| | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-00653) | |

| |

| Exact name of registrant as specified in charter: | Putnam Income Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | 800 Boylston Street |

| | Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: October 31, 2010 | | |

| |

| Date of reporting period: November 1, 2009 — October 31, 2010 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam

Income

Fund

Annual report

10 | 31 | 10

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 13 | | |

| | |

| Terms and definitions | 15 | | |

| | |

| Trustee approval of management contract | 16 | | |

| | |

| Other information for shareholders | 20 | | |

| | |

| Financial statements | 21 | | |

| | |

| Federal tax information | 73 | | |

| | |

| Shareholder meeting results | 73 | | |

| | |

| About the Trustees | 74 | | |

| | |

| Officers | 76 | | |

| | |

Message from the Trustees

Dear Fellow Shareholder:

Stock markets around the world rallied strongly over the past few months, riding a rising tide of strengthening investor confidence and slowly improving economic and corporate data. Indeed, U.S. stocks delivered their best September in 71 years, and continued to add to those gains in October. Bond markets also have generated positive results for much of 2010 and continue to be a source of refuge for risk-averse investors.

It is important to recognize, however, that we may see periods of heightened market volatility as markets and economies seek more solid ground. The slow pace of the U.S. economic recovery and ongoing European sovereign debt concerns have made markets more susceptible to disappointing news. We believe, however, that Putnam’s research-intensive, actively managed investment approach is well suited for this environment.

In developments affecting oversight of your fund, Barbara M. Baumann has been elected to the Board of Trustees of the Putnam Funds, effective July 1, 2010. Ms. Baumann is president and owner of Cross Creek Energy Corporation of Denver, Colorado, a strategic consultant to domestic energy firms and direct investor in energy assets. We also want to thank Elizabeth T. Kennan, who has retired from the Board of Trustees, for her many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Seeking high current return across a broad range of fixed-income securities

Over Putnam Income Fund’s 56-year history, the bond landscape has undergone a dramatic transformation. A significant portion of the U.S. investment-grade sector, the fund’s primary focus, is now composed of securitized debt instruments, including mortgage- and asset-backed securities. The high-yield corporate bond sector, established in the late 1970s, has also grown significantly and is now considered a mature asset class. And outside the United States, there are new opportunities to invest in the debt of developed and emerging-market countries.

Amid this evolution, the fund’s objective has remained constant. In a letter to investors in 1963, George Putnam, Jr., expressed it this way: “We have in mind those people who need a liberal current return…” His choice of “current return” rather than “current income” captures the investment philosophy of the fund today: High current income should be pursued within a total return context, and risk management is as important as yield in maintaining a high current income stream.

Since 1954, Putnam Income Fund has navigated the changing bond market landscape to seek total return for investors.

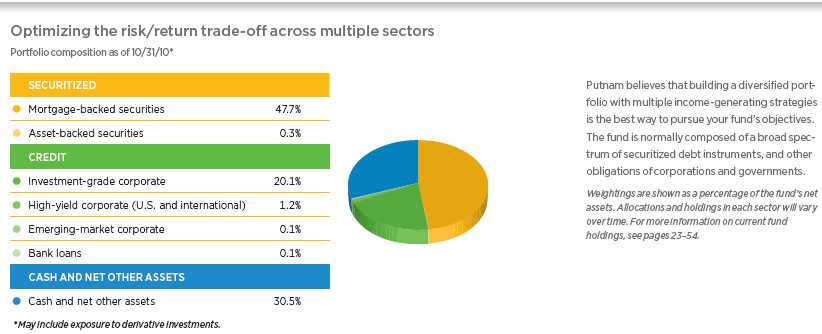

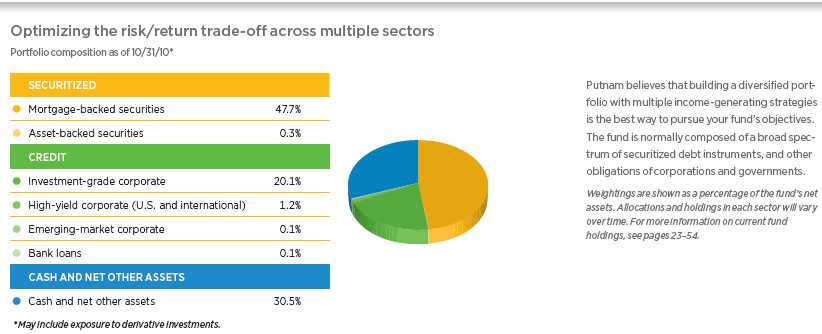

Investing in today’s global bond market requires broad expertise. Putnam’s fixed-income organization includes teams of specialists who focus on varied investment opportunities. The fund’s managers select from these opportunities, building a diversified portfolio that carefully balances risk and return.

Consider these risks before investing:

Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. The use of derivatives involves special risks and may result in losses. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk.

As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

Key fixed-income return sources

Securitized: Interest-rate cycles affect mortgage- and asset-backed securities (MBS/ABS). Because MBS are the securitized cash flows of mortgages, prepayment rates are another consideration. Some MBS are issued by the U.S. government or its agencies and others are issued by other entities.

For ABS, managers monitor the credit quality of the underlying assets, which comprise the securitized cash flow of anything from credit card debt to manufactured housing debt.

Credit: Corporate bond performance tends to track the health of the overall economy more closely than other bonds. These bonds are less sensitive to interest-rate movements; they tend to perform well when the economy strengthens, often in spite of the higher rates that accompany stronger growth.\

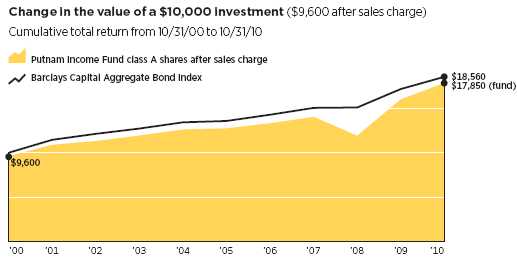

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Barclays Capital Aggregate Bond Index, was introduced on 12/31/75, and the fund’s Lipper category was introduced on 12/31/59. Both post-date the inception of the fund’s class A shares.

4

Interview with your fund’s portfolio manager

Rob Bloemker

How did the fund perform for the year ended October 31, 2010?

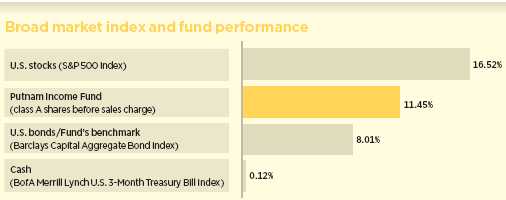

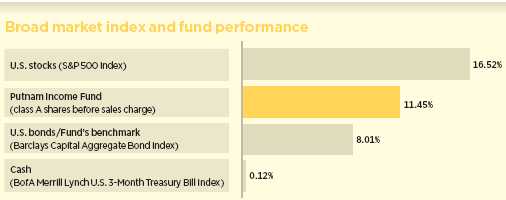

I’m pleased to report that Putnam Income Fund’s class A shares returned 11.45%, outperforming both its benchmark, the Barclays Capital Aggregate Bond Index, which gained 8.01%, and the average return of its Lipper peer group, Corporate Debt Funds A-Rated, which finished at 9.27%.

How would you characterize the broad bond market environment during the past 12 months?

