Barclays Capital U.S. Aggregate Bond Index is an unmanaged index generally representative of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year.

Barclays Capital U.S. Corporate High-Yield Bond Index is an unmanaged index that covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. The index excludes Emerging Markets debt.

Gross Domestic Product (GDP) is the measure of the market value of the goods and services produced by labor and property in the United States.

The Group of 20 (G-20) Finance Ministers and Central Bank Governors was established in 1999 to bring together systemically important industrialized and developing economies to discuss key issues in the global economy.

Lipper International Large-Cap Value Funds Average is an equally weighted average of mutual Funds that, by portfolio practice, invest at least 75% of their equity assets in companies strictly outside of the U.S. with market capitalizations (on a three-year weighted basis) above Lipper’s international large-cap floor. International large-cap value funds typically have a below-average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared to their large-cap-specific subset of the S&P/Citigroup World ex-U.S. BMI.

Lipper Large-Cap Growth Funds Average is an equally weighted average of mutual Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity large-cap floor. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

Lipper Large-Cap Core Funds is an equally weighted average of mutual Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity large-cap floor. Large-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

Lipper Large-Cap Value Funds Average is an equally weighted average of mutual Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity large-cap floor. Large-cap value funds typically have a below average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

Lipper Mid-Cap Growth Funds Average is an equally weighted average of mutual Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s U.S. Diversified Equity large-cap floor. Mid-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P MidCap 400 Index.

The MSCI EAFE Index (Europe, Australasia, Far East) which is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The MSCI EAFE Index currently consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

MSCI Emerging Markets Index is a market capitalization weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin.

Russell 1000® Growth Index is an unmanaged index which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index is an unmanaged index which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell 2000® Index is an unmanaged index which measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

Russell 2500™ Growth Index is an unmanaged index which measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”) is an unmanaged index that is the most widely used index for mid-sized companies. The S&P MidCap 400 covers 7% of the U.S. equities market, and is part of a series of S&P U.S. indices that can be used as building blocks for portfolio composition.

Standard & Poor’s 500 Index (“S&P 500”) is an unmanaged index that is widely regarded as a gauge of the U.S. equities market, this index includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities.

Lipper is an independent mutual fund performance monitor whose results are based on total return and do not reflect a sales charge.

Securities indexes assume reinvestment of all distributions and interest payments and do not take in account brokerage fees or expenses. Securities in the Funds do not match those in the indexes and performance of the Funds will differ. Investors cannot invest directly in an index.

| |

HSBC INVESTOR FAMILY OF FUNDS | 3 |

December 18, 2009

To Our Shareholders:

It is a pleasure to report on a challenging, but fruitful year.

Since money market funds comprise the vast majority of the HSBC Investor Funds family assets, we have focused especially closely on events in the credit markets over the past year, hallmarked by the freezing of the commercial paper market in the wake of the Lehman bankruptcy and the September 15, 2008 “breaking of the buck” by The Reserve Fund, and the ultra-low short-term interest yields which prevail as a result of unprecedented fiscal and monetary stimulus.

Throughout the year, the Board of Trustees and the Funds’ Adviser have sought to ensure that all of the HSBC Investor money market funds appropriately managed their liquidity and risk. Each of the money market funds, with the exception of the US Treasury Money Market Fund, participated in the US Treasury Temporary Guarantee Program for Money Market Funds, which provided insurance against loss on investments in covered money market funds. This program expired on September 18, 2009, with no claims made by any money market funds.

The Adviser also instituted minimum yields on each of the money market funds which required the Adviser and shareholder servicing agents to waive significant portions of their fees to sustain a competitive yield.

HSBC’s Investor Funds include long-term funds, which we expect to grow in number, expanding your choices within the fund group. The Board, with input from HSBC’s competitively-distinguishing Multimanager analytical team, regularly reviews these funds’ investment performance in great detail. From time to time, we change sub-advisors and believe that the Board’s consistent and careful scrutiny has contributed to the funds’ generally excellent long-term performance. Information about this performance is included in the commentaries from the portfolio managers within this annual report.

To better fulfill our responsibilities, the Board has redesigned our committee structure; it now consists of: Audit, Contracts and Expense, Valuation and Investment Oversight, and Nominating and Corporate Governance committees. All independent trustees are members of these “committees of the whole”, which are chaired by a different member of the Board. I might add that our board had perfect attendance at all meetings last year—including telephone meetings.

There is much talk in the mutual fund industry of regulatory change. We monitor these trends, and our funds’ compliance, very carefully. In connection with this responsibility, the board invited a senior staff member of the U.S. Securities and Exchange Commission to discuss the regulatory environment and possible future developments.

Regulatory change may come from the judiciary as well. The U.S. Supreme Court recently heard arguments about how mutual fund fees are set—a case known as Jones v. Harris Associates. The plaintiff seeks to supplant the rule under which mutual funds have operated since 1982—the so-called Gartenberg standard which gives boards considerable discretion in establishing advisory fees. As you know, there are over 7,000 funds in the US, a number that assures vigorous competition—one reason US fund fees are the lowest in the world. A Wall Street Journal editorial (November 3, 2009) noted: “The Jones suit is a culmination of the plaintiffs bar assault on mutual funds that began earlier this decade and seeks to achieve via judicial fiat what it hasn’t been able to accomplish in legislation. Let’s hope the high Court shuts them down.” It would be a great disservice to fund investors if the tort bar were to prevail in this case.

Our fund family has shown rapid growth in recent years, and we thank you for the confidence you’ve placed in us. On behalf of the Board of Trustees and Advisory staff, we pledge our very best effort to making the future a good one for our shareholders.

Cordially,

Michael Seely

Chairperson, HSBC Investor Funds

| |

4 | HSBC INVESTOR FAMILY OF FUNDS |

Dear Shareholder,

Welcome to the HSBC Investor Funds annual report, covering the period between November 1, 2008 and October 31, 2009. This report offers detailed information about your funds’ results, from investment operations and composition. We encourage you to review it carefully.

Inside these pages you will find a letter from the Funds’ Chairman, as well as commentary from the portfolio managers discussing the investment markets and explaining the primary reasons each fund performed as it did. The report also includes each fund’s return during the 12-month period, as well as the performance of its benchmark index and peer group average. We believe the HSBC Investor Funds have provided their shareholders with competitive returns.

In closing, we want to thank you for investing through the HSBC Investor Funds. We recognize that the past year has presented challenges for many investors, and we appreciate and honor the trust you place in us. Please contact us at any time with questions or concerns.

Sincerely,

Richard A. Fabietti

President

| |

HSBC INVESTOR FAMILY OF FUNDS | 5 |

(This Page Intentionally Left Blank)

|

Commentary From the Investment Manager |

|

HSBC Global Asset Management (USA) Inc.

U.S. Economic Review

The 12-month period between November 1, 2008 and October 31, 2009 began with the U.S. economy in severe recession and the financial system suffering from a major credit crunch.

The federal government took unprecedented steps to try to restore the economy and financial system to health. The Federal Reserve Board in December reduced the federal funds rate, its target short-term interest rate, from 1.00% to a range between 0.00% and 0.25%, and also took a wide range of other actions to inject liquidity and improve confidence in the system. The government also enacted a massive fiscal stimulus package. All told, the U.S. government and Federal Reserve committed a total of $12.8 trillion, an amount nearly equal to 2008 gross domestic product1. Governments around the world took similar steps: For example, the G-20 group1 of nations agreed to a $1.1 trillion program through which the International Monetary Fund would help countries afflicted by the global crisis to boost economic activity.

Leading economic indicators began showing signs of improvement during the second quarter of 2009. Credit spreads declined, the housing market’s descent slowed and survey data turned up. The economy continued to regain its footing throughout the period. Unemployment continued to rise, however, as is typical in the end stages of recession.

