| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number | | 811-5125 |

| Dreyfus Variable Investment Fund |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 12/31 | | |

| Date of reporting period: | | 12/31/04 | | |

P:\Edgar Filings\Pending\117\NCSRA-117-2-2005\formncsra117.doc

SSL-DOCS2 70128344v14

| | | | | FORM N-CSR |

| Item 1. | | Reports to Stockholders. | | |

| Dreyfus Variable |

| Investment Fund, |

| Appreciation Portfolio |

ANNUAL REPORT December 31, 2004

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | T H E P O R T F O L I O |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Performance |

| 6 | | Portfolio Performance |

| 8 | | Understanding Your Portfolio’s Expenses |

| 8 | | Comparing Your Portfolio’s Expenses |

| | | With Those of Other Funds |

| 9 | | Statement of Investments |

| 12 | | Statement of Assets and Liabilities |

| 13 | | Statement of Operations |

| 14 | | Statement of Changes in Net Assets |

| 16 | | Financial Highlights |

| 18 | | Notes to Financial Statements |

| 26 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 27 | | Important Tax Information |

| 28 | | Board Members Information |

| 30 | | Officers of the Fund |

| | | F O R M O R E I N F O R M AT I O N |

| |

|

| | | Back Cover |

| Dreyfus Variable Investment Fund, |

| Appreciation Portfolio |

The Portfolio

LETTER FROM THE CHAIRMAN

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2004, through December 31, 2004. Inside, you’ll find valuable information about how the portfolio was managed during the reporting period, including a discussion with the portfolio manager, Fayez Sarofim, of Fayez Sarofim & Co., the portfolio’s sub-investment adviser.

2004 represented the second consecutive year of positive stock market performance. Unlike the 2003 rally, however, in which most stocks rose as general business conditions improved,2004’s market performance largely reflected the strengths and weaknesses of individual companies and industries. As a result, fundamental research and professional judgment became more important determinants of mutual fund performance in 2004.

What’s ahead for stocks in 2005? No one knows for certain.Positive influences remain in place, including moderately expanding U.S. and global economies and low inflation. Nonetheless, a number of risks — such as rising short-term interest rates, currency fluctuations and generally slowing corporate earnings — could threaten the market environment.

As always, we urge our shareholders to view the stock market from a long-term perspective, measured in years rather than weeks or months. One of the best ways to ensure a long-term perspective is to establish an investment plan with the help of your financial advisor, and review it periodically to track your progress toward your financial goals.

Thank you for your continued confidence and support.

| Stephen E. Canter |

| Chairman and Chief Executive Officer |

| The Dreyfus Corporation |

| January 18, 2005 |

DISCUSSION OF PERFORMANCE

Fayez Sarofim, Portfolio Manager

Fayez Sarofim & Co., Sub-Investment Adviser

How did Dreyfus Variable Investment Fund, Appreciation Portfolio perform relative to its benchmark?

For the 12-month period ended December 31, 2004, the portfolio’s Initial shares produced a total return of 5.05%, and its Service shares produced a total return of 4.80% .1 For the same period, the total return of the portfolio’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), was 11.04% .2

Although stocks generally gained value over the reporting period, the market’s strength was concentrated primarily among stocks at the lower end of the S&P 500 Index’s capitalization range.The portfolio’s returns were lower than the S&P 500 Index because the larger stocks on which the portfolio focuses tended to trail the averages. In addition, the portfolio’s results were hindered by a handful of company-specific disappointments.

What is the portfolio’s investment approach?

The portfolio normally invests at least 80% of its assets in common stocks. The portfolio focuses in large, well-established multinational growth companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence and the potential to achieve predictable above-average earnings growth. We focus on purchasing reasonably priced growth stocks of fundamentally sound companies in economic sectors that we believe will expand over the next three to five years or longer.

At the same time, we manage the portfolio with long-term investors in mind. Our investment approach is based on targeting long-term growth rather than short-term profit.

What other factors influenced the portfolio’s performance?

Despite generally strong earnings reports from large-cap companies, large-cap stocks failed to advance significantly for much of the year.

DISCUSSION OF PERFORMANCE (continued)

|

Over the first 10 months of 2004, the stock market traded within a relatively narrow range, with returns constrained by uncertainty related to a fitfully growing economy, rising short-term interest rates, the U.S. presidential elections and the insurgency in Iraq. The stock market began to rally more substantially in November and December, accounting for much of the 12-month return of the S&P 500 Index.

In this challenging economic environment, investors generally continued to favor smaller stocks that, in their view, had greater potential for growth than large, well-established companies.As a result, the dominant multinational corporations in which the portfolio invests, most of which rank among the 100 largest stocks within the S&P 500 Index, produced relatively lackluster results.

In addition, the portfolio’s emphasis on consumer, financial and health care stocks hurt the portfolio’s relative performance, largely because investors apparently believed they could find better growth opportunities in other sectors. In the technology sector, semiconductor manufacturer Intel suffered from the effects of unexpectedly soft demand for its prod-ucts.The portfolio’s returns from the financial sector were held back by its investment in insurance and investment firm Marsh & McLennan Cos., which experienced turmoil related to allegations of unfair business practices.Returns from the portfolio’s health care holdings suffered when industry bellwethers Pfizer and Merck & Co. encountered safety-related issues affecting one of their better-selling drugs. In the consumer area, Coca-Cola was hurt by slower sales in Germany and North America.

On the other hand, the portfolio received positive contributions to performance from its energy holdings. Integrated oil companies, including Exxon Mobil, ChevronTexaco and British Petroleum, benefited from surging oil and gas prices during the reporting period. Good results from diversified health care company Johnson & Johnson helped offset some of the weakness experienced by other large drug producers. In the industrials area, shares of General Electric rose as investors responded to the diversified company’s renewed focus on growth businesses, which is expected to boost financial results in 2005. Food and tobacco giant Altria Group gained value when the company began to consider the possibility of separating its business units into

independent entities. Finally, publishing conglomerate The McGraw-Hill Cos. benefited from gains in its for-profit education businesses as well as better results from its Standard & Poor’s subsidiary.

Changes to the portfolio during the reporting period included, among others, the elimination of the portfolio’s position in Ford. We added ConocoPhillips and Occidental Petroleum to the portfolio’s holdings in the energy sector because we believe that supply-and-demand imbalances are likely to continue to support oil prices.We also established a small position in food distributor Sysco.

What is the portfolio’s current strategy?

Although they were out of favor for much of the reporting period, we have maintained our longstanding focus on large, high-quality corporations with dominant market positions.Valuations of the largest companies in the S&P 500 Index have fallen below historical norms, which we believe makes them attractive opportunities in a moderately growing economic environment. Indeed, many of the portfolio’s holdings ended the reporting period with record levels of cash on their balance sheets, which can be used to grow existing businesses,enter new ones or enhance shareholder value through stock buy-backs or dividend increases.

