1

Semiannual Report

Economic and Market Overview

The U.S. economy, as measured by gross domestic product growth, expanded during the six-month period ended April 30, 2012. The national unemployment rate for April 2012 stood at 8.1%, compared with 8.9% at the start of the period.1 Jobless claims touched a four-year low in February, and job creation was fairly robust. Consistent with employment trends, industrial production and manufacturing activity increased toward the end of the period. Automobile sales rose to their highest levels since February 2008, and consumer confidence climbed to pre-recession levels. Outside of the U.S., Greece secured bailout financing as bondholders agreed to concessions and the country enacted austerity measures. Although the long-term resolution of the European debt situation remained unclear, the European Central Bank’s plan to increase liquidity through loans was well received and seemed to improve investor sentiment.

At the end of the reporting period, however, significant challenges to the economy remained, including uncertainty surrounding deeply indebted European countries, soaring gas prices amid political turmoil in the Middle East, indications of reduced economic stimulus from the federal government, and continued malaise in the U.S. housing market. Signs of China’s economic growth slowdown contributed to pessimism as, despite a higher overall level of U.S. exports, the U.S. trade deficit widened following decreases in exports to China and the eurozone.

Amid the improved economic reports, U.S. stock markets reached multi-year highs in late March and early April 2012. The Dow Jones Industrial Average exceeded the 13,000 level for the first time since 2008, and the NASDAQ Composite Index hit an 11-year high. Leading market sectors included consumer discretionary, information technology and financials. Conversely, utilities and energy lagged the broader market. In this environment, investment-grade bonds posted modest returns and outperformed U.S. Treasuries.

The foregoing information reflects our analysis and opinions as of April 30, 2012. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

Semiannual Report | 3

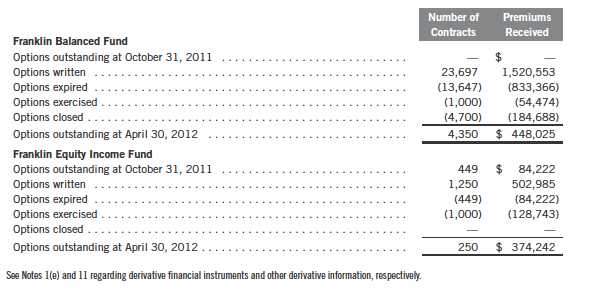

Franklin Balanced Fund

Your Fund’s Goal and Main Investments: Franklin Balanced Fund seeks income and capital appreciation by investing in a combination of stocks, convertible securities and debt securities. The Fund will normally invest at least 25% of its total assets in equity securities (primarily common and preferred stock) and at least 25% of its total assets in debt securities, including bonds, notes, debentures and money market securities.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Balanced Fund covers the period ended April 30, 2012.

Performance Overview

For the six months under review, Franklin Balanced Fund – Class A delivered a +7.52% cumulative total return. The Fund underperformed the +12.77% total return of its equity benchmark, the Standard & Poor’s® 500 Index (S&P 500®), which is a broad measure of U.S. stock performance.1 However, the Fund outperformed the +2.44% of its fixed income benchmark, the Barclays Capital (BC) U.S. Aggregate Index, which tracks the U.S. investment-grade, taxable bond market.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Investment Strategy

We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins and liquidation value. In determining an optimal mix of equity and fixed income investments for the Fund, we assess changing economic, market and industry conditions. We may sell securities for a number of possible reasons, including the achievement of certain stock prices or credit spreads, changes in the fundamental outlook or risk/reward profile of a security, less attractive values relative to market peers, or broad economic conditions affecting certain fixed income sectors.

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 50.

4 | Semiannual Report

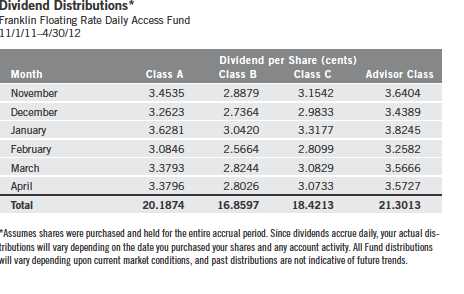

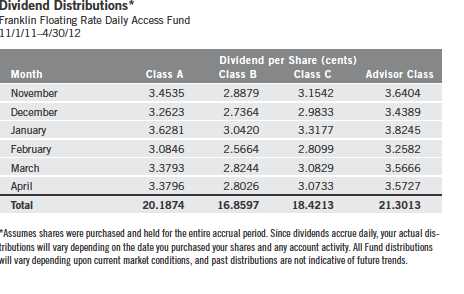

*All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Manager’s Discussion

During the six months under review, as equity markets rallied, the Fund’s equity securities delivered the bulk of returns. Our equity sectors were well diversified, with our largest weightings in industrials, materials, financials and information technology (IT) at period-end. Within fixed income markets, we remained focused on opportunities in investment-grade corporate bonds and select high yield corporate bonds. Our largest sector weightings in corporate bonds were energy, banking and consumer non-cyclical companies at period-end.

Among the Fund’s equity holdings, the industrials, financials and IT sectors were stand-out performers. General Electric in the industrials sector benefited from renewed investor confidence during a sustained period of modest global economic growth. Within financials, JPMorgan Chase & Co. shares performed well following the Federal Reserve Board’s stress test, which resulted in the company’s approval for a higher dividend and share buybacks. Shortly after this reporting period ended, JPMorgan announced a massive hedging loss that meaningfully pressured its stock price. Our U.S. Bancorp holding aided Fund performance largely due to good expense control and continued credit improvement following a decrease in the amount of uncollected loans. Intel was a top contributor among IT holdings, benefiting from solid enterprise and emerging market demand for PCs that offset weak consumer demand. Our shares of Comcast in consumer discretionary also positively impacted performance, due in part to the company’s strong digital video and high-speed Internet services. Energy was the Fund’s only equity sector detractor, reflecting losses from Chesapeake Energy, BP and Canadian Oil Sands.

Semiannual Report | 5

Within our fixed income holdings, the Fund’s corporate bond positions generally aided performance amid the backdrop of continued low and range-bound long-term U.S. interest rates. The 10-year U.S. Treasury note averaged around 2.00% yield for the period, while corporate credit yield spreads over Treasuries declined from 202 basis points (bps; 100 basis points equal one percentage point) on October 31, 2011, to 185 bps on April 30, 2012. Our banking, insurance, communications and consumer non-cyclical holdings generally contributed to results. Individual positions that bolstered Fund performance included JPMorgan Chase & Co. in banking, American International Group in insurance, Prudential Financial in finance, and Sprint Nextel and Charter Communications2 in communications. In contrast, among brokerage companies, our position in MF Global Holdings, which used to be a major global financial derivatives broker, was a major detractor. The company filed for bankruptcy protection on October 31, 2011, and near period-end was investigated by lawmakers due to liquidity problems arising from investments in European sovereign bonds. The company, which we sold before period-end, is considered to be the first major American victim of the European sovereign debt crisis. Petroplus Finance, another detractor, is an independent oil refiner in Europe that faced liquidity strains amid weak demand.

2. Sold by period-end.

6 | Semiannual Report

Thank you for your continued participation in Franklin Balanced Fund.

We look forward to serving your future investment needs.

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 7

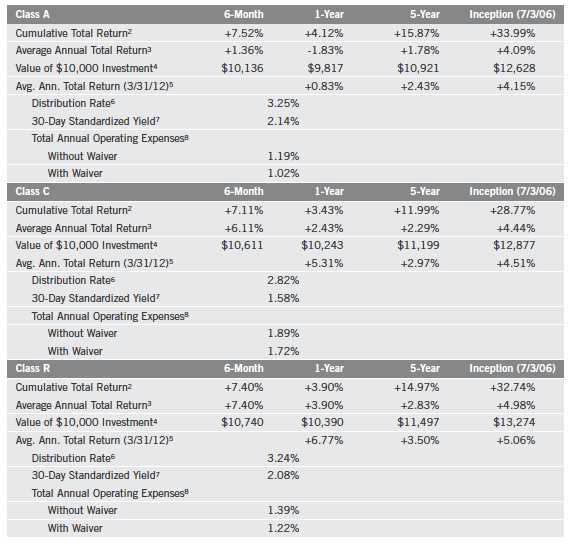

Performance Summary as of 4/30/12

Franklin Balanced Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

8 | Semiannual Report

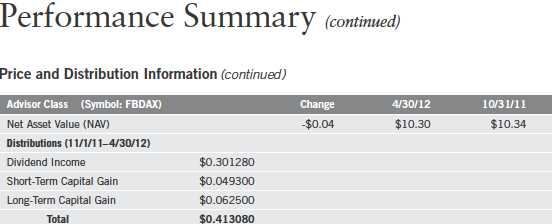

Performance Summary (continued)

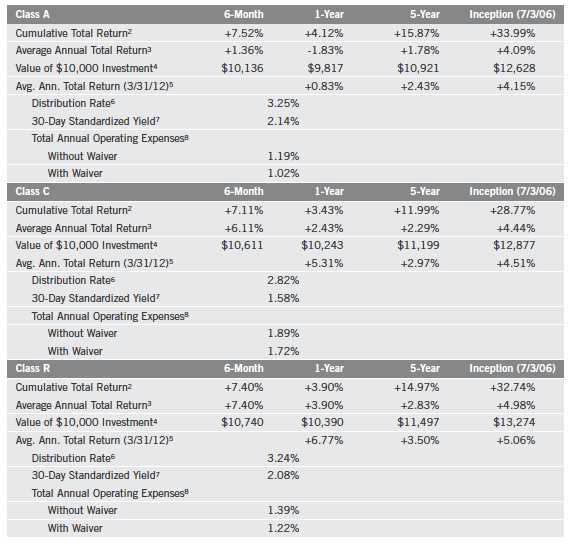

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Semiannual Report | 9

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed 0.71% (other than certain nonroutine expenses) until 2/28/13.

Endnotes

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have a higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s distribution rates and total returns would have been lower, and yields for the period would have been 2.07%, 1.51%, 2.01%, and 2.49% for Classes A, C, R and Advisor, respectively.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C, R and Advisor) per share on 4/30/12.

7. The 30-day standardized yield for the 30 days ended 4/30/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

8. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

10 | Semiannual Report

Your Fund’s Expenses

Franklin Balanced Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

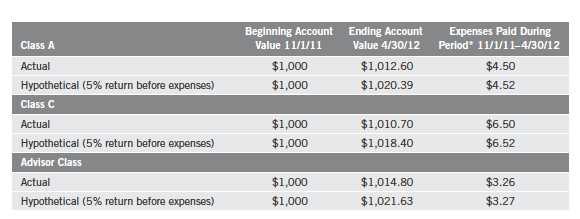

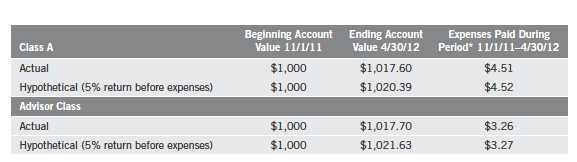

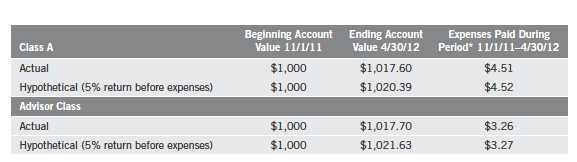

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 11

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.01%; C: 1.71%; R: 1.21%; and Advisor: 0.71%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

12 | Semiannual Report

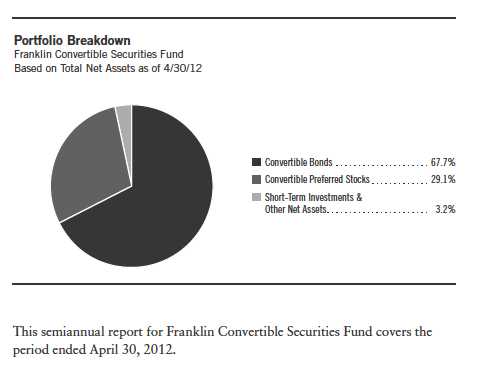

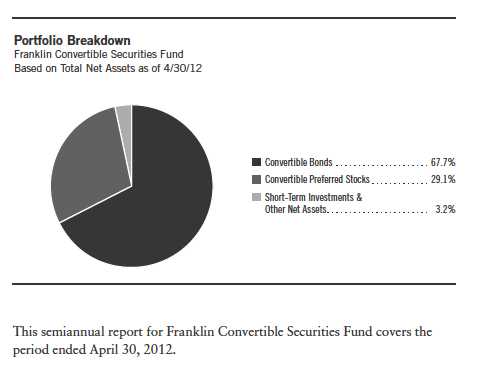

Franklin Convertible Securities Fund

Your Fund’s Goal and Main Investments: Franklin Convertible Securities Fund seeks to maximize total return, consistent with reasonable risk, by seeking to optimize capital appreciation and high current income under varying market conditions and investing at least 80% of its net assets in convertible securities.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Performance Overview

For the six months under review, Franklin Convertible Securities Fund – Class A delivered a +5.67% cumulative total return. The Fund underperformed the +6.44% total return of its benchmark, the BofA Merrill Lynch (BofAML) All Total Return Alternatives U.S. Convertibles Index, which tracks the domestic convertible securities market.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 16.

1. Source: Bank of America Corp. The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 60.

Semiannual Report | 13

Investment Strategy

We follow a strategy of maintaining a balance in the portfolio between the equity and debt characteristics of convertible securities with an emphasis on the equity features. Convertible securities are attractive for two reasons: the opportunity to participate in common stocks’ potential growth with relatively reduced volatility, and the potential for current income with potential downside protection from bonds. Typically we sell securities whose equity sensitivity becomes too high and no longer offers appropriate downside protection. Likewise, as securities become too bond-like — reducing their ability to appreciate with increases in the underlying common stock — we attempt to redeploy those assets into more balanced convertible securities and maintain the potential for the Fund’s upside participation. Our experienced team of analysts searches for investment opportunities among all economic sectors and considers a company’s long-term earnings, asset value and cash flow potential, to create a broadly diversified portfolio.

Manager’s Discussion

Nearly every sector the Fund invested in rose in value, as did most of the portfolio’s individual securities, supporting overall performance during the six-month reporting period. The Fund’s economically sensitive (or cyclical) sectors such as information technology (IT), health care, industrials, financials and materials fared particularly well and accounted for the bulk of the Fund’s total return.

Within IT, the Fund’s holdings of semiconductor and IT services-related convertible bonds enjoyed some of the largest gains as many technology companies continued to post strong corporate earnings. An acquisition agreement announced in December led holdings of semiconductor equipment manufacturer Novellus Systems to be a top contributor. Alliance Data Systems, which provides data-driven loyalty marketing solutions was also a strong performer as the company signed multi-year renewal agreements with key customers and raised its fiscal year 2012 earnings guidance.

The Fund’s top performers in the health care sector included Salix Pharmaceuticals, which develops and markets gastroenterology medicines, and biotechnology firm Gilead Sciences, which specializes in developing antiviral and pulmonary drugs. Strong contributors among industrials included WESCO International, an electrical products distributor, and commercial products manufacturer Ingersoll-Rand (sold by period-end). Other standout holdings included real estate firm Forest City Enterprises and Mexican cement giant Cemex.

Despite the Fund’s positive results this reporting period, there were a few disappointments in the portfolio. Our consumer discretionary and energy holdings

14 | Semiannual Report

detracted from performance as these sectors fell largely out of favor among investors. On an individual security basis, key detractors included Goodyear Tire & Rubber, James River Coal, and Chesapeake Energy. Goodyear reported lower-than-expected second quarter sales and management warned that tire sales would be lower in 2012 as the company focuses on higher-margin products, leading shares to decline. Falling coal prices weighed on James River Coal, and low natural gas prices hurt Chesapeake Energy.

Thank you for your continued participation in Franklin Convertible Securities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 15

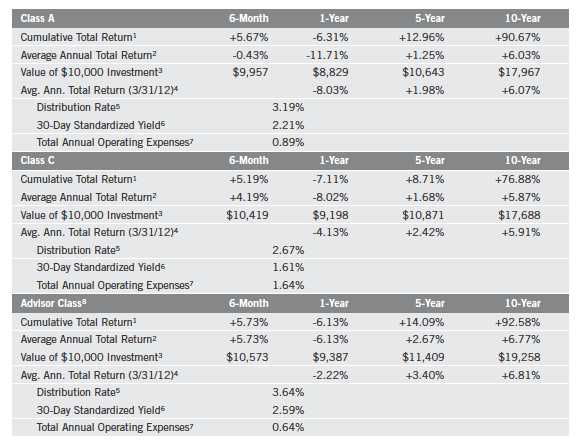

Performance Summary as of 4/30/12

Franklin Convertible Securities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

16 | Semiannual Report

Performance Summary (continued)

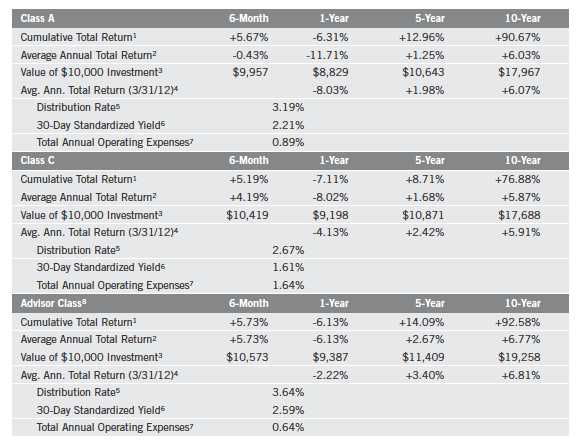

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 17

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund may invest in high yielding, fixed income securities. High yields reflect the higher credit risk associated with these lower rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund may also invest in foreign securities, which involve special risks, including political uncertainty and currency volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on the sum of the respective class’s last four quarterly dividends and the maximum offering price (NAV for Classes C and Advisor) per share on 4/30/12.

6. The 30-day standardized yield for the 30 days ended 4/30/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +16.40% and +3.91%.