The U.S. economy contracted at an annualized rate of 5.4% during the fourth calendar quarter of 2008. It fell 6.4% and 0.7% in the first and second quarters of 2009, respectively, before recovering to grow 2.8% during the third quarter of 2009.

Market Review

Investors during the first four months of the period responded to the financial crisis by fleeing assets perceived as risky. Higher-risk assets generally fared worst during this time, with emerging markets stocks, small caps and high-yield bonds posting some of the largest losses. Assets considered safe and stable, particularly bonds backed by the U.S. government, produced the best returns.

The market environment changed dramatically beginning in early 2009. As the financial system and economy began showing signs of stabilizing, investors moved quickly back into risk assets. Between March 9 and the end of the reporting period the stock market posted a powerful rebound, with the S&P 5001 gaining roughly 55.31%. For the period as a whole the S&P 500 returned 9.80%, while the small-cap Russell 2000®, 1 gained 6.46%.

Foreign stocks on the whole declined considerably through early March, then surged to produce strong returns for the 12-month period. Foreign currencies’ strength against the dollar further boosted the gains of U.S. investors’ international holdings. Japan’s market did not keep pace with other major markets; It generated a 10.62% gain in U.S. dollar terms—and just a 2.05% return in local currency—as its economic recovery proved anemic.

During the rally, investors especially favored shares in emerging markets, which in many cases offered more-attractive macroeconomic backdrops than developed countries. The MSCI EAFE Index1 of developed foreign stock markets gained 28.41% in U.S. dollar terms during the period under review, while the MSCI Emerging Markets Index1 gained 64.63%.

Investors in the fixed-income markets began the period fleeing to the most conservative and secure types of securities, particularly Treasury bills. The rally in government debt was so extreme that Treasury bills briefly offered negative yields. Meanwhile, investors sold bonds not backed by the federal government. That environment caused spreads between yields on Treasuries and other types of debt to widen to historic levels.

Conditions in the fixed-income markets changed dramatically during 2009. As the financial crisis began to recede, investors sought the greater yield available on higher-risk debt securities. Corporate bonds, in particular high-yield bonds, staged a strong rally. The Barclays Capital U.S. Aggregate Bond Index1, which tracks the broad fixed-income market, returned 13.79% for the 12 months through October, while the Barclays Capital U.S. Corporate High-Yield Bond Index1 returned 48.10%.

| |

1 | For additional information, please refer to the Glossary of Terms. |

| |

HSBC INVESTOR FAMILY OF FUNDS | 7 |

|

Portfolio Reviews |

|

HSBC Investor Growth Fund |

(Class A Shares, B Shares, C Shares and I Shares) |

by Clark J. Winslow, Chief Executive Officer/Portfolio Manager

Justin H. Kelly, CFA, Managing Director/Portfolio Manager

R. Bart Wear CFA, Managing Director/Portfolio Manager

Winslow Capital Management, Inc. |

The HSBC Investor Growth Fund (the “Fund”) seeks long-term growth of capital. Under normal market conditions, the Fund invests primarily in U.S. and foreign equity securities of high quality companies with market capitalization generally in excess of $2 billion which the subadviser believes have the potential to generate superior levels of long-term profitability and growth. The Fund utilizes a two-tier structure, commonly known as a “master-feeder” structure, in which the Fund invests all of its investable assets in the HSBC Investor Growth Portfolio (the “Portfolio”). The Portfolio employs Winslow Capital Management, Inc. as subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

The growth investment style may fall out of favor in the marketplace and result in significant declines in the value of the Portfolio’s securities. Securities of companies considered to be growth investments may have rapid price swings in the event of earnings disappointments or during periods of market, political, regulatory and economics uncertainty.

The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Market Commentary

The Fund returned 18.86% (without sales charge) for the Class A Shares and 19.11% for the Class I Shares for the 12-month period ended October 31, 2009. That compared to a 17.51% return for the Russell 1000® Growth Index1 and a 14.74% return for the Lipper Large-Cap Growth Funds Average1.

Past performance does not guarantee future results.

Portfolio Performance

The stock market in the beginning of the period declined steeply as a result of the global financial crisis. Intervention by the federal government in the form of fiscal and monetary stimulus programs helped stanch the market downturn, and by early March the stock market began a sustained rally that continued through the end of the period.

The Fund benefited from its shift to an overweight position in the information technology and energy sectors, as stocks in those sectors performed well. Stock selection in those sectors and in the financial services sector further boosted the Fund’s relative performance. We positioned the Fund with a smaller-than-benchmark stake in consumer staples stocks. Because of that strategy the Fund’s Class I Shares outperformed its benchmark index, the Russell 1000® Growth Index, as the sector lagged the benchmark during the period.*

The Fund maintained a neutral weighting in the small materials sector, but its materials allocation significantly underperformed the benchmark’s allocation. The underperformance was the result of our decision to avoid shares of non-energy, resource-related materials companies. Such shares rebounded sharply in the latter half of the period, fueling much of the sector’s gains.*

