UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-05125 |

| |

| Dreyfus Variable Investment Fund | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 12/31 | |

Date of reporting period: | 12/31/18 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Variable Investment Fund, Appreciation Portfolio

| | | |

| | ANNUAL REPORT December 31, 2018 |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Variable Investment Fund, Appreciation Portfolio

| | The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2018 through December 31, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The reporting period began with major global economies achieving above-trend growth. In the United States, a robust economy and strong labor market encouraged the Federal Reserve to continue moving away from its accommodative monetary policy while other major central banks began to consider monetary tightening. Both U.S. and non-U.S. equity markets remained on an uptrend. Interest rates rose across the yield curve, putting pressure on bond prices.

A few months into the reporting period, global growth trends began to diverge and market volatility returned. While the U.S. economy continued to grow at a healthy rate, other developed markets began to weaken. However, robust growth and strong corporate earnings continued to support U.S. stock returns while other developed markets declined throughout the summer. In the fall, a broad sell-off occurred, partially offsetting earlier U.S. gains. Emerging markets remained under pressure as weakness in their currencies relative to the U.S. dollar added to investors’ uneasiness. Global equities continued their general decline through the end of the period.

Fixed income markets struggled during the first half of the period as interest rates rose and favorable U.S. equity markets fed investor risk appetites. However, in autumn volatility crept in, the yield curve began a flattening trend that continued through the end of December. As long-term debt yields fell, prices rose for many bonds, leading to moderately positive returns for several fixed income market sectors.

Despite continuing political variables, U.S. inflationary pressures and flagging growth rates, we are optimistic that the U.S. economy will remain strong in the near term. However, we remain attentive to signs that point to potential changes on the horizon. As always, we encourage you to discuss the risks and opportunities in today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

January 15, 2019

2

DISCUSSION OF FUND PERFORMANCE(Unaudited)

For the period from January 1, 2018 through December 31, 2018, as provided by portfolio manager Fayez Sarofim of Fayez Sarofim& Co., Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended December 31, 2018, Dreyfus Variable Investment Fund, Appreciation Portfolio’s Initial shares achieved a total return of -6.86%, and its Service shares achieved a total return of -7.10%.1 In comparison, the fund’s benchmark, the S&P 500® Index (the “Index”), produced a total return of -4.38% for the same period.2

U.S. stocks posted losses during the reporting period amid sustained economic growth, rising interest rates and intensifying trade tensions. The fund underperformed its benchmark, largely due to overweighted exposure to the consumer staples and communication services sectors, and to underweighted exposure to the market-leading health care sector. Certain positions in the pharmaceutical industry also detracted from relative returns.

The Fund’s Investment Approach

The fund seeks long-term capital growth consistent with the preservation of capital. Its secondary goal is current income. To pursue its goals, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in common stocks. The fund focuses on blue-chip companies with total market capitalizations of more than $5 billion at the time of purchase, including multinational companies. These are established companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence, and the potential to achieve predictable, above-average earnings growth.

In choosing stocks, we identify economic sectors we believe will expand over the next three to five years or longer. Using fundamental analysis, we then seek companies within these sectors that have proven track records and dominant positions in their industries. The fund employs a “buy-and-hold” investment strategy, which generally has resulted in an annual portfolio turnover rate below 15%. A low portfolio turnover rate helps reduce the fund’s trading costs.3

Stocks Sold Off Amid Uncertainty

In sharp contrast to 2017, when equity markets rose steadily without any meaningful setbacks, 2018 was a turbulent year punctuated by several sharp sell-offs. Despite robust domestic economic data and earnings results, uncertainty increased throughout the year as ongoing Federal Reserve tightening, escalating trade conflicts and signs of weakening momentum abroad led investors to reassess expectations for future growth. The Index entered into correction territory three times in 2018, ultimately registering its first annual decline since 2008. The energy sector, which was pressured by plunging crude oil prices in the face of a deteriorating demand outlook, recorded the biggest loss.

Fund Strategies Produced Mixed Results

The fund declined more than the Index for the year but registered good relative results in the final quarter amid the market turmoil. The fund’s relative underperformance for the full year was primarily a result of sector allocations that differed from those of the benchmark. Specifically, overweighted representation in the lagging consumer staples and communication services sectors penalized relative results. The fund’s underweighted allocation to the market-leading health care sector, as well as weakness in key holdings within the pharmaceuticals segment, also detracted from relative returns.

3

DISCUSSION OF FUND PERFORMANCE(Unaudited) (continued)

The overall impact of stock selection, on the other hand, was positive and helped to offset these negative allocation effects. Industrials and materials issues generally struggled with the prospect of weaker demand associated with trade conflicts, and the fund’s selective positioning within these sectors supported relative results. Advantageous stock selection in the energy sector, which emphasized the major integrated oil companies and avoided the more volatile oilfield service and equipment stocks, also added value. Selection decisions in the information technology sector also proved rewarding due to strong relative performance from holdings such as Visa, Automatic Data Processing and Microsoft. The largest positive contributors to the fund’s 12-month return included Microsoft, Twenty-First Century Fox, Abbott Laboratories, Visa and Nike. The largest detractors from return included Philip Morris International, Facebook, Altria Group, State Street and BlackRock.

