UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04875

Name of Registrant: Royce Value Trust, Inc.

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | | John E. Denneen, Esquire |

| | | 745 Fifth Avenue |

| | | New York, NY 10151 |

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2009 – June 30, 2009

Item 1. Reports to Shareholders.

| A Few Words on Closed-End Funds | |

|

Royce & Associates, LLC manages three closed-end funds: Royce Value Trust, the first small-cap value closed-end fund offering; Royce Micro-Cap Trust, the only micro-cap closed-end fund; and Royce Focus Trust, a closed-end fund that invests in a limited number of primarily small-cap companies.

A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. This is in contrast to open-end mutual funds, in which the fund sells and redeems its shares on a continuous basis.

|

|

A Closed-End Fund Offers Several Distinct Advantages Not Available From An Open-End Fund Structure

| n | | Since a closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions, as an open-end fund must. | | n | | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. | |

| | | | | | | | |

| n | | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times is ideal for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. | | n | | Unlike Royce’s open-end funds, our closed-end funds are able to distribute capital gains on a quarterly basis. The Funds’ quarterly distribution policies for their common stock were suspended in May, 2009. | |

| | | | | | | | |

| n | | A closed-end fund may invest more freely in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is particularly beneficial for Royce-managed closed-end funds, which invest in small- and micro-cap securities. | | We believe that the closed-end fund structure is very suitable for the long-term investor who understands the benefits of a stable pool of capital. |

| |

|

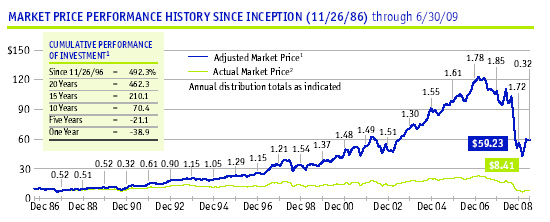

Why Dividend Reinvestment Is Important

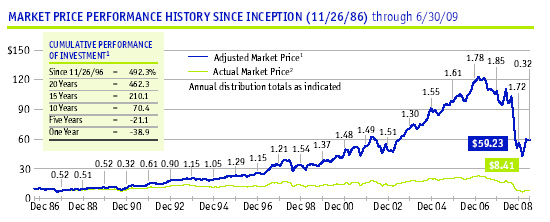

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 13, 15 and 17. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 19 or visit our website at www.roycefunds.com.

|

| This page is not part of the 2009 Semiannual Report to Stockholders |

| Table of Contents | | |

|

| Semiannual Review | | |

|

| Performance Table | | 2 |

| | | |

| Letter to Our Stockholders | | 3 |

| | | |

| Small-Cap Market Cycle Performance | | 10 |

| | | |

|

| | | |

| Semiannual Report to Stockholders | | 11 |

| | | |

|

For more than 35 years, we have used a value approach to invest in smaller-cap securities. We focus primarily on the quality of a company’s balance sheet, its ability to generate free cash flow and other measures of profitability or sound financial condition. At times, we may also look at other factors, such as a company’s unrecognized asset values, its future growth prospects or its turnaround potential following an earnings disappointment or other business difficulties. We then use these factors to assess the company’s current worth, basing the assessment on either what we believe a knowledgeable buyer might pay to acquire the entire company, or what we think the value of the company should be in the stock market.

| This page is not part of the 2009 Semiannual Report to Stockholders | 1 |

| NAV Average Annual Total Returns | Through June 30, 2009 |

| | | | Royce | | Royce | | Royce | | | |

| | | | Value Trust | | Micro-Cap Trust | | Focus Trust | | Russell 2000 |

|

| |

Second Quarter 2009* | | 29.22 | % | | 34.51 | % | | 26.91 | % | | 20.69 | % |

|

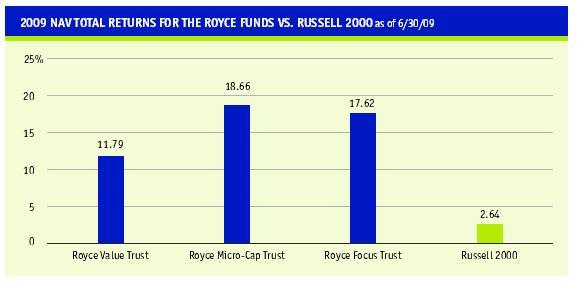

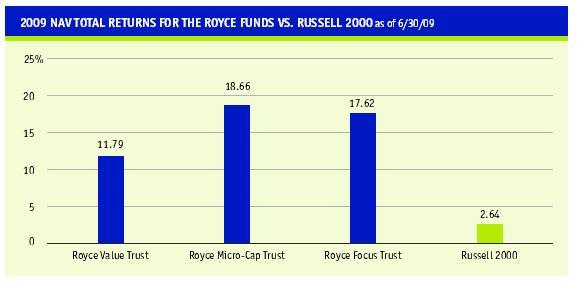

| | Year-to-Date 2009* | | 11.79 | | | 18.66 | | | 17.62 | | | 2.64 | |

|

| | One-Year | | -31.17 | | | -26.70 | | | -34.12 | | | -25.01 | |

|

| | Three-Year | | -11.38 | | | -10.58 | | | -6.77 | | | -9.89 | |

|

| | Five-Year | | -1.73 | | | -1.38 | | | 3.09 | | | -1.71 | |

|

| | 10-Year | | 5.49 | | | 7.40 | | | 8.61 | | | 2.38 | |

|

| | 15-Year | | 8.49 | | | 9.31 | | | n.a. | | | 6.55 | |

|

| | 20-Year | | 9.06 | | | n.a. | | | n.a. | | | 7.27 | |

|

| | Since Inception | | 9.28 | | | 9.05 | | | 8.93 | | | — | |

|

| | Inception Date | | 11/26/86 | | 12/14/93 | | 11/1/96** | | — | |

|

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Royce Funds invest primarily in securities of small-cap and/or micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies.

The thoughts expressed in this Review and Report to Stockholders concerning recent market movements and future prospects for small-company stocks are solely the opinion of Royce at June 30, 2009, and, of course, historical market trends are not necessarily indicative of future market movements. Statements regarding the future prospects for particular securities held in the Funds’ portfolios and Royce’s investment intentions with respect to those securities reflect Royce’s opinions as of June 30, 2009 and are subject to change at any time without notice. There can be no assurance that securities mentioned in this Review and Report to Stockholders will be included in any Royce-managed portfolio in the future.

|

| ** | | Not annualized |

| ** | | Date Royce & Associates, LLC assumed investment management responsibility for the Fund. |

| 2 | This page is not part of the 2009 Semiannual Report to Stockholders |

| Letter to Our Stockholders | | | |

| | | |

| | | |

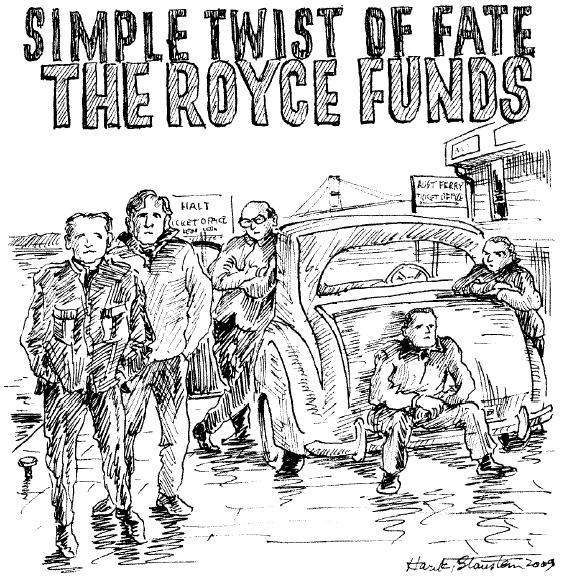

| Simple Twist of Fate | | | |

It was one year ago that, taking a cue from a Bob Dylan song, we wrote that something significant was happening in the markets, but the nature and degree of the event had not yet become clear. The intervening 12 months have certainly clarified things, in about as painful and destructive a fashion as possible from an investment standpoint. Back in March 2008, the fall of Bear Stearns was initially hoped to be, with fingers crossed in one hand and the other knocking on wood, an isolated, anomalous event. It took a few months, but the ongoing implosion of the subprime mortgage market sent shock waves throughout the global financial system. A significant correction in housing prices probably would have created some thorny economic problems in and of itself, but as fate would have it, many of these ill-awarded mortgages were securitized, packaged, ‘tranched’ and traded in a dizzying array of complicated arrangements that may never be completely understood. And once September rolled around, the once-slow pace of decline picked up so quickly that matters barely had time to escalate from bad to disastrous.

| | Lacking the fatalism that has characterized many observers’ forecasts for the economy and the stock market, we believe in the cyclicality of markets and the resourcefulness of our economy, both of which should be factors in the next year as we make our way by fits and starts to better days. |

| | | | |

| This page is not part of the 2009 Semiannual Report to Stockholders | 3 |

| |

What do people do when they buy

stocks? What are their motives and

expectations? These may seem like odd,

or at least very simple, questions, but

we think that they are worth asking in

pursuit of a larger, more important

point. After all, myriad factors can

lead a company’s stock price to higher

levels—increased demand for the

company’s existing products and/or

services, a rapidly expanding business,

a higher public profile, an innovative

new product, etc. But none of these

events ensures that the share-price

gains will last. To us, the critical

question is, what kind of companies are

most likely to experience a sustainable

increase in their business value, and

thus an increase in share price?