| |

* | Portfolio composition is subject to change. |

| |

1 | For additional information, please refer to the Glossary of Terms. |

| |

8 | HSBC INVESTOR FAMILY OF FUNDS |

| |

| Portfolio Reviews |

|

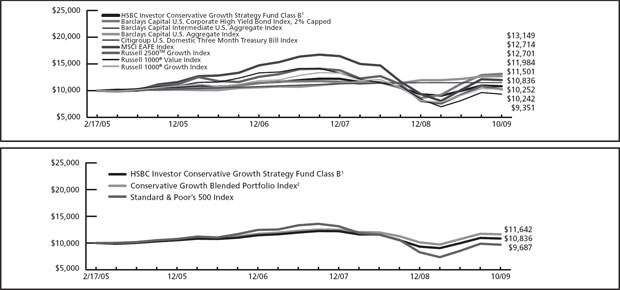

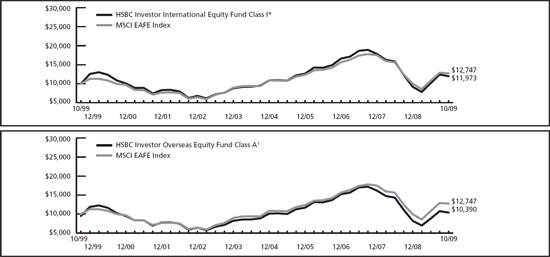

HSBC Investor Growth Fund - As of October 31, 2009 |

| |

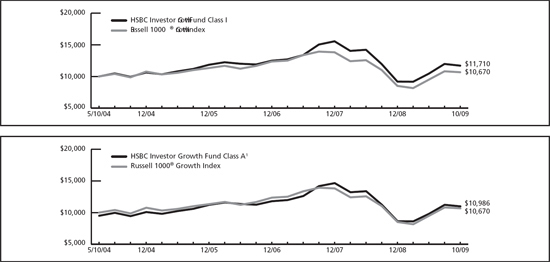

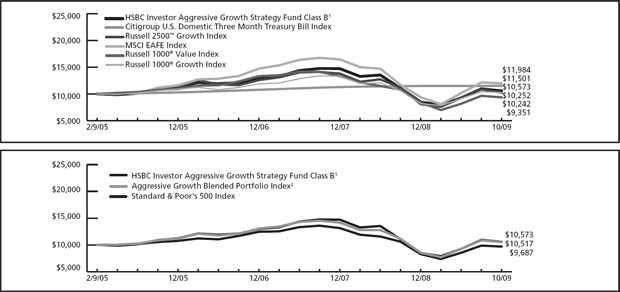

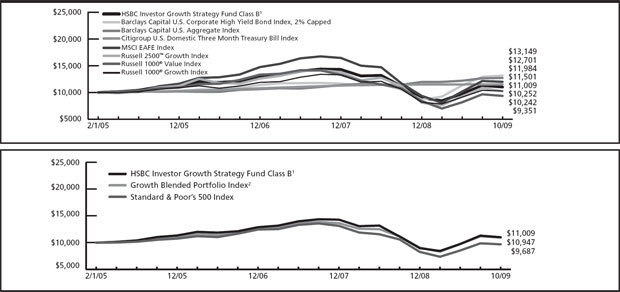

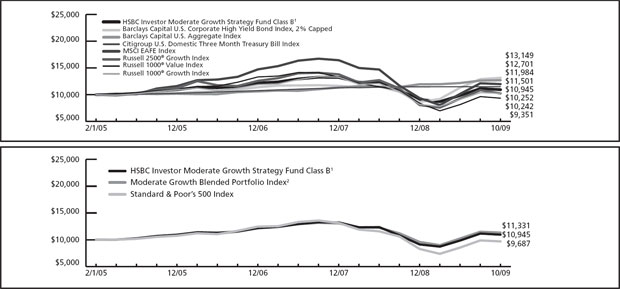

Value of a $10,000 Investment | |

|

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | | | | | | | | | | | |

Fund Performance | | | | Average Annual

Total Return (%) | | Expense

Ratio (%)6 | |

|

|

|

|

|

|

As of October 31, 2009 | | Inception

Date | | 1

Year | | 5

Year | | Since

Inception | | Gross | | Net | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Growth Fund Class A1 | | 5/7/045 | | 12.87 | | 1.90 | | 1.73 | | | 1.32 | | 1.20 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Growth Fund Class B2 | | 5/7/045 | | 13.87 | | 2.18 | | 1.91 | | | 2.07 | | 1.95 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Growth Fund Class C3 | | 5/7/045 | | 16.86 | | 2.18 | | 1.92 | | | 2.07 | | 1.95 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Growth Fund Class I | | 5/7/045 | | 19.11 | | 3.19 | | 2.92 | | | 1.07 | | 0.95 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russell 1000® Growth Index4 | | — | | 17.51 | | 1.27 | | 1.19 | 7 | | N/A | | N/A | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Large-Cap Growth Funds Average4 | | — | | 14.74 | | 0.70 | | 0.79 | 7 | | N/A | | N/A | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2009 through March 1, 2010.

During the fiscal periods ended October 31, 2008 and 2009, the Portfolio in which the Fund invests in received monies related to certain nonrecurring litigation settlements which enhanced performance. Without the receipt of these payments, the returns for applicable periods would be lower.

| |

1 | Reflects the maximum sales charge of 5.00%. |

| |

2 | Reflects the applicable contingent deferred sales charge maximum of 4.00%. |

| |

3 | Reflects the applicable contingent deferred sales charge maximum of 1.00%. |

| |

4 | For additional information, please refer to the Glossary of Terms. |

| |

5 | The HSBC Investor Growth Fund was initially offered for purchase effective May 7, 2004, however, no shareholder activity occurred until May 10, 2004. |

| |

6 | Reflects the expense ratio as reported in the prospectus dated February 27, 2009. |

| |

7 | Return for the period 5/10/04 to 10/31/09. |

The Fund’s performance is measured against the Russell 1000® Growth Index, an unmanaged index which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| |

HSBC INVESTOR FAMILY OF FUNDS | 9 |

|

Portfolio Reviews |

|

HSBC Investor International Equity Fund |

HSBC Investor Overseas Equity Fund |

(Class A Shares, B Shares, and C Shares) |

by Kevin F. Simms |

Co-CIO International Value Equities and Director of Research – Global and International Value Equities |

AllianceBernstein L.P. |

The HSBC Investor International Equity Fund and the HSBC Investor Overseas Equity Fund (the “Funds”) seek to provide their shareholders with long-term growth of capital and future income. Under normal market conditions, each Fund invests at least 80% of its net assets in equity securities of companies organized and domiciled in developed nations outside the United States or for which the principal trading market is outside the United States, including Europe, Canada, Australia and the Far East. Each Fund may invest up to 20% of its assets in equity securities of companies in emerging markets. The Funds employ a two-tier fund structure, known as a “master-feeder” structure, in which the Funds invest all of their investable assets in the HSBC Investor International Equity Portfolio (the “Portfolio”). AllianceBernstein L.P., acting through the Bernstein Value Equities Unit (“AllianceBernstein”), serves as the subadviser to the Portfolio and manages its investments.

Investment Concerns

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Market Commentary

For the 12-month period ended October 31, 2009, the Class I Shares of the HSBC Investor International Equity Fund produced a 27.90% return and the Class A Shares of the HSBC Investor Overseas Equity Fund returned 23.99% (without sales charge). That compared to a total return of 28.41% and 24.28% for the Funds’ benchmark, the MSCI EAFE Index1, and the Lipper International Large-Cap Value Funds Average1, respectively.

Past performance does not guarantee future results.

Portfolio Performance

The period was marked by two significantly different environments in the equity markets. The beginning of the period was dominated by stress in the global financial system, including a credit crunch and a contraction of economies around the world. As the period wore on, economies generally stabilized and economic growth resumed.

Stocks fell initially, then rebounded strongly. International stocks performed particularly well as many foreign markets were less affected by the issues that plagued the U.S. market, including overextended consumers and declines in the housing market. Those trends benefited the Fund’s absolute return.

We positioned the Fund to take advantage of an improving economic environment. That strategy included holding an overweight position relative to the benchmark in sectors such as financials, autos, energy and technology. Those overweight positions boosted relative performance, as did individual stock selection in each of those sectors.*

The Fund also maintained a modest allocation to emerging markets stocks, which are absent from the benchmark. Emerging markets were among the period’s best performers, so holding such stocks significantly helped the Fund’s relative performance.*

The Fund was hurt in relative terms by its underweight position in the consumer cyclical sector. Such stocks benefited as economic fundamentals improved and consumer spending increased. We positioned the Fund with an overweight stake in the telecommunications sector, believing that such stocks would benefit from a market rebound. That sector underperformed the benchmark, and dragged on the Fund’s relative performance.*

| |

* | Portfolio composition is subject to change. |

| |

1 | For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

| |

10 | HSBC INVESTOR FAMILY OF FUNDS |

| |

| Portfolio Reviews |

|

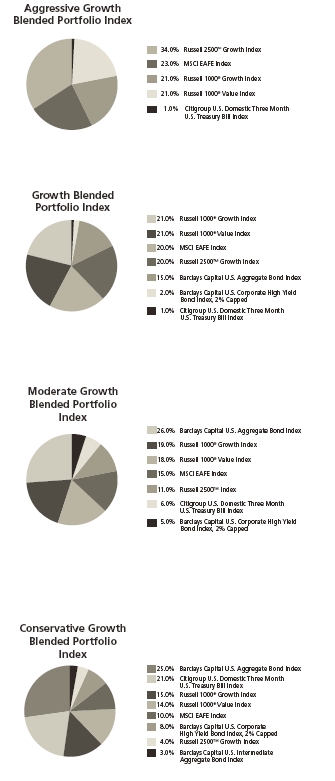

HSBC Investor International Equity Fund |

HSBC Investor Overseas Equity Fund - As of October 31, 2009 |

|

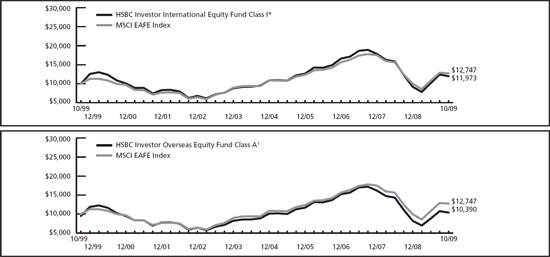

Value of a $10,000 Investment |

|

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | | | | | | | | | | |

Fund Performance | | | | Average Annual

Total Return (%) | | Expense

Ratio (%)5 | |

|

|

|

|

|

|

As of October 31, 2009 | | Inception

Date | | 1

Year | | 5

Year | | 10

Year | | Gross | | Net | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor International Equity Fund Class I* | | 1/9/95 | | 27.90 | | 4.14 | | 1.82 | | 0.84 | | 0.84 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Overseas Equity Fund Class A1 | | 8/26/96 | | 17.83 | | 1.63 | | 0.38 | | 1.81 | | 1.81 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Overseas Equity Fund Class B2 | | 1/6/98 | | 21.08 | | 1.90 | | 0.43 | | 2.56 | | 2.56 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Overseas Equity Fund Class C3 | | 11/4/98 | | 22.50 | | 1.93 | | 0.14 | | 2.56 | | 2.56 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI EAFE Index4 | | — | | 28.41 | | 5.59 | | 2.46 | | N/A | | N/A | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper International Large-Cap Value Funds Average4 | | — | | 24.28 | | 3.86 | | 3.92 | | N/A | | N/A | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower.

