This report is not authorized for distribution to prospective investors unless preceded or

accompanied by a currently effective prospectus of The Tocqueville Trust. Please call

1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Chairman’s Letter

Dear Fellow Shareholder,

Having been away from the coop for so long that many, indeed, most, of the investing public had forgotten what they looked like, the chickens have started coming home to roost. And they appear to be settling in. Expect the clucking, already loud, to become deafening.

Massive and endless deficit spending, coupled with wanton monetary expansion, was bound to awaken the slumbering fowl of inflation, sooner or later. The wonder is that it took so long to rouse them from their perch. To make matters worse, the current government, elected by the slimmest of margins, to restore “normalcy,” is, instead, laboring mightily to transform the country into a European style welfare state (on steroids), with trillions of dollars in new and unfunded social programs, and trillions more for the climate boondoggle, which, regardless of whatever else it may accomplish, will have no meaningful impact on the climate.

The predictable rise in inflation to the highest level in thirty years is bad enough for those on fixed incomes or in jobs with wage gains stagnant or below the rate of inflation, it is also responsible for distorting capital markets and asset pricing, not to mention pushing people into higher tax brackets and subjecting purely nominal gains to capital gains taxes. But wait, it gets worse. If chickens wear shoes, they have one left to drop. The bond markets seem to be as oblivious to the dangers of an inflationary cycle as the media (and much of the culture) that has been mindlessly cheering on the government’s spending extravaganza and the Fed’s complicity. Rates remain stubbornly low and historically tiny. Real rates, after deducting for inflation, are negative up and down the yield curve. This is a situation that cannot last, and, since it cannot, it will not, particularly as the Fed’s purview is being increasingly expanded to include ESG (environment, sustainability and governance), DEI (diversity, equity and inclusion), and climate engagement. In case it went unnoticed, the Fed hasn’t exactly distinguished itself in tending to its two historical charges of price stability and full employment. However one may feel about the merit of these social goals, it is something of a reach to think that the Fed will do any better with its new responsibilities, which, most reasonable people would conclude, have next to nothing to do with monetary policy.

Annual Report | 1

Once rates do begin to rise to reflect the underlying inflationary pressures, budget chaos will follow, and there is little that the unfortunately politicized Fed can do to stop that, except for more of the same. To wit, continue to monetize the debt. So, it appears we are embarking on a long and self-reinforcing inflationary cycle. The decade old game of chicken is finally over, and the Fed seems to have lost. What to do about it, from an investment point of view, is what your fund managers will discuss, among other things, in the pages that follow.

Sincerely,

Robert W. Kleinschmidt

Chairman

2 | October 31, 2021

The Tocqueville Fund

Dear Fellow Shareholder,

The twelve months ended October 31, 2021, was a robust period for equity markets by all accounts. The release of COVID-19 vaccines back in November of 2020 fueled a continued rally that only hit a brief speed bump in September of 2021 when a host of factors seemed to weigh on investors. These included fear of inflation, hints of withdrawal of central bank stimulus, possibly weakening corporate earnings momentum, the ten year Treasury rate ticking higher, possible tax changes and the political game of chicken being played in Congress about the debt ceiling. These fears seemed to fall away as Halloween actually approached and the market began to discount the likelihood of major fiscal policy changes.

Underneath the steady upward march, was turmoil in the repeated rotations between growth oriented pandemic favorites and cyclical and rate sensitive names. These rotations tended to coincide with the waxing and waning of COVID outbreaks and the back and forth on investors’ perceptions of inflation being secular and caused by excessive liquidity and money printing by central banks or temporary, with observable price increases being caused by COVID induced supply chain disruptions around the globe.

That the U.S. generally did better than other markets during the period could be primarily attributed to policy decisions where the ECB and Japan had already slowed the pace of bond market interventions and China implemented a crackdown on market leading technology companies and is taking chances with the bursting of a long simmering real estate bubble while the U.S. has so far only played lip service to tapering (probably because Chairman Powell would rather have another term as the Chairman). Although there is some irony in that, when the markets recovered after the September swoon, it was probably due to COVID resurgence that suggested to investors that central banks might not be so quick to withdraw stimulus, particularly in Europe. That is sort of the behavior of an addict but worth noting that the Fed and ECB have somewhat differing mandates. The largest contributing sectors in the U.S. market were information technology, financials and healthcare while the weakest were utilities, materials and real estate. It is worth noting that the highest returning sector was energy by a wide margin, but it is now one of the smallest components of the benchmark.

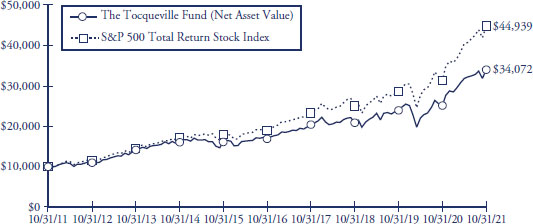

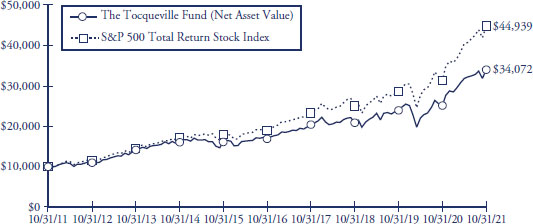

The Fund’s net asset value gained 35.17% during the year compared to the S&P 500 Index which gained 42.91% and the Russell 1000 and 3000 Value indices which gained 43.76% and 44.97%, respectively. The strongest contributing sectors were information technology, industrials and financials, while the still positive laggards were real estate, utilities and consumer staples. The top performing individual names were Applied Materials, NVIDIA, Alphabet, Microsoft and Charles Schwab, while the detractors were Alibaba, Wheaton Precious Metals, Pan American Silver, Verizon and ACADIA Pharmaceuticals.

One new position during the period was Expedia, the online travel agency. Expedia is a business most directly impacted by the COVID-19 pandemic, with non-essential travel severely curtailed. As a result, there is considerable pent-up demand for travel that we believe bodes well for the near term. Being a capital light business, the company was able to navigate the difficult period without too much damage to its balance sheet. Moreover, we believe, its rapidly growing VRBO business, akin to the more well-known Air BnB, was not getting appropriate credit in the market.

Annual Report | 3

We also added Republic Services, a leader in the waste management business. Republic Services had underperformed and was out of favor with investors because it suffered an unexpectedly large loss of volumes due to the pandemic where the business had traditionally been perceived to be very defensive. Commercial customer closures caused the business to appear more cyclical in this crisis than in other downturns. Our view was that this was an opportunity to acquire a stable business with historical pricing power that would benefit from volume recovery, at an attractive discount.

Other positions that were initiated or added to included ACADIA Pharmaceuticals, Alibaba, Allegro Microsystems, Cameco, Chevron, Diamondback Energy, Dominion Energy, DOW, DuPont, Gilead, Mesabi Trust, Newmont Goldcorp, Organon, Rockwell Automation, South32 and Tejon Ranch.

A variety of positions were reduced or eliminated during the period due to changes in circumstances, prices reaching our targets or in response to investor requests for liquidity. These included ACADIA Pharmaceuticals, Alibaba, Allegro Microsystems, Amazon, Apple, Applied Materials, Biogen, Boeing, Cameco, Caterpillar, Coca Cola, Constellation Brands, DuPont, Expedia, Fidelity National Information Services, Gilead, Intel, Ionis, Johnson & Johnson, McDonald’s, Meta (Facebook), Microsoft, NextEra, NVIDIA, Organon, Procter & Gamble, Rockwell Automation, Viatris (received in a spinoff) and Walmart.

The primary market debate that still guides investor positioning is the prospect for higher rates and inflation. Companies have been reporting supply chain disruptions, port overcrowding, low inventory levels, higher raw material costs and difficulty finding enough workers. The media focuses on higher grocery prices and getting pinched at the gas pump, but none of these are “inflation” per se just a byproduct or symptom of it. Inflation is the sustained systemic increase in prices broadly across the economy caused by too much liquidity in the market. There has been enormous money printing by central banks globally with close to half of the entire supply of dollars printed in the past year. One might have expected with all that liquidity sloshing around that gold would be skyrocketing and the velocity of money would have increased, two traditional hallmarks of inflation. Instead, gold is virtually flat over the past year and the velocity of money has collapsed in the pandemic, leaving investors to continue to ponder. In the meantime, speculation in cryptocurrencies seems to have captured the imagination of those seeing evidence of sustained inflation and the equity markets appear to be pricing in the great inventory restocking, even as supply chain bottlenecks push that further into the future. While there are plenty of legitimate concerns, we continue to seek value where others are, perhaps, too fearful.

