Exhibit (c)(5)

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

CONFIDENTIAL

[GRAPHIC]

A Presentation to:

The Board of Directors of

TWINS

Regarding:

Process Update

September 13, 2005

300 Crescent Court, Suite 600 | |

Dallas, TX 75201 | [LOGO] |

214-258-2700 | |

www.stephens.com | |

Little Rock | | Atlanta | | Dallas | | Nashville | | New York |

Table of Contents

I. | Process Update | |

| | |

II. | Valuation Update | |

| | |

III. | GHJM Letter of Intent | |

| | |

IV. | NFI Indication of Interest | |

2

I. Process Update

Process Update

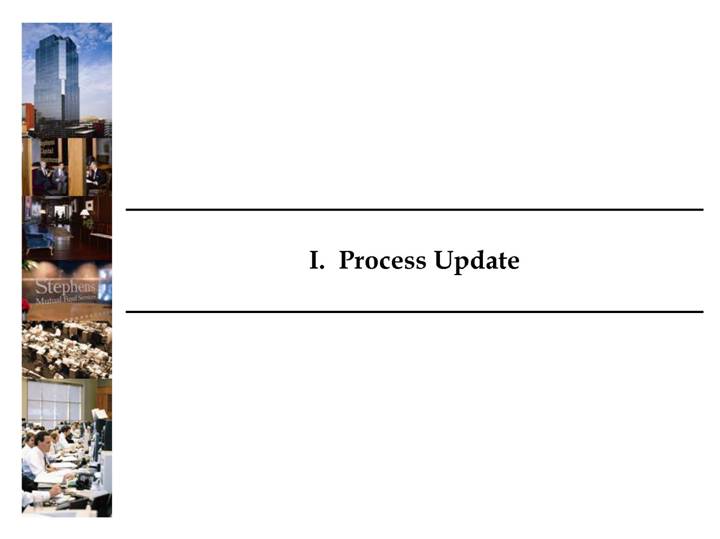

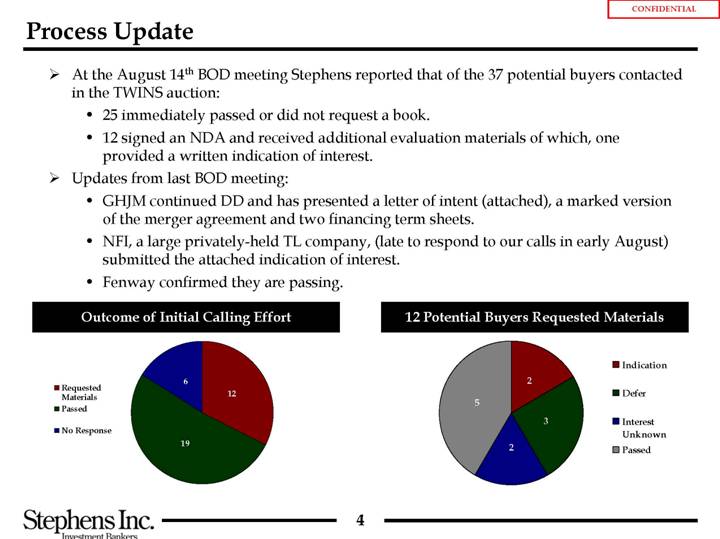

• At the August 14th BOD meeting Stephens reported that of the 37 potential buyers contacted in the TWINS auction:

• 25 immediately passed or did not request a book.

• 12 signed an NDA and received additional evaluation materials of which, one provided a written indication of interest.

• Updates from last BOD meeting:

• GHJM continued DD and has presented a letter of intent (attached), a marked version of the merger agreement and two financing term sheets.

• NFI, a large privately-held TL company, (late to respond to our calls in early August) submitted the attached indication of interest.

• Fenway confirmed they are passing.

Outcome of Initial Calling Effort | | 12 Potential Buyers Requested Materials |

| | |

[CHART] | | [CHART] |

4

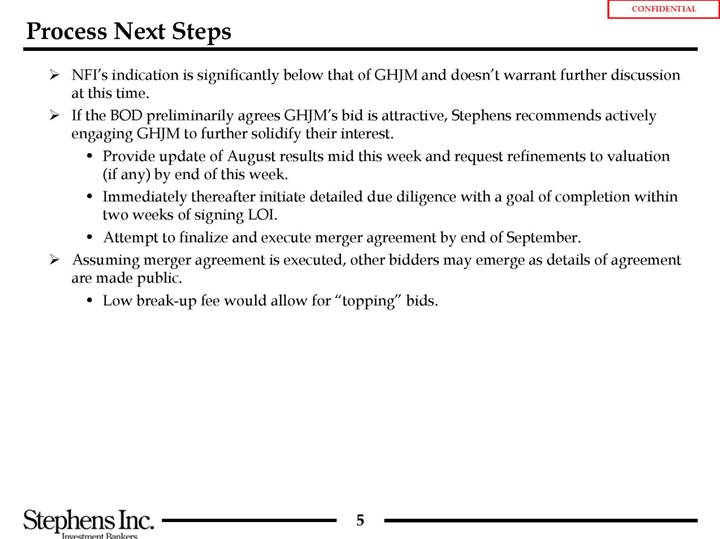

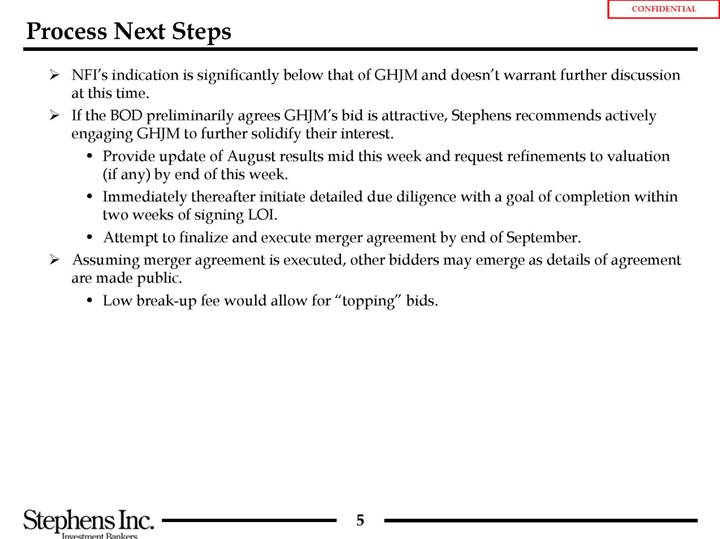

Process Next Steps

• NFI’s indication is significantly below that of GHJM and doesn’t warrant further discussion at this time.

