UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04852 |

|

Victory Portfolios |

(Exact name of registrant as specified in charter) |

|

4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | | 44144 |

(Address of principal executive offices) | | (Zip code) |

|

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 800-539-3863 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | December 31, 2019 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

December 31, 2019

Semi Annual Report

Victory Integrity Discovery Fund

Victory Integrity Mid-Cap Value Fund

Victory Integrity Small-Cap Value Fund

Victory Integrity Small/Mid-Cap Value Fund

Victory Munder Multi-Cap Fund

Victory S&P 500 Index Fund

Victory Munder Mid-Cap Core Growth Fund

Victory Munder Small Cap Growth Fund

Victory Trivalent Emerging Markets Small-Cap Fund

Victory Trivalent International Fund-Core Equity

Victory Trivalent International Small-Cap Fund

Victory INCORE Total Return Bond Fund

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Victory Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Victory Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on www.VictoryFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action.

You may elect to receive shareholder reports and other communications from the Victory Funds or your financial intermediary electronically sooner than January 1, 2021 by notifying your financial intermediary directly or, if you are a direct investor, by calling 800-539-3863 or by sending an e-mail request to TA.Processing@FISGlobal.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Victory Funds, you can call 800-539-3863 or send an e-mail request to TA.Processing@FISGlobal.com. Your election to receive reports in paper will apply to all Victory Funds you hold directly or through your financial intermediary.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

Table of Contents

Financial Statements | |

Victory Integrity Discovery Fund | |

Investment Objectives & Portfolio Holdings | | | 5 | | |

Schedule of Portfolio Investments | | | 8 | | |

Statement of Assets and Liabilities | | | 84 | | |

Statement of Operations | | | 88 | | |

Statements of Changes in Net Assets | | | 92-94 | | |

Financial Highlights | | | 104-107 | | |

Victory Integrity Mid-Cap Value Fund | |

Investment Objectives & Portfolio Holdings | | | 5 | | |

Schedule of Portfolio Investments | | | 12 | | |

Statement of Assets and Liabilities | | | 84 | | |

Statement of Operations | | | 88 | | |

Statements of Changes in Net Assets | | | 92-94 | | |

Financial Highlights | | | 108-109 | | |

Victory Integrity Small-Cap Value Fund | |

Investment Objectives & Portfolio Holdings | | | 5 | | |

Schedule of Portfolio Investments | | | 16 | | |

Statement of Assets and Liabilities | | | 84 | | |

Statement of Operations | | | 88 | | |

Statements of Changes in Net Assets | | | 92-94 | | |

Financial Highlights | | | 110-115 | | |

Victory Integrity Small/Mid-Cap Value Fund | |

Investment Objectives & Portfolio Holdings | | | 5 | | |

Schedule of Portfolio Investments | | | 20 | | |

Statement of Assets and Liabilities | | | 85 | | |

Statement of Operations | | | 89 | | |

Statements of Changes in Net Assets | | | 95-97 | | |

Financial Highlights | | | 116-117 | | |

Victory Munder Multi-Cap Fund | |

Investment Objectives & Portfolio Holdings | | | 6 | | |

Schedule of Portfolio Investments | | | 24 | | |

Statement of Assets and Liabilities | | | 85 | | |

Statement of Operations | | | 89 | | |

Statements of Changes in Net Assets | | | 95-97 | | |

Financial Highlights | | | 118-121 | | |

Victory S&P 500 Index Fund | |

Investment Objectives & Portfolio Holdings | | | 6 | | |

Schedule of Portfolio Investments | | | 27 | | |

Statement of Assets and Liabilities | | | 85 | | |

Statement of Operations | | | 89 | | |

Statements of Changes in Net Assets | | | 95-97 | | |

Financial Highlights | | | 122-125 | | |

Victory Munder Mid-Cap Core Growth Fund | |

Investment Objectives & Portfolio Holdings | | | 6 | | |

Schedule of Portfolio Investments | | | 39 | | |

Statement of Assets and Liabilities | | | 86 | | |

Statement of Operations | | | 90 | | |

Statements of Changes in Net Assets | | | 98-100 | | |

Financial Highlights | | | 126-131 | | |

1

Table of Contents (continued)

Victory Munder Small Cap Growth Fund | |

Investment Objectives & Portfolio Holdings | | | 6 | | |

Schedule of Portfolio Investments | | | 42 | | |

Statement of Assets and Liabilities | | | 86 | | |

Statement of Operations | | | 90 | | |

Statements of Changes in Net Assets | | | 98-100 | | |

Financial Highlights | | | 132-133 | | |

Victory Trivalent Emerging Markets Small-Cap Fund | |

Investment Objectives & Portfolio Holdings | | | 7 | | |

Schedule of Portfolio Investments | | | 47 | | |

Statement of Assets and Liabilities | | | 86 | | |

Statement of Operations | | | 90 | | |

Statements of Changes in Net Assets | | | 98-100 | | |

Financial Highlights | | | 134-135 | | |

Victory Trivalent International Fund-Core Equity | |

Investment Objectives & Portfolio Holdings | | | 7 | | |

Schedule of Portfolio Investments | | | 55 | | |

Statement of Assets and Liabilities | | | 87 | | |

Statement of Operations | | | 91 | | |

Statements of Changes in Net Assets | | | 101-103 | | |

Financial Highlights | | | 136-141 | | |

Victory Trivalent International Small-Cap Fund | |

Investment Objectives & Portfolio Holdings | | | 7 | | |

Schedule of Portfolio Investments | | | 67 | | |

Statement of Assets and Liabilities | | | 87 | | |

Statement of Operations | | | 91 | | |

Statements of Changes in Net Assets | | | 101-103 | | |

Financial Highlights | | | 142-143 | | |

Victory INCORE Total Return Bond Fund | |

Investment Objectives & Portfolio Holdings | | | 7 | | |

Schedule of Portfolio Investments | | | 77 | | |

Statement of Assets and Liabilities | | | 87 | | |

Statement of Operations | | | 91 | | |

Statements of Changes in Net Assets | | | 101-103 | | |

Financial Highlights | | | 144-145 | | |

Notes to Financial Statements | | | 146 | | |

Supplemental Information | |

Proxy Voting and Portfolio Holdings Information | | | 165 | | |

Expense Examples | | | 165 | | |

Advisory Contract Approval | | | 168 | | |

Privacy Policy (inside back cover) | | | |

2

The Funds are distributed by Victory Capital Advisers, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at www.vcm.com or call 800-539-3863. Read it carefully before you invest or

send money.

The information in this semi annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

Visit our website at:

www.vcm.com

3

This page is intentionally left blank.

4

Victory Portfolios | | December 31, 2019 | |

(Unaudited)

Investment Objectives & Portfolio Holdings:

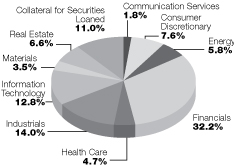

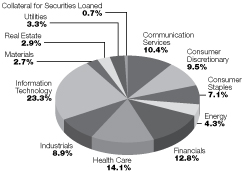

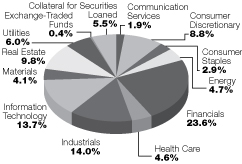

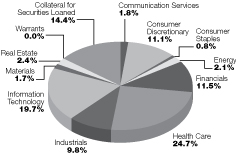

Integrity Discovery Fund

Seeks to provide capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

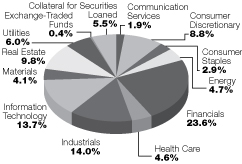

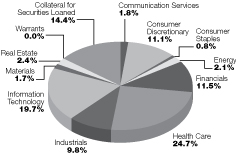

Integrity Mid-Cap Value Fund

Seeks to provide capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

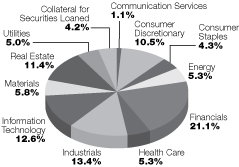

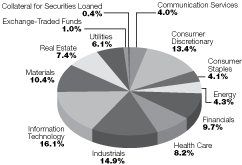

Integrity Small-Cap Value Fund

Seeks to provide long-term capital growth.

Portfolio Holdings

As a Percentage of Total Investments

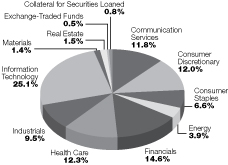

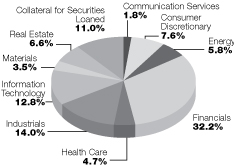

Integrity Small/Mid-Cap Value Fund

Seeks to provide capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

5

Victory Portfolios | | December 31, 2019 | |

(Unaudited)

Investment Objectives & Portfolio Holdings: (continued)

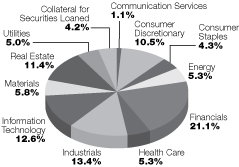

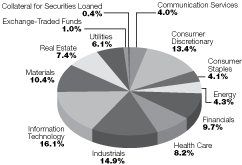

Munder Multi-Cap Fund

Seeks to provide long-term capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

S&P 500 Index Fund

Seeks to provide performance and income that is

comparable to the S&P 500 Index.

Portfolio Holdings

As a Percentage of Total Investments

Munder Mid-Cap Core Growth Fund

Seeks to provide long-term capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

Munder Small Cap Growth Fund

Seeks to provide long-term capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

6

Victory Portfolios | | December 31, 2019 | |

(Unaudited)

Investment Objectives & Portfolio Holdings: (continued)

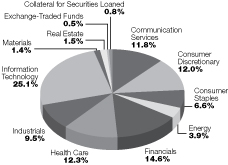

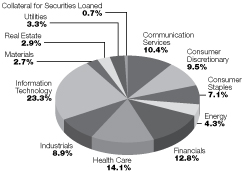

Trivalent Emerging Markets Small-Cap Fund

Seeks to provide long-term growth of capital.

Portfolio Holdings

As a Percentage of Total Investments

Trivalent International Fund-Core Equity

Seeks to provide long-term growth of capital.

Portfolio Holdings

As a Percentage of Total Investments

Trivalent International Small-Cap Fund

Seeks to provide long-term growth of capital.

Portfolio Holdings

As a Percentage of Total Investments

INCORE Total Return Bond Fund

Seeks to provide a high level of current income

together with capital appreciation.

