| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-00058) |

| | |

| Exact name of registrant as specified in charter: | The George Putnam Fund of Boston |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | July 31, 2012 |

| | |

| Date of reporting period: | August 1, 2011 — January 31, 2012 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

George Putnam

Balanced

Fund

Semiannual report

1 | 31 | 12

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio managers | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 12 | | |

| | |

| Terms and definitions | 14 | | |

| | |

| Other information for shareholders | 15 | | |

| | |

| Financial statements | 16 | | |

| | |

Message from the Trustees

Dear Fellow Shareholder:

Markets in early 2012 have signaled a more consistently positive direction, supported by strengthening fundamentals. In the United States, where corporate earnings have been strong for more than a year, the employment picture has also brightened in recent months. The Federal Reserve has pledged to leave rates at historic lows at least through the end of 2014, and the beleaguered U.S. housing market has finally shown signs of recovery. The European debt situation and likely recession in that region continue to weigh heavily on markets, of course, alongside high unemployment here at home. However, we are encouraged by the change in investor sentiment.

We believe there are numerous investment opportunities resulting from the many market dislocations in recent years. Putnam’s rigorous bottom-up, fundamental investment approach is well suited to this environment, and the Putnam team is committed to uncovering returns for our shareholders, while seeking to guard against downside risk.

Please join us in welcoming the return of Elizabeth T. Kennan to the Board of Trustees. Dr. Kennan, who served as a Trustee from 1992 until 2010, has rejoined the Board, effective January 1, 2012. Dr. Kennan is a Partner of Cambus-Kenneth Farm (thoroughbred horse breeding and general farming), and is also President Emeritus of Mount Holyoke College.

We would also like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

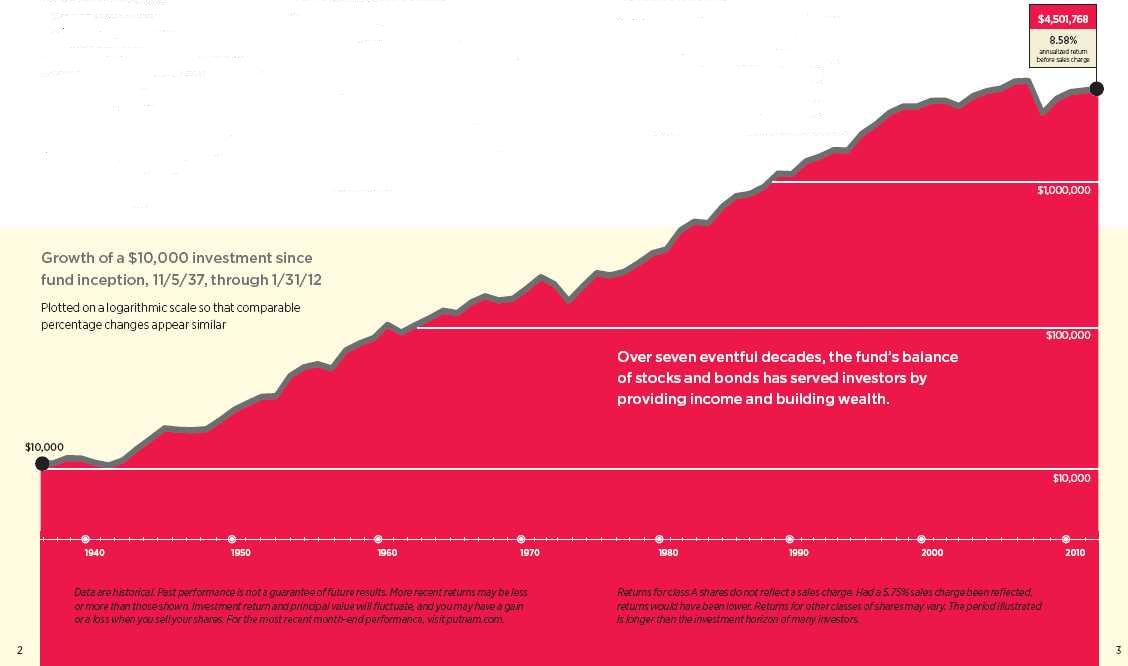

About the fund

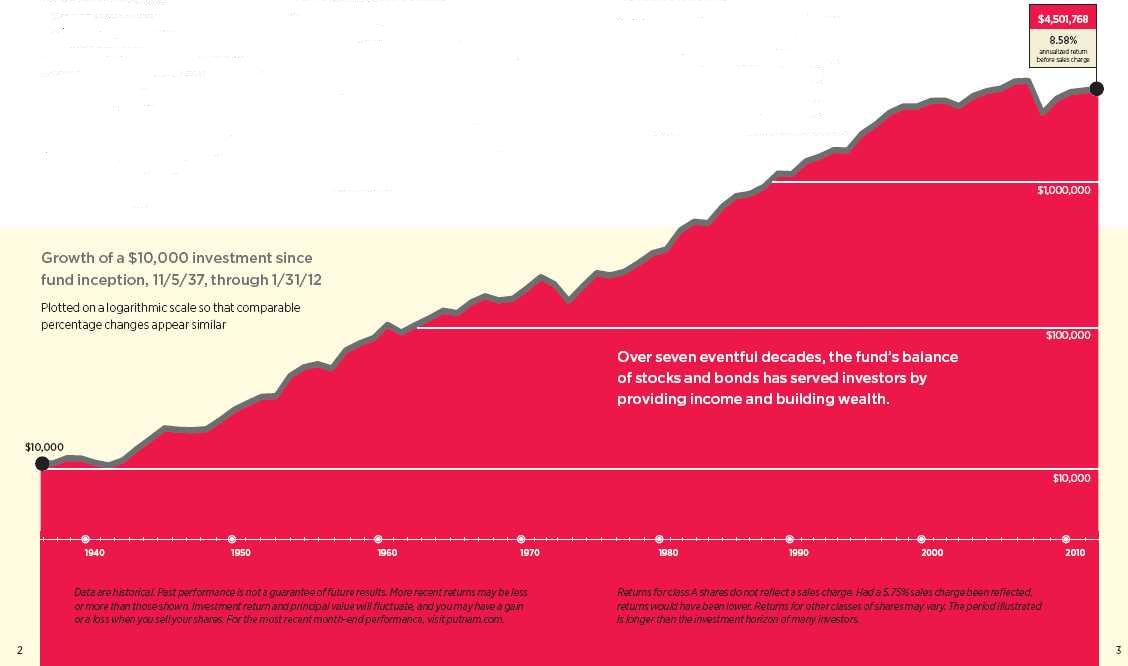

Providing the benefits of balanced investing since 1937

The fund launched in 1937 when George Putnam, a Boston investment manager, decided to introduce an innovative approach — a balance of stocks to seek capital appreciation and bonds to help provide current income. The original portfolio featured industrial stocks and railroad bonds.

This balanced approach made sense then, and we believe it continues to make sense now. In the late 1930s, the stock market experienced dramatic swings as businesses struggled to recover from the Great Depression and the shadow of war began to spread across Europe and Asia. Today, economic uncertainties continue to challenge investors.

Although the fund has experienced volatility at times, its balanced approach has kept it on course. When stocks were weak, the fund’s bonds helped results. Similarly, stocks often performed better when bonds were hurt by rising interest rates or inflation.

In a letter to shareholders dated July 12, 1938, George Putnam articulated the strategy this way: “Successful investing calls not so much for some clairvoyant ability to read the future as for the courage to stick to tested, commonsense policies in the face of the unreliable emotional stresses and strains that constantly sweep the market place.” Today, Putnam remains committed to this prudent approach.

Consider these risks before investing: The fund may invest a portion of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations. The use of derivatives involves additional risks, such as the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Value stocks may fail to rebound, and the market may not favor value-style investing. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

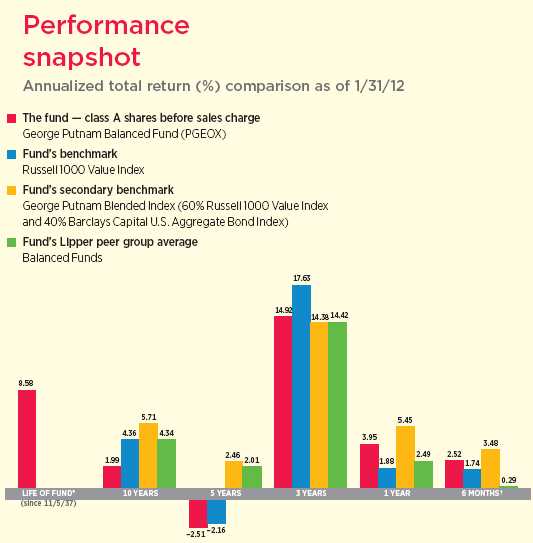

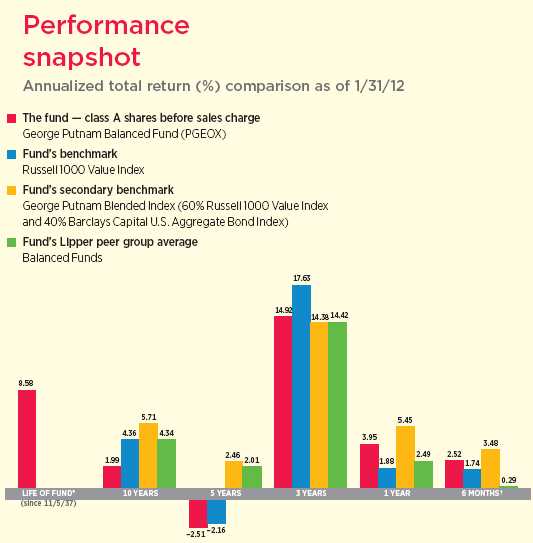

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmarks (Russell 1000 Value Index and George Putnam Blended Index) were introduced on 12/31/78 and its Lipper group (Balanced Funds) was introduced on 12/31/59; they all post-date the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

George Putnam Blended Index is an unmanaged index administered by Putnam Investment Management, LLC, 60% of which is the Russell 1000 Value Index and 40% of which is the Barclays Capital U.S. Aggregate Bond Index.

