UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt, President

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

212-698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2011

Item 1. Report to Stockholders.

ANNUAL REPORT

October 31, 2011

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Dear Fellow Shareholder,

The most striking aspect of the world stock markets’ behavior in the last couple of years is that they have held up so well in the face of almost unprecedented financial volatility and widespread predictions of “the end of the world as we know it.”

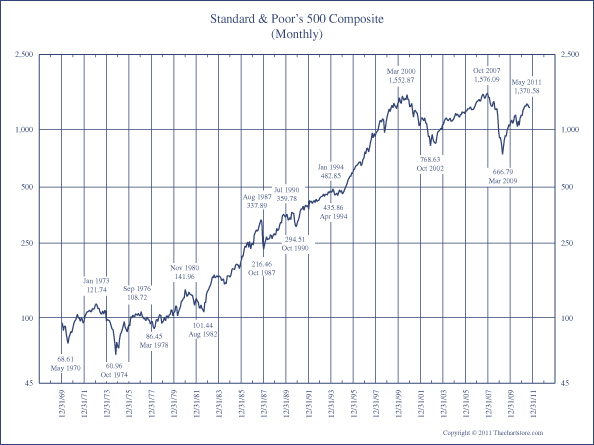

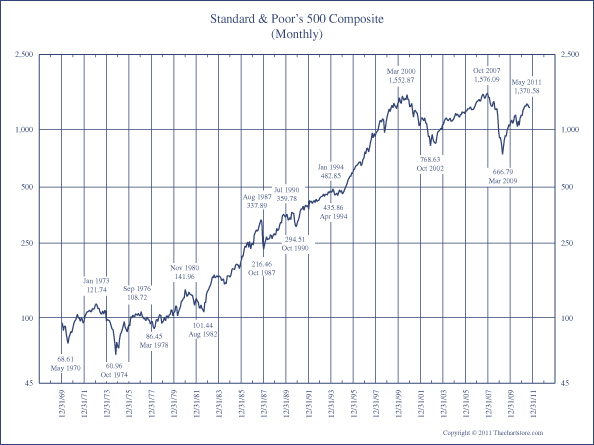

Between 1982 and 1999, a long bull market in stocks had allowed the S&P 500 Index, for example, to multiply by a factor of 15 in 17 years. This spectacular advance was only interrupted by the stock market crash of 1987 and the recession induced by the Kuwait-Iraq war of 1990 – two events that, however important, now look almost insignificant on a long-term chart such as the one above.

That long stock-market advance, reinforced by monetary policies that seemed to suppress the risk of investing, naturally led to speculative excesses, such as the technology and Internet bubble that peaked in early 2000, and the housing and subprime lending frenzy, which peaked in 2007. Both of these bubbles, once pierced, deflated violently and with worldwide consequences.

Yet, despite the traders’ increasingly volatile response to economic and political developments such as the apparently intractable problems of many sovereign debtors, the potential breakdown of the Euro, and the recent downgrading of the credit rating of the United States, the markets generally remain closer to their peaks of 2000 and 2007 than to their bottoms of 2002 and 2009.

Today, some of the more dire predictions for the financial system remain a possibility. But the main difference from three years ago is that they are largely incorporated into the expectations of investors and economic participants, whereas then, they came as a shock to a fairly complacent world.

Another difference has to do with valuations. As measured by price/earnings ratios, for example, stocks had reached record-high valuations at the peak of the high-tech/Internet bubble in early 2000. In 2007 they still were around sixteen.

Currently, most indices are selling at valuations that are much closer to their historical averages. This may not be low enough to qualify as the prelude to a major, secular bull market globally, but it leaves some room for positive investment returns over the next decade. In the case of a number of individual securities, sectors, or even countries, single-digit price/earnings ratios already discount an unexciting future and may be in a position to react very positively to the first inkling of good news.

In our modern media-governed world, we tend to overlook the real news that hides behind the obvious headlines. Currently, amid daily announcements of near-sovereign defaults, credit-rating downgrades, and apparently intractable systemic faults, the real debate has started on the fundamental economic and financial contradictions of the system we have lived under for six decades and more. The arguments remain far apart, and real progress may have to await the passage of elections in some major countries. But the debate, after being carefully avoided by successive governments and assemblies, is now taking shape. That is the real news behind the headlines.

In other words, the long period of adjustment that normally follows major financial crises is unfolding slowly but, one could say, more or less normally.

Respectfully,

François Sicart

Chairman

The Tocqueville Fund

Dear Fellow Shareholder,

The fiscal year ended October 31, 2011, was a volatile and difficult one for markets, investors, and shareholders of mutual funds. It was also a difficult year for investment managers, particularly for bottom-up stock pickers like Tocqueville. Big macroeconomic issues dominated the news and the markets, rendering careful security analysis and value discipline relatively moot. We do not believe this trend will continue indefinitely, but while it lasts, volatility and unprecedented correlation will continue to be center stage, while fundamental research will be waiting in the wings.

Although we fully expect that careful stock selection and in-depth research will reassert their importance in the investment process in the months and years ahead, we do not discount the enormous macro challenges the Western economies face. The welfare state as we have come to know it has been living on borrowed time and borrowed money for decades, and both the time and the money are getting short. The demographic shift of the baby boomers from payers for to consumers of the entitlement programs established by the Western democracies, long predicted but long ignored, is upon us. The first baby boomers, born in 1946, turned 65 in 2011, reaching the threshold age for some of the more-expensive entitlement programs. Wave after wave of new eligible recipients will flood these programs in the years ahead, even as the pool of workers available to pay for the programs shrinks or stagnates. This is not a problem that can be solved by higher levels of taxation, though surely that will be tried. The well-publicized problems of Greece and, indeed, the entire Eurozone, are but a manifestation of this dynamic.

For some time we have been both expecting and dreading these developments, the eventual denouement of which, we believe, will be much higher levels of inflation coupled with correspondingly higher bond yields, as governments are forced to print money to honor their obligations. The higher yields demanded by fixed-income investors will have a devastating effect on over-leveraged governments, particularly our own, which has benefited for so many years from depressed rates, and the foolish decision to fund long-term debts with short-term paper.

In times even as difficult and transformational as these, we remain optimistic about the prospects of well-chosen corporate equities. Indeed, equities strike us as one of the few asset classes, and the only really large one, that may protect investors from the ravages of a resurgent inflation and a deflating sovereign-debt market. Well-positioned companies, with solid finances and significant market shares, should be able to navigate these difficult times and prosper from them as weaker and more leveraged competitors struggle. Our research effort continues to be focused on finding companies that fit our criteria of quality, financial integrity, sound management, and good value. These troubled and transitional times have created a lot of values, and shares of many good-quality companies are out of favor and inexpensive. We own a fair number of them in our portfolio. For instance, AFLAC, an insurer, is out of favor and trading well below our target price because of concerns related to its exposure to European sovereign debt and lingering problems from the earthquake in Japan, where it does the majority of its business. Weyerhaeuser, a timber REIT, is trading below its intrinsic value due to lingering weakness in the U.S. housing market, despite its attractive yield and natural position as a long-term inflation hedge. Another example is Microsoft. It is unappreciated because of what we view as the misperception that it is a lumbering giant, out of step with industry trends toward cloud computing and tablet devices. In fact, it is highly cash generative, with what we believe to be a better competitive position than most realize and with several new products in the pipeline, as well as a propensity for returning cash to shareholders through both ordinary and special dividends.

