UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4526

Name of Registrant: Vanguard Quantitative Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2009 – March 31, 2010

Item 1: Reports to Shareholders

|

| Vanguard Growth and Income Fund |

| Semiannual Report |

|

| March 31, 2010 |

|

|

> Vanguard Growth and Income Fund returned almost 12%, about one percentage point ahead of the peer-group average.

> The fund more or less matched the return of the S&P 500 Index, a benchmark it seeks to outperform, as pockets of strength were neutralized by patches of weakness.

> Signs that the nascent economic recovery was sustainable buoyed investor spirits.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 6 |

| Fund Profile. | 9 |

| Performance Summary. | 10 |

| Financial Statements. | 11 |

| About Your Fund’s Expenses. | 22 |

| Glossary. | 24 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Cover photograph: Veronica Coia.

| |

| Your Fund’s Total Returns | |

| |

| |

| |

| |

| Six Months Ended March 31, 2010 | |

| | Total |

| | Returns |

| Vanguard Growth and Income Fund | |

| Investor Shares | 11.71% |

| Admiral™ Shares | 11.77 |

| S&P 500 Index | 11.75 |

| Large-Cap Core Funds Average | 10.80 |

| Large-Cap Core Funds Average: Derived from data provided by Lipper Inc. | |

Admiral Shares are a lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| September 30, 2009 , Through March 31, 2010 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Growth and Income Fund | | | | |

| Investor Shares | $22.34 | $24.73 | $0.216 | $0.000 |

| Admiral Shares | 36.48 | 40.38 | 0.377 | 0.000 |

1

Chairman’s Letter

Dear Shareholder,

During the past six months, the broad U.S. stock market generated a double-digit gain as investors became increasingly optimistic about the strength of the economic recovery. Vanguard Growth and Income Fund’s Investor Shares returned 11.71%; its lower-cost Admiral Shares returned 11.77%.

The fund’s return was superior to the average return of its peer group, and in line with that of the S&P 500 Index. Market-beating stock selections in a handful of sectors were neutralized by weakness elsewhere.

Stock market rally continued despite a few minor setbacks

After a steep but short-lived decline, stocks resumed their uphill trek in February. The broad U.S. stock market ended the six-month period up about 12%. Since stocks began their historic recovery in March just over a year ago, U.S. equities have risen more than 70%.

During the six months, small-capitalization companies outperformed larger-cap companies, while growth stocks trumped their value counterparts, though the differences weren’t all that significant.

2

Foreign stocks didn’t fare as well as domestic stocks, but still ended the period on a positive note. Investors’ concerns about Greece’s creditworthiness, as well as that of economies such as Spain and Portugal, weighed on the European markets. In Asia, possible changes to China’s monetary policies and weakness in the Japanese market hindered the region’s results. Emerging-market stocks, which made a quick and substantial recovery from the global financial crisis, continued to outperform developed-market stocks.

Investors still favored riskier bond options

The broad U.S. taxable bond market returned about 2% for the period, as investors continued to prefer higher-risk corporate bonds over government issues. The broad municipal bond market returned 0.28%. The yields of longer-term U.S. Treasury bonds rose during the six months, while those of the shortest-term securities remained near 0%.

The Federal Reserve Board has kept its target for short-term interest rates unchanged at 0% to 0.25% since December 2008 and has said that it expects to maintain that rate for “an extended period.” In late February, Fed Chairman Ben Bernanke said that low interest rates were still necessary to help the economy recover, but that the central bank would be ready to tighten credit “at the appropriate time.” The Fed has, however, begun to wind down credit programs established during the financial crisis.

| | | |

| Market Barometer | | | |

| |

| | | | Total Returns |

| | | Periods Ended March 31, 2010 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 12.11% | 51.60% | 2.31% |

| Russell 2000 Index (Small-caps) | 13.07 | 62.76 | 3.36 |

| Dow Jones U.S. Total Stock Market Index | 12.48 | 52.88 | 2.82 |

| MSCI All Country World Index ex USA (International) | 5.51 | 61.67 | 6.59 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 1.99% | 7.69% | 5.44% |

| Barclays Capital Municipal Bond Index | 0.28 | 9.69 | 4.58 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.13 | 2.76 |

| |

| CPI | | | |

| Consumer Price Index | 0.77% | 2.31% | 2.40% |

3

Strengths and weaknesses produced index-like performance

Although a double-digit gain is gratifying in absolute terms, Vanguard Growth and Income Fund’s six-month relative performance can best be described as acceptable. The fund’s advisor, Mellon Capital Management, relies on quantitative stock-selection models in its attempt to capture the risk characteristics of the S&P 500 Index but outperform the unmanaged benchmark by buying the most—and avoiding the least—attractive stocks in each sector. During the past six months, the fund’s return more or less matched that of the index.

The advisor’s models identified a number of superior performers in the consumer staples and health care sectors. While the index’s consumer staples stocks returned about 11%, the fund’s holdings returned almost 17%. The materials sector was another notable strength. The advisor’s selections returned 14%, about four percentage points more than the index’s materials stocks.

The fund surrendered most of its edge over the index with subpar selections in the industrial, utilities, financial, and telecommunication services sectors. For example, industrial stocks generated surprisingly strong returns as the economy

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Growth and Income Fund | 0.35% | 0.21% | 1.27% |

The fund expense ratios shown are from the prospectus dated January 27, 2010, and represent estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the six months ended March 31, 2010, the fund’s annualized expense ratios were 0.33% for Investor Shares and 0.18% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2009.

Peer group: Large-Cap Core Funds.

4

ground into gear and idled factories came back on line, boosting the stock prices of railroads and machinery makers. The index’s industrial stocks returned 19%. Vanguard Growth and Income Fund’s industrial holdings, by contrast, finished the period with a return of about 15%.

The net result of the fund’s strengths and weaknesses was a very strong absolute return, but no clear advantage over the index.

A useful role in a well-diversified portfolio

One of our responsibilities at Vanguard is to carefully monitor a fund’s performance and report to you on the reasons for its successes or shortfalls. At the same time, we’re careful to remember that it’s unwise to make too much of short-term results. Vanguard Growth and Income Fund has delivered unspectacular returns during the past few years of financial upheaval, generally falling short of its benchmark index.

Nevertheless, our long experience with the fund’s advisor and its disciplined approach to security selection give us confidence in its ability to build a portfolio that can earn index-beating returns without taking on excessive risk. Combined with other low-cost stock and bond funds, in proportions consistent with your unique circumstances, Vanguard Growth and Income Fund can play a useful role in helping you meet your long-term financial goals.

