Exhibit (c)(2)

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

CONFIDENTIAL

A Presentation to the Board of Directors of:

TWINS

regarding

Strategic Alternatives

June 29, 2005

[LOGO]

Table of Contents

I. | | Overview of TWINS Current Situation | |

II. | | Truckload Industry Outlook | |

III. | | Overview of Strategic Alternatives | |

| | A. | Organic Growth | |

| | B. | No Growth/Cost Reduction (to be distributed at meeting) | |

| | C. | Stock Repurchase | |

| | D. | Acquisitions | |

| | E. | Sale of Company | |

IV. | | COLTS Overview | |

V. | | COLTS/TWINS Merger Consequences | |

| | | |

Exhibits | |

A. | | Tier I Strategic Buyer Profiles | |

B. | | Comparable Companies Analysis | |

[LOGO]

2

I. Overview of TWINS Current Situation

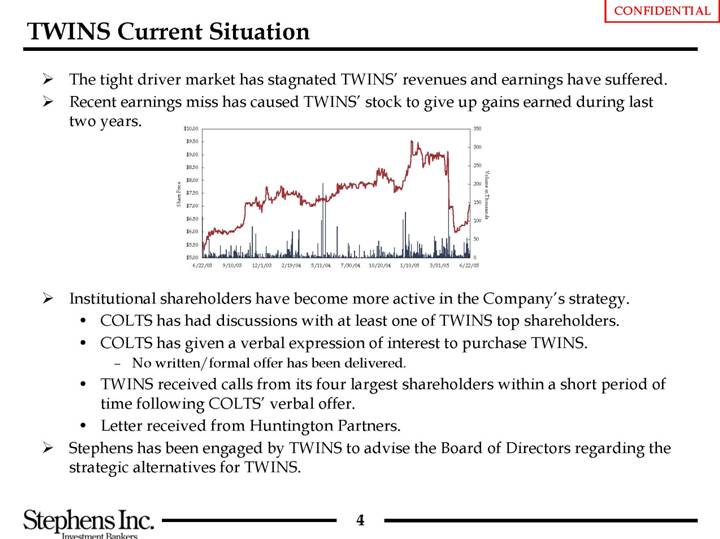

TWINS Current Situation

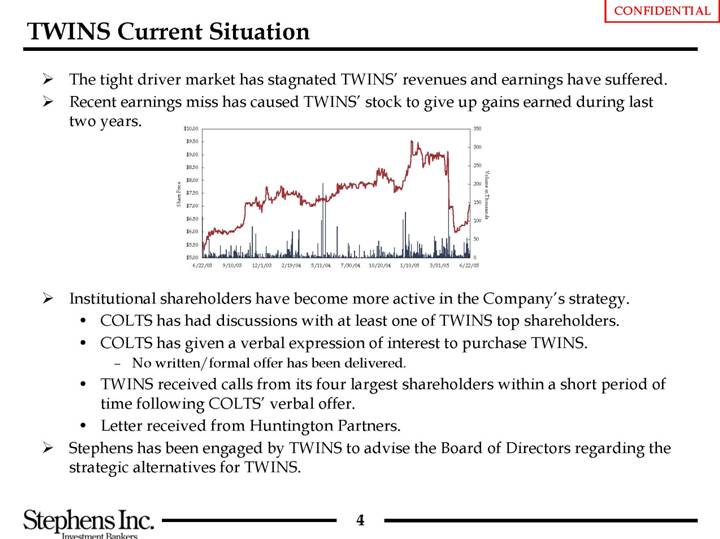

• The tight driver market has stagnated TWINS’ revenues and earnings have suffered.

• Recent earnings miss has caused TWINS’ stock to give up gains earned during last two years.

[CHART]

• Institutional shareholders have become more active in the Company’s strategy.

• COLTS has had discussions with at least one of TWINS top shareholders.

• COLTS has given a verbal expression of interest to purchase TWINS.

• No written/formal offer has been delivered.

• TWINS received calls from its four largest shareholders within a short period of time following COLTS’ verbal offer.

• Letter received from Huntington Partners.

• Stephens has been engaged by TWINS to advise the Board of Directors regarding the strategic alternatives for TWINS.

4

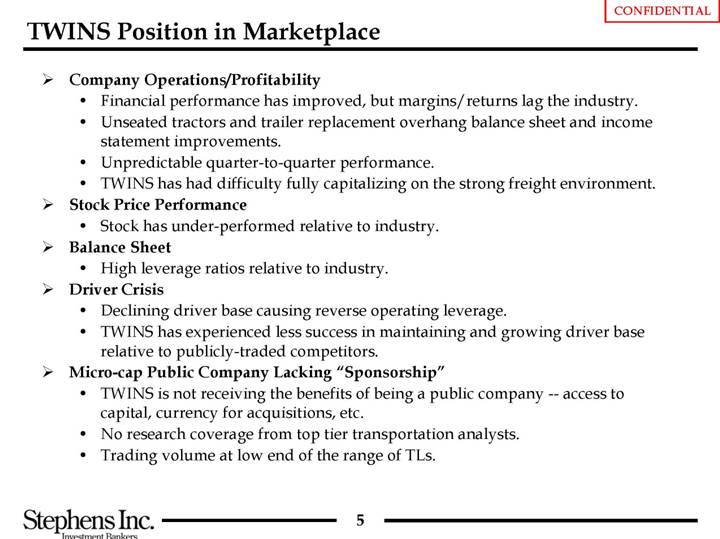

TWINS Position in Marketplace

• Company Operations/Profitability

• Financial performance has improved, but margins/returns lag the industry.

• Unseated tractors and trailer replacement overhang balance sheet and income statement improvements.

• Unpredictable quarter-to-quarter performance.

• TWINS has had difficulty fully capitalizing on the strong freight environment.

• Stock Price Performance

• Stock has under-performed relative to industry.

• Balance Sheet

• High leverage ratios relative to industry.

• Driver Crisis

• Declining driver base causing reverse operating leverage.

• TWINS has experienced less success in maintaining and growing driver base relative to publicly-traded competitors.

• Micro-cap Public Company Lacking “Sponsorship”

• TWINS is not receiving the benefits of being a public company — access to capital, currency for acquisitions, etc.

• No research coverage from top tier transportation analysts.

• Trading volume at low end of the range of TLs.

5

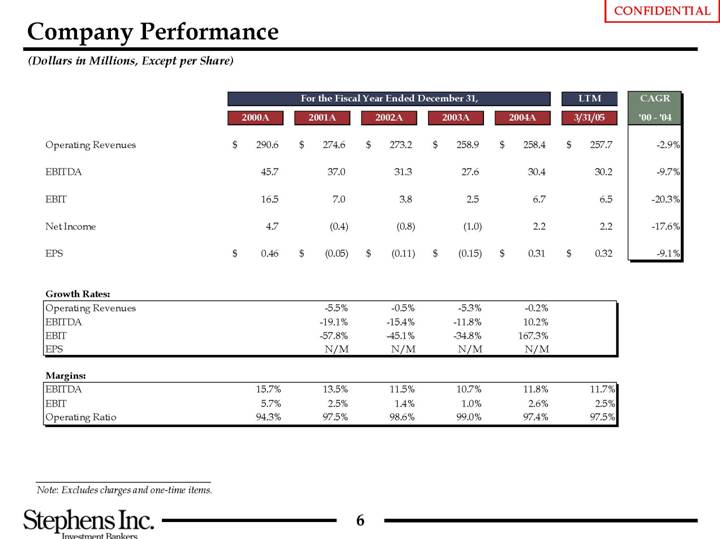

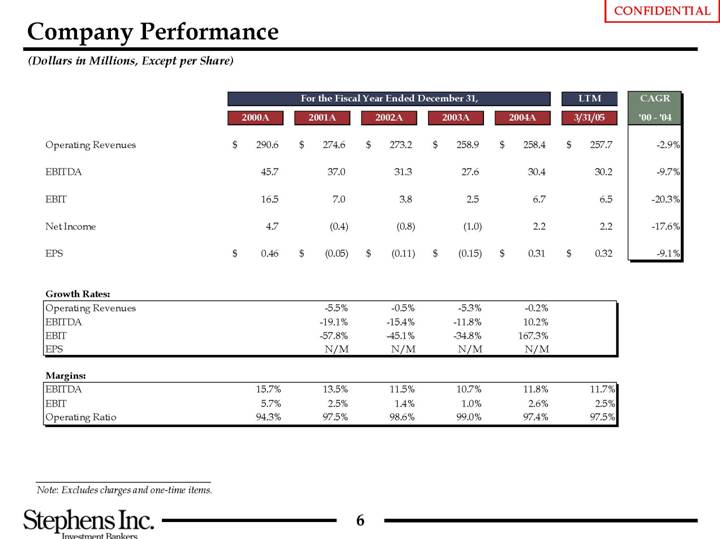

Company Performance

(Dollars in Millions, Except per Share)

| | For the Fiscal Year Ended December 31, | | LTM | | CAGR | |

| | 2000A | | 2001A | | 2002A | | 2003A | | 2004A | | 3/31/05 | | ’00 - ’04 | |

| | | | | | | | | | | | | | | |

Operating Revenues | | $ | 290.6 | | $ | 274.6 | | $ | 273.2 | | $ | 258.9 | | $ | 258.4 | | $ | 257.7 | | -2.9 | % |

| | | | | | | | | | | | | | | |

EBITDA | | 45.7 | | 37.0 | | 31.3 | | 27.6 | | 30.4 | | 30.2 | | -9.7 | % |

| | | | | | | | | | | | | | | |

EBIT | | 16.5 | | 7.0 | | 3.8 | | 2.5 | | 6.7 | | 6.5 | | -20.3 | % |

| | | | | | | | | | | | | | | |

Net Income | | 4.7 | | (0.4 | ) | (0.8 | ) | (1.0 | ) | 2.2 | | 2.2 | | -17.6 | % |

| | | | | | | | | | | | | | | |

EPS | | $ | 0.46 | | $ | (0.05 | ) | $ | (0.11 | ) | $ | (0.15 | ) | $ | 0.31 | | $ | 0.32 | | -9.1 | % |

| | | | | | | | | | | | | | | |

Growth Rates: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Operating Revenues | | | | -5.5 | % | -0.5 | % | -5.3 | % | -0.2 | % | | | | |

EBITDA | | | | -19.1 | % | -15.4 | % | -11.8 | % | 10.2 | % | | | | |

EBIT | | | | -57.8 | % | -45.1 | % | -34.8 | % | 167.3 | % | | | | |

EPS | | | | N/M | | N/M | | N/M | | N/M | | | | | |

| | | | | | | | | | | | | | | |

Margins: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

EBITDA | | 15.7 | % | 13.5 | % | 11.5 | % | 10.7 | % | 11.8 | % | 11.7 | % | | |

EBIT | | 5.7 | % | 2.5 | % | 1.4 | % | 1.0 | % | 2.6 | % | 2.5 | % | | |

Operating Ratio | | 94.3 | % | 97.5 | % | 98.6 | % | 99.0 | % | 97.4 | % | 97.5 | % | | |

Note: Excludes charges and one-time items.

6

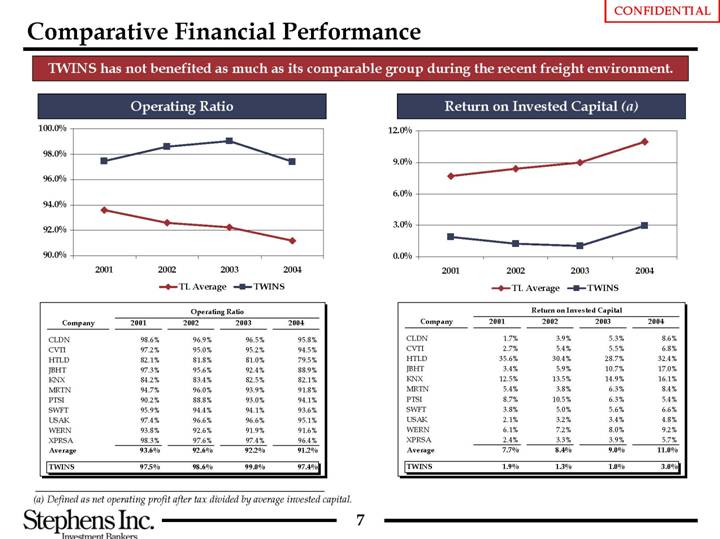

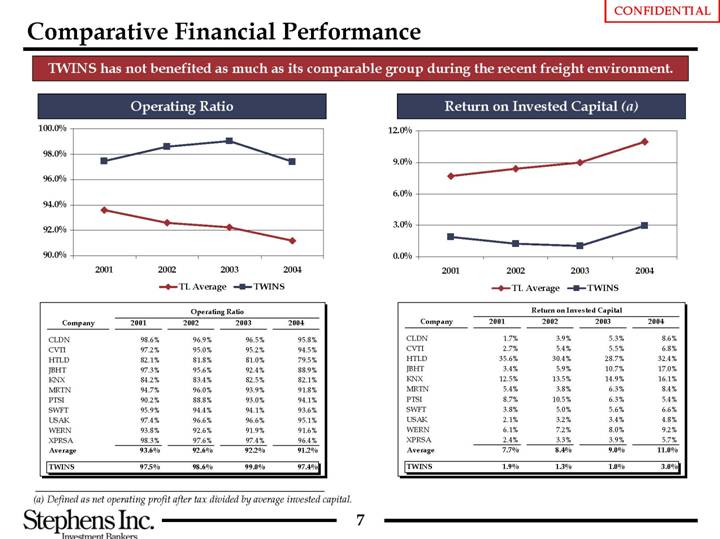

Comparative Financial Performance

TWINS has not benefited as much as its comparable group during the recent freight environment.

Operating Ratio

[CHART]

| | Operating Ratio | |

Company | | 2001 | | 2002 | | 2003 | | 2004 | |

CLDN | | 98.6 | % | 96.9 | % | 96.5 | % | 95.8 | % |

CVTI | | 97.2 | % | 95.0 | % | 95.2 | % | 94.5 | % |

HTLD | | 82.1 | % | 81.8 | % | 81.0 | % | 79.5 | % |

JBHT | | 97.3 | % | 95.6 | % | 92.4 | % | 88.9 | % |

KNX | | 84.2 | % | 83.4 | % | 82.5 | % | 82.1 | % |

MRTN | | 94.7 | % | 96.0 | % | 93.9 | % | 91.8 | % |

PTSI | | 90.2 | % | 88.8 | % | 93.0 | % | 94.1 | % |

SWFT | | 95.9 | % | 94.4 | % | 94.1 | % | 93.6 | % |

USAK | | 97.4 | % | 96.6 | % | 96.6 | % | 95.1 | % |

WERN | | 93.8 | % | 92.6 | % | 91.9 | % | 91.6 | % |

XPRSA | | 98.3 | % | 97.6 | % | 97.4 | % | 96.4 | % |

Average | | 93.6 | % | 92.6 | % | 92.2 | % | 91.2 | % |

| | | | | | | | | |

TWINS | | 97.5 | % | 98.6 | % | 99.0 | % | 97.4 | % |

Return on Invested Capital (a)

[CHART]

| | Return on Invested Capital | |

Company | | 2001 | | 2002 | | 2003 | | 2004 | |

CLDN | | 1.7 | % | 3.9 | % | 5.3 | % | 8.6 | % |

CVTI | | 2.7 | % | 5.4 | % | 5.5 | % | 6.8 | % |

HTLD | | 35.6 | % | 30.4 | % | 28.7 | % | 32.4 | % |

JBHT | | 3.4 | % | 5.9 | % | 10.7 | % | 17.0 | % |

KNX | | 12.5 | % | 13.5 | % | 14.9 | % | 16.1 | % |

MRTN | | 5.4 | % | 3.8 | % | 6.3 | % | 8.4 | % |

PTSI | | 8.7 | % | 10.5 | % | 6.3 | % | 5.4 | % |

SWFT | | 3.8 | % | 5.0 | % | 5.6 | % | 6.6 | % |

USAK | | 2.1 | % | 3.2 | % | 3.4 | % | 4.8 | % |

WERN | | 6.1 | % | 7.2 | % | 8.0 | % | 9.2 | % |

XPRSA | | 2.4 | % | 3.3 | % | 3.9 | % | 5.7 | % |

Average | | 7.7 | % | 8.4 | % | 9.0 | % | 11.0 | % |

| | | | | | | | | |

TWINS | | 1.9 | % | 1.3 | % | 1.0 | % | 3.0 | % |

(a) Defined as net operating profit after tax divided by average invested capital.

7

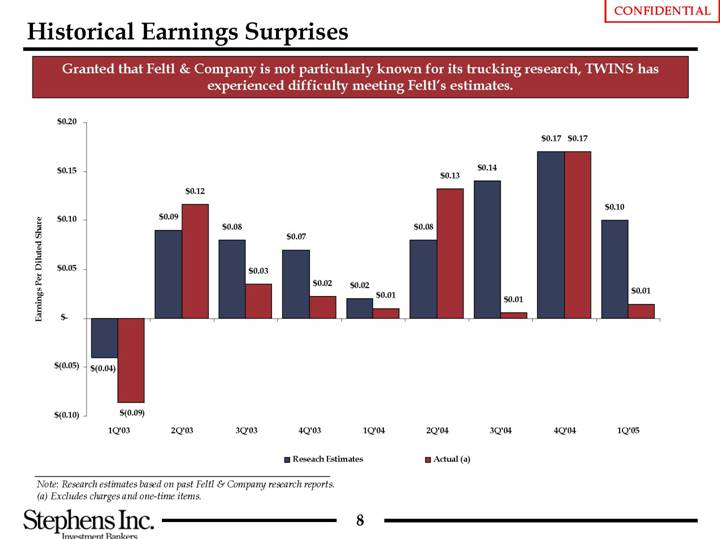

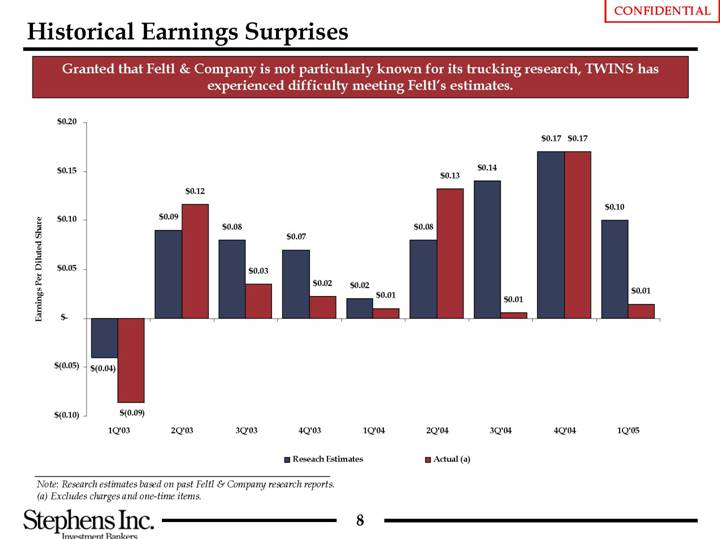

Historical Earnings Surprises

Granted that Feltl & Company is not particularly known for its trucking research, TWINS has experienced difficulty meeting Feltl’s estimates.

[CHART]

Note: Research estimates based on past Feltl & Company research reports.

(a) Excludes charges and one-time items.

8

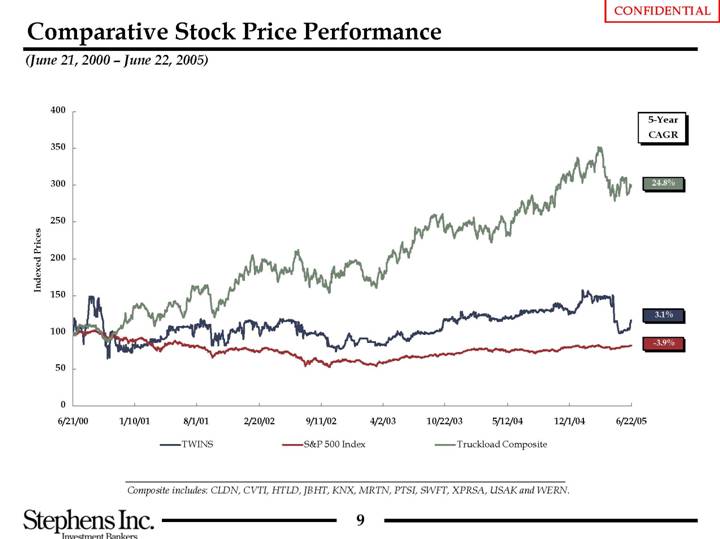

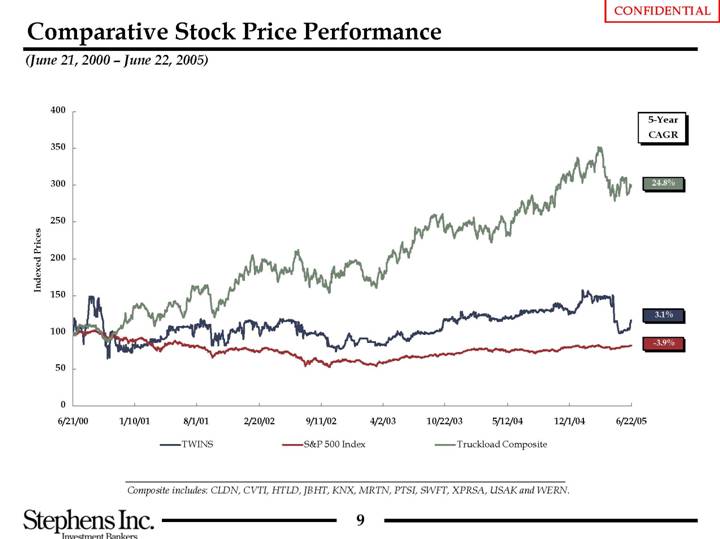

Comparative Stock Price Performance

(June 21, 2000 - June 22, 2005)

[CHART]

Composite includes: CLDN, CVTI, HTLD, JBHT, KNX, MRTN, PTSI, SWFT, XPRSA, USAK and WERN.

9

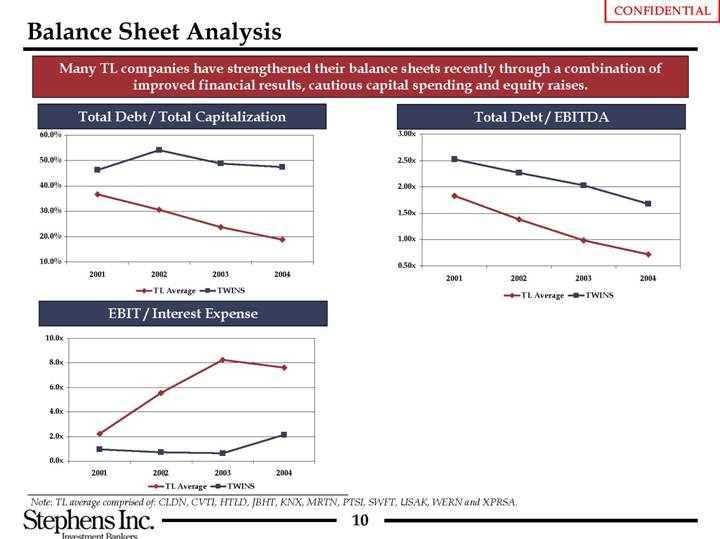

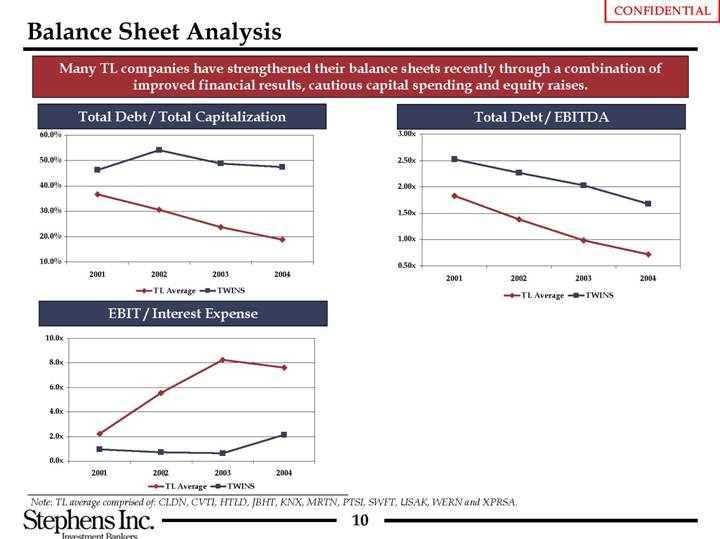

Balance Sheet Analysis

Many TL companies have strengthened their balance sheets recently through a combination of improved financial results, cautious capital spending and equity raises.

Total Debt / Total Capitalization

[CHART]

EBIT / Interest Expense

[CHART]

Total Debt / EBITDA

[CHART]

Note: TL average comprised of: CLDN, CVTI, HTLD, JBHT, KNX, MRTN, PTSI, SWFT, USAK, WERN and XPRSA.