| | | The portfolio is only available as a funding vehicle under variable life insurance policies or variable |

| | | annuity contracts issued by insurance companies. Individuals may not purchase shares of the |

| | | portfolio directly.A variable annuity is an insurance contract issued by an insurance company that |

| | | enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term |

| | | goals.The investment objective and policies of Dreyfus Variable Investment Fund,Appreciation |

| | | Portfolio made available through insurance products may be similar to other funds/portfolios |

| | | managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or |

| | | lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio’s performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. |

| 2 | | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends and, where |

| | | applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is |

| | | a widely accepted, unmanaged index of U.S. stock market performance. |

The Portfolio 5

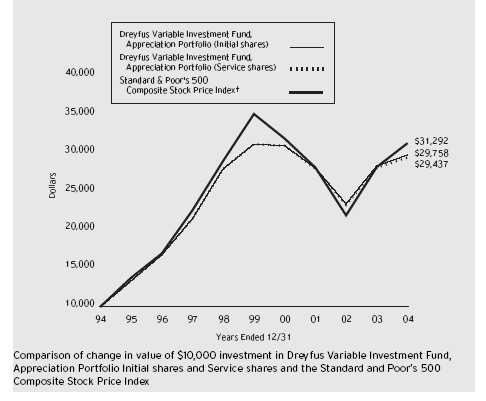

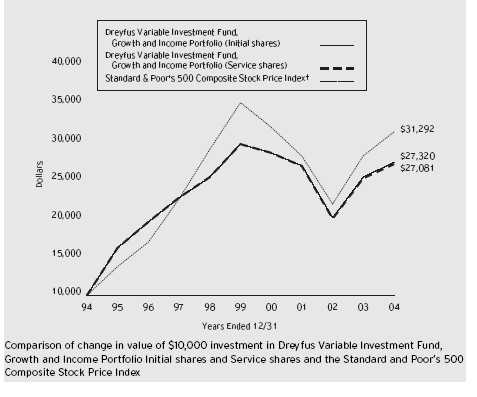

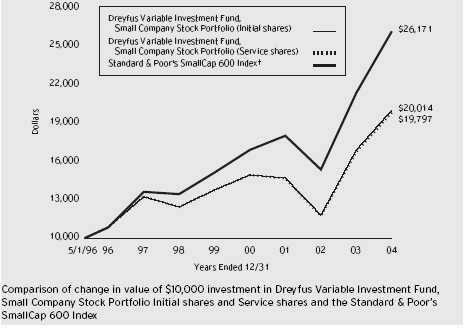

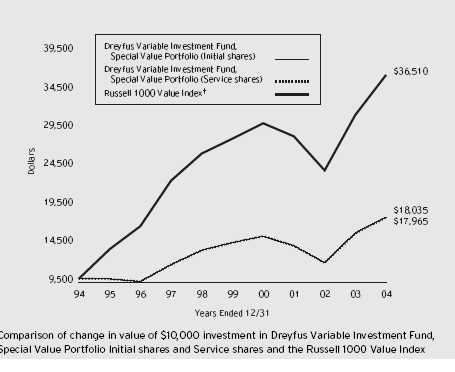

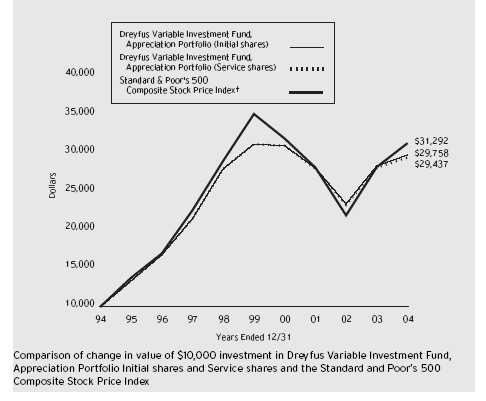

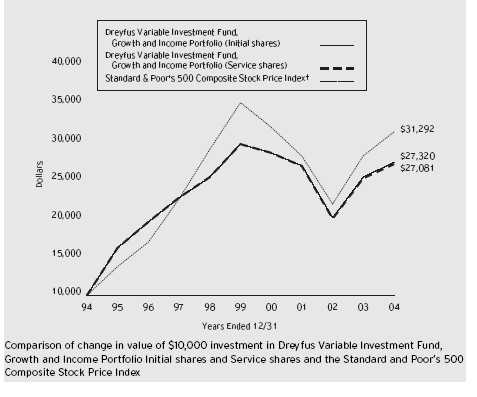

| Average Annual Total Returns as of | | 12/31/04 | | | | |

| |

| | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

|

| Initial shares | | 5.05% | | (0.91)% | | 11.52% |

| Service shares | | 4.80% | | (1.13)% | | 11.40% |

| |

| The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 |

| (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth |

| results would have been lower. See notes below. | | | | | | |

| † Source: Lipper Inc. | | | | | | |

| Past performance is not predictive of future performance.The portfolio’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. |

| The portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in |

| connection with investing in variable insurance contracts which will reduce returns. | | |

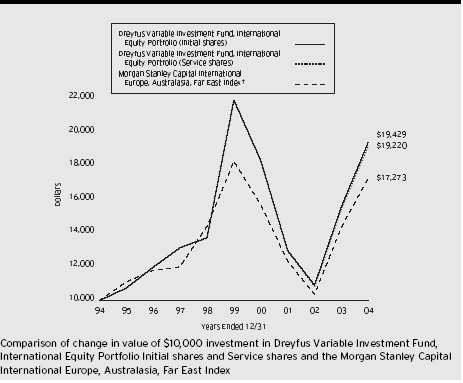

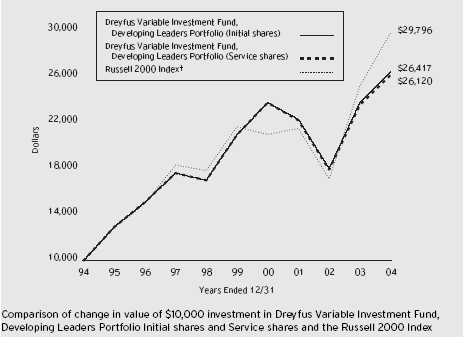

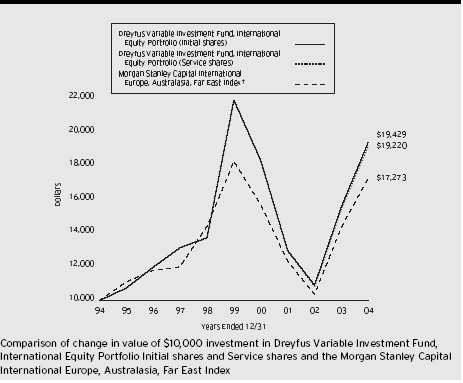

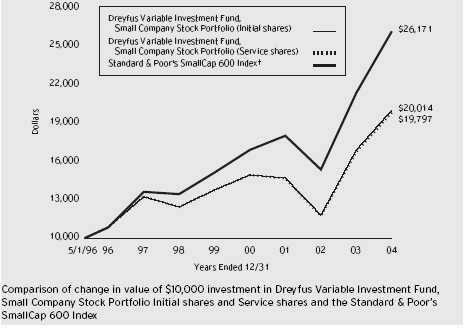

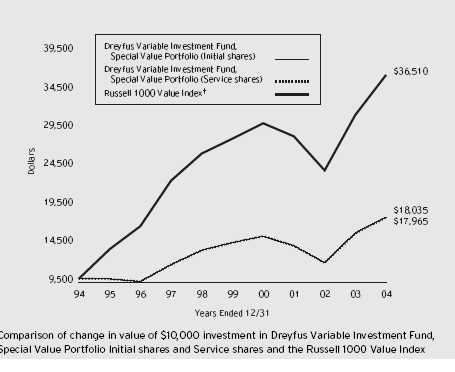

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund,Appreciation Portfolio on 12/31/94 to a $10,000 investment made in the Standard & Poor’s 500 Composite |

| Stock Price Index (the “Index”) on that date. | | | | | | |

| 6 | | | | | | |

The portfolio’s Initial shares are not subject to a Rule 12b-1 fee.The portfolio’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the portfolio’s Initial shares from their inception date through December 30, 2000, and the performance of the portfolio’s Service shares from December 31, 2000 (inception date of Service shares) to December 31, 2004 (blended performance figures).The blended performance figures have not been adjusted to reflect the higher operating expenses of the Service shares. If these expenses had been reflected, the blended performance figures would have been lower. All dividends and capital gain distributions are reinvested.

