UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-01612 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Variable Contract Account-2 |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 12/31/2016 |

| |

| Date of reporting period: | | 12/31/2016 |

Item 1 – Reports to Stockholders –

The Prudential Variable Contract Account-2

| | |

| ANNUAL REPORT | | December 31, 2016 |

This report is for the information of persons participating in The Prudential Variable Contract Account-2 (VCA-2, or the “Account”). VCA-2 is a group annuity insurance product issued by The Prudential Insurance Company of America, 751 Broad Street, Newark, NJ 07102-3777, and is distributed by Prudential Investment Management Services LLC (PIMS), member SIPC, 655 Broad Street, 19th Floor, Newark, NJ 07102. Both are Prudential Financial companies.

All are Prudential Financial companies and each is solely responsible for its financial condition and contractual obligations.

The views expressed in this report and information about the Account’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Please note that this document may include prospectus supplements that are separate from and not a part of this report.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus for VCA-2. Investors should consider the contract and VCA-2’s investment objectives, risks, charges and expenses carefully before investing. This and other important information is contained in the prospectus that can be obtained from your financial professional. You should read the prospectus carefully before investing.

Annuity contracts contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your plan sponsor or licensed financial professional can provide you with costs and complete details. Contract guarantees are based on the claims-paying ability of the issuing company.

A description of the Account’s proxy voting policies and procedures is available, without charge, upon request. Owners of variable annuity contracts should call 800-458-6333 to obtain descriptions of the Account’s proxy voting policies and procedures. Information regarding how the Account voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the website of the Securities and Exchange Commission (Commission), at www.sec.gov.

The Account’s Statement of Additional Information contains additional information about the members of the Account’s Committee and is available without charge upon request by calling 800-458-6333.

The Account files with the Commission a complete listing of portfolio holdings as of its first and third quarter-end on Form N-Q. Form N-Q is available on the Commission’s website at www.sec.gov or by visiting the Commission’s Public Reference Room. For more information on the Commission’s Public Reference Room, please visit the Commission’s website or call 1-800-SEC-0330. Participants may obtain copies of Form N-Q filings by calling 800-458-6333.

| | | | |

The Prudential Variable Contract Account-2 Table of Contents | | Annual Report | | December 31, 2016 |

| ∎ | | REPORT OF THE INVESTMENT MANAGER |

| ∎ | | PRESENTATION OF PORTFOLIO HOLDINGS |

| | | | |

| Section A | | Statement of Net Assets and Financial Statements | | |

| Section B | | Financial Highlights | | |

| Section C | | Notes to Financial Statements | | |

| Section D | | Report of Independent Registered Public Accounting Firm | | |

| Section E | | Information about Committee Members and Officers | | |

| | |

The Prudential Variable Contract Account-2 Letter to Participants | | December 31, 2016 |

At Prudential, our primary objective is to help investors achieve and maintain long-term financial success. This Variable Contract Account-2 annual report outlines our efforts to achieve this goal. We hope you find it informative and useful.

Prudential has been building on a heritage of success for more than 135 years. We believe the array of our products provides a highly attractive value proposition to clients like you who are focused on financial security.

Your financial professional is the best resource to help you make the most informed investment decisions. Together, you can build a diversified investment portfolio that aligns with your long-term financial goals. Please keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Thank you for selecting Prudential as one of your financial partners. We value your trust and appreciate the opportunity to help you achieve financial security.

Sincerely,

Stuart Parker

President,

The Prudential Variable Contract Account-2 | January 31, 2017 |

| | | | |

| Market Overview — unaudited | | Annual Report | | December 31, 2016 |

Equity Market Overview

US Equities lifted by post-election optimism

In a year of surprises, US equities left no surprise regarding investor sentiment. After a powerful fourth quarter of 2016, the S&P 500, including dividends, returned 3.82% for the quarter and 11.94% for the year.

The year began on a down note. US stocks entered into a correction in January, jolted by a steep decline in manufacturing in China, followed by a massive selloff in China’s equity markets, which spilled over to all global markets. Market woes continued roughly through the first half of February, as stocks performed poorly, but then turned upward. In March, a strong rally powered stocks in the S&P 500 to rise by one of the largest gains in any single month in recent history. Continued low interest rates and a stabilization in oil prices helped stocks to rebound.

One of the biggest surprises took place in late June. The UK’s vote to leave the European Union, known as “Brexit,” briefly increased market volatility, although the macroeconomic fallout appeared manageable, if not limited. Volatility was generally kept in check during the third quarter. Also, riskier equities, such as companies in the technology and financial sectors, outperformed.

In the fourth quarter, the presidential election delivered the year’s biggest surprise as Donald Trump was elected the 45th president of the US. Stocks, especially financials, surged on the news, as Trump’s US-focus on a growth-friendly agenda was also seen as a boon for the US financial sector. In December, to no one’s surprise, the Fed raised interest rates by 0.25%.

Sector performance reflects strength in the economy

Sector performance was positive except for health care. Cyclical stocks, which are more sensitive to developments in the economy, outpaced most of their defensive counterparts. Energy led all sectors with a 27.36% gain, as oil prices climbed. The defensive, but dividend-paying, telecommunications sector rose by 23.49%, as the search for yield continues. Financials, were boosted by the election results, shot up 22.80%, with banks and diversified financial companies achieving impressive returns. Industrials churned out an 18.86% gain, led by construction and engineering companies. Materials turned in a strong performance, rising by 16.69%, as metals & mining and construction materials industries surged.

Utilities gained 16.29%, as independent power and renewable energy producers charge forward. Information technology clicked up by 13.85% on strength in the semi-conductor & semi-conductor equipment industry. The media industry and Internet catalogue & retail industries boosted consumer discretionary, which rose by 6.03%. Consumer staples rang up a 5.38% return on gains in the tobacco and food industries. Real estate posted a gain of 3.39%, on concerns over rising interest rates. Health care stumbled to a -2.69% return on weakness in the health care technology and biotechnology industries.

Small-caps show leadership in Russell Indexes

The Russell US Indexes, which measure equity performance with respect to stock-specific styles (value and growth) and capitalization levels (small-, mid-, and large-cap), were all in positive territory. Small-cap stocks, as measured by the Russell 2000® Index, gained 21.31% against their larger counterparts, which also reflected stronger business activity. The Russell Midcap® Index returned 13.80%. In large-cap stocks, the Russell 1000® Value Index gained 17.34% against the 7.08% return of the Russell 1000® Growth Index.

International and emerging markets mixed

The MSCI-EAFE Index, which measures the performance of developed markets excluding the United States and Canada, eked out a positive return of 1.0% net of dividends, for the year.

A lackluster fourth quarter hindered market performance for the year, especially in Europe which was fraught with political uncertainty. Most heavily weighted countries in Europe turned in a moderate performance. Germany returned 2.28%, France rose by 4.88%, and the UK fell by -0.10%. Austria gained 11.26% to lead the region, while Belgium lagged the region, falling to a -15.77% return.

Countries in the Pacific region generally gained. Hong Kong rose by 2.26%. Singapore gained 1.42%. Japan was positive with a 2.37% gain. Australia rose by 11.44% and New Zealand gained 18.37% on low interest rates and strong dividend-paying companies.

