UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | |

| | Investment Company Act file number | 811-05038 | |

Clearwater Investment Trust

(Exact name of registrant as specified in charter)

2000 Wells Fargo Place, 30 East 7th Street, Saint Paul, Minnesota 55101-4930

(Address of principal executive offices) (Zip code)

Karen P. Rau

Fiduciary Counselling, Inc.

2000 Wells Fargo Place, 30 E. 7th Street

Saint Paul, Minnesota 55101-4930

Copy to:

John V. O’Hanlon, Esq.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code:651-228-0935

Date of fiscal year end:December 31

Date of reporting period:December 31, 2019

Item 1. Reports to Stockholders

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) |

CLEARWATER INVESTMENT TRUST

Clearwater Core Equity Fund

Clearwater Small Companies Fund

Clearwater Tax-Exempt Bond Fund

Clearwater International Fund

Annual Report

for the year ended

December 31, 2019

Management Discussion of Clearwater Funds’ Performance

Clearwater Core Equity Fund

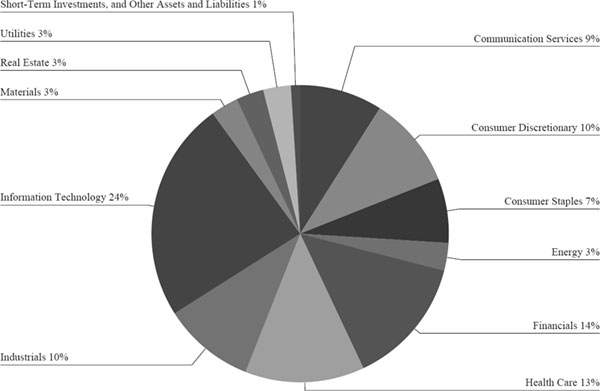

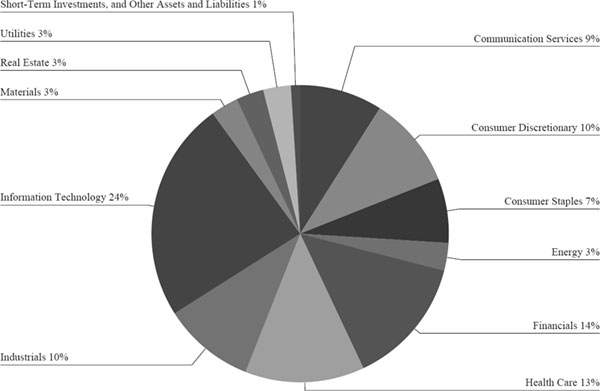

The Clearwater Core Equity Fund (the “Core Equity Fund” or the “Fund”) seeks long-term growth of capital. Under normal market conditions, the Core Equity Fund pursues its investment objective by investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of U.S. companies. The Core Equity Fund’s assets are managed in a “multi-manager, multi-style” approach. As of December 31, 2019, the Fund had three subadvisers that provide day-to-day management of Fund assets. Parametric Portfolio Associates LLC (“Parametric”), with approximately 40% to 60% of the Fund’s assets, manages its portion of the Fund’s assets to track the Russell 1000® Index as closely as possible without requiring the Fund to realize taxable gains. The remaining Fund assets are divided between AQR Capital Management, LLC (“AQR”) and O’Shaughnessy Asset Management, LLC (“OSAM”), who both utilize an active management style.

2019 Market Overview:

Domestic large capitalization equities, as defined by the Russell 1000® Index, generated more than 30% returns in 2019, driven by the Federal Reserve’s shift to a more accommodative monetary policy stance and improved investor sentiment that was in part derived from the announcement of a phase one trade deal between the U.S. and China. Value stocks underperformed growth stocks for the third straight year, as measured by the Russell 1000® Value Index and the Russell 1000® Growth Index.

2019 Performance and 2020 Outlook:

The Core Equity Fund gained 29.1%, net of fees, in 2019 compared to an increase of 31.4% for the Russell 1000® Index, the Fund’s benchmark.

Each of the three subadvisers comment on the performance of their specific portions of the Fund and provide a market outlook for the next year in the paragraphs below. For comparison of the subadvisers’ capabilities, performance is shown gross of fees. The Fund pays a single advisory fee to Clearwater Management Co., Inc., which in turn pays the subadvisers out of its advisory fee.

Although the overall performance of the Core Equity Fund is measured against its benchmark, as stated above, each of the underlying subadvisers may manage their portion of the Fund against a different benchmark that aligns more closely with their strategy. In each section below, the subadvisers discuss their view of the market over the last twelve months, the performance of their portfolios with respect to the benchmark against which their particular portfolio is managed and their outlook for the next twelve months. Parametric, the subadviser that follows a tax-managed passive strategy, slightly underperformed its benchmark in 2019. Both active managers, AQR and OSAM, underperformed their respective benchmarks in 2019 by a larger margin.

AQR Commentary

General Market Overview:

We trade a set of strategies based on the value, momentum, and quality signals of individual securities that seek a positive expected return versus the appropriate benchmark, in a variety of economic environments. Because our investment approach employs a systematic set of rules based on economic intuition and testing to seek to ensure they are robust across time, macro environments, and geographies, we typically do not offer general market overviews.

2019 Performance:

The portion of the Core Equity Fund managed by AQR (the “Portfolio”) underperformed the Russell 1000® Index (the “benchmark”) in 2019, returning 28.8%, gross of fees, while the benchmark returned 31.4%. Sector allocation was additive to performance, while stock selection within sectors detracted from performance. The largest detractor was the Health Care sector, where both sector allocation and stock selection within the sector contributed to underperformance versus the benchmark.

2020 Outlook:

In terms of sector positioning, we are currently overweight Financials while being underweight Energy. With respect to long-term attractiveness, we believe that valuations are currently less attractive in the U.S.

OSAM Commentary

General Market Overview:

2019 was a strong year for returns in global equity markets and a few key themes emerged for the year. Growth outperformed value (the Russell 1000® Growth Index outperformed the Russell 1000® Value Index by 9.8% in 2019) and large capitalization stocks outperformed small capitalization stocks (the Russell 1000® Index outperformed the Russell 2000® Index by 5.9%). 2019 was marred by trade wars, Federal Reserve policy, and political tensions. The Federal Reserve cut interest rates for the third time in October and the U.S. came to a verbal agreement with China on signing a phase one trade deal that marked a potential first step to ending the trade war.

2019 Performance:

The portion of the Core Equity Fund managed by OSAM (the “Portfolio”) underperformed the Russell 1000® Index (the “benchmark”) in 2019, returning 26.2%, gross of fees, while the benchmark returned 31.4%. The elimination of lower quality stocks was the largest detractor from the Portfolio’s performance. The Portfolio’s tilts toward factors such as value and momentum and an underweight exposure to large capitalization stocks also detracted from performance.

2020 Outlook:

We believe our Portfolio is positioned well for 2020. Our investment process favors companies that have higher levels of return on capital, lower reliance on external financing, and trade at what we believe are deep discounts across many valuation factors relative to the benchmark. At year- end 2019, the Portfolio’s holdings were returning capital to shareholders at a rate of 6.2% versus the benchmark’s 2.9%. We believe that these combined advantages can only be delivered by a portfolio which is distinct from the benchmark. We also believe that our Portfolio continues to represent a unique take on the U.S. equity market. Entering 2020 we expect to continue to focus on what we believe is our market niche: quality companies, often trading at out-of-favor prices, which are aggressively returning capital to equity shareholders through dividends and share repurchases.

Parametric Commentary

General Market Overview:

The stock market had a strong year in 2019, spanning across large and small capitalization stocks as well as value and growth stocks. The two decisive factors that impacted the market in 2019 were the trade tensions with China and Federal Reserve’s interest rate policy. In May, market sentiment turned negative when the United States increased tariffs on Chinese products and threatened new tariffs with coinciding retaliatory announcements by China. Market sentiment turned positive after trade talks resumed and phase one of the trade deal was announced. In the wake of the trade war and a slowdown in economic activity, the Federal Reserve cut interest rates three times (beginning in July), from 2.50% to 1.75%. This accommodative monetary policy further boosted market confidence.

2019 Performance:

The portion of the Core Equity Fund managed by Parametric (the “Portfolio”) underperformed the Russell 1000® Index (the “benchmark”) in 2019, returning 31.2%, gross of fees, while the benchmark returned 31.4%. Most of the underperformance was attributed to holding a small amount of cash in a strong up market (cash drag). The Technology sector was slightly underweight relative to the benchmark, which also contributed to the underperformance.