• If the BOD preliminarily agrees GHJM’s bid is attractive, Stephens recommends actively engaging GHJM to further solidify their interest.

• Provide update of August results mid this week and request refinements to valuation (if any) by end of this week.

• Immediately thereafter initiate detailed due diligence with a goal of completion within two weeks of signing LOI.

• Attempt to finalize and execute merger agreement by end of September.

• Assuming merger agreement is executed, other bidders may emerge as details of agreement are made public.

• Low break-up fee would allow for “topping” bids.

5

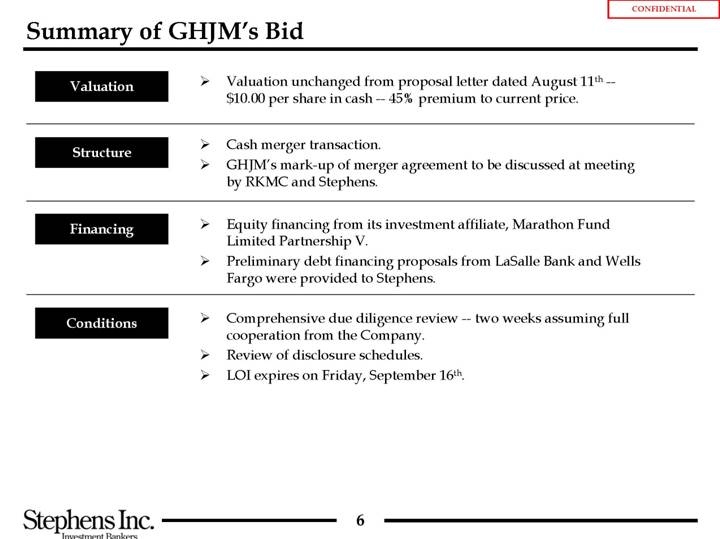

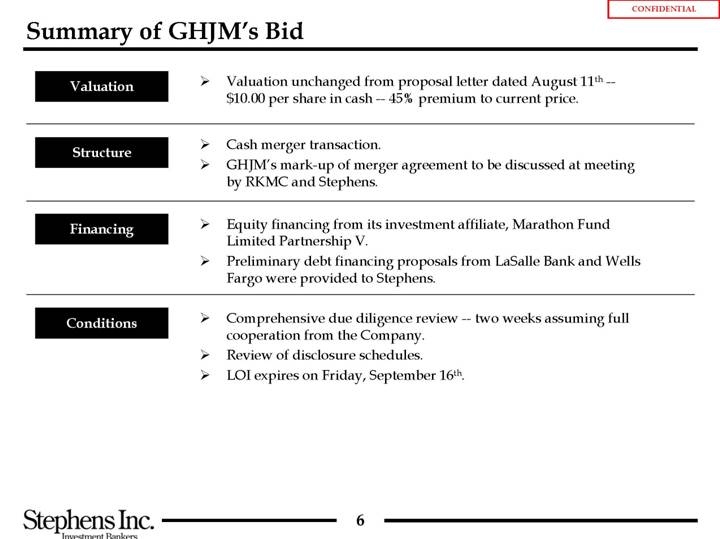

Summary of GHJM’s Bid

Valuation | | • | | Valuation unchanged from proposal letter dated August 11th — $10.00 per share in cash — 45% premium to current price. |

| | | | |

Structure | | • | | Cash merger transaction. |

| | • | | GHJM’s mark-up of merger agreement to be discussed at meeting by RKMC and Stephens. |

| | | | |

Financing | | • | | Equity financing from its investment affiliate, Marathon Fund Limited Partnership V. |

| | • | | Preliminary debt financing proposals from LaSalle Bank and Wells Fargo were provided to Stephens. |

| | | | |

Conditions | | • | | Comprehensive due diligence review — two weeks assuming full cooperation from the Company. |

| | • | | Review of disclosure schedules. |

| | • | | LOI expires on Friday, September 16th. |

6

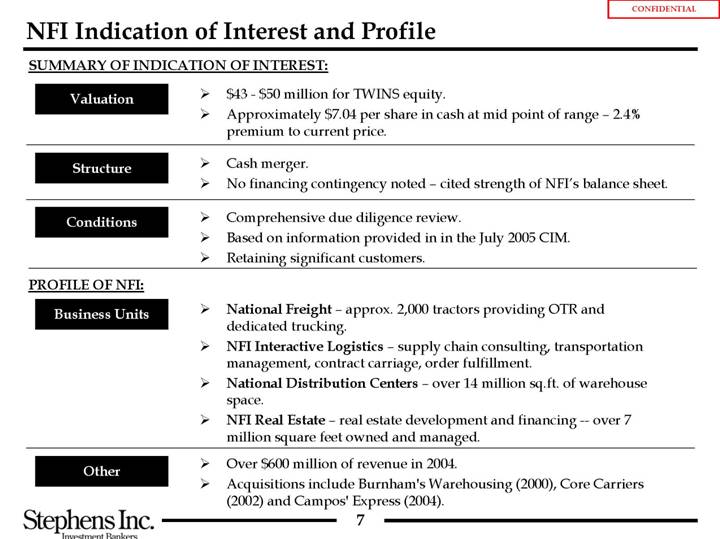

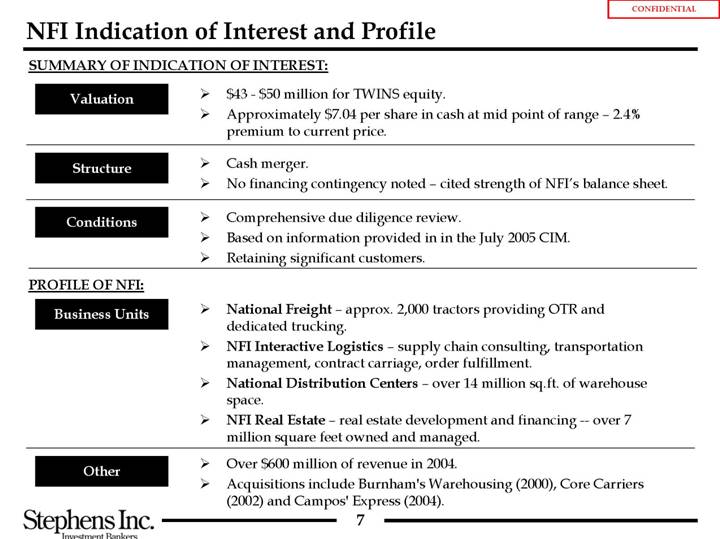

NFI Indication of Interest and Profile

SUMMARY OF INDICATION OF INTEREST:

