UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04852

Victory Portfolios

(Exact name of registrant as specified in charter)

4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio 44144

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1. Reports to Stockholders.

June 30, 2022

Semi Annual Report

Victory RS Partners Fund

Victory RS Value Fund

Victory RS Large Cap Alpha Fund

Victory RS Investors Fund

Victory Global Energy Transition Fund

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Capital website gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

TABLE OF CONTENTS

Investment Objective and Portfolio

Holdings | | | 3 | | |

Schedules of Portfolio Investments | |

Victory RS Partners Fund | | | 8 | | |

Victory RS Value Fund | | | 11 | | |

Victory RS Large Cap Alpha Fund | | | 14 | | |

Victory RS Investors Fund | | | 16 | | |

Victory Global Energy Transition Fund | | | 18 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 20 | | |

Statements of Operations | | | 22 | | |

Statements of Changes in Net Assets | | | 24 | | |

Financial Highlights | | | 30 | | |

Notes to Financial Statements | | | 40 | | |

Supplemental Information | | | 51 | | |

Proxy Voting and Portfolio Holdings Information | | | 51 | | |

Expense Examples | | | 51 | | |

Liquidity Risk Management Program | | | 53 | | |

Privacy Policy (inside back cover) | | | |

1

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call 800-539-3863 (800-235-8396 for Member Class) and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

The Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at vcm.com or call 800-539-3863 (800-235-8396 for Member Class). Read it carefully before you invest or send money.

The information in this report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

800-235-8396 for Member Class

Visit our website at:

www.vcm.com

2

Victory Portfolios

Victory RS Partners Fund | | June 30, 2022 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long-term capital appreciation.

Top 10 Holdings*:

June 30, 2022

(% of Net Assets)

White Mountains Insurance Group Ltd. | | | 4.0 | % | |

Equity Commonwealth | | | 3.8 | % | |

Kemper Corp. | | | 3.4 | % | |

Four Corners Property Trust, Inc. | | | 3.1 | % | |

Federated Hermes, Inc. | | | 3.0 | % | |

Globe Life, Inc. | | | 3.0 | % | |

Graphic Packaging Holding Co. | | | 2.9 | % | |

Eastern Bankshares, Inc. | | | 2.8 | % | |

NCR Corp. | | | 2.6 | % | |

Halozyme Therapeutics, Inc. | | | 2.6 | % | |

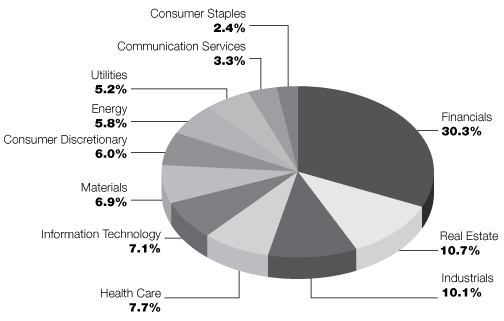

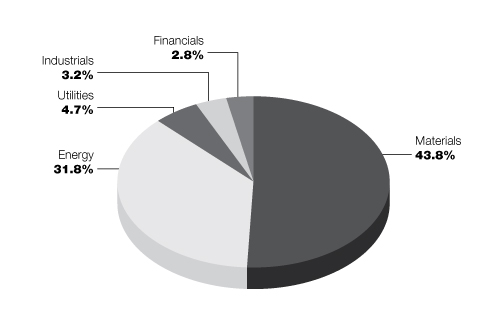

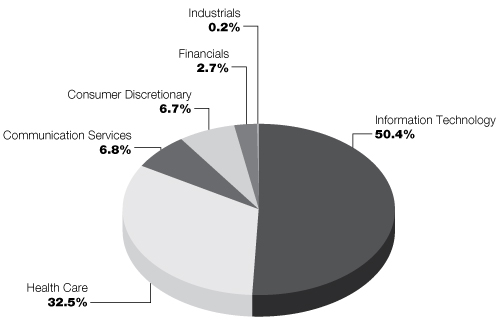

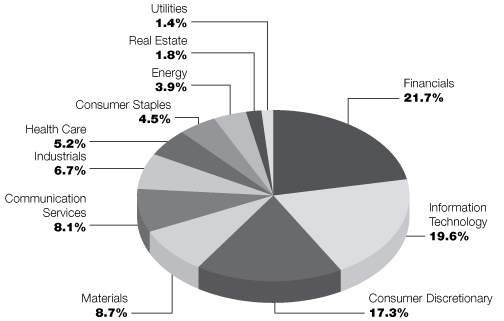

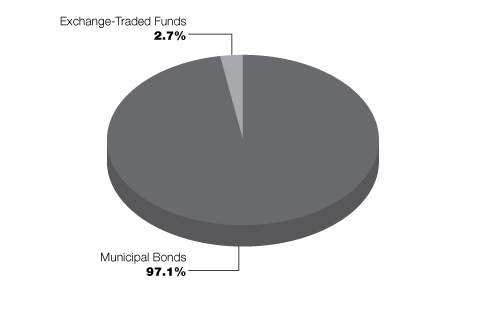

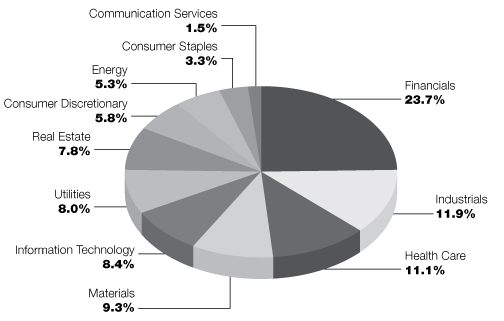

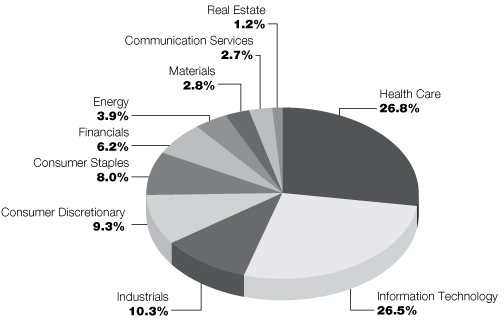

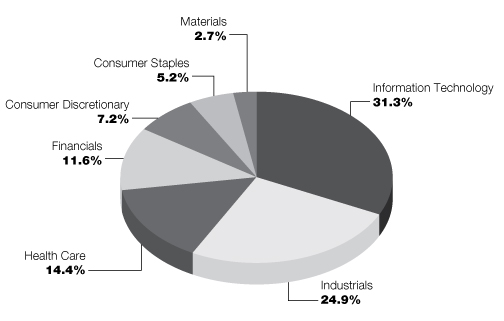

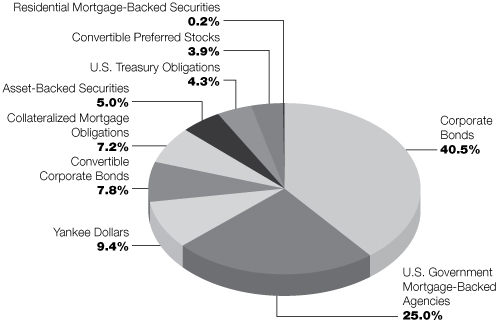

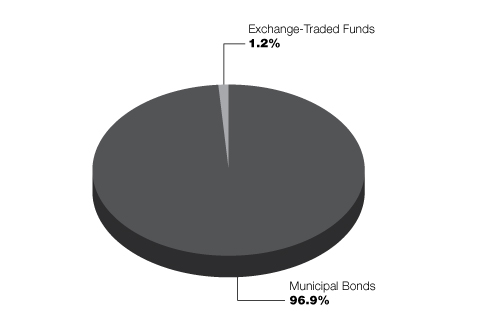

Sector Allocation*:

June 30, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

3

Victory Portfolios

Victory RS Value Fund | | June 30, 2022 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long-term capital appreciation.

Top 10 Holdings*:

June 30, 2022

(% of Net Assets)

Fairfax Financial Holdings Ltd. | | | 3.8 | % | |

Globe Life, Inc. | | | 3.7 | % | |

Equity Commonwealth | | | 3.7 | % | |

Vistra Corp. | | | 3.4 | % | |

The Progressive Corp. | | | 3.4 | % | |

Humana, Inc. | | | 2.9 | % | |

LKQ Corp. | | | 2.8 | % | |

Federated Hermes, Inc. | | | 2.8 | % | |

Graphic Packaging Holding Co. | | | 2.7 | % | |

Sotera Health Co. | | | 2.7 | % | |

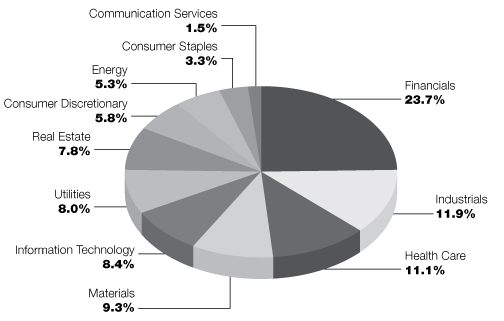

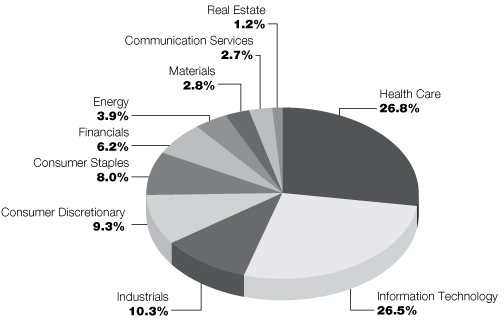

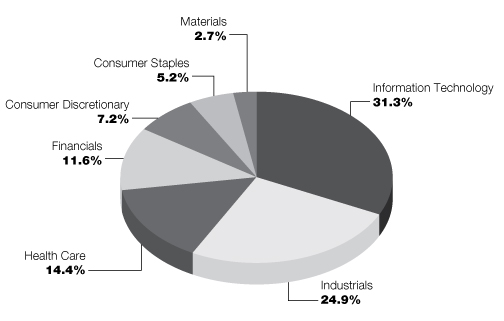

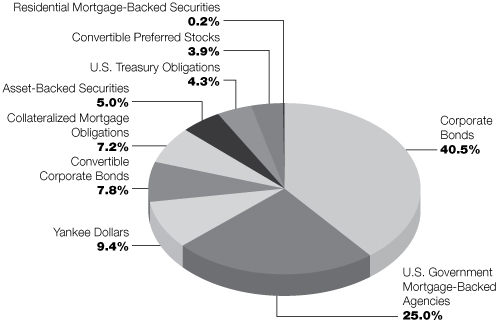

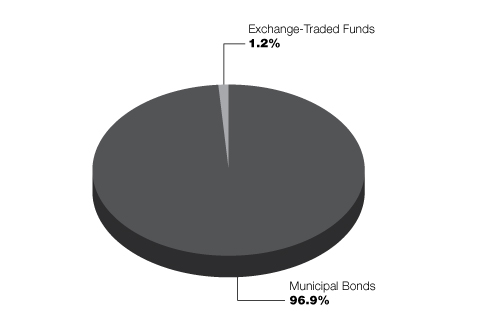

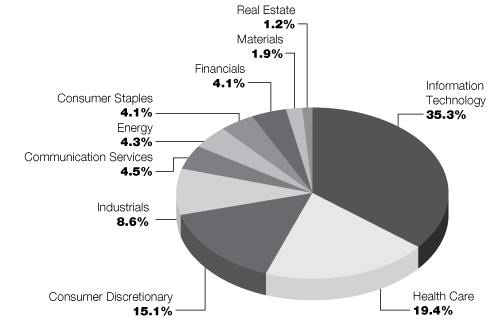

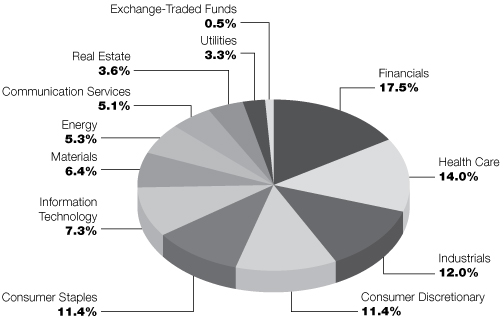

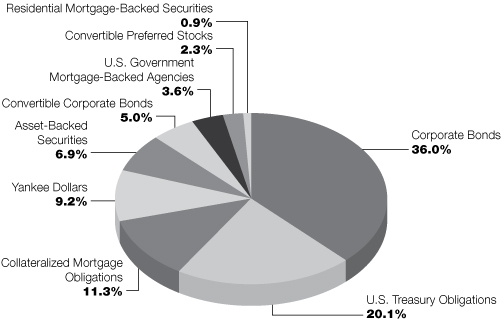

Sector Allocation*:

June 30, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

4

Victory Portfolios

Victory RS Large Cap Alpha Fund | | June 30, 2022 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long-term capital appreciation.