2020 Outlook:

The phase one trade deal between the U.S. and China was signed in January 2020. However, there are still many issues between the two largest economic powers. How it unfolds in 2020 remains an uncertainty. The Federal Reserve seems to be committed to low interest rates, ready to accommodate any deteriorating economic conditions.

Clearwater Small Companies Fund

The Clearwater Small Companies Fund (the “Small Companies Fund” or the “Fund”) seeks long-term growth of capital. Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of small companies. The Fund defines “small companies” as issuers with market capitalizations no greater than that of the largest market capitalization company included in the Russell 2000® Index at the time of purchase. Equity securities consist primarily of exchange-traded common and preferred stocks and convertible securities. The Fund uses a “multi-style, multi-manager” approach with three subadvisers who employ distinct investment styles: Cooke & Bieler, L.P. (“Cooke & Bieler”), Kennedy Capital Management Inc. (“Kennedy”), and Pzena Investment Management, LLC (“Pzena”). At December 31, 2019, Kennedy managed about 60% of the Fund while Cooke & Bieler and Pzena managed about 20% each.

2019 Market Overview:

Domestic small capitalization equities, as defined by the Russell 2000® Index, generated more than 25% returns in 2019, driven by the Federal Reserve’s shift to a more accommodative monetary policy stance and improved investor sentiment that was in part derived from the announcement of a phase one trade deal between the U.S. and China. Value stocks underperformed growth stocks for the third straight year, as measured by the Russell 2000® Value Index and the Russell 2000® Growth Index.

2019 Performance and 2020 Outlook:

The Small Companies Fund gained 26.4%, net of fees, during 2019 compared to a gain of 25.5% for the Russell 2000® Index, the Fund’s benchmark.

Each of the three subadvisers comment on the performance of their specific portions of the Fund and provide a market outlook for the next year in the paragraphs below. For comparison of the subadvisers’ capabilities, performance is shown gross of fees. The Fund pays a single advisory fee to Clearwater Management Co., Inc., which in turn pays the subadvisers out of its advisory fee.

Although the overall performance of the Small Companies Fund is measured against its benchmark, as stated above, each of the underlying subadvisers may manage their portion of the Fund against a different benchmark that aligns more closely with their strategy. In each section below, the subadvisers discuss their view of the market over the last twelve months, the performance of their portfolios with respect to the benchmark against which their particular portfolio is managed and their outlook for the next twelve months. Both Cooke & Bieler and Pzena outperformed their respective benchmarks in 2019, while Kennedy underperformed its benchmark.

Kennedy Commentary

General Market Overview:

2019 marked a significant turnaround for small capitalization equity markets, with the Russell 2000® Index rising 25.5% following an 11.0% decline in 2018. 2019 was headlined by a few important themes, including tariffs, cyclicality, impeachment, and large cap growth. After driving significant volatility in late 2018, fears of a trade war with China began to subside in 2019 as investors came to realize that verbal sparring is less likely to drive meaningful changes in cash flow for companies. As economic activity continued apace and the yield curve steepened, concerns around a near term economic contraction began to fade. Amidst this steady economic backdrop, uncertainty created by the impeachment hearings seemed to have little effect on equity markets. Gains from large capitalization growth stocks were particularly impressive and were well ahead of the gains from small capitalization value stocks. We find it surprising that the gap between large and small capitalization returns remains this wide, which we believe creates an attractive opportunity for small capitalization investors in the years to come.

2019 Performance:

The portion of the Small Companies Fund managed by Kennedy (the “Portfolio”) underperformed the Russell 2000® Index (the “benchmark”) in 2019, returning 24.5%, gross of fees, while the benchmark returned 25.5%. Positive stock selection in Financials and an underweight to Energy was more than offset by underperformance in the Health Care, Consumer Discretionary, and Industrials sectors. Considering the strength in the equity market, the Portfolio’s cash position also detracted from performance.

2020 Outlook:

As we contemplate the year to come, we are watching a few important themes. As usual, election years come with policy uncertainty, and we believe that heightened political polarity will likely lead to increased market volatility as investors grapple with potential outcomes from the presidential race. From a more fundamental perspective, the health of the U.S. consumer remains foremost in our minds, given our belief that consumers are the engine that drive our economy and hence our companies. Based on employment trends and various income metrics, coupled with continued low inflation, we believe the consumer’s buying power remains strong. Given these factors, we believe the U.S. economy should continue to grow at a modest pace over the near to medium term. From a portfolio perspective, regardless of the economic environment, we remain confident in our ability to find management teams who we believe are adept at utilizing their companies’ cash flows to enable continuing high returns. This is a dynamic that we believe is often overlooked by market participants with shorter time horizons and accrues to our benefit over time.

Cooke & Bieler Commentary

General Market Overview:

U.S. equity markets ended 2019 on a very strong note, with certain indices reaching record highs. Investor optimism was buoyed by easing trade tensions and indications of diminishing recession risks. Growth stocks outperformed value stocks and bond-proxy sectors, such as Utilities, underperformed the broader market. Investors were soothed by the Federal Reserve’s accommodative monetary policy pivot, which boosted U.S. equity indices, with particular strength in the Technology sector. Volatility receded from higher levels in 2018.

2019 Performance:

The portion of the Small Companies Fund managed by Cooke & Bieler (the “Portfolio”) outperformed the Russell 2000® Value Index (the “benchmark”) in 2019, returning 37.6%, gross of fees, while the benchmark returned 22.4%. Stock selection within sectors contributed nearly all the outperformance, although sector allocation also contributed positively. Stock selection in the Industrials, Materials, and Consumer Discretionary sectors was particularly strong. Significant individual contributors to the Portfolio’s return included Winnebago, Colfax, Schweitzer-Mauduit, Reliance Steel, and Syneos Health.

2020 Outlook:

Looking forward, we are cautiously optimistic. The Portfolio’s fundamentals remain strong, but valuations have risen to more demanding levels. The Portfolio’s pro-cyclical tilt benefitted performance in 2019 as recession fears moderated but will likely be less of a tailwind going forward. Nonetheless, we remain confident in the Portfolio’s positioning and our ability to identify what we believe to be reasonably priced stocks of high-quality businesses that should add value over the long term. All things considered, we believe the market likely will be more volatile in 2020, creating opportunities for investors like us. We remain watchful for those openings, with the knowledge that timely eliminations can strengthen the Portfolio as much as initiations.

Pzena Commentary

General Market Overview:

Stocks ended 2019 strongly with large and small capitalization stocks up significantly for the year. Small capitalization stocks lagged large capitalization stocks and growth stocks outperformed value stocks in 2019. Growth’s outperformance shifted between companies viewed as delivering reliable growth with little concern for their valuations and those that provided stability and yield. On the other hand, companies that disappointed in delivering growth were severely punished, even if the underlying businesses remained healthy.

2019 Performance:

The portion of the Small Companies Fund managed by Pzena (the “Portfolio”) outperformed the Russell 2000® Value Index (the “benchmark”) in 2019, returning 26.2%, gross of fees, while the benchmark returned 22.4%. The outperformance was driven by stock selection within the Materials, Consumer Discretionary, and Industrials sectors. Sector allocation within Financials and Health Care detracted from performance.

Specialty technology distributor Anixter was the largest individual contributor to performance, rising as a private equity player and competitor Wesco made competing bids to acquire the company. The initial takeout offer was lower than we felt reasonable, but incremental bidding brought the valuation closer to our estimate of the stock’s fair value, which led us to sell the position. C&J Energy Services was the largest individual detractor on weak crude oil prices. The company operates in the critical oil services industry, which is necessary to find and produce oil and gas. We believe weak oil prices and temporary oversupply are masking the fact that oil and gas capital spending must pick up dramatically to offset a looming shortfall in energy supply coming over the next several years, and the weak prices favor it over suppliers. The company merged with Keane Energy and was renamed NexTier Oilfield Solutions. We believe that the new combined company has incremental scale with two complementary companies brought together.

2020 Outlook:

The large underperformance of value versus growth stocks and small capitalization versus large capitalization stocks has created what we believe to be an abundance of opportunity to build an attractive small cap value portfolio. The wide dispersion between what we believe are the cheapest and most expensive stocks is near unprecedented levels. This is significant, as a wide dispersion has generally led to strong outperformance by value stocks over the long term. We continue to see a broadening of opportunities due to market moves in recent months, but the Portfolio remains heavily invested in what we believe to be attractively valued, economically sensitive market segments. We are still not yet finding opportunities in perceived safe sectors such as REITs and Utilities.