18 | Semiannual Report

Your Fund’s Expenses

Franklin Convertible Securities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 19

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.89%; C: 1.64%; and Advisor: 0.64%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

20 | Semiannual Report

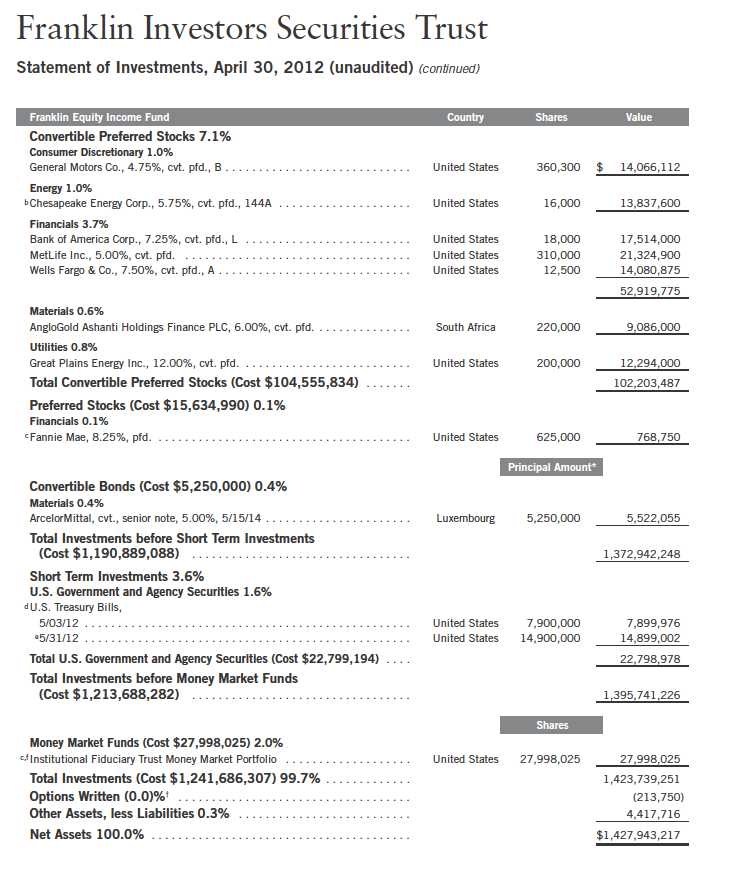

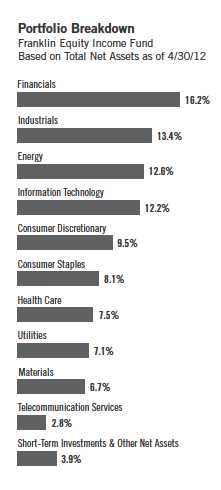

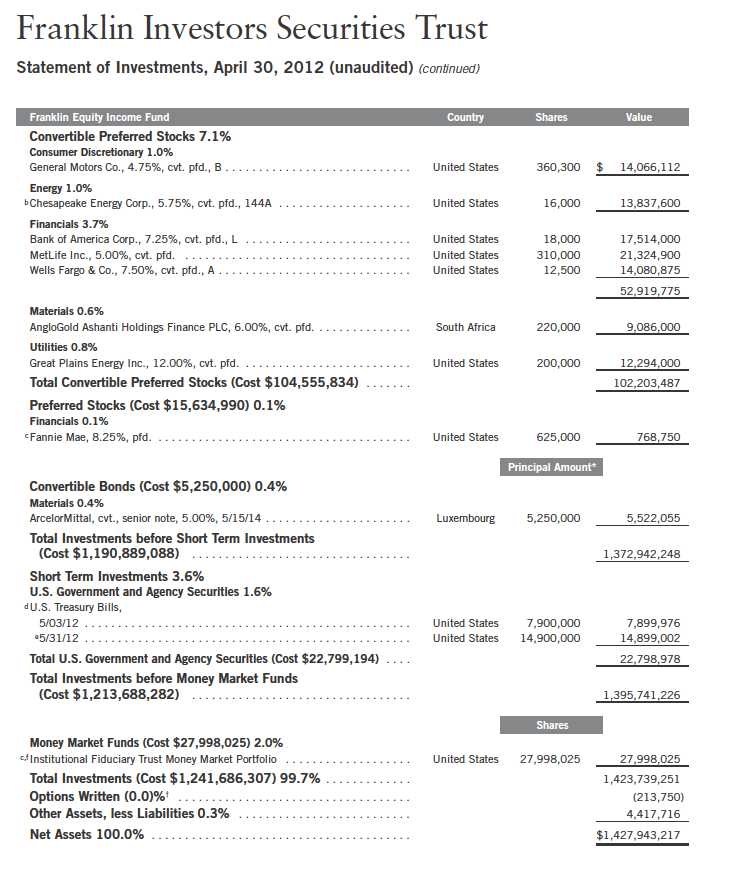

Franklin Equity Income Fund

Your Fund’s Goal and Main Investments: Franklin Equity Income Fund seeks to maximize total return, emphasizing high current income and long-term capital appreciation, consistent with reasonable risk, by investing at least 80% of its net assets in equity securities including securities convertible into common stocks.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Equity Income Fund covers the period ended April 30, 2012.

Performance Overview

For the six months under review, Franklin Equity Income Fund – Class A delivered a +9.32% cumulative total return. The Fund underperformed the +12.77% total return of its benchmark, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market.1 The Fund also under-performed the +10.34% total return of its peers in the Lipper Equity Income Funds Classification Average, which consists of funds chosen by Lipper that seek relatively high current income and growth of income by investing at least 60% of their portfolios in stocks.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 24.

Investment Strategy

We seek to invest in a broadly diversified portfolio of equity securities that we consider to be financially strong, with a focus on “blue chip” companies. We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins, balance sheet and liquidation value. We consider dividend yield in selecting stocks for the Fund because we believe that, over time, dividend income can contribute significantly to total return and can be a more consistent source of investment return than capital

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. Source: Lipper Inc. For the six-month period ended 4/30/12, this category consisted of 314 funds. Lipper calculations do not include sales charges, or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 68.

Semiannual Report | 21

* All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

** Includes an additional 2.20 cent per share distribution to meet excise tax requirements.

appreciation. We seek to take advantage of price dislocations that result from the market’s short-term focus and choose to invest in those companies that, in our opinion, offer the best trade-off between growth opportunity, business and financial risk, and valuation.

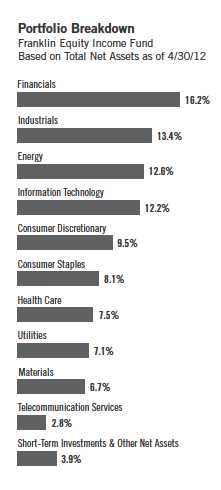

Manager’s Discussion

During the six months under review, broad-based strength in equity markets led most of our holdings to appreciate, and Fund performance benefited from positive results in several sectors, including industrials, financials, consumer discretionary, and information technology (IT). Among industrials, top performers included conglomerate General Electric and our off-benchmark position in trucking company J.B. Hunt Transport Services, where growth in the intermodal transportation division led the company to post strong earnings and increase its dividend. Within the financials sector, top performers included investment management firm BlackRock and financial services company Wells Fargo. Home improvement retailer Lowe’s and sports equipment and apparel maker NIKE were top performers in the consumer discretionary sector. As corporate earnings improved, businesses continued to engage in long-awaited equipment and productivity upgrades that had been delayed by the recession. This shift in business sentiment had a positive impact on many of the Fund’s technology-related holdings, including microchip manufacturer Intel and International Business Machines, which benefited as many companies increased spending to upgrade their technology infrastructure.

22 | Semiannual Report

There were, however, some notable detractors from Fund performance. QBE Insurance Group declined as the firm reduced its dividend, announced a planned acquisition and issued shares. Low natural gas prices led our Chesapeake Energy convertible preferred shares to hurt performance. Similarly, convertible preferred shares of gold mining company AngloGold Ashanti Holdings also detracted from performance.

Thank you for your continued participation in Franklin Equity Income Fund.

We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 23

Performance Summary as of 4/30/12

Franklin Equity Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

24 | Semiannual Report

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only;

Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 25

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investment in foreign securities also involves special risks, including currency fluctuations and economic as well as political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes B, C, R and Advisor) per share on 4/30/12.

6. The 30-day standardized yield for the 30 days ended 4/30/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +4.39% and +1.09%.

26 | Semiannual Report

Your Fund’s Expenses

Franklin Equity Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 27

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.95%; B: 1.70%; C: 1.70%; R: 1.20%; and Advisor: 0.70%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

28 | Semiannual Report

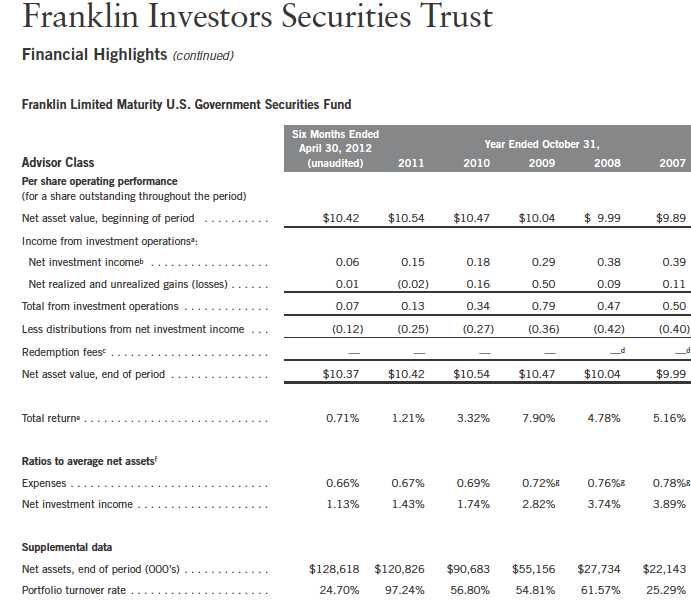

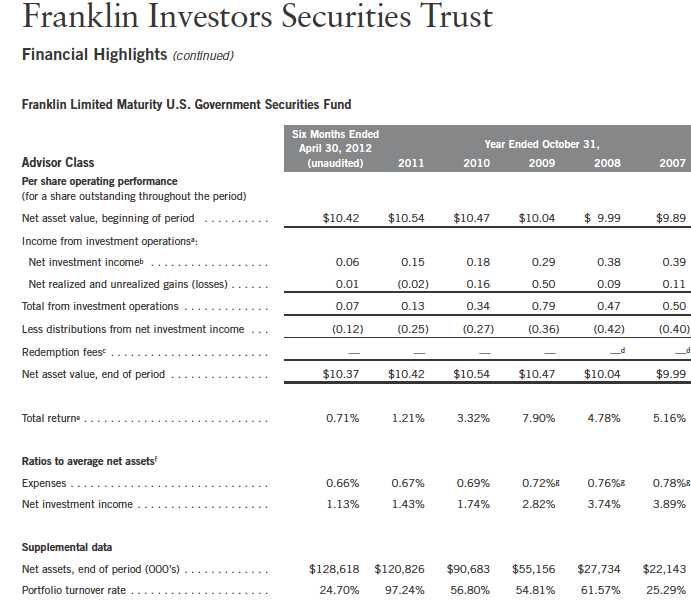

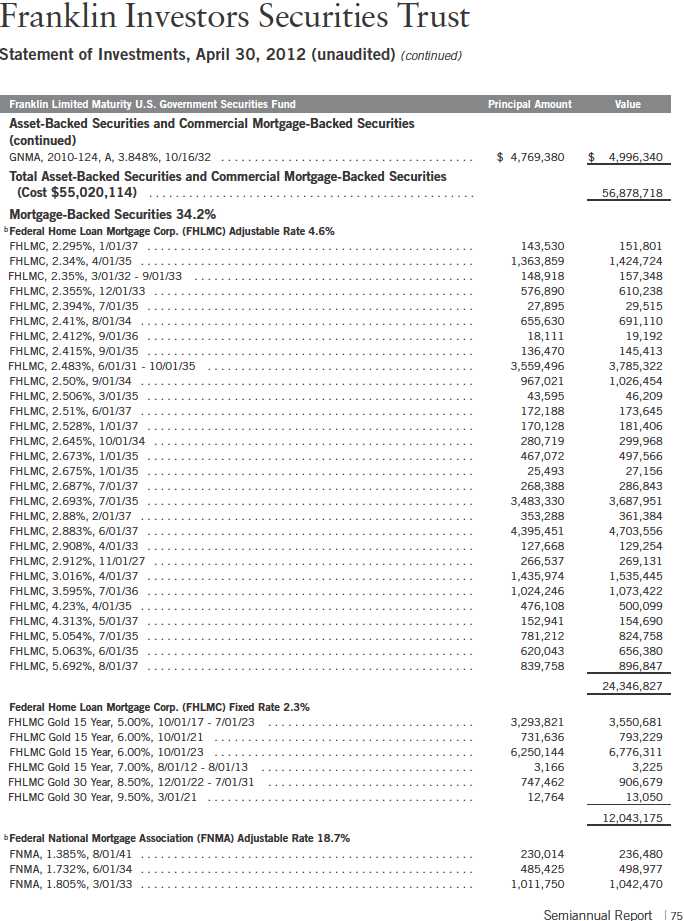

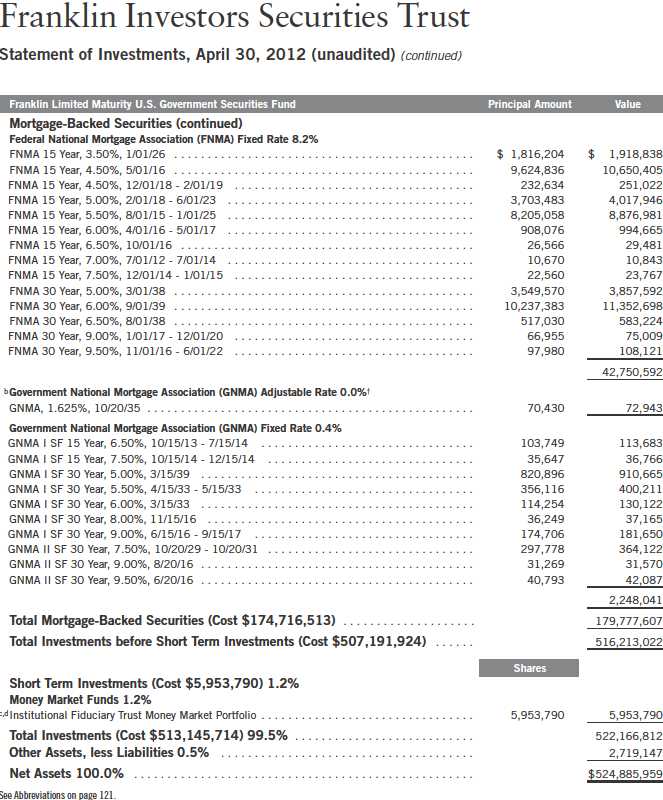

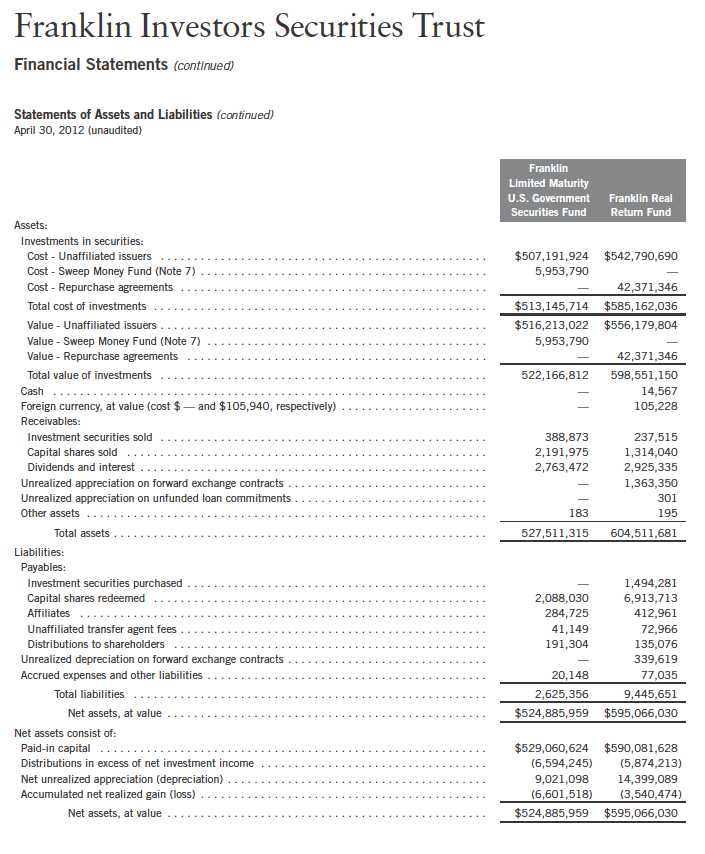

Franklin Limited Maturity U.S. Government Securities Fund

Your Fund’s Goal and Main Investments: Franklin Limited Maturity U.S. Government Securities Fund seeks to provide investors with as high a level of current income as is consistent with prudent investing, while seeking to preserve shareholders’ capital, by investing at least 80% of its net assets in securities with a dollar-weighted average maturity of less than 10 years1 and issued or guaranteed by the U.S. government, its agencies or instrumentalities.2 Some of the Fund’s investments may include securities issued by U.S. government-sponsored entities such as Fannie Mae and Freddie Mac.3

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Limited Maturity U.S. Government Securities Fund’s semiannual report for the period ended April 30, 2012.

Performance Overview

For the six months under review, Franklin Limited Maturity U.S. Government Securities Fund – Class A delivered a +0.66% cumulative total return. The

1. In determining a security’s maturity for the purposes of calculating the Fund’s average maturity, an estimate of the average time for its principal to be paid may be used. This can be substantially shorter than its stated final maturity.

2. Securities owned by the Fund, but not shares of the Fund, are issued or guaranteed by the U.S. government, its agencies or instrumentalities, including government-sponsored entities, as to timely payment of principal and interest.

3. Although U.S. government-sponsored entities may be chartered or sponsored by acts of Congress, their securities are neither insured nor guaranteed by the U.S. government. Please refer to the Fund’s prospectus for a detailed discussion regarding various levels of credit support. The Fund’s yield and share price are not guaranteed and will vary with market conditions.

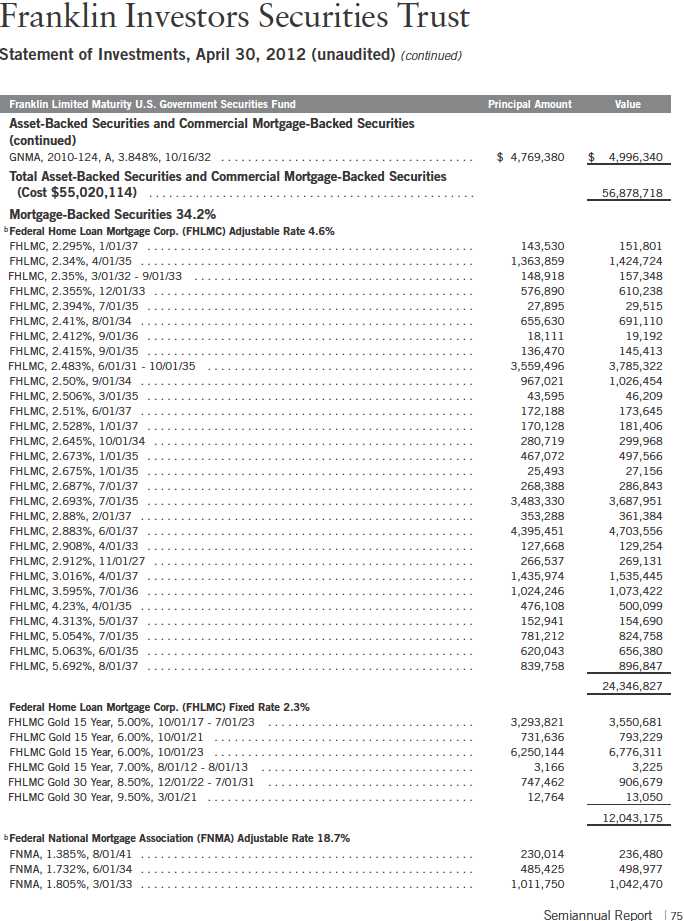

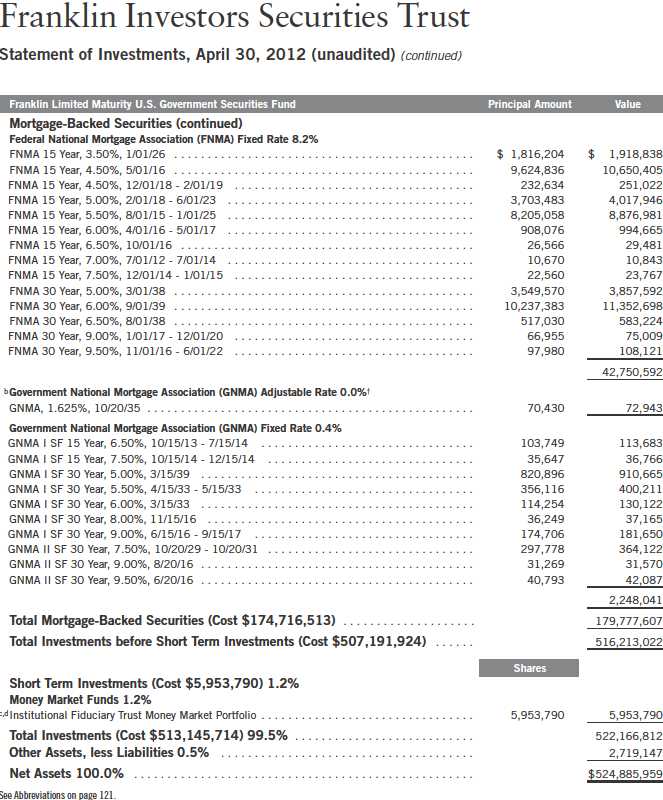

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 74.

