UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212) 698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2018

Date of reporting period: October 31, 2018

Item 1. Reports to Stockholders.

The Tocqueville Trust

Mutual Funds

Annual Report

October 31, 2018

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Chairman’s Letter

Dear Fellow Shareholder,

Toward the end of the recently concluded fiscal year (October 31, 2018) markets began to react to concerns over global trade wars, U.S. mid-term elections, an unusually chaotic Presidential administration, Brexit, weakness in commodity prices, and rising interest rates. Most of these factors were evident through-out the period, but markets turned their attention elsewhere, particularly towards the seemingly limitless opportunities and growth prospects of a select few, large capitalization, technology/new economy companies. When two of them topped one trillion dollars in market value within a few weeks of each other, it was, in retrospect, a sign that these more fundamental concerns would once again begin to matter. And, indeed they have, continuing into the current fiscal year. From our long-term, sober perspective, the change of focus was inevitable, if not outright predictable.

Timing, as they say, is everything, and, no doubt, the preoccupation with the FANG stocks lasted far longer than we would have guessed. In some cases, valuations were clearly stretched, but there were other factors, as well. Consensus bullishness is always a contrary indicator. Among other certainties, large powerful companies attract unwanted government and media attention. The FANG names have had their share of that and we believe more is to come. Make no mistake, these companies are, for the most part, high quality, disruptive technology global giants with high returns on capital, piles of cash and dominant market shares. These strengths, however, led to very widespread enthusiastic complacency, even as they raised warning flags to regulators, media kingmakers and an assorted variety of political opportunists. The pair make for a dangerous combination.

Meanwhile, most other markets and common shares had a much more difficult time of it, through-out most of the fiscal year and particularly, at the end of it. In the period ahead, we would not be surprised to see this larger group of equities, in the U.S. as well as in the rest of the world, do better, as trade tensions eventually ease, Brexit finally happens, the markets embrace, as they usually do, divided government in Washington, and the Mueller probe into Russian influence over the U.S. Presidential Elections comes to (a probable anti-climactic) close, while lower oil prices and continued solid economic growth in the world’s largest economy justify valuations. Rising interest rates remain a concern, of course, as the problem with massive sovereign dollar denominated debt has not gone away, indeed it has only worsened. This needs to be carefully watched for its fiscal and inflationary implications. But so long as inflationary expectations and

interest rates are at benign levels, we believe the path of least resistance for the army of worldwide equities will be up, even if the leadership has been de-fanged.

Sincerely,

Robert W. Kleinschmidt

Chairman

The Tocqueville Fund

Dear Fellow Shareholder,

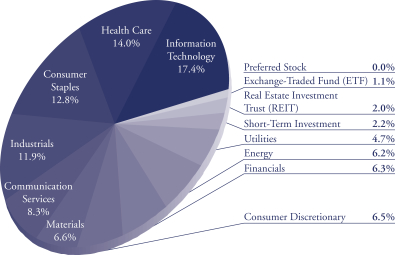

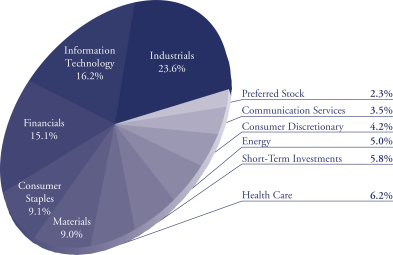

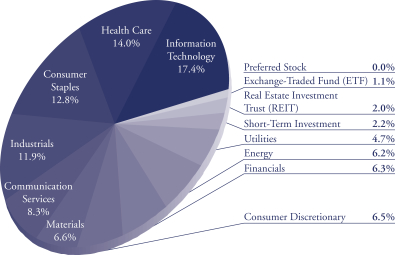

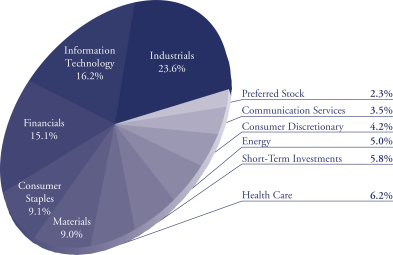

For the 12 months ended October 31, 2018, the Tocqueville Fund gained 2.01%, compared with the S&P 500, which returned 7.35% and with the Russell 3000 Value Index which returned 2.77%. Once again growth stocks outperformed value stocks; and, the S&P’s results were inflated by the now so-called FANMAG stocks (Facebook, Amazon, Netflix, Microsoft, Apple and Google), though not quite as heavily as last year, and hints of sector rotation away from large cap tech definitely appeared to begin during the later months of the period. Still, these six names (some of which are owned by the Fund but are underweighted compared with the benchmarks) combined to contribute approximately 40% of the S&P’s returns.

Sector performance of the Fund was mixed with Health Care, Information Technology and Consumer Discretionary leading the way and Energy, Industrials and Real Estate being the biggest detractors. Individually, the top performing names were Amazon, Microsoft, Boeing, Apple and Merck. Aside from the Fund’s participation in the FANMAG stocks, Boeing made the list of the top performers for the second year in a row on the continued health of the aerospace industry and Merck benefitted from its new Keytruda lung cancer drug.

The laggards in the portfolio were Applied Materials, General Electric, DowDuPont, Weyerhaeuser and Schlumberger. Applied Materials which was a top performer last year suffered as fears of a downturn in the semiconductor cycle took hold. General Electric, which was also on the list of laggards last year due to its considerable energy exposure, secular challenges and problems with cash flow conversion was held over because it had been embarking on a major restructuring with new management that we hoped would be successful. The situation has turned out to be worse than we thought, so we liquidated the position at the end of the fiscal year for tax purposes. Schlumberger was also held over despite being a laggard from last year as we had believed that oil producers would eventually need to return to large scale projects that are their specialty, and that oil prices supported a return to higher service activity levels. However, while oil production and spending may have improved, it has come in areas where Schlumberger is not as active, such as domestic shale regions. So here, too, for tax purposes, we chose to eliminate the position, as management continued to take down its forecasts and refocus on Halliburton, which is more exposed to shale.

Several new positions were initiated during the period. One of these is Fluor, an engineering and construction business. Fluor’s shares had fallen out of favor because of recent declines in its backlog, particularly in energy and mining; poor performance on several fixed price contracts; and worsening revenue mix. Our take was that its valuation more than accounted for these negatives, and with the global economy improving, so should its backlog. Importantly, we reasoned, with what we view as one of the best

balance sheets in the industry, if other participants faltered during the downturn, Fluor would be poised to pick up market share.

Another new position is Vulcan Materials, an aggregates and cement producer, which is similar to Eagle Materials, which was also purchased but later sold during the year. Vulcan, unlike Eagle, does not have the energy or homebuilding exposure that seems to continue to be a drag on Eagle’s business and were the reasons for our decision to switch out of the position. Vulcan shares appeared out of favor, as investors continued to doubt the ability of the Trump Administration to pass any infrastructure related legislation. Our view was that the company would benefit from an infrastructure bill that could be brought back into play following mid-term elections, and that weather delays would eventually resolve themselves.

Other positions that we added to or initiated during the fiscal year at times of market volatility or when opportunities presented themselves include: Apple, Arconic, Baker Hughes GE, Biogen, Brighthouse Financial, Campbell Soup, Coherent, Eagle Materials, General Electric, Goldcorp, Halliburton, JD.com, JP Morgan, Juno Therapeutics, Las Vegas Sands, Metlife, Nektar Therapeutics, Newell Brands, Noble Energy, Overstock, Parker Hannifin, PG&E, Pioneer Natural Resources, Walt Disney, Wells Fargo and Zoe’s Kitchen.