The MSCI Emerging Markets Index generally recorded solid gains, rising by 11.19%. The Brazil, Russia, India, and China (BRIC) group rose by 12.12%. Brazil rose by a whopping 66.24%, as a result of its new, pro-growth leadership. Re-energized Russian markets posted a huge 54.82% gain on rising oil prices. India dipped into negative territory with a -1.43% return, and China was slightly positive, returning 0.93%.

| | |

The Prudential Variable Contract Account-2 | | December 31, 2016 |

Report of the Investment Manager - As of December 31, 2016 (Unaudited)

| | | | | | | | | | | | |

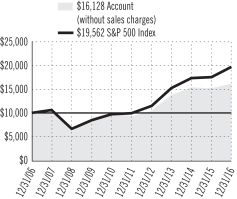

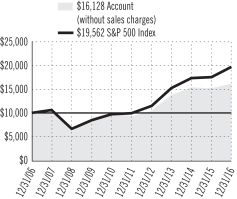

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Account (without sales charges) | | | 6.59 | % | | | 11.71 | % | | | 4.89 | % |

S&P 500 Index | | | 11.94 | | | | 14.65 | | | | 6.94 | |

Past performance does not guarantee future returns. The Account performance without sales charges is shown after the deduction of all expenses, including investment management and mortality and expense charges, but does not include the effect of any sales charge or annual account charge. The returns would be lower if they included the effects of sales charges and an annual account charge.

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2016, the Prudential Variable Contract Account-2 returned 6.59%.

The net assets of the Portfolio at December 31, 2016 were $221.2 million.

The Account’s investment objective is long-term growth of capital. It is subadvised by Jennison Associates LLC.

What were market conditions during the reporting period?

2016 was a year of volatility and surprises. Among the contributing factors were decelerating economic growth in China; the negative effect of lower energy prices on industrial sectors; fears of slowing US economic growth; uncertainty about future Federal Reserve monetary tightening; Brexit, the UK’s decision to leave the European Union; and anxiety about the highly unconventional US presidential election. US dollar strength persisted throughout the reporting period, as strong US economic growth fueled investors’ preference for the US dollar and US-dollar-denominated assets.

Regarding sector performance, energy, telecommunication services, and financials generated the largest gains in the Index. Health care was the only sector that recorded negative returns. Value stocks significantly outperformed growth stocks across market capitalizations, while small-cap companies generally outpaced large-cap and mid-cap stocks.

What strategies or holdings affected the Account’s performance?

The Account underperformed during the period, with positions in health care detracting from returns. For example, after several acquisitions, Allergan has grown in size and scope, and could become a growth leader in global pharmaceuticals. Allergan’s development pipeline could be considerably more productive than investors assume and its balance sheet should allow for significant strategic capital deployment. Uncertainty around mergers and acquisitions activity in the pharmaceuticals industry caused volatility in Teva’s share price. Near period end, the US Federal Trade Commission approved its acquisition of Allergan’s generics business and the subadviser exited the Account’s position because of a lowered outlook on Teva’s generics division. Alexion’s flagship product, Soliris, treats two rare genetic, and potentially life-threatening, blood disorders. The company is aggressively pursuing expansion opportunities for the drug in other autoimmune and inflammatory disease settings. Given heightened volatility in the health care sector and Alexion’s realization of pipeline milestones, the subadviser eliminated the position during the period.

In the consumer discretionary sector, the Account’s underperformance was driven by Netflix, which suffered from weaker-than-expected subscriber growth. Although the subadviser believes the company’s long-term competitive positioning is strong, the Account sold the position due to near-term headwinds.

Despite positive performance from Texas Instruments, the Account’s exposure to information technology detracted overall. Strong demand across Texas Instruments’ end-markets led to improved results. The subadviser likes Texas Instruments’ focus on free cash flow margins and capital returns, as well as its product mix, dominant share in analog products, and strong channel relationships. LinkedIn, a leading global online professional network, was mostly responsible for the Account’s shortfall in the information technology sector. The subadviser eliminated the position as recent high growth rates started to decelerate.

Stock selection and overweight positions in the financials and energy sectors added to performance. An improved outlook for fiscal-spending stimulus, higher interest rates, better economic growth, and regulatory relief benefited many financial companies. Goldman Sachs, JP Morgan Chase, and SLM were standouts in both the sector and the Account. In the energy sector, as crude oil prices rebounded due to falling US shale production, the market rewarded stronger energy companies such as Halliburton and Chevron.

The S&P 500 Index is an unmanaged, market value-weighted index of over 500 stocks generally representative of the broad stock market. Investors cannot invest directly in an index. For a complete list of holdings, refer to the Statement of Net Assets section of this report.

1

| | |

The Prudential Variable Contract Account-2 (VCA-2) Presentation of Portfolio Holdings — unaudited | | December 31, 2016 |

| | | | |

| VCA-2 | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Goldman Sachs Group, Inc. (The) | | | 3.4% | |

| JPMorgan Chase & Co. | | | 3.3% | |

| Microsoft Corp. | | | 2.8% | |

| Alphabet, Inc. (Class A Stock) | | | 2.5% | |

| Shire PLC, ADR | | | 2.4% | |

For a complete listing of holdings, refer to the Statement of Net Assets section of this report. Holdings reflect only long-term investments. Holdings/Issues/Industries/Sectors are subject to change.

FINANCIAL STATEMENTS OF VCA-2

December 31, 2016

| | | | | | | | |

| LONG-TERM INVESTMENTS — 98.8% | |

| COMMON STOCKS | | Shares

| | | Value

(Note 2)