4

Interview with your fund’s portfolio managers

The fiscal year began last August on the eve of the first-ever U.S. credit downgrade. Did this affect your strategy?

David: The process of deleveraging, both in the United States and abroad, prompted caution, but that fits the nature of this fund. We manage this as a fairly conservative, balanced fund, favoring high-quality stocks and bonds with the dual goals of current income and capital appreciation.

Equity prices tumbled in August and September, but the fund’s bond holdings helped to soften the impact. Fortunately, the U.S. economy also demonstrated resilience, and as month after month showed continued growth, equity prices recovered, generally rising from October through January.

Were you concerned that the economy would go back into recession?

Raman: Our baseline scenario at the start of the period was that the economy’s recovery was sustainable, and that proved to be correct. Of course, there were reasons for concern. Political gridlock in Washington and the worsening sovereign debt crisis in Europe are events that can influence consumer and business behavior. Fear could have prompted a general pullback in spending, which would have been quite damaging. Fortunately there was strength in many sectors. As an example, the automobile sector was in the midst of recovery from the supply disruptions that had followed Japan’s earthquake in March, and this trend was not derailed by macroeconomic concerns.

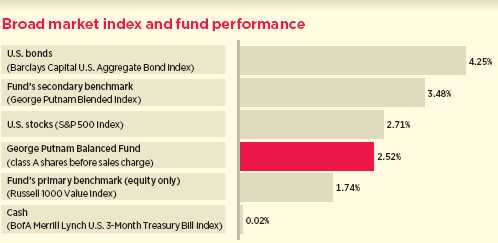

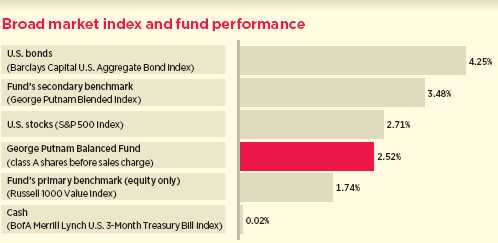

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/12. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on pages 14–15.

5

How did the fund’s equity style fare?

David: I invest with a conservative value style, favoring large, well-established, mostly dividend-paying companies with high-quality balance sheets, and whose stocks are undervalued. Stock dividends add to the fund’s income generated primarily by bonds. During this six-month period, value-style investing had modest results, below the average of the overall market. This was primarily due to the relatively large proportion of financial stocks in value indexes such as the fund’s primary benchmark, the Russell 1000 Value Index. Segments of the financials sector, especially banks, continue to struggle with a weak housing market, high foreclosure rates, and degrees of exposure to European financial markets, which were under the stress of mounting sovereign debt risk. I maintained underweight exposure to the financials sector during the period.

What were the fixed-income strategies?

Raman: The fixed-income portion seeks to provide current income with a mix of government and investment-grade corporate bonds. In this period, we believed conditions would be apt to favor corporate bonds because their yield advantage over government bonds was greater than normal. We also tactically adjusted exposures to government agency mortgages and, to a lesser extent, certain high-quality commercial mortgage-backed securities, with the goal of enhancing returns. In addition to these sector tactics, we adjusted the portfolio’s yield-curve positioning and duration, with the goal of benefiting from changes in yields for bonds of different maturities.

Did the strategies perform as you had expected?

Raman: We experienced disappointments in the corporate strategy. The bonds performed well on a fundamental basis in that the major risk in this strategy — credit risk — did not worsen, because corporate defaults were no greater than expected. However, this risk was unrewarded, which was a bit unusual, especially in light of better equity performance. Credit risk is in many ways similar to equity risk, because it is sensitive to economic

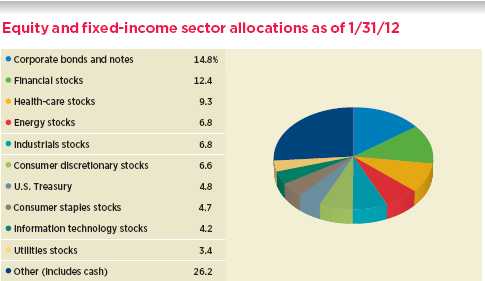

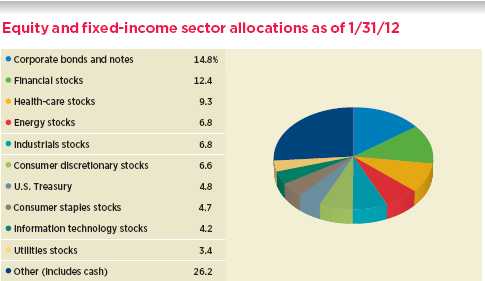

Allocations are represented as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

6

conditions and corporate earnings. In this period, there was a special factor at work —pending federal regulation associated with the Volcker Rule, named after former Fed Chairman Paul Volcker. This regulation might limit the degree to which banking institutions can commit capital to trading corporate securities. During the period it appears that many institutions prepared to reduce their capital commitments, which reduced liquidity in the market. While the peculiar underperformance of corporate bonds held back the portfolio’s results during the period, the silver lining is that these holdings now carry a higher return premium, in our view, which can add to fund performance in the future.

Turning back to the equity holdings, where did you see better and worse results?

David: Security selection played the largest role in our results, though a significant underweight position in the financials sector was beneficial. I regarded financials to be generally unattractive because many had potential exposure to Europe’s sovereign debt crisis. Although many financial stocks had attractive valuations, they did not carry the low-volatility characteristics that I prefer. There were some well-known companies in the fund, such as Citigroup and Wells Fargo, but they were underweight positions relative to the primary benchmark. Toward the end of the period, with valuations in the sector even lower and improved stability in Europe, I began to add to these positions, but for the reporting period the fund had an underweight position in the sector.

What holdings helped results?

David: The fund had an overweight position in Kimberly-Clark, a large consumer products company. With a strong market position in 80 different countries, the company generates a lot of free cash flow. It also offers an attractive dividend — a feature in strong demand in the market. The stock has been rewarded with appreciation.

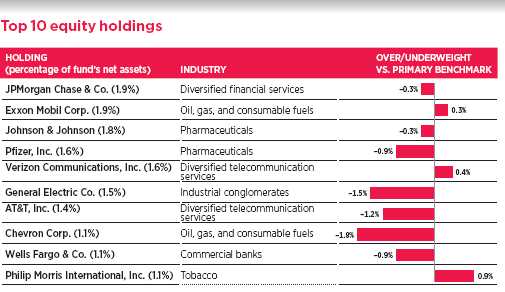

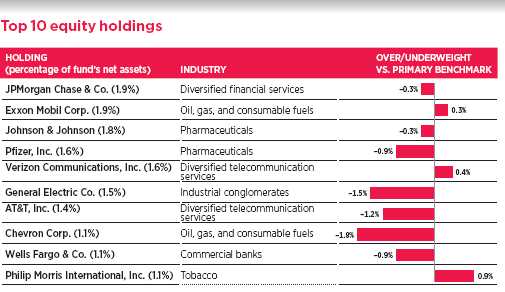

This table shows the fund’s top 10 equity holdings by percentage of the fund’s net assets as of 1/31/12. Short-term holdings are excluded. Holdings will vary over time.

7

Another holding that attracted investors with a high dividend, also likely to be sustainable, is Philip Morris International. This company has a growing franchise in overseas markets, where regulatory conditions are less of an issue than they appear to be in the United States. The company’s cash flows and dividend are generally not influenced by the economic cycle.

We held a position in a retailer that adroitly navigated trends in consumer spending during the period. TJX, which operates store chains such as T.J.Maxx and Marshalls, is not a part of the benchmark, but we believe that TJX has a great franchise selling off-price apparel and other items, and has seized the opportunity presented by consumers’ price consciousness. The holding contributed better-than-benchmark results for the fund.

In the health-care sector, pharmaceuticals company Pfizer also appreciated significantly in the period. Despite some of its strongest products facing patent expirations, Pfizer continues to develop a range of new products while, in our view, managing its cost structure well. The company also pays an attractive dividend. Aetna, the third-largest managed-care organization in the United States, also performed well. During 2011, Aetna delivered earnings growth of 40%, which was above expectations. I find the health-care sector attractive in general, because stock prices are discounting a negative impact from gradual implementation of the 2010 health reform. However, I believe the market is not acknowledging the positive revenue trends likely to take shape in the sector as Americans age and spend more on health care.

What is your outlook for the second half of the fiscal year?