A variety of names were sold or reduced during the period, mostly in response to needs for liquidity but also to make room for better ideas, as prices reached our objectives or in response to fundamental changes. These included: Alcoa, Alkermes, Amazon, Apple, Applied Materials, Baker Hughes GE, Boeing, Brighthouse Financial, Coherent, Delta Airlines, DowDuPont, Eagle Materials, Facebook, Fannie Mae 8.25% Series S Preferred, General Electric, Intel, Las Vegas Sands, Lazard, McDonald’s, Microsoft, Newell Brands, Nextera Energy, Noble Energy, Overstock.com, Palo Alto Networks, PG&E, Qualcomm, Schlumberger, Synchrony Financial, U.S. Concrete, Walmart, Wells Fargo, Williams Sonoma and Zoe’s Kitchen. Of those sold due to fundamental change, Juno Therapeutics was as a result of a takeover and JD.com, which became embroiled in controversy which could have long-term implications.

As we look forward, we continue to believe that the U.S. economy is relatively healthy, with few signs of a near-term recession, due to its strong consumer sector and the fiscal stimulus from lower taxes, reduced regulation and higher government spending. However, the market is beginning to pay more attention to perceived signs of a global slowdown (which may, or may not, materialize) as exhibited by declining commodity and energy prices and a flattening yield curve. While the market is still near its record highs, there is evidence of investor rotation away from the large-cap technology names that have led the market for so many years and toward more typical value-oriented names. If so, we believe we are well positioned to participate in that transition.

Sincerely,

| | |

| |

|

| Robert W. Kleinschmidt | | Peter D. Shawn |

| Portfolio Manager | | Director of Research |

The Tocqueville Fund

(Unaudited)

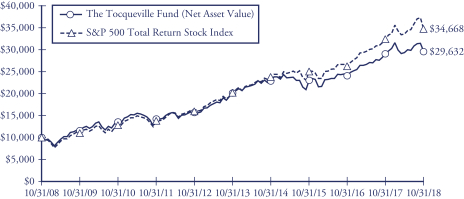

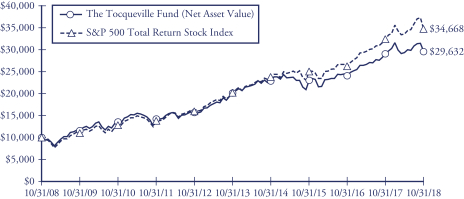

This chart assumes an initial gross investment of $10,000 made on 10/31/08. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 2.01% | | | | 8.86% | | | | 8.02% | | | | 11.47% | |

Standard & Poor’s 500 Total Return Stock Index | | | 7.35% | | | | 11.52% | | | | 11.34% | | | | 13.24% | |

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

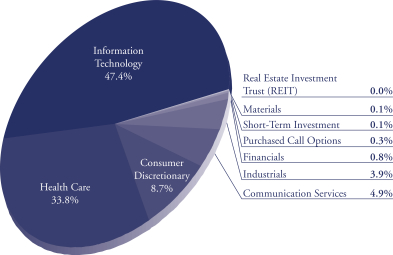

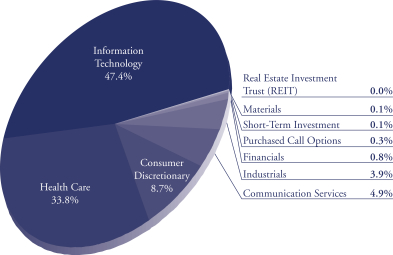

We are pleased to provide this investment overview for the 2018 fiscal year for the Tocqueville Opportunity Fund. During the year ended October 31, 2018, the Fund appreciated 5.30% and underperformed the SMID cap growth benchmark, the Russell 2500 Growth Index, which gained 5.52%. The past year’s returns followed the prior year’s (Fiscal 2017) strong investment appreciation of 36.47% versus the benchmark which gained 30.07%. We believe that the past two years of solid performance were in part driven by a very challenging environment in 2016 for growth issues due to pervasive uncertainty and a heightened sense of macro related risks, including: Chinese currency devaluation, a weakened Chinese economy, an oil price collapse, the first Fed tightening in the current cycle, EU bank credits, possible drug price regulation, Brexit, and the U.S. Presidential election. We view the past two years’ gains as not only having benefitted from a solid background of strong sales and earnings growth, but also due to recovery from negative sentiment in 2016.

We believed that the consequent economic stimulus would usher in a new period of rising consumer and corporate confidence which would lead to a pop in capital spending. Shortly after the new tax policy was passed, the Administration announced changes to U.S. trade policy—broadly targeted to major U.S. trading partners including: Mexico, Canada, China, Japan and the European Union. Initially, we believed that the impact of trade policy adjustments and tariffs on imported goods would be benign; we now believe that macroeconomic risks and uncertainty have increased. In addition to a clear slowing of economic activity outside the U.S., there is recent evidence that corporate confidence is wavering, and that capital spending and residential housing activity and prices are decelerating. The Federal Reserve appears certain to remain committed to its current cycle of rate tightening, as unemployment levels exist at historical lows and wage increases threaten underlying inflation. In short, the investment outlook has become more uncertain.

Investments in Information Technology, Basic Materials, and Energy provided the leading contributions on a relative basis versus the benchmark. Information Technology investments were the leading drivers of absolute and relative performance. Positive relative performance in the Materials and Energy sectors were attributable to the fact that we maintained appreciable underweights in each sector throughout the investment period—the two were in fact the worst two performing sectors for the year. As the fiscal year was closing out, oil price declines were accelerating given overproduction. Industrials, Financials, Real Estate and Utilities sector investments also contributed positively on a relative basis, despite the fact that the Fund was underweight each of these sectors over the course of the fiscal year. Healthcare, Consumer Discretionary, Staples and Communication Services (new sector) all lagged the benchmark on a relative basis.

While Healthcare investments provided the second leading sector gains on an absolute basis, the Fund was impacted by underperformance of several of the Fund’s longer-term healthcare investments.

Technology investments in IT Service, Internet and Cloud software drove the overall performance of the Fund on an absolute and relative basis, including: New Relic, ServiceNow, Shopify, Coupa Software, Paycom Software and Workday. Other than Coupa, all of these names have been long-term, multiyear investments for the Fund. We continue to maintain a very constructive view on the outlook for IT spending over the next year due to CIO spending surveys, CEO commentary, and the ongoing secular shift of IT spending from on-premise and license-based to edge, cloud and SAAS based models. Acquisitions in the Technology sector have confirmed not only the shift in strategy, but also attractive valuations. Healthcare investments proved to be the most challenging during the year. While the Fund’s performance was led by gains in SAGE Therapeutics, Sarepta Therapeutics and AveXis, it was significantly dragged downward by declines in at least five of last year’s leaders despite FDA approvals for most including: TESARO, Spark Therapeutics, Clovis Oncology and Alnylam Pharmaceuticals.

We are pleased to write that the Fund participated in 8 takeovers during the fiscal period, and that the Fund has participated in approximately 90 takeovers since 2010. Fiscal 2018 takeovers included: Oclaro, K2M Holdings, Juno, Integrated Devices, Callidus Software, Cavium, AveXis, and Esterline. We believe the rising uncertainty of trade policies and tariffs have not only begun to crimp capital spending but also takeover activities, despite attractive valuations and strong balance sheets.

