UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04852

Victory Portfolios

(Exact name of registrant as specified in charter)

| 4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | 44144 |

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

Item 1. Reports to Stockholders.

April 30, 2020

Semi Annual Report

Victory Diversified Stock Fund

Victory NewBridge Large Cap Growth Fund

Victory Special Value Fund

Victory Strategic Allocation Fund

Victory INCORE Fund for Income

Victory INCORE Investment Grade Convertible Fund

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Victory Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Victory Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on www.VictoryFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Victory Funds or your financial intermediary electronically by notifying your financial intermediary directly or, if you are a direct investor, by calling 800-539-3863 or by sending an e-mail request to TA.Processing@FISGlobal.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Victory Funds, you can call 800-539-3863 or send an e-mail request to TA.Processing@FISGlobal.com. Your election to receive reports in paper will apply to all Victory Funds you hold directly or through your financial intermediary.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

Table of Contents

Financial Statements | |

Victory Diversified Stock Fund | |

Investment Objectives & Portfolio Holdings | | | 4 | | |

Schedule of Portfolio Investments | | | 6 | | |

Statements of Assets and Liabilities | | | 20-21 | | |

Statements of Operations | | | 24 | | |

Statements of Changes in Net Assets | | | 26-28 | | |

Financial Highlights | | | 32-35 | | |

Victory NewBridge Large Cap Growth Fund | |

Investment Objectives & Portfolio Holdings | | | 4 | | |

Schedule of Portfolio Investments | | | 9 | | |

Statements of Assets and Liabilities | | | 20-21 | | |

Statements of Operations | | | 24 | | |

Statements of Changes in Net Assets | | | 26-28 | | |

Financial Highlights | | | 36-37 | | |

Victory Special Value Fund | |

Investment Objectives & Portfolio Holdings | | | 4 | | |

Schedule of Portfolio Investments | | | 11 | | |

Statements of Assets and Liabilities | | | 20-21 | | |

Statements of Operations | | | 24 | | |

Statements of Changes in Net Assets | | | 26-28 | | |

Financial Highlights | | | 38-41 | | |

Victory Strategic Allocation Fund | |

Investment Objectives & Portfolio Holdings | | | 4 | | |

Schedule of Portfolio Investments | | | 14 | | |

Statements of Assets and Liabilities | | | 22-23 | | |

Statements of Operations | | | 25 | | |

Statements of Changes in Net Assets | | | 29-31 | | |

Financial Highlights | | | 42-43 | | |

Victory INCORE Fund for Income | |

Investment Objectives & Portfolio Holdings | | | 5 | | |

Schedule of Portfolio Investments | | | 15 | | |

Statements of Assets and Liabilities | | | 22-23 | | |

Statements of Operations | | | 25 | | |

Statements of Changes in Net Assets | | | 29-31 | | |

Financial Highlights | | | 44-47 | | |

Victory INCORE Investment Grade Convertible Fund | |

Investment Objectives & Portfolio Holdings | | | 5 | | |

Schedule of Portfolio Investments | | | 17 | | |

Statements of Assets and Liabilities | | | 22-23 | | |

Statements of Operations | | | 25 | | |

Statements of Changes in Net Assets | | | 29-31 | | |

Financial Highlights | | | 48-49 | | |

Notes to Financial Statements | | | 50 | | |

1

Supplemental Information | | | |

Proxy Voting and Portfolio Holdings Information | | | 62 | | |

Expense Examples | | | 62 | | |

Considerations of the Board in Continuing the

Investment Advisory Agreement | | | 64 | | |

Privacy Policy (inside back cover) | | | |

The Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at vcm.com or call 800-539-3863. Read it carefully before you invest or send money.

The information in this semi annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

Visit our website at:

www.vcm.com

2

This page is intentionally left blank.

3

Victory Portfolios | | April 30, 2020 | |

(Unaudited)

Investment Objectives & Portfolio Holdings:

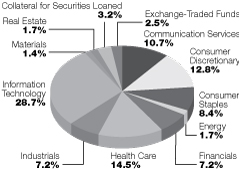

Diversified Stock Fund

Seeks to provide long-term growth of capital. | |

Portfolio Holdings

As a Percentage of Total Investments

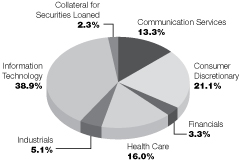

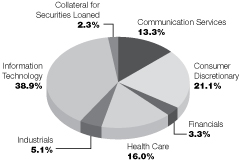

NewBridge Large Cap Growth Fund

Seeks to provide long-term capital appreciation. | |

Portfolio Holdings

As a Percentage of Total Investments

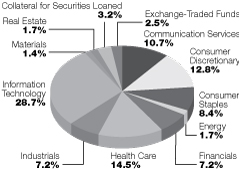

Special Value Fund

Seeks to provide long-term growth of capital

and dividend income. | |

Portfolio Holdings

As a Percentage of Total Investments

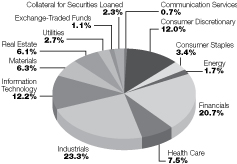

Strategic Allocation Fund

Seeks to provide income and long-term

growth of capital. | |

Portfolio Holdings

As a Percentage of Total Investments

4

Victory Portfolios | | April 30, 2020 | |

(Unaudited)

Investment Objectives & Portfolio Holdings: (continued)

INCORE Fund for Income

Seeks to provide a high level of current income

consistent with preservation of shareholder's capital. | |

Portfolio Holdings

As a Percentage of Total Investments

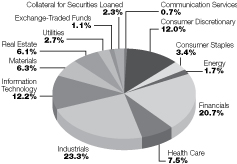

INCORE Investment Grade Convertible Fund

Seeks to provide a high level of current income

together with long-term capital appreciation. | |

Portfolio Holdings

As a Percentage of Total Investments

5

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (95.7%) | |

Communication Services (10.9%): | |

Alphabet, Inc., Class C (a) | | | 7,604 | | | $ | 10,256 | | |

Comcast Corp., Class A | | | 78,359 | | | | 2,948 | | |

Facebook, Inc., Class A (a) | | | 25,359 | | | | 5,191 | | |

Netflix, Inc. (a) | | | 7,494 | | | | 3,146 | | |

Nexstar Media Group, Inc., Class A | | | 19,457 | | | | 1,363 | | |

T-Mobile US, Inc. (a) | | | 35,144 | | | | 3,086 | | |

| | | | 25,990 | | |

Communications Equipment (1.3%): | |

Cisco Systems, Inc. | | | 41,847 | | | | 1,773 | | |

Lumentum Holdings, Inc. (a) | | | 16,028 | | | | 1,297 | | |

| | | | 3,070 | | |

Consumer Discretionary (13.0%): | |

Amazon.com, Inc. (a) | | | 5,288 | | | | 13,082 | | |

Boyd Gaming Corp. | | | 137,472 | | | | 2,294 | | |

D.R. Horton, Inc. | | | 27,714 | | | | 1,309 | | |

Dollar General Corp. | | | 21,683 | | | | 3,801 | | |

Installed Building Products, Inc. (a) | | | 22,875 | | | | 1,128 | | |

LGI Homes, Inc. (a) | | | 22,088 | | | | 1,338 | | |

Marriott Vacations Worldwide Corp. | | | 12,252 | | | | 1,017 | | |

Meritage Homes Corp. (a) | | | 26,237 | | | | 1,379 | | |

Skechers USA, Inc., Class A (a) | | | 64,615 | | | | 1,821 | | |

Target Corp. | | | 22,681 | | | | 2,489 | | |

TopBuild Corp. (a) | | | 14,367 | | | | 1,339 | | |

| | | | 30,997 | | |

Consumer Staples (8.5%): | |

Kimberly-Clark Corp. | | | 22,408 | | | | 3,103 | | |

PepsiCo, Inc. | | | 25,004 | | | | 3,307 | | |

Philip Morris International, Inc. | | | 17,425 | | | | 1,300 | | |

The Coca-Cola Co. | | | 35,882 | | | | 1,647 | | |

The Kroger Co. | | | 94,508 | | | | 2,987 | | |

The Procter & Gamble Co. | | | 28,591 | | | | 3,370 | | |

US Foods Holding Corp. (a) | | | 120,535 | | | | 2,592 | | |

Walmart, Inc. | | | 16,880 | | | | 2,052 | | |

| | | | 20,358 | | |

Electronic Equipment, Instruments & Components (1.2%): | |

CDW Corp. | | | 26,673 | | | | 2,955 | | |

Energy (1.8%): | |

Chevron Corp. | | | 14,038 | | | | 1,291 | | |

Phillips 66 | | | 19,844 | | | | 1,453 | | |

Valero Energy Corp. | | | 22,639 | | | | 1,434 | | |

| | | | 4,178 | | |

Financials (7.3%): | |

Ameriprise Financial, Inc. | | | 22,728 | | | | 2,613 | | |

Citigroup, Inc. | | | 45,639 | | | | 2,216 | | |

See notes to financial statements.