10

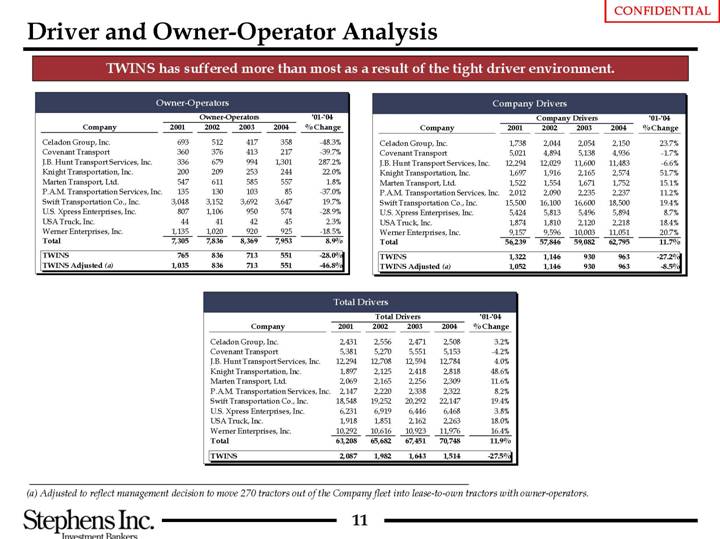

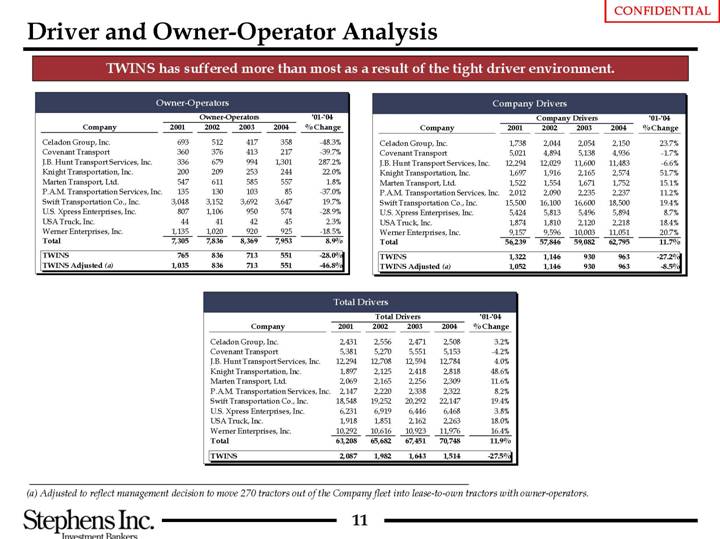

Driver and Owner-Operator Analysis

TWINS has suffered more than most as a result of the tight driver environment.

Owner-Operators

| | Owner-Operators | | ’01-’04 | |

Company | | 2001 | | 2002 | | 2003 | | 2004 | | % Change | |

Celadon Group, Inc. | | 693 | | 512 | | 417 | | 358 | | -48.3 | % |

Covenant Transport | | 360 | | 376 | | 413 | | 217 | | -39.7 | % |

J.B. Hunt Transport Services, Inc. | | 336 | | 679 | | 994 | | 1,301 | | 287.2 | % |

Knight Transportation, Inc. | | 200 | | 209 | | 253 | | 244 | | 22.0 | % |

Marten Transport, Ltd. | | 547 | | 611 | | 585 | | 557 | | 1.8 | % |

P.A.M. Transportation Services, Inc. | | 135 | | 130 | | 103 | | 85 | | -37.0 | % |

Swift Transportation Co., Inc. | | 3,048 | | 3,152 | | 3,692 | | 3,647 | | 19.7 | % |

U.S. Xpress Enterprises, Inc. | | 807 | | 1,106 | | 950 | | 574 | | -28.9 | % |

USA Truck, Inc. | | 44 | | 41 | | 42 | | 45 | | 2.3 | % |

Werner Enterprises, Inc. | | 1,135 | | 1,020 | | 920 | | 925 | | -18.5 | % |

Total | | 7,305 | | 7,836 | | 8,369 | | 7,953 | | 8.9 | % |

| | | | | | | | | | | |

TWINS | | 765 | | 836 | | 713 | | 551 | | -28.0 | % |

TWINS Adjusted (a) | | 1,035 | | 836 | | 713 | | 551 | | -46.8 | % |

Company Drivers

| | Company Drivers | | ’01-’04 | |

Company | | 2001 | | 2002 | | 2003 | | 2004 | | % Change | |

Celadon Group, Inc. | | 1,738 | | 2,044 | | 2,054 | | 2,150 | | 23.7 | % |

Covenant Transport | | 5,021 | | 4,894 | | 5,138 | | 4,936 | | -1.7 | % |

J.B. Hunt Transport Services, Inc. | | 12,294 | | 12,029 | | 11,600 | | 11,483 | | -6.6 | % |

Knight Transportation, Inc. | | 1,697 | | 1,916 | | 2,165 | | 2,574 | | 51.7 | % |

Marten Transport, Ltd. | | 1,522 | | 1,554 | | 1,671 | | 1,752 | | 15.1 | % |

P.A.M. Transportation Services, Inc. | | 2,012 | | 2,090 | | 2,235 | | 2,237 | | 11.2 | % |

Swift Transportation Co., Inc. | | 15,500 | | 16,100 | | 16,600 | | 18,500 | | 19.4 | % |

U.S. Xpress Enterprises, Inc. | | 5,424 | | 5,813 | | 5,496 | | 5,894 | | 8.7 | % |

USA Truck, Inc. | | 1,874 | | 1,810 | | 2,120 | | 2,218 | | 18.4 | % |

Werner Enterprises, Inc. | | 9,157 | | 9,596 | | 10,003 | | 11,051 | | 20.7 | % |

Total | | 56,239 | | 57,846 | | 59,082 | | 62,795 | | 11.7 | % |

| | | | | | | | | | | |

TWINS | | 1,322 | | 1,146 | | 930 | | 963 | | -27.2 | % |

TWINS Adjusted (a) | | 1,052 | | 1,146 | | 930 | | 963 | | -8.5 | % |

Total Drivers

| | Total Drivers | | ’01-’04 | |

Company | | 2001 | | 2002 | | 2003 | | 2004 | | % Change | |

Celadon Group, Inc. | | 2,431 | | 2,556 | | 2,471 | | 2,508 | | 3.2 | % |

Covenant Transport | | 5,381 | | 5,270 | | 5,551 | | 5,153 | | -4.2 | % |

J.B. Hunt Transport Services, Inc. | | 12,294 | | 12,708 | | 12,594 | | 12,784 | | 4.0 | % |

Knight Transportation, Inc. | | 1,897 | | 2,125 | | 2,418 | | 2,818 | | 48.6 | % |

Marten Transport, Ltd. | | 2,069 | | 2,165 | | 2,256 | | 2,309 | | 11.6 | % |

P.A.M. Transportation Services, Inc. | | 2,147 | | 2,220 | | 2,338 | | 2,322 | | 8.2 | % |

Swift Transportation Co., Inc. | | 18,548 | | 19,252 | | 20,292 | | 22,147 | | 19.4 | % |

U.S. Xpress Enterprises, Inc. | | 6,231 | | 6,919 | | 6,446 | | 6,468 | | 3.8 | % |

USA Truck, Inc. | | 1,918 | | 1,851 | | 2,162 | | 2,263 | | 18.0 | % |

Werner Enterprises, Inc. | | 10,292 | | 10,616 | | 10,923 | | 11,976 | | 16.4 | % |

Total | | 63,208 | | 65,682 | | 67,451 | | 70,748 | | 11.9 | % |

| | | | | | | | | | | |

TWINS | | 2,087 | | 1,982 | | 1,643 | | 1,514 | | -27.5 | % |

(a) Adjusted to reflect management decision to move 270 tractors out of the Company fleet into lease-to-own tractors with owner-operators.

11

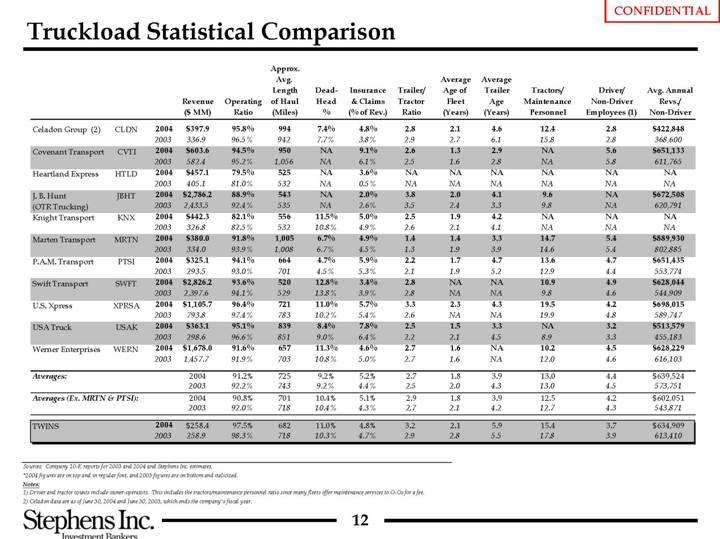

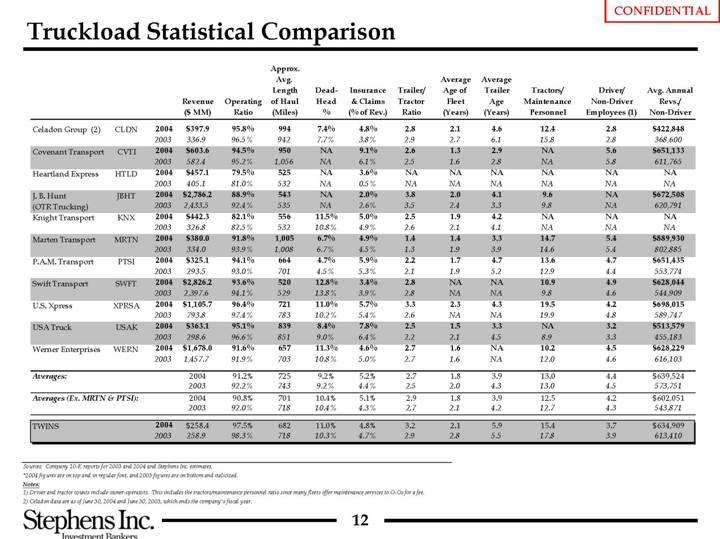

Truckload Statistical Comparison

| | | | | | | | | | Approx. | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Avg. | | | | | | | | Average | | Average | | | | | | | |

| | | | | | | | | | Length | | Dead- | | Insurance | | Trailer/ | | Age of | | Trailer | | Tractors/ | | Driver/ | | Avg. Annual | |

| | | | | | Revenue | | Operating | | of Haul | | Head | | & Claims | | Tractor | | Fleet | | Age | | Maintenance | | Non-Driver | | Revs./ | |

| | | | | | ($ MM) | | Ratio | | (Miles) | | % | | (% of Rev.) | | Ratio | | (Years) | | (Years) | | Personnel | | Employees (1) | | Non-Driver | |

Celadon Group (2) | | CLDN | | 2004 | | $ | 397.9 | | 95.8 | % | 994 | | 7.4 | % | 4.8 | % | 2.8 | | 2.1 | | 4.6 | | 12.4 | | 2.8 | | $ | 422,848 | |

| | | | 2003 | | 336.9 | | 96.5 | % | 942 | | 7.7 | % | 3.8 | % | 2.9 | | 2.7 | | 6.1 | | 15.8 | | 2.8 | | 368,600 | |

Covenant Transport | | CVTI | | 2004 | | $ | 603.6 | | 94.5 | % | 950 | | NA | | 9.1 | % | 2.6 | | 1.3 | | 2.9 | | NA | | 5.6 | | $ | 651,133 | |

| | | | 2003 | | 582.4 | | 95.2 | % | 1,056 | | NA | | 6.1 | % | 2.5 | | 1.6 | | 2.8 | | NA | | 5.8 | | 611,765 | |

Heartland Express | | HTLD | | 2004 | | $ | 457.1 | | 79.5 | % | 525 | | NA | | 3.6 | % | NA | | NA | | NA | | NA | | NA | | NA | |

| | | | 2003 | | 405.1 | | 81.0 | % | 532 | | NA | | 0.5 | % | NA | | NA | | NA | | NA | | NA | | NA | |

J. B. Hunt | | JBHT | | 2004 | | $ | 2,786.2 | | 88.9 | % | 543 | | NA | | 2.0 | % | 3.8 | | 2.0 | | 4.1 | | 9.6 | | NA | | $ | 672,508 | |

(OTR Trucking) | | | | 2003 | | 2,433.5 | | 92.4 | % | 535 | | NA | | 2.6 | % | 3.5 | | 2.4 | | 3.3 | | 9.8 | | NA | | 620,791 | |

Knight Transport | | KNX | | 2004 | | $ | 442.3 | | 82.1 | % | 556 | | 11.5 | % | 5.0 | % | 2.5 | | 1.9 | | 4.2 | | NA | | NA | | NA | |

| | | | 2003 | | 326.8 | | 82.5 | % | 532 | | 10.8 | % | 4.9 | % | 2.6 | | 2.1 | | 4.1 | | NA | | NA | | NA | |

Marten Transport | | MRTN | | 2004 | | $ | 380.0 | | 91.8 | % | 1,005 | | 6.7 | % | 4.9 | % | 1.4 | | 1.4 | | 3.3 | | 14.7 | | 5.4 | | $ | 889,930 | |

| | | | 2003 | | 334.0 | | 93.9 | % | 1,008 | | 6.7 | % | 4.5 | % | 1.3 | | 1.9 | | 3.9 | | 14.6 | | 5.4 | | 802,885 | |

P.A.M. Transport | | PTSI | | 2004 | | $ | 325.1 | | 94.1 | % | 664 | | 4.7 | % | 5.9 | % | 2.2 | | 1.7 | | 4.7 | | 13.6 | | 4.7 | | $ | 651,435 | |

| | | | 2003 | | 293.5 | | 93.0 | % | 701 | | 4.5 | % | 5.3 | % | 2.1 | | 1.9 | | 5.2 | | 12.9 | | 4.4 | | 553,774 | |

Swift Transport | | SWFT | | 2004 | | $ | 2,826.2 | | 93.6 | % | 520 | | 12.8 | % | 3.4 | % | 2.8 | | NA | | NA | | 10.9 | | 4.9 | | $ | 628,044 | |

| | | | 2003 | | 2,397.6 | | 94.1 | % | 529 | | 13.8 | % | 3.9 | % | 2.8 | | NA | | NA | | 9.8 | | 4.6 | | 544,909 | |

U.S. Xpress | | XPRSA | | 2004 | | $ | 1,105.7 | | 96.4 | % | 721 | | 11.0 | % | 5.7 | % | 3.3 | | 2.3 | | 4.3 | | 19.5 | | 4.2 | | $ | 698,015 | |

| | | | 2003 | | 793.8 | | 97.4 | % | 783 | | 10.2 | % | 5.4 | % | 2.6 | | NA | | NA | | 19.9 | | 4.8 | | 589,747 | |

USA Truck | | USAK | | 2004 | | $ | 363.1 | | 95.1 | % | 839 | | 8.4 | % | 7.8 | % | 2.5 | | 1.5 | | 3.3 | | NA | | 3.2 | | $ | 513,579 | |

| | | | 2003 | | 298.6 | | 96.6 | % | 851 | | 9.0 | % | 6.4 | % | 2.2 | | 2.1 | | 4.5 | | 8.9 | | 3.3 | | 455,183 | |

Werner Enterprises | | WERN | | 2004 | | $ | 1,678.0 | | 91.6 | % | 657 | | 11.3 | % | 4.6 | % | 2.7 | | 1.6 | | NA | | 10.2 | | 4.5 | | $ | 628,229 | |

| | | | 2003 | | 1,457.7 | | 91.9 | % | 703 | | 10.8 | % | 5.0 | % | 2.7 | | 1.6 | | NA | | 12.0 | | 4.6 | | 616,103 | |

Averages: | | | | | | 2004 | | 91.2 | % | 725 | | 9.2 | % | 5.2 | % | 2.7 | | 1.8 | | 3.9 | | 13.0 | | 4.4 | | $ | 639,524 | |

| | | | | | 2003 | | 92.2 | % | 743 | | 9.2 | % | 4.4 | % | 2.5 | | 2.0 | | 4.3 | | 13.0 | | 4.5 | | 573,751 | |

Averages (Ex. MRTN & PTSI): | | | | | | 2004 | | 90.8 | % | 701 | | 10.4 | % | 5.1 | % | 2.9 | | 1.8 | | 3.9 | | 12.5 | | 4.2 | | $ | 602,051 | |

| | | | | | 2003 | | 92.0 | % | 718 | | 10.4 | % | 4.3 | % | 2.7 | | 2.1 | | 4.2 | | 12.7 | | 4.3 | | 543,871 | |

TWINS | | | | 2004 | | $ | 258.4 | | 97.5 | % | 682 | | 11.0 | % | 4.8 | % | 3.2 | | 2.1 | | 5.9 | | 15.4 | | 3.7 | | $ | 634,909 | |

| | | | 2003 | | 258.9 | | 98.3 | % | 718 | | 10.3 | % | 4.7 | % | 2.9 | | 2.8 | | 5.5 | | 17.8 | | 3.9 | | 613,410 | |

Sources: Company 10-K reports for 2003 and 2004 and Stephens Inc. estimates.

*2004 figures are on top and in regular font, and 2003 figures are on bottom and italicized.

Notes:

(1) Driver and tractor counts include owner-operators. This includes the tractors/maintenance personnel ratio since many fleets offer maintenance services to O-Os for a fee.

(2) Celadon data are as of June 30, 2004 and June 30, 2003, which ends the company’s fiscal year.

12

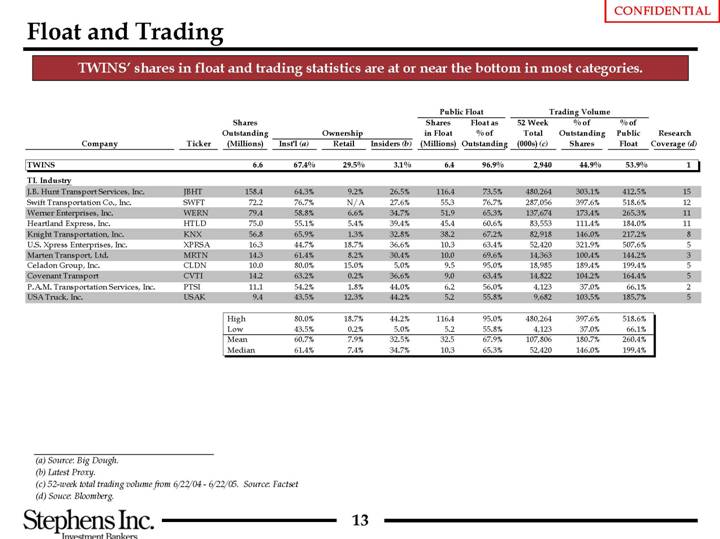

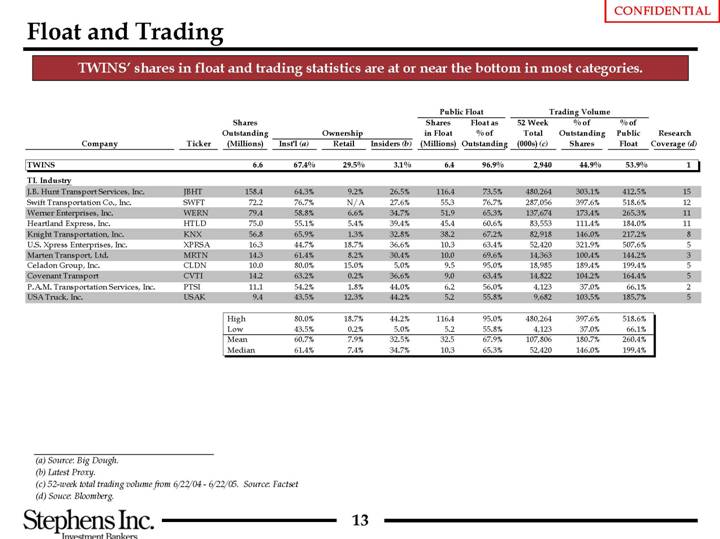

Float and Trading

TWINS’ shares in float and trading statistics are at or near the bottom in most categories.

| | | | | | | | | | | | Public Float | | Trading Volume | | | |

| | | | | | | | | | | | | | Float as | | 52 Week | | % of | | % of | | | |

| | | | Shares | | Ownership | | Shares | | % of | | Total | | Outstanding | | Public | | Research | |

Company | | Ticker | | Outstanding | | Inst’l (a) | | Retail | | Insiders (b) | | in Float | | Outstanding | | (c) | | Shares | | Float | | Coverage (d) | |

| | | | (Millions) | | | | | | | | (Millions) | | | | (000s) | | | | | | | |

TWINS | | | | 6.6 | | 67.4 | % | 29.5 | % | 3.1 | % | 6.4 | | 96.9 | % | 2,940 | | 44.9 | % | 53.9 | % | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TL Industry | | | | | | | | | | | | | | | | | | | | | | | |

J.B. Hunt Transport Services, Inc. | | JBHT | | 158.4 | | 64.3 | % | 9.2 | % | 26.5 | % | 116.4 | | 73.5 | % | 480,264 | | 303.1 | % | 412.5 | % | 15 | |

Swift Transportation Co., Inc. | | SWFT | | 72.2 | | 76.7 | % | N/A | | 27.6 | % | 55.3 | | 76.7 | % | 287,056 | | 397.6 | % | 518.6 | % | 12 | |

Werner Enterprises, Inc. | | WERN | | 79.4 | | 58.8 | % | 6.6 | % | 34.7 | % | 51.9 | | 65.3 | % | 137,674 | | 173.4 | % | 265.3 | % | 11 | |

Heartland Express, Inc. | | HTLD | | 75.0 | | 55.1 | % | 5.4 | % | 39.4 | % | 45.4 | | 60.6 | % | 83,553 | | 111.4 | % | 184.0 | % | 11 | |

Knight Transportation, Inc. | | KNX | | 56.8 | | 65.9 | % | 1.3 | % | 32.8 | % | 38.2 | | 67.2 | % | 82,918 | | 146.0 | % | 217.2 | % | 8 | |

U.S. Xpress Enterprises, Inc. | | XPRSA | | 16.3 | | 44.7 | % | 18.7 | % | 36.6 | % | 10.3 | | 63.4 | % | 52,420 | | 321.9 | % | 507.6 | % | 5 | |

Marten Transport, Ltd. | | MRTN | | 14.3 | | 61.4 | % | 8.2 | % | 30.4 | % | 10.0 | | 69.6 | % | 14,363 | | 100.4 | % | 144.2 | % | 3 | |

Celadon Group, Inc. | | CLDN | | 10.0 | | 80.0 | % | 15.0 | % | 5.0 | % | 9.5 | | 95.0 | % | 18,985 | | 189.4 | % | 199.4 | % | 5 | |

Covenant Transport | | CVTI | | 14.2 | | 63.2 | % | 0.2 | % | 36.6 | % | 9.0 | | 63.4 | % | 14,822 | | 104.2 | % | 164.4 | % | 5 | |

P.A.M. Transportation Services, Inc. | | PTSI | | 11.1 | | 54.2 | % | 1.8 | % | 44.0 | % | 6.2 | | 56.0 | % | 4,123 | | 37.0 | % | 66.1 | % | 2 | |

USA Truck, Inc. | | USAK | | 9.4 | | 43.5 | % | 12.3 | % | 44.2 | % | 5.2 | | 55.8 | % | 9,682 | | 103.5 | % | 185.7 | % | 5 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | High | | 80.0 | % | 18.7 | % | 44.2 | % | 116.4 | | 95.0 | % | 480,264 | | 397.6 | % | 518.6 | % | | |

| | | | Low | | 43.5 | % | 0.2 | % | 5.0 | % | 5.2 | | 55.8 | % | 4,123 | | 37.0 | % | 66.1 | % | | |

| | | | Mean | | 60.7 | % | 7.9 | % | 32.5 | % | 32.5 | | 67.9 | % | 107,806 | | 180.7 | % | 260.4 | % | | |

| | | | Median | | 61.4 | % | 7.4 | % | 34.7 | % | 10.3 | | 65.3 | % | 52,420 | | 146.0 | % | 199.4 | % | | |

(a) Source: Big Dough.

(b) Latest Proxy.

(c) 52-week total trading volume from 6/22/04 - 6/22/05. Source: Factset

(d) Souce: Bloomberg.