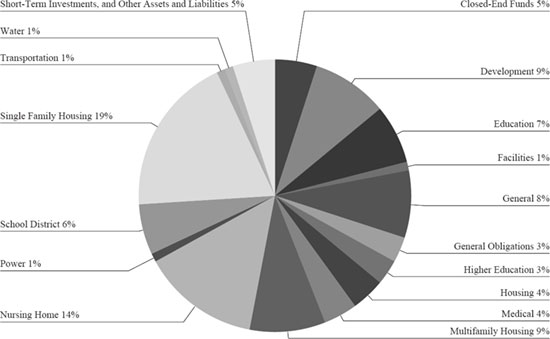

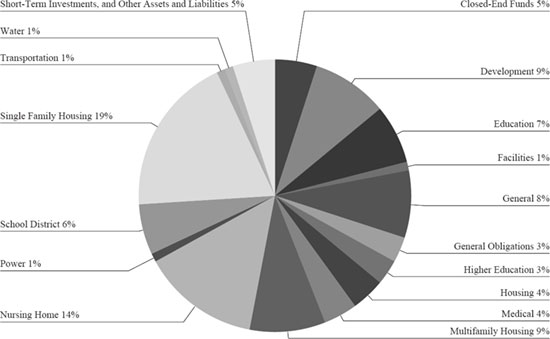

Clearwater Tax-Exempt Bond Fund

The Clearwater Tax-Exempt Bond Fund (the “Tax-Exempt Bond Fund” or the “Fund”) seeks high current income that is exempt from U.S. federal income tax, consistent with preservation of capital. Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in tax-exempt bonds, which are debt obligations issued by or for the U.S. states, territories, and possessions and the District of Columbia. The interest on these securities is generally exempt from both U.S. regular federal income tax and U.S. federal alternative minimum tax. However, the Fund may invest up to 20% of its assets in securities that generate interest income subject to federal alternative minimum tax for individuals. The Fund invests in both revenue bonds, which are backed by and payable only from the revenues derived from a specific facility or specific revenue source, and in general obligation bonds, which are secured by the full faith, credit and taxation power of the issuing municipality. The Fund’s subadviser, Sit Fixed Income Advisors II, LLC (“Sit”), provides day-to-day management for the Fund. It should be noted that the Fund is not a money market fund and is not intended to be a money market fund substitute. Under normal market conditions, the Fund’s investments may be more susceptible than a money market fund to interest rate risk and credit risks relevant to the Fund’s investments.

Sit has provided the commentary below regarding the Tax-Exempt Bond Fund. The Fund pays a single advisory fee to Clearwater Management Co., Inc., which in turn pays the subadviser out of its advisory fee.

Sit Commentary

General Market Overview:

Tax-exempt municipal bonds delivered strong returns in 2019 supported by record inflows into tax-exempt municipal bond funds and net negative supply. The U.S. Treasury yield curve inverted in March and remained inverted until the fourth quarter. Ultra-short yields fell approximately 25-40 basis points in the first half of the year, before falling further to end the year down 90-95 basis points. Meanwhile, short to intermediate yields, which fell 70-75 basis points in the first half of the year, fell slightly in the second half to end the year down about 75-80 basis points. Long U.S. Treasury yields fell by about 50 basis points in the first half of the year and ended the year down 60-65 basis points, so the net result was a slightly steeper U.S. Treasury yield curve. Meanwhile, the municipal yield curve flattened with short and intermediate tax-exempt yields down roughly 75-85 basis points on the year compared to the 30-year maturity which was down 93 basis points.

Credit fundamentals remain generally sound as credit spreads tightened significantly in the first half of the year, then remained stable in the second half. State government general fund revenue collections continue to be strong and state budgets remain largely healthy, despite a few notable exceptions such as Illinois, New Jersey and Connecticut. Puerto Rico bonds rallied significantly in 2019 as the Financial Oversight and Management Board for Puerto Rico reached agreements with various creditor groups and the debt restructuring process proceeded through U.S. District Court. The Federal Reserve kept short-term interest rates unchanged in the first half of 2019, then cut them by 25 basis points in July, September and October. Finally, direct and indirect retail demand remained solid in 2019 in the wake of the tax legislation passed in December 2017 that capped state and local tax deductions.

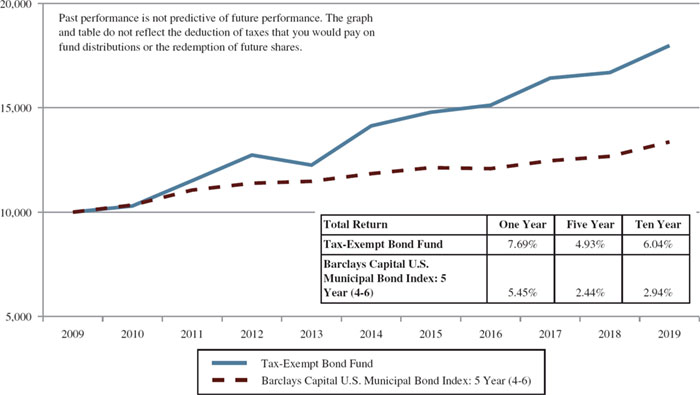

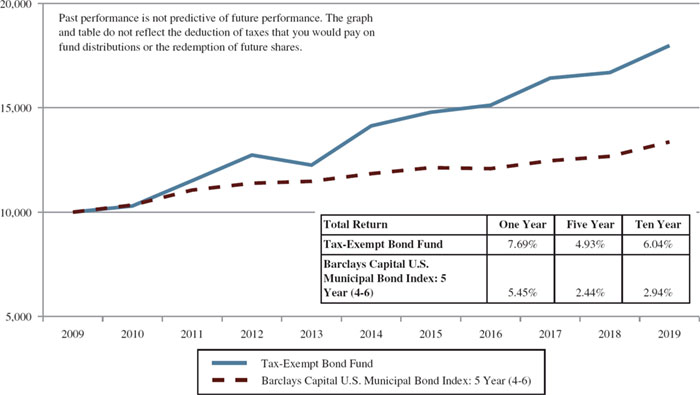

2019 Performance:

The Tax-Exempt Bond Fund returned 7.7%, net of fees, in 2019. The Fund’s benchmark, the Barclays Municipal Bond 5 Year (4-6) Index (the “benchmark”), returned 5.4% over the same period. In 2019 we continued hedging interest rate risk by shorting U.S. Treasury futures. We adjusted the hedge throughout the year as interest rates declined before finally taking off in November. The Fund’s average life duration, a measure of the Fund’s sensitivity to changes in interest rates, increased slightly from 4.6 years at the beginning of the year to 4.9 years at the end of the year. For comparison, the benchmark had a duration of 4.0 years at the beginning and the end of the year.

The Fund’s longer duration as well as an allocation to and superior security selection within non-rated bonds were the primary reasons for the outperformance during 2019. Lower investment grade rated bonds and non-rated bonds outperformed those of higher credit quality as investors sought higher yields. Another contributing factor was the Fund’s position in closed-end municipal bond funds, which performed well in 2019. The Fund’s yield fell during the year, but the Fund continues to maintain a significant yield advantage over its benchmark.

2020 Outlook:

Political discord, ongoing impeachment proceedings and the presidential election add political risk to the financial markets in 2020. In general, we believe the economy enters 2020 with good momentum, aided by precautionary monetary easing, healthy consumer spending and a reduction in trade-related risks with China. We expect U.S. real GDP growth to slow from its estimated pace of 2.5% in 2019 to around 2.0% in 2020, and inflation to inch higher. Uncertainty exists regarding the shape of the yield curve in 2020. The Federal Reserve’s “midcycle adjustment” to interest rates appears to be over for now. The Federal Reserve has indicated a pause after cutting interest rates three times in the second half of 2019 but continues to monitor the implications of incoming information. We expect gross municipal supply to be comparable to 2019, perhaps exceeding maturities and redemptions to generate positive net supply. However, taxable bond issuance continues to become a bigger component of municipal supply with tax-exempt issuance flat. That dynamic provides technical support to the tax-exempt market. We also expect strong retail demand from residents of high-income tax states to continue in the wake of the virtual elimination of the state and local income tax deduction.

Regarding credit, after tightening markedly in 2019, we expect credit spreads to modestly widen which will dampen performance of lower investment grade and non-rated bonds. More progress is expected to be made in Puerto Rico in 2020 with debt swap deals occurring within the next twelve months. We believe that Illinois, New Jersey and Connecticut related concerns will continue to weigh on the market and could produce some volatility. Furthermore, we believe the funding of retirement pensions and healthcare obligations for states and large local municipalities will remain a hot topic and the subject of negative media reports about the municipal market. We believe that the Fund’s income advantage and diversification in terms of yield curve positioning and credit quality have positioned it opportunistically for the economic and interest rate environment that we expect in 2020. We expect our investment of new cash flows to be focused on maturities in the 5-30 year range.