6

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Essent Group Ltd. | | | 82,376 | | | $ | 2,250 | | |

Flagstar Bancorp, Inc. | | | 77,220 | | | | 2,000 | | |

Meta Financial Group, Inc. (b) | | | 72,889 | | | | 1,343 | | |

NMI Holdings, Inc., Class A (a) | | | 106,825 | | | | 1,444 | | |

Primerica, Inc. | | | 18,011 | | | | 1,872 | | |

Stifel Financial Corp. | | | 24,534 | | | | 1,086 | | |

Western Alliance Bancorp | | | 70,980 | | | | 2,547 | | |

| | | | 17,371 | | |

Health Care (14.7%): | |

AbbVie, Inc. (b) | | | 57,437 | | | | 4,721 | | |

Bristol-Myers Squibb Co. | | | 70,143 | | | | 4,266 | | |

Charles River Laboratories International, Inc. (a) | | | 21,738 | | | | 3,146 | | |

HCA Healthcare, Inc. | | | 20,879 | | | | 2,294 | | |

ICON PLC (a) | | | 19,070 | | | | 3,060 | | |

Medtronic PLC | | | 10,113 | | | | 987 | | |

Merck & Co., Inc. | | | 38,823 | | | | 3,080 | | |

Pfizer, Inc. | | | 70,248 | | | | 2,695 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 5,800 | | | | 3,050 | | |

Syneos Health, Inc. (a) | | | 38,181 | | | | 2,130 | | |

UnitedHealth Group, Inc. | | | 19,750 | | | | 5,776 | | |

| | | | 35,205 | | |

Industrials (7.3%): | |

Federal Signal Corp. | | | 102,087 | | | | 2,749 | | |

Kansas City Southern | | | 16,696 | | | | 2,180 | | |

L3Harris Technologies, Inc. | | | 15,546 | | | | 3,011 | | |

Lockheed Martin Corp. | | | 10,899 | | | | 4,240 | | |

Old Dominion Freight Line, Inc. | | | 9,357 | | | | 1,359 | | |

Universal Forest Products, Inc. | | | 55,317 | | | | 2,275 | | |

XPO Logistics, Inc. (a)(b) | | | 24,164 | | | | 1,613 | | |

| | | | 17,427 | | |

IT Services (5.6%): | |

Booz Allen Hamilton Holdings Corp. | | | 37,460 | | | | 2,751 | | |

EPAM Systems, Inc. (a) | | | 12,136 | | | | 2,681 | | |

Fiserv, Inc. (a) | | | 21,741 | | | | 2,241 | | |

Leidos Holdings, Inc. | | | 25,479 | | | | 2,518 | | |

Mastercard, Inc., Class A | | | 5,071 | | | | 1,394 | | |

Visa, Inc., Class A (b) | | | 10,477 | | | | 1,872 | | |

| | | | 13,457 | | |

Materials (1.4%): | |

Silgan Holdings, Inc. | | | 38,897 | | | | 1,342 | | |

Vulcan Materials Co. | | | 18,018 | | | | 2,035 | | |

| | | | 3,377 | | |

Real Estate (1.7%): | |

American Tower Corp. | | | 8,845 | | | | 2,105 | | |

CBRE Group, Inc., Class A (a) | | | 45,677 | | | | 1,961 | | |

| | | | 4,066 | | |

See notes to financial statements.

7

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Semiconductors & Semiconductor Equipment (3.7%): | |

Broadcom, Inc. | | | 15,908 | | | $ | 4,321 | | |

NVIDIA Corp. | | | 15,641 | | | | 4,571 | | |

| | | | 8,892 | | |

Software (12.0%): | |

Adobe, Inc. (a) | | | 9,281 | | | | 3,282 | | |

Microsoft Corp. | | | 91,577 | | | | 16,412 | | |

Oracle Corp. | | | 53,210 | | | | 2,819 | | |

Salesforce.com, Inc. (a) | | | 26,336 | | | | 4,265 | | |

ServiceNow, Inc. (a) | | | 4,421 | | | | 1,554 | | |

| | | | 28,332 | | |

Technology Hardware, Storage & Peripherals (5.3%): | |

Apple, Inc. | | | 43,225 | | | | 12,700 | | |

Total Common Stocks (Cost $194,732) | | | 228,375 | | |

Exchange-Traded Funds (2.5%) | |

SPDR S&P 500 ETF Trust | | | 20,472 | | | | 5,947 | | |

Total Exchange-Traded Funds (Cost $5,631) | | | 5,947 | | |

Collateral for Securities Loaned^ (3.3%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.61% (c) | | | 147,588 | | | | 148 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Class, 0.18% (c) | | | 3,379,472 | | | | 3,379 | | |

Fidelity Investments Money Market Prime Money Market Portfolio,

Institutional Class, 0.47% (c) | | | 73,622 | | | | 74 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.67% (c) | | | 1,026,322 | | | | 1,026 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.68% (c) | | | 587,291 | | | | 587 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.72% (c) | | | 2,640,573 | | | | 2,641 | | |

Total Collateral for Securities Loaned (Cost $7,855) | | | 7,855 | | |

Total Investments (Cost $208,218) — 101.5% | | | 242,177 | | |

Liabilities in excess of other assets — (1.5)% | | | (3,462 | ) | |

NET ASSETS — 100.00% | | $ | 238,715 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on April 30, 2020.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

8

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (98.7%) | |

Communication Services (13.3%): | |

Activision Blizzard, Inc. | | | 8,873 | | | $ | 565 | | |

Alphabet, Inc., Class C (a) | | | 565 | | | | 762 | | |

Facebook, Inc., Class A (a) | | | 3,359 | | | | 688 | | |

| | | | 2,015 | | |

Consumer Discretionary (21.5%): | |

Alibaba Group Holding Ltd., ADR (a) | | | 2,823 | | | | 572 | | |

Amazon.com, Inc. (a) | | | 509 | | | | 1,259 | | |

Burlington Stores, Inc. (a) | | | 2,839 | | | | 519 | | |

Lululemon Athletica, Inc. (a) | | | 2,747 | | | | 614 | | |

Ulta Beauty, Inc. (a) | | | 1,300 | | | | 283 | | |

| | | | 3,247 | | |

Electronic Equipment, Instruments & Components (2.1%): | |

Keysight Technologies, Inc. (a) | | | 3,362 | | | | 325 | | |

Financials (3.4%): | |

MSCI, Inc. | | | 1,550 | | | | 507 | | |

Health Care (16.3%): | |

Edwards Lifesciences Corp. (a) | | | 1,966 | | | | 428 | | |

UnitedHealth Group, Inc. | | | 1,794 | | | | 525 | | |

Veeva Systems, Inc., Class A (a) | | | 2,584 | | | | 493 | | |

Vertex Pharmaceuticals, Inc. (a) | | | 1,619 | | | | 407 | | |

Zoetis, Inc. | | | 4,628 | | | | 598 | | |

| | | | 2,451 | | |

Industrials (5.3%): | |

CoStar Group, Inc. (a) | | | 738 | | | | 478 | | |

Uber Technologies, Inc. (a) | | | 10,321 | | | | 312 | | |

| | | | 790 | | |

IT Services (15.5%): | |

EPAM Systems, Inc. (a) | | | 2,352 | | | | 520 | | |

PayPal Holdings, Inc. (a) | | | 5,171 | | | | 636 | | |

Shopify, Inc., Class A (a) | | | 433 | | | | 274 | | |

Visa, Inc., Class A | | | 5,257 | | | | 939 | | |

| | | | 2,369 | | |

Semiconductors & Semiconductor Equipment (4.8%): | |

NVIDIA Corp. | | | 2,463 | | | | 720 | | |

Software (16.5%): | |

Adobe, Inc. (a) | | | 1,284 | | | | 454 | | |

Proofpoint, Inc. (a) | | | 2,687 | | | | 327 | | |

Salesforce.com, Inc. (a) | | | 3,077 | | | | 498 | | |

ServiceNow, Inc. (a) | | | 2,525 | | | | 889 | | |

The Trade Desk, Inc., Class A (a) (b) | | | 1,174 | | | | 343 | | |

| | | | 2,511 | | |

Total Common Stocks (Cost $7,949) | | | 14,935 | | |

See notes to financial statements.

9

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Collateral for Securities Loaned^ (2.3%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.61% (c) | | | 6,556 | | | $ | 7 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Class, 0.18% (c) | | | 150,126 | | | | 150 | | |

Fidelity Investments Money Market Prime Money Market Portfolio,

Institutional Class, 0.47% (c) | | | 3,270 | | | | 3 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.67% (c) | | | 45,592 | | | | 46 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.68% (c) | | | 26,089 | | | | 26 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.72% (c) | | | 117,302 | | | | 117 | | |

Total Collateral for Securities Loaned (Cost $349) | | | 349 | | |

Total Investments (Cost $8,298) — 101.0% | | | 15,284 | | |

Liabilities in excess of other assets — (1.0)% | | | (155 | ) | |

NET ASSETS — 100.00% | | $ | 15,129 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on April 30, 2020.

ADR — American Depositary Receipt

See notes to financial statements.

10

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (95.6%) | |

Communication Services (10.9%): | |

Alphabet, Inc., Class C (a) | | | 1,379 | | | $ | 1,859 | | |

Comcast Corp., Class A | | | 14,210 | | | | 535 | | |

Facebook, Inc., Class A (a) | | | 4,585 | | | | 939 | | |

Netflix, Inc. (a) | | | 1,355 | | | | 569 | | |

Nexstar Media Group, Inc., Class A | | | 3,558 | | | | 249 | | |

T-Mobile US, Inc. (a) | | | 6,340 | | | | 557 | | |

| | | | 4,708 | | |

Communications Equipment (1.3%): | |

Cisco Systems, Inc. | | | 7,591 | | | | 322 | | |

Lumentum Holdings, Inc. (a) | | | 2,907 | | | | 235 | | |

| | | | 557 | | |

Consumer Discretionary (13.0%): | |

Amazon.com, Inc. (a) | | | 969 | | | | 2,398 | | |

Boyd Gaming Corp. | | | 24,901 | | | | 416 | | |

D.R. Horton, Inc. | | | 5,043 | | | | 238 | | |

Dollar General Corp. | | | 3,887 | | | | 681 | | |

Installed Building Products, Inc. (a) | | | 4,101 | | | | 202 | | |

LGI Homes, Inc. (a) (b) | | | 4,019 | | | | 243 | | |

Marriott Vacations Worldwide Corp. | | | 2,209 | | | | 183 | | |

Meritage Homes Corp. (a) | | | 4,774 | | | | 251 | | |

Skechers USA, Inc., Class A (a) | | | 11,719 | | | | 330 | | |

Target Corp. | | | 4,078 | | | | 448 | | |

TopBuild Corp. (a) | | | 2,614 | | | | 244 | | |

| | | | 5,634 | | |

Consumer Staples (8.5%): | |

Kimberly-Clark Corp. | | | 4,066 | | | | 563 | | |

PepsiCo, Inc. | | | 4,529 | | | | 599 | | |

Philip Morris International, Inc. | | | 3,110 | | | | 232 | | |

The Coca-Cola Co. | | | 6,500 | | | | 298 | | |

The Kroger Co. | | | 17,147 | | | | 542 | | |

The Procter & Gamble Co. | | | 5,137 | | | | 606 | | |

US. Foods Holding Corp. (a) | | | 21,656 | | | | 466 | | |

Walmart, Inc. | | | 3,070 | | | | 373 | | |

| | | | 3,679 | | |

Electronic Equipment, Instruments & Components (1.2%): | |

CDW Corp. | | | 4,811 | | | | 533 | | |

Energy (1.7%): | |

Chevron Corp. | | | 2,545 | | | | 234 | | |

Phillips 66 | | | 3,581 | | | | 262 | | |

Valero Energy Corp. | | | 3,909 | | | | 248 | | |

| | | | 744 | | |

See notes to financial statements.