Semiannual Report | 29

*Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**Includes an additional 0.58 cent per share distribution to meet excise tax requirements.

Fund outperformed the +0.62% total return of its primary benchmark, the Barclays Capital (BC) U.S. Treasury Index: 1-5 Year Component, which tracks U.S. Treasury securities with one to five years remaining maturity.4 The Fund also outperformed the +0.24% total return of its secondary benchmark, the BC U.S. Treasury Index: 1-3 Year Component, which tracks U.S. Treasury securities with one to three years remaining maturity.4 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 33.

Investment Strategy

We currently maintain the portfolio’s average dollar-weighted maturity between one and five years. The Fund’s average dollar-weighted maturity will vary with market conditions and the outlook for interest rates. We invest primarily in short- to intermediate-term securities issued or guaranteed by the U.S. government, its agencies and instrumentalities.2 Some of the Fund’s investments may include securities issued by U.S. government-sponsored entities, such as Fannie Mae (FNMA) and Freddie Mac (FHLMC).3 The Fund’s portfolio emphasizes mortgage-backed bonds and agency debentures, while also diversifying across components of the U.S. Treasury sector. We analyze securities using proprietary and nonproprietary research to help identify attractive investment opportunities.

4. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

30 | Semiannual Report

Manager’s Discussion

During the period, capital markets generally favored risk assets based on improving U.S. economic data. Although economic data remained supportive of a U.S. economic recovery, a number of uncertainties led investors to question if this positive momentum was sustainable. Investors seemed to recall periods in 2010 and 2011 when the economy initially gained momentum but then turned sluggish, raising the possibility of another recession. During the reporting period, market concerns persisted regarding the eurozone debt crisis, a potential hard landing in China, the U.S. presidential election and the potential fiscal ramifications of expiring policy initiatives. Although significant headwinds still exist, we believe the U.S. economic recovery should remain positive, but uneven. Furthermore, we think efforts by foreign monetary institutions have helped reduce fears of systemic risk associated with the European sovereign credit crisis.

As measured by BC Indexes, most fixed income sectors posted positive returns during the period, including the U.S. TIPS Index (+3.74%), the U.S. Agency Fixed Rate Mortgage-Backed Securities (MBS) Index (+2.11%), the Ginnie Mae (GNMA) Index (+2.10%), the U.S. Treasury Index (+1.87%), the U.S. Hybrid Adjustable-Rate Mortgage (ARM) Index (+1.59%) and the U.S. Agency Index (+1.32%).3

The Fund invested in U.S. Treasuries, including TIPS, agency debentures, agency mortgage pass-through securities, other U.S. government related bonds and cash investments. We looked for what we viewed as attractive valuations within lower interest rate risk government bond markets.

Most of the broad sectors we invested in outperformed comparable maturity Treasuries and contributed positively to absolute returns. As a sector, agency ARMs outperformed comparable maturity Treasuries and contributed significantly to relative and absolute performance. Agency debentures, agency residential fixed-rate mortgages and TIPS generally outperformed comparable maturity Treasuries and provided a slight boost to performance versus the benchmark. Agency multi-family mortgages also contributed to returns. The portfolio had less interest rate risk than the benchmark BC U.S. Treasury Index: 1-5 Year Component due to our concern that interest rates could eventually rise from their historically low levels and lead to negative returns. However, during the period, interest rates fell and as a result, our lower interest rate risk positioning detracted from performance relative to the benchmark.

Semiannual Report | 31

During the period, we continued to emphasize agency mortgages and agency debentures because in our view they offer better return potential, as well as an income advantage over Treasuries. We found opportunities during the period to add agency ARMs that offered what we considered to be attractive yields relative to other high-quality low-duration assets. We reduced exposure to agency debentures after they become more fully valued, in our assessment.

Thank you for your continued participation in Franklin Limited Maturity U.S. Government Securities Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Limited Maturity

U.S. Government Securities Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

32 | Semiannual Report

Performance Summary as of 4/30/12

Franklin Limited Maturity U.S. Government Securities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 2.25% maximum initial sales charge; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 33

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Interest rate movements, unscheduled mortgage prepayments and other risk factors will affect the Fund’s share price and yield. Bond prices, and thus a fund’s share price, generally move in the opposite direction of interest rates. Therefore, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Advisor Class) per share on 4/30/12.

5. The 30-day standardized yield for the 30 days ended 4/30/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

34 | Semiannual Report

Your Fund’s Expenses

Franklin Limited Maturity U.S. Government Securities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6 |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 35

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.76% and Advisor: 0.66%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

36 | Semiannual Report

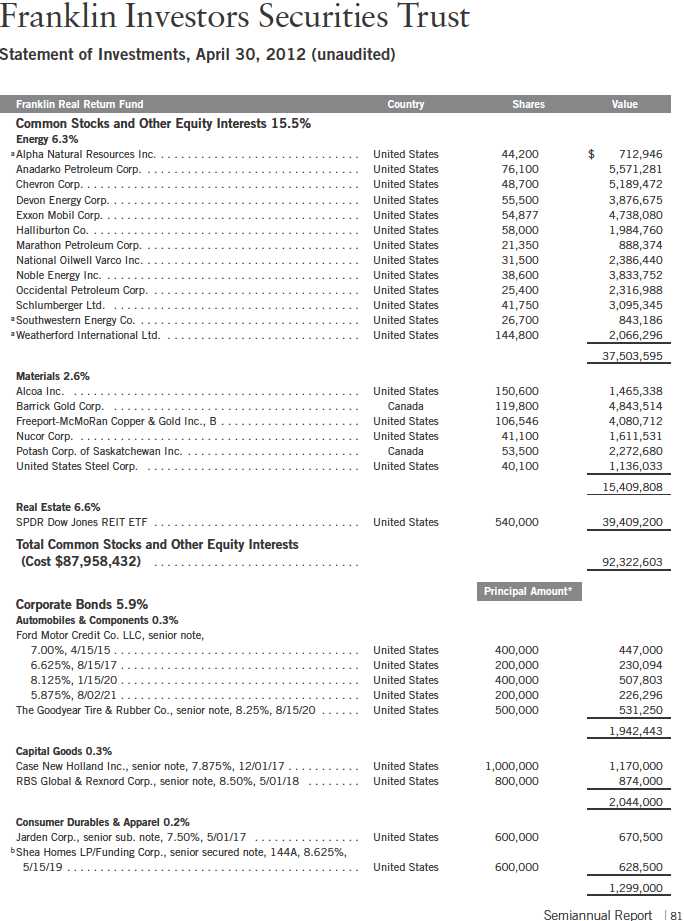

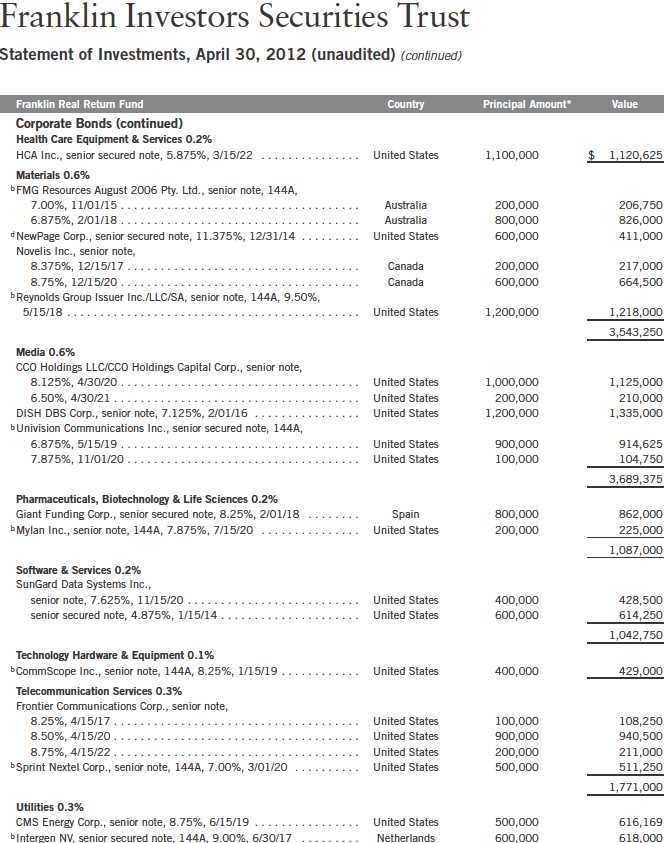

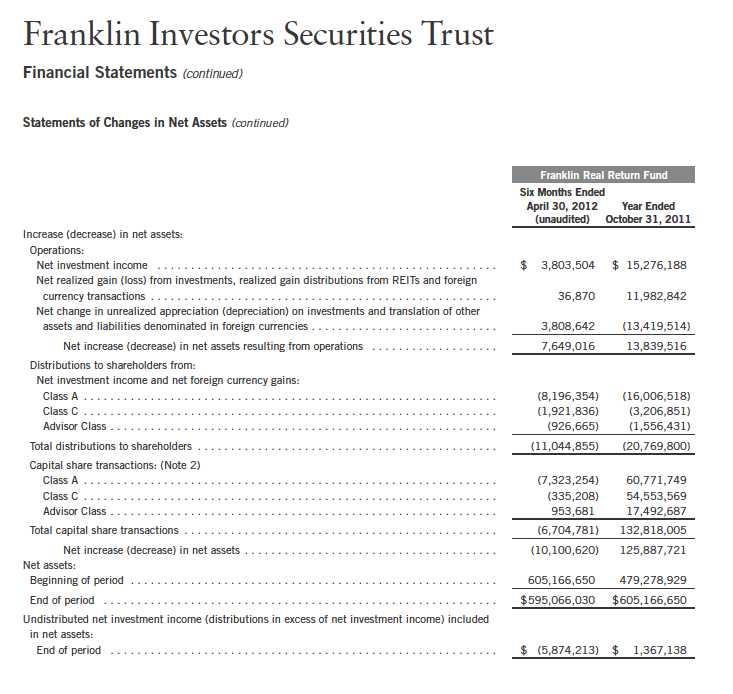

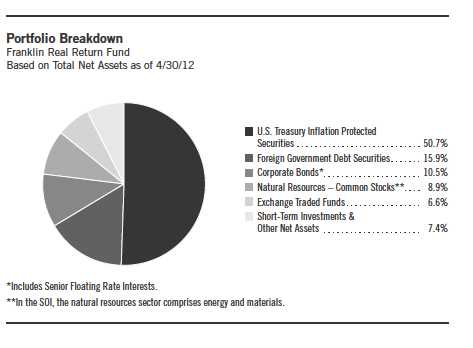

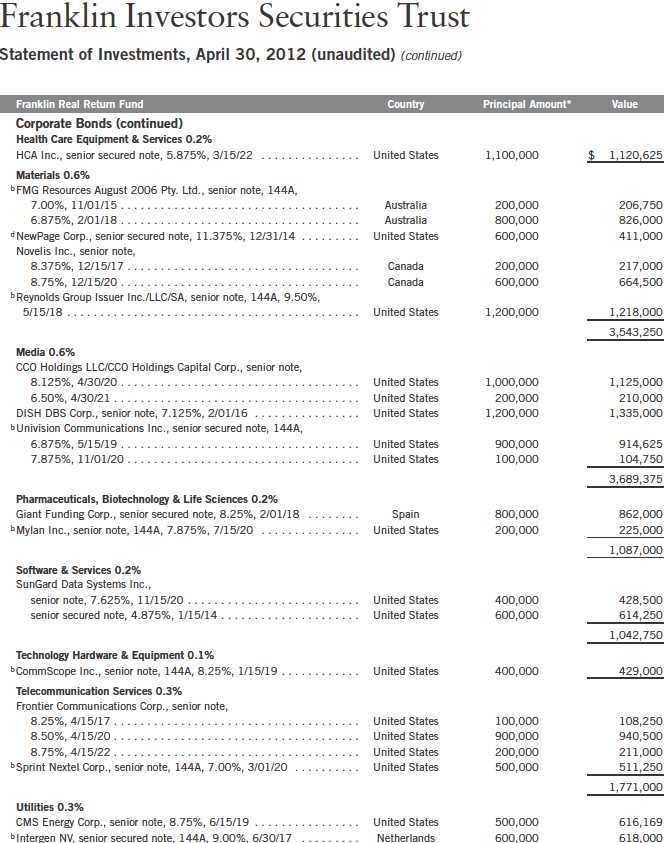

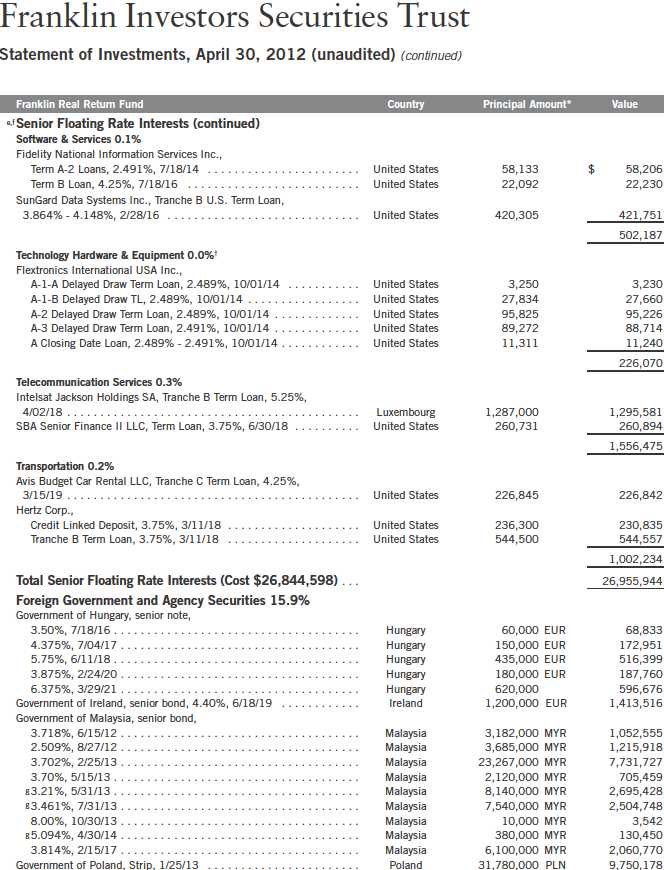

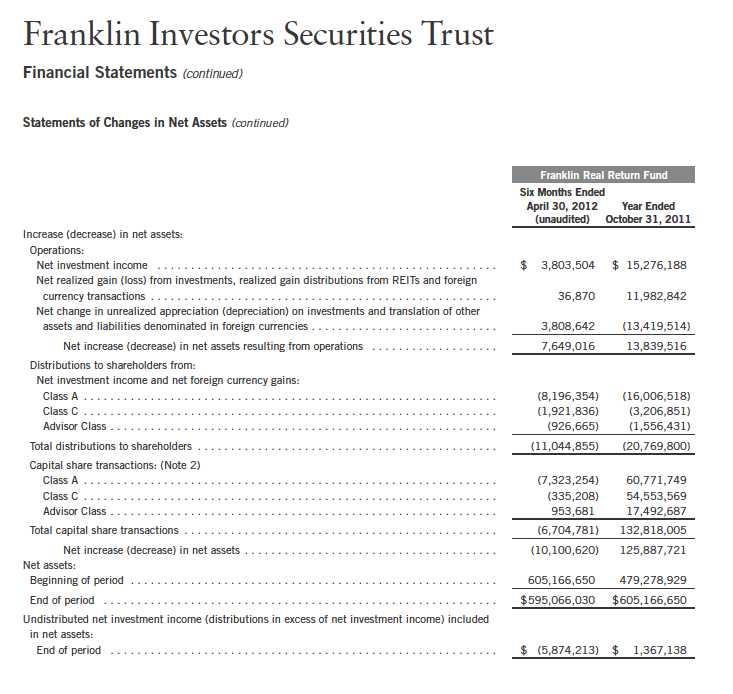

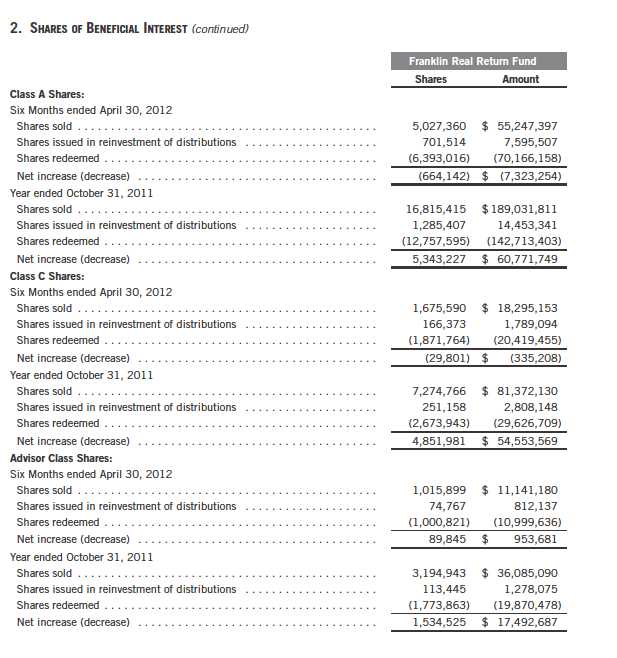

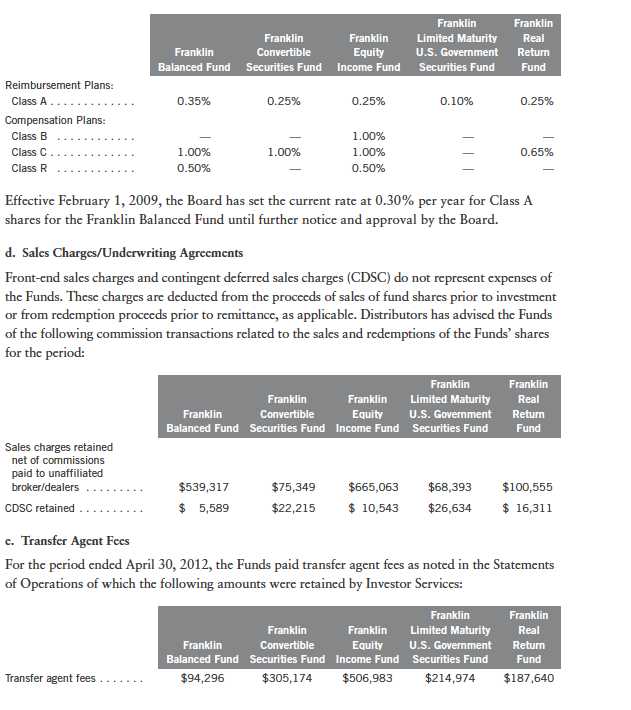

Franklin Real Return Fund

Your Fund’s Goal and Main Investments: Franklin Real Return Fund seeks to achieve total return that exceeds the rate of inflation over an economic cycle. The Fund will generally invest a substantial portion of its assets in inflation-protected securities. Managers also have the flexibility to invest in other sectors of the market to increase real return (total return less the rate of inflation) potential and offer greater diversification.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Real Return Fund covers the period ended April 30, 2012.

Performance Overview

For the six months under review, Franklin Real Return Fund – Class A delivered a +1.26% cumulative total return. The Fund underperformed the +3.74% total return of its benchmark, the Barclays Capital (BC) U.S. TIPS Index, which tracks the universe of inflation-protected notes issued by the U.S. Treasury that have at least one year to final maturity.1 The Fund underperformed the Consumer Price

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged. The BC U.S. TIPS Index includes reinvested interest. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

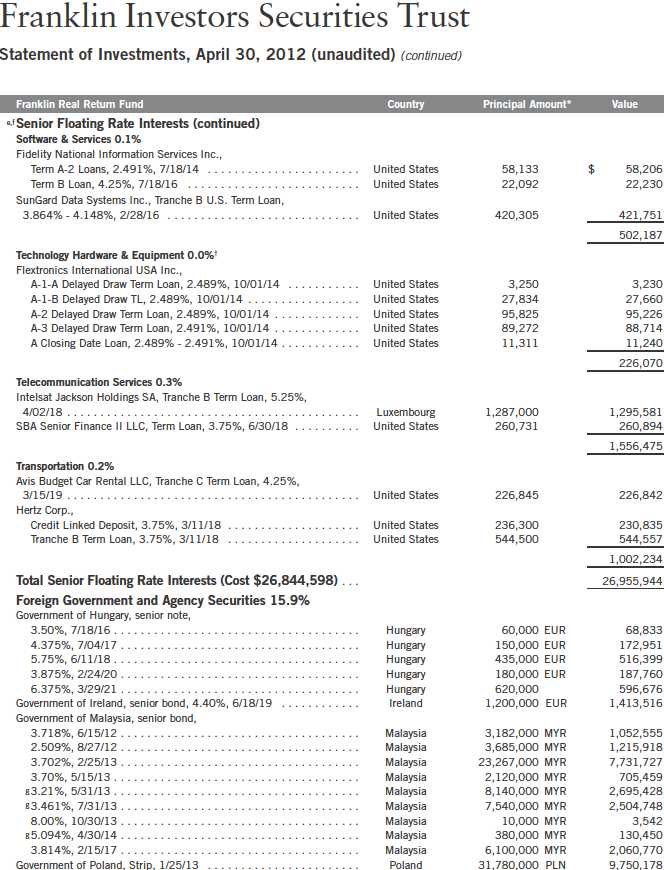

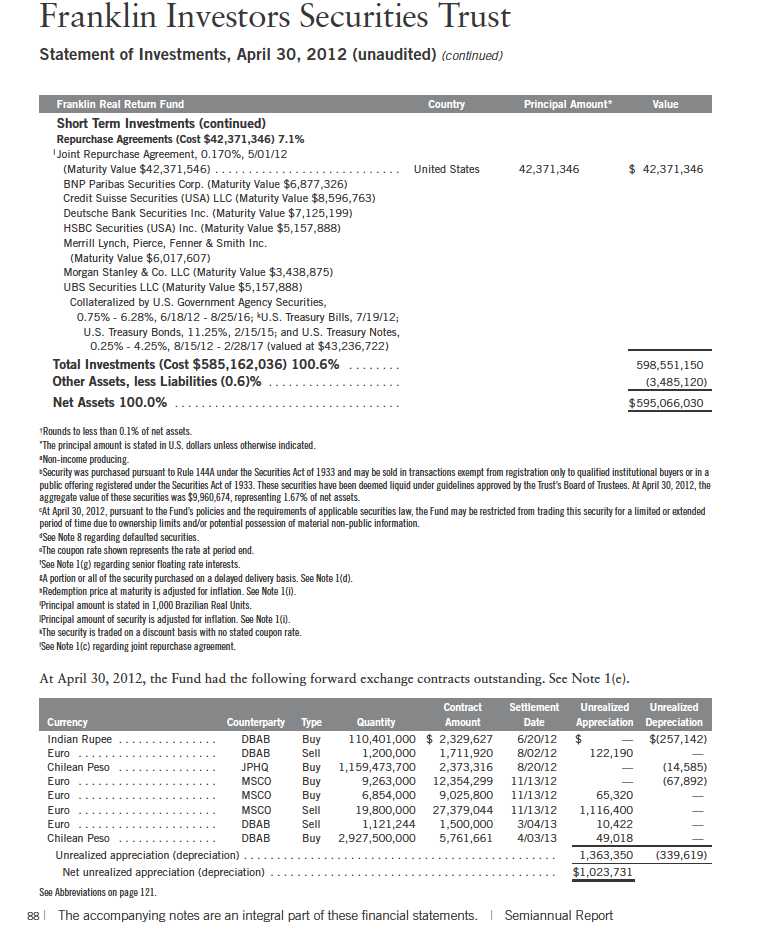

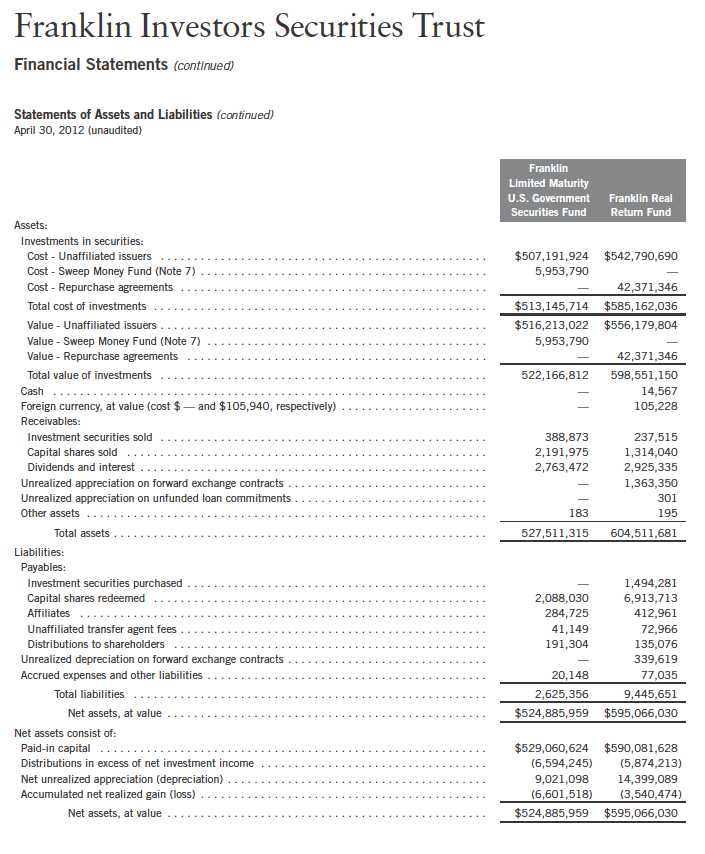

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 81.

Semiannual Report | 37

*All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**Distributions are higher than in other months primarily due to the inclusion of net foreign currency gains to meet excise tax requirements.

***The Fund paid no dividends due to negative inflation adjustments for TIPS, which are the Fund’s primary investments.

Index (CPI) for Urban Consumers (All Items) NSA (non-seasonally adjusted), a measure of the average change in prices of all goods and services purchased for consumption by urban householders, which rose 1.62% for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 41.

Investment Strategy

We seek to allocate assets among investments to achieve the highest level of real return (total return less the rate of inflation) consistent with an acceptable level of risk. We will allocate the Fund’s assets among securities in various market sectors based on our assessment of changing economic, global market, industry and issuer conditions. When making our investment decisions, we use a “top-down” analysis of macroeconomic trends combined with a “bottom-up” fundamental analysis of market sectors, industries and issuers to try to take advantage of varying sector reactions to economic events. We will evaluate such criteria as country risk, business cycles, yield curves, and values between and within markets.

38 | Semiannual Report

Manager’s Discussion

During the period, capital markets generally favored risk assets based on improving U.S. economic data. Although economic data remained supportive of a U.S. economic recovery, a number of uncertainties led investors to question if this positive momentum was sustainable. Investors seemed to recall periods in 2010 and 2011 when the economy initially gained momentum but then turned sluggish, raising the possibility of another recession. During the reporting period, market concerns persisted regarding the eurozone debt crisis, a potential hard landing in China, the U.S. presidential election and the potential fiscal ramifications of expiring policy initiatives. Although significant headwinds still exist, we believe the U.S. economic recovery should remain positive, but uneven. Furthermore, we think efforts by foreign monetary institutions have helped reduce fears of systemic risk associated with the European sovereign credit crisis.

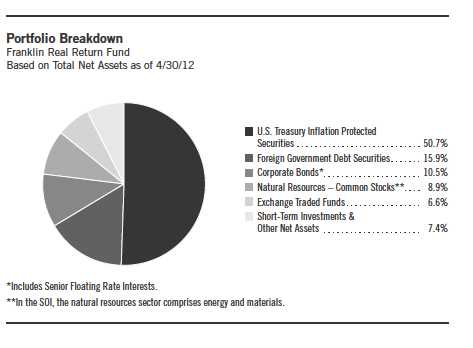

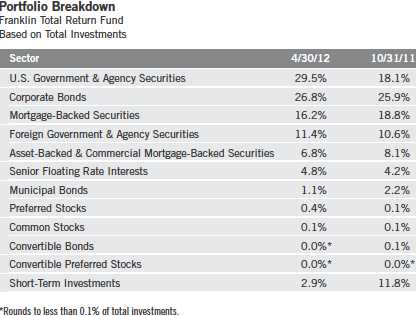

During the period, we invested the Fund’s assets in the allowable sectors. At period-end, roughly half of the Fund’s total net assets were invested in Treasury Inflation Protected Securities (TIPS). For diversification, we also allocated some of the Fund’s assets to short-term non-U.S. dollar securities as well as the natural resources, real estate investment trusts (REITs), bank loan and high yield sectors. We employed a non-U.S. dollar strategy to help hedge against dollar weakness versus certain currencies and concentrated our TIPS holdings in shorter maturities.

Our diversified mix of inflation-sensitive assets underperformed during the period. Our non-U.S. dollar holdings and allocation to REITs contributed to performance relative to the benchmark index. In contrast, our exposure to TIPS, natural resources securities and bank loans hurt performance.

Semiannual Report | 39

Thank you for your continued participation in Franklin Real Return Fund.

We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

40 | Semiannual Report

Performance Summary as of 4/30/12

Franklin Real Return Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 41

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees and acquired fees and expenses) for each class of the Fund do not exceed 0.65% (other than certain nonroutine expenses) until 2/28/13.

42 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The risks of foreign securities include currency fluctuations and political uncertainty. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Advisor Class: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s distribution rates and total returns would have been lower, and yields for the period would have been 1.85%, 1.54% and 2.18% for Classes A, C and Advisor, respectively.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C and Advisor) per share on 4/30/12.

6. The 30-day standardized yield for the 30 days ended 4/30/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 43

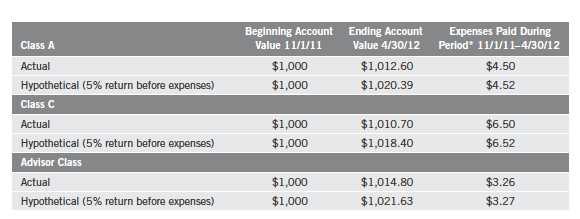

Your Fund’s Expenses

Franklin Real Return Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

44 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.90%; C: 1.30%; and Advisor: 0.65%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Semiannual Report | 45