Industry Leaders May Be Able to Weather Macroeconomic Headwinds

While the U.S. economy is expected to continue powering ahead in 2019, some slowing from the buoyant pace of growth seen last year is likely given the continued withdrawal of monetary accommodation, the fading boost from tax reform and the potential for more tariffs. In the near term, growth concerns and market pessimism appear set to persist and equity markets will likely continue to struggle until growth signals improve. Over the medium term, however, slower but steady economic growth should drive positive, albeit volatile, returns for equities.

Moderating economic growth alongside rising labor and borrowing costs has created a backdrop that should favor companies with solid balance sheets and pricing power that are capable of maintaining revenue growth and passing on higher costs. The fund’s investment strategy has long focused on such companies. We believe the high-quality industry leaders in our portfolios, with their ample financial resources, durable competitive advantages and operational scale, are well positioned to deliver consistent results through challenging business cycles. Dominant market positions and disciplined cost controls generally provide these companies with more options to protect their margins while strong recurring cash flows enable them to continue investing prudently for sustained growth in the future. Furthermore, their seasoned management teams have established records of creating long-term value for shareholders through strategic capital redeployment, dividend increases and share repurchases, providing a degree of stability as market conditions change.

January 15, 2019

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts, which will reduce returns.

2 Source: Lipper Inc. — The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

3 Achieving tax efficiency is not a part of the fund’s investment objective, and there can be no guarantee that the fund will achieve any particular level of taxable distributions in future years. In periods when the manager has to sell significant amounts of securities (e.g., during periods of significant net redemptions or changes in index components), the fund can be expected to be less tax efficient than during periods of more stable market conditions and asset flows.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund directly. A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. The investment objective and policies of Dreyfus Variable Investment Fund, Appreciation Portfolio made available through insurance products may be similar to those of other funds managed by Dreyfus. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund.

4

FUND PERFORMANCE(Unaudited)

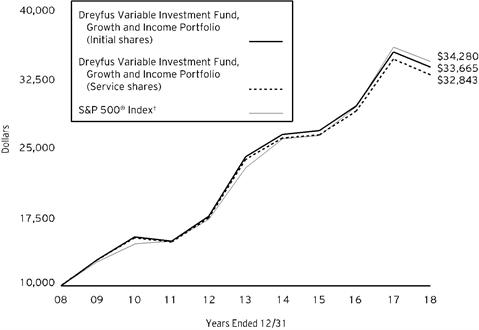

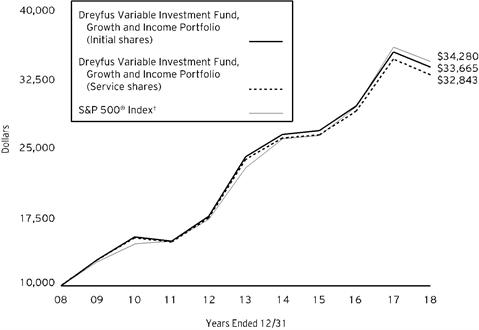

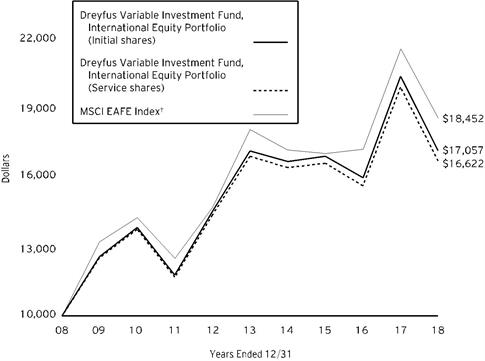

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio Initial shares and Service shares and the S&P 500® Index (the “Index”)

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio Initial shares and Service shares and the S&P 500® Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts which will reduce returns.

The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment Fund, Appreciation Portfolio on 12/31/08 to a $10,000 investment made in the Index on that date.

The fund’s performance shown in the line graph above takes into account all applicable fund fees and expenses for Initial and Service shares. The Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| | | | |

Average Annual Total Returns as of 12/31/18 |

| 1 Year | 5 Years | 10 Years |

Initial shares | -6.86% | 6.17% | 10.77% |

Service shares | -7.10% | 5.90% | 10.49% |

S&P 500® Index | -4.38% | 8.49% | 13.11% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s Initial shares are not subject to a Rule 12b-1 fee. The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

UNDERSTANDING YOUR FUND’S EXPENSES(Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio from July 1, 2018 to December 31, 2018. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended December 31, 2018 | |

| | | | Initial Shares | Service Shares |

Expenses paid per $1,000† | | | $3.87 | | $5.08 |

Ending value (after expenses) | | | $920.80 | | $919.40 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS(Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended December 31, 2018 |

| | | | Initial Shares | Service Shares |

Expenses paid per $1,000† | | | $4.08 | | $5.35 |

Ending value (after expenses) | | | $1,021.17 | | $1,019.91 |

† Expenses are equal to the fund’s annualized expense ratio of .80% for Initial shares and 1.05% for Service shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