11

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Financials (7.2%): | |

Ameriprise Financial, Inc. | | | 4,118 | | | $ | 474 | | |

Citigroup, Inc. | | | 8,300 | | | | 403 | | |

Essent Group Ltd. | | | 14,418 | | | | 394 | | |

Flagstar Bancorp, Inc. | | | 13,945 | | | | 361 | | |

Meta Financial Group, Inc. | | | 13,153 | | | | 242 | | |

NMI Holdings, Inc., Class A (a) | | | 19,243 | | | | 260 | | |

Primerica, Inc. | | | 3,277 | | | | 341 | | |

Stifel Financial Corp. | | | 4,408 | | | | 195 | | |

Western Alliance Bancorp | | | 12,708 | | | | 456 | | |

| | | | 3,126 | | |

Health Care (14.7%): | |

AbbVie, Inc. | | | 10,319 | | | | 848 | | |

Bristol-Myers Squibb Co. | | | 12,678 | | | | 770 | | |

Charles River Laboratories International, Inc. (a) | | | 3,921 | | | | 567 | | |

HCA Healthcare, Inc. | | | 3,790 | | | | 416 | | |

ICON PLC (a) | | | 3,440 | | | | 552 | | |

Medtronic PLC | | | 1,835 | | | | 179 | | |

Merck & Co., Inc. | | | 7,003 | | | | 556 | | |

Pfizer, Inc. | | | 12,631 | | | | 485 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 1,046 | | | | 550 | | |

Syneos Health, Inc. (a) | | | 6,866 | | | | 383 | | |

UnitedHealth Group, Inc. | | | 3,594 | | | | 1,052 | | |

| | | | 6,358 | | |

Industrials (7.3%): | |

Federal Signal Corp. | | | 18,294 | | | | 493 | | |

Kansas City Southern | | | 3,041 | | | | 397 | | |

L3Harris Technologies, Inc. | | | 2,807 | | | | 544 | | |

Lockheed Martin Corp. | | | 1,972 | | | | 766 | | |

Old Dominion Freight Line, Inc. | | | 1,698 | | | | 247 | | |

Universal Forest Products, Inc. | | | 9,924 | | | | 408 | | |

XPO Logistics, Inc. (a) (b) | | | 4,384 | | | | 293 | | |

| | | | 3,148 | | |

IT Services (5.7%): | |

Booz Allen Hamilton Holdings Corp. | | | 6,774 | | | | 496 | | |

EPAM Systems, Inc. (a) | | | 2,189 | | | | 484 | | |

Fiserv, Inc. (a) | | | 3,880 | | | | 400 | | |

Leidos Holdings, Inc. | | | 4,548 | | | | 449 | | |

Mastercard, Inc., Class A | | | 922 | | | | 254 | | |

Visa, Inc., Class A | | | 1,905 | | | | 340 | | |

| | | | 2,423 | | |

Materials (1.4%): | |

Silgan Holdings, Inc. | | | 7,057 | | | | 243 | | |

Vulcan Materials Co. | | | 3,237 | | | | 366 | | |

| | | | 609 | | |

See notes to financial statements.

12

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Real Estate (1.7%): | |

American Tower Corp. | | | 1,596 | | | $ | 380 | | |

CBRE Group, Inc., Class A (a) | | | 8,311 | | | | 357 | | |

| | | | 737 | | |

Semiconductors & Semiconductor Equipment (3.7%): | |

Broadcom, Inc. | | | 2,858 | | | | 776 | | |

NVIDIA Corp. | | | 2,865 | | | | 838 | | |

| | | | 1,614 | | |

Software (12.0%): | |

Adobe, Inc. (a) | | | 1,697 | | | | 600 | | |

Microsoft Corp. | | | 16,559 | | | | 2,967 | | |

Oracle Corp. | | | 9,645 | | | | 511 | | |

Salesforce.com, Inc. (a) | | | 4,823 | | | | 781 | | |

ServiceNow, Inc. (a) | | | 805 | | | | 283 | | |

| | | | 5,142 | | |

Technology Hardware, Storage & Peripherals (5.3%): | |

Apple, Inc. | | | 7,855 | | | | 2,308 | | |

Total Common Stocks (Cost $36,088) | | | 41,320 | | |

Exchange-Traded Funds (2.5%) | |

SPDR S&P 500 ETF Trust | | | 3,704 | | | | 1,076 | | |

Total Exchange-Traded Funds (Cost $1,004) | | | 1,076 | | |

Collateral for Securities Loaned^ (1.2%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.61% (c) | | | 9,453 | | | | 9 | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class,

0.18% (c) | | | 216,455 | | | | 216 | | |

Fidelity Investments Money Market Prime Money Market Portfolio, Institutional

Class, 0.47% (c) | | | 4,715 | | | | 5 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional Class,

0.67% (c) | | | 65,736 | | | | 66 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.68% (c) | | | 37,616 | | | | 38 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional Class,

0.72% (c) | | | 169,128 | | | | 169 | | |

Total Collateral for Securities Loaned (Cost $503) | | | 503 | | |

Total Investments (Cost $37,595) — 99.3% | | | 42,899 | | |

Other assets in excess of liabilities — 0.7% | | | 324 | | |

NET ASSETS — 100.00% | | $ | 43,223 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on April 30, 2020.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

13

Victory Portfolios

Victory Strategic Allocation Fund | | Schedule of Portfolio Investments

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Affiliated Exchange-Traded Funds (6.8%) | |

VictoryShares US Multi-Factor Minimum Volatility ETF | | | 51,490 | | | $ | 1,508 | | |

Total Affiliated Exchange-Traded Funds (Cost $1,307) | | | 1,508 | | |

Affiliated Mutual Funds (93.2%) | |

Victory INCORE Total Return Bond Fund, Class R6 | | | 327,464 | | | | 3,209 | | |

Victory Integrity Discovery Fund, Class Y | | | 24,258 | | | | 604 | | |

Victory Market Neutral Income Fund, Class I | | | 542,049 | | | | 5,290 | | |

Victory RS Global Fund, Class Y (a) | | | 479,056 | | | | 6,300 | | |

Victory RS Partners Fund, Class Y | | | 34,289 | | | | 658 | | |

Victory Sophus Emerging Markets Small Cap Fund, Class Y | | | 270,871 | | | | 1,503 | | |

Victory Trivalent Emerging Markets Small-Cap Fund, Class Y | | | 161,324 | | | | 1,610 | | |

Victory Trivalent International Small-Cap Fund, Class I | | | 133,014 | | | | 1,523 | | |

Total Affiliated Mutual Funds (Cost $21,862) | | | 20,697 | | |

Total Investments (Cost $23,169) — 100.0% | | | 22,205 | | |

Other assets in excess of liabilities — 0.0% | | | 10 | | |

NET ASSETS — 100.00% | | $ | 22,215 | | |

(a) Represents investments greater than 25% of the Fund's net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. The financial statements and portfolio holdings for these securities can be found at www.sec.gov.

ETF — Exchange-Traded Fund

See notes to financial statements.

14

Victory Portfolios

Victory INCORE Fund for Income | | Schedule of Portfolio Investments

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Government National Mortgage Association (72.3%) | |

