WASHINGTON, D. C. 20549

JUNE 30, 2011

SEMIANNUAL REPORT

DWS VARIABLE SERIES II

DWS Alternative Asset Allocation Plus VIP

Contents

3 Performance Summary 4 Information About Your Fund's Expenses 5 Portfolio Summary 6 Investment Portfolio 7 Statement of Assets and Liabilities 7 Statement of Operations 8 Statement of Changes in Net Assets 9 Financial Highlights 12 Notes to Financial Statements 14 Proxy Voting 16 Summary of Management Fee Evaluation by Independent Fee Consultant |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Although allocation among different asset categories generally limits risk, Fund management may favor an asset category that underperforms other assets or markets as a whole. The Fund expects to invest in underlying funds that emphasize alternatives or non-traditional asset categories or investment strategies, and as a result, it is subject to the risk factors of those underlying funds. Some of those risks include stock market risk, credit and interest rate risk, volatility in commodity prices and high-yield debt securities, short sales risk and the political, general economic, liquidity and currency risks of foreign investments, which may be particularly significant for emerging markets. The Fund may use derivatives, including as part of its Global Tactical Asset Allocation (GTAA) strategy. The Fund also expects to have direct and indirect exposure to derivatives, which may be more volatile and less liquid than traditional securities. The Fund could suffer losses on its derivative positions. See the prospectus for additional risks and specific details regarding the Fund's risk profile.

DWS Investments is part of Deutsche Bank's Asset Management division and, within the US, represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary June 30, 2011

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. While all share classes have the same underlying portfolio, their performance will differ.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2011 are 2.33% and 2.58% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. These expense ratios include net expenses of the underlying fund in which the Fund invests.

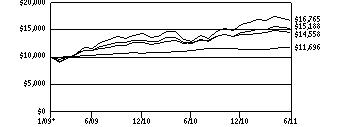

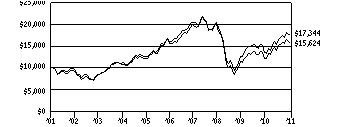

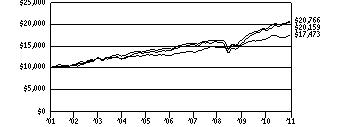

| Growth of an Assumed $10,000 Investment in DWS Alternative Asset Allocation Plus VIP from 2/2/09 to 6/30/11 |

[] DWS Asset Allocation Plus VIP — Class A [] MSCI World Index [] Barclays Capital US Aggregate Bond Index [] Blended Index | The Morgan Stanley Capital International (MSCI) World Index is an unmanaged, capitalization-weighted measure of global stock markets including the US, Canada, Europe, Australia and the Far East. The index is calculated using closing local market prices and translates into US dollars using the London close foreign exchange rates. The Barclays Capital US Aggregate Bond Index is an unmanaged, market-value-weighted measure of Treasury issues, agency issues, corporate bond issues and mortgage securities. The Blended Index is calculated using the performance of two unmanaged indices, representative of stocks (the Morgan Stanley Capital International (MSCI) World Index (70%)) and bonds (the Barclays Capital US Aggregate Bond Index (30%)). These results are summed to produce the aggregate benchmark. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| | |

* The Fund commenced offering Class A shares on February 2, 2009. Index returns began on January 31, 2009.

| Comparative Results | |

| DWS Alternative Asset Allocation Plus VIP | | 6-Month‡ | | | 1-Year | | | Life of Fund* | |

| Class A | Growth of $10,000 | | $ | 10,249 | | | $ | 11,568 | | | $ | 14,558 | |

| Average annual total return | | | 2.49 | % | | | 15.68 | % | | | 16.85 | % |

| MSCI World Index | Growth of $10,000 | | $ | 10,529 | | | $ | 13,051 | | | $ | 16,765 | |

| Average annual total return | | | 5.29 | % | | | 30.51 | % | | | 23.84 | % |

| Barclays Capital US Aggregate Bond Index | Growth of $10,000 | | $ | 10,272 | | | $ | 10,390 | | | $ | 11,696 | |

| Average annual total return | | | 2.72 | % | | | 3.90 | % | | | 6.70 | % |

| Blended Index | Growth of $10,000 | | $ | 10,455 | | | $ | 12,222 | | | $ | 15,188 | |

| Average annual total return | | | 4.55 | % | | | 22.22 | % | | | 18.19 | % |

| DWS Alternative Asset Allocation Plus VIP | | 6-Month‡ | | | 1-Year | | | Life of Class** | |

| Class B | Growth of $10,000 | | $ | 10,230 | | | $ | 11,530 | | | $ | 13,310 | |

| Average annual total return | | | 2.30 | % | | | 15.30 | % | | | 14.46 | % |

| MSCI World Index | Growth of $10,000 | | $ | 10,529 | | | $ | 13,051 | | | $ | 14,318 | |

| Average annual total return | | | 5.29 | % | | | 30.51 | % | | | 18.80 | % |

| Barclays Capital US Aggregate Bond Index | Growth of $10,000 | | $ | 10,272 | | | $ | 10,390 | | | $ | 11,442 | |

| Average annual total return | | | 2.72 | % | | | 3.90 | % | | | 6.68 | % |

| Blended Index | Growth of $10,000 | | $ | 10,455 | | | $ | 12,222 | | | $ | 13,467 | |

| Average annual total return | | | 4.55 | % | | | 22.22 | % | | | 14.72 | % |

The growth of $10,000 is cumulative.

‡ Total returns shown for periods less than one year are not annualized.

* The Fund commenced offering Class A shares on February 2, 2009. Index returns began on January 31, 2009.

** The Fund commenced offering Class B shares on May 18, 2009. Index returns began on May 31, 2009.

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include contract charges and account maintenance fees, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. In addition to the ongoing expenses which the Fund bears directly, the Fund's shareholders indirectly bear the expense of the Underlying Funds in which the Fund invests. These expenses are not included in the Fund's annualized expense ratios used to calculate the expense estimate in the tables. In the most recent six-month period, the Fund limited the ongoing expenses the Fund bears directly; had it not done so, expenses would have been higher. The examples in the table are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (January 1, 2011 to June 30, 2011).

The tables illustrate your Fund's expenses in two ways:

•Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical Fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. If these transaction costs had been included, your costs would have been higher.

Expenses and Value of a $1,000 Investment for the six months ended June 30, 2011 | |

| Actual Fund Return | | Class A | | | Class B | |

| Beginning Account Value 1/1/11 | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/11 | | $ | 1,024.90 | | | $ | 1,023.00 | |

| Expenses Paid per $1,000* | | $ | 1.31 | | | $ | 2.56 | |

| Hypothetical 5% Fund Return | | Class A | | | Class B | |

| Beginning Account Value 1/1/11 | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/11 | | $ | 1,023.51 | | | $ | 1,022.07 | |

| Expenses Paid per $1,000* | | $ | 1.30 | | | $ | 2.56 | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by 365.

Annualized Expense Ratios** | Class A | Class B |

| DWS Variable Series II — DWS Alternative Asset Allocation Plus VIP | .26% | .51% |

** The Fund invests in other funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. These ratios do not include these indirect fees and expenses.

For more information, please refer to the Fund's prospectus.

These tables do not reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option.