Valuation | • | $43 - $50 million for TWINS equity. |

| • | Approximately $7.04 per share in cash at mid point of range – 2.4% premium to current price. |

| | |

Structure | • | Cash merger. |

| • | No financing contingency noted – cited strength of NFI’s balance sheet. |

| | |

Conditions | • | Comprehensive due diligence review. |

| • | Based on information provided in in the July 2005 CIM. |

| • | Retaining significant customers. |

| | |

PROFILE OF NFI: | | |

| | |

Business Units | • | National Freight – approx. 2,000 tractors providing OTR and dedicated trucking. |

| • | NFI Interactive Logistics – supply chain consulting, transportation management, contract carriage, order fulfillment. |

| • | National Distribution Centers – over 14 million sq.ft. of warehouse space. |

| • | NFI Real Estate – real estate development and financing — over 7 million square feet owned and managed. |

| | |

Other | • | Over $600 million of revenue in 2004. |

| • | Acquisitions include Burnham’s Warehousing (2000), Core Carriers (2002) and Campos’ Express (2004). |

7

II. Valuation Update

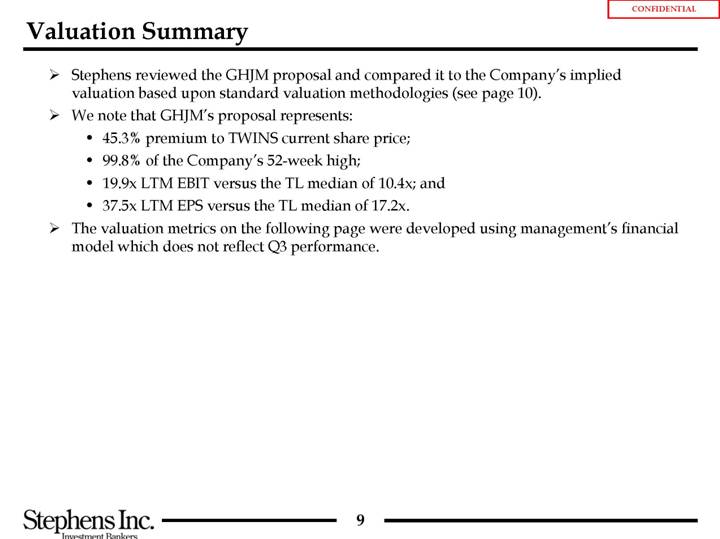

Valuation Summary

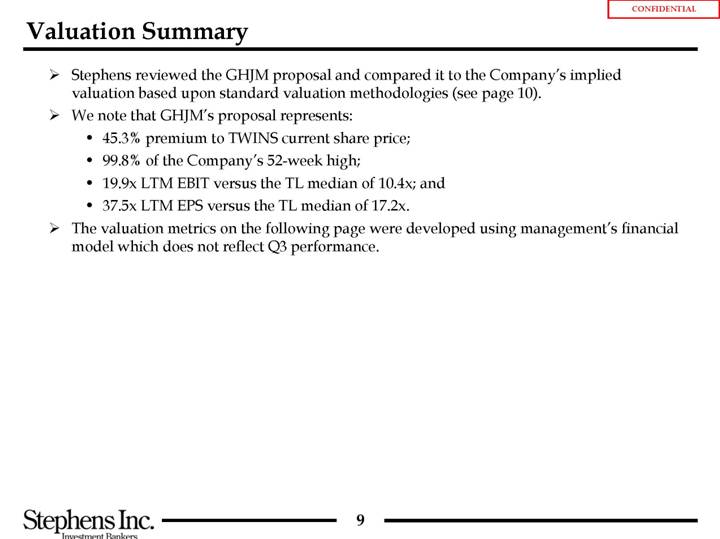

• Stephens reviewed the GHJM proposal and compared it to the Company’s implied valuation based upon standard valuation methodologies (see page 10).

• We note that GHJM’s proposal represents:

• 45.3% premium to TWINS current share price;

• 99.8% of the Company’s 52-week high;

• 19.9x LTM EBIT versus the TL median of 10.4x; and

• 37.5x LTM EPS versus the TL median of 17.2x.

• The valuation metrics on the following page were developed using management’s financial model which does not reflect Q3 performance.

9

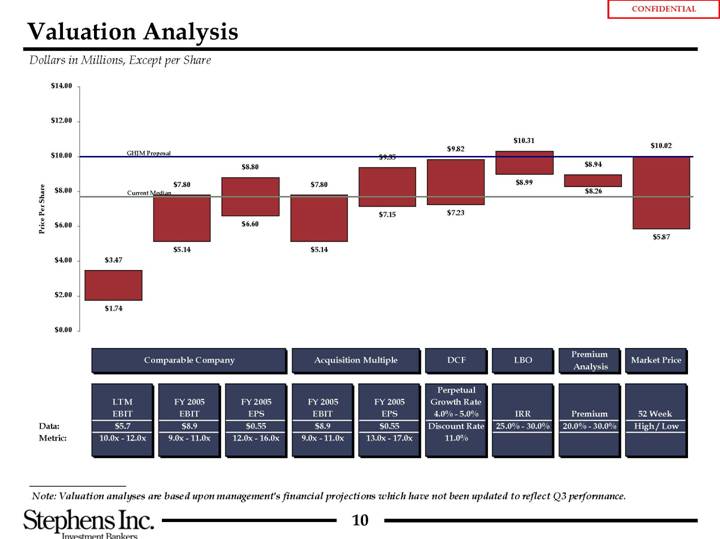

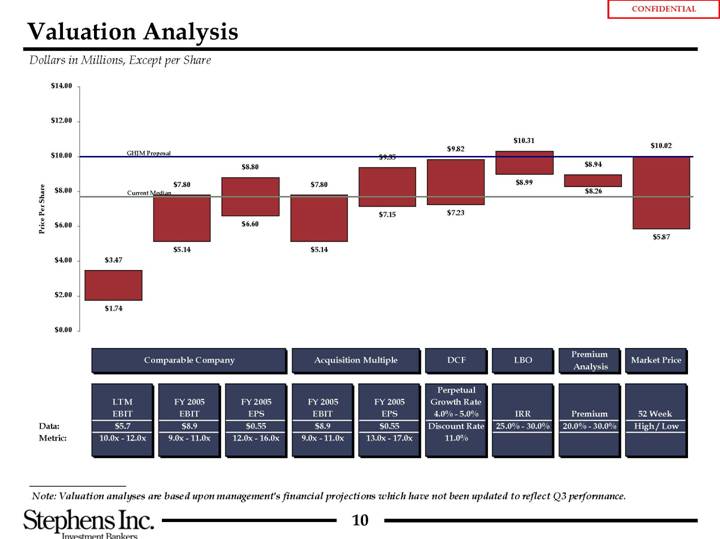

Valuation Analysis

Dollars in Millions, Except per Share

[CHART]

| | | | | | | | | | | | | | | | Premium | | | |

| | Comparable Company | | Acquisition Multiple | | DCF | | LBO | | Analysis | | Market Price | |

| | | | | | | | | | | | Perpetual | | | | | | | |

| | LTM | | FY 2005 | | FY 2005 | | FY 2005 | | FY 2005 | | Growth Rate | | | | | | | |

| | EBIT | | EBIT | | EPS | | EBIT | | EPS | | 4.0% - 5.0% | | IRR | | Premium | | 52 Week | |