Portfolio Holdings

As a Percentage of Total Investments

7

Victory Portfolios

Victory Integrity Discovery Fund | | Schedule of Portfolio Investments

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (96.8%) | |

Banks (24.7%): | |

Atlantic Capital Bancshares, Inc. (a) | | | 63,300 | | | $ | 1,162 | | |

Bridge Bancorp, Inc. | | | 37,300 | | | | 1,251 | | |

Carolina Financial Corp. (b) | | | 17,600 | | | | 761 | | |

Civista Bancshares, Inc. | | | 44,000 | | | | 1,056 | | |

Equity Bancshares, Inc. (a) | | | 23,200 | | | | 716 | | |

Financial Institutions, Inc. | | | 16,700 | | | | 536 | | |

First Bancorp, Inc., Class A | | | 8,000 | | | | 319 | | |

First Bancshares, Inc. (The) | | | 30,500 | | | | 1,083 | | |

First Bank/Hamilton NJ | | | 69,100 | | | | 764 | | |

First Foundation, Inc. | | | 80,000 | | | | 1,392 | | |

First Internet Bancorp | | | 33,700 | | | | 799 | | |

First Mid Bancshares, Inc. | | | 31,500 | | | | 1,110 | | |

Franklin Financial Network, Inc. | | | 29,800 | | | | 1,023 | | |

FVCBankcorp, Inc., Class A (a) | | | 22,500 | | | | 393 | | |

German American Bancorp, Inc., Class A | | | 40,000 | | | | 1,424 | | |

HarborOne Bancorp, Inc. (a) | | | 102,000 | | | | 1,121 | | |

Heritage Commerce Corp. | | | 101,924 | | | | 1,308 | | |

Heritage Financial Corp. | | | 28,000 | | | | 792 | | |

Hometrust Bancshares, Inc. | | | 45,100 | | | | 1,210 | | |

Howard Bancorp, Inc. (a) | | | 49,700 | | | | 839 | | |

Independent Bank Corp. | | | 60,000 | | | | 1,359 | | |

Mercantile Bank Corp. | | | 34,850 | | | | 1,271 | | |

Origin Bancorp, Inc. | | | 29,200 | | | | 1,105 | | |

Peoples Bancorp, Inc. | | | 39,000 | | | | 1,352 | | |

People's Utah Bancorp | | | 30,000 | | | | 904 | | |

QCR Holdings, Inc. | | | 29,700 | | | | 1,303 | | |

SB One Bancorp | | | 32,300 | | | | 805 | | |

Smartfinancial, Inc. | | | 47,000 | | | | 1,112 | | |

Southern National Bancorp of Virginia, Inc. | | | 75,330 | | | | 1,232 | | |

Trico Bancshares | | | 10,000 | | | | 408 | | |

Univest Financial Corp. | | | 51,400 | | | | 1,376 | | |

Washington Trust Bancorp, Inc. | | | 22,700 | | | | 1,221 | | |

| | | | 32,507 | | |

Capital Markets (1.6%): | |

Cowen, Inc., Class A (a) (b) | | | 80,500 | | | | 1,268 | | |

Diamond Hill Investment Group, Inc. | | | 5,475 | | | | 769 | | |

| | | | 2,037 | | |

Communication Services (2.0%): | |

Entravision Communications Corp., Class A | | | 179,000 | | | | 469 | | |

Glu Mobile, Inc. (a) (b) | | | 131,000 | | | | 793 | | |

The Marcus Corp. (b) | | | 40,314 | | | | 1,280 | | |

| | | | 2,542 | | |

Consumer Discretionary (8.2%): | |

BJ's Restaurants, Inc. | | | 17,600 | | | | 668 | | |

Carrols Restaurant Group, Inc. (a) (b) | | | 122,000 | | | | 860 | | |

Century Communities, Inc. (a) | | | 26,500 | | | | 725 | | |

See notes to financial statements.

8

Victory Portfolios

Victory Integrity Discovery Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Hibbett Sports, Inc. (a) (b) | | | 30,800 | | | $ | 864 | | |

M/I Homes, Inc. (a) | | | 19,100 | | | | 751 | | |

Malibu Boats, Inc., Class A (a) | | | 26,700 | | | | 1,093 | | |

MarineMax, Inc. (a) | | | 44,845 | | | | 748 | | |

Modine Manufacturing Co. (a) | | | 57,636 | | | | 444 | | |

Motorcar Parts of America, Inc. (a) (b) | | | 63,700 | | | | 1,403 | | |

Ruth's Hospitality Group, Inc. | | | 34,000 | | | | 740 | | |

Shoe Carnival, Inc. (b) | | | 29,600 | | | | 1,103 | | |

Zumiez, Inc. (a) (b) | | | 42,000 | | | | 1,451 | | |

| | | | 10,850 | | |

Consumer Finance (0.9%): | |

EZCORP, Inc., Class A (a) (b) | | | 172,000 | | | | 1,173 | | |

Energy (6.2%): | |

DHT Holdings, Inc. | | | 87,000 | | | | 720 | | |

Earthstone Energy, Inc., Class A (a) | | | 188,539 | | | | 1,193 | | |

International Seaways, Inc. (a) | | | 25,700 | | | | 765 | | |

Matrix Service Co. (a) | | | 69,650 | | | | 1,594 | | |

Natural Gas Services Group, Inc. (a) | | | 56,432 | | | | 692 | | |

Newpark Resources, Inc. (a) | | | 191,500 | | | | 1,201 | | |

Solaris Oilfield Infrastructure, Inc., Class A (b) | | | 74,000 | | | | 1,036 | | |

Tidewater, Inc. (a) | | | 52,770 | | | | 1,017 | | |

| | | | 8,218 | | |

Health Care (5.1%): | |

Addus HomeCare Corp. (a) (b) | | | 19,900 | | | | 1,935 | | |

Capital Senior Living Corp. (a) | | | 157,400 | | | | 486 | | |

Hanger, Inc. (a) | | | 42,392 | | | | 1,170 | | |

Invacare Corp. (b) | | | 104,500 | | | | 942 | | |

RadNet, Inc. (a) | | | 68,800 | | | | 1,397 | | |

RTI Surgical, Inc. (a) | | | 294,800 | | | | 808 | | |

| | | | 6,738 | | |

Industrials (15.2%): | |

CIRCOR International, Inc. (a) (b) | | | 16,400 | | | | 758 | | |

Columbus McKinnon Corp. | | | 30,900 | | | | 1,237 | | |

Covenant Transport Group, Inc., Class A (a) | | | 50,000 | | | | 646 | | |

CRA International, Inc. | | | 23,000 | | | | 1,253 | | |

Ducommon, Inc. (a) (b) | | | 13,600 | | | | 687 | | |

DXP Enterprise, Inc. (a) | | | 30,730 | | | | 1,224 | | |

Eagle Bulk Shipping, Inc. (a) (b) | | | 241,000 | | | | 1,109 | | |

Echo Global Logistics, Inc. (a) | | | 43,908 | | | | 909 | | |

Foundation Building Materials, Inc. (a) | | | 32,000 | | | | 619 | | |

Great Lakes Dredge & Dock Corp. (a) | | | 88,000 | | | | 997 | | |

Heidrick & Struggles International, Inc. | | | 25,700 | | | | 835 | | |

Heritage-Crystal Clean, Inc. (a) | | | 30,000 | | | | 941 | | |

Kelly Services, Inc., Class A (b) | | | 52,300 | | | | 1,181 | | |

MYR Group, Inc. (a) | | | 28,500 | | | | 929 | | |

NN, Inc. (b) | | | 146,000 | | | | 1,351 | | |

Park-Ohio Holdings Corp. (b) | | | 22,200 | | | | 747 | | |

SP Plus Corp. (a) | | | 29,800 | | | | 1,265 | | |

See notes to financial statements.

9

Victory Portfolios

Victory Integrity Discovery Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Spartan Motors, Inc. | | | 61,000 | | | $ | 1,103 | | |

Team, Inc. (a) (b) | | | 71,700 | | | | 1,145 | | |

Triumph Group, Inc. | | | 26,600 | | | | 672 | | |

USA Truck, Inc. (a) (b) | | | 35,724 | | | | 266 | | |

| | | | 19,874 | | |

Information Technology (14.0%): | |

Axcelis Technologies, Inc. (a) | | | 63,400 | | | | 1,528 | | |

BEL Fuse, Inc. | | | 44,500 | | | | 912 | | |

Cohu, Inc. | | | 56,264 | | | | 1,286 | | |

CTS Corp. | | | 32,400 | | | | 973 | | |

Diebold Nixdorf, Inc. (a) (b) | | | 85,000 | | | | 898 | | |

Digi International, Inc. (a) (b) | | | 70,000 | | | | 1,240 | | |

Extreme Networks, Inc. (a) (b) | | | 122,721 | | | | 904 | | |

Harmonic, Inc. (a) | | | 236,700 | | | | 1,847 | | |

I3 Verticals, Inc. (a) | | | 50,650 | | | | 1,431 | | |

Infinera Corp. (a) (b) | | | 200,500 | | | | 1,592 | | |

Mitek Systems, Inc. (a) | | | 105,000 | | | | 803 | | |

Mobileiron, Inc. (a) | | | 127,000 | | | | 617 | | |

Onto Innovation, Inc. (a) | | | 47,600 | | | | 1,739 | | |

Perficient, Inc. (a) | | | 14,500 | | | | 668 | | |

Photronics, Inc. (a) (b) | | | 117,800 | | | | 1,856 | | |

| | | | 18,294 | | |

Insurance (1.6%): | |

HCI Group, Inc. (b) | | | 20,700 | | | | 945 | | |

Heritage Insurance Holdings, Inc. | | | 85,500 | | | | 1,133 | | |

| | | | 2,078 | | |

Materials (3.9%): | |

Haynes International, Inc. | | | 28,500 | | | | 1,020 | | |

Koppers Holdings, Inc. (a) | | | 19,766 | | | | 755 | | |

Schnitzer Steel Industries, Inc. | | | 54,000 | | | | 1,170 | | |

SunCoke Energy, Inc. | | | 167,500 | | | | 1,044 | | |

Verso Corp., Class A (a) | | | 57,050 | | | | 1,029 | | |

| | | | 5,018 | | |

Mortgage Real Estate Investment Trusts (0.9%): | |

Western Asset Mortgage Capital Corp. | | | 108,000 | | | | 1,116 | | |

Real Estate (7.1%): | |

Bluerock Residential Growth REIT, Inc. | | | 76,000 | | | | 916 | | |

Catchmark Timber Trust, Inc. | | | 92,000 | | | | 1,054 | | |

Cedar Realty Trust, Inc. | | | 290,000 | | | | 856 | | |

City Office REIT, Inc. | | | 77,500 | | | | 1,048 | | |

Community Healthcare Trust, Inc. | | | 15,000 | | | | 643 | | |

Global Medical REIT, Inc. | | | 77,000 | | | | 1,018 | | |

Jernigan Capital, Inc. (b) | | | 37,000 | | | | 708 | | |

NexPoint Residential Trust, Inc. | | | 16,500 | | | | 743 | | |

Plymouth Industrial REIT, Inc. | | | 48,758 | | | | 897 | | |

UMH Properties, Inc. | | | 50,000 | | | | 787 | | |

Urstadt Biddle Properties, Inc., Class A | | | 30,147 | | | | 749 | | |

| | | | 9,419 | | |

See notes to financial statements.

