UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-05125 |

| |

| Dreyfus Variable Investment Fund | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 12/31 | |

Date of reporting period: | 12/31/15 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Variable Investment Fund, Appreciation Portfolio

| | | |

| | ANNUAL REPORT December 31, 2015 |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Variable Investment Fund, Appreciation Portfolio

| | The Fund |

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2015, through December 31, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

2015 was a year of varied and, at times, conflicting economic influences. On one hand, the U.S. economy continued to grow as domestic labor markets posted significant gains, housing markets recovered, and lower fuel prices put cash in consumers’ pockets. Indeed, these factors, along with low inflation, prompted the Federal Reserve Board in December to raise short-term interest rates for the first time in nearly a decade. On the other hand, the global economy continued to disappoint, particularly in China and other emerging markets, when reduced industrial demand and declining currency values sparked substantial declines in commodity prices.

Although several broad measures of stock and bond performance ended 2015 roughly unchanged, high levels of volatility prevailed across most financial markets. Among U.S. equities, moderate gains from consumer discretionary and health care stocks were balanced by pronounced weakness in the energy and materials sectors. Bonds also saw bifurcated performance, with municipal bonds and intermediate-term U.S. government securities faring well compared to high yield and emerging-markets debt.

Market volatility is likely to persist until investors see greater clarity from the global economy. We expect to see wide differences in underlying fundamental and technical influences across various asset classes, economic sectors, and regional markets in 2016, suggesting that selectivity may be an important determinant of investment success. As always, we encourage you to discuss the implications of our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

January 15, 2016

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2015, through December 31, 2015, as provided by Fayez Sarofim, Portfolio Manager of Fayez Sarofim & Co., Sub-Investment Adviser

Fund and Market Performance Overview

For the 12-month period ended December 31, 2015, Dreyfus Variable Investment Fund, Appreciation Portfolio’s Initial shares produced a total return of –2.47%, and its Service shares produced a total return of –2.72%.1 In comparison, the fund’s benchmark, the Standard & Poor’s® 500 Composite Stock Price Index (“S&P 500 Index”), produced a total return of 1.39% for the same period.2

Modestly positive stock market results for 2015 overall masked heightened volatility stemming from shifting global economic sentiment. The fund lagged its benchmark, mainly due to stock selection shortfalls in the information technology and consumer discretionary sectors.

The Fund’s Investment Approach

The fund seeks long-term capital growth consistent with the preservation of capital. Its secondary goal is current income. To pursue these goals, the fund normally invests at least 80% of its assets in common stocks. The fund focuses on blue-chip companies with total market capitalizations of more than $5 billion at the time of purchase, including multinational companies. These are established companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence, and the potential to achieve predictable, above-average earnings growth.

In choosing stocks, the fund first identifies economic sectors it believes will expand over the next three to five years or longer. Using fundamental analysis, the fund then seeks companies within these sectors that have proven track records and dominant positions in their industries. The fund employs a “buy-and-hold” investment strategy, which generally has resulted in an annual portfolio turnover of below 15%. A low portfolio turnover rate helps reduce the fund’s trading costs and minimizes tax liability by limiting the distribution of capital gains.3

Global Economic Concerns Sparked Market Turmoil

U.S. equity returns stagnated in 2015 as oil prices fell sharply, the U.S. dollar strengthened, and the global growth outlook became more uncertain. After a recovering U.S. economy drove the S&P 500 Index to a new record high in June, market volatility spiked over the second half of the year as global macroeconomic concerns intensified. The S&P 500 Index fell especially sharply in late August after China unexpectedly devalued its currency, but the market recovered rapidly to end the year little changed.

Market leadership was highly concentrated during the year, with the 10 largest stocks in the S&P 500 Index together registering a double-digit gain while the rest of the index’s constituents collectively declined. The consumer discretionary sector, buoyed by Internet retailing companies, was the best performing sector for the year, followed by the health care and consumer staples sectors. In contrast, the energy sector posted sharp losses.

Stock Selections Dampened Relative Results

Our stock selection strategy in the information technology and consumer discretionary sectors detracted from relative performance in 2015, as the fund did not hold a few stocks that produced especially robust gains. Relative results were also undermined by weakness among certain holdings in the industrials sector, which more than offset the benefits of underweighted exposure

3

DISCUSSION OF FUND PERFORMANCE (continued)

to the lagging industry group. Although overweighted exposure to the energy sector pressured the fund’s performance, allocation-related weakness was tempered by our focus on major integrated oil companies, which generally fared better than their less diversified peers.

On a more positive note, our emphasis on the consumer staples sector helped bolster relative results. A focus on tobacco stocks proved particularly advantageous, as was lack of exposure to the lagging utilities sector. An underweighted position in the financials sector helped mitigate stock selection shortfalls, resulting in the sector’s nearly neutral overall impact on relative results.

The largest individual contributors to the fund’s return for 2015 were Novo Nordisk, Philip Morris International, Altria Group, McDonald’s, Facebook, and Estee Lauder. The greatest detractors were Canadian Pacific Railway, Twenty-First Century Fox, ConocoPhillips, Exxon Mobil, Union Pacific, and Chevron.