13

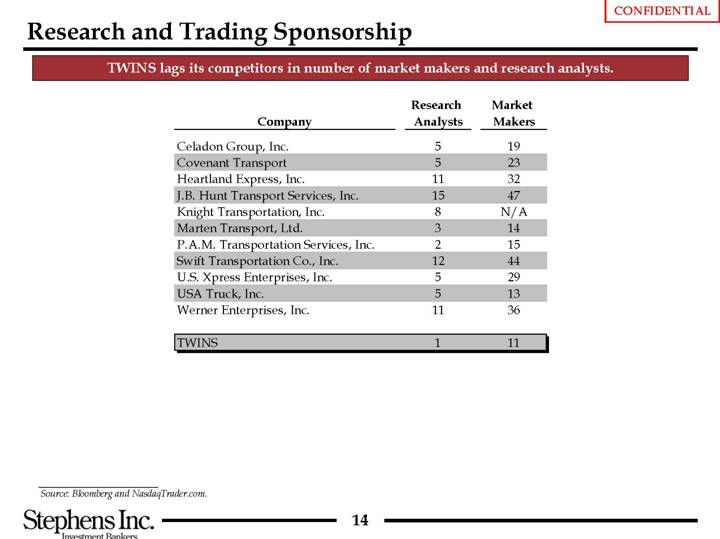

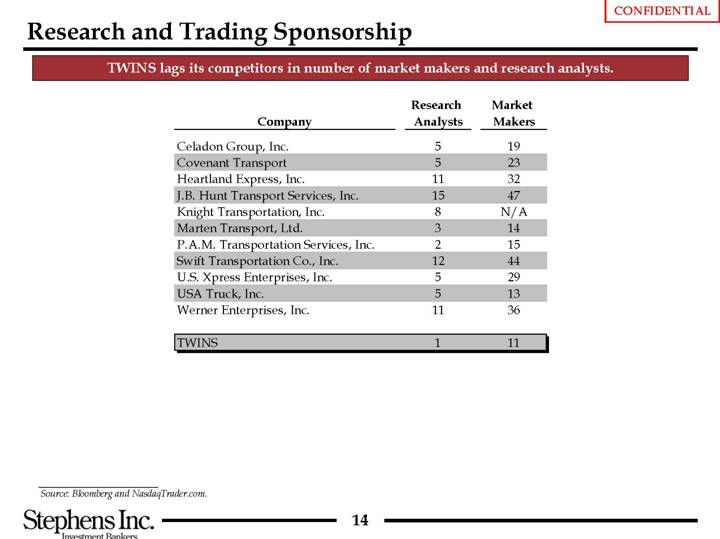

Research and Trading Sponsorship

TWINS lags its competitors in number of market makers and research analysts.

| | Research | | Market | |

Company | | Analysts | | Makers | |

Celadon Group, Inc. | | 5 | | 19 | |

Covenant Transport | | 5 | | 23 | |

Heartland Express, Inc. | | 11 | | 32 | |

J.B. Hunt Transport Services, Inc. | | 15 | | 47 | |

Knight Transportation, Inc. | | 8 | | N/A | |

Marten Transport, Ltd. | | 3 | | 14 | |

P.A.M. Transportation Services, Inc. | | 2 | | 15 | |

Swift Transportation Co., Inc. | | 12 | | 44 | |

U.S. Xpress Enterprises, Inc. | | 5 | | 29 | |

USA Truck, Inc. | | 5 | | 13 | |

Werner Enterprises, Inc. | | 11 | | 36 | |

| | | | | |

TWINS | | 1 | | 11 | |

Source: Bloomberg and NasdaqTrader.com.

14

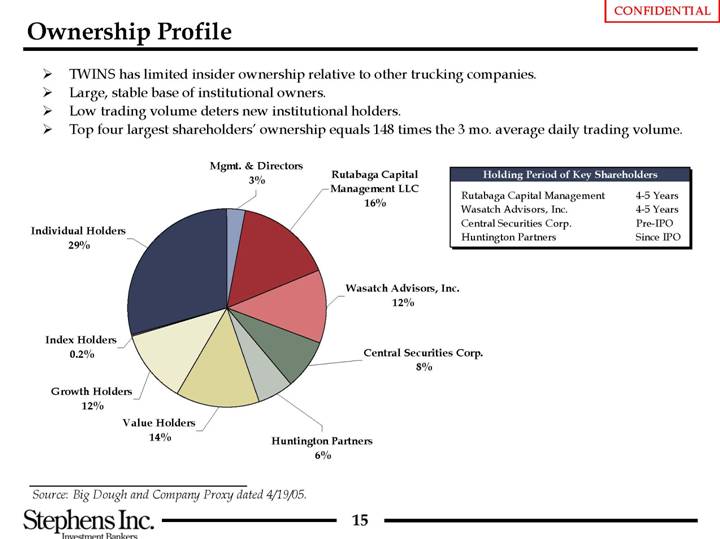

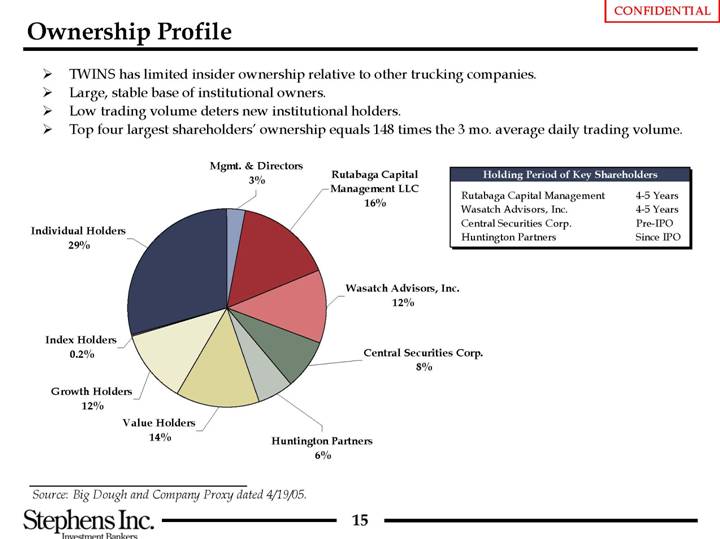

Ownership Profile

• TWINS has limited insider ownership relative to other trucking companies.

• Large, stable base of institutional owners.

• Low trading volume deters new institutional holders.

• Top four largest shareholders’ ownership equals 148 times the 3 mo. average daily trading volume.

[CHART]

Holding Period of Key Shareholders

Rutabaga Capital Management | | 4-5 Years | |

Wasatch Advisors, Inc. | | 4-5 Years | |

Central Securities Corp. | | Pre-IPO | |

Huntington Partners | | Since IPO | |

Source: Big Dough and Company Proxy dated 4/19/05.

15

II. Truckload Industry Outlook

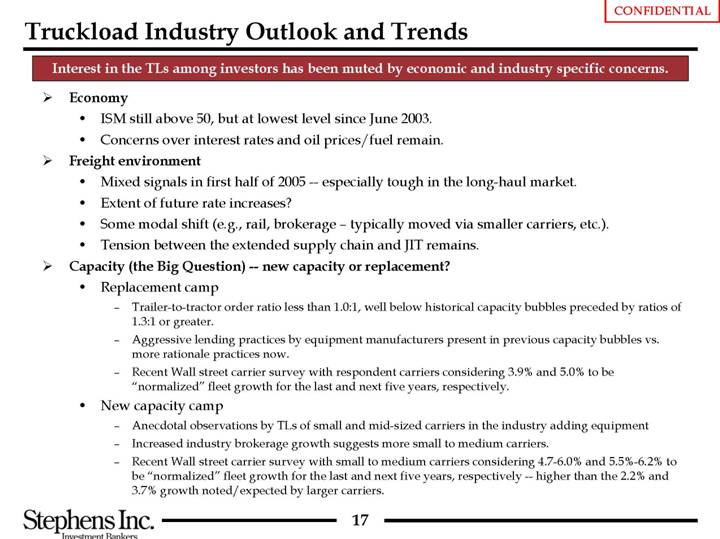

Truckload Industry Outlook and Trends

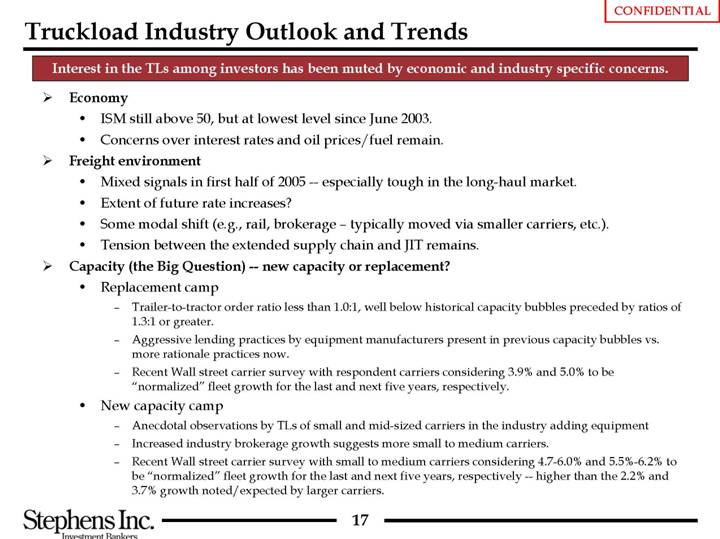

Interest in the TLs among investors has been muted by economic and industry specific concerns.

• Economy

• ISM still above 50, but at lowest level since June 2003.

• Concerns over interest rates and oil prices/fuel remain.

• Freight environment

• Mixed signals in first half of 2005 — especially tough in the long-haul market.

• Extent of future rate increases?

• Some modal shift (e.g., rail, brokerage – typically moved via smaller carriers, etc.).

• Tension between the extended supply chain and JIT remains.

• Capacity (the Big Question) — new capacity or replacement?

• Replacement camp

• Trailer-to-tractor order ratio less than 1.0:1, well below historical capacity bubbles preceded by ratios of 1.3:1 or greater.

• Aggressive lending practices by equipment manufacturers present in previous capacity bubbles vs. more rationale practices now.

• Recent Wall street carrier survey with respondent carriers considering 3.9% and 5.0% to be “normalized” fleet growth for the last and next five years, respectively.

• New capacity camp

• Anecdotal observations by TLs of small and mid-sized carriers in the industry adding equipment

• Increased industry brokerage growth suggests more small to medium carriers.

• Recent Wall street carrier survey with small to medium carriers considering 4.7-6.0% and 5.5%-6.2% to be “normalized” fleet growth for the last and next five years, respectively — higher than the 2.2% and 3.7% growth noted/expected by larger carriers.

[LOGO]

17

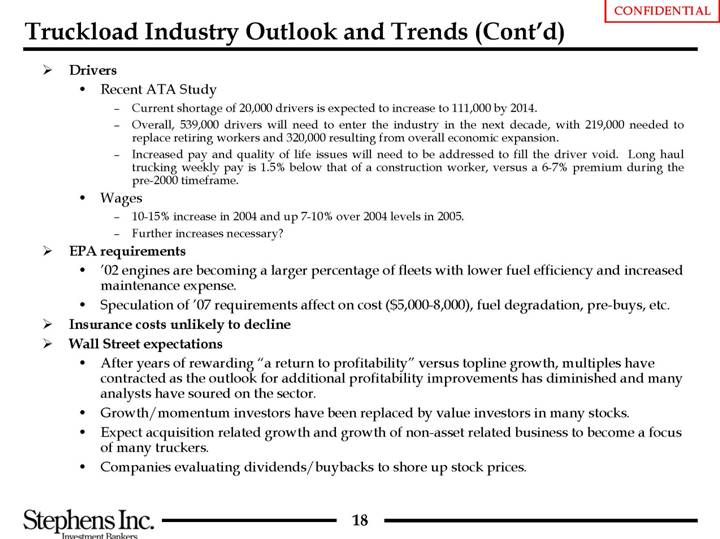

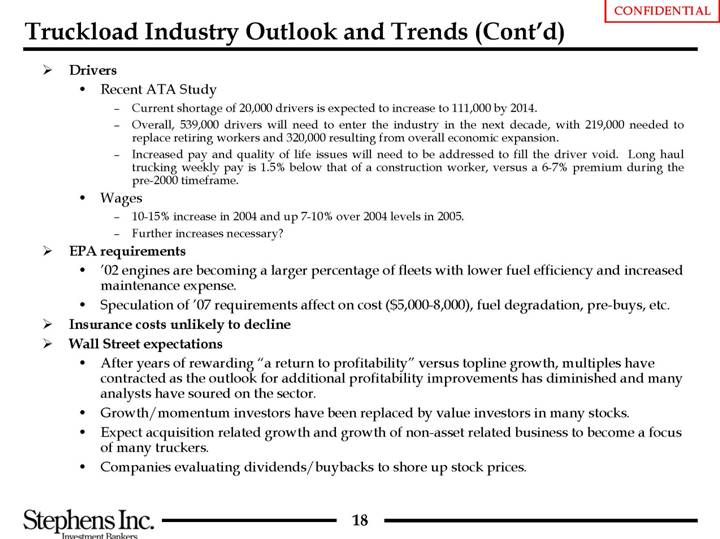

• Drivers

• Recent ATA Study

• Current shortage of 20,000 drivers is expected to increase to 111,000 by 2014.

• Overall, 539,000 drivers will need to enter the industry in the next decade, with 219,000 needed to replace retiring workers and 320,000 resulting from overall economic expansion.

• Increased pay and quality of life issues will need to be addressed to fill the driver void. Long haul trucking weekly pay is 1.5% below that of a construction worker, versus a 6-7% premium during the pre-2000 timeframe.

• Wages

• 10-15% increase in 2004 and up 7-10% over 2004 levels in 2005.

• Further increases necessary?

• EPA requirements

• ’02 engines are becoming a larger percentage of fleets with lower fuel efficiency and increased maintenance expense.

• Speculation of ’07 requirements affect on cost ($5,000-8,000), fuel degradation, pre-buys, etc.

• Insurance costs unlikely to decline

• Wall Street expectations

• After years of rewarding “a return to profitability” versus topline growth, multiples have contracted as the outlook for additional profitability improvements has diminished and many analysts have soured on the sector.

• Growth/momentum investors have been replaced by value investors in many stocks.

• Expect acquisition related growth and growth of non-asset related business to become a focus of many truckers.

• Companies evaluating dividends/buybacks to shore up stock prices.

18

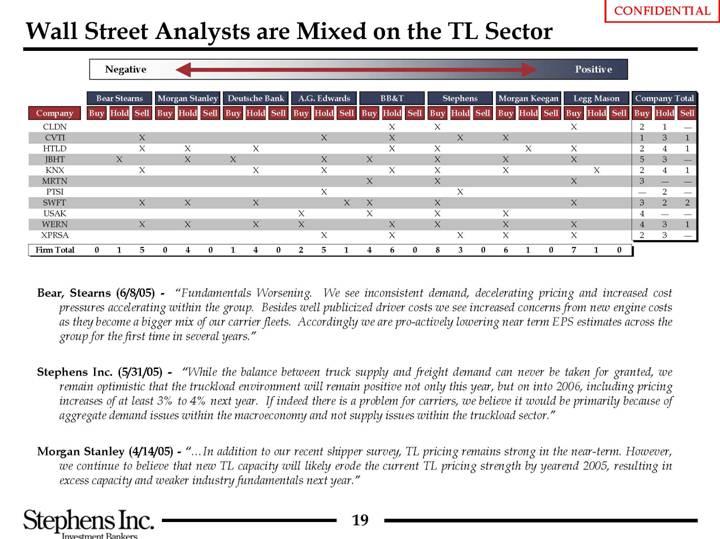

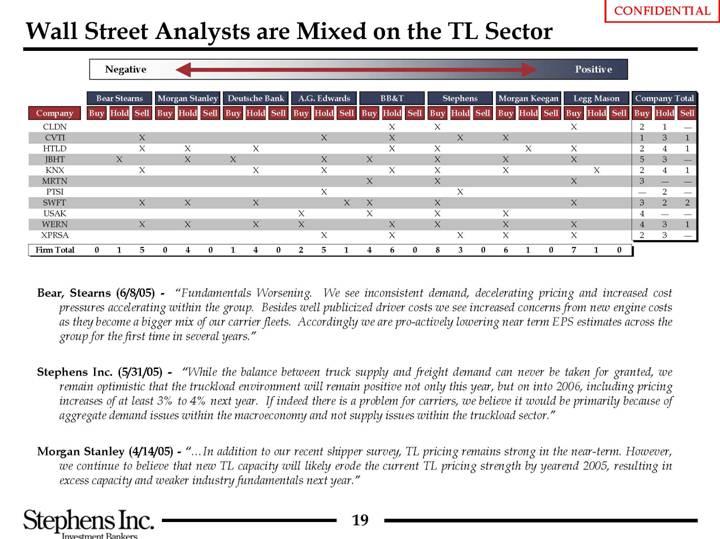

Wall Street Analysts are Mixed on the TL Sector

| | Bear Stearns | | Morgan Stanley | | Deutsche Bank | | A.G. Edwards | |

Company | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | |

CLDN | | | | | | | | | | | | | | | | | | | | | | | | | |

CVTI | | | | | | X | | | | | | | | | | | | | | | | X | | | |

HTLD | | | | | | X | | | | X | | | | | | X | | | | | | | | | |

JBHT | | | | X | | | | | | X | | | | X | | | | | | | | X | | | |

KNX | | | | | | X | | | | | | | | | | X | | | | | | X | | | |

MRTN | | | | | | | | | | | | | | | | | | | | | | | | | |

PTSI | | | | | | | | | | | | | | | | | | | | | | X | | | |

SWFT | | | | | | X | | | | X | | | | | | X | | | | | | | | | |

USAK | | | | | | | | | | | | | | | | | | | | X | | | | | |

WERN | | | | | | X | | | | X | | | | | | X | | | | X | | | | | |

XPRSA | | | | | | | | | | | | | | | | | | | | | | X | | | |

Firm Total | | 0 | | 1 | | 5 | | 0 | | 4 | | 0 | | 1 | | 4 | | 0 | | 2 | | 5 | | 1 | |

| | BB&T | | Stephens | | Morgan Keegan | | Legg Mason | | Company Total | |

Company | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | | Buy | | Hold | | Sell | |

CLDN | | | | X | | | | X | | | | | | | | | | | | X | | | | | | 2 | | 1 | | — | |

CVTI | | | | X | | | | | | X | | | | X | | | | | | | | | | | | 1 | | 3 | | 1 | |

HTLD | | | | X | | | | X | | | | | | | | X | | | | X | | | | | | 2 | | 4 | | 1 | |

JBHT | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | 5 | | 3 | | — | |

KNX | | | | X | | | | X | | | | | | X | | | | | | | | X | | | | 2 | | 4 | | 1 | |

MRTN | | X | | | | | | X | | | | | | | | | | | | X | | | | | | 3 | | — | | — | |

PTSI | | | | | | | | | | X | | | | | | | | | | | | | | | | — | | 2 | | — | |

SWFT | | X | | | | | | X | | | | | | | | | | | | X | | | | | | 3 | | 2 | | 2 | |

USAK | | X | | | | | | X | | | | | | X | | | | | | | | | | | | 4 | | — | | — | |

WERN | | | | X | | | | X | | | | | | X | | | | | | X | | | | | | 4 | | 3 | | 1 | |

XPRSA | | | | X | | | | | | X | | | | X | | | | | | X | | | | | | 2 | | 3 | | — | |

Firm Total | | 4 | | 6 | | 0 | | 8 | | 3 | | 0 | | 6 | | 1 | | 0 | | 7 | | 1 | | 0 | | | | | | | |

Bear, Stearns (6/8/05) - “Fundamentals Worsening. We see inconsistent demand, decelerating pricing and increased cost pressures accelerating within the group. Besides well publicized driver costs we see increased concerns from new engine costs as they become a bigger mix of our carrier fleets. Accordingly we are pro-actively lowering near term EPS estimates across the group for the first time in several years.”

Stephens Inc. (5/31/05) - “While the balance between truck supply and freight demand can never be taken for granted, we remain optimistic that the truckload environment will remain positive not only this year, but on into 2006, including pricing increases of at least 3% to 4% next year. If indeed there is a problem for carriers, we believe it would be primarily because of aggregate demand issues within the macroeconomy and not supply issues within the truckload sector.”

Morgan Stanley (4/14/05) - “…In addition to our recent shipper survey, TL pricing remains strong in the near-term. However, we continue to believe that new TL capacity will likely erode the current TL pricing strength by yearend 2005, resulting in excess capacity and weaker industry fundamentals next year.”

19

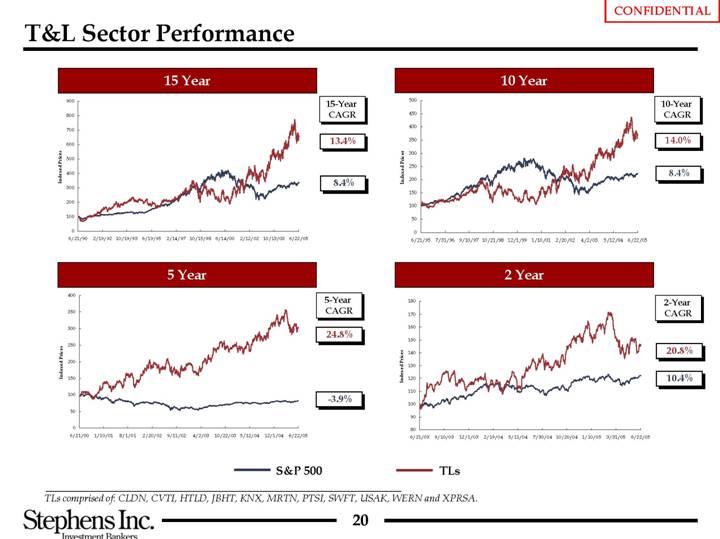

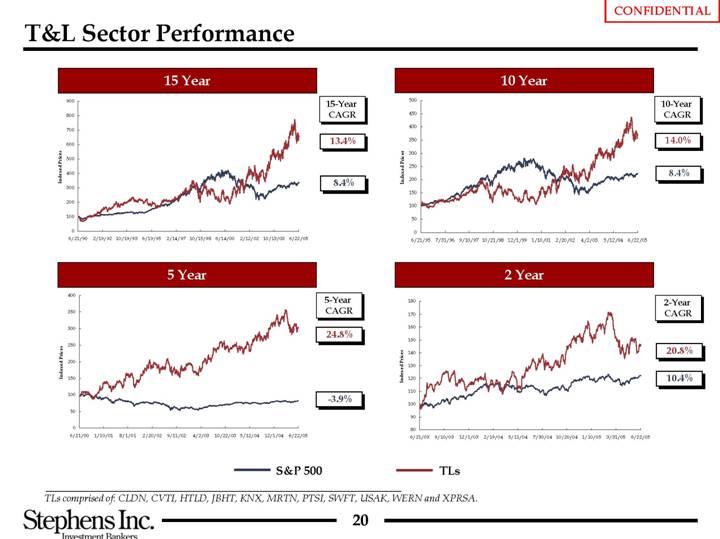

T&L Sector Performance

15 Year

[CHART]

10 Year

[CHART]

5 Year

[CHART]

2 Year

[CHART]

TLs comprised of: CLDN, CVTI, HTLD, JBHT, KNX, MRTN, PTSI, SWFT, USAK, WERN and XPRSA.

20

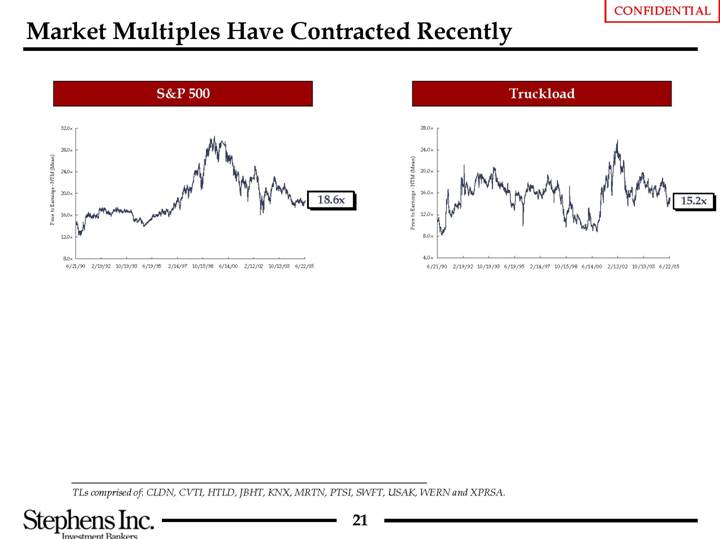

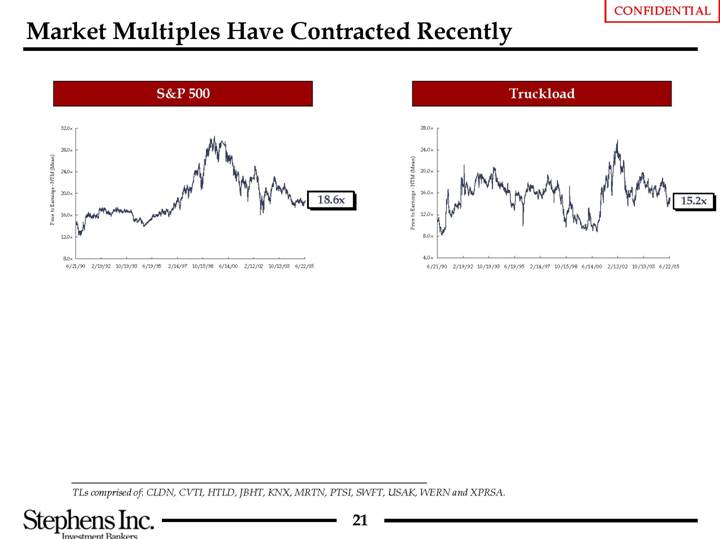

Market Multiples Have Contracted Recently

S&P 500

[CHART]

Truckload

[CHART]

TLs comprised of: CLDN, CVTI, HTLD, JBHT, KNX, MRTN, PTSI, SWFT, USAK, WERN and XPRSA.

