UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04852

Victory Portfolios

(Exact name of registrant as specified in charter)

| 4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | 44144 |

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

Item 1. Reports to Stockholders.

October 31, 2021

Annual Report

Victory Diversified Stock Fund

Victory NewBridge Large Cap Growth Fund

Victory Special Value Fund

Victory THB US Small Opportunities Fund

Victory Strategic Allocation Fund

Victory INCORE Fund for Income

Victory INCORE Investment Grade Convertible Fund

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Capital website gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

TABLE OF CONTENTS

Shareholder Letter (Unaudited) | | | 3 | | |

Managers' Commentary/Investment

Overview (Unaudited) | | | 5 | | |

Investment Objectives and Portfolio

Holdings (Unaudited) | | | 25 | | |

Schedules of Portfolio Investments | |

Victory Diversified Stock Fund | | | 32 | | |

Victory NewBridge Large Cap Growth Fund | | | 35 | | |

Victory Special Value Fund | | | 37 | | |

Victory THB US Small Opportunities Fund | | | 40 | | |

Victory Strategic Allocation Fund | | | 43 | | |

Victory INCORE Fund for Income | | | 44 | | |

Victory INCORE Investment Grade Convertible Fund | | | 46 | | |

Financial Statements | | | |

Statements of Assets and Liabilities | | | 49 | | |

Statements of Operations | | | 54 | | |

Statements of Changes in Net Assets | | | 57 | | |

Financial Highlights | | | 66 | | |

Notes to Financial Statements | | | 84 | | |

Report of Independent Registered

Public Accounting Firm | | | 100 | | |

Supplemental Information (Unaudited) | | | 102 | | |

Trustee and Officer Information | | | 102 | | |

Proxy Voting and Portfolio Holdings Information | | | 105 | | |

Expense Examples | | | 105 | | |

Advisory Contract Approval | | | 107 | | |

Additional Federal Income Tax Information | | | 109 | | |

Privacy Policy (inside back cover) | | | |

1

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call 800-539-3863 (800-235-8396 for Member Class) and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

The Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at vcm.com or call 800-539-3863 (800-235-8396 for Member Class). Read it carefully before you invest or send money.

The information in this report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

800-235-8396 for Member Class

Visit our website at:

www.vcm.com

2

Victory Funds Letter to Shareholders

(Unaudited)

Dear Shareholder,

There's no denying the enormous toll that COVID-19 has had on so many of us, both personally and professionally. But if our recent experience with this pandemic has taught us anything, it's that we — as a nation — are resilient. Through it all, our economy and the financial markets have endured and performed admirably.

Consider that just one year ago we were still anxiously awaiting the development and approval of an effective vaccine, while wondering if the initial sharp rebound in financial assets would hold. As it turns out, a vaccine was rolled out (domestically) faster than expectations, and a recovery that began during the second quarter of 2020 continued through most of the annual reporting period that ended October 31, 2021.

By all accounts, the economy, and life in general, continues trending toward a new normal. But it's always healthy to reflect on the events that transpired over the past year.

It may seem like an eternity ago, but in late 2020 financial markets were being alternately fueled and roiled by a variety of factors, including: the ebb and flow of COVID-19 cases; a contentious U.S. presidential election season; growing optimism for an effective vaccine; and a fluid debate regarding the need for more stimulus. Ultimately, stocks were propelled higher in late 2020, and the upward trajectory continued, more or less, for the first two quarters of 2021. Of course, nothing moves in a straight line, and heightened volatility re-emerged in September and October as our annual reporting period drew to a close.

More recently, investors have been pondering a new set of worries — some of them directly related to the U.S. Federal Reserve's (the "Fed") accommodative monetary policies and the various forms of fiscal stimuli that helped revive the economy from the depths of the crisis. Already, the Fed has definitively laid out a plan to begin tapering its aggressive bond buying program, and now we're all wondering how much higher interest rates will ultimately rise. Many CEOs are also expressing concerns about labor shortages, disrupted supply chains, rising commodity prices, and the potential for lasting inflation.

So how did markets actually fare during the most recent annual reporting period? Through all the volatility and surprises, the S&P 500® Index registered an impressive annual return of nearly 43% for the 12-month period ended October 31, 2021. Not coincidentally, this broad market index has been bounding around near its all-time high. Over this same annual period, the yield on the 10-Year U.S. Treasury jumped 67 basis points (a basis point is 1/100th of a percentage point), reflecting a very low starting rate, substantial fiscal stimulus, and the Fed's accommodative monetary policy. As the end of the reporting period approached, the yield on the 10-Year U.S. Treasury was hovering just below its high for the year, finishing at 1.55%, as of the end of October 2021.

All this merely exemplifies just how dynamic and resilient markets have been. Of course, there are myriad challenges ahead (some yet to be identified), and we should

3

not expect such robust equity returns each and every year. Although no one knows what the future holds, we can assure you that the investment professionals at all our independent franchises continually monitor the environment and work hard to position portfolios opportunistically no matter what the markets throw at us.

On the following pages you will find information relating to your Victory Funds investment. If you have any questions regarding the current market dynamics or your specific portfolio or investment plan, we encourage you to contact your financial advisor. If you invest with us directly, you may call (800) 539-3863 (800-235-8396 for Member Class) or visit our website at www.vcm.com.

From all of us here at Victory Capital, thank you for letting us help you work toward your investment goals.

Christopher K. Dyer, CFA

President,

Victory Funds

4

Victory Diversified Stock Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

The S&P 500® Index (the "Index") was up approximately 43% over the trailing 12 months ended October 31, 2021. This rally has been broad-based, but far from uniform, with the Financials and Energy sectors garnering outsized returns of 111% and 72%, respectively, while the Utilities and Consumer Staples sectors were laggards, up just 11% and 19%, respectively. The Technology sector, which was largely a winner as the pandemic accelerated secular trends around digital transformation, cloud computing, and artificial intelligence, also outperformed, as did the Real Estate sector.

More recently, we've seen some dramatic changes in leadership. Specifically, in September, the market declined approximately 5% as interest rates rose and longer duration/growth equities underperformed after a strong July and August. But in October, the market rebounded along with growth stocks, while interest rates pulled back despite higher inflation data.

Indeed, as the pandemic subsides, supply chains normalize, and people return to work, the economic recovery should continue while inflation should moderate, which we see as a good backdrop for equities. We see noteworthy opportunities in housing, trucking/logistics, building products/construction, autos, energy, and banking. Extended valuations/sentiment and potential for rising rates keep us underweight on speculative growth stocks, while we see much stock-specific opportunity in semiconductors/semi-cap equipment and leading-edge life science tools/biotech.

How did Victory Diversified Stock Fund (the "Fund") perform during the reporting period?

The Fund returned 46.50% (Class A at net asset value) for the fiscal year ended October 31, 2021, outperforming the Index, which returned 42.91% for the period.

What strategies did you employ during the reporting period?

The Fund pursues investments that it believes are statistically cheap or intrinsically undervalued given growth prospects, while trying to identify the presence of a catalyst for future growth.

Using this framework, the Fund generated the strongest returns within the Energy, Financials, and Industrials sectors, each up 50% or more over the fiscal year, as well as strong relative performance within the Consumer Discretionary sector. The Technology and Real Estate sectors lagged on a relative basis but still generated positive absolute returns.

Within the Energy sector, exploration & production company Matador Resources Company was our top performer. The stock mainly benefited from strong energy prices and its peer-leading growth profile. Our bank holdings, particularly Western Alliance Bancorp and ServisFirst Bancshares, drove the strong stock selection in the Financials sector, mostly due to the move higher in interest rates, and again, stronger growth profiles.

5

Victory Diversified Stock Fund (continued)

Managers' Commentary (continued)

In the Technology sector, the Fund's largest detractor for the year was optical and photonic communications equipment vendor Lumentum Holdings ("Lumentum"). Lumentum has come under pressure as near-term headwinds drive negative estimate revisions, including supply chain constraints, inventory build at certain customers, COVID-19-related issues hampering network deployments, and the decline in the 3D-sensing market. We continue to hold the stock as growth looks primed to reaccelerate and the company maintains dominant market position and technological differentiation. In the Real Estate sector, our position in American Tower Corporation, an owner and developer of multitenant cellular communication towers, drove results.

