UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212) 698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2017

Date of reporting period: October 31, 2017

| Item 1. | Reports to Stockholders. |

The Tocqueville Trust

Mutual Funds

Annual Report

October 31, 2017

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Chairman’s Letter

Dear Fellow Shareholder,

The fiscal year ending October 31, 2017, included the extraordinary U.S. presidential election and the most unusual first ten months of the Trump Administration. If at the beginning of the fiscal year someone was able to predict the election results and the political chaos that was to unfold both in the U.S. and internationally over the next twelve months, they almost certainly would have been extremely bearish on the markets. But markets surprised and disappointed any such predications. Rather than collapsing, equity markets worldwide embarked on a long rally that continues to this day.

What is going on here?

The rally demonstrates, at least in part, the key role played by animal spirits. Not much has changed on the legislative front to date, and while regulatory change has been broad, there has been but little time to see the consequences of a more pro-growth regulatory environment. What has changed, along with steadily increasing corporate earnings, is the perception that the long regulatory and rhetorical war on business has come to a halt and that taxes, having risen to confiscatory levels, will be rolled back. While this perception is hardly an endorsement of the Trump Administration (far from it, based upon recent polls) it is, perhaps, an indication of the relief felt by the investment community at the passing of the previous administration, and the long period of exceptionally slow economic growth that accompanied it.

A return to historic post-war growth levels could support a long rally in the markets, notwithstanding a litany of worries worldwide. It was a previous President, John F. Kennedy, someone no one would confuse with the current occupant of the White House, who first said, “A rising tide lifts all boats.” The country and most of the worldwide economy had been in an ebb tide of sorts ever since the financial crisis, in part due to the hangover from that crisis and in part due to misguided economic policy. A return to normal is not an unrealistic hope.

Aside from animal spirits, however, it all comes down to earnings and how they are valued, with interest rates playing a determinant role. Interest rates, perhaps more than ever before, are key because the level of sovereign debt has never been higher, and the cost of servicing that debt at higher interest rates would be crippling to most of the major economies. Fortunately, rates remain low and inflationary expectations which strongly influence rates remain benign. As long as that remains the case, we believe the equity markets will be a rewarding place to invest.

Sincerely,

Robert W. Kleinschmidt

Chairman

The Tocqueville Fund

Dear Fellow Shareholder,

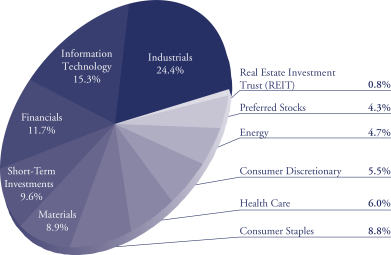

For the 12 months ended October 31, 2017, the Tocqueville Fund gained 20.88%, only modestly underperforming the Russell 3000 at 23.98% over the same period, and the S&P 500 at 23.63%. The S&P’s results were inflated by the so-called FANG stocks (Facebook, Amazon, Netflix and Google), as well as by tech titans Apple and Microsoft. Combined, these seven names contributed more than half of the S&P’s returns over the period. Fortunately, the Fund owns many of these equities, having purchased them at far lower prices, when they had been temporarily out of favor (as hard to believe as that is), but, having trimmed these positions as prices appreciated. As a result, our weighting in these names is far below that of the S&P 500. The FANG stocks are not the only story, however. For the seventh straight year, growth stocks have generally far outpaced value stocks. For example, the Russell 1000 Growth Index gained 29.71% over the twelve-month period, compared with 17.78% for the Russel 1000 Value Index. Our investment orientation is value driven, so we are pleased to have generated such strong absolute returns in a market so comparatively difficult for our investment style.

While all sectors of the market generated positive returns for the Fund, Information Technology was by far the strongest. Financials were also a significant contributor to the overall market, as interest rates generally started to rise and investors hope that the Fed will slowly continue to increase them. The Technology names performed generally in line with the applicable benchmarks. Applied Materials was the strongest performer for the second year in a row, and we also had meaningful contributions from Microsoft and Amazon. Outside of Technology, the Fund had strong contributions from Boeing, which is benefitting from a long commercial and defense aerospace cycle, as well as Ionis Pharmaceuticals, which continued to show success with its anti-sense drug discovery platform and rebounded from particularly negative sentiment for the biotechnology sector last year.

The weakest sector in the overall market was Energy, and the sector, as well as the stocks we hold in the sector, was a net drag on overall performance. The two main detractors related to Energy were Schlumberger and Noble Energy, as both companies are exposed to deep water drilling projects and have generally not participated in the shale led production recovery. However, for the year, GE was the single biggest drag on overall Fund performance, which has considerable energy exposure, and also faces potential secular challenges with its turbine based power business. GE also struggled with operational performance, particularly cash flow conversion, and is embarking on a major restructuring. The sector with the biggest factor in relative performance was the Financials sector, where the Fund was underweight, which we generally tend to be for structural and transparency reasons, not to mention risk considerations. Other names that reduced the Fund’s returns included QUALCOMM, which has been embroiled in licensing disputes

with major customers (but has recently been the recipient of an unsolicited takeover offer) and Pitney Bowes, which has been struggling to offset its legacy business with new revenue streams.

We initiated or added to a variety of positions throughout the year during periods of market uncertainty or when opportunities presented themselves. Positions were sold or reduced when valuation objectives were met, better ideas arose, circumstances changed that impacted our investment thesis or in response to needs for investor liquidity. Portfolio turnover for the period was 9.8% which is consistent with our long-term approach.

We purchased Brighthouse Financial, the annuity business that was spun-off from Metlife. Brighthouse is poised to benefit from a rising interest rate environment, if it ever comes, and in the meantime, we believe is trading at an attractive discount to book value, while generating cash returns in the low double digits.

We also purchased Fannie Mae 8.25% Series S Preferred shares. Fannie Mae, a government sponsored enterprise (GSE), is a critical player in the mortgage finance market and was in essence nationalized during the financial crisis. We believe that the Fannie Mae 8.25% Series S Preferred shares are out of favor due to the complexity of the legal situation and requirement for a successful outcome both in the courts and in raising private capital. Our view is that reforming the GSEs is a legislative priority of the Trump Administration and the Fannie Preferred shares are a potential beneficiary of such reform, as we believe they may be structurally entitled to reinstatement of their dividend and repayment of prior accruals.

Another purchase was Synchrony Financial, a provider of private label credit cards that was previously spun off from GE Capital. The shares had become out of favor as expectations for rising interest rates had been momentarily tempered, concerns that consumer credit quality may have peaked and that retail, which is a large customer and marketing partner, has been weak. Our view is that the company was overcapitalized, that consumer credit and spending will either improve as wages move up, or at least not deteriorate and the shares were trading below our assessment of intrinsic value given its return profile.