During the fiscal period ended October 31, 2007, the Portfolio in which the Fund invests in received monies related to certain nonrecurring litigation settlements which enhanced performance. Without the receipt of this payment, the returns for applicable periods would be lower.

| |

* | The Class I Shares are issued by HSBC Investor International Equity Fund and are part of the HSBC Advisor Funds Trust. |

| |

1 | Reflects the maximum sales charge of 5.00%. |

| |

2 | Reflects the applicable contingent deferred sales charge maximum of 4.00%. |

| |

3 | Reflects the applicable contingent deferred sales charge maximum of 1.00%. |

| |

4 | For additional information, please refer to the Glossary of Terms. |

| |

5 | Reflects the expense ratio as reported in the prospectus dated February 27, 2009. |

The Funds’ performance is measured against the MSCI EAFE Index (Europe, Australasia, Far East), which is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The MSCI EAFE Index currently consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The performance of the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Funds’ performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| |

HSBC INVESTOR FAMILY OF FUNDS | 11 |

|

Portfolio Reviews |

|

HSBC Investor Mid-Cap Fund |

(Class A Shares, B Shares, C Shares and Class I Shares) |

by Tony Y. Dong, CFA, Director, Mid-Cap Equity and Senior Portfolio Manager and |

Brian S. Matuszak, CFA, Senior Equity Analyst and |

Andy Y. Mui, CPA, Senior Equity Analyst |

Munder Capital Management |

The HSBC Investor Mid-Cap Fund (the “Fund”) seeks to achieve long-term growth of capital by investing at least 80% of its net assets in equity securities, i.e., common stocks, preferred stocks, convertible securities and rights and warrants, of mid-capitalization companies. Mid-capitalization companies are those companies with market capitalization within the range of companies included in the S&P MidCap 400® Index1, or within the range of companies included in the Russell Midcap® Index. The Fund employs Munder Capital Management (“Munder”) as subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Mid capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Market Commentary

The Fund’s Class A Shares posted a return of 16.07% (without sales charge) and 16.42% for the Class I Shares for the 12-month period ended October 31, 2009. That compared to 18.18% and 16.74% for the Fund’s benchmarks, the S&P MidCap 400 Index1, and the Lipper Mid-Cap Growth Funds Average1, respectively.

Past performance does not guarantee future results.

Portfolio Performance

The recent recession was the longest and deepest in the post-World War II period. The financial markets were in turmoil early in the period, but federal intervention in the form of fiscal and monetary stimulus provided a much-needed spark to the U.S. economy and helped the stock market recover beginning in early March. Stocks rebounded strongly during the rest of the period, and small- and mid-cap stocks—which typically outperform large-cap stocks coming out of recessions—were among the best performers.

The Fund’s performance relative to its benchmark benefited from stock selection in sectors including energy, information technology, financials, utilities, materials and industrials. We held a larger position than the benchmark in the industrials sector and underweight positions in financials and health care, and these sector allocations also benefited relative performance.*

Although stocks across the equity spectrum performed well during the period, higher-risk stocks provided the period’s strongest returns. We focused the Fund’s portfolio on high-quality stocks with strong fundamentals and good management, rather than more-speculative shares. As a result, the Fund did not benefit from the outsized gains among lower-quality stocks. The Fund underperformed its benchmark in part because of its underweight stake in such stocks.*

| |

* | Portfolio composition is subject to change. |

| |

1 | For additional information, please refer to the Glossary of Terms. |

| |

12 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

|

HSBC Investor Mid-Cap Fund - As of October 31, 2009 |

|

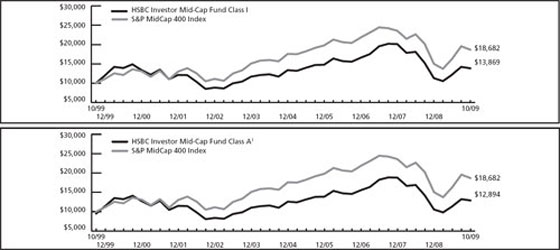

Value of a $10,000 Investment |

|

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | | | | | | | | |

Fund Performance | | | Average Annual Total Return† (%) | | Expense

Ratio (%)5 |

|

|

|

|

|

|

As of October 31, 2009 | Inception

Date† | | 1

Year | | 5

Year | | 10

Year | | Gross | | Net |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Mid-Cap Fund Class A1 | 7/1/93 | | 10.33 | | 1.58 | | 2.57 | | 1.79 | | 1.35 |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Mid-Cap Fund Class B2 | 7/1/93 | | 11.26 | | 1.86 | | 2.34 | | 2.54 | | 2.10 |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Mid-Cap Fund Class C3 | 7/1/93 | | 14.30 | | 1.85 | | 2.40 | | 2.54 | | 2.10 |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Mid-Cap Fund Class I | 7/1/93 | | 16.42 | | 2.83 | | 3.33 | | 1.54 | | 1.10 |

|

|

|

|

|

|

|

|

|

|

|

|

S&P MidCap 400 Index4 | — | | 18.18 | | 3.24 | | 6.45 | | N/A | | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Mid-Cap Growth Funds Average4 | — | | 16.74 | | 1.56 | | 1.60 | | N/A | | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2009 through March 1, 2010.

During the fiscal period ended October 31, 2009, the Fund received monies related to certain nonrecurring litigation settlements which enhanced performance. Without the receipt of this payment, the returns for applicable periods would be lower.

| |

1 | Reflects the maximum sales charge of 5.00%. |

| |

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

| |

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

| |

4 | For additional information, please refer to the Glossary of Terms. |

| |

5 | Reflects the expense ratio as reported in the prospectus dated February 27, 2009. |

| |

† | For periods prior to July 1, 2000, the performance shown above includes the total return (adjusted for Fund expenses) generated by HSBC Global Asset Management (USA) Inc.’s management of a pooled investment vehicle called a collective investment trust (“CIT”) with the same investment objective as the Fund. The assets from that CIT were converted into the HSBC Investor Mid-Cap Fund on July 1, 2000. The CIT was not registered with the Securities & Exchange Commission (SEC) and thus was not subject to certain investment restrictions that are imposed on the Fund. If the CIT had been registered with the SEC, its performance might have been adversely affected. Performance assumes reinvestment of dividends and distributions. |

The Fund’s performance is measured against the Standard & Poor’s Mid Cap 400 Index, an unmanaged index that is the most widely used index for mid-sized companies. The S&P MidCap 400 covers 7% of the U.S. equities market, and is part of a series of S&P U.S. indices that can be used as building blocks for portfolio composition. The performance of the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| |

