| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-00159) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investors Fund |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | July 31, 2014 |

| | |

| Date of reporting period: | August 1, 2013 — January 31, 2014 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Investors

Fund

Semiannual report

1 | 31 | 14

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 12 | | |

| | |

| Terms and definitions | 14 | | |

| | |

| Other information for shareholders | 15 | | |

| | |

| Trustee approval of management contract | 16 | | |

| | |

| Financial statements | 22 | | |

| | |

| Shareholder meeting results | 48 | | |

| | |

Consider these risks before investing: Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. You can lose money by investing in the fund.

Message from the Trustees

Dear Fellow Shareholder:

In early 2014, stock prices fluctuated while most bond markets advanced, reversing the trends that dominated the two asset classes during 2013. Although the economic recovery appears to remain intact and previous market forces may re-emerge, the shift in short-term trends reminds investors once again about the value of portfolio diversification.

In this environment, we believe Putnam’s commitment to active fundamental research and taking a proactive view about risk is well suited to uncovering attractive investment opportunities.

We are pleased to report that this focus continues to earn Putnam high marks among industry peers. In 2013 — and for the third time in five years — Barron’s ranked Putnam one of the top two mutual fund families based on total returns across asset classes.

Lastly, for guidance on today’s markets, we also believe that you are well served by consulting with your financial advisor, who can help you assess your individual needs, time horizon, and risk tolerance — crucial for guiding you toward your investment goals.

As always, thank you for investing with Putnam.

About the fund

Investing in America’s large, growing companies

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark and Lipper category, the Standard & Poor’s 500 Index and Lipper Large-Cap Core Funds category, were introduced on 3/4/57 and 12/31/59, respectively, which post-date the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

Interview with your fund’s portfolio manager

Jerry, how would you describe conditions for stock market investors during the six months ended January 31, 2014?

With the exception of the closing month, stocks continued their impressive advance during the period. The U.S. stock market, as measured by the S&P 500 Index, achieved and surpassed record highs several times, interrupted by only a few bouts of volatility. In October, the market endured some turbulence with a sharp but brief downturn in response to congressional debt ceiling wrangling, which led to a 16-day partial shutdown of the federal government. And although investors remained anxious about the Federal Reserve’s plans to begin tapering its bond-buying program, the market responded favorably in late December when the Fed announced its first modest reduction in asset purchases. The market closed out the 2013 calendar year with double-digit returns. In January, however — the final month of the semiannual period — stocks retreated, with the S&P 500 Index declining by 3.5% for the month. It was the sharpest one-month decline for U.S. stocks since May 2012.

How did the fund perform during the period?

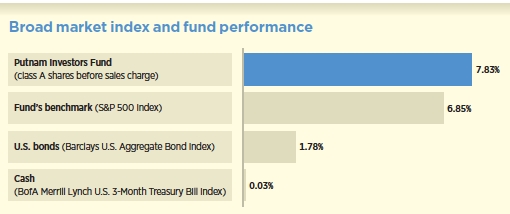

I am pleased to report that the fund outperformed its benchmark, the S&P 500 Index, as well as the average return for funds in its Lipper peer group, Large-Cap Core Funds.

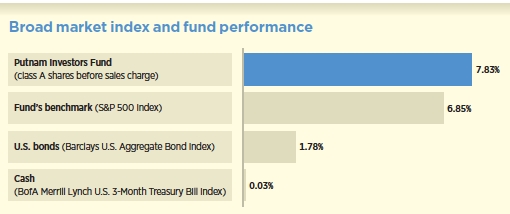

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/14. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 14.

In seeking future opportunities for the fund, are you focusing on any particular areas of the market or themes?

For some time, I have maintained overweight positions in three areas — automotive, aerospace/defense, and airlines. In the automotive sector, we have seen a considerable recovery, and I believe that in some markets, such as Europe, that recovery is still in its early stages. This has presented attractive opportunities in areas ranging from auto parts suppliers to the largest automobile manufacturers. In my view, the automotive recovery cycle still has “legs” — stocks related to the automotive sector continue to look attractive from both a valuation perspective and a cyclical perspective.

Aerospace/defense is an area many investors have avoided due to the defense spending cuts that resulted from the U.S. federal budget sequester. However, we employ fundamental research to identify companies that, in our view, are less vulnerable. We seek those that are well managed in terms of capital deployment and that have shown the ability to thrive despite budget constraints. Although many defense stocks delivered strong returns throughout 2013, I believe the sector will continue to offer opportunities in 2014. The same is true for airlines, an industry in which stocks have advanced due to a wave of restructuring and consolidation.

Another interesting aspect to all these industries is that a number of companies are coming out of bankruptcy. In many investors’ eyes, this means the businesses are “tainted.” To me, they offer opportunities, because many companies emerge from bankruptcy with new managements, better discipline, clean balance sheets, and a stronger commitment to success.

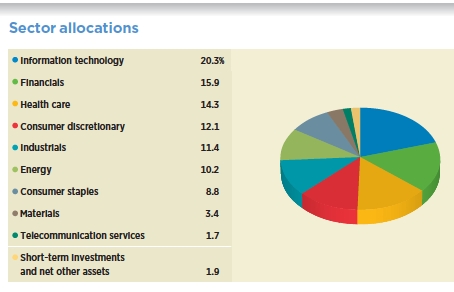

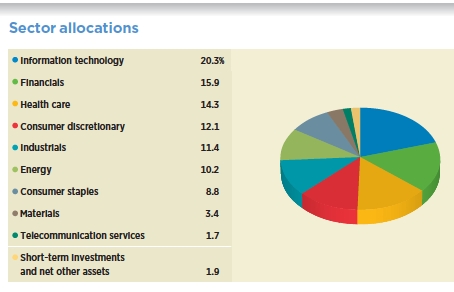

Allocations are shown as a percentage of the fund’s net assets as of 1/31/14. Short-term investments and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

Within the fund’s portfolio, what are some stocks that made a positive contribution to performance for the six-month period?

My strategy of maintaining overweight positions in defense stocks had a considerable positive impact on fund returns during this period. Three defense companies — Northrop Grumman, Raytheon, and L-3 Communications — were among the top contributors to fund performance.

The best-performing fund holding was Amira Nature Foods, a Dubai-based seller of packaged Indian specialty rice. The company drew our interest with its initial public offering [IPO] in October 2012. However, post-IPO, the company’s ownership structure raised accountability concerns, sending the stock price lower. Since that time, the company has delivered strong earnings growth, and Amira’s share price rose considerably in the past six months as investors began to take note of its fundamental strengths. I believe Amira continues to offer expertise in a niche market with attractive growth potential, and the stock remained in the portfolio at the close of the period.

Could you discuss some holdings that detracted from fund returns?