We also purchased Potash, the Canadian fertilizer producer, whose shares had been depressed due to declines in corn prices and weakened farm economy that has had knock-on effects on fertilizer pricing. Our assessment showed the shares were trading at a significant discount to what we considered intrinsic value based on mid-cycle free cash flow. However, our interest in the company was based on its pending merger with Agrium, where, in our opinion, substantial operating synergies may be achieved. We were also attracted to the company because of the support for its solid dividend, stability in diversification into retail distribution and nitrogen, as well as the company’s ability to monetize some large minority interests. Moreover, the fertilizer industry has consolidated recently, thus improving its prospects for returns through the cycle, and with the price of fertilizer at or below marginal cost of production for much of the industry, we believe the potential for upside is there.

JD.com is another recent purchase. JD is the second largest ecommerce business in China. While it is not a traditional value stock, our analysis showed that it was being valued in the market at similar levels to what Amazon was when we successfully purchased it several years ago, at a similar moment of temporary fears about competition and profitability. While there is no guarantee that JD will turn out as successfully as our investment in Amazon, we believe the growth runway for its business is significant and when we analyzed what its cash flows might look like as a mature business (as we did for Amazon several years ago) we concluded that it was trading at significant discount to intrinsic value. Our thesis was also supported by the fact that Wal-Mart is a significant shareholder and that JD generally owns all of its own distribution assets, giving it a competitive advantage.

During the period, we purchased or added to positions in Abbott Labs, Alcoa, Arconic, Bank of America, Diebold Nixdorf, Goldcorp, Kansas City Southern, Macy’s, Palo Alto Networks, Pitney Bowes, Schlumberger, Signature Bank, Snap-On Inc., US Concrete and Williams Sonoma.

Most sales or reductions were conducted to provide liquidity to investors or to make room for other ideas. Of the sales related to fundamental changes, Macy’s stands out as probably being one where the situation deteriorated much more quickly than we anticipated. Other sales and reductions included Aflac, Alcoa, Alkermes, Alphabet, Amazon, Apple, Applied Materials, Automated Data Processing, Bank of New York, Bioverativ, H&R Block, Boeing, Delta, Diebold, DowDupont, Exxon Mobil, GE, Intel, Ionis, Johnson & Johnson, Macys, Merck, Microsoft, Nextera Energy, Noble Energy, Pitney Bowes, QUALCOMM, Signature Bank, Snap On, Sonoco Products, Weyerhaeuser, Xerox and XL Group.

With equity markets at or near all-time highs, our efforts as disciplined contrarian value investors tend to be focused on idiosyncratic opportunities where individual companies fall out of favor for one reason or another or are otherwise misunderstood, rather than finding wholesale sectors of the market that might be depressed. The potential for growth enhancing legislative success, the generally synchronized global economic expansion, low rates by historical standards and still accommodative monetary policy globally (notwithstanding what tightening might come with a new Fed Chairperson) provide a still attractive backdrop for preferring equity investments over other financial alternatives.

Sincerely,

| | |

| |  |

| |

| Robert W. Kleinschmidt | | Peter D. Shawn |

| Portfolio Manager | | Director of Research |

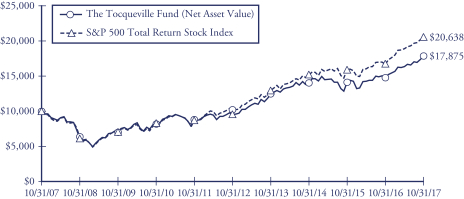

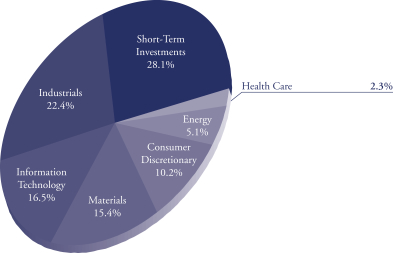

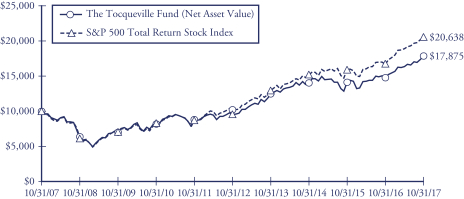

The Tocqueville Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2017

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 20.88% | | | | 8.32% | | | | 13.22% | | | | 5.98% | |

Standard & Poor’s 500 Total Return Stock Index | | | 23.63% | | | | 10.77% | | | | 15.18% | | | | 7.51% | |

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

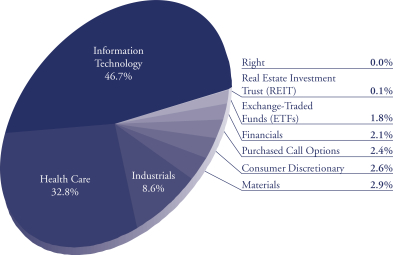

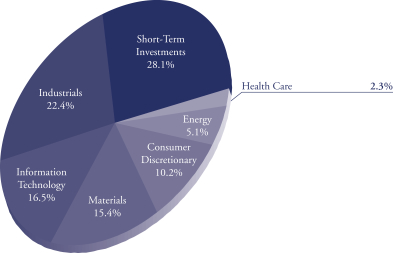

We are pleased to provide this investment overview for the 2017 fiscal year for the Tocqueville Opportunity Fund. During the year ended October 31, 2017, the Fund appreciated 36.47% and outperformed the SMID cap growth benchmark, the Russell 2500 Growth Index, which gained 30.07%. Investors in the Fund will recall that the prior fiscal year was a particularly challenging year during which SMID cap growth issues were faced with steady outflows of capital as markets were characterized by massive swings in sentiment driven by a multitude of risk concerns: Chinese currency devaluation, U.S. dollar strength, EU bank defaults, oil price collapse, negative interest rates, and Brexit. The Healthcare and Technology sectors, two of the three principal growth sectors were each twice hammered: Healthcare issues suffered under pervasive threats of drug price regulation by candidates Clinton and Trump; Technology issues suffered under candidate Trump’s threat of regulation of everything Silicon Valley—work visas, taxes, and business models; and each was hard hit in the significant January-February 2016 market correction. As the new fiscal year began in November 2016, we had hoped that with the election settled the turmoil was over—although the Fund swung positive with its exposures to financial and industrial participants in the Trump rally, software investments weighed heavily on performance under the President elect’s continued belligerent and haranguing attitude towards Technology companies.

Over the twelve-month fiscal period, Healthcare and Technology sector investments provided the leading contributions to the Fund’s total return and accounted for nearly four-fifths of the absolute increase. Surprisingly, on a relative basis, Healthcare investments drove more than one-half of outperformance versus the benchmark while the Consumer Discretionary sector provided the second best relative performance—due to a significantly underweighted position in this sector, which has been under severe pressure all year long as new models of competition undermine and disrupt existing company models. Technology investments, while lagging Discretionary issues in relative performance, ranked third; the Fund held a minimal position over the time period in Staples which enabled outperformance as well.

