UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04852

Victory Portfolios

(Exact name of registrant as specified in charter)

| 4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | 44144 |

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Item 1. Reports to Stockholders.

October 31, 2020

Annual Report

Victory Diversified Stock Fund

Victory NewBridge Large Cap Growth Fund

Victory Special Value Fund

Victory Strategic Allocation Fund

Victory INCORE Fund for Income

Victory INCORE Investment Grade Convertible Fund

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Victory Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Victory Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on www.VictoryFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change; and you need not take any action. You may elect to receive shareholder reports and other communications from the Victory Funds or your financial intermediary electronically by notifying your financial intermediary directly or, if you are a direct investor, by calling 800-539-3863 or by sending an e-mail request to TA.Processing@FISGlobal.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Victory Funds, you can call 800-539-3863 or send an e-mail request to TA.Processing@FISGlobal.com. Your election to receive reports in paper will apply to all Victory Funds you hold directly or through your financial intermediary.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

Victory Portfolios

Table of Contents

Shareholder Letter (Unaudited) | | | 4 | | |

Managers' Commentary and Investment Overview

(Unaudited) | | | 6 | | |

Investment Objective and Portfolio Holdings

(Unaudited) | | | 20 | | |

Financial Statements | |

Victory Diversified Stock Fund | |

Schedule of Portfolio Investments | | | 26 | | |

Statement of Assets and Liabilities | | | 40-41 | | |

Statement of Operations | | | 44 | | |

Statements of Changes in Net Assets | | | 46-48 | | |

Financial Highlights | | | 52-53 | | |

Victory NewBridge Large Cap Growth Fund | |

Schedule of Portfolio Investments | | | 29 | | |

Statement of Assets and Liabilities | | | 40-41 | | |

Statement of Operations | | | 44 | | |

Statements of Changes in Net Assets | | | 46-48 | | |

Financial Highlights | | | 54-55 | | |

Victory Special Value Fund | |

Schedule of Portfolio Investments | | | 31 | | |

Statement of Assets and Liabilities | | | 40-41 | | |

Statement of Operations | | | 44 | | |

Statements of Changes in Net Assets | | | 46-48 | | |

Financial Highlights | | | 56-57 | | |

Victory Strategic Allocation Fund | |

Schedule of Portfolio Investments | | | 34 | | |

Statement of Assets and Liabilities | | | 42-43 | | |

Statement of Operations | | | 45 | | |

Statements of Changes in Net Assets | | | 49-51 | | |

Financial Highlights | | | 58-59 | | |

Victory INCORE Fund for Income | |

Schedule of Portfolio Investments | | | 35 | | |

Statement of Assets and Liabilities | | | 42-43 | | |

Statement of Operations | | | 45 | | |

Statements of Changes in Net Assets | | | 49-51 | | |

Financial Highlights | | | 60-61 | | |

Victory INCORE Investment Grade Convertible Fund | |

Schedule of Portfolio Investments | | | 37 | | |

Statement of Assets and Liabilities | | | 42-43 | | |

Statement of Operations | | | 45 | | |

Statements of Changes in Net Assets | | | 49-51 | | |

Financial Highlights | | | 62-63 | | |

Notes to Financial Statements | | | 64 | | |

Report of Independent

Registered Public Accounting Firm | | | 78 | | |

1

Supplemental Information (Unaudited) | | | |

Trustee and Officer Information | | | 79 | | |

Proxy Voting and Portfolio Holdings Information | | | 82 | | |

Expense Examples | | | 82 | | |

Additional Federal Income Tax Information | | | 84 | | |

Liquidity Risk Management Program | | | 85 | | |

Privacy Policy (inside back cover) | | | |

The Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at vcm.com or call 800-539-3863. Read it carefully before you invest or send money.

The information in this annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

Visit our website at:

www.vcm.com

2

This page is intentionally left blank.

3

Victory Funds Letter to Shareholders

(Unaudited)

Dear Shareholder,

It's safe to say that the fiscal year ended October 31, 2020, has been like no other. The range of emotions that investors have experienced touched both ends of the spectrum. The annual reporting period began with relatively calm markets and more mundane questions surrounding interest rates, global trade and earnings growth. Yet those concerns took a back seat in early 2020.

A novel coronavirus and the subsequent spread of the disease that it causes ("COVID-19") throughout Asia, Europe and eventually the United States became an unprecedented event. To combat the pandemic, governments everywhere issued austere shelter-in-place orders, and the global economy slowed markedly. Equity markets sold off sharply in March and April, and U.S. GDP shrunk by a whopping 31.4% during the second quarter.

It's no surprise that so many investors flocked to the perceived safety of U.S. Treasurys. Meanwhile, liquidity evaporated (for a short spell) in many other segments of the fixed income market, including higher-yielding credits and municipal bonds. The outlook was tenuous, and credit spreads widened while prices declined for any securities perceived to be higher risk.

The U.S. Federal Reserve (the "Fed") and other monetary authorities worldwide leapt into action — cutting interest rates, (re)starting quantitative easing and, in the case of the Fed, launching an array of programs to provide liquidity to stabilize fixed income markets. The U.S. government also stepped up to provide fiscal stimulus in the form of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

In retrospect, it's amazing how quickly those actions helped to end the stock market's freefall and restored order across much of the fixed income universe. The rebound was almost as robust as the drawdown. Through all the unprecedented events and extreme volatility, the S&P 500® Index registered an impressive annual return of 9.7% for the 12-month period ended October 31, 2020. Meanwhile, the yield on 10-year U.S. Treasurys declined 81 basis points over the same period, reflecting both the Fed's interest rate cuts and its pledge to keep rates low longer. The yield on 10-Year U.S. Treasurys was 0.88% as of October 31, 2020.

The good news is that over the summer and into the fall, the economy regained its footing, and GDP increased at an annual rate of 33.1% in the third quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. Does this mean it's clear for investors now? Is it ever?

We must accept the fact that the economy and markets remain unpredictable even as we are cautiously optimistic on the reported progress toward a COVID-19 vaccine. Looking ahead, investors should expect continued bouts of volatility — both to the upside and downside — depending on the pandemic news. And let's not forget that there are other factors at play, including new political leadership and the potential for new policies and priorities.

4

Fortunately, we believe all of Victory Capital's autonomous Investment Franchises are in capable hands to withstand the ups and downs. The investment professionals who manage our funds have vetted investment philosophies and risk protocols, and market volatility can even create opportunities that benefit astute active managers.

On the following pages, you will find information relating to your Victory Funds investment. If you have any questions, we encourage you to contact your financial advisor. Or, if you invest with us directly, you may call (800) 539-3863, or visit our website at www.vcm.com.

My colleagues and I sincerely appreciate the confidence you have placed in the Victory Funds, and we value the opportunity to help meet your investment goals.

Christopher K. Dyer, CFA

President,

Victory Funds

5

Victory Diversified Stock Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

For the 12 months ended October 31, 2020, the pandemic related to the novel coronavirus and the disease it causes ("COVID-19") created an extremely volatile trailing-twelve-months period for equities, with the S&P 500® Index (the "Index") selling off approximately 34% from its February 2020 highs before rebounding off the March lows to return approximately 48% over the next seven months to close out the period. All in, the Index managed a 9.71% total return over the entire 12-month period, though this was primarily driven by 1) large capitalization names, and 2) growth stocks. Large-cap names possess the necessary flexibility, brand awareness, scale and balance sheet strength to both endure and invest through theses turbulent times, suggesting improved competitive positioning both during and after the pandemic.

Growth stocks, on the other hand, rely more on product adoption and market share gains than overall economic growth, and fundamentals have proven more resilient. In addition, powerful secular drivers that underpin many of these names, are expected to accelerate post-COVID-19 (e.g., cloud computing and collaboration software and services). Finally, we believe lower interest rates benefit growth stocks disproportionately by reducing the discount rate applied to future profits, as these stocks inherently derive a larger portion of their intrinsic or net present value from future/expected earnings.

How did Victory Diversified Stock Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide long-term capital appreciation. The Fund returned 5.47% (Class A Shares at net asset value) for the fiscal year ended October 31, 2020, underperforming the Index, which returned 9.71% for the period.

What strategies did you employ during the reporting period?

