UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04986

Franklin Investors Securities Trust

(Exact name of registrant as specified in charter)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area Code: (650) 312-2000

Date of fiscal year end: 10/31

Date of reporting period: 4/30/11

Item 1. Reports to Stockholders.

APRIL 30, 2011

SEMIANNUAL REPORT

AND SHAREHOLDER LETTER

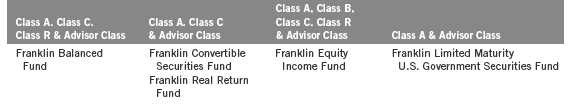

Franklin Balanced Fund

Franklin Convertible Securities Fund

Franklin Equity Income Fund

Franklin Limited Maturity

U.S. Government Securities Fund

Franklin Real Return Fund

Sign up for electronic delivery

on franklintempleton.com

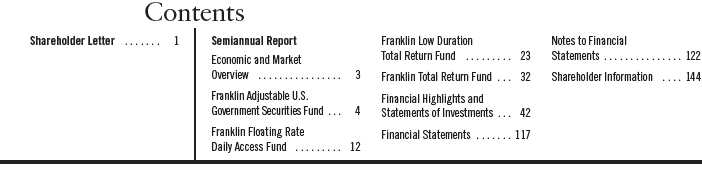

Semiannual Report

Economic and Market Overview

The U.S. economy expanded despite geopolitical and inflationary pressures from around the globe during the six-month period ended April 30, 2011. Business activity increased and consumer spending recovered to pre-recession levels. The U.S. has been a key engine in an ongoing global manufacturing rebound, which accelerated in the first quarter of 2011 and helped spur U.S. economic output. Worldwide demand for capital goods aided U.S. manufacturing profits and increased employment in the industry.

Unemployment and underemployment eased as job creation began to gain some traction and the U.S. jobless rate declined to 9.0% in April.1 Consumer spending rose for the tenth consecutive month in April, but rising gasoline and food prices led to a sharp drop in consumer confidence. The banking sector appeared closer to a full recovery, although the U.S. still faced challenges dealing with massive debt at period-end.

Inflation at the consumer, producer and trade levels rose across much of the world, but in the U.S. it remained relatively contained. The Federal Open Market Committee kept monetary policy unchanged while continuing its second round of quantitative easing, scheduled to terminate in June.

Investor confidence shifted with each release of encouraging or discouraging economic, regulatory and geopolitical news, causing equity market volatility to increase globally. U.S. investors weathered international events that included revolutions and ongoing civil unrest across the Middle East and North Africa, sovereign debt worries and credit downgrades in Europe, and the multiple crises triggered by Japan’s earthquake and tsunami. Ultimately, stock indexes experienced solid gains during the six months under review as domestic and global equity markets rose amid generally improving economic signs and rising consumer spending.

At times of uncertainty, wary investors favored short-term Treasuries, and Treasury yields dipped to low levels during the period. However, as stock markets rallied, Treasury prices declined and yields rose.

The foregoing information reflects our analysis and opinions as of April 30, 2011. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

Semiannual Report | 3

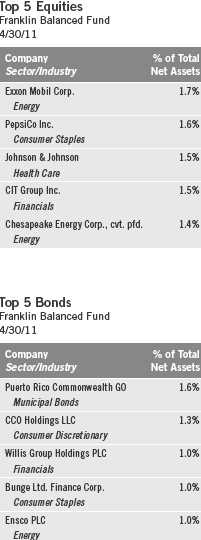

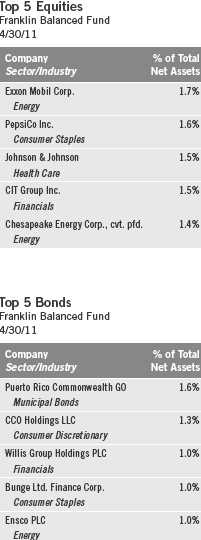

Franklin Balanced Fund

Your Fund’s Goal and Main Investments: Franklin Balanced Fund seeks income and capital appreciation by investing in a combination of stocks, convertible securities and debt securities. The Fund will normally invest at least 25% of its total assets in equity securities and at least 25% of its total assets in debt securities, including money market securities.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Balanced Fund covers the period ended April 30, 2011.

Performance Overview

For the six months under review, Franklin Balanced Fund – Class A delivered a cumulative total return of +9.98%. The Fund underperformed the +16.36% total return of its equity benchmark, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market.1 However, the Fund outperformed the +0.02% total return of its fixed income benchmark, the Barclays Capital (BC) U.S. Aggregate Index, which tracks the U.S. investment-grade, taxable bond market.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Investment Strategy

We seek income by investing in a combination of corporate, agency and government bonds issued in the U.S. and other countries, as well as dividend-paying common stocks and convertible securities. We seek capital appreciation by investing in equity securities and convertible securities of companies from a variety of industries. We will generally invest in investment-grade debt securities, but may invest up to 10% of our total assets in nonconvertible bonds rated below investment grade. We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC. Standard & Poor’s does not sponsor, endorse, sell or promote any S&P index-based product. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 50.

4 | Semiannual Report

*All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

margins and liquidation value. In determining an optimal mix of equity and fixed income investments for the Fund, we assess changing economic, market and industry conditions.

Manager’s Discussion

During the period under review, the Fund’s strong equity holdings’ performance was driven by factors including continued economic recovery in the U.S.; positive economic growth in leading emerging economies, particularly China and Brazil; continued corporate profitability and rising cash levels on corporate balance sheets. In our assessment, many company management teams shifted their focus from balance sheet strengthening, debt extending and liquidity building to more shareholder-oriented activities including issuing stock dividends and share buybacks, pursuing mergers and acquisition opportunities and increasing capital investment. Although we believe these activities can significantly contribute to a holding’s equity total returns, they do not always benefit credit spreads and by extension, corporate bond total returns.

Long-term interest rates rose along with the 10-year U.S. Treasury note yield, which increased from 2.63% at the beginning of the period to 3.32% by period-end. Investment-grade corporate bond credit spreads over Treasuries contracted during the period from 168 basis points (bps; 100 basis points equal one percentage point) to 138 bps and partially offset the negative impact of higher long-term interest rates.

During the period, the Fund’s equity securities weighting increased from 56.5% to 58.3% of total net assets, its fixed income weighting increased from 29.5% to 34.3%, and its cash holdings decreased from 14.0% to 7.4%

Semiannual Report | 5

6 | Semiannual Report

Energy, materials and industrials were some of the top-performing equity sectors, largely driven by strong global economic conditions and rising commodity prices. Positive performance from companies related to oil, metals and agricultural commodities also contributed to these sectors’ strength. Individual holdings providing major support to performance included oil service industry companies Baker Hughes, Halliburton and Schlumberger, and energy producers Exxon Mobil, ConocoPhillips and Chesapeake Energy. Although nearly all the Fund’s equity holdings contributed to performance, several lost value including Microsoft, Xerox and Cisco Systems as well as electric utility PG&E (sold by period-end).

The increase in the Fund’s fixed income weighting during the period reflected select opportunities in corporate bonds as well as additions to government-related holdings, mainly municipal debt securities. At period-end the fixed income portion of the portfolio mainly consisted of corporate bonds. Bonds issued by iStar Financial performed well, while those from Italian integrated energy company ENI declined in value.

Thank you for your continued participation in Franklin Balanced Fund.

We look forward to serving your future investment needs.

Edward D. Perks, CFA

Shawn Lyons, CFA

Blair Schmicker, CFA

Brent Loder

Alan E. Muschott, CFA

Portfolio Management Team

Franklin Balanced Fund

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Brent Loder assumed portfolio manager responsibilities for the Fund in March 2011. His research focuses on regional banks and payment processors. Prior to joining Franklin Templeton Investments in 2006, he worked as an associate at Blum Capital Partners where he helped evaluate, execute and monitor investments in public and private companies. Previously, Mr. Loder worked at Morgan Stanley as an analyst in corporate finance and mergers and acquisitions.

Blair Schmicker assumed portfolio manager responsibilities for the Fund in March 2011. He specializes in equity research analysis of the utilities and industrials sectors. His primary research coverage includes the integrated utility, capital goods, alternative energy and construction sectors. Prior to joining Franklin Templeton Investments in 2007, Mr. Schmicker worked as an associate at Aetos Capital and as an analyst at Credit Suisse.

Semiannual Report | 7

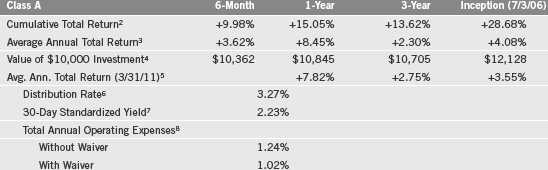

Performance Summary as of 4/30/11

Franklin Balanced Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

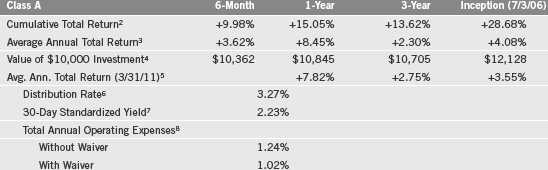

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

8 | Semiannual Report

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed 0.71% (other than certain nonroutine expenses) until 2/29/12.

Semiannual Report | 9

Performance Summary (continued)

Endnotes

The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. While stocks have historically outperformed other asset classes over the long term, they tend to fluctuate more dramatically over the short term as a result of factors affecting individual companies, industries or the securities market as a whole. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have a higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s distribution rate and total return would have been lower, and yields for the period would have been 2.12%, 1.56%, 2.06%, and 2.54% for Classes A, C, R and Advisor, respectively.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C, R and Advisor) per share on 4/30/11.

7. The 30-day standardized yield for the 30 days ended 4/30/11 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

8. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

10 | Semiannual Report

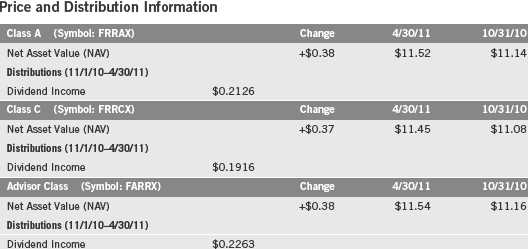

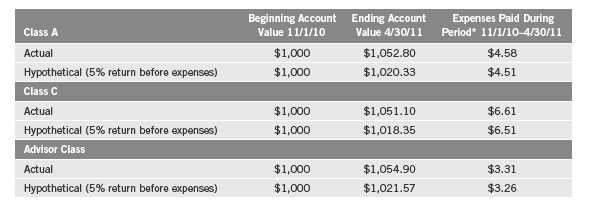

Your Fund’s Expenses

Franklin Balanced Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 11

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.01%; C: 1.71%; R: 1.21%; and Advisor: 0.71%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