But the perspective over the calendar year (excluding November-December 2016) is altogether different! Since the beginning of the 2017 calendar year, the Fund gained appreciably through the fiscal year end with an increase of 33.40% versus 20.16% for the SMID cap growth benchmark. Investments in Technology led the Fund’s performance on both an absolute and relative basis over the past ten months—while fundamentals had been supportive and excellent throughout 2016 and the first two months of the fiscal year, a meeting hosted by the new Administration soon after the Inauguration with Silicon Valley technology leaders to make peace may have marked the bottom of an excessively long period of unduly negative sentiment which had weighed on the sector for at least a year! Technology investments have provided nearly one half of the Fund’s

absolute gain in 2017 and greater than 40% of the relative gain through the October 2017 month end. Over the entire twelve-month fiscal period, Energy sector investments were the only ones to negatively contribute to the Fund’s otherwise positive or flat sector returns (all sectors included) but with an impact limited to -0.46%. Early in the fiscal period, we had increased commitments to certain U.S. based production and service based energy companies in an effort to participate in a cyclical upswing in oil prices. At the close of the fiscal period, the Fund held no investments in Energy, Consumer Staples, Telecommunications, or Utilities.

Over the past twelve months, three of the Fund’s investments more than tripled in price: Kite Pharmaceuticals, NVIDIA Corporation and Alnylam Pharmaceuticals. Kite, a developer of cancer immunotherapies with a focus on T cell approaches, demonstrated strong data in DLBCL and was taken over by Gilead Sciences. NVIDIA has continued to lead the technology industry in both gaming platform GPU processing chips and its processors are the leading chips in many new technologies, including: HPC (High Performance Computing), AI, (Artificial Intelligence), Big Data analysis, ML (Machine Learning), and ADAS (Autonomous Driving platforms).

Alnylam is a biotechnology company which has pioneered technologies based on RNA interference addressed against genetically defined diseases. In addition to the triples, the Fund had 11 doubles—some of the heavier weighted contributors included: bluebird bio, Inc., Clovis Oncology, and Shopify, Inc. Including the triples and doubles, the Fund had 46 names which gained 50% or more, including two additional takeovers—ZELTIQ Aesthetics (Allergan) and Mobileye (Intel). NVIDIA was the leading contributor to the Fund’s absolute and relative performance; as the period ended, NVIDIA was the largest position. Seven of the Top 10 contributors to overall performance were Healthcare issues and three were Technology issues (Shopify and ServiceNow). Investments in Dexcom and Acacia Communications were most detrimental to the Fund over the fiscal period, albeit together they combined for a loss of 0.84%. On a relative basis, TESARO, Inc was the Fund’s most detrimental investment—the issue declined only 4.48% during the period but at a significant weight, TESARO dragged relative performance down by nearly a full percentage point.

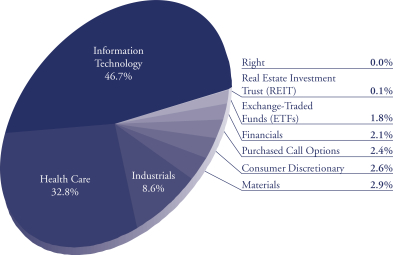

At the close of the fiscal period, investments in Technology comprised the Fund’s largest commitments and had increased by nearly one-fifth over the prior 12 months—due to appreciation, increased investments, and a positive outlook for the industry. The only other sector with increased commitment was the Materials sector. Healthcare sector allocation was relatively unchanged. Investments in Industrials, Consumer Staples and Discretionary, Financials, and Energy had all been reduced. The Top 10, Top 25, and Top 50 positions comprised 35%, 60%, and 77% respectively of the Fund’s holdings at fiscal year-end; the Top 100 positions comprised 94% of the Fund’s holdings. A year ago, the Top 10/25/50/100 positions comprised 26%, 46%, 69%, and 90% respectively of the Fund. One year ago we wrote that the selloff in Healthcare investments that had commenced in the summer of 2015, when one of the candidates had invoked the threat of price controls, had only one precedent—in the early 1990’s that same candidate had made the same threats—we argued that the attempt would fall apart under the weight of

market based competition and due process of law—it did then and the threat has evaporated again. Over the past year, Healthcare investments provided strong returns to the Fund, but we would emphasize that the successes have been driven by innovation not by politics. We dare not venture into discussions of new paradigms for fear of angering the heavens, but we are keenly aware that many of the corners of technology where we have been investing for years seem to be steadily growing, if not accelerating in influence and in critical performance—this includes mobile communications platforms, autonomous driving, language processing, inference, SAAS and cloud computing, and the realms of machine learning and big data analysis. Concepts that may have seemed remote only recently, are driving significant change today.

We remain confident that the Fund’s investments are well placed in competitively advantaged companies, led by smart, visionary managements. If there is a lesson to be reiterated, it is that selling competitively advantaged companies in industries undergoing rapid change and expansion and adoption of new models just because market sentiment shifts is a huge mistake. We have continued throughout to pursue a steady and unchanged approach to identify strategic market leaders as investors, not traders succumbing to rapid, if not weekly, shifts in market sentiment. As always, we appreciate your continued confidence in our efforts on behalf of the Fund and its shareholders.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

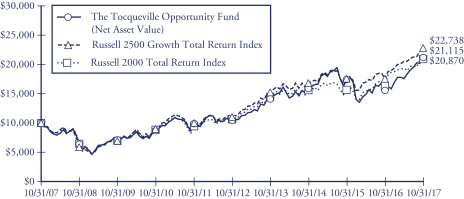

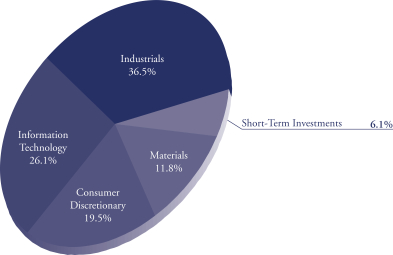

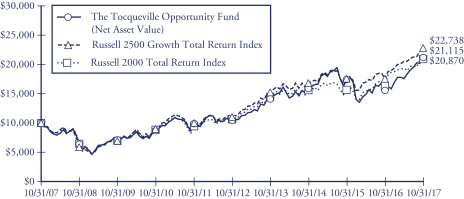

The Tocqueville Opportunity Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The chart and table reflect The Opportunity Fund’s performance achieved prior to the changes effected in 2010 to its investment strategy.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Returns assume the reinvestment of all dividends

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2017

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | 36.47% | | | | 9.99% | | | | 15.13% | | | | 7.76% | |

Russell 2500 Growth Total Return Index | | | 30.07% | | | | 10.66% | | | | 15.50% | | | | 8.56% | |

Russell 2000 Total Return Index | | | 27.85% | | | | 10.12% | | | | 14.49% | | | | 7.63% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the fiscal year ended October 31, 2017, the Tocqueville International Value Fund’s total U.S. dollar return was 23.67%. In the same period, the Morgan Stanley EAFE Index Net, the index against which we are most often compared, had a net total U.S. dollar return of 23.44%. For the 15-year period ended October 31, 2017, the Fund’s total U.S. dollar return was 10.93% per annum. In the same period, the Morgan Stanley EAFE Index Net had a net total U.S. dollar return of 7.99% per annum.