| |

Aerospace & Defense — 3.2% | |

Boeing Co. (The) | | | 15,303 | | | $ | 2,382,371 | |

TransDigm Group, Inc. | | | 8,482 | | | | 2,111,679 | |

United Technologies Corp. | | | 22,454 | | | | 2,461,407 | |

| | | | | | |

|

|

|

| | | | | | | | 6,955,457 | |

| | | | | | |

|

|

|

Banks — 11.1% | |

Bank of America Corp. | | | 213,505 | | | | 4,718,461 | |

BB&T Corp. | | | 59,569 | | | | 2,800,934 | |

Citigroup, Inc. | | | 66,994 | | | | 3,981,453 | |

JPMorgan Chase & Co. | | | 84,537 | | | | 7,294,698 | |

PNC Financial Services Group, Inc. | | | 26,020 | | | | 3,043,299 | |

Wells Fargo & Co. | | | 50,476 | | | | 2,781,732 | |

| | | | | | |

|

|

|

| | | | | | | | 24,620,577 | |

| | | | | | |

|

|

|

Biotechnology — 4.3% | |

Celgene Corp.(a) | | | 35,941 | | | | 4,160,171 | |

Shire PLC, ADR | | | 31,626 | | | | 5,388,438 | |

| | | | | | |

|

|

|

| | | | | | | | 9,548,609 | |

| | | | | | |

|

|

|

Capital Markets — 3.4% | |

Goldman Sachs Group, Inc. (The) | | | 31,625 | | | | 7,572,606 | |

| | | | | | |

|

|

|

Chemicals — 1.9% | |

Dow Chemicals Co. (The) | | | 36,005 | | | | 2,060,206 | |

FMC Corp. | | | 38,425 | | | | 2,173,318 | |

| | | | | | |

|

|

|

| | | | | | | | 4,233,524 | |

| | | | | | |

|

|

|

Communications Equipment — 1.1% | |

Brocade Communications Systems, Inc. | | | 197,806 | | | | 2,470,597 | |

| | | | | | |

|

|

|

Consumer Finance — 2.8% | |

Capital One Financial Corp. | | | 35,310 | | | | 3,080,444 | |

SLM Corp.(a) | | | 280,410 | | | | 3,090,118 | |

| | | | | | |

|

|

|

| | | | | | | | 6,170,562 | |

| | | | | | |

|

|

|

Diversified Financial Services — 0.7% | |

Voya Financial, Inc. | | | 41,454 | | | | 1,625,826 | |

| | | | | | |

|

|

|

Electric Utilities — 2.4% | |

Exelon Corp. | | | 33,708 | | | | 1,196,297 | |

PG&E Corp. | | | 67,968 | | | | 4,130,415 | |

| | | | | | |

|

|

|

| | | | | | | | 5,326,712 | |

| | | | | | |

|

|

|

Electrical Equipment — 1.0% | |

Eaton Corp. PLC | | | 31,272 | | | | 2,098,038 | |

| | | | | | |

|

|

|

Electronic Equipment, Instruments & Components — 0.9% | |

Flex Ltd.(a) | | | 160,582 | | | | 2,307,563 | |

| | | | | | |

|

|

|

Energy Equipment & Services — 1.6% | |

Halliburton Co. | | | 64,886 | | | | 3,509,684 | |

| | | | | | |

|

|

|

Equity Real Estate Investment Trust (REITs) — 0.9% | |

American Tower Corp. | | | 18,168 | | | | 1,919,994 | |

| | | | | | |

|

|

|

Food & Staples Retailing — 1.0% | |

Wal-Mart Stores, Inc. | | | 32,149 | | | | 2,222,139 | |

| | | | | | |

|

|

|

Food Products — 2.4% | |

ConAgra Foods, Inc. | | | 68,452 | | | | 2,707,277 | |

Mondelez International, Inc. (Class A Stock) | | | 56,495 | | | | 2,504,423 | |

| | | | | | |

|

|

|

| | | | | | | | 5,211,700 | |

| | | | | | |

|

|

|

| | | | | | | | |

COMMON STOCKS

(continued) | | Shares

| | | Value

(Note 2)

| |

Health Care Equipment & Supplies — 0.8% | |

Zimmer Biomet Holdings, Inc. | | | 16,959 | | | $ | 1,750,169 | |

| | | | | | |

|

|

|

Health Care Providers & Services — 2.1% | |

Cigna Corp. | | | 17,435 | | | | 2,325,655 | |

Laboratory Corp. of America

Holdings(a) | | | 17,414 | | | | 2,235,609 | |

| | | | | | |

|

|

|

| | | | | | | | 4,561,264 | |

| | | | | | |

|

|

|

Hotels, Restaurants & Leisure — 2.6% | |

Carnival Corp. | | | 37,969 | | | | 1,976,666 | |

Hyatt Hotels Corp. (Class A Stock)(a) | | | 41,697 | | | | 2,304,176 | |

McDonald’s Corp. | | | 12,805 | | | | 1,558,625 | |

| | | | | | |

|

|

|

| | | | | | | | 5,839,467 | |

| | | | | | |

|

|

|

Household Products — 1.6% | |

Procter & Gamble Co. (The) | | | 41,803 | | | | 3,514,796 | |

| | | | | | |

|

|

|

Industrial Conglomerates — 1.6% | |

General Electric Co. | | | 109,251 | | | | 3,452,332 | |

| | | | | | |

|

|

|

Insurance — 2.5% | |

Chubb Ltd. (Switzerland) | | | 24,302 | | | | 3,210,780 | |

MetLife, Inc. | | | 44,447 | | | | 2,395,249 | |

| | | | | | |

|

|

|

| | | | | | | | 5,606,029 | |

| | | | | | |

|

|

|

Internet & Direct Marketing Retail — 1.9% | |

Amazon.com, Inc.(a) | | | 5,649 | | | | 4,236,016 | |

| | | | | | |

|

|

|

Internet Software & Services — 9.1% | |

Alibaba Group Holding Ltd. (China), ADR(a) | | | 39,030 | | | | 3,427,224 | |

Alphabet, Inc. (Class A Stock)(a) | | | 6,996 | | | | 5,543,980 | |

Alphabet, Inc. (Class C Stock)(a) | | | 2,822 | | | | 2,178,076 | |

eBay, Inc.(a) | | | 66,905 | | | | 1,986,409 | |

Facebook, Inc. (Class A Stock)(a) | | | 29,654 | | | | 3,411,693 | |

Tencent Holdings Ltd. (China), ADR | | | 147,181 | | | | 3,564,724 | |

| | | | | | |

|

|

|

| | | | | | | | 20,112,106 | |

| | | | | | |

|

|

|

IT Services — 1.4% | |

Mastercard, Inc. | | | 30,572 | | | | 3,156,559 | |

| | | | | | |

|

|

|

Media — 3.9% | |

Charter Communications, Inc.(a) | | | 7,609 | | | | 2,190,783 | |

Comcast Corp. (Class A Stock) | | | 45,683 | | | | 3,154,411 | |

Liberty Global PLC (Series C) (United Kingdom)(a) | | | 25,485 | | | | 756,905 | |

Twenty-First Century Fox, Inc. (Class A Stock) | | | 41,675 | | | | 1,168,567 | |

Viacom, Inc. (Class B Stock) | | | 37,579 | | | | 1,319,023 | |

| | | | | | |

|

|

|

| | | | | | | | 8,589,689 | |

| | | | | | |

|

|

|

Oil, Gas & Consumable Fuels — 8.5% | |

Anadarko Petroleum Corp. | | | 31,785 | | | | 2,216,368 | |

Chevron Corp. | | | 30,758 | | | | 3,620,217 | |

EOG Resources, Inc. | | | 11,981 | | | | 1,211,279 | |

Hess Corp. | | | 30,667 | | | | 1,910,247 | |

Noble Energy, Inc. | | | 46,504 | | | | 1,769,942 | |

Occidental Petroleum Corp. | | | 35,203 | | | | 2,507,510 | |

Royal Dutch Shell PLC (Netherlands) (Class A Stock), ADR | | | 56,497 | | | | 3,072,307 | |

Suncor Energy, Inc. (Canada) | | | 73,683 | | | | 2,408,697 | |

| | | | | | |

|

|

|

| | | | | | | | 18,716,567 | |

| | | | | | |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

A1

FINANCIAL STATEMENTS OF VCA-2

December 31, 2016

| | | | | | | | |

COMMON STOCKS

(continued) | | Shares

| | | Value

(Note 2)

| |

Pharmaceuticals — 4.5% | |

Allergan PLC(a) | | | 10,148 | | | $ | 2,131,181 | |

Eli Lilly & Co. | | | 16,905 | | | | 1,243,363 | |

Merck & Co., Inc. | | | 56,222 | | | | 3,309,789 | |

Pfizer, Inc. | | | 103,534 | | | | 3,362,784 | |

| | | | | | |

|

|

|

| | | | | | | | 10,047,117 | |

| | | | | | |

|

|

|

Road & Rail — 1.7% | |

Ryder Systems, Inc. | | | 18,997 | | | | 1,414,137 | |

Union Pacific Corp. | | | 23,107 | | | | 2,395,734 | |

| | | | | | |

|

|

|

| | | | | | | | 3,809,871 | |

| | | | | | |

|

|

|

Semiconductors & Semiconductor Equipment — 4.6% | |

NVIDIA Corp. | | | 28,493 | | | | 3,041,343 | |

QUALCOMM, Inc. | | | 74,085 | | | | 4,830,342 | |

Texas Instruments, Inc. | | | 32,047 | | | | 2,338,470 | |

| | | | | | |

|

|

|

| | | | | | | | 10,210,155 | |

| | | | | | |

|

|

|

Software — 6.6% | |

Adobe Systems, Inc.(a) | | | 30,277 | | | | 3,117,017 | |

Microsoft Corp. | | | 98,809 | | | | 6,139,991 | |

PTC, Inc.(a) | | | 52,078 | | | | 2,409,649 | |

salesforce.com, Inc.(a) | | | 42,771 | | | | 2,928,103 | |

| | | | | | |

|

|

|

| | | | | | | | 14,594,760 | |

| | | | | | |

|

|

|

Specialty Retail — 2.5% | |

Industria de Diseno Textil SA (Spain) | | | 84,244 | | | | 2,875,578 | |

O’ Reilly Automotive, Inc.(a) | | | 9,326 | | | | 2,596,452 | |

| | | | | | |

|

|

|

| | | | | | | | 5,472,030 | |

| | | | | | |

|

|

|

Technology Hardware, Storage & Peripherals — 1.0% | |

Apple, Inc. | | | 18,621 | | | | 2,156,684 | |

| | | | | | |

|

|

|

Textiles, Apparel & Luxury Goods — 2.4% | |

adidas AG (Germany), ADR | | | 39,918 | | | | 3,135,559 | |

Coach, Inc. | | | 63,883 | | | | 2,237,183 | |

| | | | | | |

|

|

|

| | | | | | | | 5,372,742 | |

| | | | | | |

|

|

|

Wireless Telecommunication Services — 0.8% | |

Vodafone Group PLC

(United Kingdom), ADR | | | 71,962 | | | | 1,758,032 | |

| | | | | | |

|

|

|

TOTAL COMMON STOCKS

(cost $162,772,212) | | | | 218,749,973 | |

| | | | | | |

|

|

|

| | | | | | | | |

| SHORT-TERM INVESTMENT — 1.1% | |

| | | Shares

| | | Value

(Note 2)

| |

AFFILIATED MUTUAL FUND | |

Prudential Investment Portfolios 2 — Prudential Core Ultra Short Bond Fund (cost $2,385,564) (Note 4)(b) | | | 2,385,564 | | | $ | 2,385,564 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS — 99.9%