The portfolio’s performance shown in the line graph takes into account all applicable portfolio fees and expenses.The Index is a widely accepted, unmanaged index of U.S. stock market performance, which does not take into account charges, fees and other expenses. Further information relating to portfolio performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

As a mutual fund investor,you pay ongoing expenses,such as management fees and other expenses.Using the information below,you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses,including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your portfolio’s prospectus or talk to your financial adviser.

| | Review your portfolio’s expenses

|

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund,Appreciation Portfolio from July 1, 2004 to December 31, 2004. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | |

| assuming actual returns for the six months ended December 31, 2004 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.03 | | $ 5.31 |

| Ending value (after expenses) | | $1,030.70 | | $1,029.40 |

COMPARING YOUR PORTFOLIO’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your portfolio’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the portfolio with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended December 31, 2004

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.01 | | $ 5.28 |

| Ending value (after expenses) | | $1,021.17 | | $1,019.91 |

† Expenses are equal to the portfolio’s annualized expense ratio of .79% for Initial shares and 1.04% for Service shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

STATEMENT OF INVESTMENTS

December 31, 2004

| Common Stocks—100.0% | | Shares | | Value ($) |

| |

| |

|

| Banking—6.2% | | | | |

| Bank of America | | 291,216 | | 13,684,240 |

| Federal Home Loan Mortgage | | 121,600 | | 8,961,920 |

| Federal National Mortgage Association | | 200,800 | | 14,298,968 |

| HSBC Holdings, ADR | | 10,000 a | | 851,400 |

| SunTrust Banks | | 198,600 | | 14,672,568 |

| | | | | 52,469,096 |

| Capital Goods—6.2% | | | | |

| Emerson Electric | | 164,900 | | 11,559,490 |

| General Electric | | 1,115,500 | | 40,715,750 |

| | | | | 52,275,240 |

| Consumer Durables & Apparel—1.3% | | | | |

| Christian Dior | | 72,700 | | 4,936,172 |

| Polo Ralph Lauren | | 145,500 | | 6,198,300 |

| | | | | 11,134,472 |

| Consumer Staples—6.1% | | | | |

| Sysco | | 73,000 | | 2,786,410 |

| Wal-Mart Stores | | 459,700 | | 24,281,354 |

| Walgreen | | 649,900 | | 24,936,663 |

| | | | | 52,004,427 |

| Diversified Financials—8.7% | | | | |

| American Express | | 327,500 | | 18,461,175 |

| Citigroup | | 601,524 | | 28,981,426 |

| JP Morgan Chase & Co. | | 451,100 | | 17,597,411 |

| Merrill Lynch | | 145,500 | | 8,696,535 |

| | | | | 73,736,547 |

| Energy—14.6% | | | | |

| BP, ADR | | 455,900 | | 26,624,560 |

| ChevronTexaco | | 445,800 | | 23,408,958 |

| ConocoPhillips | | 75,000 | | 6,512,250 |

| Exxon Mobil | | 1,176,564 | | 60,310,671 |

| Occidental Petroleum | | 60,000 | | 3,501,600 |

| Royal Dutch Petroleum | | 59,800 | | 3,431,324 |

| | | | | 123,789,363 |

| Food, Beverage & Tobacco—17.2% | | | | |

| Altria Group | | 926,400 | | 56,603,040 |

| Anheuser-Busch Cos. | | 257,100 | | 13,042,683 |

| Coca-Cola | | 664,500 | | 27,663,135 |

The Portfolio 9

S T A T E M E N T O F I N V E S T M E N T S (continued)

| Common Stocks (continued) | | Shares | | | | Value ($) |

| |

| |

| |

|

| Food, Beverage & Tobacco (continued) | | | | | | |

| Kraft Foods, Cl. A | | 162,100 | | | | 5,772,381 |

| Nestle, ADR | | 291,000 | | | | 19,160,531 |

| PepsiCo | | 455,900 | | | | 23,797,980 |

| | | | | | | 146,039,750 |

| Hotels Restaurants & Leisure—1.2% | | | | | | |

| McDonald’s | | 304,500 | | | | 9,762,270 |

| Household & Personal Products—5.5% | | | | | | |

| Colgate-Palmolive | | 174,600 | | | | 8,932,536 |

| Estee Lauder Cos., Cl. A | | 145,500 | | | | 6,659,535 |

| Procter & Gamble | | 565,000 | | | | 31,120,200 |

| | | | | | | 46,712,271 |

| Insurance—5.1% | | | | | | |

| American International Group | | 202,920 | | | | 13,325,757 |

| Berkshire Hathaway, Cl. A | | 220 | | b | | 19,338,000 |

| Marsh & McLennan Cos. | | 316,100 | | | | 10,399,690 |

| | | | | | | 43,063,447 |

| Media—5.3% | | | | | | |

| Fox Entertainment Group, Cl. A | | 130,900 | | b | | 4,091,934 |

| McGraw-Hill Cos. | | 264,800 | | | | 24,239,792 |

| News, Cl. A | | 339,400 | | | | 6,333,204 |

| News, Cl. B | | 9,800 | | a | | 188,160 |

| Time Warner | | 226,800 | | b | | 4,408,992 |

| Viacom, Cl. B | | 150,300 | | | | 5,469,417 |

| | | | | | | 44,731,499 |

| Pharmaceuticals & Biotechnology—12.5% | | | | |

| Abbott Laboratories | | 354,100 | | | | 16,518,765 |

| Eli Lilly & Co. | | 261,900 | | | | 14,862,825 |

| Johnson & Johnson | | 403,300 | | | | 25,577,286 |

| Merck & Co. | | 373,000 | | | | 11,988,220 |

| Pfizer | | 1,231,000 | | | | 33,101,590 |

| Roche Holding, ADR | | 32,000 | | | | 3,716,000 |

| | | | | | | 105,764,686 |

| Retailing—1.6% | | | | | | |

| Target | | 261,900 | | | | 13,600,467 |

| Semiconductors & | | | | | | |

| Semiconductor Equipment—3.9% | | | | | | |

| Intel | | 1,414,700 | | | | 33,089,833 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Software & Services—2.8% | | | | |

| Microsoft | | 897,300 | | 23,966,883 |

| Technology Hardware & Equipment—.5% | | | | |

| International Business Machines | | 39,800 | | 3,923,484 |

| Transportation—1.3% | | | | |

| United Parcel Service, Cl. B | | 126,800 | | 10,836,328 |

| Total Common Stocks | | | | |

| (cost $671,328,419) | | | | 846,900,063 |

| |

| |

|

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—.1% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional | | | | |

| Preferred Plus Money Market Fund | | | | |

| (cost $1,072,000) | | 1,072,000 c | | 1,072,000 |

| |

| |

|

| |

| Total Investments (cost $672,400,419) | | 100.1% | | 847,972,063 |

| Liabilities, Less Cash and Receivables | | (.1%) | | (1,274,724) |

| Net Assets | | 100.0% | | 846,697,339 |

| |

| ADR—American Depository Receipts. | | | | |

| a All or a portion of these securites are on loan.At December 31, 2004, the total market value of the fund’s securities |

| on loan is $1,035,720 and the total market value of the collateral held by the fund is $1,072,000. |

| b Non-income producing. | | | | |

| c Investment in affiliated money market mutual fund. | | |

| Portfolio Summary † | | | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Food, Beverage & Tobacco | | 17.2 | | Capital Goods | | 6.2 |

| Energy | | 14.6 | | Consumer Staples | | 6.1 |

| Pharmaceuticals & | | | | Household & Personal Products | | 5.5 |

| Biotechnology | | 12.5 | | Other | | 23.1 |

| Diversified Financials | | 8.7 | | | | |

| Banking | | 6.2 | | | | 100.1 |

† Based on net assets.