Top 10 Holdings*:

June 30, 2022

(% of Net Assets)

Fairfax Financial Holdings Ltd. | | | 4.7 | % | |

The Progressive Corp. | | | 4.7 | % | |

Humana, Inc. | | | 4.2 | % | |

Vistra Corp. | | | 3.6 | % | |

Cigna Corp. | | | 3.4 | % | |

Cboe Global Markets, Inc. | | | 3.1 | % | |

Comerica, Inc. | | | 2.9 | % | |

Willis Towers Watson PLC | | | 2.8 | % | |

Medtronic PLC | | | 2.8 | % | |

LKQ Corp. | | | 2.8 | % | |

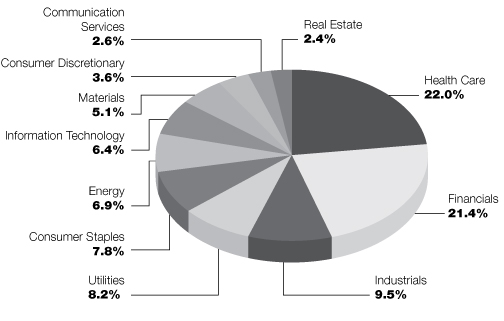

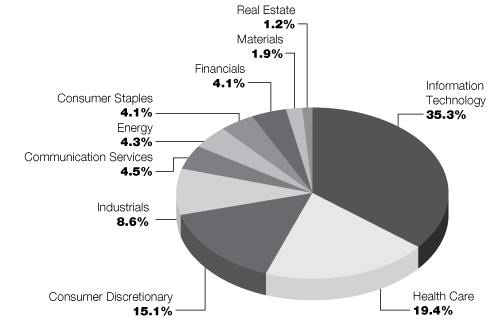

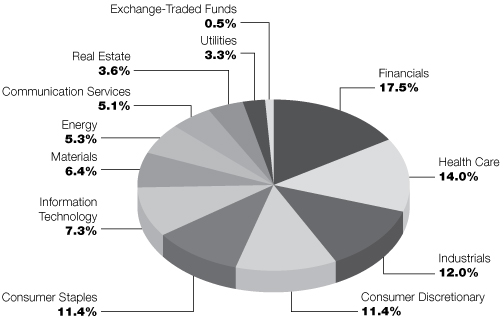

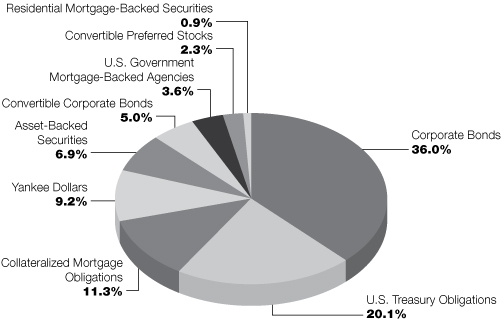

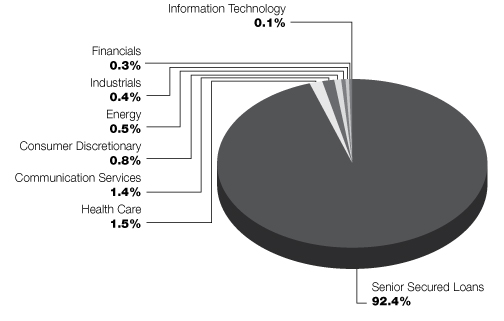

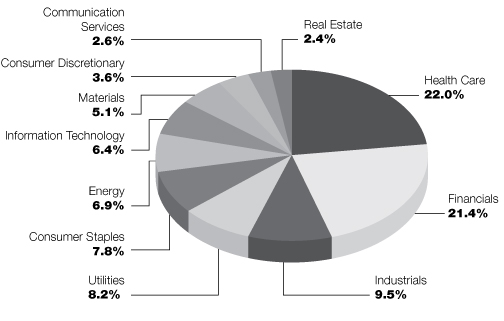

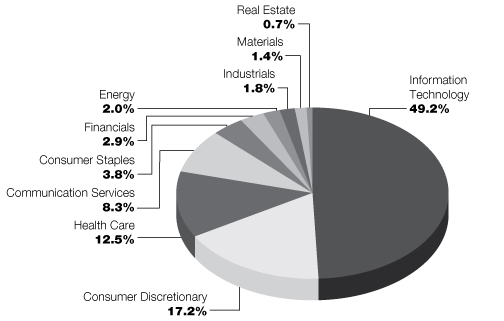

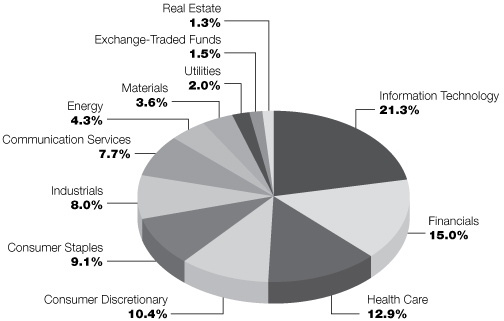

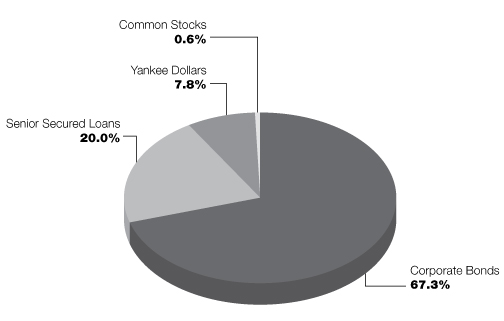

Sector Allocation*:

June 30, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

5

Victory Portfolios

Victory RS Investors Fund | | June 30, 2022 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long-term capital appreciation.

Top 10 Holdings*:

June 30, 2022

(% of Net Assets)

Fairfax Financial Holdings Ltd. | | | 6.2 | % | |

Alleghany Corp. | | | 4.8 | % | |

White Mountains Insurance Group Ltd. | | | 4.7 | % | |

Humana, Inc. | | | 4.2 | % | |

Cboe Global Markets, Inc. | | | 4.0 | % | |

Vistra Corp. | | | 4.0 | % | |

Willis Towers Watson PLC | | | 3.9 | % | |

Graphic Packaging Holding Co. | | | 3.9 | % | |

The Progressive Corp. | | | 3.7 | % | |

Federated Hermes, Inc. | | | 3.1 | % | |

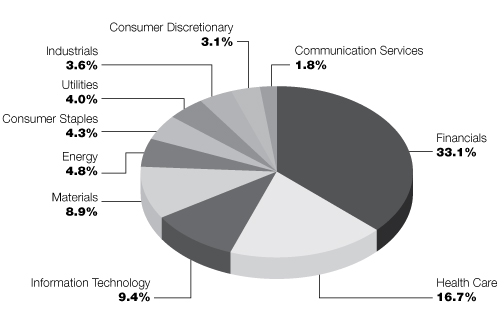

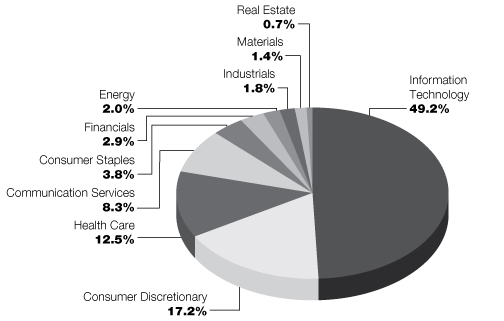

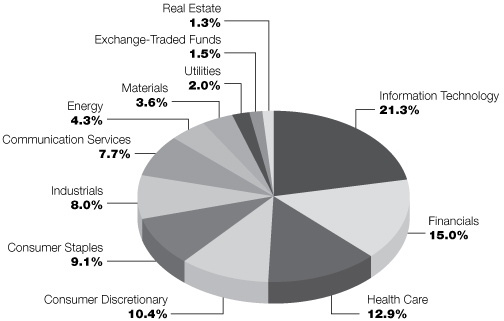

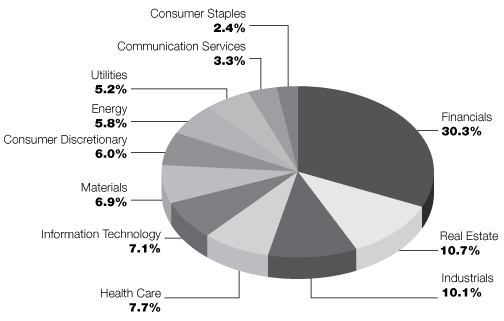

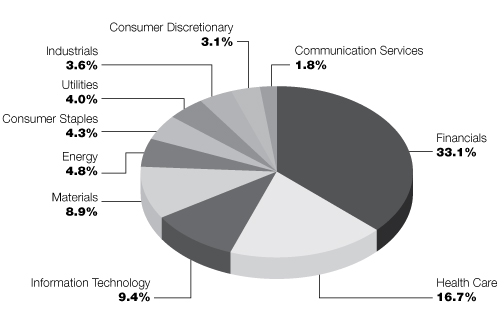

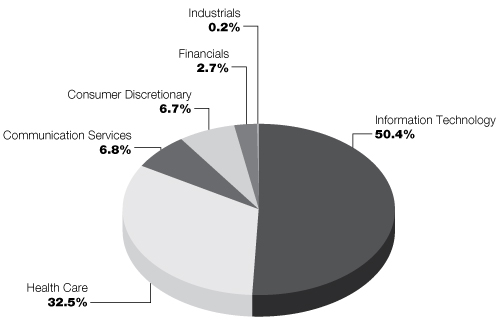

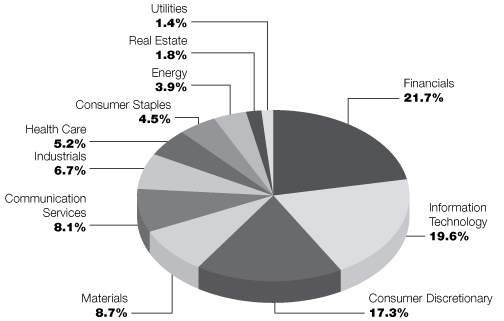

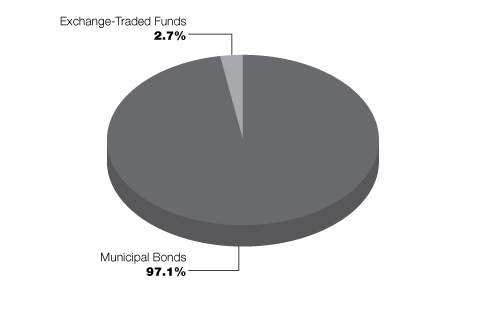

Sector Allocation*:

June 30, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

6

Victory Portfolios

Victory Global Energy Transition Fund | | June 30, 2022 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks to provide long-term capital appreciation.