(cost $165,157,776) | | | $ | 221,135,537 | |

| | | | | | |

|

|

|

OTHER ASSETS, LESS LIABILITIES — 0.1% | |

Dividends Receivable | | | | 289,437 | |

Tax Reclaim Receivable | | | | 55,155 | |

Payable Pending Capital Transactions | | | | (77,723 | ) |

Payable for Securities Purchased | | | | (167,544 | ) |

| | | | | | |

|

|

|

OTHER ASSETS IN EXCESS OF LIABILITIES | | | | 99,325 | |

| | | | | | |

|

|

|

NET ASSETS — 100% | | | $ | 221,234,862 | |

| | | | | | |

|

|

|

NET ASSETS, representing: | | | | | | | | |

Equity of Participants — | | | | | | | | |

3,384,411 Accumulation Units at an Accumulation Unit Value of $63.6995 | | | $ | 215,585,243 | |

Equity of Annuitants | | | | 4,971,942 | |

Equity of The Prudential Insurance Company of America | | | | 677,677 | |

| | | | | | |

|

|

|

| | | | | | | $ | 221,234,862 | |

| | | | | | |

|

|

|

The following abbreviation is used in the annual report:

| | |

| ADR | | American Depositary Receipt |

| (a) | Non-income producing security. |

| (b) | Prudential Investments LLC, the Manager of the Account, also serves as Manager of the Prudential Investment Portfolios 2 — Prudential Core Ultra Short Bond Fund. |

SEE NOTES TO FINANCIAL STATEMENTS.

A2

FINANCIAL STATEMENTS OF VCA-2

December 31, 2016

Various inputs are used in determining the value of the Account’s investments. These inputs are summarized in the three broad levels listed below.

| Level 1— | quoted prices generally in active markets for identical securities. |

| Level 2— | quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates, and other observable inputs. |

| Level 3— | unobservable inputs for securities valued in accordance with the Account’s Committee approved fair valuation procedures. |

The following is a summary of the inputs used as of December 31, 2016 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1

| | | Level 2

| | | Level 3

| |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Aerospace & Defense | | $ | 6,955,457 | | | $ | — | | | $ | — | |

Banks | | | 24,620,577 | | | | — | | | | — | |

Biotechnology | | | 9,548,609 | | | | — | | | | — | |

Capital Markets | | | 7,572,606 | | | | — | | | | — | |

Chemicals | | | 4,233,524 | | | | — | | | | — | |

Communications Equipment | | | 2,470,597 | | | | — | | | | — | |

Consumer Finance | | | 6,170,562 | | | | — | | | | — | |

Diversified Financial Services | | | 1,625,826 | | | | — | | | | — | |

Electric Utilities | | | 5,326,712 | | | | — | | | | — | |

Electrical Equipment | | | 2,098,038 | | | | — | | | | — | |

Electronic Equipment, Instruments & Components | | | 2,307,563 | | | | — | | | | — | |

Energy Equipment & Services | | | 3,509,684 | | | | — | | | | — | |

Equity Real Estate Investment Trust (REITs) | | | 1,919,994 | | | | — | | | | — | |

Food & Staples Retailing | | | 2,222,139 | | | | — | | | | — | |

Food Products | | | 5,211,700 | | | | — | | | | — | |

Health Care Equipment & Supplies | | | 1,750,169 | | | | — | | | | — | |

Health Care Providers & Services | | | 4,561,264 | | | | — | | | | — | |

Hotels, Restaurants & Leisure | | | 5,839,467 | | | | — | | | | — | |

Household Products | | | 3,514,796 | | | | — | | | | — | |

Industrial Conglomerates | | | 3,452,332 | | | | — | | | | — | |

Insurance | | | 5,606,029 | | | | — | | | | — | |

Internet & Direct Marketing Retail | | | 4,236,016 | | | | — | | | | — | |

Internet Software & Services | | | 20,112,106 | | | | — | | | | — | |

IT Services | | | 3,156,559 | | | | — | | | | — | |

Media | | | 8,589,689 | | | | — | | | | — | |

Oil, Gas & Consumable Fuels | | | 18,716,567 | | | | — | | | | — | |

Pharmaceuticals | | | 10,047,117 | | | | — | | | | — | |

Road & Rail | | | 3,809,871 | | | | — | | | | — | |

Semiconductors & Semiconductor Equipment | | | 10,210,155 | | | | — | | | | — | |

Software | | | 14,594,760 | | | | — | | | | — | |

Specialty Retail | | | 2,596,452 | | | | 2,875,578 | | | | — | |

Technology Hardware, Storage & Peripherals | | | 2,156,684 | | | | — | | | | — | |

Textiles, Apparel & Luxury Goods | | | 5,372,742 | | | | — | | | | — | |

Wireless Telecommunication Services | | | 1,758,032 | | | | — | | | | — | |

Affiliated Mutual Fund | | | 2,385,564 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 218,259,959 | | | $ | 2,875,578 | | | $ | — | |

| | |

|

|

| |

|

|

| |

|

|

|

During the period, there were no transfers between Level 1 and Level 2 to report.

SEE NOTES TO FINANCIAL STATEMENTS.

A3

FINANCIAL STATEMENTS OF VCA-2

December 31, 2016

The industry classification of investments and other assets in excess of liabilities shown as a percentage of net assets as of December 31, 2016 were as follows (unaudited):

| | | | |

Banks | | | 11.1 | % |

Internet Software & Services | | | 9.1 | |

Oil, Gas & Consumable Fuels | | | 8.5 | |

Software | | | 6.6 | |

Semiconductors & Semiconductor Equipment | | | 4.6 | |

Pharmaceuticals | | | 4.5 | |

Biotechnology | | | 4.3 | |

Media | | | 3.9 | |

Capital Markets | | | 3.4 | |

Aerospace & Defense | | | 3.2 | |

Consumer Finance | | | 2.8 | |

Hotels, Restaurants & Leisure | | | 2.6 | |

Insurance | | | 2.5 | |

Specialty Retail | | | 2.5 | |

Textiles, Apparel & Luxury Goods | | | 2.4 | |

Food Products | | | 2.4 | |

Electric Utilities | | | 2.4 | |

Health Care Providers & Services | | | 2.1 | |

Internet & Direct Marketing Retail | | | 1.9 | |

Chemicals | | | 1.9 | |

| | | | |

Road & Rail | | | 1.7 | % |

Household Products | | | 1.6 | |

Industrial Conglomerates | | | 1.6 | |

Energy Equipment & Services | | | 1.6 | |

IT Services | | | 1.4 | |

Communications Equipment | | | 1.1 | |

Affiliated Mutual Fund | | | 1.1 | |

Technology Hardware, Storage & Peripherals | | | 1.0 | |

Food & Staples Retailing | | | 1.0 | |

Electrical Equipment | | | 1.0 | |

Equity Real Estate Investment Trust (REITs) | | | 0.9 | |

Electronic Equipment, Instruments & Components | | | 0.9 | |

Wireless Telecommunications Services | | | 0.8 | |

Health Care Equipment & Supplies | | | 0.8 | |

Diversified Financial Services | | | 0.7 | |

| | |

|

|

|

| | | | 99.9 | |

Other assets in excess of liabilities | | | 0.1 | |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

