,471,993 | ) |

28

Notes to Financial Statements (unaudited) – continued

| | | | | | | | | | | | | | | | |

| | | Six months ended

2/28/11 | | | Year ended

8/31/10 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Net change | |

Class A | | | (12,165,687 | ) | | | $(12,165,689 | ) | | | (31,296,351 | ) | | | $(31,296,341 | ) |

Class B | | | (16,096,906 | ) | | | (16,096,906 | ) | | | (38,091,206 | ) | | | (38,091,220 | ) |

Class C | | | (4,816,068 | ) | | | (4,816,068 | ) | | | (19,806,992 | ) | | | (19,806,992 | ) |

Class R1 | | | (4,014,969 | ) | | | (4,014,969 | ) | | | 776,796 | | | | 776,796 | |

Class R2 | | | (8,920,418 | ) | | | (8,920,418 | ) | | | (11,109,904 | ) | | | (11,109,904 | ) |

Class R3 | | | (9,310,614 | ) | | | (9,310,614 | ) | | | (13,727,523 | ) | | | (13,727,523 | ) |

Class R4 | | | (1,062,335 | ) | | | (1,062,335 | ) | | | 475,311 | | | | 475,311 | |

Class 529A | | | (443,485 | ) | | | (443,485 | ) | | | 2,993,425 | | | | 2,993,425 | |

Class 529B | | | (329,633 | ) | | | (329,633 | ) | | | (328,481 | ) | | | (328,481 | ) |

Class 529C | | | (819,648 | ) | | | (819,648 | ) | | | 1,832,942 | | | | 1,832,942 | |

| | | (57,979,763 | ) | | | $(57,979,765 | ) | | | (108,281,983 | ) | | | $(108,281,987 | ) |

Effective at the close of business February 27, 2009, the sale of fund shares have been suspended except in certain circumstances. Please see the fund’s prospectus for details.

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed upon spread. For the six months ended February 28, 2011, the fund’s commitment fee and interest expense were $2,757 and $0, respectively, and are included in miscellaneous expense on the Statement of Operations.

29

BOARD REVIEW OF INVESTMENT ADVISORY AGREEMENT

A discussion regarding the Board’s most recent review and renewal of the fund’s Investment Advisory Agreement with MFS is available by clicking on the fund’s name under “Mutual Funds” in the “Products and Performance” section of the MFS Web site (mfs.com).

PROXY VOTING POLICIES AND INFORMATION

A general description of the MFS funds’ proxy voting policies and procedures is available without charge, upon request, by calling

1-800-225-2606, by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

Information regarding how the fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

QUARTERLY PORTFOLIO DISCLOSURE

The fund will file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the Commission) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q may be reviewed and copied at the:

Public Reference Room

Securities and Exchange Commission

100 F Street, NE, Room 1580

Washington, D.C. 20549

Information on the operation of the Public Reference Room may be obtained by calling the Commission at 1-800-SEC-0330. The fund’s Form N-Q is available on the EDGAR database on the Commission’s Internet Web site at http://www.sec.gov, and copies of this information may be obtained, upon payment of a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov or by writing the Public Reference Section at the above address.

A shareholder can also obtain the quarterly portfolio holdings report at mfs.com.

FURTHER INFORMATION

From time to time, MFS may post important information about the fund or the MFS funds on the MFS web site (mfs.com). This information is available by visiting the “News & Commentary” section of mfs.com or by clicking on the fund’s name under “Mutual Funds” in the “Products and Performance” section of mfs.com.

30

rev. 3/11

| | | | |

| FACTS | | WHAT DOES MFS DO WITH YOUR PERSONAL INFORMATION? | |  |

| | |

| Why? | | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

| What? | | The types of personal information we collect and share depend on the product or service you have with us. This information can include: •Social Security number and account balances •Account transactions and transaction history •Checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

| How? | | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons MFS chooses to share; and whether you can limit this sharing. |

| | | | |

| Reasons we can share your personal information | | Does MFS share? | | Can you limit

this sharing? |

For our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | | Yes | | No |

For our marketing purposes – to offer our products and services to you | | No | | We don’t share |

| For joint marketing with other financial companies | | No | | We don’t share |

For our affiliates’ everyday business purposes – information about your transactions and experiences | | No | | We don’t share |

For our affiliates’ everyday business purposes – information about your creditworthiness | | No | | We don’t share |

| For nonaffiliates to market to you | | No | | We don’t share |

| | |

| Questions? | | Call 800-225-2606 or go to mfs.com. |

31

| | |

| Who we are |

| Who is providing this notice? | | MFS Funds, MFS Investment Management, MFS Institutional Advisors, Inc., MFS Fund Distributors, Inc., MFS Heritage Trust Company, and MFS Service Center, Inc. |

| | |

| What we do |

| How does MFS protect my personal information? | | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include procedural, electronic, and physical safeguards for the protection of the personal information we collect about you. |

How does MFS

collect my personal information? | | We collect your personal information, for example, when you •open an account or provide account information •direct us to buy securities or direct us to sell your securities •make a wire transfer We also collect your personal information from others, such as credit bureaus, affiliates and other companies. |