MAJOR SHAREHOLDERS

The Company’s authorised share capital consists of ordinary shares with a nominal value of 10p each. So far as the Company is aware, other than as set out in the Directors’ report – Substantial Shareholders, see page 49, no person is the beneficial owner of 5% or more of the Company’s ordinary shares.

As at 3 March 2006, 19 459 130 ADSs (equivalent to 97 295 650 ordinary shares or approximately 2.76% of the total outstanding ordinary shares) were outstanding and held of record by 224 registered holders in the USA. The Company is aware that many ADSs are held of record by brokers and other nominees and, accordingly, the above numbers are not necessarily representative of the actual number of persons who are beneficial holders of ADSs or the number of ADSs beneficially held by such persons.

As at 3 March 2006, there were about 803 000 holders of record of BG Group plc ordinary shares. Of these holders, around 2 560 had registered addresses in the USA and held a total of some 1 307 920 BG Group plc ordinary shares, approximately 0.04% of the total outstanding ordinary shares. In addition, certain accounts of record with registered addresses other than in the USA hold BG Group plc ordinary shares, in whole or in part, beneficially for US persons.

As far as is known to the Company, it is not directly or indirectly owned or controlled by another company or by any government or any other natural or legal person, and there are no arrangements known to the Company, the operation of which may result in a change of control.

MEMORANDUM AND ARTICLES OF ASSOCIATION

The Company is incorporated in England and Wales under Company Number 3690065.

The Memorandum of the Company provides that the Company has general commercial objects including to act as a holding company or an investment holding company and to carry on the business of transporting, manufacturing, processing, storing and dealing in different forms of energy including natural gases, petroleum and electricity.

The Articles of Association (Articles) of the Company and applicable English law contain, among others, provisions to the following effect:

Directors

1. General

Unless otherwise determined by ordinary resolution of the Company, there must be at least four Directors. A Director need not be a shareholder, but a Director who is not a shareholder can still attend and speak at shareholders’ meetings.

At each Annual General Meeting (AGM), any Director who was elected or last re-elected a Director at or before the AGM held in the third calendar year before the current year shall automatically retire from office. A retiring Director is eligible for re-election by the shareholders. No maximum age limit for Directors applies.

2. Directors’ interests

Unless otherwise provided in the Articles, a Director cannot cast a vote on any contract, arrangement or any other kind of proposal in which he knows he has a material interest. For this purpose, interests of a person who is connected with a Director under Section 346 of the Companies Act 1985 are added to the interests of the Director himself. Interests purely as a result of an interest in

the Company’s shares, debentures or other securities are disregarded. In relation to an alternate Director, an interest of his appointor shall be treated as an interest of the alternate Director, in addition to any interest which the alternate Director has in his own right. A Director may not be included in the quorum of a meeting in relation to any resolution on which he is not allowed to vote.

3. Borrowing powers

So far as the relevant English law allows, the Directors can exercise all the powers of the Company to (a) borrow money, (b) issue debentures and other securities, and (c) give any form of guarantee and security for any debt, liability or obligation of the Company or of any third party.

The Directors must limit the Borrowings (as defined in the Articles) of the Company and exercise all voting and other rights or powers of control exercisable by the Company in relation to its subsidiary undertakings, so as to ensure that the total amount of all Borrowings by the Group (as defined in the Articles) outstanding at any time will not exceed twice the Adjusted Total Capital and Reserves (as defined in the Articles) at such time. This limit may be exceeded if the Company’s consent has been given in advance by an ordinary resolution passed at a general meeting.

4. Director indemnity

So far as the relevant English law and the Listing Rules of the UK Listing Authority allow, every Director, Company Secretary or other officer of the Company shall be indemnified by the Company out of its own funds against (a) liability incurred by or attaching to him in connection with any negligence, default, breach of duty, or breach of trust by him in relation to the Company or any associated company other than (i) any liability to the Company or any associated company and (ii) any liability of the kind referred to in Sections 309B(3) or (4) of the Companies Act 1985; and (b) any other liability incurred by or attaching to him in the actual or purported exercise of his powers and/or otherwise in relation to or in connection with his duties, powers or office. Such indemnity shall extend to all costs, charges, losses and expenses and liabilities incurred by the Director.

Shareholder meetings

There are two types of meetings of shareholders, AGMs and Extraordinary General Meetings (EGMs). The Company must hold an AGM in each calendar year, not more than 15 months from the previous AGM. The Directors will decide when and where to hold the AGM. Any other general meeting is known as an EGM.

The Directors can decide to call an EGM at any time. In addition, an EGM must be called by the Directors promptly in response to a requisition by shareholders under the relevant English law. When an EGM is called, the Directors must decide when and where to hold it. At least 21 clear days’ notice in writing (or, where the relevant legislation permits, by electronic mail) must be given for every AGM and for any other meeting where it is proposed to pass a special resolution or to pass some other resolution of which special notice under the Companies Act 1985 has been given to the Company. For every other general meeting, at least 14 clear days’ notice in writing (or, where the relevant legislation permits, by electronic mail) must be given.

There must be a quorum present at every general meeting. Unless provided otherwise in the Articles, a quorum is two people who are entitled to vote.

Unless a poll is demanded, a resolution that is put to the vote at a general meeting will be decided by a show of hands.

Back to Contents

| | |

| 142 | BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 |

| | |

Additional shareholder informationcontinued

Transfer of shares

Unless otherwise provided in the Articles or the terms of issue of any shares, any shareholder may transfer any or all of his shares. However, the Directors can refuse to register a transfer (a) in certificated form, if such shares are not fully paid up or the evidence of entitlement to such shares is missing, (b) if it is in respect of more than one class of share, (c) if it is in favour of more than four persons jointly, or (d) if it is not properly stamped where required. However, if any of those shares have been admitted to the Official List of the London Stock Exchange, the Directors cannot refuse to register a transfer if this would stop dealings in the shares from taking place on an open and proper basis.

If the Directors decide not to register a transfer, they must notify the person to whom the shares were to be transferred within two months.

The Directors can decide to suspend the registration of transfers by closing the Register, but the Register cannot be closed for more than 30 days per year. In the case of shares in uncertificated form, the Register must not be closed without the consent of the operator of a relevant system (currently CRESTCo Limited, the operator of a relevant system under the UK CREST Regulations).

Share capital

The Company’s authorised share capital is £500 000 001, consisting of 5 000 000 010 ordinary shares of 10p each.

Shareholders’ rights

1. Voting rights

When a shareholder is entitled to attend a general meeting and vote, he has only one vote on a show of hands. A proxy cannot vote on a show of hands. Where there is a poll, subject to any special rights or restrictions attaching to any class of shares, a shareholder who is entitled to be present and to vote has one vote for every share that he holds.

To decide who can attend or vote at a general meeting, the notice of the meeting can give a time by which people must be entered on the Register which must not be more than 48 hours before the meeting. Unless provided otherwise in the Articles, the only people who can attend or vote at general meetings are shareholders who have paid the Company all calls, and all other sums, relating to the shares that are due at the time of the meeting.

2. Restrictions on shareholders’ rights

If a shareholder has been properly served with a notice under Section 212 of the Companies Act 1985 requiring information about interests in shares, and has failed to supply such information within 14 days of the notice, then (subject to the Articles and unless the Directors otherwise decide) the shareholder is not (for so long as the default continues) entitled to attend or vote at a shareholders’ meeting or to exercise any other right in relation to a meeting as holder of any shares held by the shareholder in default.

Any person who acquires shares in relation to which a default has occurred (Default Shares) is subject to the same restrictions unless:

| • | the transfer was an approved transfer pursuant to a takeover or one which, to the Directors’ satisfaction, is a bona fide sale to a person unconnected with the shareholder; or |

| | |

| • | the transfer was by a shareholder who was not himself in default in supplying the information required by the notice and (a) the transfer is of only part of his holding and (b) the transfer is accompanied by a certificate in a form satisfactory to the |

| | Directors stating that, after due and careful enquiries, the shareholder is satisfied that none of the shares included in the transfer are Default Shares |

Where the Default Shares represent 0.25% or more of the existing shares of a class, the Directors can, in their absolute discretion, by notice to the shareholder direct that (a) any dividend or other money which would otherwise be payable on the Default Shares shall be retained by the Company (without any liability to pay interest when that dividend or money is finally paid to the shareholder) and/or (b) the shareholder will not be allowed to choose to receive shares in place of dividends and/or (c) no transfer of any of the shares held by the shareholder will be registered unless one of the provisos specified above is satisfied.