21

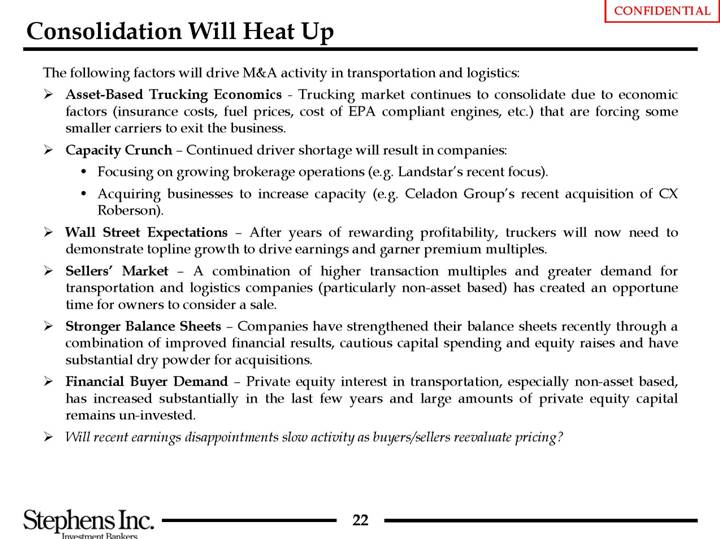

Consolidation Will Heat Up

The following factors will drive M&A activity in transportation and logistics:

• Asset-Based Trucking Economics - Trucking market continues to consolidate due to economic factors (insurance costs, fuel prices, cost of EPA compliant engines, etc.) that are forcing some smaller carriers to exit the business.

• Capacity Crunch – Continued driver shortage will result in companies:

• Focusing on growing brokerage operations (e.g. Landstar’s recent focus).

• Acquiring businesses to increase capacity (e.g. Celadon Group’s recent acquisition of CX Roberson).

• Wall Street Expectations – After years of rewarding profitability, truckers will now need to demonstrate topline growth to drive earnings and garner premium multiples.

• Sellers’ Market – A combination of higher transaction multiples and greater demand for transportation and logistics companies (particularly non-asset based) has created an opportune time for owners to consider a sale.

• Stronger Balance Sheets – Companies have strengthened their balance sheets recently through a combination of improved financial results, cautious capital spending and equity raises and have substantial dry powder for acquisitions.

• Financial Buyer Demand – Private equity interest in transportation, especially non-asset based, has increased substantially in the last few years and large amounts of private equity capital remains un-invested.

• Will recent earnings disappointments slow activity as buyers/sellers reevaluate pricing?

22

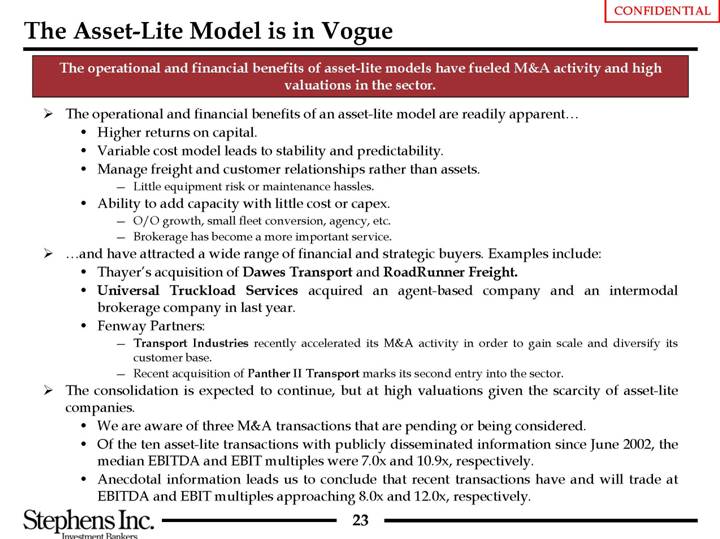

The Asset-Lite Model is in Vogue

The operational and financial benefits of asset-lite models have fueled M&A activity and high valuations in the sector.

• The operational and financial benefits of an asset-lite model are readily apparent…

• Higher returns on capital.

• Variable cost model leads to stability and predictability.

• Manage freight and customer relationships rather than assets.

• Little equipment risk or maintenance hassles.

• Ability to add capacity with little cost or capex.

• O/O growth, small fleet conversion, agency, etc.

• Brokerage has become a more important service.

• …and have attracted a wide range of financial and strategic buyers. Examples include:

• Thayer’s acquisition of Dawes Transport and RoadRunner Freight.

• Universal Truckload Services acquired an agent-based company and an intermodal brokerage company in last year.

• Fenway Partners:

• Transport Industries recently accelerated its M&A activity in order to gain scale and diversify its customer base.

• Recent acquisition of Panther II Transport marks its second entry into the sector.

• The consolidation is expected to continue, but at high valuations given the scarcity of asset-lite companies.

• We are aware of three M&A transactions that are pending or being considered.

• Of the ten asset-lite transactions with publicly disseminated information since June 2002, the median EBITDA and EBIT multiples were 7.0x and 10.9x, respectively.

• Anecdotal information leads us to conclude that recent transactions have and will trade at EBITDA and EBIT multiples approaching 8.0x and 12.0x, respectively.

23

III. Overview of Strategic Alternatives

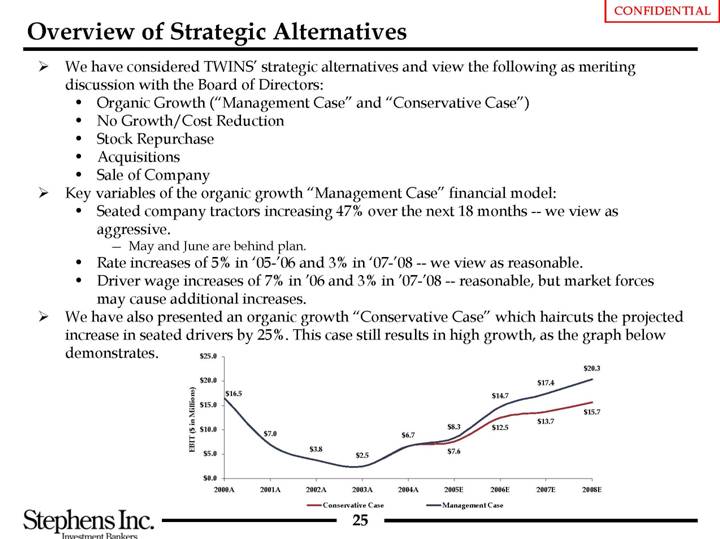

Overview of Strategic Alternatives

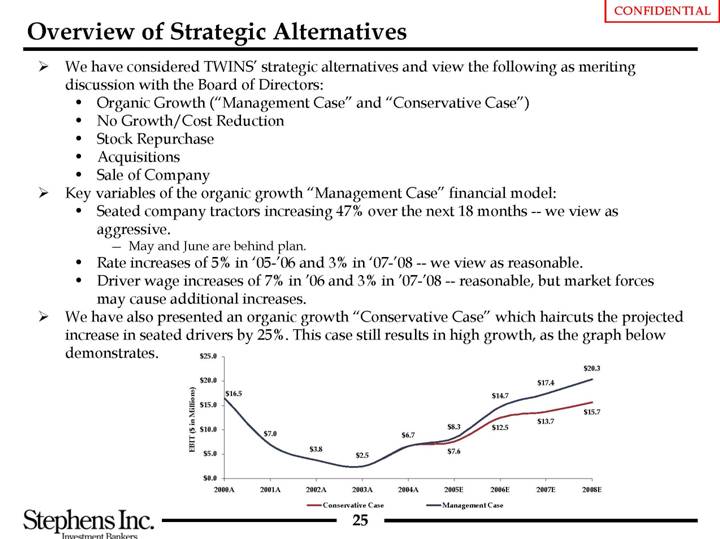

• We have considered TWINS’ strategic alternatives and view the following as meriting discussion with the Board of Directors:

• Organic Growth (“Management Case” and “Conservative Case”)

• No Growth/Cost Reduction

• Stock Repurchase

• Acquisitions

• Sale of Company

• Key variables of the organic growth “Management Case” financial model:

• Seated company tractors increasing 47% over the next 18 months — we view as aggressive.

• May and June are behind plan.

• Rate increases of 5% in ’05-’06 and 3% in ’07-’08 - -- we view as reasonable.

• Driver wage increases of 7% in ‘06 and 3% in ’07-’08 - -- reasonable, but market forces may cause additional increases.

• We have also presented an organic growth “Conservative Case” which haircuts the projected increase in seated drivers by 25%. This case still results in high growth, as the graph below demonstrates.

[CHART]

25

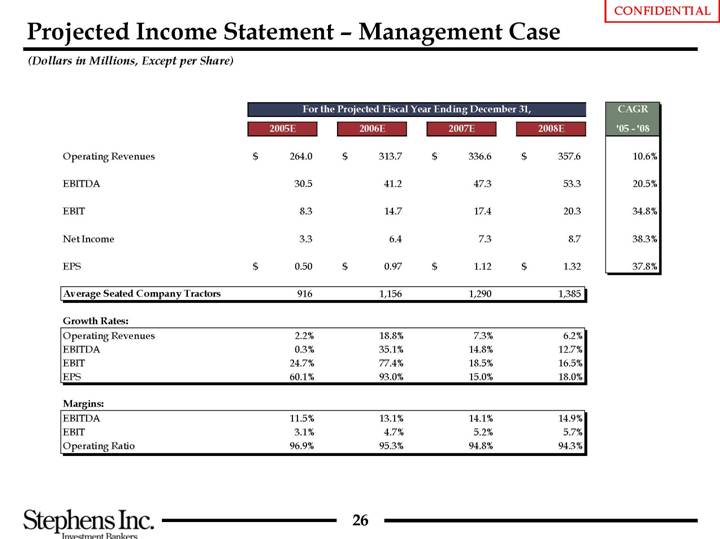

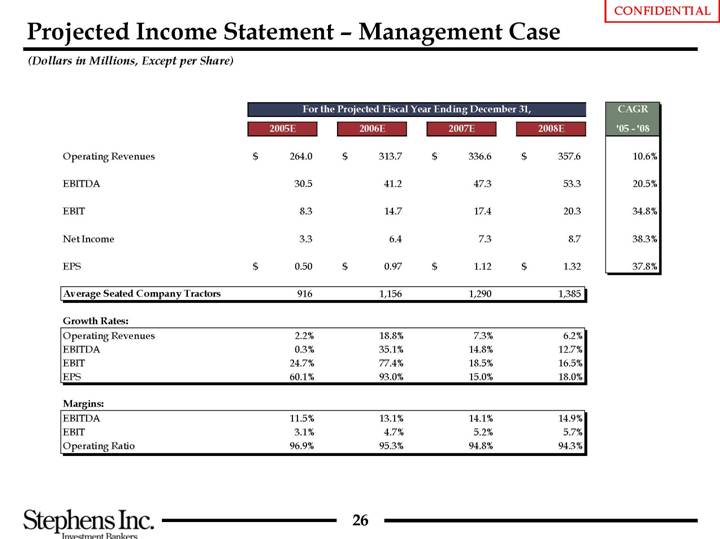

Projected Income Statement – Management Case

(Dollars in Millions, Except per Share)

| | For the Projected Fiscal Year Ending December 31, | | CAGR | |

| | 2005E | | 2006E | | 2007E | | 2008E | | ’05 - ’08 | |

| | | | | | | | | | | |

Operating Revenues | | $ | 264.0 | | $ | 313.7 | | $ | 336.6 | | $ | 357.6 | | $ | 10.6 | % |

| | | | | | | | | | | |

EBITDA | | 30.5 | | 41.2 | | 47.3 | | 53.3 | | 20.5 | % |

| | | | | | | | | | | |

EBIT | | 8.3 | | 14.7 | | 17.4 | | 20.3 | | 34.8 | % |

| | | | | | | | | | | |

Net Income | | 3.3 | | 6.4 | | 7.3 | | 8.7 | | 38.3 | % |

| | | | | | | | | | | |

EPS | | $ | 0.50 | | $ | 0.97 | | $ | 1.12 | | $ | 1.32 | | $ | 37.8 | % |

| | | | | | | | | | | |

Average Seated Company Tractors | | 916 | | 1,156 | | 1,290 | | 1,385 | | | |

| | | | | | | | | | | |

Growth Rates: | | | | | | | | | | | |

| | | | | | | | | | | |

Operating Revenues | | 2.2 | % | 18.8 | % | 7.3 | % | 6.2 | % | | |

EBITDA | | 0.3 | % | 35.1 | % | 14.8 | % | 12.7 | % | | |

EBIT | | 24.7 | % | 77.4 | % | 18.5 | % | 16.5 | % | | |

EPS | | 60.1 | % | 93.0 | % | 15.0 | % | 18.0 | % | | |

| | | | | | | | | | | |

Margins: | | | | | | | | | | | |

| | | | | | | | | | | |

EBITDA | | 11.5 | % | 13.1 | % | 14.1 | % | 14.9 | % | | |

EBIT | | 3.1 | % | 4.7 | % | 5.2 | % | 5.7 | % | | |

Operating Ratio | | 96.9 | % | 95.3 | % | 94.8 | % | 94.3 | % | | |

26

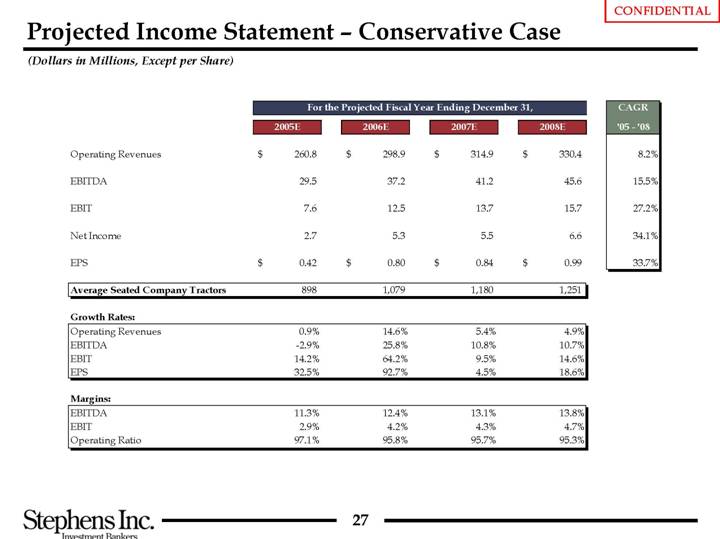

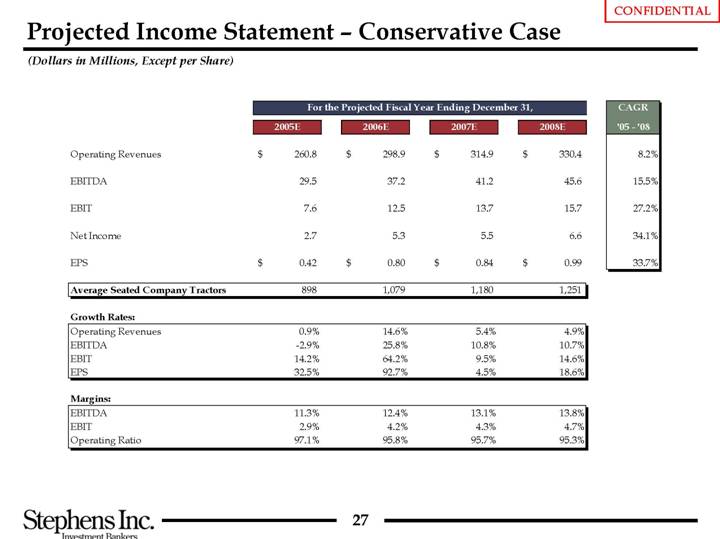

Projected Income Statement – Conservative Case

(Dollars in Millions, Except per Share)

| | For the Projected Fiscal Year Ending December 31, | | CAGR | |

| | 2005E | | 2006E | | 2007E | | 2008E | | ’05 - ’08 | |

| | | | | | | | | | | |

Operating Revenues | | $ | 260.8 | | $ | 298.9 | | $ | 314.9 | | $ | 330.4 | | $ | 8.2 | % |

| | | | | | | | | | | |

EBITDA | | 29.5 | | 37.2 | | 41.2 | | 45.6 | | 15.5 | % |

| | | | | | | | | | | |

EBIT | | 7.6 | | 12.5 | | 13.7 | | 15.7 | | 27.2 | % |

| | | | | | | | | | | |

Net Income | | 2.7 | | 5.3 | | 5.5 | | 6.6 | | 34.1 | % |

| | | | | | | | | | | |

EPS | | $ | 0.42 | | $ | 0.80 | | $ | 0.84 | | $ | 0.99 | | $ | 33.7 | % |

| | | | | | | | | | | |

Average Seated Company Tractors | | 898 | | 1,079 | | 1,180 | | 1,251 | | | |

| | | | | | | | | | | |

Growth Rates: | | | | | | | | | | | |

| | | | | | | | | | | |

Operating Revenues | | 0.9 | % | 14.6 | % | 5.4 | % | 4.9 | % | | |

EBITDA | | -2.9 | % | 25.8 | % | 10.8 | % | 10.7 | % | | |

EBIT | | 14.2 | % | 64.2 | % | 9.5 | % | 14.6 | % | | |

EPS | | 32.5 | % | 92.7 | % | 4.5 | % | 18.6 | % | | |

| | | | | | | | | | | |

Margins: | | | | | | | | | | | |

| | | | | | | | | | | |

EBITDA | | 11.3 | % | 12.4 | % | 13.1 | % | 13.8 | % | | |

EBIT | | 2.9 | % | 4.2 | % | 4.3 | % | 4.7 | % | | |

Operating Ratio | | 97.1 | % | 95.8 | % | 95.7 | % | 95.3 | % | | |

27

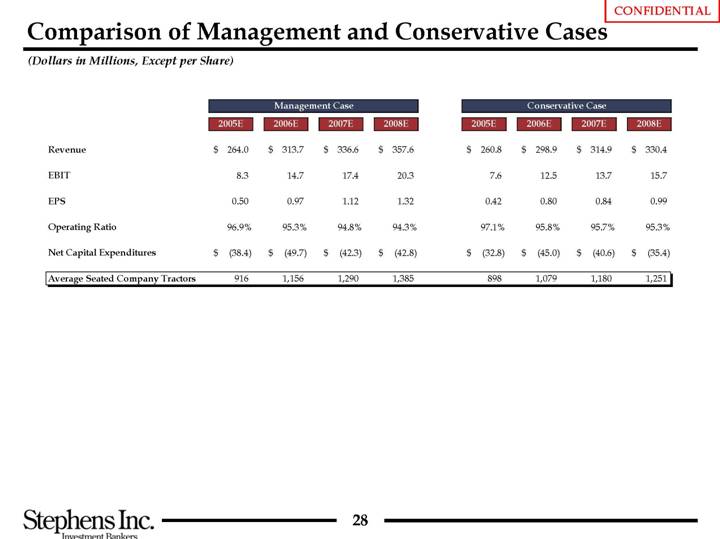

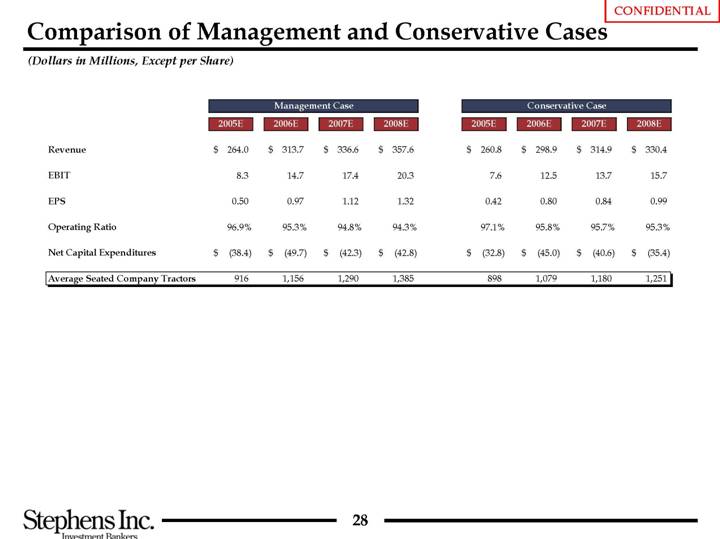

Comparison of Management and Conservative Cases

(Dollars in Millions, Except per Share)

| | Management Case | | Conservative Case | |

| | 2005E | | 2006E | | 2007E | | 2008E | | 2005E | | 2006E | | 2007E | | 2008E | |

| | | | | | | | | | | | | | | | | |

Revenue | | $ | 264.0 | | $ | 313.7 | | $ | 336.6 | | $ | 357.6 | | $ | 260.8 | | $ | 298.9 | | $ | 314.9 | | $ | 330.4 | |

| | | | | | | | | | | | | | | | | |

EBIT | | 8.3 | | 14.7 | | 17.4 | | 20.3 | | 7.6 | | 12.5 | | 13.7 | | 15.7 | |

| | | | | | | | | | | | | | | | | |

EPS | | 0.50 | | 0.97 | | 1.12 | | 1.32 | | 0.42 | | 0.80 | | 0.84 | | 0.99 | |

| | | | | | | | | | | | | | | | | |

Operating Ratio | | 96.9 | % | 95.3 | % | 94.8 | % | 94.3 | % | 97.1 | % | 95.8 | % | 95.7 | % | 95.3 | % |

| | | | | | | | | | | | | | | | | |

Net Capital Expenditures | | $ | (38.4 | ) | $ | (49.7 | ) | $ | (42.3 | ) | $ | (42.8 | ) | $ | (32.8 | ) | $ | (45.0 | ) | $ | (40.6 | ) | $ | (35.4 | ) |

| | | | | | | | | | | | | | | | | |

Average Seated Company Tractors | | 916 | | 1,156 | | 1,290 | | 1,385 | | 898 | | 1,079 | | 1,180 | | 1,251 | |

28

A. Organic Growth

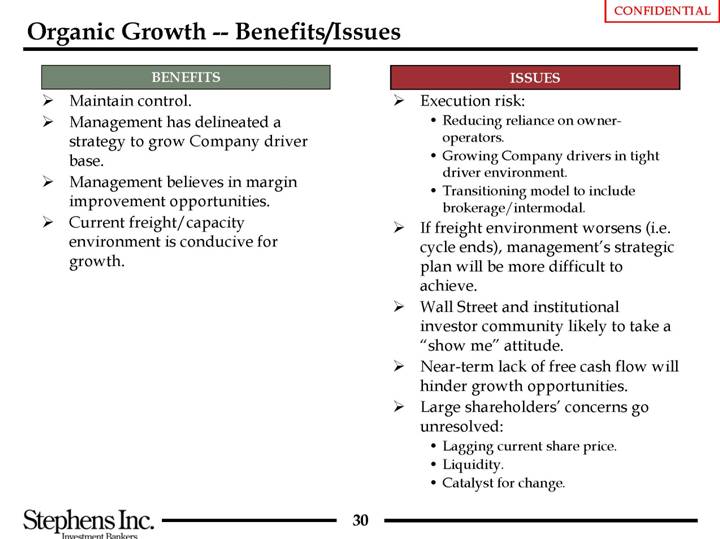

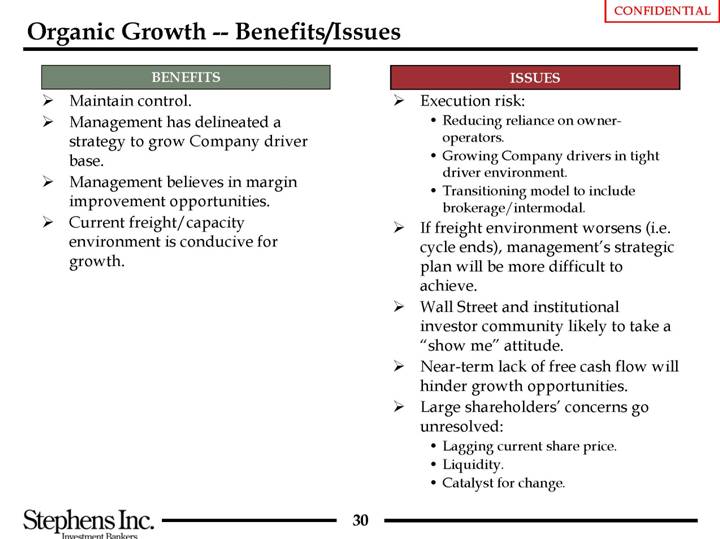

Organic Growth — Benefits/Issues

BENEFITS

• Maintain control.

• Management has delineated a strategy to grow Company driver base.

• Management believes in margin improvement opportunities.

• Current freight/capacity environment is conducive for growth.

ISSUES

• Execution risk:

• Reducing reliance on owner operators.

• Growing Company drivers in tight driver environment.

• Transitioning model to include brokerage/intermodal.

• If freight environment worsens (i.e. cycle ends), management’s strategic plan will be more difficult to achieve.

• Wall Street and institutional investor community likely to take a “show me” attitude.

• Near-term lack of free cash flow will hinder growth opportunities.

• Large shareholders’ concerns go unresolved:

• Lagging current share price.

• Liquidity.

• Catalyst for change.

30

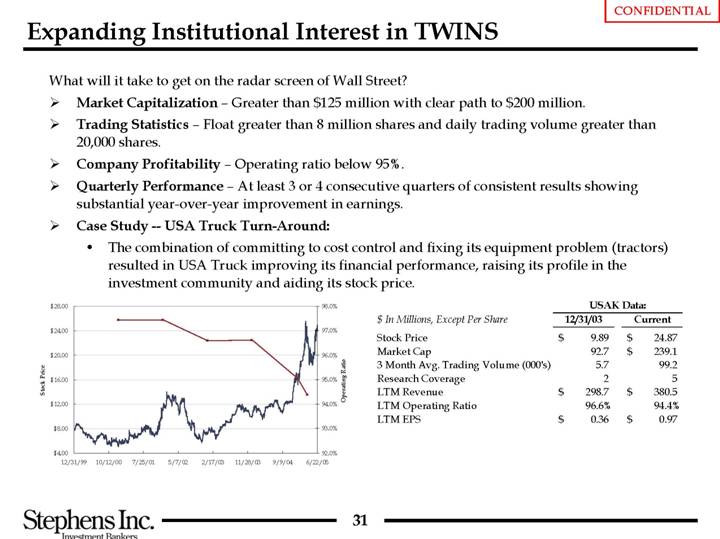

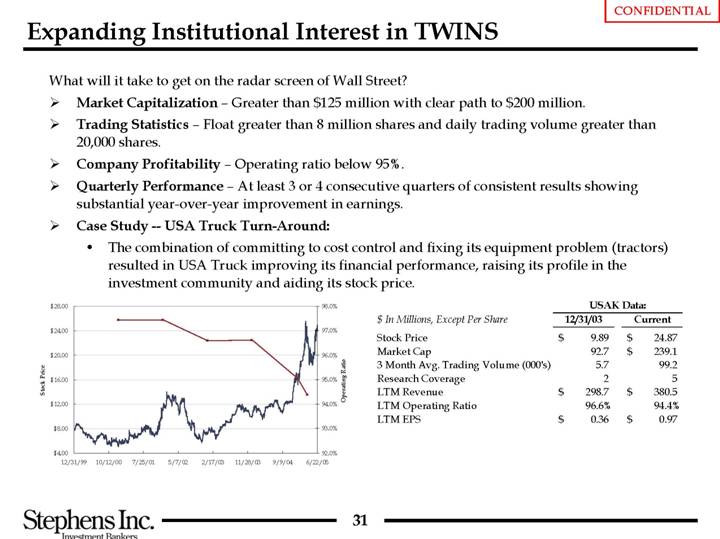

Expanding Institutional Interest in TWINS

What will it take to get on the radar screen of Wall Street?

• Market Capitalization – Greater than $125 million with clear path to $200 million.

• Trading Statistics – Float greater than 8 million shares and daily trading volume greater than 20,000 shares.

• Company Profitability – Operating ratio below 95%.

• Quarterly Performance – At least 3 or 4 consecutive quarters of consistent results showing substantial year-over-year improvement in earnings.

• Case Study — USA Truck Turn-Around:

• The combination of committing to cost control and fixing its equipment problem (tractors) resulted in USA Truck improving its financial performance, raising its profile in the investment community and aiding its stock price.

[CHART]

| | USAK Data: | |

$ In Millions, Except Per Share | | 12/31/03 | | Current | |

Stock Price | | $ | 9.89 | | $ | 24.87 | |

Market Cap | | 92.7 | | $ | 239.1 | |

3 Month Avg. Trading Volume (000’s) | | 5.7 | | 99.2 | |

Research Coverage | | 2 | | 5 | |

LTM Revenue | | $ | 298.7 | | $ | 380.5 | |

LTM Operating Ratio | | 96.6 | % | 94.4 | % |

LTM EPS | | $ | 0.36 | | $ | 0.97 | |

31

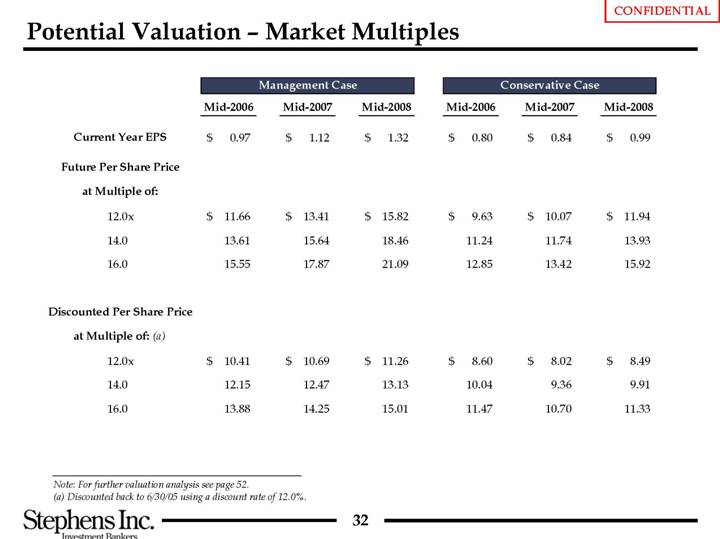

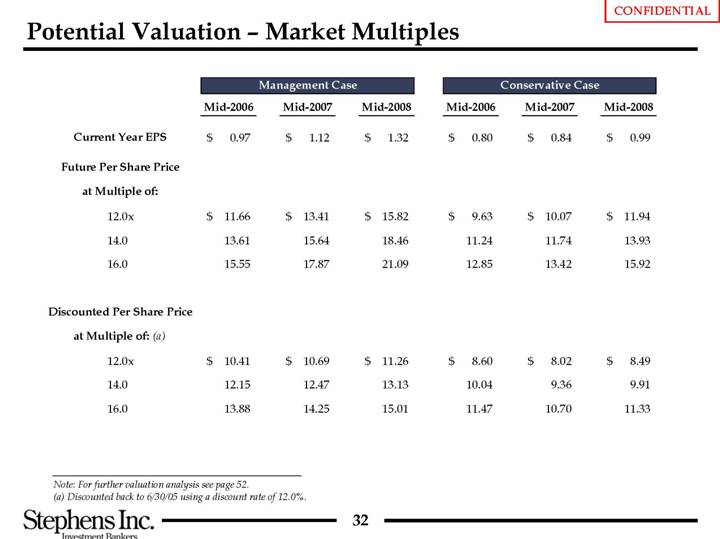

Potential Valuation – Market Multiples

| | Management Case | | Conservative Case | |

| | Mid-2006 | | Mid-2007 | | Mid-2008 | | Mid-2006 | | Mid-2007 | | Mid-2008 | |

| | | | | | | | | | | | | |

Current Year EPS | | $ | 0.97 | | $ | 1.12 | | $ | 1.32 | | $ | 0.80 | | $ | 0.84 | | $ | 0.99 | |

| | | | | | | | | | | | | |

Future Per Share Price at Multiple of: | | | | | | | | | | | | | |

12.0 | x | | $ | 11.66 | | $ | 13.41 | | $ | 15.82 | | $ | 9.63 | | $ | 10.07 | | $ | 11.94 | |

14.0 | | | 13.61 | | 15.64 | | 18.46 | | 11.24 | | 11.74 | | 13.93 | |

16.0 | | | 15.55 | | 17.87 | | 21.09 | | 12.85 | | 13.42 | | 15.92 | |

| | | | | | | | | | | | | |

Discounted Per Share Price at Multiple of: (a) | | | | | | | | | | | | | |

12.0 | x | | $ | 10.41 | | $ | 10.69 | | $ | 11.26 | | $ | 8.60 | | $ | 8.02 | | $ | 8.49 | |

14.0 | | | 12.15 | | 12.47 | | 13.13 | | 10.04 | | 9.36 | | 9.91 | |

16.0 | | | 13.88 | | 14.25 | | 15.01 | | 11.47 | | 10.70 | | 11.33 | |

Note: For further valuation analysis see page 52.

(a) Discounted back to 6/30/05 using a discount rate of 12.0%.

32

B. No Growth/Cost Reduction

(handouts to be distributed at meeting)

C. Stock Repurchase

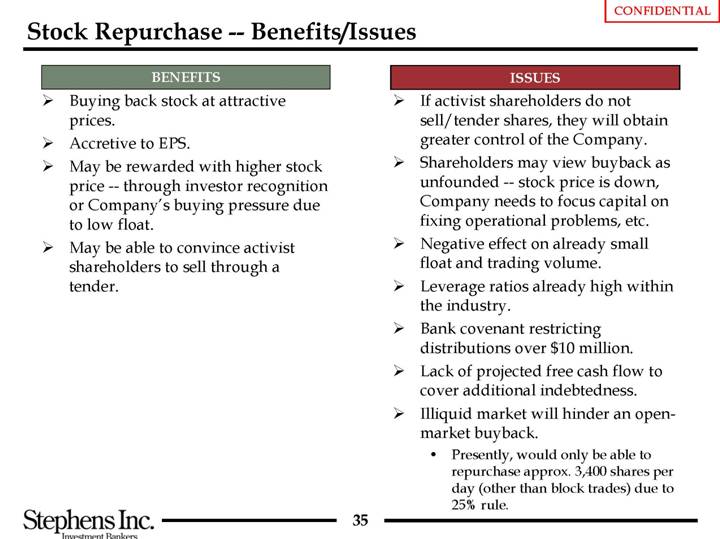

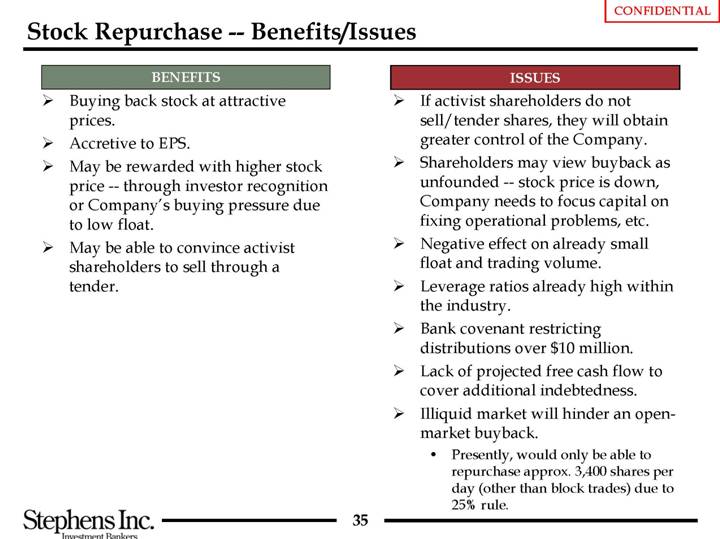

Stock Repurchase — Benefits/Issues

BENEFITS

• Buying back stock at attractive prices.

• Accretive to EPS.

• May be rewarded with higher stock price — through investor recognition or Company’s buying pressure due to low float.

• May be able to convince activist shareholders to sell through a tender.

ISSUES

• If activist shareholders do not sell/tender shares, they will obtain greater control of the Company.

• Shareholders may view buyback as unfounded — stock price is down, Company needs to focus capital on fixing operational problems, etc.

• Negative effect on already small float and trading volume.

• Leverage ratios already high within the industry.

• Bank covenant restricting distributions over $10 million.

• Lack of projected free cash flow to cover additional indebtedness.

• Illiquid market will hinder an open-market buyback.

• Presently, would only be able to repurchase approx. 3,400 shares per day (other than block trades) due to 25% rule.

35

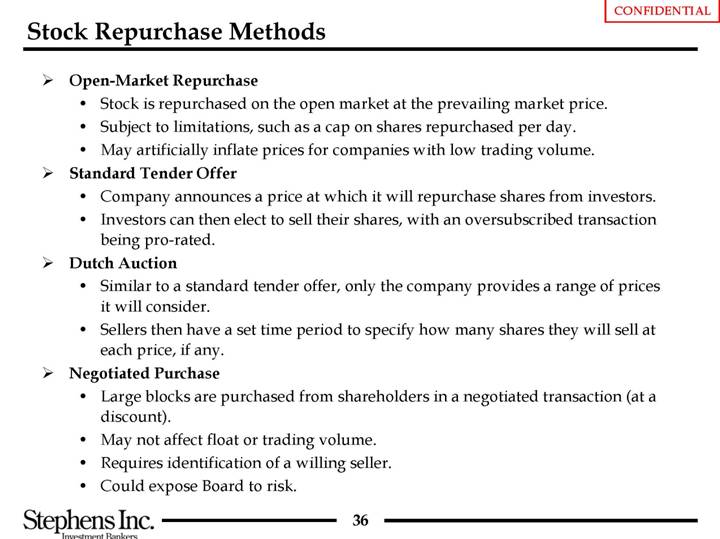

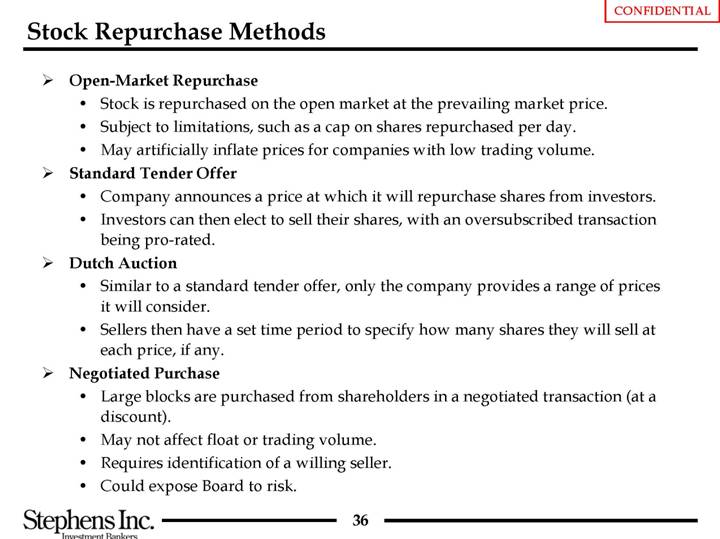

Stock Repurchase Methods

• Open-Market Repurchase

• Stock is repurchased on the open market at the prevailing market price.

• Subject to limitations, such as a cap on shares repurchased per day.

• May artificially inflate prices for companies with low trading volume.

• Standard Tender Offer

• Company announces a price at which it will repurchase shares from investors.

• Investors can then elect to sell their shares, with an oversubscribed transaction being pro-rated.

• Dutch Auction

• Similar to a standard tender offer, only the company provides a range of prices it will consider.

• Sellers then have a set time period to specify how many shares they will sell at each price, if any.

• Negotiated Purchase

• Large blocks are purchased from shareholders in a negotiated transaction (at a discount).

• May not affect float or trading volume.

• Requires identification of a willing seller.

• Could expose Board to risk.

36

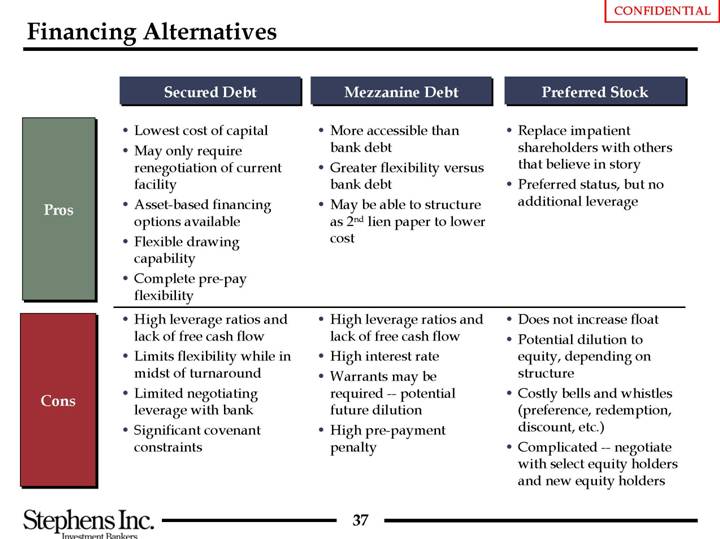

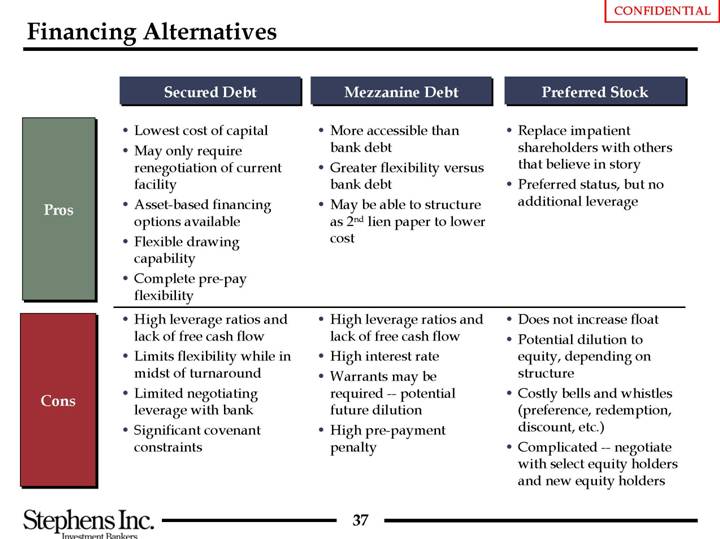

Financing Alternatives

| | Secured Debt | | Mezzanine Debt | | Preferred Stock |

| | | | | | |

Pros | | • Lowest cost of capital • May only require renegotiation of current facility • Asset-based financing options available • Flexible drawing capability • Complete pre-pay flexibility | | • More accessible than bank debt • Greater flexibility versus bank debt • May be able to structure as 2nd lien paper to lower cost | | • Replace impatient shareholders with others that believe in story • Preferred status, but no additional leverage |

| | | | | | |

Cons | | • High leverage ratios and lack of free cash flow • Limits flexibility while in midst of turnaround • Limited negotiating leverage with bank • Significant covenant constraints | | • High leverage ratios and lack of free cash flow • High interest rate • Warrants may be required — potential future dilution • High pre-payment penalty | | • Does not increase float • Potential dilution to equity, depending on structure • Costly bells and whistles (preference, redemption, discount, etc.) • Complicated — negotiate with select equity holders and new equity holders |

37

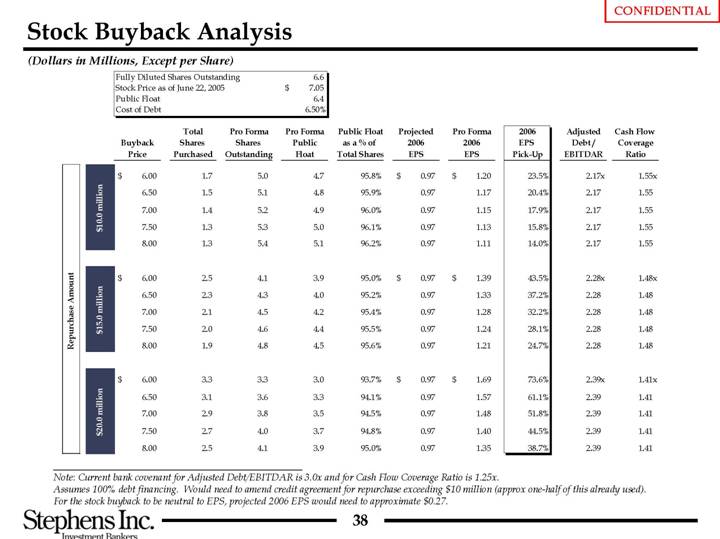

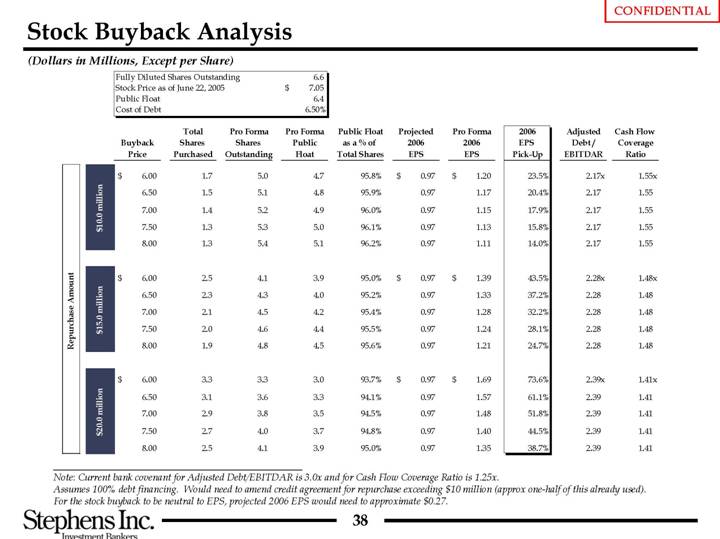

Stock Buyback Analysis

(Dollars in Millions, Except per Share)

Fully Diluted Shares Outstanding | | 6.6 | |

Stock Price as of June 22, 2005 | | $ | 7.05 | |

Public Float | | 6.4 | |

Cost of Debt | | 6.50 | % |

| | | | |

| | | | Total | | Pro Forma | | Pro Forma | | Public Float | | Projected | | Pro Forma | | 2006 | | Adjusted | | Cash Flow | |

| | Buyback | | Shares | | Shares | | Public | | as a % of | | 2006 | | 2006 | | EPS | | Debt / | | Coverage | |

| | Price | | Purchased | | Outstanding | | Float | | Total Shares | | EPS | | EPS | | Pick-Up | | EBITDAR | | Ratio | |

Repurchase Amount | | | | | | | | | | | | | | | | | | | | | |

$10.0 million | | $ | 6.00 | | 1.7 | | 5.0 | | 4.7 | | 95.8 | % | $ | 0.97 | | $ | 1.20 | | 23.5 | % | 2.17 | x | 1.55 | x |

| | 6.50 | | 1.5 | | 5.1 | | 4.8 | | 95.9 | % | 0.97 | | 1.17 | | 20.4 | % | 2.17 | | 1.55 | |

| | 7.00 | | 1.4 | | 5.2 | | 4.9 | | 96.0 | % | 0.97 | | 1.15 | | 17.9 | % | 2.17 | | 1.55 | |

| | 7.50 | | 1.3 | | 5.3 | | 5.0 | | 96.1 | % | 0.97 | | 1.13 | | 15.8 | % | 2.17 | | 1.55 | |

| | 8.00 | | 1.3 | | 5.4 | | 5.1 | | 96.2 | % | 0.97 | | 1.11 | | 14.0 | % | 2.17 | | 1.55 | |

| | | | | | | | | | | | | | | | | | | | | |

$15.0 million | | $ | 6.00 | | 2.5 | | 4.1 | | 3.9 | | 95.0 | % | $ | 0.97 | | $ | 1.39 | | 43.5 | % | 2.28 | x | 1.48 | x |

| | 6.50 | | 2.3 | | 4.3 | | 4.0 | | 95.2 | % | 0.97 | | 1.33 | | 37.2 | % | 2.28 | | 1.48 | |

| | 7.00 | | 2.1 | | 4.5 | | 4.2 | | 95.4 | % | 0.97 | | 1.28 | | 32.2 | % | 2.28 | | 1.48 | |

| | 7.50 | | 2.0 | | 4.6 | | 4.4 | | 95.5 | % | 0.97 | | 1.24 | | 28.1 | % | 2.28 | | 1.48 | |

| | 8.00 | | 1.9 | | 4.8 | | 4.5 | | 95.6 | % | 0.97 | | 1.21 | | 24.7 | % | 2.28 | | 1.48 | |

| | | | | | | | | | | | | | | | | | | | | |

$20.0 million | | $ | 6.00 | | 3.3 | | 3.3 | | 3.0 | | 93.7 | % | $ | 0.97 | | $ | 1.69 | | 73.6 | % | 2.39 | x | 1.41 | x |

| | 6.50 | | 3.1 | | 3.6 | | 3.3 | | 94.1 | % | 0.97 | | 1.57 | | 61.1 | % | 2.39 | | 1.41 | |

| | 7.00 | | 2.9 | | 3.8 | | 3.5 | | 94.5 | % | 0.97 | | 1.48 | | 51.8 | % | 2.39 | | 1.41 | |

| | 7.50 | | 2.7 | | 4.0 | | 3.7 | | 94.8 | % | 0.97 | | 1.40 | | 44.5 | % | 2.39 | | 1.41 | |

| | 8.00 | | 2.5 | | 4.1 | | 3.9 | | 95.0 | % | 0.97 | | 1.35 | | 38.7 | % | 2.39 | | 1.41 | |

Note: Current bank covenant for Adjusted Debt/EBITDAR is 3.0x and for Cash Flow Coverage Ratio is 1.25x.