The stock of Iridium, a provider of mobile voice and data communications, declined as the company missed revenue and earnings estimates and lowered its growth expectations. Despite its setbacks, I believe Iridium offers attractive long-term growth potential due to its expertise and focus on global

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 1/31/14. Short-term holdings and derivatives, if any, are excluded. Holdings may vary over time.

satellite communications. I continued to hold Iridium in the portfolio at the close of the period.

Also dampening fund performance for the period was Cisco Systems, a large technology company that is struggling to grow sufficiently in a high-growth sector. Investors have been concerned about Cisco’s declining revenue and weaker growth forecasts. I continued to maintain a position in Cisco at the close of the period because I believe it is an attractively priced stock with continued long-term growth prospects.

Finally, the stock of retailer Target was a detractor for the period, primarily due to the data breach that affected more than 40 million credit and debit cards of store customers. The stock hit a 52-week low in late January as the company struggled with disappointing sales and investors considered the costs involved with addressing the security issues.

As the fund enters the second half of its fiscal year, what is your outlook?

My outlook is determined in part by whether I can still find stocks that interest me as candidates for the fund’s portfolio. Although compellingly priced stocks are not as abundant as they were a few quarters ago, there are plenty that I believe are worth buying. The market continues to offer a reasonable price/earnings multiple, in my view, and I see potential for further earnings growth for U.S. businesses.

Although the market has achieved record highs and I’ve been fairly bullish for over a year, I believe stocks still have room to advance. Investors are finding few attractive alternatives to U.S. stocks, and the market’s recent strength is likely to attract additional

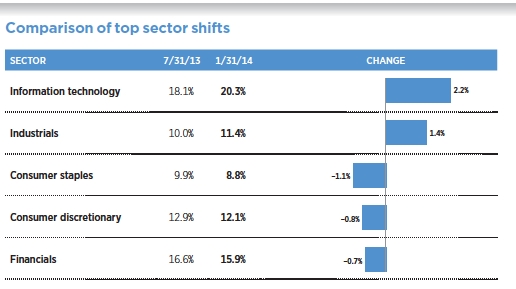

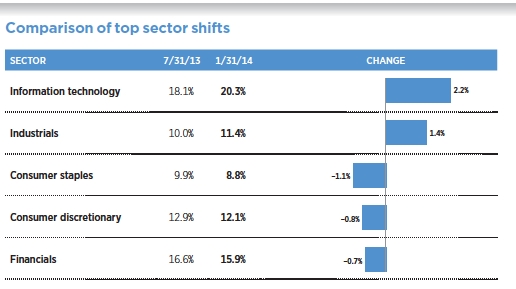

This chart shows the fund’s largest allocation shifts, by percentage, over the past six months. Allocations are shown as a percentage of the fund’s net assets. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

money into stocks, particularly from bonds and emerging markets. Of course, while I do not believe the market is near bubble territory yet, we remain vigilant about the potential for setbacks — such as the one in January — after the market’s extraordinary run.

Thank you, Jerry, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Gerard P. Sullivan has an M.B.A. from the Columbia University Graduate School of Business and a B.A. from Columbia University. Jerry joined Putnam in 2008 and has been in the investment industry since 1982.

IN THE NEWS

The U.S. federal deficit this year will dip to its lowest level since 2007, but the trend may be short-lived. The Congressional Budget Office (CBO) has projected that the U.S. deficit will fall to $514 billion by the end of the current fiscal year on September 30, 2014, down from $680 billion last fiscal year and the recent peak of $1.4 trillion in 2009. Government spending cuts, tax hikes, and the overall economic expansion all helped to lower the deficit, which has been the focus of intense political debate in Washington. However, in coming years as baby boomers age, spending will accelerate on such government programs as Medicare and Social Security, widening the deficit. Without more robust economic growth, spending for Social Security, Medicare (including offsetting receipts), Medicaid, the Children’s Health Insurance Program, and subsidies for health insurance purchased through exchanges will rise from 9.7% of GDP in 2014 to 11.7% in 2024, the CBO estimates.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2014, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R5, R6, and Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 1/31/14

| | | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| (inception dates) | (12/1/25) | (3/1/93) | (7/26/99) | (12/2/94) | (1/21/03) | (7/2/12) | (7/2/12) | (1/7/97) |

|

| | Before | After | | | | | Before | After | Net | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value | value |

|

| Annual average | | | | | | | | | | | | |

| (life of fund) | 9.22% | 9.15% | 9.12% | 9.12% | 8.40% | 8.40% | 8.47% | 8.43% | 8.95% | 9.27% | 9.28% | 9.27% |

|

| 10 years | 76.49 | 66.34 | 66.09 | 66.09 | 63.63 | 63.63 | 67.78 | 61.91 | 72.06 | 81.27 | 81.63 | 80.90 |

| Annual average | 5.85 | 5.22 | 5.20 | 5.20 | 5.05 | 5.05 | 5.31 | 4.94 | 5.58 | 6.13 | 6.15 | 6.11 |

|

| 5 years | 147.19 | 132.97 | 138.05 | 136.05 | 138.01 | 138.01 | 141.08 | 132.64 | 144.14 | 150.68 | 151.17 | 150.17 |

| Annual average | 19.84 | 18.43 | 18.94 | 18.74 | 18.94 | 18.94 | 19.24 | 18.40 | 19.54 | 20.18 | 20.23 | 20.13 |

|

| 3 years | 48.63 | 40.08 | 45.34 | 42.34 | 45.22 | 45.22 | 46.40 | 41.27 | 47.50 | 50.06 | 50.36 | 49.76 |

| Annual average | 14.12 | 11.89 | 13.27 | 12.49 | 13.24 | 13.24 | 13.55 | 12.21 | 13.83 | 14.49 | 14.56 | 14.41 |

|

| 1 year | 24.00 | 16.87 | 23.09 | 18.09 | 23.09 | 22.09 | 23.42 | 19.10 | 23.68 | 24.46 | 24.66 | 24.33 |

|

| 6 months | 7.83 | 1.63 | 7.39 | 2.39 | 7.39 | 6.39 | 7.54 | 3.77 | 7.66 | 7.98 | 8.09 | 7.94 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

Recent performance may have benefited from one or more legal settlements.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance reflects conversion to class A shares after eight years.

Comparative index returns For periods ended 1/31/14

| | |

| | | Lipper Large-Cap Core |

| | S&P 500 Index | Funds category average* |

|

| Annual average (life of fund) | —† | —† |

|

| 10 years | 93.68% | 87.79% |

| Annual average | 6.83 | 6.43 |

|

| 5 years | 140.58 | 128.95 |

| Annual average | 19.19 | 17.90 |

|

| 3 years | 47.89 | 43.01 |

| Annual average | 13.93 | 12.62 |

|

| 1 year | 21.52 | 20.43 |

|

| 6 months | 6.85 | 6.57 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, and 10-year periods ended 1/31/14, there were 951, 918, 828, 763, and 522 funds, respectively, in this Lipper category.