A4

FINANCIAL STATEMENTS OF VCA-2

Year Ended December 31, 2016

| | | | |

| | | | |

INVESTMENT INCOME | | | | |

Unaffiliated Dividend Income (net of $21,374 foreign withholding tax) | | $ | 4,147,055 | |

Affiliated Dividend Income | | | 23,558 | |

Total Income | | | 4,170,613 | |

EXPENSES | | | | |

Fees Charged to Participants and Annuitants for Investment Management Services | | | (278,213 | ) |

Fees Charged to Participants (other than Annuitants) for Assuming Mortality and Expense Risks | | | (815,570 | ) |

Total Expenses | | | (1,093,783 | ) |

NET INVESTMENT INCOME | | | 3,076,830 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENT AND FOREIGN CURRENCY TRANSACTIONS | | | | |

Net Realized Gain (Loss) on: | | | | |

Investment Transactions | | | 9,801,476 | |

Foreign Currency Transactions | | | (2,597 | ) |

| | | | 9,798,879 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 416,555 | |

NET GAIN ON INVESTMENT AND FOREIGN CURRENCY TRANSACTIONS | | | 10,215,434 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | 13,292,264 | |

| | | | | | |

| | | STATEMENT OF CHANGES IN NET ASSETS | | |

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2016 | | | 2015 | |

OPERATIONS | | | | | | | | |

Net Investment Income | | $ | 3,076,830 | | | $ | 2,927,086 | |

Net Realized Gain on Investment and Foreign Currency Transactions | | | 9,798,879 | | | | 12,603,533 | |

Net Change In Unrealized Appreciation (Depreciation) on Investments | | | 416,555 | | | | (18,213,367 | ) |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | 13,292,264 | | | | (2,682,748 | ) |

CAPITAL TRANSACTIONS | | | | | | | | |

Purchase Payments and Transfers In | | | 649,580 | | | | 731,752 | |

Withdrawals and Transfers Out | | | (34,103,734 | ) | | | (38,694,894 | ) |

Mortality and Expense Risk Charges Deducted from Annuitants’ Accounts | | | (19,069 | ) | | | (22,371 | ) |

Variable Annuity Payments | | | (768,375 | ) | | | (981,061 | ) |

NET DECREASE IN NET ASSETS RESULTING FROM CAPITAL TRANSACTIONS | | | (34,241,598 | ) | | | (38,966,574 | ) |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM SURPLUS TRANSFERS | | | (861,027 | ) | | | 744 | |

TOTAL DECREASE IN NET ASSETS | | | (21,810,361 | ) | | | (41,648,578 | ) |

NET ASSETS | | | | | | | | |

Beginning of year | | | 243,045,223 | | | | 284,693,801 | |

End of year | | $ | 221,234,862 | | | $ | 243,045,223 | |

SEE NOTES TO FINANCIAL STATEMENTS.

A5

FINANCIAL HIGHLIGHTS FOR

VCA-2

| | | | | | |

| | | INCOME AND CAPITAL CHANGES PER ACCUMULATION UNIT* | | |

(For an Accumulation Unit outstanding throughout the year)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Investment Income | | $ | 1.1021 | | | $ | .9469 | | | $ | .7348 | | | $ | .7032 | | | $ | .7051 | |

Expenses | | | | | | | | | | | | | | | | | | | | |

Investment management fee | | | (.0735 | ) | | | (.0763 | ) | | | (.0718 | ) | | | (.0596 | ) | | | (.0493 | ) |

Assuming mortality and expense risks | | | (.2203 | ) | | | (.2284 | ) | | | (.2151 | ) | | | (.1786 | ) | | | (.1476 | ) |

Net Investment Income | | | .8083 | | | | .6422 | | | | .4479 | | | | .4650 | | | | .5082 | |

Capital Changes | | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 3.1300 | | | | (1.3303 | ) | | | 5.6719 | | | | 12.5785 | | | | 4.1824 | |

Net Increase (Decrease) in Accumulation Unit Value | | | 3.9383 | | | | (.6881 | ) | | | 6.1198 | | | | 13.0435 | | | | 4.6906 | |

Accumulation Unit Value | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 59.7612 | | | | 60.4493 | | | | 54.3295 | | | | 41.2860 | | | | 36.5954 | |

End of year | | $ | 63.6995 | | | $ | 59.7612 | | | $ | 60.4493 | | | $ | 54.3295 | | | $ | 41.2860 | |

Total Return** | | | 6.59 | % | | | (1.14 | %) | | | 11.26 | % | | | 31.59 | % | | | 12.82 | % |

Ratio of Expenses To Average Net Assets*** | | | .50 | % | | | .50 | % | | | .50 | % | | | .50 | % | | | .50 | % |

Ratio of Net Investment Income To Average Net Assets*** | | | 1.37 | % | | | 1.06 | % | | | .78 | % | | | .98 | % | | | 1.29 | % |

Portfolio Turnover Rate | | | 40 | % | | | 47 | % | | | 70 | % | | | 69 | % | | | 45 | % |

Number of Accumulation Units Outstanding

For Participants at end of year (000 omitted) | | | 3,384 | | | | 3,952 | | | | 4,579 | | | | 5,046 | | | | 5,495 | |

| * | Calculated by accumulating the actual per unit amounts daily. |

| ** | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported. Total returns may reflect adjustments to conform to generally accepted accounting principles. |

| *** | These calculations exclude PICA’s equity in VCA-2. |

The above table does not reflect the annual administration charge, which does not affect the Accumulation Unit Value. This charge is made by reducing Participants’ Accumulation Accounts by a number of Accumulation Units equal in value to the charge.

SEE NOTES TO FINANCIAL STATEMENTS.

B1

NOTES TO THE FINANCIAL STATEMENTS OF

VCA-2

The Prudential Variable Contract Account-2 (VCA-2 or the Account) was established on January 9, 1968 by The Prudential Insurance Company of America (“PICA”) under the laws of the State of New Jersey and is registered as an open-end, diversified management investment company under the Investment Company Act of 1940 (“1940 Act”), as amended. VCA-2 has been designed for use by public school systems and certain tax-exempt organizations to provide for the purchase and payment of tax-deferred variable annuities. The investment objective of the Account is long-term growth of capital. Its investments are composed primarily of common stocks. Although variable annuity payments differ according to the investment performance of the Account, they are not affected by mortality or expense experience because PICA assumes the expense risk and the mortality risk under the contracts.

| Note 2: | | Accounting Policies |

The Account follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services-Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Account consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Account holds securities and other assets that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Account’s Committee Members (the “Committee”) has adopted Valuation Procedures for security valuation under which fair valuation responsibilities have been delegated to Prudential Investments LLC (“PI” or “Manager”). Under the current Valuation Procedures, the established Valuation Committee is responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures permit the Account to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Committee’s review, approval, and ratification at its next regularly-scheduled quarterly meeting.

Various inputs determine how the Account’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the table following the Account’s Statement of Net Assets.

Common and preferred stocks, exchange-traded funds, and derivative instruments, such as futures or options, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy.

In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and asked prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Common and preferred stocks traded on foreign securities exchanges are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which can be applied to the local closing price to adjust it for post closing market movements. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stocks discussed above.