The period began amid indications that global economies were emerging from the Great Recession, prompting investors to move toward the historically attractive yields offered by securities in riskier categories, such as high-yield corporate bonds and emerging-market debt. Then in April and May, after more than a year of steady improvement in credit market conditions, the fallout from Europe’s sovereign debt woes bred risk aversion and led to higher borrowing costs for a handful of smaller European economies, most notably Greece, and for some corporations. By late summer, however, the credit markets recovered, and U.S. corporations found increasingly inexpensive access to debt markets, resulting in a resurgence of bond issuance at unusually low borrowing rates. In Europe, credit conditions broadly stabilized as a nearly $1 trillion government bailout program calmed market concerns about a liquidity crisis. Still, the borrowing environment varied considerably from country to country, underscoring ongoing sovereign debt concerns. As the period came to a close, the Federal Reserve [the Fed] launched its second major quantitative easing program — dubbed “QE2,” under which it plans to purchase up to $600 billion in U.S. Treasuries.

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 10/31/10. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 15.

5

The fund outperformed its benchmark and peer category by substantial margins. What were the major factors behind this outperformance?

The fund’s strong relative performance is attributable to several key strategies and risk exposures. During the period, the fund benefited from our balanced approach to prepayment risk, credit risk, and liquidity risk, primarily as a result of three major mortgage strategies.

First, we established a moderate position in short-term commercial mortgage-backed securities [CMBS], focusing on bonds in the highly liquid topmost part of the capital structure. Our analysis suggested that these bonds were undervalued relative to their liquidity risk. Our CMBS holdings benefited from an increasing investor perception that even though commercial mortgage delinquencies have continued to grow, senior CMBSs have enough structural protection to withstand losses.

The fund’s mortgage strategies also included investments in government-agency interest-only collateralized mortgage obligations [CMO IOs]. CMOs are structured mortgage-backed securities that use pools of mortgage pass-through bonds, or mortgage loans themselves, as collateral and carve the cash flows into different classes to meet the needs of various investors. IOs are securities derived

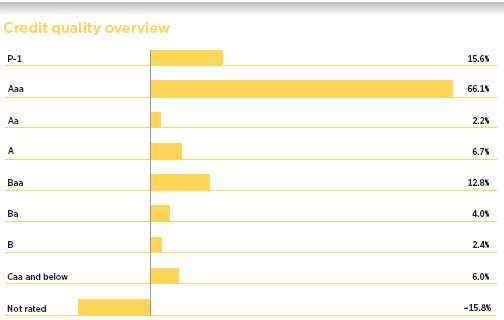

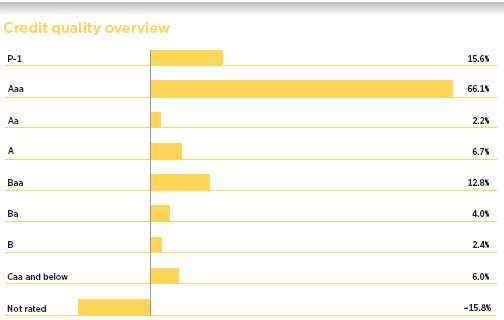

Credit qualities are shown as a percentage of net assets as of 10/31/10. A bond rated Baa or higher (Prime-3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s or, if unrated by S&P, by Fitch, and then included in the closest equivalent Moody’s rating. Ratings will vary over time.

Credit quality includes bonds and represents only the fixed-income portion of the portfolio. Derivative instruments, including currency forwards, are only included to the extent of any unrealized gain or loss on such instruments and are shown in the not-rated category. The fund itself has not been rated by an independent rating agency.

6

from the interest portion of the underlying mortgages. CMO IOs are designed so that the longer homeowners take to pay down their mortgages, the more money a security holder will make from interest payments on those loans. Despite record-low mortgage rates, refinancing activity was constrained by extremely tight bank-underwriting requirements, making it difficult for many borrowers to qualify for a new loan. Depressed home prices also hampered borrowers’ attempts to refinance by putting loan-to-home-value ratios outside ranges considered acceptable by most lenders. As a result, our CMO IOs accumulated steady cash flows throughout the fiscal year, with minimal prepayment risk.

In implementing our CMO IO strategy, we used interest-rate swaps and options to hedge the fund’s duration — or sensitivity to interest-rate changes — thereby isolating the prepayment risk that we believed was attractively priced.

Our third mortgage strategy entailed investments in non-agency residential mortgage-backed securities [RMBS]. Within the RMBS area, we emphasized hybrid adjustable-rate mortgage-backed securities, which combine features of both fixed- and adjustable-rate mortgages. We also invested in Alt-A mortgages at what we believed were attractive prices. Alt-A mortgages are considered riskier than standard prime mortgages, but higher quality than subprime mortgages because Alt-A borrowers must have reasonable credit histories.

How did your yield curve positioning affect performance?

Our yield curve, or “term structure,” strategy also helped performance. Using interest-rate swaps and options, we built positions in the intermediate-maturity, five-to-ten year part of the curve. Yields in this area of the curve were most affected by investor anticipation of the impact of the Fed’s bond purchases under QE2, because they influence consumer credit rates for mortgages, car loans, and

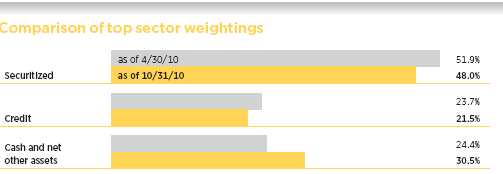

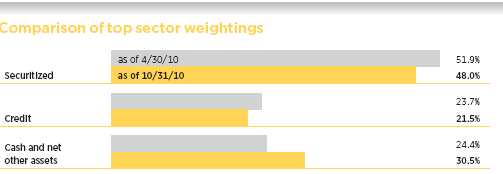

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

7

other borrowing. We avoided the short end of the curve, where Fed monetary policy had anchored short-term yields at extremely low levels. We also avoided the long end of the curve because this portion of the curve is the most sensitive to changing inflation expectations. We also used interest-rate futures and swap contracts to manage the fund’s term-structure risk.

Which areas detracted from results?

I’m happy to report that there were no notable detractors. We took a cautious approach toward interest-rate risk during the period. As a result, the fund’s duration was shorter than that of its benchmark and peer group average, which restrained its outperformance modestly in an environment of falling interest rates.

What is your outlook for the economy, the credit markets, and the fund over the coming months?

In the United States, we anticipate continued high unemployment and weak economic growth as we move into 2011. We do not anticipate a double-dip recession, barring a major negative surprise such as a blowup in Europe or a freefall in the U.S. dollar. U.S. economic growth will nonetheless be constrained by an overhang of heavy debt, housing-sector weakness, and reluctant consumers.

Credit spreads have narrowed greatly since late 2008, yet they are still attractive by historic norms in many market segments. That is especially true in securitized sectors. As a result, we plan to maintain the fund’s holdings of CMBS, CMO IOs, and RMBS. In our view, senior CMBSs can continue to generate stable cash flows with sufficient principal protection, given their seniority in the capital structure. We believe CMO IOs should fare relatively well in a weak housing market. And we believe RMBSs can continue to produce high yields supported by valuations that can accommodate even worst-case scenarios.

Many of our CMO IO holdings were structured from mortgages with lower interest rates or lower balances. In our view, these types of loans are unlikely to be refinanced, which should help to mitigate the prepayment risk of these CMO IOs. We believe these holdings may continue to perform well despite additional quantitative easing, even if the Fed’s actions trigger increasing expectations for higher inflation. What’s more, if inflation expectations do rise, our CMO IO positions may outperform due to strong demand for high-yielding securities based on mortgages that are unlikely to be paid off early. At the same time, the limited size of the IO market and the potential headline risk of government intervention have increased the likelihood of future volatility. Therefore, we are cautious about adding to our positions.