Data: | | $5.7 | | $8.9 | | $0.55 | | $8.9 | | $0.55 | | Discount Rate

11.0% | | 25.0% - 30.0% | | 20.0% - 30.0% | | High / Low | |

Metric: | | 10.0x - 12.0x | | 9.0x - 11.0x | | 12.0x - 16.0x | | 9.0x - 11.0x | | 13.0x - 17.0x | | | | | | | | | |

Note: Valuation analyses are based upon management's financial projections which have not been updated to reflect Q3 performance.

10

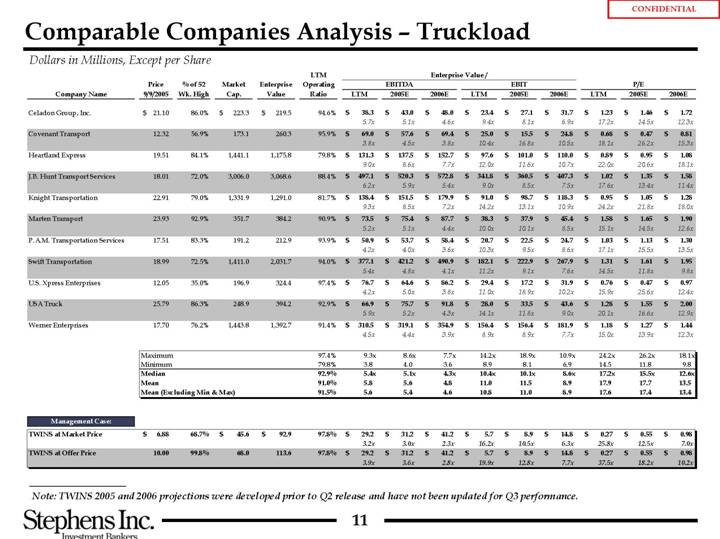

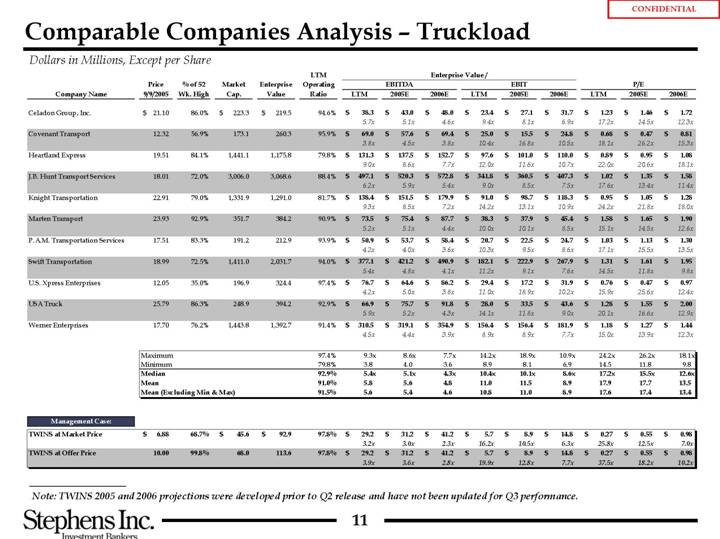

Comparable Companies Analysis – Truckload

Dollars in Millions, Except per Share

| | | | | | | | | | | | | LTM | | Enterprise Value / | | | | | | | | | | |

| | Price | | % of 52 | | Market | | Enterprise | | Operating | | EBITDA | | EBIT | | P/E | |

Company Name | | 9/9/2005 | | Wk. High | | Cap. | | Value | | Ratio | | LTM | | 2005E | | 2006E | | LTM | | 2005E | | 2006E | | LTM | | 2005E | | 2006E | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Celadon Group, Inc. | | $ | 21.10 | | 86.0 | % | $ | 223.3 | | $ | 219.5 | | $ | 94.6 | % | $ | 38.3 | | $ | 43.0 | | $ | 48.0 | | $ | 23.4 | | $ | 27.1 | | $ | 31.7 | | $ | 1.23 | | $ | 1.46 | | $ | 1.72 | |

| | | | | | | | | | | | 5.7 | x | 5.1 | x | 4.6 | x | 9.4 | x | 8.1 | x | 6.9 | x | 17.2 | x | 14.5 | x | 12.3 | x |

Covenant Transport | | 12.32 | | 56.9 | % | 173.1 | | 260.3 | | 95.9 | % | $ | 69.0 | | $ | 57.6 | | $ | 69.4 | | $ | 25.0 | | $ | 15.5 | | $ | 24.8 | | $ | 0.68 | | $ | 0.47 | | $ | 0.81 | |

| | | | | | | | | | | | 3.8 | x | 4.5 | x | 3.8 | x | 10.4 | x | 16.8 | x | 10.5 | x | 18.1 | x | 26.2 | x | 15.3 | x |

Heartland Express | | 19.51 | | 84.1 | % | 1,441.1 | | 1,175.8 | | 79.8 | % | $ | 131.3 | | $ | 137.5 | | $ | 152.7 | | $ | 97.6 | | $ | 101.0 | | $ | 110.0 | | $ | 0.89 | | $ | 0.95 | | $ | 1.08 | |

| | | | | | | | | | | | 9.0 | x | 8.6 | x | 7.7 | x | 12.0 | x | 11.6 | x | 10.7 | x | 22.0 | x | 20.6 | x | 18.1 | x |