† The fund’s benchmark and Lipper category, the Standard & Poor’s 500 Index and Lipper Large-Cap Core Funds category, were introduced on 3/4/57 and 12/31/59, respectively, which post-date the inception of the fund’s class A shares.

Fund price and distribution information For the six-month period ended 1/31/14

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.212 | $0.091 | $0.095 | $0.134 | $0.182 | $0.275 | $0.295 | $0.254 |

|

| Capital gains | — | — | — | — | — | — | — | — |

|

| Total | $0.212 | $0.091 | $0.095 | $0.134 | $0.182 | $0.275 | $0.295 | $0.254 |

|

| | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value | value |

|

| 7/31/13 | $17.64 | $18.72 | $15.84 | $16.70 | $16.63 | $17.23 | $17.37 | $17.97 | $17.98 | $17.91 |

|

| 1/31/14 | 18.81 | 19.96 | 16.92 | 17.84 | 17.75 | 18.39 | 18.52 | 19.13 | 19.14 | 19.08 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/13

| | | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| (inception dates) | (12/1/25) | (3/1/93) | (7/26/99) | (12/2/94) | (1/21/03) | (7/2/12) | (7/2/12) | (1/7/97) |

|

| | Before | After | | | | | Before | After | Net | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value | value |

|

| Annual average | | | | | | | | | | | | |

| (life of fund) | 9.27% | 9.20% | 9.17% | 9.17% | 8.45% | 8.45% | 8.52% | 8.47% | 9.00% | 9.32% | 9.33% | 9.32% |

|

| 10 years | 86.22 | 75.51 | 75.31 | 75.31 | 72.79 | 72.79 | 77.17 | 70.97 | 81.80 | 91.38 | 91.65 | 91.01 |

| Annual average | 6.41 | 5.79 | 5.77 | 5.77 | 5.62 | 5.62 | 5.89 | 5.51 | 6.16 | 6.71 | 6.72 | 6.69 |

|

| 5 years | 135.11 | 121.59 | 126.37 | 124.37 | 126.58 | 126.58 | 129.31 | 121.29 | 132.11 | 138.41 | 138.75 | 137.95 |

| Annual average | 18.65 | 17.25 | 17.75 | 17.54 | 17.77 | 17.77 | 18.06 | 17.22 | 18.34 | 18.98 | 19.01 | 18.93 |

|

| 3 years | 57.13 | 48.10 | 53.63 | 50.63 | 53.65 | 53.65 | 54.86 | 49.44 | 56.06 | 58.72 | 58.95 | 58.41 |

| Annual average | 16.26 | 13.99 | 15.39 | 14.63 | 15.39 | 15.39 | 15.69 | 14.33 | 15.99 | 16.65 | 16.70 | 16.57 |

|

| 1 year | 35.04 | 27.27 | 34.02 | 29.02 | 34.01 | 33.01 | 34.36 | 29.66 | 34.68 | 35.52 | 35.66 | 35.40 |

|

| 6 months | 18.22 | 11.42 | 17.77 | 12.77 | 17.76 | 16.76 | 17.91 | 13.78 | 18.06 | 18.46 | 18.51 | 18.38 |

|

See the discussion following the Fund performance table on page 10 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Total annual operating expenses for | | | | | | | | |

| the fiscal year ended 7/31/13 | 1.14% | 1.89% | 1.89% | 1.64% | 1.39% | 0.76% | 0.66% | 0.89% |

|

| Annualized expense ratio for the | | | | | | | | |

| six-month period ended 1/31/14 | 1.10% | 1.85% | 1.85% | 1.60% | 1.35% | 0.77% | 0.67% | 0.85% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from August 1, 2013, to January 31, 2014. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $5.76 | $9.67 | $9.67 | $8.37 | $7.07 | $4.04 | $3.51 | $4.46 |

|

| Ending value (after expenses) | $1,078.30 | $1,073.90 | $1,073.90 | $1,075.40 | $1,076.60 | $1,079.80 | $1,080.90 | $1,079.40 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/14. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

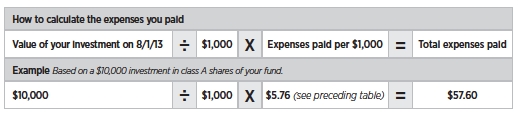

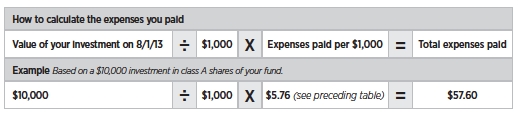

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2014, use the following calculation method. To find the value of your investment on August 1, 2013, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $5.60 | $9.40 | $9.40 | $8.13 | $6.87 | $3.92 | $3.41 | $4.33 |

|

| Ending value (after expenses) | $1,019.66 | $1,015.88 | $1,015.88 | $1,017.14 | $1,018.40 | $1,021.32 | $1,021.83 | $1,020.92 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/14. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain employer-sponsored retirement plans.

Class R5 shares and class R6 shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to employer-sponsored retirement plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2013, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of January 31, 2014, Putnam employees had approximately $433,000,000 and the Trustees had approximately $105,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Trustee approval of management contract

Putnam Investment Management (“Putnam Management”) serves as investment manager to your fund under a management contract. In addition, Putnam Management’s affiliate, Putnam Investments Limited (“PIL”), provides services to your fund under a sub-management contract between Putnam Management and PIL. Putnam Management is majority owned (directly and indirectly) by Power Corporation of Canada, a diversified international management and holding company with interests in companies in the financial services, communications and other business sectors. Until his death on October 8, 2013, The Honourable Paul G. Desmarais, both directly and through holding companies, controlled a majority of the voting shares of Power Corporation of Canada. Upon his death, Mr. Desmarais’ voting control of shares of Power Corporation of Canada was transferred to The Desmarais Family Residuary Trust (the “Transfer”). As a technical matter, the Transfer may have constituted an “assignment” within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”), causing your fund’s existing management and sub-management contracts to terminate automatically. On October 18, 2013, the Trustees, including all of the Trustees who are not “interested persons” (as this term is defined in the 1940 Act) of the Putnam funds (the “Independent Trustees”), approved interim management contracts between the Putnam funds and Putnam Management and the continuance of your fund’s sub-management contract to address this possibility and to avoid disruption of investment advisory and other services provided to the Putnam funds. At a subsequent meeting on November 22, 2013, the Trustees, including all of the Independent Trustees, approved new definitive management contracts between the Putnam funds and Putnam Management and determined to recommend their approval to the shareholders of the Putnam funds at a shareholder meeting called for February 27, 2014. The Trustees also approved new sub-management contracts, to be effective at the same time as the new definitive management contracts. The fund’s shareholders approved your fund’s new management contract at a special meeting on February 27, 2014.