12 | Semiannual Report

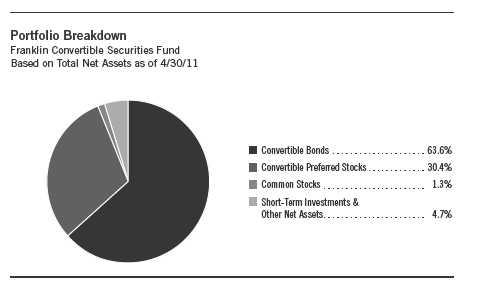

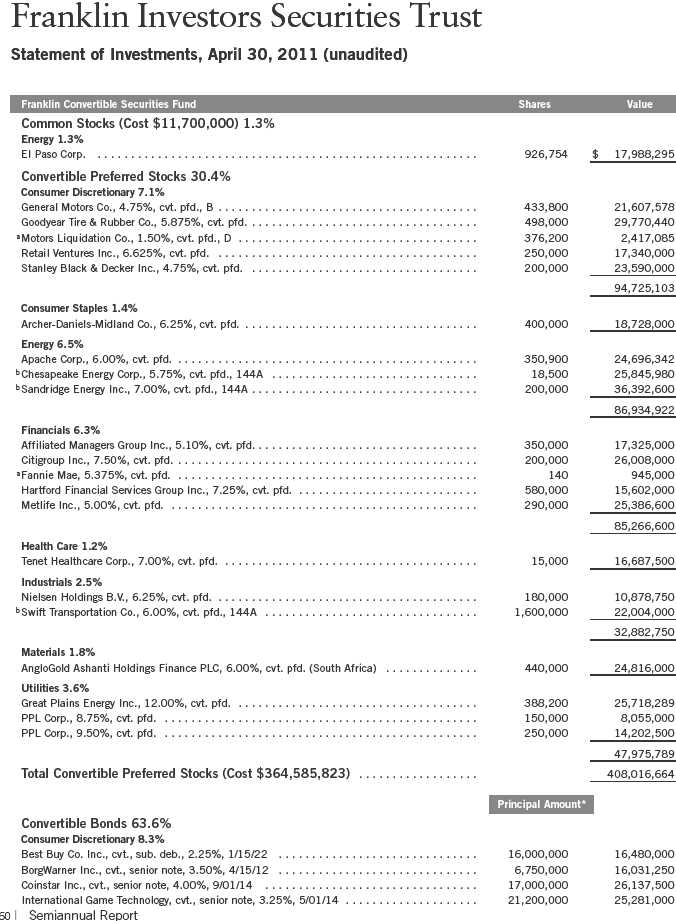

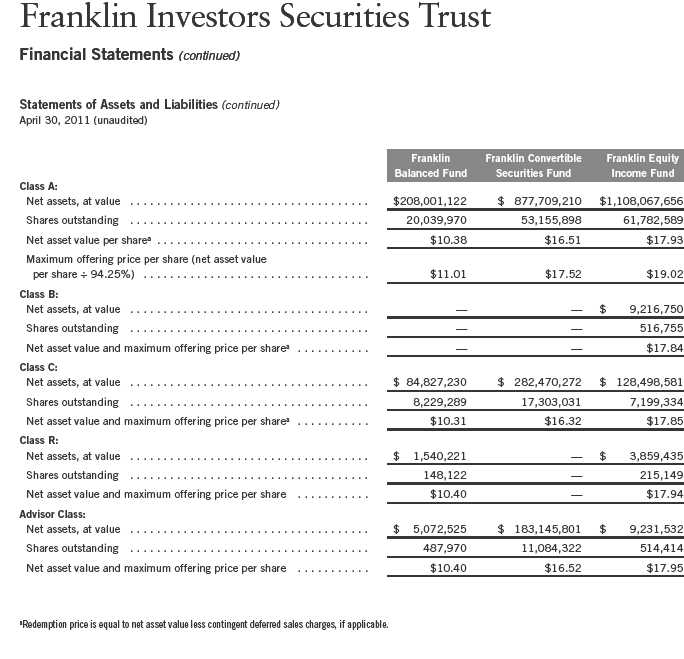

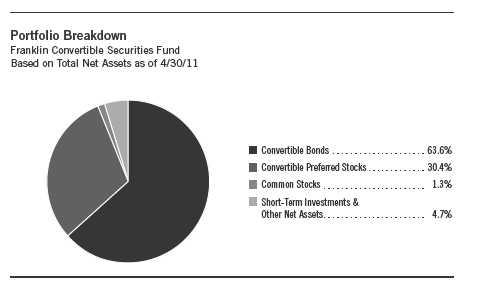

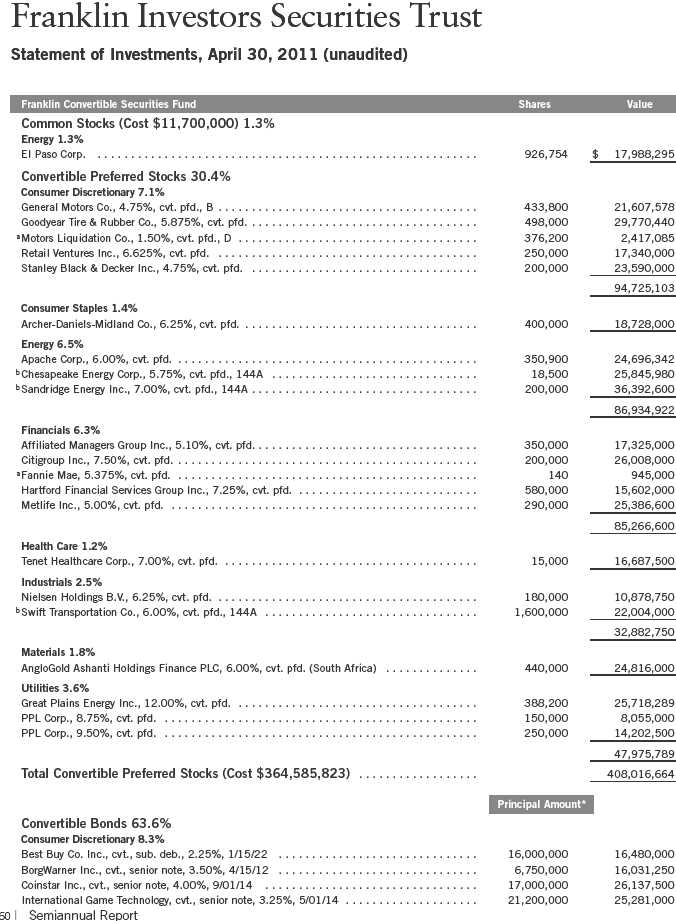

Franklin Convertible Securities Fund

Your Fund’s Goal and Main Investments: Franklin Convertible Securities Fund seeks to maximize total return consistent with reasonable risk by seeking to optimize capital appreciation and high current income under varying market conditions and investing at least 80% of its net assets in

convertible securities.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Convertible Securities Fund’s semiannual report for the period ended April 30, 2011.

Performance Overview

For the six months under review, Franklin Convertible Securities Fund – Class A delivered a +15.44% cumulative total return. The Fund outperformed the +13.86% total return of its benchmark, the BofA Merrill Lynch (BofAML) All Total Return Alternatives U.S. Convertibles Index, which tracks the domestic convertible securities market.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 16.

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 60.

Semiannual Report | 13

Investment Strategy

We follow a strategy of maintaining a balance in the portfolio between the equity and debt characteristics of convertible securities with an emphasis on the equity features. Convertible securities are attractive for two reasons: the opportunity to participate in common stocks’ potential growth with relatively reduced volatility, and the potential for current income with potential downside protection from bonds. Typically we sell securities whose equity sensitivity becomes too high and no longer offers appropriate downside protection. Likewise, as securities become too bond-like — reducing their ability to appreciate with increases in the underlying common stock — we attempt to redeploy those assets into more balanced convertible securities and maintain the potential for the Fund’s upside participation. Our experienced team of analysts searches for investment opportunities among all economic sectors and considers a company’s long-term earnings, asset value and cash flow potential, to create a broadly diversified portfolio.

Manager’s Discussion

Every sector the Fund invested in rose in value, as did nearly all of the portfolio’s individual securities, supporting overall performance during the six-month reporting period. In an environment of rising investor confidence as well as rebounding consumer and business spending, the Fund’s economically sensitive sectors such as information technology (IT), health care, industrials, consumer discretionary and energy fared particularly well and accounted for the bulk of the Fund’s total return.

Within IT, the Fund’s holdings of semiconductor and IT services-related stocks enjoyed some of the largest gains as many technology companies continued to post stronger-than-expected corporate earnings results through the calendar quarter ended March 31, 2011. As computer hardware and software sales improved at the business and consumer levels, the Fund benefited from its positions in manufacturers of memory chips and semiconductors, particularly Microchip Technology and Micron Technology. Among IT services investments, a major contributor was our holding in VeriFone Holdings, a leading supplier of electronic payment equipment such as point-of-sale software and terminals, smart card and check readers, receipt printers, and Internet commerce software.

The Fund’s top performers in the health care sector included Tenet Healthcare, which operates hospitals and other medical facilities across the U.S., and Omnicare, which provides a suite of products and services aimed primarily at assisted living, nursing home and hospice settings. Strong contributors among industrials included WESCO International, an electrical products distributor, and commercial products manufacturer Ingersoll-Rand. The Fund’s standouts among consumer discretionary holdings were automotive component makers

14 | Semiannual Report

Top 10 Holdings

Franklin Convertible Securities Fund 4/30/11

BorgWarner and Goodyear Tire & Rubber. In the energy sector, oil and gas exploration companies Chesapeake Energy and Apache boosted the Fund’s results.

Despite the Fund’s solid advance this reporting period, there were a few disappointments in the portfolio. Two sectors traditionally considered non-cyclical, consumer staples and utilities, posted relatively small positive results as they fell largely out of favor among investors. On an individual security basis, key detractors included electronics retailer Best Buy; Coinstar, which operates supermarket coin-counting machines and DVD rental kiosks; and AMR, the parent company of American Airlines.

Thank you for your continued participation in Franklin Convertible Securities Fund. We look forward to serving your future investment needs.

Alan E. Muschott, CFA

Blair Schmicker, CFA

Portfolio Management Team

Franklin Convertible Securities Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 15

Performance Summary as of 4/30/11

Franklin Convertible Securities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

16 | Semiannual Report

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 17

Performance Summary (continued)

Endnotes

The Fund may invest in high yielding, fixed income securities. High yields reflect the higher credit risk associated with these lower rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund may also invest in foreign securities, which involve special risks, including political uncertainty and currency volatility. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on the sum of the respective class’s last four quarterly dividends and the maximum offering price (NAV for Classes C and Advisor) per share on 4/30/11.

6. The 30-day standardized yield for the 30 days ended 4/30/11 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/14/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +24.00% and +7.54%.

