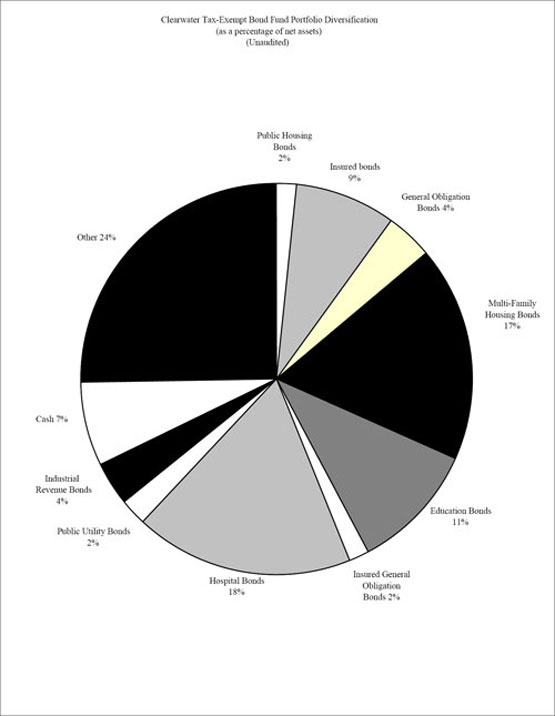

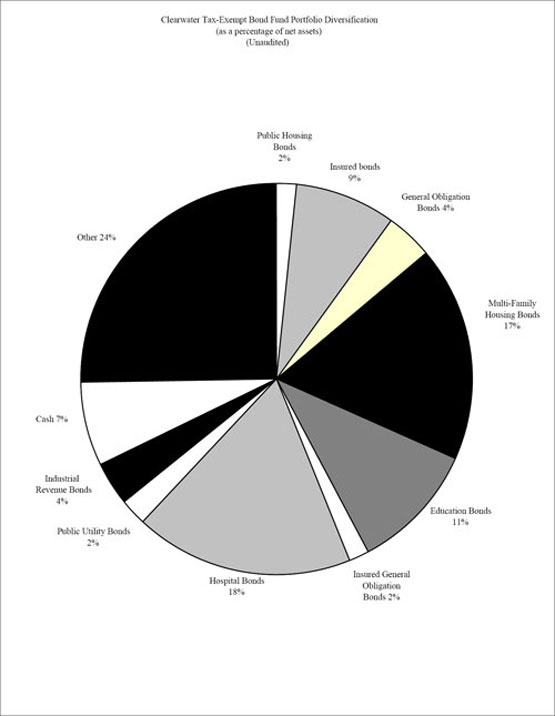

rates and spread tightening, which is what the market and the Fund experienced in 2009. The Tax-Exempt Bond Funds’ duration of 5.9 years, longer than the 4.1 years of its benchmark, contributed significantly to its outperformance. Furthermore, every sector in which the Fund invested outperformed the benchmark. The Fund’s largest sector, hospital/healthcare, with 17.7% of the Fund’s assets, returned 23.8%, gross of fees in 2009. The Fund’s second largest sector, multi-family housing, with 17.6% of the Fund’s assets, returned 18.3%, gross of fees, for the year. Of particular note, the Fund’s 6.9% weighting in tax-exempt closed-end mutual funds returned 51.4%, gross of fess, for the year.

Sit Investment Associates 2010 Market Outlook: While modest growth has returned to the economy, with the unemployment rate still above 10%, the Fed is likely to continue to remain accommodative in 2010. Furthermore, fiscal stimulus from the Obama administration will continue to have a significant impact on fixed income markets in 2010. Returns in fixed income markets, except for U.S. Treasuries, are likely to be bumpy but positive as the Fed’s accommodative policies and the federal government’s fiscal stimulus continue to help the fixed income markets stabilize. We expect revenue bonds to again be strong performers in 2010, as the Fed’s accommodative policies and the Obama administration’s fiscal stimulus should continue to allay liquidity concerns in the market, and investor focus remains on yield. General obligation bond performance should remain weak on a relative basis, however, as many cities, counties and states continue to experience revenue shortfalls despite the economy pulling out of recession due to the persistent unemployment problem. In addition, potential problems funding retirement pension and healthcare obligations still persist. We expect U.S. economic growth to remain positive throughout 2010, although it may slow somewhat in the second half of the year, as the Fed looks to wean the economy off its accommodative policies of the past few years and the federal government’s stimulus run out of steam. With the housing and sub prime mortgage mess still unwinding and unemployment reaching levels not seen in decades, interest rates may continue to be volatile during the year. The Treasury yield curve should remain relatively steep, with yields rising across the curve, while the tax-exempt curve grows somewhat flatter, with short-term rates rising and long-term municipal yields falling. Build America Bonds, which were authorized under the fiscal stimulus bill, will remove over $100 billion of tax-exempt supply in 2010, helping tax-exempt bonds to outperform.

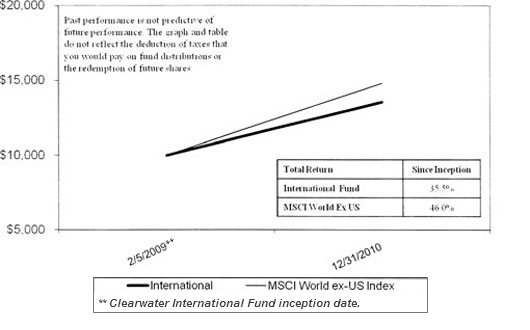

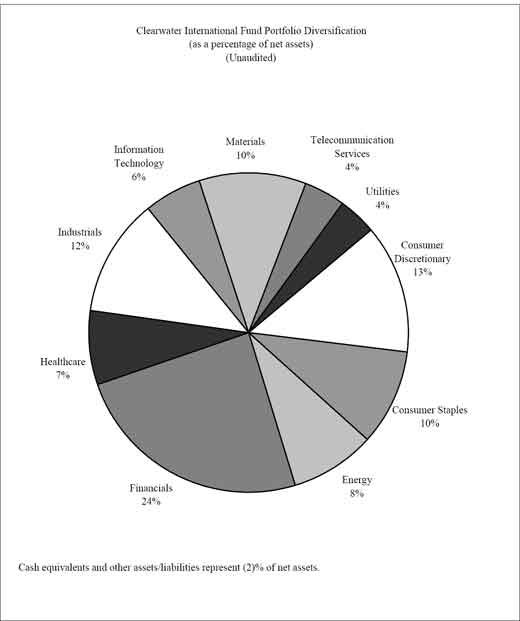

Clearwater International Fund

The Clearwater International Fund commenced operations on February 5, 2009, with two subadvisers, Parametric Portfolio Associates and Axa Rosenberg. Eagle Global Advisors and Artisan Partners were added as subadvisers of the International Fund in May and June 2009, respectively.

2009 Market Overview: Worldwide equity markets staged a dramatic recovery off their March, 2009 lows following unprecedented stimulative action by governments and central banks around the world. Globally, small cap stocks outperformed large cap, while in terms of style, growth handily outperformed value due to the strength of cyclical sectors like Technology, Consumer Discretionary and Materials. Regionally, Europe outperformed the U.S. and Japan, largely due to currency effect, while Japan failed to reach double-digit gains for the year. Emerging markets continued to lead developed markets for the year with China being the main engine of global economic growth.

A-5

As the year closed, corporate earnings came in modestly better than expected as companies improved their margins with aggressive cost cutting and productivity gains. Although the global economy has begun to show signs of improvement, top-line corporate revenue still remains under pressure. The link between earnings and stock returns has been challenged over the past 18 months as investors lacked confidence in the long-term earnings power of companies, while macroeconomic themes dominated the market environment.

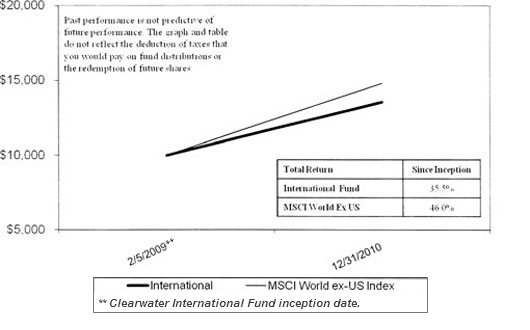

2009 Performance: For the period since inception on February 5, 2009, through December 31, 2009, the Clearwater International Fund had a total return, net of fees and expenses of 35.5%. This compared to a 46.0% return for the International Fund’s benchmark the MSCI World Index over the same period. The International Fund’s performance was negatively impacted partially due to the time required to invest in securities as part of the commencement of operations. This meant that the International Fund was not fully invested in the equities market during the period and therefore did not fully participate in the increase. Each subadviser to the International Fund has provided 2009 performance commentary for the period during which they were investing the assets of the International Fund and 2010 market outlook for their respective portion of the Fund below.

Parametric Portfolio Associates Performance Commentary: The portion of the International Fund (approximately 60%) we manage is designed to mirror the MSCI World Index. Our portion of the International Fund returned 43.12, versus 45.09% for MSCI World Index. Once the portfolio was fully invested it is generally aligned with the MSCI World as to specific securities and sector weightings. However, the time required to get the portfolio fully invested during the commencement of the International Fun negatively impacted overall performance.