Sincerely,

|  |

| Robert W. Kleinschmidt | Peter Shawn |

| Portfolio Manager | Director of Research |

4 | October 31, 2021

The Tocqueville Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/11. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2021

| | 1 Year | 3 Year | 5 Year | 10 Year |

| The Tocqueville Fund | 35.17% | 17.72% | 15.00% | 13.04% |

| Standard & Poor’s 500 Total Return Stock Index | 42.91% | 21.48% | 18.93% | 16.21% |

Annual Report | 5

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

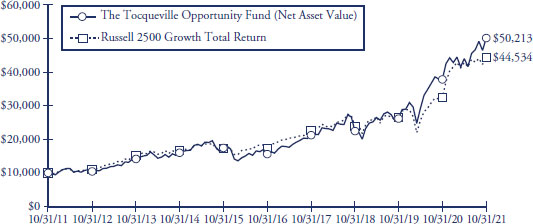

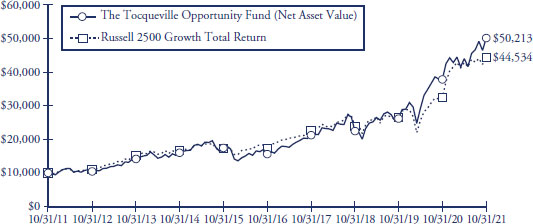

We are pleased to provide this investment overview for the 2021 fiscal year for the Tocqueville Opportunity Fund (“Fund”). During the fiscal year ended on October 31st, 2021, the Fund’s net asset value appreciated 32.60% while the SMID cap growth benchmark, the Russell 2500 Growth Index, appreciated 37.12%.

Since the last update, the unexpected announcement and rapid deployment of a COVID-19 vaccine has caused the U.S. economy to recover faster than expected. While we welcome this positive development, the unprecedented pent-up demand from consumers has outstripped available supply from companies who mothballed capacity during the pandemic. This has caused various bottlenecks in the supply chain, as materials and labor force that were once plentiful are now in severe shortage. We believe these dynamics are temporary as the amount of stimulus will not be repeated in 2022, and the high prices being experienced by consumers will create some demand destruction. On the supply side, companies should be able to add capacity over the next year to satisfy demand.

Despite our view of these temporary headwinds, investors are increasingly concerned about inflation and the knock-on effects that inflation causes. The 10-year Treasury Bond has roughly doubled over the past 12 months causing more cyclical sectors such as financials and industrials to outperform long duration cash flow stories in the Information Technology sector. While the worst of the pandemic appears to be behind us, COVID-19 has accelerated certain secular themes the Fund has been invested in, namely E-commerce and cloud computing. Shopify, one of the funds top holdings, has been a primary beneficiary of the shift from traditional brick and mortar to omni-channel solutions. Shopify enables merchants to quickly and seamlessly setup an online store within hours. In addition to a website, Shopify helps merchants fulfill orders, manage inventory, direct marketing spend, and facilitate payments among other services. It is our belief that this trend toward E-commerce will only become more important as the world returns to some semblance of normalcy and Shopify’s value proposition sets it up for years of rapid growth. Another theme that has come to the forefront during this pandemic has been the need for businesses to accelerate their digital transformation to the cloud. With more employees working from home or in a hybrid model, businesses are needing to rapidly invest to ensure their network is accessible, efficient, and secure. This has created demand for all sorts of software solutions related to the cloud such as workflow management, cyber security, and payroll processing just to name a few. The Fund’s investments in Service Now, Okta, and Paylocity are emblematic of these trends and are seeing accelerating demand for its products as a result. We continue to be long term believers in these companies as they offer an attractive pay back to its users while delivering shareholders superior growth and strong recurring revenues with little to no churn.

6 | October 31, 2021

Investments in Healthcare, Materials, and Consumer Staples provided the leading contributions on a relative basis versus the benchmark. The Information-technology sector was the leading driver of relative underperformance versus the benchmark. Looking at individual securities, Shopify, ServiceNow, Paylocity, Dexcom, and Paycom Software were the top-five contributors to performance while detractions from performance included Coupa Software, Iovance Biotherapeutics, Splunk, Skillz, and Invitae Corp.

The Fund’s allocation to its top 10 and 50 positions at the end of the fiscal period totaled 52% and 90%, respectively. The Fund’s active share relative to its benchmark continues to be high, ranging from a low of 82% to a high of 92% during the past 12 months.

As always, we sincerely appreciate your continued support.

Sincerely,

Paul Lambert

Portfolio Manager

Annual Report | 7

The Tocqueville Opportunity Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/11. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2021

| | 1 Year | 3 Year | 5 Year | 10 Year |

| The Tocqueville Opportunity Fund | 32.60% | 30.79% | 26.31% | 17.51% |

| Russell 2500 Growth Total Return Index | 37.12% | 23.10% | 20.68% | 16.11% |

8 | October 31, 2021

The Tocqueville Phoenix Fund

Dear Fellow Shareholder,

For the fiscal year ended October 31, 2021, the Tocqueville Phoenix Fund’s (“Fund”) net asset value increased 52.80%, versus an increase of 64.30% for the Russell 2000 Value Index, and an increase of 50.80% for the Russell 2000 Index, each on a total return basis.

Fiscal and monetary stimulus, removal of many COVID-19 restrictions, and successful distribution of COVID-19 vaccinations helped the U.S. economy recover during the fiscal year. Small capitalization stocks benefited the most, and experienced outstanding gains due to their increased exposure to an improving domestic economy. The Fund’s holdings generally reported positive results throughout the year, and we are optimistic about their prospects for calendar year 2022.

The U.S. government’s strategy to counter the economic impact of COVID-19 has been extraordinary. In early March, President Biden signed a $1.9 trillion stimulus bill named “The American Rescue Plan”. This comes on top of the $900 billion package that was signed in December 2020, and the $2 trillion CARES Act that was signed by President Trump at the height of the pandemic last year. All-in, there will likely be over $5 trillion of fiscal stimulus to help the U.S. economy recover from its near total shutdown in 2020. In addition, it appears likely that President Biden has the bipartisan support necessary to pass a much-needed Infrastructure Bill that is estimated to contribute an additional $1 trillion to fiscal spending. The result of such aggressive fiscal policy, accompanied with expansionary monetary policy, has been a financial system awash with liquidity, that has undoubtedly caused record prices for nearly all asset classes and the largest annual increase in consumer prices in the last 30 years.

The rapid recovery produced by such dramatic government intervention, along with lingering COVID-19 travel restrictions have caused inventory and staffing shortages, longer lead times and record high shipping costs for products imported into the United States. Container freight rates from Shanghai to Los Angeles are five times higher than anytime over the previous ten years, and lead times for basic semiconductor components used in automobiles have increased from an average of ten to forty weeks. A resolution to these issues will likely take some time; however, we anticipate that as COVID-19 variants subside, production should return to more historical levels and demand will ultimately be the determinant of economic activity.

The Fund ended the fiscal year with 92% of the portfolio invested in equities and held 41 positions. The top ten positions accounted for 36% of the portfolio, while the average position size was slightly over 2% and had a market capitalization of $4.3 billion. We added seven new positions to the portfolio during the fiscal year while exiting ten. The largest new additions were AMS AG, Comtech Telecommunications Corp and BGSF Inc. AMS, through the acquisition of Osram, is positioning itself to be an essential supplier in the growing fields of autonomous driving and display technology; Comtech is poised for significant growth as low earth orbit satellites are launched from the likes of Amazon and states and municipalities upgrade 911 systems to accept picture and video text messages; while BGSF is a temporary staffing company that should benefit substantially from the removal of COVID-19 eviction moratoriums. Of the ten stocks that were sold, four were acquired by financial and strategic acquirors at significant premiums to their current trading prices, while the remaining six were disposed of to provide capital for other opportunities.

Annual Report | 9

We believe, the companies that we own are financially sound and have specific catalysts to improve their fortunes in all economic environments. In calendar year 2021, approximately 55% of the Fund holdings will generate higher earnings per share than they did in the year prior to the COVID-19 pandemic, and we expect earnings growth of approximately 30% for the portfolio in calendar year 2022. The price to forward earnings multiple of the portfolio is a modest 13 times and the free cash flow yield is approximately 8%. In addition, we are encouraged that insiders have purchased shares in over 40% of the portfolio companies within the past 12 months, and approximately 15% of the portfolio has either activist involvement and/or has commenced a strategic review process to enhance shareholder value.

We hope you are safe and with very best wishes.