Quality Companies with Solid Fundamentals

We expect U.S. equity markets in 2016 to confront many of the same obstacles encountered in 2015. Now that the Federal Reserve Board has taken the first step to normalize short-term interest rates, debate is likely to focus on the pace and magnitude of subsequent increases. Concerns about global growth have persisted, and markets appear poised to remain volatile. Nonetheless, strengthening consumer spending, solid employment gains, and a more stimulative fiscal policy suggest that the U.S. economy can support moderately higher stock prices.

We have maintained the fund’s focus on high-quality multinational companies. Their scale and competitive advantages enable these companies to protect their margins and absorb higher labor and borrowing costs in a slow-growth environment. Furthermore, solid balance sheets and strong recurring cash flows can help support growth initiatives, increase dividends, and maintain share repurchases as interest rates rise. When the U.S. dollar stabilizes, we believe investors are likely to assign greater value to the worldwide franchises and diversified revenue streams of multinational companies.

January 15, 2016

Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund directly. A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. The investment objective and policies of Dreyfus Stock Index Fund, Inc. made available through insurance products may be similar to other funds managed by Dreyfus. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund.

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption fund shares may be worth more or less than their original cost. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts, which will reduce returns.

2 SOURCE: LIPPER INC. – Reflects reinvestment of dividends daily and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted, unmanaged index of U.S. stock market performance. Investors cannot invest directly in any index.

3 Achieving tax efficiency is not a part of the fund’s investment objective, and there can be no guarantee that the fund will achieve any particular level of taxable distributions in future years. In periods when the manager has to sell significant amounts of securities (e.g., during periods of significant net redemptions or changes in index components) the fund can be expected to be less tax efficient than during periods of more stable market conditions and asset flows.

4

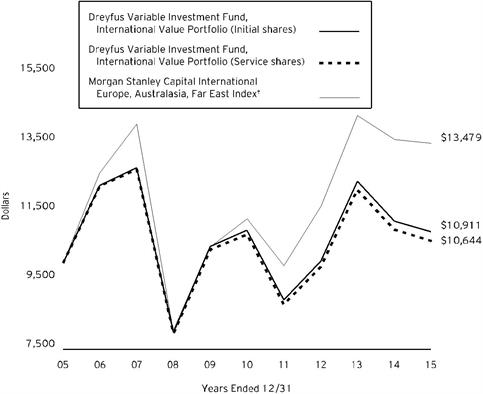

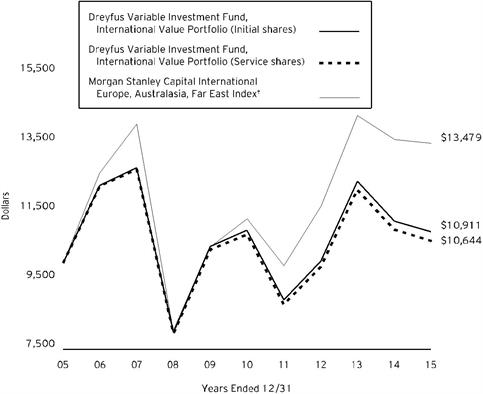

FUND PERFORMANCE

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio Initial shares and Service shares and the Standard & Poor’s 500 Composite Stock Price Index

| | | | |

Average Annual Total Returns as of 12/31/15 |

| | | | |

| 1 Year | 5 Years | 10 Years |

Initial shares | -2.47% | 8.98% | 6.68% |

Service shares | -2.72% | 8.71% | 6.42% |

Standard & Poor's 500

Composite Stock Price Index | 1.39% | 12.55% | 7.30% |

† Source: Lipper Inc.

Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts which will reduce returns.

The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment Fund, Appreciation Portfolio on 12/31/05 to a $10,000 investment made in the Standard & Poor’s 500 Composite Stock Price Index (the “Index”) on that date.

The fund’s Initial shares are not subject to a Rule 12b-1 fee. The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fund fees and expenses for Initial and Service shares. The Index is a widely accepted, unmanaged index of U.S. stock market performance. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio from July 1, 2015 to December 31, 2015. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended December 31, 2015 | |

| | | | Initial Shares | Service Shares |

Expenses paid per $1,000† | | $ 3.99 | $ 5.23 |

Ending value (after expenses) | | $ 978.30 | $ 977.20 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended December 31, 2015 |

| | | | Initial Shares | Service Shares |

Expenses paid per $1,000† | | | $4.08 | | $5.35 |

Ending value (after expenses) | | | $1,021.17 | | $1,019.91 |

† Expenses are equal to the fund’s annualized expense ratio of .80% for Initial shares and 1.05% for Service shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