Lastly, given the potential for interest-rate volatility in the months ahead — in light of QE2 and other factors — we plan to maintain the fund’s relatively short duration positioning.

Thanks for bringing us up to date, Rob.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

8

Of special interest

The fund’s dividend rate declined during the period. The dividend per class A share was reduced from $0.039 to $0.034 effective November 2010. This reduction was due to a decrease in accrued income from certain asset-backed and commercial mortgage-backed securities.

Portfolio Manager Rob Bloemker is Head of Fixed Income at Putnam. He has a B.S. and a B.A. from Washington University. Rob joined Putnam in 1999 and has been in the investment industry since 1988.

In addition to Rob, your fund’s portfolio managers are Carl Bell, Kevin Murphy, Michael Salm, and Raman Srivastava.

IN THE NEWS

The Federal Reserve’s “QE2” has set sail. In light of what has been a tepid economic recovery, in October the Fed announced a second round of monetary stimulus via quantitative easing — dubbed QE2 by the media — involving the purchase of an additional $600 billion of U.S. Treasury bonds through the end of June 2011. The Fed has suggested in recent months that it is particularly concerned about the prospect of deflation, which has plagued the Japanese economy for the better part of the past decade. By purchasing Treasuries, the central bank could drive down already low yields by injecting about $75 billion a month into the capital markets. The idea behind QE2 is that the money would then be reinvested, and the expected upward pressure on asset prices could create inflationary expectations sufficient to prevent deflation from becoming a problem.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended October 31, 2010, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 10/31/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/54) | (3/1/93) | (7/26/99) | (12/14/94) | (1/21/03) | (6/16/94) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.93% | 7.85% | 6.94% | 6.94% | 7.12% | 7.12% | 7.48% | 7.42% | 7.66% | 8.01% |

|

| 10 years | 85.88 | 78.50 | 72.46 | 72.46 | 72.50 | 72.50 | 81.24 | 75.35 | 81.39 | 90.45 |

| Annual average | 6.40 | 5.97 | 5.60 | 5.60 | 5.60 | 5.60 | 6.13 | 5.78 | 6.14 | 6.65 |

|

| 5 years | 40.04 | 34.45 | 34.90 | 32.90 | 34.95 | 34.95 | 38.24 | 33.82 | 38.36 | 41.75 |

| Annual average | 6.97 | 6.10 | 6.17 | 5.85 | 6.18 | 6.18 | 6.69 | 6.00 | 6.71 | 7.23 |

|

| 3 years | 27.17 | 22.12 | 24.32 | 21.31 | 24.37 | 24.37 | 26.30 | 22.27 | 26.12 | 28.04 |

| Annual average | 8.34 | 6.89 | 7.53 | 6.65 | 7.54 | 7.54 | 8.09 | 6.93 | 8.04 | 8.59 |

|

| 1 year | 11.45 | 6.92 | 10.54 | 5.54 | 10.57 | 9.56 | 11.28 | 7.64 | 11.10 | 11.73 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

10

Comparative index returns For periods ended 10/31/10

| | |

| | | Lipper Corporate Debt Funds A-Rated |

| | Barclays Capital Aggregate Bond Index | category average* |

|

| Annual average (life of fund) | —† | —† |

|

| 10 years | 85.60% | 75.26% |

| Annual average | 6.38 | 5.74 |

|

| 5 years | 36.66 | 29.89 |

| Annual average | 6.45 | 5.33 |

|

| 3 years | 23.28 | 19.40 |

| Annual average | 7.23 | 6.04 |

|

| 1 year | 8.01 | 9.27 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 1-year, 3-year, 5-year, and 10-year periods ended 10/31/10, there were 137, 130, 122, and 61 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Barclays Capital Aggregate Bond Index, was introduced on 12/31/75, and the fund’s Lipper category was introduced on 12/31/59. Both post-date the inception of the fund’s class A shares.

Fund price and distribution information For the 12-month period ended 10/31/10

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 12 | 12 | 12 | 12 | 12 | 12 |

|

| Income | $0.485 | $0.434 | $0.437 | $0.472 | $0.471 | $0.499 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.485 | $0.434 | $0.437 | $0.472 | $0.471 | $0.499 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 10/31/09 | $6.61 | $6.89 | $6.56 | $6.58 | $6.50 | $6.72 | $6.59 | $6.67 |

|

| 10/31/10 | 6.86 | 7.15 | 6.80 | 6.82 | 6.74 | 6.97 | 6.83 | 6.93 |

|

| Current yield (end of period) | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| Current dividend rate 1 | 6.65% | 6.38% | 6.00% | 5.98% | 6.59% | 6.37% | 6.50% | 6.75% |

|

| Current 30-day SEC yield | | | | | | | | |

| (with expense limitation) 2,3 | N/A | 5.23 | 4.70 | 4.70 | N/A | 5.03 | 5.20 | 5.69 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower.

3 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

11

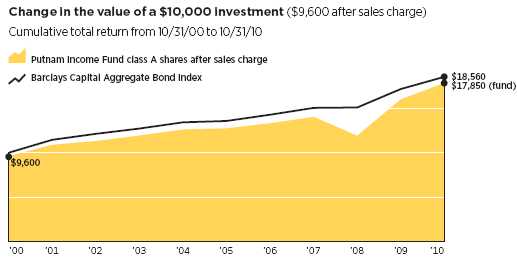

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $17,246 and $17,250, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,675 after sales charge) would have been valued at $17,535 at public offering price. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $18,139 and $19,045, respectively.

Fund performance as of most recent calendar quarter

Total return for periods ended 9/30/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/54) | (3/1/93) | (7/26/99) | (12/14/94) | (1/21/03) | (6/16/94) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.94% | 7.86% | 6.95% | 6.95% | 7.13% | 7.13% | 7.50% | 7.43% | 7.67% | 8.02% |

|

| 10 years | 85.79 | 78.45 | 72.37 | 72.37 | 72.41 | 72.41 | 81.16 | 75.30 | 81.33 | 90.36 |

| Annual average | 6.39 | 5.96 | 5.60 | 5.60 | 5.60 | 5.60 | 6.12 | 5.77 | 6.13 | 6.65 |

|

| 5 years | 39.11 | 33.61 | 33.80 | 31.80 | 33.86 | 33.86 | 37.31 | 32.77 | 37.24 | 40.81 |

| Annual average | 6.82 | 5.97 | 6.00 | 5.68 | 6.01 | 6.01 | 6.55 | 5.83 | 6.54 | 7.08 |

|

| 3 years | 28.28 | 23.17 | 25.22 | 22.22 | 25.28 | 25.28 | 27.23 | 23.16 | 27.22 | 29.15 |

| Annual average | 8.66 | 7.19 | 7.78 | 6.92 | 7.80 | 7.80 | 8.36 | 7.19 | 8.36 | 8.90 |

|

| 1 year | 14.75 | 10.15 | 13.84 | 8.84 | 13.85 | 12.85 | 14.63 | 10.96 | 14.58 | 15.19 |

|

12

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 10/31/09* | 0.95% | 1.70% | 1.70% | 1.20% | 1.20% | 0.70% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 10/31/10†‡ | 0.84% | 1.59% | 1.59% | 1.09% | 1.09% | 0.59% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Reflects projected expenses under a new management contract, effective 1/1/10, and a new expense arrangement. Excludes estimated interest expense accruing in connection with the termination of certain derivative contracts.

