UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04986

Franklin Investors Securities Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area Code: (650) 312-2000

Date of fiscal year end: 10/31

Date of reporting period: 4/30/15

Item 1. Reports to Stockholders.

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/14. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| | |

| Contents | |

| |

| Semiannual Report | |

| Economic and Market Overview | 3 |

| Franklin Balanced Fund | 4 |

| Franklin Convertible | |

| Securities Fund | 12 |

| Franklin Equity Income Fund | 19 |

| Franklin Real Return Fund | 27 |

| Financial Highlights and | |

| Statements of Investments | 34 |

| Financial Statements | 73 |

| Notes to Financial Statements | 78 |

| Shareholder Information | 93 |

franklintempleton.com

1

Semiannual Report

Economic and Market Overview

U.S. economic growth moderated during the six-month period ended April 30, 2015. In the first half of the period, greater spending by consumers, businesses and state and local governments aided growth. However, economic activity slowed in 2015’s first quarter as low energy prices and U.S. dollar strength led exports to decline. In addition, harsh weather and labor disputes weighed on business spending. Housing market data improved, as home sales and prices rose, while mortgage rates fell. Retail sales remained mixed but increased toward period-end as auto sales surged. Inflation, as measured by the Consumer Price Index, remained subdued during the past six months but rose late in the period amid higher energy prices bouncing from recent lows. Manufacturing and non-manufacturing activities increased, and the unemployment rate declined to 5.4% in April 2015 from 5.7% in October 2014.1

Although the Federal Reserve Board (Fed) had repeatedly stated that it could be patient with regard to raising interest rates, in March, the Fed removed the word “patient” from its monetary policy guidance. It added, however, that it might keep interest rates lower than what it viewed as normal. In its April meeting, the Fed attributed the economy’s first-quarter slowdown to transitory factors. The Fed reiterated that it would raise interest rates when it saw further improvement in the labor market and was reasonably confident that inflation would move back to its 2% objective over the medium term.

Investor confidence grew as the Fed maintained its cautious tone on raising interest rates and China introduced more stimulus measures. The stock markets endured sell-offs when many investors reacted to the crisis in Ukraine, Greece’s debt negotiations and signs of relatively weak global economic growth, particularly in Europe and Japan, as well as less robust growth in China. U.S. stocks rose overall for the six months under review as the Standard & Poor’s® 500 Index and the Dow Jones Industrial Average reached all-time highs.

The foregoing information reflects our analysis and opinions as of April 30, 2015. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

franklintempleton.com Semiannual Report | 3

Franklin Balanced Fund

This semiannual report for Franklin Balanced Fund covers the period ended April 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks both income and capital appreciation by investing in a combination of stocks, convertible securities and debt securities. The Fund will normally invest at least 25% of its total assets in equity securities (primarily common and preferred stock) and at least 25% of its total assets in debt securities, including bonds, notes, debentures and money market securities.

| | | |

| Portfolio Breakdown* | | |

| 4/30/15 | | |

| | % of Total | |

| | Net Assets | |

| |

| Stocks | 58.0 | % |

| Common Stocks | 44.6 | % |

| Equity-Linked Securities | 8.3 | % |

| Convertible Preferred Stocks | 4.5 | % |

| Preferred Stocks | 0.6 | % |

| |

| Bonds | 30.9 | % |

| Corporate Bonds | 30.9 | % |

| |

| Short-Term Investments & Other Net Assets | 11.1 | % |

*Percentages reflect certain derivatives held in the portfolio (or their underlying

reference assets) and may not total 100% or may be negative due to rounding,

use of derivatives, unsettled trades or other factors.

Performance Overview

For the six months under review, the Fund’s Class A shares delivered a +3.11% cumulative total return. In comparison, the Fund’s equity benchmark, the Standard & Poor’s 500 Index (S&P 500®), which is a broad measure of U.S. stock performance, posted a total return of +4.40%.1 The Fund’s fixed income benchmark, the Barclays U.S. Aggregate Bond Index, which tracks the U.S. investment-grade, taxable bond market, returned +2.06%.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

| | | | | | |

| Dividend Distributions* | | | |

| 11/1/14–4/30/15 | | | | |

| | | Dividend per Share (cents) | |

| | | | | | Advisor |

| Month | Class A | Class C | Class R | Class R6 | Class |

| November | 3.00 | 2.29 | 2.80 | 3.43 | 3.31 |

| December | 3.00 | 2.30 | 2.80 | 3.42 | 3.30 |

| January | 3.00 | 2.30 | 2.80 | 3.42 | 3.30 |

| February | 3.00 | 2.30 | 2.80 | 3.42 | 3.30 |

| March | 3.00 | 2.33 | 2.80 | 3.38 | 3.30 |

| April | 3.00 | 2.33 | 2.80 | 3.38 | 3.30 |

| Total | 18.00 | 13.85 | 16.80 | 20.45 | 19.81 |

*All Fund distributions will vary depending upon current market conditions, and past

distributions are not indicative of future trends.

Investment Strategy

We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins and liquidation value. In determining an optimal mix of equity and fixed income investments for the Fund, we assess changing economic, market and industry conditions. We may sell securities for a number of possible reasons, including the achievement of certain stock prices or credit spreads, changes in the fundamental outlook or risk/reward profile of a security, less attractive values relative to market peers, or broad economic conditions affecting certain fixed income sectors. For purposes of pursuing our investment goal, we may enter into various equity-related transactions involving derivative instruments. We may also invest in equity-linked notes, which are hybrid derivative-type instruments specially designed to combine the characteristics of one or more reference securities (usually a single stock, a stock index or a basket of stocks) and a related equity derivative, such as a put or call option.

What are put and call options?

A put option is a contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. Put options are most commonly used to protect against the decline of a stock price below a certain price. Conversely, a call option gives the holder the right to buy shares at a specified price within a specified time, regardless of the price in the future before the expiration date. If the stock price rises, the holder of the call option has the right to buy at the agreed-upon price, which could be lower.

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 39.