The Fund looks to invest in stocks with market capitalizations of $1 billion and above that we believe are of high quality with the potential for above-average earnings growth, as well as current earnings momentum. Using this framework, the Fund generated the strongest returns within the Technology, Consumer Discretionary, and Communication Services sectors over the trailing twelve months, while Materials and Energy were the most challenged. In Technology, the Fund's large-cap and cloud holdings drove performance, with both expected to be more resilient or even benefit during the pandemic. Apple was one of the strongest performers, benefiting from its fortress balance sheet, attractive growth/value profile, and potential for accelerating business momentum as we enter a new 5G handset supercycle. In Consumer Discretionary, retail and homebuilder exposures drove positive performance. Amazon was our top performer in the sector, as the company stands to benefit from an accelerated shift to e-commerce and cloud computing as a result of COVID-19. In Communication Services, strong returns were broad-based across the Fund's holdings, though positions in Facebook and Alphabet generated outsized strength. While both stocks experienced top-line pressure from reduced advertising budgets amidst the pandemic-induced recession, trends improved materially as economic conditions improved, validating the strategic value the platforms provide to advertisers. With regard to Materials and Energy, both sectors have experienced massive negative demand shocks due to the pandemic and equity prices have sold off in response.

6

Victory Diversified Stock Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2020

| | Class A | | Class C | | Class I | | Class R | | Class R6 | | Class Y | | | |

INCEPTION DATE | | 10/28/89 | | 3/1/02 | | 8/31/07 | | 3/26/99 | | 3/3/14 | | 1/28/13 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | S&P 500®

Index1 | |

One Year | | | 5.47 | % | | | –0.61 | % | | | 4.53 | % | | | 3.55 | % | | | 5.81 | % | | | 5.25 | % | | | 5.86 | % | | | 5.72 | % | | | 9.71 | % | |

Five Year | | | 7.16 | % | | | 5.90 | % | | | 6.24 | % | | | 6.24 | % | | | 7.45 | % | | | 6.86 | % | | | 7.50 | % | | | 7.40 | % | | | 11.71 | % | |

Ten Year | | | 9.56 | % | | | 8.92 | % | | | 8.65 | % | | | 8.65 | % | | | 9.86 | % | | | 9.26 | % | | | N/A | | | | N/A | | | | 13.01 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 7.66 | % | | | 9.57 | % | | | N/A | | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com. | |

The maximum offering price (MOP) reflects a maximum sales charge of 5.75% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted above may differ from the total returns shown in the Financial Highlights because they do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would

have been lower. Some fee waivers are voluntary and may be modified or terminated at any time.

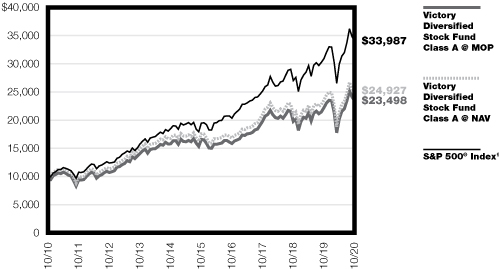

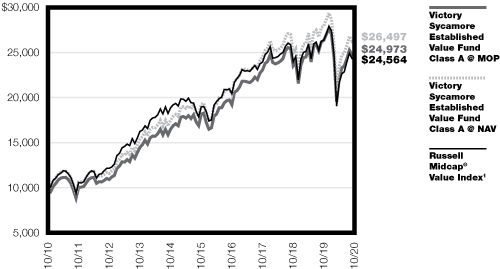

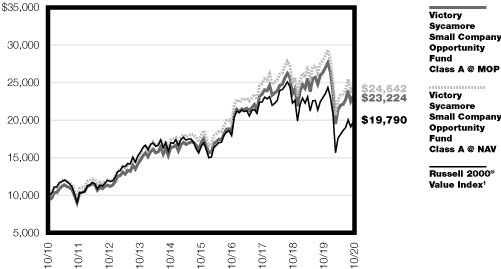

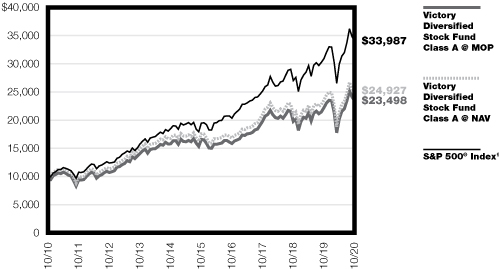

Victory Diversified Stock Fund — Growth of $10,000

1The S&P 500® Index is an unmanaged index comprised of 500 domestically traded common stocks, is weighted according to the market value of each common stock in the index, and includes reinvestment of dividends. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in Class A Shares of the Fund. The performance of other classes of the Fund's shares will be greater than or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Victory NewBridge Large Cap Growth Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

It took an outbreak of the novel coronavirus and the disease it causes ("COVID-19") to end the eleven-year bull market in U.S. stocks, the longest on record and almost the strongest. Prior to its official end on March 11, 2020, when the Dow Jones Industrial Average declined 20% from its peak and the World Health Organization officially declared the coronavirus outbreak a global pandemic, the turbulence of the third quarter of 2019 was offset by a rebound in equities in the last three months of the year that continued into February of 2020. With respect to 2020, one can essentially view the year as pre-COVID-19 and during COVID-19. The first period lasted until February 19th, when the portfolio's and benchmark's returns peaked. The portfolio outperformed its benchmark during this positive-return market environment. The second period began on February 20th, which was highlighted by the realization that the pandemic was well under way; followed by closing borders and significant portions of the economy. Both the portfolio and benchmark declined quickly and significantly amidst record-setting volatility before staging an equally incredible recovery fueled by immediate and enormous fiscal stimulus. The portfolio maintained its relative outperformance in both periods through October 31, 2020, primarily though stock selection.

As the U.S. economy went from full employment to recession in two weeks and the economy contended with widespread shutdowns and closures, several industries were acutely affected and experienced a disproportionately negative impact. Travel, Hospitality, Food, and Retail saw revenues plunge as doors, economies, and borders closed. Companies and consumers worked diligently to adapt their businesses to the limitations brought on by the pandemic as frontline workers responded courageously and tirelessly to contain the crisis and help those in need. With much of the economy closed for months, every component of the economy was faced with the historic challenge of operating in a fog of uncertainty. Technology and Communications proved to be enormously helpful as Wi-Fi connections, video conferencing, and the ability to order most anything from a smartphone or laptop allowed consumers and companies to communicate, adapt, and transact. Millions of employees worked from home and e-commerce companies became ever more indispensable. Although an undoubtedly difficult and tragic year, one can only imagine how much more devastating it would have been had the pandemic unfolded five years ago before the emergence of many critical technologies.

In such an environment, growth companies prevailed as a result of the dramatic increase in demand for products and services that enabled companies to continue to operate. Transcending the usual classifications of sectors, industries, and factors, most companies were further categorized as either stay-at-home or go-out stocks. Many stay-at-home stocks were found in, but not limited to, Technology, Communications, and Media. Providers of video conferencing for work and home schooling benefitted as did streaming and video gaming companies due to millions being quarantined with few entertainment activities. Retailers with an online presence and logistics companies that delivered goods to home-bound consumers also fared significantly better than those dependent on physical presence and traveling consumers. As the global army of researchers work at breakneck speed to develop a vaccine, investors increasingly look ahead with optimism and each step further tends to shift investment from the stay-at-home stocks to the beleaguered go-out group.

The pandemic may have taken most of the spotlight at a time in which one of the biggest risks highlighted by investors coming into the year was the U.S. Presidential election. Of

8

Victory NewBridge Large Cap Growth Fund (continued)

course, that didn't mean political risk was eliminated. It was just postponed. Heading into what many believed would be a very contentious contest, the combination of how the pandemic is managed as we approach the holiday season combined with the outcome of the election may reignite investor risk aversion for the balance of the year and into 2021. While we don't know precisely when, our view is that a globally concerted effort to defeat the virus fueled by ingenuity, commitment, collaboration, aided by technology, communication, and innovation will prevail. Adversity and challenges bring out the best in people. While the magnitude of the task at hand is truly historic, this time is no different.

How did Victory NewBridge Large Cap Growth Fund (the "Fund") perform during the reporting period?

The Fund seeks to deliver long-term capital appreciation by investing in high-quality, large-cap companies with the prospect of growth in excess of the overall market. The Fund returned 39.61% (Class A Shares at net asset value) for the fiscal year ended October 31, 2020, outperforming the Russell 1000® Growth Index (the "Index"), which returned 29.22% during the period.

What strategies did you employ during the reporting period?

As active managers assigned the responsibility of investing the Fund in large-capitalization U.S. growth companies, we continued to do so in the 12 months ended October 31, 2020. The volatile and unusual environment created by the COVID-19 pandemic did present both challenges and opportunities. Heading into the lockdown, the market had been reaching new highs against the backdrop of increasing valuations. As the harsh reality of what was unfolding sunk in, the Dow Jones Industrial Average shed more than 35%, while the Index declined 33%. The Fund outperformed at the beginning of the year, declined less than the Index in the turbulent downdraft and outperformed in the ensuing market rebound.