Raman: We believe that market and economic conditions are unlikely to change drastically, and neither will the basic balance and investment characteristics of this fund. That said, we expect to be active in trying to add to performance above what a passive index might deliver. With the bond portion, this will involve tactics such as adjusting our sector positions in investment-grade

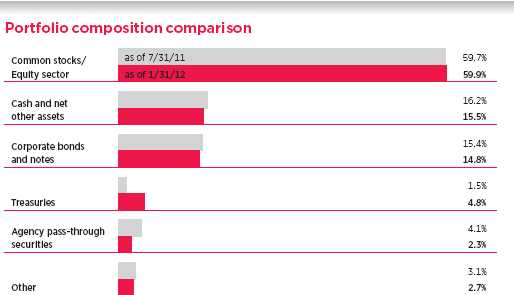

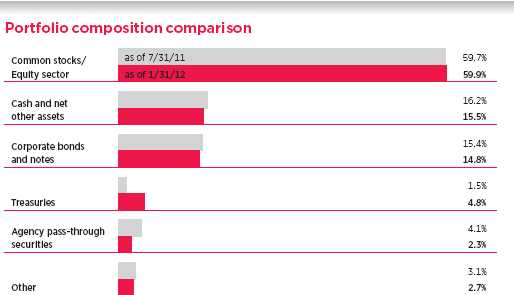

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

8

corporate, Treasury, agency, and agency mortgage-backed securities.

We believe opportunities are likely to emerge in this economic scenario. While GDP growth at a modest rate of about 2% cheers those who worry about a recession, we expect that job growth will remain fairly weak and inflationary pressures subdued. In fact, we expect that headline inflation will decline in the early months of 2012. This could cause the yield curve to flatten. As a consequence, the Fed is likely, we think, to seize on the combination of weak growth and lower inflation as an instance to attempt additional stimulus aimed at accelerating economic activity and job creation. As the market grapples with emerging data, as well as evolving Fed policies, we expect to see some movement in the yield curve and in sector opportunities, and we will try to pursue opportunities for additional returns from these movements.

David: We believe that stocks continue to look relatively attractive in this environment. Valuations have remained reasonable near the end of the fiscal period, in our view, in part because corporations delivered strong earnings growth while prices did not move much. Businesses have found ways to grow profits even in a weak economy, and in our estimation, this makes it more likely for the market to appreciate in coming years. I will continue to be selective, favoring quality companies with solid balance sheets, and undervalued earnings and cash flow.

Thank you, David and Raman, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager David M. Calabro holds a B.A. from Williams College. David joined Putnam in 2008 and has been in the investment industry since 1982.

Portfolio Manager Raman Srivastava has an M.S. in Computational Finance from Carnegie Mellon University and a B.S. from the University of Waterloo. A CFA charterholder, he joined Putnam in 1999 and has been in the investment industry since 1997.

IN THE NEWS

The U.S. unemployment rate fell to 8.3% in January, with the nation’s employers adding 243,000 jobs, according to the Labor Department. This was the fastest pace of job growth since April 2011 and was the fifth straight month of unemployment rate declines. The nation’s jobless rate is still above the 5.2%-to-6% range that Federal Reserve (Fed) officials say is consistent with maximum employment. According to the Labor Department, 12.8 million Americans remain unemployed. In testimony before the Senate Budget Committee in early February, Fed Chairman Ben S. Bernanke said that the U.S. job market is far from “operating normally.” The Fed chairman reiterated that the Fed’s benchmark interest rate will remain near zero at least through late 2014, and again called on U.S. lawmakers to reduce the federal deficit.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2012, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 1/31/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/5/37) | (4/27/92) | (7/26/99) | (12/1/94) | (1/21/03) | (3/31/94) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.58% | 8.49% | 7.57% | 7.57% | 7.76% | 7.76% | 7.84% | 7.79% | 8.31% | 8.65% |

|

| 10 years | 21.77 | 14.75 | 12.77 | 12.77 | 12.91 | 12.91 | 15.84 | 11.78 | 18.91 | 24.88 |

| Annual average | 1.99 | 1.39 | 1.21 | 1.21 | 1.22 | 1.22 | 1.48 | 1.12 | 1.75 | 2.25 |

|

| 5 years | –11.92 | –16.97 | –15.28 | –16.64 | –15.18 | –15.18 | –14.08 | –17.07 | –12.94 | –10.78 |

| Annual average | –2.51 | –3.65 | –3.26 | –3.57 | –3.24 | –3.24 | –2.99 | –3.67 | –2.73 | –2.26 |

|

| 3 years | 51.77 | 43.00 | 48.27 | 45.27 | 48.43 | 48.43 | 49.56 | 44.25 | 50.68 | 52.87 |

| Annual average | 14.92 | 12.66 | 14.03 | 13.26 | 14.07 | 14.07 | 14.36 | 12.99 | 14.64 | 15.20 |

|

| 1 year | 3.95 | –2.02 | 3.06 | –1.94 | 3.10 | 2.10 | 3.38 | –0.20 | 3.60 | 4.12 |

|

| 6 months | 2.52 | –3.34 | 2.04 | –2.96 | 2.05 | 1.05 | 2.19 | –1.41 | 2.31 | 2.56 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

10

Comparative index returns For periods ended 1/31/12

| | | | |

| | | Barclays Capital | | Lipper Balanced |

| | Russell 1000 | U.S. Aggregate | George Putnam | Funds category |

| | Value Index | Bond Index | Blended Index† | average ‡ |

|

| Annual average (life of fund) | —* | —* | —* | —* |

|

| 10 years | 53.25% | 75.47% | 74.18% | 53.89% |

| Annual average | 4.36 | 5.78 | 5.71 | 4.34 |

|

| 5 years | –10.34 | 38.27 | 12.92 | 10.68 |

| Annual average | –2.16 | 6.70 | 2.46 | 2.01 |

|

| 3 years | 62.75 | 23.87 | 49.65 | 49.94 |

| Annual average | 17.63 | 7.40 | 14.38 | 14.42 |

|

| 1 year | 1.88 | 8.66 | 5.45 | 2.49 |

|

| 6 months | 1.74 | 4.25 | 3.48 | 0.29 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* The fund’s benchmarks (Russell 1000 Value Index and George Putnam Blended Index) were introduced on 12/31/78. The Barclays Capital U.S. Aggregate Bond Index was introduced on 12/31/75, and the fund’s Lipper group (Balanced Funds) was introduced on 12/31/59. They all post-date the inception of the fund’s class A shares.

† George Putnam Blended Index is an unmanaged index administered by Putnam Management, 60% of which is the Russell 1000 Value Index and 40% of which is the Barclays Capital U.S. Aggregate Bond Index.

‡ Over the 6-month, 1-year, 3-year, 5-year, and 10-year periods ended 1/31/12, there were 732, 728, 690, 625, and 270 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 1/31/12

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 2 | 2 | 2 | 2 | 2 | 2 |

|

| Income | $0.100 | $0.052 | $0.055 | $0.069 | $0.085 | $0.115 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.100 | $0.052 | $0.055 | $0.069 | $0.085 | $0.115 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/11 | $12.21 | $12.95 | $12.08 | $12.14 | $12.06 | $12.50 | $12.18 | $12.26 |

|

| 1/31/12 | 12.41 | 13.17 | 12.27 | 12.33 | 12.25 | 12.69 | 12.37 | 12.45 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Current yield (end of period) | charge | charge | value | value | charge | charge | value | value |

|

| Current dividend rate 1 | 1.61% | 1.52% | 0.88% | 0.91% | 1.14% | 1.10% | 1.39% | 1.83% |

|

| Current 30-day SEC yield 2,3 | N/A | 1.50 | 0.86 | 0.86 | N/A | 1.07 | 1.35 | 1.84 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by share price before or after sales charge at end of period.

2 For a portion of the period, this fund’s expenses were limited, without which yields would have been lower.

3 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

11

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/11

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/5/37) | (4/27/92) | (7/26/99) | (12/1/94) | (1/21/03) | (3/31/94) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.55% | 8.46% | 7.53% | 7.53% | 7.73% | 7.73% | 7.81% | 7.76% | 8.28% | 8.61% |

|

| 10 years | 17.68 | 10.91 | 9.03 | 9.03 | 9.12 | 9.12 | 12.00 | 8.09 | 15.00 | 20.77 |

| Annual average | 1.64 | 1.04 | 0.87 | 0.87 | 0.88 | 0.88 | 1.14 | 0.78 | 1.41 | 1.91 |

|

| 5 years | –13.48 | –18.45 | –16.78 | –18.11 | –16.67 | –16.67 | –15.55 | –18.52 | –14.42 | –12.36 |

| Annual average | –2.85 | –4.00 | –3.61 | –3.92 | –3.58 | –3.58 | –3.32 | –4.01 | –3.07 | –2.60 |

|

| 3 years | 43.62 | 35.38 | 40.17 | 37.17 | 40.37 | 40.37 | 41.38 | 36.50 | 42.52 | 44.69 |

| Annual average | 12.82 | 10.62 | 11.91 | 11.11 | 11.97 | 11.97 | 12.24 | 10.93 | 12.54 | 13.10 |

|

| 1 year | 2.71 | –3.21 | 1.90 | –3.10 | 1.86 | 0.86 | 2.13 | –1.47 | 2.45 | 2.97 |

|

| 6 months | –2.06 | –7.71 | –2.49 | –7.34 | –2.45 | –3.42 | –2.35 | –5.73 | –2.19 | –1.92 |

|

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual fund operating expenses for the fiscal | | | | | | |

| year ended 7/31/11 | 1.05% | 1.80% | 1.80% | 1.55% | 1.30% | 0.80% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 1/31/12 | 1.05% | 1.80% | 1.80% | 1.55% | 1.30% | 0.80% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

12

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from August 1, 2011, to January 31, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.35 | $9.14 | $9.14 | $7.88 | $6.61 | $4.07 |

|

| Ending value (after expenses) | $1,025.20 | $1,020.40 | $1,020.50 | $1,021.90 | $1,023.10 | $1,025.60 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

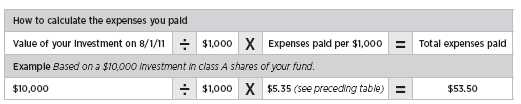

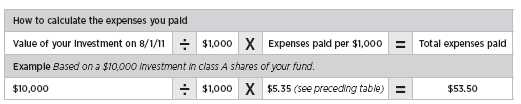

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2012, use the following calculation method. To find the value of your investment on August 1, 2011, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.33 | $9.12 | $9.12 | $7.86 | $6.60 | $4.06 |

|

| Ending value (after expenses) | $1,019.86 | $1,016.09 | $1,016.09 | $1,017.34 | $1,018.60 | $1,021.11 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

George Putnam Blended Index is an unmanaged index administered by Putnam Investment Management, LLC, 60% of which is based on the Russell 1000 Value Index and 40% of which is based on the Barclays Capital U.S. Aggregate Bond Index.

Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not

14

reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2011, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of January 31, 2012, Putnam employees had approximately $325,000,000 and the Trustees had approximately $75,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

15

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

16

The fund’s portfolio 1/31/12 (Unaudited)

| | |

| COMMON STOCKS (57.5%)* | Shares | Value |

|

| Banking (5.0%) | | |

| Bank of New York Mellon Corp. (The) | 155,000 | $3,120,150 |

|

| BB&T Corp. | 55,500 | 1,509,045 |

|

| Comerica, Inc. | 80,600 | 2,230,202 |

|

| Fifth Third Bancorp | 56,800 | 738,968 |

|

| JPMorgan Chase & Co. | 606,700 | 22,629,910 |

|

| PNC Financial Services Group, Inc. | 28,900 | 1,702,788 |

|

| State Street Corp. | 163,600 | 6,409,848 |

|

| U.S. Bancorp | 290,200 | 8,189,444 |

|

| Wells Fargo & Co. | 438,100 | 12,796,901 |

|

| | | 59,327,256 |

| Basic materials (1.9%) | | |

| Alcoa, Inc. | 194,400 | 1,975,104 |

|

| Dow Chemical Co. (The) | 56,048 | 1,878,168 |

|

| E.I. du Pont de Nemours & Co. | 132,400 | 6,737,836 |

|

| Freeport-McMoRan Copper & Gold, Inc. Class B (Indonesia) | 32,100 | 1,483,341 |