3. Variation of rights

If the Company’s share capital is split into different classes of shares, subject to the relevant English law and unless the Articles or rights attaching to any class of shares provide otherwise, the special rights which are attached to any of these classes can be varied or abrogated as provided by those rights or approved by an extraordinary resolution passed at a separate meeting of that class. Alternatively, the holders of at least three-quarters of the existing shares of the class (by nominal value) can give their consent in writing.

Alteration of share capital

The shareholders can by ordinary resolutions (a) increase the Company’s authorised share capital, (b) consolidate, or consolidate and then divide, all or any of the Company’s share capital into shares of a larger nominal amount than the existing shares, (c) cancel any shares which have not been taken, or agreed to be taken, by any person at the date of the resolution, and reduce the amount of the Company’s share capital by the amount of the cancelled shares, and (d) subject to the relevant English law divide some or all of the Company’s shares into shares which are of a smaller nominal amount than is fixed in the Memorandum.

The shareholders can, subject to the relevant English law, pass a special resolution to (a) reduce the Company’s authorised share capital in any way or (b) reduce any capital redemption reserve, share premium account or other undistributable reserve in any way.

The Company can, subject to the relevant English law, buy back, or agree to buy back in the future, any shares of any class. However, if the Company has existing shares which are admitted to the Official List of the London Stock Exchange and which are convertible into equity shares, then the Company can only buy back equity shares of that class if either the terms of issue of the convertible shares permit the Company to buy back equity shares or the buy back or agreement to buy back has been approved by an extraordinary resolution passed by such holders.

Dividends

The shareholders can declare final or interim dividends by ordinary resolution. No dividend can exceed the amount recommended by the Directors. No interim dividend shall be paid on shares which carry deferred or non-preferred rights if, at the time of payment, any preferential dividend is in arrears. Unless the rights attaching to shares or the terms of any shares provide otherwise, dividends are paid based on the amounts which have been paid up on the shares in the relevant period.

The Directors can recommend the shareholders to pass an ordinary resolution to direct all or part of a dividend to be paid by distributing specific assets. The Directors must give effect to such a resolution.

Back to Contents

| | |

BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 | 143 |

| | |

If a dividend has not been claimed for one year, the Directors may invest the dividend or use it in some other way for the benefit of the Company until the dividend is claimed. Any dividend which has not been claimed for 12 years may be forfeited and belong to the Company if the Directors so decide.

Winding up

If the Company is wound up, the liquidator can, with the authority of an extraordinary resolution and any other sanction required by relevant law, divide among the shareholders all or part of the assets of the Company or transfer any part of the assets to trustees on trust for the benefit of the shareholders. No past or present shareholder can be compelled to accept any shares or other property under the Articles which carries a liability.

Rights of foreign shareholders

There are no limitations imposed by the relevant English law or the Articles on the rights to own securities, including the rights of non-resident or foreign shareholders to hold or exercise voting rights on the securities.

Notification of interest in shares

Section 198 of the Companies Act 1985 requires any shareholder, subject to exceptions, who acquires an interest of 3% or more or, in the case of certain interests, 10% or more in the shares to notify the Company of their interest within two business days following the day on which the obligation to notify arises. After the 3% or 10%, as the case may be, level is exceeded, similar notification must be made in respect of the whole percentage figure increases or decreases.

MATERIAL CONTRACTS

No contract other than those entered into in the ordinary course of business has been entered into in the two years preceding the date of this document by the Company or its subsidiary undertakings and is, or may be, material to the Company or the Group or has been entered into by the Company or its subsidiary undertakings and contains obligations or entitlements which are, or may be, material to the Group.

EXCHANGE CONTROLS

There are currently no UK exchange control laws, decrees or regulations that restrict or would affect the transfer of capital or payments of dividends, interest or other payments to US citizens or residents who are holders of the Company’s securities except as otherwise set out under ‘Taxation’ below.

TAXATION

The taxation discussion set out below is intended only as a summary of the principal US federal and UK tax consequences to US holders (as described below) of ADSs and does not purport to be a complete analysis or listing of all potential tax consequences of owning ADSs. A ‘US holder’ is a beneficial owner of ADSs who holds the ADSs as capital assets and is one of the following: (a) a citizen or individual resident of the United States, (b) a corporation (or certain other entities taxable as corporations for US federal income tax purposes) organised under the laws of the United States or any state thereof, (c) an estate whose income is subject to US federal income tax regardless of its source, or (d) a trust if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more US persons have the authority to control all substantial decisions of the trust. If a partnership (or other entity treated as a partnership for US tax purposes) holds ADSs, the tax treatment of a partner generally will depend upon the status of the partner and the activities of the

partnership. Investors are advised to consult their tax advisers with respect to the tax consequences of their holdings and sales, including the consequences under applicable US state and local law. The statements of US and UK tax laws set out below, except as otherwise stated, are based on the laws in force as of the date of this report and accounts and are subject to any changes occurring after that date in US or UK law.

The discussion is also based on the US-UK Income Tax Convention that entered into force on 31 March 2003, as amended by a Protocol (the ‘Income Tax Convention’). US holders should note that certain articles in the Income Tax Convention limit or restrict the ability of a US holder to claim benefits under the Income Tax Convention. US holders should consult their own tax advisers concerning the applicability of the Income Tax Convention.

This discussion does not address all aspects of US federal income taxation that may apply to holders subject to special tax rules, including US expatriates, insurance companies, tax-exempt organisations, banks and other financial institutions, regulated investment companies, securities broker-dealers, traders in securities who elect to apply a mark-to-market method of accounting, persons subject to the alternative minimum tax, investors that own (directly, indirectly or by attribution) 10% or more of the outstanding share capital or voting stock of the Company, persons holding their ADSs as part of a straddle, hedging transaction or conversion transaction, persons who acquired their ADSs pursuant to the exercise of options or similar derivative securities or otherwise as compensation, or persons whose functional currency is not the US Dollar, among others. Those holders may be subject to US federal income tax consequences different from those set forth below.

For the purposes of the conventions between the US and UK for the avoidance of double taxation with respect to taxes on dividend income and capital gains and estate and gift taxes and for the purposes of the US Internal Revenue Code of 1986 as amended, as discussed below, a US holder of ADSs will be treated as the beneficial owner of the underlying ordinary shares represented thereby. Furthermore, deposits or withdrawals by a US holder of ordinary shares for ADSs, or of ADSs for shares, will not be subject to US federal income tax.

Taxation of dividends

UK taxation of dividends

Under current UK tax legislation, no UK tax will be withheld from dividend payments made by the Company.

US federal income taxation of dividends

The gross amount of dividends paid to a US holder of ADSs will be taxable as ordinary income. The amount to be included in gross income will be the US Dollar value of the payment at the time the distribution is actually or constructively received by the ADS Depositary. For foreign tax credit limitation purposes, dividends paid by the Company will be income from sources outside the United States. Pounds Sterling received by a US holder of ADSs will have a tax basis equal to the value at the time of the distribution. Any gain or loss realised on a subsequent sale or other disposition of the pounds Sterling will be US source ordinary income or loss. Special rules govern the manner in which accrual method taxpayers are required (or may elect) to determine the US Dollar amount to be included in income in the case of taxes withheld in a foreign currency. Certain of these rules have changed effective 1 January 2005. Accrual basis taxpayers therefore are urged to consult their

Back to Contents

| | |

| 144 | BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 |

| | |

Additional shareholder information continued

own tax advisers regarding the requirements and elections applicable in this regard.

Dividends paid will be treated as ‘passive income’ for purposes of computing allowable foreign tax credits for US federal income tax purposes or for certain US holders, as ‘financial services’ income. For taxable years beginning 1 January 2007, dividend income generally will constitute ‘passive category income’, or in the case of certain US holders, ‘general category income’. Certain US holders (including individuals and some trusts and estates) are eligible for reduced rates of US federal income tax of a maximum rate of 15% in respect of ‘qualified dividend income’ received in taxable years beginning before 1 January 2009, provided that the US holder meets certain holding period and other requirements. The Company currently believes that dividends paid with respect to its ADSs will constitute qualified dividend income for US federal income tax purposes, however, this is a factual matter and subject to change. The Company anticipates that its dividends will be reported as qualified dividends on Form S1099–DIV delivered to US holders. US holders of ADSs are urged to consult their own tax advisers regarding the availability to them of the reduced dividend rate in light of their own particular situation and the computations of the foreign tax credit limitation with respect to any qualified dividends paid to them, as applicable.