HSBC INVESTOR FAMILY OF FUNDS | 13 |

|

Portfolio Reviews |

|

HSBC Investor Opportunity Fund |

(Class A Shares, B Shares, C Shares and I Shares)

by William A. Muggia

President–Chief Investment Officer

Westfield Capital Management Company, L.P. |

The HSBC Investor Opportunity Fund (the “Fund”) seeks to provide its shareholders with long-term growth of capital by investing in equity securities of small cap companies. The Fund may also invest in bonds, notes, commercial paper, U.S. Government securities, and foreign securities. Small cap companies generally are defined as those that have market capitalizations within the range of market capitalizations represented in the Russell 2500™ Growth Index.1 The Fund may also invest in equity securities of larger, more established companies if they are expected to show increased earnings. The Fund employs a two-tier structure, commonly referred to as “master-feeder” structure, in which the Fund invests all of its investable assets in the HSBC Investor Opportunity Portfolio (the “Portfolio”). The Portfolio employs Westfield Capital Management Company, L.P. as subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Market Commentary

For the 12-month period ended October 31, 2009, the Class I Shares of the HSBC Investor Opportunity Fund produced a 15.47% return, and the Class A Shares of the Fund produced a 14.85% return (without sales charge). The Fund’s benchmarks, the Russell 2500™ Growth Index1, and the Lipper Mid-Cap Growth Funds Average1, returned 18.21% and 16.74%, respectively.

Past performance does not guarantee future results.

Portfolio Performance

The 12-month period consisted of two distinct market and economic environments. In the first half of the period, continued fallout from the financial crisis caused equities to fall sharply. Stocks recovered dramatically in the second half of the period, as investors began to act on their belief that a depression had been averted.

The Fund’s performance relative to its benchmark index benefited from certain stock selection decisions. Within the energy sector, the focus on companies with solid fundamentals and strong competitive positions led to investments in coal and oil & gas exploration firms. This emphasis boosted the Fund’s performance relative to the benchmark. Stock selection in industrials and technology also boosted relative returns.*

The Fund held a smaller position than its benchmark in consumer discretionary stocks. This underweight position dragged on performance relative to the benchmark. The Fund did not have a bullish view on the sector as a whole, believing that there was insufficient evidence of improving fundamentals to merit increasing the Fund’s consumer discretionary holdings. But investors proved to have a significant appetite for stocks in cyclically sensitive industries. The Fund generally did not hold these stocks, so did not benefit from their rally. Stock selection in the financial services sector also weighed on returns relative to the benchmark.*

| |

* | Portfolio composition is subject to change. |

| |

1 | For additional information, please refer to the Glossary of Terms. |

| |

14 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

|

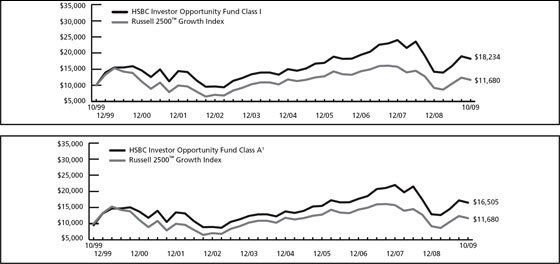

HSBC Investor Opportunity Fund - As of October 31, 2009 |

|

Value of a $10,000 Investment |

|

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | | | | | | | | |

Fund Performance | | | Average Annual Total Return (%) | | Expense

Ratio (%)5 |

|

|

|

|

|

|

As of October 31, 2009 | Inception

Date | | 1

Year | | 5

Year | | 10

Year | | Gross | | Net |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Opportunity Fund Class A1 | 9/23/96 | | 9.16 | | 4.24 | | 5.14 | | 1.82 | | 1.65 |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Opportunity Fund Class B2 | 1/6/98 | | 9.92 | | 4.52 | | 5.19 | | 2.57 | | 2.40 |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Opportunity Fund Class C3 | 11/4/98 | | 12.83 | | 4.51 | | 4.88 | | 2.57 | | 2.40 |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Opportunity Fund Class I* | 9/3/96 | | 15.47 | | 5.67 | | 6.19 | | 0.97 | | 0.97 |

|

|

|

|

|

|

|

|

|

|

|

|

Russell 2500™ Growth Index4 | — | | 18.21 | | 2.00 | | 1.56 | | N/A | | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Mid-Cap Growth Funds Average4 | — | | 16.74 | | 1.56 | | 1.60 | | N/A | | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2009 through March 1, 2010.

| |

* | The Class I Shares of the HSBC Investor Opportunity Fund are part of the HSBC Advisor Funds Trust. |

| |

1 | Reflects the maximum sales charge of 5.00%. |

| |

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

| |

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

| |

4 | For additional information, please refer to the Glossary of Terms. |

| |

5 | Reflects the expense ratio as reported in the prospectus dated February 27, 2009. |

The Fund’s performance is measured against the Russell 2500™ Growth Index, an unmanaged index which measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those 2500 companies with higher price-to-book ratios and higher forecasted growth values. The performance for the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| |

HSBC INVESTOR FAMILY OF FUNDS | 15 |

|

Portfolio Reviews |

|

HSBC Investor Value Fund |

(Class A Shares, B Shares, C Shares and I Shares)

by Jon D. Bosse, CFA

Chief Investment Officer

NWQ Investment Management Company, LLC |

The HSBC Investor Value Fund (the “Fund”) seeks long-term growth of capital and income. Under normal market conditions, the Fund invests primarily in U.S. and foreign companies with large and medium capitalizations that the subadviser believes possess opportunities underappreciated or misperceived by the market. The Fund utilizes a two-tier structure, commonly known as a “master-feeder” structure, in which the Fund invests all of its investable assets in the HSBC Investor Value Portfolio (the “Portfolio”). The Portfolio employs NWQ Investment Management Company, LLC (“NWQ”) as subadviser.

Investment Concerns

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

The net asset value per share of this Fund will fluctuate as the value of the securities in the Portfolio changes.

Market Commentary

The Fund returned 19.59% (without sales charge) for the Class A Shares and 19.82% for the Class I Shares for the 12-month period ended October 31, 2009. That compared to a 4.78% return for the Russell 1000® Value Index1 and a 10.85% return for the Lipper Large-Cap Core Funds Average1.

Past performance does not guarantee future results.

Portfolio Performance

During the period, global equity markets experienced considerable volatility. During the first half of the period, the U.S. equity markets declined materially due to economic weakness, as well as fears that a number of major money center banks would fail and that the financial system would collapse. The second half saw stabilization within the U.S. and global financial system. Credit spreads tightened dramatically, reflecting lower risk premiums and better-functioning capital markets. These factors, combined with an improvement in the U.S. economy, contributed to appreciation and a reversal of the U.S. equity market’s first half decline.