On another matter, I would like to inform you that as of January 1, 2010, we completed a leadership transition that began in March 2008. I succeeded Jack Brennan as chairman of Vanguard and each of the funds. Jack has agreed to serve as chairman emeritus and senior advisor. Under Jack’s leadership, Vanguard has grown to become a preeminent firm in the mutual fund industry. Jack’s energy, his relentless pursuit of perfection, and his unwavering focus on always doing the right thing for our clients are evident in every facet of Vanguard policy today.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

April 16, 2010

5

Advisor’s Report

Vanguard Growth and Income Fund’s Investor Shares returned 11.71% for the six months ended March 31. The Admiral Shares returned 11.77%. The S&P 500 Index returned 11.75%, while the average return of large-cap core funds was 10.80%.

Significant market gains over the period

The S&P 500 Index has risen more than 75% from its low in March 2009 amid increasing confidence in the sustainability of the economic recovery. Although the government has wound down several market support programs in the past two quarters, economic signals have continued to show improvement. Corporate earnings have also improved, initially on margin improvement because of cost controls and more recently also because of revenue gains.

As the fourth quarter of 2009 began, the S&P 500 initially fell because of concerns about the sustainability of the recovery and about a “double dip” recession. Outside of the areas most directly affected by the government stimulus efforts, there was considerable uncertainty regarding near-term economic prospects. U.S. unemployment continued to rise, exceeding the 10% mark in October. However, as companies began to rebuild inventories and as expectations improved for corporate earnings, markets gained in November and December.

At the start of the year, gains continued amid good economic news, particularly in the manufacturing sector. Then, from mid-January to mid-February, the markets declined as investors became concerned about several global economic issues. China’s tightening of its monetary policy and the fiscal health of Greece were of particular concern. However, the rally resumed in late February and March, as the economy showed continued improvement, merger-and-acquisition activity picked up, and corporate earnings expectations rose.

Fund performance was in line with that of the S&P 500 benchmark

The fund performed in line with the S&P 500 Index over the period, underperforming it slightly during the fourth quarter and outperforming in the first quarter of 2010. In aggregate, the fund’s performance was not affected significantly either by differences in sector weightings relative to the benchmark or by stock selection within sectors, as our stock picks in some areas outperformed the benchmark and in other areas lagged the benchmark.

The tenor of the U.S. equity market was more favorable to our stock selection process in the last six months than it was earlier in 2009. Our investment process seeks stocks with strong business and price momentum at attractive valuations that we believe can sustain that earnings

6

momentum. Particularly in the first quarter of 2010, the market began rewarding companies with positive earnings expectations, after rewarding stocks for which earnings momentum had not yet materialized through the beginning part of the rally that started in March 2009.

Stock selection was strongest in the health care and consumer staples sectors. In consumer staples, the fund benefited from an overweight position in Coca-Cola Enterprises, which soared in late February after announcing the sale of its North American bottling operations to Coca Cola. The fund held an overweight position in Tyson Foods, which reported strong fourth-quarter earnings, announced higher expected margins, and rose sharply.

Among health care stocks, Merck KGaA, a German company, announced its acquisition of Millipore, a supplier of tools and technology to the life sciences research industry that gained more than 50% during the reporting period. Other strong performers in the sector were Cardinal Health, a drug distributor, and Stryker, a maker of orthopedic replacements.

Stock selection was less favorable within the industrials and technology sectors. Qualcomm, the telecom chipset producer, fell sharply in late January when it scaled back its sales forecasts. Disk drive manufacturer Western Digital reported strong fourth-quarter earnings, but underperformed the sector on concerns that margins had peaked. Within industrials, the fund did not own Boeing, which performed well as the long-delayed 787 plane appeared to come closer to launch. Genuine Parts, a replacement parts distributor that is no longer in the portfolio, underperformed its peers in the industry.

The fund’s positioning and risk controls

Over the past six months, we have made a number of significant enhancements to our stock selection model. We have implemented new research and also synthesized many of our best ideas with those of our new colleagues at Mellon Capital Management, our recent merger partner. We continue to emphasize the same three primary attributes of attractive valuation, favorable momentum, and the sustainability and quality of earnings, and we have been able to improve and further diversify the stock selection metrics we employ. For example, our estimate of earnings quality now incorporates a significantly expanded set of financial statement measures, broadening our ability to assess forward-looking earnings potential. We are enthusiastic about continuing process enhancements.

In 2009, we were particularly watchful of market volatility and uncertainty, and strictly limited differences in industry and sector positions relative to the S&P 500.

7

The fund’s weighting in financials, in particular, closely tracked the sector’s weighting in the benchmark. In response to continuing difficulties in credit markets, we also ensured that the fund did not become overweighted in companies with higher levels of leverage than their industry norms. More recently, as market volatility has declined, we have returned our risk control protocols to normal. And, as markets have again begun to reward fundamentals, we have seen the fund’s performance improve. We believe that the Growth and Income Fund is well positioned in the current environment.

Oliver E. Buckley,

Executive Vice President and Chief Investment Officer,

Active Equity Strategies

Mellon Capital Management Corp.

April 20, 2010

8

Growth and Income Fund

Fund Profile

As of March 31, 2010

| | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VQNPX | VGIAX |

| Expense Ratio1 | 0.35% | 0.21% |

| 30-Day SEC | | |

| Yield | 1.44% | 1.59% |

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | | U.S. Total |

| | | S&P 500 | Market |

| | Fund | Index | Index |

| Number of Stocks | 137 | 500 | 4,159 |

| Median Market Cap | $39.6B | $48.2B | $31.4B |

| Price/Earnings Ratio | 16.8x | 20.9x | 23.0x |

| Price/Book Ratio | 2.2x | 2.2x | 2.2x |

| Return on Equity | 21.4% | 20.6% | 19.1% |

| Earnings Growth Rate | 11.3% | 6.8% | 6.9% |

| Dividend Yield | 1.9% | 1.9% | 1.7% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | | | |

| (Annualized) | 90% | — | — |

| Short-Term Reserves | 0.0% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | | DJ |

| | | | U.S. Total |

| | | S&P 500 | Market |

| | Fund | Index | Index |

| Consumer | | | |

| Discretionary | 9.7% | 10.1% | 11.0% |

| Consumer Staples | 10.4 | 11.3 | 9.8 |

| Energy | 10.4 | 10.9 | 10.0 |

| Financials | 16.6 | 16.5 | 17.3 |

| Health Care | 13.5 | 12.1 | 12.4 |

| Industrials | 9.2 | 10.5 | 10.9 |

| Information | | | |

| Technology | 20.3 | 18.9 | 18.5 |

| Materials | 3.1 | 3.5 | 4.0 |

| Telecommunication | | | |

| Services | 3.2 | 2.8 | 2.6 |

| Utilities | 3.6 | 3.4 | 3.5 |

| | |

| Volatility Measures | | |

| | | DJ |

| | | U.S. Total |

| | S&P 500 | Market |

| | Index | Index |

| R-Squared | 0.99 | 0.99 |

| Beta | 1.02 | 0.99 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| | |

| Ten Largest Holdings (% of total net assets) |

| Exxon Mobil Corp. | Integrated Oil & | |

| | Gas | 3.2% |

| Microsoft Corp. | Systems Software | 2.7 |

| Johnson & Johnson | Pharmaceuticals | 2.7 |

| International Business | Computer | |

| Machines Corp. | Hardware | 2.7 |

| Apple Inc. | Computer | |

| | Hardware | 2.6 |

| JPMorgan Chase & Co. | Diversified Financial | |

| | Services | 2.5 |

| AT&T Inc. | Integrated | |

| | Telecommunication | |

| | Services | 2.4 |

| Procter & Gamble Co. | Household | |

| | Products | 2.1 |

| Pfizer Inc. | Pharmaceuticals | 2.1 |

| Goldman Sachs Group | Investment Banking | |

| Inc. | & Brokerage | 1.9 |

| Top Ten | | 24.9% |

The holdings listed exclude any temporary cash investments and equity index products.

