UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212) 698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016

Item 1. Reports to Stockholders.

The Tocqueville Trust

Mutual Funds

Annual Report

October 31, 2016

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocqueville.com/mutual-funds

Chairman’s Letter

Dear Fellow Shareholder,

Now that the elections are mercifully behind us, the markets should be able to focus on fundamentals, which are, as of this writing, neither terribly positive nor terribly negative. Over the next 12 months, we would expect, so long as U.S. growth continues, that interest rates will rise gradually at first, but then, possibly, more rapidly, in response to greater levels of inflation than what we have witnessed for the past several years. This will provide something of a headwind to stock valuations, particularly growth-oriented names that depend, in part, upon expanding price-earnings ratios. So long as economic growth continues, or accelerates modestly, we would expect traditional value names, which have long underperformed the growth sector until just recently, to do better.

The key to stock price performance going forward will be economic growth. The Trump administration is likely to be far more growth-oriented and business-friendly than was the case in the Obama era. So, we expect this to provide a tailwind for the markets. The upside to the tepid growth of the past nine years is that few excesses have been built up in the economy. Indeed, the one identifiable excess, and the one obvious bubble, is sovereign debt. This situation has persisted for some time, but there is reason to believe that the day of reckoning may be here sooner than the markets seem to think. This is a very obvious headwind.

Very moderate commercial-loan demand and quiescent inflation statistics have kept bond rates at unprecedented lows, even negative, levels. It is simply wishful thinking to suppose that this can continue for very much longer. (And, indeed, since the Trump election, rates have begun moving up.) Higher rates and higher deficits, without very robust economic growth, is a recipe for fiscal disaster. So it seems obvious to us that the Trump administration will have no choice but to pursue an aggressive growth agenda. How successful they will be is another question, but at least until budgets get completely out of control, we would expect an expansionary bias to government policy that should have a salutary impact on the global economy.

Our portfolios are generally positioned to participate in this environment, should it come to pass; but, as we are bottom-up stock pickers, rather than top-down managers, our stock selection is not dependent upon this scenario unfolding. Rather, we focus on companies of good quality that are selling below what we believe to be their intrinsic value. We will look at companies in any sector or industry. Value investors need to search for value wherever it can be found, not necessarily where we would like it to be.

The past several years have been difficult ones for active managers, and beating the benchmarks has been a formidable challenge that very few managers have achieved. For any number of reasons, we believe that active management will have a recovery over the course of the next several years and we look forward to participating in that revival.

Sincerely,

Robert W. Kleinschmidt

Chairman

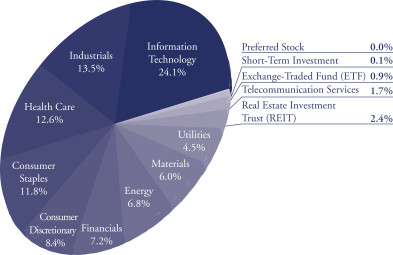

The Tocqueville Fund

Dear Fellow Shareholder,

For the 12 months ended October 31, 2016, the Tocqueville Fund gained 4.6%, compared with 4.5% for the S&P 500 Index, 4.2% for the Russell 3000.

The period running up to the quadrennial U.S. elections was a turbulent one, with major swings, positive and negative, reflecting changing expectations on both the political and economic scenes. A steep sell-off early in the 2016 calendar year was followed by an equally steep rally in the early spring. Another sell-off in June was followed by a July rally, and then a two-month period of relative calm. Finally, yet another sell-off at the end of the reporting period underscored the volatility of U.S. markets, which seemed to move in an inverse direction to the prospects of GOP nominee Donald Trump.

At the end of October, however, the broader market was not much changed from where it stood a year earlier, with most of the return in the index due to dividend payments. Utilities and consumer staples were the best performing sectors of the broader market, as investors were attracted to stocks with strong dividend yields. Our U.S. results were in line with or modestly better than broader market indices like the S&P 500 and the Russell 3000, due to strong performance in technology names like Applied Materials—by far the single biggest contributor to 12-month results—as well as Microsoft and QUALCOMM; in digital media, especially Facebook and Amazon; in the metals, mining and material sectors Alcoa, BHP, DuPont and Caterpillar contributed to results, as did XME, a metals and mining ETF that was purchased earlier in the year.

Offsetting our gains, in part, was the extreme weakness in the healthcare sector, particularly biotech names such as PTC Therapeutics, Omeros and Ionis Pharmaceuticals, as well as Alkermes. The profound weakness in healthcare names followed a very strong previous year, but also reflected growing concern over pricing due to real and anticipated political pressure. Also detracting from results were energy companies like Energen, Frank’s and Cameco, a uranium producer, although Exxon Mobile, Noble Energy and Schlumberger largely offset these losses. Transportation related companies Ford, Boeing and Delta Airlines hurt results, as did financials, M&T Bank, Lazard and the XL Group.

We initiated or added to a variety of domestic positions throughout the year, during periods of market uncertainty or when opportunities presented themselves. Positions were sold or reduced when valuation objectives were achieved, better ideas arose, or circumstances changed that influenced our investment thesis. Overall, portfolio turnover during the past year was less than 25% which is consistent with our long-term approach.

Abbott Labs was one of the largest purchases during the year. Abbott has transformed itself into a medical-device company with generics exposure in the emerging markets. Its shares had come under pressure due to concerns over recent acquisitions and

the poor sentiment for the healthcare sector. Abbott’s defensive business model, highly regarded management team, and a long track record of generating shareholder returns make it attractive at its price, in our view.

Another large purchase was Macy’s, which has been suffering with much of the retail industry as consumer tastes and shopping habits change and the threat from Amazon looms large. However, our view is that Macy’s real estate, particularly its flagship Herald Square location, was significantly undervalued in the then-current stock price, and that investors weren’t giving them credit for any stabilization, much less improvement, in the retail business.

We also purchased Walt Disney, which has an enviable list of high-quality brands (Disney, Marvel, Star Wars, ESPN, etc.) that it monetizes across its business segments (Media Networks, Studio, Consumer, and Theme Parks). Disney shares have been under pressure as concerns about technological changes across the media landscape and challenges to its cable networks took hold of investor sentiment. In our view, while there is clearly some risk to the current model, the positives outweigh those concerns, and the stock was still quite attractive.

Lazard Ltd., the investment banking and asset-management firm, is a name we have owned for several years but were able to add to our position during the downdraft in the markets caused by the Brexit surprise. Investors were concerned that economic and political uncertainty would put a damper on merger activity, which represents about half of Lazard’s business. However, the other half of the business is asset management, which has proven resilient and “sticky” in the face of volatile markets. The shares seemed to be trading at close to a worst-case scenario, but with an unlevered balance sheet and healthy dividend, they were available at a sizeable discount.

We also purchased Johnson Controls, which was undergoing a transformational merger and spin-off with Tyco. The result has been the creation of an integrated building-efficiency, fire, and security business; much of the automotive-related operations have been kept separate. The complexity of the transaction and investors’ fears about a peak in the auto cycle created the opportunity to purchase a leading and highly cash-generative manufacturer at a valuation that met our criteria.