Global equity markets generally rallied during the year, as positive economic and earnings data globally, combined with still low inflation and interest rates, trumped geopolitical tensions in Asia and policy gridlock in the U.S. Early on, economic indicators in most developed economies and in China gave credence to the notion of a synchronized global expansion. A positive election result in France helped investor sentiment by allaying fears regarding the future of the Eurozone. With growth accelerating outside the U.S. and policy reform efforts in the U.S. falling short of high expectations, most currencies increased in value against the U.S. dollar, though the Yen weakened from overbought levels. Industrial metals generally increased in price, as did oil to a lesser extent. Globally, long interest rates remained at low levels, credit spreads remained tight and volatility low. Among industry groups, home furnishings, machinery, industrial products, construction, transport, chemicals, software and certain financials performed well, while food retail, tobacco, energy, media and utilities were weak.

During the fiscal year period, the Fund benefited from stock selection in the consumer staples, health care, industrials, information technology and real estate areas. This was offset in part by a low exposure to financials, which had a strong year, as well as stock selection in the consumer and financials areas. The Fund had meaningful contributions from Samsung Electronics, software and service provider Sopra Steria Group, industrial conglomerate Hitachi, compact equipment maker Wacker Neuson, analog chipmaker Infineon Technologies, inspection services concern Applus Services and logistics and media conglomerate Bollore. Notable detractors were oil service concern Schlumberger, real estate broker Countrywide, advertising agency Publicis Groupe and Goldcorp. Results benefited from corporate activity in several of the Fund’s stocks. Specialty chemical producer Akzo Nobel received a takeover offer from PPG Industries, consumer goods company Unilever received a takeover offer from Kraft Heinz, aeronautical equipment maker Zodiac received a takeover offer from Safran, business services concern Spotless Group received a takeover offer from Downer EDI, real estate enterprise Global Logistics effectively put itself up for sale in response to pressure from shareholders, free to air TV Broadcasts offered to repurchase 27.4% of its shares at a roughly 30% premium to the market price, packaging producer Greatview Aseptic received a large investment from Jardine Strategic, and software concern Aveva Group received a takeover offer from Schneider electric.

During the year, we exited positions in Spotless Group, TV Broadcasts, Greatview Aseptic, mining concern Rio Tinto, U.K. drugmaker GlaxoSmithKline, industrial products distributor Rexel, branded food products company Orkla, defense contractor Cobham, and fuel distributor Superior Plus, as their respective share prices approached our estimates of intrinsic value. We sold Goldcorp when operational disappointments led us to reassess our estimates of intrinsic value.

We purchased shares of mobile and fixed data service provider Telefonica Brasil, which is down due to political turbulence in Brazil and related currency weakness. The company has low financial leverage, a high single digit free cash flow yield, margin improvement potential, and operates in a region characterized by improving competitive dynamics and moderating capital expenditure requirements. We believe shares should appreciate as free cash flow expands. We took a new position in diversified mining company BHP Billiton, which following several years of rationalizing assets, costs and capital expenditures, is poised to generate substantial amounts of free cash flow at prevailing commodity prices. We purchased shares of UBS, a leading global wealth management franchise which trades a reasonable multiple of current cash flow, has excess capital that should be returned to shareholders, and whose earnings will derive a meaningful benefit from any increase in interest rates in the U.S. and elsewhere. We established a new position in U.K. building materials distributor Travis Perkins, a well-managed and well-capitalized business with strong market positions and returns on capital, which trades at a discount to intrinsic value due to concerns about the construction volumes post-Brexit.

We purchased a new position in data network equipment supplier Ericsson, which is down in price as losses in the media division and cyclical weakness in the equipment business have obscured investor perceptions of the company’s long-term prospects. We believe Ericsson has a strong technological position in a consolidated equipment market and a bloated cost structure, and trades at a modest multiple of its potential mid-cycle cash flow. A strong new CEO with a large equity stake is highly incentivized to realize the intrinsic value of the enterprise. We purchased a new position in British American Tobacco (BAT), when the shares declined in response to proposed new FDA regulations. BAT is well-positioned in new smokeless technologies and has a strong franchise in growing emerging markets and trades at an attractive multiple of free cash flow.

We established a new position in French inspection services provider Bureau Veritas, a well-managed, cash generative business whose shares are depressed and trading at an attractive valuation level due to cyclical weakness in its energy and marine end markets. Another new position is Japanese in vitro diagnostic and clinical lab testing concern Miraca, also a cash generative business with a strong competitive position. Shares are down along with short-term earnings prospects, as new management makes investments in future growth that we judge will increase the long-term value of the franchise. During the year, we added to positions in Bayer, Fanuc, Royal Dutch Shell, Siemens, Publicis, Schlumberger, Applus Servces and Bollore, among others.

Overall, there was a marginal decrease in our exposure to Japan, Asia and Rest of World and an increase in our exposure to Latin America and Europe, including the U.K. We began the period with approximately 9% in cash reserves and finished the period with roughly 9%.

Equity markets are enjoying a combination of healthy economic growth, low inflation, still loose monetary policy, still low interest rates, expectations of increased fiscal spending and, in the U.S., lower taxes. This is an unusually positive confluence of factors for equities. The combination of growth and low inflation underpins valuation multiples that are high on a historical basis. We therefore remain vigilant regarding any pickup in inflation and a corresponding increase in interest rates. There are plenty more reasons for caution, including political turmoil in the U.S. and U.K administrations, the reemergence of populist politics in Europe, volatile relations with North Korea and Iran, among others. That said, absent a geopolitical shock, we believe the global economic expansion is likely to continue for some time, particularly outside the U.S., where there is also a meaningful opportunity to improve corporate profitability. Furthermore, sentiment toward stocks is generally not effusive. In this mixed context, we remain focused on individual company fundamentals and valuations.

The Fund’s investment objective remains long-term capital appreciation consistent with preservation of capital. To protect and grow your capital, we continue to seek out compelling long-term investment opportunities in companies that have defensible business franchises, are out of favor or misunderstood, and trade at a substantial discount to intrinsic value.