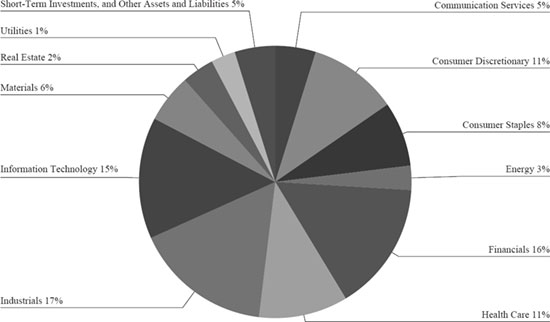

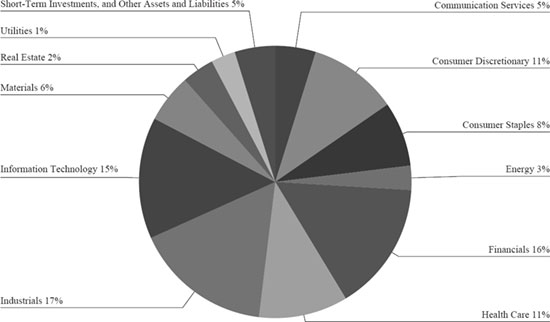

Clearwater International Fund

The Clearwater International Fund (the “International Fund” or the “Fund”) seeks long-term growth of capital. The Fund generally invests at least 80% of the value of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of companies organized or located outside the United States and doing a substantial amount of business outside the United States. The Fund diversifies its investments among many different countries throughout the world and may invest in companies of any size. The Fund does not intend to invest more than 20% of its net assets in the equity securities of developing or emerging market issuers. The Fund uses a “multi-style, multi-manager” approach. The Fund’s adviser allocates portions of the Fund’s assets among subadvisers who employ distinct investment styles. The Fund currently has four subadvisers that provide day-to-day management of Fund assets. Parametric Portfolio Associates LLC (“Parametric”) manages its portion of the portfolio (approximately 35%) to track the MSCI World Ex U.S.A. Index – Net Dividends as closely as possible without requiring the Fund to realize taxable gains. The Fund’s other three subadvisers, Artisan Partners Limited Partnership (“Artisan”), LSV Asset Management (“LSV”) and WCM Investment Management, LLC (“WCM”), utilize an active management style and manage the remaining 65% of the Fund. LSV was added as a subadviser in September 2019 and at the same time WCM, which already managed a large cap strategy, began managing a separate small cap strategy for the Fund. Templeton Investment Counsel, LLC was terminated as a subadviser at that time.

2019 Market Overview:

As defined by the Fund’s benchmark, the MSCI World Ex U.S.A. Index - Net Dividends (the “benchmark”), large and mid-capitalization, international developed market stocks returned more than 22% in 2019. The strong performance was partially attributable to the renewed prospects for, and ultimately a phase one trade deal between the U.S. and China. International small capitalization stocks outperformed large capitalization stocks in 2019, after underperforming in 2018.

2019 Performance and 2020 Outlook:

The International Fund gained 26.5%, net of fees, in 2019 compared to an increase of 22.5% for the benchmark.

Each of the four subadvisers comment on the performance of their specific portions of the Fund and provide a market outlook for the next year in the paragraphs below. For comparison of the subadvisers’ capabilities, performance is shown gross of fees. The Fund pays a single advisory fee to Clearwater Management Co., Inc., which in turn pays the subadvisers out of its advisory fee.

Although the overall performance of the International Fund is measured against its benchmark, as stated above, each of the underlying subadvisers may manage their portion of the Fund against a different benchmark that aligns more closely with their strategy. In each section below, the subadvisers discuss their view of the market over the last twelve months, the performance of their portfolios with respect to the benchmark against which their particular portfolio is managed and their outlook for the next twelve months. Each subadviser allocation outperformed its respective benchmark for the applicable period, with WCM’s Focused Growth International strategy generating significant outperformance.

Artisan Commentary

General Market Overview:

Measured in U.S. dollar terms, the MSCI EAFE Index (the “benchmark”) returned 22.0% in 2019, as a variety of concerns abated, including global trade tensions, global monetary policy’s future direction, Brexit uncertainty and signs of slowing economic growth (particularly as the year concluded). U.S. stocks outperformed developed international stocks. All sectors generated positive returns in 2019, led by Technology, Health Care and Industrials. Conversely, Energy was the worst-performing sector on a relative basis.

2019 Performance:

The portion of the International Fund managed by Artisan (the “Portfolio”) outperformed the benchmark in 2019, returning 25.2%, gross of fees, while the benchmark returned 22.0%. Performance of the following stocks had a positive impact on the Portfolio during the period: Samsung Electronics, a leader in smartphones, semiconductors and other electronic components; Arch Capital, a Bermuda-based company that writes insurance and reinsurance on a worldwide basis; NXP Semiconductors, one of the two dominant suppliers of semiconductors to the automotive industry and one of the top-five suppliers of analog semiconductors for general industrial uses; ABB, a leading global engineering company and the largest global supplier of industrial motors, generators and power grids; and Tesco, the UK’s largest food retailer. Among the period’s negative contributors were Baidu, the dominant Internet search business in China; Bankia, a leading Spanish bank; Fresenius Medical Care, the world’s leading provider of essential kidney dialysis services via its network of owned clinics and in patients’ homes; John Wood Group, a provider of project, engineering and technical services to the oil and gas, industrial, refining, power generation and other sectors worldwide; and Diageo, a world-leading producer and distiller of alcoholic beverages.

2020 Outlook:

As markets rose over the course of 2019, the Portfolio’s discount to intrinsic value accordingly narrowed; however, we still believe the Portfolio holds strong businesses that are trading at attractive valuations.

LSV Commentary

General Market Overview:

International equities rallied in the fourth quarter of 2019, capping off a strong calendar year of performance. Developed international small capitalization stocks outperformed international large capitalization stocks. From a style perspective, international small capitalization value stocks underperformed international small capitalization growth stocks. We define value stocks as stocks that are cheap on multiple measures of value with particular emphasis on stocks that are attractive based on their ability to generate strong cash flow and earnings. While it has been a difficult environment for value stocks over the last several years, our portfolio of value stocks recovered some over the last few months of 2019.

2019 Performance:

The portion of the International Fund managed by LSV (the “Portfolio”) outperformed the MSCI All-Country World Ex U.S.A. Small Cap Value Index - Net Dividends (the “benchmark”) since LSV’s inception in the Fund on September 26, 2019, returning 14.0%, gross of fees, while the benchmark returned 10.8%. Strong stock selection across several sectors accounted for most of the outperformance. Stock selection was particularly strong in the Industrials, Financials and Technology sectors. Within Industrials, our airline and construction companies were positive contributors. In Technology, our holdings in the electronic equipment, electronic components and semiconductor equipment industries added value.

2020 Outlook:

While we do not develop an outlook or use macro forecasts in our investment decision making process, we can comment on the relative attractiveness of the Portfolio from a valuation standpoint. While valuation multiples for the market and the Portfolio expanded in 2019 given the strong market performance, we believe the Portfolio is trading at a significant discount relative to the benchmark. The Portfolio is also yielding nearly 4%, which is in excess of the benchmark’s yield of 3.5%.

While value stocks performed well over the last four months of 2019, we believe that value stocks continue to trade at a significant discount to growth stocks relative to history, after relatively poor performance over the last several years. While it is difficult to time growth/value performance cycles, in the past when we have observed similar spreads between growth and value, value as a style has recovered over the subsequent years.

WCM Commentary

General Market Overview:

Global equity markets enjoyed a strong rally to end 2019, pushing most indices to all-time highs. Investors applauded the more stable U.S.-China trade relationship going into year-end. We did see a resurgence of secular growth stocks toward the end of 2019, although these types of stocks carry a smaller weight in the portfolio as we continue to trim more expensive stocks within this portion of the portfolio.

2019 Performance (Focused Growth International strategy):

The portion of the International Fund managed by WCM pursuant to WCM’s Focused Growth International strategy (the “Portfolio”) significantly outperformed the MSCI All-Country World Ex U.S.A. Growth Index - Net Dividends (the “benchmark”) in 2019, returning 37.4%, gross of fees, while the benchmark returned 27.3%. Stock selection was the primary driver of the outperformance. Sector allocation also contributed to performance, driven by overweights to the Technology, Health Care and Consumer Discretionary sectors. Geographically the story was similar. Country allocation provided a relatively modest contribution to performance, meaning that stock selection drove most of the outperformance.