In both periods, pre-pandemic and during, we maintained our focus by investing in growth companies we believed were, and would continue to be, capable of performing well against peers and expectations due to well-positioned businesses with attractive profitability profiles, strong financials, and talented and responsible management teams. As we continually monitored the portfolio throughout the year using our traditional screens and risk analysis, we also included an additional view to incorporate the current environment and evaluate how the portfolio is positioned within the context of stay-at-home beneficiaries and go-out stocks.

Throughout our long tenure together, we have traversed many notable and precipitous market selloffs such as the technology bust of 2000, September 11, 2001, the Great Recession, the fourth quarter of 2018, and now a global pandemic. These events have trained us to not panic or act emotionally. Instead, our experience together has shown us that, while painful, broad market selloffs also present opportunities. Difficult as the months of March and April were, we stayed the course and took advantage of the volatility by making changes we believed would benefit the portfolio such as adding Uber, Shopify, Trade Desk, Adobe, Masimo Corp, Twilio, and Trane Technologies. The performance throughout the year supports those decisions overall. In our view, the portfolio remains well balanced among sectors and industries as well as companies that have managed to grow despite or because of the pandemic and those which will likely rebound sharply as the economy fully reopens and takes the next step towards recovery. It's been a long year marked by tremendous loss on all levels. Looking ahead, it's our contention that the path forward, while not necessarily smooth, will require the innovation, boundless energy, and strong leadership we look for in the companies in which we invest.

9

Victory NewBridge Large Cap Growth Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2020

| | Class A | | Class C | | Class I | | Class Y | | | |

INCEPTION DATE | | 12/31/03 | | 12/31/03 | | 3/1/11 | | 1/28/13 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Russell 1000®

Growth Index1 | |

One Year | | | 39.61 | % | | | 31.51 | % | | | 37.97 | % | | | 37.16 | % | | | 39.95 | % | | | 39.72 | % | | | 29.22 | % | |

Five Year | | | 13.36 | % | | | 12.02 | % | | | 12.43 | % | | | 12.43 | % | | | 13.81 | % | | | 13.70 | % | | | 17.32 | % | |

Ten Year | | | 12.54 | % | | | 11.88 | % | | | 11.61 | % | | | 11.61 | % | | | N/A | | | | N/A | | | | 16.31 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 12.15 | % | | | 14.00 | % | | | N/A | | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) reflects a maximum sales charge of 5.75% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

The total returns quoted above may differ from the total returns shown in the Financial Highlights because they do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Some fee waivers are voluntary and may be modified or terminated at any time.

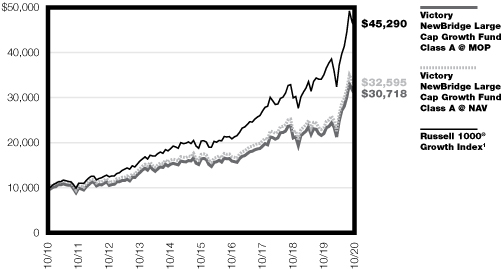

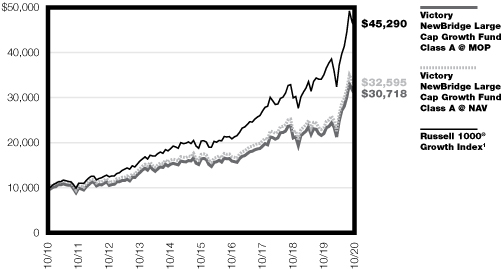

Victory NewBridge Large Cap Growth Fund — Growth of $10,000

1The Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment growth of a hypothetical $10,000 investment in Class A Shares of the Fund. The performance of other classes of the Fund's shares will be greater than or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

Victory Special Value Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

For the 12 months ended October 31, 2020, the pandemic related to the novel coronavirus and the disease it causes ("COVID-19") created an extremely volatile trailing-twelve-months period for equities, with the S&P 500® Index (the "Index") selling off approximately 34% from its February 2020 highs before rebounding off the March lows to return approximately 48% over the next seven months to close out the period. All in, the Index managed a 9.71% total return over the entire 12-month period, though this was primarily driven by 1) large capitalization names, and 2) growth stocks. Large-cap names possess the necessary flexibility, brand awareness, scale and balance sheet strength to both endure and invest through theses turbulent times, suggesting improved competitive positioning both during and after the pandemic. Growth stocks, on the other hand, rely more on product adoption and market share gains than overall economic growth, and fundamentals have proven more resilient. In addition, powerful secular drivers that underpin many of these names, are expected to accelerate post-COVID-19 (e.g., cloud computing and collaboration software and services). Finally, we believe lower interest rates benefit growth stocks disproportionately by reducing the discount rate applied to future profits, as these stocks inherently derive a larger portion of their intrinsic or net-present-value from future/expected earnings.

How did Victory Special Value Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide long-term capital appreciation. The Fund returned 5.15% (Class A Shares at net asset value) for the fiscal year ended October 31, 2020, underperforming the Index, which returned 9.71% for the period.

What strategies did you employ during the reporting period?

The Fund looks to invest in stocks with market capitalizations of $1 billion and above that we believe are of high quality with the potential for above-average earnings growth, as well as current earnings momentum. Using this framework, the Fund generated the strongest returns within the Technology, Consumer Discretionary and Communication Services sectors over the trailing-twelve-months, while Materials and Energy were the most challenged. In Technology, the Fund's large-cap and cloud holdings drove performance, with both expected to be more resilient or even benefit during the pandemic. Apple was one of the strongest performers, benefiting from its fortress balance sheet, attractive growth/value profile, and potential for accelerating business momentum as we enter a new 5G handset supercycle. In Consumer Discretionary, retail and homebuilder exposures drove positive performance. Amazon was our top performer in the sector, as the company stands to benefit from an accelerated shift to e-commerce and cloud computing as a result of COVID-19. In Communication Services, strong returns were broad-based across the Fund's holdings, though positions in Facebook and Alphabet generated outsized strength. While both stocks experienced top-line pressure from reduced advertising budgets amidst the pandemic-induced recession, trends improved materially as economic conditions improved, validating the strategic value the platforms provide to advertisers. With regards to Materials and Energy, both sectors have experienced massive negative demand shocks due to the pandemic and equity prices have sold off in response.

11

Victory Special Value Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2020

| | Class A | | Class C | | Class I | | Class R | | Class Y | | | |

INCEPTION DATE | | 12/3/93 | | 3/1/03 | | 8/31/07 | | 12/21/99 | | 1/28/13 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | S&P 500®

Index1 | |

One Year | | | 5.15 | % | | | –0.89 | % | | | 4.26 | % | | | 3.26 | % | | | 5.35 | % | | | 4.82 | % | | | 5.40 | % | | | 9.71 | % | |

Five Year | | | 6.73 | % | | | 5.47 | % | | | 5.76 | % | | | 5.76 | % | | | 6.87 | % | | | 6.42 | % | | | 6.98 | % | | | 11.71 | % | |

Ten Year | | | 7.62 | % | | | 6.99 | % | | | 6.66 | % | | | 6.66 | % | | | 7.85 | % | | | 7.30 | % | | | N/A | | | | 13.01 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 8.27 | % | | | N/A | | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) reflects a maximum sales charge of 5.75% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

The total returns quoted above may differ from the total returns shown in the Financial Highlights because they do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Some fee waivers are voluntary and may be modified or terminated at any time.

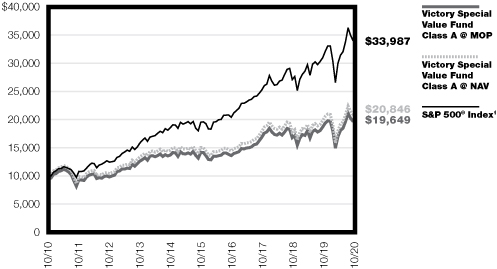

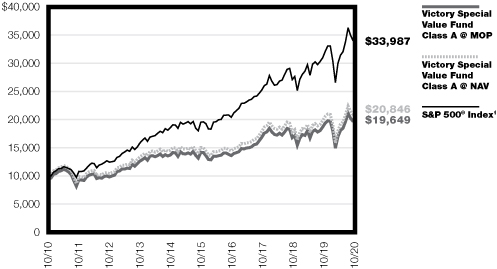

Victory Special Value Fund — Growth of $10,000

1The S&P 500® Index, an unmanaged index comprised of 500 domestically traded common stocks, is weighted according to the market value of each common stock in the index, and includes reinvestment of dividends. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment growth of a hypothetical $10,000 investment in Class A Shares of the Fund. The performance of other classes of the Fund's shares will be greater than or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes.

Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

Victory Strategic Allocation Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

Global equities (as measured by the MSCI All Country World Index) registered positive gains over the last 12 months. Though economic output and corporate earnings remain subdued from the impact of the novel coronavirus and the disease it causes ("COVID-19") earlier in the year, signs of a recovery across regions fueled market gains in July and August as COVID-19 restrictions eased and governmental (and, especially, central bank) support remained steadfast. September, however, ushered in a market pullback, with virus hot spots popping up in Europe and parts of Asia as well as a breakdown of stimulus talks in the United States. U.S. equities and Emerging Market equities (as measured by the S&P 500® Index and MSCI Emerging Markets Index, respectively) were the stronger-performing regions during the 12 months ended October 31, 2020, while the Non-U.S. Developed Market equities and World Commodity Producer equities (as measured by the MSCI EAFE Index and MSCI World Commodity Producers Index, respectively) were the laggards.

How did Victory Strategic Allocation Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide income and long-term growth of capital. The Fund returned 3.99% (Class A Shares at net asset value) for the fiscal year ended October 31, 2020, underperforming the MSCI All Country World Index (the "Index") and the "Custom Index" (60% MSCI ACWI/40% Bloomberg Barclays U.S. Aggregate Bond Index), which returned 4.89% and 6.03%, respectively, during the period.

What strategies did you employ during the reporting period?

The Fund was positioned throughout the period to provide more diversification by more equally weighting the U.S. and foreign equity markets when compared to the Index, which detracted from Fund performance versus its Custom Index. The valuation of equity markets abroad appears more compelling and commensurate with the risks facing those markets, in our view. This detracted from the Fund's return as those exposures did not keep pace with the strong U.S. equity markets. The Fund also continued to be positioned to exhibit less interest rate risk associated with the U.S. Treasury market versus its Custom Index by partially substituting an equity income-oriented strategy. This negatively impacted Fund performance as interest rates on 30- Year and 10-Year U.S. Treasurys fell to near all-time historic lows.

13

Victory Strategic Allocation Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2020

| | Class A | | Class C | | Class I | | Class R | | | | | |

INCEPTION DATE | | 12/10/93 | | 3/1/03 | | 8/31/07 | | 12/15/99 | | | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | MSCI All

Country

World

Index1 | | 60% MSCI

All Country

World

Index/40%

Barclays

U.S.

Aggregate

Bond

Index2 | |

One Year | | | 3.99 | % | | | 1.64 | % | | | 3.23 | % | | | 2.23 | % | | | 4.22 | % | | | 3.74 | % | | | 4.89 | % | | | 6.03 | % | |

Five Year | | | 4.74 | % | | | 4.26 | % | | | 3.98 | % | | | 3.98 | % | | | 4.99 | % | | | 4.47 | % | | | 8.11 | % | | | 6.75 | % | |

Ten Year | | | 6.83 | % | | | 6.59 | % | | | 6.06 | % | | | 6.06 | % | | | 7.17 | % | | | 6.53 | % | | | 7.90 | % | | | 6.40 | % | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) reflects a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

The total returns quoted above may differ from the total returns shown in the Financial Highlights because they do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Some fee waivers are voluntary and may be modified or terminated at any time.

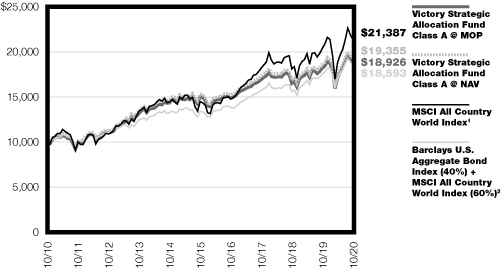

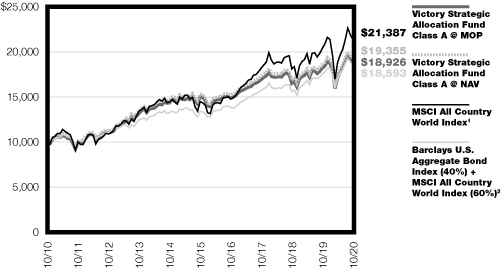

Victory Strategic Allocation Fund — Growth of $10,000

1The MSCI All Country World Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

2The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes U.S. Treasurys, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment growth of a hypothetical $10,000 investment in Class A Shares of the Fund. The performance of other classes of the Fund's shares will be greater than or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

Victory Taxable Fixed Income Fund

Victory INCORE Fund for Income

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

The novel coronavirus and the disease it causes (COVID-19) and the resulting pandemic dominated the last nine months of the 12-month period ended October 31, 2020. Despite these dire times, and due to aggressive measures to support the U.S. economy, all major indices were positive for the period, with the Dow Jones Industrial Average at 0.34%. The S&P 500® Index was up 9.71% and the NASDAQ Composite Index was up a whopping 32.94%; interesting times indeed. Due to safe-haven demand, interest rates fell for U.S. Treasury bonds and they fell more for shorter maturities than longer, steepening the U.S. Treasury yield curve. Prices move opposite yields. In the U.S. housing market, the pandemic spurred a flight from community living in large cities to single-family home ownership away from big cities. Due to this development, home sales and home prices increased year over year. As a result, the available supply of homes for sale fell as did affordability, despite lower borrowing costs. The rate for a 30-year fixed mortgage fell from 3.78% to 2.81% for conventional borrowers. The U.S. fixed income markets also had a good year despite the pandemic, as evidenced by the Bloomberg Barclays U.S. Aggregate Bond Index, which returned 6.19%. Within fixed income markets, U.S. Treasury bonds returned 6.95%, and relative to U.S. Treasury bonds, duration neutral, asset-backed securities outperformed most (+0.80%), while mortgage-backed securities outperformed slightly (+0.13%), followed closely by commercial mortgage-backed securities (-0.98%), while corporate and agency debt underperformed the most at (-1.02%) and (-3.45%), respectively. Drilling deeper still, within the mortgage market, Fannie Mae ("FNMA") led Freddie Mac ("FHLMC"), which in turn led Ginnie Mae ("GNMA"). Both FNMA and FHLMC (conventional mortgage providers) slightly outperformed duration-neutral U.S. Treasury bonds while GNMA slightly lagged.

How did Victory INCORE Fund for Income (the "Fund") perform during the reporting period?

The Fund's objective is to deliver high, reliable income via securities backed by the 100% full faith and credit of the U.S. government. The Fund returned 2.75% (Class A Shares at net asset value) for the fiscal year ended October 31, 2020, underperforming the Bloomberg Barclays U.S. Capital 1-5 Year U.S. Government Bond Index, which returned 4.22% during the period.

What strategies did you employ during the reporting period?

We continued to focus solely on our objective. As such, we continued to pursue GNMA borrowers making above-market payments, who have proven to be unable or unwilling to refinance efficiently. We also continued to selectively buy or create high-coupon GNMA platinum pools as opportunities arose. No matter the circumstances, the goal of our strategy remains to deliver high, reliable income consistent with preservation of capital.

15

Victory Taxable Fixed Income Fund

Victory INCORE Fund for Income

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2020

| | Class A | | Class C | | Class I | | Class R | | Class R6 | | Class Y | | | |

INCEPTION DATE | | 3/26/99 | | 3/1/02 | | 3/1/11 | | 9/16/87 | | 3/4/15 | | 1/28/13 | | | |

| | | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Barclays

Capital

1-5 Year U.S.

Gov't Bond

Index1 | |

One Year | | | 2.75 | % | | | 0.41 | % | | | 1.85 | % | | | 0.87 | % | | | 3.01 | % | | | 2.87 | % | | | 3.18 | % | | | 2.95 | % | | | 4.22 | % | |

Five Year | | | 1.66 | % | | | 1.20 | % | | | 0.84 | % | | | 0.84 | % | | | 1.92 | % | | | 1.66 | % | | | 1.95 | % | | | 1.86 | % | | | 2.23 | % | |

Ten Year | | | 1.65 | % | | | 1.42 | % | | | 0.85 | % | | | 0.85 | % | | | N/A | | | | 1.64 | % | | | N/A | | | | N/A | | | | 1.26 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 2.02 | % | | | N/A | | | | 1.84 | % | | | 1.61 | % | | | N/A | | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

The total returns quoted above may differ from the total returns shown in the Financial Highlights because they do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Some fee waivers are voluntary and may be modified or terminated at any time.

