| 1

Semiannual Report

Economic and Market Overview

Modest growth for the U.S. economy, as measured by gross domestic product, characterized the six-month period ended April 30, 2013. Increasing job creation helped the unemployment rate decline during the period, and consumer spending remained strong. In the housing sector, accelerating new and existing homes sales accompanied record-low mortgage rates, affordable housing prices, low new-home inventories and a five-year low in U.S. foreclosures. Orders for manufactured goods and manufacturers’ inventory reached record levels in February and the sector expanded for the fifth consecutive month through period-end.

Businesses and investors awaited the U.S. election that resulted in an unchanged balance of power in Washington, given the re-election of President Obama and respective control of the House and Senate by Republicans and Democrats. Uncertainty surrounding budget deadlines set for the end of 2012 largely abated when an agreement between Congress and the President resolved many issues, including preserving lower income tax rates for most U.S. households. Concerns remained about the effects of the expired payroll tax cut, far-reaching federal spending cuts and future negotiations regarding the federal debt ceiling.

U.S. stocks generated healthy returns as the Standard & Poor’s® 500 Index and Dow Jones Industrial Average reached all-time highs near period-end.1 Rising corporate profits and generally favorable economic data bolstered investor confidence, but some caution surrounded the extent to which positive business and market results were dependent on the Federal Reserve Board’s accommodative monetary policy. The 10-year U.S. Treasury yield declined to 1.70% at period-end from 1.72% on October 31, 2012.

The foregoing information reflects our analysis and opinions as of April 30, 2013. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable

1. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC.

Semiannual Report | 3

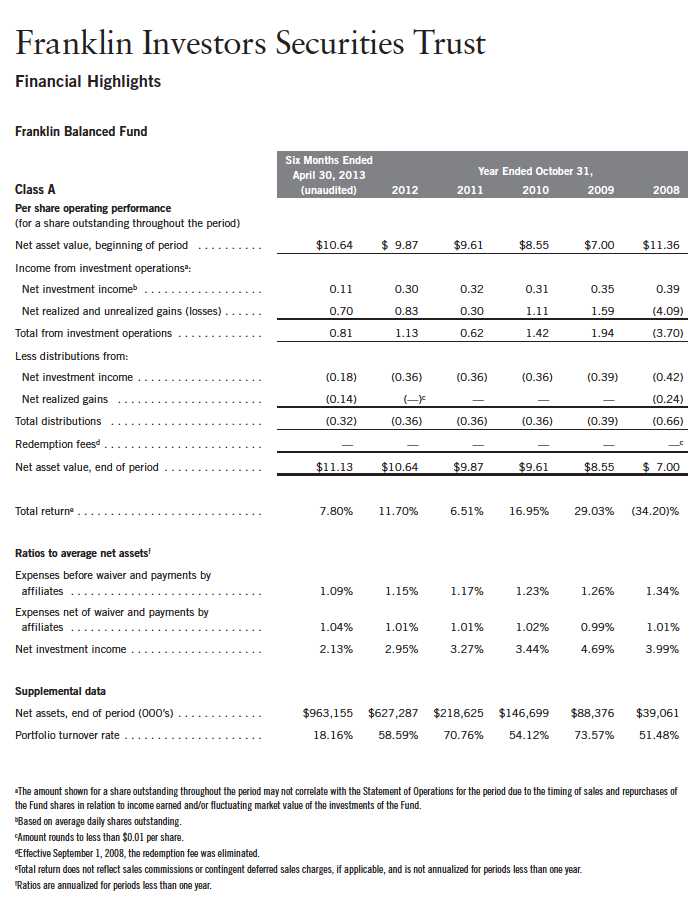

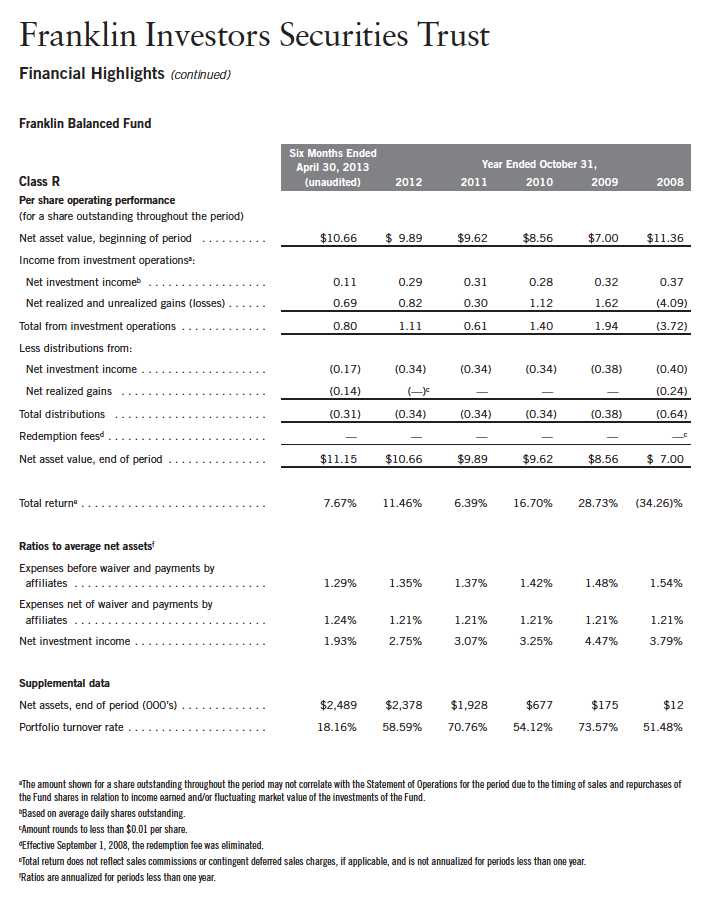

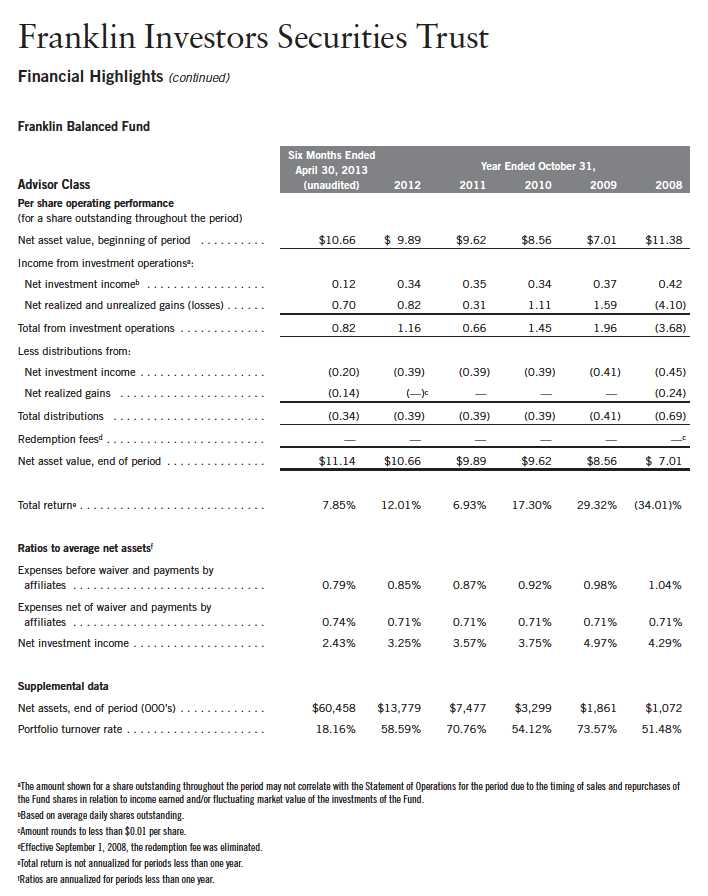

Franklin Balanced Fund

Your Fund’s Goal and Main Investments: Franklin Balanced Fund seeks both income and capital appreciation by investing in a combination of stocks, convertible securities and debt securities. The Fund will normally invest at least 25% of its total assets in equity securities (primarily common and preferred stock) and at least 25% of its total assets in debt securities, including bonds, notes, debentures and money market securities.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Balanced Fund covers the period ended April 30, 2013.

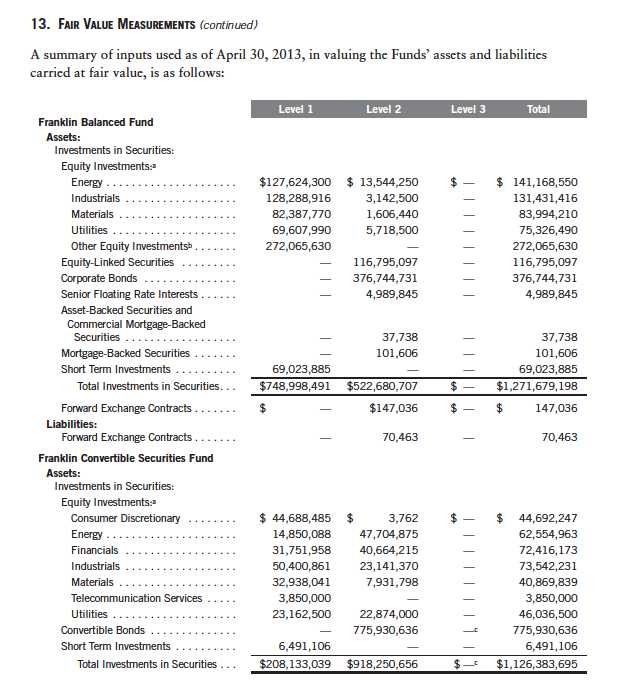

Performance Overview

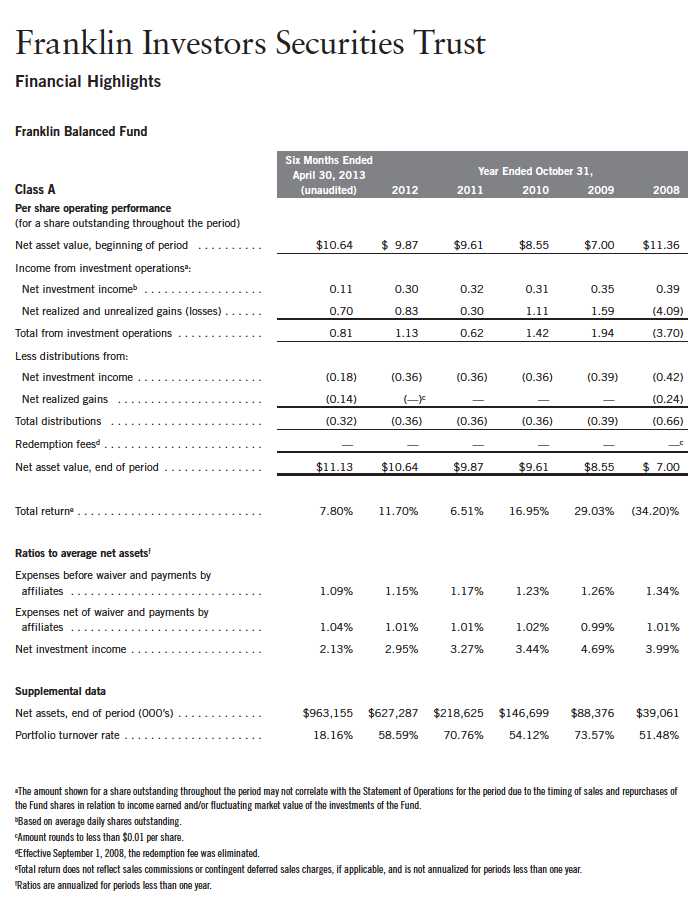

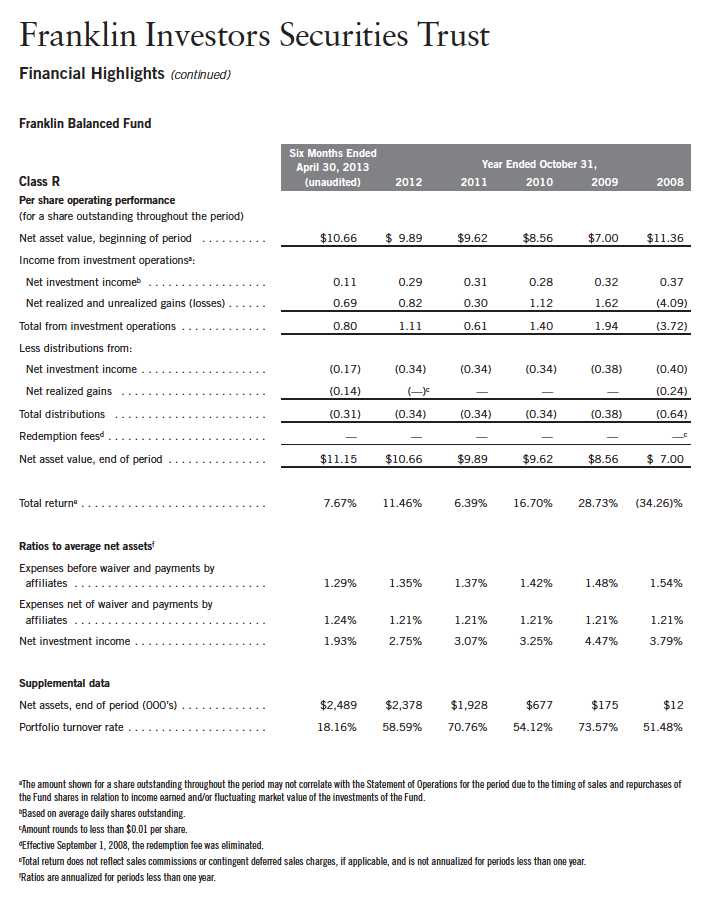

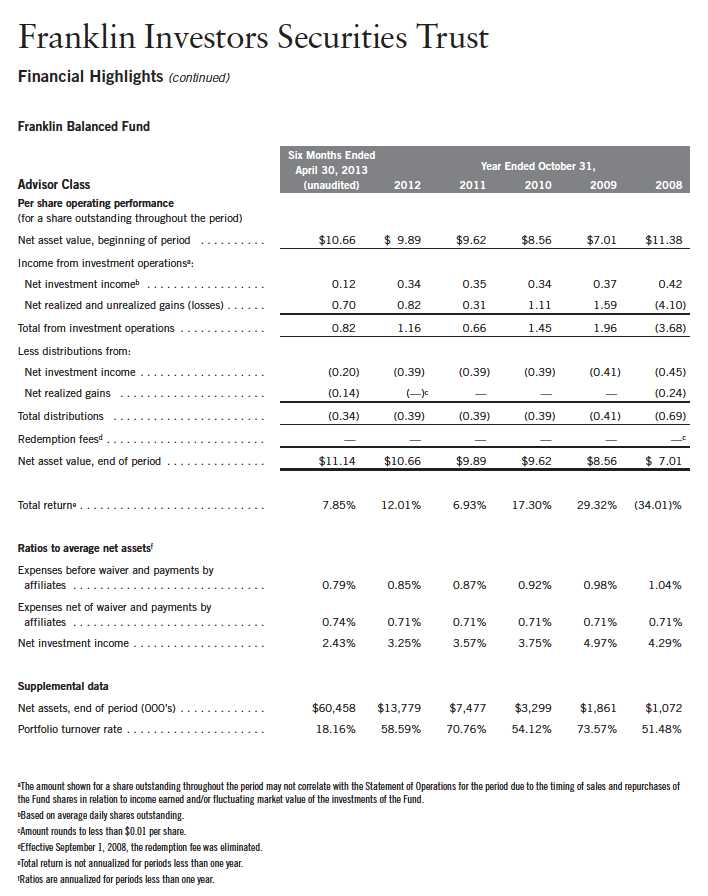

For the six months under review, Franklin Balanced Fund – Class A delivered a +7.80% cumulative total return. The Fund’s equity benchmark, the Standard & Poor’s 500 Index (S&P 500®), which is a broad measure of U.S. stock performance, posted a +14.42% total return.1 The Fund’s fixed income benchmark, the Barclays U.S. Aggregate Index, which tracks the U.S. investment-grade, taxable bond market, returned +0.90%.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Investment Strategy

We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins and liquidation value. In determining an optimal mix of equity and fixed income investments for the Fund, we assess changing economic, market and industry conditions. We may sell securities for a number of possible reasons, including the achievement of certain stock prices or credit spreads, changes in the fundamental outlook or risk/reward profile of a security, less attractive values relative to market peers, or broad economic conditions affecting certain fixed income sectors.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 50.

4 | Semiannual Report

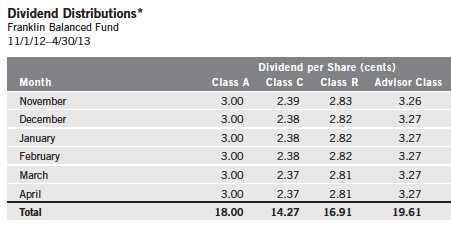

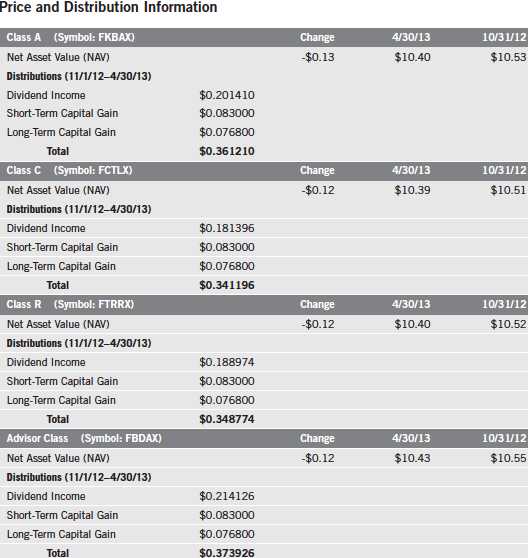

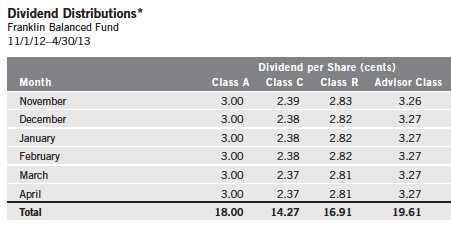

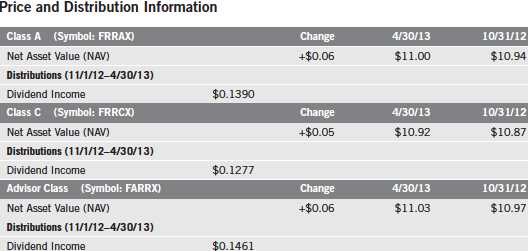

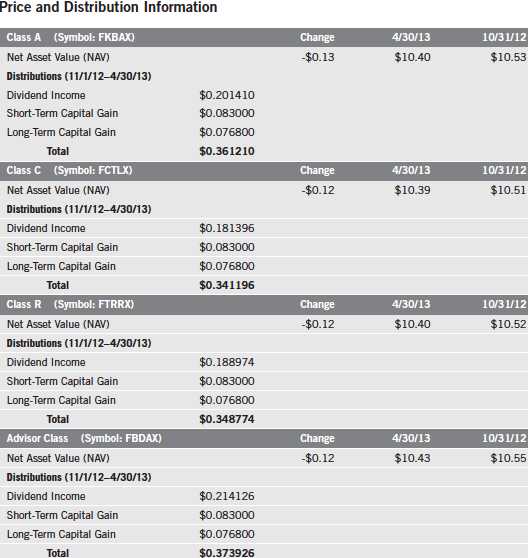

*All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Manager’s Discussion

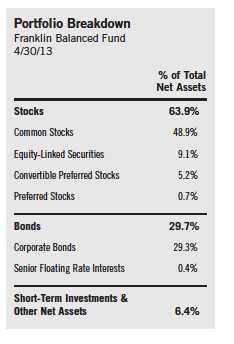

During the six months under review, the Fund’s equity and fixed income holdings generally delivered strong performance. Low long-term interest rates and tight corporate credit spreads dampened our enthusiasm for fixed income securities, however, as such securities were less able to provide what we considered to be attractive total returns. In this environment, stocks outperformed fixed income markets and led us to shift our allocation toward equities.

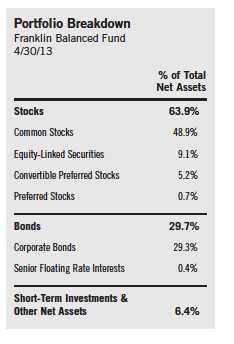

The Fund’s equity exposure increased during the period to 63.9% from 61.6% of total net assets, reflecting our view that relative value swung in favor of equities and away from fixed income securities. The Fund’s total fixed income exposure decreased to 29.7% from 31.1% of total net assets. The Fund’s cash position decreased during the period to 6.4% from 7.3% of total net assets. The Fund’s assets under management increased significantly.

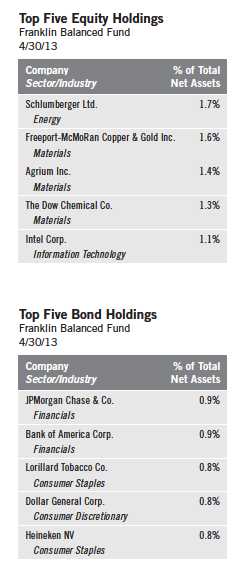

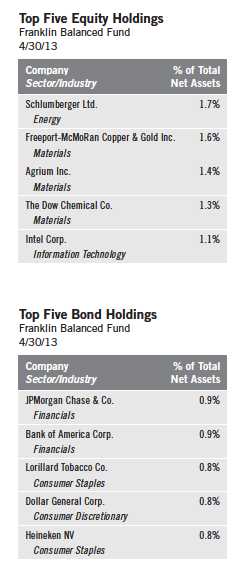

The Fund’s equity sectors remained well diversified, with our largest weightings in energy, materials and industrials at period-end. The industrials, consumer discretionary, utilities and consumer staples sectors were top contributors. In contrast, the materials sector detracted from performance, largely because of investor fears of potential slowdowns in the Chinese and global economies.

Semiannual Report | 5

The Fund’s top individual equity contributors were a diverse group of companies with high-quality characteristics including strong balance sheets, name recognition, and dividend yields and dividend growth potential we considered attractive. They included Texas Instruments, NIKE, Boeing, Kellogg and E. I. du Pont de Nemours and Co. In contrast, mining stocks in the materials sector including Barrick Gold, Newmont Mining and AngloGold Ashanti hurt portfolio performance because of falling commodity prices and concerns regarding the industry’s ability to generate better returns on its investments going forward. We maintained our investments in the materials sector as we believed these companies could deliver positive returns over the longer term. The Fund’s positions in Walter Energy and Peabody Energy were hurt by weakening demand for coal during the period.

The Fund’s fixed income sectors generally delivered positive returns, led by energy, banking and basic industry.2 Plains Exploration & Production was a top individual contributor. Our position in the independent oil and gas producer advanced after Freeport-McMoRan Copper & Gold announced it would acquire the company. The Fund’s position in ArcelorMittal (sold by period-end) benefited performance after it took steps to shore up its balance sheet, most notably a sale of common stock and convertible securities that raised a substantial amount of equity. The Fund’s position in Chesapeake Energy performed well following management changes that investors believed could improve the company’s financial discipline and credit rating. In contrast, our position in oil and gas company Apache lost value largely because of a general downturn in the power market.

The portfolio utilized derivatives such as equity options. Equity options are used to hedge against market risk, to earn income, to gain or increase exposure to certain equity securities or segments of the equity markets, or to otherwise enhance Fund returns.

2. Banking holdings are in financials in the SOI. Basic industry holdings are in energy and materials in the SOI.

6 | Semiannual Report

Thank you for your continued participation in Franklin Balanced Fund.

We look forward to serving your future investment needs.

Semiannual Report | 7

Performance Summary as of 4/30/13

Franklin Balanced Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

8 | Semiannual Report

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 9

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Fund investment results reflect past expense reductions, without which the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C, R and

Advisor) per share on 4/30/13.

7. The 30-day standardized yield for the 30 days ended 4/30/13 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

8. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

10 | Semiannual Report

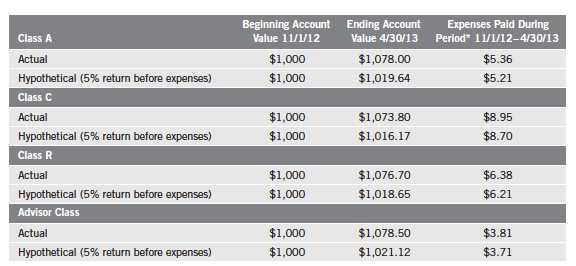

Your Fund’s Expenses

Franklin Balanced Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 11

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.04%; C: 1.74%; R: 1.24%; and Advisor: 0.74%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

12 | Semiannual Report

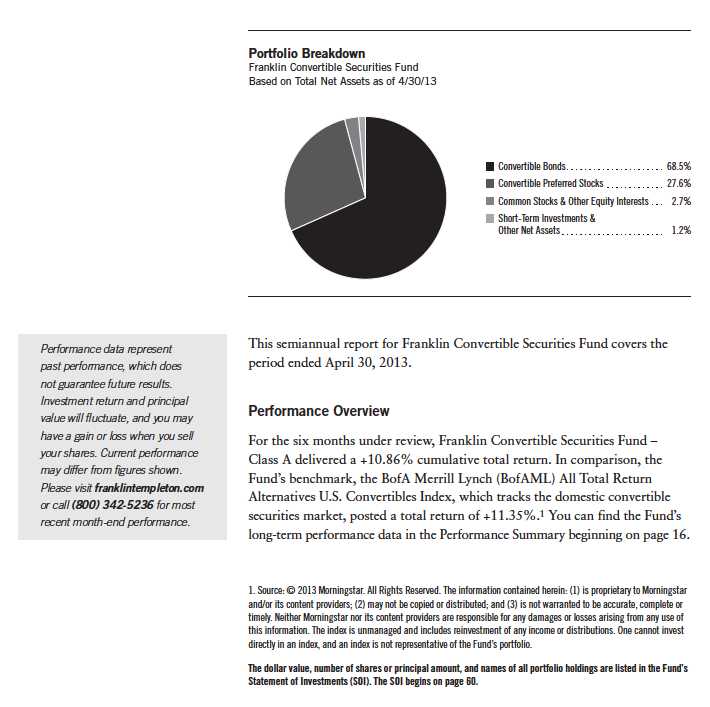

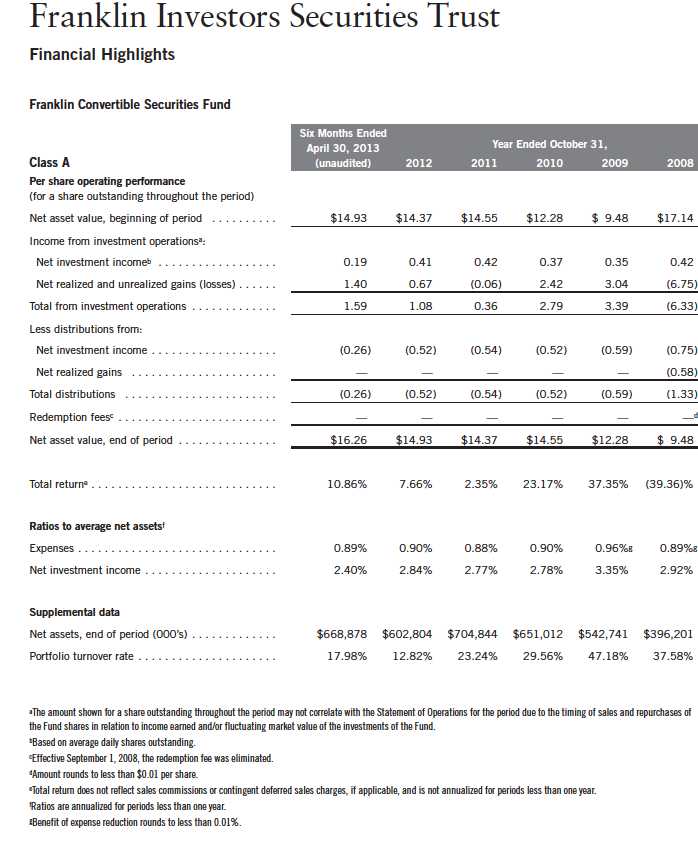

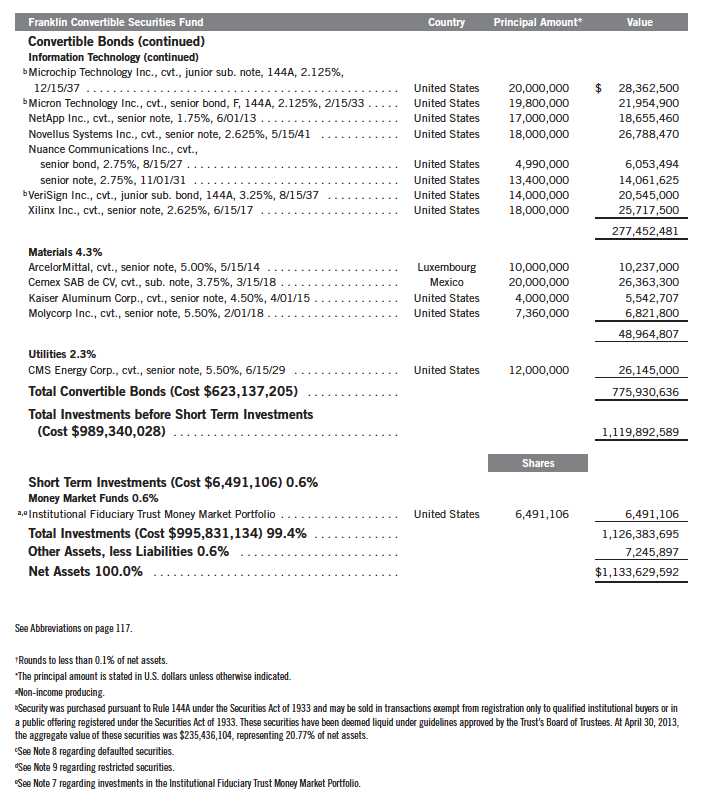

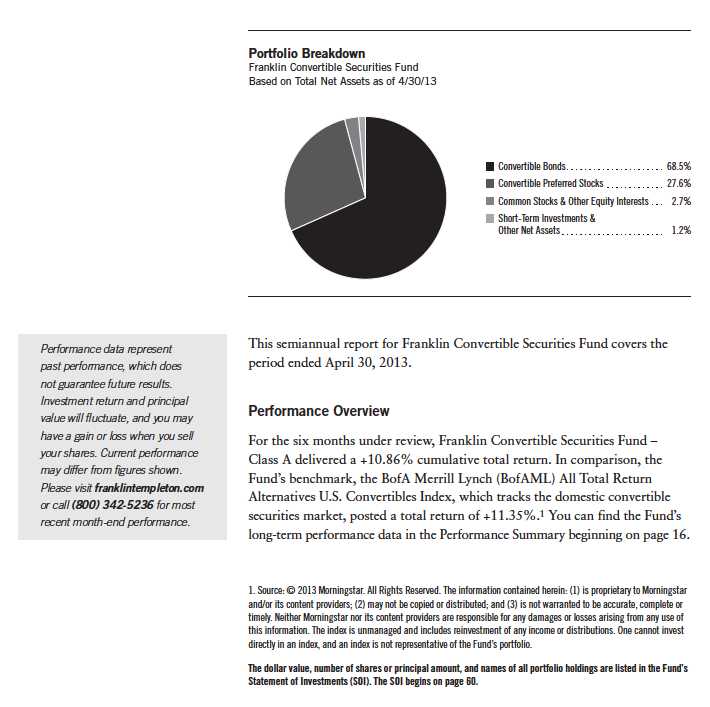

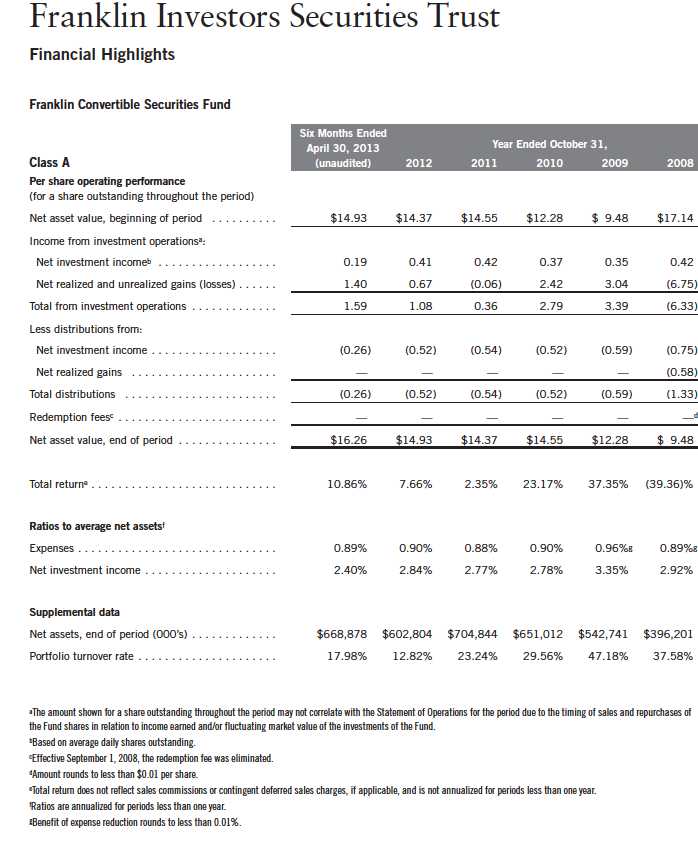

Franklin Convertible Securities Fund

Your Fund’s Goal and Main Investments: Franklin Convertible Securities Fund seeks to maximize total return, consistent with reasonable risk, by seeking to optimize capital appreciation and high current income under varying market conditions and investing at least 80% of its net assets in convertible securities.

Semiannual Report | 13

Investment Strategy

We follow a strategy of maintaining a balance in the portfolio between the equity and debt characteristics of convertible securities with an emphasis on the equity features. Convertible securities are attractive for two reasons: the opportunity to participate in common stocks’ potential growth with relatively reduced volatility, and the potential for current income with potential downside protection from bonds. Typically we sell securities whose equity sensitivity becomes too high and no longer offers appropriate downside protection. Likewise, as securities become too bond-like — reducing their ability to appreciate with increases in the underlying common stock — we attempt to redeploy those assets into more balanced convertible securities and maintain the potential for the Fund’s upside participation. Our experienced team of analysts searches for investment opportunities among all economic sectors and considers a company’s long-term earnings, asset value and cash flow potential, to create a broadly diversified portfolio.

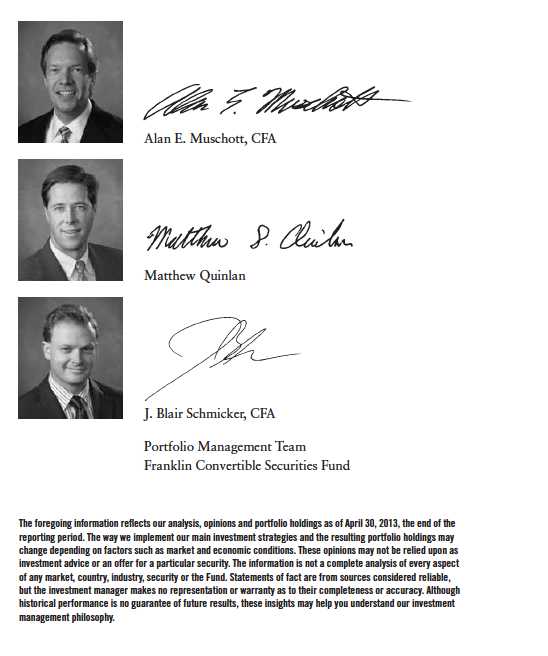

Manager’s Discussion

Most sectors the Fund invested in rose in value, supporting overall performance during the six months under review. Investments in the health care, information technology (IT), financials and consumer discretionary sectors accounted for the bulk of the Fund’s total return. Within health care, the Fund’s holdings of biotechnology and pharmaceuticals convertible bonds enjoyed some of the largest gains. Top performers in the sector included Biomarin Pharmaceutical, a maker of innovative drugs, and Gilead Sciences, which specializes in developing antiviral and cardiopulmonary drugs. In IT, semiconductor equipment manufacturer Lam Research (Novellus Systems in the SOI) and Alliance Data Systems, which provides data-driven loyalty marketing solutions, were strong performers. Within financials, investment manager holding company Affiliated Managers Group’s convertible preferred stock was a top contributor. Other standout holdings included convertible bonds of Mexico-based building materials supplier and cement producer Cemex and Michigan-based electric and gas utility CMS Energy.