Multi-family (0.5%): | |

Collateralized Mortgage Obligations (0.3%): | |

Government National Mortgage Assoc. | |

Series 2012-33, Class AB, 7.00%, 3/16/46 | | $ | 2,407 | | | $ | 2,558 | | |

Pass-throughs (0.2%): | |

Government National Mortgage Assoc. | |

7.49%, 8/15/20 – 11/15/20 | | | 5 | | | | 5 | | |

7.50%, 8/15/21 | | | 6 | | | | 6 | | |

7.92%, 7/1/23 | | | 225 | | | | 225 | | |

8.00%, 1/15/31 – 11/15/33 | | | 1,134 | | | | 1,135 | | |

7.75%, 9/15/33 | | | 407 | | | | 407 | | |

| | | | 1,778 | | |

Single Family (71.8%): | |

Collateralized Mortgage Obligations (3.0%): | |

Government National Mortgage Assoc. | |

Series 1999-4, Class ZB, 6.00%, 2/20/29 | | | 229 | | | | 229 | | |

Series 2001-10, Class PE, 6.50%, 3/16/31 | | | 180 | | | | 180 | | |

Series 2002-22, Class GF, 6.50%, 3/20/32 | | | 31 | | | | 31 | | |

Series 2005-74, Class HB, 7.50%, 9/16/35 | | | 14 | | | | 16 | | |

Series 2005-74, Class HC, 7.50%, 9/16/35 | | | 70 | | | | 82 | | |

Series 2011-166, Class NT, 7.75%, 11/20/31 (a) | | | 1,045 | | | | 1,234 | | |

Series 2012-106, Class JM, 7.30%, 10/20/34 (a) | | | 834 | | | | 991 | | |

Series 2012-30, Class WB, 7.07%, 11/20/39 (a) | | | 3,271 | | | | 3,821 | | |

Series 2013-190, Class KT, 8.12%, 9/20/30 (a) | | | 470 | | | | 539 | | |

Series 2013-51, Class BL, 6.08%, 4/20/34 (a) | | | 2,229 | | | | 2,607 | | |

Series 2013-64, Class KY, 6.87%, 12/20/38 (a) | | | 1,348 | | | | 1,565 | | |

Series 2013-70, Class KP, 7.05%, 2/20/39 (a) | | | 1,113 | | | | 1,333 | | |

Series 2014-69, Class W, 7.21%, 11/20/34 (a) | | | 165 | | | | 194 | | |

Series 2014-74, Class PT, 7.78%, 5/16/44 (a) | | | 282 | | | | 325 | | |

Series 2015-77, Class PT, 7.74%, 6/20/39 (a) | | | 685 | | | | 789 | | |

Series 2019-22, Class PT, 7.91%, 2/20/49 (a) | | | 9,836 | | | | 11,430 | | |

| | | | 25,366 | | |

Pass-throughs (68.8%): | |

Government National Mortgage Assoc. | |

9.00%, 6/15/20 – 12/15/30 | | | 3,399 | | | | 3,828 | | |

9.50%, 6/15/20 – 9/15/27 | | | 203 | | | | 221 | | |

7.75%, 11/15/20 | | | 17 | | | | 17 | | |

10.50%, 12/15/20 | | | — | (b) | | | — | (b) | |

6.00%, 1/15/22 – 2/20/49 | | | 66,396 | | | | 76,199 | | |

7.95%, 9/15/22 | | | 11 | | | | 11 | | |

7.13%, 3/15/23 – 7/15/25 | | | 650 | | | | 673 | | |

5.50%, 7/15/23 | | | 22 | | | | 24 | | |

6.50%, 8/20/23 – 2/20/41 (c) (d) | | | 164,158 | | | | 193,610 | | |

7.00%, 12/15/23 – 1/15/39 | | | 114,133 | | | | 135,984 | | |

7.50%, 3/15/24 – 5/15/49 | | | 88,775 | | | | 104,361 | | |

8.00%, 6/20/24 – 5/15/49 | | | 51,251 | | | | 61,358 | | |

See notes to financial statements.

15

Victory Portfolios

Victory INCORE Fund for Income | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares or

Principal

Amount | | Value | |

10.00%, 4/15/25 – 2/15/26 | | $ | 47 | | | $ | 47 | | |

6.13%, 6/20/28 – 9/20/29 | | | 447 | | | | 473 | | |

6.28%, 10/20/28 – 10/20/29 | | | 805 | | | | 869 | | |

6.10%, 5/20/29 – 7/20/31 | | | 685 | | | | 745 | | |

7.30%, 4/20/30 – 2/20/31 | | | 302 | | | | 323 | | |

6.49%, 5/20/31 – 3/20/32 | | | 1,095 | | | | 1,209 | | |

8.50%, 6/15/31 – 7/15/32 | | | 8,698 | | | | 10,168 | | |

| | | | 590,120 | | |

Total Government National Mortgage Association (Cost $605,507) | | | 619,822 | | |

U.S. Treasury Obligations (26.5%) | |

U.S. Treasury Bills, 0.11%, 9/24/20 (e) | | | 101,461 | | | | 101,414 | | |

U.S. Treasury Bonds, 8.00%, 11/15/21 | | | 112,049 | | | | 125,525 | | |

Total U.S. Treasury Obligations (Cost $226,138) | | | 226,939 | | |

Investment Companies (1.6%) | |

BlackRock Liquidity Funds Fedfund Portfolio, 0.20% | | | 13,479,400 | | | | 13,479 | | |

Total Investment Companies (Cost $13,479) | | | 13,479 | | |

Total Investments (Cost $845,124) — 100.4% | | | 860,240 | | |

Liabilities in excess of other assets — (0.4)% | | | (3,596 | ) | |

NET ASSETS — 100.00% | | $ | 856,644 | | |

(a) The rate for certain asset-backed and mortgage-backed securities may vary based on factors relating to the pool of assets underlying the security. The rate disclosed is the rate in effect at April 30, 2020.

(b) Rounds to less than $1 thousand.

(c) Security purchased on a when-issued basis.

(d) All or a portion of this security has been segregated as collateral for securities purchased on a when-issued basis.

(e) Rate represents the effective yield at April 30, 2020.

See notes to financial statements.

16

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | Schedule of Portfolio Investments

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Convertible Corporate Bonds (67.5%) | |

Communication Services (0.6%): | |

Snap, Inc., 0.75%, 8/1/26 (a) | | $ | 1,595 | | | $ | 1,651 | | |

Consumer Discretionary (4.4%): | |

Booking Holdings, Inc. | |

0.35%, 6/15/20 | | | 4,750 | | | | 5,361 | | |

0.90%, 9/15/21 | | | 3,522 | | | | 3,555 | | |

0.75%, 5/1/25 (a) | | | 3,720 | | | | 4,197 | | |

| | | | 13,113 | | |

Financials (15.7%): | |

Ares Capital Corp. | |

3.75%, 2/1/22 | | | 8,335 | | | | 8,099 | | |

4.63%, 3/1/24 | | | 3,845 | | | | 3,683 | | |

Barclays Bank PLC | |

0.00%, 2/4/25 (b) | | | 3,025 | | | | 3,501 | | |

0.00%, 2/18/25 | | | 1,595 | | | | 1,635 | | |

BlackRock Capital Investment Corp., 5.00%, 6/15/22 | | | 3,712 | | | | 3,080 | | |

Blackstone Mortgage Trust, Inc., 4.75%, 3/15/23 (c) | | | 4,000 | | | | 3,519 | | |

JPMorgan Chase Financial Co. LLC, 0.25%, 5/1/23 (a) | | | 9,355 | | | | 9,037 | | |

MGIC Investment Corp. Convertible Subordinated Notes, 9.00%, 4/1/63 (a) | | | 4,127 | | | | 5,323 | | |

Prospect Capital Corp., 4.95%, 7/15/22, Callable 4/15/22 @ 100 | | | 5,923 | | | | 5,607 | | |

TPG Specialty Lending, Inc., 4.50%, 8/1/22 | | | 2,985 | | | | 2,951 | | |

| | | | 46,435 | | |

Health Care (17.8%): | |

ALZA Corp. Convertible Subordinated Notes, 7/28/20,

Callable 5/21/20 @ 99.44 (d) | | | 5,029 | | | | 10,381 | | |

Anthem, Inc., 2.75%, 10/15/42 | | | 3,649 | | | | 14,469 | | |

Bristol-Myers Squibb Co., Convertible Subordinated Notes, 0.24%

(LIBOR03M-50bps), 9/15/23, Callable 6/5/20 @ 100 (e) (f) | | | 2,466 | | | | 3,797 | | |

Danaher Corp., Convertible Subordinated Notes, 1/22/21,

Callable 5/21/20 @ 98.42 (d) | | | 1,557 | | | | 9,722 | | |

Illumina, Inc., Convertible Subordinated Notes, 0.50%, 6/15/21 (b) | | | 9,352 | | | | 12,472 | | |

Teladoc Health, Inc., 3.00%, 12/15/22 | | | 500 | | | | 1,946 | | |

| | | | 52,787 | | |

Industrials (6.6%): | |

Dycom Industries, Inc., 0.75%, 9/15/21 | | | 1,555 | | | | 1,435 | | |

Fortive Corp., 0.88%, 2/15/22 | | | 10,380 | | | | 9,976 | | |

Macquarie Infrastructure, 2.00%, 10/1/23 | | | 6,441 | | | | 5,161 | | |

Southwest Airlines Co., 1.25%, 5/1/25 | | | 2,650 | | | | 2,912 | | |

| | | | 19,484 | | |

Information Technology (15.3%): | |

Akamai Technologies, Inc., 0.13%, 5/1/25 | | | 4,622 | | | | 5,473 | | |

Euronet Worldwide, Inc., 0.75%, 3/15/49, Callable 3/20/25 @ 100 (b) | | | 4,705 | | | | 4,265 | | |

Micron Technology, Inc., Convertible Subordinated Notes, 3.13%, 5/1/32 | | | 1,093 | | | | 5,162 | | |

Novellus Systems, Inc., Convertible Subordinated Notes, 2.63%, 5/15/41 | | | 1,521 | | | | 12,134 | | |

Nuance Communication, Inc. Convertible Subordinated Notes,

1.00%, 12/15/35, Callable 12/20/22 @ 100 | | | 2,345 | | | | 2,442 | | |

See notes to financial statements.

17

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares or

Principal

Amount | | Value | |

ON Semiconductor Corp. | |

1.00%, 12/1/20 | | $ | 925 | | | $ | 967 | | |

1.63%, 10/15/23 (b) | | | 660 | | | | 722 | | |

Palo Alto Networks, Inc., 0.75%, 7/1/23 | | | 1,365 | | | | 1,395 | | |

Western Digital Corp., 1.50%, 2/1/24 | | | 14,000 | | | | 12,811 | | |

| | | | 45,371 | | |

Real Estate (7.1%): | |

Spirit Realty Capital, Inc., 3.75%, 5/15/21 | | | 10,175 | | | | 9,847 | | |

VEREIT, Inc., 3.75%, 12/15/20 | | | 11,352 | | | | 11,088 | | |

| | | | 20,935 | | |

Total Convertible Corporate Bonds (Cost $191,415) | | | 199,776 | | |

Convertible Preferred Stocks (29.6%) | |

Financials (11.5%): | |

AMG Capital Trust II, 5.15%, 10/15/37 | | | 181,860 | | | | 6,537 | | |

Bank of America Corp., Series L, 7.25% (g) | | | 8,630 | | | | 11,930 | | |

New York Community Capital Trust, 6.00%, 11/1/51 (c) | | | 67,654 | | | | 2,977 | | |

Wells Fargo & Co., Series L, 7.50% (g) | | | 9,024 | | | | 12,623 | | |

| | | | 34,067 | | |

Industrials (3.2%): | |

Stanley Black & Decker, Inc., 5.25%, 11/15/22 | | | 119,525 | | | | 9,503 | | |

Utilities (14.9%): | |

American Electric Power Co., Inc., 6.13%, 3/15/22 | | | 98,985 | | | | 5,028 | | |

CenterPoint Energy, Inc. Convertible Subordinated Notes, 4.57%, 9/15/29 (f) | | | 80,000 | | | | 4,260 | | |

Dominion Energy, Inc., Series A, 7.25%, 6/1/22 | | | 100,003 | | | | 9,823 | | |

DTE Energy Co., 6.25%, 11/1/22 | | | 152,215 | | | | 6,363 | | |

NextEra Energy, Inc., 4.87%, 9/1/22 | | | 127,545 | | | | 6,115 | | |

NextEra Energy, Inc., 5.28%, 3/1/23 | | | 75,000 | | | | 3,239 | | |

Southern Co., 6.75%, 8/1/22 | | | 199,220 | | | | 9,432 | | |

| | | | 44,260 | | |

Total Convertible Preferred Stocks (Cost $94,551) | | | 87,830 | | |

Collateral for Securities Loaned^ (5.2%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.61% (h) | | | 290,240 | | | | 290 | | |

Fidelity Investments Money Market Prime Money Market Portfolio,

Institutional Class, 0.47% (h) | | | 144,781 | | | | 145 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Shares, 0.18% (h) | | | 6,645,927 | | | | 6,646 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional

Class, 0.67%(h) | | | 2,018,320 | | | | 2,018 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.68% (h) | | | 1,154,941 | | | | 1,155 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional

Class, 0.72% (h) | | | 5,192,839 | | | | 5,193 | | |

Total Collateral for Securities Loaned (Cost $15,447) | | | 15,447 | | |

Total Investments (Cost $301,413) — 102.3% | | | 303,053 | | |

Liabilities in excess of other assets — (2.3)% | | | (6,825 | ) | |

NET ASSETS — 100.00% | | $ | 296,228 | | |

See notes to financial statements.