|

| Nucor Corp. | 83,500 | 3,714,915 |

|

| PPG Industries, Inc. | 44,200 | 3,959,436 |

|

| Rio Tinto PLC ADR (United Kingdom) | 29,100 | 1,759,386 |

|

| Weyerhaeuser Co. R | 35,072 | 702,141 |

|

| | | 22,210,327 |

| Capital goods (3.4%) | | |

| Eaton Corp. | 83,100 | 4,074,393 |

|

| Emerson Electric Co. | 54,200 | 2,784,796 |

|

| Illinois Tool Works, Inc. | 76,800 | 4,072,704 |

|

| Ingersoll-Rand PLC | 49,400 | 1,726,036 |

|

| KBR, Inc. | 46,900 | 1,507,366 |

|

| Lockheed Martin Corp. | 19,300 | 1,588,776 |

|

| Northrop Grumman Corp. | 82,200 | 4,771,710 |

|

| Parker Hannifin Corp. | 60,400 | 4,873,072 |

|

| Raytheon Co. | 85,500 | 4,103,145 |

|

| Staples, Inc. | 236,300 | 3,457,069 |

|

| United Technologies Corp. | 86,100 | 6,745,935 |

|

| | | 39,705,002 |

| Communication services (4.6%) | | |

| AT&T, Inc. | 563,982 | 16,586,711 |

|

| Comcast Corp. Class A | 328,500 | 8,734,815 |

|

| DIRECTV Class A † | 16,300 | 733,663 |

|

| Juniper Networks, Inc. † | 86,800 | 1,816,724 |

|

| Time Warner Cable, Inc. | 49,200 | 3,627,024 |

|

| Verizon Communications, Inc. | 488,200 | 18,385,612 |

|

| Vodafone Group PLC ADR (United Kingdom) | 159,300 | 4,315,437 |

|

| | | 54,199,986 |

| Conglomerates (2.3%) | | |

| 3M Co. | 34,200 | 2,965,482 |

|

| General Electric Co. | 935,000 | 17,493,850 |

|

| Tyco International, Ltd. | 128,100 | 6,526,695 |

|

| | | 26,986,027 |

17

| | |

| COMMON STOCKS (57.5%)* cont. | Shares | Value |

|

| Consumer cyclicals (5.4%) | | |

| Bed Bath & Beyond, Inc. † | 28,100 | $1,705,670 |

|

| Carnival Corp. | 71,200 | 2,150,240 |

|

| Ford Motor Co. † | 201,400 | 2,501,388 |

|

| Hasbro, Inc. | 80,500 | 2,810,255 |

|

| Home Depot, Inc. (The) | 69,500 | 3,085,105 |

|

| Johnson Controls, Inc. | 61,400 | 1,950,678 |

|

| Kimberly-Clark Corp. | 61,700 | 4,415,252 |

|

| Marriott International, Inc. Class A | 78,820 | 2,715,349 |

|

| News Corp. Class A | 89,700 | 1,689,051 |

|

| Omnicom Group, Inc. | 32,400 | 1,477,764 |

|

| Stanley Black & Decker, Inc. | 15,700 | 1,101,826 |

|

| Target Corp. | 116,300 | 5,909,203 |

|

| Time Warner, Inc. | 226,900 | 8,408,914 |

|

| TJX Cos., Inc. (The) | 113,900 | 7,761,146 |

|

| Viacom, Inc. Class B | 110,200 | 5,183,808 |

|

| Wal-Mart Stores, Inc. | 45,900 | 2,816,424 |

|

| Walt Disney Co. (The) | 204,500 | 7,955,050 |

|

| | | 63,637,123 |

| Consumer finance (0.4%) | | |

| American Express Co. | 98,900 | 4,958,846 |

|

| | | 4,958,846 |

| Consumer staples (4.6%) | | |

| Avon Products, Inc. | 109,400 | 1,944,038 |

|

| Coca-Cola Co. (The) | 26,300 | 1,776,039 |

|

| Coca-Cola Enterprises, Inc. | 151,000 | 4,045,290 |

|

| Colgate-Palmolive Co. | 20,400 | 1,850,688 |

|

| CVS Caremark Corp. | 181,300 | 7,569,275 |

|

| General Mills, Inc. | 56,500 | 2,250,395 |

|

| Hertz Global Holdings, Inc. † | 223,400 | 3,038,240 |

|

| Kellogg Co. | 33,000 | 1,634,160 |

|

| Kraft Foods, Inc. Class A | 78,562 | 3,008,925 |

|

| Lorillard, Inc. | 17,200 | 1,847,108 |

|

| Newell Rubbermaid, Inc. | 175,500 | 3,241,485 |

|

| PepsiCo, Inc. | 35,000 | 2,298,450 |

|

| Philip Morris International, Inc. | 167,000 | 12,486,590 |

|

| Procter & Gamble Co. (The) | 87,600 | 5,522,304 |

|

| SYSCO Corp. | 41,100 | 1,237,521 |

|

| | | 53,750,508 |

| Energy (6.5%) | | |

| Anadarko Petroleum Corp. | 14,100 | 1,138,152 |

|

| Chevron Corp. | 116,000 | 11,957,280 |

|

| ConocoPhillips | 48,200 | 3,287,722 |

|

| Devon Energy Corp. | 46,000 | 2,935,260 |

|

| Exxon Mobil Corp. | 267,500 | 22,400,450 |

|

| Hess Corp. | 47,600 | 2,679,880 |

|

| National Oilwell Varco, Inc. | 29,200 | 2,160,216 |

|

| Newfield Exploration Co. † | 43,300 | 1,637,173 |

|

| Noble Corp. (Switzerland) | 104,600 | 3,644,264 |

|

18

| | |

| COMMON STOCKS (57.5%)* cont. | Shares | Value |

|

| Energy cont. | | |

| Occidental Petroleum Corp. | 63,200 | $6,305,464 |

|

| Royal Dutch Shell PLC ADR (United Kingdom) | 68,700 | 4,902,432 |

|

| Schlumberger, Ltd. | 67,995 | 5,111,184 |

|

| Total SA ADR (France) | 137,800 | 7,299,266 |

|

| Valero Energy Corp. | 60,300 | 1,446,597 |

|

| | | 76,905,340 |

| Financials (3.4%) | | |

| Aflac, Inc. | 81,600 | 3,935,568 |

|

| Citigroup, Inc. | 312,450 | 9,598,464 |

|

| Goldman Sachs Group, Inc. (The) | 77,410 | 8,628,893 |

|

| MetLife, Inc. | 85,000 | 3,003,050 |

|

| Progressive Corp. (The) | 231,200 | 4,688,736 |

|

| Prudential Financial, Inc. | 176,200 | 10,085,688 |

|

| | | 39,940,399 |

| Health care (9.3%) | | |

| Abbott Laboratories | 28,200 | 1,527,030 |

|

| Aetna, Inc. | 160,600 | 7,018,220 |

|

| Baxter International, Inc. | 136,900 | 7,595,212 |

|

| Bristol-Myers Squibb Co. | 81,900 | 2,640,456 |

|

| Celgene Corp. † | 22,700 | 1,650,290 |

|

| CIGNA Corp. | 88,200 | 3,954,006 |

|

| Covidien PLC (Ireland) | 66,812 | 3,440,818 |

|

| Johnson & Johnson | 314,900 | 20,755,059 |

|

| Medtronic, Inc. | 90,000 | 3,471,300 |

|

| Merck & Co., Inc. | 317,300 | 12,139,898 |

|

| Novartis AG ADR (Switzerland) | 40,500 | 2,201,580 |

|

| Pfizer, Inc. | 898,558 | 19,229,141 |

|

| Quest Diagnostics, Inc. | 80,700 | 4,687,056 |

|

| St. Jude Medical, Inc. | 116,100 | 4,842,531 |

|

| Stryker Corp. | 89,200 | 4,944,356 |

|

| Teva Pharmaceutical Industries, Ltd. ADR (Israel) | 53,700 | 2,423,481 |

|

| Thermo Fisher Scientific, Inc. † | 140,100 | 7,411,290 |

|

| | | 109,931,724 |

| Insurance (2.1%) | | |

| Allstate Corp. (The) | 179,900 | 5,190,115 |

|

| Chubb Corp. (The) | 64,600 | 4,354,686 |

|

| Marsh & McLennan Cos., Inc. | 193,800 | 6,122,142 |

|

| RenaissanceRe Holdings, Ltd. | 17,000 | 1,242,870 |

|

| Sun Life Financial, Inc. (Canada) | 62,700 | 1,255,254 |

|

| Travelers Cos., Inc. (The) | 112,600 | 6,564,580 |

|

| | | 24,729,647 |

| Investment banking/Brokerage (0.3%) | | |

| Charles Schwab Corp. (The) | 156,200 | 1,819,730 |

|

| Morgan Stanley | 102,740 | 1,916,101 |

|

| | | 3,735,831 |

| Real estate (0.5%) | | |

| CreXus Investment Corp. R | 73,100 | 809,217 |

|

| Equity Residential Trust R | 26,048 | 1,551,158 |

|

19

| | |

| COMMON STOCKS (57.5%)* cont. | Shares | Value |

|

| Real estate cont. | | |

| Prologis, Inc. R | 56,481 | $1,791,013 |

|

| Simon Property Group, Inc. R | 10,562 | 1,434,953 |

|

| | | 5,586,341 |

| Technology (4.8%) | | |

| Adobe Systems, Inc. † | 100,700 | 3,116,665 |

|

| Apple, Inc. † | 4,300 | 1,962,864 |

|

| Cisco Systems, Inc. | 395,800 | 7,769,554 |

|

| EMC Corp. † | 233,800 | 6,022,688 |

|

| Hewlett-Packard Co. | 133,800 | 3,743,724 |

|

| Honeywell International, Inc. | 150,800 | 8,752,432 |

|

| IBM Corp. | 21,500 | 4,140,900 |

|

| Intel Corp. | 153,600 | 4,058,112 |

|

| KLA-Tencor Corp. | 22,500 | 1,150,425 |

|

| Microsoft Corp. | 205,300 | 6,062,509 |

|

| Oracle Corp. | 65,100 | 1,835,820 |

|

| Qualcomm, Inc. | 49,800 | 2,929,236 |

|

| SanDisk Corp. † | 43,300 | 1,986,604 |

|

| Texas Instruments, Inc. | 56,000 | 1,813,280 |

|

| Yahoo!, Inc. † | 89,800 | 1,389,206 |

|

| | | 56,734,019 |

| Transportation (0.4%) | | |

| FedEx Corp. | 15,400 | 1,408,946 |

|

| United Parcel Service, Inc. Class B | 38,400 | 2,904,960 |

|

| | | 4,313,906 |

| Utilities and power (2.6%) | | |

| Ameren Corp. | 139,200 | 4,404,288 |

|

| American Electric Power Co., Inc. | 98,000 | 3,876,880 |

|

| Dominion Resources, Inc. | 27,300 | 1,366,092 |

|

| Duke Energy Corp. | 76,300 | 1,625,953 |

|

| Edison International | 120,500 | 4,945,320 |

|

| Entergy Corp. | 83,000 | 5,758,540 |

|

| Exelon Corp. | 20,400 | 811,512 |

|

| NextEra Energy, Inc. | 39,600 | 2,370,060 |

|

| PG&E Corp. | 119,550 | 4,860,903 |

|

| | | 30,019,548 |

| | | |

| Total common stocks (cost $603,552,248) | | $676,671,830 |

|

| |

| CORPORATE BONDS AND NOTES (16.4%)* | Principal amount | Value |

|

| Basic materials (1.0%) | | |

| Allegheny Technologies, Inc. sr. unsec. | | |

| unsub. notes 9 3/8s, 2019 | $275,000 | $354,404 |

|

| ArcelorMittal sr. unsec. unsub. 9.85s, 2019 (France) | 1,545,000 | 1,821,732 |

|

| Dow Chemical Co. (The) sr. unsec. notes 5 1/4s, 2041 | 550,000 | 598,426 |

|

| Freeport-McMoRan Copper & Gold, Inc. sr. unsec. notes 8 3/8s, | | |

| 2017 (Indonesia) | 1,450,000 | 1,527,938 |

|

| Georgia-Pacific, LLC sr. unsec. unsub. notes 7 3/4s, 2029 | 850,000 | 1,092,447 |

|

| International Paper Co. sr. unsec. notes 9 3/8s, 2019 | 1,018,000 | 1,337,844 |

|

| International Paper Co. sr. unsec. notes 8.7s, 2038 | 10,000 | 13,961 |

|

20

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Basic materials cont. | | |

| International Paper Co. sr. unsec. notes 7.95s, 2018 | $221,000 | $275,806 |

|

| International Paper Co. sr. unsec. unsub. notes 7.3s, 2039 | 20,000 | 25,060 |

|

| Mosaic Co. (The) sr. unsec. notes 3 3/4s, 2021 | 200,000 | 209,128 |

|

| PPG Industries, Inc. sr. unsec. unsub. debs. 7.4s, 2019 | 350,000 | 437,488 |

|

| Rio Tinto Finance USA, Ltd. company guaranty sr. unsec. notes 9s, | | |

| 2019 (Australia) | 450,000 | 626,235 |

|

| Rio Tinto Finance USA, Ltd. company guaranty sr. unsec. notes 5.2s, | | |

| 2040 (Australia) | 570,000 | 667,768 |

|

| Rohm & Haas Co. sr. unsec. unsub. notes 7.85s, 2029 | 385,000 | 513,903 |

|

| Sealed Air Corp. sr. notes 7 7/8s, 2017 | 585,000 | 622,675 |

|

| Teck Resources Limited sr. notes 10 3/4s, 2019 (Canada) | 35,000 | 42,786 |

|

| Teck Resources Limited sr. notes 10 1/4s, 2016 (Canada) | 51,000 | 58,599 |

|

| Teck Resources Limited sr. notes 9 3/4s, 2014 (Canada) | 16,000 | 18,860 |

|

| Temple-Inland, Inc. sr. unsec. unsub. notes 6 5/8s, 2018 | 195,000 | 225,646 |

|

| Union Carbide Corp. sr. unsec. unsub. bonds 7 3/4s, 2096 | 180,000 | 194,767 |

|

| Xstrata Finance Canada, Ltd. 144A company guaranty | | |

| sr. unsec. unsub. bonds 5.8s, 2016 (Canada) | 735,000 | 820,442 |

|

| Xstrata Finance Canada, Ltd. 144A company guaranty sr. unsec. | | |

| notes 6s, 2041 (Canada) | 5,000 | 5,320 |

|

| | | 11,491,235 |

| Capital goods (0.4%) | | |

| Allied Waste North America, Inc. company guaranty sr. unsec. notes | | |

| 6 7/8s, 2017 | 1,595,000 | 1,680,731 |

|

| Legrand SA unsec. unsub. debs. 8 1/2s, 2025 (France) | 767,000 | 915,300 |

|

| Parker Hannifin Corp. sr. unsec. unsub. notes Ser. MTN, 6 1/4s, 2038 | 975,000 | 1,218,815 |

|

| Republic Services, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5 1/2s, 2019 | 240,000 | 276,972 |

|

| United Technologies Corp. sr. unsec. notes 5.7s, 2040 | 100,000 | 125,082 |

|

| | | 4,216,900 |

| Communication services (1.6%) | | |

| America Movil SAB de CV company guaranty sr. unsec. unsub. notes | | |

| 6 1/8s, 2040 (Mexico) | 200,000 | 243,513 |

|

| America Movil SAB de CV company guaranty unsec. unsub. notes | | |

| 2 3/8s, 2016 (Mexico) | 280,000 | 284,448 |

|

| American Tower REIT, Inc. sr. unsec. notes 7 1/4s, 2019 R | 800,000 | 908,462 |

|

| American Tower REIT, Inc. sr. unsec. unsub. notes 4 5/8s, 2015 R | 555,000 | 581,165 |

|

| AT&T, Inc. sr. unsec. unsub. bonds 5 1/2s, 2018 | 705,000 | 835,814 |

|

| AT&T, Inc. sr. unsec. unsub. notes 6.3s, 2038 | 1,194,000 | 1,456,087 |

|

| Bellsouth Capital Funding unsec. notes 7 7/8s, 2030 | 1,380,000 | 1,865,822 |

|

| CenturyLink, Inc. sr. unsec. debs. Ser. G, 6 7/8s, 2028 | 715,000 | 692,474 |

|

| CenturyLink, Inc. sr. unsec. unsub. notes Ser. P, 7.6s, 2039 | 305,000 | 309,929 |