Sincerely,

|  |

| James Maxwell | Michael Sellecchia |

| Portfolio Manager | Portfolio Manager |

10 | October 31, 2021

The Tocqueville Phoenix Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/11. On February 15, 2019, The Delafield Fund’s name changed to The Tocqueville Phoenix Fund. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Value Total Return Index measures performance of the small cap value segment of the U.S. equity universe. Securities are categorized as growth or value based on their relative book-to-price ratios, historical sales growth, and expected earnings growth. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2021

| | 1 Year | 3 Year | 5 Year | 10 Year |

| The Tocqueville Phoenix Fund*(a) | 52.80% | 13.65% | 9.32% | 7.73% |

| Russell 2000 Value Total Return Index | 64.30% | 13.44% | 12.61% | 12.12% |

| Russell 2000 Total Return Index | 50.80% | 16.47% | 15.52% | 13.50% |

| * | Prior to February 15, 2019, the Fund’s name was The Delafield Fund. |

| (a) | On November 15, 2019, The Tocqueville Phoenix Fund acquired all the net assets of The Tocqueville Select Fund. |

Annual Report | 11

Expense Example—October 31, 2021 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2021-October 31, 2021).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12 | October 31, 2021

Expense Example Tables (Unaudited)

The Tocqueville Fund

| | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | May 1, 2021- |

| | | May 1, 2021 | | October 31, 2021 | | October 31, 2021 |

| Actual | | $ | 1,000.00 | | | $ | 1,068.40 | | | $ | 6.52 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.25% for The Tocqueville Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Opportunity Fund

| | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | May 1, 2021- |

| | | May 1, 2021 | | October 31, 2021 | | October 31, 2021 |

| Actual | | $ | 1,000.00 | | | $ | 1,139.90 | | | $ | 6.80 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.85 | | | | 6.41 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.26% for The Tocqueville Opportunity Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Phoenix Fund

| | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | May 1, 2021- |

| | | May 1, 2021 | | October 31, 2021 | | October 31, 2021 |

| Actual | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 6.36 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.25% for The Tocqueville Phoenix Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Annual Report | 13

The Tocqueville Fund

Financial Highlights

| Per share operating performance | | Years Ended October 31, | |

| (For a share outstanding throughout the year) | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 37.03 | | | $ | 37.80 | | | $ | 35.84 | | | $ | 38.60 | | | $ | 33.72 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.25 | | | | 0.31 | | | | 0.43 | | | | 0.35 | | | | 0.37 | |

| Net realized and unrealized gain | | | 12.49 | | | | 1.58 | | | | 4.46 | | | | 0.45 | | | | 6.40 | |

| Total from investment operations | | | 12.74 | | | | 1.89 | | | | 4.89 | | | | 0.80 | | | | 6.77 | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.25 | ) | | | (0.37 | ) | | | (0.34 | ) | | | (0.33 | ) | | | (0.39 | ) |

| Distributions from net realized gains | | | (1.13 | ) | | | (2.29 | ) | | | (2.59 | ) | | | (3.23 | ) | | | (1.50 | ) |

| Total distributions | | | (1.38 | ) | | | (2.66 | ) | | | (2.93 | ) | | | (3.56 | ) | | | (1.89 | ) |

| Change in net asset value for the year | | | 11.36 | | | | (0.77 | ) | | | 1.96 | | | | (2.76 | ) | | | 4.88 | |

| Net asset value, end of year | | $ | 48.39 | | | $ | 37.03 | | | $ | 37.80 | | | $ | 35.84 | | | $ | 38.60 | |

| Total Return | | | 35.2 | % | | | 5.0 | % | | | 14.9 | % | | | 2.0 | % | | | 20.9 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000) | | $ | 313,739 | | | $ | 251,096 | | | $ | 285,070 | | | $ | 272,043 | | | $ | 293,637 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses before waiver | | | 1.34 | % | | | 1.38 | % | | | 1.30 | % | | | 1.26 | % | | | 1.27 | % |

| Expenses after waiver | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(2) | | | 1.25 | % | | | 1.26 | %(2) |

| Net investment income before waiver | | | 0.46 | % | | | 0.69 | % | | | 1.11 | % | | | 0.91 | % | | | 0.97 | % |

| Net investment income after waiver | | | 0.55 | % | | | 0.82 | % | | | 1.16 | % | | | 0.92 | % | | | 0.98 | % |

| Portfolio turnover rate | | | 11 | % | | | 9 | % | | | 13 | % | | | 19 | % | | | 10 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Notes are an Integral Part of these Financial Statements.

14 | October 31, 2021

The Tocqueville Opportunity Fund

Financial Highlights

| Per share operating performance | | Years Ended October 31, | |

| (For a share outstanding throughout the year) | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 38.34 | | | $ | 28.11 | | | $ | 26.60 | | | $ | 26.12 | | | $ | 19.14 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (1) | | | (0.53 | ) | | | (0.40 | ) | | | (0.29 | ) | | | (0.29 | ) | | | (0.37 | ) |

| Net realized and unrealized gain | | | 12.76 | | | | 12.29 | | | | 4.29 | | | | 1.63 | | | | 7.35 | |

| Total from investment operations | | | 12.23 | | | | 11.89 | | | | 4.00 | | | | 1.34 | | | | 6.98 | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (1.52 | ) | | | (1.66 | ) | | | (2.49 | ) | | | (0.86 | ) | | | — | |

| Total distributions | | | (1.52 | ) | | | (1.66 | ) | | | (2.49 | ) | | | (0.86 | ) | | | — | |

| Change in net asset value for the year | | | 10.71 | | | | 10.23 | | | | 1.51 | | | | 0.48 | | | | 6.98 | |

| Net asset value, end of year | | $ | 49.05 | | | $ | 38.34 | | | $ | 28.11 | | | $ | 26.60 | | | $ | 26.12 | |

| Total Return | | | 32.6 | % | | | 44.3 | % | | | 16.9 | % | | | 5.3 | % | | | 36.5 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000) | | $ | 111,189 | | | $ | 91,147 | | | $ | 84,583 | | | $ | 82,106 | | | $ | 77,773 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses before waiver | | | 1.40 | % | | | 1.49 | % | | | 1.41 | % | | | 1.33 | % | | | 1.38 | % |

| Expenses after waiver | | | 1.26 | %(2) | | | 1.26 | %(2) | | | 1.28 | %(2) | | | 1.26 | %(2) | | | 1.30 | %(2)(3) |

| Net investment income before waiver | | | (1.28 | )% | | | (1.18 | )% | | | (1.10 | )% | | | (1.13 | )% | | | (1.05 | )% |

| Net investment income after waiver | | | (1.13 | )% | | | (0.95 | )% | | | (0.97 | )% | | | (1.06 | )% | | | (0.97 | )%(3) |

| Portfolio turnover rate | | | 20 | % | | | 30 | % | | | 133 | % | | | 151 | % | | | 133 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Includes interest expense of 0.01% for the year ended October 31, 2021, 0.01% for the year ended October 31, 2020, 0.03% for the year ended October 31, 2019, 0.01% for the year ended October 31, 2018, and 0.05% for the year ended October 31, 2017. Interest expense is not included in the Fund’s operating expense cap. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

Annual Report | 15

The Tocqueville Phoenix Fund

Financial Highlights

| Per share operating performance | | Years Ended October 31, | |

| (For a share outstanding throughout the year) | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 17.67 | | | $ | 19.98 | | | $ | 20.20 | | | $ | 26.40 | | | $ | 26.47 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (1) | | | (0.16 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.14 | ) | | | (0.15 | ) |

| Net realized and unrealized gain (loss) | | | 9.40 | | | | (1.81 | ) | | | 1.16 | | | | (2.27 | ) | | | 4.91 | |

| Total from investment operations | | | 9.24 | | | | (1.84 | ) | | | 1.13 | | | | (2.41 | ) | | | 4.76 | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | — | | | | — | | | | — | (2) | | | — | | | | — | |

| Distributions from net realized gains | | | (0.38 | ) | | | (0.47 | ) | | | (1.35 | ) | | | (3.79 | ) | | | (4.83 | ) |

| Total distributions | | | (0.38 | ) | | | (0.47 | ) | | | (1.35 | ) | | | (3.79 | ) | | | (4.83 | ) |

| Change in net asset value for the year | | | 8.86 | | | | (2.31 | ) | | | (0.22 | ) | | | (6.20 | ) | | | (0.07 | ) |

| Net asset value, end of year | | $ | 26.53 | | | $ | 17.67 | | | $ | 19.98 | | | $ | 20.20 | | | $ | 26.40 | |

| Total Return | | | 52.8 | % | | | (9.5 | )% | | | 6.2 | % | | | (10.6 | )% | | | 19.0 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000) | | $ | 177,082 | | | $ | 131,658 | | | $ | 160,433 | | | $ | 237,119 | | | $ | 373,353 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses before waiver | | | 1.43 | % | | | 1.50 | % | | | 1.39 | % | | | 1.32 | % | | | 1.31 | % |

| Expenses after waiver | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(3) |

| Net investment income before waiver | | | (0.78 | )% | | | (0.41 | )% | | | (0.24 | )% | | | (0.55 | )% | | | (0.55 | )% |

| Net investment income after waiver/reimbursement | | | (0.60 | )% | | | (0.16 | )% | | | (0.10 | )% | | | (0.48 | )% | | | (0.49 | )%(3) |

| Portfolio turnover rate | | | 21 | % | | | 24 | % | | | 40 | % | | | 40 | % | | | 36 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