18

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | Schedule of Portfolio Investments — continued

April 30, 2020 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

^ Purchased with cash collateral from securities on loan.

(a) Rule 144A security or other security that is restricted as to resale to institutional investors. The Fund's Adviser has deemed this security to be liquid based upon procedures approved by the Board of Trustees. As of April 30, 2020, the fair value of these securities was $20,208 (thousands) and amounted to 6.8% of net assets.

(b) All or a portion of this security is on loan.

(c) The Fund's Adviser has deemed this security to be illiquid based upon procedures approved by the Board of Trustees. As of April 30, 2020, illiquid securities were 2.2% of the Fund's net assets.

(d) Continuously callable with 15 days' notice.

(e) Variable or Floating-Rate Security. Rate disclosed is as of April 30, 2020.

(f) Continuously callable with 30 days' notice.

(g) Security is perpetual and has no final maturity date but may be subject to calls at various dates in the future.

(h) Rate disclosed is the daily yield on April 30, 2020.

bps — Basis points

LIBOR — London InterBank Offered Rate

LIBOR03M — 3 Month US Dollar LIBOR, rate disclosed as of April 30, 2020, based on the last reset date of the security

LLC — Limited Liability Company

PLC — Public Limited Company

See notes to financial statements.

19

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2020 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | Victory

Diversified

Stock Fund | | Victory

NewBridge

Large Cap

Growth Fund | | Victory

Special

Value Fund | |

ASSETS: | |

Investments, at value (Cost $208,218, $8,298 and

$37,595) | | $ | 242,177 | (a) | | $ | 15,284 | (b) | | $ | 42,899 | (c) | |

Cash and cash equivalents | | | 4,306 | | | | 225 | | | | 901 | | |

Receivables: | |

Interest and dividends | | | 140 | | | | 5 | | | | 24 | | |

Capital shares issued | | | 61 | | | | — | (d) | | | 233 | | |

Investments sold | | | 1,498 | | | | — | | | | 270 | | |

From Adviser | | | 8 | | | | 9 | | | | 8 | | |

Prepaid expenses | | | 36 | | | | 11 | | | | 27 | | |

Total Assets | | | 248,226 | | | | 15,534 | | | | 44,362 | | |

LIABILITIES: | |

Payables: | |

Collateral received on loaned securities | | | 7,855 | | | | 349 | | | | 503 | | |

Investments purchased | | | 841 | | | | — | | | | 152 | | |

Capital shares redeemed | | | 606 | | | | 39 | | | | 437 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 120 | | | | 9 | | | | 25 | | |

Administration fees | | | 11 | | | | 1 | | | | 2 | | |

Custodian fees | | | 2 | | | | — | (d) | | | 1 | | |

Transfer agent fees | | | 32 | | | | 3 | | | | 7 | | |

Compliance fees | | | — | (d) | | | — | (d) | | | — | (d) | |

Trustees' fees | | | — | (d) | | | — | | | | — | | |

| 12b-1 fees | | | 26 | | | | 1 | | | | 6 | | |

Other accrued expenses | | | 18 | | | | 3 | | | | 6 | | |

Total Liabilities | | | 9,511 | | | | 405 | | | | 1,139 | | |

NET ASSETS: | |

Capital | | | 211,663 | | | | 7,272 | | | | 39,181 | | |

Total distributable earnings/(loss) | | | 27,052 | | | | 7,857 | | | | 4,042 | | |

Net Assets | | $ | 238,715 | | | $ | 15,129 | | | $ | 43,223 | | |

Net Assets | |

Class A Shares | | $ | 171,151 | | | $ | 5,618 | | | $ | 22,649 | | |

Class C Shares | | | 3,847 | | | | 1,460 | | | | 961 | | |

Class I Shares | | | 22,648 | | | | 5,688 | | | | 3,009 | | |

Class R Shares | | | 36,798 | | | | — | | | | 16,082 | | |

Class R6 Shares | | | 709 | | | | — | | | | — | | |

Class Y Shares | | | 3,562 | | | | 2,363 | | | | 522 | | |

Total | | $ | 238,715 | | | $ | 15,129 | | | $ | 43,223 | | |

Shares (unlimited number of shares authorized with

a par value of $0.001 per share): | |

Class A Shares | | | 11,390 | | | | 1,104 | | | | 999 | | |

Class C Shares | | | 277 | | | | 913 | | | | 49 | | |

Class I Shares | | | 1,511 | | | | 984 | | | | 131 | | |

Class R Shares | | | 2,505 | | | | — | | | | 746 | | |

Class R6 Shares | | | 47 | | | | — | | | | — | | |

Class Y Shares | | | 237 | | | | 432 | | | | 23 | | |

Total | | | 15,967 | | | | 3,433 | | | | 1,948 | | |

(continues on next page)

See notes to financial statements.

20

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2020 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited) (continued)

| | | Victory

Diversified

Stock Fund | | Victory

NewBridge

Large Cap

Growth Fund | | Victory

Special

Value Fund | |

Net asset value, offering (except Class A Shares) and

redemption price per share: (e) | |

Class A Shares | | $ | 15.03 | | | $ | 5.09 | | | $ | 22.66 | | |

Class C Shares (f) | | | 13.90 | | | | 1.60 | | | | 19.71 | | |

Class I Shares | | | 14.99 | | | | 5.78 | | | | 22.95 | | |

Class R Shares | | | 14.69 | | | | — | | | | 21.56 | | |

Class R6 Shares | | | 15.00 | | | | — | | | | — | | |

Class Y Shares | | | 15.02 | | | | 5.47 | | | | 22.81 | | |

Maximum Sales Charge — Class A Shares | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % | |

Maximum offering price

(100%/(100%-maximum sales charge) of net asset

value adjusted to the nearest cent) per share —

Class A Shares | | $ | 15.95 | | | $ | 5.40 | | | $ | 24.04 | | |

(a) Includes $7,537 of securities on loan.

(b) Includes $340 of securities on loan.

(c) Includes $472 of securities on loan.

(d) Rounds to less than $1 thousand.

(e) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

(f) Redemption price per share varies by the length of time shares are held.

See notes to financial statements.

21

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2020 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | Victory

Strategic

Allocation

Fund | | Victory

INCORE

Fund for

Income | | Victory

INCORE

Investment

Grade

Convertible

Fund | |

ASSETS: | |

Affiliated investments, at value (Cost $23,169,

$— and $—) | | $ | 22,205 | | | $ | — | | | $ | — | | |

Unaffiliated Investments, at value (Cost $—,

$845,124 and $301,413) | | | — | | | | 860,240 | | | | 303,053 | (a) | |

Cash and cash equivalents | | | 10 | | | | — | | | | 9,308 | | |

Receivables: | |

Interest and dividends | | | 8 | | | | 7,187 | | | | 1,276 | | |

Capital shares issued | | | — | (b) | | | 3,347 | | | | 1,264 | | |

Investments sold | | | — | | | | — | | | | 1,269 | | |

From Adviser | | | 18 | | | | 1 | | | | — | | |

Prepaid expenses | | | 31 | | | | 56 | | | | 56 | | |

Total Assets | | | 22,272 | | | | 870,831 | | | | 316,226 | | |

LIABILITIES: | |

Payables: | |

Collateral received on loaned securities | | | — | | | | — | | | | 15,447 | | |

Investments purchased | | | — | | | | 12,504 | | | | 4,011 | | |

Capital shares redeemed | | | 42 | | | | 1,159 | | | | 285 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 2 | | | | 321 | | | | 177 | | |

Administration fees | | | 1 | | | | 41 | | | | 15 | | |

Custodian fees | | | — | (b) | | | 6 | | | | 2 | | |

Transfer agent fees | | | 5 | | | | 89 | | | | 40 | | |

Compliance fees | | | — | (b) | | | 1 | | | | — | (b) | |

Trustees' fees | | | — | (b) | | | 3 | | | | 1 | | |

| 12b-1 fees | | | 2 | | | | 25 | | | | 4 | | |

Other accrued expenses | | | 5 | | | | 38 | | | | 16 | | |

Total Liabilities | | | 57 | | | | 14,187 | | | | 19,998 | | |

NET ASSETS: | |

Capital | | | 23,575 | | | | 1,156,818 | | | | 291,318 | | |

Total distributable earnings/(loss) | | | (1,360 | ) | | | (300,174 | ) | | | 4,910 | | |

Net Assets | | $ | 22,215 | | | $ | 856,644 | | | $ | 296,228 | | |

Net Assets | |

Class A Shares | | $ | 13,493 | | | $ | 123,867 | | | $ | 37,461 | | |

Class C Shares | | | 2,203 | | | | 21,065 | | | | — | | |

Class I Shares | | | 5,368 | | | | 523,712 | | | | 258,767 | | |

Class R Shares | | | 1,151 | | | | 39,695 | | | | — | | |

Class R6 Shares | | | — | | | | 44,205 | | | | — | | |

Class Y Shares | | | — | | | | 104,100 | | | | — | | |

Total | | $ | 22,215 | | | $ | 856,644 | | | $ | 296,228 | | |

(continues on next page)

See notes to financial statements.