|

| Comcast Cable Communications company guaranty sr. unsub. notes | | |

| 8 7/8s, 2017 | 290,000 | 377,646 |

|

| Comcast Corp. company guaranty sr. unsec. unsub. notes | | |

| 6.95s, 2037 | 225,000 | 291,778 |

|

| Corning, Inc. sr. unsec. unsub. notes 5 3/4s, 2040 | 165,000 | 193,232 |

|

| Cox Communications, Inc. 144A notes 5 7/8s, 2016 | 289,000 | 334,366 |

|

| Crown Castle Towers, LLC 144A company guaranty sr. notes | | |

| 4.883s, 2020 | 710,000 | 739,314 |

|

21

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Communication services cont. | | |

| France Telecom sr. unsec. unsub. notes 8 1/2s, 2031 (France) | $250,000 | $352,497 |

|

| France Telecom sr. unsec. unsub. notes 5 3/8s, 2019 (France) | 255,000 | 284,203 |

|

| France Telecom sr. unsec. unsub. notes 4 1/8s, 2021 (France) | 283,000 | 293,948 |

|

| Koninklijke (Royal) KPN NV sr. unsec. unsub. bonds 8 3/8s, | | |

| 2030 (Netherlands) | 70,000 | 92,205 |

|

| NBC Universal Media, LLC sr. unsec. unsub. notes 5.15s, 2020 | 295,000 | 337,888 |

|

| NBC Universal Media, LLC sr. unsec. unsub. notes 6.4s, 2040 | 380,000 | 481,808 |

|

| Qwest Corp. notes 6 3/4s, 2021 | 462,000 | 514,466 |

|

| Rogers Communications, Inc. company guaranty sr. unsec. bonds | | |

| 8 3/4s, 2032 (Canada) | 95,000 | 123,500 |

|

| Rogers Communications, Inc. sec. notes 6 3/8s, 2014 (Canada) | 122,000 | 135,319 |

|

| SBA Tower Trust 144A company guaranty sr. notes 5.101s, 2017 | 1,125,000 | 1,204,587 |

|

| TCI Communications, Inc. company guaranty sr. unsec. unsub. debs. | | |

| 7 7/8s, 2026 | 610,000 | 803,330 |

|

| Telecom Italia Capital SA company guaranty sr. unsec. unsub. notes | | |

| 6.175s, 2014 (Italy) | 300,000 | 301,500 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. unsub. notes | | |

| 6.221s, 2017 (Spain) | 845,000 | 903,255 |

|

| Time Warner Cable, Inc. company guaranty sr. notes 7.3s, 2038 | 640,000 | 807,091 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. notes | | |

| 7 1/2s, 2014 | 150,000 | 169,389 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. unsub. notes | | |

| 6 3/4s, 2039 | 355,000 | 426,546 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes 8 3/4s, 2018 | 110,000 | 153,164 |

|

| Verizon New Jersey, Inc. debs. 8s, 2022 | 770,000 | 979,293 |

|

| Verizon Pennsylvania, Inc. debs. 8.35s, 2030 | 980,000 | 1,249,653 |

|

| | | 18,727,692 |

| Consumer cyclicals (1.0%) | | |

| Advance Auto Parts, Inc. company guaranty sr. unsec. notes | | |

| 5 3/4s, 2020 | 475,000 | 532,715 |

|

| CBS Corp. company guaranty sr. unsec. notes 7 7/8s, 2030 | 730,000 | 943,724 |

|

| Choice Hotels International, Inc. company guaranty sr. unsec. unsub. | | |

| notes 5.7s, 2020 | 430,000 | 463,100 |

|

| DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. company | | |

| guaranty sr. unsec. notes 6.35s, 2040 | 370,000 | 427,632 |

|

| DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. company | | |

| guaranty sr. unsec. unsub. notes 5 7/8s, 2019 | 820,000 | 935,991 |

|

| Ecolab, Inc. sr. unsec. unsub. notes 5 1/2s, 2041 | 90,000 | 104,738 |

|

| Ecolab, Inc. sr. unsec. unsub. notes 4.35s, 2021 | 210,000 | 231,705 |

|

| Expedia, Inc. company guaranty sr. unsec. notes 7.456s, 2018 | 325,000 | 364,000 |

|

| Expedia, Inc. company guaranty sr. unsec. unsub. notes 5.95s, 2020 | 555,000 | 564,109 |

|

| FUEL Trust 144A company guaranty asset backed notes | | |

| 4.207s, 2016 | 1,245,000 | 1,278,510 |

|

| Grupo Televisa, S.A.B sr. unsec. bonds 6 5/8s, 2040 (Mexico) | 300,000 | 340,849 |

|

| Grupo Televisa, S.A.B sr. unsec. notes 6s, 2018 (Mexico) | 290,000 | 329,490 |

|

| Lender Processing Services, Inc. company guaranty sr. unsec. unsub. | | |

| notes 8 1/8s, 2016 | 846,000 | 833,310 |

|

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. notes | | |

| 5 1/8s, 2042 | 70,000 | 72,599 |

|

22

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Consumer cyclicals cont. | | |

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. notes | | |

| 3 7/8s, 2022 | $110,000 | $112,766 |

|

| News America Holdings, Inc. company guaranty sr. unsec. debs. | | |

| 7 3/4s, 2024 | 1,045,000 | 1,304,180 |

|

| Owens Corning company guaranty sr. unsec. notes 9s, 2019 | 324,000 | 389,610 |

|

| Time Warner Entertainment Co., LP debs. 8 3/8s, 2023 | 170,000 | 227,932 |

|

| Time Warner, Inc. company guaranty sr. unsec. bonds 7.7s, 2032 | 520,000 | 690,192 |

|

| Time Warner, Inc. company guaranty sr. unsec. notes 4.7s, 2021 | 120,000 | 133,198 |

|

| Time Warner, Inc. debs. 9.15s, 2023 | 340,000 | 468,609 |

|

| Toyota Motor Credit Corp. sr. unsec. unsub. notes 3.3s, 2022 | 630,000 | 640,579 |

|

| | | 11,389,538 |

| Consumer staples (0.9%) | | |

| Altria Group, Inc. company guaranty sr. unsec. notes 9.7s, 2018 | 375,000 | 516,450 |

|

| Altria Group, Inc. company guaranty sr. unsec. notes 9 1/4s, 2019 | 595,000 | 810,041 |

|

| Anheuser-Busch InBev Worldwide, Inc. company guaranty sr. unsec. | | |

| unsub. notes 8.2s, 2039 | 165,000 | 259,411 |

|

| Bacardi, Ltd. 144A unsec. notes 4 1/2s, 2021 (Bermuda) | 495,000 | 540,540 |

|

| Campbell Soup Co. debs. 8 7/8s, 2021 | 855,000 | 1,257,496 |

|

| Corrections Corporation of America company guaranty sr. notes | | |

| 7 3/4s, 2017 | 279,000 | 302,715 |

|

| CVS Pass-Through Trust 144A company guaranty sr. notes 7.507s, 2032 | 736,076 | 874,715 |

|

| CVS Pass-Through Trust 144A pass-through certificates 6.117s, 2013 | 135,447 | 139,482 |

|

| Darden Restaurants, Inc. sr. unsec. unsub. notes 6.8s, 2037 | 810,000 | 922,171 |

|

| Diageo Investment Corp. company guaranty sr. unsec. debs. 8s, | | |

| 2022 (Canada) | 820,000 | 1,140,911 |

|

| General Mills, Inc. sr. unsec. notes 5.65s, 2019 | 130,000 | 155,868 |

|

| H.J. Heinz Finance Co. 144A company guaranty sr. unsec. notes | | |

| 7 1/8s, 2039 | 360,000 | 479,607 |

|

| Kraft Foods, Inc. sr. unsec. unsub. notes 6 1/2s, 2040 | 309,000 | 394,710 |

|

| Kroger Co. company guaranty sr. unsec. unsub. notes 6 3/4s, 2012 | 275,000 | 278,342 |

|

| Kroger Co. company guaranty sr. unsec. unsub. notes 6.4s, 2017 | 500,000 | 601,298 |

|

| McDonald’s Corp. sr. unsec. Ser. MTN, 6.3s, 2038 | 535,000 | 748,667 |

|

| McDonald’s Corp. sr. unsec. notes 5.7s, 2039 | 600,000 | 784,111 |

|

| SABMiller Holdings, Inc. 144A company guaranty sr. unsec. notes | | |

| 4.95s, 2042 | 200,000 | 212,669 |

|

| WPP Finance UK company guaranty sr. unsec. notes 8s, 2014 | | |

| (United Kingdom) | 690,000 | 777,671 |

|

| | | 11,196,875 |

| Energy (1.0%) | | |

| Anadarko Finance Co. company guaranty sr. unsec. unsub. notes | | |

| Ser. B, 7 1/2s, 2031 | 985,000 | 1,236,038 |

|

| BG Energy Capital PLC 144A company guaranty sr. unsec. notes | | |

| 4s, 2021 (United Kingdome) | 250,000 | 267,979 |

|

| BP Capital Markets PLC company guaranty sr. unsec. unsub. notes | | |

| 4.742s, 2021 (United Kingdom) | 655,000 | 751,830 |

|

| BP Capital Markets PLC company guaranty sr. unsec. unsub. notes | | |

| 4 1/2s, 2020 (United Kingdom) | 175,000 | 195,962 |

|

| Chesapeake Energy Corp. sr. unsec. notes 7 5/8s, 2013 | 10,000 | 10,525 |

|

| DCP Midstream, LLC 144A sr. unsec. notes 5.35s, 2020 | 375,000 | 407,008 |

|

23

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Energy cont. | | |

| El Paso Pipeline Partners Operating Co., LP company guaranty | | |

| sr. unsec. notes 6 1/2s, 2020 | $235,000 | $261,438 |

|

| Ente Nazionale Idrocarburi (ENI) SpA 144A sr. unsec. notes 4.15s, | | |

| 2020 (Italy) | 825,000 | 830,699 |

|

| EOG Resources, Inc. sr. unsec. notes 5 5/8s, 2019 | 205,000 | 246,064 |

|

| Kerr-McGee Corp. company guaranty sr. unsec. unsub. notes | | |

| 7 7/8s, 2031 | 340,000 | 442,486 |

|

| Marathon Petroleum Corp. sr. unsec. unsub. notes 6 1/2s, 2041 | 175,000 | 194,357 |