Despite the Fund’s positive results this reporting period, there were a few disappointments in the portfolio. Our materials and energy holdings detracted from performance as these sectors fell largely out of favor among investors. On an individual security basis, key detractors included convertible preferred stock of AngloGold Ashanti Holdings Finance and Cliffs Natural Resources as well as James River Coal convertible bonds.

14 | Semiannual Report

Thank you for your continued participation in Franklin Convertible Securities Fund. We look forward to serving your future investment needs.

Semiannual Report | 15

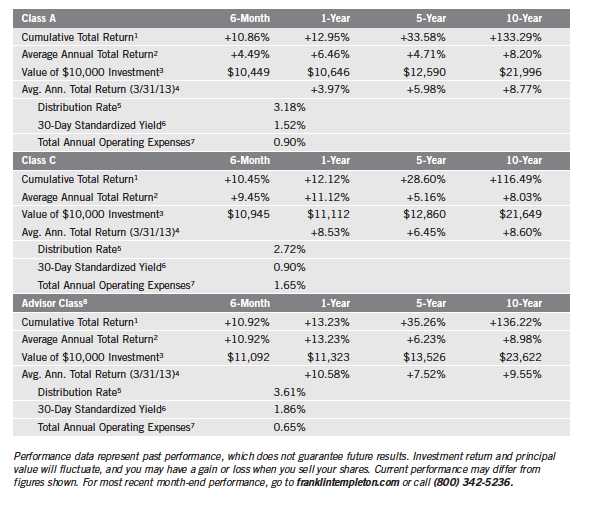

Performance Summary as of 4/30/13

Franklin Convertible Securities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

16 | Semiannual Report

Performance Summary (continued)

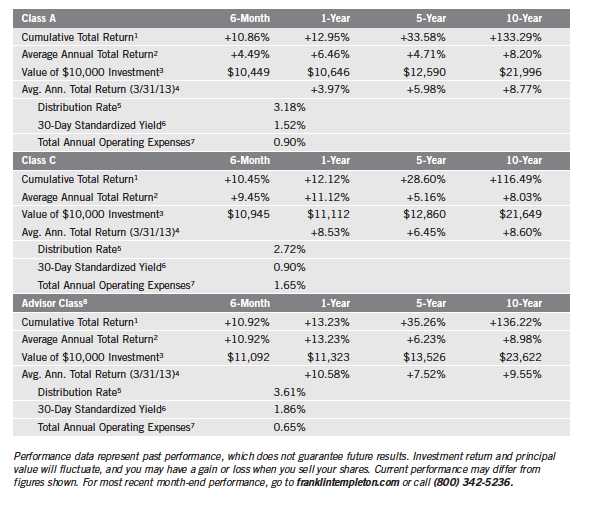

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Semiannual Report | 17

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund may invest in high yielding, fixed income securities. High yields reflect the higher credit risk associated with these lower rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund may also invest in foreign securities, which involve special risks, including political uncertainty and currency volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on the sum of the respective class’s last four quarterly dividends and the maximum offering price (NAV for Classes C

and Advisor) per share on 4/30/13.

6. The 30-day standardized yield for the 30 days ended 4/30/13 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

8. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations

for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A

performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for peri-

ods after 5/15/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement

of sales), the cumulative and average annual total returns of Advisor Class shares were +31.80% and +5.73%.

18 | Semiannual Report

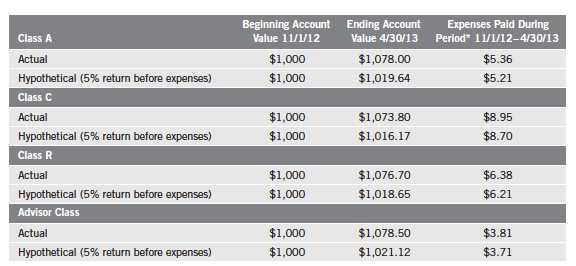

Your Fund’s Expenses

Franklin Convertible Securities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 19

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.89%; C: 1.64%; and Advisor: 0.64%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

20 | Semiannual Report

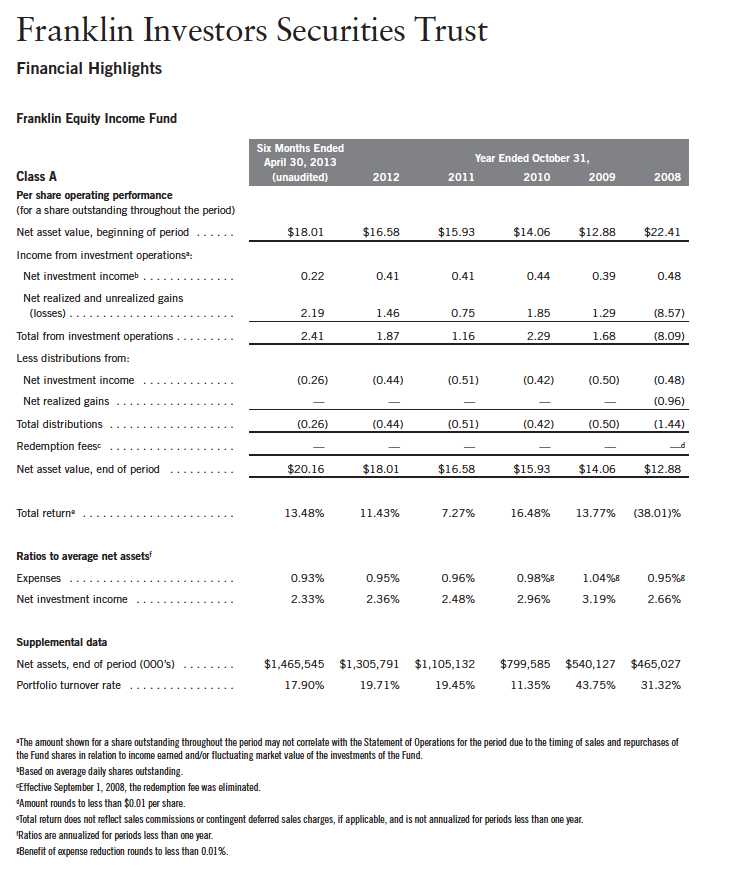

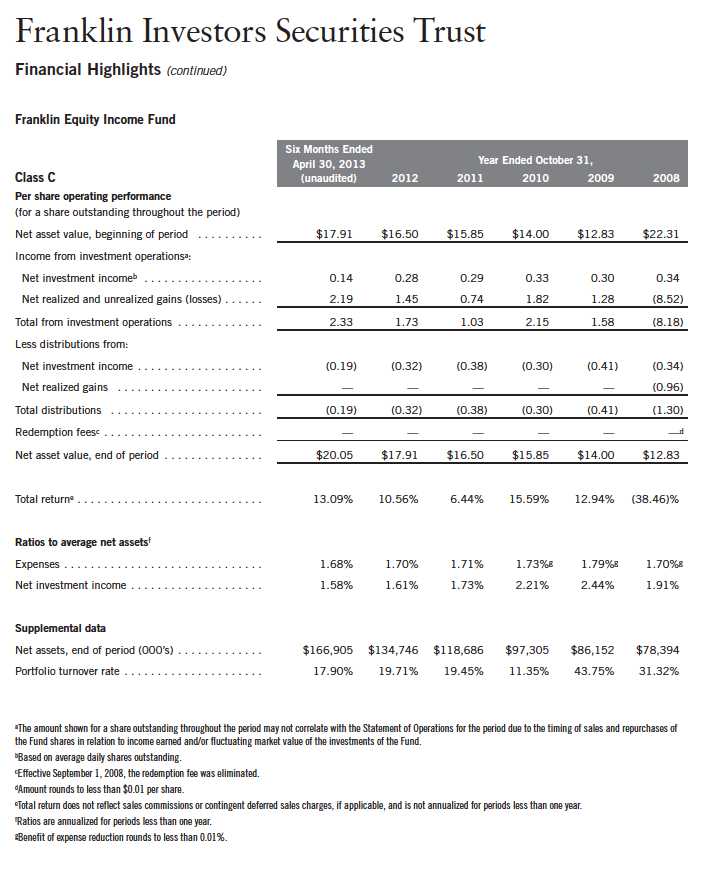

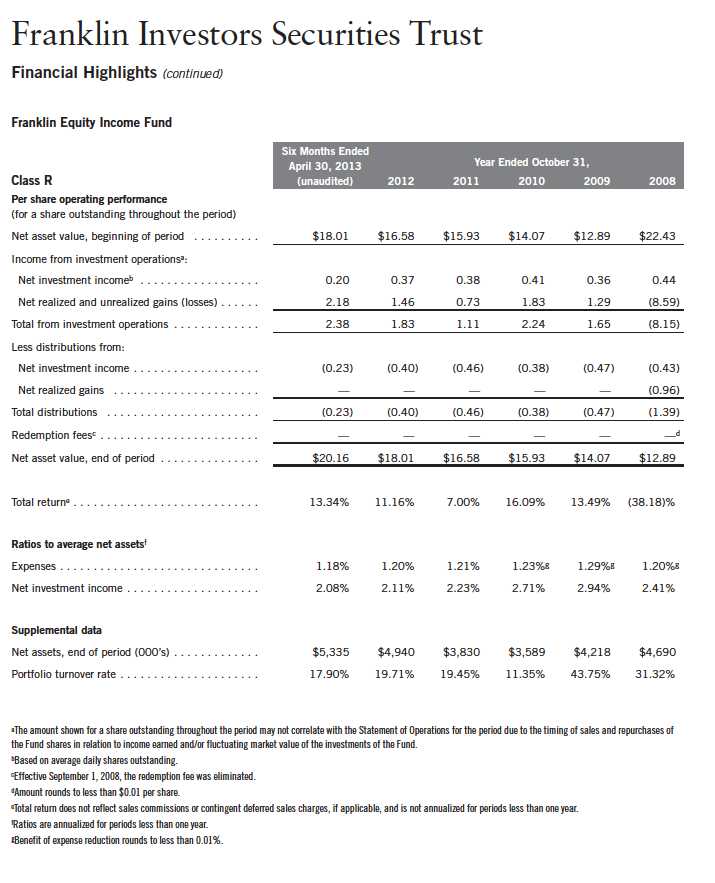

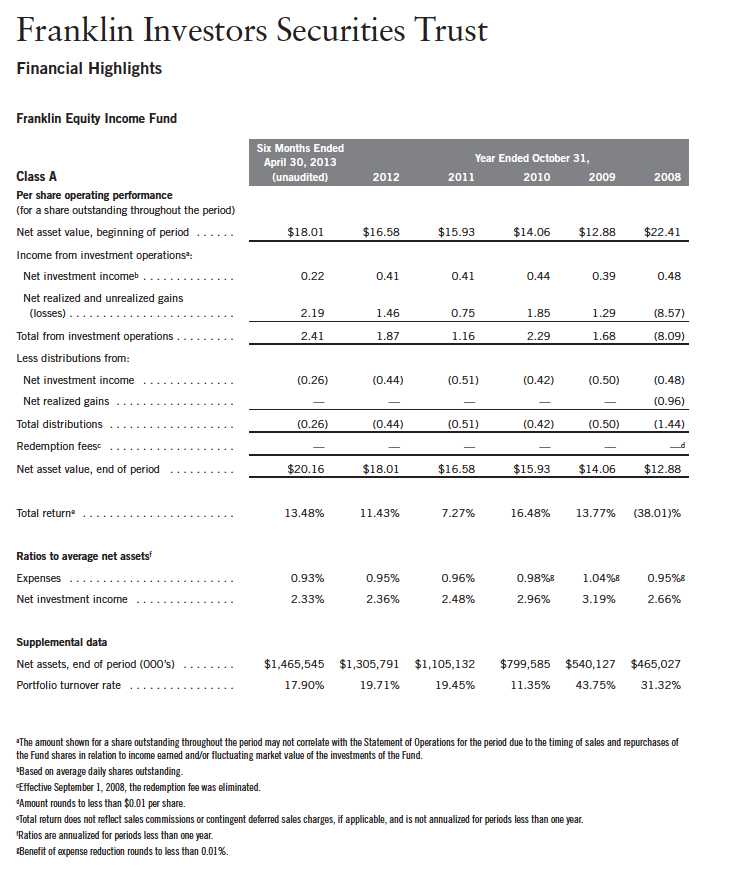

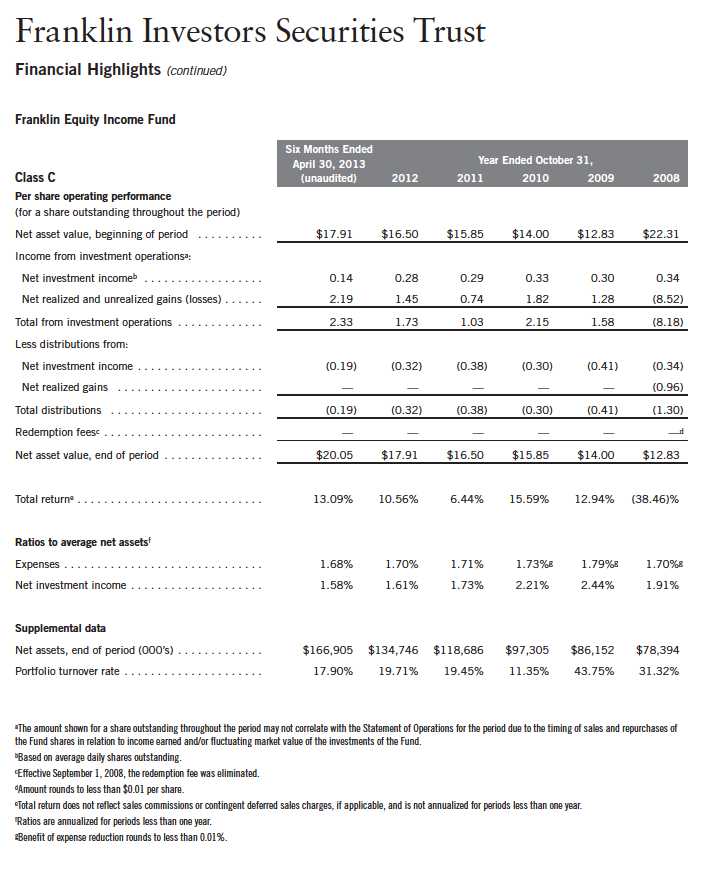

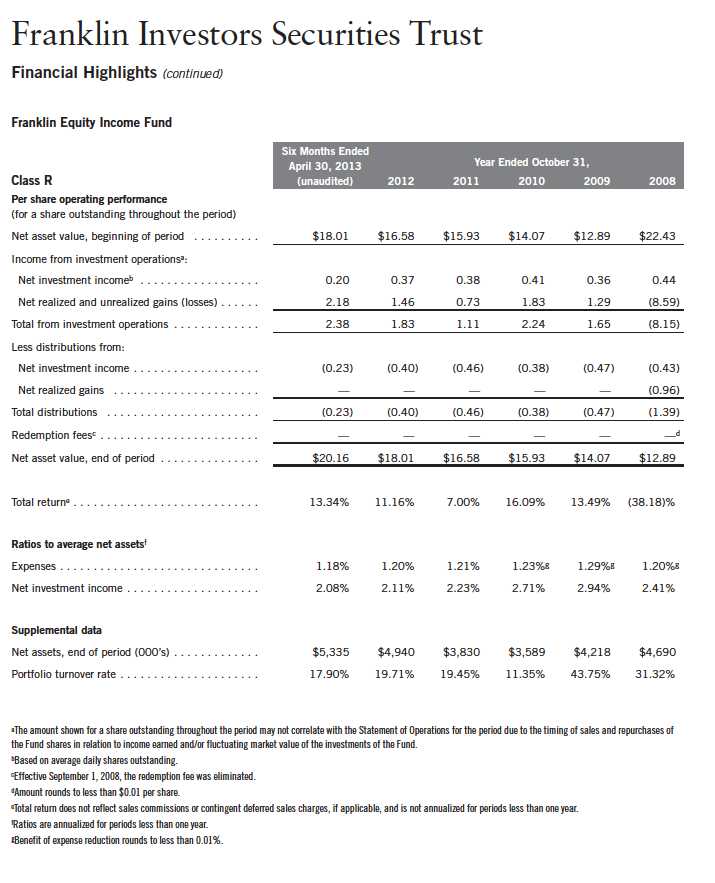

Franklin Equity Income Fund

Your Fund’s Goal and Main Investments: Franklin Equity Income Fund seeks to maximize total return, emphasizing high current income and long-term capital appreciation, consistent with reasonable risk, by investing at least 80% of its net assets in equity securities including securities convertible into common stocks.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Equity Income Fund covers the period ended April 30, 2013.

Performance Overview

For the six months under review, Franklin Equity Income Fund – Class A delivered a +13.48% cumulative total return. In comparison, the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market, generated a +14.42% total return.1 The Fund’s peers, as measured by the Lipper Equity Income Funds Classification Average, which consists of funds chosen by Lipper that seek relatively high current income and growth of income by investing at least 60% of their portfolios in stocks, posted a +14.08% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 24.

Investment Strategy

We seek to invest in a broadly diversified portfolio of equity securities that we consider to be financially strong, with a focus on “blue chip” companies. We apply a bottom-up approach to investing in individual securities. We will assess the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins, balance sheet and liquidation value. We consider dividend yield in selecting stocks for the Fund because we

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. Source: Lipper Inc. For the six-month period ended 4/30/13, this category consisted of 374 funds. Lipper calculations do not include sales charges, or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 67.

Semiannual Report | 21

* All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

** Includes an additional 4.63 cent per share distribution to meet excise tax requirements.

believe that, over time, dividend income can contribute significantly to total return and can be a more consistent source of investment return than capital appreciation. We seek to take advantage of price dislocations that result from the market’s short-term focus and choose to invest in those companies that, in our opinion, offer the best trade-off between growth opportunity, business and financial risk, and valuation.

Manager’s Discussion

Nearly every sector the Fund invested in rose in value, as did most of the portfolio’s individual securities, supporting overall performance during the six months under review. Key contributing sectors included financials, industrials, consumer discretionary and consumer staples. Many of the Fund’s positions in capital markets, diversified financial services and insurance companies such as BlackRock, JPMorgan Chase, Bank of America and Aflac were strong performers. Among industrials, leading performers included aerospace firm Boeing, conglomerates Honeywell International and 3M (sold by period-end), and waste management company Republic Services. In consumer discretionary, athletic equipment and apparel manufacturer NIKE and restaurant chain McDonald’s led results. In the consumer staples sector, food products company Kellogg and beverage firm PepsiCo were key contributors.

Despite the Fund’s positive results this reporting period, there were a few disappointments in the portfolio. Our materials sector holdings detracted from performance as prices of several commodities fell during the period. On an individual security basis, key detractors included positions in mining firms,

22 | Semiannual Report

such as AngloGold Ashanti Holdings Finance convertible preferred stock and a Freeport-McMoRan Copper & Gold equity-linked security. An Apple equity-linked security further hurt Fund performance.

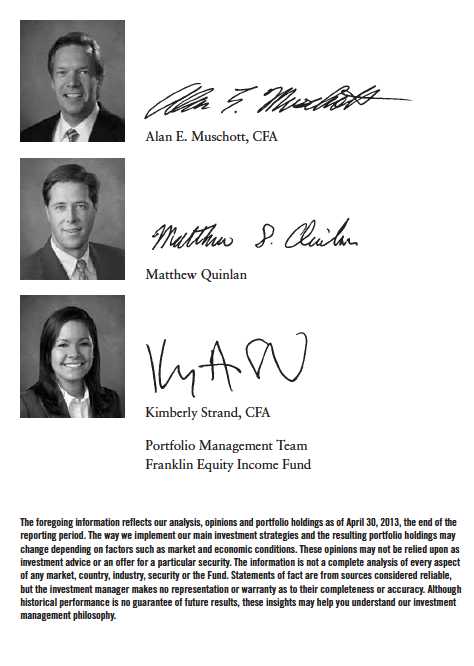

Thank you for your continued participation in Franklin Equity Income Fund.

We look forward to serving your future investment needs.

Semiannual Report | 23

Performance Summary as of 4/30/13

Franklin Equity Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

24 | Semiannual Report

Performance Summary (continued)

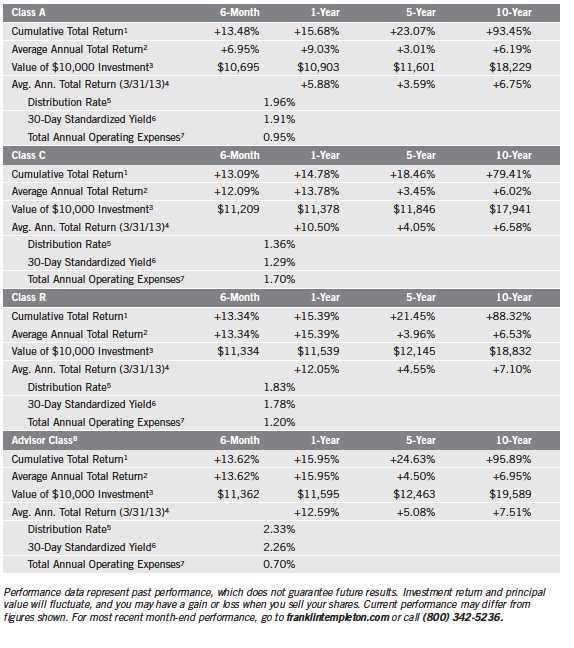

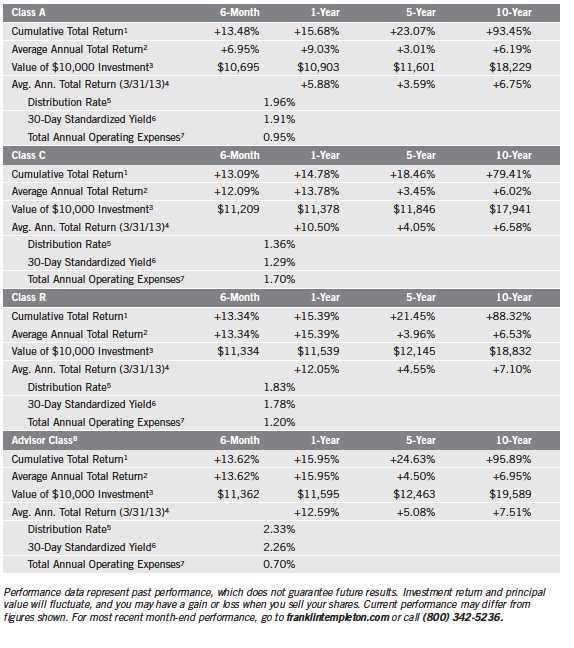

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Semiannual Report | 25

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investment in foreign securities also involves special risks, including currency fluctuations and economic as well as political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C, R and

Advisor) per share on 4/30/13.

6. The 30-day standardized yield for the 30 days ended 4/30/13 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

8. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations

for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A

performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for peri-

ods after 5/15/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement

of sales), the cumulative and average annual total returns of Advisor Class shares were +21.04% and +3.93%.

26 | Semiannual Report

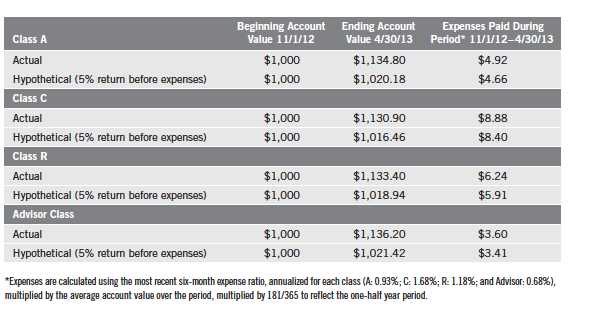

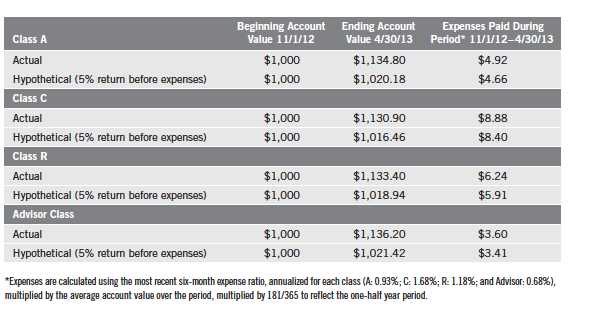

Your Fund’s Expenses

Franklin Equity Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 27

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

28 | Semiannual Report

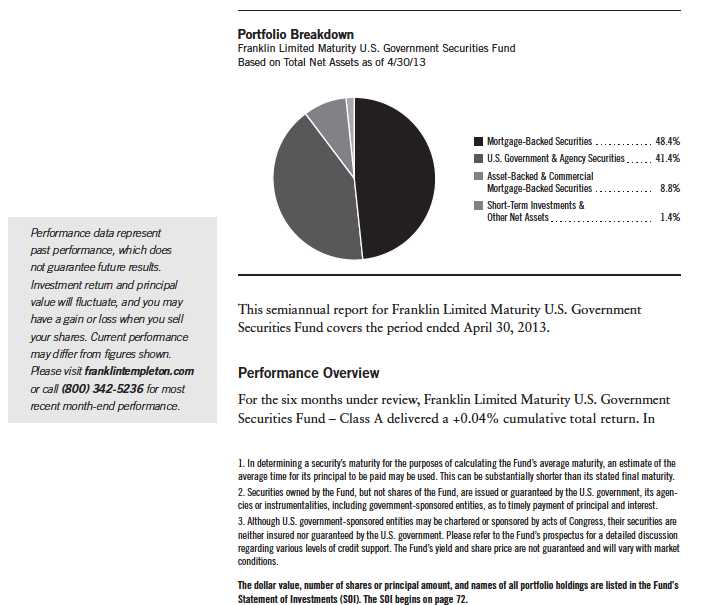

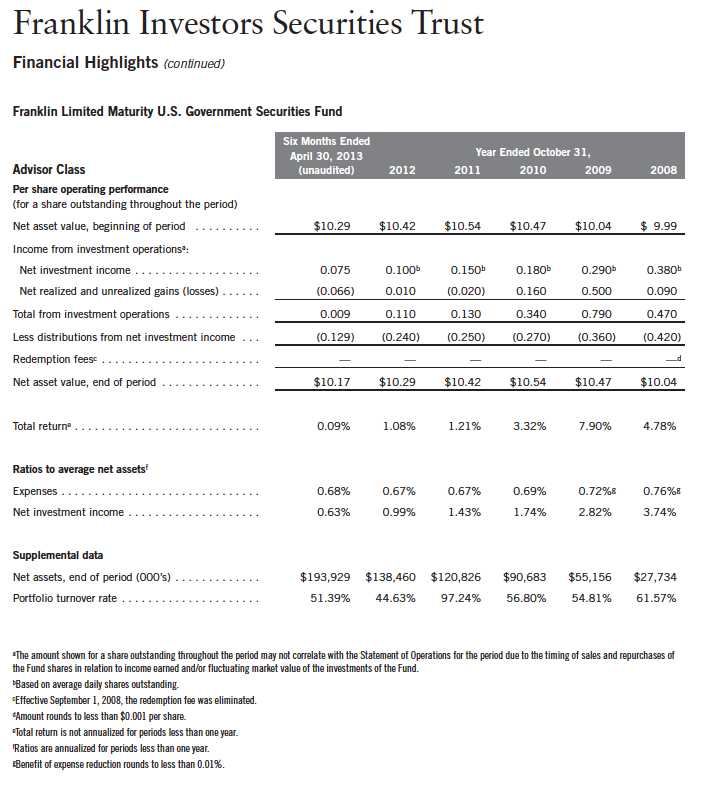

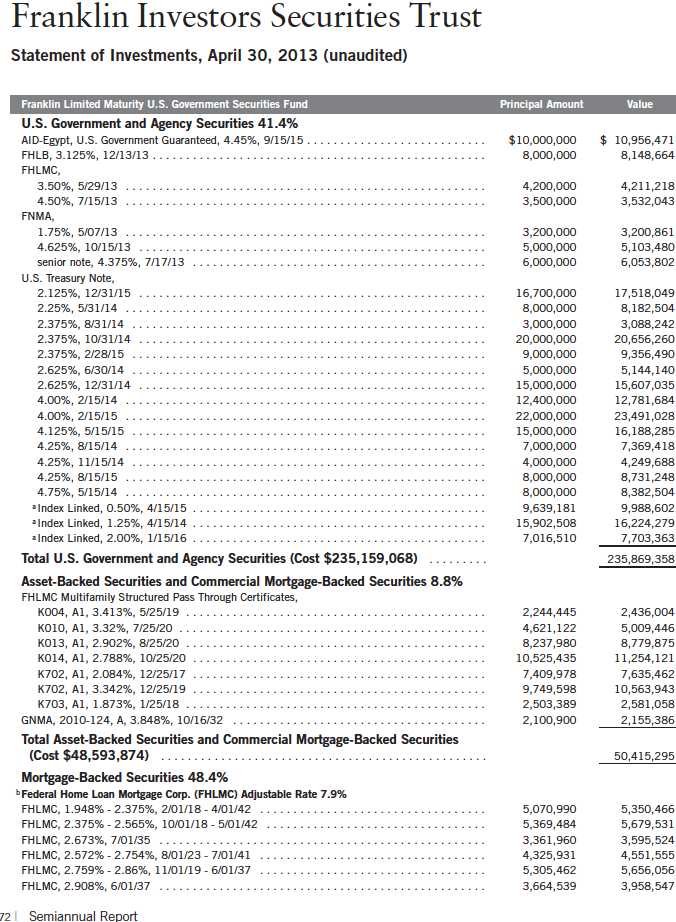

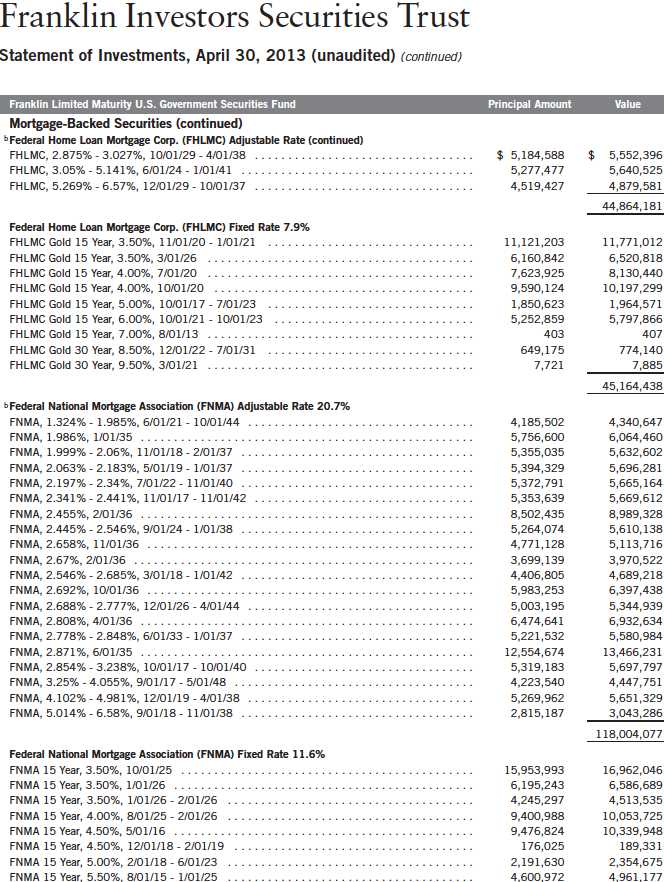

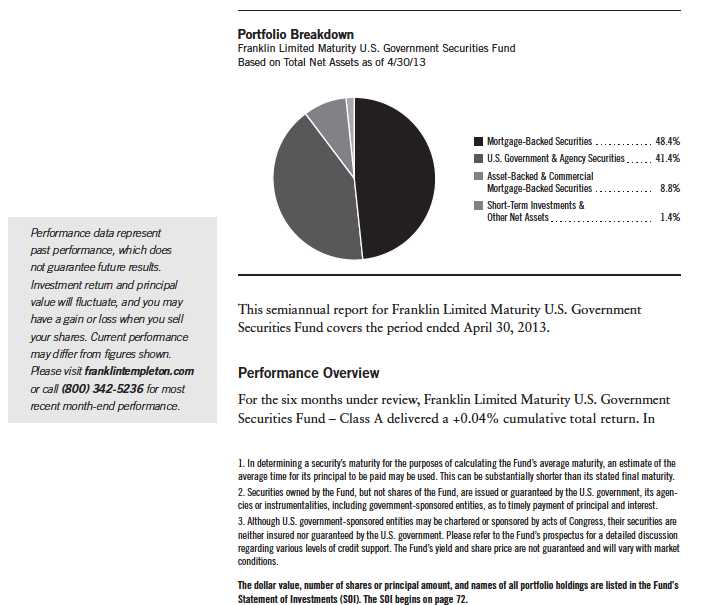

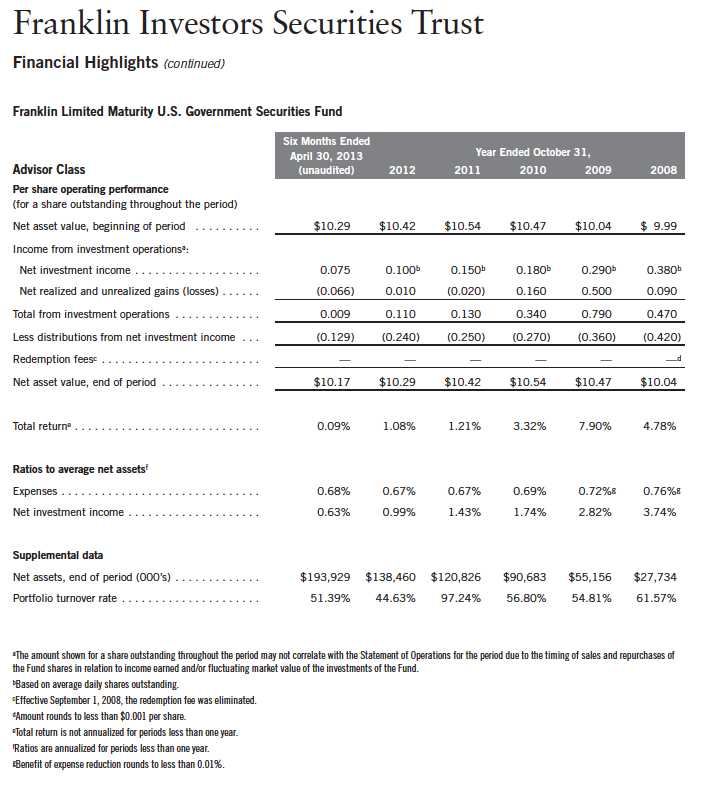

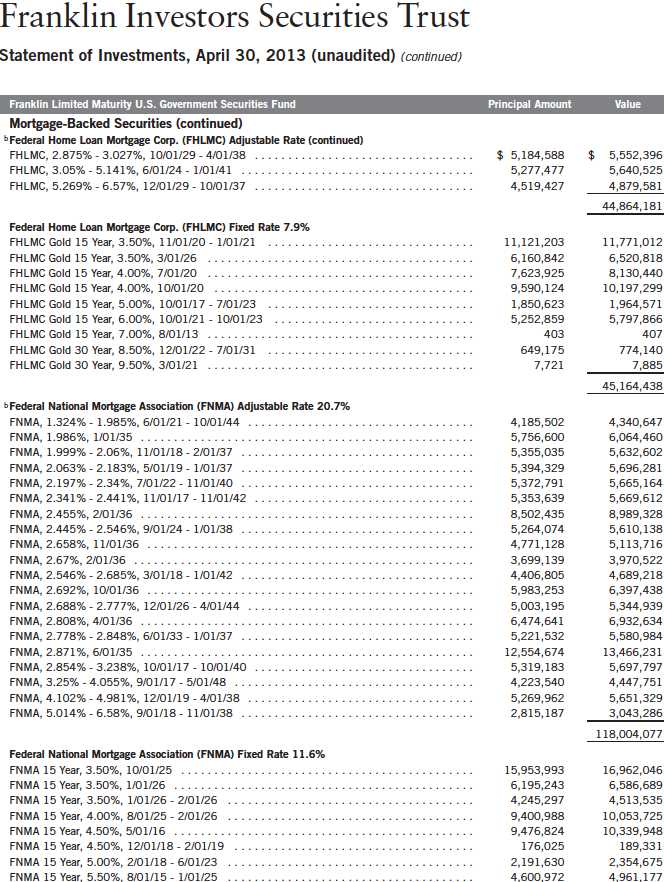

Franklin Limited Maturity U.S. Government Securities Fund

Your Fund’s Goal and Main Investments: Franklin Limited Maturity U.S. Government Securities Fund seeks to provide investors with as high a level of current income as is consistent with prudent investing, while seeking to preserve shareholders’ capital, by investing at least 80% of its net assets in securities with a dollar-weighted average maturity of less than 10 years1 and issued or guaranteed by the U.S. government, its agencies or instrumentalities.2 Some of the Fund’s investments may include securities issued or guaranteed by U.S. government-sponsored entities such as Fannie Mae and Freddie Mac.3

Semiannual Report | 29

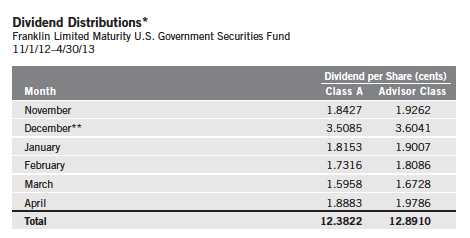

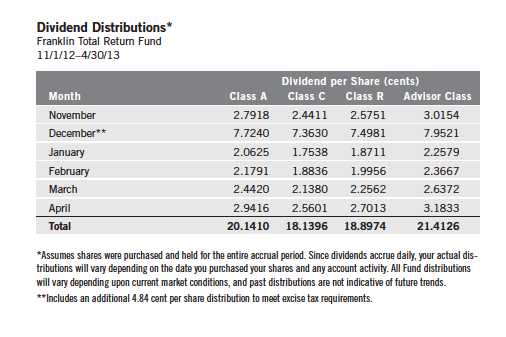

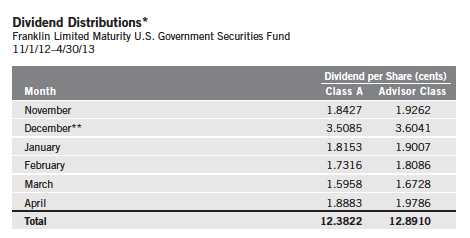

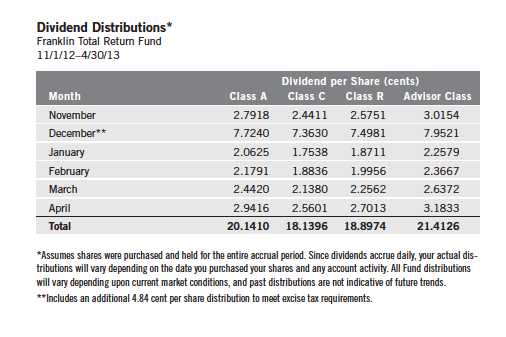

*Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual dis-

tributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions

will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**Includes distributions of 1.62 and 1.63 cents per share for Classes A and Advisor, which represent the remaining

undistributed net investment income at the time the Fund converted to a variable-pay dividend.

comparison, the Fund’s primary benchmark, the Barclays U.S. Treasury Index: 1-5 Year Component, which tracks U.S. Treasury securities with one to five years remaining maturity, posted a +0.54% total return.4 Also for comparison, the Fund’s secondary benchmark, the Barclays U.S. Treasury Index: 1-3 Year Component, which tracks U.S. Treasury securities with one to three years remaining maturity, returned +0.35%.4 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 33.