2019 Performance (International Small Cap Growth strategy):

The portion of the International Fund managed by WCM pursuant to WCM’s International Small Cap Growth strategy (the “Portfolio”) outperformed the MSCI All-Country World Ex U.S.A. Small Cap Growth Index - Net Dividends (the “benchmark”) since WCM’s inception in the Fund on September 27, 2019, returning 15.6%, gross of fees, while the benchmark returned 10.9%. The outperformance was driven about equally by stock selection and sector allocation. An overweight to the Technology sector and an underweight to the Real Estate sector was additive to performance. Stock selection within the Financials, Industrials and Consumer Discretionary sectors contributed positively. Geographically, nearly all the outperformance was attributable to stock selection.

2020 Outlook:

Despite our Focused Growth International strategy realizing its second strongest absolute return in the strategy’s history, we still believe there are plenty of market inefficiencies in global equity markets that can be exploited by our focused, low turnover approach.

Parametric Commentary

General Market Overview:

In 2019, global markets rallied strongly from the December 2018 lows. Global markets rebounded on the renewed prospects of a U.S. trade deal with China. The rally was widespread across all economic sectors and countries. The Technology sector had the highest returns, followed by Health Care.

2019 Performance:

The portion of the International Fund managed by Parametric (the “Portfolio”) outperformed the MSCI World Ex U.S.A. Index - Net Dividends (the “benchmark”) in 2019, returning 23.4%, gross of fees, while the benchmark returned 22.5%. Most of the outperformance was attributable to stock selection in the Materials and Financials sectors. Cash was the largest detractor from performance given the market’s strong returns during the period.

2020 Outlook:

We believe that in 2020, the potential trade war between the U.S. and China could still have a significant impact on the rest of the world. Given China’s large market and imports, a slowdown in its economy due to the trade war directly affects the rest of the world. We believe this risk factor will persist into the foreseeable future.

Comparison of the Change in Value of a $10,000 Investment in the Core Equity Fund and the Russell 1000® Index

Comparison of the Change in Value of a $10,000 Investment in the Small Companies Fund and the Russell 2000® Index

Comparison of the Change in Value of a $10,000 Investment in the Tax-Exempt Bond Fund and the Barclays Capital U.S. Municipal Bond 5 Year (4-6) Index

Comparison of the Change in Value of a $10,000 Investment in the International Fund and the MSCI World Ex U.S.A. Index - Net Dividends

Fund Expense Example

(unaudited)

As a shareholder of the Clearwater Core Equity Fund (“Core Equity Fund”), Clearwater Small Companies Fund (“Small Companies Fund”), Clearwater Tax-Exempt Bond Fund (“Tax-Exempt Bond Fund”), and Clearwater International Fund (“International Fund” and together with the Core Equity Fund, Small Companies Fund and Tax-Exempt Bond Fund, the “Funds”), you incur costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. In addition to the ongoing costs which the Funds pay directly, you as a shareholder indirectly bear the expenses of any outside exchange traded funds or mutual funds in which the Funds invest. (These are also referred to as “acquired funds” and those indirect expenses represent the Funds’ pro rata portion of the cumulative expense charged by the acquired funds.)

The example provided is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period ended December 31, 2019.

Actual Expenses

The first section of the table on the following page provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period July 1, 2019 through December 31, 2019” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the second section of the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you compare the relative total costs of the Funds to other mutual funds that charge transaction costs and/or sales charges or redemption fees.

| Actual returns | Beginning Account

Value July 1, 2019 | Ending Account Value

December 31, 2019 | Expenses Paid During the

Period July 1, 2019

through

December 31, 2019* |

| Core Equity Fund | $1,000.00 | $1,103.30 | $1.86 |

| Small Companies Fund | $1,000.00 | $1,086.20 | $5.15 |

| Tax-Exempt Bond Fund | $1,000.00 | $1,024.00 | $1.63 |

| International Fund | $1,000.00 | $1,087.10 | $3.58 |

Hypothetical 5% return (before expenses) | | | |

| Core Equity Fund | $1,000.00 | $1,023.44 | $1.79 |

| Small Companies Fund | $1,000.00 | $1,020.27 | $4.99 |

| Tax-Exempt Bond Fund | $1,000.00 | $1,023.59 | $1.63 |

| International Fund | $1,000.00 | $1,021.78 | $3.47 |

| * | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expense ratios for the most recent one-half year period may differ from expense ratios based on one-year data in the Financial Highlights. |

The annualized expense ratios (reflecting voluntary fee waivers in effect during the period) are as follows:

| Core Equity Fund | 0.35% |

| Small Companies Fund | 0.98% |

| Tax-Exempt Bond Fund | 0.32% |

| International Fund | 0.68% |

Approval of Investment Management and Subadvisory Agreements

Clearwater Management Co., Inc. (“CMC”) is responsible for managing the investment programs and strategies for the Core Equity Fund, Small Companies Fund, Tax-Exempt Bond Fund, and International Fund (collectively, the “Funds”). CMC also provides other administrative services to the Funds and these services, as well as its investment management services, are provided to the Funds under an agreement (the “Management Agreement”). CMC conducts due diligence when selecting each subadviser (collectively, the “Subadvisers”) for the Funds and oversees the performance of the Subadvisers. The Subadvisers provide portfolio management and related services for the Funds under individual subadvisory agreements (the “Subadvisory Agreements”).

The Trust’s Board of Trustees (the “Board” or “Trustees”) met periodically throughout the year to address a broad range of agenda items. For example, at each regularly scheduled meeting, the Trustees reviewed information about the investment performance and financial results of the Funds. On an annual basis, the Trustees, including the Trustees who are not “interested persons” of the Trust (the “Independent Trustees”), consider the renewal of the Management Agreement and the Subadvisory Agreements. In addition, the Trustees periodically consider the retention of new subadvisers.

Approval of Subadvisory Agreement – LSV Asset Management (International Fund)

At an in-person meeting held on September 12, 2019, the Trustees considered a new subadvisory agreement with LSV Asset Management (“LSV”) (the “LSV Agreement”) for the International Fund. At this meeting, the Trustees met with representatives of LSV and received a presentation discussing LSV’s investment philosophy and process, past performance, subadvisory experience, investment team and organizational structure.

In advance of the meeting on September 12, 2019, the Trustees received written information that included: information as to the proposed allocation of assets among the Fund’s subadvisers, and a summary of information about LSV, including its investment professionals, process, philosophy, portfolio construction, past performance and proposed subadvisory fees. In addition, at the meeting on September 12, 2019, the Trustees received information from the Trust’s Chief Compliance Officer as to his review of LSV’s Code of Ethics, Form ADV and compliance program.

At the September 12, 2019 meeting, counsel to the International Fund and Trustees reviewed with the Trustees the various factors relevant to their consideration of the LSV Agreement and the Trustees’ responsibilities related to their review. The Trustees reviewed and analyzed a number of factors that the Trustees deemed relevant with respect to the LSV Agreement. These factors included: the nature, quality, and extent of the services to be provided to the International Fund by LSV; LSV’s investment process; performance data for LSV’s strategy; the qualifications and experience of the investment professionals who would be responsible for the management of their allocation of the International Fund’s assets; and LSV’s overall resources.

No single factor determined whether or not the agreement would be approved but rather the totality of factors considered was determinative. Following an analysis and discussion of the factors described below, the Trustees, including all of the Independent Trustees, approved the LSV Agreement.

Nature, Extent, and Quality of Services Provided

The Trustees considered the specific investment processes LSV would use in managing its allocation of the Fund’s assets. The Trustees looked at the qualifications of LSV’s investment team who would be responsible for managing its allocation of the Fund’s assets. The Trustees concluded that the nature, extent, and quality of the subadvisory services expected to be provided by LSV were appropriate for the Fund.

Investment Performance

The Trustees discussed the performance record for the strategy LSV would use in managing its allocation of the Fund’s assets as compared to its strategy benchmark. The Trustees noted that the strategy’s performance compared favorably to its strategy benchmark for the period since its inception in 2002. The Trustees concluded that this data supported the decision to approve the LSV Agreement.

Comparative Fees and Cost of Services Provided

The Trustees evaluated the proposed subadvisory fee schedule, which was negotiated at arm’s length by CMC. The Trustees noted that the fee schedule was competitive with the fee schedule for the current subadviser managing a small cap portfolio based on the expected allocation to LSV. The Trustees also noted that CMC, not the Fund, would pay the subadvisory fee to LSV. The Trustees concluded that the proposed subadvisory fee schedule was reasonable given the nature, extent and quality of the subadvisory services to be performed by LSV.