J.B. Hunt Transport Services | | 18.01 | | 72.0 | % | 3,006.0 | | 3,068.6 | | 88.4 | % | $ | 497.1 | | $ | 520.3 | | $ | 572.8 | | $ | 341.8 | | $ | 360.5 | | $ | 407.3 | | $ | 1.02 | | $ | 1.35 | | $ | 1.58 | |

| | | | | | | | | | | | 6.2 | x | 5.9 | x | 5.4 | x | 9.0 | x | 8.5 | x | 7.5 | x | 17.6 | x | 13.4 | x | 11.4 | x |

Knight Transportation | | 22.91 | | 79.0 | % | 1,331.9 | | 1,291.0 | | 81.7 | % | $ | 138.4 | | $ | 151.5 | | $ | 179.9 | | $ | 91.0 | | $ | 98.7 | | $ | 118.3 | | $ | 0.95 | | $ | 1.05 | | $ | 1.28 | |

| | | | | | | | | | | | 9.3 | x | 8.5 | x | 7.2 | x | 14.2 | x | 13.1 | x | 10.9 | x | 24.2 | x | 21.8 | x | 18.0 | x |

Marten Transport | | 23.93 | | 92.9 | % | 351.7 | | 384.2 | | 90.9 | % | $ | 73.5 | | $ | 75.4 | | $ | 87.7 | | $ | 38.3 | | $ | 37.9 | | $ | 45.4 | | $ | 1.58 | | $ | 1.65 | | $ | 1.90 | |

| | | | | | | | | | | | 5.2 | x | 5.1 | x | 4.4 | x | 10.0 | x | 10.1 | x | 8.5 | x | 15.1 | x | 14.5 | x | 12.6 | x |

P.A.M. Transportation Services | | 17.51 | | 83.3 | % | 191.2 | | 212.9 | | 93.9 | % | $ | 50.9 | | $ | 53.7 | | $ | 58.4 | | $ | 20.7 | | $ | 22.5 | | $ | 24.7 | | $ | 1.03 | | $ | 1.13 | | $ | 1.30 | |

| | | | | | | | | | | | 4.2 | x | 4.0 | x | 3.6 | x | 10.3 | x | 9.5 | x | 8.6 | x | 17.1 | x | 15.5 | x | 13.5 | x |

Swift Transportation | | 18.99 | | 72.5 | % | 1,411.0 | | 2,031.7 | | 94.0 | % | $ | 377.1 | | $ | 421.2 | | $ | 490.9 | | $ | 182.1 | | $ | 222.9 | | $ | 267.9 | | $ | 1.31 | | $ | 1.61 | | $ | 1.95 | |

| | | | | | | | | | | | 5.4 | x | 4.8 | x | 4.1 | x | 11.2 | x | 9.1 | x | 7.6 | x | 14.5 | x | 11.8 | x | 9.8 | x |

U.S. Xpress Enterprises | | 12.05 | | 35.0 | % | 196.9 | | 324.4 | | 97.4 | % | $ | 76.7 | | $ | 64.6 | | $ | 86.2 | | $ | 29.4 | | $ | 17.2 | | $ | 31.9 | | $ | 0.76 | | $ | 0.47 | | $ | 0.97 | |

| | | | | | | | | | | | 4.2 | x | 5.0 | x | 3.8 | x | 11.0 | x | 18.9 | x | 10.2 | x | 15.9 | x | 25.6 | x | 12.4 | x |

USA Truck | | 25.79 | | 86.3 | % | 248.9 | | 394.2 | | 92.9 | % | $ | 66.9 | | $ | 75.7 | | $ | 91.8 | | $ | 28.0 | | $ | 33.5 | | $ | 43.6 | | $ | 1.28 | | $ | 1.55 | | $ | 2.00 | |

| | | | | | | | | | | | 5.9 | x | 5.2 | x | 4.3 | x | 14.1 | x | 11.8 | x | 9.0 | x | 20.1 | x | 16.6 | x | 12.9 | x |

Werner Enterprises | | 17.70 | | 76.2 | % | 1,443.8 | | 1,392.7 | | 91.4 | % | $ | 310.5 | | $ | 319.1 | | $ | 354.9 | | $ | 156.4 | | $ | 156.4 | | $ | 181.9 | | $ | 1.18 | | $ | 1.27 | | $ | 1.44 | |

| | | | | | | | | | | | 4.5 | x | 4.4 | x | 3.9 | x | 8.9 | x | 8.9 | x | 7.7 | x | 15.0 | x | 13.9 | x | 12.3 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maximum | | | | | | 97.4 | % | 9.3 | x | 8.6 | x | 7.7 | x | 14.2 | x | 18.9 | x | 10.9 | x | 24.2 | x | 26.2 | x | 18.1 | x |

| | Minimum | | | | | | 79.8 | % | 3.8 | | 4.0 | | 3.6 | | 8.9 | | 8.1 | | 6.9 | | 14.5 | | 11.8 | | 9.8 | |

| | Median | | | | | | 92.9 | % | 5.4 | x | 5.1 | x | 4.3 | x | 10.4 | x | 10.1 | x | 8.6 | x | 17.2 | x | 15.5 | x | 12.6 | x |

| | Mean | | | | | | 91.0 | % | 5.8 | | 5.6 | | 4.8 | | 11.0 | | 11.5 | | 8.9 | | 17.9 | | 17.7 | | 13.5 | |

| | Mean (Excluding Min & Max) | | | | | | 91.5 | % | 5.6 | | 5.4 | | 4.6 | | 10.8 | | 11.0 | | 8.9 | | 17.6 | | 17.4 | | 13.4 | |

Management Case:

TWINS at Market Price | | $ | 6.88 | | 68.7 | % | $ | 45.6 | | $ | 92.9 | | $ | 97.8 | % | $ | 29.2 | | $ | 31.2 | | $ | 41.2 | | $ | 5.7 | | $ | 8.9 | | $ | 14.8 | | $ | 0.27 | | $ | 0.55 | | $ | 0.98 | |

| | | | | | | | | | | | 3.2 | x | 3.0 | x | 2.3 | x | 16.2 | x | 10.5 | x | 6.3 | x | 25.8 | x | 12.5 | x | 7.0 | x |

TWINS at Offer Price | | 10.00 | | 99.8 | % | 68.0 | | 113.6 | | 97.8 | % | $ | 29.2 | | $ | 31.2 | | $ | 41.2 | | $ | 5.7 | | $ | 8.9 | | $ | 14.8 | | $ | 0.27 | | $ | 0.55 | | $ | 0.98 | |

| | | | | | | | | | | | 3.9 | x | 3.6 | x | 2.8 | x | 19.9 | x | 12.8 | x | 7.7 | x | 37.5 | x | 18.2 | x | 10.2 | x |

Note: TWINS 2005 and 2006 projections were developed prior to Q2 release and have not been updated for Q3 performance.