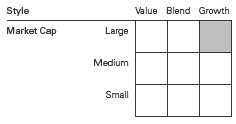

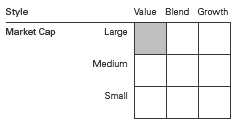

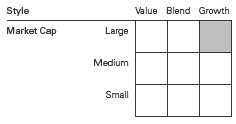

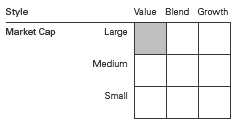

Investment Focus

1 The expense ratios shown are from the prospectus dated January 27, 2010, and represent estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the six months ended March 31, 2010, the annualized expense ratios were 0.33% for Investor Shares and 0.18% for Admiral Shares.

9

Growth and Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

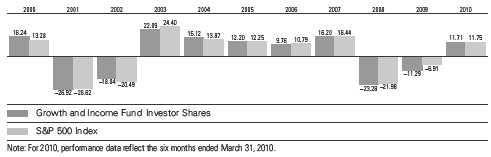

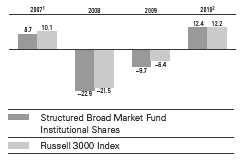

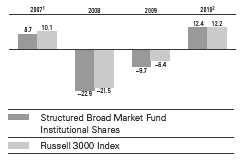

Fiscal-Year Total Returns (%): September 30, 1999, Through March 31, 2010

| | | | |

| Average Annual Total Returns: Periods Ended March 31, 2010 | | | |

| |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 12/10/1986 | 47.20% | 0.21% | -1.01% |

| Admiral Shares | 5/14/2001 | 47.43 | 0.36 | 0.691 |

| 1 Return since inception. | | | | |

Vanguard fund total returns do not include any transaction or account fees that applied in the periods shown. Fund prospectuses provide

information about current fees.

See Financial Highlights for dividend and capital gains information.

10

Growth and Income Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Common Stocks (99.0%)1 | | |

| Consumer Discretionary (9.6%) | |

| | Comcast Corp. Class A | 3,261,700 | 61,385 |

| | Target Corp. | 953,500 | 50,154 |

| | TJX Cos. Inc. | 1,085,300 | 46,147 |

| | Time Warner Inc. | 1,412,100 | 44,156 |

| * | Viacom Inc. Class B | 1,162,600 | 39,970 |

| | Wyndham | | |

| | Worldwide Corp. | 1,538,300 | 39,581 |

| | Mattel Inc. | 1,689,300 | 38,415 |

| * | Starbucks Corp. | 1,400,100 | 33,980 |

| | Gap Inc. | 1,407,700 | 32,532 |

| * | AutoNation Inc. | 1,139,600 | 20,604 |

| | Sherwin-Williams Co. | 153,700 | 10,402 |

| * | Amazon.com Inc. | 65,900 | 8,945 |

| | Time Warner Cable Inc. | 139,866 | 7,456 |

| * | Bed Bath & Beyond Inc. | 137,400 | 6,013 |

| * | Kohl’s Corp. | 105,300 | 5,768 |

| | Omnicom Group Inc. | 148,300 | 5,756 |

| | | | 451,264 |

| Consumer Staples (10.3%) | | |

| | Procter & Gamble Co. | 1,575,400 | 99,676 |

| | Philip Morris | | |

| | International Inc. | 1,174,500 | 61,262 |

| | Walgreen Co. | 1,591,400 | 59,025 |

| | Kimberly-Clark Corp. | 733,700 | 46,135 |

| | PepsiCo Inc. | 694,300 | 45,935 |

| | Hormel Foods Corp. | 920,600 | 38,674 |

| | Wal-Mart Stores Inc. | 685,200 | 38,097 |

| | Tyson Foods Inc. Class A | 1,035,600 | 19,832 |

| | Coca-Cola Enterprises Inc. | 582,800 | 16,120 |

| | Safeway Inc. | 506,200 | 12,584 |

| | ConAgra Foods Inc. | 450,100 | 11,284 |

| | Coca-Cola Co. | 182,100 | 10,016 |

| | Kraft Foods Inc. | 248,700 | 7,521 |

| | Lorillard Inc. | 90,900 | 6,839 |

| | Hershey Co. | 146,000 | 6,250 |

| | Molson Coors Brewing Co. | | |

| | Class B | 118,200 | 4,971 |

| | | | 484,221 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Energy (10.3%) | | |

| | Exxon Mobil Corp. | 2,216,636 | 148,470 |

| | Chevron Corp. | 965,000 | 73,176 |

| | Williams Cos. Inc. | 1,966,400 | 45,424 |

| | National Oilwell Varco Inc. | 1,095,900 | 44,472 |

| | Pioneer Natural | | |

| | Resources Co. | 635,700 | 35,803 |

| | Apache Corp. | 280,600 | 28,481 |

| | Occidental Petroleum Corp. | 310,700 | 26,266 |

| | Peabody Energy Corp. | 516,800 | 23,618 |

| | XTO Energy Inc. | 442,100 | 20,858 |

| | Spectra Energy Corp. | 738,600 | 16,641 |

| | Chesapeake Energy Corp. | 416,000 | 9,834 |

| * | FMC Technologies Inc. | 151,900 | 9,817 |

| | | | 482,860 |

| Financials (16.4%) | | |

| | JPMorgan Chase & Co. | 2,658,900 | 118,986 |

| | Goldman Sachs Group Inc. | 522,600 | 89,171 |

| | American Express Co. | 1,691,500 | 69,791 |

| | Wells Fargo & Co. | 1,996,800 | 62,140 |

| | Prudential Financial Inc. | 886,200 | 53,615 |

| | Travelers Cos. Inc. | 992,300 | 53,525 |

| | Unum Group | 1,699,500 | 42,097 |

| | Bank of America Corp. | 2,192,899 | 39,143 |

| | Hudson City Bancorp Inc. | 2,590,100 | 36,676 |

| | Franklin Resources Inc. | 273,300 | 30,309 |

| | Northern Trust Corp. | 530,500 | 29,315 |

| | Loews Corp. | 672,600 | 25,075 |

| | Fifth Third Bancorp | 1,405,700 | 19,103 |

| | Chubb Corp. | 349,400 | 18,116 |

| | Ameriprise Financial Inc. | 359,200 | 16,293 |

| * | First Horizon National Corp. | 995,100 | 13,981 |

| | XL Capital Ltd. Class A | 655,000 | 12,380 |

| | Principal Financial Group Inc. | 377,600 | 11,030 |

| * | Berkshire Hathaway Inc. | | |

| | Class B | 113,800 | 9,249 |

| | Public Storage | 71,200 | 6,550 |

| | HCP Inc. | 186,800 | 6,164 |

| | State Street Corp. | 132,900 | 5,999 |

| | | | 768,708 |

11

| | | |

| Growth and Income Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Health Care (13.4%) | | |