See notes to financial statements.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2004

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement | | |

| of Investments (including securities on loan, | | |

| valued at $1,035,720)—Note 1(c): | | |

| Unaffiliated issuers | | 671,328,419 | | 846,900,063 |

| Affiliated issuers | | 1,072,000 | | 1,072,000 |

| Cash | | | | 333,520 |

| Dividends and interest receivable | | | | 1,339,749 |

| Receivable for shares of Beneficial Interest subscribed | | 175,716 |

| Prepaid expenses | | | | 50,074 |

| | | | | 849,871,122 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 332,582 |

| Due to Fayez Sarofim & Co. | | | | 229,509 |

| Payable for shares of Beneficial Interest redeemed | | 1,413,308 |

| Liability for securities on loan—Note 1(c) | | 1,072,000 |

| Bank loan payable—Note 2 | | | | 50,000 |

| Interest payable—Note 2 | | | | 4,082 |

| Accrued expenses | | | | 72,302 |

| | | | | 3,173,783 |

| |

| |

|

| Net Assets ($) | | | | 846,697,339 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 727,999,226 |

| Accumulated undistributed investment income—net | | 130,363 |

| Accumulated net realized gain (loss) on investments | | (57,003,894) |

| Accumulated net unrealized appreciation (depreciation) | | |

| on investments and foreign currency transactions | | 175,571,644 |

| |

|

| Net Assets ($) | | | | 846,697,339 |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Net Assets ($) | | 766,168,679 | | 80,528,660 |

| Shares Outstanding | | 21,545,682 | | 2,270,849 |

| |

| |

|

| Net Asset Value Per Share ($) | | 35.56 | | 35.46 |

See notes to financial statements.

|

STATEMENT OF OPERATIONS

Year Ended December 31, 2004

|

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $105,981 foreign taxes withheld at source): |

| Unaffiliated issuers | | 20,753,254 |

| Affiliated issuers | | 4,464 |

| Income from securities lending | | 32,581 |

| Total Income | | 20,790,299 |

| Expenses: | | |

| Investment advisory fee—Note 3(a) | | 3,709,636 |

| Sub-investment advisory fee—Note 3(a) | | 2,809,636 |

| Distribution fees—Note 3(b) | | 203,374 |

| Trustees’ fees and expenses—Note 3(c) | | 82,127 |

| Custodian fees—Note 3(b) | | 64,246 |

| Prospectus and shareholders’ reports | | 61,117 |

| Professional fees | | 42,963 |

| Shareholder servicing costs—Note 3(b) | | 42,378 |

| Interest expense—Note 2 | | 21,662 |

| Loan commitment fees—Note 2 | | 5,425 |

| Registration fees | | 1,356 |

| Miscellaneous | | 16,941 |

| Total Expenses | | 7,060,861 |

| Investment Income—Net | | 13,729,438 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments and | | |

| foreign currency transactions | | (5,994,905) |

| Net unrealized appreciation (depreciation) | | |

| on investments and foreign currency transactions | | 33,662,361 |

| Net Realized and Unrealized Gain (Loss) on Investments | | 27,667,456 |

| Net Increase in Net Assets Resulting from Operations | | 41,396,894 |

See notes to financial statements.

|

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 13,729,438 | | 11,441,662 |

| Net realized gain (loss) on investments | | (5,994,905) | | (14,655,861) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 33,662,361 | | 164,515,474 |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 41,396,894 | | 161,301,275 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Initial shares | | (12,718,082) | | (10,470,353) |

| Service shares | | (1,102,158) | | (952,535) |

| Total Dividends | | (13,820,240) | | (11,422,888) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Initial shares | | 58,196,296 | | 115,536,630 |

| Service shares | | 21,783,851 | | 24,248,136 |

| Dividends reinvested: | | | | |

| Initial shares | | 12,718,082 | | 10,470,353 |

| Service shares | | 1,102,158 | | 952,535 |

| Cost of shares redeemed: | | | | |

| Initial shares | | (150,984,809) | | (163,523,003) |

| Service shares | | (34,135,074) | | (10,401,232) |

| Increase (Decrease) in Net Assets from | | | | |

| Beneficial Interest Transactions | | (91,319,496) | | (22,716,581) |

| Total Increase (Decrease) in Net Assets | | (63,742,842) | | 127,161,806 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 910,440,181 | | 783,278,375 |

| End of Period | | 846,697,339 | | 910,440,181 |

| Undistributed investment income—net | | 130,363 | | 219,381 |

| | | Year Ended December 31, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Initial Shares | | | | |

| Shares sold | | 1,672,805 | | 3,772,306 |

| Shares issued for dividends reinvested | | 357,874 | | 310,231 |

| Shares redeemed | | (4,347,023) | | (5,327,254) |

| Net Increase (Decrease) in Shares Outstanding | | (2,316,344) | | (1,244,717) |

| |

| |

|

| Service Shares | | | | |

| Shares sold | | 629,793 | | 797,930 |

| Shares issued for dividends reinvested | | 31,090 | | 28,309 |

| Shares redeemed | | (987,230) | | (338,806) |

| Net Increase (Decrease) in Shares Outstanding | | (326,347) | | 487,433 |

See notes to financial statements.

|

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single portfolio share.Total return shows how much your investment in the portfolio would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the portfolio’s financial statements.

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Initial Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 34.42 | | 28.79 | | 34.98 | | 38.91 | | 39.87 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .56 | | .43 | | .36 | | .30 | | .27 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 1.18 | | 5.64 | | (6.19) | | (3.93) | | (.52) |

| Total from Investment Operations | | 1.74 | | 6.07 | | (5.83) | | (3.63) | | (.25) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.60) | | (.44) | | (.36) | | (.30) | | (.26) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | — | | (.45) |

| Total Distributions | | (.60) | | (.44) | | (.36) | | (.30) | | (.71) |

| Net asset value, end of period | | 35.56 | | 34.42 | | 28.79 | | 34.98 | | 38.91 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 5.05 | | 21.17 | | (16.71) | | (9.31) | | (.65) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .79 | | .80 | | .78 | | .78 | | .78 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.60 | | 1.41 | | 1.10 | | .84 | | .67 |

| Portfolio Turnover Rate | | 1.64 | | 4.60 | | 6.61 | | 4.19 | | 6.15 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 766,169 | | 821,319 | | 722,706 | | 897,5351,009,713 |

a Based on average shares outstanding at each month end.

See notes to financial statements.

|

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Service Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 a |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 34.31 | | 28.71 | | 34.89 | | 38.91 | | 38.91 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .46b | | .36b | | .29b | | .18b | | — |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 1.19 | | 5.61 | | (6.17) | | (3.94) | | — |

| Total from Investment Operations | | 1.65 | | 5.97 | | (5.88) | | (3.76) | | — |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.50) | | (.37) | | (.30) | | (.26) | | — |

| Net asset value, end of period | | 35.46 | | 34.31 | | 28.71 | | 34.89 | | 38.91 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 4.80 | | 20.83 | | (16.89) | | (9.63) | | — |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.04 | | 1.05 | | 1.02 | | 1.10 | | — |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.34 | | 1.16 | | .91 | | .53 | | — |

| Portfolio Turnover Rate | | 1.64 | | 4.60 | | 6.61 | | 4.19 | | 6.15 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 80,529 | | 89,121 | | 60,572 | | 35,632 | | 1 |

| |

| a | | The portfolio commenced offering Service shares on December 31, 2000. | | | | | | |

| b | | Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Variable Investment Fund (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company, operating as a series company currently offering twelve series, including the Appreciation Portfolio (the “portfolio”). The portfolio is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The portfolio is a diversified series. The portfolio’s investment objective is to provide long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (“Dreyfus”) serves as the portfolio’s investment adviser. Dreyfus is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”). Fayez Sarofim & Co. (“Sarofim”) serves as the portfolio’s sub-investment adviser.

Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the portfolio’s shares, which are sold without a sales charge.The portfolio is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan and the expenses borne by each class and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The fund accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The portfolio’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifica-tions.The portfolio’s maximum exposure under these arrangements is unknown. The portfolio does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Investments in registered investment companies are valued at their net asset value. When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the portfolio calculates its net asset value, the portfolio may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Investments denominated in foreign cur-

NOTES TO FINANCIAL STATEMENTS (continued)

|

rencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

(b) Foreign currency transactions: The portfolio does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the portfolio’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The portfolio has an arrangement with the custodian bank whereby the portfolio receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the portfolio includes net earnings credits, if any, as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with Mellon Bank, N.A., an affiliate of Dreyfus, the portfolio may lend securities to qualified institutions.At origination, all loans are secured by collateral of at least

102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan will be maintained at all times. Cash collateral is invested in certain money market mutual funds managed by Dreyfus. The portfolio will be entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the portfolio would bear the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gain, if any, are normally declared and paid annually, but the portfolio may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, it is the policy of the portfolio not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the portfolio to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

At December 31, 2004, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $130,363, accumulated capital losses $57,003,881 and unrealized appreciation $175,571,631.

NOTES TO FINANCIAL STATEMENTS (continued)

|

The accumulated capital loss carryover is available to be applied against future net securities profits, if any, realized subsequent to December 31, 2004. If not applied, $6,595,648 of the carryover expires in fiscal 2009, $23,015,684 expires in fiscal 2010, $20,683,522 expires in fiscal 2011 and $6,709,027 expires in fiscal 2012.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2004 and December 31, 2003 were as follows: ordinary income $13,820,240 and $11,422,888, respectively.

During the period ended December 31, 2004, as a result of permanent book to tax differences primarily due to the tax treatment for foreign currency transactions, the portfolio increased accumulated undistributed investment income-net by $1,784 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

|

The portfolio participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the portfolio has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the portfolio at rates based on prevailing market rates in effect at the time of borrowings.

The average daily amount of borrowings outstanding during the period ended December 31, 2004 was approximately $1,175,300, with a related weighted average annualized interest rate of 1.81% .

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Advisory Agreement with Dreyfus, the investment advisory fee is based on the value of the portfolio’s average daily net assets and is computed at the following annual rates: .55 of 1% of the first $150 million; .50 of 1% of the next $150 million; and

.375 of 1% over $300 million.The fee is payable monthly. Pursuant to a Sub-Investment Advisory Agreement with Sarofim, the sub-investment advisory fee is based upon the value of the portfolio’s average daily net assets and is computed at the following annual rates: .20 of 1% of the first $150 million; .25 of 1% of the next $150 million; and .375 of 1% over $300 million.The fee is payable monthly.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing their shares, for servicing and/or maintaining Service shares shareholder accounts and for advertising and marketing for Service shares.The Plan provides for payments to be made at an annual rate of .25 of 1% of the value of the Service shares’ average daily net assets. The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products.The fees payable under the Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2004, Service shares were charged $203,374 pursuant to the Plan.

The portfolio compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the portfolio. During the period ended December 31, 2004, the portfolio was charged $486 pursuant to the transfer agency agreement.

The portfolio compensates Mellon Bank, N.A., an affiliate of Dreyfus, under a custody agreement to provide custodial services for the portfolio. During the period ended December 31, 2004, the portfolio was charged $64,246 pursuant to the custody agreement.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: management fees $305,575, Rule 12b-1 distribution plan fees $16,790, custodian fees $10,065 and transfer agency per account fees $152.

NOTES TO FINANCIAL STATEMENTS (continued)

|

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

(d) Pursuant to an exemptive order from the Securities and Exchange Commission, the portfolio may invest its available cash in affiliated money market mutual funds. Management fees of the underlying money market mutual funds have been waived by Dreyfus.

(e) During the period ended December 31, 2004, the portfolio incurred total brokerage commissions of $114,930 of which $240 was paid to Harborside Plus Inc., a wholly-owned subsidiary of Mellon Financial.

NOTE 4—Securities Transactions:

|

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2004, amounted to $14,281,877 and $104,499,369, respectively.

At December 31, 2004, the cost of investments for federal income tax purposes was $672,400,432; accordingly, accumulated net unrealized appreciation on investments was $175,571,631, consisting of $207,994,545 gross unrealized appreciation and $32,422,914 gross unrealized depreciation.

In early 2004, two purported class and derivative actions were filed against Mellon Financial, Mellon Bank, N.A., Dreyfus, Founders Asset Management LLC, and certain directors of the Dreyfus Funds and the Dreyfus Founders Funds (together, the ��Funds”). In September 2004, plaintiffs served a Consolidated Amended Complaint (the “Amended Complaint”) on behalf of a purported class of all persons who acquired interests in any of the Funds between January 30, 1999 and November 17, 2003, and derivatively on behalf of the Funds. The Amended Complaint in the newly styled In re Dreyfus Mutual Funds Fee Litigation also named the Distributor, Premier Mutual Fund Services, Inc. and two additional Fund directors as defendants and alleges viola-

tions of the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Pennsylvania Unfair Trade Practices and Consumer Protection Law and common-law claims. Plaintiffs seek to recover allegedly improper and excessive Rule 12b-1 and advisory fees allegedly charged to the Funds for marketing and distribution services. More specifically, plaintiffs claim, among other things, that 12b-1 fees and directed brokerage were improperly used to pay brokers to recommend the Funds over other funds, and that such payments were not disclosed to investors. In addition, plaintiffs assert that economies of scale and soft-dollar benefits were not passed on to the Funds. Plaintiffs further allege that 12b-1 fees were improperly charged to certain of the Funds that were closed to new investors.The Amended Complaint seeks compensatory and punitive damages, rescission of the advisory contracts, and an accounting and restitution of any unlawful fees, as well as an award of attorneys’ fees and litigation expenses. As noted, some of the claims in this litigation are asserted derivatively on behalf of the Funds that have been named as nominal defendants. With respect to such derivative claims, no relief is sought against the Funds. Dreyfus believes the allegations to be totally without merit and intends to defend the action vig-orously.Defendants filed motions to dismiss the Amended Complaint on November 12, 2004, and those motions are pending.

Additional lawsuits arising out of these circumstances and presenting similar allegations and requests for relief may be filed against the defendants in the future. Neither Dreyfus nor the Funds believe that any of the pending actions will have a material adverse effect on the Funds or Dreyfus’ ability to perform its contract with the Funds.

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Trustees

Dreyfus Variable Investment Fund, Appreciation Portfolio

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the funds comprising Dreyfus Variable Investment Fund) as of December 31, 2004, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the periods indicated therein.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights. Our procedures included verification by examination of securities held by the custodian as of December 31, 2004 and confirmation of securities not held by the custodian by correspondence with others. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Variable Investment Fund,Appreciation Portfolio at December 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated periods, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 4, 2005

|

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the portfolio hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2004 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in January 2005 of the percentage applicable to the preparation of their 2004 income tax returns.