† Excludes the impact of a current period revision to interest expense related to the resolution of certain terminated derivative contracts.

‡ For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

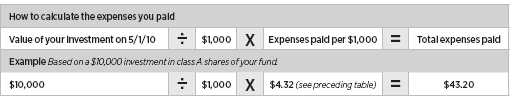

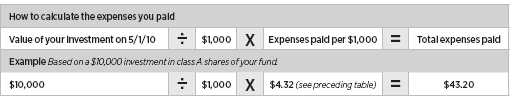

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in Putnam Income Fund from May 1, 2010, to October 31, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $4.32 | $8.16 | $8.16 | $5.60 | $5.60 | $3.04 |

|

| Ending value (after expenses) | $1,040.60 | $1,035.60 | $1,035.70 | $1,038.90 | $1,038.20 | $1,041.30 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended October 31, 2010, use the following calculation method. To find the value of your investment on May 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $4.28 | $8.08 | $8.08 | $5.55 | $5.55 | $3.01 |

|

| Ending value (after expenses) | $1,020.97 | $1,017.19 | $1,017.19 | $1,019.71 | $1,019.71 | $1,022.23 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

14

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

15

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2010, the Contract Committee met on a number of occasions with representatives of Putnam Management and in executive session to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. At the Trustees’ June 11, 2010 meeting, the Contract Committee recommended, and the Independent Trustees appro ved, the continuance of your fund’s management contract, and sub-management contracts, effective July 1, 2010. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing such services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in prior years.

Consideration of implementation of strategic pricing initiative

The Trustees were mindful that new management contracts had been implemented for all but a few funds at the beginning of 2010 as part of Putnam Management’s strategic pricing initiative. These new management contracts reflected the implementation of more competitive fee levels for many funds, complex-wide breakpoints for the open-end

16

funds and performance fees for some funds. The Trustees had approved these new management contracts on July 10, 2009 and submitted them to shareholder meetings of the affected funds in late 2009, where the contracts were in all cases approved by overwhelming majorities of the shares voted.

Because the management contracts had been implemented only recently, the Contract Committee had limited practical experience with the operation of the new fee structures. The financial data available to the Committee reflected actual operations under the prior contracts; information was also available on a pro forma basis, adjusted to reflect the fees payable under the new management contracts. In light of the limited information available regarding operations under the new management contracts, in recommending the continuation of the new management contracts in June 2010, the Contract Committee relied to a considerable extent on its review of the financial information and analysis that formed the basis of the Board’s approval of the new management contracts on July 10, 2009.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

As in the past, the Trustees continued to focus on the competitiveness of the total expense ratio of each fund. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement certain expense limitations. Most funds, including your fund, had sufficiently low expenses that these expense limitations did not apply. The expense limitations were: (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, taxes, brokerage commissions and extraordinary expenses). These expense limitations serve in parti cular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and funds with relatively small net assets.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 4th quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 3rd quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2009 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The Trustees also considered that your fund ranked in the 1st quintile in effective management fees, on a pro forma basis adjusted to reflect the i mpact of the strategic pricing initiative discussed above, as of December 31, 2009.

17

Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee observed that the complex-wide breakpoints of the open-end funds have only been in place for a short while, and the Trustees will examine the operation of this new breakpoint structure in future years in light of actual experience.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at c urrent asset levels, the fee schedules currently in place represented an appropriate sharing of economies of scale at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of such fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset clas ses are typically higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients, and did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which met on a regular basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable invest ment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s

18

performance with various benchmarks and with the performance of competitive funds.

The Committee noted the substantial improvement in the performance of most Putnam funds during 2009. The Committee also noted the disappointing investment performance of a number of the funds for periods ended December 31, 2009 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve performance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (Lipper Corporate Debt Funds —A-Rated) for the one-year, three-year and five-year periods ended December 31, 2009 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| | | |

| One-year period | 1st | | |

| | |

| Three-year period | 1st | | |

| | |

| Five-year period | 1st | | |

| | |

Over the one-year, three-year and five-year periods ended December 31, 2009, there were 154, 145 and 134 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered a change made, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policies commencing in 2010, which increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees noted that a portion of available soft dollars continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management contract, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

19

Other information for shareholders

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section at putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of October 31, 2010, Putnam employees had approximately $324,000,000 and the Trustees had approximately $68,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

20

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

21

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

Putnam Income Fund:

We have audited the accompanying statement of assets and liabilities of Putnam Income Fund (the fund), including the fund’s portfolio, as of October 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2010 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam Income Fund as of October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

December 16, 2010

22

| | |

| The fund’s portfolio 10/31/10 | | |

| |

| MORTGAGE-BACKED SECURITIES (41.2%)* | Principal amount | Value |

|

| Asset Securitization Corp. Ser. 96-MD6, Class A7, 8.335s, 2029 | $826,297 | $870,574 |