Asset Allocation (As a % of Investment Portfolio) | 6/30/11 | 12/31/10 |

| Emerging Markets | | DWS Emerging Markets Equity Fund DWS Enhanced Emerging Market Fixed Income Fund WisdomTree Emerging Markets Local Debt Fund | | 19% | 18% |

| Market Neutral | | DWS Disciplined Market Neutral Fund | | 15% | 18% |

| Commodities | | DWS Enhanced Commodity Strategy Fund | | 14% | 13% |

| Global Real Estate | | DWS RREEF Global Real Estate Securities Fund | | 14% | 14% |

| Treasury Inflation Protected Securities | | DWS Global Inflation Plus Fund | | 12% | 14% |

| Floating Rate Notes | | DWS Floating Rate Plus Fund | | 10% | 5% |

| Global Infrastructure | | DWS RREEF Global Infrastructure Fund | | 7% | 5% |

| International Small Cap | | iShares MSCI EAFE Small Cap Index ETF Vanguard FTSE All World ex-US Small-Cap Fund | | 3% | 2% |

| Money Market Fund | | Central Cash Management Fund | | 2% | 4% |

| Gold | | DWS Gold & Precious Metals Fund | | 2% | 5% |

| International Treasury Bond | | SPDR Barclays Capital International Treasury Bond | | 2% | 2% |

| | | | | 100% | 100% |

Asset allocation is subject to change.

For more complete details about the Fund's investment portfolio, see page 6.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on www.dws-investments.com from time to time. Please see the Fund's current prospectus for more information.

Investment Portfolio June 30, 2011 (Unaudited) | | | Shares | | | Value ($) | |

| | | | |

| Mutual Funds 92.0% | |

| DWS Disciplined Market Neutral Fund "Institutional" | | | 622,411 | | | | 6,031,161 | |

| DWS Emerging Markets Equity Fund "Institutional" | | | 215,525 | | | | 4,049,715 | |

| DWS Enhanced Commodity Strategy Fund "Institutional"* | | | 1,339,263 | | | | 5,999,899 | |

| DWS Enhanced Emerging Markets Fixed Income Fund "Institutional" | | | 300,546 | | | | 3,224,854 | |

| DWS Floating Rate Plus Fund "Institutional" | | | 427,895 | | | | 4,013,654 | |

| DWS Global Inflation Plus Fund "Institutional" | | | 449,784 | | | | 4,808,186 | |

| DWS Gold & Precious Metals Fund "Institutional" | | | 38,712 | | | | 807,155 | |

| DWS RREEF Global Infrastructure Fund "Institutional" | | | 269,056 | | | | 2,825,092 | |

| DWS RREEF Global Real Estate Securities Fund "Institutional" | | | 712,630 | | | | 5,658,282 | |

Total Mutual Funds (Cost $35,156,595) | | | | 37,417,998 | |

| | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Exchange-Traded Funds 6.9% | |

| iShares MSCI EAFE Small Cap Index Fund | | | 9,056 | | | | 395,113 | |

| SPDR Barclays Capital International Treasury Bond | | | 12,687 | | | | 783,676 | |

| Vanguard FTSE All World ex-US Small-Cap Fund | | | 6,823 | | | | 700,927 | |

| WisdomTree Emerging Markets Local Debt Fund | | | 14,745 | | | | 789,152 | |

| WisdomTree Emerging Markets SmallCap Dividend Fund | | | 2,319 | | | | 121,818 | |

Total Exchange-Traded Funds (Cost $2,605,238) | | | | 2,790,686 | |

| | |

| Cash Equivalents 2.4% | |

| Central Cash Management Fund (Cost $966,074) | | | 966,074 | | | | 966,074 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $38,727,907)+ | | | 101.3 | | | | 41,174,758 | |

| Other Assets and Liabilities, Net | | | (1.3 | ) | | | (503,554 | ) |

| Net Assets | | | 100.0 | | | | 40,671,204 | |

* Non-income producing security.

+ The cost for federal income tax purposes was $38,745,386. At June 30, 2011, net unrealized appreciation for all securities based on tax cost was $2,429,372. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $2,446,851 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $17,479.

EAFE: Europe, Australasia and Far East

FTSE: Financial Times and the London Stock Exchange

MSCI: Morgan Stanley Capital International

SPDR: Standard & Poor's Depositary Receipt

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2011 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Mutual Funds | | $ | 37,417,998 | | | $ | — | | | $ | — | | | $ | 37,417,998 | |

| Exchange-Traded Funds | | | 2,790,686 | | | | — | | | | — | | | | 2,790,686 | |

| Short-Term Investments | | | 966,074 | | | | — | | | | — | | | | 966,074 | |

| Total | | $ | 41,174,758 | | | $ | — | | | $ | — | | | $ | 41,174,758 | |

There have been no transfers between Level 1 and Level 2 fair value measurements during the period ended June 30, 2011.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities | as of June 30, 2011 (Unaudited) | |

| Assets | |

Investments: Investments in affiliated Underlying Funds, at value (cost $36,122,669) | | $ | 38,384,072 | |

| Investments in non-affiliated Underlying Funds, at value (cost $2,605,238) | | | 2,790,686 | |

| Total investments in securities, at value (cost $38,727,907) | | | 41,174,758 | |

| Receivable for investments sold | | | 210,000 | |

| Receivable for Fund shares sold | | | 92,894 | |

| Due from Advisor | | | 652 | |

| Other assets | | | 322 | |

| Total assets | | | 41,478,626 | |

| Liabilities | |

| Payable for investments purchased | | | 775,263 | |

| Payable for Fund shares redeemed | | | 37 | |

| Accrued expenses and other liabilities | | | 32,122 | |

| Total liabilities | | | 807,422 | |

| Net assets, at value | | $ | 40,671,204 | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 108,161 | |

| Net unrealized appreciation (depreciation) on investments | | | 2,446,851 | |

| Accumulated net realized gain (loss) | | | (121,219 | ) |

| Paid-in capital | | | 38,237,411 | |

| Net assets, at value | | $ | 40,671,204 | |

Class A Net Asset Value, offering and redemption price per share ($7,523,616 ÷ 538,678 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | | $ | 13.97 | |

Class B Net Asset Value, offering and redemption price per share ($33,147,588 ÷ 2,372,343 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | | $ | 13.97 | |

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the six months ended June 30, 2011 (Unaudited) | |

| Investment Income | |

Income: Income distributions from affiliated Underlying Funds | | $ | 182,452 | |

| Dividends | | | 17,563 | |

| Income distributions — Central Cash Management Fund | | | 526 | |

| Total income | | | 200,541 | |

Expenses: Management fee | | | 45,062 | |

| Administration fee | | | 17,428 | |

| Services to shareholders | | | 549 | |

| Distribution service fee (Class B) | | | 35,684 | |

| Custodian fee | | | 3,830 | |

| Audit and tax fees | | | 20,634 | |

| Legal fees | | | 6,851 | |

| Reports to shareholders | | | 12,440 | |

| Trustees' fees and expenses | | | 2,138 | |

| Other | | | 502 | |

| Total expenses before expense reductions | | | 145,118 | |

| Expense reductions | | | (63,828 | ) |

| Total expenses after expense reductions | | | 81,290 | |

| Net investment income (loss) | | | 119,251 | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) from: Sale of affiliated Underlying Funds | | | (98,145 | ) |

| Change in net unrealized appreciation (depreciation) on investments | | | 850,428 | |

| Net gain (loss) | | | 752,283 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 871,534 | |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | Increase (Decrease) in Net Assets | | Six Months Ended June 30, 2011 (Unaudited) | | | Year Ended December 31, 2010 | |

Operations: Net investment income | | $ | 119,251 | | | $ | 432,715 | |

| Net realized gain (loss) | | | (98,145 | ) | | | 94,561 | |

| Change in net unrealized appreciation (depreciation) | | | 850,428 | | | | 1,382,244 | |

| Net increase (decrease) in net assets resulting from operations | | | 871,534 | | | | 1,909,520 | |