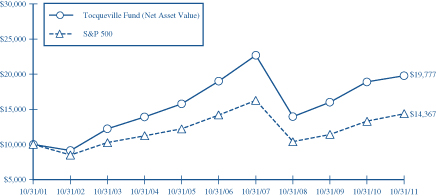

Performance of the Tocqueville Fund for fiscal 2011 was a tepid 4.77%. This compares with 8.09% for the S&P 500 Index. While we are hardly thrilled with these results, neither are we overly disappointed. In tempestuous times like these, it is extremely important to avoid taking on large risks in order to seek outsized returns. (The recent collapse of MF Global, run by former New Jersey Senator and Governor Jon Corzine, is a case in point.) It is far more important to keep capital intact while waiting for the storm clouds to blow over. If temporary and modest underperformance in pursuit of risk control is the result, so be it.

As one of the largest individual shareholders of the Tocqueville Fund, as well as its portfolio manager, let me take this opportunity to thank you for your continued support of the fund and our efforts to preserve and grow your capital.

Respectfully,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

(Unaudited)

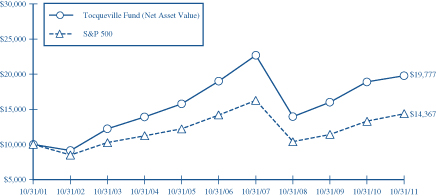

This chart assumes an initial gross investment of $10,000 made on 10/31/01. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville Fund | | | 4.77% | | | | 12.36% | | | | 0.84% | | | | 7.06% | |

Standard & Poor’s 500 Stock Index | | | 8.09% | | | | 11.41% | | | | 0.25% | | | | 3.69% | |

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

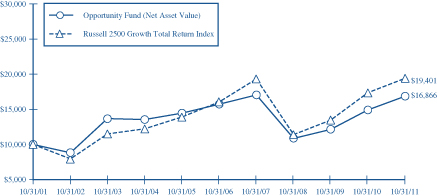

We are pleased to provide this review of the Tocqueville Opportunity Fund’s investment performance and strategy for the fiscal year ended October 31, 2011. On October 12, 2010, the Fund’s name was changed to the Opportunity Fund (formerly the Small Cap Value Fund), and our new investment strategy became effective. During the fiscal year, Fund performance was +13.33%, which outperformed the Russell 2500 Growth Index and the Russell 2000 Index, which increased 11.91% and 6.71% respectively.

The Fund’s investment strategy is focused primarily on small and mid-capitalization issues that may fall within classifications of either growth or value stocks. The portfolio approach does not restrict the Fund from investing in large-capitalization issues, and the Fund has maintained holdings in certain issues as market capitalizations have risen above the SMID capitalization range at the time of initial purchase. Investment selection is driven by analysis of the persistency and level of growth rates, valuation, stability, and capital returns on investment. Our efforts to identify and remain invested in companies include meeting and speaking with the corporate management. Although the Fund’s holdings are predominantly invested in issues that have demonstrated steady and superior growth in earnings, we have also invested in numerous cyclical and economy-sensitive issues, including holdings in the energy, industrial, and material sectors. The investment selection criteria are geared to identify investments under a valuation discipline that we deem “growth at a reasonable price,” not “growth at any price.” While the selection approach is tilted toward historical growth and valuation parameters, the Fund holds, and will continue to invest in, new issues and certain industries where operating histories are short and the business model is not yet fully developed – our investments in certain Internet and healthcare issues fall into this realm.

The Fund seeks to invest for strategic purposes in companies that are positioned to gain market share in expanding industries and markets. We seek to identify companies on the cusp of innovation that can introduce new products and services, or approaches that can revolutionize business processes and consumer models of behavior. Standards that are critical to our evaluation of companies include the following:

| | • | | A differentiated and disruptive technology or solution, product, or service; |

| | • | | An innovative R&D platform; |

| | • | | A leadership position in a growth market; |

| | • | | A strong reinvestment rate in a high return on capital business; |

| | • | | Strong barriers to competition and an identifiable competitive advantage; |

| | • | | High inside ownership and a dedicated, visionary management. |

Over the past fiscal year, the Fund has significantly increased its diversification. We believe that diversification has provided two substantial benefits: 1) reduced risk to competitive threats or operating risks for any single issue; and 2) a disciplined method to initiate investments in new, emerging investment opportunities, which can be increased if there is evidence of success. We deem such investments as pawns in the game of chess, where a surviving pawn may advance from the weakest to the most powerful piece on the chessboard. “Pawns” represent a significant investment strategy of the Fund. Generally they have averaged less than 0.50% position weights in the Fund; but over the past fiscal year, the Fund has nearly doubled its commitment to investments in pawns to more than one-third of the Fund. The Fund’s investments in IPOs and recent issues generally fall within the “pawn” classification. In addition to providing diversification and investment benefits, pawns also have increased the Fund’s exposure to merger-and-acquisition activity. Over the past fiscal year, fourteen of the Fund’s holdings were taken over; all were originally pawns.

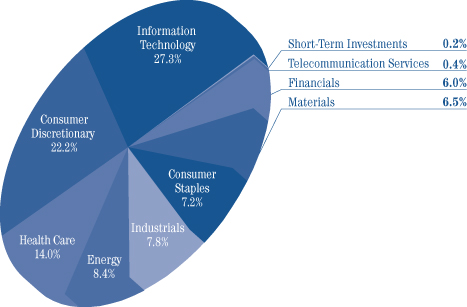

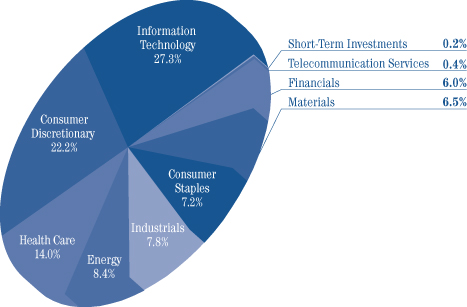

The technology, consumer discretionary, staples, and healthcare sectors constituted the Fund’s predominant investments at the fiscal year’s end: 22.3%, 24.8%, 6.1%, and 14.2% respectively. Over the past year the most significant increases in sector commitments were to the materials (+7.0%) and technology (+4.5%) sectors; and we reduced investment in the healthcare (-5.5%) sector. Although the energy sector weighting was reduced on an overall basis (-2.5%), the Fund had four takeovers of energy holdings: Brigham Exploration, Complete Production Services, Pride International, and Petrohawk Energy. While the level of commitment to the sector was reduced, we expanded the number

of issues in the sector by nearly 50 percent. Overall performance attribution during the year was led by investments in the consumer discretionary, staples, and energy sectors. Investments and an initial overweighting in the healthcare sector impacted performance most negatively.

Strong investment performance attribution was generated by a number of issues that nearly doubled during the period, including Deckers Outdoor, Herbalife, Alexion Pharmaceuticals, and Tempur-Pedic International. The Fund’s leading contributors were Tractor Supply, Lululemon Athletica, and TIBCO Software. Several investments in the healthcare sector proved disappointing and negatively impacted the Fund. Human Genomes Sciences and Dendreon both won FDA approvals of significant new therapies in lupus and prostate cancer, respectively, but subsequent product revenues missed expectations. The Fund also suffered a hit from an investment in a biotechnology company with a promising drug in cystic fibrosis that failed to meet a primary endpoint of efficacy. The company was later bought by Merck.

The past fiscal year has proven to be a very unsettled period during which business and investor confidence has been undermined. The Japan tsunami, the Arab Spring, and dysfunctional politics in Washington and Europe have pressured valuations and capital flows in global equity markets. Overarching issues of economic uncertainty and political inertia have worn down investor sentiment – policy uncertainty and its ensuing destructive economic yoke have been unanticipated and downright unimaginable. Against an eroded, unpredictable macroeconomic background, however, a majority of our company investments have consistently managed to exceed both revenue and earnings expectations on a quarterly basis. We cannot forecast global-policy outcomes with confidence, but we can invest in and monitor the performance of companies experiencing rapid growth even as the headline news is disconcerting.