|

| Banc of America Commercial Mortgage, Inc. | | |

| FRB Ser. 07-3, Class A3, 5.658s, 2049 | 1,213,000 | 1,285,869 |

| Ser. 07-2, Class A2, 5.634s, 2049 | 5,096,002 | 5,255,075 |

| Ser. 06-4, Class A2, 5.522s, 2046 | 6,363,000 | 6,479,800 |

| Ser. 07-1, Class XW, IO, 0.285s, 2049 | 11,385,505 | 152,757 |

|

| Banc of America Commercial Mortgage, Inc. 144A | | |

| Ser. 02-PB2, Class XC, IO, 0.734s, 2035 | 25,786,161 | 193,409 |

| Ser. 04-4, Class XC, IO, 0.243s, 2042 | 30,580,940 | 483,506 |

| Ser. 04-5, Class XC, IO, 0.202s, 2041 | 52,602,484 | 734,557 |

| Ser. 06-5, Class XC, IO, 0.146s, 2016 | 97,518,289 | 1,510,939 |

| Ser. 05-1, Class XW, IO, 0.094s, 2042 | 316,267,836 | 358,110 |

| Ser. 07-5, Class XW, IO, 0.431s, 2051 | 23,210,034 | 436,936 |

|

| Banc of America Large Loan 144A FRB Ser. 05-MIB1, Class J, | | |

| 1.306s, 2022 | 1,095,000 | 700,800 |

|

| Bayview Commercial Asset Trust 144A | | |

| Ser. 07-5A, IO, 3.047s, 2037 | 6,696,232 | 704,444 |

| Ser. 05-3A, IO, 2.87s, 2035 | 7,648,336 | 353,353 |

| FRB Ser. 05-1A, Class A1, 0.556s, 2035 | 635,398 | 505,142 |

|

| Bear Stearns Commercial Mortgage Securities, Inc. | | |

| FRB Ser. 00-WF2, Class F, 8.251s, 2032 | 379,000 | 391,481 |

| Ser. 07-PW17, Class A3, 5.736s, 2050 | 15,217,000 | 16,002,197 |

| FRB Ser. 07-PW16, Class A2, 5.665s, 2040 | 1,921,000 | 1,984,335 |

| Ser. 04-PR3I, Class X1, IO, 0.303s, 2041 | 9,465,565 | 172,273 |

| Ser. 05-PWR9, Class X1, IO, 0.208s, 2042 | 38,686,009 | 350,495 |

|

| Bear Stearns Commercial Mortgage Securities, Inc. 144A | | |

| Ser. 06-PW14, Class XW, IO, 0.683s, 2038 | 16,883,851 | 506,516 |

| Ser. 06-PW14, Class X1, IO, 0.134s, 2038 | 16,129,633 | 266,139 |

| Ser. 07-PW15, Class X1, IO, 0.104s, 2044 | 47,641,139 | 364,931 |

| Ser. 05-PW10, Class X1, IO, 0.058s, 2040 | 62,634,758 | 117,753 |

|

| Bear Stearns Small Balance Commercial Trust 144A Ser. 06-1A, | | |

| Class AIO, IO, 1s, 2034 | 1,431,400 | 2,290 |

|

| Citigroup Commercial Mortgage Trust FRB Ser. 07-C6, Class A3, | | |

| 5.698s, 2049 | 5,593,000 | 5,971,915 |

|

| Citigroup Commercial Mortgage Trust 144A Ser. 06-C5, Class XC, | | |

| IO, 0.106s, 2049 | 95,526,332 | 1,271,455 |

|

| Citigroup Mortgage Loan Trust, Inc. FRB Ser. 06-AR7, Class 2A2A, | | |

| 5.38s, 2036 | 246,145 | 140,303 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust Ser. 07-CD4, | | |

| Class A2B, 5.205s, 2049 | 2,040,000 | 2,126,095 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust 144A | | |