18 | Semiannual Report

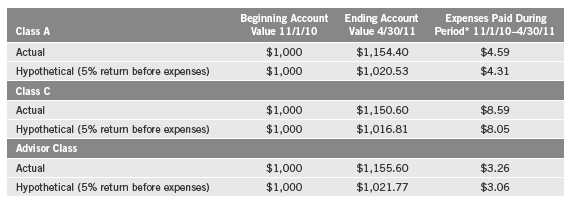

Your Fund’s Expenses

Franklin Convertible Securities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 19

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.86%; C: 1.61%; and Advisor: 0.61%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

20 | Semiannual Report

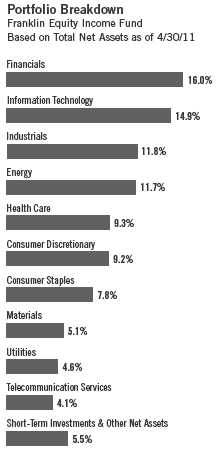

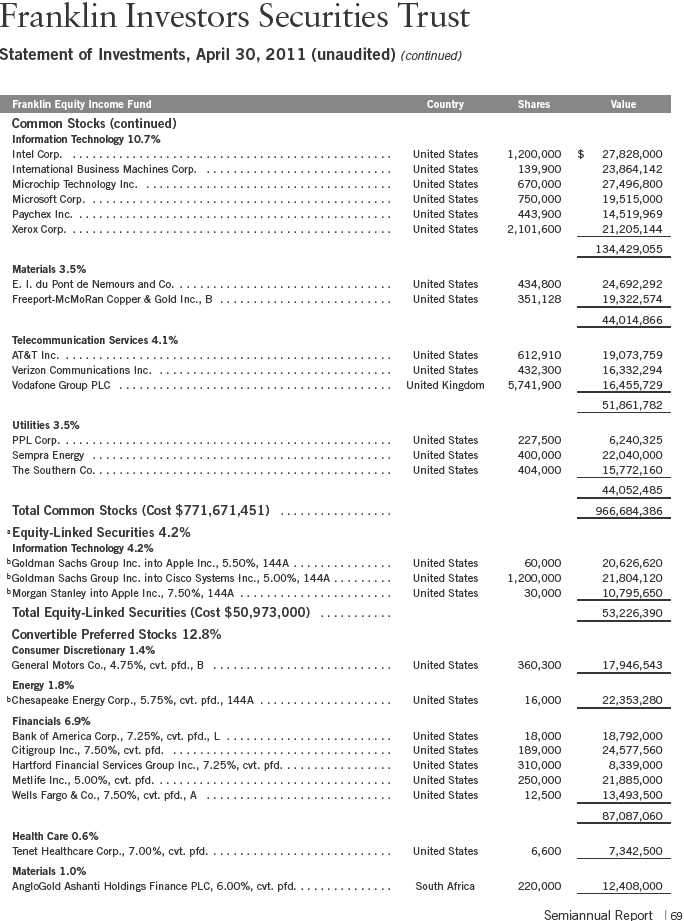

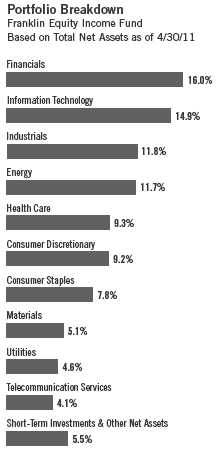

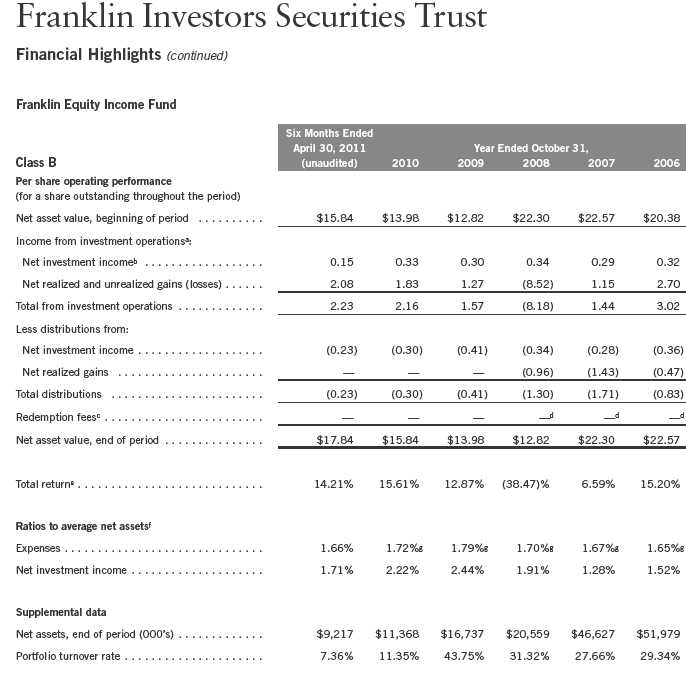

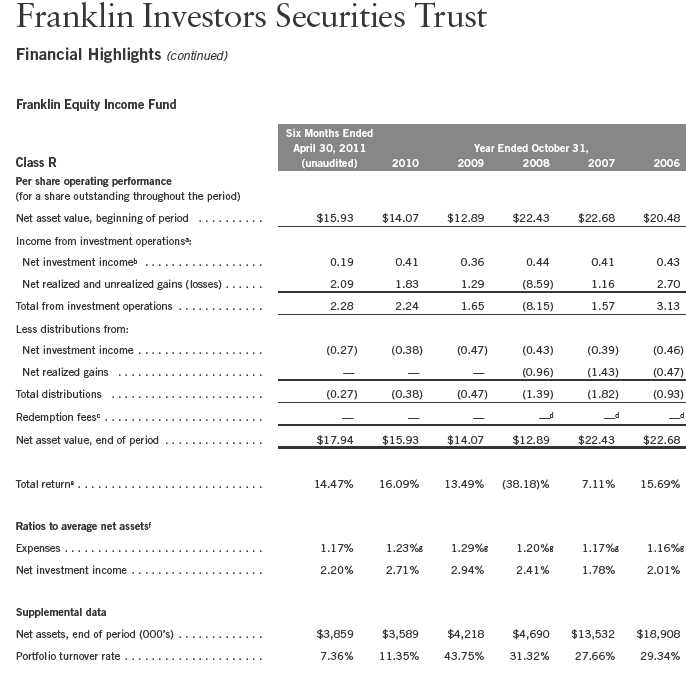

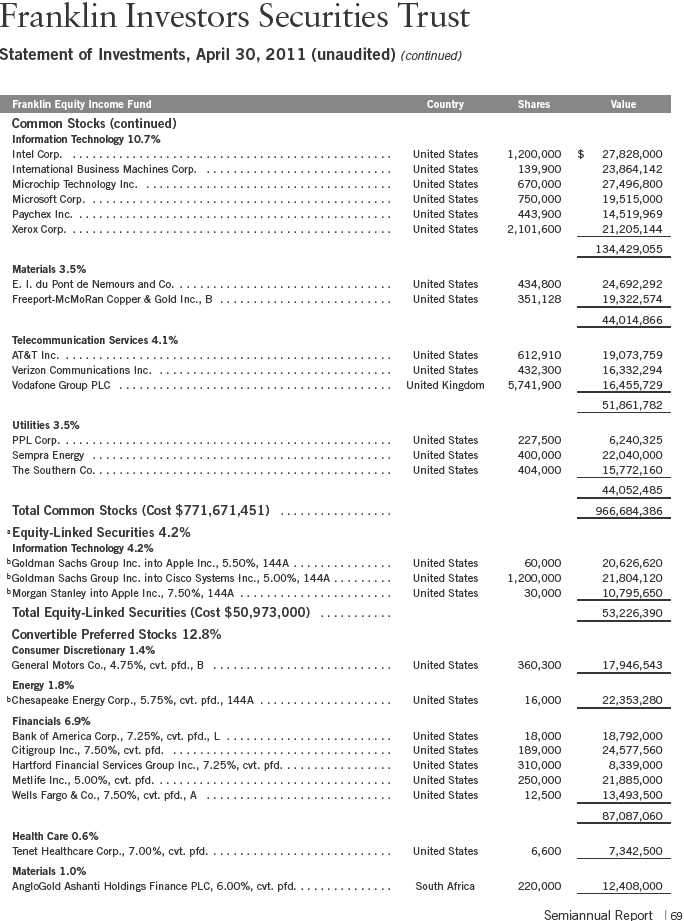

Franklin Equity Income Fund

Your Fund’s Goal and Main Investments: Franklin Equity Income Fund seeks to maximize total return, emphasizing high current income and long-term capital appreciation, consistent with reasonable risk, by investing at least 80% of its net assets in equity securities including securities convertible into common stocks.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Equity Income Fund covers the period ended April 30, 2011.

Performance Overview

For the six months under review, Franklin Equity Income Fund – Class A delivered a +14.61% cumulative total return. The Fund underperformed the broad U.S. stock market as measured by the Standard & Poor’s 500 Index (S&P 500), which produced a +16.36% total return.1 The Fund also under-performed the +15.56% total return of its peers in the Lipper Equity Income Funds Classification Average, which consists of funds chosen by Lipper that seek relatively high current income and growth of income by investing at least 60% of their portfolios in stocks.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 25.

Investment Strategy

We emphasize dividends in selecting stocks for the Fund because we believe that over time dividend income can contribute significantly to total return. We target companies we believe are financially strong but undervalued by the market. To identify such companies, we use a current relative yield analysis that focuses on a company’s dividend yield (calculated by dividing a stock’s annual per-share dividends by its per-share market price). Our experienced

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. Source: Lipper Inc. For the six-month period ended 4/30/11, this category consisted of 287 funds. Lipper calculations do not include sales charges, or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 68.

Semiannual Report | 21

team of analysts searches for investment opportunities among all economic sectors, and considers a company’s long-term earnings, asset value and cash flow potential, to create a broadly diversified portfolio.

Manager’s Discussion

Fund performance benefited from positive and broad-based returns across equity markets, and more specifically from investors’ preference for cyclical (economically sensitive) stocks as the U.S. and global economic recoveries generally gathered momentum. In this environment, every sector the Fund invested in produced positive results, and our holdings in the energy, industrials, information technology (IT), financials and consumer discretionary sectors generated major contributions to return. As prices for petroleum and other energy products climbed sharply throughout the reporting period, many of the Fund’s energy sector positions in major oil producers, as well as oil and gas exploration companies and oilfield services providers, increased in value. Standout performers within the sector included Halliburton, Chesapeake Energy, Chevron, ConocoPhillips and ExxonMobil, all of which posted double-digit returns.

The Fund’s industrials sector stocks were particularly beneficial, led by gains in heavy machinery manufacturer Caterpillar, global air freight and logistics specialist United Parcel Service, trucking firm J.B. Hunt Transport Services, and industrial conglomerates General Electric and 3M. As corporate earnings

22 | Semiannual Report

improved, businesses continued to engage in long-awaited equipment and productivity upgrades that had been delayed by the recession. This shift in business sentiment had a positive impact on many of the Fund’s technology-related holdings. These included makers of computer hardware and electronic consumer products such as IBM and Apple, in addition to microchip manufacturers Intel and Microchip Technology, which benefited as many companies increased spending to upgrade their IT infrastructure.

Among financials, we held relatively large positions in T. Rowe Price Group, Wells Fargo, JPMorgan Chase and Marsh & McLennan during the reporting period, making their double-digit returns even more meaningful to overall higher Fund performance. Elsewhere, an environment of rising consumer sentiment, incomes and increasingly robust discretionary spending combined to aid the Fund’s positions in retailers Limited Brands and The Home Depot, as well as Comcast, the largest U.S. cable services provider.

Despite the Fund’s solid results this reporting period, some typically noncyclical sectors represented in the Fund’s portfolio, notably consumer staples and utilities, lagged the overall market’s advance, producing positive though comparatively weaker returns as they generally fell out of favor with investors. On an individual security basis, only a few holdings hindered performance. Key detractors included Cisco Systems and Xerox from the IT sector, retailers Best Buy (sold by period-end) and Target, and Bank of America common stock.

Semiannual Report | 23

Thank you for your continued participation in Franklin Equity Income Fund.

We look forward to serving your future investment needs.