6

Victory Diversified Stock Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | Class A | | Class C | | Class I | | Class R | | Class R6 | | Class Y | | | |

INCEPTION DATE | | 10/28/89 | | 3/1/02 | | 8/31/07 | | 3/26/99 | | 3/3/14 | | 1/28/13 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | S&P 500®

Index1 | |

One Year | | | 46.50 | % | | | 38.09 | % | | | 45.01 | % | | | 44.01 | % | | | 46.79 | % | | | 46.02 | % | | | 46.89 | % | | | 46.75 | % | | | 42.91 | % | |

Five Year | | | 16.67 | % | | | 15.29 | % | | | 15.61 | % | | | 15.61 | % | | | 16.96 | % | | | 16.35 | % | | | 17.02 | % | | | 16.91 | % | | | 18.93 | % | |

Ten Year | | | 13.79 | % | | | 13.12 | % | | | 12.81 | % | | | 12.81 | % | | | 14.09 | % | | | 13.47 | % | | | N/A | | | | N/A | | | | 16.21 | % | |

Since

Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 12.11 | % | | | 13.28 | % | | | N/A | | |

| The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com. | |

The maximum offering price ("MOP") figures reflect a maximum sales charge of 5.75% for Class A. Class C is not subject to an initial sales charge, but is subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

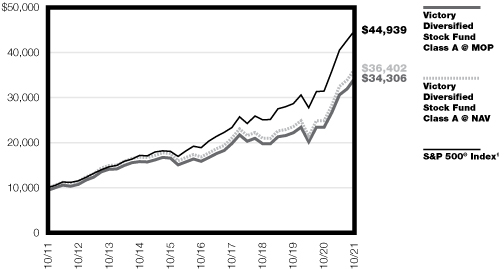

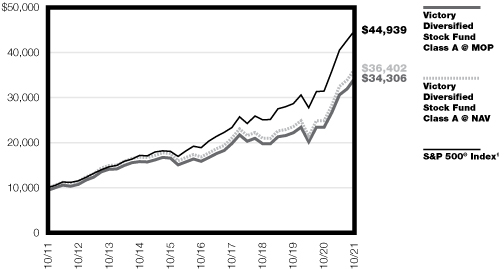

Victory Diversified Stock Fund — Growth of $10,000

1The S&P 500® Index is an unmanaged index comprised of 500 domestically traded common stocks, is weighted according to the market value of each common stock in the index, and includes reinvestment of dividends. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

7

Victory NewBridge Large Cap Growth Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

It's been approximately 20 months since the pandemic started to unfold in the United States in February 2020 and we continue to work through it on many levels. As heroic frontline workers and first responders worked tirelessly to save lives and serve those in need, others have done their best to adjust and adapt. Thankfully, a vast array of technological advancements allowed people to communicate, collaborate and transact in a way that wasn't possible only a few years ago. Communications networks were not robust or reliable enough to work remotely, have R&D teams collaborate from far-flung locations in a rush to develop much needed vaccines or have companies stay in business by shifting almost completely to e-commerce. Whereas last year was consumed by the need to save lives as vaccines were being developed in record-breaking time, this year the focus shifted more to repairing and reopening the economy; especially in the hardest-hit sectors and industries such as travel, hospitality, food service and retail. Much-needed relief arrived late last year on November 9, 2020; now known as "Pfizer Monday." Emergency-use authorization was also granted to Eli Lilly and a few days later, Moderna reported a 94.5% reduction in COVID-19 infection risk among those who received its vaccine. The good news came not a moment too soon as only a few weeks before, on November 4, the United States reached the scary milestone of 100,000 infections in one day for the first time.

The arrival of vaccine treatments also helped fuel a rebound in the 10-year U.S. Treasury yield that had been as low as 0.50% in August of 2020. From that point forward, the equity market's performance started to transition towards value/cyclical sectors as expectations of widespread vaccinations leading to a reopening economy increased. Along with those rising expectations came a rapid increase in the 10-year U.S. Treasury yield, which jumped from 0.50% in August to 1.74% in February 2021. The velocity and composition of the increase in interest rates led to this year's first selloff in growth stocks that lasted between mid-February and the first week in March. As the 10-year U.S. Treasury yield stopped rising and earning reports were reassuring, growth stocks did bounce from oversold levels and were on the rise once more. The second challenging period for growth came in late April and lasted through mid-May as Consumer Price Index ("CPI") figures showed marked inflation trends versus last year; especially in some commodities such as oil, copper and lumber. Renewed inflation concerns negatively influenced growth stocks once more and it wasn't until May that CPI figures showed that the rate of inflation had slowed sequentially before growth stocks staged their recovery from the second slide that began at the end of April. From mid-May through the beginning of September, equity markets in general shrugged off rising energy prices, ongoing negotiations over the U.S. administration's infrastructure package, a delayed recovery in travel and postponed return to offices due to the COVID-19 Delta variant. Unfortunately, September's market action held true to historical form — with increased volatility and a negative monthly return in several major indexes — mostly caused by macro factors (the Evergrande default, monetary and fiscal policy considerations, inflationary pressures, COVID-19 Delta variant issues, etc.). More consequentially, in the last week of September, the 10-year U.S. Treasury yield rose rapidly to above 1.50% for the first time since June, oil prices hit a three-year high, and the price of natural gas surged. While the speed of the backup in rates was likely the primary driver, these dynamics contributed

8

Victory NewBridge Large Cap Growth Fund (continued)

Managers' Commentary (continued)

to a very significant rotation away from growth stocks and into value. Investors continued to debate the duration of inflationary pressures with a rotation away from growth stocks for the third time this year, indicating that it may be more persistent than previously contemplated. Fortunately, October brought some relief as there were some signs of improvement or at least a belief that pressures may have peaked, leading to healthier investor sentiment and a bounce in growth stocks.

Overall, it appears that equity investors are coming to grips with a higher level of inflation in all its forms and are not quite willing to accept that a recession is imminent. Although the U.S. Federal Reserve (the "Fed") has expressed it will be vigilant, monetary policy remains accommodative, consumers are in good financial shape, demand remains robust and interest rates are still lower than the level immediately preceding the pandemic.

How did Victory NewBridge Large Cap Growth Fund perform during the reporting period?

The Fund returned 31.73% (Class A at net asset value) for the fiscal year ended October 31, 2021, underperforming the Russell 1000® Growth Index (the "Index"), which returned 43.21% for the period.

What strategies did you employ during the reporting period?

The majority of the underperformance was attributed to the Consumer Discretionary, Health Care and Information Technology sectors, which underperformed the respective sectors in the Index by -3.98%, -2.34% and -1.92%, respectively.

Within the Consumer Discretionary sector, not owning Tesla, which was up 187% during the period, represented a -2.09% drag; almost half of the underperformance. With respect to companies we did own that negatively impacted performance, Alibaba and Airbnb were the top two. Given the lack of clarity in China, we sold Alibaba. Understanding the near-term delays in travel-related businesses, we continue to own Airbnb as we believe the company is a long-term beneficiary and is managing costs well in the interim.

Similarly, not owning Microsoft in the Information Technology sector until early October represented a -1.45% relative performance drag. Beyond Microsoft, the Fund's investments in Twilio, Micron Technology and Visa were notable performance detractors as well. We exited Micron Technology but remain invested in Twilio and Visa.

In the Health Care sector, the distribution of underperformance was less concentrated. Our top detractors in descending order were Veeva Systems, Vertex Pharmaceuticals, TG Therapeutics and Align. All companies largely delivered what was expected of them but their valuations demanded more. We sold our position in Vertex, as the pace of development disappointed and weighed on performance. The top two drags on performance from companies we don't own were Moderna and Eli Lilly which were up 411% and 98%, respectively.

Having managed a focused portfolio of high-quality growth stocks through the tech boom and bust, September 11, the Great Financial Crisis, the fourth quarter of 2018, and the COVID-19 pandemic, we know not to panic nor act emotionally. Instead, experience has taught us never to short-change the hard work, perseverance, and ability to adapt that

9

Victory NewBridge Large Cap Growth Fund (continued)

Managers' Commentary (continued)

people draw on to overcome adversity. Difficult as it was, we adhered to our investment philosophy and process by focusing on company fundamentals and looking for investment opportunities created by the greatest increase in volatility in 12 years and we endeavor to do so in the future

Equities have gone through several significant style rotations over the last 12 months as investor preference oscillated between secular growth or "stay-at-home"/pandemic beneficiaries and value/cyclical or "reopening" stocks. The first phase, which began in late March 2020 and lasted until Pfizer Monday, was dominated by growth stocks as they demonstrated resiliency, and in many cases accelerated their growth opportunities by several years because they offered solutions to navigate an economy that was largely closed. Clear as it was that swift and significant monetary stimulus would be a huge tailwind for high-growth stocks initially, it was equally evident to us that the next phase would most likely benefit "reopening stocks" in the hardest-hit sectors and industries. Therefore, we thought it was prudent to maintain positions in select "reopening" stocks that we believe also have long-term growth prospects that meet our criteria. This diversified, barbell approach positioned the portfolio well for favorable COVID-19 headlines and reopening in a post-pandemic environment without having to time the transition, which in hindsight spans the last fiscal year ending October and was more challenging for our pure growth portfolio than the prior year. Looking ahead and preparing for what comes next, we continue to barbell the portfolio and believe the portfolio is well-positioned for the rest of this year and next.

While many are looking to the Fed to contain inflationary pressures, there are a few concomitant tools available. First, as the bond market anticipates a higher level of inflation, capital will cost more as interest rates rise. Despite the readily accepted conclusion that rising interest rates hurt long-duration assets like growth stocks, it is worth considering that what worked in 2020 might actually work again in 2022. Companies struggling to contend with labor shortages, escalating raw material costs and supply chain disruptions are likely to seek productivity-enhancing solutions, as opposed to relying solely on price increases that may lead to demand destruction or market share loss. In addition to helping manage inflationary pressures, many growth companies have enviable business models with high profit margins that require less debt and can self-finance current operations, R&D, and future growth in an environment in which capital is less abundant; thereby making them more attractive.

We are committed to adhering to our investment process and philosophy of finding and buying high-quality, high-growth stocks that will be successful over the longer term. We believe we have upgraded the growth and quality of the portfolio over the last several months and believe the portfolio and our investment process and philosophy are well-positioned in the current environment and the future.

10

Victory NewBridge Large Cap Growth Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | Class A | | Class C | | Class I | | Class Y | | | |

INCEPTION DATE | | 12/31/03 | | 12/31/03 | | 3/1/11 | | 1/28/13 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Russell 1000®

Growth Index1 | |

One Year | | | 31.73 | % | | | 24.06 | % | | | 31.44 | % | | | 30.58 | % | | | 32.38 | % | | | 32.32 | % | | | 43.21 | % | |

Five Year | | | 20.52 | % | | | 19.10 | % | | | 19.67 | % | | | 19.67 | % | | | 21.03 | % | | | 20.92 | % | | | 25.49 | % | |

Ten Year | | | 15.12 | % | | | 14.44 | % | | | 14.24 | % | | | 14.24 | % | | | 15.55 | % | | | N/A | | | | 19.42 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 15.96 | % | | | N/A | | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price ("MOP") figures reflect a maximum sales charge of 5.75% for Class A. Class C is not subject to an initial sales charge, but is subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

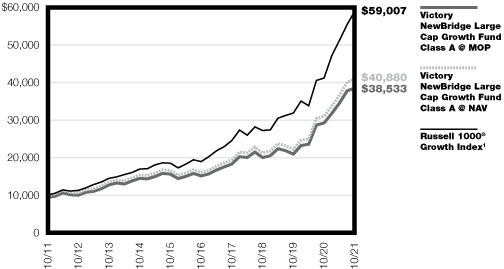

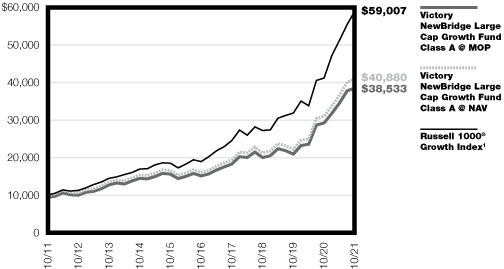

Victory NewBridge Large Cap Growth Fund — Growth of $10,000

1The Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

11

Victory Special Value Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

The S&P 500® Index (the "Index") was up approximately 43% over the trailing 12 months ended October 31, 2021. This rally has been broad-based, but far from uniform, with the Financials and Energy sectors garnering outsized returns of 111% and 72%, respectively, while the Utilities and Consumer Staples sectors were laggards, up just 11% and 19%, respectively. The Technology sector, which was largely a winner as the pandemic accelerated secular trends around digital transformation, cloud computing, and artificial intelligence, also outperformed, as did the Real Estate sector.

More recently, we've seen some dramatic changes in leadership. Specifically, in September, the market declined approximately 5% as interest rates rose and longer duration/ growth equities underperformed after a strong July and August. But in October, the market rebounded along with growth stocks, while interest rates pulled back despite higher inflation data.

Indeed, as the pandemic subsides, supply chains normalize, and people return to work, the economic recovery should continue while inflation should moderate, which we see as a good backdrop for equities. We see noteworthy opportunities in housing, trucking/logistics, building products/construction, autos, energy, and banking. Extended valuations/sentiment and potential for rising rates keep us underweight on speculative growth stocks, while we see much stock-specific opportunity in semiconductors/semi-cap equipment and leading-edge life science tools/biotech.

How did Victory Special Value Fund (the "Fund") perform during the reporting period?

The Fund returned 46.06% (Class A at net asset value) for the fiscal year ended October 31, 2021, outperforming the Index, which returned 42.91% for the period.

What strategies did you employ during the reporting period?

The Fund pursues investments that it believes are statistically cheap or intrinsically undervalued given growth prospects, while trying to identify the presence of a catalyst for future growth.

Using this framework, the Fund generated the strongest returns within the Energy, Financials, and Industrials sectors, each up 50% or more over the trailing 12 months, as well as strong relative performance within the Consumer Discretionary sector. The Technology and Real Estate sectors lagged on a relative basis but still generated positive absolute returns.

Within the Energy sector, exploration & production company Matador Resources Company was our top performer. The stock mainly benefited from strong energy prices and its peer-leading growth profile. Our bank holdings, particularly Western Alliance Bancorp and ServisFirst Bancshares, drove the strong stock selection in the Financials sector, mostly due to the move higher in interest rates, and again, stronger growth profiles.

In the Technology sector, the Fund's largest detractor for the year was optical and photonic communications equipment vendor Lumentum Holdings ("Lumentum"). Lumentum has come under pressure as near-term headwinds drive negative estimate revisions, including supply

12

Victory Special Value Fund (continued)

Managers' Commentary (continued)

chain constraints, inventory build at certain customers, COVID-19-related issues hampering network deployments, and the decline in the 3D-sensing market. We continue to hold the stock as growth looks primed to reaccelerate and the company maintains dominant market position and technological differentiation. In the Real Estate sector, our position in American Tower Corporation, an owner and developer of multitenant cellular communication towers, drove results.

13

Victory Special Value Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | Class A | | Class C | | Class I | | Class R | | Class Y | | | |

INCEPTION DATE | | 12/3/93 | | 3/1/03 | | 8/31/07 | | 12/21/99 | | 1/28/13 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | S&P 500®

Index1 | |

One Year | | | 46.06 | % | | | 37.66 | % | | | 44.81 | % | | | 43.81 | % | | | 46.29 | % | | | 45.59 | % | | | 46.39 | % | | | 42.91 | % | |

Five Year | | | 16.09 | % | | | 14.72 | % | | | 15.05 | % | | | 15.05 | % | | | 16.25 | % | | | 15.74 | % | | | 16.35 | % | | | 18.93 | % | |

Ten Year | | | 11.89 | % | | | 11.23 | % | | | 10.89 | % | | | 10.89 | % | | | 12.10 | % | | | 11.56 | % | | | N/A | | | | 16.21 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 12.06 | % | | | N/A | | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price ("MOP") figures reflect a maximum sales charge of 5.75% for Class A. Class C is not subject to an initial sales charge, but is subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

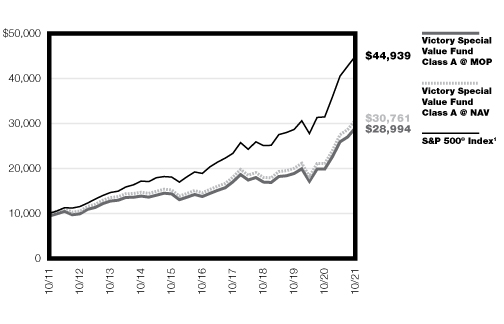

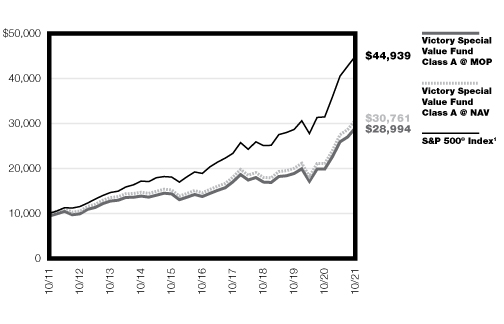

Victory Special Value Fund — Growth of $10,000

1The S&P 500® Index is an unmanaged index comprised of 500 domestically traded common stocks, is weighted according to the market value of each common stock in the index, and includes reinvestment of dividends. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

14

Victory THB US Small Opportunities Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

The United States has managed with COVID-19 for 18 months and finally resumed pre-pandemic levels of activity across most parts of the economy. The solid economic foundation comprised of incredibly liquid consumers, a tight labor market, record-high consumer net worth, and accommodative monetary policy remains fully intact. Uncertainty regarding China and relations with Western countries has created new business opportunities for smaller, domestic companies.

Equity markets continued their recovery from the lows witnessed as the pandemic began. Smaller companies outpaced larger ones with the S&P 500® Index up approximately 43% and the Russell 2000® Index (Small Cap) up 51% for the period.

How did THB US Small Opportunities Fund (the "Fund") perform during the reporting period?

The Fund returned 56.27% (Class A at net asset value) for the fiscal year ended October 31, 2021, underperforming the Russell Microcap® Index, which returned 62.54% for the period.

What strategies did you employ during the reporting period?

The Fund utilizes a bottom-up, fundamental approach to find mispriced securities within the investment universe. The Fund selects investments based on an active fundamental process that combines financial analysis and proprietary research to evaluate potential investments' management and long-term outlook and business strategy. Using this process, the Fund generated the strongest returns within the Information Technology, Consumer Discretionary, and Health Care sectors over the trailing 12 months, while the Communication Services, Real Estate and Materials sectors were the most challenged. The Fund's top five-performing stocks (from a contribution standpoint) were Joint Corp. (Health Care), Perficient, Inc. (Information Technology), PAR Technology Corp. (Information Technology), Sonos, Inc. (Consumer Discretionary) and Ultra Clean Holdings, Inc. (Information Technology). The bottom five-performing stocks (from a contribution standpoint) were EverQuote, Inc. (Communication Services), Trean Insurance Group, Inc. (Financials), Ruth's Hospitality Group, Inc. (Consumer Discretionary), Broadwind, Inc. (Industrials) and Iteris, Inc. (Information Technology).

15

Victory THB US Small Opportunities Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | Class A | | Class I | | | |

INCEPTION DATE | | 3/30/12 | | 3/30/12 | | | |

| | Net Asset Value | | Maximum

Offering

Price | | Net Asset Value | | Russell Microcap®

Index1 | |

One Year | | | 56.27 | % | | | 47.27 | % | | | 56.98 | % | | | 62.54 | % | |

Five Year | | | 16.29 | % | | | 14.93 | % | | | 16.80 | % | | | 16.33 | % | |

Since Inception | | | 12.63 | % | | | 11.93 | % | | | 13.12 | % | | | 13.61 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com. The performance figures for Class A and Class I reflect the historical performance of, respectively, the Investor Class and Institutional Class of the THB Asset Management Microcap Fund (the "Predecessor Fund"), a series of Advisors' Inner Circle Fund. The Fund's performance has not been restated to reflect any difference in the expenses of the Predecessor Fund prior to its reorganization into the Fund on May 3, 2021.

The maximum offering price ("MOP") figures reflect a maximum sales charge of 5.75% for Class A. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

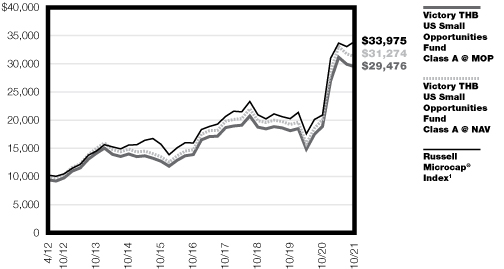

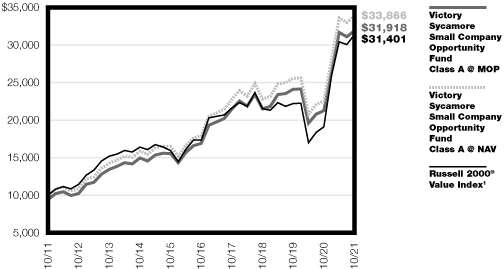

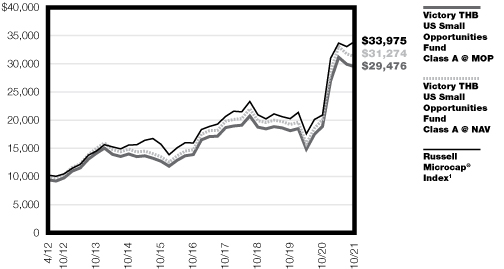

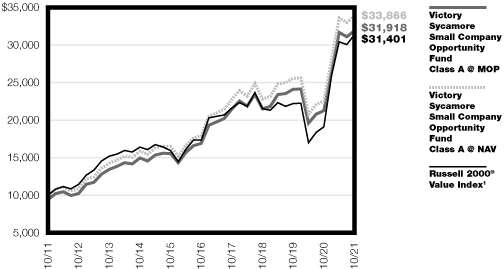

Victory THB US Small Opportunities Fund — Growth of $10,000

1Russell Microcap® Index is a capitalization weighted index of 2,000 small-cap and micro-cap stocks that captures the smallest 1,000 companies in the Russell 2000® Index, plus the next 1,000 smallest eligible securities by market capitalization.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

16

Victory Strategic Allocation Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

Over the last fiscal year, the global capital markets generally were strong except for fixed-income markets, as represented by the Bloomberg U.S. Aggregate Bond Index, registering a slight negative return. The U.S. Equity Markets were exceptionally strong leading the broad Non-U.S. Developed and Emerging Market equity markets. Commodity-oriented stocks were the strongest subcomponent of the broad global equity markets as global supply chain challenges have not kept pace with rising post-pandemic consumer demand and leading to elevated commodity price levels. Lackluster returns in the fixed-income markets were driven by rising interest rates accompanied by relatively low yields.

How did Victory Strategic Allocation Fund (the "Fund") perform during the reporting period?

The Fund returned 24.51% (Class A at net asset value) for the fiscal year ended October 31, 2021, underperforming the MSCI All Country World Index (ACWI) (the "Index"), which returned 37.28% for the period, and outperforming the "Custom Index" (60% MSCI ACWI/40% Bloomberg U.S. Aggregate Bond Index), which returned 21.02% for the period.

What strategies did you employ during the reporting period?

The Fund benefited from a slight overweight to equities overall and strong stock selection of the underlying Victory RS Global Fund. The Fund also continued to be positioned to exhibit less interest rate risk associated with the U.S. Treasury market versus its Custom Index by partially substituting an equity income-oriented strategy. This strategy outperformed the broad fixed-income markets. The Fund was positioned throughout the year to provide more diversification by more equally weighting the U.S. and foreign equity markets when compared to the Index, which detracted slightly from Fund performance versus its Custom Index.

17

Victory Strategic Allocation Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | Class A | | Class C | | Class I | | Class R | | | | | |

INCEPTION DATE | | 12/10/93 | | 3/1/03 | | 8/31/07 | | 12/15/99 | | | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | MSCI All

Country

World

Index1 | | 60% MSCI

All Country

World

Index/40%

Bloomberg

U.S.

Aggregate

Bond Index2 | |

One Year | | | 24.51 | % | | | 21.71 | % | | | 23.57 | % | | | 22.57 | % | | | 24.86 | % | | | 24.20 | % | | | 37.28 | % | | | 21.02 | % | |

Five Year | | | 9.63 | % | | | 9.13 | % | | | 8.82 | % | | | 8.82 | % | | | 9.90 | % | | | 9.35 | % | | | 14.72 | % | | | 10.23 | % | |

Ten Year | | | 9.02 | % | | | 8.77 | % | | | 8.23 | % | | | 8.23 | % | | | 9.29 | % | | | 8.72 | % | | | 11.32 | % | | | 8.16 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price ("MOP") figures reflect a maximum sales charge of 2.25% for Class A. Class C is not subject to an initial sales charge, but is subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

Victory Strategic Allocation Fund — Growth of $10,000

1The MSCI All Country World Index is a market capitalization-weighted index designed to provide a broad measure of equity-market performance throughout the world. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

2The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes U.S. Treasurys, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

18

Victory Taxable Fixed Income Funds

Victory INCORE Fund for Income

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

Major averages in the equity markets rocketed up 35% to 42%. Unlike last year, most bond prices fell (yields rose) as evidenced by the Bloomberg U.S. Aggregate Bond Index declining 0.48%. The two-year to 10-year section of the yield curve steepened, yet interestingly, the five-year to thirty-year portion flattened, as five-year yields increased the most. Prices move opposite of yields. During the year, a few sectors of the bond market outperformed duration-neutral U.S. Treasury bonds. The outperformance was led by corporate bonds at 2.18%. Commercial mortgage-backed securities outperformed by 0.59% and asset-backed by 0.24%. Agency debt and mortgage-backed bonds lagged U.S. Treasury bonds by -0.67% and -0.58%, respectively. The U.S. Treasury market had a total return of -2.45%. Within the mortgage market, Fannie Mae led Freddie Mac, which in turn led Ginnie Mae ("GNMA").

With vaccines now approved for emergency use for school-age children in the United States, a COVID-19 severity-reducing pill approved for use in the United Kingdom (and presumably soon in the United States, with another similar drug in progress), we are likely nearer to the end of the pandemic than the beginning. The pandemic caused a swift contraction in the global economy, which rapidly reversed, in nearly symmetrical fashion. While some measures of improvement have yet to reach pre-pandemic levels — such as U.S. employment, and some measures of inflation remain elevated, the ongoing improvement in medical advances argues for continued improvement, albeit at a lesser pace, as the economy has rebounded rapidly. Demand for durable goods is likely to slow as pandemic support has been withdrawn, interest rates and home prices are higher than the beginning of 2021, and thus affordability and related housing turnover — which had reached a fevered pitch as affluent city dwellers fled during work-from-home, has also slowed. Spending on travel should slowly resume, replacing some of the goods demand due to home-bound shoppers. In all, we expect growth and inflation to moderate. With central bankers firmly in control of monetary policy, rates should remain relatively range-bound, with the occasional slight increases as we begin to near pre-pandemic levels in most tenors.

How did Victory INCORE Fund for Income (the "Fund") perform during the reporting period?

The Fund returned -1.14% (Class A at net asset value) for the fiscal year ended October 31, 2021, underperforming the Bloomberg U.S. Capital 1-5 Year Government Bond Index, which returned -0.81% for the period.

What strategies did you employ during the reporting period?

The Fund's 4% allocation to GNMA-structured securities led performance. Our largest allocation to GNMA single-family pools, which typically drives our performance, was slightly positive. Our 24% allocation to U.S. Treasury bonds detracted slightly from performance and our roughly one-half percent allocation to GNMA multi-family weighed the most on performance. Our strategy has faced multiple headwinds with interest rates having risen rapidly in the past 12 months, to nearly pre-pandemic levels. Lower-coupon GNMA bonds (which the Fund does not own) had higher than normal delinquencies and defaults causing the GNMA label to underperform, while our strategy enjoyed a delinquency pipeline that was lower than pre-COVID-19 levels. And, strong demand for riskier rebound-sensitive assets

19

Victory Taxable Fixed Income Funds

Victory INCORE Fund for Income (continued)

Managers' Commentary (continued)

left safe-haven assets to languish. We think these three headwinds are abating and our investors will be rewarded for their patience.

Our objective remains to provide a high level of current income via securities backed by the full faith and credit of the U.S. government.

20

Victory Taxable Fixed Income Funds

Victory INCORE Fund for Income

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | | Class A | | Class C | | Class I | | Class R | | Class R6 | | Class Y | | Member

Class | | | |

INCEPTION DATE | | 3/26/99 | | 3/1/02 | | 3/1/11 | | 9/16/87 | | 3/4/15 | | 1/28/13 | | 11/3/20 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Capital

1-5 Year U.S.

Government

Bond

Index1 | |

One Year | | | –1.14 | % | | | –3.33 | % | | | –1.81 | % | | | –2.75 | % | | | –0.77 | % | | | –1.14 | % | | | –0.89 | % | | | –0.94 | % | | | N/A | | | | –0.81 | % | |

Five Year | | | 1.10 | % | | | 0.65 | % | | | 0.30 | % | | | 0.30 | % | | | 1.38 | % | | | 1.10 | % | | | 1.39 | % | | | 1.29 | % | | | N/A | | | | 1.76 | % | |

Ten Year | | | 1.26 | % | | | 1.03 | % | | | 0.48 | % | | | 0.48 | % | | | 1.55 | % | | | 1.25 | % | | | N/A | | | | N/A | | | | N/A | | | | 1.40 | % | |

Since

Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 1.43 | % | | | 1.32 | % | | | –1.08 | % | | | N/A | | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price ("MOP") figures reflect a maximum sales charge of 2.25% for Class A. Class C is not subject to an initial sales charge, but is subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

Victory INCORE Fund for Income — Growth of $10,000

1Bloomberg Capital 1-5 Year U.S. Government Bond Index is a market-weighted index measuring the performance of Treasury and Agency securities issued by the United States government with maturities of one to five years. The index does not include the effect of sales charges, commissions, expenses or taxes is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

21

Victory INCORE Investment Grade Convertible Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

Stock and convertible markets experienced very strong returns during the fiscal year ended October 31, 2021. Over the period, stocks, as measured by the S&P 500® Index, returned 42.91%, while investment-grade convertibles, as measured by the ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index (the "Index") returned 20.11%. Bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, returned -0.48%. Convertible securities are either bonds or preferred stock that can be converted into the common stock of the issuing company. Because of this ability to convert to common stock, convertibles participate in the upward and downward movement of the stock market. But because they are part fixed income, they tend to move up and down at a reduced rate. Therefore, as was the case this year, it is typical that convertible returns end up in between stock and bond returns.

Stocks were strong right out of the gate in the fiscal year, reacting positively to the November 2020 U.S. presidential election results. Markets were further boosted mid-month by overwhelmingly efficacious vaccine data out of Pfizer, and later Moderna. During November, the S&P 500® Index returned 10.95%, and the Dow Jones Industrial Average had its best month since 1987, topping the 30,000 milestone for the first time. Market strength continued throughout December and into calendar 2021, fueled by passage of a $900 billion stimulus bill and the initial roll out of Pfizer's and Moderna's COVID-19 vaccines. Stocks fell sharply the last week of January causing a decline for the month, but then started a streak of seven consecutive monthly gains. While not in a straight line, and with some notable bumps along the way, the S&P 500® Index returned 22.82% from the end of January to the end of August. Over this period, stocks were spurred on by robust economic growth, continued fiscal and monetary stimulus, and expanding earnings. The streak of higher returns came to an end in September as the S&P 500® Index fell 4.65%. Losses in the month were triggered by concerns over the potential fallout resulting from the debt troubles of property developer China Evergrande Group. But stocks quickly resumed their upward climb as investors shrugged off higher inflation readings and supply chain disruptions, choosing instead to focus on strong third-quarter earnings. Stocks finished the fiscal year like they began it, with strong returns, as the S&P 500® Index posted a 7.0% gain in October.

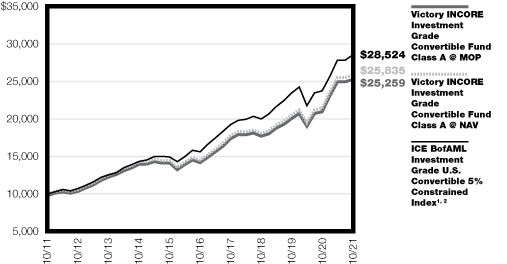

How did Victory INCORE Investment Grade Convertible Fund (the "Fund") perform during the reporting period?

The Fund returned 20.62% (Class A at net asset value) for the fiscal year ended October 31, 2021, outperforming the ICE BofA Investment Grade U.S. Convertible 5% Constrained Index (the "Index"), which returned 20.11% for the period.

What strategies did you employ during the reporting period?

In managing the Fund, we strive to invest in high-quality convertibles with attractive underlying common stocks. We structure the Fund by spreading out our holdings across the three types of convertibles: 1) equity-sensitive, high-delta convertibles; 2) total return, middle-of-the-road convertibles; and 3) defensive, fixed-income-oriented convertibles. With this structure, we seek to provide a favorable balance between upside potential and downside exposure to equities. As of October 31, 2021, the Fund is overweight compared to the Index

22

Victory INCORE Investment Grade Convertible Fund (continued)

Managers' Commentary (continued)

in the Health Care and Information Technology sectors. It is underweighted in the Utilities sector. It is approximately equal weighted in the Consumer Discretionary, Energy, Financials, and Industrials sectors. The Fund is broadly diversified amongst individual issues, economic sectors, credits, and convertible types. Performance during the fiscal year was aided by overweights in the Health Care and Information Technology sectors, as well as positive security selection in the same sectors. Performance was negatively impacted by underweights in the Energy and Utilities sectors, and negative security selection in the Financials sector.

23

Victory INCORE Investment Grade Convertible Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended October 31, 2021

| | Class A | | Class I | | Member Class | | | |

INCEPTION DATE | | 4/14/88 | | 8/31/07 | | 11/3/20 | | | |

| | Net Asset

Value | | Maximum

Offering Price | | Net Asset

Value | | Net Asset

Value | | ICE BofAML

Investment

Grade U.S. Conv

5% Constrained

Index1,2 | |

One Year | | | 20.62 | % | | | 17.90 | % | | | 21.19 | % | | | N/A | | | | 20.11 | % | |

Five Year | | | 12.26 | % | | | 11.74 | % | | | 12.75 | % | | | N/A | | | | 12.81 | % | |

Ten Year | | | 9.96 | % | | | 9.71 | % | | | 10.44 | % | | | N/A | | | | 11.05 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | 20.63 | % | | | N/A | | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price ("MOP") figures reflect a maximum sales charge of 2.25% for Class A. Net Asset Value does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

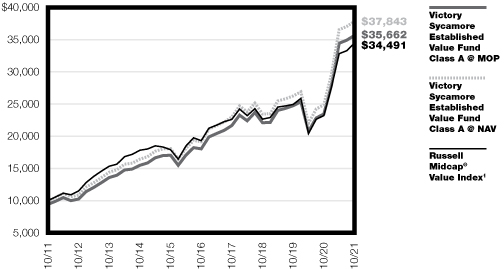

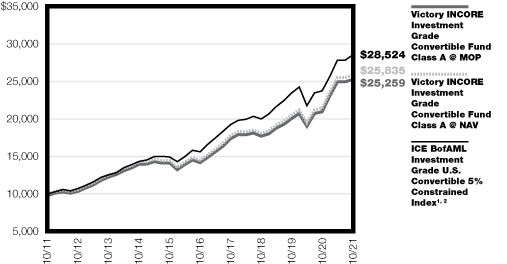

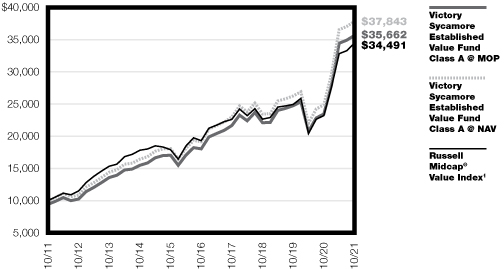

Victory INCORE Investment Grade Convertible Fund — Growth of $10,000

1ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index is a market capitalization-weighted index of domestic corporate convertible securities. Bonds and preferred stocks must be convertible only to common stock, ADR's or cash equivalent and have a market value of at least $50 million. Composed of Coupon, OID, or zero coupon convertible bonds rated by Moody's and/or S&P with an average rating of Baa3/BBB- or higher. This Index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

2The ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index commenced on January 1, 2012. Performance from October 31, 2010 to December 31, 2011 reflects performance of ICE BofAML All Investment Grade U.S. Convertibles Index. Performance from January 1, 2012 to present reflects the ICE BofAML Investment Grade U.S. Convertible 5% Constrained Index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

24

Victory Portfolios

Victory Diversified Stock Fund | | October 31, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long?term growth of capital.

Top 10 Holdings*:

October 31, 2021

(% of Net Assets)

Microsoft Corp. | | | 6.7 | % | |

Apple, Inc. | | | 5.9 | % | |

Alphabet, Inc., Class A | | | 3.5 | % | |

NVIDIA Corp. | | | 2.7 | % | |

SPDR S&P 500 ETF Trust | | | 2.0 | % | |

JPMorgan Chase & Co. | | | 1.9 | % | |

Chevron Corp. | | | 1.9 | % | |

PepsiCo, Inc. | | | 1.9 | % | |

Meta Platforms, Inc., Class A | | | 1.9 | % | |

Advanced Micro Devices, Inc. | | | 1.9 | % | |

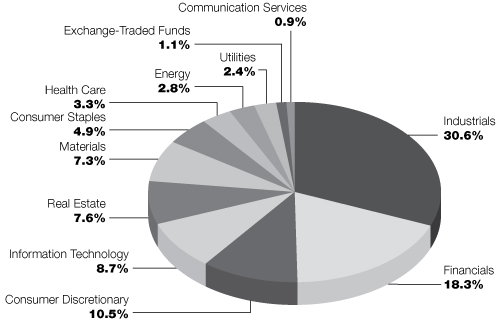

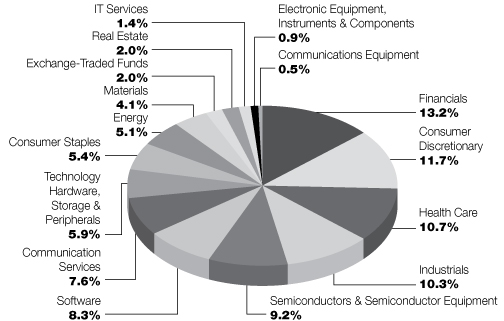

Sector Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

25

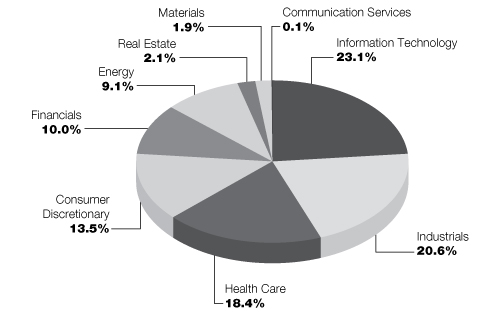

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | October 31, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long?term capital appreciation.

Top 10 Holdings*:

October 31, 2021

(% of Net Assets)

Amazon.com, Inc. | | | 7.4 | % | |

NVIDIA Corp. | | | 7.1 | % | |

Alphabet, Inc., Class C | | | 6.0 | % | |

Visa, Inc., Class A | | | 4.3 | % | |

ServiceNow, Inc. | | | 4.2 | % | |

PayPal Holdings, Inc. | | | 4.1 | % | |

EPAM Systems, Inc. | | | 4.1 | % | |

Adobe, Inc. | | | 4.0 | % | |

Generac Holdings, Inc. | | | 3.6 | % | |

Thermo Fisher Scientific, Inc. | | | 3.4 | % | |

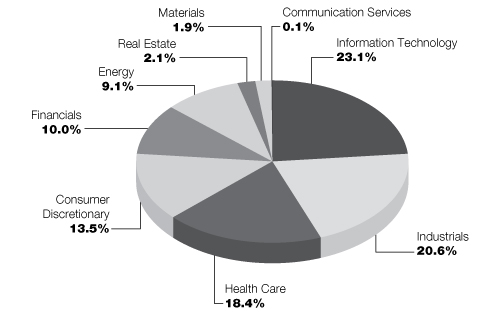

Sector Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

26

Victory Portfolios

Victory Special Value Fund | | October 31, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long?term growth of capital and dividend income.

Top 10 Holdings*:

October 31, 2021

(% of Net Assets)

Microsoft Corp. | | | 6.6 | % | |

Apple, Inc. | | | 5.7 | % | |

Alphabet, Inc., Class C | | | 3.5 | % | |

NVIDIA Corp. | | | 2.8 | % | |

SPDR S&P 500 ETF Trust | | | 2.0 | % | |

JPMorgan Chase & Co. | | | 2.0 | % | |

Chevron Corp. | | | 1.9 | % | |

PepsiCo, Inc. | | | 1.9 | % | |

Meta Platforms, Inc., Class A | | | 1.9 | % | |

Advanced Micro Devices, Inc. | | | 1.8 | % | |

Sector Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

27

Victory Portfolios

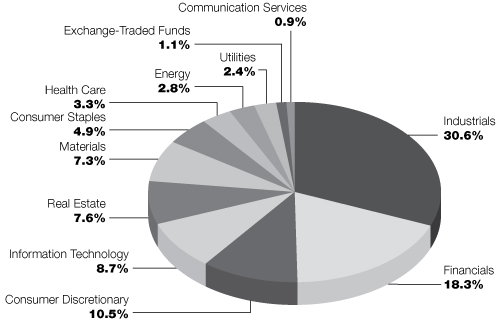

Victory THB US Small Opportunities Fund | | October 31, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide capital appreciation.

Top 10 Holdings*:

October 31, 2021

(% of Net Assets)

Perficient, Inc. | | | 3.4 | % | |

First Busey Corp. | | | 3.2 | % | |

Transcat, Inc. | | | 2.7 | % | |

Napco Security Technologies, Inc. | | | 2.6 | % | |

Grid Dynamics Holdings, Inc. | | | 2.6 | % | |

ePlus, Inc. | | | 2.5 | % | |

BioLife Solutions, Inc. | | | 2.2 | % | |

PAR Technology Corp. | | | 2.1 | % | |

Renewable Energy Group, Inc. | | | 2.1 | % | |

Movado Group, Inc. | | | 2.0 | % | |

Sector Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

28

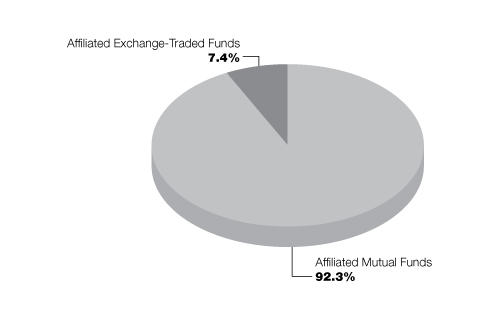

Victory Portfolios

Victory Strategic Allocation Fund | | October 31, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide income and long?term growth of capital.

Top 10 Holdings*:

October 31, 2021

(% of Net Assets)

Victory RS Global Fund, Class Y | | | 31.2 | % | |

Victory Market Neutral Income Fund, Class I | | | 19.2 | % | |

Victory INCORE Total Return Bond Fund, Class R6 | | | 10.9 | % | |

Victory Sophus Emerging Markets Fund, Class R6 | | | 9.4 | % | |

Victory Trivalent International Small-Cap Fund, Class I | | | 7.5 | % | |

VictoryShares U.S. Multi-Factor Minimum Volatility ETF | | | 7.4 | % | |

Victory INCORE Investment Grade Convertible Fund, Class I | | | 6.3 | % | |

Victory Integrity Discovery Fund, Class Y | | | 4.0 | % | |

Victory RS Partners Fund, Class Y | | | 3.8 | % | |

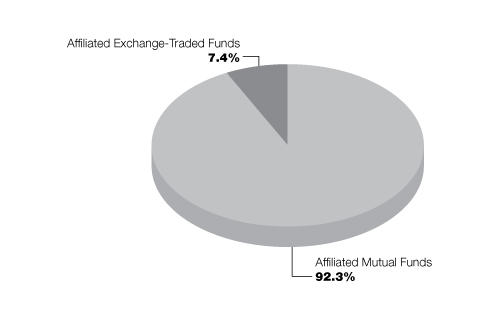

Asset Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

29

Victory Portfolios

Victory INCORE Fund for Income | | October 31, 2021 | |

(Unaudited)

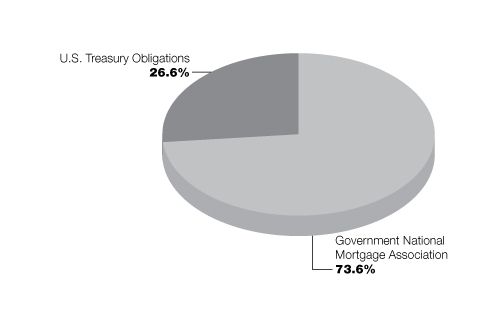

Investment Objective and Portfolio Holdings:

The Fund seeks to provide a high level of current income consistent with preservation of shareholders' capital.

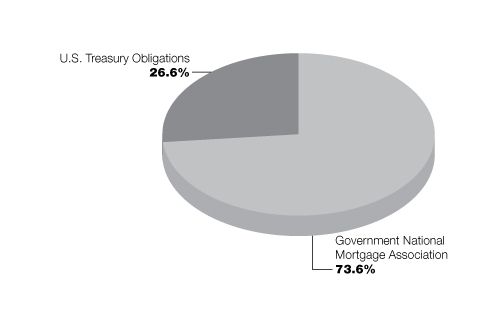

Asset Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

30

Victory Portfolios

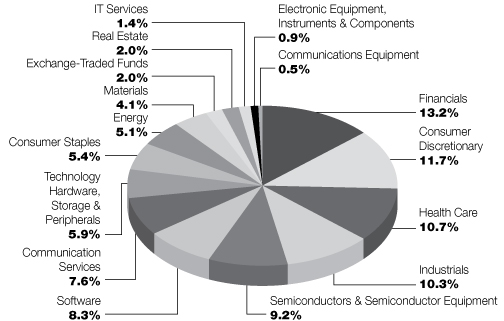

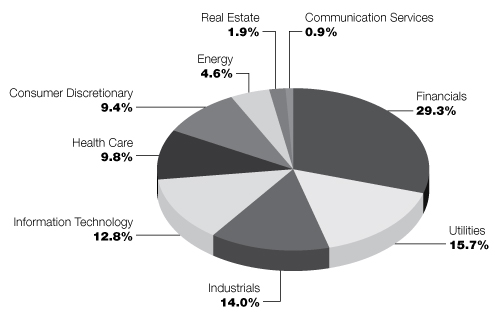

Victory INCORE Investment Grade Convertible Fund | | October 31, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide a high level of current income together with long?term capital appreciation.

Top 10 Holdings*:

October 31, 2021

(% of Net Assets)

Anthem, Inc. | | | 5.4 | % | |

Western Digital Corp. | | | 4.8 | % | |

Booking Holdings, Inc. | | | 4.7 | % | |

Pioneer Natural Resources Co. | | | 4.6 | % | |

Southwest Airlines Co. | | | 4.5 | % | |

Fortive Corp. | | | 4.4 | % | |

Stanley Black & Decker, Inc. | | | 4.0 | % | |

Wells Fargo & Co. | | | 3.9 | % | |

Euronet Worldwide, Inc. | | | 3.6 | % | |

Illumina, Inc. | | | 3.5 | % | |

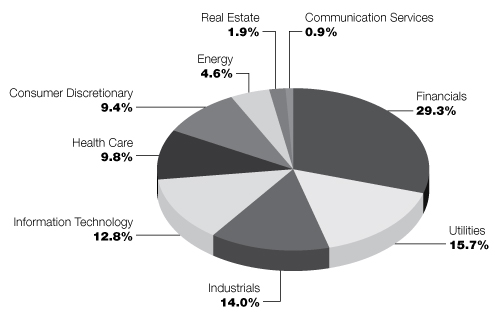

Sector Allocation*:

October 31, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

31

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments

October 31, 2021 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Common Stocks (96.3%) | |

Communication Services (7.6%): | |

Alphabet, Inc., Class C (a) | | | 3,979 | | | $ | 11,799 | | |

Charter Communications, Inc., Class A (a) | | | 4,151 | | | | 2,801 | | |

Meta Platforms, Inc., Class A (a) | | | 19,600 | | | | 6,342 | | |

Nexstar Media Group, Inc., Class A | | | 30,224 | | | | 4,532 | | |

| | | | 25,474 | | |

Communications Equipment (0.5%): | |

Lumentum Holdings, Inc. (a) | | | 20,925 | | | | 1,728 | | |

Consumer Discretionary (11.7%): | |

Amazon.com, Inc. (a) | | | 1,454 | | | | 4,903 | | |

Asbury Automotive Group, Inc. (a) | | | 25,436 | | | | 4,978 | | |

Brunswick Corp. | | | 21,798 | | | | 2,029 | | |

D.R. Horton, Inc. | | | 30,975 | | | | 2,765 | | |

Group 1 Automotive, Inc. | | | 26,961 | | | | 4,848 | | |

LCI Industries | | | 28,109 | | | | 3,925 | | |

Lowe's Cos., Inc. | | | 7,814 | | | | 1,827 | | |

Meritage Homes Corp. (a) | | | 38,254 | | | | 4,159 | | |

Patrick Industries, Inc. | | | 43,960 | | | | 3,425 | | |

Rent-A-Center, Inc. | | | 78,274 | | | | 4,169 | | |

Tesla, Inc. (a) | | | 1,964 | | | | 2,188 | | |

| | | | 39,216 | | |

Consumer Staples (5.4%): | |

BJ's Wholesale Club Holdings, Inc. (a) | | | 66,306 | | | | 3,875 | | |

Darling Ingredients, Inc. (a) | | | 25,636 | | | | 2,167 | | |

PepsiCo, Inc. (a) | | | 39,617 | | | | 6,402 | | |

Philip Morris International, Inc. | | | 58,595 | | | | 5,539 | | |

| | | | 17,983 | | |

Electronic Equipment, Instruments & Components (0.9%): | |

Fabrinet (a) | | | 30,746 | | | | 2,952 | | |

Energy (5.1%): | |

Chevron Corp. | | | 56,115 | | | | 6,425 | | |

Matador Resources Co. | | | 82,638 | | | | 3,458 | | |

Pioneer Natural Resources Co. | | | 20,575 | | | | 3,847 | | |

Valero Energy Corp. | | | 44,572 | | | | 3,447 | | |

| | | | 17,177 | | |

Financials (13.2%): | |

Ally Financial, Inc. | | | 46,089 | | | | 2,200 | | |

Ameriprise Financial, Inc. | | | 8,210 | | | | 2,480 | | |

Bank of America Corp. | | | 108,654 | | | | 5,192 | | |

Chubb Ltd. | | | 24,794 | | | | 4,844 | | |

JPMorgan Chase & Co. | | | 37,957 | | | | 6,449 | | |

Morgan Stanley | | | 42,028 | | | | 4,320 | | |

Primerica, Inc. | | | 24,856 | | | | 4,182 | | |

ServisFirst Bancshares, Inc. | | | 23,946 | | | | 1,923 | | |

Signature Bank (b) | | | 12,058 | | | | 3,591 | | |

See notes to financial statements.

32

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

October 31, 2021 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

T. Rowe Price Group, Inc. | | | 16,406 | | | $ | 3,558 | | |

Western Alliance Bancorp | | | 46,491 | | | | 5,397 | | |

| | | | 44,136 | | |

Health Care (10.7%): | |

AbbVie, Inc. | | | 46,684 | | | | 5,353 | | |

AmerisourceBergen Corp. | | | 27,679 | | | | 3,377 | | |

ICON PLC (a) | | | 15,396 | | | | 4,415 | | |

Insulet Corp. (a) | | | 5,889 | | | | 1,826 | | |

McKesson Corp. | | | 21,511 | | | | 4,472 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 8,781 | | | | 5,619 | | |

Stryker Corp. (a) | | | 16,228 | | | | 4,318 | | |

Thermo Fisher Scientific, Inc. | | | 5,475 | | | | 3,466 | | |

UnitedHealth Group, Inc. | | | 6,576 | | | | 3,028 | | |

| | | | 35,874 | | |

Industrials (10.3%): | |

Builders FirstSource, Inc. (a) | | | 78,599 | | | | 4,580 | | |

Chart Industries, Inc. (a) | | | 12,113 | | | | 2,150 | | |

GXO Logistics, Inc. (a) | | | 26,640 | | | | 2,366 | | |

Marten Transport Ltd. | | | 194,779 | | | | 3,239 | | |

Old Dominion Freight Line, Inc. | | | 14,243 | | | | 4,862 | | |

Parker-Hannifin Corp. | | | 9,982 | | | | 2,960 | | |

Saia, Inc. (a) | | | 13,124 | | | | 4,103 | | |

Trex Co., Inc. (a) | | | 28,781 | | | | 3,062 | | |

UFP Industries, Inc. | | | 57,773 | | | | 4,728 | | |

XPO Logistics, Inc. (a) | | | 26,640 | | | | 2,286 | | |

| | | | 34,336 | | |

IT Services (1.4%): | |

EPAM Systems, Inc. (a) | | | 6,678 | | | | 4,496 | | |

Materials (4.1%): | |

Avery Dennison Corp. | | | 14,946 | | | | 3,254 | | |

Dow, Inc. | | | 43,692 | | | | 2,445 | | |

Summit Materials, Inc., Class A (a) | | | 123,246 | | | | 4,394 | | |

Valvoline, Inc. | | | 102,828 | | | | 3,492 | | |

| | | | 13,585 | | |

Real Estate (2.0%): | |

American Tower Corp. | | | 9,104 | | | | 2,567 | | |

CBRE Group, Inc., Class A (a) | | | 19,308 | | | | 2,009 | | |

Simon Property Group, Inc. | | | 14,543 | | | | 2,132 | | |

| | | | 6,708 | | |

Semiconductors & Semiconductor Equipment (9.2%): | |

Advanced Micro Devices, Inc. (a) | | | 51,483 | | | | 6,190 | | |

Applied Materials, Inc. | | | 28,985 | | | | 3,961 | | |

Broadcom, Inc. | | | 8,194 | | | | 4,356 | | |

Lam Research Corp. | | | 6,560 | | | | 3,697 | | |

NVIDIA Corp. | | | 35,518 | | | | 9,081 | | |

Qorvo, Inc. (a) | | | 21,129 | | | | 3,555 | | |

| | | | 30,840 | | |

See notes to financial statements.

33

Victory Portfolios

Victory Diversified Stock Fund | | Schedule of Portfolio Investments — continued

October 31, 2021 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Software (8.3%): | |

Adobe, Inc. (a) | | | 2,744 | | | $ | 1,785 | | |

Cadence Design Systems, Inc. (a) | | | 20,624 | | | | 3,570 | | |

Microsoft Corp. | | | 67,620 | | | | 22,424 | | |

| | | | 27,779 | | |

Technology Hardware, Storage & Peripherals (5.9%): | |

Apple, Inc. | | | 131,499 | | | | 19,699 | | |

Total Common Stocks (Cost $200,175) | | | 321,983 | | |

Exchange-Traded Funds (2.0%) | |

SPDR S&P 500 ETF Trust | | | 14,576 | | | | 6,694 | | |

Total Exchange-Traded Funds (Cost $5,234) | | | 6,694 | | |

Collateral for Securities Loaned^ (0.1%) | |

BlackRock Liquidity Funds TempFund, Institutional Shares, 0.04% (c) | | | 7,280 | | | | 7 | | |

Fidelity Investments Money Market Government Portfolio,

Institutional Shares, 0.01% (c) | | | 228,954 | | | | 229 | | |

Goldman Sachs Financial Square Prime Obligations Fund,

Institutional Shares, 0.02% (c) | | | 3,633 | | | | 4 | | |

JPMorgan Prime Money Market Fund, Capital Shares, 0.07% (c) | | | 28,969 | | | | 29 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio,

Institutional Shares, 0.06% (c) | | | 130,251 | | | | 130 | | |

Total Collateral for Securities Loaned (Cost $399) | | | 399 | | |

Total Investments (Cost $205,808) — 98.4% | | | 329,076 | | |

Other assets in excess of liabilities — 1.6% | | | 5,263 | | |

NET ASSETS — 100.00% | | $ | 334,339 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) Rate disclosed is the daily yield on October 31, 2021.

ETF — Exchange-Traded Fund

PLC — Public Limited Company

See notes to financial statements.

34

Victory Portfolios

Victory NewBridge Large Cap Growth Fund | | Schedule of Portfolio Investments

October 31, 2021 | |

(Amounts in Thousands, Except for Shares)

Security Description | | Shares | | Value | |

Common Stocks (99.1%) | |

Communication Services (9.4%): | |

Alphabet, Inc., Class C (a) | | | 362 | | | $ | 1,073 | | |

Meta Platforms, Inc., Class A (a) | | | 1,003 | | | | 325 | | |

Snap, Inc., Class A (a) | | | 5,210 | | | | 274 | | |

| | | | 1,672 | | |

Consumer Discretionary (20.6%): | |

Airbnb, Inc., Class A (a) | | | 2,152 | | | | 367 | | |