16 | October 31, 2021

The Tocqueville Fund

Schedule of Investments as of October 31, 2021

| Common Stocks—97.8% | | Shares | | | Value | |

| Banks—1.8% | | | | | | | | |

| Bank of America Corp. | | | 120,000 | | | $ | 5,733,600 | |

| Capital Goods—6.7% | | | | | | | | |

| Caterpillar, Inc. | | | 20,000 | | | | 4,080,200 | |

| Deere & Co. | | | 20,000 | | | | 6,846,200 | |

| Illinois Tool Works, Inc. | | | 25,000 | | | | 5,696,750 | |

| Parker-Hannifin Corp. | | | 15,000 | | | | 4,448,850 | |

| | | | | | | | 21,072,000 | |

| Commercial & Professional Services—2.5% |

| Republic Services, Inc. | | | 40,000 | | | | 5,384,000 | |

| Steelcase, Inc.—Class A | | | 200,000 | | | | 2,380,000 | |

| | | | | | | | 7,764,000 | |

| Consumer Services—3.3% | | | | | | | | |

| Expedia Group, Inc.(a) | | | 25,000 | | | | 4,110,250 | |

| McDonald’s Corp. | | | 25,000 | | | | 6,138,750 | |

| | | | | | | | 10,249,000 | |

| Diversified Financials—3.5% | | | | | | | | |

| Berkshire Hathaway, Inc.(a) | | | 10,000 | | | | 2,870,100 | |

| The Charles Schwab Corp. | | | 100,000 | | | | 8,203,000 | |

| | | | | | | | 11,073,100 | |

| Energy—3.0% | | | | | | | | |

| Cameco Corp.—ADR(b) | | | 25,000 | | | | 607,500 | |

| Chevron Corp. | | | 40,000 | | | | 4,579,600 | |

| Diamondback Energy, Inc. | | | 40,000 | | | | 4,287,600 | |

| | | | | | | | 9,474,700 | |

| Food & Staples Retailing—2.1% | | | | | | | | |

| Walmart, Inc. | | | 45,000 | | | | 6,723,900 | |

| Food, Beverage & Tobacco—2.7% | | | | | | | | |

| Constellation Brands, Inc.—Class A | | | 7,500 | | | | 1,626,075 | |

| The Coca-Cola Co. | | | 120,000 | | | | 6,764,400 | |

| | | | | | | | 8,390,475 | |

| Health Care Equipment & Services—2.1% |

| Abbott Laboratories | | | 50,000 | | | | 6,444,500 | |

| Household & Personal Products—4.7% | | | | | | | | |

| Colgate-Palmolive Co. | | | 100,000 | | | | 7,619,000 | |

| The Procter & Gamble Co. | | | 50,000 | | | | 7,149,500 | |

| | | | | | | | 14,768,500 | |

| Insurance—1.7% | | | | | | | | |

| Aflac, Inc. | | | 100,000 | | | | 5,367,000 | |

| Common Stocks—97.8% | | Shares | | | Value | |

| Materials—11.5% | | | | | | | | |

| BHP Group Ltd.—ADR(b) | | | 50,000 | | | $ | 2,742,000 | |

| Dow, Inc. | | | 40,000 | | | | 2,238,800 | |

| DuPont de Nemours, Inc. | | | 25,000 | | | | 1,740,000 | |

| Freeport-McMoRan, Inc. | | | 100,000 | | | | 3,772,000 | |

| Mesabi Trust | | | 10,000 | | | | 220,300 | |

| Newmont Mining Corp. | | | 10,000 | | | | 540,000 | |

| Nutrien Ltd.(b) | | | 50,000 | | | | 3,495,500 | |

| Pan American Silver Corp.—ADR(b) | | | 100,000 | | | | 2,561,000 | |

| Sibanye Stillwater Ltd.—ADR(b) | | | 100,000 | | | | 1,420,000 | |

| Sonoco Products Co. | | | 75,000 | | | | 4,346,250 | |

| South32 Ltd.—ADR(b) | | | 100,000 | | | | 1,350,000 | |

| Vulcan Materials Co. | | | 40,000 | | | | 7,604,800 | |

| Wheaton Precious Metals Corp.—ADR(b) | | | 100,000 | | | | 4,041,000 | |

| | | | | | | | 36,071,650 | |

| Media & Entertainment—8.4% | | | | | | | | |

| Alphabet, Inc.—Class A(a) | | | 5,000 | | | | 14,804,600 | |

| Meta Platforms, Inc.—Class A(a) | | | 10,000 | | | | 3,235,700 | |

| The Walt Disney Co.(a) | | | 50,000 | | | | 8,453,500 | |

| | | | | | | | 26,493,800 | |

| Pharmaceuticals, Biotechnology & Life Sciences—7.2% | | | | | | | | |

| Gilead Sciences, Inc. | | | 25,000 | | | | 1,622,000 | |

| Johnson & Johnson | | | 20,000 | | | | 3,257,600 | |

| Merck & Co., Inc. | | | 100,000 | | | | 8,805,000 | |

| Pfizer, Inc. | | | 200,000 | | | | 8,748,000 | |

| | | | | | | | 22,432,600 | |

| Real Estate—0.1% | | | | | | | | |

| Tejon Ranch Co.(a) | | | 25,000 | | | | 455,250 | |

| Retailing—6.1% | | | | | | | | |

| Alibaba Group Holding Ltd.—ADR—ADR(a)(b) | | | 7,500 | | | | 1,237,050 | |

| Amazon.com, Inc.(a) | | | 3,000 | | | | 10,117,290 | |

| eBay, Inc. | | | 100,000 | | | | 7,672,000 | |

| | | | | | | | 19,026,340 | |

| Semiconductors & Semiconductor Equipment—11.0% | | | | | | | | |

| Applied Materials, Inc. | | | 75,000 | | | | 10,248,750 | |

| Intel Corp. | | | 99,000 | | | | 4,851,000 | |

The Accompanying Notes are an Integral Part of these Financial Statements.

Annual Report | 17

The Tocqueville Fund

Schedule of Investments as of October 31, 2021

| Common Stocks—97.8% | | Shares | | | Value | |

| NVIDIA Corp. | | | 50,000 | | | $ | 12,783,500 | |

| QUALCOMM, Inc. | | | 50,000 | | | | 6,652,000 | |

| | | | | | | | 34,535,250 | |

| Software & Services—7.6% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 40,000 | | | | 8,979,600 | |

| Microsoft Corp. | | | 45,000 | | | | 14,922,900 | |

| | | | | | | | 23,902,500 | |

| Technology Hardware & Equipment—3.6% |

| Apple, Inc. | | | 75,000 | | | | 11,235,000 | |

| Telecommunication Services—1.7% | | | | | | | | |

| Verizon Communications, Inc. | | | 100,000 | | | | 5,299,000 | |

| Transportation—1.2% | | | | | | | | |

| Delta Air Lines, Inc.(a) | | | 100,000 | | | | 3,913,000 | |

| Utilities—5.3% | | | | | | | | |

| Dominion Energy, Inc. | | | 50,000 | | | | 3,796,500 | |

| NextEra Energy, Inc. | | | 150,000 | | | | 12,799,500 | |

| | | | | | | | 16,596,000 | |

| Total Common Stocks | | | | | | | | |

| (Cost $115,143,507) | | | | | | | 307,021,165 | |

| Real Estate Investment Trust (REIT)—2.3% |

| Real Estate—2.3% | | | | | | | | |

| Weyerhaeuser Co. | | | 200,000 | | | | 7,144,000 | |

| Total Real Estate Investment Trust | | | | | | | | |

| (Cost $3,868,091) | | | | | | | 7,144,000 | |

| Short-Term Investment—0.0% | | Shares | | | Value | |

| Money Market Fund—0.0% | | | | | | | | |

| STIT Treasury Portfolio—Institutional Class, 0.010%(c) | | | 557 | | | $ | 557 | |

| Total Short-Term Investment | | | | | | | | |

| (Cost $557) | | | | | | | 557 | |

| Total Investments | | | | | | | | |

| (Cost $119,012,155)—100.1% | | | | | | | 314,165,722 | |

| Liabilities in Excess of Other Assets—(0.1%) | | | | | | | (426,223 | ) |

| Total Net Assets—100.0% | | | | | | $ | 313,739,499 | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued Security. Foreign Concentration (including ADR’s) was as follows: Australia 1.3%; Canada 3.4%; Cayman Islands 0.4%; South Africa 0.5%. |

| (c) | Rate listed is the 7-day effective yield. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The Accompanying Notes are an Integral Part of these Financial Statements.