22

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2020 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited) (continued)

| | | Victory

Strategic

Allocation

Fund | | Victory

INCORE

Fund for

Income | | Victory

INCORE

Investment

Grade

Convertible

Fund | |

Shares (unlimited number of shares authorized with

a par value of $0.001 per share): | |

Class A Shares | | | 900 | | | | 14,403 | | | | 2,363 | | |

Class C Shares | | | 149 | | | | 2,474 | | | | — | | |

Class I Shares | | | 356 | | | | 60,926 | | | | 16,325 | | |

Class R Shares | | | 77 | | | | 4,612 | | | | — | | |

Class R6 Shares | | | — | | | | 5,148 | | | | — | | |

Class Y Shares | | | — | | | | 12,105 | | | | — | | |

Total | | | 1,482 | | | | 99,668 | | | | 18,688 | | |

Net asset value, offering (except Class A Shares)

and redemption price per share: (c) | |

Class A Shares | | $ | 15.00 | | | $ | 8.60 | | | $ | 15.85 | | |

Class C Shares (d) | | | 14.73 | | | | 8.52 | | | | — | | |

Class I Shares | | | 15.08 | | | | 8.60 | | | | 15.85 | | |

Class R Shares | | | 14.97 | | | | 8.61 | | | | — | | |

Class R6 Shares | | | — | | | | 8.59 | | | | — | | |

Class Y Shares | | | — | | | | 8.60 | | | | — | | |

Maximum Sales Charge — Class A Shares | | | 5.75 | % | | | 2.00 | % | | | 2.00 | % | |

Maximum offering price

(100%/(100%-maximum sales charge) of net asset

value adjusted to the nearest cent) per share —

Class A Shares | | $ | 15.92 | | | $ | 8.78 | | | $ | 16.17 | | |

(a) Includes $15,194 of securities on loan.

(b) Rounds to less than $1 thousand.

(c) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

(d) Redemption price per share varies by the length of time shares are held.

See notes to financial statements.

23

Victory Portfolios | | Statements of Operations

For the Year Ended April 30, 2020 | |

(Amounts in Thousands) (Unaudited)

| | | Victory

Diversified

Stock Fund | | Victory

NewBridge

Large Cap

Growth Fund | | Victory

Special

Value Fund | |

Investment Income: | |

Dividends | | $ | 1,935 | | | $ | 28 | | | $ | 346 | | |

Interest | | | 19 | | | | 2 | | | | 4 | | |

Securities lending (net of fees) | | | 8 | | | | — | (a) | | | — | (a) | |

Total Income | | | 1,962 | | | | 30 | | | | 350 | | |

Expenses: | |

Investment advisory fees | | | 888 | | | | 57 | | | | 186 | | |

Administration fees | | | 82 | | | | 5 | | | | 15 | | |

12b-1 fees — Class A Shares | | | 242 | | | | 7 | | | | 32 | | |

12b-1 fees — Class C Shares | | | 24 | | | | 8 | | | | 5 | | |

12b-1 fees — Class R Shares | | | 108 | | | | — | | | | 48 | | |

Custodian fees | | | 7 | | | | 1 | | | | 2 | | |

Transfer agent fees — Class A Shares | | | 75 | | | | 3 | | | | 15 | | |

Transfer agent fees — Class C Shares | | | 3 | | | | 1 | | | | 1 | | |

Transfer agent fees — Class I Shares | | | 8 | | | | 3 | | | | 1 | | |

Transfer agent fees — Class R Shares | | | 19 | | | | — | | | | 16 | | |

Transfer agent fees — Class R6 Shares | | | — | (a) | | | — | | | | — | | |

Transfer agent fees — Class Y Shares | | | 3 | | | | 1 | | | | — | (a) | |

Trustees' fees | | | 12 | | | | 1 | | | | 2 | | |

Compliance fees | | | 1 | | | | — | (a) | | | — | (a) | |

Legal and audit fees | | | 10 | | | | 4 | | | | 5 | | |

State registration and filing fees | | | 41 | | | | 26 | | | | 33 | | |

Other expenses | | | 29 | | | | 9 | | | | 15 | | |

Total Expenses | | | 1,552 | | | | 126 | | | | 376 | | |

Expenses waived/reimbursed by Adviser | | | (18 | ) | | | (33 | ) | | | (40 | ) | |

Net Expenses | | | 1,534 | | | | 93 | | | | 336 | | |

Net Investment Income (Loss) | | | 428 | | | | (63 | ) | | | 14 | | |

Realized/Unrealized Gains (Losses) from Investments: | |

Net realized gains (losses) from investment securities | | | (6,184 | ) | | | 1,092 | | | | (1,050 | ) | |

Net change in unrealized appreciation/depreciation on

investment securities | | | (18,760 | ) | | | 750 | | | | (3,316 | ) | |

Net realized/unrealized gains (losses) on investments | | | (24,944 | ) | | | 1,842 | | | | (4,366 | ) | |

Change in net assets resulting from operations | | $ | (24,516 | ) | | $ | 1,779 | | | $ | (4,352 | ) | |

(a) Rounds to less than $1 thousand.

See notes to financial statements.

24

Victory Portfolios | | Statements of Operations

For the Year Ended April 30, 2020 | |

(Amounts in Thousands) (Unaudited)

| | | Victory

Strategic

Allocation

Fund | | Victory

INCORE

Fund for

Income | | Victory

INCORE

Investment

Grade

Convertible

Fund | |

Investment Income: | |

Interest from non-affiliates | | $ | — | | | $ | 8,414 | | | $ | 1,804 | | |

Dividends from affiliates | | | 294 | | | | — | | | | — | | |

Dividends from non-affiliates | | | — | | | | 15 | | | | 2,432 | | |

Securities lending (net of fees) | | | — | | | | — | | | | 45 | | |

Total Income | | | 294 | | | | 8,429 | | | | 4,281 | | |

Expenses: | |

Investment advisory fees | | | 12 | | | | 1,753 | | | | 1,082 | | |

Administration fees | | | 7 | | | | 221 | | | | 87 | | |

12b-1 fees — Class A Shares | | | 18 | | | | 156 | | | | 27 | | |

12b-1 fees — Class C Shares | | | 14 | | | | 104 | | | | — | | |

12b-1 fees — Class R Shares | | | 3 | | | | 48 | | | | — | | |

Custodian fees | | | 1 | | | | 16 | | | | 7 | | |

Transfer agent fees — Class A Shares | | | 10 | | | | 50 | | | | 22 | | |

Transfer agent fees — Class C Shares | | | 2 | | | | 12 | | | | — | | |

Transfer agent fees — Class I Shares | | | 2 | | | | 174 | | | | 119 | | |

Transfer agent fees — Class R Shares | | | 1 | | | | 12 | | | | — | | |

Transfer agent fees — Class R6 Shares | | | — | | | | 1 | | | | — | | |

Transfer agent fees — Class Y Shares | | | — | | | | 46 | | | | — | | |

Trustees' fees | | | 1 | | | | 30 | | | | 12 | | |

Compliance fees | | | — | (a) | | | 3 | | | | 1 | | |

Legal and audit fees | | | 4 | | | | 20 | | | | 11 | | |

State registration and filing fees | | | 26 | | | | 52 | | | | 22 | | |

Other expenses | | | 12 | | | | 72 | | | | 29 | | |

Total Expenses | | | 113 | | | | 2,770 | | | | 1,419 | | |

Expenses waived/reimbursed by Adviser | | | (60 | ) | | | (65 | ) | | | — | | |

Net Expenses | | | 53 | | | | 2,705 | | | | 1,419 | | |

Net Investment Income (Loss) | | | 241 | | | | 5,724 | | | | 2,862 | | |

Realized/Unrealized Gains (Losses) from Investments: | |

Net realized gains (losses) from affiliated securities transactions | | | (211 | ) | | | — | | | | — | | |

Net realized gains (losses) from unaffiliated securities transactions | | | 8 | | | | 18 | | | | 5,809 | | |

Distributions of realized gains from affiliated underlying

investment companies | | | 30 | | | | — | | | | — | | |

Net change in unrealized appreciation/depreciation on affiliated

investments | | | (1,500 | ) | | | — | | | | — | | |

Net change in unrealized appreciation/depreciation on

unaffiliated investments | | | — | | | | 16,124 | | | | (21,985 | ) | |

Net realized/unrealized gains (losses) on investments | | | (1,673 | ) | | | 16,142 | | | | (16,176 | ) | |

Change in net assets resulting from operations | | $ | (1,432 | ) | | $ | 21,866 | | | $ | (13,314 | ) | |

(a) Rounds to less than $1 thousand.

See notes to financial statements.