Distributions to shareholders from: Net investment income: Class A | | | (92,242 | ) | | | (29,328 | ) |

| Class B | | | (344,882 | ) | | | (74,563 | ) |

Net realized gains: Class A | | | (18,623 | ) | | | (23,912 | ) |

| Class B | | | (86,109 | ) | | | (82,873 | ) |

| Total distributions | | | (541,856 | ) | | | (210,676 | ) |

Fund share transactions: Class A Proceeds from shares sold | | | 2,796,002 | | | | 3,888,928 | |

| Reinvestment of distributions | | | 110,865 | | | | 53,240 | |

| Payments for shares redeemed | | | (456,780 | ) | | | (529,532 | ) |

| Net increase (decrease) in net assets from Class A share transactions | | | 2,450,087 | | | | 3,412,636 | |

Class B Proceeds from shares sold | | | 12,749,430 | | | | 19,061,697 | |

| Reinvestment of distributions | | | 430,991 | | | | 157,436 | |

| Payments for shares redeemed | | | (3,230,983 | ) | | | (1,070,014 | ) |

| Net increase (decrease) in net assets from Class B share transactions | | | 9,949,438 | | | | 18,149,119 | |

| Increase (decrease) in net assets | | | 12,729,203 | | | | 23,260,599 | |

| Net assets at beginning of period | | | 27,942,001 | | | | 4,681,402 | |

| Net assets at end of period (including undistributed net investment income of $108,161 and $426,034, respectively) | | $ | 40,671,204 | | | $ | 27,942,001 | |

| Other Information | |

Class A Shares outstanding at beginning of period | | | 362,411 | | | | 101,099 | |

| Shares sold | | | 201,461 | | | | 298,581 | |

| Shares issued to shareholders in reinvestment of distributions | | | 7,775 | | | | 4,172 | |

| Shares redeemed | | | (32,969 | ) | | | (41,441 | ) |

| Net increase (decrease) in Class A shares | | | 176,267 | | | | 261,312 | |

| Shares outstanding at end of period | | | 538,678 | | | | 362,411 | |

Class B Shares outstanding at beginning of period | | | 1,656,043 | | | | 270,064 | |

| Shares sold | | | 914,365 | | | | 1,454,814 | |

| Shares issued to shareholders in reinvestment of distributions | | | 30,202 | | | | 12,329 | |

| Shares redeemed | | | (228,267 | ) | | | (81,164 | ) |

| Net increase (decrease) in Class B shares | | | 716,300 | | | | 1,385,979 | |

| Shares outstanding at end of period | | | 2,372,343 | | | | 1,656,043 | |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| Class A | | Six Months Ended 6/30/11 (Unaudited) | | | Year Ended 12/31/10 | | | Period Ended 12/31/09a | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 13.85 | | | $ | 12.63 | | | $ | 10.00 | |

Income (loss) from investment operations: Net investment incomeb | | | .06 | | | | .46 | | | | .57 | |

| Net realized and unrealized gain (loss) | | | .29 | | | | 1.09 | | | | 2.06 | |

| Total from investment operations | | | .35 | | | | 1.55 | | | | 2.63 | |

Less distributions from: Net investment income | | | (.19 | ) | | | (.18 | ) | | | — | |

| Net realized gains | | | (.04 | ) | | | (.15 | ) | | | — | |

| Total distributions | | | (.23 | ) | | | (.33 | ) | | | — | |

| Net asset value, end of period | | $ | 13.97 | | | $ | 13.85 | | | $ | 12.63 | |

Total Return (%)c,d | | | 2.49 | ** | | | 12.46 | | | | 26.30 | ** |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 8 | | | | 5 | | | | 1 | |

Ratio of expenses before expense reductions (%)e | | | .63 | * | | | .94 | | | | 11.67 | * |

Ratio of expenses after expense reductions (%)e | | | .26 | * | | | .21 | | | | .21 | * |

| Ratio of net investment income (%) | | | .89 | * | | | 3.51 | | | | 5.39 | * |

| Portfolio turnover rate (%) | | | 19 | ** | | | 6 | | | | 155 | ** |

a For the period from February 2, 2009 (commencement of operations of Class A shares) to December 31, 2009. b Based on average shares outstanding during the period. c Total return would have been lower had certain expenses not been reduced. d Total return would have been lower if the Advisor had not reduced some affiliated Underlying Funds' expenses. e The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the affiliated Underlying Funds and non-affiliated funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. * Annualized ** Not annualized | |

| Class B | | Six Months Ended 6/30/11 (Unaudited) | | | Year Ended 12/31/10 | | | Period Ended 12/31/09a | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 13.84 | | | $ | 12.61 | | | $ | 10.87 | |

Income (loss) from investment operations: Net investment incomeb | | | .04 | | | | .42 | | | | .35 | |

| Net realized and unrealized gain (loss) | | | .28 | | | | 1.09 | | | | 1.39 | |

| Total from investment operations | | | .32 | | | | 1.51 | | | | 1.74 | |

Less distributions from: Net investment income | | | (.15 | ) | | | (.13 | ) | | | — | |

| Net realized gains | | | (.04 | ) | | | (.15 | ) | | | — | |

| Total distributions | | | (.19 | ) | | | (.28 | ) | | | — | |

| Net asset value, end of period | | $ | 13.97 | | | $ | 13.84 | | | $ | 12.61 | |

Total Return (%)c,d | | | 2.30 | ** | | | 12.15 | | | | 16.01 | ** |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 33 | | | | 23 | | | | 3 | |

Ratio of expenses before expense reductions (%)e | | | .88 | * | | | 1.19 | | | | 5.37 | * |

Ratio of expenses after expense reductions (%)e | | | .51 | * | | | .46 | | | | .61 | * |

| Ratio of net investment income (%) | | | .64 | * | | | 3.26 | | | | 4.66 | * |

| Portfolio turnover rate (%) | | | 19 | ** | | | 6 | | | | 155 | ** |

a For the period from May 18, 2009 (commencement of operations of Class B shares) to December 31, 2009. b Based on average shares outstanding during the period. c Total return would have been lower had certain expenses not been reduced. d Total return would have been lower if the Advisor had not reduced some affiliated Underlying Funds' expenses. e The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the affiliated Underlying Funds and non-affiliated funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. * Annualized ** Not annualized | |

Notes to Financial Statements (Unaudited)

A. Organization and Significant Accounting Policies

DWS Alternative Asset Allocation Plus VIP (the "Fund") is a diversified series of DWS Variable Series II (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust. The Fund mainly invests in other affiliated DWS funds (the "Underlying DWS Funds"), derivative investments and exchange-traded funds ("ETFs"). ETFs and Underlying DWS Funds are collectively referred to as "Underlying Funds." Each Underlying DWS Fund's accounting policies and investment holdings are outlined in the Underlying DWS Funds' financial statements and are available upon request.

Multiple Classes of Shares of Beneficial Interest. The Fund offers two classes of shares (Class A shares and Class B shares). Sales of Class B shares are subject to Rule 12b-1 fees under the 1940 Act equal to an annual rate of 0.25% of the average daily net assets of the Class B shares of the Fund. Class A shares are not subject to such fees.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares except that each class bears certain expenses unique to that class (including the applicable Rule 12b-1 fee). Differences in class-level expenses may result in payment of different per share dividends by class. All shares have equal rights with respect to voting subject to class-specific arrangements.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Investments in the Underlying Funds are valued at the net asset value per share of each class of the Underlying Funds and are categorized as Level 1.

ETFs are valued at the most recent sale price or official closing price reported on the exchange (US or foreign) or over-the-counter market on which they trade and are categorized as Level 1 securities. ETFs for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the "Act") was enacted. Under the Act, net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses. As a result of this ordering rule, pre-enactment capital loss carryforwards may expire unused, whereas under the previous rules these losses may have been utilized. This change is effective for fiscal years beginning after the date of enactment.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2010 and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior two fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Net investment income of the Fund, if any, is declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gains distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Trust arising in connection with a specific fund are allocated to that fund. Other Trust expenses which cannot be directly attributed to a fund are apportioned among the funds in the Trust.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend Income is recorded on the ex-dividend date. Realized gains and losses from investment transactions are recorded on an identified cost basis and may include proceeds from litigation. Distributions of income and capital gains from the Underlying Funds are recorded on the ex-dividend date.