4 | Semiannual Report franklintempleton.com

FRANKLIN BALANCED FUND

Manager’s Discussion

During the six months under review, we continued to strategically shift the Fund’s asset mix seeking to manage risks, and our equity holdings declined while our fixed income holdings increased. The Fund’s equity weighting fell to 58.0% from 64.4% of total net assets, and the Fund’s fixed income weighting rose to 30.9% from 29.8%. Our cash position rose during the period to 11.1% from 5.8% of total net assets.

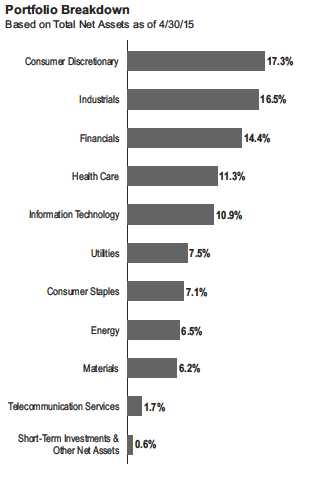

The Fund’s equity holdings performed in line with the S&P 500 during the period. The Fund’s equity information technology, consumer discretionary and consumer staples sector positions performed well. In contrast, our equity energy, materials and utilities sector positions were weak performers.

Our equity-linked security in computer and personal electronics maker Apple was a leading contributor in the equity information technology sector. The company experienced record revenues in its second fiscal quarter based on strong iPhone, Mac and App Store sales. Other notable sector contributors included Analog Devices, Cisco Systems and an equity-linked security in Freescale Semiconductor.

In the equity consumer discretionary sector, big-box retailer Target was able to overcome negative sentiment associated with the company’s disappointing expansion into Canada and the data breach it suffered in December 2013. Home improvement products retailer Lowe’s generated sales growth across all regions of the country in its first fiscal quarter.2 Auto manufacturer General Motors put a period of failed recalls and fatalities behind it by focusing on improving its operational efficiency and taking steps to build shareholder value.

Notable equity contributors from other sectors included Walgreens Boots Alliance, The Boeing Co. and an equity-linked security in LyondellBasell Industries.

The slowing global economy outside North America and growing production led to excess supply in oil, coal, copper and iron ore and contributed to an energy price decline in 2014’s fourth quarter. This collapse drove a substantial amount of the underperformance in the Fund’s equity energy and materials sectors and placed significant pressure on the Fund’s share price during the period.

| | | |

| Top Five Equity Holdings | | |

| 4/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Schlumberger Ltd., ord. & equity linked | 1.4 | % |

| Energy | | |

| Target Corp. | 1.4 | % |

| Consumer Discretionary | | |

| Intel Corp., ord. & equity linked | 1.4 | % |

| Information Technology | | |

| General Electric Co., ord. & equity linked | 1.4 | % |

| Industrials | | |

| Cisco Systems Inc., ord. & equity linked | 1.3 | % |

| Information Technology | | |

Major equity energy detractors included exploration and production companies Rex Energy, Chesapeake Energy2 and Sanchez Energy and oilfield services companies Schlumberger and Halliburton. Falling copper and iron ore prices weighed on our equity materials sector positions, which included BHP Billiton and Rio Tinto and an equity-linked security in Freeport-McMoRan.

Notable equity detractors from other sectors included Caterpillar, QUALCOMM and Johnson & Johnson.

Within fixed income, we continued to focus on corporate bonds, which helped Fund performance. Although fixed income markets experienced volatility and credit spreads widened during the period, we believed the sector’s fundamentals remained solid. Leverage increased but did not reach levels associated with the end of the business cycle. Investment-grade corporate bonds, as measured by the Barclays U.S. Aggregate Bond Index, outperformed Treasuries, agencies, mortgage-backed securities and other securitized products during the period. In this environment, we found valuations that presented what we considered opportunities to add modest exposure at attractive prices. Our industry positioning and security selection within the corporate bond side of the portfolio benefited Fund results. Major fixed income contributors included the banking, consumer non-cyclical and real estate investment trust sectors.3 In contrast, the basic industry, finance companies and capital goods sectors weighed on performance.4

2. No longer held at period-end.

3. Banking holdings are in financials in the fixed income section of the SOI. Consumer non-cyclical holdings are in consumer staples and health care in the fixed income

section of the SOI. Real estate investment trust holdings are in financials in the fixed income section of the SOI.

4. Basic industry holdings are in energy and materials in the fixed income section of the SOI. Finance companies are in financials in the fixed income section of the SOI.

Capital goods holdings are in industrials and materials in the fixed income section of the SOI.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com Semiannual Report | 5

FRANKLIN BALANCED FUND

| | | |

| Top Five Bond Holdings | | |

| 4/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Morgan Stanley | 0.9 | % |

| Financials | | |

| Bank of America Corp. | 0.9 | % |

| Financials | | |

| Citigroup Inc. | 0.9 | % |

| Financials | | |

| Valeant Pharmaceuticals International Inc. | 0.9 | % |

| Health Care | | |

| Energy Transfer Partners LP | 0.8 | % |

| Energy | | |

We continued to find what we considered opportunities in the fixed income banking sector during the period, as we believed the sector could benefit from potential interest rate changes that may result in higher margins. Financial services provider Citigroup benefited from growth in its loans and deposits and its focus on keeping expenses low. Other sector contributors included Wells Fargo & Co. and Royal Bank of Scotland Group.

One of the Fund’s new acquisitions during the period, medical device developer Medtronic, was a notable performer among fixed income consumer non-cyclicals. The company successfully integrated health care products company Covidien during the period. The merged company experienced revenue growth from its cardiac and vascular, minimally invasive therapies, restorative therapies and diabetes business lines. Other sector contributors included Mondelez International and Valeant Pharmaceuticals International.

Notable fixed income contributors from other sectors included Dollar General, Freescale Semiconductor and Nippon Life Insurance.

The commodity price collapse during the period also negatively impacted our fixed income results. Coal company Peabody Energy and copper and gold miner Freeport-McMoRan in basic industry detracted from Fund performance, as did oil and gas services companies Weatherford International and Chesapeake Energy in energy. We strategically introduced some new energy positions during the period as valuations became attractive in our view. At period-end, we viewed our energy holdings favorably, believing they should be more tied to recently stabilized energy prices rather than potential interest rate moves.