We began buying shares in Diebold, a provider of hardware and software to the banking and retail industries. Its shares were out of favor as a result of concerns about its merger with Wincor Nixdorf, as well as the health and capital-spending patterns of its target markets. Our view is that the synergy opportunities from the merger are significant and, following what will likely be a heavy year of cash expenditures in 2017 related to restructuring efforts, the combined company is poised to generate substantial free cash flow thereafter. We have confidence that management, which is doing some heavy insider buying, is more than capable of successfully integrating the two companies; and we believe that the shares, currently trading at less than seven times our pro forma 2017 EBITDA estimate, are undervalued.

We also purchased or added to our existing position in the aforementioned ETF, Alcoa, Qualcomm, Caesar Stone, H&R Block, Biogen, Snap On, Inc., Alkermes, Cameco, IAC/Interactive, PTC Therapeutics, BHP Billiton.

Our largest sale during the reporting period was EMC Corp., which was the recipient of a takeover offer from Dell. ADT was also sold in response to a takeover offer from private-equity firm, Apollo Global Management.

Another significant sale was Express Scripts. This was somewhat of a change of heart, though not a costly one. A closer examination of its business model suggested to us that the company was more vulnerable from a political/regulatory standpoint than we had originally believed, despite its attractive valuation and return characteristics.

Amazon Inc., Facebook, and Applied Materials represented some of the better ideas of the past year and were reduced as they approached our valuation objectives. Ionis Pharmaceuticals was reduced initially as it approached our valuation objective, and again later, at a lower price, as we reduced our risk when there was concern about safety of its platform product. Alphabet, the parent of Google was reduced, based upon price, as was Target, Campbell Soups, and Pitney Bowes. A number of other positions were trimmed to accommodate fund redemptions.

We remain committed to our goals of capital preservation and the generation of positive absolute returns regardless of the market climate. As ever, we thank you for your continued loyalty and support of the Tocqueville Fund.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

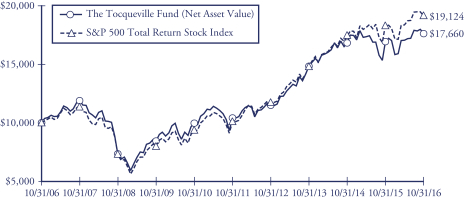

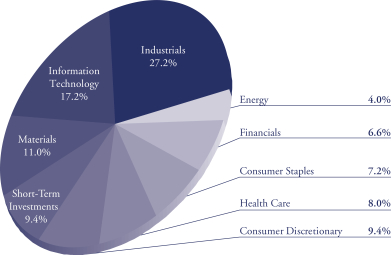

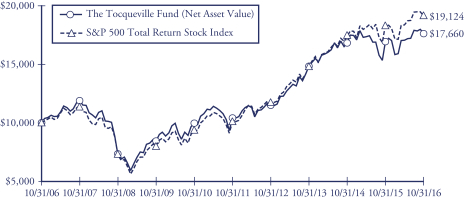

The Tocqueville Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/06. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2016

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 4.61% | | | | 6.04% | | | | 11.12% | | | | 5.85% | |

Standard & Poor’s 500 Total Return Stock Index | | | 4.51% | | | | 8.84% | | | | 13.57% | | | | 6.70% | |

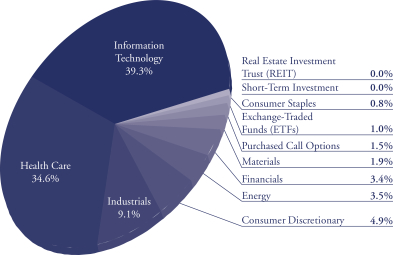

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

We are pleased to provide this investment overview for the 2016 fiscal year for the Opportunity Fund. During the fiscal year ended October 31, 2016, the Fund declined (10.6%) and underperformed its SMID cap growth benchmark which also declined. During a period over which small cap growth issues were significantly out of favor, the Russell 2000 Growth Index which tracks the performance of small cap growth stocks also ended the period in negative territory. The measuring dates for the fiscal year bookended a particularly difficult and volatile time period for the Fund, and the price actually peaked less than one month into the new fiscal on November 25, 2015. As we wrote in the semi-annual letter, the subsequent decline in the Fund was the worst over the past six years and it exceeded the magnitude of the 2011 correction which was caused by fears of financial, political and currency instability within the European Union. The deep correction finally ended in early February 2016 and we believe that it stemmed from heightened macroeconomic fears related to a number of risks: Chinese currency devaluation, U.S. dollar strength, EU bank default concerns, oil price collapse, growth slowdown, negative interest rates, Fed tightening, and political banter around increased regulation. A very toxic mix!

Since the bottom in early February 2016, the Fund gained +25.26% through the period’s end. And although the Fund had risen solidly back into positive territory by late September, election related sentiment overwhelmed good quarterly earnings reports which led to yet another correction into the fiscal year end. To write that 2016 has been a challenging period would be an understatement—the volatility has been unprecedented. From the February low, the Fund cycled through price moves of +25% (4/21/16), (7%) (5/6/16), +13% (6/8/16), (13%) (6/27/16, Brexit), +23% (9/28/16), and (11%) (10/27/16, election). We believe markets entered a period of heightened sensitivity to macro (currency, interest rate, policy, trade) and political risks during the late Spring 2015 which has governed much of the market action in the small cap growth arena for at least the past fifteen months. Just as importantly, market risk has outweighed and camouflaged the solid execution and fundamental investment opportunity of many of the Fund’s investments as investors appear to be preoccupied with “the forests and not the trees”.

We believe that the intense and persistent volatility obscures an ongoing trend under which many market participants are not embracing traditional approaches to evaluating and appraising the value of an ongoing business. Such investors are trading stocks as if the underlying values are determined by “Tweet” or a Presidential candidate’s flip opinion, as opposed to a company’s market share, management, cash flows, competitive advantage, and opportunity set. While a bias towards short term trading has presented an unwelcome headwind, we continue to believe that the economy will be governed by due process and that fundamentals will determine the long run valuation of our investments.

Despite the challenging starts of the 2016 fiscal and calendar years, the Fund performed solidly during the second and third calendar quarters—outperforming the benchmark comfortably +5.1% (versus +2.7%) and +11.3% (versus +7%) respectively. But overall performance was impacted during the first six weeks of 2016 as Healthcare and Technology issues accounted for nearly two thirds of the Fund’s decline. While holdings in both sectors are traditionally the “go to sell” beta names during periodic corrections, Healthcare names came under the greatest pressure, as concerns mounted that a new administration would attempt a radical transformation of the U.S. drug industry pricing model. The correction dragged down not only the large, well established pharmaceutical companies, but also the full array of smaller Biotechnology issues which have been so enabled by genomics. The correction in Biotechnology stocks was one of the three worst since the industry’s inception in 1981. Although we were encouraged by the Fund’s gains from the February low through the October period end (+26.7% versus SMID growth +23.7%), Healthcare issues had continued to be weighed down under the threats of regulation and price controls espoused during the election cycle. Lost in the political narrative of price controls have been the cost and risk of R&D of new therapies and the potential savings to the health care system. While many Healthcare issues rallied strongly into late September, they sold off hard again in October—as the reporting period ended, these investments as a group had recouped only about 60% of their losses from the first weeks of 2016 and significantly impacted fiscal period return.