Sincerely,

James Hunt

Portfolio Manager

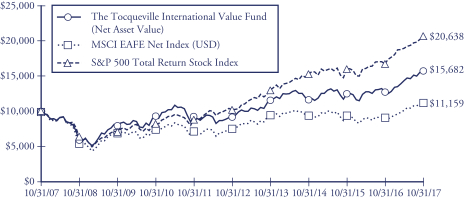

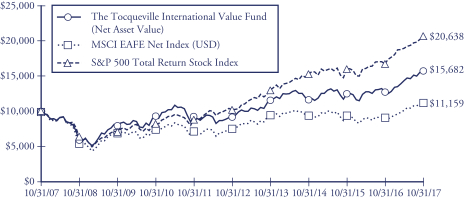

The Tocqueville International Value Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The MSCI EAFE Net Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 21 Developed Market Countries in Europe, Australia, Asia and the Far East.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2017

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville International Value Fund | | | 23.67% | | | | 10.57% | | | | 11.54% | | | | 4.60% | |

MSCI EAFE Net Index | | | 23.44% | | | | 6.08% | | | | 8.53% | | | | 1.10% | |

Standard & Poor’s 500 Total Return Stock Index | | | 23.63% | | | | 10.77% | | | | 15.18% | | | | 7.51% | |

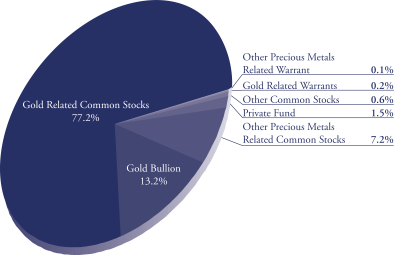

The Tocqueville Gold Fund

Dear Fellow Shareholder,

During the period from November 2016 through October 2017, gold markets traded in a broad range. The Tocqueville Gold Fund was down 9.36% during the period, while the Philadelphia Gold and Silver index (including dividends) was down 6.08%, and while the price of gold was down 0.5%.

The precious metals sector has taken a breather this year after last year’s strong performance. In our view, the major headwind preventing broader investment interest has been the continuing strength of global equity markets. In our opinion, the most likely catalyst for renewed interest in gold would be a serious market correction. While we can suggest many reasons why a setback to strong financial asset valuations might occur, timing is another matter and more elusive.

In summary, our investment rationale for precious metals exposure is based on the core idea that the ongoing debasement of paper currencies imperils not only high financial asset valuations but the fundamentals of the real economy on which those values are predicated. In our view, this is an inescapable reality, which the financial markets, for now have chosen to ignore. Our more immediate focus for the Fund is to invest in mining companies that advance per share value through exploration, mine development, production, and corporate M&A. Value created in this manner is not dependent on rising gold and silver prices, but in our view is sure to be recognized when the long overdue (in our opinion) resumption of broader interest in gold awakens.

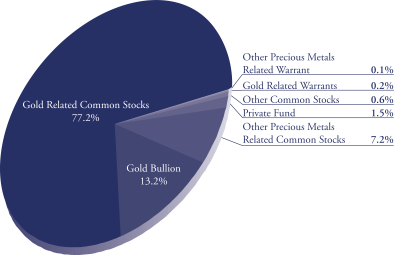

The largest position in the Fund is physical gold, at 119,680 ounces. It makes up about 13% of the Fund’s asset value. The gold is not traded but rather is vaulted outside the financial system in a secure Brink’s facility, which we regularly monitor and audit. Holding physical gold has reduced the volatility of the overall Fund and did so this past year. Additionally, it gives shareholders direct exposure to gold that the Fund owns.

Other than the position in physical gold, the Fund’s holdings are in precious metal mining equities, in which it seeks exposure across various aspects of the value creation spectrum within the precious metals mining sector. Through exposure to the different stages of mining activity, the Fund is able to diversify risk and capture the value inherent in discovery, development and production. As of October 31, 2017, the Fund’s equity exposure was in the following categories: senior producers (31%), mid-tier producers/advanced developers (22%), small producers/developers (31%), and early developers/exploration (16%).

Over the past year, the precious metal mining stocks that contributed to Fund performance included Ivanhoe Mines Ltd., Franco-Nevada Corporation, Royal Gold Inc., Premier Gold Mines Ltd. and Osisko Gold Royalties Ltd. Ivanhoe Mines Ltd. and Premier Gold Mines Ltd. have successfully expanded and improved on their resource

through exploration and project advancement. Royalty companies, such as Franco-Nevada Corporation, Royal Gold Inc. and Osisko Gold Royalties Ltd. continue to see their revenues and profits expand from the various investments in mining projects they have made in recent years.

Detour Gold Corporation, Jaguar Mining Inc., Semafo Inc., Torex Gold Resources and Mag Silver Corp. declined during the period, as those stocks corrected from much stronger performance during the previous reporting period. With the exception of Mag Silver, which is in the development stage, the other companies experienced some type of production disruption or delay due to mining activity, which we expect to be resolved over the next year.

During the reporting period, we established new positions in Iamgold Corporation, Barkerville Gold Mines Ltd., Independence Group, Northern Star Resources Ltd., Contango ORE Inc., Kinross Gold Corporation and Wellgreen Platinum Ltd. The common theme among the new additions was resource discovery and development each is undertaking, which we expect to result in positive revaluation.

Positions that were eliminated because they were either fully valued or presented limited value creation opportunities unassociated with the moves in the precious metal markets included AngloGold Ashanti Ltd., Hochschild Mining, Gold Road Resources, JDL Gold, Rubicon Minerals Corp., Silver Range Resources Ltd., Tahoe Resources Inc., Klondex Mines Ltd., Plata Latina Minerals Corp. and Eldorado Gold Corporation. The Richmont Mines Inc. position was sold after it was announced that the company would be acquired by Alamos Gold Inc.

Sincerely,

| | | | |

| |  | |  |

| John C. Hathaway | | Douglas B. Groh | | Ryan McIntyre |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

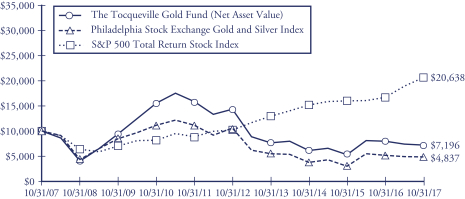

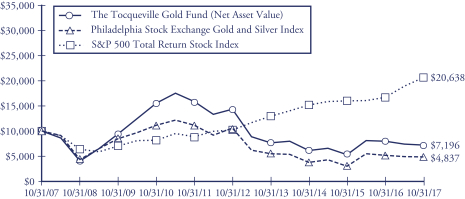

The Tocqueville Gold Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2009, 2010, and 2016 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2017

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund | | | -9.36% | | | | 5.47% | | | | -12.87% | | | | -3.24% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -6.08% | | | | 8.59% | | | | -14.47% | | | | -6.99% | |

Standard & Poor’s 500 Total Return Stock Index | | | 23.63% | | | | 10.77% | | | | 15.18% | | | | 7.51% | |

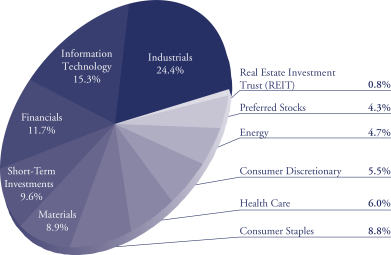

The Delafield Fund

Dear Fellow Shareholder,

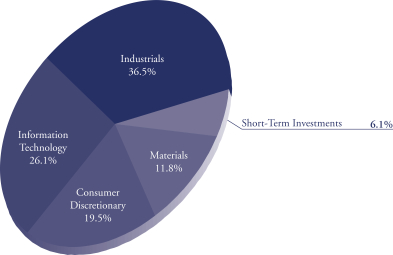

For the fiscal year ended October 31, 2017, the Delafield Fund’s net asset value increased 19.01% versus an increase of 27.85% for the Russell 2000 Index (“Russell 2000”) and an increase of 23.63% for the Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. Owing to the smaller average market capitalization of companies in the Russell 2000, we view it as the more appropriately comparative index to the Fund. The Fund’s net asset value as of October 31, 2017, was $26.40 per share. The net asset value amounted to $373,353,042 of which 71.9% was invested in equities, and the balance in cash and equivalents.

