UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04852

Victory Portfolios

(Exact name of registrant as specified in charter)

| | 4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | 44144 | |

| | (Address of principal executive offices) | (Zip code) | |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: October 31

Date of reporting period: April 30, 2021

Item 1. Reports to Stockholders.

April 30, 2021

Semi Annual Report

Victory Diversified Stock Fund

Victory NewBridge Large Cap Growth Fund

Victory Special Value Fund

Victory Strategic Allocation Fund

Victory INCORE Fund for Income

Victory INCORE Investment Grade Convertible Fund

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

TABLE OF CONTENTS

Investment Objectives and Portfolio

Holdings | | | 4 | | |

Schedule of Portfolio Investments | |

Victory Diversified Stock Fund | | | 10 | | |

Victory NewBridge Large Cap Growth Fund | | | 13 | | |

Victory Special Value Fund | | | 15 | | |

Victory Strategic Allocation Fund | | | 18 | | |

Victory INCORE Fund for Income | | | 19 | | |

Victory INCORE Investment Grade Convertible Fund | | | 21 | | |

Financial Statements | | | |

Statements of Assets and Liabilities | | | 24 | | |

Statements of Operations | | | 28 | | |

Statements of Changes in Net Assets | | | 30-35 | | |

Financial Highlights | | | 36-53 | | |

Notes to Financial Statements | | | 54 | | |

Supplemental Information | | | 66 | | |

Proxy Voting and Portfolio Holdings Information | | | 66 | | |

Expense Examples | | | 66 | | |

Advisory Contract Approval | | | 68 | | |

Liquidity Risk Management Program | | | 72 | | |

Privacy Policy (inside back cover) | | | |

1

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call 800-539-3863 (800-235-8396 for Member Class) and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

The Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at vcm.com or call 800-539-3863 (800-235-8396 for Member Class). Read it carefully before you invest or send money.

The information in this report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

800-235-8396 for Member Class

Visit our website at:

www.vcm.com

2

This page is intentionally left blank.

3

Victory Portfolios

Victory Diversified Stock Fund | | April 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund's investment objective seeks to provide long-term growth of capital.

Top 10 Holdings*:

April 30, 2021

(% of Net Assets)

Microsoft Corp. | | | 5.9 | % | |

Apple, Inc. | | | 5.1 | % | |

Amazon.com, Inc. | | | 3.5 | % | |

Alphabet, Inc., Class C | | | 3.3 | % | |

NVIDIA Corp. | | | 2.2 | % | |

JPMorgan Chase & Co. | | | 2.0 | % | |

AbbVie, Inc. | | | 1.8 | % | |

Facebook, Inc., Class A | | | 1.7 | % | |

Old Dominion Freight Line, Inc. | | | 1.6 | % | |

Bank of America Corp. | | | 1.5 | % | |

Sector Allocation*:

April 30, 2021

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

4

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | April 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund's investment objective seeks to provide long-term capital appreciation.

Top 10 Holdings*:

April 30, 2021

(% of Net Assets)

Amazon.com, Inc. | | | 7.7 | % | |

Alphabet, Inc., Class C | | | 5.4 | % | |

Visa, Inc., Class A | | | 5.3 | % | |

NVIDIA Corp. | | | 5.3 | % | |

PayPal Holdings, Inc. | | | 5.1 | % | |

ServiceNow, Inc. | | | 3.9 | % | |

Adobe, Inc. | | | 3.8 | % | |

EPAM Systems, Inc. | | | 3.5 | % | |

Facebook, Inc., Class A | | | 3.3 | % | |

Uber Technologies, Inc. | | | 3.3 | % | |

Sector Allocation*:

April 30, 2021

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

5

Victory Portfolios

Victory Special Value Fund | | April 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund's investment objective seeks to provide long-term growth of capital and dividend income.

Top 10 Holdings*:

April 30, 2021

(% of Net Assets)

Microsoft Corp. | | | 5.7 | % | |

Apple, Inc. | | | 4.8 | % | |

Amazon.com, Inc. | | | 3.4 | % | |

Alphabet, Inc., Class C | | | 3.2 | % | |

SPDR S&P 500 ETF Trust | | | 2.5 | % | |

NVIDIA Corp. | | | 2.1 | % | |

JPMorgan Chase & Co. | | | 2.1 | % | |

AbbVie, Inc. | | | 1.8 | % | |

Facebook, Inc., Cass A | | | 1.7 | % | |

Bank of America Corp. | | | 1.6 | % | |

Sector Allocation*:

April 30, 2021

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

6

Victory Portfolios

Victory Strategic Allocation Fund | | April 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund's investment objective seeks to provide income and long-term growth of capital.

Top 10 Holdings*:

April 30, 2021

(% of Net Assets)

Victory RS Global Fund, Class Y | | | 29.5 | % | |

Victory Market Neutral Income Fund, Class I | | | 19.3 | % | |

Victory INCORE Total Return Bond Fund, Class R6 | | | 10.8 | % | |

Victory Trivalent International Small-Cap Fund, Class I | | | 7.2 | % | |

VictoryShares U.S. Multi-Factor Minimum Volatility ETF | | | 6.9 | % | |

Victory Integrity Discovery Fund, Class Y | | | 4.3 | % | |

Victory RS Partners Fund, Class Y | | | 4.2 | % | |

Victory Sophus Emerging Markets Fund, Class R6 | | | 0.2 | % | |

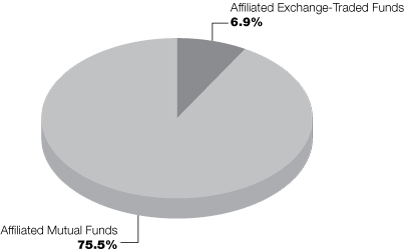

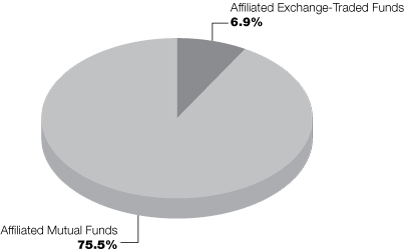

Asset Allocation*:

April 30, 2021

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

7

Victory Portfolios

Victory INCORE Fund for Income | | April 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund's investment objective seeks to provide a high level of current income consistent with preservation of shareholders' capital.

Asset Allocation*:

April 30, 2021

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

8

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | April 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund's investment objective seeks to provide a high level of current income together with long-term capital appreciation.

Top 10 Holdings*:

April 30, 2021

(% of Net Assets)

Fortive Corp. | | | 4.8 | % | |

Western Digital Corp. | | | 4.8 | % | |

Southwest Airlines Co. | | | 4.6 | % | |

Wells Fargo & Co., Series L | | | 4.2 | % | |

Anthem, Inc. | | | 4.0 | % | |

Stanley Black & Decker, Inc. | | | 4.0 | % | |

Booking Holdings, Inc. | | | 3.9 | % | |

Pioneer Natural Resources Co. | | | 3.8 | % | |

Micron Technology, Inc., Convertible Subordinated Notes | | | 3.4 | % | |

Euronet Worldwide, Inc. | | | 3.3 | % | |

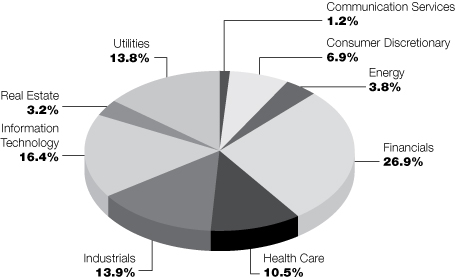

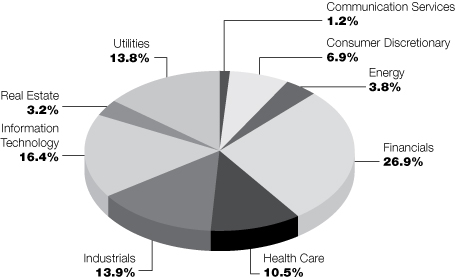

Sector Allocation*:

April 30, 2021

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

9

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (98.4%) | |

Communication Services (9.1%): | |

Alphabet, Inc., Class C (a) | | | 4,291 | | | $ | 10,342 | | |

Charter Communications, Inc., Class A (a) | | | 5,908 | | | | 3,979 | | |

Facebook, Inc., Class A (a) | | | 16,340 | | | | 5,312 | | |

Iridium Communications, Inc. (a) | | | 39,886 | | | | 1,515 | | |

Nexstar Media Group, Inc., Class A | | | 20,264 | | | | 2,987 | | |

Zynga, Inc., Class A (a) | | | 408,498 | | | | 4,420 | | |

| | | | 28,555 | | |

Communications Equipment (1.0%): | |

Lumentum Holdings, Inc. (a) | | | 38,401 | | | | 3,266 | | |

Consumer Discretionary (16.7%): | |

Amazon.com, Inc. (a) | | | 3,179 | | | | 11,023 | | |

Asbury Automotive Group, Inc. (a) | | | 21,169 | | | | 4,203 | | |

Boyd Gaming Corp. (a) | | | 46,734 | | | | 3,091 | | |

Brunswick Corp. | | | 29,893 | | | | 3,202 | | |

D.R. Horton, Inc. | | | 33,420 | | | | 3,285 | | |

Group 1 Automotive, Inc. (b) | | | 19,180 | | | | 3,149 | | |

LCI Industries | | | 21,004 | | | | 3,077 | | |

LGI Homes, Inc. (a) | | | 28,006 | | | | 4,644 | | |

Lowe's Cos., Inc. | | | 15,860 | | | | 3,113 | | |

Malibu Boats, Inc., Class A (a) | | | 33,743 | | | | 2,813 | | |

Meritage Homes Corp. (a) | | | 32,454 | | | | 3,453 | | |

Rent-A-Center, Inc. | | | 51,520 | | | | 2,965 | | |

Tesla, Inc. (a) | | | 2,117 | | | | 1,502 | | |

TopBuild Corp. (a) | | | 11,761 | | | | 2,615 | | |

| | | | 52,135 | | |

Consumer Staples (4.7%): | |

BJ's Wholesale Club Holdings, Inc. (a) | | | 65,528 | | | | 2,927 | | |

Monster Beverage Corp. (a) | | | 30,501 | | | | 2,960 | | |

PepsiCo, Inc. | | | 21,932 | | | | 3,163 | | |

Performance Food Group Co. (a) | | | 53,376 | | | | 3,133 | | |

Philip Morris International, Inc. | | | 27,605 | | | | 2,622 | | |

| | | | 14,805 | | |

Energy (2.9%): | |

Chevron Corp. | | | 30,222 | | | | 3,116 | | |

Matador Resources Co. | | | 107,139 | | | | 2,819 | | |

Pioneer Natural Resources Co. | | | 11,002 | | | | 1,692 | | |

Valero Energy Corp. | | | 19,556 | | | | 1,446 | | |

| | | | 9,073 | | |

Financials (10.8%): | |

Ameriprise Financial, Inc. | | | 8,858 | | | | 2,289 | | |

Bank of America Corp. | | | 117,220 | | | | 4,751 | | |

Flagstar Bancorp, Inc. | | | 48,555 | | | | 2,260 | | |

JPMorgan Chase & Co. | | | 40,948 | | | | 6,298 | | |

Morgan Stanley | | | 45,353 | | | | 3,744 | | |

See notes to financial statements.