Participatory notes (“P-notes”) are generally valued based upon the value of a related underlying security that trades actively in the market and are classified as Level 2 in the fair value hierarchy.

C1

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Account Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Committee. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Rights: The Account may hold rights acquired either through a direct purchase, including as part of private placement, or pursuant to corporate actions. Rights entitle the holder to buy a proportionate amount of common stock at a specific price and time through the expiration dates. Such rights are held as long positions by the Account until exercised, sold or expired. Rights are valued at fair value in accordance with the Committee Members’ approved fair valuation procedures.

Restricted and Illiquid Securities: Subject to guidelines adopted by the Committee, the Account may invest up to 15% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities are valued pursuant to the valuation procedures noted above. Illiquid securities are those that, because of the absence of a readily available market or due to legal or contractual restrictions on resale, cannot be sold within seven days in the ordinary course of business at approximately the amount at which the Account has valued the investment. Therefore, the Account may find it difficult to sell illiquid securities at the time considered most advantageous by its subadviser and may incur expenses that would not be incurred in the sale of securities that were freely marketable. Certain securities that would otherwise be considered illiquid because of legal restrictions on resale to the general public may be traded among qualified institutional buyers under Rule 144A of the Securities Act of 1933. These Rule 144A securities, as well as commercial paper that is sold in private placements under Section 4(2) of the Securities Act, may be deemed liquid by the Account’s subadviser under the guidelines adopted by the Committee Members of the Account. However, the liquidity of the Account’s investments in Rule 144A securities could be impaired if trading does not develop or declines.

Foreign Currency Translation: The books and records of the Account are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities — at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Account are presented at the foreign exchange rates and market values at the close of the period, the Account does not generally isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Account does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions. Notwithstanding the above, the Account does isolate the effect of fluctuations in foreign currency exchange rates when determining the gain (loss) upon the sale or maturity of foreign currency denominated debt obligations; such amounts are included in net realized gains (losses) on foreign currency transactions.

Additionally, net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from holdings of foreign currencies, currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Account’s books and the U.S. dollar equivalent amounts

C2

actually received or paid. Net unrealized currency gains (losses) from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Concentration of Risk: Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability or the level of governmental supervision and regulation of foreign securities markets.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on the accrual basis, which may require the use of certain estimates by management that may differ from actual. Income and realized and unrealized gains (losses) are allocated to the Participants and PICA on a daily basis in proportion to their respective ownership in VCA-2.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Federal Income Taxes: The operations of VCA-2 are part of, and are taxed with, the operations of PICA. Under the current provisions of the Internal Revenue Code, PICA does not expect to incur federal income taxes on earnings of VCA-2 to the extent the earnings are credited under the Contracts. As a result, the Unit Value of VCA-2 has not been reduced by federal income taxes.

Annuity Reserves: Reserves are computed for purchased annuities using the Prudential 1950 Group Annuity Valuation (GAV) Table, adjusted, and a valuation interest rate related to the Assumed Investment Result (AIR). The valuation interest rate is equal to the AIR less 0.50% in contract charges defined in Note 3. The AIRs are selected by each Contract-holder and are described in the prospectus.

| Note 3: | | Investment Management Agreement and Charges |

The Account has a management agreement with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison will furnish investment advisory services in connection with management of the Account. PI pays for the services of Jennison.

A daily charge, at an effective annual rate of 0.125% of the current value of the Participant’s (other than Annuitants’ and PICA’s) equity in VCA-2, is charged to the Account and paid to PI for investment management services. An equivalent charge is deducted monthly in determining the amount of Annuitants’ payments.

A daily charge, paid to PI for assuming mortality and expense risks, is calculated at an effective annual rate of 0.375% of the current value of the Participant’s (other than Annuitants’ and PICA’s) equity in VCA-2. A one-time equivalent charge is deducted when the Annuity Units for Annuitants are determined.

PICA, PI and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

An annual administration charge of not more than $30 annually is deducted from the accumulation account of certain Participants either at the time of withdrawal of the value of the entire Participant’s account or at the end of the fiscal year by canceling Accumulation Units. This deduction may be made from a fixed-dollar annuity contract if the Participant is enrolled under such a contract.

A charge of 2.5% for sales and other marketing expenses is deducted from certain Participant’s purchase payments. For the year ended December 31, 2016, PICA has advised the Account it has not received any sales charges.

| Note 4: | | Other Transactions with Affiliates |

The Account may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act, that permits purchase and

C3

sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors, and/or common officers. Such transactions are subject to ratification by the Account’s Committee.

For the year ended December 31, 2016 the Account invested in the Prudential Core Ultra Short Bond Fund (the “Core Fund”), a portfolio of the Prudential Investment Portfolios 2, registered under the 1940 Act, and managed by PI. Earnings from the Core Fund are disclosed on the Statement of Operations as affiliated dividend income.

| Note 5: | | Purchases and Sales of Portfolio Securities |

For the year ended December 31, 2016, the aggregate cost of purchases and the proceeds from sales of securities, excluding short-term investments, were $88,975,320 and $121,928,439, respectively.

| Note 6: | | Unit Transactions |

The number of Accumulation Units issued and redeemed for the year ended December 31, 2016 and the year ended December 31, 2015, respectively, are as follows:

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2016 | | | 2015 | |

Units issued | | | 10,962 | | | | 12,094 | |

Units redeemed | | | (578,400 | ) | | | (638,920 | ) |

Net decrease | | | (567,438 | ) | | | (626,826 | ) |

| Note 7: | | Net Increase (Decrease) In Net Assets Resulting From Surplus Transfers |

The increase (decrease) in net assets resulting from surplus transfers represents the net increases to/(reductions from) PICA’s investment Account. The increase (decrease) includes reserve adjustments for mortality and expense risks assumed by PICA.

| Note 8: | | Participant Loans |

Participant loan initiations are not permitted in VCA-2. However, participants who initiated loans in other accounts are permitted to direct loan repayments into VCA-2.

For the year ended December 31, 2016 and year ended December 31, 2015, $1,068 and $2,119 of participant loan principal and interest have been paid to VCA-2, respectively. The participant loan principal and interest repayments are included in Purchase Payments and Transfers In within the Statement of Changes in Net Assets.

| Note 9: | | Recent Accounting Pronouncements and Reporting Updates |

In December 2016, the FASB released an Accounting Standards Update (“ASU”) that makes technical changes to various sections of the Accounting Standards Codification (“ASC”), including Topic 820, Fair Value Measurement. The changes to Topic 820 are intended to clarify the difference between a valuation approach and a valuation technique. The changes to ASC 820-10-50-2 require a reporting entity to disclose, for Level 2 and Level 3 fair value measurements, a change in either or both a valuation approach and a valuation technique and the reason(s) for the change. The changes to Topic 820 are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. At this time, management is evaluating the implications of the ASU and its impact on the financial statements and disclosures has not yet been determined.

On October 13, 2016, the Securities and Exchange Commission (the “SEC”) adopted new rules and forms and amended existing rules and forms which are intended to modernize and enhance the reporting and disclosure of information by registered investment companies and to improve the quality of information that funds provide to investors, including modifications to Regulation S-X which would require standardized, enhanced disclosure about derivatives in investment company financial statements. In an effort to enhance monitoring and regulation, the new rules and forms will allow the SEC to more effectively collect and use data reported by funds. The new rules also enhance disclosure regarding fund liquidity and redemption practices. Also under the new rules, the SEC will permit open-end funds, with the exception of money market funds, to offer swing

C4

pricing, subject to board approval and review. The compliance dates of the modifications to Regulation S-X are August 1, 2017 and other amendments and rules are generally June 1, 2018 and December 1, 2018. Management is currently evaluating the impacts to the financial statement disclosures, if any.