B. Purchases and Sales of Securities

During the six months ended June 30, 2011, purchases and sales of affiliated Underlying Funds (excluding short-term investments) aggregated $18,034,952 and $6,735,000, respectively. Purchases and sales of non-affiliated Underlying Funds (excluding short-term investments) aggregated $1,477,909 and $0, respectively.

C. Related Parties

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund or delegates such responsibility to the Fund's subadvisor.

QS Investors, LLC ("QS Investors") acts as an investment subadvisor to the Fund. As an investment subadvisor to the Fund, QS Investors renders strategic asset allocation services for the Fund. QS Investors is paid by the Advisor for the services QS Investors provides to the Fund.

RREEF America L.L.C. ("RREEF") acts as an investment sub-advisor to the Fund. As an investment subadvisor to the Funds, RREEF provides investment management services to the portions of Fund's portfolio allocated to direct investments in global real estate and global infrastructure securities. RREEF is paid by the Advisor for the services RREEF provides to the Fund. As of the date of this report, the Fund obtained its exposure to global real estate and global infrastructure securities indirectly through investments in other Underlying DWS Funds.

The Fund does not invest in the Underlying DWS Funds for the purpose of exercising management or control; however, investments within the set limits may represent 5% or more of an Underlying DWS Fund's outstanding shares. At June 30, 2011, the Fund did not invest in more than 5% of any Underlying DWS Fund.

Pursuant to the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund's average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| On assets invested in other DWS Funds | .200% |

| On assets invested in all other assets not considered DWS Funds | 1.200% |

In addition, the Advisor will receive management fees from managing the Underlying DWS Funds in which the Fund invests.

For the period from January 1, 2010 through April 30, 2011, the Advisor had contractually agreed to waive its fee and/or reimburse certain operating expenses to the extent necessary to maintain the operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and Underlying Funds) of each class as follows:

For the period from May 1, 2011 through April 30, 2012, the Advisor has contractually agreed to waive its fee and/or reimburse certain operating expenses to the extent necessary to maintain the operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and Underlying Funds) of each class as follows:

For the six months ended June 30, 2011, the Advisor has agreed to waive 0.15% of the monthly management fee based on average daily net assets for the Fund.

Accordingly, for the six months ended June 30, 2011, the fee pursuant to the Investment Management Agreement charged to the Fund was $45,062, all of which was waived, resulting in an annualized effective rate of 0.00% of the Fund's average daily net assets.

In addition, for the six months ended June 30, 2011, the Advisor waived $1,316 of other expenses.

The Fund indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which it is invested.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays DIMA an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly. For the six months ended June 30, 2011, the Administration Fee was $17,428, all of which was waived.

Service Provider Fees. DWS Investments Service Company ("DISC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DISC and DST Systems, Inc. ("DST"), DISC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DISC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended June 30, 2011, the amounts charged to the Fund by DISC were as follows:

| Services to Shareholders | | Total Aggregated | | | Waived | | | Unpaid at June 30, 2011 | |

| Class A | | $ | 22 | | | $ | 22 | | | $ | — | |

| Class B | | | 23 | | | | — | | | | 23 | |

| | | $ | 45 | | | $ | 22 | | | $ | 23 | |

Distribution Service Agreement. Under the Fund's Class B 12b-1 plans, DWS Investments Distributors, Inc. ("DIDI") received a fee ("Distribution Service Fee") of 0.25% of average daily net assets of Class B shares. For the six months ended June 30, 2011, the Distribution Service Fee aggregated $35,684, of which $6,566 is unpaid.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the six months ended June 30, 2011, the amount charged to the Fund by DIMA included in the Statement of Operations under "reports to shareholders" aggregated $10,085, of which $568 is unpaid.

Trustees' Fees and Expenses. The Fund paid each Trustee not affiliated with the Advisor retainer fees plus specified amounts for various committee services and for the Board Chairperson.

Affiliated Cash Management Vehicle. The Fund may invest uninvested cash balances in Central Cash Management Fund, which is managed by the Advisor. The Fund indirectly bears its proportionate share of the expenses of Central Cash Management Fund. Central Cash Management Fund does not pay the Advisor an investment management fee. Central Cash Management Fund seeks a high level of current income consistent with liquidity and the preservation of capital.

D. Investing in Emerging Markets

Investing in emerging markets may involve special risks and considerations not typically associated with investing in developed markets. These risks include revaluation of currencies, high rates of inflation or deflation, repatriation restrictions on income and capital, and future adverse political, social and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls or delayed settlements, and may have prices that are more volatile or less easily assessed than those of comparable securities of issuers in developed markets.

E. Ownership of the Fund

At June 30, 2011, one Participating Insurance Company was the owner of record of 10% or more of the total outstanding Class A shares of the Fund, owning 98%. One Participating Insurance Company was the owner of record of 10% or more of the total outstanding Class B shares of the Fund, owning 95%.

The Trust's policies and procedures for voting proxies for portfolio securities and information about how the Trust voted proxies related to its portfolio securities during the 12-month period ended June 30 are available on our Web site — www.dws-investments.com (click on "proxy voting" at the bottom of the page) — or on the SEC's Web site — www.sec.gov. To obtain a written copy of the Trust's policies and procedures without charge, upon request, call us toll free at (800) 728-3337.

Summary of Management Fee Evaluation by Independent Fee Consultant

October 3, 2010

Pursuant to an Order entered into by Deutsche Investment Management Americas and affiliates (collectively, "DeAM") with the Attorney General of New York, I, Thomas H. Mack, have been appointed the Independent Fee Consultant for the DWS Funds (formerly the DWS Scudder Funds). My duties include preparing an annual written evaluation of the management fees DeAM charges the Funds, considering among other factors the management fees charged by other mutual fund companies for like services, management fees DeAM charges other clients for like services, DeAM's costs of supplying services under the management agreements and related profit margins, possible economies of scale if a Fund grows larger, and the nature and quality of DeAM's services, including fund performance. This report summarizes my evaluation for 2010, including my qualifications, the evaluation process for each of the DWS Funds, consideration of certain complex-level factors, and my conclusions. I served in substantially the same capacity in 2007, 2008, and 2009.

Qualifications

For more than 35 years I have served in various professional capacities within the investment management business. I have held investment analysis and advisory positions, including securities analyst, portfolio strategist and director of investment policy with a large investment firm. I have also performed business management functions, including business development, financial management and marketing research and analysis.

Since 1991, I have been an independent consultant within the asset management industry. I have provided services to over 125 client organizations, including investment managers, mutual fund boards, product distributors and related organizations. Over the past ten years I have completed a number of assignments for mutual fund boards, specifically including assisting boards with management contract renewal.

I hold a Master of Business Administration degree, with highest honors, from Harvard University and Master of Science and Bachelor of Science (highest honors) degrees from the University of California at Berkeley. I am an independent director and audit committee financial expert for two closed-end mutual funds and have served in various leadership and financial oversight capacities with non-profit organizations.

Evaluation of Fees for each DWS Fund

My work focused primarily on evaluating, fund-by-fund, the fees charged to each of the 118 publicly offered Fund portfolios in the DWS Fund family. For each Fund, I considered each of the key factors mentioned above, as well as any other relevant information. In doing so I worked closely with the Funds' Independent Directors in their annual contract renewal process, as well as in their approval of contracts for several new funds (documented separately).

In evaluating each Fund's fees, I reviewed comprehensive materials provided by or on behalf of DeAM, including expense information prepared by Lipper Analytical, comparative performance information, profitability data, manager histories, and other materials. I also accessed certain additional information from the Lipper and Morningstar databases and drew on my industry knowledge and experience.