|

| Motiva Enterprises, LLC 144A sr. unsec. unsub. notes 5.2s, 2012 | 225,000 | 229,741 |

|

| Motiva Enterprises, LLC 144A sr. unsec. notes 6.85s, 2040 | 220,000 | 284,512 |

|

| Newfield Exploration Co. sr. sub. notes 6 5/8s, 2016 | 650,000 | 666,250 |

|

| Noble Holding International, Ltd. company guaranty sr. unsec. notes | | |

| 6.05s, 2041 | 390,000 | 439,566 |

|

| Petrobras International Finance Co. company guaranty sr. unsec. | | |

| notes 6 3/4s, 2041 (Brazil) | 300,000 | 341,614 |

|

| Petrobras International Finance Co. company guaranty sr. unsec. | | |

| notes 5 3/8s, 2021 (Brazil) | 825,000 | 864,555 |

|

| Petrobras International Finance Co. company guaranty sr. unsec. | | |

| notes 3 7/8s, 2016 (Brazil) | 355,000 | 363,479 |

|

| Pride International, Inc. sr. unsec. notes 7 7/8s, 2040 | 760,000 | 1,033,545 |

|

| Ras Laffan Liquefied Natural Gas Co., Ltd. 144A company guaranty | | |

| sr. notes 5 1/2s, 2014 (Qatar) | 675,000 | 720,563 |

|

| Spectra Energy Partners LP sr. unsec. notes 4.6s, 2021 | 245,000 | 258,885 |

|

| Statoil ASA company guaranty sr. unsec. notes 5.1s, 2040 (Norway) | 480,000 | 574,901 |

|

| Weatherford Bermuda company guaranty sr. unsec. notes 9 5/8s, 2019 | 180,000 | 241,155 |

|

| Weatherford International, Inc. company guaranty sr. unsec. unsub. | | |

| notes 6.8s, 2037 | 245,000 | 278,737 |

|

| Weatherford International, Inc. company guaranty sr. unsec. unsub. | | |

| notes 6.35s, 2017 | 280,000 | 319,590 |

|

| Weatherford International, Ltd. sr. notes 5 1/2s, 2016 (Switzerland) | 455,000 | 504,088 |

|

| | | 11,965,567 |

| Financials (6.8%) | | |

| ABN Amro Bank NV 144A sr. unsec. notes 4 1/4s, 2017 (Netherlands) | 3,030,000 | 3,029,166 |

|

| Aflac, Inc. sr. unsec. notes 6.9s, 2039 | 500,000 | 574,748 |

|

| Aflac, Inc. sr. unsec. notes 6.45s, 2040 | 345,000 | 378,142 |

|

| American Express Bank FSB notes Ser. BKN1, 5.55s, 2012 | 1,160,000 | 1,194,945 |

|

| American Express Bank FSB sr. unsec. FRN Ser. BKNT, 0.596s, 2017 | 545,000 | 501,551 |

|

| American International Group, Inc. jr. sub. bonds FRB 8.175s, 2058 | 300,000 | 289,500 |

|

| American International Group, Inc. sr. unsec. Ser. MTN, 5.85s, 2018 | 665,000 | 694,113 |

|

| AON Corp. jr. unsec. sub. notes 8.205s, 2027 | 1,150,000 | 1,355,538 |

|

| Assurant, Inc. sr. unsec. notes 6 3/4s, 2034 | 525,000 | 555,678 |

|

| Bank Nederlandse Gemeenten 144A bonds 1 3/4s, 2015 (Netherlands) | 12,100,000 | 12,127,700 |

|

| Bank of America Corp. sr. unsec. unsub. notes 6 1/2s, 2016 | 1,405,000 | 1,498,137 |

|

| Bank of America NA sub. notes Ser. BKNT, 5.3s, 2017 | 315,000 | 313,435 |

|

| Barclays Bank PLC jr. unsec. sub. notes FRN 6.278s, 2049 | | |

| (United Kingdom) | 145,000 | 114,550 |

|

| Barclays Bank PLC 144A sub. notes 10.179s, 2021 (United Kingdom) | 804,000 | 922,172 |

|

| Barclays Bank PLC 144A unsec. sub. notes 6.05s, 2017 | | |

| (United Kingdom) | 1,415,000 | 1,426,534 |

|

24

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Financials cont. | | |

| Bear Stearns Cos., Inc. (The) sr. notes 6.4s, 2017 | $500,000 | $570,569 |

|

| Bear Stearns Cos., Inc. (The) sr. unsec. notes 7 1/4s, 2018 | 331,000 | 395,797 |

|

| Bosphorus Financial Services, Ltd. 144A sr. notes FRN 2.257s, 2012 | 148,625 | 148,597 |

|

| Camden Property Trust sr. unsec. notes 4 7/8s, 2023 R | 1,040,000 | 1,114,345 |

|

| Capital One Bank USA NA sub. notes 8.8s, 2019 | 385,000 | 464,081 |

|

| Capital One Capital III company guaranty jr. unsec. sub. notes | | |

| 7.686s, 2036 | 320,000 | 323,200 |

|

| Capital One Capital V company guaranty jr. unsec. sub. notes | | |

| 10 1/4s, 2039 | 450,000 | 470,813 |

|

| Citigroup, Inc. sr. unsec. sub. FRN 0.81s, 2016 | 123,000 | 100,331 |

|

| Citigroup, Inc. sub. notes 5s, 2014 | 1,369,000 | 1,407,810 |

|

| Citigroup, Inc. unsec. sub. notes 6 1/8s, 2036 | 200,000 | 192,985 |

|

| Citigroup, Inc. unsec. sub. notes 5 5/8s, 2012 | 290,000 | 295,538 |

|

| CNA Financial Corp. sr. unsec. unsub. notes 5 3/4s, 2021 | 210,000 | 221,758 |

|

| CNA Financial Corp. unsec. notes 6 1/2s, 2016 | 435,000 | 474,384 |

|

| Commonwealth Bank of Australia 144A sr. unsec. notes 3 3/4s, | | |

| 2014 (Australia) | 1,220,000 | 1,268,785 |

|

| Credit Suisse Guernsey sr. unsec. notes 5.3s, 2019 | 475,000 | 509,240 |

|

| DDR Corp. sr. unsec. unsub. notes 7 7/8s, 2020 R | 605,000 | 715,630 |

|

| Deutsche Bank AG/London sr. unsec. notes 3 7/8s, 2014 | | |

| (United Kingdom) | 635,000 | 660,843 |

|

| Deutsche Bank Capital Funding Trust VII 144A jr. unsec. sub. bonds | | |

| FRB 5.628s, 2016 | 470,000 | 357,200 |

|

| Duke Realty LP sr. unsec. notes 6 1/2s, 2018 R | 361,000 | 413,453 |

|

| Duke Realty LP sr. unsec. notes 6 1/4s, 2013 R | 19,000 | 19,882 |

|

| Erac USA Finance, Co. 144A sr. notes 4 1/2s, 2021 | 785,000 | 809,316 |

|

| GATX Financial Corp. notes 5.8s, 2016 | 560,000 | 605,211 |

|

| GE Capital Trust I unsec. sub. bonds FRB 6 3/8s, 2067 | 355,000 | 353,704 |

|

| General Electric Capital Corp. sr. unsec. 5 5/8s, 2018 | 260,000 | 298,094 |

|

| General Electric Capital Corp. sr. unsec. FRN Ser. MTN, 0.653s, 2016 | 455,000 | 422,399 |

|

| General Electric Capital Corp. sr. unsec. notes 6 3/4s, 2032 | 40,000 | 47,899 |

|

| General Electric Capital Corp. sr. unsec. notes 6.15s, 2037 | 1,200,000 | 1,360,045 |

|

| Genworth Financial, Inc. sr. unsec. unsub. notes 7 5/8s, 2021 | 1,410,000 | 1,398,540 |

|

| Goldman Sachs Group, Inc. (The) sr. notes 7 1/2s, 2019 | 805,000 | 917,852 |

|

| Goldman Sachs Group, Inc. (The) sub. notes 6 3/4s, 2037 | 745,000 | 739,751 |

|

| Hartford Financial Services Group, Inc. (The) sr. unsec. unsub. notes | | |

| 6 5/8s, 2040 | 1,540,000 | 1,572,593 |

|

| HBOS PLC 144A sr. unsec. sub. notes 6 3/4s, 2018 (United Kingdom) | 360,000 | 316,725 |

|

| HBOS PLC 144A unsec. sub. bonds 6s, 2033 (United Kingdom) | 890,000 | 625,925 |

|

| Highwood Realty LP sr. unsec. bonds 5.85s, 2017 R | 1,005,000 | 1,082,454 |

|

| HSBC Finance Capital Trust IX FRN 5.911s, 2035 | 2,000,000 | 1,730,000 |

|

| HSBC Holdings PLC sub. notes 6 1/2s, 2037 (United Kingdom) | 905,000 | 962,519 |

|

| ING Bank NV 144A sr. unsec. notes FRN 1.596s, 2013 (Netherlands) | 1,535,000 | 1,514,726 |