Benefits to the Subadviser

The Trustees considered the ancillary benefits that could accrue to LSV due to its relationship with the Fund and noted that the relationship would be limited to the provision of subadvisory services. The Trustees concluded that no significant ancillary benefits would result from the LSV Agreement.

Profitability

The Trustees considered that LSV is an independent firm and that the subadvisory fee to be charged is the result of arm’s length bargaining between LSV and CMC.

Economies of Scale

The Trustees noted that CMC, not the Fund, would pay the subadvisory fee to LSV and that the Trustees consider on an annual basis whether economies of scale might be realized by CMC as the Fund’s assets grow and whether there also might be benefits from such growth for the Fund’s shareholders

Other Considerations

The Trustees considered CMC’s judgment and recommendation that adding LSV as a subadviser would add value to the Fund’s shareholders and would be complementary to the Fund’s other subadvisers.

Conclusion

After full consideration of the factors described above along with other information, with no single factor identified as being of paramount importance, the Trustees, including all of the Independent Trustees, concluded that the approval of the LSV Agreement was in the best interests of the Fund and its shareholders and approved the LSV Agreement, with the proposed fee to be paid by CMC out of its management fee.

Approval of Subadvisory Agreement – WCM Investment Management, LLC (International Fund)

At an in-person meeting held on September 12, 2019, the Trustees considered an amended and restated subadvisory agreement with WCM Investment Management, LLC (“WCM”) pursuant to which WCM would manage a sleeve of the International Fund using its International Small Cap Growth strategy, in addition to its existing sleeve managed using is Focused Growth International strategy (the “New WCM Agreement”). At this meeting, the Trustees met with representatives of WCM and received a presentation discussing WCM’s investment philosophy and process, past performance, investment team and organizational structure.

In advance of the meeting on September 12, 2019, the Trustees received written information that included: information as to the proposed allocation of assets among the Fund’s subadvisers, and a summary of information about WCM, including its investment professionals, process, philosophy, portfolio construction, past performance and proposed subadvisory fees.

At the September 12, 2019 meeting, counsel to the International Fund and Trustees reviewed with the Trustees the various factors relevant to their consideration of the New WCM Agreement and the Trustees’ responsibilities related to their review. The Trustees reviewed and analyzed a number of factors that the Trustees deemed relevant with respect to the New WCM Agreement. These factors included: the nature, quality, and extent of the services to be provided to the International Fund by WCM; WCM’s investment process; performance data for WCM’s strategy; the qualifications and experience of the investment professionals who would be responsible for the management of their allocation of the International Fund’s assets; and WCM’s overall resources.

No single factor determined whether or not the agreement would be approved but rather the totality of factors considered was determinative. Following an analysis and discussion of the factors described below, the Trustees, including all of the Independent Trustees, approved the New WCM Agreement

Nature, Extent, and Quality of Services Provided

The Trustees considered the specific investment processes WCM would use in managing its new allocation of the Fund’s assets. The Trustees looked at the qualifications of WCM’s investment team who would be responsible for managing its allocation of the Fund’s assets. The Trustees concluded that the nature, extent, and quality of the subadvisory services expected to be provided by WCM were appropriate for the Fund.

Investment Performance

The Trustees discussed the performance record for the strategy WCM would use in managing its allocation of the Fund’s assets as compared to its strategy benchmark. The Trustees noted that the strategy’s performance compared favorably to its strategy benchmark for the period since its inception in 2015. The Trustees concluded that this data supported the decision to approve the New WCM Agreement.

Comparative Fees and Cost of Services Provided

The Trustees evaluated the proposed subadvisory fee schedule, which was negotiated at arm’s length by CMC. The Trustees noted that the WCM fee schedule is competitive when compared to the Templeton fee schedule based on the prior allocation to Templeton. The Trustees also noted that CMC, not the Fund, would pay the subadvisory fee to WCM. The Trustees concluded that the proposed subadvisory fee schedule was reasonable given the nature, extent and quality of the subadvisory services to be performed by WCM.

Benefits to the Subadviser

The Trustees considered the ancillary benefits that could accrue to WCM due to its relationship with the Fund and noted that the relationship would be limited to the provision of subadvisory services. The Trustees concluded that no significant ancillary benefits would result from the New WCM Agreement.

Profitability

The Trustees considered that WCM is an independent firm and that the subadvisory fee to be charged is the result of arm’s length bargaining between WCM and CMC.

Economies of Scale

The Trustees noted that CMC, not the Fund, would pay the subadvisory fee to WCM and that the Trustees consider on an annual basis whether economies of scale might be realized by CMC as the Fund’s assets grow and whether there also might be benefits from such growth for the Fund’s shareholders.

Other Considerations

The Trustees considered CMC’s judgment and recommendation that hiring WCM to manage an additional sleeve of the International Fund would add value to the Fund’s shareholders and would be complementary to the Fund’s other subadvisers.

Conclusion

After full consideration of the factors described above along with other information, with no single factor identified as being of paramount importance, the Trustees, including all of the Independent Trustees, concluded that the approval of the New WCM Agreement was in the best interests of the Fund and its shareholders and approved the New WCM Agreement, with the proposed fee to be paid by CMC out of its management fee.

Approval of Investment Management and Subadvisory Agreements (All Funds)

At their in-person meetings on November 1 and December 12, 2019, the Trustees considered the renewal of the Management Agreement and the Subadvisory Agreements for AQR Capital Management, LLC (“AQR”), Artisan Partners Limited Partnership, Cooke & Bieler, L.P., Fiduciary Counselling, Inc. (“FCI”), Kennedy Capital Management (“KCM”), Inc., O’Shaughnessy Asset Management, LLC, Parametric Portfolio Associates LLC (“Parametric”), Pzena Investment Management, LLC, Sit Fixed Income Advisors II, LLC (“Sit”) and WCM.

Prior to the November 1, 2019 meeting, the Trustees requested, received, and reviewed written responses from CMC and the Subadvisers to questions posed to them on behalf of the Trustees and supporting materials relating to those questions and responses. The information presented at the meeting, including comparative performance and expense data, was designed to assist the Trustees in making their determination as to the renewal of the Management Agreement and Subadvisory Agreements. At this meeting, counsel to the Funds and Trustees reviewed with the Trustees the various factors relevant to their consideration of the Management Agreement and Subadvisory Agreements, and the Trustees’ responsibilities related to their review.

At the November 1 and December 12, 2019 meetings, the Trustees considered a number of factors, including those discussed below, that they believed to be relevant. No single factor determined whether or not an agreement would be approved but rather the totality of factors considered was determinative. Following an analysis and discussion of the factors described below, the Trustees, including all of the Independent Trustees, approved the renewal of the Management Agreement and the Subadvisory Agreements.

Nature, Extent, and Quality of Services Provided

The Trustees considered information presented as to the nature, extent, and quality of services provided by CMC and the Subadvisers, as well as their investment expertise, resources, and capabilities. The Trustees considered the quality of the Subadvisers previously recommended by CMC, as well as the ongoing work performed by CMC to recommend enhancements to individual fund management. The Trustees reviewed information regarding the financial condition of CMC and the Subadvisers related to their ongoing ability to provide services specified under the Management Agreement and Subadvisory Agreements. The Trustees considered that FCI provides, in addition to investment management services, certain services related to due diligence, performance reporting, compliance, and other administrative functions that support the investment management services and Subadviser oversight services provided by CMC. Based on their analysis of the data presented, the Trustees concluded that they were generally satisfied with the nature and quality of the services being provided under the Management Agreement and respective Subadvisory Agreements.

Investment Performance

The Trustees reviewed specific information as to the investment performance of the Funds over various periods of time as compared to the performance of their respective benchmark indices and peer groups. On a quarterly basis, the Trustees reviewed reports summarizing the net assets, redemptions, and purchases of shares of the Funds, as well as information regarding the performance of each Subadviser compared to the benchmark against which its particular portfolio is measured. The Trustees concluded that they were generally satisfied with CMC’s and the Subadvisers’ investment performance to date.

Comparative Fees and Cost of Services Provided

The Trustees reviewed the fees paid to CMC and the Subadvisers. The Trustees reviewed reports describing both the management fees charged by CMC and the total expense ratios of the Funds in comparison to those of similarly situated funds. In addition, on a quarterly basis, the Trustees reviewed information as to the expense ratios of the Funds compared to the median expense ratio of a peer group of funds with comparable investment strategies. The Trustees also reviewed information provided by each of the Subadvisers as to fees they charge to other clients, as applicable.