To facilitate evaluating this considerable body of information, I prepared for each Fund a document summarizing the key data elements in each area as well as additional analytics discussed below. This made it possible to consider each key data element in the context of the others.

In the course of contract renewal, DeAM agreed to implement a number of fee and expense adjustments requested by the Independent Directors which will favorably impact future fees and expenses, and my evaluation includes the effects of these changes.

Fees and Expenses Compared with Other Funds

The competitive fee and expense evaluation for each fund focused on two primary comparisons:

The Fund's contractual management fee (the advisory fee plus the administration fee where applicable) compared with those of a group of typically 12-15 funds in the same Lipper investment category (e.g. Large Capitalization Growth) having similar distribution arrangements and being of similar size.

The Fund's total expenses compared with a broader universe of funds from the same Lipper investment category and having similar distribution arrangements.

These two comparisons provide a view of not only the level of the fee compared with funds of similar scale but also the total expense the Fund bears for all the services it receives, in comparison with the investment choices available in the Fund's investment category and distribution channel. The principal figure-of-merit used in these comparisons was the subject Fund's percentile ranking against peers.

DeAM's Fees for Similar Services to Others

DeAM provided management fee schedules for all of its US domiciled fund and non-fund investment management accounts in any of the investment categories where there is a DWS Fund. These similar products included the other DWS Funds, non-fund pooled accounts, institutional accounts and sub-advisory accounts. Using this information, I calculated for each Fund the fee that would be charged to each similar product, at the subject Fund's asset level.

Evaluating information regarding non-fund products is difficult because there are varying levels of services required for different types of accounts, with mutual funds generally requiring considerably more regulatory and administrative types of service as well as having more frequent cash flows than other types of accounts. Also, while mutual fund fees for similar fund products can be expected to be similar, there will be some differences due to different pricing conditions in different distribution channels (e.g. retail funds versus those used in variable insurance products), differences in underlying investment processes and other factors.

Costs and Profit Margins

DeAM provided a detailed profitability analysis for each Fund. After making some adjustments so that the presentation would be more comparable to the available industry figures, I reviewed profit margins from investment management alone, from investment management plus other fund services (excluding distribution) provided to the Funds by DeAM (principally shareholder services), and DeAM profits from all sources, including distribution. A later section comments on overall profitability.

Economies of Scale

Economies of scale — an expected decline in management cost per dollar of fund assets as fund assets grow — are very rarely quantified and documented because of inherent difficulties in collecting and analyzing relevant data. However, in virtually every investment category that I reviewed, larger funds tend to have lower fees and lower total expenses than smaller funds. To see how each DWS Fund compares with this industry observation, I reviewed:

The trend in Fund assets over the last five years and the accompanying trend in total expenses. This shows if the Fund has grown and, if so, whether total expense (management fees as well as other expenses) have declined as a percent of assets.

Whether the Fund has break-points in its management fee schedule, the extent of the fee reduction built into the schedule and the asset levels where the breaks take effect, and in the case of a sub-advised Fund how the Fund's break-points compare with those of the sub-advisory fee schedule.

How the Fund's contractual fee schedule compares with trends in the industry data. To accomplish this, I constructed a chart showing how actual latest-fiscal-year contractual fees of the Fund and of other similar funds relate to average fund assets, with the subject Fund's contractual fee schedule superimposed.

Quality of Service — Performance

The quality-of-service evaluation focused on investment performance, which is the principal result of the investment management service. Each Fund's performance was reviewed over the past 1, 3, 5 and 10 years, as applicable, and compared with that of other funds in the same investment category and with a suitable market index.

In addition, I calculated and reviewed risk-adjusted returns relative to an index of similar mutual funds' returns and a suitable market index. The risk-adjusted returns analysis provides a way of determining the extent to which the Fund's return comparisons are mainly the product of investment value-added (or lack thereof) or alternatively taking considerably more or less risk than is typical in its investment category.

I also received and considered the history of portfolio manager changes for each Fund, as this provided an important context for evaluating the performance results.

Complex-Level Considerations

While this evaluation was conducted mainly at the individual fund level, there are some issues relating to the reasonableness of fees that can alternatively be considered across the whole fund complex:

I reviewed DeAM's profitability analysis for all DWS Funds, with a view toward determining if the allocation procedures used were reasonable and how profit levels compared with public data for other investment managers.

I considered whether DeAM and affiliates receive any significant ancillary or "fall-out" benefits that should be considered in interpreting the direct profitability results. These would be situations where serving as the investment manager of the Funds is beneficial to another part of the Deutsche Bank organization.

I considered how aggregated DWS Fund expenses had varied over the years, by asset class and in the context of trends in asset levels.

I reviewed the structure of the DeAM organization, trends in staffing levels, and information on compensation of investment management and other professionals compared with industry data.

Findings

Based on the process and analysis discussed above, which included reviewing a wide range of information from management and external data sources and considering among other factors the fees DeAM charges other clients, the fees charged by other fund managers, DeAM's costs and profits associated with managing the Funds, economies of scale, possible fall-out benefits, and the nature and quality of services provided, in my opinion the management fees charged the DWS Funds are reasonable.

Thomas H. Mack

DWS Investments Distributors, Inc.

222 South Riverside Plaza

Chicago, IL 60606

(800) 621-1148

VS2AAAP-3 (R-023287-1 8/11)

JUNE 30, 2011

SEMIANNUAL REPORT

DWS VARIABLE SERIES II

DWS Balanced VIP

Contents

3 Performance Summary 4 Information About Your Fund's Expenses 5 Portfolio Summary 6 Investment Portfolio 22 Statement of Assets and Liabilities 22 Statement of Operations 23 Statement of Changes in Net Assets 25 Financial Highlights 26 Notes to Financial Statements 32 Proxy Voting 33 Summary of Management Fee Evaluation by Independent Fee Consultant |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Although allocation among different asset categories generally limits risk, fund management may favor an asset category that underperforms other assets or markets as a whole. Bond investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. The Fund may use derivatives, including as part of its Global Tactical Asset Allocation (GTAA) strategy. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Stocks may decline in value. See the prospectus for details

DWS Investments is part of Deutsche Bank's Asset Management division and, within the US, represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary June 30, 2011

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated May 1, 2011 is 0.67% for Class A shares and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

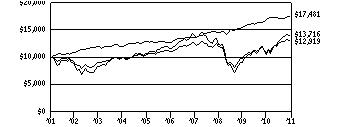

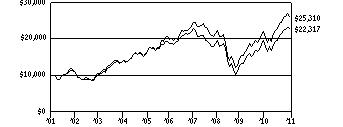

| Growth of an Assumed $10,000 Investment in DWS Balanced VIP |

[] DWS Balanced VIP — Class A [] Russell 1000® Index [] Barclays Capital US Aggregate Bond Index | |

| | The Russell 1000® Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Barclays Capital US Aggregate Bond Index is an unmanaged, market-value-weighted measure of Treasury issues, agency issues, corporate bond issues and mortgage securities. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| Yearly periods ended June 30 | |

| Comparative Results | |

| DWS Balanced VIP | | 6-Month‡ | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

| Class A | Growth of $10,000 | | $ | 10,362 | | | $ | 11,875 | | | $ | 10,822 | | | $ | 11,751 | | | $ | 12,919 | |

| Average annual total return | | | 3.62 | % | | | 18.75 | % | | | 2.67 | % | | | 3.28 | % | | | 2.59 | % |

| Russell 1000 Index | Growth of $10,000 | | $ | 10,637 | | | $ | 13,193 | | | $ | 11,145 | | | $ | 11,763 | | | $ | 13,716 | |

| Average annual total return | | | 6.37 | % | | | 31.93 | % | | | 3.68 | % | | | 3.30 | % | | | 3.21 | % |

| Barclays Capital US Aggregate Bond Index | Growth of $10,000 | | $ | 10,272 | | | $ | 10,390 | | | $ | 12,065 | | | $ | 13,715 | | | $ | 17,481 | |

| Average annual total return | | | 2.72 | % | | | 3.90 | % | | | 6.46 | % | | | 6.52 | % | | | 5.74 | % |

The growth of $10,000 is cumulative.