Top 10 Holdings*:

June 30, 2022

(% of Net Assets)

Turquoise Hill Resources Ltd. | | | 18.4 | % | |

Whitecap Resources, Inc. | | | 6.7 | % | |

Cameco Corp. | | | 6.6 | % | |

Antero Resources Corp. | | | 5.2 | % | |

First Quantum Minerals Ltd. | | | 5.0 | % | |

Linde PLC | | | 4.8 | % | |

NextEra Energy, Inc. | | | 4.7 | % | |

Newmont Corp. | | | 4.6 | % | |

Tourmaline Oil Corp. | | | 4.1 | % | |

Iluka Resources Ltd. | | | 4.1 | % | |

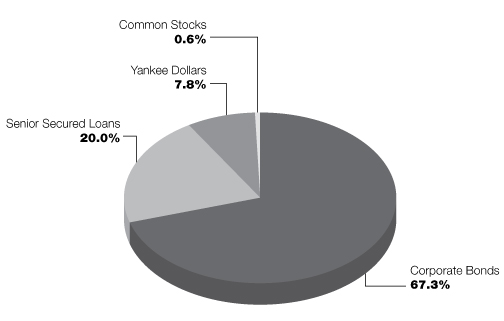

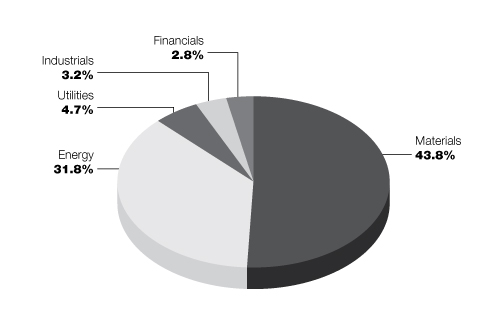

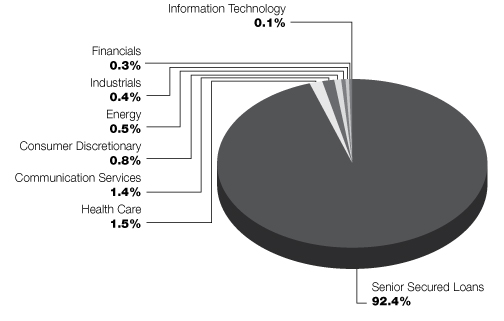

Sector Allocation*:

June 30, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

7

Victory Portfolios

Victory RS Partners Fund | | Schedule of Portfolio Investments

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (95.3%) | |

Banks (12.7%): | |

Banner Corp. | | | 80,970 | | | $ | 4,551,324 | | |

Eastern Bankshares, Inc. | | | 522,640 | | | | 9,647,934 | | |

First BanCorp/Puerto Rico | | | 594,780 | | | | 7,678,610 | | |

Pinnacle Financial Partners, Inc. | | | 35,970 | | | | 2,600,991 | | |

SouthState Corp. | | | 47,270 | | | | 3,646,881 | | |

Synovus Financial Corp. | | | 99,030 | | | | 3,570,031 | | |

The Bank of NT Butterfield & Son Ltd. | | | 281,170 | | | | 8,769,692 | | |

UMB Financial Corp. | | | 43,062 | | | | 3,707,638 | | |

| | | | 44,173,101 | | |

Capital Markets (3.0%): | |

Federated Hermes, Inc. | | | 332,170 | | | | 10,559,684 | | |

Communication Services (3.3%): | |

Madison Square Garden Sports Corp. (a) | | | 41,860 | | | | 6,320,860 | | |

World Wrestling Entertainment, Inc., Class A (b) | | | 81,050 | | | | 5,064,815 | | |

| | | | 11,385,675 | | |

Consumer Discretionary (6.0%): | |

Carter's, Inc. | | | 32,680 | | | | 2,303,286 | | |

Dana, Inc. | | | 175,070 | | | | 2,463,235 | | |

Dine Brands Global, Inc. | | | 76,990 | | | | 5,010,509 | | |

Light & Wonder, Inc. (a) | | | 70,430 | | | | 3,309,506 | | |

The Wendy's Co. | | | 157,720 | | | | 2,977,754 | | |

Wolverine World Wide, Inc. | | | 235,120 | | | | 4,740,019 | | |

| | | | 20,804,309 | | |

Consumer Staples (2.4%): | |

Spectrum Brands Holdings, Inc. | | | 68,060 | | | | 5,582,282 | | |

U.S. Foods Holding Corp. (a) | | | 90,140 | | | | 2,765,495 | | |

| | | | 8,347,777 | | |

Energy (5.8%): | |

California Resources Corp. | | | 118,480 | | | | 4,561,480 | | |

Comstock Resources, Inc. (a) | | | 134,870 | | | | 1,629,230 | | |

Northern Oil and Gas, Inc. | | | 188,310 | | | | 4,756,711 | | |

PDC Energy, Inc. | | | 84,780 | | | | 5,223,296 | | |

Plains GP Holdings LP, Class A | | | 393,870 | | | | 4,064,738 | | |

| | | | 20,235,455 | | |

Health Care (7.5%): | |

Encompass Health Corp. | | | 101,560 | | | | 5,692,438 | | |

Halozyme Therapeutics, Inc. (a) | | | 203,300 | | | | 8,945,200 | | |

The Ensign Group, Inc. | | | 100,100 | | | | 7,354,347 | | |

Zimvie, Inc. (a) | | | 273,830 | | | | 4,384,018 | | |

| | | | 26,376,003 | | |

See notes to financial statements.

8

Victory Portfolios

Victory RS Partners Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Industrials (10.1%): | |

Altra Industrial Motion Corp. | | | 51,800 | | | $ | 1,825,950 | | |

Applied Industrial Technologies, Inc. | | | 37,390 | | | | 3,595,796 | | |

Atkore, Inc. (a) | | | 20,990 | | | | 1,742,380 | | |

Finning International, Inc. | | | 86,290 | | | | 1,816,314 | | |

Fluor Corp. (a) | | | 281,280 | | | | 6,846,355 | | |

GMS, Inc. (a) | | | 26,100 | | | | 1,161,450 | | |

H&E Equipment Services, Inc. | | | 88,520 | | | | 2,564,424 | | |

IAA, Inc. (a) | | | 101,420 | | | | 3,323,534 | | |

ICF International, Inc. | | | 50,420 | | | | 4,789,900 | | |

McGrath RentCorp | | | 34,090 | | | | 2,590,840 | | |

Primoris Services Corp. | | | 62,250 | | | | 1,354,560 | | |

SkyWest, Inc. (a) | | | 65,960 | | | | 1,401,650 | | |

Triton International Ltd. | | | 44,400 | | | | 2,337,660 | | |

| | | | 35,350,813 | | |

Information Technology (7.1%): | |

Euronet Worldwide, Inc. (a) | | | 42,220 | | | | 4,246,910 | | |

NCR Corp. (a) | | | 288,580 | | | | 8,977,724 | | |

Verint Systems, Inc. (a) | | | 122,390 | | | | 5,183,216 | | |

Verra Mobility Corp. (a) | | | 410,410 | | | | 6,447,541 | | |

| | | | 24,855,391 | | |

Insurance (14.6%): | |

Alleghany Corp. (a) | | | 7,340 | | | | 6,114,954 | | |

Globe Life, Inc. | | | 107,790 | | | | 10,506,291 | | |

Kemper Corp. | | | 244,510 | | | | 11,712,029 | | |

Primerica, Inc. | | | 72,813 | | | | 8,714,988 | | |

White Mountains Insurance Group Ltd. | | | 11,100 | | | | 13,832,043 | | |

| | | | 50,880,305 | | |

Materials (6.9%): | |

AdvanSix, Inc. | | | 52,650 | | | | 1,760,616 | | |

Constellium SE (a) | | | 140,130 | | | | 1,851,117 | | |

Graphic Packaging Holding Co. | | | 483,350 | | | | 9,908,675 | | |

Olin Corp. | | | 153,490 | | | | 7,103,517 | | |

Summit Materials, Inc., Class A (a) | | | 70,147 | | | | 1,633,724 | | |

Victoria Gold Corp. (a) | | | 235,630 | | | | 1,829,016 | | |

| | | | 24,086,665 | | |

Real Estate (10.7%): | |

Corporate Office Properties Trust | | | 272,570 | | | | 7,138,608 | | |

Equity Commonwealth (a) | | | 477,060 | | | | 13,133,462 | | |

Four Corners Property Trust, Inc. | | | 405,280 | | | | 10,776,395 | | |

Kennedy-Wilson Holdings, Inc. | | | 325,190 | | | | 6,159,099 | | |

| | | | 37,207,564 | | |

Utilities (5.2%): | |

Black Hills Corp. | | | 85,555 | | | | 6,225,837 | | |

NorthWestern Corp. | | | 99,840 | | | | 5,883,571 | | |

ONE Gas, Inc. | | | 76,430 | | | | 6,205,352 | | |

| | | | 18,314,760 | | |

Total Common Stocks (Cost $303,657,100) | | | 332,577,502 | | |

See notes to financial statements.

9

Victory Portfolios

Victory RS Partners Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Preferred Stocks (0.2%) | |

Health Care (0.2%): | |

WellDoc, Inc. Series B (c) (d) | | | 1,587,483 | | | $ | 587,369 | | |

Total Preferred Stocks (Cost $1,942,920) | | | 587,369 | | |

Collateral for Securities Loaned (0.7%)^ | |

BlackRock Liquidity Funds TempFund, Institutional Shares, 1.47% (e) | | | 72,843 | | | | 72,843 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional

Shares, 1.42% (e) | | | 36,352 | | | | 36,352 | | |

HSBC U.S. Government Money Market Fund I Shares, 1.46% (e) | | | 453,387 | | | | 453,387 | | |

JPMorgan Prime Money Market Fund, Capital Shares, 1.50% (e) | | | 289,862 | | | | 289,862 | | |

Morgan Stanley Institutional Liquidity Government Portfolio, Institutional

Shares, 1.39% (e) | | | 193,305 | | | | 193,305 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional

Shares, 1.53% (e) | | | 1,303,278 | | | | 1,303,278 | | |

Total Collateral for Securities Loaned (Cost $2,349,027) | | | 2,349,027 | | |

Total Investments (Cost $307,949,047) — 96.2% | | | 335,513,898 | | |

Other assets in excess of liabilities — 3.8% | | | 13,266,407 | | |

NET ASSETS — 100.00% | | $ | 348,780,305 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) The Fund's Adviser has deemed this security to be illiquid based upon procedures approved by the Board of Trustees. As of June 30, 2022, illiquid securities were 0.2% of net assets.

(d) Security was fair valued based upon procedures approved by the Board of Trustees and represents 0.2% of net assets as of June 30, 2022. This security is classified as Level 3 within the fair value hierarchy. (See Note 2 in the Notes to Financial Statements)

(e) Rate disclosed is the daily yield on June 30, 2022.

LP — Limited Partnership

See notes to financial statements.

10

Victory Portfolios

Victory RS Value Fund | | Schedule of Portfolio Investments

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (96.1%) | |

Communication Services (1.5%): | |

World Wrestling Entertainment, Inc., Class A (a) | | | 69,200 | | | $ | 4,324,308 | | |

Consumer Discretionary (5.8%): | |

Carter's, Inc. | | | 26,670 | | | | 1,879,702 | | |

LKQ Corp. | | | 166,690 | | | | 8,182,812 | | |

O'Reilly Automotive, Inc. (b) | | | 3,440 | | | | 2,173,254 | | |

The Wendy's Co. | | | 234,570 | | | | 4,428,682 | | |

| | | | 16,664,450 | | |

Consumer Staples (3.3%): | |

Keurig Dr Pepper, Inc. | | | 131,645 | | | | 4,658,916 | | |

U.S. Foods Holding Corp. (b) | | | 157,770 | | | | 4,840,384 | | |

| | | | 9,499,300 | | |

Energy (5.3%): | |

Baker Hughes Co. | | | 130,300 | | | | 3,761,761 | | |

Chesapeake Energy Corp. (a) | | | 48,350 | | | | 3,921,185 | | |

Marathon Oil Corp. | | | 173,430 | | | | 3,898,706 | | |

Ovintiv, Inc. | | | 82,510 | | | | 3,646,117 | | |

| | | | 15,227,769 | | |

Financials (23.7%): | |

Alleghany Corp. (b) | | | 5,140 | | | | 4,282,134 | | |

Cboe Global Markets, Inc. | | | 48,440 | | | | 5,482,924 | | |

Fairfax Financial Holdings Ltd. | | | 20,810 | | | | 11,029,138 | | |

Federated Hermes, Inc. | | | 254,460 | | | | 8,089,283 | | |

Globe Life, Inc. | | | 110,010 | | | | 10,722,675 | | |

Interactive Brokers Group, Inc. | | | 97,640 | | | | 5,371,176 | | |

KeyCorp | | | 75,080 | | | | 1,293,628 | | |

State Street Corp. | | | 21,980 | | | | 1,355,067 | | |

The Progressive Corp. | | | 84,060 | | | | 9,773,656 | | |

White Mountains Insurance Group Ltd. | | | 5,330 | | | | 6,641,873 | | |

Willis Towers Watson PLC | | | 20,040 | | | | 3,955,696 | | |

| | | | 67,997,250 | | |

Health Care (11.1%): | |

Encompass Health Corp. | | | 67,580 | | | | 3,787,859 | | |

Halozyme Therapeutics, Inc. (b) | | | 156,570 | | | | 6,889,080 | | |

Humana, Inc. | | | 17,970 | | | | 8,411,218 | | |

Sotera Health Co. (b) | | | 395,900 | | | | 7,755,681 | | |

Zimmer Biomet Holdings, Inc. | | | 48,500 | | | | 5,095,410 | | |

| | | | 31,939,248 | | |

Industrials (11.9%): | |

AGCO Corp. | | | 28,630 | | | | 2,825,781 | | |

Crane Holdings Co. | | | 30,030 | | | | 2,629,427 | | |

Curtiss-Wright Corp. | | | 25,090 | | | | 3,313,385 | | |

Fluor Corp. (b) | | | 215,070 | | | | 5,234,804 | | |

L3Harris Technologies, Inc. | | | 7,340 | | | | 1,774,078 | | |

Leidos Holdings, Inc. | | | 59,740 | | | | 6,016,415 | | |

See notes to financial statements.

11

Victory Portfolios

Victory RS Value Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

nVent Electric PLC | | | 67,890 | | | $ | 2,126,994 | | |

Sensata Technologies Holding PLC | | | 135,670 | | | | 5,604,528 | | |

The Timken Co. | | | 65,570 | | | | 3,478,488 | | |

Triton International Ltd. | | | 25,310 | | | | 1,332,572 | | |

| | | | 34,336,472 | | |

Information Technology (8.4%): | |

Euronet Worldwide, Inc. (b) | | | 33,933 | | | | 3,413,320 | | |

Fiserv, Inc. (b) | | | 75,400 | | | | 6,708,338 | | |

Global Payments, Inc. | | | 30,470 | | | | 3,371,201 | | |

NCR Corp. (b) | | | 224,620 | | | | 6,987,928 | | |

Verint Systems, Inc. (b) | | | 86,730 | | | | 3,673,016 | | |

| | | | 24,153,803 | | |

Materials (9.3%): | |

Agnico Eagle Mines Ltd. | | | 111,490 | | | | 5,101,782 | | |

Graphic Packaging Holding Co. | | | 381,580 | | | | 7,822,390 | | |

Olin Corp. | | | 116,860 | | | | 5,408,281 | | |

Sealed Air Corp. | | | 124,040 | | | | 7,159,589 | | |

Summit Materials, Inc., Class A (b) | | | 56,310 | | | | 1,311,460 | | |

| | | | 26,803,502 | | |

Real Estate (7.8%): | |

Americold Realty Trust, Inc. | | | 44,430 | | | | 1,334,677 | | |

Equity Commonwealth (b) | | | 382,540 | | | | 10,531,326 | | |

Healthcare Trust of America, Inc., Class A | | | 74,990 | | | | 2,092,971 | | |

Highwoods Properties, Inc. | | | 75,460 | | | | 2,579,978 | | |

Invitation Homes, Inc. | | | 162,380 | | | | 5,777,480 | | |

| | | | 22,316,432 | | |

Utilities (8.0%): | |

Constellation Energy Corp. | | | 35,450 | | | | 2,029,867 | | |

Evergy, Inc. | | | 54,480 | | | | 3,554,820 | | |

FirstEnergy Corp. | | | 89,650 | | | | 3,441,664 | | |

The AES Corp. | | | 189,110 | | | | 3,973,201 | | |

Vistra Corp. | | | 432,160 | | | | 9,874,856 | | |

| | | | 22,874,408 | | |

Total Common Stocks (Cost $254,196,912) | | | 276,136,942 | | |

Collateral for Securities Loaned (2.7%)^ | |

BlackRock Liquidity Funds TempFund, Institutional Shares, 1.47% (c) | | | 240,267 | | | | 240,267 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional

Shares, 1.42% (c) | | | 119,905 | | | | 119,905 | | |

HSBC U.S. Government Money Market Fund I Shares, 1.46% (c) | | | 1,495,459 | | | | 1,495,459 | | |

JPMorgan Prime Money Market Fund, Capital Shares, 1.50% (c) | | | 956,087 | | | | 956,087 | | |

Morgan Stanley Institutional Liquidity Government Portfolio, Institutional

Shares, 1.39% (c) | | | 637,602 | | | | 637,602 | | |

See notes to financial statements.

12

Victory Portfolios

Victory RS Value Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional

Shares, 1.53% (c) | | | 4,298,754 | | | $ | 4,298,754 | | |

Total Collateral for Securities Loaned (Cost $7,748,074) | | | 7,748,074 | | |

Total Investments (Cost $261,944,986) — 98.8% | | | 283,885,016 | | |

Other assets in excess of liabilities — 1.2% | | | 3,428,165 | | |

NET ASSETS — 100.00% | | $ | 287,313,181 | | |

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security is on loan.

(b) Non-income producing security.

(c) Rate disclosed is the daily yield on June 30, 2022.

PLC — Public Limited Company

See notes to financial statements.

13

Victory Portfolios

Victory RS Large Cap Alpha Fund | | Schedule of Portfolio Investments

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (95.9%) | |

Communication Services (2.6%): | |

Alphabet, Inc., Class A (a) | | | 2,050 | | | $ | 4,467,483 | | |

Meta Platforms, Inc., Class A (a) | | | 48,350 | | | | 7,796,438 | | |

| | | | 12,263,921 | | |

Consumer Discretionary (3.6%): | |

LKQ Corp. | | | 267,060 | | | | 13,109,975 | | |

Target Corp. | | | 29,150 | | | | 4,116,855 | | |

| | | | 17,226,830 | | |

Consumer Staples (7.8%): | |

Keurig Dr Pepper, Inc. | | | 313,220 | | | | 11,084,856 | | |

Lamb Weston Holdings, Inc. | | | 98,100 | | | | 7,010,226 | | |

Mondelez International, Inc., Class A | | | 175,300 | | | | 10,884,377 | | |

U.S. Foods Holding Corp. (a) | | | 255,190 | | | | 7,829,229 | | |

| | | | 36,808,688 | | |

Energy (6.9%): | |

Enterprise Products Partners LP | | | 395,670 | | | | 9,642,478 | | |

Hess Corp. | | | 47,040 | | | | 4,983,417 | | |

Marathon Oil Corp. | | | 302,380 | | | | 6,797,502 | | |

Ovintiv, Inc. | | | 157,840 | | | | 6,974,950 | | |

Valero Energy Corp. | | | 41,610 | | | | 4,422,311 | | |

| | | | 32,820,658 | | |

Financials (21.4%): | |

Cboe Global Markets, Inc. | | | 128,690 | | | | 14,566,421 | | |

Comerica, Inc. | | | 189,020 | | | | 13,870,288 | | |

Fairfax Financial Holdings Ltd. | | | 42,320 | | | | 22,429,271 | | |

Interactive Brokers Group, Inc. | | | 173,950 | | | | 9,568,990 | | |

KeyCorp | | | 147,750 | | | | 2,545,732 | | |

State Street Corp. | | | 41,340 | | | | 2,548,611 | | |

The Progressive Corp. | | | 192,020 | | | | 22,326,165 | | |

Willis Towers Watson PLC | | | 68,140 | | | | 13,450,155 | | |

| | | | 101,305,633 | | |

Health Care (22.0%): | |

AbbVie, Inc. | | | 85,350 | | | | 13,072,206 | | |

Cigna Corp. | | | 61,740 | | | | 16,269,725 | | |

Humana, Inc. | | | 42,360 | | | | 19,827,445 | | |

Johnson & Johnson | | | 47,780 | | | | 8,481,428 | | |

Medtronic PLC | | | 148,200 | | | | 13,300,950 | | |

Merck & Co., Inc. | | | 137,220 | | | | 12,510,347 | | |

Sotera Health Co. (a) | | | 464,370 | | | | 9,097,008 | | |

UnitedHealth Group, Inc. | | | 23,155 | | | | 11,893,103 | | |

| | | | 104,452,212 | | |

Industrials (9.5%): | |

FedEx Corp. | | | 21,000 | | | | 4,760,910 | | |

Johnson Controls International PLC | | | 95,760 | | | | 4,584,989 | | |

L3Harris Technologies, Inc. | | | 24,040 | | | | 5,810,468 | | |

See notes to financial statements.

14

Victory Portfolios

Victory RS Large Cap Alpha Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Leidos Holdings, Inc. | | | 97,130 | | | $ | 9,781,962 | | |

PACCAR, Inc. | | | 28,720 | | | | 2,364,805 | | |

Raytheon Technologies Corp. | | | 59,462 | | | | 5,714,893 | | |

Sensata Technologies Holding PLC | | | 182,250 | | | | 7,528,747 | | |

Union Pacific Corp. | | | 21,560 | | | | 4,598,317 | | |

| | | | 45,145,091 | | |

Information Technology (6.4%): | |

Euronet Worldwide, Inc. (a) | | | 63,320 | | | | 6,369,359 | | |

Fidelity National Information Services, Inc. | | | 122,870 | | | | 11,263,493 | | |

FleetCor Technologies, Inc. (a) | | | 30,080 | | | | 6,320,109 | | |

Global Payments, Inc. | | | 58,880 | | | | 6,514,483 | | |

| | | | 30,467,444 | | |

Materials (5.1%): | |

Newmont Corp. | | | 140,790 | | | | 8,400,939 | | |

PPG Industries, Inc. | | | 32,640 | | | | 3,732,058 | | |

Sealed Air Corp. | | | 206,982 | | | | 11,947,001 | | |

| | | | 24,079,998 | | |

Real Estate (2.4%): | |

Host Hotels & Resorts, Inc. | | | 196,940 | | | | 3,088,019 | | |

Invitation Homes, Inc. | | | 236,750 | | | | 8,423,565 | | |

| | | | 11,511,584 | | |

Utilities (8.2%): | |

Constellation Energy Corp. | | | 109,633 | | | | 6,277,586 | | |

Exelon Corp. | | | 195,760 | | | | 8,871,843 | | |

FirstEnergy Corp. | | | 178,330 | | | | 6,846,089 | | |

Vistra Corp. | | | 741,030 | | | | 16,932,535 | | |

| | | | 38,928,053 | | |

Total Common Stocks (Cost $408,737,001) | | | 455,010,112 | | |

Total Investments (Cost $408,737,001) — 95.9% | | | 455,010,112 | | |

Other assets in excess of liabilities — 4.1% | | | 19,494,170 | | |

NET ASSETS — 100.00% | | $ | 474,504,282 | | |

(a) Non-income producing security.

LP — Limited Partnership

PLC — Public Limited Company

See notes to financial statements.

15

Victory Portfolios

Victory RS Investors Fund | | Schedule of Portfolio Investments

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (89.7%) | |

Banks (2.7%): | |

Comerica, Inc. | | | 11,240 | | | $ | 824,791 | | |

Capital Markets (7.1%): | |

Cboe Global Markets, Inc. | | | 10,620 | | | | 1,202,078 | | |

Federated Hermes, Inc. | | | 29,030 | | | | 922,864 | | |

| | | | 2,124,942 | | |

Communication Services (1.8%): | |

Meta Platforms, Inc., Class A (a) | | | 3,470 | | | | 559,538 | | |

Consumer Discretionary (3.1%): | |

LKQ Corp. | | | 18,770 | | | | 921,419 | | |

Consumer Staples (4.3%): | |

Keurig Dr Pepper, Inc. | | | 19,300 | | | | 683,027 | | |

U.S. Foods Holding Corp. (a) | | | 19,450 | | | | 596,726 | | |

| | | | 1,279,753 | | |

Energy (4.8%): | |

Northern Oil and Gas, Inc. | | | 21,400 | | | | 540,564 | | |

PDC Energy, Inc. | | | 14,490 | | | | 892,729 | | |

| | | | 1,433,293 | | |

Health Care (16.7%): | |

Cigna Corp. | | | 2,950 | | | | 777,384 | | |

Humana, Inc. | | | 2,700 | | | | 1,263,789 | | |

Medtronic PLC | | | 8,520 | | | | 764,670 | | |

Merck & Co., Inc. | | | 8,500 | | | | 774,945 | | |

Sotera Health Co. (a) | | | 38,280 | | | | 749,905 | | |

Zimmer Biomet Holdings, Inc. | | | 6,460 | | | | 678,688 | | |

| | | | 5,009,381 | | |

Industrials (3.6%): | |

Fluor Corp. (a) | | | 29,810 | | | | 725,575 | | |

Sensata Technologies Holding PLC | | | 9,000 | | | | 371,790 | | |

| | | | 1,097,365 | | |

Information Technology (9.4%): | |

Euronet Worldwide, Inc. (a) | | | 4,920 | | | | 494,903 | | |

Fidelity National Information Services, Inc. | | | 9,850 | | | | 902,949 | | |

NCR Corp. (a) | | | 24,000 | | | | 746,640 | | |

Verint Systems, Inc. (a) | | | 15,860 | | | | 671,671 | | |

| | | | 2,816,163 | | |

Insurance (23.3%): | |

Alleghany Corp. (a) | | | 1,730 | | | | 1,441,263 | | |

Fairfax Financial Holdings Ltd. | | | 3,520 | | | | 1,865,573 | | |

The Progressive Corp. | | | 9,500 | | | | 1,104,565 | | |

White Mountains Insurance Group Ltd. | | | 1,120 | | | | 1,395,665 | | |

Willis Towers Watson PLC | | | 5,980 | | | | 1,180,392 | | |

| | | | 6,987,458 | | |

See notes to financial statements.

16

Victory Portfolios

Victory RS Investors Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Materials (8.9%): | |

Graphic Packaging Holding Co. | | | 57,010 | | | $ | 1,168,705 | | |

Olin Corp. | | | 16,100 | | | | 745,108 | | |

Sealed Air Corp. | | | 13,190 | | | | 761,327 | | |

| | | | 2,675,140 | | |

Utilities (4.0%): | |

Vistra Corp. | | | 52,420 | | | | 1,197,797 | | |

Total Common Stocks (Cost $24,597,140) | | | 26,927,040 | | |

Total Investments (Cost $24,597,140) — 89.7% | | | 26,927,040 | | |

Other assets in excess of liabilities — 10.3% | | | 3,079,671 | | |

NET ASSETS — 100.00% | | $ | 30,006,711 | | |

(a) Non-income producing security.

PLC — Public Limited Company

See notes to financial statements.

17

Victory Portfolios

Victory Global Energy Transition Fund | | Schedule of Portfolio Investments

June 30, 2022 | |

(Unaudited)

Security Description | | Shares or

Principal

Amount | | Value | |

Common Stocks (85.0%) | |

Chemicals (4.8%): | |

Linde PLC | | | 62,522 | | | $ | 17,976,951 | | |

Financials (2.8%): | |

Ivanhoe (a) (b) (d) (e) | | | 1,370,663 | | | | 10,745,546 | | |

Industrials (3.2%): | |

Energy Vault Holdings, Inc. (a) (c) | | | 534,964 | | | | 5,360,337 | | |

NuScale Power Corp. (PIPE) (a) (b) | | | 563,808 | | | | 5,361,814 | | |

NuScale Power Corp. (a) (c) | | | 142,608 | | | | 1,424,654 | | |

| | | | 12,146,805 | | |

Metals & Mining (39.0%): | |

First Quantum Minerals Ltd. | | | 993,719 | | | | 18,855,181 | | |

Iluka Resources Ltd. | | | 2,378,770 | | | | 15,496,552 | | |

Ivanhoe Electric, Inc. (a) | | | 594,049 | | | | 5,168,226 | | |

Lundin Mining Corp. | | | 944,011 | | | | 5,985,338 | | |

Newmont Corp. | | | 290,871 | | | | 17,356,272 | | |

Norsk Hydro ASA | | | 1,365,557 | | | | 7,650,770 | | |

Sunrise Energy Metals, Ltd. (a) (c) | | | 4,606,042 | | | | 7,151,894 | | |

Turquoise Hill Resources Ltd. (a) | | | 2,608,571 | | | | 69,857,531 | | |

| | | | 147,521,764 | | |

Oil, Gas & Consumable Fuels (30.5%): | |

Antero Resources Corp. (a) | | | 648,006 | | | | 19,861,384 | | |

Cameco Corp. | | | 1,195,215 | | | | 25,130,161 | | |

Cheniere Energy, Inc. | | | 49,576 | | | | 6,595,095 | | |

Peyto Exploration & Development Corp. | | | 1,238,790 | | | | 11,588,991 | | |

Range Resources Corp. (a) | | | 466,388 | | | | 11,543,103 | | |

Tourmaline Oil Corp. | | | 298,761 | | | | 15,536,965 | | |

Whitecap Resources, Inc. | | | 3,669,315 | | | | 25,488,482 | | |

| | | | 115,744,181 | | |

Utilities (4.7%): | |

NextEra Energy, Inc. | | | 226,960 | | | | 17,580,321 | | |

Total Common Stocks (Cost $220,122,619) | | | 321,715,568 | | |

Preferred Stocks (0.6%) | |

Oil, Gas & Consumable Fuels (0.6%): | |

Energy Vault SA (a) (b) (d) (e) | | | 248,310 | | | | 2,458,269 | | |

Total Preferred Stocks (Cost $2,323,956) | | | 2,458,269 | | |

Convertible Corporate Bonds (0.7%) | |

Oil & Gas (0.7%): | |

Ipulse (PIK), 2.00%, 7/31/23 (b) (d) (e) | | $ | 1,608,540 | | | | 2,706,273 | | |

Total Convertible Corporate Bonds (Cost $1,608,540) | | | 2,706,273 | | |

See notes to financial statements.

18

Victory Portfolios

Victory Global Energy Transition Fund | | Schedule of Portfolio Investments — continued

June 30, 2022 | |

(Unaudited)

Security Description | | Shares | | Value | |

Collateral for Securities Loaned (1.3%)^ | |

BlackRock Liquidity Funds TempFund, Institutional Shares, 1.47% (f) | | | 148,615 | | | $ | 148,615 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional

Shares, 1.42% (f) | | | 74,166 | | | | 74,166 | | |

HSBC U.S. Government Money Market Fund I Shares, 1.46% (f) | | | 925,001 | | | | 925,001 | | |

JPMorgan Prime Money Market Fund, Capital Shares, 1.50% (f) | | | 591,378 | | | | 591,378 | | |

Morgan Stanley Institutional Liquidity Government Portfolio, Institutional

Shares, 1.39% (f) | | | 394,382 | | | | 394,382 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional

Shares, 1.53% (f) | | | 2,658,950 | | | | 2,658,950 | | |

Total Collateral for Securities Loaned (Cost $4,792,492) | | | 4,792,492 | | |

Total Investments (Cost $228,847,607) — 87.6% | | | 331,672,602 | | |

Other assets in excess of liabilities — 12.4% | | | 46,916,241 | | |

NET ASSETS — 100.00% | | $ | 378,588,843 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) The Fund's Adviser has deemed this security to be illiquid based upon procedures approved by the Board of Trustees. As of June 30, 2022, illiquid securities were 5.6% of net assets.

(c) All or a portion of this security is on loan.

(d) Restricted security that is not registered under the Securities Act of 1933.

(e) The following table details the acquisition date and cost of the Fund's restricted securities at June 30, 2022:

Security Name | | Acquisition Date | | Cost | |

Energy Vault SA | | 8/24/2021 | | $ | 5,006,775 | | |

Ipulse | | 7/28/2021 | | | 1,608,540 | | |

Ivanhoe | | 7/28/2021 | | | 11,366,610 | | |

(f) Rate disclosed is the daily yield on June 30, 2022.

PIK — Paid In-Kind

PLC — Public Limited Company

See notes to financial statements.

19

Victory Portfolios | | Statements of Assets and Liabilities

June 30, 2022 | |

(Unaudited)

| | | Victory

RS Partners

Fund | | Victory

RS Value

Fund | | Victory

RS Large

Cap Alpha

Fund | |

Assets: | |

Investments, at value (Cost $307,949,047,

$261,944,986 and $408,737,001) | | $ | 335,513,898 | (a) | | $ | 283,885,016 | (b) | | $ | 455,010,112 | | |

Cash | | | 15,016,423 | | | | 11,206,615 | | | | 19,376,751 | | |

Receivables: | |

Interest and dividends | | | 493,101 | | | | 123,249 | | | | 605,774 | | |

Capital shares issued | | | 151,191 | | | | 189,637 | | | | 7,686 | | |

Investments sold | | | 415,439 | | | | — | | | | — | | |

From Adviser | | | 44,305 | | | | 13,406 | | | | 35,146 | | |

Prepaid expenses | | | 43,791 | | | | 31,625 | | | | 30,991 | | |

Total Assets | | | 351,678,148 | | | | 295,449,548 | | | | 475,066,460 | | |

Liabilities: | |

Payables: | |

Collateral received on loaned securities | | | 2,349,027 | | | | 7,748,074 | | | | — | | |

Capital shares redeemed | | | 99,983 | | | | 41,855 | | | | 178,761 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 301,369 | | | | 209,067 | | | | 200,188 | | |

Administration fees | | | 16,258 | | | | 13,310 | | | | 21,680 | | |

Custodian fees | | | 3,153 | | | | 4,555 | | | | 3,888 | | |

Transfer agent fees | | | 78,318 | | | | 72,551 | | | | 87,063 | | |

Compliance fees | | | 207 | | | | 172 | | | | 283 | | |

| 12b-1 fees | | | 17,718 | | | | 17,462 | | | | 48,138 | | |

Other accrued expenses | | | 31,810 | | | | 29,321 | | | | 22,177 | | |

Total Liabilities | | | 2,897,843 | | | | 8,136,367 | | | | 562,178 | | |

Net Assets: | |

Capital | | | 291,204,408 | | | | 241,526,000 | | | | 368,466,344 | | |

Total accumulated earnings/(loss) | | | 57,575,897 | | | | 45,787,181 | | | | 106,037,938 | | |

Net Assets | | $ | 348,780,305 | | | $ | 287,313,181 | | | $ | 474,504,282 | | |

Net Assets | |

Class A | | $ | 168,493,660 | | | $ | 164,701,282 | | | $ | 443,808,799 | | |

Class C | | | — | | | | 1,029,322 | | | | 3,888,387 | | |

Class R | | | 1,373,750 | | | | 628,643 | | | | 5,980,808 | | |

Class Y | | | 175,081,311 | | | | 120,953,934 | | | | 20,826,288 | | |

Member Class | | | 3,831,584 | | | | — | | | | — | | |

Total | | $ | 348,780,305 | | | $ | 287,313,181 | | | $ | 474,504,282 | | |

Shares (unlimited number of shares authorized

with a par value of $0.001 per share): | |

Class A | | | 6,972,284 | | | | 6,898,666 | | | | 8,657,827 | | |

Class C | | | — | | | | 50,900 | | | | 93,950 | | |

Class R | | | 65,244 | | | | 28,308 | | | | 117,785 | | |

Class Y | | | 6,642,321 | | | | 4,891,916 | | | | 407,809 | | |

Member Class | | | 158,143 | | | | — | | | | — | | |

Total | | | 13,837,992 | | | | 11,869,790 | | | | 9,277,371 | | |

Net asset value, offering (except Class A)

and redemption price per share: | |

Class A | | $ | 24.17 | | | $ | 23.87 | | | $ | 51.26 | | |

Class C (c) | | | — | | | | 20.22 | | | | 41.39 | | |

Class R | | | 21.06 | | | | 22.21 | | | | 50.78 | | |

Class Y | | | 26.36 | | | | 24.73 | | | | 51.07 | | |

Member Class | | | 24.23 | | | | — | | | | — | | |

Maximum Sales Charge — Class A | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % | |

Maximum offering price (100%/(100%-maximum

sales charge) of net asset value adjusted to the

nearest cent) per share — Class A | | $ | 25.64 | | | $ | 25.33 | | | $ | 54.39 | | |

(a) Includes $2,315,629 of securities on loan.

(b) Includes $7,339,014 of securities on loan.

(c) Redemption price per share varies by the length of time shares are held.

See notes to financial statements.

20

Victory Portfolios | | Statements of Assets and Liabilities

June 30, 2022 | |

(Unaudited)

| | | Victory

RS Investors

Fund | | Victory

Global Energy

Transition

Fund | |

Assets: | |

Investments, at value (Cost $24,597,140 and $228,847,607) | | $ | 26,927,040 | | | $ | 331,672,602 | (a) | |

Foreign currency, at value (Cost $— and $44,397) | | | — | | | | 44,397 | | |

Cash | | | 3,190,741 | | | | 50,829,442 | | |

Receivables: | |

Interest and dividends | | | 39,843 | | | | 537,711 | | |

Capital shares issued | | | 29,000 | | | | 146,127 | | |

Investments sold | | | — | | | | 11,549,302 | | |

From Adviser | | | 19,904 | | | | 29,329 | | |

Prepaid expenses | | | 18,636 | | | | 33,522 | | |

Total Assets | | | 30,225,164 | | | | 394,842,432 | | |

Liabilities: | |

Payables: | |

Collateral received on loaned securities | | | — | | | | 4,792,492 | | |

Investments purchased | | | 170,906 | | | | 10,589,952 | | |

Capital shares redeemed | | | 4,704 | | | | 399,045 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 25,181 | | | | 354,911 | | |

Administration fees | | | 1,364 | | | | 19,106 | | |

Custodian fees | | | 625 | | | | 3,881 | | |

Transfer agent fees | | | 7,850 | | | | 56,762 | | |

Compliance fees | | | 18 | | | | 249 | | |

Trustees' fees | | | 1 | | | | 920 | | |

| 12b-1 fees | | | 2,187 | | | | 11,263 | | |

Other accrued expenses | | | 5,617 | | | | 25,008 | | |

Total Liabilities | | | 218,453 | | | | 16,253,589 | | |

Net Assets: | |

Capital | | | 25,649,348 | | | | 2,109,477,885 | | |

Total accumulated earnings/(loss) | | | 4,357,363 | | | | (1,730,889,042 | ) | |

Net Assets | | $ | 30,006,711 | | | $ | 378,588,843 | | |

Net Assets | |

Class A | | $ | 14,213,352 | | | $ | 89,795,550 | | |

Class C | | | 1,387,702 | | | | 2,604,961 | | |

Class R | | | 800,102 | | | | 1,683,165 | | |

Class Y | | | 13,605,555 | | | | 284,505,167 | | |

Total | | $ | 30,006,711 | | | $ | 378,588,843 | | |

Shares (unlimited number of shares authorized with a

par value of $0.001 per share): | |

Class A | | | 1,072,075 | | | | 3,224,419 | | |

Class C | | | 124,108 | | | | 106,325 | | |

Class R | | | 70,009 | | | | 64,635 | | |

Class Y | | | 988,278 | | | | 9,760,551 | | |

Total | | | 2,254,470 | | | | 13,155,930 | | |

Net asset value, offering (except Class A) and

redemption price per share: | |

Class A | | $ | 13.26 | | | $ | 27.85 | | |

Class C (b) | | | 11.18 | | | | 24.50 | | |

Class R | | | 11.43 | | | | 26.04 | | |

Class Y | | | 13.77 | | | | 29.15 | | |

Maximum Sales Charge — Class A | | | 5.75 | % | | | 5.75 | % | |

Maximum offering price (100%/(100%-maximum

sales charge) of net asset value adjusted to the

nearest cent) per share — Class A | | $ | 14.07 | | | $ | 29.55 | | |

(a) Includes $4,718,454 of securities on loan.

(b) Redemption price per share varies by the length of time shares are held.

See notes to financial statements.

21

Victory Portfolios | | Statements of Operations

For the Six Months Ended June 30, 2022 | |

(Unaudited)

| | | Victory

RS Partners

Fund | | Victory

RS Value

Fund | | Victory

RS Large

Cap Alpha

Fund | |

Investment Income: | | | |

Dividends | | $ | 3,033,129 | | | $ | 2,601,916 | | | $ | 4,625,949 | | |

Interest | | | 7,049 | | | | 5,310 | | | | 9,308 | | |

Securities lending (net of fees) | | | 1,701 | | | | 3,639 | | | | 421 | | |

Foreign tax withholding | | | (22,134 | ) | | | (6,690 | ) | | | — | | |

Total Income | | | 3,019,745 | | | | 2,604,175 | | | | 4,635,678 | | |

Expenses: | | | |

Investment advisory fees | | | 1,859,434 | | | | 1,335,899 | | | | 1,271,813 | | |

Administration fees | | | 100,475 | | | | 84,920 | | | | 137,440 | | |

Sub-Administration fees | | | 8,428 | | | | 8,418 | | | | 7,530 | | |

| 12b-1 fees — Class A | | | 231,838 | | | | 223,103 | | | | 595,518 | | |

| 12b-1 fees — Class C | | | — | | | | 6,181 | | | | 25,835 | | |

| 12b-1 fees — Class R | | | 3,791 | | | | 1,613 | | | | 15,808 | | |

Custodian fees | | | 10,119 | | | | 6,649 | | | | 12,158 | | |

Transfer agent fees — Class A | | | 127,824 | | | | 112,893 | | | | 200,518 | | |

Transfer agent fees — Class C | | | — | | | | 613 | | | | 1,415 | | |

Transfer agent fees — Class R | | | 1,444 | | | | 792 | | | | 5,226 | | |

Transfer agent fees — Class Y | | | 78,911 | | | | 71,237 | | | | 8,214 | | |

Transfer agent fees — Member Class | | | 2,852 | | | | — | | | | — | | |

Trustees' fees | | | 11,263 | | | | 9,702 | | | | 15,059 | | |

Compliance fees | | | 1,310 | | | | 1,118 | | | | 1,800 | | |

Legal and audit fees | | | 13,709 | | | | 12,300 | | | | 17,688 | | |

State registration and filing fees | | | 37,495 | | | | 27,578 | | | | 27,461 | | |

Other expenses | | | 22,978 | | | | 17,381 | | | | 21,194 | | |

Recoupment of prior expenses waived/reimbursed

by Adviser | | | — | | | | 66 | | | | 430 | | |

Total Expenses | | | 2,511,871 | | | | 1,920,463 | | | | 2,365,107 | | |

Expenses waived/reimbursed by Adviser | | | (116,671 | ) | | | (33,574 | ) | | | (92,078 | ) | |

Net Expenses | | | 2,395,200 | | | | 1,886,889 | | | | 2,273,029 | | |

Net Investment Income (Loss) | | | 624,545 | | | | 717,286 | | | | 2,362,649 | | |

Realized/Unrealized Gains (Losses) from

Investments: | | | |

Net realized gains (losses) from investment

securities and foreign currency transactions | | | 22,945,689 | | | | 13,023,905 | | | | 32,177,665 | | |

Net change in unrealized appreciation/depreciation

on investment securities | | | (61,571,514 | ) | | | (43,444,642 | ) | | | (70,978,568 | ) | |

Net realized/unrealized gains (losses) on

investments | | | (38,625,825 | ) | | | (30,420,737 | ) | | | (38,800,903 | ) | |

Change in net assets resulting from operations | | $ | (38,001,280 | ) | | $ | (29,703,451 | ) | | $ | (36,438,254 | ) | |

See notes to financial statements.

22

Victory Portfolios | | Statements of Operations

For the Six Months Ended June 30, 2022 | |

(Unaudited)

| | | Victory RS

Investors

Fund | | Victory

Global Energy

Transition

Fund | |

Investment Income: | | | |

Dividends | | $ | 203,305 | | | $ | 3,802,781 | | |

Interest | | | 935 | | | | 125,640 | | |

Securities lending (net of fees) | | | 10 | | | | 653,869 | | |

Foreign tax withholding | | | — | | | | (532,519 | ) | |

Total Income | | | 204,250 | | | | 4,049,771 | | |

Expenses: | | | |

Investment advisory fees | | | 150,738 | | | | 1,966,591 | | |

Administration fees | | | 8,146 | | | | 106,277 | | |

Sub-Administration fees | | | 6,693 | | | | 6,693 | | |

| 12b-1 fees — Class A | | | 18,477 | | | | 123,943 | | |

| 12b-1 fees — Class C | | | 9,700 | | | | 15,946 | | |

| 12b-1 fees — Class R | | | 2,029 | | | | 3,740 | | |

Custodian fees | | | 2,057 | | | | 16,233 | | |

Transfer agent fees — Class A | | | 8,021 | | | | 73,908 | | |

Transfer agent fees — Class C | | | 1,273 | | | | 1,683 | | |

Transfer agent fees — Class R | | | 711 | | | | 1,010 | | |

Transfer agent fees — Class Y | | | 6,702 | | | | 110,959 | | |

Trustees' fees | | | 1,565 | | | | 10,516 | | |

Compliance fees | | | 106 | | | | 1,295 | | |

Legal and audit fees | | | 4,501 | | | | 15,007 | | |

State registration and filing fees | | | 20,926 | | | | 38,406 | | |

Other expenses | | | 6,372 | | | | 21,728 | | |

Recoupment of prior expenses waived/reimbursed by Adviser | | | 187 | | | | 35 | | |

Total Expenses | | | 248,204 | | | | 2,513,970 | | |

Expenses waived/reimbursed by Adviser | | | (55,760 | ) | | | (62,308 | ) | |

Net Expenses | | | 192,444 | | | | 2,451,662 | | |

Net Investment Income (Loss) | | | 11,806 | | | | 1,598,109 | | |

Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains (losses) from investment securities and

foreign currency transactions | | | 1,934,815 | | | | 65,039,968 | | |

Net change in unrealized appreciation/depreciation on

investment securities and foreign currency translations | | | (3,387,668 | ) | | | (3,734,188 | ) | |

Net realized/unrealized gains (losses) on investments | | | (1,452,853 | ) | | | 61,305,780 | | |

Change in net assets resulting from operations | | $ | (1,441,047 | ) | | $ | 62,903,889 | | |

See notes to financial statements.

23

Victory Portfolios | | Statements of Changes in Net Assets | |

| | | Victory RS Partners

Fund | | Victory RS Value

Fund | | Victory RS Large Cap Alpha

Fund | |

| | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | |

From Investment Activities: | |

Operations: | |

Net Investment

Income (Loss) | | $ | 624,545 | | | $ | (449,102 | ) | | $ | 717,286 | | | $ | 748,848 | | | $ | 2,362,649 | | | $ | 5,769,360 | | |

Net realized gains

(losses) from

investments | | | 22,945,689 | | | | 80,047,267 | | | | 13,023,905 | | | | 67,085,450 | | | | 32,177,665 | | | | 79,181,305 | | |

Net change in

unrealized

appreciation/

depreciation

on investments | | | (61,571,514 | ) | | | 13,032,470 | | | | (43,444,642 | ) | | | 11,836,881 | | | | (70,978,568 | ) | | | 20,032,914 | | |

Change in net assets

resulting from

operations | | | (38,001,280 | ) | | | 92,630,635 | | | | (29,703,451 | ) | | | 79,671,179 | | | | (36,438,254 | ) | | | 104,983,579 | | |

Distributions to

Shareholders: | |

Class A | | | — | | | | (28,047,422 | ) | | | — | | | | (23,751,997 | ) | | | — | | | | (55,880,468 | ) | |

Class C | | | — | | | | — | | | | — | | | | (199,127 | ) | | | — | | | | (812,225 | ) | |

Class R | | | — | | | | (261,917 | ) | | | — | | | | (83,609 | ) | | | — | | | | (699,959 | ) | |

Class Y | | | — | | | | (24,006,515 | ) | | | — | | | | (17,934,828 | ) | | | — | | | | (2,330,388 | ) | |

Member Class | | | — | | | | (434,976 | ) | | | — | | | | — | | | | — | | | | — | | |

Change in net assets

resulting from

distributions to

shareholders | | | — | | | | (52,750,830 | ) | | | — | | | | (41,969,561 | ) | | | — | | | | (59,723,040 | ) | |

Change in net assets

resulting from

capital transactions | | | 9,804,037 | | | | 10,857,122 | | | | (17,682,484 | ) | | | (10,957,822 | ) | | | (17,774,707 | ) | | | 5,894,424 | | |

Change in net assets | | | (28,197,243 | ) | | | 50,736,927 | | | | (47,385,935 | ) | | | 26,743,796 | | | | (54,212,961 | ) | | | 51,154,963 | | |

Net Assets: | |

Beginning of period | | | 376,977,548 | | | | 326,240,621 | | | | 334,699,116 | | | | 307,955,320 | | | | 528,717,243 | | | | 477,562,280 | | |

End of period | | $ | 348,780,305 | | | $ | 376,977,548 | | | $ | 287,313,181 | | | $ | 334,699,116 | | | $ | 474,504,282 | | | $ | 528,717,243 | | |

(continues on next page)

See notes to financial statements.

24

Victory Portfolios | | Statements of Changes in Net Assets | |

(continued)

| | | Victory RS Partners

Fund | | Victory RS Value

Fund | | Victory RS Large Cap Alpha

Fund | |

| | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | |

Capital Transactions: | |

Class A | |

Proceeds from

shares issued | | $ | 5,945,049 | | | $ | 32,378,102 | | | $ | 4,078,373 | | | $ | 12,582,595 | | | $ | 6,746,770 | | | $ | 18,537,698 | | |

Distributions

reinvested | | | — | | | | 27,357,527 | | | | — | | | | 23,208,972 | | | | — | | | | 54,292,632 | | |

Cost of shares

redeemed | | | (13,745,261 | ) | | | (38,380,359 | ) | | | (11,161,457 | ) | | | (27,845,087 | ) | | | (24,744,311 | ) | | | (63,635,769 | ) | |

Total Class A | | $ | (7,800,212 | ) | | $ | 21,355,270 | | | $ | (7,083,084 | ) | | $ | 7,946,480 | | | $ | (17,997,541 | ) | | $ | 9,194,561 | | |

Class C | |

Proceeds from

shares issued | | $ | — | | | $ | — | | | $ | 87,546 | | | $ | 93,397 | | | $ | 210,440 | | | $ | 183,579 | | |

Distributions

reinvested | | | — | | | | — | | | | — | | | | 199,127 | | | | — | | | | 784,649 | | |

Cost of shares

redeemed | | | — | | | | — | | | | (338,215 | ) | | | (1,731,042 | ) | | | (2,191,871 | ) | | | (6,904,121 | ) | |

Total Class C | | $ | — | | | $ | — | | | $ | (250,669 | ) | | $ | (1,438,518 | ) | | $ | (1,981,431 | ) | | $ | (5,935,893 | ) | |

Class R | |

Proceeds from

shares issued | | $ | 52,857 | | | $ | 102,925 | | | $ | 67,848 | | | $ | 79,653 | | | $ | 342,144 | | | $ | 569,839 | | |

Distributions

reinvested | | | — | | | | 261,917 | | | | — | | | | 78,836 | | | | — | | | | 695,951 | | |

Cost of shares

redeemed | | | (172,704 | ) | | | (278,653 | ) | | | (13,476 | ) | | | (280,742 | ) | | | (317,031 | ) | | | (1,527,178 | ) | |

Total Class R | | $ | (119,847 | ) | | $ | 86,189 | | | $ | 54,372 | | | $ | (122,253 | ) | | $ | 25,113 | | | $ | (261,388 | ) | |

Class Y | |

Proceeds from

shares issued | | $ | 34,014,942 | | | $ | 64,038,117 | | | $ | 4,387,104 | | | $ | 12,404,934 | | | $ | 4,119,994 | | | $ | 4,827,781 | | |

Distributions

reinvested | | | — | | | | 23,949,470 | | | | — | | | | 17,722,595 | | | | — | | | | 2,275,335 | | |

Cost of shares

redeemed | | | (17,535,644 | ) | | | (101,782,209 | ) | | | (14,790,207 | ) | | | (47,471,060 | ) | | | (1,940,842 | ) | | | (4,205,972 | ) | |

Total Class Y | | $ | 16,479,298 | | | $ | (13,794,622 | ) | | $ | (10,403,103 | ) | | $ | (17,343,531 | ) | | $ | 2,179,152 | | | $ | 2,897,144 | | |

Member Class | |

Proceeds from

shares issued | | $ | 1,778,175 | | | $ | 4,042,884 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

Distributions

reinvested | | | — | | | | 434,976 | | | | — | | | | — | | | | — | | | | — | | |

Cost of shares

redeemed | | | (533,377 | ) | | | (1,267,575 | ) | | | — | | | | — | | | | — | | | | — | | |

Total Member Class | | $ | 1,244,798 | | | $ | 3,210,285 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

Change in net assets

resulting from capital

transactions | | $ | 9,804,037 | | | $ | 10,857,122 | | | $ | (17,682,484 | ) | | $ | (10,957,822 | ) | | $ | (17,774,707 | ) | | $ | 5,894,424 | | |

(continues on next page)

See notes to financial statements.

25

Victory Portfolios | | Statements of Changes in Net Assets | |

(continued)

| | | Victory RS Partners

Fund | | Victory RS Value

Fund | | Victory RS Large Cap Alpha

Fund | |

| | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | |

Share Transactions: | |

Class A | |

Issued | | | 226,181 | | | | 1,071,551 | | | | 159,420 | | | | 459,952 | | | | 123,184 | | | | 327,763 | | |

Reinvested | | | — | | | | 1,045,777 | | | | — | | | | 900,018 | | | | — | | | | 1,000,925 | | |

Redeemed | | | (525,913 | ) | | | (1,316,022 | ) | | | (435,157 | ) | | | (1,031,826 | ) | | | (454,839 | ) | | | (1,117,937 | ) | |

Total Class A | | | (299,732 | ) | | | 801,306 | | | | (275,737 | ) | | | 328,144 | | | | (331,655 | ) | | | 210,751 | | |

Class C | |

Issued | | | — | | | | — | | | | 4,051 | | | | 3,951 | | | | 4,886 | | | | 3,697 | | |

Reinvested | | | — | | | | — | | | | — | | | | 9,118 | | | | — | | | | 17,967 | | |

Redeemed | | | — | | | | — | | | | (15,592 | ) | | | (77,404 | ) | | | (50,255 | ) | | | (151,544 | ) | |

Total Class C | | | — | | | | — | | | | (11,541 | ) | | | (64,335 | ) | | | (45,369 | ) | | | (129,880 | ) | |

Class R | |

Issued | | | 2,290 | | | | 3,946 | | | | 2,880 | | | | 3,060 | | | | 6,333 | | | | 10,041 | | |

Reinvested | | | — | | | | 11,467 | | | | — | | | | 3,293 | | | | — | | | | 12,969 | | |

Redeemed | | | (7,603 | ) | | | (10,507 | ) | | | (565 | ) | | | (10,767 | ) | | | (5,976 | ) | | | (26,224 | ) | |

Total Class R | | | (5,313 | ) | | | 4,906 | | | | 2,315 | | | | (4,414 | ) | | | 357 | | | | (3,214 | ) | |

Class Y | |

Issued | | | 1,187,148 | | | | 1,974,973 | | | | 165,482 | | | | 451,850 | | | | 76,191 | | | | 81,687 | | |

Reinvested | | | — | | | | 839,425 | | | | — | | | | 663,195 | | | | — | | | | 42,077 | | |

Redeemed | | | (614,464 | ) | | | (3,210,913 | ) | | | (553,450 | ) | | | (1,681,077 | ) | | | (35,754 | ) | | | (74,261 | ) | |

Total Class Y | | | 572,684 | | | | (396,515 | ) | | | (387,968 | ) | | | (566,032 | ) | | | 40,437 | | | | 49,503 | | |

Member Class | |

Issued | | | 67,292 | | | | 132,546 | | | | — | | | | — | | | | — | | | | — | | |

Reinvested | | | — | | | | 16,583 | | | | — | | | | — | | | | — | | | | — | | |

Redeemed | | | (20,595 | ) | | | (41,908 | ) | | | — | | | | — | | | | — | | | | — | | |

Total Member Class | | | 46,697 | | | | 107,221 | | | | — | | | | — | | | | — | | | | — | | |

Change in Shares | | | 314,336 | | | | 516,918 | | | | (672,931 | ) | | | (306,637 | ) | | | (336,230 | ) | | | 127,160 | | |

See notes to financial statements.

26

Victory Portfolios | | Statements of Changes in Net Assets | |

| | | Victory RS

Investors Fund | | Victory Global Energy

Transition Fund | |

| | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | |

From Investment Activities: | |

Operations: | |

Net Investment Income (Loss) | | $ | 11,806 | | | $ | 45,520 | | | $ | 1,598,109 | | | $ | 12,401 | | |

Net realized gains (losses) from

investments | | | 1,934,815 | | | | 6,937,784 | | | | 65,039,968 | | | | 8,906,170 | | |

Net change in unrealized

appreciation/depreciation

on investments | | | (3,387,668 | ) | | | (144,539 | ) | | | (3,734,188 | ) | | | 121,511,876 | | |

Change in net assets resulting

from operations | | | (1,441,047 | ) | | | 6,838,765 | | | | 62,903,889 | | | | 130,430,447 | | |

Distributions to Shareholders: | |

Class A | | | — | | | | (2,084,214 | ) | | | — | | | | — | | |

Class C | | | — | | | | (430,072 | ) | | | — | | | | — | | |

Class R | | | — | | | | (124,797 | ) | | | — | | | | — | | |

Class Y | | | — | | | | (1,716,122 | ) | | | — | | | | (86,748 | ) | |

Change in net assets resulting

from distributions to shareholders | | | — | | | | (4,355,205 | ) | | | — | | | | (86,748 | ) | |

Change in net assets resulting

from capital transactions | | | 324,073 | | | | 762,677 | | | | 22,516,131 | | | | 3,720,084 | | |

Change in net assets | | | (1,116,974 | ) | | | 3,246,237 | | | | 85,420,020 | | | | 134,063,783 | | |

Net Assets: | |

Beginning of period | | | 31,123,685 | | | | 27,877,448 | | | | 293,168,823 | | | | 159,105,040 | | |

End of period | | $ | 30,006,711 | | | $ | 31,123,685 | | | $ | 378,588,843 | | | $ | 293,168,823 | | |

(continues on next page)

See notes to financial statements.

27

Victory Portfolios | | Statements of Changes in Net Assets | |

(continued)

| | | Victory RS

Investors Fund | | Victory Global Energy

Transition Fund | |

| | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | |

Capital Transactions: | |

Class A | |

Proceeds from shares issued | | $ | 1,384,596 | | | $ | 1,456,481 | | | $ | 32,058,551 | | | $ | 45,428,214 | | |

Distributions reinvested | | | — | | | | 1,959,510 | | | | — | | | | — | | |

Cost of shares redeemed | | | (1,534,796 | ) | | | (2,154,752 | ) | | | (39,029,470 | ) | | | (36,106,014 | ) | |

Total Class A | | $ | (150,200 | ) | | $ | 1,261,239 | | | $ | (6,970,919 | ) | | $ | 9,322,200 | | |

Class C | |

Proceeds from shares issued | | $ | 10,680 | | | $ | 115,128 | | | $ | 165,958 | | | $ | 1,198,233 | | |

Distributions reinvested | | | — | | | | 430,072 | | | | — | | | | — | | |

Cost of shares redeemed | | | (1,225,296 | ) | | | (1,412,389 | ) | | | (1,474,474 | ) | | | (1,858,895 | ) | |

Total Class C | | $ | (1,214,616 | ) | | $ | (867,189 | ) | | $ | (1,308,516 | ) | | $ | (660,662 | ) | |

Class R | |

Proceeds from shares issued | | $ | 53,767 | | | $ | 37,764 | | | $ | 608,775 | | | $ | 1,274,162 | | |

Distributions reinvested | | | — | | | | 124,797 | | | | — | | | | — | | |

Cost of shares redeemed | | | (19,759 | ) | | | (47,693 | ) | | | (124,588 | ) | | | (1,575,801 | ) | |

Total Class R | | $ | 34,008 | | | $ | 114,868 | | | $ | 484,187 | | | $ | (301,639 | ) | |

Class Y | |

Proceeds from shares issued | | $ | 3,973,969 | | | $ | 1,797,156 | | | $ | 115,815,616 | | | $ | 102,421,824 | | |

Distributions reinvested | | | — | | | | 1,711,171 | | | | — | | | | 81,976 | | |

Cost of shares redeemed | | | (2,319,088 | ) | | | (3,254,568 | ) | | | (85,504,237 | ) | | | (107,143,615 | ) | |

Total Class Y | | $ | 1,654,881 | | | $ | 253,759 | | | $ | 30,311,379 | | | $ | (4,639,815 | ) | |

Change in net assets resulting from

capital transactions | | $ | 324,073 | | | $ | 762,677 | | | $ | 22,516,131 | | | $ | 3,720,084 | | |

(continues on next page)

See notes to financial statements.

28

Victory Portfolios | | Statements of Changes in Net Assets | |

(continued)

| | | Victory RS

Investors Fund | | Victory Global Energy

Transition Fund | |

| | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | | Six Months

Ended

June 30,

2022

(Unaudited) | | Year

Ended

December 31,

2021 | |

Share Transactions: | |

Class A | |

Issued | | | 101,195 | | | | 99,952 | | | | 1,101,081 | | | | 2,394,815 | | |

Reinvested | | | — | | | | 143,240 | | | | — | | | | — | | |

Redeemed | | | (111,304 | ) | | | (147,295 | ) | | | (1,338,538 | ) | | | (1,910,846 | ) | |

Total Class A | | | (10,109 | ) | | | 95,897 | | | | (237,457 | ) | | | 483,969 | | |

Class C | |

Issued | | | 901 | | | | 9,121 | | | | 6,594 | | | | 78,427 | | |

Reinvested | | | — | | | | 37,139 | | | | — | | | | — | | |

Redeemed | | | (106,452 | ) | | | (111,183 | ) | | | (62,430 | ) | | | (133,023 | ) | |

Total Class C | | | (105,551 | ) | | | (64,923 | ) | | | (55,836 | ) | | | (54,596 | ) | |

Class R | |

Issued | | | 4,563 | | | | 2,913 | | | | 20,948 | | | | 83,535 | | |

Reinvested | | | — | | | | 10,549 | | | | — | | | | — | | |

Redeemed | | | (1,615 | ) | | | (3,805 | ) | | | (4,723 | ) | | | (93,632 | ) | |

Total Class R | | | 2,948 | | | | 9,657 | | | | 16,225 | | | | (10,097 | ) | |

Class Y | |

Issued | | | 277,519 | | | | 117,213 | | | | 3,630,819 | | | | 5,277,694 | | |

Reinvested | | | — | | | | 120,357 | | | | — | | | | 3,515 | | |

Redeemed | | | (162,067 | ) | | | (214,659 | ) | | | (2,778,561 | ) | | | (5,630,485 | ) | |

Total Class Y | | | 115,452 | | | | 22,911 | | | | 852,258 | | | | (349,276 | ) | |

Change in Shares | | | 2,740 | | | | 63,542 | | | | 575,190 | | | | 70,000 | | |

See notes to financial statements.

29

Victory Portfolios | | Financial Highlights | |

For a Share Outstanding Throughout Each Period

| | | | | Investment Activities | | Distributions to

Shareholders From | |

| | | Net Asset

Value,

Beginning of

Period | | Net

Investment

Income

(Loss)(a) | |

Net Realized

and Unrealized

Gains (Losses) | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investments | |

Victory RS Partners Fund | | | |

Class A | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 26.82 | | | | 0.02 | | | | (2.67 | ) | | | (2.65 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 24.21 | | | | (0.09 | ) | | | 7.14 | | | | 7.05 | | | | — | | | | (4.44 | ) | |

2020 | | $ | 24.47 | | | | 0.04 | | | | 0.07 | | | | 0.11 | | | | — | | | | (0.37 | ) | |

2019 | | $ | 20.66 | | | | 0.12 | | | | 6.12 | | | | 6.24 | | | | (0.21 | ) | | | (2.22 | ) | |

2018 | | $ | 29.21 | | | | 0.04 | | | | (3.52 | ) | | | (3.48 | ) | | | (0.08 | ) | | | (4.99 | ) | |

2017 | | $ | 31.58 | | | | (0.25 | ) | | | 4.78 | | | | 4.53 | | | | — | | | | (6.90 | ) | |

Class R | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 23.41 | | | | (0.02 | ) | | | (2.33 | ) | | | (2.35 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 21.65 | | | | (0.17 | ) | | | 6.37 | | | | 6.20 | | | | — | | | | (4.44 | ) | |

2020 | | $ | 22.01 | | | | (0.03 | ) | | | 0.04 | | | | 0.01 | | | | — | | | | (0.37 | ) | |

2019 | | $ | 18.79 | | | | 0.03 | | | | 5.55 | | | | 5.58 | | | | (0.14 | ) | | | (2.22 | ) | |

2018 | | $ | 27.09 | | | | (0.04 | ) | | | (3.27 | ) | | | (3.31 | ) | | | — | | | | (4.99 | ) | |

2017 | | $ | 29.84 | | | | (0.44 | ) | | | 4.59 | | | | 4.15 | | | | — | | | | (6.90 | ) | |

Class Y | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 29.21 | | | | 0.07 | | | | (2.92 | ) | | | (2.85 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 25.99 | | | | 0.02 | | | | 7.69 | | | | 7.71 | | | | (0.05 | ) | | | (4.44 | ) | |

2020 | | $ | 26.17 | | | | 0.12 | | | | 0.07 | | | | 0.19 | | | | — | | | | (0.37 | ) | |

2019 | | $ | 21.94 | | | | 0.21 | | | | 6.52 | | | | 6.73 | | | | (0.28 | ) | | | (2.22 | ) | |

2018 | | $ | 30.67 | | | | 0.14 | | | | (3.71 | ) | | | (3.57 | ) | | | (0.17 | ) | | | (4.99 | ) | |

2017 | | $ | 32.75 | | | | (0.04 | ) | | | 4.86 | | | | 4.82 | | | | — | | | | (6.90 | ) | |

Member Class | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 26.87 | | | | 0.05 | | | | (2.69 | ) | | | (2.64 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 24.22 | | | | (0.04 | ) | | | 7.17 | | | | 7.13 | | | | (0.04 | ) | | | (4.44 | ) | |

November 3, 2020 (g)

through

December 31, 2020 | | $ | 19.64 | | | | 0.01 | | | | 4.94 | | | | 4.95 | | | | — | | | | (0.37 | ) | |

(a) Per share net investment income (loss) has been calculated using the average daily shares method.

(b) Not annualized for periods less than one year.

(c) Annualized for periods less than one year.

(d) Does not include acquired fund fees and expenses, if any.

(e) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(f) Reflects an increase in trading activity due to asset allocation shifts.

(g) Commencement of operations.

See notes to financial statements.

30

Victory Portfolios | | Financial Highlights — continued | |

For a Share Outstanding Throughout Each Period

| | | | | Ratios to Average Net Assets | | Supplemental Data | |

| | | Total

Distributions | | Net Asset

Value,

End of

Period | | Total

Return

(Excludes

Sales

Charge)(b) | | Net

Expenses(c)(d) | | Net

Investment

Income

(Loss)(c) | | Gross

Expenses(c)(d) | | Net Assets,

End of

Period

(000's) | | Portfolio

Turnover(b)(e) | |

Victory RS Partners Fund | |

Class A | |

Six Months Ended

June 30, 2022

(Unaudited) | | | — | | | $ | 24.17 | | | | (9.88 | )% | | | 1.45 | % | | | 0.16 | % | | | 1.49 | % | | $ | 168,494 | | | | 53 | % | |

Year Ended December 31: | |

2021 | | | (4.44 | ) | | $ | 26.82 | | | | 29.58 | % | | | 1.45 | % | | | (0.29 | )% | | | 1.49 | % | | $ | 195,053 | | | | 64 | % | |

2020 | | | (0.37 | ) | | $ | 24.21 | | | | 0.46 | % | | | 1.45 | % | | | 0.20 | % | | | 1.53 | % | | $ | 156,629 | | | | 108 | %(f) | |

2019 | | | (2.43 | ) | | $ | 24.47 | | | | 30.69 | % | | | 1.45 | % | | | 0.49 | % | | | 1.52 | % | | $ | 193,630 | | | | 57 | % | |

2018 | | | (5.07 | ) | | $ | 20.66 | | | | (12.04 | )% | | | 1.45 | % | | | 0.14 | % | | | 1.52 | % | | $ | 175,723 | | | | 62 | % | |

2017 | | | (6.90 | ) | | $ | 29.21 | | | | 14.21 | % | | | 1.45 | % | | | (0.75 | )% | | | 1.50 | % | | $ | 259,050 | | | | 38 | % | |

Class R | |

Six Months Ended

June 30, 2022

(Unaudited) | | | — | | | $ | 21.06 | | | | (10.04 | )% | | | 1.81 | % | | | (0.21 | )% | | | 2.54 | % | | $ | 1,374 | | | | 53 | % | |

Year Ended December 31: | |

2021 | | | (4.44 | ) | | $ | 23.41 | | | | 29.15 | % | | | 1.81 | % | | | (0.65 | )% | | | 2.48 | % | | $ | 1,652 | | | | 64 | % | |

2020 | | | (0.37 | ) | | $ | 21.65 | | | | 0.06 | % | | | 1.81 | % | | | (0.15 | )% | | | 2.87 | % | | $ | 1,421 | | | | 108 | %(f) | |

2019 | | | (2.36 | ) | | $ | 22.01 | | | | 30.26 | % | | | 1.81 | % | | | 0.12 | % | | | 2.63 | % | | $ | 1,510 | | | | 57 | % | |

2018 | | | (4.99 | ) | | $ | 18.79 | | | | (12.39 | )% | | | 1.81 | % | | | (0.16 | )% | | | 2.37 | % | | $ | 1,207 | | | | 62 | % | |

2017 | | | (6.90 | ) | | $ | 27.09 | | | | 13.81 | % | | | 1.81 | % | | | (1.40 | )% | | | 2.28 | % | | $ | 2,168 | | | | 38 | % | |

Class Y | |

Six Months Ended

June 30, 2022

(Unaudited) | | | — | | | $ | 26.36 | | | | (9.76 | )% | | | 1.12 | % | | | 0.52 | % | | | 1.19 | % | | $ | 175,081 | | | | 53 | % | |

Year Ended December 31: | |

2021 | | | (4.49 | ) | | $ | 29.21 | | | | 30.03 | % | | | 1.12 | % | | | 0.05 | % | | | 1.19 | % | | $ | 177,278 | | | | 64 | % | |

2020 | | | (0.37 | ) | | $ | 25.99 | | | | 0.77 | % | | | 1.12 | % | | | 0.54 | % | | | 1.23 | % | | $ | 168,087 | | | | 108 | %(f) | |

2019 | | | (2.50 | ) | | $ | 26.17 | | | | 31.18 | % | | | 1.12 | % | | | 0.82 | % | | | 1.21 | % | | $ | 232,432 | | | | 57 | % | |

2018 | | | (5.16 | ) | | $ | 21.94 | | | | (11.77 | )% | | | 1.12 | % | | | 0.48 | % | | | 1.19 | % | | $ | 250,709 | | | | 62 | % | |

2017 | | | (6.90 | ) | | $ | 30.67 | | | | 14.59 | % | | | 1.12 | % | | | (0.11 | )% | | | 1.21 | % | | $ | 349,022 | | | | 38 | % | |

Member Class | |

Six Months Ended

June 30, 2022

(Unaudited) | | | — | | | $ | 24.23 | | | | (9.83 | )% | | | 1.25 | % | | | 0.42 | % | | | 1.79 | % | | $ | 3,832 | | | | 53 | % | |

Year Ended December 31: | |

2021 | | | (4.48 | ) | | $ | 26.87 | | | | 29.90 | % | | | 1.25 | % | | | (0.14 | )% | | | 3.05 | % | | $ | 2,994 | | | | 64 | % | |

November 3, 2020 (g)

through

December 31, 2020 | | | (0.37 | ) | | $ | 24.22 | | | | 25.22 | % | | | 1.25 | % | | | 0.36 | % | | | 33.63 | % | | $ | 102 | | | | 108 | %(f) | |

See notes to financial statements.

31

Victory Portfolios | | Financial Highlights | |

For a Share Outstanding Throughout Each Period

| | | | | Investment Activities | | Distributions to

Shareholders From | |

| | | Net Asset

Value,

Beginning of

Period | | Net

Investment

Income

(Loss)(a) | |

Net Realized

and Unrealized

Gains (Losses) | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investments | |

Victory RS Value Fund | | | |

Class A | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 26.33 | | | | 0.05 | | | | (2.51 | ) | | | (2.46 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 23.68 | | | | 0.03 | | | | 6.34 | | | | 6.37 | | | | (0.11 | ) | | | (3.61 | ) | |

2020 | | $ | 24.79 | | | | 0.03 | | | | (0.68 | ) | | | (0.65 | ) | | | — | | | | (0.46 | ) | |

2019 | | $ | 20.28 | | | | 0.07 | | | | 6.28 | | | | 6.35 | | | | (0.14 | ) | | | (1.70 | ) | |

2018 | | $ | 26.21 | | | | 0.06 | | | | (2.85 | ) | | | (2.79 | ) | | | (0.14 | ) | | | (3.00 | ) | |

2017 | | $ | 27.94 | | | | 0.03 | | | | 4.80 | | | | 4.83 | | | | (0.04 | ) | | | (6.52 | ) | |

Class C | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 22.38 | | | | (0.04 | ) | | | (2.12 | ) | | | (2.16 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 20.65 | | | | (0.16 | ) | | | 5.50 | | | | 5.34 | | | | — | | | | (3.61 | ) | |

2020 | | $ | 21.85 | | | | (0.11 | ) | | | (0.63 | ) | | | (0.74 | ) | | | — | | | | (0.46 | ) | |

2019 | | $ | 18.08 | | | | (0.11 | ) | | | 5.58 | | | | 5.47 | | | | — | | | | (1.70 | ) | |

2018 | | $ | 23.76 | | | | (0.13 | ) | | | (2.55 | ) | | | (2.68 | ) | | | — | | | | (3.00 | ) | |

2017 | | $ | 26.01 | | | | (0.08 | ) | | | 4.35 | | | | 4.27 | | | | — | | | | (6.52 | ) | |

Class R | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 24.54 | | | | — | (f) | | | (2.33 | ) | | | (2.33 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 22.27 | | | | (0.07 | ) | | | 5.95 | | | | 5.88 | | | | — | (f) | | | (3.61 | ) | |

2020 | | $ | 23.44 | | | | (0.05 | ) | | | (0.66 | ) | | | (0.71 | ) | | | — | | | | (0.46 | ) | |

2019 | | $ | 19.26 | | | | (0.03 | ) | | | 5.95 | | | | 5.92 | | | | (0.04 | ) | | | (1.70 | ) | |

2018 | | $ | 25.06 | | | | (0.03 | ) | | | (2.72 | ) | | | (2.75 | ) | | | (0.05 | ) | | | (3.00 | ) | |

2017 | | $ | 27.03 | | | | (0.03 | ) | | | 4.58 | | | | 4.55 | | | | — | | | | (6.52 | ) | |

Class Y | | | |

Six Months Ended

June 30, 2022

(Unaudited) | | $ | 27.23 | | | | 0.08 | | | | (2.58 | ) | | | (2.50 | ) | | | — | | | | — | | |

Year Ended December 31: | |

2021 | | $ | 24.38 | | | | 0.10 | | | | 6.53 | | | | 6.63 | | | | (0.17 | ) | | | (3.61 | ) | |

2020 | | $ | 25.45 | | | | 0.08 | | | | (0.69 | ) | | | (0.61 | ) | | | — | | | | (0.46 | ) | |

2019 | | $ | 20.77 | | | | 0.13 | | | | 6.44 | | | | 6.57 | | | | (0.19 | ) | | | (1.70 | ) | |

2018 | | $ | 26.77 | | | | 0.13 | | | | (2.92 | ) | | | (2.79 | ) | | | (0.21 | ) | | | (3.00 | ) | |

2017 | | $ | 28.40 | | | | 0.06 | | | | 4.94 | | | | 5.00 | | | | (0.11 | ) | | | (6.52 | ) | |

(a) Per share net investment income (loss) has been calculated using the average daily shares method.

(b) Not annualized for periods less than one year.

(c) Annualized for periods less than one year.

(d) Does not include acquired fund fees and expenses, if any.

(e) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(f) Amount is less than $0.005 per share.

See notes to financial statements.

32