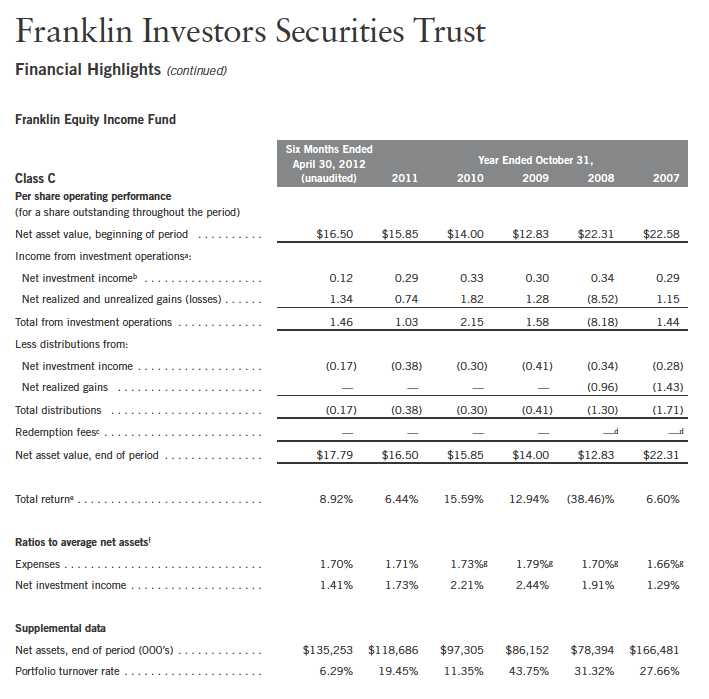

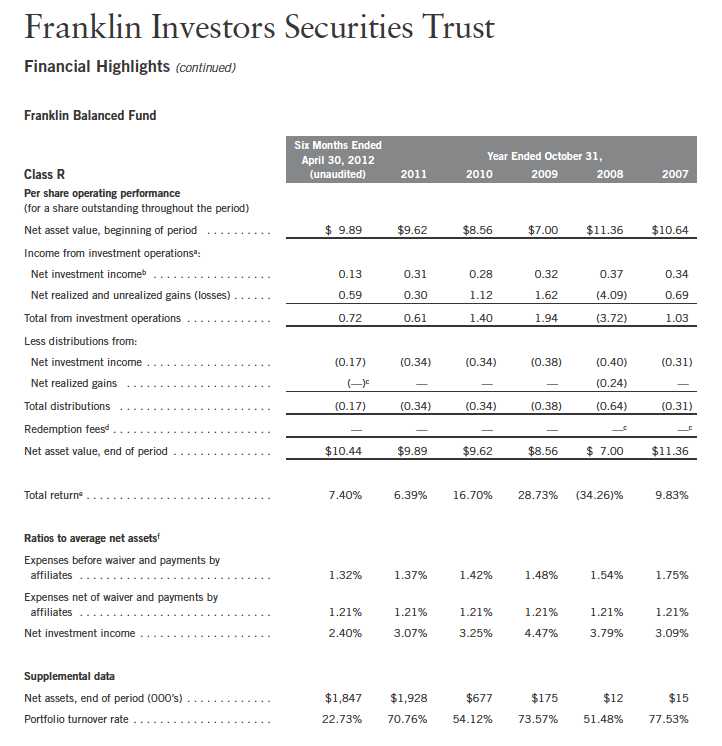

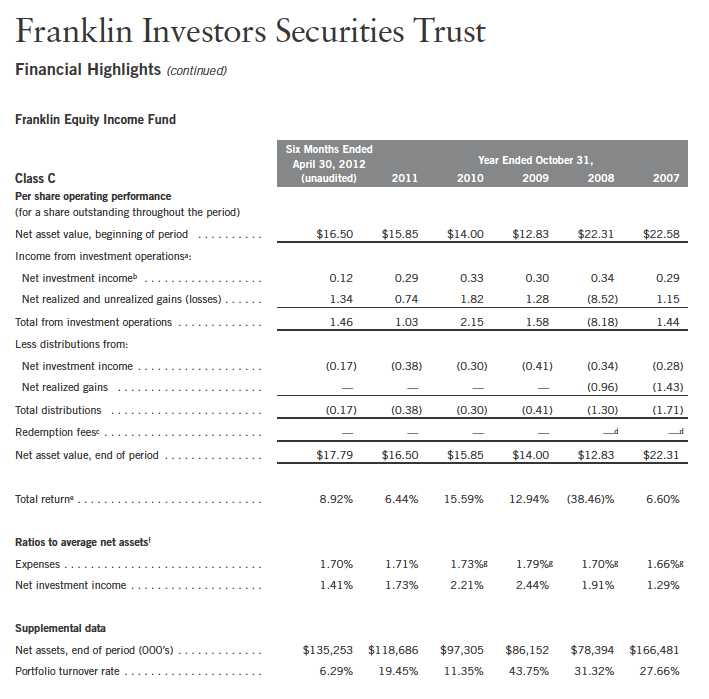

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

46 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

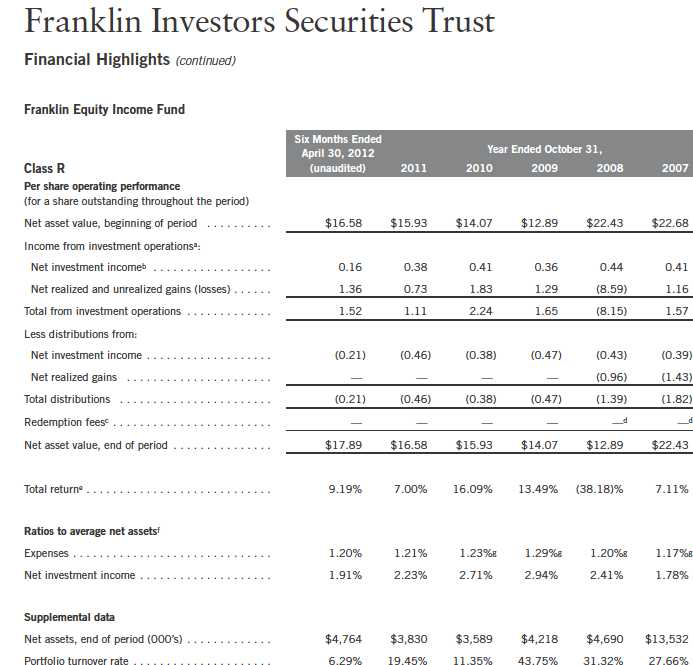

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 47

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

48 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 49

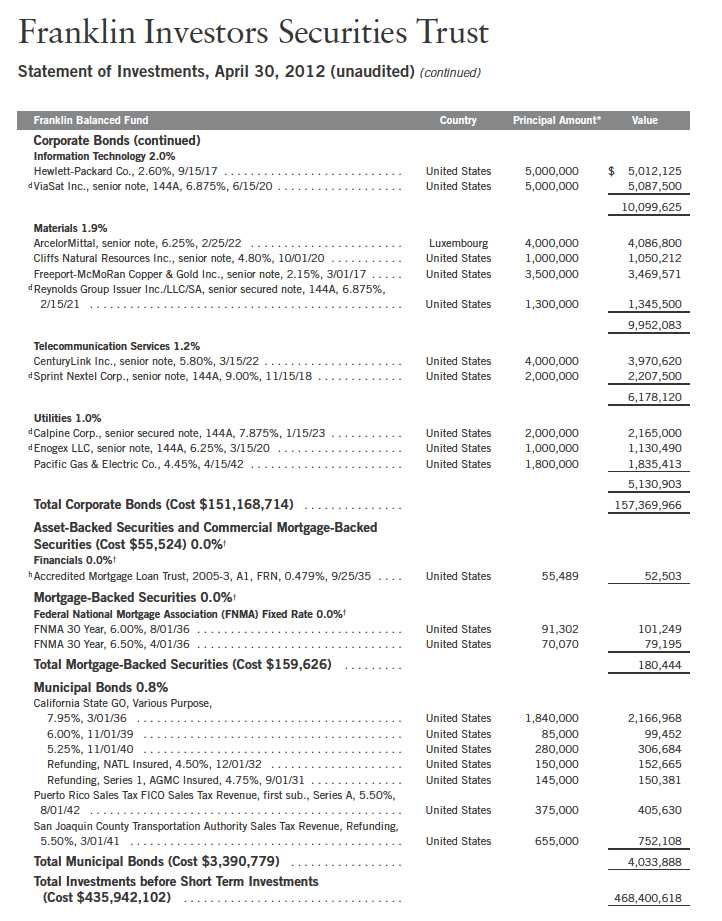

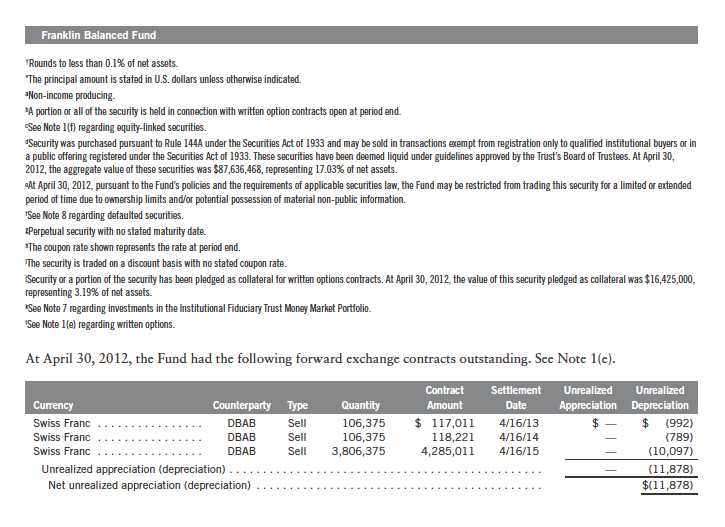

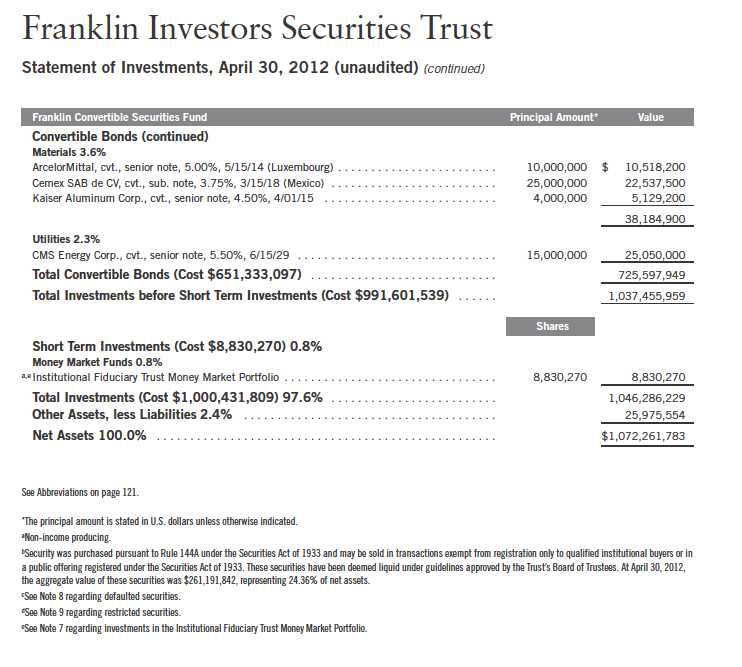

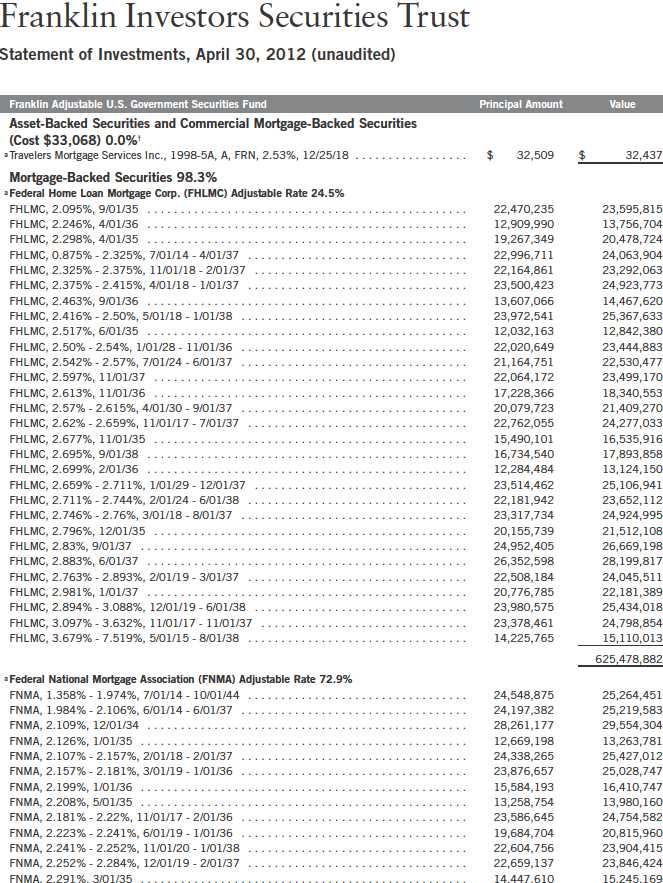

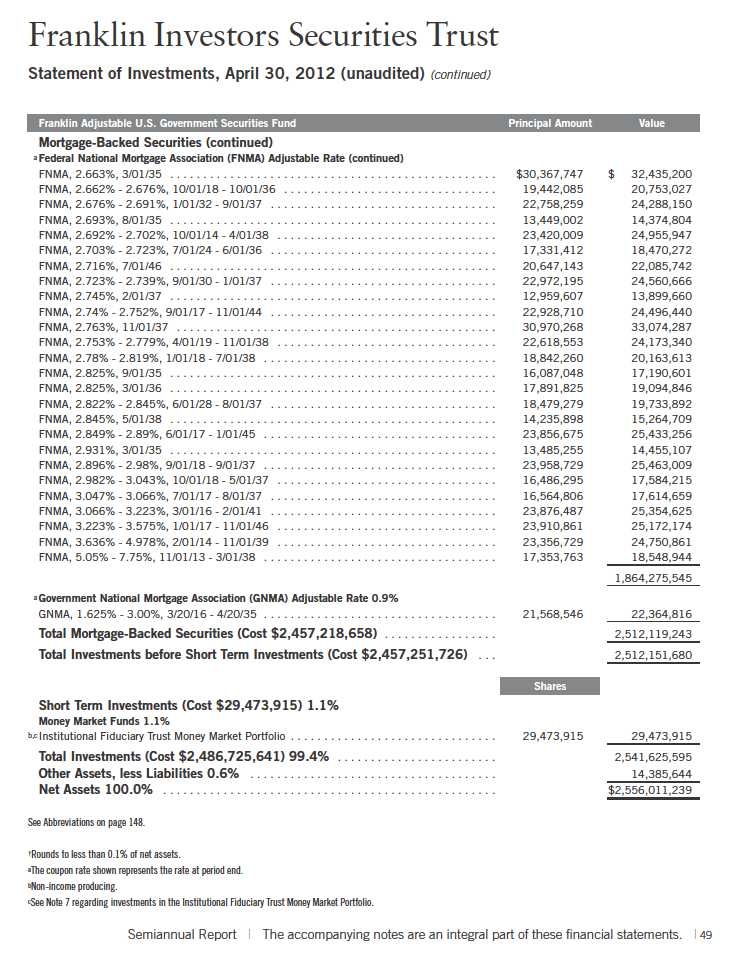