In considering whether to approve your fund’s interim management contract and the continuance of your fund’s sub-management contract in October, and in considering whether to approve your fund’s new definitive management contract and its new sub-management contract in November, the Trustees took into account that they had recently approved the continuation (through June 30, 2014) of the fund’s previous management and sub-management contracts at their meeting in June 2013. The Trustees considered that the terms of the interim management contract and new definitive management contract were identical to those of the previous management contract, except for the effective dates and initial terms and for certain non-substantive changes. They also considered that the terms of the sub-management contract were identical to those of the previous sub-management contract, except for the effective dates and initial terms. In light of the substantial similarity between the proposed contracts and the previous versions of these contracts approved by the Trustees at their June 2013 meeting, the Trustees relied to a considerable extent on their review of these contracts in connection with their June meeting. In addition, the Trustees considered a number other factors relating to the Transfer, including, but not limited to, the following:

• Information about the operations of The Desmarais Family Residuary Trust, including that Paul Desmarais, Jr. and André Desmarais, Mr. Desmarais’ sons, were expected to exercise, jointly, voting control over the Power Corporation of Canada shares controlled by The Desmarais Family Residuary Trust.

• That Paul Desmarais, Jr. and André Desmarais had been playing active managerial roles at Power Corporation of Canada, with responsibility for the oversight of Power Corporation of Canada’s subsidiaries, including Putnam Investments, since Power Corporation of Canada had acquired Putnam Investments in 2007, including serving as Directors of Putnam Investments, and that the Transfer would not affect their responsibilities as officers of Power Corporation of Canada.

• The intention expressed by representatives of Power Corporation of Canada and its subsidiaries, Power Financial Corporation and Great-West Lifeco, that there would be no change to the operations or management of Putnam Investments, to Putnam Management’s management of the funds or to investment, advisory and other services provided to the funds by Putnam Management and its affiliates as a result of the Transfer.

• Putnam Management’s assurances that, following the Transfer, Putnam Management would continue to provide the same level of services to each fund and that the Transfer will not have an adverse impact on the ability of Putnam Management and its affiliates to continue to provide high quality investment advisory and other services to the funds.

• Putnam Management’s assurances that there are no current plans to make any changes to the operations of the funds, existing management fees, expense limitations, distribution arrangements, or the quality of any services provided to the funds or their shareholders, as a result of the Transfer.

• The benefits that the funds have received and may potentially receive as a result of Putnam Management being a member of the Power Corporation of Canada group of companies, which promotes the stability of the Putnam organization.

• Putnam Investments’ commitment to bear a reasonable share of the expenses incurred by the Putnam Funds in connection with the Transfer.

General conclusions in connection with the Trustees’ June 2013 approval of the fund’s management and sub-management contracts

As noted above, in connection with their deliberations in October and November 2013, in addition to the factors described above, the Trustees considered their recent approval of your fund’s management and sub-management contracts in June 2013. The Board oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management and sub-management contracts. The Board, with the assistance of its Contract Committee, requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. The Contract Committee consists solely of Independent Trustees.

At the outset of the review process, members of the Board’s independent staff and independent legal counsel met with representatives of Putnam Management to review the annual contract review materials furnished to the Contract Committee during the course of the previous year’s review and to discuss possible changes in these materials that might be necessary or desirable for the coming year. Following these discussions and in consultation with the Contract Committee, the Independent Trustees’ independent legal counsel requested that Putnam Management furnish specified information, together with any additional information that Putnam Management considered relevant, to the Contract Committee. Over the course of several months ending in June 2013, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information

that Putnam Management provided. Throughout this process, the Contract Committee was assisted by the members of the Board’s independent staff and by independent legal counsel for the Putnam funds and the Independent Trustees.

In May 2013, the Contract Committee met in executive session to discuss and consider its preliminary recommendations with respect to the continuance of the contracts. At the Trustees’ June 20, 2013 meeting, the Contract Committee met in executive session with the other Independent Trustees to review a summary of the key financial data that the Contract Committee considered in the course of its review. The Contract Committee then presented its written report, which summarized the key factors that the Committee had considered and set forth its final recommendations. The Contract Committee then recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contracts, effective July 1, 2013, subject to certain changes in the sub-management contract noted below. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ June 2013 approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing services to the fund, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the management arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that some aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in previous years. For example, with some minor exceptions, the current fee arrangements in the management contracts for the Putnam funds were implemented at the beginning of 2010 following extensive review and discussion by the Trustees, as well as approval by shareholders.

As noted above, the Trustees considered administrative revisions to your fund’s sub-management contract. Putnam Management recommended that the sub-management contract be revised to reduce the sub-management fee that Putnam Management pays to PIL with respect to the portion of the portfolios of certain funds, but not your fund, that may be allocated to PIL from time to time. The Independent Trustees’ approval of this recommendation was based on their conclusion that these changes would have no practical effect on Putnam Management’s continued responsibility for the management of these funds or the costs borne by fund shareholders and would not result in any reduction in the nature and quality of services provided to the funds.

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. The Trustees also reviewed the total expenses of each Putnam fund, recognizing that in most cases management fees represented the major, but not the sole, determinant of total costs to shareholders.

In reviewing fees and expenses, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management, changes in a fund’s investment style, changes in Putnam Management’s operating costs or profitability, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

Under its management contract, your fund has the benefit of breakpoints in its management fee schedule that provide shareholders with economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale between fund shareholders and Putnam Management.

As in the past, the Trustees also focused on the competitiveness of each fund’s total expense ratio. In order to ensure that expenses of the Putnam funds continue to meet competitive standards, the Trustees and Putnam Management have implemented certain expense limitations. These expense limitations were: (i) a contractual expense limitation applicable to all retail open-end funds of 32 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, investment-related expenses, interest, taxes, brokerage commissions, extraordinary expenses and acquired fund fees and expenses). These expense limitations serve in particular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and funds with relatively small net assets. Most funds had sufficiently low expenses that these expense limitations did not apply. However, in the case of your fund, the first of the expense limitations applied during its fiscal year ending in 2012. Putnam Management’s support for these expense limitations was an important factor in the Trustees’ decision to approve the continuance of your fund’s management and sub-management contracts.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the second quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the third quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2012 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The fee and expense data reported by Lipper as of December 31, 2012 reflected the most recent fiscal year-end data available in Lipper’s database at that time.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of

the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing of such economies of scale as may exist in the management of the Putnam funds at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of those fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these different types of clients. The Trustees observed that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate markets. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the investment oversight committees of the Trustees, which meet on a regular basis with the funds’ portfolio teams and with the Chief Investment Officer and other senior members of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period.