6

STATEMENT OF INVESTMENTS

December 31, 2015

| | | | | | |

| |

Common Stocks - 99.5% | | Shares | | Value ($) | |

Banks - 1.3% | | | | | |

Wells Fargo & Co. | | 117,250 | | 6,373,710 | |

Capital Goods - 1.2% | | | | | |

United Technologies | | 63,800 | | 6,129,266 | |

Consumer Durables & Apparel - 3.1% | | | | | |

Christian Dior | | 52,600 | | 8,935,123 | |

Hermes International | | 3,177 | | 1,071,169 | |

NIKE, Cl. B | | 84,140 | | 5,258,750 | |

| | | | | 15,265,042 | |

Consumer Services - 1.5% | | | | | |

McDonald's | | 60,900 | | 7,194,726 | |

Diversified Financials - 9.8% | | | | | |

American Express | | 101,600 | | 7,066,280 | |

BlackRock | | 29,900 | | 10,181,548 | |

Intercontinental Exchange | | 19,500 | | 4,997,070 | |

JPMorgan Chase & Co. | | 209,350 | | 13,823,380 | |

State Street | | 78,550 | | 5,212,578 | |

Visa, Cl. A | | 84,900 | | 6,583,995 | |

| | | | | 47,864,851 | |

Energy - 10.4% | | | | | |

Chevron | | 163,700 | | 14,726,452 | |

ConocoPhillips | | 153,550 | a | 7,169,249 | |

Exxon Mobil | | 250,064 | | 19,492,489 | |

Occidental Petroleum | | 139,750 | | 9,448,497 | |

| | | | | 50,836,687 | |

Food & Staples Retailing - 2.3% | | | | | |

Walgreens Boots Alliance | | 97,100 | | 8,268,551 | |

Whole Foods Market | | 84,850 | a | 2,842,475 | |

| | | | | 11,111,026 | |

Food, Beverage & Tobacco - 20.9% | | | | | |

Altria Group | | 271,850 | | 15,824,388 | |

Anheuser-Busch InBev, ADR | | 35,000 | | 4,375,000 | |

Coca-Cola | | 412,800 | | 17,733,888 | |

Diageo, ADR | | 21,900 | | 2,388,633 | |

Nestle, ADR | | 193,150 | | 14,374,223 | |

PepsiCo | | 104,600 | | 10,451,632 | |

Philip Morris International | | 351,800 | | 30,926,738 | |

7

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| |

Common Stocks - 99.5% (continued) | | Shares | | Value ($) | |

Food, Beverage & Tobacco - 20.9% (continued) | | | | | |

SABMiller | | 98,300 | | 5,888,169 | |

| | | | | 101,962,671 | |

Health Care Equipment & Services - 1.7% | | | | | |

Abbott Laboratories | | 186,100 | | 8,357,751 | |

Household & Personal Products - 3.9% | | | | | |

Estee Lauder, Cl. A | | 123,200 | | 10,848,992 | |

Procter & Gamble | | 102,100 | | 8,107,761 | |

| | | | | 18,956,753 | |

Insurance - 2.6% | | | | | |

ACE | | 108,500 | | 12,678,225 | |

Materials - 1.9% | | | | | |

Air Products & Chemicals | | 5,000 | | 650,550 | |

Praxair | | 83,700 | | 8,570,880 | |

| | | | | 9,221,430 | |

Media - 5.0% | | | | | |

McGraw-Hill Financial | | 53,050 | | 5,229,669 | |

Twenty-First Century Fox, Cl. A | | 266,386 | | 7,235,044 | |

Walt Disney | | 115,200 | | 12,105,216 | |

| | | | | 24,569,929 | |

Pharmaceuticals, Biotechnology & Life Sciences - 11.2% | | | | | |

AbbVie | | 185,100 | | 10,965,324 | |

Celgene | | 32,000 | b | 3,832,320 | |

Gilead Sciences | | 56,000 | | 5,666,640 | |

Novartis, ADR | | 80,150 | | 6,896,106 | |

Novo Nordisk, ADR | | 262,550 | | 15,248,904 | |

Roche Holding, ADR | | 349,750 | | 12,055,883 | |

| | | | | 54,665,177 | |

Retailing - .5% | | | | | |

Target | | 34,200 | | 2,483,262 | |

Semiconductors & Semiconductor Equipment - 3.8% | | | | | |

ASML Holding | | 55,050 | a | 4,886,789 | |

Texas Instruments | | 212,000 | | 11,619,720 | |

Xilinx | | 42,750 | | 2,007,968 | |

| | | | | 18,514,477 | |

Software & Services - 7.9% | | | | | |

Alphabet, Cl. C | | 8,030 | b | 6,093,806 | |

Automatic Data Processing | | 30,440 | | 2,578,877 | |

Facebook, Cl. A | | 103,600 | b | 10,842,776 | |

International Business Machines | | 33,550 | | 4,617,151 | |

8

| | | | | | |

| |

Common Stocks - 99.5% (continued) | | Shares | | Value ($) | |

Software & Services - 7.9% (continued) | | | | | |

Microsoft | | 106,610 | | 5,914,722 | |

Oracle | | 155,350 | | 5,674,936 | |

VeriSign | | 35,000 | a,b | 3,057,600 | |

| | | | | 38,779,868 | |

Technology Hardware & Equipment - 6.2% | | | | | |

Apple | | 249,350 | | 26,246,581 | |

QUALCOMM | | 79,000 | | 3,948,815 | |

| | | | | 30,195,396 | |

Telecommunication Services - 1.9% | | | | | |

Comcast, Cl. A | | 164,400 | | 9,277,092 | |

Transportation - 2.4% | | | | | |

Canadian Pacific Railway | | 47,150 | a | 6,016,340 | |

Union Pacific | | 70,650 | | 5,524,830 | |

| | | | | 11,541,170 | |

Total Common Stocks (cost $258,986,457) | | | | 485,978,509 | |

Other Investment - .5% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Preferred Plus Money Market Fund

(cost $2,158,196) | | 2,158,196 | c | 2,158,196 | |

Investment of Cash Collateral for Securities Loaned - 2.5% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Cash Advantage Fund

(cost $12,078,979) | | 12,078,979 | c | 12,078,979 | |

Total Investments (cost $273,223,632) | | 102.5% | | 500,215,684 | |

Liabilities, Less Cash and Receivables | | (2.5%) | | (11,966,591) | |

Net Assets | | 100.0% | | 488,249,093 | |

ADR—American Depository Receipt

aSecurity, or portion thereof, on loan. At December 31, 2015, the value of the fund’s securities on loan was $15,182,143 and the value of the collateral held by the fund was $15,642,236, consisting of cash collateral of $12,078,979 and U.S. Government & Agency securities valued at $3,563,257.

bNon-income producing security.

cInvestment in affiliated money market mutual fund.

9

STATEMENT OF INVESTMENTS (continued)

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Food, Beverage & Tobacco | 20.9 |

Pharmaceuticals, Biotechnology & Life Sciences | 11.2 |

Energy | 10.4 |

Diversified Financials | 9.8 |

Software & Services | 7.9 |

Technology Hardware & Equipment | 6.2 |

Media | 5.0 |

Household & Personal Products | 3.9 |

Semiconductors & Semiconductor Equipment | 3.8 |

Consumer Durables & Apparel | 3.1 |

Money Market Investments | 3.0 |

Insurance | 2.6 |

Transportation | 2.4 |

Food & Staples Retailing | 2.3 |

Materials | 1.9 |

Telecommunication Services | 1.9 |

Health Care Equipment & Services | 1.7 |

Consumer Services | 1.5 |

Banks | 1.3 |

Capital Goods | 1.2 |

Retailing | .5 |

| | 102.5 |

† Based on net assets.

See notes to financial statements.

10

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2015

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $15,182,143)—Note 1(c): | | | | |

Unaffiliated issuers | | 258,986,457 | | 485,978,509 | |

Affiliated issuers | | 14,237,175 | | 14,237,175 | |

Cash | | | | | 21,981 | |

Dividends and securities lending income receivable | | | | | 1,202,281 | |

Receivable for investment securities sold | | | | | 308,523 | |

Prepaid expenses | | | | | 9,994 | |

| | | | | 501,758,463 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | | | 306,903 | |

Due to Fayez Sarofim & Co. | | | | | 91,313 | |

Liability for securities on loan—Note 1(c) | | | | | 12,078,979 | |

Payable for shares of Beneficial Interest redeemed | | | | | 952,563 | |

Interest payable—Note 2 | | | | | 1,887 | |

Accrued expenses | | | | | 77,725 | |

| | | | | 13,509,370 | |

Net Assets ($) | | | 488,249,093 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 190,657,971 | |

Accumulated undistributed investment income—net | | | | | 183,582 | |

Accumulated net realized gain (loss) on investments | | | | | 70,415,765 | |

Accumulated net unrealized appreciation (depreciation)

on investments and foreign currency transactions | | | | | 226,991,775 | |

Net Assets ($) | | | 488,249,093 | |

| | | | |

Net Asset Value Per Share | Initial Shares | Service Shares | |

Net Assets ($) | 256,828,175 | 231,420,918 | |

Shares Outstanding | 5,678,003 | 5,147,388 | |

Net Asset Value Per Share ($) | 45.23 | 44.96 | |

See notes to financial statements.

11

STATEMENT OF OPERATIONS

Year Ended December 31, 2015

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $301,524 foreign taxes withheld at source): | | | | |

Unaffiliated issuers | | | 13,722,889 | |

Affiliated issuers | | | 2,029 | |

Income from securities lending—Note 1(c) | | | 15,055 | |

Total Income | | | 13,739,973 | |

Expenses: | | | | |

Investment advisory fee—Note 3(a) | | | 2,931,134 | |

Sub-investment advisory fee—Note 3(a) | | | 1,197,223 | |

Distribution fees—Note 3(b) | | | 628,468 | |

Professional fees | | | 91,761 | |

Prospectus and shareholders’ reports | | | 57,093 | |

Custodian fees—Note 3(b) | | | 45,973 | |

Trustees’ fees and expenses—Note 3(c) | | | 40,181 | |

Loan commitment fees—Note 2 | | | 5,709 | |

Interest expense—Note 2 | | | 2,564 | |

Shareholder servicing costs—Note 3(b) | | | 2,299 | |

Miscellaneous | | | 24,876 | |

Total Expenses | | | 5,027,281 | |

Less—reduction in fees due to earnings credits—Note 3(b) | | | (7) | |

Net Expenses | | | 5,027,274 | |

Investment Income—Net | | | 8,712,699 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 70,475,479 | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | (92,595,893) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (22,120,414) | |

Net (Decrease) in Net Assets Resulting from Operations | | (13,407,715) | |

See notes to financial statements.

12

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Year Ended December 31, |

| | | | 2015 | | | | 2014 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 8,712,699 | | | | 10,358,834 | |

Net realized gain (loss) on investments | | 70,475,479 | | | | 27,347,692 | |

Net unrealized appreciation (depreciation)

on investments | | (92,595,893) | | | | 7,612,519 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | (13,407,715) | | | | 45,319,045 | |

Dividends to Shareholders from ($): | | | | | | | | |

Investment income—net: | | | | | | | | |

Initial Shares | | | (5,009,601) | | | | (6,210,078) | |

Service Shares | | | (3,652,322) | | | | (4,157,846) | |

Net realized gain on investments: | | | | | | | | |

Initial Shares | | | (14,565,874) | | | | (9,146,788) | |

Service Shares | | | (12,097,365) | | | | (6,764,797) | |

Total Dividends | | | (35,325,162) | | | | (26,279,509) | |

Beneficial Interest Transactions ($): | | | | | | | | |

Net proceeds from shares sold: | | | | | | | | |

Initial Shares | | | 9,530,088 | | | | 16,457,471 | |

Service Shares | | | 22,363,920 | | | | 35,946,895 | |

Dividends reinvested: | | | | | | | | |

Initial Shares | | | 19,575,475 | | | | 15,356,866 | |

Service Shares | | | 15,749,687 | | | | 10,922,643 | |

Cost of shares redeemed: | | | | | | | | |

Initial Shares | | | (75,721,615) | | | | (72,828,378) | |

Service Shares | | | (49,112,680) | | | | (45,422,441) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | (57,615,125) | | | | (39,566,944) | |

Total Increase (Decrease) in Net Assets | (106,348,002) | | | | (20,527,408) | |

Net Assets ($): | | | | | | | | |

Beginning of Period | | | 594,597,095 | | | | 615,124,503 | |

End of Period | | | 488,249,093 | | | | 594,597,095 | |

Undistributed investment income—net | 183,582 | | | | 132,806 | |

Capital Share Transactions (Shares): | | | | | | | | |

Initial Shares | | | | | | | | |

Shares sold | | | 200,086 | | | | 342,337 | |

Shares issued for dividends reinvested | | | 420,632 | | | | 325,702 | |

Shares redeemed | | | (1,603,573) | | | | (1,518,733) | |

Net Increase (Decrease) in Shares Outstanding | (982,855) | | | | (850,694) | |

Service Shares | | | | | | | | |

Shares sold | | | 475,109 | | | | 751,479 | |

Shares issued for dividends reinvested | | | 340,217 | | | | 233,185 | |

Shares redeemed | | | (1,046,754) | | | | (951,348) | |

Net Increase (Decrease) in Shares Outstanding | (231,428) | | | | 33,316 | |

| | | | | | | | | | |

See notes to financial statements.

13

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts. These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | | | | |

| | Year Ended December 31, |

Initial Shares | | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 49.51 | 47.95 | 40.47 | 37.99 | 35.44 |

Investment Operations: | | | | | | |

Investment income—neta | | .80 | .89 | .86 | .82 | .73 |

Net realized and unrealized

gain (loss) on investments | | (1.97) | 2.86 | 7.59 | 3.14 | 2.42 |

Total from Investment Operations | | (1.17) | 3.75 | 8.45 | 3.96 | 3.15 |

Distributions: | | | | | | |

Dividends from investment income—net | | (.81) | (.90) | (.87) | (1.48) | (.60) |

Dividends from net realized

gain on investments | | (2.30) | (1.29) | (.10) | - | - |

Total Distributions | | (3.11) | (2.19) | (.97) | (1.48) | (.60) |

Net asset value, end of period | | 45.23 | 49.51 | 47.95 | 40.47 | 37.99 |

Total Return (%) | | (2.47) | 8.09 | 21.11 | 10.44 | 9.01 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | .80 | .80 | .81 | .81 | .80 |

Ratio of net expenses to average net assets | | .80 | .80 | .81 | .81 | .80 |

Ratio of net investment income

to average net assets | | 1.70 | 1.84 | 1.95 | 2.02 | 1.99 |

Portfolio Turnover Rate | | 11.97 | 3.65 | 7.71 | 3.05 | 4.24 |

Net Assets, end of period ($ x 1,000) | | 256,828 | 329,802 | 360,197 | 345,985 | 326,445 |

a Based on average shares outstanding.

See notes to financial statements.

14

| | | | | | | | | | |

| | | | | | | |

| | Year Ended December 31, |

Service Shares | | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 49.23 | 47.69 | 40.25 | 37.74 | 35.23 |

Investment Operations: | | | | | | |

Investment income—neta | | .68 | .76 | .75 | .72 | .63 |

Net realized and unrealized

gain (loss) on investments | | (1.96) | 2.85 | 7.55 | 3.10 | 2.42 |

Total from Investment Operations | | (1.28) | 3.61 | 8.30 | 3.82 | 3.05 |

Distributions: | | | | | | |

Dividends from investment income—net | | (.69) | (.78) | (.76) | (1.31) | (.54) |

Dividends from net realized

gain on investments | | (2.30) | (1.29) | (.10) | - | - |

Total Distributions | | (2.99) | (2.07) | (.86) | (1.31) | (.54) |

Net asset value, end of period | | 44.96 | 49.23 | 47.69 | 40.25 | 37.74 |

Total Return (%) | | (2.72) | 7.83 | 20.83 | 10.14 | 8.74 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | 1.05 | 1.05 | 1.06 | 1.06 | 1.05 |

Ratio of net expenses to average net assets | | 1.05 | 1.05 | 1.06 | 1.06 | 1.05 |

Ratio of net investment income

to average net assets | | 1.45 | 1.59 | 1.70 | 1.79 | 1.75 |

Portfolio Turnover Rate | | 11.97 | 3.65 | 7.71 | 3.05 | 4.24 |

Net Assets, end of period ($ x 1,000) | | 231,421 | 264,795 | 254,928 | 220,568 | 174,160 |

a Based on average shares outstanding.

See notes to financial statements.

15

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Appreciation Portfolio (the “fund”) is a separate diversified series of Dreyfus Variable Investment Fund (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. The fund’s investment objective is to seek long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the fund’s sub–investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the Distribution Plan, and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these

16

arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of

17

NOTES TO FINANCIAL STATEMENTS (continued)

the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The following is a summary of the inputs used as of December 31, 2015 in valuing the fund’s investments:

18

| | | | | |

| | Level 1 - Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 -Significant Unobservable Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Equity Securities - Domestic Common Stocks† | 403,842,170 | - | - | 403,842,170 |

Equity Securities - Foreign Common Stocks† | 66,241,878 | 15,894,461†† | - | 82,136,339 |

Mutual Funds | 14,237,175 | - | - | 14,237,175 |

† See Statement of Investments for additional detailed categorizations.

†† Securities classified within Level 2 at period end as the values were determined pursuant to the fund’s fair valuation procedures. See note above for additional information.

At December 31, 2014, $15,893,896 of exchange traded foreign equity securities were classified within Level 2 of the fair value hierarchy pursuant to the fund’s fair valuation procedures.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

19

NOTES TO FINANCIAL STATEMENTS (continued)

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. During the period ended December 31, 2015, The Bank of New York Mellon earned $3,381 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended December 31, 2015 were as follows:

| | | | | | |

Affiliated Investment Company | Value 12/31/2014 ($) | Purchases ($) | Sales ($) | Value 12/31/2015 ($) | Net

Assets (%) |

Dreyfus Institutional Preferred Plus Money Market Fund | 1,263,200 | 63,458,257 | 62,563,261 | 2,158,196 | .5 |

Dreyfus Institutional Cash Advantage Fund | 4,154,880 | 107,815,445 | 99,891,346 | 12,078,979 | 2.5 |

Total | 5,418,080 | 171,273,702 | 162,454,607 | 14,237,175 | 3.0 |

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are normally declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such

20

gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2015, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended December 31, 2015, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended December 31, 2015 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2015, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $343,484, undistributed capital gains $70,318,851 and unrealized appreciation $226,928,787.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2015 and December 31, 2014 were as follows: ordinary income $8,792,819 and $10,543,184, and long-term capital gains $26,532,343 and $15,736,325, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $480 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 7, 2015, the unsecured credit facility with Citibank, N.A. was $430 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended December 31, 2015 was approximately $228,800 with a related weighted average annualized interest rate of 1.12%.

21

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with Dreyfus, the investment advisory fee is computed at the annual rate of .5325% of the value of the fund’s average daily net assets. Pursuant to a sub-investment advisory agreement with Sarofim & Co., the fund pays Sarofim & Co. a monthly sub-investment advisory fee at the annual rate of .2175% of the value of the fund’s average daily net assets. Both fees are payable monthly.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing its shares, for servicing and/or maintaining Service shares’ shareholder accounts and for advertising and marketing for Service shares. The Distribution Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets. The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products. The fees payable under the Distribution Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2015, Service shares were charged $628,468 pursuant to the Distribution Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended December 31, 2015, the fund was charged $2,069 for transfer agency services and $139 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $7.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended December 31, 2015, the fund was charged $45,973 pursuant to the custody agreement.

22

During the period ended December 31, 2015, the fund was charged $10,946 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $223,558, Distribution Plan fees $49,830, custodian fees $30,671, Chief Compliance Officer fees $2,647 and transfer agency fees $197.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2015, amounted to $65,228,410 and $149,555,998, respectively.

At December 31, 2015, the cost of investments for federal income tax purposes was $273,286,620; accordingly, accumulated net unrealized appreciation on investments was $226,929,064, consisting of $232,950,728 gross unrealized appreciation and $6,021,664 gross unrealized depreciation.

23

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Trustees

Dreyfus Variable Investment Fund, Appreciation Portfolio

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the series comprising Dreyfus Variable Investment Fund) as of December 31, 2015, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2015 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Variable Investment Fund, Appreciation Portfolio at December 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 11, 2016

24

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby reports 100% of the ordinary dividends paid during the fiscal year ended December 31, 2015 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in early 2016 of the percentage applicable to the preparation of their 2015 income tax returns. Also, the fund hereby reports $.0113 per share as a short-term capital gain distribution and $2.2905 per share as a long-term capital gain distribution paid on March 31, 2015.

25

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (72)

Chairman of the Board (1995)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

No. of Portfolios for which Board Member Serves: 139

———————

Peggy C. Davis (72)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Shad Professor of Law, New York University School of Law (1983-present)

No. of Portfolios for which Board Member Serves: 50

———————

David P. Feldman (76)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1985-present)

Other Public Company Board Memberships During Past 5 Years:

· BBH Mutual Funds Group (5 registered mutual funds), Director (1992-2014)

No. of Portfolios for which Board Member Serves: 36

———————

Ehud Houminer (75)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Executive-in-Residence at the Columbia Business School, Columbia

University (1992-present)

Other Public Company Board Memberships During Past 5 Years:

· Avnet, Inc., an electronics distributor, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 60

———————

26

Lynn Martin (76)

Board Member (2012)

Principal Occupation During Past 5 Years:

· President of The Martin Hall Group LLC, a human resources consulting firm (2005-2012)

Other Public Company Board Memberships During Past 5 Years:

· AT&T, Inc., a telecommunications company, Director (1999-2012)

· Ryder System, Inc., a supply chain and transportation management company, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 36

———————

Robin A. Melvin (52)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Co-chairman, Illinois Mentoring Partnership, non-profit organization dedicated to increasing the quantity and quality of mentoring services in Illinois; (2014-present; a board member since 2013)

· Director, Boisi Family Foundation, a private family foundation that supports youth-serving organizations that promote the self sufficiency of youth from disadvantaged circumstances (1995-2012)

No. of Portfolios for which Board Member Serves: 110

———————

Dr. Martin Peretz (76)

Board Member (1990)

Principal Occupation During Past 5 Years:

· Editor-in-Chief Emeritus of The New Republic Magazine (2011-2012) (previously,

Editor-in-Chief, 1974-2011)

· Director of TheStreet.com, a financial information service on the web (1996-2010)

· Lecturer at Harvard University (1969-2012)

No. of Portfolios for which Board Member Serves: 36

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James F. Henry, Emeritus Board Member

Dr. Paul A. Marks, Emeritus Board Member

Philip L. Toia, Emeritus Board Member

27

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Executive Vice President of the Distributor since June 2007. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 65 investment companies (comprised of 139 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015

Chief Legal Officer of the Manager since June 2015; from June 2005 to June 2015, Director and Associate General Counsel of Deutsche Bank – Asset & Wealth Management Division, and Chief Legal Officer of Deutsche Investment Management Americas Inc. He is an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 2015.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Assistant General Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. She is 53 years old and has been an employee of the Manager since February 1984.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. She is 60 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 54 years old and has been an employee of the Manager since June 2000.

MAUREEN E. KANE, Vice President and Assistant Secretary since April 2015.

Managing Counsel of BNY Mellon since July 2014; from October 2004 until July 2014, General Counsel, and from May 2009 until July 2014, Chief Compliance Officer of Century Capital Management. She is an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. She is 53 years old and has been an employee of the Manager since July 2014.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Senior Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager; from August 2005 to March 2013, Associate General Counsel of Third Avenue Management. She is 40 years old and has been an employee of the Manager since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Manager since September 1982.

28

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 66 investment companies (comprised of 164 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (66 investment companies, comprised of 164 portfolios). He is 58 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

CARI M. CAROSELLA, Anti-Money Laundering Compliance Officer since January 2016

Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust since January 2016; from May 2015 to December 2015, Interim Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust and the Distributor; from January 2012 to May 2015, AML Surveillance Officer of the Distributor and from 2007 to December 2011, Financial Processing Manager of the Distributor. She is an officer of 62 investment companies (comprised of 160 portfolios) managed by the Manager. She is 47 years old and has been an employee of the Distributor since 1997.

29

Dreyfus Variable Investment Fund, Appreciation Portfolio

200 Park Avenue

New York, NY 10166

Manager

The Dreyfus Corporation

200 Park Avenue

New York, NY 10166

Sub-Investment Adviser

Fayez Sarofim & Co.

Two Houston Center

Suite 2907

Houston, TX 77010

Custodian

The Bank of New York Mellon

225 Liberty Street

New York, NY 10286

Transfer Agent &

Dividend Disbursing Agent

Dreyfus Transfer, Inc.

200 Park Avenue

New York, NY 10166

Distributor

MBSC Securities Corporation

200 Park Avenue

New York, NY 10166

Telephone 1-800-242-8671 or 1-800-346-3621

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 Attn: Institutional Services Department

E-mail Send your request to info@dreyfus.com

Internet Information can be viewed online or downloaded at www.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the most recent 12-month period ended June 30 is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-DREYFUS.

| | |

© 2016 MBSC Securities Corporation

0112AR1215 |

|

Dreyfus Variable Investment Fund, Growth and Income Portfolio

| | | |

| | ANNUAL REPORT December 31, 2015 |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Variable Investment Fund, Growth and Income Portfolio

| | The Fund |

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Growth and Income Portfolio, covering the 12-month period from January 1, 2015, through December 31, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

2015 was a year of varied and, at times, conflicting economic influences. On one hand, the U.S. economy continued to grow as domestic labor markets posted significant gains, housing markets recovered, and lower fuel prices put cash in consumers’ pockets. Indeed, these factors, along with low inflation, prompted the Federal Reserve Board in December to raise short-term interest rates for the first time in nearly a decade. On the other hand, the global economy continued to disappoint, particularly in China and other emerging markets, when reduced industrial demand and declining currency values sparked substantial declines in commodity prices.

Although several broad measures of stock and bond performance ended 2015 roughly unchanged, high levels of volatility prevailed across most financial markets. Among U.S. equities, moderate gains from consumer discretionary and health care stocks were balanced by pronounced weakness in the energy and materials sectors. Bonds also saw bifurcated performance, with municipal bonds and intermediate-term U.S. government securities faring well compared to high yield and emerging-markets debt.

Market volatility is likely to persist until investors see greater clarity from the global economy. We expect to see wide differences in underlying fundamental and technical influences across various asset classes, economic sectors, and regional markets in 2016, suggesting that selectivity may be an important determinant of investment success. As always, we encourage you to discuss the implications of our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

January 15, 2016

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2015, through December 31, 2015, as provided by John Bailer and Elizabeth Slover, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended December 31, 2015, Dreyfus Variable Investment Fund, Growth and Income Portfolio’s Initial shares achieved a total return of 1.59%, and its Service shares achieved a total return of 1.32%.1 In comparison, the fund’s benchmark, the Standard & Poor’s 500® Composite Stock Price Index (the “S&P 500 Index”), produced a total return of 1.39% for the same period.2

U.S. equities generally achieved modest gains during 2015 amid choppy domestic growth and global economic concerns. The fund performed roughly in line with its benchmark, as good results in the energy, consumer staples, utilities, and materials sectors were balanced by disappointments in the financials, information technology and telecommunications services sectors.

The Fund’s Investment Approach

The fund seeks long-term capital growth, current income, and growth of income consistent with reasonable investment risk. To pursue these goals, the fund normally invests primarily in stocks of domestic and foreign issuers. We seek to create a portfolio that includes a blend of growth and dividend-paying stocks, as well as other investments that provide income. We choose stocks through a disciplined investment process that combines computer modeling techniques, “bottom-up” fundamental analysis, and risk management. The investment process is designed to provide investors with investment exposure to sector weightings and risk characteristics similar to those of the S&P 500 Index.

Economic Uncertainties Limited the Market’s Gains

Markets proved volatile during 2015, rising and falling sharply amid shifting economic sentiment. The year started on a weak note, as U.S. economic growth stalled in the face of severe winter weather. Exporters were undermined by a strengthening U.S. dollar, and energy producers were challenged by declining oil prices. The economy got back on track in the spring, when labor markets resumed their vigorous gains, housing markets rebounded, oil prices began to recover, and currency exchange rates stabilized.

Positive U.S. economic developments supported higher stock prices until mid-June, when contentious negotiations surrounding the Greek debt crisis injected new uncertainty into the market. After a series of rises and declines over the summer, stocks plunged in August when Chinese authorities devaluated the country’s currency, exacerbating fears about slowing China’s economic growth. An October bounce in equity prices put most major U.S. indices back in positive territory. Investors again grew concerned that global economic instability and falling energy prices might dampen economic conditions in the United States, and stock prices remained volatile over the final months of the year.

Stock Selections Drove Fund Performance

The fund’s relative performance in 2015 benefited from underweighted exposure to the weak utilities sector, as well as strong stock selections in the energy, consumer staples, and

3

DISCUSSION OF FUND PERFORMANCE (continued)

materials sectors. In the energy sector, the fund held relatively little exposure to large integrated oil companies that were hurt by falling commodity prices, focusing instead on refiners such as Valero Energy and Phillips 66, which benefited from lower input costs and rising demand for gasoline. Among consumer staples stocks, food-and-beverage companies Molson Coors Brewing, Coca-Cola, and Mondelez International rose on the strength of improving profitability and favorable developments involving industry consolidation. In the materials sector, construction aggregate producers Martin Marietta Materials and Vulcan Materials gained ground due to positive domestic construction trends.

The benefits of these positions were largely offset by disappointing returns from individual holdings in the financials and information technology sectors. Among financial stocks, the fund held little exposure to richly valued real estate investment trusts (REITs), a group that benefited from a low interest rate environment. In addition, insurer and retirement services provider Voya Financial, broker Morgan Stanley, and asset manager Ameriprise Financial were hurt by weak growth and concerns regarding reduced levels of capital markets activity. In the information technology sector, Alphabet (formerly Google) performed well, but the fund did not participate in gains from software giant Microsoft. Moreover, semiconductor equipment maker Applied Materials declined due to weakness in end markets and the failure of a merger that was blocked by regulators.

Focused on Opportunities for Growth

The Federal Reserve Board raised short-term interest rates in December for the first time in nearly 10 years. As the interest rate environment normalizes, we expect prospects for our active management strategy to improve. As of the reporting period’s end, we have found a relatively large number of opportunities in the consumer discretionary, information technology, materials, financials, and telecommunications services sectors. In contrast, we have allocated relatively few assets to the utilities, industrials, consumer staples, and health care sectors.

January 15, 2016

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period.

Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets. Derivatives can be highly volatile, illiquid, and difficult to value and there is the risk that changes in the value of a derivative held by the fund will not correlate with the underlying instruments or the fund’s other investments.

The fund is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund directly. A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. The investment objective and policies of Dreyfus Variable Investment Fund, Growth and Income Portfolio made available through insurance products may be similar to other funds managed or advised by Dreyfus. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund.

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts, which will reduce returns.

2 SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500® Composite Stock Price Index is a widely accepted, unmanaged index of U.S. stock market performance. Investors cannot invest directly in any index.

4

FUND PERFORMANCE

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Growth and Income Portfolio Initial shares and Service shares and the Standard & Poor’s 500 Composite Stock Price Index

| | | | |

Average Annual Total Returns as of 12/31/15 | |

| 1 Year | 5 Years | 10 Years |

Initial shares | 1.59% | 11.91% | 7.09% |

Service shares | 1.32% | 11.64% | 6.84% |

Standard & Poor’s 500 Composite Stock Price Index | 1.39% | 12.55% | 7.30% |

† Source: Lipper Inc.