The US Treasury has expressed concern that parties to whom ADSs are released may be taking actions inconsistent with the claiming of reduced rates in respect of qualified dividend incomes by US holders of ADSs. Accordingly, the analysis above of the availability of qualified dividend treatment could be affected by future actions that may be taken by the US Treasury.

TAXATION OF CAPITAL GAINS

A holder of ADSs will be liable for UK tax on capital gains accruing on a disposal of ADSs only if such holder is resident or ordinarily resident for tax purposes in the UK or if such holder carries on a trade, profession or vocation in the UK through a branch, agency or permanent establishment and the ADSs are used, held or acquired for the purposes of the trade, profession or vocation of the branch, agency or permanent establishment. Special rules can also impose UK capital gains tax on disposals by individuals who recommence UK residence after a period of non-residence. US citizens or corporations who are so liable for UK tax may be liable for both UK and US tax in respect of a gain on the disposal of ADSs. However, such persons generally will be entitled to a tax credit against their US federal tax liability for the amount of the UK tax paid in respect of such gain (subject to applicable credit limitations).

For US federal income tax purposes, a US holder generally will recognise a capital gain or loss on the sale or other disposition of ADSs held as capital assets, in an amount equal to the difference between the US Dollar value of the amount realised on the disposition and the US holder’s adjusted tax basis, determined in US Dollar, in the ADSs. Such gain or loss generally will be treated as US source gain or loss, and will be treated as a long-term capital gain or loss if the US holder’s holding period in the ADSs exceeds one year at the time of disposition. In the case of a US holder who is an individual, capital gains, if any, generally will be subject to US federal income tax at preferential rates if specified minimum holding periods are met. The deductibility of capital losses is subject to significant limitations.

US INFORMATION REPORTING AND BACKUP WITHHOLDING

A US holder who holds ADSs may in certain circumstances be subject to information reporting to the Internal Revenue Service

(the IRS) and possible US backup withholding at a current rate of 28% with respect to dividends on ADSs and proceeds from the sale, exchange or other disposition of ADSs unless such holder furnishes a correct taxpayer identification number or certificate of foreign status and makes any other required certification, or is otherwise exempt from backup withholding. US persons who are required to establish their exempt status generally must provide IRS Form W-9 (Request for Taxpayer Identification Number and Certification). Non-US holders generally will not be subject to US information reporting or backup withholding. However, such holders may be required to provide certification of non-US status (generally on IRS Form W-8BEN) in connection with payments received in the US or through certain US-related financial intermediaries. Backup withholding is not an additional tax. Amounts withheld as backup withholding may be credited against a holder’s US federal income tax liability. A holder may obtain a refund of any excess amounts withheld under the backup withholding rules by filing the appropriate claim for refund with the IRS and furnishing any required information.

INHERITANCE TAX

ADSs held by an individual, who is domiciled in the US for the purposes of the Convention between the US and the UK for the avoidance of double taxation with respect to taxes on estates and gifts (the Estate Tax Convention) and is not for the purposes of the Estate Tax Convention a national of the UK, will not be subject to UK inheritance tax on the individual’s death or on a transfer of the ADSs during the individual’s lifetime unless the ADSs form part of the business property of a permanent establishment situated in the UK or pertain to a fixed base in the UK used for the performance of independent personal services. In the exceptional case where ADSs are subject both to UK inheritance tax and to US federal gift or estate tax, the Estate Tax Convention generally provides for the tax paid in the UK to be credited against tax payable in the US or for the tax paid in the US to be credited against tax payable in the UK based on priority rules set forth in the Estate Tax Convention.

STAMP DUTY AND STAMP DUTY RESERVE TAX

No UK stamp duty will be payable on the acquisition or transfer of ADSs if there is no instrument of transfer. If there is an instrument of transfer then provided that the instrument of transfer is not executed in the UK and remains at all times outside the UK subsequently then in practice no UK stamp duty will be payable. Neither will an agreement to transfer ADSs in the form of ADRs give rise to a liability to stamp duty reserve tax. An agreement to purchase ordinary shares, as opposed to ADSs, will normally give rise to a charge to UK stamp duty or stamp duty reserve tax at the rate of 0.5% of the price. Stamp duty reserve tax is generally the liability of the purchaser and the stamp duty is normally also paid by the purchaser. Where such ordinary shares are later transferred to the depositary’s nominee, further stamp duty or stamp duty reserve tax will normally be payable at the rate of 1.5% of the price payable for the ordinary shares so acquired.

A transfer of ordinary shares by an instrument of transfer to the relative ADS holder without transfer of beneficial ownership will in principle give rise to UK stamp duty at the rate of £5 per transfer. Transfers that are not sales will generally be exempt from the £5 stamp duty charge if made under the CREST system for paperless share transfers.

Back to Contents

| | |

BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 | 145 |

| | |

DOCUMENTS ON DISPLAY

All reports and other information that BG Group files with the SEC may be inspected at their public reference facilities at Room 1580, 100 F Street, N.E., Washington, DC 20549, USA. These reports may also be accessed via the SEC’s website at www.sec.gov

ACCOUNTANTS’ FEES AND SERVICES

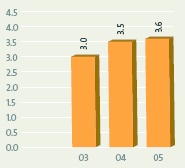

PricewaterhouseCoopers LLP has served as BG Group’s independent public accountants for each of the financial years in the three year period ended 31 December 2005, for which audited financial statements appear in this Annual Report on Form 20-F. The external Auditors are subject to re-appointment at the AGM.

The following table presents the aggregate fees for professional services and other services rendered by PricewaterhouseCoopers LLP to BG Group in 2005 and 2004.

| For the year ended 31 December | 2005 | 2004 |

| | £m | £m |

|

|

|

| Audit fees(a) | 2.2 | 2.6 |

|

|

|

| Audit-related fees(b) | 0.3 | 0.4 |

|

|

|

| Tax fees(c) | 0.3 | 0.4 |

|

|

|

| All other fees(d) | – | – |

|

|

|

| Total | 2.8 | 3.4 |

|

|

|

| (a) | Audit fees consist of fees billed for the annual audit services engagement and other audit services, which are those services that only the external Auditor can reasonably provide, and include the Group audit, statutory audits, comfort letters and consents, attest services and assistance with and review of documents filed with the SEC. |

| (b) | Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Group’s Financial Statements or that are traditionally performed by the external Auditor, and include consultations concerning financial accounting and reporting standards; internal control reviews of new systems, programmes andprojects, reviews of security controls and operational effectiveness of systems, reviews of plans and controls for shared service centres; due diligence related to acquisitions; accounting assistance and audits in connection with proposed or completed acquisitions; and employee benefit plan audits. |

| (c) | Tax fees include fees billed for tax compliance services, including the preparation of original and amended tax returns and claims for refund, tax consultations, such as assistance and representation in connection with tax audits and appeals, tax advice related to mergers and acquisitions, transfer pricing, and requests for rulings or technical advice from tax authorities, tax planning services, and expatriate tax planning and services. |

| (d) | All other fees include fees billed for training, forensic accounting, data security reviews, treasury control reviews and process improvement and advice, and environmental, sustainability and corporate social responsibility advisory services. |

AUDIT COMMITTEE PRE-APPROVAL POLICY AND PROCEDURES

The Audit Committee annually agrees a framework of non-audit activities, which are described with sufficient specificity to enable the Committee to ensure that the proposed activity will not compromise the independence of the external Auditors. For each activity, the Committee approves a budget for the financial year.

Accordingly, the Audit Committee is deemed to have given its pre-approval in respect of individual assignments where the fees fall within the agreed framework and agreed budget for that service. Pre-approval of assignments which are either outside the agreed framework, or are within the agreed framework but not within the agreed budget is delegated to the Audit Committee Chairman or, in his absence, any other member of the Committee. At each meeting, the Committee receives a list of all the non-audit services provided by the external Auditors, the specific nature of the work and the fees involved, for their review.

During 2005, 100% of Audit fees, 100% of Audit-related fees, 100% of Tax fees and 100% of all other fees provided to BG Group by PricewaterhouseCoopers LLP were approved by the Audit Committee pursuant to the pre-approval policy and procedures.

Back to Contents

| | |

| 146 | BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 |

| | |

Notice of seventh Annual General Meeting of BG Group plc

The seventh Annual General Meeting (AGM) of BG Group plc (the ‘Company’) will be held in Hall 1 of the International Convention Centre, Birmingham B1 2EA on Friday, 28 April 2006 at 11.00am for the transaction of the business set out below.