C5

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

THE COMMITTEE AND PARTICIPANTS OF

THE PRUDENTIAL VARIABLE CONTRACT ACCOUNT-2:

We have audited the accompanying statement of net assets of The Prudential Variable Contract Account-2 (the “Account”) as of December 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Account’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2016, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Account as of December 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 16, 2017

D1

INFORMATION ABOUT COMMITTEE MEMBERS AND OFFICERS

VCA 2 is managed by the VCA 2 Committee. The members of the VCA 2 Committee are elected by the persons having voting rights in respect of the VCA 2 Account. The affairs of VCA 2 are conducted in accordance with the Rules and Regulations of VCA 2. Information pertaining to the members of the VCA 2 Committee (hereafter referred to as “Committee Members”) is set forth below. Committee Members who are not deemed to be “interested persons” of VCA 2 as defined in the Investment Company Act of 1940, as amended (the 1940 Act) are referred to as “Independent Committee Members.” Committee Members who are deemed to be “interested persons” of VCA 2 are referred to as “Independent Committee Members.” Information pertaining to the Officers of VCA 2 is also set forth below.

| | | | |

| Independent Committee Members(1) |

Name, Address, Age Position(s) Portfolios Overseen | | Principal Occupation(s) During Past Five Years | | Other Directorships Held During Past Five Years |

Ellen S. Alberding (58) Committee Member Portfolios Overseen: 88 | | President and Board Member, The Joyce Foundation (charitable foundation) (since 2002); Vice Chair, City Colleges of Chicago (community college system) (since 2011); Trustee, Skills for America’s Future (national initiative to connect employers to community colleges) (since 2011); Trustee, National Park Foundation (charitable foundation for national park system) (since 2009); Trustee, Economic Club of Chicago (since 2009). | | None. |

Kevin J. Bannon (64) Committee Member Portfolios Overseen: 88 | | Managing Director (April 2008-May 2015) and Chief Investment Officer (October 2008-November 2013) of Highmount Capital LLC (registered investment adviser); formerly Executive Vice President and Chief Investment Officer (April 1993-August 2007) of Bank of New York Company; President (May 2003-May 2007) of BNY Hamilton Family of Mutual Funds. | | Director of Urstadt Biddle Properties (equity real estate investment trust) (since September 2008). |

Linda W. Bynoe (64) Committee Member Portfolios Overseen: 88 | | President and Chief Executive Officer (since March 1995) and formerly Chief Operating Officer (December 1989-February 1995) of Telemat Ltd. (management consulting); formerly Vice President (January 1985-June 1989) at Morgan Stanley & Co. (broker-dealer). | | Director of Simon Property Group, Inc. (retail real estate) (May 2003-May 2012); Director of Anixter International, Inc. (communication products distributor) (since January 2006); Director of Northern Trust Corporation (financial services) (since April 2006); Trustee of Equity Residential (residential real estate) (since December 2009). |

Keith F. Hartstein (60) Committee Member & Independent Chair Portfolios Overseen: 88 | | Retired; Member (since November 2014) of the Governing Council of the Independent Directors Council (organization of independent mutual fund directors); formerly President and Chief Executive Officer (2005-2012), Senior Vice President (2004-2005), Senior Vice President of Sales and Marketing (1997-2004), and various executive management positions (1990-1997), John Hancock Funds, LLC (asset management); Chairman, Investment Company Institute’s Sales Force Marketing Committee (2003-2008). | | None. |

Michael S. Hyland, CFA (71) Committee Member Portfolios Overseen: 88 | | Retired (since February 2005); formerly Senior Managing Director (July 2001-February 2005) of Bear Stearns & Co, Inc.; Global Partner, INVESCO (1999-2001); Managing Director and President of Salomon Brothers Asset Management (1989-1999). | | None. |

Richard A. Redeker (73) Committee Member & Independent Vice Chair Portfolios Overseen: 88 | | Retired Mutual Fund Senior Executive (47 years); Management Consultant; Director, Mutual Fund Directors Forum (since 2014); Independent Directors Council (organization of independent mutual fund directors)-Executive Committee, Chair of Policy Steering Committee, Governing Council. | | None. |

Stephen G. Stoneburn (73) Committee Member Portfolios Overseen: 88 | | Chairman (since July 2011), President and Chief Executive Officer (since June 1996) of Frontline Medical Communications (publishing company); formerly President (June 1995-June 1996) of Argus Integrated Media, Inc.; Senior Vice President and Managing Director (January 1993-1995) of Cowles Business Media; Senior Vice President of Fairchild Publications, Inc. (1975-1989). | | None. |

E1

| | | | |

| Interested Committee Members(1) |

Name, Address, Age Position(s) Portfolios Overseen | | Principal Occupation(s) During Past Five Years | | Other Directorships Held During Past Five Years |

Stuart S. Parker (54) Committee Member & President Portfolios Overseen: 88 | | President of Prudential Investments LLC (since January 2012); Executive Vice President of Prudential Investment Management Services LLC (since December 2012); Executive Vice President of Jennison Associates LLC and Head of Retail Distribution of Prudential Investments LLC (June 2005-December 2011). | | None. |

Scott E. Benjamin (43) Committee Member & Vice President Portfolios Overseen: 88 | | Executive Vice President (since June 2009) of Prudential Investments LLC; Executive Vice President (June 2009-June 2012) and Vice President (since June 2012) of Prudential Investment Management Services LLC; Executive Vice President (since September 2009) of AST Investment Services, Inc.; Senior Vice President of Product Development and Marketing, Prudential Investments (since February 2006); Vice President of Product Development and Product Management, Prudential Investments (2003-2006). | | None. |

Grace C. Torres* (57) Committee Member Portfolios Overseen: 86 | | Retired; formerly Treasurer and Principal Financial and Accounting Officer of the Prudential Investments Funds, Target Funds, Advanced Series Trust, Prudential Variable Contract Accounts and The Prudential Series Fund (1998-June 2014); Assistant Treasurer (March 1999-June 2014) and Senior Vice President (September 1999-June 2014) of Prudential Investments LLC; Assistant Treasurer (May 2003-June 2014) and Vice President (June 2005-June 2014) of AST Investment Services, Inc.; Senior Vice President and Assistant Treasurer (May 2003-June 2014) of Prudential Annuities Advisory Services, Inc. | | Director (since July 2015) of Sun Bancorp, Inc. N.A. |

* Note: Prior to her retirement in 2014, Ms. Torres was employed by Prudential Investments LLC. Due to her prior employment, she is considered to be an “interested person” under the 1940 Act. Ms. Torres is a Non-Management Interested Committee Member.

(1) The year that each Committee Member joined the VCA 2 Committee is as follows: Ellen S. Alberding, 2013; Kevin J. Bannon, 2008; Linda W. Bynoe, 2008; Keith F. Hartstein, 2013; Michael S. Hyland, 2008; Richard A. Redeker, 2008; Stephen G. Stoneburn, 2008; Grace C. Torres, 2015; Stuart S. Parker, Committee Member since 2015 and President since 2012; Scott E. Benjamin, Committee Member since 2010 and Vice President since 2009.

| | | | |

| VCA 2 Officers(a) | | | | |

Name, Address and Age Position with VCA 2 | | Principal Occupation(s) During Past Five Years | | Length of

Service as

VCA 2 Officer |

Raymond A. O’Hara (61) Chief Legal Officer | | Vice President and Corporate Counsel (since July 2010) of Prudential Insurance Company of America (Prudential); Vice President (March 2011-Present) of Pruco Life Insurance Company and Pruco Life Insurance Company of New Jersey; Vice President and Corporate Counsel (March 2011-Present) of Prudential Annuities Life Assurance Corporation; Chief Legal Officer of Prudential Investments LLC (since June 2012); Chief Legal Officer of Prudential Mutual Fund Services LLC (since June 2012) and Corporate Counsel of AST Investment Services, Inc. (since June 2012); formerly Assistant Vice President and Corporate Counsel (September 2008-July 2010) of The Hartford Financial Services Group, Inc.; formerly Associate (September 1980-December 1987) and Partner (January 1988-August 2008) of Blazzard & Hasenauer, P.C. (formerly, Blazzard, Grodd & Hasenauer, P.C.). | | Since 2012 |