Moreover, our confidence in the bright outlook for many of our companies has been boosted by a slew of “Merger Mondays” where investments in the Fund have been taken over! These events provide confirmation of our investment approach, and support the competitive advantage and significant undervaluation of companies in which we have invested. Unlike many of today’s in-and-out traders, corporate buyers are seizing the opportunity to establish a strategic and long-term advantage. Sideways, back-and-forth, and volatile daily price moves are evidence of anxious markets, but have provided frequent opportunities for the Fund to accumulate and increase its investments in the best-positioned companies at discounts to our future expected values for such investments. We remain optimistic that this period of uncertainty will pass and equity-market valuations will normalize, and we believe that investors who maintain longer-term investment horizons will be well rewarded for their perseverance and constancy.

As portfolio manager of the Tocqueville Opportunity Fund, I appreciate your confidence in our ongoing efforts and I look forward to the coming year.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

The Tocqueville Opportunity Fund

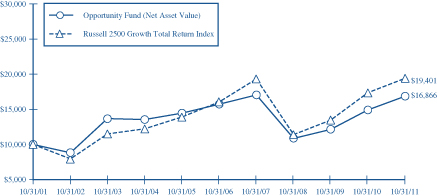

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/01. On July 1, 2010, a new portfolio management team assumed management of The Tocqueville Small Cap Fund and the Fund’s name and investment strategy changed as of October 12, 2010 (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forcasted growth values. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville Opportunity Fund | | | 13.33% | | | | 15.76% | | | | 1.43% | | | | 5.37% | |

Russell 2500 Growth Total Return Index | | | 11.91% | | | | 19.43% | | | | 3.88% | | | | 6.85% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

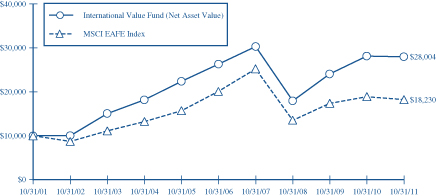

For the fiscal year ended October 31, 2011, the Tocqueville International Value Fund’s total U.S. dollar return was a loss of 0.47%. In the same period, the Morgan Stanley EAFE Index, the index against which we are most often compared, had a total U.S. dollar loss of 3.64%. For the 10-year period ended October 31, 2011, the Fund’s total U.S. dollar cumulative return was 180.06%. In the same period, the Morgan Stanley EAFE Index had a total U.S. dollar cumulative return of 82.31%.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-697-3863. The Fund imposes a 2% redemption fee on shares held less than 90 days. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

During the first half of the 2011 fiscal year, global equity markets generally advanced in spite of geopolitical turmoil in the Middle East, fiscal problems in southern Europe, and natural disaster in Japan. Developed markets in the U.S., Europe, and Japan rose as corporate earnings continued to improve, interest rates remained low, and liquidity was abundant. Equity markets declined during the second half of the year, and sharply during the third quarter, as investors marked down valuations to reflect reduced economic growth expectations and the macroeconomic risks associated with the sovereign-debt crisis in Europe, the deficit problem in the U.S., and the seeming inability of governments to respond decisively and effectively to either.

Over the course of the fiscal year, on a total-return basis, the European BE 500 Index declined by 6.53% in local-currency terms, the Japanese Nikkei 225 Index declined by 0.44% in local-currency terms, and the MSCI Asia Pacific ex Japan Index declined by 8.83%. The Euro declined slightly against the U.S. dollar as shaky bank and sovereign finances undercut confidence in the currency, while the Japanese Yen strengthened slightly. Elsewhere, the currencies of commodity producers like Australia and Norway and perceived safe havens, like Switzerland and Uruguay, increased against the U.S. dollar, while currencies of indebted nations in Eastern Europe and elsewhere flagged.

The CRB RIND Index of commodities followed the movement of economic growth expectations and equity markets during the course of the year, finishing modestly higher. Gold continued its ascent as money-printing undercut the credibility of paper currencies and tepid economic performance in developed economies raised the specter of competitive devaluations. In equities, the greatest gains were experienced in commodity-dependent frontier markets like Mongolia and distressed emerging markets like Venezuela and Pakistan. In terms of sectors, gainers included traditionally defensive sectors like tobacco products, healthcare, and food, as well as computer software, while financials, steel, transportation, and leisure shares experienced substantial losses.

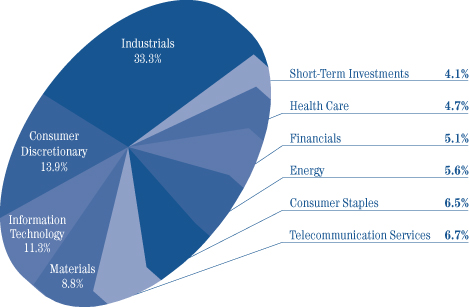

Our Fund produced a small loss during the fiscal year, which in light of our focus on positive absolute returns represents a disappointing outcome. We did, however, finish well ahead of the Fund’s benchmark and managed to avoid a meaningful loss. This was largely due to security selection in the areas of consumer staples, industrials, technology, and materials, as well as a low exposure to financials and companies with significant financial leverage. Standout contributors to profits during the year included UK managed-services concern Interserve, Japanese tire maker Bridgestone, Dutch consumer-products company Unilever, Mexican beverage producer FEMSA, supplementary-insurance provider Aflac, Japanese conglomerate Hitachi, Hong Kong electric utility Power Assets Holdings, and Belgian chemical producer Solvay. Our losses were concentrated in economically sensitive shares in Europe, which declined late in the year in the context of rising concerns about sovereign debt. These included Spain-based global hotel group Melia Holdings, French industrial-cable producer Nexans, German steel distributor Kloeckner, German truck-component maker SAF-Holland, and German compact-equipment maker Wacker Neuson. Losses in German shares were magnified by the fact that Germany is one of the few markets in Europe where short-selling is allowed, making it the preferred market for hedge funds making negative bets.

Our baseline view going into the 2011 fiscal year was that the global economy would continue along a path of uneven recovery, with developed markets working against the tide of deleveraging and emerging economies helping at the margin. We believed there was bound to be a soft patch during 2011, with several emerging economies having raised interest rates in late 2010 to combat inflation and stimulus packages in the U.S. and elsewhere coming to an end. But the lack of decisive and effective government response to the sovereign-debt issue in Europe, coupled with the fiscal debate

in the U.S., produced uncertainty. This in turn caused businesses and consumers to slow their spending, intensifying the slowdown in Europe and impeding a recovery in the U.S.

Currently it would appear that Europe is working its way toward a solution that will stave off a disorderly dissolution of the Eurozone, but not one that will encourage growth. And with an election year in the U.S., good economic decision-making will remain hostage to politics. In short, we do not expect much of an economic tailwind from the developed Western economies during the coming year. On the other hand, several emerging markets like China and Brazil that had raised rates last year have become more accommodative and growth-focused, with inflation apparently subdued.