Among fixed income finance companies, Navient, which services and collects student loans, lost value. Airplane and train manufacturer Bombardier, in the capital goods sector, was another detractor.

The Fund used derivative instruments during the period, such as equity options. The goal of these instruments is to enhance Fund returns and more efficiently enter and exit stock positions at prices the Fund deems attractive. None of these positions had a material impact on performance. We were comfortable with the Fund’s rising cash position during the period, as we believed it helped reduce volatility and enabled us to invest opportunistically at times when the markets retreated.

Thank you for your continued participation in Franklin Balanced Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

6 | Semiannual Report franklintempleton.com

FRANKLIN BALANCED FUND

Performance Summary as of April 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 4/30/15 | | 10/31/14 | | Change |

| A (FBLAX) | $ | 11.88 | $ | 11.86 | +$ | 0.02 |

| C (FBMCX) | $ | 11.78 | $ | 11.77 | +$ | 0.01 |

| R (N/A) | $ | 11.90 | $ | 11.89 | +$ | 0.01 |

| R6 (FBFRX) | $ | 11.90 | $ | 11.89 | +$ | 0.01 |

| Advisor (FBFZX) | $ | 11.90 | $ | 11.88 | +$ | 0.02 |

| |

| |

| Distributions (11/1/14–4/30/15) | | | | | | |

| | | Dividend | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Total |

| A | $ | 0.1800 | $ | 0.1574 | $ | 0.3374 |

| C | $ | 0.1385 | $ | 0.1574 | $ | 0.2959 |

| R | $ | 0.1680 | $ | 0.1574 | $ | 0.3254 |

| R6 | $ | 0.2045 | $ | 0.1574 | $ | 0.3619 |

| Advisor | $ | 0.1981 | $ | 0.1574 | $ | 0.3555 |

franklintempleton.com

Semiannual Report | 7

FRANKLIN BALANCED FUND

PERFORMANCE SUMMARY

Performance as of 4/30/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | $ | 10,000 Investment4 | Total Return (3/31/15)5 | | Operating Expenses6 | |

| A | | | | | | | | | 1.09 | % |

| 6-Month | +3.11 | % | -2.79 | % | $ | 9,721 | | | | |

| 1-Year | +5.67 | % | -0.43 | % | $ | 9,957 | +0.03 | % | | |

| 5-Year | +56.88 | % | +8.14 | % | $ | 14,789 | +8.39 | % | | |

| Since Inception (7/3/06) | +75.47 | % | +5.87 | % | $ | 16,538 | +5.80 | % | | |

| C | | | | | | | | | 1.79 | % |

| 6-Month | +2.68 | % | +1.68 | % | $ | 10,168 | | | | |

| 1-Year | +4.88 | % | +3.88 | % | $ | 10,388 | +4.35 | % | | |

| 5-Year | +51.42 | % | +8.65 | % | $ | 15,142 | +8.90 | % | | |

| Since Inception (7/3/06) | +65.01 | % | +5.84 | % | $ | 16,501 | +5.78 | % | | |

| R | | | | | | | | | 1.29 | % |

| 6-Month | +2.91 | % | +2.91 | % | $ | 10,291 | | | | |

| 1-Year | +5.36 | % | +5.36 | % | $ | 10,536 | +5.83 | % | | |

| 5-Year | +55.36 | % | +9.21 | % | $ | 15,536 | +9.44 | % | | |

| Since Inception (7/3/06) | +72.71 | % | +6.39 | % | $ | 17,271 | +6.33 | % | | |

| R6 | | | | | | | | | 0.68 | % |

| 6-Month | +3.23 | % | +3.23 | % | $ | 10,323 | | | | |

| 1-Year | +6.18 | % | +6.18 | % | $ | 10,618 | +6.57 | % | | |

| Since Inception (5/1/13) | +18.63 | % | +8.93 | % | $ | 11,863 | +8.74 | % | | |

| Advisor | | | | | | | | | 0.79 | % |

| 6-Month | +3.26 | % | +3.26 | % | $ | 10,326 | | | | |

| 1-Year | +5.98 | % | +5.98 | % | $ | 10,598 | +6.45 | % | | |

| 5-Year | +59.32 | % | +9.76 | % | $ | 15,932 | +10.01 | % | | |

| Since Inception (7/3/06) | +80.23 | % | +6.90 | % | $ | 18,023 | +6.84 | % | | |

| | | | | | | |

| | Distribution | | 30-Day Standardized Yield8 | |

| Share Class | Rate7 | | (with waiver) | | (without waiver) | |

| A | 2.86 | % | 1.85 | % | 1.84 | % |

| C | 2.37 | % | 1.27 | % | 1.26 | % |

| R | 2.82 | % | 1.77 | % | 1.75 | % |

| R6 | 3.41 | % | 2.37 | % | 2.36 | % |

| Advisor | 3.33 | % | 2.26 | % | 2.25 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

8 | Semiannual Report

franklintempleton.com

| |

| FRANKLIN BALANCED FUND |

| PERFORMANCE SUMMARY |

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| | |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Class R6 has a fee waiver contractually guaranteed through at least 2/29/16. Fund investment results reflect the fee waivers, to the extent applicable; without these

reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C, R, R6 and Advisor) per share

on 4/30/15.

8. The 30-day standardized yield for the 30 days ended 4/30/15 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends

paid to shareholders) or the income reported in the Fund’s financial statements.

franklintempleton.com Semiannual Report | 9

FRANKLIN BALANCED FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

10 | Semiannual Report

franklintempleton.com

FRANKLIN BALANCED FUND

YOUR FUND’S EXPENSES

| | | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/14 | | Value 4/30/15 | | Period* 11/1/14–4/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,031.10 | $ | 5.34 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.54 | $ | 5.31 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,026.80 | $ | 8.84 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.07 | $ | 8.80 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,029.10 | $ | 6.34 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.55 | $ | 6.31 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,032.30 | $ | 3.33 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.52 | $ | 3.31 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,032.60 | $ | 3.83 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.03 | $ | 3.81 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.06%;

C: 1.76%; R: 1.26%; R6: 0.66%; and Advisor: 0.76%), multiplied by the average account value over the period, multiplied by 181/365 to

reflect the one-half year period.

franklintempleton.com

Semiannual Report | 11

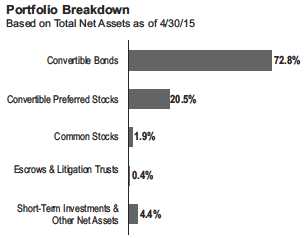

Franklin Convertible Securities Fund

This semiannual report for Franklin Convertible Securities Fund covers the period ended April 30, 2015.