10

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Primerica, Inc. | | | 26,827 | | | $ | 4,286 | | |

ServisFirst Bancshares, Inc. | | | 37,353 | | | | 2,362 | | |

T. Rowe Price Group, Inc. | | | 17,705 | | | | 3,173 | | |

Western Alliance Bancorp | | | 42,709 | | | | 4,487 | | |

| | | | 33,650 | | |

Health Care (11.1%): | |

AbbVie, Inc. | | | 50,380 | | | | 5,618 | | |

Bristol-Myers Squibb Co. | | | 29,767 | | | | 1,858 | | |

Charles River Laboratories International, Inc. (a) | | | 13,360 | | | | 4,441 | | |

ICON PLC (a) (b) | | | 16,619 | | | | 3,605 | | |

Insulet Corp. (a) | | | 6,351 | | | | 1,875 | | |

Quest Diagnostics, Inc. | | | 22,022 | | | | 2,905 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 7,854 | | | | 3,780 | | |

Stryker Corp. | | | 13,136 | | | | 3,450 | | |

Thermo Fisher Scientific, Inc. | | | 9,011 | | | | 4,237 | | |

UnitedHealth Group, Inc. | | | 7,092 | | | | 2,828 | | |

| | | | 34,597 | | |

Industrials (12.3%): | |

Builders FirstSource, Inc. (a) | | | 65,806 | | | | 3,203 | | |

Chart Industries, Inc. (a) (b) | | | 13,065 | | | | 2,099 | | |

Kansas City Southern | | | 15,788 | | | | 4,613 | | |

Marten Transport Ltd. | | | 160,181 | | | | 2,678 | | |

Masco Corp. | | | 63,054 | | | | 4,028 | | |

Masonite International Corp. (a) | | | 15,551 | | | | 1,964 | | |

Old Dominion Freight Line, Inc. | | | 19,000 | | | | 4,899 | | |

Patrick Industries, Inc. | | | 36,956 | | | | 3,311 | | |

Trex Co., Inc. (a) | | | 31,051 | | | | 3,353 | | |

UFP Industries, Inc. | | | 53,177 | | | | 4,469 | | |

XPO Logistics, Inc. (a) | | | 28,751 | | | | 4,000 | | |

| | | | 38,617 | | |

IT Services (4.0%): | |

Akamai Technologies, Inc. (a) | | | 31,857 | | | | 3,463 | | |

EPAM Systems, Inc. (a) | | | 8,246 | | | | 3,775 | | |

Fiserv, Inc. (a) | | | 27,355 | | | | 3,286 | | |

Visa, Inc., Class A | | | 8,723 | | | | 2,037 | | |

| | | | 12,561 | | |

Materials (4.4%): | |

Avery Dennison Corp. | | | 16,124 | | | | 3,454 | | |

Berry Global Group, Inc. (a) | | | 26,729 | | | | 1,700 | | |

Dow, Inc. | | | 27,574 | | | | 1,723 | | |

Silgan Holdings, Inc. | | | 38,589 | | | | 1,627 | | |

Summit Materials, Inc., Class A (a) | | | 101,753 | | | | 2,929 | | |

Valvoline, Inc. (b) | | | 70,521 | | | | 2,215 | | |

| | | | 13,648 | | |

Real Estate (1.1%): | |

American Tower Corp. | | | 13,641 | | | | 3,475 | | |

See notes to financial statements.

11

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Semiconductors & Semiconductor Equipment (6.9%): | |

Advanced Micro Devices, Inc. (a) | | | 55,537 | | | $ | 4,533 | | |

Applied Materials, Inc. | | | 14,016 | | | | 1,860 | | |

Broadcom, Inc. | | | 8,845 | | | | 4,035 | | |

NVIDIA Corp. | | | 11,273 | | | | 6,768 | | |

Qorvo, Inc. (a) | | | 22,794 | | | | 4,289 | | |

| | | | 21,485 | | |

Software (8.3%): | |

Adobe, Inc. (a) | | | 2,960 | | | | 1,505 | | |

Cadence Design Systems, Inc. (a) | | | 22,255 | | | | 2,933 | | |

Microsoft Corp. | | | 72,977 | | | | 18,402 | | |

ServiceNow, Inc. (a) | | | 5,713 | | | | 2,893 | | |

| | | | 25,733 | | |

Technology Hardware, Storage & Peripherals (5.1%): | |

Apple, Inc. | | | 120,148 | | | | 15,795 | | |

Total Common Stocks (Cost $193,436) | | | 307,395 | | |

Exchange-Traded Funds (1.1%) | |

SPDR S&P 500 ETF Trust | | | 8,570 | | | | 3,576 | | |

Total Exchange-Traded Funds (Cost $2,355) | | | 3,576 | | |

Collateral for Securities Loaned^ (1.9%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.04% (c) | | | 119,142 | | | | 119 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Class, 0.01% (c) | | | 3,188,302 | | | | 3,188 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.02% (c) | | | 59,507 | | | | 60 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.09% (c) | | | 474,494 | | | | 474 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.06% (c) | | | 2,133,516 | | | | 2,134 | | |

Total Collateral for Securities Loaned (Cost $5,975) | | | 5,975 | | |

Total Investments (Cost $201,766) — 101.4% | | | 316,946 | | |

Liabilities in excess of other assets — (1.4)% | | | (4,244 | ) | |

NET ASSETS — 100.00% | | $ | 312,702 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on April 30, 2021.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

12

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (99.1%) | |

Communication Services (13.1%): | |

Activision Blizzard, Inc. | | | 4,778 | | | $ | 436 | | |

Alphabet, Inc., Class C (a) | | | 398 | | | | 959 | | |

Facebook, Inc., Class A (a) | | | 1,823 | | | | 593 | | |

Snap, Inc., Class A (a) | | | 5,350 | | | | 331 | | |

| | | | 2,319 | | |

Consumer Discretionary (17.6%): | |

Airbnb, Inc., Class A (a) (b) | | | 1,471 | | | | 254 | | |

Amazon.com, Inc. (a) | | | 395 | | | | 1,370 | | |

Burlington Stores, Inc. (a) | | | 1,684 | | | | 550 | | |

Lululemon Athletica, Inc. (a) | | | 1,468 | | | | 492 | | |

NIKE, Inc., Class B | | | 3,537 | | | | 469 | | |

| | | | 3,135 | | |

Financials (3.1%): | |

MSCI, Inc. | | | 1,136 | | | | 552 | | |

Health Care (14.4%): | |

Align Technology, Inc. (a) | | | 765 | | | | 456 | | |

Masimo Corp. (a) | | | 1,312 | | | | 305 | | |

TG Therapeutics, Inc. (a) | | | 2,891 | | | | 129 | | |

Thermo Fisher Scientific, Inc. | | | 933 | | | | 439 | | |

Veeva Systems, Inc., Class A (a) | | | 1,678 | | | | 474 | | |

Vertex Pharmaceuticals, Inc. (a) | | | 1,301 | | | | 284 | | |

Zoetis, Inc. | | | 2,632 | | | | 455 | | |

| | | | 2,542 | | |

Industrials (10.4%): | |

CoStar Group, Inc. (a) | | | 588 | | | | 502 | | |

Generac Holdings, Inc. (a) | | | 814 | | | | 264 | | |

Trane Technologies PLC | | | 2,856 | | | | 496 | | |

Uber Technologies, Inc. (a) | | | 10,704 | | | | 586 | | |

| | | | 1,848 | | |

IT Services (18.6%): | |

EPAM Systems, Inc. (a) | | | 1,359 | | | | 622 | | |

PayPal Holdings, Inc. (a) | | | 3,466 | | | | 909 | | |

Shopify, Inc., Class A (a) | | | 337 | | | | 399 | | |

Twilio, Inc., Class A (a) | | | 1,188 | | | | 437 | | |

Visa, Inc., Class A | | | 4,019 | | | | 938 | | |

| | | | 3,305 | | |

Semiconductors & Semiconductor Equipment (8.2%): | |

Micron Technology, Inc. (a) | | | 6,113 | | | | 526 | | |

NVIDIA Corp. | | | 1,563 | | | | 939 | | |

| | | | 1,465 | | |

See notes to financial statements.