There was little market volatility for nearly the entire fiscal year. The Russell 2000 posted gains in ten out of twelve months, while the S&P 500 did not experience a single losing month for the entire fiscal year. Early in the fiscal year, markets rallied on the heels of the Trump victory in November and held those gains to close out Calendar 2016, despite a mid-December increase in interest rates. Stocks continued to rise through the second fiscal quarter, with solid consumer confidence and improving employment data buoying investor conviction and more than offsetting market disappointment when the Trump administration failed in its initial attempt at repeal and replacement of the Affordable Care Act. The second half of the fiscal year was marked with the continuation of favorable domestic economic statistics, including labor force participation, consumer confidence and manufacturing data, for example, but also, a series of external events that in the past, may have managed to derail market momentum. These included the surprise firing of the then FBI Director James Comey in May, escalations in the verbal tensions between the U.S. and North Korea through the summer, a terrorist attack in Barcelona in August, devastation from Hurricane Harvey late in the summer, and a ballistic missile launch by the North Koreans also in late summer. And yet, seemingly ever-optimistic investors seized on dovish Fed commentary, generally favorable corporate results, modestly positive global economic data and the release of President Trump’s tax reform framework and continued to drive U.S. equity markets overall and small cap stocks in particular, to gains in both the third and fourth fiscal quarters.

While we trailed the indices, we believe that our fiscal year performance was satisfactory given our large reserves. In a world that from our perspective is fraught with uncertainties, we continued to hold substantially larger than normal reserves, which accounted for nearly 90% of our underperformance relative to the Russell 2000.

For the fiscal year, the top contributors included TrueBlue Inc., Harco Corporation, Korn Ferry, and US Concrete Inc. TrueBlue, Korn Ferry and US Concrete Inc. all benefited from satisfactory earnings expectations and from investors’ more optimistic outlook for organic growth prospects under the Trump administration. Harsco shares responded favorably to profits that exceeded expectations as well as successive increases in company issued earnings guidance.

In contrast, Team Inc. and Sequential Brands Group Inc., were the largest detractors to the performance, with both companies disappointing the market with weaker than expected earnings results more than once during the fiscal year.

We added a number of new positions to the portfolio during the fiscal year, the largest of which included Acacia Communications Inc, Avnet Inc., Fabrinet, and Hanesbrands Inc. In contrast, the largest portfolio deletions included Calgon Carbon Corporation, which was acquired by a competitor, Dover Corporation, Electro Scientific Industries Inc., and Honeywell International Inc.

From a macro perspective, we continue to be cautiously optimistic, with domestic economic data continuing to show modest signs of improvement. Further, should the recent efforts to modify the tax code, especially potential changes to the corporate tax rate and repatriation of profit rules, succeed; we would expect a meaningful benefit to corporations, and specifically, to a number of our industrial holdings which have substantial cash trapped overseas. However, as is our nature, we are not counting on exogenous factors such as these and will continue to search for compelling investment opportunities utilizing our fundamental and bottom up process with which to generate outsize returns over time.

Sincerely,

| | |

| |  |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

| | |

| |  |

| Joshua Kaufthal | | James Maxwell |

| Portfolio Manager | | Portfolio Manager |

The Delafield Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/07. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2017

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | 19.01% | | | | 2.54% | | | | 7.66% | | | | 5.62% | |

Russell 2000 Total Return Index | | | 27.85% | | | | 10.12% | | | | 14.49% | | | | 7.63% | |

Standard & Poor’s 500 Total Return Stock Index | | | 23.63% | | | | 10.77% | | | | 15.18% | | | | 7.51% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

For the fiscal year ended October 31, 2017 the Tocqueville Select Fund’s net asset value increased 8.93% verses increases of 24.68% for the Russell 2500 Index (“Russell 2500”) and 27.85% for the Russell 2000 Index (“Russell 2000”), each on a total return basis. The Fund’s net asset value as of October 31, 2017 was $11.87 per share. The net asset value amounted to $49,452,528 of which 93.5% was invested in equities, and the balance in cash and equivalents.

The Russell 2500 posted gains in nine out of twelve months this fiscal year and overall market volatility was unusually low. Early in the fiscal year, markets rallied on the heels of the Trump victory in November and held those gains to close out Calendar 2016, despite a mid-December increase in interest rates. Stocks continued to rise through the second fiscal quarter, with solid consumer confidence and improving employment data buoying investor conviction and more than offsetting market disappointment when the Trump administration failed in its initial attempt at repeal and replacement of the Affordable Care Act. The second half of the fiscal year was marked with the continuation of favorable domestic economic statistics, including labor force participation, consumer confidence and manufacturing data, for example, but also, a series of external events that in the past, may have managed to derail market momentum. These included the surprise firing of the then FBI Director James Comey in May, escalations in the verbal tensions between the U.S. and North Korea through the summer, a terrorist attack in Barcelona in August, devastation from Hurricane Harvey late in the summer, and a ballistic missile launch by the North Koreans also in late summer. And yet, seemingly ever-optimistic investors seized on dovish Fed commentary, generally favorable corporate results, modestly positive global economic data and the release of President Trump’s tax reform framework and continued to drive U.S. equity markets overall and small cap stocks in particular, to gains in both the third and fourth fiscal quarters.

Our performance this past fiscal year was unsatisfactory, with stock selection being the primary issue. Owing to the concentrated nature of the Fund, individual miscues can be rather meaningful to its aggregate performance, and this fiscal year, the Fund suffered particularly meaningful declines in five of its holdings. Three of these, namely Team Inc., Horizon Global Corporation and Xerium Technologies Inc. experienced what we believe were mostly temporary miscues and remain in the portfolio. Of the other two, Ascena Retail Group Inc. was sold out of the Fund, while Real Industry Inc. remained under review at fiscal year-end. In total, these five names detracted from our relative performance by in excess of ten percentage points during the fiscal year. Additionally, our cash reserves also impacted our relative performance by almost 200 basis points.

In contrast, for the fiscal year, our top contributors included Harsco Corporation and TrueBlue Inc. Harsco shares responded favorably to profits that exceeded expectations as well as successive increases in company issued earnings guidance. TrueBlue Inc. benefited from satisfactory earnings results and from investors’ more optimistic outlook for organic growth prospects under the Trump administration.