BOARD MEMBERS INFORMATION (Unaudited)

Joseph S. DiMartino (61)

Chairman of the Board (1995)

|

Principal Occupation During Past 5 Years:

• Corporate Director and Trustee

|

Other Board Memberships and Affiliations:

|

- The Muscular Dystrophy Association, Director

- Levcor International, Inc., an apparel fabric processor, Director

- Century Business Services, Inc., a provider of outsourcing functions for small and medium size companies, Director

- The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director

- Azimuth Trust, an institutional asset management firm, Member of Board of Managers and Advisory Board

No. of Portfolios for which Board Member Serves: 186

David P. Feldman (65)

Board Member (1994)

|

Principal Occupation During Past 5 Years:

• Corporate Director and Trustee

|

Other Board Memberships and Affiliations:

|

- BBH Mutual Funds Group (11 funds), Director

- The Jeffrey Company, a private investment company, Director

- QMED, a medical device company, Director

No. of Portfolios for which Board Member Serves: 51

———————

James F. Henry (74)

Board Member (1990)

|

Principal Occupation During Past 5 Years:

|

- President, CPR Institute for Dispute Resolution, a non-profit organization principally engaged in the development of alternatives to business litigation (Retired 2003)

No. of Portfolios for which Board Member Serves: 22

|

———————

Rosalind Gersten Jacobs (79)

Board Member (1990)

|

Principal Occupation During Past 5 Years:

• Merchandise and marketing consultant

|

No. of Portfolios for which Board Member Serves: 33

|

| | Dr. Paul A. Marks (78)

Board Member (1990)

|

Principal Occupation During Past 5 Years:

• President and Chief Executive Officer of Memorial Sloan-Kettering Cancer Center (Retired 1999)

Other Board Memberships and Affiliations:

- Pfizer, Inc., a pharmaceutical company, Director-Emeritus

- Atom Pharm, Director

- Lazard Freres & Company, LLC, Senior Adviser

- Merck, Consultant

No. of Portfolios for which Board Member Serves: 22

| | Dr. Martin Peretz (65)

Board Member (1990)

|

Principal Occupation During Past 5 Years:

- Editor-in-Chief of The New Republic Magazine

- Lecturer in Social Studies at Harvard University (1965-2001)

- Co-Chairman of TheStreet.com, a financial daily on the web

Other Board Memberships and Affiliations:

- Academy for Liberal Education, an accrediting agency for colleges and universities certified by the U.S. Department of Education, Director

- Digital Learning Group, LLC, an online publisher of college textbooks, Director

- Harvard Center for Blood Research,Trustee

- Bard College,Trustee

- YIVO Institute for Jewish Research,Trustee

No. of Portfolios for which Board Member Serves: 22

| | Bert W.Wasserman (72)

Board Member (1993)

|

Principal Occupation During Past 5 Years:

• Financial Consultant

Other Board Memberships and Affiliations:

• Lillian Vernon Corporation, Director

No. of Portfolios for which Board Member Serves: 22

———————

Once elected all Board Members serve for an indefinite term.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166.Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

| John M. Fraser, Jr., Emeritus Board Member |

| Irving Kristol, Emeritus Board Member |

OFFICERS OF THE FUND (Unaudited)

| STEPHEN E. CANTER, President since | | MICHAEL A. ROSENBERG, Secretary since |

| March 2000. | | March 2000. |

| Chairman of the Board, Chief Executive | | Associate General Counsel of Dreyfus, and an |

| Officer and Chief Operating Officer of | | officer of 90 investment companies (comprised |

| Dreyfus, and an officer of 92 investment | | of 194 portfolios) managed by Dreyfus. He is |

| companies (comprised of 185 portfolios) | | 44 years old and has been an employee of |

| managed by Dreyfus. Mr. Canter also is a | | Dreyfus since October 1991. |

| |

| Board member and, where applicable, an | | ROBERT R. MULLERY, Assistant Secretary |

| Executive Committee Member of the other | | since March 2000. |

| investment management subsidiaries of Mellon | | |

| Financial Corporation, each of which is an | | Associate General Counsel of Dreyfus, and an |

| affiliate of Dreyfus. He is 59 years old and has | | officer of 26 investment companies (comprised |

| been an employee of Dreyfus since May 1995. | | of 60 portfolios) managed by Dreyfus. He is 52 |

| | | years old and has been an employee of Dreyfus |

| STEPHEN R. BYERS, Executive Vice | | since May 1986. |

| President since November 2002. | | |

| | | STEVEN F. NEWMAN, Assistant Secretary |

| Chief Investment Officer,Vice Chairman and a | | since March 2000. |

| director of Dreyfus, and an officer of 92 | | |

| investment companies (comprised of 185 | | Associate General Counsel and Assistant |

| portfolios) managed by Dreyfus. Mr. Byers also | | Secretary of Dreyfus, and an officer of 93 |

| is an officer, director or an Executive | | investment companies (comprised of 201 |

| Committee Member of certain other | | portfolios) managed by Dreyfus. He is 55 years |

| investment management subsidiaries of Mellon | | old and has been an employee of Dreyfus since |

| Financial Corporation, each of which is an | | July 1980. |

| affiliate of Dreyfus. He is 51 years old and has | | JAMES WINDELS, Treasurer since |

| been an employee of Dreyfus since January | | November 2001. |

| 2000. Prior to joining Dreyfus, he served as an | | |

| Executive Vice President-Capital Markets, | | Director – Mutual Fund Accounting of Dreyfus, |

| Chief Financial Officer and Treasurer at | | and an officer of 93 investment companies |

| Gruntal & Co., L.L.C. | | (comprised of 201 portfolios) managed by |

| | | Dreyfus. He is 46 years old and has been an |

| MARK N. JACOBS, Vice President since | | employee of Dreyfus since April 1985. |

| March 2000. | | |

| | | RICHARD CASSARO, Assistant Treasurer |

| Executive Vice President, Secretary and | | since August 2003. |

| General Counsel of Dreyfus, and an officer of | | |

| 93 investment companies (comprised of 201 | | Senior Accounting Manager – Equity Funds of |

| portfolios) managed by Dreyfus. He is 58 years | | Dreyfus, and an officer of 26 investment |

| old and has been an employee of Dreyfus since | | companies (comprised of 102 portfolios) |

| June 1977. | | managed by Dreyfus. He is 44 years old and |

| | | has been an employee of Dreyfus since |

| | | September 1982. |

| ERIK D. NAVILOFF, Assistant Treasurer | | JOSEPH W. CONNOLLY, Chief Compliance |

| since December 2002. | | Officer since October 2004. |

| Senior Accounting Manager – Taxable Fixed | | Chief Compliance Officer of Dreyfus and The |

| Income Funds of Dreyfus, and an officer of 19 | | Dreyfus Family of Funds (93 investment |

| investment companies (comprised of 75 | | companies, comprising 201 portfolios). From |

| portfolios) managed by Dreyfus. He is 36 years | | November 2001 through March 2004, Mr. |

| old and has been an employee of Dreyfus since | | Connolly was first Vice-President, Mutual Fund |

| November 1992. | | Servicing for Mellon Global Securities |

| |

| ROBERT ROBOL, Assistant Treasurer | | Services. In that capacity, Mr. Connolly was |

| since August 2003. | | responsible for managing Mellon’s Custody, |

| | | Fund Accounting and Fund Administration |

| Senior Accounting Manager – Money Market | | services to third-party mutual fund clients. He |

| Funds of Dreyfus, and an officer of 39 | | is 47 years old and has served in various |

| investment companies (comprised of 84 | | capacities with Dreyfus since 1980, including |

| portfolios) managed by Dreyfus. He is 40 years | | manager of the firm’s Fund Accounting |

| old and has been an employee of Dreyfus since | | Department from 1997 through October 2001. |

| October 1988. | | |

| | | WILLIAM GERMENIS, Anti-Money |

| ROBERT SVAGNA, Assistant Treasurer | | Laundering Compliance Officer since |

| since December 2002. | | September 2002. |

| Senior Accounting Manager – Equity Funds of | | Vice President and Anti-Money Laundering |

| Dreyfus, and an officer of 27 investment | | Compliance Officer of the Distributor, and the |