As long-term investors with a

disciplined value approach, we are

therefore less concerned with what

may or may not make a stock price

climb, particularly in the short run.

Short-term gains for our portfolio

holdings are always welcome, but our

focus is on identifying companies

capable of long-term success as both

businesses and stocks. There are

several methods that we use to try to

determine this. The first critical step

entails a close examination of a

company’s financial profile and

Continued on page 6... | | |

Letter to Our Stockholders

The subprime fallout hit the markets with its most devastating blows less than one year ago, though it seems much further away in time, perhaps because so much trouble arrived so quickly and perhaps because so many other significant events—a deep recession, an ensuing credit crisis, a presidential election, the bankruptcy of two of the three major American automakers, two ongoing wars, and unrest and agitation in Iran—were occurring as the financial crisis was unfolding. As of this writing, we have seen the small-cap stock market go from a stumble to a near-collapse to a short-term (and hopefully more lasting) recovery in the space of a little less than two years, with the most eventful action coming between September 2008 and the present.

The pertinent questions are: How long can the nascent bull market last? Has the economy stabilized to the point that a sustainable recovery is just a matter of time? Will economic improvement arrive in time to prevent the recurrence of a stock market swoon? Will the federal government’s stimulus package have a tangibly positive effect on growth? For each question, the answer, unfortunately, is not ‘blowin’ in the wind’, or anywhere else for that matter. One need only look at the intensity of the debates over economic ‘green shoots’ and the question of whether they presage genuine resurgence or are simply anomalous occurrences in a still contracting economy. Our own take, about which we have more to say later in this letter, is guardedly optimistic. However, before moving on we wish to point out that our long-term perspective allows us some measure of distance from the heat of these debates. Lacking the fatalism that has characterized many observers’ forecasts for the economy and the stock market, we believe in the cyclicality of markets and the resourcefulness of our economy, both of which should be factors in the next year as we make our way by fits and starts to better days.

Modern Times

As for those days most recently passed, they were definitely better, as the market spent much of the period from March through June rallying from the worrisome depths it had tested in the fall and winter months. The better days began after the most recent market trough on March 9 and continued mostly unimpeded through the end of June, though there were notable sell-offs, particularly late in June and early in July. However, even the most fatalistic observer was likely cheered by the year-to-date results for the major equity indices: The small-cap Russell 2000 was up 2.6% through June 30, 2009, while the large-cap S&P 500 gained 3.2%, the more tech-laden Nasdaq Composite shot up 16.4% and the global MSCI EAFE (Europe, Australasia and Far East) rose 8.0%.

As the date of the recent market bottom indicates, the first half of 2009 offered the worst of the recent bear market and the sparkling hope of a new, more bullish era, all within a compact six months. During the first quarter, the Russell 2000 was down 15.0%, the S&P |

| | | | |

| |

| | | | |

| 4 | This page is not part of the 2009 Semiannual Report to Stockholders |

| | |

500 fell 11.0%, the Nasdaq Composite slipped “only” 3.1% and the MSCI EAFE sagged 13.9%. It should be remembered that these results included the beginning of the recent rally, more than three weeks’ worth of mostly rising stock prices that closed out the quarter and saw each index posting positive double-digit returns from March 9 through March 31, 2009. That the rally then took up almost the entire second quarter was thus a more than welcome development, especially as results for the four indices referenced above represented the largest respective quarterly advances since the second quarter of 2003. Yet we are still a long way from celebration. For the periods ended June 30, 2009, one-year and three-year average annual returns for all four indices remained negative, and only the MSCI EAFE managed a positive performance for the five-year period.

| | In such a volatile environment, the question of where market leadership will next reside remains an open one, as does the question of how long any such leadership period is likely to last. |

Market leadership remains unclear. Consider the following: The Russell 2000 trailed the S&P 500 in the first quarter, outperformed in the second quarter, but remained behind its large-cap counterpart for the year-to-date period ended June 30, 2009. The small-cap index led its large-cap sibling for the one-year period through the end of June, trailed in the three-year period, and led in the five- and 10-year periods. Small-cap stocks also significantly outperformed large-caps for the decade-to-date period, with the Russell 2000 gaining 14.0% versus the S&P 500’s decline of 25.9% from December 31, 1999 through June 30, 2009. With dramatic and well-defined bear and bull periods over the last two years, none of us needs a reminder that market volatility has been very much the norm. However, we think that another important example of its omnipresence can be seen in the near-regular rotation of small- and large-cap leadership over recent shorter-term calendar-based periods. In such an environment, the question of where market leadership will next reside remains an open one, as does the question of how long any such leadership period is likely to last.

| | |

| It Takes Growth to Laugh, It Takes Value to Cry | | |

| Within the small-cap universe, the current leadership issue is more than settled. Small-cap growth, as measured by the Russell 2000 Growth index, remained in the top spot over small-cap value, as measured by the Russell 2000 Value index. For the year-to-date period ended June 30, 2009, the Russell 2000 Growth index gained 11.4%, while the Russell 2000 Value index fell 5.2%. Both small-cap indices enjoyed robust results in the second quarter, but the Russell 2000 Value index’s 18.0% gain trailed its growth counterpart’s 23.4% return, so the turn in the tide of stock prices did little to help the small-cap value index to narrow the performance gap. Small-cap growth first gained its advantage in 2009 by outperforming in the bearish first quarter, down 9.7% compared to a decline of 19.6% for small-cap value, which marked the third consecutive quarter in which small-cap growth fared better than small-cap value in a negative return period. (However, at the end | | |

This page is not part of the 2009 Semiannual Report to Stockholders | 5

| |

history. We search for evidence of

our definition of quality—a strong

balance sheet, a history of solid

earnings, the ability to generate

positive cash flow and high returns on

invested capital. While it’s true that a

company possessing each of these

qualities is hardly guaranteed positive

stock performance (as returns for our

Funds in 2008 made painfully clear),

we think that businesses with these

characteristics are most likely to be

solid, if not strong, performers over

long-term time horizons.

Another route is of particular

significance to us, though it may at

first seem counterintuitive: A company

can achieve an attractive long-term

record by losing less during economic

or market downturns. Our years of

research bear out that those attributes

that we value so highly can help a firm

to weather these storms—profitable

companies with low debt and plentiful

cash have historically been stalwarts

in poor markets and/or economies (the

recent bear market notwithstanding).

In other words, we are seeking great

companies, not just great stocks.

At first, this may appear to be a

distinction without a difference, but

the difference is very real to us

because we see ourselves as business

buyers. We have always taken very

seriously the simple truth that when

one buys even one share of stock,

one becomes a stakeholder in a

business. This is why our approach

generally requires developing a deep

understanding of what a company

does and how it operates. In addition

Continued on page 8...

| |

| |

|

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Letter to Our Stockholders

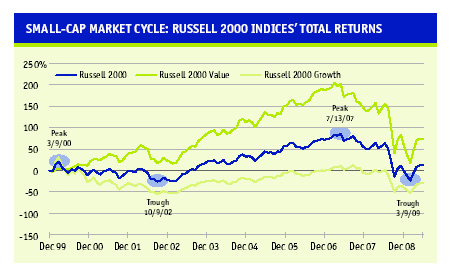

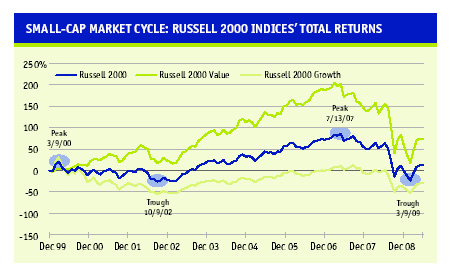

of 2008, small-cap value held a slender lead over growth from the small-cap peak on July 13, 2007, the official start of the small-cap bear market.) In a curious twist of fate, then, the small-cap growth index has solidified its leadership position in large part by defying its historical norm of trailing small-cap value in down markets.

The Russell 2000 Growth index also beat its small-cap value counterpart for the one-, three- and five-year periods ended June 30, 2009. Over longer-term periods, small-cap value held sway, thanks to an earlier period of long-term leadership. The end of 2006 marked the end of an extended span of small-cap value outperformance. In each of the first seven years of the current decade, small-cap value underperformed small-cap growth only once, in 2003, and by a slight margin. These years of often-decisive performance advantages helped the Russell 2000 Value index to outpace the small-cap growth index for the 10-, 15-, 20- and 25-year periods ended June 30, 2009.