Investment Strategy

We currently maintain the portfolio’s average dollar-weighted maturity between one and five years. The Fund’s average dollar-weighted maturity will vary with market conditions and the outlook for interest rates. We invest primarily in short- to intermediate-term securities issued or guaranteed by the U.S. government, its agencies and instrumentalities.2 Some of the Fund’s investments may include securities issued by U.S. government-sponsored entities, such as Fannie Mae (FNMA) and Freddie Mac (FHLMC).3 The Fund’s portfolio emphasizes mortgage-backed bonds and agency debentures, while also diversifying across components of the U.S. Treasury sector. We analyze securities using proprietary and nonproprietary research to help identify attractive investment opportunities.

4. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

30 | Semiannual Report

Manager’s Discussion

During the period, U.S. economic data releases initially showed a nascent but firming trend. Later economic releases, however, reflected a more moderate, yet still positive, pace of growth. In this environment, U.S. consumers remained fairly strong, although declines in consumer spending suggested that income tax increases took a heavier toll on consumer sentiment than initially indicated. Overall, the labor market remained solid, even though some employment measures missed expectations. The unemployment rate declined from 7.9% to 7.5%, but this slight decline was largely a result of a lower participation rate.5 The U.S. housing market continued to show a gradual but persistent improvement trend. Overall, economic data during the period did not suggest any increased risk that the U.S. Federal Reserve Board (Fed) would exit its quantitative easing policy early.

A Federal Open Market Committee meeting held near period-end did not result in changes to the Fed’s current accommodative monetary policy. The Fed used a cautious tone and acknowledged strains in global financial markets but expected growth to remain moderate and gradually improve over the coming quarters. This expectation was based on improving labor market conditions and housing market gains, although the Fed noted the housing sector remained depressed. We believe short-term rates could remain low until the U.S. economy shows significant upward momentum and threats of systematic risk abate. The Fed continued to provide support to the mortgage sector, as prepayment risk remained heightened with the market priced at a premium and mortgage rates near historical lows. With its purchases and reinvestments totaling about $85 billion a month, the Fed remained the largest source of demand for the market. However, potential risks to the sector exist if the Fed eventually tapers or ends its asset purchase program, which could negatively affect mortgage sector spreads.

As measured by Barclays indexes, most fixed income sectors posted positive total returns during the period, including U.S. Treasury Inflation Protected Securities (TIPS), U.S. agency securities, Ginnie Maes (GNMAs), U.S. agency fixed rate mortgage-backed securities (MBS) and hybrid adjustable-rate mortgage securities (ARMs).

The Fund invested in U.S. Treasuries, including TIPS, agency debentures, agency mortgage pass-through securities, other U.S. government related bonds and cash investments. We looked for what we viewed as attractive valuations within lower interest rate risk government bond markets.

5. Source: Bureau of Labor Statistics.

Semiannual Report | 31

The broad sectors in which we invested had mixed performance versus comparable maturity Treasuries. As a sector, agency ARMs outperformed comparable maturity Treasuries and contributed to relative and absolute performance. Our TIPS allocation was a slight drag on performance versus the benchmark. Our fixed rate and multi-family agency MBS detracted slightly from returns. The Fund’s defensive position against interest rate risk also detracted from returns during the period.

Residential agency mortgages were one of the Fund’s largest sector allocations because of their return potential and income advantage over Treasuries. We added exposure to the adjustable and fixed-rate portions of the sector over the period. We decreased exposure to agency debentures as they had become more fully valued in our assessment. Our exposure to multi-family agency mortgages declined marginally during the period.

Thank you for your continued participation in Franklin Limited Maturity U.S. Government Securities Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Limited Maturity

U.S. Government Securities Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2013, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

32 | Semiannual Report

Performance Summary as of 4/30/13

Franklin Limited Maturity U.S. Government Securities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 2.25% maximum initial sales charge; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 33

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Interest rate movements, unscheduled mortgage prepayments and other risk factors will affect the Fund’s share price and yield. Bond prices, and thus a fund’s share price, generally move in the opposite direction of interest rates. Therefore, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Advisor Class) per share on 4/30/13.

5. The 30-day standardized yield for the 30 days ended 4/30/13 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

34 | Semiannual Report

Your Fund’s Expenses

Franklin Limited Maturity U.S. Government Securities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 35

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

36 | Semiannual Report

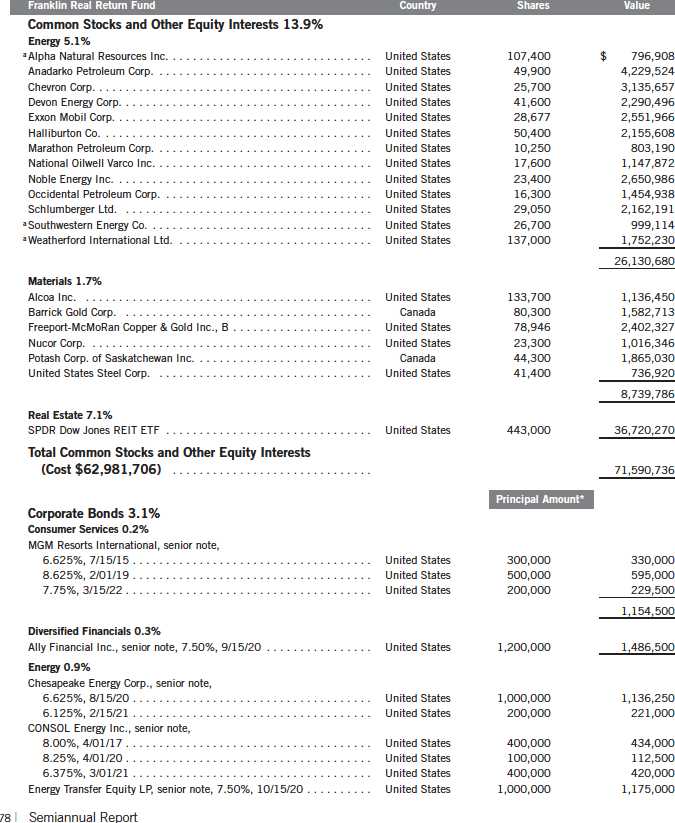

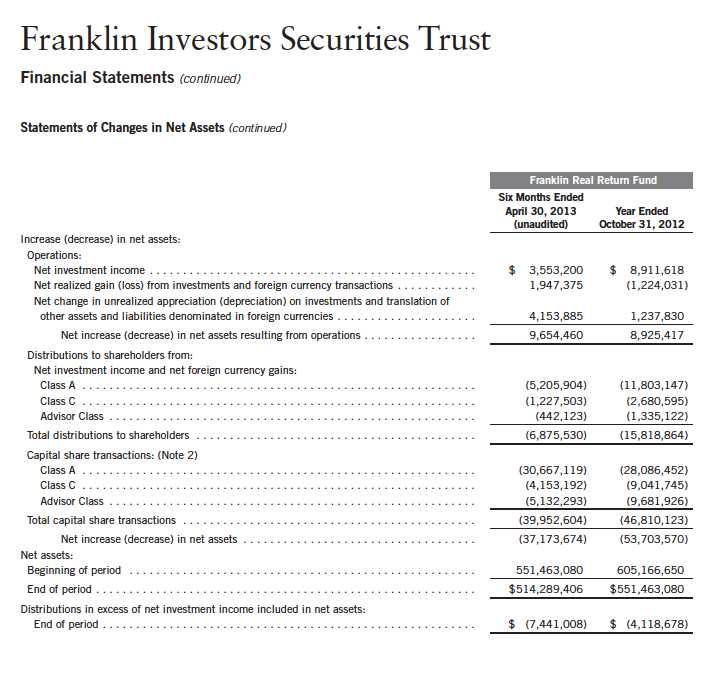

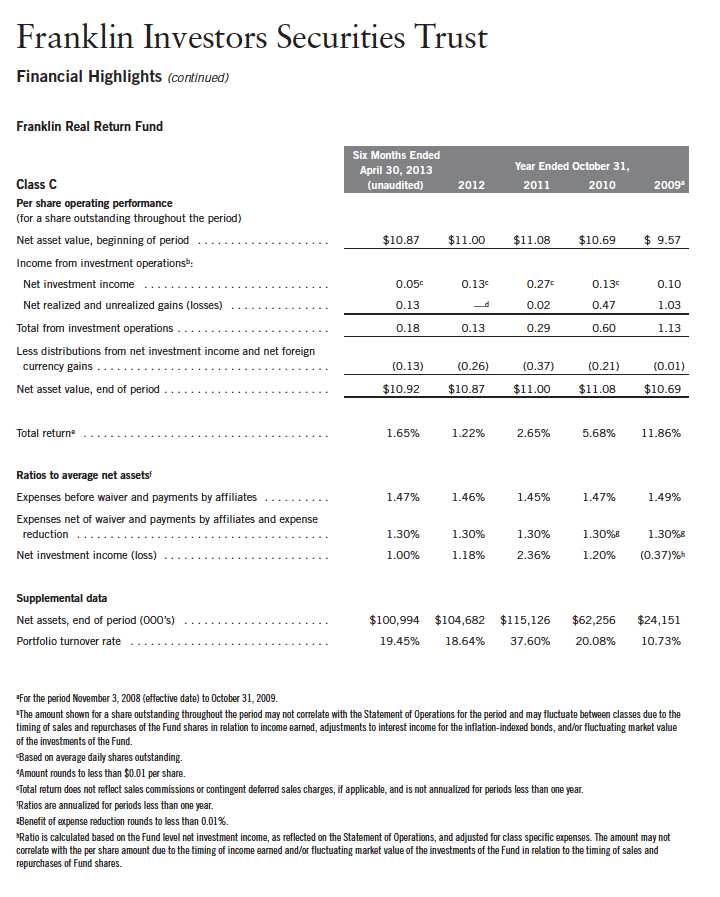

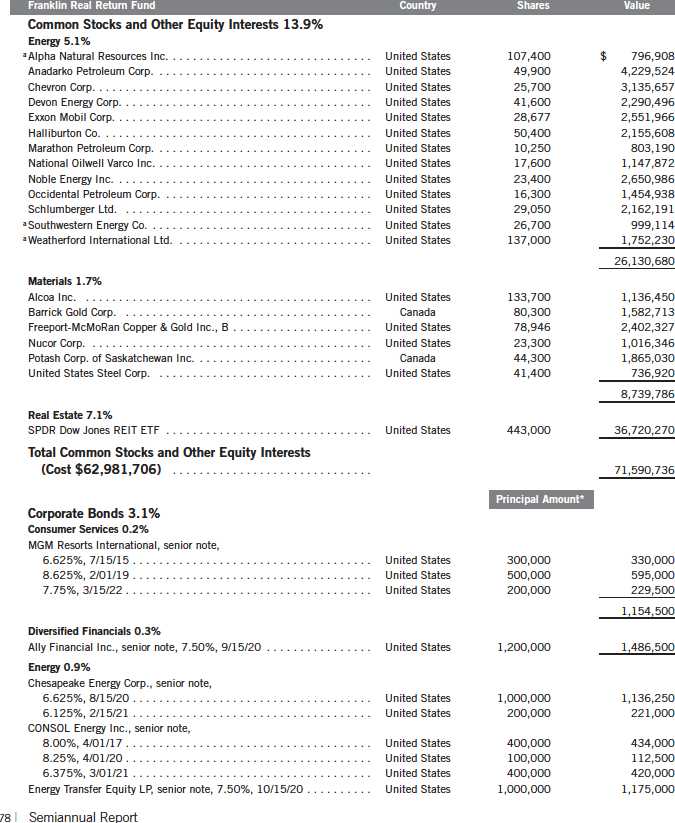

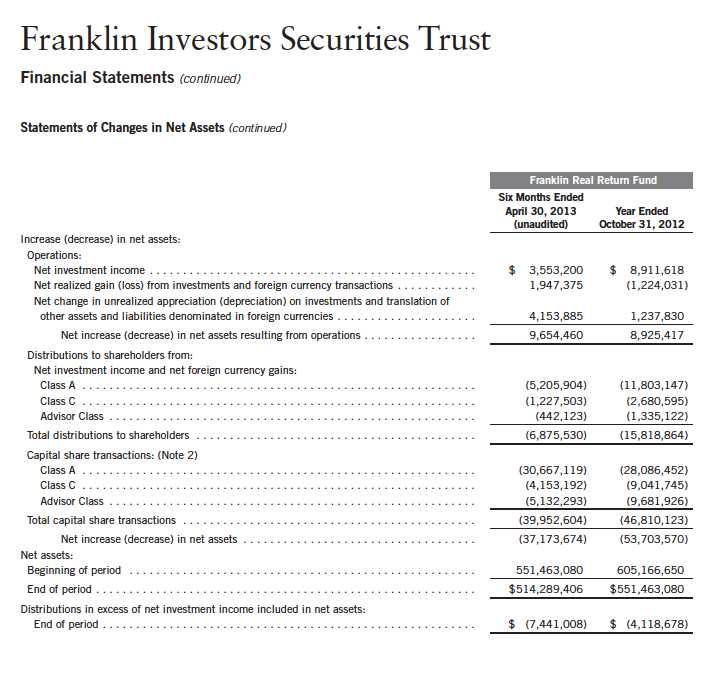

Franklin Real Return Fund

Your Fund’s Goal and Main Investments: Franklin Real Return Fund seeks to achieve total return that exceeds the rate of inflation over an economic cycle. The Fund will generally invest a substantial portion of its assets in inflation-protected securities. Managers also have the flexibility to invest in other sectors of the market to increase real return (total return less inflation) potential and offer greater diversification.

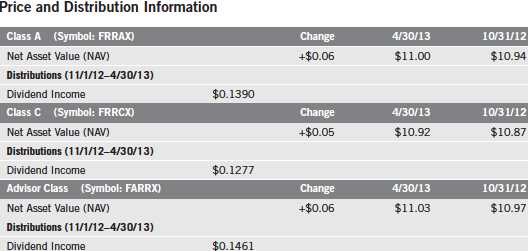

*All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative

of future trends.

**The Fund paid two distributions in November. The distribution scheduled to be paid in October 2012 was paid in

November because of the market’s closure following Hurricane Sandy.

†Distributions are higher than in other months primarily due to the inclusion of net foreign currency gains to meet excise

tax requirements.

The Fund paid no dividends due to negative inflation adjustments for TIPS, which are the Fund’s primary investments.

Consumers (All Items) NSA (non-seasonally adjusted), a measure of the average change in prices of all goods and services purchased for consumption by urban householders, rose 0.52% for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 41.

Investment Strategy

We seek to allocate assets among investments to achieve the highest level of real return (total return less the rate of inflation) consistent with an acceptable level of risk. We will allocate the Fund’s assets among securities in various market sectors based on our assessment of changing economic, global market, industry and issuer conditions. When making our investment decisions, we use a “top-down” analysis of macroeconomic trends combined with a “bottom-up” fundamental analysis of market sectors, industries and issuers to try to take advantage of varying sector reactions to economic events. We will evaluate such criteria as country risk, business cycles, yield curves, and values between and within markets.

38 | Semiannual Report

Manager’s Discussion

During the period, U.S. economic data releases initially showed a nascent but firming trend. Later economic releases, however, reflected a more moderate, yet still positive, pace of growth. In this environment, U.S. consumers remained fairly strong, although declines in consumer spending suggested that income tax increases took a heavier toll on consumer sentiment than initially indicated. Overall, the labor market remained solid, even though some employment measures missed expectations. The unemployment rate declined from 7.9% to 7.5%, but this slight decline was largely a result of a lower participation rate.2 The U.S. housing market continued to show a gradual but persistent improvement trend. Overall, economic data during the period did not suggest any increased risk that the U.S. Federal Reserve Board (Fed) would exit its quantitative easing policy early.

A Federal Open Market Committee meeting held near period-end did not result in changes to the Fed’s current accommodative monetary policy. The Fed used a cautious tone and acknowledged strains in global financial markets but expected growth to remain moderate and gradually improve over the coming quarters. This expectation was based on improving labor market conditions and housing market gains, although the Fed noted the housing sector remained depressed. We believe short-term rates could remain low until the U.S. economy shows significant upward momentum and threats of systematic risk abate. The Fed continued to provide support to the mortgage sector, as prepayment risk remained heightened with the market priced at a premium and mortgage rates near historical lows. With its purchases and reinvestments totaling about $85 billion a month, the Fed remained the largest source of demand for the market. However, potential risks to the sector exist if the Fed eventually tapers or ends its asset purchase program, which could negatively affect mortgage sector spreads.

We invested the Fund’s assets in the allowable sectors during the period under review. At period-end, just over half of total net assets were invested in Treasury Inflation Protected Securities (TIPS). For diversification, we also allocated the Fund’s assets to short-term non-U.S. dollar securities, natural resources, real estate investment trusts (REITs), high yield bonds and corporate loans. We employed a non-U.S. dollar strategy to help hedge against U.S. dollar weakness versus certain currencies and concentrated our TIPS holdings in shorter maturities.

2. Source: Bureau of Labor Statistics.

Semiannual Report | 39

Our diversified mix of inflation-sensitive assets did well over the period. In particular, our non-dollar holdings and allocation to REITS, high yield corporate bonds and natural resource securities contributed to performance relative to the benchmark index. Our TIPS and floating rate loan exposures were also positive for returns.

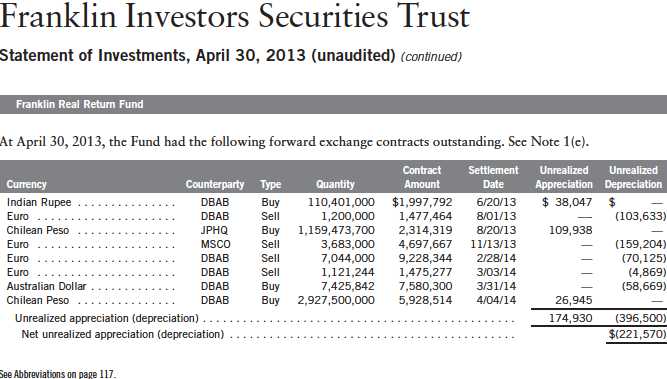

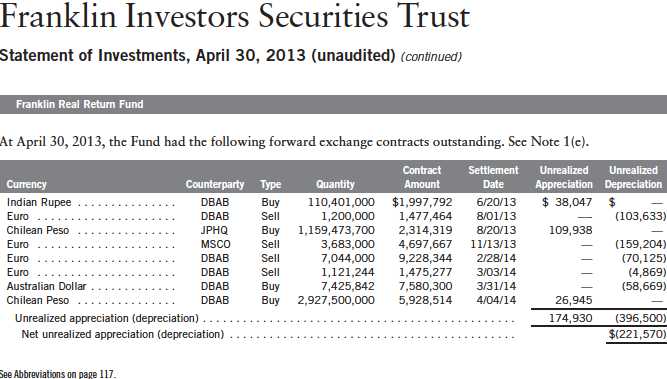

The portfolio utilized derivatives, including currency forwards. Currency forwards are principally used as a tool to reduce a specific risk exposure of a portfolio security or its denominated currency, or to obtain net long exposure to selected currencies.

Thank you for your continued participation in Franklin Real Return Fund.

We look forward to serving your future investment needs.

40 | Semiannual Report

Performance Summary as of 4/30/13

Franklin Real Return Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 41

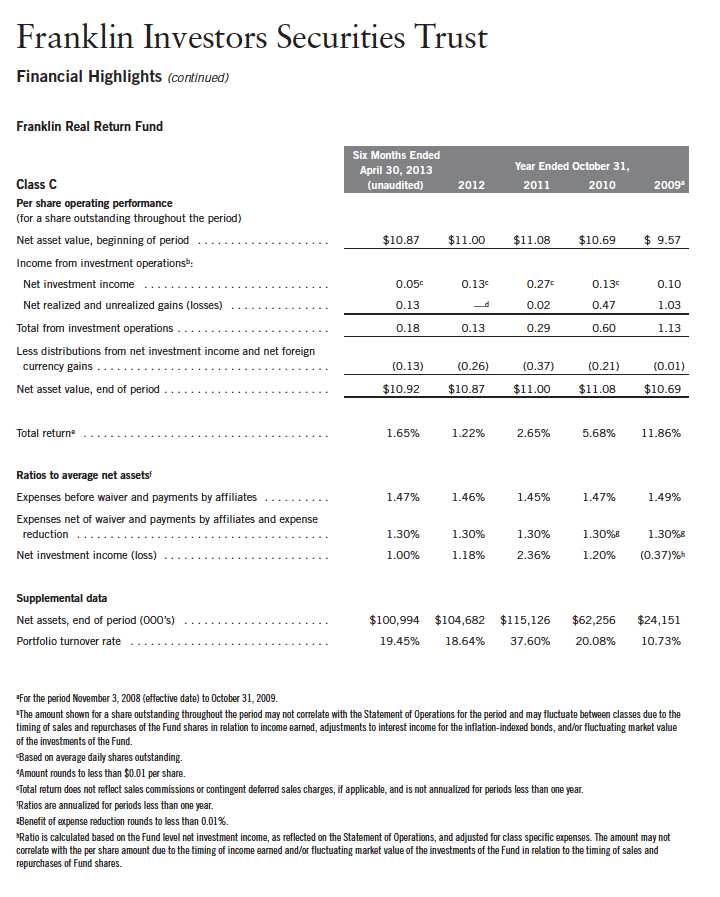

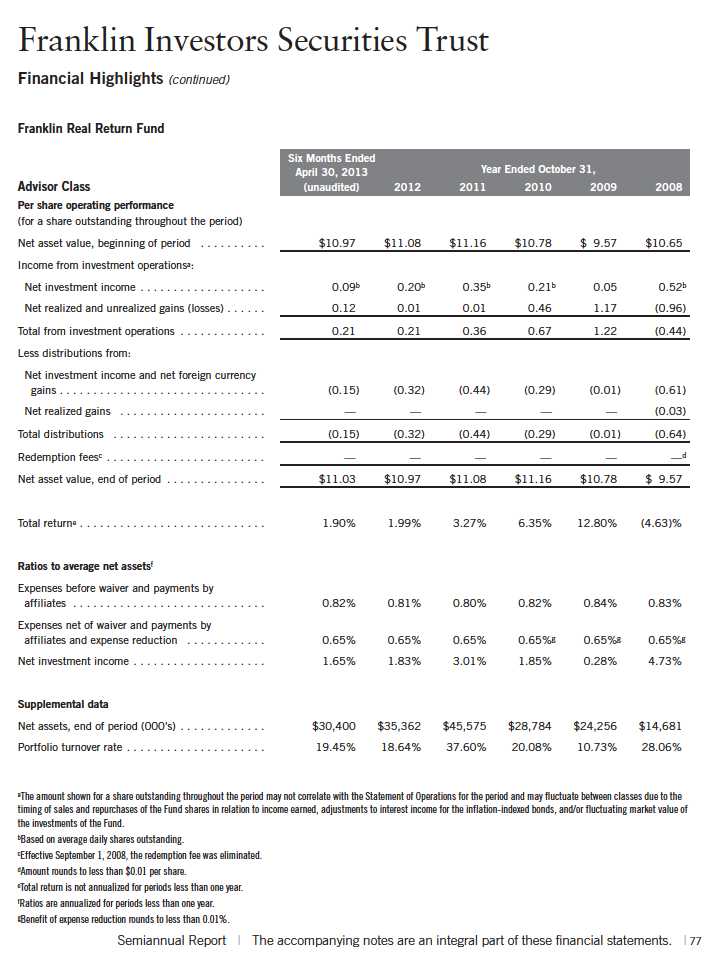

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

42 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Interest rate movements will affect the Fund’s share price and yield. Bond

prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s

share price may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular

industries or sectors, or general market conditions. These price movements may result from factors affecting individual companies, industries

or the securities market as a whole. The risks of foreign securities include currency fluctuations and political uncertainty. The Fund is actively

managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes

a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Fund investment results reflect the expense reduction, without which the results would have been lower, and yields for the period would have been

3.39%, 3.15% and 3.79% for Classes A, C and Advisor, respectively.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Classes C and

Advisor) per share on 4/30/13.

6. The 30-day standardized yield for the 30 days ended 4/30/13 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

Semiannual Report | 43

Your Fund’s Expenses

Franklin Real Return Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

44 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

Semiannual Report | 45

46 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 47

48 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 49

50 | Semiannual Report

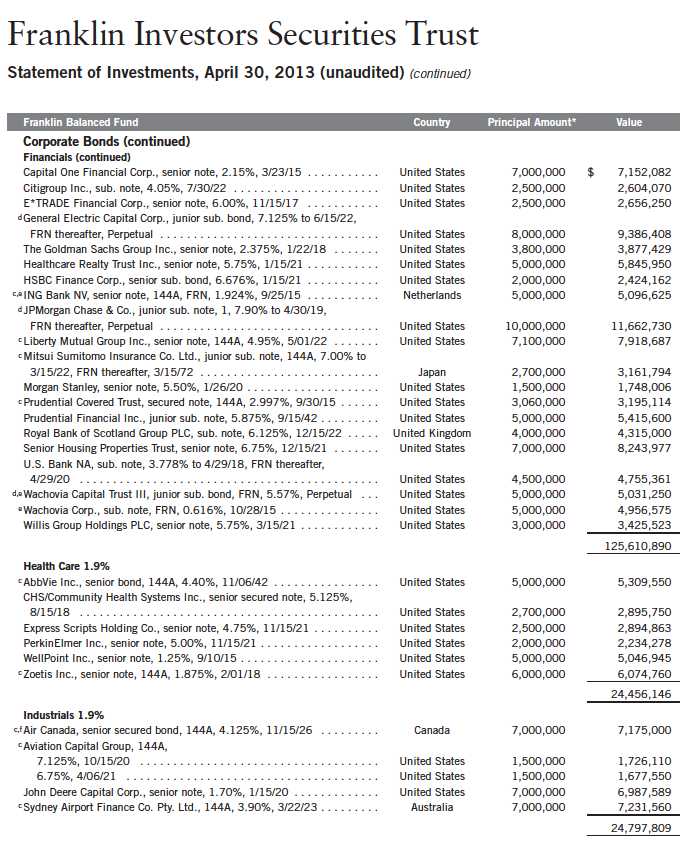

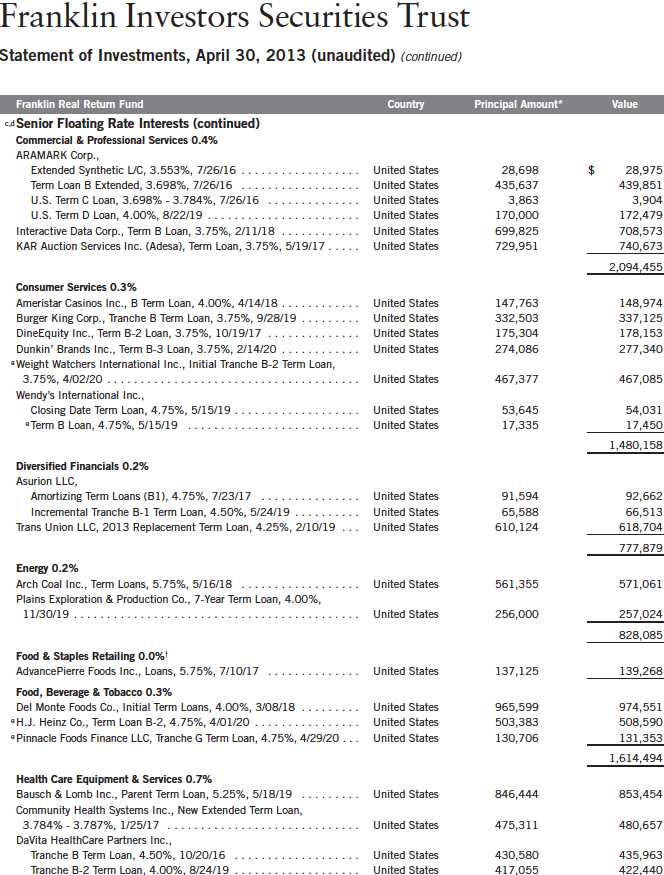

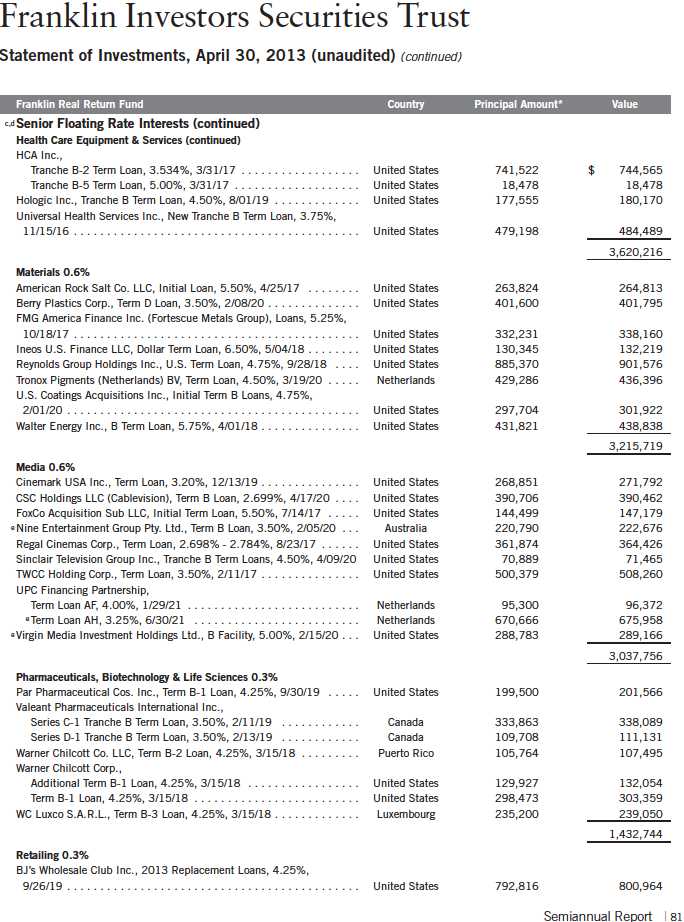

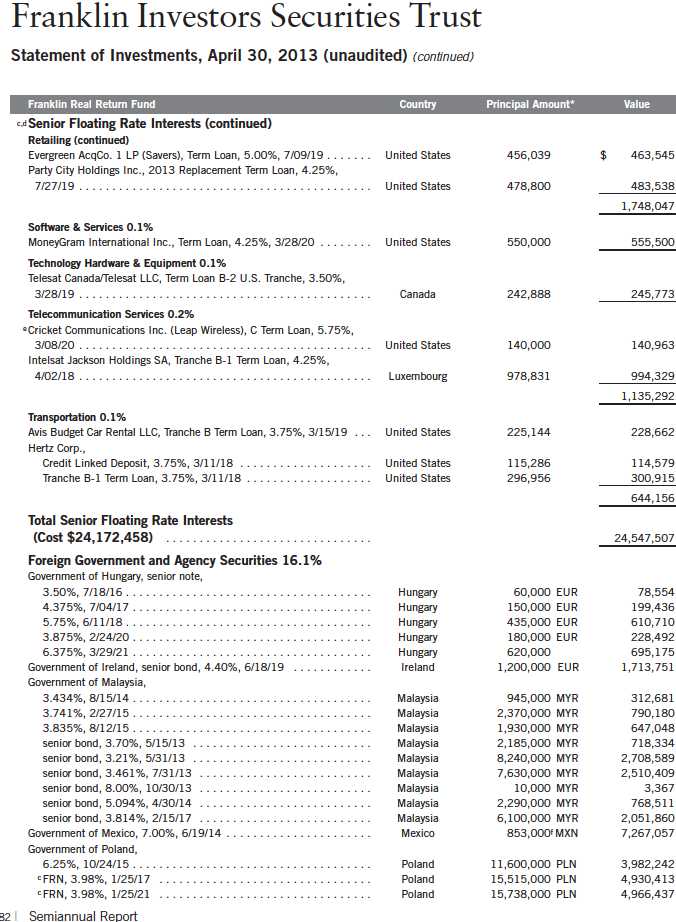

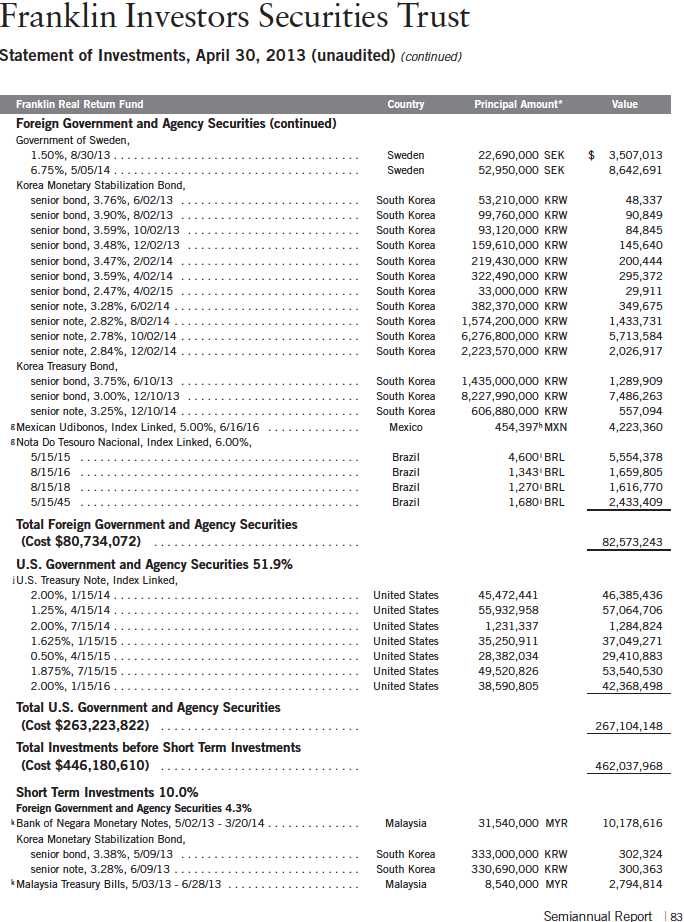

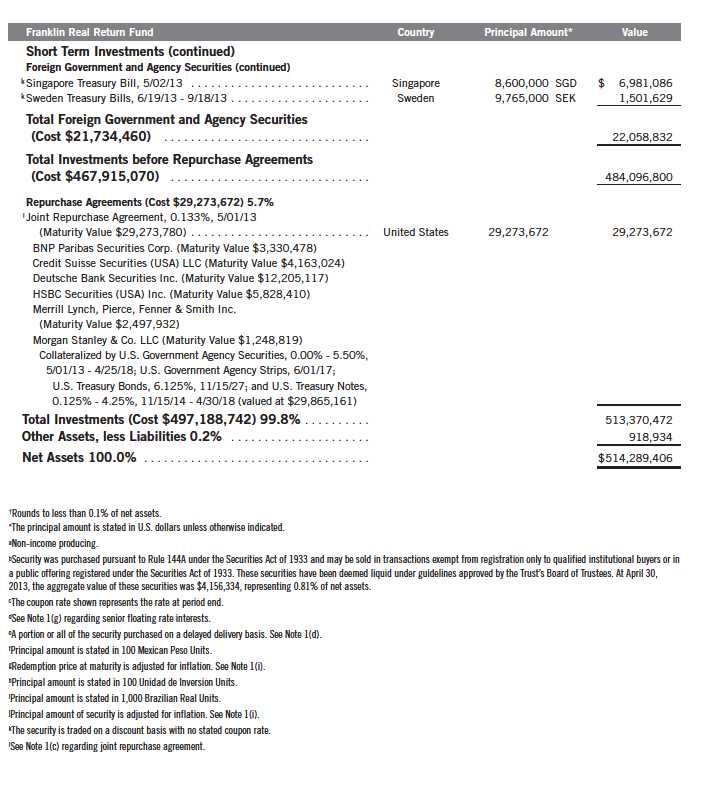

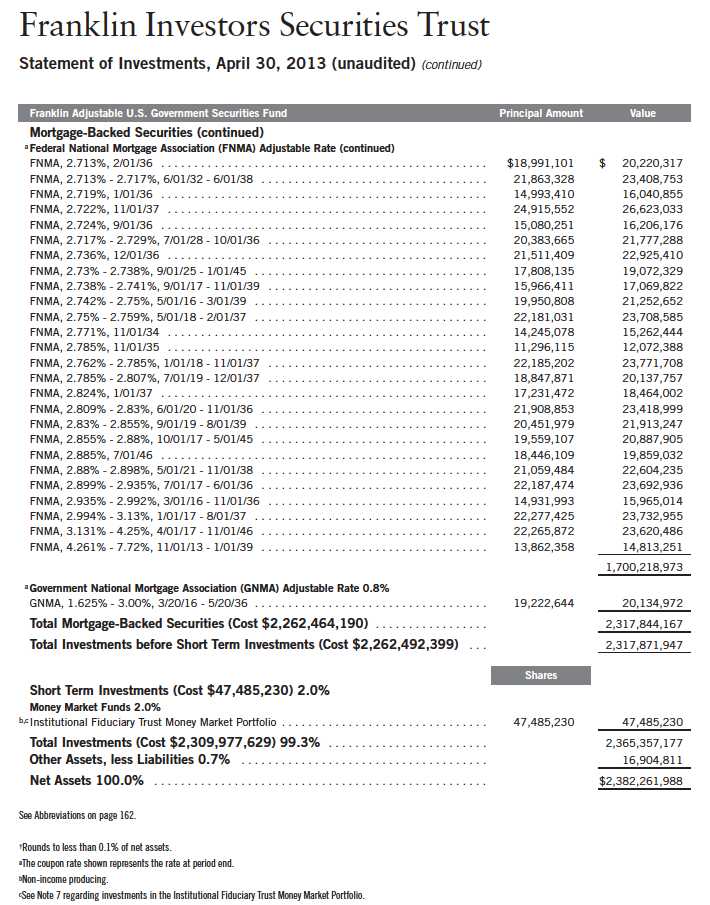

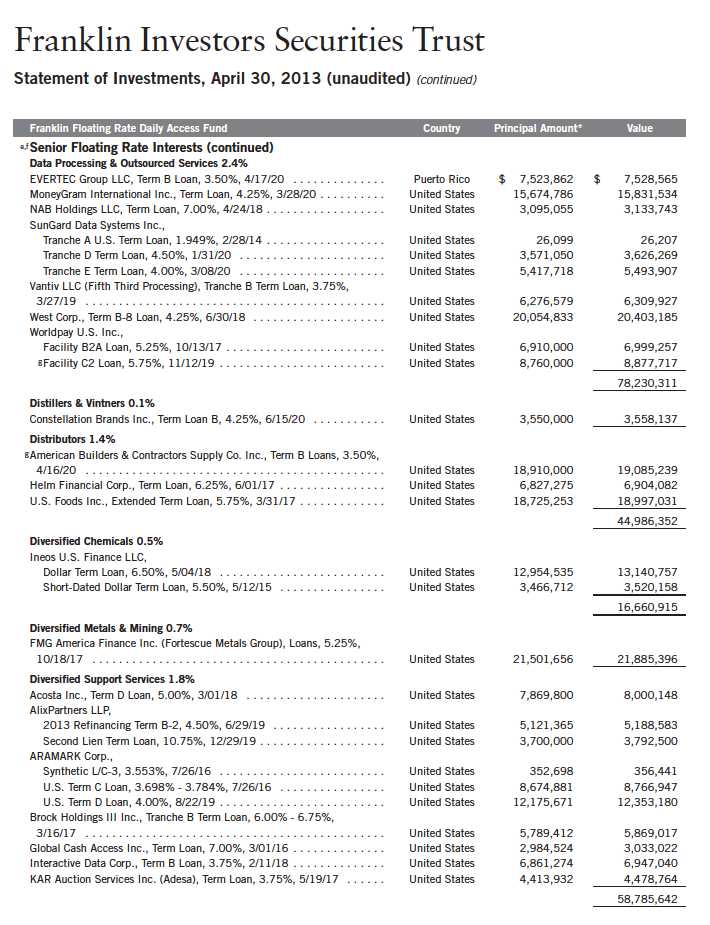

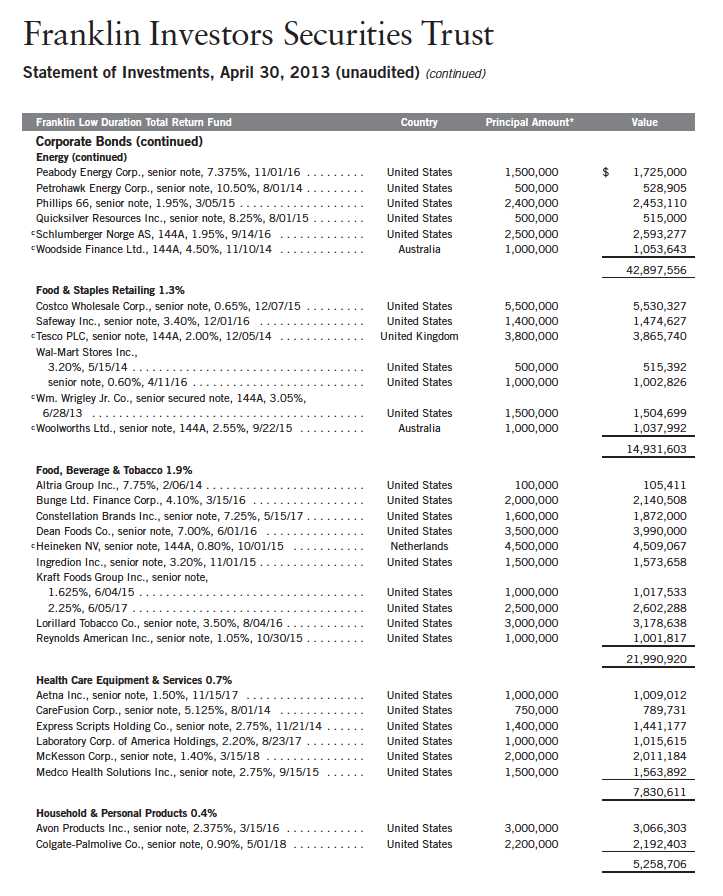

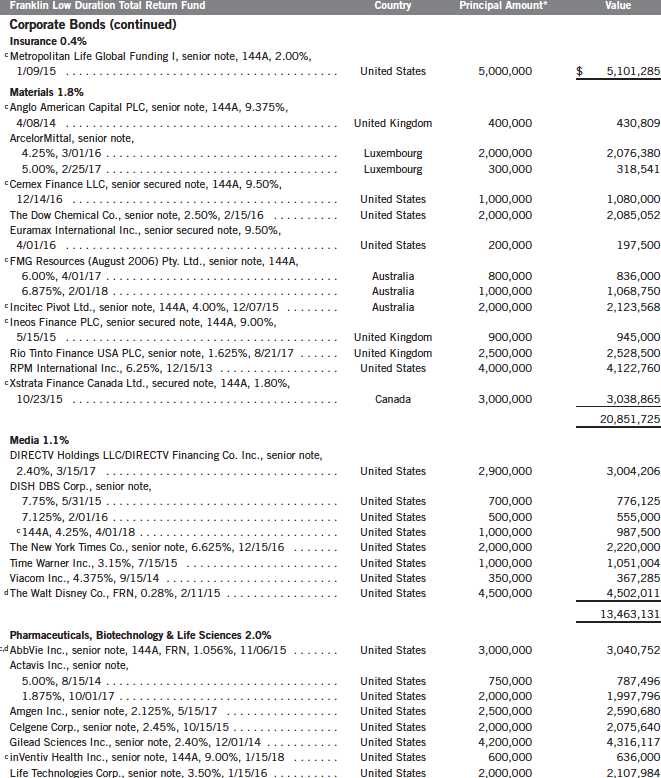

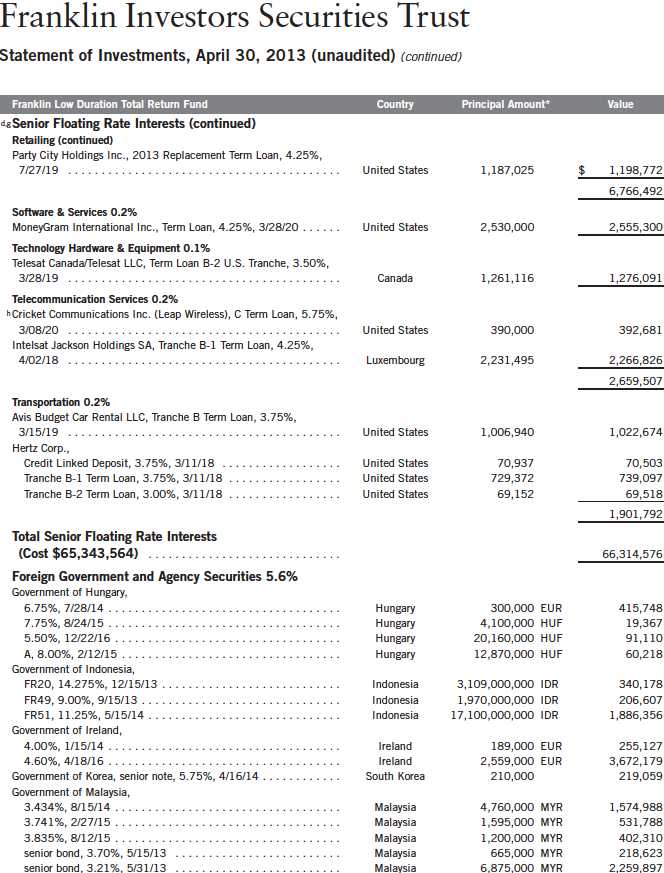

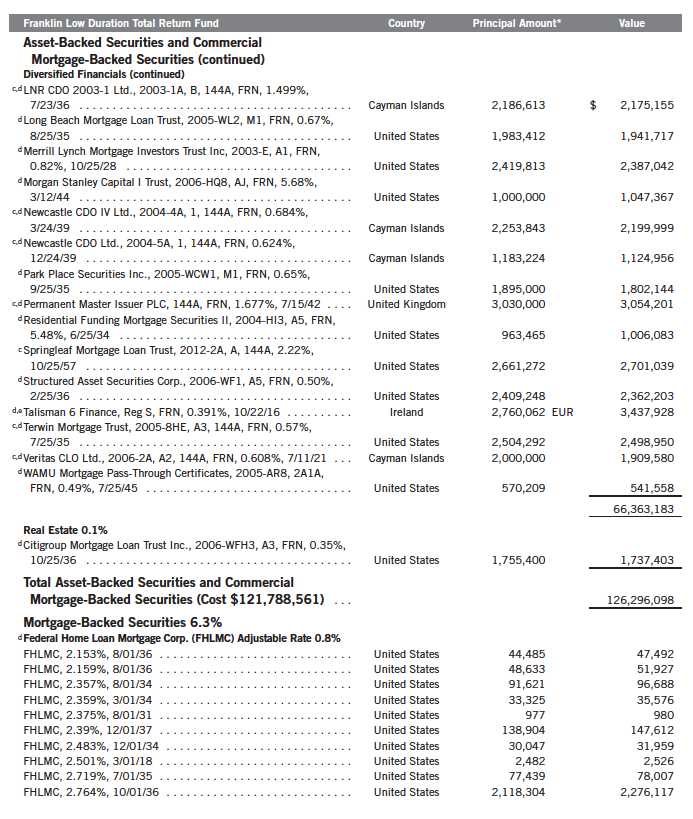

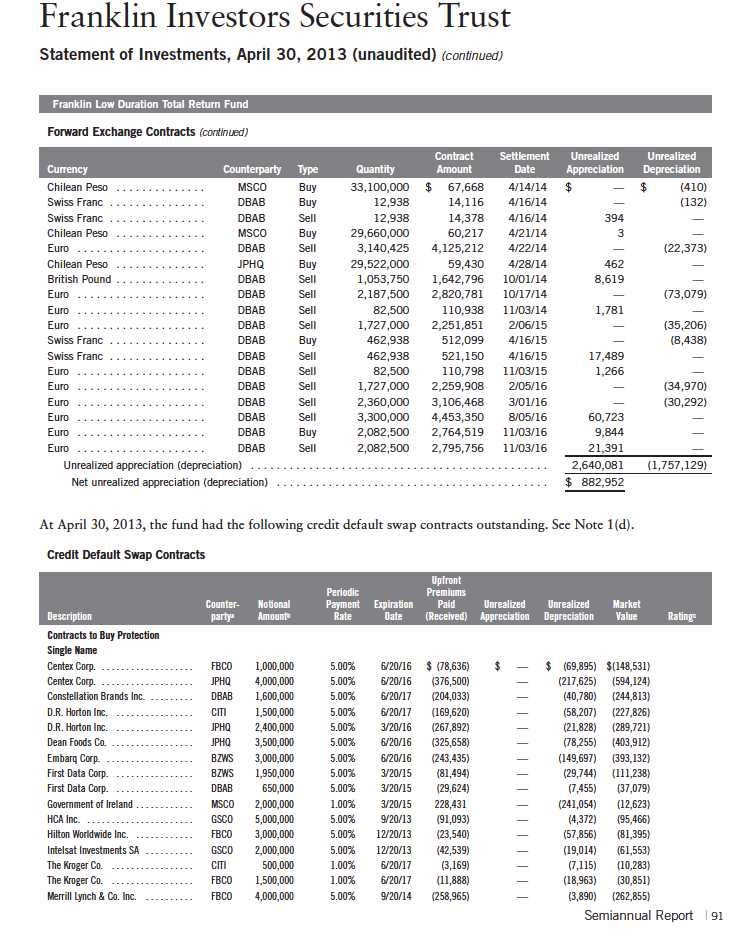

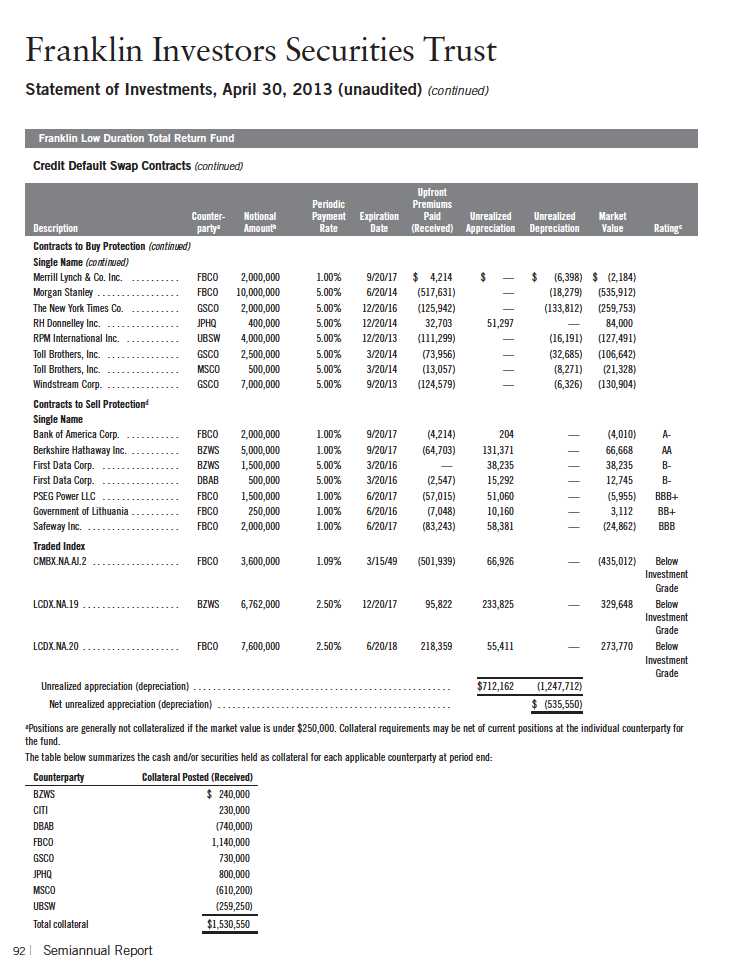