Alan E. Muschott, CFA

Edward D. Perks, CFA

Frank M. Felicelli, CFA

Portfolio Management Team

Franklin Equity Income Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

24 | Semiannual Report

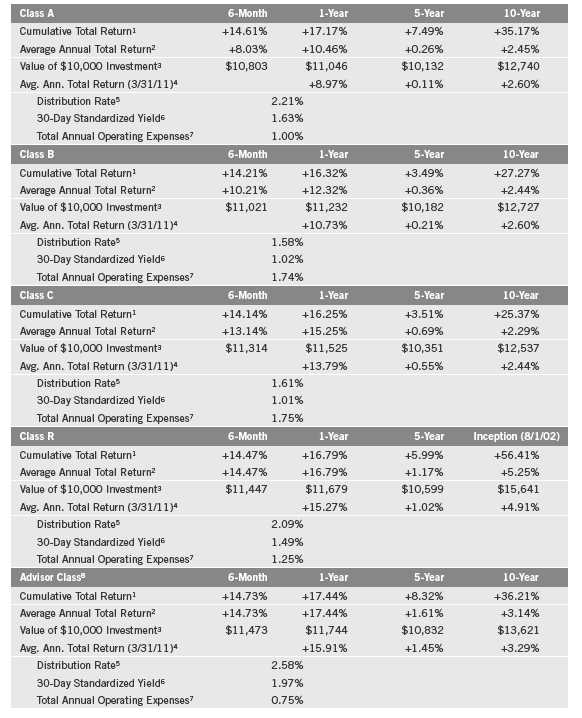

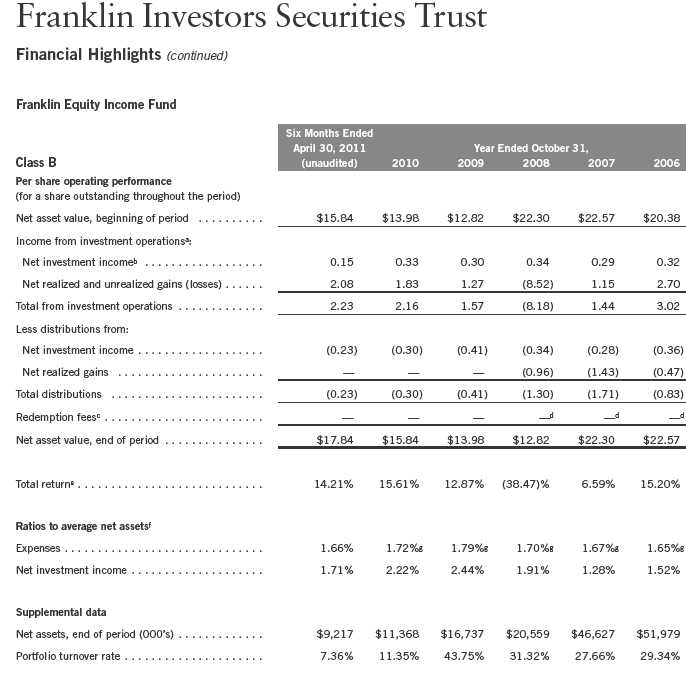

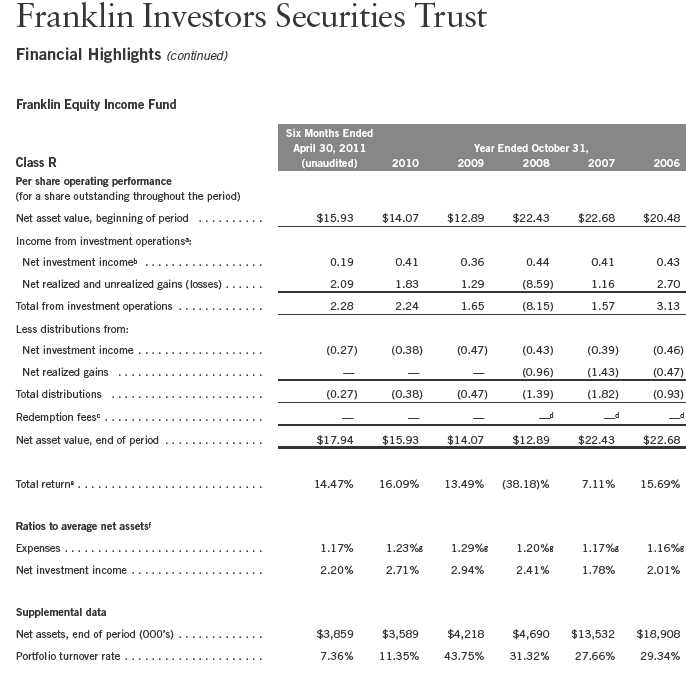

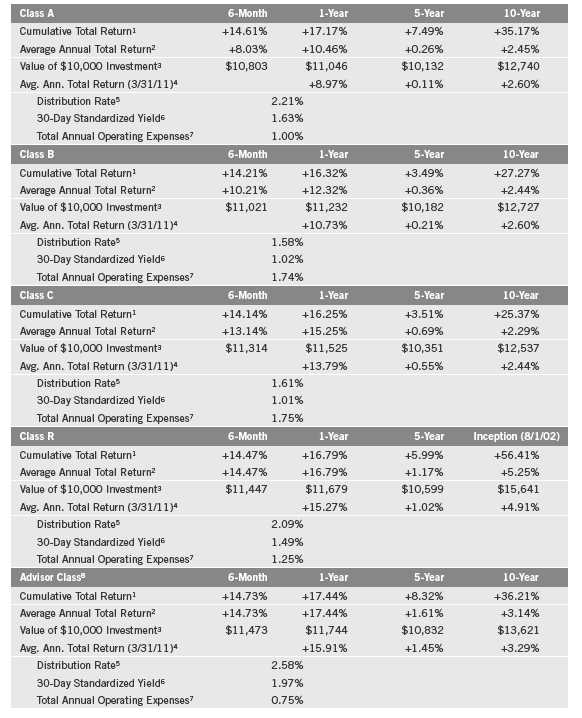

Performance Summary as of 4/30/11

Franklin Equity Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 25

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

26 | Semiannual Report

Performance Summary (continued)

Endnotes

While stocks have historically outperformed other asset classes over the long term, they tend to fluctuate more dramatically over the short term as a result of factors affecting individual companies, industries or the securities market as a whole. The Fund’s investment in foreign securities also involves special risks, including currency fluctuations and economic as well as political uncertainty. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes B, C, R and Advisor) per share on 4/30/11.

6. The 30-day standardized yield for the 30 days ended 4/30/11 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/14/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +1.76% and +0.59%.

Semiannual Report | 27

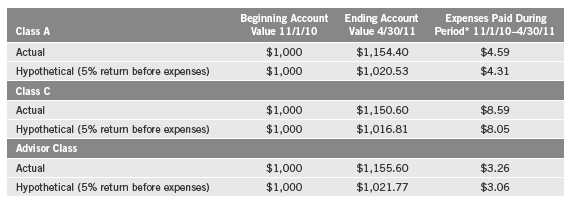

Your Fund’s Expenses

Franklin Equity Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

28 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.92%; B: 1.66%; C: 1.67%; R: 1.17%; and Advisor: 0.67%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 29