| Ser. 07-CD4, Class XW, IO, 0.373s, 2049 | 56,442,018 | 942,582 |

| Ser. 07-CD4, Class XC, IO, 0 1/8s, 2049 | 69,858,336 | 575,633 |

| Ser. 06-CD2, Class X, IO, 0.079s, 2046 | 59,270,155 | 160,559 |

|

| Commercial Mortgage Acceptance Corp. 144A | | |

| Ser. 98-C1, Class F, 6.23s, 2031 | 1,028,234 | 1,080,320 |

| Ser. 98-C2, Class F, 5.44s, 2030 | 2,996,000 | 3,126,806 |

|

| Commercial Mortgage Loan Trust Ser. 08-LS1, Class A4B, | | |

| 6.014s, 2017 | 1,301,000 | 1,388,896 |

|

23

| | |

| MORTGAGE-BACKED SECURITIES (41.2%)* cont. | Principal amount | Value |

|

| Commercial Mortgage Pass-Through Certificates 144A | | |

| Ser. 05-LP5, Class XC, IO, 0.185s, 2043 | $30,325,350 | $297,149 |

| Ser. 06-C8, Class XS, IO, 0.14s, 2046 | 66,746,532 | 682,051 |

| Ser. 05-C6, Class XC, IO, 0.059s, 2044 | 52,184,481 | 291,785 |

|

| Countrywide Alternative Loan Trust | | |

| Ser. 06-2CB, Class A11, 6s, 2036 | 8,811,106 | 5,964,017 |

| Ser. 07-HY5R, Class 2A1A, 5.544s, 2047 | 1,222,403 | 1,197,955 |

|

| Countrywide Home Loans | | |

| FRB Ser. 05-HYB7, Class 6A1, 5.514s, 2035 | 52,849 | 40,694 |

| FRB Ser. 05-HYB4, Class 2A1, 2.915s, 2035 | 1,988,991 | 1,432,074 |

|

| Countrywide Home Loans 144A | | |

| IFB Ser. 05-R2, Class 2A3, 8s, 2035 | 344,471 | 313,469 |

| Ser. 04-R2, Class 1AS, IO, 5.656s, 2034 | 10,611,355 | 1,540,456 |

| IFB Ser. 05-R1, Class 1AS, IO, 5.655s, 2035 | 11,378,034 | 1,659,272 |

| Ser. 06-R2, Class AS, IO, 5.528s, 2036 | 5,584,034 | 684,044 |

| Ser. 05-R3, Class AS, IO, 5.506s, 2035 | 38,197,616 | 5,061,184 |

| Ser. 06-R1, Class AS, IO, 5.471s, 2036 | 2,697,006 | 300,042 |

| Ser. 05-R2, Class 1AS, IO, 5.303s, 2035 | 23,132,676 | 3,122,373 |

| FRB Ser. 04-R2, Class 1AF1, 0.676s, 2034 | 10,541,581 | 8,854,928 |

| FRB Ser. 05-R3, Class AF, 0.656s, 2035 | 683,909 | 581,323 |

|

| Credit Suisse Mortgage Capital Certificates | | |

| FRB Ser. 08-C1, Class A2, 6.214s, 2041 | 2,834,000 | 2,978,429 |

| FRB Ser. 07-C4, Class A2, 5.805s, 2039 | 4,383,000 | 4,553,390 |

| FRB Ser. 07-C3, Class A2, 5.721s, 2039 | 6,673,145 | 6,888,300 |

| Ser. 07-C5, Class AAB, 5.62s, 2040 | 4,243,000 | 4,552,341 |

| Ser. 07-C2, Class A2, 5.448s, 2049 | 1,980,000 | 2,031,955 |

| Ser. 07-C1, Class AAB, 5.336s, 2040 | 4,975,000 | 5,261,560 |

| Ser. 06-C5, Class AX, IO, 0.141s, 2039 | 30,572,209 | 470,139 |

|

| Credit Suisse Mortgage Capital Certificates 144A | | |

| Ser. 06-C4, Class AX, IO, 0.168s, 2039 | 61,522,978 | 865,825 |

| Ser. 07-C2, Class AX, IO, 0.108s, 2049 | 95,295,151 | 611,414 |

| Ser. 07-C1, Class AX, IO, 0.09s, 2040 | 113,405,292 | 819,807 |

|

| CS First Boston Mortgage Securities Corp. | | |

| FRB Ser. 04-C3, Class A5, 5.113s, 2036 | 39,000 | 41,681 |

| Ser. 04-C3, Class A3, 4.302s, 2036 | 8,864 | 8,857 |

|

| CS First Boston Mortgage Securities Corp. 144A | | |

| Ser. 03-C3, Class AX, IO, 1.735s, 2038 | 68,155,241 | 2,442,432 |

| Ser. 02-CP3, Class AX, IO, 1.409s, 2035 | 28,558,703 | 529,730 |

| FRB Ser. 04-TF2A, Class J, 1.206s, 2016 | 254,000 | 243,840 |

| FRB Ser. 04-TF2A, Class H, 0.956s, 2019 | 495,000 | 490,050 |

| Ser. 01-CK1, Class AY, IO, 0.725s, 2035 | 10,460,671 | 837 |

| Ser. 04-C4, Class AX, IO, 0.379s, 2039 | 7,576,300 | 172,140 |

|

| CWCapital Cobalt Ser. 07-C2, Class A2, 5.334s, 2047 | 3,287,330 | 3,422,830 |

|

| DLJ Commercial Mortgage Corp. 144A | | |

| Ser. 99-CG2, Class B3, 6.1s, 2032 | 716,749 | 716,695 |

| Ser. 99-CG2, Class B4, 6.1s, 2032 | 2,084,000 | 2,083,842 |

|

| Federal National Mortgage Association | | |

| IFB Ser. 10-129, Class PS, IO, 6.444s, 2038 | 29,628,000 | 4,343,791 |

| IFB Ser. 10-100, Class QS, IO, 6.394s, 2040 | 18,484,267 | 3,151,855 |

| IFB Ser. 10-102, Class S, IO, 6.294s, 2040 | 28,140,109 | 4,361,717 |

| IFB Ser. 10-35, Class SG, IO, 6.144s, 2040 | 46,468,149 | 6,800,149 |

24

| | |

| MORTGAGE-BACKED SECURITIES (41.2%)* cont. | Principal amount | Value |

|

| Federal National Mortgage Association | | |

| IFB Ser. 10-110, Class SB, IO, 5.744s, 2040 | $15,634,012 | $2,158,744 |

| Ser. 10-67, Class BI, IO, 5 1/2s, 2025 | 17,075,062 | 1,878,257 |

| Ser. 10-98, Class DI, IO, 5s, 2040 | 4,058,254 | 657,397 |

| Ser. 10-100, Class AI, IO, 4 1/2s, 2025 | 43,618,594 | 3,135,086 |

| IFB Ser. 07-75, Class JS, 50.31s, 2037 | 1,306,479 | 2,493,598 |

| IFB Ser. 06-62, Class PS, 38.363s, 2036 | 2,559,147 | 4,357,267 |

| IFB Ser. 07-30, Class FS, 28.641s, 2037 | 1,448,715 | 2,397,463 |

| IFB Ser. 06-49, Class SE, 27.975s, 2036 | 2,693,654 | 4,273,994 |

| IFB Ser. 05-25, Class PS, 27.033s, 2035 | 65,206 | 102,413 |

| IFB Ser. 06-115, Class ES, 25.535s, 2036 | 960,504 | 1,457,574 |

| IFB Ser. 06-8, Class HP, 23.627s, 2036 | 1,281,103 | 1,967,992 |

| IFB Ser. 05-74, Class DM, 23.444s, 2035 | 1,166,064 | 1,728,741 |

| IFB Ser. 05-45, Class DC, 23.37s, 2035 | 1,081,796 | 1,668,116 |

| IFB Ser. 05-95, Class OP, 19.564s, 2035 | 599,052 | 899,205 |

| IFB Ser. 05-106, Class JC, 19.329s, 2035 | 1,178,651 | 1,679,378 |

| IFB Ser. 05-83, Class QP, 16.728s, 2034 | 299,168 | 390,433 |

| IFB Ser. 03-W6, Class 5S, IO, 7.344s, 2042 | 6,211,281 | 1,271,555 |

| IFB Ser. 06-24, Class QS, IO, 6.944s, 2036 | 2,527,915 | 468,701 |

| IFB Ser. 03-76, Class SB, IO, 6.794s, 2033 | 29,533,624 | 4,367,993 |

| IFB Ser. 07-58, Class SP, IO, 6.494s, 2037 | 1,439,315 | 261,079 |

| IFB Ser. 07-24, Class SD, IO, 6.494s, 2037 | 5,324,328 | 800,939 |

| IFB Ser. 06-23, Class SP, IO, 6.444s, 2036 | 4,657,742 | 738,112 |

| IFB Ser. 06-116, Class LS, IO, 6.394s, 2036 | 147,346 | 23,711 |

| IFB Ser. 04-92, Class SQ, IO, 6.394s, 2034 | 105,193 | 16,302 |

| IFB Ser. 06-103, Class SB, IO, 6.344s, 2036 | 3,967,877 | 539,834 |

| IFB Ser. 07-89, Class SA, IO, 6.174s, 2037 | 4,873,123 | 691,374 |

| IFB Ser. 10-2, Class SD, IO, 6.044s, 2040 | 2,555,744 | 276,315 |