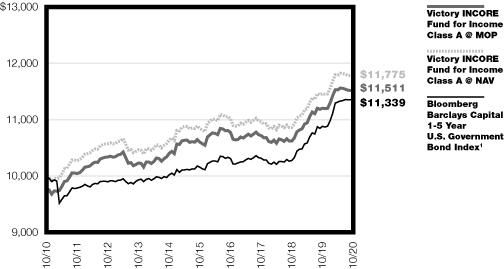

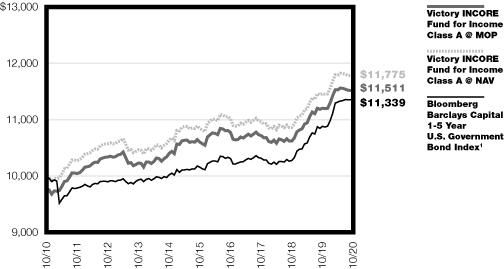

Victory INCORE Fund for Income — Growth of $10,000

1Bloomberg Barclays Capital 1-5 Year U.S. Government Bond Index is a market-weighted index measuring the performance of Treasury and Agency securities issued by the United States Government with maturities of one to five years. The index does not include the effect of sales charges, commissions, expenses or taxes is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment growth of a hypothetical $10,000 investment in Class A Shares of the Fund. The performance of other classes of the Fund's shares will be greater than or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16

Victory INCORE Investment Grade Convertible Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

Equity and convertible markets began the fiscal year ended October 31, 2020 on a very strong note on the heels of a U.S. Federal Reserve (the "Fed") rate cut and signals that the Fed would likely leave rates on hold throughout 2020. Market strength continued into January and early February with the expectation of an accelerating economy looking to benefit from the completion of the NAFTA renegotiation (USMCA) and the China phase one trade deal. However, the social and economic trajectory of the United States changed abruptly in late February as consumers and broad financial markets came to the realization that the effects of the novel coronavirus and the disease it causes ("COVID-19") virus were no longer confined to international markets. The negative economic backdrop caused by reactions to COVID-19 had a very detrimental effect on U.S. equity performance. After reaching an all-time closing high of 3,386 on February 19th, the S&P 500® Index fell 430 points (-12.7%) over the next seven days to month-end. The last day of February was particularly wild, as the Dow Jones Industrial Average, at one point, was down over 1,000 points before rallying 600 points in the final minutes of the day. Stocks began March on an up note encouraged by presidential candidate Joe Biden's strong Super Tuesday results, coming on the heels of the Fed's emergency mid-meeting half-point rate cut. Markets, however, soon fell victim to increasingly bad news concerning the spread of COVID-19, which was exacerbated by tumbling oil prices. From the March 4th close to March 23rd, the S&P 500® Index fell an astonishing 28%. This period included three 9%-plus daily swings in the S&P 500® Index, and three days where the Dow Jones Industrial Average fell by over 2,000 points. Stocks began a strong rally post March 23rd, as passage of a $2 trillion U.S. government stimulus program blossomed into reality. The market rally continued into the second calendar quarter as investors seemed to overlook much of the dour economic news, including negative U.S. GDP, declining earnings, and spiking unemployment. More positive news later in the quarter, such as optimistic vaccine news and a stunning May jobs report led to the stock market's best quarterly return in 20 years. Stocks continued to advance in July and August despite a U.S. Commerce Department report of a 9.5% drop in second quarter U.S. GDP. The stock market finished August with five consecutive monthly gains before giving back some in the final two months of the fiscal year. Thanks to the strong start to the year, the S&P 500® Index managed a gain of 9.71% for the fiscal year. Bonds, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, also produced good results with a 6.19% return. After outperforming both stocks and bonds during the previous fiscal year, investment-grade convertibles lagged behind both asset classes in the fiscal year ended October 31, 2020.

How did Victory INCORE Investment Grade Convertible Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide a high level of current income together with long-term capital appreciation. The Fund returned 4.43% (Class A Shares at net asset value) for the fiscal year ended October 31, 2020, outperforming the ICE BofA Investment Grade U.S. Convertible 5% Constrained Index, which returned 1.20% during the period.

17

Victory INCORE Investment Grade Convertible Fund (continued)

What strategies did you employ during the reporting period?

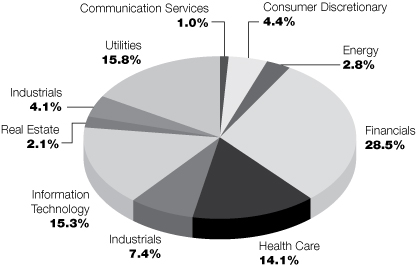

In managing the Fund, we strive to invest in high-quality convertibles with attractive underlying common stocks. We structure the Fund by spreading out our holdings across the three types of convertibles: 1) equity-sensitive, high-delta convertibles; 2) total return, middle-of-the-road convertibles; and 3) defensive, fixed-income-oriented convertibles. With this structure, we seek to provide a favorable balance between upside potential and downside exposure to equities. As of October 31, 2020, the Fund is overweight compared to the benchmark in the Health Care, and Information Technology sectors. It is underweighted in the Industrials, Utilities, and Energy sectors. It is approximately equally weighted in the Financials and Consumer Discretionary sectors. The Fund is broadly diversified among individual issues, economic sectors, credits, and convertible types. Performance during the fiscal year was aided by overweights in the Health Care and Information Technology sectors, as well as positive security selection in the same sectors. Performance was negatively impacted by underweights in the Industrials and Utilities sectors.

18

Victory INCORE Investment Grade Convertible Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ending October 31, 2020

| | Class A | | Class I | | | |

INCEPTION DATE | | 4/14/88 | | 8/31/07 | | | |

| | Net Asset

Value | | Maximum

Offering Price | | Net Asset

Value | | ICE BofAML

Investment Grade

U.S. Convertible

5% Constrained

Index1,2 | |

One Year | | | 4.43 | % | | | 2.10 | % | | | 4.91 | % | | | 1.20 | % | |

Five Year | | | 8.19 | % | | | 7.70 | % | | | 8.67 | % | | | 9.74 | % | |

Ten Year | | | 7.97 | % | | | 7.73 | % | | | 8.44 | % | | | 9.18 | % | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. NAV does not reflect sales charges.

The total returns quoted above may differ from the total returns shown in the Financial Highlights because they do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Some fee waivers are voluntary and may be modified or terminated at any time.

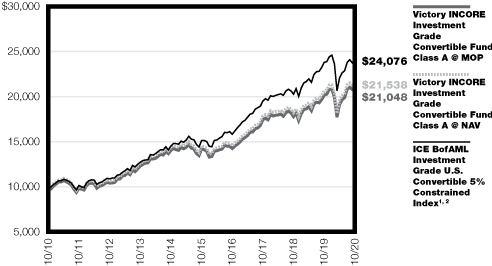

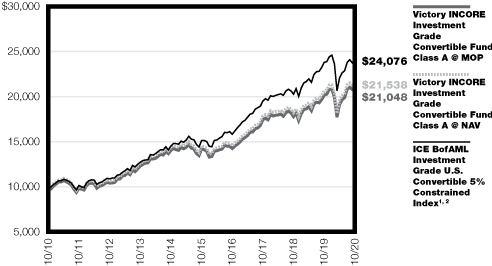

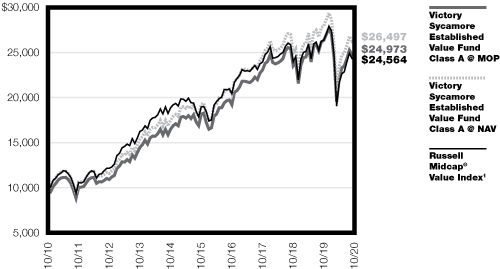

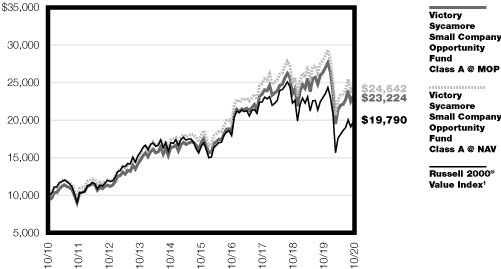

Victory INCORE Investment Grade Convertible Fund — Growth of $10,000

1ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index is a market capitalization-weighted index of domestic corporate convertible securities. Bonds and preferred stocks must be convertible only to common stock, ADR's or cash equivalent and have a market value of at least $50 million. Composed of Coupon, OID, or zero coupon convertible bonds rated by Moody's and/or S&P with an average rating of Baa3/BBB- or higher. This Index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment growth of a hypothetical $10,000 investment in Class A Shares of the Fund. The performance of other classes of the Fund's shares will be greater than or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. Past performance is no guarantee of future results.