10

Victory Portfolios

Victory Integrity Discovery Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Thrifts & Mortgage Finance (5.4%): | |

Bridgewater Bancshares, Inc. (a) | | | 80,000 | | | $ | 1,102 | | |

First Defiance Financial Corp. (b) | | | 39,500 | | | | 1,244 | | |

Home Bancorp, Inc. | | | 17,700 | | | | 694 | | |

Homestreet, Inc. (a) | | | 37,000 | | | | 1,258 | | |

PCSB Financial Corp. | | | 62,500 | | | | 1,266 | | |

United Community Financial Corp. | | | 127,500 | | | | 1,486 | | |

| | | | 7,050 | | |

Total Common Stocks (Cost $109,231) | | | 126,914 | | |

Collateral for Securities Loaned (11.9%)^ | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 1.75% (c) | | | 744,246 | | | | 744 | | |

Fidelity Investments Money Market Government Portfolio, Class I, 1.54% (c) | | | 4,100,262 | | | | 4,100 | | |

Fidelity Investments Prime Money Market Portfolio, Class I, 1.75% (c) | | | 124,307 | | | | 124 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional Class,

1.80% (c) | | | 2,476,982 | | | | 2,477 | | |

JPMorgan Prime Money Market Fund, Capital Class, 1.73% (c) | | | 2,724,872 | | | | 2,725 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional Class,

1.76% (c) | | | 5,449,558 | | | | 5,450 | | |

Total Collateral for Securities Loaned (Cost $15,620) | | | 15,620 | | |

Total Investments (Cost $124,851) — 108.7% | | | 142,534 | | |

Liabilities in excess of other assets — (8.7)% | | | (11,438 | ) | |

NET ASSETS — 100.00% | | $ | 131,096 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on December 31, 2019.

REIT — Real Estate Investment Trust

See notes to financial statements.

11

Victory Portfolios

Victory Integrity Mid-Cap Value Fund | | Schedule of Portfolio Investments

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (98.9%) | |

Communication Services (1.5%): | |

Cinemark Holdings, Inc. (a) | | | 49,268 | | | $ | 1,668 | | |

ViacomCBS, Inc., Class B | | | 54,176 | | | | 2,274 | | |

| | | | 3,942 | | |

Consumer Discretionary (9.2%): | |

Advance Auto Parts, Inc. | | | 9,531 | | | | 1,526 | | |

Aramark | | | 62,024 | | | | 2,692 | | |

Bed Bath & Beyond, Inc. | | | 78,300 | | | | 1,355 | | |

BorgWarner, Inc. | | | 49,677 | | | | 2,155 | | |

Brunswick Corp. | | | 37,533 | | | | 2,251 | | |

D.R. Horton, Inc. | | | 36,976 | | | | 1,950 | | |

Dollar Tree, Inc. (b) | | | 18,835 | | | | 1,771 | | |

Kohl's Corp. | | | 42,350 | | | | 2,158 | | |

Newell Brands, Inc. | | | 97,393 | | | | 1,872 | | |

Ralph Lauren Corp. | | | 15,382 | | | | 1,803 | | |

Royal Caribbean Cruises Ltd. | | | 18,370 | | | | 2,453 | | |

Wyndham Destinations, Inc. | | | 39,159 | | | | 2,024 | | |

| | | | 24,010 | | |

Consumer Staples (3.8%): | |

Post Holdings, Inc. (b) | | | 19,403 | | | | 2,117 | | |

The Kroger Co. | | | 66,922 | | | | 1,940 | | |

Tyson Foods, Inc., Class A | | | 36,295 | | | | 3,304 | | |

U.S. Foods Holding Corp. (b) | | | 59,242 | | | | 2,482 | | |

| | | | 9,843 | | |

Energy (6.1%): | |

Concho Resources, Inc. | | | 27,695 | | | | 2,425 | | |

Diamondback Energy, Inc. | | | 28,820 | | | | 2,677 | | |

Hess Corp. | | | 28,990 | | | | 1,937 | | |

HollyFrontier Corp. | | | 40,771 | | | | 2,067 | | |

Noble Energy, Inc. | | | 82,940 | | | | 2,060 | | |

Pioneer Natural Resources Co. | | | 13,951 | | | | 2,112 | | |

WPX Energy, Inc. (b) | | | 186,337 | | | | 2,560 | | |

| | | | 15,838 | | |

Financials (18.7%): | |

American Financial Group, Inc. | | | 25,639 | | | | 2,811 | | |

Arthur J. Gallagher & Co. | | | 34,283 | | | | 3,265 | | |

Assurant, Inc. | | | 16,210 | | | | 2,125 | | |

Everest Re Group Ltd. | | | 9,417 | | | | 2,607 | | |

Fidelity National Financial, Inc., Class A | | | 60,672 | | | | 2,751 | | |

Fifth Third Bancorp. | | | 127,285 | | | | 3,914 | | |

Lincoln National Corp. | | | 44,984 | | | | 2,655 | | |

LPL Financial Holdings, Inc. | | | 25,809 | | | | 2,381 | | |

M&T Bank Corp. | | | 18,948 | | | | 3,216 | | |

Northern Trust Corp. | | | 34,046 | | | | 3,617 | | |

See notes to financial statements.

12

Victory Portfolios

Victory Integrity Mid-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Raymond James Financial, Inc. | | | 25,606 | | | $ | 2,291 | | |

Regions Financial Corp. | | | 187,028 | | | | 3,209 | | |

Sterling Bancorp | | | 89,779 | | | | 1,893 | | |

Voya Financial, Inc. | | | 55,141 | | | | 3,362 | | |

W.R. Berkley Corp. | | | 30,990 | | | | 2,141 | | |

Western Alliance Bancorp | | | 48,552 | | | | 2,767 | | |

Zions Bancorp NA | | | 71,192 | | | | 3,697 | | |

| | | | 48,702 | | |

Health Care (7.6%): | |

Encompass Health Corp. | | | 39,055 | | | | 2,705 | | |

Hill-Rom Holdings, Inc. | | | 19,834 | | | | 2,252 | | |

Hologic, Inc. (b) | | | 59,820 | | | | 3,123 | | |

Laboratory Corp. of America Holdings (b) | | | 19,254 | | | | 3,257 | | |

McKesson Corp. | | | 17,813 | | | | 2,464 | | |

Perrigo Co. PLC | | | 39,624 | | | | 2,047 | | |

Zimmer Biomet Holdings, Inc. | | | 27,173 | | | | 4,067 | | |

| | | | 19,915 | | |

Industrials (14.6%): | |

AGCO Corp. | | | 21,743 | | | | 1,680 | | |

Beacon Roofing Supply, Inc. (a) (b) | | | 63,264 | | | | 2,023 | | |

Colfax Corp. (b) | | | 60,332 | | | | 2,195 | | |

Crane Co. | | | 18,221 | | | | 1,574 | | |

Curtiss-Wright Corp. | | | 13,609 | | | | 1,917 | | |

Dycom Industries, Inc. (b) | | | 45,814 | | | | 2,160 | | |

ITT, Inc. | | | 22,697 | | | | 1,678 | | |

Kansas City Southern (a) | | | 21,231 | | | | 3,252 | | |

Knight-Swift Transportation Holdings, Inc. (a) | | | 45,156 | | | | 1,618 | | |

L3Harris Technologies, Inc. | | | 10,667 | | | | 2,111 | | |

Old Dominion Freight Line, Inc. | | | 10,793 | | | | 2,048 | | |

Oshkosh Corp. | | | 25,822 | | | | 2,444 | | |

Quanta Services, Inc. | | | 58,731 | | | | 2,391 | | |

Regal Beloit Corp. | | | 21,267 | | | | 1,821 | | |

Republic Services, Inc., Class A | | | 31,365 | | | | 2,811 | | |

Stanley Black & Decker, Inc. | | | 17,040 | | | | 2,823 | | |

Textron, Inc. | | | 40,079 | | | | 1,788 | | |

United Airlines Holdings, Inc. (b) | | | 22,925 | | | | 2,019 | | |

| | | | 38,353 | | |

Information Technology (11.5%): | |

Arrow Electronics, Inc. (b) | | | 30,569 | | | | 2,590 | | |

Flex Ltd. (b) | | | 208,623 | | | | 2,633 | | |

Leidos Holdings, Inc. | | | 22,004 | | | | 2,154 | | |

Lumentum Holdings, Inc. (b) | | | 17,176 | | | | 1,362 | | |

Microchip Technology, Inc. (a) | | | 24,640 | | | | 2,581 | | |

MKS Instruments, Inc. | | | 20,255 | | | | 2,228 | | |

Motorola Solutions, Inc. | | | 11,554 | | | | 1,862 | | |

NCR Corp. (b) | | | 70,739 | | | | 2,487 | | |

NortonLifeLock, Inc. | | | 83,599 | | | | 2,133 | | |

See notes to financial statements.

13

Victory Portfolios

Victory Integrity Mid-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Nuance Communications, Inc. (b) | | | 140,057 | | | $ | 2,498 | | |

ON Semiconductor Corp. (b) | | | 90,437 | | | | 2,205 | | |

Qorvo, Inc. (b) | | | 13,803 | | | | 1,604 | | |

SYNNEX Corp. | | | 19,028 | | | | 2,451 | | |

Western Digital Corp. | | | 22,551 | | | | 1,431 | | |

| | | | 30,219 | | |

Materials (6.6%): | |

Allegheny Technologies, Inc. (a) (b) | | | 60,548 | | | | 1,251 | | |

Carpenter Technology Corp. | | | 25,663 | | | | 1,278 | | |

Celanese Corp., Series A | | | 15,529 | | | | 1,911 | | |

FMC Corp. | | | 19,153 | | | | 1,912 | | |

Freeport-McMoRan, Inc. | | | 228,888 | | | | 3,003 | | |

Huntsman Corp. | | | 79,122 | | | | 1,912 | | |

Martin Marietta Materials, Inc. | | | 6,952 | | | | 1,944 | | |

Newmont Goldcorp Corp. | | | 46,225 | | | | 2,008 | | |

Westrock Co. | | | 46,565 | | | | 1,998 | | |

| | | | 17,217 | | |

Real Estate (10.5%): | |

Alexandria Real Estate Equities, Inc. | | | 8,209 | | | | 1,326 | | |

Americold Realty Trust | | | 62,718 | | | | 2,199 | | |

Apartment Investment & Management Co. | | | 61,365 | | | | 3,170 | | |

Camden Property Trust | | | 29,546 | | | | 3,135 | | |

Duke Realty Investments, Inc. | | | 104,645 | | | | 3,629 | | |

Healthpeak Properties, Inc. | | | 101,079 | | | | 3,484 | | |

Host Hotels & Resorts, Inc. | | | 156,913 | | | | 2,911 | | |

Medical Properties Trust, Inc. | | | 119,499 | | | | 2,523 | | |

STORE Capital Corp. | | | 65,331 | | | | 2,433 | | |

Weyerhaeuser Co. | | | 88,460 | | | | 2,671 | | |

| | | | 27,481 | | |

Utilities (8.8%): | |

Alliant Energy Corp. | | | 45,155 | | | | 2,471 | | |

Atmos Energy Corp. | | | 20,357 | | | | 2,277 | | |

DTE Energy Co. | | | 23,685 | | | | 3,076 | | |

Edison International | | | 29,956 | | | | 2,259 | | |

Evergy, Inc. | | | 30,354 | | | | 1,976 | | |

FirstEnergy Corp. | | | 60,797 | | | | 2,954 | | |

Pinnacle West Capital Corp. | | | 19,506 | | | | 1,754 | | |

PPL Corp. | | | 113,370 | | | | 4,067 | | |

UGI Corp. | | | 46,452 | | | | 2,098 | | |

| | | | 22,932 | | |

Total Common Stocks (Cost $231,669) | | | 258,452 | | |

See notes to financial statements.