| | Johnson & Johnson | 1,912,300 | 124,682 |

| | Pfizer Inc. | 5,619,421 | 96,373 |

| * | Amgen Inc. | 1,128,100 | 67,415 |

| | Bristol-Myers Squibb Co. | 2,078,892 | 55,506 |

| | Stryker Corp. | 842,600 | 48,214 |

| | McKesson Corp. | 538,100 | 35,364 |

| | Allergan Inc. | 493,900 | 32,262 |

| | Aetna Inc. | 889,100 | 31,216 |

| | UnitedHealth Group Inc. | 910,500 | 29,746 |

| | Cardinal Health Inc. | 822,600 | 29,638 |

| * | Humana Inc. | 438,500 | 20,509 |

| * | Gilead Sciences Inc. | 356,800 | 16,227 |

| * | Forest Laboratories Inc. | 470,700 | 14,761 |

| | Eli Lilly & Co. | 292,200 | 10,584 |

| * | Zimmer Holdings Inc. | 159,600 | 9,448 |

| | Becton Dickinson and Co. | 77,100 | 6,070 |

| | | | 628,015 |

| Industrials (9.1%) | | |

| | General Electric Co. | 3,355,100 | 61,063 |

| | 3M Co. | 689,900 | 57,655 |

| | United Parcel | | |

| | Service Inc. Class B | 759,300 | 48,907 |

| | Raytheon Co. | 814,600 | 46,530 |

| | Caterpillar Inc. | 623,700 | 39,200 |

| | CH Robinson | | |

| | Worldwide Inc. | 531,300 | 29,673 |

| | Illinois Tool Works Inc. | 505,300 | 23,931 |

| | WW Grainger Inc. | 218,700 | 23,646 |

| | ITT Corp. | 425,300 | 22,800 |

| * | Jacobs Engineering | | |

| | Group Inc. | 427,200 | 19,305 |

| | CSX Corp. | 320,600 | 16,319 |

| | Textron Inc. | 644,000 | 13,672 |

| | L-3 Communications | | |

| | Holdings Inc. | 136,800 | 12,535 |

| | General Dynamics Corp. | 94,200 | 7,272 |

| | Fluor Corp. | 121,100 | 5,632 |

| | | | 428,140 |

| Information Technology (20.1%) | |

| | Microsoft Corp. | 4,268,200 | 124,930 |

| | International Business | | |

| | Machines Corp. | 970,100 | 124,415 |

| * | Apple Inc. | 514,300 | 120,825 |

| | QUALCOMM Inc. | 1,646,600 | 69,141 |

| | Oracle Corp. | 2,690,800 | 69,127 |

| * | Google Inc. Class A | 121,140 | 68,688 |

| * | Computer Sciences Corp. | 1,100,100 | 59,944 |

| | Intel Corp. | 1,655,800 | 36,858 |

| * | Western Digital Corp. | 932,200 | 36,346 |

| * | Dell Inc. | 2,077,500 | 31,183 |

| * | Intuit Inc. | 802,200 | 27,548 |

| | KLA-Tencor Corp. | 797,700 | 24,665 |

| | Xerox Corp. | 2,403,700 | 23,436 |

| * | Micron Technology Inc. | 2,128,600 | 22,116 |

| | | | |

| | | | | Market |

| | | | | Value• |

| | | | Shares | ($000) |

| * | Cisco Systems Inc. | | 790,000 | 20,564 |

| * | SanDisk Corp. | | 427,300 | 14,797 |

| | Harris Corp. | | 241,100 | 11,450 |

| | Jabil Circuit Inc. | | 692,800 | 11,216 |

| | CA Inc. | | 466,100 | 10,939 |

| | Xilinx Inc. | | 375,600 | 9,578 |

| | Texas Instruments Inc. | 273,100 | 6,683 |

| | Total System Services Inc. | 367,100 | 5,749 |

| | Mastercard Inc. Class A | 22,600 | 5,740 |

| | Western Union Co. | | 304,700 | 5,168 |

| | | | | 941,106 |

| Materials (3.1%) | | | |

| | International Paper Co. | 1,208,900 | 29,751 |

| | Freeport-McMoRan | | | |

| | Copper & Gold Inc. | | 296,800 | 24,795 |

| | EI du Pont de | | | |

| | Nemours & Co. | | 520,900 | 19,398 |

| | Newmont Mining Corp. | 369,000 | 18,793 |

| * | Titanium Metals Corp. | 985,500 | 16,349 |

| | Eastman Chemical Co. | 224,700 | 14,309 |

| | Bemis Co. Inc. | | 484,800 | 13,924 |

| | Sealed Air Corp. | | 263,800 | 5,561 |

| | | | | 142,880 |

| Telecommunication Services (3.2%) | |

| | AT&T Inc. | | 4,423,400 | 114,301 |

| | Verizon | | | |

| | Communications Inc. | 1,097,100 | 34,032 |

| | | | | 148,333 |

| Utilities (3.5%) | | | |

| | FPL Group Inc. | | 1,018,300 | 49,215 |

| | Exelon Corp. | | 967,300 | 42,377 |

| | Constellation Energy | | | |

| | Group Inc. | | 1,055,900 | 37,073 |

| | Oneok Inc. | | 507,800 | 23,181 |

| | Integrys Energy Group Inc. | 210,700 | 9,983 |

| | Ameren Corp. | | 164,500 | 4,290 |

| | | | | 166,119 |

| Total Common Stocks | | | |

| (Cost $4,079,098) | | | 4,641,646 |

| Temporary Cash Investment (1.0%)1 | |

| Money Market Fund (1.0%) | | |

| 2 | Vanguard Market | | | |

| | Liquidity Fund, 0.183% | | |

| | (Cost $47,732) | 47,732,044 | 47,732 |

| Total Investments (100.0%) | | |

| (Cost $4,126,830) | | | 4,689,378 |

| Other Assets and Liabilities (0.0%) | |

| Other Assets3 | | | 211,879 |

| Liabilities | | | (210,853) |

| | | | | 1,026 |

| Net Assets (100%) | | | 4,690,404 |

12

Growth and Income Fund

| |

| At March 31, 2010, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 5,952,588 |

| Undistributed Net Investment Income | 4,087 |

| Accumulated Net Realized Losses | (1,829,621) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 562,548 |

| Futures Contracts | 802 |

| Net Assets | 4,690,404 |

| |

| Investor Shares—Net Assets | |

| Applicable to 134,225,957 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,318,887 |

| Net Asset Value Per Share— | |

| Investor Shares | $24.73 |

| |

| Admiral Shares—Net Assets | |

| Applicable to 33,963,441 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 1,371,517 |

| Net Asset Value Per Share— | |

| Admiral Shares | $40.38 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 99.9% and 0.1%, respectively, of ne t assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Cash of $5,580,000 has been segregated as initial margin for open futures contracts.

See accompanying Notes, which are an integral part of the Financial Statements.

13

Growth and Income Fund

Statement of Operations

| |

| | Six Months Ended |

| | March 31, 2010 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 46,688 |

| Interest1 | 54 |

| Security Lending | 846 |

| Total Income | 47,588 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 2,320 |

| Performance Adjustment | (1,233) |

| The Vanguard Group—Note C | |

| Management and Administrati ve—Investor Shares | 4,172 |

| Management and Administrati ve—Admiral Shares | 771 |

| Marketing and Distribution& #151;Investor Shares | 308 |

| Marketing and Distribution& #151;Admiral Shares | 123 |

| Custodian Fees | 20 |

| Shareholders’ Reports—Investor Shares | 43 |

| Shareholders’ Reports—Admiral Shares | 4 |

| Trustees’ Fees and Expenses | 5 |

| Total Expenses | 6,533 |

| Expenses Paid Indirectly | (116) |

| Net Expenses | 6,417 |

| Net Investment Income | 41,171 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 108,079 |

| Futures Contracts | 2,972 |

| Realized Net Gain (Loss) | 111,051 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 359,917 |

| Futures Contracts | 642 |

| Change in Unrealized Appreciation (Depreciation) | 360,559 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 512,781 |

| 1 Interest income from an affiliated company of the fund was $54,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

14

| | |

| Growth and Income Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Six Months Ended | Year Ended |

| | March 31, | September 30, |

| | 2010 | 2009 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 41,171 | 98,334 |

| Realized Net Gain (Loss) | 111,051 | (1,371,420) |

| Change in Unrealized Appreciation (Depreciation) | 360,559 | 545,703 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 512,781 | (727,383) |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (30,073) | (73,186) |

| Admiral Shares | (13,454) | (36,418) |

| Realized Capital Gain | | |

| Investor Shares | — | — |

| Admiral Shares | — | — |

| Total Distributions | (43,527) | (109,604) |

| Capital Share Transactions | | |

| Investor Shares | (263,929) | (120,422) |

| Admiral Shares | (209,097) | (174,315) |

| Net Increase (Decrease) from Capital Share Transactions | (473,026) | (294,737) |

| Total Increase (Decrease) | (3,772) | (1,131,724) |

| Net Assets | | |

| Beginning of Period | 4,694,176 | 5,825,900 |

| End of Period1 | 4,690,404 | 4,694,176 |

| 1 Net Assets—End of Period includes undistributed net investment income of $4,087,000 and $6,443,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

15

| | | | | | | |

| Growth and Income Fund | | | | | | | |

| |

| |

| Financial Highlights | | | | | | |

| |

| |

| Investor Shares | | | | | | | |

| | Six Months | | | | | |

| | | Ended | | | | | |

| For a Share Outstanding | March 31, | | | Year Ended September 30, |

| Throughout Each Period | | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $22.34 | $25.84 | $38.62 | $33.79 | $31.29 | $28.31 |

| Investment Operations | | | | | | | |

| Net Investment Income | | .207 | .447 | .546 | .600 | .550 | .460 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | | 2.399 | (3.453) | (8.758) | 4.840 | 2.470 | 2.980 |

| Total from Investment Operations | | 2.606 | (3.006) | (8.212) | 5.440 | 3.020 | 3.440 |

| Distributions | | | | | | | |

| Dividends from Net Investment Income | (.216) | (.494) | (.560) | (.610) | (.520) | (.460) |

| Distributions from Realized Capital Gains | — | — | (4.008) | — | — | — |

| Total Distributions | | (.216) | (.494) | (4.568) | (.610) | (.520) | (.460) |

| Net Asset Value, End of Period | | $24.73 | $22.34 | $25.84 | $38.62 | $33.79 | $31.29 |

| |

| Total Return1 | | 11.71% | -11.29% | -23.28% | 16.20% | 9.76% | 12.20% |

| |

| Ratios/Supplemental Data | | | | | | | |

| Net Assets, End of Period (Millions) | $3,319 | $3,253 | $3,919 | $5,465 | $5,088 | $5,202 |

| Ratio of Total Expenses to | | | | | | | |

| Average Net Assets2 | | 0.33%3 | 0.35% | 0.31% | 0.32% | 0.38% | 0.40% |

| Ratio of Net Investment Income to | | | | | | | |

| Average Net Assets | | 1.73%3 | 2.28% | 1.69% | 1.61% | 1.65% | 1.53% |

| Portfolio Turnover Rate | | 90%3 | 83% | 96% | 100% | 93% | 84% |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Includes performance-based investment advisory fee increases (decreases) of (0.05%), (0.04%), (0.02%), 0.00%, 0.01%, and 0.01%.

3 Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

16

| | | | | | | |

| Growth and Income Fund | | | | | | | |

| |

| |

| Financial Highlights | | | | | | |

| |

| |

| Admiral Shares | | | | | | | |

| | Six Months | | | | | |

| | | Ended | | | | | |

| For a Share Outstanding | March 31, | | | Year Ended September 30, |

| Throughout Each Period | | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $36.48 | $42.20 | $63.08 | $55.20 | $51.12 | $46.25 |

| Investment Operations | | | | | | | |

| Net Investment Income | | .365 | .775 | .963 | 1.070 | .997 | .849 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | | 3.912 | (5.638) | (14.313) | 7.903 | 4.036 | 4.853 |

| Total from Investment Operations | | 4.277 | (4.863) | (13.350) | 8.973 | 5.033 | 5.702 |

| Distributions | | | | | | | |

| Dividends from Net Investment Income | (.377) | (.857) | (.985) | (1.093) | (.953) | (.832) |

| Distributions from Realized Capital Gains | — | — | (6.545) | — | — | — |

| Total Distributions | | (.377) | (.857) | (7.530) | (1.093) | (.953) | (.832) |

| Net Asset Value, End of Period | | $40.38 | $36.48 | $42.20 | $63.08 | $55.20 | $51.12 |

| |

| Total Return | | 11.77% | -11.15% | -23.19% | 16.37% | 9.97% | 12.39% |

| |

| Ratios/Supplemental Data | | | | | | | |

| Net Assets, End of Period (Millions) | $1,372 | $1,441 | $1,907 | $2,794 | $2,321 | $2,039 |

| Ratio of Total Expenses to | | | | | | | |

| Average Net Assets1 | | 0.18%2 | 0.21% | 0.16% | 0.18% | 0.20% | 0.23% |

| Ratio of Net Investment Income to | | | | | | | |

| Average Net Assets | | 1.88%2 | 2.42% | 1.84% | 1.75% | 1.83% | 1.68% |

| Portfolio Turnover Rate | | 90%2 | 83% | 96% | 100% | 93% | 84% |

1 Includes performance-based investment advisory fee increases (decreases) of (0.05%), (0.04%), (0.02% ), 0.00%, 0.01%, and 0.01%.

2 Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Growth and Income Fund

Notes to Financial Statements

Vanguard Growth and Income Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase require ments. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are value d at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not re adily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing serv ices. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market va lues of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2006–2009), and for the period ended March 31, 2010, and has concluded that no provision for federal income t ax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

18

Growth and Income Fund

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing an d distribution expenses are alloc ated to each class of shares base d on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Mellon Capital Management Corporation provides investment advisory service s to the fund for a fee calculated at an annual percentage rate of average net assets. The basic fee is subject to quarterly adjustments based on the fund’s performance for the preceding three years relative to the S&P 500 Index. For the six months ended March 31, 2010, the investment advisory fee represented an effective annual basic rate of 0.10% of the fund’s average net assets before a decrease of $1,233,000 (0.05%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At March 31, 2010, the fund had contributed capital of $874,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.35% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. The fund has asked its investment advisor to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. For the six months ended March 31, 2010, these arrangemen ts reduced the fund’s expenses by $116,000 (an annual rate of 0.01% of average net assets).

E. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

19

Growth and Income Fund

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At March 31, 2010, 100% of the fund’s investments were valued based on Level 1 inputs.

F. At March 31, 2010, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| S&P 500 Index | June 2010 | 156 | 45,443 | 802 |

Unrealized appreciation (depreciation) on open futures contracts is required t o be treated as realized gain (loss) for tax purposes.

G. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of shor t-term gains as ordinary income for tax purposes.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at September 30, 2009, the fund had available capital loss carryforwards totaling $845,748,000 to offset future net capital gains through September 30, 2017. In addition, the fund realized losses of $1,093,871,000 during the period from November 1, 2008, through September 30, 2009, which are deferred and will be treated as realized for tax purposes in fiscal 2010. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending September 30, 2010; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balance above.

At March 31, 2010, the cost of investment securities for tax purposes was $4,126,830,000. Net unrealized appreciation of investment securities for tax purposes was $562,548,000, consisting of unrealized gains of $677,398,000 on securities that had risen in value since their purchase and $114,850,000 in unrealized losses on securities that had fallen in value since their purchase.

20

Growth and Income Fund

H. During the six months ended March 31, 2010, the fund purchased $2,035,583,000 of investment securities and sold $2,482,737,000 of investment securities, other than temporary cash investments.

| | | | |

| I. Capital share transactions for each class of shares were: | | |

| | Six Months Ended | | Year Ended |

| | March 31, 2010 | September 30, 2009 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 127,309 | 5,472 | 342,754 | 17,955 |

| Issued in Lieu of Cash Distributions | 29,184 | 1,235 | 70,600 | 3,711 |

| Redeemed | (420,422) | (18,067) | (533,776) | (27,759) |

| Net Increase (Decrease)—Investor Shares | (263,929) | (11,360) | (120,422) | (6,093) |

| Admiral Shares | | | | |

| Issued | 71,182 | 1,873 | 152,599 | 4,878 |

| Issued in Lieu of Cash Distributions | 12,161 | 315 | 32,886 | 1,059 |

| Redeemed | (292,440) | (7,733) | (359,800) | (11,621) |

| Net Increase (Decrease)—Admiral Shares | (209,097) | (5,545) | (174,315) | (5,684) |

J. In preparing the financial statements as of March 31, 2010, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

21

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the account service fee described in the prospectus. If such a fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

22

| | | |

| Six Months Ended March 31, 2010 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Growth and Income Fund | 9/30/2009 | 3/31/2010 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $1,117.10 | $1.74 |

| Admiral Shares | 1,000.00 | 1,117.72 | 0.95 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,023.29 | $1.66 |

| Admiral Shares | 1,000.00 | 1,024.03 | 0.91 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.33% for Investor Shares and 0.18% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

23

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (in the case of bonds) or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

24

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

25

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 162 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Informatio n, which can be obtained, wit hout charge, by contacting Vanguard at 800-662-7447, or online at www.vanguard.com.

| |

| Interested Trustee1 | Rajiv L. Gupta |

| | Born 1945. Trustee Since December 2001.2 |

| F. William McNabb III | Principal Occupation (s) During the Past Five Years: |

| Born 1957. Trustee Since July 2009. Chairman of the | Chairman and Chief Executive Officer (retired 2009) |

| Board. Principal Occupation(s) During the Past Five | and President (2006–2008) of Rohm and Haas Co. |

| Years: Chairman of the Board of The Vanguard Group, | (chemicals); Director of Tyco International, Ltd. |

| Inc., and of each of the investment companies served | (diversified manufacturing and services) and Hewlett- |

| by The Vanguard Group, since January 2010; Director | Packard Co. (electronic computer manufacturing); |

| of The Vanguard Group since 2008; Chief Executive | Trustee of The Conference Board; Member of the |

| Officer and President of The Vanguard Group and of | Board of Managers of Delphi Automotive LLP |

| each of the investment companies served by The | (automotive components). |

| Vanguard Group since 2008; Director of Vanguard | |

| Marketing Corporation; Managing Director of The | Amy Gutmann |

| Vanguard Group (1995–2008). | Born 1949. Trustee Since June 2006. Principal |

| | Occupation(s) During the Past Five Years: President |

| | of the University of Pennsylvania; Christopher H. |

| Independent Trustees | Browne Distinguished Professor of Political Science |

| | in the School of Arts and Sciences with secondary |

| Emerson U. Fullwood | appointments at the Annenberg School for Commu- |

| Born 1948. Trustee Since January 2008. Principal | nication and the Graduate School of Education of |

| Occupation(s) During the Past Five Years: Executive | the University of Pennsylvania; Director of Carnegie |

| Chief Staff and Marketing Officer for North America | Corporation of New York, Schuylkill River Development |

| and Corporate Vice President (retired 2008) of Xerox | Corporation, and Greater Philadelphia Chamber of |

| Corporation (documen t management products and | Commerce; Trustee of the National Constitution Center; |

| services); Director of SPX Corporation (multi-industry | Chair of the Presidential Commission for the Study of |

| manufacturing), the United Way of Rochester, | Bioethical Issues. |

| Amerigroup Corporation (managed health care), | |

| the University of Rochester Medical Center, and | |

| Monroe Community College Foundation. | |

| | |

| JoAnn Heffernan Heisen | Executive Officers | |

| Born 1950. Trustee Since July 1998. Principal | | |

| Occupation(s) During the Past Five Years: Corporate | Thomas J. Higgins | |

| Vice President and Chief Global Diversity Officer since | Born 1957. Chief Financial Officer Since September |