Your Fund’s Goal and Main Investments

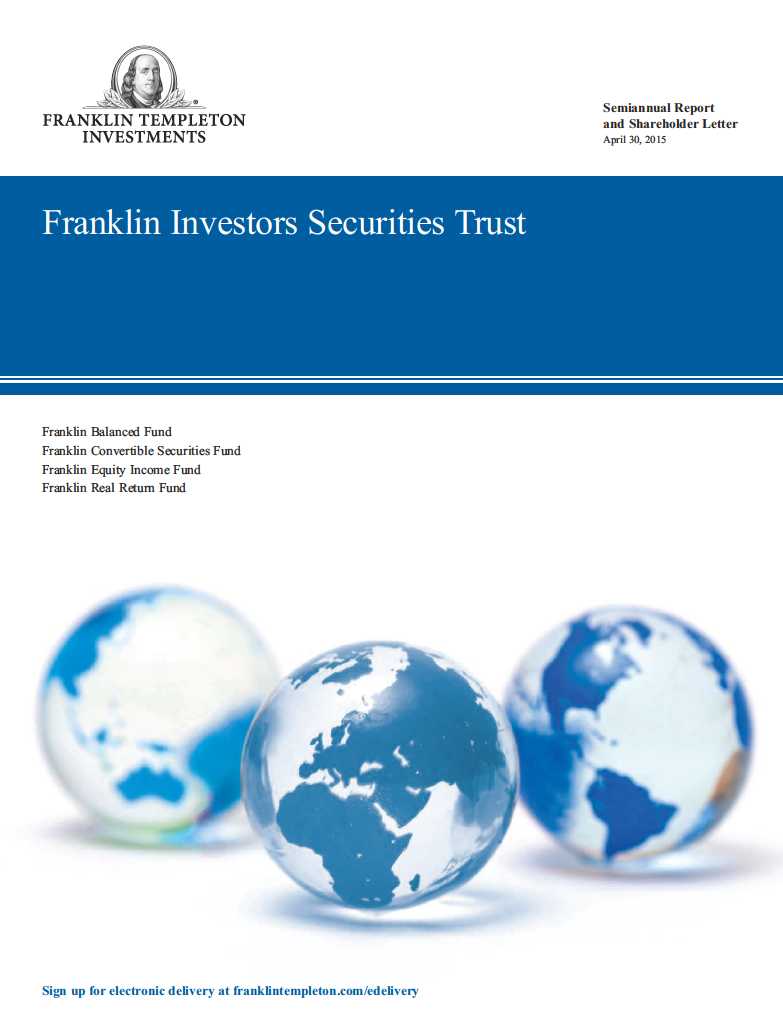

The Fund seeks to maximize total return, consistent with reasonable risk, by seeking to optimize capital appreciation and high current income under varying market conditions and investing at least 80% of its net assets in convertible securities.

Performance Overview

For the six months under review, the Fund’s Class A shares delivered a +2.48% cumulative total return. In comparison, the Fund’s benchmark, the BofA Merrill Lynch (BofAML) All Total Return Alternatives U.S. Convertibles Index, which tracks the domestic convertible securities market, posted a +4.18% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 14.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We follow a strategy of maintaining a balance in the portfolio between the equity and debt characteristics of convertible securities with an emphasis on the equity features. Convertible securities are attractive for two reasons: the opportunity to participate in common stocks’ potential growth with relatively reduced volatility, and the potential for current income with potential downside protection from bonds. Typically, we sell securities whose equity sensitivity becomes too high and no longer offers appropriate downside protection. Likewise, as securities become too bond-like — reducing their ability to appreciate with increases in the underlying common stock —we attempt to redeploy those assets into more balanced convertible securities and maintain the potential for the Fund’s upside participation. Our experienced team of analysts searches for investment opportunities among all economic sectors and considers a company’s long-term earnings, asset value and cash flow potential, to create a broadly diversified portfolio.

| | | |

| Top 10 Holdings | | |

| 4/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Electronic Arts Inc. | 2.9 | % |

| Information Technology | | |

| Novellus Systems Inc. | 2.3 | % |

| Information Technology | | |

| Omnicare Inc. | 2.3 | % |

| Health Care | | |

| Forest City Enterprises Inc. | 2.2 | % |

| Financials | | |

| Palo Alto Networks Inc. | 2.1 | % |

| Information Technology | | |

| Jarden Corp. | 2.1 | % |

| Consumer Discretionary | | |

| Trulia Inc. | 2.1 | % |

| Information Technology | | |

| Salix Pharmaceuticals Ltd. | 2.1 | % |

| Health Care | | |

| Salesforce.com Inc. | 2.0 | % |

| Information Technology | | |

| ServiceNow Inc. | 2.0 | % |

| Information Technology | | |

1. Source: BofA Merrill Lynch.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 50.

12 | Semiannual Report franklintempleton.com

FRANKLIN CONVERTIBLE SECURITIES FUND

Manager’s Discussion

Most sectors the Fund invested in rose in value, as did the majority of the portfolio’s individual securities, supporting overall performance during the six months under review. Investments in the health care, information technology (IT), telecommunication services and consumer staples sectors accounted for the bulk of the Fund’s total return. Among health care sector holdings, pharmaceuticals firms BioMarin Pharmaceutical, Mylan and Salix Pharmaceuticals were top contributors. Within IT, the Fund’s holdings of convertible notes issued by video game company Electronic Arts, network security firm Palo Alto Networks and semiconductor manufacturer Microchip Technology2 enjoyed some of the largest gains. In the telecommunication services sector, a new position in convertible preferred shares of wireless network operator T-Mobile US was a top contributor. Post Holdings, which specializes in cereals and granola, was a key consumer staples contributor.