11

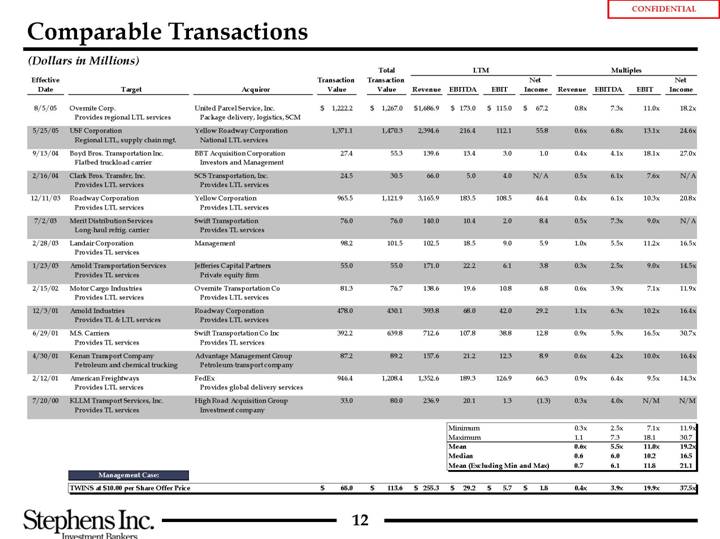

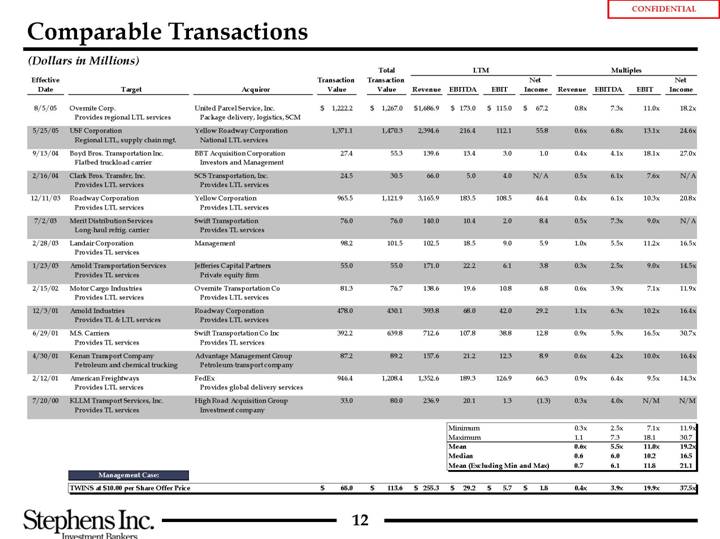

Comparable Transactions

(Dollars in Millions)

| | | | | | | | Total | | LTM | | Multiples | |

Effective | | | | | | Transaction | | Transaction | | | | | | | | Net | | | | | | | | Net | |

Date | | Target | | Acquiror | | Value | | Value | | Revenue | | EBITDA | | EBIT | | Income | | Revenue | | EBITDA | | EBIT | | Income | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

8/5/05 | | Overnite Corp.

Provides regional LTL services | | United Parcel Service, Inc.

Package delivery, logistics, SCM | | $ | 1,222.2 | | $ | 1,267.0 | | $ | 1,686.9 | | $ | 173.0 | | $ | 115.0 | | $ | 67.2 | | 0.8 | x | 7.3 | x | 11.0x | | 18.2 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

5/25/05 | | USF Corporation

Regional LTL, supply chain mgt. | | Yellow Roadway Corporation

National LTL services | | 1,371.1 | | 1,470.3 | | 2,394.6 | | 216.4 | | 112.1 | | 55.8 | | 0.6 | x | 6.8 | x | 13.1 | x | 24.6 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

9/13/04 | | Boyd Bros. Transportation Inc.

Flatbed truckload carrier | | BBT Acquisition Corporation

Investors and Management | | 27.4 | | 55.3 | | 139.6 | | 13.4 | | 3.0 | | 1.0 | | 0.4 | x | 4.1 | x | 18.1 | x | 27.0 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2/16/04 | | Clark Bros. Transfer, Inc.

Provides LTL services | | SCS Transportation, Inc.

Provides LTL services | | 24.5 | | 30.5 | | 66.0 | | 5.0 | | 4.0 | | N/A | | 0.5 | x | 6.1 | x | 7.6 | x | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

12/11/03 | | Roadway Corporation

Provides LTL services | | Yellow Corporation

Provides LTL services | | 965.5 | | 1,121.9 | | 3,165.9 | | 183.5 | | 108.5 | | 46.4 | | 0.4 | x | 6.1 | x | 10.3 | x | 20.8 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

7/2/03 | | Merit Distribution Services

Long-haul refrig. carrier | | Swift Transportation

Provides TL services | | 76.0 | | 76.0 | | 140.0 | | 10.4 | | 2.0 | | 8.4 | | 0.5 | x | 7.3 | x | 9.0 | x | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2/28/03 | | Landair Corporation

Provides TL services | | Management | | 98.2 | | 101.5 | | 102.5 | | 18.5 | | 9.0 | | 5.9 | | 1.0 | x | 5.5 | x | 11.2 | x | 16.5 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

1/23/03 | | Arnold Transportation Services

Provides TL services | | Jefferies Capital

Partners Private equity firm | | 55.0 | | 55.0 | | 171.0 | | 22.2 | | 6.1 | | 3.8 | | 0.3 | x | 2.5 | x | 9.0 | x | 14.5 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2/15/02 | | Motor Cargo Industries

Provides LTL services | | Overnite Transportation Co

Provides LTL services | | 81.3 | | 76.7 | | 138.6 | | 19.6 | | 10.8 | | 6.8 | | 0.6 | x | 3.9 | x | 7.1 | x | 11.9 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

12/3/01 | | Arnold Industries

Provides TL & LTL services | | Roadway Corporation

Provides LTL services | | 478.0 | | 430.1 | | 393.8 | | 68.0 | | 42.0 | | 29.2 | | 1.1 | x | 6.3 | x | 10.2 | x | 16.4 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

6/29/01 | | M.S. Carriers

Provides TL services | | Swift Transportation Co Inc

Provides TL services | | 392.2 | | 639.8 | | 712.6 | | 107.8 | | 38.8 | | 12.8 | | 0.9 | x | 5.9 | x | 16.5 | x | 30.7 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

4/30/01 | | Kenan Transport Company

Petroleum and chemical trucking | | Advantage Management Group

Petroleum-transport company | | 87.2 | | 89.2 | | 157.6 | | 21.2 | | 12.3 | | 8.9 | | 0.6 | x | 4.2 | x | 10.0 | x | 16.4 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2/12/01 | | American Freightways

Provides LTL services | | FedEx

Provides global delivery services | | 946.4 | | 1,208.4 | | 1,352.6 | | 189.3 | | 126.9 | | 66.3 | | 0.9 | x | 6.4 | x | 9.5 | x | 14.3 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | |

7/20/00 | | KLLM Transport Services, Inc.