13

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Software (13.7%): | |

Adobe, Inc. (a) | | | 1,319 | | | $ | 671 | | |

Autodesk, Inc. (a) | | | 1,076 | | | | 314 | | |

Cadence Design Systems, Inc. (a) | | | 2,682 | | | | 353 | | |

ServiceNow, Inc. (a) | | | 1,379 | | | | 697 | | |

The Trade Desk, Inc., Class A (a) | | | 550 | | | | 401 | | |

| | | | 2,436 | | |

Total Common Stocks (Cost $8,626) | | | 17,602 | | |

Collateral for Securities Loaned^ (1.0%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.04% (c) | | | 3,543 | | | | 4 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Shares, 0.01% (c) | | | 94,734 | | | | 95 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.02% (c) | | | 1,768 | | | | 2 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.09% (c) | | | 14,099 | | | | 14 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.06% (c) | | | 63,390 | | | | 63 | | |

Total Collateral for Securities Loaned (Cost $178) | | | 178 | | |

Total Investments (Cost $8,804) — 100.1% | | | 17,780 | | |

Liabilities in excess of other assets — (0.1)% | | | (12 | ) | |

NET ASSETS — 100.00% | | $ | 17,768 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on April 30, 2021.

PLC — Public Limited Company

See notes to financial statements.

14

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (97.4%) | |

Communication Services (9.0%): | |

Alphabet, Inc., Class C (a) | | | 658 | | | $ | 1,586 | | |

Charter Communications, Inc., Class A (a) | | | 909 | | | | 612 | | |

Facebook, Inc., Class A (a) | | | 2,573 | | | | 836 | | |

Iridium Communications, Inc. (a) | | | 6,218 | | | | 236 | | |

Nexstar Media Group, Inc., Class A | | | 3,270 | | | | 482 | | |

Zynga, Inc., Class A (a) | | | 63,744 | | | | 690 | | |

| | | | 4,442 | | |

Consumer Discretionary (16.6%): | |

Amazon.com, Inc. (a) | | | 479 | | | | 1,661 | | |

Asbury Automotive Group, Inc. (a) | | | 3,304 | | | | 656 | | |

Boyd Gaming Corp. (a) | | | 7,542 | | | | 499 | | |

Brunswick Corp. | | | 4,740 | | | | 508 | | |

D.R. Horton, Inc. | | | 5,391 | | | | 530 | | |

Group 1 Automotive, Inc. | | | 2,992 | | | | 491 | | |

LCI Industries | | | 3,238 | | | | 474 | | |

LGI Homes, Inc. (a) | | | 4,518 | | | | 748 | | |

Lowe's Cos., Inc. | | | 2,560 | | | | 502 | | |

Malibu Boats, Inc., Class A (a) | | | 5,444 | | | | 454 | | |

Meritage Homes Corp. (a) | | | 5,169 | | | | 550 | | |

Rent-A-Center, Inc. | | | 8,315 | | | | 479 | | |

Tesla, Inc. (a) | | | 328 | | | | 233 | | |

TopBuild Corp. (a) | | | 1,843 | | | | 410 | | |

| | | | 8,195 | | |

Consumer Staples (4.7%): | |

BJ's Wholesale Club Holdings, Inc. (a) | | | 10,064 | | | | 450 | | |

Monster Beverage Corp. (a) | | | 4,796 | | | | 465 | | |

PepsiCo, Inc. | | | 3,474 | | | | 502 | | |

Performance Food Group Co. (a) | | | 8,615 | | | | 505 | | |

Philip Morris International, Inc. | | | 4,327 | | | | 411 | | |

| | | | 2,333 | | |

Energy (2.9%): | |

Chevron Corp. | | | 4,877 | | | | 502 | | |

Matador Resources Co. | | | 16,719 | | | | 440 | | |

Pioneer Natural Resources Co. | | | 1,775 | | | | 273 | | |

Valero Energy Corp. | | | 2,999 | | | | 222 | | |

| | | | 1,437 | | |

Financials (10.8%): | |

Ameriprise Financial, Inc. | | | 1,365 | | | | 353 | | |

Bank of America Corp. | | | 18,916 | | | | 767 | | |

Flagstar Bancorp, Inc. | | | 7,733 | | | | 360 | | |

JPMorgan Chase & Co. | | | 6,608 | | | | 1,016 | | |

Morgan Stanley | | | 7,079 | | | | 584 | | |

Primerica, Inc. | | | 4,206 | | | | 672 | | |

See notes to financial statements.

15

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

ServisFirst Bancshares, Inc. | | | 5,736 | | | $ | 363 | | |

T. Rowe Price Group, Inc. | | | 2,784 | | | | 499 | | |

Western Alliance Bancorp | | | 6,881 | | | | 723 | | |

| | | | 5,337 | | |

Health Care (10.9%): | |

AbbVie, Inc. | | | 7,773 | | | | 866 | | |

Bristol-Myers Squibb Co. | | | 4,578 | | | | 286 | | |

Charles River Laboratories International, Inc. (a) | | | 2,093 | | | | 696 | | |

ICON PLC (a) | | | 2,604 | | | | 565 | | |

Insulet Corp. (a) | | | 991 | | | | 293 | | |

Quest Diagnostics, Inc. | | | 3,408 | | | | 449 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 1,194 | | | | 575 | | |

Stryker Corp. | | | 2,066 | | | | 542 | | |

Thermo Fisher Scientific, Inc. | | | 1,435 | | | | 675 | | |

UnitedHealth Group, Inc. | | | 1,098 | | | | 438 | | |

| | | | 5,385 | | |

Industrials (12.4%): | |

Builders FirstSource, Inc. (a) | | | 10,619 | | | | 517 | | |

Chart Industries, Inc. (a) | | | 2,036 | | | | 327 | | |

Kansas City Southern | | | 2,548 | | | | 745 | | |

Marten Transport Ltd. | | | 24,785 | | | | 414 | | |

Masco Corp. | | | 9,553 | | | | 610 | | |

Masonite International Corp. (a) | | | 2,510 | | | | 317 | | |

Old Dominion Freight Line, Inc. | | | 2,871 | | | | 740 | | |

Patrick Industries, Inc. | | | 5,964 | | | | 534 | | |

Trex Co., Inc. (a) | | | 5,012 | | | | 541 | | |

UFP Industries, Inc. | | | 8,578 | | | | 721 | | |

XPO Logistics, Inc. (a) | | | 4,526 | | | | 630 | | |

| | | | 6,096 | | |

Information Technology (24.6%): | |

Adobe, Inc. (a) | | | 462 | | | | 235 | | |

Advanced Micro Devices, Inc. (a) | | | 8,529 | | | | 696 | | |

Akamai Technologies, Inc. (a) | | | 4,986 | | | | 542 | | |

Apple, Inc. | | | 17,951 | | | | 2,360 | | |

Applied Materials, Inc. | | | 2,261 | | | | 300 | | |

Broadcom, Inc. | | | 1,392 | | | | 635 | | |

Cadence Design Systems, Inc. (a) | | | 3,473 | | | | 458 | | |

EPAM Systems, Inc. (a) | | | 1,292 | | | | 592 | | |

Fiserv, Inc. (a) | | | 4,289 | | | | 515 | | |

Lumentum Holdings, Inc. (a) | | | 6,003 | | | | 511 | | |

Microsoft Corp. | | | 11,142 | | | | 2,809 | | |

NVIDIA Corp. | | | 1,731 | | | | 1,040 | | |

Qorvo, Inc. (a) | | | 3,689 | | | | 694 | | |

ServiceNow, Inc. (a) | | | 880 | | | | 446 | | |

Visa, Inc., Class A | | | 1,367 | | | | 319 | | |

| | | | 12,152 | | |

See notes to financial statements.

16

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Materials (4.4%): | |

Avery Dennison Corp. | | | 2,601 | | | $ | 557 | | |

Berry Global Group, Inc. (a) | | | 4,167 | | | | 265 | | |

Dow, Inc. | | | 4,448 | | | | 278 | | |

Silgan Holdings, Inc. | | | 6,016 | | | | 254 | | |

Summit Materials, Inc., Class A (a) | | | 16,413 | | | | 473 | | |

Valvoline, Inc. | | | 10,899 | | | | 342 | | |

| | | | 2,169 | | |

Real Estate (1.1%): | |

American Tower Corp. | | | 2,100 | | | | 535 | | |

Total Common Stocks (Cost $30,616) | | | 48,081 | | |

Exchange-Traded Funds (2.5%) | |

SPDR S&P 500 ETF Trust | | | 2,931 | | | | 1,223 | | |

Total Exchange-Traded Funds (Cost $1,139) | | | 1,223 | | |

Total Investments (Cost $31,755) — 99.9% | | | 49,304 | | |

Other assets in excess of liabilities — 0.1% | | | 55 | | |

NET ASSETS — 100.00% | | $ | 49,359 | | |

(a) Non-income producing security.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

17

Victory Portfolios

Victory Strategic Allocation Fund | | Schedule of Portfolio Investments

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Affiliated Exchange-Traded Funds (6.9%) | |

VictoryShares U.S. Multi-Factor Minimum Volatility ETF | | | 54,280 | | | $ | 2,015 | | |

Total Affiliated Exchange-Traded Funds (Cost $1,400) | | | 2,015 | | |

Affiliated Mutual Funds (75.5%) | |

Victory INCORE Total Return Bond Fund, Class R6 | | | 321,551 | | | | 3,151 | | |

Victory Integrity Discovery Fund, Class Y | | | 25,959 | | | | 1,264 | | |

Victory Market Neutral Income Fund, Class I | | | 586,334 | | | | 5,647 | | |

Victory RS Global Fund, Class Y (a) | | | 458,725 | | | | 8,579 | | |

Victory RS Partners Fund, Class Y | | | 37,802 | | | | 1,240 | | |

Victory Sophus Emerging Markets Fund, Class R6 | | | 2,641 | | | | 71 | | |

Victory Trivalent International Small-Cap Fund, Class I | | | 118,131 | | | | 2,107 | | |

Total Affiliated Mutual Funds (Cost $17,182) | | | 22,059 | | |

Total Investments (Cost $18,582) — 82.4% | | | 24,074 | | |

Other assets in excess of liabilities — 17.6% | | | 5,158 | | |

NET ASSETS — 100.00% | | $ | 29,232 | | |

(a) Represents investments greater than 25% of the Fund's net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. The financial statements and portfolio holdings for these securities can be found at www.sec.gov.

ETF — Exchange-Traded Fund

See notes to financial statements.

18

Victory Portfolios

Victory INCORE Fund for Income | | Schedule of Portfolio Investments

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Government National Mortgage Association (71.5%) | |

Multi-family (0.3%): | |

Collateralized Mortgage Obligations (0.1%): | |

Government National Mortgage Assoc. | |

Series 2012-33, Class AB, 7.00%, 3/16/46 | | $ | 982 | | | $ | 1,019 | | |

Pass-throughs (0.2%): | |

Government National Mortgage Assoc. | |

7.50%, 8/15/21 | | | 1 | | | | 1 | | |

7.92%, 7/1/23 | | | 162 | | | | 162 | | |

8.00%, 1/15/31 – 11/15/33 | | | 1,071 | | | | 1,073 | | |

7.75%, 9/15/33 | | | 390 | | | | 390 | | |

| | | | 1,626 | | |

Single Family (71.2%): | |

Collateralized Mortgage Obligations (3.3%): | |

Government National Mortgage Assoc. | |

Series 1999-4, Class ZB, 6.00%, 2/20/29 | | | 168 | | | | 168 | | |

Series 2001-10, Class PE, 6.50%, 3/16/31 | | | 137 | | | | 137 | | |

Series 2005-74, Class HB, 7.50%, 9/16/35 | | | 10 | | | | 11 | | |

Series 2005-74, Class HC, 7.50%, 9/16/35 | | | 54 | | | | 62 | | |

Series 2011-166, Class NT, 7.75%, 11/20/31 (a) | | | 831 | | | | 964 | | |

Series 2012-106, Class JM, 7.32%, 10/20/34 (a) | | | 619 | | | | 732 | | |

Series 2012-30, Class WB, 7.06%, 11/20/39 (a) | | | 2,375 | | | | 2,756 | | |

Series 2013-190, Class KT, 8.13%, 9/20/30 (a) | | | 268 | | | | 308 | | |

Series 2013-51, Class BL, 6.07%, 4/20/34 (a) | | | 1,776 | | | | 2,059 | | |

Series 2013-64, Class KY, 6.80%, 12/20/38 (a) | | | 984 | | | | 1,124 | | |

Series 2013-70, Class KP, 7.06%, 2/20/39 (a) | | | 878 | | | | 1,034 | | |

Series 2014-69, Class W, 7.20%, 11/20/34 (a) | | | 125 | | | | 146 | | |

Series 2014-74, Class PT, 7.79%, 5/16/44 (a) | | | 194 | | | | 219 | | |

Series 2015-77, Class PT, 7.53%, 6/20/39 (a) | | | 408 | | | | 471 | | |

Series 2019-22, Class PT, 7.92%, 2/20/49 (a) | | | 6,800 | | | | 7,797 | | |

Series 2021-1, Class WT, 7.84%, 1/20/51 (a) | | | 6,889 | | | | 8,038 | | |

| | | | 26,026 | | |

Pass-throughs (67.9%): | |

Government National Mortgage Assoc. | |

8.50%, 7/15/21 – 7/15/32 | | | 5,874 | | | | 6,722 | | |

9.00%, 7/15/21 – 9/15/30 | | | 1,642 | | | | 1,858 | | |

9.50%, 8/15/21 – 9/15/24 | | | 1 | | | | — | (b) | |

8.00%, 12/15/21 – 5/15/49 | | | 37,702 | | | | 44,315 | | |

6.00%, 1/15/22 – 9/20/50 | | | 81,606 | | | | 96,087 | | |

7.13%, 3/15/23 – 7/15/25 | | | 264 | | | | 268 | | |

5.50%, 7/15/23 – 11/15/45 | | | 15,539 | | | | 18,272 | | |

7.50%, 8/15/23 – 5/15/49 | | | 65,613 | | | | 75,814 | | |

6.50%, 8/20/23 – 2/20/41 | | | 130,429 | | | | 152,564 | | |

7.00%, 12/15/23 – 9/20/50 | | | 91,750 | | | | 107,843 | | |

10.00%, 4/15/25 – 2/15/26 | | | 2 | | | | 2 | | |

6.13%, 6/20/28 – 9/20/29 | | | 363 | | | | 388 | | |

6.28%, 10/20/28 – 9/20/29 | | | 646 | | | | 708 | | |

See notes to financial statements.

19

Victory Portfolios

Victory INCORE Fund for Income | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares or

Principal

Amount | | Value | |

6.10%, 5/20/29 – 7/20/31 | | $ | 476 | | | $ | 523 | | |

7.30%, 4/20/30 – 2/20/31 | | | 186 | | | | 195 | | |

6.49%, 5/20/31 – 3/20/32 | | | 922 | | | | 1,028 | | |

6.50%, 12/15/32 (c) | | | 8,414 | | | | 9,860 | | |

6.00%, 11/15/33 (c) | | | 5,230 | | | | 6,187 | | |

4.50%, 12/15/33 – 5/15/41 | | | 4,338 | | | | 4,989 | | |

5.00%, 1/20/34 – 1/15/40 | | | 10,003 | | | | 11,600 | | |

4.00%, 8/15/41 | | | 775 | | | | 868 | | |

| | | | 540,091 | | |

Total Government National Mortgage Association (Cost $559,580) | | | 568,762 | | |

U.S. Treasury Obligations (28.9%) | |

U.S. Treasury Bills, 9/9/21 (d) | | | 21,009 | | | | 21,007 | | |

U.S. Treasury Bonds | |

7.13%, 2/15/23 (c) | | | 113,300 | | | | 127,459 | | |

7.50%, 11/15/24 | | | 65,226 | | | | 81,400 | | |

Total U.S. Treasury Obligations (Cost $230,673) | | | 229,866 | | |

Investment Companies (0.0%) (e) | |

BlackRock Liquidity Funds Fedfund Portfolio, 0.02% (f) | | | 100,369 | | | | 100 | | |

Total Investment Companies (Cost $100) | | | 100 | | |

Total Investments (Cost $790,353) — 100.4% | | | 798,728 | | |

Liabilities in excess of other assets — (0.4)% | | | (3,560 | ) | |

NET ASSETS — 100.00% | | $ | 795,168 | | |

(a) The rate for certain asset-backed and mortgage-backed securities may vary based on factors relating to the pool of assets underlying the security. The rate disclosed is the rate in effect at April 30, 2021.

(b) Rounds to less than $1 thousand.

(c) All or a portion of the security has been segregated as collateral for securities purchased on a when-issued basis.

(d) Zero-coupon bond.

(e) Amount represents less than 0.05% of net assets.

(f) Rate represents the effective yield at April 30, 2021.

Continuously callable — Investment is continuously callable or will be continuously callable on any date after the first call date until its maturity.

See notes to financial statements.

20

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | Schedule of Portfolio Investments

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Convertible Corporate Bonds (66.7%) | |

Communication Services (1.2%): | |

Snap, Inc., 0.75%, 8/1/26 | | $ | 1,595 | | | $ | 4,363 | | |

Consumer Discretionary (6.9%): | |

Booking Holdings, Inc. | |

0.90%, 9/15/21 | | | 2,722 | | | | 3,325 | | |

0.75%, 5/1/25 (a) | | | 9,410 | | | | 14,252 | | |

Expedia Group, Inc. , 0.00%, 2/15/26 (b) | | | 7,125 | | | | 7,775 | | |

| | | | 25,352 | | |

Energy (3.8%): | |

Pioneer Natural Resources Co., 0.25%, 5/15/25 (a) (b) | | | 9,225 | | | | 14,025 | | |

Financials (14.8%): | |

Ares Capital Corp. | |

3.75%, 2/1/22 | | | 8,240 | | | | 8,547 | | |

4.63%, 3/1/24 | | | 7,515 | | | | 8,161 | | |

Barclays Bank PLC | |

0.00%, 2/4/25 | | | 4,815 | | | | 6,605 | | |

0.00%, 2/18/25 | | | 1,990 | | | | 2,341 | | |

BlackRock Capital Investment Corp., 5.00%, 6/15/22 | | | 3,712 | | | | 3,722 | | |

BlackRock TCP Capital Corp., 4.63%, 3/1/22 | | | 1,390 | | | | 1,421 | | |

GSK Finance NO 3 PLC , 0.00%, 6/22/23 (b) | | | 1,545 | | | | 1,665 | | |

JPMorgan Chase Financial Co. LLC, 0.25%, 5/1/23 (b) | | | 9,355 | | | | 10,623 | | |

MGIC Investment Corp. Convertible Subordinated Notes, 9.00%, 4/1/63 | | | 4,127 | | | | 5,534 | | |

TPG Specialty Lending, Inc., 4.50%, 8/1/22 | | | 4,391 | | | | 5,101 | | |

| | | | 53,720 | | |

Health Care (10.5%): | |

Anthem, Inc., 2.75%, 10/15/42 | | | 3,427 | | | | 18,259 | | |

Bristol-Myers Squibb Co., Convertible Subordinated Notes, 0.24%

(LIBOR03M-50bps), 9/15/23, Callable 6/7/21 @ 100 (c) (d) | | | 2,466 | | | | 3,839 | | |

Illumina, Inc. , 0.00%, 8/15/23 (a) | | | 8,375 | | | | 10,031 | | |

Illumina, Inc., Convertible Subordinated Notes, 0.50%, 6/15/21 | | | 4,265 | | | | 6,568 | | |

| | | | 38,697 | | |

Industrials (9.9%): | |

Fortive Corp., 0.88%, 2/15/22 | | | 17,361 | | | | 17,576 | | |

Parsons Corp., 0.25%, 8/15/25 (b) | | | 1,500 | | | | 1,714 | | |

Southwest Airlines Co., 1.25%, 5/1/25 | | | 9,660 | | | | 16,795 | | |

| | | | 36,085 | | |

Information Technology (16.4%): | |

Akamai Technologies, Inc., 0.13%, 5/1/25 | | | 1,922 | | | | 2,417 | | |

Euronet Worldwide, Inc., 0.75%, 3/15/49, Callable 3/20/25 @ 100 (a) | | | 10,545 | | | | 12,152 | | |

Micron Technology, Inc., Convertible Subordinated Notes, 3.13%, 5/1/32 | | | 1,462 | | | | 12,588 | | |

Novellus Systems, Inc., Convertible Subordinated Notes, 2.63%, 5/15/41 | | | 353 | | | | 6,965 | | |

Nuance Communication, Inc. Convertible Subordinated Notes, 1.00%,

12/15/35, Callable 12/20/22 @ 100 | | | 1,410 | | | | 3,098 | | |

ServiceNow, Inc. , 0.00%, 6/1/22 | | | 520 | | | | 1,930 | | |

See notes to financial statements.

21

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Shares or

Security Description | | Principal

Amount | | Value | |

Vishay Intertechnology, Inc., 2.25%, 6/15/25 | | $ | 3,186 | | | $ | 3,463 | | |

Western Digital Corp., 1.50%, 2/1/24 | | | 16,943 | | | | 17,556 | | |

| | | | 60,169 | | |

Real Estate (3.2%): | |

Kite Realty Group, LP, 0.75%, 4/1/27 (b) | | | 5,185 | | | | 5,273 | | |

Spirit Realty Capital, Inc., 3.75%, 5/15/21 | | | 6,255 | | | | 6,302 | | |

| | | | 11,575 | | |

Total Convertible Corporate Bonds (Cost $200,165) | | | 243,986 | | |

Convertible Preferred Stocks (29.9%) | |

Financials (12.1%): | |

AMG Capital Trust II, 5.15%, 10/15/37 | | | 181,860 | | | | 10,525 | | |

Bank of America Corp., Series L, 7.25% (e) | | | 7,130 | | | | 10,096 | | |

KKR & Co., Inc., Series C, 6.00%, 9/15/23 | | | 70,650 | | | | 5,297 | | |

New York Community Capital Trust, 6.00%, 11/1/51 | | | 57,174 | | | | 2,886 | | |

Wells Fargo & Co., Series L, 7.50% (e) | | | 10,809 | | | | 15,498 | | |

| | | | 44,302 | | |

Industrials (4.0%): | |

Stanley Black & Decker, Inc., 5.25%, 11/15/22 | | | 119,525 | | | | 14,583 | | |

Utilities (13.8%): | |

American Electric Power Co., Inc., 6.13%, 3/15/22 | | | 49,970 | | | | 2,508 | | |

American Electric Power Co., Inc., 6.13%, 8/15/23 | | | 49,910 | | | | 2,554 | | |

CenterPoint Energy, Inc., Convertible Subordinated Notes, 4.57%, 9/15/29 | | | 80,000 | | | | 5,180 | | |

Dominion Energy, Inc., Series A, 7.25%, 6/1/22 | | | 100,003 | | | | 10,315 | | |

DTE Energy Co., 6.25%, 11/1/22 | | | 162,215 | | | | 8,231 | | |

NextEra Energy, Inc., 4.87%, 9/1/22 | | | 127,545 | | | | 7,441 | | |

NextEra Energy, Inc., 5.28%, 3/1/23 | | | 75,000 | | | | 3,778 | | |

The Southern Co., Series 2019, 6.75%, 8/1/22 | | | 199,220 | | | | 10,440 | | |

| | | | 50,447 | | |

Total Convertible Preferred Stocks (Cost $98,194) | | | 109,332 | | |

Collateral for Securities Loaned^ (11.0%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.04% (f) | | | 800,266 | | | | 800 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Shares, 0.01% (f) | | | 21,400,329 | | | | 21,400 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.02% (f) | | | 399,522 | | | | 400 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.09% (f) | | | 3,184,868 | | | | 3,185 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.06% (f) | | | 14,319,786 | | | | 14,320 | | |

Total Collateral for Securities Loaned (Cost $40,105) | | | 40,105 | | |

Total Investments (Cost $338,464) — 107.6% | | | 393,423 | | |

Liabilities in excess of other assets — (7.6)% | | | (27,780 | ) | |

NET ASSETS — 100.00% | | $ | 365,643 | | |

See notes to financial statements.

22

Victory Portfolios

Victory INCORE Investment Grade Convertible Fund | | Schedule of Portfolio Investments — continued

April 30, 2021 | |

(Unaudited)

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security is on loan.

(b) Rule 144A security or other security that is restricted as to resale to institutional investors. The Fund's Adviser has deemed this security to be liquid based upon procedures approved by the Board of Trustees. As of April 30, 2021, the fair value of these securities was $41,075 (thousands) and amounted to 11.2% of net assets.

(c) Variable or Floating-Rate Security. Rate disclosed is as of April 30, 2021.

(d) Continuously callable with 30 days' notice.

(e) Security is perpetual and has no final maturity date but may be subject to calls at various dates in the future.

(f) Rate disclosed is the daily yield on April 30, 2021.

bps — Basis points

Continuously callable — Investment is continuously callable or will be continuously callable on any date after the first call date until its maturity.

LIBOR — London InterBank Offered Rate

LIBOR03M — 3 Month US Dollar LIBOR, rate disclosed as of April 30, 2021, based on the last reset date of the security

LLC — Limited Liability Company

LP — Limited Partnership

PLC — Public Limited Company

See notes to financial statements.

23

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2021 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | Victory

Diversified

Stock Fund | | Victory

NewBridge

Large Cap

Growth Fund | | Victory

Special

Value Fund | |

Assets: | |

Investments, at value (Cost $201,766, $8,804 and

$31,755) | | $ | 316,946 | (a) | | $ | 17,780 | (b) | | $ | 49,304 | | |

Cash | | | 989 | | | | 169 | | | | 191 | | |

Receivables: | |

Interest and dividends | | | 106 | | | | 3 | | | | 16 | | |

Capital shares issued | | | 16 | | | | — | (c) | | | 26 | | |

Investments sold | | | 2,507 | | | | — | | | | 394 | | |

From Adviser | | | 5 | | | | 11 | | | | 8 | | |

Prepaid expenses | | | 44 | | | | 21 | | | | 29 | | |

Total Assets | | | 320,613 | | | | 17,984 | | | | 49,968 | | |

Liabilities: | |

Payables: | |

Collateral received on loaned securities | | | 5,975 | | | | 178 | | | | — | | |

Investments purchased | | | 1,170 | | | | — | | | | 180 | | |

Capital shares redeemed | | | 501 | | | | 17 | | | | 378 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 165 | | | | 11 | | | | 30 | | |

Administration fees | | | 15 | | | | 1 | | | | 2 | | |

Custodian fees | | | 2 | | | | — | (c) | | | 1 | | |

Transfer agent fees | | | 31 | | | | 3 | | | | 4 | | |

Compliance fees | | | — | (c) | | | — | (c) | | | — | (c) | |

Trustees' fees | | | — | (c) | | | — | | | | — | (c) | |

| 12b-1 fees | | | 34 | | | | 1 | | | | 7 | | |

Other accrued expenses | | | 18 | | | | 5 | | | | 7 | | |

Total Liabilities | | | 7,911 | | | | 216 | | | | 609 | | |

Net Assets: | |

Capital | | | 179,048 | | | | 5,821 | | | | 27,770 | | |

Total accumulated earnings/(loss) | | | 133,654 | | | | 11,947 | | | | 21,589 | | |

Net Assets | | $ | 312,702 | | | $ | 17,768 | | | $ | 49,359 | | |

Net Assets | |

Class A | | $ | 228,026 | | | $ | 8,330 | | | $ | 28,087 | | |

Class C | | | 2,550 | | | | 723 | | | | 875 | | |

Class I | | | 25,796 | | | | 7,190 | | | | 3,859 | | |

Class R | | | 47,746 | | | | — | | | | 15,843 | | |

Class R6 | | | 3,889 | | | | — | | | | — | | |

Class Y | | | 4,695 | | | | 1,525 | | | | 695 | | |

Total | | $ | 312,702 | | | $ | 17,768 | | | $ | 49,359 | | |

Shares (unlimited number of shares authorized with

a par value of $0.001 per share): | |

Class A | | | 10,261 | | | | 1,255 | | | | 849 | | |

Class C | | | 125 | | | | 478 | | | | 31 | | |

Class I | | | 1,163 | | | | 935 | | | | 115 | | |

Class R | | | 2,202 | | | | — | | | | 506 | | |

Class R6 | | | 175 | | | | — | | | | — | | |

Class Y | | | 211 | | | | 211 | | | | 21 | | |

Total | | | 14,137 | | | | 2,879 | | | | 1,522 | | |

(continues on next page)

See notes to financial statements.

24

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2021 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited) (continued)

| | | Victory

Diversified

Stock Fund | | Victory

NewBridge

Large Cap

Growth Fund | | Victory

Special

Value Fund | |

Net asset value, offering (except Class A) and

redemption price per share: (d) | |

Class A | | $ | 22.22 | | | $ | 6.64 | | | $ | 33.07 | | |

Class C (e) | | | 20.36 | | | | 1.52 | | | | 28.36 | | |

Class I | | | 22.19 | | | | 7.69 | | | | 33.52 | | |

Class R | | | 21.68 | | | | — | | | | 31.32 | | |

Class R6 | | | 22.20 | | | | — | | | | — | | |

Class Y | | | 22.23 | | | | 7.22 | | | | 33.30 | | |

Maximum Sales Charge — Class A | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % | |

Maximum offering price

(100%/(100%-maximum sales charge) of net asset

value adjusted to the nearest cent) per share —

Class A | | $ | 23.58 | | | $ | 7.05 | | | $ | 35.09 | | |

(a) Includes $5,775 of securities on loan.

(b) Includes $169 of securities on loan.

(c) Rounds to less than $1 thousand.

(d) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

(e) Redemption price per share varies by the length of time shares are held.

See notes to financial statements.

25

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2021 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | Victory

Strategic

Allocation

Fund | | Victory

INCORE

Fund for

Income | | Victory

INCORE

Investment

Grade

Convertible

Fund | |

Assets: | |

Affiliated investments, at value (Cost $18,582,

$— and $—) | | $ | 24,074 | | | $ | — | | | $ | — | | |

Unaffiliated investments, at value (Cost $—,

$790,353 and $338,464) | | | — | | | | 798,728 | | | | 393,423 | (a) | |

Cash | | | 5,118 | | | | — | | | | 10,796 | | |

Receivables: | |

Interest and dividends | | | — | | | | 6,665 | | | | 1,066 | | |

Capital shares issued | | | 2 | | | | 1,016 | | | | 719 | | |

Investments sold | | | — | | | | — | | | | 1,714 | | |

From Adviser | | | 20 | | | | 37 | | | | 8 | | |

Prepaid expenses | | | 37 | | | | 99 | | | | 31 | | |

Total Assets | | | 29,251 | | | | 806,545 | | | | 407,757 | | |

Liabilities: | |

Payables: | |

Collateral received on loaned securities | | | — | | | | — | | | | 40,105 | | |

Investments purchased | | | — | | | | 4,287 | | | | 1,540 | | |

Capital shares redeemed | | | 2 | | | | 6,490 | | | | 152 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 2 | | | | 340 | | | | 221 | | |

Administration fees | | | 1 | | | | 45 | | | | 18 | | |

Custodian fees | | | — | (b) | | | — | | | | 2 | | |

Transfer agent fees | | | 5 | | | | 133 | | | | 56 | | |

Compliance fees | | | — | (b) | | | 1 | | | | — | (b) | |

Trustees' fees | | | — | | | | 2 | | | | — | (b) | |

| 12b-1 fees | | | 3 | | | | 23 | | | | 2 | | |

Other accrued expenses | | | 6 | | | | 56 | | | | 18 | | |

Total Liabilities | | | 19 | | | | 11,377 | | | | 42,114 | | |

Net Assets: | |

Capital | | | 23,582 | | | | 1,144,578 | | | | 292,125 | | |

Total accumulated earnings/(loss) | | | 5,650 | | | | (349,410 | ) | | | 73,518 | | |

Net Assets | | $ | 29,232 | | | $ | 795,168 | | | $ | 365,643 | | |

Net Assets | |

Class A | | $ | 16,741 | | | $ | 141,270 | | | $ | 21,662 | | |

Class C | | | 2,329 | | | | 12,209 | | | | — | | |

Class I | | | 8,809 | | | | 429,376 | | | | 343,693 | | |

Class R | | | 1,353 | | | | 37,950 | | | | — | | |

Class R6 | | | — | | | | 29,099 | | | | — | | |

Class Y | | | — | | | | 144,429 | | | | — | | |

Member Class | | | — | | | | 835 | | | | 288 | | |

Total | | $ | 29,232 | | | $ | 795,168 | | | $ | 365,643 | | |

(continues on next page)

See notes to financial statements.

26

Victory Portfolios | | Statements of Assets and Liabilities

April 30, 2021 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited) (continued)

| | | Victory

Strategic

Allocation

Fund | | Victory

INCORE

Fund for

Income | | Victory

INCORE

Investment

Grade

Convertible

Fund | |

Shares (unlimited number of shares authorized with

a par value of $0.001 per share): | |

Class A | | | 850 | | | | 17,286 | | | | 1,093 | | |

Class C | | | 120 | | | | 1,510 | | | | — | | |

Class I | | | 444 | | | | 52,555 | | | | 17,336 | | |

Class R | | | 69 | | | | 4,639 | | | | — | | |

Class R6 | | | — | | | | 3,566 | | | | — | | |

Class Y | | | — | | | | 17,674 | | | | — | | |

Member Class | | | — | | | | 102 | | | | 14 | | |

Total | | | 1,483 | | | | 97,332 | | | | 18,443 | | |

Net asset value, offering (except Class A)

and redemption price per share: (c) | |

Class A | | $ | 19.71 | | | $ | 8.17 | | | $ | 19.82 | | |

Class C (d) | | | 19.35 | | | | 8.09 | | | | — | | |

Class I | | | 19.83 | | | | 8.17 | | | | 19.82 | | |

Class R | | | 19.66 | | | | 8.18 | | | | — | | |

Class R6 | | | — | | | | 8.16 | | | | — | | |

Class Y | | | — | | | | 8.17 | | | | — | | |

Member Class | | | — | | | | 8.20 | | | | 20.55 | | |

Maximum Sales Charge — Class A | | | 2.25 | % | | | 2.25 | % | | | 2.25 | % | |

Maximum offering price

(100%/(100%-maximum sales charge) of net asset

value adjusted to the nearest cent) per share —

Class A | | $ | 20.16 | | | $ | 8.36 | | | $ | 20.28 | | |

(a) Includes $39,019 of securities on loan.

(b) Rounds to less than $1 thousand.

(c) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

(d) Redemption price per share varies by the length of time shares are held.

See notes to financial statements.

27

Victory Portfolios | | Statements of Operations

For the Year Ended April 30, 2021 | |

(Amounts in Thousands) (Unaudited)

| | | Victory

Diversified

Stock Fund | | Victory

NewBridge

Large Cap

Growth Fund | | Victory

Special

Value Fund | |

Investment Income: | | | |

Dividends | | $ | 1,528 | | | $ | 17 | | | $ | 251 | | |

Interest | | | — | (a) | | | — | (a) | | | — | (a) | |

Securities lending (net of fees) | | | 2 | | | | — | (a) | | | — | (a) | |

Total Income | | | 1,530 | | | | 17 | | | | 251 | | |

Expenses: | | | |

Investment advisory fees | | | 929 | | | | 65 | | | | 177 | | |

Administration fees | | | 82 | | | | 5 | | | | 14 | | |

Sub-Administration fees | | | 8 | | | | 7 | | | | 8 | | |

| 12b-1 fees — Class A | | | 260 | | | | 10 | | | | 33 | | |

| 12b-1 fees — Class C | | | 14 | | | | 5 | | | | 4 | | |

| 12b-1 fees — Class R | | | 110 | | | | — | | | | 38 | | |

Custodian fees | | | 7 | | | | 1 | | | | 2 | | |

Transfer agent fees — Class A | | | 73 | | | | 4 | | | | 15 | | |

Transfer agent fees — Class C | | | 2 | | | | 1 | | | | 1 | | |

Transfer agent fees — Class I | | | 7 | | | | 2 | | | | 1 | | |

Transfer agent fees — Class R | | | 18 | | | | — | | | | 12 | | |

Transfer agent fees — Class R6 | | | — | (a) | | | — | | | | — | | |

Transfer agent fees — Class Y | | | 3 | | | | 1 | | | | — | (a) | |

Trustees' fees | | | 11 | | | | 1 | | | | 2 | | |

Compliance fees | | | 1 | | | | — | (a) | | | — | (a) | |

Legal and audit fees | | | 10 | | | | 4 | | | | 5 | | |

State registration and filing fees | | | 40 | | | | 27 | | | | 33 | | |

Other expenses | | | 18 | | | | 5 | | | | 7 | | |

Total Expenses | | | 1,593 | | | | 138 | | | | 352 | | |

Expenses waived/reimbursed by Adviser | | | (18 | ) | | | (32 | ) | | | (38 | ) | |

Net Expenses | | | 1,575 | | | | 106 | | | | 314 | | |

Net Investment Income (Loss) | | | (45 | ) | | | (89 | ) | | | (63 | ) | |

Realized/Unrealized Gains (Losses) from

Investments: | | | |

Net realized gains (losses) from investment securities | | | 19,926 | | | | 3,134 | | | | 4,452 | | |

Net change in unrealized appreciation/depreciation on

investment securities | | | 56,058 | | | | (102 | ) | | | 8,074 | | |

Net realized/unrealized gains (losses) on investments | | | 75,984 | | | | 3,032 | | | | 12,526 | | |

Change in net assets resulting from operations | | $ | 75,939 | | | $ | 2,943 | | | $ | 12,463 | | |

(a) Rounds to less than $1 thousand.

See notes to financial statements.

28

Victory Portfolios | | Statements of Operations

For the Year Ended April 30, 2021 | |

(Amounts in Thousands) (Unaudited)

| | | Victory

Strategic

Allocation

Fund | | Victory

INCORE

Fund for

Income | | Victory

INCORE

Investment

Grade

Convertible

Fund | |

Investment Income: | | | |

Income distributions from affiliated funds | | $ | 930 | | | $ | — | | | $ | — | | |

Dividends from unaffiliated investments | | | — | | | | — | | | | 2,823 | | |

Interest from unaffiliated investments | | | — | (a) | | | 5,153 | | | | 1,359 | | |

Securities lending (net of fees) | | | — | | | | — | | | | 40 | | |

Total Income | | | 930 | | | | 5,153 | | | | 4,222 | | |

Expenses: | | | |

Investment advisory fees | | | 14 | | | | 2,184 | | | | 1,189 | | |

Administration fees | | | 8 | | | | 272 | | | | 91 | | |

Sub-Administration fees | | | 6 | | | | 11 | | | | 8 | | |

| 12b-1 fees — Class A | | | 20 | | | | 176 | | | | 24 | | |

| 12b-1 fees — Class C | | | 11 | | | | 80 | | | | — | | |

| 12b-1 fees — Class R | | | 3 | | | | 50 | | | | — | | |

Custodian fees | | | 1 | | | | 25 | | | | 7 | | |

Transfer agent fees — Class A | | | 10 | | | | 56 | | | | 21 | | |

Transfer agent fees — Class C | | | 1 | | | | 11 | | | | — | | |

Transfer agent fees — Class I | | | 3 | | | | 242 | | | | 117 | | |

Transfer agent fees — Class R | | | 1 | | | | 16 | | | | — | | |

Transfer agent fees — Class R6 | | | — | | | | 1 | | | | — | | |

Transfer agent fees — Class Y | | | — | | | | 93 | | | | — | | |

Transfer agent fees — Member Class (b) | | | — | | | | — | (a) | | | — | (a) | |

Trustees' fees | | | 2 | | | | 36 | | | | 12 | | |

Compliance fees | | | — | (a) | | | 4 | | | | 1 | | |

Legal and audit fees | | | 4 | | | | 27 | | | | 12 | | |

State registration and filing fees | | | 28 | | | | 81 | | | | 47 | | |

Interfund lending fees | | | — | | | | — | (a) | | | — | (a) | |

Other expenses | | | 6 | | | | 92 | | | | 25 | | |

Total Expenses | | | 118 | | | | 3,457 | | | | 1,554 | | |

Expenses waived/reimbursed by Adviser | | | (64 | ) | | | (80 | ) | | | (28 | ) | |

Net Expenses | | | 54 | | | | 3,377 | | | | 1,526 | | |

Net Investment Income (Loss) | | | 876 | | | | 1,776 | | | | 2,696 | | |

Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains (losses) from unaffiliated investment securities | | | 2 | | | | (814 | ) | | | 22,883 | | |

Net realized gains (losses) from sales of affiliated funds | | | (310 | ) | | | — | | | | — | | |

Capital gain distributions received from affiliated funds | | | 118 | | | | — | | | | — | | |

Net change in unrealized appreciation/depreciation on

unaffiliated investment securities | | | — | | | | (2,871 | ) | | | 29,992 | | |

Net change in unrealized appreciation/depreciation on

affiliated funds | | | 4,312 | | | | — | | | | — | | |

Net realized/unrealized gains (losses) on investments | | | 4,122 | | | | (3,685 | ) | | | 52,875 | | |

Change in net assets resulting from operations | | $ | 4,998 | | | $ | (1,909 | ) | | $ | 55,571 | | |

(a) Rounds to less than $1 thousand.

(b) Member Class commenced operations on November 3, 2020.

See notes to financial statements.

29

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands)

| | | Victory

Diversified Stock Fund | | Victory

NewBridge Large Cap

Growth Fund | | Victory

Special Value Fund | |

| | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | |

From Investment Activities: | |

Operations: | |

Net investment income (loss) | | $ | (45 | ) | | $ | 701 | | | $ | (89 | ) | | $ | (153 | ) | | $ | (63 | ) | | $ | 12 | | |

Net realized gains (losses) from

investments | | | 19,926 | | | | 6,025 | | | | 3,134 | | | | 2,698 | | | | 4,452 | | | | 1,501 | | |

Net change in unrealized

appreciation/depreciation

on investments | | | 56,058 | | | | 6,403 | | | | (102 | ) | | | 2,842 | | | | 8,074 | | | | 855 | | |

Change in net assets resulting

from operations | | | 75,939 | | | | 13,129 | | | | 2,943 | | | | 5,387 | | | | 12,463 | | | | 2,368 | | |

Distributions to Shareholders: | |

Class A | | | (4,846 | ) | | | (13,665 | ) | | | (924 | ) | | | (1,005 | ) | | | (913 | ) | | | (912 | ) | |

Class C | | | (83 | ) | | | (369 | ) | | | (429 | ) | | | (746 | ) | | | (36 | ) | | | (40 | ) | |

Class I | | | (570 | ) | | | (1,940 | ) | | | (641 | ) | | | (987 | ) | | | (121 | ) | | | (114 | ) | |

Class R | | | (1,037 | ) | | | (3,072 | ) | | | — | | | | — | | | | (543 | ) | | | (660 | ) | |

Class R6 | | | (85 | ) | | | (57 | ) | | | — | | | | — | | | | — | | | | — | | |

Class Y | | | (99 | ) | | | (287 | ) | | | (148 | ) | | | (385 | ) | | | (23 | ) | | | (19 | ) | |

Change in net assets resulting from

distributions to shareholders | | | (6,720 | ) | | | (19,390 | ) | | | (2,142 | ) | | | (3,123 | ) | | | (1,636 | ) | | | (1,745 | ) | |

Change in net assets resulting from

capital transactions | | | (11,123 | ) | | | (36,149 | ) | | | 105 | | | | (1,443 | ) | | | (4,375 | ) | | | (11,653 | ) | |

Change in net assets | | | 58,096 | | | | (42,410 | ) | | | 906 | | | | 821 | | | | 6,452 | | | | (11,030 | ) | |

Net Assets: | |

Beginning of period | | | 254,606 | | | | 297,016 | | | | 16,862 | | | | 16,041 | | | | 42,907 | | | | 53,937 | | |

End of period | | $ | 312,702 | | | $ | 254,606 | | | $ | 17,768 | | | $ | 16,862 | | | $ | 49,359 | | | $ | 42,907 | | |

(continues on next page)

See notes to financial statements.

30

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Diversified Stock Fund | | Victory

NewBridge Large Cap

Growth Fund | | Victory

Special Value Fund | |

| | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | |

Capital Transactions: | |

Class A | |

Proceeds from shares issued | | $ | 5,169 | | | $ | 7,727 | | | $ | 608 | | | $ | 1,914 | | | $ | 934 | | | $ | 2,733 | | |

Distributions reinvested | | | 4,436 | | | | 12,429 | | | | 740 | | | | 817 | | | | 831 | | | | 818 | | |

Cost of shares redeemed | | | (16,133 | ) | | | (36,795 | ) | | | (1,234 | ) | | | (1,714 | ) | | | (4,144 | ) | | | (7,356 | ) | |

Total Class A | | $ | (6,528 | ) | | $ | (16,639 | ) | | $ | 114 | | | $ | 1,017 | | | $ | (2,379 | ) | | $ | (3,805 | ) | |

Class C | |

Proceeds from shares issued | | $ | 21 | | | $ | 169 | | | $ | 90 | | | $ | 286 | | | $ | — | (a) | | $ | 446 | | |

Distributions reinvested | | | 82 | | | | 311 | | | | 338 | | | | 569 | | | | 36 | | | | 29 | | |

Cost of shares redeemed | | | (1,280 | ) | | | (3,132 | ) | | | (644 | ) | | | (1,193 | ) | | | (217 | ) | | | (870 | ) | |

Total Class C | | $ | (1,177 | ) | | $ | (2,652 | ) | | $ | (216 | ) | | $ | (338 | ) | | $ | (181 | ) | | $ | (395 | ) | |

Class I | |

Proceeds from shares issued | | $ | 812 | | | $ | 2,816 | | | $ | 1,007 | | | $ | 522 | | | $ | 281 | | | $ | 436 | | |

Distributions reinvested | | | 537 | | | | 1,805 | | | | 624 | | | | 927 | | | | 101 | | | | 98 | | |

Cost of shares redeemed | | | (2,347 | ) | | | (14,222 | ) | | | (1,073 | ) | | | (2,375 | ) | | | (641 | ) | | | (601 | ) | |

Total Class I | | $ | (998 | ) | | $ | (9,601 | ) | | $ | 558 | | | $ | (926 | ) | | $ | (259 | ) | | $ | (67 | ) | |

Class R | |

Proceeds from shares issued | | $ | 346 | | | $ | 1,667 | | | $ | — | | | $ | — | | | $ | 975 | | | $ | 2,086 | | |

Distributions reinvested | | | 1,016 | | | | 2,947 | | | | — | | | | — | | | | 530 | | | | 613 | | |

Cost of shares redeemed | | | (3,654 | ) | | | (12,020 | ) | | | — | | | | — | | | | (3,022 | ) | | | (10,132 | ) | |

Total Class R | | $ | (2,292 | ) | | $ | (7,406 | ) | | $ | — | | | $ | — | | | $ | (1,517 | ) | | $ | (7,433 | ) | |

Class R6 | |

Proceeds from shares issued | | $ | 129 | | | $ | 2,494 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

Distributions reinvested | | | 85 | | | | 57 | | | | — | | | | — | | | | — | | | | — | | |

Cost of shares redeemed | | | (272 | ) | | | (1,945 | ) | | | — | | | | — | | | | — | | | | — | | |

Total Class R6 | | $ | (58 | ) | | $ | 606 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

Class Y | |

Proceeds from shares issued | | $ | 161 | | | $ | 188 | | | $ | 207 | | | $ | 310 | | | $ | 15 | | | $ | 105 | | |

Distributions reinvested | | | 83 | | | | 244 | | | | 131 | | | | 184 | | | | 18 | | | | 14 | | |

Cost of shares redeemed | | | (314 | ) | | | (889 | ) | | | (689 | ) | | | (1,690 | ) | | | (72 | ) | | | (72 | ) | |

Total Class Y | | $ | (70 | ) | | $ | (457 | ) | | $ | (351 | ) | | $ | (1,196 | ) | | $ | (39 | ) | | $ | 47 | | |

Change in net assets resulting from

capital transactions | | $ | (11,123 | ) | | $ | (36,149 | ) | | $ | 105 | | | $ | (1,443 | ) | | $ | (4,375 | ) | | $ | (11,653 | ) | |

(a) Rounds to less than $1 thousand.

(continues on next page)

See notes to financial statements.

31

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Diversified Stock Fund | | Victory

NewBridge Large Cap

Growth Fund | | Victory

Special Value Fund | |

| | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | |

Share Transactions: | |

Class A | |

Issued | | | 261 | | | | 473 | | | | 96 | | | | 336 | | | | 31 | | | | 111 | | |

Reinvested | | | 231 | | | | 719 | | | | 118 | | | | 171 | | | | 29 | | | | 31 | | |

Redeemed | | | (810 | ) | | | (2,225 | ) | | | (189 | ) | | | (314 | ) | | | (138 | ) | | | (294 | ) | |

Total Class A | | | (318 | ) | | | (1,033 | ) | | | 25 | | | | 193 | | | | (78 | ) | | | (152 | ) | |

Class C | |

Issued | | | 1 | | | | 11 | | | | 64 | | | | 176 | | | | 1 | | | | 21 | | |

Reinvested | | | 5 | | | | 19 | | | | 236 | | | | 377 | | | | 1 | | | | 1 | | |

Redeemed | | | (71 | ) | | | (199 | ) | | | (425 | ) | | | (678 | ) | | | (9 | ) | | | (39 | ) | |

Total Class C | | | (65 | ) | | | (169 | ) | | | (125 | ) | | | (125 | ) | | | (7 | ) | | | (17 | ) | |

Class I | |

Issued | | | 40 | | | | 169 | | | | 133 | | | | 86 | | | | 10 | | | | 18 | | |

Reinvested | | | 28 | | | | 105 | | | | 86 | | | | 170 | | | | 3 | | | | 4 | | |

Redeemed | | | (118 | ) | | | (856 | ) | | | (143 | ) | | | (383 | ) | | | (21 | ) | | | (24 | ) | |

Total Class I | | | (50 | ) | | | (582 | ) | | | 76 | | | | (127 | ) | | | (8 | ) | | | (2 | ) | |

Class R | |

Issued | | | 18 | | | | 102 | | | | — | | | | — | | | | 34 | | | | 95 | | |

Reinvested | | | 54 | | | | 174 | | | | — | | | | — | | | | 20 | | | | 25 | | |

Redeemed | | | (188 | ) | | | (734 | ) | | | — | | | | — | | | | (105 | ) | | | (422 | ) | |

Total Class R | | | (116 | ) | | | (458 | ) | | | — | | | | — | | | | (51 | ) | | | (302 | ) | |

Class R6 | |

Issued | | | 6 | | | | 154 | | | | — | | | | — | | | | — | | | | — | | |

Reinvested | | | 4 | | | | 3 | | | | — | | | | — | | | | — | | | | — | | |

Redeemed | | | (14 | ) | | | (109 | ) | | | — | | | | — | | | | — | | | | — | | |

Total Class R6 | | | (4 | ) | | | 48 | | | | — | | | | — | | | | — | | | | — | | |

Class Y | |

Issued | | | 8 | | | | 12 | | | | 30 | | | | 59 | | | | — | (a) | | | 4 | | |

Reinvested | | | 4 | | | | 14 | | | | 19 | | | | 36 | | | | 1 | | | | 1 | | |

Redeemed | | | (16 | ) | | | (52 | ) | | | (95 | ) | | | (264 | ) | | | (2 | ) | | | (3 | ) | |

Total Class Y | | | (4 | ) | | | (26 | ) | | | (46 | ) | | | (169 | ) | | | (1 | ) | | | 2 | | |

Change in Shares | | | (557 | ) | | | (2,220 | ) | | | (70 | ) | | | (228 | ) | | | (145 | ) | | | (471 | ) | |

(a) Rounds to less than 1 thousand.

See notes to financial statements.

32

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands)

| | | Victory

Strategic

Allocation Fund | | Victory INCORE

Fund for Income | | Victory

INCORE Investment Grade

Convertible Fund | |

| | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | |

From Investment Activities: | |

Operations: | |

Net investment income (loss) | | $ | 876 | | | $ | 347 | | | $ | 1,776 | | | $ | 7,347 | | | $ | 2,696 | | | $ | 5,803 | | |

Net realized gains (losses) from

investments | | | (190 | ) | | | (96 | ) | | | (814 | ) | | | 877 | | | | 22,883 | | | | 8,565 | | |

Net change in unrealized

appreciation/depreciation

on investments | | | 4,312 | | | | 644 | | | | (2,871 | ) | | | 12,254 | | | | 29,992 | | | | 1,342 | | |

Change in net assets resulting

from operations | | | 4,998 | | | | 895 | | | | (1,909 | ) | | | 20,478 | | | | 55,571 | | | | 15,710 | | |

Distributions to Shareholders: | |

Class A | | | (119 | ) | | | (582 | ) | | | (3,366 | ) | | | (6,067 | ) | | | (718 | ) | | | (1,183 | ) | |

Class C | | | (10 | ) | | | (99 | ) | | | (326 | ) | | | (809 | ) | | | — | | | | — | | |

Class I | | | (66 | ) | | | (239 | ) | | | (13,111 | ) | | | (25,543 | ) | | | (12,171 | ) | | | (15,554 | ) | |

Class R | | | (8 | ) | | | (45 | ) | | | (960 | ) | | | (1,831 | ) | | | — | | | | — | | |

Class R6 | | | — | | | | — | | | | (1,120 | ) | | | (1,832 | ) | | | — | | | | — | | |

Class Y | | | — | | | | — | | | | (4,195 | ) | | | (5,074 | ) | | | — | | | | — | | |

Member Class(a) | | | — | | | | — | | | | (11 | ) | | | — | | | | (1 | ) | | | — | | |

Change in net assets resulting from

distributions to shareholders | | | (203 | ) | | | (965 | ) | | | (23,089 | ) | | | (41,156 | ) | | | (12,890 | ) | | | (16,737 | ) | |

Change in net assets resulting from

capital transactions | | | (201 | ) | | | (901 | ) | | | (221,734 | ) | | | 346,322 | | | | 29,468 | | | | 14,191 | | |

Change in net assets | | | 4,594 | | | | (971 | ) | | | (246,732 | ) | | | 325,644 | | | | 72,149 | | | | 13,164 | | |

Net Assets: | |

Beginning of period | | | 24,638 | | | | 25,609 | | | | 1,041,900 | | | | 716,256 | | | | 293,494 | | | | 280,330 | | |

End of period | | $ | 29,232 | | | $ | 24,638 | | | $ | 795,168 | | | $ | 1,041,900 | | | $ | 365,643 | | | $ | 293,494 | | |

(a) Member Class commenced operations on November 3, 2020.

(continues on next page)

See notes to financial statements.

33

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)

| | | Victory

Strategic

Allocation Fund | | Victory INCORE

Fund for Income | | Victory

INCORE Investment Grade

Convertible Fund | |

| | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | | Six

Months

Ended

April 30,

2021

(unaudited) | | Year

Ended

October 31,

2020 | |

Capital Transactions: | |

Class A | |

Proceeds from shares issued | | $ | 1,163 | | | $ | 2,364 | | | $ | 31,445 | | | $ | 73,304 | | | $ | 5,075 | | | $ | 26,469 | | |

Distributions reinvested | | | 114 | | | | 557 | | | | 2,948 | | | | 5,164 | | | | 622 | | | | 1,032 | | |

Cost of shares redeemed | | | (1,692 | ) | | | (3,895 | ) | | | (40,514 | ) | | | (60,933 | ) | | | (3,127 | ) | | | (29,802 | ) | |

Total Class A | | $ | (415 | ) | | $ | (974 | ) | | $ | (6,121 | ) | | $ | 17,535 | | | $ | 2,570 | | | $ | (2,301 | ) | |

Class C | |

Proceeds from shares issued | | $ | 394 | | | $ | 574 | | | $ | 1,312 | | | $ | 6,690 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | 10 | | | | 98 | | | | 302 | | | | 690 | | | | — | | | | — | | |

Cost of shares redeemed | | | (475 | ) | | | (1,845 | ) | | | (9,782 | ) | | | (8,697 | ) | | | — | | | | — | | |

Total Class C | | $ | (71 | ) | | $ | (1,173 | ) | | $ | (8,168 | ) | | $ | (1,317 | ) | | $ | — | | | $ | — | | |

Class I | |

Proceeds from shares issued | | $ | 1,145 | | | $ | 2,267 | | | $ | 113,776 | | | $ | 410,936 | | | $ | 89,300 | | | $ | 181,653 | | |

Distributions reinvested | | | 65 | | | | 233 | | | | 11,364 | | | | 21,645 | | | | 12,051 | | | | 15,054 | | |

Cost of shares redeemed | | | (784 | ) | | | (1,204 | ) | | | (272,553 | ) | | | (277,267 | ) | | | (74,729 | ) | | | (180,215 | ) | |

Total Class I | | $ | 426 | | | $ | 1,296 | | | $ | (147,413 | ) | | $ | 155,314 | | | $ | 26,622 | | | $ | 16,492 | | |

Class R | |

Proceeds from shares issued | | $ | 10 | | | $ | 30 | | | $ | 3,673 | | | $ | 18,508 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | 8 | | | | 45 | | | | 934 | | | | 1,753 | | | | — | | | | — | | |

Cost of shares redeemed | | | (159 | ) | | | (125 | ) | | | (9,255 | ) | | | (14,365 | ) | | | — | | | | — | | |

Total Class R | | $ | (141 | ) | | $ | (50 | ) | | $ | (4,648 | ) | | $ | 5,896 | | | $ | — | | | $ | — | | |

Class R6 | |

Proceeds from shares issued | | $ | — | | | $ | — | | | $ | 7,122 | | | $ | 49,482 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | — | | | | — | | | | 1,110 | | | | 1,818 | | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | | | (26,964 | ) | | | (17,319 | ) | | | — | | | | — | | |

Total Class R6 | | $ | — | | | $ | — | | | $ | (18,732 | ) | | $ | 33,981 | | | $ | — | | | $ | — | | |

Class Y | |

Proceeds from shares issued | | $ | — | | | $ | — | | | $ | 52,184 | | | $ | 189,431 | | | $ | — | | | $ | — | | |

Distributions reinvested | | | — | | | | — | | | | 4,190 | | | | 3,546 | | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | | | (93,875 | ) | | | (58,064 | ) | | | — | | | | — | | |

Total Class Y | | $ | — | | | $ | — | | | $ | (37,501 | ) | | $ | 134,913 | | | $ | — | | | $ | — | | |

Member Class(a) | |

Proceeds from shares issued | | $ | — | | | $ | — | | | $ | 1,045 | | | $ | — | | | $ | 356 | | | $ | — | | |

Distributions reinvested | | | — | | | | — | | | | 11 | | | | — | | | | 1 | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | | | (207 | ) | | | — | | | | (81 | ) | | | — | | |

Total Member Class | | $ | — | | | $ | — | | | $ | 849 | | | $ | — | | | $ | 276 | | | $ | — | | |

Change in net assets resulting from

capital transactions | | $ | (201 | ) | | $ | (901 | ) | | $ | (221,734 | ) | | $ | 346,322 | | | $ | 29,468 | | | $ | 14,191 | | |

(a) Member Class commenced operations on November 3, 2020.

(continues on next page)

See notes to financial statements.

34

Victory Portfolios | | Statements of Changes in Net Assets | |

(Amounts in Thousands) (continued)