| IFB Ser. 08-11, Class SC, IO, 6.024s, 2038 | 233,257 | 34,816 |

| IFB Ser. 07-30, Class UI, IO, 5.844s, 2037 | 1,643,261 | 221,702 |

| Ser. 06-W3, Class 1AS, IO, 5.773s, 2046 | 10,604,330 | 1,607,609 |

| Ser. 06-W2, Class 1AS, IO, 5.771s, 2036 | 1,974,709 | 229,560 |

| IFB Ser. 05-W2, Class A2, IO, 4.954s, 2035 | 8,083,083 | 981,444 |

| Ser. 03-W12, Class 2, IO, 2.23s, 2043 | 9,431,808 | 721,319 |

| Ser. 03-W10, Class 3, IO, 1.781s, 2043 | 3,227,049 | 208,499 |

| Ser. 03-W10, Class 1, IO, 1.665s, 2043 | 13,697,518 | 796,856 |

| Ser. 03-W8, Class 12, IO, 1.64s, 2042 | 37,014,791 | 1,714,468 |

| Ser. 03-W17, Class 12, IO, 1.137s, 2033 | 4,348,691 | 172,943 |

| Ser. 03-W19, IO, 1.086s, 2033 | 796,310 | 17,026 |

| Ser. 03-T2, Class 2, IO, 0.811s, 2042 | 32,792,753 | 887,605 |

| Ser. 03-W3, Class 2IO1, IO, 0.673s, 2042 | 9,630,862 | 137,991 |

| Ser. 03-W6, Class 51, IO, 0.654s, 2042 | 6,535,159 | 128,548 |

| Ser. 03-18, Class X1, IO, 0.64s, 2042 | 11,198,540 | 244,641 |

| Ser. 03-W10, Class 3A, IO, 0.601s, 2043 | 324,102 | 7,075 |

| Ser. 01-T12, Class IO, 0.565s, 2041 | 11,548,643 | 237,289 |

| Ser. 03-W10, Class 1A, IO, 0.495s, 2043 | 270,690 | 5,218 |

| Ser. 03-W2, Class 1, IO, 0.465s, 2042 | 13,087,757 | 100,839 |

| Ser. 03-W3, Class 1, IO, 0.443s, 2042 | 8,774,445 | 92,763 |

| Ser. 02-T4, IO, 0.443s, 2041 | 6,381,402 | 109,680 |

| Ser. 02-T1, Class IO, IO, 0.423s, 2031 | 10,162,631 | 152,290 |

| Ser. 01-50, Class B1, IO, 0.405s, 2041 | 1,463,105 | 19,133 |

25

| | |

| MORTGAGE-BACKED SECURITIES (41.2%)* cont. | Principal amount | Value |

|

| Federal National Mortgage Association | | |

| Ser. 03-W6, Class 3, IO, 0.368s, 2042 | $9,142,811 | $103,571 |

| Ser. 03-W6, Class 23, IO, 0.35s, 2042 | 9,554,515 | 106,567 |

| Ser. 03-34, Class P1, PO, zero %, 2043 | 293,447 | 228,888 |

| Ser. 07-64, Class LO, PO, zero %, 2037 | 361,790 | 339,562 |

| Ser. 07-14, Class KO, PO, zero %, 2037 | 756,652 | 674,881 |

| Ser. 06-125, Class OX, PO, zero %, 2037 | 190,938 | 174,866 |

| Ser. 06-84, Class OT, PO, zero %, 2036 | 150,203 | 138,497 |

| Ser. 06-46, Class OC, PO, zero %, 2036 | 107,285 | 95,415 |

| Ser. 05-50, Class LO, PO, zero %, 2035 | 9,146 | 9,058 |

| Ser. 04-61, Class CO, PO, zero %, 2031 | 740,482 | 729,349 |

| FRB Ser. 06-115, Class SN, zero %, 2036 | 642,622 | 594,318 |

| FRB Ser. 06-104, Class EK, zero %, 2036 | 59,268 | 56,491 |

| FRB Ser. 05-117, Class GF, zero %, 2036 | 26,530 | 26,079 |

| FRB Ser. 05-36, Class QA, zero %, 2035 | 24,794 | 24,605 |

| FRB Ser. 06-1, Class HF, zero %, 2032 | 29,611 | 27,731 |

| IFB Ser. 06-48, Class FG, zero %, 2036 | 264,235 | 263,215 |

|

| First Union National Bank-Bank of America Commercial Mortgage | | |

| 144A Ser. 01-C1, Class 3, IO, 1.524s, 2033 | 8,026,748 | 5,272 |

|

| First Union-Lehman Brothers Commercial Mortgage Trust II | | |

| Ser. 97-C2, Class F, 7 1/2s, 2029 | 2,112,000 | 2,292,283 |

| Ser. 97-C2, Class G, 7 1/2s, 2029 | 696,000 | 771,029 |

|

| Federal Home Loan Mortgage Corp. | | |

| IFB Ser. T-56, Class 2ASI, IO, 7.844s, 2043 | 1,197,876 | 243,681 |

| IFB Ser. T-56, Class 3ASI, IO, 7.244s, 2043 | 937,245 | 194,675 |

| Ser. T-56, Class A, IO, 0.104s, 2043 | 15,919,437 | 302,041 |

| Ser. T-56, Class 1, IO, zero %, 2043 | 19,254,174 | 26,204 |

| Ser. T-56, Class 2, IO, zero %, 2043 | 6,736,202 | 480 |

| Ser. T-56, Class 3, IO, zero %, 2043 | 5,469,979 | 995 |

| IFB Ser. 3182, Class PS, 27.575s, 2032 | 1,325,246 | 2,053,382 |

| IFB Ser. 3408, Class EK, 24.762s, 2037 | 2,645,273 | 3,887,745 |

| IFB Ser. 2976, Class LC, 23.48s, 2035 | 323,524 | 500,434 |

| IFB Ser. 2976, Class KL, 23.444s, 2035 | 1,350,298 | 2,064,404 |

| IFB Ser. 2979, Class AS, 23.334s, 2034 | 302,650 | 435,493 |

| IFB Ser. 3065, Class DC, 19.091s, 2035 | 1,267,535 | 1,793,954 |

| IFB Ser. 3105, Class SI, IO, 18.958s, 2036 | 325,115 | 168,010 |

| IFB Ser. 2990, Class LB, 16.291s, 2034 | 1,368,786 | 1,801,583 |

| IFB Ser. 3184, Class SP, IO, 7.094s, 2033 | 2,028,511 | 224,897 |

| IFB Ser. 3110, Class SP, IO, 7.044s, 2035 | 2,999,865 | 568,384 |

| IFB Ser. 3149, Class SE, IO, 6.894s, 2036 | 1,664,728 | 323,390 |

| IFB Ser. 3157, Class SA, IO, 6.894s, 2036 | 4,344,131 | 828,773 |

| IFB Ser. 3208, Class PS, IO, 6.844s, 2036 | 13,912,325 | 2,173,540 |

| IFB Ser. 3287, Class SE, IO, 6.444s, 2037 | 5,332,177 | 842,377 |

| IFB Ser. 3117, Class SI, IO, 6.444s, 2036 | 37,576,163 | 6,012,186 |

| IFB Ser. 3031, Class BI, IO, 6.434s, 2035 | 1,066,092 | 194,500 |

| IFB Ser. 3240, Class SM, IO, 6.394s, 2036 | 4,573,037 | 668,624 |

| IFB Ser. 3147, Class SD, IO, 6.394s, 2036 | 5,954,618 | 840,904 |

| IFB Ser. 3398, Class SI, IO, 6.394s, 2036 | 5,217,733 | 683,262 |

| IFB Ser. 3065, Class DI, IO, 6.364s, 2035 | 794,817 | 132,560 |

| IFB Ser. 3145, Class GI, IO, 6.344s, 2036 | 2,883,824 | 446,827 |

| IFB Ser. 3114, Class IP, IO, 6.344s, 2036 | 2,802,901 | 417,156 |

26

| | |

| MORTGAGE-BACKED SECURITIES (41.2%)* cont. | Principal amount | Value |

|

| Federal National Mortgage Association | | |

| IFB Ser. 3677, Class KS, IO, 6.294s, 2040 | $11,668,501 | $1,749,939 |

| IFB Ser. 3485, Class SI, IO, 6.294s, 2036 | 1,819,516 | 297,327 |

| IFB Ser. 3349, Class AS, IO, 6.244s, 2037 | 11,808,414 | 1,777,520 |

| IFB Ser. 3510, Class IA, IO, 6.244s, 2037 | 3,595,776 | 500,892 |

| IFB Ser. 3171, Class ST, IO, 6.229s, 2036 | 4,515,199 | 733,720 |

| IFB Ser. 3308, Class SA, IO, 6.194s, 2037 | 18,870,156 | 2,712,774 |

| IFB Ser. 3199, Class S, IO, 6.194s, 2036 | 1,218,528 | 188,616 |

| IFB Ser. 3265, Class SC, IO, 6.154s, 2037 | 739,525 | 105,449 |

| IFB Ser. 3502, Class DS, IO, 5.894s, 2039 | 687,239 | 84,298 |

| IFB Ser. 3303, Class SD, IO, 5.834s, 2037 | 1,705,664 | 207,297 |

| IFB Ser. 3309, Class SG, IO, 5.814s, 2037 | 4,629,308 | 620,617 |