The Fund’s Top 10, 50, and 100 positions at the end of the fiscal period comprised 36%, 76%, and 94%, respectively. The Fund’s active share relative to its benchmark continues to be high and has ranged from a low of 78.5% to high of 84.5% during the past 12 months.

We believe that the Fund’s investments are placed in competitively advantaged companies which are led by strong management. We have learned lessons over the years, and one of the most important is not to sell competitively advantaged companies when sentiment shifts to negative although investment fundamentals for such companies remain strong and market shares are expanding. Investing in fast growing companies in industries that are undergoing rapid innovations, change and expansion can be particularly challenging during periods of heightened macroeconomic risks; however, as we experienced in 2011 (Greece) and 2016 (China, Oil, Brexit, Presidential Election), volatile markets generally present the best investment opportunities for the patient investor.

As always, we appreciate your continued confidence in our efforts on behalf of the Fund and its shareholders.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

The Tocqueville Opportunity Fund

(Unaudited)

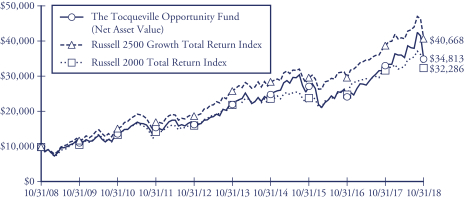

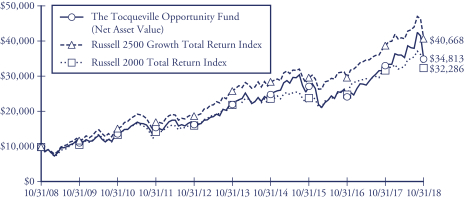

This chart assumes an initial gross investment of $10,000 made on 10/31/08. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The chart and table reflect The Opportunity Fund’s performance achieved prior to the changes effected in 2010 to its investment strategy.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Returns assume the reinvestment of all dividends

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | 5.30% | | | | 8.71% | | | | 9.54% | | | | 13.29% | |

Russell 2500 Growth Total Return Index | | | 5.52% | | | | 11.13% | | | | 9.53% | | | | 15.06% | |

Russell 2000 Total Return Index | | | 1.85% | | | | 10.68% | | | | 8.01% | | | | 12.44% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

During the fiscal year ended October 31, 2018, the Tocqueville International Value Fund’s total U.S. dollar return was negative 13.22%. In the same period, the Morgan Stanley EAFE Index Net, the index against which we are most often compared to, had a net total U.S. dollar return of negative 6.85%. For the 15-year period ended October 31, 2018, the Fund’s total U.S. dollar return was 6.95% per annum. In the same period, the Morgan Stanley EAFE Index Net had a net total U.S. dollar return of 5.78% per annum.

Developed equity markets outside the U.S. generally declined during the year, as positive earnings growth data was overshadowed by investor concerns regarding Brexit, Italy’s politics and budget deficit, and trade wars and their damaging impact on global growth. Growth concerns were magnified by the U.S. Federal Reserve’s apparent determination to increase interest rates. With growth relatively strong in the U.S., the dollar increased in value against most currencies, which in turn contributed to declines in the price of most commodities. In spite of growth concerns, long-term interest rates were generally up. Equity market volatility increased, and credit spreads widened somewhat. Among the worst performing markets were China, Korea and Germany, each levered to global growth and trade. Among industry groups, paper and forest products, home furnishings, pharmaceuticals, oil & gas producers, travel and leisure and retail performed well, while banks, auto parts, building materials, tobacco and telecoms were weak.

During the period, the Fund benefited from security selection in the consumer discretionary, financials and materials areas. Results were negatively impacted by the performance of positions in the healthcare, industrials and information technology areas. The Fund had meaningful contributions from design software concern Aveva, telecom equipment provider Ericsson, resource company BHP Billiton, fertilizer producer and distributor Nutrien, and drug maker Novartis. Notable detractors were chemical and consumer company Bayer, IT services concern Sopra Steria, medical equipment maker Miraca, building materials maker and distributor Saint Gobain, and analog chipmaker Infineon.

The Fund sold its positions in DCC, Misumi, Ericsson, and Johnson Matthey as their respective share prices approached our estimates of intrinsic value. Tender offers for Fund holdings Zodiac and Global Logistics Properties were completed, and Fund holding Potash Corp. became Nutrien following its merger with Agrium. We eliminated the position in Telefonica Brasil as the competitive environment became more uncertain. We exited the position in Miraca when the company’s senior management failed to convince us of the strategic rationale for its surprise large capital expenditure plan. We reduced the position in Bayer when a California court ruled in favor of a plaintiff claiming the company’s glyphosate herbicide product causes cancer.

During the period, the Fund purchased a position in software concern Micro Focus International, when shares sold off in response to weaker than expected operating results. Micro Focus has a portfolio of mature, cash generative enterprise software businesses and a fast-growing cloud software business. In our view, the market is valuing the company as if the mature businesses are in double digit decline, enabling us to acquire a largely recurring stream of free cash flows at a low multiple. We took a position in sporting goods maker Asics, which trades at a multi-year low valuation due to weak performance in the U.S. and European operations. We believe that management has a credible plan to improve results in the U.S. and Europe. Meanwhile, the company is generating profitable growth in China and the rest of Asia. We purchased shares of megabank Mitsubishi UFJ, which trades at a deep discount to book value and we believe that a combination of strategic focus on asset management and lending outside Japan should translate to an improving return on equity. We purchased a position in branded food company Danone. Danone’s product portfolio and growth profile have been among the best in the industry; however, subpar operating margins and questions about capital allocation have caused the stock to trade at a discount to intrinsic value. Under the leadership of its current CEO, Danone is shifting its focus from sales growth to improving margins and returns on capital, which should lead to improved profit growth and a rerating of the stock.

During the year, we added to positions in BHP Billiton, Nokia, Sanofi, UBS, Bollore, Smiths Group, CRH, Siemens, ISS, and St. Gobain, among others. Overall, there was a marginal increase in our exposure to Japan and Europe, including the U.K. and a decrease in our exposure to Latin America. We began the period with approximately 9% in cash reserves and finished the period with roughly 6%.

At the outset of the year, we noted that equity markets were enjoying an unusually positive confluence of factors, including strong growth, low inflation, low interest rates, lax monetary policy, and fiscal stimulus. Since then, we have seen a mild slowdown in growth, an uptick in inflation, a small pickup in interest rates, and a shift away from lax monetary policy in the U.S. The macro landscape is complicated by several factors, including trade disputes, Brexit, and budget deficits in the U.S. and Italy. That said, PMIs remain in positive territory and employment levels and consumer confidence are healthy. Inflation and interest rates remain low in absolute terms, liquidity conditions remain supportive in Europe and Japan, and valuations remain reasonable in absolute terms. Investor sentiment has shifted from complacent to guarded in recent months. In this mixed context, we continue to focus on individual company fundamentals and valuations.

Our investment objective remains to generate positive absolute returns and to exceed the returns of the major indices over the course of an economic cycle. To protect and grow your capital, we continue to seek out compelling long-term investment opportunities in companies that have defensible business franchises, are out of favor or misunderstood, and trade at a substantial discount to intrinsic value.