As longstanding believers in reversion to the mean, we thought it likely that this long period of outperformance for small-cap value was likely to be succeeded by a strong turn for small-cap growth when the small-cap market cycle that began in March 9, 2000 came to an end, which happened in July 2007. For the periods ended June 30, 2009, the Russell 2000 Growth index outpaced its value sibling from the small-cap peak on July 13, 2007 (-35.2% versus -42.5%) and from the small-cap market low on March 9, 2009 (+49.9% versus +47.9%). We were not surprised to see small-cap growth hold an advantage throughout the recent bear market or thus far in the rally. As much as outperformance in both an up and a down market, even over a short-term period, is a convincing measure of leadership, the current volatile condition of the market makes small-cap growth’s ongoing dominance an uncertain proposition at best.

|

| Don’t Think Twice, It’s All Right |

| We were more than happy to see each of our closed-end funds bounce back with solid to very strong performances during the first six months of 2009, particularly after they endured the worst returns in their respective histories in 2008. The fact that all three portfolios turned in strong absolute performances, which is most meaningful to us, and also outperformed their respective benchmarks made 2009’s first-half results that much sweeter. Even more pleasing was the fact that our closed-end funds’ year-to-date returns were a combination of strong relative performance in the downturn between January and the small-cap low on March 9, followed by equally strong results in the rally that lasted into early June, though second-quarter market price results may have been adversely affected by the suspension of each Fund’s quarterly distribution. Losing less in poor markets has often been a historical hallmark of our management, and we welcomed its return, even in a short-term time frame. |

| 6 | This page is not part of the 2009 Semiannual Report to Stockholders |

| | |

| | |

| The rally benefitted stocks across all asset and style categories, though it gave the strongest boost to non-dividend paying companies, those without earnings and low-priced stocks. The latter group was especially compelling because companies whose share prices had hit single digits needed very little to score large percentage-point gains. We do a lot of work in the low-priced area in our three closed-end portfolios, though our search is for quality smaller companies that have fallen on hard times. During the recent rally, however, many other investors seemed to be more focused on momentum. For the portfolios taken as a whole, net gains could be found in several industry groups, even some of those in the beleaguered consumer and financial sectors. The most significant net gains for the three portfolios as a group, however, were in the Technology sector, with Financial Services in RVT, Industrial Products and Natural Resources in RMT, and Natural Resources, Industrial Products and Consumer Products in FUND also enjoying encouraging rebounds. | | |

| | | |

Things Have Changed

The significant question, of course, is what happens next? Late June and early July saw just enough selling for many observers to be convinced that the rally might have breathed its last, at least until more compelling evidence of a growing economy surfaces. Our own take is that the first phase of the bull market is probably complete. The rally that began in March was characterized by dynamic, double-digit returns, and stocks of all sizes in nearly all sectors and industries benefiting greatly. Around the middle of June, the market fell into a corrective period, almost as if it were catching its breath after the wild run-up of stock prices. This period could last for another few months or could be over by the time this Semiannual Review and Report is being read. We would expect an overall modest decline in the range of 10%-15%, regardless of the time frame. We also expect | |

We were more than happy to see each of our closed-end funds collectively bounce back with solid to very strong performances during the first six months of 2009... Losing less in poor markets has often been a historical hallmark of our management, and we welcomed its return, even in a short-term time frame. |

| This page is not part of the 2009 Semiannual Report to Stockholders | 7 |

| | |

| | |

to our discussions with a company’s

management, we often speak to

suppliers, customers and competitors

in order to expand our knowledge of

the company.

To be sure, we buy stocks to make

money, but the means to that sought-after

end are very specific. We are

looking for the happy marriage of

a strong financial profile with a

wonderful business that we think we

know well. This necessitates a

commitment to a disciplined process,

one that demands we know as much

about these businesses as we possibly

can. It involves making an investment

in a business as if we were purchasing

the entire company, as if we were

owners, because, after all, that is

what we become when we buy stocks.

| |

Letter to Our Stockholders

the next phase in the current cycle to be different—still bullish, but with returns that will not be as lofty. It seems to us we will see more historically typical performance patterns, frequent sector and industry rotation and greater discrimination on the part of investors for quality companies. We also feel confident that stocks of higher quality companies—those with solid earnings, high returns on invested capital and/or that pay dividends—should take the lead in the next bull phase.

Our reasoning is that enough investors should begin to focus on company quality now that the period of momentum-driven results appears to be behind us and a recovering economy in front of us, though no one knows how far ahead it lies. Recent selling has been driven more by fundamentals than liquidity, which is a good sign for the stability of equities as a whole. Without the sense of panic that was so prevalent in the last four months of 2008, investors would be free to think more about factors such as risk, long-term performance and sustainable growth. In such a setting, we think that quality stocks would do well across virtually all asset classes and in all industries where they can be found. So we may see, for example, small-cap leadership for a short time, then a period of large-cap outperformance, etc. However, quality is likely to be a lingering presence—a constant in a solid bull market that should otherwise see regular rotations in leadership.

Beyond Here Lies...

The economy is the elephant in the room. The recent rally was fueled in large part by investors’ expectations of an economic recovery that, perhaps needless to say, has thus far not materialized. We suspect that some investors may have confused economic |

|

|

| 8 | This page is not part of the 2009 Semiannual Report to Stockholders |

| | |

| | | |

stabilization with economic recovery, something that surely helped the prices of certain stocks to run ahead of what their fundamentals might suggest, which in part explains why the rally lost steam in June. From an equity investor’s standpoint, economic recovery is necessary for the market’s bullish moves to be sustained. Rancorous debate about where the economy is and where it is going will continue. There will be plenty of disappointment and cynicism, as well as an ample supply of naysayers braying along the road to economic recovery, which we think will proceed slowly, at times at a pace of two steps forward one step back, to the point that within a year a recovery should be well under way. We do not think that it will be as driven by consumer spending, but instead will be led by revived industrial activity, natural resources and perhaps even financial services. Consumer activity will still play an important role, but we expect consumer spending to account for far less of GDP than it did prior to the recession, which will be a positive development.

We look forward to the next several months and even more so to the next three to five years. Our own confidence about the economy and the equity markets is tempered by the fact that ‘less bad’ does not equate to ‘good.’ We suspect that the next round of concerns will center on the pace of improvement rather than the question of its existence, which seems to dominate economic discussions as of this writing. Yet the current mood, part of which we have just described and which seems to shift from optimism to pessimism and back again, often in the space of a single day, is infinitely preferable to the panic and capitulation that made last fall and winter so chilling. This is the kind of incremental, at times imperceptible, progress that we expect the economy to make. The market’s moves, far easier to track, will be less subtle, but both should be moving, however slowly, to a far better place.

| | Quality is likely to be a lingering presence—a constant in a solid bull market that should otherwise see regular rotations in leadership. |

| | | |

Sincerely, | | | | | | | |

| | | | | | | | |

| |  | |  | | | |

| Charles M. Royce | | W. Whitney George | | Jack E. Fockler, Jr. | | | |

| President | | Vice President | | Vice President | | | |

| | | | | | | | |

| | | | | | | | |

| July 31, 2009 | | | | | | | |

| This page is not part of the 2009 Semiannual Report to Stockholders | 9 |

Small-Cap Market Cycle Performance

We believe strongly in the idea that a long-term investment perspective is crucial for determining the success of a particular investment approach. Flourishing in an up market is wonderful. Surviving a bear market by losing less (or not at all) is at least as good. However, the true test of a portfolio’s mettle is performance over full market cycle periods, which include both up and down market periods. We believe that providing full market cycle results is more appropriate even than showing three- to five-year standardized returns because the latter periods may not include the up and down phases that constitute a full market cycle.

Since the Russell 2000’s inception on 12/31/78, value—as measured by the Russell 2000 Value Index—outperformed growth—as measured by the Russell 2000 Growth Index—in six of the small-cap index’s eight full market cycles. The most recently concluded cycle, which ran from 3/9/00 through 7/13/07, was the longest in the index’s history, and represented what we believe was a return to more historically typical performance in that value provided a significant advantage during its downturn (3/9/00–10/9/02) and for the full cycle. In contrast, the new market cycle that began on 7/13/07 has so far favored growth over value, an unsurprising development when one considers how thoroughly value dominated growth in the previous full cycle.

Peak-to-Peak

For the full cycle, value provided a sizeable margin over growth, which finished the period with a loss. Each of our closed-end funds held a sizeable performance advantage over the Russell 2000 on both an NAV (net asset value) and market price basis. On an NAV basis, Royce Focus Trust (+264.2%) was our best performer by a wide margin, followed by Royce Micro-Cap Trust (+175.9%) and Royce Value Trust (+161.3%).

Peak-to-Current

During the difficult, volatile period ended 6/30/09, both value and growth posted similarly negative returns. Events in the financial markets immediately preceding the end of 2008’s third quarter caused the Russell 2000 to decline significantly. After a brief rally at the end of 2008, the index continued its fall, dropping it to a cyclical low on 3/9/09. Since then the index recovered significantly, gaining 48.9% from 3/9/09 through 6/30/09.

Royce Focus Trust managed to slightly outperform the index during the decline, while all three of our closed-end funds outperformed during the short rally from 3/9/09 through 6/30/09. |

|

| |

ROYCE FUNDS NAV TOTAL RETURNS VS. RUSSELL 2000 INDEX:

MARKET CYCLE RESULTS |

|

| | Peak-to-Peak

3/9/00-7/13/07 | | Peak-to-Trough

7/13/07-3/9/09 | | Trough-to-Current

3/9/09-6/30/09 |

| |

| Russell 2000 | | 54.9 | % | | | -58.9 | % | | | 48.9 | % |

|

| Russell 2000 Value | | 189.5 | | | | -61.1 | | | | 47.9 | |

|

| Russell 2000 Growth | | -14.8 | | | | -56.8 | | | | 49.9 | |

|

| Royce Value Trust | | 161.3 | | | | -65.6 | | | | 64.2 | |

|

| Royce Micro-Cap Trust | | 175.9 | | | | -66.3 | | | | 73.3 | |

|

| Royce Focus Trust | | 264.2 | | | | -58.3 | | | | 49.5 | |

|

The thoughts concerning recent market movements and future prospects for smaller-company stocks are solely those of Royce & Associates and, of course, there can be no assurance with regard to future market movements. Smaller-company stocks may involve considerably more risk than larger-cap stocks. Past performance is no guarantee of future results. See page 2 for important performance information for all of the above funds.

| 10 | This page is not part of the 2009 Semiannual Report to Stockholders |

| Semiannual Report to Stockholders | |

|

| | |

| Managers’ Discussions of Fund Performance | |

| | |

| Royce Value Trust | 12 |

| | |

| Royce Micro-Cap Trust | 14 |

| | |

| Royce Focus Trust | 16 |

| | |

| History Since Inception | 18 |

| | |

| Distribution Reinvestment and Cash Purchase Options | 19 |

| | |

| Schedules of Investments and Other Financial Statements | |

| | |

| Royce Value Trust | 20 |

| | |

| Royce Micro-Cap Trust | 34 |

| | |

| Royce Focus Trust | 46 |

| | |

| Notes to Performance and Other Important Information | 55 |

| | |

| Board Approval and Investment Advisory Agreements | 56 |

| 2009 Semiannual Report to Stockholders | 11 |

| | | |

| | | |

| | | |

| | AVERAGE ANNUAL NAV TOTAL RETURNS

Through 6/30/09 | |

| |

| |

| | Second Quarter 2009* | | 29.22 | % | |

| |

| |

| | Year-to-Date 2009* | | 11.79 | | |

| |

| |

| | One-Year | | | | | -31.17 | | |

| |

| |

| | Three-Year | | | | | -11.38 | | |

| |

| |

| | Five-Year | | | | | -1.73 | | |

| |

| |

| | 10-Year | | | | | 5.49 | | |

| |

| |

| | 15-Year | | | | | 8.49 | | |

| |

| |

| | 20-Year | | | | | 9.06 | | |

| |

| |

| | Since Inception (11/26/86) | | | | | 9.28 | | |

| |

| |

| | * Not annualized | |

| | | | | |

| | CALENDAR YEAR NAV TOTAL RETURNS | |

| |

| |

| | Year | | RVT | | | Year | | | RVT | | |

| |

| |

| | 2008 | | -45.6 | % | | 1999 | | | 11.7 | % | |

| |

| |

| | 2007 | | 5.0 | | | 1998 | | | 3.3 | | |

| |

| |

| | 2006 | | 19.5 | | | 1997 | | | 27.5 | | |

| |

| |

| | 2005 | | 8.4 | | | 1996 | | | 15.5 | | |

| |

| |

| | 2004 | | 21.4 | | | 1995 | | | 21.6 | | |

| |

| |

| | 2003 | | 40.8 | | | 1994 | | | 0.1 | | |

| |

| |

| | 2002 | | -15.6 | | | 1993 | | | 17.3 | | |

| |

| |

| | 2001 | | 15.2 | | | 1992 | | | 19.3 | | |

| |

| |

| | 2000 | | 16.6 | | | 1991 | | | 38.4 | | |

| |

| |

| | | | | | | | | | | |

| | TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders | |

| |

| |

| | Ash Grove Cement Cl. B | | 1.4 | % | |

| |

| |

| | Ritchie Bros. Auctioneers | | 1.3 | | |

| |

| |

| | SEACOR Holdings | | 1.2 | | |

| |

| |

| | Simpson Manufacturing | | 1.0 | | |

| |

| |

| | AllianceBernstein Holding L.P. | | 1.0 | | |

| |

| |

| | Alleghany Corporation | | 1.0 | | |

| |

| |

| | SPSS | | 0.9 | | |

| |

| |

| | GAMCO Investors Cl. A | | 0.9 | | |

| |

| |

| | Forward Air | | 0.9 | | |

| |

| |

| | HEICO Corporation | | 0.9 | | |

| |

| |

| | | | | | | | | | | |

| | PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders | |

| |

| |

| | Technology | | 21.1 | % | |

| |

| |

| | Industrial Products | | 20.1 | | |

| |

| |

| | Industrial Services | | 16.8 | | |

| |

| |

| | Financial Services | | 14.4 | | |

| |

| |

| | Financial Intermediaries | | 12.7 | | |

| |

| |

| | Natural Resources | | 8.4 | | |

| |

| |

| | Consumer Products | | 7.0 | | |

| |

| |

| | Health | | 6.2 | | |

| |

| |

| | Consumer Services | | 4.3 | | |

| |

| |

| | Diversified Investment Companies | | 0.5 | | |

| |

| |

| | Miscellaneous | | 4.7 | | |

| |

| |

| | Preferred Stock | | 0.7 | | |

| |

| |

| | Cash and Cash Equivalents | | 16.6 | | |

| |

| |

| | | |

|

|

Royce Value Trust

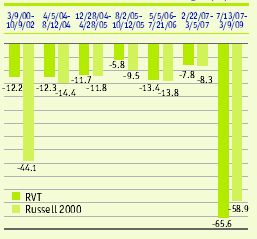

Manager’s DiscussionFollowing a discouraging 2008, the rally in the first half of 2009 lifted stock prices and spirits, including those of us who manage Royce Value Trust (RVT). The Fund’s portfolio of small-cap and micro-cap stocks did well in the first half on both relative and absolute basis. Its results were strong on both a net asset value (NAV) and market price basis. For the year-to-date period ended 6/30/09, the Fund gained 11.8% on an NAV basis, and 5.5% based on market price, outpacing both of its unleveraged benchmarks, the Russell 2000, which was up 2.6%, and the S&P Small-Cap 600, which was up 0.7%, for the same period. After managing both to post a dismal absolute performance and to lag its benchmarks in 2008, we were very pleased to see such a strong rebound in 2009’s first half, particularly with the suspension of the Fund’s quarterly distribution policy negatively impacting its market price returns. RVT’s solid relative showing in the bearish first quarter was especially gratifying. During this period, the Fund was down 13.5% and 11.4% on an NAV and market price basis, respectively, while the Russell 2000 fell 15.0%, and the S&P 600 declined 16.8%. During the second quarter, when stock prices rose precipitously, RVT held its advantage with impressive gains of 29.2% (NAV) and 19.1% (market price), compared to the Russell 2000’s increase of 20.7%, and the S&P 600’s of 21.1%. Manager’s DiscussionFollowing a discouraging 2008, the rally in the first half of 2009 lifted stock prices and spirits, including those of us who manage Royce Value Trust (RVT). The Fund’s portfolio of small-cap and micro-cap stocks did well in the first half on both relative and absolute basis. Its results were strong on both a net asset value (NAV) and market price basis. For the year-to-date period ended 6/30/09, the Fund gained 11.8% on an NAV basis, and 5.5% based on market price, outpacing both of its unleveraged benchmarks, the Russell 2000, which was up 2.6%, and the S&P Small-Cap 600, which was up 0.7%, for the same period. After managing both to post a dismal absolute performance and to lag its benchmarks in 2008, we were very pleased to see such a strong rebound in 2009’s first half, particularly with the suspension of the Fund’s quarterly distribution policy negatively impacting its market price returns. RVT’s solid relative showing in the bearish first quarter was especially gratifying. During this period, the Fund was down 13.5% and 11.4% on an NAV and market price basis, respectively, while the Russell 2000 fell 15.0%, and the S&P 600 declined 16.8%. During the second quarter, when stock prices rose precipitously, RVT held its advantage with impressive gains of 29.2% (NAV) and 19.1% (market price), compared to the Russell 2000’s increase of 20.7%, and the S&P 600’s of 21.1%. |

The recent rally began on 3/9/09, just before the end of the first quarter. From that small-cap low through 6/30/09, RVT outpaced the Russell 2000, up 64.2% on an NAV basis and 70.2% on a market price basis versus 48.9% for the Russell 2000 and 48.4% for the S&P 600. This short-term outperformance would have been less encouraging had it not helped the Fund to narrow the performance gap on its benchmarks in the current severe bear market cycle. From the small-cap market peak on 7/13/07 through 6/30/09, RVT was down 43.5% on an NAV basis and 51.1% based on market price, compared to declines of 38.8% and 38.1% for the Russell 2000 and the S&P 600, respectively.

RVT trailed its two benchmarks for the one-year period ended 6/30/09 on both an NAV and market price basis. The performance picture was better on an NAV basis over longer-term periods. From the previous small-cap market peak on 3/9/00 through 6/30/09, RVT gained 47.8% and 51.8% on an NAV and market price basis, versus a decline of 5.2% for the Russell 2000 and a gain of 31.6% for the S&P 600. The Fund also outperformed the Russell 2000 for the 10-, 15-, 20-year, and since inception (11/26/86) periods ended 6/30/09 on an NAV basis, and the S&P 600 for the 10-, 20-, and 25-year periods. RVT’s NAV average annual total return since inception was 9.3%.

| | | | | |

| | | GOOD IDEAS THAT WORKED

Top Contributors to Performance*

Year-to-Date Through 6/30/09 |

| | |

|

| | | Diodes | | 0.43% |

| | |

|

| | | GAMCO Investors Cl. A | | 0.42 |

| | |

|

| | | Evercore Partners Cl. A | | 0.36 |

| | |

|

| | | Advent Software | | 0.33 |

| | |

|

| | | Waddell & Reed Financial Cl. A | | 0.31 |

| | |

|

| | | *Includes dividends | | |

| | | | | | |

| | | | | | |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and micro-cap companies, which may involve considerably more risk than investing in a more diversified portfolio of larger-cap companies. |

12 | 2009 Semiannual Report to Stockholders

| |

| |

| |

Performance and Portfolio Review

The Technology and Financial Services sectors made the most significant positive impact on performance through the end of June. Technology holdings were particularly strong as a group, as tech stocks in general enjoyed both a relatively better first quarter—that is, they tended to lose less than the market as a whole—and a stronger second quarter. Net gains were spread fairly evenly through the sector’s industry groups, with software companies, the semiconductors and equipment group, and components and systems businesses leading in terms of net gains. Diodes, which makes semiconductors used in a variety of industries, was RVT’s top performer in the first half, in part benefiting from better-than-expected earnings earlier in the year. Advent Software, a provider of financial management, accounting and trading software to asset managers, was also a strong contributor. The gradual recovery of investment management companies—themselves a key area of strength for RVT’s portfolio—combined with solid earnings that exceeded estimates helped its stock price to climb.

Four of the Fund’s top seven performers were investment management businesses: GAMCO Investors, which spun off an advisory unit in February, Evercore Partners, Waddell & Reed Financial and Federated Investors. Investment management is an area that we think we know well and in which we see strong potential going forward. It was an industry largely battered in the downturn, and stocks began to recover earlier in 2009. We were happy to hold good-sized positions in each at the end of June, though we sold some shares in each stock as share prices climbed.

|

| | | | We held our shares of Bermuda-based Bank of N.T. Butterfield & Son mostly owing to its strong core business, which has suffered amid the ongoing struggles of banking stocks. Our thought was that its shares could rebound when its industry comes back. Woodward Governor makes energy control systems for commercial and military aircraft. Its stock price plunged as the company announced a large acquisition around the same time it revised downward its outlook for the year due to continuing softening conditions in aircraft manufacturing. We reduced our stake as the acquisition caused enough balance sheet dilution to revise our view of its prospects. |

GOOD IDEAS AT THE TIME

Top Detractors from Performance*

Year-to-Date Through 6/30/09 | |

| |

| |

| Bank of N.T. Butterfield & Son | -0.37% | |

| |

| Woodward Governor | -0.32 | |

| |

| Lawson Products | -0.27 | |

| |

| Ash Grove Cement Cl. B | -0.25 | |

| |

| Adaptec | -0.25 | |

| |

| *Net of dividends | |

| | |

|

1Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all annual distributions as indicated and fully participated in primary subscriptions of the Fund’s rights offerings. |

2Reflects the actual market price of one share as it traded on the NYSE. |

| | |

| | | |

| | | |

| | FUND INFORMATION AND

PORTFOLIO DIAGNOSTICS | |

| |

| |

| | Average Market Capitalization* | $866 million | |

| |

| |

| | Weighted Average P/E Ratio** | 14.4x | |

| |

| |

| | Weighted Average P/B Ratio | 1.5x | |

| |

| |

| | Weighted Average Portfolio Yield | 1.4% | |

| |

| |

| | Fund Total Net Assets | $877 million | |

| |

| |

| | Net Leverage† | 17% | |

| |

| |

| | Turnover Rate | 11% | |

| |

| |

| | Symbol | | |

| | Market Price | RVT | |

| | NAV | XRVTX | |

| |

| |

| | * Geometrically calculated | |

| | | |

| | **The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (22% of portfolio holdings as of 6/30/09). | |

| | | |

| | † Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets, excluding preferred stock. | |

| | | |

| | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding

at 6/30/09 at NAV or Liquidation Value | |

| |

| |

| | 66.0 million shares

of Common Stock | $657 million | |

| |

| |

| | 5.90% Cumulative

Preferred Stock | $220 million | |

| |

| |

| | | |

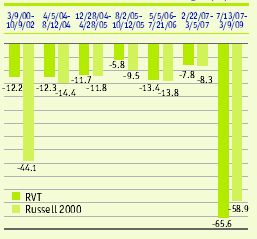

| | DOWN MARKET PERFORMANCE COMPARISON

All Down Periods of 7.5% or Greater

Over the Last 10 Years, in Percentages(%) | |

| | | |

| |  | |

| | | |

|

|

2009 Semiannual Report to Stockholders | 13

| | | |

| | | |

| | | |

| | AVERAGE ANNUAL NAV TOTAL RETURNS

Through 6/30/09 | |

| |

| |

| | Second Quarter 2009* | | 34.51 | % | |

| |

| |

| | Year-to-Date 2009* | | 18.66 | | |

| |

| |

| | One-Year | | | | | -26.70 | | |

| |

| |

| | Three-Year | | | | | -10.58 | | |

| |

| |

| | Five-Year | | | | | -1.38 | | |

| |

| |

| | 10-Year | | | | | 7.40 | | |

| |

| |

| | 15-Year | | | | | 9.31 | | |

| |

| |

| | Since Inception (12/14/93) | | | | | 9.05 | | |

| |

| |

| | * Not annualized | |

| | | | | |

| | CALENDAR YEAR NAV TOTAL RETURNS | |

| |

| |

| | Year | | RMT | | | Year | | | RMT | | |

| |

| |

| | 2008 | | -45.5 | % | | 2000 | | | 10.9 | % | |

| |

| |

| | 2007 | | 0.6 | | | 1999 | | | 12.7 | | |

| |

| |

| | 2006 | | 22.5 | | | 1998 | | | -4.1 | | |

| |

| |

| | 2005 | | 6.8 | | | 1997 | | | 27.1 | | |

| |

| |

| | 2004 | | 18.7 | | | 1996 | | | 16.6 | | |

| |

| |

| | 2003 | | 55.5 | | | 1995 | | | 22.9 | | |

| |

| |

| | 2002 | | -13.8 | | | 1994 | | | 5.0 | | |

| |

| |

| | 2001 | | 23.4 | | | | | | | | |

| |

| |

| | | | | | | | | | | | |

| | TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders | |

| |

| |

| | Seneca Foods | | 2.2 | % | |

| |

| |

| | Sapient Corporation | | 1.6 | | |

| |

| |

| | Pegasystems | | 1.1 | | |

| |

| |

| | Universal Truckload Services | | 1.1 | | |

| |

| |

| | Willbros Group | | 1.0 | | |

| |

| |

| | Deswell Industries | | 1.0 | | |

| |

| |

| | America’s Car-Mart | | 1.0 | | |

| |

| |

| | Computer Task Group | | 1.0 | | |

| |

| |

| | Movado Group | | 1.0 | | |

| |

| |

| | Hawkins | | 0.9 | | |

| |

| |

| | | | | | | | | | | | |

| | PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders | |

| |

| |

| | Technology | | 20.2 | % | |

| |

| |

| | Industrial Products | | 19.6 | | |

| |

| |

| | Industrial Services | | 13.0 | | |

| |

| |

| | Natural Resources | | 11.0 | | |

| |

| |

| | Financial Intermediaries | | 9.9 | | |

| |

| |

| | Health | | 9.1 | | |

| |

| |

| | Consumer Products | | 7.2 | | |

| |

| |

| | Financial Services | | 6.3 | | |

| |

| |

| | Consumer Services | | 4.3 | | |

| |

| |

| | Diversified Investment Companies | | 0.9 | | |

| |

| |

| | Miscellaneous | | 4.9 | | |

| |

| |

| | Preferred Stock | | 1.1 | | |

| |

| |

| | Cash and Cash Equivalents | | 23.0 | | |

| |

| |

| | | |

|

|

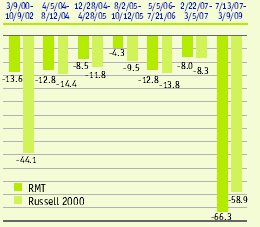

Royce Micro-Cap Trust

Manager’s DiscussionPerformance for Royce Micro-Cap Trust (RMT) was solid during the first half of 2008, but the stubborn and unfortunate reality of the bear market must still be kept in mind. As things stand, we will settle for describing RMT’s strong first half as ‘encouraging.’ The Fund gained 18.7% for the year-to-date period ended 6/30/09 on a net asset value basis (NAV) and 12.5% based on market price, well ahead of its unleveraged small-cap benchmark, the Russell 2000, which was up 2.6%, and the Russell Microcap index, which rose 6.0%, for the same period. The Fund’s first-half outperformance was a near-ideal combination of a strong relative showing in the first-quarter downturn and a terrific absolute and relative result in the second-quarter upswing. RMT lost 11.8% on an NAV basis, and 5.9% based on market price, in the opening quarter of 2009, compared to respective declines of 15.0% and 15.2% for the Russell 2000 and Russell Microcap indices. When stock prices rose in the second quarter, the Fund was up 34.5% on an NAV basis and 19.5% on a market price basis as RMT’s market price return suffered from the suspension of the Fund’s quarterly distribution. For the same period, the Russell 2000 was up 20.7%, and the Russell Microcap rose 25.0%. Manager’s DiscussionPerformance for Royce Micro-Cap Trust (RMT) was solid during the first half of 2008, but the stubborn and unfortunate reality of the bear market must still be kept in mind. As things stand, we will settle for describing RMT’s strong first half as ‘encouraging.’ The Fund gained 18.7% for the year-to-date period ended 6/30/09 on a net asset value basis (NAV) and 12.5% based on market price, well ahead of its unleveraged small-cap benchmark, the Russell 2000, which was up 2.6%, and the Russell Microcap index, which rose 6.0%, for the same period. The Fund’s first-half outperformance was a near-ideal combination of a strong relative showing in the first-quarter downturn and a terrific absolute and relative result in the second-quarter upswing. RMT lost 11.8% on an NAV basis, and 5.9% based on market price, in the opening quarter of 2009, compared to respective declines of 15.0% and 15.2% for the Russell 2000 and Russell Microcap indices. When stock prices rose in the second quarter, the Fund was up 34.5% on an NAV basis and 19.5% on a market price basis as RMT’s market price return suffered from the suspension of the Fund’s quarterly distribution. For the same period, the Russell 2000 was up 20.7%, and the Russell Microcap rose 25.0%.

The Fund also showed much-improved relative returns on an NAV basis in the recent market cycle. First, in the rally that began following the small-cap low on 3/9/09 through 6/30/09, RMT was up 73.3% versus a gain of 48.9% for the Russell 2000 and 54.6% for the Russell Microcap index. For the market cycle period that began with the most recent small-cap peak on 7/13/07 (and thus marked the beginning of the current bear market) through 6/30/09, RMT trailed its benchmark, down 41.6% on an NAV basis versus a loss of 38.8% for the Russell 2000. However, the Fund did outpace the microcap index, which declined 44.7% for the same period.

|

The Fund’s market cycle returns were a critical factor in beating its benchmark on an NAV basis for the five-, 10-, 15-year and since inception (12/14/93) periods ended 6/30/09. On a market price basis, the news was less encouraging, as RMT was ahead of the Russell 2000 for the 10-year, 15-year and since inception periods. RMT’s NAV average annual total return since inception was 9.1%.

Technology and Industrial Products, the Fund’s two largest sectors at the end of June, also made the most significant positive contributions to performance in the first half. Tech stocks made a long-sought comeback, and the strongest net gains in the portfolio came from software companies, the semiconductors and equipment group and IT Services. RMT has held Pegasystems, which makes business process management software, since 2001. We liked

| | | GOOD IDEAS THAT WORKED

Top Contributors to Performance*

Year-to-Date Through 6/30/09 |

| | |

|

| | | Pegasystems | | 1.39% |

| | |

|

| | | Spherion Corporation | | 0.73 |

| | |

|

| | | Stein Mart | | 0.68 |

| | |

|

| | | Deswell Industries | | 0.60 |

| | |

|

| | | Sapient Corporation | | 0.52 |

| | |

|

| | | *Includes dividends | | |

| | | | | | |

| | | | | | |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests in micro-cap companies, which may involve considerably more risk than investing in a more diversified portfolio of larger-cap companies. |

14 | 2009 Semiannual Report to Stockholders

| | |

| |

| Performance and Portfolio Review |

|

| |

the company’s attractive niche almost as much as its strong balance sheet. With little analyst coverage, its stock price soared in April after better-than-expected first-quarter earnings results were announced. We continued to reduce our position as its stock price rose. Another key contributor and long-time favorite was Sapient Corporation, which provides business, marketing, and technology consulting services worldwide. Sapient benefitted from the general revival of tech stocks, and reported a positive earnings surprise, which helped to bring investors back to the stock.

Elsewhere in the portfolio, staffing and placement services company Spherion Corporation saw its share price begin to recover as it fought its way back from a dismal 2008. Deswell Industries, in the Industrial Products sector, was another top contributor. This manufacturer of injection-molded plastic parts and components experienced a revival in earnings and solid, if unspectacular, growth during the period, though it was enough to attract investors during the recent rally. The Industrial Products sector, however, was also home to some of RMT’s significant detractors during the period—Quixote Corporation and Trex Company. Trex manufactures and distributes wood/plastic composite products used in residential and commercial construction. The slowdown in each market has hurt its business. Our hope was that the company’s fortunes could revive with a pickup in its market, especially as the company has reduced operating costs. The ongoing recession also slowed the business of Quixote Corporation, which |

| | | manufactures highway and transportation safety products. Recent earnings were not only negative—a discouraging enough development—but also slightly worse than expected, which, along with its spotty profits, left us unsure about its long-term prospects. As a result, we trimmed our position in February and March. Pason Systems, which provides rental oilfield instrumentation and data acquisition systems, also disappointed, a result of the tough times for natural gas drilling and exploration. We still like its market share in what we think is a highly attractive industry niche. |

GOOD IDEAS AT THE TIME

Top Detractors from Performance*

Year-to-Date Through 6/30/09 |

|

| Quixote Corporation | | -0.68 | % |

|

| Pason Systems | | -0.43 | |

|

| Trex Company | | -0.30 | |

|

| NYMAGIC | | -0.29 | |

|

| Integral Systems | | -0.27 | |

|

| *Net of dividends | | | |

| |

MARKET PRICE PERFORMANCE HISTORY SINCE INCEPTION (12/14/93) through 6/30/09

|

| |

1Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($7.50 IPO), reinvested distributions as indicated and fully participated in the primary subscription of the 1994 rights offering. 2 Reflects the actual market price of one share as it traded on the NYSE and, prior to 12/1/03, on Nasdaq. |

| | | | | |

| | | | | |

| | | | | |

| | FUND INFORMATION AND

PORTFOLIO DIAGNOSTICS | |

| |

| |

| | Average Market Capitalization* | | $228 million | |

| |

| |

| | Weighted Average P/B Ratio | | 1.2x | |

| |

| |

| | Weighted Average Portfolio Yield | | 1.1% | |

| |

| |

| | Fund Total Net Assets | | $257 million | |

| |

| |

| | Net Leverage† | | 8% | |

| |

| |

| | Turnover Rate | | 16% | |

| |

| |

| | Symbol | | | |

| | Market Price | | RMT | |

| | NAV | | XOTCX | |

| |

| |

| | *Geometrically calculated | |

| | †Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets, excluding preferred stock. | |

| | | |

| | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding

at 6/30/09 at NAV or Liquidation Value | |

| |

| |

| | 27.3 million shares of Common Stock | $197 million | |

| |

| |

| | 6.00% Cumulative Preferred Stock | $60 million | |

| |

| |

| |

| |

| | | |

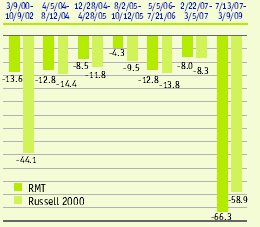

| | DOWN MARKET PERFORMANCE COMPARISON

All Down Periods of 7.5% or Greater Over the

Last 10 Years, in Percentages(%) | |

| |

| |

| | | |

| |  | |

| | | |

|

2009 Semiannual Report to Stockholders | 15

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | AVERAGE ANNUAL NAV TOTAL RETURNS

Through 6/30/09 | |

| |

| |

| | Second Quarter 2009* | | 26.91 | % | |

| |

| |

| | Year-to-Date 2009* | | 17.62 | | |

| |

| |

| | One-Year | | -34.12 | | |

| |

| |

| | Three-Year | | -6.77 | | |

| |

| |

| | Five-Year | | 3.09 | | |

| |

| |

| | 10-Year | | 8.61 | | |

| |

| |

| | Since Inception (11/1/96)† | | 8.93 | | |

| |

| |

| | * Not annualized | | | | |

| | † Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. | |

| | | | | | | | | | |

| | CALENDAR YEAR NAV TOTAL RETURNS | |

| |

| |

| | Year | FUND | | Year | | FUND | |

| |

| |

| | 2008 | -42.7 | % | | 2002 | | -12.5 | % | |

| |

| |

| | 2007 | 12.2 | | | 2001 | | 10.0 | | |

| |

| |

| | 2006 | 16.3 | | | 2000 | | 20.9 | | |

| |

| |

| | 2005 | 13.3 | | | 1999 | | 8.7 | | |

| |

| |

| | 2004 | 29.2 | | | 1998 | | -6.8 | | |

| |

| |

| | 2003 | 54.3 | | | 1997 | | 20.5 | | |

| |

| |

| | | | | | | | | | |

| | TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders | |

| |

| |

| | Kennedy-Wilson Conv. | | 6.7 | % | |

| |

| |

| | Reliance Steel & Aluminum | | 3.6 | | |

| |

| |

| | Sims Metal Management ADR | | 3.1 | | |

| |

| |

| | Knight Capital Group Cl. A | | 2.8 | | |

| |

| |

| | Ensign Energy Services | | 2.7 | | |

| |

| |

| | Silver Standard Resources | | 2.6 | | |

| |

| |

| | Unit Corporation | | 2.6 | | |

| |

| |

| | Microsoft Corporation | | 2.2 | | |

| |

| |

| | GrafTech International | | 2.1 | | |

| |

| |

| | Sanderson Farms | | 2.1 | | |

| |

| |

| | | | | | | | | | |

| | PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders | |

| |

| |

| | Natural Resources | | 29.2 | % | |

| |

| |

| | Industrial Products | | 24.9 | | |

| |

| |

| | Consumer Products | | 11.3 | | |

| |

| |

| | Technology | | 8.1 | | |

| |

| |

| | Financial Services | | 7.3 | | |

| |

| |

| | Industrial Services | | 4.5 | | |

| |

| |

| | Financial Intermediaries | | 3.8 | | |

| |

| |

| | Health | | 3.0 | | |

| |

| |

| | Diversified Investment Companies | | 1.9 | | |

| |

| |

| | Consumer Services | | 1.3 | | |

| |

| |

| | Miscellaneous | | 0.7 | | |

| |

| |

| | Preferred Stock | | 6.7 | | |

| |

| |

| | Cash and Cash Equivalents | | 20.4 | | |

| |

| |

| | | |

| | | |

|

| |

| |

| Royce Focus Trust |

|

| |

Manager’s Discussion

After taking it on the chin in 2008, at least in the year’s second half, we were very pleased to see Royce Focus Trust (FUND) get off the mat and battle back in the first half of 2009. For the year-to-date period ended 6/30/09, FUND gained 17.6% on a net asset value (NAV) basis and 15.7% on a market price basis, in both cases substantially ahead of the 2.6% return during the same period for its unleveraged small-cap benchmark, the Russell 2000. Particularly gratifying was the Fund’s strong relative performance when stock prices were falling, though we were also cheered by its full participation in the rally that began early in March. During the bearish first quarter, the Fund lost 7.3% on an NAV basis and only 1.7% on a market price basis, while the Russell 2000 fell 15.0%. When the second quarter began, share prices had already begun to recover. FUND gained 26.9% on an NAV basis and 17.7% on a market price basis during this more bullish quarter compared to a gain of 20.7% for the small-cap index (the Fund’s market price return having been dampened somewhat by the suspension of the Fund’s quarterly distribution).

The Fund’s NAV performance has been better than its market price results through the current quite bearish market cycle, though both showed improvement at the end of the first half. From the small-cap peak on 7/13/07 through 6/30/09, FUND fell 37.6% on an NAV basis and was down 41.3% on a market price basis versus a decline of 38.8% for the Russell 2000. The recent rally—as well as strong relative results in the first quarter—was a factor. From the recent small-cap low on 3/9/09 through 6/30/09, FUND rose 49.5% on an NAV basis and 52.5% based on market price, while the Russell 2000 gained 48.9%. |

Longer-term and calendar-based results were solid as well, though the severity of the bear market means that returns look better the further out in time one goes. From the previous small-cap market peak on 3/9/00 through 6/30/09, FUND gained 127.2% on an NAV basis and was up 158.1% on a market price basis while the Russell 2000 was down 5.2% for the same period. The Fund was also ahead of its benchmark on both an NAV and market price basis for the three-, five-, 10-year and since inception of our management (11/1/96) periods ended 6/30/09. FUND’s NAV average annual total return since inception was 8.9%.

| | |

GOOD IDEAS THAT WORKED

Top Contributors to Performance*

Year-to-Date Through 6/30/09 |

|

| Reliance Steel & Aluminum | | 1.96 | % |

|

| Sims Metal Management ADR | | 1.63 | |

|

| Ivanhoe Mines | | 1.17 | |

|

| Sigma Designs | | 1.01 | |

|

| CF Industries Holdings | | 1.00 | |

|

| *Includes dividends | | | |

| All but two of the Fund’s sectors finished the first half in the black, with Natural Resources, Industrial Products and Consumer Products making the largest positive contributions to performance. The first of these three areas saw strong gains from holdings in the precious metals and mining group. These holdings profited from stable or rising commodity prices |

| |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests primarily in small-cap companies, which may involve considerably more risk than investing in a more diversified portfolio of larger-cap companies. |

| 16 | 2009 Semiannual Report to Stockholders |

| |

| |

| Performance and Portfolio Review |

|

| |

and a decline in mining costs. Improved commodity prices also had the apparent effect of making financing easier to obtain, which in turn seemed to help stock prices. Ivanhoe Mines was the leader in this group, followed by solid results from Gammon Gold, Allied Nevada Gold and Silver Standard Resources.

The portfolio’s leading industry was the metal fabrication and distribution group in the Industrial Products sector. Two of the Fund’s top-ten holdings dominated this group’s performance. Reliance Steel & Aluminum, a processor and distributor of metal products, had falling profits, but its earnings remained positive, which was sufficient to attract investors. The core business of Sims Metal Management, the world’s largest scrap metal recycler, gradually started to stabilize after an uptick in prices materialized from a stimulus-driven increase in demand from China, other Asian countries and Turkey. Sims also began to see a modest pick-up in orders from U.S. mills as destocking ran its course. Each stock’s success was mostly attributable to investors looking to metals-related stocks in anticipation of an industrial recovery in the second half of 2009. While these two companies experienced no significant improvement in fundamentals, modest growth or even “not getting worse” translated into “good” for many investors during the rally.

Sigma Designs makes semiconductors for use in various media, including specialized chips used in video image compression that creates high definition. Its earnings have remained positive and more recently were growing, and its other fundamentals remain strong. We reduced |

| | | our stake in February and March. During January and February, we sold some shares of Endo Pharmaceuticals Holdings. We were not quite certain about how it will handle the transition away from its core pain management products into new areas. The strong but suffering business of welding and cutting products maker (and long-time holding) Lincoln Electric Holdings inspired more confidence for the long run. We think that its stock could flourish in an economic recovery that would include a resumption in global infrastructure construction. |

GOOD IDEAS AT THE TIME

Top Detractors from Performance*

Year-to-Date Through 6/30/09 |

|

| Endo Pharmaceuticals Holdings | | -1.00 | % |

|

| Lincoln Electric Holdings | | -0.77 | |

|

| Pason Systems | | -0.74 | |

|

| Simpson Manufacturing | | -0.63 | |

|

| Kennedy-Wilson Conv. | | -0.59 | |

|

| *Net of dividends | | | |

| |

| |

|

1Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. 2Reflects the cumulative total return experience of a continuous common stockholder who reinvested all distributions as indicated and fully participated in the primary subscription of the 2005 rights offering. 3Reflects the actual market price of one share as it traded on Nasdaq. |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | FUND INFORMATION AND

PORTFOLIO DIAGNOSTICS | |

| |

| |

| | Average Market Capitalization* | | $1,492 million | |

| |

| |

| | Weighted Average P/E Ratio** | | 11.5x | |

| |

| |

| | Weighted Average P/B Ratio | | 1.7x | |

| |

| |

| | Weighted Average Portfolio Yield | | 1.6% | |

| |

| |

| | Fund Total Net Assets | | $133 million | |

| |

| |

| | Net Leverage† | | 3% | |

| |

| |

| | Turnover Rate | | 24% | |

| |

| |

| | Symbol | | | |

| | Market Price | | FUND | |

| | NAV | | XFUNX | |

| |

| |

| | *Geometrically calculated | |

| | **The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (22% of portfolio holdings as of 6/30/09). | |

| | †Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets, excluding preferred stock. | |

| | | |

| | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding

at 6/30/09 at NAV or Liquidation Value | |

| |

| |

| | 19.8 million shares of Common Stock | $108 million | |

| |

| |

| | 6.00% Cumulative Preferred Stock | $25 million | |

| |

| |

| | | |

| | DOWN MARKET PERFORMANCE COMPARISON

All Down Periods of 7.5%

or Greater, in Percentages(%) | |

| |

| |

| |  |

| | | |

|

2009 Semiannual Report to Stockholders | 17

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions (including fractional shares) and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds.

| | | | | | Amount | | | Purchase | | | | | NAV | | | Market | |

| | History | | | Invested | | | Price* | | Shares | | | Value** | | | Value** | |

| Royce Value Trust | | | | | | | | | | | | | | | |

| 11/26/86 | | Initial Purchase | | $ | 10,000 | | $ | 10.000 | | 1,000 | | $ | 9,280 | | $ | 10,000 | |

| 10/15/87 | | Distribution $0.30 | | | | | | 7.000 | | 42 | | | | | | | |

| 12/31/87 | | Distribution $0.22 | | | | | | 7.125 | | 32 | | | 8,578 | | | 7,250 | |

| 12/27/88 | | Distribution $0.51 | | | | | | 8.625 | | 63 | | | 10,529 | | | 9,238 | |

| 9/22/89 | | Rights Offering | | | 405 | | | 9.000 | | 45 | | | | | | | |

| 12/29/89 | | Distribution $0.52 | | | | | | 9.125 | | 67 | | | 12,942 | | | 11,866 | |

| 9/24/90 | | Rights Offering | | | 457 | | | 7.375 | | 62 | | | | | | | |

| 12/31/90 | | Distribution $0.32 | | | | | | 8.000 | | 52 | | | 11,713 | | | 11,074 | |

| 9/23/91 | | Rights Offering | | | 638 | | | 9.375 | | 68 | | | | | | | |

| 12/31/91 | | Distribution $0.61 | | | | | | 10.625 | | 82 | | | 17,919 | | | 15,697 | |

| 9/25/92 | | Rights Offering | | | 825 | | | 11.000 | | 75 | | | | | | | |

| 12/31/92 | | Distribution $0.90 | | | | | | 12.500 | | 114 | | | 21,999 | | | 20,874 | |

| 9/27/93 | | Rights Offering | | | 1,469 | | | 13.000 | | 113 | | | | | | | |

| 12/31/93 | | Distribution $1.15 | | | | | | 13.000 | | 160 | | | 26,603 | | | 25,428 | |

| 10/28/94 | | Rights Offering | | | 1,103 | | | 11.250 | | 98 | | | | | | | |

| 12/19/94 | | Distribution $1.05 | | | | | | 11.375 | | 191 | | | 27,939 | | | 24,905 | |

| 11/3/95 | | Rights Offering | | | 1,425 | | | 12.500 | | 114 | | | | | | | |

| 12/7/95 | | Distribution $1.29 | | | | | | 12.125 | | 253 | | | 35,676 | | | 31,243 | |

| 12/6/96 | | Distribution $1.15 | | | | | | 12.250 | | 247 | | | 41,213 | | | 36,335 | |

| 1997 | | Annual distribution total $1.21 | | | | | | 15.374 | | 230 | | | 52,556 | | | 46,814 | |

| 1998 | | Annual distribution total $1.54 | | | | | | 14.311 | | 347 | | | 54,313 | | | 47,506 | |

| 1999 | | Annual distribution total $1.37 | | | | | | 12.616 | | 391 | | | 60,653 | | | 50,239 | |

| 2000 | | Annual distribution total $1.48 | | | | | | 13.972 | | 424 | | | 70,711 | | | 61,648 | |

| 2001 | | Annual distribution total $1.49 | | | | | | 15.072 | | 437 | | | 81,478 | | | 73,994 | |

| 2002 | | Annual distribution total $1.51 | | | | | | 14.903 | | 494 | | | 68,770 | | | 68,927 | |

| 1/28/03 | | Rights Offering | | | 5,600 | | | 10.770 | | 520 | | | | | | | |

| 2003 | | Annual distribution total $1.30 | | | | | | 14.582 | | 516 | | | 106,216 | | | 107,339 | |

| 2004 | | Annual distribution total $1.55 | | | | | | 17.604 | | 568 | | | 128,955 | | | 139,094 | |

| 2005 | | Annual distribution total $1.61 | | | | | | 18.739 | | 604 | | | 139,808 | | | 148,773 | |

| 2006 | | Annual distribution total $1.78 | | | | | | 19.696 | | 693 | | | 167,063 | | | 179,945 | |

| 2007 | | Annual distribution total $1.85 | | | | | | 19.687 | | 787 | | | 175,469 | | | 165,158 | |

| 2008 | | Annual distribution total $1.72 | | | | | | 12.307 | | 1,294 | | | 95,415 | | | 85,435 | |

| 2009 | | Year-to-date distribution total $0.32 | | | | | | 6.070 | | 537 | | | | | | | |

|

| 6/30/09 | | | | $ | 21,922 | | | | | 10,720 | | $ | 106,664 | | $ | 90,155 | |

|

| Royce Micro-Cap Trust | | | | | | | | | | | | | | | |

| 12/14/93 | | Initial Purchase | | $ | 7,500 | | $ | 7.500 | | 1,000 | | $ | 7,250 | | $ | 7,500 | |

| 10/28/94 | | Rights Offering | | | 1,400 | | | 7.000 | | 200 | | | | | | | |

| 12/19/94 | | Distribution $0.05 | | | | | | 6.750 | | 9 | | | 9,163 | | | 8,462 | |

| 12/7/95 | | Distribution $0.36 | | | | | | 7.500 | | 58 | | | 11,264 | | | 10,136 | |

| 12/6/96 | | Distribution $0.80 | | | | | | 7.625 | | 133 | | | 13,132 | | | 11,550 | |

| 12/5/97 | | Distribution $1.00 | | | | | | 10.000 | | 140 | | | 16,694 | | | 15,593 | |

| 12/7/98 | | Distribution $0.29 | | | | | | 8.625 | | 52 | | | 16,016 | | | 14,129 | |

| 12/6/99 | | Distribution $0.27 | | | | | | 8.781 | | 49 | | | 18,051 | | | 14,769 | |

| 12/6/00 | | Distribution $1.72 | | | | | | 8.469 | | 333 | | | 20,016 | | | 17,026 | |

| 12/6/01 | | Distribution $0.57 | | | | | | 9.880 | | 114 | | | 24,701 | | | 21,924 | |

| 2002 | | Annual distribution total $0.80 | | | | | | 9.518 | | 180 | | | 21,297 | | | 19,142 | |

| 2003 | | Annual distribution total $0.92 | | | | | | 10.004 | | 217 | | | 33,125 | | | 31,311 | |

| 2004 | | Annual distribution total $1.33 | | | | | | 13.350 | | 257 | | | 39,320 | | | 41,788 | |

| 2005 | | Annual distribution total $1.85 | | | | | | 13.848 | | 383 | | | 41,969 | | | 45,500 | |

| 2006 | | Annual distribution total $1.55 | | | | | | 14.246 | | 354 | | | 51,385 | | | 57,647 | |

| 2007 | | Annual distribution total $1.35 | | | | | | 13.584 | | 357 | | | 51,709 | | | 45,802 | |

| 2008 | | Annual distribution total $1.19 | | | | | | 8.237 | | 578 | | | 28,205 | | | 24,807 | |

| 2009 | | Year-to-date distribution total $0.22 | | | | | | 4.260 | | 228 | | | | | | | |

|

| 6/30/09 | | | | $ | 8,900 | | | | | 4,642 | | $ | 33,469 | | $ | 27,898 | |

|

| Royce Focus Trust | | | | | | | | | | | | | | | |

| 10/31/96 | | Initial Purchase | | $ | 4,375 | | $ | 4.375 | | 1,000 | | $ | 5,280 | | $ | 4,375 | |

| 12/31/96 | | | | | | | | | | | | | 5,520 | | | 4,594 | |

| 12/5/97 | | Distribution $0.53 | | | | | | 5.250 | | 101 | | | 6,650 | | | 5,574 | |

| 12/31/98 | | | | | | | | | | | | | 6,199 | | | 5,367 | |

| 12/6/99 | | Distribution $0.145 | | | | | | 4.750 | | 34 | | | 6,742 | | | 5,356 | |