The Trustees considered that 2012 was a year of strong competitive performance for many of the Putnam funds, with only a relatively small number of exceptions. They noted that this strong performance was exemplified by the fact that the Putnam funds were recognized by Barron’s as the best performing mutual fund complex for 2012 — the second time in four years that Putnam Management has achieved this distinction for the Putnam funds. They also noted, however, the disappointing investment performance of some funds for periods ended

December 31, 2012 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional actions to address areas of underperformance are warranted.

For purposes of evaluating investment performance, the Trustees generally focus on competitive industry rankings for the one-year, three-year, and five-year periods. For a number of Putnam funds with relatively unique investment mandates, the Trustees evaluated performance based on comparisons of their total returns with the returns of selected investment benchmarks or targeted returns. In the case of your fund, the Trustees considered that its class A share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (Lipper Large-Cap Core Funds) for the one-year, three-year and five-year periods ended December 31, 2012 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| | | |

| One-year period | 2nd | | |

| | |

| Three-year period | 2nd | | |

| | |

| Five-year period | 3rd | | |

| | |

Over the one-year, three-year and five-year periods ended December 31, 2012, there were 941, 864 and 753 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. Subject to policies established by the Trustees, soft dollars generated by these means are used primarily to acquire brokerage and research services that enhance Putnam Management’s investment capabilities and supplement Putnam Management’s internal research efforts. However, the Trustees noted that a portion of available soft dollars continues to be used to pay fund expenses. The Trustees indicated their continued intent to monitor regulatory and industry developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the allocation of the Putnam funds’ brokerage in order to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management and sub-management contracts, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services, the fees paid by competitive funds, and the costs incurred by PSERV and PRM, as applicable, in providing such services.

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 1/31/14 (Unaudited)