This Notice contains the resolutions to be voted on at the Company’s AGM. Resolutions 1 to 12 below are ordinary resolutions that will be passed if more than 50% of the votes cast are in favour of the resolutions. Resolutions 13 and 14 are special resolutions that will be passed if not less than 75% of the votes cast are in favour of the resolutions.

A poll will be called on each of the resolutions set out below.

Further details are set out in the explanatory notes.

ORDINARY RESOLUTIONS

Resolution 1

To receive the accounts and reports of the Directors and the Auditors for the year ended 31 December 2005.

Resolution 2

To approve the Remuneration report as set out on pages 51 to 61 of the BG Group Annual Report and Accounts for the year ended 31 December 2005.

Resolution 3

To declare a final dividend in respect of the year ended 31 December 2005 of 4.09 pence per ordinary share payable on 12 May 2006 to holders of ordinary shares on the register of shareholders of the Company at the close of business on 31 March 2006.

Resolution 4

To elect Jürgen Dormann as a Director of the Company.

Resolution 5

To re-elect Sir Robert Wilson as a Director of the Company.

Resolution 6

To re-elect Frank Chapman as a Director of the Company.

Resolution 7

To re-elect Ashley Almanza as a Director of the Company.

Resolution 8

To re-elect Sir John Coles as a Director of the Company.

Resolution 9

To re-appoint PricewaterhouseCoopers LLP as Auditors of the Company, to hold office until the conclusion of the next general meeting at which accounts are laid before the Company.

Resolution 10

To authorise the Audit Committee to determine the remuneration of the Auditors.

Resolution 11

That in accordance with Part XA of the Companies Act 1985 as amended (the ‘Act’), the Company and its wholly owned subsidiary BG International Limited each be and is hereby authorised:

| (a) | to make donations to EU political organisations not exceeding £25 000 in total; and |

| |

| (b) | to incur EU political expenditure not exceeding £25 000 in total; |

during the period commencing on the date of this resolution and ending on the date of the AGM of the Company in 2007 or, if earlier, 28 July 2007.

For the purpose of this resolution, ‘donations’, ‘EU political organisations’ and ‘EU political expenditure’ have the meanings given to them in Section 347A of the Act.

Resolution 12

That the authority conferred on the Directors by Article 12.2 of the Company’s Articles of Association be renewed and for this purpose:

| (a) | the Section 80 amount be £123 379 866; and |

| |

| (b) | the prescribed period be the period ending on the date of the AGM of the Company in 2007 or, if earlier, 28 July 2007. |

SPECIAL RESOLUTIONS

Resolution 13

That the Directors be empowered to allot equity securities (as defined in Section 94 of the Companies Act 1985 as amended (the ‘Act’)), entirely paid for in cash:

| (a) | of an unlimited amount in connection with a rights issue (as defined in the Company’s Articles of Association); and |

| | |

| (b) | otherwise than in connection with a rights issue, of an amount up to £17 652 373, free of the restrictions in Section 89(1) of the Act provided that: |

| | | | | | | | |

| | 1 | This document is important. If you are in any doubt about its | | | (i) | copies of all Directors’ service contracts and letters | |

| | | content, you should consult an appropriate independent adviser. | | | | of appointment; | |

| | | | | | | | |

| | | If you have sold or transferred all of your shares in BG Group plc, | | | (ii) | the register of interests of the Directors in the share capital | |

| | | please send this document and all accompanying documents to the | | | | of the Company; and | |

| | | purchaser or transferee, or to the stockbroker, bank or other agent | | | | | |

| | | through or to whom the sale or transfer was effected so that they | | | (iii) | the Memorandum and Articles of Association of the Company. | |

| | | can be passed on to the person who now owns the shares. | | | | | |

| | | | | 3 | The Company, pursuant to Regulation 41 of the Uncertificated | |

| | 2 | The following documents, which are available for inspection during | | | Securities Regulations 1995, specifies that only those holders of | |

| | | normal business hours at the registered office of the Company on | | | ordinary shares registered in the register of members of the | |

| | | any weekday (Saturdays, Sundays and public holidays excluded), | | | Company as at 6.00pm on 26 April 2006 shall be entitled to attend | |

| | | will also be available for inspection at the place of the AGM from | | | or vote at the AGM in respect of the number of ordinary shares | |

| | | 10.00am on the day of the Meeting until its conclusion: | | | registered in their name at that time. Changes to entries on the | |

| | | | | | register of members after 6.00pm on 26 April 2006 shall be | |

| | | | | | disregarded in determining the rights of any person to attend | |

| | | | | | or vote at the Meeting. | |

| | | | | | | | |

Back to Contents

| | |

BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 | 147 |

| | |

| | (i) | this power shall expire on the date of the AGM of the Company in 2007 or, if earlier, 28 July 2007 and is in substitution for all previous such powers, which shall cease to have effect from the date of this Resolution, without affecting the validity of any allotment of securities already made under them; and |

| | | |

| | (ii) | during that period, the Directors can make offers and enter into agreements that would, or might, require equity securities to be allotted after that period. |

In working out the maximum amount of equity securities for the purposes of paragraph (b) above, the nominal value of rights to subscribe for shares or to convert any securities into shares will be taken as the nominal value of the shares that would be allotted if the subscription or conversion takes place.

For the purposes of this Resolution:

| (a) | references (except in paragraph (b) below) to an allotment of equity securities shall include a sale of Treasury shares; and |

| |

| (b) | the power granted by this Resolution, insofar as it relates to the allotment of equity securities rather than the sale of Treasury shares, is granted pursuant to the authority under Section 80 of the Act conferred by Resolution 12. |

Resolution 14

That the Company be generally and unconditionally authorised to make market purchases (within the meaning of Section 163(3) of the Companies Act 1985) of ordinary shares of 10 pence each of the Company (‘ordinary shares’) provided that:

| (a) | the maximum number of ordinary shares hereby authorised to be acquired is 353 047 470; |

| |

| (b) | the minimum price that may be paid for any such ordinary share is 10 pence, the nominal value of that share; |

| |

| (c) | the maximum price that may be paid for any such ordinary share is an amount equal to 105% of the average of the middle market quotations for an ordinary share as derived from the London Stock Exchange Daily Official List for the five business days immediately preceding the day on which the share is contracted to be purchased; and |

| |

| (d) | the authority hereby conferred shall expire on the date of the AGM of the Company in 2007 or, if earlier, 28 July 2007; but a contract for purchase may be made before such expiry, that will or may be executed wholly or partly thereafter, and a purchase of ordinary shares may be made in pursuance of any such contract. |

| |

| Registered Office: | By order of the Board |

| 100 Thames Valley Park Drive | Ben Mathews |

| Reading | Company Secretary |

| Berkshire RG6 1PT | |

| | |

| Registered in England & Wales No. 3690065 | 8 March 2006 |

A shareholder entitled to attend and vote is entitled to appoint a proxy or proxies to attend and, on a poll, to vote instead of him/her. A proxy need not be a shareholder of the Company. Further details on how to appoint a proxy are given on page 148.

EXPLANATORY NOTES

In line with the recommendations by Paul Myners and the Shareholder Voting Working Group issued in January 2004 (the ‘Myners Report’), which the Company has met in full since 2004, voting at the Meeting will be by poll rather than by show of hands.

The Chairman will invite each shareholder and proxy present at the meeting to complete a poll card indicating how they wish to cast their votes in respect of each resolution. In addition, the Chairman will cast the votes for which he has been appointed as proxy. Poll cards will be collected at the end of the meeting and the preliminary results declared. Once the results have been verified by the Company’s Registrar, they will be notified to the UK Listing Authority and published on the Company’s website.

Annual Report and Accounts (Resolution 1)

The Directors are required to lay before the Meeting the accounts of the Company for the financial year ended 31 December 2005, the Directors’ report, the Remuneration report and the Auditors’ report on the accounts and the auditable part of the Remuneration report.

Remuneration report (Resolution 2)

UK listed companies must put an ordinary resolution to shareholders at the AGM seeking approval of the Remuneration report. The vote is advisory in nature, in that payments made or promised to Directors will not have to be repaid in the event that the resolution is not passed.

Declaration of a dividend (Resolution 3)

A final dividend for the year ended 31 December 2005 of 4.09 pence per ordinary share is recommended by the Directors. A final dividend can be paid only after it has been declared by the shareholders at a general meeting. It is proposed that shareholders declare this dividend by passing Resolution 3. If so declared, the final dividend will be paid on 12 May 2006 to ordinary shareholders who were on the register of the Company at the close of business on 31 March 2006. ADS holders will be entitled to receive the US Dollar equivalent of £0.2045 per ADS on 19 May 2006.