6

STATEMENT OF INVESTMENTS

December 31, 2018

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.3% | | | | | |

Banks - 3.5% | | | | | |

JPMorgan Chase & Co. | | | | 121,825 | | 11,892,556 | |

Capital Goods - 1.6% | | | | | |

United Technologies | | | | 49,875 | | 5,310,690 | |

Commercial & Professional Services - .8% | | | | | |

Verisk Analytics | | | | 23,740 | a | 2,588,610 | |

Consumer Durables & Apparel - 3.0% | | | | | |

Hermes International | | | | 2,677 | | 1,480,506 | |

LVMH Moet Hennessy Louis Vuitton | | | | 15,250 | | 4,481,149 | |

NIKE, Cl. B | | | | 58,115 | | 4,308,647 | |

| | | | | 10,270,302 | |

Consumer Services - 1.9% | | | | | |

McDonald's | | | | 35,775 | | 6,352,567 | |

Diversified Financials - 8.4% | | | | | |

American Express | | | | 65,175 | | 6,212,481 | |

BlackRock | | | | 19,400 | | 7,620,708 | |

Intercontinental Exchange | | | | 48,800 | | 3,676,104 | |

S&P Global | | | | 35,250 | | 5,990,385 | |

State Street | | | | 79,625 | | 5,021,949 | |

| | | | | 28,521,627 | |

Energy - 6.6% | | | | | |

Chevron | | | | 79,550 | | 8,654,245 | |

ConocoPhillips | | | | 71,250 | | 4,442,437 | |

Exxon Mobil | | | | 134,639 | | 9,181,033 | |

| | | | | 22,277,715 | |

Food, Beverage & Tobacco - 14.1% | | | | | |

Altria Group | | | | 169,175 | | 8,355,553 | |

Anheuser-Busch InBev, ADR | | | | 34,150 | b | 2,247,411 | |

Coca-Cola | | | | 203,600 | | 9,640,460 | |

Constellation Brands, Cl. A | | | | 22,450 | | 3,610,409 | |

Nestle, ADR | | | | 72,075 | | 5,835,192 | |

PepsiCo | | | | 59,675 | | 6,592,894 | |

Philip Morris International | | | | 171,575 | | 11,454,347 | |

| | | | | 47,736,266 | |

Health Care Equipment & Services - 3.6% | | | | | |

Abbott Laboratories | | | | 100,075 | | 7,238,425 | |

UnitedHealth Group | | | | 20,450 | | 5,094,504 | |

| | | | | 12,332,929 | |

Household & Personal Products - 2.9% | | | | | |

Estee Lauder, Cl. A | | | | 75,425 | | 9,812,792 | |

Insurance - 3.1% | | | | | |

Chubb | | | | 79,900 | | 10,321,482 | |

7

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.3% (continued) | | | | | |

Materials - 2.9% | | | | | |

Air Products & Chemicals | | | | 9,900 | | 1,584,495 | |

Linde | | | | 39,150 | | 6,108,966 | |

Sherwin-Williams | | | | 5,250 | | 2,065,665 | |

| | | | | 9,759,126 | |

Media & Entertainment - 14.1% | | | | | |

Alphabet, Cl. C | | | | 13,394 | a | 13,870,960 | |

Comcast, Cl. A | | | | 261,840 | | 8,915,652 | |

Facebook, Cl. A | | | | 114,085 | a | 14,955,403 | |

Twenty-First Century Fox, Cl. A | | | | 137,661 | | 6,624,247 | |

Walt Disney | | | | 29,875 | | 3,275,794 | |

| | | | | 47,642,056 | |

Pharmaceuticals Biotechnology & Life Sciences - 5.5% | | | | | |

AbbVie | | | | 82,250 | | 7,582,628 | |

Novo Nordisk, ADR | | | | 132,275 | | 6,093,909 | |

Roche Holding, ADR | | | | 157,525 | | 4,895,877 | |

| | | | | 18,572,414 | |

Retailing - 2.1% | | | | | |

Amazon.com | | | | 4,700 | a | 7,059,259 | |

Semiconductors & Semiconductor Equipment - 5.5% | | | | | |

ASML Holding | | | | 35,975 | | 5,598,429 | |

Infineon Technologies, ADR | | | | 85,000 | | 1,698,725 | |

Texas Instruments | | | | 121,375 | | 11,469,937 | |

| | | | | 18,767,091 | |

Software & Services - 11.1% | | | | | |

Automatic Data Processing | | | | 16,665 | | 2,185,115 | |

Microsoft | | | | 226,585 | | 23,014,238 | |

Visa, Cl. A | | | | 93,225 | b | 12,300,106 | |

| | | | | 37,499,459 | |

Technology Hardware & Equipment - 5.1% | | | | | |

Apple | | | | 110,200 | | 17,382,948 | |

Transportation - 3.5% | | | | | |

Canadian Pacific Railway | | | | 28,925 | b | 5,137,659 | |

Union Pacific | | | | 47,750 | | 6,600,482 | |

| | | | | 11,738,141 | |

Total Common Stocks(cost $167,111,219) | | | | 335,838,030 | |

| | | 1-Day

Yield (%) | | | | | |

Investment Companies - .5% | | | | | |

Registered Investment Companies - .5% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund

(cost $1,633,898) | | 2.32 | | 1,633,898 | c | 1,633,898 | |

8

| | | | | | | | |

| |

Description | | 1-Day

Yield (%) | | Shares | | Value ($) | |

Investment of Cash Collateral for Securities Loaned - .6% | | | | | |

Registered Investment Companies - .6% | | | | | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares

(cost $2,043,845) | | 2.69 | | 2,043,845 | c | 2,043,845 | |

Total Investments(cost $170,788,962) | | 100.4% | | 339,515,773 | |

Liabilities, Less Cash and Receivables | | (.4%) | | (1,496,912) | |

Net Assets | | 100.0% | | 338,018,861 | |

ADR—American Depository Receipt

a Non-income producing security.

b Security, or portion thereof, on loan. At December 31, 2018, the value of the fund’s securities on loan was $13,394,577 and the value of the collateral held by the fund was $13,578,089, consisting of cash collateral of $2,043,845 and U.S. Government & Agency securities valued at $11,534,244.

c Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited)† | Value (%) |

Information Technology | 21.8 |

Consumer Staples | 17.0 |

Financials | 15.0 |

Communication Services | 14.1 |

Health Care | 9.1 |

Consumer Discretionary | 7.0 |

Energy | 6.6 |

Industrials | 5.8 |

Materials | 2.9 |

Investment Companies | 1.1 |

| | 100.4 |

† Based on net assets.

See notes to financial statements.

9

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Registered Investment Companies | Value

12/31/17($) | Purchases($) | Sales ($) | Value

12/31/18($) | Net

Assets(%) | Dividends/

Distributions($) |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | - | 51,138,013 | 49,094,168 | 2,043,845 | .6 | - |

Dreyfus Institutional Preferred Government Plus Money Market Fund | 1,867,769 | 37,713,975 | 37,947,846 | 1,633,898 | .5 | 26,183 |

Total | 1,867,769 | 88,851,988 | 87,042,014 | 3,677,743 | 1.1 | 26,183 |

See notes to financial statements.

10

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $13,394,577)—Note 1(c): | | | |

Unaffiliated issuers | 167,111,219 | | 335,838,030 | |

Affiliated issuers | | 3,677,743 | | 3,677,743 | |

Cash denominated in foreign currency | | | 29,826 | | 30,204 | |

Dividends and securities lending income receivable | | 846,086 | |

Receivable for shares of Beneficial Interest subscribed | | 100,011 | |

Receivable for investment securities sold | | 70,876 | |

Prepaid expenses | | | | | 3,088 | |

| | | | | 340,566,038 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | | 196,327 | |

Due to Fayez Sarofim & Co. | | | | | 64,301 | |

Liability for securities on loan—Note 1(c) | | 2,043,845 | |

Payable for shares of Beneficial Interest redeemed | | 168,114 | |

Trustees fees and expenses payable | | 2,231 | |

Unrealized depreciation on foreign currency transactions | | 400 | |

Accrued expenses | | | | | 71,959 | |

| | | | | 2,547,177 | |

Net Assets ($) | | | 338,018,861 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 126,241,519 | |

Total distributable earnings (loss) | | | | | 211,777,342 | |

Net Assets ($) | | | 338,018,861 | |

| | | | |

Net Asset Value Per Share | Initial Shares | Service Shares | |

Net Assets ($) | 225,631,491 | 112,387,370 | |

Shares Outstanding | 6,295,681 | 3,166,291 | |

Net Asset Value Per Share ($) | 35.84 | 35.49 | |

| | | | |

See notes to financial statements. | | | |

11

STATEMENT OF OPERATIONS

Year Ended December 31, 2018

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $180,090 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 8,236,118 | |

Affiliated issuers | | | 26,183 | |

Income from securities lending—Note 1(c) | �� | | 41,654 | |

Total Income | | | 8,303,955 | |

Expenses: | | | | |

Investment advisory fee—Note 3(a) | | | 2,099,871 | |

Sub-investment advisory fee—Note 3(a) | | | 857,694 | |

Distribution fees—Note 3(b) | | | 336,109 | |

Professional fees | | | 92,425 | |

Prospectus and shareholders’ reports | | | 43,946 | |

Trustees’ fees and expenses—Note 3(c) | | | 30,776 | |

Custodian fees—Note 3(b) | | | 16,548 | |

Loan commitment fees—Note 2 | | | 8,301 | |

Shareholder servicing costs—Note 3(b) | | | 2,095 | |

Interest expense—Note 2 | | | 228 | |

Miscellaneous | | | 38,565 | |

Total Expenses | | | 3,526,558 | |

Investment Income—Net | | | 4,777,397 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | 42,632,807 | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | (71,694,542) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (29,061,735) | |

Net (Decrease) in Net Assets Resulting from Operations | | (24,284,338) | |

| | | | | | | |

See notes to financial statements. | | | | | |

12

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended December 31, |

| | | | 2018 | | 2017 | a |

Operations ($): | | | | | | | | |

Investment income—net | | | 4,777,397 | | | | 5,173,319 | |

Net realized gain (loss) on investments | | 42,632,807 | | | | 50,697,356 | |

Net unrealized appreciation (depreciation)

on investments | | (71,694,542) | | | | 42,703,302 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | (24,284,338) | | | | 98,573,977 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Initial Shares | | | (36,501,235) | | | | (36,073,115) | |

Service Shares | | | (18,803,539) | | | | (23,829,387) | |

Total Distributions | | | (55,304,774) | | | | (59,902,502) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Initial Shares | | | 6,205,656 | | | | 7,444,269 | |

Service Shares | | | 7,827,922 | | | | 8,089,313 | |

Distributions reinvested: | | | | | | | | |

Initial Shares | | | 36,501,235 | | | | 36,073,115 | |

Service Shares | | | 18,803,539 | | | | 23,829,387 | |

Cost of shares redeemed: | | | | | | | | |

Initial Shares | | | (36,212,750) | | | | (35,224,654) | |

Service Shares | | | (32,792,813) | | | | (61,387,520) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | 332,789 | | | | (21,176,090) | |

Total Increase (Decrease) in Net Assets | (79,256,323) | | | | 17,495,385 | |

Net Assets ($): | |

Beginning of Period | | | 417,275,184 | | | | 399,779,799 | |

End of Period | | | 338,018,861 | | | | 417,275,184 | |

Capital Share Transactions (Shares): | |

Initial Shares | | | | | | | | |

Shares sold | | | 151,190 | | | | 177,820 | |

Shares issued for distributions reinvested | | | 957,001 | | | | 937,609 | |

Shares redeemed | | | (891,681) | | | | (847,904) | |

Net Increase (Decrease) in Shares Outstanding | 216,510 | | | | 267,525 | |

Service Shares | | | | | | | | |

Shares sold | | | 194,324 | | | | 198,043 | |

Shares issued for distributions reinvested | | | 497,903 | | | | 625,749 | |

Shares redeemed | | | (807,266) | | | | (1,507,252) | |

Net Increase (Decrease) in Shares Outstanding | (115,039) | | | | (683,460) | |

| | | | | | | | | | |

aDistributions to shareholders include $3,397,259 Initial shares and $1,710,007 Service shares distributions from net investment income and $32,675,856 Initial shares and $22,119,380 Service shares distributions from net realized gains. Undistributed investment income—net was $313,234 in 2017 and is no longer presented as a result of the adoption of SEC’s Disclosure Update and Simplification Rule. | |

See notes to financial statements. | | | | | | | | |

13

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts. These figures have been derived from the fund’s financial statements.

| | | | | | | | | | | | | | |

| | | | | | | |

| | | |

Initial Shares | | | Year Ended December 31, |

| | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 44.71 | 41.01 | 45.23 | 49.51 | 47.95 |

Investment Operations: | | | | | | |

Investment income—neta | | .53 | .56 | .68 | .80 | .89 |

Net realized and unrealized

gain (loss) on investments | | (3.27) | 9.55 | 2.48 | (1.97) | 2.86 |

Total from Investment Operations | | (2.74) | 10.11 | 3.16 | (1.17) | 3.75 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.52) | (.57) | (.69) | (.81) | (.90) |

Dividends from net realized

gain on investments | | (5.61) | (5.84) | (6.69) | (2.30) | (1.29) |

Total Distributions | | (6.13) | (6.41) | (7.38) | (3.11) | (2.19) |

Net asset value, end of period | | 35.84 | 44.71 | 41.01 | 45.23 | 49.51 |

Total Return (%) | | (6.86) | 27.33 | 7.91 | (2.47) | 8.09 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .81 | .81 | .82 | .80 | .80 |

Ratio of net expenses

to average net assets | | .81 | .81 | .82 | .80 | .80 |

Ratio of net investment income

to average net assets | | 1.30 | 1.35 | 1.64 | 1.70 | 1.84 |

Portfolio Turnover Rate | | 6.50 | 3.97 | 4.19 | 11.97 | 3.65 |

Net Assets, end of period ($ x 1,000) | | 225,631 | 271,790 | 238,340 | 256,828 | 329,802 |

a Based on average shares outstanding.

See notes to financial statements.

14

| | | | | | | | | | | | | |

| | | | | | | |

| | | |

Service Shares | | | Year Ended December 31, |

| | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 44.34 | 40.72 | 44.96 | 49.23 | 47.69 |

Investment Operations: | | | | | | |

Investment income—neta | | .42 | .46 | .57 | .68 | .76 |

Net realized and unrealized

gain (loss) on investments | | (3.25) | 9.46 | 2.46 | (1.96) | 2.85 |

Total from Investment Operations | | (2.83) | 9.92 | 3.03 | (1.28) | 3.61 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.41) | (.46) | (.58) | (.69) | (.78) |

Dividends from net realized

gain on investments | | (5.61) | (5.84) | (6.69) | (2.30) | (1.29) |

Total Distributions | | (6.02) | (6.30) | (7.27) | (2.99) | (2.07) |

Net asset value, end of period | | 35.49 | 44.34 | 40.72 | 44.96 | 49.23 |

Total Return (%) | | (7.10) | 27.00 | 7.64 | (2.72) | 7.83 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.06 | 1.06 | 1.07 | 1.05 | 1.05 |

Ratio of net expenses

to average net assets | | 1.06 | 1.06 | 1.07 | 1.05 | 1.05 |

Ratio of net investment income

to average net assets | | 1.05 | 1.11 | 1.41 | 1.45 | 1.59 |

Portfolio Turnover Rate | | 6.50 | 3.97 | 4.19 | 11.97 | 3.65 |

Net Assets, end of period ($ x 1,000) | | 112,387 | 145,485 | 161,440 | 231,421 | 264,795 |

a Based on average shares outstanding.

See notes to financial statements.

15

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Appreciation Portfolio (the “fund”) is a separate diversified series of Dreyfus Variable Investment Fund (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. The fund’s investment objective is to seek long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the fund’s sub–investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the Distribution Plan, and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Companyenters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these

16

arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of

17

NOTES TO FINANCIAL STATEMENTS(continued)

the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The following is a summary of the inputs used as of December 31, 2018in valuing the fund’s investments:

18

| | | | | | |

| | Level 1 -

Unadjusted

Quoted Prices | Level 2 - Other

Significant

Observable Inputs | Level 3 – Significant

Unobservable

Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Equity Securities - Common Stocks† | 329,876,375 | 5,961,655†† | - | 335,838,030 |

Investment Companies | 3,677,743 | - | - | 3,677,743 |

† See Statement of Investments for additional detailed categorizations.

†† Securities classified within Level 2 at period end as the values were determined pursuant to the fund’s fair valuation procedures.

At December 31, 2018, there were no transfers between levels of the fair value hierarchy. It is the fund’s policy to recognize transfers between levels at the end of the reporting period.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c)Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at

19

NOTES TO FINANCIAL STATEMENTS(continued)

origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended December 31, 2018, The Bank of New York Mellon earned $7,598 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are considered “affiliated” under the Act.

(e) Dividends and distributions to shareholders:Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net are normally declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2018, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended December 31, 2018, the fund did not incur any interest or penalties.

20

Each tax year in the four-year period ended December 31, 2018 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2018, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $677,631, undistributed capital gains $42,436,296 and unrealized appreciation $168,663,415.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2018 and December 31, 2017 were as follows: ordinary income $4,703,453 and $5,358,909, and long-term capital gains $50,601,321 and $54,543,593, respectively.

(g) New Accounting Pronouncements: In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The update provides guidance that eliminates, adds and modifies certain disclosure requirements for fair value measurements. ASU 2018-13 will be effective for annual periods beginning after December 15, 2019. Management is currently assessing the potential impact of these changes to future financial statements.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed long-term open-end funds in a $1.030 billion unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by The Bank of New York Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $830 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is in amount equal to $200 million and is available only to the Dreyfus Floating Rate Income Fund, a series of The Dreyfus/Laurel Funds, Inc. Prior to October 3, 2018, the unsecured credit facility with Citibank, N.A. was $830 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended December 31, 2018 was approximately $7,670 with a related weighted average annualized interest rate of 2.97%.

21

NOTES TO FINANCIAL STATEMENTS(continued)

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions with Affiliates:

(a)Pursuant to an investment advisory agreement with Dreyfus, the investment advisory fee is computed at the annual rate of .5325% of the value of the fund’s average daily net assets. Pursuant to a sub-investment advisory agreement with Sarofim & Co., the fund pays Sarofim & Co. a monthly sub-investment advisory fee at the annual rate of .2175% of the value of the fund’s average daily net assets. Both fees are payable monthly.

(b)Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing its shares, for servicing and/or maintaining Service shares’ shareholder accounts and for advertising and marketing for Service shares. The Distribution Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets. The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products. The fees payable under the Distribution Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2018,Service shares were charged $336,109 pursuant to the Distribution Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits, if any, as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended December 31, 2018, the fund was charged $1,996 for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended December 31, 2018, the fund was charged $16,548 pursuant to the custody agreement.

During the period ended December 31, 2018, the fund was charged $12,774 for services performed by the Chief Compliance Officer and his

22

staff. These fees are included in Miscellaneous in the Statement of Operations.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $157,428, Distribution Plan fees $24,612, custodian fees $7,526, Chief Compliance Officer fees $6,289 and transfer agency fees $472.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2018, amounted to $25,489,672 and $75,362,409, respectively.

At December 31, 2018, the cost of investments for federal income tax purposes was $170,852,336; accordingly, accumulated net unrealized appreciation on investments was $168,663,437, consisting of $172,982,044 gross unrealized appreciation and $4,318,607 gross unrealized depreciation.

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of Appreciation Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Appreciation Portfolio (the “Fund”) (one of the funds constituting Dreyfus Variable Investment Fund), including the statements of investments and investments in affiliated issuers, as of December 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting Dreyfus Variable Investment Fund) at December 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Dreyfus investment companies since at least 1957, but we are unable to determine the specific year.

New York, New York

February 11, 2019

24

IMPORTANT TAX INFORMATION(Unaudited)

For federal tax purposes, the fund hereby reports 100% of the ordinary dividends paid during the fiscal year ended December 31, 2018 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in early 2019 of the percentage applicable to the preparation of their 2018 income tax returns. Also, the fund hereby reports $.0109 per share as a short-term capital gain distribution and $5.5963 per share as a long-term capital gain distribution paid on March 29, 2018.

25

BOARD MEMBERS INFORMATION(Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (75)

Chairman of the Board (1995)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

No. of Portfolios for which Board Member Serves:122

———————

Peggy C. Davis (75)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Shad Professor of Law, New York University School of Law (1983-present)

No. of Portfolios for which Board Member Serves: 45

———————

David P. Feldman (79)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1985-present)

Other Public Company Board Memberships During Past 5 Years:

· BBH Mutual Funds Group (5 registered mutual funds), Director (1992-2014)

No. of Portfolios for which Board Member Serves:31

———————

Joan Gulley (71)

Board Member (2017)

Principal Occupation During Past 5 Years:

· PNC Financial Services Group, Inc.(1993-2014), Executive Vice President and Chief Human Resources Officer and Executive Committee Member (2008-2014)

No. of Portfolios for which Board Member Serves:52

———————

26

Ehud Houminer (78)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Board of Overseers at the Columbia Business School, Columbia University (1992-present)

· Trustee, Ben Gurion University

No. of Portfolios for which Board Member Serves: 52

———————

Lynn Martin (79)

Board Member (2012)

Principal Occupation During Past 5 Years:

· President of The Martin Hall Group LLC, a human resources consulting firm (2005-2012)

No. of Portfolios for which Board Member Serves:31

———————

Robin A. Melvin (55)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Co-chairman, Illinois Mentoring Partnership, non-profit organization dedicated to increasing the quantity and quality of mentoring services in Illinois; (2014-present; board member since 2013)

No. of Portfolios for which Board Member Serves:99

———————

Dr. Martin Peretz (79)

Board Member (1990)

Principal Occupation During Past 5 Years:

· Editor-in-Chief Emeritus of The New Republic Magazine (2011-2012) (previously,

Editor-in-Chief, 1974-2011)

· Lecturer at Harvard University (1968-2010)

No. of Portfolios for which Board Member Serves:31

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James F. Henry, Emeritus Board Member

Philip L. Toia, Emeritus Board Member

27

OFFICERS OF THE FUND(Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Chief Executive Officer of MBSC Securities Corporation since August 2016. He is an officer of 62 investment companies (comprised of 122 portfolios) managed by the Manager. He is 60 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015.

Chief Legal Officer of the Manager and Associate General Counsel and Managing Director of BNY Mellon since June 2015; from June 2005 to June 2015, he served in various capacities with Deutsche Bank – Asset & Wealth Management Division, including as Director and Associate General Counsel, and Chief Legal Officer of Deutsche Investment Management Americas Inc. from June 2012 to May 2015. He is an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since June 2015.

JAMES BITETTO, Vice President since August 2005 and Secretary since February 2018.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since December 1996.

SONALEE CROSS, Vice President and Assistant Secretary since March 2018.

Counsel of BNY Mellon since October 2016; Associate at Proskauer Rose LLP from April 2016 to September 2016; Attorney at EnTrust Capital from August 2015 to February 2016; Associate at Sidley Austin LLP from September 2013 until August 2015. She is an officer of 63 investment companies (comprised of 147 portfolios) managed by Dreyfus. She is 31 years old and has been an employee of the Manager since October 2016.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Managing Counsel of BNY Mellon since December 2017, from March 2013 to December 2017, Senior Counsel of BNY Mellon. She is an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. She is 43 years old and has been an employee of the Manager since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since October 1990.

NATALYA ZELENSKY, Vice President and Assistant Secretary since March 2017.

Counsel of BNY Mellon since May 2016; Attorney at Wildermuth Endowment Strategy Fund/Wildermuth Advisory, LLC from November 2015 until May 2016; Assistant General Counsel at RCS Advisory Services from July 2014 until November 2015; Associate at Sutherland, Asbill & Brennan from January 2013 until January 2014. She is an officer of 63 investment companies (comprised of 147 portfolios) managed by Dreyfus. She is 33 years old and has been an employee of the Manager since May 2016.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 60 years old and has been an employee of the Manager since April 1985.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Dreyfus Financial Reporting of the Manager, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 54 years old and has been an employee of the Manager since October 1988.

28

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Fixed Income and Equity Funds of the Manager, and an officer of 63 investment companies (comprised of 147 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager, the Dreyfus Family of Funds and BNY Mellon Funds Trust (63 investment companies, comprised of 147 portfolios). He is 61 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

CARIDAD M. CAROSELLA, Anti-Money Laundering Compliance Officer since January 2016.

Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust since January 2016; from May 2015 to December 2015, Interim Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust and the Distributor; from January 2012 to May 2015, AML Surveillance Officer of the Distributor and from 2007 to December 2011, Financial Processing Manager of the Distributor. She is an officer of 57 investment companies (comprised of 141 portfolios) managed by the Manager. She is 50 years old and has been an employee of the Distributor since 1997.

29

Dreyfus Variable Investment Fund, Appreciation Portfolio

200 Park Avenue

New York, NY 10166

Manager

The Dreyfus Corporation

200 Park Avenue

New York, NY 10166

Sub-Investment Adviser

Fayez Sarofim & Co.

Two Houston Center

Suite 2907

Houston, TX 77010

Custodian

The Bank of New York Mellon

240 Greenwich Street

New York, NY 10286

Transfer Agent &

Dividend Disbursing Agent

Dreyfus Transfer, Inc.

200 Park Avenue

New York, NY 10166

Distributor

MBSC Securities Corporation

200 Park Avenue

New York, NY 10166

Telephone 1-800-258-4260 or 1-800-258-4261

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 Attn: Institutional Services Department

E-mailSend your request toinfo@dreyfus.com

InternetInformation can be viewed online or downloaded atwww.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the most recent 12-month period ended June 30 is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-DREYFUS.

| | |

© 2019 MBSC Securities Corporation

0112AR1218 |

|

Dreyfus Variable Investment Fund, Government Money Market Portfolio

| | | |

| | ANNUAL REPORT December 31, 2018 |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Variable Investment Fund, Government Money Market Portfolio

| | The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Government Money Market Portfolio, covering the 12-month period from January 1, 2018 through December 31, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The reporting period began with major global economies achieving above-trend growth. In the United States, a robust economy and strong labor market encouraged the Federal Reserve to continue moving away from its accommodative monetary policy while other major central banks began to consider monetary tightening. Both U.S. and non-U.S. equity markets remained on an uptrend. Interest rates rose across the yield curve, putting pressure on bond prices.

A few months into the reporting period, global growth trends began to diverge and market volatility returned. While the U.S. economy continued to grow at a healthy rate, other developed markets began to weaken. However, robust growth and strong corporate earnings continued to support U.S. stock returns while other developed markets declined throughout the summer. In the fall, a broad sell-off occurred, partially offsetting earlier U.S. gains. Emerging markets remained under pressure as weakness in their currencies relative to the U.S. dollar added to investors’ uneasiness. Global equities continued their general decline through the end of the period.

Fixed income markets struggled during the first half of the period as interest rates rose and favorable U.S. equity markets fed investor risk appetites. However, in autumn volatility crept in, the yield curve began a flattening trend that continued through the end of December. As long-term debt yields fell, prices rose for many bonds, leading to moderately positive returns for several fixed income market sectors.

Despite continuing political variables, U.S. inflationary pressures and flagging growth rates, we are optimistic that the U.S. economy will remain strong in the near term. However, we remain attentive to signs that point to potential changes on the horizon. As always, we encourage you to discuss the risks and opportunities in today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

January 15, 2019

2

DISCUSSION OF FUND PERFORMANCE(Unaudited)

For the period from January 1, 2018 through December 31, 2018, as provided by Bernard W. Kiernan, Jr., Senior Portfolio Manager

Market and Fund Performance Overview

For the 12-month period ended December 31, 2018, Dreyfus Variable Investment Fund, Government Money Market Portfolio produced a yield of 1.27%. Taking into account the effects of compounding, the fund provided an effective yield of 1.28% for the same period.1

Yields of money market instruments climbed over the reporting period in response to sustained economic growth, more stimulative fiscal policies, and four increases in short-term interest rates by the Federal Reserve Board (the “Fed”).

The Fund’s Investment Approach

The fund seeks as high a level of current income as is consistent with the preservation of capital and the maintenance of liquidity. The fund pursues its investment objective by investing only in government securities (i.e., securities issued or guaranteed as to principal and interest by the U.S. government or its agencies or instrumentalities, including those with floating or variable rates of interest), repurchase agreements collateralized solely by government securities and/or cash, and cash. The fund is a money market fund subject to the maturity, quality, liquidity and diversification requirements of Rule 2a-7 and seeks to maintain a stable share price of $1.00. The fund has been designated as a “government money market fund” as that term is defined in Rule 2a-7, and as such is required to invest at least 99.5% of its total assets in securities issued or guaranteed as to principal and interest by the U.S. government or its agencies or instrumentalities, repurchase agreements collateralized solely by government securities and/or cash, and cash. The fund normally invests at least 80% of its net assets in government securities and repurchase agreements collateralized solely by government securities (i.e., under normal circumstances, the fund will not invest more than 20% of its net assets in cash and/or repurchase agreements collateralized by cash).

Short-Term Interest Rates Rise

The months before the start of the reporting period saw a continued economic expansion, robust labor market gains, and rising short-term interest rates as the Fed continued to move away from its aggressively accommodative monetary policy of the past decade. The Fed implemented another interest-rate hike in mid-December 2017, raising the federal funds rate to between 1.25% and 1.50%. Meanwhile, investors responded positively to the enactment of federal tax-reform legislation that sharply reduced corporate tax rates.

In January 2018, 171,000 new jobs were added, and the unemployment rate stayed at 4.1%. Corporate earnings growth continued to exceed expectations, and hiring activity proved brisk. Hourly wages began to rise at their strongest pace since the 2008 recession, suggesting that inflation might begin to accelerate.

February saw renewed volatility in the financial markets, as inflation fears mounted in response to the addition of 330,000 jobs and an unemployment rate that stayed steady at 4.1%. Manufacturing activity continued to expand, and consumer confidence remained high.

3

DISCUSSION OF FUND PERFORMANCE(Unaudited) (continued)

Heightened volatility in the financial markets persisted in March, when investors reacted nervously to political rhetoric regarding potential new trade tariffs. Job creation trailed off, compared with the previous month, with 182,000 new jobs, but the manufacturing industry posted its strongest job gains in more than three years. The unemployment rate fell to 4.0%, but consumer confidence fell slightly due to worries about potential trade disputes. The U.S. economy grew at a 2.2% annualized rate over the first quarter of 2018.

In April, the unemployment rate slid to 3.9%, and 196,000 new jobs were added to the workforce. Retail sales grew by 0.3% amid persistently strong consumer confidence, which showed no sign of deterioration despite sharply rising fuel prices. In addition, long-term interest rates continued to climb, as the yield on 10-year U.S. Treasury bonds topped 3% for the first time since 2014.

May saw a further decrease in the unemployment rate to 3.8%, its lowest level since December 1969, as 270,000 new jobs were added during the month. Meanwhile, retail sales grew at a faster-than-expected 1.2% rate in May. The Fed’s preferred measure of inflation, the “core” Personal Consumption Expenditures (PCE) Price Index, which excludes food and energy prices, rose to 2.0%, matching the Fed’s target, while average hourly wages increased 2.8% above year-ago levels, suggesting that inflation could accelerate.

In June, the unemployment rate ticked up to 4.0%, and 208,000 new jobs were added. The Fed raised short-term interest rates for the second time in 2018, sending the federal funds rate to between 1.75% and 2.00%. The core PCE Price Index remained at 2.0%.

The economy generated 178,000 new jobs in July, and the unemployment rate declined to 3.9%. Activity in the manufacturing sector rebounded, and retail sales beat expectations. In August, 282,000 jobs were added, while the unemployment rate slid to 3.8%. Housing starts were disappointing, possibly due to capacity constraints, while the core PCE Price Index slipped to 1.9%.

In September, the labor market produced 108,000 new jobs, and the unemployment rate fell to 3.7%. The U.S. economy expanded at a 3.4% annualized rate in the third quarter of 2018, according to the final estimate, down from 4.2% in the second quarter. Consumer spending remained strong, while business investment declined modestly. The Fed continued on its path of monetary tightening, raising the federal funds target rate for a third time in 2018, bringing it to between 2.00% and 2.25%. The core PCE Price Index ticked up to 2.0%.