2The ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index commenced on January 1, 2012. Performance from October 31, 2010 to December 31, 2011 reflects performance of ICE BofAML All Investment Grade U.S. Convertibles Index. Performance from January 1, 2012 to present reflects the ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

19

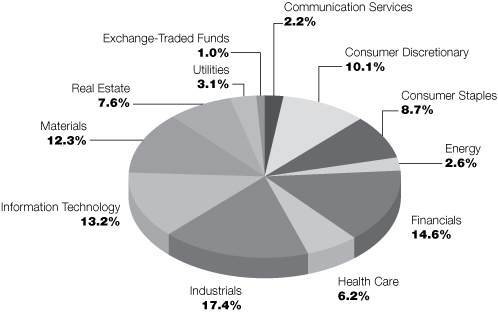

Victory Portfolios

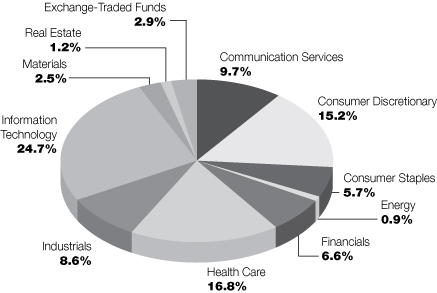

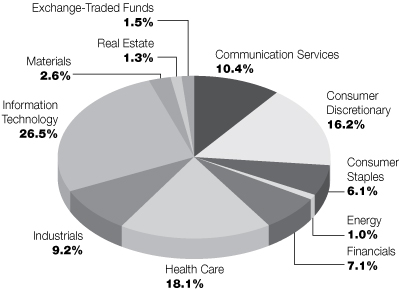

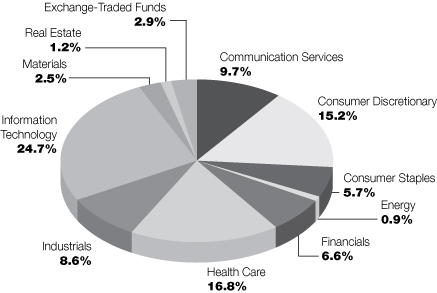

Victory Diversified Stock Fund | | October 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory Diversified Stock Fund seeks to provide long-term growth of capital.

Sector Allocation*:

October 31, 2020

(% of Total Investments)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

20

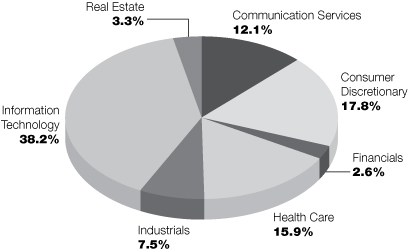

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | October 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory NewBridge Large Cap Growth Fund seeks to provide long-term capital appreciation.

Sector Allocation*:

October 31, 2020

(% of Total Investments)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

21

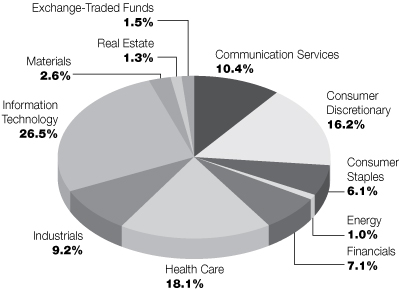

Victory Portfolios

Victory Special Value Fund | | October 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory Special Value Fund seeks to provide long-term growth of capital and dividend income.

Sector Allocation*:

October 31, 2020

(% of Total Investments)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

22

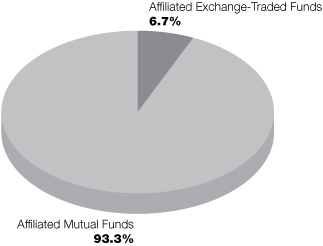

Victory Portfolios

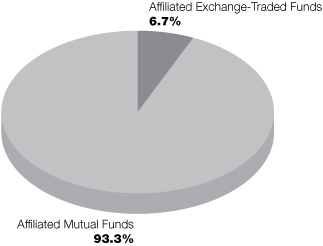

Victory Strategic Allocation Fund | | October 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory Strategic Allocation Fund seeks to provide income and long-term growth of capital.

Portfolio Holdings:

October 31, 2020

(% of Total Investments)

23

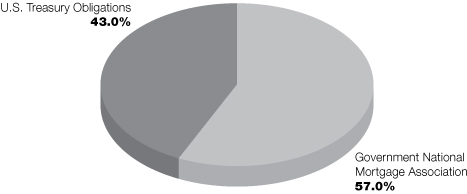

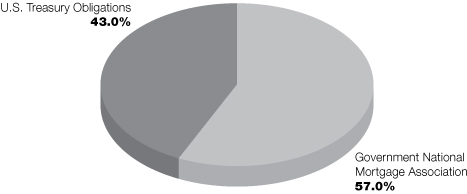

Victory Portfolios

Victory INCORE Fund for Income | | October 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory INCORE Fund for Income seeks to provide a high level of current income consistent with preservation of shareholders' capital.

Portfolio Holdings:

October 31, 2020

(% of Total Investments)

24

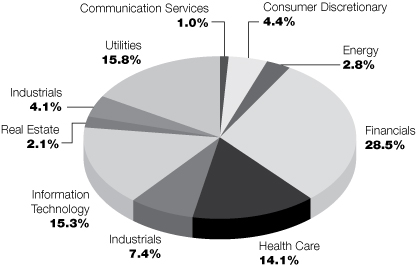

Victory Portfolios

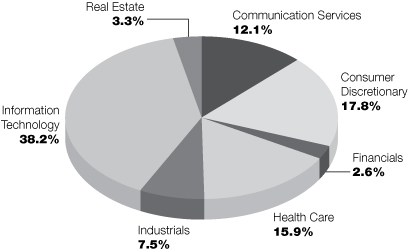

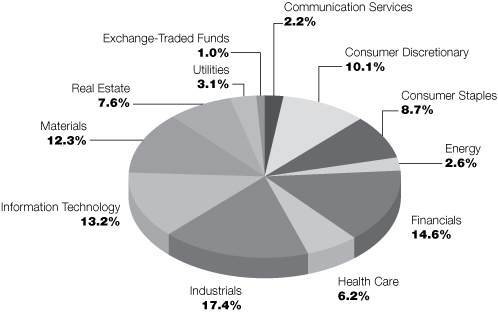

Victory INCORE Investment Grade Convertible Fund | | October 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory INCORE Investment Grade Convertible Fund seeks to provide a high level of current income together with long-term capital appreciation.

Sector Allocation*:

October 31, 2020

(% of Total Investments)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

25

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Common Stocks (96.1%) | |

Communication Services (10.1%): | |

Alphabet, Inc., Class C (a) | | | 6,226 | | | $ | 10,092 | | |

Charter Communications, Inc., Class A (a) | | | 6,269 | | | | 3,786 | | |

Facebook, Inc., Class A (a) | | | 17,339 | | | | 4,562 | | |

Nexstar Media Group, Inc., Class A | | | 39,555 | | | | 3,259 | | |

T-Mobile U.S., Inc. (a) | | | 23,100 | | | | 2,531 | | |

Zynga, Inc., Class A (a) | | | 170,764 | | | | 1,535 | | |

| | | | 25,765 | | |

Communications Equipment (1.3%): | |

Lumentum Holdings, Inc. (a) | | | 40,748 | | | | 3,369 | | |

Consumer Discretionary (15.9%): | |

Amazon.com, Inc. (a) | | | 3,373 | | | | 10,241 | | |

Asbury Automotive Group, Inc. (a) (b) | | | 26,288 | | | | 2,707 | | |

Boyd Gaming Corp. | | | 97,372 | | | | 3,089 | | |

D.R. Horton, Inc. | | | 33,356 | | | | 2,229 | | |

Dollar General Corp. | | | 17,171 | | | | 3,584 | | |

Group 1 Automotive, Inc. | | | 24,085 | | | | 2,555 | | |

LCI Industries | | | 13,819 | | | | 1,515 | | |

LGI Homes, Inc. (a) | | | 19,351 | | | | 2,068 | | |

Lowe's Cos., Inc. | | | 17,163 | | | | 2,713 | | |

Meritage Homes Corp. (a) | | | 22,959 | | | | 1,999 | | |

Target Corp. | | | 13,928 | | | | 2,120 | | |

TopBuild Corp. (a) | | | 12,480 | | | | 1,912 | | |

Williams-Sonoma, Inc. (b) | | | 41,101 | | | | 3,750 | | |

| | | | 40,482 | | |

Consumer Staples (5.9%): | |

Monster Beverage Corp. (a) | | | 32,365 | | | | 2,478 | | |

PepsiCo, Inc. | | | 23,273 | | | | 3,103 | | |

Philip Morris International, Inc. | | | 29,292 | | | | 2,080 | | |

The Kroger Co. | | | 85,676 | | | | 2,760 | | |

The Procter & Gamble Co. | | | 18,901 | | | | 2,591 | | |

Walmart, Inc. | | | 14,913 | | | | 2,069 | | |

| | | | 15,081 | | |

Energy (1.0%): | |

Chevron Corp. | | | 11,621 | | | | 808 | | |

Phillips 66 | | | 17,470 | | | | 815 | | |

Valero Energy Corp. | | | 20,753 | | | | 801 | | |

| | | | 2,424 | | |

Financials (6.9%): | |

Ameriprise Financial, Inc. | | | 16,010 | | | | 2,576 | | |

Flagstar Bancorp, Inc. | | | 66,386 | | | | 1,948 | | |

JPMorgan Chase & Co. | | | 36,454 | | | | 3,574 | | |

Morgan Stanley | | | 48,126 | | | | 2,317 | | |

See notes to financial statements.