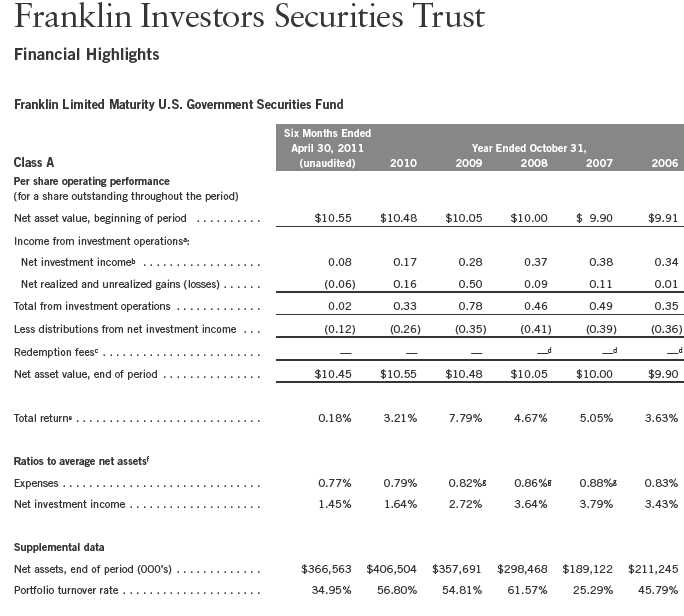

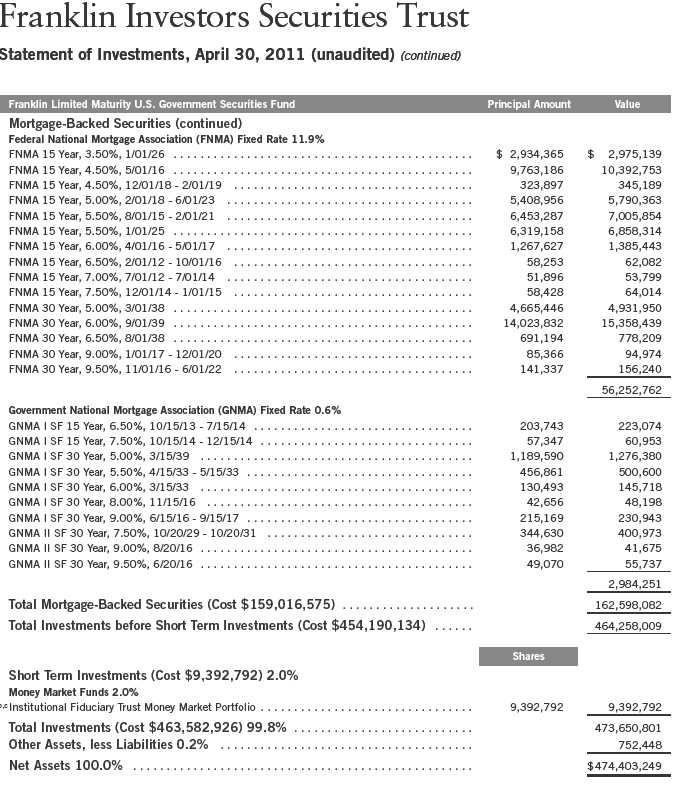

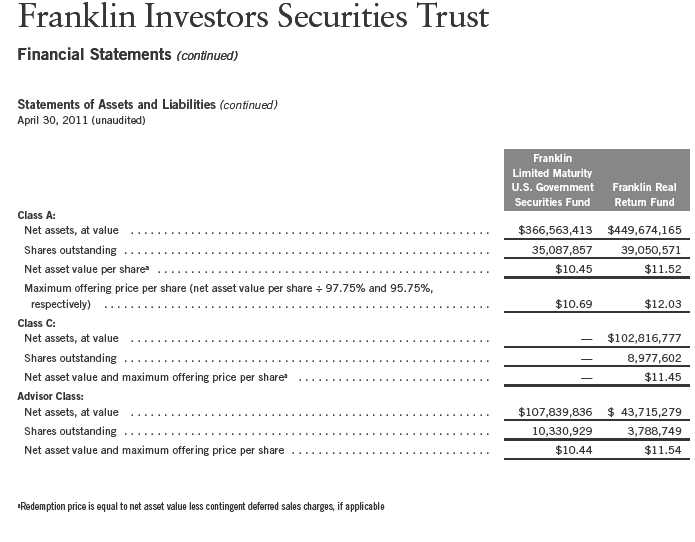

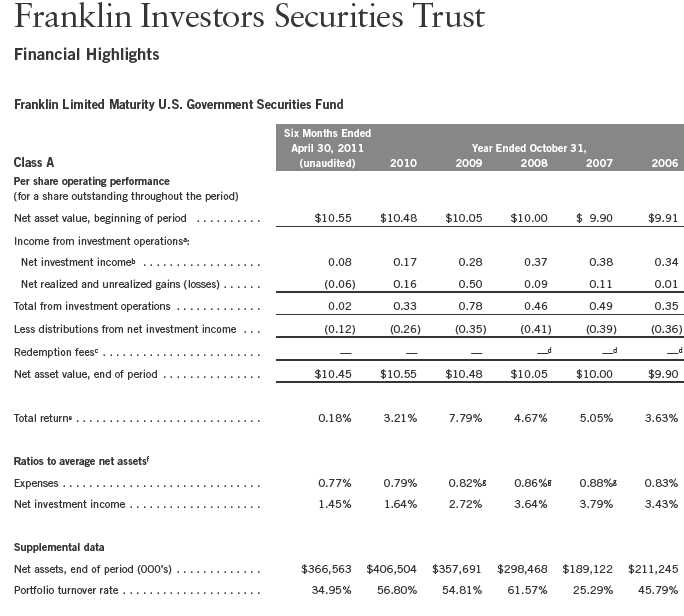

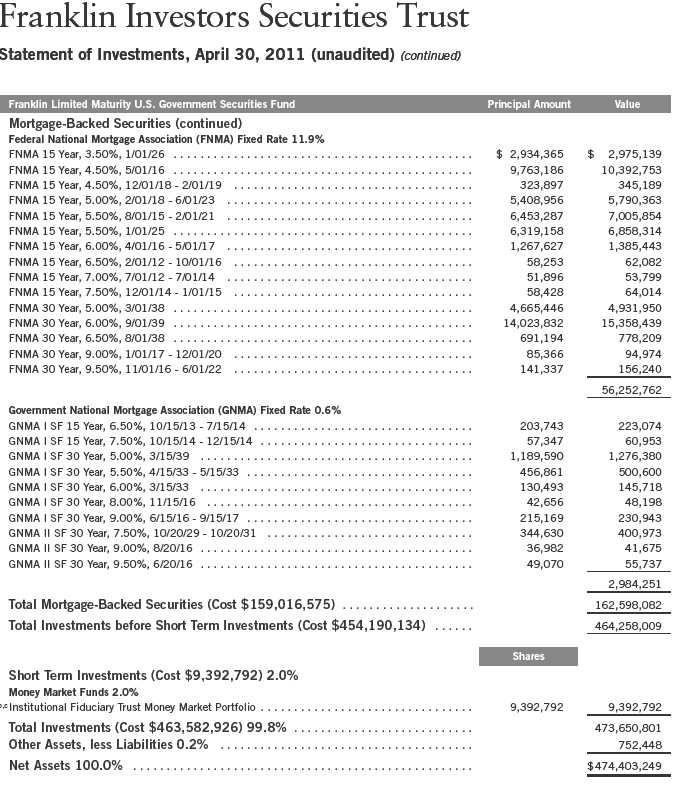

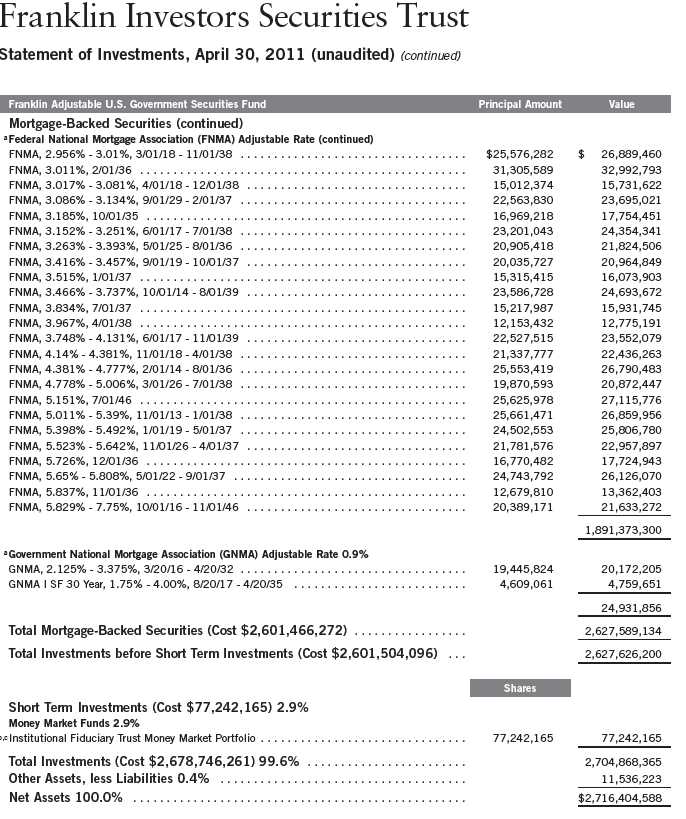

Franklin Limited Maturity U.S. Government Securities Fund

Your Fund’s Goal and Main Investments: Franklin Limited Maturity U.S. Government Securities Fund seeks to provide investors with as high a level of current income as is consistent with prudent investing, while seeking to preserve shareholders’ capital, by investing at least 80% of its net assets in securities with a dollar-weighted average maturity of less than 10 years and issued or guaranteed by the U.S. government, its agencies or instrumentalities.1 Some of the Fund’s investments may include securities issued by U.S. government-sponsored entities such as Fannie Mae and Freddie Mac.2

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Limited Maturity U.S. Government Securities Fund’s semiannual report for the period ended April 30, 2011.

Performance Overview

For the six months under review, Franklin Limited Maturity U.S. Government Securities Fund – Class A delivered a +0.18% cumulative total return. The

1. In determining a security’s maturity for the purposes of calculating the Fund’s average maturity, an estimate of the average time for its principal to be paid may be used. This can be substantially shorter than its stated final maturity.

2. Although U.S. government-sponsored entities may be chartered or sponsored by acts of Congress, their securities are neither insured nor guaranteed by the U.S. government. Please refer to the Fund’s prospectus for a detailed discussion regarding various levels of credit support. The Fund’s yield and share price are not guaranteed and will vary with market conditions.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 73.

30 | Semiannual Report

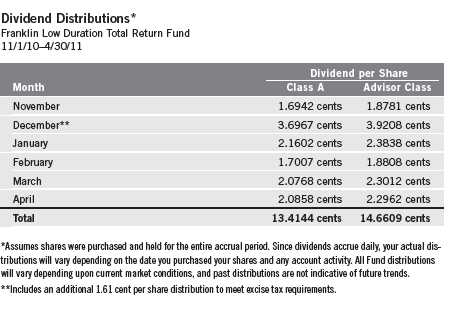

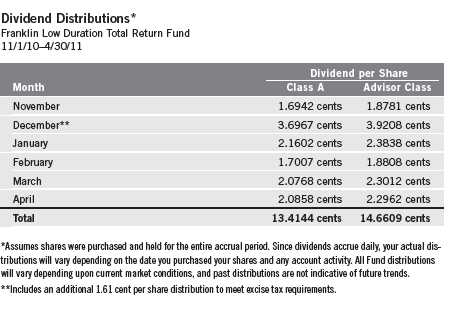

*Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**Includes an additional 0.63 cent per share distribution to meet excise tax requirements.

Fund outperformed the -0.33% total return of its primary benchmark, the Barclays Capital (BC) U.S. Treasury Index: 1-5 Year Component, which tracks U.S. Treasury securities with one to five years remaining maturity.3 The Fund also outperformed the +0.08% total return of its secondary benchmark, the Barclays Capital (BC) U.S. Treasury Index: 1-3 Year Component, which tracks U.S. Treasury securities with one to three years remaining maturity.3 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 34.

Investment Strategy

We currently maintain the portfolio’s average dollar-weighted maturity between one and five years. The Fund’s average dollar-weighted maturity will vary with market conditions and the outlook for interest rates. We invest primarily in short-to intermediate-term securities guaranteed by the U.S. government, its agencies and instrumentalities. Some of the Fund’s investments may include securities issued by U.S. government-sponsored entities, such as Fannie Mae (FNMA) and Freddie Mac (FHLMC).2 The Fund’s portfolio emphasizes mortgage-backed bonds and agency debentures, while also diversifying across components of the U.S. Treasury sector. We analyze securities using proprietary and nonpro-prietary research to help identify attractive investment opportunities.

3. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

Semiannual Report | 31

Manager’s Discussion

During the period, the U.S. economic recovery appeared to make progress despite mixed economic data. The U.S. consumer was resilient and retail sales remained relatively strong, in spite of higher gasoline prices. The labor market showed signs of healing, and the corporate sector generally delivered healthy profits and solid balance sheets. The unemployment rate remained elevated, which restrained labor costs and wages and made it difficult for businesses to pass higher commodity prices to consumers. A global recovery seems to be in place, driven largely by growth in emerging markets. However, potential risks to economic expansion persisted, including U.S. federal debt levels, global inflationary pressures, concerns surrounding some eurozone countries and a distressed U.S. housing market.

Most fixed income sectors, as measured by their relevant BC indexes, posted positive returns during the period, including the Treasury Inflation Protected Securities (TIPS) Index (+1.28%), the Ginnie Mae Index (+1.12%), the U.S. Hybrid Adjustable-Rate Mortgage (ARM) Index (+1.08%) and the U.S. Agency Fixed Rate Mortgage-Backed Securities (MBS) Index (+0.94%).3 In contrast, the U.S. Agency Index lagged with a -0.31% return.3

The Fund, which typically looks for attractive valuations within lower interest rate risk government bond markets, invested in government-related securities, such as U.S. Treasuries, agency debentures, agency mortgage pass-through securities (both fixed and adjustable rate) and cash investments. We continued to emphasize agency debentures and mortgage pass-through securities because we believe they offer better return potential, as well as an income advantage over Treasuries. We slightly decreased exposure to agency ARMs and marginally increased allocation to fixed-rate agency mortgages as we looked for what we considered the best opportunities in these securities. We added agency mortgages backed by commercial properties that were trading, in our view, at attractive yield spreads versus other government related bonds. We reduced our allocation to TIPS after valuations richened.

Our exposure to agency MBS (both fixed and adjustable rate) and agency debentures contributed to performance. The Fund’s Treasury exposure aided returns because of our TIPS holdings. We positioned the portfolio to have less interest rate risk than the benchmark as we were mindful of the potential for rising interest rates.

32 | Semiannual Report

Thank you for your continued participation in Franklin Limited Maturity U.S. Government Securities Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Limited Maturity

U.S. Government Securities Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 33

Performance Summary as of 4/30/11

Franklin Limited Maturity U.S. Government Securities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 2.25% maximum initial sales charge; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

34 | Semiannual Report

Performance Summary (continued)

Endnotes

Interest rate movements, unscheduled mortgage prepayments and other risk factors will affect the Fund’s share price and yield. Bond prices, and thus a fund’s share price, generally move in the opposite direction of interest rates. Therefore, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Advisor Class) per share on 4/30/11.

5. The 30-day standardized yield for the 30 days ended 4/30/11 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 35

Your Fund’s Expenses

Franklin Limited Maturity U.S. Government Securities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

36 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.77% and Advisor: 0.67%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 37

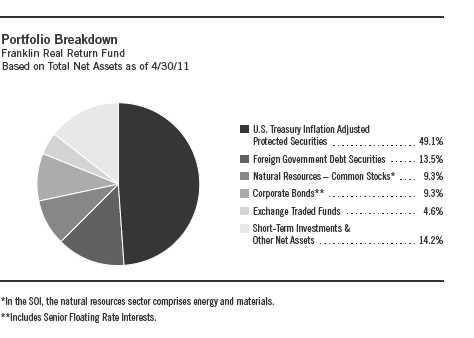

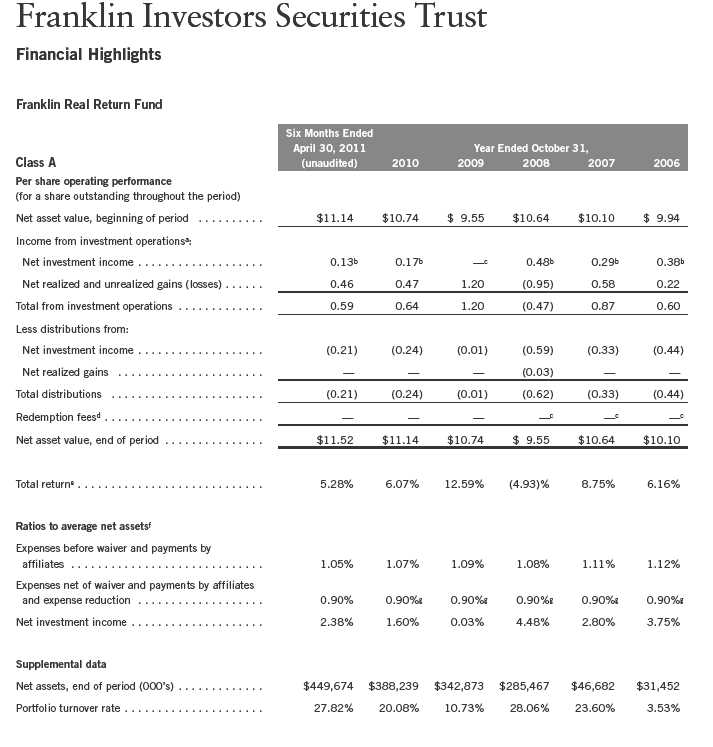

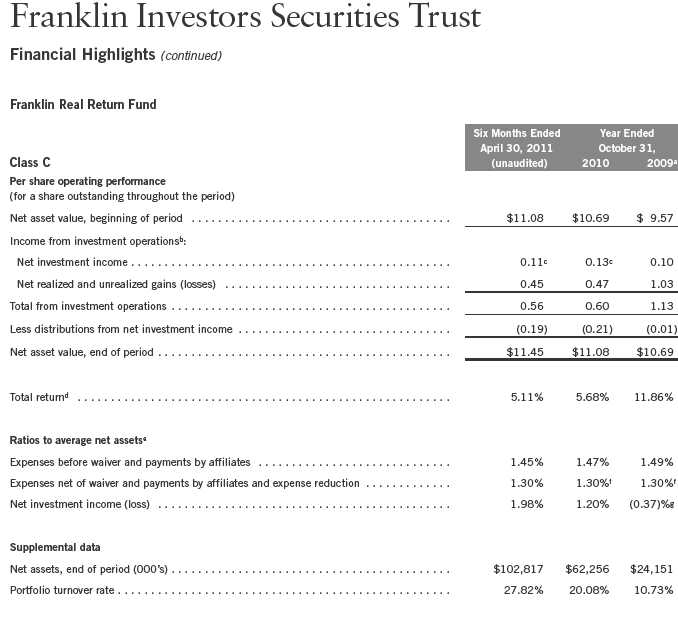

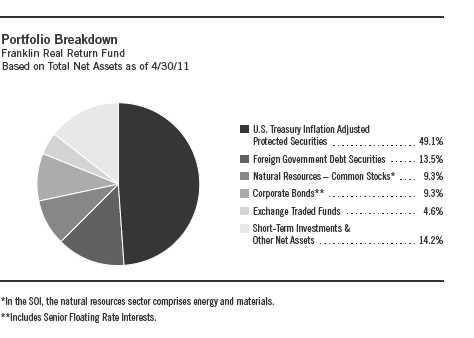

Franklin Real Return Fund

Your Fund’s Goal and Main Investments: Franklin Real Return Fund seeks to achieve total return that exceeds the rate of inflation over an economic cycle. The Fund will generally invest a substantial portion of its assets in inflation-protected securities. Managers also have the flexibility to invest in other sectors of the market to increase real return (total return less the rate of inflation) potential and offer greater diversification.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Real Return Fund’s semiannual report for the period ended April 30, 2011.

Performance Overview

For the six months under review, Franklin Real Return Fund – Class A delivered a +5.28% cumulative total return. The Fund outperformed the +1.28% total return of its benchmark, the Barclays Capital (BC) U.S. TIPS Index, which tracks the universe of inflation-protected notes issued by the U.S. Treasury that have at least one year to final maturity.1 The Fund outperformed the Consumer Price

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged. The BC U.S. TIPS Index includes reinvested interest. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

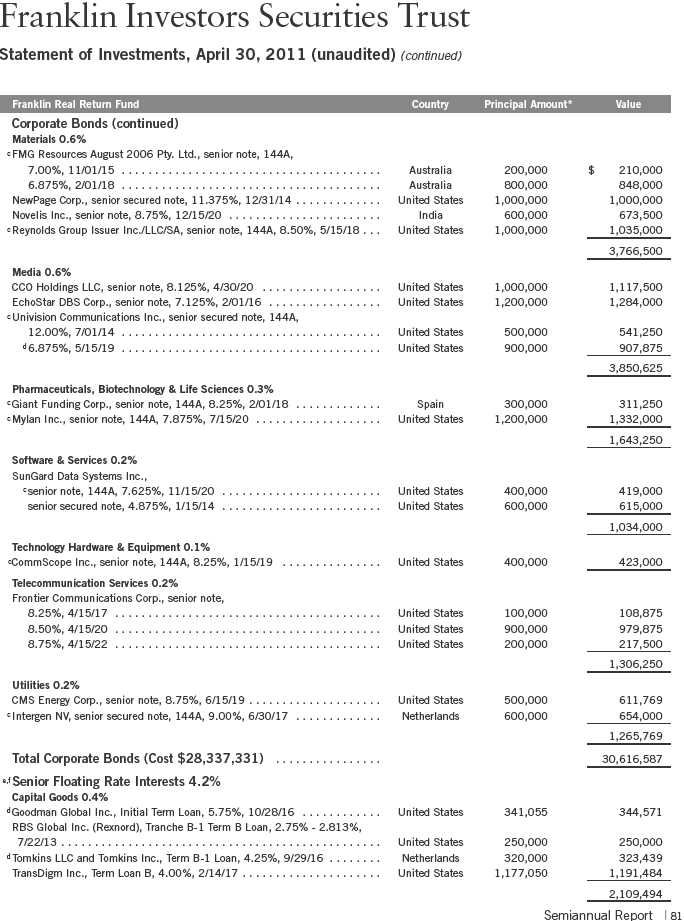

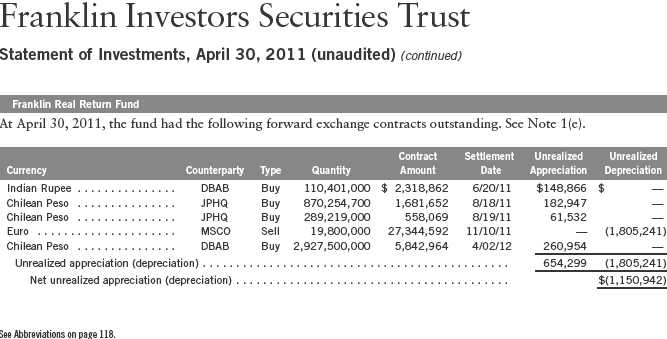

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 79.

38 | Semiannual Report

*All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Index (CPI) for Urban Consumers (All Items) NSA (non-seasonally adjusted), a measure of the average change in prices of all goods and services purchased for consumption by urban householders, which rose 2.83% for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 41.

Investment Strategy

We seek to allocate assets among investments to achieve the highest level of real return (total return less the rate of inflation) consistent with an acceptable level of risk. We will allocate the Fund’s assets among securities in various market sectors based on our assessment of changing economic, global market, industry and issuer conditions. When making our investment decisions, we will evaluate such criteria as country risk, business cycles, yield curves, and values between and within markets.

Manager’s Discussion

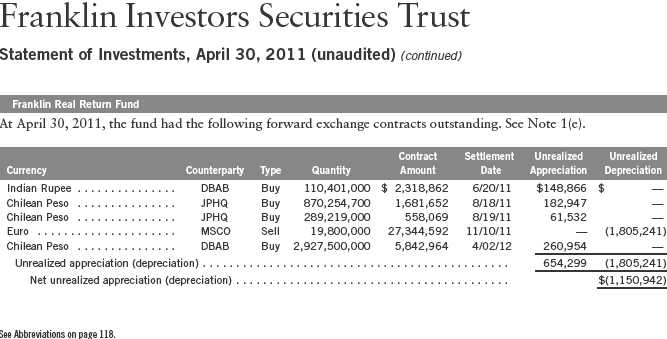

During the period under review, we invested the Fund’s assets in the allowable sectors. At period-end, nearly half of the Fund’s total net assets were invested in U.S. Treasury Inflation Protected Securities (TIPS). For diversification, we also allocated some of the Fund’s assets to natural resources, real estate investment trusts (REITs), short-term non-U.S. dollar securities, bank loans and high yield sectors. We employed a non-U.S. dollar strategy to help manage against dollar weakness versus certain currencies. We concentrated our TIPS holdings in shorter maturities, helping the Fund’s relative performance as interest rates rose during the period.

Semiannual Report | 39

The global economic recovery continued in early 2011 despite global concerns including European debt, Middle Eastern and North African political unrest and multiple crises triggered by the Japanese earthquake and tsunami. Inflationary pressures began to emerge through increased commodity and energy prices. In the U.S., broad inflation measures picked up, and we believe there is evidence inflation began to affect areas besides food and energy. Manufacturers and retailers showed indications of passing their costs to their end consumers. Our diversified mix of inflation-sensitive assets outperformed during the period as risk assets in general continued to do well versus the safe haven of long-term U.S. Treasuries. In particular, our allocation to natural resources securities and REITs helped performance relative to the BC U.S. TIPS Index.

Thank you for your continued participation in Franklin Real Return Fund. We look forward to serving your future investment needs.

T. Anthony Coffey, CFA

Kent Burns, CFA

Portfolio Management Team

Franklin Real Return Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

40 | Semiannual Report

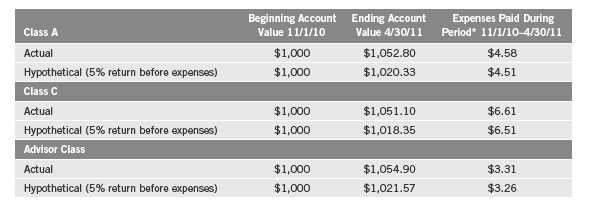

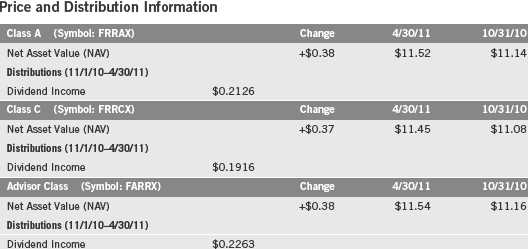

Performance Summary as of 4/30/11

Franklin Real Return Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 41

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees and acquired fees and expenses) for each class of the Fund do not exceed 0.65% (other than certain nonroutine expenses) until 2/29/12.

42 | Semiannual Report

Performance Summary (continued)

Endnotes

Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. While stocks have historically outperformed other asset classes over the long term, they tend to fluctuate more dramatically over the short term. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. The risks of foreign securities include currency fluctuations and political uncertainty. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. If the manager and administrator had not waived fees, the Fund’s distribution rate and total return would have been lower, and yield for the period would have been 2.46%, 2.16% and 2.81% for Classes A, C and Advisor, respectively.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C and Advisor) per share on 4/30/11.

