UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04875

Name of Registrant: Royce Value Trust, Inc.

Address of Registrant: 1414 Avenue of the Americas

New York, NY 10019

| Name and address of agent for service: | John E. Denneen, Esquire |

| | 1414 Avenue of the Americas |

| | New York, NY 10019 |

Registrant’s telephone number, including area code: (212) 486-1445

Date of fiscal year end: December 31

Date of reporting period: January 1, 2006 - June 30, 2006

Item 1: Reports to Shareholders

| |

|

| S E M I A N N U A L R E V I E W |

|

| |

Royce Value Trust

Royce Micro-Cap Trust

Royce Focus Trust

www.roycefunds.com

| | AND

R E P O R T T O S T O C K H O L D E R S

2006 |

| | | | TheRoyceFunds |

| | | |

VALUE INVESTING IN SMALL COMPANIES FOR MORE THAN 30 YEARS

|

A FEW WORDS ON CLOSED-END FUNDS

| |

| | Royce & Associates, LLC manages three closed-end funds: Royce Value Trust, the first small-cap value closed-end fund offering; Royce Micro-Cap Trust, the only micro-cap closed-end fund; and Royce Focus Trust, a closed-end fund that invests in a limited number of primarily small-cap companies.

A closed-end fund is an investment company whose shares are listed on a stock exchange or are traded in the over-the-counter market. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange or the Nasdaq market, as with any publicly traded stock. This is in contrast to open-end mutual funds, in which the fund sells and redeems its shares on a continuous basis.

| |

| | A CLOSED-END FUND OFFERS SEVERAL DISTINCT ADVANTAGES

NOT AVAILABLE FROM AN OPEN-END FUND STRUCTURE |

| |

| | • | Since a closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions, as an open-end fund must. | |

| |

| | • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times is ideal for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. | |

| |

| | • | A closed-end fund may invest more freely in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is particularly beneficial for Royce-managed closed-end funds, which invest in small- and micro-cap securities. | |

| |

| | • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. | |

| |

| | • | Unlike Royce’s open-end funds, our closed-end funds are able to distribute capital gains on a quarterly basis. Each of the Funds has adopted a quarterly distribution policy for its common stock. | |

| |

| | We believe that the closed-end fund structure is very suitable for the long-term investor who understands the benefits of a stable pool of capital. | |

| | WHY DIVIDEND REINVESTMENT IS IMPORTANT | |

| |

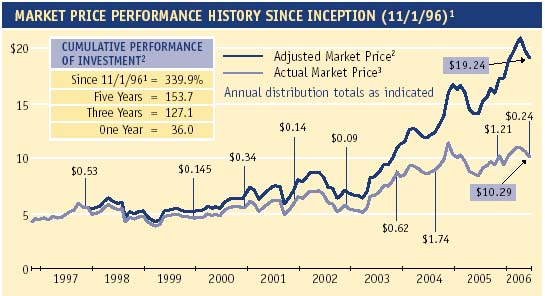

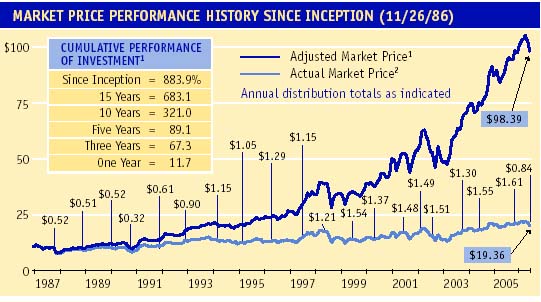

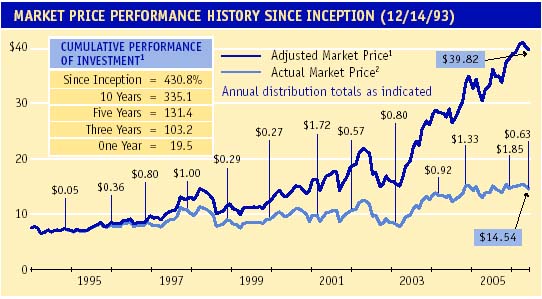

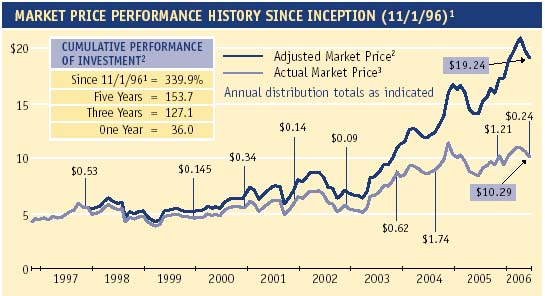

| | A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 13, 15 and 17. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 19 or visit our website at www.roycefunds.com. | |

| |

| |

| THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | | |

| Semiannual Review | | |

|

| Performance Table | | 2 |

|

| Letter to Our Stockholders | | 3 |

|

Online Update | | 10 |

|

| | |

|

| Semiannual Report to Stockholders | | 11 |

|

For more than 30 years, we have used a value approach to invest in smaller-cap securities. We focus primarily on the quality of a company’s balance sheet, its ability to generate free cash flow and other measures of profitability or sound financial condition. At times, we may also look at other factors, such as a company’s unrecognized asset values, its future growth prospects or its turnaround potential following an earnings disappointment or other business difficulties. We then use these factors to assess the company’s current worth, basing the assessment on either what we believe a knowledgeable buyer might pay to acquire the entire company, or what we think the value of the company should be in the stock market.

THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 1 |

| |

| |

Charles M. Royce, President

When we discuss specific security

selection criteria for many of The

Royce Funds, four qualities are

commonly listed: a strong balance

sheet, a history of earnings, high

internal rates of return and the

ability to generate free cash flow.

Each is a critical part of

determining both a company’s

current quality and the likelihood

that it will be able to maintain

that quality in the future. They

are also in many ways interrelated.

For example, previously we

discussed the importance of a low-

debt, asset-rich balance sheet in

helping to maintain or fuel

earnings, especially when a business

is experiencing earnings trouble.

Similarly, a company’s ability to

generate free cash flow is often

linked to its ability to sustain

positive earnings and to generate

high internal rates of return. We

think that it’s a positive sign

Continued on Page 4...

| | | |

| | | |

| | | | PERFORMANCE TABLE |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | AVERAGE ANNUAL NAV TOTAL RETURNS Through June 30, 2006 |

| | | |

|

| | | | | | Royce | | | Royce | | | Royce | | | Russell | |

| | | | | | Value Trust | | | Micro-Cap Trust | | | Focus Trust | | | 2000 | |

| | | |

|

| | | | Second Quarter 2006* | | | -3.86 | % | | | | -3.16 | % | | | | -4.83 | % | | | | -5.02 | % | |

| | | |

|

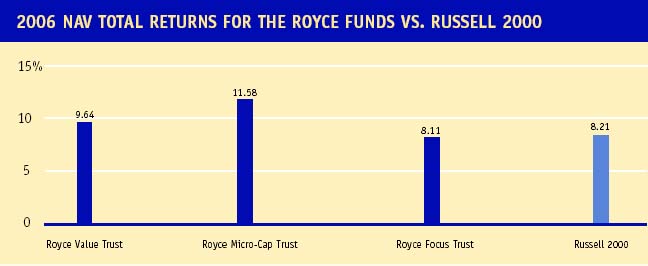

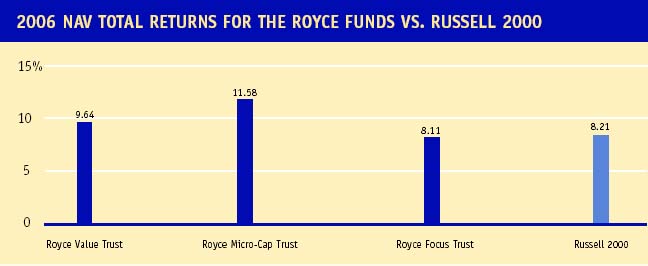

| | | | January - June 2006* | | | 9.64 | | | | | 11.58 | | | | | 8.11 | | | | | 8.21 | | |

| | | |

|

| | | | One-Year | | | 21.33 | | | | | 20.80 | | | | | 30.73 | | | | | 14.58 | | |

| | | |

|

| | | | Three-Year | | | 21.33 | | | | | 22.60 | | | | | 27.21 | | | | | 18.70 | | |

| | | |

|

| | | | Five-Year | | | 11.34 | | | | | 14.02 | | | | | 16.16 | | | | | 8.50 | | |

| | | |

|

| | | | 10-Year | | | 13.88 | | | | | 14.11 | | | | | n/a | | | | | 9.05 | | |

| | | |

|

| | | | 15-Year | | | 14.27 | | | | | n/a | | | | | n/a | | | | | 11.80 | | |

| | | |

|

| | | | Since Inception | | | 12.85 | | | | | 14.36 | | | | | 14.28 | | | | | — | | |

| | | |

|

| | | | Inception Date | | | 11/26/86 | | | | 12/14/93 | | | | | | | — | | |

| | | | * Not annualized. |

| | | | ** Date Royce & Associates, LLC assumed investment management responsibility for the Fund. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | IMPORTANT PERFORMANCE AND RISK INFORMATION |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | All performance information in this Review and Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Performance information does not reflect the deduction of taxes that a stockholder would pay on distributions or on the sale of Fund shares. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Royce Funds invest primarily in securities of small-cap and/or micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies.