26

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Primerica, Inc. | | | 28,466 | | | $ | 3,138 | | |

T. Rowe Price Group, Inc. | | | 18,787 | | | | 2,380 | | |

Western Alliance Bancorp | | | 41,537 | | | | 1,711 | | |

| | | | 17,644 | | |

Health Care (17.6%): | |

AbbVie, Inc. | | | 53,460 | | | | 4,550 | | |

AmerisourceBergen Corp. | | | 17,071 | | | | 1,640 | | |

Amgen, Inc. | | | 8,446 | | | | 1,832 | | |

Bristol-Myers Squibb Co. | | | 80,376 | | | | 4,697 | | |

Charles River Laboratories International, Inc. (a) | | | 14,177 | | | | 3,227 | | |

Cigna Corp. | | | 15,406 | | | | 2,572 | | |

Hologic, Inc. (a) | | | 39,628 | | | | 2,727 | | |

ICON PLC (a) | | | 17,635 | | | | 3,180 | | |

Medtronic PLC | | | 8,851 | | | | 890 | | |

Merck & Co., Inc. | | | 47,741 | | | | 3,591 | | |

Pfizer, Inc. | | | 62,984 | | | | 2,235 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 6,380 | | | | 3,468 | | |

Stryker Corp. | | | 13,939 | | | | 2,816 | | |

Thermo Fisher Scientific, Inc. | | | 3,626 | | | | 1,716 | | |

UnitedHealth Group, Inc. | | | 18,203 | | | | 5,555 | | |

| | | | 44,696 | | |

Industrials (9.0%): | |

Federal Signal Corp. | | | 72,267 | | | | 2,073 | | |

Kansas City Southern | | | 21,941 | | | | 3,865 | | |

L3Harris Technologies, Inc. | | | 13,898 | | | | 2,239 | | |

Lockheed Martin Corp. | | | 7,971 | | | | 2,791 | | |

Masco Corp. | | | 66,909 | | | | 3,586 | | |

Old Dominion Freight Line, Inc. | | | 13,980 | | | | 2,661 | | |

UFP Industries, Inc. | | | 56,659 | | | | 2,828 | | |

XPO Logistics, Inc. (a) | | | 30,508 | | | | 2,746 | | |

| | | | 22,789 | | |

IT Services (5.4%): | |

Akamai Technologies, Inc. (a) | | | 33,804 | | | | 3,215 | | |

Booz Allen Hamilton Holdings Corp. | | | 41,846 | | | | 3,286 | | |

EPAM Systems, Inc. (a) | | | 8,750 | | | | 2,703 | | |

Fiserv, Inc. (a) | | | 29,027 | | | | 2,771 | | |

Visa, Inc., Class A | | | 9,256 | | | | 1,682 | | |

| | | | 13,657 | | |

Materials (2.6%): | |

Berry Global Group, Inc. (a) | | | 67,909 | | | | 3,167 | | |

Silgan Holdings, Inc. | | | 97,864 | | | | 3,371 | | |

| | | | 6,538 | | |

Real Estate (1.3%): | |

American Tower Corp. | | | 14,475 | | | | 3,324 | | |

See notes to financial statements.

27

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Semiconductors & Semiconductor Equipment (4.4%): | |

Advanced Micro Devices, Inc. (a) | | | 42,140 | | | $ | 3,173 | | |

Broadcom, Inc. | | | 9,386 | | | | 3,282 | | |

NVIDIA Corp. | | | 9,433 | | | | 4,729 | | |

| | | | 11,184 | | |

Software (9.3%): | |

Adobe, Inc. (a) | | | 5,982 | | | | 2,675 | | |

Cadence Design Systems, Inc. (a) | | | 23,616 | | | | 2,583 | | |

Microsoft Corp. | | | 77,437 | | | | 15,678 | | |

ServiceNow, Inc. (a) | | | 6,062 | | | | 3,015 | | |

| | | | 23,951 | | |

Technology Hardware, Storage & Peripherals (5.4%): | |

Apple, Inc. | | | 127,491 | | | | 13,879 | | |

Total Common Stocks (Cost $185,847) | | | 244,783 | | |

Exchange-Traded Funds (3.1%) | |

SPDR S&P 500 ETF Trust (b) | | | 23,802 | | | | 7,772 | | |

Total Exchange-Traded Funds (Cost $7,586) | | | 7,772 | | |

Collateral for Securities Loaned^ (5.5%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.10% (c) | | | 321,333 | | | | 321 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Class, 0.02% (c) | | | 4,288,131 | | | | 4,288 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.02% (c) | | | 2,234,542 | | | | 2,235 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.07% (c) | | | 1,358,519 | | | | 1,359 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.11% (c) | | | 5,749,144 | | | | 5,749 | | |

Total Collateral for Securities Loaned (Cost $13,952) | | | 13,952 | | |

Total Investments (Cost $207,385) — 104.7% | | | 266,507 | | |

Liabilities in excess of other assets — (4.7)% | | | (11,901 | ) | |

NET ASSETS — 100.00% | | $ | 254,606 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on October 31, 2020.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

28

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Common Stocks (99.1%) | |

Communication Services (12.4%): | |

Activision Blizzard, Inc. | | | 6,431 | | | $ | 487 | | |

Alphabet, Inc., Class C (a) | | | 499 | | | | 809 | | |

Facebook, Inc., Class A (a) | | | 3,009 | | | | 792 | | |

| | | | 2,088 | | |

Consumer Discretionary (18.2%): | |

Alibaba Group Holding Ltd., ADR (a) | | | 1,989 | | | | 606 | | |

Amazon.com, Inc. (a) | | | 454 | | | | 1,378 | | |

Burlington Stores, Inc. (a) | | | 2,529 | | | | 490 | | |

Lululemon Athletica, Inc. (a) | | | 1,845 | | | | 589 | | |

| | | | 3,063 | | |

Financials (2.6%): | |

MSCI, Inc. | | | 1,270 | | | | 444 | | |

Health Care (16.3%): | |

Edwards Lifesciences Corp. (a) | | | 6,220 | | | | 446 | | |

Masimo Corp. (a) | | | 1,481 | | | | 331 | | |

UnitedHealth Group, Inc. | | | 1,599 | | | | 488 | | |

Veeva Systems, Inc., Class A (a) | | | 2,166 | | | | 585 | | |

Vertex Pharmaceuticals, Inc. (a) | | | 1,444 | | | | 301 | | |

Zoetis, Inc. | | | 3,672 | | | | 582 | | |

| | | | 2,733 | | |

Industrials (7.6%): | |

CoStar Group, Inc. (a) | | | 659 | | | | 543 | | |

Trane Technologies PLC | | | 2,653 | | | | 352 | | |

Uber Technologies, Inc. (a) | | | 11,545 | | | | 386 | | |

| | | | 1,281 | | |

IT Services (16.2%): | |

EPAM Systems, Inc. (a) | | | 1,737 | | | | 537 | | |

PayPal Holdings, Inc. (a) | | | 4,342 | | | | 808 | | |

Shopify, Inc., Class A (a) | | | 383 | | | | 354 | | |

Twilio, Inc., Class A (a) | | | 691 | | | | 193 | | |

Visa, Inc., Class A | | | 4,687 | | | | 852 | | |

| | | | 2,744 | | |

Real Estate (3.4%): | |

American Tower Corp. | | | 2,462 | | | | 565 | | |

Semiconductors & Semiconductor Equipment (5.3%): | |

NVIDIA Corp. | | | 1,795 | | | | 900 | | |

Software (17.1%): | |

Adobe, Inc. (a) | | | 1,486 | | | | 664 | | |

Cadence Design Systems, Inc. (a) | | | 2,447 | | | | 268 | | |

salesforce.com, Inc. (a) | | | 2,742 | | | | 637 | | |

See notes to financial statements.