| | |

| COMMON STOCKS (99.4%)* | Shares | Value |

|

| Aerospace and defense (4.7%) | | |

| Boeing Co. (The) | 76,500 | $9,582,390 |

|

| General Dynamics Corp. | 93,600 | 9,482,616 |

|

| Honeywell International, Inc. | 162,430 | 14,818,489 |

|

| L-3 Communications Holdings, Inc. | 80,400 | 8,930,028 |

|

| Northrop Grumman Corp. | 110,000 | 12,710,500 |

|

| Raytheon Co. | 93,400 | 8,879,538 |

|

| United Technologies Corp. | 87,600 | 9,988,152 |

|

| | | 74,391,713 |

| Air freight and logistics (0.3%) | | |

| FedEx Corp. | 35,200 | 4,692,864 |

|

| | | 4,692,864 |

| Airlines (1.1%) | | |

| Copa Holdings SA Class A (Panama) | 20,100 | 2,627,070 |

|

| Delta Air Lines, Inc. | 187,500 | 5,739,375 |

|

| Southwest Airlines Co. | 340,500 | 7,133,475 |

|

| Spirit Airlines, Inc. † | 43,600 | 2,044,840 |

|

| | | 17,544,760 |

| Auto components (0.9%) | | |

| Lear Corp. | 44,100 | 3,189,753 |

|

| Magna International, Inc. (Canada) | 38,500 | 3,266,725 |

|

| TRW Automotive Holdings Corp. † | 103,911 | 7,705,001 |

|

| | | 14,161,479 |

| Automobiles (0.7%) | | |

| Ford Motor Co. | 250,300 | 3,744,488 |

|

| General Motors Co. † | 190,281 | 6,865,338 |

|

| | | 10,609,826 |

| Beverages (2.2%) | | |

| Coca-Cola Co. (The) | 205,600 | 7,775,792 |

|

| Coca-Cola Enterprises, Inc. | 182,000 | 7,878,780 |

|

| Dr. Pepper Snapple Group, Inc. | 85,100 | 4,074,588 |

|

| PepsiCo, Inc. | 185,100 | 14,874,636 |

|

| | | 34,603,796 |

| Biotechnology (3.0%) | | |

| Alkermes PLC † | 117,700 | 5,729,636 |

|

| Amgen, Inc. | 111,300 | 13,239,135 |

|

| Biogen Idec, Inc. † | 14,700 | 4,595,808 |

|

| Celgene Corp. † | 86,300 | 13,111,559 |

|

| Cubist Pharmaceuticals, Inc. † | 27,200 | 1,988,048 |

|

| Gilead Sciences, Inc. † | 115,200 | 9,290,880 |

|

| | | 47,955,066 |

| Building products (0.2%) | | |

| Masco Corp. | 128,700 | 2,723,292 |

|

| | | 2,723,292 |

| Capital markets (3.3%) | | |

| Ameriprise Financial, Inc. | 71,700 | 7,574,388 |

|

| Apollo Global Management, LLC. Class A | 148,300 | 4,812,335 |

|

| Artisan Partners Asset Management, Inc. | 58,548 | 3,713,114 |

|

| Carlyle Group LP (The) (Partnership shares) | 104,000 | 3,620,240 |

|

| Charles Schwab Corp. (The) | 141,900 | 3,521,958 |

|

| Goldman Sachs Group, Inc. (The) | 87,300 | 14,327,676 |

|

| | |

| COMMON STOCKS (99.4%)* cont. | Shares | Value |

|

| Capital markets cont. | | |

| KKR & Co. LP | 120,300 | $2,900,433 |

|

| Legg Mason, Inc. | 75,500 | 3,197,425 |

|

| Morgan Stanley S | 281,600 | 8,310,016 |

|

| | | 51,977,585 |

| Chemicals (2.1%) | | |

| Albemarle Corp. S | 38,200 | 2,451,676 |

|

| CF Industries Holdings, Inc. | 19,600 | 4,524,856 |

|

| Dow Chemical Co. (The) | 166,443 | 7,574,821 |

|

| Eastman Chemical Co. | 28,300 | 2,206,268 |

|

| Givaudan SA (Switzerland) | 2,065 | 3,056,560 |

|

| LyondellBasell Industries NV Class A | 61,600 | 4,851,616 |

|

| Monsanto Co. | 44,400 | 4,730,820 |

|

| Potash Corp. of Saskatchewan, Inc. (Canada) S | 118,400 | 3,708,288 |

|

| | | 33,104,905 |

| Commercial banks (3.3%) | | |

| Ally Financial, Inc. † | 635 | 5,016,500 |

|

| Fifth Third Bancorp | 196,700 | 4,134,634 |

|

| First Southern Bancorp, Inc. Class B † F | 112,320 | 676,166 |

|

| KeyCorp | 309,000 | 3,942,840 |

|

| Regions Financial Corp. | 350,700 | 3,566,619 |

|

| U.S. Bancorp | 101,100 | 4,016,703 |

|

| Wells Fargo & Co. | 679,498 | 30,808,439 |

|

| | | 52,161,901 |

| Commercial services and supplies (0.9%) | | |

| ADT Corp. (The) S | 79,400 | 2,385,176 |

|

| Cintas Corp. S | 66,900 | 3,817,983 |

|

| KAR Auction Services, Inc. | 65,862 | 1,832,281 |

|

| MiX Telematics, Ltd. ADR (South Africa) † | 152,333 | 1,814,286 |

|

| Pitney Bowes, Inc. S | 165,600 | 4,169,808 |

|

| | | 14,019,534 |

| Communications equipment (2.3%) | | |

| Cisco Systems, Inc. | 922,400 | 20,209,784 |

|

| Qualcomm, Inc. | 213,100 | 15,816,282 |

|

| | | 36,026,066 |

| Computers and peripherals (4.7%) | | |

| Apple, Inc. | 82,867 | 41,483,220 |

|

| EMC Corp. S | 419,700 | 10,173,528 |

|

| Hewlett-Packard Co. | 237,392 | 6,884,368 |

|

| NetApp, Inc. | 54,300 | 2,299,062 |

|

| SanDisk Corp. | 68,499 | 4,764,105 |

|

| Western Digital Corp. | 102,400 | 8,823,808 |

|

| | | 74,428,091 |

| Construction and engineering (0.3%) | | |

| Fluor Corp. | 58,100 | 4,413,276 |

|

| | | 4,413,276 |

| Consumer finance (1.6%) | | |

| American Express Co. | 56,700 | 4,820,634 |

|

| Capital One Financial Corp. | 85,300 | 6,023,033 |

|

| Discover Financial Services | 120,800 | 6,480,920 |

|

| Santander Consumer USA Holdings, Inc. † | 184,661 | 4,732,861 |

|

| SLM Corp. | 157,100 | 3,575,596 |

|

| | | 25,633,044 |

| | |

| COMMON STOCKS (99.4%)* cont. | Shares | Value |

|

| Containers and packaging (0.8%) | | |

| Avery Dennison Corp. | 65,500 | $3,227,185 |

|

| Owens-Illinois, Inc. † | 127,000 | 4,069,080 |

|

| Rock-Tenn Co. Class A | 31,600 | 3,206,768 |

|

| Sealed Air Corp. | 83,100 | 2,591,889 |

|

| | | 13,094,922 |

| Diversified financial services (4.7%) | | |

| Bank of America Corp. | 899,142 | 15,060,629 |

|

| Berkshire Hathaway, Inc. Class B † | 44,280 | 4,941,648 |

|

| Citigroup, Inc. | 234,417 | 11,118,398 |

|

| JPMorgan Chase & Co. | 763,373 | 42,260,331 |

|

| Moody’s Corp. | 43,400 | 3,236,772 |

|

| | | 76,617,778 |

| Diversified telecommunication services (1.2%) | | |

| AT&T, Inc. | 181,005 | 6,031,087 |

|

| Iridium Communications, Inc. † S | 506,197 | 3,209,289 |

|

| Verizon Communications, Inc. | 223,200 | 10,718,064 |

|

| | | 19,958,440 |

| Electric utilities (0.6%) | | |

| Edison International | 130,400 | 6,280,064 |

|

| Exelon Corp. | 92,800 | 2,691,200 |

|

| | | 8,971,264 |

| Electrical equipment (0.5%) | | |

| Emerson Electric Co. | 71,300 | 4,701,522 |