18 | October 31, 2021

The Tocqueville Opportunity Fund

Schedule of Investments as of October 31, 2021

| Common Stocks—100.3% | | Shares | | | Value | |

| Capital Goods—4.7% | | | | | | |

| Advanced Drainage Systems, Inc. | | | 2,500 | | | $ | 282,000 | |

| Array Technologies, Inc.(a) | | | 15,000 | | | | 320,250 | |

| Dover Corp. | | | 2,000 | | | | 338,160 | |

| HEICO Corp. | | | 3,843 | | | | 535,676 | |

| Hubbell, Inc. | | | 2,500 | | | | 498,425 | |

| IDEX Corp. | | | 2,500 | | | | 556,425 | |

| Masco Corp. | | | 6,000 | | | | 393,300 | |

| Nordson Corp. | | | 2,000 | | | | 508,420 | |

| nVent Electric PLC ADR(a)(b) | | | 10,000 | | | | 354,500 | |

| Simpson Manufacturing Co, Inc. | | | 2,500 | | | | 265,225 | |

| SiteOne Landscape Supply, Inc.(a) | | | 2,500 | | | | 587,400 | |

| Trex Co., Inc.(a) | | | 5,000 | | | | 532,000 | |

| | | | | | | | 5,171,781 | |

| Commercial & Professional Services—6.4% | | | | | | | | |

| Booz Allen Hamilton Holding Corp. | | | 6,500 | | | | 564,590 | |

| Cintas Corp. | | | 3,000 | | | | 1,299,300 | |

| Copart, Inc.(a) | | | 7,000 | | | | 1,087,030 | |

| CoStar Group, Inc.(a) | | | 10,000 | | | | 860,500 | |

| Exponent, Inc. | | | 5,000 | | | | 574,000 | |

| TransUnion | | | 8,500 | | | | 979,965 | |

| Verisk Analytics, Inc. | | | 4,000 | | | | 841,080 | |

| Waste Connections, Inc.—ADR(a)(b) | | | 7,000 | | | | 952,070 | |

| | | | | | | | 7,158,535 | |

| Consumer Durables & Apparel—0.6% | | | | | | | | |

| TopBuild Corp.(a) | | | 1,500 | | | | 385,455 | |

| YETI Holdings, Inc.(a) | | | 2,500 | | | | 245,825 | |

| | | | | | | | 631,280 | |

| Consumer Services—0.7% | | | | | | | | |

| Bright Horizons Family Solutions, Inc.(a) | | | 3,500 | | | | 581,000 | |

| DraftKings, Inc.(a) | | | 5,000 | | | | 232,950 | |

| Restaurant Brands International LP | | | 37 | | | | 2,089 | |

| | | | | | | | 816,039 | |

| Diversified Financials—4.3% | | | | | | | | |

| Coinbase Global, Inc.—Class A(a) | | | 1,700 | | | | 543,014 | |

| Common Stocks—100.3% | | Shares | | | Value | |

| LPL Financial Holdings, Inc. | | | 2,500 | | | $ | 410,050 | |

| MarketAxess Holdings, Inc. | | | 1,250 | | | | 510,838 | |

| MSCI, Inc. | | | 2,000 | | | | 1,329,760 | |

| S&P Global, Inc. | | | 2,500 | | | | 1,185,400 | |

| Tradeweb Markets, Inc.—Class A | | | 9,000 | | | | 801,900 | |

| | | | | | | | 4,780,962 | |

| Health Care Equipment & Services—10.5% |

| DexCom, Inc.(a) | | | 7,000 | | | | 4,362,470 | |

| IDEXX Laboratories, Inc.(a) | | | 2,800 | | | | 1,865,192 | |

| Insulet Corp.(a) | | | 5,600 | | | | 1,736,112 | |

| Intuitive Surgical, Inc.(a) | | | 1,950 | | | | 704,204 | |

| Masimo Corp.(a) | | | 1,500 | | | | 425,310 | |

| STAAR Surgical Co.(a) | | | 2,000 | | | | 236,920 | |

| Tandem Diabetes Care, Inc.(a) | | | 4,500 | | | | 613,485 | |

| Veeva Systems, Inc.—Class A(a) | | | 5,500 | | | | 1,743,555 | |

| | | | | | | | 11,687,248 | |

| Materials—0.3% | | | | | | | | |

| Ranpak Holdings Corp.(a) | | | 10,000 | | | | 344,600 | |

| Media & Entertainment—2.1% | | | | | | | | |

| Cardlytics, Inc.(a) | | | 2,000 | | | | 157,320 | |

| fuboTV, Inc.(a) | | | 15,000 | | | | 447,150 | |

| IAC/InterActiveCorp(a) | | | 3,800 | | | | 579,006 | |

| Magnite, Inc.(a) | | | 10,000 | | | | 270,300 | |

| Roku, Inc.(a) | | | 2,000 | | | | 609,800 | |

| Vimeo, Inc.(a) | | | 7,110 | | | | 239,820 | |

| | | | | | | | 2,303,396 | |

| Pharmaceuticals, Biotechnology & Life Sciences—6.0% | | | | | | | | |

| Acceleron Pharma, Inc.(a) | | | 2,000 | | | | 348,360 | |

| Avantor, Inc.(a) | | | 12,000 | | | | 484,560 | |

| Bio-Techne Corp. | | | 1,200 | | | | 628,380 | |

| Charles River Laboratories International, Inc.(a) | | | 2,400 | | | | 1,076,832 | |

| Elanco Animal Health, Inc.(a) | | | 10,000 | | | | 328,800 | |

| Genmab A/S(a)(b) | | | 3,000 | | | | 1,344,522 | |

| Iovance Biotherapeutics, Inc.(a) | | | 50,000 | | | | 1,215,500 | |

| Mirati Therapeutics, Inc.(a) | | | 2,000 | | | | 378,040 | |

| Neurocrine Biosciences, Inc.(a) | | | 4,000 | | | | 421,640 | |

| Seagen, Inc.(a) | | | 2,500 | | | | 440,825 | |

| | | | | | | | 6,667,459 | |

The Accompanying Notes are an Integral Part of these Financial Statements.

Annual Report | 19

The Tocqueville Opportunity Fund

Schedule of Investments as of October 31, 2021

| Common Stocks—100.3% | | Shares | | | Value | |

| Retailing—2.9% | | | | | | | | |

| Floor & Decor Holdings, Inc.—Class A(a) | | | 3,000 | | | $ | 407,760 | |

| Pool Corp. | | | 2,750 | | | | 1,416,690 | |

| RH(a) | | | 2,150 | | | | 1,418,205 | |

| | | | | | | | 3,242,655 | |

| Software & Services—61.2% | | | | | | | | |

| ANSYS, Inc.(a) | | | 1,500 | | | | 569,370 | |

| Aspen Technology, Inc.(a) | | | 2,000 | | | | 313,380 | |

| Atlassian Corp. PLC—Class A—ADR(a)(b) | | | 3,500 | | | | 1,603,455 | |

| Avalara, Inc.(a) | | | 7,000 | | | | 1,257,480 | |

| Cadence Design Systems, Inc.(a) | | | 5,000 | | | | 865,550 | |

| Coupa Software, Inc.(a) | | | 13,000 | | | | 2,960,100 | |

| EPAM Systems, Inc.(a) | | | 2,000 | | | | 1,346,480 | |

| Fair Isaac Corp.(a) | | | 1,500 | | | | 597,300 | |

| Fiserv, Inc.(a) | | | 7,625 | | | | 750,986 | |

| Fortinet, Inc.(a) | | | 4,500 | | | | 1,513,530 | |

| Global Payments, Inc. | | | 12,531 | | | | 1,791,808 | |

| Marqeta, Inc. Class—A(a) | | | 15,000 | | | | 459,000 | |

| MongoDB, Inc.(a) | | | 2,500 | | | | 1,303,225 | |

| Okta, Inc.(a) | | | 21,000 | | | | 5,190,780 | |

| Paycom Software, Inc.(a) | | | 9,800 | | | | 5,368,930 | |

| Paylocity Holding Corp.(a) | | | 22,500 | | | | 6,865,650 | |

| ServiceNow, Inc.(a) | | | 17,000 | | | | 11,861,920 | |

| Shopify, Inc.—Class A—ADR(a)(b) | | | 8,150 | | | | 11,953,849 | |

| TaskUS, Inc.—Class A(a) | | | 8,000 | | | | 463,200 | |

| Toast, Inc. Class—A(a) | | | 5,000 | | | | 266,100 | |

| Twilio, Inc.—Class A(a) | | | 9,500 | | | | 2,767,920 | |

| Tyler Technologies, Inc.(a) | | | 1,000 | | | | 543,220 | |

| Unity Software, Inc.(a) | | | 6,000 | | | | 907,860 | |

| Workday, Inc.—Class A(a) | | | 17,000 | | | | 4,929,660 | |

| Zendesk, Inc.(a) | | | 16,000 | | | | 1,628,800 | |

| | | | | | | | 68,079,553 | |

| Common Stocks—100.3% | | Shares | | | Value | |

| Transportation—0.6% | | | | | | | | |

| Saia, Inc.(a) | | | 1,950 | | | $ | 609,648 | |

| Total Common Stocks | | | | | | | | |

| (Cost $34,511,114) | | | | | | | 111,493,156 | |

| Short-Term Investment—0.0% | | | | | | | | |

| Money Market Fund—0.0% | | | | | | | | |

| STIT-Treasury Portfolio—Institutional Class, 0.010%(c) | | | 314 | | | | 314 | |

| Total Short-Term Investment | | | | | | | | |

| (Cost $314) | | | | | | | 314 | |

| Total Investments | | | | | | | | |

| (Cost $34,511,428)—100.3% | | | | | | | 111,493,470 | |

| Liabilities in Excess of Other Assets—(0.3)% | | | | | | | (304,134 | ) |

| Total Net Assets—100.0% | | | | | | $ | 111,189,336 | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

(a) Non-income producing security.