| IFB Ser. 3725, Class CS, IO, 5.744s, 2040 | 49,823,879 | 7,163,179 |

| Ser. 3672, Class PI, IO, 5 1/2s, 2039 | 7,849,772 | 1,493,655 |

| Ser. 3707, Class IK, IO, 5s, 2040 | 2,527,677 | 435,089 |

| Ser. 3645, Class ID, IO, 5s, 2040 | 570,640 | 82,788 |

| Ser. 3632, Class CI, IO, 5s, 2038 | 732,082 | 109,637 |

| Ser. 3626, Class DI, IO, 5s, 2037 | 538,898 | 52,004 |

| Ser. 3623, Class CI, IO, 5s, 2036 | 481,955 | 45,786 |

| Ser. 3751, Class SB, IO, 4 1/2s, 2040 D | 21,669,000 | 3,060,096 |

| Ser. 3707, Class PI, IO, 4 1/2s, 2025 | 22,991,120 | 1,924,587 |

| Ser. 3736, Class QI, IO, 4s, 2034 | 15,157,000 | 1,581,936 |

| Ser. 3740, Class KI, IO, 4s, 2033 | 21,266,000 | 2,298,217 |

| Ser. 3692, Class KI, IO, 4s, 2024 | 95,058,164 | 4,515,263 |

| Ser. 3707, Class HI, IO, 4s, 2023 | 6,716,990 | 484,899 |

| Ser. 3369, Class BO, PO, zero %, 2037 | 99,852 | 91,775 |

| Ser. 3327, Class IF, IO, zero %, 2037 | 150,264 | 1,634 |

| Ser. 3369, PO, zero %, 2037 | 45,796 | 44,924 |

| Ser. 3391, PO, zero %, 2037 | 198,705 | 168,824 |

| Ser. 3300, PO, zero %, 2037 | 1,813,652 | 1,657,352 |

| Ser. 3206, Class EO, PO, zero %, 2036 | 69,165 | 61,241 |

| Ser. 3175, Class MO, PO, zero %, 2036 | 199,596 | 175,309 |

| Ser. 3210, PO, zero %, 2036 | 55,898 | 50,160 |

| Ser. 3145, Class KO, PO, zero %, 2034 | 18,280 | 17,412 |

| FRB Ser. 3349, Class DO, zero %, 2037 | 6,075 | 6,068 |

| FRB Ser. 3326, Class YF, zero %, 2037 | 157,922 | 155,156 |

| FRB Ser. 3263, Class TA, zero %, 2037 | 53,151 | 52,965 |

| FRB Ser. 3147, Class SF, zero %, 2036 | 315,704 | 275,020 |

| FRB Ser. 3117, Class AF, zero %, 2036 | 73,907 | 60,726 |

| FRB Ser. 3047, Class BD, zero %, 2035 | 81,171 | 80,060 |

| FRB Ser. 3326, Class WF, zero %, 2035 | 316,506 | 305,724 |

| FRB Ser. 3033, Class YF, zero %, 2035 | 100,966 | 96,990 |

| FRB Ser. 3036, Class AS, zero %, 2035 | 104,801 | 84,004 |

| FRB Ser. 3251, Class TP, zero %, 2035 | 38,776 | 38,547 |

| FRB Ser. 3003, Class XF, zero %, 2035 | 593,506 | 585,622 |

| FRB Ser. 2947, Class GF, zero %, 2034 | 52,692 | 52,294 |

|

| GE Capital Commercial Mortgage Corp. 144A | | |

| Ser. 05-C2, Class XC, IO, 0.119s, 2043 | 54,296,222 | 446,315 |

| Ser. 07-C1, Class XC, IO, 0.075s, 2049 | 136,675,714 | 712,996 |

| Ser. 05-C3, Class XC, IO, 0.068s, 2045 | 130,903,440 | 654,018 |

|

27

| | |

| MORTGAGE-BACKED SECURITIES (41.2%)* cont. | Principal amount | Value |

|

| GMAC Commercial Mortgage Securities, Inc. | | |

| Ser. 97-C1, Class X, IO, 1.274s, 2029 | $4,592,705 | $188,396 |

| Ser. 05-C1, Class X1, IO, 0.371s, 2043 | 40,008,982 | 525,322 |

|

| GMAC Commercial Mortgage Securities, Inc. 144A | | |

| Ser. 99-C3, Class G, 6.974s, 2036 | 357,120 | 285,696 |

| Ser. 06-C1, Class XC, IO, 0.09s, 2045 | 123,245,760 | 608,148 |

|

| Government National Mortgage Association | | |

| IFB Ser. 09-77, Class CS, IO, 6.744s, 2038 | 20,371,011 | 2,907,025 |

| IFB Ser. 10-98, Class CS, IO, 6.444s, 2038 | 5,052,706 | 849,815 |

| IFB Ser. 10-98, Class SA, IO, 6.444s, 2038 | 4,888,188 | 818,576 |

| IFB Ser. 10-32, Class SP, IO, 6.444s, 2036 | 6,735,913 | 789,516 |

| IFB Ser. 10-125, Class CS, IO, 6.394s, 2040 | 13,314,882 | 2,166,789 |

| IFB Ser. 10-85, Class SA, IO, 6.394s, 2040 | 2,108,829 | 335,220 |

| IFB Ser. 10-85, Class AS, IO, 6.394s, 2039 | 6,919,561 | 1,059,385 |

| IFB Ser. 10-113, Class AS, IO, 6.394s, 2039 | 4,896,769 | 832,745 |

| IFB Ser. 10-125, Class ES, IO, 6.394s, 2039 | 35,744,955 | 5,910,484 |

| IFB Ser. 10-85, Class SD, IO, 6.394s, 2038 | 4,619,760 | 702,850 |

| IFB Ser. 10-98, Class QS, IO, 6.344s, 2040 | 6,551,710 | 1,004,115 |

| IFB Ser. 10-98, Class YS, IO, 6.344s, 2039 | 6,776,111 | 1,027,597 |

| IFB Ser. 10-47, Class HS, IO, 6.344s, 2039 | 3,147,623 | 495,404 |

| IFB Ser. 10-68, Class SD, 6.324s, 2040 | 73,443,089 | 11,203,509 |

| IFB Ser. 10-42, Class SM, IO, 6.294s, 2039 | 36,518,317 | 6,200,242 |

| IFB Ser. 10-60, Class S, IO, 6.244s, 2040 | 12,726,187 | 1,741,070 |

| IFB Ser. 10-50, Class LS, IO, 6.244s, 2040 | 19,783,370 | 2,675,701 |

| IFB Ser. 10-53, Class SA, IO, 6.244s, 2039 | 24,241,948 | 3,470,211 |

| IFB Ser. 10-2, Class SA, IO, 6.244s, 2037 | 7,382,498 | 929,235 |

| IFB Ser. 09-101, Class SB, IO, 6.194s, 2039 | 18,360,748 | 2,021,886 |

| IFB Ser. 09-35, Class SP, IO, 6.144s, 2037 | 6,676,637 | 772,220 |

| IFB Ser. 10-20, Class SE, IO, 5.994s, 2040 | 66,919,230 | 8,442,530 |

| IFB Ser. 09-58, Class SG, IO, 5.844s, 2039 | 17,053,960 | 1,676,575 |

| IFB Ser. 10-115, Class SN, IO, 5.844s, 2038 | 15,553,335 | 2,328,140 |

| IFB Ser. 10-116, Class JS, IO, 5.794s, 2039 | 39,419,572 | 6,019,481 |

| IFB Ser. 10-113, Class BS, IO, 5.744s, 2040 | 46,833,373 | 5,820,452 |

| IFB Ser. 10-37, Class US, IO, 5.744s, 2039 | 19,948,833 | 2,656,570 |

| IFB Ser. 10-68, Class MS, IO, 5.594s, 2040 | 13,588,863 | 1,629,851 |

| IFB Ser. 10-62, Class SE, IO, 5.494s, 2040 | 27,516,762 | 3,177,636 |

| IFB Ser. 10-20, Class SD, IO, 5.424s, 2040 | 12,752,063 | 1,620,277 |

| Ser. 10-70, Class PI, IO, 5s, 2039 | 23,552,380 | 2,737,964 |

| Ser. 10-101, Class GI, IO, 4 1/2s, 2038 | 12,229,027 | 1,785,555 |

| Ser. 10-109, Class CI, IO, 4 1/2s, 2037 | 29,056,732 | 4,213,226 |

| Ser. 06-36, Class OD, PO, zero %, 2036 | 153,211 | 143,512 |

| Ser. 99-31, Class MP, PO, zero %, 2029 | 50,473 | 46,282 |

| FRB Ser. 07-73, Class KI, IO, zero %, 2037 | 2,511,849 | 10,618 |

| FRB Ser. 07-73, Class KM, zero %, 2037 | 252,321 | 231,290 |

| FRB Ser. 07-35, Class UF, zero %, 2037 | 66,118 | 64,582 |

|

| Greenwich Capital Commercial Funding Corp. | | |

| Ser. 05-GG5, Class A2, 5.117s, 2037 | 962,231 | 972,704 |

| Ser. 05-GG5, Class XC, IO, 0.122s, 2037 | 339,611,642 | 907,069 |

|

| Greenwich Capital Commercial Funding Corp. 144A Ser. 05-GG3, | | |

| Class XC, IO, 0.384s, 2042 | 59,737,360 | 950,206 |

|

28

| | |