‡ Total returns shown for periods less than one year are not annualized.

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees and other Fund expenses. Examples of transaction costs include contract charges, redemption fees and account maintenance fees, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (January 1, 2011 to June 30, 2011).

The tables illustrate your Fund's expenses in two ways:

•Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical Fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. If these transaction costs had been included, your costs would have been higher.

Expenses and Value of a $1,000 Investment for the six months ended June 30, 2011 | |

| Actual Fund Return | | Class A | |

| Beginning Account Value 1/1/11 | | $ | 1,000.00 | |

| Ending Account Value 6/30/11 | | $ | 1,036.20 | |

| Expenses Paid per $1,000* | | $ | 3.03 | |

| Hypothetical 5% Fund Return | | Class A | |

| Beginning Account Value 1/1/11 | | $ | 1,000.00 | |

| Ending Account Value 6/30/11 | | $ | 1,021.82 | |

| Expenses Paid per $1,000* | | $ | 3.01 | |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by 365.

| Annualized Expense Ratio | Class A | |

| DWS Variable Series II — DWS Balanced VIP | .60% | |

For more information, please refer to the Fund's prospectus.

These tables do not reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option.

Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | 6/30/11 | 12/31/10 |

| | | |

| Common Stocks | 53% | 55% |

| Exchange-Traded Funds — Equity | 5% | 5% |

| Total Equity | 58% | 60% |

| | | |

| Government & Agency Obligations | 10% | 9% |

| Exchange-Traded Funds — Fixed income | 8% | 7% |

| Corporate Bonds | 6% | 7% |

| Mortgage-Backed Securities Pass-Throughs | 6% | 7% |

| Commercial Mortgage-Backed Securities | 3% | 2% |

| Asset-Backed | 1% | 0% |

| Municipal Bonds and Notes | 0% | 1% |

| Preferred Stocks | 0% | 1% |

| Total Fixed Income | 34% | 34% |

| | | |

| Cash Equivalents | 8% | 6% |

| | 100% | 100% |

Sector Diversification (As a % of Equities, Corporate Bonds, Senior Loans and Preferred Securities) | 6/30/11 | 12/31/10 |

| | | |

| Information Technology | 16% | 16% |

| Financials | 15% | 13% |

| Energy | 12% | 14% |

| Health Care | 12% | 10% |

| Industrials | 11% | 11% |

| Consumer Discretionary | 11% | 12% |

| Consumer Staples | 9% | 9% |

| Materials | 5% | 6% |

| Utilities | 5% | 4% |

| Telecommunication Services | 4% | 5% |

| | 100% | 100% |

Asset allocation and sector diversification exclude derivatives and are subject to change.

For more complete details about the Fund's investment portfolio, see page 6.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on www.dws-investments.com from time to time. Please see the Fund's current prospectus for more information.

Investment Portfolio June 30, 2011 (Unaudited) | | | Shares | | | Value ($) | |

| | | | |

| Common Stocks 53.8% | |

| Consumer Discretionary 5.4% | |

| Auto Components 0.9% | |

| Autoliv, Inc. | | | 8,231 | | | | 645,722 | |

| BorgWarner, Inc.* | | | 10,596 | | | | 856,051 | |

| Continental AG* | | | 2,940 | | | | 308,683 | |

| Minth Group Ltd. | | | 90,486 | | | | 146,839 | |

| Nippon Seiki Co., Ltd. | | | 8,574 | | | | 113,740 | |

| TRW Automotive Holdings Corp.* | | | 7,920 | | | | 467,517 | |

| | | | | | | | 2,538,552 | |

| Automobiles 0.1% | |

| Honda Motor Co., Ltd. | | | 7,567 | | | | 291,659 | |

| Distributors 0.2% | |

| Genuine Parts Co. | | | 11,463 | | | | 623,587 | |

| Li & Fung Ltd. | | | 56,000 | | | | 112,629 | |

| | | | | | | | 736,216 | |

| Diversified Consumer Services 0.3% | |

| H&R Block, Inc. | | | 54,638 | | | | 876,394 | |

| Hotels Restaurants & Leisure 1.3% | |

| Bwin.Party Digital Entertainment PLC* | | | 15,660 | | | | 37,774 | |

| Carnival Corp. (Units) | | | 26,529 | | | | 998,286 | |

| Darden Restaurants, Inc. | | | 15,717 | | | | 782,078 | |

| Domino's Pizza UK & IRL PLC | | | 10,905 | | | | 70,658 | |

| McDonald's Corp. | | | 9,344 | | | | 787,886 | |

| Paddy Power PLC | | | 3,140 | | | | 170,649 | |

| REXLot Holdings Ltd. | | | 1,202,664 | | | | 116,312 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 17,344 | | | | 971,958 | |

| Trump Entertainment Resorts, Inc.* | | | 2 | | | | 37 | |

| | | | | | | | 3,935,638 | |

| Household Durables 0.1% | |

| Hajime Construction Co., Ltd. | | | 3,264 | | | | 86,340 | |

| Jarden Corp. | | | 1,779 | | | | 61,393 | |

| | | | | | | | 147,733 | |

| Leisure Equipment & Products 0.1% | |

| Universal Entertainment Corp. | | | 5,166 | | | | 172,576 | |

| Media 0.4% | |

| Aegis Group PLC | | | 23,040 | | | | 59,137 | |

| Charm Communications, Inc. (ADR)* | | | 5,970 | | | | 71,043 | |

| Dex One Corp.* | | | 245 | | | | 620 | |

| JC Decaux SA* | | | 3,392 | | | | 108,661 | |

| News Corp. "A" | | | 58,237 | | | | 1,030,795 | |

| SuperMedia, Inc.* | | | 43 | | | | 161 | |

| Vertis Holdings, Inc.* | | | 111 | | | | 1,969 | |

| | | | | | | | 1,272,386 | |

| Multiline Retail 0.3% | |

| Dollar General Corp.* | | | 10,690 | | | | 362,284 | |

| Nordstrom, Inc. | | | 12,830 | | | | 602,240 | |

| | | | | | | | 964,524 | |

| Specialty Retail 1.1% | |

| Advance Auto Parts, Inc. | | | 1,691 | | | | 98,907 | |

| Aeropostale, Inc.* | | | 4,315 | | | | 75,512 | |

| AutoZone, Inc.* | | | 1,707 | | | | 503,309 | |

| Best Buy Co., Inc. | | | 10,732 | | | | 337,092 | |

| Dick's Sporting Goods, Inc.* | | | 18,212 | | | | 700,251 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Guess?, Inc. | | | 2,261 | | | | 95,098 | |