(b) Foreign issued Security. Foreign Concentration (including ADR’s) was as follows: Canada 11.6%; Denmark 1.2%; Ireland 0.3%; United Kingdom 1.4%.

(c) Rate listed is the 7-day effective yield.

The Accompanying Notes are an Integral Part of these Financial Statements.

20 | October 31, 2021

The Tocqueville Phoenix Fund

Schedule of Investments as of October 31, 2021

| Common Stocks—92.2% | | Shares | | | Value | |

| Auto Components—3.9% | | | | | | |

| Lear Corp. | | | 15,000 | | | $ | 2,577,750 | |

| Modine Manufacturing Co.(a) | | | 70,000 | | | | 770,000 | |

| Visteon Corp.(a) | | | 31,000 | | | | 3,508,580 | |

| | | | | | | | 6,856,330 | |

| Building Products—3.2% | | | | | | | | |

| Apogee Enterprises, Inc. | | | 135,000 | | | | 5,660,550 | |

| Chemicals—8.9% | | | | | | | | |

| Avient Corp. | | | 85,000 | | | | 4,579,800 | |

| HB Fuller Co. | | | 32,000 | | | | 2,256,320 | |

| Innospec, Inc. | | | 29,000 | | | | 2,627,690 | |

| Orion Engineered Carbons SA—ADR(a)(b) | | | 340,000 | | | | 6,392,000 | |

| | | | | | | | 15,855,810 | |

| Commercial Services & Supplies—5.2% | | | | | | | | |

| ABM Industries, Inc. | | | 105,000 | | | | 4,621,050 | |

| Harsco Corp.(a) | | | 270,000 | | | | 4,617,000 | |

| | | | | | | | 9,238,050 | |

| Communications Equipment—6.2% | | | | | | | | |

| Comtech Telecommunications Corp. | | | 190,435 | | | | 4,107,683 | |

| Lumentum Holdings, Inc.(a) | | | 83,000 | | | | 6,854,140 | |

| | | | | | | | 10,961,823 | |

| Electrical Equipment—3.4% | | | | | | | | |

| Acuity Brands, Inc. | | | 29,000 | | | | 5,957,470 | |

| Electronic Equipment, Instruments & Components—15.5% | | | | | | | | |

| Fabrinet—ADR(a)(b) | | | 62,100 | | | | 5,961,600 | |

| Flex Ltd.—ADR(a)(b) | | | 415,000 | | | | 7,013,500 | |

| II-VI, Inc.(a) | | | 35,000 | | | | 2,117,850 | |

| Knowles Corp.(a) | | | 85,000 | | | | 1,771,400 | |

| Plexus Corp.(a) | | | 60,000 | | | | 5,239,200 | |

| TTM Technologies, Inc.(a) | | | 400,000 | | | | 5,296,000 | |

| | | | | | | | 27,399,550 | |

| Food Products—2.7% | | | | | | | | |

| Farmer Brothers Co.(a) | | | 240,000 | | | | 1,812,000 | |

| Landec Corp.(a) | | | 298,700 | | | | 2,903,364 | |

| | | | | | | | 4,715,364 | |

| Common Stocks—92.2% | | Shares | | | Value | |

| Health Care Equipment & Supplies—2.1% |

| Inogen, Inc.(a) | | | 35,000 | | | $ | 1,387,750 | |

| Lantheus Holdings, Inc.(a) | | | 100,000 | | | | 2,339,000 | |

| | | | | | | | 3,726,750 | |

| Health Care Providers & Services—2.1% | | | | | | | | |

| Cross Country Healthcare, Inc.(a) | | | 182,000 | | | | 3,772,860 | |

| Household Durables—2.7% | | | | | | | | |

| Mohawk Industries, Inc.(a) | | | 19,700 | | | | 3,491,037 | |

| Newell Brands, Inc. | | | 55,000 | | | | 1,258,950 | |

| | | | | | | | 4,749,987 | |

| Interactive Media & Services—2.7% | | | | | | | | |

| Cars.com, Inc.(a) | | | 363,500 | | | | 4,732,770 | |

| IT Services—5.2% | | | | | | | | |

| DXC Technology Co.(a) | | | 124,000 | | | | 4,038,680 | |

| Unisys Corp.(a) | | | 204,598 | | | | 5,231,571 | |

| | | | | | | | 9,270,251 | |

| Machinery—9.4% | | | | | | | | |

| Crane Co. | | | 57,500 | | | | 5,938,600 | |

| Mayville Engineering Co., Inc.(a) | | | 281,311 | | | | 4,996,083 | |

| REV Group, Inc. | | | 75,000 | | | | 1,133,250 | |

| Stanley Black & Decker, Inc. | | | 26,000 | | | | 4,672,980 | |

| | | | | | | | 16,740,913 | |

| Media—4.0% | | | | | | | | |

| TEGNA, Inc. | | | 361,000 | | | | 7,097,260 | |

| Pharmaceuticals—1.7% | | | | | | | | |

| Phibro Animal Health Corp.—Class A | | | 140,000 | | | | 3,071,600 | |

| Professional Services—2.5% | | | | | | | | |

| BGSF, Inc. | | | 300,000 | | | | 3,609,000 | |

| Mistras Group, Inc.(a) | | | 80,000 | | | | 785,600 | |

| | | | | | | | 4,394,600 | |

| Semiconductors & Semiconductor Equipment—3.3% | | | | | | | | |

| ams AG(a)(b) | | | 300,000 | | | | 5,927,261 | |

| Textiles, Apparel & Luxury Goods—3.3% | | | | | | | | |

| PVH Corp.(a) | | | 53,000 | | | | 5,794,490 | |

The Accompanying Notes are an Integral Part of these Financial Statements.

Annual Report | 21

The Tocqueville Phoenix Fund

Schedule of Investments as of October 31, 2021

| Common Stocks—92.2% | | Shares | | | Value | |

| Trading Companies & Distributors—2.6% |

| Rush Enterprises, Inc.—Class A | | | 88,000 | | | $ | 4,583,040 | |

| Wireless Telecommunication Services—1.6% |

| Spok Holdings, Inc. | | | 280,000 | | | | 2,881,200 | |

| Total Common Stocks | | | | | | | | |

| (Cost $113,462,487) | | | | | | | 163,387,929 | |

| Short-Term Investment—5.0% | | | | | | | | |

| Money Market Fund—5.0% | | | | | | | | |

| STIT-Treasury Portfolio—Institutional Class, 0.010%(c) | | | 8,800,000 | | | | 8,800,000 | |

| Total Short-Term Investment | | | | | | | | |

| (Cost $8,800,000) | | | | | | | 8,800,000 | |

| Total Investments | | | | | | | | |

| (Cost $122,262,487)—97.2% | | | | | | | 172,187,929 | |

| Other Assets in Excess of Liabilities—2.8% | | | | | | | 4,894,376 | |

| Total Net Assets—100.0% | | | | | | $ | 177,082,305 | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

(a) Non-income producing security.

(b) Foreign issued Security. Foreign Concentration (including ADR’s) was as follows: Austria 3.3%; Cayman Islands 3.4%; Luxembourg 3.6%; Singapore 4.0%.

(c) Rate listed is the 7-day effective yield.

The Accompanying Notes are an Integral Part of these Financial Statements.

22 | October 31, 2021

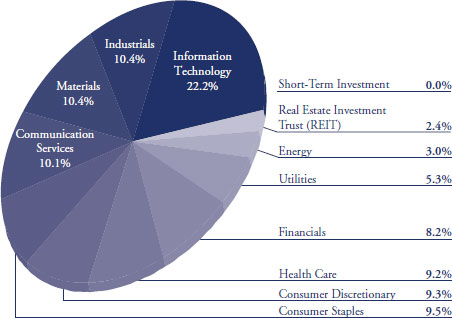

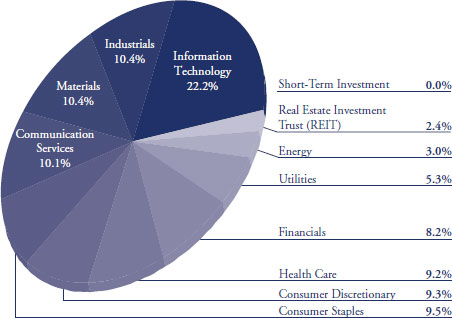

Percent of Total Investments (Unaudited)

The Tocqueville Fund

Allocation of Portfolio Holdings

October 31, 2021

The Tocqueville Opportunity Fund

Allocation of Portfolio Holdings

October 31, 2021

Annual Report | 23

Percent of Total Investments (Unaudited)

The Tocqueville Phoenix Fund

Allocation of Portfolio Holdings

October 31, 2021

24 | October 31, 2021

The Tocqueville Trust

Statements of Assets and Liabilities

October 31, 2021

| | The

Tocqueville

Fund | | | The

Tocqueville

Opportunity

Fund | | | The

Tocqueville

Phoenix

Fund | |

Assets: | | | | | | | | | | | | |

Investments, at value (1) | | $ | 314,165,722 | | | $ | 111,493,470 | | | $ | 172,187,929 | |