AXA Rosenberg Performance Commentary: Our portion of the Clearwater International Fund (approximately 15%) posted impressive absolute returns of 44.55%, gross of fees and expenses, but underperformed the MSCI World, which returned 53.9% during the period between March 31, 2009 (when the portfolio funded) and December 31, 2009. Relative returns suffered as our proprietary valuation approach and emphasis on earnings remained out of favor. Instead, the market was focused on distressed opportunities, creating a sharp disconnect between the long term corporate earnings power and its short term trajectory. Overall, country and industry attribution was modestly negative for 2009, and stock selection was the primary detractor of relative performance. We maintain fairly neutral regional weights, and country and Industry weights are a result of bottom-up fundamentals. While stock selection was negative across most sectors, several industries reflected a rationalization of prices and valuation. Security selection within Banks, Paper and Forest Products, Metal, Aircraft and Telephone were positive. We remain overweight software stocks within Information Technology. As the global economy recovers, particularly in Asia, technology companies are likely to benefit from a revival in corporate capital expenditures and the software and hardware industry groups continue to present attractive earning profiles, both on valuation and earnings outlook. Towards the end of the year, we increased our overweight in Materials and significantly reduced our underweight to Consumer Staples.

A-6

Axa Rosenberg 2010 Market Outlook: As the economies around the world recover, and earnings visibility improves, we believe that investors will be more discerning in their focus on the relationship between earnings and price. This is a welcome development for fundamental stock pickers like ourselves as we seek to build portfolios that will capture more future earnings per dollar invested than the benchmark. As the recovery continues, the market will shift away from distress and rationalization will broaden to other more stable companies that exhibit large mispricings.

Artisan Partners Performance Commentary: Our portion of the Clearwater International Fund represents approximately 15% of the total Fund. For period June 15, 2009 through December 31, 2009 our portfolio returned 21.87%, gross of fees, versus 21.80% for the benchmark. Our largest contributor to the portfolio’s return during the year was, Signet Jewelers. The stock increased by more than 200% from its level at the end of 2008 and was the largest contributor to the portfolio’s investment returns for the year. Significant returns during the year also came across many industries and geographies with notable impacts from Experian, Publicis Groupe, Samsung Electronics, Guoco Group and Adecco. There were, though, several equities that declined during the year. Meitec declined as fundamentals deteriorated in its Japanese engineering outsourcing business and we also incurred losses on our shares of Nokia and Julius Baer. Both of these latter companies, in our view, were facing significant secular challenges. We sold them close to the bottom of the market in favor of other undervalued equities. In the fourth quarter, the portfolio’s consumer staples businesses generated very good returns as Unilever, Diageo, Nestle and Grupo Modelo all increased more than 10%. These global franchises simply became too cheap as more cyclical companies were favored by the market earlier in the year. Our significant investments in the health care sector also gained considerably as the current version of U.S. health reform looks less threatening to the near term economics of the industry.

Artisan Partners 2010 Market Outlook: Providing an outlook is, of course, a fool’s errand. In the short-term, markets are unpredictable. Over the long-term, we believe, our businesses will grow business value and undervaluation gaps will unwind. Our only insight into today’s market resides in the aggregate discount of our portfolio. Today, the aggregate portfolio discount is in the range of normal relative to our own history, though valuations are based on estimates that assume a rather muted economic environment. Macro trends are tough to discern (as usual) with obvious imbalances offset by the fact that we have had a significant rebasing of the global economy from which we could grow. Though the outcome could vary widely, we remain invested in what we believe are superior businesses with strong balance sheets, at cheap prices — factors that enhance the odds of generating wealth over time.

Eagle Global Advisors Performance Commentary: Initial funding of our portfolio (approximately 10% of the Clearwater International Fund) commenced in mid-June, continued through the third and fourth quarters, and was completed in early December. In total there were 39 inflows of varied amounts over that period. Concurrently, global equity markets were in the midst of a significant yet volatile rally (the MSCI World Index rose 19.7% from July through September), extending a sharp rebound from the depths of the lows seen in mid-March. For the period June 30, 2009 through December 31, 2009, our portion of the International Fund posted a return, gross of fees and expenses of 20.3%, versus 22.3% for the MSCI World Index. From a

A-7

portfolio management perspective, such circumstances provide additional challenge when investing new monies, particularly when there is a high frequency of large inflows. As a result, the portfolio contained, on average, a larger allocation to cash than expected under normal circumstances. This allocation hindered portfolio performance with fund results trailing the MSCI World Index by approximately 400 basis points from June 30 through year-end (+20.15% vs. +24.16%). With a cash balance of only 2.3% the account was fully invested as of 12/31 and performing as expected.

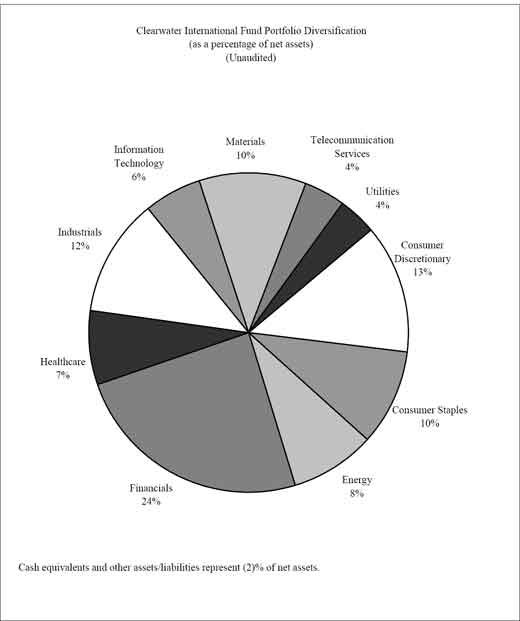

During the last half of 2009, our investment process was guiding the team to adopt a cautious optimism and, accordingly, we began to transition the portfolio away from the defensive posture that was a legacy of our 2008 strategy. The resulting actions increased allocations to the more cyclically oriented sectors, with relative overweights in Energy and Technology and increased, although still underweight, exposures in Industrials and Materials. Allocations to the traditionally defensive Staples and Telecom sectors remained overweight with a combination of both developed and emerging markets names. Although confidence in Financials is increasing, a long-standing underweight to this sector remains. This combination of both cyclical and defensive holdings provides a balanced exposure that will benefit from improving global economic conditions.

Eagle Global Advisors 2010 Market Outlook: Global growth is back and poised to accelerate in 2010 as developed economies recover from one of the worst recessions in recent history and as emerging markets resume strong economic growth. The strength of the recovery in many developed countries is uncertain as analysts worry about potential deleveraging from households and financial institutions. In addition, government fiscal stimulus measures will begin to decelerate into the latter half of the year. Moreover, recent meetings of major economic powers at the G-20 Summit and the Bank of International Settlements (BIS) meetings resulted in concerns about the timing of and the tools necessary to unwind the highly accommodative and sometimes unconventional monetary policies around the world. Most agree a gradual approach is needed, although we have already seen commodity-centric countries like Australia and Norway be the first to begin increasing interest rates. The Eurozone economy grew for the first time in a year and a half in the third quarter of 2009 and is likely to accelerate further into 2010. Yet, there is stress in the Eurozone in some of its smaller economies like Spain, Greece, and Ireland. The OECD projects Eurozone GDP to grow about 1% in 2010 from a projected -4% decline in 2009, although some economists expect a better recovery. The U.K. economy showed mixed signals in the fourth quarter of 2009, with an unexpected plunge in industrial activity in November leading the monetary authorities to increase their quantitative easing measures in the same month. The significant stimulative fiscal and monetary measures in the U.K. are likely to lift growth in that country to almost 2% for 2010, according to Bloomberg consensus estimates. The emerging markets have again taken their place as the growth engines of the world with some expecting a strong bounce of greater than 6% real GDP growth in 2010 for the emerging economies. This will be led by the likes of China, India, and Brazil.