The Fund’s absolute return was enhanced by positive contributions from all sectors except industrials and utilities. The largest contributor to performance came from the Fund’s investments in materials, specifically gold and fertilizer stocks. The Fund’s overweight position as well as specific holdings contributed to this performance. The second largest contribution came from the Fund’s overweight position, relative to the Russell 1000® Value Index1, and stock selection in information technology. Other notable contributors to performance in the Fund came from its investments in the energy, financials and consumer staples sectors. Underweight positions, again relative to the Russell 1000® Value Index1, in consumer discretionary and health care shares dragged on relative performance.*

| |

* | Portfolio composition is subject to change. |

| |

1 | For additional information, please refer to the Glossary of Terms. |

| |

16 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

|

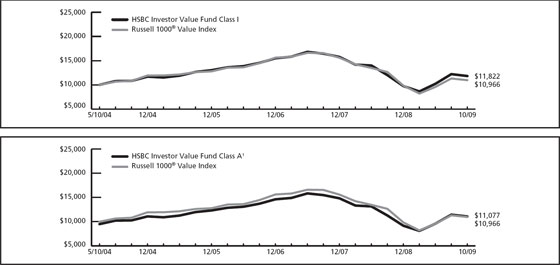

HSBC Investor Value Fund - As of October 31, 2009 |

|

Value of a $10,000 Investment |

|

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | | | | | | | | | | |

Fund Performance | | | | Average Annual Total Return (%) | | Expense

Ratio (%)6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

As of October 31, 2009 | | Inception

Date | | 1

Year | | 5

Year | | Since

Inception | | Gross | | Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Value Fund Class A1 | | 5/7/04 | 5 | 13.61 | | 0.72 | | 1.89 | | | 1.23 | | 1.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Value Fund Class B2 | | 5/7/04 | 5 | 14.63 | | 0.97 | | 2.07 | | | 1.98 | | 1.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Value Fund Class C3 | | 5/7/04 | 5 | 17.60 | | 0.98 | | 2.06 | | | 1.98 | | 1.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC Investor Value Fund Class I | | 5/7/04 | 5 | 19.82 | | 1.99 | | 3.10 | | | 0.98 | | 0.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russell 1000® Value Index4 | | — | | 4.78 | | -0.05 | | 1.70 | 7 | | N/A | | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Large-Cap Core Funds Average4 | | — | | 10.85 | | 0.51 | | 1.11 | 7 | | N/A | | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2009 through March 1, 2010.

During the fiscal periods ended October 31, 2008 and 2009, the Portfolio in which the Fund invests received monies related to certain nonrecurring litigation settlements. Without the receipt of these payments, the returns for applicable periods would have been lower.

| |

1 | Reflects the maximum sales charge of 5.00%. |

| |

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

| |

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

| |

4 | For additional information, please refer to the Glossary of Terms. |

| |

5 | The HSBC Investor Value Fund was initially offered for purchase effective May 7, 2004, however, no shareholder activity occurred until May 10, 2004. |

| |

6 | Reflects the expense ratio as reported in the prospectus dated February 27, 2009. |

| |

7 | Return for the period 5/10/04 to 10/31/09. |

The Fund’s performance is measured against the Russell 1000® Value Index, an unmanaged index which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The performance of the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| |

HSBC INVESTOR FAMILY OF FUNDS | 17 |

(This Page Intentionally Left Blank)