The thoughts expressed in this Review and Report to Stockholders concerning recent market movements and future prospects for small company stocks are solely the opinion of Royce at June 30, 2006, and, of course, historical market trends are not necessarily indicative of future market movements. Statements regarding the future prospects for particular securities held in the Funds’ portfolios and Royce’s investment intentions with respect to those securities reflect Royce’s opinions as of June 30, 2006 and are subject to change at any time without notice. There can be no assurance that securities mentioned in this Review and Report to Stockholders will be included in any Royce-managed portfolio in the future. |

| | | | |

2 | THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL

REPORT TO STOCKHOLDERS | | | |

| | | | |

LETTER TO OUR STOCKHOLDERS

|

|

Value In Vogue?

After three full decades managing small-cap value portfolios, we thought that we had seen all of the various movements, fads and trends that periodically capture the imaginations (to say nothing of the wallets) of investors. It was always easy for us to be amused at such things. Being value investors, with that term’s inherent sense of caution and conservatism, we have always measured a comfortable distance between the work that we do and anything that smacks of trends in equity investing. With its emphasis on attributes such as patience and diligence, with its demands of long hours of detailed research, value seems by nature not simply unfashionable, but nearly impervious to the short-term mindsets that typically dominate the stock market equivalent of the runways of Paris, Milan and Manhattan. Even earlier in the current decade, when value, especially small-cap value, began scoring high returns and glowing press, it did not appear to capture the investment zeitgeist in quite the same way that large-cap or Technology investments had during the ’90s. This was more than all right with us. After all, we’re not exactly high-fashion material (there’s a reason we always look better in cartoon form), and we did not think that our approach was, either.

Yet here we are just past the halfway mark of 2006, and in our view small-cap value investing is nearing the end of its stint as domestic investment’s hottest approach. How did our style become so stylish? Its success over the last several years occurred during a period in which few alternatives in the domestic equity universe could compete with its strong results. As measured by the Russell 2000, small-cap bested large-cap (as measured by the S&P 500) for the one-, three-, five-, 10- and 15-year periods ended 6/30/06. In turn, the Russell 2000 Value index outperformed the Russell 2000 for each of these periods as well as the 20- and

|

|

The market still awaits Next Year’s Model, but small-cap value’s unexpected turn on the runway should hardly result in obsolescence.

|

|

THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 3 |

| |

| |

when earnings and cash flows

are closely aligned.

Cash flow is usually defined as the

amount of net cash that a company

brings in that may be used for

various company purposes, such as

to build assets or pay dividends.

(Cash flow can also be negative, in

which case there are no funds with

which to further capitalize business

activities or make payouts to

shareholders.) For most businesses,

cash flow comes from three

activities—operations, investment

and financing.

Our preference in most cases is for a

company that generates the bulk of

its net cash flow from operations,

from the day-to-day activities of its

business. Cash flow from operations

is also significant because it may

likely affect the other two activities.

Although they are similar

in that they help us to understand

a company’s profitability, cash flow

differs from earnings (the profits a

company makes) because it

also takes into account certain non-

cash accounting items, most

importantly depreciation.

Continued on Page 6...

| | |

LETTER TO OUR STOCKHOLDERS

25-year periods ended 6/30/06. These terrific results led to the plainly dressed small-cap value approach attracting speculative dollars from short-term investors, money hungry for the Next Big Thing that probably originated from those whose only experience with smaller stocks would most likely have come on the growth side. It was not long ago that this activity would have been difficult, if not impossible, without considered investments in specific small-cap stocks or astute choices in small-cap value mutual funds. However, with the advent of investment vehicles such as ETFs (Exchange Traded Funds), moving quickly in and out of virtually any equity style index has become more convenient for investors of all tastes, temperaments and time frames.

What becomes of investment approaches when they are no longer considered the most fashionable? We suspect that styles such as ours will manage just fine beyond the glare of the hot lights just as they did before they became trendy. Although the last few years have been wonderful, the rally has been top-heavy with an extended run for energy stocks (that may not be over) and shorter, less stellar bursts in other areas. This leaves ample room for potential growth in those places that have enjoyed only intermittent success or have been mostly left out. The market still awaits Next Year’s Model, but small-cap value’s unexpected turn on the runway should hardly result in obsolescence.

Is Large the New Small?

Our track record for large-scale stock market prognostication is checkered at best—we like to joke that we’ve called 10 of the last three corrections. Still, the case for emerging large-cap leadership remains compelling to us, even as it’s also important to re-assert our view that any leadership phase in the coming months is likely to be short-lived, whether for large-caps, as measured by the S&P 500, or small-caps, as measured by the Russell 2000. The 10-year period ended 12/31/05 offered an almost eerily symmetrical split between long-term periods first of large-cap, then of small-cap dominance. We do not expect anything resembling the previous 10 years in terms of the time span of asset-class leadership or the breadth in performance spreads. We continue to believe that the stock market will be characterized by frequent leadership rotation and low returns.

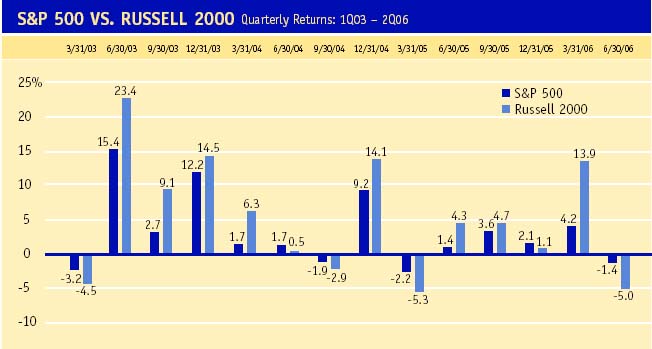

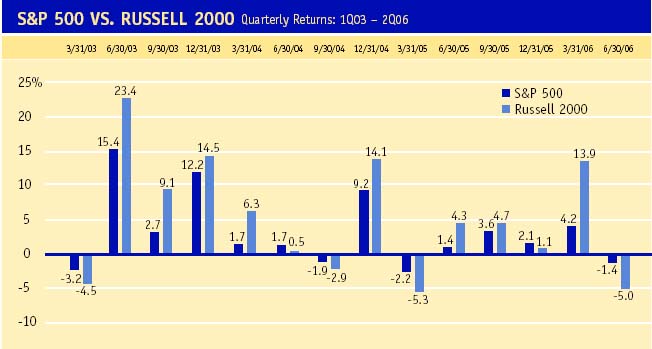

After narrowly outperforming small-cap stocks in 2005, large-caps took their by-now-familiar position in the back seat to small-cap during the first half of 2006. The Russell 2000 was up 8.2% for the year-to-date period ended 6/30/06, versus a gain of 2.7% for the S&P 500 (and a loss of 1.5% for the still-struggling Nasdaq Composite). Small-cap’s advantage came primarily from its considerable outperformance in the bullish first quarter, when the Russell 2000 was up 13.9% versus a gain of 4.2% for the S&P 500. When stock prices began to correct in the second quarter, large-cap outperformed (-1.4% for the S&P 500 versus -5.0% |

4 | THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL

REPORT TO STOCKHOLDERS

| | |

|

|

for the Russell 2000). The pattern of small-cap leading in brief up-market phases then ceding leadership to large-cap during equally brief downturns dates back to 2003.

The down-market resilience of large-cap stocks seems to us to be the central story of the recent decline. Our earlier contention, made in our 2005 Annual Review and Report, was that large-cap would lose less during declines, which has been the case so far in 2006. We also surmised that small-cap would have an edge in any subsequent rally, which held true in the first quarter. Yet we are no longer convinced that small-cap will lead in every subsequent bullish phase. An underreported element in the downturn was the tightening of liquidity on a worldwide level. The combination of better near-term down market results for large-cap stocks and the widespread liquidity crunch is likely to draw investors in the short run to cash, bonds and what they perceive to be stable, high-quality equities. In other words, the unfashionable nature of large-cap stocks may be exactly what helps to make them fashionable again.

|

Value—Always in Style?

Of course, no style has been more fashionable in the current decade than small-cap value. However much we may think of our work as an all-weather strategy—a fashion perennial more akin to a navy blazer or black cocktail dress than the latest creations adorning the windows of boutiques on Rodeo Drive—there’s no denying the recent attraction of small-cap value for investors burdened with what we would describe as the investment equivalent of short attention spans. And its long run in the current decade has indeed been wildly impressive. The Russell 2000 Value index outpaced its small-cap growth counterpart, as measured by the Russell 2000 Growth index, for the one-, three-, five-, 10-, 15-, 20- and 25-year periods ended 6/30/06. One notable aspect of small-cap value’s remarkable run in the current decade has been its absolute and relative strength during the most recent long-term

|

|

We do not expect anything resembling the previous 10 years in terms of the time span of asset-class leadership or the breadth in performance spreads. We continue to believe that the stock market will be characterized by frequent leadership rotation and low returns.

|

|

THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 5 |

| |

| |

| | |

LETTER TO OUR STOCKHOLDERS

|

| |

A company’s statement of cash

flows is crucial, because it

provides a record of how the firm

has handled cash inflows and

outflows over a given quarterly or

annual period.

It also helps to reconcile

information found on the balance

sheet (which shows a firm’s assets

and liabilities) and the income

statement (which shows all revenue,

costs, expenses and earnings).

While the balance sheet can be

used to determine the increase or

decrease in assets and the

income statement shows the

profits that have made an impact

on that growth (or lack thereof),

the statement of cash flows gives

us an idea of how that growth

was financed. It tells the story of

where the money came from and

where it went.

This is especially relevant for

capital-intensive businesses such as

industrial companies that maintain

physical plants and own stores of

equipment that will eventually

need upgrading or replacing.

Continued on Page 8...

| | |

up-market period. From the small-cap market trough on 10/9/02 through 6/30/06, the Russell 2000 Value index gained 140.1% versus 123.1% for the Russell 2000 Growth index. Small-cap value’s recent short-term returns were also strong. For the year-to-date period ended 6/30/06, the small-cap value index was up 10.4% versus 6.1% for the small-cap growth index. Although it trailed growth in the first quarter (+13.5% versus +14.4%), it moved ahead in the second, -2.7% versus -7.3%.