A-8

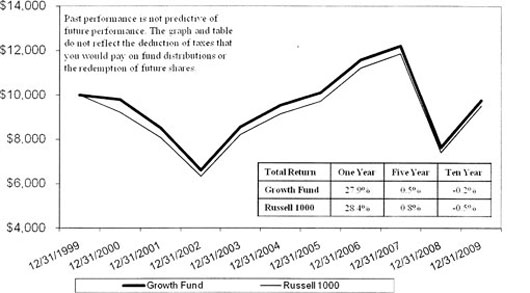

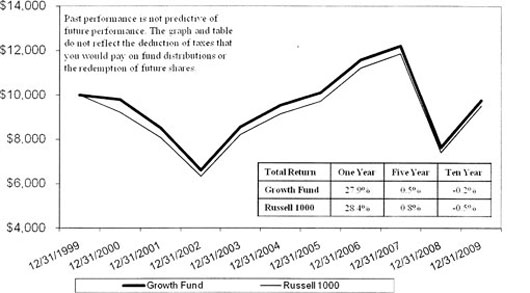

Comparison of the Change in Value of a $10,000 Investment in the Clearwater

Growth Fund and the Russell 1000 Index

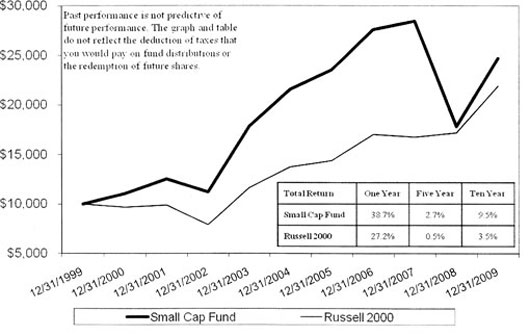

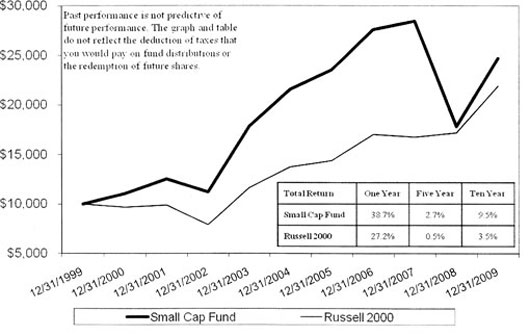

Comparison of the Change in Value of a $10,000 Investment in the Clearwater

Small Cap Fund and the Russell 2000 Index

A-9

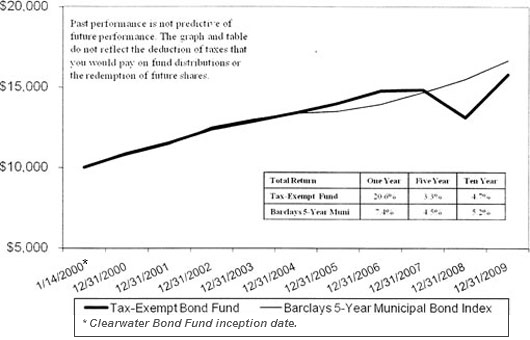

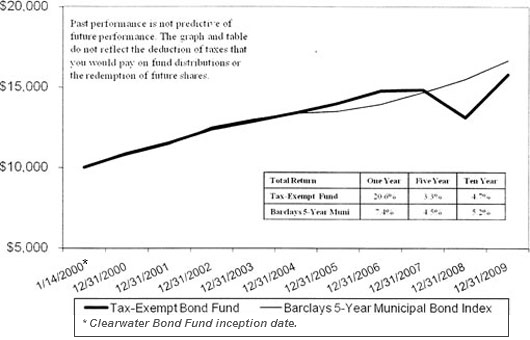

Comparison of the Change in Value of a $10,000 Investment in the Clearwater

Tax-Exempt Bond Fund and the Barclays 5-Year Municipal Bond Fund Index

Comparison of the Change in Value of a $10,000 Investment in the Clearwater

International Fund and the MSCI World ex-US Index

A-10

Fund Expense Example

(unaudited)

As a shareholder of the Funds, you incur costs, including management fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. In addition to the ongoing costs which the Funds pay directly, you as a shareholder indirectly bear the expenses of any outside mutual funds in which the Funds invest. (These are also referred to as “acquired funds” and those indirect expenses represent the Funds’ pro rata portion of the cumulative expenses charged by the acquired funds.)

The example provided is based on an investment of $1,000 invested at the beginning of the period and held for the six month ended December 31, 2009.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Clearwater Funds and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the second section of the table are meant to highlight your ongoing costs only. Therefore, the second section of the table will not help you compare the relative total costs of the Clearwater Funds to funds that charge transaction costs and/or sales charges or redemption fees.

A-11

| | | | | | | | | |

Actual

| | | Beginning Account

Value

July 1, 2009 | | | Ending Account

Value

December 31,

2009 | | | Expenses Paid

During the Period*

July 1, 2009 thru

December 31,

2009 |

Growth Fund | | | $1,000.00 | | | $1,227.10 | | | $1.57 |

Small Cap Fund | | | $1,000.00 | | | $1,266.30 | | | $5.43 |

Tax-Exempt Bond Fund | | | $1,000.00 | | | $1,081.90 | | | $1.89 |

International Fund | | | $1,000.00 | | | $1,208.50 | | | $5.01 |

| | | | | | | | | |

Hypothetical (5% return

before expenses) | | | | | | | | | |

Growth Fund | | | $1,000.00 | | | $1,025.21 | | | $1.43 |

Small Cap Fund | | | $1,000.00 | | | $1,025.21 | | | $4.85 |

Tax-Exempt Bond Fund | | | $1,000.00 | | | $1,025.21 | | | $1.84 |

International Fund | | | $1,000.00 | | | $1,025.21 | | | $4.59 |

* Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The annualized expense ratios are as follows:

| | |

| Growth Fund | 0.28% |

| Small Cap Fund | 0.95% |

| Tax-Exempt Bond Fund | 0.36% |

| International Fund (a) | 0.90% |

| |

| (a) The expense ratio for the International Fund represents the blended expense ratio during the period. The management fee at inception of the Fund was 1.00%, but was reduced through voluntary waivers to 0.80% during the period ended December 31, 2009. |

Quarterly Portfolio Schedule of Investments

The Funds file a complete schedule of their portfolio holdings as of the close of the first and third quarters of their fiscal years with the SEC on Form N-Q. Shareholders may request copies of Form N-Q free of charge by calling the Transfer Agent toll free at 1-888-228-0935 or by sending a written request to: Fiduciary Counselling, Inc, 30 East 7th Street, Suite 2000, St. Paul, MN 55101 Attn: Clearwater Investment Trust Transfer Agent. These filings are also available on the SEC’s Internet site at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information about the public reference room may be obtained by calling 1-800-SEC-0330.

A-12

Voting Proxies on Fund Portfolio Securities

The funds have established Proxy Voting Policies and Procedure (“Policies”) that the funds use to determine how to vote proxies relating to portfolio securities. They also report, on Form N-PX, how the Funds voted any such proxies during the most recent 12-month period ended June 30. Shareholders may request copies of the Policies or Form N-PX free of charge by calling the Transfer Agent toll free at 1-888-228-0935 or by sending a written request to: Fiduciary Counselling, Inc, 30 East 7th Street, Suite 2000, St. Paul, MN 55101 Attn: Clearwater Investment Trust Transfer Agent. Form N-PX is also available from the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

A-13

EXECUTIVE OFFICERS AND TRUSTEES

Information About the Funds’ Independent Trustees

| | | | | | | | | | |

Name, Address,

and Age | | Positions Held

with the Funds | | Term of Office

and Length of

Time Served | | Principal

Occupation(s)

During the Last 5

Years | | Number of

Portfolios in the

Fund Complex

Overseen by the

Trustee | | Other

Directorships Held

by the Trustee |

Lucy R. Jones

(68)

30 East 7th Street,

Saint. Paul,

Minnesota 55101 | | Trustee | | Tenure: 10 yrs

Term:

Indefinite | | Private Investor | | 4 | | None |

| | | | | | | | | | |

Charles W.

Rasmussen (43)1

30 East 7th Street,

Saint. Paul,

Minnesota 55101 | | Trustee | | Tenure: 10 yrs

Term:

Indefinite | | President and Chief Executive Officer, P&G Manufacturing, Inc. (air filtration

equipment, 2002- Present); | | 4 | | None |

| | | | | | | | | | |

Laura E.

Rasmussen (46)1

30 East 7th Street,

Saint. Paul,

Minnesota 55101 | | Trustee | | Tenure: 10 yrs

Term:

Indefinite | | Business Owner | | 4 | | None |

| | | | | | | | | | |

Justin H. Weyerhaeuser (36)

30 East 7th Street,

Saint. Paul,

Minnesota 55101 | | Trustee | | Tenure: 2 yrs Term:

Indefinite | | Attorney | | 4 | | None |

| | | | | | | | | | |

1 Mr. Rasmussen and Ms. Rasmussen are spouses-in-law, and are nieces or nephews of Mr. F. T.

Weyerhaeuser (see below).

A-14

EXECUTIVE OFFICERS AND TRUSTEES

Information About the Funds’ Officers and Interested Trustee

| | | | | | | | | | |

Name, Address,

and Age | | Positions Held

with the Funds | | Term of Office

and Length of

Time Served | | Principal

Occupation(s)

During the Last 5

Years | | Number of

Portfolios in the

Fund Complex

Overseen by the

Trustee | | Other

Directorships Held

by the Trustee |

George H.

Weyerhaeuser, Jr.

(56)

30 East 7th Street,

Saint. Paul,

Minnesota 55101 | | Trustee, Chairman, Chief Executive Officer and Treasurer | | As Trustee; Tenure: 3 yrs Term: Indefinite

As Officer; Tenure: 3 yr Term: Reappointed annually | | Senior Vice President, Technology, Weyerhaeuser Company (1998 - 2006)

Director, Clearwater Management Company (1987- 2006)

Member, Advisory Board, Pictet Advisory Overseas Services Ltd (2009 - Present) | | 4 | | Foss Waterway Development Authority |

| | | | | | | | | | |

Frederick T.