Provides TL services | | High Road Acquisition Group

Investment company | | 33.0 | | 80.0 | | 236.9 | | 20.1 | | 1.3 | | (1.3 | ) | 0.3 | x | 4.0 | x | N/M | | N/M | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Minimum | | 0.3 | x | 2.5 | x | 7.1 | x | 11.9 | x |

| | | | | | | | | | | | Maximum | | | | | | 1.1 | | 7.3 | | 18.1 | | 30.7 | |

| | | | | | | | | | | | Mean | | | | | 0.6 | x | 5.5 | x | 11.0 | x | 19.2 | x |

| | | | | | | | | | | | Median | | | | | 0.6 | | 6.0 | | 10.2 | | 16.5 | |

| | | | | | | | | | | | Mean (Excluding Min and Max) | | 0.7 | | 6.1 | | 11.8 | | 21.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Management Case:

| TWINS at $10.00 per Share Offer Price | | $ | 68.0 | | $ | 113.6 | | $ | 255.3 | | $ | 29.2 | | $ | 5.7 | | $ | 1.8 | | $ | 0.4 | x | 3.9 | x | 19.9 | x | 37.5 | x |

12

[GRAPHIC]

III. GHJM Letter of Intent

Goldner Hawn Johnson & Morrison

Incorporated

3700 Wells Fargo Center

90 South Seventh Street

Minneapolis, Minnesota 55402-4128

612/338-5912

Fax 612/338-2860

September 9, 2005

Transport Corporation of America, Inc.

c/o Michael Miller

Stephens, Inc.

300 Crescent Court

Suite 600

Dallas, TX 75201

Re: Proposal to Purchase Transport Corporation of America, Inc.

Dear Sirs:

Thank you for affording us the opportunity to become acquainted with Transport Corporation of America, Inc. (the “Company”) and its management team.

This letter is intended to summarize the principal terms upon which Goldner Hawn Johnson & Morrison Incorporated (“GHJ&M”), through an acquisition corporation (“Purchaser”) owned by its investment affiliate, Marathon Fund Limited Partnership V (“Marathon”), proposes to acquire the Company in a cash merger. In this letter, the Company and its subsidiaries are collectively referred to herein as the “Company”; the proposed acquisition of the Company by Purchaser is sometimes called the “Potential Acquisition”; and GHJ&M, Purchaser and the Company are sometimes called the “Parties.”

Part I of this letter describes the proposed terms of the Potential Acquisition based upon the information contained in the confidential offering memorandum prepared on behalf of the Company and the limited investigation of the Company’s business that has been permitted GHJ&M. The provisions of Part I are not intended to be legally binding between the Parties and are subject to, among other things, the completion of GHJ&M’s examination of the business, assets and financial and other records of the Company and to the negotiation and execution of a definitive written acquisition agreement providing for the Potential Acquisition (a “Definitive Agreement”). We are submitting with this letter a draft of such an agreement (the “Draft Agreement”) which incorporates our revisions to the draft distributed with Stephens Inc.’s bid instruction letter of August 25, 2005 (the “Bid Letter”).

The provisions of Part II of this letter constitute a legally binding agreement of the Parties regarding the rights, obligations and behavior of the Parties during the drafting and negotiation of the Definitive Agreement.

PART I

Based upon the information currently known to GHJ&M, we propose the following in response to the Bid Letter request:

1. Purchaser would acquire all of the outstanding equity of the Company through a triangular merger (the “Merger”), for a cash price per share to the Company’s shareholders of $10 per share, without interest (the “Merger Consideration”). This price assumes that the fully diluted equity of the Company is as set forth in the draft agreement distributed with the Bid Letter.

2. We have enclosed our mark-up of the Definitive Agreement in the form in which we are prepared to sign, subject to satisfactory completion of our due diligence and review of the applicable disclosure schedules to be distributed by the Company.

3. We intend to finance the Merger Consideration from the proceeds of debt and equity financing. The equity portion of the financing would be provided by Marathon and the equity investments, if any, of senior management of the Company. GHJ&M intends to obtain the requisite debt financing from among the commercial and institutional lenders who routinely provide such financing and with whom we have long-standing relationships. While GHJ&M has not initiated a formal request for financing commitments, we have had extensive discussions with our lenders and expect that any necessary financial commitments will be obtained prior to or contemporaneously with the completion and signing of the Definitive Agreement. Documentation of the state of those discussions is submitted herewith.

4. While we have been permitted to conduct only limited due diligence to date, we intend to engage accounting, environmental, legal and industry advisors to assist us to complete our investigation. We refer you to our proposal letter of August 11, 2005 for a list of some of the lenders, advisors and consultants we would expect to engage. Assuming full cooperation from the Company, we would expect to have our remaining diligence completed within the two-week period contemplate by the Bid Letter.

5. As background, GHJ&M is a private equity investment firm based in Minneapolis, Minnesota. The only approvals necessary to invest Marathon assets come from GHJ&M’s internal investment committee, which consists entirely of the firm’s principals. That committee has authorized the delivery of this proposal and its final approval would be required prior to execution of a Definitive Agreement.

6. Other than filings in connection with the Hart-Scott-Rodino Antitrust Improvements Act of 1976, we do not anticipate any regulatory approvals necessary to complete this transaction. In addition to conditions customary to a transaction of this type, which are set forth in the enclosed Definitive Agreement mark-up, we would condition the Merger on obtaining the financing necessary to complete the Merger pursuant to the financing commitment letters to be entered into at the time of signing the Definitive Agreement.

- 2 -

PART II

The following paragraphs of this letter agreement (the “Binding Provisions”) are legal and enforceable agreements of GHJ&M and the Company.

1. From and after the date this letter is signed by the Company (the “Signing Date”), the Company will provide GHJ&M and its authorized representatives, including its independent auditors, attorneys, environmental consultants and potential lenders, complete access to the Company and each subsidiary, their personnel, properties, contracts, customers, financial, tax, legal and other records and all other documents and data for the purpose of conducting an investigation of the Company and each subsidiary and their assets and businesses.