| 2006 (retired 2008) and Member of the Executive | 2008. Principal Occupation(s) During the Past Five |

| Committee (retired 2008) of Johnson & Johnson | Years: Principal of The Vanguard Group, Inc.; Chief |

| (pharmaceuticals/consumer products); Vice President | Financial Officer of each of the investment companies |

| and Chief Information Officer of Johnson & Johnson | served by The Vanguard Group since 2008; Treasurer |

| (1997–2005); Director of the University Medical Center | of each of the investment companies served by The |

| at Princeton and Women’s Research and Education | Vanguard Group (1998–2008). |

| Institute; Member of the Advisory Board of the | | |

| Maxwell School of Citizenship and Public Affairs | Kathryn J. Hyatt | |

| at Syracuse University. | Born 1955. Treasurer Since November 2008. Principal |

| | Occupation(s) During the Past Five Years: Principal |

| F. Joseph Loughrey | of The Vanguard Group, Inc.; Treasurer of each of |

| Born 1949. Trustee Since October 2009. Principal | the investment companies served by The Vanguard |

| Occupation(s) During the Past Five Years: President | Group since 2008; Assistant Treasurer of each of the |

| and Chief Operating Officer since 2005 (retired 2009) | investment companies served by The Vanguard Group |

| and Vice Chairman of the Board (2008–2009) of | (1988–2008). | |

| Cummins Inc. (industrial machinery); Director of | | |

| SKF AB (industrial machinery), Hillenbrand, Inc. | Heidi Stam | |

| (specialized consumer services), Sauer-Danfoss Inc. | Born 1956. Secretary Since July 2005. Principal |

| (machinery), the Lumina Foundation for Education, | Occupation(s) During the Past Five Years: Managing |

| and Oxfam America; Chairman of the Advisory Council | Director of The Vanguard Group, Inc., since 2006; |

| for the College of Arts and Letters at the University of | General Counsel of The Vanguard Group since 2005; |

| Notre Dame. | Secretary of The Vanguard Group and of each of the |

| | investment companies served by The Vanguard Group |

| André F. Perold | since 2005; Director and Senior Vice President of |

| Born 1952. Trustee Since December 2004. Principal | Vanguard Marketing Corporation since 2005; |

| Occupation(s) During the Past Five Years: George | Principal of The Vanguard Group (1997–2006). |

| Gund Professor of Finance and Banking at the Harvard | | |

| Business School; Chair of the Investment Committee | | |

| of HighVista Strategies LLC (private investment firm). | Vanguard Senior Management Team |

| |

| Alfred M. Rankin, Jr. | R. Gregory Barton | Michael S. Miller |

| Born 1941. Trustee Since January 1993. Principal | Mortimer J. Buckley | James M. Norris |

| Occupation(s) During the Past Five Years: Chairman, | Kathleen C. Gubanich | Glenn W. Reed |

| President, and Chief Executive Officer of NACCO | Paul A. Heller | George U. Sauter |

| Industries, Inc. (forklift trucks/housewares/lignite); | | |

| Director of Goodrich Corporation (industrial products/ | | |

| aircraft systems and services); Chairman of the Federal | Chairman Emeritus and Senior Advisor |

| Reserve Bank of Cleveland; Trustee of The Cleveland | | |

| Museum of Art. | John J. Brennan | |

| | Chairman, 1996–2009 | |

| Peter F. Volanakis | Chief Executive Officer and President, 1996–2008 |

| Born 1955. Trustee Since July 2009. Principal | | |

| Occupation(s) During the Past Five Years: President | | |

| since 2007 and Chief Operating Officer since 2005 | Founder | |

| of Corning Incorporated (communications equipment); | | |

| President of Corning Technologies (2001–2005); | John C. Bogle | |

| Director of Corning Incorporated and Dow Corning; | Chairman and Chief Executive Officer, 1974–1996 |

| Trustee of the Corning Incorporated Foundation and | | |

| the Corning Museum of Glass; Overseer of the | | |

| Amos Tuck School of Business Administration at | | |

| Dartmouth College. | | |

1 Mr. McNabb is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

|

|

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > www.vanguard.com

|

| Fund Information > 800-662-7447 |

| Direct Investor Account Services > 800-662-2739 |

| Institutional Investor Services > 800-523-1036 |

| Text Telephone for People |

| With Hearing Impairment > 800-749-7273 |

| |

| This material may be used in conjunction |

| with the offering of shares of any Vanguard |

| fund only if preceded or accompanied by |

| the fund’s current prospectus. |

| |

| All comparative mutual fund data are from Lipper Inc. or |

| Morningstar, Inc., unless otherwise noted. |

| |

| You can obtain a free copy of Vanguard’s proxy voting |

| guidelines by visiting our website, www.vanguard.com, |

| and searching for “proxy voting guidelines,” or by calling |

| Vanguard at 800-662-2739. The guidelines are also |

| available from the SEC’s website, www.sec.gov. In |

| addition, you may obtain a free report on how your fund |

| voted the proxies for securities it owned during the 12 |

| months ended June 30. To get the report, visit either |

| www.vanguard.com or www.sec.gov. |

| |

| You can review and copy information about your fund at |

| the SEC’s Public Reference Room in Washington, D.C. To |

| find out more about this public service, call the SEC at |

| 202-551-8090. Information about your fund is also |

| available on the SEC’s website, and you can receive |

| copies of this information, for a fee, by sending a |

| request in either of two ways: via e-mail addressed to |

| publicinfo@sec.gov or via regular mail addressed to the |

| Public Reference Section, Securities and Exchange |

| Commission, Washington, DC 20549-1520. |

© 2010 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

Q932 052010

|

| Vanguard Structured Equity Funds |

| Semiannual Report |

|

| March 31, 2010 |

|

|

|

| Vanguard Structured Large-Cap Equity Fund |

| Vanguard Structured Large-Cap Growth Fund |

| Vanguard Structured Large-Cap Value Fund |

| Vanguard Structured Broad Market Fund |

|

> For the fiscal half-year, the four Vanguard Structured Equity Funds delivered double-digit returns as stock prices rallied.

> The Large-Cap Equity and Broad Market Funds outperformed their benchmark indexes, while the Large-Cap Growth and Large-Cap Value Funds trailed.