Weyerhaeuser

(78)1

30 East 7th Street,

Saint. Paul,

Minnesota 55101 | | Trustee, Vice President and Secretary | | As Trustee; Tenure: 22 yrs Term: Indefinite

As Officer; Tenure: 22 yrs Term: Reappointed Annually | | Private Investor | | 4 | | Potlach Corporation (1960 - 2003) |

| | | | | | | | | | |

1 Mr. F. T. Weyerhaeuser is an interested trustee due to his daughter's position as a director of Clearwater Management Company, the Funds’ adviser.

A-15

EXECUTIVE OFFICERS AND TRUSTEES

Information About the Funds’ Officers and Interested Trustee

| | | | | | | | | | |

Name, Address,

and Age | | Positions Held

with the Funds | | Term of Office

and Length of

Time Served | | Principal

Occupation(s)

During the Last 5

Years | | Number of

Portfolios in the

Fund Complex

Overseen by the

Trustee | | Other

Directorships Held

by the Trustee |

Jennifer D.

Lammers (49) | | Chief Compliance Officer | | Tenure: September 2009- Present Term: Reappointed Annually | | Clearwater Management Company, Inc: Chief Compliance Officer, 9/09 - Present; Fiduciary Counselling, Chief Financial Officer and Chief Compliance Officer, 9/09 - Present; RiverSource Investments and RiverSource Funds, Chief Compliance Officer, 2006 - 2009; President, Tamarack Funds, 2003 - 2006 | | N/A | | N/A |

30 East 7th Street,

Saint. Paul,

Minnesota 55101

| | | | | | | | | | |

| | | | | | | | | | |

Additional information about the Fund Directors is available in the Funds’ Statement of Additional Information (SAI). The SAI is available, without charge, upon request, by contacting the transfer agent at (888) 228-0935 or writing the Funds at 2000 Wells Fargo Place, 30 East 7th Street, St. Paul, Minnesota 55101-4930. The Funds do not have an Internet Web site.

A-16

Approval of the Investment Management and Subadviser Service Agreements

Clearwater Management Company (“CMC”) is responsible for managing the investment programs and strategies for the Growth Fund, Small Cap Fund, Tax-Exempt Bond Fund, and International Fund (collectively, “the Funds”.) CMC also provides other administrative services to the Funds, and these services, as well as its investment management services, are provided to the Funds under an agreement (the “Management Agreement”.) CMC conducts due diligence when selecting each subadviser (collectively, the “Subadvisers”) for the Funds and oversees the performance of the Subadvisers. The Subadvisers provide portfolio management and related services for the Funds under individual subadvisory agreements (the “Subadvisory Agreements”.)

On an annual basis, the Funds’ Board of Trustees (the “Trustees”) including the independent trustees, considers renewal of the Management Agreement and the Subadvisory Agreements. The Trustees considered the renewal of the Agreements at their in-person meeting on December 10-11, 2009. Prior to the meeting, the Trustees requested, received, and reviewed written responses from CMC and the Subadvisers to questions posed to them on behalf of the Trustees and supporting materials relating to those questions and responses. The information presented at the meeting, including performance and expense data obtained from independent sources were designed to assist the Trustees in making their determination as to the renewal of the Management Agreement and Subadvisory Agreements. Also during this meeting, counsel to the Funds reviewed with the Trustees the various factors relevant to their consideration of the Management Agreement and Subadvisory Agreements, and the Trustees’ responsibilities related to their review. In addition to the information presented on December 10-11, 2009, at each regularly scheduled meeting throughout the year, the Trustees reviewed information on the investment performance and financial results of the Funds. Following an analysis and discussion of the factors described below, the Trustees, including all independent trustees present, approved renewal of the Management Agreement and the Subadvisory Agreements, with the exception of the Subadvisory Agreement described in the paragraph titled “Keeley Asset Management Subadvisory Agreement” below, for an additional one year period.

Nature, Extent and Quality of Services Provided

The Trustees considered information presented as to the services provided by CMC and the Subadvisers, as well as their investment expertise, resources and capabilities. The Trustees considered the quality of the Subadvisers previously recommended by CMC, as well as the ongoing work performed by CMC to recommend enhancements as to individual fund management or creation of new funds. The Board of Trustees specifically noted the work performed by CMC to create the new International Fund during 2009. The Trustees also noted the efforts of CMC to enhance its compliance program and oversight of Subadvisers. The Trustees reviewed information regarding the financial condition of CMC and the Subadvisers as related to their ongoing ability to provide services as specified under the Investment Management Agreement and Subadvisory Agreements. The Trustees reviewed specific information as to the investment performance of the Funds for various periods, as well as the performance of their respective benchmark indices and peer groups. The Trustees also reviewed reports summarizing the net assets, redemptions and purchases of shares of the Funds during 2009. Based on their analysis of the data presented, the Trustees concluded that they were generally satisfied with the nature and quality of the services being provided under the Investment Management Agreement and Subadvisory Agreements.

A-17

Comparative Fees and Cost of Services Provided

The Trustees reviewed the fees paid to CMC and the Subadvisers. The Trustees reviewed reports describing both the management fees charged by CMC and the total expense ratios of the Funds in comparison to those of similarly situated funds. In addition, throughout the year, the Trustees reviewed information as to the expense ratios of the Funds compared to the median expense ratio of a peer group of funds with a comparable investment strategy. The Trustees also reviewed information provided by the Subadvisers as to fees charged to other subadvisory clients. The Trustees noted the ongoing efforts of CMC to reduce fees paid by shareholders via voluntary waivers. The Trustees also reviewed CMC’s profitability, particularly noting CMC’s payment of fees and expenses normally absorbed by mutual fund shareholders, and profitability information provided by the Subadvisers. The Trustees concluded that profitability levels for CMC and the Subadvisers were reasonable.

Economies of Scale

The Trustees considered whether economies of scale might be realized by CMC as the Funds’ assets grow, and whether there also might be benefits from such growth for the Funds’ shareholders. The Trustees noted that the Growth, Tax-Exempt and Small Cap funds have been in operation for a number of years, and based on the distribution strategy of the Funds will probably not see significant increases in size. The Trustees further noted that CMC has already reduced, through voluntary waivers, the management fees for the International Fund, which commenced operations in 2009. However, the Trustees determined that they would continue to monitor the growth of the International Fund and consider whether there were additional opportunities to realize benefits from economies of scale for shareholders in the future.

Based on the factors as described above, the Trustees, including all of the independent trustees present, concluded that the investment management fees and subadvisory fees were fair and reasonable especially in view of the investment performance and quality of services provided. In reaching this conclusion, no single factor was considered determinative.

Keeley Asset Management Subadvisory Agreement

Keeley Asset Management (Keeley) is responsible for managing a portion (approximately 25%) of the portfolio of the Small Cap Fund. The Trustees originally retained Keeley under the terms of a Subadvisory Agreement dated August 1, 2006. During the in-person meeting on December 10-11, 2009, the Trustees reviewed material provided by Keeley. The Trustees determined that they were not satisfied with the quality and extent of the information provided and therefore voted to extend the Subadvisory Agreement through the next regularly scheduled meeting of the Trustees, during which time additional information would be requested from Keeley. The Trustees, including all independent Trustees, met at an in person meeting on February 9, 2010 to review the additional information provided by Keeley. Upon review of the additional information provided specifically related to trading operations, the Trustees, including all of the independent Trustees, determined that they were not satisfied with the quality of services provided and voted to terminate Keeley’s Subadvisory Agreement.

In considering the Agreements, the Trustees reviewed and evaluated information and factors they believed to be relevant and appropriate in the exercise of their reasonable business judgment.

A-18

While individual Trustees may have weighed certain factors differently, the Trustees determinations with respect to the Agreements were based on a comprehensive consideration of all information provided to the Trustees throughout the year, and specifically with respect to the consideration of the Agreements. In connection with their deliberations, the independent Trustees met separately in executive session on several occasions, with independent legal counsel, to review the relevant materials and consider their responsibilities under relevant laws and regulations.