Sincerely,

James Hunt

Portfolio Manager

The Tocqueville International Value Fund

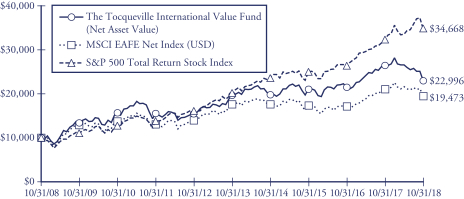

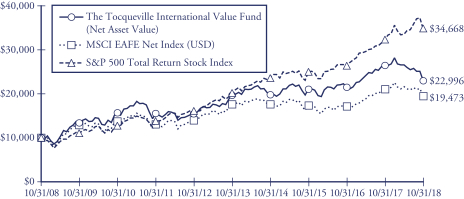

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/08. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The MSCI EAFE Net Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 21 Developed Market Countries in Europe, Australia, Asia and the Far East.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville International Value Fund | | | -13.22% | | | | 3.06% | | | | 3.23% | | | | 8.68% | |

MSCI EAFE Net Index | | | -6.85% | | | | 3.62% | | | | 2.02% | | | | 6.89% | |

Standard & Poor’s 500 Total Return Stock Index | | | 7.35% | | | | 11.52% | | | | 11.34% | | | | 13.24% | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

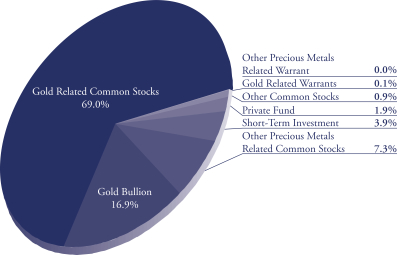

During the past year, the gold price declined 4.43% and the Tocqueville Gold Fund declined 18.60%. During the same period, the U.S. dollar as measured by the DXY rose 2.72%. Over the past few years, the stronger dollar has been a headwind for gold. We believe that dollar strength is unsustainable due to intractable fiscal issues facing the U.S. As the financial markets begin to focus on the likelihood that trillion-dollar fiscal deficits are becoming commonplace, the dollar will begin to weaken. Famed investment manager Ray Dalio of Bridgewater Associates expects the dollar to decline by 30% over the next two years. If he is correct, and we believe that he is, a decline of that magnitude would very likely lead to chaotic financial markets and a substantial rise in inflation.

Gold ownership is a proven strategy to protect capital against systemic financial risk. In recent years, financial markets have been sanguine as to the implications of reckless U.S. fiscal and monetary policy. We believe that a moment of clarity is fast approaching, and it will take the form of a substantial decline in equities and a concomitant rise in the precious metals complex.

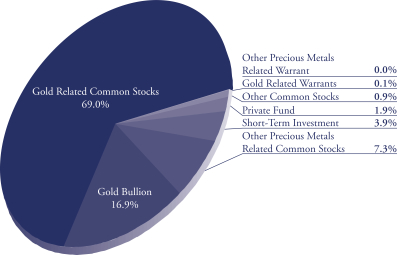

The Fund’s largest position is physical gold bullion made up of 119,680 ounces and represents about 17% of the Fund’s assets. That investment is held outside the financial system in secured vaults and audited regularly. The position provides Fund investors direct ownership of gold. Because gold bullion is less volatile than the precious metal equities held by the Fund, the physical gold position helped reduce the Fund’s overall volatility this past year.

The vast majority of the Fund’s assets are invested in mining equities that are focused on gold discovery or production. Additionally, and sometimes along with gold, we are exposed to silver. Silver is not only a precious metal but has many industrial applications as well. Similar to gold, it is considered a monetary metal. It often occurs with gold in multi-metallic orebodies, enhancing the value of those metal deposits.

The precious metal mining stocks that contributed positively during the past year included Corvus Gold Inc., Northern Star Resources Ltd., Evolution Mining Ltd., and Aurico Metals Inc. Corvus Gold Inc. is currently developing a significant gold resource on its Nevada property and has the potential to add more gold ounces from its drilling campaign. Northern Star Resources Ltd. and Evolution Mining Ltd. are two Australian based companies that are benefiting from well-executed acquisition strategies and improved operating costs due to a weaker Australian dollar. Aurico Metals Inc. was acquired in a friendly acquisition at a premium to its average market price during the past year.

Detour Gold Corporation, Franco-Nevada Corporation, Ivanhoe Mines Ltd., and Fresnillo PLC declined during the period and had the greatest negative impact on the

Fund’s performance. Detour Gold Corporation changed its mine plan which delayed some mining activity and reduced gold production this year. Franco-Nevada Corporation corrected from much stronger performance during 2017. Ivanhoe Mines Ltd. corrected from the market’s concern surrounding resource nationalism. Fresnillo PLC, a major silver producer, sold off as silver prices came under pressure between June and September, but more recently has recovered as silver prices generally stabilized.

During the period, the Fund established new positions in Cia de Minas Buenaventura, Yamana Gold Inc. and Gold Standard Ventures Corp. Buenaventura is growing cash flow from its current and new operating mines, while Yamana Gold Inc. is improving on its financial condition. Gold Standard Ventures Corp. has been developing gold deposits on its Nevada properties, which are likely to be attractive to a major mining company looking for U.S. based gold resources. Several positions were eliminated because they were either fully valued or presented limited value creation opportunities, such as Almadex Minerals and Independence Group; while Dalradian Resources was acquired during the year. With the proposed merger of two of the sector’s larger gold miners, Barrick and Randgold, we expect to see more sector M&A activity in the coming years.

It is notable that the precious metals mining sector represents one of the few islands of value in an overvalued equity market. Valuations relative to earnings, cash flow, reserves and production are the lowest in two decades. At the same time, companies in the Fund’s portfolio have done a good job of creating value for shareholders even if that accomplishment has been unrecognized in share performance.

As 2019 unfolds, we expect inflationary pressure to become manifest, while monetary policy remains behind the curve. Investor interest in precious metals was dormant during 2018, but we expect it to return as macroeconomic trends turn more favorable. These would include equity market weakness reflecting softening economic growth and dollar weakness accompanied by rising inflation and interest rates.

We appreciate your support over the past year and look forward to improved returns in 2019 and the years ahead.

Sincerely,

| | | | |

| |  | |  |

| John C. Hathaway | | Douglas B. Groh | | Ryan McIntyre |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

The Tocqueville Gold Fund

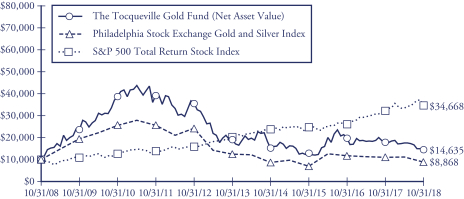

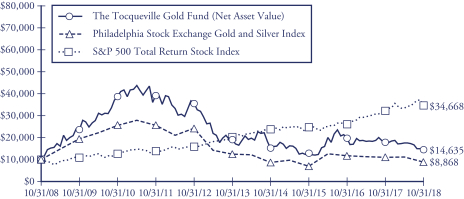

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/08. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2009, 2010, and 2016 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund | | | -18.60% | | | | 3.67% | | | | -5.26% | | | | 3.88% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -20.23% | | | | 8.36% | | | | -6.73% | | | | -1.19% | |

Standard & Poor’s 500 Total Return Stock Index | | | 7.35% | | | | 11.52% | | | | 11.34% | | | | 13.24% | |

The Delafield Fund

Dear Fellow Shareholder,

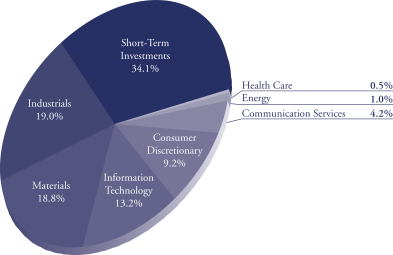

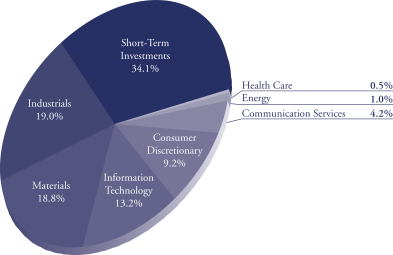

For the fiscal year ended October 31, 2018, the Fund’s net asset value decreased 10.61%, underperforming an increase of 1.85% for the Russell 2000 Index (“Russell 2000”) and an increase of 7.35% for the larger cap oriented Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. Broadly speaking, during the first quarter of the fiscal year U.S. equity indices captured in excess of their eventual full fiscal year returns. During that three-month period, the Russell 2000 posted a 5.14% increase and the S&P 500 advanced in excess of 10%. Stocks rallied on favorable corporate earnings results, solid labor market data and an improved outlook for prospects of continued U.S. economic growth. The subsequent nine months of the fiscal year, however, were marked with the return of volatility and both domestic and foreign worries drove overall declines in the indices. On the domestic front, investors seemed to reverse course and focus on the possibility of spiking inflation and probability of rising interest rates, as well as the tumultuous and acrimonious political environment. Further, later in the fiscal period, President Trump’s trade war with China began to evidence itself in negative corporate earnings surprises. Internationally, friction remained constant in many parts of the world; Brexit related worries were renewed with ongoing negotiations unresolved and several foreign economies appearing to be headed into decline. From February 1, 2018 through October 31, 2018, the Russell 2000 declined 3.13%, while the S&P 500 dropped a comparable 2.57%.

The Fund’s performance for the fiscal year was disappointing. Both the Fund’s style (value) and the Fund’s market cap sweet spot (small to mid) remained out of favor with investors. The Russell 2000 Value Index finished the fiscal year in the red and underperformed the Russell 2000 Growth Index by nearly 500 basis points. While the Standard & Poor’s 500 Value Index managed to eke out a modest gain for the year, its growth-oriented counterpart outperformed by about 800 basis points. The divergence in performance between small and large cap stocks during the fiscal year was evident in the roughly 5.5 percentage point differential in the respective returns of the Russell 2000 and S&P 500. In an environment that was hostile to the Fund’s investment approach, investment selection needed to be nearly flawless; unfortunately, that was not the case. Six of the Fund’s holdings experienced outsized declines that in aggregate accounted for almost all of the underperformance, relative to the Russell 2000. At present, we believe the dislocation in three of these stocks (TTMI Technologies, Inc. (TTMI), U.S. Concrete, Inc. (USCR) and Flex Ltd. (FLEX)) is only temporary and they remain core holdings in the Fund’s portfolio, while the remaining three (Horizon Global Corporation (HZN), Diebold Nixdorf, Inc. (DBD) and McDermott International, Inc. (MDR)) have either been sold out entirely or have been greatly reduced in size. In contrast, Xerium Technologies Inc. (XRM), Team Inc. (TISI) and Fabrinet (FN) generated outsized returns during the fiscal year and were the largest positive contributors.

Not surprisingly, the Fund’s relative performance on a sector basis was highly correlated to the aforementioned six stocks. Information technology was the most challenged sector relative to the Russell 2000, with declines in DBD, FLEX and TTMI leading the way. The Fund’s materials sector investments (USCR) similarly underperformed, followed by consumer discretionary (HZN). A relative lack of exposure to the healthcare sector was also a detriment to the Fund’s performance, as it was the largest absolute contributor to the Russell 2000 during the fiscal year. Industrials, the Fund’s most heavily weighted sector, was a relative bright spot during the fiscal year.

During the fiscal year, we added a number of new positions to the portfolio, the largest of which included Acuity Brands Inc. (AYI), Apogee Enterprises Inc. (APOG), Commercial Metals Company (CMC), W.R. Grace (GRA), Mohawk Industries Inc (MHK), and Newell Brands Inc (NWL). The largest portfolio deletions included Acacia Communications Inc. (ACIA), Barnes Group Inc. (B), Boardwalk Pipeline Partners LP (BWP), Diebold Nixdorf (DBD), G-III Apparel Group, LTD (GIII), Invacare Corp (IVC) and Korn Ferry (KFY).

While the Fund’s performance has trailed the market for a frustratingly long period of time, the companies in which the Fund invests have, for the most part, continued to show progress. They are generating cash, increasing earnings and, in some cases, making strategic acquisitions to accelerate their growth. We remain convinced that their progress will be reflected in higher market values over time.

Sincerely,

| | |

| |  |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

| | |

| |  |

| Joshua Kaufthal | | James Maxwell |

| Portfolio Manager | | Portfolio Manager |

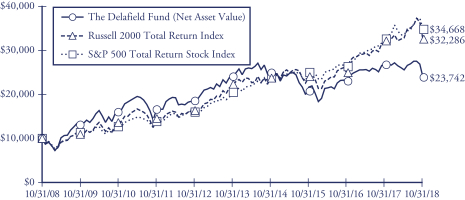

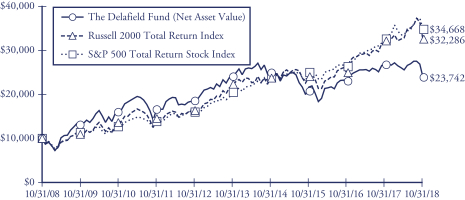

The Delafield Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/08. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | -10.61% | | | | 3.18% | | | | -0.42% | | | | 9.03% | |

Russell 2000 Total Return Index | | | 1.85% | | | | 10.68% | | | | 8.01% | | | | 12.44% | |

Standard & Poor’s 500 Total Return Stock Index | | | 7.35% | | | | 11.52% | | | | 11.34% | | | | 13.24% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

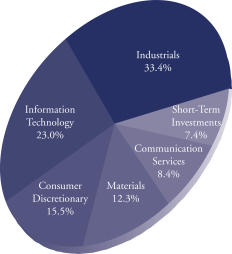

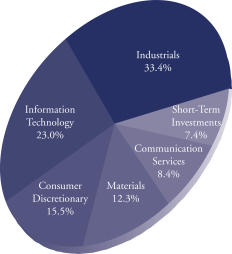

For the fiscal year ended October 31, 2018, the Fund’s net asset value decreased 6.39%, underperforming total returns of 2.80% and 1.85% for the Russell 2500 Index (“Russell 2500”) and Russell 2000 Index (“Russell 2000”), respectively. Performance of U.S. equity markets was uneven during the fiscal year, with stocks generating in excess of their eventual full fiscal year returns in the first quarter and declining in aggregate for the balance of the year. During the first quarter, the Russell 2500 posted a 6.79% increase, with stocks rallying on favorable corporate earnings results, solid labor market data and an improved outlook for prospects for continued U.S. economic growth. The Russell 2500 subsequently endured a 3.74% decline over the next nine months of the fiscal year, with volatility returning to the market and domestic and foreign macro worries re-emerging. On the domestic front, investors seemed to reverse course and focus on the possibility of spiking inflation and probability of rising interest rates, as well as the tumultuous and acrimonious political environment. Further, later in the fiscal period, President Trump’s trade war with China began to evidence itself in negative corporate earnings surprises. Internationally, friction remained constant in many parts of the world; Brexit related worries were renewed with ongoing negotiations unresolved and several foreign economies appearing to be headed into decline.

The Fund’s performance for the fiscal year was unsatisfactory. Through three quarters, the Fund’s performance was generally in-line with the Russell 2500 and then in the fourth quarter, a number of individual holdings suffered particularly meaningful declines. Owing to the concentrated nature of the Fund, individual miscues can be rather meaningful to the aggregate performance, as was the case this fiscal year. Namely Flex Ltd., Mohawk Industries and TTM Technologies Inc. experienced what we believe to be temporary miscues and remain in the Fund’s portfolio. In contrast, Horizon Global Corporation, Real Industry Inc. and Diebold Nixdorf were sold out of the Fund. In total, during the fiscal year, these five names detracted from the Fund’s relative performance by almost 15 percentage points.

Not surprisingly, the Fund’s relative performance on a sector basis was highly correlated to the aforementioned six stocks. Consumer discretionary was the Fund’s most challenged sector relative to the Russell 2500, with declines in Horizon Global and Mohawk leading the way. The Fund similarly underperformed in the information technology sector owing to Diebold, Flex and TTM Technologies. The Fund’s lack of exposure to the healthcare sector was also a detriment to its performance, as it was the largest absolute contributor to the Russell 2500 during the fiscal year. Industrials, the Fund’s most heavily weighted sector, was a relative bright spot during the fiscal year. Industrials holdings, led by Team, Inc., ICF International, Inc. and Harsco Corporation, contributed nearly 300 basis points of absolute and relative performance.

We added a number of new positions to the portfolio during the fiscal year, including Acuity Brands Inc., Apogee Enterprises Inc., Fabrinet, W.R. Grace, Mohawk Industries, Newell Brands Inc., and Tile Shop Holdings Inc. In addition to the portfolio deletions mentioned earlier, we also exited our positions in Dover Corporation, G-III Apparel Group, Pier 1 Imports Inc., and Xerium Technologies.

While we are disappointed in our trailing performance, we believe that we have positioned the portfolio for future success. We also believe that the companies in which we are invested have, for the most part, made progress. They are generating cash, increasing earnings and, in some cases, making strategic acquisitions to accelerate their growth. We remain convinced that this progress will be reflected in higher market values over time.

Sincerely,

| | | | |

| |  | |  |

J. Dennis Delafield | | Vincent Sellecchia | | Joshua Kaufthal |

Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

| | |

| |  |

Donald Wang | | James Maxwell |

Portfolio Manager | | Portfolio Manager |

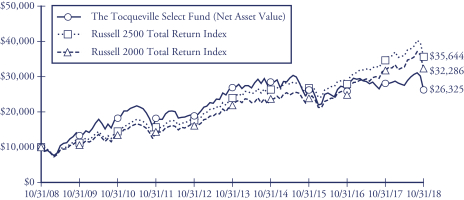

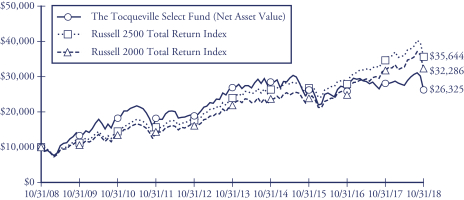

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/08. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

In 2013 the performance of The Tocqueville Select Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Russell 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | -6.39% | | | | 0.00% | | | | -0.47% | | | | 10.16% | |

Russell 2500 Total Return Index | | | 2.80% | | | | 10.05% | | | | 8.32% | | | | 13.55% | |

Russell 2000 Total Return Index | | | 1.85% | | | | 10.68% | | | | 8.01% | | | | 12.44% | |

Expense Example—October 31, 2018 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2018-October 31, 2018).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

The Tocqueville Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period*

May 1, 2018 -

October 31, 2018 | |

Actual | | $ | 1,000.00 | | | $ | 1,010.10 | | | $ | 6.33 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.25% for The Tocqueville Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Opportunity Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period*

May 1, 2018 -

October 31, 2018 | |

Actual | | $ | 1,000.00 | | | $ | 986.60 | | | $ | 6.31 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.85 | | | | 6.41 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.26% for The Tocqueville Opportunity Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville International Value Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period*

May 1, 2018 -

October 31, 2018 | |

Actual | | $ | 1,000.00 | | | $ | 865.50 | | | $ | 5.88 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville International Value Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Gold Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period*

May 1, 2018 -

October 31, 2018 | |

Actual | | $ | 1,000.00 | | | $ | 832.40 | | | $ | 6.60 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.00 | | | | 7.27 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.43% for The Tocqueville Gold Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Delafield Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period*

May 1, 2018 -

October 31, 2018 | |

Actual | | $ | 1,000.00 | | | $ | 930.00 | | | $ | 6.08 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Delafield Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Select Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period*

May 1, 2018 -

October 31, 2018 | |

Actual | | $ | 1,000.00 | | | $ | 956.10 | | | $ | 6.16 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville Select Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of year | | $ | 38.60 | | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | | | $ | 30.67 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.35 | | | | 0.37 | | | | 0.42 | | | | 0.37 | | | | 0.28 | |

Net realized and unrealized gain (loss) | | | 0.45 | | | | 6.40 | | | | 1.07 | | | | (0.19 | ) | | | 3.78 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 0.80 | | | | 6.77 | | | | 1.49 | | | | 0.18 | | | | 4.06 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.33 | ) | | | (0.39 | ) | | | (0.35 | ) | | | (0.25 | ) | | | (0.30 | ) |

Distributions from net realized gains | | | (3.23 | ) | | | (1.50 | ) | | | (0.33 | ) | | | (1.20 | ) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (3.56 | ) | | | (1.89 | ) | | | (0.68 | ) | | | (1.45 | ) | | | (0.55 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (2.76 | ) | | | 4.88 | | | | 0.81 | | | | (1.27 | ) | | | 3.51 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 35.84 | | | $ | 38.60 | | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 2.0 | % | | | 20.9 | % | | | 4.6 | % | | | 0.5 | % | | | 13.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 272,043 | | | $ | 293,637 | | | $ | 283,126 | | | $ | 309,267 | | | $ | 380,561 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.26 | % | | | 1.27 | % | | | 1.27 | % | | | 1.29 | % | | | 1.25 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.26 | %(3) | | | 1.24 | %(3) | | | 1.25 | % | | | 1.24 | % |

Net investment income before waiver/reimbursement | | | 0.91 | % | | | 0.97 | % | | | 1.18 | % | | | 0.91 | % | | | 0.84 | % |

Net investment income after waiver/reimbursement | | | 0.92 | % | | | 0.98 | % | | | 1.21 | % | | | 0.95 | % | | | 0.85 | % |

Portfolio turnover rate | | | 19 | % | | | 10 | % | | | 12 | % | | | 15 | % | | | 19 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes 0.01% of interest expense. Interest expense is not included in the Fund’s waiver/reimbursement. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of year | | $ | 26.12 | | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | | | $ | 21.29 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.29 | ) | | | (0.37 | ) | | | (0.29 | ) | | | (0.15 | ) | | | (0.22 | ) |

Net realized and unrealized gain (loss) | | | 1.63 | | | | 7.35 | | | | (1.98 | ) | | | 1.98 | | | | 2.80 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 1.34 | | | | 6.98 | | | | (2.27 | ) | | | 1.83 | | | | 2.58 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (0.86 | ) | | | — | | | | — | | | | (3.20 | ) | | | (1.09 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.86 | ) | | | — | | | | — | | | | (3.20 | ) | | | (1.09 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 0.48 | | | | 6.98 | | | | (2.27 | ) | | | (1.37 | ) | | | 1.49 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 26.60 | | | $ | 26.12 | | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 5.3 | % | | | 36.5 | % | | | (10.6 | )% | | | 9.1 | % | | | 12.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 82,106 | | | $ | 77,773 | | | $ | 92,958 | | | $ | 153,456 | | | $ | 80,324 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.33 | % | | | 1.38 | % | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % |

Expenses after waiver/reimbursement | | | 1.26 | %(3) | | | 1.30 | %(3)(4) | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % |

Net investment loss before waiver/reimbursement | | | (1.13 | )% | | | (1.05 | )% | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% |

Net investment loss after waiver/reimbursement | | | (1.06 | )% | | | (0.97 | )%(4) | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% |

Portfolio turnover rate | | | 151 | % | | | 133 | % | | | 108 | % | | | 101 | % | | | 92 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes interest expense of 0.01% for the year ended October 31, 2018 and 0.05% for the year ended October 31, 2017. Interest expense is not included in the Fund’s waiver/reimbursement. |

| (4) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the year) | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of year | | $ | 17.58 | | | $ | 14.44 | | | $ | 14.59 | | | $ | 14.48 | | | $ | 14.71 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.24 | | | | 0.14 | | | | 0.14 | | | | 0.15 | | | | 0.15 | |

Net realized and unrealized gain (loss) | | | (2.53 | ) | | | 3.23 | | | | 0.14 | | | | 0.80 | | | | (0.15 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (2.29 | ) | | | 3.37 | | | | 0.28 | | | | 0.95 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.17 | ) | | | (0.15 | ) | | | (0.25 | ) | | | (0.32 | ) | | | (0.23 | ) |

Distributions from net realized gains | | | (0.06 | ) | | | (0.08 | ) | | | (0.18 | ) | | | (0.52 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.23 | ) | | | (0.23 | ) | | | (0.43 | ) | | | (0.84 | ) | | | (0.23 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (2.52 | ) | | | 3.14 | | | | (0.15 | ) | | | 0.11 | | | | (0.23 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 15.06 | | | $ | 17.58 | | | $ | 14.44 | | | $ | 14.59 | | | $ | 14.48 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | (13.2 | )% | | | 23.7 | % | | | 2.0 | % | | | 7.2 | % | | | (0.0 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 1,060,000 | | | $ | 1,120,994 | | | $ | 525,808 | | | $ | 333,762 | | | $ | 237,051 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.48 | % | | | 1.53 | % | | | 1.58 | % | | | 1.57 | % | | | 1.54 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Net investment income before waiver/reimbursement | | | 1.09 | % | | | 0.73 | % | | | 0.90 | % | | | 0.71 | % | | | 0.62 | % |

Net investment income after waiver/reimbursement | | | 1.32 | % | | | 1.01 | % | | | 1.23 | % | | | 1.03 | % | | | 0.91 | % |

Portfolio turnover rate | | | 25 | % | | | 22 | % | | | 26 | % | | | 42 | % | | | 31 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the year) | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of year | | $ | 35.64 | | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | | | $ | 38.01 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.38 | ) | | | (0.39 | ) | | | (0.33 | ) | | | (0.27 | ) | | | (0.08 | ) |

Net realized and unrealized gain (loss) | | | (6.25 | ) | | | (3.29 | ) | | | 13.61 | | | | (4.07 | ) | | | (7.55 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (6.63 | ) | | | (3.68 | ) | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (6.63 | ) | | | (3.68 | ) | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 29.01 | | | $ | 35.64 | | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.02 | |

Total Return | | | (18.6 | )% | | | (9.4 | )% | | | 51.0 | % | | | (14.3 | )% | | | (20.1 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 859,394 | | | $ | 1,153,287 | | | $ | 1,365,282 | | | $ | 947,367 | | | $ | 1,138,557 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.42 | % | | | 1.38 | % | | | 1.39 | % | | | 1.43 | % | | | 1.36 | % |

Net investment loss | | | (0.88 | )% | | | (0.95 | )% | | | (0.91 | )% | | | (0.84 | )% | | | (0.78 | )% |

Portfolio turnover rate | | | 9 | % | | | 14 | % | | | 15 | % | | | 11 | % | | | 10 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the year) | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of year | | $ | 26.40 | | | $ | 26.47 | | | $ | 28.64 | | | $ | 36.40 | | | $ | 37.13 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.14 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.10 | ) |

Net realized and unrealized gain (loss) | | | (2.27 | ) | | | 4.91 | | | | 0.78 | | | | (3.99 | ) | | | 0.70 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (2.41 | ) | | | 4.76 | | | | 0.63 | | | | (4.13 | ) | | | 0.60 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (3.79 | ) | | | (4.83 | ) | | | (2.80 | ) | | | (3.63 | ) | | | (1.33 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (3.79 | ) | | | (4.83 | ) | | | (2.80 | ) | | | (3.63 | ) | | | (1.33 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (6.20 | ) | | | (0.07 | ) | | | (2.17 | ) | | | (7.76 | ) | | | (0.73 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 20.20 | | | $ | 26.40 | | | $ | 26.47 | | | $ | 28.64 | | | $ | 36.40 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | (10.6 | )% | | | 19.0 | % | | | 3.3 | % | | | (12.3 | )% | | | 1.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 237,119 | | | $ | 373,353 | | | $ | 400,827 | | | $ | 674,525 | | | $ | 1,475,139 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.32 | % | | | 1.31 | % | | | 1.29 | % | | | 1.25 | % | | | 1.21 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | %(3) | | | 1.29 | % | | | 1.25 | % | | | 1.21 | % |

Net investment loss before waiver/reimbursement | | | (0.55 | )% | | | (0.55 | )% | | | (0.33 | )% | | | (0.15 | )% | | | (0.24 | )% |

Net investment loss after waiver/reimbursement | | | (0.48 | )% | | | (0.49 | )%(3) | | | (0.33 | )% | | | (0.15 | )% | | | (0.24 | )% |

Portfolio turnover rate | | | 40 | % | | | 36 | % | | | 39 | % | | | 19 | % | | | 34 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of year | | $ | 11.87 | | | $ | 11.43 | | | $ | 12.08 | | | $ | 14.90 | | | $ | 15.57 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.05 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.08 | ) | | | (0.07 | ) |

Net realized and unrealized gain (loss) | | | (0.70 | ) | | | 1.12 | | | | (0.18 | ) | | | (1.00 | ) | | | 0.94 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (0.75 | ) | | | 1.06 | | | | (0.25 | ) | | | (1.08 | ) | | | 0.87 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (0.22 | ) | | | (0.62 | ) | | | (0.40 | ) | | | (1.74 | ) | | | (1.54 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.22 | ) | | | (0.62 | ) | | | (0.40 | ) | | | (1.74 | ) | | | (1.54 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (0.97 | ) | | | 0.44 | | | | (0.65 | ) | | | (2.82 | ) | | | (0.67 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 10.90 | | | $ | 11.87 | | | $ | 11.43 | | | $ | 12.08 | | | $ | 14.90 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | (6.4 | )% | | | 8.9 | % | | | (1.9 | )% | | | (8.0 | )% | | | 6.1 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 39,225 | | | $ | 49,453 | | | $ | 63,812 | | | $ | 81,813 | | | $ | 108,060 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.37 | % | | | 1.37 | % | | | 1.37 | % | | | 1.36 | % | | | 1.32 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | %(3) | | | 1.37 | % | | | 1.36 | % | | | 1.32 | % |

Net investment loss before waiver/reimbursement | | | (0.50 | )% | | | (0.47 | )% | | | (0.45 | )% | | | (0.52 | )% | | | (0.50 | )% |

Net investment loss after waiver/reimbursement | | | (0.38 | )% | | | (0.35 | )%(3) | | | (0.45 | )% | | | (0.52 | )% | | | (0.50 | )% |

Portfolio turnover rate | | | 27 | % | | | 24 | % | | | 32 | % | | | 43 | % | | | 32 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2018

| | | | | | | | |

| Common Stocks—94.2% | | Shares | | | Value | |

Automobiles & Components—1.2% | | | | | |

Ford Motor Co. | | | 350,000 | | | $ | 3,342,500 | |

Banks—1.4% | | | | | | | | |

Bank of America Corp. | | | 100,000 | | | | 2,750,000 | |

JPMorgan Chase & Co. | | | 9,000 | | | | 981,180 | |

| | | | | | | | 3,731,180 | |

Capital Goods—8.0% | | | | | | | | |

Arconic, Inc. | | | 175,000 | | | | 3,557,750 | |

Caterpillar, Inc. | | | 25,000 | | | | 3,033,000 | |

Fluor Corp. | | | 25,000 | | | | 1,096,500 | |

Illinois Tool Works, Inc. | | | 40,000 | | | | 5,102,800 | |

Parker-Hannifin Corp. | | | 13,000 | | | | 1,971,190 | |

The Boeing Co. | | | 20,000 | | | | 7,097,200 | |

| | | | | | | | 21,858,440 | |

Commercial & Professional Services—1.2% | |

Steelcase, Inc.—Class A | | | 200,000 | | | | 3,320,000 | |

Consumer Services—2.3% | | | | | | | | |

McDonald’s Corp. | | | 35,000 | | | | 6,191,500 | |

Diversified Financials—2.2% | | | | | |

The Bank of New York Mellon Corp. | | | 125,000 | | | | 5,916,250 | |

Energy—6.2% | | | | | | | | |

Exxon Mobil Corp. | | | 100,000 | | | | 7,968,000 | |

Halliburton Co. | | | 130,000 | | | | 4,508,400 | |

Pioneer Natural Resources Co. | | | 29,000 | | | | 4,270,830 | |

| | | | | | | | 16,747,230 | |

Food & Staples Retailing—3.3% | | | | | |

Walmart, Inc. | | | 90,000 | | | | 9,025,200 | |

Food, Beverage & Tobacco—4.0% | |

Campbell Soup Co. | | | 100,000 | | | | 3,741,000 | |

The Coca-Cola Co. | | | 150,000 | | | | 7,182,000 | |

| | | | | | | | 10,923,000 | |

Health Care Equipment & Services—1.3% | |

Abbott Laboratories | | | 50,000 | | | | 3,447,000 | |

Household & Personal Products—5.4% | |

Colgate-Palmolive Co. | | | 100,000 | | | | 5,955,000 | |

The Procter & Gamble Co. | | | 100,000 | | | | 8,868,000 | |

| | | | | | | | 14,823,000 | |

Insurance—2.7% | | | | | | | | |

Aflac, Inc. | | | 100,000 | | | | 4,307,000 | |

Brighthouse Financial, Inc.(a) | | | 25,000 | | | | 990,750 | |

MetLife, Inc. | | | 50,000 | | | | 2,059,500 | |

| | | | | | | | 7,357,250 | |

Materials—6.6% | | | | | | | | |

BHP Billiton Ltd.—ADR(b) | | | 50,000 | | | | 2,309,000 | |

DowDuPont, Inc. | | | 100,000 | | | | 5,392,000 | |

Goldcorp, Inc.(b) | | | 100,000 | | | | 902,000 | |

Nutrien Ltd.(b) | | | 40,000 | | | | 2,117,200 | |

Sonoco Products Co. | | | 75,000 | | | | 4,093,500 | |

Vulcan Materials Co. | | | 30,000 | | | | 3,034,200 | |

| | | | | | | | 17,847,900 | |

Media—1.7% | | | | | | | | |

The Walt Disney Co. | | | 40,000 | | | | 4,593,200 | |

Media & Entertainment—2.8% | |

Alphabet, Inc.—Class A(a) | | | 7,000 | | | | 7,634,060 | |

Pharmaceuticals, Biotechnology & Life Sciences—12.7% | |

Biogen, Inc.(a) | | | 10,000 | | | | 3,042,700 | |

Ionis Pharmaceuticals, Inc.(a) | | | 75,000 | | | | 3,716,250 | |

Johnson & Johnson | | | 70,000 | | | | 9,799,300 | |

Merck & Co., Inc. | | | 125,000 | | | | 9,201,250 | |

Nektar Therapeutics(a) | | | 5,000 | | | | 193,400 | |

Pfizer, Inc. | | | 200,000 | | | | 8,612,000 | |

| | | | | | | | 34,564,900 | |

Retailing—2.9% | |

Amazon.com, Inc.(a) | | | 5,000 | | | | 7,990,050 | |

Semiconductors & Semiconductor Equipment—5.5% | |

Applied Materials, Inc. | | | 150,000 | | | | 4,932,000 | |

Intel Corp. | | | 150,000 | | | | 7,032,000 | |

QUALCOMM, Inc. | | | 50,000 | | | | 3,144,500 | |

| | | | | | | | 15,108,500 | |

Software & Services—9.6% | |

Automatic Data Processing, Inc. | | | 75,000 | | | | 10,806,000 | |

Facebook, Inc.—Class A(a) | | | 30,000 | | | | 4,553,700 | |

Microsoft Corp. | | | 100,000 | | | | 10,681,000 | |

| | | | | | | | 26,040,700 | |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2018

| | | | | | | | |

| Common Stocks—94.2% | | Shares | | | Value | |

Technology Hardware & Equipment—3.8% | |

Apple, Inc. | | | 47,500 | | | $ | 10,395,850 | |

Bio-key International, Inc.(a)(c)(d)

(Originally acquired 09/16/05, Cost $0) | | | 1,963 | | | | — | |

| | | | | | | | 10,395,850 | |

Telecommunication Services—2.1% | |

Verizon Communications, Inc. | | | 100,000 | | | | 5,709,000 | |

Transportation—2.6% | | | | | |

Delta Air Lines, Inc. | | | 100,000 | | | | 5,473,000 | |

Kansas City Southern | | | 15,000 | | | | 1,529,400 | |

| | | | | | | | 7,002,400 | |

Utilities—4.7% | | | | | | | | |

NextEra Energy, Inc. | | | 74,000 | | | | 12,765,000 | |

Total Common Stocks

(Cost $131,132,132) | | | | | | | 256,334,110 | |

Preferred Stock—0.0% | | | | | | | | |

Health Care Equipment & Supplies—0.0% | |

Velico Medical, Inc.(c)(d) (Originally acquired 10/13/16, Cost $0) | | | 400,000 | | | | 1,600 | |

Total Preferred Stock

(Cost $—) | | | | | | | 1,600 | |