> The advisor’s stock-selection models enjoyed notable success in consumer-oriented sectors, but generally lagged in the industrial and financial sectors.

| |

| Contents | |

| Your Fund’s Total Returns | 1 |

| Chairman’s Letter | 2 |

| Advisor’s Report | 6 |

| Structured Large-Cap Equity Fund | 8 |

| Structured Large-Cap Growth Fund | 20 |

| Structured Large-Cap Value Fund | 32 |

| Structured Broad Market Fund | 43 |

| About Your Fund’s Expenses | 58 |

| Trustees Approve Advisory Arrangement | 60 |

| Glossary | 61 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Cover photograph: Veronica Coia.

| | |

| Your Fund’s Total Returns | | |

| |

| |

| |

| |

| Six Months Ended March 31, 2010 | | |

| | Ticker | Total |

| | Symbol | Returns |

| Vanguard Structured Large-Cap Equity Fund | | |

| Institutional Shares1 | VSLIX | 12.14% |

| Institutional Plus Shares2 | VSLPX | 12.16 |

| S&P 500 Index | | 11.75 |

| Large-Cap Core Funds Average3 | | 10.80 |

| |

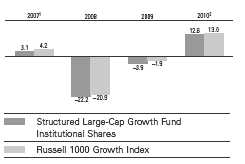

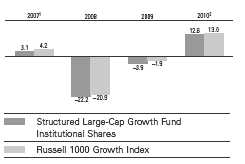

| Vanguard Structured Large-Cap Growth Fund | | |

| Institutional Shares1 | VSTLX | 12.56% |

| Institutional Plus Shares2 | VSGPX | 12.61 |

| Russell 1000 Growth Index | | 12.96 |

| Large-Cap Growth Funds Average3 | | 11.58 |

| |

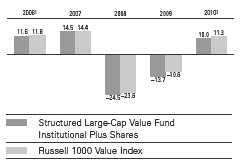

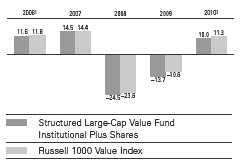

| Vanguard Structured Large-Cap Value Fund | | |

| Institutional Plus Shares2 | VSLVX | 10.03% |

| Russell 1000 Value Index | | 11.28 |

| Large-Cap Value Funds Average3 | | 10.59 |

| |

| Vanguard Structured Broad Market Fund | | |

| Institutional Shares1 | VSBMX | 12.38% |

| Institutional Plus Shares2 | VSBPX | 12.43 |

| Russell 3000 Index | | 12.19 |

| Multi-Cap Core Funds Average3 | | 11.00 |

1 This class of shares carries low expenses and is available for a minimum investment of $5 million.

2 This class of shares also carries low expenses and is available for a minimum investment of $200 million.

3 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

The Vanguard Structured Equity Funds generated double-digit returns for the six months ended March 31, 2010, as stocks rallied on optimism about the strength of the U.S. economic recovery and the rebound in corporate earnings.

The Large-Cap Equity and Broad Market Funds outperformed their unmanaged benchmark indexes, while the Large-Cap Growth and Large-Cap Value Funds fell short. In general, the funds’ quantitative stock-selection models delivered strong returns in consumer-oriented sectors, but struggled in industrials and financials.

Stock market rally continued despite a few minor setbacks

After a steep but short-lived decline, stocks resumed their uphill trek in February. The broad U.S. stock market ended the six-month period up about 12%. Since stocks began their historic recovery in March just over a year ago, U.S. equities have risen more than 70%.

During the six months, small-capitalization companies outperformed larger-cap companies, while growth stocks trumped their value counterparts, though the differences weren’t all that significant.

Foreign stocks didn’t fare as well as domestic stocks, but still ended the period on a positive note. Investors’ concerns about Greece’s creditworthiness, as well as that of economies such as Spain and Portugal, weighed on the European

2

markets. In Asia, possible changes to China’s monetary policies and weakness in the Japanese market hindered the region’s results. Emerging-market stocks, which made a quick and substantial recovery from the global financial crisis, continued to outperform developed-market stocks.

Investors still favored riskier bond options

The broad U.S. taxable bond market returned about 2% for the period, as investors continued to prefer higher-risk corporate bonds over government issues. The broad municipal bond market returned 0.28%. The yields of longer-term U.S. Treasury bonds rose during the six months, while those of the shortest-term securities remained near 0%.

The Federal Reserve Board has kept its target for short-term interest rates unchanged at 0% to 0.25% since December 2008 and has said that it expects to maintain that rate for “an extended period.” In late February, Fed Chairman Ben Bernanke said that low interest rates were still necessary to help the economy recover, but that the central bank would be ready to tighten credit “at the appropriate time.” The Fed has, however, begun to wind down credit programs established during the financial crisis.

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended March 31, 2010 |

| | Six Months | One Year | Five Years1 |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 12.11% | 51.60% | 2.31% |

| Russell 2000 Index (Small-caps) | 13.07 | 62.76 | 3.36 |

| Dow Jones U.S. Total Stock Market Index | 12.48 | 52.88 | 2.82 |

| MSCI All Country World Index ex USA (International) | 5.51 | 61.67 | 6.59 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 1.99% | 7.69% | 5.44% |

| Barclays Capital Municipal Bond Index | 0.28 | 9.69 | 4.58 |

| Citigroup 3-Month Treasury Bill Index | 0.05 | 0.13 | 2.76 |

| |

| CPI | | | |

| Consumer Price Index | 0.77% | 2.31% | 2.40% |

1 Annualized.

3

Mixed results during a period of strength

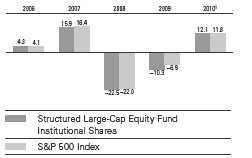

The Vanguard Structured Equity Funds delivered strong returns during the past six months, a welcome contrast to the performance we reported to you a year ago, when stock prices were near their bear-market bottom. Returns ranged from 10.03% for the Institutional Plus Shares of Vanguard Structured Large-Cap Value Fund to 12.61% for the Institutional Plus Shares of Vanguard Structured Large-Cap Growth Fund. On a relative basis—the more meaningful standard for these quantitatively managed portfolios—results were mixed.

The Structured Large-Cap Equity and Structured Broad Market Funds outperformed their indexes by modest margins, consistent with their attempts to produce index-beating returns while keeping portfolio risk levels in line with those of their benchmarks. The stock-selection models used by the funds’ advisor, Vanguard Quantitative Equity Group, delivered impressive results in the consumer discretionary, consumer staples, and information technology sectors.

While consumer discretionary stocks in the Standard & Poor’s 500 Index returned about 20%, for example, those in the Structured Large-Cap Equity Fund returned almost 27%. The Structured Broad Market Fund delivered a similar margin of advantage among the retailers, restaurants, and entertainment purveyors that make up the consumer discretionary sector.

The Structured Large-Cap Growth and Large-Cap Value Funds trailed the returns of their indexes, as the funds’ stock selection in both the industrial and financial sectors restrained performance. The industrial stocks in the Russell 1000 Growth Index, for example, rose almost 18% as the economic recovery gathered momentum, boosting the stock prices of transportation companies and machinery makers. The Large-Cap Growth Fund’s industrial stocks returned about 5 percentage points less. The shortfalls in the financial sector were smaller. In the Large-Cap Value Fund, however, their consequence loomed larger, simply because financials are by far the index’sand the fund’s—largest exposure.

Risk-controlled portfolios with the potential for outperformance