An interim dividend for the year ended 31 December 2005 of 1.91 pence per ordinary share was paid on 16 September 2005.

Election of Jürgen Dormann (Resolution 4)

The Company’s Articles of Association require any Director newly appointed by the Board to retire at the first AGM following their appointment. Jürgen Dormann was appointed to the Board as a non-executive Director on 1 June 2005. He is a member of the Corporate Responsibility Committee and the Remuneration Committee. Biographical details of Jürgen Dormann are given on page 45. In reviewing the recommendation of the Nominations Committee concerning this election, the Board has concluded that Jürgen Dormann is independent in character and judgment and makes an effective and valuable contribution to the Board and demonstrates commitment to the role. The Board unanimously recommends his election.

Re-election of Directors (Resolutions 5 to 8)

Directors are subject to re-election by shareholders every three years. Biographical details of the Directors proposed to be re-elected, namely Sir Robert Wilson, Frank Chapman, Ashley Almanza and Sir John Coles, are shown on page 45. In reviewing the recommendation of the Nominations Committee concerning these re-elections, the Board has concluded that Sir John Coles is independent in character and judgment. In addition and, following the annual evaluation exercise conducted during the year, the Board considers that each of the Directors proposed for re-election continues to make an effective and valuable contribution and demonstrates commitment to the role. Accordingly, the Board unanimously recommends their re-election.

Back to Contents

| | |

| 148 | BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 |

| | |

Notice of seventh Annual General Meeting of BG Group plccontinued

Re-appointment and remuneration of Auditors (Resolutions 9 and 10)

The Company is required to appoint auditors at each general meeting at which accounts are laid before the Company, to hold office until the next such meeting. Following the recommendation of the Audit Committee, the Directors propose that PricewaterhouseCoopers LLP be reappointed as Auditors of the Company. Resolution 10 proposes that the Audit Committee be authorised to determine the level of the Auditors’ remuneration.

Political donations (Resolution 11)

As stated in the Company’s Statement of Business Principles, it is the Company’s policy not to make contributions to political parties. This policy is strictly adhered to and there is no intention to change it. Section 347A of the Companies Act 1985 (the ‘Act’) includes very broad definitions of ‘donations’ to ‘EU political organisations’ and of ‘EU political expenditure’ that may have the effect of covering a number of normal business activities that would not be thought to be political donations in the usual sense. To avoid any possibility of inadvertently contravening the Act, the Directors consider that it would be prudent to follow the procedure specified in the Act to obtain shareholder approval for the Company and BG International Limited each to make donations to EU political organisations of up to £25 000 and to incur EU political expenditure of up to £25 000 in the forthcoming year. BG International Limited is a wholly owned subsidiary of the Company and is the largest employer in the Group. This authority will not be used to make any political donations as that expression would have been understood before Part XA of the Act became law.

Authority to allot shares (Resolution 12)

The Directors are currently authorised to allot relevant securities. However, this authority terminates on the date of the 2006 AGM. This resolution proposes that such authority be renewed and that the Directors be authorised to allot up to 1 233 798 657 ordinary shares for the period ending on the date of the Company’s AGM in 2007 or, if earlier, 28 July 2007. The authority represents 33 1/ 3% (excluding Treasury shares) of the share capital of the Company in issue at 3 March 2006 together with shares outstanding under BG Group’s option schemes. This amount complies with guidelines issued by investor bodies. The Directors have no present intention of issuing any relevant securities other than pursuant to employee share schemes.

Disapplication of pre-emption rights (Resolution 13)

The Directors are currently authorised to allot unissued shares for cash without first offering them to existing shareholders in proportion to their holdings (a pre-emptive offer). However, this authority terminates on the date of the 2006 AGM. This resolution proposes that such authority be renewed and that the Directors be authorised to allot up to 176 523 735 ordinary shares for cash without a pre-emptive offer being made for the period ending on the date of the Company’s AGM in 2007 or, if earlier, 28 July 2007. Following the introduction of the Treasury Shares Regulations, this authority will now also cover the sale of Treasury shares for cash. The authority represents approximately 5% of the share capital in issue at 3 March 2006. This amount complies with guidelines issued by investor bodies.

Authority to make market purchases of own ordinary shares (Resolution 14)

In certain circumstances, it may be advantageous for the Company to purchase its own ordinary shares and Resolution 14 seeks authority from shareholders to do so. The resolution specifies

the maximum number of shares that may be acquired (10% of the Company’s issued ordinary share capital) and the maximum and minimum prices at which they may be bought.

Any shares purchased in this way will, unless the Directors determine that they are to be held as Treasury shares, be cancelled and the number of shares in issue will be reduced accordingly. Shares held in treasury will not automatically be cancelled and will not be taken into account in future calculations of earnings per share (unless they are subsequently resold or transferred out of treasury).

On 8 November 2005, the Company announced its intention to make market purchases of up to £1 billion of shares and to hold these shares in treasury. During the period 8 November 2005 to 3 March 2006, the Company purchased 20 094 000 shares representing 0.57% of the total share capital of the Company at a total cost of £118 million (including dealing costs). These shares are held in treasury in accordance with Section 162(A) of the Companies Act 1985. No dividends are paid on and no voting rights attach to Treasury shares. Any Treasury shares sold by the Company will count towards the number of shares that, if Resolution 13 is passed, may be issued without offering them first to existing shareholders.

As the existing shareholder approval to purchase shares expires at the 2006 AGM, purchases after that date are subject to renewed shareholder approval at the AGM. The Directors will use the authority to purchase shares only after careful consideration, taking into account market conditions, other investment opportunities, appropriate gearing levels and the overall financial position of the Company. The Directors will only purchase such shares after taking into account the effects on earnings per share and the benefit for shareholders.

The total number of options to subscribe for ordinary shares outstanding at 3 March 2006 is 57.0 million. This represents 1.61% of the issued share capital at that date. If the Company bought back the maximum number of shares permitted pursuant to the passing of this resolution and cancelled them, then the total number of options to subscribe for ordinary shares outstanding at that date would represent 1.79% of the issued share capital as reduced following those repurchases. At 3 March 2006, there are no warrants to subscribe for ordinary shares outstanding.

Recommendation

Your Directors unanimously recommend that you vote in favour of all the above resolutions as they intend to do so themselves in respect of their own beneficial holdings.

Appointing a proxy

A proxy form is enclosed with this Notice and instructions for its use are shown on the form. Proxies must be submitted by 11.00am on Wednesday 26 April 2006 to Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DW. Details of how to submit your proxy electronically are given below.

Electronic proxy voting

Shareholders may register the appointment of a proxy for the AGM electronically at www.sharevote.co.uk, a website operated by the Company’s Registrar, Lloyds TSB Registrars. Shareholders are advised to read the terms and conditions, shown on the website, relating to the use of this facility before appointing a proxy. Any electronic communication sent by a shareholder that is found to contain a computer virus will not be accepted. Electronic

Back to Contents

| | |

BG GROUP ANNUAL REVIEW 2005 | 149 |

| | |

communication facilities are available to all shareholders and those who use them will not be disadvantaged in any way.

Electronic proxy appointment through CREST

CREST members who wish to appoint a proxy or proxies through the CREST electronic proxy appointment service may do so for the AGM to be held on 28 April 2006 and any adjournment(s) thereof by using the procedures described in the CREST Manual. CREST Personal Members or other CREST sponsored members, and those CREST members who have appointed a voting service provider(s), should refer to their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf.

In order for a proxy appointment or instruction made using the CREST service to be valid, the appropriate CREST message (a ‘CREST Proxy Instruction’) must be properly authenticated in accordance with CRESTCo’s specifications and must contain the information required for such instructions, as described in the CREST Manual. The message, regardless of whether it constitutes the appointment of a proxy or an amendment to the instruction given to a previously appointed proxy, must, in order to be valid, be transmitted so as to be received by the issuer’s agent (ID 7RA01) by 11.00am on Wednesday 26 April 2006. For this purpose, the time of receipt will be taken to be the time (as determined by the timestamp applied to the message by the CREST Applications Host) from which the issuer’s agent is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST. After this time, any change of instructions to proxies appointed through CREST should be communicated to the appointee through other means.

CREST members and, where applicable, their CREST sponsors or voting service providers should note that CRESTCo does not make available special procedures in CREST for any particular messages. Normal system timings and limitations will therefore apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if the CREST member is a CREST personal member or sponsored member or has appointed a voting service provider(s), to procure that his CREST sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In this connection, CREST members and, where applicable, their CREST sponsors or voting service providers are referred, in particular, to those sections of the CREST Manual concerning practical limitations of the CREST system and timings.