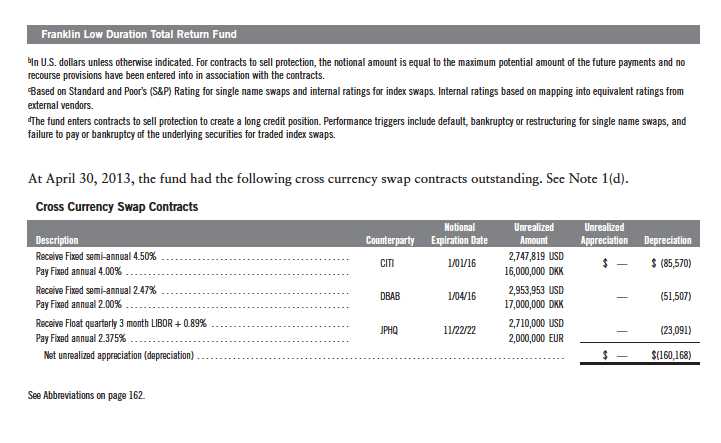

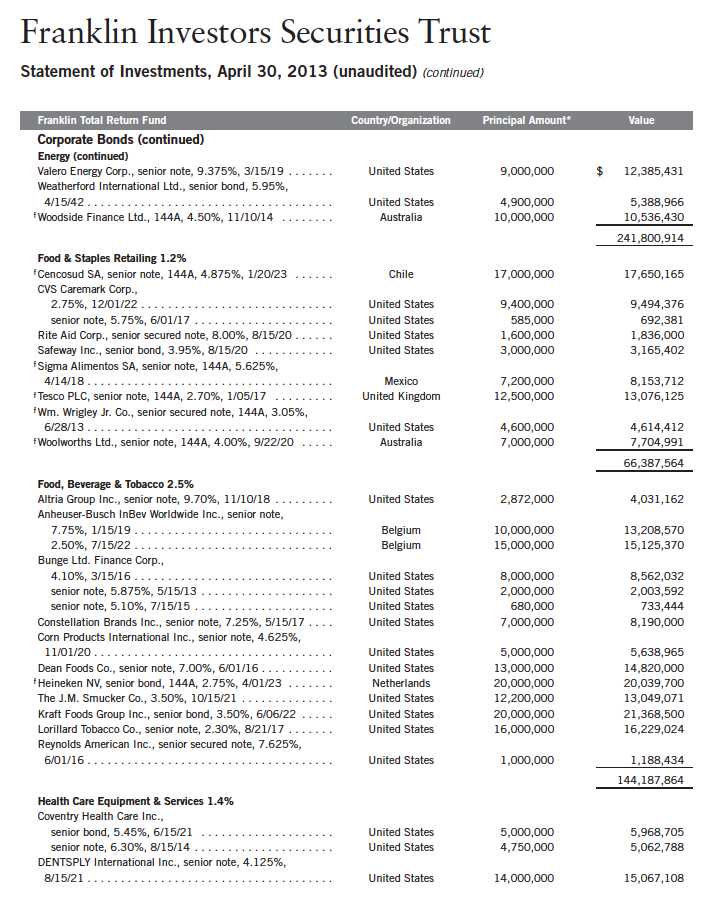

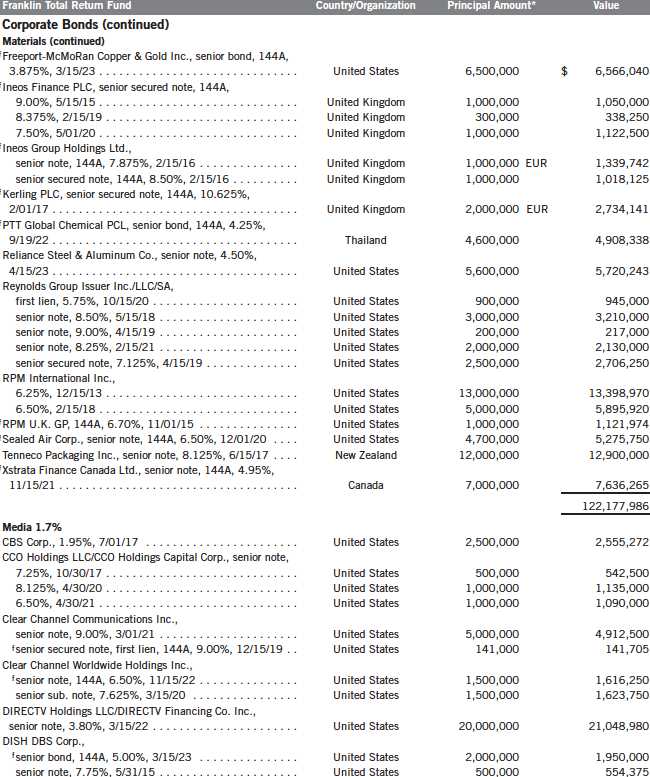

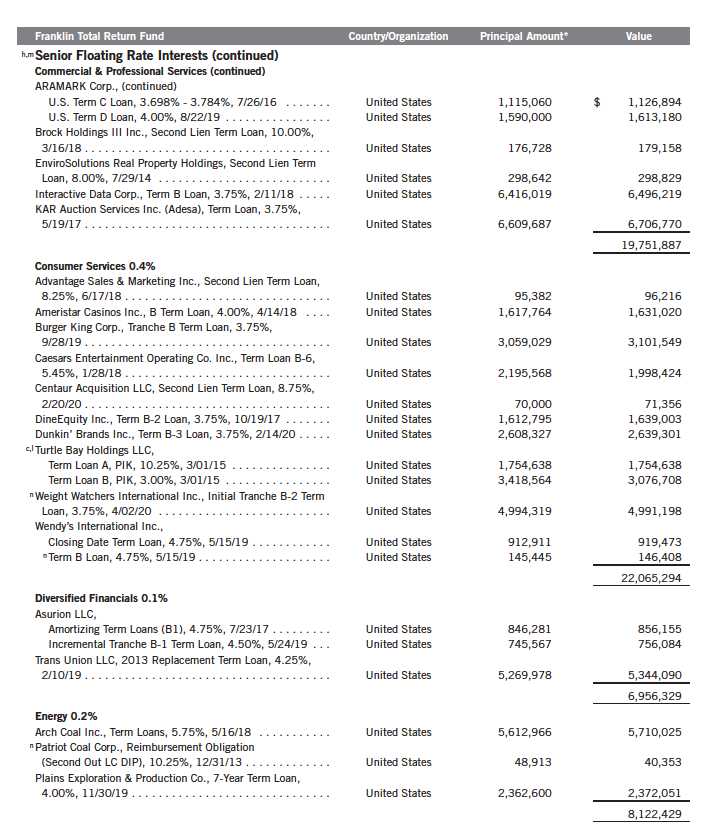

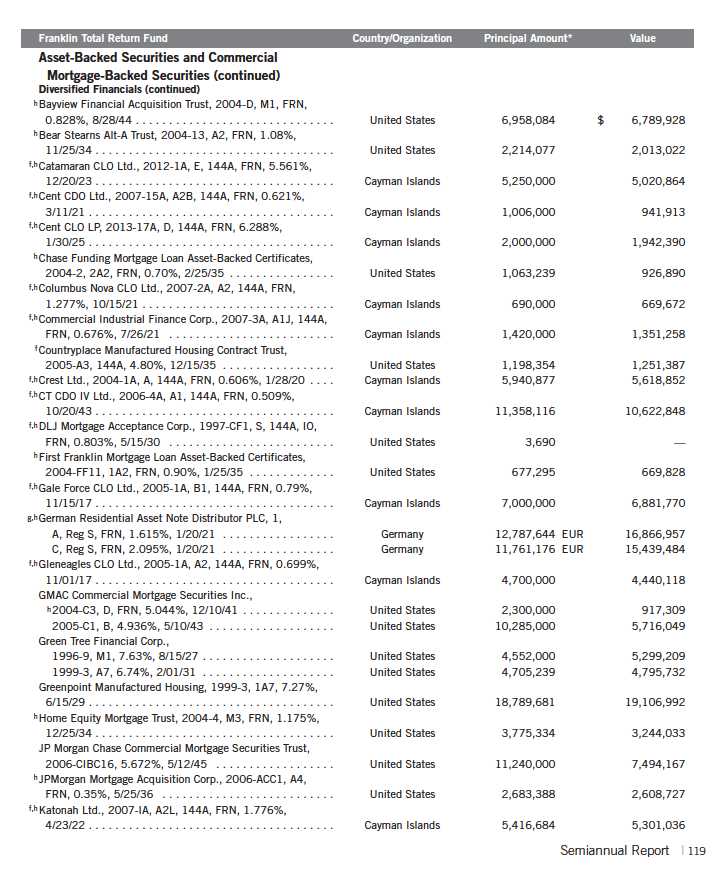

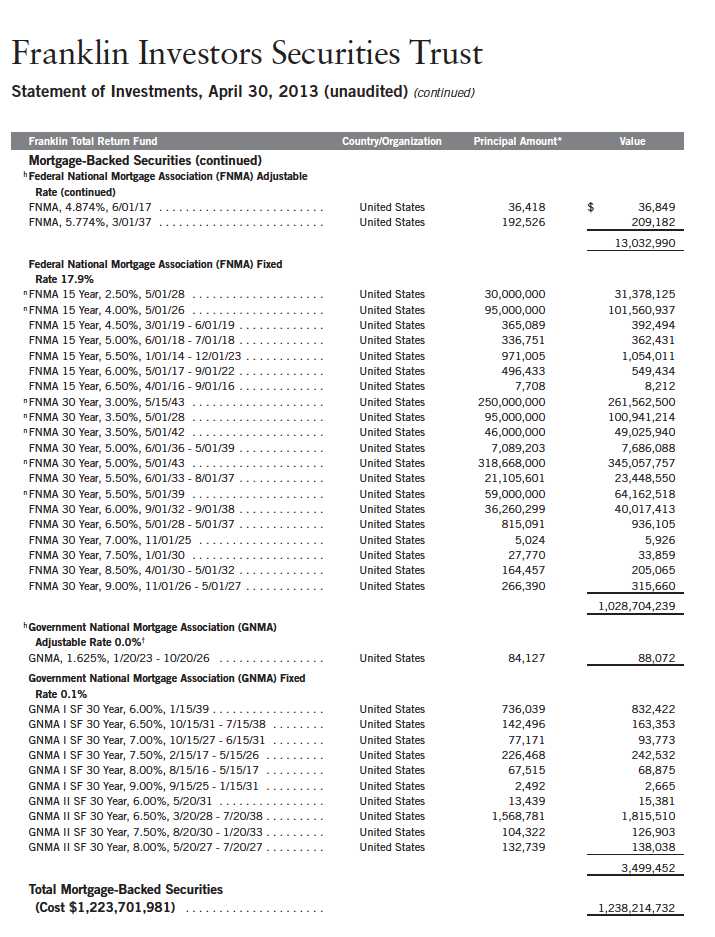

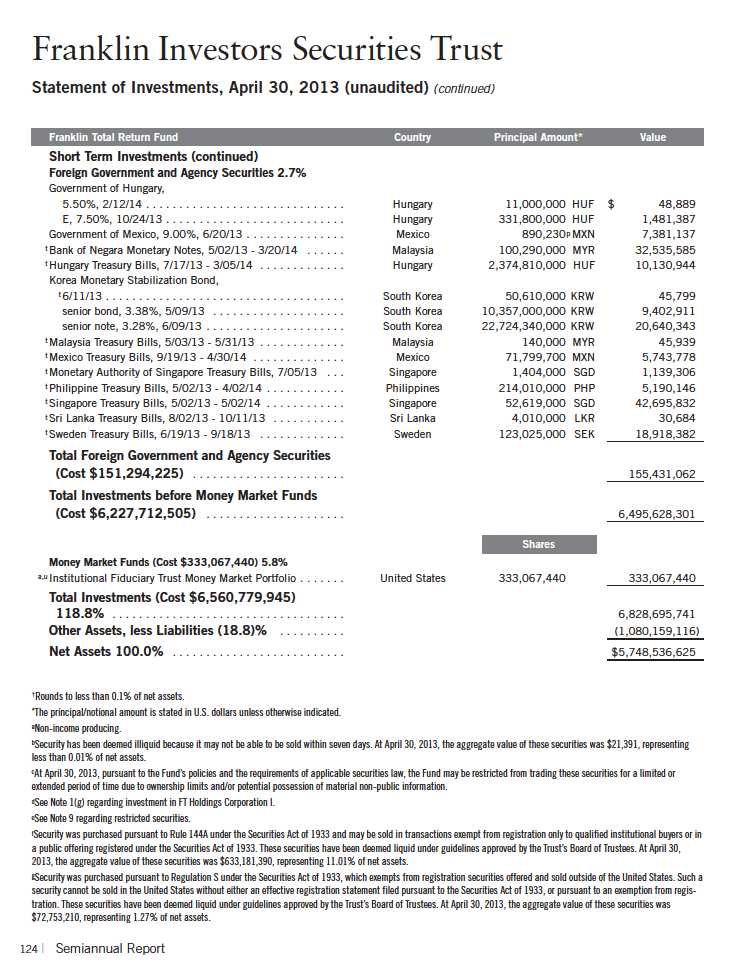

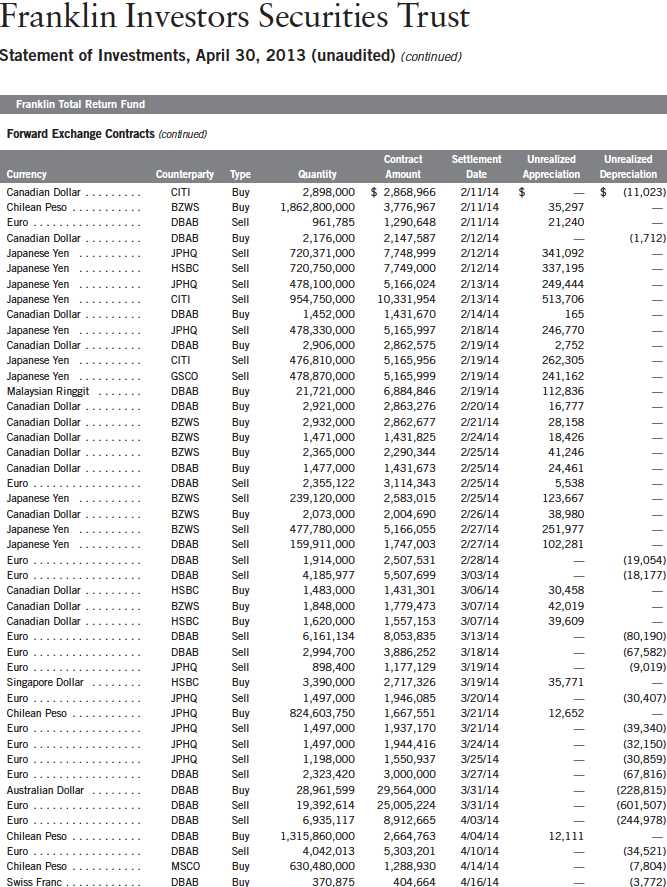

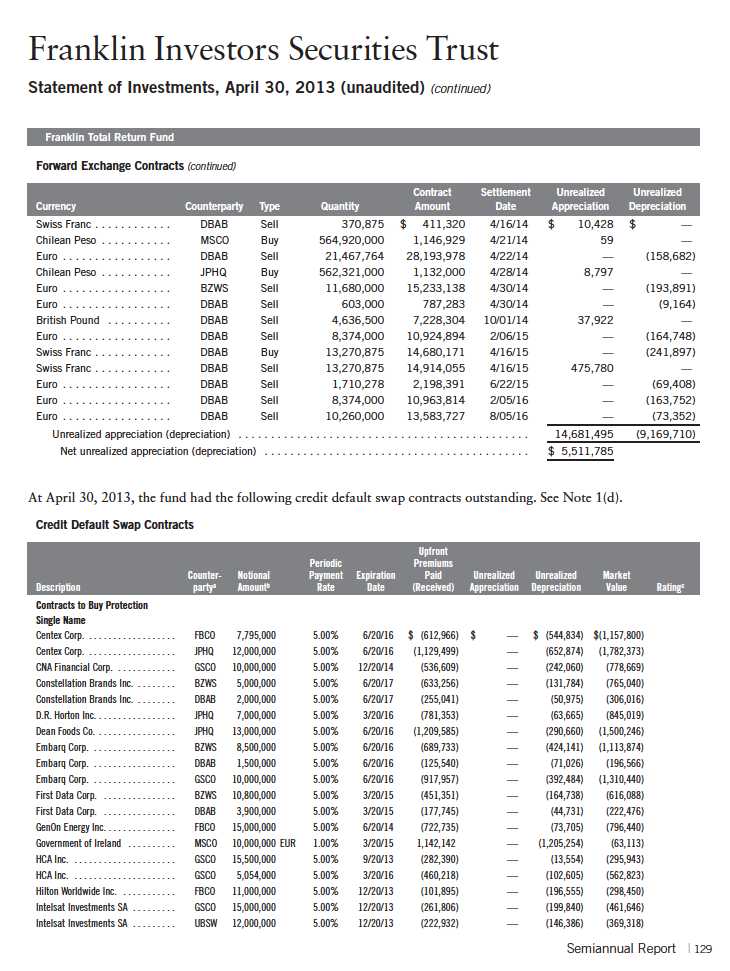

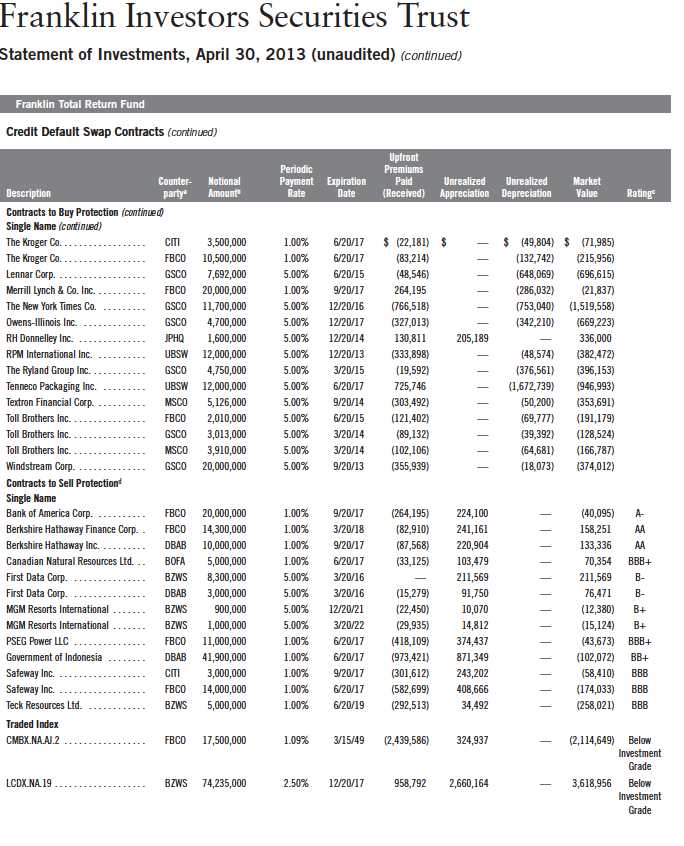

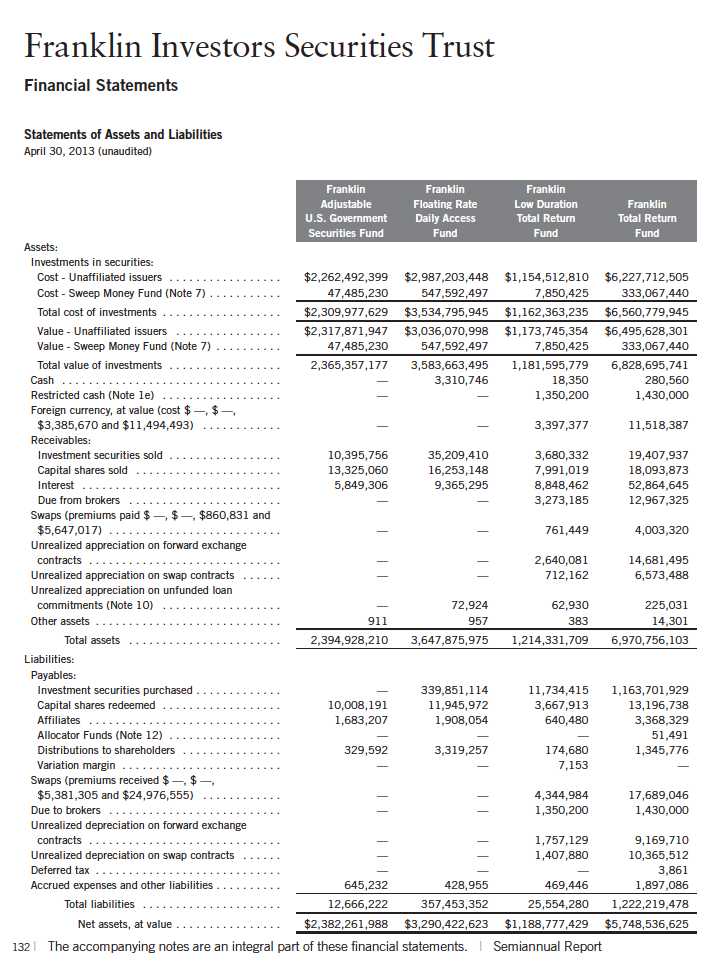

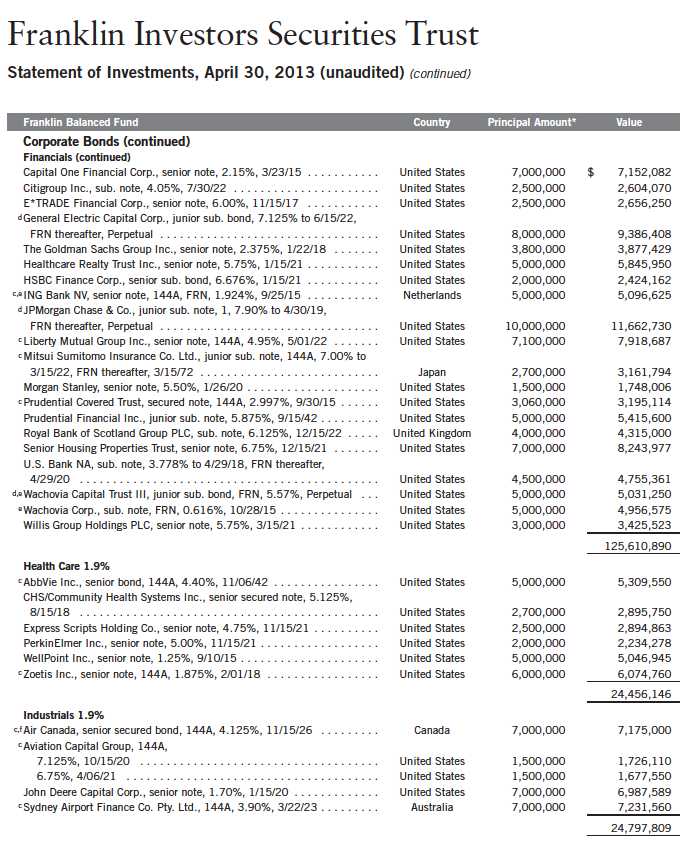

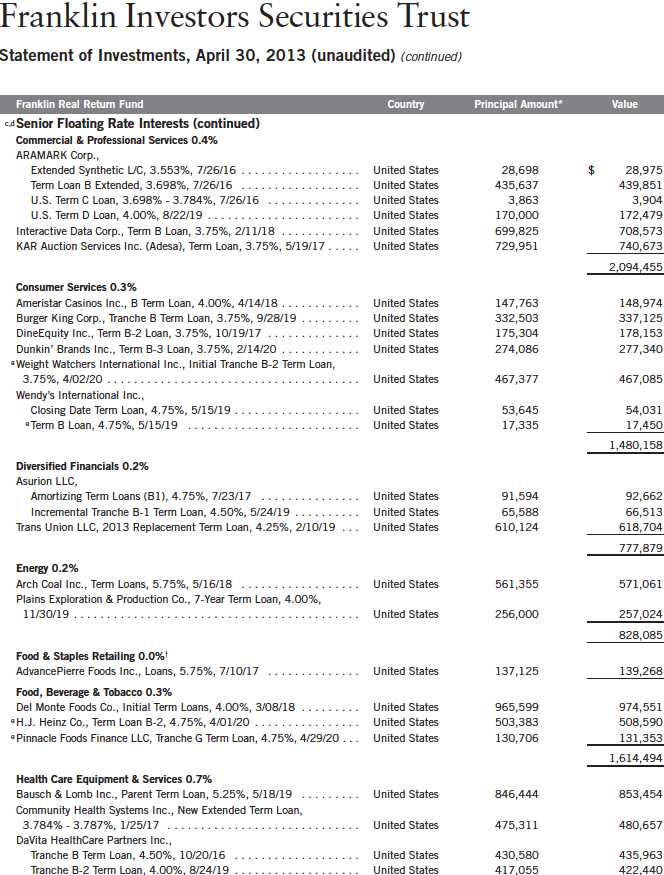

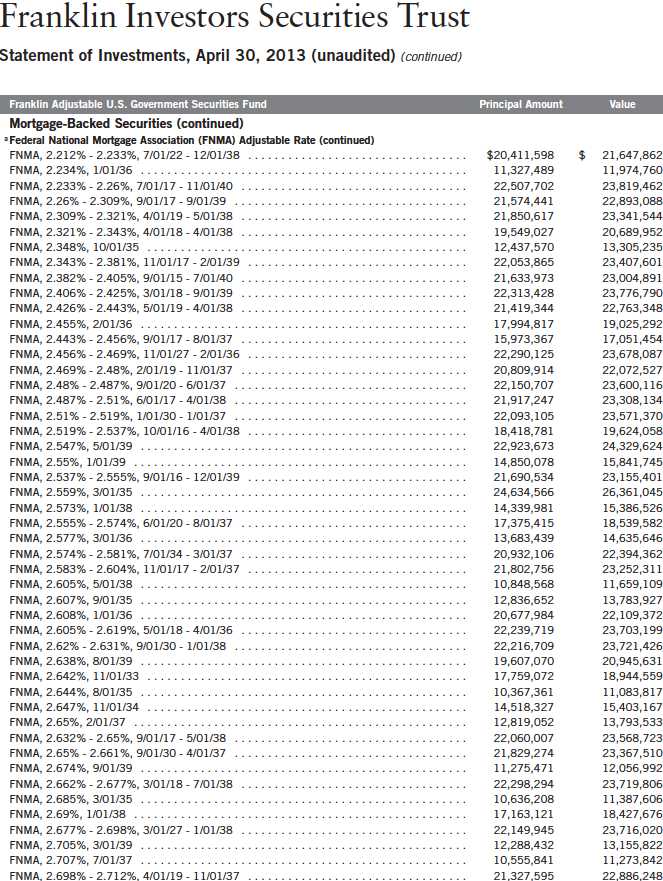

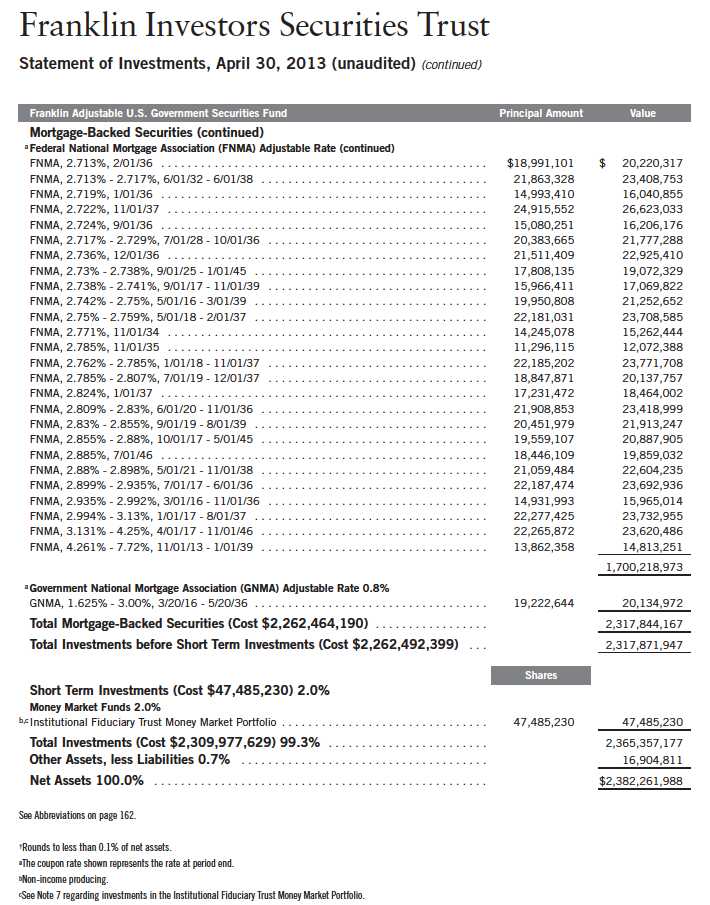

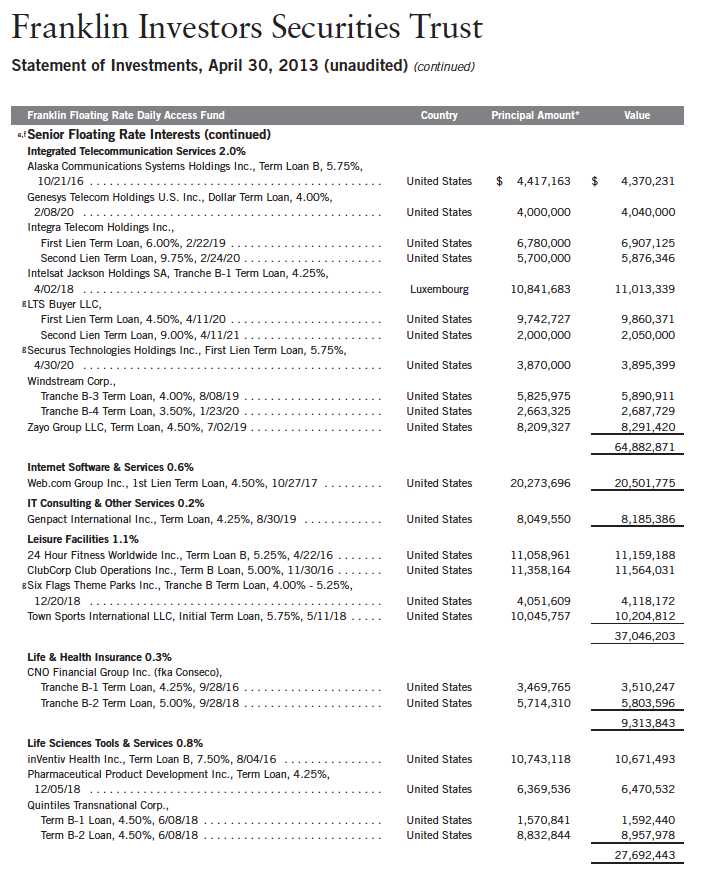

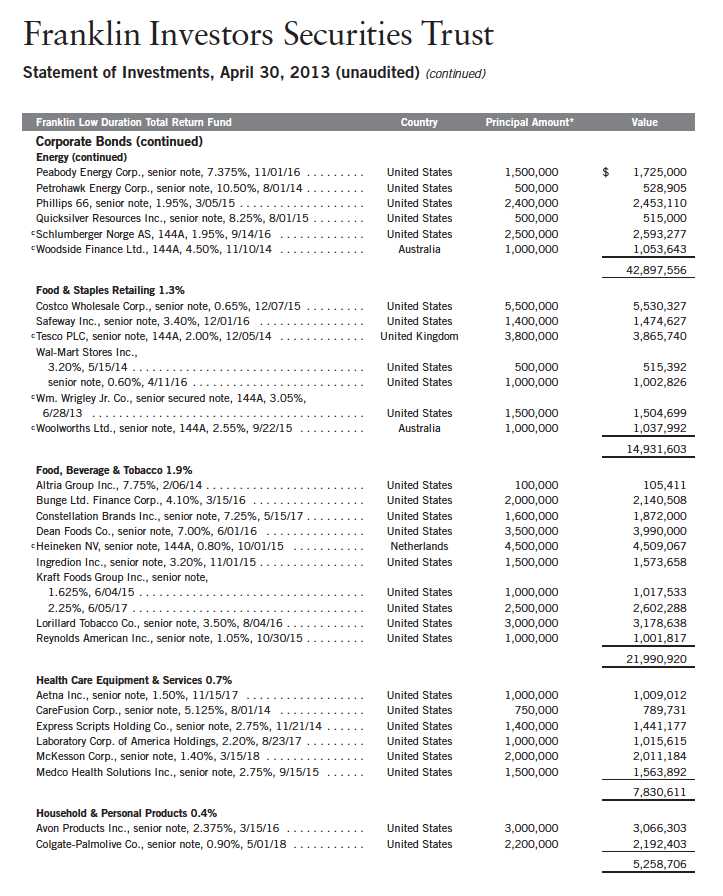

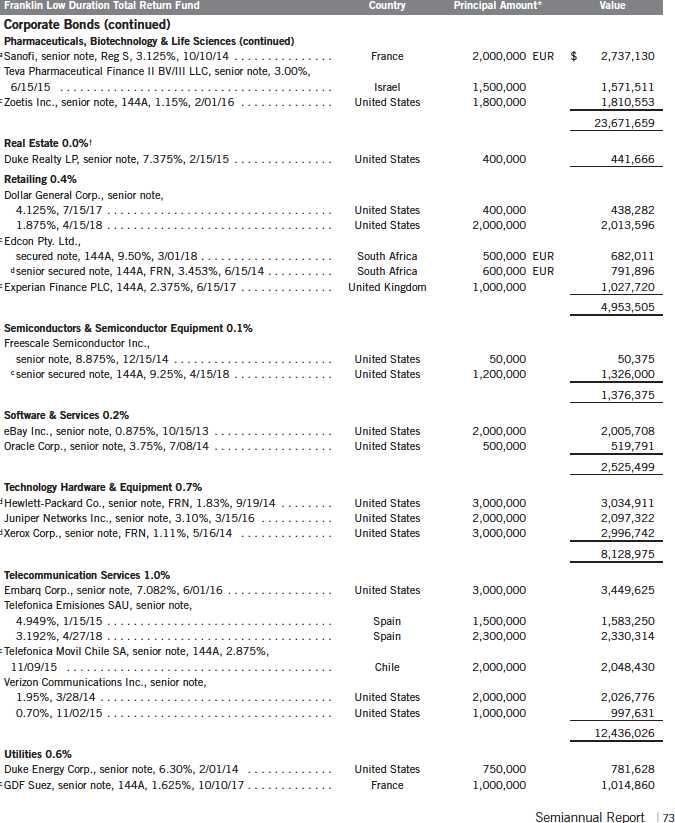

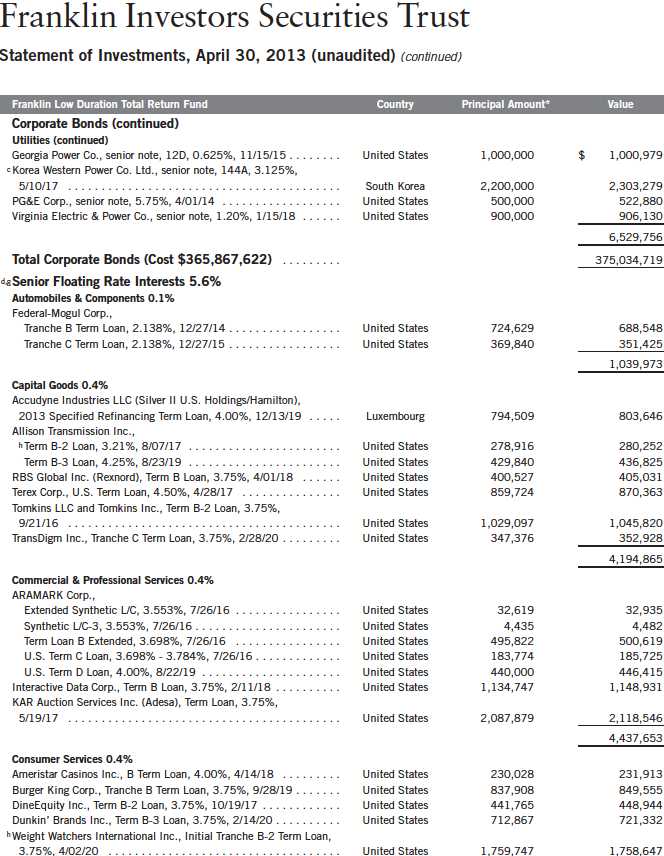

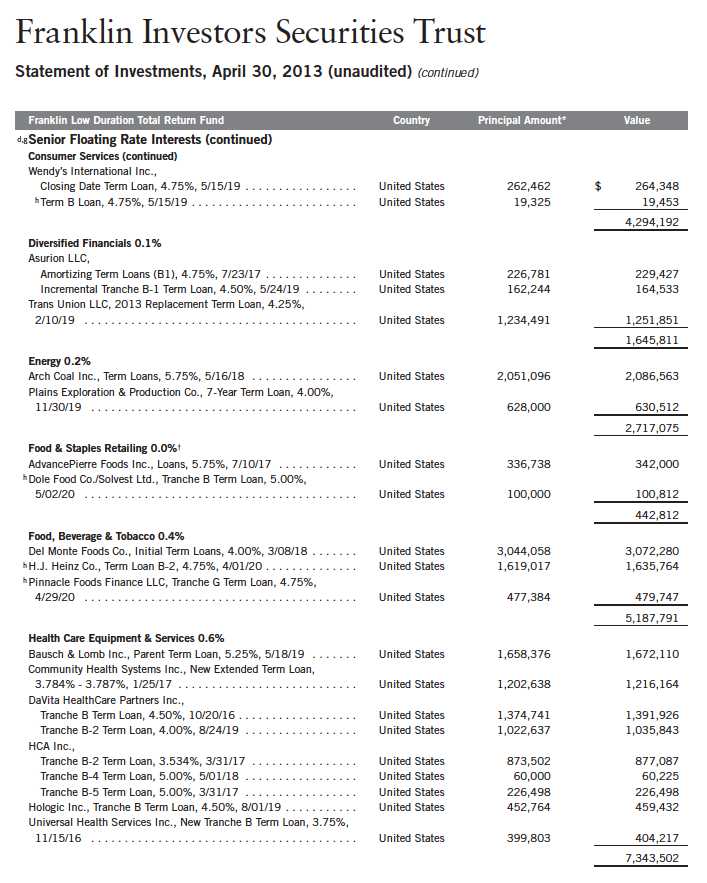

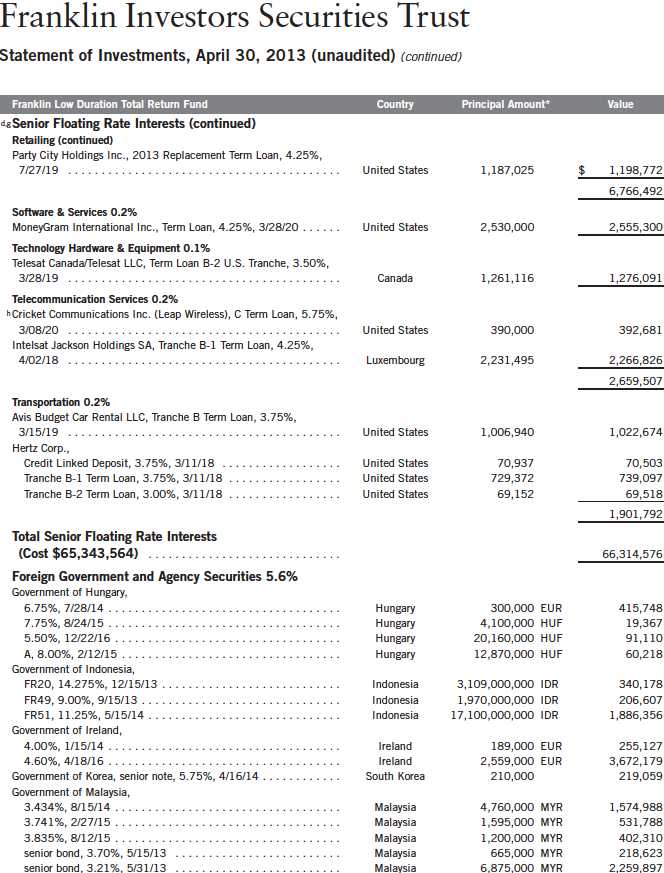

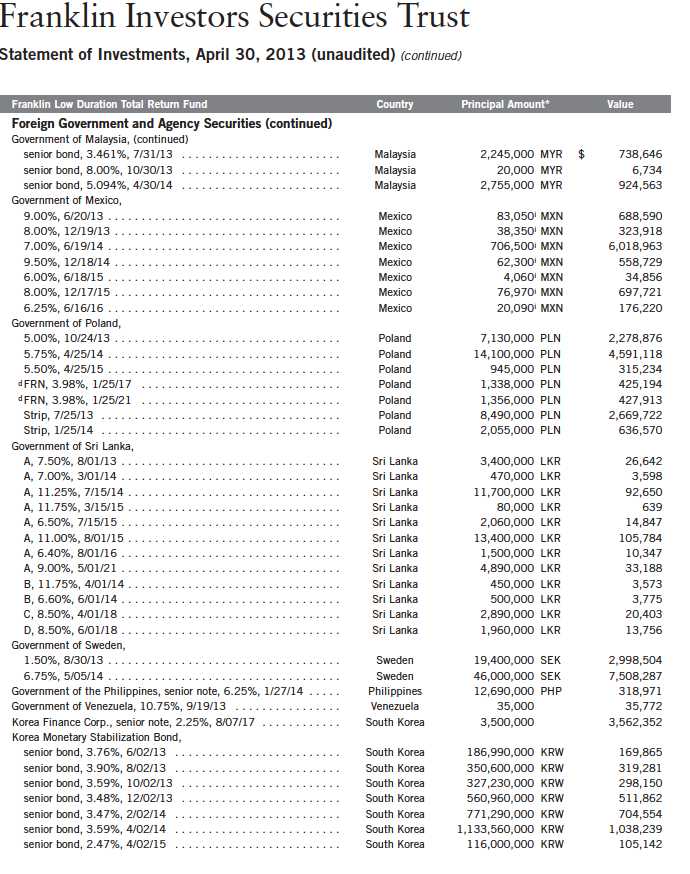

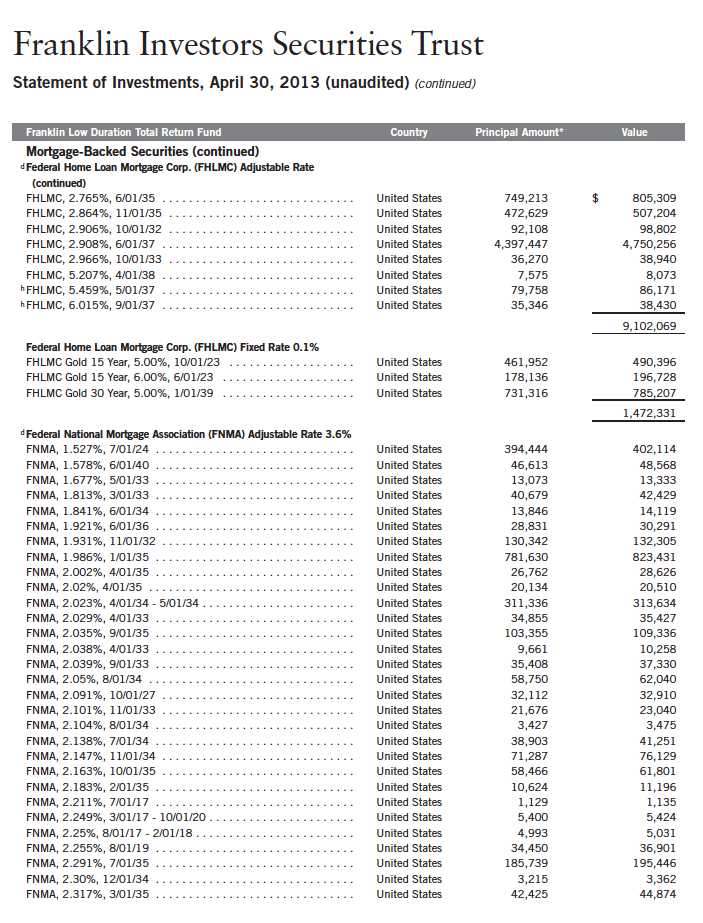

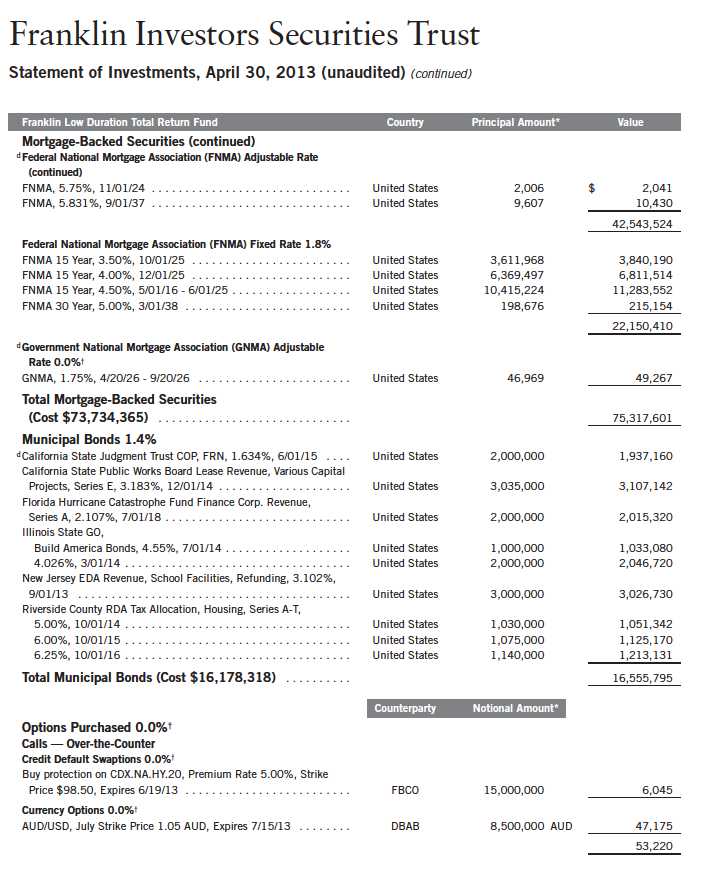

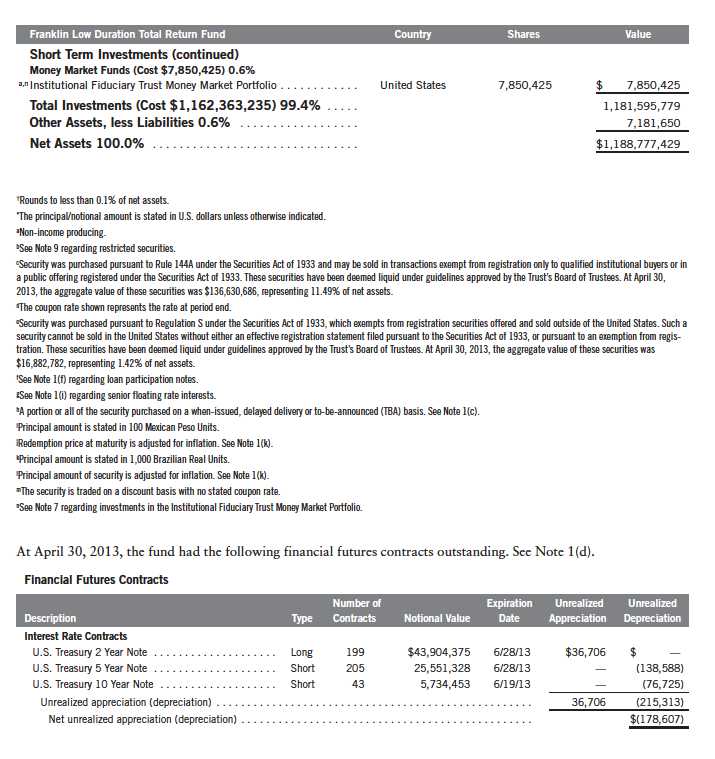

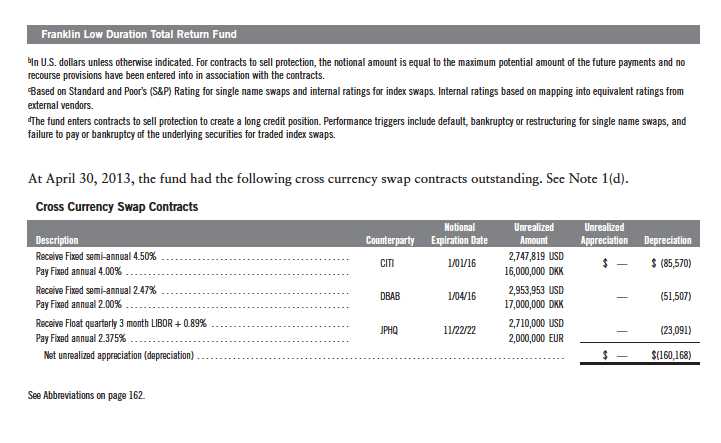

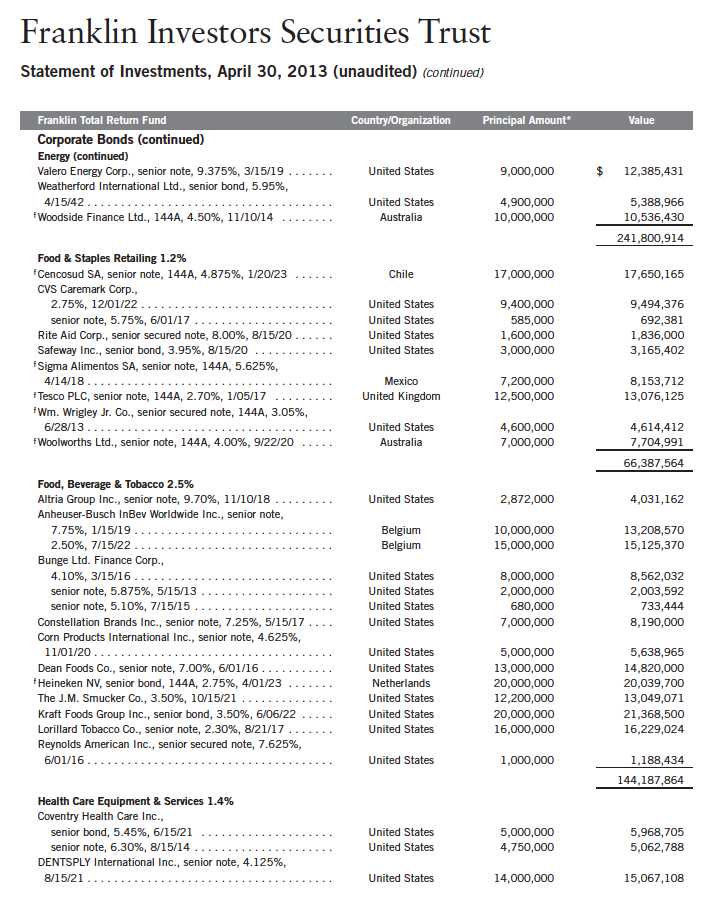

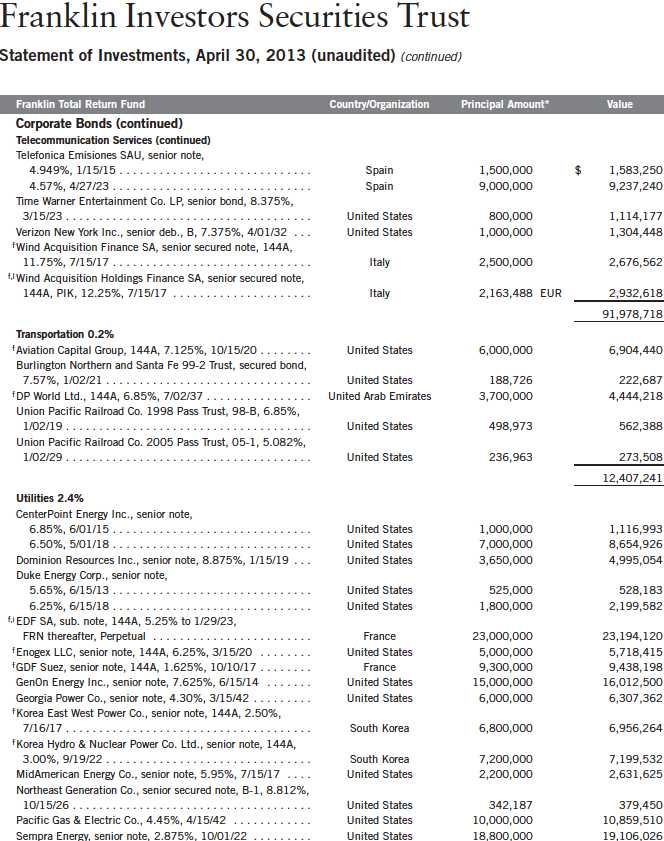

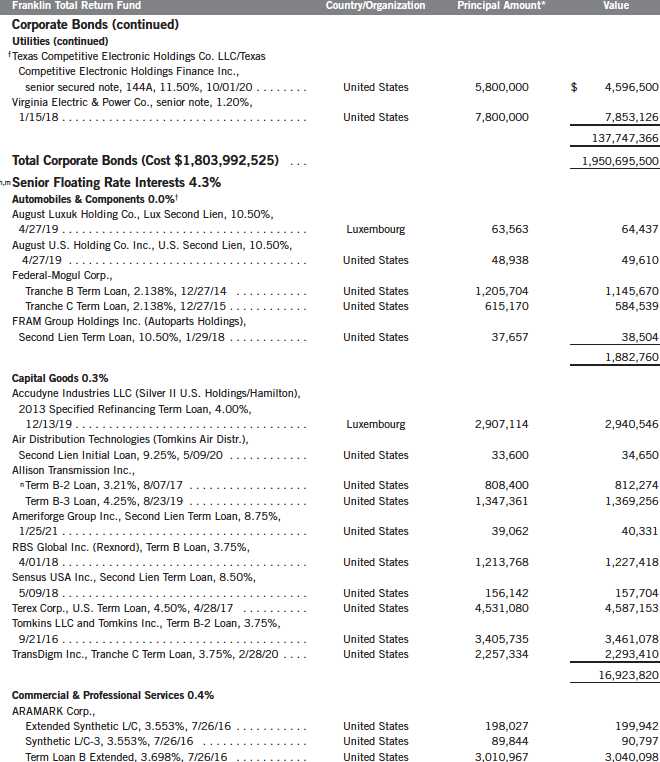

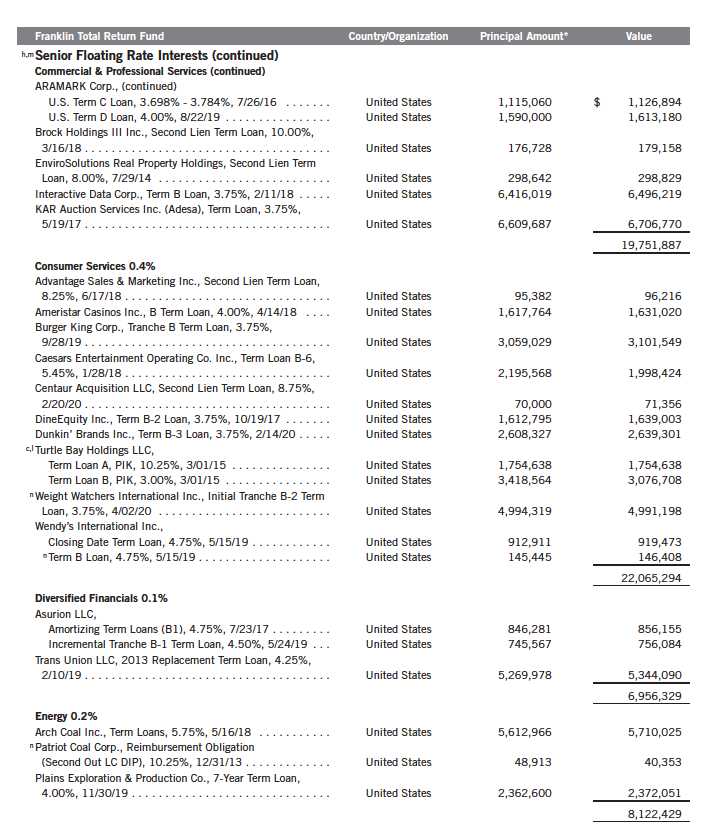

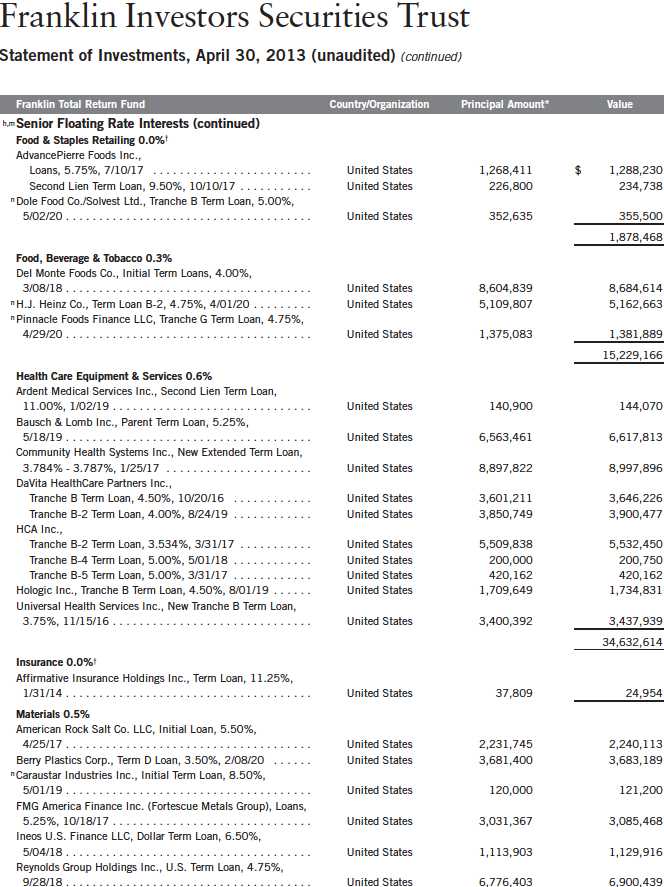

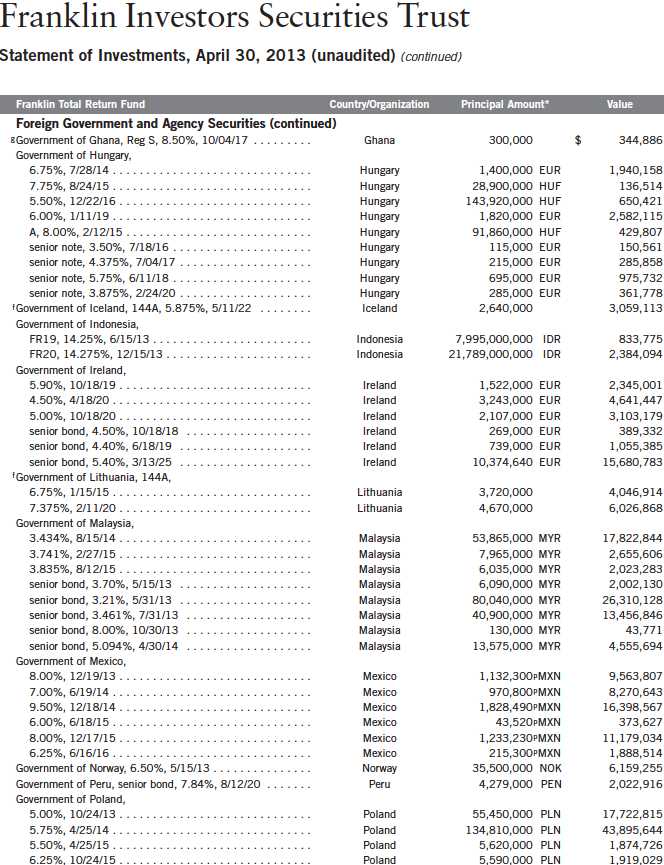

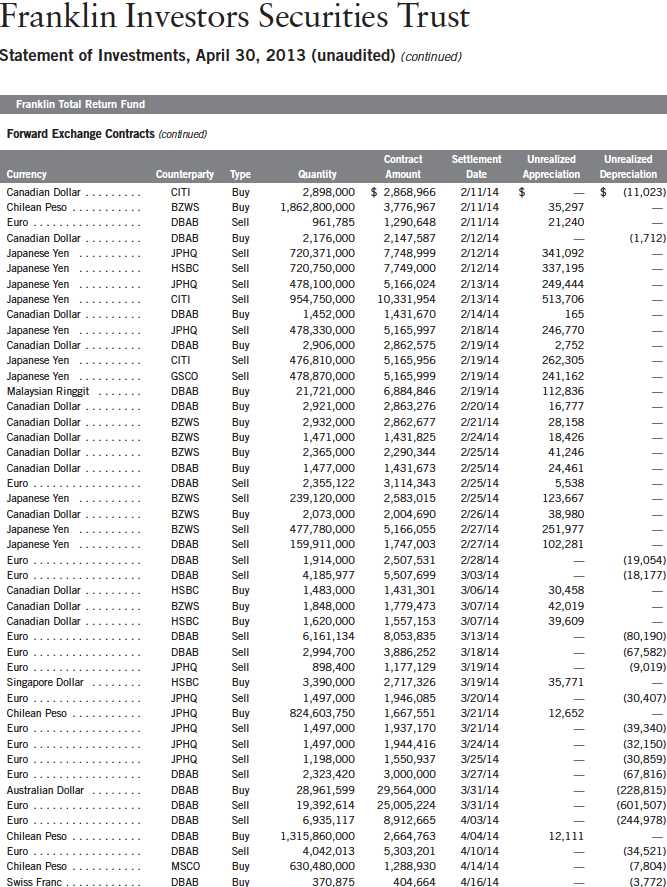

Franklin Investors Securities Trust

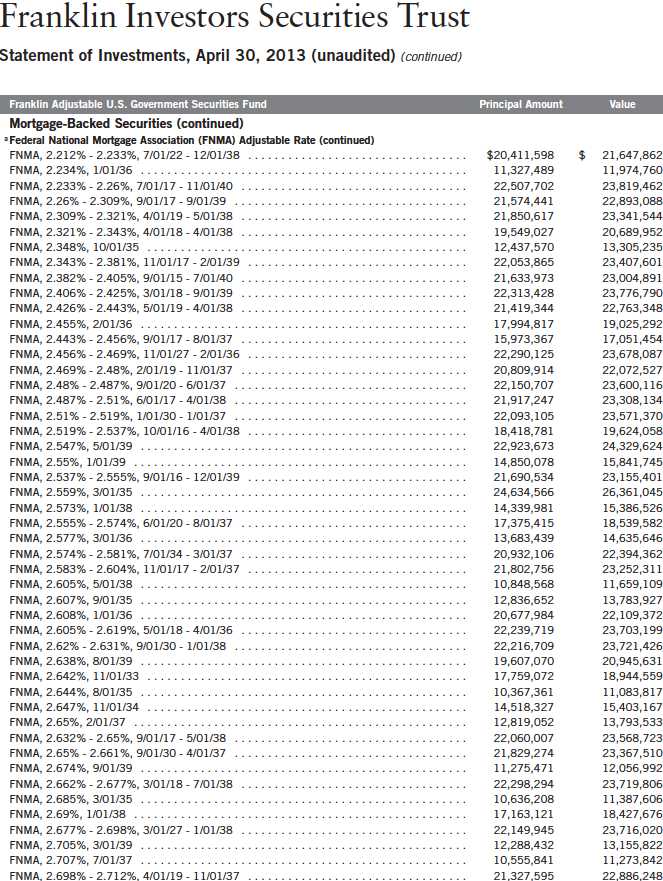

Statement of Investments, April 30, 2013 (unaudited) (continued)

54 | Semiannual Report

Semiannual Report | 55

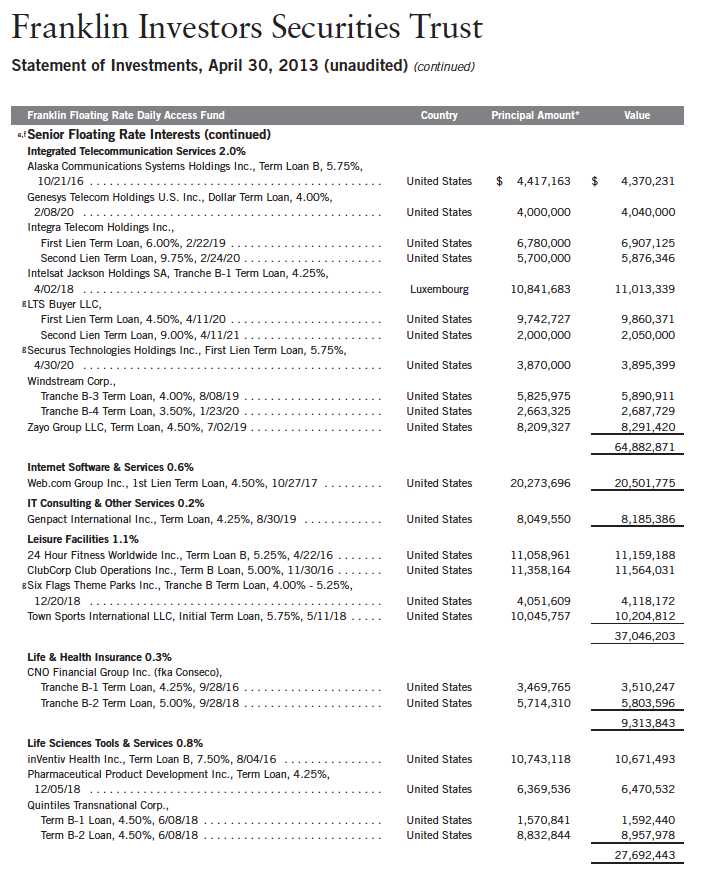

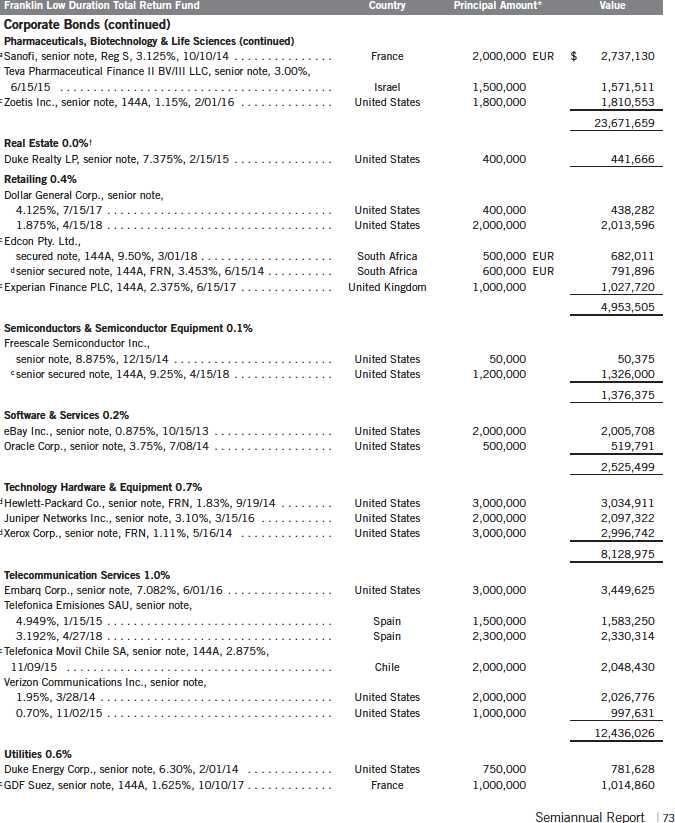

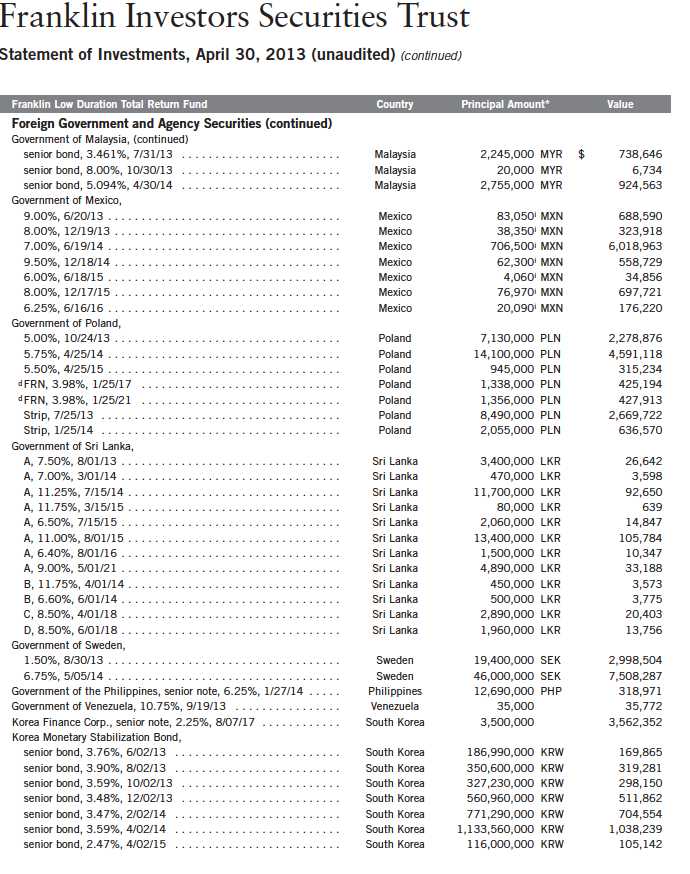

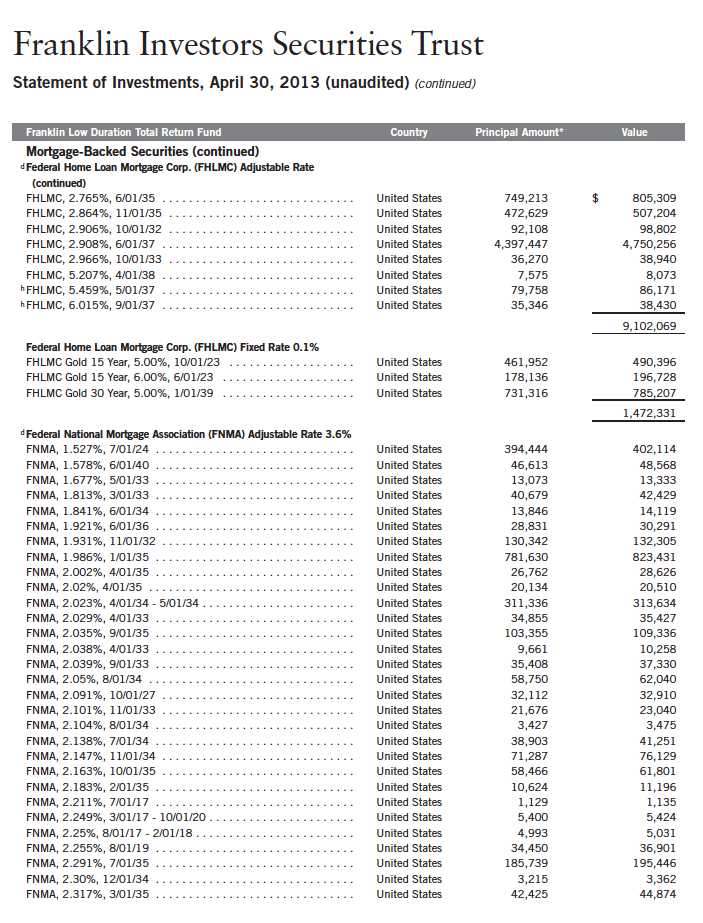

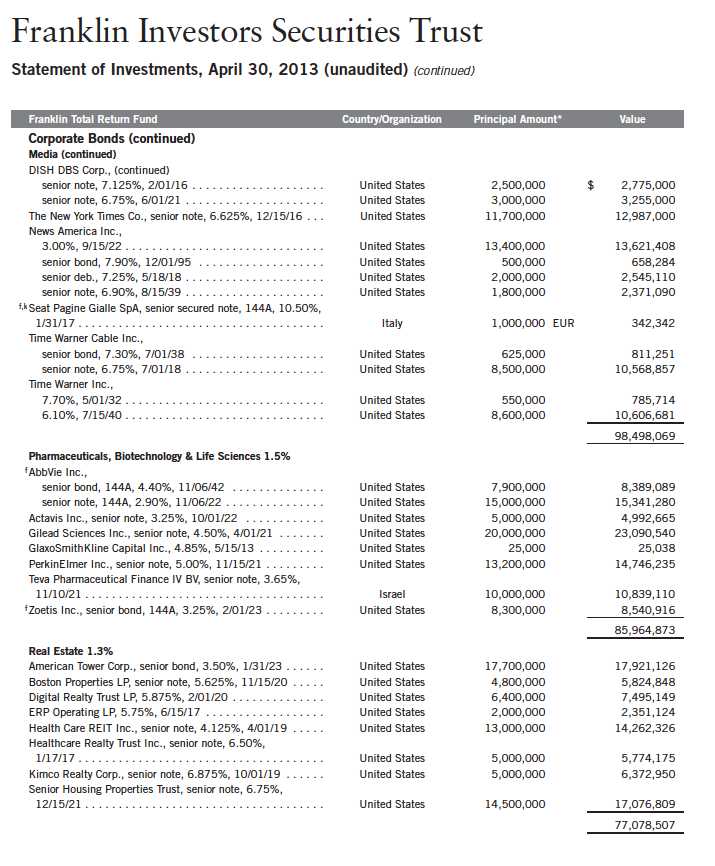

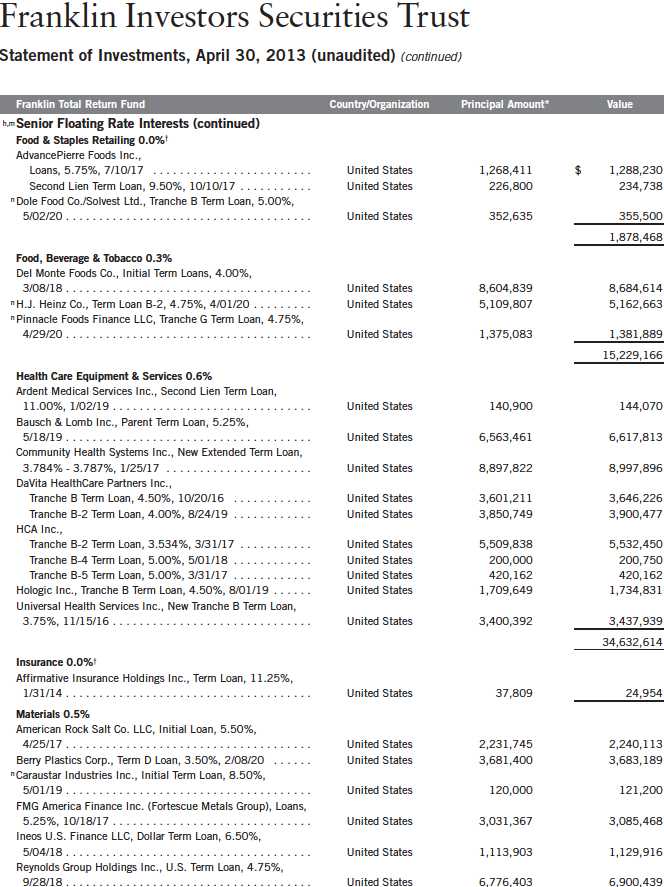

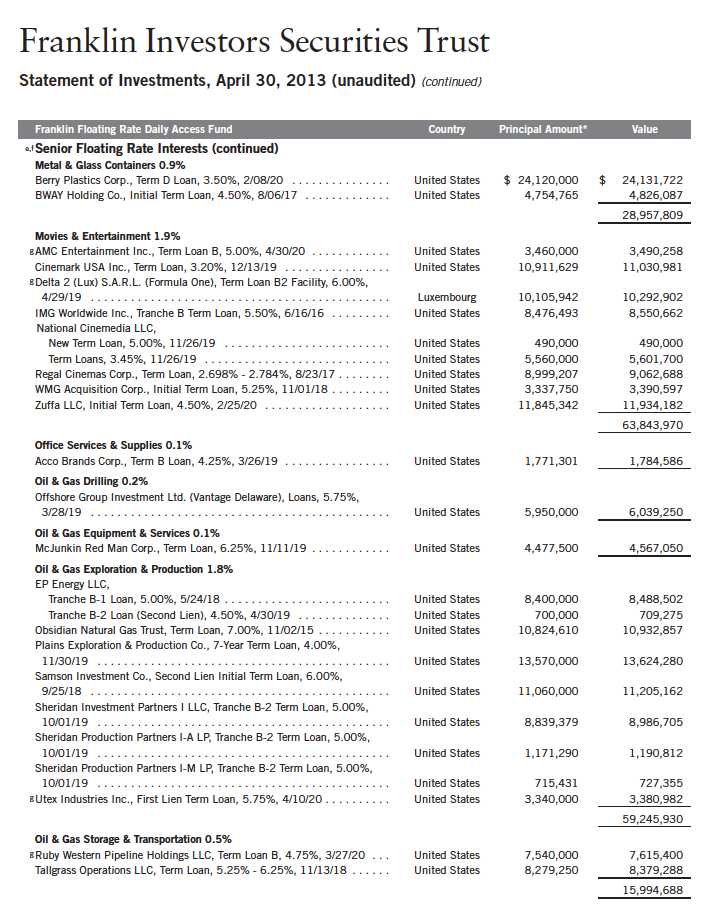

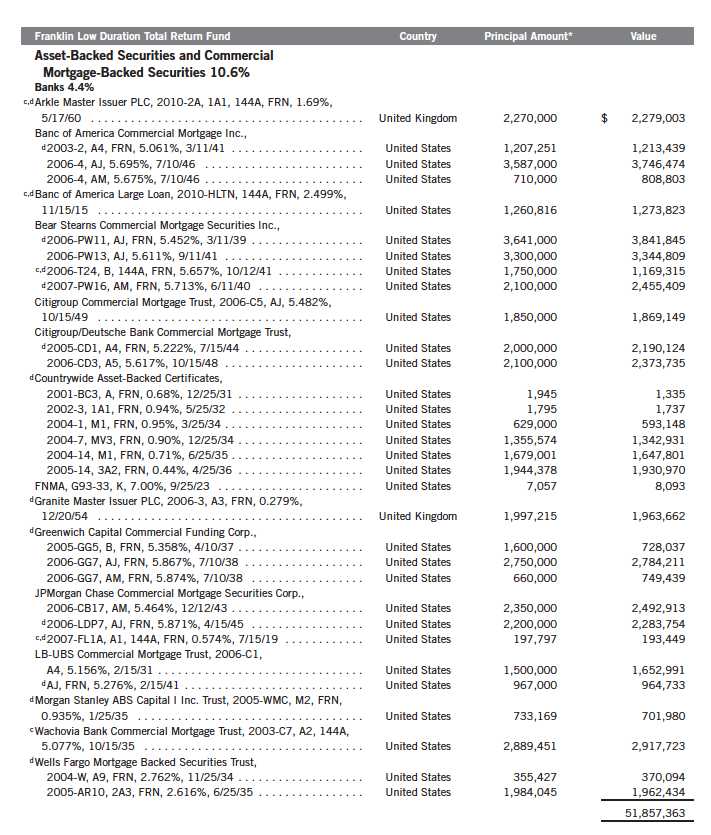

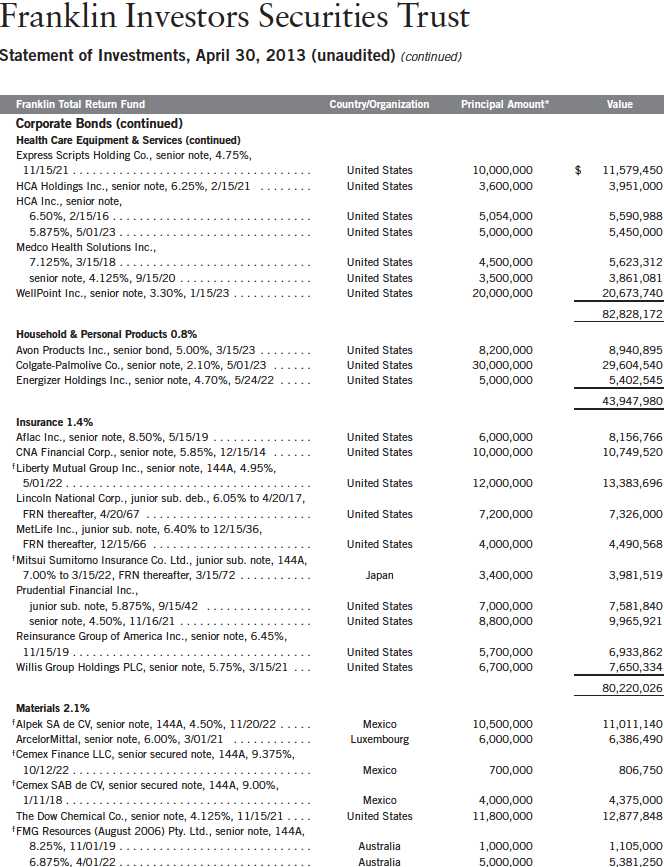

Franklin Investors Securities Trust

Statement of Investments, April 30, 2013 (unaudited) (continued)

56 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 57

58 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 59

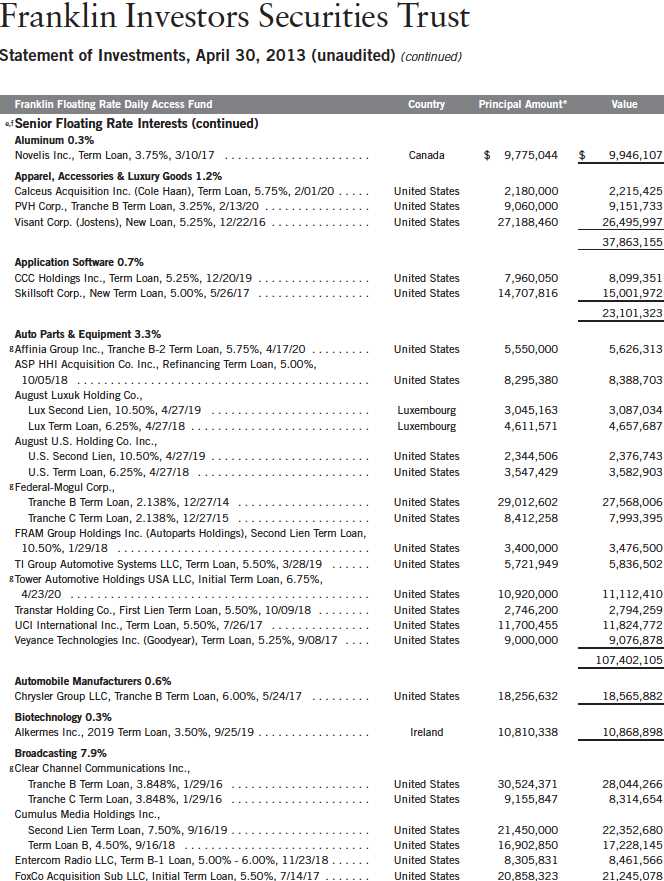

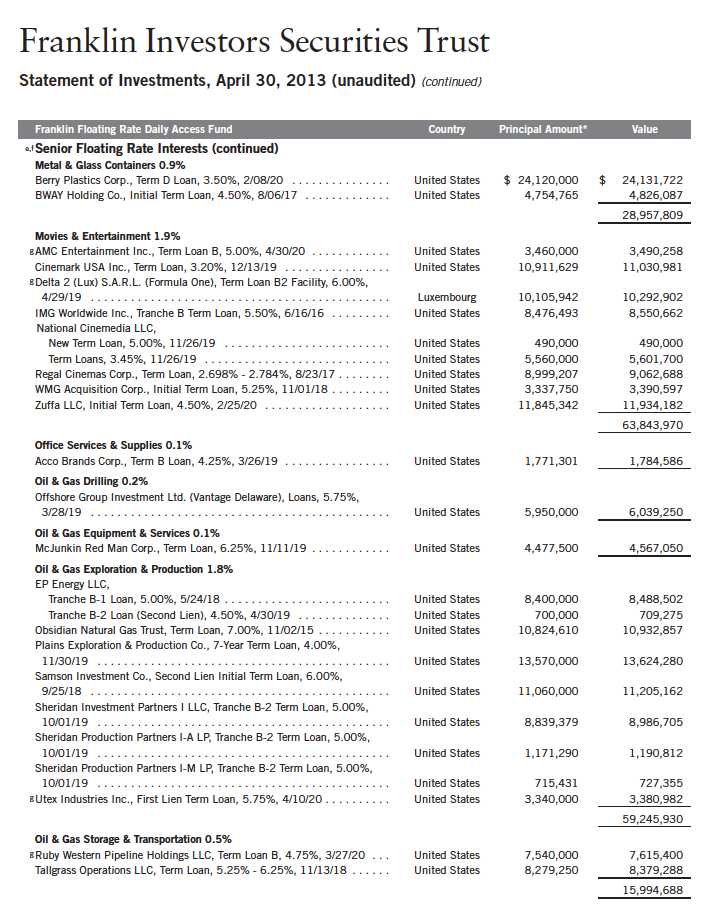

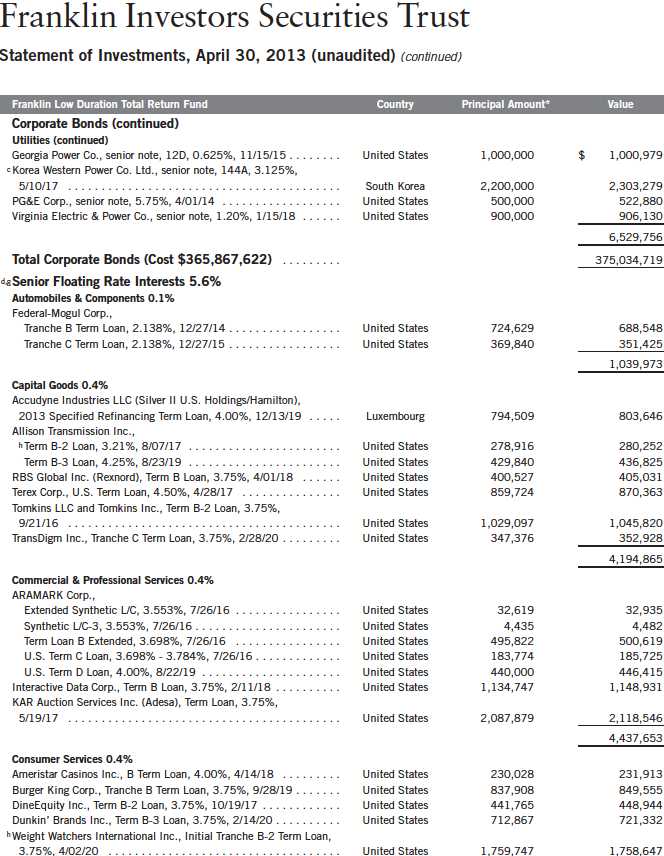

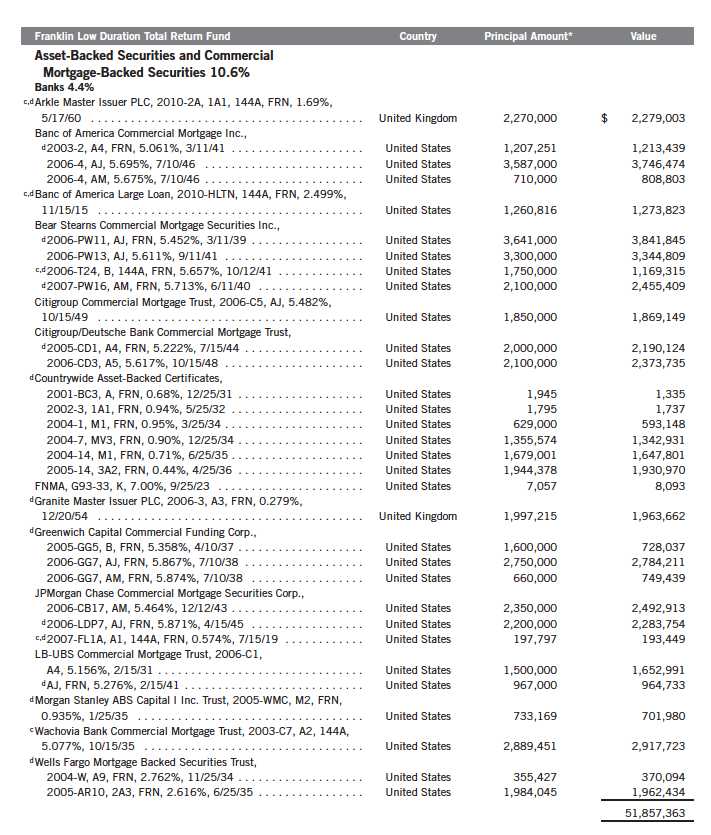

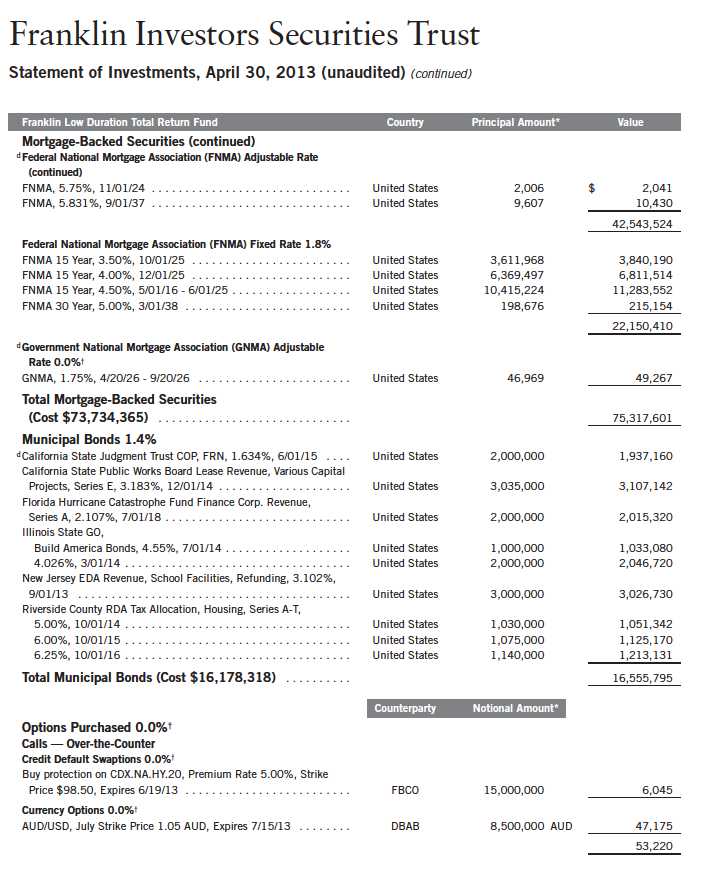

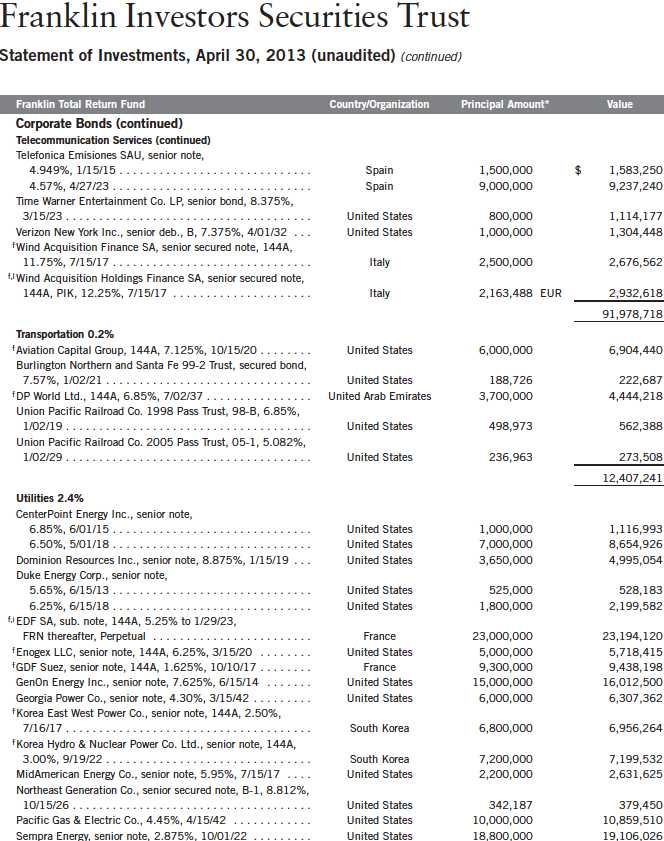

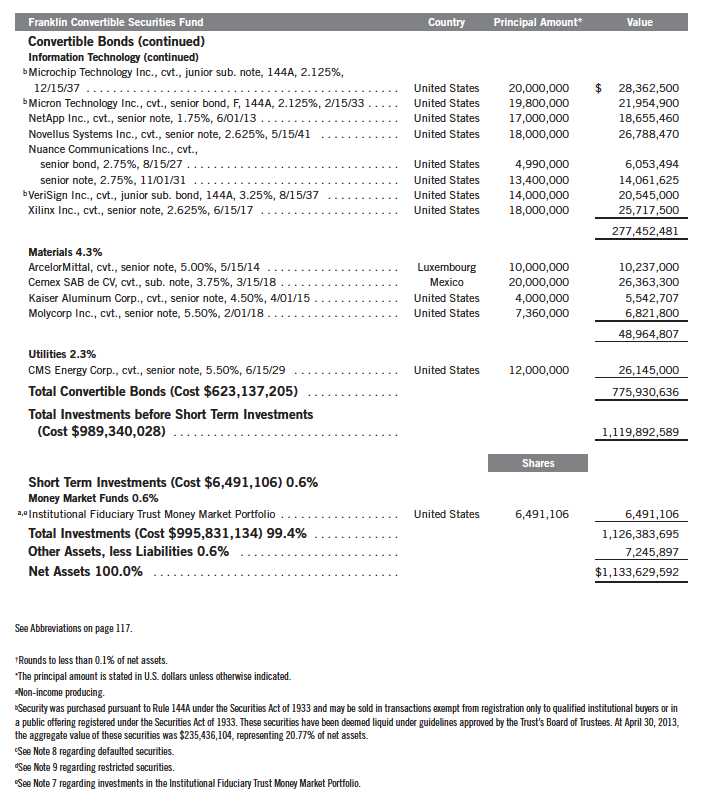

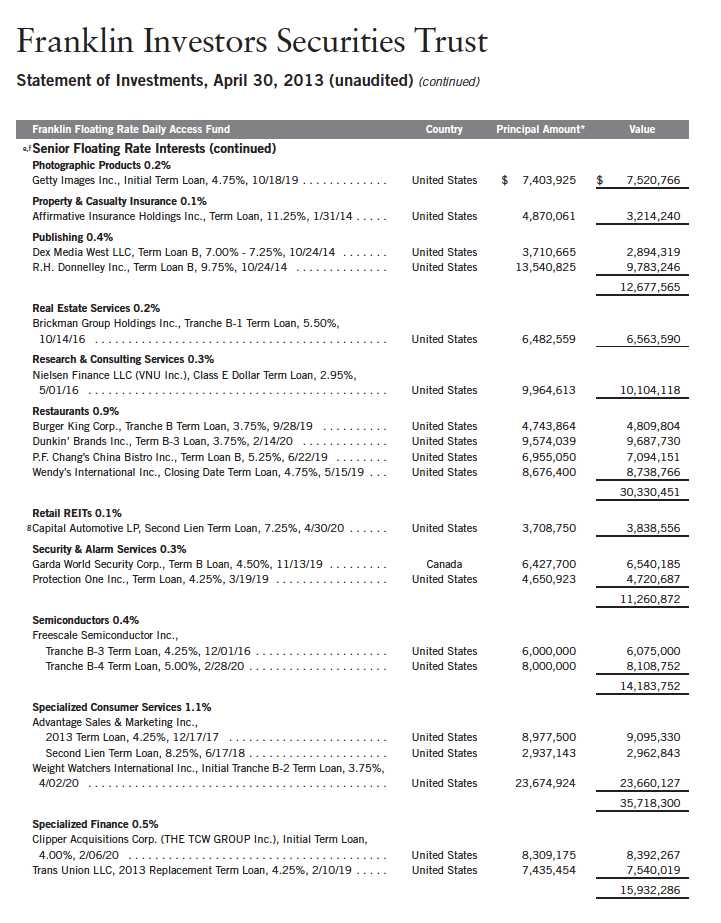

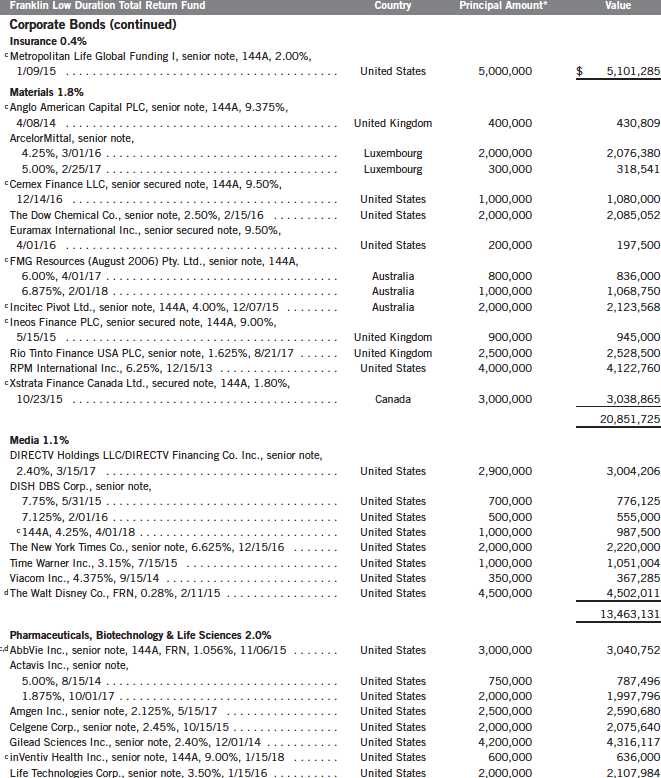

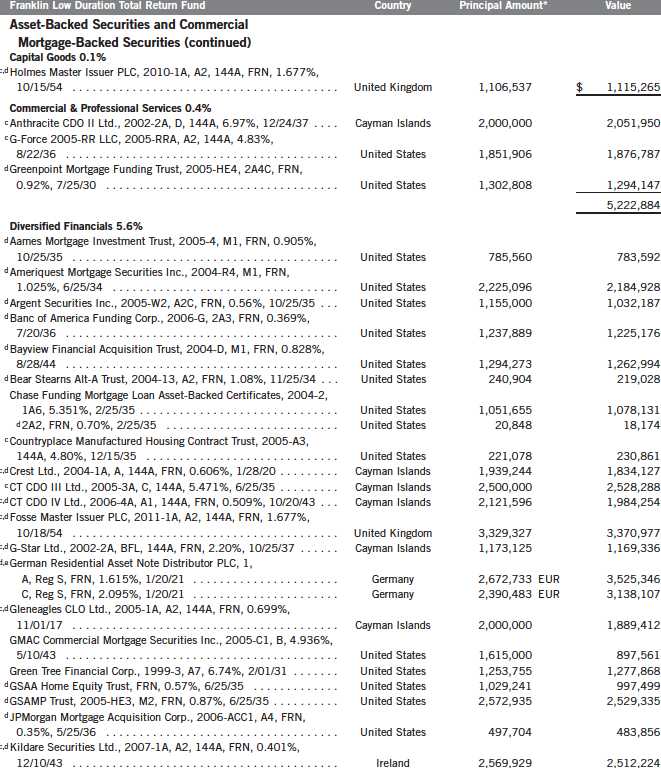

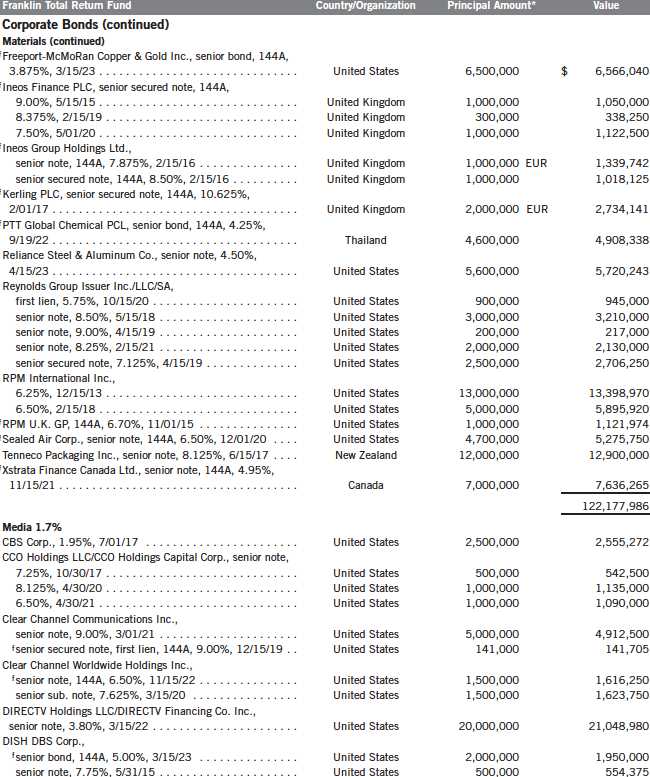

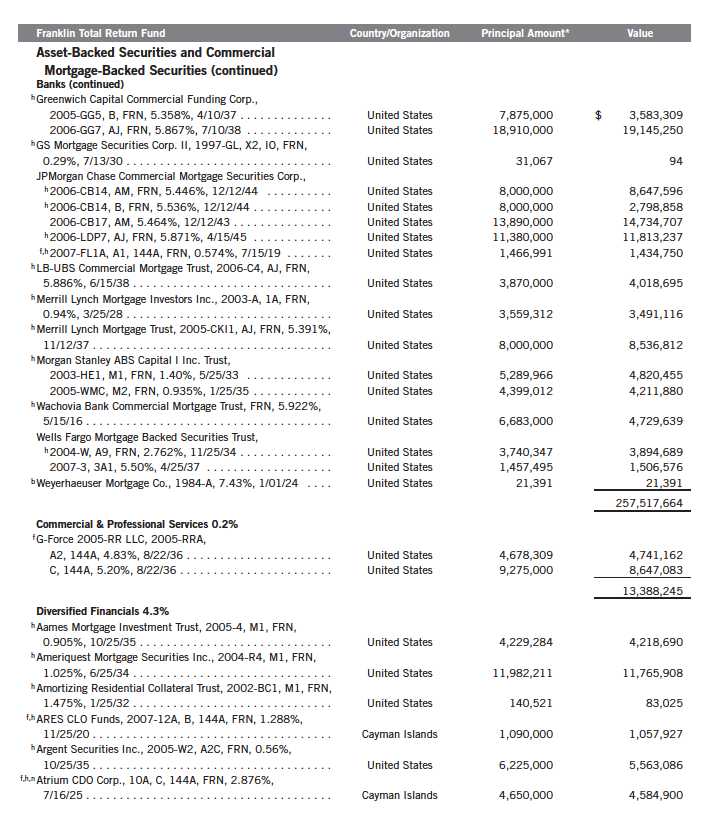

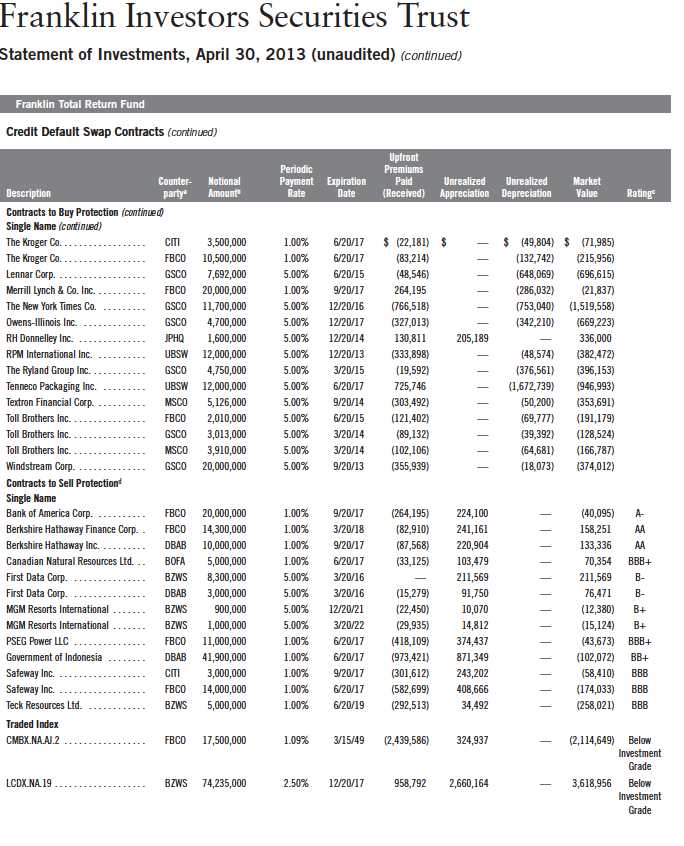

Franklin Investors Securities Trust

Statement of Investments, April 30, 2013 (unaudited)

Semiannual Report | 61

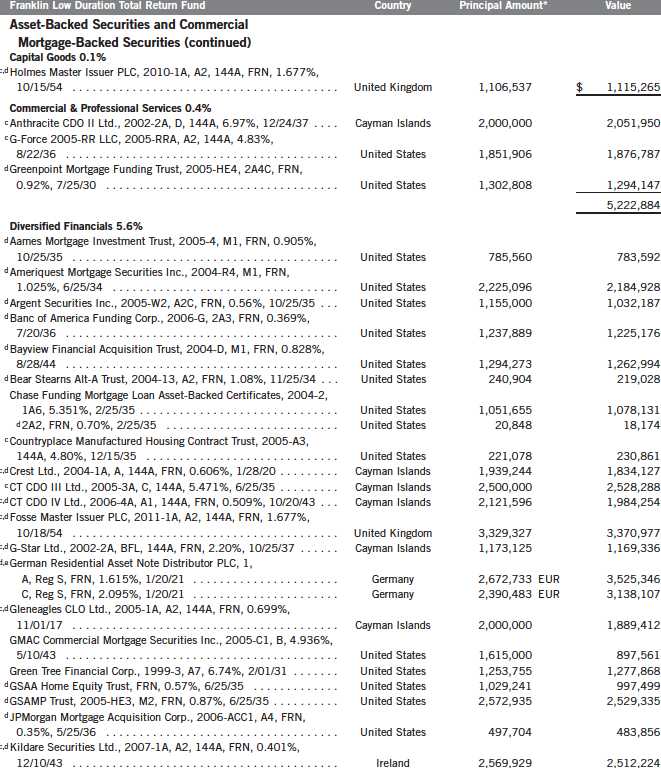

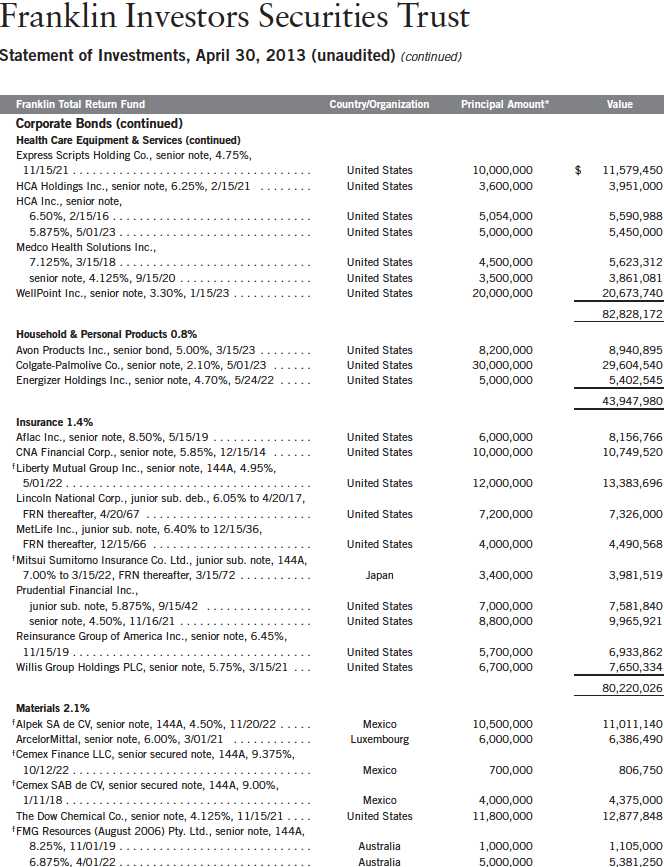

Franklin Investors Securities Trust

Statement of Investments, April 30, 2013 (unaudited) (continued)

62 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 63

64 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 65

66 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | 67

68 | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 69

70 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 71

Semiannual Report | 73

74 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

76 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

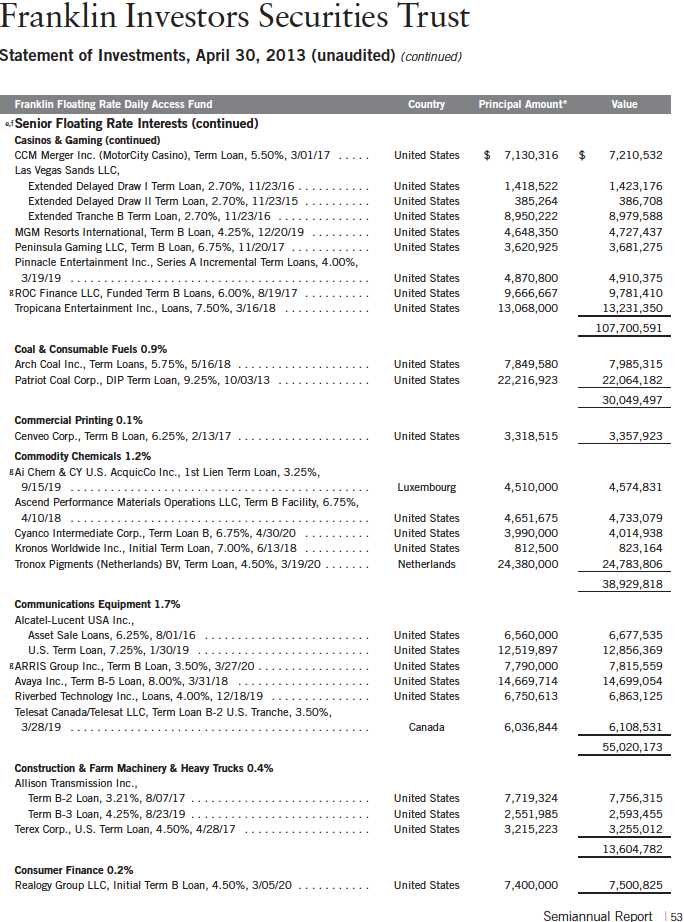

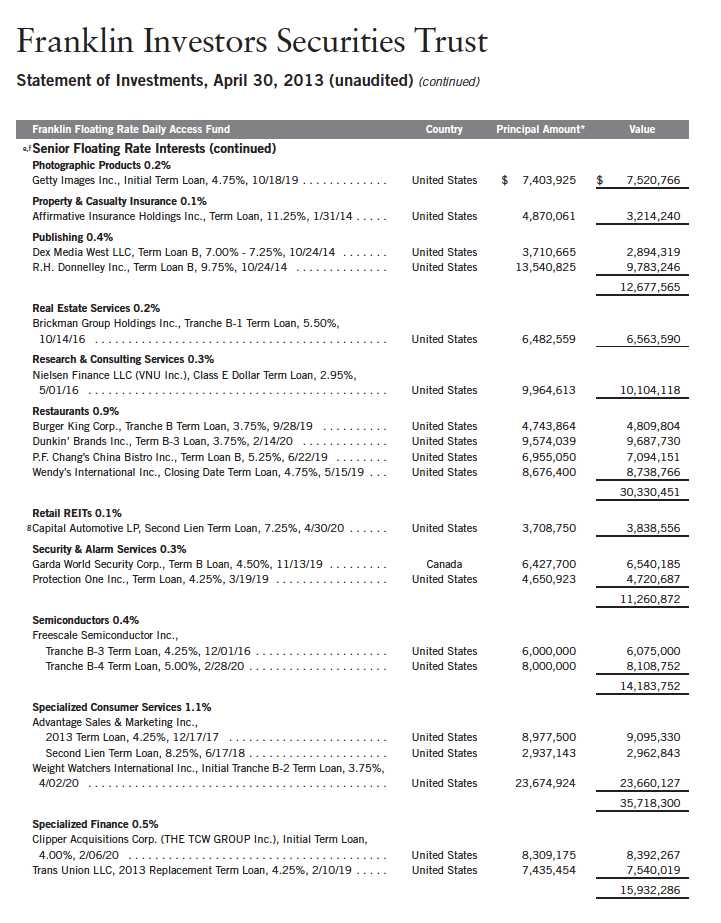

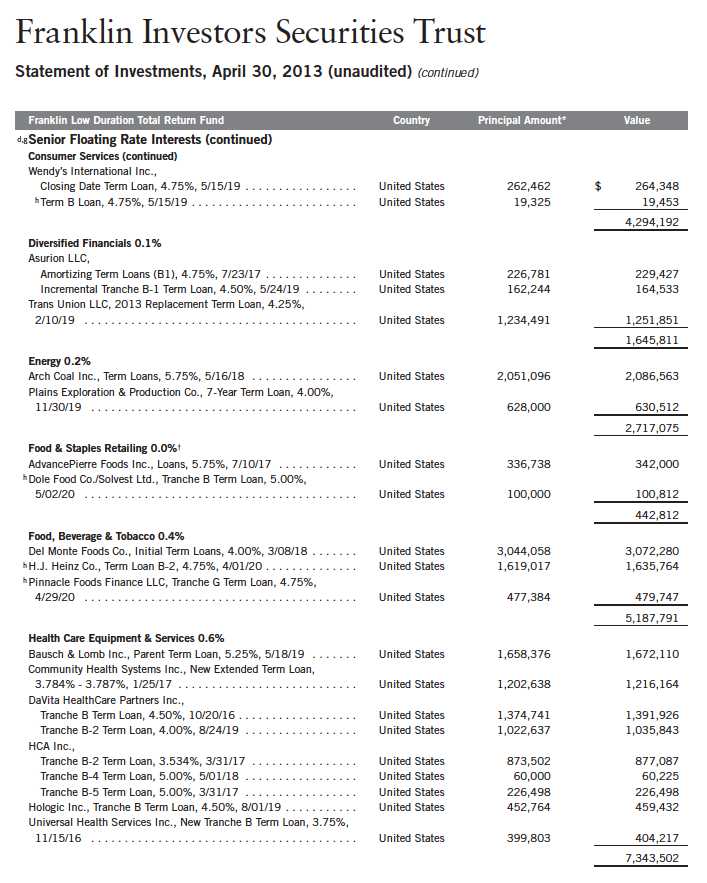

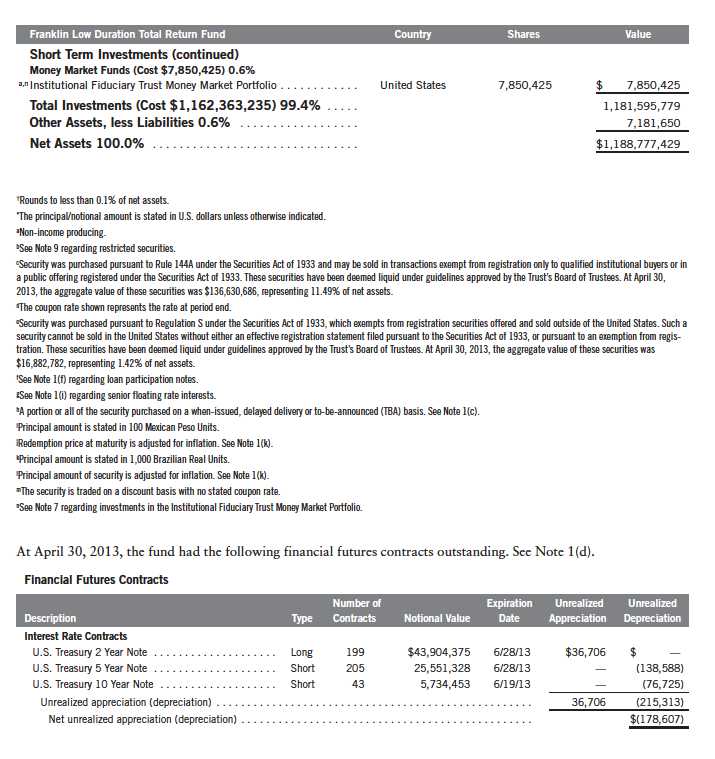

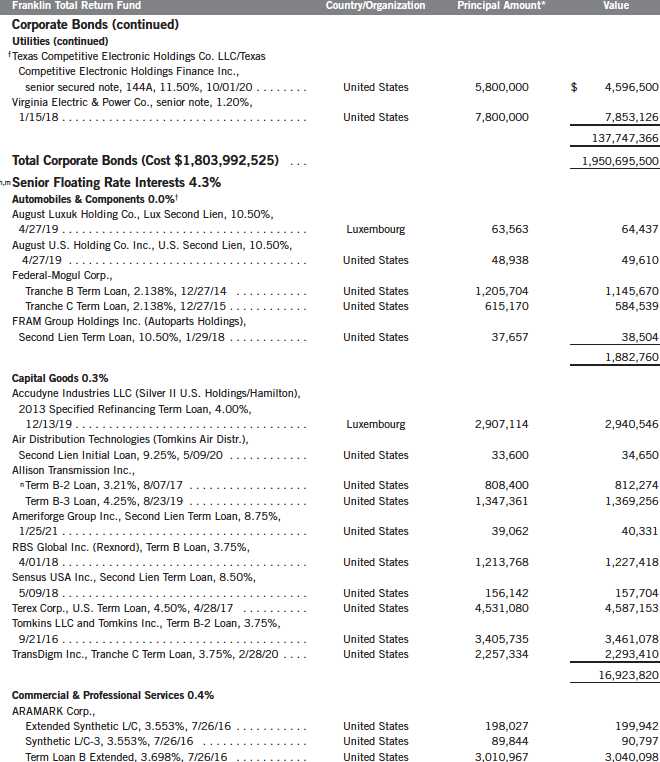

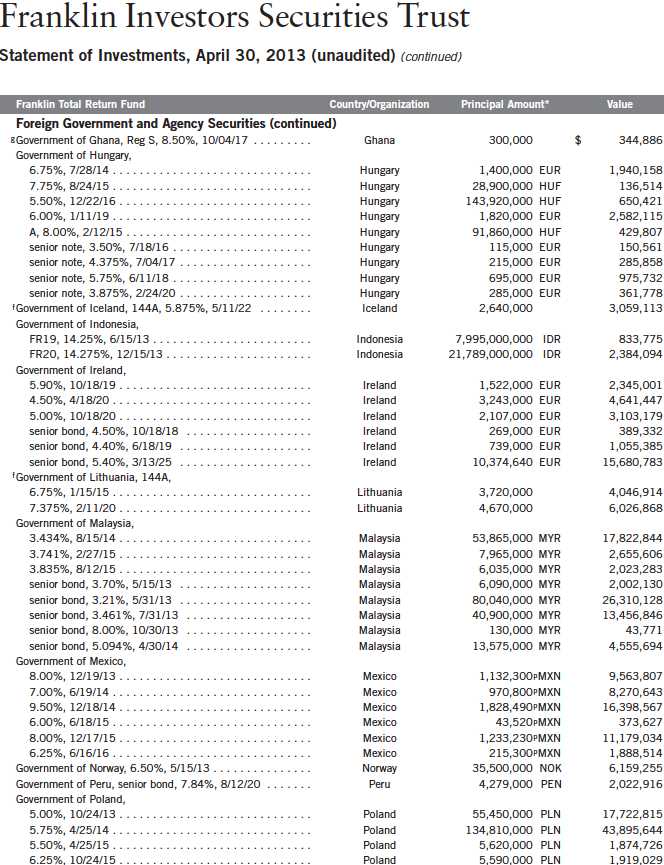

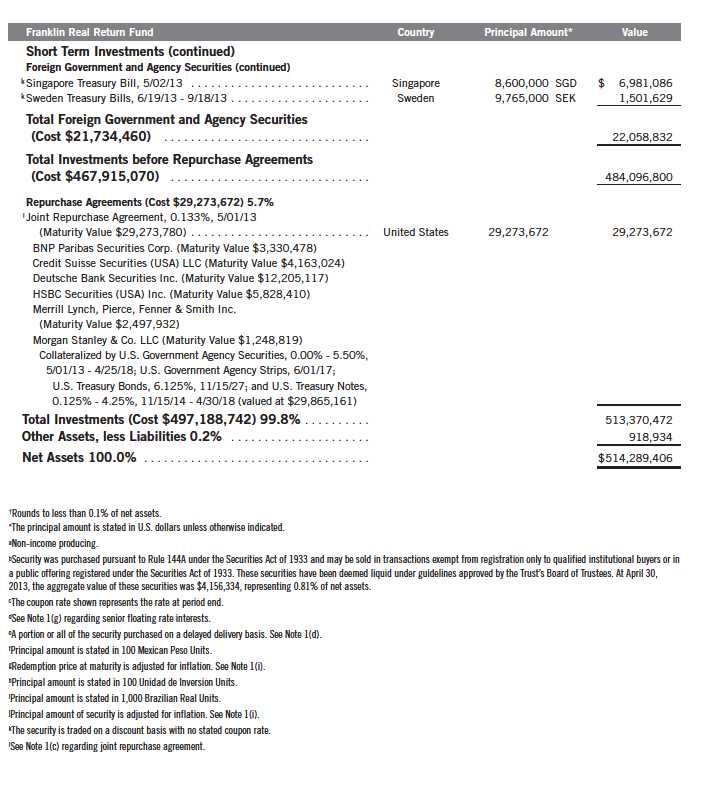

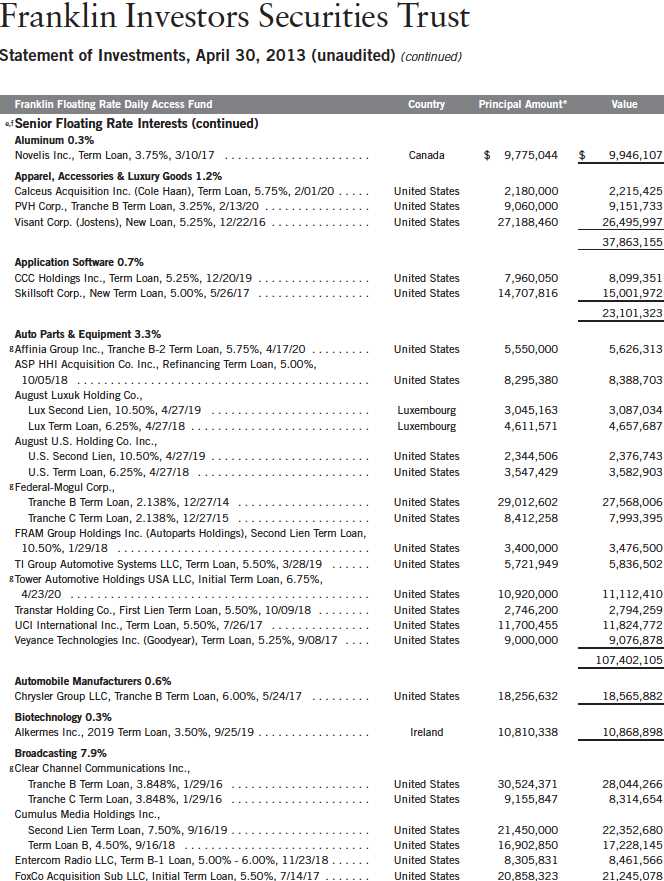

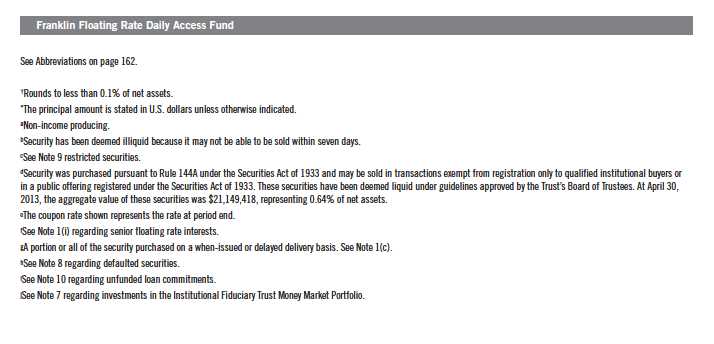

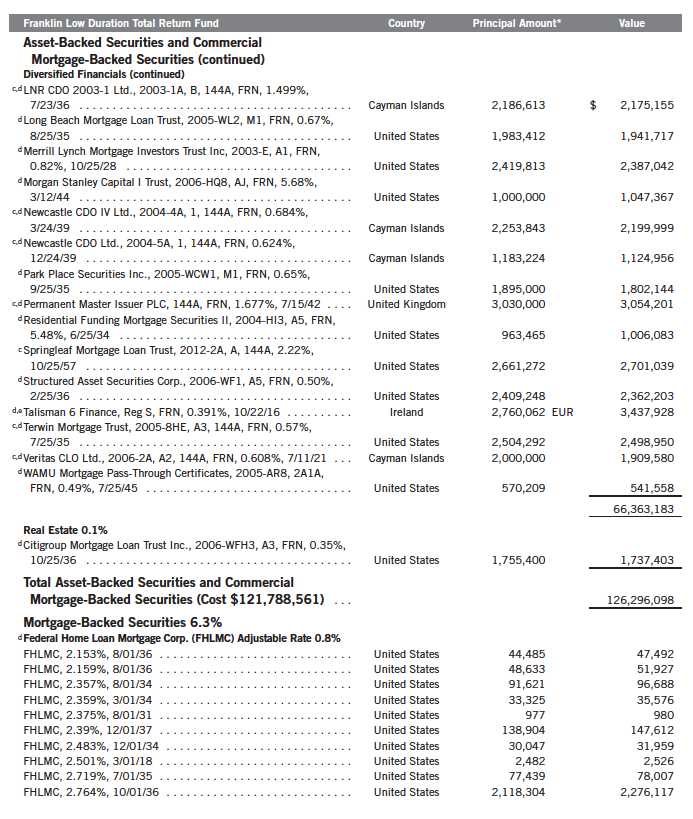

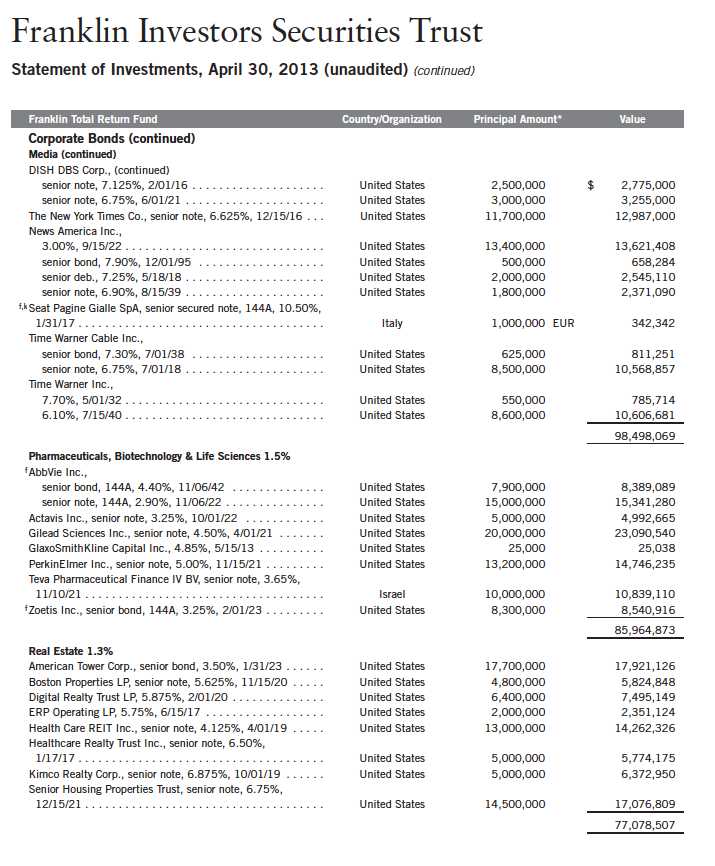

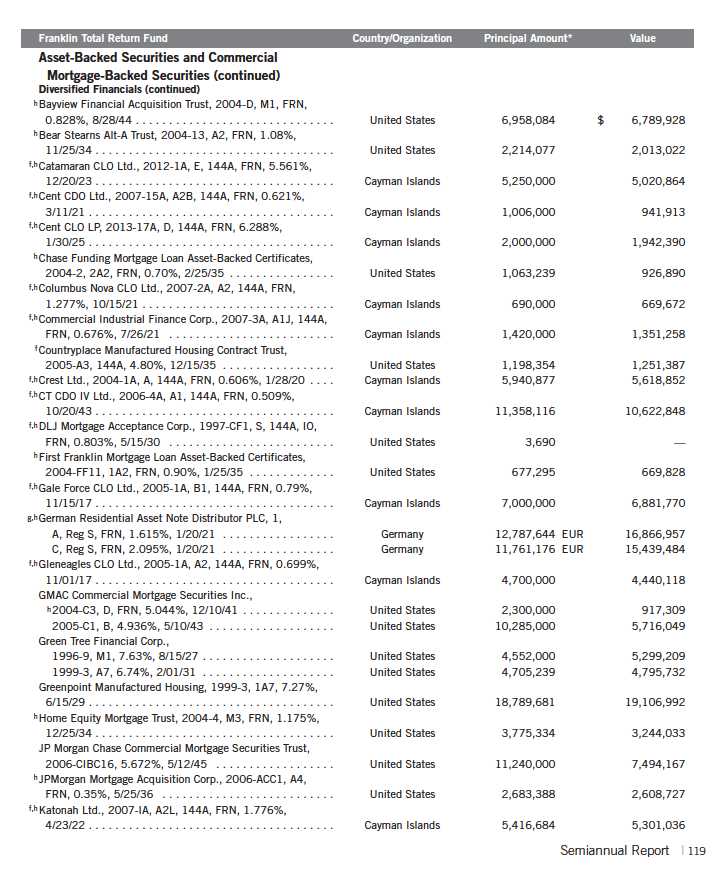

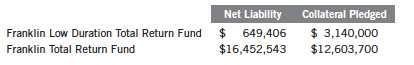

Franklin Investors Securities Trust

Statement of Investments, April 30, 2013 (unaudited)

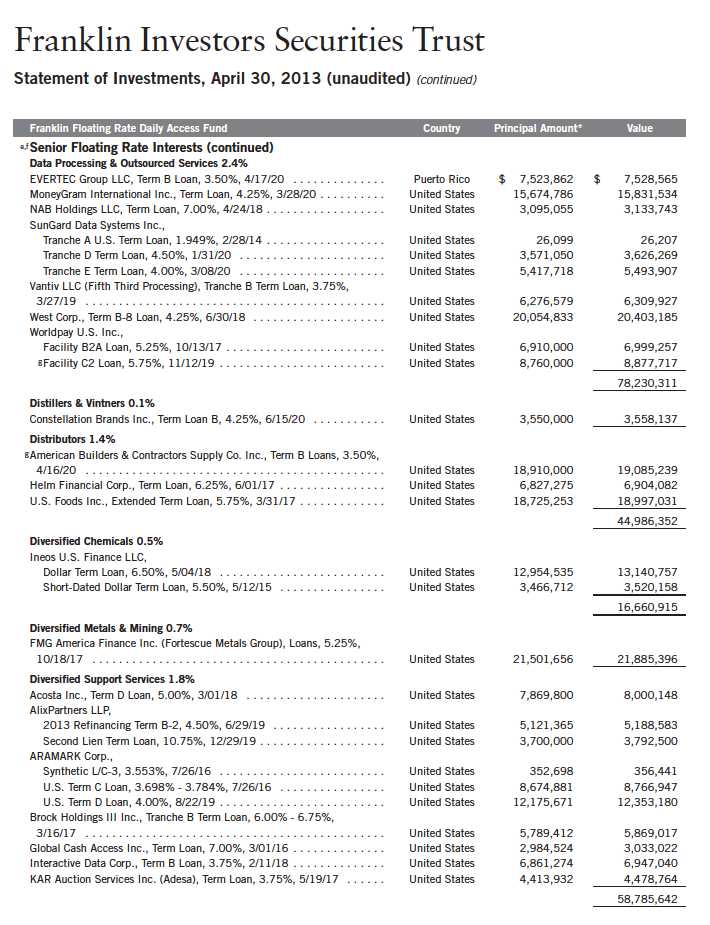

Franklin Investors Securities Trust

Statement of Investments, April 30, 2013 (unaudited) (continued)

Semiannual Report | 79

80 | Semiannual Report

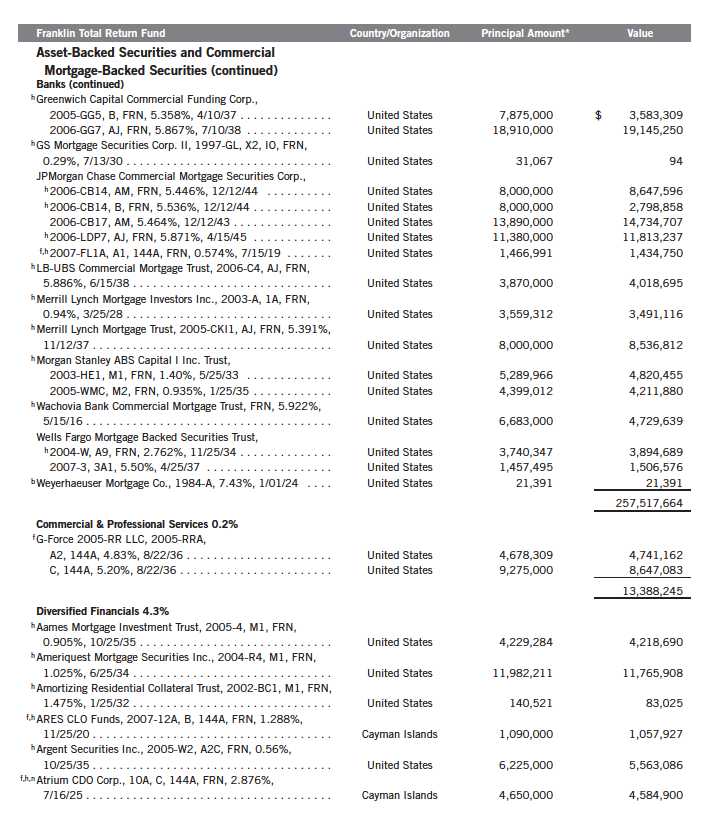

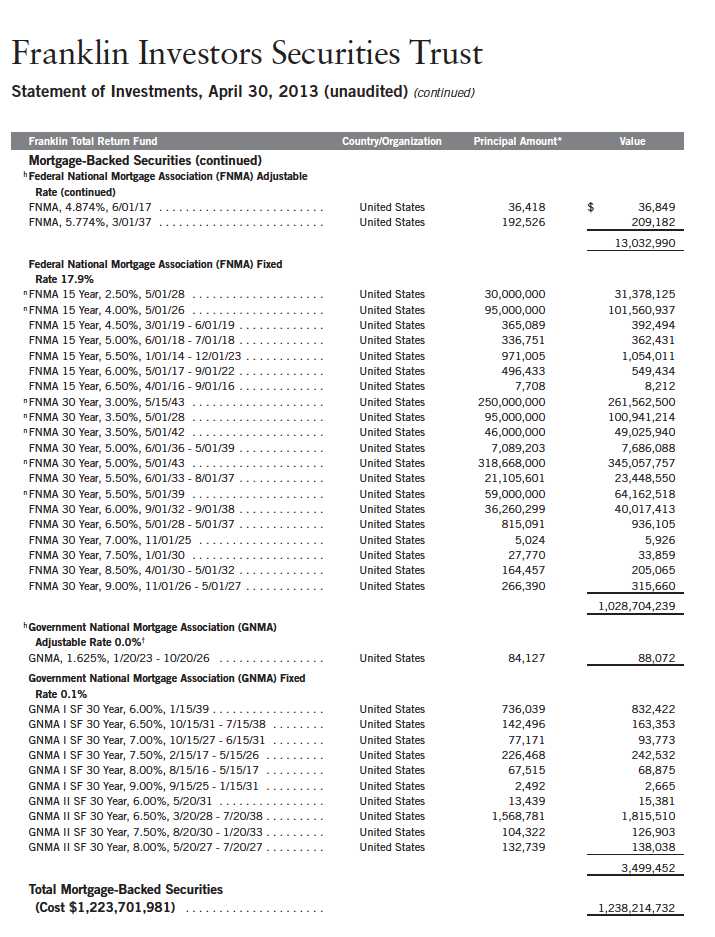

Franklin Investors Securities Trust

Statement of Investments, April 30, 2013 (unaudited) (continued)

84 | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 85

86 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 87

88 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 89

90 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

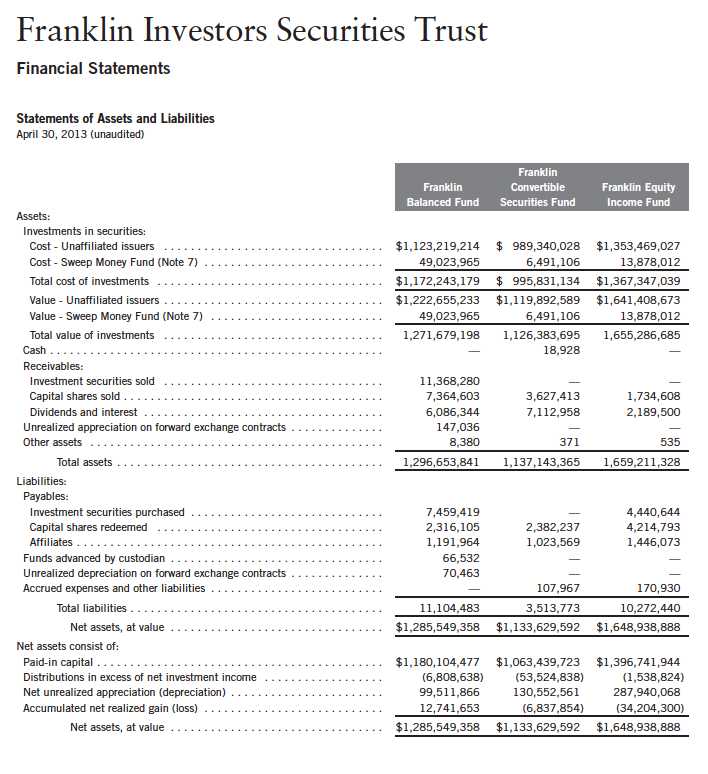

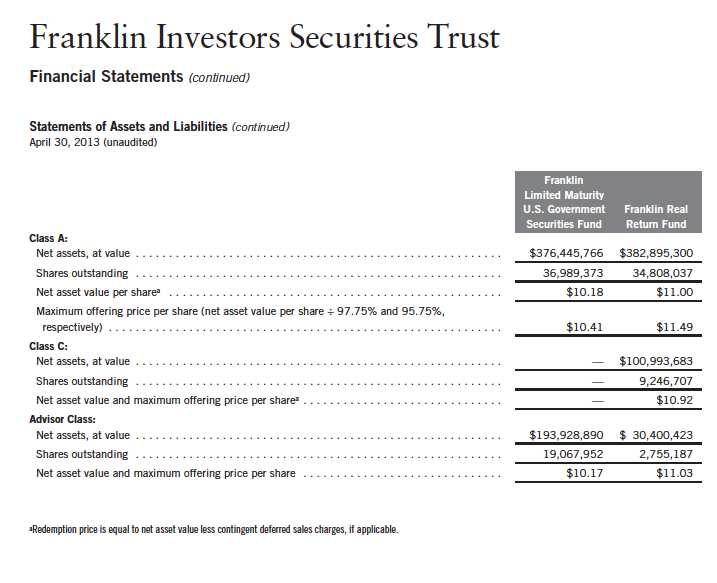

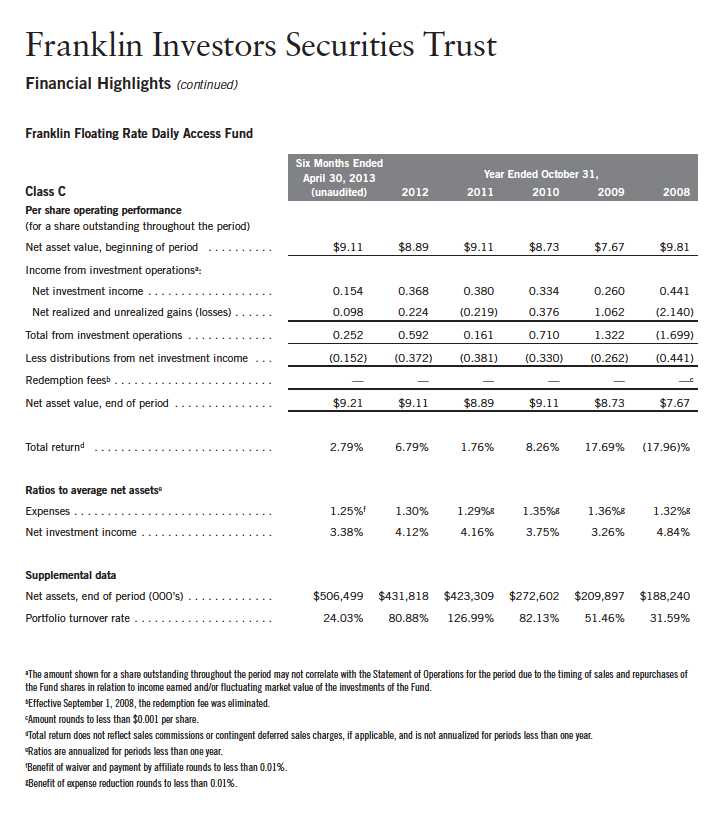

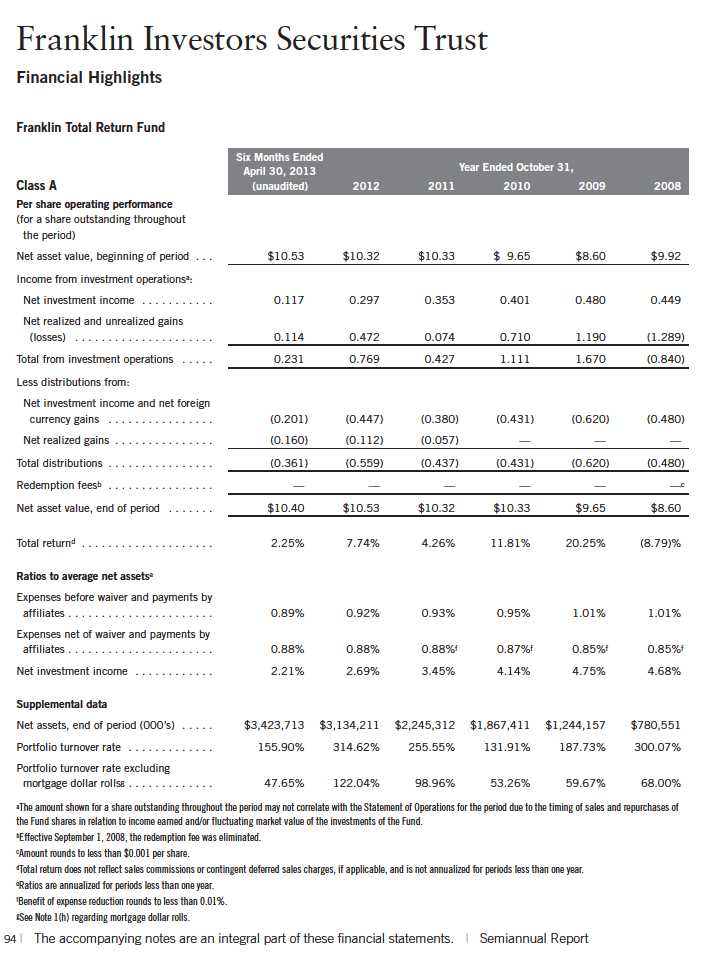

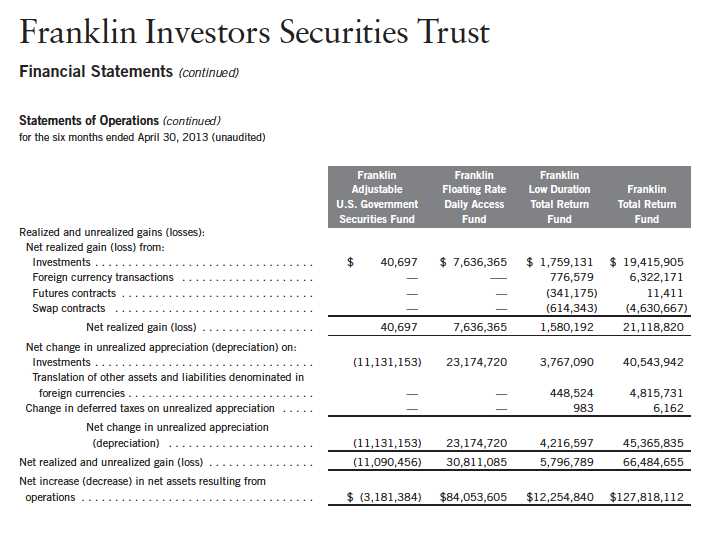

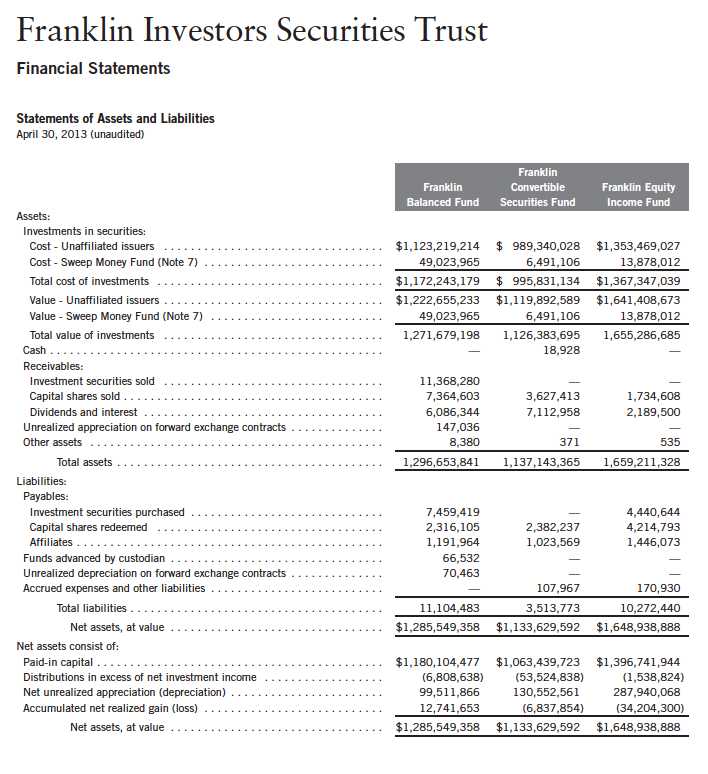

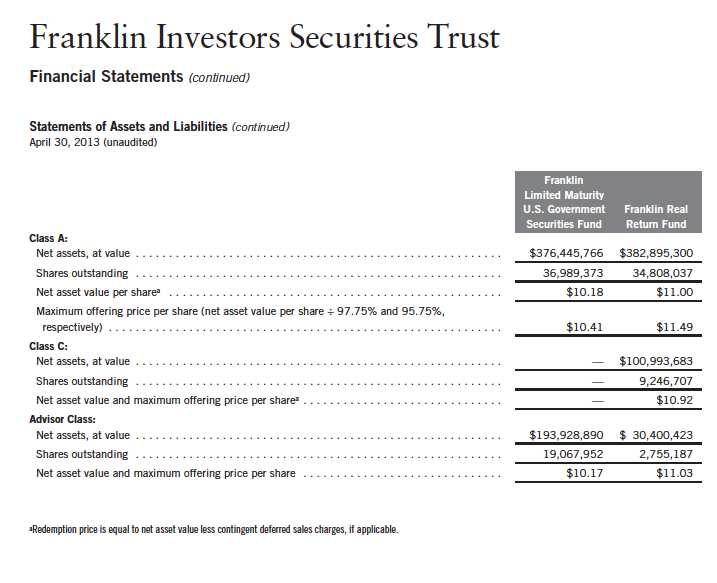

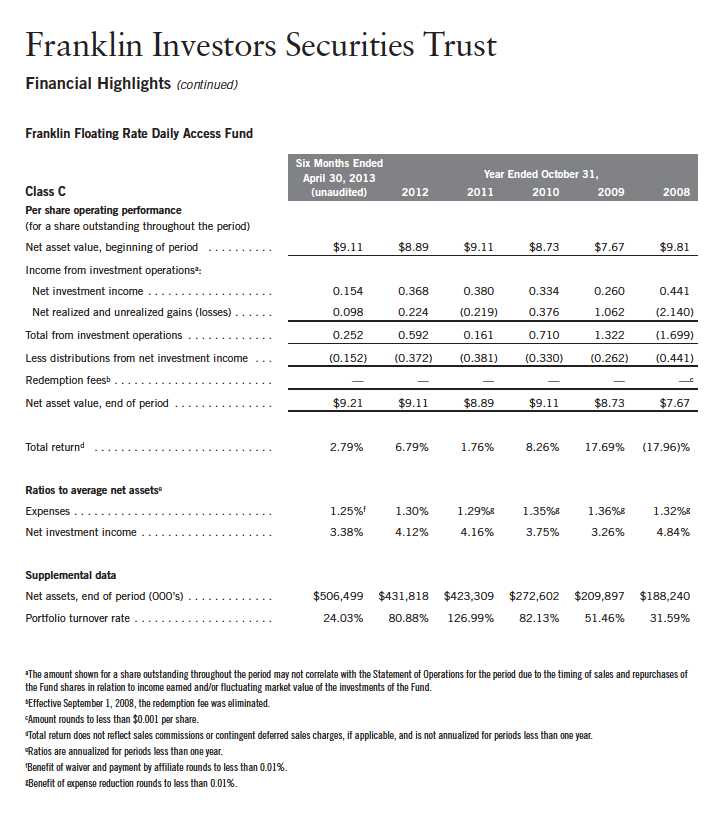

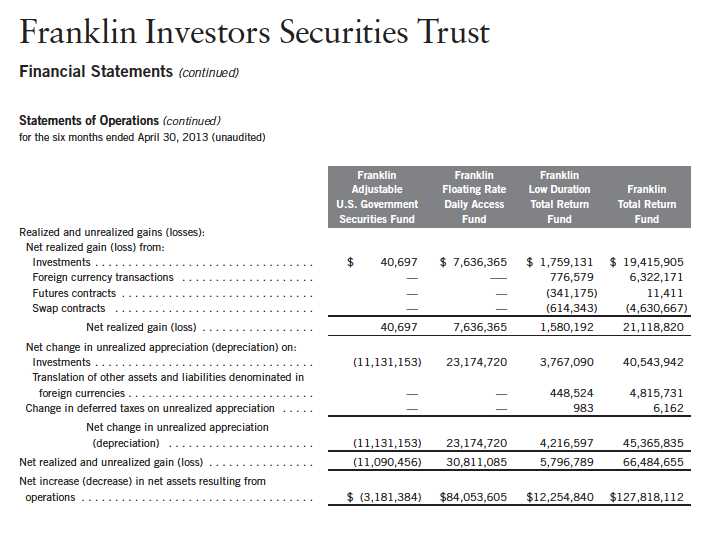

Franklin Investors Securities Trust

Financial Statements (continued)

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 91

92 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 93

94 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Investors Securities Trust

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

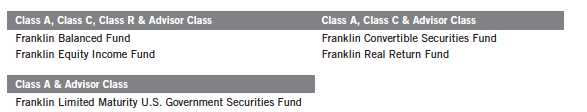

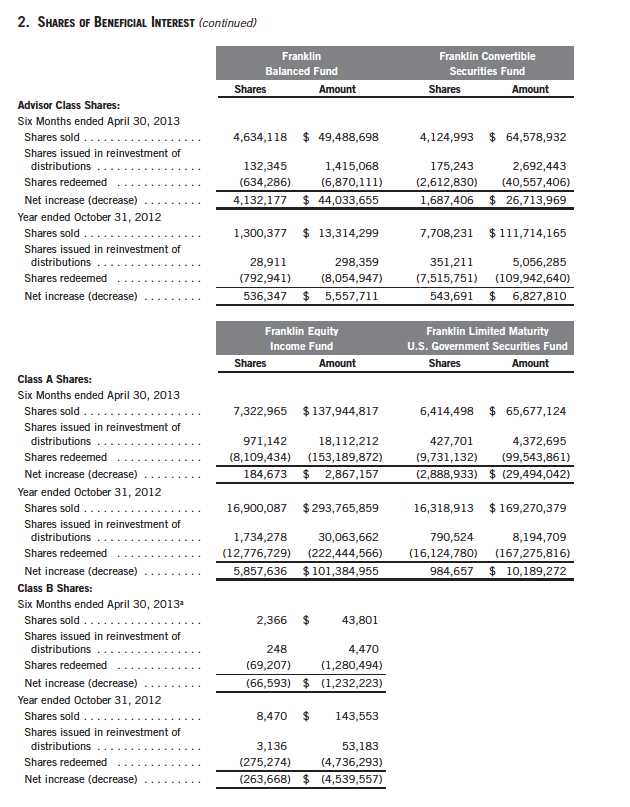

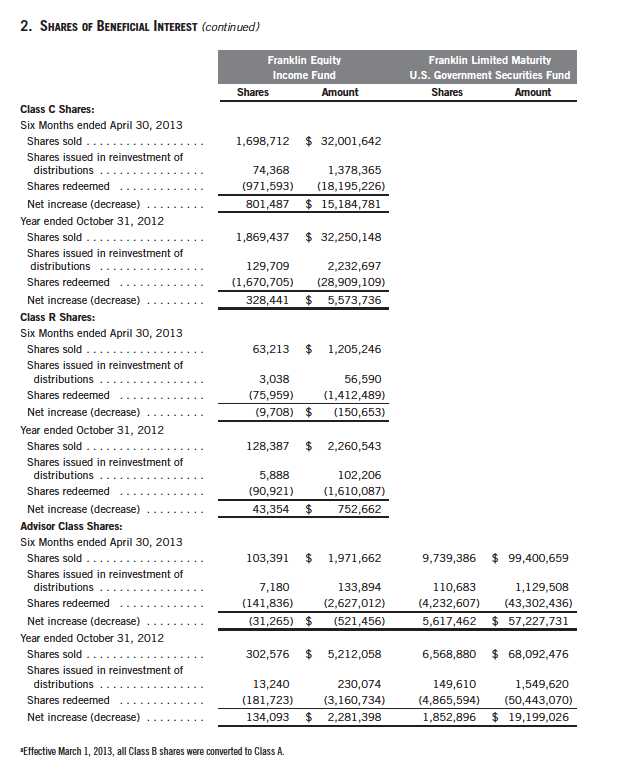

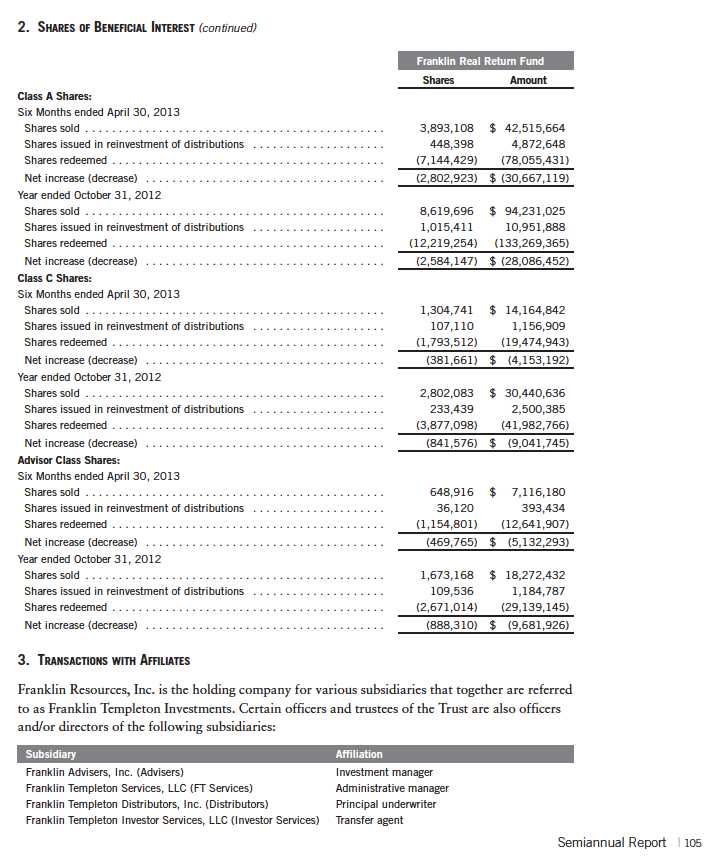

Franklin Investors Securities Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of nine separate funds, five of which are included in this report (Funds). The financial statements of the remaining funds in the Trust are presented separately. The classes of shares offered within each of the Funds are indicated below. Effective May 1, 2013, the Funds, except the Franklin Convertible Securities Fund, began offering a new class of shares, R6. Effective March 1, 2013, all Class B shares were converted to Class A. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Funds’ significant accounting policies.

a. Financial Instrument Valuation

The Funds’ investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees (the Board), the Funds’ administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Funds’ valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Funds to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and exchange traded funds listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter (OTC) secu rities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

Semiannual Report | 95

Franklin Investors Securities Trust

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Debt and certain preferred securities generally trade in the OTC market rather than on a securities exchange. The Funds’ pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined. Repurchase agreements are valued at cost, which approximates market value.

Certain derivative financial instruments (derivatives) trade in the OTC market. The Funds’ pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Funds’ net benefit or obligation under the derivative contract, as measured by the fair market value of the contract, is included in net assets.

The Funds have procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the fund. As a result, differences may arise between the value of the Funds’ portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize

96 | Semiannual Report

Franklin Investors Securities Trust

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Funds. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

In addition, certain foreign markets may be open on days that the NYSE is closed, which could result in differences between the value of the Funds’ portfolio securities on the last business day and the last calendar day of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Funds for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Funds may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Funds do not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statements of Operations.