2. The Confidentiality Agreement between the Company and GHJ&M dated July 19, 2005 will remain in full force and effect.

3. Except as and to the extent required by law and except for disclosure to their respective authorized representatives, without the prior written consent of the other Parties, neither GHJ&M nor the Company will, and each will direct its representatives not to make, directly or indirectly, any public comment, statement, or communication with respect to, or otherwise to disclose or to permit the disclosure of the existence of discussions regarding, a possible transaction between the Parties or any of the terms, conditions, or other aspects of the transaction proposed in this letter. If a Party is required by law to make any such disclosure, it must first provide to the other Parties the content of the proposed disclosure, the reasons that such disclosure is required by law, and the time and place that the disclosure will be made.

4. Until the Termination Date:

(a) the Company shall not, directly or indirectly, through any representative or otherwise, solicit or entertain offers from, negotiate with or in any manner encourage, discuss, accept, or consider any proposal of any other person relating to the acquisition of the Company, their assets or business, in whole or in part, whether directly or indirectly, through purchase, merger, consolidation, or otherwise; and

(b) the Company shall immediately notify GHJ&M regarding any contact between the Company or any of its representatives and any other person regarding any such offer or proposal or any related inquiry.

5. Except as set forth in the Definitive Agreement, each Party will be responsible for and bear all of its own costs and expenses (including any broker’s fees or finder’s fees and the expenses of its representatives) incurred at any time in connection with pursuing or consummating the Potential Acquisition.

6. Except as provided in Paragraph 2 of this Part II, the Binding Provisions constitute the entire agreement between and among the Parties, and supersede all prior oral or written agreements, understandings, representations and warranties, and courses of conduct and

- 3 -

dealing between the Parties on the subject matter hereof. Except as otherwise provided herein, the Binding Provisions may be amended or modified only by a writing executed by all of the Parties.

7. This letter, including, without limitation, the Binding Provisions, will be governed by and construed under the laws of the State of Minnesota without regard to conflicts of laws principles.

8. Any action or proceeding seeking to enforce any provision of, or based on any right arising out of, this letter agreement may be brought against any of the Parties in the courts of the State of Minnesota, County of Hennepin, or, if it has or can acquire jurisdiction, in the United States District Court for the District of Minnesota, and each of the Parties consents to the jurisdiction of such courts (and of the appropriate appellate courts) in any such action or proceeding and waives any objection to venue laid therein. Process in any action or proceeding referred to in the preceding sentence may be served on any Party anywhere in the world.

9. Except as stated in the last sentence of this Paragraph 9, the Binding Provisions will automatically terminate at 11:59 P.M. CDT on the thirtieth calendar day after the Signing Date, and may be terminated earlier upon written notice by GHJ&M to the other Parties unilaterally, for any reason or no reason, with or without cause, at any time that it has determined not to proceed with the Potential Acquisition (the date of such termination referred to herein as the “Termination Date”); provided, however, that a termination of the Binding Provisions will not affect the liability of a Party for breach of any of the Binding Provisions prior to the termination. Upon termination of the Binding Provisions, the Parties will have no further obligations hereunder, except as stated in Paragraphs 2, 3, 5, 6, 7, 8, 9, 10 and 11 of this Part II, which will survive any such termination.

10. This letter agreement may be executed in one or more counterparts, each of which will be deemed to be an original copy of this letter and all of which, when taken together, will be deemed to constitute one and the same letter.

11. The Paragraphs and provisions of Part I of this letter do not constitute and will not give rise to any legally binding obligation on the part of any of the Parties. Moreover, except as expressly provided in the Binding Provisions (or as expressly provided in any binding written agreement that the Parties may enter into in the future), no past or future action, course of conduct, or failure to act relating to the Potential Acquisition, or relating to the negotiation of the terms of the Potential Acquisition or any Definitive Agreement, will give rise to or serve as a basis for any obligation or other liability on the part of the Parties.

If you are in agreement with the foregoing, please sign and return one copy of this letter by Friday, September 16, 2005. Thereupon, this letter will constitute our agreement with respect to its subject matter.

- 4 -

Thank you again for the opportunity to consider this transaction. If you have any questions concerning any of the foregoing, please feel free to contact the undersigned at (612) 338-5912.

| Very truly yours, |

| |

| GOLDNER HAWN JOHNSON & MORRISON INCORPORATED |

| |

| |

| |

| By | /s/ Van Zandt Hawn |

| Van Zandt Hawn |

| Managing Director |

Duly executed and, as to Part II, agreed, on

September ____ , 2005

TRANSPORT CORPORATION OF AMERICA, INC.

- 5 -

[GRAPHIC]

IV. NFI Indication of Interest

[LETTERHEAD]

September 6, 2005

Michael Miller

STEPHENS, INC.

300 Crescent Court

Suite 600

Dallas, TX 75201

RE: Transportation Corporation of America, Inc.

Dear Mr. Miller:

Thank you very much for inviting us to examine the possible acquisition of Transportation Corporation of America, Inc. (“TCAM”). Based on our initial review, as well as our pre-existing awareness of TCAM business, we are very excited about the potential fit and look forward to meeting with management and exploring the opportunity together.

As you may know, NFI Industries is one of the leading transportation, warehousing and logistics companies in North America. The company was established in 1932 and has a revenue base of over $600 million generated by its trucking, warehousing, logistics and real estate entities. We believe that TCAM and NFI both have several strengths in common, including a legacy of successful growth from traditional family-based roots into a modern, professionally-run transportation company. This should enable us to complete our due diligence process quickly and efficiently. We also believe we will be able to provide particularly compelling opportunities for the senior management team post-transaction, as we seek to grow the combined enterprise.

Pursuant to your Offering Memorandum on the subject, and your request for indications of interest, we hereby submit our non-binding offer in the amount of $43 to $50 million in cash at closing. The offer is based on the information supplied in the Offering Memorandum and would be subject to change based on a more formal review of this information along with our confirmation that customers with substantial revenue base will remain. The purchase would be made by NFI Industries or its assignee. We have the ability to finance the purchase entirely with cash, and although we intend to employ debt financing as well as the possibility of existing lines of credit, our balance sheet gives us the ability to fast track the purchase and complete the transaction as expected.

We believe the synergies between NFI and TCAM make this an excellent opportunity for all parties involved. Please feel free to contact me directly to discuss any questions. We look forward to the possibility of meeting with TCAM’s management and would appreciate the opportunity to explore this in further detail.

Sincerely,

/s/ Frank R. Raschilli

Frank R. Raschilli

Executive Vice President-CFO