Chad A. Earnst (41) Chief Compliance Officer | | Chief Compliance Officer (September 2014-Present) of Prudential Investments LLC; Chief Compliance Officer (September 2014-Present) of the Prudential Investments Funds, Target Funds, Advanced Series Trust, The Prudential Series Fund, Prudential’s Gibraltar Fund, Inc., Prudential Global Short Duration High Yield Income Fund, Inc., Prudential Short Duration High Yield Fund, Inc. and Prudential Jennison MLP Income Fund, Inc.; formerly Assistant Director (March 2010-August 2014) of the Asset Management Unit, Division of Enforcement, US Securities & Exchange Commission; Assistant Regional Director (January 2010-August 2014), Branch Chief (June 2006-December 2009) and Senior Counsel (April 2003-May 2006) of the Miami Regional Office, Division of Enforcement, US Securities & Exchange Commission. | | Since 2014 |

Deborah A. Docs (59) Secretary | | Vice President and Corporate Counsel (since January 2001) of Prudential; Vice President (since December 1996) and Assistant Secretary (since March 1999) of Prudential Investments LLC; formerly Vice President and Assistant Secretary (May 2003-June 2005) of AST Investment Services, Inc. | | Since 2004 |

Jonathan D. Shain (58) Assistant Secretary | | Vice President and Corporate Counsel (since August 1998) of Prudential; Vice President and Assistant Secretary (since May 2001) of Prudential Investments LLC; Vice President and Assistant Secretary (since February 2001) of Prudential Mutual Fund Services LLC; formerly Vice President and Assistant Secretary (May 2003-June 2005) of AST Investment Services, Inc. | | Since 2005 |

Claudia DiGiacomo (42) Assistant Secretary | | Vice President and Corporate Counsel (since January 2005) of Prudential; Vice President and Assistant Secretary of Prudential Investments LLC (since December 2005); Associate at Sidley Austin Brown & Wood LLP (1999-2004). | | Since 2005 |

E2

| | | | |

| VCA 2 Officers(a) | | | | |

Name, Address and Age Position with VCA 2 | | Principal Occupation(s) During Past Five Years | | Length of

Service as

VCA 2 Officer |

Andrew R. French (54) Assistant Secretary | | Vice President and Corporate Counsel (since February 2010) of Prudential; formerly Director and Corporate Counsel (2006-2010) of Prudential; Vice President and Assistant Secretary (since January 2007) of Prudential Investments LLC; Vice President and Assistant Secretary (since January 2007) of Prudential Mutual Fund Services LLC. | | Since 2006 |

Theresa C. Thompson (54) Deputy Chief Compliance Officer | | Vice President, Compliance, Prudential Investments LLC (since April 2004); and Director, Compliance, Prudential Investments LLC (2001-2004). | | Since 2008 |

Charles H. Smith (43) Anti-Money Laundering Compliance Officer | | Vice President, Corporate Compliance, Anti-Money Laundering Unit (since January 2015) of Prudential; committee member of the American Council of Life Insurers Anti-Money Laundering and Critical Infrastructure Committee (since January 2016); formerly Global Head of Economic Sanctions Compliance at AIG Property Casualty (February 2007-December 2014); Assistant Attorney General at the New York State Attorney General’s Office, Division of Public Advocacy. (August 1998-January 2007). | | Since 2016 |

M. Sadiq Peshimam (53) Treasurer and Principal Financial and Accounting Officer | | Vice President (since 2005) of Prudential Investments LLC; formerly Assistant Treasurer of funds in the Prudential Mutual Fund Complex (2006-2014). | | Since 2006 |

Peter Parrella (58) Assistant Treasurer | | Vice President (since 2007) and Director (2004-2007) within Prudential Mutual Fund Administration; formerly Tax Manager at SSB Citi Fund Management LLC (1997-2004). | | Since 2007 |

Lana Lomuti (49) Assistant Treasurer | | Vice President (since 2007) and Director (2005-2007), within Prudential Mutual Fund Administration; formerly Assistant Treasurer (December 2007-February 2014) of The Greater China Fund, Inc. | | Since 2014 |

Linda McMullin (55) Assistant Treasurer | | Vice President (since 2011) and Director (2008-2011) within Prudential Mutual Fund Administration. | | Since 2014 |

Kelly A. Coyne (48) Assistant Treasurer | | Director, Investment Operations of Prudential Mutual Fund Services LLC (since 2010). | | Since 2015 |

(a) Excludes Mr. Parker and Mr. Benjamin, interested Committee Members who also serve as President and Vice President, respectively.

Explanatory Notes to Tables:

| • | | Committee Members are deemed to be “Interested,” as defined in the 1940 Act, by reason of their affiliation with Prudential Investments LLC and/or an affiliate of Prudential Investments LLC. |

| • | | Unless otherwise noted, the address of all Committee Members and Officers is c/o Prudential Investments LLC, 655 Broad Street, Newark, New Jersey 07102-4410. |

| • | | There is no set term of office for Committee Members or Officers. The Committee Members have adopted a retirement policy, which calls for the retirement of Committee Members on December 31 of the year in which they reach the age of 75. |

| • | | “Other Directorships Held” includes only directorships of companies required to register or file reports with the SEC under the 1934 Act (that is, “public companies”) or other investment companies registered under the 1940 Act. |

| • | | “Portfolios Overseen” includes all investment companies managed by Prudential Investments LLC. The investment companies for which Prudential Investments LLC serves as manager include the Prudential Investments Mutual Funds, The Prudential Variable Contract Accounts, Target Mutual Funds, Prudential Short Duration High Yield Fund, Inc., Prudential Global Short Duration High Yield Fund, Inc., The Prudential Series Fund, Prudential’s Gibraltar Fund, Inc. and the Advanced Series Trust. |

E3

The toll-free number shown below can be used to make transfers and reallocations, review how your premiums are being allocated, and receive current investment option values in your contract. Unit values for each investment option are available to all participants from the toll-free number. Please be sure to have your contract number available when you call.

(800) 458-6333

The Prudential Insurance Company of America

751 Broad Street

Newark, NJ 07102-3777

Presorted

Standard

U.S. Postage

PAID

Prudential

©2017 Prudential Financial, Inc. and its related entities. Prudential Investments, the Prudential logo, the Rock symbol, and Bring Your Challenges are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

LT.RS.001

Item 2 – Code of Ethics – – See Exhibit (a)

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer and Principal Financial Officer; the registrant’s Principal Financial Officer also serves as the Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 973-367-7521, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

Item 3 – Audit Committee Financial Expert –

The registrant’s Board has determined that Mr. Kevin J. Bannon, member of the Board’s Audit Committee is an “audit committee financial expert,” and that he is “independent,” for purposes of this Item.

Item 4 – Principal Accountant Fees and Services –

(a) Audit Fees

For the fiscal years ended December 31, 2016 and December 31, 2015, KPMG LLP (“KPMG”), the Registrant’s principal accountant, billed the Registrant $19,961 and $19,570, respectively, for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

(b) Audit-Related Fees

For the fiscal years ended December 31, 2016 and December 31, 2015: none.

(c) Tax Fees

For the fiscal years ended December 31, 2016 and December 31, 2015: none.

(d) All Other Fees

For the fiscal years ended December 31, 2016 and December 31, 2015: none.

(e) (1) Audit Committee Pre-Approval Policies and Procedures

THE PRUDENTIAL MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent Accountants

The Audit Committee of each Prudential Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve the independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | | a review of the nature of the professional services expected to be provided, |

| | • | | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds