| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-5125 |

| |

| DREYFUS VARIABLE INVESTMENT FUND |

| (Exact name of Registrant as specified in charter) |

| |

| |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 12/31 | | |

| Date of reporting period: | | 06/30/05 | | |

FORM N-CSR

| Item 1. | | Reports to Stockholders. |

| Dreyfus Variable |

| Investment Fund, |

| Appreciation Portfolio |

SEMIANNUAL REPORT June 30, 2005

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | T H E P O R T F O L I O |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Performance |

| 6 | | Understanding Your Portfolio's Expenses |

| 6 | | Comparing Your Portfolio's Expenses |

| | | With Those of Other Funds |

| 7 | | Statement of Investments |

| 10 | | Statement of Assets and Liabilities |

| 11 | | Statement of Operations |

| 12 | | Statement of Changes in Net Assets |

| 14 | | Financial Highlights |

| 16 | | Notes to Financial Statements |

| 24 | | Information About the Review |

| and Approval of the Portfolio's |

| Investment Advisory Agreement |

| | | F O R M O R E I N F O R M AT I O N |

| |

|

| | | Back Cover |

| Dreyfus Variable Investment Fund, |

| Appreciation Portfolio |

The Portfolio

L E T T E R F R O M T H E C H A I R M A N

Dear Shareholder:

We are pleased to present this semiannual report for Dreyfus Variable Investment Fund,Appreciation Portfolio, covering the six-month period from January 1, 2005, through June 30, 2005. Inside, you'll find valuable information about how the portfolio was managed during the reporting period, including a discussion with the portfolio manager, Fayez Sarofim, of Fayez Sarofim & Co., the portfolio's sub-investment adviser.

On average, U.S. stock prices ended the first half of 2005 slightly lower than where they began, largely due to headwinds caused by higher energy prices, rising short-term interest rates and recent evidence of slower economic growth. While midcap stocks generally produced higher returns than large-cap stocks, and large-cap stocks generally outperformed small-cap stocks, these differences were relatively small. Conversely, value-oriented stocks continued to produce substantially better results than their more growth-oriented counterparts.

In some ways, market conditions at midyear remind us of those from one year ago, when stock prices languished due to economic and political concerns before rallying strongly later in the year. Currently, our economists expect the U.S. economy to continue to grow over the foreseeable future without significant new inflationary pressures, potentially setting the stage for better business conditions that could send stock prices higher.As always, we encourage you to discuss these and other matters with your financial advisor.

Thank you for your continued confidence and support.

D I S C U S S I O N O F P E R F O R M A N C E

Fayez Sarofim, Portfolio Manager

Fayez Sarofim & Co., Sub-Investment Adviser

How did Dreyfus Variable Investment Fund, Appreciation Portfolio perform relative to its benchmark?

For the six-month period ended June 30, 2005, the portfolio's Initial shares produced a total return of 0.66%, and its Service shares produced a total return of 0.54% .1 For the same period, the total return of the portfolio's benchmark, the Standard & Poor's 500 Composite Stock Price Index ("S&P 500 Index"), was –0.81% .2

Stocks ended the reporting period roughly unchanged from where they began, as the benefits of a growing economy and strong earnings reports were offset by concerns regarding higher interest rates and surging energy prices.The portfolio produced higher returns than the S&P 500 Index, primarily due to a shift in investor sentiment away from smaller, more speculative investments and toward the larger, better-established, multinational companies in which the portfolio primarily invests.

What is the portfolio's investment approach?

The portfolio normally invests at least 80% of its assets in common stocks. The portfolio focuses on large, well-established multinational growth companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence and the potential to achieve predictable above-average earnings growth. We focus on purchasing reasonably priced growth stocks of fundamentally sound companies in economic sectors that we believe will expand over the next three to five years or longer.

What other factors influenced the portfolio's performance?

Stocks traded in a relatively narrow range over the first half of 2005 as positive factors, such as a generally robust economy and encouraging corporate earnings, were offset by other, potentially adverse influences. Rising interest rates and inflationary pressures caused primarily by

T h e P o r t f o l i o 3

|

D I S C U S S I O N O F P E R F O R M A N C E (continued)

escalating energy prices proved to be particularly worrisome for investors, who grew concerned that higher borrowing and commodity costs might dampen future economic activity and financial results.

Perhaps due to these concerns, investors apparently began to shift their focus away from the smaller, more speculative investments that had done well over the past several years. Increasingly, they turned their attention to large, well-established companies with track records of consistent growth. Historically, companies with these characteristics have tended to generate profits under a variety of economic conditions. In addition, investors may have been attracted to relatively low valuations among large growth companies. Indeed, when 2005 began, stocks of large-cap growth companies were generally selling toward the low end of their historical valuation ranges.

In this changing environment, the portfolio's returns benefited from our sector allocation and stock selection strategies. Because the portfolio was more heavily exposed to energy companies than the benchmark, it participated more fully in the energy sector's gains when oil and gas prices reached new record highs. Conversely, the portfolio invested a substantially smaller percentage of its assets in technology stocks compared to the benchmark, which helped it avoid the full brunt of the technology area's weakness. Nonetheless, semiconductor leader Intel proved to be one of the portfolio's top performers for the reporting period, while software developer Microsoft provided more modest returns.

The portfolio also received positive contributions to performance from the consumer staples sector, an area we have emphasized for some time. Pharmacy chain Walgreen continued to enjoy strong operating results while recovering from earlier weakness, while food and tobacco giant Altria Group benefited from a more benign litigation environment and investors' expectations of a potential restructuring that could unlock shareholder value.

On the other hand, the portfolio's performance was constrained by sub-par returns from the financials sector, where global insurer American International Group and mortgage agency Fannie Mae both

were hurt by regulatory scrutiny of their accounting practices and changes in senior management. Because of the risks surrounding these developments, we reduced the portfolio's holdings of both companies. In addition, the portfolio held no utilities stocks, preventing it from participating in the sector's relatively robust gains.

What is the portfolio's current strategy?

We have remained fully invested in a diversified portfolio of large-cap growth companies that we regard as leaders in their markets.We eliminated the portfolio's holdings in food company Kraft Foods and computing giant International Business Machines due to disappointing financial results. In addition, we added two new positions.We expect industrial gasses producer Praxair to benefit from continued robust demand for its products from oil refiners and drug companies, and French integrated oil company TotalFinaElf gives the portfolio a way to participate in growing markets that U.S. oil companies currently do not serve. In our judgment, the portfolio is well positioned to benefit from companies, such as these, that have demonstrated their ability to deliver positive operating results in good economic times and bad.

| | | The portfolio is only available as a funding vehicle under variable life insurance policies or variable |

| | | annuity contracts issued by insurance companies. Individuals may not purchase shares of the |

| | | portfolio directly. A variable annuity is an insurance contract issued by an insurance company that |

| | | enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term |

| | | goals.The investment objective and policies of Dreyfus Variable Investment Fund, Appreciation |

| | | Portfolio made available through insurance products may be similar to other funds/portfolios |

| | | managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or |

| | | lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio's performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. |

| 2 | | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends and, where |

| | | applicable, capital gain distributions.The Standard & Poor's 500 Composite Stock Price Index is |

| | | a widely accepted, unmanaged index of U.S. stock market performance. |

T h e P o r t f o l i o 5

|

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your portfolio's prospectus or talk to your financial adviser.

Review your portfolio's expenses

|

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund,Appreciation Portfolio from January 1, 2005 to June 30, 2005. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | |

| assuming actual returns for the six months ended June 30, 2005 | | |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.03 | | $ 5.27 |

| Ending value (after expenses) | | $1,006.60 | | $1,005.40 |

COMPARING YOUR PORTFOLIO'S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC's method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your portfolio's expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the portfolio with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended June 30, 2005

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.06 | | $ 5.31 |

| Ending value (after expenses) | | $1,020.78 | | $1,019.54 |

† Expenses are equal to the portfolio's annualized expense ratio of .81% for Initial shares and 1.06% for Service shares, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

S TAT E M E N T O F I N V E S T M E N T S

J u n e 3 0 , 2 0 0 5 (Unaudited)

| Common Stocks—99.5% | | Shares | | Value ($) |

| |

| |

|

| Apparel—1.5% | | | | |

| Christian Dior | | 72,700 a | | 5,637,753 |

| Polo Ralph Lauren | | 145,500 | | 6,272,505 |

| | | | | 11,910,258 |

| Banking—4.9% | | | | |

| Bank of America | | 291,216 | | 13,282,362 |

| Federal Home Loan Mortgage | | 101,600 | | 6,627,368 |

| Federal National Mortgage Association | | 108,800 | | 6,353,920 |

| HSBC Holdings, ADR | | 30,000 | | 2,389,500 |

| SunTrust Banks | | 150,600 | | 10,879,344 |

| | | | | 39,532,494 |

| Capital Goods—6.1% | | | | |

| Emerson Electric | | 164,900 | | 10,327,687 |

| General Electric | | 1,115,500 | | 38,652,075 |

| | | | | 48,979,762 |

| Consumer Services—1.0% | | | | |

| McDonald's | | 304,500 | | 8,449,875 |

| Consumer Staples—6.7% | | | | |

| Sysco | | 80,000 | | 2,895,200 |

| Wal-Mart Stores | | 449,700 | | 21,675,540 |

| Walgreen | | 649,900 | | 29,888,901 |

| | | | | 54,459,641 |

| Diversified Financials—8.4% | | | | |

| American Express | | 307,500 | | 16,368,225 |

| Citigroup | | 601,524 | | 27,808,455 |

| J.P. Morgan Chase & Co. | | 451,100 | | 15,932,852 |

| Merrill Lynch | | 145,500 | | 8,003,955 |

| | | | | 68,113,487 |

| Energy—18.3% | | | | |

| BP, ADR | | 455,900 | | 28,439,042 |

| Chevron | | 445,800 | | 24,929,136 |

| ConocoPhillips | | 200,000 | | 11,498,000 |

| Exxon Mobil | | 1,176,564 | | 67,617,133 |

| Occidental Petroleum | | 60,000 | | 4,615,800 |

| Royal Dutch Petroleum | | 59,800 | | 3,881,020 |

| TotalFinaElf, ADR | | 60,000 a | | 7,011,000 |

| | | | | 147,991,131 |

T h e P o r t f o l i o 7

S TAT E M E N T O F I N V E S T M E N T S (Unaudited) (continued)

| Common Stocks (continued) | | Shares | | | | Value ($) |

| |

| |

| |

|

| Food, Beverage & Tobacco—17.3% | | | | | | |

| Altria Group | | 926,400 | | | | 59,901,024 |

| Anheuser-Busch Cos. | | 200,100 | | | | 9,154,575 |

| Coca-Cola | | 664,500 | | | | 27,742,875 |

| Nestle, ADR | | 291,000 | | | | 18,613,105 |

| PepsiCo | | 455,900 | | | | 24,586,687 |

| | | | | | | 139,998,266 |

| Household & Personal Products—5.3% | | | | |

| Colgate-Palmolive | | 154,600 | | | | 7,716,086 |

| Estee Lauder Cos., Cl. A | | 145,500 | | | | 5,693,415 |

| Procter & Gamble | | 565,000 | | | | 29,803,750 |

| | | | | | | 43,213,251 |

| Insurance—2.1% | | | | | | |

| American International Group | | 105,920 | | | | 6,153,952 |

| Berkshire Hathaway, Cl. A | | 100 | | b | | 8,350,000 |

| Marsh & McLennan Cos. | | 91,100 | | | | 2,523,470 |

| | | | | | | 17,027,422 |

| Materials—.3% | | | | | | |

| Praxair | | 50,000 | | | | 2,330,000 |

| Media—5.0% | | | | | | |

| McGraw-Hill Cos. | | 501,600 | | | | 22,195,800 |

| News, Cl. A | | 606,436 | | | | 9,812,134 |

| News, Cl. B | | 9,800 | | | | 165,228 |

| Time Warner | | 226,800 | | b | | 3,789,828 |

| Viacom, Cl. B | | 150,300 | | | | 4,812,606 |

| | | | | | | 40,775,596 |

| Pharmaceuticals & Biotechnology—12.4% | | | | |

| Abbott Laboratories | | 334,100 | | | | 16,374,241 |

| Johnson & Johnson | | 373,300 | | | | 24,264,500 |

| Eli Lilly & Co. | | 261,900 | | | | 14,590,449 |

| Merck & Co. | | 313,000 | | | | 9,640,400 |

| Pfizer | | 1,151,000 | | | | 31,744,580 |

| Roche Holding, ADR | | 64,000 | | | | 4,048,674 |

| | | | | | | 100,662,844 |

| Retailing—1.8% | | | | | | |

| Target | | 261,900 | | | | 14,249,979 |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Semiconductors & Semiconductor Equipment—4.6% | | |

| Intel | | 1,414,700 | | 36,867,082 |

| Software & Services—2.7% | | | | |

| Microsoft | | 867,300 | | 21,543,732 |

| Transportation—1.1% | | | | |

| United Parcel Service, Cl. B | | 126,800 | | 8,769,488 |

| Total Common Stocks | | | | |

| (cost $626,059,657) | | | | 804,874,308 |

| |

| |

|

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—1.5% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred Plus Money Market Fund | | |

| (cost $12,322,026) | | 12,322,026 c | | 12,322,026 |

| |

| |

|

| Total Investments (cost $638,381,683) | | 101.0% | | 817,196,334 |

| Liabilities, Less Cash and Receivables | | (1.0%) | | (8,246,352) |

| Net Assets | | 100.0% | | 808,949,982 |

| ADR—American Depository Receipts. |

| a All or a portion of these securities are on loan. At June 30, 2005 the total market value of the fund's securities on |

| loan is $11,905,675 and the total market value of the collateral held by the fund is $12,322,026. |

| b Non-Income Producing. |

| c Investment in affiliated money market mutual fund. |

| Portfolio Summary (Unaudited) † | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Energy | | 18.3 | | Capital Goods | | 6.1 |

| Food, Beverage & Tobacco | | 17.3 | | Household & Personal Products | | 5.3 |

| Pharmaceuticals & Biotechnology | | 12.4 | | Media | | 5.0 |

| Diversified Financials | | 8.4 | | Other | | 21.5 |

| Consumer Staples | | 6.7 | | | | 101.0 |

| |

| † Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

T h e P o r t f o l i o 9

|

S TAT E M E N T O F A S S E T S A N D L I A B I L I T I E S

| J u n e 3 0 , 2 0 0 5 (Unaudited) | | |

| |

|

| |

| |

| |

| |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement | | |

| of Investments (including securities on loan, | | |

| valued at $11,905,675)—Note 1(c): | | |

| Unaffiliated issuers | | 626,059,657 | | 804,874,308 |

| Affiliated issuers | | 12,322,026 | | 12,322,026 |

| Cash | | | | 202,141 |

| Receivable for shares of Beneficial Interest subscribed | | 2,902,330 |

| Receivable for investment securities sold | | 1,585,956 |

| Dividends and interest receivable | | | | 1,337,874 |

| Prepaid expenses | | | | 51,203 |

| | | | | 823,275,838 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 326,111 |

| Due to Fayez Sarofim & Co. | | | | 217,120 |

| Liability for securities on loan—Note 1(c) | | 12,322,026 |

| Bank loan payable—Note 2 | | | | 800,000 |

| Payable for shares of Beneficial Interest redeemed | | 575,702 |

| Interest payable—Note 2 | | | | 80 |

| Accrued expenses | | | | 84,817 |

| | | | | 14,325,856 |

| |

| |

|

| Net Assets ($) | | | | 808,949,982 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 685,143,745 |

| Accumulated undistributed investment income—net | | 6,121,406 |

| Accumulated net realized gain (loss) on investments | | (61,129,820) |

| Accumulated net unrealized appreciation (depreciation) | | |

| on investments and foreign currency transactions | | 178,814,651 |

| |

|

| Net Assets ($) | | | | 808,949,982 |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Net Assets ($) | | 722,589,661 | | 86,360,321 |

| Shares Outstanding | | 20,191,256 | | 2,422,390 |

| |

| |

|

| Net Asset Value Per Share ($) | | 35.79 | | 35.65 |

See notes to financial statements.

|

| S TAT E M E N T | | O F | | O P E R AT I O N S | | |

| S i x M o n t h s E n d e d | | J u n e | | 3 0 , 2 0 0 5 (Unaudited) | | |

| |

| |

| |

|

| |

| |

| |

| |

| Investment Income ($): | | | | |

| Income: | | | | | | |

| Cash dividends (net of $125,630 foreign taxes withheld at source): |

| Unaffiliated issuers | | | | | | 9,521,220 |

| Affiliated issuers | | | | | | 29,138 |

| Income from securities lending | | | | 42,297 |

| Total Income | | | | | | 9,592,655 |

| Expenses: | | | | | | |

| Investment advisory fee—Note 3(a) | | 1,775,246 |

| Sub-investment advisory fee—Note 3(a) | | 1,328,944 |

| Prospectus and shareholders' reports | | 105,985 |

| Distribution fees—Note 3(b) | | | | 102,824 |

| Shareholder servicing costs—Note 3(b) | | 32,528 |

| Trustees' fees and expenses—Note 3(c) | | 32,168 |

| Custodian fees—Note 3(b) | | | | 30,484 |

| Professional fees | | | | | | 30,273 |

| Interest expense—Note 2 | | | | 10,601 |

| Loan commitment fees—Note 2 | | | | 3,646 |

| Registration fees | | | | | | 799 |

| Miscellaneous | | | | | | 12,257 |

| Total Expenses | | | | | | 3,465,755 |

| Investment Income—Net | | | | 6,126,900 |

| |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | |

| and foreign currency transactions | | (4,125,926) |

| Net unrealized appreciation (depreciation) on investments | | 3,243,007 |

| Net Realized and Unrealized Gain (Loss) on Investments | | (882,919) |

| Net Increase in Net Assets Resulting from Operations | | 5,243,981 |

See notes to financial statements.

|

T h e P o r t f o l i o 11

|

S TAT E M E N T O F C H A N G E S I N N E T A S S E T S

| | | Six Months Ended | | |

| | | June 30, 2005 | | Year Ended |

| | | (Unaudited) | | December 31, 2004 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 6,126,900 | | 13,729,438 |

| Net realized gain (loss) on investments | | (4,125,926) | | (5,994,905) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 3,243,007 | | 33,662,361 |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 5,243,981 | | 41,396,894 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Initial shares | | (135,857) | | (12,718,082) |

| Service shares | | — | | (1,102,158) |

| Total Dividends | | (135,857) | | (13,820,240) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Initial shares | | 38,856,444 | | 58,196,296 |

| Service shares | | 10,779,373 | | 21,783,851 |

| Dividends reinvested: | | | | |

| Initial shares | | 135,857 | | 12,718,082 |

| Service shares | | — | | 1,102,158 |

| Cost of shares redeemed: | | | | |

| Initial shares | | (87,251,791) | | (150,984,809) |

| Service shares | | (5,375,364) | | (34,135,074) |

| Increase (Decrease) in Net Assets from | | | | |

| Beneficial Interest Transactions | | (42,855,481) | | (91,319,496) |

| Total Increase (Decrease) in Net Assets | | (37,747,357) | | (63,742,842) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 846,697,339 | | 910,440,181 |

| End of Period | | 808,949,982 | | 846,697,339 |

| Undistributed investment income—net | | 6,121,406 | | 130,363 |

| | | Six Months Ended | | |

| | | June 30, 2005 | | Year Ended |

| | | (Unaudited) | | December 31, 2004 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Initial Shares | | | | |

| Shares sold | | 1,080,281 | | 1,672,805 |

| Shares issued for dividends reinvested | | 3,819 | | 357,874 |

| Shares redeemed | | (2,438,526) | | (4,347,023) |

| Net Increase (Decrease) in Shares Outstanding | | (1,354,426) | | (2,316,344) |

| |

| |

|

| Service Shares | | | | |

| Shares sold | | 302,133 | | 629,793 |

| Shares issued for dividends reinvested | | — | | 31,090 |

| Shares redeemed | | (150,592) | | (987,230) |

| Net Increase (Decrease) in Shares Outstanding | | 151,541 | | (326,347) |

See notes to financial statements.

|

T h e P o r t f o l i o 13

|

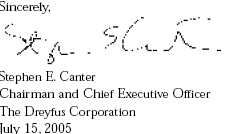

F I N A N C I A L H I G H L I G H T S

|

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single portfolio share.Total return shows how much your investment in the portfolio would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the portfolio's financial statements.

| | | Six Months Ended | | | | | | | | | | |

| | | June 30, 2005 | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Initial Shares | | (Unaudited) | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of period | | 35.56 | | 34.42 | | 28.79 | | 34.98 | | 38.91 | | 39.87 |

| Investment Operations: | | | | | | | | | | | | |

| Investment income—net a | | .27 | | .56 | | .43 | | .36 | | .30 | | .27 |

| Net realized and unrealized | | | | | | | | | | | | |

| gain (loss) on investments | | (.03) | | 1.18 | | 5.64 | | (6.19) | | (3.93) | | (.52) |

| Total from Investment Operations | | .24 | | 1.74 | | 6.07 | | (5.83) | | (3.63) | | (.25) |

| Distributions: | | | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | | | |

| income—net | | (.01) | | (.60) | | (.44) | | (.36) | | (.30) | | (.26) |

| Dividends from net realized | | | | | | | | | | | | |

| gain on investments | | — | | — | | — | | — | | — | | (.45) |

| Total Distributions | | (.01) | | (.60) | | (.44) | | (.36) | | (.30) | | (.71) |

| Net asset value, end of period | | 35.79 | | 35.56 | | 34.42 | | 28.79 | | 34.98 | | 38.91 |

| |

| |

| |

| |

| |

| |

|

| Total Return (%) | | .66b | | 5.05 | | 21.17 | | (16.71) | | (9.31) | | (.65) |

| |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | | | |

| to average net assets | | .40b | | .79 | | .80 | | .78 | | .78 | | .78 |

| Ratio of net investment income | | | | | | | | | | | | |

| to average net assets | | .75b | | 1.60 | | 1.41 | | 1.10 | | .84 | | .67 |

| Portfolio Turnover Rate | | 1.72b | | 1.64 | | 4.60 | | 6.61 | | 4.19 | | 6.15 |

| |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | | | |

| ($ x 1,000) | | 722,590 | | 766,169 | | 821,319 | | 722,706 | | 897,535 | | 1,009,713 |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Not annualized. | | | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | | | |

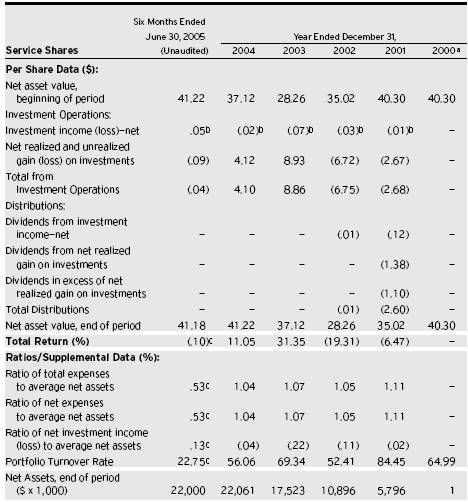

| | | Six Months Ended | | | | | | | | | | |

| | | June 30, 2005 | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Service Shares | | (Unaudited) | | 2004 | | 2003 | | 2002 | | 2001 | | 2000a |

| |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of period | | 35.46 | | 34.31 | | 28.71 | | 34.89 | | 38.91 | | 38.91 |

| Investment income—net | | .22b | | .46b | | .36b | | .29b | | .18b | | — |

| Net realized and unrealized | | | | | | | | | | | | |

| gain (loss) on investments | | (.03) | | 1.19 | | 5.61 | | (6.17) | | (3.94) | | — |

| Total from Investment Operations | | .19 | | 1.65 | | 5.97 | | (5.88) | | (3.76) | | — |

| Distributions: | | | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | | | |

| income—net | | — | | (.50) | | (.37) | | (.30) | | (.26) | | — |

| Net asset value, end of period | | 35.65 | | 35.46 | | 34.31 | | 28.71 | | 34.89 | | 38.91 |

| |

| |

| |

| |

| |

| |

|

| Total Return (%) | | .54c | | 4.80 | | 20.83 | | (16.89) | | (9.63) | | — |

| |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | | | |

| to average net assets | | .53c | | 1.04 | | 1.05 | | 1.02 | | 1.10 | | — |

| Ratio of net investment income | | | | | | | | | | | | |

| to average net assets | | .63c | | 1.34 | | 1.16 | | .91 | | .53 | | — |

| Portfolio Turnover Rate | | 1.72c | | 1.64 | | 4.60 | | 6.61 | | 4.19 | | 6.15 |

| |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | | | |

| ($ x 1,000) | | 86,360 | | 80,529 | | 89,121 | | 60,572 | | 35,632 | | 1 |

| |

| a | | The portfolio commenced offering Service shares on December 31, 2000. | | | | | | |

| b | | Based on average shares outstanding at each month end. | | | | | | | | |

| c | | Not annualized. | | | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | | | |

T h e P o r t f o l i o 15

|

N O T E S T O F I N A N C I A L S TAT E M E N T S (Unaudited)

NOTE 1—Significant Accounting Policies:

Dreyfus Variable Investment Fund (the "fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as an open-end management investment company, operating as a series company currently offering twelve series, including the Appreciation Portfolio (the "portfolio"). The portfolio is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The portfolio is a diversified series. The portfolio's investment objective is to provide long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation ("Dreyfus") serves as the portfolio's investment adviser. Dreyfus is a wholly-owned subsidiary of Mellon Financial Corporation ("Mellon Financial"). Fayez Sarofim & Co. ("Sarofim") serves as the portfolio's sub-investment adviser.

Dreyfus Service Corporation (the "Distributor"), a wholly-owned subsidiary of the Manager, is the distributor of the portfolio's shares, which are sold without a sales charge.The portfolio is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan and the expenses borne by each class and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The fund accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series' operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The portfolio's financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifica-tions.The portfolio's maximum exposure under these arrangements is unknown. The portfolio does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Investments in registered investment companies are valued at their net asset value.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the portfolio calculates its net asset value, the portfolio may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR's and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

T h e P o r t f o l i o 17

|

N O T E S T O F I N A N C I A L S TAT E M E N T S ( U n a u d i t e d ) (continued)

(b) Foreign currency transactions: The portfolio does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the portfolio's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The portfolio has an arrangement with the custodian bank whereby the portfolio receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the portfolio includes net earnings credits, if any, as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with Mellon Bank, N.A., an affiliate of Dreyfus, the portfolio may lend securities to qualified institutions.At origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan will be maintained at all times. Cash collateral is invested in certain money market mutual funds managed by Dreyfus. The portfolio will be entitled to receive all income on

securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the portfolio would bear the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as "affiliated" in the Act.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gain, if any, are normally declared and paid annually, but the portfolio may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the "Code").To the extent that net realized capital gain can be offset by capital loss carryovers, it is the policy of the portfolio not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(e) Federal income taxes: It is the policy of the portfolio to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

The portfolio has an unused capital loss carryover of $57,003,881 available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2004. If not applied, $6,595,648 of the carryover expires in fiscal 2009, $23,015,684 expires in fiscal 2010, $20,683,522 expires in fiscal 2011 and $6,709,027 expires in fiscal 2012.

The tax character of distributions paid to shareholders during the fiscal year ended December 31, 2004 was as follows: ordinary income $13,820,240. The tax character of current year distributions will be determined at the end of the current fiscal year.

T h e P o r t f o l i o 19

|

N O T E S T O F I N A N C I A L S TAT E M E N T S ( U n a u d i t e d ) (continued)

NOTE 2—Bank Line of Credit:

|

The portfolio participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the "Facility") to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the portfolio has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the portfolio at rates based on prevailing market rates in effect at the time of borrowings.

The average daily amount of borrowings outstanding during the period ended June 30, 2005 was approximately $656,400, with a related weighted average annualized interest rate of 3.21% .

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Advisory Agreement with Dreyfus, the investment advisory fee is based on the value of the portfolio's average daily net assets and is computed at the following annual rates: .55 of 1% of the first $150 million; .50 of 1% of the next $150 million; and .375 of 1% over $300 million.The fee is payable monthly. Pursuant to a Sub-Investment Advisory Agreement with Sarofim, the sub-investment advisory fee is based upon the value of the portfolio's average daily net assets and is computed at the following annual rates: .20 of 1% of the first $150 million; .25 of 1% of the next $150 million; and .375 of 1% over $300 million.The fee is payable monthly.

(b) Under the Distribution Plan (the "Plan") adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing their shares, for servicing and/or maintaining Service shares shareholder accounts and for advertising and marketing for Service shares.The Plan provides for payments to be made at an annual rate of .25 of 1% of the value of the Service shares' average daily net assets. The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products.The fees payable under the Plan

are payable without regard to actual expenses incurred. During the period ended June 30, 2005, Service shares were charged $102,824 pursuant to the Plan.

The portfolio compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the portfolio. During the period ended June 30, 2005, the portfolio was charged $515 pursuant to the transfer agency agreement.

The portfolio compensates Mellon Bank, N.A., an affiliate of Dreyfus, under a custody agreement to provide custodial services for the portfolio. During the period ended June 30, 2005, the portfolio was charged $30,484 pursuant to the custody agreement.

During the period ended June 30, 2005, the portfolio was charged $1,998 for services performed by the Chief Compliance Officer.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: investment advisory fees $291,092, Rule 12b-1 distribution plan fees $17,445, custodian fees $15,424, chief compliance officer fees $1,998 and transfer agency per account fees $152.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

(d) Pursuant to an exemptive order from the Securities and Exchange Commission, the portfolio may invest its available cash in affiliated money market mutual funds. Management fees of the underlying money market mutual funds have been waived by Dreyfus.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended June 30, 2005, amounted to $14,279,610 and $55,424,039, respectively.

T h e P o r t f o l i o 21

|

N O T E S T O F I N A N C I A L S TAT E M E N T S ( U n a u d i t e d ) (continued)

At June 30, 2005, accumulated net unrealized appreciation on investments was $178,814,651, consisting of $214,174,260 gross unrealized appreciation and $35,359,609 gross unrealized depreciation.

At June 30, 2005, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

In early 2004, two purported class and derivative actions were filed against Mellon Financial, Mellon Bank, N.A., Dreyfus, Founders Asset Management LLC, and certain directors of the Dreyfus Funds and the Dreyfus Founders Funds (together, the "Funds") in the United States District Court for the Western District of Pennsylvania. In September 2004, plaintiffs served a Consolidated Amended Complaint (the "Amended Complaint") on behalf of a purported class of all persons who acquired interests in any of the Funds between January 30, 1999 and November 17, 2003, and derivatively on behalf of the Funds.The Amended Complaint in the newly styled In re Dreyfus Mutual Funds Fee Litigation also named the Distributor, Premier Mutual Fund Services, Inc. and two additional Fund directors as defendants and alleges violations of the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Pennsylvania Unfair Trade Practices and Consumer Protection Law and common-law claims. Plaintiffs seek to recover allegedly improper and excessive Rule 12b-1 and advisory fees allegedly charged to the Funds for marketing and distribution services. More specifically, plaintiffs claim, among other things, that 12b-1 fees and directed brokerage were improperly used to pay brokers to recommend the Funds over other funds, and that such payments were not disclosed to investors. In addition, plaintiffs assert that economies of scale and soft-dollar benefits were not passed on to the Funds. Plaintiffs further allege that 12b-1 fees were improperly charged to certain of the Funds that were closed to new investors.The Amended Complaint seeks compensatory and punitive damages, rescission of the advisory contracts, and an accounting and restitution of any

unlawful fees, as well as an award of attorneys' fees and litigation expenses. As noted, some of the claims in this litigation are asserted derivatively on behalf of the Funds that have been named as nominal defendants. With respect to such derivative claims, no relief is sought against the Funds. Dreyfus believes the allegations to be totally without merit and intends to defend the action vigorously. In November 2004, all named defendants moved to dismiss the Amended Complaint in whole or substantial part. Briefing was completed in May 2005.

Additional lawsuits arising out of these circumstances and presenting similar allegations and requests for relief may be filed against the defendants in the future. Neither Dreyfus nor the Funds believe that any of the pending actions will have a material adverse effect on the Funds or Dreyfus' ability to perform its contract with the Funds.

T h e P o r t f o l i o 23

|

I N F O R M AT I O N A B O U T T H E R E V I E W

A N D A P P R O VA L O F T H E P O R T F O L I O ' S

I N V E S T M E N T A DV I S O RY A G R E E M E N T (Unaudited)

|

At separate meetings of the Board of Trustees for the fund held on June 8-9, 2005, the Board considered the re-approval, through its annual renewal date of July 31, 2006, of the Investment Advisory Agreement with Dreyfus for the portfolio, pursuant to which Dreyfus provides the portfolio with investment advisory and administrative services, and the portfolio's Sub-Investment Advisory Agreement ("Sub-Advisory Agreement") with Fayez Sarofim & Co. (the "Sub-Adviser"), pursuant to which the Sub-Adviser provides day-to-day management of the portfolio's investments subject to Dreyfus' oversight.The Board members who are not "interested persons" (as defined in the Act (the "Independent Trustees")) of the fund were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus and the Sub-Adviser.

Analysis of Nature, Extent and Quality of Services Provided to the Portfolio. The Board members received a presentation from representatives of Dreyfus regarding services provided to the portfolio and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the portfolio pursuant to its Investment Advisory Agreement and by the Sub-Adviser pursuant to the Sub-Advisory Agreement. Dreyfus' representatives reviewed the portfolio's distribution of accounts and the relationships Dreyfus has with various intermediaries and the different needs of each.The Board noted that the portfolio's shares were offered only to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. Dreyfus' representatives noted the diversity of distribution among the funds in the Dreyfus complex, and Dreyfus' corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including that of the portfolio.The Board also reviewed the number of shareholder accounts in the portfolio, as well as the portfolio's asset size.

The Board members also considered Dreyfus' and the Sub-Adviser's research and portfolio management capabilities, with the Sub-Adviser subject to Dreyfus' oversight, and that Dreyfus also provides oversight of day-to-day portfolio operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board members also considered Dreyfus' extensive administrative, accounting and compliance infrastructure.

Comparative Analysis of the Portfolio's Performance, Investment Advisory Fee and Expense Ratio. The Board members reviewed the portfolio's performance and expense ratios and placed significant emphasis on comparisons to two groups of comparable funds and Lipper category averages, as applicable.The Board reviewed the portfolio's performance, investment advisory and sub-investment advisory fees, and total expense ratios within these comparison groups and against the portfolio's Lipper category averages, as applicable.The groups of comparable funds were previously approved by the Board for this purpose, and were prepared using a Board-approved selection methodology that was based, in part, on selecting non-affiliated funds reported in the same Lipper category as the portfolio. The Board members discussed the results of the comparisons and noted that the portfolio's longer term performance (3-, 5-, and 10-years) for its Initial shares was above the averages of its comparison group and its Lipper category, that the portfolio's 5- and 10-year performance for its Initial shares was in the first quartile of the Lipper category, and that the recent 3-month and 4-month performance for its Initial shares improved significantly versus that of its comparison group and Lipper category rankings over its 1-year performance. The Board members also discussed the portfolio's expense ratio for each class of shares, noting it is higher than the average for its respective comparison group, but that several funds in the groups have higher expense ratios than the portfolio.They reviewed the

T h e P o r t f o l i o 25

|

I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E P O R T FO L I O ' S

INVESTMENT ADVISORY AGREEMENT (Unaudited) (continued)

|

range of management fees in the comparison groups and noted that the portfolio's aggregate investment advisory and sub-investment advisory fee is in the bottom half of the comparison groups, with several funds having the same or higher management fees than the portfolio.

Representatives of Dreyfus reviewed with the Board the fees paid to Dreyfus or its affiliates and to the Sub-Adviser or its affiliates by mutual funds managed by Dreyfus or its affiliates and the Sub-Adviser or its affiliates, as the case may be, with similar investment objectives, policies and strategies as the portfolio (the "Similar Funds") and the fees paid to the Sub-Adviser by separate accounts with similar investment objectives, policies and strategies as the portfolio (the "Separate Accounts" and, collectively with the Similar Funds, the "Similar Accounts") and explained the nature of each Similar Accounts and the differences, from Dreyfus' perspective,in management of such Similar Accounts as compared to the managing and providing other services to the portfolio. The Similar Funds' comparison group was composed exclusively of affiliated mutual funds of Dreyfus that were reported in the portfolio's Lipper category and in a similar Lipper category for non-insurance product funds. Dreyfus' representatives also reviewed the costs associated with distribution through intermediaries.The Board analyzed differences in fees paid to Dreyfus and the Sub-Adviser and discussed the relationship of the advisory fees paid in light of Dreyfus' and the Sub-Adviser's performance and the services provided. It was noted that the Similar Funds included four unitary fee structure funds that had higher management fees than the fee borne by the portfolio and that several of the other funds had the same management fee as the fee borne by the portfolio. The Board members considered the relevance of the fee information provided for the Separate Accounts managed by the Sub-Adviser to evaluate the appropriateness and reasonableness of the portfolio's advisory fees.The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services provided.

Analysis of Profitability and Economies of Scale. Dreyfus' representatives reviewed the dollar amount of expenses allocated and profit received by Dreyfus and the method used to determine such expenses and profit. (The Board members subsequent to the meeting were provided a profitability statement for the Sub-Adviser with respect to the portfolio.) The Board received and considered information prepared by an independent consulting firm regarding Dreyfus' approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus mutual fund complex.The consulting firm also analyzed where any economies of scale might emerge as assets grow.The Board members evaluated the analysis in light of the relevant circumstances for the portfolio, including the decline in assets and the extent to which economies of scale would be realized as the portfolio grows and whether fee levels reflect these economies of scale for the benefit of portfolio investors. The Board members also considered potential benefits to Dreyfus from acting as investment adviser and to the Sub-Adviser from acting as sub-adviser and noted the soft dollar arrangements with respect to trading the portfolio's portfolio.

It was noted that the Board members should consider Dreyfus' and the Sub-Adviser's profitability with respect to the portfolio as part of their evaluation of whether the fees under the Investment Advisory Agreement and the Sub-Advisory Agreement bears a reasonable relationship to the mix of services provided by Dreyfus and the Sub-Adviser, including the nature, extent and quality of such services and that a discussion of economies of scale are predicated on increasing assets and that, if a fund's assets had been decreasing, the possibility that Dreyfus or Sub-Adviser may have realized any economies of scale would be less.The profitability percentages for managing the portfolio were within ranges determined by appropriate court cases to be reasonable given the services rendered and, given the portfolio's overall performance and generally superior service levels provided.

T h e P o r t f o l i o 27

|

I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E P O R T FO L I O ' S

INVESTMENT ADVISORY AGREEMENT (Unaudited) (continued)

|

At the conclusion of these discussions, each of the Independent Trustees expressed the opinion that he or she had been furnished with sufficient information to make an informed business decision with respect to continuation of the portfolio's Investment Advisory Agreement and Sub-Investment Advisory Agreement. Based on their discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by Dreyfus and the Sub-Adviser are adequate and appropriate.

- The Board generally was satisfied with the portfolio's Initial shares longer term performance as compared to its comparison group and Lipper category averages, its Initial shares longer term performance rankings in its comparison group and its Lipper category, and the portfolio's recent 3-month and 4-month performance in its Initial shares comparison group.

- The Board concluded that the fees paid by the portfolio to Dreyfus and to the Sub-Adviser were reasonable in light of comparative per- formance and expense and advisory fee information, costs of the services provided and profits to be realized and benefits derived or to be derived by Dreyfus and the Sub-Adviser from their relation- ship with the portfolio.

- The Board determined that, to the extent that material economies of scale had not been shared with the portfolio, the Board would seek to do so.

The Board members considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that approval of the portfolio's Investment Advisory Agreement and Sub-Advisory Agreement was in the best interests of the portfolio and its shareholders.

| For More | | Information |

| |

|

| |

| |

| |

| Dreyfus Variable | | Custodian |

| |

| Investment Fund, | | |

| | | Mellon Bank, N.A. |

| Appreciation Portfolio | | |

| | | One Mellon Bank Center |

| 200 Park Avenue | | |

| | | Pittsburgh, PA 15258 |

| New York, NY 10166 | | |

| |

| | | Transfer Agent & |

| |

| Investment Adviser | | Dividend Disbursing Agent |

| |

| The Dreyfus Corporation | | |

| | | Dreyfus Transfer, Inc. |

| 200 Park Avenue | | |

| | | 200 Park Avenue |

| New York, NY 10166 | | |

| | | New York, NY 10166 |

| |

| |

| Sub-Investment Advisor | | Distributor |

| |

| Fayez Sarofim & Co. | | |

| | | Dreyfus Service Corporation |

| Two Houston Center | | |

| | | 200 Park Avenue |

| Suite 2907 | | |

| | | New York, NY 10166 |

| Houston,TX 77010 | | |

Telephone 1-800-554-4611 or 516-338-3300

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 Attn: Institutional Servicing

The portfolio files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The portfolio's Forms N-Q are available on the SEC's website at http://www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the portfolio uses to determine how to vote proxies relating to portfolio securities, and information regarding how the portfolio voted these proxies for the 12-month period ended June 30, 2005, is available at http://www.dreyfus.com and on the SEC's website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

© 2005 Dreyfus Service Corporation

| Dreyfus Variable |

| Investment Fund, |

| Balanced Portfolio |

SEMIANNUAL REPORT June 30, 2005

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | T H E P O R T F O L I O |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Performance |

| 6 | | Understanding Your Portfolio's Expenses |

| 6 | | Comparing Your Portfolio's Expenses |

| | | With Those of Other Funds |

| 7 | | Statement of Investments |

| 14 | | Statement of Assets and Liabilities |

| 15 | | Statement of Operations |

| 16 | | Statement of Changes in Net Assets |

| 18 | | Financial Highlights |

| 20 | | Notes to Financial Statements |

| 29 | | Information About the Review |

| and Approval of the Portfolio's |

| Investment Advisory Agreement |

| | | F O R M O R E I N F O R M AT I O N |

| |

|

| | | Back Cover |

| Dreyfus Variable Investment Fund, |

| Balanced Portfolio |

The Portfolio

LETTER FROM THE CHAIRMAN

We are pleased to present this semiannual report for Dreyfus Variable Investment Fund, Balanced Portfolio, covering the six-month period from January 1, 2005, through June 30, 2005. Inside, you'll find valuable information about how the portfolio was managed during the reporting period, including a discussion with the portfolio manager, Thomas Plumb of Wisconsin Capital Management, LLC, the portfolio's sub-investment adviser.

On average, stocks prices ended the first half of 2005 slightly lower than where they began, largely due to headwinds caused by higher energy prices, rising short-term interest rates and evidence of slower economic growth. In this same environment, contrary to historical norms, longer-term U.S. government securities rallied amid robust demand from overseas investors. As a result, the more interest-rate-sensitive parts of the bond market generally produced higher returns than stocks and corporate bonds.

In some ways, market conditions at midyear remind us of those from one year ago, when stock prices languished due to economic and political concerns before rallying strongly later in the year. Our economists currently expect the U.S. economy to continue to grow over the foreseeable future without significant new inflationary pressures, potentially setting the stage for market conditions that could affect the various sectors of the U.S. stock and bond markets in different ways. As always, we encourage you to discuss these and other matters with your financial advisor.

Thank you for your continued confidence and support.

DISCUSSION OF PERFORMANCE

Thomas Plumb, Primary Portfolio Manager

Wisconsin Capital Management, LLC, Sub-Investment Adviser

How did Dreyfus Variable Investment Fund, Balanced Portfolio perform relative to its benchmarks?

For the six-month period ended June 30, 2005, the portfolio's total returns were –1.32% for its Initial shares and –1.43% for its Service shares.1 In comparison, the portfolio's benchmark, a hybrid index composed of 60% Standard & Poor's 500 Composite Stock Price Index (the "S&P 500 Index") and 40% Lehman Brothers U.S. Aggregate Index (the "Lehman Aggregate Index"), achieved a total return of 0.52% for the reporting period.2 Separately, the S&P 500 Index and the Lehman Aggregate Index achieved total returns of –0.81% and 2.51%, respectively, for the reporting period.

Stocks and bonds produced mixed results during the reporting period as investor sentiment regarding the economy, inflation and interest rates shifted. The portfolio's returns were lower than those of its benchmark, primarily due to the portfolio's relatively light exposure to energy and utilities stocks.

What is the portfolio's investment approach?

The portfolio seeks high total return through a combination of capital appreciation and current income.To pursue this goal, the portfolio invests in a diversified mix of stocks and fixed-income securities.The portfolio will vary the mix of stocks and bonds from time to time, but normally the portfolio will allocate more than 50% of its assets to stocks and the remainder to bonds and other fixed-income securities.

In allocating portfolio assets between stocks and bonds, the portfolio manager assesses the relative return and risk of each asset class, analyzing several factors, including general economic conditions, anticipated future changes in interest rates and the outlook for stocks generally.

The Portfolio 3

DISCUSSION OF PERFORMANCE (continued)

|

In choosing stocks for the portfolio, the manager looks for high-quality companies that possess most of the following characteristics: leading market positions, high barriers to market entry and other competitive or technological advantages, high returns on equity and assets, good growth prospects, strong management, and relatively low debt burdens.

The portfolio normally invests at least 25% of its assets in fixed-income securities.The fixed-income securities in which the portfolio may invest include corporate bonds and other debt instruments, mortgage-related securities, asset-backed securities, debt securities issued or guaranteed by the U.S. government (including its agencies and instrumentalities), convertible debt securities and preferred stock that is convertible into common stock.

What other factors influenced the portfolio's performance?

Early in 2005, renewed inflationary pressures caused investors to worry that the Federal Reserve Board (the "Fed") might raise interest rates to a higher level than previously expected, potentially hurting corporate profits and eroding bond prices. Later in the reporting period, inflation and interest-rate concerns generally eased, but equity investors became worried that business conditions might deteriorate in a maturing economy.

As investor sentiment shifted, we intensified our focus with respect to the equity portion of the portfolio on high-quality companies selling at attractive valuations. Indeed, a number of the portfolio's "blue chip" holdings fared well, including pharmaceutical giant Merck & Co. and beverage leader Coca-Cola, which bounced back from earlier weakness. Pharmaceuticals distributor McKesson, a core position, also fared well as the company adapted to a changing marketplace.

On the other hand,because they seemed expensive to us,the portfolio was underweighted relative to the S&P 500 Index in energy or utilities stocks, which performed well in the period. In addition, for-profit education company, Corinthian Colleges, gave back some of the gains it achieved.

Because it was clear to us that the Fed was likely to continue raising interest rates, we set the average duration (a measure of sensitivity to changing interest rates) of the portfolio's bond portion in a range we

considered slightly shorter than average. This strategy helped performance early in the reporting period but prevented the portfolio from participating more fully in later bond market rally. Our emphasis on corporate bonds also detracted from relative performance amid weakness in the airline and automobile industries.

What is the portfolio's current strategy?

The difference in valuations between higher- and lower-quality companies has widened beyond historical norms, and we believe that investors currently are not being rewarded for incurring the risks of holding lower-quality stocks. Accordingly, we have continued to focus on well-established companies with strong cash flows, healthy balance sheets and high returns on capital. In addition, companies with these characteristics may be well-positioned to raise their dividends, which we potentially believe may become an increasingly important component of the stock market's total return. As for bonds, we have maintained the portfolio's relatively defensive posture, including short maturities, in anticipation of further rate hikes.

| | | The portfolio is only available as a funding vehicle under variable life insurance policies or variable |

| | | annuity contracts issued by insurance companies. Individuals may not purchase shares of the |

| | | portfolio directly. A variable annuity is an insurance contract issued by an insurance company that |

| | | enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term |

| | | goals.The investment objective and policies of Dreyfus Variable Investment Fund, Balanced |

| | | Portfolio made available through insurance products may be similar to other funds/portfolios |

| | | managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or |

| | | lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio's performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. Return figures provided reflect the |

| | | absorption of portfolio expenses by The Dreyfus Corporation pursuant to an agreement in effect |

| | | through December 31, 2005, at which time it may be extended, terminated or modified. Had |

| | | these expenses not been absorbed, the portfolio's returns would have been lower. |

| 2 | | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, |

| | | capital gain distributions.The Standard & Poor's 500 Composite Stock Price Index ("S&P 500 |

| | | Index") is a widely accepted, unmanaged index of U.S. stock market performance.The Lehman |

| | | Brothers U.S. Aggregate Index is a widely accepted, unmanaged total return index of corporate, |

| | | U.S. government and U.S. government agency debt instruments, mortgage-backed securities and |

| | | asset-backed securities with an average maturity of 1-10 years. |

The Portfolio 5

UNDERSTANDING YOUR

PORTFOLIO'S EXPENSES (Unaudited)

|

As a mutual fund investor, you pay ongoing expenses,such as management fees and other expenses.Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your portfolio's prospectus or talk to your financial adviser.

Review your portfolio's expenses

|

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund, Balanced Portfolio from January 1, 2005 to June 30, 2005. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | |

| assuming actual returns for the six months ended June 30, 2005 | | |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.58 | | $ 4.92 |

| Ending value (after expenses) | | $986.80 | | $985.70 |

COMPARING YOUR PORTFOLIO'S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC's method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your portfolio's expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the portfolio with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended June 30, 2005

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.66 | | $ 5.01 |

| Ending value (after expenses) | | $1,020.18 | | $1,019.84 |

† Expenses are equal to the portfolio's annualized expense ratio of .93% for Initial shares and 1.00% for Service shares, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

STATEMENT OF INVESTMENTS

June 30, 2005 (Unaudited)

|

| Common Stocks—67.0% | | Shares | | | | Value ($) |

| |

| |

| |

|

| Consumer Discretionary—7.9% | | | | | | |

| Catalina Marketing | | 34,000 | | | | 863,940 |

| Interpublic Group of Companies | | 65,000 | | a,b | | 791,700 |

| Kohl's | | 21,000 | | a | | 1,174,110 |

| Liberty Media, Cl.A | | 87,000 | | a | | 886,530 |

| Time Warner | | 61,500 | | a | | 1,027,665 |

| Viacom, Cl. B | | 36,000 | | | | 1,152,720 |

| | | | | | | 5,896,665 |

| Consumer Staples—4.8% | | | | | | |

| CVS | | 24,000 | | | | 697,680 |

| Coca-Cola | | 33,300 | | | | 1,390,275 |

| Nestle, ADR | | 23,400 | | | | 1,496,724 |

| | | | | | | 3,584,679 |

| Energy—4.0% | | | | | | |

| Chevron | | 28,900 | | | | 1,616,088 |

| Exxon Mobil | | 24,000 | | | | 1,379,280 |

| | | | | | | 2,995,368 |

| Financials—14.9% | | | | | | |

| American International Group | | 27,400 | | | | 1,591,940 |

| Bank of America | | 32,000 | | | | 1,459,520 |

| Berkshire Hathaway, Cl. A | | 7 | | a | | 584,500 |

| Citigroup | | 29,000 | | | | 1,340,670 |

| Doral Financial | | 75,000 | | | | 1,240,500 |

| Fannie Mae | | 26,600 | | | | 1,553,440 |

| Freddie Mac | | 12,000 | | | | 782,760 |

| J.P. Morgan Chase & Co. | | 34,000 | | | | 1,200,880 |

| Marsh & McLennan Cos. | | 46,800 | | | | 1,296,360 |

| | | | | | | 11,050,570 |

| Health Care—14.3% | | | | | | |

| Bristol-Myers Squibb | | 39,000 | | | | 974,220 |

| Cardinal Health | | 31,000 | | | | 1,784,980 |

| IMS Health | | 29,500 | | | | 730,715 |

The Portfolio 7

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Health Care (continued) | | | | |

| McKesson | | 34,000 | | 1,522,860 |

| Merck & Co. | | 20,000 | | 616,000 |

| Pfizer | | 60,600 | | 1,671,348 |

| Schering-Plough | | 36,000 | | 686,160 |

| Wright Medical Group | | 58,000 a | | 1,548,600 |

| Wyeth | | 25,000 | | 1,112,500 |

| | | | | 10,647,383 |

| Industrials—8.1% | | | | |

| Career Education | | 48,500 a | | 1,775,585 |

| Cendant | | 25,000 | | 559,250 |

| Corinthian Colleges | | 165,000 a | | 2,107,050 |

| General Electric | | 45,000 | | 1,559,250 |

| | | | | 6,001,135 |

| Information Technology—13.0% | | | | |

| BISYS Group | | 105,000 a | | 1,568,700 |

| Electronic Data Systems | | 84,000 | | 1,617,000 |

| First Data | | 36,000 | | 1,445,040 |

| Fiserv | | 24,000 a | | 1,030,800 |

| Microsoft | | 75,500 | | 1,875,420 |

| Sabre Holdings | | 58,000 | | 1,157,100 |

| Unisys | | 150,000 a | | 949,500 |

| | | | | 9,643,560 |

| Total Common Stocks | | | | |

| (cost $49,029,719) | | | | 49,819,360 |

| |

| |

|

| |

| Preferred Stocks—2.1% | | | | |

| |

| |

|

| Auto Manufacturing—.6% | | | | |

| General Motors | | | | |

| Cum., $ 1.84 | | 21,000 | | 450,188 |

| Banking/Finance—1.5% | | | | |

| Citigroup Capital, | | | | |

| Cum., $ 1.78 | | 25,000 | | 650,782 |

| Preferred Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Banking/Finance (continued) | | | | |

| General Motors Acceptance, | | | | |

| Cum., $ 1.84 | | 22,500 b | | 475,313 |

| | | | | 1,126,095 |

| Total Preferred Stocks | | | | |

| (cost $1,754,875) | | | | 1,576,283 |

| |

| |

|

| | | Principal | | |

| Bonds and Notes—29.4% | | Amount ($) | | Value ($) |

| |

| |

|

| Automotive—.4% | | | | |

| General Motors, | | | | |

| Notes, 7.1%, 3/15/2006 | | 270,000 | | 273,713 |

| Banks—.6% | | | | |

| Bank of America, | | | | |

| Sr. Notes, 4.375%, 12/1/2010 | | 445,000 | | 447,324 |

| Beverages—.1% | | | | |

| Miller Brewing, | | | | |