|

Portfolio Reviews |

|

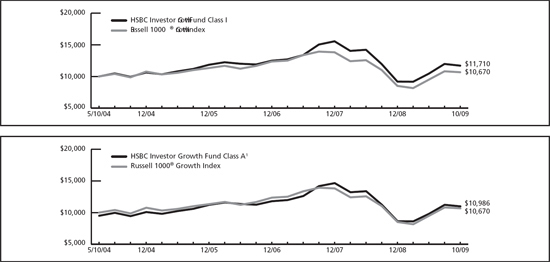

Portfolio Composition* |

October 31, 2009 |

(Unaudited) |

| | | | |

HSBC Investor Growth Portfolio | | | | |

|

|

|

|

|

| | | | |

Investment Allocation | | Percentage of Investments at Value | |

|

|

|

|

Financial Services | | 13.1 | % | |

|

|

|

|

|

Internet Related | | 8.8 | % | |

|

|

|

|

|

Telecommunications | | 8.6 | % | |

|

|

|

|

|

Computers | | 8.4 | % | |

|

|

|

|

|

Pharmaceuticals | | 8.4 | % | |

|

|

|

|

|

Oil & Gas | | 8.0 | % | |

|

|

|

|

|

Retail | | 6.5 | % | |

|

|

|

|

|

Computer Services | | 4.7 | % | |

|

|

|

|

|

Computer Software | | 4.6 | % | |

|

|

|

|

|

Health Care | | 3.7 | % | |

|

|

|

|

|

Cash and Equivalents | | 3.6 | % | |

|

|

|

|

|

Diversified Manufacturing Operations | | 3.4 | % | |

|

|

|

|

|

Transportation | | 3.4 | % | |

|

|

|

|

|

Electronic Components & Semiconductors | | 3.2 | % | |

|

|

|

|

|

Business Services | | 3.0 | % | |

|

|

|

|

|

Aerospace & Defense | | 2.3 | % | |

|

|

|

|

|

Metals & Mining | | 1.7 | % | |

|

|

|

|

|

Biotechnology | | 1.5 | % | |

|

|

|

|

|

Chemicals | | 1.2 | % | |

|

|

|

|

|

Consumer Products | | 1.0 | % | |

|

|

|

|

|

Leisure | | 0.9 | % | |

|

|

|

|

|

Total | | 100.0 | % | |

|

|

|

|

|

| | | | |

HSBC International Equity Portfolio | | | | |

|

|

|

|

|

| | | |

Investment Allocation | | Percentage of Investments at Value | |

|

|

|

|

Europe | | 71.0 | % | |

|

|

|

|

|

Japan | | 12.0 | % | |

|

|

|

|

|

Australia & Far East | | 11.5 | % | |

|

|

|

|

|

Canada | | 4.0 | % | |

|

|

|

|

|

Cash | | 0.9 | % | |

|

|

|

|

|

Other | | 0.6 | % | |

|

|

|

|

|

Total | | 100.0 | % | |

|

|

|

|

|

| | | | |

HSBC Investor Mid-Cap Fund | | | | |

|

|

|

|

|

| | | |

Investment Allocation | | Percentage of Investments at Value | |

|

|

|

|

Health Care | | 8.3 | % | |

|

|

|

|

|

Oil & Gas | | 7.5 | % | |

|

|

|

|

|

Computer Services | | 6.1 | % | |

|

|

|

|

|

Financial Services | | 5.9 | % | |

|

|

|

|

|

Computer Software | | 5.7 | % | |

|

|

|

|

|

Consumer Products | | 5.1 | % | |

|

|

|

|

|

Utilities | | 4.9 | % | |

|

|

|

|

|

Electronic Components & Semiconductors | | 4.6 | % | |

|

|

|

|

|

Commercial Services | | 4.5 | % | |

|

|

|

|

|

Insurance | | 4.3 | % | |

|

|

|

|

|

Cash and Equivalents | | 4.0 | % | |

|

|

|

|

|

Food & Beverage | | 3.9 | % | |

|

|

|

|

|

Real Estate | | 3.4 | % | |

|

|

|

|

|

Distribution & Wholesale | | 3.3 | % | |

|

|

|

|

|

Retail | | 2.6 | % | |

|

|

|

|

|

Industrial Manufacturing | | 2.5 | % | |

|

|

|

|

|

Chemicals | | 2.3 | % | |

|

|

|

|

|

Telecommunications | | 2.2 | % | |

|

|

|

|

|

Business Services | | 1.9 | % | |

|

|

|

|

|

Machinery | | 1.9 | % | |

|

|

|

|

|

Education | | 1.7 | % | |

|

|

|

|

|

Energy | | 1.7 | % | |

|

|

|

|

|

Correctional Institutions | | 1.5 | % | |

|

|

|

|

|

Aerospace & Defense | | 1.4 | % | |

|

|

|

|

|

Environmental Services | | 1.3 | % | |

|

|

|

|

|

Biotechnology | | 1.2 | % | |

|

|

|

|

|

Communications | | 1.1 | % | |

|

|

|

|

|

Agricultural Chemicals | | 1.0 | % | |

|

|

|

|

|

Automotive & Transport | | 1.0 | % | |

|

|

|

|

|

Banking | | 0.8 | % | |

|

|

|

|

|

Specialty Retail | | 0.7 | % | |

|

|

|

|

|

Leisure | | 0.6 | % | |

|

|

|

|

|

Metal Processors & Fabrication | | 0.6 | % | |

|

|

|

|

|

Transportation | | 0.5 | % | |

|

|

|

|

|

Total | | 100.0 | % | |

|

|

|

|

|

| |

* | Portfolio composition is subject to change. |

| |

HSBC INVESTOR FAMILY OF FUNDS | 19 |

|

Portfolio Reviews |

|

Portfolio Composition* |

October 31, 2009 |

(Unaudited) |

| | | | |

HSBC Investor Opportunity Portfolio | | | | |

|

|

|

|

|

| | | | | | | |

Investment Allocation | | Percentage of Investments at Value | |

|

|

|

|

Oil & Gas | | 12.3 | % | |

|

|

|

|

|

Computer Software | | 10.7 | % | |

|

|

|

|

|

Pharmaceuticals | | 10.5 | % | |

|

|

|

|

|

Industrial Manufacturing | | 6.7 | % | |

|

|

|

|

|

Health Care | | 6.5 | % | |

|

|

|

|

|

Telecommunications | | 5.8 | % | |

|

|

|

|

|

Biotechnology | | 5.6 | % | |

|

|

|

|

|

Consumer Products | | 5.3 | % | |

|

|

|

|

|

Retail | | 5.0 | % | |

|

|

|

|

|

Diversified Manufacturing Operations | | 4.3 | % | |

|

|

|

|

|

Financial Services | | 3.9 | % | |

|

|

|

|

|

Electronic Components & Semiconductors | | 3.4 | % | |

|

|

|

|

|

Internet Related | | 3.4 | % | |

|

|

|

|

|

Business Services | | 2.6 | % | |

|

|

|

|

|

Cash and Equivalents | | 2.5 | % | |

|

|

|

|

|

Aerospace & Defense | | 2.3 | % | |

|

|

|

|

|

Environmental Services | | 2.1 | % | |

|

|

|

|

|

Chemicals | | 1.7 | % | |

|

|

|

|

|

Education | | 1.5 | % | |

|

|

|

|

|

Transportation | | 1.5 | % | |

|

|

|

|

|

Communications | | 1.2 | % | |

|

|

|

|

|

Gaming | | 1.2 | % | |

|

|

|

|

|

Total | | 100.0 | % | |

|

|

|

|

|

| | | | |

HSBC Investor Value Portfolio | | | | |

|

|

|

|

|

| | | | |

Investment Allocation | | Percentage of Investments at Value | |

|

|

|

|

Oil & Gas | | 14.8 | % | |

|

|

|

|

|

Pharmaceuticals | | 11.2 | % | |

|

|

|

|

|

Insurance | | 10.4 | % | |

|

|

|

|

|

Telecommunications | | 8.3 | % | |

|

|

|

|

|

Computer Software | | 7.4 | % | |

|

|

|

|

|

Media | | 6.9 | % | |

|

|

|

|

|

Metals & Mining | | 6.8 | % | |

|

|

|

|

|

Aerospace & Defense | | 5.4 | % | |

|

|

|

|

|

Conglomerates | | 3.4 | % | |

|

|

|

|

|

Business Services | | 3.2 | % | |

|

|

|

|

|

Energy | | 3.2 | % | |

|

|

|

|

|

Consumer Products | | 2.9 | % | |

|

|

|

|

|

Cash and Equivalents | | 2.8 | % | |

|

|

|

|

|

Banking | | 2.6 | % | |

|

|

|

|

|

Financial Services | | 2.5 | % | |

|

|

|

|

|

Tobacco | | 2.5 | % | |

|

|

|

|

|

Transportation | | 1.9 | % | |

|

|

|

|

|

Diversified Manufacturing Operations | | 1.6 | % | |

|

|

|

|

|

Agricultural Chemicals | | 1.1 | % | |

|

|

|

|

|

Retail | | 1.1 | % | |

|

|

|

|

|

Total | | 100.0 | % | |

|

|

|

|

|

| |

* | Portfolio composition is subject to change. |

| |

20 | HSBC INVESTOR FAMILY OF FUNDS |

|

HSBC INVESTOR MID-CAP FUND |

|

Schedule of Portfolio Investments—As of October 31, 2009 |

| | | | | | | |

Common Stocks—97.1% | | | | | | | |

|

|

|

|

|

|

|

|

| | | | | | | |

| | Shares | | Value($) | |

| |

| |

| |

Aerospace & Defense – 1.4% | | | | | | | |

Elbit Systems Ltd. | | | 500 | | | 30,255 | |

L-3 Communications Holdings, Inc. | | | 2,100 | | | 151,809 | |

| | | | |

|

| |

| | | | | | 182,064 | |

| | | | |

|

| |

Agricultural Chemicals – 1.0% | | | | | | | |

Compass Minerals International, Inc. | | | 2,200 | | | 137,104 | |

| | | | |

|

| |

Automotive & Transport – 1.0% | | | | | | | |

BorgWarner, Inc. | | | 4,450 | | | 134,924 | |

| | | | |

|

| |

Banking – 0.8% | | | | | | | |

Signature Bank (a) | | | 3,350 | | | 105,726 | |

| | | | |

|

| |

Biotechnology – 1.2% | | | | | | | |

BioMarin Pharmaceuticals, Inc. (a) | | | 10,400 | | | 161,824 | |

| | | | |

|

| |

Business Services – 1.9% | | | | | | | |

Fiserv, Inc. (a) | | | 3,400 | | | 155,958 | |

Morningstar, Inc. (a) | | | 1,900 | | | 96,938 | |

| | | | |

|

| |

| | | | | | 252,896 | |

| | | | |

|

| |

Chemicals – 2.3% | | | | | | | |

Airgas, Inc. | | | 3,550 | | | 157,478 | |

Valspar Corp. (The) | | | 5,700 | | | 144,609 | |

| | | | |

|

| |

| | | | | | 302,087 | |

| | | | |

|

| |

Commercial Services – 4.6% | | | | | | | |

Aaron’s, Inc. | | | 4,200 | | | 105,210 | |

IHS, Inc., Class A (a) | | | 4,200 | | | 217,392 | |

Ritchie Brothers Auctioneers, Inc. ADR | | | 7,275 | | | 159,468 | |

URS Corp. (a) | | | 3,050 | | | 118,523 | |

| | | | |

|

| |

| | | | | | 600,593 | |

| | | | |

|

| |

Communications – 1.1% | | | | | | | |

Discovery Communications, Inc., Class A (a) | | | 2,250 | | | 61,875 | |

Discovery Communications, Inc., Class C (a) | | | 3,600 | | | 86,472 | |

| | | | |

|

| |

| | | | | | 148,347 | |

| | | | |

|

| |

Computer Services – 6.1% | | | | | | | |

Cognizant Technology Solutions Corp. (a) | | | 7,425 | | | 286,976 | |

FactSet Research Systems, Inc. | | | 2,950 | | | 188,948 | |

McAfee, Inc. (a) | | | 6,250 | | | 261,750 | |

Teradata Corp. (a) | | | 2,600 | | | 72,488 | |

| | | | |

|

| |

| | | | | | 810,162 | |

| | | | |

|

| |

Computer Software – 5.7% | | | | | | | |

Akamai Technologies, Inc. (a) | | | 3,550 | | | 78,100 | |

Check Point Software Technologies Ltd. (a) | | | 5,800 | | | 180,206 | |

MICROS Systems, Inc. (a) | | | 5,200 | | | 139,984 | |

Solera Holdings, Inc. | | | 5,300 | | | 170,766 | |

Sybase, Inc. (a) | | | 4,700 | | | 185,932 | |

| | | | |

|

| |

| | | | | | 754,988 | |

| | | | |

|

| |

| | | | | | | |

Common Stocks, continued | | | | | | | |

|

|

|

|

|

|

|

|

| | | | | | | |

| | Shares | | Value($) | |

| |

| |

| |

Consumer Products – 5.1% | | | | | | | |

Church & Dwight Co., Inc. | | | 3,050 | | | 173,484 | |

Crown Holdings, Inc. (a) | | | 9,100 | | | 242,515 | |

Gildan Activewear, Inc. (a) | | | 1,100 | | | 19,503 | |

Tupperware Brands Corp. | | | 3,800 | | | 171,076 | |

VF Corp. | | | 1,000 | | | 71,040 | |

| | | | |

|

| |

| �� | | | | | 677,618 | |

| | | | |

|

| |

Correctional Institutions – 1.5% | | | | | | | |

Corrections Corp. of America (a) | | | 8,275 | | | 198,104 | |

| | | | |

|

| |

Distribution & Wholesale – 3.3% | | | | | | | |

Genuine Parts Co. | | | 5,100 | | | 178,449 | |

LKQ Corp. (a) | | | 14,825 | | | 256,028 | |

| | | | |

|

| |

| | | | | | 434,477 | |

| | | | |

|

| |

Education – 1.8% | | | | | | | |

DeVry, Inc. | | | 2,600 | | | 143,754 | |

New Oriental Education & Technology Group, Inc. ADR (a) | | | 1,250 | | | 87,300 | |

| | | | |

|

| |

| | | | | | 231,054 | |

| | | | |

|

| |

Electronic Components & Semiconductors – 4.7% | | | | | | | |

American Superconductor Corp. (a) | | | 3,300 | | | 110,616 | |

Cree, Inc. (a) | | | 5,100 | | | 214,710 | |

Itron, Inc. (a) | | | 2,300 | | | 138,092 | |

Microchip Technology, Inc. | | | 6,400 | | | 153,344 | |

| | | | |

|

| |

| | | | | | 616,762 | |

| | | | |

|

| |

Energy – 1.8% | | | | | | | |

Core Laboratories N.V. | | | 2,225 | | | 232,068 | |

| | | | |

|

| |

Environmental Services – 1.3% | | | | | | | |

Stericycle, Inc. (a) | | | 3,375 | | | 176,749 | |

| | | | |

|

| |

Financial Services – 6.0% | | | | | | | |

Affiliated Managers Group, Inc. (a) | | | 2,750 | | | 174,598 | |

Annaly Capital Management, Inc. | | | 16,350 | | | 276,478 | |

Eaton Vance Corp. | | | 4,975 | | | 141,240 | |

Lazard Ltd., Class A | | | 3,600 | | | 135,900 | |

People’s United Financial, Inc. | | | 4,000 | | | 64,120 | |

| | | | |

|

| |

| | | | | | 792,336 | |

| | | | |

|

| |

Food & Beverage – 3.9% | | | | | | | |

Central European Distribution Corp. (a) | | | 5,625 | | | 174,994 | |

Flowers Foods, Inc. | | | 6,025 | | | 140,744 | |

J.M. Smucker Co. (The) | | | 2,650 | | | 139,734 | |

Yum! Brands, Inc. | | | 1,900 | | | 62,605 | |

| | | | |

|

| |

| | | | | | 518,077 | |

| | | | |

|

| |

Health Care – 8.4% | | | | | | | |

DaVita, Inc. (a) | | | 3,000 | | | 159,090 | |

Haemonetics Corp. (a) | | | 2,900 | | | 149,350 | |

Hologic, Inc. (a) | | | 4,276 | | | 63,199 | |

Intuitive Surgical, Inc. (a) | | | 300 | | | 73,905 | |

| | |

See notes to financial statements. | HSBC INVESTOR FAMILY OF FUNDS | 21 |

|

HSBC INVESTOR MID-CAP FUND |

|

Schedule of Portfolio Investments—As of October 31, 2009 (continued) |

| | | | | | | |

Common Stocks, continued | | | | | | | |

|

|

|

|

|

|

|

|

| | | | | |

| | Shares | | Value($) | |

| |

| |

| |

Health Care, continued | | | | | | | |

Laboratory Corp. of America Holdings (a) | | | 2,175 | | | 149,836 | |

Masimo Corp. (a) | | | 2,800 | | | 74,396 | |

ResMed, Inc. (a) | | | 4,150 | | | 204,221 | |

Techne Corp. | | | 725 | | | 45,320 | |

West Pharmaceutical Services, Inc. | | | 4,750 | | | 187,483 | |

| | | | |

|

| |

| | | | | | 1,106,800 | |

| | | | |

|

| |

Industrial Manufacturing – 2.6% | | | | | | | |

Eaton Corp. | | | 1,350 | | | 81,607 | |

Lincoln Electric Holdings, Inc. | | | 2,850 | | | 135,204 | |

Valmont Industries, Inc. | | | 1,700 | | | 122,859 | |

| | | | |

|

| |

| | | | | | 339,670 | |

| | | | |

|

| |

Insurance – 4.4% | | | | | | | |

Axis Capital Holdings Ltd. | | | 7,100 | | | 205,119 | |

Lincoln National Corp. | | | 7,300 | | | 173,959 | |

Proassurance Corp. (a) | | | 3,950 | | | 198,606 | |

| | | | |

|

| |

| | | | | | 577,684 | |

| | | | |

|

| |

Leisure – 0.6% | | | | | | | |

Penn National Gaming, Inc. (a) | | | 3,300 | | | 82,929 | |

| | | | |

|

| |

| | | | | | | |

Machinery – 2.0% | | | | | | | |

AGCO Corp. (a) | | | 1,700 | | | 47,787 | |

Flowserve Corp. | | | 2,150 | | | 211,151 | |

| | | | |

|

| |

| | | | | | 258,938 | |

| | | | |

|

| |

Metal Processors & Fabrication – 0.6% | | | | | | | |

Precision Castparts Corp. | | | 800 | | | 76,304 | |

| | | | |

|

| |

Oil & Gas – 7.6% | | | | | | | |

Arena Resources, Inc. (a) | | | 3,650 | | | 135,999 | |

Atlas Energy, Inc. | | | 8,512 | | | 222,844 | |

Denbury Resources, Inc. (a) | | | 10,200 | | | 148,920 | |

EQT Corp. | | | 5,125 | | | 214,533 | |

Oil States International, Inc. (a) | | | 3,175 | | | 109,347 | |

Southwestern Energy Co. (a) | | | 3,950 | | | 172,141 | |

| | | | |

|

| |

| | | | | | 1,003,784 | |

| | | | |

|

| |

Real Estate – 3.4% | | | | | | | |

Corporate Office Properties Trust | | | 3,500 | | | 116,165 | |

Digital Realty Trust, Inc. | | | 4,600 | | | 207,598 | |

Essex Property Trust, Inc. | | | 1,700 | | | 127,806 | |

| | | | |

|

| |

| | | | | | 451,569 | |

| | | | |

|

| |

Retail – 2.6% | | | | | | | |

Chipotle Mexican Grill, Inc., Class A (a) | | | 1,200 | | | 97,788 | |

Guess?, Inc. | | | 2,650 | | | 96,857 | |

O’Reilly Automotive, Inc. (a) | | | 4,000 | | | 149,120 | |

| | | | |

|

| |

| | | | | | 343,765 | |

| | | | |

|

| |

Specialty Retail – 0.7% | | | | | | | |

GameStop Corp., Class A (a) | | | 3,975 | | | 96,553 | |

| | | | |

|

| |

Telecommunications – 2.2% | | | | | | | |

American Tower Corp., Class A (a) | | | 5,100 | | | 187,782 | |

NII Holdings, Inc. (a) | | | 3,850 | | | 103,680 | |

| | | | |

|

| |

| | | | | | 291,462 | |

| | | | |

|

| |

| | | | | | | |

Common Stocks, continued | | | | | | | |

|

|

|

|

|

|

|

|

| | | | | | | |

| | Shares | | Value($) | |

| |

| |

| |