Cash and cash equivalents | | | — | | | | — | | | | 5,103,546 | |

Receivable for investments sold | | | 790,229 | | | | — | | | | — | |

Receivable for Fund shares sold | | | 2,431 | | | | 38,574 | | | | 1,851 | |

Dividends, interest and other receivables | | | 248,135 | | | | 1,751 | | | | 69,840 | |

Other assets | | | 21,513 | | | | 16,564 | | | | 12,655 | |

Total Assets | | | 315,228,030 | | | | 111,550,359 | | | | 177,375,821 | |

Liabilities: | | | | | | | | | | | | |

Payable for loans outstanding | | | 983,000 | | | | 157,000 | | | | — | |

Payable for Fund shares redeemed | | | 99,581 | | | | 50,131 | | | | 69,240 | |

Payable to Adviser | | | 209,476 | | | | 73,299 | | | | 108,143 | |

Payable to Administrator | | | 48,534 | | | | 16,971 | | | | 20,660 | |

Payable to Trustees | | | 25,846 | | | | 9,538 | | | | 14,532 | |

Accrued distribution fee | | | 51,895 | | | | 15,395 | | | | 20,859 | |

Accrued expenses and other liabilities | | | 70,199 | | | | 38,689 | | | | 60,082 | |

Total Liabilities | | | 1,488,531 | | | | 361,023 | | | | 293,516 | |

Net Assets | | $ | 313,739,499 | | | $ | 111,189,336 | | | $ | 177,082,305 | |

| | | | | | | | | | | | |

Net assets consist of: | | | | | | | | | | | | |

Paid in capital | | $ | 86,584,201 | | | $ | 28,350,631 | | | $ | 109,349,216 | |

Total distributable earnings | | | 227,155,298 | | | | 82,838,705 | | | | 67,733,089 | |

Net assets | | $ | 313,739,499 | | | $ | 111,189,336 | | | $ | 177,082,305 | |

| | | | | | | | | | | | |

Shares of beneficial interest outstanding (unlimited shares | | | | | | | | | | | | |

of $0.01 par value authorized) | | | 6,483,619 | | | | 2,266,984 | | | | 6,675,096 | |

Net asset value, offering and redemption price per share | | $ | 48.39 | | | $ | 49.05 | | | $ | 26.53 | |

| | | | | | | | | | | | |

(1) Cost of investments | | $ | 119,012,155 | | | $ | 34,511,428 | | | $ | 122,262,487 | |

The Accompanying Notes are an Integral Part of these Financial Statements.

Annual Report | 25

The Tocqueville Trust

Statements of Operations

For the Year Ended October 31, 2021

| | The

Tocqueville

Fund | | | The

Tocqueville

Opportunity

Fund | | | The

Tocqueville

Phoenix

Fund | |

Investment Income: | | | | | | | | | | | | |

Dividends* | | $ | 5,295,756 | | | $ | 127,951 | | | $ | 1,130,514 | |

Interest | | | 94 | | | | 20 | | | | 880 | |

Total investment income | | | 5,295,850 | | | | 127,971 | | | | 1,131,394 | |

Expenses: | | | | | | | | | | | | |

Investment Adviser’s fee (See Note 4) | | | 2,207,037 | | | | 771,393 | | | | 1,385,961 | |

Distribution (12b-1) fees (See Note 4) | | | 735,679 | | | | 257,130 | | | | 433,113 | |

Administration fees (See Note 4) | | | 441,407 | | | | 154,279 | | | | 259,868 | |

Legal fees | | | 137,269 | | | | 54,576 | | | | 80,863 | |

Transfer agent and shareholder services fees | | | 96,882 | | | | 45,800 | | | | 91,968 | |

Trustee fees and expenses | | | 87,129 | | | | 30,805 | | | | 50,800 | |

Other expenses | | | 57,715 | | | | 32,977 | | | | 39,945 | |

Fund accounting fees | | | 51,849 | | | | 20,596 | | | | 29,821 | |

Printing and mailing expense | | | 35,274 | | | | 14,614 | | | | 38,045 | |

Audit fees | | | 34,874 | | | | 4,508 | | | | 11,524 | |

Blue sky fees | | | 25,323 | | | | 24,106 | | | | 26,433 | |

Insurance expense | | | 23,814 | | | | 8,388 | | | | 14,058 | |

Custody fees | | | 15,052 | | | | 12,621 | | | | 13,580 | |

Registration fees | | | 4,059 | | | | 2,659 | | | | 3,139 | |

Interest expense | | | 1,434 | | | | 7,711 | | | | — | |

Total expenses before waiver | | | 3,954,797 | | | | 1,442,163 | | | | 2,479,118 | |

Less: Fees waived (See Note 4) | | | (273,697 | ) | | | (148,797 | ) | | | (313,553 | ) |

Net expenses | | | 3,681,100 | | | | 1,293,366 | | | | 2,165,565 | |

Net Investment Income (Loss) | | | 1,614,750 | | | | (1,165,395 | ) | | | (1,034,171 | ) |

Realized and Unrealized Gain (Loss): | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Investments | | | 32,413,869 | | | | 8,977,264 | | | | 20,184,152 | |

Foreign currency translation | | | — | | | | (389 | ) | | | 4,848 | |

Purchased options | | | — | | | | (179,344 | ) | | | — | |

| | | 32,413,869 | | | | 8,797,531 | | | | 20,189,000 | |

Net change in unrealized appreciation on: Investments | | | 51,257,914 | | | | 20,759,746 | | | | 47,541,402 | |

| | | 51,257,914 | | | | 20,759,746 | | | | 47,541,402 | |

Net gain on investments and foreign currency | | | 83,671,783 | | | | 29,557,277 | | | | 67,730,402 | |

Net Increase in Net Assets Resulting from Operations | | $ | 85,286,533 | | | $ | 28,391,882 | | | $ | 66,696,231 | |

* Net of foreign taxes withheld of: | | $ | 51,207 | | | $ | 1,058 | | | $ | — | |

The Accompanying Notes are an Integral Part of these Financial Statements.

26 | October 31, 2021

The Tocqueville Trust

Statements of Changes in Net Assets

| | The Tocqueville Fund | | | The Tocqueville

Opportunity Fund

| | | The Tocqueville

Phoenix Fund

| |

| | For the

Year Ended

October 31,

2021 | | | For the

Year Ended

October 31,

2020 | | | For the

Year Ended

October 31,

2021 | | | For the

Year Ended

October 31,

2020 | | | For the

Year Ended

October 31,

2021 | | | For the

Year Ended

October 31,

2020 | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 1,614,750 | | | $ | 2,140,752 | | | $ | (1,165,395 | ) | | $ | (798,233 | ) | | $ | (1,034,171 | ) | | $ | (230,473 | ) |

Net realized gain on investments and foreign currency | | | 32,413,869 | | | | 9,207,859 | | | | 8,976,875 | | | | 4,435,871 | | | | 20,189,000 | | | | 3,324,516 | |

Net realized gain on written options | | | — | | | | — | | | | — | | | | 602,485 | | | | — | | | | — | |

Net realized loss on purchased options | | | — | | | | — | | | | (179,344 | ) | | | — | | | | — | | | | — | |

Net change in unrealized appreciation (depreciation) | | | 51,257,914 | | | | (841,853 | ) | | | 20,759,746 | | | | 27,115,889 | | | | 47,541,402 | | | | (23,588,188 | ) |

Net change in unrealized appreciation on written options | | | — | | | | — | | | | — | | | | 40,806 | | | | — | | | | — | |

Net increase (decrease) in net assets resulting

from operations | | | 85,286,533 | | | | 10,506,758 | | | | 28,391,882 | | | | 31,396,818 | | | | 66,696,231 | | | | (20,494,145 | ) |

Total dividends and distributions | | | (9,233,776 | ) | | | (20,004,394 | ) | | | (3,607,856 | ) | | | (4,684,120 | ) | | | (2,758,109 | ) | | | (3,732,986 | ) |

Fund share transactions: | | | | | | | | | | | | | | | | | | | | | | | | |

Proceed from merger (see Note 8) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 33,427,094 | |

Shares sold | | | 7,070,997 | | | | 3,714,741 | | | | 10,665,735 | | | | 19,679,061 | | | | 7,574,788 | | | | 4,772,451 | |

Shares issued to holders in reinvestment of dividends | | | 8,758,558 | | | | 19,015,810 | | | | 3,539,900 | | | | 4,449,601 | | | | 2,688,871 | | | | 3,437,712 | |

Shares redeemed | | | (29,239,052 | ) | | | (47,206,946 | ) | | | (18,947,317 | ) | | | (44,276,906 | ) | | | (28,777,744 | ) | | | (46,184,545 | ) |

Net decrease | | | (13,409,497 | ) | | | (24,476,395 | ) | | | (4,741,682 | ) | | | (20,148,244 | ) | | | (18,514,085 | ) | | | (4,547,288 | ) |

Net increase (decrease) in net assets | | | 62,643,260 | | | | (33,974,031 | ) | | | 20,042,344 | | | | 6,564,454 | | | | 45,424,037 | | | | (28,774,419 | ) |

Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 251,096,239 | | | | 285,070,270 | | | | 91,146,992 | | | | 84,582,538 | | | | 131,658,268 | | | | 160,432,687 | |

End of year | | $ | 313,739,499 | | | $ | 251,096,239 | | | $ | 111,189,336 | | | $ | 91,146,992 | | | $ | 177,082,305 | | | $ | 131,658,268 | |

*Net of redemption fees of: | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

The Accompanying Notes are an Integral Part of these Financial Statements.