6. The 30-day standardized yield for the 30 days ended 4/30/11 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 43

Your Fund’s Expenses

Franklin Real Return Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

44 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.90%; C: 1.30%; and Advisor: 0.65%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 45

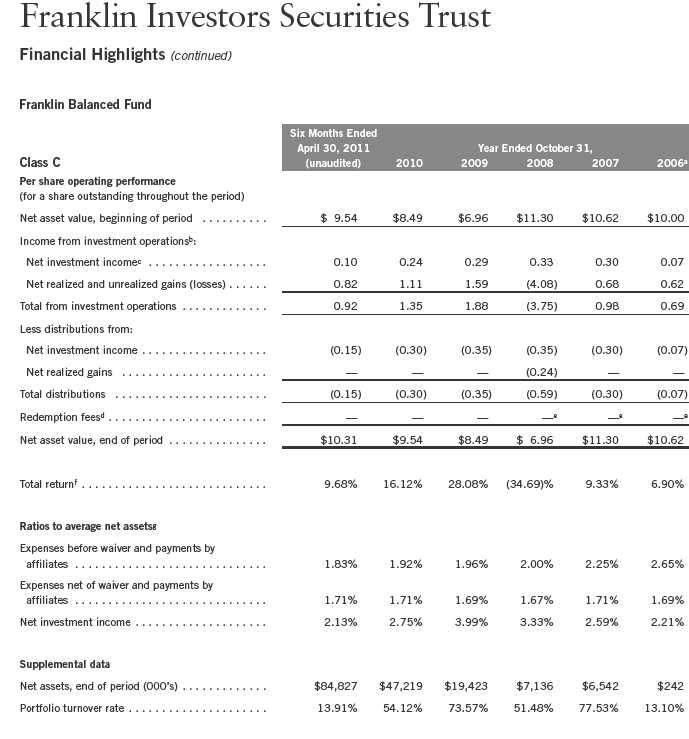

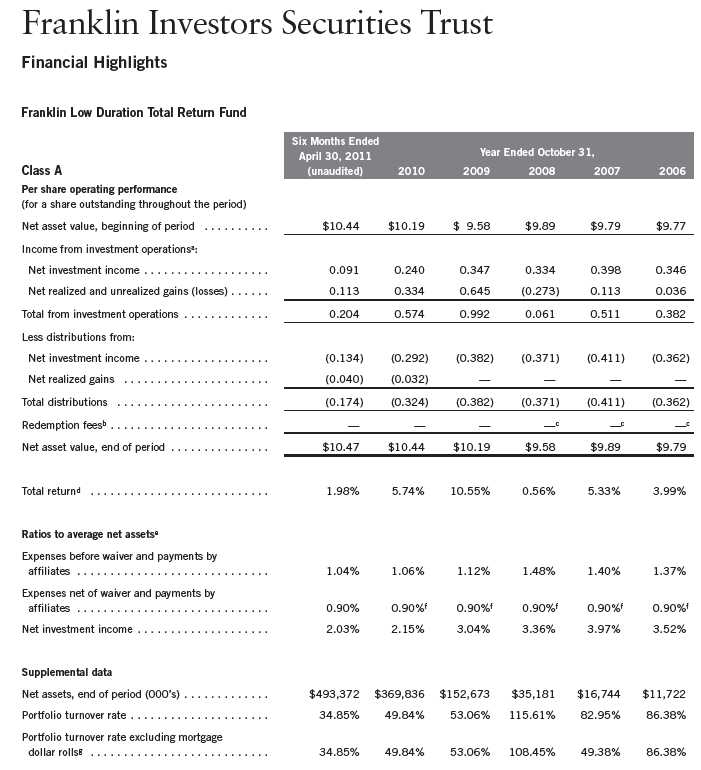

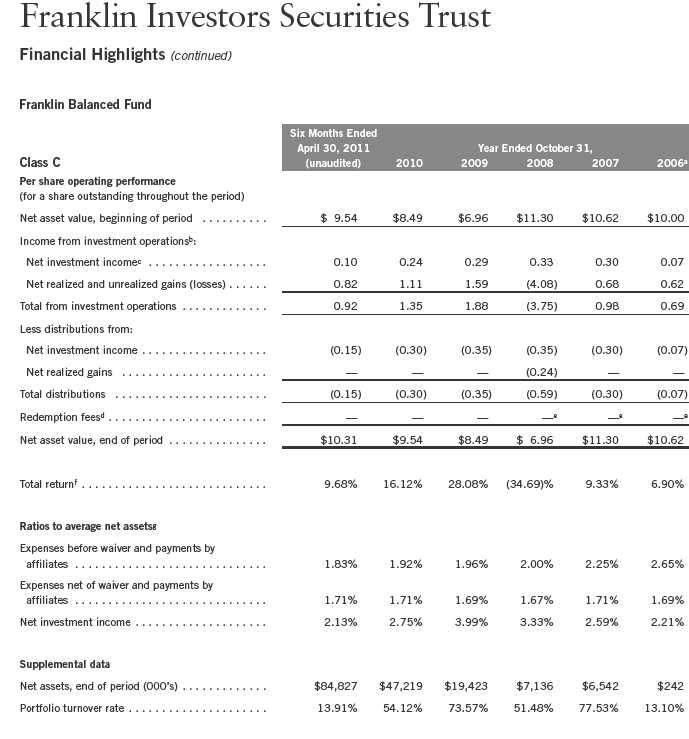

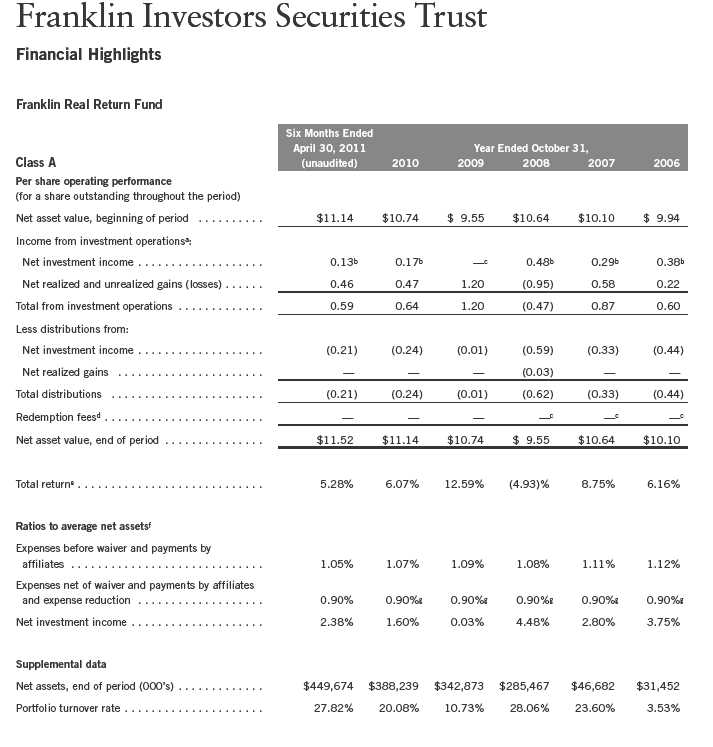

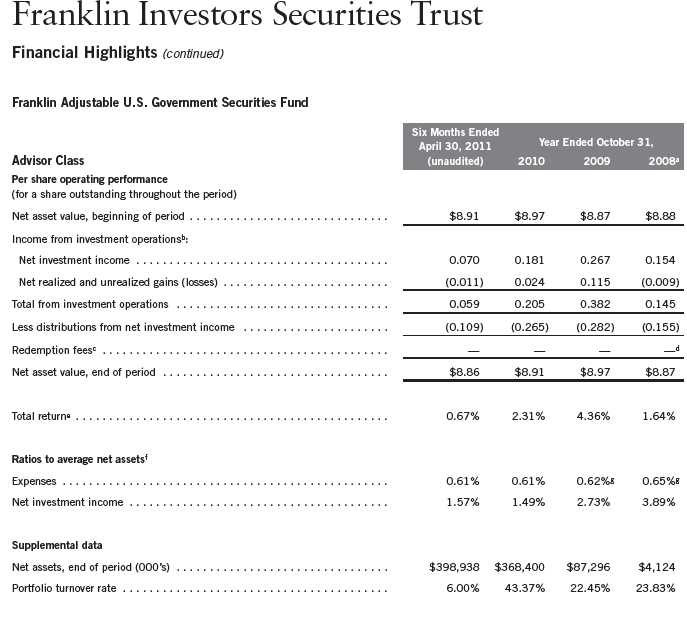

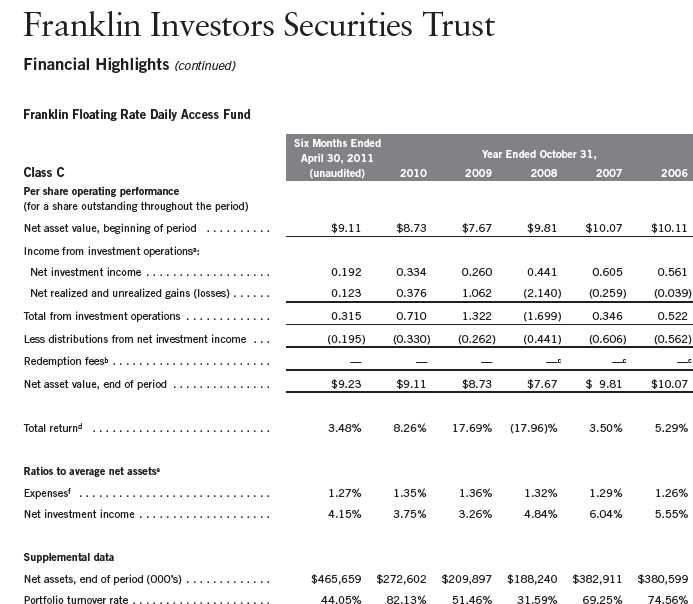

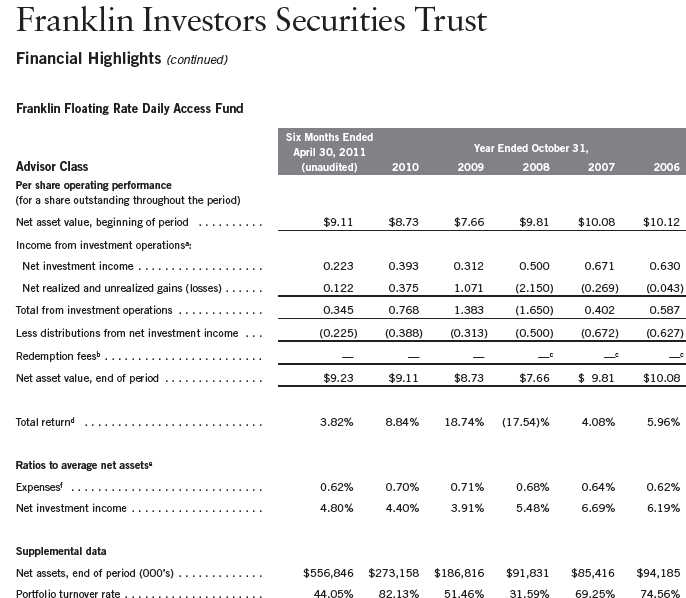

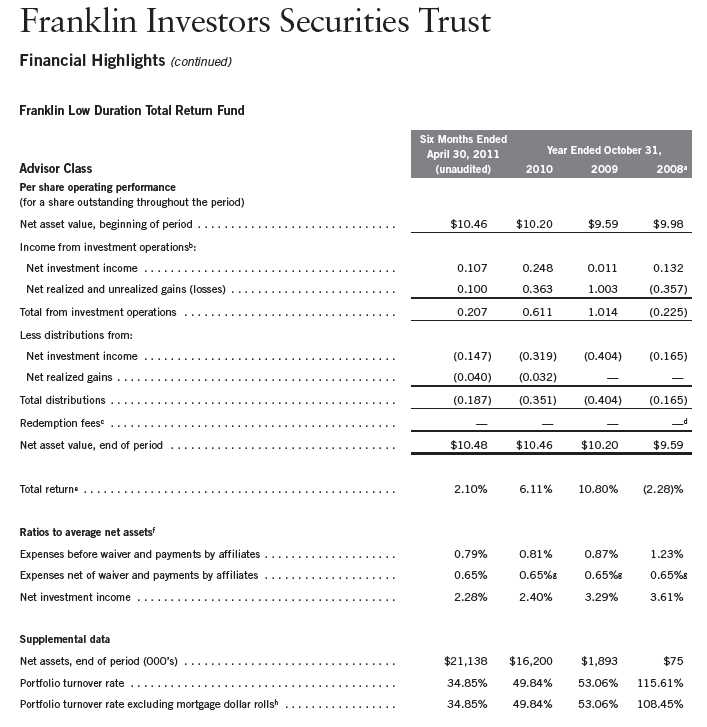

aFor the period July 3, 2006 (commencement of operations) to October 31, 2006.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dEffective September 1, 2008, the redemption fee was eliminated.