|

| Generac Holdings, Inc. | 60,400 | 2,907,052 |

|

| | | 7,608,574 |

| Electronic equipment, instruments, and components (0.4%) | | |

| CDW Corp. of Delaware | 238,876 | 5,654,195 |

|

| | | 5,654,195 |

| Energy equipment and services (2.2%) | | |

| Halliburton Co. | 127,800 | 6,263,478 |

|

| Helmerich & Payne, Inc. | 42,100 | 3,706,484 |

|

| Nabors Industries, Ltd. | 278,900 | 4,763,612 |

|

| Rowan Cos. PLC Class A † | 86,500 | 2,713,505 |

|

| Schlumberger, Ltd. | 197,224 | 17,270,906 |

|

| | | 34,717,985 |

| Food and staples retail (2.3%) | | |

| CVS Caremark Corp. | 243,510 | 16,490,497 |

|

| Kroger Co. (The) | 261,700 | 9,447,370 |

|

| Wal-Mart Stores, Inc. | 138,200 | 10,320,776 |

|

| | | 36,258,643 |

| Food products (1.1%) | | |

| Amira Nature Foods, Ltd. (United Arab Emirates) † S | 189,117 | 3,597,005 |

|

| Archer Daniels-Midland Co. | 123,600 | 4,879,728 |

|

| Bunge, Ltd. S | 24,200 | 1,833,392 |

|

| Kellogg Co. | 32,600 | 1,890,148 |

|

| Pinnacle Foods, Inc. | 88,300 | 2,384,100 |

|

| Tyson Foods, Inc. Class A | 85,800 | 3,208,920 |

|

| | | 17,793,293 |

| Gas utilities (0.5%) | | |

| AGL Resources, Inc. | 52,300 | 2,498,894 |

|

| UGI Corp. | 112,200 | 4,868,358 |

|

| | | 7,367,252 |

| | |

| COMMON STOCKS (99.4%)* cont. | Shares | Value |

|

| Health-care equipment and supplies (1.5%) | | |

| Baxter International, Inc. | 65,900 | $4,500,970 |

|

| Medtronic, Inc. | 156,600 | 8,857,296 |

|

| St. Jude Medical, Inc. | 126,700 | 7,694,491 |

|

| Zimmer Holdings, Inc. | 24,800 | 2,330,456 |

|

| | | 23,383,213 |

| Health-care providers and services (3.1%) | | |

| Cardinal Health, Inc. | 90,800 | 6,176,216 |

|

| Catamaran Corp. † | 78,200 | 3,802,084 |

|

| Express Scripts Holding Co. † | 79,500 | 5,937,855 |

|

| HealthSouth Corp. S | 87,400 | 2,719,888 |

|

| Humana, Inc. | 26,800 | 2,607,640 |

|

| McKesson Corp. | 54,600 | 9,522,786 |

|

| Omnicare, Inc. S | 70,000 | 4,372,200 |

|

| UnitedHealth Group, Inc. | 107,600 | 7,777,328 |

|

| WellPoint, Inc. | 83,900 | 7,215,400 |

|

| | | 50,131,397 |

| Hotels, restaurants, and leisure (1.5%) | | |

| Hilton Worldwide Holdings, Inc. † | 54,022 | 1,169,576 |

|

| International Game Technology | 141,300 | 2,038,959 |

|

| Intrawest Resorts Holdings, Inc. † | 128,400 | 1,527,960 |

|

| Las Vegas Sands Corp. | 35,600 | 2,724,112 |

|

| McDonald’s Corp. | 71,300 | 6,714,321 |

|

| Red Robin Gourmet Burgers, Inc. † | 56,000 | 3,608,080 |

|

| Wynn Resorts, Ltd. | 29,200 | 6,348,664 |

|

| | | 24,131,672 |

| Household durables (0.7%) | | |

| New Home Co., Inc. (The) † | 218,747 | 2,668,714 |

|

| WCI Communities, Inc. † | 105,730 | 1,979,266 |

|

| Whirlpool Corp. | 44,000 | 5,865,200 |

|

| | | 10,513,180 |

| Household products (1.0%) | | |

| Energizer Holdings, Inc. | 21,000 | 1,984,500 |

|

| Procter & Gamble Co. (The) | 185,500 | 14,213,010 |

|

| | | 16,197,510 |

| Independent power producers and energy traders (0.6%) | | |

| AES Corp. | 349,662 | 4,916,248 |

|

| NRG Energy, Inc. | 185,800 | 5,174,530 |

|

| | | 10,090,778 |

| Industrial conglomerates (1.2%) | | |

| General Electric Co. | 561,100 | 14,100,443 |

|

| Siemens AG (Germany) | 34,148 | 4,327,365 |

|

| | | 18,427,808 |

| Insurance (2.2%) | | |

| American International Group, Inc. | 156,650 | 7,512,934 |

|

| Genworth Financial, Inc. Class A † | 231,100 | 3,408,725 |

|

| Hartford Financial Services Group, Inc. (The) | 73,000 | 2,427,250 |

|

| Lincoln National Corp. | 131,000 | 6,291,930 |

|

| MetLife, Inc. | 169,366 | 8,307,402 |

|

| Travelers Cos., Inc. (The) | 48,300 | 3,925,824 |

|

| Unum Group. | 95,200 | 3,065,440 |

|

| | | 34,939,505 |

| | |

| COMMON STOCKS (99.4%)* cont. | Shares | Value |

|

| Internet and catalog retail (1.1%) | | |

| Amazon.com, Inc. † | 15,900 | $5,703,171 |

|

| Bigfoot GmbH (acquired 8/2/13, cost $1,538,743) (Private) | | |

| (Brazil) †∆∆ F | 70 | 1,171,648 |

|

| Priceline.com, Inc. † | 8,900 | 10,189,521 |

|

| | | 17,064,340 |

| Internet software and services (3.2%) | | |

| eBay, Inc. † | 73,700 | 3,920,840 |

|

| Facebook, Inc. Class A † | 96,100 | 6,012,977 |

|

| Google, Inc. Class A † | 29,563 | 34,913,016 |

|

| VeriSign, Inc. † S | 62,500 | 3,671,875 |

|

| Yahoo!, Inc. † | 88,800 | 3,198,576 |

|

| | | 51,717,284 |

| IT Services (3.4%) | | |

| Accenture PLC Class A | 59,700 | 4,768,836 |

|

| Alliance Data Systems Corp. † S | 27,700 | 6,638,582 |

|

| Computer Sciences Corp. | 156,400 | 9,448,124 |

|

| IBM Corp. | 74,900 | 13,233,332 |

|

| MasterCard, Inc. Class A | 85,000 | 6,432,800 |

|

| Unisys Corp. † | 49,280 | 1,688,826 |

|

| Visa, Inc. Class A | 39,700 | 8,552,571 |

|

| Xerox Corp. | 398,100 | 4,319,385 |

|

| | | 55,082,456 |

| Life sciences tools and services (0.7%) | | |

| Agilent Technologies, Inc. | 68,800 | 4,000,720 |

|

| PerkinElmer, Inc. | 59,600 | 2,598,560 |

|

| Thermo Fisher Scientific, Inc. | 42,000 | 4,835,880 |

|

| | | 11,435,160 |

| Machinery (1.4%) | | |

| Caterpillar, Inc. S | 72,600 | 6,817,866 |

|

| Deere & Co. | 31,600 | 2,716,336 |

|

| Ingersoll-Rand PLC | 89,300 | 5,249,947 |

|

| Parker Hannifin Corp. | 27,900 | 3,163,023 |

|

| Trinity Industries, Inc. S | 66,200 | 3,854,826 |

|

| | | 21,801,998 |

| Media (3.0%) | | |

| CBS Corp. Class B (non-voting shares) | 66,700 | 3,916,624 |

|

| Comcast Corp. Class A | 258,500 | 14,075,325 |

|

| DISH Network Corp. Class A † | 58,900 | 3,320,782 |

|

| SFX Entertainment, Inc. † S | 170,251 | 1,583,334 |

|

| Time Warner Cable, Inc. | 53,300 | 7,103,291 |

|

| Viacom, Inc. Class B | 84,600 | 6,945,660 |

|

| Walt Disney Co. (The) | 161,000 | 11,690,210 |

|

| | | 48,635,226 |

| Metals and mining (0.3%) | | |

| ArcelorMittal SA (France) | 114,300 | 1,883,664 |

|

| Freeport-McMoRan Copper & Gold, Inc. (Indonesia) | 112,500 | 3,646,125 |

|

| | | 5,529,789 |

| Multiline retail (1.0%) | | |

| Macy’s, Inc. | 146,100 | 7,772,520 |

|

| Nordstrom, Inc. S | 53,800 | 3,090,810 |

|

| Target Corp. S | 82,500 | 4,672,800 |

|

| | | 15,536,130 |

| | |

| COMMON STOCKS (99.4%)* cont. | Shares | Value |

|

| Oil, gas, and consumable fuels (7.9%) | | |

| Apache Corp. | 97,900 | $7,857,454 |

|

| BP PLC ADR (United Kingdom) S | 68,400 | 3,207,276 |

|

| Cabot Oil & Gas Corp. | 69,900 | 2,794,602 |

|

| Chesapeake Energy Corp. S | 156,100 | 4,200,651 |

|

| Chevron Corp. | 131,400 | 14,668,182 |

|

| ConocoPhillips | 107,400 | 6,975,630 |

|

| Continental Resources, Inc. † S | 34,100 | 3,757,820 |

|

| Energy Transfer Equity LP | 53,000 | 2,211,160 |

|

| EOG Resources, Inc. | 28,600 | 4,725,864 |

|

| Exxon Mobil Corp. | 294,925 | 27,180,288 |

|

| Marathon Oil Corp. | 78,100 | 2,560,899 |

|

| Marathon Petroleum Corp. | 40,400 | 3,516,820 |

|

| Midcoast Energy Partners LP † | 152,235 | 3,196,935 |

|

| Occidental Petroleum Corp. | 196,000 | 17,163,720 |

|

| Oiltanking Partners LP (Units) | 4,378 | 278,572 |

|

| QEP Resources, Inc. | 264,400 | 8,167,316 |

|

| Royal Dutch Shell PLC ADR (United Kingdom) | 68,646 | 4,743,439 |

|

| RSP Permian, Inc. † | 222,654 | 4,553,274 |

|

| Suncor Energy, Inc. (Canada) | 116,500 | 3,824,695 |

|

| World Point Terminals LP (Units) | 132,495 | 2,587,627 |

|

| | | 128,172,224 |

| Paper and forest products (0.1%) | | |

| International Paper Co. | 49,800 | 2,377,452 |

|

| | | 2,377,452 |

| Personal products (0.3%) | | |

| Coty, Inc. Class A | 171,320 | 2,311,107 |

|

| Herbalife, Ltd. | 46,465 | 2,990,952 |

|

| | | 5,302,059 |

| Pharmaceuticals (5.9%) | | |

| AbbVie, Inc. | 239,300 | 11,780,739 |

|

| AstraZeneca PLC (United Kingdom) | 76,376 | 4,844,517 |

|

| Endo Health Solutions, Inc. † | 39,300 | 2,589,084 |

|

| Jazz Pharmaceuticals PLC † | 18,532 | 2,810,563 |

|

| Johnson & Johnson | 348,700 | 30,849,489 |

|

| Merck & Co., Inc. | 228,200 | 12,087,754 |

|

| Pfizer, Inc. | 830,826 | 25,257,110 |

|

| Shire PLC ADR (United Kingdom) | 32,400 | 4,847,688 |

|

| | | 95,066,944 |

| Professional services (0.3%) | | |

| ManpowerGroup, Inc. | 55,800 | 4,346,820 |

|

| | | 4,346,820 |

| Real estate investment trusts (REITs) (0.6%) | | |

| American Tower Corp. | 44,100 | 3,566,808 |

|

| Armada Hoffler Properties, Inc. S | 387,244 | 3,523,920 |

|

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 137,336 | 1,816,955 |

|

| | | 8,907,683 |

| Real estate management and development (0.2%) | | |

| CBRE Group, Inc. Class A † | 98,400 | 2,611,536 |

|

| | | 2,611,536 |

| | |

| COMMON STOCKS (99.4%)* cont. | Shares | Value |

|

| Road and rail (0.4%) | | |

| Union Pacific Corp. | 38,700 | $6,743,088 |

|

| | | 6,743,088 |

| Semiconductors and semiconductor equipment (1.9%) | | |

| Intel Corp. | 431,700 | 10,593,918 |

|

| Magnachip Semiconductor Corp. (South Korea) † | 60,517 | 956,774 |

|

| Marvell Technology Group, Ltd. | 228,700 | 3,414,491 |

|

| Micron Technology, Inc. † | 225,800 | 5,202,432 |

|

| NVIDIA Corp. S | 196,900 | 3,091,330 |

|

| Texas Instruments, Inc. | 166,400 | 7,055,360 |

|

| | | 30,314,305 |

| Software (4.4%) | | |

| Electronic Arts, Inc. † | 134,100 | 3,540,240 |

|

| Microsoft Corp. | 851,300 | 32,221,705 |

|

| Oracle Corp. | 680,300 | 25,103,070 |

|

| Symantec Corp. | 250,600 | 5,365,346 |

|

| Synopsys, Inc. † | 83,000 | 3,308,380 |

|

| TiVo, Inc. † | 249,600 | 3,092,544 |

|

| | | 72,631,285 |

| Specialty retail (2.1%) | | |

| Bed Bath & Beyond, Inc. † | 79,100 | 5,050,535 |

|

| Best Buy Co., Inc. | 90,300 | 2,125,662 |

|

| GNC Holdings, Inc. Class A | 55,000 | 2,811,050 |

|

| Home Depot, Inc. (The) | 113,300 | 8,707,105 |

|

| Lowe’s Cos., Inc. | 153,600 | 7,110,144 |

|

| Office Depot, Inc. † | 614,000 | 3,002,460 |

|

| TJX Cos., Inc. (The) | 82,600 | 4,737,936 |

|

| | | 33,544,892 |

| Textiles, apparel, and luxury goods (1.1%) | | |

| Hanesbrands, Inc. | 56,800 | 4,040,752 |

|

| Michael Kors Holdings, Ltd. (Hong Kong) † | 46,300 | 3,700,759 |

|

| NIKE, Inc. Class B | 78,300 | 5,704,155 |

|

| VF Corp. S | 77,600 | 4,535,720 |

|

| | | 17,981,386 |

| Tobacco (1.9%) | | |

| Altria Group, Inc. | 348,200 | 12,263,604 |

|

| Lorillard, Inc. | 52,900 | 2,603,738 |

|

| Philip Morris International, Inc. | 188,500 | 14,729,390 |

|

| | | 29,596,732 |

| Trading companies and distributors (0.2%) | | |

| Air Lease Corp. | 77,799 | 2,449,113 |

|

| Stock Building Supply Holdings, Inc. † | 63,587 | 1,108,321 |

|

| | | 3,557,434 |

| Wireless telecommunication services (0.3%) | | |

| Vodafone Group PLC ADR (United Kingdom) | 128,600 | 4,765,916 |

|

| | | 4,765,916 |

| | | |

| Total common stocks (cost $1,340,865,562) | | $1,587,026,746 |

| | |

| CONVERTIBLE PREFERRED STOCKS (0.3%)* | Shares | Value |

|

| Iridium Communications, Inc. 144A $7.00 cv. pfd. | 27,936 | $2,536,938 |

|

| Unisys Corp. Ser. A, 6.25% cv. pfd. | 16,345 | 1,512,934 |

|

| Total convertible preferred stocks (cost $4,428,100) | | $4,049,872 |

| |

| INVESTMENT COMPANIES (0.2%)* | Shares | Value |

|

| SPDR S&P Homebuilders ETF S | 80,900 | $2,554,013 |

|

| Total investment companies (cost $1,860,634) | | $2,554,013 |

| |

| PREFERRED STOCKS (—%)* | Shares | Value |

|

| First Southern Bancorp, Inc. 5.00% cum. pfd. (acquired 12/17/09, cost | | |

| $192,000) †∆∆ F | 192 | $447,341 |

|

| Total preferred stocks (cost $192,000) | | $447,341 |

| |

| SHORT-TERM INVESTMENTS (5.2%)* | Shares | Value |

|

| Putnam Cash Collateral Pool, LLC 0.15% d | 77,546,232 | $77,546,232 |

|

| Putnam Short Term Investment Fund 0.07% L | 5,366,272 | 5,366,272 |

|