Despite the Fund’s positive results this reporting period, there were a few disappointments in the portfolio. By sector, energy, materials and consumer discretionary detracted from performance. The slowing global economy outside North America and growing production led to excess supply in oil, coal and iron ore and contributed to a decline in energy prices in 2014’s fourth quarter. This collapse drove a substantial amount of the underperformance in the Fund’s energy and materials sectors. On an individual security basis, key detractors included SandRidge Energy convertible preferred shares, Iconix Brand Group convertible notes and Rex Energy convertible preferred shares. Holdings of flash memory manufacturer Sandisk and Pacira Pharmaceuticals also hurt Fund performance.

Thank you for your continued participation in Franklin Convertible Securities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

2. One security sold and another purchased during the period.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com Semiannual Report | 13

FRANKLIN CONVERTIBLE SECURITIES FUND

Performance Summary as of April 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | | |

| Net Asset Value | | | | | | | | |

| Share Class (Symbol) | | 4/30/15 | | 10/31/14 | | Change | | |

| A (FISCX) | $ | 18.54 | $ | 18.97 | -$ | 0.43 | | |

| C (FROTX) | $ | 18.29 | $ | 18.73 | -$ | 0.44 | | |

| R6 (N/A) | $ | 18.55 | $ | 18.99 | -$ | 0.44 | | |

| Advisor (FCSZX) | $ | 18.54 | $ | 18.98 | -$ | 0.44 | | |

| |

| |

| Distributions (11/1/14–4/30/15) | | | | | | | | |

| | | Dividend | | Short-Term | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Capital Gain | | Total |

| A | $ | 0.1770 | $ | 0.1578 | $ | 0.5215 | $ | 0.8563 |

| C | $ | 0.1094 | $ | 0.1578 | $ | 0.5215 | $ | 0.7887 |

| R6 | $ | 0.2138 | $ | 0.1578 | $ | 0.5215 | $ | 0.8931 |

| Advisor | $ | 0.2016 | $ | 0.1578 | $ | 0.5215 | $ | 0.8809 |

14 | Semiannual Report

franklintempleton.com

FRANKLIN CONVERTIBLE SECURITIES FUND

PERFORMANCE SUMMARY

Performance as of 4/30/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R6/Advisor Class: no sales charges.

| | | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | $ | 10,000 Investment4 | Total Return (3/31/15)5 | | Operating Expenses6 | |

| A | | | | | | | | | 0.88 | % |

| 6-Month | +2.48 | % | -3.42 | % | $ | 9,658 | | | | |

| 1-Year | +5.20 | % | -0.87 | % | $ | 9,913 | -2.10 | % | | |

| 5-Year | +58.50 | % | +8.36 | % | $ | 14,938 | +8.91 | % | | |

| 10-Year | +111.16 | % | +7.13 | % | $ | 19,906 | +6.77 | % | | |

| C | | | | | | | | | 1.63 | % |

| 6-Month | +2.07 | % | +1.10 | % | $ | 10,110 | | | | |

| 1-Year | +4.38 | % | +3.39 | % | $ | 10,339 | +2.10 | % | | |

| 5-Year | +52.62 | % | +8.82 | % | $ | 15,262 | +9.37 | % | | |

| 10-Year | +95.91 | % | +6.96 | % | $ | 19,591 | +6.60 | % | | |

| R6 | | | | | | | | | 0.51 | % |

| 6-Month | +2.63 | % | +2.63 | % | $ | 10,263 | | | | |

| 1-Year | +5.55 | % | +5.55 | % | $ | 10,555 | +4.31 | % | | |

| Since Inception (3/4/14) | +2.74 | % | +2.37 | % | $ | 10,274 | +1.93 | % | | |

| Advisor7 | | | | | | | | | 0.63 | % |

| 6-Month | +2.56 | % | +2.56 | % | $ | 10,256 | | | | |

| 1-Year | +5.43 | % | +5.43 | % | $ | 10,543 | +4.13 | % | | |

| 5-Year | +60.41 | % | +9.91 | % | $ | 16,041 | +10.48 | % | | |

| 10-Year | +114.92 | % | +7.95 | % | $ | 21,492 | +7.60 | % | | |

| | | | | | | |

| | Distribution | | 30-Day Standardized Yield9 | |

| Share Class | Rate8 | | (with waiver) | | (without waiver) | |

| A | 1.64 | % | 1.40 | % | 1.40 | % |

| C | 1.02 | % | 0.75 | % | 0.75 | % |

| R6 | 2.12 | % | 1.86 | % | 1.86 | % |

| Advisor | 2.01 | % | 1.74 | % | 1.74 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com

Semiannual Report | 15

FRANKLIN CONVERTIBLE SECURITIES FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The Fund may invest in high yielding, fixed income securities. High yields reflect the higher credit risk associated with these lower rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund may also invest in foreign securities, which involve special risks, including political uncertainty and currency volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| | |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Class R6 has a fee waiver contractually guaranteed through at least 2/29/16. Fund investment results reflect the fee waivers, to the extent applicable; without these

reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s

maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08, actual Advisor Class performance is used reflecting

all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were

+63.86% and +7.35%.

8. Distribution rate is based on the sum of the respective class’s past four quarterly dividends and the maximum offering price (NAV for Classes C, R6 and Advisor) per

share on 4/30/15.

9. The 30-day standardized yield for the 30 days ended 4/30/15 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends

paid to shareholders) or the income reported in the Fund’s financial statements.

16 | Semiannual Report franklintempleton.com

FRANKLIN CONVERTIBLE SECURITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com Semiannual Report | 17

| | | | | | | |

| FRANKLIN CONVERTIBLE SECURITIES FUND | | | | |

| YOUR FUND’S EXPENSES | | | | | | |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/14 | | Value 4/30/15 | | Period* 11/1/14–4/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,024.80 | $ | 4.32 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.53 | $ | 4.31 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,020.70 | $ | 8.07 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.81 | $ | 8.05 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,026.30 | $ | 2.51 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.32 | $ | 2.51 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,025.60 | $ | 3.06 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.77 | $ | 3.06 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.86%;

C: 1.61%; R6: 0.50%; and Advisor: 0.61%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the

one-half year period.

18 | Semiannual Report franklintempleton.com

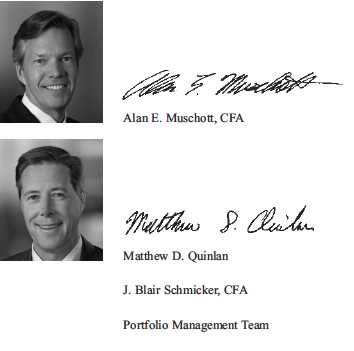

Franklin Equity Income Fund

This semiannual report for Franklin Equity Income Fund covers the period ended April 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks to maximize total return, emphasizing high current income and long-term capital appreciation, consistent with reasonable risk, by investing at least 80% of its net assets in equity securities including securities convertible into common stocks.

Performance Overview

For the six months under review, the Fund’s Class A shares delivered a +3.50% cumulative total return. In comparison, the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market, generated a +4.40% total return.1 The Fund’s peers, as measured by the Lipper Equity Income Funds Classification Average, which consists of funds chosen by Lipper that seek relatively high current income and growth of income by investing at least 60% of their portfolios in stocks, posted a +2.96% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 22.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We seek to invest in a broadly diversified portfolio of equity securities that we consider to be financially strong, with a focus on “blue chip” companies. We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio,

profit margins, balance sheet and liquidation value. We consider dividend yield in selecting stocks for the Fund because we believe that, over time, dividend income can contribute significantly to total return and can be a more consistent source of investment return than capital appreciation. We seek to take advantage of price dislocations that result from the market’s short-term focus and choose to invest in those companies that, in our opinion, offer the best trade-off between growth opportunity, business and financial risk, and valuation.

1. Source: Morningstar.

2. Source: Lipper, a Thomson Reuters Company. For the six-month period ended 4/30/15, this category consisted of 514 funds. Lipper calculations do not include sales

charges, or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 59.

franklintempleton.com Semiannual Report | 19

| | | | | | |

| FRANKLIN EQUITY INCOME FUND | | |

| |

| |

| Dividend Distributions* | | | |

| 11/1/14–4/30/15 | | | | |

| | | Dividend per Share (cents) | |

| | | | | | Advisor |

| Month | Class A | Class C | Class R | Class R6 | Class |

| November | 3.90 | 2.42 | 3.41 | 4.64 | 4.40 |

| December** | 26.44 | 24.92 | 25.94 | 27.17 | 26.94 |

| January | 3.90 | 2.38 | 3.40 | 4.63 | 4.40 |

| February | 3.90 | 2.38 | 3.40 | 4.63 | 4.40 |

| March | 3.90 | 2.52 | 3.43 | 4.59 | 4.37 |

| April | 3.90 | 2.52 | 3.43 | 4.59 | 4.37 |

| Total | 45.94 | 37.14 | 43.01 | 50.25 | 48.88 |

*All Fund distributions will vary depending upon current market conditions, and past

distributions are not indicative of future trends.

**Includes an additional 22.54 cent per share distribution to meet excise tax

requirements.

Manager’s Discussion

Most sectors the Fund invested in rose in value, as did the majority of the portfolio’s individual securities, supporting overall performance during the six months under review. Key contributing sectors included consumer discretionary, information technology (IT), industrials and health care.

Within the consumer discretionary sector, specialty retailer L Brands, multiline retailer Target and Internet retailer Amazon.com led results. Among IT holdings, communications equipment company Cisco Systems, semiconductor and semiconductor equipment maker Maxim Integrated Products and software firm CA were key contributors. Aerospace and defense firm The Boeing Co.3 and waste management company Republic Services were leading contributors in the industrials sector. Top-performing health care sector holdings included pharmaceuticals firms Pfizer and Eli Lilly & Co. Other standout performers included Starwood Hotels & Resorts Worldwide and investment manager BlackRock.

| | | |

| Top 10 Holdings | | |

| 4/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Microsoft Corp. | 2.3 | % |

| Information Technology | | |

| Cisco Systems Inc. | 2.3 | % |

| Information Technology | | |

| Ford Motor Co. | 2.3 | % |

| Consumer Discretionary | | |

| BlackRock Inc. | 2.2 | % |

| Financials | | |

| L Brands Inc. | 2.2 | % |

| Consumer Discretionary | | |

| NIKE Inc., B | 2.1 | % |

| Consumer Discretionary | | |

| Target Corp. | 2.1 | % |

| Consumer Discretionary | | |

| Starwood Hotels & Resorts Worldwide Inc. | 2.1 | % |

| Consumer Discretionary | | |

| Sanofi, ADR (France) | 2.1 | % |

| Health Care | | |

| JPMorgan Chase & Co. | 2.1 | % |

| Financials | | |

The slowing global economy outside North America and growing production led to excess supply in oil, coal and iron ore and contributed to a decline in commodity prices in 2014’s fourth quarter. This collapse drove a substantial amount of the underperformance in the Fund’s energy and materials sectors. Copper and gold miner Freeport-McMoRan and aluminum producer Alcoa were notable detractors. Energy firms Royal Dutch Shell, Chesapeake Energy, Exxon Mobil and HollyFrontier also posted losses. Other key detractors included hotel and casino operator Wynn Resorts3 and heavy equipment manufacturer Caterpillar.

3. No longer held at period-end.

See www.franklintempletondatasources.com for additional data provider information.

20 | Semiannual Report franklintempleton.com

FRANKLIN EQUITY INCOME FUND

Thank you for your continued participation in Franklin Equity Income Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com Semiannual Report | 21

FRANKLIN EQUITY INCOME FUND

Performance Summary as of April 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | | |

| Net Asset Value | | | | | | | | |

| Share Class (Symbol) | | 4/30/15 | | 10/31/14 | | Change | | |

| A (FISEX) | $ | 23.18 | $ | 23.93 | -$ | 0.75 | | |

| C (FRETX) | $ | 23.05 | $ | 23.79 | -$ | 0.74 | | |

| R (FREIX) | $ | 23.18 | $ | 23.93 | -$ | 0.75 | | |

| R6 (N/A) | $ | 23.20 | $ | 23.95 | -$ | 0.75 | | |

| Advisor (FEIFX) | $ | 23.21 | $ | 23.96 | -$ | 0.75 | | |

| |

| |

| Distributions (11/1/14–4/30/15) | | | | | | | | |

| | | Dividend | | Short-Term | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Capital Gain | | Total |

| A | $ | 0.4594 | $ | 0.2690 | $ | 0.7955 | $ | 1.5239 |

| C | $ | 0.3714 | $ | 0.2690 | $ | 0.7955 | $ | 1.4359 |

| R | $ | 0.4301 | $ | 0.2690 | $ | 0.7955 | $ | 1.4946 |

| R6 | $ | 0.5025 | $ | 0.2690 | $ | 0.7955 | $ | 1.5670 |

| Advisor | $ | 0.4888 | $ | 0.2690 | $ | 0.7955 | $ | 1.5533 |

22 | Semiannual Report

franklintempleton.com

FRANKLIN EQUITY INCOME FUND

PERFORMANCE SUMMARY

Performance as of 4/30/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | | | |

| | | | | | | Value of | Average Annual | | | | | |

| | | | | | | | | | Total Annual Operating Expenses6 | |

| | Cumulative | | Average Annual | | $ | 10,000 | Total Return | | | | | |

| Share Class | Total Return2 | | Total Return3 | | | Investment4 | (3/31/15 | )5 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 0.87 | % | 0.87 | % |

| 6-Month | +3.50 | % | -2.45 | % | $ | 9,755 | | | | | | |

| 1-Year | +7.36 | % | +1.19 | % | $ | 10,119 | +0.88 | % | | | | |

| 5-Year | +76.99 | % | +10.78 | % | $ | 16,685 | +10.96 | % | | | | |

| 10-Year | +81.48 | % | +5.52 | % | $ | 17,106 | +5.27 | % | | | | |

| C | | | | | | | | | 1.62 | % | 1.62 | % |

| 6-Month | +3.18 | % | +2.21 | % | $ | 10,221 | | | | | | |

| 1-Year | +6.60 | % | +5.60 | % | $ | 10,560 | +5.27 | % | | | | |

| 5-Year | +70.49 | % | +11.26 | % | $ | 17,049 | +11.45 | % | | | | |

| 10-Year | +68.48 | % | +5.35 | % | $ | 16,848 | +5.11 | % | | | | |

| R | | | | | | | | | 1.12 | % | 1.12 | % |

| 6-Month | +3.37 | % | +3.37 | % | $ | 10,337 | | | | | | |

| 1-Year | +7.09 | % | +7.09 | % | $ | 10,709 | +6.76 | % | | | | |

| 5-Year | +74.66 | % | +11.80 | % | $ | 17,466 | +11.99 | % | | | | |

| 10-Year | +76.78 | % | +5.86 | % | $ | 17,678 | +5.62 | % | | | | |

| R6 | | | | | | | | | 0.50 | % | 1.78 | % |

| 6-Month | +3.69 | % | +3.69 | % | $ | 10,369 | | | | | | |

| 1-Year | +7.75 | % | +7.75 | % | $ | 10,775 | +7.41 | % | | | | |

| Since Inception (5/1/13) | +29.70 | % | +13.91 | % | $ | 12,970 | +13.89 | % | | | | |

| Advisor7 | | | | | | | | | 0.62 | % | 0.62 | % |

| 6-Month | +3.63 | % | +3.63 | % | $ | 10,363 | | | | | | |

| 1-Year | +7.63 | % | +7.63 | % | $ | 10,763 | +7.34 | % | | | | |

| 5-Year | +79.28 | % | +12.38 | % | $ | 17,928 | +12.58 | % | | | | |

| 10-Year | +84.82 | % | +6.33 | % | $ | 18,482 | +6.09 | % | | | | |

| | | | | | | |

| | | | 30-Day Standardized Yield9 | |

| | Distribution | | | | | |

| Share Class | Rate8 | | (with waiver) | | (without waiver) | |

| A | 1.90 | % | 2.10 | % | 2.10 | % |

| C | 1.31 | % | 1.49 | % | 1.49 | % |

| R | 1.78 | % | 1.98 | % | 1.98 | % |

| R6 | 2.37 | % | 2.60 | % | 2.60 | % |

| Advisor | 2.26 | % | 2.48 | % | 2.48 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com Semiannual Report | 23

FRANKLIN EQUITY INCOME FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price and debt securities when the underlying stock price is low relative to the conversion price. The Fund’s investment in foreign securities also involves special risks, including currency fluctuations and economic as well as political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| | |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Class R6 has a fee waiver contractually guaranteed through at least 2/29/16. Fund investment results reflect the fee waivers, to the extent applicable; without these

reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s

maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08, actual Advisor Class performance is used reflecting

all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were

+55.35% and +6.53%.

8. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C, R, R6 and Advisor) per share

on 4/30/15.

9. The 30-day standardized yield for the 30 days ended 4/30/15 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends

paid to shareholders) or the income reported in the Fund’s financial statements.

24 | Semiannual Report franklintempleton.com

FRANKLIN EQUITY INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com

Semiannual Report | 25

| | | | | | | |

| FRANKLIN EQUITY INCOME FUND | | | | | | |

| YOUR FUND’S EXPENSES | | | | | | |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/14 | | Value 4/30/15 | | Period* 11/1/14–4/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,035.00 | $ | 4.39 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.48 | $ | 4.36 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,031.80 | $ | 8.16 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.76 | $ | 8.10 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,033.70 | $ | 5.65 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.24 | $ | 5.61 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,036.90 | $ | 2.53 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.32 | $ | 2.51 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,036.30 | $ | 3.13 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.72 | $ | 3.11 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.87%;

C: 1.62%; R: 1.12%; R6: 0.50%; and Advisor: 0.62%), multiplied by the average account value over the period, multiplied by 181/365 to

reflect the one-half year period.

26 | Semiannual Report

franklintempleton.com

Franklin Real Return Fund

This semiannual report for Franklin Real Return Fund covers the period ended April 30, 2015.

Your Fund’s Goal and Main Investments

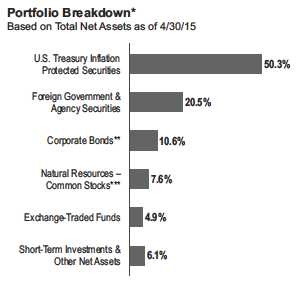

The Fund seeks to achieve total return that exceeds the rate of inflation over an economic cycle. The Fund will generally invest a substantial portion of its assets in inflation-protected securities. The managers also have the flexibility to invest in other sectors of the market to increase real return (total return less inflation) potential and offer greater diversification.

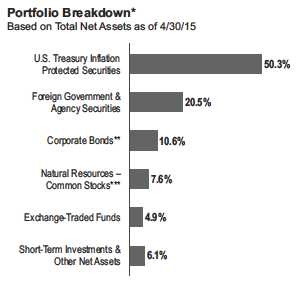

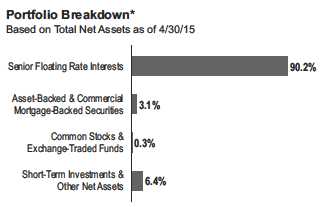

*Figures reflect certain derivatives held in the portfolio (or their underlying

reference assets) and may not total 100% or may be negative due to rounding,

use of any derivatives, unsettled trades or other factors.

**Includes Senior Floating Rate Interests.

***In the SOI, the natural resources sector comprises energy and materials.

Performance Overview

For the six months under review, the Fund’s Class A shares had a -1.69% cumulative total return. In comparison, the Barclays U.S. TIPS Index, which tracks the universe of inflation-protected notes issued by the U.S. Treasury that have at least one year to final maturity, posted a +1.28% total return.1 Also for comparison, the Consumer Price Index (CPI) for Urban Consumers (All Items) NSA (non-seasonally adjusted), a measure of the average change in prices of all goods and services purchased for consumption by urban householders, declined 0.35% for the same period.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 29.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We seek to allocate assets among investments to achieve the highest level of real return (total return less the rate of inflation) consistent with an acceptable level of risk. We will allocate the Fund’s assets among securities in various market sectors based on our assessment of changing economic, global market, industry and issuer conditions. When making our investment decisions, we use a “top-down” analysis of macroeconomic trends combined with a “bottom-up” fundamental analysis of market sectors, industries and issuers to try to take advantage of varying sector reactions to economic events. We will evaluate such criteria as country risk, business cycles, yield curves, and values between and within markets.

Manager’s Discussion

The economy grew slowly during the period. Growth in the fourth quarter of 2014 stemmed from greater spending by consumers, businesses, and state and local governments. Economic activity moderated in 2015’s first quarter, however, partly because of an ongoing energy price collapse, shrinking exports and weaker business spending. Despite the slowdown, home prices and sales increased while mortgage rates fell.

Near period-end, the Fed noted it expected economic activity would expand at a moderate pace with appropriate policy accommodation. The Fed also stated it would raise interest rates when inflation and employment data met its expectations.

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

2. Source: Bureau of Labor Statistics, bls.gov/cpi.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 66.

franklintempleton.com Semiannual Report | 27

| | | | | |

| FRANKLIN REAL RETURN FUND | | |

| |

| |

| Dividend Distributions* | | | |

| 11/1/14–4/30/15 | | | | |

| | | Dividend per Share (cents) | |

| | | | | Advisor |

| Month | Class A | Class C | Class R6 | Class |

| November | 1.34 | 1.03 | 1.64 | 1.54 |

| December | 5.64 | 5.31 | 6.01 | 5.88 |

| January** | — | — | — | — |

| February** | — | — | — | — |

| March** | — | — | — | — |

| April** | — | — | — | — |

| Total | 6.98 | 6.34 | 7.65 | 7.42 |

*All Fund distributions will vary depending upon current market conditions, and past

distributions are not indicative of future trends.

**The Fund paid no dividends due to negative inflation adjustments for TIPS, which

are the Fund’s primary investments.

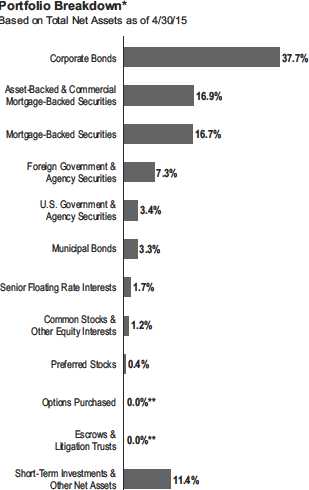

We invested the Fund’s assets in the allowable sectors during the period under review. At period-end, half of total net assets were invested in Treasury Inflation Protected Securities (TIPS). For diversification, we also allocated the Fund’s assets to foreign government and agency securities, senior secured floating rate loans, natural resources, exchange-traded funds and short-term investments. We employed a non-U.S. dollar strategy to help hedge against potential U.S. dollar weakness versus certain currencies and concentrated our TIPS holdings in shorter maturities.

During the period, we increased the Fund’s allocations to foreign government debt securities and TIPS. In contrast, we decreased the Fund’s allocations in real estate investment trusts (REITs) and natural resources. Our allocations to high yield corporate credit and corporate loans remained about the same. The Fund’s heaviest allocations were in TIPS and foreign government debt securities.

The Fund’s investments in foreign government bonds and REITs helped results. In contrast, the Fund’s positions in non-U.S. dollar holdings, natural resources stocks and TIPS hindered Fund performance.

Thank you for your continued participation in Franklin Real Return Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

28 | Semiannual Report franklintempleton.com

FRANKLIN REAL RETURN FUND

Performance Summary as of April 30, 2015