UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04852

Victory Portfolios

(Exact name of registrant as specified in charter)

4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio 44144

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

December 31, 2020

Annual Report

Victory INCORE Investment Quality Bond Fund

Victory INCORE Low Duration Bond Fund

Victory High Yield Fund

Victory Tax-Exempt Fund

Victory High Income Municipal Bond Fund

Victory Floating Rate Fund

Victory Strategic Income Fund

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Victory Funds' shareholder reports may no longer be sent by mail, unless you specifically request paper copies of the reports from the Victory Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on www.VictoryFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Victory Funds, you can call 800-539-3863 (800-235-8396 for Member Class) or send an e-mail request to TA.Processing@FISGlobal.com. Your election to receive reports in paper will apply to all Victory Funds you hold directly or through your financial intermediary.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

Victory Portfolios

Table of Contents

Shareholder Letter (Unaudited) | | | 5 | | |

Managers' Commentary and Investment

Overview (Unaudited) | | | 7 | | |

Investment Objective and Portfolio

Holdings (Unaudited) | | | 26 | | |

Financial Statements | |

The Victory Fixed Income Funds | |

Victory INCORE Investment Quality Bond Fund | |

Schedule of Portfolio Investments | | | 33 | | |

Statement of Assets and Liabilities | | | 76 | | |

Statement of Operations | | | 79 | | |

Statements of Changes in Net Assets | | | 82-84 | | |

Financial Highlights | | | 90-91 | | |

Victory INCORE Low Duration Bond Fund | |

Schedule of Portfolio Investments | | | 42 | | |

Statement of Assets and Liabilities | | | 76 | | |

Statement of Operations | | | 79 | | |

Statements of Changes in Net Assets | | | 82-84 | | |

Financial Highlights | | | 92-93 | | |

Victory High Yield Fund | |

Schedule of Portfolio Investments | | | 49 | | |

Statement of Assets and Liabilities | | | 76 | | |

Statement of Operations | | | 79 | | |

Statements of Changes in Net Assets | | | 82-84 | | |

Financial Highlights | | | 94-95 | | |

Victory Tax-Exempt Fund | |

Schedule of Portfolio Investments | | | 55 | | |

Statement of Assets and Liabilities | | | 77 | | |

Statement of Operations | | | 80 | | |

Statements of Changes in Net Assets | | | 85-87 | | |

Financial Highlights | | | 96-97 | | |

Victory High Income Municipal Bond Fund | |

Schedule of Portfolio Investments | | | 59 | | |

Statement of Assets and Liabilities | | | 77 | | |

Statement of Operations | | | 80 | | |

Statements of Changes in Net Assets | | | 85-87 | | |

Financial Highlights | | | 98-99 | | |

Victory Floating Rate Fund | |

Schedule of Portfolio Investments | | | 63 | | |

Statement of Assets and Liabilities | | | 77 | | |

Statement of Operations | | | 80 | | |

Statements of Changes in Net Assets | | | 85-87 | | |

Financial Highlights | | | 100-101 | | |

1

Table of Contents (continued)

Victory Strategic Income Fund | |

Schedule of Portfolio Investments | | | 70 | | |

Statement of Assets and Liabilities | | | 78 | | |

Statement of Operations | | | 81 | | |

Statements of Changes in Net Assets | | | 88-89 | | |

Financial Highlights | | | 102-103 | | |

Notes to Financial Statements | | | 104 | | |

Report of Independent Registered Public

Accounting Firm | | | 122 | | |

Supplemental Information (Unaudited) | | | 123 | | |

Trustee and Officer Information | | | 123 | | |

Proxy Voting and Form Portfolio Holdings

Information | | | 126 | | |

Expense Examples | | | 126 | | |

Additional Federal Income Tax Information | | | 128 | | |

Advisory Contract Approval | | | 129 | | |

Privacy Policy (inside back cover) | | | |

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call 800-539-3863 (800-235-8396 for Member Class) and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

2

The Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at www.vcm.com or call 800-539-3863 (800-235-8396 for Member Class). Read it carefully before you invest or send money.

The information in this annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

800-235-8396 for Member Class

Visit our website at:

www.vcm.com

3

This page is intentionally left blank.

4

Victory Funds Letter to Shareholders

(Unaudited)

Dear Shareholder,

When we look back on 2020, we will undoubtedly remember it as an extraordinary year. A year ago, no one could have imagined the unusual events that would challenge us personally, professionally, and collectively as a nation. But in retrospect, the trajectory of financial markets over the past year was nothing short of extraordinary.

The year began with rudimentary worries, such as economic growth rates, trade deals, and interest rates. But a novel coronavirus and the subsequent worldwide spread of COVID-19 became an unprecedented event. To combat the pandemic, governments everywhere issued austere shelter-in-place orders, and the global economy slowed markedly. Equity markets sold off sharply in March and April, and second quarter U.S. GDP contracted by an alarming annual rate of 31.4%.

It's no surprise that so many investors flocked to the perceived safety of U.S. Treasurys. Meanwhile, liquidity evaporated (for a short spell) in many other segments of the fixed income market, including higher-yielding credits and municipal bonds. The outlook was tenuous, and credit spreads widened while prices declined for most securities perceived to be higher risk.

A response, however, came swiftly. The U.S. Federal Reserve (the "Fed") and other monetary authorities worldwide leapt into action — cutting interest rates, (re)starting quantitative easing and, in the case of the Fed, launching an array of programs to provide liquidity to stabilize fixed-income markets. The U.S. government also stepped up to provide fiscal stimulus in the form of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

It was impressive how quickly those actions helped end the stock market's freefall and restore order across much of the fixed-income universe. The rebound was almost as robust as the drawdown, and third-quarter GDP (the most recent finalized data available) grew at a 33.4% annualized rate.

Late in the year, markets were alternately fueled and roiled by a contentious election season, growing optimism for an effective vaccine, and a fluid debate regarding the need for additional fiscal stimulus. Ultimately, stocks were propelled higher in the fourth quarter when it became clear the United States Congress would provide another dose of fiscal stimulus in the form of direct payments, more unemployment insurance, and additional aid to businesses.

Through all the unprecedented events and extreme volatility, the S&P 500® Index registered an impressive annual return of 18.40% for the 12-month period ended December 31, 2020. Meanwhile, the yield on 10-year U.S. Treasurys declined 95 basis points over the same period, reflecting both the Fed's interest rate cuts and its pledge to keep rates low longer. The yield on 10-Year U.S. Treasurys was 0.93% as of December 31, 2020.

While markets endured and performed admirably during 2020, perhaps the key takeaway is that the unexpected can and will happen. That's why it's important to

5

remain focused on your long-term investment goals and avoid making emotional decisions. Moreover, we continue to have confidence in all of Victory Capital's autonomous Investment Franchises and their ability to navigate the ups and downs.

On the following pages, you will find information relating to your Victory Funds investment. If you have any questions, we encourage you to contact your financial advisor. Or, if you invest with us directly, you may call 800-539-3863 (800-235-8396 for Member Class), or visit our website at www.vcm.com.

My colleagues and I sincerely appreciate the confidence you have placed in the Victory Funds, and we value the opportunity to help meet your investment goals.

Christopher K. Dyer, CFA

President,

Victory Funds

6

Victory Fixed Income Funds

Victory INCORE Investment Quality Bond Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

As we end one of the most turbulent years in economic history, markets remain near all-time highs, driven by unprecedented levels of monetary and fiscal stimulus. The U.S. economy experienced its single largest economic loss in the nation's history, contracting by 31.4% during the second quarter of 2020. The dramatic second-quarter collapse in economic activity has been followed by consecutive quarters of robust economic growth. Specifically, third-quarter U.S. gross domestic product ("GDP") rebounded by a robust 33.4%, and the Atlanta Fed's GDPNow forecasting model predicts fourth-quarter growth to print around 8.6%. While the GDPNow forecast will likely vary from the final U.S. GDP growth figure, what we can take away from the estimate is that the recovery has been quicker than anticipated.

Despite a better-than-expected economic recovery, much has hinged on the overwhelming amount of fiscal and monetary stimulus injected into the economy. Since March, the U.S. Federal Reserve (the "Fed") has provided trillions in monetary stimulus. Monetary policy has helped stabilize and buoy financial markets, but it is the fiscal stimulus that has supported the rebound in actual economic activity. The U.S. Congress has passed three rounds of fiscal stimulus since March totaling an additional $4 trillion, which is equivalent to nearly 20% of U.S. GDP in 2019.

It is difficult to estimate the long-term consequences of unprecedented fiscal and monetary stimulus. The Fed, U.S. Treasury, and the U.S. Congress are embarking upon a grand experiment in Modern Monetary Theory ("MMT"), where massive fiscal deficits purportedly do not matter for countries that control their own currency. In the short run, we believe monetary and fiscal stimulus is likely to be supportive of economic growth and market valuations. We worry that early success with MMT may lead to long-term unintended economic consequences later in the decade.

We remain concerned about the possible long-term inflationary effects of continued MMT, but thus far the Fed's preferred measure of inflation, core personal consumption expenditures (PCE), remains below their long-term 2% objective. Furthermore, the Fed seems intent on anchoring front-end interest rates near zero for the foreseeable future in order to meet, or exceed, their target. As a result, we do not expect much movement in short-term interest rates; however, we remain concerned about the impact continued stimulus combined with the Fed's newly announced inflation-targeting policy could have on intermediate- and long-end interest rates. These concerns are motivating us to position accounts relatively short duration versus benchmarks going into 2021.

How did Victory INCORE Investment Quality Bond Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide a high level of current income and capital appreciation without undue risk to principal. The Fund returned 7.94% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the Bloomberg Barclays U.S. Aggregate Bond Index (the "Index"), which returned 7.51% during the reporting period.

7

Victory Fixed Income Funds

Victory INCORE Investment Quality Bond Fund (continued)

Managers' Commentary (continued)

What strategies did you employ during the reporting period?

The Fund came into 2020 overweight agency mortgages and relatively light corporate credit exposure, with only a modest overweight to 0-3-year BBB corporate credit. During the late part of the first quarter and beginning part of the second quarter, during the worst of the market rout, we moved to a large overweight position in corporate credit across the curve. We maintained this corporate credit overweight as we ended the year. The Fund greatly benefited from this positioning during the year.

We believe that with yields on short- and intermediate-term U.S. Treasurys near historic lows, investors have no other reasonable alternative but to invest in high-quality corporate and consumer credit. We do not believe investors are receiving enough yield or duration benefit from owning U.S. Treasurys at current levels. As a result, we added a significant overweight to corporate credit at discounted valuations late in the first quarter and beginning part of the second quarter. We maintained this overweight at year-end and continue to selectively add high-grade corporates across the curve as opportunities present themselves. This positioning has been additive to performance over the year, helping the Fund outpace the Index for 2020.

As we enter a new year, we believe massive monetary and fiscal stimulus will continue to buoy markets as both the incoming Biden administration and the Fed seem interested in continuing the MMT experiment in the near term. However, it is likely to be a volatile and uncertain time as the long-term effects of MMT are unknown. The key attributes we strive for when positioning client portfolios for an uncertain outlook are quality, balance and diversification. We believe we are well positioned across our portfolios for this uncertain environment, and we believe being overweight credit and underweight duration versus the Index should be additive to performance as we enter the coming year.

8

Victory Fixed Income Funds

Victory INCORE Investment Quality Bond Fund

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class R | | Class Y | | | |

INCEPTION DATE | | 2/16/93 | | 8/7/00 | | 5/15/01 | | 5/12/09 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Barclays U.S.

Aggregate

Bond Index1 | |

One Year | | | 7.94 | % | | | 5.55 | % | | | 6.89 | % | | | 5.89 | % | | | 7.37 | % | | | 8.21 | % | | | 7.51 | % | |

Five Year | | | 4.40 | % | | | 3.93 | % | | | 3.50 | % | | | 3.50 | % | | | 3.99 | % | | | 4.66 | % | | | 4.44 | % | |

Ten Year | | | 3.77 | % | | | 3.54 | % | | | 2.91 | % | | | 2.91 | % | | | 3.36 | % | | | 3.99 | % | | | 3.84 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

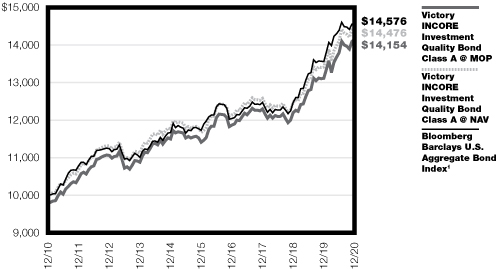

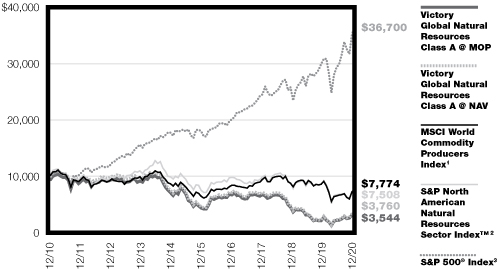

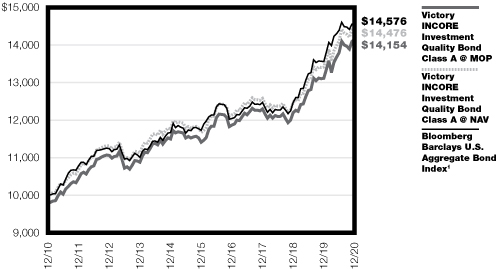

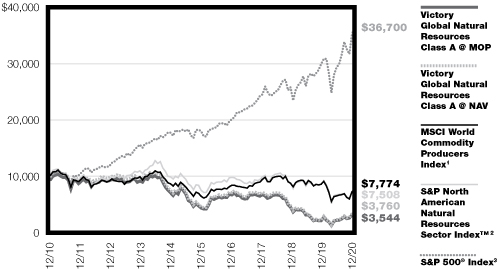

Victory INCORE Investment Quality Bond Fund — Growth of $10,000

1The Bloomberg Barclays U.S. Aggregate Bond Index is generally considered to be representative of U.S. bond market activity. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

9

Victory Fixed Income Funds

Victory INCORE Low Duration Bond Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

As we end one of the most turbulent years in economic history, markets remain near all-time highs, driven by unprecedented levels of monetary and fiscal stimulus. The U.S. economy experienced its single largest economic loss in the nation's history, contracting by 31.4% during the second quarter of 2020. The dramatic second-quarter collapse in economic activity has been followed by consecutive quarters of robust economic growth. Specifically, third-quarter U.S. gross domestic product ("GDP") rebounded by a robust 33.4%, and the Atlanta Fed's GDPNow forecasting model predicts fourth-quarter growth to print around 8.6%. While the GDPNow forecast will likely vary from the final U.S. GDP growth figure, what we can take away from the estimate is that the recovery has been quicker than anticipated.

Despite a better than expected economic recovery, much has hinged on the overwhelming amount of fiscal and monetary stimulus injected into the economy. Since March, the U.S. Federal Reserve (the "Fed") has provided trillions in monetary stimulus. Monetary policy has helped stabilize and buoy financial markets, but it is the fiscal stimulus that has supported the rebound in actual economic activity. The U.S. Congress has passed three rounds of fiscal stimulus since March totaling an additional $4 trillion, which is equivalent to nearly 20% of U.S. GDP in 2019.

It is difficult to estimate the long-term consequences of unprecedented fiscal and monetary stimulus. The Fed, U.S. Treasury, and the U.S. Congress are embarking upon a grand experiment in Modern Monetary Theory ("MMT"), where massive fiscal deficits purportedly do not matter for countries that control their own currency. In the short run, we believe monetary and fiscal stimulus is likely to be supportive of economic growth and market valuations. We worry that early success with MMT may lead to long-term unintended economic consequences later in the decade.

We remain concerned about the possible long-term inflationary effects of continued MMT, but thus far the Fed's preferred measure of inflation, core personal consumption expenditures (PCE), remains below their long-term 2% objective. Furthermore, the Fed seems intent on anchoring front-end interest rates near zero for the foreseeable future in order to meet, or exceed, their target. As a result, we do not expect much movement in short-term interest rates; however, we remain concerned about the impact continued stimulus combined with the Fed's newly announced inflation-targeting policy could have on intermediate- and long-end interest rates. These concerns are motivating us to position accounts relatively short duration versus benchmarks going into 2021.

How did Victory INCORE Low Duration Bond Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide a high level of current income consistent with preservation of capital. The Fund returned 3.85% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the Bloomberg Barclays U.S. 1-3 Year Government Bond Index (the "Index"), which returned 3.14% during the reporting period.

10

Victory Fixed Income Funds

Victory INCORE Low Duration Bond Fund (continued)

Managers' Commentary (continued)

What strategies did you employ during the reporting period?

The Fund came into 2020 overweight agency mortgages and relatively light corporate credit exposure. During the late part of the first quarter and beginning part of the second quarter, during the worst of the market rout, we moved to a large overweight position in corporate credit. We maintained this corporate credit overweight as we ended the year. The Fund greatly benefited from this positioning during the year.

We believe that with yields on short- and intermediate-term U.S. Treasurys near historic lows, investors have no other reasonable alternative but to invest in high-quality corporate and consumer credit. We do not believe investors are receiving enough yield or duration benefit from owning U.S. Treasurys at current levels. As a result, we added a significant overweight to corporate credit at discounted valuations late in the first quarter and beginning part of the second quarter. We maintained this overweight at year-end and continue to selectively add high-grade corporates across the curve as opportunities present themselves. This positioning has been additive to performance over the year, helping the Fund outpace the Index for 2020.

As we enter a new year, we believe massive monetary and fiscal stimulus will continue to buoy markets as both the incoming Biden administration and the Fed seem interested in continuing the MMT experiment in the near term. However, it is likely to be a volatile and uncertain time as the long-term effects of MMT are unknown. The key attributes we strive for when positioning client portfolios for an uncertain outlook are quality, balance and diversification. We believe we are well positioned across our portfolios for this uncertain environment, and we believe being overweight credit and underweight duration versus the Index should be additive to performance as we enter the coming year.

11

Victory Fixed Income Funds

Victory INCORE Low Duration Bond Fund

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class R | | Class Y | | | |

INCEPTION DATE | | 7/30/03 | | 7/30/03 | | 7/30/03 | | 5/12/09 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Barclays U.S.

Government 1-3

Year Bond Index1 | |

One Year | | | 3.85 | % | | | 1.51 | % | | | 3.05 | % | | | 2.05 | % | | | 3.41 | % | | | 4.08 | % | | | 3.14 | % | |

Five Year | | | 2.26 | % | | | 1.80 | % | | | 1.48 | % | | | 1.48 | % | | | 1.85 | % | | | 2.50 | % | | | 1.92 | % | |

Ten Year | | | 1.72 | % | | | 1.49 | % | | | 0.95 | % | | | 0.95 | % | | | 1.31 | % | | | 1.96 | % | | | 1.32 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

Victory INCORE Low Duration Bond Fund — Growth of $10,000

1The Bloomberg Barclays U.S. Government 1-3 Year Bond Index is generally considered to be representative of U.S. government bonds with maturities between one and three years. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

12

Victory Fixed Income Funds

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

After a gut-wrenching plunge as the deadly novel coronavirus and the disease it causes ("COVID-19") emerged in the first quarter of 2020, markets surged as central banks and governments fought back with unprecedented stimulus measures that supported risk-taking in the markets.

High-yield investors were rewarded for taking a bungee jump through market turmoil — even if it required closed eyes and a primal scream. At the end of the first quarter, the Bloomberg Barclays U.S. Corporate High Yield Bond Index (the "Index") had returned -12.7%, a result not seen since the financial crisis in 2008. It ended the year as the strongest performer among the major domestic fixed-income indexes. The pivotal event came in late March 2020 when the U.S. Federal Reserve announced a massive bond-buying program that included corporate debt. Markets responded with a surge that often belied grim economic and public health realities.

How did Victory High Yield Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide current income. The Fund returned 7.61% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the Index, which returned 7.11% during the reporting period.

What strategies did you employ during the reporting period?

The Fund aims to provide higher levels of income and less sensitivity to interest rate changes than most fixed-income investments by investing primarily in U.S. corporate bonds rated below investment grade. The Fund may invest in other securities and in floating rate loans. It emphasizes in-depth research and a concentrated portfolio strategy.

The Fund's management team strongly believes that the potential cost of a passive or wide-net approach to high-yield investing has never been higher or more misunderstood. We view the high-yield market in three categories:

1) Bonds yielding less than 6%: 88% of the market

2) Bonds yielding 6% to 10%: 9% of the market

3) Bonds yielding more than 10%: 3% of the market

We believe the first category offers limited upside along with interest rate risk, while the third category, with an average interest rate of 23%, is excessively speculative. The second category, a narrow segment that we believe offers a reasonable balance of risk and opportunity, cannot be exploited with broadly diversified index-like portfolios.

In addition to keeping a tight focus, we seek to use rigorous research to continually pare overpriced risk from the portfolio and uncover the idiosyncratic opportunities that have benefited returns in the past.

Prior to the fourth quarter, we culled select holdings that we did not believe would survive intact once COVID-19 had run its course. And throughout the year, we resisted cruise lines,

13

Victory Fixed Income Funds

Victory High Yield Fund (continued)

Managers' Commentary (continued)

theater operators, and several leisure companies that we believed face significant headwinds. However, confidence in our research and high-conviction strategy led us to successfully maintain our higher-risk orientation.

Security selection was the dominant factor in the Fund's outperformance of the Index in 2020. Asset allocation had a negative impact on relative performance.

Not surprisingly, given the market's embrace of risk, the Fund's positive security selection in CCC-rated bonds was the top contributor to relative performance. Although the struggling energy sector rebounded strongly in the fourth quarter, the Fund's underweight there was an important contributor to its outperformance for the year. The largest detractors were an underweight in BB-rated bonds and an overweight in the CCC-rated cohort.

14

Victory Fixed Income Funds

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class R | | Class Y | | | |

INCEPTION DATE | | 9/1/98 | | 8/7/00 | | 5/15/01 | | 5/12/09 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Barclays U.S.

Corporate High

Yield Index1 | |

One Year | | | 7.61 | % | | | 5.26 | % | | | 6.68 | % | | | 5.68 | % | | | 7.24 | % | | | 7.73 | % | | | 7.11 | % | |

Five Year | | | 9.48 | % | | | 9.00 | % | | | 8.71 | % | | | 8.71 | % | | | 9.07 | % | | | 9.75 | % | | | 8.59 | % | |

Ten Year | | | 6.65 | % | | | 6.41 | % | | | 5.88 | % | | | 5.88 | % | | | 6.26 | % | | | 6.89 | % | | | 6.80 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

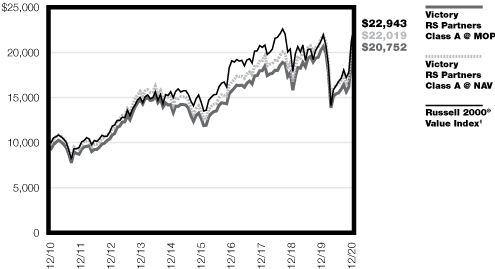

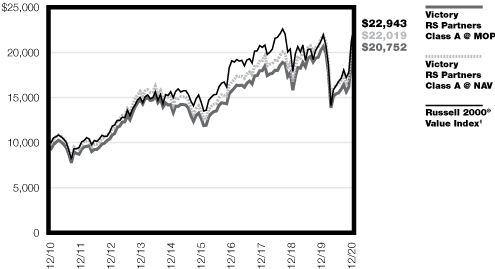

Victory High Yield Fund — Growth of $10,000

1The Bloomberg Barclays U.S. Corporate High Yield Index is generally considered to be representative of the investable universe of the U.S.-dominated high-yield debt market. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

15

Victory Fixed Income Funds

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

The municipal market had an eventful 2020. The year started off well, continuing the trend we saw in 2019, as strong investor demand translated into a return of over 3% for the broad municipal index (Bloomberg Barclays Municipal Bond Index (the "Index")) just two months into the year. However, the good times were short-lived, with a sharp selloff in March, induced by the outbreak of disease called COVID-19, pushing market returns to a low of -7.6% for the year. The market remained volatile through April before embarking on a several-month recovery that pushed index returns to over +4% in early August. This recovery was heavily driven by both actual and potential government intervention to include both fiscal and monetary stimulus. The recovery lagged in late Summer and early Autumn, likely due to investors grappling with uncertainty caused by the November U.S. presidential election, the lack of an additional round of stimulus for state and local governments, as well as rising COVID-19 cases. The market recovery continued post-election and municipal market returns were strong in November and December 2020.

How did Victory Tax-Exempt Fund (the "Fund") perform during the reporting period?

The Fund seeks to maximize current income exempt from federal income taxes, consistent with the preservation of capital. The Fund returned 5.39% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the Index, which returned 5.21% for the reporting period.

What strategies did you employ during the reporting period?

The Fund tends to be more credit-heavy than the Index, holding more BBB- rated (the lowest category of investment grade) bonds than the Index. We overweight these credits to provide additional tax-free income to our investors. These bonds tend to underperform in periods of market dislocation when credit spreads widen significantly. As a result, the Fund underperformed the Index during the market downturn in March and April 2020; however, the Fund outperformed as the year progressed and the market recovered. During the downturn, the Fund purchased additional lower rated bonds as yields were very attractive. These positions benefited the Fund during the ensuing recovery as well. Lastly, the Fund increased its number of holdings during the year to diversify its positions.

We remain committed to our core competency of evaluating, taking, and managing credit risk in the municipal market. We continue to build our portfolios bond-by-bond, relying on our assessment of fundamental credit risk and attempting to capture and distribute incremental yield that will drive higher long-term income to our investors. While there might be some volatility in the municipal market in the short term, we remain confident that the right approach is to focus on what matters in the long term.

16

Victory Fixed Income Funds

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class Y | | | |

INCEPTION DATE | | 2/16/93 | | 8/7/00 | | 5/12/09 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Bloomberg

Barclays

Municipal

Bond Index1 | |

One Year | | | 5.39 | % | | | 2.99 | % | | | 4.56 | % | | | 3.56 | % | | | 5.51 | % | | | 5.21 | % | |

Five Year | | | 4.20 | % | | | 3.73 | % | | | 3.37 | % | | | 3.37 | % | | | 4.34 | % | | | 3.91 | % | |

Ten Year | | | 4.50 | % | | | 4.26 | % | | | 3.67 | % | | | 3.67 | % | | | 4.62 | % | | | 4.63 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

Victory Tax-Exempt Fund — Growth of $10,000

1The Bloomberg Barclays Municipal Bond Index is generally considered to be representative of the municipal bond market. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

17

Victory Fixed Income Funds

Victory High Income Municipal Bond Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

The municipal market had an eventful 2020. The year started off well, continuing the trend we saw in 2019, as strong investor demand translated into a return of over 3% for the broad municipal index (Bloomberg Barclays Municipal Bond Index (the "Index")) just two months into the year. However, the good times were short-lived, with a sharp selloff in March, induced by the outbreak of disease called COVID-19, pushing market returns to a low of -7.6% for the year. The market remained volatile through April before embarking on a several-month recovery that pushed index returns to over +4% in early August. This recovery was heavily driven by both actual and potential government intervention to include both fiscal and monetary stimulus. The recovery lagged in late Summer and early Autumn, likely due to investors grappling with uncertainty caused by the November United States presidential election, the lack of an additional round of stimulus for state and local governments, as well as rising COVID-19 cases. The market recovery continued post-election and municipal market returns were strong in November and December 2020.

How did Victory High Income Municipal Bond Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide high current income exempt from federal income taxes, with a secondary objective of capital appreciation. The Fund returned 5.52% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the Index, which returned 5.21% during the reporting period.

What strategies did you employ during the reporting period?

The Fund tends to be more credit-heavy than the Index, holding more BBB-rated (the lowest category of investment grade) bonds than the benchmark. We overweight these credits to provide additional tax-free income to our investors. These bonds tend to underperform in periods of market dislocation when credit spreads widen significantly. As a result, the Fund underperformed the Index during the market downturn in March and April 2020; however, the Fund outperformed as the year progressed and the market recovered. During the downturn, the Fund purchased additional lower-rated bonds as yields were very attractive. These positions benefited the Fund during the ensuing recovery as well. Lastly, the Fund increased its number of holdings during the year to diversify its positions.

We remain committed to our core competency of evaluating, taking, and managing credit risk in the municipal market. We continue to build our portfolios bond-by-bond, relying on our assessment of fundamental credit risk and attempting to capture and distribute incremental yield that will drive higher long-term income to our investors. While there might be some volatility in the municipal market in the short term, we remain confident that the right approach is to focus on what matters in the long term.

18

Victory Fixed Income Funds

Victory High Income Municipal Bond Fund

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class Y | | Member Class | | | | | |

INCEPTION DATE | | 12/31/09 | | 12/31/09 | | 12/31/09 | | 11/3/20 | | | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Barclays

Municipal

Bond Index1 | | Bloomberg

Barclays High

Yield Municipal

Bond Index2 | |

One Year | | | 5.52 | % | | | 3.12 | % | | | 4.72 | % | | | 3.72 | % | | | 5.76 | % | | | N/A | | | | 5.21 | % | | | 4.89 | % | |

Five Year | | | 4.26 | % | | | 3.79 | % | | | 3.47 | % | | | 3.47 | % | | | 4.51 | % | | | N/A | | | | 3.91 | % | | | 6.56 | % | |

Ten Year | | | 5.28 | % | | | 5.04 | % | | | 4.49 | % | | | 4.49 | % | | | 5.52 | % | | | N/A | | | | 4.63 | % | | | 6.86 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 4.12 | % | | | N/A | | | | N/A | | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

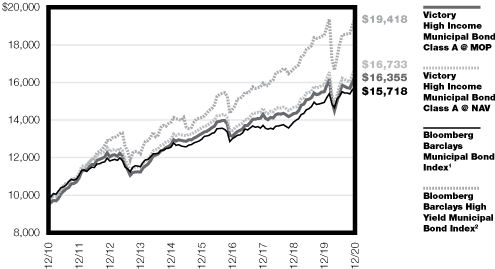

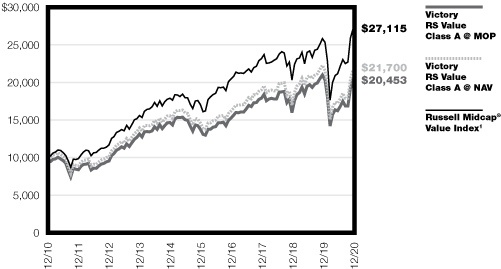

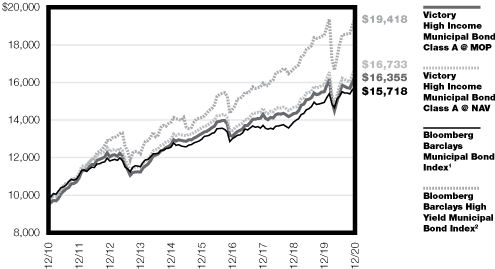

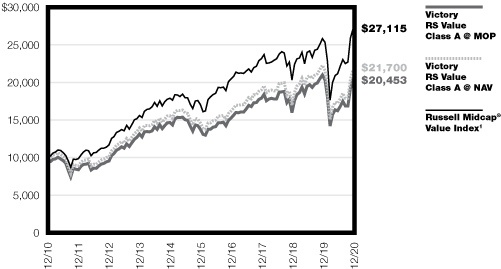

Victory High Income Municipal Bond Fund — Growth of $10,000

1The Bloomberg Barclays Municipal Bond Index is generally considered to be representative of the municipal bond market. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

2The Bloomberg Barclays High Yield Municipal Bond Index is generally considered to be representative of the investable universe of the U.S high-yield municipal debt market. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

19

Victory Fixed Income Funds

Victory Floating Rate Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

For most of 2020, securities markets seemed like the only things that were immune to the pandemic related to a novel coronavirus and the disease it causes ("COVID-19").

After a gut-wrenching plunge as the deadly virus emerged in the first quarter, equity and fixed-income markets surged as central banks and governments fought back with unprecedented stimulus measures that supported risk-taking in the markets. The risk-on sentiment grew stronger in the fourth quarter as optimism over a COVID-19 vaccine and an improving economic outlook brightened investors' expectations and drove stock indexes to record levels.

In fixed income, investors continued to seek higher income amid extremely low interest rates. In the below-investment-grade debt market, which includes floating rate loans, this resulted in tightening spreads and tough investor competition for new issues.

How did Victory Floating Rate Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide a high level of current income. The Fund returned 4.82% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the S&P/LSTA U.S. Leveraged Loan Index (the "Index"), which returned 3.12% during the reporting period.

What strategies did you employ during the reporting period?

In 2020, the Fund's outperformance of the Index reflected both positive security selection and effective asset allocation. The Fund's allocation to high-yield corporate bonds was the leading contributor as investors leaned into risk.

The largest contributors after bonds were an overweight and security selection in Health Care and security selection in the Air Freight and Logistics industry. The largest detractor was an underweight in Electronics. Security selection in the Aerospace and Defense industry also detracted, largely as a result of its negative impact in the first quarter.

The Fund's management team seeks to provide higher current income than most short-term investments available to retail investors, while also providing some protection from rising interest rates and inflation by investing primarily in floating-rate bank loans, whose rates adjust with market benchmarks. The Fund may also hold select bonds and other floating-rate investments of domestic or foreign issuers. The Fund's holdings are typically U.S.-based and below investment grade.

The investment team focuses on rigorous fundamental research that includes macroeconomic, company-specific and deal-specific factors.

In navigating investment challenges, the Fund follows a high-conviction strategy. It typically has 100 to 150 holdings, compared with some competitors that have several times that number. Concentration risks are mitigated by investing mostly in large, liquid loan deals and maintaining firm sell discipline. The Fund also maintains a mix of roughly 85% leveraged

20

Victory Fixed Income Funds

Victory Floating Rate Fund (continued)

Managers' Commentary (continued)

loans and 15% high yield bonds. The option of holding bonds offers liquidity and the flexibility to invest in the most attractive form of debt of companies the Fund's management team favors.

While we are optimistic about a solid economic recovery in 2021, we think there is a good chance that deficit spending and extremely easy monetary conditions could trigger inflationary trends. And while investors have been principally focused on defaults, downgrades, and other forms of credit risk, we believe that an equally serious and increasing risk has been all but dismissed: duration, or interest rate risk. Duration, a measure of a security's sensitivity to interest rate changes, is near an all-time high, meaning that big losses could be in store for many bondholders if rates rise. The adjustable rates of leveraged loans can provide some protection from rising rates.

21

Victory Fixed Income Funds

Victory Floating Rate Fund

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class R | | Class Y | | Member Class | | | |

INCEPTION DATE | | 12/31/09 | | 12/31/09 | | 12/31/09 | | 12/31/09 | | 11/3/20 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Net Asset

Value | | S&P/LSTA U.S.

Leveraged

Loan Index1 | |

One Year | | | 4.81 | % | | | 2.41 | % | | | 3.96 | % | | | 2.97 | % | | | 4.23 | % | | | 4.92 | % | | | N/A | | | | 3.12 | % | |

Five Year | | | 6.07 | % | | | 5.59 | % | | | 5.23 | % | | | 5.23 | % | | | 5.47 | % | | | 6.30 | % | | | N/A | | | | 5.24 | % | |

Ten Year | | | 4.16 | % | | | 3.92 | % | | | 3.35 | % | | | 3.35 | % | | | 3.61 | % | | | 4.38 | % | | | N/A | | | | 4.32 | % | |

Since Inception | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 4.30 | % | | | N/A | | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

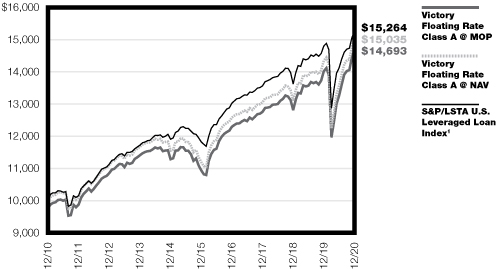

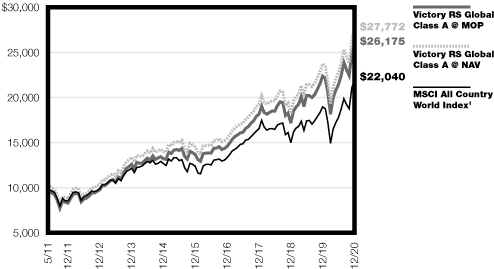

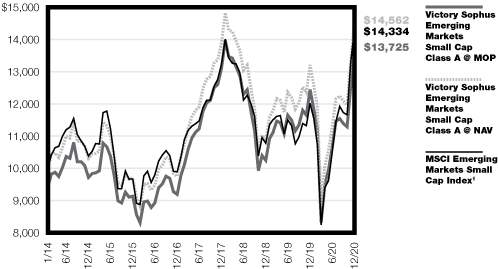

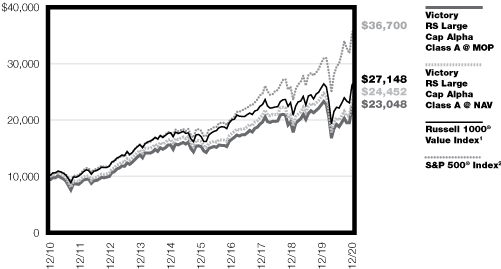

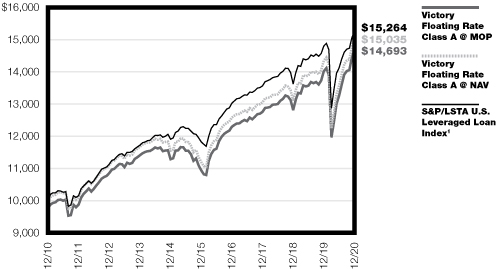

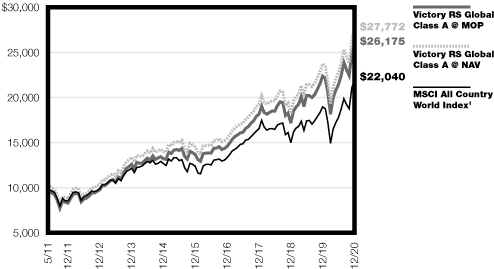

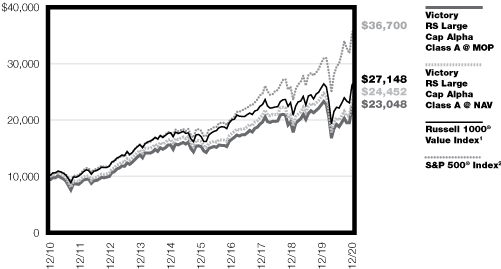

Victory Floating Rate Fund — Growth of $10,000

1The S&P/LSTA U.S. Leveraged Loan Index covers more than 1,100 loan facilities and reflects the market-value-weighted performance of U.S. dollar-denominated institutional leveraged loans. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

22

Victory Fixed Income Funds

Victory Strategic Income Fund

Managers' Commentary

(Unaudited)

What were the market conditions during the reporting period?

For most of 2020, securities markets seemed like the only things that were immune to the pandemic related to a novel coronavirus and the disease it causes (COVID-19).

After a gut-wrenching plunge as the deadly virus emerged in the first quarter, equity and fixed income markets surged even as the virus upended the global economy, killed nearly 2 million people worldwide, and threw tens of millions of people out of work.

Central banks and governments fought back with unprecedented stimulus measures that supported risk-taking in the markets. An almost willful optimism that prevailed in the markets after the first quarter gained strength late in the year as the first vaccines rolled out, a profoundly divisive U.S. election was decided, and the economic outlook, though still troubled, improved.

In fixed income, traditionally riskier assets outperformed. Investment-grade and high-yield corporate bonds led the charge, with the Bloomberg Barclays U.S. Corporate High Yield Bond Index returning 7.1% for the year. The 10-year Treasury returned 10.6%, while its yield dropped below 1.0% in the first quarter and remained there.

How did Victory Strategic Income Fund (the "Fund") perform during the reporting period?

The Fund seeks to provide high current income with a secondary objective of capital appreciation. The Fund returned 9.09% (Class A Shares at net asset value) for the year ended December 31, 2020, outperforming the Bloomberg Barclays U.S. Aggregate Bond Index (the "Index"), which returned 7.51% during the reporting period.

What strategies did you employ during the reporting period?

The investment team analyzes income and price appreciation potential based on credit fundamentals along with a broad market, economic, political, and regulatory risk assessment.

An overweight in corporate bonds has long been a mainstay of the Fund's strategy, and we added to the Fund's corporate holdings as the year progressed, both by increasing exposure to BBB-rated bonds and by reintroducing a small out-of-Index exposure to high-yield corporate debt. Accompanying these increases were reductions in U.S. Treasury holdings and corporate bonds rated AAA through A.

Corporate bonds outperformed sharply as market sentiment favored traditionally riskier sectors throughout much of the year. As a result, the Fund's substantial overweight in corporate bonds, including high-yield corporate debt, was the largest contributor to its performance relative to the Index. Overall security selection also contributed, while yield curve positioning detracted.

The Fund's overweight and positive security selection in BBB-rated corporate bonds with maturities of 3 to 10 years made them the largest single contributor to performance relative to the Index.

23

Victory Fixed Income Funds

Victory Strategic Income Fund (continued)

Managers' Commentary (continued)

Security selection in asset-backed securities was the largest detractor from relative performance. An out-of-Index allocation to credit default swaps early in the year also detracted, as did an overweight in BBB-rated corporate bonds with maturities greater than 25 years.

24

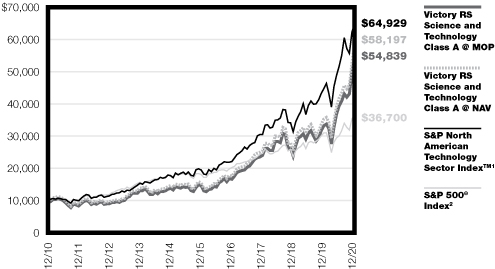

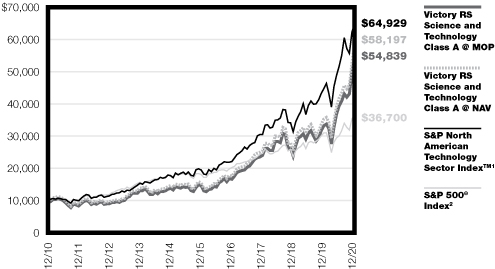

Victory Fixed Income Funds

Victory Strategic Income Fund

Investment Overview

(Unaudited)

Average Annual Total Returns

Year Ended December 31, 2020

| | Class A | | Class C | | Class R | | Class Y | | | |

INCEPTION DATE | | 12/31/09 | | 12/31/09 | | 12/31/09 | | 12/31/09 | | | |

| | Net Asset

Value | | Maximum

Offering

Price | | Net Asset

Value | | Contingent

Deferred

Charges | | Net Asset

Value | | Net Asset

Value | | Bloomberg

Barclays U.S.

Aggregate

Bond Index1 | |

One Year | | | 9.09 | % | | | 6.61 | % | | | 8.28 | % | | | 7.28 | % | | | 8.61 | % | | | 9.37 | % | | | 7.51 | % | |

Five Year | | | 5.72 | % | | | 5.25 | % | | | 4.90 | % | | | 4.90 | % | | | 5.30 | % | | | 5.96 | % | | | 4.44 | % | |

Ten Year | | | 4.44 | % | | | 4.20 | % | | | 3.63 | % | | | 3.63 | % | | | 4.02 | % | | | 4.66 | % | | | 3.84 | % | |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The maximum offering price (MOP) figures reflect a maximum sales charge of 2.25% for Class A Shares. Class C Shares are not subject to an initial sales charge, but are subject to a deferred sales charge of 1.00% on shares redeemed within one year of purchase. NAV does not reflect sales charges.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

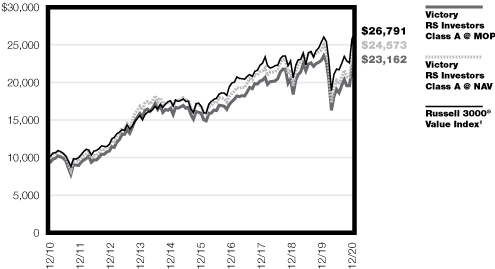

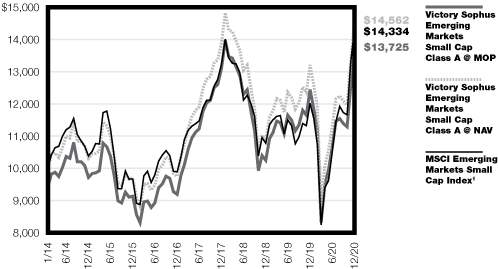

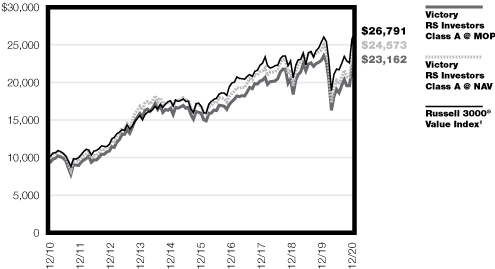

Victory Strategic Income Fund — Growth of $10,000

1The Bloomberg Barclays U.S. Aggregate Bond Index is generally considered to be representative of U.S. bond market activity. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future results.

25

Victory Fixed Income Funds

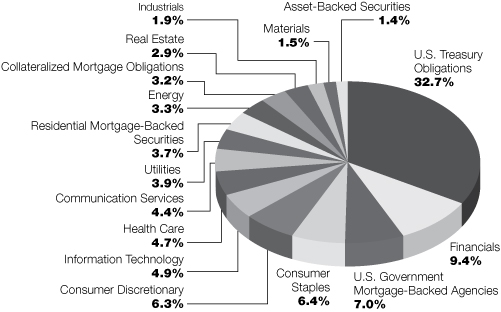

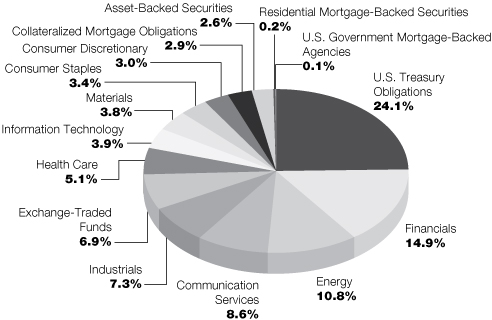

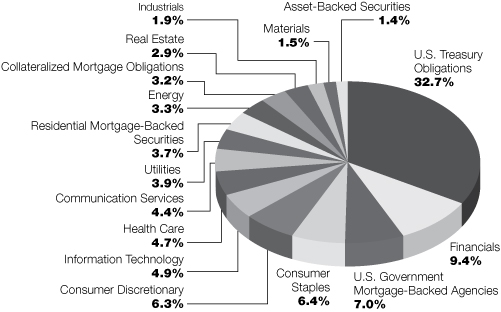

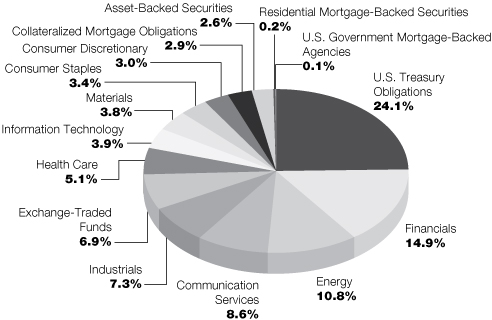

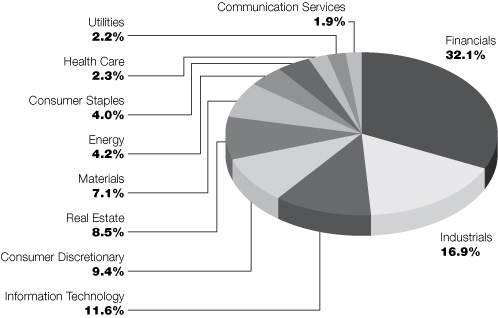

Victory INCORE Investment Quality Bond Fund | | December 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory INCORE Investment Quality Bond Fund seeks to provide a high level of current income and capital appreciation without undue risk to principal.

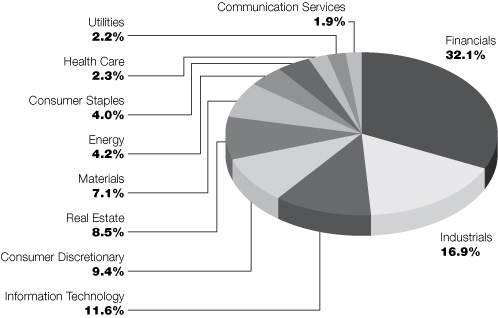

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

26

Victory Fixed Income Funds

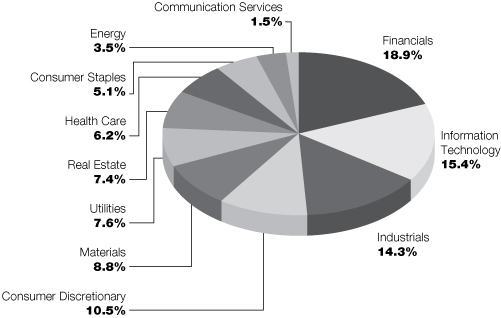

Victory INCORE Low Duration Bond Fund | | December 31, 2020 | |

(Unaudited)

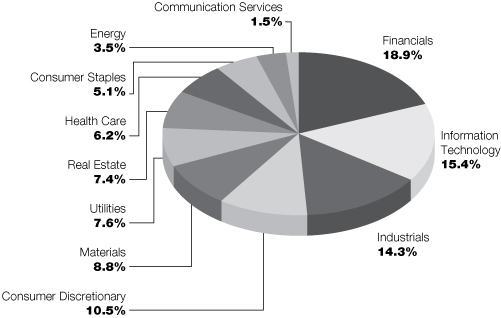

Investment Objective & Portfolio Holdings:

Victory INCORE Low Duration Bond Fund seeks to provide a high level of current income consistent with preservation of capital.

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

27

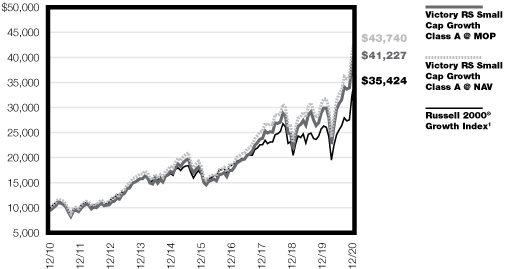

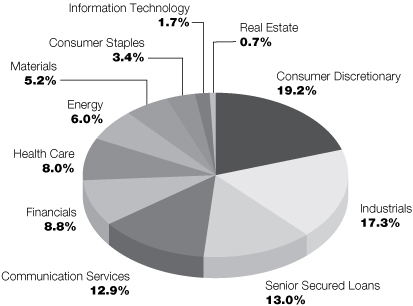

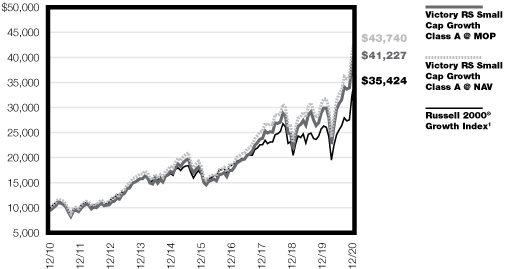

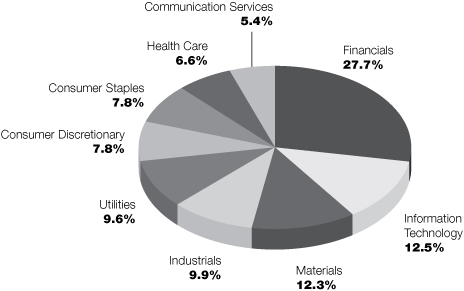

Victory Fixed Income Funds

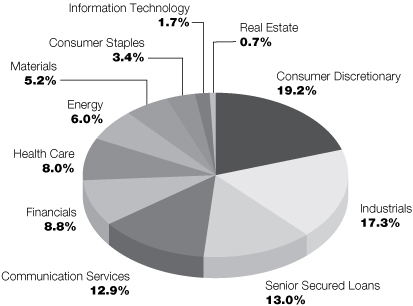

Victory High Yield Fund | | December 31, 2020 | |

(Unaudited)

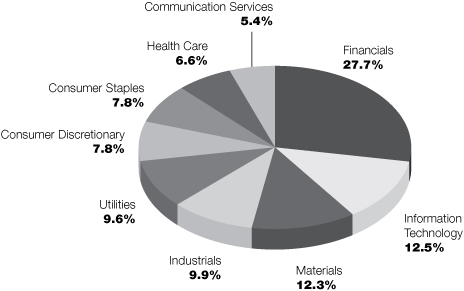

Investment Objective & Portfolio Holdings:

Victory High Yield Fund seeks to provide current income. Capital appreciation is a secondary objective.

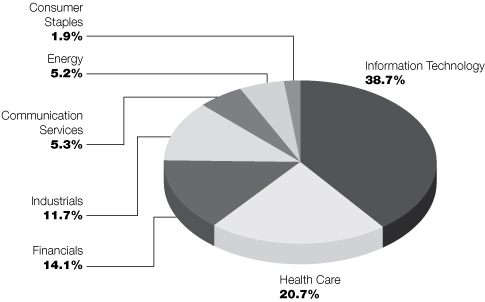

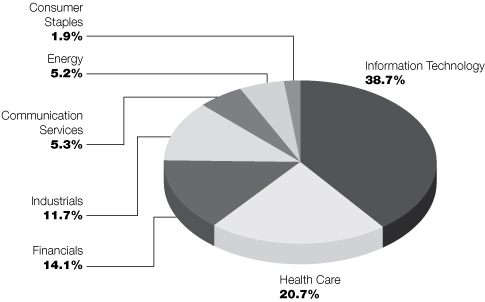

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

28

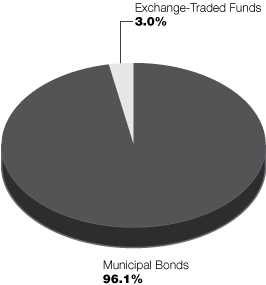

Victory Fixed Income Funds

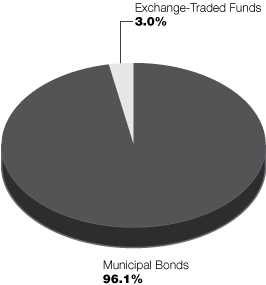

Victory Tax-Exempt Fund | | December 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory Tax-Exempt Fund seeks to maximize current income exempt from federal income taxes, consistent with the preservation of capital.

Portfolio Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

29

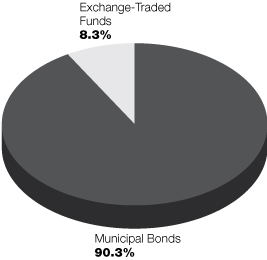

Victory Fixed Income Funds

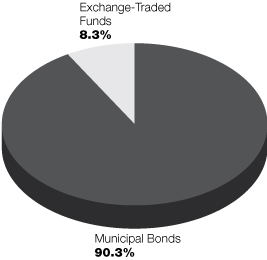

Victory High Income Municipal Bond Fund | | December 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory High Income Municipal Bond Fund seeks to provide a high current income exempt from federal income taxes with a secondary objective of capital appreciation.

Portfolio Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

30

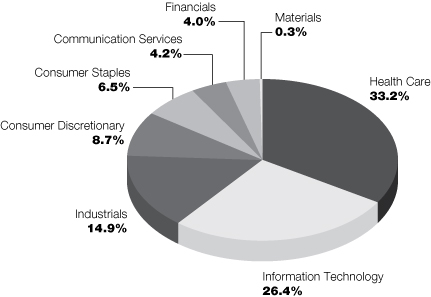

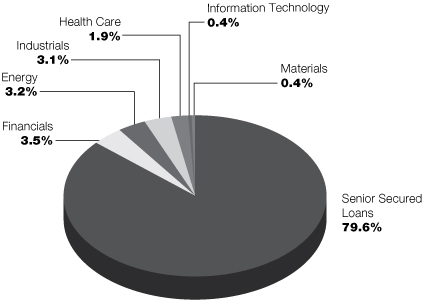

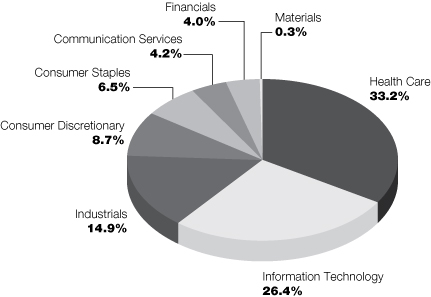

Victory Fixed Income Funds

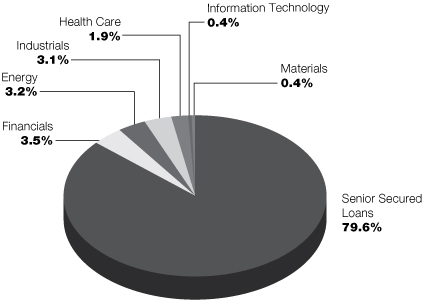

Victory Floating Rate Fund | | December 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory Floating Rate Fund seeks to provide a high level of current income.

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

31

Victory Fixed Income Funds

Victory Strategic Income Fund | | December 31, 2020 | |

(Unaudited)

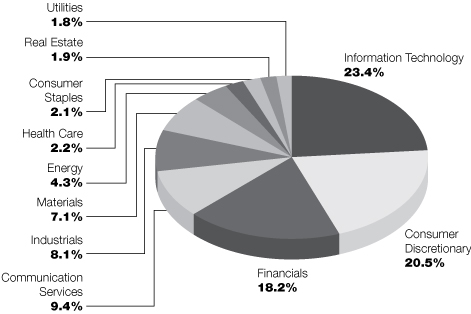

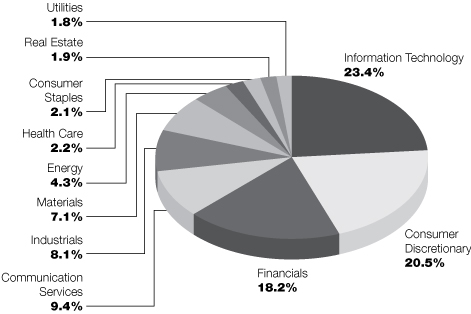

Investment Objective & Portfolio Holdings:

Victory Strategic Income Fund seeks to provide a high current income with a secondary objective of capital appreciation.

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

32

Victory Portfolios

Victory INCORE Investment Quality Bond Fund | | Schedule of Portfolio Investments

December 31, 2020 | |

Security Description | | Shares or

Principal

Amount | | Value | |

Asset-Backed Securities (0.6%) | |

Santander Drive Auto Receivables Trust, Series 2020-1, Class A2A, 2.07%,

1/17/23, Callable 8/15/23 @ 100 (a) | | $ | 36,336 | | | $ | 36,497 | | |

Synchrony Credit Card Master Note Trust, Series 2018-1, Class A, 2.97%,

3/15/24 | | | 130,000 | | | | 130,660 | | |

Total Asset-Backed Securities (Cost $166,700) | | | 167,157 | | |

Collateralized Mortgage Obligations (0.9%) | |

Bank, Series 2020-BN26, Class AS, 2.69%, 3/15/63, Callable 3/15/30 @ 100 | | | 130,000 | | | | 139,671 | | |

Citigroup Commercial Mortgage Trust, Series 2020-GC46, Class AS, 2.92%,

2/15/53 | | | 117,000 | | | | 128,343 | | |

Total Collateralized Mortgage Obligations (Cost $254,308) | | | 268,014 | | |

Preferred Stocks (2.0%) | |

Financials (0.7%): | |

AMG Capital Trust II, 10/15/37, 5.15% | | | 255 | | | | 12,376 | | |

Bank of America Corp., Series L, 7.25% (b) | | | 45 | | | | 68,336 | | |

KKR & Co., Inc., Series C, 9/15/23, 6.00% | | | 865 | | | | 52,143 | | |

Wells Fargo & Co., Series L, 7.50% (b) | | | 50 | | | | 75,895 | | |

| | | | 208,750 | | |

Health Care (0.2%): | |

Danaher Corp., Series B, 4/15/23, 5.00% (d) | | | 42 | | | | 54,646 | | |

Industrials (0.2%): | |

Stanley Black & Decker, Inc., 11/15/22, 5.25% | | | 635 | | | | 71,018 | | |

Utilities (0.9%): | |

American Electric Power Co., Inc., 8/15/23, 6.13% | | | 230 | | | | 11,645 | | |

CenterPoint Energy, Inc., 4.57%, 9/15/29 (g) | | | 455 | | | | 28,183 | | |

Dominion Energy, Inc., Series A, 6/1/22, 7.25% | | | 680 | | | | 68,224 | | |

DTE Energy Co., 11/1/22, 6.25% | | | 906 | | | | 43,615 | | |

NextEra Energy, Inc., 3/1/23, 5.28% | | | 1,190 | | | | 60,500 | | |

The Southern Co., Series 2019, 8/1/22, 6.75% | | | 1,057 | | | | 54,858 | | |

| | | 267,025 | | |

Total Preferred Stocks (Cost $584,456) | | | 601,439 | | |

Corporate Bonds (54.5%) | |

Communication Services (2.5%): | |

Alphabet, Inc., 2.05%, 8/15/50, Callable 2/15/50 @ 100 | | | 80,000 | | | | 76,253 | | |

AT&T, Inc.

4.25%, 3/1/27, Callable 12/1/26 @ 100 (a) | | | 76,000 | | | | 88,799 | | |

1.65%, 2/1/28, Callable 12/1/27 @ 100 (d) | | | 51,000 | | | | 52,127 | | |

5.15%, 11/15/46, Callable 5/15/46 @ 100 (a) | | | 126,000 | | | | 162,726 | | |

CenturyLink, Inc., 6.75%, 12/1/23 | | | 50,000 | | | | 55,641 | | |

Comcast Corp.

3.45%, 2/1/50, Callable 8/1/49 @ 100 | | | 70,000 | | | | 82,231 | | |

2.80%, 1/15/51, Callable 7/15/50 @ 100 | | | 56,000 | | | | 58,326 | | |

See notes to financial statements.

33

Victory Portfolios

Victory INCORE Investment Quality Bond Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

Security Description | | Principal

Amount | | Value | |

Sirius XM Radio, Inc., 4.13%, 7/1/30, Callable 7/1/25 @ 102.06 (e) | | $ | 62,000 | | | $ | 65,988 | | |

Verizon Communications, Inc.

5.15%, 9/15/23 (a) | | | 60,000 | | | | 67,627 | | |

3.38%, 2/15/25 (a) | | | 38,000 | | | | 42,196 | | |

| | | | 751,914 | | |

Consumer Discretionary (5.9%): | |

Booking Holdings, Inc.

0.90%, 9/15/21 | | | 10,000 | | | | 11,590 | | |

0.75%, 5/1/25 (d) (e) | | | 45,000 | | | | 65,376 | | |

D.R. Horton, Inc., 2.50%, 10/15/24, Callable 9/15/24 @ 100 | | | 315,000 | | | | 336,171 | | |

Dana, Inc., 5.63%, 6/15/28, Callable 6/15/23 @ 102.81 | | | 48,000 | | | | 51,740 | | |

Expedia Group, Inc., 3.60%, 12/15/23, Callable 11/15/23 @ 100 (e) | | | 87,000 | | | | 92,860 | | |

General Motors Co., 4.88%, 10/2/23 (a) | | | 96,000 | | | | 106,578 | | |

Hasbro, Inc., 2.60%, 11/19/22 | | | 130,000 | | | | 134,728 | | |

Hilton Domestic Operating Co., Inc., 4.88%, 1/15/30, Callable 1/15/25 @ 102.44 | | | 48,000 | | | | 52,655 | | |

Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp., 4.88%, 4/1/27,

Callable 4/1/22 @ 102.44 | | | 55,000 | | | | 58,145 | | |

Lear Corp., 3.50%, 5/30/30, Callable 2/28/30 @ 100 | | | 52,000 | | | | 56,818 | | |

Lennar Corp., 5.00%, 6/15/27, Callable 12/15/26 @ 100 | | | 93,000 | | | | 109,716 | | |

Marriott International, Inc., 3.60%, 4/15/24, Callable 3/15/24 @ 100 | | | 142,000 | | | | 151,820 | | |

NIKE, Inc., 3.88%, 11/1/45, Callable 5/1/45 @ 100 | | | 100,000 | | | | 129,689 | | |

NVR, Inc.

3.95%, 9/15/22, Callable 6/15/22 @ 100 (a) | | | 126,000 | | | | 132,534 | | |

3.00%, 5/15/30, Callable 11/15/29 @ 100 | | | 118,000 | | | | 128,659 | | |

Ross Stores, Inc.

3.38%, 9/15/24, Callable 6/15/24 @ 100 | | | 70,000 | | | | 75,152 | | |

0.88%, 4/15/26, Callable 3/15/26 @ 100 | | | 82,000 | | | | 81,907 | | |

| | | | 1,776,138 | | |

Consumer Staples (3.1%): | |

Altria Group, Inc., 4.40%, 2/14/26, Callable 12/14/25 @ 100 (a) | | | 64,000 | | | | 74,243 | | |

BAT Capital Corp., 5.28%, 4/2/50, Callable 10/2/49 @ 100 | | | 75,000 | | | | 92,521 | | |

Church & Dwight Co., Inc., 2.45%, 8/1/22, Callable 7/1/22 @ 100 (a) | | | 30,000 | | | | 30,891 | | |

Estee Lauder Cos., Inc., 4.15%, 3/15/47, Callable 9/15/46 @ 100 | | | 52,000 | | | | 68,539 | | |

Hormel Foods Corp., 1.80%, 6/11/30, Callable 3/11/30 @ 100 | | | 160,000 | | | | 165,429 | | |

Keurig Dr Pepper, Inc., 4.06%, 5/25/23, Callable 4/25/23 @ 100 (a) | | | 160,000 | | | | 173,870 | | |

Molson Coors Beverage Co., 4.20%, 7/15/46, Callable 1/15/46 @ 100 | | | 42,000 | | | | 48,051 | | |

Reynolds American, Inc., 5.70%, 8/15/35, Callable 2/15/35 @ 100 | | | 92,000 | | | | 116,746 | | |

The Coca-Cola Co., 2.95%, 3/25/25 | | | 117,000 | | | | 129,015 | | |

Tyson Foods, Inc., 5.10%, 9/28/48, Callable 3/28/48 @ 100 | | | 39,000 | | | | 55,834 | | |

| | | | 955,139 | | |

Energy (4.1%): | |

Chevron USA, Inc., 1.02%, 8/12/27, Callable 6/12/27 @ 100 | | | 140,000 | | | | 140,198 | | |

Continental Resources, Inc., 4.50%, 4/15/23, Callable 1/15/23 @ 100 (a) | | | 113,000 | | | | 116,453 | | |

EOG Resources, Inc., 4.95%, 4/15/50, Callable 10/15/49 @ 100 | | | 65,000 | | | | 88,270 | | |

EQM Midstream Partners LP, 4.75%, 7/15/23, Callable 6/15/23 @ 100 (a) | | | 113,000 | | | | 118,558 | | |

HollyFrontier Corp., 2.63%, 10/1/23 | | | 116,000 | | | | 118,566 | | |

Phillips 66 Partners LP, 4.90%, 10/1/46, Callable 4/1/46 @ 100 | | | 90,000 | | | | 101,183 | | |

See notes to financial statements.

34

Victory Portfolios

Victory INCORE Investment Quality Bond Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

Security Description | | Principal

Amount | | Value | |

Pioneer Natural Resources Co.

0.25%, 5/15/25 (d) (e) | | $ | 50,000 | | | $ | 66,434 | | |

1.90%, 8/15/30, Callable 5/15/30 @ 100 | | | 109,000 | | | | 108,060 | | |

Plains All American Pipeline LP/PAA Finance Corp., 2.85%, 1/31/23,

Callable 10/31/22 @ 100 (a) | | | 120,000 | | | | 124,005 | | |

Valero Energy Corp.

4.00%, 4/1/29, Callable 1/1/29 @ 100 (a) | | | 62,000 | | | | 69,771 | | |

6.63%, 6/15/37 | | | 140,000 | | | | 185,662 | | |

| | | | 1,237,160 | | |

Financials (14.0%): | |

Aflac, Inc.

2.88%, 10/15/26, Callable 7/15/26 @ 100 | | | 185,000 | | | | 204,573 | | |

4.75%, 1/15/49, Callable 7/15/48 @ 100 | | | 20,000 | | | | 27,908 | | |

Alleghany Corp.

3.63%, 5/15/30, Callable 2/15/30 @ 100 | | | 55,000 | | | | 62,249 | | |

4.90%, 9/15/44, Callable 3/15/44 @ 100 | | | 89,000 | | | | 114,798 | | |

Ares Capital Corp., 4.63%, 3/1/24 | | | 70,000 | | | | 73,676 | | |

Bank of America Corp.

2.50%, 10/21/22, Callable 10/21/21 @ 100, MTN | | | 285,000 | | | | 290,114 | | |

4.20%, 8/26/24, MTN (a) | | | 51,000 | | | | 57,159 | | |

3.25%, 10/21/27, Callable 10/21/26 @ 100, MTN | | | 100,000 | | | | 111,987 | | |

Capital One Financial Corp., 3.30%, 10/30/24, Callable 9/30/24 @ 100 (a) | | | 72,000 | | | | 79,135 | | |

Cincinnati Financial Corp., 6.13%, 11/1/34 | | | 100,000 | | | | 139,770 | | |

Citigroup, Inc.

2.75%, 4/25/22, Callable 3/25/22 @ 100 | | | 175,000 | | | | 180,192 | | |

3.88%, 3/26/25 | | | 35,000 | | | | 39,184 | | |

4.60%, 3/9/26 (a) | | | 36,000 | | | | 42,219 | | |

4.45%, 9/29/27 (a) | | | 63,000 | | | | 74,409 | | |

3.88% (LIBOR03M+117bps), 1/24/39, Callable 1/24/38 @ 100 (f) | | | 51,000 | | | | 61,053 | | |

Fifth Third Bancorp

1.63%, 5/5/23, Callable 4/5/23 @ 100 | | | 55,000 | | | | 56,594 | | |

3.65%, 1/25/24, Callable 12/25/23 @ 100 (a) | | | 261,000 | | | | 284,598 | | |

Ford Motor Credit Co. LLC, 4.06%, 11/1/24, Callable 10/1/24 @ 100 | | | 200,000 | | | | 209,894 | | |

General Motors Financial Co., Inc., 4.15%, 6/19/23, Callable 5/19/23 @ 100 | | | 49,000 | | | | 52,765 | | |

Globe Life, Inc., 2.15%, 8/15/30, Callable 5/15/30 @ 100 | | | 110,000 | | | | 111,716 | | |

JPMorgan Chase & Co.

2.95%, 10/1/26, Callable 7/1/26 @ 100 | | | 170,000 | | | | 188,746 | | |

5.60%, 7/15/41 | | | 52,000 | | | | 78,306 | | |

Morgan Stanley

4.88%, 11/1/22 (a) | | | 144,000 | | | | 155,228 | | |

3.75%, 2/25/23 (a) | | | 300,000 | | | | 321,584 | | |

3.13%, 7/27/26, MTN | | | 305,000 | | | | 340,968 | | |

Sixth Street Specialty Lending, Inc., 4.50%, 8/1/22 | | | 50,000 | | | | 53,927 | | |

SVB Financial Group, 3.13%, 6/5/30, Callable 3/5/30 @ 100 | | | 164,000 | | | | 184,708 | | |

Truist Financial Corp., 2.75%, 4/1/22, MTN, Callable 3/1/22 @ 100 | | | 260,000 | | | | 267,407 | | |

Unum Group, 4.00%, 6/15/29, Callable 3/15/29 @ 100 | | | 92,000 | | | | 103,629 | | |

See notes to financial statements.

35

Victory Portfolios

Victory INCORE Investment Quality Bond Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

Security Description | | Principal

Amount | | Value | |

Wells Fargo & Co.

4.30%, 7/22/27, MTN | | $ | 180,000 | | | $ | 211,090 | | |

4.90%, 11/17/45 (a) | | | 80,000 | | | | 106,483 | | |

| | | | 4,286,069 | | |

Health Care (5.8%): | |

AbbVie, Inc.

3.20%, 11/21/29, Callable 8/21/29 @ 100 | | | 135,000 | | | | 152,064 | | |

4.45%, 5/14/46, Callable 11/14/45 @ 100 | | | 62,000 | | | | 78,924 | | |

Amgen, Inc., 4.40%, 5/1/45, Callable 11/1/44 @ 100 | | | 70,000 | | | | 88,563 | | |

Anthem, Inc.

2.38%, 1/15/25, Callable 12/15/24 @ 100 | | | 65,000 | | | | 69,473 | | |

2.75%, 10/15/42 | | | 15,000 | | | | 67,199 | | |

Baxter International, Inc., 3.50%, 8/15/46, Callable 2/15/46 @ 100 | | | 48,000 | | | | 54,695 | | |

Bristol-Myers Squibb Co., 3.40%, 7/26/29, Callable 4/26/29 @ 100 | | | 220,000 | | | | 255,744 | | |

Centene Corp., 4.25%, 12/15/27, Callable 12/15/22 @ 102.13 | | | 73,000 | | | | 77,698 | | |

Gilead Sciences, Inc., 4.40%, 12/1/21, Callable 9/1/21 @ 100 (a) | | | 318,000 | | | | 326,443 | | |

HCA, Inc., 4.13%, 6/15/29, Callable 3/15/29 @ 100 | | | 91,000 | | | | 105,645 | | |

Hologic, Inc., 3.25%, 2/15/29, Callable 9/28/23 @ 101.63 (e) | | | 114,000 | | | | 116,294 | | |

Humana, Inc., 2.90%, 12/15/22, Callable 11/15/22 @ 100 (a) | | | 65,000 | | | | 67,961 | | |

Illumina, Inc.

0.50%, 6/15/21 | | | 30,000 | | | | 43,841 | | |

8/15/23 (j) | | | 25,000 | | | | 28,178 | | |

Merck & Co., Inc., 2.45%, 6/24/50, Callable 12/24/49 @ 100 | | | 59,000 | | | | 61,109 | | |

Regeneron Pharmaceuticals, Inc., 2.80%, 9/15/50, Callable 3/15/50 @ 100 | | | 63,000 | | | | 61,011 | | |

Teladoc Health, Inc., 1.25%, 6/1/27 (e) | | | 25,000 | | | | 29,943 | | |

Universal Health Services, Inc., 2.65%, 10/15/30, Callable 7/15/30 @ 100 (e) | | | 44,000 | | | | 45,700 | | |

Upjohn, Inc., 2.30%, 6/22/27, Callable 4/22/27 @ 100 (e) | | | 40,000 | | | | 42,480 | | |

| | | | 1,772,965 | | |

Industrials (5.2%): | |

Acuity Brands Lighting, Inc., 2.15%, 12/15/30, Callable 9/15/30 @ 100 | | | 105,000 | | | | 106,508 | | |