Annual Report | 27

The Tocqueville Trust

Notes to Financial Statements

The Tocqueville Trust (the “Trust”) is a Massachusetts business trust registered under the Investment Company Act of 1940 and organized on September 17, 1986, consisting of three separate funds (each, a “Fund” or, collectively, the “Funds”). Each Fund is an open-end management investment company with a different investment objective. The Tocqueville Fund, The Tocqueville Opportunity Fund (the “Opportunity Fund”), and The Tocqueville Phoenix Fund are each classified as diversified investment companies. The Tocqueville Fund’s investment objective is long-term capital appreciation which it seeks to achieve by investing primarily in securities of United States issuers. The Opportunity Fund’s investment objective is to achieve long-term capital appreciation which it seeks to achieve by investing in the common stocks of small and mid-cap companies which have the potential to deliver superior long term earnings growth. The Tocqueville Phoenix Fund’s investment objectives are to seek long-term preservation of capital (sufficient growth to outpace inflation over an extended period of time) and growth of capital which it seeks to achieve by investing primarily in common stocks of small and mid-cap value companies that the portfolio managers consider to be undervalued, generate strong free cash flow, have shareholder friendly management teams and possess a catalyst for improved financial performance.

The Tocqueville Phoenix Fund (formerly known as The Delafield Fund), a series of the Trust, commenced operations on September 28, 2009 as successor to Delafield Fund, Inc. The predecessor Delafield Fund, Inc. commenced operations on November 19, 1993. The Delafield Fund changed its name to The Tocqueville Phoenix Fund on February 15, 2019. On November 15, 2019, The Tocqueville Phoenix Fund acquired all the net assets of The Tocqueville Select Fund.

2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Portfolios in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Funds follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

a) | Security valuation and security transactions |

Investments in securities, including foreign securities, traded on an exchange or quoted on the over-the-counter market are valued at the last sale price or, if no sale occurred during the day, at the mean between closing bid and asked prices, as last reported by a pricing service approved by the Trustees. Securities that are principally traded on the National Association of Securities Dealers Automated Quotation National Market (“NASDAQ”) are generally valued at the NASDAQ Official Closing Price (“NOCP”). If there is no NASDAQ Official Closing Price for a NASDAQ-listed security or sale price available for an over-the-counter security, the mean of the latest bid and asked quotations from NASDAQ will be used. When market quotations for securities are not readily available, or when restricted securities or other assets are being valued, such assets are valued at fair value as determined in good faith by or under procedures approved by the Trustees. Money market funds are valued at net asset value (“NAV”).

Fixed Income securities, such as corporate bonds, convertible bonds and U.S. government agency issues are valued based on evaluated mean prices supplied by independent pricing services using matrix pricing formulas and/or independent broker bid quotations.

28 | October 31, 2021

Trading in securities on foreign securities exchanges normally is completed before the calculation of the Funds’ NAV. Trading on these foreign exchanges may not take place on all days on which there is regular trading on the New York Stock Exchange (“NYSE”), or may take place on days on which there is no regular trading on the NYSE. Similarly, the Funds may hold securities traded in domestic markets where the market may close early on a given day prior to calculation of the Funds’ NAV. Events affecting the value of such securities held by the Funds that occur between the close of trading in the security and the close of trading on the NYSE normally will not be reflected in the Funds’ calculation of the NAV. However, significant events will be closely monitored, and where it is determined that an adjustment should be made to the security’s value because significant interim events may materially affect the value of the security, the security will be priced at its fair value in accordance with the procedures approved by the Trustees.

Cash and cash equivalents may exceed federal insurance limits. Money market deposit accounts are considered cash equivalents and reflected at cost.

Investment transactions are recorded on trade date. Dividend income is recognized on the ex-dividend date. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premiums and accretion of discounts. Net realized gains and losses from sales of securities are determined on the specific identification cost method.

b) | Restricted and illiquid securities |

The Funds may invest in securities that are subject to legal or contractual restrictions on resale or are illiquid. A security may be considered illiquid if it lacks a readily available market or if its valuation has not changed for a certain period of time. Disposal of these securities may involve time consuming negotiations and expense, and a prompt sale at the current valuation may be difficult.

Annual Report | 29

c) | Fair Valuation Measurements |

The Trust has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the year. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 - Quoted prices in active markets for identical securities. |

| ● | Level 2 - Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| ● | Level 3 - Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

When using the market quotations or closing price provided by the pricing service for equity investments, including common stocks, preferred stocks, foreign issued common stocks, exchange-traded funds, closed end mutual funds and real estate investment trusts, which are traded on an exchange are valued at the last sale price reported by the exchange on which the securities are primarily traded on the day of valuation and when the market is considered active, the security will be classified as a Level 1 security. When using the mean between the latest bid and ask price, the security will be classified as Level 2.

Investment in mutual funds, including money market funds, are generally priced at the ending NAV provided by the service agent of the funds and will be classified as Level 1 securities.

Fixed Income securities, such as corporate bonds, convertible bonds, commercial paper, money market deposit accounts and U.S. government agency issues are valued based on evaluated mean prices supplied by independent pricing services using matrix pricing formulas and/or independent broker bid quotations and are classified as Level 2.

Options are valued at the composite last price reported by the exchange on which the options are primarily traded on the day of the valuation and are classified as Level 1. If there is no composite last price on a given day the mean between the latest bid and ask price will be used. These contracts are classified as Level 2.

Any securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Adviser pursuant to procedures established under the general supervision and responsibility of the Funds’ Board of Trustees and may be classified as Level 3 securities. In determining fair value, a Fund will seek to assign a value to the security which it believes represents the amount that the Fund could reasonably expect to receive upon its current sale. With respect to securities that are actively traded on U.S. exchanges, the Funds expect that market quotations will generally be available and that fair value might be used only in limited circumstances, such as when trading for a security is halted during the trading day.

In determining whether a significant event has occurred with respect to securities traded principally in foreign markets, the Funds may engage a third party fair value service provider to systematically recommend the adjustment of closing market prices of non-U.S. securities based upon changes in a designated U.S. securities market index occurring from the time of close of the relevant foreign market and the close of the NYSE Fair value pricing may also be used to value restricted securities held by the Funds or securities with little or no trading activity for extended periods of time. Fair value pricing involves judgments that are inherently subjective and inexact and it is not possible to determine with certainty when, and to what extent, an event will affect a market price. As a result, there can be no assurance that fair value pricing will reflect actual market value and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security.

30 | October 31, 2021

The following is a summary of the inputs used, as of October 31, 2021, involving the Funds’ assets and liabilities carried at fair value. The inputs of methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

The Tocqueville Fund* | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 307,021,165 | | | $ | — | | | $ | — | | | $ | 307,021,165 | |

Real Estate Investment Trust (REIT) | | | 7,144,000 | | | | — | | | | — | | | | 7,144,000 | |

Money Market Fund | | | 557 | | | | — | | | | — | | | | 557 | |

Total Assets | | $ | 314,165,722 | | | $ | — | | | $ | — | | | $ | 314,165,722 | |

| | | | | | | | | | | | | | | | |

The Tocqueville Opportunity Fund* | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 111,493,156 | | | $ | — | | | $ | — | | | $ | 111,493,156 | |

Money Market Fund | | | 314 | | | | — | | | | — | | | | 314 | |

Total Assets | | $ | 111,493,470 | | | $ | — | | | $ | — | | | $ | 111,493,470 | |

| | | | | | | | | | | | | | | | |

The Tocqueville Phoenix Fund* | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 163,387,929 | | | $ | — | | | $ | — | | | $ | 163,387,929 | |

Money Market Fund | | | 8,800,000 | | | | — | | | | — | | | | 8,800,000 | |

Total Assets | | $ | 172,187,929 | | | $ | — | | | $ | — | | | $ | 172,187,929 | |

* | For further information regarding portfolio characteristics, please see the accompanying Schedules of Investments. |

The Funds did not hold any investments during the current fiscal year ended October 31, 2021 with significant unobservable inputs which would be classified as Level 3.

The Trust’s valuation procedures have been adopted by the Trust’s Board of Trustees, which has established a Valuation Committee to oversee the valuation process. The Valuation Committee meets on an as needed basis to evaluate changes in the valuation of portfolio securities. The full findings and valuations are then reviewed quarterly by the Independent Trustees.

Annual Report | 31

d) Derivative Instruments and Hedging Activities