|

| International Lease Finance Corp. sr. unsec. notes 6 1/4s, 2019 | 275,000 | 270,531 |

|

| JPMorgan Chase Bank NA sub. notes Ser. BKNT, 6s, 2017 | 1,000,000 | 1,110,463 |

|

| JPMorgan Chase Capital XVIII bonds Ser. R, 6.95s, 2036 | 499,000 | 504,511 |

|

| JPMorgan Chase Capital XXIII company guaranty jr. unsec. sub. notes | | |

| FRN 1.457s, 2047 | 2,443,000 | 1,712,414 |

|

25

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Financials cont. | | |

| JPMorgan Chase Capital XXV bonds Ser. Y, 6.8s, 2037 | $523,000 | $527,636 |

|

| Liberty Mutual Insurance Co. 144A notes 7.697s, 2097 | 1,060,000 | 993,636 |

|

| Lloyds TSB Bank PLC bank guaranty sr. unsec. unsub. notes 6 3/8s, | | |

| 2021 (United Kingdom) | 280,000 | 299,524 |

|

| Lloyds TSB Bank PLC company guaranty sr. unsec. sub. notes | | |

| Ser. MTN, 6 1/2s, 2020 (United Kingdom) | 1,080,000 | 1,007,463 |

|

| Macquarie Bank Ltd. 144A unsec. sub. notes 6 5/8s, 2021 (Australia) | 1,020,000 | 970,860 |

|

| Massachusetts Mutual Life Insurance Co. 144A notes 8 7/8s, 2039 | 815,000 | 1,199,924 |

|

| Merrill Lynch & Co., Inc. jr. sub. bonds 7 3/4s, 2038 | 1,565,000 | 1,646,547 |

|

| MetLife Capital Trust IV 144A jr. sub. debs. 7 7/8s, 2037 | 1,300,000 | 1,387,750 |

|

| MetLife, Inc. jr. unsec. sub. notes 6.4s, 2036 | 590,000 | 574,916 |

|

| Metropolitan Life Global Funding I 144A notes 3.65s, 2018 | 100,000 | 104,979 |

|

| Nationwide Financial Services, Inc. notes 5 5/8s, 2015 | 465,000 | 491,805 |

|

| Nationwide Mutual Insurance Co. 144A notes 8 1/4s, 2031 | 415,000 | 453,142 |

|

| Nordea Bank AB 144A jr. unsec. sub. notes FRN 5.424s, 2015 | | |

| (Sweden) | 525,000 | 498,750 |

|

| Nordea Bank AB 144A sub. notes 4 7/8s, 2021 (Sweden) | 1,300,000 | 1,225,844 |

|

| OneAmerica Financial Partners, Inc. 144A bonds 7s, 2033 | 370,000 | 380,407 |

|

| Pacific LifeCorp 144A sr. notes 6s, 2020 | 365,000 | 397,610 |

|

| Progressive Corp. (The) jr. unsec. sub. notes FRN 6.7s, 2037 | 2,020,000 | 2,070,500 |

|

| Prudential Financial, Inc. sr. notes 7 3/8s, 2019 | 600,000 | 730,031 |

|

| Prudential Financial, Inc. sr. notes 6.2s, 2015 | 190,000 | 210,453 |

|

| Prudential Holdings, LLC sr. notes FRN Ser. AGM, 1.434s, 2017 | 210,000 | 200,245 |

|

| Royal Bank of Scotland Group PLC sr. unsec. unsub. notes 6.4s, | | |

| 2019 (United Kingdom) | 355,000 | 365,084 |

|

| Santander Issuances S.A. Unipersonal 144A bank guaranty unsec. | | |

| sub. notes 5.911s, 2016 (Spain) | 900,000 | 796,266 |

|

| Societe Generale SA 144A jr. unsec. sub. bonds FRN 1.333s, | | |

| 2017 (France) | 385,000 | 187,949 |

|

| Standard Chartered PLC 144A jr. sub. bonds FRB 7.014s, 2049 | | |

| (United Kingdom) | 800,000 | 772,794 |

|

| State Street Capital Trust IV company guaranty jr. unsec. sub. bonds | | |

| FRB 1.546s, 2037 | 1,790,000 | 1,205,738 |

|

| Tanger Properties, LP sr. unsec. notes 6 1/8s, 2020 R | 265,000 | 299,480 |

|

| TD Ameritrade Holding Corp. company guaranty sr. unsec. unsub. | | |

| notes 5.6s, 2019 | 480,000 | 520,939 |

|

| Teachers Insurance & Annuity Association of America 144A notes | | |

| 6.85s, 2039 | 750,000 | 987,665 |

|

| Ventas Realty LP/Capital Corp. sr. notes 6 3/4s, 2017 R | 470,000 | 486,995 |

|

| Vornado Realty LP sr. unsec. unsub. notes 4 1/4s, 2015 R | 555,000 | 579,543 |

|

| Wachovia Bank NA sub. notes Ser. BKNT, 6s, 2017 | 1,060,000 | 1,205,855 |

|

| Wachovia Corp. sr. unsec. notes 5 3/4s, 2017 | 145,000 | 166,631 |

|

| WEA Finance, LLC/ WT Finance Aust. Pty. Ltd. 144A company | | |

| guaranty sr. unsec. notes 6 3/4s, 2019 | 570,000 | 673,488 |

|

| Wells Fargo Bank NA unsec. sub. notes FRN 0.671s, 2016 | 710,000 | 643,480 |

|

| Westpac Capital Trust III 144A unsec. sub. notes FRN 5.819s, | | |

| 2013 (Australia) | 1,010,000 | 975,387 |

|

26

| | |

| CORPORATE BONDS AND NOTES (16.4%)* cont. | Principal amount | Value |

|

| Financials cont. | | |

| Willis Group Holdings Ltd. company guaranty sr. unsec. unsub. | | |

| notes 5 3/4s, 2021 (United Kingdom) | $710,000 | $769,983 |

|

| ZFS Finance USA Trust V 144A bonds FRB 6 1/2s, 2037 | 159,000 | 146,280 |

|

| | | 79,612,401 |

| Government (0.5%) | | |

| International Bank for Reconstruction & Development unsec. | | |

| unsub. bonds 7 5/8s, 2023 | 4,000,000 | 5,870,192 |

|

| | | 5,870,192 |

| Health care (0.2%) | | |

| Aetna, Inc. sr. unsec. unsub. notes 6 3/4s, 2037 | 95,000 | 121,768 |

|

| CIGNA Corp. sr. unsec. unsub. notes 5 3/8s, 2042 | 205,000 | 217,786 |

|

| Coventry Health Care, Inc. sr. unsec. notes 5.45s, 2021 | 450,000 | 500,079 |

|

| Quest Diagnostics, Inc. company guaranty sr. unsec. notes | | |

| 6.95s, 2037 | 335,000 | 427,808 |

|

| Quest Diagnostics, Inc. company guaranty sr. unsec. notes | | |

| 4 3/4s, 2020 | 121,000 | 132,062 |

|

| UnitedHealth Group, Inc. sr. unsec. unsub. notes 4 5/8s, 2041 | 300,000 | 319,021 |

|

| WellPoint, Inc. notes 7s, 2019 | 155,000 | 191,256 |

|

| | | 1,909,780 |

| Technology (0.2%) | | |

| Computer Sciences Corp. sr. unsec. notes 6 1/2s, 2018 | 281,000 | 286,620 |

|

| Dell, Inc. sr. unsec. notes 5 7/8s, 2019 | 715,000 | 852,329 |

|

| KLA-Tencor Corp. sr. unsec. notes 6.9s, 2018 | 915,000 | 1,081,832 |

|

| Xerox Corp. sr. unsec. notes 4 1/2s, 2021 | 395,000 | 405,417 |

|

| | | 2,626,198 |

| Transportation (0.4%) | | |

| American Airlines 2011-2 Class A Pass Through Trust company | | |

| guaranty secured airplanes 8 5/8s, 2021 | 340,000 | 360,400 |

|

| Burlington Northern Santa Fe Corp. sr. unsec. notes 4.7s, 2019 | 176,000 | 202,147 |

|

| Burlington Northern Santa Fe, LLC sr. unsec. notes 5.4s, 2041 | 605,000 | 703,272 |

|

| Burlington Northern Santa Fe, LLC sr. unsec. unsub. notes | | |

| 5 3/4s, 2040 | 145,000 | 177,885 |

|

| Continental Airlines, Inc. pass-through certificates Ser. 97-4A, | | |

| 6.9s, 2018 | 152,607 | 162,526 |

|

| Continental Airlines, Inc. pass-through certificates Ser. 98-1A, | | |

| 6.648s, 2017 | 388,751 | 404,301 |

|

| CSX Corp. sr. unsec. unsub. notes 4 3/4s, 2042 | 205,000 | 215,249 |

|

| Norfolk Southern Corp. sr. unsec. notes 6s, 2111 | 390,000 | 461,909 |

|

| Northwest Airlines Corp. pass-through certificates Ser. 00-1, | | |

| 7.15s, 2019 | 1,283,791 | 1,264,534 |

|

| Southwest Airlines Co. pass-through certificates Ser. 07-1, | | |

| 6.15s, 2022 | 727,442 | 785,638 |

|

| Union Pacific Corp. 144A pass-through certificates 5.214s, 2014 | 590,000 | 645,962 |

|

| | | 5,383,823 |

| Utilities and power (2.4%) | | |

| AEP Texas North Co. sr. notes Ser. B, 5 1/2s, 2013 | 500,000 | 520,643 |

|