We added a number of new positions to the portfolio during the fiscal year, the largest of which included G-III Apparel Group, Ltd. and TTM Technologies Inc. In contrast, the largest portfolio deletions included Consol Energy Inc., Carlisle Companies Inc., and Ralph Lauren Corporation.

From a macro perspective, we continue to be cautiously optimistic, with domestic economic data continuing to show modest signs of improvement. Further, should the recent efforts to modify the tax code, especially potential changes to the corporate tax rate and repatriation of profit rules succeed, we would expect a meaningful benefit to corporations. However, as is our nature, we are not counting on exogenous factors such as these and will continue to search for compelling investment opportunities utilizing our fundamental and bottom up process to generate outsize returns over time.

Sincerely,

| | | | |

| |  | |  |

J. Dennis Delafield | | Vincent Sellecchia | | Joshua Kaufthal |

Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

| | |

| |  |

Donald Wang | | James Maxwell |

Portfolio Manager | | Portfolio Manager |

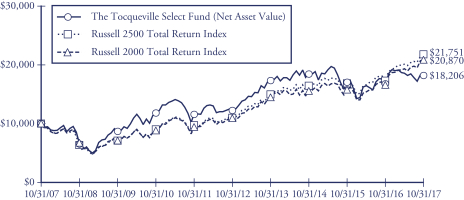

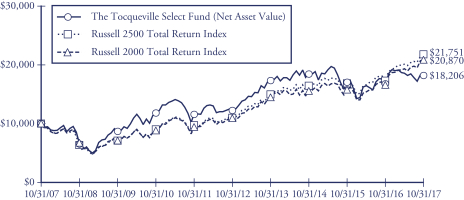

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/07. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

In 2013 the performance of The Tocqueville Select Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Russell 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2017

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | 8.93% | | | | -0.56% | | | | 8.36% | | | | 6.17% | |

Russell 2500 Total Return Index | | | 24.68% | | | | 9.58% | | | | 14.45% | | | | 8.08% | |

Russell 2000 Total Return Index | | | 27.85% | | | | 10.12% | | | | 14.49% | | | | 7.63% | |

Expense Example—October 31, 2017 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2017-October 31, 2017).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

The Tocqueville Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2017 | | | Ending

Account Value

October 31, 2017 | | | Expenses Paid

During Period*

May 1, 2017 -

October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 1,090.70 | | | $ | 6.64 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.85 | | | | 6.41 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.26% for The Tocqueville Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Opportunity Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2017 | | | Ending

Account Value

October 31, 2017 | | | Expenses Paid

During Period*

May 1, 2017 -

October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 1,201.50 | | | $ | 7.16 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.70 | | | | 6.56 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.29% for The Tocqueville Opportunity Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville International Value Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2017 | | | Ending

Account Value

October 31, 2017 | | | Expenses Paid

During Period*

May 1, 2017 -

October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 1,096.00 | | | $ | 6.60 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville International Value Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Gold Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2017 | | | Ending

Account Value

October 31, 2017 | | | Expenses Paid

During Period*

May 1, 2017 -

October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 977.50 | | | $ | 6.83 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.30 | | | | 6.97 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.37% for The Tocqueville Gold Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Delafield Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2017 | | | Ending

Account Value

October 31, 2017 | | | Expenses Paid

During Period*

May 1, 2017 -

October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 1,039.40 | | | $ | 6.43 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Delafield Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Select Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2017 | | | Ending

Account Value

October 31, 2017 | | | Expenses Paid

During Period*

May 1, 2017 -

October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 981.00 | | | $ | 6.24 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville Select Fund, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of year | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | | | $ | 30.67 | | | $ | 24.11 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.37 | | | | 0.42 | | | | 0.37 | | | | 0.28 | | | | 0.40 | |

Net realized and unrealized gain (loss) | | | 6.40 | | | | 1.07 | | | | (0.19 | ) | | | 3.78 | | | | 6.51 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 6.77 | | | | 1.49 | | | | 0.18 | | | | 4.06 | | | | 6.91 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.39 | ) | | | (0.35 | ) | | | (0.25 | ) | | | (0.30 | ) | | | (0.35 | ) |

Distributions from net realized gains | | | (1.50 | ) | | | (0.33 | ) | | | (1.20 | ) | | | (0.25 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.89 | ) | | | (0.68 | ) | | | (1.45 | ) | | | (0.55 | ) | | | (0.35 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 4.88 | | | | 0.81 | | | | (1.27 | ) | | | 3.51 | | | | 6.56 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 38.60 | | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | | | $ | 30.67 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 20.9 | % | | | 4.6 | % | | | 0.5 | % | | | 13.4 | % | | | 29.0 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 293,637 | | | $ | 283,126 | | | $ | 309,267 | | | $ | 380,561 | | | $ | 348,269 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.27 | % | | | 1.27 | % | | | 1.29 | % | | | 1.25 | % | | | 1.28 | % |

Expenses after waiver/reimbursement | | | 1.26 | %(3) | | | 1.24 | %(3) | | | 1.25 | % | | | 1.24 | % | | | 1.26 | %(3) |

Net investment income before waiver/reimbursement | | | 0.97 | % | | | 1.18 | % | | | 0.91 | % | | | 0.84 | % | | | 1.33 | % |

Net investment income after waiver/reimbursement | | | 0.98 | % | | | 1.21 | % | | | 0.95 | % | | | 0.85 | % | | | 1.35 | % |

Portfolio turnover rate | | | 10 | % | | | 12 | % | | | 15 | % | | | 19 | % | | | 16 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of year | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | | | $ | 21.29 | | | $ | 15.76 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.37 | ) | | | (0.29 | ) | | | (0.15 | ) | | | (0.22 | ) | | | (0.13 | ) |

Net realized and unrealized gain (loss) | | | 7.35 | | | | (1.98 | ) | | | 1.98 | | | | 2.80 | | | | 5.66 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 6.98 | | | | (2.27 | ) | | | 1.83 | | | | 2.58 | | | | 5.53 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | (3.20 | ) | | | (1.09 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | (3.20 | ) | | | (1.09 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 6.98 | | | | (2.27 | ) | | | (1.37 | ) | | | 1.49 | | | | 5.53 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 26.12 | | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | | | $ | 21.29 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 36.5 | % | | | (10.6 | )% | | | 9.1 | % | | | 12.6 | % | | | 35.1 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 77,773 | | | $ | 92,958 | | | $ | 153,456 | | | $ | 80,324 | | | $ | 80,609 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.38 | % | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % | | | 1.30 | % |

Expenses after waiver/reimbursement | | | 1.30 | %(3)(4) | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % | | | 1.30 | % |

Net investment loss before waiver/reimbursement | | | (1.05 | )% | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% | | | (0.64 | )% |

Net investment loss after waiver/reimbursement | | | (0.97 | )%(4) | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% | | | (0.64 | )% |

Portfolio turnover rate | | | 133 | % | | | 108 | % | | | 101 | % | | | 92 | % | | | 100 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes 0.05% of interest expense which is not included in the Fund’s operating expense cap. |

| (4) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the year) | | Years Ended October 31, | |

| | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of year | | $ | 14.44 | | | $ | 14.59 | | | $ | 14.48 | | | $ | 14.71 | | | $ | 11.68 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.14 | | | | 0.14 | | | | 0.15 | | | | 0.15 | | | | 0.24 | |

Net realized and unrealized gain (loss) | | | 3.23 | | | | 0.14 | | | | 0.80 | | | | (0.15 | ) | | | 2.97 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 3.37 | | | | 0.28 | | | | 0.95 | | | | — | | | | 3.21 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.15 | ) | | | (0.25 | ) | | | (0.32 | ) | | | (0.23 | ) | | | (0.18 | ) |

Distributions from net realized gains | | | (0.08 | ) | | | (0.18 | ) | | | (0.52 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.23 | ) | | | (0.43 | ) | | | (0.84 | ) | | | (0.23 | ) | | | (0.18 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 3.14 | | | | (0.15 | ) | | | 0.11 | | | | (0.23 | ) | | | 3.03 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 17.58 | | | $ | 14.44 | | | $ | 14.59 | | | $ | 14.48 | | | $ | 14.71 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 23.7 | % | | | 2.0 | % | | | 7.2 | % | | | (0.0 | )% | | | 27.8 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 1,120,994 | | | $ | 525,808 | | | $ | 333,762 | | | $ | 237,051 | | | $ | 262,981 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.53 | % | | | 1.58 | % | | | 1.57 | % | | | 1.54 | % | | | 1.55 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.30 | %(3) |

Net investment income before waiver/reimbursement | | | 0.73 | % | | | 0.90 | % | | | 0.71 | % | | | 0.62 | % | | | 1.55 | % |

Net investment income after waiver/reimbursement | | | 1.01 | % | | | 1.23 | % | | | 1.03 | % | | | 0.91 | % | | | 1.80 | %(3) |

Portfolio turnover rate | | | 22 | % | | | 26 | % | | | 42 | % | | | 31 | % | | | 37 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on January 1, 2013. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the year) | | Years Ended October 31, | |

| | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of year | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | | | $ | 38.01 | | | $ | 72.82 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.39 | ) | | | (0.33 | ) | | | (0.27 | ) | | | (0.08 | ) | | | (0.26 | ) |

Net realized and unrealized gain (loss) | | | (3.29 | ) | | | 13.61 | | | | (4.07 | ) | | | (7.55 | ) | | | (32.93 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (3.68 | ) | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) | | | (33.19 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (1.62 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | — | | | | — | | | | (1.62 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (3.68 | ) | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) | | | (34.81 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 35.64 | | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | | | $ | 38.01 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.02 | | | | 0.02 | |

Total Return | | | (9.4 | )% | | | 51.0 | % | | | (14.3 | )% | | | (20.1 | )% | | | (46.4 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 1,153,287 | | | $ | 1,365,282 | | | $ | 947,367 | | | $ | 1,138,557 | | | $ | 1,215,081 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.38 | % | | | 1.39 | % | | | 1.43 | % | | | 1.36 | % | | | 1.34 | % |

Net investment loss | | | (0.95 | )% | | | (0.91 | )% | | | (0.84 | )% | | | (0.78 | )% | | | (0.41 | )% |

Portfolio turnover rate | | | 14 | % | | | 15 | % | | | 11 | % | | | 10 | % | | | 14 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the year) | | Years Ended October 31, | |

| | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of year | | $ | 26.47 | | | $ | 28.64 | | | $ | 36.40 | | | $ | 37.13 | | | $ | 29.79 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.15 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.10 | ) | | | (0.05 | ) |

Net realized and unrealized gain (loss) | | | 4.91 | | | | 0.78 | | | | (3.99 | ) | | | 0.70 | | | | 9.19 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 4.76 | | | | 0.63 | | | | (4.13 | ) | | | 0.60 | | | | 9.14 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (4.83 | ) | | | (2.80 | ) | | | (3.63 | ) | | | (1.33 | ) | | | (1.80 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (4.83 | ) | | | (2.80 | ) | | | (3.63 | ) | | | (1.33 | ) | | | (1.80 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (0.07 | ) | | | (2.17 | ) | | | (7.76 | ) | | | (0.73 | ) | | | 7.34 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 26.40 | | | $ | 26.47 | | | $ | 28.64 | | | $ | 36.40 | | | $ | 37.13 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 19.0 | % | | | 3.3 | % | | | (12.3 | )% | | | 1.6 | % | | | 32.1 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 373,353 | | | $ | 400,827 | | | $ | 674,525 | | | $ | 1,475,139 | | | $ | 1,759,341 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.31 | % | | | 1.29 | % | | | 1.25 | % | | | 1.21 | % | | | 1.21 | % |

Expenses after waiver/reimbursement | | | 1.25 | %(3) | | | 1.29 | % | | | 1.25 | % | | | 1.21 | % | | | 1.21 | % |

Net investment loss before waiver/reimbursement | | | (0.55 | )% | | | (0.33 | )% | | | (0.15 | )% | | | (0.24 | )% | | | (0.15 | )% |

Net investment loss after waiver/reimbursement | | | (0.49 | )%(3) | | | (0.33 | )% | | | (0.15 | )% | | | (0.24 | )% | | | (0.15 | )% |

Portfolio turnover rate | | | 36 | % | | | 39 | % | | | 19 | % | | | 34 | % | | | 34 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of year | | $ | 11.43 | | | $ | 12.08 | | | $ | 14.90 | | | $ | 15.57 | | | $ | 11.35 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.06 | ) | | | (0.07 | ) | | | (0.08 | ) | | | (0.07 | ) | | | (0.06 | ) |

Net realized and unrealized gain (loss) | | | 1.12 | | | | (0.18 | ) | | | (1.00 | ) | | | 0.94 | | | | 4.79 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 1.06 | | | | (0.25 | ) | | | (1.08 | ) | | | 0.87 | | | | 4.73 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (0.62 | ) | | | (0.40 | ) | | | (1.74 | ) | | | (1.54 | ) | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.62 | ) | | | (0.40 | ) | | | (1.74 | ) | | | (1.54 | ) | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 0.44 | | | | (0.65 | ) | | | (2.82 | ) | | | (0.67 | ) | | | 4.22 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 11.87 | | | $ | 11.43 | | | $ | 12.08 | | | $ | 14.90 | | | $ | 15.57 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 8.9 | % | | | (1.9 | )% | | | (8.0 | )% | | | 6.1 | % | | | 43.2 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 49,453 | | | $ | 63,812 | | | $ | 81,813 | | | $ | 108,060 | | | $ | 99,888 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.37 | % | | | 1.37 | % | | | 1.36 | % | | | 1.32 | % | | | 1.34 | % |