14

Victory Portfolios

Victory Integrity Mid-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Collateral for Securities Loaned (2.6%)^ | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 1.75% (c) | | | 323,401 | | | $ | 323 | | |

Fidelity Investments Money Market Government Portfolio, Class I, 1.54% (c) | | | 1,781,708 | | | | 1,782 | | |

Fidelity Investments Prime Money Market Portfolio, Class I, 1.75% (c) | | | 54,016 | | | | 54 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional Class,

1.80% (c) | | | 1,076,336 | | | | 1,076 | | |

JPMorgan Prime Money Market Fund, Capital Class, 1.73% (c) | | | 1,184,053 | | | | 1,184 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional Class,

1.76% (c) | | | 2,368,525 | | | | 2,369 | | |

Total Collateral for Securities Loaned (Cost $6,788) | | | 6,788 | | |

Total Investments (Cost $238,457) — 101.5% | | | 265,240 | | |

Liabilities in excess of other assets — (1.5)% | | | (3,966 | ) | |

NET ASSETS — 100.00% | | $ | 261,274 | | |

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security is on loan.

(b) Non-income producing security.

(c) Rate disclosed is the daily yield on December 31, 2019.

PLC — Public Limited Company

See notes to financial statements.

15

Victory Portfolios

Victory Integrity Small-Cap Value Fund | | Schedule of Portfolio Investments

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (98.7%) | |

Communication Services (2.0%): | |

AMC Entertainment Holdings, Inc. (a) | | | 1,105,501 | | | $ | 8,004 | | |

Gray Television, Inc. (a) (b) | | | 930,980 | | | | 19,960 | | |

Lions Gate Entertainment (b) | | | 970,200 | | | | 9,634 | | |

The Marcus Corp. (a) | | | 325,200 | | | | 10,332 | | |

| | | | 47,930 | | |

Consumer Discretionary (9.0%): | |

American Eagle Outfitters, Inc. (a) | | | 1,084,481 | | | | 15,942 | | |

Asbury Automotive Group, Inc. (b) | | | 134,602 | | | | 15,047 | | |

Bed Bath & Beyond, Inc. (a) | | | 1,052,300 | | | | 18,205 | | |

Brunswick Corp. | | | 319,486 | | | | 19,163 | | |

Caleres, Inc. | | | 811,347 | | | | 19,269 | | |

Century Communities, Inc. (a) (b) | | | 666,600 | | | | 18,232 | | |

Dana, Inc. | | | 830,100 | | | | 15,108 | | |

G-III Apparel Group Ltd. (b) | | | 622,910 | | | | 20,868 | | |

Helen of Troy Ltd. (b) | | | 70,800 | | | | 12,729 | | |

Jack in the Box, Inc. | | | 221,141 | | | | 17,256 | | |

Penn National Gaming, Inc. (b) | | | 1,164,977 | | | | 29,776 | | |

Wolverine World Wide, Inc. | | | 545,200 | | | | 18,395 | | |

| | | | 219,990 | | |

Consumer Staples (3.1%): | |

BJ's Wholesale Club Holdings, Inc. (b) | | | 691,600 | | | | 15,727 | | |

Performance Food Group Co. (b) | | | 472,786 | | | | 24,339 | | |

Sanderson Farms, Inc. | | | 106,400 | | | | 18,749 | | |

The Simply Good Foods Co. (a) (b) | | | 487,200 | | | | 13,905 | | |

| | | | 72,720 | | |

Energy (4.8%): | |

Callon Petroleum Co. (b) | | | 1,435,500 | | | | 6,933 | | |

Delek US Holdings, Inc. | | | 444,453 | | | | 14,903 | | |

Helix Energy Solutions Group, Inc. (a) (b) | | | 2,508,302 | | | | 24,155 | | |

Magnolia Oil & Gas Corp. (a) (b) | | | 1,852,094 | | | | 23,300 | | |

Matador Resources Co. (a) (b) | | | 830,900 | | | | 14,931 | | |

PDC Energy, Inc. (a) (b) | | | 538,600 | | | | 14,095 | | |

World Fuel Services Corp. (a) | | | 423,200 | | | | 18,375 | | |

| | | | 116,692 | | |

Financials (24.8%): | |

American Equity Investment Life Holding Co. | | | 506,500 | | | | 15,160 | | |

Banc of California, Inc. | | | 509,900 | | | | 8,760 | | |

BancorpSouth Bank (a) | | | 1,015,553 | | | | 31,898 | | |

BankUnited, Inc. | | | 721,505 | | | | 26,378 | | |

Berkshire Hills Bancorp, Inc. (a) | | | 740,700 | | | | 24,354 | | |

Carolina Financial Corp. | | | 245,300 | | | | 10,604 | | |

Cathay General Bancorp | | | 623,400 | | | | 23,720 | | |

First Bancorp, Inc., Class A | | | 249,000 | | | | 9,938 | | |

First Commonwealth Financial Corp. (a) | | | 1,328,480 | | | | 19,276 | | |

First Financial Bancorp | | | 570,468 | | | | 14,513 | | |

See notes to financial statements.

16

Victory Portfolios

Victory Integrity Small-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

First Merchants Corp. | | | 551,700 | | | $ | 22,945 | | |

Fulton Financial Corp. (a) | | | 1,315,248 | | | | 22,925 | | |

Great Western Bancorp, Inc. (a) | | | 880,700 | | | | 30,595 | | |

Hancock Whitney Corp., Class B (a) | | | 539,286 | | | | 23,664 | | |

Heritage Financial Corp. | | | 345,100 | | | | 9,766 | | |

IBERIABANK Corp. | | | 76,866 | | | | 5,752 | | |

Kemper Corp. | | | 226,159 | | | | 17,527 | | |

Ladder Capital Corp. | | | 225,300 | | | | 4,065 | | |

MGIC Investment Corp. | | | 1,168,500 | | | | 16,558 | | |

PacWest Bancorp | | | 471,300 | | | | 18,037 | | |

Piper Jaffray Co. | | | 178,213 | | | | 14,246 | | |

Primerica, Inc. | | | 137,480 | | | | 17,949 | | |

Prosperity Bancshares, Inc. | | | 236,805 | | | | 17,024 | | |

RLI Corp. (a) | | | 248,513 | | | | 22,371 | | |

Sterling Bancorp | | | 769,479 | | | | 16,221 | | |

Stewart Information Services Corp. (a) | | | 231,000 | | | | 9,422 | | |

Stifel Financial Corp. | | | 421,039 | | | | 25,536 | | |

The Hanover Insurance Group, Inc. | | | 132,967 | | | | 18,173 | | |

United Community Banks, Inc. | | | 746,116 | | | | 23,040 | | |

Veritex Holdings, Inc. | | | 829,300 | | | | 24,158 | | |

WesBanco, Inc. | | | 619,100 | | | | 23,396 | | |

Western Alliance Bancorp | | | 472,923 | | | | 26,957 | | |

Western Asset Mortgage Capital Corp. | | | 334,200 | | | | 3,452 | | |

| | | | 598,380 | | |

Health Care (4.8%): | |

Brookdale Senior Living, Inc. (b) | | | 1,524,126 | | | | 11,080 | | |

CONMED Corp. | | | 199,824 | | | | 22,346 | | |

Magellan Health, Inc. (b) | | | 377,806 | | | | 29,564 | | |

Select Medical Holdings Corp. (b) | | | 1,222,467 | | | | 28,532 | | |

Syneos Health, Inc. (b) | | | 404,200 | | | | 24,040 | | |

| | | | 115,562 | | |

Industrials (14.8%): | |

AAR Corp. | | | 431,000 | | | | 19,438 | | |

Aerojet Rocketdyne Holdings, Inc. (a) (b) | | | 362,867 | | | | 16,569 | | |

AZZ, Inc. | | | 456,600 | | | | 20,981 | | |

Beacon Roofing Supply, Inc. (b) | | | 590,272 | | | | 18,877 | | |

Chart Industries, Inc. (b) | | | 329,400 | | | | 22,231 | | |

Clean Harbors, Inc. (b) | | | 219,800 | | | | 18,848 | | |

Colfax Corp. (a) (b) | | | 486,800 | | | | 17,710 | | |

Continental Building Products, Inc. (b) | | | 542,600 | | | | 19,767 | | |

Dycom Industries, Inc. (b) | | | 492,922 | | | | 23,241 | | |

EMCOR Group, Inc. | | | 193,856 | | | | 16,730 | | |

Hub Group, Inc., Class A (b) | | | 319,452 | | | | 16,385 | | |

Kennametal, Inc. (a) | | | 488,300 | | | | 18,013 | | |

Meritor, Inc. (b) | | | 869,778 | | | | 22,780 | | |

Regal Beloit Corp. | | | 189,700 | | | | 16,240 | | |

Saia, Inc. (b) | | | 233,981 | | | | 21,789 | | |

SkyWest, Inc. | | | 400,701 | | | | 25,897 | | |

Team, Inc. (a) (b) | | | 713,082 | | | | 11,388 | | |

See notes to financial statements.