The Company may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5) (a) of the Uncertificated Securities Regulations 2001.

Summary of AGM business

A summary of the business carried out at the Meeting will be published on the Group’s website, www.bg-group.com

Back to Contents

| | |

| 150 | BGGROUP ANNUAL REPORT ANDACCOUNTS 2005 |

| | |

Cross-reference to Form 20-F

| Item | | | | Page |

|

|

|

|

|

| 1 | | Identity of Directors, Senior Management and Advisers | | |

| | | Not applicable | | – |

| 2 | | Offer Statistics and Expected Timetable | | |

| | | Not applicable | | – |

| 3 | | Key Information | | |

| | | Three year financial | | |

| | | summary (unaudited) | | 134-135 |

| | | Five year financial | | |

| | | summary (unaudited) | | 136-137 |

| | | Risk factors | | 35-37 |

| 4 | | Information on the Company | | |

| | | BG Group’s global operations | | 6-7 |

| | | Financial review | | |

| | | – | Disposals and | | |

| | | | Re-measurements | | 23-24 |

| | | – | Capital investment | | 25 |

| | | – | Cash flow | | 25-26 |

| | | Shareholder information | | |

| | | – | Headquarters and | | |

| | | | Registered Office Address | | 138 |

| | | – | Agent for Service of Process | | |

| | | | in the USA | | 138 |

| | | Additional shareholder information | | |

| | | – | This Annual Report and Accounts | | |

| | | | Incorporates the US Form 20-F | | 139 |

| | | – | History and Development | | |

| | | | of the Company | | 139 |

| | | Presentation of non-GAAP | | |

| | | measures | | 152 |

| | | Cautionary Note to Shareholders | | |

| | | in Relation to Certain | | |

| | | Forward-Looking Statements | | 153 |

| | | Strategy review* | | 8-11 |

| | | Future prospects | | 12 |

| | | Operating review* | | 13-20 |

| | | Corporate Responsibility | | |

| | | – | Environment | | 34 |

| | | Supplementary information – gas | | |

| | | and oil (unaudited) | | 128-132 |

| | | Historical production | | |

| | | (unaudited) | | 133 |

| | | Notes to the accounts | | |

| | | – | Note 2 (Segmental Analysis and | | |

| | | | Results Presentation) | | 71-75 |

| | | – | Note 13 (Property, Plant and | | |

| | | | Equipment) | | 87 |

| | | – | Note 27(A) (Commitments and | | |

| | | | Contingencies – | | |

| | | | Capital Expenditure) | | 99 |

| | | – | Note 32 (Principal Subsidiary | | |

| | | Undertakings, Joint Ventures | | |

| | | and Associates) | | 116-117 |

| 4A | | Unresolved Staff Comments | | |

| | | Not applicable | | – |

| 5 | | Operating and Financial Review and Prospects | | |

| | | Financial review* | | 21-30 |

| | | Risk factors | | |

| | | – | Commodity Prices | | |

| | | | to Credit | | 35-36 |

| | | Presentation of | | |

| | | non-GAAP measures | | 152 |

| | | Cautionary Note to Shareholders | | |

| | | in Relation to Certain | | |

| | | Forward-Looking Statements | | 153 |

| Item | | | | Page |

|

|

|

|

|

| | | Notes to the accounts | | |

| | | – | Note 4 (Operating Costs) | | 76 |

| | | – | Notes 20 (Borrowings) to 21 | | |

| | | | (Financial Instruments) | | 91-96 |

| | | – | Note 27 (Commitments | | |

| | | | and Contingencies) | | 99-101 |

| | | Strategy review* | | 8-11 |

| | | Future prospects | | 12 |

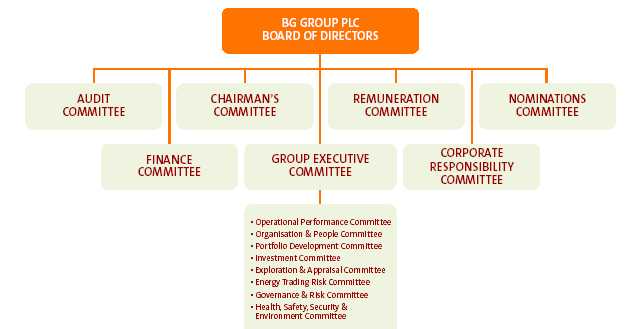

| 6 | | Directors, Senior Management and Employees | | |

| | | Board of Directors | | 44-45 |

| | | Group Executive Committee | | |

| | | and Company Secretary | | 46-47 |

| | | Directors’ report | | 49-50 |

| | | Remuneration report | | 51-61 |

| | | Governance framework | | 38-43 |

| | | Corporate Responsibility | | |

| | | – | Our People | | 32-33 |

| | | Notes to the accounts | | |

| | | – | Note 5 (Directors | | |

| | | | and Employees) | | 77-80 |

| 7 | | Major Shareholders and Related Party Transactions | | |

| | | Additional shareholder information | | |

| | | – | Major Shareholders | | 141 |

| | | Financial review | | |

| | | – | Related Party Transactions | | 30 |

| | | Notes to the accounts | | |

| | | – | Note 28 (Related | | |

| | | | Party Transactions) | | 101 |

| 8 | | Financial Information | | |

| | | US Report of Independent | | |

| | | Accountants – see item 18 of the | | |

| | | Company’s Form 20-F filed with | | |

| | | the US Securities and Exchange | | |

| | | Commission | | |

| | | Financial review – Dividend | | 27-28 |

| | | Principal accounting policies | | 63-65 |

| | | Consolidated income | | |

| | | statements | | 66-67 |

| | | Consolidated statement of | | |

| | | recognised income and expense | | 67 |

| | | Balance sheets | | 68-69 |

| | | Cash flow statements | | 70 |

| | | Notes to the accounts | | 71-127 |

| | | Five year financial | | |

| | | summary (unaudited) | | |

| | | – | Annual Dividends | | 136 |

| | | Directors’ report | | |

| | | – | Significant Events Subsequent | | |

| | | | to 31 December 2005 | | 49 |

| 9 | | The Offer and Listing | | |

| | | Additional shareholder information | | |

| | | – | Listing and Price History | | 140 |

| 10 | | Additional Information | | |

| | | Additional shareholder information | | |

| | | – | Memorandum and Articles | | |

| | | | of Association | | 141-143 |

| | | – | Material Contracts | | 143 |

| | | – | Exchange Controls | | 143 |

| | | – | Taxation | | 143-144 |

| | | – | Documents on Display | | 145 |

| 11 | | Quantitative and Qualitative Disclosures about Market Risk | | |

| | | Financial review – Critical | | |

| | | Accounting Policies – Financial | | |

| | | Instruments to | | |

| | | Commodity Instruments | | 29-30 |

| Item | | | | Page |

|

|

|

|

|

| | | Risk factors – Commodity | | |

| | | Prices to Credit | | 35-36 |

| | | Principal accounting policies | | |

| | | – | Financial Instruments (from | | |

| | | | 1 January 2005) to | | |

| | | | Commodity Instruments | | |

| | | | (to 31 December 2004) | | 65 |

| | | Notes to the accounts | | |

| | | – | Note 21 | | |

| | | | (Financial Instruments) | | 93-96 |

| 12 | | Description of Securities Other than Equity Securities | | |

| | | Not applicable | | – |

| 13 | | Defaults, Dividend Arrearages and Delinquencies | | |

| | | None | | – |

| 14 | | Material Modifications to the Rights of Security Holders and Use of Proceeds | | |