| companies (comprised of 107 portfolios) | | Anti-Money Laundering Compliance Officer |

| managed by Dreyfus. He is 37 years old and | | of 88 investment companies (comprised of 196 |

| has been an employee of Dreyfus since | | portfolios) managed by Dreyfus. He is 34 years |

| November 1990. | | old and has been an employee of the |

| KENNETH J. SANDGREN, Assistant | | Distributor since October 1998. |

| Treasurer since November 2001. | | |

| Mutual Funds Tax Director of Dreyfus, and an | | |

| officer of 93 investment companies (comprised | | |

| of 201 portfolios) managed by Dreyfus. He is | | |

| 50 years old and has been an employee of | | |

| Dreyfus since June 1993. | | |

NOTES

For More Information

| Dreyfus Variable |

| Investment Fund, |

| Appreciation Portfolio |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Investment Adviser |

| The Dreyfus Corporation |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Sub-Investment Advisor |

| Fayez Sarofim & Co. |

| Two Houston Center |

| Suite 2907 |

| Houston,TX 77010 |

| Custodian |

| Mellon Bank, N.A. |

| One Mellon Bank Center |

| Pittsburgh, PA 15258 |

| |

| Transfer Agent & |

| Dividend Disbursing Agent |

| Dreyfus Transfer, Inc. |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Distributor |

| Dreyfus Service Corporation |

| 200 Park Avenue |

| New York, NY 10166 |

Telephone 1-800-554-4611 or 516-338-3300

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 Attn: Institutional Servicing

The portfolio files its complete schedule of portfolio holdings with the Securities and

Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The portfolio’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the portfolio uses to determine how to vote proxies relating to portfolio securities, and information regarding how the portfolio voted these proxies for the 12-month period ended June 30, 2004, is available through the portfolio’s website at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

© 2005 Dreyfus Service Corporation

| Dreyfus Variable |

| Investment Fund, |

| Balanced Portfolio |

| ANNUAL REPORT December 31, 2004 |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | T H E P O R T F O L I O |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Performance |

| 6 | | Portfolio Performance |

| 8 | | Understanding Your Portfolio’s Expenses |

| 8 | | Comparing Your Portfolio’s Expenses |

| | | With Those of Other Funds |

| 9 | | Statement of Investments |

| 16 | | Statement of Assets and Liabilities |

| 17 | | Statement of Operations |

| 18 | | Statement of Changes in Net Assets |

| 20 | | Financial Highlights |

| 22 | | Notes to Financial Statements |

| 31 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 32 | | Important Tax Information |

| 32 | | Proxy Results |

| 33 | | Board Members Information |

| 35 | | Officers of the Fund |

| | | F O R M O R E I N F O R M AT I O N |

| |

|

| | | Back Cover |

| Dreyfus Variable Investment Fund, |

| Balanced Portfolio |

LETTER FROM THE CHAIRMAN

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Balanced Portfolio, covering the 12-month period from January 1, 2004, through December 31, 2004. Inside, you’ll find valuable information about how the portfolio was managed during the reporting period, including a discussion with the portfolio managers, Thomas Plumb, David Duchow, Timothy O’Brien and Clint Oppermann, of Wisconsin Capital Management, Inc., the portfolio’s sub-investment adviser.

2004 represented another year of positive performance for both stocks and bonds. Unlike the 2003 rallies, however, in which rising prices were primarily the result of generally improving business conditions, 2004’s performance largely reflected the strengths and weaknesses of individual issuers and market sectors.As a result, fundamental research and professional judgment became more important determinants of mutual fund performance in 2004.

What’s ahead for stocks and bonds in 2005? No one knows for certain. Positive influences remain in place, including moderately expanding U.S. and global economies and low inflation. Nonetheless, a number of risks — such as rising interest rates and global terrorism — could threaten the market environment.

As always, we urge our shareholders to view the financial markets from a long-term perspective, measured in years rather than weeks or months. One of the best ways to ensure a long-term perspective is to establish an investment plan with the help of your financial advisor, and review it periodically to track your progress toward your financial goals.

Thank you for your continued confidence and support.

DISCUSSION OF PERFORMANCE

Thomas Plumb, David Duchow, Timothy O’Brien and Clint Oppermann, Portfolio Managers Wisconsin Capital Management, Inc., Sub-Investment Adviser

How did Dreyfus Variable Investment Fund, Balanced Portfolio perform relative to its benchmark?

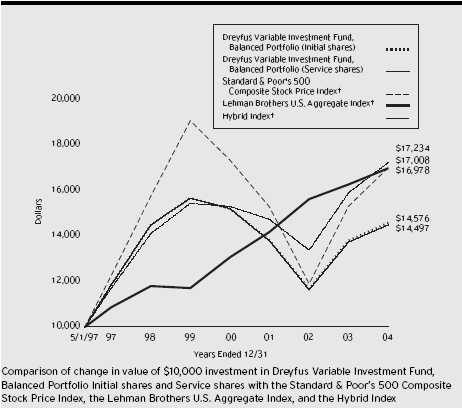

For the 12-month period ending December 31, 2004, the portfolio’s total returns were 5.64% for its Initial shares and 5.57% for its Service shares.1 In comparison, the portfolio’s benchmark, a hybrid index composed of 60% Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) and 40% Lehman Brothers U.S. Aggregate Index (the “Lehman Aggregate Index”), achieved a total return of 8.26% for the reporting period.2 Separately, the S&P 500 Index and the Lehman Aggregate Index achieved total returns of 11.04% and 4.34%, respectively, for the reporting period.

Both stocks and bonds produced generally positive returns in 2004 as a growing economy and low inflation offset headwinds caused by rising interest rates, higher energy prices and geopolitical concerns. The portfolio’s returns were modestly lower than its benchmark, primarily due to its security selection strategy and its relatively heavy allocation to stocks over bonds.

We are pleased to announce that on December 10, 2004, Wisconsin Capital Management, Inc. assumed responsibility as sub-investment adviser of the portfolio following shareholder approval of a Sub-Investment Advisory Agreement between The Dreyfus Corporation and Wisconsin Capital Management, Inc.

What is the portfolio’s investment approach?

The portfolio seeks high total return through a combination of capital appreciation and current income. To pursue this goal, the portfolio invests in a diversified mix of stocks and bonds of both U.S. and foreign issuers.The portfolio’s normal asset allocation is approximately 60% stocks and 40% bonds. However, the portfolio is permitted to invest up to 75%, and as little as 40%, of its assets in stocks and up to 60%, and as little as 25%, of its assets in bonds.

The portfolio’s stock investments may include common stocks, preferred stocks and convertible securities, including those purchased in initial public offerings or shortly thereafter.

In choosing stocks, the portfolio employs fundamental analysis, generally seeking companies with strong positions in their industries, and companies with a catalyst that can trigger a price increase (such as

DISCUSSION OF PERFORMANCE (continued)

|

accelerating earnings growth, a corporate restructuring or change in management). The portfolio managers seek to create a broadly diversified core portfolio comprised of growth stocks, value stocks and stocks that exhibit characteristics of both investment styles.The managers select stocks based on: value, or how a stock is priced relative to its perceived intrinsic worth; growth, in this case the sustainability or growth of earnings or cash flow; and financial profile, which measures the financial health of the company.

In choosing bonds and other fixed-income securities, the portfolio managers review economic, market and other factors, leading to valuations by sector, maturity and quality.

In allocating assets between stocks and bonds, the portfolio managers assess the relative return and risks of each asset class, analyzing several factors, including interest-rate-adjusted price/earnings ratios, the valuation and volatility levels of stocks relative to bonds, and other economic factors, such as interest rates.

What other factors influenced the portfolio’s performance?

For much of the reporting period, lackluster economic growth and rising interest rates held back the stock market’s returns. However, stocks rallied strongly during the final two months of the year, after uncertainty surrounding the U.S. presidential election dissipated. Despite rising interest rates during the second half of the year, bonds also fared relatively well as inflation remained persistently low, with corporate bonds producing particularly attractive results.

In addition to benefiting from a relatively heavy emphasis on equities during the stock market’s rally toward the end of the year, the portfolio also received strong contributions from its consumer discretionary holdings early in the year and financial stocks during the reporting period’s second half. Top performers in the consumer discretionary sector included a number of specialty retailers, while winners in the financials sector included mortgage originator Countrywide Financial, credit card issuer Capital One Financial and government-sponsored enterprise Freddie Mac.

Energy stocks gained value when oil and gas prices surged during the spring and summer of 2004, driving higher the stocks of independent energy companies XTO Energy and Anadarko Petroleum. Health care stocks also produced positive returns overall, with strength among medical devices and equipment companies offsetting weakness among large pharmaceutical producers. For example, defibrillator manufacturer St. Jude Medical and coated stent maker Guidant contributed strongly to the portfolio’s performance.

On the other hand, the portfolio’s equity returns were constrained primarily by a handful of disappointments in the telecommunications, industrials and consumer staples sectors. Food producer Dean Foods,

European discount airline Ryanair and U.S. railroad CSX Corporation ranked among the greatest detractors from the portfolio’s performance for the reporting period.

For much of the year, the portfolio’s bond portfolio was structured to approximate the composition of the Lehman Aggregate Index. Later, we focused primarily on short-maturity bonds, including single-A rated corporate bonds and U.S. government securities. This strategy was designed to manage the risks of rising short-term interest rates in a strengthening economy.

What is the portfolio’s current strategy?

We have continued to emphasize stocks over bonds. However, we have reduced the portfolio’s equity holdings from approximately 90 stocks to around 50 stocks in which we have a high degree of confidence.We have focused primarily on what we believe to be growing companies available at reasonable prices. Recently, we have identified a number of such opportunities among major drug distributors, for-profit education providers and software developers serving the financial services industry. On the other hand, we have identified relatively few reasonably valued opportunities in the energy sector, where values rose sharply in 2004. The portfolio’s fixed-income holdings have continued to focus on shorter-term, investment-grade securities. In our view, this is a prudent strategy in a rising interest-rate environment.

| | | The portfolio is only available as a funding vehicle under variable life insurance policies or variable |

| | | annuity contracts issued by insurance companies. Individuals may not purchase shares of the |

| | | portfolio directly.A variable annuity is an insurance contract issued by an insurance company that |

| | | enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term |

| | | goals.The investment objective and policies of Dreyfus Variable Investment Fund, Balanced |

| | | Portfolio made available through insurance products may be similar to other funds/portfolios |

| | | managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or |

| | | lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio’s performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. Return figures provided reflect the |

| | | absorption of portfolio expenses by The Dreyfus Corporation pursuant to an agreement in effect |

| | | through December 31, 2005, at which time it may be extended, terminated or modified. Had |

| | | these expenses not been absorbed, the portfolio’s returns would have been lower. |

| 2 | | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, |

| | | capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 |

| | | Index”) is a widely accepted, unmanaged index of U.S. stock market performance.The Lehman |

| | | Brothers U.S.Aggregate Index is a widely accepted, unmanaged total return index of corporate, |

| | | U.S. government and U.S. government agency debt instruments, mortgage-backed securities and |

| | | asset-backed securities with an average maturity of 1-10 years. |

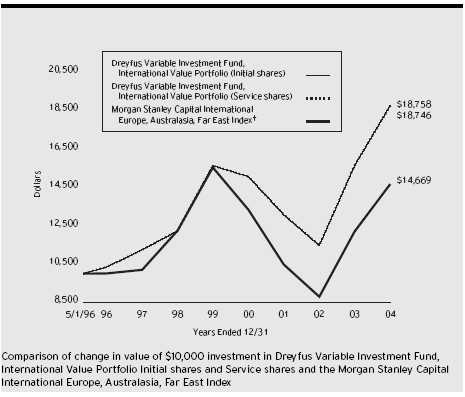

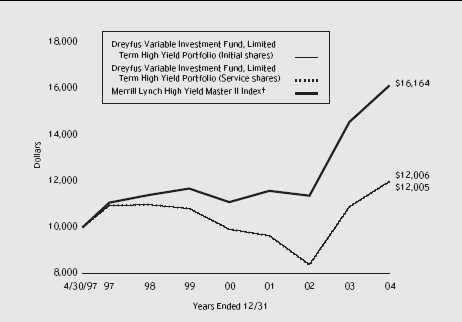

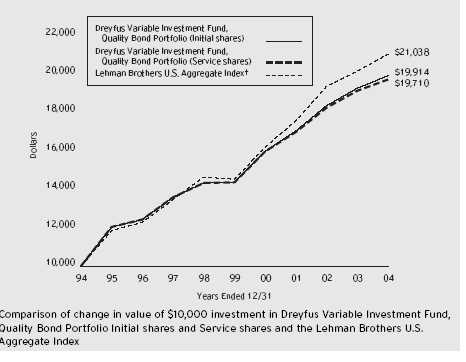

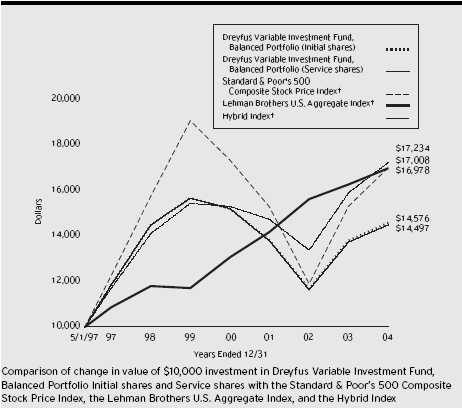

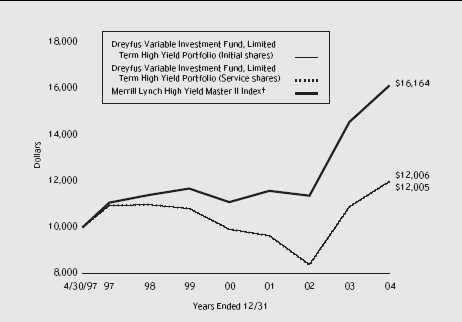

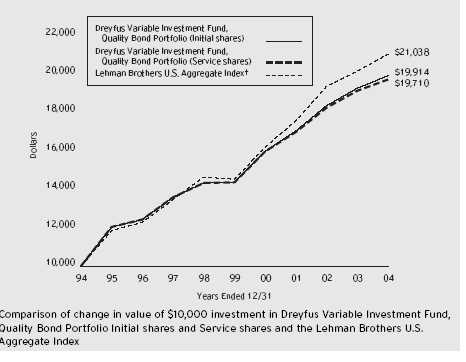

| Average Annual Total Returns as | | of 12/31/04 | | | | |

| | | Inception | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | Inception |

| |

| |

| |

| |

|

| Initial shares | | 5/1/97 | | 5.64% | | (1.44)% | | 5.04% |

| Service shares | | 5/1/97 | | 5.57% | | (1.55)% | | 4.96% |

| The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 |

| (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth |

| results would have been lower. See notes below. |

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The portfolio’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. |

| The portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in |

| connection with investing in variable insurance contracts which will reduce returns. |

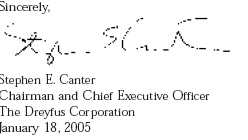

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund, Balanced Portfolio on 5/1/97 (inception date of Initial shares) to a $10,000 investment made in each of the |

| 6 |