There was plenty of good news to report. Five of the Fund’s leading contributors were Healthcare issues, three were Technology holdings, and two were Consumer Discretionary names. On a relative basis, five of the ten leaders were Healthcare investments. The leaders included: TESARO—PARP inhibition in ovarian cancer; Paycom Software—cloud based HR and human capital management; GW Pharmaceutical—cannabinoid platform in epilepsy disorder; and NVIDIA—semiconductor platform in visual computing, gaming, artificial intelligence/machine learning, and autonomous driving.

The Fund held several issues which were M&A targets, two of which were top contributors: Medivation—prostate cancer and PARP inhibition, and WhiteWave Foods—organic foods. Other significant takeovers included: Fleetmatics, Anacor Pharmaceuticals, Netsuite, NXP Semiconductor, and Demandware. Overall, there were at least eleven outright takeovers—takeovers reinforce the argument that despite the unsettled political and trading environment, acquirers continue to appreciate long term and strategic value. While there were success stories, there were also plenty of issues to fret about—Clovis Oncology missed on a non-inferior endpoint and its shares collapsed 70% only two weeks into the new fiscal year; a second drug, a PARP inhibitor has recently been filed for approval and the shares have commenced a recovery. The greatest disappointment and the worst impact to the portfolio was Intra-Cellular Therapies, which has developed a first in class treatment, with benign side effect profile, for schizophrenia (dementia and bipolar). However, despite prior significance in clinical trials, ITI-007 failed to separate versus placebo in a second Phase 3 trial. Nevertheless, we understand

that the company hopes to proceed to file for FDA approval based on prior trial data, ongoing FDA discussions, and an argument that certain trial centers incorrectly biased the latest data set.

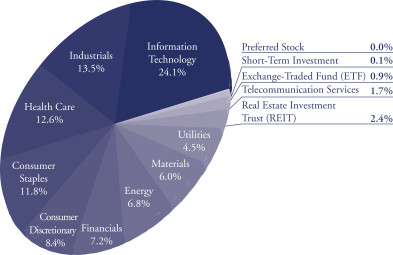

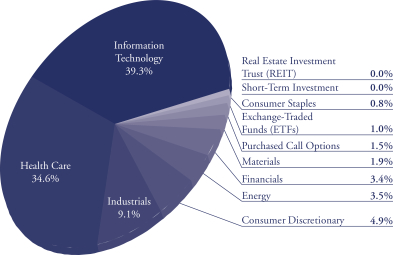

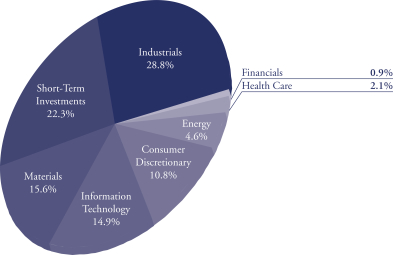

At the period end, Technology sector investments led all others in commitments. Technology issues led performance since the February low and are comprised of investments in cloud based software, semiconductors, security, payments, and gaming. Seven of the Top 10 holdings were tech issues, including: ServiceNow—an enterprise cloud company with roots in IT management; and INPHI Corp—a leading fabless semiconductor company, designing components and optical interconnects for the highest speed data and bandwidth needs. Healthcare sector investments represented the second largest commitment for the Fund, at nearly one third of the Fund. In addition to TESARO and GW Pharma, Aerie Pharmaceuticals was a top holding of the Fund; Aerie has developed the first novel treatment for glaucoma in over twenty years. We have continued to be encouraged by advances and milestone successes in the healthcare investments. In addition, a steady pace in and high probability of ongoing M&A activity, and an expectation that with any reform of healthcare, the bark would have been worse than the bite, as a result, In the end, we believe that our holdings should perform very well, as sentiment improves. The remainder of the portfolio has been focused in the cyclical sectors of Financial, Energy, Materials, and Industrials. Although investments in the Energy sector increased to an overweight mid-year, the overall investment has been maintained at less than 5%. Investments in the Financial services sector increased over the last month, as the probability of a December rate increase has risen. Investments in producer and materials companies have been balanced against a view that the domestic U.S. economy has continued to move ahead grudgingly; we have continued to underweight the consumer sectors throughout 2016, due to changing models of competition and pricing pressures with only a few clear winners.

The Top 10, Top 25, and Top 50 positions comprised 26%, 46%, and 69% respectively of the Fund’s holdings at the fiscal year end. The Top 100 holdings accounted for 90% of the Fund’s holdings. While the past months have been more than a bit unnerving at times, there have been numerous opportunities to build positions in the most exceptional investments, as “jitteries” have indiscriminately bailed out of stocks without regard to valuations or fundamentals. It is impossible to forecast when or even if small cap growth issues will resume a steadier and upward track—the good news is that each successive correction subsequent to the “big one” in January has stopped cold above the prior correction low—a good indication that selling has been exhausted. It is impossible to discuss Healthcare investments over the past eighteen months, without considering the prospect of price controls which was repeatedly invoked during certain candidates’ campaigns. There is only one precedent for such actions which occurred during the early 1990s; those attempts failed as the model of market based competition proceeded under due process and law. And Healthcare issues went on to innovate and succeed as enterprises.

We remain confident that the Fund’s investments are well placed in competitively advantaged companies led by visionary management. Our methodology is steady and unchanged, and we continue to approach investments from a strategic perspective—not for day trading purposes. Innovation, market share, differentiation, barriers to competition, high reinvestment and ROE, and business model are sacrosanct.

We look forward to a more normal period for investing, as political noise subsides. As always, we greatly appreciate your continued confidence in our efforts on behalf of the Fund and its shareholders.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

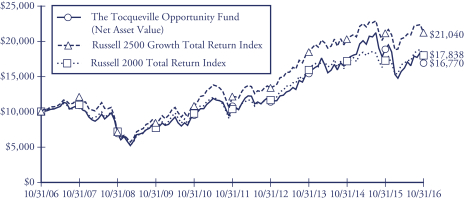

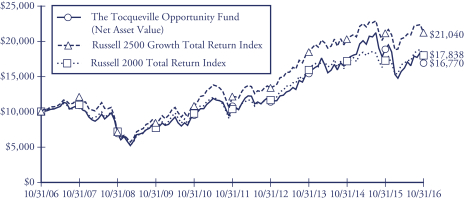

The Tocqueville Opportunity Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/06. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The chart and table reflect The Opportunity Fund’s performance achieved prior to the changes effected in 2010 to its investment strategy.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Returns assume the reinvestment of all dividends

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2016

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | -10.60% | | | | 3.15% | | | | 9.33% | | | | 5.31% | |

Russell 2500 Growth Total Return Index | | | 0.00% | | | | 4.72% | | | | 11.71% | | | | 7.72% | |

Russell 2000 Total Return Index | | | 4.11% | | | | 4.12% | | | | 11.51% | | | | 5.96% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the fiscal year ended October 31, 2016, the Tocqueville International Value Fund’s total U.S. dollar return was 2.01%. In the same period, the Morgan Stanley EAFE Index Net, the index against which we are most often compared, had a net total U.S. dollar loss of (3.23)%. For the 15 year period ended October 31, 2016, the Fund’s total U.S. dollar return was 9.40% per annum. In the same period, the Morgan Stanley EAFE Index Net had a net total U.S. dollar return of 5.49% per annum.

��

Global equity markets were mixed during the year, with developed markets generally down and select emerging markets up meaningfully. Markets declined through mid-February, as investors focused on flagging growth and currency devaluation in China, low oil prices and their implications for credit markets and financial institutions, and weak economic data in the U.S. All assets linked to commodities and emerging markets came under stress. Then the U.S. dollar weakened and oil prices recovered, sparking a recovery in equities led by emerging markets and commodities. In June, there was another bout of volatility and market declines in response to the U.K. referendum vote to leave the European Union. Subsequently, markets rebounded, as concerns regarding the impact of “Brexit” on the global economy abated, and global economic statistics generally improved. Italy and a handful of African markets were among the worst performers globally, while commodity linked economies in Latin America and certain eastern European emerging markets had strong increases. The U.S. dollar decreased in value against most currencies, including the Euro and the Yen, but increased versus the Chinese Yuan and the British Pound. Most sectors declined, with financials, transport, leisure, retail, and media doing worst, while building materials and basic resources fared best.

The Fund’s portfolio benefitted from stock selection in the consumer, industrial and information technology areas, in both Europe and Japan, and from a low exposure to banks and other financial stocks. This was offset in part by weakness in healthcare related holdings as well as certain stocks in the U.K. and elsewhere that were impacted by Brexit fears. Notable contributors to profits were market research concern Ipsos, time management equipment maker Amano, analog chipmaker Infineon, power tool maker Makita, aeronautical equipment producer Zodiac, industrial conglomerate Smiths Group, wire and cable producer Bekaert, and buildings materials producer CRH. There were meaningful declines in real estate brokerage Countrywide, specialty pharma concern Allergan, and logistics service company Bollore.

During the year, we exited positions in Bekaert, cosmetics and household products maker Shiseido, logistics service company Singapore Post, precious metals miner Fresnillo, real estate concern Hopewell Holdings, and Volkswagen as they approached our estimates of intrinsic value. We sold the position in Syngenta following the takeover offer by ChemChina, and tendered the shares of specialty chemicals producer Royal Ten Cate,

subject of a takeover offer by Gilde Partners. We exited the position in Norwegian oil & gas producer Statoil when a questionable capital allocation decision by company management undercut our investment thesis. We also sold Australian explosives and fertilizer maker Incitec Pivot when deteriorating conditions in the U.S. ammonia markets caused us to reduce our estimate of intrinsic value, and in shares of U.K. drugmaker Shire when an expensive acquisition called into question managements capital allocation discipline.

We purchased shares of Zodiac Aerospace, a niche manufacturer of aerospace equipment, with strong positions in specialized markets; we believe that operating margins and the share price are depressed due to temporary production problems, causing the stock to trade at a deep discount to intrinsic value. We believe that operating margins will recover over time and that Zodiac Aerospace will be an attractive acquisition candidate for a larger player. We took a position in global mining concern Rio Tinto when shares were depressed along with the price of iron ore, the company’s most important commodity by revenues. Rio Tinto has the lowest cash cost of production and the strongest balance sheet in the industry which in our judgment provide downside protection while supply and demand for the commodity come into balance and prices firm. We bought shares of Schlumberger, a global oil services company with attractive return on capital and free cash generation characteristics. Shares have declined with the price of oil, and while profits will be depressed for a period due to a decline in exploration and production activity, Schlumberger is managing its expenses well and taking market share, which should result in strong cash flows when activity recovers. We purchased shares of Global Logistic Properties, which owns and leases out modern warehouse facilities in China and Japan, when fears regarding flagging growth and currency devaluation in China caused it to trade down. Global Logistic has a large first mover advantage in China, first class real estate, warehouse technology and customer list, and trades at a meaningful discount to the net asset value of its properties. We took a new position in shares of leading global industrial automation concern Fanuc, as concerns about the impact of a strong Yen and soft results in China on current earnings gave us the opportunity to purchase this growing, well-capitalized franchise at a meaningful discount to intrinsic value. We purchased shares of Australian office services provider—Spotless—after shares traded down in response to a poorly communicated earnings shortfall. We owned Spotless when it was taken private in 2012 and regard it as a consistent, highly cash generative business which is trading at a low multiple of free cash flow. We purchased shares of telecom equipment supplier Nokia which recently merged with Alcatel and whose share price has been depressed due to a weak near term business outlook and a lack of clarity regarding pro forma financials for the combined entity. With a cash rich balance sheet, the company is well placed to withstand the lull in business activity, while significant merger synergies and an improved product offer should allow for a meaningful expansion in free cash generation when spending on its products rebounds.

We took a new position in Cobham plc, a niche manufacturer of electronics with strong positions in specialized military and communications markets. Cobham’s stock

came under pressure as a result of cyclical weakness in certain of its end markets, and a rights issuance aimed at reducing corporate financial leverage enabled us to purchase shares at a meaningful discount to intrinsic value based on normalized cash flows. We purchased shares of U.K. real estate brokerage Countrywide which has been depressed by investor concerns regarding prospective real estate prices and transaction volumes in the post-Brexit context. In our judgment, the shares are reasonably valued based on a conservative scenario regarding future prices and volumes and stand to recover handsomely when transaction activity increases to levels more in line with long-term trends. We took a new position in Canadian miner Goldcorp, which possesses attractive long-lived assets in Canada, Mexico, and Central and South America. Shares have lagged peers due to heavy development spending and resulting poor cash-flow generation. The company is transitioning from a period of high investment to a period of asset optimization and cash-flow harvesting under the direction of a new CEO, who has a strong focus on producing adequate returns on capital and increasing net asset value per share.

We purchased shares of drug and chemical company Bayer when shares sold off in response to its bid for Monsanto. Bayer has strong franchises in consumer and animal health, crop science and pharma, and in our view the combined value of the three businesses exceeds the price of the shares by a wide margin. During the period, we added to Kingfisher, Applus, Aveva, Sanofi, Royal Dutch, Sanofi, Countrywide, Kingfisher, and Sopra, inter alia.

Overall, there was a marginal decrease in our exposure to Japan and Asia and a small increase in our exposure to Europe and Rest of World, where we have been finding the most attractive values. We began the period with approximately 10% in cash reserves and finished the period with roughly 9%.

Economic growth has improved marginally in the U.S. and Europe, and commodity prices have stabilized, which in turn has improved the prospects for a number of emerging markets. Against this backdrop, investor expectations for earnings growth are quite modest. Meanwhile, the perceived failure of monetary policy to stimulate global growth has given rise to a growing consensus regarding the need for broad fiscal stimulus. Indeed, it would appear that the economic agenda of the U.S. President-elect will include fiscal stimulus and tax cuts, intended to stimulate economic growth. Growth in the U.S. would be supportive of global growth, notwithstanding the lip service that has been paid to protectionism. We believe that the combination of improving growth and earnings against the backdrop of investor skepticism should be supportive of equities. That said, we remain vigilant regarding the risks of surprise political outcome in Europe, a faster than expected rise in interest rates, the intractability of and potential for increased conflict in the Middle East, to name a few.

Our goal remains to generate positive absolute returns and to exceed the returns of the major indices over the course of an economic cycle. To protect and grow your capital, we continue to seek out compelling long-term investment opportunities in companies that have defensible business franchises, are out of favor or misunderstood, and trade at a substantial discount to intrinsic value.

Sincerely,

James Hunt

Portfolio Manager

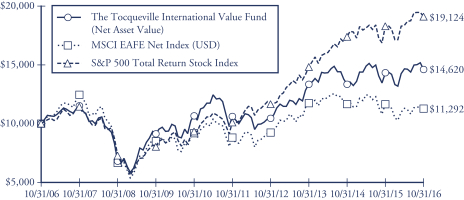

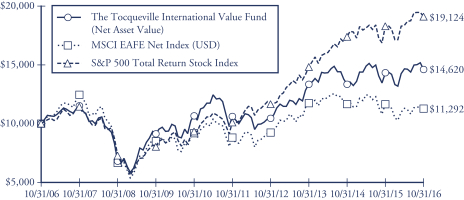

The Tocqueville International Value Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/06. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The MSCI EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 21 Developed Market Countries in Europe, Australia, Asia and the Far East.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2016

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville International Value Fund | | | 2.01% | | | | 2.99% | | | | 6.55% | | | | 3.87% | |

MSCI EAFE Net Index | | | -3.23% | | | | -1.31% | | | | 4.99% | | | | 1.22% | |

Standard & Poor’s 500 Total Return Stock Index | | | 4.51% | | | | 8.84% | | | | 13.57% | | | | 6.70% | |

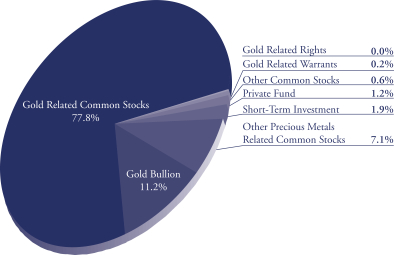

The Tocqueville Gold Fund

Dear Fellow Shareholder,

The past year through October 31, 2016, has seen significant change in the gold market. Gold prices set a low not seen in over five years in December only to rise to a two-year high by July. For the 12-month period, gold rose 11.5%, finishing at $1,273.10 per ounce, while the Tocqueville Gold Fund returned 51.0%. The overarching theme of the past year has been the market’s obsession with the U.S. Federal Reserve Bank’s monetary policy, and the impact on global markets and financial assets from rising interest rates.

As the fiscal year began in November 2015, investors braced for an increase in U.S. interest rates, which the Fed did raise in December, while gold prices marked multi-year lows. The 2016 year began as markets obsessed on weakening economic developments in China and softening global oil markets. As gold turned around in February and March, investors embraced gold’s cyclical low as an opportunity to offset risk exposure from other markets. Meanwhile, global interest rates continued to turn negative on the back of easier central bank policies in Europe and Japan. Market participants showed a renewed interest in physical gold by re-building exposure through gold exchange traded funds—a noteworthy turnaround from the sell-off of the past several years. The Brexit vote in June further supported gold markets as investors sought to offset the weakening British pound sterling and the global impact from Britain being less integrated with Europe. During the late summer months and early autumn, gold and gold mining shares consolidated the substantial gains from earlier in the year, as markets continued to speculate on when the U.S. Fed would raise interest rates.

As the new fiscal year begins, gold markets have reacted to the uncertain implications of a new presidential regime. At this stage, with the transition just underway, it seems there are too many unknowns, except for the market’s expression of relief that the past is behind. There is a decent chance interest rates will continue to rise and bond market losses will mount. So too, it is likely that inflation will rise, as fiscal deficits expand under programs intended to “Make America Great Again”. The momentary euphoria over the prospective change of course in public policy could easily turn to disenchantment, as these realities settle in.

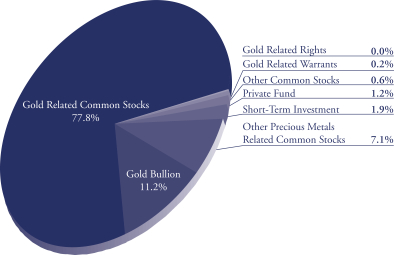

The Fund continues to hold physical gold vaulted at a secure storage facility (which, very importantly, is outside the financial system), as its largest single position, at approximately 11% of the Fund’s assets. This exposure offsets some of the volatility inherent in equities in general and gold mining stocks in particular.

The precious metal mining stocks that contributed the most during the period included Agnico-Eagle Mines, Alamos Gold, B2Gold, Detour Gold, Fresnillo Plc, Jaguar Mining, Newmont Mining Corp. Mag Silver, Silver Wheaton, and Torex Gold. Each position participated with the positive move in precious metals this past year, but each has

also created value in unique ways whether through discovery, resource development or successful, corporate strategic execution and profitable precious metal production. The Fund seeks exposure across various aspects of the value creation spectrum within the precious metals sector, as a way to not only diversify risk but also capture the value inherent in discovery, development and production.

New positions were established during the year such as Jaguar Mining, Gold Road, Hochschild Mining, Klondex, and NuLegacy. Each has the potential to generate value from its assets. These companies are developing economic ore deposits and/or generating quality cash flow from assets that have the potential to expand from the influence of the gold price or from geologic discovery. Several companies were sold from the Fund that either presented limited value creation opportunities or posed risks unassociated with moves in the precious metals markets. This includes companies such as Americas Silver, Buenaventura, Continental Gold, Gold Fields, Iamgold, Kinross, New Gold, and Primero Mining. While each of those companies has different challenges and opportunities, we determined they did not offer the best nor an immediate contribution to value creation.

Some positions were held for under a year, as investments that were originally undervalued by the market but reached higher values, to the point of excessive, as the gold price ran up in mid-2016. This was the case with Barrick, held for much of the year as the position was acquired when the company’s valuation was extremely low in early 2016. As markets and valuations rose into mid-year, the position was sold down. The same was true for Reservoir Minerals, but in that case, the company was acquired. TMAC Resources was another company that reached a favorable valuation late in the year and was sold off.

We continue to avoid the more financially or operationally leveraged companies that make up a good portion of indexes such as the Philadelphia Gold and Silver index or various gold mining equity ETFs. As always, we seek to invest in those companies characterized by “wealth builders”, managements that we believe can produce accretive per share growth in production and reserves independent of changes in the gold price.

In our view, the systemic risks that existed prior to the presidential election have not suddenly vanished. Most important among these is a massive bond market bubble. How the new administration will deal with this vexing issue is a complete unknown. Any unwinding process promises to be extremely precarious and full of potential pitfalls, which we believe is reason enough to hedge all bets on a positive outcome with exposure to gold and precious metals equities. Rising interest rates, expanding fiscal deficits, and the return of inflation may well prove to be the catalysts necessary to drive gold prices much higher.

We believe that the recent sharp correction in precious metal prices will form into a solid foundation from which gold and gold mining stocks will advance toward new highs. We recommend taking advantage of any price weakness as an opportunity to build on or establish new positions in the precious metal sector.

Sincerely,

| | |

| |  |

| John C. Hathaway | | Douglas B. Groh |

| Portfolio Manager | | Portfolio Manager |

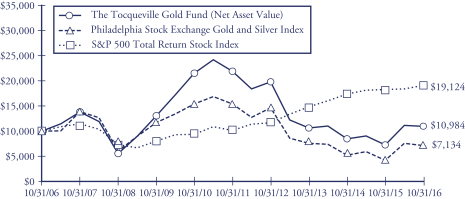

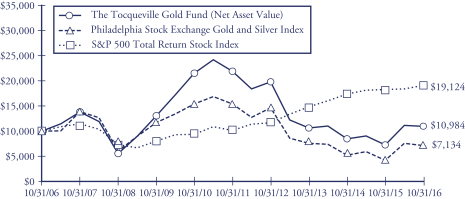

The Tocqueville Gold Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/06. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2006, 2009, 2010, and 2016 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2016

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund | | | 51.00% | | | | 1.14% | | | | -12.90% | | | | 0.94% | |

Philadelphia Stock Exchange Gold and Silver Index | | | 69.93% | | | | -1.95% | | | | -14.23% | | | | -3.30% | |

Standard & Poor’s 500 Total Return Stock Index | | | 4.51% | | | | 8.84% | | | | 13.57% | | | | 6.70% | |

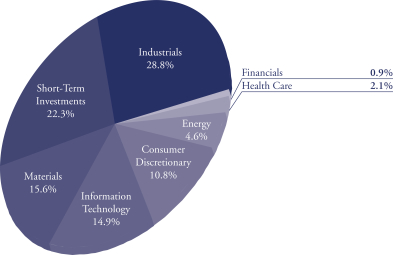

The Delafield Fund

Dear Fellow Shareholder,

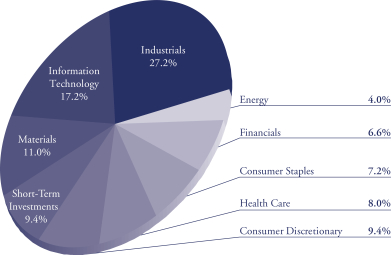

For the fiscal year ended October 31, 2016 the Delafield Fund’s net asset value increased 3.26% versus an increase of 4.11% for the Russell 2000 Index (“Russell 2000”) and an increase of 4.51% for the Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. Owing to the smaller average market capitalization of companies in the Russell 2000, we view it as the more appropriately comparative index to the Fund. The Fund’s net asset value as of October 31, 2016 was $26.47 per share. The net asset value amounted to $400,826,962 of which 77.6% was invested in equities, and the balance in cash and equivalents.

Stock markets endured a battering in the first quarter of our fiscal 2016 and then proceeded on a nearly unabated upward trajectory for the balance of the fiscal year. From November 1, 2015 through January 31, 2016, the Russell 2000 experienced a 10.56% drop and our portfolio trailed, declining 15.04% for the same period. During the first quarter, the deceleration in the Chinese economy (and related weakness in commodity metals), the energy sector’s continued swoon, and the strong U.S. dollar continued to be among the leading headlines. Unfortunately, these external fears most severely challenged stocks in the industrial, material, energy and retail sectors, all which have commonly been ripe for our strategy of discovering unloved and misunderstood opportunities in which to invest. While the lion’s share of our portfolio companies in these sectors advanced on their respective internal operating initiatives during this challenging quarter, these accomplishments were overshadowed by exogenous macro concerns, and our exposure to these sectors contributed to the Fund’s relative first quarter underperformance.

Beginning with the second fiscal quarter and throughout the balance of the fiscal year, the market, and the Fund’s portfolio in particular, snapped back sharply. From February 1, 2016 through October 31, 2016, the Russell 2000 returned 16.40%, while the Fund outperformed by about 600 basis points, generating a 21.53% gain, net of fees. Energy and commodity prices began to stabilize early in the period, and a somewhat weaker dollar also benefited the macro environment, helping to fuel the start of the market rally. Favorable employment, wage and inflation data drove improved investor expectations and stock prices through the first half of the third fiscal quarter before Britain’s unexpected vote on the so called “Brexit” shocked the system and caused a massive two day selloff. However, the promise of further government stimulus around the globe, including the expectation that the U.S. Fed would shelve a previously anticipated rate hike quickly pulled the markets out of their doldrums and the rally resumed into the fourth fiscal quarter, before petering out towards quarter end on U.S. presidential election uncertainty. While the portfolio of course benefited from these external factors, performance during quarters two through four of the fiscal year was augmented with strong moves in a number of our holdings that reported operating results which highlighted the internal progress they had managed to make in their operations and/or capital structures.

For the fiscal year, top contributors included Consol Energy Inc. (Consol), Hewlett Packard Enterprise Company (HPE), and Horizon Global Corporation (Horizon). Consol responded favorably to energy price stabilization as well as evidence that operational improvements had begun to take hold. HPE had a successful debut following its spin-off from HP Inc., while Horizon benefited from improved earnings results owing to margin enhancing strategies implemented by its new management team.

In contrast, Ascena Retail Group Inc., TrueBlue, Inc., and Xerium Technologies Inc. were the largest detractors to our performance. Despite making progress on righting issues within their Justice division, Ascena’s overall results and its shares, disappointed throughout the year due to both retail industry headwinds as well as missteps in other operating divisions. TrueBlue disappointed the market with weaker than expected earnings and the unexpected loss of contract work with Amazon, while Xerium’s shares declined on soft earnings results.

We added a number of new positions to the portfolio during the fiscal year, the largest of which included Team Inc., Tegna Inc., U.S. Concrete Inc., Barnes Group Inc., and Korn Ferry. In contrast, the largest portfolio deletions included two companies which announced deals to be acquired, namely Ingram Micro Inc. and Fairchild Semiconductor International Inc, as well as Consol Energy Inc., Jabil Circuit Inc., Carlisle Corporation, and Avery Dennison Corporation.

Looking forward, in the near-term, the transition of power to President-elect Trump, the movement of the U.S. dollar and energy prices and interest rate expectations are likely to dominate the headlines. Further, we expect that market volatility will continue to be an issue as ETFs, computer traded portfolios and hedge funds dominate day to day investment activity. On the plus side is our domestic economy which is growing, albeit at a moderate pace. This macro backdrop could make for a tentative investment climate, which we believe could be ripe for the discovery of the value and special situation opportunities which we look to invest in.

Sincerely,

| | |

| |  |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

| | |

| |  |

| Joshua Kaufthal | | James Maxwell |

| Portfolio Manager | | Portfolio Manager |

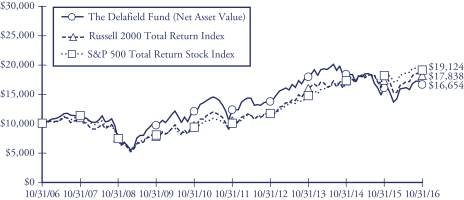

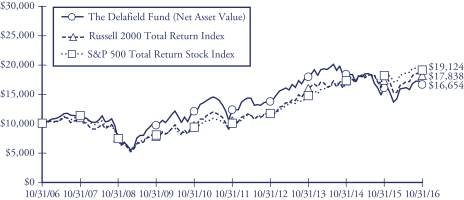

The Delafield Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/06. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2016

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | 3.26% | | | | -2.74% | | | | 6.16% | | | | 5.23% | |

Russell 2000 Total Return Index | | | 4.11% | | | | 4.12% | | | | 11.51% | | | | 5.96% | |

Standard & Poor’s 500 Total Return Stock Index | | | 4.51% | | | | 8.84% | | | | 13.57% | | | | 6.70% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

For the fiscal year ended October 31, 2016 the Tocqueville Select Fund’s net asset value decreased 1.93% verses increases of 3.98% for the Russell 2500 Index (“Russell 2500”) and 4.11% for the Russell 2000 Index (“Russell 2000”), each on a total return basis. The Fund’s net asset value as of October 31, 2016 was $11.43 per share. The net asset value amounted to $63,812,085 of which 85.8% was invested in equities, and the balance in cash and equivalents.

Stock markets endured a battering in the first quarter of our fiscal 2016 and then proceeded on a nearly unabated upward trajectory for the balance of the fiscal year. From November 1, 2015 through January 31, 2016, the Russell 2500 experienced a 9.99% drop and the Fund’s portfolio trailed, declining 16.43% for the same period. During the first quarter, the deceleration in the Chinese economy (and related weakness in commodity metals), the energy sector’s continued swoon, and the strong U.S. dollar continued to be among the leading headlines. Unfortunately, these external fears most severely challenged stocks in the industrial, material, energy and retail sectors, all which have commonly been ripe for our strategy of discovering unloved and misunderstood opportunities in which to invest in. While the majority of portfolio companies in these sectors advanced on their respective internal operating initiatives during this challenging quarter, these accomplishments were overshadowed by exogenous macro concerns, and our exposure to these sectors contributed to our relative first quarter underperformance.

Beginning with the second fiscal quarter and throughout the balance of the fiscal year, the market, and the Fund’s portfolio in particular, snapped back sharply, albeit not enough to entirely offset our relative underperformance in the first fiscal quarter. From February 1, 2016 through October 31, 2016, the Russell 2500 returned 15.52%, while the Fund generated a 17.35% gain, net of fees. Energy and commodity prices began to stabilize early in the period, and a somewhat weaker dollar also benefited the macro environment, helping to fuel the start of the market rally. Favorable employment, wage and inflation data drove improved investor expectations and stock prices through the first half of the third fiscal quarter before Britain’s unexpected vote on the so called “Brexit” shocked the system and caused a massive two day selloff. However, the promise of further government stimulus around the globe, including the expectation that the U.S. Fed would shelve a previously anticipated rate hike, quickly pulled the markets out of their doldrums and the rally resumed into the fourth fiscal quarter, before petering out towards quarter end on U.S. presidential election uncertainty. While the Fund’s portfolio of course benefited from these external factors, performance during quarters two through four of the fiscal year was augmented with strong moves in a number of our holdings that reported operating results which highlighted the internal progress they had managed to make in their operations and/or capital structures. Fund holdings in the consumer discretionary and materials sectors were particularly strong relative to the Russell 2500 and were outsize contributors to the Fund’s relative strength for this period.

For the fiscal year, top contributors included Horizon Global Corporation (Horizon) and Consol Energy Inc. (Consol). Horizon benefited from improved earnings results owing to margin enhancing strategies implemented by its new management team, while Consol responded favorably to energy price stabilization as well as evidence that operational improvements had begun to take hold. In contrast, Ascena Retail Group Inc., and Xerium Technologies Inc. were the largest detractors to performance. Despite making progress on righting issues within their Justice division, Ascena’s overall results and its shares, disappointed throughout the year due to both retail industry headwinds as well as missteps in other operating divisions. Xerium’s shares declined on soft earnings results.

We added a number of new positions to the portfolio during the fiscal year, the largest of which included TrueBlue Inc., Tegna Inc., Diebold Inc., and ICF International Inc. We also exited several investments, the largest of which was Fairchild Semiconductor International Inc., which announced a deal to be acquired. Other large positions that were exited included Avery Dennison Corporation, Jabil Circuit Inc., Carpenter Technology Corp., and Acco Brands Corp.

Looking forward, in the near-term, the transition of power to President-elect Trump, the movement of the U.S. dollar and energy prices and interest rate expectations are likely to dominate the headlines. Further, we expect that market volatility will continue to be an issue as ETFs, computer traded portfolios and hedge funds dominate day to day investment activity. On the plus side is the domestic economy which is growing, albeit at a moderate pace. This macro backdrop could make for a tentative investment climate, which we believe could be ripe for the discovery of the value and special situation opportunities which we look to invest in.

Sincerely,

| | | | |

| |  | |  |

| J. Dennis Delafield | | Vincent Sellecchia | | Joshua Kaufthal |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

| | |

| |  |

| Donald Wang | | James Maxwell |

| Portfolio Manager | | Portfolio Manager |

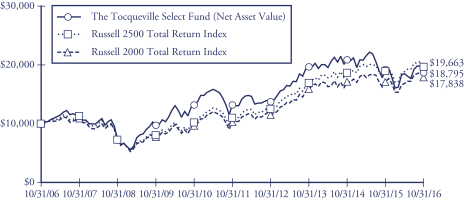

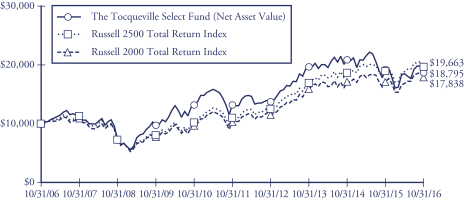

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/06. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

In 2013 the performance of The Tocqueville Select Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Russell 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED OCTOBER 31, 2016

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | -1.93% | | | | -1.42% | | | | 7.29% | | | | 6.51% | |

Russell 2500 Total Return Index | | | 3.98% | | | | 5.17% | | | | 12.22% | | | | 7.00% | |

Russell 2000 Total Return Index | | | 4.11% | | | | 4.12% | | | | 11.51% | | | | 5.96% | |

Expense Example—October 31, 2016 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2016-October 31, 2016).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

The Tocqueville Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2016 | | | Ending

Account Value

October 31, 2016 | | | Expenses Paid

During Period*

May 1, 2016 -

October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 1,035.60 | | | $ | 6.24 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,019.00 | | | | 6.19 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.22% for The Tocqueville Fund, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

The Tocqueville Opportunity Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2016 | | | Ending

Account Value

October 31, 2016 | | | Expenses Paid

During Period*

May 1, 2016 -

October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 1,039.70 | | | $ | 7.33 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.95 | | | | 7.25 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.43% for The Tocqueville Opportunity Fund, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

The Tocqueville International Value Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2016 | | | Ending

Account Value

October 31, 2016 | | | Expenses Paid

During Period*

May 1, 2016 -

October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 995.90 | | | $ | 6.27 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.85 | | | | 6.34 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville International Value Fund, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

The Tocqueville Gold Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2016 | | | Ending