Investors can thus be forgiven if they’re a little anxious about small-cap value’s ongoing prospects. Our admittedly biased view is that small-cap value should be all right, even if its days of doing star turns on the most chic runways may be drawing to a close. Although returns for the approach seldom reached the same levels, its performance in the current decade is analogous to some degree to what large-cap stocks were during the mid-to-late ’90s–a fashionable area where people were putting money almost to the exclusion of the rest of the stock market. Now that the attention seems to be waning, we are finally beginning to see valuations come back to what we regard as more sensible levels throughout the small-cap world, although the number of bargains as of this writing is still not as plentiful as we would like.

Royce on the Runway

While the first six months of 2006 were terrific for the Russell 2000 (and the Russell 2000 Value index), results were slightly more mixed for our three closed-end offerings. All three Funds posted strong net asset value (NAV) results on an absolute basis, but Royce Focus Trust narrowly trailed the Russell 2000 on that basis. However, this was only a small blemish, especially in the wider context of longer-term returns for periods ended 6/30/06. Over market cycle and other long-term time periods, each Fund posted impressive absolute and relative returns on both an NAV and market price basis. These are the time spans that matter most to us in evaluating performance.

Both in our portfolios and the small-cap world as a whole, energy stocks enjoyed a strong first half, as did many Industrial Products and Services companies. However, these were not the only three areas in which Fund performance was strong in the first half. Technology companies also made a sizeable positive contribution to performance. In fact, net

|

6 | THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL

REPORT TO STOCKHOLDERS

| |

losses on a dollar basis were hard to find at the sector level, an impressive, albeit short-term, accomplishment during a volatile six months for equities.

|

From the Catwalk to the Coal Mine?

Some investors may be concerned that small-cap’s run has been of such long duration that the asset class is poised for a long period of desultory performance, with the recent downturn a harbinger of things to come. We respectfully disagree. The recent decline has been fairly benign as corrections go and hardly catastrophic for small-cap as a whole. In the coming months, we think that micro-cap stocks will be the area to watch most closely as a potential indicator of small-cap movement. They are generally more volatile to begin with, and having enjoyed strong performance over the last few years, they are especially vulnerable to nervous investors looking for safety. For the more fatalistic among us, they are the canary in the small-cap coal mine in that any major decline for our asset class would probably begin with them. However, we’re more confident about the prospects for the entire small-cap area. We do not believe that the recent down-market period marks the beginning of a severe and/or long-term bear market for any asset class, including micro-caps. What we have been seeing lately seems to us less serious and more in line with what has happened historically following successful, speculative periods. The really interesting element in the downturn has been that several typically non-correlated asset categories–small-cap stocks, natural resources stocks and commodities, real estate and emerging markets–were coming off strong long-term performances and then began to correct at more or less the same time in the spring of this year. It’s been an odd confluence of declining performance that we believe has been making the downward move look more severe than it really is.

We define a correction as a decline of 15% or more from a previous small-cap peak. It remains too early to tell whether the current decline will reach this level (as of this writing it has not). However, like any previous decline, it has presented us with some discrete purchase opportunities, even as it has caused pain for investors. Although a market that steadily climbed year after year would make investors sleep more soundly, it is volatility that helps to create the pricing inefficiencies that attract value investors like ourselves. As any market sell-off worsens, quality companies are often lumped together with weaker ones, as short-term investors rush for the exits. This leaves many worthwhile companies trading for less than our estimate of their intrinsic value, piled among the rubble of companies walloped by the correction. The current decline has begun to create such situations, though not yet in large numbers. At least in the short run, further erosion in stock prices would not be the worst thing that could happen to small-cap stocks.

|

|

Although returns for the approach seldom reached the same stratospheric levels, small-caps performance in the current decade is analogous to some degree to what large-cap stocks were during the mid-to-late ’90s–a fashionable area where people were putting money almost to the exclusion of the rest of the stock market.

|

|

THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 7 |

| |

| | |

LETTER TO OUR STOCKHOLDERS

|

| |

Without positive cash flow, these

businesses are likely to have trouble

keeping up with more profitable,

cash-laden competitors. In such

businesses, we like to see cash

flows that are greater than earnings

because it means that the company’s

depreciation expenses are healthy.

In high-returning businesses, we

prefer that cash flows be reinvested

at high returns.

In all cases, regardless of the type

of business, we want to see cash

flows used intelligently. To our way

of thinking, this means reinvesting

in the business or paying dividends

to shareholders. As with most

things, we think about the longterm

picture when it comes to cash

flow. We may be willing to buy a

firm in a negative cash flow

moment if we think the firm is

capable of righting itself. However,

cash flow problems should be

temporary as few factors signal

quality more definitively than

stable, growing cash flows.

| | |

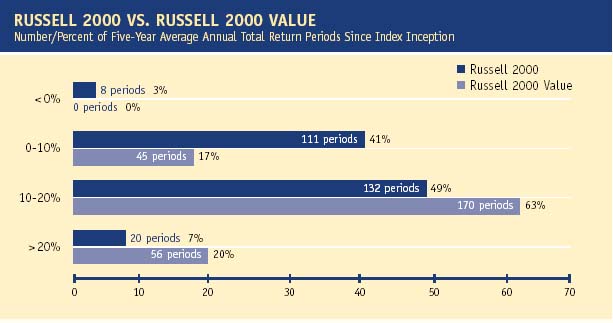

Five Years of FashionMost small-cap market cycles have been much shorter than the current cycle’s nearly six-year time span, with the average length of the eight completed cycles in the history of the Russell 2000 being 3.3 years. The shortest was little more than one-and-a-quarter years (2/8/80-6/15/81), while the longest lasted approximately six-and-a-half years (10/9/89-5/22/96). If the current cycle were to end soon, it would be the second longest on record. This is one of the reasons why we evaluate Fund performance on an absolute basis over long-term periods, such as five years, in addition to full market cycles. Examining five-year periods is especially useful because they typically include all of or most of a full market cycle, sometimes two. In addition, examining rolling five-year results gives a better picture of long-term market trends, and can also provide insight into what we might expect as the market moves forward.

There have been 269 monthly trailing five-year return periods since the Russell 2000’s inception on 12/31/78. From inception through 6/30/06, the index’s five-year return was less than zero in only 3% of these periods. The index provided positive single-digit returns more than 40% of the time and double-digit returns 56% of the time. Over the entire period, the average of all of the 269 five-year average annual total return periods was 11.6%. In the case of small-cap value, the results are even stronger. The Russell 2000 Value index did not have any negative five-year return periods since its inception and produced positive single-digit returns in 17% of the periods. In an impressive 83% of the periods, the value index produced double-digit five-year average annual total returns, averaging 14.5% for all of the 269 return periods. (Please see the following page for more details.) |

8 | THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL

REPORT TO STOCKHOLDERS

| |

|

The foregoing is in large part why we believe that small-caps continually offer the potential to produce above-average returns over long-term time horizons, and why we regard them as a necessary component in any asset allocation plan. Fashions come and go, but we believe that approaches such as ours, those that patiently strive to build wealth over the long haul, have what it takes to remain successful no matter what happens to be in (or out) of style elsewhere in the investment world.

|

| | | | | | |

| Sincerely, | | | | | |

| | | | | | |

| |  | |  | |

| | | | | | |

| Charles M. Royce | | W. Whitney George | | Jack E. Fockler, Jr. | |

| President | | Vice President | | Vice President | |

| | | | | | |

| July 31, 2006 | | | | | |

| | | | | | |

| | | | | | |

|

The Russell 2000 Value index did not have any negative five-year return periods since its inception and produced positive single-digit returns in 17% of the periods. In an impressive 83% of the periods, the value index produced double-digit five-year average annual total returns, averaging 14.5% for all of the 269 return periods.

|

|

THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 9 |

| |

10 | THIS PAGE IS NOT PART OF THE 2006 SEMIANNUAL REPORT TO STOCKHOLDERS |

| |

| |

| | | |

| TABLE OF CONTENTS | | |

|

| | | |

| Semiannual Report to Stockholders | | |

|

| Managers’ Discussions of Fund Performance | | |

| | | |

Royce Value Trust | | 12 |

|

Royce Micro-Cap Trust | | 14 |

|

Royce Focus Trust | | 16 |

|

| History Since Inception | | 18 |

|

| Distribution Reinvestment and Cash Purchase Options | | 19 |

|

| Schedules of Investments and Other Financial Statements | | |

| | | |

Royce Value Trust | | 20 |

|

Royce Micro-Cap Trust | | 33 |

|

Royce Focus Trust | | 46 |

|

| Board Approval of Investment Advisory Agreements | | 54 |

|

| Other Important Information | | 56 |

|

2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 11 |

| |

ROYCE VALUE TRUST

AVERAGE ANNUAL NAV TOTAL RETURNS

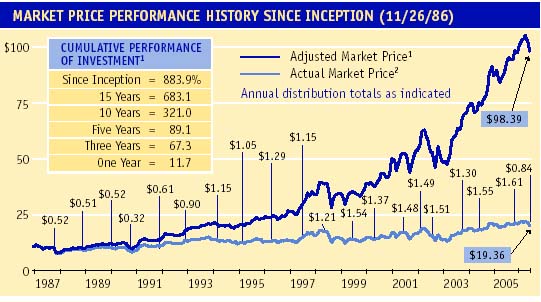

Through 6/30/06 | |  Manager’s Discussion The first-half results for Royce Value Trust’s (RVT) diversified portfolio of small- and micro-cap stocks fully reflected the schizoid nature of the first six months of 2006. For the year-to-date period ended 6/30/06, the Fund was up 9.6% on a net asset value (NAV) basis and 0.7% on a market price basis versus an 8.2% return for the Russell 2000 and a 7.7% result for the S&P 600. On an NAV basis, RVT stayed ahead of both of its small-cap benchmarks, although its market price return trailed by a substantial margin. Much of the Fund’s market price lag can be attributed to its relative lack of participation in the dynamic rally that characterized the first quarter, in which RVT’s market price return was 6.1%. During the same period, the Russell 2000 was up 13.9% and the S&P 600 gained 12.8%, while RVT gained 14.0% on an NAV basis. When stock prices fell in the second quarter, RVT lost 3.9% on an NAV basis and 5.1% on a market price basis. The Russell 2000 declined 5.0% and the S&P 600 lost 4.6% in the second quarter.

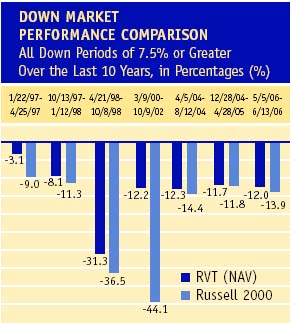

The Fund’s solid first-half NAV return contributed to its strong absolute and relative results over market-cycle and other long-term periods. From the small-cap market peak on 3/9/00 through 6/30/06, RVT gained 112.3% versus 29.5% for the Russell 2000 and 77.8% for the S&P 600. During the more bullish phase from the small-cap market trough on 10/9/02 through 6/30/06, the Fund was up 141.8% compared to a gain of 131.8% for the Russell 2000 and 128.0% for the S&P 600. On an NAV basis, RVT also held a performance advantage over each of its benchmarks for the one-, three-, five-, 10-, 15-year and since inception (11/26/86) periods ended 6/30/06. The Fund outperformed the Russell 2000 on a market price basis for each of these periods except the one year interval and bested the S&P 600 for all but the one-and three-year periods. RVT’s average annual NAV total return since inception was 12.9%.

Each of the Fund’s equity sectors posted positive net gains during the first half. On a dollar basis, the leading sectors were Industrial Products, Industrial Services and Natural Resources. Within Industrial Products, more than 40% of the sector’s dollar-based gains came from holdings in the machinery industry, including the portfolio’s top gainer–and top-ten position–Lincoln Electric Holdings, a security that we have owned in RVT’s portfolio since 1998. What has attracted us over the years to this welding and cutting products maker were its strong balance sheet, history of positive earnings and ability to generate positive cash flow from operating activities. Its cyclical industrial business was one that attracted quality-seeking value investors like ourselves. We were pleasantly surprised by its impressive first half, as the worldwide demand for its products continued to grow at a torrid pace. The firm announced record revenues in February for both the fiscal year and fourth quarter ended 12/31/05. Record revenues were also reported in April for the fiscal first quarter of 2006. In between, the company was added to the S&P 400 MidCap index.

We have owned shares of another Industrial Products business, Kimball International, since 1989. The firm, whose low debt and consistent dividend helped maintain our attraction, makes |

|

Second Quarter 2006* | | -3.86 | % |

|

Jan - June 2006* | | 9.64 | |

|

One-Year | | | | | | | | 21.33 | |

|

Three-Year | | | | | | | | 21.33 | |

|

Five-Year | | | | | | | | 11.34 | |

|

10-Year | | | | | | | | 13.88 | |

|

15-Year | | | | | | | | 14.27 | |

|

Since Inception (11/26/86) | | 12.85 | |

|

| | | |

CALENDAR YEAR NAV TOTAL RETURNS |

|

Year | | RVT | | | Year | | | RVT | |

|

2005 | | 8.4 | % | | 1996 | | | 15.5 | % |

|

2004 | | 21.4 | | | 1995 | | | 21.1 | |

|

2003 | | 40.8 | | | 1994 | | | 0.1 | |

|

2002 | | -15.6 | | | 1993 | | | 17.3 | |

|

2001 | | 15.2 | | | 1992 | | | 19.3 | |

|

2000 | | 16.6 | | | 1991 | | | 38.4 | |

| |

1999 | | 11.7 | | | 1990 | | | -13.8 | | All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds’ P/E ratio calculations exclude companies with zero or negative earnings. |

|

1998 | | 3.3 | | | 1989 | | | 18.3 | |

|

1997 | | 27.5 | | | 1988 | | | 22.7 | |

| | | | | | | | | | |

TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders |

|

AllianceBernstein Holding L.P. | | 1.9 | % |

|

Ritchie Bros. Auctioneers | | 1.5 | |

|

Lincoln Electric Holdings | | 1.3 | |

|

Sotheby’s | | 1.1 | |

|

SEACOR Holdings | | 1.1 | |

|

Plexus Corporation | | 1.0 | |

|

Ash Grove Cement Company Cl. B | | 0.9 | |

|

Forward Air | | 0.9 | |

|

Newport Corporation | | 0.9 | |

|

Brady Corporation Cl. A | | 0.8 | |

| | | | | | | | | | |

PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders |

|

Technology | | 21.6 | % |

|

Industrial Products | | 18.0 | |

|

Industrial Services | | 14.1 | |

|

Natural Resources | | 9.8 | |

|

Financial Intermediaries | | 8.9 | |

|

Health | | 7.4 | |

|

Financial Services | | 7.4 | |

|

Consumer Services | | 5.7 | |

|

Consumer Products | | 4.6 | |

|

Utilities | | 0.2 | |

|

Diversified Investment Companies | | 0.1 | |

|

Miscellaneous | | 1.6 | |

|

Bond & Preferred Stocks | | 0.3 | |

|

Cash and Cash Equivalents | | 20.2 | |

12 | 2006 SEMIANNUAL REPORT TO STOCKHOLDERS |

| |

Performance and Portfolio Review

GOOD IDEAS THAT WORKED

Net Realized and Unrealized Gain Through 6/30/06 | | wood furniture and cabinets, as well as electronic assembly products. Better-than-expected fiscal third-quarter earnings and new opportunities for its electronics division seemed to attract more investors. Unlike many stocks in the first half, Kimball’s price climbed relatively late, not really taking off until May. Oregon Steel Mills specializes in steel plate and pipe products. A resurgent steel industry and recent earnings increases helped its stock price to climb and prompted us to trim our position in the first quarter. Outside of the Industrial Products sector, the Fund had success with two top-ten holdings. The price of fine art, antique and collectibles auction house Sotheby’s rose on news of higher profits in its fiscal fourth quarter. Steady, better-than- | | PORTFOLIO DIAGNOSTICS |

| Lincoln Electric Holdings | $4,900,103 | | |

|

| | | Average Market Capitalization | $1,055 million |

| Kimball International Cl. B | 3,971,411 | | |

|

| | | Weighted Average P/E Ratio | 20.7x |

| Sotheby’s | 3,828,228 | | |

|

| | | Weighted Average P/B Ratio | 2.2x |

| Plexus Corporation | 3,735,779 | | |

|

| | | Weighted Average Yield | 0.8% |

| Ritchie Bros. Auctioneers | 3,392,672 | | |

|

| | | | | Fund Net Assets | $1,108 million |

| expected earnings, as well as a promising outlook, seemed to create excitement for the shares of industrial equipment auctioneer Ritchie Bros. Auctioneers. | |

|

| MAXIMUS provides consulting, as well as systems and operations management, to federal, state and local government agencies and privatesector clients. Its price plummeted amidst a now-settled lawsuit, a large contract problem and some | | Turnover Rate | 8% |

| | | | management decisions that left investors scratching their heads as they were selling its shares. We held a position at the end of June, hopeful that the firm was capable of righting itself. We also held a small position in PXRE Group. Its share price collapsed in the wake of fiscal fourth-quarter losses resulting from the damage wrought by Hurricanes Katrina, Rita and Wilma. | |

|

GOOD IDEAS AT THE TIME

Net Realized and Unrealized Loss Through 6/30/06 | | | Net Leverage† | 0% |

| | |

|

| MAXIMUS | $1,731,766 | | | Symbol | |

| | | Market Price | RVT |

| PXRE Group | 1,538,931 | | | NAV | XRVTX |

| | | † Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets, applicable to Common Stockholders. |

| HealthSouth Corporation | 1,230,400 | | |

| | | | | | |

| Foundry Networks | 1,176,210 | | | |

| | | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding at 6/30/06 at

NAV or Liquidation Value |

| Fleetwood Enterprises | 1,126,983 | | |

|

| | | | | 55.9 million shares of Common Stock | $1,108 million |

| | | | |

|

| | | | | | 5.90% Cumulative Preferred Stock | $220 million |

| | | | | | | | | |

| | RISK/RETURN COMPARISON

Three-Year Period Ended 6/30/06 |

| |

|

| | | Average Annual

Total Return | Standard Deviation | Return

Efficiency* |

| |

|

| | RVT (NAV) | 21.3% | 14.1 | 1.51 |

| |

|

| | S&P 600 | 20.5 | 13.7 | 1.50 |

| |

|

| | Russell 2000 | 18.7 | 14.6 | 1.28 |

| | * Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. |

1 Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all annual distributions as indicated and fully participated in primary subscriptions of the Fund’s rights offerings. | | | | | |

2 Reflects the actual market price of one share as it traded on the NYSE. | |  |

2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 13

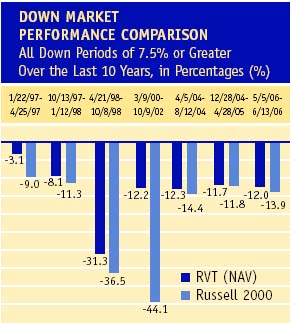

ROYCE MICRO-CAP TRUST

AVERAGE ANNUAL NAV TOTAL RETURNS

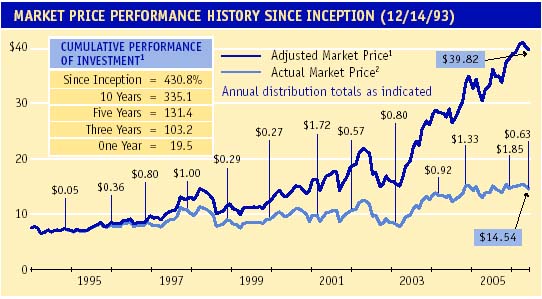

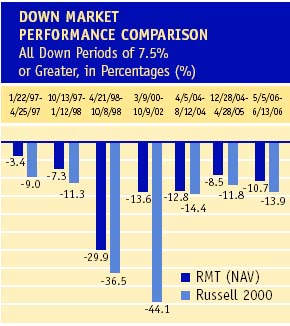

Through 6/30/06 | |  Manager’s Discussion During the first half of 2006, the diversified portfolio of Royce Micro-Cap Trust (RMT) posted solid results on both an absolute and relative basis. For the year-to-date period ended 6/30/06, RMT gained 11.6% on a net asset value (NAV) basis and 4.5% on a market price basis versus a return of 8.2% for the Russell 2000, the Fund’s small-cap benchmark. In the bullish opening quarter, RMT’s portfolio fully participated in the dynamic up market with a gain of 15.2% versus the Russell 2000’s return of 13.9%, while on a market price basis the Fund lagged, gaining 7.0%. Even better news was the Fund’s stronger relative down-market showing in the second quarter, a more bearish time span that saw stock prices fall. From April through the end of June, RMT was down 3.2% on an NAV basis and 2.3% on a market price basis, both results ahead of the Russell 2000’s 5.0% decline. For the even shorter-term downturn from the most recent small-cap market high on 5/5/06 through 6/30/06, the Fund was down 6.1% on an NAV basis and 5.4% on a market price basis, both results again better then the small-cap index’s return of -7.1%. Although short-term performance periods are typically not of great interest or concern, we were pleased with RMT’s near-term down market results considering the volatility and vulnerability of the micro-cap asset class.

We were also pleased with the Fund’s NAV full market cycle and other long-term results on both an absolute and relative basis. These are the periods that we believe matter most in any evaluation of the portfolio’s merits. From the small-cap market peak on 3/9/00 through 6/30/06, RMT gained 125.2% on an NAV basis (+174.3% on a market price basis) versus 29.5% for the Russell 2000. Arguably even more impressive was the Fund’s gain during the more bullish phase that ran from the small-cap market trough on 10/9/02 through 6/30/06, a period in which RMT was up 160.7% on an NAV basis (+191.5% on a market price basis) compared to the Russell 2000’s gain of 131.8%. The Fund also outperformed its benchmark for the one-, three-, five, 10-year and since inception (12/14/93) periods on both an NAV and market price basis. RMT’s average annual NAV total return since inception was 14.4%.

All but one of the Fund’s equity sectors posted net gains during the first half, and losses at the individual company level were relatively small. Multi-business holding company BB Holdings spun off a subsidiary that trades in the U.S., but the prospect of its own domestic de-listing sent investors fleeing; its stock continues to trade overseas. Small pharmaceuticals companies have endured tough times recently, even conservatively capitalized businesses such as Momenta Pharmaceuticals. The firm experienced net losses as it waited for new drugs to be approved, which led many investors to go cold turkey on its stock. After selling some shares in March, we repurchased the stock in April. At the end of June, we held a position in American Bank Note Holographics, a firm that produces holograms for currency, credit card identification and document security. Its shares dropped 60% in March on news that a major credit card company |

|

Second Quarter 2006* | | -3.16 | % |

|

Jan - June 2006* | | 11.58 | |

|

One-Year | | | | | | | | 20.80 | |

|

Three-Year | | | 22.60 | |

|

Five-Year | | | | | | | | 14.02 | |

|

10-Year | | | | | | | | 14.11 | |

|

Since Inception (12/14/93) | | 14.36 | |

|

| | | |

CALENDAR YEAR NAV TOTAL RETURNS |

|

Year | | RMT | | | Year | | | RMT | |

|

2005 | | 6.8 | % | | 1999 | | | 12.7 | % |

|

2004 | | 18.7 | | | 1998 | | | -4.1 | |

|

2003 | | 55.6 | | | 1997 | | | 27.1 | |

|

2002 | | -13.8 | | | 1996 | | | 16.6 | |

|

2001 | | 23.4 | | | 1995 | | | 22.9 | |

|

2000 | | 10.9 | | | 1994 | | | 5.0 | |

| | | | | | | | | | | All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds’ P/E ratio calculations exclude companies with zero or negative earnings. |

TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders |

|

ASA Bermuda | | 1.5 | % |

|

Universal Truckload Services | | 1.4 | |

|

Transaction Systems Architects Cl. A | | 1.3 | |

|

Seneca Foods | | 1.2 | |

|

PAREXEL International | | 1.1 | |

|

Pason Systems | | 1.0 | |

|

First Acceptance | | 0.9 | |

|

Forrester Research | | 0.9 | |

|

MVC Capital | | 0.9 | |

|

Weyco Group | | 0.9 | |

| | | | | | | | | | |

PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders |

|

Technology | | 22.5 | % |

|

Industrial Products | | 14.6 | |

|

Health | | 14.4 | |

|

Industrial Services | | 13.1 | |

|

Natural Resources | | 8.8 | |

|

Financial Intermediaries | | 8.4 | |

|

Consumer Services | | 6.4 | |

|

Consumer Products | | 5.0 | |

|

Financial Services | | 2.0 | |

|

Diversified Investment Companies | | 2.1 | |

|

Miscellaneous | | 4.0 | |

|

Preferred Stock | | 0.5 | |

|

Cash and Cash Equivalents | | 16.9 | |

14 | 2006 SEMIANNUAL REPORT TO STOCKHOLDERS |

| |

Performance and Portfolio Review

GOOD IDEAS THAT WORKED

Net Realized and Unrealized Gain Through 6/30/06 | | would no longer be using the firm’s security stripe.

Industrial Products made the largest positive dollar-based contribution to performance. Insteel Industries manufactures concrete reinforcing metal products. The firm reported highly improved earnings for the fiscal first quarter of 2006, as well as strong operating cash flow results, developments that helped its stock price to soar earlier in the year. Insteel then announced even stronger fiscal second-quarter results, but also said that it was giving up its well-regarded industrial-wire business and closing the plant where these operations took place, which led to a 19% decline in its stock price. The announcement of a two-for-one stock split in May helped its share price to recover a bit. We reduced our position | | PORTFOLIO DIAGNOSTICS |

| Volt Information Sciences | $1,744,138 | | |

|

| | | Average Market Capitalization | $273 million |

| Dril-Quip | 1,702,095 | | |

|

| | | Weighted Average P/E Ratio | 17.9x* |

| Universal Truckload Services | 1,493,254 | | |

|

| | | Weighted Average P/B Ratio | 2.9x |

| Insteel Industries | 1,492,665 | | |

|

| | | Weighted Average Yield | 0.7% |

| Transactions Systems Architects Cl. A | 1,433,301 | | |

|

| | | | | Fund Net Assets | $321 million |

between February and early April, then began to repurchase shares later that month.

Elsewhere in the portfolio, the share price of staffing, computer system and telephone services business Volt Information Sciences climbed on news of better-than-expected fiscal second quarter earnings in June, when we began to reduce our position. During March and April, we sold a little more than half our shares of Dril-Quip, which manufactures offshore drilling | |

|

| | Turnover Rate | 16% |

| |

|

| | | | and production equipment. Strong results for fiscal 2005 and the fiscal first quarter of 2006 helped its stock price to rise. Top-ten holding Universal Truckload Services saw its increased revenues and steady earnings drive increasing numbers of investors towards its stock. We trimmed our stake in February, but otherwise saw solid prospects for growth. | | Net Leverage† | 2% |

GOOD IDEAS AT THE TIME

Net Realized and Unrealized Loss Through 6/30/06 | | |

|

| | | Symbol | |

| BB Holdings | $1,161,864 | | | Market Price | RMT |

| | | NAV | XOTX |

| American Bank Note Holographics | 692,692 | | | * Excludes 17% of portfolio holdings with zero or negative earnings as of 6/30/06. † Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets, applicable to Common Stockholders. |

| | |

| Momenta Pharmaceuticals | 594,939 | | |

| | | | | | |

| Herley Industries | 583,094 | | | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding at 6/30/06 at

NAV or Liquidation Value |

| | |

|

| Stein Mart | 498,815 | | | 22.4 million shares of Common Stock | $321 million |

| | | | |

|

| | | | | 6.00% Cumulative Preferred Stock | $60 million |

| | | | | | | | | |

| | RISK/RETURN COMPARISON

Three-Year Period Ended 6/30/06 |

| |

|

| | | Average Annual

Total Return | Standard Deviation | Return

Efficiency* |

| |

|

| | RMT (NAV) | 22.6% | 14.2 | 1.59 |

| |

|

| | Russell 2000 | 18.1 | 14.6 | 1.28 |

| | *Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. |

1 Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($7.50 IPO), reinvested distributions as indicated and fully participated in the primary subscription of the 1994 rights offering. | | | | | |

2 Reflects the actual market price of one share as it traded on the Nasdaq and, beginning on 12/1/03, on the NYSE. | |  |

2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 15

ROYCE FOCUS TRUST

AVERAGE ANNUAL NAV TOTAL RETURNS

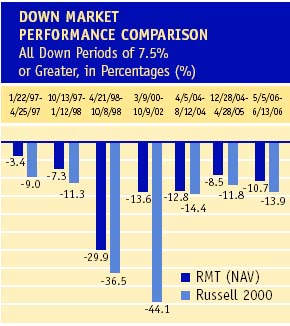

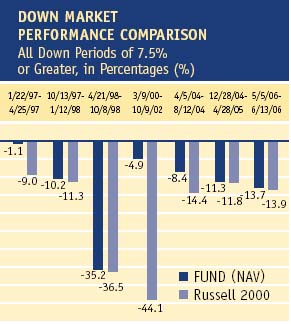

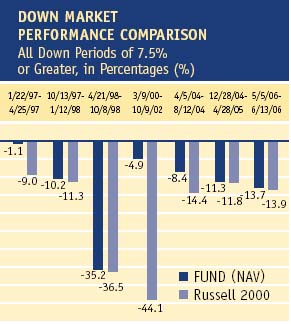

Through 6/30/06 | |  Manager’s Discussion We were pleased with the first-half results for Royce Focus Trust (FUND) on an absolute basis, even if the Fund’s net asset value (NAV) returns came up short by a hair’s breadth on a relative basis. For the year-to-date period ended 6/30/06, FUND gained 8.1% on an NAV basis and 10.6% on a market price basis versus a return of 8.2% for its small-cap benchmark, the Russell 2000. In hindsight, the Fund’s NAV results in the year’s first six months went as we would expect—a solid up-market turn and better relative down-market performance. During the bullish first quarter, the Fund was up 13.6% on an NAV basis and 18.4% on a market price basis, compared to a 13.9% gain for the Russell 2000. The second quarter saw stock prices decline, and the Fund lost 4.8% on an NAV basis (-6.5% on a market price basis), while the Russell 2000 declined 5.0%.

These historically characteristic performances helped FUND to post strong absolute and superior relative results over market-cycle and other long-term performance periods. From the most recent small-cap market peak on 3/9/00 through 6/30/06, the Fund gained 179.3% on an NAV basis (+233.4% on a market price basis) versus 29.5% for the Russell 2000. In the mostly up-market phase from the small-cap market trough on 10/9/02 through 6/30/06, FUND’s NAV return was 193.6% (+210.9% on a market price basis) versus a gain of 131.8% for its small-cap benchmark. On both an NAV and market price basis, FUND outperformed the Russell 2000 for the one-, three-, five-year and since inception of Royce’s management (11/1/96) periods ended 6/30/06. The Fund’s average annual NAV total return since inception was 14.3%.

Each of the Fund’s sectors posted net gains during the first half, led on a dollar basis by its three largest, Industrial Products, Natural Resources and Technology. Net losses at the individual company level were relatively minor, however disappointing. Orchid Cellmark has a dominant position in DNA testing, a promising niche business that we liked a great deal. However, it struggled with losses and meeting new regulations and the resulting accounting difficulties left us uncertain about the firm’s future prospects. Multi-business holding company BB Holdings spun off a subsidiary that trades in the U.S., but the prospect of its own domestic de-listing sent investors fleeing; its stock continues to trade overseas.

Within Industrial Products, several holdings posted impressive net gains. We have owned shares of welding and cutting products maker Lincoln Electric Holdings since shortly after we assumed management of FUND’s portfolio, drawn to its strong business, low-debt balance sheet, history of earnings and steady dividend. The firm’s business has recently undergone explosive growth, reporting record sales for the fiscal year and fiscal fourth quarter of 2005, as well as the first fiscal quarter of 2006. It was a top-ten holding at the end of June. In the metal fabrication and distribution industry, we enjoyed success with Metal Management, in which we took some gains during April and May, as well as Reliance Steel & Aluminum, Canadian steel producer and |

|

Second Quarter 2006* | | -4.83 | % |

|

Jan - June 2006* | | 8.11 | |

|

One-Year | | | | | | | | 30.73 | |

|

Three-Year | | | | | | | | 27.21 | |

|

Five-Year | | | | | | | | 16.16 | |

|

Since Inception (11/1/96)† | | | 14.28 | |

|

† Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. |

| | | |

CALENDAR YEAR NAV TOTAL RETURNS |

|

Year | | RFT | | | Year | | | RFT | |

|

2005 | | 13.3 | % | | 2000 | | | 20.9 | % |

|

2004 | | 29.2 | | | 1999 | | | 8.7 | |

|

2003 | | 54.3 | | | 1998 | | | -6.8 | |

|

2002 | | -12.5 | | | 1997 | | | 20.5 | |

|

2001 | | 10.0 | | | | | | | |

| | | | | | | | | | | All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds’ P/E ratio calculations exclude companies with zero or negative earnings. |

TOP 10 POSITIONS*

% of Net Assets Applicable

to Common Stockholders |

|

New Zealand Government 6.00% Bond | | 3.9 | % |

|

Athena Neurosciences Finance 7.25% Bond | | 3.9 | |

|

IPSCO | | 3.7 | |

|

Canadian Government 3.00% Bond | | 3.5 | |

|

Endo Pharmaceuticals Holdings | | 3.2 | |

|

Lincoln Electric Holdings | | 3.1 | |

|

Thor Industries | | 2.8 | |

|

Simpson Manufacturing | | 2.8 | |

|

Reliance Steel & Aluminum | | 2.7 | |

|

Tesco Corporation | | 2.7 | |

* Does not include U.S. Government securities. |

| | | | | | | | | | |

PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders |

|

Industrial Products | | 23.8 | % |

|

Natural Resources | | 22.9 | |

|

Technology | | 8.0 | |

|

Consumer Products | | 6.1 | |

|

Health | | 5.9 | |

|

Consumer Services | | 4.4 | |

|

Industrial Services | | 3.6 | |

|

Financial Intermediaries | | 3.4 | |

|

Financial Services | | 3.1 | |

|

Bonds | | 11.4 | |

|

Treasuries, Cash and Cash Equivalents | | 23.7 | |

16 | 2006 SEMIANNUAL REPORT TO STOCKHOLDERS |

| |

Performance and Portfolio Review

GOOD IDEAS THAT WORKED

Net Realized and Unrealized Gain Through 6/30/06 | | fabricator IPSCO, Schnitzer Steel Industries and Harris Steel Group. The once-thriving steel industry underwent a long period of consolidation and reorganization earlier in the decade after falling on tough times. It seems to us that neither the positive effects of these efforts nor the steady worldwide demand for steel products have yet been fully grasped by investors, which in turn allowed us to find what we thought were attractively valued, conservatively capitalized firms.

In the Natural Resources sector, holdings in the precious metals and mining industry posted significant net gains on a dollar basis. We began to establish positions in certain precious metals companies between 2002 and 2005 as the industry struggled to rebound. Throughout this period, we | | PORTFOLIO DIAGNOSTICS |

| Lincoln Electric Holdings | $1,724,250 | | |

|

| | | Average Market Capitalization | $1,675 million |

| Glamis Gold | 1,299,161 | | |

|

| | | Weighted Average P/E Ratio | 13.3x |

| Meridian Gold | 1,231,308 | | |

|

| | | Weighted Average P/B Ratio | 2.1x |

| Metal Management | 1,185,559 | | |

|

| | | Weighted Average Yield | 1.4% |

| Lowrance Electronics | 1,120,055 | | |

|

| | | | | Fund Net Assets | $154 million |

| remained patient, in part because of our belief that the close-to-20-year bear market for precious metals prices was likely to end, but mostly because we thought that the individual company qualities we held in such high regard would eventually be recognized by other investors. At times, we took advantage of further stock price declines by building positions. Commodity and stock prices finally began to recover during 2005. By the end of last year, the industry’s rebound was well under way, and the first half of 2006 | |

|

| | Turnover Rate | 17% |

| |

|

| | | | saw further recovery. We reduced our stake in Glamis Gold during the first half and trimmed our position in Meridian Gold. | | Net Leverage* | 0% |

GOOD IDEAS AT THE TIME

Net Realized and Unrealized Loss Through 6/30/06 | | |

|

| | | Symbol | |

| BB Holdings | $760,536 | | | Market Price | FUND |

| | | NAV | XFUNX |

| Orchid Cellmark | 721,500 | | | * Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets applicable to Common Stockholders. |

| | |

| Trican Well Service | 559,191 | | |

| | | | | | |

| Nu Skin Enterprises Cl. A | 546,000 | | | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding at 6/30/06 at

NAV or Liquidation Value |

| | |

|

| International Coal Group | 453,678 | | | 14.9 million shares of Common Stock | $154 million |

| | | | |

|

| | | | | 6.00% Cumulative Preferred Stock | $25 million |

| | | | | | | | | |

| | RISK/RETURN COMPARISON

Three-Year Period Ended 6/30/06 |

| |

|

| | | Average Annual

Total Return | Standard Deviation | Return

Efficiency* |

| |

|

| | FUND (NAV) | 27.2% | 15.1 | 1.80 |

| |

|

| | Russell 2000 | 18.7 | 14.6 | 1.28 |

| | * Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. |

1 Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. | | | | | |

2 Reflects the cumulative total return of a continuous common stockholder who reinvested all distributions as

indicated and fully participated in the primary subscription of the 2005 rights offering. 3 Reflects the actual market price of one share as it traded on the Nasdaq. | |  |

| | |

2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 17

HISTORY SINCE INCEPTION

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions (including fractional shares) and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds.

|

| | | | | Amount | | Purchase | | | | | NAV | | Market |

History | | Invested | | Price* | | Shares | | Value** | | Value** |

|

| Royce Value Trust | | | | | | | | | | | | | | | | | | | |

| 11/26/86 | | Initial Purchase | | $ | 10,000 | | | $ | 10.000 | | | 1,000 | | | $ | 9,280 | | | $ | 10,000 | |

| 10/15/87 | | Distribution $0.30 | | | | | | | 7.000 | | | 42 | | | | | | | | | |

| 12/31/87 | | Distribution $0.22 | | | | | | | 7.125 | | | 32 | | | | 8,578 | | | | 7,250 | |

| 12/27/88 | | Distribution $0.51 | | | | | | | 8.625 | | | 63 | | | | 10,529 | | | | 9,238 | |

| 9/22/89 | | Rights Offering | | | 405 | | | | 9.000 | | | 45 | | | | | | | | | |

| 12/29/89 | | Distribution $0.52 | | | | | | | 9.125 | | | 67 | | | | 12,942 | | | | 11,866 | |

| 9/24/90 | | Rights Offering | | | 457 | | | | 7.375 | | | 62 | | | | | | | | | |

| 12/31/90 | | Distribution $0.32 | | | | | | | 8.000 | | | 52 | | | | 11,713 | | | | 11,074 | |

| 9/23/91 | | Rights Offering | | | 638 | | | | 9.375 | | | 68 | | | | | | | | | |

| 12/31/91 | | Distribution $0.61 | | | | | | | 10.625 | | | 82 | | | | 17,919 | | | | 15,697 | |

| 9/25/92 | | Rights Offering | | | 825 | | | | 11.000 | | | 75 | | | | | | | | | |

| 12/31/92 | | Distribution $0.90 | | | | | | | 12.500 | | | 114 | | | | 21,999 | | | | 20,874 | |

| 9/27/93 | | Rights Offering | | | 1,469 | | | | 13.000 | | | 113 | | | | | | | | | |

| 12/31/93 | | Distribution $1.15 | | | | | | | 13.000 | | | 160 | | | | 26,603 | | | | 25,428 | |

| 10/28/94 | | Rights Offering | | | 1,103 | | | | 11.250 | | | 98 | | | | | | | | | |

| 12/19/94 | | Distribution $1.05 | | | | | | | 11.375 | | | 191 | | | | 27,939 | | | | 24,905 | |

| 11/3/95 | | Rights Offering | | | 1,425 | | | | 12.500 | | | 114 | | | | | | | | | |

| 12/7/95 | | Distribution $1.29 | | | | | | | 12.125 | | | 253 | | | | 35,676 | | | | 31,243 | |

| 12/6/96 | | Distribution $1.15 | | | | | | | 12.250 | | | 247 | | | | 41,213 | | | | 36,335 | |

| 1997 | | Annual distribution total $1.21 | | | | | | | 15.374 | | | 230 | | | | 52,556 | | | | 46,814 | |

| 1998 | | Annual distribution total $1.54 | | | | | | | 14.311 | | | 347 | | | | 54,313 | | | | 47,506 | |

| 1999 | | Annual distribution total $1.37 | | | | | | | 12.616 | | | 391 | | | | 60,653 | | | | 50,239 | |

| 2000 | | Annual distribution total $1.48 | | | | | | | 13.972 | | | 424 | | | | 70,711 | | | | 61,648 | |

| 2001 | | Annual distribution total $1.49 | | | | | | | 15.072 | | | 437 | | | | 81,478 | | | | 73,994 | |

| 2002 | | Annual distribution total $1.51 | | | | | | | 14.903 | | | 494 | | | | 68,770 | | | | 68,927 | |

| 1/28/03 | | Rights Offering | | | 5,600 | | | | 10.770 | | | 520 | | | | | | | | | |

| 2003 | | Annual distribution total $1.30 | | | | | | | 14.582 | | | 516 | | | | 106,216 | | | | 107,339 | |

| 2004 | | Annual distribution total $1.55 | | | | | | | 17.604 | | | 568 | | | | 128,955 | | | | 139,094 | |

| 2005 | | Annual distribution total $1.61 | | | | | | | 18.739 | | | 604 | | | | 139,808 | | | | 148,773 | |

| 2006 | | Year-to-date distribution total $0.84 | | | | | | | 19.114 | | | 329 | | | | | | | | | |

|

| 6/30/06 | | | | $ | 21,922 | | | | | | | 7,738 | | | $ | 153,290 | | | $ | 149,808 | |

|

| Royce Micro-Cap Trust | | | | | | | | | | | | | | | | | | | |

| 12/14/93 | | Initial Purchase | | $ | 7,500 | | | $ | 7.500 | | | 1,000 | | | $ | 7,250 | | | $ | 7,500 | |

| 10/28/94 | | Rights Offering | | | 1,400 | | | | 7.000 | | | 200 | | | | | | | | | |

| 12/19/94 | | Distribution $0.05 | | | | | | | 6.750 | | | 9 | | | | 9,163 | | | | 8,462 | |

| 12/7/95 | | Distribution $0.36 | | | | | | | 7.500 | | | 58 | | | | 11,264 | | | | 10,136 | |

| 12/6/96 | | Distribution $0.80 | | | | | | | 7.625 | | | 133 | | | | 13,132 | | | | 11,550 | |

| 12/5/97 | | Distribution $1.00 | | | | | | | 10.000 | | | 140 | | | | 16,694 | | | | 15,593 | |

| 12/7/98 | | Distribution $0.29 | | | | | | | 8.625 | | | 52 | | | | 16,016 | | | | 14,129 | |

| 12/6/99 | | Distribution $0.27 | | | | | | | 8.781 | | | 49 | | | | 18,051 | | | | 14,769 | |

| 12/6/00 | | Distribution $1.72 | | | | | | | 8.469 | | | 333 | | | | 20,016 | | | | 17,026 | |

| 12/6/01 | | Distribution $0.57 | | | | | | | 9.880 | | | 114 | | | | 24,701 | | | | 21,924 | |

| 2002 | | Annual distribution total $0.80 | | | | | | | 9.518 | | | 180 | | | | 21,297 | | | | 19,142 | |

| 2003 | | Annual distribution total $0.92 | | | | | | | 10.004 | | | 217 | | | | 33,125 | | | | 31,311 | |

| 2004 | | Annual distribution total $1.33 | | | | | | | 13.350 | | | 257 | | | | 39,320 | | | | 41,788 | |

| 2005 | | Annual distribution total $1.85 | | | | | | | 13.848 | | | 383 | | | | 41,969 | | | | 45,500 | |

| 2006 | | Year-to-date distribution total $0.63 | | | | | | | 13.725 | | | 145 | | | | | | | | | |

|

| 6/30/06 | | | | $ | 8,900 | | | | | | | 3,270 | | | $ | 46,826 | | | $ | 47,546 | |

|

| Royce Focus Trust | | | | | | | | | | | | | | | | | | | |

| 10/31/96 | | Initial Purchase | | $ | 4,375 | | | $ | 4.375 | | | 1,000 | | | $ | 5,280 | | | $ | 4,375 | |

| 12/31/96 | | | | | | | | | | | | | | | | 5,520 | | | | 4,594 | |

| 12/5/97 | | Distribution $0.53 | | | | | | | 5.250 | | | 101 | | | | 6,650 | | | | 5,574 | |

| 12/31/98 | | | | | | | | | | | | | | | | 6,199 | | | | 5,367 | |

| 12/6/99 | | Distribution $0.145 | | | | | | | 4.750 | | | 34 | | | | 6,742 | | | | 5,356 | |

| 12/6/00 | | Distribution $0.34 | | | | | | | 5.563 | | | 69 | | | | 8,151 | | | | 6,848 | |

| 12/6/01 | | Distribution $0.14 | | | | | | | 6.010 | | | 28 | | | | 8,969 | | | | 8,193 | |

| 12/6/02 | | Distribution $0.09 | | | | | | | 5.640 | | | 19 | | | | 7,844 | | | | 6,956 | |

| 12/8/03 | | Distribution $0.62 | | | | | | | 8.250 | | | 94 | | | | 12,105 | | | | 11,406 | |

| 2004 | | Annual distribution total $1.74 | | | | | | | 9.325 | | | 259 | | | | 15,639 | | | | 16,794 | |

| 5/6/05 | | Rights offering | | | 2,669 | | | | 8.340 | | | 320 | | | | | | | | | |

| 2005 | | Annual distribution total $1.21 | | | | | | | 9.470 | | | 249 | | | | 21,208 | | | | 20,709 | |

| 2006 | | Year-to-date distribution total $0.24 | | | | | | | 9.897 | | | 53 | | | | | | | | | |

|

| 6/30/06 | | | | $ | 7,044 | | | | | | | 2,226 | | | $ | 22,928 | | | $ | 22,906 | |

|

| * | | Beginning with the 1997 (RVT), 2002 (RMT) and 2004 (FUND) distributions, the purchase price of distributions is a weighted average of the distribution reinvestment prices for the year. |

| ** | | Other than for initial purchase and June 30, 2006, values are stated as of December 31 of the year indicated, after reinvestment of distributions. |

| 18 | 2006 SEMIANNUAL REPORT TO STOCKHOLDERS |

DISTRIBUTION REINVESTMENT AND CASH PURCHASE OPTIONS

Why should I reinvest my distributions?

By reinvesting distributions, a stockholder can maintain an undiluted investment in the Fund. The regular reinvestment of distributions has a significant impact on stockholder returns. In contrast, the stockholder who takes distributions in cash is penalized when shares are issued below net asset value to other stockholders.

How does the reinvestment of distributions from the Royce closed-end funds work?

The Funds automatically issue shares in payment of distributions unless you indicate otherwise. The shares are generally issued at the lower of the market price or net asset value on the valuation date.

How does this apply to registered stockholders?

If your shares are registered directly with a Fund, your distributions are automatically reinvested unless you have otherwise instructed the Funds’ transfer agent, Computershare, in writing. A registered stockholder also has the option to receive the distribution in the form of a stock certificate or in cash if Computershare is properly notified.

What if my shares are held by a brokerage firm or a bank?

If your shares are held by a brokerage firm, bank, or other intermediary as the stockholder of record, you should contact your brokerage firm or bank to be certain that it is automatically reinvesting distributions on your behalf. If they are unable to reinvest distributions on your behalf, you should have your shares registered in your name in order to participate.

What other features are available for registered stockholders?

The Distribution Reinvestment and Cash Purchase Plans also allow registered stockholders to make optional cash purchases of shares of a Fund’s common stock directly through Computershare on a monthly basis, and to deposit certificates representing your Fund shares with Computershare for safekeeping. The Funds’ investment adviser is absorbing all commissions on optional cash purchases under the Plans through December 31, 2006.

How do the Plans work for registered stockholders?

Computershare maintains the accounts for registered stockholders in the Plans and sends written confirmation of all transactions in the account. Shares in the account of each participant will be held by Computershare in non-certificated form in the name of the participant, and each participant will be able to vote those shares at a stockholder meeting or by proxy. A participant may also send other stock certificates held by them to Computershare to be held in non-certificated form. There is no service fee charged to participants for reinvesting distributions. If a participant elects to sell shares from a Plan account, Computershare will deduct a $2.50 fee plus brokerage commissions from the sale transaction. If a nominee is the registered owner of your shares, the nominee will maintain the accounts on your behalf.

How can I get more information on the Plans?

You can call an Investor Services Representative at (800) 221-4268 or you can request a copy of the Plan for your Fund from Computershare. All correspondence (including notifications) should be directed to: [Name of Fund] Distribution Reinvestment and Cash Purchase Plan, c/o Computershare, PO Box 43010, Providence, RI 02940-3010, telephone (800) 426-5523.

2006 SEMIANNUAL REPORT TO STOCKHOLDERS | 19

ROYCE VALUE TRUST

|

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

Schedule of Investments |

|

| | | | | | | | | | | | | | | | |

| | | SHARES | | | VALUE | | | | SHARES | | | VALUE |

| |

| COMMON STOCKS – 99.4% | | | | | | | Restaurants and Lodgings - 1.0% | | | | | |

| | | | | | | | Applebee’s International | | 63,000 | | $ | 1,210,860 |

| Consumer Products – 4.6% | | | | | | | Benihana Cl. A a | | 6,600 | | | 179,124 |

| Apparel and Shoes - 1.9% | | | | | | | CEC Entertainment a, c | | 121,400 | | | 3,899,368 |

Kenneth Cole Productions Cl. A | | 35,000 | | $ | 781,550 | | IHOP Corporation | | 93,400 | | | 4,490,672 |

Columbia Sportswear Company a, c | | 34,600 | | | 1,565,996 | | Ryan’s Restaurant Group a, c | | 7,200 | | | 85,752 |

Jones Apparel Group | | 81,500 | | | 2,590,885 | | Steak n Shake Company (The) a | | 92,600 | | | 1,401,964 |

K-Swiss Cl. A | | 105,000 | | | 2,803,500 | | | | | |

|

Oakley | | 94,900 | | | 1,599,065 | | | | | | | 11,267,740 |

Polo Ralph Lauren Cl. A | | 58,200 | | | 3,195,180 | | | | | |

|

Tandy Brands Accessories | | 16,900 | | | 175,084 | | Retail Stores - 2.0% | | | | | |

Timberland Company Cl. A a | | 60,000 | | | 1,566,000 | | Big Lots a | | 255,300 | | | 4,360,524 |

Weyco Group | | 307,992 | | | 7,151,574 | | CarMax a, c | | 84,000 | | | 2,978,640 |

| | | | |

| | Children’s Place Retail Stores a, c | | 13,670 | | | 820,883 |

| | | | | | 21,428,834 | | Claire’s Stores | | 189,800 | | | 4,841,798 |

| | | | |

| | Cost Plus a, c | | 80,500 | | | 1,180,130 |

| Collectibles - 0.1% | | | | | | | Fred’s Cl. A | | 50,000 | | | 667,500 |

Enesco Group a, c | | 174,800 | | | 92,644 | | Gander Mountain Company a, c | | 53,300 | | | 308,074 |

| | | | |

| | Hot Topic a, c | | 44,100 | | | 507,591 |

| Food/Beverage/Tobacco - 0.2% | | | | | | | Krispy Kreme Doughnuts a, c | | 85,000 | | | 691,900 |

Hain Celestial Group a, c | | 37,800 | | | 973,728 | | 99 Cents Only Stores a, c | | 95,000 | | | 993,700 |

Hershey Creamery Company | | 709 | | | 1,418,000 | | Stein Mart | | 142,800 | | | 2,113,440 |

| | | | |

| | Urban Outfitters a, c | | 27,000 | | | 472,230 |

| | | | | | 2,391,728 | | West Marine a | | 131,100 | | | 1,767,228 |

| | | | |

| | Wet Seal (The) Cl. A a | | 162,000 | | | 790,560 |

| Home Furnishing and Appliances - 0.3% | | | | | | | | | | |

|

Aaron Rents | | 4,500 | | | 120,960 | | | | | | | 22,494,198 |

Ethan Allen Interiors | | 35,800 | | | 1,308,490 | | | | | |

|

†Jacuzzi Brands a, c | | 145,000 | | | 1,276,000 | | Other Consumer Services - 2.4% | | | | | |

La-Z-Boy c | | 68,200 | | | 954,800 | | Corinthian Colleges a, c | | 106,500 | | | 1,529,340 |

| | | | |

| | ITT Educational Services a | | 106,000 | | | 6,975,860 |

| | | | | | 3,660,250 | | Laureate Education a, c | | 75,000 | | | 3,197,250 |

| | | | |

| | MoneyGram International | | 74,900 | | | 2,542,855 |

| Publishing - 0.3% | | | | | | | Sotheby’s a, c | | 485,200 | | | 12,736,500 |

Scholastic Corporation a, c | | 130,000 | | | 3,376,100 | | | | | |

|

| | | | |

| | | | | | | 26,981,805 |

| Sports and Recreation - 0.4% | | | | | | | | | | |

|

Coachmen Industries | | 47,700 | | | 569,538 | | Total (Cost $44,547,555) | | | | | 63,100,488 |

Monaco Coach | | 161,050 | | | 2,045,335 | | | | | |

|

Nautilus | | 2,000 | | | 31,420 | | Diversified Investment Companies – 0.1% | | | | | |

Thor Industries | | 26,100 | | | 1,264,545 | | Closed-End Mutual Funds - 0.1% | | | | | |

| | | | |

| | Central Fund of Canada Cl. A | | 111,500 | | | 958,900 |

| | | | | | 3,910,838 | | | | | |

|

| | | | |

| | Total (Cost $589,526) | | | | | 958,900 |

| Other Consumer Products - 1.4% | | | | | | | | | | |

|

Blyth | | 14,700 | | | 271,362 | | Financial Intermediaries – 8.9% | | | | | |

Burnham Holdings Cl. B | | 36,000 | | | 693,000 | | Banking - 3.2% | | | | | |

Fossil a, c | | 82,800 | | | 1,491,228 | | BOK Financial | | 129,327 | | | 6,423,672 |

Lazare Kaplan International a | | 103,600 | | | 854,700 | | Bank of NT Butterfield | | 62,500 | | | 3,562,500 |

Leapfrog Enterprises a, c | | 175,000 | | | 1,767,500 | | CFS Bancorp | | 260,000 | | | 3,858,400 |

Matthews International Cl. A | | 166,000 | | | 5,722,020 | | Cadence Financial | | 30,300 | | | 674,781 |

RC2 Corporation a | | 132,600 | | | 5,126,316 | | Commercial National Financial | | 44,900 | | | 865,223 |

| | | | |

| | Exchange National Bancshares | | 50,400 | | | 1,491,840 |

| | | | | | 15,926,126 | | Farmers & Merchants Bank of Long Beach | | 1,266 | | | 7,311,150 |

| | | | |

| | Heritage Financial | | 12,915 | | | 340,181 |

| Total (Cost $32,213,286) | | | | | 50,786,520 | | HopFed Bancorp | | 25,000 | | | 410,500 |

| | | | |

| | Jefferson Bancshares | | 25,000 | | | 322,500 |

| Consumer Services – 5.7% | | | | | | | Mechanics Bank | | 200 | | | 3,900,000 |

| Direct Marketing - 0.1% | | | | | | | NetBank | | 70,000 | | | 464,100 |

FTD Group a, c | | 55,000 | | | 742,500 | | Old Point Financial | | 20,000 | | | 587,400 |

| | | | |

| | Partners Trust Financial Group | | 100,000 | | | 1,141,000 |

| Leisure and Entertainment - 0.1% | | | | | | | Sun Bancorp a, c | | 44,100 | | | 716,184 |

Gemstar-TV Guide International a, c | | 201,100 | | | 707,872 | | Tompkins Trustco | | 17,545 | | | 754,435 |

Shuffle Master a, c | | 15,000 | | | 491,700 | | Whitney Holding | | 40,500 | | | 1,432,485 |

Steiner Leisure a, c | | 2,100 | | | 83,013 | | Wilber Corporation | | 31,700 | | | 332,850 |

| | | | |

| | | | | | | |

| | | | | | 1,282,585 | | | | | | | |

| | | | |

| | | | | | | |

| Media and Broadcasting - 0.1% | | | | | | | | | | | | |

Cox Radio Cl. A a | | 23,000 | | | 331,660 | | | | | | | |

| | | | |

| | | | | | | |

| 20 | 2006 SEMIANNUAL REPORT TO STOCKHOLDERS | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

JUNE 30, 2006 (Unaudited)

|

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

| |

|

| | | | | | | | | | | | | | | | |