| Hennes & Mauritz AB "B" | | | 3,500 | | | | 120,624 | |

| hhgregg, Inc.* | | | 3,791 | | | | 50,799 | |

| Industria de Diseno Textil SA | | | 1,660 | | | | 151,586 | |

| L'Occitane International SA* | | | 24,785 | | | | 66,357 | |

| Limited Brands, Inc. | | | 28,706 | | | | 1,103,746 | |

| Urban Outfitters, Inc.* | | | 3,012 | | | | 84,788 | |

| | | | | | | | 3,388,069 | |

| Textiles, Apparel & Luxury Goods 0.6% | |

| Burberry Group PLC | | | 4,013 | | | | 93,302 | |

| Deckers Outdoor Corp.* | | | 2,239 | | | | 197,346 | |

| Luxottica Group SpA | | | 4,500 | | | | 144,251 | |

| NIKE, Inc. "B" | | | 13,382 | | | | 1,204,112 | |

| | | | | | | | 1,639,011 | |

| Consumer Staples 5.1% | |

| Beverages 1.2% | |

| Anheuser-Busch InBev NV | | | 4,600 | | | | 266,731 | |

| C&C Group PLC | | | 27,420 | | | | 142,696 | |

| Carlsberg AS "B" | | | 2,500 | | | | 272,034 | |

| Central European Distribution Corp.* | | | 1,961 | | | | 21,963 | |

| Foster's Group Ltd. | | | 19,600 | | | | 108,504 | |

| Heineken NV | | | 14,200 | | | | 854,087 | |

| PepsiCo, Inc. | | | 28,509 | | | | 2,007,889 | |

| Treasury Wine Estates Ltd.* | | | 6,533 | | | | 23,824 | |

| | | | | | | | 3,697,728 | |

| Food & Staples Retailing 1.7% | |

| Costco Wholesale Corp. | | | 11,429 | | | | 928,492 | |

| CVS Caremark Corp. | | | 29,327 | | | | 1,102,109 | |

| Kroger Co. | | | 25,886 | | | | 641,973 | |

| Tesco PLC | | | 44,000 | | | | 284,173 | |

| Wal-Mart Stores, Inc. | | | 24,840 | | | | 1,319,998 | |

| Wesfarmers Ltd. | | | 4,077 | | | | 139,720 | |

| Whole Foods Market, Inc. | | | 4,958 | | | | 314,585 | |

| William Morrison Supermarkets PLC | | | 23,100 | | | | 110,375 | |

| Woolworths Ltd. | | | 10,200 | | | | 304,160 | |

| | | | | | | | 5,145,585 | |

| Food Products 1.3% | |

| Diamond Foods, Inc. | | | 2,594 | | | | 198,026 | |

| General Mills, Inc. | | | 14,715 | | | | 547,692 | |

| Golden Agri-Resources Ltd. | | | 274,000 | | | | 152,273 | |

| Green Mountain Coffee Roasters, Inc.* | | | 1,362 | | | | 121,572 | |

| Kellogg Co. | | | 31,919 | | | | 1,765,759 | |

| Mead Johnson Nutrition Co. | | | 9,016 | | | | 609,031 | |

| Nestle SA (Registered) | | | 2,006 | | | | 124,672 | |

| SunOpta, Inc.* | | | 17,401 | | | | 123,721 | |

| Unilever PLC | | | 4,600 | | | | 148,446 | |

| | | | | | | | 3,791,192 | |

| Household Products 0.1% | |

| Reckitt Benckiser Group PLC | | | 5,400 | | | | 298,152 | |

| Personal Products 0.1% | |

| Beiersdorf AG | | | 2,270 | | | | 147,305 | |

| Tobacco 0.7% | |

| Altria Group, Inc. | | | 44,430 | | | | 1,173,396 | |

| Philip Morris International, Inc. | | | 13,750 | | | | 918,088 | |

| | | | | | | | 2,091,484 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Energy 6.7% | |

| Energy Equipment & Services 2.0% | |

| AMEC PLC | | | 7,384 | | | | 129,040 | |

| Complete Production Services, Inc.* | | | 3,070 | | | | 102,415 | |

| Dresser-Rand Group, Inc.* | | | 2,009 | | | | 107,984 | |

| Halliburton Co. | | | 9,600 | | | | 489,600 | |

| John Wood Group PLC | | | 10,486 | | | | 109,031 | |

| Lamprell PLC | | | 16,170 | | | | 97,951 | |

| National Oilwell Varco, Inc. | | | 13,484 | | | | 1,054,584 | |

| Noble Corp. | | | 22,458 | | | | 885,070 | |

| Oil States International, Inc.* | | | 7,043 | | | | 562,806 | |

| ProSafe SE | | | 8,450 | | | | 63,618 | |

| SBM Offshore NV | | | 5,583 | | | | 147,685 | |

| Schlumberger Ltd. | | | 12,763 | | | | 1,102,723 | |

| Seadrill Ltd. | | | 4,200 | | | | 147,844 | |

| Technip SA | | | 2,660 | | | | 284,936 | |

| Tecnicas Reunidas SA | | | 1,045 | | | | 53,775 | |

| Transocean Ltd. | | | 9,784 | | | | 631,655 | |

| | | | | | | | 5,970,717 | |

| Oil, Gas & Consumable Fuels 4.7% | |

| Anadarko Petroleum Corp. | | | 12,421 | | | | 953,436 | |

| Approach Resources, Inc.* | | | 2,573 | | | | 58,330 | |

| BP PLC | | | 121,700 | | | | 896,685 | |

| Canadian Natural Resources Ltd. | | | 20,140 | | | | 843,060 | |

| Chevron Corp. | | | 11,582 | | | | 1,191,093 | |

| Cloud Peak Energy, Inc.* | | | 3,229 | | | | 68,778 | |

| ConocoPhillips | | | 10,952 | | | | 823,481 | |

| EOG Resources, Inc. | | | 9,618 | | | | 1,005,562 | |

| Exxon Mobil Corp. | | | 10,516 | | | | 855,792 | |

| INPEX Corp. | | | 40 | | | | 295,309 | |

| Marathon Oil Corp. | | | 36,926 | | | | 1,945,262 | |

| Nexen, Inc. | | | 29,198 | | | | 656,955 | |

| Northern Oil & Gas, Inc.* | | | 2,904 | | | | 64,324 | |

| Occidental Petroleum Corp. | | | 20,458 | | | | 2,128,450 | |

| Origin Energy Ltd. | | | 8,300 | | | | 141,141 | |

| Plains Exploration & Production Co.* | | | 13,306 | | | | 507,225 | |

| Royal Dutch Shell PLC "B" | | | 7,700 | | | | 274,861 | |

| Suncor Energy, Inc. | | | 28,257 | | | | 1,104,849 | |

| Ultra Petroleum Corp.* | | | 1,274 | | | | 58,349 | |

| Woodside Petroleum Ltd. | | | 2,931 | | | | 129,292 | |

| | | | | | | | 14,002,234 | |

| Financials 6.5% | |

| Capital Markets 1.2% | |

| Affiliated Managers Group, Inc.* | | | 837 | | | | 84,914 | |

| Ameriprise Financial, Inc. | | | 7,094 | | | | 409,182 | |

| Ashmore Group PLC | | | 24,681 | | | | 157,747 | |

| Charles Schwab Corp. | | | 28,274 | | | | 465,107 | |

| ICAP PLC | | | 7,822 | | | | 59,358 | |

| Jefferies Group, Inc. | | | 4,267 | | | | 87,047 | |

| Lazard Ltd. "A" | | | 1,701 | | | | 63,107 | |

| Morgan Stanley | | | 29,583 | | | | 680,705 | |

| Partners Group Holding AG | | | 691 | | | | 122,299 | |

| T. Rowe Price Group, Inc. | | | 21,449 | | | | 1,294,233 | |

| UOB-Kay Hian Holdings Ltd. | | | 44,575 | | | | 58,833 | |

| Waddell & Reed Financial, Inc. "A" | | | 2,092 | | | | 76,044 | |

| | | | | | | | 3,558,576 | |

| Commercial Banks 1.0% | |

| Australia & New Zealand Banking Group Ltd. | | | 5,618 | | | | 132,678 | |

| BOC Hong Kong (Holdings) Ltd. | | | 146,000 | | | | 423,936 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Dah Sing Banking Group Ltd. | | | 39,579 | | | | 55,706 | |

| DGB Financial Group, Inc.* | | | 6,545 | | | | 99,311 | |

| DnB NOR ASA | | | 18,200 | | | | 253,693 | |

| Lloyds Banking Group PLC* | | | 151,000 | | | | 118,650 | |

| National Australia Bank Ltd. | | | 9,961 | | | | 274,827 | |

| Prosperity Bancshares, Inc. | | | 2,109 | | | | 92,416 | |

| Resona Holdings, Inc. | | | 27,200 | | | | 128,091 | |

| Societe Generale | | | 23,364 | | | | 1,384,820 | |

| Zions Bancorp. | | | 3,112 | | | | 74,719 | |

| | | | | | | | 3,038,847 | |

| Consumer Finance 0.0% | |

| Kiatnakin Bank PCL (Foreign Registered) | | | 56,609 | | | | 60,800 | |

| Magma Fincorp Ltd. | | | 663 | | | | 1,086 | |

| | | | | | | | 61,886 | |

| Diversified Financial Services 0.4% | |

| ING Groep NV (CVA)* | | | 22,326 | | | | 275,398 | |

| JPMorgan Chase & Co. | | | 22,122 | | | | 905,675 | |

| | | | | | | | 1,181,073 | |

| Insurance 3.3% | |

| Allianz SE (Registered) | | | 10,280 | | | | 1,436,293 | |

| Assurant, Inc. | | | 22,130 | | | | 802,655 | |

| AXA SA | | | 42,424 | | | | 963,195 | |

| Fidelity National Financial, Inc. "A" | | | 43,138 | | | | 678,992 | |

| HCC Insurance Holdings, Inc. | | | 21,261 | | | | 669,722 | |

| Lincoln National Corp. | | | 39,101 | | | | 1,113,987 | |

| MetLife, Inc. | | | 14,617 | | | | 641,248 | |

| Old Mutual PLC | | | 63,969 | | | | 136,968 | |

| PartnerRe Ltd. | | | 14,850 | | | | 1,022,423 | |

| Prudential Financial, Inc. | | | 16,947 | | | | 1,077,660 | |

| Transatlantic Holdings, Inc. | | | 12,227 | | | | 599,245 | |

| Zurich Financial Services AG* | | | 3,400 | | | | 859,338 | |

| | | | | | | | 10,001,726 | |

| Real Estate Investment Trusts 0.3% | |

| CapitaMall Trust (REIT) | | | 350,000 | | | | 533,815 | |

| Klepierre (REIT) | | | 3,600 | | | | 148,559 | |

| Westfield Group (REIT) (Units) | | | 15,100 | | | | 140,713 | |

| | | | | | | | 823,087 | |

| Real Estate Management & Development 0.3% | |

| K Wah International Holdings Ltd. | | | 266,509 | | | | 98,732 | |

| Mitsubishi Estate Co., Ltd. | | | 17,600 | | | | 308,965 | |

| Mitsui Fudosan Co., Ltd. | | | 17,000 | | | | 293,088 | |

| Sumitomo Realty & Development Co., Ltd. | | | 4,000 | | | | 89,428 | |

| | | | | | | | 790,213 | |

| Health Care 6.5% | |

| Biotechnology 1.2% | |

| Amgen, Inc.* | | | 5,649 | | | | 329,619 | |

| Celgene Corp.* | | | 22,199 | | | | 1,339,044 | |

| Gilead Sciences, Inc.* | | | 41,865 | | | | 1,733,630 | |

| Metabolix, Inc.* | | | 3,431 | | | | 24,497 | |

| Onyx Pharmaceuticals, Inc.* | | | 1,688 | | | | 59,586 | |

| | | | | | | | 3,486,376 | |

| Health Care Equipment & Supplies 1.3% | |

| Accuray, Inc.* | | | 9,687 | | | | 77,593 | |

| Baxter International, Inc. | | | 20,984 | | | | 1,252,535 | |

| Becton, Dickinson & Co. | | | 9,573 | | | | 824,906 | |

| CareFusion Corp.* | | | 17,624 | | | | 478,844 | |

| CONMED Corp.* | | | 2,230 | | | | 63,510 | |

| Edwards Lifesciences Corp.* | | | 5,620 | | | | 489,952 | |

| Kinetic Concepts, Inc.* | | | 1,792 | | | | 103,273 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Merit Medical Systems, Inc.* | | | 1,705 | | | | 30,639 | |

| NxStage Medical, Inc.* | | | 5,004 | | | | 104,183 | |

| Sirona Dental Systems, Inc.* | | | 1,420 | | | | 75,402 | |

| Terumo Corp. | | | 5,300 | | | | 286,403 | |

| Thoratec Corp.* | | | 4,537 | | | | 148,904 | |

| | | | | | | | 3,936,144 | |

| Health Care Providers & Services 2.0% | |

| Aetna, Inc. | | | 11,051 | | | | 487,239 | |

| Centene Corp.* | | | 4,013 | | | | 142,582 | |

| Express Scripts, Inc.* | | | 23,774 | | | | 1,283,321 | |

| Fleury SA | | | 9,033 | | | | 131,561 | |

| Fresenius Medical Care AG & Co. KGaA | | | 5,241 | | | | 391,847 | |

| Humana, Inc. | | | 7,952 | | | | 640,454 | |

| McKesson Corp. | | | 26,028 | | | | 2,177,242 | |

| WellPoint, Inc. | | | 7,999 | | | | 630,081 | |

| | | | | | | | 5,884,327 | |

| Health Care Technology 0.1% | |

| SXC Health Solutions Corp.* | | | 2,659 | | | | 156,668 | |

| Life Sciences Tools & Services 0.2% | |

| Life Technologies Corp.* | | | 2,261 | | | | 117,730 | |

| Thermo Fisher Scientific, Inc.* | | | 10,400 | | | | 669,656 | |

| | | | | | | | 787,386 | |

| Pharmaceuticals 1.7% | |

| AstraZeneca PLC | | | 2,942 | | | | 146,899 | |

| Eisai Co., Ltd. | | | 9,000 | | | | 351,510 | |

| Flamel Technologies SA (ADR)* | | | 11,590 | | | | 62,007 | |

| GlaxoSmithKline PLC | | | 65,900 | | | | 1,410,963 | |

| Merck & Co., Inc. | | | 31,487 | | | | 1,111,176 | |

| Merck KGaA | | | 1,390 | | | | 151,050 | |

| Novartis AG (Registered) | | | 2,510 | | | | 153,756 | |

| Novo Nordisk AS "B" | | | 2,317 | | | | 290,490 | |

| Pacira Pharmaceuticals. Inc.* | | | 8,434 | | | | 101,208 | |

| Questcor Pharmaceuticals, Inc.* | | | 7,602 | | | | 183,208 | |

| Teva Pharmaceutical Industries Ltd. (ADR) | | | 21,887 | | | | 1,055,391 | |

| VIVUS, Inc.* | | | 6,982 | | | | 56,834 | |

| | | | | | | | 5,074,492 | |

| Industrials 6.7% | |

| Aerospace & Defense 1.8% | |

| BAE Systems PLC | | | 16,300 | | | | 83,326 | |

| BE Aerospace, Inc.* | | | 3,097 | | | | 126,389 | |

| European Aeronautic Defence & Space Co. NV | | | 15,500 | | | | 518,807 | |

| Northrop Grumman Corp. | | | 12,413 | | | | 860,842 | |

| Raytheon Co. | | | 16,466 | | | | 820,830 | |

| TransDigm Group, Inc.* | | | 7,739 | | | | 705,719 | |

| United Technologies Corp. | | | 26,072 | | | | 2,307,633 | |

| | | | | | | | 5,423,546 | |

| Airlines 0.1% | |

| Cebu Air, Inc. | | | 33,058 | | | | 69,573 | |