eAmount rounds to less than $0.01 per share.

fTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

46 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

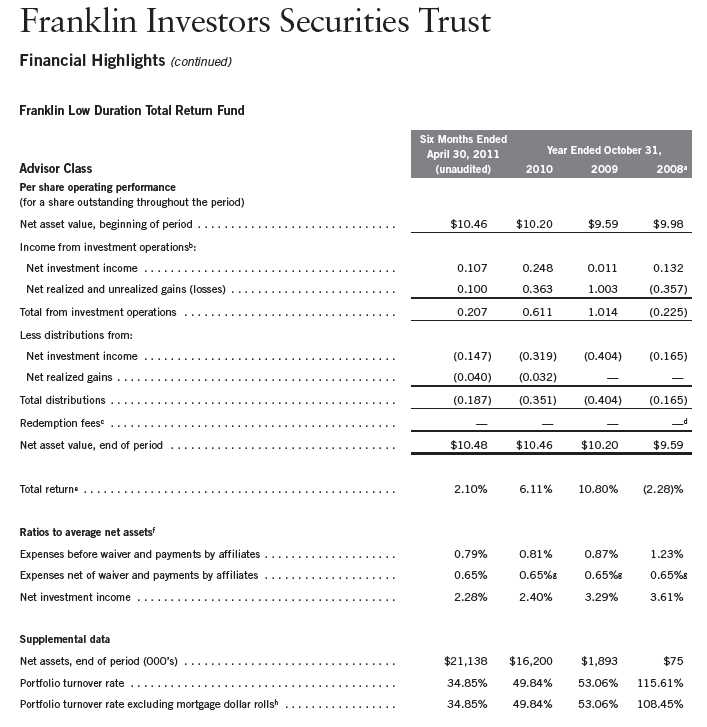

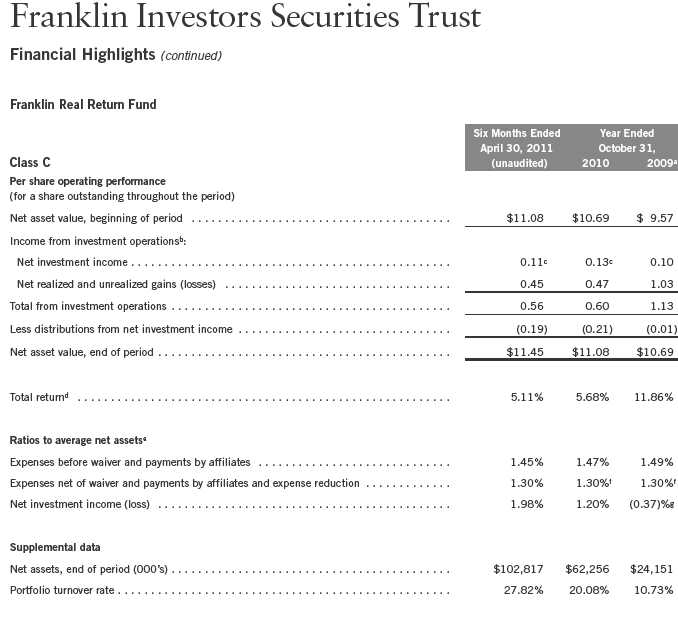

aFor the period July 3, 2006 (commencement of operations) to October 31, 2006.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dEffective September 1, 2008, the redemption fee was eliminated.

eAmount rounds to less than $0.01 per share.

fTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 47

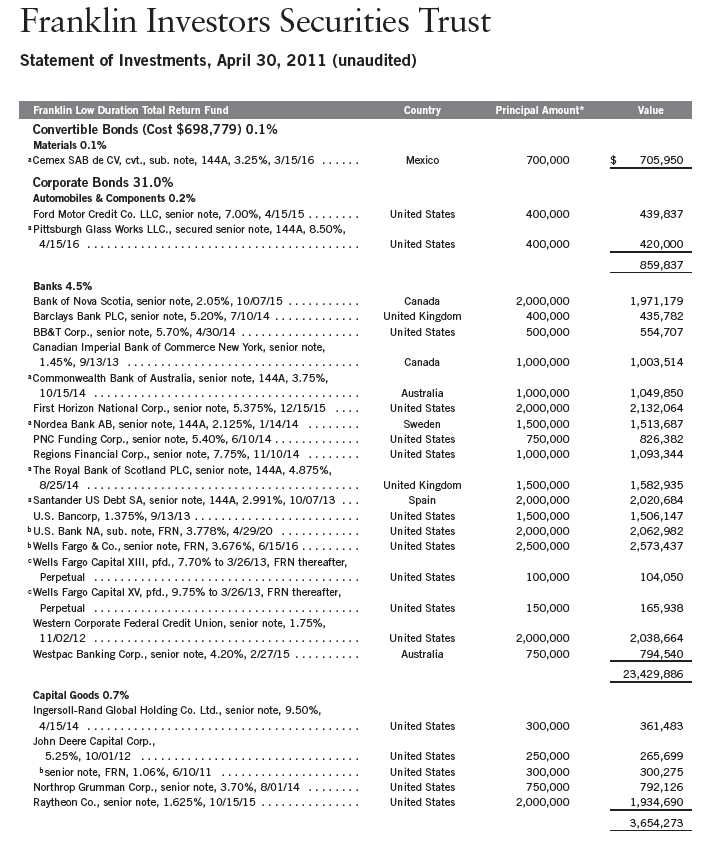

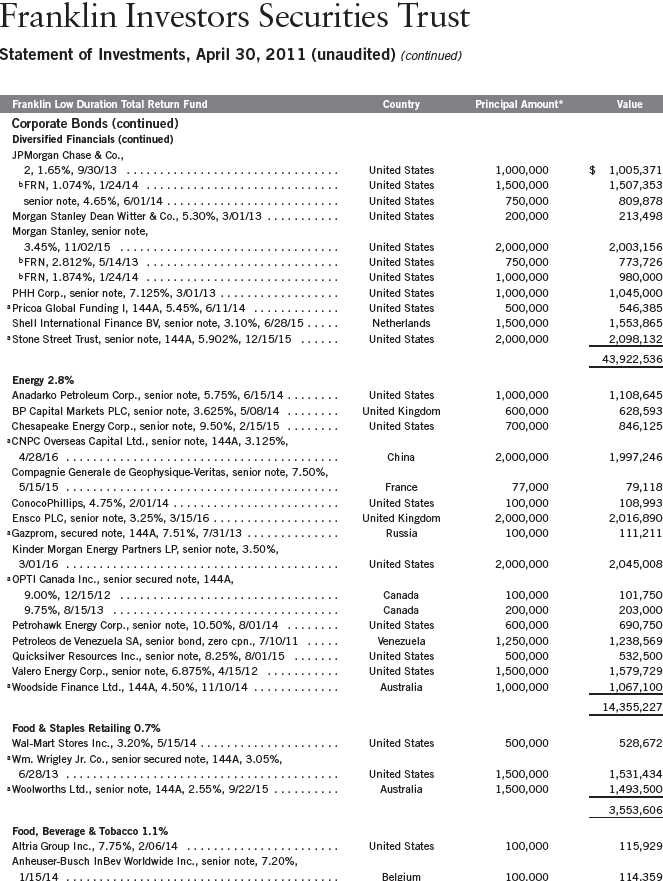

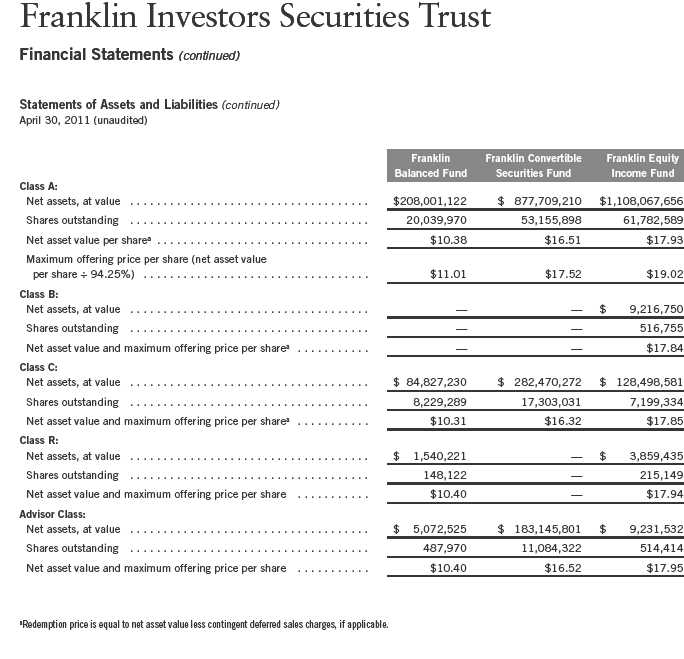

aFor the period July 3, 2006 (commencement of operations) to October 31, 2006.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dEffective September 1, 2008, the redemption fee was eliminated.

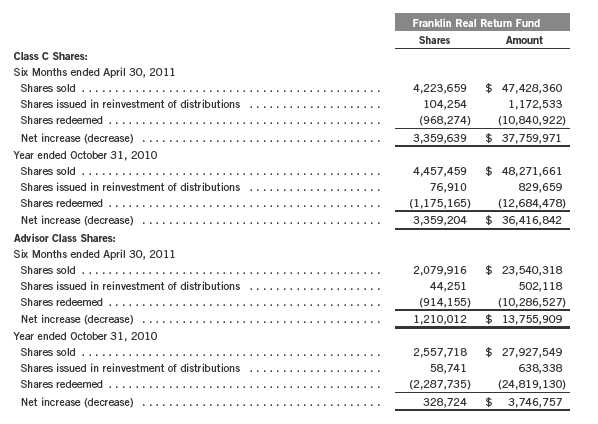

eAmount rounds to less than $0.01 per share.