29

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments — continued

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

ServiceNow, Inc. (a) | | | 1,872 | | | $ | 932 | | |

The Trade Desk, Inc., Class A (a) (b) | | | 717 | | | | 406 | | |

| | | | 2,907 | | |

Total Common Stocks (Cost $7,647) | | | 16,725 | | |

Collateral for Securities Loaned^ (2.7%) | |

BlackRock Liquidity Funds TempFund, Institutional Class, 0.10% (c) | | | 10,306 | | | | 10 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Class, 0.02% (c) | | | 137,499 | | | | 137 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Class, 0.02% (c) | | | 71,693 | | | | 72 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.07% (c) | | | 43,570 | | | | 44 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Class, 0.11% (c) | | | 184,384 | | | | 184 | | |

Total Collateral for Securities Loaned (Cost $447) | | | 447 | | |

Total Investments (Cost $8,094) — 101.8% | | | 17,172 | | |

Liabilities in excess of other assets — (1.8)% | | | (310 | ) | |

NET ASSETS — 100.00% | | $ | 16,862 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on October 31, 2020.

ADR — American Depositary Receipt

PLC — Public Limited Company

See notes to financial statements.

30

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Common Stocks (97.8%) | |

Communication Services (10.3%): | |

Alphabet, Inc., Class C (a) | | | 1,064 | | | $ | 1,725 | | |

Charter Communications, Inc., Class A (a) | | | 1,060 | | | | 640 | | |

Facebook, Inc., Class A (a) | | | 2,999 | | | | 789 | | |

Nexstar Media Group, Inc., Class A | | | 6,841 | | | | 564 | | |

T-Mobile U.S., Inc. (a) | | | 3,965 | | | | 434 | | |

Zynga, Inc., Class A (a) | | | 29,500 | | | | 265 | | |

| | | | 4,417 | | |

Communications Equipment (1.3%): | |

Lumentum Holdings, Inc. (a) | | | 6,998 | | | | 579 | | |

Consumer Discretionary (16.1%): | |

Amazon.com, Inc. (a) | | | 567 | | | | 1,721 | | |

Asbury Automotive Group, Inc. (a) | | | 4,548 | | | | 468 | | |

Boyd Gaming Corp. | | | 16,638 | | | | 528 | | |

D.R. Horton, Inc. | | | 5,723 | | | | 383 | | |

Dollar General Corp. | | | 2,934 | | | | 612 | | |

Group 1 Automotive, Inc. | | | 4,132 | | | | 438 | | |

LCI Industries | | | 2,362 | | | | 259 | | |

LGI Homes, Inc. (a) | | | 3,332 | | | | 356 | | |

Lowe's Cos., Inc. | | | 2,947 | | | | 466 | | |

Meritage Homes Corp. (a) | | | 3,954 | | | | 344 | | |

Target Corp. | | | 2,404 | | | | 366 | | |

TopBuild Corp. (a) | | | 2,149 | | | | 329 | | |

Williams-Sonoma, Inc. | | | 7,100 | | | | 649 | | |

| | | | 6,919 | | |

Consumer Staples (6.1%): | |

Monster Beverage Corp. (a) | | | 5,591 | | | | 428 | | |

PepsiCo, Inc. | | | 4,050 | | | | 540 | | |

Philip Morris International, Inc. | | | 5,044 | | | | 358 | | |

The Kroger Co. | | | 14,754 | | | | 476 | | |

The Procter & Gamble Co. | | | 3,255 | | | | 446 | | |

Walmart, Inc. | | | 2,568 | | | | 356 | | |

| | | | 2,604 | | |

Energy (1.0%): | |

Chevron Corp. | | | 2,000 | | | | 139 | | |

Phillips 66 | | | 3,008 | | | | 140 | | |

Valero Energy Corp. | | | 3,496 | | | | 135 | | |

| | | | 414 | | |

Financials (7.1%): | |

Ameriprise Financial, Inc. | | | 2,708 | | | | 436 | | |

Flagstar Bancorp, Inc. | | | 11,431 | | | | 335 | | |

JPMorgan Chase & Co. | | | 6,258 | | | | 613 | | |

Morgan Stanley | | | 8,253 | | | | 397 | | |

See notes to financial statements.

31

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments — continued

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Primerica, Inc. | | | 4,903 | | | $ | 541 | | |

T. Rowe Price Group, Inc. | | | 3,246 | | | | 411 | | |

Western Alliance Bancorp | | | 7,154 | | | | 295 | | |

| | | | 3,028 | | |

Health Care (17.9%): | |

AbbVie, Inc. | | | 9,210 | | | | 784 | | |

AmerisourceBergen Corp. | | | 2,935 | | | | 282 | | |

Amgen, Inc. | | | 1,454 | | | | 315 | | |

Bristol-Myers Squibb Co. | | | 13,902 | | | | 813 | | |

Charles River Laboratories International, Inc. (a) | | | 2,441 | | | | 556 | | |

Cigna Corp. | | | 2,653 | | | | 443 | | |

Hologic, Inc. (a) | | | 6,846 | | | | 471 | | |

ICON PLC (a) | | | 3,036 | | | | 547 | | |

Medtronic PLC | | | 1,523 | | | | 153 | | |

Merck & Co., Inc. | | | 8,223 | | | | 618 | | |

Pfizer, Inc. | | | 10,847 | | | | 385 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 1,087 | | | | 591 | | |

Stryker Corp. | | | 2,410 | | | | 487 | | |

Thermo Fisher Scientific, Inc. | | | 625 | | | | 296 | | |

UnitedHealth Group, Inc. | | | 3,135 | | | | 957 | | |

| | | | 7,698 | | |

Industrials (9.1%): | |

Federal Signal Corp. | | | 12,444 | | | | 357 | | |

Kansas City Southern | | | 3,763 | | | | 663 | | |

L3Harris Technologies, Inc. | | | 2,394 | | | | 386 | | |

Lockheed Martin Corp. | | | 1,378 | | | | 482 | | |

Masco Corp. | | | 11,318 | | | | 606 | | |

Old Dominion Freight Line, Inc. | | | 2,415 | | | | 460 | | |

UFP Industries, Inc. | | | 9,690 | | | | 484 | | |

XPO Logistics, Inc. (a) | | | 5,276 | | | | 475 | | |

| | | | 3,913 | | |

IT Services (5.5%): | |

Akamai Technologies, Inc. (a) | | | 5,813 | | | | 553 | | |

Booz Allen Hamilton Holdings Corp. | | | 7,231 | | | | 567 | | |

EPAM Systems, Inc. (a) | | | 1,507 | | | | 466 | | |

Fiserv, Inc. (a) | | | 4,999 | | | | 477 | | |

Visa, Inc., Class A | | | 1,595 | | | | 290 | | |

| | | | 2,353 | | |

Materials (2.6%): | |

Berry Global Group, Inc. (a) | | | 11,649 | | | | 543 | | |

Silgan Holdings, Inc. | | | 16,926 | | | | 583 | | |

| | | | 1,126 | | |

Real Estate (1.3%): | |

American Tower Corp. | | | 2,448 | | | | 562 | | |

See notes to financial statements.

32

Victory Portfolios

Victory Special Value Fund | | Schedule of Portfolio Investments — continued

October 31, 2020 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Semiconductors & Semiconductor Equipment (4.5%): | |

Advanced Micro Devices, Inc. (a) | | | 7,192 | | | $ | 541 | | |

Broadcom, Inc. | | | 1,623 | | | | 567 | | |

NVIDIA Corp. | | | 1,612 | | | | 809 | | |

| | | | 1,917 | | |

Software (9.5%): | |

Adobe, Inc. (a) | | | 1,034 | | | | 462 | | |

Cadence Design Systems, Inc. (a) | | | 4,049 | | | | 443 | | |

Microsoft Corp. | | | 13,202 | | | | 2,674 | | |

ServiceNow, Inc. (a) | | | 1,025 | | | | 510 | | |

| | | | 4,089 | | |

Technology Hardware, Storage & Peripherals (5.5%): | |

Apple, Inc. | | | 21,566 | | | | 2,348 | | |

Total Common Stocks (Cost $32,441) | | | 41,967 | | |

Exchange-Traded Funds (1.5%) | |

SPDR S&P 500 ETF Trust | | | 1,995 | | | | 651 | | |

Total Exchange-Traded Funds (Cost $702) | | | 651 | | |

Total Investments (Cost $33,143) — 99.3% | | | 42,618 | | |

Other assets in excess of liabilities — 0.7% | | | 289 | | |

NET ASSETS — 100.00% | | $ | 42,907 | | |

(a) Non-income producing security.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

33

Victory Portfolios

Victory Strategic Allocation Fund | | Schedule of Portfolio Investments

October 31, 2020 | |