| | | None | | – |

| 15 | | Controls and Procedures | | |

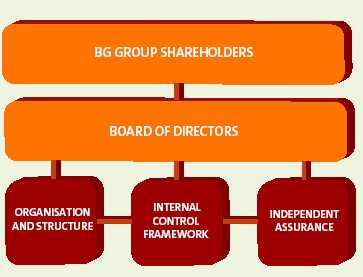

| | | Governance framework | | |

| | | – | Internal Control Framework to | | |

| | | | Evaluation of discosure controls | | |

| | | | and procedures | | 43 |

| 16A | | Audit Committee Financial Expert | | |

| | | Governance framework | | |

| | | – | Board committees – Audit Committee | | 42 |

| 16B | | Code of Ethics | | |

| | | Corporate Responsibility | | 31 |

| 16C | | Principal Accountant Fees and Services | | |

| | | Additional shareholder information | | |

| | | – | Accountants’ Fees and Services | | |

| | | | to Audit Committee | | |

| | | | Pre-Approval Policy and | | |

| | | | Procedures | | 145 |

| 16D | | Exemptions from the Listing Standards for Audit Committees | | |

| | | Not applicable | | – |

| 16E | | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | | |

| | | See item 16E of the Company’s | | |

| | | Form 20-F filed with the US Securities | | |

| | | and Exchange Commission | | |

| 17 | | Financial Statements | | |

| | | Not applicable | | – |

| 18 | | Financial Statements | | |

| | | US Report of Independent | | |

| | | Accountants – see item 18 of the | | |

| | | Company’s Form 20-F filed with | | |

| | | the US Securities and Exchange | | |

| | | Commission | | |

| | | Principal accounting policies | | 63-65 |

| | | Consolidated income | | |

| | | statements | | 66-67 |

| | | Consolidated statement of | | |

| | | recognised income and expense | | 67 |

| | | Balance sheets | | 68-69 |

| | | Cash flow statements | | 70 |

| | | Notes to the accounts | | 71-127 |

| 19 | | Exhibits | | |

| | | See item 19 of the Company’s | | |

| | | Form 20-F filed with the US | | |

| | | Securities and Exchange Commission | | |

*Disclosure relating to finding and development costs, annual unit operating costs and proved reserves replacement rates have been redacted and excluded from our Form 20-F filed with the US Securities and Exchange Commission.

Back to Contents

| | |

BGGROUP ANNUAL REPORT ANDACCOUNTS 2005 | 151 |

| | |

Index

| Item | | Page |

|

|

|

| Accountants’ fees and services | | 145 |

| Acquisition of subsidiary undertaking | | 89 |

| Additional shareholder information | | 139-144 |

| American Depositary Receipts | | 84, 138, 140 |

| American Depositary Shares | | 28, 38, 60, 108, 111, 136, 143, 144 |

| Annual General Meeting | | 41 |

| Assets | | 68 |

| Total | | 68, 134 |

| Net | | 68 |

| Assets held for sale | | 90 |

| Associates | | 73, 88, 116-117, 152 |

| Audit fees | | 76, 145 |

| Balance sheets | | 68-69 |

| Three year financial summary | | 134 |

| Basis of consolidation | | 63 |

| Basis of preparation | | 63 |

| Borrowings | | 68, 91-92 |

| Capital investment/expenditure | | 25-26, 75 |

| Cash flow | | 25-26, 70, 107 |

| Three year financial summary | | 135 |

| Chairman’s statement | | 2-3 |

| Charitable donations | | 33, 50 |

| Chief Executive’s statement | | 4-5 |

| Commitments and contingencies | | 99-101 |

| Committees | | 42 |

| Community | | 50 |

| Corporate governance | | 38-47 |

| Corporate Responsibility | | 31-34 |

| Cross-reference to Form 20-F | | 150 |

| Debt/equity ratio | | 135 |

| Decommissioning | | 28-29, 63, 64 |

| Deferred taxation | | 64, 68, 97-98 |

| Definitions | | ibc |

| Depreciation and amortisation | | 28, 63, 74, 76, 86, 107 |

| Derivatives | | 68, 93-96 |

| Directors | | 44-45, 77 |

| Directors’ report | | 49-50 |

| Disposals and re-measurements | | 23, 24, 66, 67, 81-82, 152 |

| Dividends | | ifc, 27, 84 |

| Earnings per ordinary share | | ifc, 25, 66, 67, 85, 134, 136 |

| Employees | | 76, 77-80 |

| Equity | | 69, 98-99 |

| Exchange rate information | | 137 |

| Exploration and Production (E&P) | | 6, 13-15, 21-22, 49, 71-72, 74-75 |

| Exploration expenditure | | 22, 28, 64, 76 |

| Finance income and costs | | 24, 66, 67, 83 |

| Financial instruments | | 29, 65, 93-96 |

| Five year financial summary | | 136-137 |

| Foreign currencies | | 64 |

| Future prospects | | 12 |

| Gearing | | 135 |

| Going concern | | 50 |

| Goodwill | | 63, 68, 85 |

| Governance framework | | 38-43 |

| Group Executive Committee | | 46-47 |

| Item | | Page |

|

|

|

| Guarantees | | 99 |

| Health, Safety, Security and Environment | | 32-34 |

| Historical production | | 133 |

| Independent Auditors’ report | | 62 |

| Income statement | | 66-67 |

| Five year financial summary | | 136 |

| Three year financial summary | | 134 |

| Internal Control Framework | | 38, 43 |

| Impairments | | 29 |

| Investments | | 68, 88 |

| Accounted for using the equity method | | 68, 88 |

| In subsidiary undertakings | | 68 |

| Other | | 68, 88 |

| Joint ventures | | 88, 117, 152 |

| Leases | | 64, 91, 100 |

| Legal proceedings | | 100 |

| Listing and Price History | | 140 |

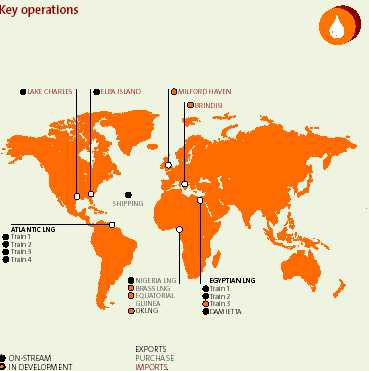

| Liquefied Natural Gas (LNG) | | 6-7, 16-17, 22, 71-75 |

| New accounting standards | | 71 |

| Notice of AGM | | 146-149 |

| Operating and financial review | | 6-37 |

| Operating costs | | 76 |

| Operating profit/(loss) | | 21-24, 66, 67, 72-73 |

| Other activities | | 7, 20, 23, 71-72, 74-75 |

| Other intangible assets | | 86 |

| Other operating income | | 75 |

| Petroleum revenue tax | | 84, 97 |

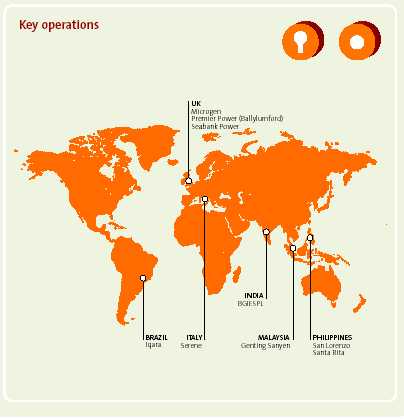

| Power | | 7, 20, 23, 71-75 |

| Principal accounting policies | | 63-65 |

| Principal activities | | 49 |

| Property, plant and equipment | | 68, 87 |

| Provisions for other liabilities and charges | | 68, 96 |

| Related party transactions | | 30, 101 |

| Remuneration report | | 51-61 |

| Research and development | | 65, 76 |

| Reserves | | 69, 98-99 |

| Retirement benefit obligations | | 68, 102-106 |

| Return on average capital employed | | 135, 152 |

| Risk factors | | 35-37 |

| Segmental analysis | | 71-75 |

| Share capital | | 69, 98-99 |

| Shareholder information | | 138-145 |

| Statement of total recognised income and expense | | 67 |

| Inventories | | 64, 68, 89 |

| Strategy | | 8-11 |

| Subsidiary undertakings | | 116 |

| Substantial shareholders | | 49 |

| Supplementary information – gas and oil | | 128-132 |

| Suppliers | | 50 |

| Taxation | | 24, 66, 67, 84 |

| Three year financial summary | | 134-135 |

| Trade and other payables | | 68, 96 |

| Trade and other receivables | | 68, 89-90 |

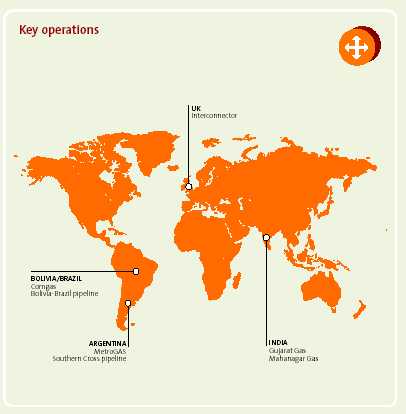

| Transmission and Distribution (T&D) | | 7, 18-19, 23, 71-75 |

| US GAAP | | 105-106, 108-115, 136 |

Back to Contents

| | |

| 152 | BG GROUP ANNUAL REPORT ANDACCOUNTS 2005 |

| | |

Presentation of non-GAAP measures

BG Group gives certain additional information in a non-statutory format in order to provide readers with an increased insight into the underlying performance of the business. The measures BG Group uses are explained below.

BUSINESS PERFORMANCE

‘Business Performance’ excludes certain disposals and re-measurements (see below) and is presented as exclusion of these items provides readers with a clear and consistent presentation of the underlying operating performance of the Group’s ongoing business.

BG Group uses commodity instruments to manage price exposures associated with its marketing and optimisation activity in the UK and US. This activity enables the Group to take advantage of commodity price movements. It is considered more appropriate to include both unrealised and realised gains and losses arising from the mark-to-market of derivatives associated with this activity in ‘Business Performance’.

DISPOSALS AND RE-MEASUREMENTS

BG Group’s commercial arrangements for marketing gas include the use of long-term gas sales contracts. Whilst the activity surrounding these contracts involves the physical delivery of gas, certain UK gas sales contracts are classified as derivatives under the rules of International Accounting Standard (IAS) 39, ‘Financial Instruments: Recognition and Measurement’, issued by the International Accounting Standards Board and are required to be measured at fair value at the balance sheet date. Unrealised gains and losses on these contracts reflect the comparison between current market gas prices and the actual prices to be realised under the gas sales contract.

BG Group also uses commodity instruments to manage certain price exposures in respect of optimising the timing of its gas sales associated with contracted UK storage and pipeline capacity. These instruments are also required to be measured at fair value at the balance sheet date under IAS 39. However, IAS 39 does not allow the matching of these fair values to the economically hedged value of the related gas in storage (taking account of gas prices based on the forward curve or expected delivery destination and the associated storage and capacity costs).

BG Group also uses financial instruments, including derivatives, to manage foreign exchange and interest rate exposure. These instruments are required to be recognised at fair value or amortised cost on the balance sheet in accordance with IAS 39. Most of these instruments have been designated either as hedges of foreign exchange movements associated with the Group’s net investments in foreign operations, or as hedges of interest rate risk. Where these instruments represent effective economic hedging activities but cannot be designated as hedges under IAS 39, unrealised movements in fair value are recorded in the income statement.

Unrealised gains and losses in respect of long-term gas sales contracts, commodity instruments used to optimise the timing of gas sales associated with contracted UK storage and pipeline facilities and interest rate and foreign exchange exposure in respect of financial instruments which cannot be designated as hedges under IAS 39 are disclosed separately within ‘disposals and re-measurements’. Realised gains and losses relating to these instruments are included in Business Performance. This presentation best reflects the underlying performance of the business since it distinguishes between the temporary timing differences associated with re-measurements under IAS 39 rules and actual realised gains and losses.

BG Group has also separately identified profits and losses associated with the disposal of non-current assets and impairments of non-current assets as they require separate disclosure in order to provide a clearer understanding of the results for the period. For a reconciliation between the overall results and Business Performance and details of disposals and re-measurements, see segmental analysis and results presentation, note 2 page 71.

JOINT VENTURES AND ASSOCIATES

Under IFRS the results from jointly controlled entities (joint ventures) and associates, accounted for under the equity method, are required to be presented net of finance costs and tax on the face of the income statement. Given the relevance of these businesses within BG Group, the results of joint ventures and associates are presented before interest and tax, and after tax. This approach provides additional information on the source of BG Group’s operating profits. For a reconciliation between operating profit and earnings including and excluding the results of joint ventures and associates, see segmental analysis and results presentation note 2, page 71, and earnings per ordinary share, note 10, page 85.

EXCHANGE RATES AND PRICES

BG Group also discloses certain information, as indicated, at constant UK£/US$ exchange rates and upstream prices. The presentation of results in this manner is intended to provide additional information to explain further the underlying trends in the business. The disclosure recalculates the current year profit on the basis that the UK£/US$ exchange rate and the upstream commodity prices were the same as in the previous year – so providing a comparable base in respect of these two factors.

NET BORROWINGS/FUNDS

BG Group provides a reconciliation of net borrowings/funds and an analysis of the amounts included within net borrowings/funds as this is an important liquidity measure for the Group.

Return on average capital employed (ROACE) represents profit before tax (excluding disposals and re-measurements) plus net interest payable on net borrowings, as a percentage of average capital employed.

Back to Contents

| | |

BG GROUP ANNUAL REPORT AND ACCOUNTS 2005 | 153 |

| | |

| | | | | | | |

| | Definitions | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | For the purpose of this report the following definitions apply: | | | | | |

| | ‘$’ | | US Dollars | | ‘GAAP’ | | Generally Accepted Accounting Principles | |

| | ‘£’ | | UK pounds Sterling | | ‘GASA’ | | Gas Argentino S.A. | |

| | ‘ABI’ | | Association of British Insurers | | ‘Group’ | | BG Group plc and/or any of its subsidiaryundertakings, joint ventures or associatedundertakings | |

| | ‘ADR’ | | American Depositary Receipt | | ‘HSSE’ | | Health, Safety, Security and the Environment | |

| | ‘ADS’ | | American Depositary Share | | ‘IAS’ | | International Accounting Standard issued by the IASB | |

| | ‘AGM’ | | Annual General Meeting | | ‘IASB’ | | International Accounting Standards Board | |

| | ‘Annual unit operating cost’ | | Total production and operating costs for the year divided by net production for the year | | ‘IFRS’ | | International Financial Reporting Standards issued by the IASB and endorsed by the European Union | |

| ‘km’ | | Kilometres | |

| | ‘bcf’ | | Billion cubic feet | | ‘LNG’ | | Liquefied Natural Gas | |

| | ‘bcfd’ | | Billion cubic feet per day | | ‘LTIS’ | | Long Term Incentive Scheme | |

| | ‘bcma’ | | Billion cubic metres per annum | | ‘m’ | | Million | |

| | ‘BG’ or ‘BG Group’ | | BG Group plc and/or any of its subsidiaryundertakings, joint ventures or associatedundertakings | | ‘mcmd’ | | Thousand cubic metres per day | |

| | | | | ‘mmbbl’ | | Million barrels | |

| | | | | ‘mmboe’ | | Million barrels of oil equivalent | |

| | ‘BG Energy Holdings | | BG Energy Holdings Limited, a subsidiary | | ‘mmbtu’ | | Million British thermal units | |

| | Limited’ or ‘BGEH’ | | of BG Group plc | | ‘mmcm’ | | Million cubic metres | |

| | ‘billion’ or ‘bn’ | | One thousand million | | ‘mmcmd’ | | Million cubic metres per day | |

| | ‘boe’ | | Barrels of oil equivalent | | ‘mmscfd’ | | Million standard cubic feet per day | |

| | ‘boed’ | | Barrels of oil equivalent per day | | ‘mmscm’ | | Million standard cubic metres | |

| | ‘bopd’ | | Barrels of oil per day | | ‘mmscmd’ | | Million standard cubic metres per day | |

| | ‘CPC’ | | Caspian Pipeline Consortium | | ‘mtpa’ | | Million tonnes per annum | |

| | ‘CCGT’ | | Combined Cycle Gas Turbine | | ‘MW’ | | Megawatt | |

| | ‘Combined Code’ | | The 2003 Combined Code on Corporate Governanceissued by the UK Financial Reporting Council | | ’NGV’ | | Natural Gas Vehicle | |

| | | | | ‘NYSE’ | | New York Stock Exchange | |

| | ‘Company’ | | BG Group plc | | ‘OECD’ | | Organisation for Economic Co-operation andDevelopment | |

| | ‘CR’ | | Corporate Responsibility | | | |

| | ‘CSOS’ | | Company Share Option Scheme | | ‘PSA’ | | Production Sharing Agreement | |

| | ‘demerger’ | | The demerger of certain businesses described in moredetail on page 139 (Additional shareholder information) | | ‘PSC’ | | Production Sharing Contract | |

| | | | | ‘ROACE’ | | Return on Average Capital Employed | |

| | ‘DCQ’ | | Daily Contracted Quantity | | ‘T&D’ | | Transmission and Distribution | |

| | ‘E&P’ | | Exploration and Production | | ‘three year proved reserves | | The three year average proved reserves replacement | |

| | ‘EITF’ | | Emerging Issues Task Force | | replacement rate’ or ‘RRR’ | | rate is the total net proved reserves changes over the three year period including purchases and sales (excluding production) divided by the total net production for that period | |

| | ‘EPC’ | | Engineer Procure Construct | |

| | ‘EPS’ | | Earnings per Share | |

| | ‘EPV’ | | Estimated Present Value | |