The Trustees noted the ongoing efforts of CMC to reduce expenses charged to shareholders through oversight of service providers and by voluntarily waiving a portion of the management fee payable to CMC as specified in the Funds’ prospectus. In this regard, the Board considered that, effective January 1, 2020, CMC has voluntarily agreed to waive: (i) the management fee for the Core Equity Fund from the contractual fee of 0.90% to 0.31%; (ii) the management fee for the Small Companies Fund from the contractual fee of 1.35% to 0.95%; (iii) the management fee for the Tax-Exempt Bond Fund from the contractual fee of 0.60% to 0.29%; and the management fee for the International Fund from the contractual fee of 1.00% to 0.65%.

At its November 1, 2019 meeting, the Trustees approved amendments to the subadvisory agreements between the Trust, CMC, and each of: (i) AQR on behalf of the Core Equity Fund; (ii) KCM on behalf of the Small Companies Fund; (iii) Sit on behalf of the Tax-Exempt Bond Fund; (iv) Parametric on behalf of the Core Equity Fund; and (v) Parametric on behalf of the International Fund, in each case to reduce the fee rates payable by CMC thereunder based on current asset levels. The Trustees noted that CMC passes through the benefit of subadvisory fee reductions to the Funds through its voluntary fee waiver arrangements.

Management Profitability

The Trustees reviewed CMC’s level of profitability with respect to the Funds, particularly noting CMC’s payment of fees and expenses typically absorbed by mutual fund shareholders. The Trustees concluded that profitability levels for CMC were reasonable. The Trustees considered that the Subadvisers are each independent firms and the subadvisory fees charged are the result of arm’s length bargaining between them and CMC.

Economies of Scale

The Trustees considered whether economies of scale might be realized by CMC as the Funds’ assets grow and whether there also might be benefits from such growth for the Funds’ shareholders. The Trustees noted that the Funds have been in operation for a number of years and, based on their distribution strategy, the Funds will probably not see significant increases in size. However, the Trustees determined that they would continue to monitor the assets of the Funds and consider whether there were additional opportunities to realize benefits from economies of scale for shareholders in the future.

Conclusion

Based on the factors described above, the Trustees, including all of the Independent Trustees, concluded that the investment management fees and subadvisory fees were fair and reasonable in view of the investment performance and quality of services provided. In reaching this conclusion, no single factor was considered determinative.

Quarterly Portfolio Schedule of Investments

The Funds file a complete schedule of their portfolio holdings as of the close of the first and third quarters of their fiscal years with the Securities and Exchange Commission (the “SEC”) on Form N-PORT. Shareholders may request portfolio holdings information free of charge by calling the Transfer Agent toll free at 1- 855-684-9144 or by sending a written request to: The Northern Trust Company, P.O. Box 4766, Chicago, IL 60680-4766 Attn: Clearwater Investment Trust Funds. These filings are also available on the SEC’s Internet site athttp://www.sec.gov.

Voting Proxies on Fund Portfolio Securities

The Funds have established Proxy Voting Policies and Procedures (“Policies”) that the Funds use to determine how to vote proxies relating to portfolio securities. They also report, on Form N-PX, how the Funds voted any such proxies during the most recent 12-month period ended June 30. Shareholders may request copies of the Policies or Form N-PX free of charge by calling Fiduciary Counselling, Inc. toll free at 1-888-228-0935 or by sending a written request to: Fiduciary Counselling, Inc., 30 East 7th Street, Suite 2000, St. Paul, MN 55101 Attn: Clearwater Investment Trust Funds. Form N-PX is also available from the EDGAR database on the SEC’s Internet site athttp://www.sec.gov.

EXECUTIVE OFFICERS AND TRUSTEES

(As of February 2020)

Information About the Independent Trustees

| Name and Age | Positions Held With the Funds | Term of Office | Principal Occupation or Employment During the Last Five Years and Other Relevant Experience | Number of Portfolios in the Fund Complex to Be Overseen by the Trustee | Other Directorships Held by the Trustee During the Last 5 Years |

Charles W. Rasmussen1(53)

30 East 7th Street Saint Paul,

Minnesota 55101 | Trustee, Chair of the Board | As Trustee: Tenure: 2000 - Present Term: Indefinite As Chair: Tenure: 2020 - Present Term: Indefinite | President and Chief Executive Officer, P&G Manufacturing, Inc. (air filtration equipment, 2002-Present) | 4 | Forest History Society. (non-profit, 2018- Present) Nu Star Inc. (private company 2014- Present) |

Sara G. Dent (61)

30 East 7th Street

Saint Paul,

Minnesota 55101 | Trustee, Chair of the Governance and Nominating Committee | As Trustee: Tenure: 2013- Present Term: Indefinite As Chair of the Governance and Nominating Committee: Tenure: 2019– Present Term: Indefinite | Private Investor | 4 | None |

Laura E. Rasmussen1(56)

30 East 7th Street Saint Paul,

Minnesota 55101 | Trustee, Chair of the Audit Committee | As Trustee: Tenure: 2000- Present Term: Indefinite As Chair of the Audit Committee: Tenure: 2016 – Present Term: Indefinite | Business Owner, 3 Kittens Needle Arts (textile sales, 2006- Present) | 4 | None |

James E. Johnson (77)

30 East 7th Street

Saint Paul, Minnesota 55101 | Trustee | Tenure: 2011- Present Term: Indefinite | Retired as Executive Vice President, Securian Financial Group, Inc. in 2010, Securian Financial Group, Inc. (1968-2010); Chair of the Board of the Trust (2013 – 2019) | 4 | None |

Lindsay R. Schack (42)

30 East 7th Street Saint Paul,

Minnesota 55101 | Trustee | Tenure: 2015- Present Term: Indefinite | Owner and Architect, LS Architecture (2013 – Present), Adjunct Faculty, Montana State University School of Architecture (2007 – 2013) | 4 | None |

| Name and Age | Positions Held With the Funds | Term of Office | Principal Occupation or Employment During the Last Five Years and Other Relevant Experience | Number of Portfolios in the Fund Complex to Be Overseen by the Trustee | Other Directorships Held by the Trustee During the Last 5 Years |

David M. Weyerhaeuser (61)

30 East 7th Street Saint Paul,

Minnesota 55101 | Trustee | Tenure: 2016- Present Term: Indefinite | Vice President, Sales and Marketing, Northwest Hardwoods (lumber manufacturer and distributor, 1991 – 2016) | 4 | Chicago Capital, LLC (investment adviser, 2018 - Present) R.D. Merrill Company, Inc. (private company, 1992 – Present) |

1Mr. Rasmussen and Ms. Rasmussen are siblings-in-law.

Information about the Funds’ Executive Officers and Interested Trustees

| Name and Age | Positions Held With the Funds | Term of Office | Principal Occupation or Employment During the Last Five Years and Other Relevant Experience | Number of Portfolios in the Fund Complex to Be Overseen by the Officer/ Trustee | Other Directorships Held by the Officer/ Trustee During the Last 5 Years |

E. Rodman Titcomb, Jr.2(71)

30 East 7th Street Saint Paul,

Minnesota 55101 | Trustee | Tenure: 2016 – Present Term: Indefinite | Chairman and Chief Executive Officer, Rock Island Company (Communications and event planning, 1998-2013), Managing Director, Elizabeth Ordway Dunn Foundation (1983-2013) | 4 | None |

Justin H. Weyerhaeuser3(46) 30 East 7th Street

Saint Paul,

Minnesota 55101 | Trustee, President and Treasurer | As Trustee: Tenure: 2008 – Present Term: Indefinite As President and Treasurer Tenure: 2013- Present Term: Reappointed Annually | Private Investor (February 2013 - Present), Attorney, Davis Graham & Stubbs LLP (law firm, November 2011- February 2013) | 4 | None |

| Name and Age | Positions Held With the Funds | Term of Office | Principal Occupation or Employment During the Last Five Years and Other Relevant Experience | Number of Portfolios in the Fund Complex to Be Overseen by the Officer/ Trustee | Other Directorships Held by the Officer/ Trustee During the Last 5 Years |

Karen P. Rau (60) 30 East 7th Street Saint Paul,

Minnesota 55101 | Secretary and Interim Chief Compliance Officer | As Secretary: Tenure: 2020 – Present Term: Reappointed Annually As Interim Chief Compliance Officer: Tenure: 2020 – Present Term: Reappointed Annually | Senior Compliance Analyst, Fiduciary Counselling, Inc. (August 2016 – Present), Regional Manager, Fifth Third Bank (October 2013 – July 2016) | N/A | N/A |

Shari L. Clifford (51)

30 East 7th Street

Saint Paul,

Minnesota 55101 | Assistant Treasurer | Tenure: 2014 - Present Term: Reappointed Annually | Chief Financial Officer and Treasurer, Fiduciary Counselling, Inc. (February 2014-Present) Controller and Finance Director, Woodbury Financial Services, Inc. November 2007 - February 2014) | N/A | N/A |

Michael D. Jiang (35)

The Northern Trust Company

50 South LaSalle Street

Chicago, Illinois 60603 | Assistant Secretary | Tenure: 2016- Present Term: Reappointed Annually | Vice President, (2018-Present), Second Vice President, The Northern Trust Company, (2015-2018), Cabrini Green Legal Aid (2014-2015) | N/A | N/A |

2Mr. Titcomb is an interested Trustee due to his brother’s position as a director of CMC.