25

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands)

| | | Victory

Diversified Stock Fund | | Victory

NewBridge Large Cap

Growth Fund | | Victory

Special Value Fund | |

| | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | |

From Investment Activities: | |

Operations: | |

Net investment income (loss) | | $ | 428 | | | $ | 1,645 | | | $ | (63 | ) | | $ | (160 | ) | | $ | 14 | | | $ | 167 | | |

Net realized gains (losses) from

investments | | | (6,184 | ) | | | 18,632 | | | | 1,092 | | | | 3,860 | | | | (1,050 | ) | | | 1,560 | | |

Net change in unrealized

appreciation (depreciation)

on investments | | | (18,760 | ) | | | 13,132 | | | | 750 | | | | (2,906 | ) | | | (3,316 | ) | | | 4,228 | | |

Change in net assets resulting

from operations | | | (24,516 | ) | | | 33,409 | | | | 1,779 | | | | 794 | | | | (4,352 | ) | | | 5,955 | | |

Distributions to Shareholders: | |

Class A Shares | | | (13,479 | ) | | | (28,297 | ) | | | (1,005 | ) | | | (1,659 | ) | | | (913 | ) | | | (3,327 | ) | |

Class C Shares | | | (369 | ) | | | (1,188 | ) | | | (746 | ) | | | (1,416 | ) | | | (40 | ) | | | (223 | ) | |

Class I Shares | | | (1,887 | ) | | | (4,956 | ) | | | (987 | ) | | | (2,847 | ) | | | (114 | ) | | | (366 | ) | |

Class R Shares | | | (3,064 | ) | | | (5,943 | ) | | | — | | | | (265 | ) | | | (659 | ) | | | (2,640 | ) | |

Class R6 Shares | | | (53 | ) | | | (255 | ) | | | — | | | | — | | | | — | | | | — | | |

Class Y Shares | | | (279 | ) | | | (476 | ) | | | (385 | ) | | | (957 | ) | | | (19 | ) | | | (47 | ) | |

Change in net assets resulting from

distributions to shareholders | | | (19,131 | ) | | | (41,115 | ) | | | (3,123 | ) | | | (7,144 | ) | | | (1,745 | ) | | | (6,603 | ) | |

Change in net assets resulting from

capital transactions | | | (14,654 | ) | | | (78,621 | ) | | | 432 | | | | (969 | ) | | | (4,617 | ) | | | (10,771 | ) | |

Change in net assets | | | (58,301 | ) | | | (86,327 | ) | | | (912 | ) | | | (7,319 | ) | | | (10,714 | ) | | | (11,419 | ) | |

Net Assets: | |

Beginning of period | | | 297,016 | | | | 383,343 | | | | 16,041 | | | | 23,360 | | | | 53,937 | | | | 65,356 | | |

End of period | | $ | 238,715 | | | $ | 297,016 | | | $ | 15,129 | | | $ | 16,041 | | | $ | 43,223 | | | $ | 53,937 | | |

(continues on next page)

See notes to financial statements.

26

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Diversified Stock Fund | | Victory

NewBridge Large Cap

Growth Fund | | Victory

Special Value Fund | |

| | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | |

Capital Transactions: | |

Class A Shares | |

Proceeds from shares issued | | $ | 4,767 | | | $ | 10,469 | | | $ | 562 | | | $ | 1,642 | | | $ | 1,566 | | | $ | 2,878 | | |

Distributions reinvested | | | 12,261 | | | | 25,681 | | | | 817 | | | | 1,429 | | | | 818 | | | | 2,670 | | |

Cost of shares redeemed | | | (19,819 | ) | | | (90,032 | ) | | | (1,124 | ) | | | (1,465 | ) | | | (4,314 | ) | | | (9,989 | ) | |

Total Class A Shares | | $ | (2,791 | ) | | $ | (53,882 | ) | | $ | 255 | | | $ | 1,606 | | | $ | (1,930 | ) | | $ | (4,441 | ) | |

Class C Shares | |

Proceeds from shares issued | | $ | 130 | | | $ | 864 | | | $ | 190 | | | $ | 448 | | | $ | 244 | | | $ | 345 | | |

Distributions reinvested | | | 311 | | | | 962 | | | | 569 | | | | 1,198 | | | | 29 | | | | 134 | | |

Cost of shares redeemed | | | (1,749 | ) | | | (7,037 | ) | | | (512 | ) | | | (1,643 | ) | | | (414 | ) | | | (1,334 | ) | |

Total Class C Shares | | $ | (1,308 | ) | | $ | (5,211 | ) | | $ | 247 | | | $ | 3 | | | $ | (141 | ) | | $ | (855 | ) | |

Class I Shares | |

Proceeds from shares issued | | $ | 1,055 | | | $ | 3,181 | | | $ | 291 | | | $ | 557 | | | $ | 328 | | | $ | 588 | | |

Distributions reinvested | | | 1,757 | | | | 4,500 | | | | 927 | | | | 2,644 | | | | 98 | | | | 317 | | |

Cost of shares redeemed | | | (7,502 | ) | | | (21,038 | ) | | | (1,264 | ) | | | (5,198 | ) | | | (302 | ) | | | (1,283 | ) | |

Total Class I Shares | | $ | (4,690 | ) | | $ | (13,357 | ) | | $ | (46 | ) | | $ | (1,997 | ) | | $ | 124 | | | $ | (378 | ) | |

Class R Shares | |

Proceeds from shares issued | | $ | 685 | | | $ | 1,997 | | | $ | — | | | $ | 84 | | | $ | 1,446 | | | $ | 2,963 | | |

Distributions reinvested | | | 2,939 | | | | 5,689 | | | | — | | | | 265 | | | | 613 | | | | 2,334 | | |

Cost of shares redeemed | | | (7,920 | ) | | | (13,852 | ) | | | — | | | | (814 | ) | | | (4,798 | ) | | | (10,470 | ) | |

Total Class R Shares | | $ | (4,296 | ) | | $ | (6,166 | ) | | $ | — | | | $ | (465 | ) | | $ | (2,739 | ) | | $ | (5,173 | ) | |

Class R6 Shares | |

Proceeds from shares issued | | $ | 125 | | | $ | 180 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

Distributions reinvested | | | 53 | | | | 255 | | | | — | | | | — | | | | — | | | | — | | |

Cost of shares redeemed | | | (1,682 | ) | | | (314 | ) | | | — | | | | — | | | | — | | | | — | | |

Total Class R6 Shares | | $ | (1,504 | ) | | $ | 121 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

Class Y Shares | |

Proceeds from shares issued | | $ | 161 | | | $ | 867 | | | $ | 285 | | | $ | 554 | | | $ | 89 | | | $ | 144 | | |

Distributions reinvested | | | 237 | | | | 387 | | | | 184 | | | | 397 | | | | 14 | | | | 33 | | |

Cost of shares redeemed | | | (463 | ) | | | (1,380 | ) | | | (493 | ) | | | (1,067 | ) | | | (34 | ) | | | (101 | ) | |

Total Class Y Shares | | $ | (65 | ) | | $ | (126 | ) | | $ | (24 | ) | | $ | (116 | ) | | $ | 69 | | | $ | 76 | | |

Change in net assets resulting from

capital transactions | | $ | (14,654 | ) | | $ | (78,621 | ) | | $ | 432 | | | $ | (969 | ) | | $ | (4,617 | ) | | $ | (10,771 | ) | |

(continues on next page)

See notes to financial statements.

27

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Diversified Stock Fund | | Victory

NewBridge Large Cap

Growth Fund | | Victory

Special Value Fund | |

| | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | |

Share Transactions: | |

Class A Shares | |

Issued | | | 299 | | | | 648 | | | | 116 | | | | 295 | | | | 66 | | | | 121 | | |

Reinvested | | | 709 | | | | 1,778 | | | | 171 | | | | 297 | | | | 31 | | | | 126 | | |

Redeemed | | | (1,230 | ) | | | (5,576 | ) | | | (220 | ) | | | (254 | ) | | | (177 | ) | | | (416 | ) | |

Total Class A Shares | | | (222 | ) | | | (3,150 | ) | | | 67 | | | | 338 | | | | (80 | ) | | | (169 | ) | |

Class C Shares | |

Issued | | | 9 | | | | 60 | | | | 126 | | | | 203 | | | | 12 | | | | 17 | | |

Reinvested | | | 19 | | | | 71 | | | | 377 | | | | 562 | | | | 1 | | | | 7 | | |

Redeemed | | | (110 | ) | | | (458 | ) | | | (318 | ) | | | (645 | ) | | | (19 | ) | | | (61 | ) | |

Total Class C Shares | | | (82 | ) | | | (327 | ) | | | 185 | | | | 120 | | | | (6 | ) | | | (37 | ) | |

Class I Shares | |

Issued | | | 65 | | | | 194 | | | | 52 | | | | 87 | | | | 14 | | | | 23 | | |

Reinvested | | | 102 | | | | 311 | | | | 170 | | | | 497 | | | | 4 | | | | 15 | | |

Redeemed | | | (451 | ) | | | (1,291 | ) | | | (224 | ) | | | (850 | ) | | | (12 | ) | | | (52 | ) | |

Total Class I Shares | | | (284 | ) | | | (786 | ) | | | (2 | ) | | | (266 | ) | | | 6 | | | | (14 | ) | |

Class R Shares | |

Issued | | | 44 | | | | 126 | | | | — | | | | 13 | | | | 69 | | | | 130 | | |

Reinvested | | | 173 | | | | 403 | | | | — | | | | 72 | | | | 25 | | | | 116 | | |

Redeemed | | | (488 | ) | | | (869 | ) | | | — | | | | (194 | ) | | | (207 | ) | | | (447 | ) | |

Total Class R Shares | | | (271 | ) | | | (340 | ) | | | — | | | | (109 | ) | | | (113 | ) | | | (201 | ) | |

Class R6 Shares | |

Issued | | | 7 | | | | 11 | | | | — | | | | — | | | | — | | | | — | | |

Reinvested | | | 3 | | | | 18 | | | | — | | | | — | | | | — | | | | — | | |

Redeemed | | | (94 | ) | | | (20 | ) | | | — | | | | — | | | | — | | | | — | | |

Total Class R6 Shares | | | (84 | ) | | | 9 | | | | — | | | | — | | | | — | | | | — | | |

Class Y Shares | |

Issued | | | 10 | | | | 54 | | | | 56 | | | | 107 | | | | 3 | | | | 6 | | |

Reinvested | | | 14 | | | | 27 | | | | 36 | | | | 78 | | | | 1 | | | | 2 | | |

Redeemed | | | (28 | ) | | | (84 | ) | | | (86 | ) | | | (173 | ) | | | (1 | ) | | | (5 | ) | |

Total Class Y Shares | | | (4 | ) | | | (3 | ) | | | 6 | | | | 12 | | | | 3 | | | | 3 | | |

Change in Shares | | | (947 | ) | | | (4,597 | ) | | | 256 | | | | 95 | | | | (190 | ) | | | (418 | ) | |

See notes to financial statements.

28

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands)

| | | Victory

Strategic

Allocation Fund | | Victory INCORE

Fund for Income | | Victory

INCORE Investment Grade

Convertible Fund | |

| | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | |

From Investment Activities: | |

Operations: | |

Net investment income (loss) | | $ | 241 | | | $ | 715 | | | $ | 5,724 | | | $ | 12,415 | | | $ | 2,862 | | | $ | 3,557 | | |

Net realized gains (losses) from

affiliated and unaffiliated

investment transactions | | | (173 | ) | | | 393 | | | | 18 | | | | 37 | | | | 5,809 | | | | 9,776 | | |

Net change in unrealized

appreciation (depreciation)

on affiliated and unaffiliated

investments | | | (1,500 | ) | | | 1,486 | | | | 16,124 | | | | 22,751 | | | | (21,985 | ) | | | 14,314 | | |

Change in net assets resulting

from operations | | | (1,432 | ) | | | 2,594 | | | | 21,866 | | | | 35,203 | | | | (13,314 | ) | | | 27,647 | | |

Distributions to Shareholders: | |

Class A Shares | | | (514 | ) | | | (574 | ) | | | (3,045 | ) | | | (7,959 | ) | | | (847 | ) | | | (663 | ) | |

Class C Shares | | | (97 | ) | | | (114 | ) | | | (427 | ) | | | (1,264 | ) | | | — | | | | — | | |

Class I Shares | | | (202 | ) | | | (231 | ) | | | (11,533 | ) | | | (21,576 | ) | | | (12,793 | ) | | | (7,328 | ) | |

Class R Shares | | | (40 | ) | | | (44 | ) | | | (920 | ) | | | (2,160 | ) | | | — | | | | — | | |

Class R6 Shares | | | — | | | | — | | | | (730 | ) | | | (815 | ) | | | — | | | | — | | |

Class Y Shares | | | — | | | | — | | | | (1,649 | ) | | | (2,348 | ) | | | — | | | | — | | |

Change in net assets resulting from

distributions to shareholders | | | (853 | ) | | | (963 | ) | | | (18,304 | ) | | | (36,122 | ) | | | (13,640 | ) | | | (7,991 | ) | |

Change in net assets resulting from

capital transactions | | | (1,109 | ) | | | (9,554 | ) | | | 136,826 | | | | 111,166 | | | | 42,852 | | | | 119,535 | | |

Change in net assets | | | (3,394 | ) | | | (7,923 | ) | | | 140,388 | | | | 110,247 | | | | 15,898 | | | | 139,191 | | |

Net Assets: | |

Beginning of period | | | 25,609 | | | | 33,532 | | | | 716,256 | | | | 606,009 | | | | 280,330 | | | | 141,139 | | |

End of period | | $ | 22,215 | | | $ | 25,609 | | | $ | 856,644 | | | $ | 716,256 | | | $ | 296,228 | | | $ | 280,330 | | |

(continues on next page)

See notes to financial statements.

29

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Strategic

Allocation Fund | | Victory INCORE

Fund for Income | | Victory

INCORE Investment Grade

Convertible Fund | |

| | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | |

Capital Transactions: | |

Class A Shares | |

Proceeds from shares issued | | $ | 982 | | | $ | 1,078 | | | $ | 25,249 | | | $ | 52,087 | | | $ | 23,650 | | | $ | 5,609 | | |

Distributions reinvested | | | 491 | | | | 546 | | | | 2,560 | | | | 6,231 | | | | 718 | | | | 531 | | |

Cost of shares redeemed | | | (1,969 | ) | | | (5,939 | ) | | | (40,972 | ) | | | (75,399 | ) | | | (2,625 | ) | | | (5,263 | ) | |

Total Class A Shares | | $ | (496 | ) | | $ | (4,315 | ) | | $ | (13,163 | ) | | $ | (17,081 | ) | | $ | 21,743 | | | $ | 877 | | |

Class C Shares | |

Proceeds from shares issued | | $ | 89 | | | $ | 281 | | | $ | 2,642 | | | $ | 3,731 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | 96 | | | | 106 | | | | 356 | | | | 1,066 | | | | — | | | | — | | |

Cost of shares redeemed | | | (955 | ) | | | (1,868 | ) | | | (4,558 | ) | | | (14,281 | ) | | | — | | | | — | | |

Total Class C Shares | | $ | (770 | ) | | $ | (1,481 | ) | | $ | (1,560 | ) | | $ | (9,484 | ) | | $ | — | | | $ | — | | |

Class I Shares | |

Proceeds from shares issued | | $ | 691 | | | $ | 673 | | | $ | 192,792 | | | $ | 212,608 | | | $ | 110,699 | | | $ | 188,612 | | |

Distributions reinvested | | | 197 | | | | 223 | | | | 9,572 | | | | 15,748 | | | | 12,346 | | | | 6,976 | | |

Cost of shares redeemed | | | (684 | ) | | | (4,348 | ) | | | (128,657 | ) | | | (111,040 | ) | | | (101,936 | ) | | | (76,930 | ) | |

Total Class I Shares | | $ | 204 | | | $ | (3,452 | ) | | $ | 73,707 | | | $ | 117,316 | | | $ | 21,109 | | | $ | 118,658 | | |

Class R Shares | |

Proceeds from shares issued | | $ | 15 | | | $ | 90 | | | $ | 4,195 | | | $ | 5,048 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | 40 | | | | 39 | | | | 873 | | | | 2,042 | | | | — | | | | — | | |

Cost of shares redeemed | | | (102 | ) | | | (435 | ) | | | (4,155 | ) | | | (11,905 | ) | | | — | | | | — | | |

Total Class R Shares | | $ | (47 | ) | | $ | (306 | ) | | $ | 913 | | | $ | (4,815 | ) | | $ | — | | | $ | — | | |

Class R6 Shares | |

Proceeds from shares issued | | $ | — | | | $ | — | | | $ | 33,594 | | | $ | 8,367 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | — | | | | — | | | | 724 | | | | 811 | | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | | | (6,274 | ) | | | (7,027 | ) | | | — | | | | — | | |

Total Class R6 Shares | | $ | — | | | $ | — | | | $ | 28,044 | | | $ | 2,151 | | | $ | — | | | $ | — | | |

Class Y Shares | |

Proceeds from shares issued | | $ | — | | | $ | — | | | $ | 70,112 | | | $ | 44,007 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | — | | | | — | | | | 809 | | | | 1,155 | | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | | | (22,036 | ) | | | (22,083 | ) | | | — | | | | — | | |

Total Class Y Shares | | $ | — | | | $ | — | | | $ | 48,885 | | | $ | 23,079 | | | $ | — | | | $ | — | | |

Change in net assets resulting from

capital transactions | | $ | (1,109 | ) | | $ | (9,554 | ) | | $ | 136,826 | | | $ | 111,166 | | | $ | 42,852 | | | $ | 119,535 | | |

(continues on next page)

See notes to financial statements.

30

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Strategic

Allocation Fund | | Victory INCORE

Fund for Income | | Victory

INCORE Investment Grade

Convertible Fund | |

| | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | | Six

Months

Ended

April 30,

2020

(unaudited) | | Year

Ended

October 31,

2019 | |

Share Transactions: | |

Class A Shares | |

Issued | | | 62 | | | | 69 | | | | 2,945 | | | | 6,053 | | | | 1,549 | | | | 345 | | |

Reinvested | | | 30 | | | | 37 | | | | 301 | | | | 727 | | | | 43 | | | | 34 | | |

Redeemed | | | (125 | ) | | | (387 | ) | | | (4,804 | ) | | | (8,762 | ) | | | (162 | ) | | | (326 | ) | |

Total Class A Shares | | | (33 | ) | | | (281 | ) | | | (1,558 | ) | | | (1,982 | ) | | | 1,430 | | | | 53 | | |

Class C Shares | |

Issued | | | 6 | | | | 18 | | | | 310 | | | | 438 | | | | — | | | | — | | |

Reinvested | | | 6 | | | | 7 | | | | 42 | | | | 125 | | | | — | | | | — | | |

Redeemed | | | (60 | ) | | | (121 | ) | | | (537 | ) | | | (1,674 | ) | | | — | | | | — | | |

Total Class C Shares | | | (48 | ) | | | (96 | ) | | | (185 | ) | | | (1,111 | ) | | | — | | | | — | | |

Class I Shares | |

Issued | | | 44 | | | | 43 | | | | 22,465 | | | | 24,691 | | | | 6,804 | | | | 11,502 | | |

Reinvested | | | 12 | | | | 15 | | | | 1,123 | | | | 1,837 | | | | 726 | | | | 445 | | |

Redeemed | | | (47 | ) | | | (279 | ) | | | (15,016 | ) | | | (12,911 | ) | | | (6,289 | ) | | | (4,689 | ) | |

Total Class I Shares | | | 9 | | | | (221 | ) | | | 8,572 | | | | 13,617 | | | | 1,241 | | | | 7,258 | | |

Class R Shares | |

Issued | | | 1 | | | | 6 | | | | 487 | | | | 586 | | | | — | | | | — | | |

Reinvested | | | 2 | | | | 3 | | | | 102 | | | | 238 | | | | — | | | | — | | |

Redeemed | | | (6 | ) | | | (28 | ) | | | (484 | ) | | | (1,384 | ) | | | — | | | | — | | |

Total Class R Shares | | | (3 | ) | | | (19 | ) | | | 105 | | | | (560 | ) | | | — | | | | — | | |

Class R6 Shares | |

Issued | | | — | | | | — | | | | 3,939 | | | | 974 | | | | — | | | | — | | |

Reinvested | | | — | | | | — | | | | 85 | | | | 95 | | | | — | | | | — | | |

Redeemed | | | — | | | | — | | | | (733 | ) | | | (820 | ) | | | — | | | | — | | |

Total Class R6 Shares | | | — | | | | — | | | | 3,291 | | | | 249 | | | | — | | | | — | | |

Class Y Shares | |

Issued | | | — | | | | — | | | | 8,149 | | | | 5,117 | | | | — | | | | — | | |

Reinvested | | | — | | | | — | | | | 95 | | | | 135 | | | | — | | | | — | | |

Redeemed | | | — | | | | — | | | | (2,560 | ) | | | (2,567 | ) | | | — | | | | — | | |