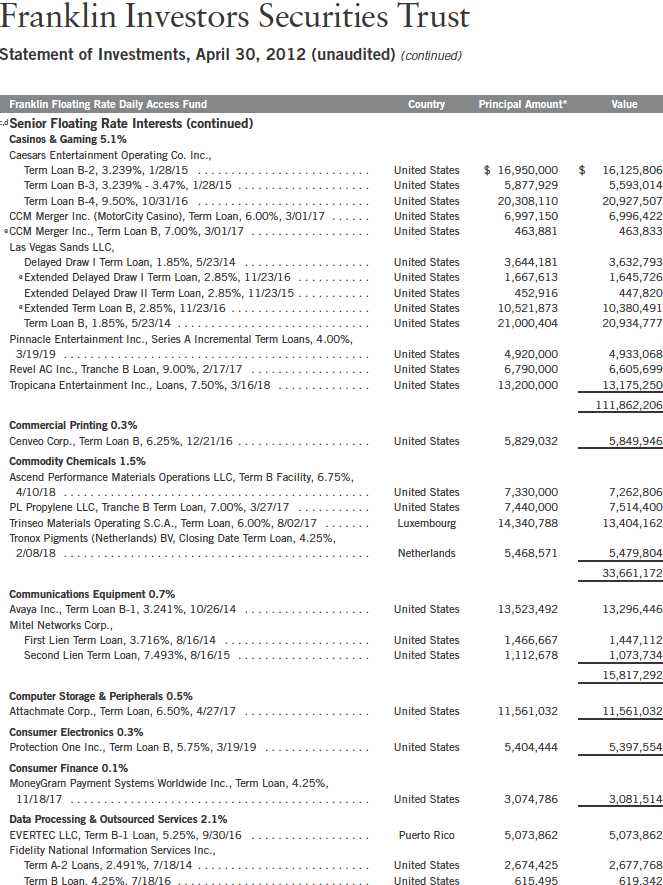

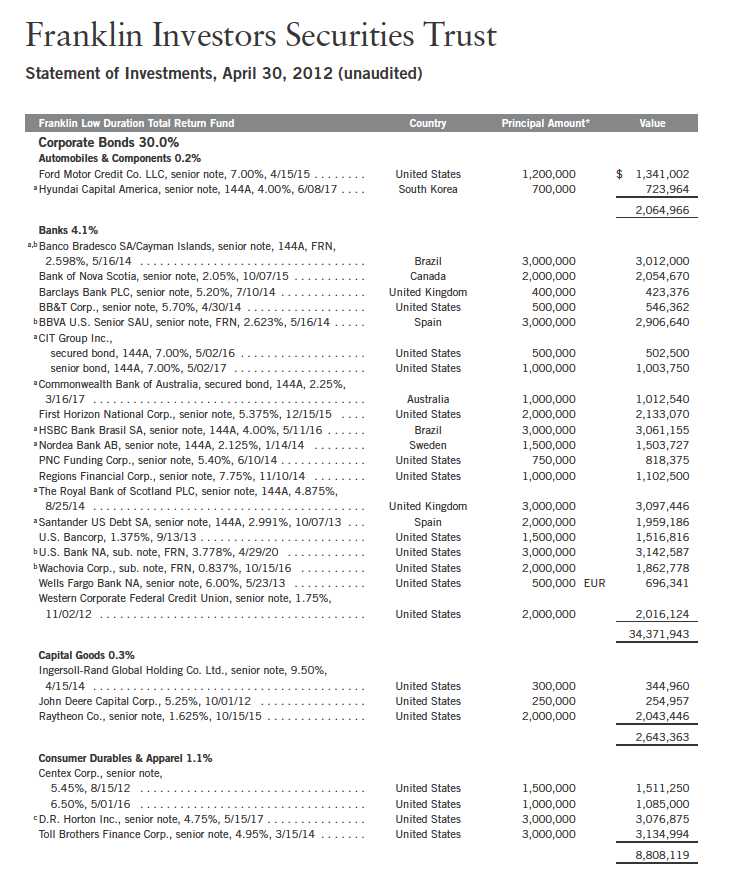

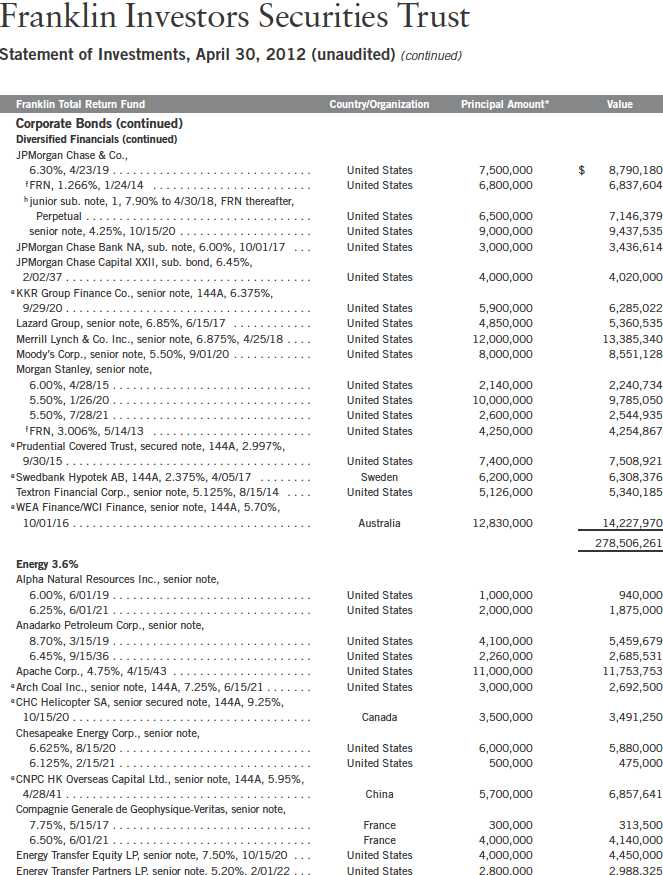

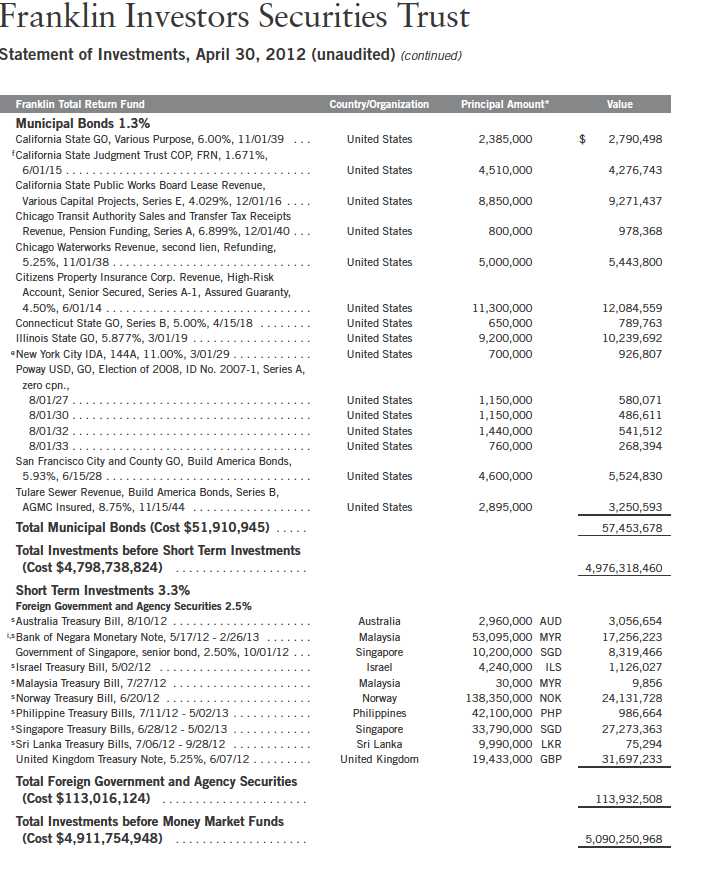

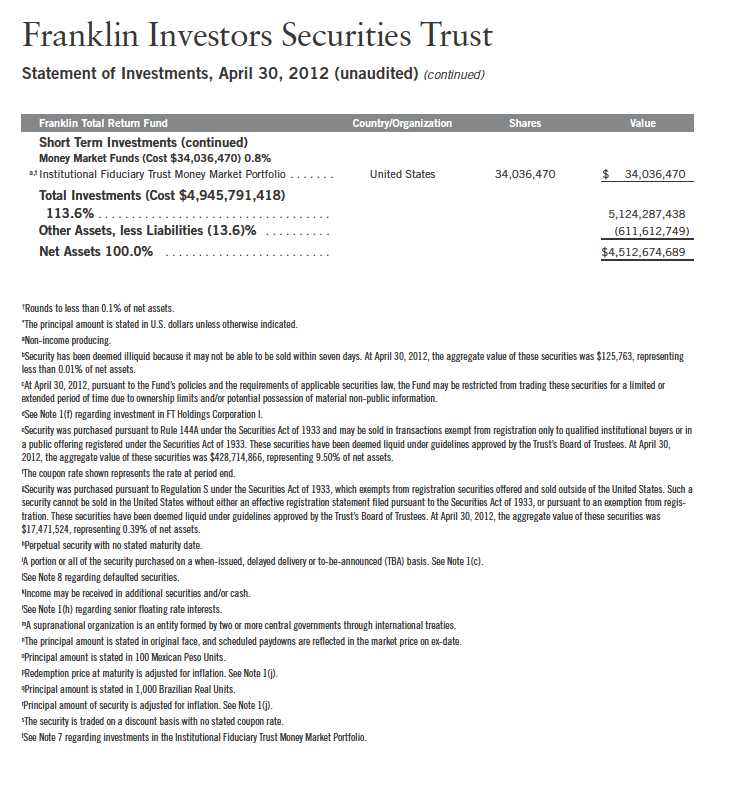

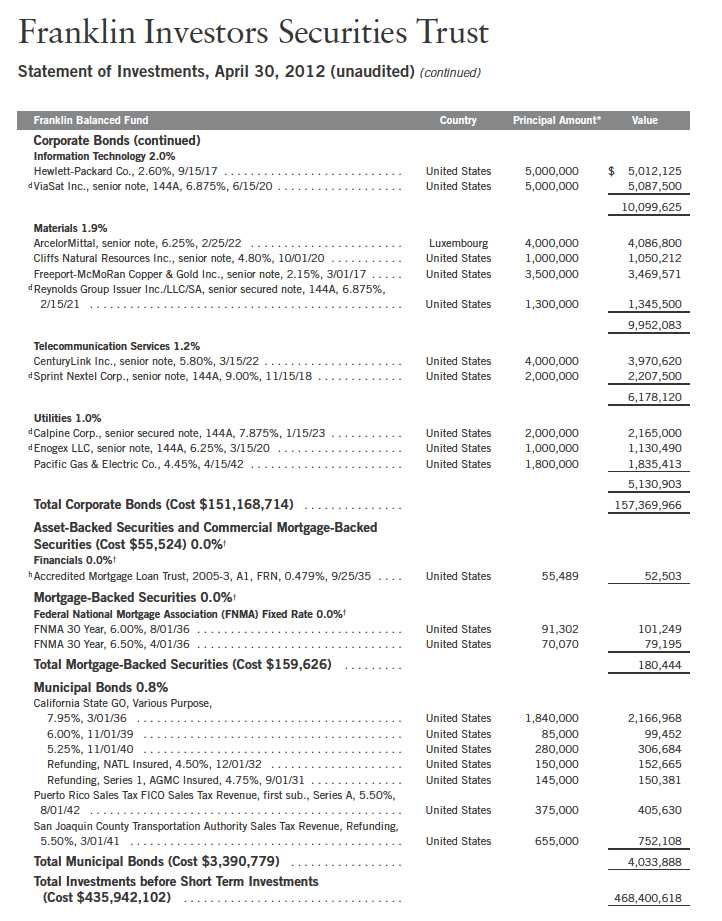

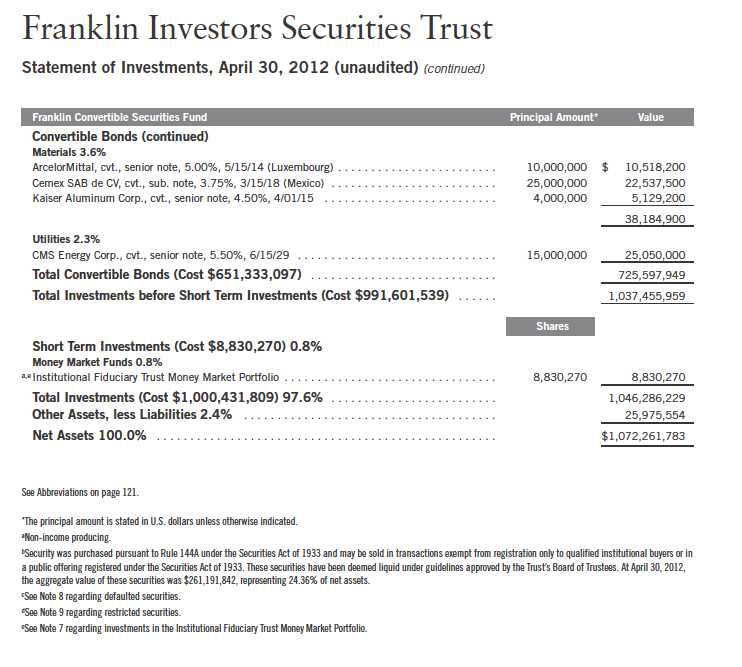

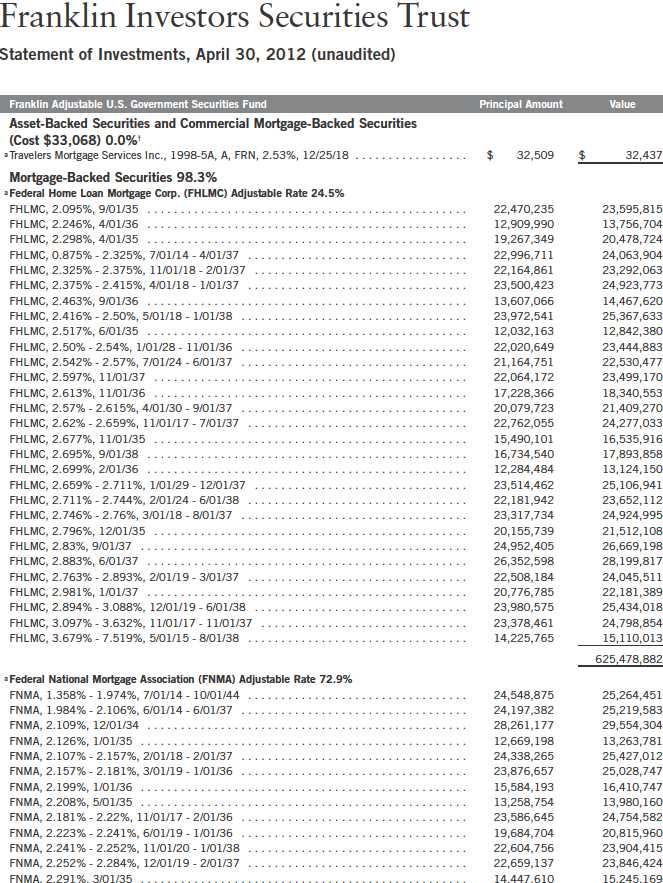

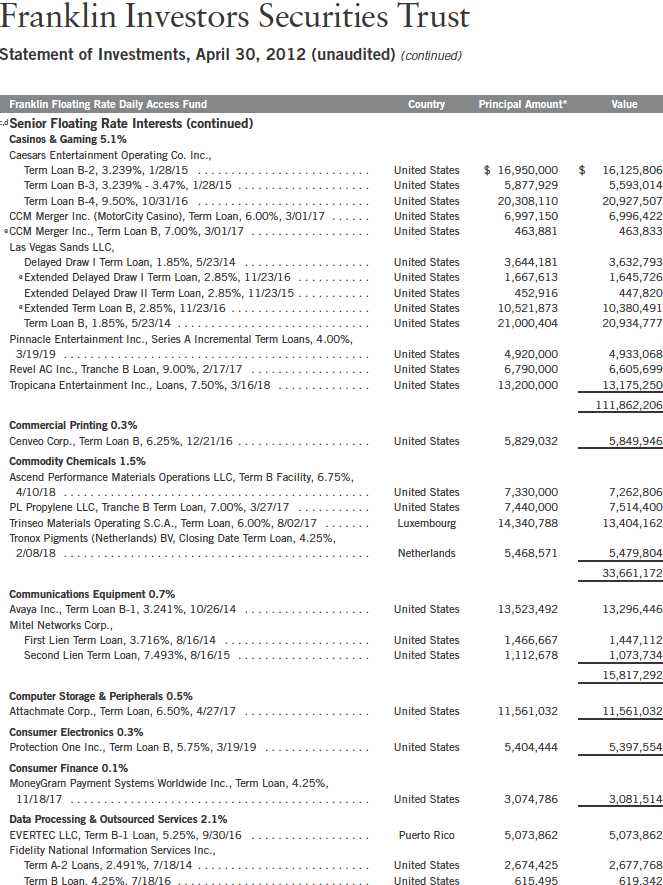

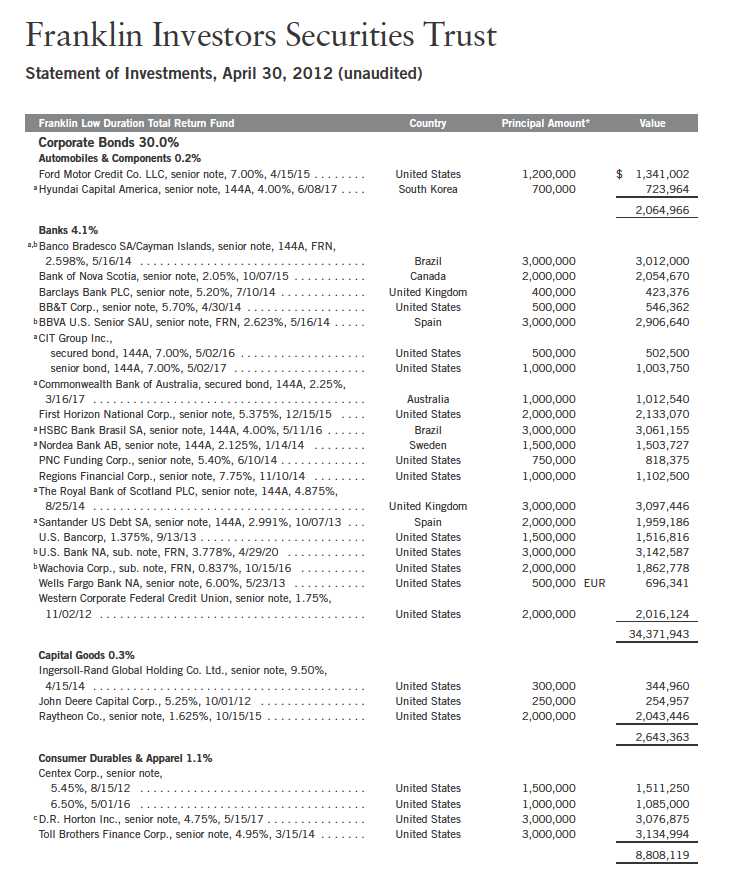

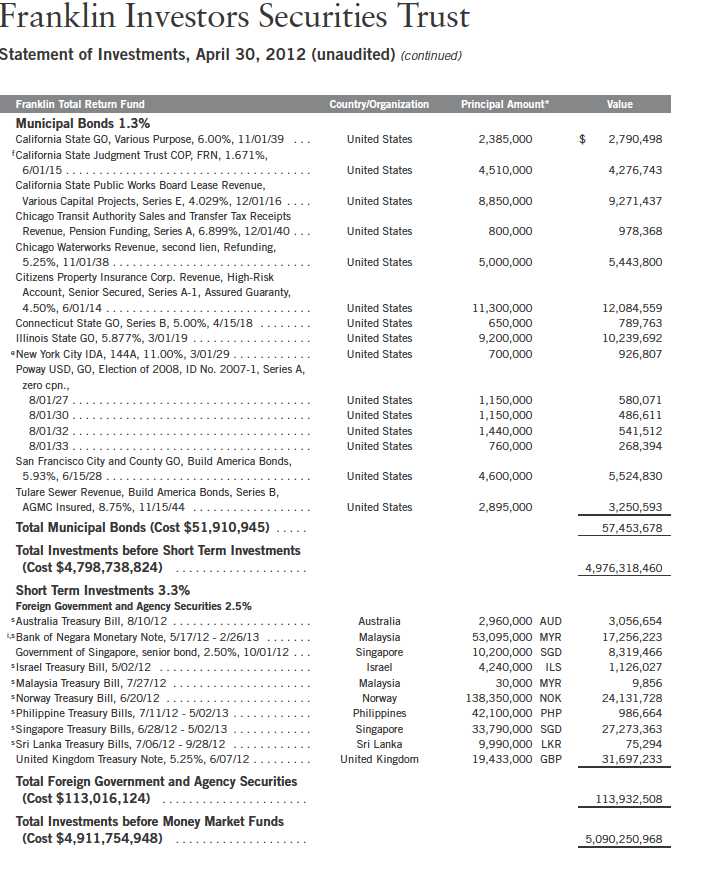

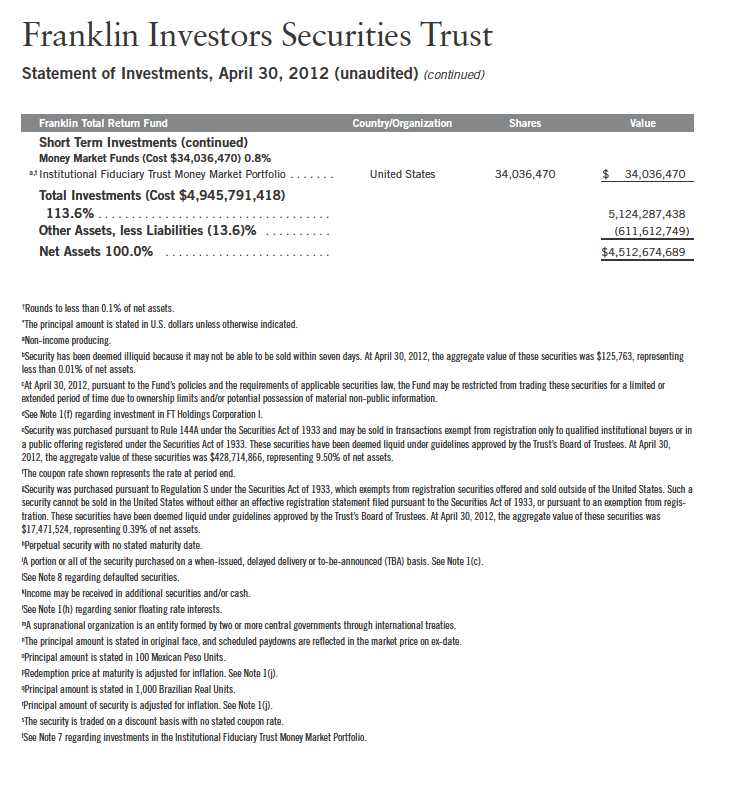

54 | Semiannual Report

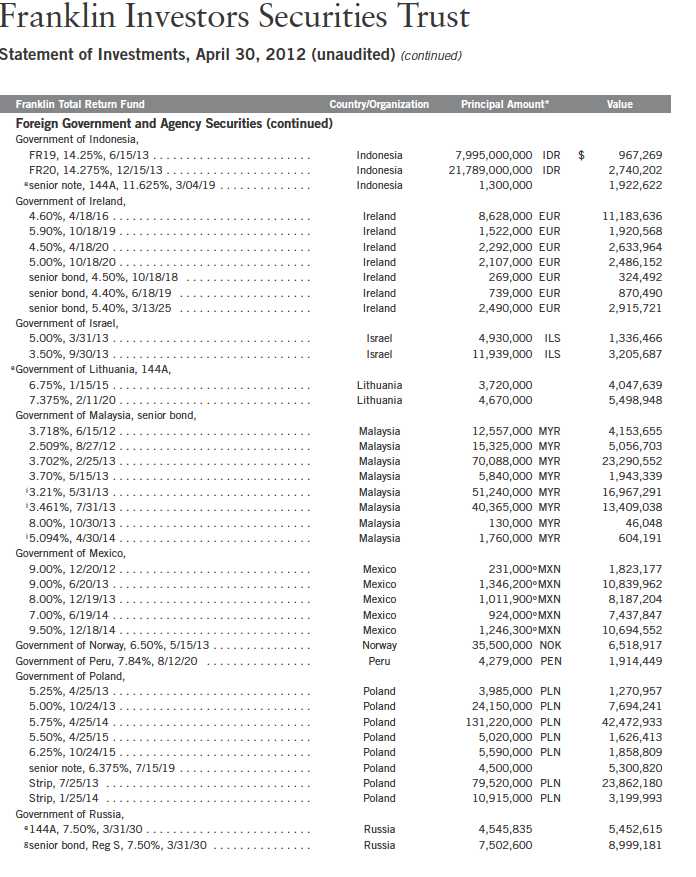

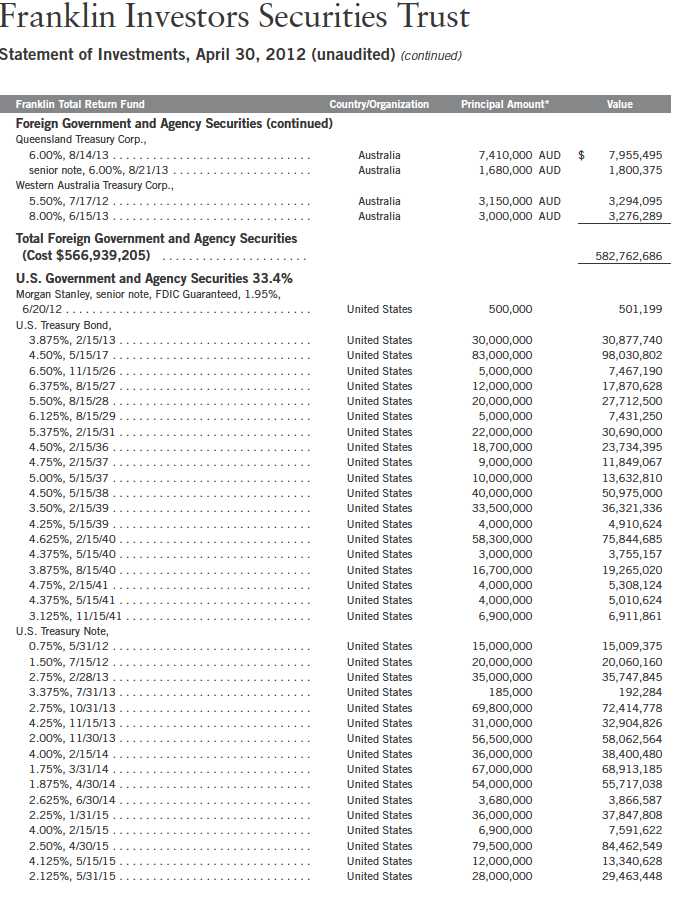

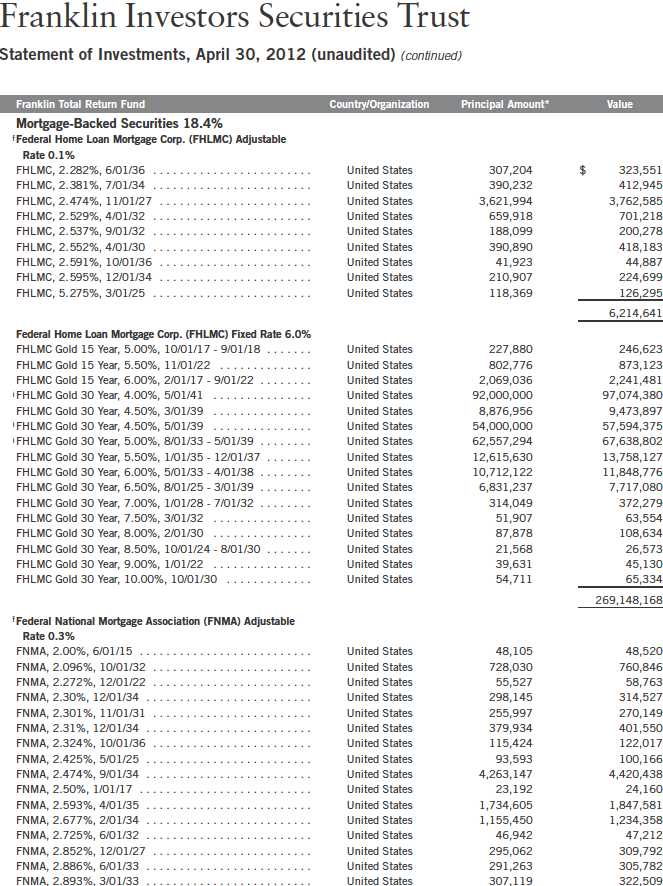

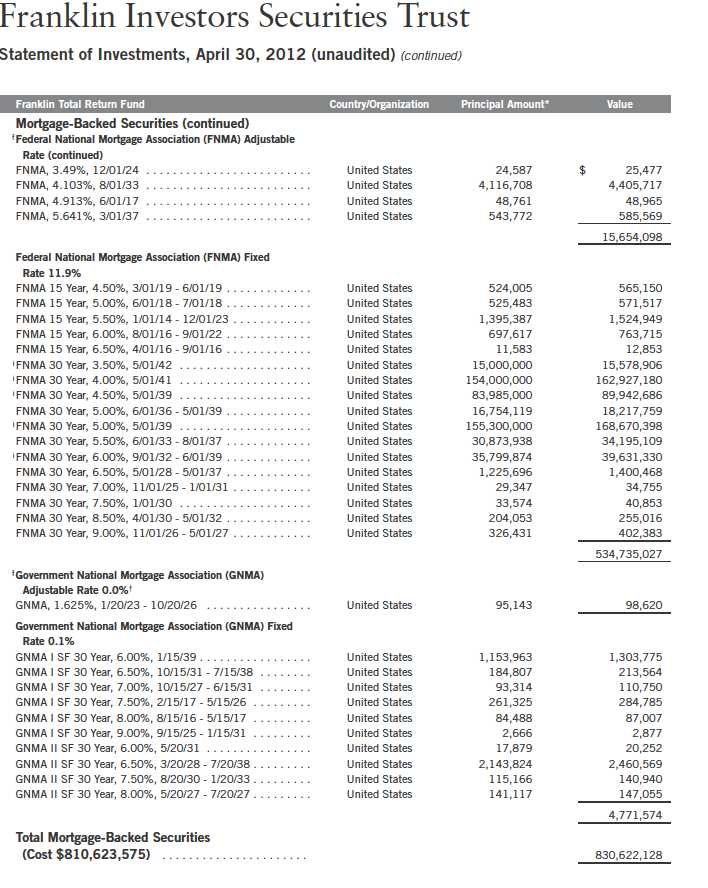

Franklin Investors Securities Trust

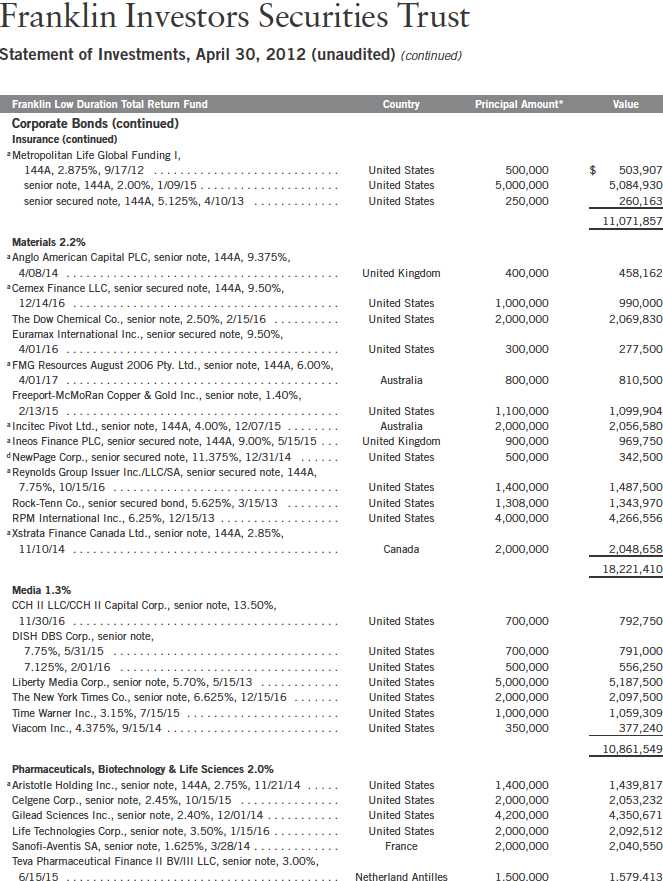

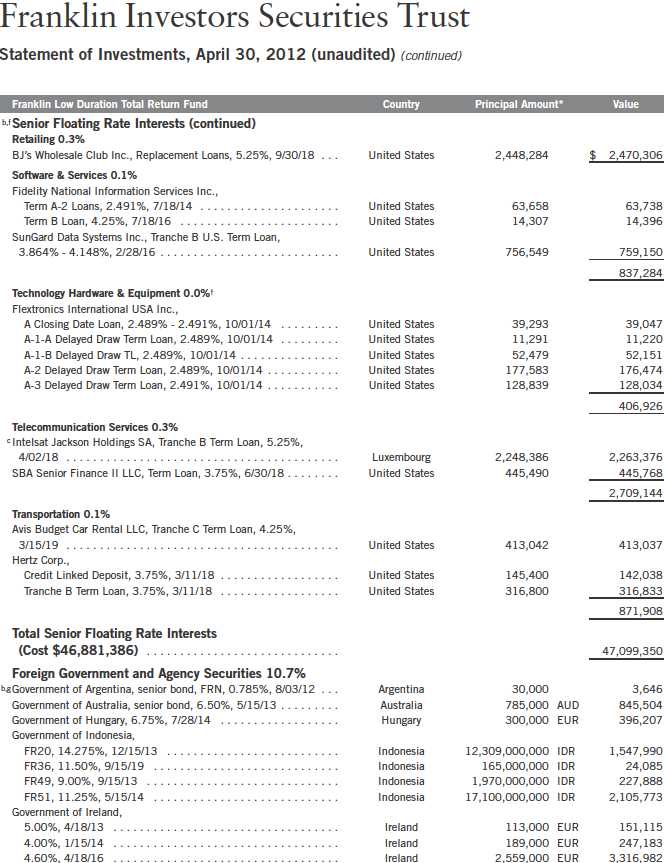

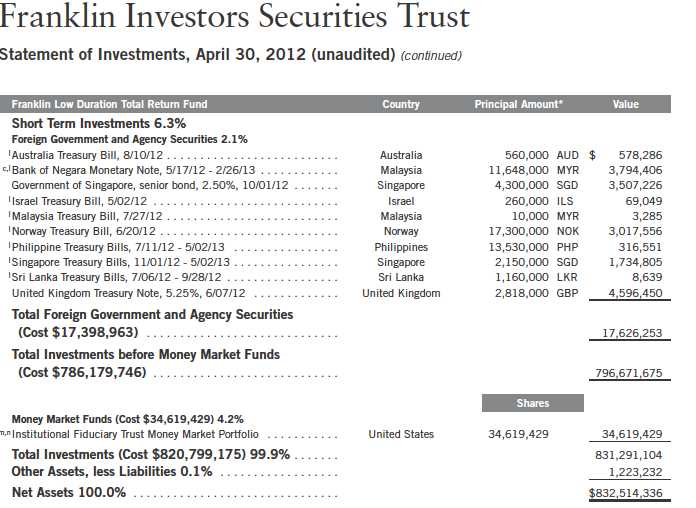

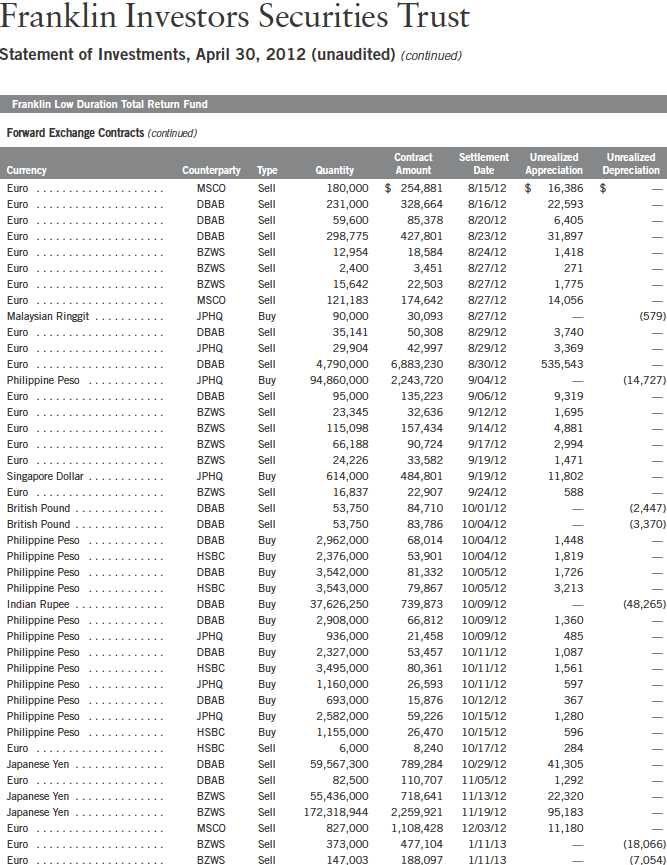

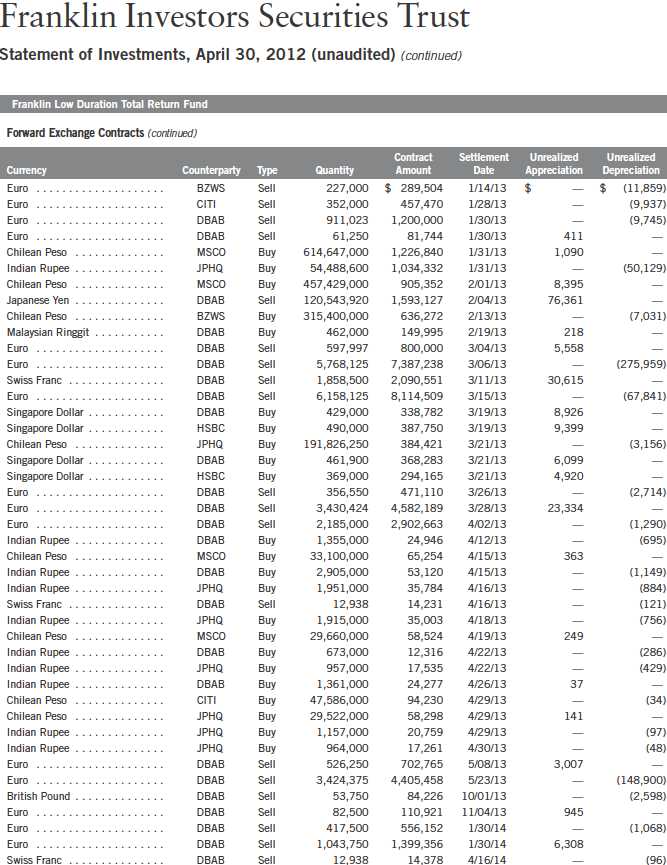

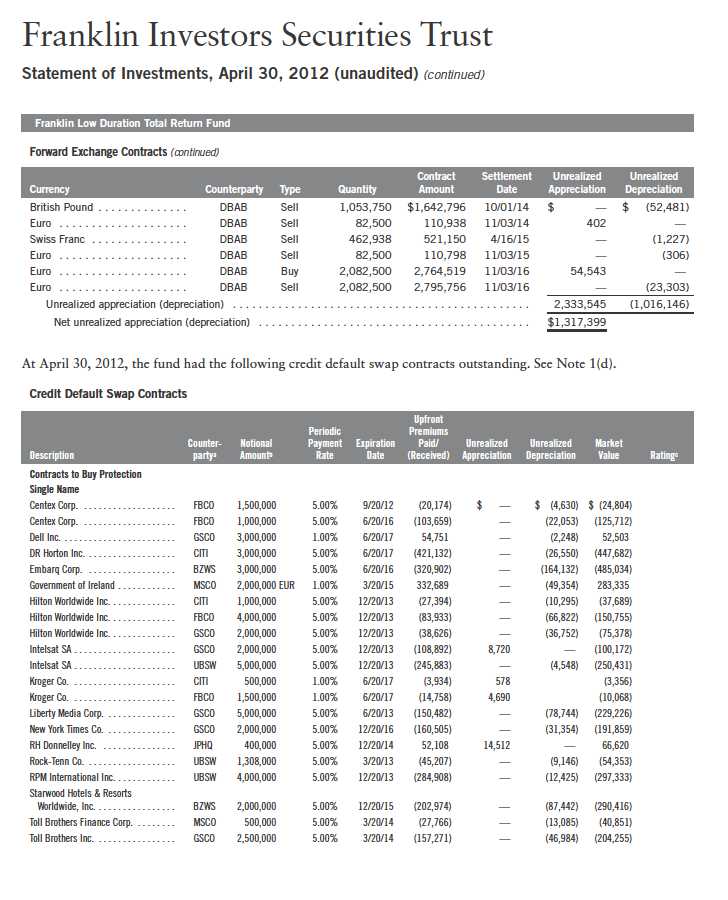

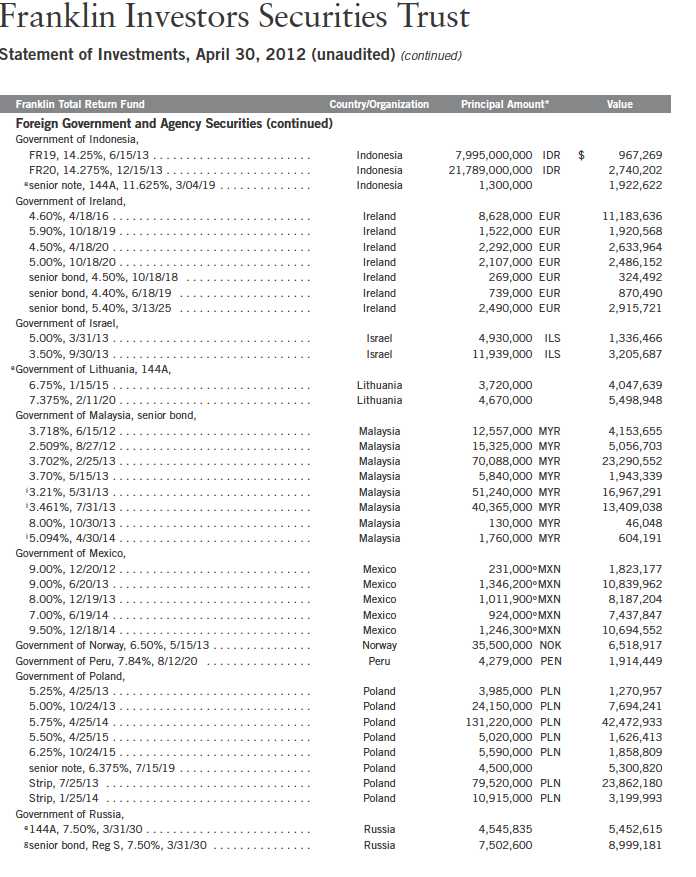

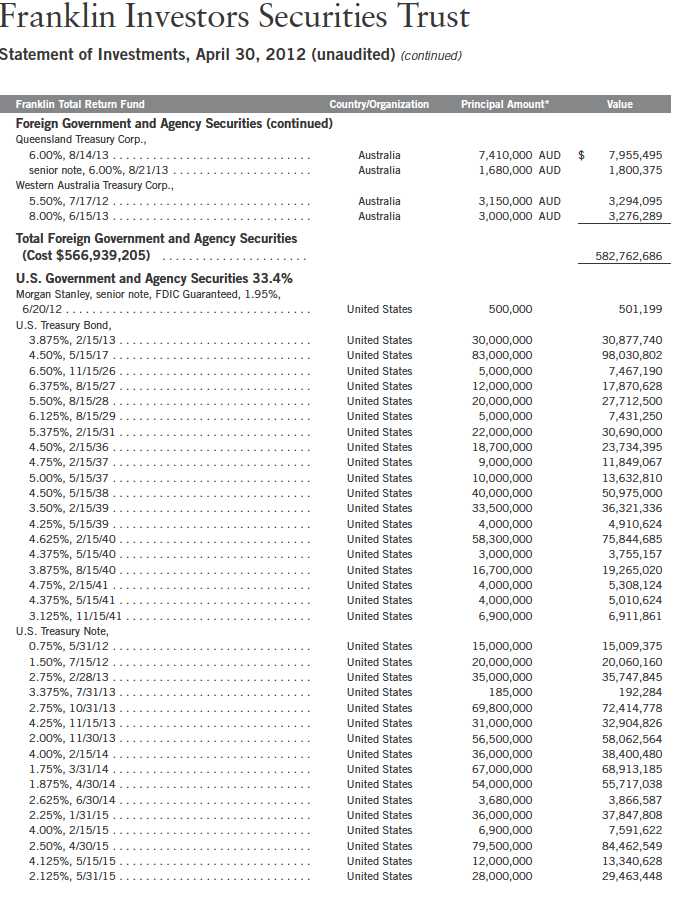

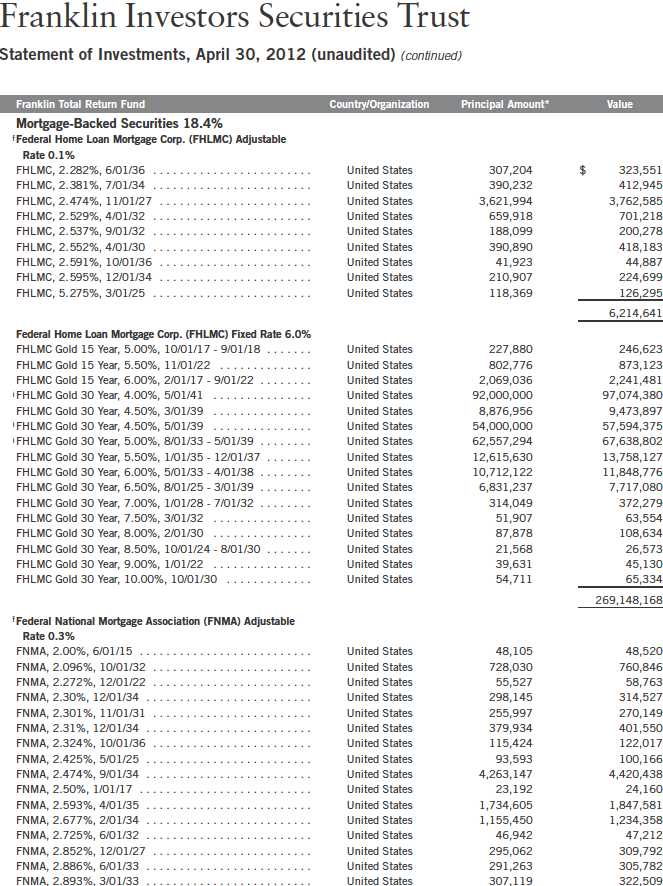

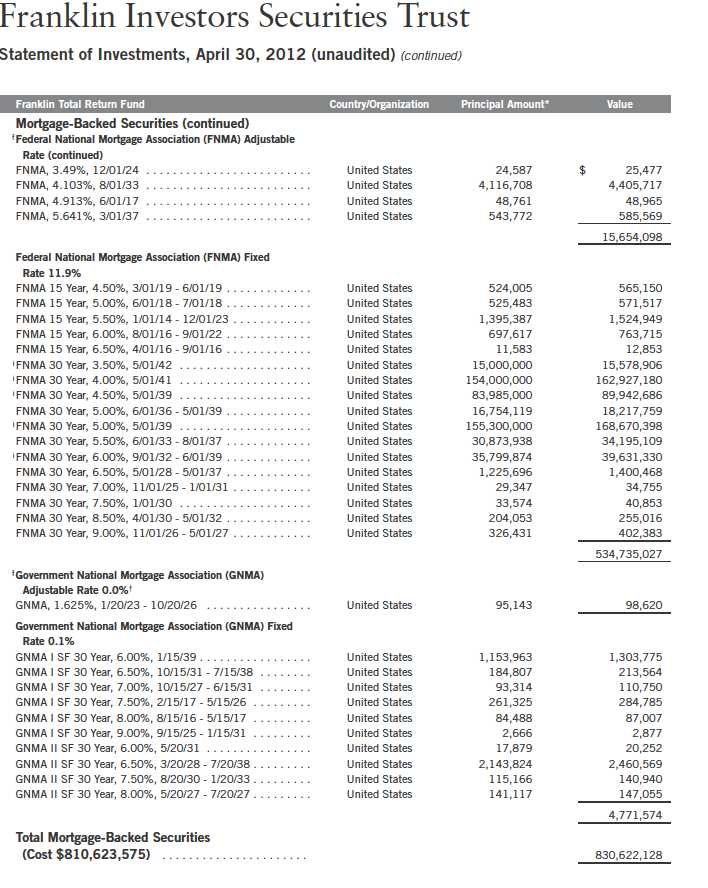

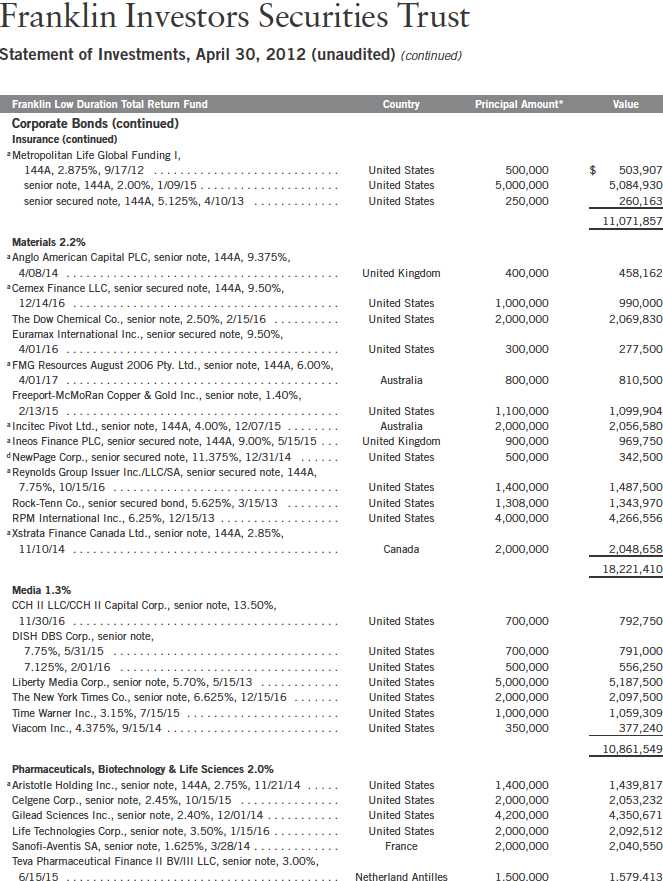

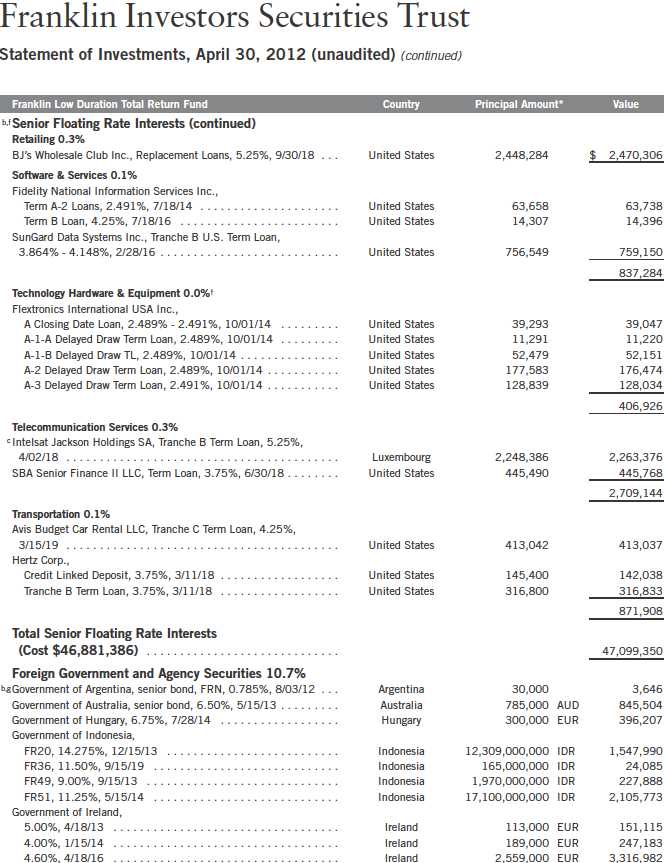

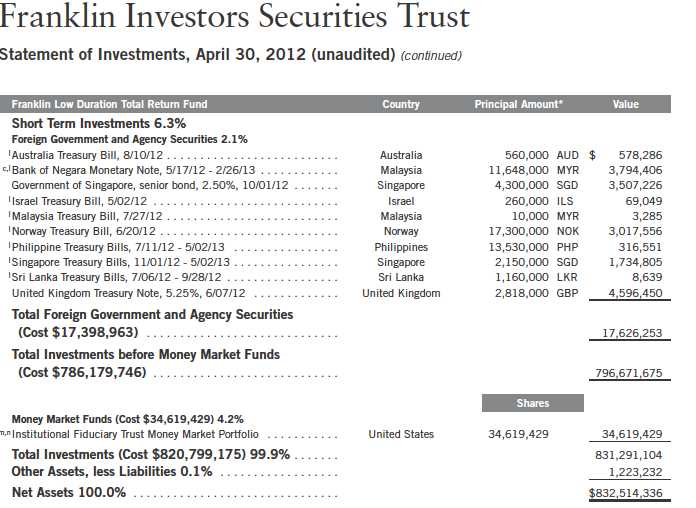

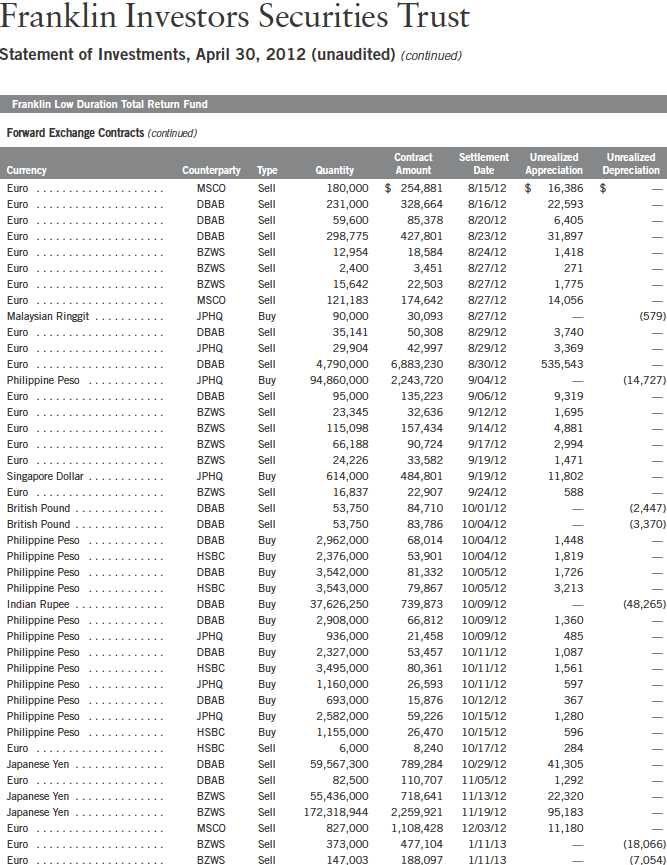

Statement of Investments, April 30, 2012 (unaudited) (continued)

Semiannual Report | 55

Franklin Investors Securities Trust

Statement of Investments, April 30, 2012 (unaudited) (continued)

56 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

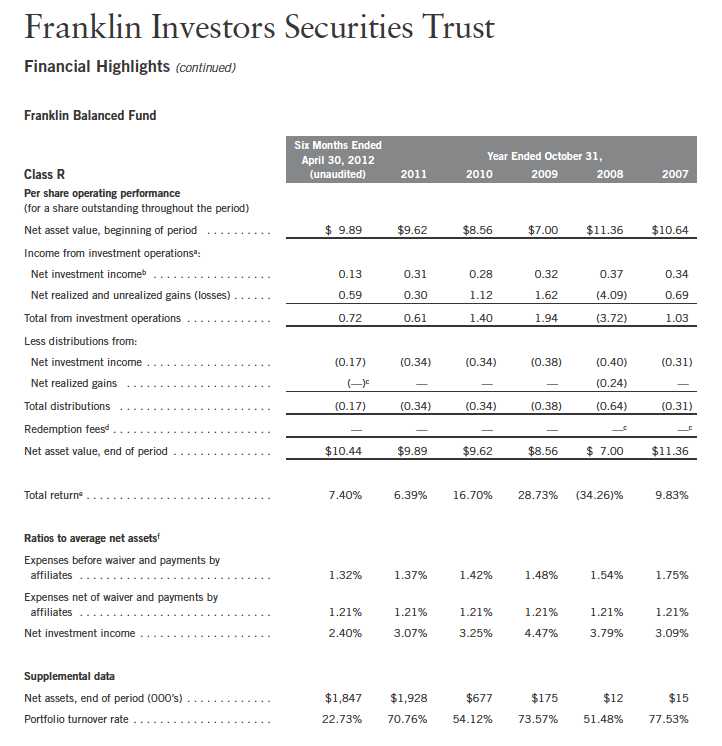

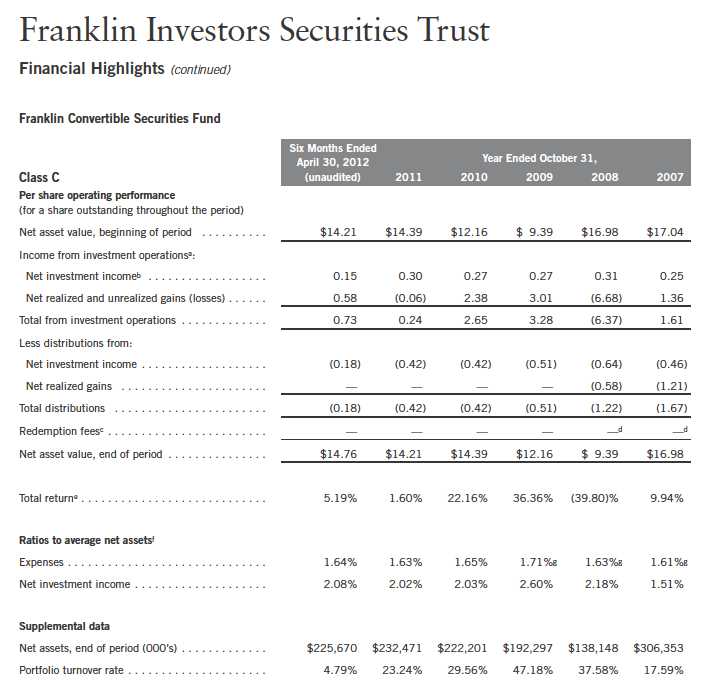

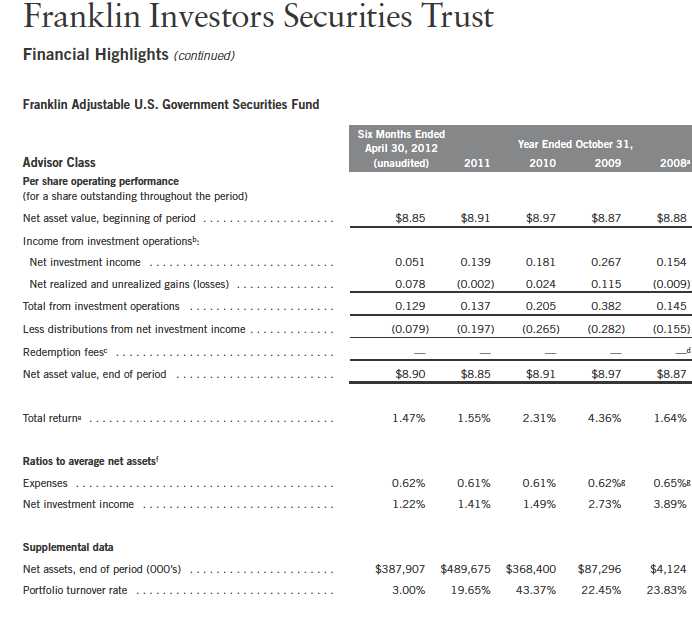

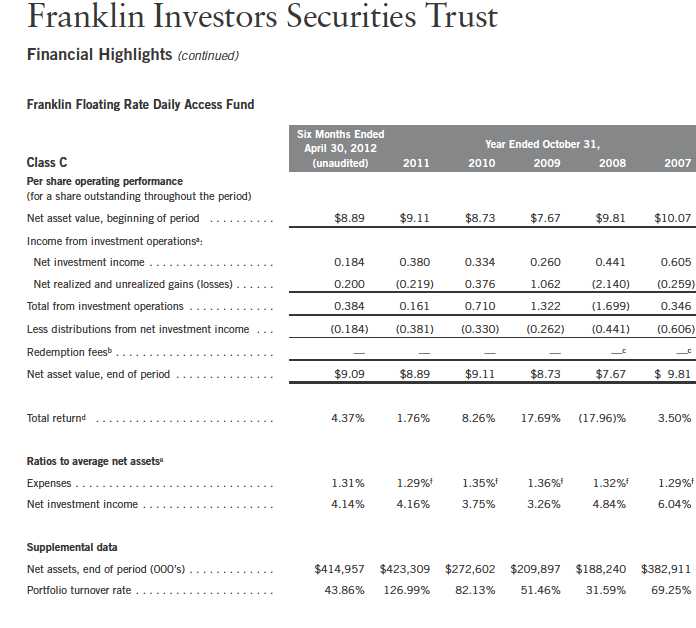

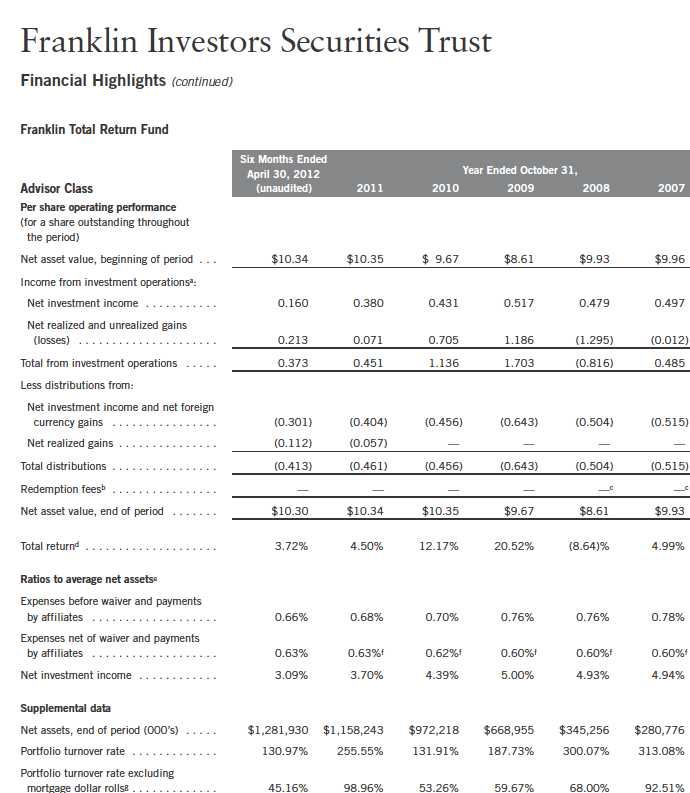

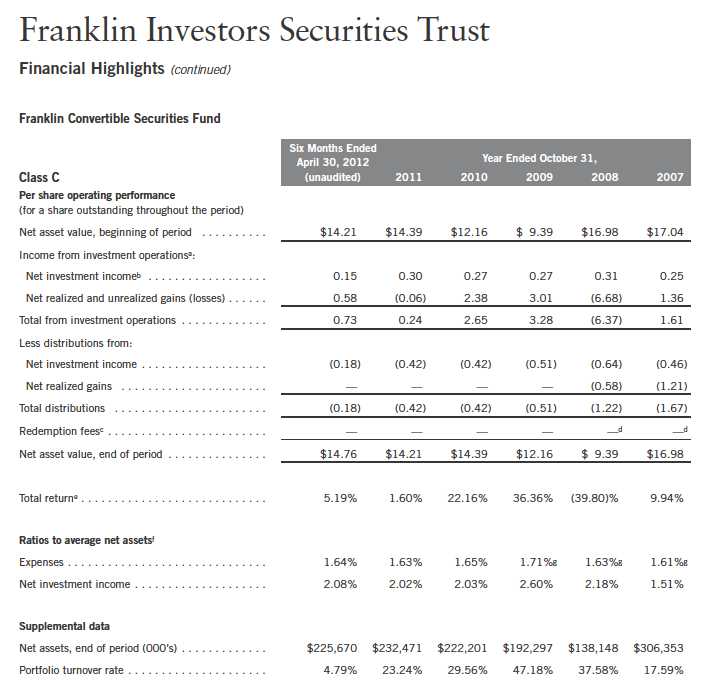

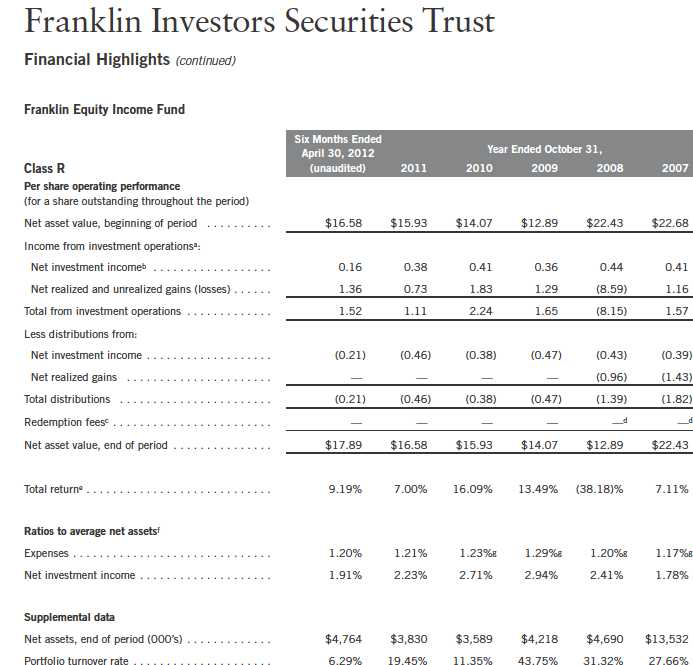

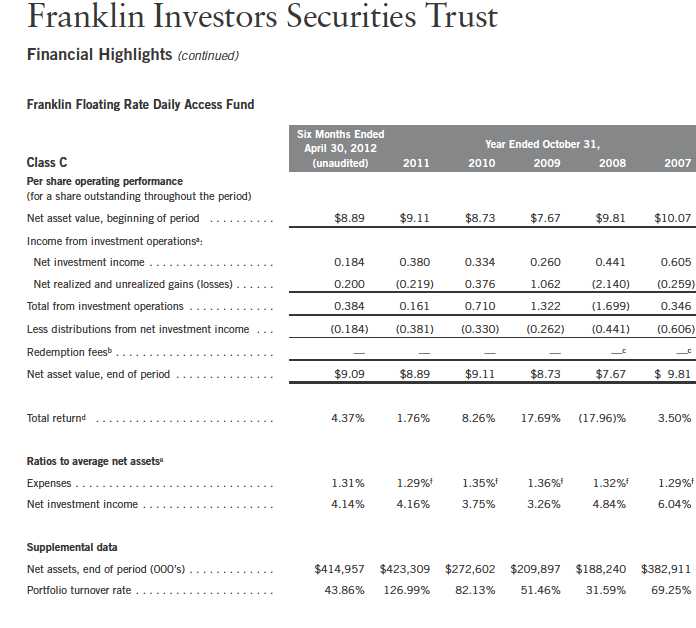

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 57