A-19

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Clearwater Investment Trust:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Clearwater Growth Fund, Clearwater Small Cap Fund, Clearwater Tax-Exempt Bond Fund, and Clearwater International Fund (funds within Clearwater Investment Trust) (the Funds) as of December 31, 2009, and the related statements of operations for the year or period then ended, the statements of changes in net assets for each of the years or periods in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2009, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Clearwater Growth Fund, Clearwater Small Cap Fund, Clearwater Tax-Exempt Bond Fund, and Clearwater International Fund as of December 31, 2009, the results of their operations for the year or period then ended, the changes in their net assets for each of the years or periods in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Minneapolis, Minnesota

February 26, 2010

CLEARWATER INVESTMENT TRUST

Statements of Assets and Liabilities

December 31, 2009

| | | | | | | | | | | | | |

| | Growth

Fund | | Small Cap

Fund | | Tax-Exempt

Bond Fund | | International

Fund | |

Assets | |

Investments in securities, at fair value (identified cost: $219,797,937 Growth Fund; $183,979,346 Small Cap Fund; $553,658,511 Tax-Exempt Bond Fund; $220,330,599 International Fund) | | $ | 294,775,266 | | | 214,855,860 | | | 539,879,917 | | | 287,400,491 | |

Cash and cash equivalents | | | — | | | — | | | 5,298 | | | 6,443,945 | |

Foreign currencies, at value (cost: $156,445) | | | — | | | — | | | — | | | 156,382 | |

Receivable for securities sold | | | 1,877,497 | | | 3,326,735 | | | 557,205 | | | 151,129 | |

Receivable for shares of beneficial interest sold | | | — | | | — | | | 200,700 | | | — | |

Accrued dividend and interest receivable, less the allowance for uncollectible interest of $597,609 (Tax-Exempt Bond Fund) | | | 384,734 | | | 188,357 | | | 6,604,354 | | | 359,366 | |

Foreign tax reclaimable receivable | | | — | | | — | | | — | | | 143,998 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | — | | | — | | | — | | | 5,831 | |

Total assets | | | 297,037,497 | | | 218,370,952 | | | 547,247,474 | | | 294,661,142 | |

Liabilities | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Payables for investment securities purchased | | | — | | | 3,221,889 | | | 3,453,826 | | | 1,185,474 | |

Payables for fund shares redeemed | | | 3,652,447 | | | 329,899 | | | 917,386 | | | 328 | |

Accrued investment advisory fee | | | 197,195 | | | 484,223 | | | 482,511 | | | 568,546 | |

Unrealized depreciation on forward foreign currency exchange contracts | | | — | | | — | | | — | | | 4,899 | |

Total liabilities | | | 3,849,642 | | | 4,036,011 | | | 4,853,723 | | | 1,759,247 | |

Net assets | | $ | 293,187,855 | | | 214,334,941 | | | 542,393,751 | | | 292,901,895 | |

Capital | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Capital stock and additional paid-in capital (authorized unlimited number of shares at no par value for each Fund: outstanding 12,527,061; 14,874,041; 58,619,344; and 22,257,269 shares, respectively) | | $ | 236,185,498 | | | 228,843,400 | | | 564,712,778 | | | 225,668,748 | |

Undistributed net investment income (loss) | | | 133,061 | | | — | | | 188 | | | (679,781 | ) |

Accumulated net realized gain (loss) | | | (18,108,033 | ) | | (45,384,973 | ) | | (8,540,621 | ) | | 843,369 | |

Unrealized appreciation (depreciation) of investments | | | 74,977,329 | | | 30,876,514 | | | (13,778,594 | ) | | 67,069,559 | |

Net assets | | $ | 293,187,855 | | | 214,334,941 | | | 542,393,751 | | | 292,901,895 | |

Net asset value per share of outstanding capital stock | | $ | 23.40 | | | 14.41 | | | 9.25 | | | 13.16 | |

| |

See accompanying notes to financial statements. | |

2

CLEARWATER INVESTMENT TRUST

Statements of Operations

Year ended December 31, 2009

| | | | | | | | | | | | | |

| | Growth

Fund | | Small Cap

Fund | | Tax-Exempt

Bond Fund | | International

Fund* | |

Investment income: | | | | | | | | | | | | | |

Income: | | | | | | | | | | | | | |

Dividends (net of foreign taxes withheld of $555, $527, $0, and $490,792 respectively) | | $ | 5,350,914 | | | 1,443,713 | | | 2,032,088 | | | 4,658,912 | |

Interest | | | 6,723 | | | 40,625 | | | 24,752,362 | | | 16,735 | |

Total income | | | 5,357,637 | | | 1,484,338 | | | 26,784,450 | | | 4,675,647 | |

| | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | |

Federal excise taxes | | | — | | | — | | | 61 | | | — | |

Investment advisory fee | | | 1,066,576 | | | 2,203,193 | | | 2,818,053 | | | 1,754,776 | |

Voluntary fee reduction | | | (402,929 | ) | | (652,798 | ) | | (1,127,221 | ) | | (140,724 | ) |

Total expenses | | | 663,647 | | | 1,550,395 | | | 1,690,893 | | | 1,614,052 | |

Net investment income (loss) | | | 4,693,990 | | | (66,057 | ) | | 25,093,557 | | | 3,061,595 | |

Realized and unrealized gain (loss) on investments: | | | | | | | | | | | | | |

Net realized gain (loss) on security transactions | | | (8,594,039 | ) | | (12,244,262 | ) | | (3,545,962 | ) | | 5,289,409 | |

Net realized gain (loss) on foreign currency transactions | | | — | | | — | | | — | | | 272,268 | |

Unrealized appreciation during the period | | | 68,041,563 | | | 71,407,497 | | | 62,240,551 | | | 67,069,892 | |

Unrealized appreciation on forward foreign currency exchange contracts during the period | | | — | | | — | | | — | | | 932 | |

Translation of other assets and liabilities denominated in foreign currencies during the period | | | — | | | — | | | — | | | (1,265 | ) |

Net gain on investments | | | 59,447,524 | | | 59,163,235 | | | 58,694,589 | | | 72,631,236 | |

| | | | | | | | | | | | | |

Net increase in net assets from operations | | $ | 64,141,514 | | | 59,097,178 | | | 83,788,146 | | | 75,692,831 | |

| | | | | | | | | | | | | |

See accompanying notes to financial statements. |

| | | | | | | | | | | | | |

* Period from February 5, 2009 (commencement of operations) to December 31, 2009. | |

| | | | | | | | | | | | | |

3

CLEARWATER INVESTMENT TRUST

Statements of Changes in Net Assets

Years ended December 31, 2009 and 2008

| | | | | | | | | | | | | |

| | Growth Fund | | Small Cap Fund | |

| | 12/31/2009 | | 12/31/2008 | | 12/31/2009 | | 12/31/2008 | |

Operations: | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 4,693,990 | | | 5,402,700 | | | (66,057 | ) | | 632,123 | |

Net realized gain (loss) on investments | | | (8,594,039 | ) | | (3,244,756 | ) | | (12,244,262 | ) | | (33,071,302 | ) |

Change in unrealized appreciation (depreciation) during the period | | | 68,041,563 | | | (129,750,015 | ) | | 71,407,497 | | | (50,669,506 | ) |

Net increase (decrease) in net assets from operations | | | 64,141,514 | | | (127,592,071 | ) | | 59,097,178 | | | (83,108,685 | ) |

Distributions to shareholders from: | | | | | | | | | | | | | |

Net investment income | | | (4,613,011 | ) | | (5,407,889 | ) | | — | | | (619,899 | ) |

Net realized gain on investments | | | — | | | — | | | — | | | — | |

Total distributions to shareholders | | | (4,613,011 | ) | | (5,407,889 | ) | | — | | | (619,899 | ) |

Capital share transactions: | | | | | | | | | | | | | |

Proceeds from shares sold | | | 85,875,365 | | | 44,225,789 | | | 75,386,269 | | | 70,802,034 | |

Reinvestment of distributions from net investment income and gain | | | 4,613,011 | | | 5,407,889 | | | — | | | 619,899 | |

Payments for shares redeemed | | | (54,091,900 | ) | | (50,362,010 | ) | | (40,994,631 | ) | | (113,834,227 | ) |

Increase (decrease) in net assets from capital share transactions | | | 36,396,476 | | | (728,332 | ) | | 34,391,638 | | | (42,412,293 | ) |

Total increase (decrease) in net assets | | | 95,924,979 | | | (133,728,292 | ) | | 93,488,816 | | | (126,140,877 | ) |

Net assets: | | | | | | | | | | | | | |

At the beginning of the period | | | 197,262,876 | | | 330,991,168 | | | 120,846,125 | | | 246,987,001 | |

At the end of the period | | $ | 293,187,855 | | | 197,262,876 | | | 214,334,941 | | | 120,846,124 | |

Undistributed net investment income (loss) | | $ | 133,061 | | | 52,082 | | | (53,833 | ) | | 12,224 | |

| | | | | | | | | | |

| | Tax-Exempt Bond Fund | | International

Fund | |

| | 12/31/2009 | | 12/31/2008 | | 12/31/09* | |

Operations: | | | | | | | | | | |

Net investment income (loss) | | $ | 25,093,557 | | | 18,391,619 | | | 3,061,595 | |

Net realized gain (loss) on investments | | | (3,545,962 | ) | | (3,472,572 | ) | | 5,561,677 | |

Change in unrealized appreciation (depreciation) during the period | | | 62,240,551 | | | (64,059,902 | ) | | 67,069,559 | |

Net increase (decrease) in net assets from operations | | | 83,788,146 | | | (49,140,855 | ) | | 75,692,831 | |

Distributions to shareholders from: | | | | | | | | | | |

Net investment income | | | (25,117,859 | ) | | (18,367,129 | ) | | (4,013,644 | ) |

Net realized gain on investments | | | — | | | — | | | (4,446,040 | ) |

Total distributions to shareholders | | | (25,117,859 | ) | | (18,367,129 | ) | | (8,459,684 | ) |

Capital share transactions: | | | | | | | | | | |

Proceeds from shares sold | | | 120,179,220 | | | 171,622,315 | | | 244,076,067 | |

Reinvestment of distributions from net investment income and gain | | | 25,117,859 | | | 18,367,120 | | | 8,459,684 | |

Payments for shares redeemed | | | (32,421,588 | ) | | (89,028,497 | ) | | (26,867,003 | ) |

Increase (decrease) in net assets from capital share transactions | | | 112,875,491 | | | 100,960,938 | | | 225,668,748 | |

Total increase (decrease) in net assets | | | 171,545,778 | | | 33,452,954 | | | 292,901,895 | |

Net assets: | | | | | | | | | | |

At the beginning of the period | | | 370,847,973 | | | 337,395,019 | | | — | |

At the end of the period | | $ | 542,393,751 | | | 370,847,973 | | | 292,901,895 | |

Undistributed net investment income (loss) | | $ | 188 | | | 24,490 | | | (669,341 | ) |

See accompanying notes to financial statements.