17

Victory Portfolios

Victory Integrity Small-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Triumph Group, Inc. | | | 489,600 | | | $ | 12,372 | | |

Werner Enterprises, Inc. (a) | | | 432,900 | | | | 15,753 | | |

| | | | 355,009 | | |

Information Technology (14.2%): | |

Belden, Inc. | | | 336,100 | | | | 18,485 | | |

Cohu, Inc. (a) | | | 478,900 | | | | 10,943 | | |

Conduent, Inc. (b) | | | 1,710,900 | | | | 10,608 | | |

CTS Corp. | | | 381,900 | | | | 11,461 | | |

Diebold Nixdorf, Inc. (a) (b) | | | 1,435,900 | | | | 15,163 | | |

Diodes, Inc. (a) (b) | | | 332,256 | | | | 18,729 | | |

Flex Ltd. (b) | | | 1,373,796 | | | | 17,337 | | |

FormFactor, Inc. (b) | | | 916,176 | | | | 23,793 | | |

Infinera Corp. (a) (b) | | | 1,632,800 | | | | 12,964 | | |

KBR, Inc. (a) | | | 871,889 | | | | 26,592 | | |

Knowles Corp. (b) | | | 531,300 | | | | 11,237 | | |

Lumentum Holdings, Inc. (b) | | | 282,800 | | | | 22,426 | | |

MACOM Technology Solutions Holdings, Inc. (a) (b) | | | 802,600 | | | | 21,349 | | |

NCR Corp. (b) | | | 550,239 | | | | 19,347 | | |

Nuance Communications, Inc. (b) | | | 1,181,245 | | | | 21,061 | | |

Perspecta, Inc. | | | 628,728 | | | | 16,624 | | |

Sanmina Corp. (b) | | | 468,685 | | | | 16,048 | | |

TTM Technologies, Inc. (b) | | | 1,202,630 | | | | 18,100 | | |

Verint Systems, Inc. (b) | | | 275,246 | | | | 15,238 | | |

Viavi Solutions, Inc. (a) (b) | | | 1,145,400 | | | | 17,181 | | |

| | | | 344,686 | | |

Materials (4.5%): | |

Allegheny Technologies, Inc. (a) (b) | | | 566,180 | | | | 11,697 | | |

Carpenter Technology Corp. | | | 239,679 | | | | 11,931 | | |

Cleveland-Cliffs, Inc. (a) | | | 2,375,000 | | | | 19,950 | | |

Ingevity Corp. (b) | | | 181,321 | | | | 15,844 | | |

Louisiana-Pacific Corp. | | | 716,300 | | | | 21,253 | | |

Summit Materials, Inc., Class A (b) | | | 682,600 | | | | 16,314 | | |

US Concrete, Inc. (b) | | | 245,300 | | | | 10,219 | | |

| | | | 107,208 | | |

Real Estate (10.4%): | |

Alexander & Baldwin, Inc. | | | 660,100 | | | | 13,836 | | |

CareTrust REIT, Inc. | | | 828,000 | | | | 17,082 | | |

City Office REIT, Inc. | | | 601,800 | | | | 8,136 | | |

DiamondRock Hospitality Co. | | | 1,425,541 | | | | 15,795 | | |

Essential Properties Realty Trust, Inc. | | | 737,800 | | | | 18,305 | | |

First Industrial Realty Trust, Inc. | | | 697,497 | | | | 28,952 | | |

Kite Realty Group Trust | | | 809,498 | | | | 15,809 | | |

Lexington Realty Trust | | | 1,670,800 | | | | 17,744 | | |

Mack Cali Realty Corp. | | | 961,435 | | | | 22,238 | | |

Pennsylvania Real Estate Investment Trust (a) | | | 1,160,305 | | | | 6,184 | | |

Physicians Realty Trust (a) | | | 1,243,082 | | | | 23,544 | | |

SITE Centers Corp. | | | 1,311,521 | | | | 18,388 | | |

STAG Industrial, Inc. | | | 727,237 | | | | 22,959 | | |

See notes to financial statements.

18

Victory Portfolios

Victory Integrity Small-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Summit Hotel Properties, Inc. | | | 1,261,505 | | | $ | 15,567 | | |

Sunstone Hotel Investors, Inc. | | | 509,242 | | | | 7,089 | | |

| | | | 251,628 | | |

Utilities (6.3%): | |

ALLETE, Inc. | | | 252,969 | | | | 20,532 | | |

Black Hills Corp. | | | 228,723 | | | | 17,964 | | |

New Jersey Resources Corp. | | | 387,485 | | | | 17,270 | | |

NorthWestern Corp. | | | 242,991 | | | | 17,415 | | |

ONE Gas, Inc. | | | 180,901 | | | | 16,927 | | |

PNM Resources, Inc. | | | 430,325 | | | | 21,822 | | |

Southwest Gas Holdings, Inc. (a) | | | 282,370 | | | | 21,452 | | |

Spire, Inc. | | | 197,400 | | | | 16,446 | | |

| | | | 149,828 | | |

Total Common Stocks (Cost $1,985,142) | | | 2,379,633 | | |

Exchange-Traded Funds (0.5%) | |

iShares Russell 2000 Value Index Fund (a) | | | 85,034 | | | | 10,934 | | |

Total Exchange-Traded Funds (Cost $9,757) | | | 10,934 | | |

Collateral for Securities Loaned (5.7%)^ | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 1.75% (c) | | | 6,597,433 | | | | 6,597 | | |

Fidelity Investments Money Market Government Portfolio, Class I, 1.54% (c) | | | 36,347,687 | | | | 36,348 | | |

Fidelity Investments Prime Money Market Portfolio, Class I, 1.75% (c) | | | 1,101,949 | | | | 1,102 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional Class,

1.80% (c) | | | 21,957,761 | | | | 21,958 | | |

JPMorgan Prime Money Market Fund, Capital Class, 1.73% (c) | | | 24,155,239 | | | | 24,155 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional Class,

1.76% (c) | | | 48,308,830 | | | | 48,309 | | |

Total Collateral for Securities Loaned (Cost $138,469) | | | 138,469 | | |

Total Investments (Cost $2,133,368) — 104.9% | | | 2,529,036 | | |

Liabilities in excess of other assets — (4.9)% | | | (117,015 | ) | |

NET ASSETS — 100.00% | | $ | 2,412,021 | | |

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security is on loan.

(b) Non-income producing security.

(c) Rate disclosed is the daily yield on December 31, 2019.

REIT — Real Estate Investment Trust

See notes to financial statements.

19

Victory Portfolios

Victory Integrity Small/Mid-Cap Value Fund | | Schedule of Portfolio Investments

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (99.3%) | |

Communication Services (1.2%): | |

Cinemark Holdings, Inc. | | | 31,742 | | | $ | 1,074 | | |

Lions Gate Entertainment (a) | | | 66,028 | | | | 656 | | |

| | | | 1,730 | | |

Consumer Discretionary (10.9%): | |

American Eagle Outfitters, Inc. (b) | | | 64,001 | | | | 941 | | |

Aramark | | | 35,511 | | | | 1,541 | | |

Bed Bath & Beyond, Inc. | | | 69,227 | | | | 1,198 | | |

Brunswick Corp. | | | 21,831 | | | | 1,309 | | |

Caleres, Inc. | | | 30,922 | | | | 734 | | |

Dana, Inc. | | | 38,427 | | | | 699 | | |

G-III Apparel Group Ltd. (a) | | | 35,009 | | | | 1,173 | | |

Kohl's Corp. | | | 27,923 | | | | 1,423 | | |

Macy's, Inc. (b) | | | 45,346 | | | | 771 | | |

Newell Brands, Inc. | | | 53,474 | | | | 1,028 | | |

PulteGroup, Inc. | | | 31,243 | | | | 1,212 | | |

Ralph Lauren Corp. | | | 11,558 | | | | 1,354 | | |

Wolverine World Wide, Inc. | | | 32,143 | | | | 1,085 | | |

Wyndham Destinations, Inc. | | | 26,985 | | | | 1,395 | | |

| | | | 15,863 | | |

Consumer Staples (4.5%): | |

BJ's Wholesale Club Holdings, Inc. (a) | | | 38,340 | | | | 872 | | |

Grocery Outlet Holding Corp. (a) (b) | | | 20,778 | | | | 674 | | |

Lamb Weston Holdings, Inc. | | | 16,029 | | | | 1,379 | | |

Performance Food Group Co. (a) | | | 29,969 | | | | 1,543 | | |

Pilgrim's Pride Corp. (a) (b) | | | 30,145 | | | | 986 | | |

Post Holdings, Inc. (a) | | | 10,695 | | | | 1,167 | | |

| | | | 6,621 | | |

Energy (5.6%): | |

Callon Petroleum Co. (a) | | | 85,834 | | | | 415 | | |

Delek US Holdings, Inc. (b) | | | 26,653 | | | | 894 | | |

Diamondback Energy, Inc. | | | 16,295 | | | | 1,513 | | |

Helix Energy Solutions Group, Inc. (a) | | | 145,400 | | | | 1,400 | | |

HollyFrontier Corp. | | | 23,548 | | | | 1,194 | | |

Parsley Energy, Inc., Class A | | | 56,582 | | | | 1,070 | | |

WPX Energy, Inc. (a) | | | 121,919 | | | | 1,675 | | |

| | | | 8,161 | | |

Financials (21.9%): | |

Agnc Investment Corp. | | | 101,947 | | | | 1,802 | | |

American Financial Group, Inc. | | | 18,090 | | | | 1,985 | | |

Arthur J. Gallagher & Co. | | | 12,867 | | | | 1,225 | | |

Assurant, Inc. | | | 10,231 | | | | 1,341 | | |

BankUnited, Inc. | | | 46,467 | | | | 1,699 | | |

East West Bancorp, Inc. | | | 35,980 | | | | 1,752 | | |

Everest Re Group Ltd. | | | 3,537 | | | | 979 | | |

First American Financial Corp. | | | 18,285 | | | | 1,066 | | |

See notes to financial statements.

20

Victory Portfolios

Victory Integrity Small/Mid-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Great Western Bancorp, Inc. | | | 42,545 | | | $ | 1,478 | | |

Hancock Whitney Corp., Class B | | | 18,588 | | | | 816 | | |

IBERIABANK Corp. | | | 4,574 | | | | 342 | | |

Kemper Corp. | | | 14,804 | | | | 1,147 | | |

LPL Financial Holdings, Inc. | | | 14,835 | | | | 1,368 | | |

MGIC Investment Corp. | | | 75,903 | | | | 1,076 | | |

People's United Financial, Inc. | | | 78,060 | | | | 1,319 | | |

Primerica, Inc. | | | 7,875 | | | | 1,028 | | |

Sterling Bancorp | | | 61,694 | | | | 1,301 | | |

Stifel Financial Corp. | | | 18,630 | | | | 1,130 | | |

The Hanover Insurance Group, Inc. | | | 9,186 | | | | 1,255 | | |

Umpqua Holdings Corp. | | | 90,538 | | | | 1,603 | | |

Voya Financial, Inc. | | | 31,376 | | | | 1,913 | | |

WesBanco, Inc. | | | 37,174 | | | | 1,405 | | |

Western Alliance Bancorp | | | 29,714 | | | | 1,694 | | |

Zions Bancorp NA | | | 29,969 | | | | 1,556 | | |

| | | | 32,280 | | |

Health Care (5.3%): | |

Brookdale Senior Living, Inc. (a) | | | 81,253 | | | | 591 | | |

Encompass Health Corp. | | | 21,912 | | | | 1,517 | | |

Hill-Rom Holdings, Inc. | | | 11,601 | | | | 1,317 | | |

Hologic, Inc. (a) | | | 23,807 | | | | 1,243 | | |

Magellan Health, Inc. (a) | | | 16,967 | | | | 1,328 | | |

Perrigo Co. PLC | | | 14,188 | | | | 733 | | |

STERIS PLC | | | 7,590 | | | | 1,157 | | |

| | | | 7,886 | | |

Industrials (14.0%): | |

Alaska Air Group, Inc. | | | 12,894 | | | | 874 | | |

Beacon Roofing Supply, Inc. (a) | | | 35,480 | | | | 1,135 | | |

Chart Industries, Inc. (a) | | | 19,883 | | | | 1,341 | | |

Clean Harbors, Inc. (a) | | | 13,715 | | | | 1,176 | | |

Colfax Corp. (a) | | | 29,701 | | | | 1,081 | | |

Curtiss-Wright Corp. | | | 8,188 | | | | 1,154 | | |

Dycom Industries, Inc. (a) | | | 27,582 | | | | 1,301 | | |

EMCOR Group, Inc. | | | 12,420 | | | | 1,072 | | |

Kennametal, Inc. | | | 29,482 | | | | 1,088 | | |

Kirby Corp. (a) | | | 12,660 | | | | 1,133 | | |

Knight-Swift Transportation Holdings, Inc. (b) | | | 29,241 | | | | 1,048 | | |

Meritor, Inc. (a) | | | 42,825 | | | | 1,122 | | |

Old Dominion Freight Line, Inc. | | | 6,167 | | | | 1,170 | | |

Oshkosh Corp. | | | 13,315 | | | | 1,260 | | |

Quanta Services, Inc. | | | 30,225 | | | | 1,230 | | |

Regal Beloit Corp. | | | 12,755 | | | | 1,092 | | |

SkyWest, Inc. | | | 17,775 | | | | 1,148 | | |

Textron, Inc. | | | 22,253 | | | | 992 | | |

| | | | 20,417 | | |

Information Technology (13.0%): | |

Arrow Electronics, Inc. (a) | | | 17,153 | | | | 1,454 | | |

Belden, Inc. | | | 19,070 | | | | 1,049 | | |

See notes to financial statements.

21

Victory Portfolios

Victory Integrity Small/Mid-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Conduent, Inc. (a) | | | 99,192 | | | $ | 615 | | |

Diodes, Inc. (a) (b) | | | 18,325 | | | | 1,033 | | |

Flex Ltd. (a) | | | 116,424 | | | | 1,469 | | |

Leidos Holdings, Inc. | | | 14,820 | | | | 1,451 | | |

Lumentum Holdings, Inc. (a) | | | 14,743 | | | | 1,169 | | |

MACOM Technology Solutions Holdings, Inc. (a) | | | 47,917 | | | | 1,275 | | |

MKS Instruments, Inc. | | | 11,373 | | | | 1,251 | | |

NCR Corp. (a) | | | 37,000 | | | | 1,301 | | |

Nuance Communications, Inc. (a) | | | 86,838 | | | | 1,548 | | |

ON Semiconductor Corp. (a) | | | 66,035 | | | | 1,610 | | |

SYNNEX Corp. | | | 11,979 | | | | 1,542 | | |

Verint Systems, Inc. (a) | | | 22,555 | | | | 1,249 | | |

Viavi Solutions, Inc. (a) | | | 64,259 | | | | 964 | | |

| | | | 18,980 | | |

Materials (6.0%): | |

Allegheny Technologies, Inc. (a) (b) | | | 34,191 | | | | 706 | | |

Carpenter Technology Corp. | | | 14,551 | | | | 724 | | |

Cleveland-Cliffs, Inc. (b) | | | 144,047 | | | | 1,211 | | |

Graphic Packaging Holding Co. | | | 64,280 | | | | 1,070 | | |

Huntsman Corp. | | | 44,619 | | | | 1,078 | | |

Ingevity Corp. (a) | | | 11,762 | | | | 1,028 | | |

Louisiana-Pacific Corp. | | | 37,463 | | | | 1,112 | | |

Summit Materials, Inc., Class A (a) | | | 49,250 | | | | 1,177 | | |

US Concrete, Inc. (a) | | | 18,174 | | | | 757 | | |

| | | | 8,863 | | |

Real Estate (11.7%): | |

Americold Realty Trust | | | 46,167 | | | | 1,619 | | |

Apartment Investment & Management Co. | | | 35,042 | | | | 1,810 | | |

Camden Property Trust | | | 17,947 | | | | 1,904 | | |

DiamondRock Hospitality Co. | | | 96,519 | | | | 1,069 | | |

Duke Realty Investments, Inc. | | | 68,891 | | | | 2,389 | | |

Highwoods Properties, Inc. | | | 39,519 | | | | 1,933 | | |

Kimco Realty Corp. | | | 35,713 | | | | 740 | | |

Mack Cali Realty Corp. | | | 47,838 | | | | 1,106 | | |

Medical Properties Trust, Inc. | | | 77,982 | | | | 1,646 | | |

SITE Centers Corp. | | | 99,756 | | | | 1,399 | | |

STORE Capital Corp. | | | 44,440 | | | | 1,655 | | |

| | | | 17,270 | | |

Utilities (5.2%): | |

ALLETE, Inc. | | | 11,342 | | | | 921 | | |

Alliant Energy Corp. | | | 31,589 | | | | 1,728 | | |

Black Hills Corp. | | | 16,250 | | | | 1,276 | | |

Pinnacle West Capital Corp. | | | 11,558 | | | | 1,039 | | |

PNM Resources, Inc. | | | 29,202 | | | | 1,481 | | |

UGI Corp. | | | 26,997 | | | | 1,219 | | |

| | | | 7,664 | | |

Total Common Stocks (Cost $127,729) | | | 145,735 | | |

See notes to financial statements.

22

Victory Portfolios

Victory Integrity Small/Mid-Cap Value Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Collateral for Securities Loaned (4.3%)^ | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 1.75% (c) | | | 301,726 | | | $ | 302 | | |

Fidelity Investments Money Market Government Portfolio, Class I, 1.54% (c) | | | 1,662,295 | | | | 1,662 | | |

Fidelity Investments Prime Money Market Portfolio, Class I, 1.75% (c) | | | 50,396 | | | | 50 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional Class,

1.80% (c) | | | 1,004,198 | | | | 1,004 | | |

JPMorgan Prime Money Market Fund, Capital Class, 1.73% (c) | | | 1,104,496 | | | | 1,105 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional Class,

1.76% (c) | | | 2,209,316 | | | | 2,210 | | |

Total Collateral for Securities Loaned (Cost $6,333) | | | 6,333 | | |

Total Investments (Cost $134,062) — 103.6% | | | 152,068 | | |

Liabilities in excess of other assets — (3.6)% | | | (5,284 | ) | |

NET ASSETS — 100.00% | | $ | 146,784 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on December 31, 2019.

PLC — Public Limited Company

See notes to financial statements.

23

Victory Portfolios

Victory Munder Multi-Cap Fund | | Schedule of Portfolio Investments

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (98.7%) | |

Communication Services (11.8%): | |

Alphabet, Inc., Class A (a) | | | 11,193 | | | $ | 14,991 | | |

Comcast Corp., Class A | | | 187,950 | | | | 8,452 | | |

Facebook, Inc., Class A (a) | | | 49,700 | | | | 10,201 | | |

Nexstar Media Group, Inc., Class A (b) | | | 53,400 | | | | 6,261 | | |

The Walt Disney Co. | | | 28,000 | | | | 4,050 | | |

T-Mobile US, Inc. (a) | | | 39,000 | | | | 3,058 | | |

| | | | 47,013 | | |

Communications Equipment (0.8%): | |

Cisco Systems, Inc. | | | 64,300 | | | | 3,084 | | |

Consumer Discretionary (12.0%): | |

Aaron's, Inc. | | | 41,300 | | | | 2,359 | | |

Amazon.com, Inc. (a) | | | 4,910 | | | | 9,073 | | |

Boot Barn Holdings, Inc. (a) (b) | | | 103,100 | | | | 4,591 | | |

D.R. Horton, Inc. | | | 101,800 | | | | 5,371 | | |

Dollar General Corp. | | | 14,520 | | | | 2,265 | | |

Group 1 Automotive, Inc. | | | 27,600 | | | | 2,760 | | |

LCI Industries | | | 22,700 | | | | 2,432 | | |

LGI Homes, Inc. (a) | | | 34,300 | | | | 2,423 | | |

Marriott Vacations Worldwide Corp. | | | 19,100 | | | | 2,459 | | |

Meritage Homes Corp. (a) | | | 64,200 | | | | 3,923 | | |

Skechers USA, Inc., Class A (a) | | | 99,400 | | | | 4,293 | | |

Target Corp. | | | 47,100 | | | | 6,039 | | |

| | | | 47,988 | | |

Consumer Staples (6.6%): | |

PepsiCo, Inc. | | | 41,300 | | | | 5,644 | | |

The Coca-Cola Co. | | | 104,600 | | | | 5,790 | | |

The Procter & Gamble Co. | | | 57,100 | | | | 7,132 | | |

US Foods Holding Corp. (a) | | | 136,200 | | | | 5,706 | | |

Walmart, Inc. | | | 19,365 | | | | 2,301 | | |

| | | | 26,573 | | |

Electronic Equipment, Instruments & Components (3.6%): | |

CDW Corp. | | | 40,800 | | | | 5,828 | | |

Jabil, Inc. | | | 146,700 | | | | 6,063 | | |

Zebra Technologies Corp. (a) | | | 10,350 | | | | 2,644 | | |

| | | | 14,535 | | |

Energy (3.9%): | |

Chevron Corp. | | | 34,310 | | | | 4,135 | | |

Exxon Mobil Corp. | | | 65,900 | | | | 4,598 | | |

Phillips 66 | | | 31,775 | | | | 3,540 | | |

Valero Energy Corp. | | | 37,700 | | | | 3,531 | | |

| | | | 15,804 | | |

Financials (14.6%): | |

Ally Financial, Inc. | | | 188,065 | | | | 5,747 | | |

Ameriprise Financial, Inc. | | | 35,800 | | | | 5,964 | | |

See notes to financial statements.

24

Victory Portfolios

Victory Munder Multi-Cap Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Citigroup, Inc. | | | 104,100 | | | $ | 8,317 | | |

Discover Financial Services | | | 69,000 | | | | 5,853 | | |

Essent Group Ltd. | | | 111,555 | | | | 5,800 | | |

LPL Financial Holdings, Inc. | | | 69,500 | | | | 6,411 | | |

Meta Financial Group, Inc. | | | 68,200 | | | | 2,490 | | |

NMI Holdings, Inc., Class A (a) (b) | | | 186,200 | | | | 6,178 | | |

Primerica, Inc. | | | 42,700 | | | | 5,575 | | |

Western Alliance Bancorp | | | 110,600 | | | | 6,304 | | |

| | | | 58,639 | | |

Health Care (12.3%): | |

AbbVie, Inc. | | | 88,250 | | | | 7,814 | | |

Anthem, Inc. | | | 20,100 | | | | 6,071 | | |

Biogen, Inc. (a) | | | 18,200 | | | | 5,400 | | |

Bristol-Myers Squibb Co. | | | 133,200 | | | | 8,550 | | |

CVS Health Corp. | | | 47,200 | | | | 3,506 | | |

HCA Healthcare, Inc. | | | 35,600 | | | | 5,262 | | |

Jazz Pharmaceuticals PLC (a) | | | 25,300 | | | | 3,777 | | |

Medtronic PLC | | | 17,200 | | | | 1,951 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 10,600 | | | | 3,980 | | |

UnitedHealth Group, Inc. | | | 10,025 | | | | 2,947 | | |

| | | | 49,258 | | |

Industrials (9.5%): | |

Air Lease Corp. | | | 131,100 | | | | 6,230 | | |

EMCOR Group, Inc. | | | 61,300 | | | | 5,290 | | |

Federal Signal Corp. | | | 158,400 | | | | 5,108 | | |

Kansas City Southern | | | 15,500 | | | | 2,374 | | |

L3Harris Technologies, Inc. | | | 23,700 | | | | 4,690 | | |

Lockheed Martin Corp. | | | 17,600 | | | | 6,853 | | |

SkyWest, Inc. | | | 74,360 | | | | 4,806 | | |

Universal Forest Products, Inc. | | | 55,400 | | | | 2,643 | | |

| | | | 37,994 | | |

IT Services (8.0%): | |

Booz Allen Hamilton Holdings Corp. | | | 52,800 | | | | 3,756 | | |

EPAM Systems, Inc. (a) | | | 19,200 | | | | 4,073 | | |

Euronet Worldwide, Inc. (a) | | | 35,200 | | | | 5,546 | | |

Fiserv, Inc. (a) | | | 49,300 | | | | 5,700 | | |

Mastercard, Inc., Class A | | | 12,000 | | | | 3,583 | | |

Visa, Inc., Class A | | | 23,800 | | | | 4,472 | | |

WNS Holdings Ltd., ADR (a) | | | 87,400 | | | | 5,782 | | |

| | | | 32,912 | | |

Materials (1.4%): | |

Vulcan Materials Co. | | | 39,400 | | | | 5,673 | | |

Real Estate (1.5%): | |

CBRE Group, Inc., Class A (a) | | | 100,000 | | | | 6,129 | | |

Semiconductors & Semiconductor Equipment (1.4%): | |

Broadcom, Inc. | | | 17,200 | | | | 5,436 | | |

See notes to financial statements.

25

Victory Portfolios

Victory Munder Multi-Cap Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Software (6.6%): | |

Adobe, Inc. (a) | | | 9,700 | | | $ | 3,199 | | |

Microsoft Corp. | | | 122,460 | | | | 19,311 | | |

Oracle Corp. | | | 83,800 | | | | 4,440 | | |

| | | | 26,950 | | |

Technology Hardware, Storage & Peripherals (4.7%): | |

Apple, Inc. | | | 64,820 | | | | 19,034 | | |

Total Common Stocks (Cost $314,616) | | | 397,022 | | |

Exchange-Traded Funds (0.5%) | |

iShares Russell 3000 ETF | | | 9,800 | | | | 1,847 | | |

Total Exchange-Traded Funds (Cost $1,826) | | | 1,847 | | |

Collateral for Securities Loaned (0.8%)^ | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 1.75% (c) | | | 147,356 | | | | 147 | | |

Fidelity Investments Money Market Government Portfolio, Class I, 1.54% (c) | | | 811,826 | | | | 812 | | |

Fidelity Investments Prime Money Market Portfolio, Class I, 1.75% (c) | | | 24,612 | | | | 25 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional Class,

1.80% (c) | | | 490,427 | | | | 490 | | |

JPMorgan Prime Money Market Fund, Capital Class, 1.73% (c) | | | 539,508 | | | | 540 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional Class,

1.76% (c) | | | 1,078,979 | | | | 1,079 | | |

Total Collateral for Securities Loaned (Cost $3,093) | | | 3,093 | | |

Total Investments (Cost $319,535) — 100.0% | | | 401,962 | | |

Other assets in excess of liabilities — 0.0% (d) | | | 24 | | |

NET ASSETS — 100.00% | | $ | 401,986 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on December 31, 2019.

(d) Amount represents less than 0.05% of net assets.

ADR — American Depositary Receipt

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

26

Victory Portfolios

Victory S&P 500 Index Fund | | Schedule of Portfolio Investments

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (99.2%) | |

Communication Services (10.3%): | |

Activision Blizzard, Inc. | | | 6,432 | | | $ | 382 | | |

Alphabet, Inc., Class A (a) | | | 2,509 | | | | 3,361 | | |

Alphabet, Inc., Class C (a) | | | 2,502 | | | | 3,345 | | |

AT&T, Inc. | | | 61,158 | | | | 2,390 | | |

CenturyLink, Inc. | | | 8,215 | | | | 109 | | |

Charter Communications, Inc., Class A (a) | | | 1,313 | | | | 637 | | |

Comcast Corp., Class A | | | 38,008 | | | | 1,709 | | |

Discovery, Inc., Class A (a) (b) | | | 1,324 | | | | 43 | | |

Discovery, Inc., Class C (a) | | | 2,808 | | | | 86 | | |

DISH Network Corp., Class A (a) | | | 2,135 | | | | 76 | | |

Electronic Arts, Inc. (a) | | | 2,444 | | | | 263 | | |

Facebook, Inc., Class A (a) | | | 20,147 | | | | 4,135 | | |

Fox Corp., Class A | | | 2,968 | | | | 110 | | |

Fox Corp., Class B | | | 1,359 | | | | 49 | | |

Live Nation Entertainment, Inc. (a) | | | 1,180 | | | | 84 | | |

Netflix, Inc. (a) | | | 3,669 | | | | 1,187 | | |

News Corp., Class A | | | 3,253 | | | | 46 | | |

News Corp., Class B | | | 1,020 | | | | 15 | | |

Omnicom Group, Inc. | | | 1,823 | | | | 148 | | |

Take-Two Interactive Software, Inc. (a) | | | 948 | | | | 116 | | |

The Interpublic Group of Co., Inc. | | | 3,246 | | | | 75 | | |

The Walt Disney Co. | | | 15,090 | | | | 2,183 | | |

T-Mobile US, Inc. (a) | | | 2,650 | | | | 208 | | |

Twitter, Inc. (a) | | | 6,500 | | | | 208 | | |

Verizon Communications, Inc. | | | 34,625 | | | | 2,126 | | |

ViacomCBS, Inc., Class B | | | 4,524 | | | | 190 | | |

| | | | 23,281 | | |

Consumer Discretionary (9.5%): | |

Advance Auto Parts, Inc. | | | 580 | | | | 93 | | |

Amazon.com, Inc. (a) | | | 3,487 | | | | 6,443 | | |

Aptiv PLC | | | 2,137 | | | | 203 | | |

AutoZone, Inc. (a) | | | 199 | | | | 237 | | |

Best Buy Co., Inc. | | | 1,907 | | | | 167 | | |

Booking Holdings, Inc. (a) | | | 350 | | | | 719 | | |

BorgWarner, Inc. | | | 1,729 | | | | 75 | | |

Capri Holdings Ltd. (a) | | | 1,269 | | | | 48 | | |

CarMax, Inc. (a) | | | 1,377 | | | | 121 | | |

Carnival Corp. | | | 3,354 | | | | 170 | | |

Chipotle Mexican Grill, Inc. (a) | | | 214 | | | | 179 | | |

D.R. Horton, Inc. | | | 2,807 | | | | 148 | | |

Darden Restaurants, Inc. | | | 1,026 | | | | 112 | | |

Dollar General Corp. | | | 2,132 | | | | 333 | | |

Dollar Tree, Inc. (a) | | | 1,981 | | | | 186 | | |

eBay, Inc. | | | 6,402 | | | | 231 | | |

Expedia Group, Inc. | | | 1,170 | | | | 127 | | |

Ford Motor Co. | | | 32,601 | | | | 303 | | |

Garmin Ltd. | | | 1,210 | | | | 118 | | |

See notes to financial statements.

27

Victory Portfolios

Victory S&P 500 Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

General Motors Co., Class C | | | 10,526 | | | $ | 385 | | |

Genuine Parts Co. | | | 1,216 | | | | 129 | | |

H&R Block, Inc. | | | 1,635 | | | | 38 | | |

Hanesbrands, Inc. | | | 3,028 | | | | 45 | | |

Harley-Davidson, Inc. (b) | | | 1,292 | | | | 48 | | |

Hasbro, Inc. | | | 1,065 | | | | 112 | | |

Hilton Worldwide Holdings, Inc. | | | 2,362 | | | | 262 | | |

Kohl's Corp. | | | 1,311 | | | | 67 | | |

L Brands, Inc. | | | 1,944 | | | | 35 | | |

Las Vegas Sands Corp. | | | 2,829 | | | | 195 | | |

Leggett & Platt, Inc. | | | 1,102 | | | | 56 | | |

Lennar Corp., Class A | | | 2,343 | | | | 131 | | |

LKQ Corp. (a) | | | 2,566 | | | | 92 | | |

Lowe's Cos., Inc. | | | 6,417 | | | | 768 | | |

Macy's, Inc. | | | 2,587 | | | | 44 | | |

Marriott International, Inc., Class A | | | 2,272 | | | | 344 | | |

McDonald's Corp. | | | 6,305 | | | | 1,247 | | |

MGM Resorts International | | | 4,311 | | | | 143 | | |

Mohawk Industries, Inc. (a) | | | 498 | | | | 68 | | |

Newell Brands, Inc. | | | 3,190 | | | | 61 | | |

Nike, Inc., Class B | | | 10,432 | | | | 1,058 | | |

Nordstrom, Inc. (b) | | | 897 | | | | 37 | | |

Norwegian Cruise Line Holdings Ltd. (a) | | | 1,781 | | | | 104 | | |

NVR, Inc. (a) | | | 29 | | | | 110 | | |

O'Reilly Automotive, Inc. (a) | | | 633 | | | | 277 | | |

PulteGroup, Inc. | | | 2,133 | | | | 83 | | |

PVH Corp. | | | 621 | | | | 65 | | |

Ralph Lauren Corp. | | | 416 | | | | 49 | | |

Ross Stores, Inc. | | | 3,028 | | | | 353 | | |

Royal Caribbean Cruises Ltd. | | | 1,439 | | | | 192 | | |

Starbucks Corp. | | | 9,887 | | | | 869 | | |

Tapestry, Inc. | | | 2,310 | | | | 62 | | |

Target Corp. | | | 4,242 | | | | 543 | | |

The Gap, Inc. | | | 1,781 | | | | 31 | | |

The Home Depot, Inc. | | | 9,133 | | | | 1,995 | | |

The TJX Cos., Inc. | | | 10,153 | | | | 620 | | |

Tiffany & Co. | | | 904 | | | | 121 | | |

Tractor Supply Co. | | | 991 | | | | 93 | | |

Ulta Beauty, Inc. (a) | | | 479 | | | | 121 | | |

Under Armour, Inc., Class A (a) (b) | | | 1,576 | | | | 34 | | |

Under Armour, Inc., Class C (a) | | | 1,629 | | | | 31 | | |

VF Corp. | | | 2,742 | | | | 273 | | |

Whirlpool Corp. | | | 529 | | | | 78 | | |

Wynn Resorts Ltd. | | | 809 | | | | 112 | | |

Yum! Brands, Inc. | | | 2,532 | | | | 255 | | |

| | | | 21,849 | | |

Consumer Staples (7.1%): | |

Altria Group, Inc. | | | 15,640 | | | | 781 | | |

Archer-Daniels-Midland Co. | | | 4,661 | | | | 216 | | |

Brown-Forman Corp., Class B | | | 1,525 | | | | 103 | | |

See notes to financial statements.

28

Victory Portfolios

Victory S&P 500 Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Campbell Soup Co. (b) | | | 1,414 | | | $ | 70 | | |

Church & Dwight Co., Inc. | | | 2,055 | | | | 145 | | |

Colgate-Palmolive Co. | | | 7,175 | | | | 494 | | |

Conagra Brands, Inc. | | | 4,074 | | | | 139 | | |

Constellation Brands, Inc., Class A | | | 1,402 | | | | 266 | | |

Costco Wholesale Corp. | | | 3,699 | | | | 1,087 | | |

Coty, Inc., Class A | | | 2,475 | | | | 28 | | |

General Mills, Inc. | | | 5,060 | | | | 271 | | |

Hormel Foods Corp. (b) | | | 2,328 | | | | 105 | | |

Kellogg Co. | | | 2,085 | | | | 144 | | |

Kimberly-Clark Corp. | | | 2,870 | | | | 395 | | |

Lamb Weston Holdings, Inc. | | | 1,223 | | | | 105 | | |

McCormick & Co., Inc. | | | 1,035 | | | | 176 | | |

Molson Coors Beverage Co., Class B | | | 1,573 | | | | 85 | | |

Mondelez International, Inc., Class A | | | 12,054 | | | | 664 | | |

Monster Beverage Corp. (a) | | | 3,196 | | | | 203 | | |

PepsiCo, Inc. | | | 11,674 | | | | 1,595 | | |

Philip Morris International, Inc. | | | 13,026 | | | | 1,108 | | |

Sysco Corp. | | | 4,272 | | | | 365 | | |

The Clorox Co. | | | 1,051 | | | | 161 | | |

The Coca-Cola Co. | | | 32,283 | | | | 1,787 | | |

The Estee Lauder Cos., Inc., Class A | | | 1,863 | | | | 385 | | |

The Hershey Co. | | | 1,242 | | | | 183 | | |

The J.M. Smucker Co. | | | 955 | | | | 99 | | |

The Kraft Heinz Co. | | | 5,214 | | | | 168 | | |

The Kroger Co. | | | 6,714 | | | | 195 | | |

The Procter & Gamble Co. | | | 20,878 | | | | 2,607 | | |

Tyson Foods, Inc., Class A | | | 2,471 | | | | 225 | | |

Walgreens Boots Alliance, Inc. | | | 6,277 | | | | 370 | | |

Walmart, Inc. | | | 11,876 | | | | 1,412 | | |

| | | | 16,137 | | |

Energy (4.3%): | |

Apache Corp. | | | 3,148 | | | | 81 | | |

Baker Hughes Co. | | | 5,441 | | | | 139 | | |

Cabot Oil & Gas Corp. | | | 3,415 | | | | 59 | | |

Chevron Corp. | | | 15,830 | | | | 1,908 | | |

Cimarex Energy Co. | | | 852 | | | | 45 | | |

Concho Resources, Inc. | | | 1,683 | | | | 147 | | |

ConocoPhillips | | | 9,186 | | | | 597 | | |

Devon Energy Corp. | | | 3,240 | | | | 84 | | |

Diamondback Energy, Inc. | | | 1,349 | | | | 125 | | |

EOG Resources, Inc. | | | 4,871 | | | | 408 | | |

Exxon Mobil Corp. | | | 35,423 | | | | 2,472 | | |

Halliburton Co. | | | 7,349 | | | | 180 | | |

Helmerich & Payne, Inc. | | | 908 | | | | 41 | | |

Hess Corp. | | | 2,168 | | | | 145 | | |

HollyFrontier Corp. | | | 1,243 | | | | 63 | | |

Kinder Morgan, Inc. | | | 16,308 | | | | 345 | | |

Marathon Oil Corp. | | | 6,697 | | | | 91 | | |

Marathon Petroleum Corp. | | | 5,436 | | | | 328 | | |

See notes to financial statements.

29

Victory Portfolios

Victory S&P 500 Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

National Oilwell Varco, Inc. | | | 3,230 | | | $ | 81 | | |

Noble Energy, Inc. | | | 4,004 | | | | 99 | | |

Occidental Petroleum Corp. | | | 7,479 | | | | 308 | | |

ONEOK, Inc. | | | 3,458 | | | | 262 | | |

Phillips 66 | | | 3,720 | | | | 414 | | |

Pioneer Natural Resources Co. | | | 1,387 | | | | 210 | | |

Schlumberger Ltd. | | | 11,590 | | | | 466 | | |

TechnipFMC PLC | | | 3,518 | | | | 75 | | |

The Williams Cos., Inc. | | | 10,147 | | | | 241 | | |

Valero Energy Corp. | | | 3,438 | | | | 322 | | |

| | | | 9,736 | | |

Financials (12.8%): | |

Aflac, Inc. | | | 6,145 | | | | 325 | | |

American Express Co. | | | 5,618 | | | | 699 | | |

American International Group, Inc. | | | 7,283 | | | | 374 | | |

Ameriprise Financial, Inc. | | | 1,061 | | | | 177 | | |

Aon PLC | | | 1,960 | | | | 409 | | |

Arthur J. Gallagher & Co. | | | 1,562 | | | | 149 | | |

Assurant, Inc. | | | 508 | | | | 67 | | |

Bank of America Corp. | | | 67,777 | | | | 2,386 | | |

Berkshire Hathaway, Inc., Class B (a) | | | 16,376 | | | | 3,709 | | |

BlackRock, Inc., Class A | | | 987 | | | | 496 | | |

Capital One Financial Corp. | | | 3,899 | | | | 401 | | |

Cboe Global Markets, Inc. | | | 928 | | | | 111 | | |

Chubb Ltd. | | | 3,794 | | | | 591 | | |

Cincinnati Financial Corp. | | | 1,272 | | | | 134 | | |

Citigroup, Inc. | | | 18,278 | | | | 1,460 | | |

Citizens Financial Group, Inc. | | | 3,639 | | | | 148 | | |

CME Group, Inc. | | | 3,000 | | | | 602 | | |

Comerica, Inc. | | | 1,207 | | | | 87 | | |

Discover Financial Services | | | 2,624 | | | | 223 | | |

E*TRADE Financial Corp. | | | 1,891 | | | | 86 | | |

Everest Re Group Ltd. | | | 341 | | | | 94 | | |

Fifth Third Bancorp. | | | 5,941 | | | | 183 | | |

First Republic Bank | | | 1,411 | | | | 166 | | |

Franklin Resources, Inc. | | | 2,335 | | | | 61 | | |

Globe Life, Inc. (b) | | | 834 | | | | 88 | | |

Huntington Bancshares, Inc. | | | 8,646 | | | | 130 | | |

Intercontinental Exchange, Inc. | | | 4,662 | | | | 431 | | |

Invesco Ltd. (b) | | | 3,116 | | | | 56 | | |

JPMorgan Chase & Co. | | | 26,259 | | | | 3,660 | | |

KeyCorp | | | 8,246 | | | | 167 | | |

Lincoln National Corp. | | | 1,660 | | | | 98 | | |

Loews Corp. | | | 2,142 | | | | 112 | | |

M&T Bank Corp. | | | 1,105 | | | | 188 | | |

MarketAxess Holdings, Inc. | | | 318 | | | | 121 | | |

Marsh & McLennan Cos., Inc. | | | 4,225 | | | | 470 | | |

MetLife, Inc. | | | 6,544 | | | | 334 | | |

Moody's Corp. | | | 1,359 | | | | 323 | | |

Morgan Stanley | | | 10,299 | | | | 526 | | |

See notes to financial statements.

30

Victory Portfolios

Victory S&P 500 Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

MSCI, Inc. | | | 709 | | | $ | 183 | | |

Nasdaq, Inc. | | | 961 | | | | 103 | | |

Northern Trust Corp. | | | 1,774 | | | | 188 | | |

People's United Financial, Inc. | | | 3,718 | | | | 63 | | |

Principal Financial Group, Inc. | | | 2,162 | | | | 119 | | |

Prudential Financial, Inc. | | | 3,366 | | | | 316 | | |

Raymond James Financial, Inc. | | | 1,034 | | | | 93 | | |

Regions Financial Corp. | | | 8,076 | | | | 139 | | |

S&P Global, Inc. | | | 2,046 | | | | 559 | | |

State Street Corp. | | | 3,044 | | | | 241 | | |

SVB Financial Group (a) | | | 432 | | | | 108 | | |

Synchrony Financial | | | 4,977 | | | | 179 | | |

T. Rowe Price Group, Inc. | | | 1,956 | | | | 238 | | |

The Allstate Corp. | | | 2,712 | | | | 305 | | |

The Bank of New York Mellon Corp. | | | 7,026 | | | | 354 | | |

The Charles Schwab Corp. | | | 9,572 | | | | 455 | | |

The Goldman Sachs Group, Inc. | | | 2,668 | | | | 613 | | |

The Hartford Financial Services Group, Inc. | | | 3,017 | | | | 183 | | |

The PNC Financial Services Group, Inc. | | | 3,668 | | | | 586 | | |

The Progressive Corp. | | | 4,895 | | | | 354 | | |

The Travelers Cos., Inc. | | | 2,161 | | | | 296 | | |

Truist Financial Corp. | | | 11,227 | | | | 632 | | |

U.S. Bancorp | | | 11,899 | | | | 705 | | |

Unum Group | | | 1,727 | | | | 50 | | |

W.R. Berkley Corp. | | | 1,215 | | | | 84 | | |

Wells Fargo & Co. | | | 32,222 | | | | 1,733 | | |

Willis Towers Watson PLC | | | 1,076 | | | | 217 | | |

Zions Bancorp NA | | | 1,427 | | | | 74 | | |

| | | | 29,012 | | |

Health Care (14.1%): | |

Abbott Laboratories | | | 14,797 | | | | 1,286 | | |

AbbVie, Inc. | | | 12,381 | | | | 1,097 | | |

ABIOMED, Inc. (a) | | | 378 | | | | 64 | | |

Agilent Technologies, Inc. | | | 2,591 | | | | 221 | | |

Alexion Pharmaceuticals, Inc. (a) | | | 1,853 | | | | 200 | | |

Align Technology, Inc. (a) | | | 600 | | | | 167 | | |

Allergan PLC | | | 2,748 | | | | 525 | | |

AmerisourceBergen Corp. | | | 1,259 | | | | 107 | | |