3Mr. Justin H. Weyerhaeuser is an interested Trustee due to his position as the Funds’ President and Treasurer.

Additional information about the Funds’ Directors is available in the Funds’ Statement of Additional Information (“SAI”). The SAI is available without charge, upon request, by contacting the transfer agent at 1-855-684-9144 or writing the Funds at The Northern Trust Company, P.O. Box 4766, Chicago, IL 60680-4766. The Funds do not have an internet website.

Federal Tax Information

(unaudited)

Qualified Dividend Income.Under the Jobs and Growth Tax Relief Reconciliation Act of 2003 (the “Act”), 100.00% of ordinary dividends paid during the fiscal year ended December 31, 2019 for the Core Equity Fund, 100.00% of ordinary dividends paid during the fiscal year ended December 31, 2019 for the Small Companies Fund, and 100.00% of ordinary dividends paid during the fiscal year ended December 31, 2019 for the International Fund are designated as “qualified dividend income”, as defined in the Act, subject to reduced tax rates in 2019.

Corporate Dividends-Received Deduction. 100.00%, 100.00%, and 0.37% of the dividends distributed during the fiscal year ended December 31, 2019, for the Core Equity, Small Companies, and International Funds, respectively, qualify for the dividends-received deduction for corporate shareholders.

Capital Gain Distribution.The following Funds made capital gain distributions in December 2019, and hereby designated these long-term capital gain distributions as follows:

| Fund | | | | Long-Term Capital Gain | |

| | | | | | |

| Core Equity Fund | | | $ | 2,349,736 | (1) |

| Small Companies Fund | | | | 5,292,066 | (2) |

| Tax-Exempt Bond Fund | | | | — | |

| International Fund | | | | 8,846,708 | (3) |

| (1) | During the fiscal year 2019, Core Equity Fund designated long-term capital gain distributions in the amount of $2,635,960. Core Equity Fund utilized equalization accounting for tax purposes, whereby a portion of redemption payments were treated as distributions of long-term capital gain. As a result the Fund paid long-term capital gain distributions in the amount of $2,349,736. |

| (2) | During the fiscal year 2019, Small Companies Fund designated long-term capital gain distributions in the amount of $5,358,161. Small Companies Fund utilized equalization accounting for tax purposes, whereby a portion of redemption payments were treated as distributions of long-term capital gain. As a result the Fund paid long-term capital gain distributions in the amount of $5,292,066. |

| (3) | During the fiscal year 2019, International Fund utilized equalization accounting for tax purposes, whereby a portion of redemption payments were treated as distributions of long-term capital gains in the amount of $9,080,240. As a result the Fund paid long-term capital gain distributions in the amount of $8,846,708. |

Clearwater Investment Trust

Financial Statements

For the Fiscal Year Ended December 31, 2019

Table of Contents

KPMG LLP

4200 Wells Fargo Center

90 South Seventh Street

Minneapolis, MN 55402

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees

Clearwater Investment Trust:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Clearwater Core Equity Fund, Clearwater Small Companies Fund, Clearwater Tax-Exempt Bond Fund, and Clearwater International Fund (collectively, the Funds), including the schedules of investments, as of December 31, 2019, the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights of each Fund present fairly, in all material respects, the financial position of each Fund as of December 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of December 31, 2019, by correspondence with custodians and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Clearwater Investment Trust investment companies since 1992.

Minneapolis, Minnesota

February 25, 2020

KPMG LLP is a Delaware limited liability partnership and the U.S. member

firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity.

CLEARWATER INVESTMENT TRUST

Statements of Assets and Liabilities

December 31, 2019

| | Core Equity

Fund | | | Small Companies

Fund | | | Tax-Exempt

Bond Fund | | | International

Fund | |

Assets | | | | | | | | | | | | | | | | |

Investments in securities, at fair value (including securities on loan of: $0, $3,424,021, $0 and $7,056,635, respectively); (identified cost: $268,556,334, $331,850,201, $569,172,843 and $502,542,174, respectively) | | $ | 543,176,764 | | | | 378,091,114 | | | | 598,475,122 | | | | 717,689,979 | |

Foreign currencies, at value (cost: $0, $0, $0 and $2,078,240, respectively) | | | - | | | | - | | | | - | | | | 2,113,910 | |

Receivable for securities sold | | | 3,758,107 | | | | 1,655,194 | | | | - | | | | 92,485 | |

Receivable for shares of beneficial interest sold | | | 17,200 | | | | 12,900 | | | | - | | | | 4,400 | |

Accrued dividend and interest receivable | | | 551,422 | | | | 405,676 | | | | 5,653,629 | | | | 726,017 | |

Foreign tax reclaim receivable | | | 3,498 | | | | - | | | | - | | | | 1,137,111 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | - | | | | - | | | | - | | | | 2,800 | |

Total assets | | | 547,506,991 | | | | 380,164,884 | | | | 604,128,751 | | | | 721,766,702 | |

Liabilities | | | | | | | | | | | | | | | | |

Payables for investment securities purchased | | | - | | | | 2,332,788 | | | | - | | | | 458,770 | |

Payable for fund shares redeemed | | | 3,872,231 | | | | 22,224 | | | | 22,900 | | | | - | |

Accrued investment advisory fee | | | 463,458 | | | | 876,203 | | | | 481,085 | | | | 1,140,385 | |

Payable for dividend distribution | | | - | | | | - | | | | 348,180 | | | | - | |

Payable upon return of securities loaned | | | - | | | | 3,509,148 | | | | - | | | | 8,084,387 | |

Unrealized depreciation on forward foreign currency exchange contracts | | | - | | | | - | | | | - | | | | 27,677 | |

Deferred foreign capital gains taxes payable | | | - | | | | - | | | | - | | | | 204,467 | |

Total liabilities | | | 4,335,689 | | | | 6,740,363 | | | | 852,165 | | | | 9,915,686 | |

Net assets | | $ | 543,171,302 | | | | 373,424,521 | | | | 603,276,586 | | | | 711,851,016 | |

Capital | | | | | | | | | | | | | | | | |

Capital Stock and additional paid-in capital (authorized unlimited number of shares at no par value for each Fund: 11,283,799, 20,240,648, 59,528,485 and 41,201,732 shares, respectively) | | $ | 266,019,126 | | | | 326,323,233 | | | | 576,620,212 | | | | 499,212,474 | |

Distributable earnings | | | 277,152,176 | | | | 47,101,288 | | | | 26,656,374 | | | | 212,638,542 | |

Net assets | | $ | 543,171,302 | | | | 373,424,521 | | | | 603,276,586 | | | | 711,851,016 | |

Net asset value per share of outstanding capital stock | | $ | 48.14 | | | | 18.45 | | | | 10.13 | | | | 17.28 | |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Statements of Operations

Year ended December 31, 2019

| | Core Equity

Fund | | | Small Companies

Fund | | | Tax-Exempt

Bond Fund | | | International

Fund | |

Investment income: | | | | | | | | | | | | | | | | |

Income: | | | | | | | | | | | | | | | | |

Dividends (net of foreign taxes withheld of $12,296, $6,411, $0 and $1,343,496, respectively) | | $ | 9,584,310 | | | | 5,507,189 | | | | 1,262,966 | | | | 15,337,805 | |

Interest | | | 2,136 | | | | 22,422 | | | | 23,160,925 | | | | - | |

Net income from securities loaned | | | - | | | | 26,989 | | | | - | | | | 178,883 | |

Total income | | | 9,586,446 | | | | 5,556,600 | | | | 24,423,891 | | | | 15,516,688 | |

Expenses: | | | | | | | | | | | | | | | | |

Investment advisory fee | | | 4,565,655 | | | | 4,621,039 | | | | 3,349,753 | | | | 6,050,114 | |