During the fiscal year we exited our positions in Hong Kong electric utility Power Assets, Belgian chemical producer Solvay, Dutch animal-feed concern Nutreco, Belgian wire-cord producer Bekaert, French water utility Veolia Environnement, Brazilian iron-ore producer Vale, and global oil-services provider Schlumberger, as they reached our valuation objectives. We sold Telekom Indonesia, where our investment thesis was undercut by a change in competitive conditions that produced pricing and margin pressures; and Brazilian producer Petrobras, whose massive capital-expenditure plans could cause the company to consume cash for the foreseeable future. Our contrarian approach led us to look for ideas in discrete areas of the global economy that were out of favor at times during the year. In the wake of the tsunami in Japan, we capitalized on the market decline by adding to several existing positions there, including Takata, Hitachi, Bridgestone, Makita, and Canon. We responded to the sharp sell-off in Europe in late summer by focusing our research efforts on identifying economically sensitive businesses whose valuations were attractive, even assuming a recessionary economic scenario. As a result, we took a position in Akzo Nobel, a leading global producer of chemicals for paint and coatings, that has consistently earned returns in excess of its cost of capital over the last decade and was trading at a low multiple of free cash flow.

We also sought out companies whose shares had declined in sympathy with the decline in European bank shares, but that were not subject to the same balance-sheet risks. As a result, we took a position in Japanese supplemental-insurance provider Aflac, which had declined due to its relatively small exposure to European sovereign debt in its bond portfolio and was trading at a modest multiple of earnings.

During the fiscal year we also took new positions in Spanish information-technology concern Indra Systems, which was depressed due to concerns about its government contracts but had a high free cash-flow yield and growth opportunities in Latin America; in French pharmaceutical concern Ipsen, which traded at a discount to the net present value of cash flows from its existing portfolio of drugs and gave no value to its pipeline of new products; in Australian facilities-management and food-services concern Spotless Group, which has a strong market position, attractive cash-flow characteristics, and is restructuring certain underperforming assets to improve financial performance; in Belgian telecom services provider Mobistar, which has a double-digit free cash-flow yield and would represent an accretive acquisition for controlling shareholder France Telecom; in French wire and cable producer Nexans, which has implemented a meaningful cost-reduction program to enhance margins; in Japanese optics maker Hoya, a net cash company with leading positions in niche electronics markets and a growing healthcare business; and in Halfords, a UK auto retail/repair-shop chain, which generates ample free cash flow and strong returns on capital despite cyclically depressed consumer confidence.

With macro considerations dominating investor psychology over the last half year, market and security price movements have been highly correlated. We expect that as volatility subsides the importance of security selection will reassert itself.

We continue to employ our investment discipline, seeking to discover fundamentally attractive companies that are out of favor and undervalued, and to provide our shareholders with above-average returns with below-average risk over the course of an economic cycle.

Respectfully,

|

|

|

|

James Hunt |

| Portfolio Manager |

The Tocqueville International Value Fund

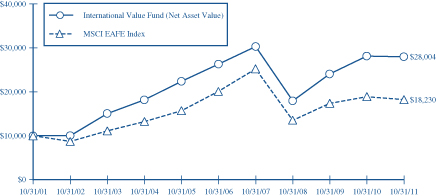

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/01. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The MSCI EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 20 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville International Value Fund | | | -0.47% | | | | 15.99% | | | | 1.26% | | | | 10.85% | |

MSCI EAFE Index | | | -3.64% | | | | 10.42% | | | | -1.95% | | | | 6.19% | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

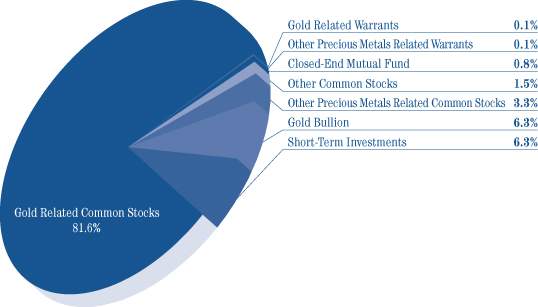

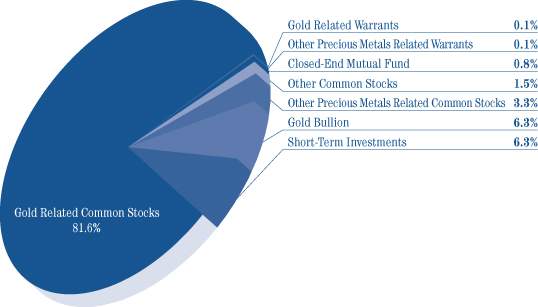

During fiscal 2011 ending October 31, the Tocqueville Gold Fund returned 1.84%, compared to -0.05% for the PHLX Gold/Silver Sector Index (XAU) and 8.09% for the S&P 500 Index. The price of gold rose 26.15% during the period. The Fund’s position in physical gold is 6.3% of its net assets; the balance is in shares of companies whose principal business is gold production, mine development, or exploration. The Fund also holds equities of silver-mining companies.

Events over the past fiscal year have served as a tumultuous setting for gold’s record advance to slightly above $1900/oz. before settling back to close the Fund’s fiscal year at $1715/oz. Mounting geopolitical tensions in the Mideast and the natural disaster in Japan earlier in the year added yet more reasons to the list of why to own gold, as investors sought the refuge of a safe-haven asset. However, the ongoing financial crises on both sides of the Atlantic underpin gold’s continued prominence as an investment and the rational justification for ownership. In the U.S., failures to raise the debt ceiling and enact reasonable reductions to spending have kept the government on credit watch by the credit agencies. Across the Atlantic, what used to be a problem confined to the PIIGS seems to have spread to the core of the Eurozone.

Most investors expect economic growth to provide some resolution of these problems. However, the prospects for growth are undermined by the contentious political climate. Failing growth, the market seems to hope that another round of quantitative easing will provide the impetus to alleviate global catastrophe. The consequence of such an action would be inflationary, which should continue to drive the bid for gold.

Although gold has continued to perform well in this environment, gold-mining equities have not kept pace with bullion. Relative to mining equities, investment in the metal is straightforward and clear cut. There is no business risk. Investing in the business of mining gold demands more complex and specialized analysis. Given the flight to safety in capital markets, it is not surprising that investors flock first to bullion.

However, given the historically wide divergence in performance between the two, we believe gold-mining equities represent an extraordinary opportunity to participate in the bullish secular trend for gold. Mining shares can provide potential sources of additional return compared to bullion: dividends, addition of further ounces through exploration, and the prospect for accretive M&A. As the market normalizes the advances in the bullion price to some sustainable level, it will come to realize that the sector is producing strong and sustainable free cash flows, thus providing tremendous flexibility for the sector to increase its dividend payout ratios.

The Fund outperformed its benchmark for the fiscal year. The top contributors over this period included physical gold, Scorpio Mining, and Richfield Ventures, which appreciated 26.2%, 137.4%, and 243.7% respectively. Disappointments included Agnico-Eagle Mines, ATAC Resources, and Romarco Minerals, which declined by 43.7%, 46.1%, and 63.2% respectively. Despite the market volatility, we continue to stick by our strategy of investing in promising exploration companies that we see adding value through resource discovery and potentially M&A. During the period, Richfield Ventures was acquired by a producing company looking to bolster its development pipeline. It is merely one example over the years that continues to affirm our investment strategy. However, in recognition of the valuation gap between bullion and equities and the expectation of increased dividends in the sector, we have selectively increased positions of producing companies to the portfolio as well.

We believe that the current environment represents an excellent entry point for those investors who wish to protect capital from the monetary debasement that, in our view, almost certainly lies ahead.

Sincerely,

John C. Hathaway

Portfolio Manager

The Tocqueville Gold Fund

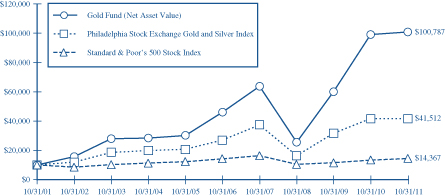

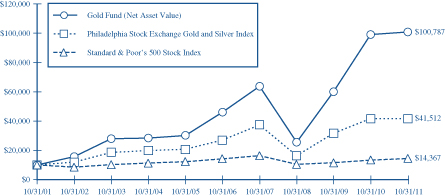

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/01. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2003, 2006, 2009, and 2010 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville Gold Fund | | | 1.84% | | | | 58.18% | | | | 16.99% | | | | 25.99% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -0.05% | | | | 36.72% | | | | 9.03% | | | | 15.29% | |

Standard & Poor’s 500 Stock Index | | | 8.09% | | | | 11.41% | | | | 0.25% | | | | 3.69% | |

The Delafield Fund

Dear Fellow Shareholder,

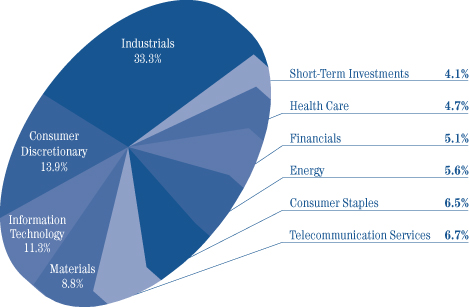

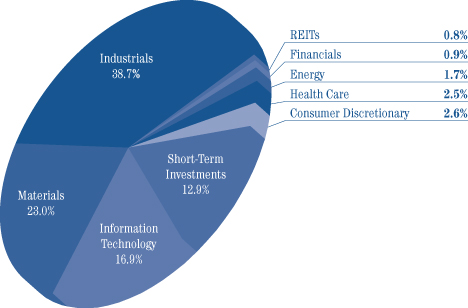

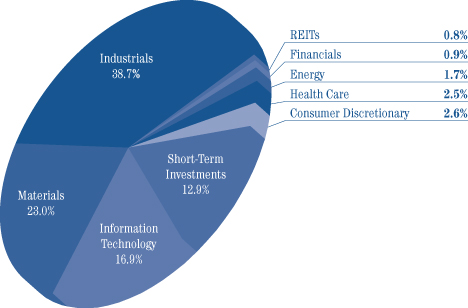

For the 12 months ended October 31, 2011, the Fund’s net asset value increased 2.10%. This compares to an 8.09% increase in the Standard & Poor’s 500 Index (“S&P 500”) and an increase of 6.71% for the more-representative Russell 2000 Index (“Russell 2000”), both on a total-return basis. The Fund’s net asset value as of October 31, 2011, was $27.21 per share. The net asset value amounted to $1,262,875,778, of which 85.49% was invested in equities and the balance held in cash reserves.

The stock market and the Fund began the year with substantial increases driven by investors’ optimistic outlooks for continued global economic recovery. However, while second-quarter market and Fund returns remained solid, both foreign and domestic political and economic environments had already begun to destabilize. This was particularly apparent in the Middle East, where Egyptian President Hosni Mubarak was forced to resign amidst massive and sometimes violent public protests; and in Japan, where a massive earthquake caused a tsunami and a nuclear disaster in the northeast portion of the country. Through the first six months ending April 30, 2011, the Fund was up 20.49% versus total returns of 16.36% and 23.73% for the S&P 500 and Russell 2000, respectively.

In the second half of the fiscal year, a continuous barrage of bad news influenced investors, including stubbornly high unemployment in the U.S., the domestic budget deficit impasse, the still-unresolved sovereign-debt crisis in Europe, and slowing global economic growth, including in China. Additionally, market volatility was enormous during the second half of the year, which also likely contributed to selling pressure. The Fund declined 15.26% during the final six months of the fiscal year, while the S&P 500 lost 7.11% and the Russell 2000 declined 13.76%, both on a total-return basis.

Our performance in this generally challenging and volatile year was disappointing. Some of our largest holdings reported poor results, while others seemed to suffer disproportionately from the market’s volatility. In the second half of the fiscal year, cyclical stocks were especially hard-hit, which impacted the Fund negatively.

El Paso Corporation and Lubrizol Corporation were acquired at substantial premiums during the fiscal year, making them the largest contributors to our performance. Ferro Corporation, Checkpoint Systems, Inc., and Owens-Illinois, Inc. were the largest detractors, negatively impacting our return by more than 900 basis points in total. Ferro was penalized for its exposure to the solar industry and European end markets. Checkpoint’s earnings results were weak and its exposure to retail end markets was a negative, and shares in Owens-Illinois fell sharply on the heels of disappointing earnings and outlook.

We cannot forecast near-term market movements with any degree of certainty. Indeed, the market continues to experience unpredictable daily fluctuations, with fear and uncertainty driving stocks down one day, followed by optimistic and opportunistic buying the next. Therefore, we remain focused on what we do control, which is the strategy we employ to protect your capital and to enhance its growth. While this fiscal year has been a frustrating one, our approach has resulted in above-average returns for many years. We will seek to provide attractive returns in the years ahead by continuing to employ this logical approach:

1. We search for companies that we believe are selling at prices that seem modest in relationship to the company’s intrinsic value.

2. We meet with management, visit plants, talk to the company’s competitors, consider the makeup of the board of directors, and make a judgment as to whether we wish to be in business with the management. In other words, we try to understand the business of the companies in which we invest and the individuals who direct each company’s future.

3. We search for companies in which something may change that will alter that company’s future for the better. This can range from a change in the management or management’s attitude toward how they run the business, to a change in control, to a change in business opportunity, to a change in the dynamics of a company’s cash flow and its use.

4. If we perform our analysis correctly, the value-added we bring to you is an earlier and better understanding of the companies in our portfolio than that possessed by other investors. Then, if the companies begin to improve, their earnings should increase and they should be valued at a higher price-earnings multiple.

5. We have never worried about the profits that we did not make. We worry much more about what we might lose. We believe that stock selection is much more relevant to successful investing than total commitment to equities. In the volatile markets that have developed over the last 15 to 20 years, we have come to believe that the long-term investor’s best hedge against volatility is to have cash with which to invest in companies when prices seem unduly depressed.

We have lived through such extraordinary declining markets in the past. Our experience has been that such intense selling usually leads to attractive investment opportunities and, once the panic subsides, to significant gains. In fact, our focus on special-situations investments uncovered a number of opportunities in more cyclical stocks during the second half of the fiscal period, and we began to use excess cash to take advantage of the market dislocation by adding new names to the portfolio and buying more of our favorite holdings.

We are pleased with the current positioning of the portfolio. In general, our investments have solid balance sheets, strong free cash-flow generation, and excellent management teams; and we believe that they are well positioned to prosper and increase in value over time.

Sincerely,

| | |

| |  |

| |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

The Delafield Fund

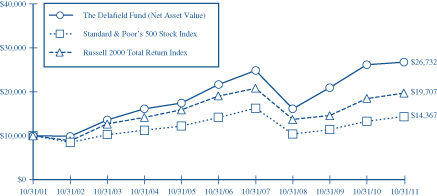

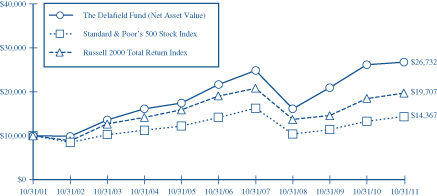

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/01. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee wiaviers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | 2.10% | | | | 18.28% | | | | 4.31% | | | | 10.33% | |

Standard & Poor’s 500 Stock Index | | | 8.09% | | | | 11.41% | | | | 0.25% | | | | 3.69% | |

Russell 2000 Total Return Index | | | 6.71% | | | | 12.87% | | | | 0.68% | | | | 7.02% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

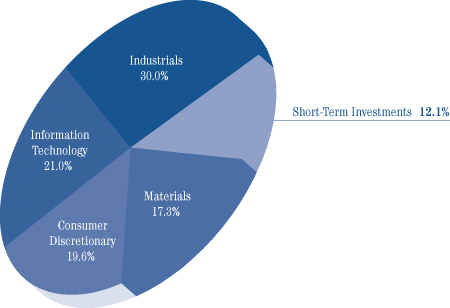

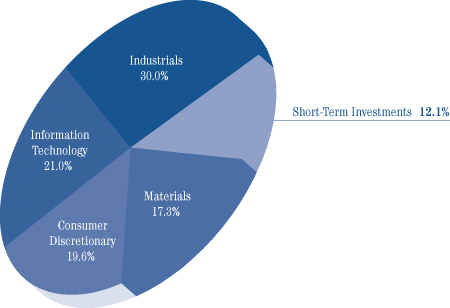

For the 12 months ended October 31, 2011, the Fund’s net asset value decreased 0.10% versus an increase of 7.97% for the Russell 2500 Index (“Russell 2500”) and 6.71% for the Russell 2000 Index (“Russell 2000”), each on a total-return basis. The Fund’s net asset value as of October 31, 2011, was $11.06 per share. The net asset value amounted to $71,553,741, of which 87.81% was invested in equities and the balance held in cash reserve.

The stock market and the Fund began the year with substantial increases driven by investors’ optimistic outlooks for continued global economic recovery. However, while second-quarter market and Fund returns remained solid, both foreign and domestic political and economic environments had already begun to destabilize. This was particularly apparent in the Middle East, where Egyptian President Hosni Mubarak was forced to resign amidst massive and sometimes violent public protests, and in Japan, where a massive earthquake caused a tsunami and a nuclear disaster in the northeast portion of the country. Through the first six months ending April 30, 2011, the Fund was up 19.69% versus total returns of 23.71% and 23.73% for the Russell 2500 and Russell 2000, respectively.

In the second half of the fiscal year, a continuous barrage of bad news influenced investors, including stubbornly high unemployment in the U.S., the domestic budget deficit impasse, the still-unresolved sovereign-debt crisis in Europe, and slowing global economic growth, including in China. Additionally, market volatility was enormous during the second half of the year, which also likely contributed to selling pressure. The Fund declined 16.53% during the final six months of the fiscal year, while the Russell 2500 lost 12.72% and the Russell 2000 declined 13.76%, both on a total-return basis.

Monotype Imaging Holdings returned more than 32% during the fiscal year as investors drove the shares higher on strong earnings; it was the largest positive contributor to performance. In contrast, our Checkpoint Systems, Inc. and Ferro Corporation holdings suffered substantial declines and were the largest detractors. Checkpoint’s results were weak and its exposure to retail end markets was a negative, while Ferro was penalized for its exposure to the solar industry and European end markets.

We cannot forecast near-term market movements with any degree of certainty. Indeed, the market continues to experience unpredictable daily fluctuations, with fear and uncertainty driving stocks down one day, followed by optimistic and opportunistic buying the next. Therefore, we remain focused on what we do control, which is the strategy we employ to protect your capital and to enhance its growth. While this fiscal year has been a frustrating one, our approach has resulted in above-average returns for many years. We will seek to provide attractive returns in the years ahead by continuing to employ this logical approach:

1. We search for companies that we believe are selling at prices that seem modest in relationship to the company’s intrinsic value.

2. We meet with management, visit plants, talk to the company’s competitors, consider the makeup of the board of directors, and make a judgment as to whether we wish to be in business with the management. In other words, we try to understand the business of the companies in which we invest and the individuals who direct each company’s future.

3. We search for companies in which something may change that will alter that company’s future for the better. This can range from a change in the management or management’s attitude toward how they run the business, to a change in control, to a change in business opportunity, to a change in the dynamics of a company’s cash flow and its use.

4. We will typically invest in a focused group of 25 to 35 common stocks issued primarily by small-to-mid-sized domestic companies.

5. If we perform our analysis correctly, the value-added we bring to you is an earlier and better understanding of the companies in our portfolio than that possessed by other investors. Then, if the companies begin to improve, their earnings should increase and they should be valued at a higher price-earnings multiple.

6. We have never worried about the profits that we did not make. We worry much more about what we might lose. We believe that stock selection is much more relevant to successful investing than total commitment to equities. In the volatile markets that have developed over the last 15 to 20 years, we have come to believe that the long-term investor’s best hedge against volatility is to have cash with which to invest in companies when prices seem unduly depressed.

We have lived through such extraordinary declining markets in the past. Our experience has been that such intense selling usually leads to attractive investment opportunities and, once the panic subsides, to significant gains. We are pleased with the current positioning of the portfolio. In general, our investments have solid balance sheets, strong free cash-flow generation, and excellent management teams; and we believe that they are well positioned to prosper and increase in value over time.

| | | | |

| Sincerely, | | | | |

| | |

| |  | |  |

| | |

| J. Dennis Delafield | | Vincent Sellecchia | | Donald Wang |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 10/31/01. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Russel 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | -0.10% | | | | 22.00% | | | | 5.74% | | | | 11.78% | |

Russell 2500 Total Return Index | | | 7.97% | | | | 16.04% | | | | 2.01% | | | | 8.01% | |

Russell 2000 Total Return Index | | | 6.71% | | | | 12.87% | | | | 0.68% | | | | 7.02% | |

Expense Example—October 31, 2011 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2011-October 31, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

| | | | | | | | | | | | |

The Tocqueville Fund | | Beginning

Account Value

May 1, 2011 | | | Ending

Account Value

October 31, 2011 | | | Expenses Paid

During Period*

May 1, 2011 -

October 31, 2011 | |

Actual | | $ | 1,000.00 | | | $ | 913.30 | | | $ | 6.03 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| | | |

| The Tocqueville Opportunity Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 906.70 | | | $ | 6.68 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.20 | | | | 7.07 | |

| | | |

| The Tocqueville International Value Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 854.70 | | | $ | 7.39 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.24 | | | | 8.03 | |

| | | |

| The Tocqueville Gold Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 904.90 | | | $ | 6.10 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.80 | | | | 6.46 | |

| | | |

| The Delafield Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 847.40 | | | $ | 5.82 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

| | | |

| The Tocqueville Select Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 834.70 | | | $ | 6.43 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.20 | | | | 7.07 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25%, 1.39%, 1.58%, 1.27%, 1.25% and 1.39% for The Tocqueville Fund, Opportunity Fund, International Value Fund, Gold Fund, Delafield Fund, and Select Fund, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Net asset value, beginning of year | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | | | $ | 28.93 | | | $ | 24.25 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.23 | | | | 0.32 | | | | 0.28 | | | | 0.24 | | | | 0.18 | |

Net realized and unrealized gain (loss) | | | 0.80 | | | | 2.97 | | | | 2.09 | | | | (10.56 | ) | | | 4.53 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 1.03 | | | | 3.29 | | | | 2.37 | | | | (10.32 | ) | | | 4.71 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) | | | (0.19 | ) | | | (0.03 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | (2.03 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) | | | (2.22 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 0.70 | | | | 3.06 | | | | 2.08 | | | | (12.54 | ) | | | 4.68 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 22.23 | | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | | | $ | 28.93 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 4.8 | % | | | 18.0 | % | | | 14.8 | % | | | (38.5 | )% | | | 19.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 491,541 | | | $ | 489,670 | | | $ | 383,470 | | | $ | 328,609 | | | $ | 523,878 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.25 | %(2) | | | 1.25 | %(2) | | | 1.25 | %(2) | | | 1.25 | %(2) | | | 1.25 | %(2) |

Net investment income | | | 0.98 | %(2) | | | 1.66 | %(2) | | | 1.68 | %(2) | | | 0.94 | %(2) | | | 0.69 | %(2) |

Portfolio turnover rate | | | 28 | % | | | 23 | % | | | 32 | % | | | 51 | % | | | 39 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.002, $0.002, $0.004, $0.009 and $0.002 per share for the fiscal years ended October 31, 2011, 2010, 2009, 2008 and 2007, respectively. |

| (2) | Net of fees waived amounting to 0.01%, 0.01%, 0.08%, 0.04%, and 0.01% of average net assets for the fiscal years ended October 31, 2011, 2010, 2009, 2008 and 2007, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Net asset value, beginning of year | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | | | $ | 17.24 | | | $ | 18.04 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.13 | ) | | | (0.12 | ) | | | (0.11 | ) | | | 0.02 | | | | 0.11 | |

Net realized and unrealized gain (loss) | | | 1.89 | | | | 2.54 | | | | 1.23 | | | | (5.67 | ) | | | 1.26 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 1.76 | | | | 2.42 | | | | 1.12 | | | | (5.65 | ) | | | 1.37 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.01 | ) | | | (0.12 | ) | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | (0.10 | ) | | | (1.70 | ) | | | (2.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | (0.11 | ) | | | (1.82 | ) | | | (2.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 1.76 | | | | 2.42 | | | | 1.01 | | | | (7.47 | ) | | | (0.80 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 14.96 | | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | | | $ | 17.24 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 13.3 | % | | | 22.6 | % | | | 11.7 | % | | | (36.2 | )% | | | 8.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 46,963 | | | $ | 32,863 | | | $ | 30,498 | | | $ | 36,429 | | | $ | 49,543 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.36 | % | | | 1.41 | % | | | 1.41 | % | | | 1.35 | % | | | 1.32 | % |

Net investment income (loss) | | | (1.04 | )% | | | (1.08 | )% | | | (0.97 | %) | | | 0.12 | % | | | 0.63 | % |

Portfolio turnover rate | | | 110 | % | | | 104 | % | | | 62 | % | | | 169 | % | | | 90 | % |

| (1) | Total from investment operations per share includes redemption fees of less than $0.001 for the fiscal years ended October 31, 2011 and 2010, $0.001, $0.005 and $0.001 for the fiscal years ended October 31, 2009, 2008 and 2007, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Net asset value, beginning of year | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | | | $ | 16.48 | | | $ | 16.72 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.11 | | | | 0.11 | | | | 0.10 | | | | 0.13 | | | | 0.08 | |

Net realized and unrealized gain (loss) | | | (0.16 | ) | | | 1.65 | | | | 2.59 | | | | (6.09 | ) | | | 2.25 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | (0.05 | ) | | | 1.76 | | | | 2.69 | | | �� | (5.96 | ) | | | 2.33 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.07 | ) | | | (0.12 | ) | | | (0.20 | ) | | | (0.10 | ) | | | (0.27 | ) |

Distributions from net realized gains | | | — | | | | — | | | | (0.50 | ) | | | (1.93 | ) | | | (2.30 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.07 | ) | | | (0.12 | ) | | | (0.70 | ) | | | (2.03 | ) | | | (2.57 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (0.12 | ) | | | 1.64 | | | | 1.99 | | | | (7.99 | ) | | | (0.24 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 12.00 | | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | | | $ | 16.48 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | (0.5 | )% | | | 17.0 | % | | | 34.0 | % | | | (40.8 | )% | | | 15.3 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 199,848 | | | $ | 150,103 | | | $ | 131,613 | | | $ | 118,189 | | | $ | 219,220 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.56 | % | | | 1.56 | % | | | 1.62 | % | | | 1.56 | % | | | 1.59 | % |

Net investment income | | | 0.99 | % | | | 1.03 | % | | | 0.96 | % | | | 1.07 | % | | | 0.49 | % |

Portfolio turnover rate | | | 30 | % | | | 27 | % | | | 27 | % | | | 63 | % | | | 49 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.010, $0.002, $0.001, $0.001 and $0.002 per share for the fiscal years ended October 31, 2011, 2010, 2009, 2008 and 2007, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Net asset value, beginning of year | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | | | $ | 64.36 | | | $ | 51.41 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.67 | ) | | | (0.58 | ) | | | (0.45 | ) | | | (0.57 | ) | | | (0.30 | ) |

Net realized and unrealized gain (loss) | | | 2.25 | | | | 32.96 | | | | 29.28 | | | | (33.24 | ) | | | 18.52 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 1.58 | | | | 32.38 | | | | 28.83 | | | | (33.81 | ) | | | 18.22 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | (0.46 | ) | | | (0.22 | ) |

Dividends from net realized gains | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) | | | (8.32 | ) | | | (5.05 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) | | | (8.78 | ) | | | (5.27 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | (0.03 | ) | | | 32.29 | | | | 27.94 | | | | (42.59 | ) | | | 12.95 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 81.97 | | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | | | $ | 64.36 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 1.8 | % | | | 65.2 | % | | | 135.2 | % | | | (60.0 | )% | | | 38.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 2,647,078 | | | $ | 2,199,603 | | | $ | 937,492 | | | $ | 410,857 | | | $ | 1,231,475 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.25 | % | | | 1.34 | % | | | 1.50 | % | | | 1.43 | % | | | 1.42 | % |

Net investment income (loss) | | | (0.86 | )% | | | (1.11 | )% | | | (1.25 | )% | | | (1.07 | )% | | | (0.81 | )% |

Portfolio turnover rate | | | 3 | % | | | 9 | % | | | 9 | % | | | 28 | % | | | 26 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.102, $0.056, $0.025, $0.027 and $0.028 per share for the fiscal years ended October 31, 2011, 2010, 2009, 2008 and 2007, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the period) | | Years Ended

October 31, | | | January 1,

2009

through

October 31, | | | Years Ended December 31, | |

| | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Net asset value, beginning of period | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | | | $ | 24.33 | | | $ | 25.64 | | | $ | 23.63 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.08 | ) | | | (0.00 | )(2) | | | 0.03 | | | | 0.07 | | | | 0.17 | | | | 0.19 | |

Net realized and unrealized gain (loss) | | | 0.64 | | | | 5.32 | | | | 6.25 | | | | (9.23 | ) | | | 1.10 | | | | 4.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 0.56 | | | | 5.32 | | | | 6.28 | | | | (9.16 | ) | | | 1.27 | | | | 4.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.03 | ) | | | (0.07 | ) | | | (0.16 | ) | | | (0.19 | ) |

Dividends from net realized gains | | | — | | | | — | | | | — | | | | (0.00 | )(2) | | | (2.42 | ) | | | (2.63 | ) |

Return of capital | | | — | | | | (0.02 | ) | | | (0.00 | )(2) | | | (0.00 | )(2) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | (0.02 | ) | | | (0.03 | ) | | | (0.07 | ) | | | (2.58 | ) | | | (2.82 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 0.56 | | | | 5.30 | | | | 6.25 | | | | (9.23 | ) | | | (1.31 | ) | | | 2.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 27.21 | | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | | | $ | 24.33 | | | $ | 25.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.1 | % | | | 25.0 | % | | | 41.6 | %(3) | | | (37.6 | )% | | | 4.9 | % | | | 20.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,262,876 | | | $ | 933,674 | | | $ | 636,548 | | | $ | 404,860 | | | $ | 656,999 | | | $ | 532,108 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.23 | % | | | 1.27 | % | | | 1.38 | %(4) | | | 1.34 | %(5) | | | 1.28 | %(5) | | | 1.32 | %(5) |

Net investment income (loss) | | | (0.30 | )% | | | (0.02 | )% | | | 0.21 | %(4) | | | 0.35 | %(5) | | | 0.57 | %(5) | | | 0.82 | %(5) |

Portfolio turnover rate | | | 38 | % | | | 30 | % | | | 46 | %(3) | | | 81 | % | | | 61 | % | | | 72 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.006 per share for the fiscal years ended October 31, 2011 and 2010, $0.008 per share for the period ended October 31, 2009, $0.01 for the fiscal year ended December 31, 2007 and less than $0.01 per share for the fiscal years ended December 31, 2008 and 2006. |

| (2) | Represents less than $0.01. |

| (5) | Net of fees waived amounting to 0.06%, 0.05% and 0.08% for the fiscal years ended December 31, 2008, 2007, and 2006, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the period) | | Years Ended

October 31, | | | January 1,

2009

through

October 31,

2009 | | | Period from

September 29,

2008 (2)

through

December 31,

2008 | |

| | 2011 | | | 2010 | | | |

Net asset value, beginning of period | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | | | $ | 8.74 | |

| | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.07 | ) | | | (0.03 | ) | | | (0.00 | )(3) | | | 0.01 | |

Net realized and unrealized gain (loss) | | | 0.12 | | | | 3.12 | | | | 2.70 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 0.05 | | | | 3.09 | | | | 2.70 | | | | (2.96 | ) |

| | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.01 | ) | | | (0.00 | )(3) | | | (0.01 | ) |

Dividends from net realized gains | | | (0.53 | ) | | | — | | | | — | | | | — | |

Return of capital | | | — | | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.53 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (0.48 | ) | | | 3.08 | | | | 2.69 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.06 | | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | |

| | | | | | | | | | | | | | | | |

Total return | | | (0.1 | )% | | | 36.6 | % | | | 46.7 | %(4) | | | (33.9 | )%(4) |

Ratios/supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 71,554 | | | $ | 41,788 | | | $ | 24,681 | | | $ | 9,226 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | |

Expenses | | | 1.36 | % | | | 1.38 | % | | | 1.26 | %(5)(6) | | | 1.15 | %(5)(6) |

Net investment income (loss) | | | (0.67 | )% | | | (0.43 | )% | | | (0.16 | )%(5)(6) | | | 0.29 | %(5)(6) |

Portfolio turnover rate | | | 28 | % | | | 40 | % | | | 24 | %(4) | | | 29 | %(4) |

| (1) | Total from investment operations per share includes redemption fees of $0.008 and $0.007 per share for the fiscal years ended October 31, 2011 and 2010, respectively. |

| (3) | Represents less than $0.01 per share. |

| (6) | Net of fees waived amounting to 0.77% and 2.32% for the periods ended October 31, 2009 and December 31, 2008, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2011

| | | | | | | | |

| Common Stocks—99.3% | | Shares | | | Value | |

Automobiles & Components—1.4% | |

Ford Motor Co.(a) | | | 600,000 | | | $ | 7,008,000 | |

Banks—2.7% | | | | | | | | |

Banco Santander SA—ADR | | | 500,000 | | | | 4,280,000 | |

East West Bancorp, Inc. | | | 250,000 | | | | 4,867,500 | |

Mitsubishi UFJ Financial Group, Inc.—ADR | | | 1,000,000 | | | | 4,330,000 | |

| | | | | | | | 13,477,500 | |

Capital Goods—8.3% | |

The Boeing Co. | | | 75,000 | | | | 4,934,250 | |

General Electric Co. | | | 1,000,000 | | | | 16,710,000 | |

Illinois Tool Works, Inc. | | | 150,000 | | | | 7,294,500 | |

ITT Corp. | | | 192,100 | | | | 8,759,760 | |

Masco Corp. | | | 295,800 | | | | 2,839,680 | |

| | | | | | | | 40,538,190 | |

Commercial & Professional Services—1.5% | |

Steelcase, Inc. | | | 1,000,000 | | | | 7,410,000 | |

Diversified Financials—1.3% | | | | | | | | |

The Bank of New York Mellon Corp. | | | 300,000 | | | | 6,384,000 | |

Energy—10.8% | | | | | | | | |

Cameco Corp.(b) | | | 200,000 | | | | 4,286,000 | |

CARBO Ceramics, Inc. | | | 20,000 | | | | 2,717,000 | |

Chesapeake Energy Corp. | | | 300,000 | | | | 8,436,000 | |

Exxon Mobil Corp. | | | 200,000 | | | | 15,618,000 | |

Murphy Oil Corp. | | | 200,000 | | | | 11,074,000 | |

Schlumberger Ltd.(b) | | | 150,000 | | | | 11,020,500 | |

| | | | | | | | 53,151,500 | |

Food & Staples Retailing—1.4% | |

Wal-Mart Stores, Inc. | | | 125,000 | | | | 7,090,000 | |

Food, Beverage & Tobacco—4.5% | |

Campbell Soup Co. | | | 250,000 | | | | 8,312,500 | |

The Coca-Cola Co. | | | 150,000 | | | | 10,248,000 | |

Unilever NV—ADR | | | 100,000 | | | | 3,453,000 | |

| | | | | | | | 22,013,500 | |

Health Care Equipment & Services—1.0% | |

St. Jude Medical, Inc. | | | 125,000 | | | | 4,875,000 | |

Household & Personal Products—4.0% | |

Colgate-Palmolive Co. | | | 100,000 | | | | 9,037,000 | |

Kimberly-Clark Corp. | | | 150,000 | | | | 10,456,500 | |

| | | | | | | | 19,493,500 | |

Insurance—2.6% | | | | | | | | |

Aflac, Inc. | | | 200,000 | | | | 9,018,000 | |

Fidelity National Financial, Inc. | | | 250,000 | | | | 3,860,000 | |

| | | | | | | | 12,878,000 | |

Materials—13.0% | | | | | | | | |

BHP Billiton Ltd.—ADR | | | 75,000 | | | $ | 5,856,000 | |

Cliffs Natural Resources, Inc. | | | 100,000 | | | | 6,822,000 | |

EI du Pont de Nemours & Co. | | | 300,000 | | | | 14,421,000 | |

Newmont Mining Corp. | | | 275,000 | | | | 18,378,250 | |

Owens-Illinois, Inc.(a) | | | 400,000 | | | | 8,032,000 | |

Sonoco Products Co. | | | 200,000 | | | | 6,278,000 | |

Vulcan Materials Co. | | | 125,000 | | | | 3,911,250 | |

| | | | | | | | 63,698,500 | |

Pharmaceuticals, Biotechnology & Life Sciences—10.2% | |

Alkermes PLC(a)(b) | | | 300,000 | | | | 5,247,000 | |

Forest Laboratories, Inc.(a) | | | 100,000 | | | | 3,130,000 | |

Johnson & Johnson | | | 175,000 | | | | 11,268,250 | |

Merck & Co., Inc. | | | 200,000 | | | | 6,900,000 | |

Myriad Genetics, Inc.(a) | | | 300,000 | | | | 6,384,000 | |

Pfizer, Inc. | | | 900,000 | | | | 17,334,000 | |

| | | | | | | | 50,263,250 | |

Real Estate—2.4% | | | | | | | | |

CBRE Group, Inc.(a) | | | 250,000 | | | | 4,445,000 | |

Weyerhaeuser Co. | | | 400,000 | | | | 7,192,000 | |

| | | | | | | | 11,637,000 | |

Retailing—2.4% | | | | | | | | |