* Period from February 5, 2009 (commencement of operations) to December 31, 2009.

4

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

Clearwater Investment Trust (the Trust) was established on January 12, 1987 as a Massachusetts business trust and is registered under the Investment Company Act of 1940 (as amended) as a diversified open end management investment company and presently includes four series of funds: Clearwater Growth Fund, Clearwater Small Cap Fund, Clearwater Tax-Exempt Bond Fund, and Clearwater International Fund (the Funds). The Trust’s declaration of trust permits the Board of Trustees to create additional funds in the future. The investment objective of the Clearwater Growth, Small Cap, and International Funds is long term capital growth. The investment objective of the Clearwater Tax-Exempt Bond Fund is high current income that is exempt from federal income tax, consistent with preservation of capital. The Clearwater International Fund commenced operations on February 5, 2009.

The Clearwater Growth Fund is passively managed to track but not replicate the Russell 1000® Index (the Index), an unmanaged, capitalization weighted index of the largest 1000 public companies in the United States. The Fund is managed so that its holdings match the holdings of the Index as closely as possible while attempting to minimize the realization of taxable gains. This means that the Fund will not buy and sell securities to match changes in the composition of securities in the Index. Instead, the Fund’s portfolio is adjusted periodically to reflect the holdings and weightings of the Index, but only after consideration of the Fund’s policy to minimize realization of taxable gains.

The Clearwater Small Cap Fund invests primarily in equity securities of issuers with market capitalizations, at the time of investment, no greater than the range of capitalizations of the companies included in the Russell 2000® Index, an unmanaged, capitalization weighted. The Fund may invest up to 20% of its assets in microcap securities, generally defined as securities with a market capitalization under $300 million.

The Clearwater Tax-Exempt Bond Fund invests at least 80% of its assets in municipal securities, which are debt obligations issued by or for the U.S. states, territories and possessions, and the District of Columbia. The interest on these securities is generally exempt from regular federal income tax and may also be exempt from federal alternative minimum tax. However, the Fund may invest up to 20% of its assets in securities that generate interest income subject to federal alternative minimum tax.

The Clearwater International Fund, using a “multi-style, multi-manager” approach, allocates portions of its assets among subadvisers who employ distinct investment styles. The Fund currently has four subadvisers, Parametric Portfolio Associates (Parametric), AXA Rosenberg Investment Management LLC (AXA Rosenberg), Artisan Partners Limited Partnership (Artisan Partners), and Eagle Global Advisors, LLC (Eagle). The Fund generally invests at least 80% of the value of its net assets in equity securities that trade in markets outside the United States. Such securities are generally issued by companies domiciled outside of the United States or companies that derive more than half of their revenues or pre-tax income from activities occurring outside of the United States. The Fund diversifies its investments among a number of different countries throughout the world, and may invest in companies of any size. The Fund does not currently intend to invest more than 20% of its net assets in the equity securities of developing or emerging market issuers.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| |

(2) | Summary of Significant Accounting Policies |

| |

The significant accounting policies followed by the Funds are as follows: |

| |

(a) | Investments in Securities |

| |

| Investments in U.S. and foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded. Foreign security values are stated in U.S. dollars. Equity securities which have not traded on the date of valuation or securities for which sales prices are not generally reported are valued at the mean between the last bid and asked prices. Debt securities maturing more than 60 days from the valuation date are valued at the market price supplied by an independent pricing vendor; those securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued at amortized cost, which approximates fair value. Securities for which no market quotations are readily available (including those the trading of which has been suspended) will be valued at fair value as determined in good faith by the board of trustees, although the actual computations may be made by persons acting pursuant to the direction of the board. |

| |

| Security transactions are accounted for on the trade date which is the date the securities are purchased or sold. Realized gains and losses are calculated on an identified cost basis. Dividend income is recognized on the ex-dividend date or, for foreign securities, as soon as the information is available. Interest income, including amortization of original issue discount and premium, is accrued daily. |

| |

(b) | Foreign Currency Translations |

| |

| The International Fund invests in securities which are purchased and sold in foreign currencies as a principal investment strategy. The cost of purchases and proceeds from sales of investments, interest and dividend income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The value of the International Fund’s assets as measured in U.S. dollars therefore may be affected favorably or unfavorably by changes in foreign currency exchange rates and exchange control regulations. The gains or losses, if any, on investments resulting from changes in foreign exchange rates are included in the Statements of Operations with net realized and unrealized gain (loss) on investments. The realized gains or losses, if any, on translations of other assets and liabilities denominated in foreign currencies are included in foreign currency transactions on the Statements of Operations. The International Fund also will incur costs in converting U.S. dollars to local currencies, and vice versa. The International Fund therefore may enter into foreign currency transactions as a principal investment strategy. |

| |

| Risks may arise upon investing in foreign securities including, but not limited to, political, social or economic instability in the country of the issuer, the difficulty of predicting international trade patterns, the possibility of the imposition of exchange controls, expropriation, limits on removal of currency or other assets, nationalization of assets, foreign withholding and income tax and possible delays in the settlement of foreign stock exchange transactions. The principal markets on which these securities trade may have less volume and liquidity, and may be more volatile, than securities markets in the United States. |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| |

(c) | Forward Foreign Currency Exchange Contracts |

| |

| The International Fund enters into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date as a hedge against either specific transactions or the portfolio position. The objective of the International Fund’s foreign currency hedging transactions is to reduce the risk that the U.S. dollar value of the International Fund’s foreign currency denominated securities will decline in value due to changes in foreign currency exchange rates. Forward foreign currency exchange contracts are marked-to-market daily at the applicable exchange rates and any resulting unrealized gains or losses are recorded in the financial statements. The International Fund records realized gains or losses at the time the forward foreign currency exchange contract is offset by entering into a closing transaction with the same counterparty or is extinguished by delivery of the currency. |

| |

| Risks may arise upon entering into forward foreign currency exchange contracts from the potential of the issuer to default on its obligations under the contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. The contractual amounts of forward foreign currency exchange contracts do not necessarily represent the amounts potentially subject to risk. The measurement of risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. The Statements of Operations reflect realized gains or losses, if any, in net realized gain (loss) on foreign currency transactions and unrealized gains or losses in unrealized appreciation (depreciation) on forward foreign currency exchange contracts. Additional information on derivative instruments and how these positions may impact the financial statements is found in Note 9. |

| |

(d) | Spot Contracts |

| |

| The International Fund enters into spot contracts in order to buy or sell a certain amount of foreign currency at the current market rate, with settlement occurring in two business days. The International Fund may enter into spot contracts in order to make payments, or to receive payments, based on trading activity in a foreign currency. A spot contract allows the International Fund to buy or sell foreign currency on the day it chooses to deal. |

| |

| Risks may arise upon entering into spot contracts from unanticipated movements in the value of a foreign currency relative to the U.S. dollar in a short period of time. Additional information on derivative instruments and how these positions may impact the financial statements is found in Note 9. |

| |

(e) | Cash and Cash Equivalents |

| |

| For the International Fund, cash and cash equivalents include cash and short-term deposits maintained in foreign currencies. |

| |

(f) | Recoverable Taxes |

| |

| The balance disclosed as foreign tax reclaimable receivable represents net amounts withheld by foreign governments on dividend income earned in the respective countries subject to reclamation. All reclaims are paid directly to the International Fund. |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| |

(g) | Federal Taxes |

| |

| The Trust’s policy is to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies. On a calendar-year basis, the Funds intend to distribute substantially all of their net investment income and realized gains, if any, to avoid the payment of federal income and excise taxes. Therefore, no income tax provision is required. Each fund is treated as a separate entity for federal income tax purposes. |

| |

| Management has yet to file a federal tax return for the International Fund as operations commenced on February 5, 2009. Therefore, management has not yet analyzed the International Fund’s tax positions; however, the International Fund anticipates concluding that no provision for income tax will be required in the International Fund’s financial statements for December 31, 2009. Management has analyzed the other three funds’ tax positions taken on federal tax returns for all open tax years and has concluded that as of December 31, 2009, no provision for income tax would be required in the Funds’ financial statements. The Funds’ federal and Minnesota state income and federal excise tax returns for the 2006, 2007, 2008 and 2009 tax years for which the applicable statutes of limitations have not expired remain subject to examination by the Internal Revenue Service and state departments of revenue. |

| |

| Net investment income and net realized gains (losses) for the Funds may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains, if any, may differ from their ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the period or fiscal year in which amounts are distributed may differ from the period or year that the income or realized gains (losses) were recorded by the Funds. The tax character of distributions paid by the funds during the years ended December 31, 2009 and 2008 was as follows: |

| | | | | | | | | | | | | |

| | Tax-Exempt | | Ordinary Income | |

| | 2009 | | 2008 | | 2009 | | 2008 | |

|

Growth Fund | | $ | — | | | — | | | 4,613,011 | | | 5,407,889 | |

Small Cap Fund | | | — | | | — | | | — | | | 619,899 | |

Tax-Exempt Bond Fund | | | 24,795,282 | | | 18,268,358 | | | 322,577 | | | 98,771 | |

International Fund* | | | — | | | — | | | 8,459,684 | | | — | |

| |

| *Commenced investment operations on February 5, 2009. |

| |

| Qualified Dividend Income Under the Jobs and Growth Tax Relief Reconciliation Act of 2003 (the “Act”), 100% of ordinary dividends paid during the years ended December 31, 2008 and 2009 for the Growth Fund, 100% of ordinary dividends paid during the year ended December 31, 2008 for the Small Cap Fund, and 47.02% of ordinary dividends paid during the period ended December 31, 2009 for the International Fund are designated as “qualified dividend income”, as defined in the Act, subject to reduced tax rates in 2009. |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| |

| Foreign Tax Credit The International Fund intends to make an election that will allow shareholders to treat their proportionate share of foreign taxes paid by the Fund as having been paid by them. The amounts per share which represent income from sources within foreign countries and the foreign tax credit were 0.2286 and 0.0221, respectively. |

| |

| As of December 31, 2009, the components of distributable earnings on a tax basis were as follows: |

| | | | | | | | | | | | | |

| | Growth Fund | | Small Cap

Fund | | Tax-Exempt

Bond Fund | | International

Fund* | |

|

Undistributed ordinary income | | $ | 133,061 | | | (53,833 | ) | | 188 | | | 1,066,168 | |

Undistributed capital gain | | | — | | | — | | | — | | | — | |

Accumulated capital losses | | | (17,834,842 | ) | | (45,354,932 | ) | | (8,540,621 | ) | | — | |

Unrealized appreciation (depreciation) | | | 74,704,138 | | | 30,846,473 | | | (13,778,594 | ) | | 66,167,973 | |

|

Total | | $ | 57,002,357 | | | (14,562,292 | ) | | (22,319,027 | ) | | 67,234,141 | |

| |

| *Commenced investment operations on February 5, 2009. |

| |

| On the statements of assets and liabilities, due to permanent book-to-tax differences, the following adjustments have been made: |

| | | | | | | | | | | | | |

| | Growth Fund | | Small Cap Fund | | Tax-Exempt

Bond Fund | | International

Fund* | |

|

Undistributed net investment income | | $ | — | | $ | 53,833 | | $ | — | | $ | 272,268 | |

Accumulated net realized gains (loss) | | | — | | | — | | | — | | | (272,268 | ) |

Additional paid-in capital | | | — | | | (53,833 | ) | | — | | | — | |

| |

| *Commenced investment operations on February 5, 2009. |

| |

(h) | Distributions to Shareholders |

| |

| Distributions to shareholders from net investment income, if any, are declared annually for the Growth, Small Cap, and International Funds and declared daily, payable monthly, for the Tax-Exempt Bond Fund. Distributions to shareholders from net realized gains, if any, are declared annually for all Funds. Distributions are paid in cash or reinvested in additional shares. |

| |

(i) | Use of Estimates |

| |

| The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increase and decrease in net assets from operations during the period. Actual results could differ from those estimates. |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| |

(j) | Recent Accounting Pronouncements |

| |

| In April 2009, the Financial Accounting Standards Board (“FASB”) issued additional guidance related to fair value measurement. This guidance requires enhanced disclosures about the inputs and valuation technique(s) used to measure fair value and a discussion of changes in valuation techniques and related inputs, if any, during the period. In addition, the three-level hierarchy disclosure and the level three roll-forward disclosure are to be expanded for each major category of equity and debt securities. There were no changes to the financial position of the Funds and the results of their operations upon adoption of this guidance. Management believes that appropriate disclosures, reflecting the potential impact of this guidance, have been made for the current period as part of the Notes to Financial Statements and Schedule of Investments. |

| |

| In June 2009, the FASB issued guidance establishing general standards of accounting for and disclosure of events that occur after the balance sheet date, but before the financial statements are issued. Management has evaluated subsequent events for the Funds as described in note 10. |

| |

(3) | Fair Value Measurements |

| |

Fair value is an estimate of the price the Funds would receive upon selling a security in a timely transaction to an independent buyer in the principal or most advantageous market of the security. Fair value measurement guidance establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Funds’ investments, as described in note 2(a) above. These inputs are summarized in the three broad levels listed below. |

|

• | Level 1 – quoted prices in active markets for identical securities |

| |

• | Level 2 – other significant observable inputs including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc. or quoted prices for identical or similar assets in markets that are not active. Inputs that are derived principally from or corroborated by observable market data. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| |

• | Level 3 – valuations based on unobservable inputs, which may include the advisor’s own assumptions in determining the fair value of an investment. |

| |

Investments are valued as of the close of business on the New York Stock Exchange, normally 4:00pm Eastern time. Security transactions are accounted for as of trade date. Wherever possible, the Funds use independent pricing services approved by the Board of Trustees to value their estimates. When prices are not readily available, or are determined not to reflect fair value, the Funds may value these securities at fair value as determined in accordance with the procedures approved by the Funds’ Board of Trustees. |

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the investments of each Fund as of December 31, 2009 using the Fair Value methodology and broad levels described above: |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| | | | | | | |

| Investments in Securities at Value |

| | Growth

Fund (a) | | Small Cap

Fund (b) | |

|

Level 1 | | $ | 294,775,266 | | | 214,416,140 | |

Level 2 | | | — | | | 439,720 | |

Level 3 | | | — | | | — | |

|

Total | | $ | 294,775,266 | | | 214,855,860 | |

| |

(a) | For the Growth Fund, 100% of the investment value is compromised of equity securities and cash equivalents. See the Fund’s Schedule of Investments for industry classification. |

| |

(b) | For the Small Cap Fund, 100% of the investment value is compromised of equity and fixed income securities and cash equivalents. See the Fund’s Schedule of Investments for industry classification. Level 2 securities are fixed income securities. |

| | | | | | | | | | | | | |

Clearwater Tax-Exempt Bond Fund (c) | | Level 1

Quoted

Prices | | Level 2

Other

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Total | |

| | | | | | | | | | | | | |

Cash Equivalents | | | | | | | | | | | | | |

STIF- Type Instrument | | $ | — | | | 15,798,249 | | | — | | | 15,798,249 | |

Total Cash Equivalents | | | — | | | 15,798,249 | | | — | | | 15,798,249 | |

Fixed Income | | | | | | | | | | | | | |

Closed-End Funds | | | 36,715,907 | | | — | | | — | | | 36,715,907 | |

Municipal Bonds | | | — | | | 486,482,817 | | | 552,924 | | | 487,035,741 | |

Other Asset Backed | | | — | | | 330,020 | | | — | | | 330,020 | |

Total Fixed Income | | | 36,715,907 | | | 486,812,837 | | | 552,924 | | | 524,081,668 | |

|

Total | | $ | 36,715,907 | | | 502,611,086 | | | 552,924 | | | 539,879,917 | |

|

(c) For this fund, 100% of the investment value is compromised of closed-end funds, fixed income securities, and cash equivalents. Level 2 securities are primarily fixed income securities. |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

The following is a reconciliation of investments for the Clearwater Tax-Exempt Bond Fund in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | |

| | Municipal

Bonds | |

Balance as of 12/31/08 | | $ | — | |

Net realized gain (loss) | | | — | |

Net change in unrealized appreciation (depreciation) | | | 71,716 | |

Net purchases (sales) | | | 481,208 | |

Net transfers in and/or out of Level 3 | | | — | |

Balance as of 12/31/09 | | $ | 552,924 | |

As of December 31, 2009 total change in unrealized gains or losses on Level 3 securities still held at year end and included in the change in net assets was $0.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| | | | | | | | | | | | | |

Clearwater International Fund (d) | | Level 1

Quoted

Prices | | Level 2

Other

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Total | |

| | | | | | | | | | | | | |

Common Stock | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 3,628,715 | | | 33,471,223 | | | — | | | 37,099,938 | |

Consumer Staple | | | 2,955,426 | | | 25,345,048 | | | — | | | 28,300,474 | |

Energy | | | 5,648,177 | | | 17,616,871 | | | 421,737 | | | 23,686,785 | |

Financials | | | 7,639,687 | | | 61,454,335 | | | — | | | 69,094,022 | |

Health Care | | | 3,152,567 | | | 18,219,055 | | | — | | | 21,371,622 | |

Industrials | | | 1,389,329 | | | 32,876,771 | | | 188,354 | | | 34,454,454 | |

Information Technology | | | 3,177,965 | | | 13,346,030 | | | 160,485 | | | 16,684,480 | |

Materials | | | 6,748,229 | | | 23,946,149 | | | — | | | 30,694,378 | |

Telecommunication Services | | | 1,358,040 | | | 10,694,860 | | | — | | | 12,052,900 | |

Utilities | | | 258,838 | | | 11,118,935 | | | — | | | 11,377,773 | |

Total Common Stock | | | 35,956,973 | | | 248,089,277 | | | 770,576 | | | 284,816,826 | |

Preferred Stocks | | | | | | | | | | | | | |

Consumer Discretionary | | | — | | | 263,052 | | | — | | | 263,052 | |

Consumer Staples | | | — | | | 122,867 | | | — | | | 122,867 | |

Energy | | | 627,372 | | | — | | | — | | | 627,372 | |

Health Care | | | — | | | 79,614 | | | — | | | 79,614 | |

Materials | | | 412,012 | | | — | | | — | | | 412,012 | |

Utilities | | | — | | | 76,820 | | | — | | | 76,820 | |

Total Preferred Stock | | | 1,039,384 | | | 542,353 | | | — | | | 1,581,737 | |

Corporate Bonds | | | — | | | — | | | 995,466 | | | 995,466 | |

Total Corporate Bonds | | | — | | | — | | | 995,466 | | | 995,466 | |

Rights | | | | | | | | | | | | | |

Energy | | | — | | | 2,927 | | | — | | | 2,927 | |

Total Rights | | | — | | | 2,927 | | | — | | | 2,927 | |

Warrants | | | | | | | | | | | | | |

Financials | | | 3,535 | | | — | | | — | | | 3,535 | |

Total Warrants | | | 3,535 | | | — | | | — | | | 3,535 | |

|

Total | | $ | 36,999,892 | | | 248,634,557 | | | 1,766,042 | | | 287,400,491 | |

| | | | | | | | | | | | | |

Other Financial Instruments* | | $ | — | | | 932 | | | — | | | 932 | |

|

*Other Financial instruments include futures and forwards, if applicable. |

(d) For this fund, 100% of the investment value is compromised of equity securities, corporate bonds, rights, and warrants. See the Fund’s Schedule of Investments for geographical classification. Level 2 securities are primarily foreign securities where the closing price has been adjusted by application of a systematic process for events occurring after the close of the foreign exchange.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| |

| The following is a reconciliation of investments for the Clearwater International Fund in which significant unobservable inputs (Level 3) were used in determining fair value: |

| | | | | | | | | | | | | |

| | Common Stock | | | | |

| | Energy | | Industrials | | Information

Technology | | Corporate

Bonds | |

Balance as of 2/5/09* | | $ | — | | | — | | | — | | | — | |

Net realized gain (loss) | | | — | | | — | | | — | | | — | |

Net change in unrealized appreciation (depreciation) | | | 86,686 | | | 40,022 | | | 21,042 | | | (58,993 | ) |

Net purchases (sales) | | | 335,051 | | | 148,332 | | | 139,443 | | | 1,054,459 | |

Net transfers in and/or out of Level 3 | | | — | | | — | | | — | | | — | |

Balance as of 12/31/09 | | $ | 421,737 | | | 188,354 | | | 160,485 | | | 995,466 | |

| |

| *Commenced investment operations on February 5, 2009. |

| |

| As of December 31, 2009 total change in unrealized gains or losses on Level 3 securities still held at year end and included in the change in net assets was $88,757. |

| |

(4) | Investment Security Transactions |

The cost of purchases and proceeds from sales of securities, other than temporary investments in short term securities, for the period ended December 31, 2009, were as follows:

| | | | | | | |

| | Purchases | | Sales | |

|

Growth Fund | | $ | 88,485,288 | | | 51,246,757 | |

Small Cap Fund | | | 180,562,530 | | | 148,167,992 | |

Tax-Exempt Bond Fund | | | 202,852,431 | | | 104,241,263 | |

International Fund* | | | 285,010,450 | | | 69,969,260 | |

*Fund commenced operations on February 5, 2009.

| |

(5) | Capital Share Transactions |

Transactions in shares of each fund for the periods ended December 31, 2009 and 2008 were as follows:

| | | | | | | | | | | | | |

| | Growth Fund | | Small Cap Fund | |

| | 2009 | | 2008 | | 2009 | | 2008 | |

|

Sold | | | 4,317,991 | | | 1,825,122 | | | 6,858,845 | | | 5,527,593 | |

Issued for reinvested distributions | | | 197,053 | | | 290,747 | | | — | | | 59,663 | |

Redeemed | | | (2,592,135 | ) | | (2,338,433 | ) | | (3,617,902 | ) | | (8,764,097 | ) |

|

Increase | | | 1,922,909 | | | (222,564 | ) | | 3,240,943 | | | (3,176,841 | ) |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

| | | | | | | | | | |

| | Tax-Exempt Bond Fund | | International

Fund* | |

| | 2009 | | 2008 | | 2009 | |

|

Sold | | | 13,601,897 | | | 19,251,653 | | | 23,904,428 | |

Issued for reinvested distributions | | | 2,823,365 | | | 2,036,379 | | | 642,834 | |

Redeemed | | | (3,640,932 | ) | | (10,437,584 | ) | | (2,289,993 | ) |

|

Increase | | | 12,784,330 | | | 10,850,448 | | | 22,257,269 | |

* Fund commenced operations on February 5, 2009.

| |

(6) | Capital Loss Carry Over |

For federal income tax purposes, the Growth Fund, Small Cap Fund, Tax-Exempt Bond Fund, and International Fund have capital loss carryovers of $17,834,842, $45,354,932, $8,540,621, and $0, respectively, at December 31, 2009, which, if not offset by subsequent capital gains, will expire as follows:

| | | | | | | | | | | | | |

| | Growth Fund | | Small Cap

Fund | | Tax-Exempt

Bond Fund | | International

Fund | |

|

Year of expiration: | | | | | | | | | | | | | |

2010 | | $ | 5,878,353 | | | — | | | — | | | — | |

2012 | | | — | | | — | | | — | | | — | |

2013 | | | 183,070 | | | — | | | 508,252 | | | — | |

2014 | | | — | | | — | | | — | | | — | |

2015 | | | — | | | — | | | 1,013,836 | | | — | |

2016 | | | 3,166,401 | | | 33,061,735 | | | 3,472,571 | | | — | |

2017 | | | 8,607,018 | | | 12,293,197 | | | 3,545,962 | | | — | |

|

Total | | $ | 17,834,842 | | | 45,354,932 | | | 8,540,621 | | | — | |

| |

(7) | Expenses and Related-Party Transactions |

The Trust has a contract for investment advisory services with Clearwater Management Company (CMC), a management firm of which the Trust’s President and Treasurer is a shareholder. Under terms of an agreement, Clearwater Growth Fund, Clearwater Small Cap Fund, Clearwater Tax-Exempt Bond Fund and Clearwater International Fund pay a fee equal to an annual rate of 0.45%, 1.35%, 0.60% and 1.00% of average net assets, respectively. CMC is responsible for the payment or reimbursement of all the Funds’ expenses, except brokerage, taxes, interest, and extraordinary expenses. CMC has periodically reduced its management fee for each of the Funds through voluntary waivers. As of December 31, 2009, the management fee paid by the Growth Fund net of voluntary waiver is 0.28%. Effective July 1, 2008 CMC voluntarily reduced the fees paid by the Clearwater Small Cap Fund and Clearwater Tax-Exempt Bond Fund funds to 0.95% and 0.36%, respectively. On October 1, 2009 CMC voluntarily reduced the fees paid by the Clearwater International Fund to 0.80%. These voluntary fee reductions may be discontinued at any time.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements

December 31, 2009

In addition to fees and expenses which the Funds bear directly, the Funds indirectly bear a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in any of the reported expense ratios.

CMC has entered into sub advisory contracts with independent investment advisory firms for each fund to provide daily investment management services. CMC pays each subadviser an annual fee, based on average daily net assets, in the following amounts:

| | | | | | | | | | | | | | |

| | | | Growth

Fund | | | Small Cap Fund | | | Tax-Exempt Bond

Fund | | | International Fund | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Parametric Portfolio Associates | | | 0.15% of net assets | | | | | | | | | 0.15% of net assets | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Kennedy Capital Management, Inc. | | | | | | 0.85% of the first $50 million in net assets it manages and then 0.80% of net assets in excess of $50 million | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Keeley Asset Management | | | | | | 1.00% of the first $2 million in net assets it manages, then 0.85% of the next $8 million in net assets, and then 0.70% of net assets in excess of $10 million | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Sit Fixed Income Advisers II, LLC | | | | | | | | | 0.40% of the first $20 million in net assets and decreasing in reduced percentages to 0.20% of net assets in excess of $75 million | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| AXA Rosenberg | | | | | | | | | | | | 0.85% of the first $50 million in net assets it manages, then 0.75% of the next $50 million in net assets, and then 0.65% of net assets in excess of $100 million | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Artisan Partners, LP | | | | | | | | | | | | 0.80% of the first $50 million in net assets it manages, then 0.60% of the next $50 million in net assets, and then 0.50% of net assets in excess of $100 million | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |