UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 W. 57th St., 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212) 698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Item 1. Reports to Stockholders.

ANNUAL REPORT

October 31, 2013

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocqueville.com/mutual-funds

Dear Fellow Shareholder,

In the last twenty years, we experienced two major stock market bubbles: the NASDAQ and Internet craze of the late 1990s and the sub-prime lending and real-estate folly of the mid-2000s. Each ended in a painful stock market crash of around 50%, accompanied by a severe recession. It is not surprising, therefore that investors have become accustomed to think of the stock market in terms of bubbles and crashes. Yet, bear markets in stocks and economic recessions, if not always as severe, have been a recurring feature of free economies ever since they have been in existence.

What has been different this time is the extent to which central banks—and principally the U.S. Federal Reserve—have taken center stage—both as saviors of last resort when these bubbles burst and as engineers of the following speculative bubble as a result of their rescue operations.

During the last two decades, it became an accepted view that fluctuations in the wealth of investors determined spending and saving trends in the economy. The Federal Reserve thus became concerned that any serious stock market decline might precipitate an economic recession, and it began to pour liquidity into the banking system as soon as a stock market decline threatened to gather momentum.

Naturally, investors tend to become addicted to a market that they “know” will be bailed out as soon as it threatens to decline and, in such a market, prices keep going up regardless of valuations—at least until some accident sends them back down to earth. This is what happened when the tech stock bubble burst in early 2000, and in the post-financial crisis bear market of 2007-2009.

Today, we are living through perhaps the greatest monetary policy experiment of modern times: having brought interest rates all the way down to near zero, the U.S. Federal Reserve has embarked onto “Quantitative Easing” by buying Treasury and related securities regardless of the impact on interest rates. Initially, this was a desperate effort by the United States to bail out its financial system and to drag the economy out of a deep and stubborn recession. Soon, the United Kingdom and Japan opted to follow a similar route and eventually so did the European Central Bank, albeit somewhat reluctantly.

The resulting torrent of liquidity produced powerful rallies in the global financial markets, including bounces back to historical highs in some instances, even though the real economies had only partially recovered. As a result, valuations could never reach the low levels that had characterized major market bottoms in the past.

To generalize, valuation measures today stand somewhere between those at major market bottoms of the past and the extreme highs reached during the last speculative bubble. Part of the investing crowd is busy trying to participate in what might be a major new (though ageing) bull market, while the rest spends its time worrying about when the speculative bubbles potentially created by the central banks’ lavish provision of liquidity will burst.

It could be argued that the major stock markets are not yet in bubble territory, since there remains a fair number of skeptics and worriers. But it also seems hard to envision major gains from here as many studies, including by Nobel Prize laureate Robert Shiller, indicate that 5-10 year returns from current stock market valuation levels tend to be very slim.

At the same time, a number of observers have pointed out that the distribution of P/E multiples among stocks in the S&P 500 stock market index has recently been the narrowest in about 25 years. Simply speaking, this means that the difference between the highest P/Es and the lowest P/Es among stocks in the index is historically very low. It also means, therefore, that companies with very different qualities and growth potentials may be selling at similar price/earnings ratios, which should translate in attractive opportunities for analysts capable to detect the anomalies.

Between the great financial crisis of 2007-2009 and the monetary-fueled recoveries that followed, the most important investment decisions have been of a macro nature: to be invested in the market or not or, in today’s fashionable lingo, “risk in or risk out”. Now is a good time to remember the fundamentals of stock selection.

Respectfully,

François Sicart

Chairman

The Tocqueville Fund

Dear Fellow Shareholder,

The fiscal year just completed was a remarkable one, and not just because of the stellar performance put in by the market and by the Fund. Economic, and, more strikingly, political, developments which one might have thought would have had profound negative influence on the market seemed not to have mattered to equity investors. At the same time, the market’s bull run seemed to have an equally unimpressive impact on the investing public, as fund flows, or more accurately, lack thereof, into equities demonstrated. What, exactly, is going on?

Fortunately, fund managers do not have to answer such questions. Their role, and particularly, as I see mine, is to purchase shares of good companies at bargain prices when they have fallen out of favor with the investing public, and hold them for as long as their prospects appear under appreciated by the markets. Though hardly a walk in the park, this is far easier to accomplish than to predict with any accuracy, and more importantly, with any consistency, the path of the overall market.

That said, we did predict, last year in this letter, a benign market environment. Our reasoning then was that the “fiscal cliff” would be the 21st Century equivalent of Y2K: To wit, much ado about nothing. Ditto, it turns out, for the sequester, and now, as recent data has shown, “la meme chose” for the government shutdown. These political hysterics may sell newspapers and win or lose votes, but they have had little effect, correctly, in my view, on the markets. Why? Well, in part, because, notwithstanding all the dire rhetoric that surrounded them, the numbers involved were tiny, on a relative basis, compared with the overall burden of public sector spending or when compared with the economy as a whole. The markets, it seemed, saw through the rhetoric and concluded, rightly, that the emperor wasn’t wearing any clothes.

This is not to say that there are not very large fiscal issues that must be addressed. The entire entitlement structure of the Federal government must be overhauled. At the state and local levels, public employees’ pension issues are overhanging most budgets. But these problems are far from unknown and the solutions to these issues are both simple and obvious, in spite of the political difficulty involved in getting to them. And, so, the markets seem to have concluded, they will be solved. I concur, but not without some drama and pain.

Beyond looking past political shenanigans, the markets also seemed indifferent to anemic economic growth in the U.S. and elsewhere. Now, markets are supposed to be discounting mechanisms and what they are supposed to discount is the future. They may be wrong about the future, in which case they must adjust and discount a new consensus future, but in no event are the markets expected to discount the present or the past. Consequently, one could conclude that the markets have discounted a brighter economic picture than the sluggish growth one which is currently in focus. If so, there is room for disappointment in the year ahead, and caution is warranted. True enough, but from our risk adverse, capital preservation orientation, caution is always warranted. So I can’t say much is new there.

That the investing public at large has not been lured back into the markets in droves after such an impressive uplift is by far the most interesting and telling development of the past year. What it signals to this long-time observer, is a sea change in public attitude regarding equities, coupled with a secular shift in demographics. While both factors are important, it is the latter, I suspect, which is the more profound and the longest lasting. First the former. After the collapse of the internet bubble in 2000 through 2002, and followed so closely by 2007 through 2009 meltdown, the bloom seems to have come off the rose of the equity markets for many erstwhile investors. Much like the wariness of generations after the 1929 collapse and the ensuing Depression, generations of investors who were raised on the notion that there was no alternative to equities have been badly burned by the markets and are in no hurry to reengage. Risk taking has lost its allure to many, and just as deleveraging is the strategy of choice for debtors, fixed income securities, as witnessed by the huge inflows into bond funds over the past few years, have become the investment vehicle of choice for many. That this has turned out to be precisely the wrong strategy is of no particular moment, and I suspect that it will take far more ebullience in the markets even than what we have seen this year to change that mindset.

As for the demographic shift, this is increasingly well documented, though, astonishingly, few were speaking of it only a few years ago. The implication for the markets, as well as for public policy and the national fiscal predicament, are profound. An aging population is a dissaving population, and the long standing zero interest rate policy of the central bank implies that retirees cannot count on their savings to provide them an income. This means, perforce, the need to “eat” their capital, and/or to continue working. But in either event, it does not mean reengaging with an equity market perceived as risky. So, for the foreseeable future, one should expect to see considerable flow out of the equity markets from this large group, as baby boomers cash in their IRAs, 401ks and other savings to pay for their living expenses.

Nor is this the only demographic change of note. The ethnic and cultural make-up of the nation is changing rapidly and it is not too much to speculate that the new America will have different attitudes about risk and entrepreneurship than the one it replaces. It certainly seems that the role that government is expected to play by the emerging majority will be different and larger than what was acceptable in the past. Whatever positive societal alterations may occur as a result of these changes, these developments are likely to have the same long term effects on equity markets that they have had in many other countries where these attitudes, expectations and policies prevail, i.e., not exactly salutary.

But there is little that an investor can do about these large changes, other than to be cognizant of them, so, I return to my earlier premise that fund managers should stick to their knitting and concentrate on finding and owning shares of good companies, at reasonable prices, and let the equity markets take care of themselves. In the most recent fiscal year, that is exactly what we have done and the results were most satisfactory, from both an absolute and relative perspective. The Tocqueville Fund registered a 29.04% return over the fiscal year, compared with a 27.18% for the overall market, as measured by the S&P 500, the index against which we are most commonly measured. With the exception of Newmont Mining, a gold mining company that had a miserable year, almost all the names in our portfolio generated a positive contribution to the results. In particular, large cap names like Ford, Xerox, Google, Du Pont, MasterCard, Applied Materials, Johnson and Johnson, and Boeing were significant contributors to our performance, but so too were Isis Pharmaceuticals, Alkermes, and Steelcase, smaller capitalization names. Combined, these names, which comprised the top ten performers during the past fiscal year, provide some insight into our eclectic, multicap, style agnostic approach to investing. It is an approach that has generated consistently satisfactory returns—at least from the perspective of this very large shareholder—over the long period I have been managing the Fund. And it is the approach we will continue to employ, with caution, in the years ahead.

Thank you for your continued support,

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

(Unaudited)

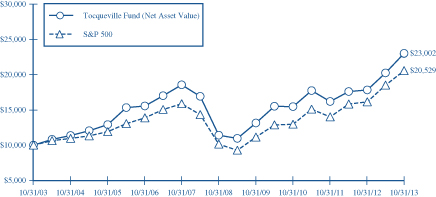

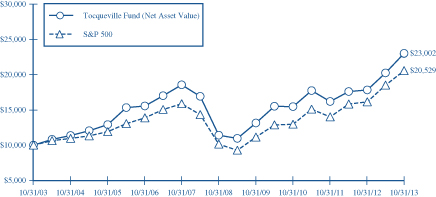

This chart assumes an initial gross investment of $10,000 made on 10/31/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 29.04% | | | | 14.17% | | | | 15.04% | | | | 8.69% | |

Standard & Poor’s 500 Stock Index | | | 27.18% | | | | 16.56% | | | | 15.17% | | | | 7.46% | |

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

We are pleased to provide this review of the Tocqueville Opportunity Fund’s performance for the fiscal year ended October 31, 2013. The Fund performed slightly below the SMID cap (small/mid cap) growth benchmark (the Russell 2500 Growth Index) and gained 35.09% while the Index gained 37.60%. The performance of small and mid-capitalization issues was favored throughout the past fiscal year over larger capitalization issues. Longer term investors in the Fund will recall that the fiscal year commenced in the midst of a sell-off in equity markets post the 2012 Labor Day weekend precipitated by a combination of European Union related macro fears, the U.S. Presidential election, the expiration of fiscal stimulus at the end of 2012, and the probability of higher dividend and capital taxation in 2013. In retrospect the correction ran for about two months from mid-September 2012 through mid-November 2012; the correction in SMID cap growth issues was significant at 9.5%. The recovery from the lows was impressive, and equity indices have been marked since by a steady series of higher highs and higher lows. While SMID cap value issues led growth for most of the past fiscal year, growth issues usurped the lead in late June upon the conclusion of a mid-year correction which was brought on by fears of an imminent shift in policy away from quantitative easing due to an improved economic outlook.

Over the past year, there have been several noteworthy shifts in sector allocations which have resulted from both performance and investment strategy. At the fiscal year end, the Fund’s largest sector commitments were in the economy sensitive sectors: Basic Materials, Autos and Transportation, and Producer Durables. During the year, we increased the weightings in these more cyclical areas from about 17% to 27% of the Fund’s total investments as we gained increased confidence in the persistency of the economic recovery and passing threats of sequestration, the shut down, and QE tapering. Although Healthcare sector investments had comprised the largest share of the Fund’s capital at the start of the fiscal year, we continued to increase exposures and ended the period at more than 23% of the Fund’s investments. Healthcare issues provided leading performance, and throughout the period was a steady stream of new issue offerings and positive news supporting the sector—trial results and new drug approvals. We lowered investment allocations to the combined Consumer Staples/Consumer Discretionary sectors, but the group represented the third largest sector level commitment of the Fund at approximately 25%. Our bias toward the Consumer holdings has been to tilt holdings toward issues which stand to benefit the most from a recovery in discretionary spending, including: housing, leisure activities and travel. We have also continued to increase the Fund’s investments in Financial issues, and over the past year have moved from a significant underweight to an overweight on a relative basis. Financials generated the second best relative sector performance for the Fund over the past year, and the Fund’s holdings are characterized by a group of issues that has benefitted from consolidation, rapid loan and market share growth, and exceptional management and execution. The aforementioned increases in sector investments have essentially been funded from a dramatic reduction in the Technology sector—one year ago Technology investments were the Fund’s largest holdings but over the past year, we reduced Technology investments from approximately 23% to nearly 16%. While several of the Fund’s leading performers were Technology issues (LinkedIn, priceline.com), the overall sector was the worst performing for the Fund and the Fund’s holding in Apple was the single worst contributor to Fund performance. Apple’s share price declined nearly 25% during the period.

Healthcare issues powered the Fund’s performance during the past fiscal year. Eleven of the top 15 absolute performers were Healthcare issues, and all but one of these doubled in price during the period—the top five of these included: Aegerion Pharmaceuticals, Alnylam Pharmaceuticals, NPS Pharmaceuticals, Isis Pharmaceuticals and Incyte Pharmaceuticals. On a relative basis, Healthcare issues occupied seven of the top 15 contributors with the leading five including: Alnylam Pharmaceuticals, NPS Pharmaceuticals, Regeneron Pharmaceuticals, Pharmacyclics, and Vertex Pharmaceuticals. While we don’t regard “top ten” holdings as a statistically meaningful metric due to the Fund’s diversification strategies, Healthcare issues comprised six of the “top ten” issues at the end of the fiscal year versus two at the start. We have gained increased confidence over the past three years that the new era of medicine marked by targeted therapies against rare, orphan diseases and cancers, enabled by genetic identification and characterization, represents one of the most significant investment opportunities of a lifetime. Nevertheless, we recognize that Healthcare investments are inherently risky for reasons ranging from adverse events to the FDA approval process—the Fund’s Healthcare holdings are very diversified and the relative risk of any single holding is diligently monitored and controlled.

The combined Industrials names (Auto and Transportation, Durables and Materials) contributed positively to Fund performance during the fiscal year, even as we increased investments significantly. Outside of the dominant performance of Healthcare issues, contributions were varied but equally significant. Facebook was a top 5 issue in terms of absolute gains and turned in the second best relative contribution during the period. LinkedIn, a long term holding, was top 10 in absolute gains and top 5 in relative contribution. Other impressive absolute and/or relative contributors included: Tesla Motors, Boston Beer, Hanesbrands, Delta, and CaeserStone. Delta, Tesla, Priceline and Manhattan Associates were the only four non-Healthcare issues in the “top ten” list at the end of the fiscal year. The fiscal year was unique for the lack of takeovers of Fund investments in comparison with the two prior fiscal years when a steady stream of takeovers which benefitted performance. However, in a bit of a paradox, the Fund benefitted from positions in numerous “acquiring” companies whose share prices predominantly rose as acquisitions were driven by accretive and market share enhancing strategies. Names of issues involved in significant transactions included: Hanesbrands, Constellation Brands, Warner Chilcott, Actavis, Valeant Pharmaceuticals, First Financial Holdings, Middleby, Generac Holdings, Westinhouse Air Brake Technologies, Onyx Pharmaceuticals, Endo Health Solutions, and 3D Systems.

In closing we would like to reiterate our investment strategy—we employ fundamental research in a classic approach in order to identify and to invest in leading companies and companies which we expect to be market leaders. We focus upon those companies which are positioned to continually and successfully innovate, to gain market share, to expand in new markets and geographies, and most importantly to sustain competitive advantage and high returns on capital. Brand and patent and first to market advantages are naturally unique advantages which we search to identify—differentiation and barriers to entry are critical attributes. While we recognize that dividend yield and stock repurchases are attractive return opportunities, we prefer to be an owner in a business in which capital can be reinvested at very high and sustainable returns. Companies with pricing power are uniquely interesting, and we favor companies which are “category killers” and true “game changers”. Examples of such winning companies include numerous names which have been held in the Fund on a long term basis.

We appreciate your ongoing confidence in our efforts on behalf of the Opportunity Fund.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

The Tocqueville Opportunity Fund

(Unaudited)

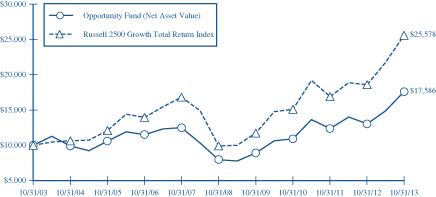

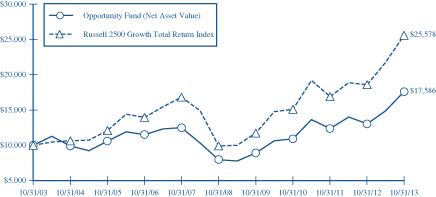

This chart assumes an initial gross investment of $10,000 made on 10/31/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The chart and table primarily reflect The Opportunity Fund’s performance achieved prior to the changed effected in 2010 to its investment strategy.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forcasted growth values. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | 35.09% | | | | 17.27% | | | | 17.16% | | | | 5.81% | |

Russell 2500 Growth Total Return Index | | | 37.60% | | | | 19.24% | | | | 20.87% | | | | 9.85% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the fiscal year ended October 31, 2013, the Tocqueville International Value Fund’s total U.S. dollar return was 27.75%. In the same period, the Morgan Stanley EAFE Index, the index against which we are most often compared, had a net total U.S. dollar gain of 27.40%. For the 10 year period ended October 31, 2013, the Tocqueville International Value Fund’s total U.S. dollar return was 133.58%. In the same period, the Morgan Stanley EAFE Index had a net total U.S. dollar return of 119.88%.

During the fiscal year, global equity markets advanced, driven by expansionary monetary policy and low interest rates, an improving global growth picture and a further improvement in investor perception regarding systemic risk. At the outset of the year, China’s once in a decade political transition passed without major disruption and Japan’s new government implemented policies designed to promote growth and weaken the Yen, a positive for corporate profits. By midyear, European policy makers began to move away from their insistence on fiscal austerity and toward a more growth oriented approach. Meanwhile, the U.S. Fed maintained its accommodative stance. Toward the end of the period, investors began to believe in the possibility of a synchronized global expansion. Among equity sectors, gains were led by financials, real estate, transportation, industrial products, media, paper, and auto related shares, while mining and oil & gas shares performed poorly.

The Fund had substantial gains in Italian auto parts maker Sogefi, French logistics-focused holding company Bollore, Japanese industrial automation and test equipment concern Omron, German truck parts producer SAF-Holland, French construction materials producer and distributor Saint-Gobain, Japanese tire maker Bridgestone, French broadcast television concern M6-Metropole, Japanese industrial conglomerate Hitachi, and Swiss drug maker Novartis. The Fund also had significant profits in Hong Kong financial and real estate conglomerate Guoco Group, subject of a going private offer by its controlling shareholder. The Fund had losses in the shares of mining companies IAMGold and Newmont Mining in connection with the decline in the price of gold. Relative to the EAFE Index, the Fund’s results were enhanced by the strong performance of our industrial and information technology shares, as well as our large exposure in those areas. This positive effect was partially offset by the low exposure to financials, a sector that performed very well again this year, the mining shares discussed above, and our cash reserve, which we maintain in order to capitalize on opportunities created by any unforeseen negative macro events.

From a portfolio standpoint, the major change that occurred during the year was a shift in exposure away from Japan and towards developed Europe, as we harvested positions in Japan and added to our European holdings when sentiment toward the region was negative around midyear.

During the period, the Fund exited its positions in Japanese companies Bridgestone, power tool maker Makita, office equipment and camera maker Canon, and chemical maker Asahi Kasei, as they approached our estimates of intrinsic value. The Fund also exited UK auto parts retailer Halfords, UK based telecom services provider Vodafone, French media conglomerate Vivendi Universal, and Swiss food company Nestle, for reasons of valuation.

During the year, the Fund took new positions in UK retailer Tesco, which is cash generative, rich in real estate, and where a new returns-oriented management team is in the process of divesting underperforming assets; in Japanese household products company Kao, a market leader with a substantial business in growth markets in Asia, that trades a single digit multiple of cash flow and a deep discount to its global peers; in UK emergency home repair insurer Homeserve, a cash generative business with operational challenges which we deem temporary; in Telecom Italia, which is depressed due to investor concerns about growth in its home market and generates a high teens percentage free cash flow yield and has the potential for a corporate event that would be value enhancing; in Dutch mail and logistics company TNT Express, when the price collapsed after a proposed acquisition by UPS was scuttled by anti-trust authorities, enabling us to pick up shares at a substantial discount to intrinsic value; in Norwegian chemical logistics company Stolt-Nielsen, where we believe we purchased the shares for less than the value of the liquids storage terminal and tank containers businesses, giving us a free option on a recovery in the tanker business; in global oil services concern Schlumberger, which was trading at a multi-year low multiple of cash flow due to misplaced investor concerns about demand for its

services; and in Dutch specialty textile and functional materials maker Ten Cate, which was out of favor due to its exposure to government spending on military defense and was trading a substantial discount to intrinsic value based on normalized cash flow margins. The Fund also added to positions in Infineon, Hitachi, Hoya, Akzo Nobel, Nexans, Freeport McMoran, Orkla, and Groupe Bruxelles Lambert.

With interest rates at multi-year lows, and aggressive monetary policy being pursued throughout the developed world, investors are taking on more risk. As the market becomes more complacent, we become more concerned about potential risks, including continued risk of volatility in the Middle East, growing tensions between China and Japan, the sustainability of historically high corporate profit margins, and the unknowable consequences of unprecedented expansionary monetary policy, to name a few. As evidenced above in the discussion of new positions, in Europe, we continue to find the most attractive opportunities in economically sensitive companies, and in “special situations”, where managements are creating shareholder value via restructuring and other means of self-improvement. In Japan, we continue to seek and find opportunities in companies that have good assets and management teams focused on improving corporate profitability and capital allocation from a relatively weak starting point. As we have noted, the poor performance of emerging markets during the last several quarters has brought them back into our research focus, and we expect the U.S. move toward tapering will create interesting opportunities for the Fund.

To protect and grow your capital, we continue to seek out companies that have defensible business franchises, pricing power, limited financial leverage and the ability to return cash to shareholders, and which trade at a discount to intrinsic value based on future cash flows in a conservative economic growth scenario.

Respectfully,

James Hunt

Portfolio Manager

The Tocqueville International Value Fund

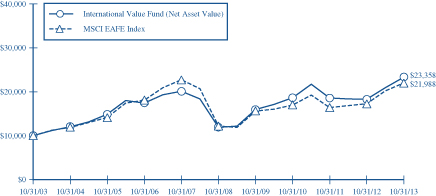

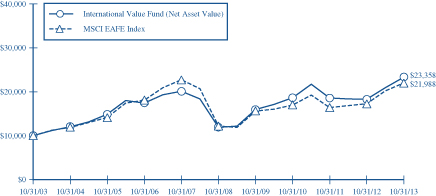

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The MSCI EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 21 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville International Value Fund | | | 27.75% | | | | 7.75% | | | | 14.42% | | | | 8.85% | |

MSCI EAFE Index | | | 27.40% | | | | 8.88% | | | | 12.52% | | | | 8.20% | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

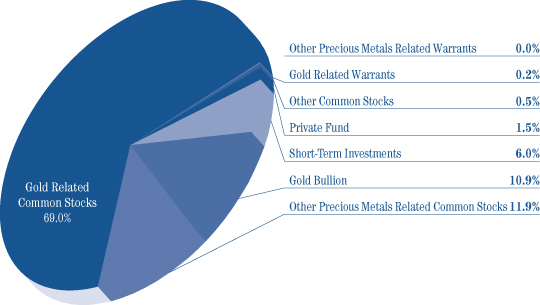

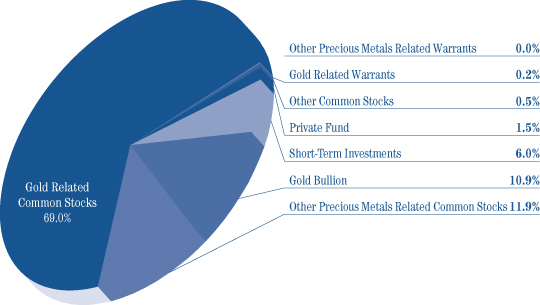

During the past fiscal year, the Tocqueville Gold Fund declined 46.44% compared to a decline of 23% for gold bullion and 48.34% for the Philadelphia Stock Exchange Gold/Silver Index (“XAU”), our benchmark index. The top three listed contributors to the Fund’s performance over this period included Tahoe Resources Inc., Alamos Gold Inc. and Franco-Nevada Corporation which depreciated by 5.8%, 17.8% and 20.7%, respectively. The bottom three performers were Banro Corporation, Sunward Resources Ltd. and International Tower Hill Mines Ltd. which declined by 82.2%, 80.1% and 78.6%, respectively.

The disappointing performance of gold and gold shares at a time when the macroeconomic fundamentals for gold, as we understand them, continued to strengthen is incongruous. The correction from the price peak of $1,921/oz in 2011 is now into its second year. Sentiment gauges and valuation benchmarks that we rely on continue to suggest that initiating or adding to a gold investment strategy both makes sense, and that the current entry point is low risk.

We do not think the Fed will be able to exit its policy of extreme monetary ease without causing considerable collateral damage in the equity and bond markets. Our view is obviously not shared by the investment consensus. It seems to us that in order to avoid adverse financial market consequences, the policy of quantitative easing will continue indefinitely and risk serious inflation. We have discussed this view in several of our quarterly commentaries over the past year. The decline in the price of gold does not, in our opinion, invalidate the investment premise for gold, which is that it will be difficult if not impossible for policy makers to avoid monetary debasement, whether inflation or some other form.

We believe that the incongruity between gold’s price behavior and compelling fundamentals is explained by physical flows of bullion. It has become apparent over the past year that there has been a significant drain of physical gold from depositories in the Western World to China, India, and other Asian destinations. Imports of gold into China over the past two years by themselves account for nearly all of the global mine production. The story is similar for India, where despite government attempts to discourage gold imports through higher import duties, flows remain strong.

The business of mining gold is either attractive or unattractive based on one’s expectation and eventual outcome for the gold price. Since we continue to expect higher gold prices in the future, we believe that investing in gold mining companies with quality assets, in attractive political jurisdictions, and with competent management teams offers the optimal exposure to that expectation. Since mining companies are leveraged to the gold price, their shares tend to rise or fall to a greater extent than the price of the metal itself. Since the launching of the Tocqueville Gold Fund in 1998, this strategy has served us well and we expect it to continue to do so.

There has been wholesale turnover in the executive ranks of the gold mining industry over the past year, in large part due to investor disenchantment. The result, we believe, will be greater attention by new management groups to cost containment, restrictions on capital expenditures, and greater inclination to increase dividend payouts. Over the intermediate term, it seems likely that the pipeline of new gold mining projects will dwindle and that future gold supply will be constrained and quite possibly decline.

Our research team continues to stay on top of specific company developments. We believe that our current holdings position the Fund quite favorably to upside movements in the gold price while protecting downside based on strong financials, quality assets, and good management. We appreciate your support over the past year and look forward to responding to any questions or comments that you may have.

Sincerely,

| | |

| |  |

| John C. Hathaway | | Douglas B. Groh |

| Portfolio Manager | | Portfolio Manager |

The Tocqueville Gold Fund

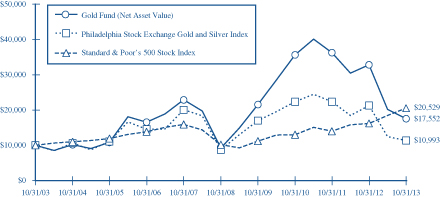

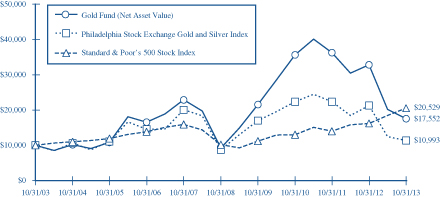

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2006, 2009, and 2010 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund | | | -46.44% | | | | -20.98% | | | | 13.91% | | | | 5.79% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -48.34% | | | | -21.03% | | | | 4.68% | | | | 0.95% | |

Standard & Poor’s 500 Stock Index | | | 27.18% | | | | 16.56% | | | | 15.17% | | | | 7.46% | |

The Delafield Fund

Dear Fellow Shareholder,

With the re-election of President Obama in early November 2012, the fiscal year began with at least the certainty of who would lead the U.S. for the next four years as well as the prospect that our partisan government could amicably resolve the various issues which we were facing. Unfortunately, we were quickly brought back to reality with the fiscal cliff debacle, which was not resolved until the very last moment (and even then only partially), with neither party able to claim an advantage and the reputation of both further tarnished by dysfunction. Political stalemate remained a theme through the balance of the fiscal year, with disagreements on managing our deficit, the fiscal budget, inflation and the debt ceiling dominating headlines and causing a two week government shutdown late in the fiscal year. Despite these conditions, which no doubt have stunted corporate hiring and spending, our economy continued to show modest improvement through the fiscal year. The U.S. housing market and consumer net worth exhibited substantial progress, and more recently, American manufacturing has experienced the start of a renaissance, aided in large part by historically low domestic natural gas prices. The international picture remained similarly mixed for much of the year. Growth in China slowed considerably earlier in the year, but continues to be robust in comparison to the rest of the world, while Europe experienced another banking crisis this past spring, this time in Cyprus, but generally appears stable now.

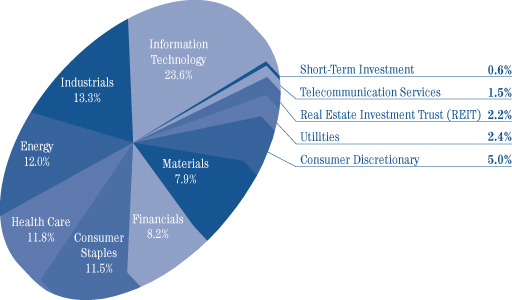

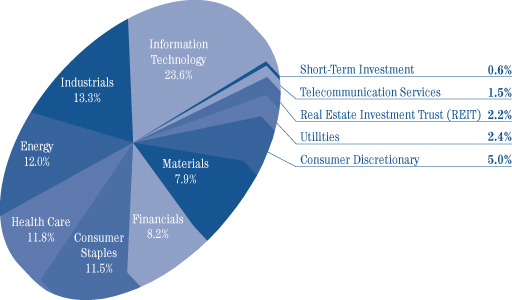

While we would have expected this backdrop to make for an unsettled outlook and cautious investment environment, domestic equity markets were blissfully unaware and rallied for virtually the entire fiscal year. For the twelve months ended October 31, 2013, the Standard & Poor’s 500 Index (“S&P 500”) increased 27.18%, while the Russell 2000 Index (“Russell 2000”) posted a 36.28% increase, both on a total return basis. During the same twelve months, the Delafield Fund’s (the “Fund”) net asset value increased 32.07% to $37.13 per share with dividends reinvested. The net asset value amounted to $1,759,341,275, of which 84.2% was invested in equities, and the balance held in cash and equivalents and fixed income securities. Overall, we were satisfied with the Fund’s progress during the fiscal year, though our performance was tempered by the size of our reserves. That said, we were and still are content to use the cash as a hedge against volatility in the near term and ultimately, we will employ these cash reserves to seize upon attractive and appropriately priced investment opportunities as we uncover them.

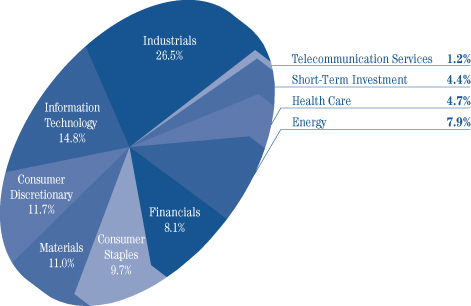

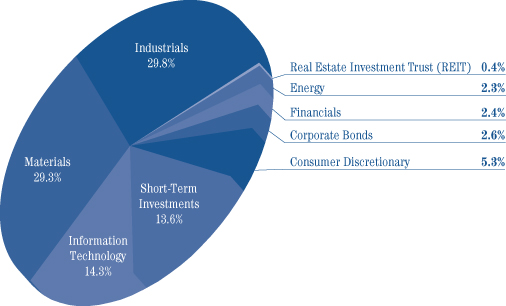

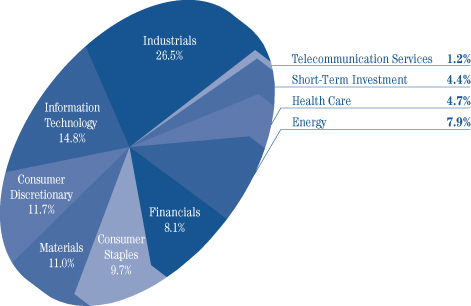

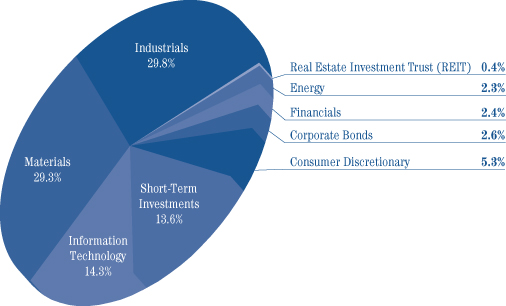

The Fund was heavily weighted towards the industrials and materials sectors during the year, as the inherent cyclicality of the companies in these areas presented a number of investment opportunities for us. On an absolute basis, holdings in these sectors contributed favorably to the Fund’s performance for the fiscal year. Relative to the more comparable Russell 2000, the Fund’s materials stocks were particularly strong, contributing about 300 basis points of relative outperformance, while in contrast, the Fund’s industrials names modestly underperformed. The Fund’s investments in the information technology sector also generated strong returns.

Dover Corporation was the largest contributor to the Fund’s performance during the year, with the shares showing steady gains on strong earnings and the announced spin-off of its mobile consumer electronics and specialty components businesses. Sealed Air Corporation was the next largest contributor during the fiscal year, benefiting from favorable senior management appointments and stabilized earnings trends. In contrast, Acco Brands Corp. and Molycorp, Inc. were the largest detractors, with the former continuing to experience earnings pressure, while the latter experienced startup delays at its Mountain Pass mine and was forced to raise capital to cover cost overruns.

In closing, we remain steadfast in our bottom-up investment philosophy and continue to believe that the portfolio is composed of companies where managements are taking actions to position their businesses for the long term. Over time, we expect that the market will accurately reflect the true value of these businesses and our focus remains on employing our long-standing strategy to protect your capital and to enhance its growth.

Sincerely,

| | |

| |  |

| |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

The Delafield Fund

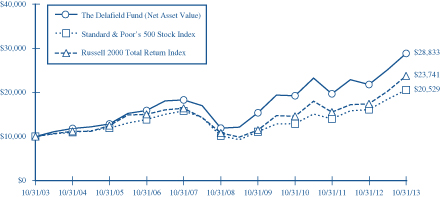

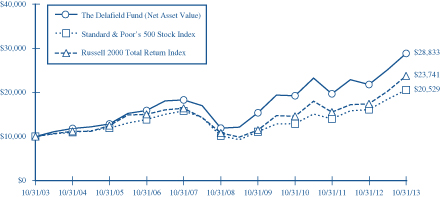

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/03. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | 32.07% | | | | 14.38% | | | | 19.39% | | | | 11.17% | |

Standard & Poor’s 500 Stock Index | | | 27.18% | | | | 16.56% | | | | 15.17% | | | | 7.46% | |

Russell 2000 Total Return Index | | | 36.28% | | | | 17.69% | | | | 17.04% | | | | 9.03% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

With the re-election of President Obama in early November 2012, the fiscal year began with at least the certainty of who would lead the U.S. for the next four years as well as the prospect that our partisan government could amicably resolve the various issues which we were facing. Unfortunately, we were quickly brought back to reality with the fiscal cliff debacle, which was not resolved until the very last moment (and even then only partially), with neither party able to claim an advantage and the reputation of both further tarnished by dysfunction. Political stalemate remained a theme through the balance of the fiscal year, with disagreements on managing our deficit, the fiscal budget, inflation and the debt ceiling dominating headlines and causing a two week government shutdown late in the fiscal year. Despite these conditions, which no doubt have stunted corporate hiring and spending, our economy continued to show modest improvement through the fiscal year. The U.S. housing market and consumer net worth exhibited substantial progress, and more recently, American manufacturing has experienced the start of a renaissance, aided in large part by historically low domestic natural gas prices. The international picture remained similarly mixed for much of the year. Growth in China slowed considerably earlier in the year, but continues to be robust in comparison to the rest of the world, while Europe experienced another banking crisis this past spring, this time in Cyprus, but generally appears stable now.

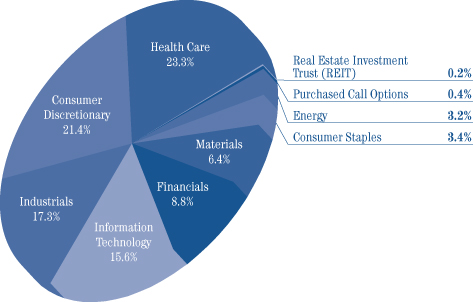

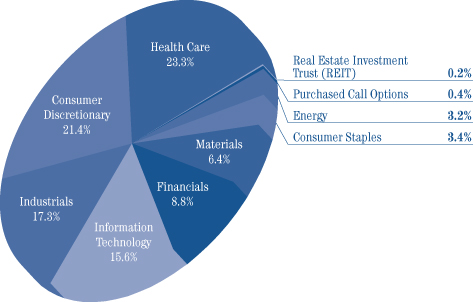

While we would have expected this backdrop to make for an unsettled outlook and cautious investment environment, domestic equity markets were blissfully unaware and rallied for virtually the entire fiscal year. For the twelve months ended October 31, 2013, the Russell 2500 Index (“Russell 2500”) increased 35.41%, while the Russell 2000 Index (“Russell 2000”) posted a 36.28% increase, both on a total return basis. During the same twelve months, the Tocqueville Select Fund’s (the “Fund”) net asset value increased 43.15% to $15.57 per share with dividends reinvested. The net asset value amounted to $99,887,608, of which 84.3% was invested in equities and the balance held in cash reserves.

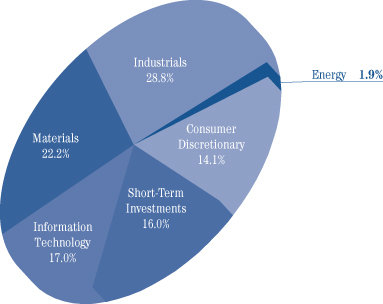

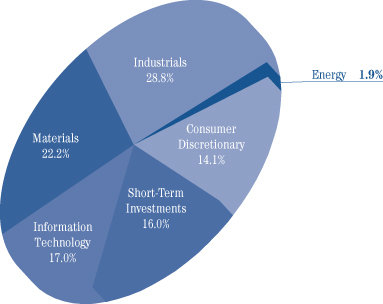

Stock selection was favorable to the Fund’s performance this year. Among the four sectors that comprised most of our equities exposure, our holdings in the information technology, consumer discretionary and materials areas all contributed strongly to both the Fund’s absolute and relative performance while the Fund’s positions in the industrials names generated a solid return, but underperformed the comparable Russell 2500 sector performance. While sector allocation is a by-product of our bottom-up investment style, we should also note that we had no exposure to either the financials or health care sectors during the year, which together represented about 34% of the Russell 2500. In the case of financials, this was beneficial to the Fund’s relative performance, while it was a negative with respect to the health care space, which was among the strongest performing sectors during the year. While we were satisfied with the Fund’s progress during the year, our sizeable cash position did temper our performance somewhat, though we were and still are content to use the cash as a hedge against volatility in the near term and ultimately, as dry powder for attractive investment opportunities as we uncover them. With respect to individual stocks, Universal Electronics, Stantec Inc. and Monotype Imaging Holdings were the largest positive contributor to the portfolio’s performance. In contrast, Acco Brands Corp. and Xerium Technologies Inc. were the largest detractors to our performance during period.

| | | | |

Sincerely, | | | | |

| |  | |  |

| J. Dennis Delafield | | Vincent Sellecchia | | Donald Wang |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

The Tocqueville Select Fund

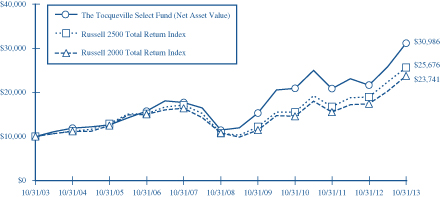

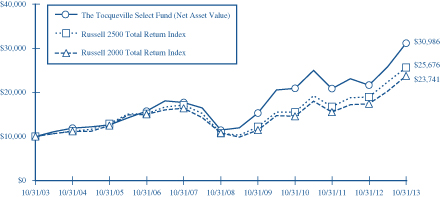

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/03. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2013 the performance of The Tocqueville Select Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Russel 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | 43.15% | | | | 14.02% | | | | 21.93% | | | | 11.97% | |

Russell 2500 Total Return Index | | | 35.41% | | | | 18.21% | | | | 19.04% | | | | 9.89% | |

Russell 2000 Total Return Index | | | 36.28% | | | | 17.69% | | | | 17.04% | | | | 9.03% | |

Expense Example—October 31, 2013 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2013-October 31, 2013).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

| | | | | | | | | | | | |

| The Tocqueville Fund | | Beginning

Account Value

May 1, 2013 | | | Ending

Account Value

October 31, 2013 | | | Expenses Paid

During Period*

May 1, 2013 -

October 31, 2013 | |

Actual | | $ | 1,000.00 | | | $ | 1,138.00 | | | $ | 6.74 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| | | |

| The Tocqueville Opportunity Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,185.40 | | | $ | 7.16 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.65 | | | | 6.61 | |

| | | |

| The Tocqueville International Value Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | �� | $ | 1,114.40 | | | $ | 6.66 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| | | |

| The Tocqueville Gold Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 869.60 | | | $ | 6.55 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.20 | | | | 7.07 | |

| | | |

| The Delafield Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,146.00 | | | $ | 6.55 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,019.11 | | | | 6.16 | |

| | | |

| The Tocqueville Select Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,199.50 | | | $ | 7.32 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.55 | | | | 6.72 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including extraordinary expenses) of 1.25%, 1.30%, 1.25%, 1.39%, 1.21% and 1.32% for The Tocqueville Fund, Opportunity Fund, International Value Fund, Gold Fund, Delafield Fund, and Select Fund, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of year | | $ | 24.11 | | | $ | 22.23 | | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.40 | | | | 0.40 | | | | 0.23 | | | | 0.32 | | | | 0.28 | |

Net realized and unrealized gain | | | 6.51 | | | | 1.81 | | | | 0.80 | | | | 2.97 | | | | 2.09 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 6.91 | | | | 2.21 | | | | 1.03 | | | | 3.29 | | | | 2.37 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.35 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.35 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 6.56 | | | | 1.88 | | | | 0.70 | | | | 3.06 | | | | 2.08 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 30.67 | | | $ | 24.11 | | | $ | 22.23 | | | $ | 21.53 | | | $ | 18.47 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.01 | |

Total Return | | | 29.0 | % | | | 10.1 | % | | | 4.8 | % | | | 18.0 | % | | | 14.8 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 348,269 | | | $ | 366,025 | | | $ | 491,541 | | | $ | 489,670 | | | $ | 383,470 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.28 | % | | | 1.29 | % | | | 1.26 | % | | | 1.26 | % | | | 1.33 | % |

Expenses after waiver/reimbursement | | | 1.26 | %(3) | | | 1.26 | %(3) | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Net investment income before waiver/reimbursement | | | 1.33 | % | | | 1.30 | % | | | 0.97 | % | | | 1.65 | % | | | 1.60 | % |

Net investment income after waiver/reimbursement | | | 1.35 | % | | | 1.33 | % | | | 0.98 | % | | | 1.66 | % | | | 1.68 | % |

Portfolio turnover rate | | | 16 | % | | | 17 | % | | | 28 | % | | | 23 | % | | | 32 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of year | | $ | 15.76 | | | $ | 14.96 | | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.13 | ) | | | (0.11 | ) | | | (0.13 | ) | | | (0.12 | ) | | | (0.11 | ) |

Net realized and unrealized gain | | | 5.66 | | | | 0.91 | | | | 1.89 | | | | 2.54 | | | | 1.23 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 5.53 | | | | 0.80 | | | | 1.76 | | | | 2.42 | | | | 1.12 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | — | | | | — | | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 5.53 | | | | 0.80 | | | | 1.76 | | | | 2.42 | | | | 1.01 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 21.29 | | | $ | 15.76 | | | $ | 14.96 | | | $ | 13.20 | | | $ | 10.78 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.00 | (2) |

Total Return | | | 35.1 | % | | | 5.4 | % | | | 13.3 | % | | | 22.6 | % | | | 11.7 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 80,609 | | | $ | 65,455 | | | $ | 46,963 | | | $ | 32,863 | | | $ | 30,498 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.30 | % | | | 1.32 | % | | | 1.36 | % | | | 1.41 | % | | | 1.41 | % |

Net investment loss | | | (0.64 | )% | | | (0.76 | )% | | | (1.04 | )% | | | (1.08 | )% | | | (0.97 | )% |

Portfolio turnover rate | | | 100 | % | | | 77 | % | | | 110 | % | | | 104 | % | | | 62 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of year | | $ | 11.68 | | | $ | 12.00 | | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.24 | | | | 0.17 | | | | 0.11 | | | | 0.11 | | | | 0.10 | |

Net realized and unrealized gain (loss) | | | 2.97 | | | | (0.37 | ) | | | (0.16 | ) | | | 1.65 | | | | 2.59 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 3.21 | | | | (0.20 | ) | | | (0.05 | ) | | | 1.76 | | | | 2.69 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.18 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.12 | ) | | | (0.20 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.50 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.18 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.12 | ) | | | (0.70 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 3.03 | | | | (0.32 | ) | | | (0.12 | ) | | | 1.64 | | | | 1.99 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 14.71 | | | $ | 11.68 | | | $ | 12.00 | | | $ | 12.12 | | | $ | 10.48 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.01 | | | $ | 0.00 | (2) | | $ | 0.00 | (2) |

Total Return | | | 27.8 | % | | | (1.6 | )% | | | (0.5 | )% | | | 17.0 | % | | | 34.0 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 262,981 | | | $ | 218,793 | | | $ | 199,848 | | | $ | 150,103 | | | $ | 131,613 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.55 | % | | | 1.56 | % | | | 1.56 | % | | | 1.56 | % | | | 1.62 | % |

Expenses after waiver/reimbursement | | | 1.30 | %(3) | | | 1.56 | % | | | 1.56 | % | | | 1.56 | % | | | 1.62 | % |

Net investment income before waiver/reimbursement | | | 1.55 | % | | | 1.53 | % | | | 0.99 | % | | | 1.03 | % | | | 0.96 | % |

Net investment income after waiver/reimbursement | | | 1.80 | % | | | 1.53 | % | | | 0.99 | % | | | 1.03 | % | | | 0.96 | % |

Portfolio turnover rate | | | 37 | % | | | 38 | % | | | 30 | % | | | 27 | % | | | 27 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on January 1, 2013. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of year | | $ | 72.82 | | | $ | 81.97 | | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.26 | ) | | | (0.35 | ) | | | (0.67 | ) | | | (0.58 | ) | | | (0.45 | ) |

Net realized and unrealized gain (loss) | | | (32.93 | ) | | | (7.47 | ) | | | 2.25 | | | | 32.96 | | | | 29.28 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | (33.19 | ) | | | (7.82 | ) | | | 1.58 | | | | 32.38 | | | | 28.83 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (1.62 | ) | | | (1.33 | ) | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.62 | ) | | | (1.33 | ) | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (34.81 | ) | | | (9.15 | ) | | | (0.03 | ) | | | 32.29 | | | | 27.94 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 38.01 | | | $ | 72.82 | | | $ | 81.97 | | | $ | 82.00 | | | $ | 49.71 | |

| | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.10 | | | $ | 0.06 | | | $ | 0.03 | |

Total Return | | | (46.4 | )% | | | (9.5 | )% | | | 1.8 | % | | | 65.2 | % | | | 135.2 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 1,215,081 | | | $ | 2,445,913 | | | $ | 2,647,078 | | | $ | 2,199,603 | | | $ | 937,492 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.34 | % | | | 1.28 | % | | | 1.25 | % | | | 1.34 | % | | | 1.50 | % |

Net investment loss | | | (0.41 | )% | | | (0.56 | )% | | | (0.86 | )% | | | (1.11 | )% | | | (1.25 | )% |

Portfolio turnover rate | | | 14 | % | | | 11 | % | | | 3 | % | | | 9 | % | | | 9 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the period) | | Years Ended October 31, | | | January 1,

2009

through

October 31,

2009 | | | Year Ended

December 31,

2008 | |

| | 2013 | | | 2012 | | | 2011 | | | 2010 | | | |

Net asset value, beginning of period | | $ | 29.79 | | | $ | 27.21 | | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | | | $ | 24.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | (0.05 | ) | | | (0.04 | ) | | | (0.08 | ) | | | (0.00 | )(2) | | | 0.03 | | | | 0.07 | |

Net realized and unrealized gain | | | 9.19 | | | | 2.99 | | | | 0.64 | | | | 5.32 | | | | 6.25 | | | | (9.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 9.14 | | | | 2.95 | | | | 0.56 | | | | 5.32 | | | | 6.28 | | | | (9.16 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.03 | ) | | | (0.07 | ) |

Distributions from net realized gains | | | (1.80 | ) | | | (0.37 | ) | | | — | | | | — | | | | — | | | | (0.00 | )(2) |

Return of capital | | | — | | | | — | | | | — | | | | (0.02 | ) | | | (0.00 | )(2) | | | (0.00 | )(2) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.80 | ) | | | (0.37 | ) | | | — | | | | (0.02 | ) | | | (0.03 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 7.34 | | | | 2.58 | | | | 0.56 | | | | 5.30 | | | | 6.25 | | | | (9.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 37.13 | | | $ | 29.79 | | | $ | 27.21 | | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.00 | (2) | | $ | 0.00 | (2) | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.00 | (2) |

Total Return | | | 32.1 | % | | | 11.0 | % | | | 2.1 | % | | | 25.0 | % | | | 41.6 | %(3) | | | (37.6 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,759,341 | | | $ | 1,346,273 | | | $ | 1,262,876 | | | $ | 933,674 | | | $ | 636,548 | | | $ | 404,860 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.21 | % | | | 1.23 | % | | | 1.23 | % | | | 1.27 | % | | | 1.38 | %(4) | | | 1.40 | % |

Expenses after waiver/reimbursement | | | 1.21 | % | | | 1.23 | % | | | 1.23 | % | | | 1.27 | % | | | 1.38 | %(4) | | | 1.34 | % |

Net investment income (loss) before waiver/reimbursement | | | (0.15 | )% | | | (0.13 | )% | | | (0.30 | )% | | | (0.02 | )% | | | 0.21 | %(4) | | | 0.29 | % |

Net investment income (loss) after waiver/reimbursement | | | (0.15 | )% | | | (0.13 | )% | | | (0.30 | )% | | | (0.02 | )% | | | 0.21 | %(4) | | | 0.35 | % |

Portfolio turnover rate | | | 34 | % | | | 49 | % | | | 38 | % | | | 30 | % | | | 46 | %(3) | | | 81 | % |

| (1) | Net investment income (loss) per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the period) | | Years Ended October 31, | | | January 1,

2009

through

October 31,

2009 | | | Period from

September 28,

2008(2)

through

December 31,

2008 | |

| | 2013 | | | 2012 | | | 2011 | | | 2010 | | | |

Net asset value, beginning of period | | $ | 11.35 | | | $ | 11.06 | | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | | | $ | 8.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | (0.06 | ) | | | (0.04 | ) | | | (0.07 | ) | | | (0.03 | ) | | | (0.00 | )(4) | | | 0.01 | |

Net realized and unrealized gain | | | 4.79 | | | | 0.44 | | | | 0.12 | | | | 3.12 | | | | 2.70 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 4.73 | | | | 0.40 | | | | 0.05 | | | | 3.09 | | | | 2.70 | | | | (2.96 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.00 | )(4) | | | (0.01 | ) |

Distributions from net realized gains | | | (0.51 | ) | | | (0.11 | ) | | | (0.53 | ) | | | — | | | | — | | | | — | |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.51 | ) | | | (0.11 | ) | | | (0.53 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 4.22 | | | | 0.29 | | | | (0.48 | ) | | | 3.08 | | | | 2.69 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 15.57 | | | $ | 11.35 | | | $ | 11.06 | | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | $ | 0.00 | (3) | | $ | 0.00 | (3) | | $ | 0.01 | | | $ | 0.01 | | | $ | — | | | $ | — | |

Total Return | | | 43.2 | % | | | 3.7 | % | | | (0.1 | )% | | | 36.6 | % | | | 46.7 | %(4) | | | (33.9 | )%(4) |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 99,888 | | | $ | 84,549 | | | $ | 71,554 | | | $ | 41,788 | | | $ | 24,681 | | | $ | 9,226 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.34 | % | | | 1.37 | % | | | 1.36 | % | | | 1.38 | % | | | 2.03 | %(5) | | | 3.47 | %(5) |

Expenses after waiver/reimbursement | | | 1.34 | % | | | 1.37 | % | | | 1.36 | % | | | 1.38 | % | | | 1.26 | %(5) | | | 1.15 | %(5) |

Net investment income (loss) before waiver/reimbursement | | | (0.39 | )% | | | (0.36 | )% | | | (0.67 | )% | | | (0.43 | )% | | | (0.93 | )%(5) | | | (2.03 | )%(5) |

Net investment income (loss) after waiver/reimbursement | | | (0.39 | )% | | | (0.36 | )% | | | (0.67 | )% | | | (0.43 | )% | | | (0.16 | )%(5) | | | 0.29 | %(5) |

Portfolio turnover rate | | | 28 | % | | | 31 | % | | | 28 | % | | | 40 | % | | | 24 | %(4) | | | 29 | %(4) |

| (1) | Net investment income (loss) per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (3) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2013

| | | | | | | | |

| Common Stocks—96.6% | | Shares | | | Value | |

Automobiles & Components—2.0% | | | | | |

Ford Motor Co. | | | 400,000 | | | $ | 6,844,000 | |

Banks—1.6% | | | | | | | | |

M&T Bank Corp. | | | 20,000 | | | | 2,250,600 | |

Mitsubishi UFJ Financial Group, Inc.—ADR | | | 500,000 | | | | 3,200,000 | |

| | | | | | | | 5,450,600 | |

Capital Goods—6.8% | | | | | | | | |

General Electric Co. | | | 500,000 | | | | 13,070,000 | |

Illinois Tool Works, Inc. | | | 50,000 | | | | 3,939,500 | |

The Boeing Co. | | | 50,000 | | | | 6,525,000 | |

| | | | | | | | 23,534,500 | |

Commercial & Professional Services—2.9% | | | | | |

Pitney Bowes, Inc. | | | 250,000 | | | | 5,335,000 | |

Steelcase, Inc. | | | 300,000 | | | | 4,917,000 | |

| | | | | | | | 10,252,000 | |

Consumer Services—1.5% | | | | | | | | |

DeVry Education Group, Inc. | | | 150,000 | | | | 5,385,000 | |

Diversified Financials—3.4% | | | | | | | | |

Lazard Ltd.(a) | | | 100,000 | | | | 3,865,000 | |

The Bank of New York Mellon Corp. | | | 250,000 | | | | 7,950,000 | |

| | | | | | | | 11,815,000 | |

Energy—11.9% | | | | | |

Cameco Corp.(a) | | | 200,000 | | | | 3,800,000 | |

Chesapeake Energy Corp. | | | 200,000 | | | | 5,592,000 | |

Energen Corp. | | | 100,000 | | | | 7,832,000 | |

Exxon Mobil Corp. | | | 100,000 | | | | 8,962,000 | |

Murphy Oil Corp. | | | 100,000 | | | | 6,032,000 | |

Schlumberger Ltd.(a) | | | 100,000 | | | | 9,372,000 | |

| | | | | | | | 41,590,000 | |

Food & Staples Retailing—2.2% | | | | | |

Wal-Mart Stores, Inc. | | | 100,000 | | | | 7,675,000 | |

Food, Beverage & Tobacco—5.0% | | | | | |

Campbell Soup Co. | | | 125,000 | | | | 5,321,250 | |

PepsiCo, Inc. | | | 50,000 | | | | 4,204,500 | |

The Coca-Cola Co. | | | 200,000 | | | | 7,914,000 | |

| | | | | | | | 17,439,750 | |

Household & Personal Products—4.2% | | | | | |

Colgate-Palmolive Co. | | | 100,000 | | | | 6,473,000 | |

The Procter & Gamble Co. | | | 100,000 | | | | 8,075,000 | |

| | | | | | | | 14,548,000 | |

Insurance—3.2% | | | | | |

Aflac, Inc. | | | 100,000 | | | | 6,498,000 | |

XL Group PLC(a) | | | 150,000 | | | | 4,585,500 | |

| | | | | | | | 11,083,500 | |

Materials—7.8% | | | | | | | | |

BHP Billiton Ltd.—ADR | | | 75,000 | | | | 5,301,750 | |

EI du Pont de Nemours & Co. | | | 150,000 | | | | 9,180,000 | |

Goldcorp, Inc.(a) | | | 265,000 | | | | 6,738,950 | |

Sonoco Products Co. | | | 150,000 | | | | 6,096,000 | |

| | | | | | | | 27,316,700 | |

Pharmaceuticals, Biotechnology & Life Sciences—11.8% | |

Alkermes PLC(a)(b) | | | 200,000 | | | | 7,038,000 | |

Allergan, Inc. | | | 40,000 | | | | 3,624,400 | |

Isis Pharmaceuticals, Inc.(b) | | | 200,000 | | | | 6,654,000 | |

Johnson & Johnson | | | 100,000 | | | | 9,261,000 | |

Merck & Co., Inc. | | | 150,000 | | | | 6,763,500 | |

Pfizer, Inc. | | | 250,000 | | | | 7,670,000 | |

| | | | | | | | 41,010,900 | |

Retailing—1.4% | | | | | | | | |

Lowe’s Companies, Inc. | | | 100,000 | | | | 4,978,000 | |

Semiconductors & Semiconductor Equipment—4.9% | |