Assumes 100% debt financing. Would need to amend credit agreement for repurchase exceeding $10 million (approx one-half of this already used). For the stock buyback to be neutral to EPS, projected 2006 EPS would need to approximate $0.27.

38

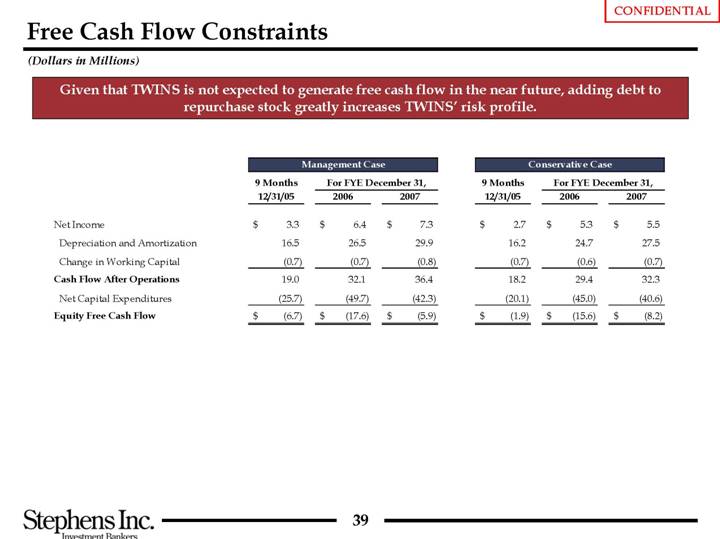

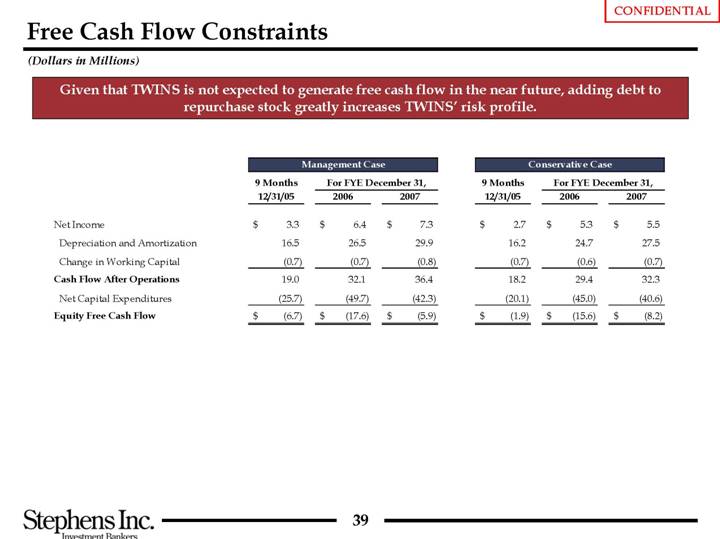

Free Cash Flow Constraints

(Dollars in Millions)

Given that TWINS is not expected to generate free cash flow in the near future, adding debt to repurchase stock greatly increases TWINS’ risk profile.

| | Management Case | | Conservative Case | |

| | 9 Months | | For FYE December 31, | | 9 Months | | For FYE December 31, | |

| | 12/31/05 | | 2006 | | 2007 | | 12/31/05 | | 2006 | | 2007 | |

| | | | | | | | | | | | | |

Net Income | | $ | 3.3 | | $ | 6.4 | | $ | 7.3 | | $ | 2.7 | | $ | 5.3 | | $ | 5.5 | |

Depreciation and Amortization | | 16.5 | | 26.5 | | 29.9 | | 16.2 | | 24.7 | | 27.5 | |

Change in Working Capital | | (0.7 | ) | (0.7 | ) | (0.8 | ) | (0.7 | ) | (0.6 | ) | (0.7 | ) |

Cash Flow After Operations | | 19.0 | | 32.1 | | 36.4 | | 18.2 | | 29.4 | | 32.3 | |

Net Capital Expenditures | | (25.7 | ) | (49.7 | ) | (42.3 | ) | (20.1 | ) | (45.0 | ) | (40.6 | ) |

Equity Free Cash Flow | | $ | (6.7 | ) | $ | (17.6 | ) | $ | (5.9 | ) | $ | (1.9 | ) | $ | (15.6 | ) | $ | (8.2 | ) |

39

D. Acquisitions

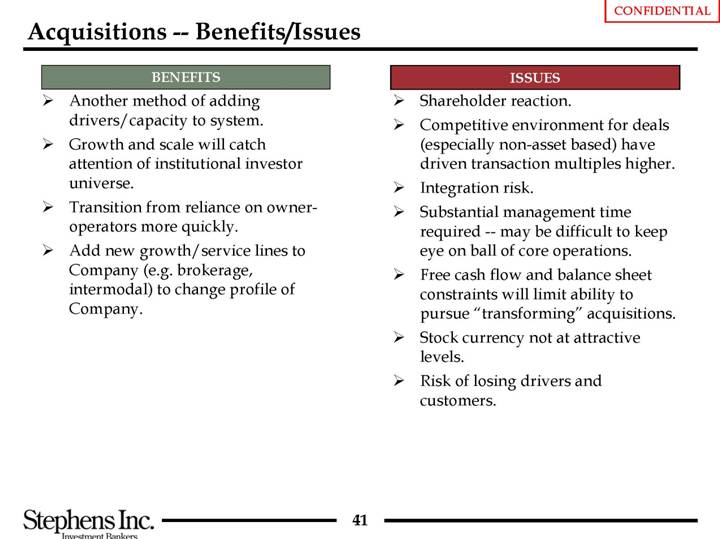

Acquisitions — Benefits/Issues

BENEFITS

• Another method of adding drivers/capacity to system.

• Growth and scale will catch attention of institutional investor universe.

• Transition from reliance on owner-operators more quickly.

• Add new growth/service lines to Company (e.g. brokerage, intermodal) to change profile of Company.

ISSUES

• Shareholder reaction.

• Competitive environment for deals (especially non-asset based) have driven transaction multiples higher.

• Integration risk.

• Substantial management time required — may be difficult to keep eye on ball of core operations.

• Free cash flow and balance sheet constraints will limit ability to pursue “transforming” acquisitions.

• Stock currency not at attractive levels.

• Risk of losing drivers and customers.

41

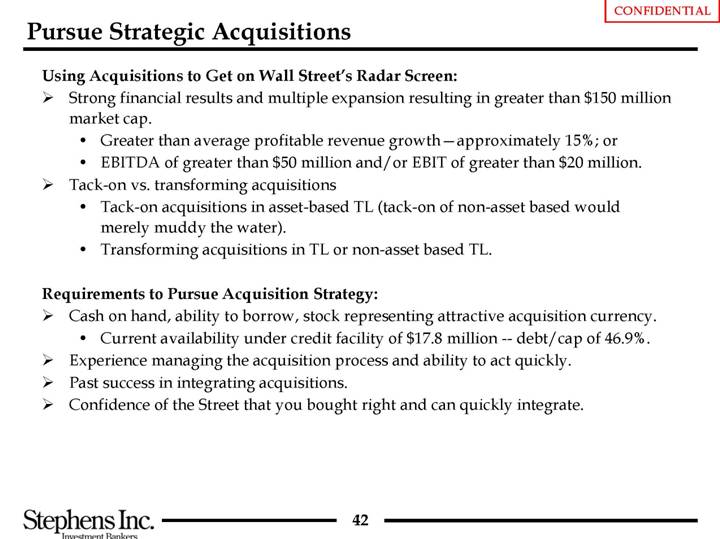

Pursue Strategic Acquisitions

Using Acquisitions to Get on Wall Street’s Radar Screen:

• Strong financial results and multiple expansion resulting in greater than $150 million market cap.

• Greater than average profitable revenue growth–approximately 15%; or

• EBITDA of greater than $50 million and/or EBIT of greater than $20 million.

• Tack-on vs. transforming acquisitions

• Tack-on acquisitions in asset-based TL (tack-on of non-asset based would merely muddy the water).

• Transforming acquisitions in TL or non-asset based TL.

Requirements to Pursue Acquisition Strategy:

• Cash on hand, ability to borrow, stock representing attractive acquisition currency.

• Current availability under credit facility of $17.8 million — debt/cap of 46.9%.

• Experience managing the acquisition process and ability to act quickly.

• Past success in integrating acquisitions.

• Confidence of the Street that you bought right and can quickly integrate.

42

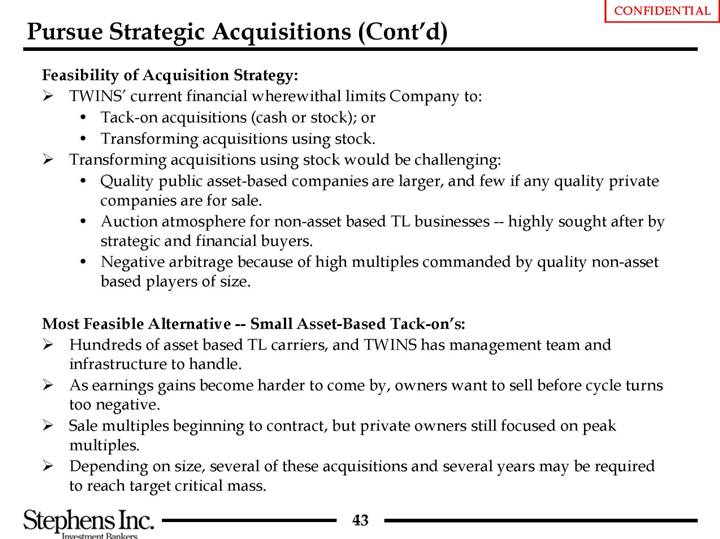

Feasibility of Acquisition Strategy:

• TWINS’ current financial wherewithal limits Company to:

• Tack-on acquisitions (cash or stock); or

• Transforming acquisitions using stock.

• Transforming acquisitions using stock would be challenging:

• Quality public asset-based companies are larger, and few if any quality private companies are for sale.

• Auction atmosphere for non-asset based TL businesses — highly sought after by strategic and financial buyers.

• Negative arbitrage because of high multiples commanded by quality non-asset based players of size.

Most Feasible Alternative — Small Asset-Based Tack-on’s:

• Hundreds of asset based TL carriers, and TWINS has management team and infrastructure to handle.

• As earnings gains become harder to come by, owners want to sell before cycle turns too negative.

• Sale multiples beginning to contract, but private owners still focused on peak multiples.

• Depending on size, several of these acquisitions and several years may be required to reach target critical mass.

43

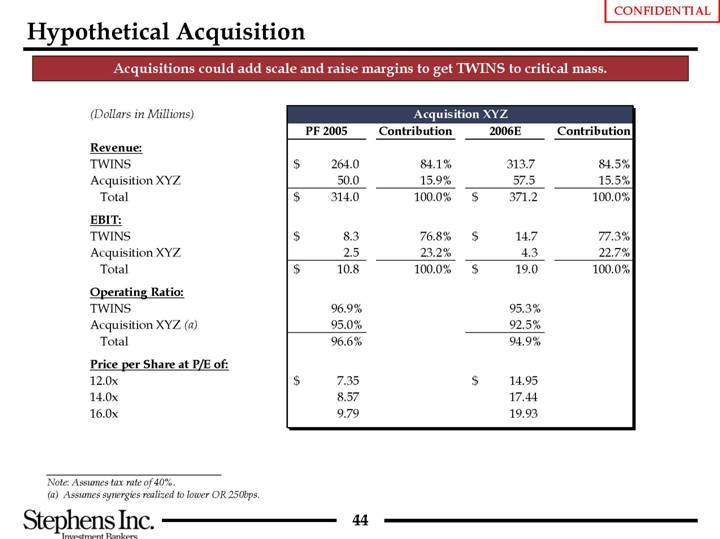

Hypothetical Acquisition

Acquisitions could add scale and raise margins to get TWINS to critical mass.

| | Acquisition XYZ | |

(Dollars in Millions) | | PF 2005 | | Contribution | | 2006E | | Contribution | |

Revenue: | | | | | | | | | |

TWINS | | $ | 264.0 | | 84.1 | % | 313.7 | | 84.5 | % |

Acquisition XYZ | | 50.0 | | 15.9 | % | 57.5 | | 15.5 | % |

Total | | $ | 314.0 | | 100.0 | % | $ | 371.2 | | 100.0 | % |

| | | | | | | | | |

EBIT: | | | | | | | | | |

TWINS | | $ | 8.3 | | 76.8 | % | $ | 14.7 | | 77.3 | % |

Acquisition XYZ | | 2.5 | | 23.2 | % | 4.3 | | 22.7 | % |

Total | | $ | 10.8 | | 100.0 | % | $ | 19.0 | | 100.0 | % |

| | | | | | | | | |

Operating Ratio: | | | | | | | | | |

TWINS | | 96.9 | % | | | 95.3 | % | | |

Acquisition XYZ (a) | | 95.0 | % | | | 92.5 | % | | |

Total | | 96.6 | % | | | 94.9 | % | | |

| | | | | | | | | |

Price per Share at P/E of: | | | | | | | | | |

12.0x | | $ | 7.35 | | | | $ | 14.95 | | | |

14.0x | | 8.57 | | | | 17.44 | | | |

16.0x | | 9.79 | | | | 19.93 | | | |

Note: Assumes tax rate of 40%.

(a) Assumes synergies realized to lower OR 250bps.

44

E. Sale of Company

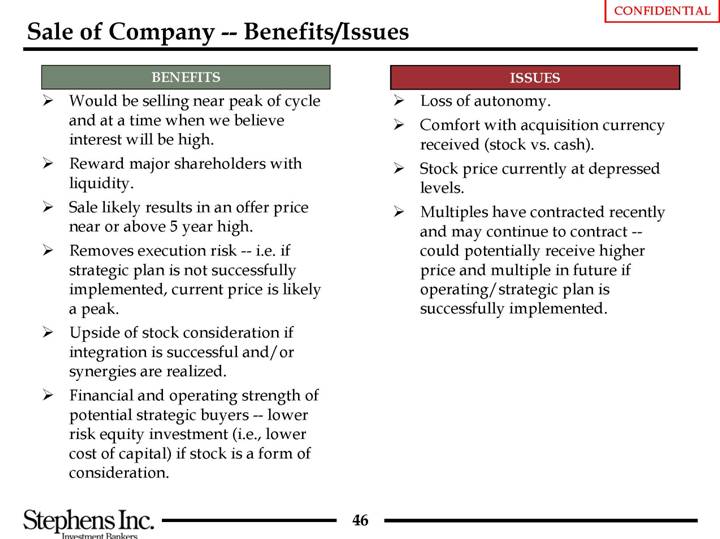

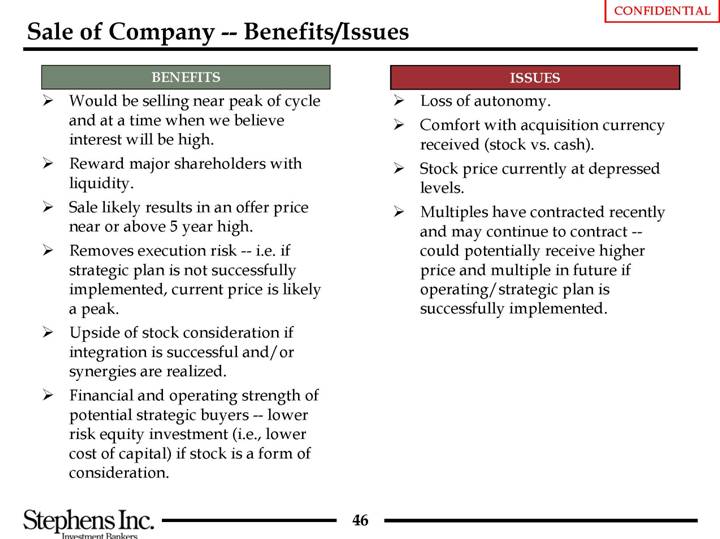

Sale of Company — Benefits/Issues

|

• Would be selling near peak of cycle and at a time when we believe interest will be high. • Reward major shareholders with liquidity. • Sale likely results in an offer price near or above 5 year high. • Removes execution risk — i.e. if strategic plan is not successfully implemented, current price is likely a peak. • Upside of stock consideration if integration is successful and/or synergies are realized. • Financial and operating strength of potential strategic buyers — lower risk equity investment (i.e., lower cost of capital) if stock is a form of consideration. |

|

ISSUES |

|

• Loss of autonomy. • Comfort with acquisition currency received (stock vs. cash). • Stock price currently at depressed levels. • Multiples have contracted recently and may continue to contract – could potentially receive higher price and multiple in future if operating/strategic plan is successfully implemented. |

|

46

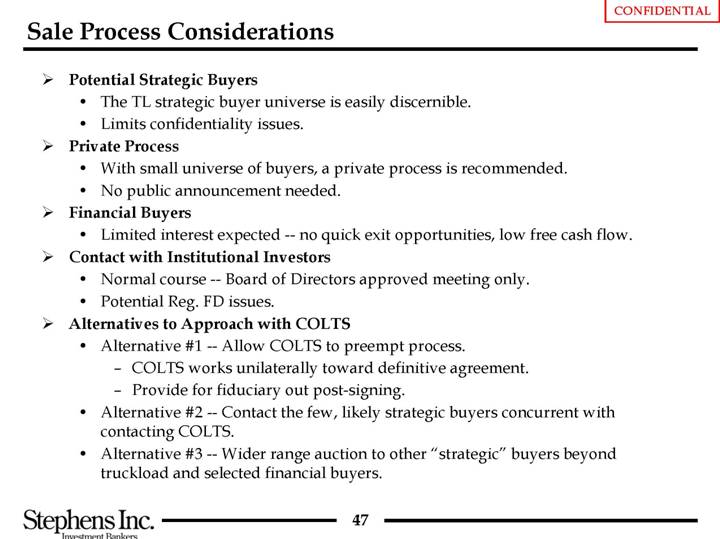

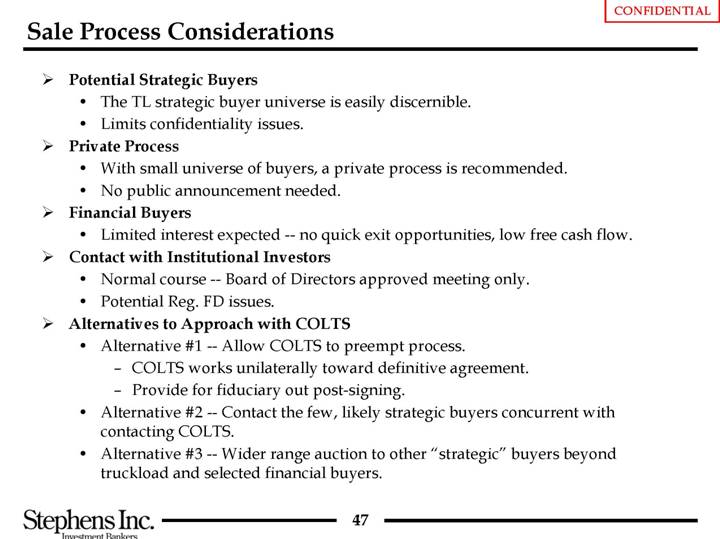

Sale Process Considerations

• Potential Strategic Buyers

• The TL strategic buyer universe is easily discernible.

• Limits confidentiality issues.

• Private Process

• With small universe of buyers, a private process is recommended.

• No public announcement needed.

• Financial Buyers

• Limited interest expected — no quick exit opportunities, low free cash flow.

• Contact with Institutional Investors

• Normal course — Board of Directors approved meeting only.

• Potential Reg. FD issues.

• Alternatives to Approach with COLTS

• Alternative #1 — Allow COLTS to preempt process.

• COLTS works unilaterally toward definitive agreement.

• Provide for fiduciary out post-signing.

• Alternative #2 — Contact the few, likely strategic buyers concurrent with contacting COLTS.

• Alternative #3 — Wider range auction to other “strategic” buyers beyond truckload and selected financial buyers.

47

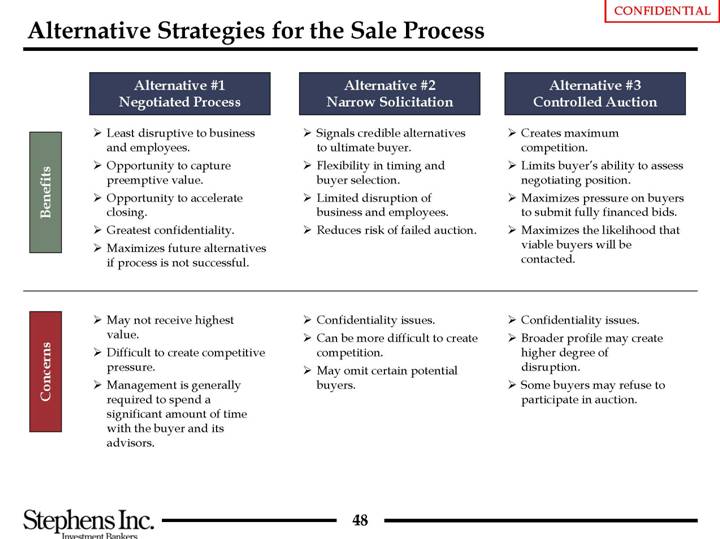

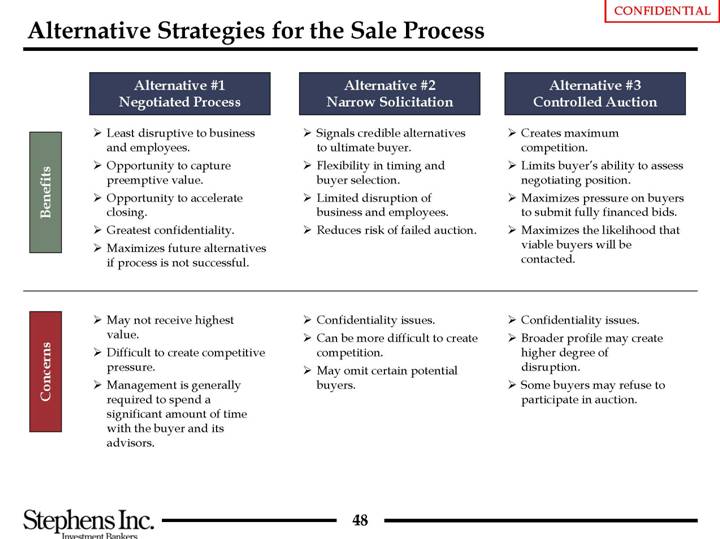

Alternative Strategies for the Sale Process

Alternative #1 | | Alternative #2 | | Alternative #3 |

Negotiated Process | | Narrow Solicitation | | Controlled Auction |

| | | | |

Benefits | | | | |

• Least disruptive to business and employees. • Opportunity to capture preemptive value. • Opportunity to accelerate closing. • Greatest confidentiality. • Maximizes future alternatives if process is not successful. | | • Signals credible alternatives to ultimate buyer. • Flexibility in timing and buyer selection. • Limited disruption of business and employees. • Reduces risk of failed auction. | | • Creates maximum competition. • Limits buyer’s ability to assess negotiating position. • Maximizes pressure on buyers to submit fully financed bids. • Maximizes the likelihood that viable buyers will be contacted. |

| | | | |

Concerns | | | | |

| | | | |

• May not receive highest value. • Difficult to create competitive pressure. • Management is generally required to spend a significant amount of time with the buyer and its advisors. | | • Confidentiality issues. • Can be more difficult to create competition. • May omit certain potential buyers. | | • Confidentiality issues. • Broader profile may create higher degree of disruption. • Some buyers may refuse to participate in auction. |

48

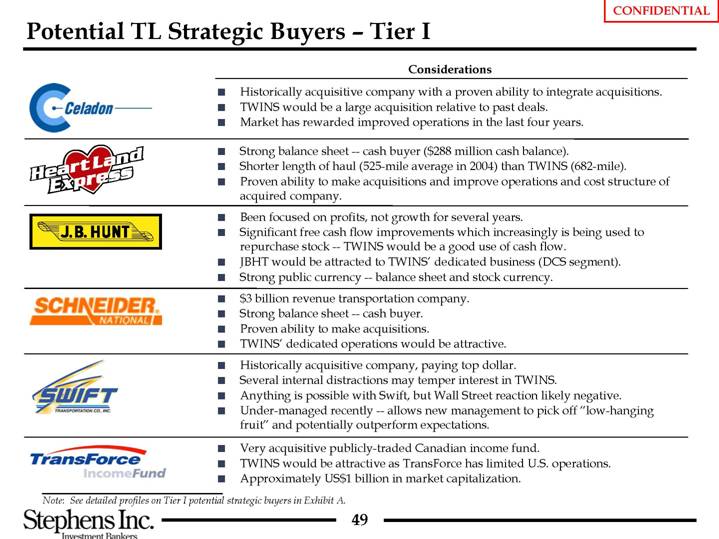

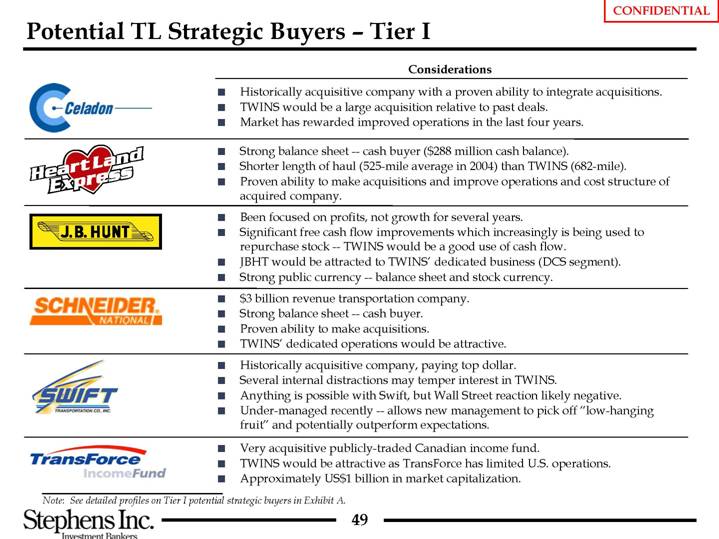

Potential TL Strategic Buyers – Tier I

| Considerations |

| | |

| • | Historically acquisitive company with a proven ability to integrate acquisitions. |

[LOGO] | • | TWINS would be a large acquisition relative to past deals. |

| • | Market has rewarded improved operations in the last four years. |

| | |

| • | Strong balance sheet — cash buyer ($288 million cash balance). |

[LOGO] | • | Shorter length of haul (525-mile average in 2004) than TWINS (682-mile). |

| • | Proven ability to make acquisitions and improve operations and cost structure of acquired company. |

| | |

[LOGO] | • | Been focused on profits, not growth for several years. |

| • | Significant free cash flow improvements which increasingly is being used to repurchase stock — TWINS would be a good use of cash flow. |

| • | JBHT would be attracted to TWINS’ dedicated business (DCS segment). |

| • | Strong public currency — balance sheet and stock currency. |

| | |

[LOGO] | • | $3 billion revenue transportation company. |

| • | Strong balance sheet — cash buyer. |

| • | Proven ability to make acquisitions. |

| • | TWINS’ dedicated operations would be attractive. |

| | |

[LOGO] | • | Historically acquisitive company, paying top dollar. |

| • | Several internal distractions may temper interest in TWINS. |

| • | Anything is possible with Swift, but Wall Street reaction likely negative. |

| • | Under-managed recently — allows new management to pick off “low-hanging fruit” and potentially outperform expectations. |

| | |

[LOGO] | • | Very acquisitive publicly-traded Canadian income fund. |

| • | TWINS would be attractive as TransForce has limited U.S. operations. |

| • | Approximately US$1 billion in market capitalization. |

Note: See detailed profiles on Tier I potential strategic buyers in Exhibit A.

49

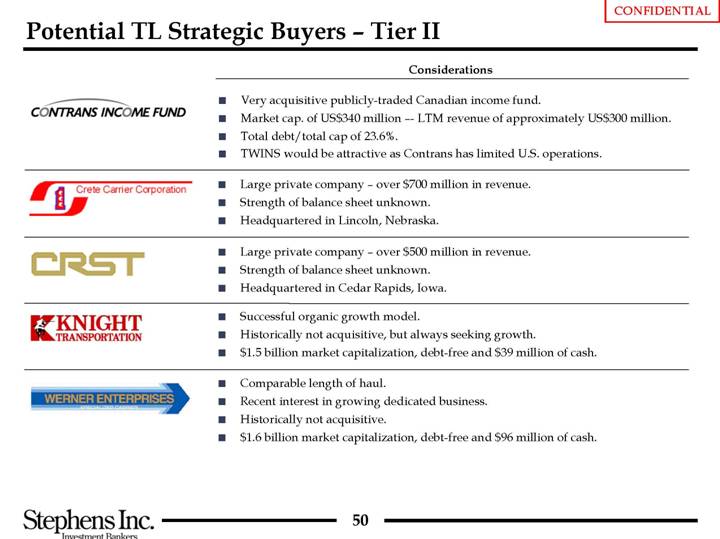

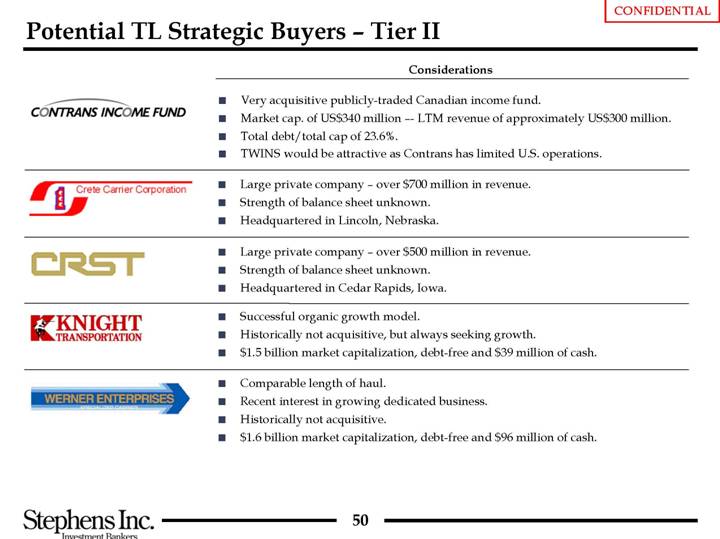

Potential TL Strategic Buyers – Tier II

| Considerations |

| | | |

[LOGO] | • | | Very acquisitive publicly-traded Canadian income fund. |

| • | | Market cap. of US$340 million – LTM revenue of approximately US$300 million. |

| • | | Total debt/total cap of 23.6%. |

| • | | TWINS would be attractive as Contrans has limited U.S. operations. |

| | | |

[LOGO] | • | | Large private company – over $700 million in revenue. |

| • | | Strength of balance sheet unknown. |

| • | | Headquartered in Lincoln, Nebraska. |

| | | |

[LOGO] | • | | Large private company – over $500 million in revenue. |

| • | | Strength of balance sheet unknown. |

| • | | Headquartered in Cedar Rapids, Iowa. |

| | | |

[LOGO] | • | | Successful organic growth model. |

| • | | Historically not acquisitive, but always seeking growth. |

| • | | $1.5 billion market capitalization, debt-free and $39 million of cash. |

| | | |

[LOGO] | • | | Comparable length of haul. |

| • | | Recent interest in growing dedicated business. |

| • | | Historically not acquisitive. |

| • | | $1.6 billion market capitalization, debt-free and $96 million of cash. |

50

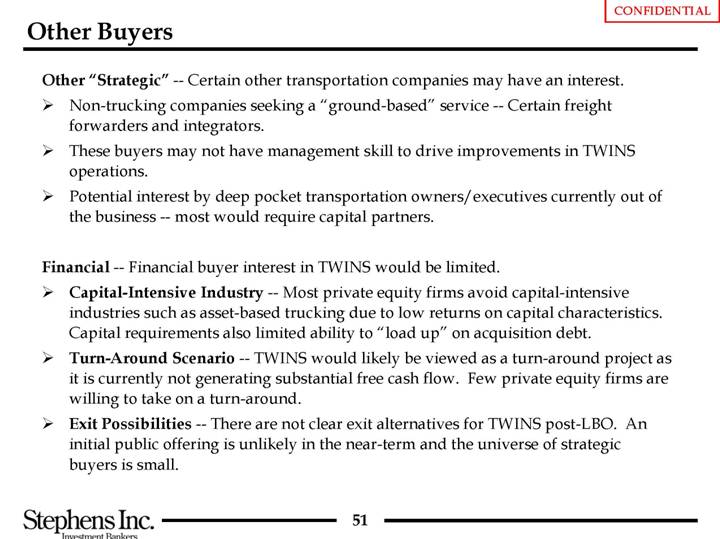

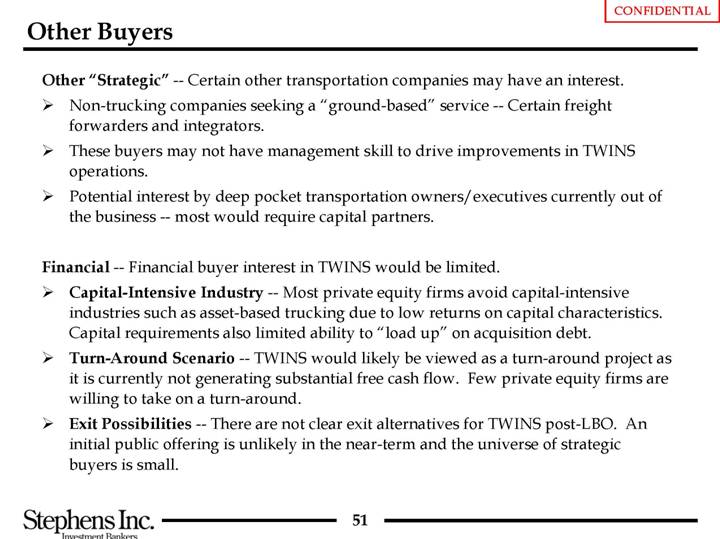

Other Buyers

Other “Strategic” — Certain other transportation companies may have an interest.

• Non-trucking companies seeking a “ground-based” service — Certain freight forwarders and integrators.

• These buyers may not have management skill to drive improvements in TWINS operations.

• Potential interest by deep pocket transportation owners/executives currently out of the business — most would require capital partners.

Financial — Financial buyer interest in TWINS would be limited.

• Capital-Intensive Industry — Most private equity firms avoid capital-intensive industries such as asset-based trucking due to low returns on capital characteristics. Capital requirements also limited ability to “load up” on acquisition debt.

• Turn-Around Scenario — TWINS would likely be viewed as a turn-around project as it is currently not generating substantial free cash flow. Few private equity firms are willing to take on a turn-around.

• Exit Possibilities — There are not clear exit alternatives for TWINS post-LBO. An initial public offering is unlikely in the near-term and the universe of strategic buyers is small.

51

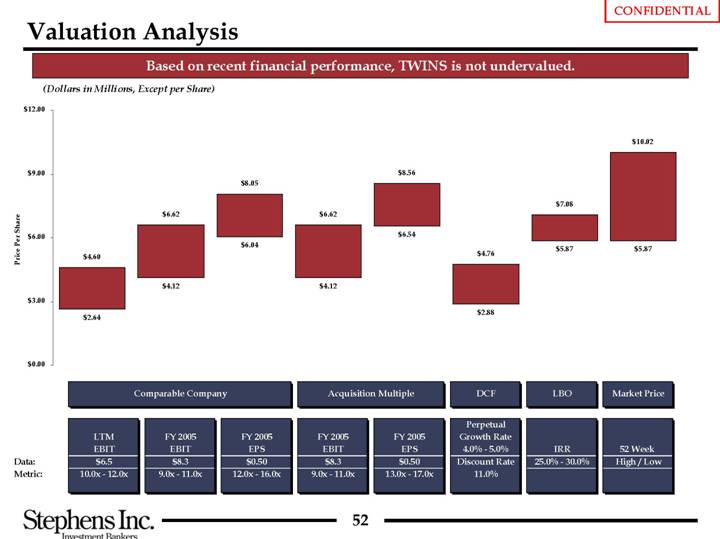

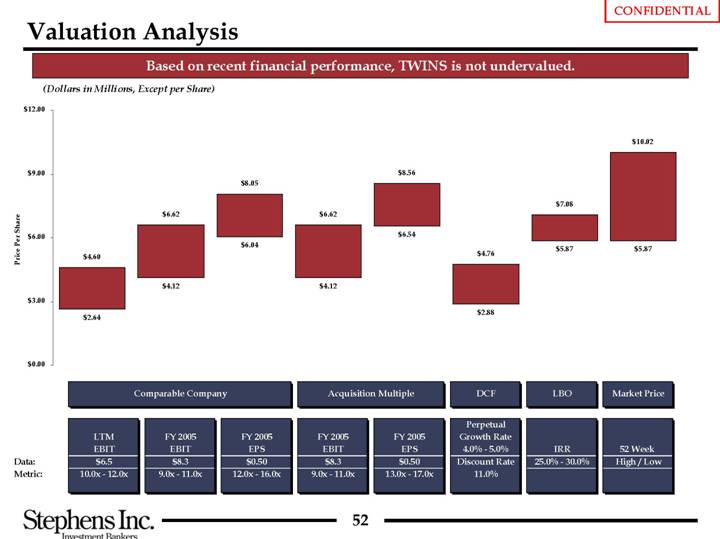

Valuation Analysis

Based on recent financial performance, TWINS is not undervalued.

(Dollars in Millions, Except per Share)

[CHART]

| | Comparable Company | | Acquisition Multiple | | DCF | | | | | |

| | | | | | | | | | | | Perpetual | | | | Market | |

| | LTM | | FY 2005 | | FY 2005 | | FY 2005 | | FY 2005 | | Growth Rate | | LBO | | Price | |

| | EBIT | | EBIT | | EPS | | EBIT | | EPS | | 4.0% - 5.0% | | IRR | | 52 Week | |

Data: | | $ | 6.5 | | $ | 8.3 | | $ | 0.50 | | $ | 8.3 | | $ | 0.50 | | Discount Rate | | 25.0% - 30.0% | | High / Low | |

Metric: | | 10.0x - 12.0x | | 9.0x - 11.0x | | 12.0x - 16.0x | | 9.0x - 11.0x | | 13.0x - 17.0x | | 11.0 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

52

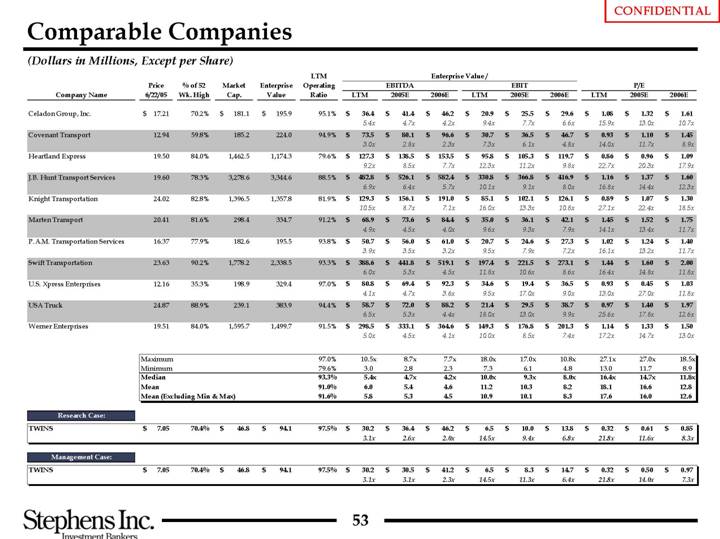

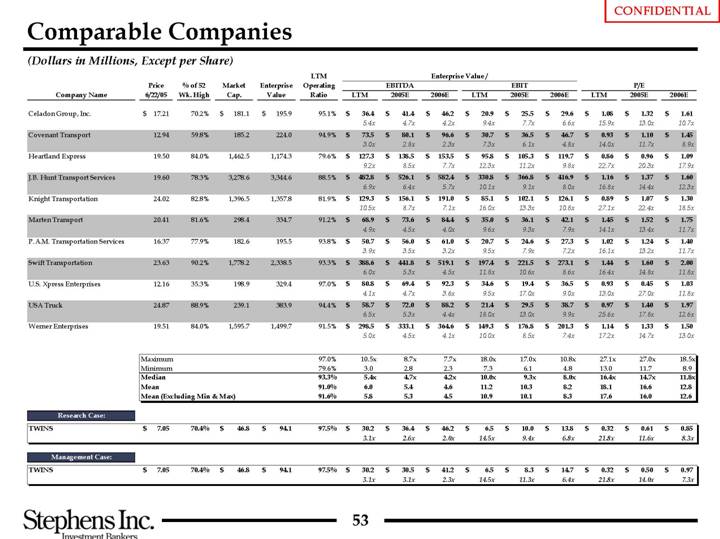

Comparable Companies

(Dollars in Millions, Except per Share)

| | | | | | | | | | LTM | | Enterprise Value / | | | | | | | |

| | Price | | % of 52 | | Market | | Enterprise | | Operating | | EBITDA | | EBIT | | P/E | |

Company Name | | 6/22/05 | | Wk. High | | Cap. | | Value | | Ratio | | LTM | | 2005E | | 2006E | | LTM | | 2005E | | 2006E | | LTM | | 2005E | | 2006E | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Celadon Group, Inc. | | $ | 17.21 | | 70.2 | % | $ | 181.1 | | $ | 195.9 | | 95.1 | % | $ | 36.4 | | $ | 41.4 | | $ | 46.2 | | $ | 20.9 | | $ | 25.5 | | $ | 29.6 | | $ | 1.08 | | $ | 1.32 | | $ | 1.61 | |

| | | | | | | | | | | | 5.4 | x | 4.7 | x | 4.2 | x | 9.4 | | 7.7 | | 6.6 | x | 15.9x | x | 13.0 | x | 10.7 | x |

Covenant Transport | | 12.94 | | 59.8 | % | 185.2 | | 224.0 | | 94.9 | % | $ | 73.5 | | | 80.1 | | $ | | | | 30.7 | | $ | | | | 46.7 | | $ | 0.93 | | $ | 1.10 | | $ | 1.45 | |

| | | | | | | | | | | | 3.0 | x | 2.8 | x | 2.3 | x | 7.3 | | 6.1 | | 4.8 | x | 14.0x | x | 11.7 | x | 8.9 | x |

Heartland Express | | 19.50 | | 84.0 | % | 1,462.5 | | 1,174.3 | | 79.6 | % | $ | 127.3 | | | 138.5 | | $ | | | | 95.8 | | $ | | | | 119.7 | | $ | 0.86 | | $ | 0.96 | | $ | 1.09 | |

| | | | | | | | | | | | 9.2 | x | 8.5 | x | 7.7 | x | 12.3 | | 11.2 | | 9.8 | x | 22.7x | x | 20.3 | x | 17.9 | x |

J.B. Hunt Transport Services | | 19.60 | | 78.3 | % | 3,278.6 | | 3,344.6 | | 88.5 | % | $ | 482.8 | | | 526.1 | | $ | | | | 330.8 | | $ | | | | 416.9 | | $ | 1.16 | | $ | 1.37 | | $ | 1.60 | |

| | | | | | | | | | | | 6.9 | x | 6.4 | x | 5.7 | x | 10.1 | | 9.1 | | 8.0 | x | 16.8x | x | 14.4 | x | 12.3 | x |

Knight Transportation | | 24.02 | | 82.8 | % | 1,396.5 | | 1,357.8 | | 81.9 | % | $ | 129.3 | | | 156.1 | | $ | | | | 85.1 | | $ | | | | 126.1 | | $ | 0.89 | | $ | 1.07 | | $ | 1.30 | |

| | | | | | | | | | | | 10.5 | x | 8.7 | x | 7.1 | x | 16.0 | | 13.3 | | 10.8 | x | 27.1x | x | 22.4 | x | 18.5 | x |

Marten Transport | | 20.41 | | 81.6 | % | 298.4 | | 334.7 | | 91.2 | % | $ | 68.9 | | | 73.6 | | $ | | | | 35.0 | | $ | | | | 42.1 | | $ | 1.45 | | $ | 1.52 | | $ | 1.75 | |

| | | | | | | | | | | | 4.9 | x | 4.5 | x | 4.0 | x | 9.6 | | 9.3 | | 7.9 | x | 14.1x | x | 13.4 | x | 11.7 | x |

P.A.M. Transportation Services | | 16.37 | | 77.9 | % | 182.6 | | 195.5 | | 93.8 | % | $ | 50.7 | | | 56.0 | | $ | | | | 20.7 | | $ | | | | 27.3 | | $ | 1.02 | | $ | 1.24 | | $ | 1.40 | |

| | | | | | | | | | | | 3.9 | x | 3.5 | x | 3.2 | x | 9.5 | | 7.9 | | 7.2 | x | 16.1x | x | 13.2 | x | 11.7 | x |

Swift Transportation | | 23.63 | | 90.2 | % | 1,778.2 | | 2,338.5 | | 93.3 | % | $ | 388.6 | | | 441.8 | | $ | | | | 197.4 | | $ | | | | 273.1 | | $ | 1.44 | | $ | 1.60 | | $ | 2.00 | |

| | | | | | | | | | | | 6.0 | x | 5.3 | x | 4.5 | x | 11.8 | | 10.6 | | 8.6 | x | 16.4x | x | 14.8 | x | 11.8 | x |

U.S. Xpress Enterprises | | 12.16 | | 35.3 | % | 198.9 | | 329.4 | | 97.0 | % | $ | 80.8 | | | 69.4 | | $ | | | | 34.6 | | $ | | | | 36.5 | | $ | 0.93 | | $ | 0.45 | | $ | 1.03 | |

| | | | | | | | | | | | 4.1 | x | 4.7 | x | 3.6 | x | 9.5 | | 17.0 | | 9.0 | x | 13.0x | x | 27.0 | x | 11.8 | x |

USA Truck | | 24.87 | | 88.9 | % | 239.1 | | 383.9 | | 94.4 | % | $ | 58.7 | | | 72.0 | | $ | | | | 21.4 | | $ | | | | 38.7 | | $ | 0.97 | | $ | 1.40 | | $ | 1.97 | |

| | | | | | | | | | | | 6.5 | x | 5.3 | x | 4.4 | x | 18.0 | | 13.0 | | 9.9 | x | 25.6x | x | 17.8 | x | 12.6 | x |

Werner Enterprises | | 19.51 | | 84.0 | % | 1,595.7 | | 1,499.7 | | 91.5 | % | $ | 298.5 | | | 333.1 | | $ | | | | 149.3 | | $ | | | | 201.3 | | $ | 1.14 | | $ | 1.33 | | $ | 1.50 | |

| | | | | | | | | | | | 5.0 | x | 4.5 | x | 4.1 | x | 10.0 | x | 8.5 | x | 7.4 | x | 17.2 | x | 14.7 | x | 13.0 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maximum | | | | | | 97.0 | % | 10.5 | x | 8.7 | x | 7.7 | x | 18.0 | x | 17.0 | x | 10.8 | x | 27.1 | x | 27.0 | x | 18.5 | x |

| | Minimum | | | | | | 79.6 | % | 3.0 | | 2.8 | | 2.3 | | 7.3 | | 6.1 | | 4.8 | | 13.0 | | 11.7 | | 8.9 | |

| | Median | | | | | | 93.3 | % | 5.4 | x | 4.7 | x | 4.2 | x | 10.0 | x | 9.3 | x | 8.0 | x | 16.4 | x | 14.7 | x | 11.8 | x |

| | Mean | | | | | | 91.0 | % | 6.0 | | 5.4 | | 4.6 | | 11.2 | | 10.3 | | 8.2 | | 18.1 | | 16.6 | | 12.8 | |

| | Mean (Excluding Min & Max) | | | | 91.6 | % | 5.8 | | 5.3 | | 4.5 | | 10.9 | | 10.1 | | 8.3 | | 17.6 | | 16.0 | | 12.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Research Case: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TWINS | | $ | 7.05 | 70.4 | % | $ | 46.8 | | $ | 94.1 | | 97.5 | % | $ | 30.2 | | $ | 36.4 | | $ | 46.2 | | $ | 6.5 | | $ | 10.0 | | $ | 13.8 | | $ | 0.32 | | $ | 0.61 | | $ | 0.85 | |

| | | | | | | | | | | | 3.1 | x | 2.6 | x | 2.0 | x | 14.5 | x | 9.4 | x | 6.8 | x | 21.8 | x | 11.6 | x | 8.3 | x |

Management Case: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TWINS | | $ | 7.05 | | 70.4 | % | $ | 46.8 | | $ | 94.1 | | 97.5 | % | $ | 30.2 | | $ | 30.5 | | $ | 41.2 | | $ | 6.5 | | $ | 8.3 | | $ | 14.7 | | $ | 0.32 | | $ | 0.50 | | $ | 0.97 | |

| | | | | | | | | | | | 3.1 | x | 3.1 | x | 2.3 | x | 14.5 | x | 11.3 | x | 6.4 | x | 21.8 | x | 14.0 | x | 7.3 | x |

53

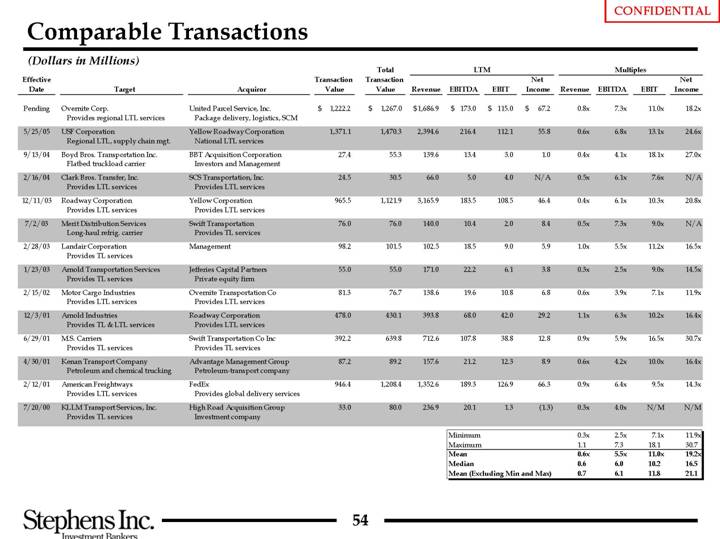

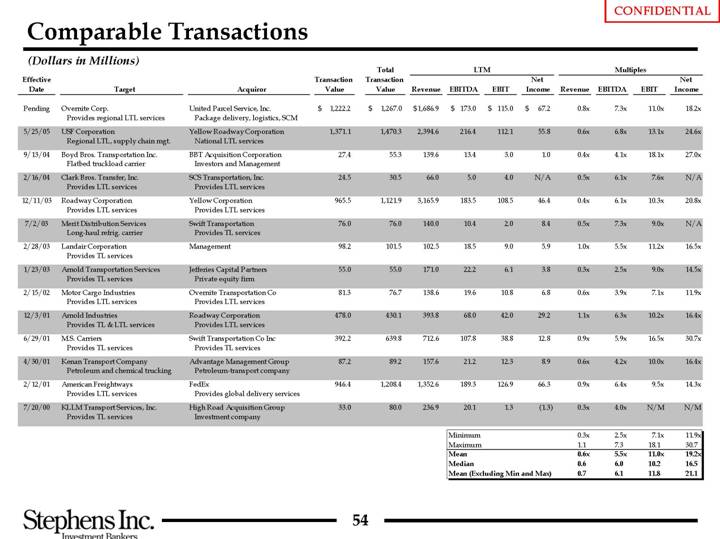

Comparable Transactions

(Dollars in Millions)

| | | | | | | | Total | | LTM | | Multiples | |

Effective | | | | | | Transaction | | Transaction | | | | | | | | Net | | | | | | | | Net | |

Date | | Target | | Acquiror | | Value | | Value | | Revenue | | EBITDA | | EBIT | | Income | | Revenue | | EBITDA | | EBIT | | Income | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Pending | | Overnite Corp. | | United Parcel Service, Inc. | | $ | 1,222.2 | | $ | 1,267.0 | | $ | 1,686.9 | | $ | 173.0 | | $ | 115.0 | | $ | 67.2 | | 0.8 | x | 7.3x | x | 11.0x | | 18.2 | x |

| | Provides regional LTL services | | Package delivery, logistics, SCM | | | | | | | | | | | | | | | | | | | | | |

5/25/05 | | USF Corporation | | Yellow Roadway Corporation | | 1,371.1 | | 1,470.3 | | 2,394.6 | | 216.4 | | 112.1 | | 55.8 | | 0.6 | x | 6.8 | x | 13.1 | x | 24.6 | x |

| | Regional LTL, supply chain mgt. | | National LTL services | | | | | | | | | | | | | | | | | | | | | |

9/13/04 | | Boyd Bros. Transportation Inc. | | BBT Acquisition Corporation | | 27.4 | | 55.3 | | 139.6 | | 13.4 | | 3.0 | | 1.0 | | 0.4 | x | 4.1 | x | 18.1 | x | 27.0 | x |

| | Flatbed truckload carrier | | Investors and Management | | | | | | | | | | | | | | | | | | | | | |

2/16/04 | | Clark Bros. Transfer, Inc. | | SCS Transportation, Inc. | | 24.5 | | 30.5 | | 66.0 | | 5.0 | | 4.0 | | N/A | | 0.5 | x | 6.1 | x | 7.6 | x | N/A | |

| | Provides LTL services | | Provides LTL services | | | | | | | | | | | | | | | | | | | | | |

12/11/03 | | Roadway Corporation | | Yellow Corporation | | 965.5 | | 1,121.9 | | 3,165.9 | | 183.5 | | 108.5 | | 46.4 | | 0.4 | x | 6.1 | x | 10.3 | x | 20.8 | x |

| | Provides LTL services | | Provides LTL services | | | | | | | | | | | | | | | | | | | | | |

7/2/03 | | Merit Distribution Services | | Swift Transportation | | 76.0 | | 76.0 | | 140.0 | | 10.4 | | 2.0 | | 8.4 | | 0.5 | x | 7.3 | x | 9.0 | x | N/A | |

| | Long-haul refrig. carrier | | Provides TL services | | | | | | | | | | | | | | | | | | | | | |

2/28/03 | | Landair Corporation | | Management | | 98.2 | | 101.5 | | 102.5 | | 18.5 | | 9.0 | | 5.9 | | 1.0 | x | 5.5 | x | 11.2 | x | 16.5 | x |

| | Provides TL services | | | | | | | | | | | | | | | | | | | | | | | |

1/23/03 | | Arnold Transportation Services | | Jefferies Capital Partners | | 55.0 | | 55.0 | | 171.0 | | 22.2 | | 6.1 | | 3.8 | | 0.3 | x | 2.5 | x | 9.0 | x | 14.5 | x |

| | Provides TL services | | Private equity firm | | | | | | | | | | | | | | | | | | | | | |

2/15/02 | | Motor Cargo Industries | | Overnite Transportation Co | | 81.3 | | 76.7 | | 138.6 | | 19.6 | | 10.8 | | 6.8 | | 0.6 | x | 3.9 | x | 7.1 | x | 11.9 | x |

| | Provides LTL services | | Provides LTL services | | | | | | | | | | | | | | | | | | | | | |

12/3/01 | | Arnold Industries | | Roadway Corporation | | 478.0 | | 430.1 | | 393.8 | | 68.0 | | 42.0 | | 29.2 | | 1.1 | x | 6.3 | x | 10.2 | x | 16.4 | x |

| | Provides TL & LTL services | | Provides LTL services | | | | | | | | | | | | | | | | | | | | | |

6/29/01 | | M.S. Carriers | | Swift Transportation Co Inc | | 392.2 | | 639.8 | | 712.6 | | 107.8 | | 38.8 | | 12.8 | | 0.9 | x | 5.9 | x | 16.5 | x | 30.7 | x |

| | Provides TL services | | Provides TL services | | | | | | | | | | | | | | | | | | | | | |

4/30/01 | | Kenan Transport Company | | Advantage Management Group | | 87.2 | | 89.2 | | 157.6 | | 21.2 | | 12.3 | | 8.9 | | 0.6 | x | 4.2 | x | 10.0 | x | 16.4 | x |

| | Petroleum and chemical trucking | | Petroleum-transport company | | | | | | | | | | | | | | | | | | | | | |

2/12/01 | | American Freightways | | FedEx | | 946.4 | | 1,208.4 | | 1,352.6 | | 189.3 | | 126.9 | | 66.3 | | 0.9 | x | 6.4 | x | 9.5 | x | 14.3 | x |

| | Provides LTL services | | Provides global delivery services | | | | | | | | | | | | | | | | | | | | | |

7/20/00 | | KLLM Transport Services, Inc. | | High Road Acquisition Group | | 33.0 | | 80.0 | | 236.9 | | 20.1 | | 1.3 | | (1.3 | ) | 0.3 | x | 4.0 | x | N/M | | N/M | |

| | Provides TL services | | Investment company | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Minimum | | | | 0.3 | x | 2.5 | x | 7.1 | x | 11.9 | x |

| | | | | | | | | | | | Maximum | | | | 11 | | 7.3 | | 18.1 | | 30.7 | |

| | | | | | | | | | | | Mean | | | | 0.6 | x | 5.5 | x | 11.0 | x | 19.2 | x |

| | | | | | | | | | | | Median | | | | 0.6 | | 6.0 | | 10.2 | | 16.5 | |

| | | | | | | | | | | | Mean (Excluding Min and Max) | | 0.7 | | 6.1 | | 11.8 | | 21.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

54

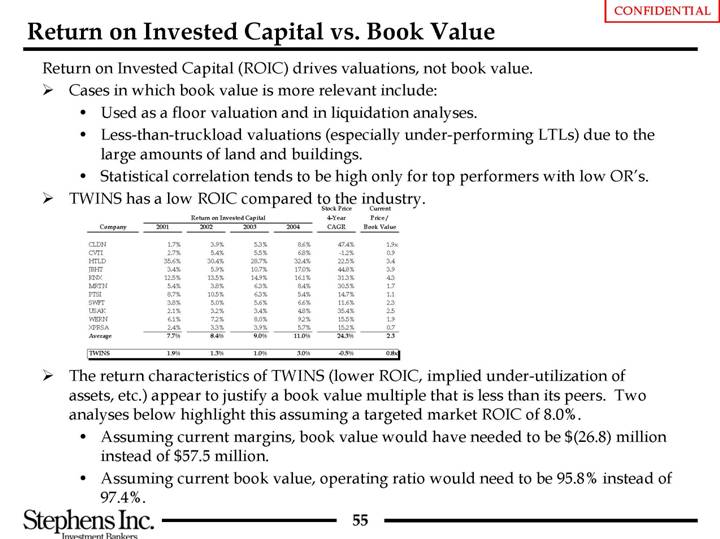

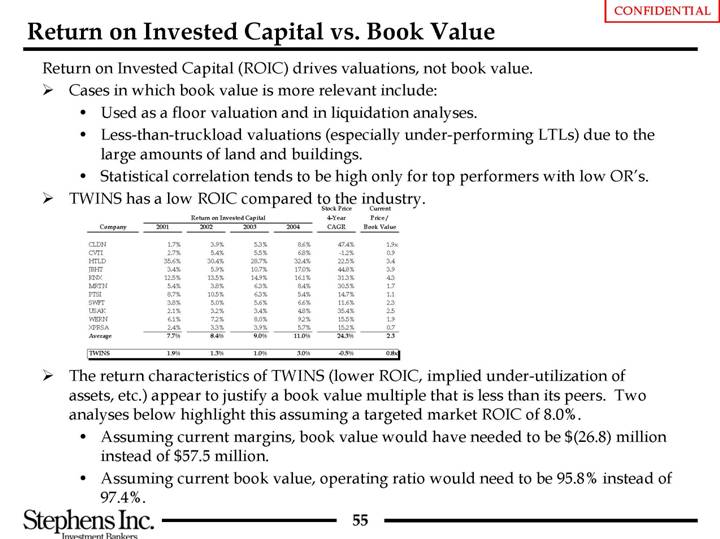

Return on Invested Capital vs. Book Value

Return on Invested Capital (ROIC) drives valuations, not book value.

• Cases in which book value is more relevant include:

• Used as a floor valuation and in liquidation analyses.

• Less-than-truckload valuations (especially under-performing LTLs) due to the large amounts of land and buildings.

• Statistical correlation tends to be high only for top performers with low OR’s.

• TWINS has a low ROIC compared to the industry.

| | | | | | | | | | Stock Price | | Current | |

| | Return on Invested Capital | | 4-Year | | Price / | |

Company | | 2001 | | 2002 | | 2003 | | 2004 | | CAGR | | Book Value | |

| | | | | | | | | | | | | |

CLDN | | 1.7 | % | 3.9 | % | 5.3 | % | 8.6 | % | 47.4 | % | 1.9 | x |

CVTI | | 2.7 | % | 5.4 | % | 5.5 | % | 6.8 | % | -1.2 | % | 0.9 | |

HTLD | | 35.6 | % | 30.4 | % | 28.7 | % | 32.4 | % | 22.5 | % | 3.4 | |

JBHT | | 3.4 | % | 5.9 | % | 10.7 | % | 17.0 | % | 44.8 | % | 3.9 | |

KNX | | 12.5 | % | 13.5 | % | 14.9 | % | 16.1 | % | 31.3 | % | 4.3 | |

MRTN | | 5.4 | % | 3.8 | % | 6.3 | % | 8.4 | % | 30.5 | % | 1.7 | |

PTSI | | 8.7 | % | 10.5 | % | 6.3 | % | 5.4 | % | 14.7 | % | 1.1 | |

SWFT | | 3.8 | % | 5.0 | % | 5.6 | % | 6.6 | % | 11.6 | % | 2.3 | |

USAK | | 2.1 | % | 3.2 | % | 3.4 | % | 4.8 | % | 35.4 | % | 2.5 | |

WERN | | 6.1 | % | 7.2 | % | 8.0 | % | 9.2 | % | 15.5 | % | 1.9 | |

XPRSA | | 2.4 | % | 3.3 | % | 3.9 | % | 5.7 | % | 15.2 | % | 0.7 | |

Average | | 7.7 | % | 8.4 | % | 9.0 | % | 11.0 | % | 24.3 | % | 2.3 | |

| | | | | | | | | | | | | |

TWINS | | 1.9 | % | 1.3 | % | 1.0 | % | 3.0 | % | -0.5 | % | 0.8 | x |

• The return characteristics of TWINS (lower ROIC, implied under-utilization of assets, etc.) appear to justify a book value multiple that is less than its peers. Two analyses below highlight this assuming a targeted market ROIC of 8.0%.

• Assuming current margins, book value would have needed to be $(26.8) million instead of $57.5 million.

• Assuming current book value, operating ratio would need to be 95.8% instead of 97.4%.

55

IV. COLTS Overview

COLTS Overview

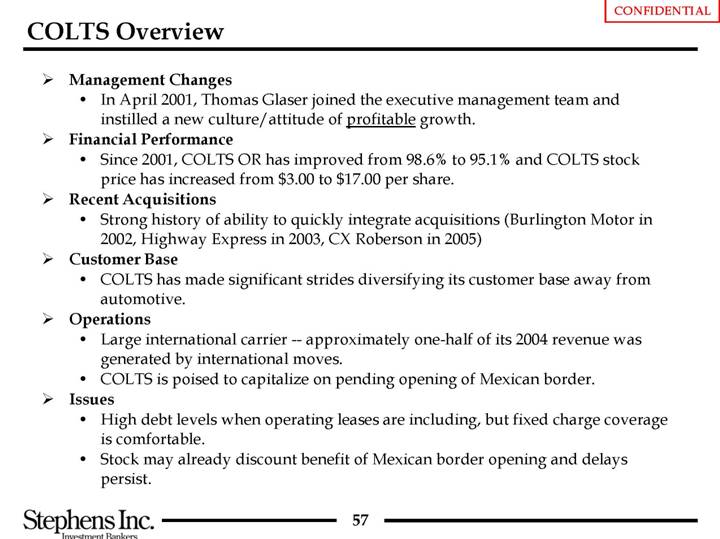

• Management Changes

• In April 2001, Thomas Glaser joined the executive management team and instilled a new culture/attitude of profitable growth.

• Financial Performance

• Since 2001, COLTS OR has improved from 98.6% to 95.1% and COLTS stock price has increased from $3.00 to $17.00 per share.

• Recent Acquisitions

• Strong history of ability to quickly integrate acquisitions (Burlington Motor in 2002, Highway Express in 2003, CX Roberson in 2005)

• Customer Base

• COLTS has made significant strides diversifying its customer base away from automotive.

• Operations

• Large international carrier — approximately one-half of its 2004 revenue was generated by international moves.

• COLTS is poised to capitalize on pending opening of Mexican border.

• Issues

• High debt levels when operating leases are including, but fixed charge coverage is comfortable.

• Stock may already discount benefit of Mexican border opening and delays persist.

57

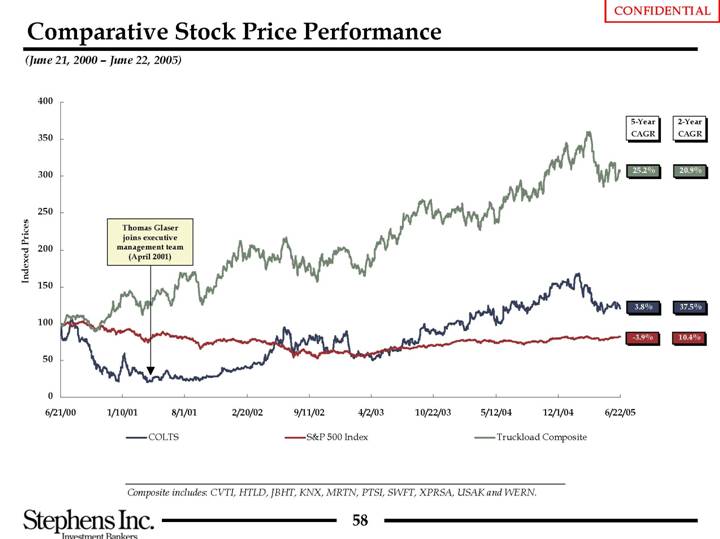

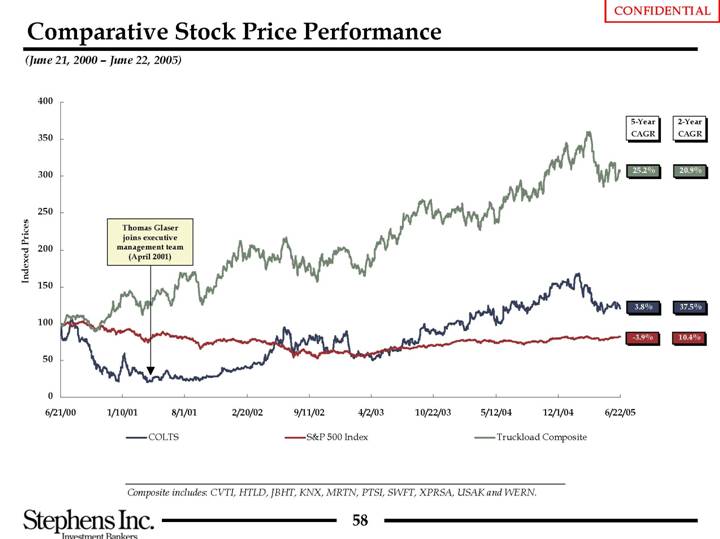

Comparative Stock Price Performance

(June 21, 2000 – June 22, 2005)

[CHART]

Composite includes: CVTI, HTLD, JBHT, KNX, MRTN, PTSI, SWFT, XPRSA, USAK and WERN.

58

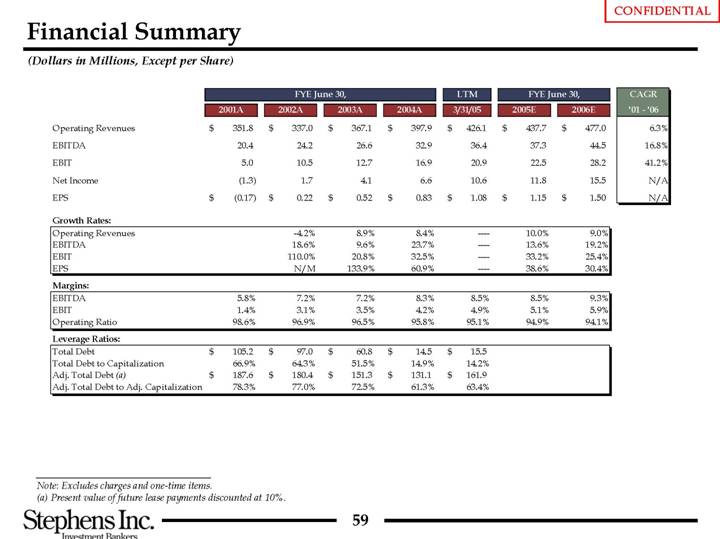

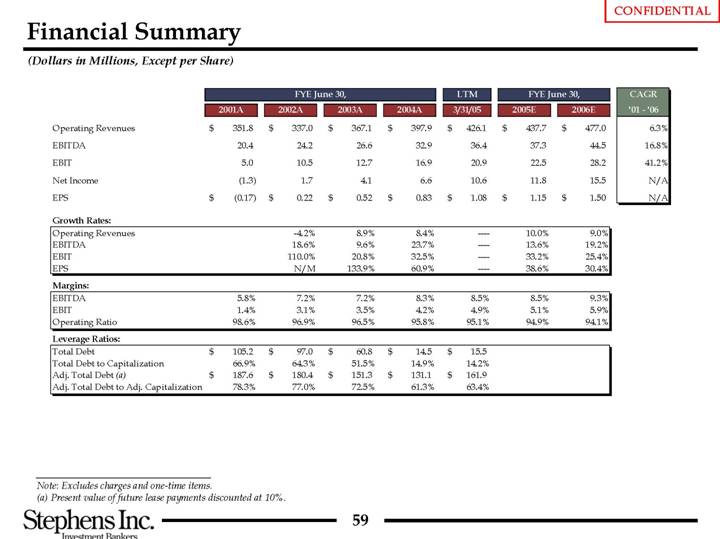

Financial Summary

(Dollars in Millions, Except per Share)

| | FYE June 30, | | LTM | | FYE June 30, | | CAGR | |

| | 2001A | | 2002A | | 2003A | | 2004A | | 3/31/05 | | 2005E | | 2006E | | ’01 - ’06 | |

Operating Revenues | | $ | 351.8 | | $ | 337.0 | | $ | 367.1 | | $ | 397.9 | | $ | 426.1 | | $ | 437.7 | | $ | 477.0 | | 6.3 | % |

EBITDA | | 20.4 | | 24.2 | | 26.6 | | 32.9 | | 36.4 | | 37.3 | | 44.5 | | 16.8 | % |

EBIT | | 5.0 | | 10.5 | | 12.7 | | 16.9 | | 20.9 | | 22.5 | | 28.2 | | 41.2 | % |

Net Income | | (1.3 | ) | 1.7 | | 4.1 | | 6.6 | | 10.6 | | 11.8 | | 15.5 | | N/A | |

EPS | | $ | (0.17 | ) | $ | 0.22 | | $ | 0.52 | | $ | 0.83 | | $ | 1.08 | | $ | 1.15 | | $ | 1.50 | | N/A | |

| | | | | | | | | | | | | | | | | |

Growth Rates: | | | | | | | | | | | | | | | | | |

Operating Revenues | | | | -4.2 | % | 8.9 | % | 8.4 | % | — | | 10.0 | % | 9.0 | % | | |

EBITDA | | | | 18.6 | % | 9.6 | % | 23.7 | % | — | | 13.6 | % | 19.2 | % | | |

EBIT | | | | 110.0 | % | 20.8 | % | 32.5 | % | — | | 33.2 | % | 25.4 | % | | |

EPS | | | | N/M | | 133.9 | % | 60.9 | % | — | | 38.6 | % | 30.4 | % | | |

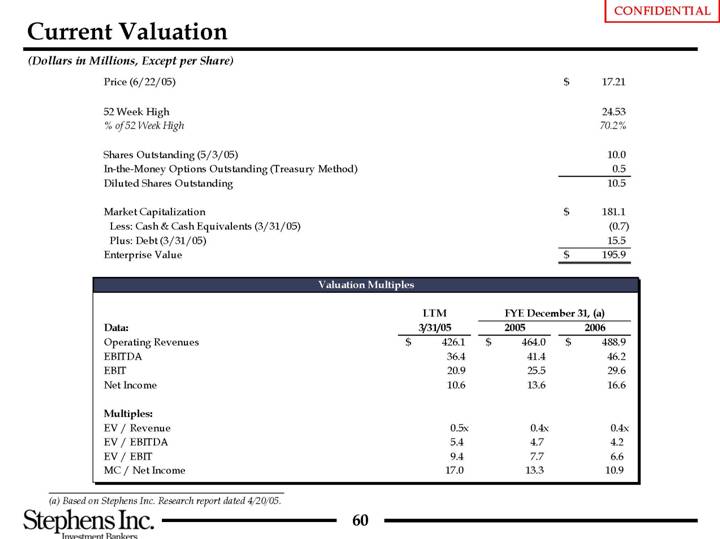

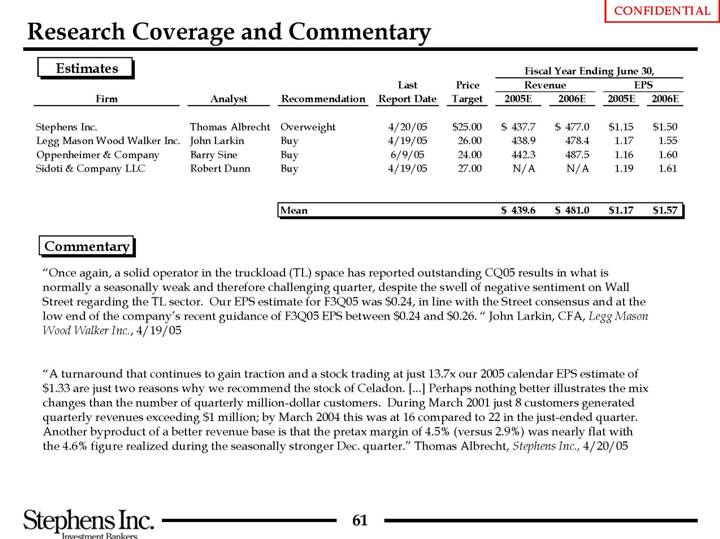

| | | | | | | | | | | | | | | | | |