Account Value

October 31, 2016 | | | Expenses Paid

During Period*

May 1, 2016 -

October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 984.50 | | | $ | 6.68 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.40 | | | | 6.80 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.34% for The Tocqueville Gold Fund, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

The Delafield Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2016 | | | Ending

Account Value

October 31, 2016 | | | Expenses Paid

During Period*

May 1, 2016 -

October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 1,038.90 | | | $ | 6.20 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,019.05 | | | | 6.14 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.21% for The Delafield Fund, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

The Tocqueville Select Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2016 | | | Ending

Account Value

October 31, 2016 | | | Expenses Paid

During Period*

May 1, 2016 -

October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 1,016.00 | | | $ | 6.79 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.40 | | | | 6.80 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.34% for The Tocqueville Select Fund, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of year | | $ | 32.91 | | | $ | 34.18 | | | $ | 30.67 | | | $ | 24.11 | | | $ | 22.23 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.42 | | | | 0.37 | | | | 0.28 | | | | 0.40 | | | | 0.40 | |

Net realized and unrealized gain (loss) | | | 1.07 | | | | (0.19 | ) | | | 3.78 | | | | 6.51 | | | | 1.81 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 1.49 | | | | 0.18 | | | | 4.06 | | | | 6.91 | | | | 2.21 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.35 | ) | | | (0.25 | ) | | | (0.30 | ) | | | (0.35 | ) | | | (0.33 | ) |

Distributions from net realized gains | | | (0.33 | ) | | | (1.20 | ) | | | (0.25 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.68 | ) | | | (1.45 | ) | | | (0.55 | ) | | | (0.35 | ) | | | (0.33 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 0.81 | | | | (1.27 | ) | | | 3.51 | | | | 6.56 | | | | 1.88 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | | | $ | 30.67 | | | $ | 24.11 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) |

Total Return | | | 4.6 | % | | | 0.5 | % | | | 13.4 | % | | | 29.0 | % | | | 10.1 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 283,126 | | | $ | 309,267 | | | $ | 380,561 | | | $ | 348,269 | | | $ | 366,025 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.27 | % | | | 1.29 | % | | | 1.25 | % | | | 1.28 | % | | | 1.29 | % |

Expenses after waiver/reimbursement | | | 1.24 | %(3) | | | 1.25 | % | | | 1.24 | % | | | 1.26 | %(3) | | | 1.26 | %(3) |

Net investment income before waiver/reimbursement | | | 1.18 | % | | | 0.91 | % | | | 0.84 | % | | | 1.33 | % | | | 1.30 | % |

Net investment income after waiver/reimbursement | | | 1.21 | % | | | 0.95 | % | | | 0.85 | % | | | 1.35 | % | | | 1.33 | % |

Portfolio turnover rate | | | 12 | % | | | 15 | % | | | 19 | % | | | 16 | % | | | 17 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of year | | $ | 21.41 | | | $ | 22.78 | | | $ | 21.29 | | | $ | 15.76 | | | $ | 14.96 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.29 | ) | | | (0.15 | ) | | | (0.22 | ) | | | (0.13 | ) | | | (0.11 | ) |

Net realized and unrealized gain (loss) | | | (1.98 | ) | | | 1.98 | | | | 2.80 | | | | 5.66 | | | | 0.91 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (2.27 | ) | | | 1.83 | | | | 2.58 | | | | 5.53 | | | | 0.80 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | (3.20 | ) | | | (1.09 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | (3.20 | ) | | | (1.09 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (2.27 | ) | | | (1.37 | ) | | | 1.49 | | | | 5.53 | | | | 0.80 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | | | $ | 21.29 | | | $ | 15.76 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) |

Total Return | | | (10.6 | )% | | | 9.1 | % | | | 12.6 | % | | | 35.1 | % | | | 5.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 92,958 | | | $ | 153,456 | | | $ | 80,324 | | | $ | 80,609 | | | $ | 65,455 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % | | | 1.30 | % | | | 1.32 | % |

Net investment loss | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% | | | (0.64 | )% | | | (0.76 | )% |

Portfolio turnover rate | | | 108 | % | | | 101 | % | | | 92 | % | | | 100 | % | | | 77 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

year) | | Years Ended October 31, | |

| | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of year | | $ | 14.59 | | | $ | 14.48 | | | $ | 14.71 | | | $ | 11.68 | | | $ | 12.00 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.14 | | | | 0.15 | | | | 0.15 | | | | 0.24 | | | | 0.17 | |

Net realized and unrealized gain (loss) | | | 0.14 | | | | 0.80 | | | | (0.15 | ) | | | 2.97 | | | | (0.37 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 0.28 | | | | 0.95 | | | | — | | | | 3.21 | | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.25 | ) | | | (0.32 | ) | | | (0.23 | ) | | | (0.18 | ) | | | (0.12 | ) |

Distributions from net realized gains | | | (0.18 | ) | | | (0.52 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.43 | ) | | | (0.84 | ) | | | (0.23 | ) | | | (0.18 | ) | | | (0.12 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (0.15 | ) | | | 0.11 | | | | (0.23 | ) | | | 3.03 | | | | (0.32 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 14.44 | | | $ | 14.59 | | | $ | 14.48 | | | $ | 14.71 | | | $ | 11.68 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) |

Total Return | | | 2.0 | % | | | 7.2 | % | | | (0.0 | )% | | | 27.8 | % | | | (1.6 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 525,808 | | | $ | 333,762 | | | $ | 237,051 | | | $ | 262,981 | | | $ | 218,793 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.58 | % | | | 1.57 | % | | | 1.54 | % | | | 1.55 | % | | | 1.56 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.30 | %(3) | | | 1.56 | % |

Net investment income before waiver/reimbursement | | | 0.90 | % | | | 0.71 | % | | | 0.62 | % | | | 1.55 | % | | | 1.53 | % |

Net investment income after waiver/reimbursement | | | 1.23 | % | | | 1.03 | % | | | 0.91 | % | | | 1.80 | %(3) | | | 1.53 | % |

Portfolio turnover rate | | | 26 | % | | | 42 | % | | | 31 | % | | | 37 | % | | | 38 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense cap of 1.25% was implemented on January 1, 2013. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the year) | | Years Ended October 31, | |

| | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of year | | $ | 26.04 | | | $ | 30.38 | | | $ | 38.01 | | | $ | 72.82 | | | $ | 81.97 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.33 | ) | | | (0.27 | ) | | | (0.08 | ) | | | (0.26 | ) | | | (0.35 | ) |

Net realized and unrealized gain (loss) | | | 13.61 | | | | (4.07 | ) | | | (7.55 | ) | | | (32.93 | ) | | | (7.47 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) | | | (33.19 | ) | | | (7.82 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | (1.62 | ) | | | (1.33 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | — | | | | (1.62 | ) | | | (1.33 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) | | | (34.81 | ) | | | (9.15 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | | | $ | 38.01 | | | $ | 72.82 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.02 | |

Total Return | | | 51.0 | % | | | (14.3 | )% | | | (20.1 | )% | | | (46.4 | )% | | | (9.5 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 1,365,282 | | | $ | 947,367 | | | $ | 1,138,557 | | | $ | 1,215,081 | | | $ | 2,445,913 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |